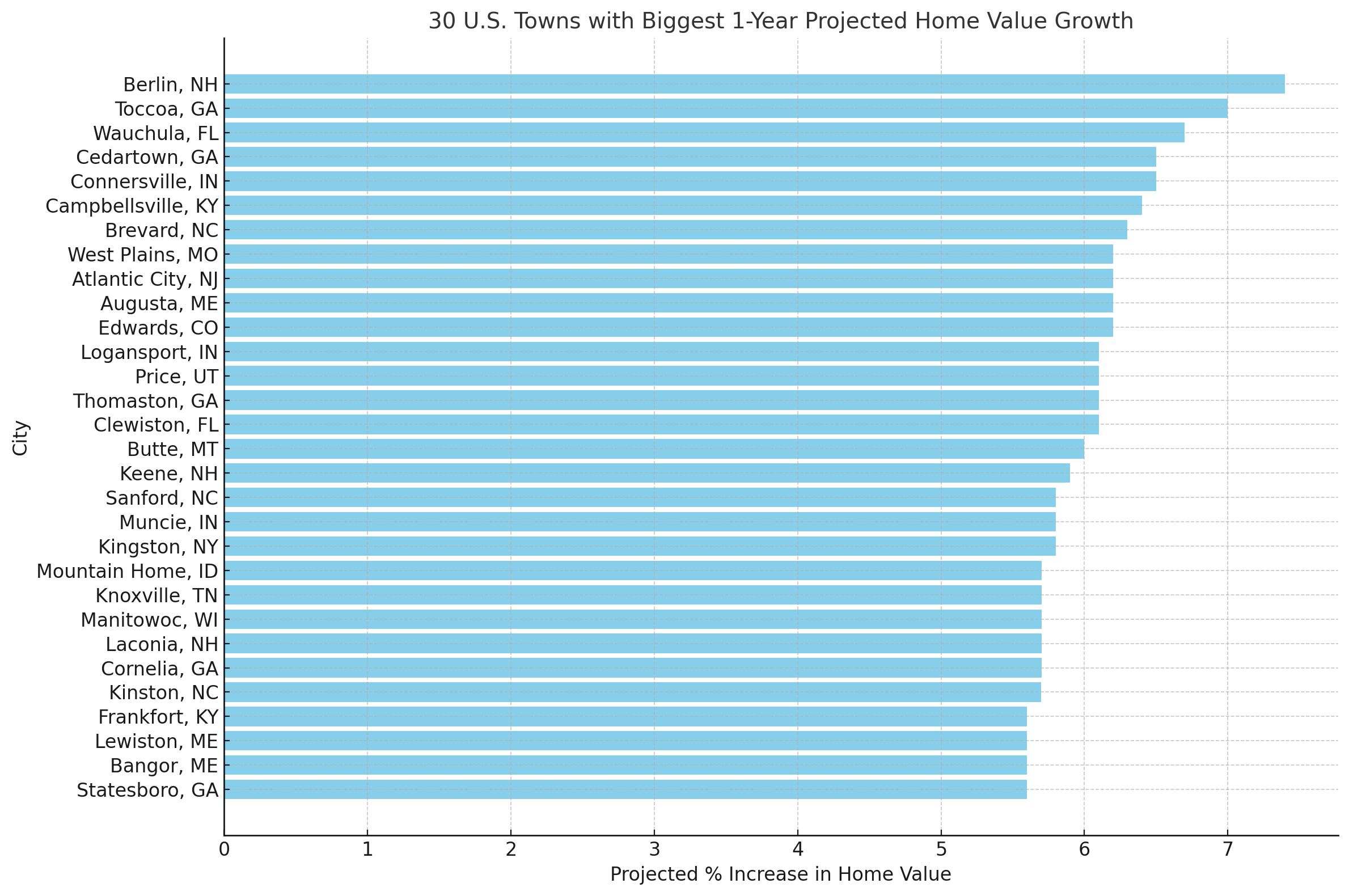

According to the Zillow Home Value Index data and projections as of November 2024, the top 30 U.S. cities for projected home value growth show a median expected appreciation rate of 6.0% through November 2025. Georgia’s dominance with five cities in the list, all projecting growth above 5.7%, highlights strong regional economic momentum in the Southeast, while the presence of Edwards, CO ($1.7M), Kingston, NY ($443,813), and Brevard, NC ($440,084) demonstrates that robust growth projections aren’t limited to affordable markets. The data reveals particular strength in higher education markets, with at least seven college towns making the list, suggesting the stability these institutional anchors provide to local housing markets.

The geographic patterns prove particularly telling, with New Hampshire placing all three of its entries (Berlin, Keene, and Laconia) among the top 20 for projected growth, while Maine’s three cities show identical 5.6% projections, indicating coordinated regional market dynamics. Mountain states show surprisingly limited representation, with only Edwards, CO, Mountain Home, ID, Butte, MT, and Price, UT making the list. The median home value among these 30 cities sits at $271,242 (matching Augusta, ME’s current value), indicating a bias toward affordable markets in growth projections, even as some premium locations show strong appreciation potential.

Overview chart: projected percentage growth for the top 30 U.S. towns

The relationship between current values and growth rates emerges as a key theme, with four of the top five growth rates belonging to cities with current values under $220,000, suggesting stronger percentage growth potential in more affordable markets. Yet the diversity of high-performing markets tells a broader story, from historic small towns experiencing revitalization to state capitals poised for growth. Notably, outdoor recreation amenities and quality of life appear as common threads among the highest-value markets, with Edwards, Kingston, and Brevard all benefiting from these attributes, suggesting that lifestyle factors increasingly drive market performance across price points.

Please note that these are merely projections and not set in stone.

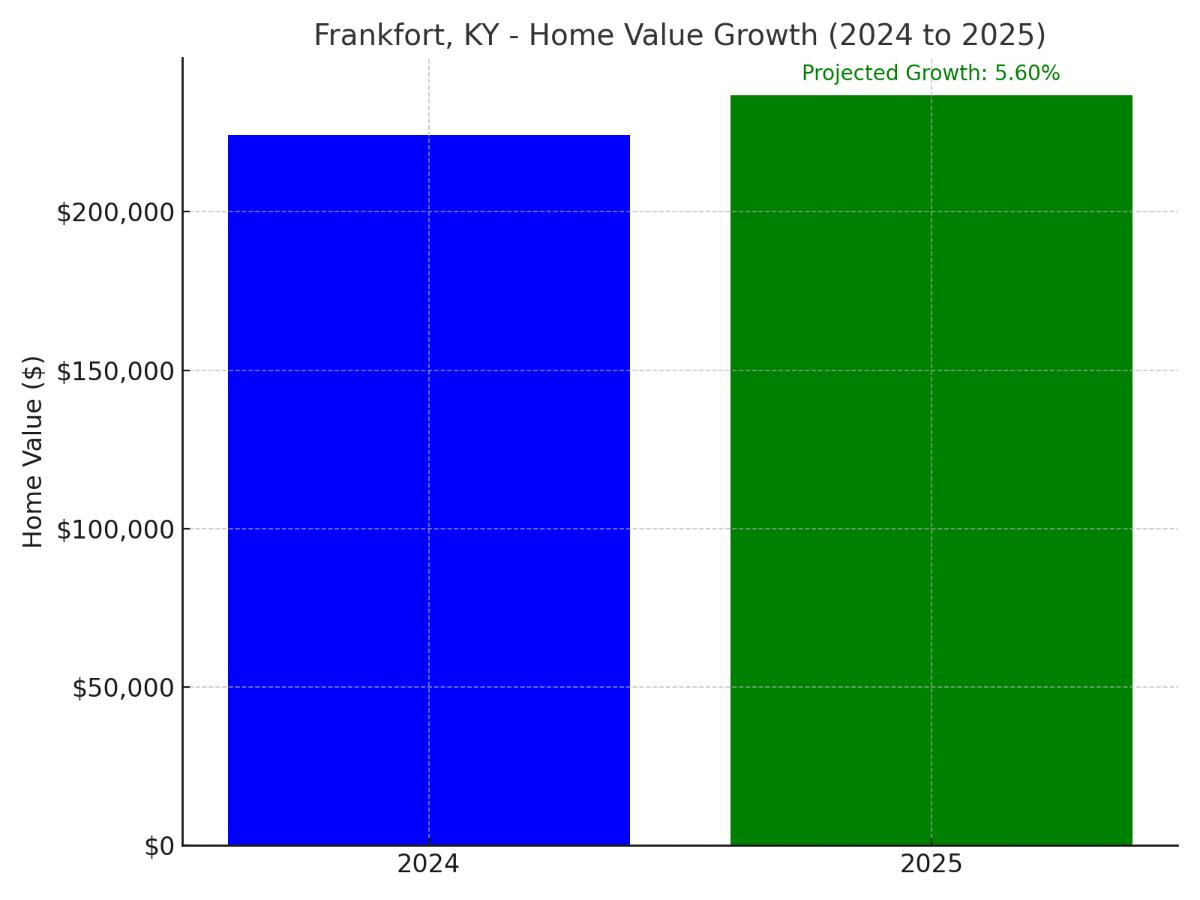

#30. Frankfort, KY (5.6% Growth)

Kentucky’s historic capital city, situated along the Kentucky River between Louisville and Lexington, currently shows a home value of $224,309. With a projected 5.6% increase, values are expected to reach $236,871 by November 2025. The city’s government-centered economy and growing bourbon tourism industry contribute to its stable growth outlook.

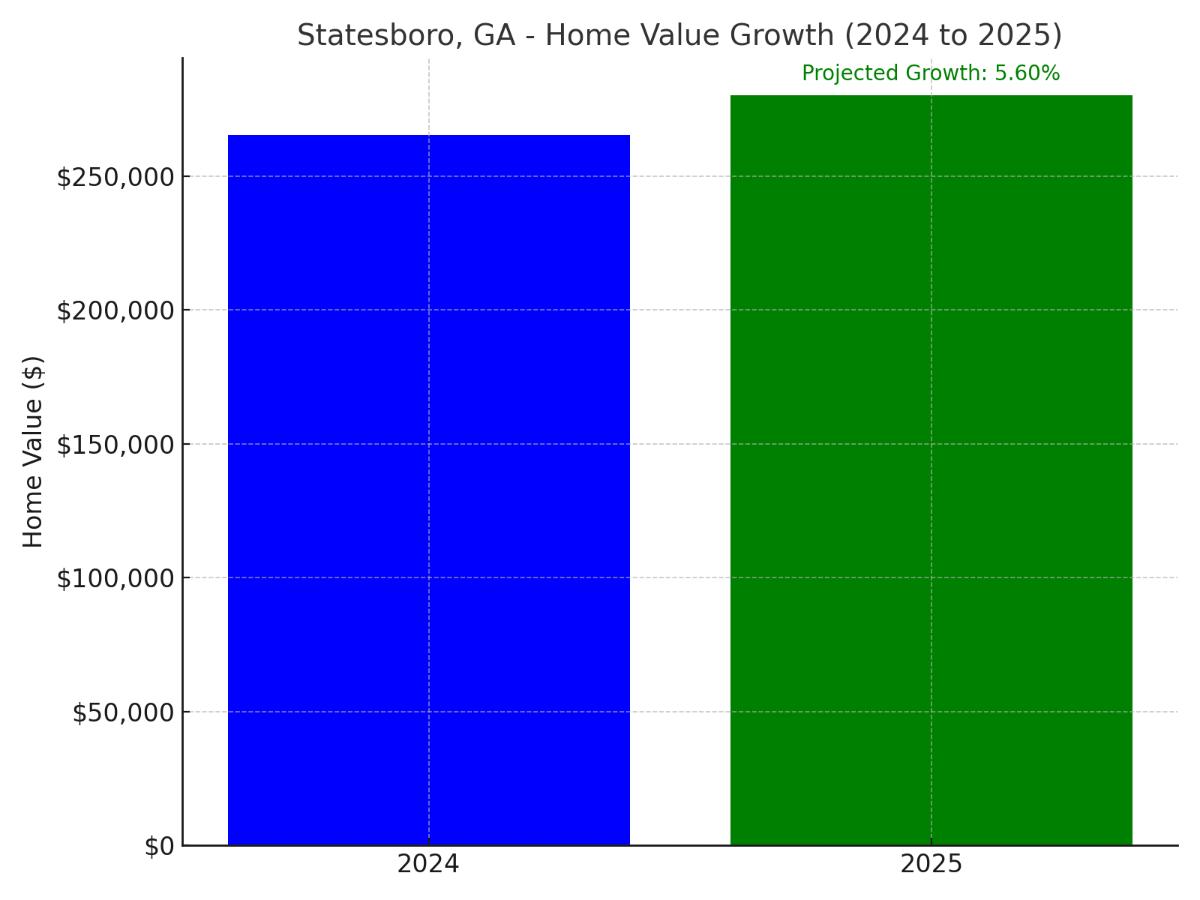

#29. Statesboro, GA (5.6% Growth)

Home to Georgia Southern University and located about 55 miles northwest of Savannah, Statesboro’s current home value of $265,386 is projected to reach $280,247 by late 2025. The university’s presence and growing regional business hub status drive its real estate market.

