Idaho’s housing landscape transformed dramatically from 2018 to 2023. Home prices surged at one of the fastest rates in the nation, far outpacing income growth. For households earning under $250,000 (a bracket encompassing the vast majority of Idaho families), these years brought both opportunities and challenges in buying homes.

Owner-occupied purchases dominated as Idaho attracted waves of new residents seeking primary homes, but investment and vacation property buying also spiked during the pandemic-driven housing boom. Find out what Idaho’s under-$250K households bought – from single-family houses to townhomes and manufactured homes – and how they financed these purchases.

Skyrocketing Prices and Affordability Challenges

The Housing Price Boom

Idaho experienced an extraordinary run-up in home values in this period. From 2019 onward, the state consistently ranked at or near the top for price appreciation. Since 2014, Idaho’s median home price jumped about 155%, the steepest increase of any state. Much of that growth came in the late 2010s and the pandemic housing boom of 2020–2021.

Boise’s median sale price in 2018 was around the mid-$200,000s; by mid-2021 it had exploded to nearly $500,000, a 37% year-over-year increase. Statewide, the Zillow Home Value Index climbed from roughly the low-$200,000s in 2018 to the mid-$400,000s by 2023, doubling in just five years.

Even traditionally affordable rural counties saw major price hikes. In Kootenai County (Coeur d’Alene area), the median single-family home price hit $530,000 by mid-2024, up from the low $300Ks in 2018. Contrast that with a rural county like Shoshone, where the median was about $289,000 in mid-2024 (still nearly double its pre-2018 levels).

Income vs. Home Prices

This rapid appreciation far outstripped income gains. Statewide, housing values jumped ~75% from 2015 to 2020, while median household income rose only ~18%. By 2023 the median Idaho household income was around $74,000 – up modestly from the mid-$60Ks in 2018 – yet the median home price was roughly 6 times that income.

Housing affordability plummeted. Idaho and Montana overtook even California as the least affordable states for homebuyers by 2023, when measured by the ability of local incomes to afford local home prices. The National Association of Realtors’ affordability index rated Idaho around 0.4 on a 0-to-2 scale (where 1.0 means the median income can afford the median home) – putting Idaho among the bottom five states.

Boise became emblematic of the crisis: by mid-2021, only 21% of homes for sale in Boise were affordable to a family earning the area’s median income (~$75K). This Housing Opportunity Index of 21% put Boise in the bottom 10 of all U.S. metros for affordability at that time. A Boise Regional Realtors study likewise found the city’s median home price (around $535K in 2021) was nearly 10× the median income, an unprecedented ratio for the area.

Cost-Burdened Households

As prices soared, many Idahoans had to devote large shares of their income to housing. By 2019, about 25.7% of Idaho homeowner households with mortgages were cost-burdened, spending over 30% of income on housing. These figures worsened through 2023 as home values outpaced wages. Essential workers and moderate-income families often found themselves priced out of the cities where they worked, reflecting a growing affordability gap.

Pandemic Surge and Market Cooling

Ultra-low mortgage rates and pandemic-driven demand turbocharged Idaho’s market in 2020–2021. The average 30-year fixed rate hit 3% or below in 2020–21, enabling buyers to stretch their budgets. Combined with a flood of out-of-state buyers and limited supply, this led to intense bidding wars. Many homes sold above asking price in a matter of days at the height of the frenzy.

By late 2022, however, the Federal Reserve’s rate hikes pushed mortgage rates past 6–7%. This abrupt spike in financing costs dramatically cooled Idaho’s market. Statewide home sales slowed and prices plateaued or dipped slightly in 2022–2023.

November 2022 median home price was $464,500, down 0.45% year-over-year – the first annual decline in a decade. In Boise’s Ada County, the median fell from around $580K in mid-2022 to ~$510K by end of 2023 as the market stabilized. Inventory, which had been under 1 month of supply during the peak frenzy, crept back toward 3–4 months by late 2022.

While this cooling brought a modest measure of relief, affordability remained a serious challenge in 2023: higher interest rates meant record-high monthly payments even as prices leveled off. By mid-2023, a median-income household in Idaho could afford only about 67% of the median-priced home’s cost, according to an Atlanta Fed index (down from 100%+ affordability in 2019 when rates were low).

