The Zillow Home Value Index reveals a fascinating transformation in many of America’s housing markets between June 30, 2009, and October 31, 2024. Following the turbulent aftermath of the 2008 financial crisis, when home values bottomed out, certain cities and towns across the United States experienced extraordinary appreciation in their housing markets.

While coastal technology hubs like San Jose saw the largest absolute dollar increases, it was smaller cities and towns, particularly in California’s Central Valley, Florida, and growing Mountain West communities, that experienced the most dramatic percentage gains. The following analysis examines the 25 locations that saw the largest percentage increases in home values during this fifteen-year period, starting with more modest gains of 171% and culminating in an astounding 260% appreciation. These communities represent a diverse cross-section of America, from rural agricultural towns to technology hubs, from mountain resort communities to suburban enclaves, each with its own unique story of recovery and growth.

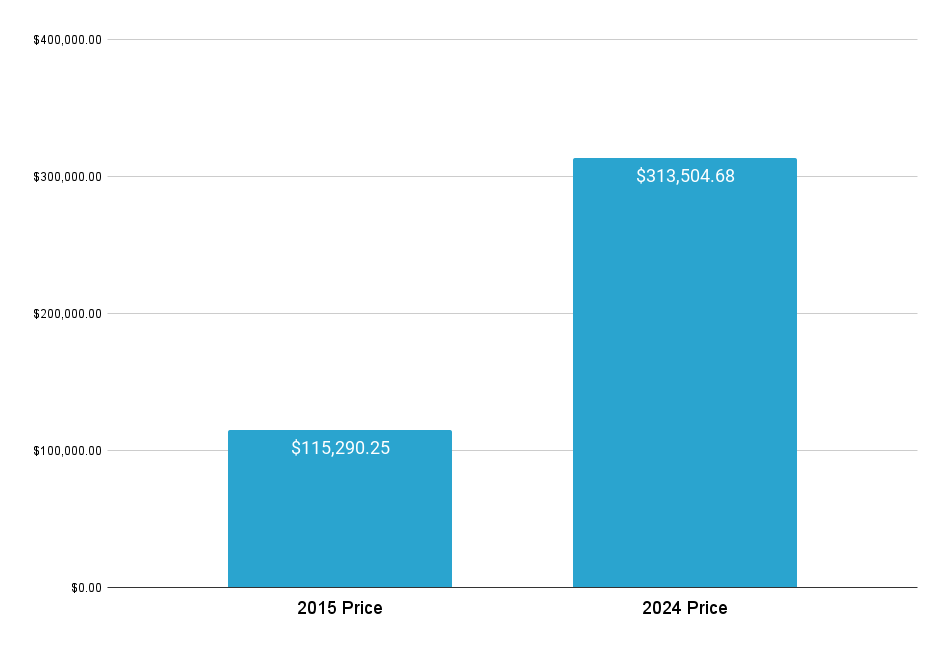

#25. Shelbyville, TN

In 2009, in the aftermath of the financial crisis, Shelbyville, Tennessee had an average home value of $115,290. This modest price point reflected the challenging economic conditions that affected communities across the United States during that period. The city’s housing market, like many others, was still finding its footing after the tumultuous events of 2008.

Fast forward to 2024, and Shelbyville’s housing market has undergone a remarkable transformation. Home values have climbed to $313,505, representing a 171.93% increase over the fifteen-year period. This translates to an absolute dollar increase of $198,214, demonstrating the substantial wealth creation for homeowners who held property through this period. This growth has positioned Shelbyville as one of the top 25 cities in the nation for home value appreciation since the financial crisis.

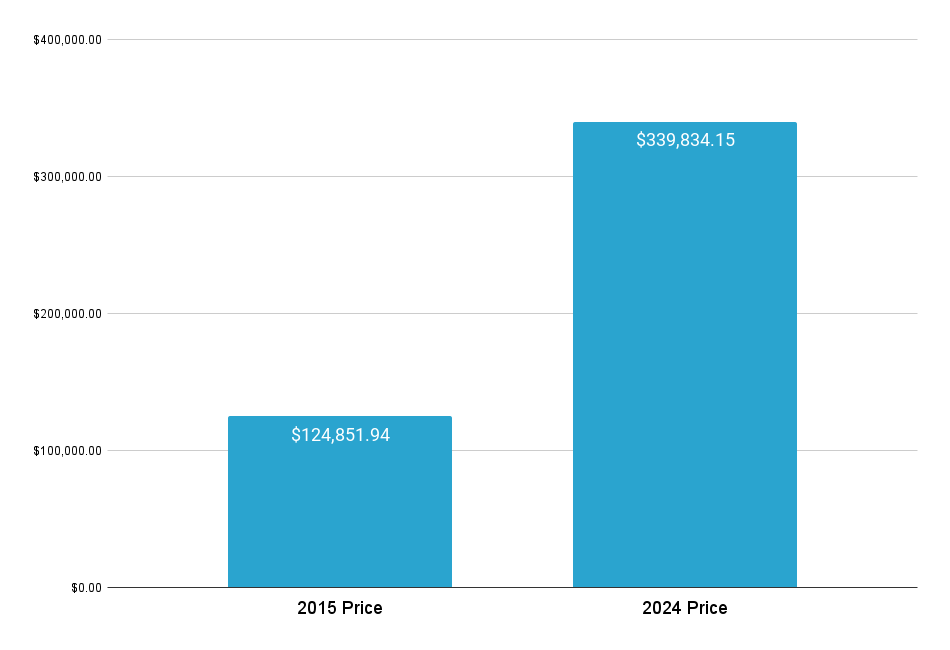

#24. Ontario, OR

In 2009, Ontario, Oregon’s average home value stood at $124,852, reflecting the affordable housing options available in this eastern Oregon city during the post-financial crisis period. This baseline price point made homeownership accessible to many residents, even during the economic uncertainties of that time.

