I’ve been analyzing data from the Zillow Home Value Index to uncover the most lucrative real estate investments across South Carolina. What struck me immediately was the sheer magnitude of appreciation across these high-end neighborhoods, with many doubling or even tripling in value over a 15-year period.

Charleston dominates the list with 14 of the top 25 neighborhoods, but what’s fascinating is the consistent financial performance of island communities like Sea Pines and Palmetto Dunes. These coastal havens have shown remarkable resilience, weathering economic fluctuations to deliver consistent returns for property owners.

The data reveals that investing in South Carolina’s premium neighborhoods has outperformed many traditional investment vehicles. Looking at appreciation rates from 2020-2025 alone, it’s clear that even pandemic-era buyers have realized exceptional returns in a remarkably short timespan.

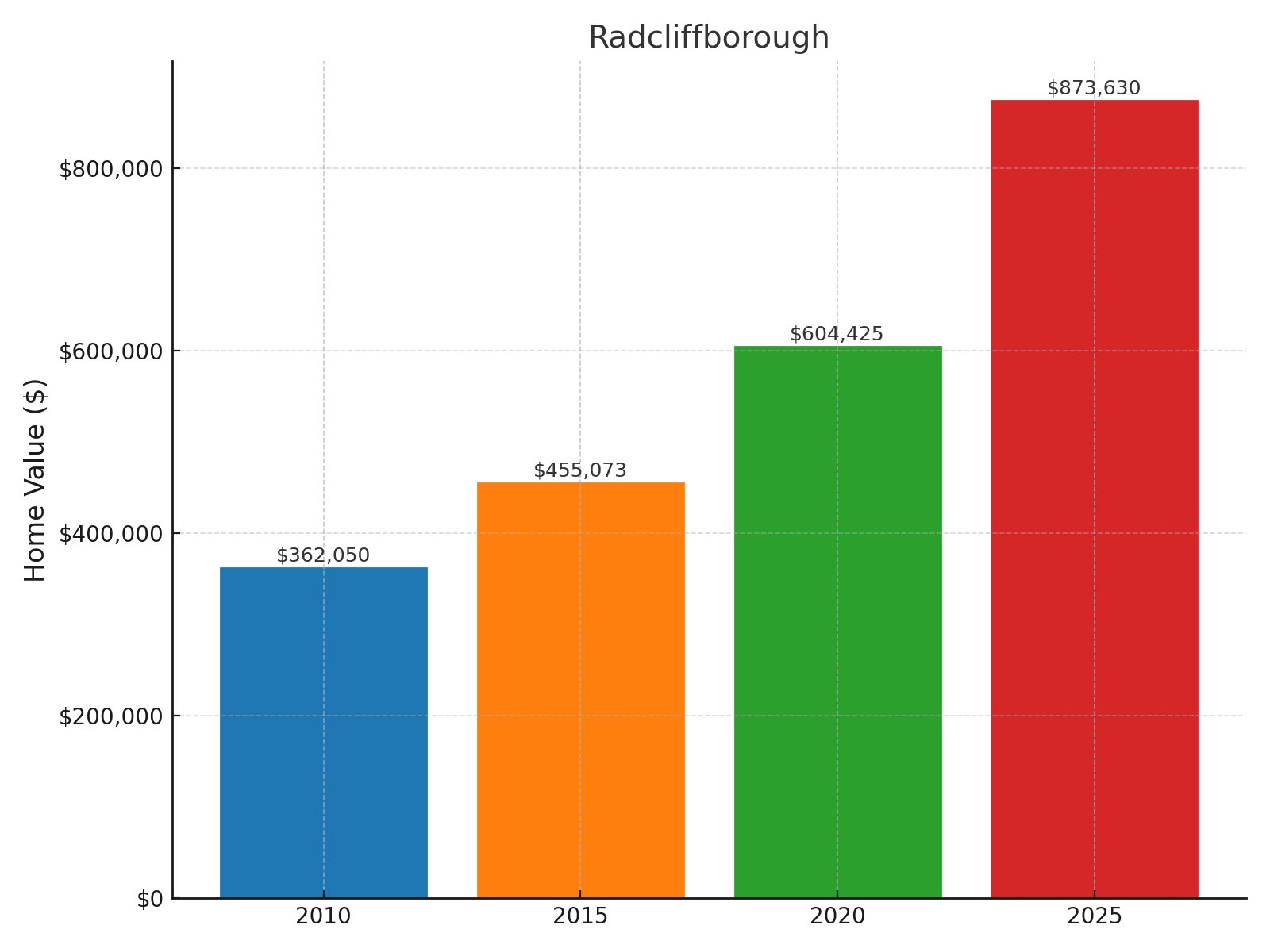

25. Radcliffborough

- 2025 Home Value: $873,630

- 2020 Home Value: $604,425

- 2015 Home Value: $455,073

- 2010 Home Value: $362,050

- % Change (2010–2025): 141.3%

- % Change (2015–2025): 92.0%

- % Change (2020–2025): 44.5%

Radcliffborough has demonstrated exceptional investment potential with its value more than doubling from $362,050 in 2010 to $873,630 in 2025, representing a staggering 141.3% appreciation. The neighborhood’s financial trajectory has been consistently strong, with 44.5% growth in just the last five years, significantly outpacing inflation. This historic Charleston district combines architectural charm with powerful market momentum, offering investors both cultural significance and robust returns.

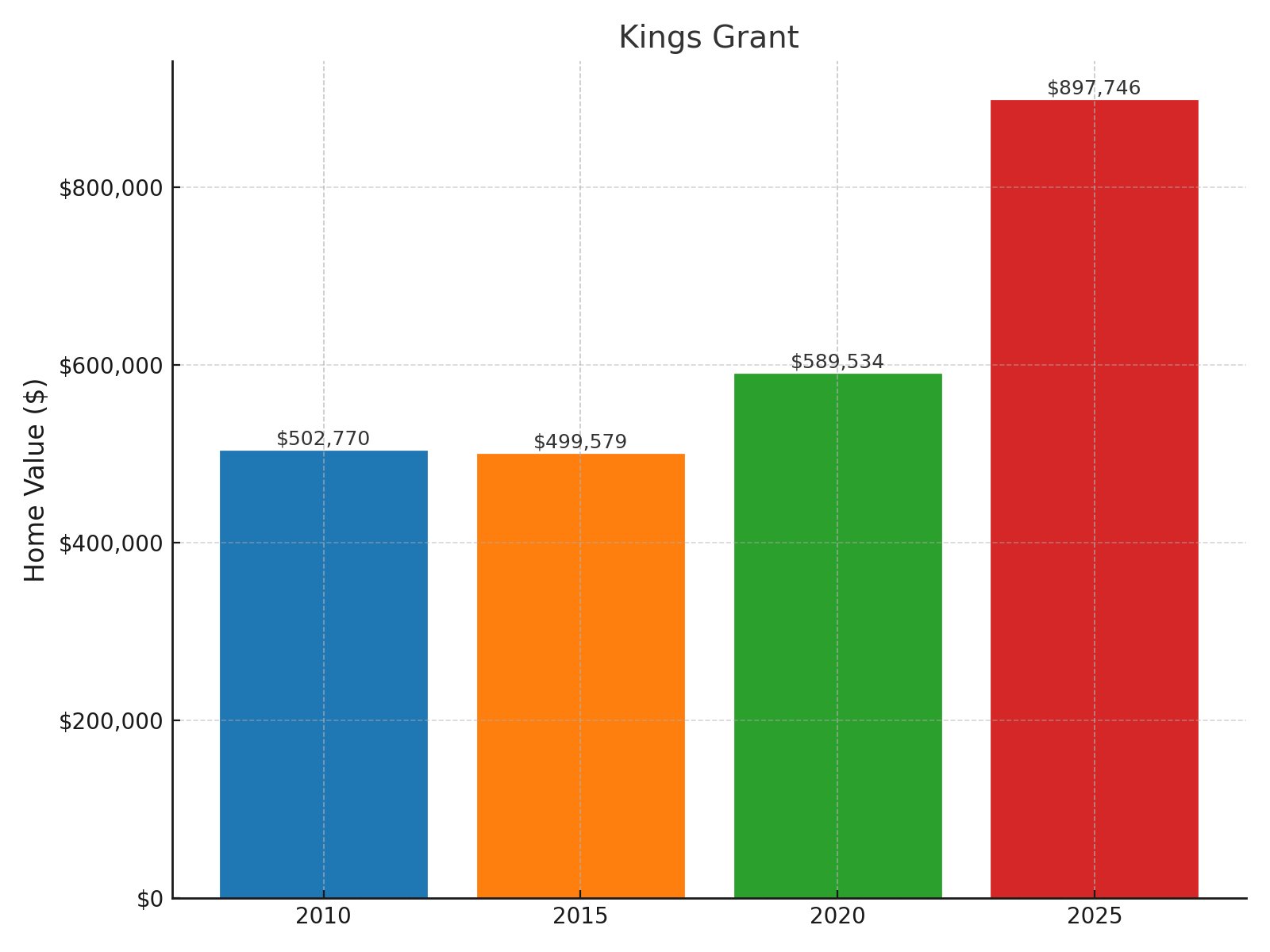

24. Kings Grant

- 2025 Home Value: $897,746

- 2020 Home Value: $589,534

- 2015 Home Value: $499,579

- 2010 Home Value: $502,770

- % Change (2010–2025): 78.6%

- % Change (2015–2025): 79.7%

- % Change (2020–2025): 52.3%

Kings Grant presents a fascinating investment case with its unusual flat performance between 2010-2015, followed by explosive growth of nearly 80% in the decade since. Property values have surged from $499,579 in 2015 to $897,746 in 2025, demonstrating remarkable resilience and acceleration. Located in Columbia’s Richland County, this neighborhood offers investors a unique combination of suburban tranquility and metropolitan access, all while delivering exceptional financial returns in recent market cycles.

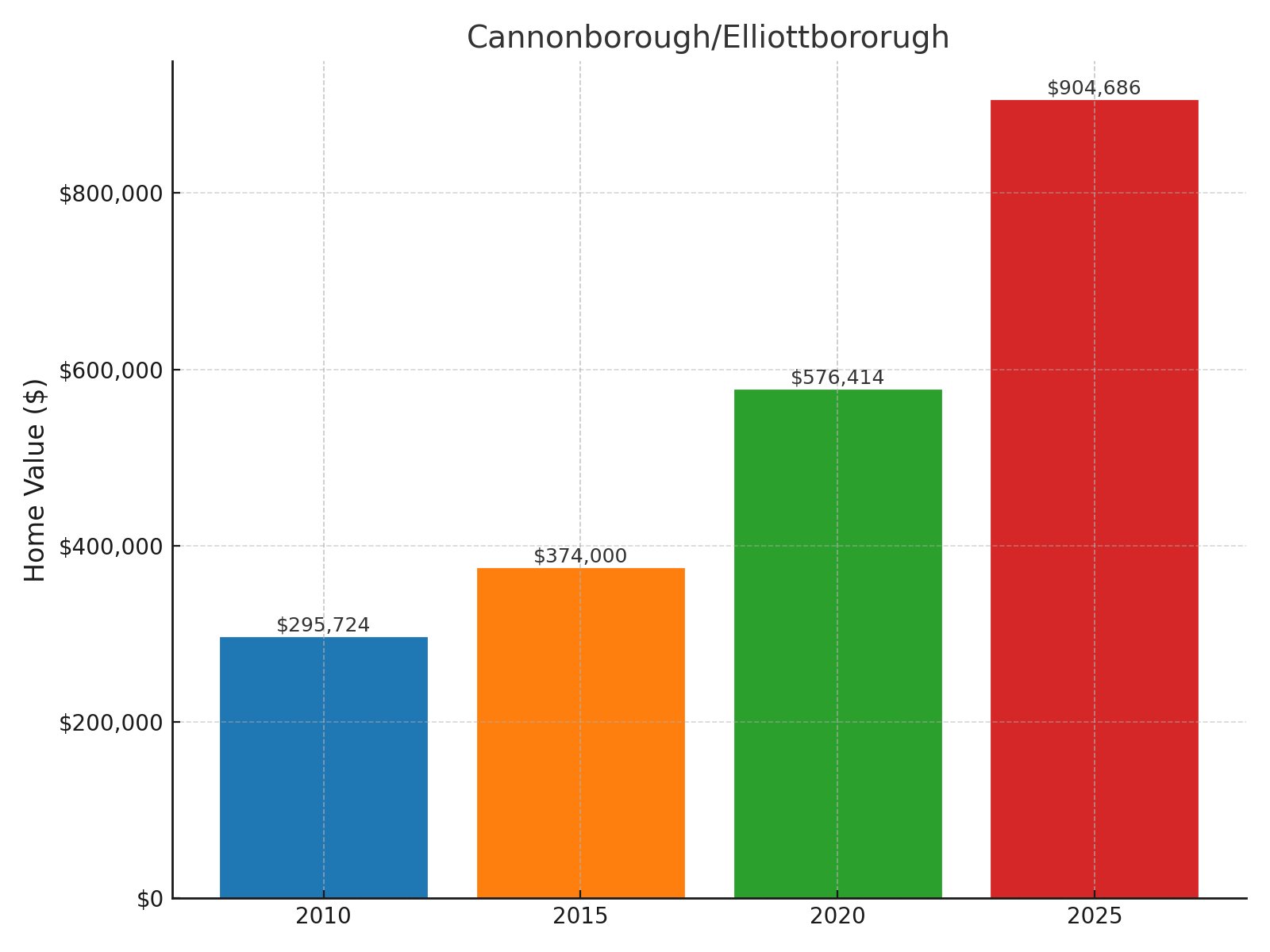

23. Cannonborough/Elliottbororugh

- 2025 Home Value: $904,686

- 2020 Home Value: $576,414

- 2015 Home Value: $374,000

- 2010 Home Value: $295,724

- % Change (2010–2025): 205.9%

- % Change (2015–2025): 141.9%

- % Change (2020–2025): 57.0%

Cannonborough/Elliottbororugh represents a financial powerhouse in Charleston’s real estate landscape, with property values more than tripling from $295,724 in 2010 to $904,686 in 2025 – an extraordinary 205.9% appreciation. The neighborhood’s incredible wealth-building trajectory continues unabated, with 57% growth in just the last five years alone. Situated in Charleston’s urban core, this once-overlooked district has transformed into one of South Carolina’s most financially rewarding investment opportunities, delivering consistent double-digit returns year after year.

