Would you like to save this?

Homeownership in America has become increasingly difficult for millions of people across the country. The housing affordability crisis now affects 70% of households who cannot afford a typical $400,000 home, while median earners can only afford homes in just 3 of the 50 largest U.S. metros. Economic factors, market conditions, and policy decisions have created barriers that make buying a home nearly impossible for many working families.

The reasons you cannot afford a home go far beyond simple supply and demand. From investment properties driving up prices to wage growth failing to keep pace with housing costs, multiple forces work together to price out potential buyers. Understanding these interconnected factors can help you navigate the current market and make informed decisions about your housing future.

30. Investment properties driving up prices

Large investment firms are buying houses across the country. They turn these homes into rental properties instead of selling them to families.

Investors have bought hundreds of thousands of houses to rent out. This removes homes from the market that you could have bought.

When investors buy homes, they often pay with cash. You cannot compete with these cash offers if you need a mortgage.

Investment companies drive up real estate prices and make affordable homes harder to find. They can afford to pay more than families.

Corporate landlords create competitive markets where regular buyers struggle to keep up. These companies have more money than individual home buyers.

The result is fewer homes for sale and higher prices. First-time buyers get squeezed out when competing against well-funded investment firms.

Some lawmakers want to crack down on this practice. They believe it hurts regular families trying to buy homes.

29. Rising inflation impacting overall buying power

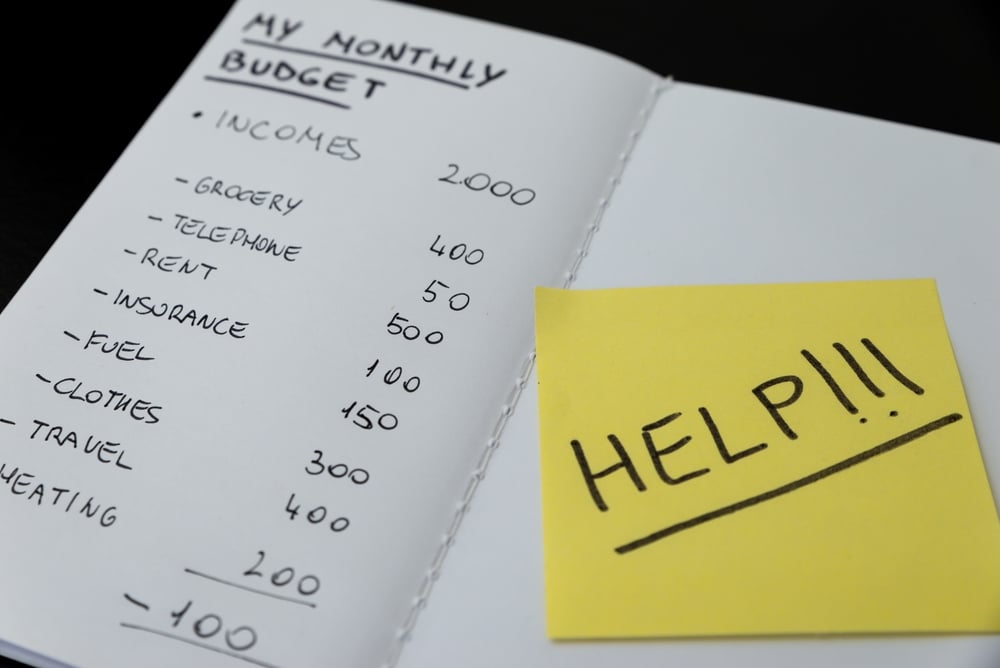

Inflation reduces the amount of goods a fixed sum of money can buy, directly affecting your ability to purchase a home. When prices rise across the economy, your dollars stretch less far.

Your salary buys fewer goods and services during inflationary periods. This means less money remains available for saving toward a down payment or qualifying for a mortgage.

Low-income households spend more on necessities such as groceries, energy, and housing than higher-income ones. Rising costs for basic needs consume a larger portion of your budget.

Consumers are cutting back on their overall expenditure, reducing spend on non-essential items as they feel the financial pressure. You may delay major purchases like homes to manage daily expenses.

When inflation rises, the purchasing power of money falls. Your pre-approved mortgage amount may no longer cover the same quality or size of home you originally planned to buy.