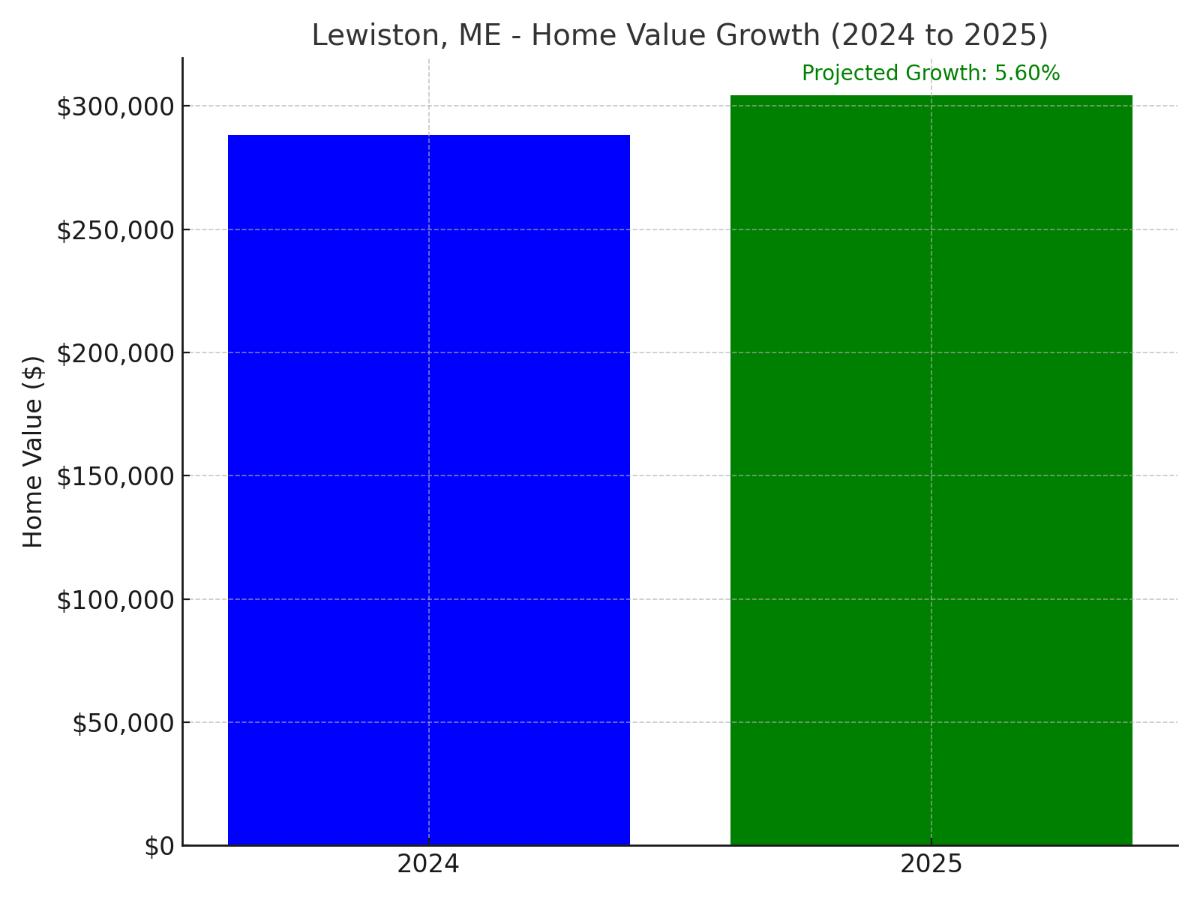

#28. Lewiston, ME (5.6% Growth)

Maine’s second-largest city, situated along the Androscoggin River, shows current values of $288,254. With the projected growth, home values should reach $304,396 by November 2025. The city’s ongoing downtown revitalization and proximity to Portland support its growth trajectory.

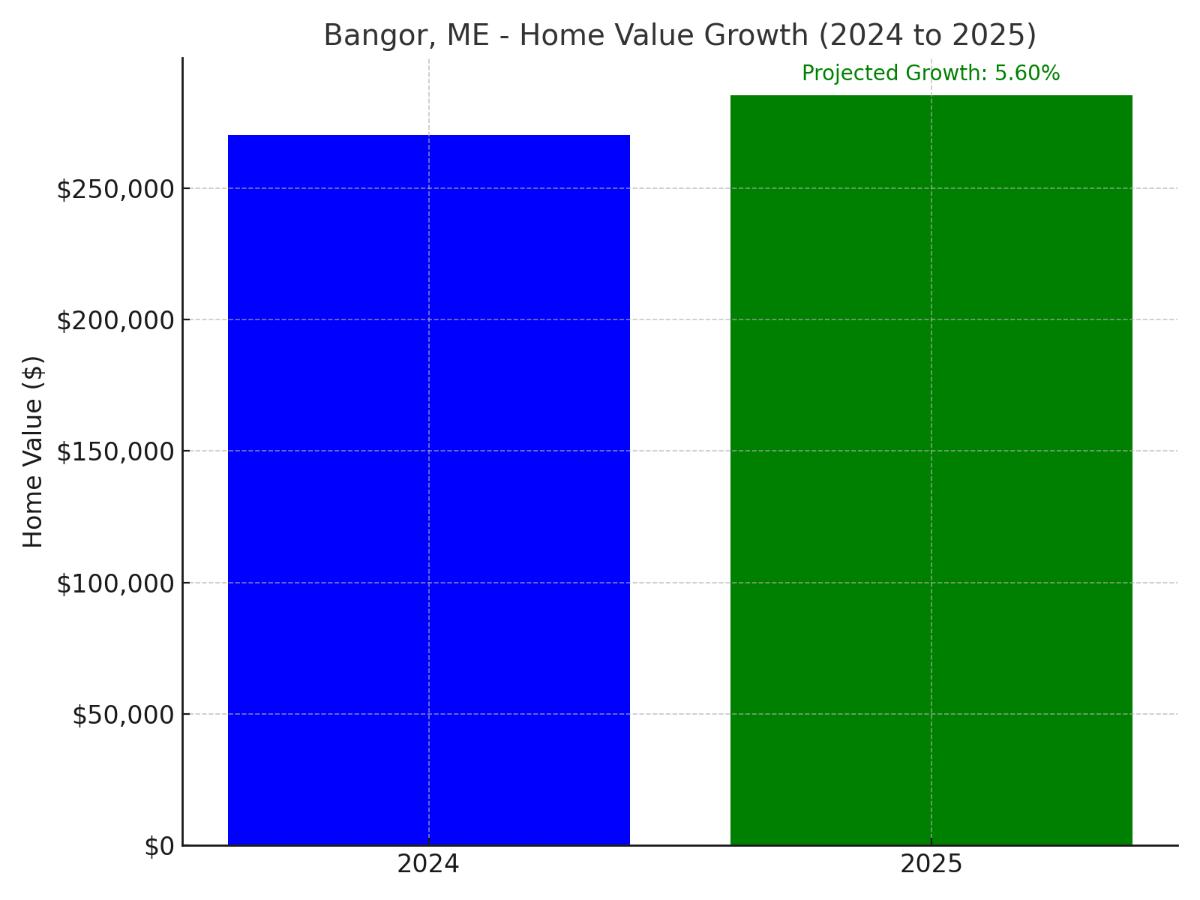

#27. Bangor, ME (5.6% Growth)

This historic lumber city and cultural hub of northern Maine currently posts home values of $270,310. The projected 5.6% increase would bring values to $285,447 by late 2025. Its role as a regional medical and educational center underpins steady growth.

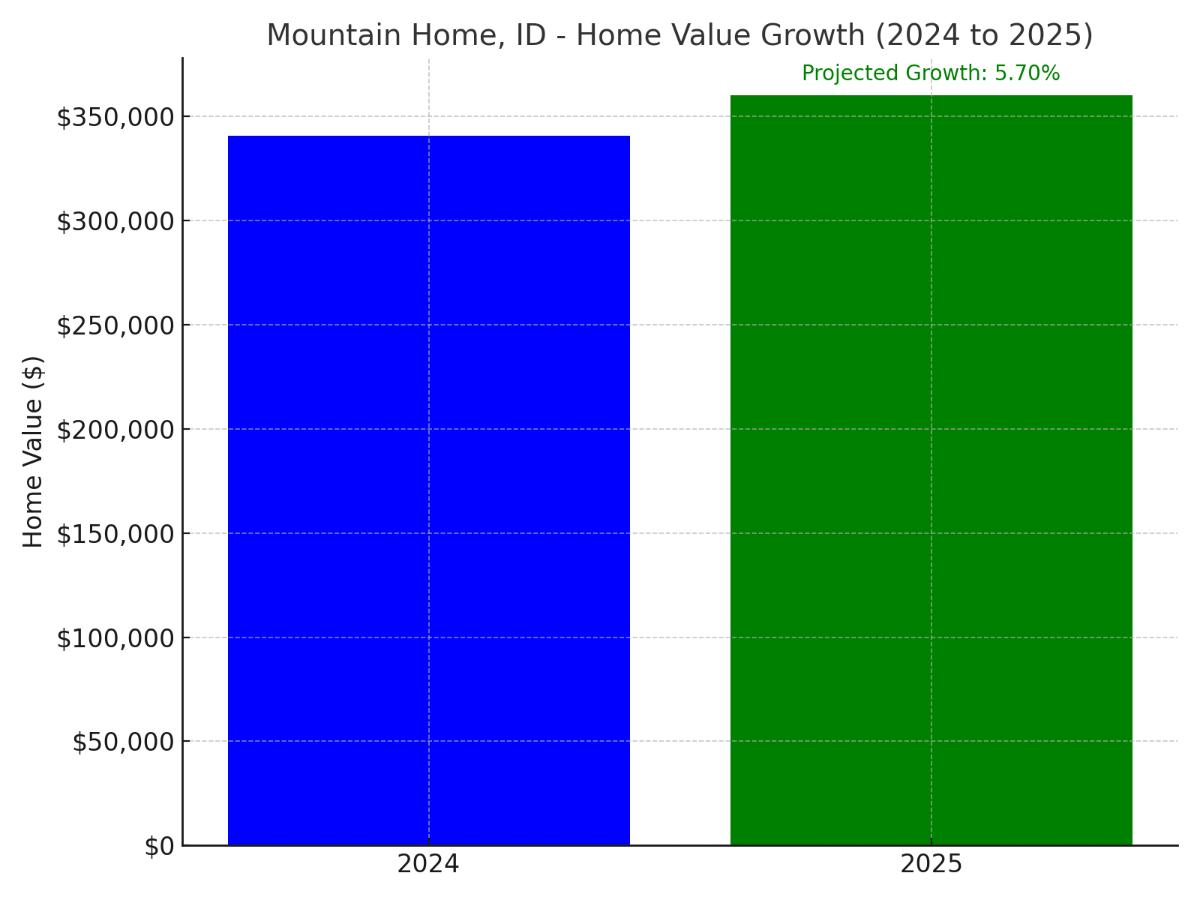

#26. Mountain Home, ID (5.7% Growth)

Located in southwestern Idaho between Boise and Sun Valley, Mountain Home’s current value of $340,794 is expected to reach $360,220 by November 2025. The nearby Air Force base and growing appeal as a mountain gateway city support its market.

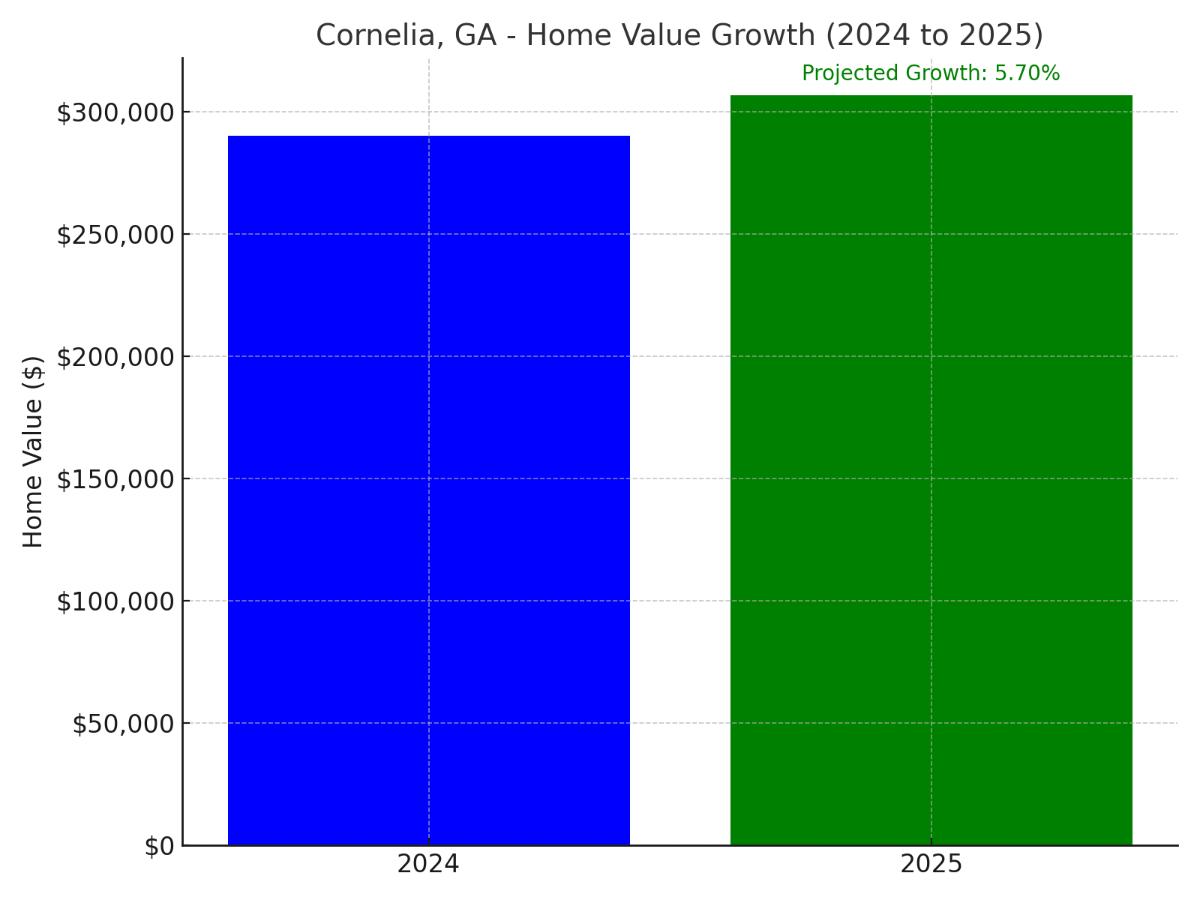

#25. Cornelia, GA (5.7% Growth)

Nestled in the foothills of the Blue Ridge Mountains, this northeast Georgia town shows current values of $290,409, projected to reach $306,962 by late 2025. Its scenic location and proximity to Atlanta drive steady appreciation.