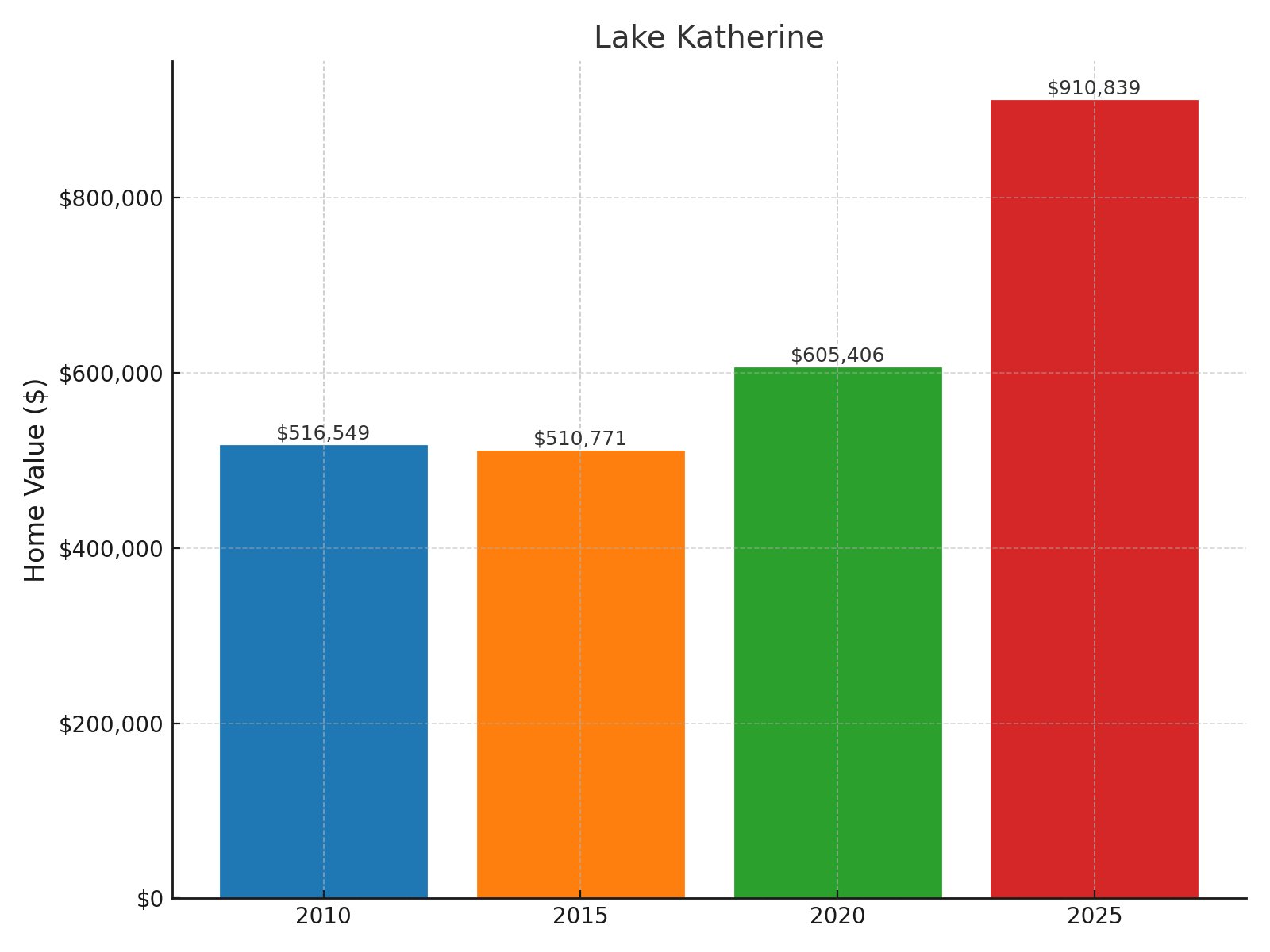

22. Lake Katherine

- 2025 Home Value: $910,839

- 2020 Home Value: $605,406

- 2015 Home Value: $510,771

- 2010 Home Value: $516,549

- % Change (2010–2025): 76.3%

- % Change (2015–2025): 78.3%

- % Change (2020–2025): 50.5%

Lake Katherine showcases an intriguing investment timeline with a slight dip between 2010-2015, followed by extraordinary appreciation that brought values to $910,839 by 2025 – a 76.3% increase from 2010 levels. The last five years have been particularly lucrative, with property values jumping 50.5% since 2020. This prestigious Columbia enclave combines waterfront living with proximity to South Carolina’s capital, creating a rare financial opportunity where lifestyle amenities and investment performance align perfectly.

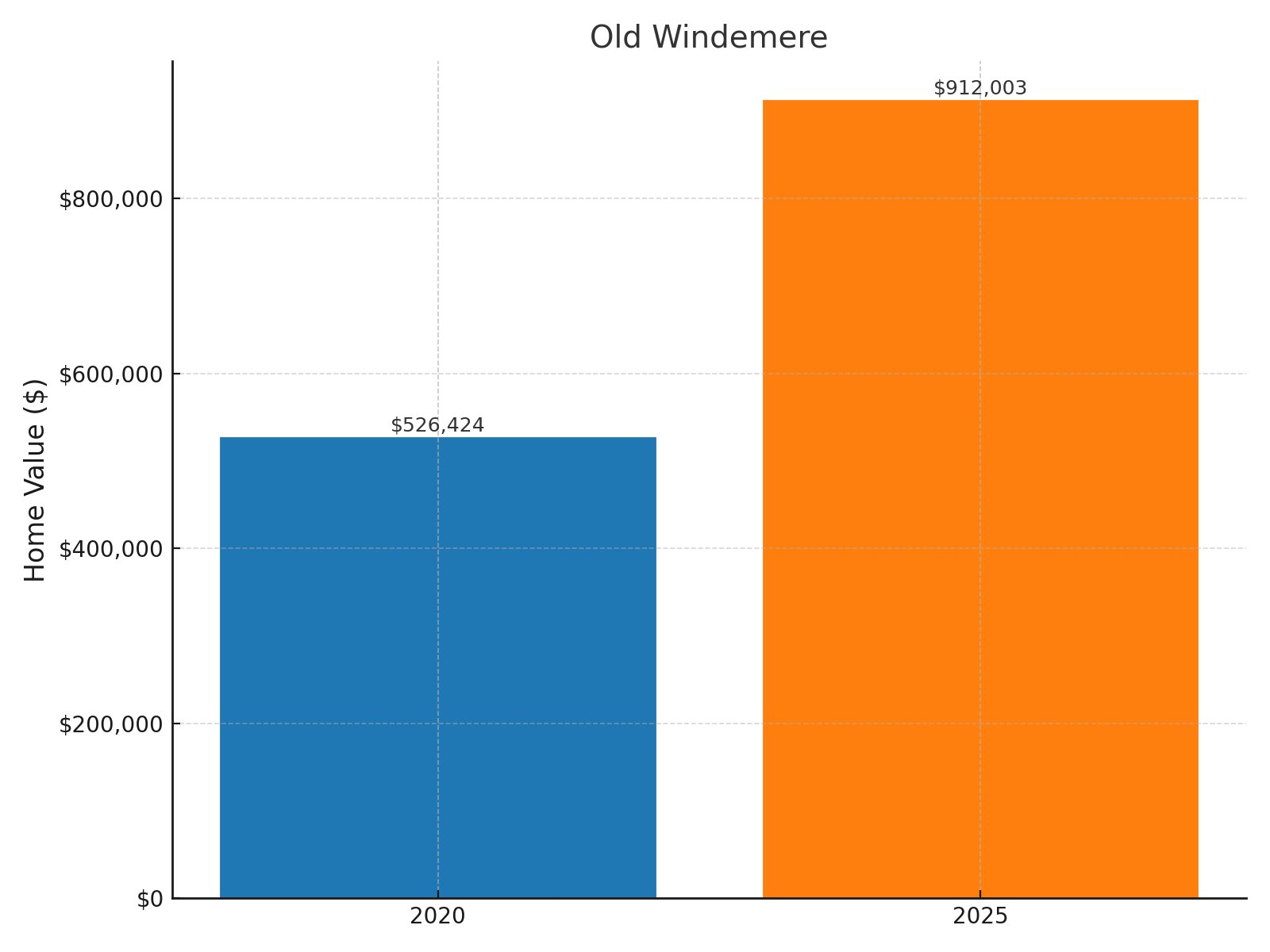

21. Old Windemere

- 2025 Home Value: $912,003

- 2020 Home Value: $526,424

- 2015 Home Value: N/A

- 2010 Home Value: N/A

- % Change (2010–2025): N/A

- % Change (2015–2025): N/A

- % Change (2020–2025): 73.2%

Old Windemere has emerged as a financial juggernaut in recent years, with property values skyrocketing 73.2% from $526,424 in 2020 to $912,003 in 2025 – one of the steepest five-year appreciation rates in South Carolina. This remarkable growth trajectory suggests early investors have realized extraordinary returns in a compressed timeframe. Nestled in Charleston’s desirable west side, Old Windemere combines historic charm with modern conveniences, creating an investment sweet spot where limited housing supply meets escalating buyer demand.

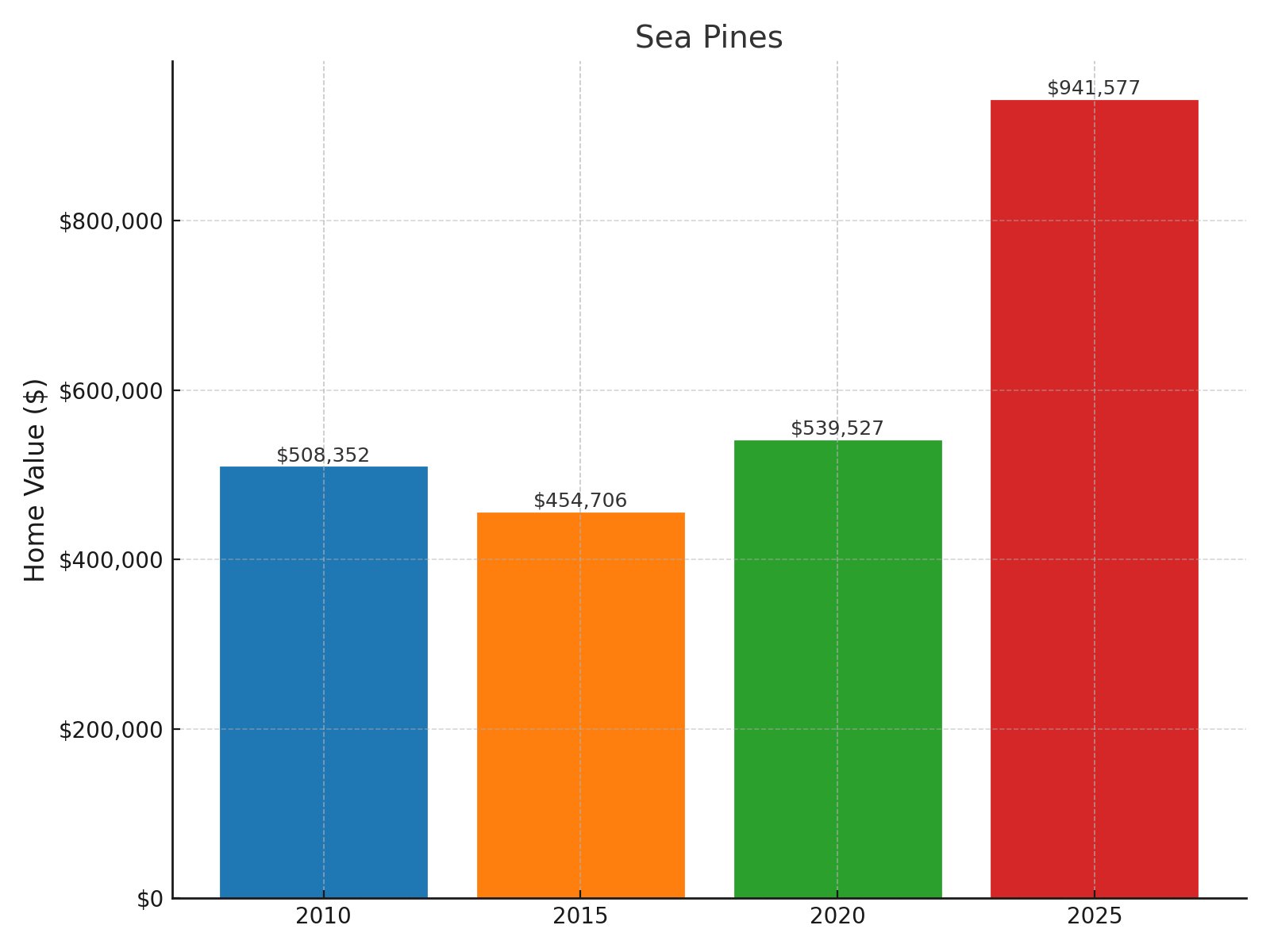

20. Sea Pines

- 2025 Home Value: $941,577

- 2020 Home Value: $539,527

- 2015 Home Value: $454,706

- 2010 Home Value: $508,352

- % Change (2010–2025): 85.2%

- % Change (2015–2025): 107.1%

- % Change (2020–2025): 74.5%

Sea Pines represents a textbook case of coastal real estate appreciation, with values breaking through $941,577 in 2025 – a phenomenal 85.2% increase since 2010 despite an initial post-recession dip. The financial acceleration has been particularly impressive since 2015, with values more than doubling (107.1%) in just a decade. Located on Hilton Head Island in Beaufort County, this iconic planned community combines world-class amenities with investment-grade property appreciation, delivering both lifestyle benefits and exceptional financial returns.