Rising inflation creates a cycle where housing becomes less affordable as your buying power decreases.

28. High down payment demands

Most lenders expect you to put down a significant amount of money upfront when buying a home. Traditional mortgages often require 10% to 20% of the home’s purchase price as a down payment.

On a $400,000 home, you would need $40,000 to $80,000 just for the down payment. This creates a major barrier for many potential buyers who struggle to save such large amounts.

Analysis shows that 20% down payments are commonly used in affordability calculations. This requirement forces you to accumulate tens of thousands of dollars before you can even consider homeownership.

First-time buyer programs may offer lower down payment options. Some FHA loans allow as little as 3.5% down. However, these programs often come with additional fees and mortgage insurance requirements.

Even with lower down payment options, you still face the challenge of saving thousands of dollars. Many Americans find it difficult to build this kind of savings while paying rent and covering daily expenses.

The high upfront costs effectively lock out buyers who earn decent incomes but lack substantial savings accounts.

27. Shortage of homes under $400,000

The housing market faces a serious supply problem. There aren’t enough affordable homes for people who need them.

94 million households in the U.S. can’t afford a $400,000 home. That’s about 70% of all households in America.

The problem gets worse in lower price ranges. More households can afford homes in the $200,000 to $300,000 range than there are units available.

This mismatch creates fierce competition. When few affordable homes exist, buyers must compete against many others for the same property.

The shortage hits people who make $100,000 a year especially hard. Far fewer homes are available to these buyers than just a few years ago.

Builders focus on expensive homes because they make more profit. This leaves gaps in affordable housing stock across the country.

You face limited choices when shopping for homes under $400,000. The few available options often receive multiple offers quickly.

26. Credit score requirements becoming stricter

Lenders have tightened their credit score standards in recent years. Many banks now hesitate to approve loans for borrowers with scores below 640.

You need higher credit scores than before to qualify for good rates. A good credit score to buy a house is 720 or higher, with 800 being ideal for the best terms.

Lower credit scores mean you’ll face higher interest rates. You might also need to pay additional points and fees to get approved.

Stricter mortgage lending requirements impact both low-income and affluent house hunters. Even buyers with decent incomes struggle with new lending restrictions.

Your monthly payment increases when you have a lower score. You’ll pay more in total through the term of the mortgage due to higher rates.

Different loan types require different minimum scores. Conventional loans typically need at least 620, while the best rates require 740 or higher.

25. Economic uncertainty affecting lending policies

When the economy becomes unpredictable, banks change how they lend money. This makes it harder for you to get a home loan.

Economic policy uncertainty has a significant negative effect on bank credit growth. Banks worry about future losses when they can’t predict what will happen next.

During uncertain times, banks tend to increase their loan loss provisioning. They set aside more money to cover loans that might go bad.

You face tighter lending standards when banks feel nervous about the future. They require higher credit scores, bigger down payments, and more proof of income.

Banks tightened the criteria used to approve loans over the past year. This happened partly because of economic conditions that increase loan risk.

Uncertainty shocks can trigger recessionary conditions. When banks expect trouble, they pull back on lending before problems actually start.

Your mortgage application gets rejected more easily when lenders can’t predict market conditions. Banks prefer to be safe rather than sorry during uncertain periods.

24. Urban sprawl and expensive commuting costs

Urban sprawl creates cities where homes, jobs, and shops are far apart. This forces you to drive long distances for work and daily needs.

Transportation costs in car-dependent areas have surged nearly three-fold compared to walkable neighborhoods. You end up spending thousands more each year just getting around.

Sprawled areas have poor access to pedestrian streets and long distances between work, school, recreation, shopping, and home. This means you need a car for almost everything.

In some cases, sprawl and limited transit don’t just mean long commutes — they mean commutes that never happen. You might not be able to reach jobs that are too far away.

While housing might cost less in sprawled areas, a cheap house is not truly affordable if located in a sprawled, automobile-dependent area with high transportation costs.

Your total housing and transportation costs often end up higher than living closer to city centers.

23. Lack of affordable rental options pushing demand for buying

The rental market has lost millions of affordable units over recent years. Housing is unaffordable for a record half of all U.S. renters according to Harvard analysis.

When you can’t find affordable rent, buying starts to look like your only option. This pushes more people into the housing market even when they’re not ready.

