Missouri’s baby boomers – those born 1946–1964 – have had an outsized impact on the housing market in recent years. Between 2018 and 2023, booming home values, demographic shifts, and economic swings have all influenced how and where this generation lives. Let’s look at key trends among Missouri’s baby boomer homeowners and renters during this period.

Boomer Homebuying Trends: Urban, Suburban, and Rural Preferences

Baby boomers regained their status as the largest share of home buyers nationwide by the early 2020s. In 2022–2023, boomers accounted for 42% of U.S. home purchases (with millennials falling to 29%). Many of these purchases involved relocation or lifestyle-driven moves, and the preferred locales of older buyers often differed from younger generations.

Younger boomers (ages ~60–69) were most likely to buy homes in small towns, while older boomers (70+) were the most likely to purchase in suburbs or subdivisions. This suggests that mid-life boomers in Missouri may favor quieter rural communities or micropolitan areas, whereas the oldest boomers who are still buying lean toward suburban settings near services.

Small Town and Suburban Appeal

The strongest boomer homebuying interest in Missouri has been in smaller towns and suburban neighborhoods – places that offer a balance of community amenities and a slower pace. Boomers bought for reasons like wanting to be closer to friends/family, retirement, and the desire for a smaller home, all factors that influence choice of location.

Baby boomers also tend to move longer distances when they do relocate. Nationally, buyers age 60+ moved a median of 35 miles from their previous home – the longest distance of any age group. In Missouri, this could mean a boomer in St. Louis selling the family house and moving out to the Ozarks, or someone from a rural county moving closer to a regional hub for healthcare access.