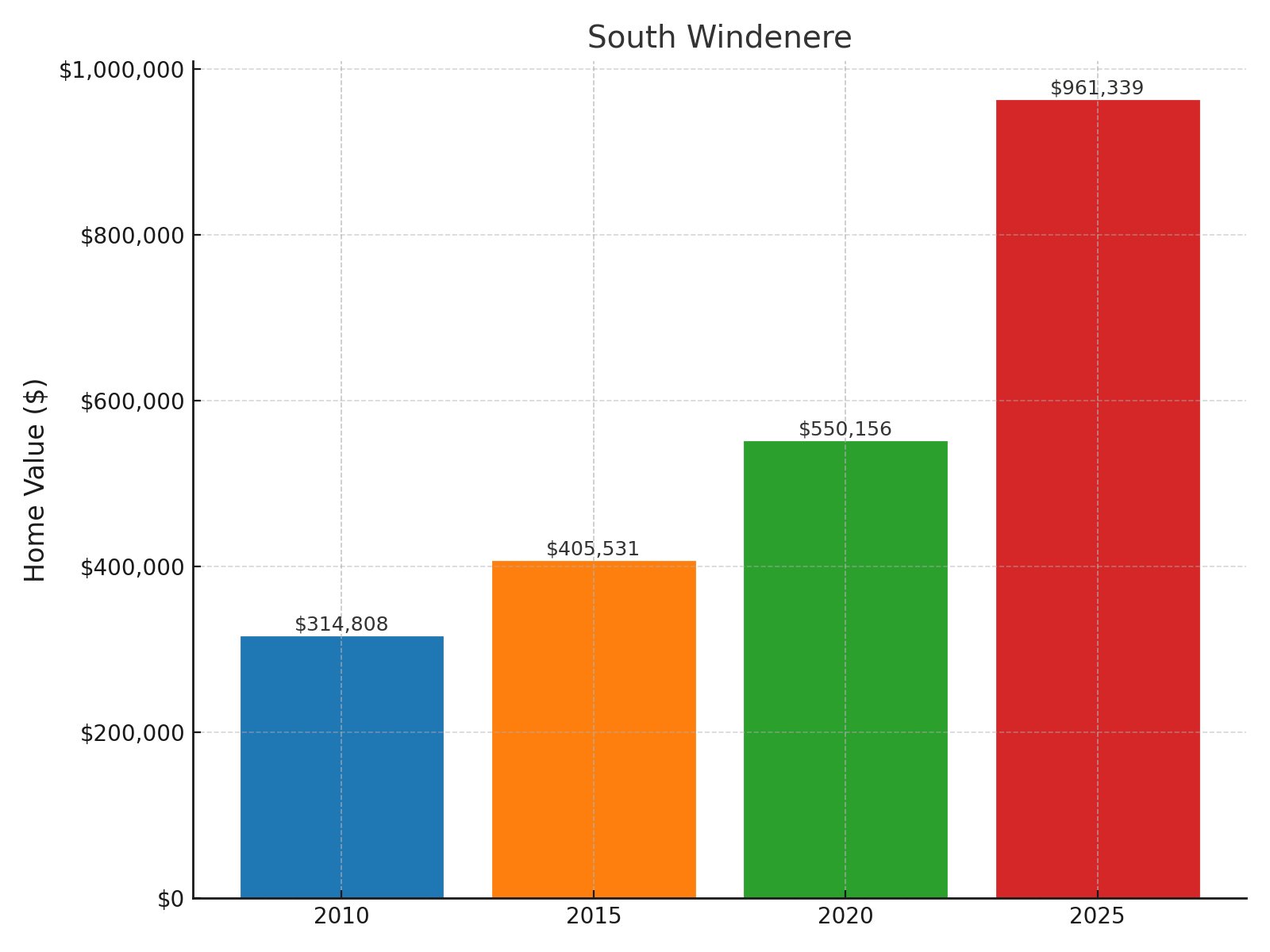

19. South Windenere

- 2025 Home Value: $961,339

- 2020 Home Value: $550,156

- 2015 Home Value: $405,531

- 2010 Home Value: $314,808

- % Change (2010–2025): 205.4%

- % Change (2015–2025): 137.1%

- % Change (2020–2025): 74.7%

South Windenere has delivered spectacular financial performance, with values more than tripling from $314,808 in 2010 to $961,339 in 2025 – an astonishing 205.4% appreciation that rivals high-performing stock portfolios. The wealth creation has accelerated recently, with a 74.7% surge in just five years, demonstrating the neighborhood’s growing financial momentum. Positioned in Charleston’s dynamic west side, South Windenere offers investors both historical significance and contemporary growth potential, with consistent year-over-year returns that validate its status as an investment powerhouse.

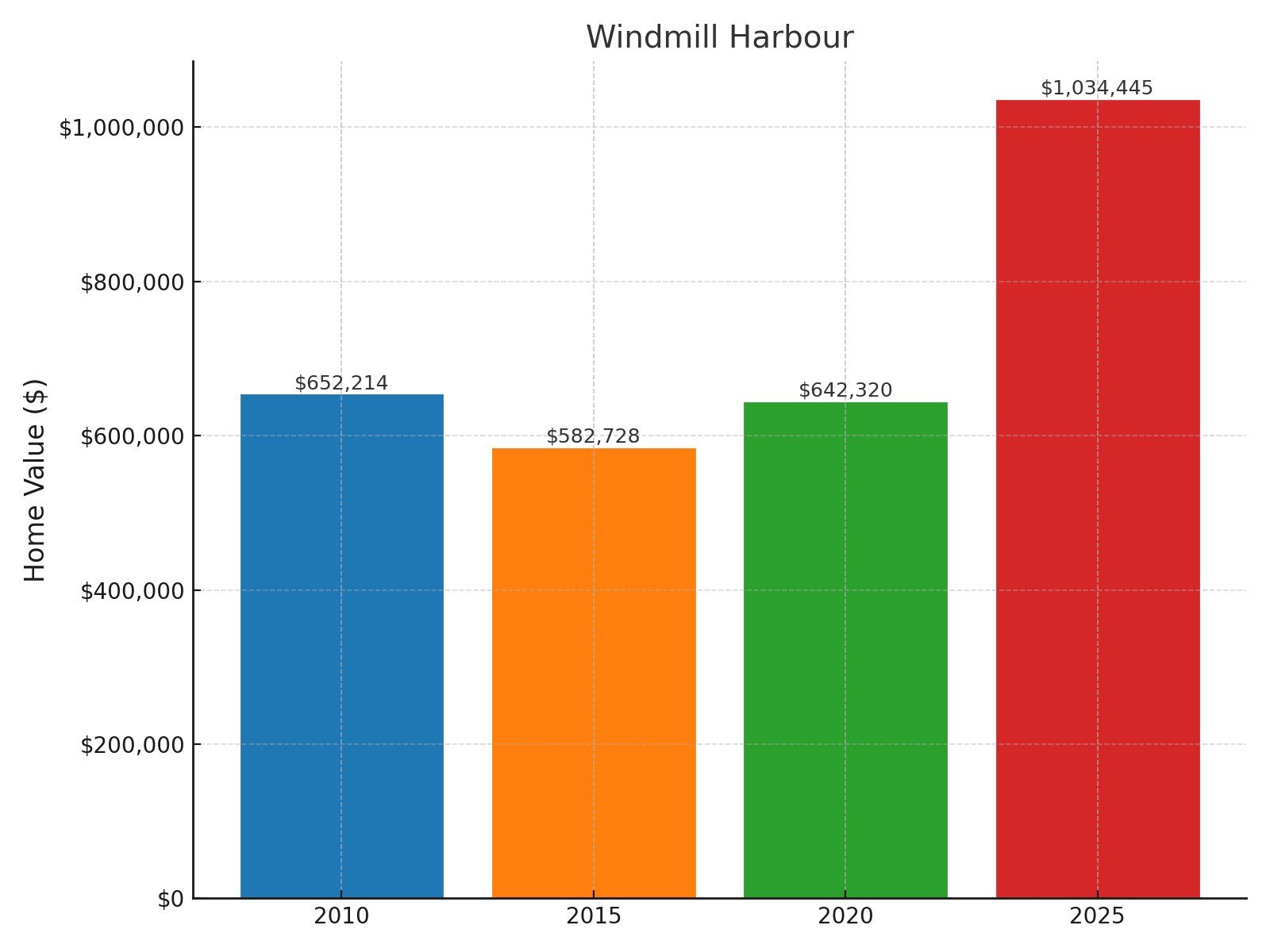

18. Windmill Harbour

- 2025 Home Value: $1,034,445

- 2020 Home Value: $642,320

- 2015 Home Value: $582,728

- 2010 Home Value: $652,214

- % Change (2010–2025): 58.6%

- % Change (2015–2025): 77.5%

- % Change (2020–2025): 61.0%

Windmill Harbour showcases a fascinating recovery story, with values initially dropping post-2010 before surging dramatically to break the million-dollar threshold at $1,034,445 by 2025 – representing 58.6% growth over 15 years. The financial acceleration has been particularly notable since 2020, with a robust 61% gain during a period of broader economic volatility. This exclusive Hilton Head Island community combines protected harbor living with exceptional investment fundamentals, offering both lifestyle advantages and compelling financial performance in South Carolina’s competitive coastal market.

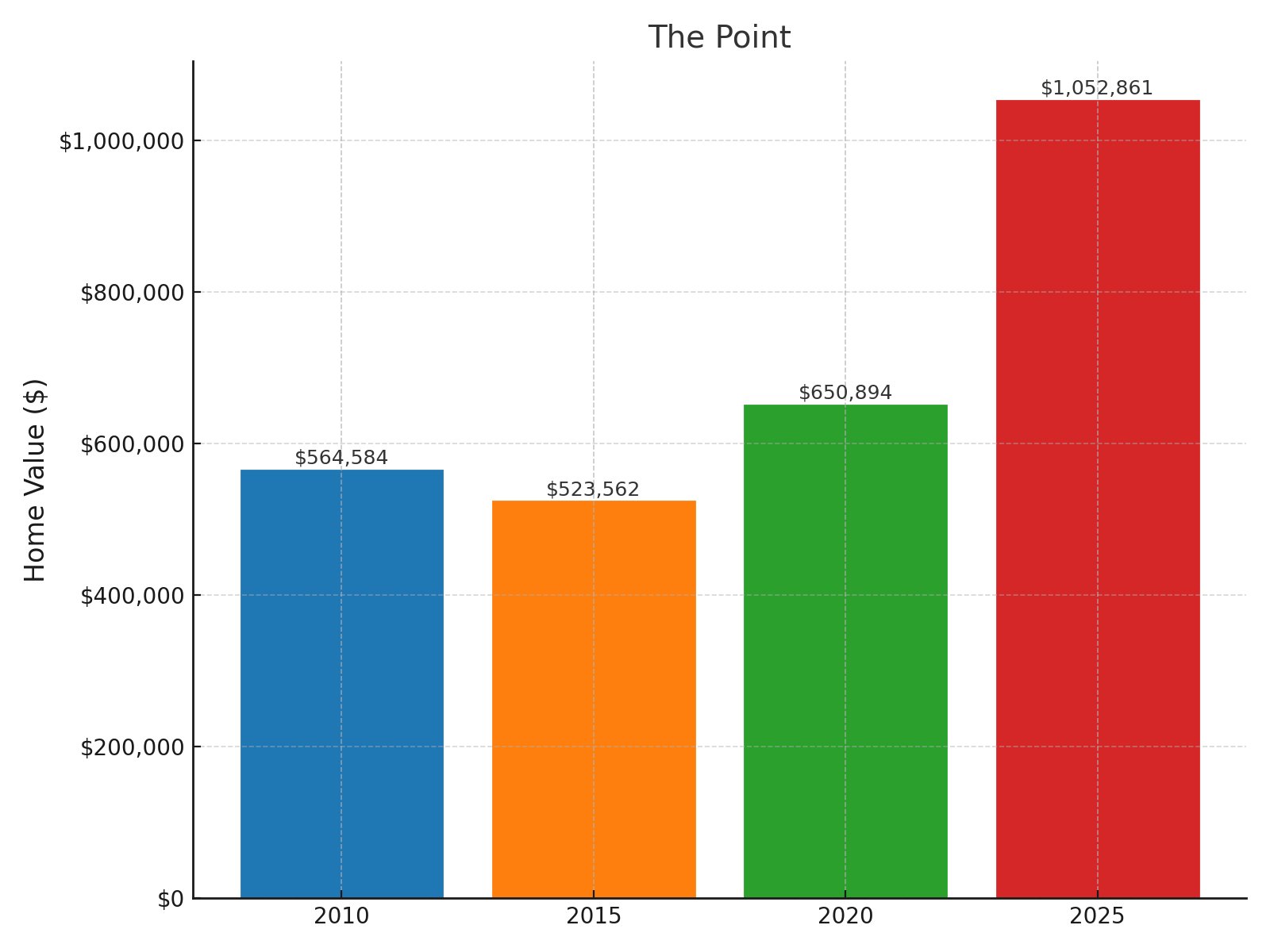

17. The Point

- 2025 Home Value: $1,052,861

- 2020 Home Value: $650,894

- 2015 Home Value: $523,562

- 2010 Home Value: $564,584

- % Change (2010–2025): 86.5%

- % Change (2015–2025): 101.1%

- % Change (2020–2025): 61.8%

The Point demonstrates remarkable financial resilience, overcoming a post-recession dip to achieve spectacular growth, with values doubling since 2015 to reach $1,052,861 in 2025 – representing an 86.5% increase over the 15-year period. Property appreciation has accelerated dramatically, with 61.8% growth in just the last five years, significantly outpacing broader market indexes. This historic Beaufort neighborhood combines architectural significance with waterfront allure, creating a perfect financial storm where limited inventory meets escalating demand from luxury buyers seeking both heritage and investment performance.