There is a shortage of more than 7 million affordable homes for extremely low-income families. New construction focuses mostly on high-end rentals instead of affordable units.

Rising rent costs force you to consider homeownership as an escape. You might stretch your budget to buy because renting has become too expensive.

The rental housing crisis is a supply problem that needs more affordable units built. Without enough rental options, you compete with other renters-turned-buyers for limited homes.

This extra demand from displaced renters drives up home prices. You end up paying more whether you rent or buy.

22. Limited availability of starter homes

The supply of starter homes has dropped dramatically over the past few decades. Starter homes made up 40% of new construction in 1982 but only 9% in 2023.

This means you have fewer affordable options when looking for your first home. Most new construction focuses on larger, more expensive houses instead of smaller entry-level properties.

Starter homes are typically under 1,400 square feet. These smaller homes used to help first-time buyers enter the housing market at lower price points.

In half of the 50 largest metro areas, families earning median income cannot afford starter homes. This makes it harder for you to find an affordable first home even in smaller markets.

The typical starter home now costs $250,000 nationwide. This requires a monthly payment of nearly $2,000, putting homeownership out of reach for many first-time buyers.

Builders prefer constructing larger homes because they generate higher profit margins. This business decision reduces the number of affordable starter homes available to you.

21. High student loan and consumer debt levels

Student loan debt creates a major barrier to homeownership. Student debt in the U.S. reached $1.78 trillion in 2024, with average federal loan balances hitting $38,375 per borrower.

Nearly 29% of student loan holders say their debt has impacted their ability to purchase a home. Monthly loan payments reduce how much you can qualify for when applying for a mortgage.

Your debt-to-income ratio includes student loans, credit cards, and other monthly payments. Lenders typically want this ratio below 43% for mortgage approval.

Student loan debt particularly affects families of color, creating wider homeownership gaps. Black graduates are more likely to carry student debt and face repayment challenges.

High consumer debt from credit cards and auto loans further limits your buying power. These monthly obligations reduce the mortgage amount you can afford and delay your ability to save for a down payment.

20. Longer mortgage approval processes

Getting your mortgage approved takes much longer than it used to. This delay can cost you the home you want to buy.

When mortgage rates drop, lenders get swamped with applications. Mortgage lenders become busier during low-rate periods, which slows down the entire process.

You might lose out to cash buyers while waiting for approval. Cash offers close faster than financed purchases.

The extra time also means more chances for problems to come up. Your financial situation could change during the long wait.

Multiple income checks and document requests stretch out the timeline. Lenders want to verify everything before they approve your loan.

Hot housing markets make the problem worse. More buyers mean more applications for lenders to process.

You may need to make backup offers on other homes while waiting. This creates stress and adds complexity to your home search.

The longer process also gives sellers more time to find better offers. They might choose someone else if your approval takes too long.

Planning extra time for mortgage approval has become necessary in today’s market.

19. Increasing construction labor costs

Construction workers are earning more money than before. Labor costs and hourly wages continue to rise across the building industry.

These higher wages get passed on to you as the home buyer. When builders pay more for workers, your home price goes up too.

The problem gets worse because there aren’t enough skilled workers. Without having skilled labor, construction times are extended by an estimated two months.

Longer build times mean builders spend more on their projects. They charge you more to cover these extra costs.

Some smaller building companies can’t keep up. Many smaller remodeling companies can’t afford the skyrocketing wages, so they’re scaling back.

When companies close or do less work, fewer homes get built. This makes the homes that do get finished more expensive for you to buy.

18. People with disabilities disproportionately affected

Would you like to save this?

People with disabilities face extra challenges when trying to buy homes. They often earn less money than others, making it harder to save for down payments.

Many people with disabilities rely on government benefits like Social Security Disability Insurance. These payments are usually much lower than regular wages. This makes qualifying for mortgages extremely difficult.

Housing discrimination against people with disabilities creates additional barriers. Landlords and sellers sometimes refuse to rent or sell to disabled individuals.

The lack of accessible housing limits your options if you have mobility needs. Homes with ramps, wider doorways, and accessible bathrooms cost more to buy or modify.

Nearly 900,000 people with disabilities under age 64 live in institutions partly due to housing shortages. Many could live independently if affordable accessible homes existed.

