Would you like to save this?

According to the Zillow Home Value Index, South Carolina still has towns where buying a home won’t break the bank. In 2025, we’ve pinpointed 15 communities with some of the state’s most affordable home prices—places where value still outweighs hype. Whether you’re a first-time buyer, a downsizing retiree, or just looking to stretch your dollar, these towns offer a mix of charm and cost-effectiveness. Some have flown under the radar for years; others are just starting to pop onto buyers’ maps. With year-by-year price trends and local insights, this list reveals where affordability and livability still go hand in hand.

15. Windsor – 24% Home Price Decrease Since 2017

- 2017: $133,031

- 2018: $146,763 (+$13,732, +10.32% from previous year)

- 2019: $149,931 (+$3,168, +2.16% from previous year)

- 2020: $166,256 (+$16,324, +10.89% from previous year)

- 2021: $162,479 (-$3,777, -2.27% from previous year)

- 2022: $163,548 (+$1,069, +0.66% from previous year)

- 2023: $140,446 (-$23,102, -14.13% from previous year)

- 2024: $118,588 (-$21,859, -15.56% from previous year)

- 2025: $101,127 (-$17,460, -14.72% from previous year)

After a strong climb in value between 2017 and 2020, Windsor’s housing market has taken a steep dive. Prices have fallen nearly 40% from their peak, settling at just over $101,000 in 2025. While this might raise eyebrows, it also opens the door for buyers looking to get into a market where affordability is back on the table.

Windsor – A Market Correction Creates Opportunity

Windsor is a small, rural town in Aiken County, tucked into the quiet southern corner of South Carolina. While it lacks the hustle of bigger cities, it’s surrounded by farmland and woodlands, offering peaceful surroundings for residents who value space and simplicity. The recent drop in home values follows several years of strong growth, likely accelerated by national buying trends during the early pandemic years.

The town’s affordability may be tied to its limited commercial development and slower population growth, both of which can impact long-term demand. That said, homes here now cost a fraction of the state average, and the sharp correction could represent a rebalancing rather than a permanent slump.

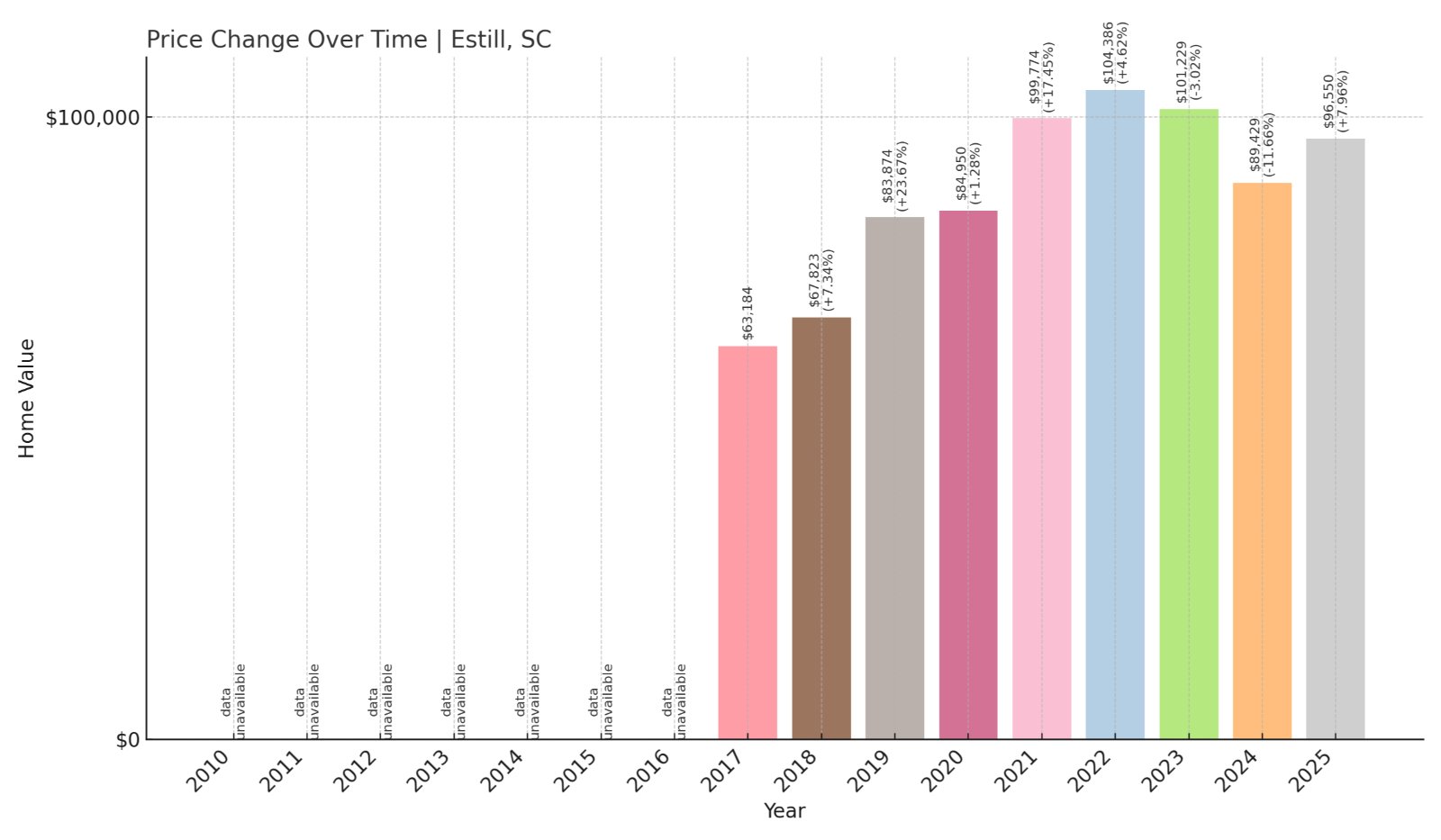

14. Estill – 53% Home Price Increase Since 2017

- 2017: $63,184

- 2018: $67,823 (+$4,639, +7.34% from previous year)

- 2019: $83,874 (+$16,051, +23.67% from previous year)

- 2020: $84,950 (+$1,076, +1.28% from previous year)

- 2021: $99,774 (+$14,824, +17.45% from previous year)

- 2022: $104,386 (+$4,611, +4.62% from previous year)

- 2023: $101,229 (-$3,156, -3.02% from previous year)

- 2024: $89,429 (-$11,801, -11.66% from previous year)

- 2025: $96,550 (+$7,121, +7.96% from previous year)

Estill’s real estate market has seen considerable growth since 2017, despite some recent turbulence. The 2025 price of $96,550 is more than 50% higher than it was eight years ago. After two down years, prices began to rebound in 2025, signaling renewed interest or market stabilization in this small town.

Estill – Recovery After a Dip

Located in Hampton County near the Georgia border, Estill is a town with deep agricultural roots and a close-knit community. Its affordable housing market makes it attractive to buyers seeking lower costs without giving up Southern charm. The town’s recent rebound in home values may reflect shifting demand as buyers explore alternatives to larger urban areas.

Estill experienced strong appreciation between 2017 and 2021, followed by a noticeable pullback. Still, with values inching back up in 2025, it suggests that interest in the area remains steady. A modest infrastructure and rural setting keep prices low, but access to nearby highways adds some convenience for commuters or those seeking occasional city amenities.

