Between 2018 and 2023, Indiana’s housing market surged—and millennials were right in the middle of it. As home prices climbed and bidding wars became the norm, millennial buyers stepped in at full force. By 2023, they drove over half of all mortgage requests in the Indianapolis area alone. But buying a home wasn’t easy. They faced steep prices, shifting interest rates, and tough competition. Still, they adapted—choosing smaller homes, longer commutes, and new neighborhoods. Their impact reshaped not just who was buying, but what was being bought and where.

Indiana’s Housing Boom and Price Surge

Indiana’s housing market underwent dramatic changes from 2018 through 2023. Home prices in the Hoosier State surged far beyond historical norms. The median sale price for an Indiana home jumped from about $157,000 in 2018 to roughly $242,000 by mid-2023, an increase of over 50%. That averages out to roughly 10% price growth per year – much higher than usual.

In the 11-county Indianapolis metro, the median home price was about $219,000 in August 2020, but hit $305,000 by August 2023 – a 40% leap in three years. This rapid appreciation created serious affordability concerns for many buyers.

Market Drivers

Several factors fueled Indiana’s housing boom:

- Record-low interest rates in 2020–2021 made monthly mortgage payments more affordable

- Pandemic-driven demand for space led many Hoosiers to seek homes with yards and extra rooms

- Housing supply remained extremely tight, with under 2 months’ supply by late 2022

- Indiana added over 31,000 new residents from 2018 to 2022

- Young adult households surged, with Indiana gaining over 93,000 additional households headed by adults under age 45

This perfect storm of low interest rates, high demand, and limited supply drove Indiana’s home prices up 42% just since mid-2020. By 2023, the state was in an affordability crunch. Even as the buying frenzy cooled, prices stayed elevated. Mortgage rates then rose sharply, doubling borrowing costs within a few years.

Millennial Home Preferences

With such market conditions, what kinds of homes did Indiana’s millennials actually end up purchasing? In general, most gravitated toward single-family houses – the traditional detached home with a yard. Indiana’s housing stock is dominated by single-family homes, and millennials largely followed that pattern.

Starter Homes and Affordability

Many first-time millennial buyers sought “starter homes,” which are typically modestly sized and priced. In the Indianapolis area, the average first-time buyer’s home was around $200,000 in 2023. These are often small three-bedroom houses or older homes that fit a tighter budget. However, finding such homes wasn’t easy. The supply of houses around $200,000 in Indy has shrunk by about half since 2018, making the starter home segment very competitive.

Geographic Differences

Younger millennials (late 20s to early 30s) mostly bought their first homes during 2018–2023. They often chose affordable suburbs or small cities where their money went further. For instance, cities like Fort Wayne and South Bend tend to have lower prices than Indianapolis. In 2019, Fort Wayne already had a relatively high young homeownership rate – about 41% of Fort Wayne residents under 35 owned their home, one of the higher rates in the nation for that age group.

By contrast, millennials in Indianapolis faced a bigger-city market where fewer young adults owned homes. Many Indy millennials started with older houses in urban neighborhoods or townhomes/condos if they wanted to stay close to downtown jobs, though single-family homes in outlying areas were more common for those who could commute.

Upsizing Trends

As millennials aged during 2018–2023, some moved beyond their starter homes. Older millennials (mid-30s to early 40s by 2023) often looked to upsize – selling their first small home and purchasing a larger house to accommodate growing families or simply to upgrade their living space.

These buyers, having built up home equity and savings, showed a distinct trend: “Older millennials are buying bigger and newer homes with larger down payments than their younger counterparts,” according to the National Association of Realtors (NAR). This move-up buying was prevalent in the late 2010s and 2021, when low interest rates made it easier to trade up.

Space Preferences

One thing most millennial buyers have in common is preference for space. The COVID-19 pandemic amplified this: with remote work and lockdowns, demand for houses with extra rooms or yards soared. Many millennials specifically sought homes where they could have a home office or outdoor area for children and pets. This steered them toward single-family homes over condos.