Rising housing costs hit disabled communities especially hard. When you’re already living on limited income, even small price increases can make homeownership impossible.

The housing affordability crisis has led to over 653,000 people experiencing homelessness, with disabilities being a major risk factor.

17. Older adults facing housing affordability challenges

When you reach retirement age, housing costs become even harder to manage. Over 11 million seniors spend more than 30% of their income on housing, making them cost-burdened.

Unlike younger buyers, you have less flexibility with your budget as a senior. Most older adults live on fixed incomes from Social Security or pensions. When housing costs rise, you can’t easily increase your earnings.

The number of cost-burdened older households dramatically increased between 2001 and 2016. This trend continues as baby boomers enter retirement during a housing shortage.

You face three main housing challenges as an older adult. These include affordability, physical accessibility, and access to medical services. Only 4% of homes accommodate mobility challenges, despite 55% of adults over 80 reporting disabilities.

Baby boomers are entering older age amid a historic affordable-housing shortage. This creates a perfect storm where you need suitable housing but can’t afford the limited options available.

16. Racial disparities in homeownership affordability

You face different challenges buying a home depending on your race or ethnicity. The numbers show clear gaps in who can afford to own homes.

White Americans have a homeownership rate of 73.3%. This drops to 63.3% for Asian Americans, 51.1% for Hispanic Americans, and just 44.1% for Black Americans.

Black and Hispanic home buyers encounter additional hurdles in securing mortgages beyond basic affordability issues. These barriers make it harder to get approved for loans.

You might pay more for the same home if you’re a minority buyer. Black Americans continue to face discrimination in housing, including through higher costs.

Income gaps make it harder for you to save for a down payment if you’re from certain racial groups. Lower incomes mean less money available for home purchases.

The current 30 percentage point gap between White and Black homeownership rates is greater than it was in 1960 when housing discrimination was legal.

15. Insufficient government incentives for affordable housing

The federal government provides some housing assistance through HUD subsidies and rental programs. However, insufficient funding prevents millions of deserving people from accessing these benefits.

Current programs help those who can access them. The problem is that demand far exceeds supply for government housing assistance.

Government incentives and subsidies play a crucial role in addressing housing challenges. They help make housing development more affordable for builders and buyers.

Without enough government support, you face higher housing costs. Developers need incentives to build affordable units instead of luxury homes.

The lack of adequate programs means fewer affordable housing options exist. This creates more competition for the limited affordable units available.

You end up paying more when government programs don’t meet the demand. Without adequate government intervention through rental assistance and affordable housing development, millions of low-income households spend unsustainable portions of their income on housing.

Limited government backing also means fewer financing options for first-time buyers. This makes homeownership even harder to achieve.

14. Rising monthly mortgage payments reaching record highs

Monthly mortgage payments have hit record highs across the United States. You now face the highest housing costs in history when buying a home.

The typical monthly payment reached $2,807 during March 2025. This represents a 5.3% increase from the previous year.

Two main factors drive these soaring costs. Rising home prices continue to push up your total loan amount. Higher mortgage rates also increase what you pay each month.

Mortgage rates have climbed for two straight weeks after a brief decline. This upward trend directly affects your monthly budget.

Your purchasing power shrinks as payments increase faster than wages. Monthly payments now cost almost 50% more than they did just one year ago.

These record-breaking payments put homeownership out of reach for many buyers. You must earn significantly more income to qualify for the same homes that were affordable last year.

13. Significant wealth gaps impacting purchasing power

The wealthiest 1% of Americans hold about 38% of the nation’s total wealth. This means a tiny group controls more resources than hundreds of millions of other people combined.

Wealth gaps create unequal opportunities and outcomes. When resources are concentrated at the top, your access to homeownership becomes much harder.

The wealth gap is growing faster than the income gap. Even if your salary increases, the gap between what you can afford and what wealthy buyers can afford keeps getting wider.

Your purchasing power gets affected by inflation while wealthy households see their assets grow through home appreciation and stock market gains. They can buy homes with cash while you struggle with rising interest rates.

Income drives your financial health. When wealth concentrates among the few, your ability to save for a down payment becomes nearly impossible compared to previous generations.