By 2024, Ontario’s housing market has shown remarkable resilience and growth, with average home values reaching $339,834. This represents a 172.19% increase from the 2009 levels, with homeowners seeing an absolute dollar increase of $214,982 in their property values. This substantial appreciation has transformed the wealth prospects of many Ontario homeowners who maintained their properties through this period of growth.

#23. Miami, FL

In 2009, Miami, Florida had an average home value of $178,205, reflecting the significant impact the financial crisis had on this major metropolitan market. This price point represented a substantial correction from the pre-crisis peaks, as Miami was one of the epicenters of the housing market collapse in the late 2000s.

By 2024, Miami’s real estate market has experienced a dramatic revival, with average home values surging to $487,015. This represents a 173.29% increase from the post-crisis lows, resulting in an absolute dollar increase of $308,810. This remarkable recovery reflects Miami’s continued appeal as a major international city and its strong draw for both domestic and foreign investors.

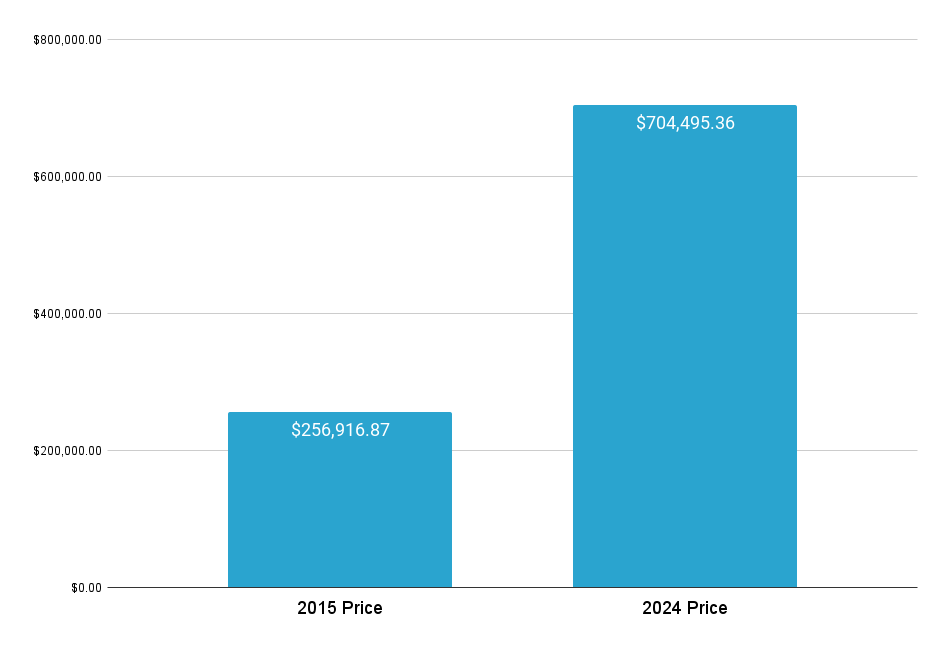

#22. Bozeman, MT

In 2009, Bozeman, Montana had an average home value of $256,917, which was relatively high for the post-crisis period, indicating the city’s desirability even during economic downturn. This mountain town was already showing signs of its potential as a growing technology hub and outdoor recreation destination.

Fast forward to 2024, and Bozeman’s home values have skyrocketed to $704,495, representing a 174.21% increase. The absolute dollar increase of $447,578 reflects Bozeman’s transformation into a premier Mountain West destination, attracting remote workers, tech companies, and outdoor enthusiasts, all contributing to its robust real estate appreciation.

