Would you like to save this?

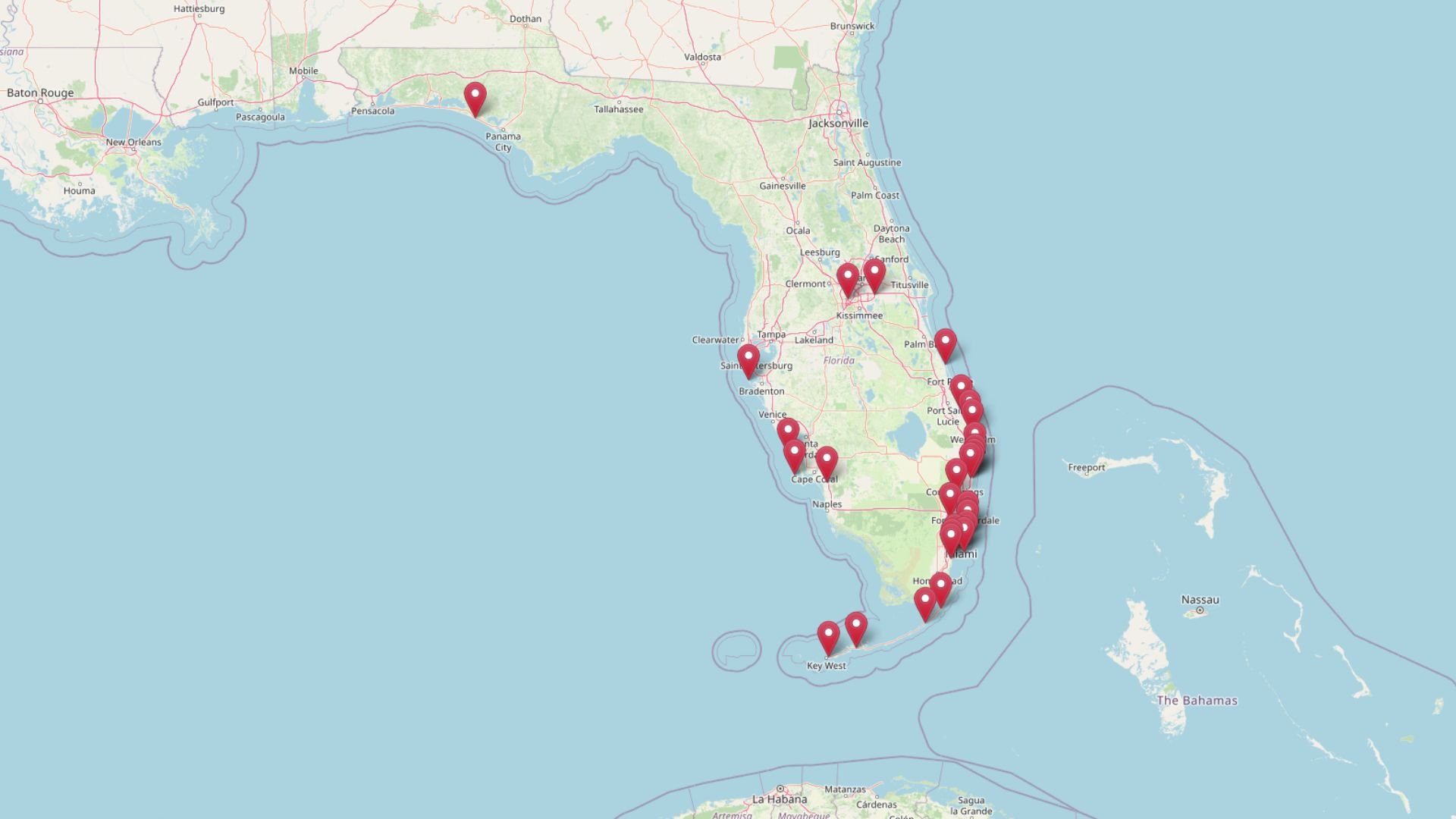

Based on the latest Zillow Home Value Index data as of May 2025, Montana continues to offer a range of budget-friendly housing options—if you know where to look. From small farming communities to rural service hubs, this roundup highlights 19 towns where home prices remain surprisingly affordable compared to national and state averages. Each town on this list has its own economic story and housing trend, shaped by factors like location, employment, amenities, and local demand. We’ve ranked them by price as of May 2025, and included historical data from as early as 2010 to show exactly how the market has shifted. Whether you’re a first-time buyer, investor, or simply curious about the real estate landscape, this guide sheds light on places where you can stretch your dollar further—without sacrificing small-town charm or Montana’s rugged beauty. Let’s take a closer look at the 19 Montana towns with the lowest home values heading into mid-2025—and what’s been driving those prices over time.

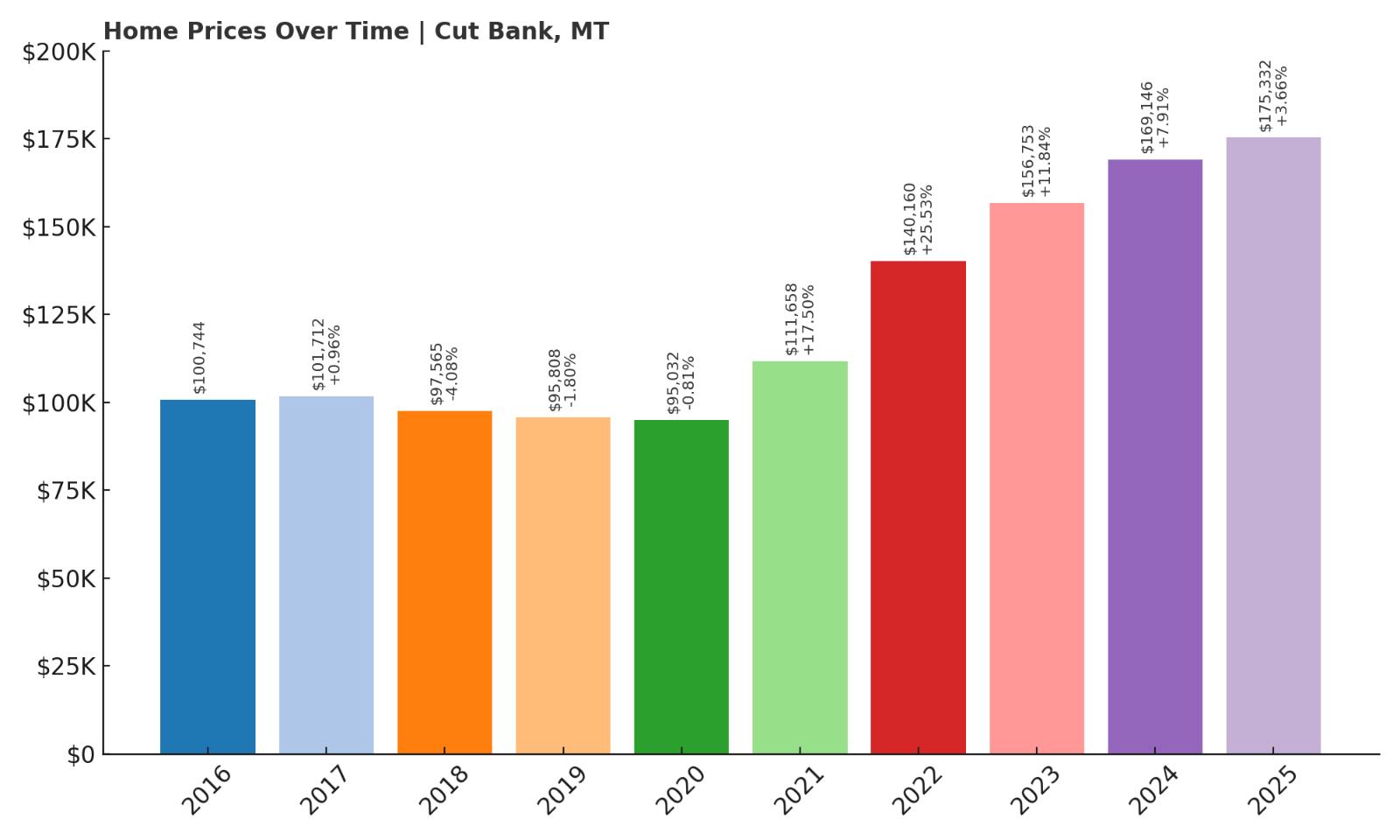

19. Cut Bank – 74% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $100,744

- 2017: $101,712 (+$968, +0.96% from previous year)