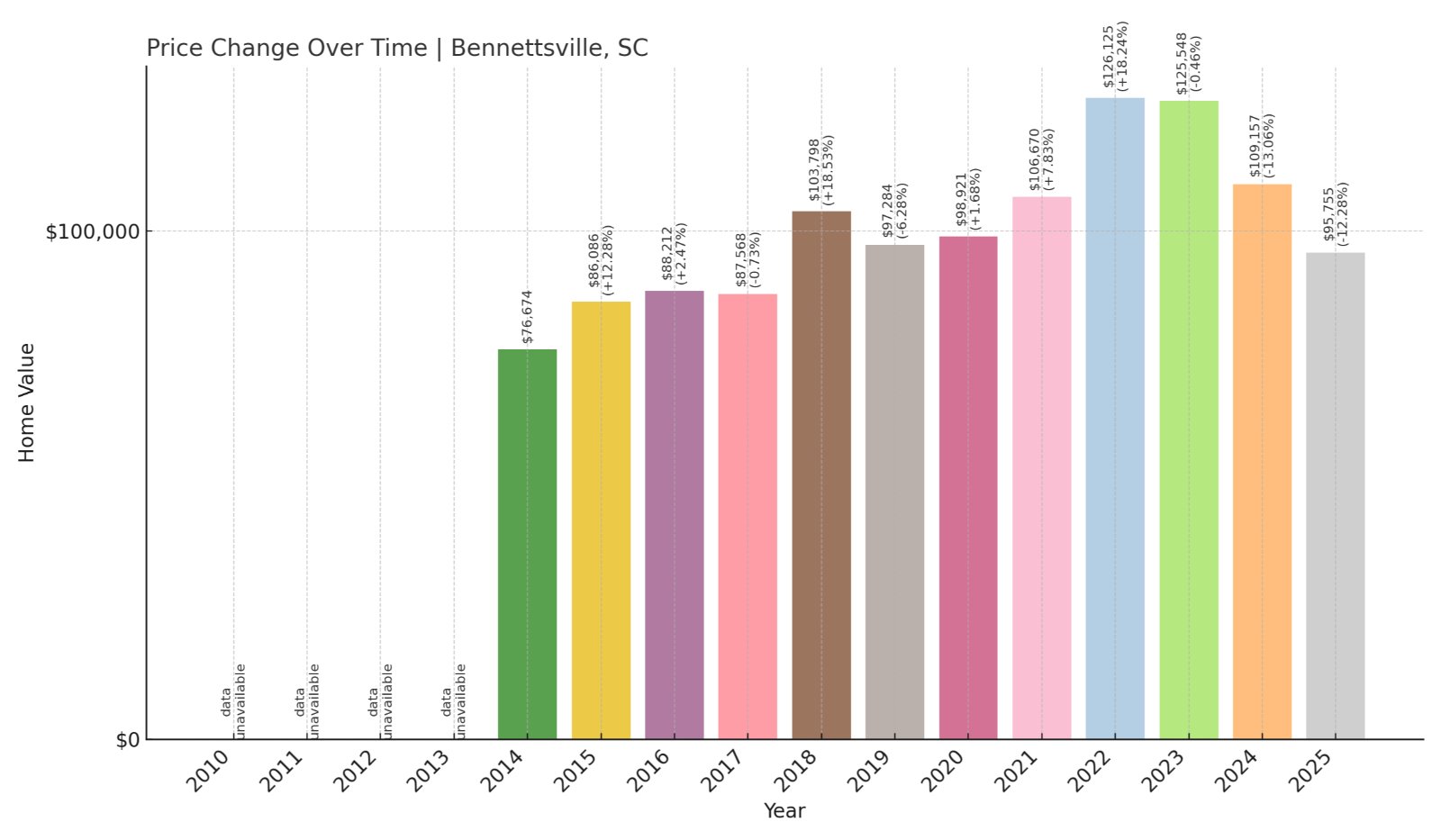

13. Bennettsville – 26% Home Price Increase Since 2014

- 2014: $76,674

- 2015: $86,086 (+$9,413, +12.28% from previous year)

- 2016: $88,212 (+$2,126, +2.47% from previous year)

- 2017: $87,568 (-$644, -0.73% from previous year)

- 2018: $103,798 (+$16,230, +18.53% from previous year)

- 2019: $97,284 (-$6,514, -6.28% from previous year)

- 2020: $98,921 (+$1,637, +1.68% from previous year)

- 2021: $106,670 (+$7,748, +7.83% from previous year)

- 2022: $126,125 (+$19,455, +18.24% from previous year)

- 2023: $125,548 (-$577, -0.46% from previous year)

- 2024: $109,157 (-$16,391, -13.06% from previous year)

- 2025: $95,755 (-$13,401, -12.28% from previous year)

Bennettsville has seen home prices increase by over a quarter since 2014, but recent years have been marked by a steady decline. The town peaked in 2022 and has since lost nearly 25% in value. Still, at under $100,000, it’s an affordable option with a longer-term growth trend still intact.

Bennettsville – A Small City with Historic Appeal

Would you like to save this?

Sitting near the North Carolina border in Marlboro County, Bennettsville is known for its historic buildings and tree-lined streets. As a former cotton hub, it boasts a rich history and Southern architecture that continues to attract buyers looking for charm and value. Though the market cooled recently, Bennettsville had a solid decade of appreciation before the downturn.

The town has local schools, a small downtown district, and proximity to Florence and other regional centers, adding to its accessibility. Its decline in home prices may reflect the broader national correction, but the current affordability could draw in buyers interested in historic homes and low entry points.

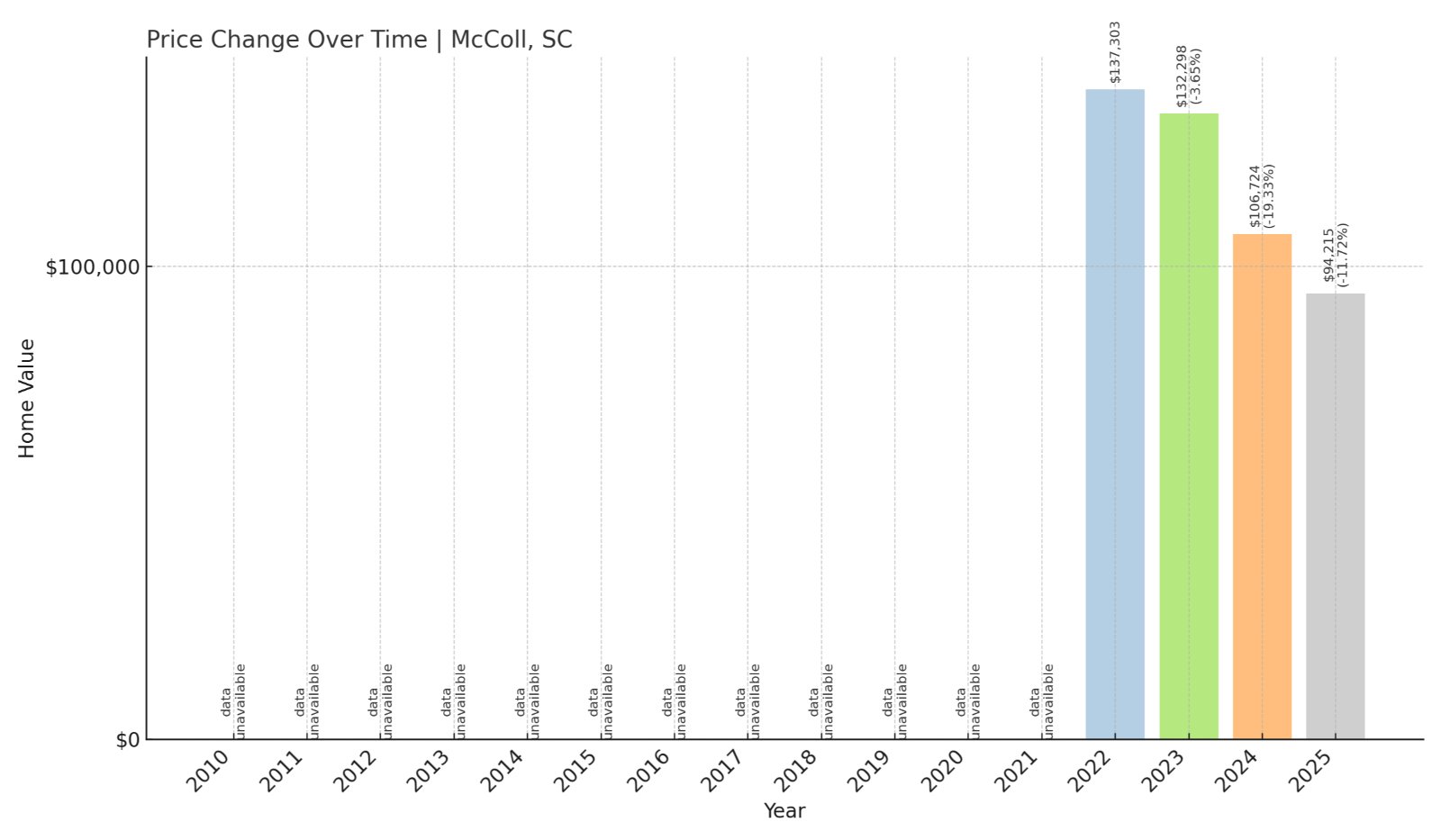

12. McColl – 31% Home Price Decrease Since 2022

- 2022: $137,303

- 2023: $132,298 (-$5,005, -3.65% from previous year)

- 2024: $106,724 (-$25,574, -19.33% from previous year)

- 2025: $94,215 (-$12,509, -11.72% from previous year)

Since reaching a recent high in 2022, McColl’s home prices have plummeted by nearly a third. In 2025, the average price stands just above $94,000, making it one of the more affordable towns in the state. The sharp correction signals a buyer-friendly market, though the reasons behind the shift warrant a closer look.

McColl – Sudden Drop Brings Affordability

McColl is a small town in Marlboro County, near the Pee Dee region of northeastern South Carolina. Once supported by textiles and railroads, its economy has slowed in recent years. The drop in property values could reflect waning local demand or reduced economic activity, but it also means homes here are more accessible than they’ve been in years.

While infrastructure is limited, McColl’s location near the North Carolina line offers regional access to larger towns like Laurinburg or Rockingham. Its quiet, residential neighborhoods and low cost of living may appeal to those looking for simplicity and affordability. If the price correction stabilizes, McColl may emerge as a budget-conscious alternative in the region.