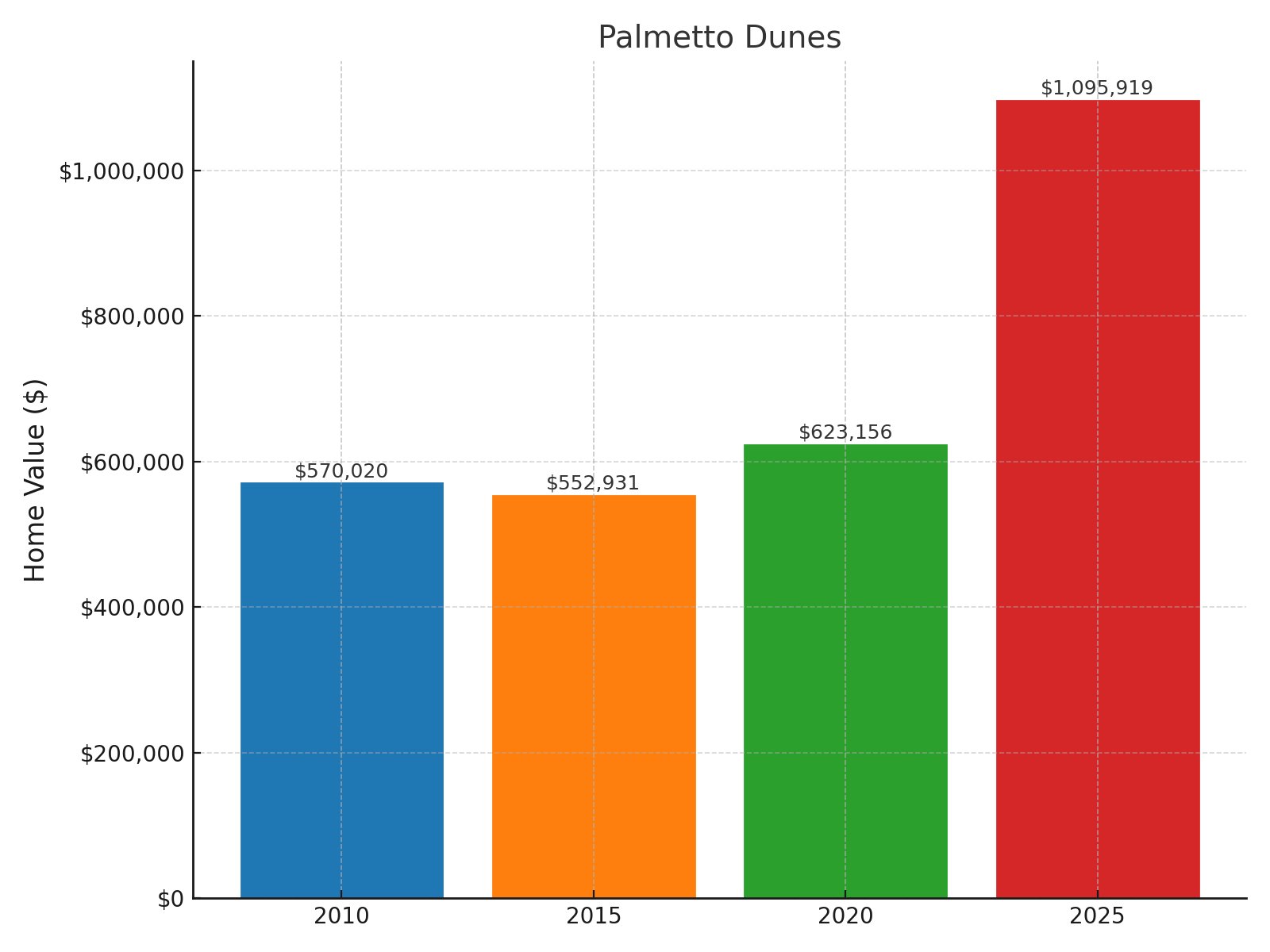

16. Palmetto Dunes

- 2025 Home Value: $1,095,919

- 2020 Home Value: $623,156

- 2015 Home Value: $552,931

- 2010 Home Value: $570,020

- % Change (2010–2025): 92.3%

- % Change (2015–2025): 98.2%

- % Change (2020–2025): 75.9%

Palmetto Dunes exemplifies explosive coastal real estate growth, with values nearly doubling from $570,020 in 2010 to $1,095,919 in 2025 – a remarkable 92.3% appreciation. The financial acceleration has been particularly dramatic since 2020, with a 75.9% surge in just five years. This premier Hilton Head Island oceanfront community combines world-class golf, tennis and beach access with exceptional investment fundamentals, creating a rare scenario where lifestyle amenities and financial performance are equally impressive.

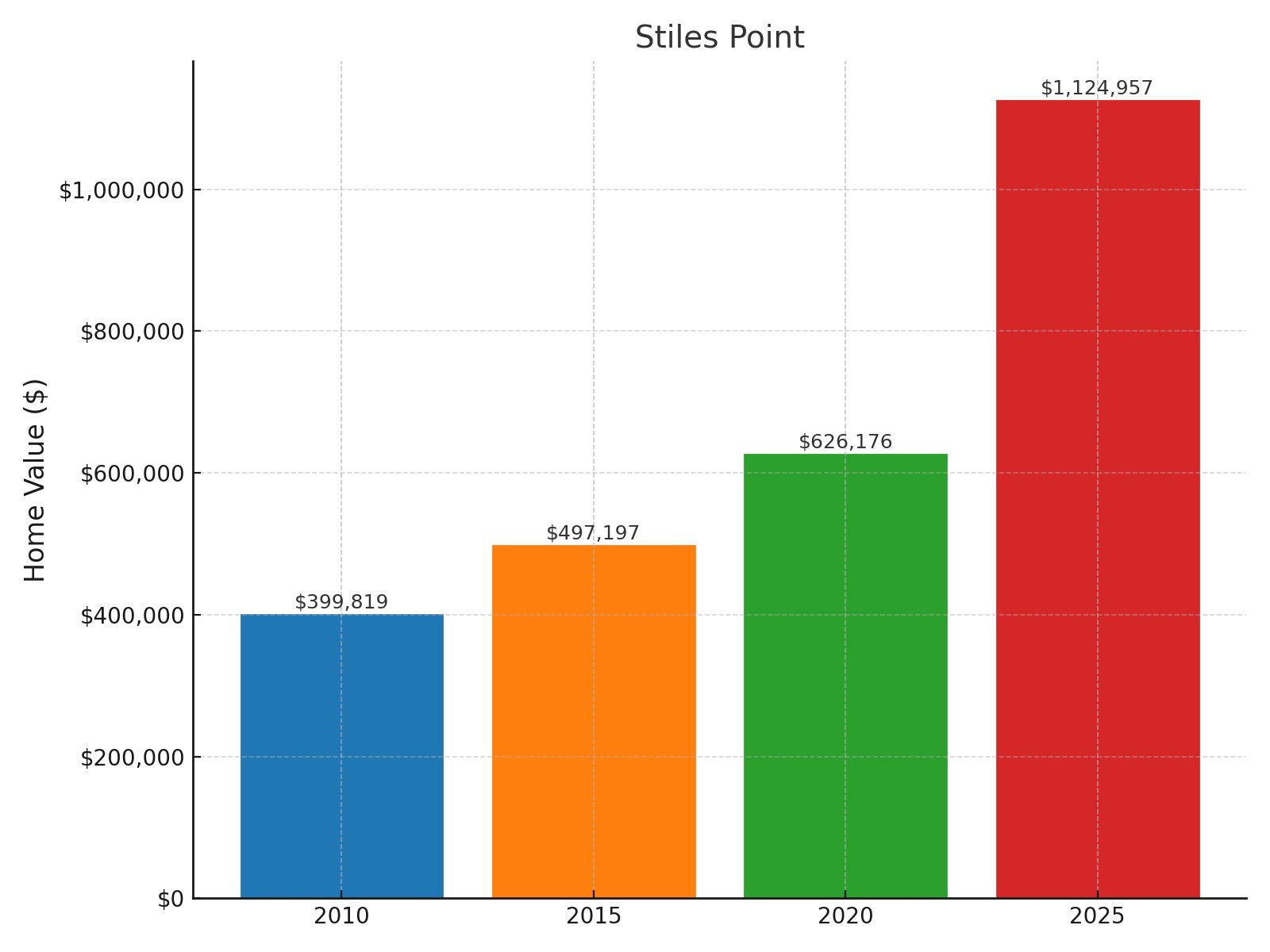

15. Stiles Point

- 2025 Home Value: $1,124,957

- 2020 Home Value: $626,176

- 2015 Home Value: $497,197

- 2010 Home Value: $399,819

- % Change (2010–2025): 181.4%

- % Change (2015–2025): 126.3%

- % Change (2020–2025): 79.7%

Stiles Point has emerged as a financial powerhouse in Charleston’s real estate market, with values soaring from $399,819 in 2010 to $1,124,957 in 2025 – an extraordinary 181.4% appreciation that dwarfs most traditional investments. The wealth creation has accelerated dramatically in recent years, with nearly 80% growth since 2020 alone. Nestled along the James Island waterfront in Charleston County, this sought-after enclave combines scenic marsh views with proximity to downtown, creating a perfect investment scenario where location advantages translate directly into superior financial returns.

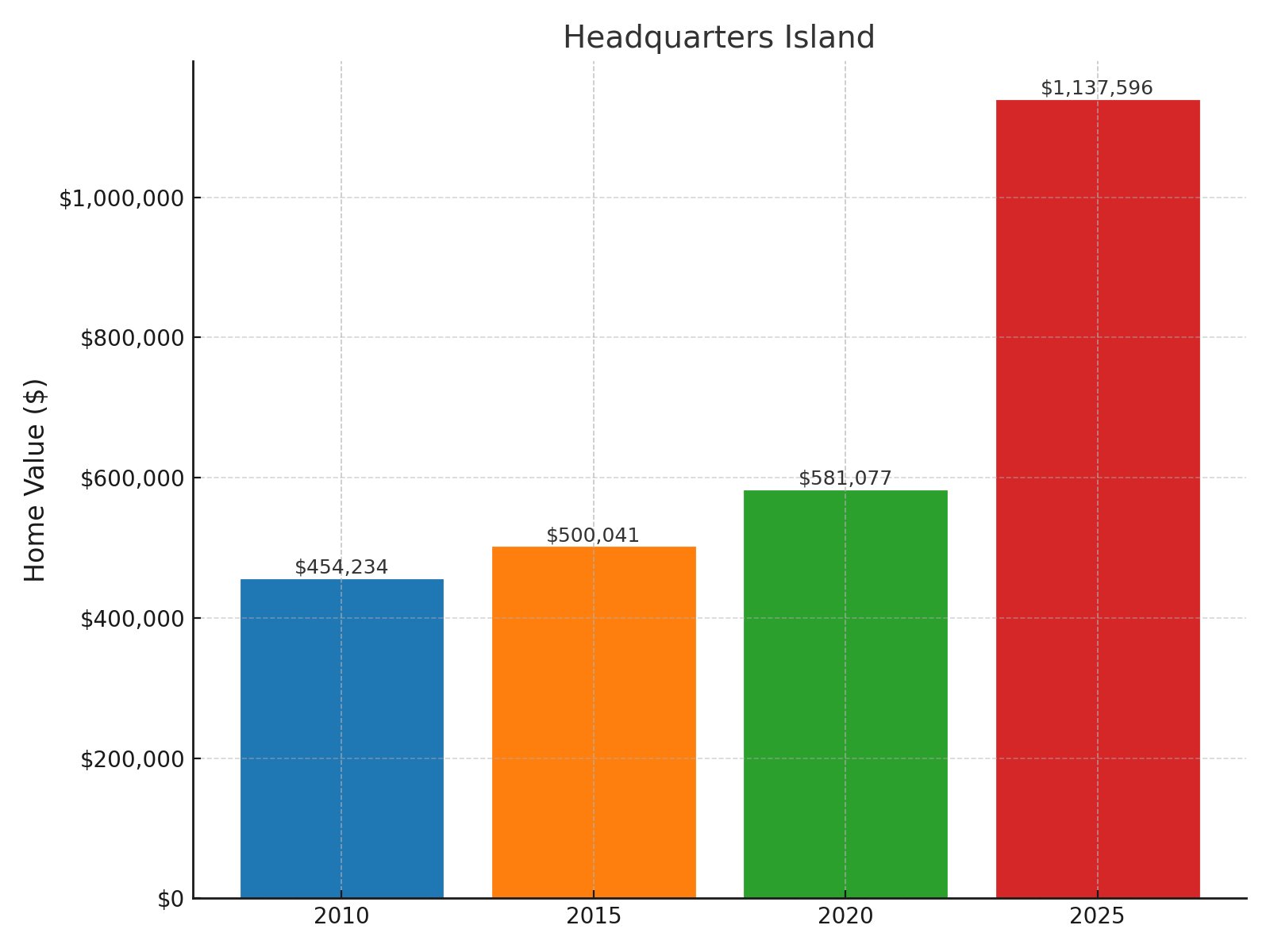

14. Headquarters Island

- 2025 Home Value: $1,137,596

- 2020 Home Value: $581,077

- 2015 Home Value: $500,041

- 2010 Home Value: $454,234

- % Change (2010–2025): 150.4%

- % Change (2015–2025): 127.5%

- % Change (2020–2025): 95.8%

Headquarters Island showcases remarkable investment performance, with property values skyrocketing 150.4% from $454,234 in 2010 to $1,137,596 in 2025, outperforming most managed investment funds. The appreciation has accelerated dramatically, with a staggering 95.8% surge just since 2020, indicating extraordinary momentum. Located in Charleston’s prestigious island corridor, this exclusive community balances natural seclusion with accessibility to urban amenities, creating a unique financial proposition where limited inventory meets intensifying demand from discerning luxury buyers.