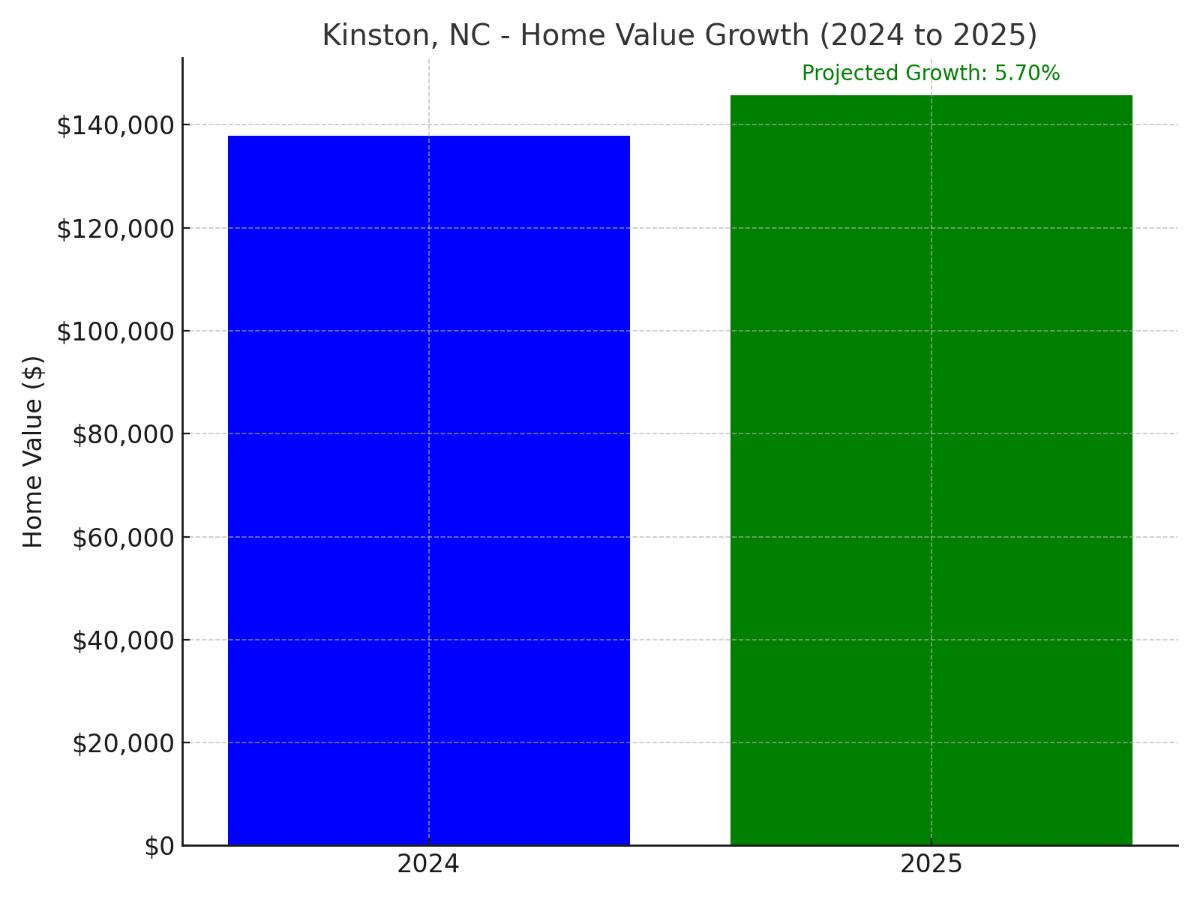

#24. Kinston, NC (5.7% Growth)

Located in eastern North Carolina’s coastal plain, Kinston’s current home value of $137,935 is expected to grow to $145,797. The city’s emerging culinary scene and arts district contribute to its revitalization and growth prospects.

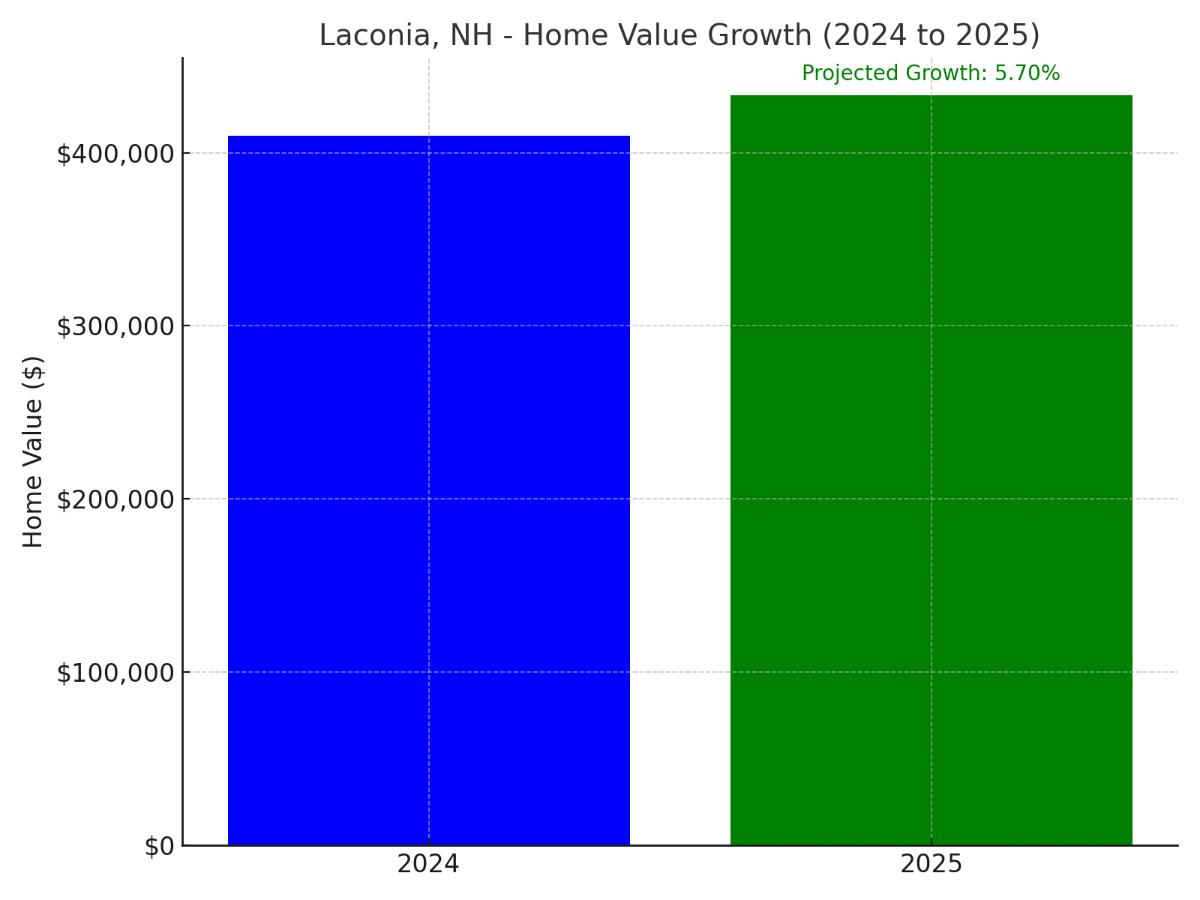

#23. Laconia, NH (5.7% Growth)

Situated in New Hampshire’s Lakes Region, Laconia shows strong current values of $409,901, projected to reach $433,265 by late 2025. Its position as a four-season recreation destination supports premium valuations.

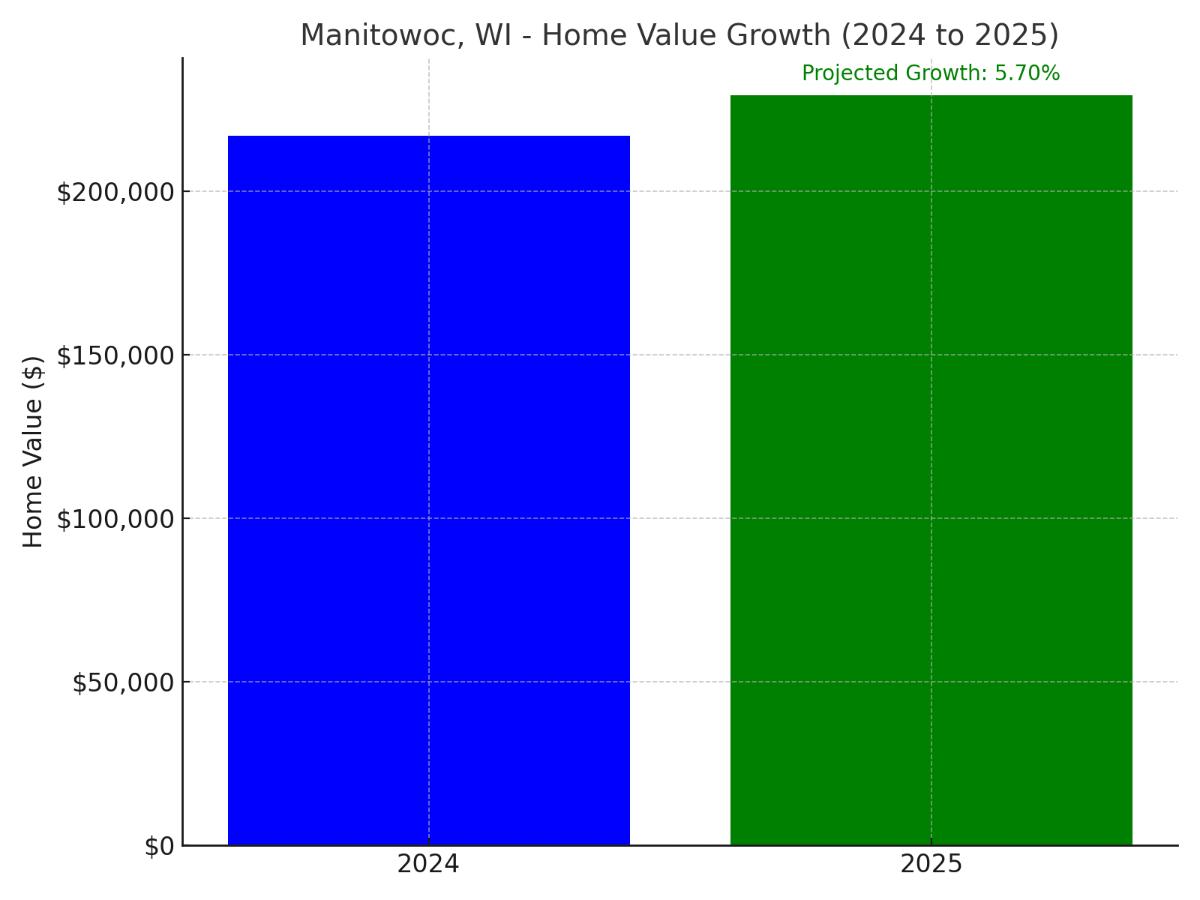

#22. Manitowoc, WI (5.7% Growth)

This Lake Michigan port city currently shows home values of $216,933, expected to reach $229,298 by November 2025. Its maritime heritage and growing manufacturing base contribute to steady growth.

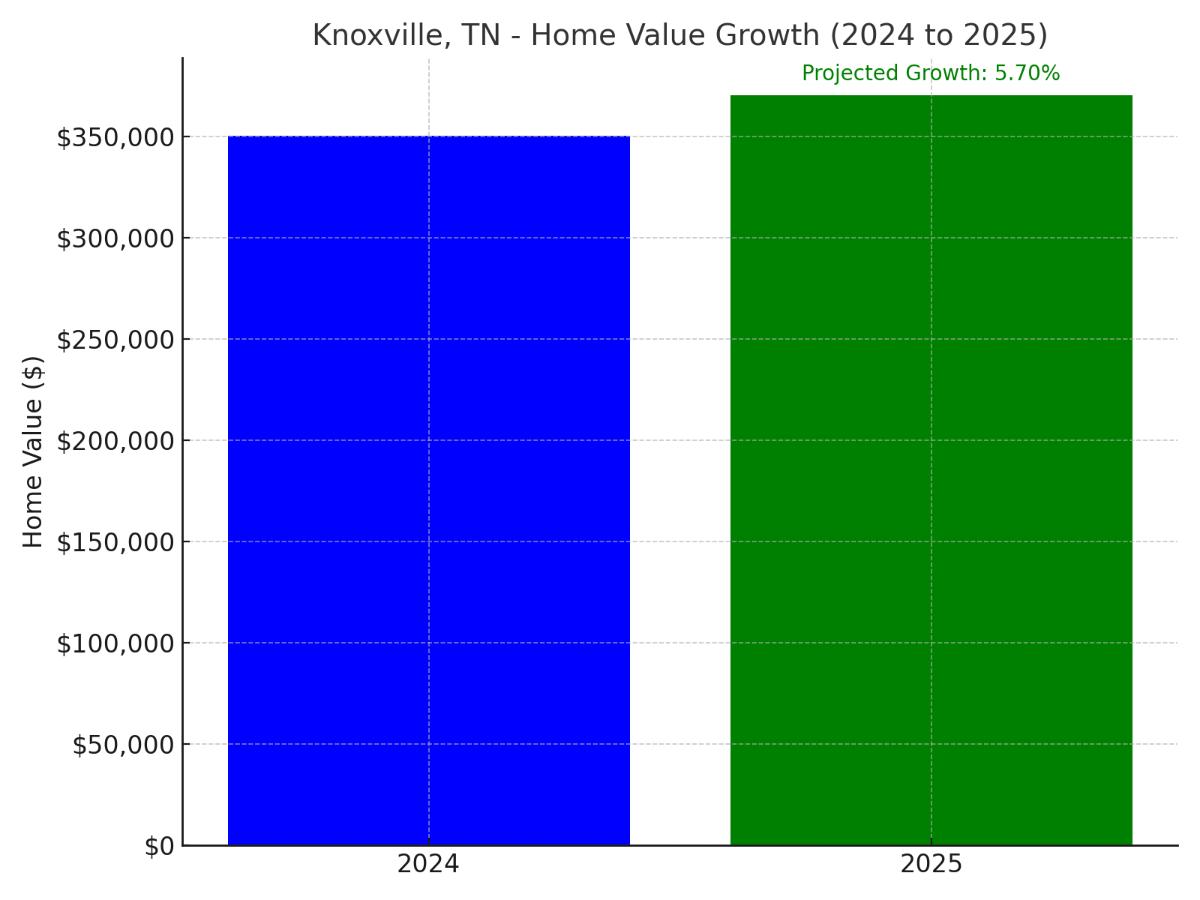

#21. Knoxville, TN (5.7% Growth)

Home to the University of Tennessee and gateway to the Great Smoky Mountains, Knoxville’s current value of $350,614 is projected to reach $370,599. The city’s diverse economy and quality of life drive consistent appreciation.