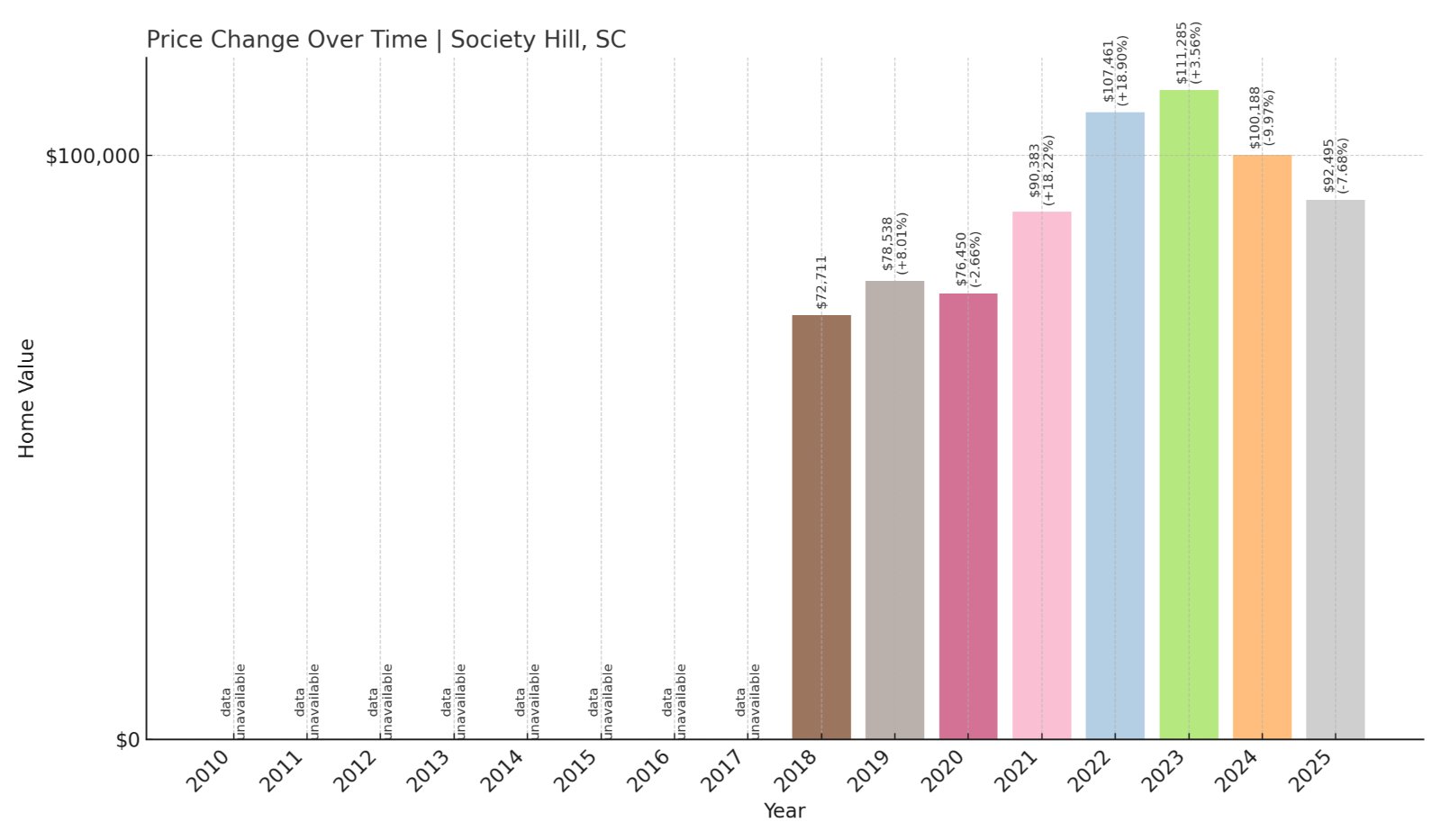

11. Society Hill – 27% Home Price Increase Since 2018

- 2018: $72,711

- 2019: $78,538 (+$5,827, +8.01% from previous year)

- 2020: $76,450 (-$2,088, -2.66% from previous year)

- 2021: $90,383 (+$13,933, +18.23% from previous year)

- 2022: $107,461 (+$17,078, +18.89% from previous year)

- 2023: $111,285 (+$3,824, +3.56% from previous year)

- 2024: $100,188 (-$11,097, -9.97% from previous year)

- 2025: $92,495 (-$7,693, -7.68% from previous year)

Society Hill’s prices have risen steadily since 2018, despite a recent pullback. The current average of $92,495 still represents significant long-term growth. It’s a market that gained traction quickly but is now returning to more stable pricing, creating an opportunity for buyers.

Society Hill – Historic Roots and Modern Shifts

Nestled along the Pee Dee River in Darlington County, Society Hill is one of the oldest towns in the state, with colonial-era history and preserved architecture. That character, along with quiet streets and riverside scenery, helped attract homebuyers during the pandemic-era surge. Prices nearly doubled from 2018 to 2023 before tapering off.

The drop over the past two years could be due to market corrections or fewer out-of-town buyers, but the area remains a compelling option for those who value heritage and affordability. Its proximity to Florence provides access to services and jobs while keeping housing costs far below the state average.

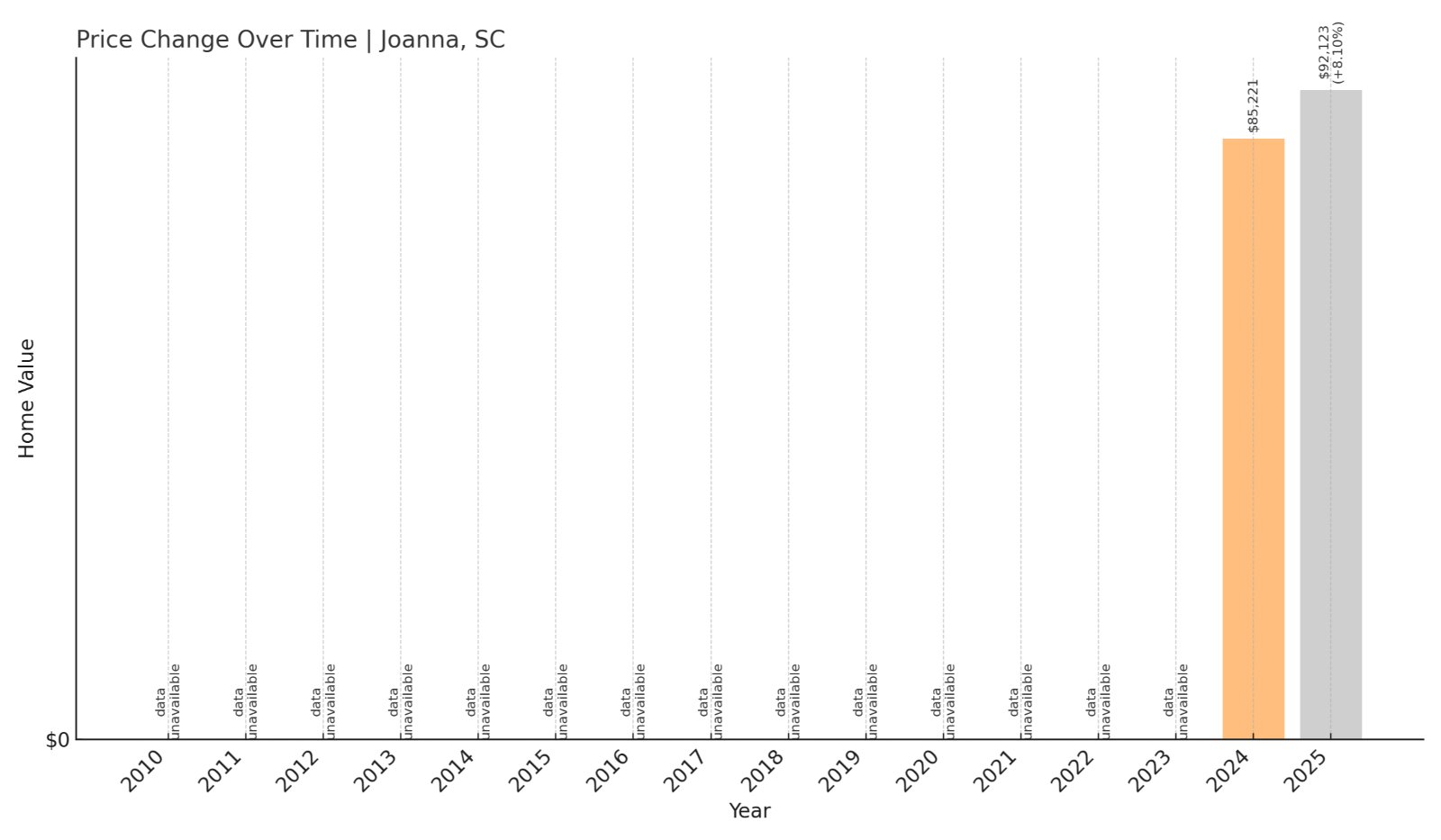

10. Joanna – 8% Home Price Increase Since 2024

- 2024: $85,221

- 2025: $92,123 (+$6,902, +8.10% from previous year)

Joanna is one of the few towns on this list that posted a price increase in 2025. With values rising over 8% in just a year, it stands out as a place where demand is heating up, even as many neighboring markets cool off. The current home price of $92,123 suggests it’s still affordable—but maybe not for long.

Joanna – Gaining Attention Amidst a Down Market

Located in Laurens County, Joanna sits near the center of the state and has traditionally flown under the radar. The town benefits from its position along SC-76, giving residents direct access to larger areas like Clinton and Newberry. Its quiet setting, surrounded by rural landscapes and pine forests, offers an appealing balance of solitude and connection.

While most towns in South Carolina have faced falling home values over the past two years, Joanna’s increase hints at renewed interest—possibly from buyers priced out of nearby areas. Though it’s still a small and modest town, its affordability and recent price gains could make it one to watch as economic conditions shift.