- 2018: $97,565 ($-4,147, -4.08% from previous year)

- 2019: $95,808 ($-1,757, -1.80% from previous year)

- 2020: $95,032 ($-776, -0.81% from previous year)

- 2021: $111,658 (+$16,626, +17.50% from previous year)

- 2022: $140,160 (+$28,502, +25.53% from previous year)

- 2023: $156,753 (+$16,593, +11.84% from previous year)

- 2024: $169,146 (+$12,393, +7.91% from previous year)

- 2025: $175,332 (+$6,185, +3.66% from previous year)

Cut Bank’s home prices have risen by about 74% since 2016, with a 2025 value of $175,332. After a slight decline between 2017 and 2020, prices surged dramatically from 2021 onward, driven by double-digit annual increases. Notably, 2022 alone saw a jump of more than $28,000—a 25% gain in one year. While growth has slowed since then, the town remains far more affordable than many parts of Montana. These figures highlight a long-term upswing despite early stagnation, showing that even small towns are not immune to statewide housing pressures.

Cut Bank – Eastern Montana Affordability Stronghold

Located near the eastern front of the Rocky Mountains, Cut Bank serves as a regional hub in Glacier County and offers a low cost of living relative to other parts of Montana. Its history is tied to agriculture, energy, and the railroad, giving the town a practical character and stable economy. The presence of amenities like medical centers and schools supports local demand, but without the tourism-driven pricing spikes seen in mountain resort towns. That said, the rapid climb in home values since 2021 points to renewed interest in small-town Montana living—perhaps driven by remote work trends or spillover from larger markets like Great Falls. With average prices still well under $200K, Cut Bank remains one of the best bets for affordability in the state, even as momentum pushes prices higher.

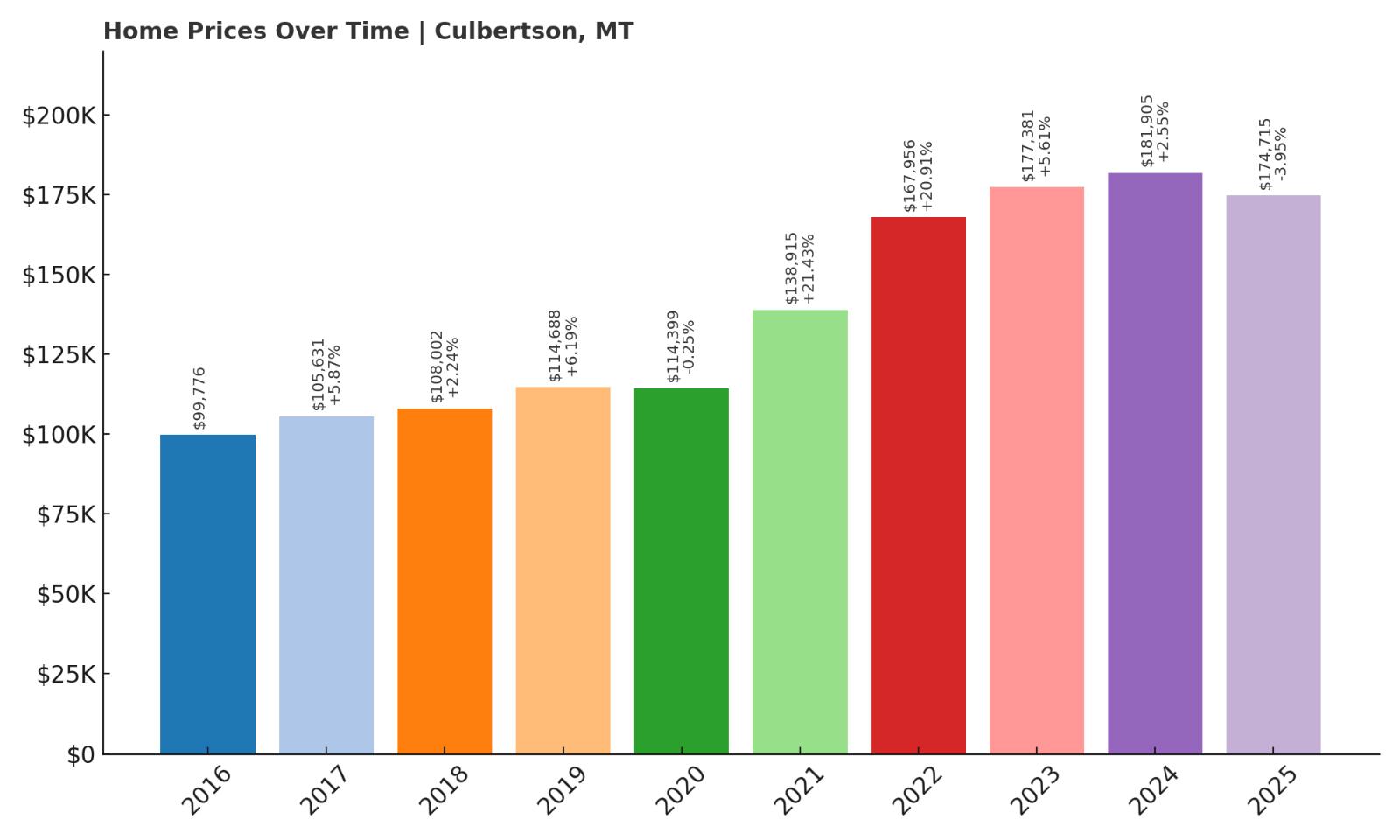

18. Culbertson – 75% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $99,776

- 2017: $105,631 (+$5,855, +5.87% from previous year)

- 2018: $108,002 (+$2,371, +2.24% from previous year)

- 2019: $114,688 (+$6,686, +6.19% from previous year)

- 2020: $114,399 ($-289, -0.25% from previous year)

- 2021: $138,915 (+$24,516, +21.43% from previous year)

- 2022: $167,956 (+$29,041, +20.91% from previous year)

- 2023: $177,381 (+$9,425, +5.61% from previous year)

- 2024: $181,905 (+$4,523, +2.55% from previous year)

- 2025: $174,715 ($-7,190, -3.95% from previous year)

From $99,776 in 2016 to $174,715 in 2025, Culbertson has seen a 75% jump in home values over nine years. Most of the growth occurred between 2020 and 2022, with massive increases during that window. However, 2025 marks a rare price dip, with a decrease of nearly $7,200 from the prior year. Even so, Culbertson’s long-term affordability remains intact, especially compared to Montana’s western towns. The volatility in recent years may reflect a market that’s adjusting after pandemic-era spikes.