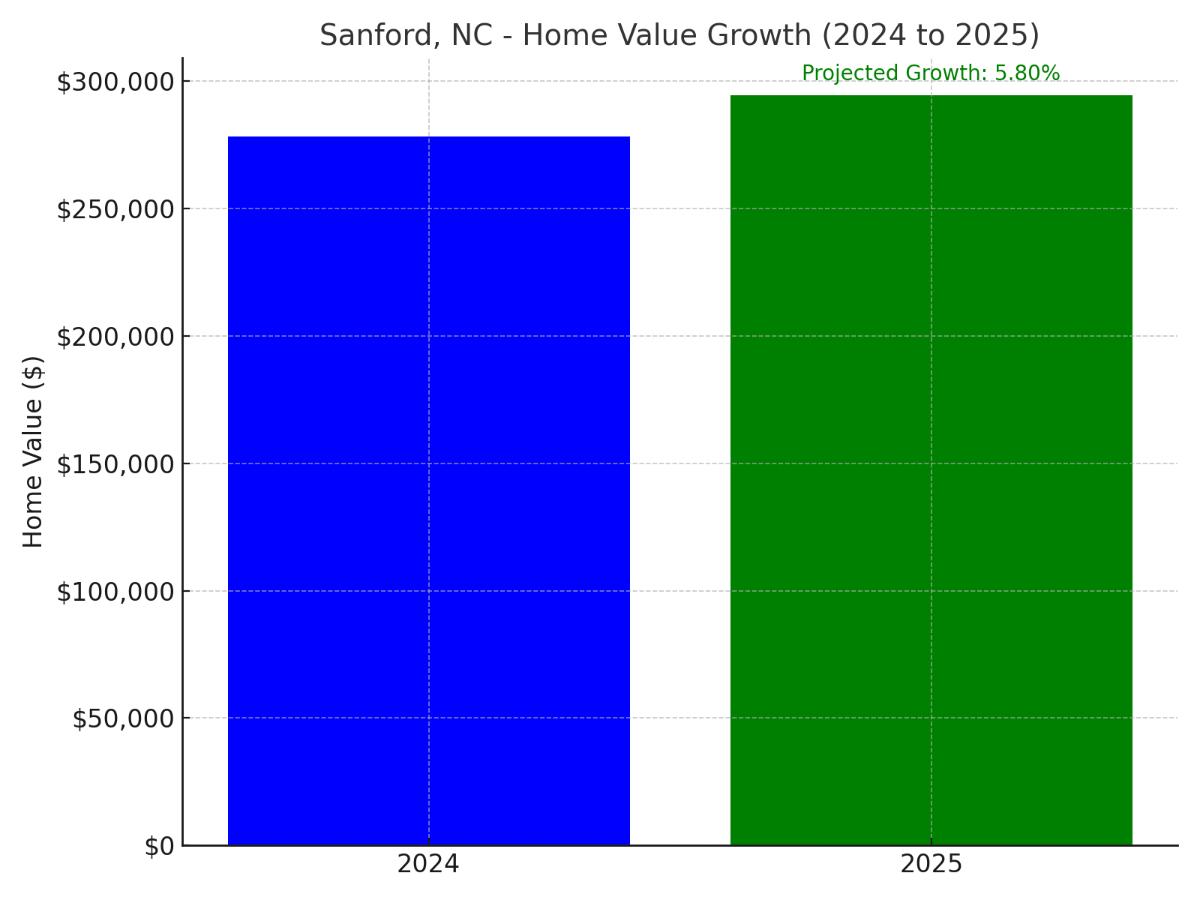

#20. Sanford, NC (5.8% Growth)

Located in North Carolina’s growing research triangle region, Sanford shows current values of $278,368, expected to reach $294,514 by late 2025. Its strategic location between Raleigh and Charlotte supports steady growth.

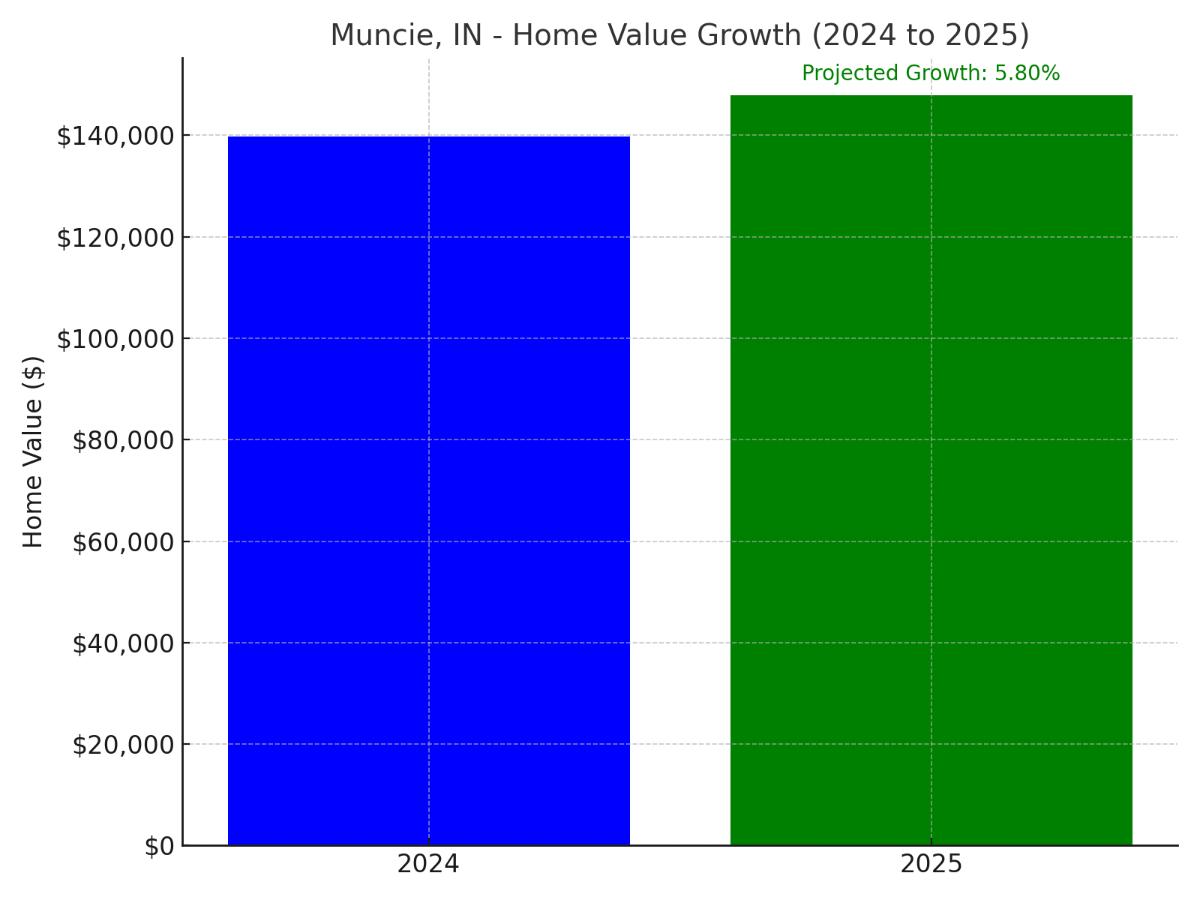

#19. Muncie, IN (5.8% Growth)

This college town, home to Ball State University, currently posts values of $139,845, projected to reach $147,956. The university’s influence and affordable market entry points drive growth potential.

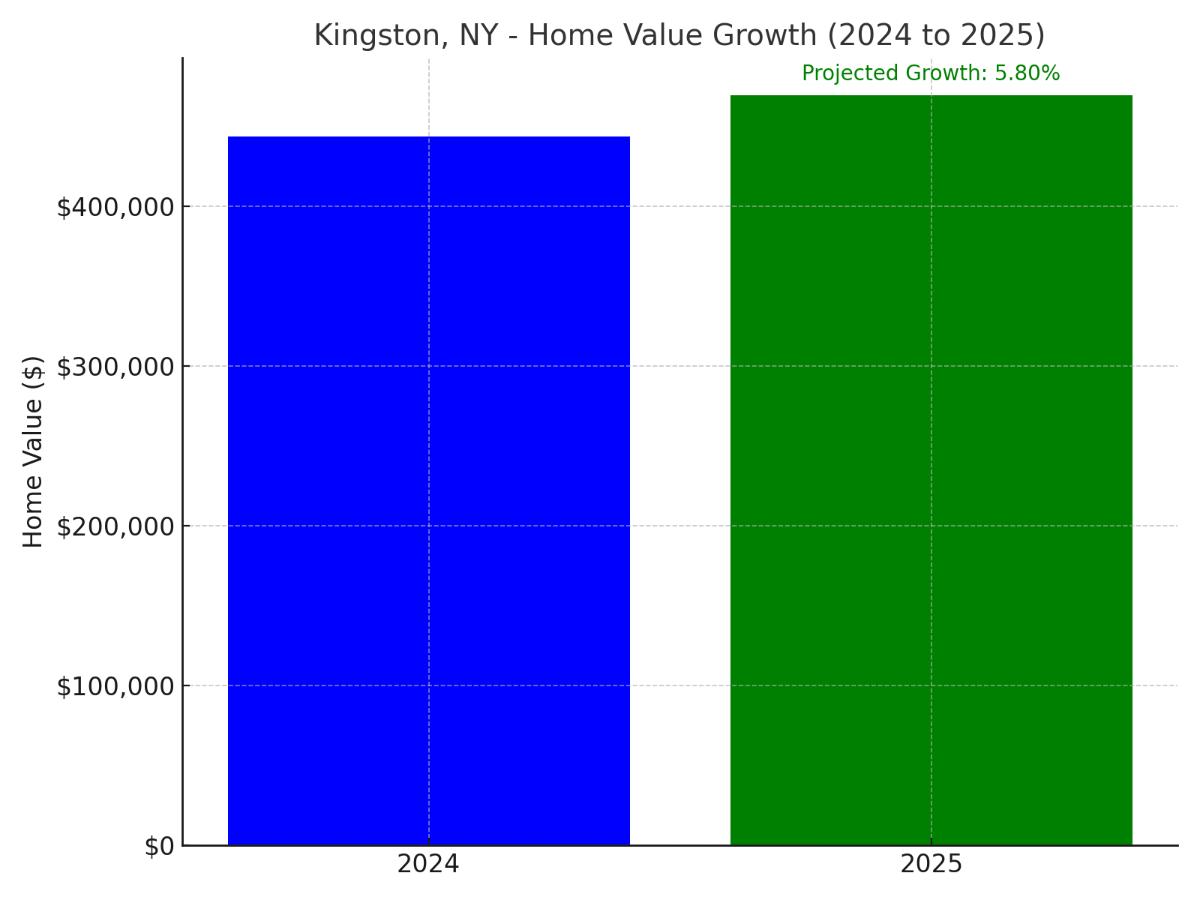

#18. Kingston, NY (5.8% Growth)

Situated in New York’s Hudson Valley, Kingston shows strong current values of $443,813, expected to reach $469,554. Its growing appeal to New York City transplants and historic character drive premium valuations.