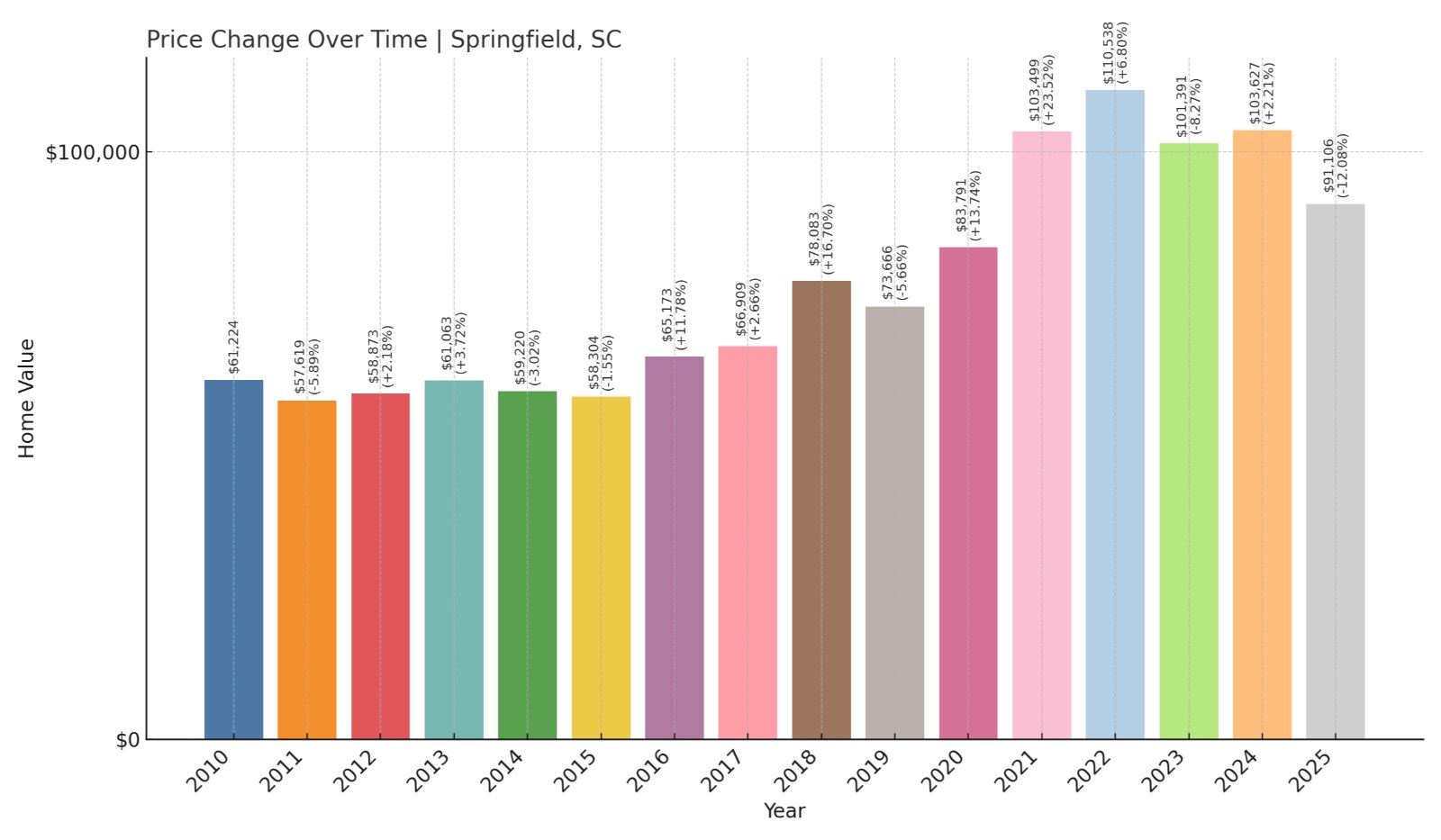

9. Springfield – 49% Home Price Increase Since 2010

- 2010: $61,224

- 2011: $57,619 (-$3,605, -5.89% from previous year)

- 2012: $58,873 (+$1,254, +2.18% from previous year)

- 2013: $61,063 (+$2,189, +3.72% from previous year)

- 2014: $59,220 (-$1,842, -3.02% from previous year)

- 2015: $58,304 (-$916, -1.55% from previous year)

- 2016: $65,173 (+$6,869, +11.78% from previous year)

- 2017: $66,909 (+$1,736, +2.66% from previous year)

- 2018: $78,083 (+$11,174, +16.70% from previous year)

- 2019: $73,666 (-$4,417, -5.66% from previous year)

- 2020: $83,791 (+$10,125, +13.74% from previous year)

- 2021: $103,499 (+$19,707, +23.52% from previous year)

- 2022: $110,538 (+$7,039, +6.80% from previous year)

- 2023: $101,391 (-$9,147, -8.27% from previous year)

- 2024: $103,627 (+$2,236, +2.21% from previous year)

- 2025: $91,106 (-$12,522, -12.08% from previous year)

Over the past 15 years, Springfield’s home values have risen almost 50%, despite a noticeable dip in 2025. After peaking in 2022, the town saw some fluctuations, but even with recent drops, prices remain well above early-2010 levels. At $91,106, homes in Springfield are still considered very affordable.

Springfield – Holding Value in the Long Run

Springfield is a small town in Orangeburg County, located just off U.S. Route 78 in the heart of South Carolina’s agricultural belt. Known for its traditional Southern feel and community-focused events like the annual Governor’s Frog Jump, it has long been a modest and quiet place to live.

Though prices cooled recently, Springfield’s long-term price appreciation is notable. Much of the earlier surge may have been driven by broader rural buying trends during the pandemic, followed by corrections as those pressures eased. Its current values reflect both its stability and ongoing affordability for new buyers.

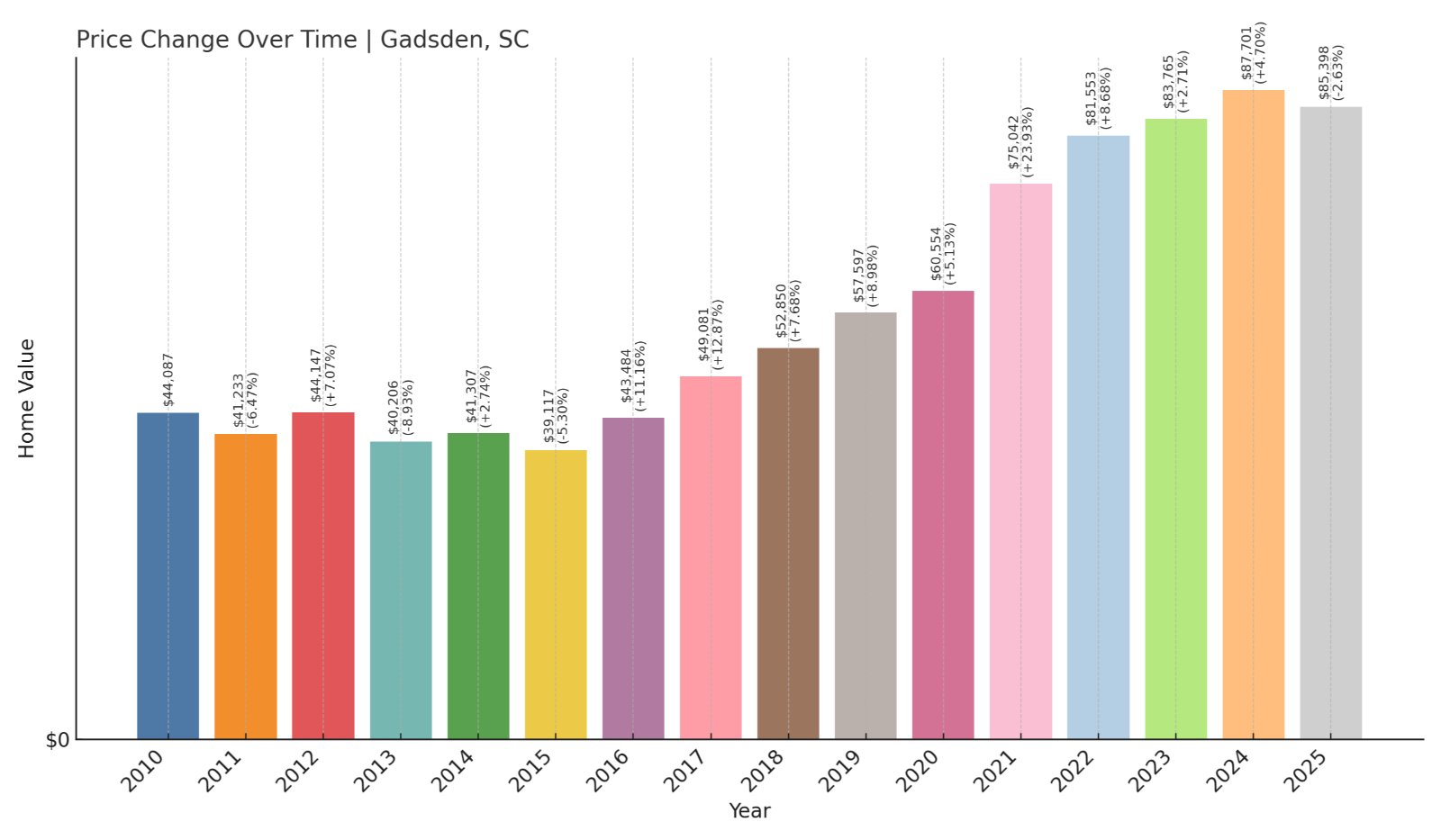

8. Gadsden – 94% Home Price Increase Since 2010

- 2010: $44,087

- 2011: $41,233 (-$2,854, -6.47% from previous year)

- 2012: $44,147 (+$2,913, +7.07% from previous year)

- 2013: $40,206 (-$3,941, -8.93% from previous year)

- 2014: $41,307 (+$1,101, +2.74% from previous year)

- 2015: $39,117 (-$2,190, -5.30% from previous year)

- 2016: $43,484 (+$4,366, +11.16% from previous year)

- 2017: $49,081 (+$5,597, +12.87% from previous year)

- 2018: $52,850 (+$3,769, +7.68% from previous year)

- 2019: $57,597 (+$4,747, +8.98% from previous year)

- 2020: $60,554 (+$2,957, +5.13% from previous year)

- 2021: $75,042 (+$14,488, +23.93% from previous year)

- 2022: $81,553 (+$6,511, +8.68% from previous year)

- 2023: $83,765 (+$2,211, +2.71% from previous year)

- 2024: $87,701 (+$3,937, +4.70% from previous year)

- 2025: $85,398 (-$2,303, -2.63% from previous year)

Gadsden’s home prices have more than doubled since 2010, climbing from just over $44,000 to $85,398 in 2025. Even with a small decline this year, the long-term trend has been one of steady growth. That said, prices remain low by statewide standards.