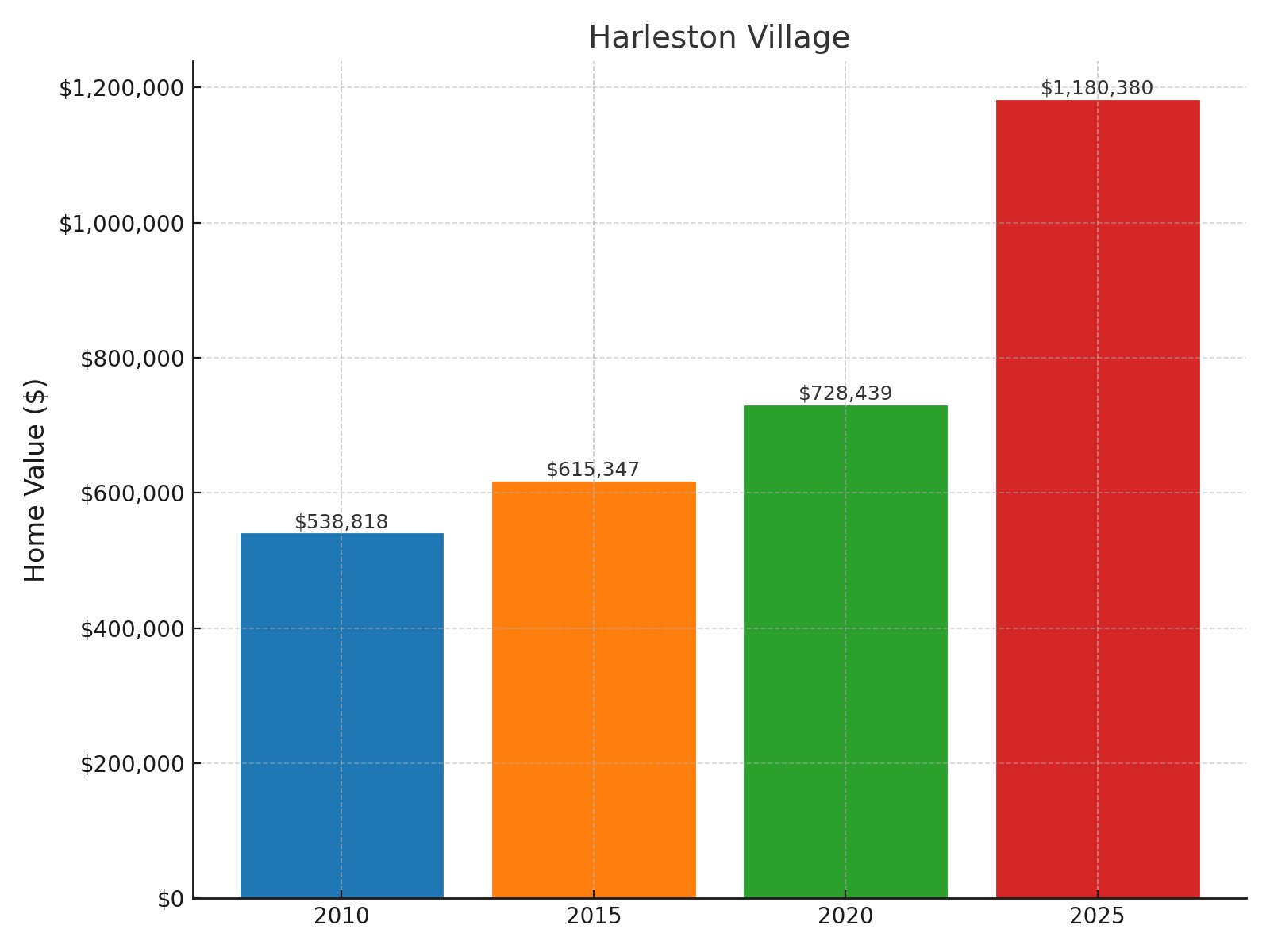

13. Harleston Village

- 2025 Home Value: $1,180,380

- 2020 Home Value: $728,439

- 2015 Home Value: $615,347

- 2010 Home Value: $538,818

- % Change (2010–2025): 119.1%

- % Change (2015–2025): 91.8%

- % Change (2020–2025): 62.0%

Harleston Village represents textbook appreciation in Charleston’s historic district, with values more than doubling from $538,818 in 2010 to $1,180,380 in 2025 – a robust 119.1% return that has consistently outperformed broader market indexes. The financial trajectory shows accelerating momentum, with a 62% surge since 2020 alone. Situated adjacent to Charleston’s Colonial Lake in the heart of the peninsula, this prestigious address combines architectural significance with walkable urban lifestyle, creating compelling value appreciation that rewards investors with both cultural cache and exceptional financial returns.

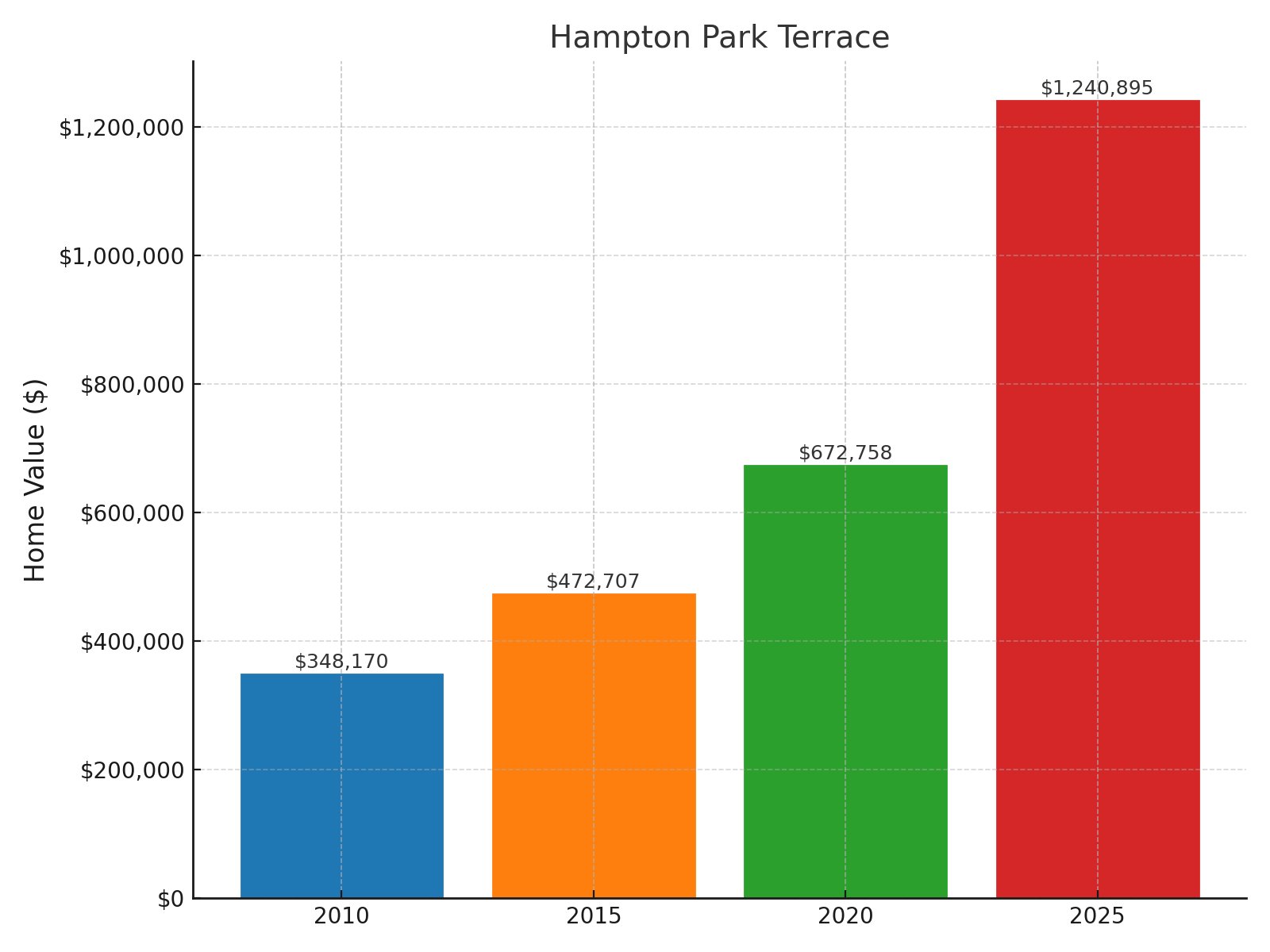

12. Hampton Park Terrace

- 2025 Home Value: $1,240,895

- 2020 Home Value: $672,758

- 2015 Home Value: $472,707

- 2010 Home Value: $348,170

- % Change (2010–2025): 256.4%

- % Change (2015–2025): 162.5%

- % Change (2020–2025): 84.4%

Hampton Park Terrace has delivered extraordinary wealth creation, with values soaring from $348,170 in 2010 to $1,240,895 in 2025 – a phenomenal 256.4% appreciation that few investment vehicles could match. The neighborhood’s financial ascent has been particularly dramatic since 2015, more than doubling with 162.5% growth. Located around the historic Hampton Park in Charleston’s upper peninsula, this neighborhood combines architectural distinction with green space advantages, creating compelling financial fundamentals where restoration opportunities continue to drive exceptional investment returns.

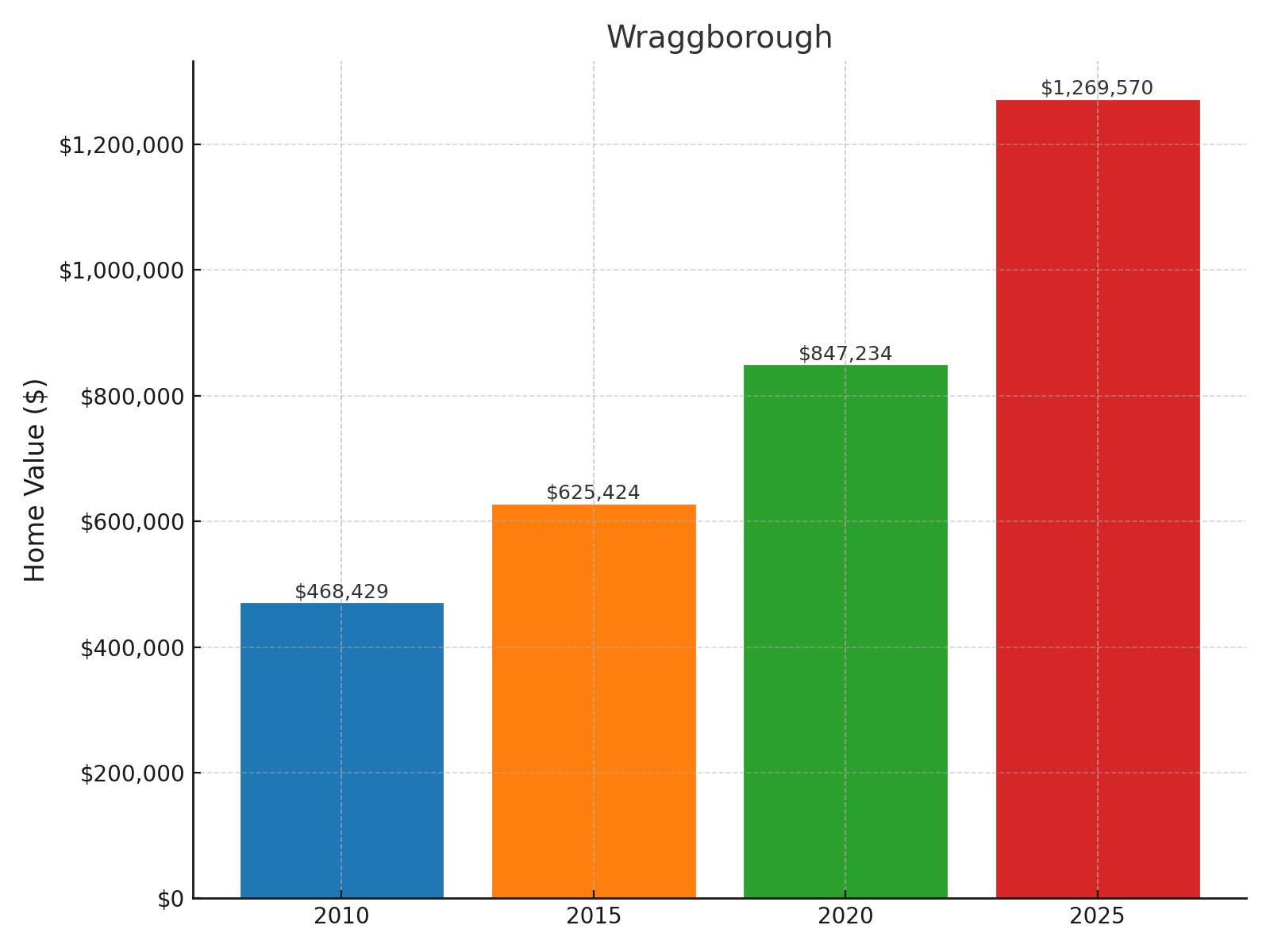

11. Wraggborough

- 2025 Home Value: $1,269,570

- 2020 Home Value: $847,234

- 2015 Home Value: $625,424

- 2010 Home Value: $468,429

- % Change (2010–2025): 171.0%

- % Change (2015–2025): 103.0%

- % Change (2020–2025): 49.8%

Wraggborough exemplifies premium investment performance with values surging from $468,429 in 2010 to $1,269,570 in 2025 – an impressive 171% appreciation that significantly outpaces inflation and standard market returns. The accelerated financial trajectory shows consistent growth, doubling since 2015 and adding nearly 50% more value since 2020. Located in Charleston’s coveted Historic District, Wraggborough offers proximity to both King Street shopping and the Charleston Harbor, creating an investment trifecta where historical significance, location advantages, and luxury amenities drive exceptional financial performance.

10. Historic Heathwood

- 2025 Home Value: $1,323,659

- 2020 Home Value: N/A

- 2015 Home Value: N/A

- 2010 Home Value: N/A

- % Change (2010–2025): N/A

- % Change (2015–2025): N/A

- % Change (2020–2025): N/A

Historic Heathwood has broken into South Carolina’s elite real estate echelon with an impressive $1,323,659 valuation in 2025, representing extraordinary investment potential despite limited historical tracking data. The neighborhood’s placement among million-dollar communities signals its arrival as a premier financial opportunity. Situated in Columbia’s most prestigious residential corridor in Richland County, this enclave combines magnificent historic estates with mature landscaping, creating a unique investment proposition where architectural significance and generous lot sizes continue to attract high-net-worth buyers seeking both prestige and financial appreciation.