Culbertson – High Growth, Low Entry Point

Situated near the North Dakota border in Roosevelt County, Culbertson has quietly transformed over the past decade. Its location along U.S. Route 2 gives it logistical importance, particularly for the oil and gas industry that has ebbed and flowed in the Bakken region. This proximity helped drive the double-digit jumps seen in the early 2020s. Despite the temporary slowdown in 2025, the town remains a stronghold of affordability. With home prices still under $175K, Culbertson appeals to buyers seeking space, quiet, and value. Its recent growth might be tied to infrastructure upgrades and housing demand from nearby energy projects, but its fundamental low-cost appeal remains strong.

17. Ekalaka – 145% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $66,019

- 2017: $65,975 ($-44, -0.07% from previous year)

- 2018: $75,878 (+$9,903, +15.01% from previous year)

- 2019: $80,967 (+$5,088, +6.71% from previous year)

- 2020: $86,325 (+$5,359, +6.62% from previous year)

- 2021: $102,801 (+$16,475, +19.09% from previous year)

- 2022: $125,900 (+$23,099, +22.47% from previous year)

- 2023: $131,976 (+$6,076, +4.83% from previous year)

- 2024: $144,647 (+$12,671, +9.60% from previous year)

- 2025: $161,867 (+$17,221, +11.91% from previous year)

Ekalaka’s home prices have more than doubled since 2016—rising 145% in under a decade. After modest early growth, values exploded post-2020, consistently posting double-digit gains for several years. The current price of $161,867 might seem high in context, but it’s still low for Montana. These increases suggest rising demand in an area that’s likely seeing more attention from value-conscious buyers.

Ekalaka – Frontier Life With Rising Demand

Would you like to save this?

Located in Carter County in southeastern Montana, Ekalaka is one of the most remote and traditional ranching towns in the state. Known for its natural beauty and the nearby Medicine Rocks State Park, the town attracts both history buffs and outdoor enthusiasts. Its relative isolation may have insulated it from early price pressures, but that has changed sharply in the last five years. The rise in prices since 2020 reflects both demand and a tightening housing supply. With fewer listings and growing interest from out-of-state buyers, even small towns like Ekalaka are experiencing significant price hikes. Still, it remains one of the most affordable places in Montana—and a notable outlier in terms of growth rate.

16. Plentywood – 62% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $97,809

- 2017: $97,636 ($-173, -0.18% from previous year)

- 2018: $100,535 (+$2,898, +2.97% from previous year)

- 2019: $109,803 (+$9,268, +9.22% from previous year)

- 2020: $116,948 (+$7,145, +6.51% from previous year)

- 2021: $142,057 (+$25,108, +21.47% from previous year)

- 2022: $171,943 (+$29,887, +21.04% from previous year)

- 2023: $173,007 (+$1,064, +0.62% from previous year)

- 2024: $159,589 ($-13,417, -7.76% from previous year)

- 2025: $158,118 ($-1,471, -0.92% from previous year)

Plentywood’s home prices have grown by 62% since 2016, though recent years show signs of cooling. After a meteoric climb through 2022, values dipped in 2024 and again slightly in 2025. This leveling off could reflect market correction after two years of breakneck growth. Still, a home price just above $158K in 2025 makes Plentywood a solid option for affordability-minded buyers.

Plentywood – Still a Deal Despite the Dip

Home Stratosphere Guide

Your Personality Already Knows

How Your Home Should Feel

113 pages of room-by-room design guidance built around your actual brain, your actual habits, and the way you actually live.

You might be an ISFJ or INFP designer…

You design through feeling — your spaces are personal, comforting, and full of meaning. The guide covers your exact color palettes, room layouts, and the one mistake your type always makes.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

Kitchen Style?

You might be an ISTJ or INTJ designer…

You crave order, function, and visual calm. The guide shows you how to create spaces that feel both serene and intentional — without ending up sterile.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ENFP or ESTP designer…

You design by instinct and energy. Your home should feel alive. The guide shows you how to channel that into rooms that feel curated, not chaotic.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ENTJ or ESTJ designer…

You value quality, structure, and things done right. The guide gives you the framework to build rooms that feel polished without overthinking every detail.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

Situated in Sheridan County near the Canadian border, Plentywood blends small-town calm with strong community infrastructure. It serves as a commercial center for northeast Montana, with healthcare, schools, and services that draw in residents from surrounding rural areas. Its distance from larger cities may account for its relatively low pricing over time. While prices took a hit in the last two years, Plentywood’s overall trend since 2016 remains upward. The town’s earlier growth aligns with broader trends of urban-to-rural migration and may rebound if demand picks up again. For now, it offers great value in a region with stable amenities and slow-paced living.

15. Winnett – 80% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $87,299

- 2017: $85,655 ($-1,644, -1.88% from previous year)

- 2018: $97,893 (+$12,238, +14.29% from previous year)

- 2019: $104,931 (+$7,038, +7.19% from previous year)

- 2020: $108,048 (+$3,117, +2.97% from previous year)

- 2021: $121,162 (+$13,114, +12.14% from previous year)

- 2022: $137,194 (+$16,032, +13.23% from previous year)

- 2023: $130,941 ($-6,253, -4.56% from previous year)

- 2024: $138,152 (+$7,211, +5.51% from previous year)

- 2025: $156,746 (+$18,594, +13.46% from previous year)

Winnett’s home values have grown by 80% since 2016, with the 2025 average reaching $156,746. The market showed a brief decline in 2023, but that was quickly reversed with strong double-digit growth in 2025. This rebound is especially notable given the town’s remote location and small population base. Despite its size, Winnett has proven to be resilient and attractive in recent years. The steep climb between 2021 and 2022—nearly $16,000 in gains—signals increasing demand or tightening inventory in the area. With consistent year-over-year increases and only one brief dip, the trend suggests a stable long-term growth trajectory.

Winnett – Rural Quiet With Surprising Momentum

Winnett is the county seat of Petroleum County, which is the least populated county in Montana. This isolation has long kept housing costs low, and for many years, Winnett remained off the radar of investors and new buyers alike. The area is largely ranchland and prairie, offering quietude, big skies, and a strong sense of local tradition. While amenities are limited, the town has a post office, a school, and community institutions that serve its tight-knit population. The affordability makes it an interesting alternative for those who want a no-frills lifestyle or are looking for inexpensive real estate to hold over time. The strong home price rebound in 2025 suggests that even rural outposts like Winnett are starting to experience the ripple effects of wider Montana real estate trends. Whether driven by remote work opportunities or people looking to escape denser urban centers, demand in these frontier towns is starting to inch upward. With homes still priced under $160K, Winnett offers long-term affordability without the volatility seen in resort-heavy regions of the state.

14. Walkerville – 223% Home Price Increase Since 2013

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: $48,236

- 2014: $54,345 (+$6,109, +12.66% from previous year)

- 2015: $53,473 ($-872, -1.60% from previous year)

- 2016: $62,139 (+$8,666, +16.21% from previous year)

- 2017: $61,935 ($-204, -0.33% from previous year)

- 2018: $70,059 (+$8,124, +13.12% from previous year)

- 2019: $73,161 (+$3,102, +4.43% from previous year)

- 2020: $86,437 (+$13,275, +18.15% from previous year)

- 2021: $108,959 (+$22,522, +26.06% from previous year)

- 2022: $137,797 (+$28,839, +26.47% from previous year)

- 2023: $145,796 (+$7,998, +5.80% from previous year)

- 2024: $161,182 (+$15,387, +10.55% from previous year)

- 2025: $155,679 ($-5,503, -3.41% from previous year)

Walkerville has experienced a remarkable 223% increase in home values since 2013, rising from under $50,000 to over $155,000 in 2025. While the most recent year saw a small decline, the broader trajectory remains sharply upward. The years 2020 through 2022 saw particularly explosive growth, including a nearly $29,000 gain in 2022 alone. This mirrors patterns seen across parts of western Montana, particularly those near larger employment hubs. Although prices dipped slightly in 2025, Walkerville’s affordability continues to attract attention, especially from those priced out of neighboring Butte and Bozeman.