Gadsden – Steady Gains in a Quiet Corner

Gadsden is located in Richland County, southeast of Columbia, and serves as a quiet outpost for those who work in the capital but want to live at a slower pace. The town’s rural character and proximity to Congaree National Park have kept it appealing for nature lovers and those seeking space on a budget.

The near-doubling of home values over the past 15 years is impressive, especially considering the town’s size and low population density. The market’s slight pullback in 2025 could be seasonal or a short-term correction. Gadsden continues to offer low-cost housing just a short drive from city amenities.

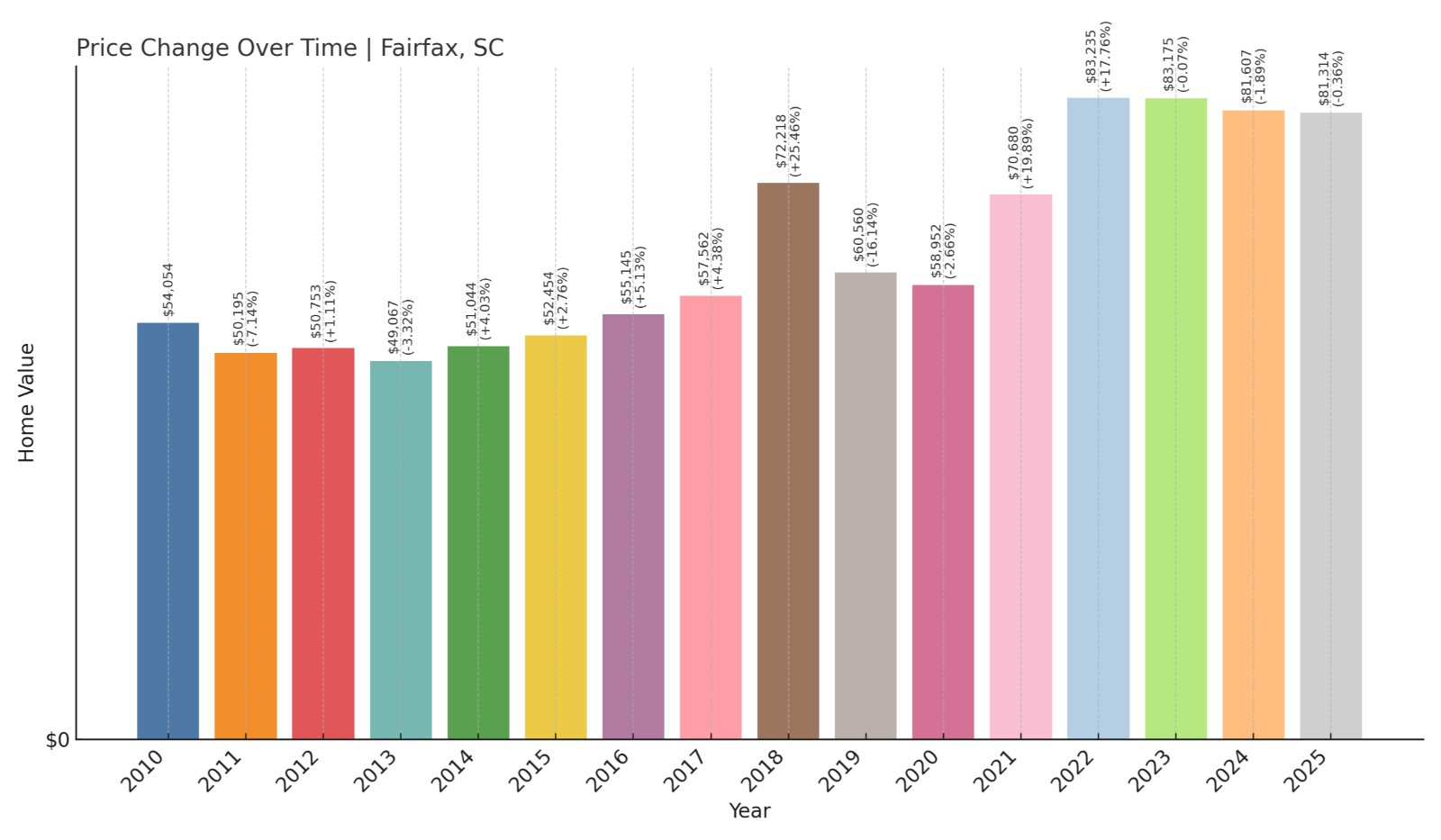

7. Fairfax – 50% Home Price Increase Since 2010

- 2010: $54,054

- 2011: $50,195 (-$3,858, -7.14% from previous year)

- 2012: $50,753 (+$558, +1.11% from previous year)

- 2013: $49,067 (-$1,686, -3.32% from previous year)

- 2014: $51,044 (+$1,977, +4.03% from previous year)

- 2015: $52,454 (+$1,409, +2.76% from previous year)

- 2016: $55,145 (+$2,692, +5.13% from previous year)

- 2017: $57,562 (+$2,416, +4.38% from previous year)

- 2018: $72,218 (+$14,657, +25.46% from previous year)

- 2019: $60,560 (-$11,658, -16.14% from previous year)

- 2020: $58,952 (-$1,608, -2.66% from previous year)

- 2021: $70,680 (+$11,728, +19.89% from previous year)

- 2022: $83,235 (+$12,555, +17.76% from previous year)

- 2023: $83,175 (-$60, -0.07% from previous year)

- 2024: $81,607 (-$1,568, -1.89% from previous year)

- 2025: $81,314 (-$293, -0.36% from previous year)

Fairfax home values have grown by around 50% since 2010, despite some bumpy years. In 2025, the average home price sits just above $81,000, making it a consistent low-cost option with a fairly stable pricing trend over time.

Fairfax – Slow and Steady Over the Years

Situated in Allendale County, Fairfax is a quiet town near the Georgia border. It’s part of a largely rural region of South Carolina where housing remains more affordable than in metro areas. Fairfax’s growth has been gradual, with a few spikes and dips but no major collapse or runaway inflation.

The town experienced a surge in 2018 followed by a sharp drop, then regained momentum in the early 2020s. It’s not a place for big bets or fast flips, but its consistent pricing and affordability make it a strong candidate for buyers looking for value and long-term stability in a small-town setting.