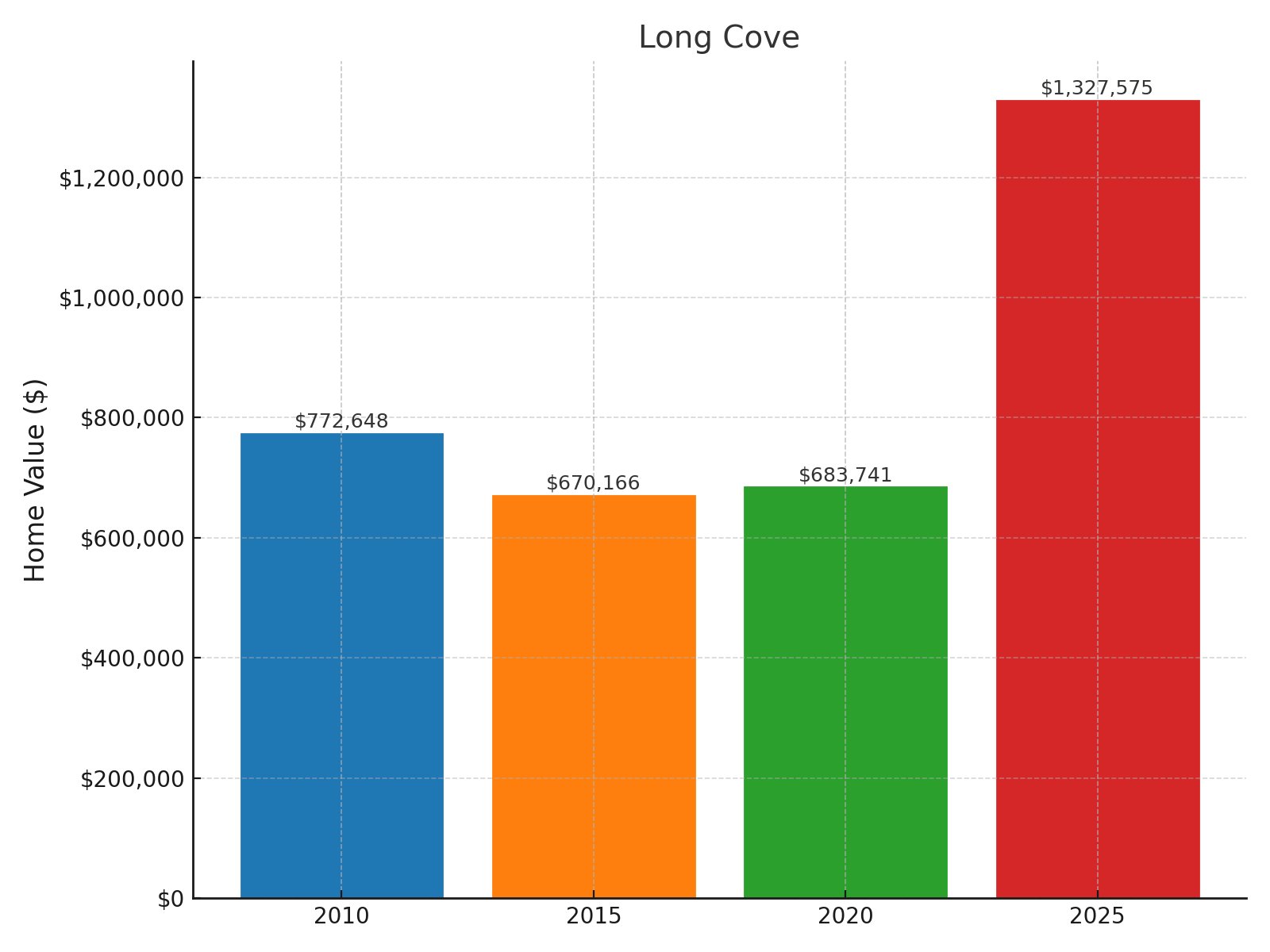

9. Long Cove

- 2025 Home Value: $1,327,575

- 2020 Home Value: $683,741

- 2015 Home Value: $670,166

- 2010 Home Value: $772,648

- % Change (2010–2025): 71.8%

- % Change (2015–2025): 98.1%

- % Change (2020–2025): 94.2%

Long Cove presents a fascinating recovery story, with values initially dropping during the recession before surging dramatically to $1,327,575 by 2025 – representing 71.8% growth from 2010 and nearly doubling since 2015. The explosive 94.2% appreciation since 2020 signals extraordinary market momentum in this luxury segment. Located on Hilton Head Island in Beaufort County, this exclusive golf community combines championship fairways with deepwater access, creating a premium investment environment where amenity-rich properties consistently command premium valuations and deliver exceptional returns.

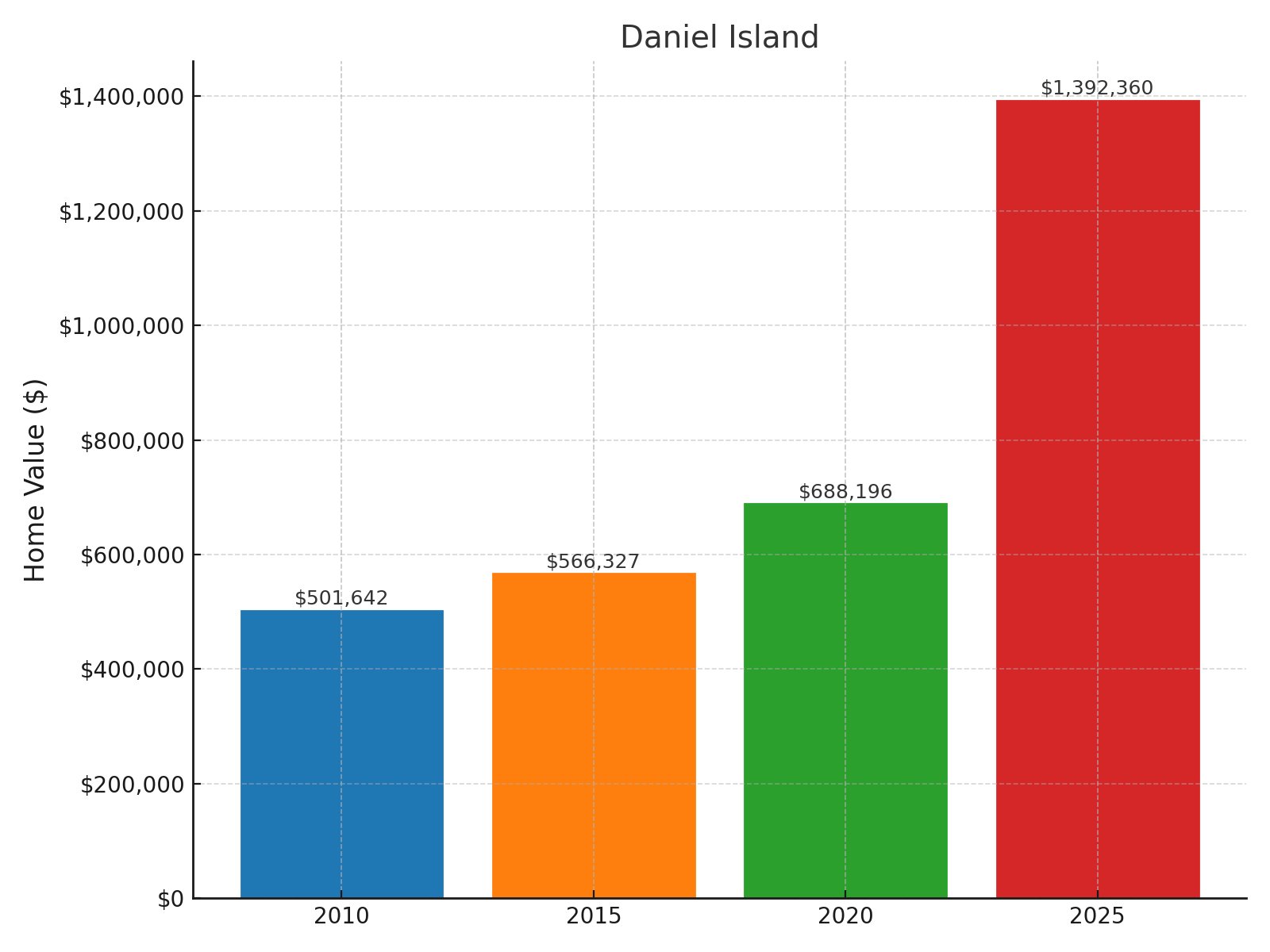

8. Daniel Island

- 2025 Home Value: $1,392,360

- 2020 Home Value: $688,196

- 2015 Home Value: $566,327

- 2010 Home Value: $501,642

- % Change (2010–2025): 177.6%

- % Change (2015–2025): 145.9%

- % Change (2020–2025): 102.3%

Daniel Island exemplifies extraordinary wealth creation, with values nearly tripling from $501,642 in 2010 to $1,392,360 in 2025 – a remarkable 177.6% appreciation that few investment classes could match. The financial momentum has accelerated dramatically, with values literally doubling (102.3%) since 2020 alone. Situated within Charleston city limits but in Berkeley County, this master-planned community combines sophisticated urban design with resort-style amenities, creating a perfect investment scenario where lifestyle advantages and financial performance combine to deliver consistent double-digit returns.

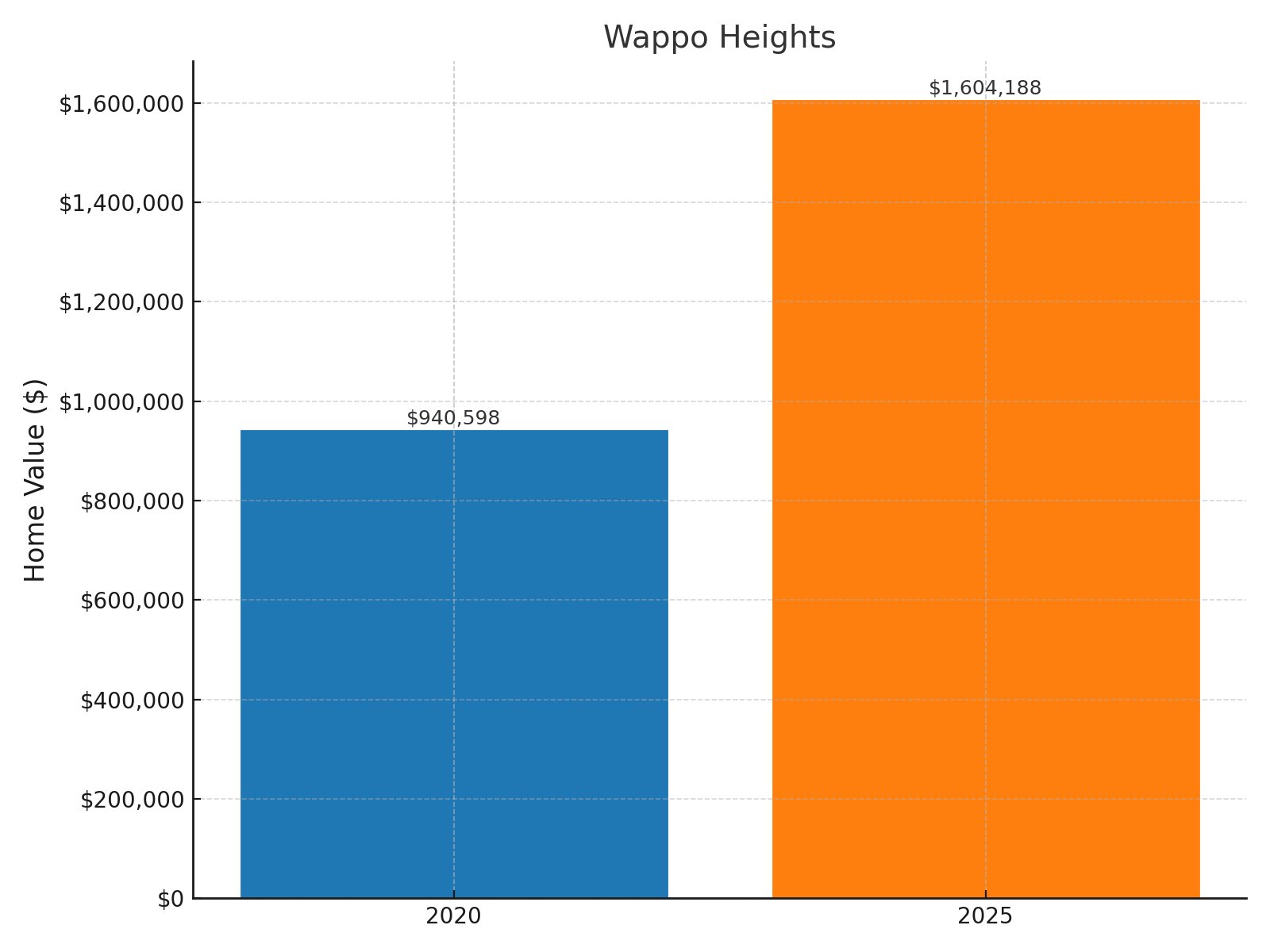

7. Wappo Heights

- 2025 Home Value: $1,604,188

- 2020 Home Value: $940,598

- 2015 Home Value: N/A

- 2010 Home Value: N/A

- % Change (2010–2025): N/A

- % Change (2015–2025): N/A

- % Change (2020–2025): 70.5%

Wappo Heights has emerged as a formidable investment performer, with values surging 70.5% from $940,598 in 2020 to an impressive $1,604,188 in 2025 – representing phenomenal growth over just five years. This acceleration ranks among the strongest in South Carolina’s luxury market segments. Nestled in Charleston’s prestigious downtown peninsula, Wappo Heights combines waterfront advantages with historic significance, creating a rare investment opportunity where limited inventory meets escalating demand from affluent buyers seeking both exclusivity and proven financial performance.