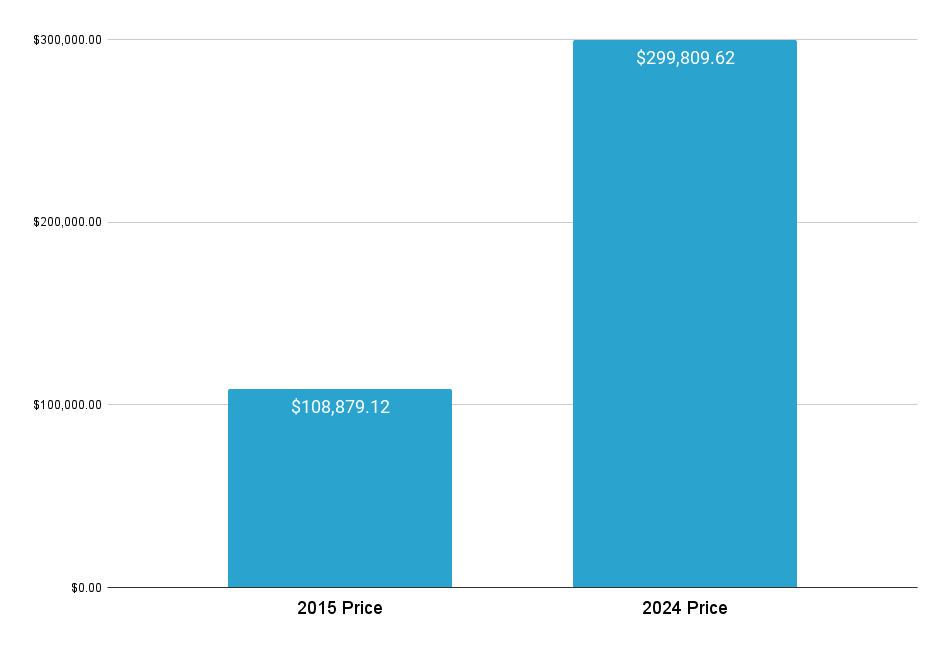

#21. Huntsville, AL

In 2009, Huntsville, Alabama had an average home value of $108,879, representing the affordable housing market typical of many Southern cities during the post-financial crisis period. This price point made homeownership accessible to many residents in this aerospace and technology hub.

By 2024, Huntsville’s housing market has seen tremendous growth, with average home values reaching $299,810. This represents a 175.36% increase, with an absolute dollar increase of $190,930. The growth reflects Huntsville’s expanding role as a major technology and research center, attracting high-paying jobs and new residents to the area.

#20. Greeley, CO

In 2009, Greeley, Colorado had an average home value of $178,825, reflecting its position as a growing community along Colorado’s Front Range during the post-crisis period. Despite the national housing downturn, Greeley maintained relatively stable housing values.

By 2024, Greeley’s home values have risen dramatically to $497,044, representing a 177.95% increase. The absolute dollar increase of $318,219 demonstrates the city’s successful economic diversification and its ability to attract residents seeking more affordable alternatives to the Denver metropolitan area.

#19. Mount Vernon, OH

In 2009, Mount Vernon, Ohio had an average home value of $95,394, typical of many Midwestern communities during the post-financial crisis period. This price point reflected the affordable nature of housing in smaller Ohio cities at the time.

By 2024, Mount Vernon’s housing market has shown impressive growth, with average home values reaching $265,688. This represents a 178.52% increase, with an absolute dollar increase of $170,294. This growth demonstrates the increasing appeal of smaller, well-connected communities in the post-pandemic era.

#18. Steamboat Springs, CO

In 2009, Steamboat Springs, Colorado had an average home value of $390,247, already showing its status as a premium mountain resort destination even during the post-crisis period. This higher baseline reflected the city’s established reputation as a world-class ski resort town.

By 2024, Steamboat Springs’ home values have surged to $1,089,520, representing a 179.19% increase. The absolute dollar increase of $699,273 reflects the growing demand for luxury mountain properties and the continued appeal of Colorado’s resort communities to wealthy buyers and investors.

#17. Coeur d’Alene, ID

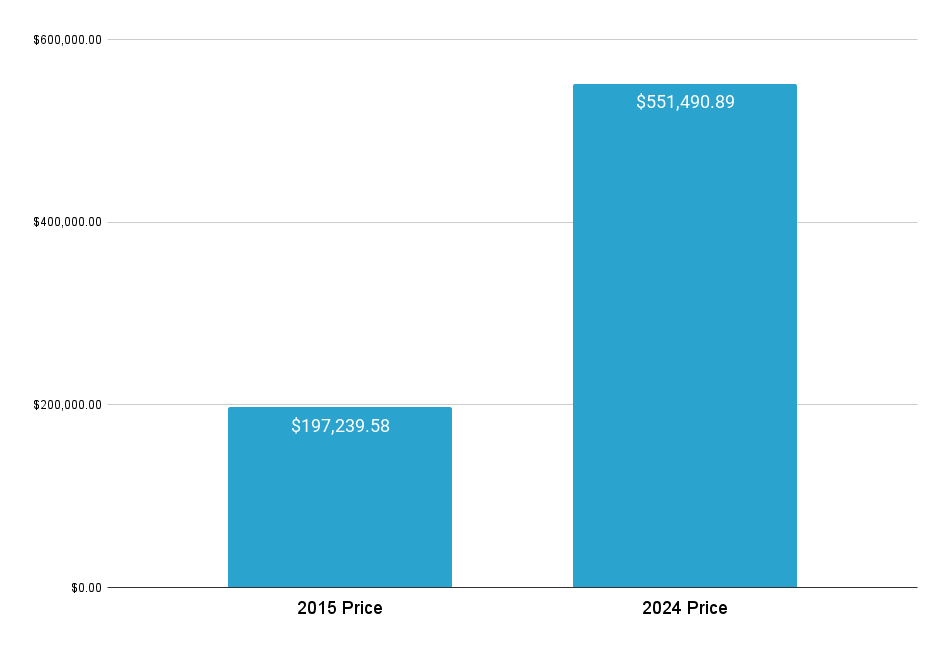

In 2009, Coeur d’Alene, Idaho had an average home value of $197,240, representing its status as an emerging destination in the Mountain West during the post-crisis period. This lakeside city was already attracting attention for its natural beauty and quality of life.

By 2024, Coeur d’Alene’s housing market has experienced substantial growth, with average home values reaching $551,491. This represents a 179.60% increase, with an absolute dollar increase of $354,251. This growth reflects the city’s transformation into a highly desirable destination for remote workers and retirees seeking a high quality of life.