Who’s Buying? First-Time Buyers, Repeat Buyers, and Migrants

Demographics of Buyers

The profile of Idaho homebuyers shifted during this period. Millennials entered their prime homebuying years, yet first-time buyer participation actually fell to historic lows by 2022. Nationally, only 26% of home purchases in 2022 were by first-time buyers, the lowest share since tracking began in 1981.

Idaho likely mirrored this trend or was even more skewed toward repeat buyers – many local agents noted that cash-rich newcomers and existing homeowners with equity often outcompeted true first-timers. The median age of first-time buyers climbed into the mid/late-30s, reflecting how difficult it became for younger families to enter the market.

At the same time, Baby Boomers emerged as a dominant buying force. By 2022–2023, Boomers actually surpassed Millennials as the largest generation of homebuyers nationwide. In Idaho, boomers – often recent retirees or empty-nesters relocating from pricier states – were an influential cohort. Many paid cash or carried substantial equity, making their offers very competitive.

Boomers also made up 45% of home sellers in recent years, and those aged 69–77 were the most likely of any group to downsize when buying again. This meant a typical pattern for older Idaho homeowners was to sell a larger family home (often at a hefty profit, given price gains) and either move to a smaller home or relocate to a quieter region.

However, downsizing wasn’t always straightforward – 78% of boomers indicated they planned to “age in place” rather than move. Many found that even much smaller homes carried high price tags after the boom, so selling and buying back into the market could mean paying more for less.

Migration into Idaho

Perhaps the most defining feature of Idaho’s recent housing market was in-migration. Idaho was one of the nation’s fastest growing states (17.3% population growth 2010–2020), and from 2018 onward it saw a surge of new residents moving in, especially from the West Coast. Net in-migration accounted for over 80% of Idaho’s population growth during this period.