Walkerville – Historic Roots With Modern Appeal

Perched just above Butte, Walkerville is one of Montana’s smallest incorporated towns but boasts a rich mining history that dates back to the late 1800s. Once a bustling hub for copper and silver extraction, the area has evolved into a residential community with views of the surrounding mountains and proximity to urban conveniences. Residents can easily access shopping, dining, and employment opportunities in Butte while enjoying a quieter, small-town feel. Its strategic location and charm have begun to influence the housing market, especially as more people seek affordable alternatives within driving distance of Montana’s economic centers. The impressive growth since 2013 reflects that shift. As inventory tightens across the region, Walkerville has emerged as a viable option for first-time buyers and those seeking historical character without a hefty price tag. With a 2025 price of $155,679, it offers compelling value in one of the state’s most dynamic corridors.

13. Scobey – 52% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $101,599

- 2017: $99,278 ($-2,321, -2.28% from previous year)

- 2018: $103,945 (+$4,667, +4.70% from previous year)

- 2019: $111,790 (+$7,846, +7.55% from previous year)

- 2020: $119,656 (+$7,865, +7.04% from previous year)

- 2021: $149,746 (+$30,090, +25.15% from previous year)

- 2022: $172,134 (+$22,388, +14.95% from previous year)

- 2023: $163,965 ($-8,169, -4.75% from previous year)

- 2024: $162,165 ($-1,800, -1.10% from previous year)

- 2025: $154,841 ($-7,324, -4.52% from previous year)

Home prices in Scobey have climbed by 52% since 2016, despite a recent three-year stretch of minor declines. After peaking at over $172,000 in 2022, values have adjusted downward, landing at $154,841 in 2025. This pattern is consistent with broader trends in rural housing markets that experienced rapid gains during the early pandemic years and then softened. Still, the 2021–2022 surge stands out, with more than $50,000 in combined growth over just two years. The town remains affordable by state standards and shows a long-term trend of rising demand with some correction.

Scobey – Affordable Prairie Living With Ups and Downs

Located in Daniels County near the Canadian border, Scobey is a small prairie town with a strong agricultural backbone. With its wide-open spaces, clean air, and tight-knit community, the town appeals to residents seeking simplicity and low living costs. The local economy is tied to farming and ranching, which contributes to a stable, if slow-growing, real estate market. Services like schools, a hospital, and retail shops give residents access to basic needs without long-distance travel. While Scobey experienced dramatic increases during the early 2020s, the last few years have introduced a leveling effect. This is common in rural markets after an acceleration period driven by urban out-migration. Nonetheless, the town’s real estate remains attractive to buyers prioritizing affordability over flash. Its history of steady if uneven growth suggests it will continue to be a solid low-cost option in the northeastern corner of the state.

12. Harlem – 118% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $70,992

- 2017: $72,008 (+$1,016, +1.43% from previous year)

- 2018: $76,535 (+$4,527, +6.29% from previous year)

- 2019: $81,647 (+$5,112, +6.68% from previous year)

- 2020: $95,953 (+$14,306, +17.52% from previous year)

- 2021: $120,026 (+$24,073, +25.09% from previous year)

- 2022: $141,118 (+$21,092, +17.57% from previous year)

- 2023: $134,656 ($-6,462, -4.58% from previous year)

- 2024: $150,048 (+$15,391, +11.43% from previous year)

- 2025: $154,695 (+$4,647, +3.10% from previous year)

Since 2016, Harlem’s home prices have surged by approximately 118%, going from just under $71,000 to nearly $155,000 in 2025. Much of that increase came in large bursts, particularly in 2020 and 2021, when values rose by over $38,000 in just two years. These gains suggest a dramatic uptick in demand during that period, which was common across many rural towns due to shifting migration patterns during the pandemic. Harlem did experience a dip in 2023, but it was quickly reversed by strong gains the following year. The market has since stabilized, with modest growth continuing into 2025. While prices remain well below the statewide median, the scale of increase reflects deeper shifts in the town’s housing dynamics.

Harlem – Agricultural Center With Community Appeal

Harlem is located in Blaine County along the Hi-Line in northern Montana and serves as a small but essential community in the region’s agricultural economy. Positioned near the Fort Belknap Indian Reservation, Harlem benefits from cultural diversity and the presence of local institutions, including schools, health services, and a public library. While the town is remote by urban standards, it remains well connected by U.S. Route 2 and the nearby Amtrak station in Havre, just 45 miles to the west. These connections, coupled with a strong sense of local pride, have helped Harlem remain a viable place to live even as other small towns have faded. The affordability and modest size of Harlem’s housing stock have made it particularly attractive to buyers looking for value and elbow room. Although homes here are simple and inventory remains tight, the overall trend in home prices reflects sustained local demand. Many buyers are likely drawn by the combination of low entry prices and essential amenities, especially during a period when urban areas have become increasingly unaffordable. Harlem’s strong growth since 2020 may also indicate greater attention from remote workers or regional buyers seeking to settle in smaller, more self-sufficient towns with reliable infrastructure and community cohesion. As home values now hover around $155,000, Harlem continues to represent a practical option for affordable living in northern Montana.

11. Glasgow – 63% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $93,954

- 2017: $93,738 ($-216, -0.23% from previous year)

- 2018: $102,382 (+$8,644, +9.22% from previous year)

- 2019: $104,556 (+$2,175, +2.12% from previous year)

- 2020: $112,604 (+$8,048, +7.70% from previous year)

- 2021: $131,301 (+$18,697, +16.60% from previous year)

- 2022: $153,593 (+$22,292, +16.98% from previous year)

- 2023: $147,510 ($-6,083, -3.96% from previous year)

- 2024: $152,331 (+$4,821, +3.27% from previous year)

- 2025: $153,576 (+$1,245, +0.82% from previous year)

Glasgow has posted a steady 63% increase in home values since 2016, a figure that reflects slow but consistent market strength in this northeastern Montana town. Most of the appreciation occurred in the three-year span from 2020 to 2022, when prices leapt from $112,604 to over $153,000. While the town experienced a modest dip in 2023, values have since recovered, with 2025 landing just above the 2022 peak. That slight cooling may indicate a more sustainable growth pattern going forward. Glasgow’s stable trend, especially compared to some towns with volatile spikes, suggests a mature and gradually appreciating housing market grounded in long-term demand rather than speculative surges.

Glasgow – Regional Hub With Strong Foundations

Known as the “Middle of Nowhere” by some because of its remote location, Glasgow is a key regional hub in Valley County with a population of just over 3,000. Despite its geographic isolation, the town has a strong infrastructure that includes a hospital, public schools, a courthouse, and several large employers. It also serves as a central shopping and service destination for residents from smaller neighboring towns and ranches. The presence of the BNSF Railway, Amtrak access, and an airport further enhance its role as an economic anchor in the region. Glasgow’s relatively strong housing market growth reflects the town’s position as a dependable and livable location in an otherwise sparsely populated part of the state. Housing remains affordable, but the steady rise in value points to a market that is both active and resilient. The town offers a good quality of life for residents who value space, safety, and community connection. With current home prices just over $153,000, Glasgow remains accessible for buyers while offering many of the services found in larger municipalities. Its long-term prospects are promising, particularly as more Montanans and transplants seek practical alternatives to overburdened cities like Missoula or Bozeman.