#16. Boise City, ID

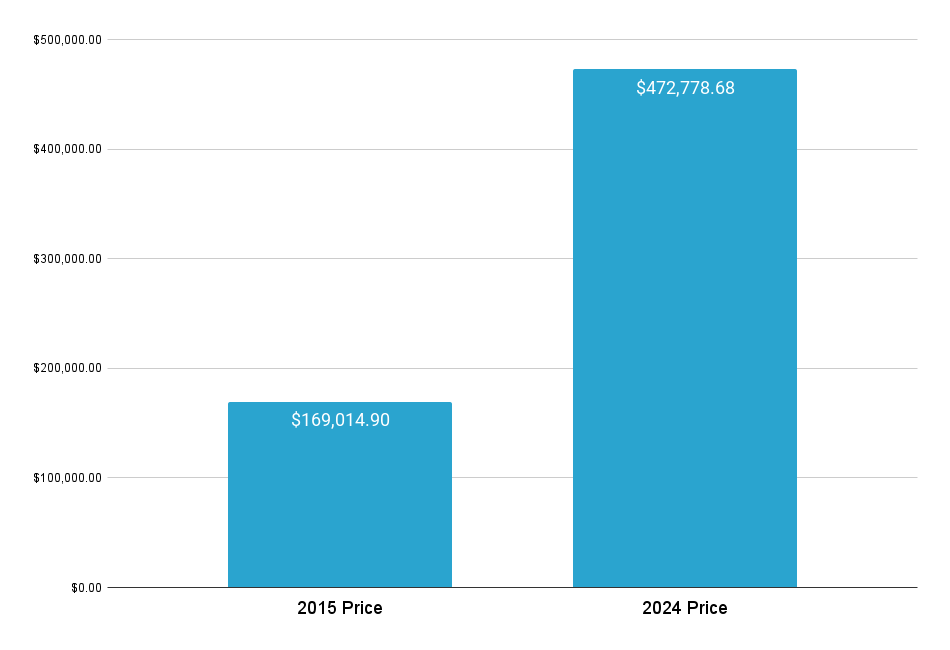

In 2009, Boise City, Idaho had an average home value of $169,015, reflecting its position as an affordable western state capital during the post-crisis period. This price point made homeownership accessible to many residents in this growing metropolitan area.

By 2024, Boise’s housing market has experienced remarkable growth, with average home values reaching $472,779. This represents a 179.73% increase, with an absolute dollar increase of $303,764. This growth reflects Boise’s emergence as a major technology hub and its appeal to those seeking a high quality of life at a lower cost than coastal cities.

#15. Madera, CA

In 2009, Madera, California had an average home value of $144,130, reflecting the significant impact of the financial crisis on California’s Central Valley. This price point represented a substantial correction from pre-crisis levels.

By 2024, Madera’s housing market has seen significant appreciation, with average home values reaching $407,500. This represents a 182.73% increase, with an absolute dollar increase of $263,371. This growth reflects the overall recovery of California’s housing market and the increasing appeal of more affordable alternatives to coastal cities.

#14. Cedartown, GA

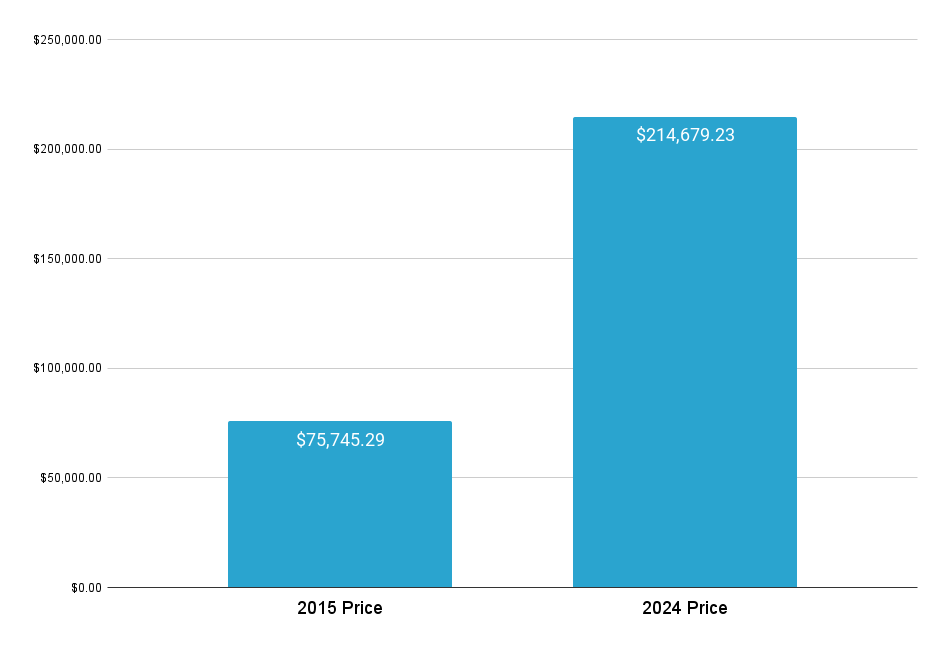

In 2009, Cedartown, Georgia had an average home value of $75,745, representing one of the more affordable markets in our analysis during the post-crisis period. This price point reflected the challenging economic conditions in many smaller Southern communities at the time.