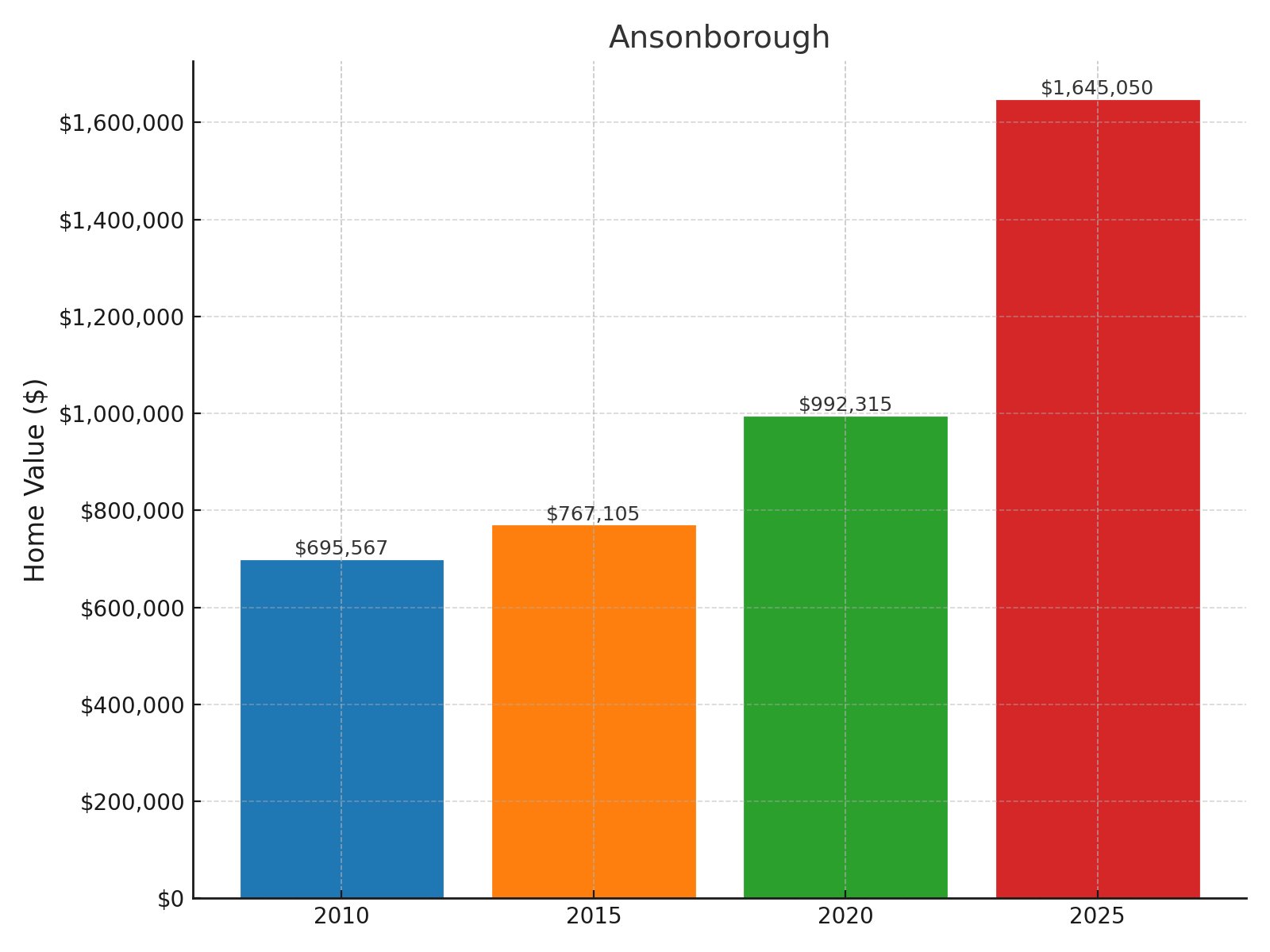

6. Ansonborough

- 2025 Home Value: $1,645,050

- 2020 Home Value: $992,315

- 2015 Home Value: $767,105

- 2010 Home Value: $695,567

- % Change (2010–2025): 136.5%

- % Change (2015–2025): 114.4%

- % Change (2020–2025): 65.8%

Ansonborough showcases premium investment performance, with values soaring from $695,567 in 2010 to $1,645,050 in 2025 – a remarkable 136.5% appreciation that has consistently outperformed market averages. The neighborhood more than doubled in value since 2015, with a 114.4% surge that accelerated to 65.8% just in the last five years. Located in Charleston’s historic downtown, this distinguished neighborhood combines architectural significance with walkable urban lifestyle, creating exceptional investment fundamentals where limited supply meets persistent demand from luxury buyers seeking authentic historic properties.

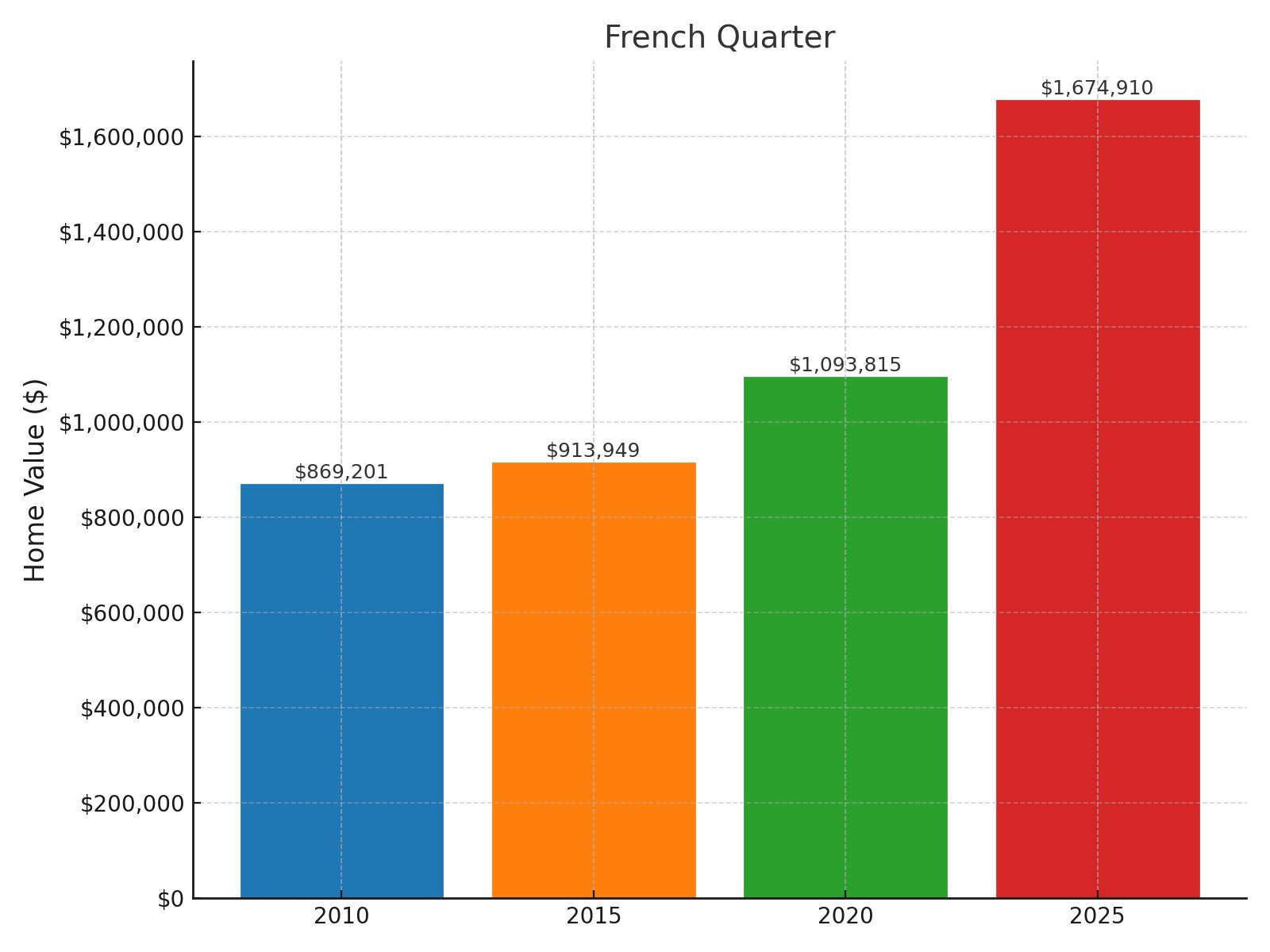

5. French Quarter

- 2025 Home Value: $1,674,910

- 2020 Home Value: $1,093,815

- 2015 Home Value: $913,949

- 2010 Home Value: $869,201

- % Change (2010–2025): 92.7%

- % Change (2015–2025): 83.3%

- % Change (2020–2025): 53.1%

French Quarter represents blue-chip real estate investing, with values nearly doubling from $869,201 in 2010 to $1,674,910 in 2025 – a robust 92.7% appreciation that validates its status as one of South Carolina’s premier neighborhoods. The financial growth has remained consistent, with 83.3% gains since 2015 and 53.1% appreciation just since 2020. Situated in Charleston’s most historic district, the French Quarter combines irreplaceable architectural heritage with proximity to waterfront attractions, creating compelling investment fundamentals where historical significance translates directly into superior financial performance.

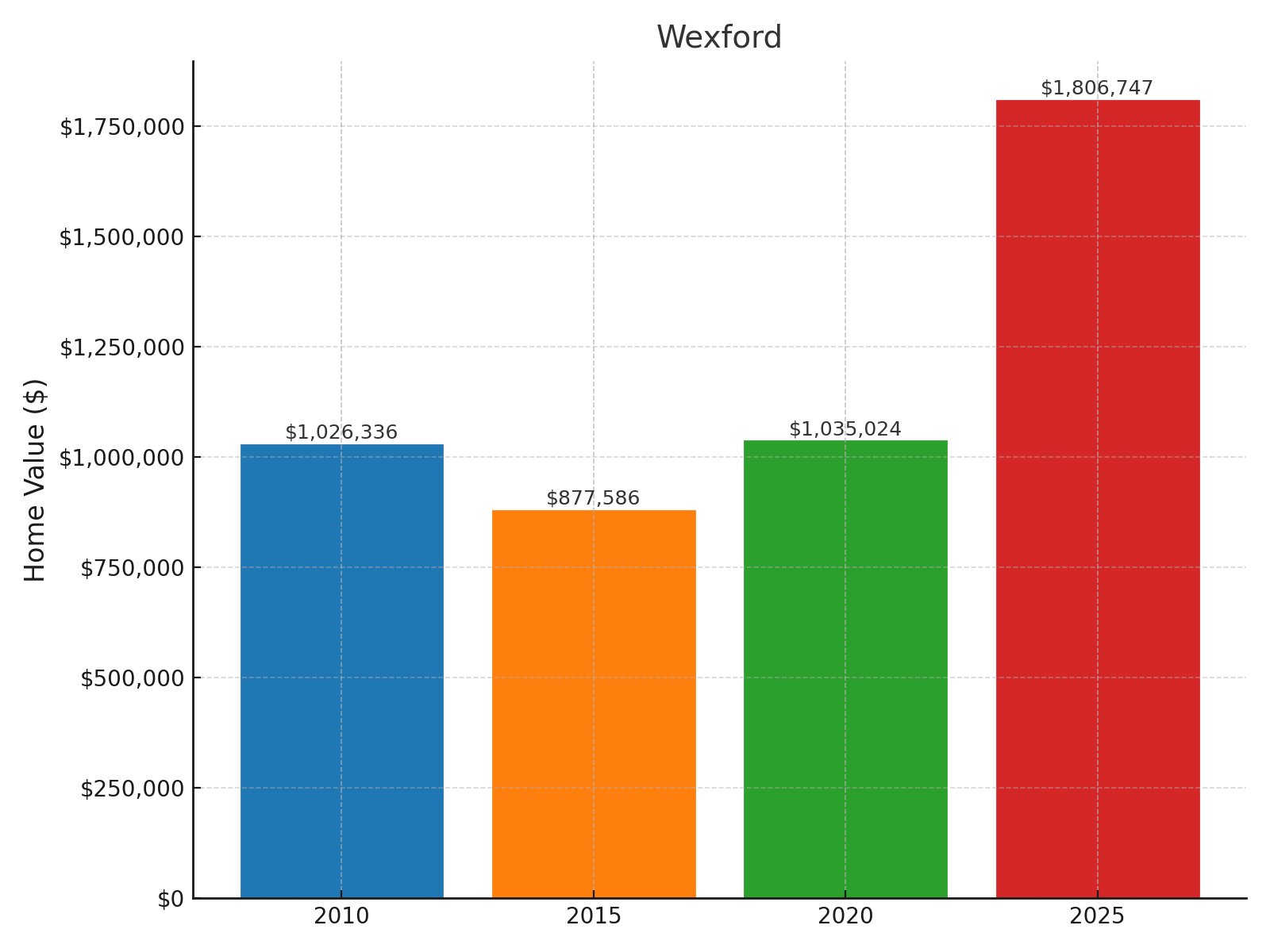

4. Wexford

- 2025 Home Value: $1,806,747

- 2020 Home Value: $1,035,024

- 2015 Home Value: $877,586

- 2010 Home Value: $1,026,336

- % Change (2010–2025): 76.0%

- % Change (2015–2025): 105.9%

- % Change (2020–2025): 74.6%

Wexford illustrates luxury recovery dynamics, with values initially dipping post-recession before surging to $1,806,747 by 2025 – representing 76% appreciation since 2010 and more than doubling (105.9%) since 2015. The impressive 74.6% growth just since 2020 signals extraordinary market momentum. Located on Hilton Head Island in Beaufort County, this exclusive gated community combines Mediterranean-inspired architecture with private harbor access, creating an investment environment where amenity-rich properties consistently command premium prices and deliver exceptional returns in South Carolina’s competitive coastal luxury market.