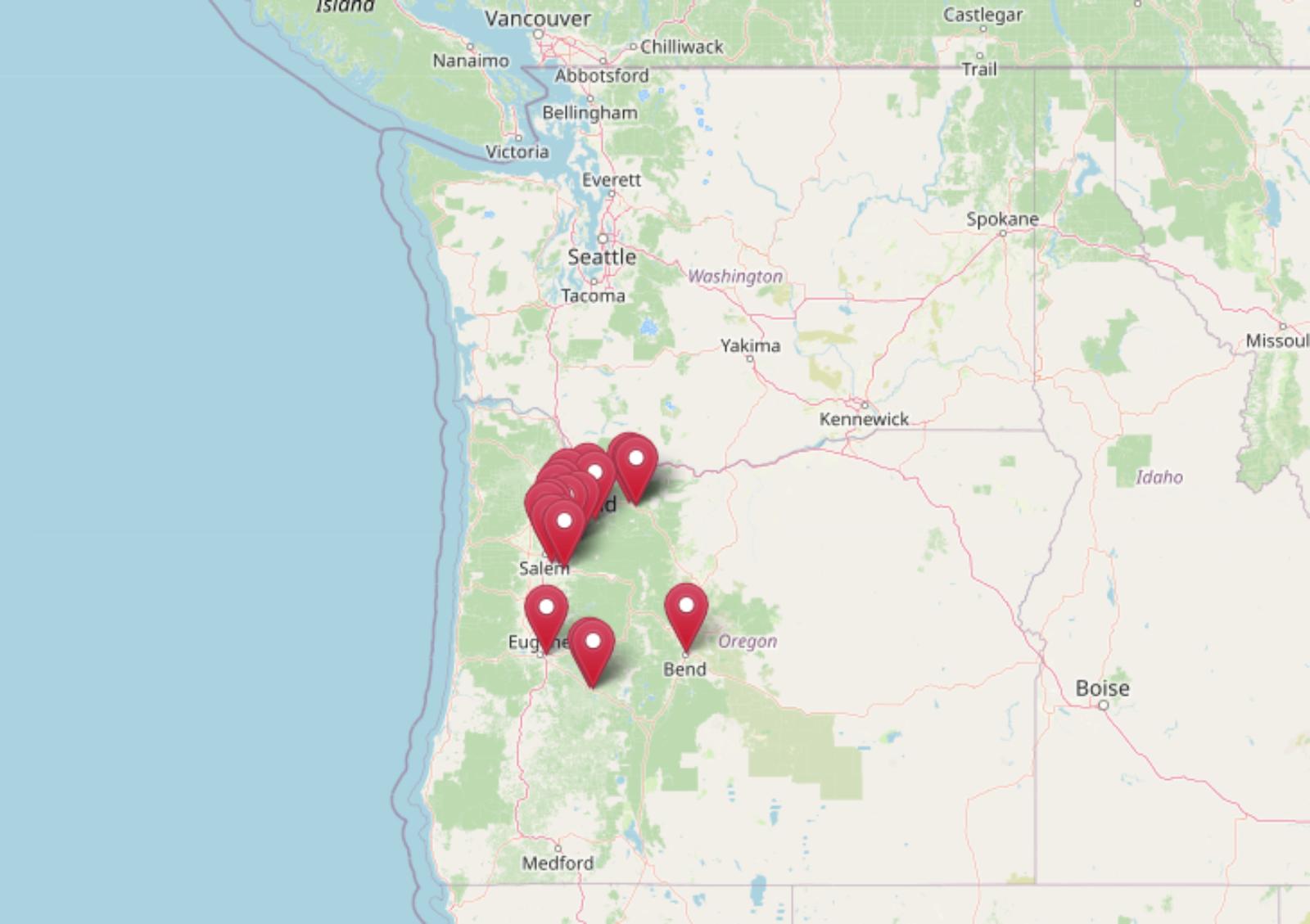

The Boise metro and Coeur d’Alene in North Idaho were prime magnets. In 2020–2021, the COVID-19 pandemic’s remote work revolution enabled many Californians, Oregonians, and Washingtonians to relocate to Idaho in search of more space and relative affordability.

By mid-2021, 72.9% of people searching for Boise homes on Redfin were from outside the area – an enormous inflow. The top origin markets were Los Angeles (nearly 20% of searches), Seattle (~14%), and the San Francisco Bay Area (~13%).

This wave of transplants often had home-buying budgets well above what local Boise-area residents earned, after cashing out of expensive coastal markets. Their demand pushed prices up rapidly.

Other regions saw similar influxes. North Idaho became a popular escape for folks from Washington and California; Kootenai County experienced a housing boom with many out-of-state license plates at open houses. Even smaller cities like Idaho Falls and Twin Falls saw increased interest due to companies relocating and remote workers dispersing.

Where Local Buyers Went

Within Idaho, many moderate-income buyers adjusted their target locations to find affordable homes. For example, in the Treasure Valley (Boise metro), households under $250K income increasingly bought in Canyon County (Nampa/Caldwell) rather than Ada County (Boise/Meridian), because of the price gap.

In early 2025, Ada County’s median price was about $539,000, whereas neighboring Canyon County was around $416,000 – over $120K cheaper on average. This pattern emerged during the boom: as Boise prices shot up, more first-time buyers looked to Nampa, Caldwell, Kuna, and other outlying communities where their dollars stretched further.

New construction followed suit, with many builders concentrating on these fringe areas to offer slightly more affordable new homes. Similarly, some Boise workers moved outside the metro entirely – for instance, to the Emmett area or Mountain Home – accepting longer commutes in exchange for homeownership opportunities.

Investor and Vacation-Home Buyers

Not all buyers were owner-occupants. During 2020–2021, low interest rates and surging rents attracted real estate investors to Idaho’s market, from mom-and-pop landlords to larger firms. They often targeted entry-level single-family homes (the same homes first-time buyers wanted), converting them to rentals.

One analysis noted that investors “gobbled up” starter homes, worsening the shortage for aspiring owner-occupiers. This investor activity was especially noted around Boise and Coeur d’Alene, where rent growth was high.

Meanwhile, Idaho’s scenic appeal led to a spike in vacation home purchases by high-income out-of-staters – e.g. lakefront cabins, ski condos in Sun Valley, and mountain retreats.

What Are They Buying? Property Types and Sizes

Despite the changing market, traditional single-family homes remained the most sought-after property type for Idaho buyers under $250K income. However, with inventory scarce and prices high, many buyers showed flexibility in the type of home they chose.