By 2024, Cedartown’s housing market has shown remarkable growth, with average home values reaching $214,679. This represents a 183.42% increase, with an absolute dollar increase of $138,934. This growth demonstrates the increasing appeal of smaller, affordable communities within commuting distance of larger metropolitan areas.

#13. Heber, UT

In 2009, Heber, Utah had an average home value of $380,212, already showing its premium position as a desirable mountain community during the post-crisis period. This higher baseline reflected its proximity to Park City and its growing appeal to outdoor enthusiasts.

By 2024, Heber’s housing market has experienced dramatic growth, with average home values reaching $1,078,245. This represents a 183.59% increase, with an absolute dollar increase of $698,033. This substantial growth reflects Utah’s strong economic performance and the increasing demand for mountain lifestyle communities.

#12. Lewisburg, TN

In 2009, Lewisburg, Tennessee had an average home value of $109,260, typical of many smaller Southern communities during the post-crisis period. This price point made homeownership accessible to many residents in this Middle Tennessee community.

By 2024, Lewisburg’s housing market has seen substantial appreciation, with average home values reaching $310,312. This represents a 184.01% increase, with an absolute dollar increase of $201,052. This growth reflects the broader trend of appreciation in Tennessee’s housing market and the spillover effects from Nashville’s economic boom.

#11. Fernley, NV

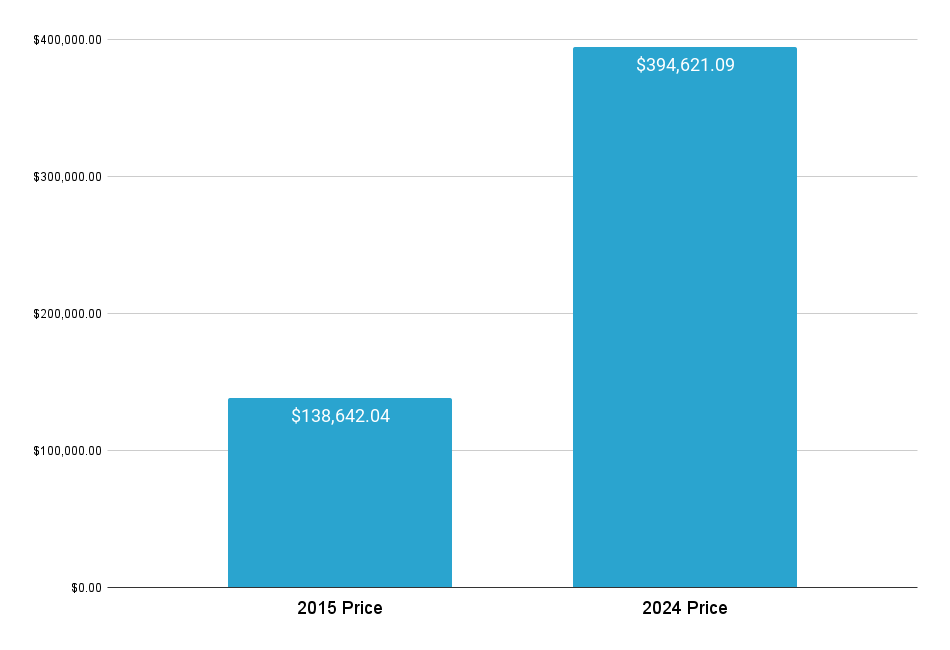

In 2009, Fernley, Nevada had an average home value of $138,642, reflecting the severe impact of the financial crisis on Nevada’s housing market. This price point represented a significant correction from pre-crisis levels.

By 2024, Fernley’s housing market has experienced remarkable recovery and growth, with average home values reaching $394,621. This represents a 184.63% increase, with an absolute dollar increase of $255,979. This growth reflects Nevada’s economic recovery and Fernley’s increasing appeal as an affordable alternative near Reno.