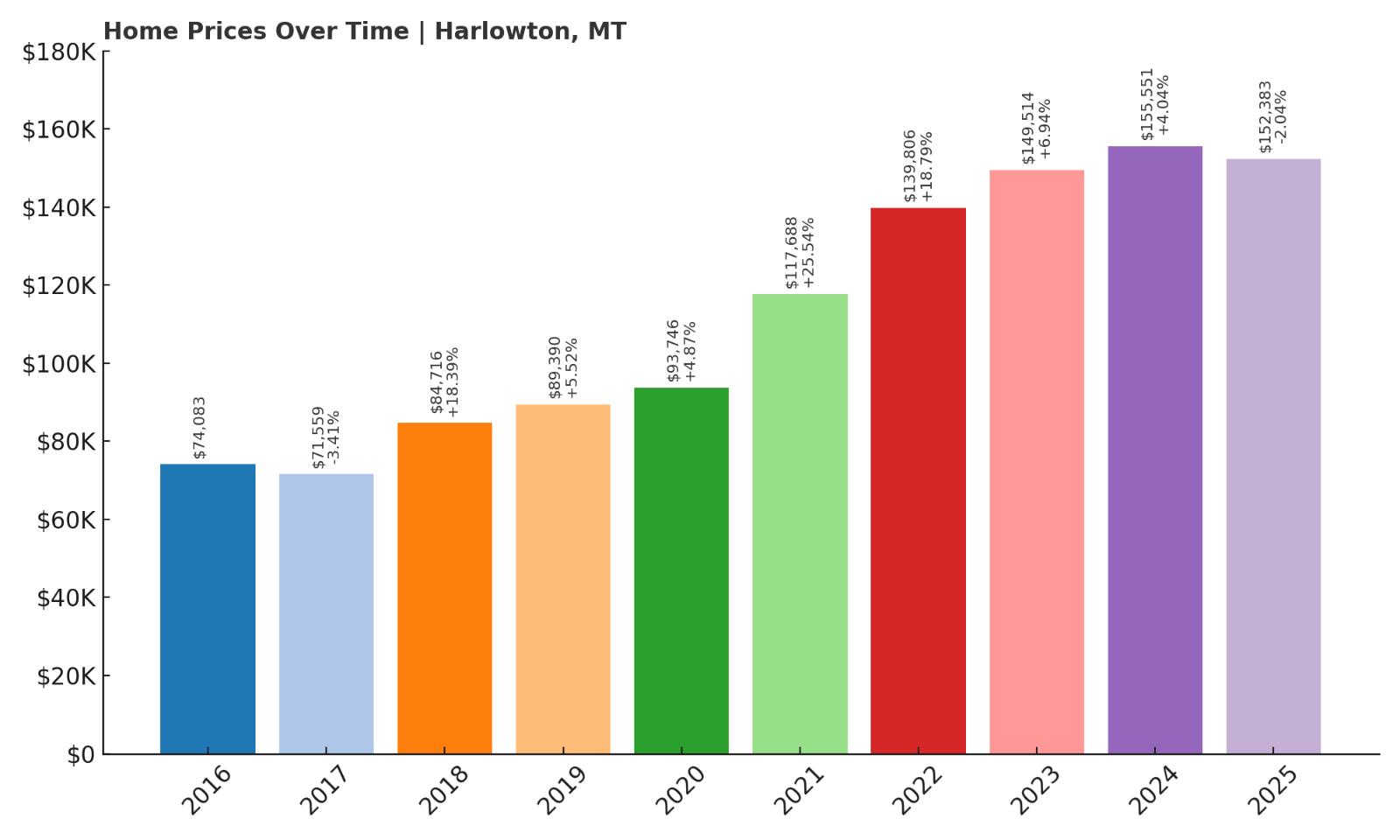

10. Harlowton – 105% Home Price Increase Since 2016

Would you like to save this?

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $74,083

- 2017: $71,559 ($-2,523, -3.41% from previous year)

- 2018: $84,716 (+$13,157, +18.39% from previous year)

- 2019: $89,390 (+$4,673, +5.52% from previous year)

- 2020: $93,746 (+$4,356, +4.87% from previous year)

- 2021: $117,688 (+$23,942, +25.54% from previous year)

- 2022: $139,806 (+$22,118, +18.79% from previous year)

- 2023: $149,514 (+$9,708, +6.94% from previous year)

- 2024: $155,551 (+$6,036, +4.04% from previous year)

- 2025: $152,383 ($-3,168, -2.04% from previous year)

Harlowton’s housing market has more than doubled since 2016, with a 105% increase that brought prices from the low $70,000s to over $152,000 by 2025. The town’s strongest growth occurred between 2020 and 2022, when property values soared by nearly $46,000 in just two years. Like many rural towns in Montana, Harlowton experienced a post-pandemic boost in real estate interest, likely due to remote work flexibility and urban flight. While 2025 shows a modest decline of around 2%, this follows several years of consecutive growth and may simply represent market stabilization. The current value reflects strong long-term appreciation in a historically low-cost area.

Harlowton – A Small Town on the Rise

Located in Wheatland County, Harlowton is a quiet railroad town nestled at the base of the Crazy Mountains in central Montana. It’s known for its historical depot, welcoming community, and scenic surroundings. Once a key point in the Milwaukee Road electric rail line, the town has transitioned into a peaceful residential hub with a mix of retirees, working families, and newcomers drawn by its low costs and slow pace of life. While Harlowton doesn’t have the same tourist appeal as Montana’s mountain towns, it compensates with an authenticity and small-town charm that resonates with many buyers. The recent growth in home prices may be due to its central location, local investment, and interest from people seeking homes in walkable, affordable towns away from larger cities. The town is close enough to Billings and Bozeman to attract commuters and weekenders, but far enough away to keep real estate prices grounded. Its rise in value suggests growing confidence in the town’s prospects, bolstered by improvements in local infrastructure and increased visibility. With homes still averaging around $152,000, Harlowton remains a highly attractive choice for buyers who want Montana living without the hefty price tags of the western corridor.

9. Richey – 74% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $84,874

- 2017: $85,320 (+$446, +0.53% from previous year)

- 2018: $82,943 ($-2,378, -2.79% from previous year)

- 2019: $85,199 (+$2,257, +2.72% from previous year)

- 2020: $91,716 (+$6,516, +7.65% from previous year)

- 2021: $113,081 (+$21,365, +23.30% from previous year)

- 2022: $138,364 (+$25,284, +22.36% from previous year)

- 2023: $124,078 ($-14,287, -10.33% from previous year)

- 2024: $133,418 (+$9,340, +7.53% from previous year)

- 2025: $147,450 (+$14,032, +10.52% from previous year)

Richey’s housing market has appreciated by 74% since 2016, climbing from roughly $85,000 to over $147,000 in 2025. This growth has been uneven but dramatic in the years it occurred—most notably between 2020 and 2022, when values jumped by over $46,000 in just two years. The sharp correction in 2023, which saw prices drop by more than 10%, signaled a short-term pullback. However, the market quickly rebounded in the following two years with back-to-back increases. By 2025, values have reached a new high, reflecting renewed confidence and buyer activity in the area. This combination of past volatility and ongoing growth marks Richey as a community where market forces continue to evolve—suggesting opportunity for buyers looking for both affordability and potential upside.