Overall, townhouses and condos made up a smaller share of millennial purchases in Indiana, since free-standing homes were often available at similar prices in many markets. For example, a $250,000 budget in Indianapolis might buy a small house with a yard, whereas in Chicago that might only fetch a condo – so Indy millennials often chose the house.

The “Golden Handcuffs” Effect

In 2022–2023, many who bought homes at low 3% mortgage rates felt “locked in” and chose not to sell and move (since a new mortgage would carry a much higher rate around 6–7%). This created a kind of golden handcuffs effect, where staying in the starter home was financially smarter than upgrading and paying double interest.

Economic Factors Shaping Millennial Decisions

Multiple economic forces between 2018 and 2023 influenced whether and what millennials bought in Indiana.

Interest Rate Rollercoaster

A key factor was mortgage interest rates. Millennials who purchased in 2018 or 2019 saw rates around 4%, and those who bought in 2020–2021 scored rates under 3% – historically low levels. These low rates significantly lowered monthly payments, letting millennials afford more house for the money.

By August 2023, the median-priced Indy home with a 7% loan had a monthly payment nearly double what a median home cost just three years earlier. So early in this period, low rates helped millennials enter the market, but later on, soaring rates sidelined many. As rates shot up in 2022, millennial buyers had to either stretch their budgets or pause their plans.

Student Loan Burden

Another major economic challenge was student loan debt. Millennials carry more student debt than any previous generation, and it has been a barrier to buying homes. Nationwide surveys show that 61% of millennials say they’ve delayed purchasing a house because of student loan debt.

The average student loan balance for an Indiana borrower is around $33,000, which can feel like a mortgage in itself. Until 2020, these loan payments were a monthly reality, reducing how much millennials could save for a down payment or afford in a mortgage.

There was a temporary pandemic-era pause on federal student loan payments from 2020 to 2023, which gave some millennial buyers breathing room to save extra cash – but as of late 2023, payments have resumed. High student debt has meant millennials tend to buy homes later in life than previous generations.

Income vs. Housing Costs

Income and wages play a role too. Indiana’s economy in 2018–2023 was relatively strong, but wages did not grow as fast as home prices. The median household income in Indiana is roughly $67,000, while the median home price is around $258,000. That’s a price-to-income ratio of about 3.9, which is considered affordable by national standards.

But compare that to a decade earlier: since 2008, U.S. house prices have risen about three times faster than incomes on average. Millennials felt this pinch. Saving for a down payment became a tall order as rents and living costs also climbed with inflation. Surveys found that 43% of millennials who don’t own homes cite the inability to afford a down payment and closing costs as a top barrier.

Family Assistance and Programs

To overcome these financial hurdles, many millennial buyers turned to family assistance or special programs. It’s estimated that over one-third (38%) of recent homebuyers under age 30 received money from family to help with the down payment.

Even among slightly older millennials, 27% of younger millennials (26–34) and 13% of older millennials (35–44) used a gift or loan from family or friends toward their down payment. Indiana also offers support: the Indiana Housing and Community Development Authority provides first-time buyers up to 6% of the home price in down payment assistance for those who qualify.