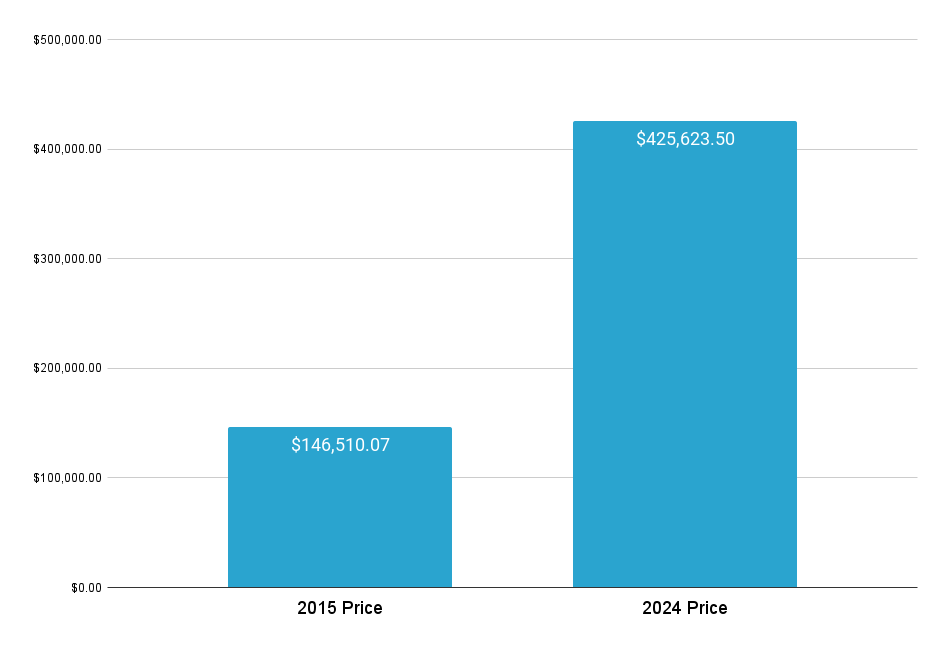

#10. Yuba City, CA

In 2009, Yuba City, California had an average home value of $146,510, showing the significant impact of the financial crisis on California’s Central Valley communities. This price point represented a substantial correction from pre-crisis levels.

By 2024, Yuba City’s housing market has seen dramatic appreciation, with average home values reaching $425,624. This represents a 190.51% increase, with an absolute dollar increase of $279,113. This growth reflects California’s overall housing recovery and the increasing appeal of more affordable markets outside major metropolitan areas.

#9. Modesto, CA

In 2009, Modesto, California had an average home value of $160,227, reflecting the severe impact of the financial crisis on California’s Central Valley. This price point represented a significant correction from pre-crisis levels.

By 2024, Modesto’s housing market has experienced substantial growth, with average home values reaching $465,917. This represents a 190.79% increase, with an absolute dollar increase of $305,690. This growth reflects the recovery of California’s housing market and Modesto’s appeal as a more affordable alternative to Bay Area living.

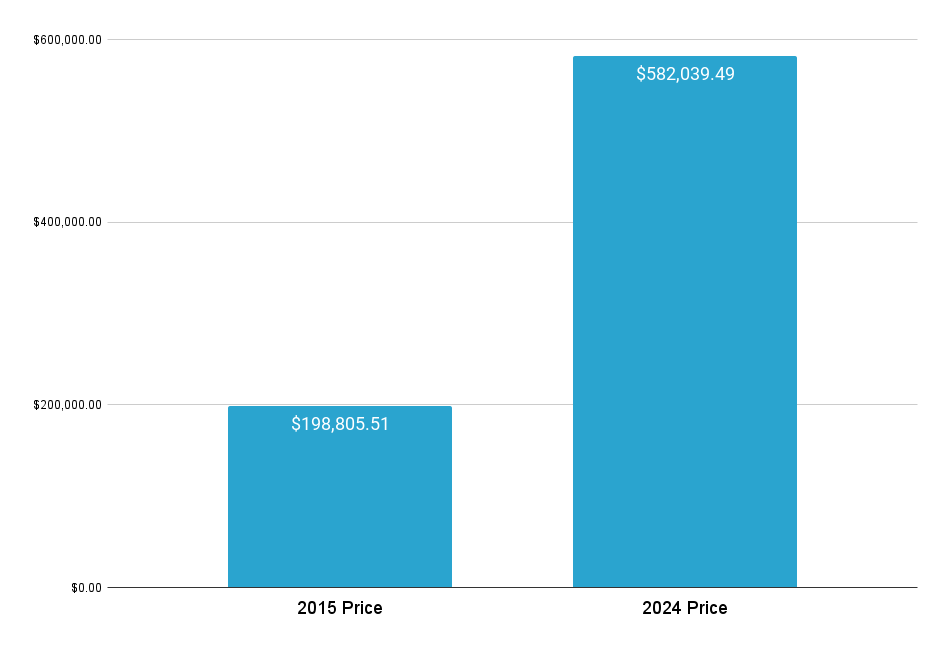

#8. Riverside, CA

In 2009, Riverside, California had an average home value of $198,806, showing the significant impact of the financial crisis on Southern California’s Inland Empire. This price point represented a substantial correction from pre-crisis levels.

By 2024, Riverside’s housing market has seen dramatic appreciation, with average home values reaching $582,039. This represents a 192.77% increase, with an absolute dollar increase of $383,234. This growth reflects the strong recovery of Southern California’s housing market and Riverside’s appeal as an affordable alternative to coastal communities.