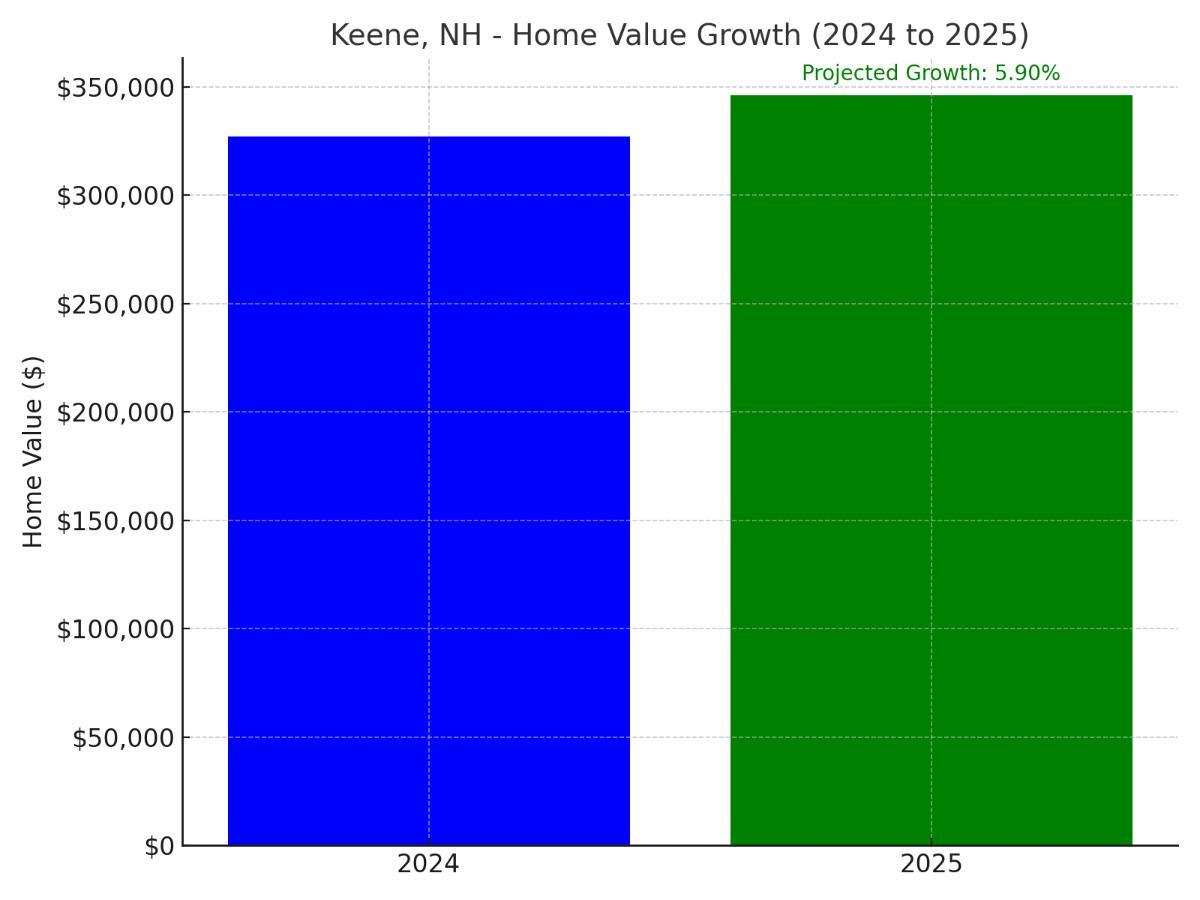

#17. Keene, NH (5.9% Growth)

Located in southwestern New Hampshire’s Monadnock Region, Keene’s current value of $326,974 is projected to reach $346,265. Its college-town atmosphere and strong regional economy support steady appreciation.

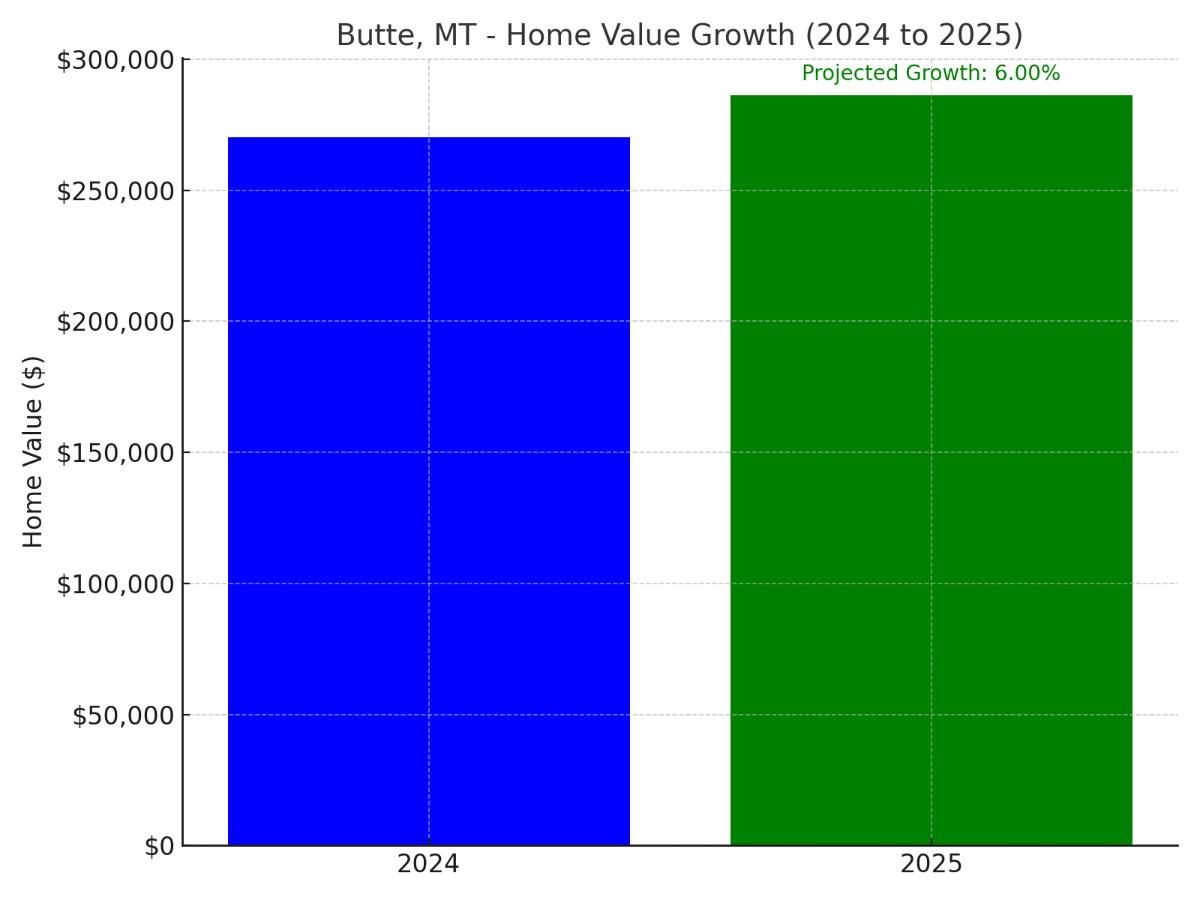

#16. Butte, MT (6.0% Growth)

This historic mining city in western Montana shows current values of $270,140, expected to reach $286,348. Its rich history and growing outdoor recreation economy drive market growth.

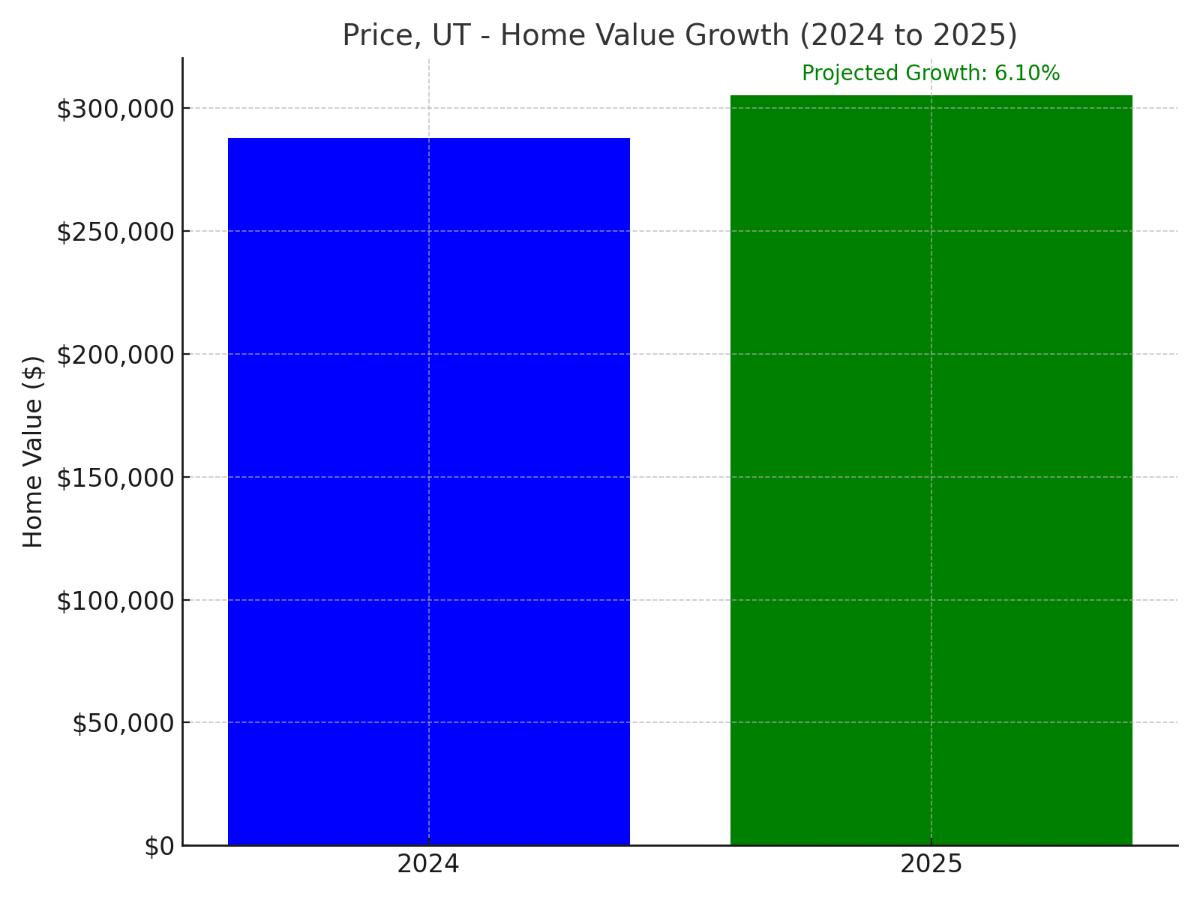

#15. Price, UT (6.1% Growth)

Located in central Utah’s energy corridor, Price currently shows values of $287,802, projected to reach $305,358. Its role as a regional hub and proximity to outdoor recreation support steady growth.

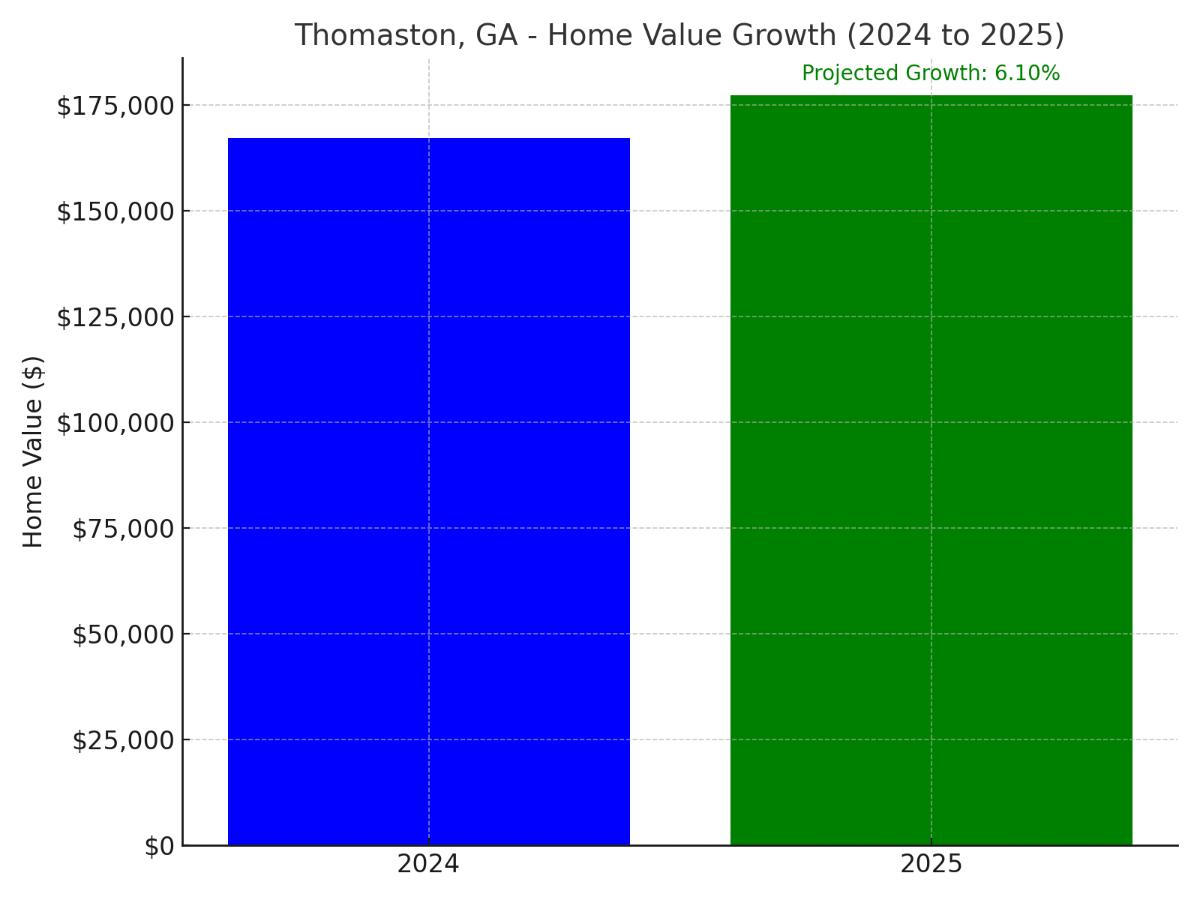

#14. Thomaston, GA (6.1% Growth)

This historic mill town south of Atlanta shows current values of $167,150, expected to reach $177,346. Its small-town character and proximity to major markets drive appreciation.