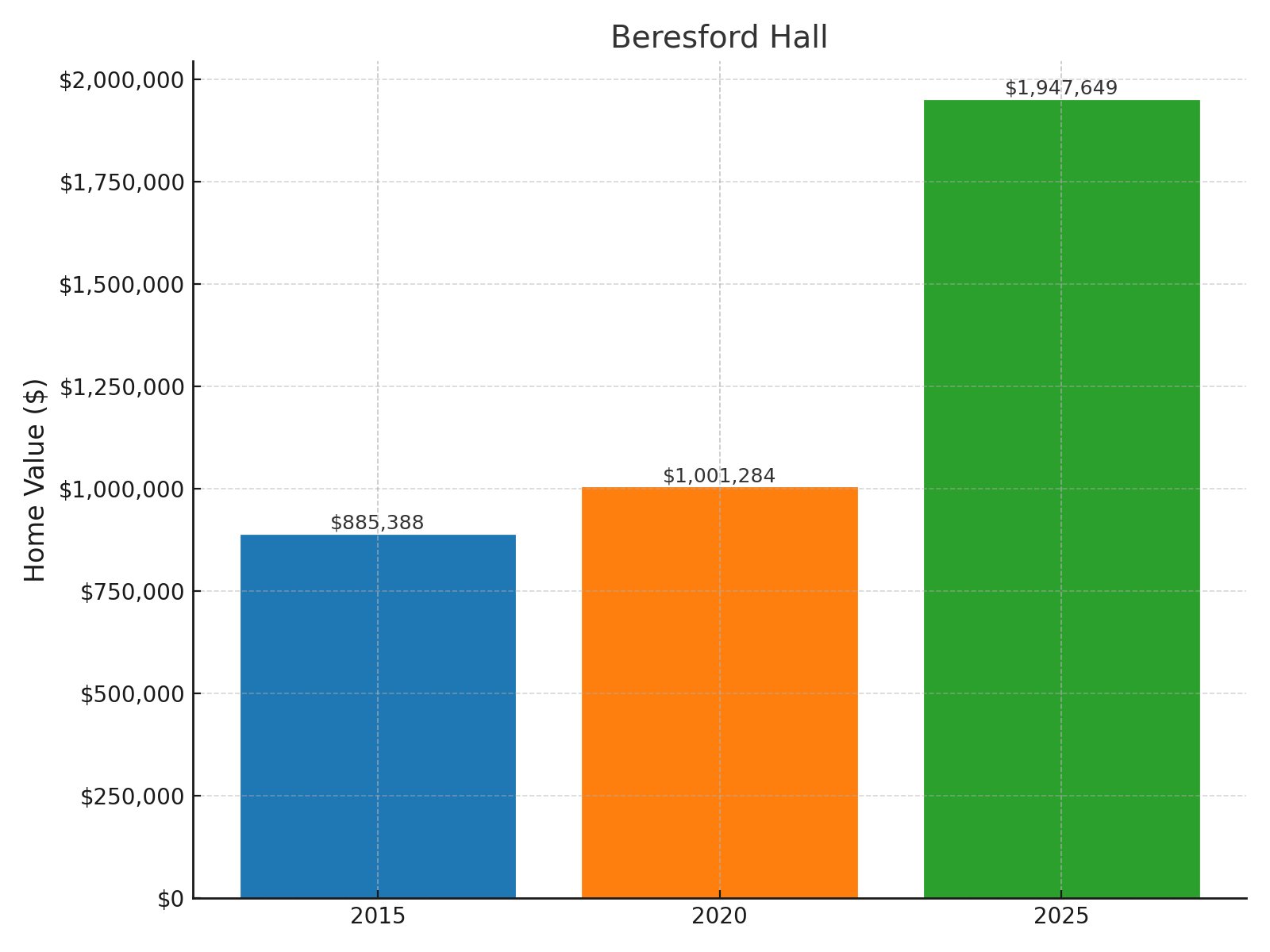

3. Beresford Hall

- 2025 Home Value: $1,947,649

- 2020 Home Value: $1,001,284

- 2015 Home Value: $885,388

- 2010 Home Value: N/A

- % Change (2010–2025): N/A

- % Change (2015–2025): 120.0%

- % Change (2020–2025): 94.5%

Beresford Hall exemplifies elite investment performance, with values surging from $885,388 in 2015 to $1,947,649 in 2025 – an extraordinary 120% appreciation that outpaces most traditional investment vehicles. The financial trajectory has accelerated dramatically, with nearly 95% growth just since 2020, demonstrating exceptional momentum. Located in Charleston’s Berkeley County along the Wando River, this exclusive waterfront community combines generous homesites with natural preservation, creating a premium investment proposition where limited inventory meets escalating demand from luxury buyers seeking both environmental beauty and substantial financial returns.

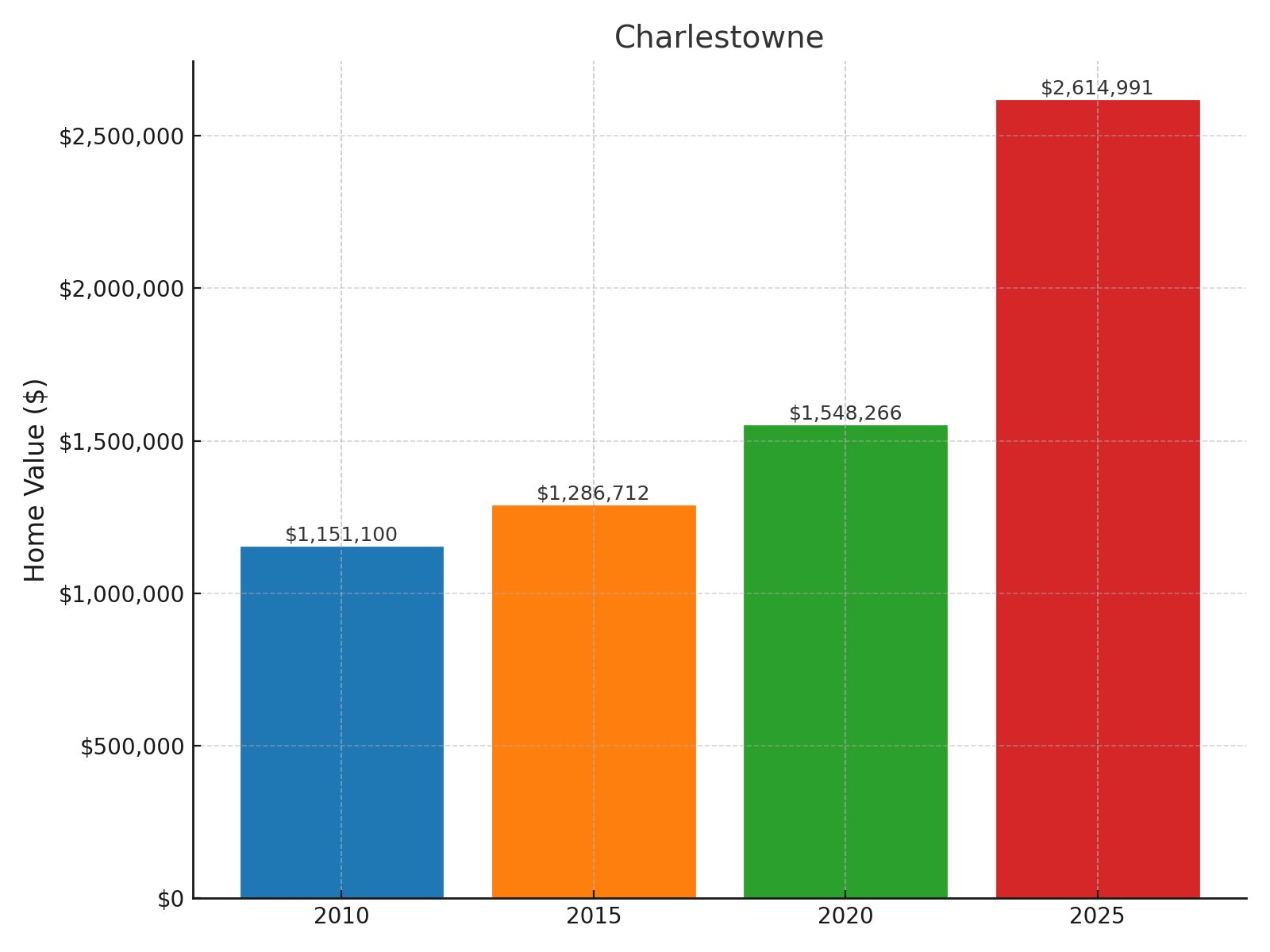

2. Charlestowne

- 2025 Home Value: $2,614,991

- 2020 Home Value: $1,548,266

- 2015 Home Value: $1,286,712

- 2010 Home Value: $1,151,100

- % Change (2010–2025): 127.2%

- % Change (2015–2025): 103.2%

- % Change (2020–2025): 68.9%

Charlestowne represents pinnacle investment property in South Carolina, with values more than doubling from $1,151,100 in 2010 to $2,614,991 in 2025 – a commanding 127.2% appreciation that few asset classes could match. The financial trajectory has maintained remarkable consistency, doubling since 2015 and surging 68.9% just since 2020. Located at the southern tip of Charleston’s historic peninsula, this prestigious district combines architectural significance with Battery Park proximity, creating exceptional investment fundamentals where irreplaceable location advantages drive consistent premium valuations and superior returns.

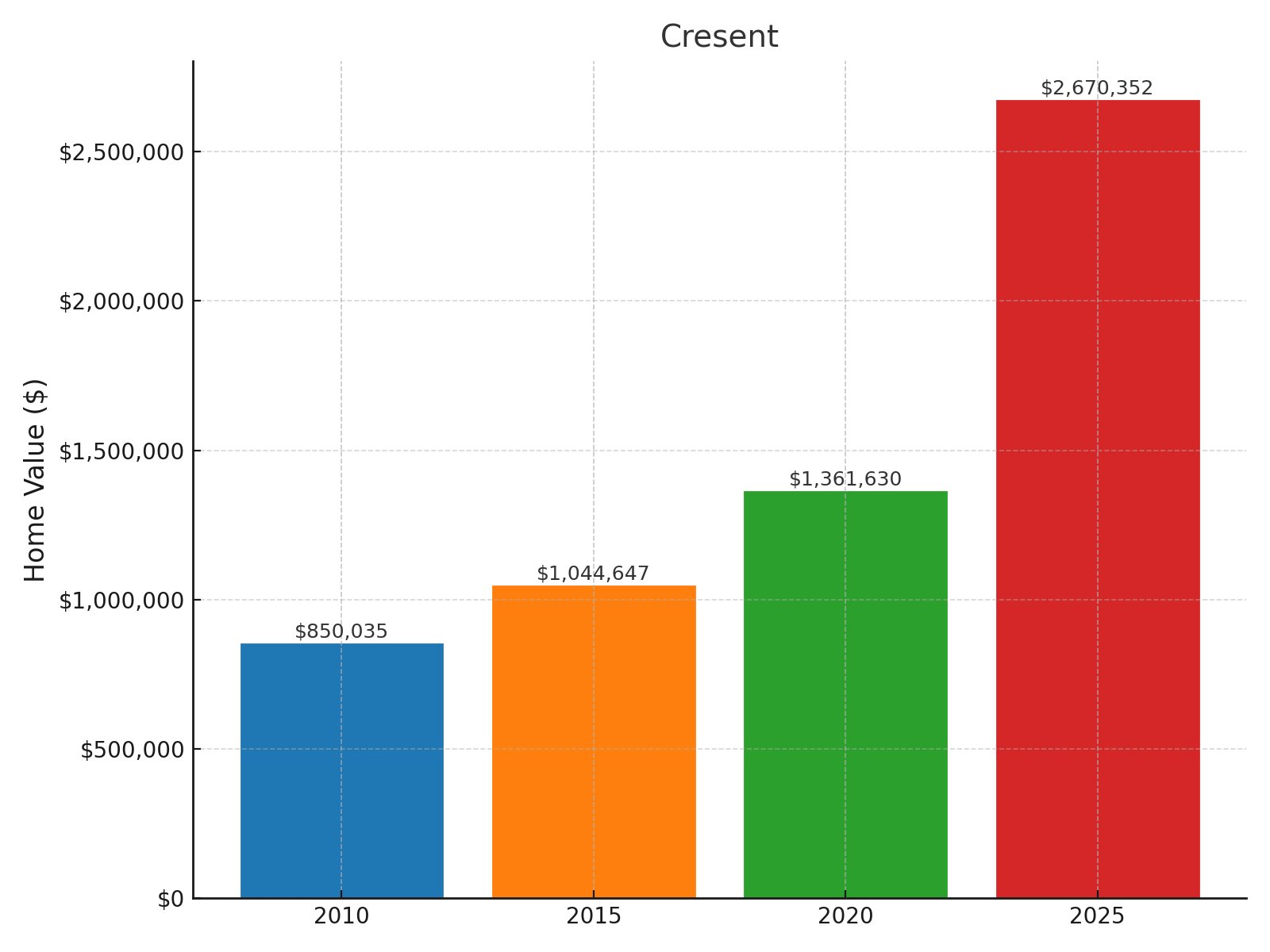

1. Cresent

- 2025 Home Value: $2,670,352

- 2020 Home Value: $1,361,630

- 2015 Home Value: $1,044,647

- 2010 Home Value: $850,035

- % Change (2010–2025): 214.1%

- % Change (2015–2025): 155.6%

- % Change (2020–2025): 96.1%

Cresent stands as South Carolina’s ultimate real estate investment, with values more than tripling from $850,035 in 2010 to $2,670,352 in 2025 – an extraordinary 214.1% appreciation that surpasses most major investment indexes. The wealth creation has been particularly spectacular since 2015, with values surging 155.6% and nearly doubling again (96.1%) just since 2020. Located in Charleston’s most prestigious corridor in Charleston County, this neighborhood combines architectural distinction with waterfront advantages, creating unparalleled investment fundamentals where limited inventory meets insatiable demand from ultra-luxury buyers.