Richey – Resilient Prairie Town With Upside

Richey is a modest community in Dawson County, nestled in eastern Montana’s broad prairie landscape. Like many towns in this region, Richey was built on agriculture and continues to be defined by ranching and farming as its economic backbone. With a population of under 200 residents, it exemplifies the rural quietude and simplicity many Montanans value. It may not offer the restaurants or nightlife of bigger towns, but what it lacks in urban amenities, it makes up for in community cohesion, low living costs, and an expansive sense of space. Residents tend to know one another, and families often span multiple generations in the area. Basic services, like a post office and public school, serve the town’s needs, while larger errands may require a drive to Glendive or Miles City. Despite its size, Richey’s home values have risen impressively over the past decade. The town’s affordability and potential for property value appreciation have caught the attention of investors and new residents looking to escape urban centers or purchase rental properties at a lower price point. There may also be a growing interest from retirees or young families looking for a back-to-basics lifestyle with minimal costs. While home prices saw a brief drop in 2023, the rebound in 2024 and continued growth in 2025 suggest a community that is holding its own economically. With homes averaging around $147,000, Richey offers the kind of affordability that’s becoming increasingly rare—not just in Montana, but nationwide. The housing stock is modest, and listings are infrequent, but for those who value peace, land, and long-term value, Richey remains one of the state’s most appealing rural opportunities.

8. Lodge Grass – 86% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $78,177

- 2017: $80,571 (+$2,395, +3.06% from previous year)

- 2018: $85,706 (+$5,134, +6.37% from previous year)

- 2019: $89,708 (+$4,003, +4.67% from previous year)

- 2020: $94,453 (+$4,744, +5.29% from previous year)

- 2021: $112,306 (+$17,853, +18.90% from previous year)

- 2022: $122,213 (+$9,907, +8.82% from previous year)

- 2023: $119,905 ($-2,308, -1.89% from previous year)

- 2024: $126,254 (+$6,349, +5.30% from previous year)

- 2025: $145,196 (+$18,942, +15.00% from previous year)

Home prices in Lodge Grass have jumped by 86% since 2016, a notable rise for a town of its size and location. After a string of steady but moderate increases through the late 2010s, values began to surge in 2021, increasing by nearly $18,000 in just one year. A short-lived price dip in 2023 was quickly reversed, and 2025 brought one of the strongest single-year gains yet, with a 15% jump that pushed average values to $145,196. This long-term growth trajectory is a sign of renewed interest in the town and a gradual tightening of housing availability. Lodge Grass may be small, but it’s becoming increasingly recognized for its affordability and long-term real estate potential in southern Montana.

Lodge Grass – Culturally Rich and Underrated

Home Stratosphere Guide

Your Personality Already Knows

How Your Home Should Feel

113 pages of room-by-room design guidance built around your actual brain, your actual habits, and the way you actually live.

You might be an ISFJ or INFP designer…

You design through feeling — your spaces are personal, comforting, and full of meaning. The guide covers your exact color palettes, room layouts, and the one mistake your type always makes.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ISTJ or INTJ designer…

You crave order, function, and visual calm. The guide shows you how to create spaces that feel both serene and intentional — without ending up sterile.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ENFP or ESTP designer…

You design by instinct and energy. Your home should feel alive. The guide shows you how to channel that into rooms that feel curated, not chaotic.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ENTJ or ESTJ designer…

You value quality, structure, and things done right. The guide gives you the framework to build rooms that feel polished without overthinking every detail.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

Situated in Big Horn County on the Crow Indian Reservation, Lodge Grass offers a unique cultural heritage that sets it apart from many other Montana towns. Its population is primarily Indigenous, and the community is closely tied to Crow traditions, language, and ways of life. This deep-rooted cultural presence makes the town a center of local pride and history, with events, ceremonies, and educational efforts that reflect a commitment to preserving identity while fostering resilience. The landscape around Lodge Grass is beautiful and serene, surrounded by high plains and not far from the Big Horn Mountains. While it lacks large-scale commercial infrastructure, the community’s connection to nature, culture, and tradition adds a richness to life here that goes beyond economics. The steady growth in home prices likely reflects a combination of outside interest and internal development. More people are recognizing the town’s value as a residential base, especially with proximity to Hardin and the I-90 corridor. While Lodge Grass remains among the most affordable towns in the state, the pace of appreciation suggests increasing competition for available housing. Services remain basic, but access to schools and essential goods is available nearby. For those seeking affordability, cultural immersion, and quiet surroundings, Lodge Grass provides a compelling option. With the average home price still under $150,000, it is a place where heritage and housing opportunity exist in rare balance—something that may become even more valuable in the years ahead.

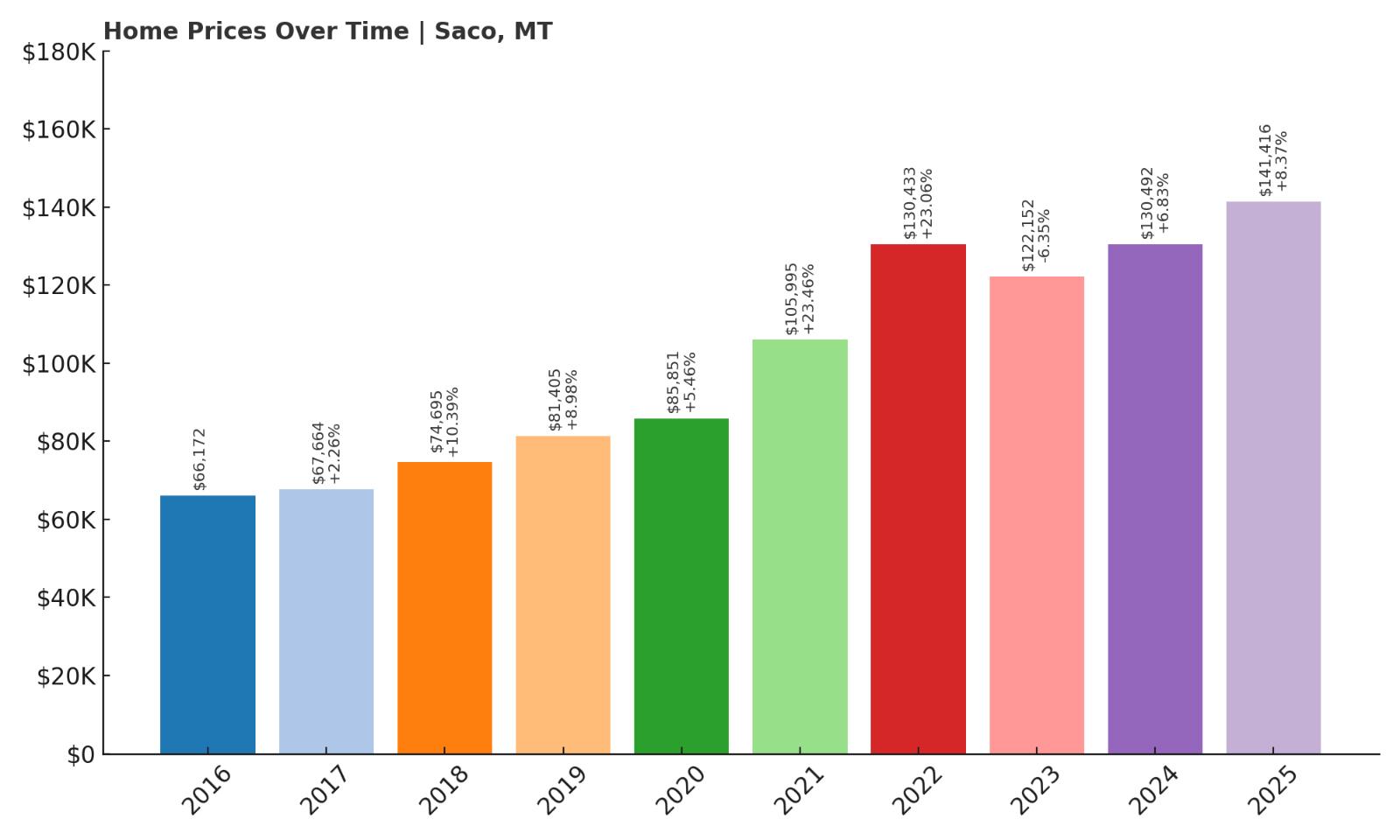

7. Saco – 114% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $66,172

- 2017: $67,664 (+$1,493, +2.26% from previous year)