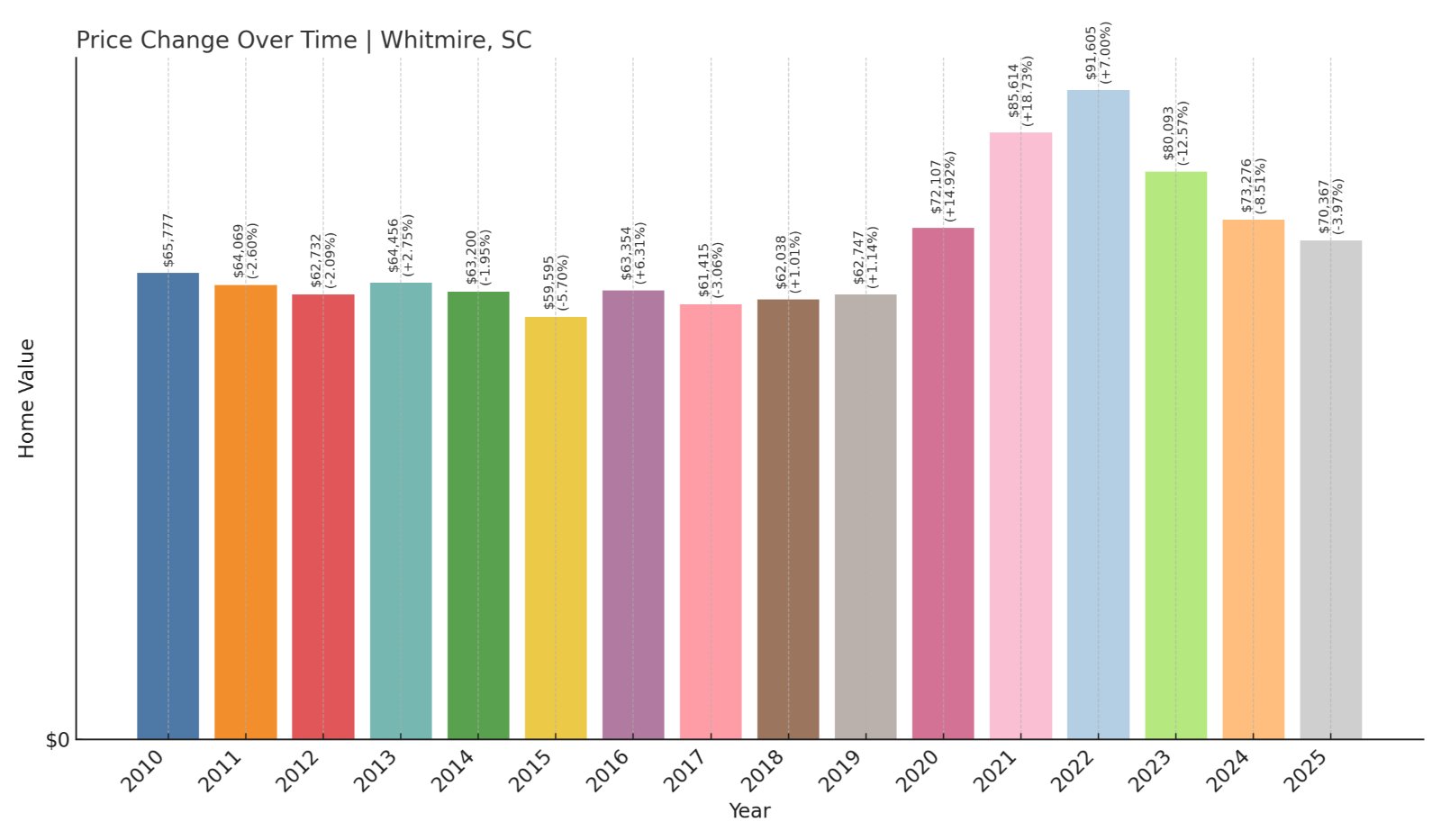

6. Whitmire – 7% Home Price Increase Since 2010

Would you like to save this?

- 2010: $65,777

- 2011: $64,069 (-$1,708, -2.60% from previous year)

- 2012: $62,732 (-$1,338, -2.09% from previous year)

- 2013: $64,456 (+$1,724, +2.75% from previous year)

- 2014: $63,200 (-$1,256, -1.95% from previous year)

- 2015: $59,595 (-$3,605, -5.70% from previous year)

- 2016: $63,354 (+$3,759, +6.31% from previous year)

- 2017: $61,415 (-$1,939, -3.06% from previous year)

- 2018: $62,038 (+$624, +1.02% from previous year)

- 2019: $62,747 (+$708, +1.14% from previous year)

- 2020: $72,107 (+$9,360, +14.92% from previous year)

- 2021: $85,614 (+$13,507, +18.73% from previous year)

- 2022: $91,605 (+$5,991, +7.00% from previous year)

- 2023: $80,093 (-$11,512, -12.57% from previous year)

- 2024: $73,276 (-$6,818, -8.51% from previous year)

- 2025: $70,367 (-$2,908, -3.97% from previous year)

Whitmire’s housing market has had its share of ups and downs over the past 15 years. Prices peaked in 2022 and have since slid by more than 20%, though the long-term trajectory still reflects modest growth. In 2025, homes average about $70,000, just slightly above where they stood in 2010.

Whitmire – Resilient Despite Price Fluctuations

Located in Newberry County, Whitmire sits at the edge of Sumter National Forest and has long been known for its quiet charm and access to outdoor recreation. The town is small but well-established, and its proximity to forestland and rivers gives it a unique draw for those who enjoy rural life.

The pandemic years sparked a sharp jump in local prices, which has since cooled off. Recent declines bring affordability back into focus, making Whitmire a good option for buyers seeking a stable small-town environment without breaking the bank. Its modest price shifts reflect a market adjusting after rapid, temporary surges.

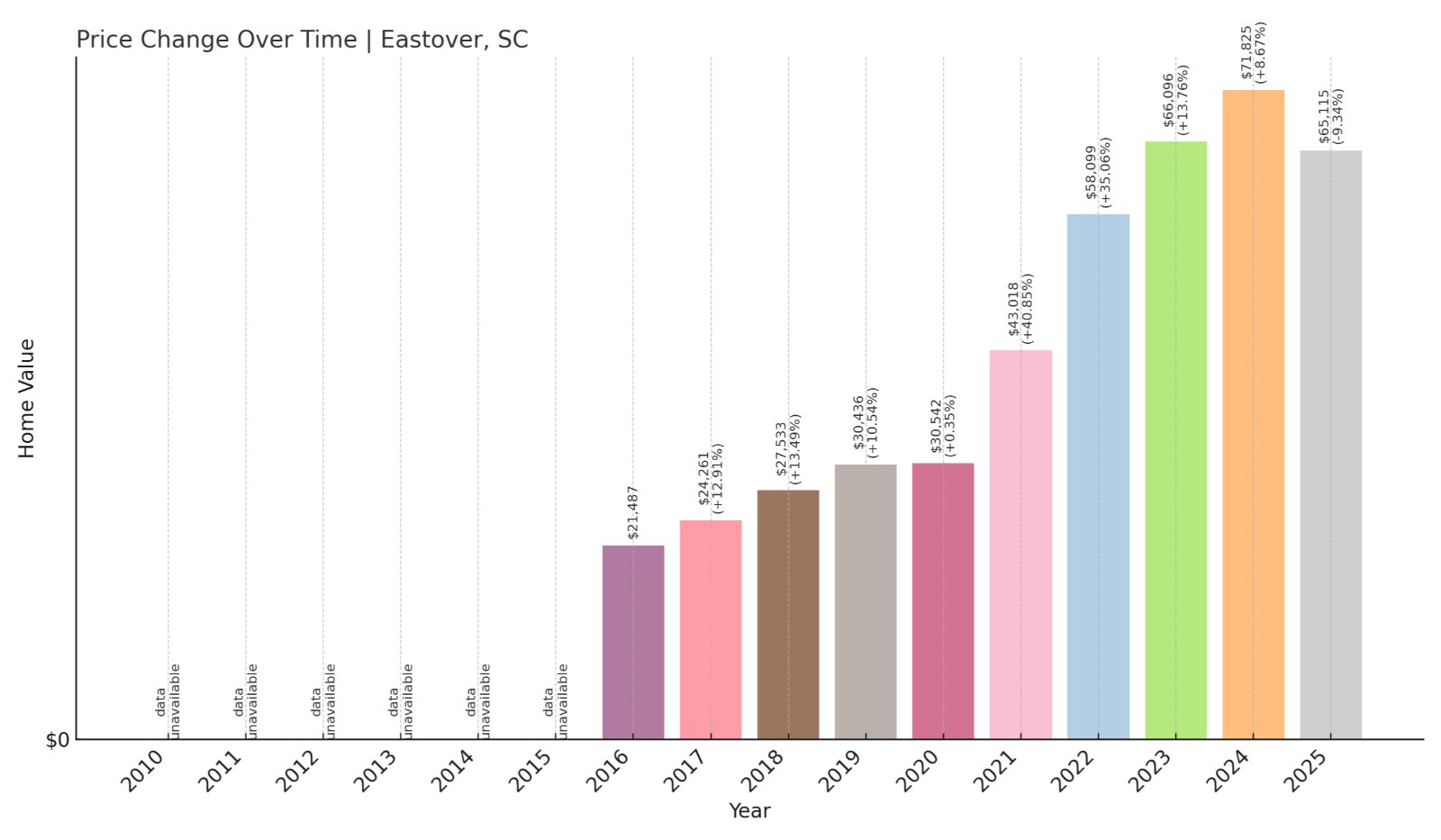

5. Eastover – 203% Home Price Increase Since 2016

- 2016: $21,487

- 2017: $24,261 (+$2,775, +12.91% from previous year)

- 2018: $27,533 (+$3,272, +13.49% from previous year)

- 2019: $30,436 (+$2,902, +10.54% from previous year)

- 2020: $30,542 (+$106, +0.35% from previous year)

- 2021: $43,018 (+$12,476, +40.85% from previous year)

- 2022: $58,099 (+$15,081, +35.06% from previous year)

- 2023: $66,096 (+$7,997, +13.76% from previous year)

- 2024: $71,825 (+$5,729, +8.67% from previous year)

- 2025: $65,115 (-$6,709, -9.34% from previous year)

Since 2016, Eastover’s housing prices have more than tripled, despite a decline in 2025. Homes here are still very affordable, averaging just over $65,000 this year. That places Eastover among the highest-growth towns on this list, though the recent pullback suggests the market may be cooling.

Eastover – From Rock Bottom to Rapid Rise

Eastover is a small town in Richland County, southeast of Columbia. Once overlooked in real estate circles, it has seen a massive surge in values over the past several years. Affordable land and proximity to Fort Jackson and Congaree National Park may have helped boost local interest, particularly during the post-2020 housing boom.

The town’s incredibly low starting point in 2016 explains part of the dramatic growth rate. Even now, prices remain low by state and national standards. The recent drop may reflect a natural market correction after several years of large percentage gains. Still, Eastover continues to offer solid value in a location with future potential.