12. Cost burdens affecting over half of lowest-income families

When you earn very little money, housing takes up most of your income. Seventy percent of all extremely low-income families are severely cost-burdened, paying more than half their income on rent.

This means if you make $2,000 per month, you might pay $1,000 or more just for housing. That leaves very little money for food, medicine, or other basic needs.

Nearly 1 in 6, or 15.9% of U.S. households paid over half of their income on housing. For low-income families, this creates serious problems.

You cannot save money for a down payment when most of your paycheck goes to rent. You also struggle to build credit or emergency savings.

Housing cost burden affects households across different income and education levels. However, families with the lowest incomes face the biggest challenges.

If you work full-time at minimum wage, you cannot afford basic housing in any state. This makes it nearly impossible to ever buy a home.

11. Wage growth not keeping up with housing costs

Your paycheck isn’t growing as fast as housing prices. This creates a bigger gap between what you earn and what you can afford.

Housing prices are rising faster than wage growth in 80% of markets. This means your buying power gets weaker over time.

The hourly wage needed to afford a one-bedroom apartment is $23.67. This is more than three times the federal minimum wage.

Even when wages do increase, it often makes the problem worse. Higher wages can boost housing demand, which pushes home prices and buying costs even higher.

For the past two decades, rents and house prices have been rising faster than incomes across most parts of the United States. This trend affects families nationwide.

When your income can’t keep up with housing costs, you have less money for other needs. This makes it harder to save for a down payment or qualify for a mortgage.

10. High demand outpacing supply

The housing market faces a basic math problem. Too many people want homes, but not enough homes exist to meet that demand.

Housing demand grew by 26 percent between 2000 and 2020. During the same time, the actual housing supply only grew by 19 percent.

This gap between what people want and what’s available drives prices higher. When more buyers compete for fewer homes, sellers can ask for more money.

The housing shortage is essentially a problem of supply and demand. There simply isn’t enough housing supply to meet buyer demand.

Several factors fuel this high demand. Millennials are now at the age where they want to buy homes and start families. They need bigger spaces than apartments can offer.

The pandemic also changed how people think about housing. More people wanted their own homes instead of renting.

Low inventory continues to contribute to affordability issues. Until builders can create more homes, you’ll keep facing tough competition and higher prices when house hunting.

9. Increased competition among buyers

You face fierce competition when trying to buy a home today. Multiple buyers often bid on the same property, driving prices higher than asking.

The limited supply of homes in affordable price ranges has led to increased competition among buyers. This makes it harder for you to find suitable homes within your budget.

You must compete with other buyers who may offer cash or waive inspections. These tactics put you at a disadvantage if you need financing or want to protect yourself with contingencies.

Bidding wars have become common in desirable neighborhoods. You might find yourself offering thousands above the listing price just to have your offer considered.

Investment companies also compete for the same homes you want. They often have more resources and can close faster than individual buyers.

The competition forces you to make quick decisions with limited time to think. You may feel pressured to offer more money or better terms than you can comfortably afford.

When demand exceeds supply, sellers have the upper hand. They can choose from multiple offers and select the most favorable terms.

8. Lack of affordable housing inventory

The housing market has very few homes that regular families can afford. This shortage affects millions of people across the country.

Low housing inventory continues to push home prices upward. When there are fewer homes for sale, you have to compete with more buyers for the same property.

Nearly 60% of U.S. households cannot afford a $300,000 home. This means most families are priced out of buying even basic houses.

Construction companies are not building enough new homes. Many areas have zoning rules that only allow one house with a big yard instead of smaller, cheaper options.

Older homes that could be affordable need repairs that many buyers cannot afford. You might find a cheaper house but lack the money to fix it up.

The shortage is worst in expensive areas where teachers, nurses, and public safety workers cannot afford local housing.

7. Restrictive zoning laws in many areas

Zoning laws control what types of housing can be built in different neighborhoods. Many cities have restrictive zoning that makes it hard to add new housing, especially apartments and townhomes.

These rules often limit areas to single-family homes only. This prevents builders from creating more affordable housing options like duplexes or small apartment buildings.

When cities block new construction through zoning, housing supply stays low. Restrictive zoning practices act as barriers to development by limiting the creation of much-needed housing stock.

Less housing supply means higher prices for you. Areas with strict zoning rules typically see faster rent growth compared to places that allow more housing types.