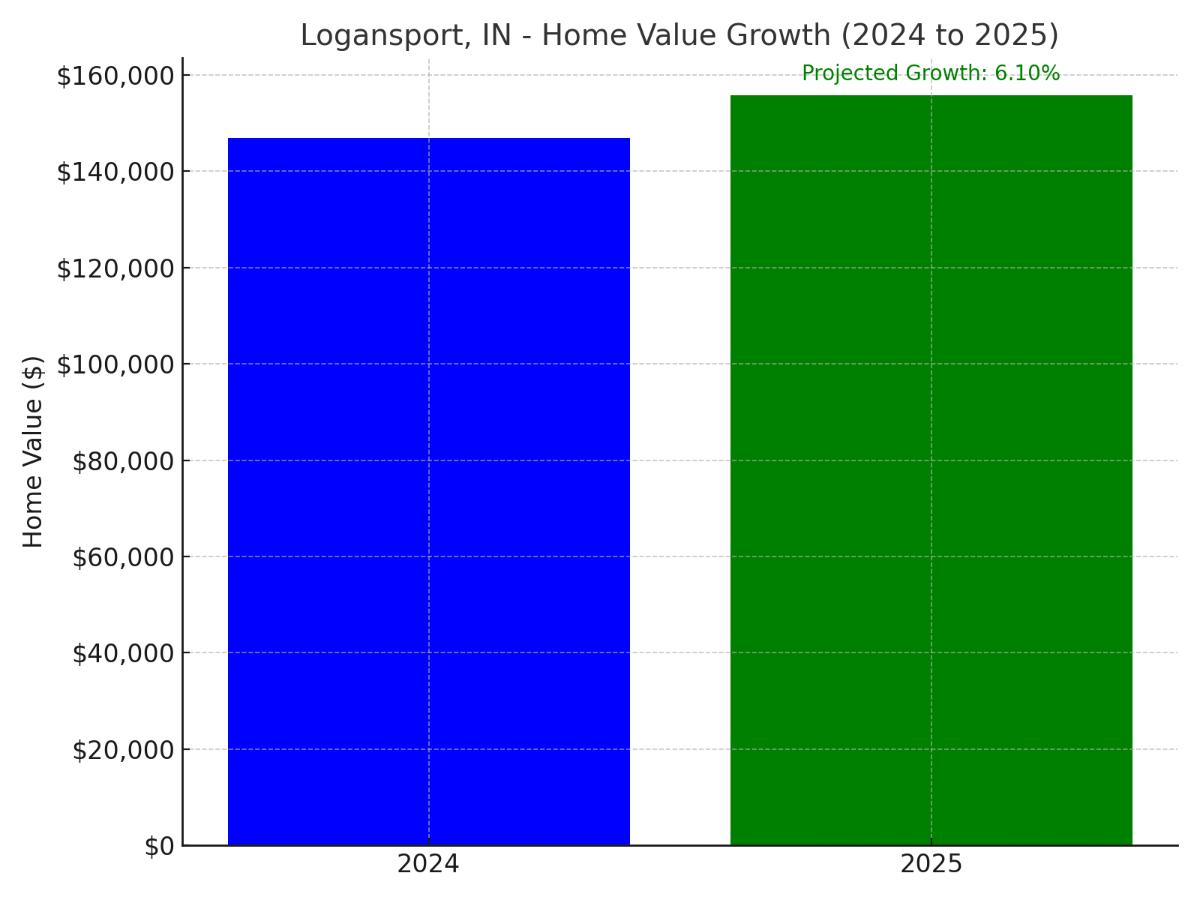

#13. Logansport, IN (6.1% Growth)

Situated at the junction of the Wabash and Eel rivers, Logansport’s current value of $146,881 is projected to reach $155,841. Its historic character and manufacturing base support steady growth.

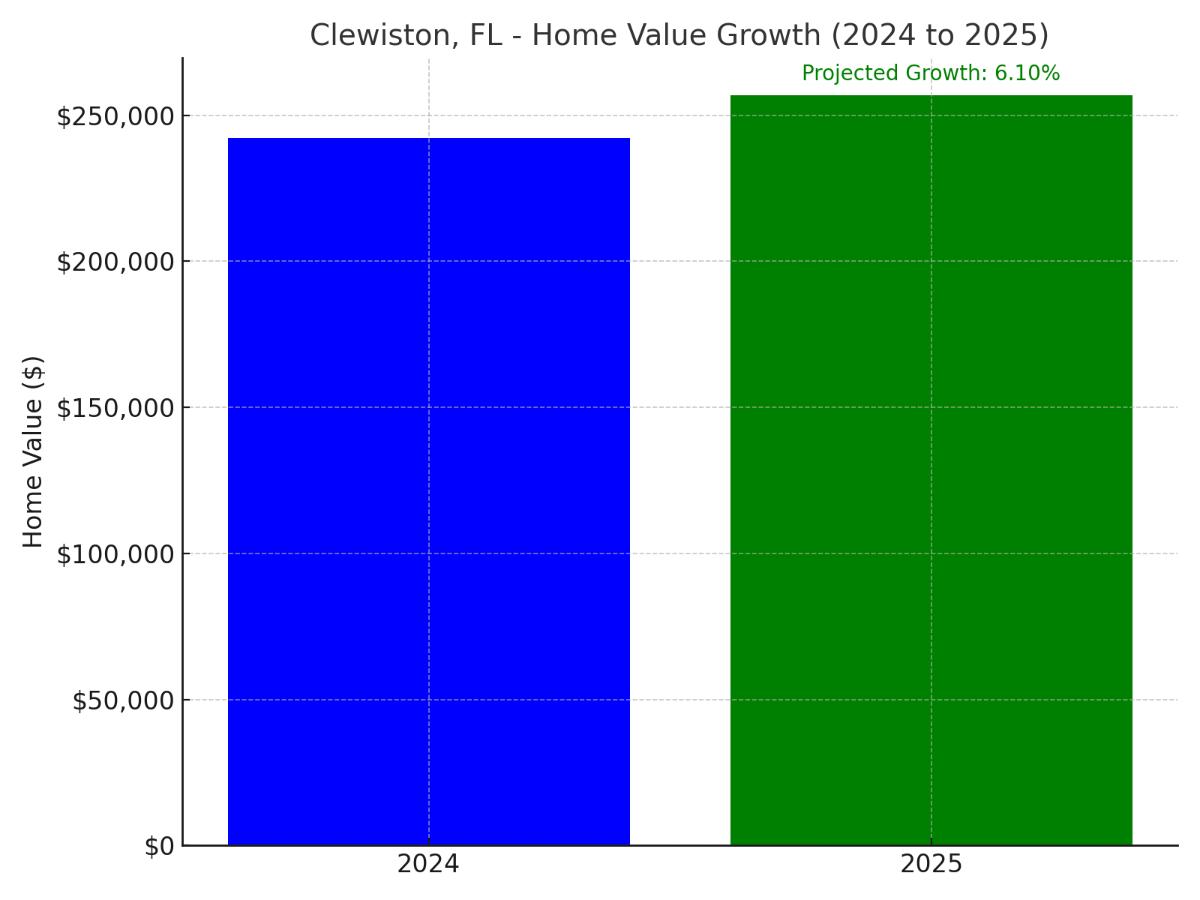

#12. Clewiston, FL (6.1% Growth)

Known as “America’s Sweetest Town,” this Lake Okeechobee community shows current values of $242,159, expected to reach $256,930. Its agricultural base and lakefront location drive market stability.

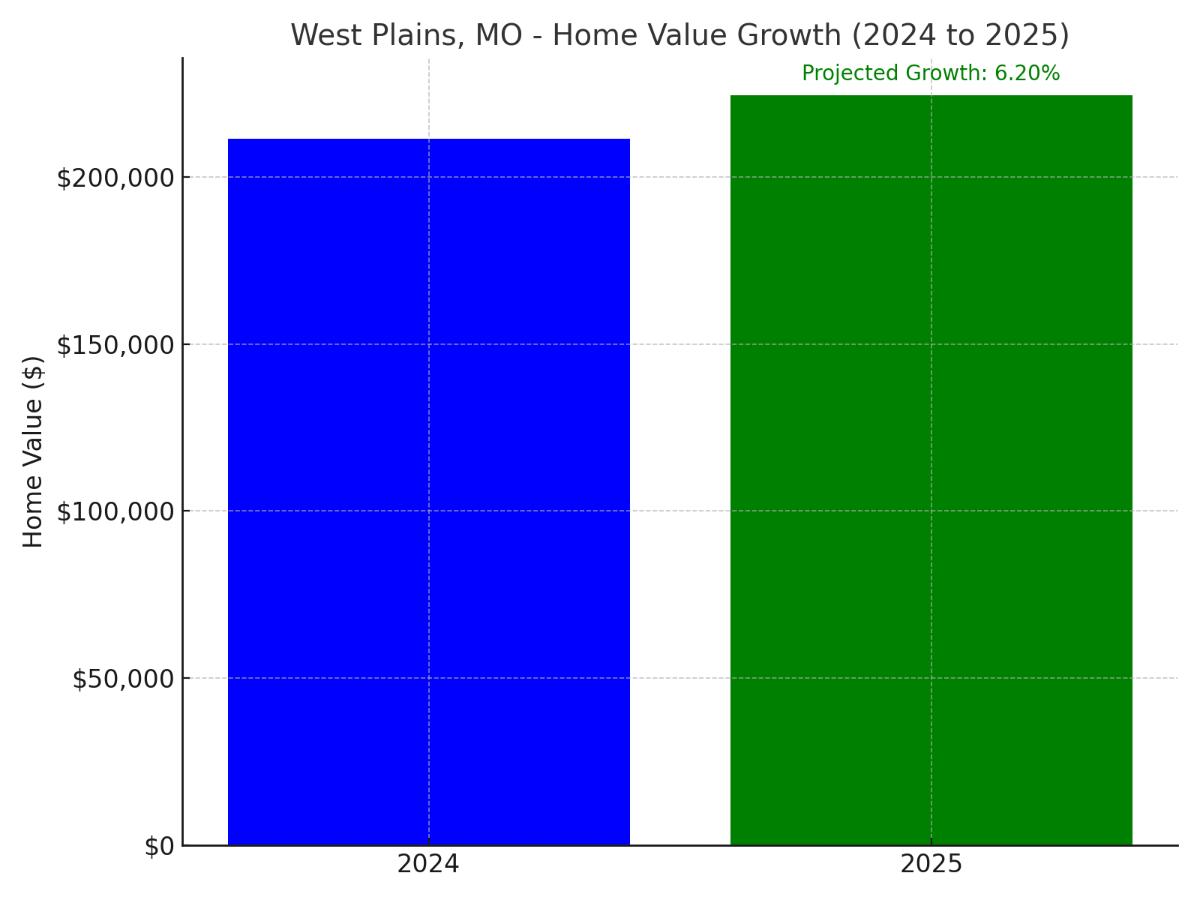

#11. West Plains, MO (6.2% Growth)

Located in south-central Missouri’s Ozark region, West Plains posts current values of $211,352, projected to reach $224,456. Its role as a regional hub drives steady appreciation.

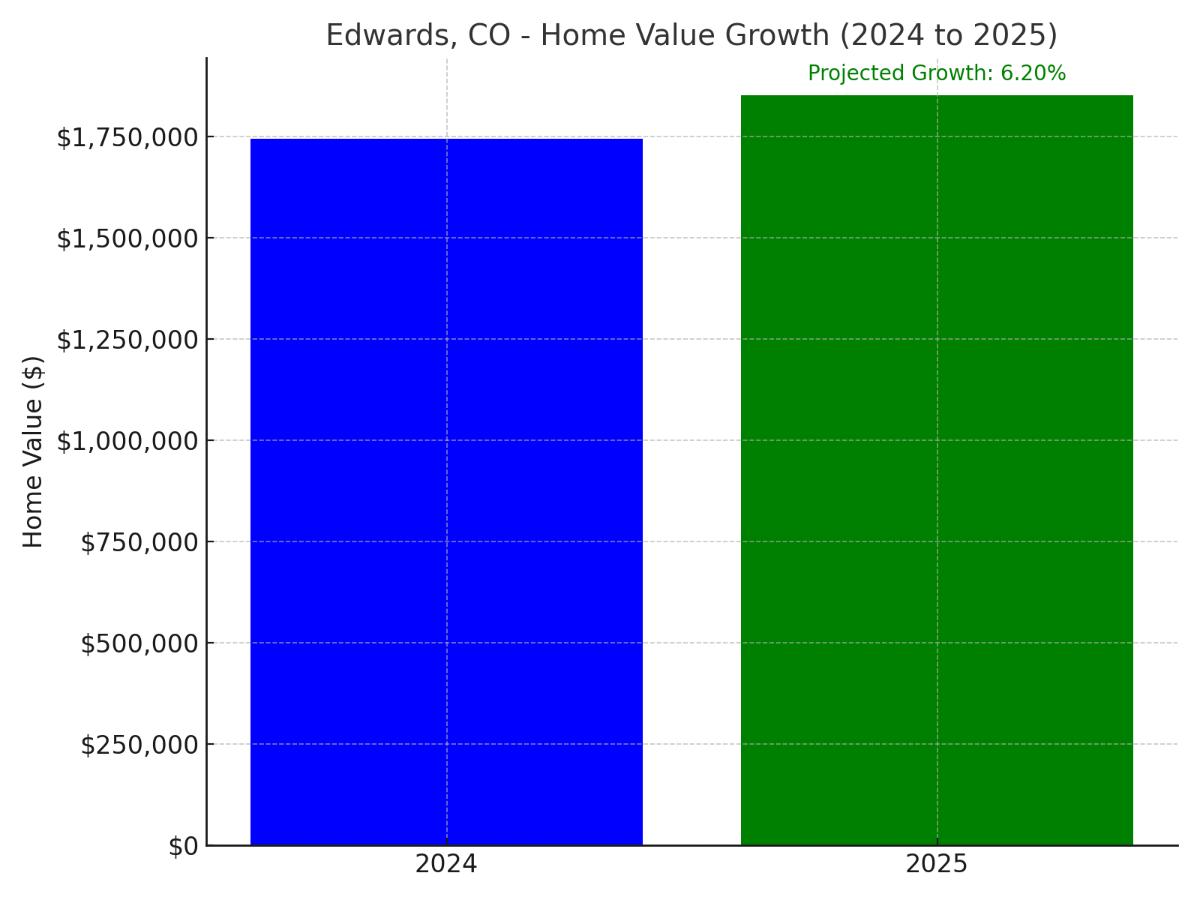

#10. Edwards, CO (6.2% Growth)

This upscale resort community near Vail shows the highest current values in our list at $1,743,323, expected to reach $1,851,409. Its premium ski resort location and luxury market drive exceptional valuations.