The Rise of Attached Housing

Attached housing gained ground, particularly in urban areas. Boise in particular saw a sharp rise in “missing middle” development (duplexes, townhouses, small multi-units) as a response to affordability constraints.

In 2023, fully 76% of new housing units added in the City of Boise were multi-family or missing-middle units, up from just 42% in 2018. Across Ada County, over 52% of permitted units in 2020–2023 were multi-family, versus ~31% in 2018–2020.

These included townhome subdivisions and small condo projects targeting first-time buyers. Many local buyers gladly bought townhouses or condo flats as starter homes when priced out of detached houses.

New Construction vs. Older Homes

Idaho’s building boom delivered many new homes during this period. Statewide, developers added thousands of units per year (though still not enough to meet demand). Ada County led in new construction, often in large subdivisions of single-family homes on small lots, as well as suburban townhome complexes.

Households under $250K income were active buyers of these new homes, often using specialized programs or builder incentives to afford them. That said, new construction prices rose dramatically – the median price of a newly built home in Boise reached the mid-$400Ks by 2021, well above the price of an older home.

Thus, some moderate-income buyers turned to older housing stock: mid-century houses or even fixer-uppers in less expensive neighborhoods. A common strategy was to buy an older home in need of some TLC because it was more affordable, then gradually renovate as finances allow.

Manufactured and Mobile Homes

Idaho has long had a significant share of manufactured housing, especially in rural counties. During 2018–2023, manufactured homes (whether in parks or on private land) remained one of the last affordable ownership options for lower-income Idahoans.

Housing advocates frequently pointed out that mobile home communities were a crucial source of housing for retirees on fixed incomes and working-class families, albeit a vulnerable one. For under $250K, one could buy a manufactured home in many parts of Idaho when stick-built homes were out of reach.

However, these buyers often face unique challenges: if the home is in a park, they rent the land (lot rent increases became an issue), and financing a manufactured home can be harder. Nonetheless, manufactured homes sales did increase as other housing slipped out of reach.

Upsizing vs. Downsizing

Buyers’ choices in home size varied by life stage. Younger families often upsized, seeking more square footage or extra rooms – especially after pandemic remote-work trends made a home office desirable. Indeed, move-up buyers were very active in 2020–21; many leveraged their equity and low rates to upsize.

On the flip side, many Boomers and empty nesters downsized (or attempted to). Older sellers who had large homes often sold to cash in on high values, then looked for a smaller single-level home or a condo. However, as noted earlier, a lot of seniors actually stayed put because downsizing didn’t always save money in such a tight market.

How They Financed Homes: Mortgages and Rates

Loan Types

The majority of Idaho homebuyers in 2018–2023 used 30-year fixed-rate mortgages, with conventional loans being the most common. However, low-down-payment programs were crucial for those without hefty savings:

FHA Loans

Insured by the Federal Housing Administration, FHA loans have looser credit requirements and as low as 3.5% down payments, making them popular with first-time buyers. In Idaho’s booming market, FHA’s role was mixed. Early on (2018–2019), FHA loans were widely used by entry-level buyers across the state.

But during the 2020–2021 frenzy, many sellers in hot markets were hesitant to accept FHA offers. As a result, some FHA-dependent buyers struggled to get offers accepted in Boise and Coeur d’Alene, losing out to cash or conventional bidders.

By 2022–2023, as the market cooled slightly, FHA usage ticked back up. Notably, FHA loan limits did become an issue: in Ada County, for example, the FHA loan limit (mid-$400Ks in 2022) lagged the soaring home prices, meaning many Boise homes were simply too expensive for FHA financing.

USDA Rural Loans

Idaho’s plentiful rural areas meant the USDA Rural Development home loan program was heavily utilized. USDA loans offer 0% down mortgages for income-qualified buyers in designated rural zones.

Much of Idaho outside the Boise and Coeur d’Alene urbanized areas is USDA-eligible, so this program was a game-changer for many small-town buyers. During 2018–2023, USDA-backed mortgages increased in popularity as buyers sought affordability in outlying regions.

VA Loans

Idaho has a significant population of veterans and active-duty military, so VA loans also played a steady role. VA loans offer zero-down financing like USDA, but for eligible veterans/servicemembers. They likely comprised around 5–10% of Idaho’s home purchase loans in this period.