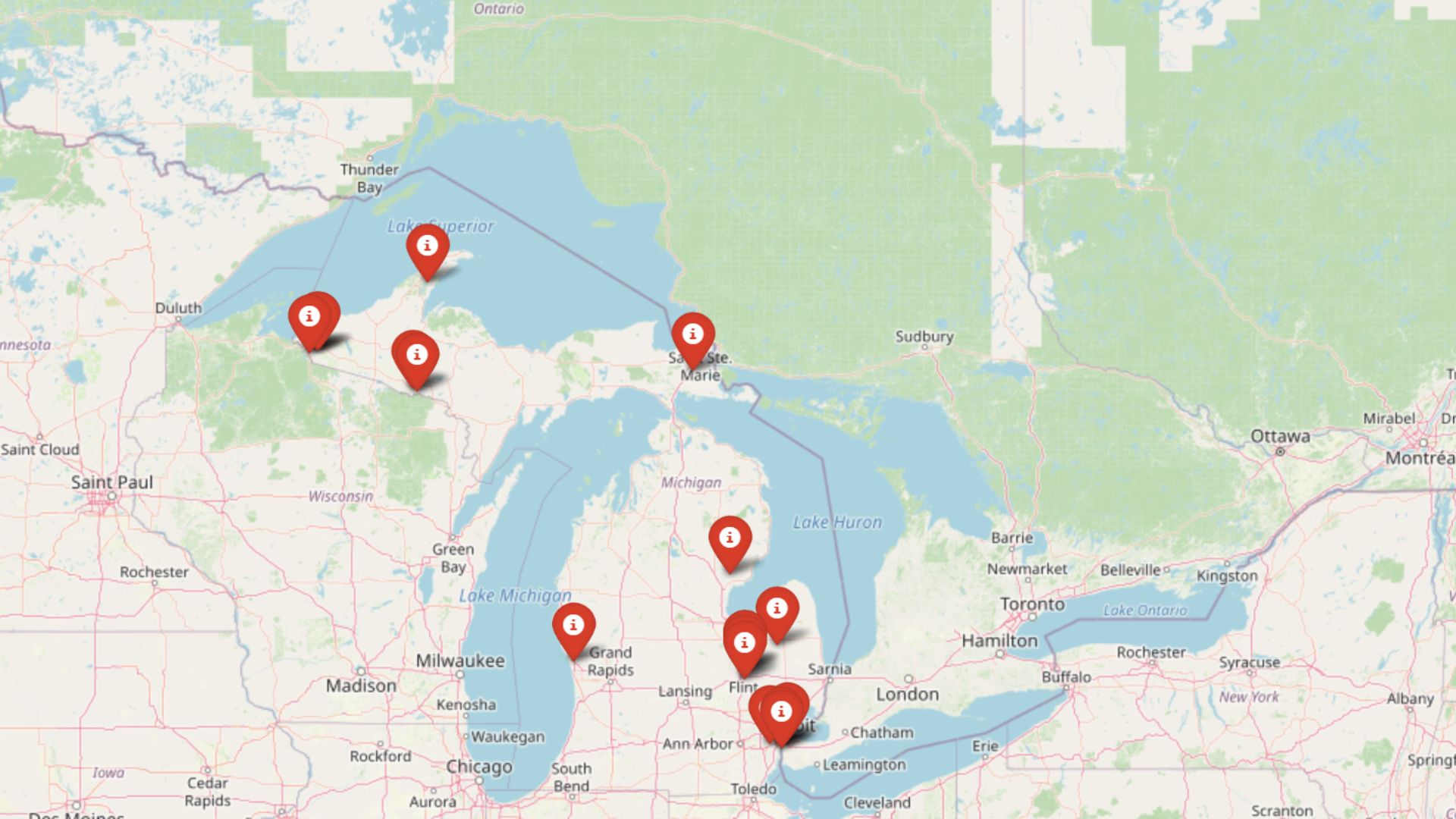

Regional Differences Across Indiana

While statewide patterns show rising prices and tight supply, millennial homebuying trends varied across Indiana’s regions.

Indianapolis Metro Area

Indianapolis and its suburbs were a hotspot for young buyers but also one of the most competitive markets. Indy is the state’s largest job center, attracting millennials for work – and many want to buy homes there rather than pay high urban rents. According to one analysis, Indianapolis was a “hot market for young people” due to its relative affordability compared to bigger cities.

Nonetheless, within Indy the inventory of starter homes under $250K dropped steeply, forcing millennials to either compromise on location or home features. Some chose to buy in far-flung suburbs or even exurban areas where new construction was booming. Homebuilders around Indy did cater to first-time buyers to some extent, offering smaller new homes and even incentives like mortgage rate buydowns in 2023.