- 2018: $74,695 (+$7,031, +10.39% from previous year)

- 2019: $81,405 (+$6,710, +8.98% from previous year)

- 2020: $85,851 (+$4,446, +5.46% from previous year)

- 2021: $105,995 (+$20,144, +23.46% from previous year)

- 2022: $130,433 (+$24,439, +23.06% from previous year)

- 2023: $122,152 ($-8,281, -6.35% from previous year)

- 2024: $130,492 (+$8,339, +6.83% from previous year)

- 2025: $141,416 (+$10,924, +8.37% from previous year)

Saco’s home prices have grown by an impressive 114% since 2016, with a current average of $141,416. Early gains were modest, but beginning in 2021, prices surged more than $44,000 in just two years. A dip in 2023 cooled the market slightly, but steady recovery since then suggests that interest remains strong. The latest year brought another 8% increase, keeping Saco on the radar for buyers in search of consistent long-term appreciation. Despite its small size, the town has shown that even the quietest parts of Montana are not immune to rising real estate values. The housing stock may be limited, but the overall upward trend is clear and sustained.

Saco – Small-Town Stillness With Growing Momentum

Located in Phillips County along U.S. Route 2, Saco is a quintessential Montana prairie town. Its population is small—hovering around 200—but what it lacks in size, it makes up for in charm, affordability, and a peaceful lifestyle. The town is surrounded by farmland, open sky, and a pace of life that hasn’t changed much in decades. While it offers only basic services, including a school, post office, and a few small businesses, its proximity to Malta (roughly 30 miles west) allows residents to access larger amenities when needed. Saco is also near recreational destinations like Nelson Reservoir, making it appealing to hunters, anglers, and nature lovers who appreciate wide-open landscapes and quiet weekends. The housing market here has benefitted from the broader shift in Montana’s real estate landscape, where more buyers are looking beyond traditional hotspots to find value and simplicity. Saco’s steep growth since 2020 reflects those new dynamics. Although inventory is tight and homes may take time to come on the market, when they do, the pricing remains highly competitive. The affordability and small-town environment make it especially attractive to retirees, remote workers, and anyone seeking refuge from city pressures. As prices continue their upward climb, Saco’s reputation as one of Montana’s best-kept affordable secrets is slowly giving way to broader recognition—and a steady, manageable rise in value.

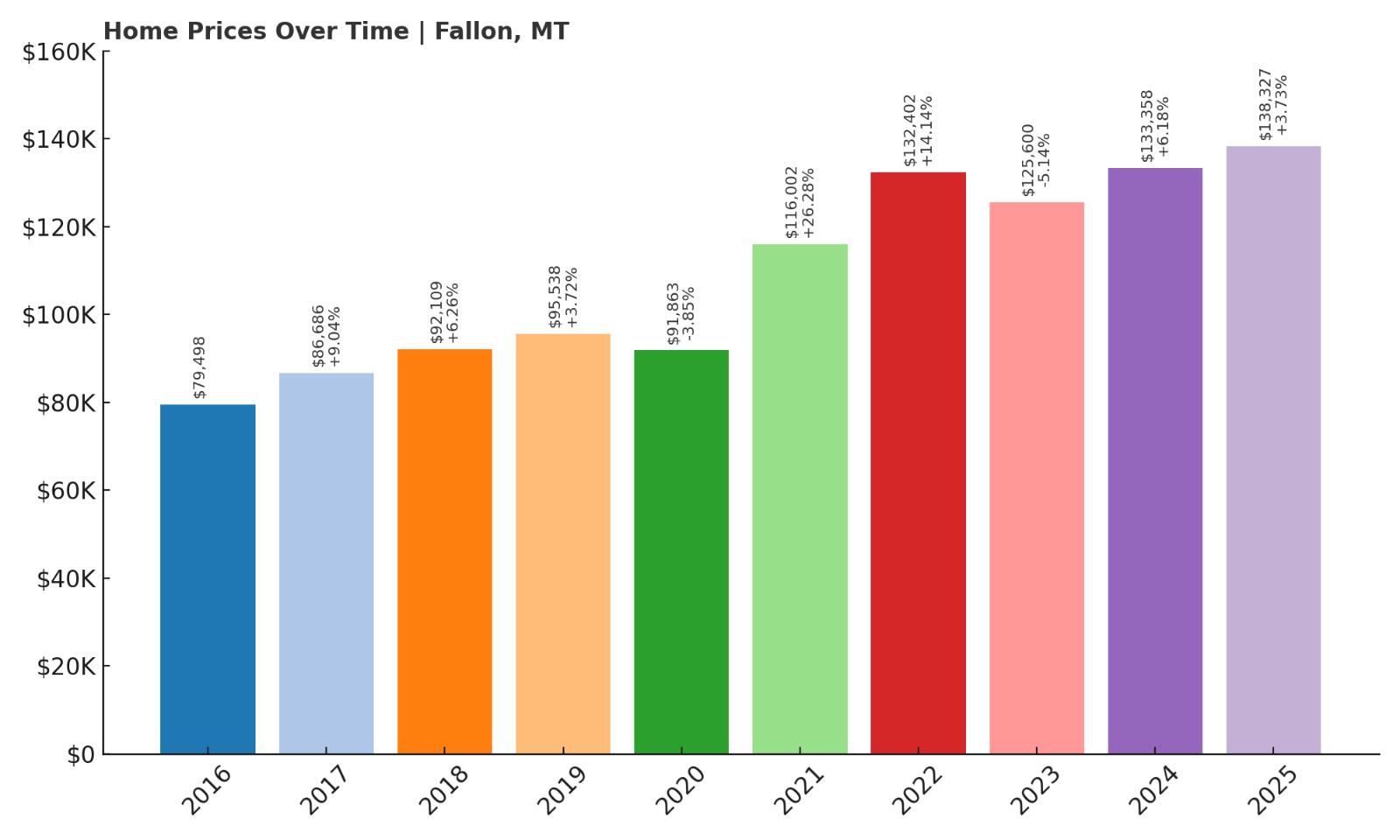

6. Fallon – 74% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $79,498

- 2017: $86,686 (+$7,187, +9.04% from previous year)

- 2018: $92,109 (+$5,423, +6.26% from previous year)

- 2019: $95,538 (+$3,429, +3.72% from previous year)

- 2020: $91,863 ($-3,674, -3.85% from previous year)

- 2021: $116,002 (+$24,138, +26.28% from previous year)

- 2022: $132,402 (+$16,401, +14.14% from previous year)

- 2023: $125,600 ($-6,802, -5.14% from previous year)

- 2024: $133,358 (+$7,757, +6.18% from previous year)

- 2025: $138,327 (+$4,970, +3.73% from previous year)

Fallon’s home prices have appreciated by 74% since 2016, moving from under $80,000 to over $138,000 in 2025. This growth has been fueled by steady increases in the late 2010s, punctuated by a major jump in 2021 of over $24,000—one of the most aggressive single-year gains on this list. Though 2023 saw a temporary dip, the market rebounded in the two years following, signaling continued interest in Fallon’s housing market. With consistent value increases and a relatively mild recent trajectory, the town offers both growth potential and stability for buyers priced out of larger Montana markets.