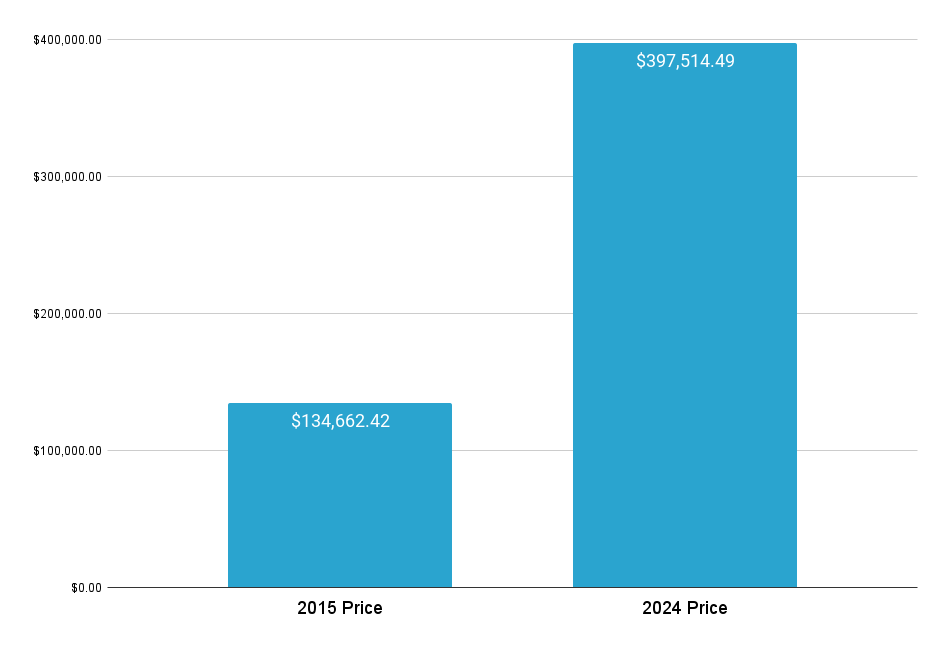

#7. Port St. Lucie, FL

In 2009, Port St. Lucie, Florida had an average home value of $134,662, reflecting the severe impact of the financial crisis on Florida’s housing market. This price point represented a significant correction from pre-crisis levels.

By 2024, Port St. Lucie’s housing market has experienced remarkable growth, with average home values reaching $397,514. This represents a 195.19% increase, with an absolute dollar increase of $262,852. This growth reflects Florida’s strong recovery and Port St. Lucie’s appeal as a more affordable alternative to South Florida’s larger metropolitan areas.

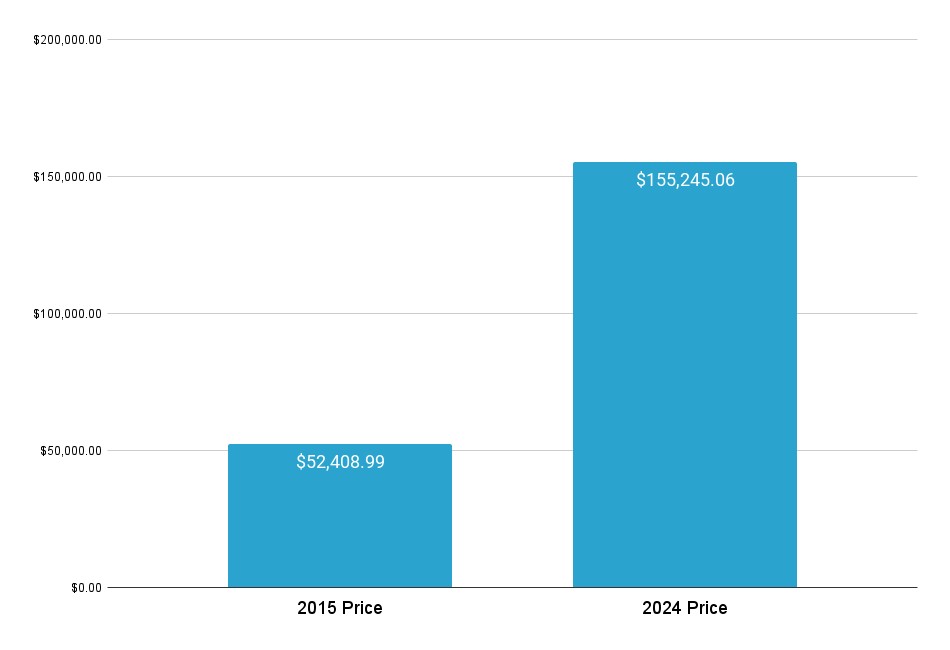

#6. Somerset, KY

In 2009, Somerset, Kentucky had an average home value of $52,409, representing one of the most affordable markets in our analysis during the post-crisis period. This price point reflected the rural nature of the community and the broader economic challenges of the time.

By 2024, Somerset’s housing market has shown remarkable appreciation, with average home values reaching $155,245. This represents a 196.22% increase, with an absolute dollar increase of $102,836. While still affordable compared to many markets, this growth demonstrates the increasing appeal of smaller, rural communities.

#5. Prineville, OR

In 2009, Prineville, Oregon had an average home value of $152,492, reflecting its position as an affordable community in central Oregon during the post-crisis period. This price point made homeownership accessible to many residents.

By 2024, Prineville’s housing market has experienced dramatic growth, with average home values reaching $457,802. This represents a 200.21% increase, with an absolute dollar increase of $305,310. This growth reflects Oregon’s strong housing market recovery and Prineville’s transformation, partly driven by technology sector investments.