Interest Rate Rollercoaster

How buyers financed also depended on the interest rate environment:

- 2018–2019: Rates were in the 4%–5% range. Buyers in these years often refinanced later when rates dropped.

- 2020–2021: The drop in rates to ~3% (even sub-3% for some in 2021) led to a refinancing boom and allowed buyers to afford more house for the same payment. Virtually everyone locked in 30-year fixed loans at record lows.

- 2022–2023: Rates spiked above 5%, then 6%, reaching around 7% in late 2022 – a 20-year high. Buyers suddenly faced monthly payments 30–40% higher for the same loan amount compared to a year prior.

To cope, lenders and builders got creative: 2-1 buydowns became a popular incentive. The higher rates forced many households to lower their price range or bring more cash. Consequently, many buyers in late 2022 either downsized expectations or paused their search.

Cash Buyers

It’s worth noting that a notable minority of buyers – often those from out of state or investors – paid cash. In 2021–22, roughly 1 in 4 homebuyers nationally paid all cash (26% in 2022, a record high).

Idaho likely saw similar or higher cash shares in hot markets. Californians selling bungalows for $1M and moving to Idaho with $500K cash, or investors snapping up homes to rent, meant cash offers were relatively common.

This put financed buyers under pressure to be pre-approved, maybe waive some contingencies, and generally strengthen their offers. Some Idaho buyers resorted to unconventional means – e.g. borrowing from family or retirement accounts – to compete with cash.

Investment and Vacation Property Purchases

While our focus is owner-occupiers, it’s important to note the significant activity in investment and vacation home purchases in Idaho from 2018 to 2023.

Investor Purchases

Idaho’s strong population growth and rising rents made it attractive to real estate investors. By 2021, at the peak, an estimated 20%+ of home sales in some Idaho markets were to investors (individual or institutional), mirroring national trends.

These investors often targeted the same price tier as first-time buyers (homes under ~$400K), reducing the supply for owner-occupants. This trend cooled somewhat by late 2022 as high interest rates made leveraged investing less attractive.

Vacation and Second Homes

Idaho’s recreational destinations experienced a vacation-home buying boom during the pandemic. Areas like McCall, Sandpoint, and Sun Valley saw surges in second-home sales.

Nationally, vacation home sales jumped 16% in 2020 and over 50% year-over-year in early 2021, and Idaho partook in that wave. By January 2022, second-home purchases nationally hit a record 22% of home sales (when including investment properties).

In leisure-rich Idaho counties like Valley (McCall) and Blaine (Sun Valley), the share was likely even higher at times. These cash-rich second-home buyers bid up prices in resort towns beyond what local incomes could afford, contributing to an affordability crunch for local workers.

The trend started waning in 2022–2023 as travel normalized and rates rose; by August 2023 the second-home share nationally fell back to ~16%. Still, relative to the pre-2018 era, Idaho has a larger stock of homes now held as vacation retreats or part-time Airbnbs.

Comparison to 2008–2017: How Have Things Changed?

The 2018–2023 housing market in Idaho was markedly different from the 2008–2017 period:

Market Cycle

The 2008–2017 period began with the housing crash. Around 2008–2011, Idaho home prices fell or stagnated, and foreclosures were common after the national mortgage crisis. From about 2012–2017, prices recovered steadily at ~5–8% annual growth – a healthy pace, but nothing like the exponential gains of 2018–2021.

In contrast, 2018–2023 saw an unprecedented price boom followed by a modest correction. A buyer in 2012 could reasonably expect to pay similar or less than a buyer in 2007; a buyer in 2023 paid dramatically more than a buyer in 2018.

Inventory and Construction

Post-2008, Idaho had a glut of housing for a few years. Homebuilders went bankrupt or drastically slowed building. Thus around 2012–2015, inventory was relatively ample and buyers had the upper hand in many Idaho markets.

Fast-forward to 2018–2021: inventory hit record lows. Boise frequently had <1 month of supply at the peak, versus 6+ months being normal back in 2010. Builders in the 2018–2023 period ramped up construction to meet demand, but faced headwinds like labor shortages, higher material costs, and regulatory limits.