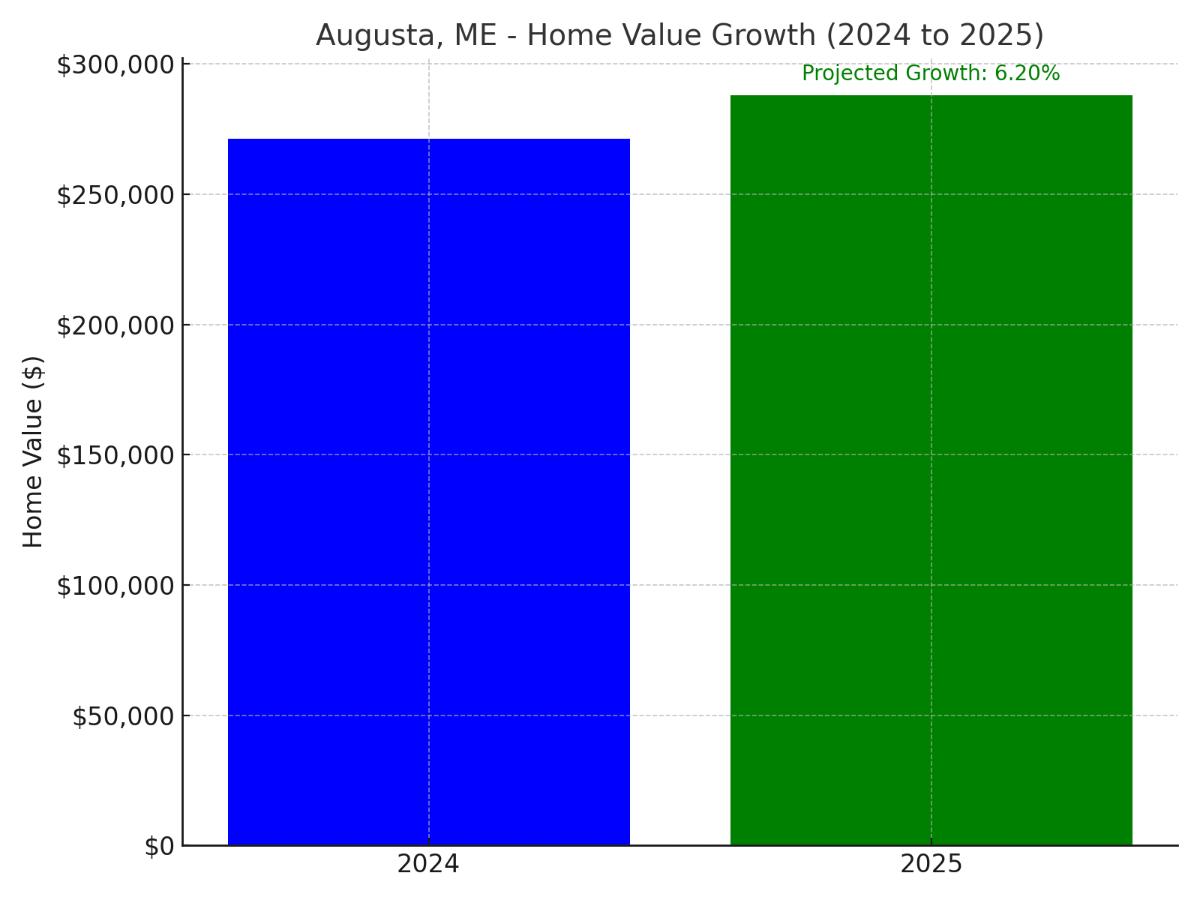

#9. Augusta, ME (6.2% Growth)

Maine’s capital city shows current values of $271,242, projected to reach $288,059. Its government center status and historic character support steady growth.

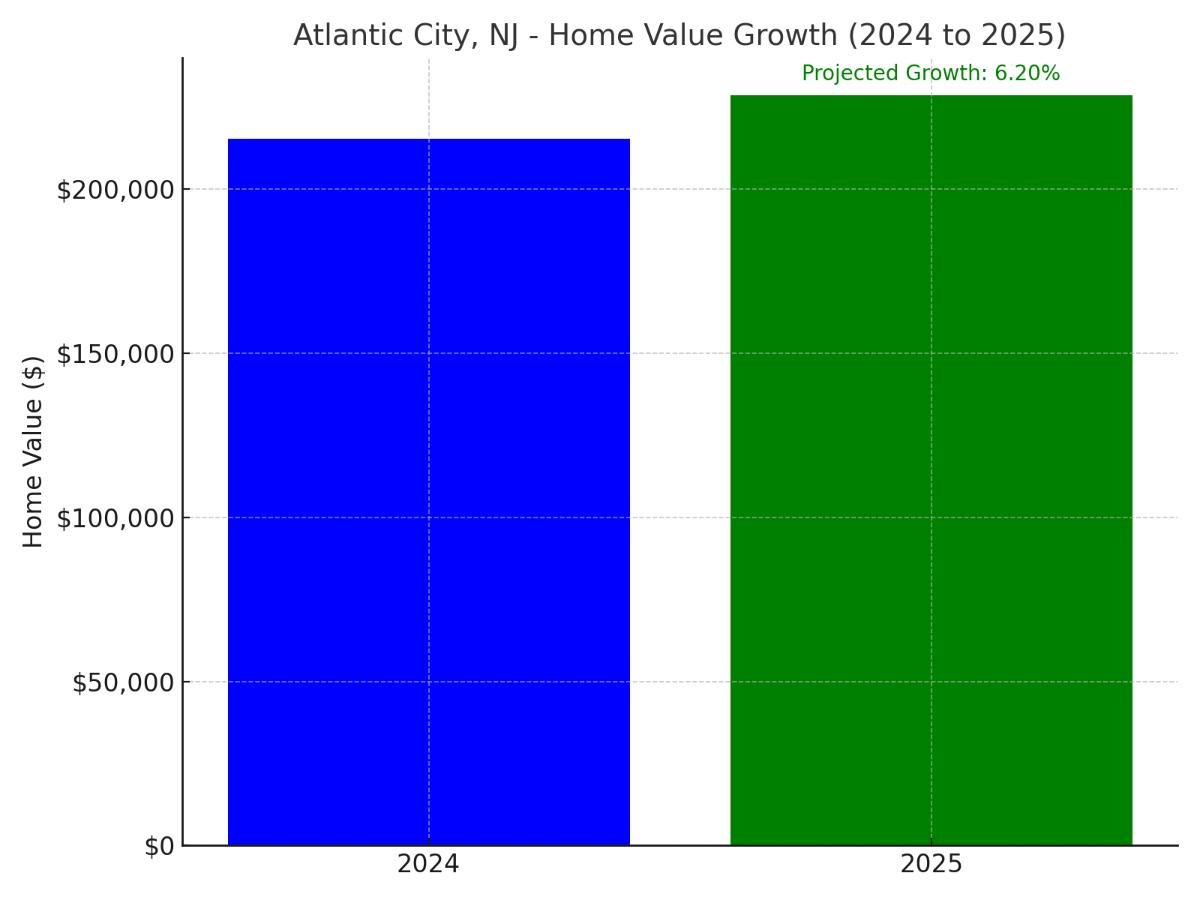

#8. Atlantic City, NJ (6.2% Growth)

This famous coastal resort city posts current values of $215,336, expected to reach $228,687. Its gaming industry and beachfront location drive market dynamics.

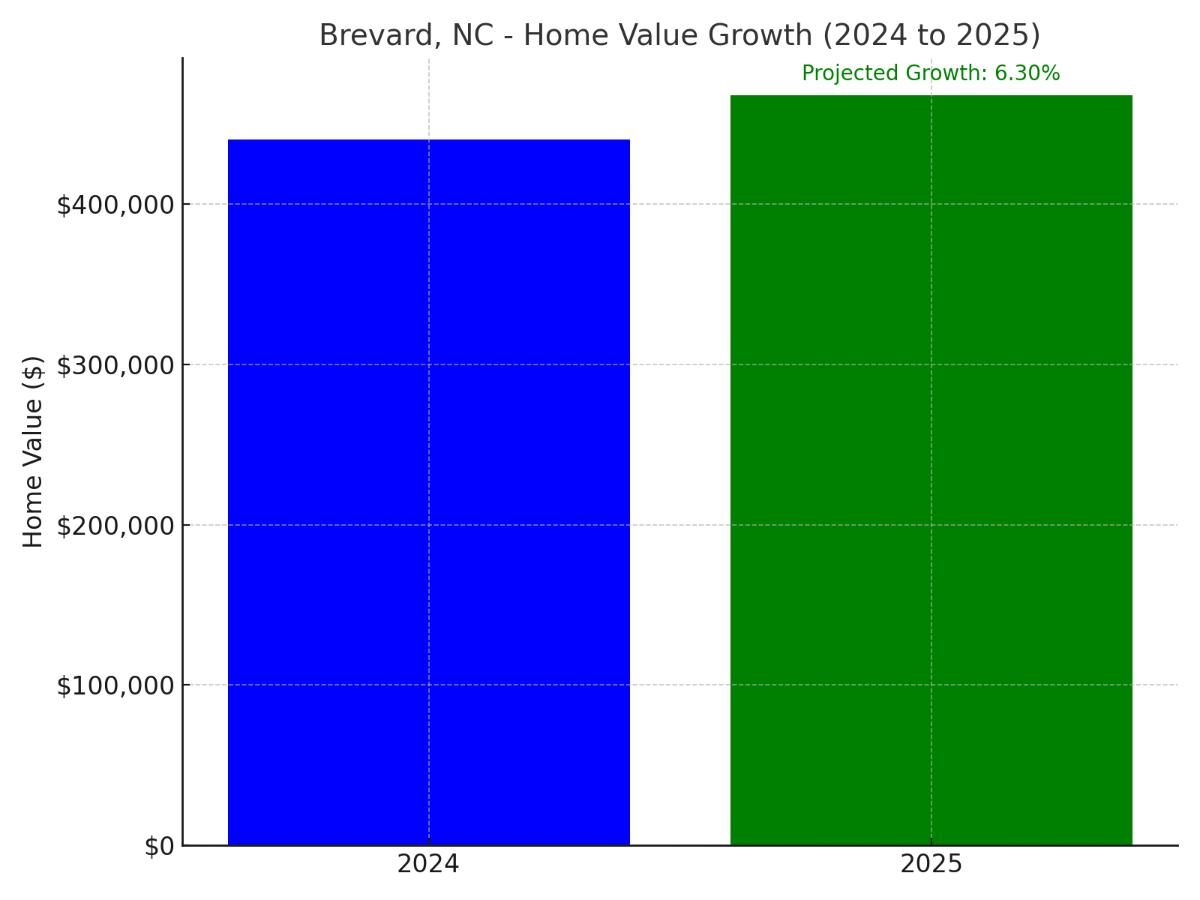

#7. Brevard, NC (6.3% Growth)

Nestled in western North Carolina’s mountains, Brevard shows strong values of $440,084, projected to reach $467,810. Its outdoor recreation opportunities and arts scene support premium valuations.