Migration Patterns

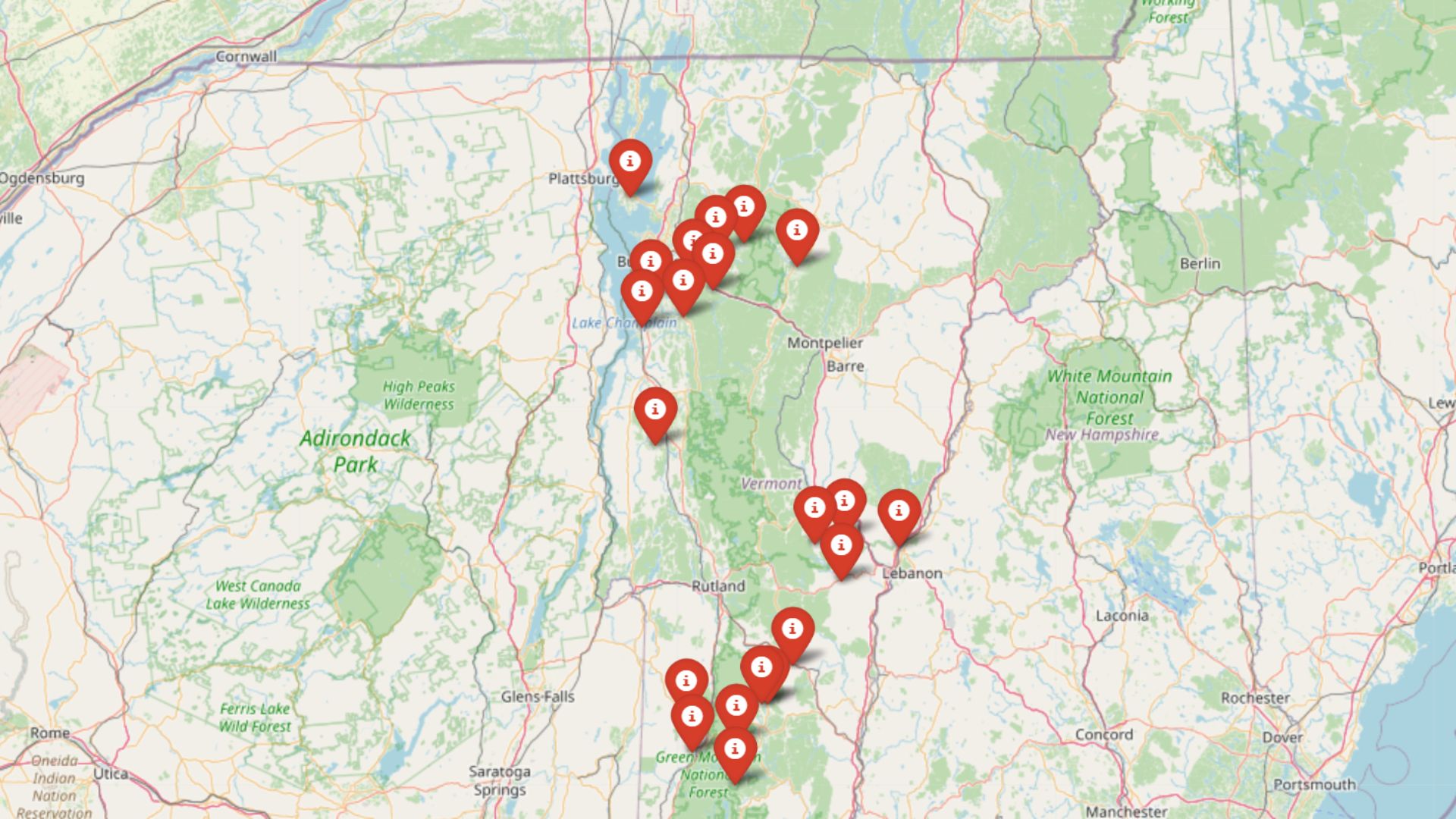

These migration patterns contribute to a redistribution of Missouri’s senior population: urban and suburban counties are seeing growth in older residents, while many rural areas face declines. In other words, some boomers are concentrating around cities (or attractive small-town “amenity” regions), even as very remote areas lose population. Boomers show an affinity for scenic rural destinations with lower costs as they near retirement – an effect likely playing out in Missouri’s lake communities and Ozark mountain towns.

Aging in Place: Most Boomers Stay Put in Their Homes

Despite notable numbers of boomers buying homes, the dominant trend among Missouri’s baby boom generation is aging in place – staying in their current homes and communities rather than moving. Surveys consistently show that the vast majority of older Americans prefer to remain in their own homes as they age. A 2021 AARP survey found roughly 75% of adults 50+ want to stay in their homes and communities for the long term.

More recently, a Redfin-commissioned survey in early 2024 reported that more than three-quarters (78%) of baby boomer homeowners plan to stay in their current home as they grow older. This was by far the most common plan among boomers; the next most cited option – moving to a 55+ age-restricted community – was chosen by only 20% (about one in five).

Impact on Housing Market

Boomers’ propensity to age in place has major implications for Missouri’s housing market. With so many homeowners staying put, fewer homes are being listed for sale. National housing inventory hit historic lows in 2021–2022, and boomers staying put is one contributing factor. Older Americans remaining in their homes is helping to prolong the housing shortage by keeping inventory off the market.

Many of these owners locked in ultra-low mortgage rates in 2020–2021 and are now reluctant to give up those rates and take on a new, higher-interest loan. In Missouri, where the homeownership rate is relatively high (around 68.7% in 2023, above the U.S. average), the effect of many boomers aging in place means a significant portion of the state’s housing stock is effectively off-market at any given time.

Financial Incentives to Stay Put

Why are boomers so inclined to stay? Aside from personal attachments and community ties, financial incentives play a big role. By their 60s or 70s, a large share of homeowners have either paid off their mortgage or have a very low interest rate. Indeed, over half (54%) of boomer homeowners nationwide are mortgage-free.

In Missouri, many boomers also benefit from relatively low property taxes and senior tax relief programs, reducing the cost of staying. With their housing costs stable and often minimal, there’s little financial pressure to move out.

Over half of boomers who weren’t planning to sell said it’s because they like their home and see no reason to move, and 27% said it’s because their home is paid off (providing significant financial security). Only about 1 in 5 cited high current home prices as a reason for staying.

Renting and Senior Living: A Growing Niche

While most Missouri boomers are homeowners, a notable subset are renting or considering moves to senior-oriented housing. In Missouri as of 2023, roughly 650,500 households were headed by baby boomers who own their home, whereas about 138,500 boomer-led households were renters. That means roughly 82% of boomer households in the state are owner-occupied, with around 18% renting. Renting becomes more common at the older end of the spectrum or among those with lower incomes.

Downsizing to Rentals

One clear trend in larger metro areas is an increase in older adults downsizing from suburban homes into rental apartments or senior living communities. In St. Louis, for example, developers have reported a surge of interest from baby boomers looking to sell their single-family homes and move into maintenance-free multi-family living.

Their children are grown, the large house feels like too much, and they want to tap their home equity and simplify. By cashing out of a suburban home, boomers can free up money for retirement and rid themselves of upkeep chores like mowing lawns or repairs. Many boomers “no longer need all the space or maintenance of a home” and prefer a more flexible, lock-and-leave lifestyle.

Housing Industry Response

In response, Missouri’s housing industry is adjusting. Developers are designing new apartments and condos to attract downsizing boomers, especially in urban/suburban hubs like St. Louis County and Kansas City. They’re building larger-unit apartments (including two- and three-bedroom units) to accommodate boomers’ needs for space and storage, since this generation is bringing plenty of furniture and belongings from their old homes.