Many zoning laws were created decades ago when cities were smaller. Now these outdated rules make it nearly impossible to build the housing that growing communities need.

Restrictive land use regulations and zoning laws have been linked to higher housing prices. This directly impacts your ability to find affordable housing in many urban areas.

6. Supply chain disruptions increasing material costs

Would you like to save this?

Supply chain problems are making building materials much more expensive. This directly affects how much you pay for a new home.

Construction costs have grown by 21% over the past year according to the National Association of Home Builders. Delivery delays and steep lumber price increases are the main reasons.

Lumber futures hit $658 per thousand board feet, the highest price since 2022. Fewer logs mean fewer boards available for building your home.

Nearly 85 percent of contractors report material costs have increased over the past year. Three-fourths of building firms are experiencing project delays due to material shortages.

These higher costs get passed directly to you as the buyer. Supply chain disruptions are eroding construction profit margins, making it harder for builders to keep prices affordable.

The result is that new homes cost significantly more than they did just a few years ago.

5. Limited new home construction

The housing market faces a serious shortage of new homes being built. Construction has slipped due to reduced demand as many Americans simply cannot afford to buy.

When fewer homes get built, the existing supply becomes more valuable. This drives up prices for everyone looking to buy.

You face higher costs because there aren’t enough homes to meet buyer demand. The basic rules of supply and demand work against you when construction stays low.

Many people want to buy homes but lack the money to do so. This creates a challenging cycle where builders reduce construction because fewer people can afford their homes.

The shortage of new construction means you compete with more buyers for fewer available properties. This competition pushes prices higher and makes homeownership even harder to achieve.

Builders struggle to create affordable entry-level housing due to various regulatory costs and fees. These extra expenses get passed on to you as the buyer.

Without enough new homes entering the market, your options remain limited and expensive.

4. Rising property taxes and insurance costs

Your monthly housing costs keep climbing even after you buy a home. Property taxes and insurance now eat up more of your budget than ever before.

Home insurance premiums jumped 57% from 2019 to 2024. This sharp increase hits your wallet hard every month.

Property taxes rose about 27% nationally during the same period. Some areas saw increases up to 50%, like Colorado.

In many areas, insurance and taxes now cost more than your actual mortgage payment. This reverses the traditional cost structure of homeownership.

Florida homeowners face especially tough challenges. Property taxes surged nearly 50% over five years, while escrow payments jumped 62%.

44% of homeowners saw monthly costs increase by 10-20% due to rising insurance alone. Another 13% faced increases of 20-30%.

These rising costs make homeownership unaffordable for many buyers who could handle the mortgage payment itself.

3. Annual income requirement over $126,700 for median home

You need to earn a lot more money than before to buy a home today. First-time homeowners must make at least $126,700 per year to afford the median monthly home payment.

This income requirement creates a huge barrier for most Americans. Many families earn far less than this amount each year.

The numbers show how expensive homes have become. To buy a median-priced home at $390,333, you need an annual income of $124,150.

Compare this to 1990 when things were different. Back then, first-time buyers earned about $23,400 annually and could afford homes up to $59,600.

Your income would need to be in the top 25% of all earners to meet today’s requirements. This puts homeownership out of reach for teachers, nurses, and many other middle-class workers.

2. Median home prices exceeding $300,000

The median price of a new home in the United States has reached $459,826. This means half of all new homes cost more than this amount.

When home prices climb above $300,000, you face significant financial barriers. Nearly 60% of U.S. households cannot afford a $300,000 home based on current mortgage rates.

You need substantial income to qualify for these higher-priced homes. The math becomes challenging when you consider down payments and monthly mortgage costs.

Home prices have grown much faster than wages. The median house price is now 5.8 times more than the median annual income of $80,000. In 1990, homes cost just two times the median income.

Even if you can afford monthly payments, you still need to save for a down payment. A 20% down payment on a $300,000 home requires $60,000 in cash.

The supply of affordable homes remains limited. Around 53 million households can afford homes priced at $200,000 or less, but only 22 million owner-occupied homes exist in this price range.

1. High mortgage interest rates around 6.35%

Current mortgage rates are hovering around 6.35%, making home loans much more expensive than in recent years. This rate means you pay significantly more in interest over the life of your loan.