Mid-Sized Cities

In mid-sized cities like Fort Wayne, Evansville, and South Bend, millennials generally found a more balanced market. These cities have lower median home prices than Indianapolis, which made it easier for young buyers to afford homes without stretching as much.

Fort Wayne, for example, has been highlighted as a great market for first-time buyers – it was even named the 3rd best city nationally for first-time homebuyers in one 2023 study. The median home value in Fort Wayne (~$230K) and a decent supply of homes meant millennials there could achieve homeownership sooner.

College Towns and Rural Areas

College towns and smaller communities saw mixed trends. In Bloomington (home to Indiana University) or West Lafayette (Purdue University), many millennials are there as students or recent grads, so homebuying is less common in their early 20s.

In rural areas of Indiana, housing is very inexpensive – it’s not uncommon to find houses under $100,000 in some small towns. Thus, for millennials who either remained in or returned to rural hometowns, owning a home can be easier financially. The challenge in rural regions is economic opportunity: fewer millennials live there compared to urban areas, as many move towards cities for jobs.

Investor Competition

One regional factor worth noting is the presence of out-of-state buyers and investors in certain areas. Indianapolis in particular saw a surge of investor activity during this period. By 2021, roughly 1 in 4 home sales in central Indiana were to institutional investors rather than owner-occupants.

Investors from out-of-state identified Indy as an attractive market for rental properties, given the relatively low prices and high rent potential. In fact, Indianapolis was ranked the #1 U.S. city for out-of-state real estate investment in single-family rentals around 2021.

This had an indirect effect on millennial homebuyers: starter homes and affordable houses were often snatched up by investors paying cash, making it harder for first-time buyers to compete. A report found nearly a third of homes under $250,000 were being bought by investors in central Indiana.

Comparison: Millennials Now vs. the 2008–2017 Era

Millennial homebuying in 2018–2023 looks very different from the previous decade (2008–2017), which covered the housing crash and slow recovery.

Delayed Entry vs. Active Participation

To put it simply, 2008–2017 was a period of delay and pent-up demand for millennials, whereas 2018–2023 was a period of realization of that demand. The Great Recession of 2008–2009 hit just as the oldest millennials were trying to buy their first homes. Job losses and tightened credit forced many young adults to postpone homeownership.

Throughout the early 2010s, a large share of millennials remained renters or lived with parents well into their late 20s. Homeownership rates for young adults plummeted nationally – by 2016, the U.S. homeownership rate for under-35 households hit around 34%, the lowest in decades.

Market Conditions: Then vs. Now

Housing market conditions in 2008–2017 were almost the inverse of the late 2010s. In the immediate aftermath of the 2008 crash, home prices fell or stagnated. A millennial lucky enough to have a stable job and good credit around 2010 could actually find very affordable homes and low interest rates.

The paradox is that many millennials couldn’t take advantage then – either they lacked the means or hesitated due to economic uncertainty. Meanwhile, housing supply was actually ample in the late 2000s; there were even vacant homes from the prior building boom sitting on the market. It was a buyer’s market around 2009–2012, with sellers offering concessions.

Contrast that with 2018–2021, a true seller’s market with bidding wars and no concessions. Essentially, the power flipped. In 2008–2012, millennials (the few who were buying) had the upper hand with plenty of choice and low prices; by 2018–2021, sellers held all the cards and young buyers faced an uphill battle.

Buyer Demographics Shift

One striking difference is in the demographics of buyers between the two periods. Around 2010, the homebuyer pool “skewed local and younger” in Indiana. By 2020–2021, the average buyer was more likely an older, move-up suburban family or even an out-of-state transplant with cash.

For several years in the 2010s, millennials were the largest group of homebuyers nationally as they finally started purchasing in larger numbers – by 2016–2017 they made up around 36% of buyers, climbing to 43% by 2021.