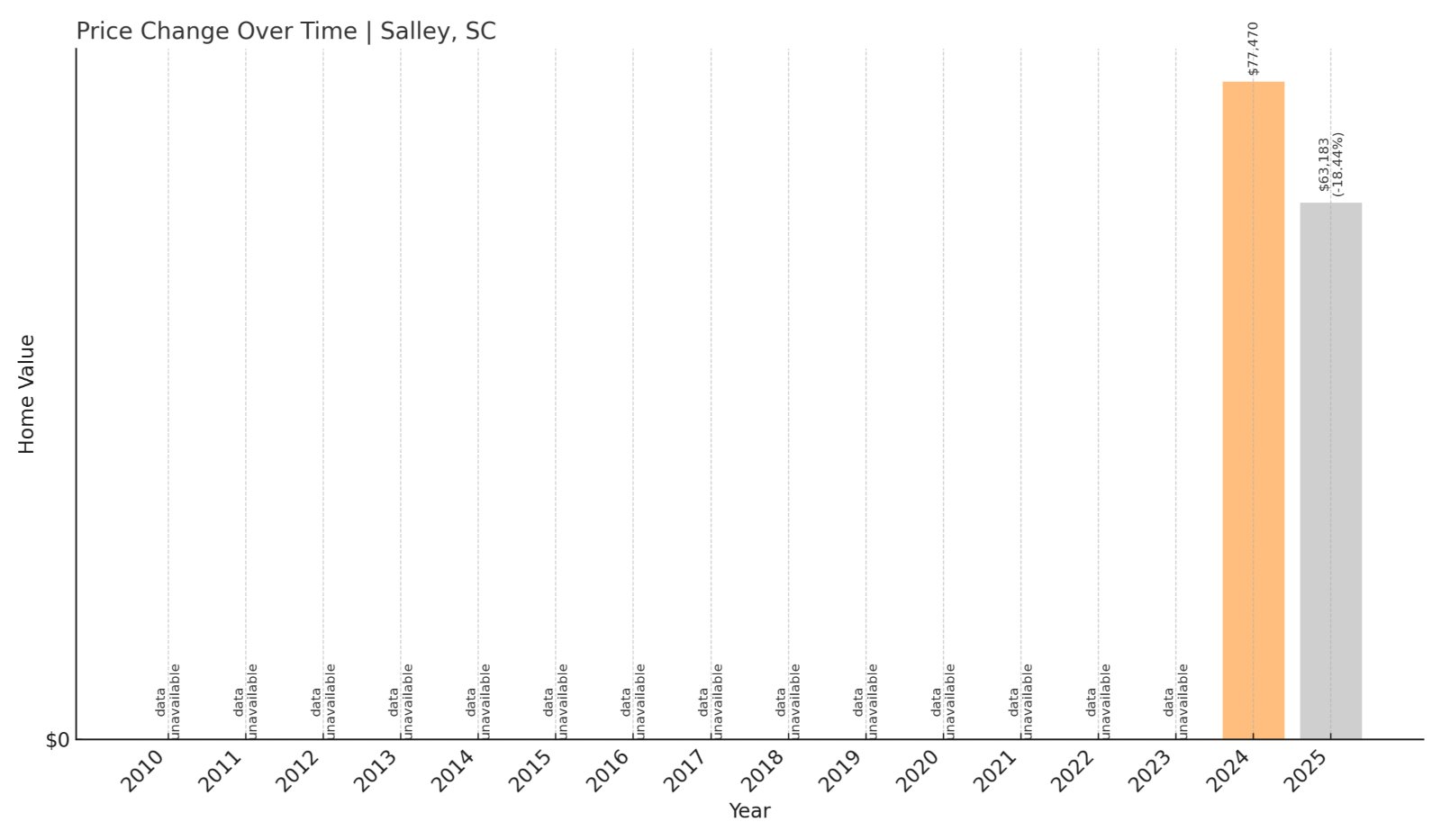

4. Salley – 18% Home Price Decrease Since 2024

- 2024: $77,470

- 2025: $63,183 (-$14,287, -18.44% from previous year)

In just one year, Salley’s average home price dropped by over 18%, landing at just above $63,000 in 2025. Though this is the first year with available data, the sharp drop may indicate a shift in demand or a correction after an unsustainable peak.

Salley – Sudden Shift in a Rural Community

Salley is a small town in Aiken County, widely known for its annual Chitlin’ Strut festival. It has a rural, agricultural identity and a population under 500. With no data prior to 2024, it’s unclear what drove the original pricing, but the town’s steep one-year drop points to volatility.

Still, with prices now below $65,000, Salley represents one of the cheapest real estate options in the state. The area is extremely quiet, making it attractive to buyers looking for a truly small-town feel. Whether the price decline is a blip or the start of a trend remains to be seen.

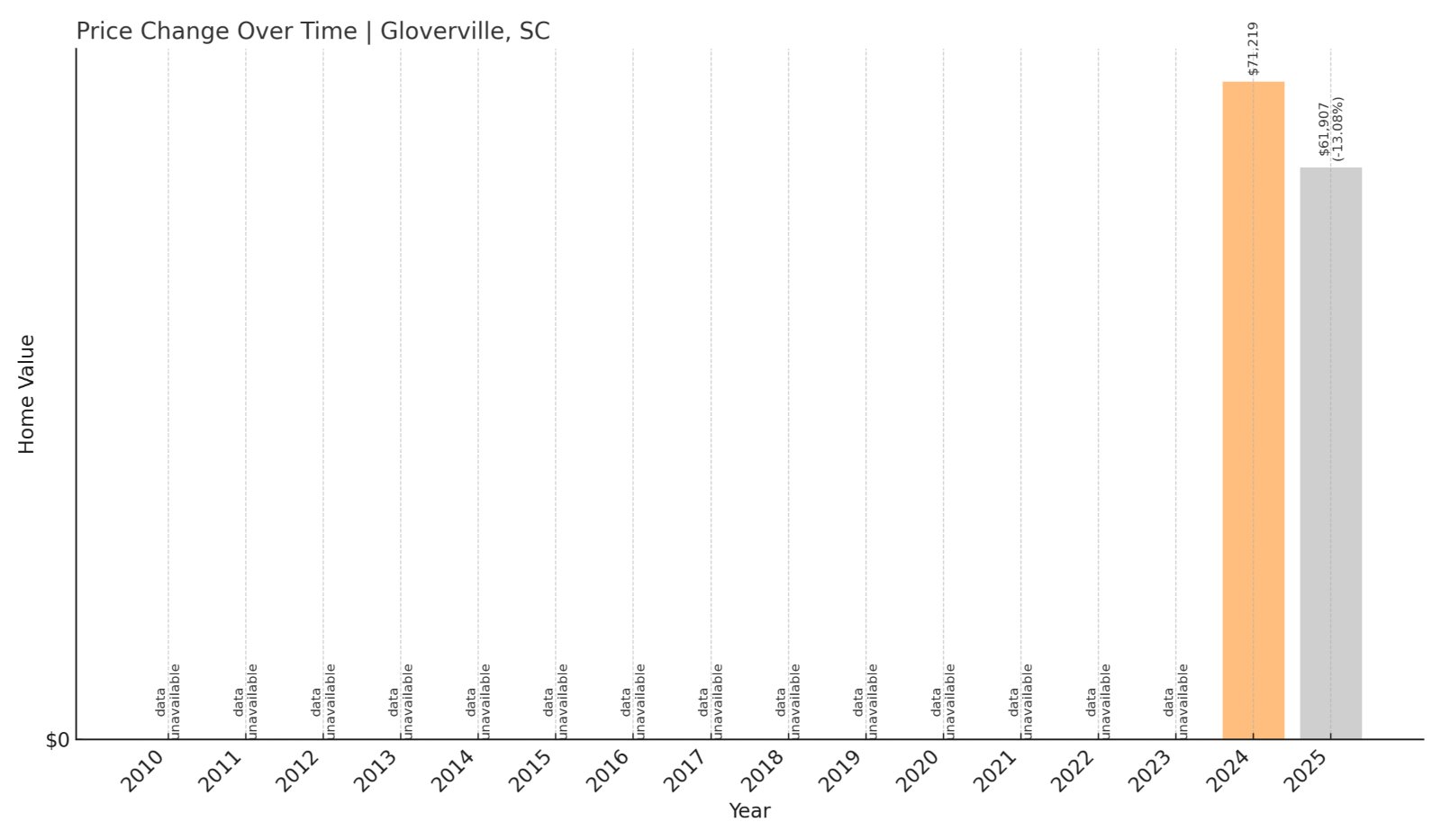

3. Gloverville – 13% Home Price Decrease Since 2024

- 2024: $71,219

- 2025: $61,907 (-$9,312, -13.08% from previous year)

Gloverville saw a drop of just over 13% in home prices between 2024 and 2025. With no previous data, it’s unclear how much fluctuation the area has seen historically, but current home values remain low at under $62,000.

Gloverville – Modest Prices in a Working-Class Area

Located in Aiken County, just a few miles from the Georgia border, Gloverville sits within the broader Augusta metro region. That proximity gives it access to more jobs and services than other rural towns, even though it remains economically modest itself.

The recent drop may reflect adjustments after increased demand from buyers seeking cheaper homes near Augusta. As a working-class town, Gloverville offers simple housing at low cost, and that continues to be its main appeal. The market correction could also attract new interest from value-focused buyers.