When you get a 30-year mortgage at 6.35%, your monthly payment increases dramatically compared to lower rates. For every $100,000 you borrow, the higher rate adds hundreds of dollars to your monthly payment.

Most homeowners today have mortgages with rates well below 6.35%. The majority of current homeowners are paying borrowing costs lower than the average 6.35% offered on new mortgages.

This creates a big gap between what existing homeowners pay and what you would pay as a new buyer. The difference makes it harder for you to compete in the housing market.

Your purchasing power drops when rates are high. A home that cost $2,000 per month at 3% interest might cost $2,500 per month at 6.35% interest for the same loan amount.

Core Economic Factors Influencing Homeownership

Your ability to buy a home depends largely on three economic forces beyond your control. Wages have failed to keep pace with rising home prices, cities face severe housing shortages, and interest rates directly impact your monthly payments.

Impact of Wage Stagnation on Affordability

Your income hasn’t grown at the same rate as home prices over the past decade. This creates a widening gap between what you earn and what homes cost.

The median home price has increased by approximately 60% since 2015. During the same period, median wages grew by only 25-30%. This means your purchasing power for housing has dropped significantly.

Key wage vs. housing price disparities:

- Tech workers in San Francisco need 8-10 years of savings for a down payment

- Teachers in major cities spend 40-50% of income on housing costs

- Minimum wage workers require 2-3 full-time jobs to afford average rent

Consumer confidence and wage growth directly affect your ability to qualify for mortgages. When wages don’t match housing costs, you’re forced to either relocate or delay homeownership indefinitely.

Many employers haven’t adjusted salaries to reflect local housing markets. This leaves you competing for homes with buyers from higher-income areas or investment firms with cash offers.

Housing Supply Constraints in Major Cities

Cities aren’t building enough homes to meet demand. This shortage drives up prices and creates bidding wars that price out regular buyers.

Zoning laws limit where builders can construct new housing. Many areas restrict building to single-family homes only. This prevents the construction of affordable townhomes, condos, and apartments.

Major supply constraints include:

- Zoning restrictions that limit density

- Lengthy permitting processes taking 12-18 months

- High construction costs for materials and labor

- Limited developable land in desirable areas

Multiple competing offers have become standard in many markets. You’re often bidding against 5-15 other buyers for the same property.

Construction hasn’t kept up with population growth in major metropolitan areas. Cities like Austin, Denver, and Seattle need 20,000-40,000 additional units annually to meet demand.

Interest Rate Trends and Mortgage Accessibility

Interest rates determine your monthly mortgage payment. Even small rate changes can add hundreds of dollars to your monthly costs or eliminate your buying power entirely.

A 1% increase in mortgage rates reduces your buying power by approximately 10%. If rates rise from 6% to 7%, a home you could afford at $400,000 drops to $360,000 in your budget.

Rate impact on monthly payments:

- $300,000 loan at 5%: $1,610/month

- $300,000 loan at 7%: $1,996/month

- Difference: $386 more per month

Lending conditions and standards affect your ability to qualify for loans. Banks require higher credit scores and larger down payments when rates are volatile.

Current mortgage processes require extensive documentation of income, assets, and debt. You need consistent employment history, low debt-to-income ratios, and substantial cash reserves. These requirements eliminate many potential buyers from the market.

Higher rates also slow home sales, but don’t necessarily lower prices. Sellers often wait for better market conditions rather than reduce their asking prices.

Long-Term Implications of the Housing Affordability Crisis

The housing crisis creates lasting damage that extends far beyond monthly payments. When entire generations cannot buy homes, society loses economic stability and families lose their primary path to building wealth.

Societal Effects of Declining Homeownership

Homeownership rates have dropped significantly among younger Americans. Only 43% of millennials own homes compared to 51% of Gen X at the same age.

Communities suffer when fewer people can afford to buy homes. Rental turnover increases as people move frequently searching for affordable options. This constant movement weakens neighborhood bonds and reduces civic engagement.

Schools face funding challenges in areas with declining homeownership. Property taxes fund local schools, so when fewer people own homes, tax revenue drops. Renters typically have less say in local school board decisions.

Young adults delay major life decisions when housing costs consume too much income. Marriage rates decline and family formation gets postponed when people cannot afford stable housing.