However, the housing frenzy of 2021–2022 flipped the script: in 2022, Baby Boomers overtook millennials as the largest share of homebuyers (Boomers were 39-42% of buyers vs millennials’ 28-29%). This was unprecedented, and it happened because older buyers with existing equity or cash could navigate the crazy market more easily than first-timers.

Homeownership Progress

By the end of 2017, only a minority of millennials owned homes, and many were still waiting. But by 2023, over 51% of millennials nationally owned a home – the first time a majority have been homeowners. Indiana likely exceeds that national average, as the Midwest generally has higher young adult homeownership.

The homeownership rate among Hoosiers under 35 jumped in 2020-2021 after a long decline. The state actually saw a “significant jump” in young adult ownership during those years, reversing two decades of drops.

Second Homes and Investments

While the focus is on primary residences, vacation homes and investment properties provide context. Nationally, the pandemic era saw a spike in second-home buying. By early 2021, mortgage applications for vacation properties were up 80–90% above pre-pandemic levels.

A portion of these buyers were older millennials with high incomes. In Indiana, some higher-earning millennials did purchase second homes – for example, a remote worker in Indianapolis might buy a cottage on Lake Michigan or a cabin in Brown County for weekend retreats. But this was a relatively niche trend.

More common was the trend of millennials turning their first home into a rental property when moving to a second home. Rather than selling, some chose to keep their starter home as an investment and rent it out, especially if they had locked in a 3% interest rate.

For the vast majority, the goal in 2018–2023 was to secure a primary residence and perhaps hold onto it. By 2023 many millennials were indeed staying put longer in their homes, partly because trading up became cost-prohibitive with higher rates.

Conclusion

From 2018 to 2023, millennial Hoosiers navigated a rollercoaster housing market to achieve homeownership. They bought mostly single-family homes – starting small, then upsizing as able – and dealt with intense competition, whether from other buyers, cash-rich investors, or baby boomer downsizers.

Economic forces like low interest rates opened a narrow window for many to buy, only for high rates and prices later to slam it shut for others. Yet despite obstacles like student debt and scarce starter homes, more than half of Indiana’s millennials had become homeowners by 2023, marking a significant generational milestone.

This represents a stark change from the 2008–2017 period when millennials were largely missing from the buyer market. Indiana’s relatively affordable prices (compared to the coasts) and strong job market provided a backdrop that, while challenging, was still conducive to young buyers planting roots.

Looking ahead, millennial homebuying trends in Indiana will likely continue to evolve. As interest rates stabilize, some who paused their searches may re-enter the market. Others will remain renters longer, saving up in hopes of a cooler market.

The experiences of 2018–2023 have shown that millennials are determined to own homes, even if it takes them longer and requires more creativity to get there. They are now a generation of Indiana homeowners, shaping neighborhoods from the cities to the suburbs. Their journey reflects both the resilience of a generation coming of age in tumultuous times and the enduring appeal of the American dream of owning a home – a dream that millennials, at long last, are claiming for themselves in the Hoosier State.

References

- Indiana housing market outlook for 2024 – Indiana Business Research Center

- Millennial home buyers in Indianapolis face high mortgage rates, few options – Axios Indianapolis

- Fort Wayne ranked 17th in the nation for homeownership rates among millennials – GoKite

- 61% of millennials report delaying homeownership due to student loan debt – Maverick Investor Group

- Fort Wayne named 3rd best city for first-time homebuyers – 21Alive News

- Baby Boomers Regain Top Spot as Largest Share of Home Buyers – National Association of Realtors

- How investors are buying homes in Indiana and driving up prices – Greater Indianapolis Multifaith Alliance

- Millennial Homeownership Statistics – Self Financial

- Investor Trends in Indiana Housing Market – Fair Housing Center of Central Indiana

- Indiana Homeownership Rates – USA Facts

- Generational Trends: Home Buyers and Sellers – Real Estate News