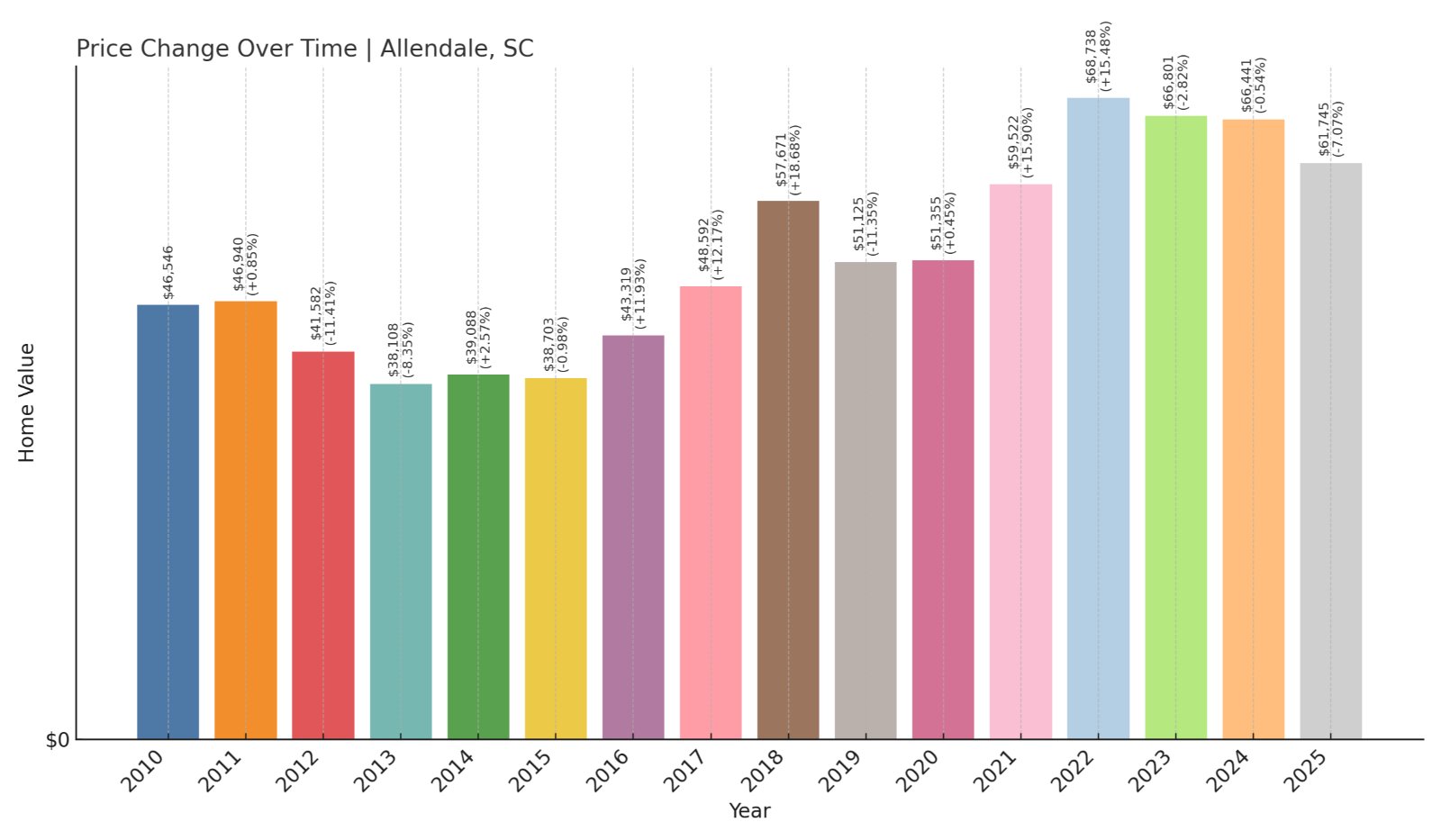

2. Allendale – 32% Home Price Increase Since 2010

- 2010: $46,546

- 2011: $46,940 (+$395, +0.85% from previous year)

- 2012: $41,582 (-$5,358, -11.41% from previous year)

- 2013: $38,108 (-$3,474, -8.35% from previous year)

- 2014: $39,088 (+$980, +2.57% from previous year)

- 2015: $38,703 (-$385, -0.98% from previous year)

- 2016: $43,319 (+$4,615, +11.93% from previous year)

- 2017: $48,592 (+$5,274, +12.17% from previous year)

- 2018: $57,671 (+$9,078, +18.68% from previous year)

- 2019: $51,125 (-$6,546, -11.35% from previous year)

- 2020: $51,355 (+$230, +0.45% from previous year)

- 2021: $59,522 (+$8,167, +15.90% from previous year)

- 2022: $68,738 (+$9,217, +15.48% from previous year)

- 2023: $66,801 (-$1,938, -2.82% from previous year)

- 2024: $66,441 (-$360, -0.54% from previous year)

- 2025: $61,745 (-$4,696, -7.07% from previous year)

Allendale’s market has been turbulent over the years, with big gains followed by sharp drops. Still, prices are up 32% since 2010. At just over $61,000, homes remain deeply affordable despite recent price cuts.

Allendale – Long-Term Growth With Short-Term Volatility

As the seat of Allendale County, this town has faced decades of economic challenges but has seen waves of renewed investment in recent years. Located near the Savannah River Site, it benefits from both local history and proximity to federal operations that support jobs.

Prices have fluctuated significantly, reflecting the town’s changing fortunes. After a few years of rapid growth, the recent cooldown may be a reset. Still, the long-term outlook shows that Allendale has managed to build value while keeping costs low—an important balance for new homeowners.

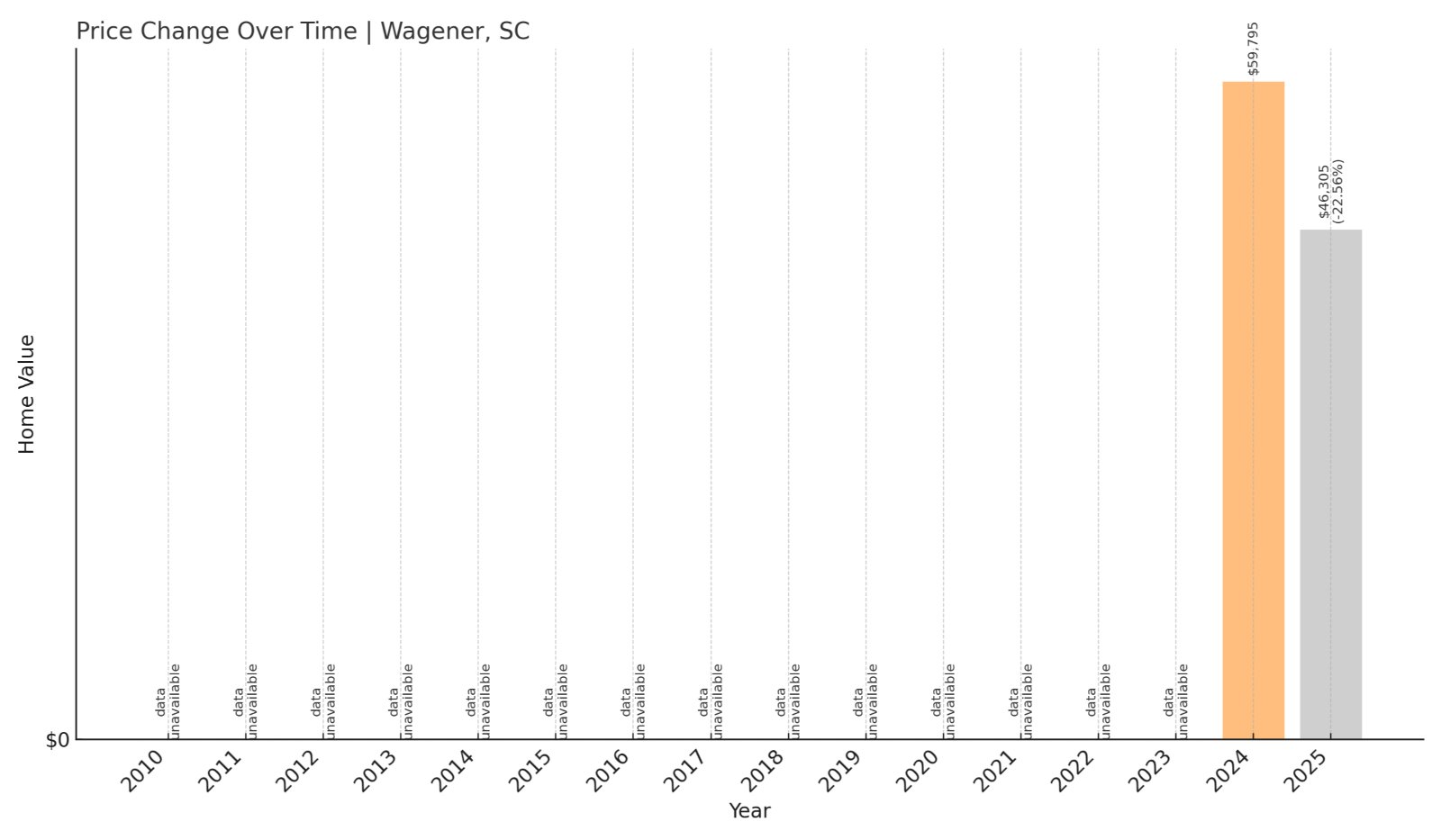

1. Wagener – 22% Home Price Decrease Since 2024

- 2024: $59,795

- 2025: $46,305 (-$13,490, -22.56% from previous year)

Wagener posted the steepest one-year decline on this list, with home prices falling by over 22% between 2024 and 2025. The average price now sits at just $46,305, making it one of the least expensive housing markets in the state.

Wagener – Deeply Discounted, Still Undervalued

Wagener is located in western Aiken County, roughly 30 miles southwest of Columbia. With a small population and a quiet town center, it remains deeply rural. The sharp drop in prices may reflect a post-pandemic correction, especially after a year of previously undocumented gains in 2024.

Despite the dip, Wagener’s homes are among the most affordable in South Carolina. Its low cost of entry could appeal to retirees, first-time buyers, or anyone looking to invest in a quiet town with long-term potential—provided the market finds its footing in the years ahead.