Local businesses lose customers when residents spend most of their income on rent. Communities become less stable as working families move away seeking cheaper housing options.

Economic Mobility and Generational Wealth Gaps

Homeownership represents the primary way American families build wealth. Home equity accounts for about 70% of total wealth for middle-class families.

When you cannot buy a home, you miss out on decades of potential wealth building. A family that bought a $200,000 home in 2000 would have gained roughly $150,000 in equity by 2020.

Wealth Gap Indicators:

- Homeowners have 40 times more wealth than renters on average

- First-time buyers now need 20% down payments versus 10% historically

- Parents increasingly help adult children with home purchases

The annual income required to afford median-priced homes exceeds $150,000 in many cities. This locks out families earning the national median income of $75,000.

Your ability to pass wealth to children becomes limited without home equity. Families who rent cannot leave property to the next generation. This creates a cycle where each generation starts from zero financially.

Career choices become restricted when housing costs are too high. Young professionals cannot afford to work in public service, teaching, or other lower-paying but essential jobs in expensive cities.

Frequently Asked Questions

Many Americans struggle with housing costs due to strict lending requirements, high student debt burdens, and significant regional price differences that make homeownership increasingly difficult to achieve.

What factors contribute to the rising cost of homes in the United States?

Investment properties are driving up home prices across many markets. When investors buy homes to rent out, they compete with regular families trying to buy their first home.

Rising inflation reduces your buying power for everything, including homes. The money you saved for a down payment buys less house than it did a few years ago.

A shortage of homes under $400,000 means most buyers compete for expensive properties. This pushes prices higher as more people bid on fewer affordable options.

Limited housing supply combined with high demand creates bidding wars. You often need to offer more than the asking price to win.

How have lending practices affected individuals’ ability to purchase homes?

Credit score requirements are becoming stricter than in previous years. Banks now want higher credit scores before they approve your mortgage application.

High down payment demands make it harder to qualify for loans. Many lenders want 10% to 20% down, which equals $40,000 to $80,000 on a $400,000 home.

Interest rates around 6.35% increase your monthly payments significantly. Higher rates mean you pay more each month for the same house.

Debt-to-income ratios have become more restrictive. Lenders want your total monthly debt payments to be less than 43% of your income.

What impact does student debt have on home affordability for younger generations?

Student loan payments count against your debt-to-income ratio when applying for mortgages. Large monthly student loan payments reduce how much house you can afford.

Student debt prevents you from saving for down payments. Money that could go toward home savings goes to loan payments instead.

Many young adults delay major purchases like homes while paying off education debt. This pushes homebuying later in life when prices may be even higher.

Student loans affect your credit utilization and payment history. Missing payments or high balances can lower your credit score.

What role does the location play in the affordability of housing across the US?

Coastal cities and major metropolitan areas have much higher home prices than rural areas. A $500,000 budget might buy a small condo in expensive cities but a large house in cheaper regions.

Local job markets affect what you can afford in each area. High-paying jobs in expensive cities don’t always translate to better buying power.

Property taxes vary significantly by state and county. Some areas have low home prices but high annual tax bills that increase your monthly costs.

HOA fees in some regions average $600 per month or more. These mandatory fees add substantial costs to your monthly housing budget.

Is there a correlation between the cost of living and the ability to afford residential properties?

Areas with high housing costs typically have expensive groceries, gas, and services too. Your income stretches less when everything costs more.

Low-income families struggle most with housing costs and often spend over 30% of income on housing. This leaves little money for other needs or savings.

Wage growth hasn’t kept pace with housing price increases in many markets. Your salary may have grown 3% while home prices rose 10% or more annually.

Higher cost areas often require two incomes to afford homeownership. Single buyers face even greater challenges in expensive markets.

How do changing economic conditions influence the real estate market and home affordability?

Economic uncertainty makes lenders more cautious about approving loans. Banks tighten requirements during unstable times, making it harder to qualify.

Inflation affects construction costs, which builders pass on to buyers through higher home prices. Materials, labor, and land all cost more during inflationary periods.

Job market changes affect your ability to qualify for mortgages. Lenders want stable employment history and consistent income sources.

Interest rate fluctuations directly impact your monthly payments. Even small rate changes can add hundreds of dollars to your monthly mortgage payment.