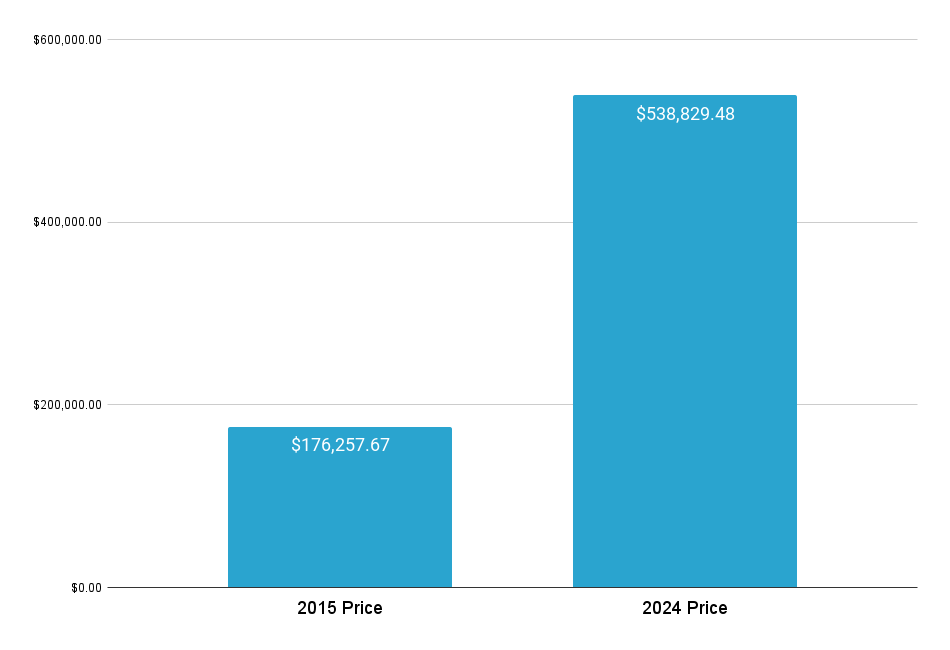

#4. Stockton, CA

In 2009, Stockton, California had an average home value of $176,258, showing the severe impact of the financial crisis on California’s Central Valley. This city was particularly hard hit by the foreclosure crisis.

By 2024, Stockton’s housing market has seen remarkable recovery and growth, with average home values reaching $538,829. This represents a 205.71% increase, with an absolute dollar increase of $362,572. This dramatic turnaround reflects California’s housing recovery and Stockton’s appeal as a more affordable alternative to Bay Area living.

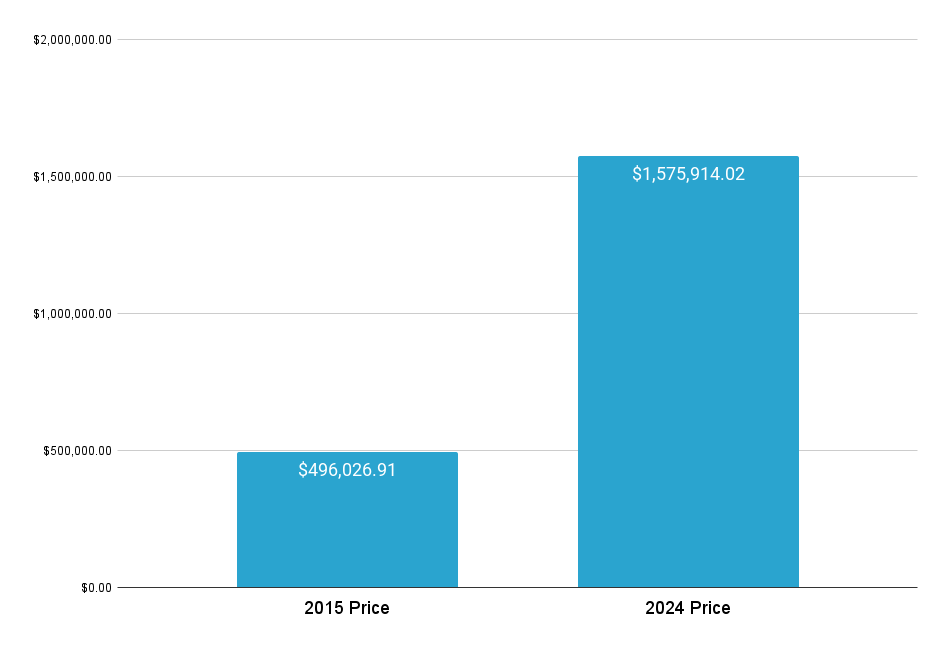

#3. San Jose, CA

In 2009, San Jose, California had an average home value of $496,027, reflecting its status as a major technology hub even during the post-crisis period. This higher baseline demonstrated the resilient nature of Silicon Valley’s housing market.

By 2024, San Jose’s housing market has experienced extraordinary growth, with average home values reaching $1,575,914. This represents a 217.71% increase, with an absolute dollar increase of $1,079,887. This remarkable appreciation reflects San Jose’s position at the heart of Silicon Valley and the tremendous wealth creation in the technology sector.

#2. Clewiston, FL

In 2009, Clewiston, Florida had an average home value of $83,238, reflecting both the impact of the financial crisis and its position as a smaller, rural Florida community. This price point represented a significant correction from pre-crisis levels.

By 2024, Clewiston’s housing market has shown extraordinary growth, with average home values reaching $272,021. This represents a 226.80% increase, with an absolute dollar increase of $188,783. This remarkable growth reflects Florida’s strong recovery and the increasing appeal of smaller communities in the state.

#1. Merced, CA

In 2009, Merced, California had an average home value of $115,119, demonstrating the severe impact of the financial crisis on California’s Central Valley. This city was particularly affected by the foreclosure crisis and economic downturn.

By 2024, Merced’s housing market has experienced the most dramatic growth of all cities in our analysis, with average home values reaching $414,772. This represents a 260.30% increase, with an absolute dollar increase of $299,653. This remarkable transformation reflects California’s housing recovery, the influence of UC Merced’s growth, and the increasing appeal of more affordable alternatives to coastal California cities.