They’re also adding amenities like concierge services (for grocery delivery, laundry, cleaning, etc.) to replicate some of the comforts of homeownership and provide convenience and security for older residents. In the St. Louis metro, numerous age-restricted independent living complexes have sprung up in communities such as Chesterfield, Town and Country, and O’Fallon, indicating demand from retirees in those suburban areas.

Senior Living Communities

Beyond market-rate rentals, senior living communities remain an important option as boomers age. During 2018–2023, most boomers were still below the age to enter nursing homes in large numbers – the nursing home population is dominated by people in their 80s and 90s (the Silent Generation). However, the oldest boomers (now in their late 70s) have begun trickling into assisted living and continuing care retirement communities.

Missouri has a well-established senior housing sector: as of the early 2020s there were over 300 independent living facilities, 600 assisted living facilities, and ~400 nursing homes statewide. The vast majority of boomers won’t move into institutional senior housing unless health forces them to. Nevertheless, some are proactively choosing 55+ retirement communities or “active adult” subdivisions, especially those at the younger end of the generation.

Why Boomers Move: Key Motivations

When baby boomers do decide to make a housing change, several key motivations emerged between 2018 and 2023:

Downsizing from Large Homes

Many boomers spent decades in a family-sized house. Once children are grown, there’s often a desire to downsize to a smaller, more manageable home (or condo). Nationally, homeowners over age 70 were the most likely to report downsizing when selling. In Missouri, it’s common to see empty nesters selling four-bedroom suburban homes in favor of something like a two-bedroom ranch or a low-maintenance townhouse.

Family and Healthcare Proximity

A top reason boomers move is to be closer to children, grandchildren, or other family. As their needs change, being near a support network is crucial. For example, a boomer couple in rural northern Missouri might relocate to the St. Louis area to be near their adult kids – or vice versa, a city-dwelling retiree might move to a smaller city like Columbia to be closer to family there.

Proximity to quality healthcare is another factor. Some retirees leave very rural areas in favor of regional centers (like Springfield or Kansas City) where major hospitals and specialists are available. This practical need often underpins moves even when not explicitly stated.

Retirement Lifestyle and Climate

Upon retiring (typically in one’s 60s), some boomers seek a change of pace or environment – whether that’s moving to a lake house, a golf community, or a warmer climate in winter. Missouri sees a bit of both sides: outbound retirees moving to classic Sun Belt havens, and inbound retirees from colder states or expensive regions coming to Missouri for its affordable cost of living.

Inside Missouri, popular retirement areas include Lake of the Ozarks and Branson for their recreation and beauty, as well as college towns (like Columbia) that offer cultural amenities. That said, the majority of Missouri boomers have stayed in-state upon retirement, often just relocating within a few hours of their original home.

Affordability and Cost of Living

Housing affordability has cut two ways for boomers. On one hand, rising home values gave many boomers substantial equity, enabling some to relocate or upgrade. On the other hand, high prices (and in 2022–2023, high interest rates) have also dissuaded moves – some boomers feel they “can’t afford to move” because any new house would be so much more expensive than what they paid originally.

By 2018–2021, with Missouri home prices up significantly, more boomers had the financial incentive to sell high. But by 2022–2023, rapidly rising mortgage rates and inflation made buying again costlier, which reduced the downsizing trend. In fact, about 21% of boomers staying put said home prices are too high now to justify a move.

Locking in Equity / Inheritance Goals

Some boomers have an eye on estate planning. A survey noted that 37% of boomer homeowners had considered leaving their home as an inheritance instead of selling. The idea of keeping a mortgage-free home “in the family” can motivate aging in place.

Conversely, others sell and downsize specifically to unlock equity for other purposes – travel, healthcare expenses, or gifting money to family while still alive. Missouri’s relatively steady home price appreciation meant many boomers’ homes appreciated faster than inflation, encouraging some to cash out.

Regional Spotlight: Missouri’s Metropolitan Areas

St. Louis

The St. Louis metro is home to one of Missouri’s largest concentrations of baby boomers. St. Louis County and surrounding suburban counties saw significant growth in their senior populations from 2010 to 2020, as boomers entered their 60s. Many St. Louis boomers have aged in place in suburban communities like Florissant, Kirkwood, or Chesterfield, where they bought homes in the 1980s–90s.

An interesting local trend has been affluent suburban boomers downsizing into luxury condos or 55+ communities in the metro area. Some empty nesters from West County have moved into downtown Clayton or the Central West End in the city, seeking walkability and cultural amenities. Meanwhile, others have done the opposite – selling homes in the city and moving to outer suburbs or even out-of-state.