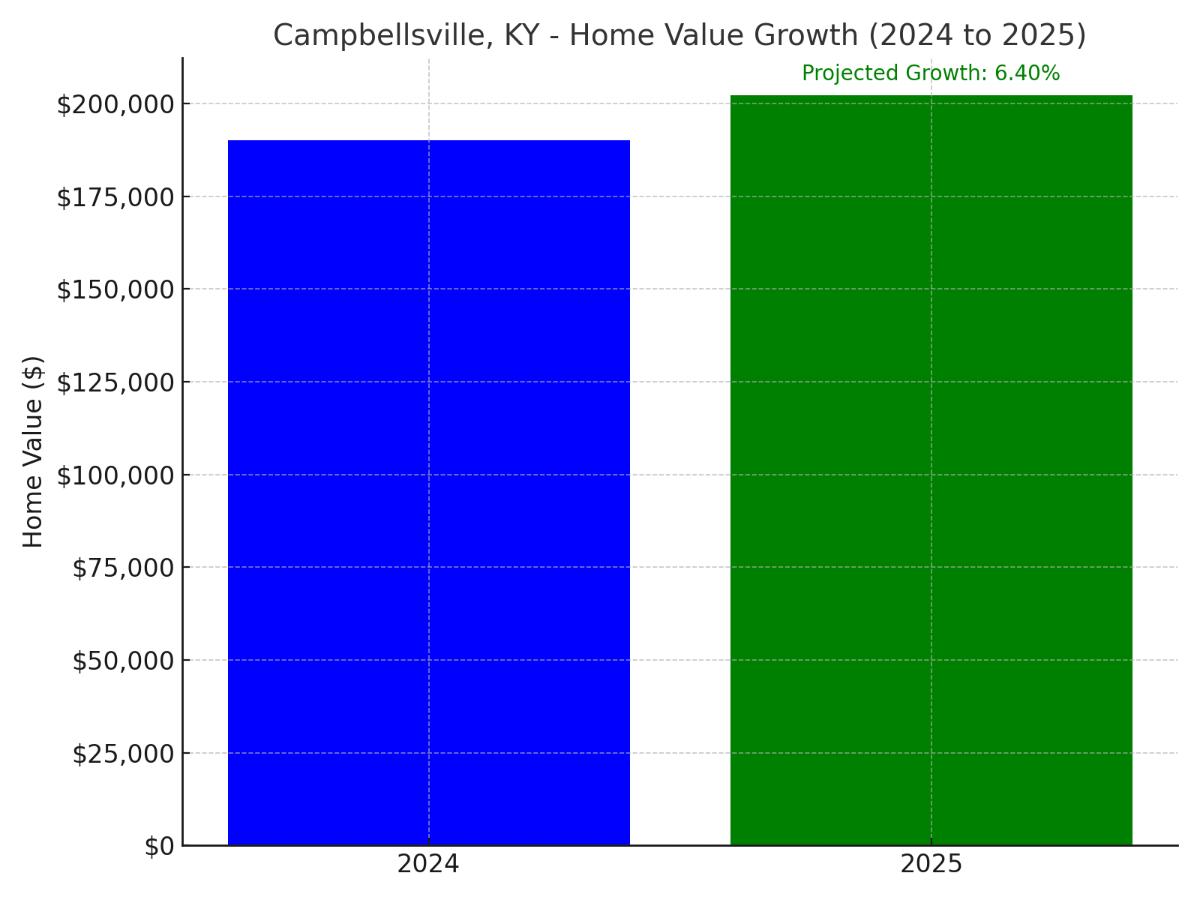

#6. Campbellsville, KY (6.4% Growth)

Located in central Kentucky, Campbellsville’s current value of $190,102 is expected to reach $202,269. Its university presence and manufacturing base drive steady growth.

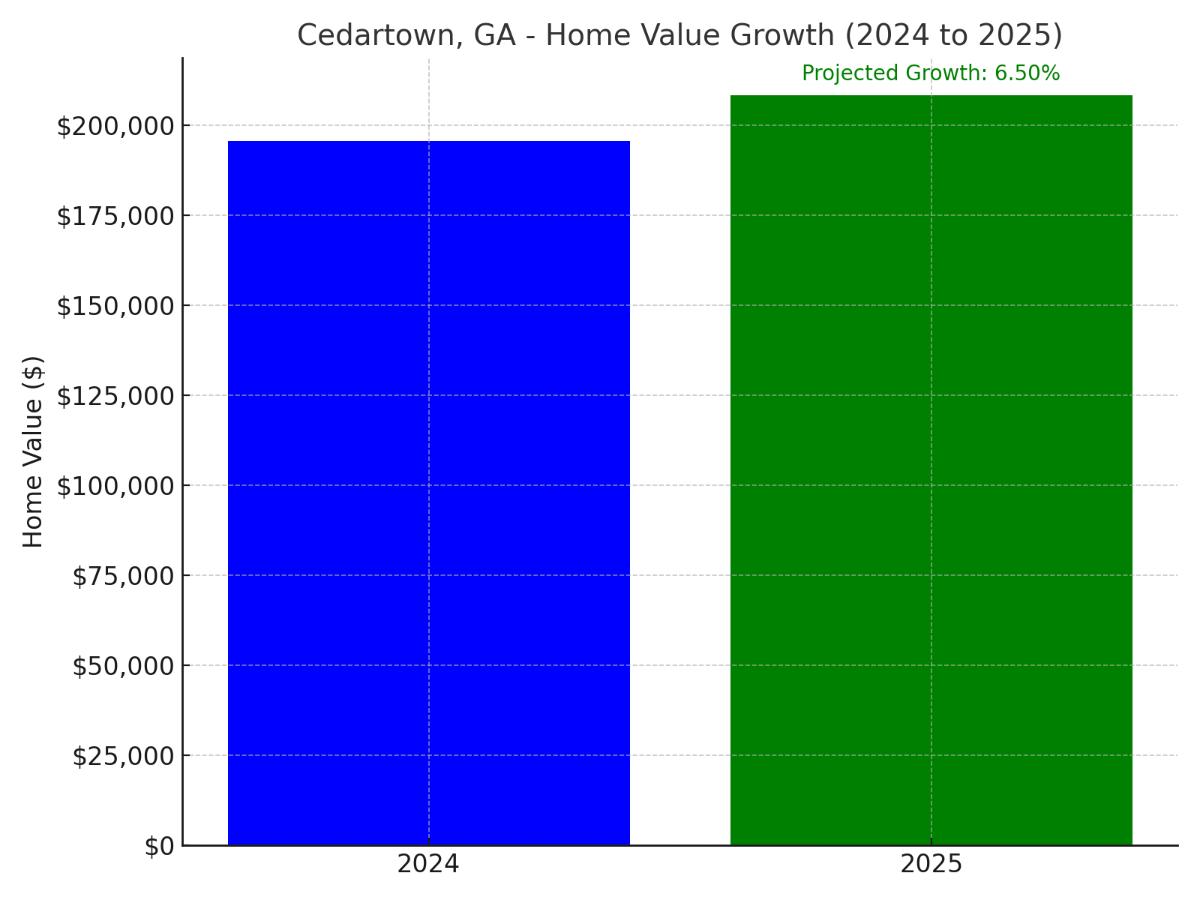

#5. Cedartown, GA (6.5% Growth)

This historic northwest Georgia city shows current values of $195,588, projected to reach $208,301. Its location between Atlanta and Birmingham supports emerging market growth.

#4. Connersville, IN (6.5% Growth)

Located in eastern Indiana, Connersville posts current values of $147,843, expected to reach $157,452. Its manufacturing heritage and affordability drive market momentum.

#3. Wauchula, FL (6.7% Growth)

This central Florida community shows current values of $218,530, projected to reach $233,172. Its agricultural base and growing regional importance support steady appreciation.

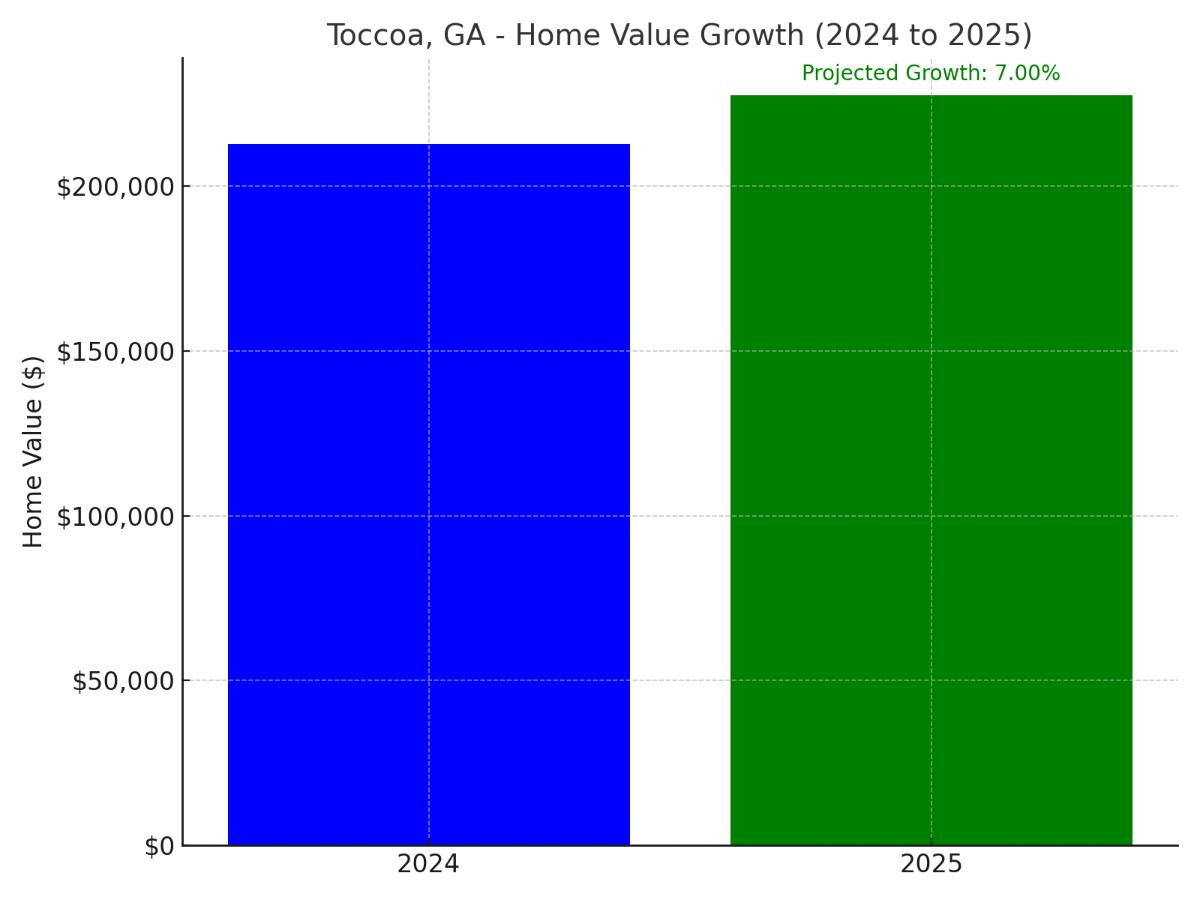

#2. Toccoa, GA (7.0% Growth)

Situated in northeast Georgia’s foothills, Toccoa’s current value of $212,675 is expected to reach $227,563. Its scenic location and proximity to Athens drive market growth.

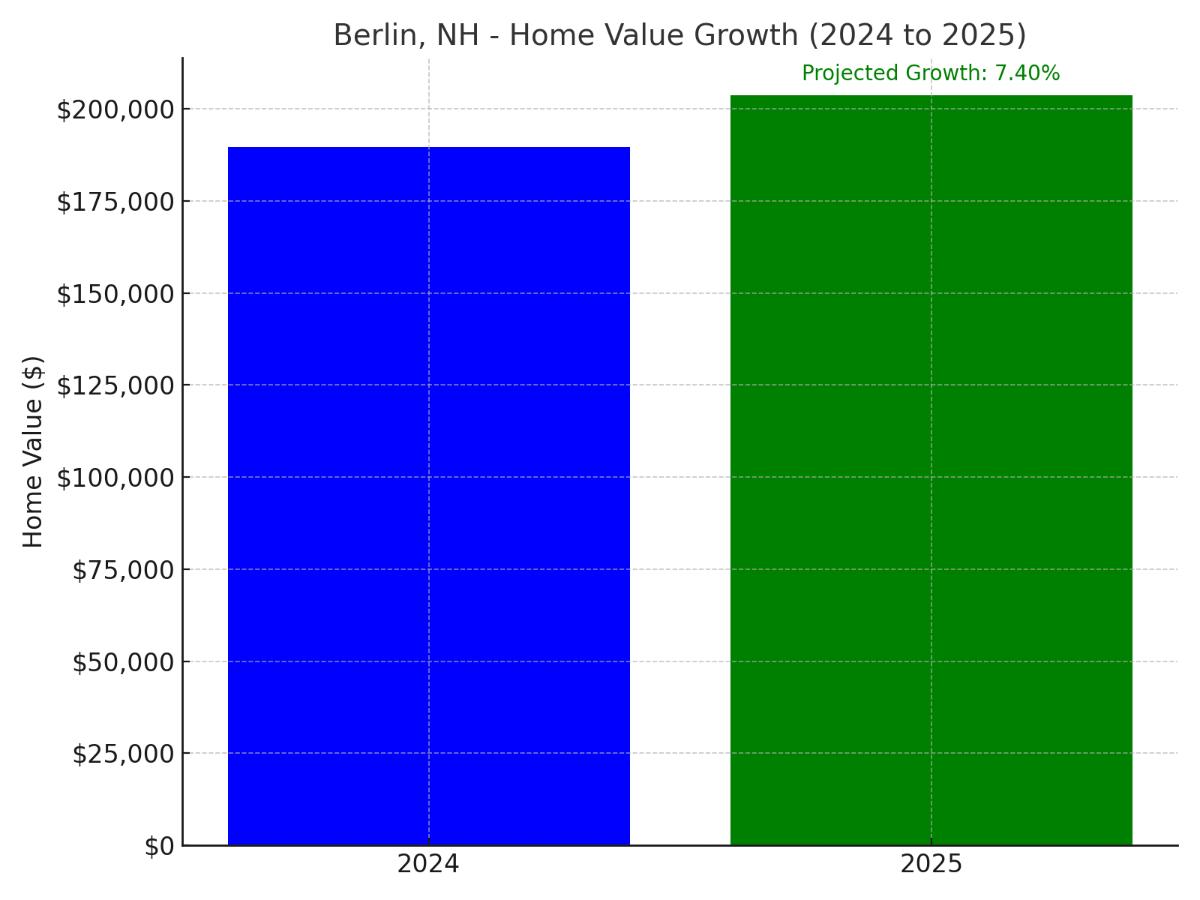

#1. Berlin, NH (7.4% Growth)

Located in northern New Hampshire’s White Mountains, Berlin shows current values of $189,691, projected to reach $203,728. Its outdoor recreation opportunities and affordable entry points drive the highest projected growth rate on our list.