Buyer Composition

The prior decade (2008–2017) saw fewer out-of-state migrants and a more local buyer pool. The average buyer in 2010 was likely an Idaho resident and possibly a first-time buyer taking advantage of post-crash low prices.

By contrast, the average buyer in 2021 might have been a Californian selling a property there to buy in Idaho, or a local move-up buyer with significant equity. The fact that Boomers now outnumber Millennials among buyers is a shift; back in 2015, Millennials were ascendant.

Financing Environment

In 2008, mortgage credit crunched – exotic loans vanished, and lenders tightened standards drastically after the subprime crisis. By 2016, lending standards eased a bit, but interest rates were in the 3.5–4.5% range for much of 2012–2017.

But 2018–2023 had a whiplash in rates – starting around 4–5%, down to ~3%, then up to ~7%. This volatility was unlike the relatively stable low-rate environment of the mid-2010s.

Homebuyer Behavior

In 2008–2012, buyers were skittish due to falling prices – the mindset was cautious. Compare that to 2020–2021: buyers were frantic, fearing missing out as prices rose monthly. The FOMO mentality drove many to bid tens of thousands over asking, waive inspections, etc., behaviors rarely seen in the earlier era.

Additionally, remote work changed preferences: post-2020 many buyers prioritized home offices and suburban/rural locales, whereas pre-2017 that wasn’t a factor.

Conclusion

From 2018 through 2023, Idaho’s housing market underwent a dramatic upswing that tested the perseverance and ingenuity of homebuyers earning under $250,000. Many adapted by broadening their search to more rural areas, considering townhouses or manufactured homes, and utilizing every financing tool available to achieve homeownership.

The frenzy of 2020–2021 highlighted how demand can overwhelm supply, as Idaho became a magnet for remote workers and retirees, driving affordability to record lows. By 2023, rising interest rates had cooled the market’s temperature slightly, yet the fundamental challenge remained: housing costs have far outpaced incomes, especially in urban centers.

Looking ahead from 2024 onward, Idaho faces the task of improving housing affordability and availability so that its teachers, nurses, technicians – the backbone of communities – can buy homes without stretching to a breaking point. With prudent measures, the state can hope to balance growth with affordability, so that households across income levels can continue to put down roots in the Gem State.

References

- Cities With the Largest Increase in Home Prices Over the Last Decade (2024) – Construction Coverage

- Since pandemic, Montana, Idaho have surpassed California as most unaffordable states for homebuyers – Idaho Capital Sun

- It’s Official – Boise City Is the Worst Kept Secret in Housing – Homeownership Hub (Fairway)

- Average House Price by State in 2024 – The Motley Fool

- Kootenai County median home prices edge up – Coeur d’Alene Press

- Idaho Statewide Housing Analysis – Idaho Policy Institute (Boise State University)

- Median household income – U.S. Census Bureau QuickFacts: Idaho

- The least affordable housing market in the U.S.? Boise – CBS News

- As residents struggle with rising rent, North Idaho manufactured home park is no exception – Idaho Capital Sun

- Mortgage Rate History: 1970s To 2025 – Bankrate

- Boise Real Estate Market – Housing Market & Home Values – We Know Boise

- Idaho REALTORS® 2022 Market Summary – Idaho REALTORS®

- NAR Finds Share of First-Time Home Buyers Smaller, Older – GlobeNewswire

- Home Buyers and Sellers Generational Trends – National Association of REALTORS®

- Idaho’s Baby Boomer Real Estate Trends in the Last 5 Years – Home Stratosphere

- Comprehensive Housing Market Analysis for Boise City, Idaho – HUD

- Baby Boomers Overtake Millennials as Largest Generation of Home Buyers – National Association of REALTORS®

- NAR Generational Trends Report: Millennials fall back while Gen Z rises – Chicago Agent Magazine

- The average age of first-time U.S. homebuyers is 38, an all-time high – CNBC

- First-Time Home Buyers Shrink to Historic Low of 24% as Buyer Age Hits Record High – National Association of REALTORS®

- Vacation Home Sales Surges During Pandemic – National Association of REALTORS®

- Vacation, Resort, and Second Homes – National Association of REALTORS®

- US second home sales slide in pandemic-era vacation hot spots – Reuters

- Mortgage Insurance Data At A Glance – Urban Institute