On the rental side, the St. Louis area multifamily market is adapting to an influx of older renters. Developers in 2022 noted a rising demand from boomers looking for high-end apartments after selling homes, prompting new construction tailored to senior renters. Additionally, St. Louis’s healthcare infrastructure makes it a magnet for retirees needing medical care – rural seniors often relocate to be nearer the top-notch hospitals in St. Louis.

Kansas City

Missouri’s other major metro, Kansas City, has similarly seen boomers shaping its housing market. Suburban Johnson County, KS and Jackson/Clay Counties in MO have large boomer populations. Many continue to live in suburban subdivisions (Lee’s Summit, Overland Park, etc.) long after their children have moved out.

KC’s strong housing price growth in 2018–2022 gave boomer owners big equity gains, but also meant that those who would downsize might not save much by buying a smaller place in the same area. Some Kansas City boomers have taken an alternative route: moving to rural properties on the outskirts or to lake communities in the Ozarks for retirement, effectively “exporting” their equity to quieter parts of Missouri.

Within KC, there’s also a notable trend of downtown revitalization attracting some retirees. Empty-nesters have been renting lofts or condos in areas like Downtown KC or Country Club Plaza to enjoy urban amenities. The Kansas City metro has been working on senior-friendly initiatives (transportation, aging-in-place programs) recognizing that a large share of its homeowners are now over 60 and may need supportive services.

Springfield and the Ozarks

Springfield and the broader Ozarks region stand out as a retirement-friendly area in Missouri. The Springfield metro has about 15–16% of its population aged 65+, slightly above the national average. It is frequently cited as one of the best places to retire in the Midwest, thanks to its low cost of living (about 7% below U.S. average) and robust healthcare system.

During 2018–2023, Springfield saw both local boomers staying put and in-migration of retirees from other areas. Some rural Missourians from the surrounding Ozarks hills move into Springfield or Branson to be closer to hospitals and services. The city offers dozens of independent living and senior apartment complexes, making it easier for retirees to find suitable downsizing options.

Springfield provides a nice balance for boomers: it’s large enough to have shopping, entertainment, and a university (which many retirees enjoy for events and lifelong learning), but it retains a relaxed pace. Springfield’s housing costs average only ~18% of retirement income for locals, a very reasonable figure. This affordability kept many boomers comfortable staying in their homes.

Rural Missouri and Lake Communities

Outside the big metros, Missouri has both aging rural counties and pockets of boomer influx. Rural northern Missouri, for instance, has a high median age – many younger folks left, leaving a remaining population skewed toward older adults. These areas face challenges with housing quality and accessibility; homes are older and not always senior-friendly, and fewer new housing developments are built.

Conversely, recreation and amenity-rich areas have attracted boomers. The Lake of the Ozarks region is a prime example. Traditionally a vacation and second-home market, it has seen more retirees making it a primary residence. With lake views, boating, and golf, the area is a draw for those who can handle being somewhat remote. Branson, known for entertainment and lakes, also draws many retirees.

Economic Trends Impacting Boomer Decisions (2018–2023)

Housing Price Boom

Home prices in Missouri surged from roughly 2018 through mid-2022. Missouri’s median home values rose significantly, with year-over-year gains often in the 5–10% range. This rapid appreciation benefitted baby boomer homeowners by swelling their home equity.

A boomer who bought a home in, say, 1995 likely saw its value double or more by 2022. This created newfound wealth that some leveraged – either through cash-out refinances (when rates were low) or by selling at a high price and downsizing.

Baby boomers overtook younger buyers in the housing market during the peak of price increases; their equity allowed them to bid competitively. Boomers often beat out millennials in bidding wars because they could make larger down payments or pay cash thanks to equity, whereas many millennials were priced out.

Interest Rate Swings

The late 2010s saw relatively low mortgage rates, which fell further to historic lows in 2020–2021 during the pandemic response. Many boomer homeowners refinanced or bought new homes during this time, locking in these low rates.

Come 2022, however, the Federal Reserve’s fight against inflation drove rates up sharply – by 2023, 30-year mortgage rates hovered around 7%. This rate spike had a chilling effect on moves. A homeowner with a 3% mortgage has little incentive to sell and then borrow at 7% for a new purchase. Boomers, often risk-averse in later life, reacted by staying put to avoid new debt at high interest.

Inflation and Cost of Living

Post-pandemic inflation (which spiked in 2022 to levels not seen in 40 years) hit those on fixed incomes particularly hard. Missouri’s boomers saw groceries, utilities, insurance, and taxes all rise in cost. This undoubtedly made some homeowners think twice about upsizing or moving to pricier locales.

Instead, many doubled down on frugality: staying in paid-off homes, or if renting, perhaps moving to cheaper units. High gas prices and general inflation may also have curbed long-distance relocations. On the flip side, inflation in rents and home prices made homeownership relatively advantageous for those who already owned (their costs were fixed).

Pandemic Lifestyle Changes

COVID-19 influenced housing trends. Many boomers spent much of 2020–2021 at home due to the virus. This experience reinforced the value of home for many – investing in home improvements, creating home offices, etc. Some decided to relocate to be nearer family after feeling the isolation of lockdowns. Others retired early and possibly left high-cost cities for quieter areas.

In Missouri, there were anecdotal reports of out-of-state retirees relocating to the Ozarks during the pandemic, likely to escape more crowded areas. The pandemic also temporarily reduced occupancy in senior facilities (many families brought elders home from nursing homes due to safety concerns), which may have in turn delayed some boomers from transitioning into assisted living.

Then vs. Now: Comparing with the Prior Decade

It’s illuminating to compare recent boomer housing trends to the prior decade (2008–2017). The late 2000s were marked by the housing crash and Great Recession, which hit just as many boomers were entering their 50s and early 60s. In Missouri, home prices slumped around 2008–2011, and some boomers found themselves with depressed home equity or even underwater mortgages.

As a result, many delayed retirement moves in the early 2010s – they stayed in place until the market recovered. In 2008, Americans 55+ owned about 44% of owner-occupied homes; by 2018, that share had ballooned as boomers held on to their houses. Between 2008 and 2023, the share of homes owned by older Americans (55+) climbed from roughly 44% to 54%.

This dramatic rise indicates how boomers consolidated homeownership. Younger generations were slower to buy (hit by recession and student debt), while boomers simply stayed put or bought second homes. The “aging” of housing inventory was underway in 2008–2017 and accelerated in 2018–2023.

During 2008–2017, some boomers did take advantage of recovering markets to relocate. We saw a mini-wave of downsizing in the mid-2010s as home prices rose again and boomers who had waited out the recession finally sold. But even then, the numbers were modest.

One big difference is that prior to 2018, millennials and Gen X were more active in the market relative to boomers. In 2015, for example, millennials were the largest group of home buyers, and there was an expectation that boomers might start downsizing en masse. However, that “silver tsunami” of listings didn’t materialize in the 2010s at the scale predicted.

Boomers proved more inclined to stay than previous generations of retirees. Between 2018–2023 this became even more apparent – instead of downsizing in their late 60s en masse, boomers largely bucked historical downsizing trends and remained the primary occupants of large suburban homes.

By 2023, baby boomers held a larger share of Missouri housing than ever, were moving less frequently than before, and had adjusted their plans to “stay put” far more than the previous generation did. The housing trends among Missouri boomers in 2018–2023 have thus cemented this group’s influence on the market – simultaneously reducing turnover, keeping a lid on supply, and in many cases quietly enjoying the fruits of decades of homeownership.

References

- National Association of REALTORS® (NAR): Baby Boomers Regain Top Spot as Largest Share of Home Buyers

- National Association of REALTORS® (NAR): Home Buyers and Sellers Generational Trends

- Health Business Resource Center: Missouri’s Silver Tsunami: Navigating the Statistics in Senior Living and Care in Missouri

- USDA Economic Research Service: Baby Boom Migration Tilts Toward Rural America

- Missouri Independent: Older adults want to ‘age in place,’ but their options are limited in most states

- Redfin: More Than Three-Quarters of Baby Boomers Plan to Stay In Their Home As They Grow Older

- USAFacts: What is the homeownership rate in Missouri?

- REBusinessOnline: Metro St. Louis Multifamily Market Caters to Aging Population

- Springfield Business Journal: Report: Springfield among best places to retire in Midwest

- KSMU: Springfield Selected as One of the Best Places to Retire

- LeadingAge Missouri: Who Are Missouri’s Older Adults

- Fortune: Baby boomers are beating millennials in a housing showdown with all-cash buys

- Fortune: Boomers are pushing millennials out of the housing market

- Redfin: Missouri Housing Market: House Prices & Trends

- unbiased.com: Retiring in Missouri: A Complete Guide

- American City Business Journals: Baby boomer homeownership share keeps growing amid inventory shortage

- Wall Street Journal: Boomers Bought Up the Big Homes. Now They’re Not Budging

- Construction Coverage: Baby Boomer-Dominant Housing Markets

- Consumer Affairs: A wave of baby boomer home sales probably won’t resolve the housing shortage