Fallon – Quiet Access Point to Montana’s Heartland

Fallon is an unincorporated community in Prairie County, located along the Yellowstone River and just off Interstate 94. Its strategic position between Glendive and Miles City makes it more connected than many towns its size, providing residents with access to larger job markets and services while maintaining a rural character. Fallon’s history is rooted in ranching and transportation, and it still functions as a stopover and service hub for long-haul traffic and travelers exploring southeastern Montana. The community is small, but that’s part of its draw—peaceful surroundings, a close-knit population, and plenty of room to grow. Housing in Fallon is modest and often older, but the recent rise in values suggests a tightening market and growing interest. With more Montanans and out-of-state buyers seeking remote work lifestyles or rural retirement options, towns like Fallon have emerged as hidden-value targets. The strong uptick in 2021 could reflect a spike in relocation interest during the pandemic years, while the subsequent years suggest the town has maintained that attention. The overall trajectory paints a picture of long-term potential in a place where housing is still relatively cheap and life moves at an intentionally slower pace. At just over $138,000 in 2025, Fallon provides an accessible entry point to homeownership in a historically affordable corridor of the state.

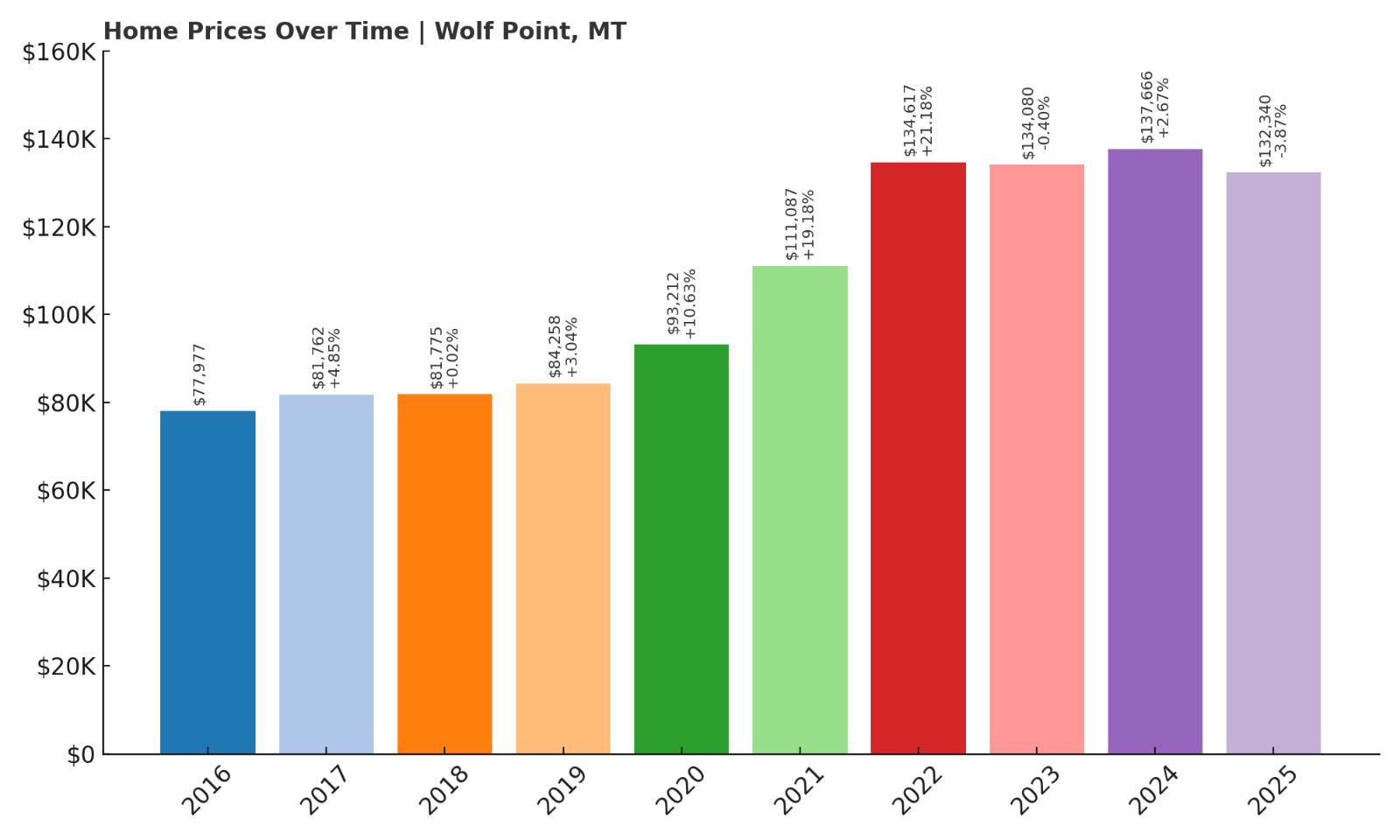

5. Wolf Point – 70% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $77,977

- 2017: $81,762 (+$3,785, +4.85% from previous year)

- 2018: $81,775 (+$14, +0.02% from previous year)

- 2019: $84,258 (+$2,483, +3.04% from previous year)

- 2020: $93,212 (+$8,955, +10.63% from previous year)

- 2021: $111,087 (+$17,875, +19.18% from previous year)

- 2022: $134,617 (+$23,529, +21.18% from previous year)

- 2023: $134,080 ($-537, -0.40% from previous year)

- 2024: $137,666 (+$3,586, +2.67% from previous year)

- 2025: $132,340 ($-5,326, -3.87% from previous year)

Wolf Point’s home values have increased 70% since 2016, growing from around $78,000 to over $132,000 in 2025. This rise has occurred in waves, with moderate gains early on followed by dramatic leaps in 2021 and 2022—when prices climbed over $41,000 across just two years. Though recent figures show some softening, including a dip in 2025, the market remains significantly elevated from where it was a decade ago. That sustained upward movement suggests a foundational shift in local housing demand, one that may continue as attention grows toward affordable towns with strong civic institutions.

Wolf Point – Cultural Center on the Hi-Line

Wolf Point is the largest city on the Fort Peck Indian Reservation and serves as the cultural, economic, and transportation hub for northeastern Montana. Situated along the Hi-Line and served by U.S. Route 2, the town also has an Amtrak station, a regional airport, and several government and tribal agencies, making it far more connected than its population of roughly 2,500 might suggest. The annual Wild Horse Stampede rodeo is a major event in the region, showcasing the town’s blend of western traditions and Indigenous culture. Wolf Point’s economy revolves around education, healthcare, public administration, and retail—providing a level of stability rare in smaller rural towns. Its diverse community and established infrastructure make Wolf Point stand out as more than just a stop on the highway. These features also help support housing demand, especially as affordability in other parts of the state declines. While its housing market is still subject to fluctuations—seen in 2025’s small drop in average price—the long-term trend is clear: steady growth built on genuine local strengths. With a current average home price of $132,340, Wolf Point remains a compelling option for buyers seeking community, accessibility, and a cost of living that’s still well below the Montana average. As other small towns chase relevance, Wolf Point has held onto it—and that consistency is beginning to pay off in home values.

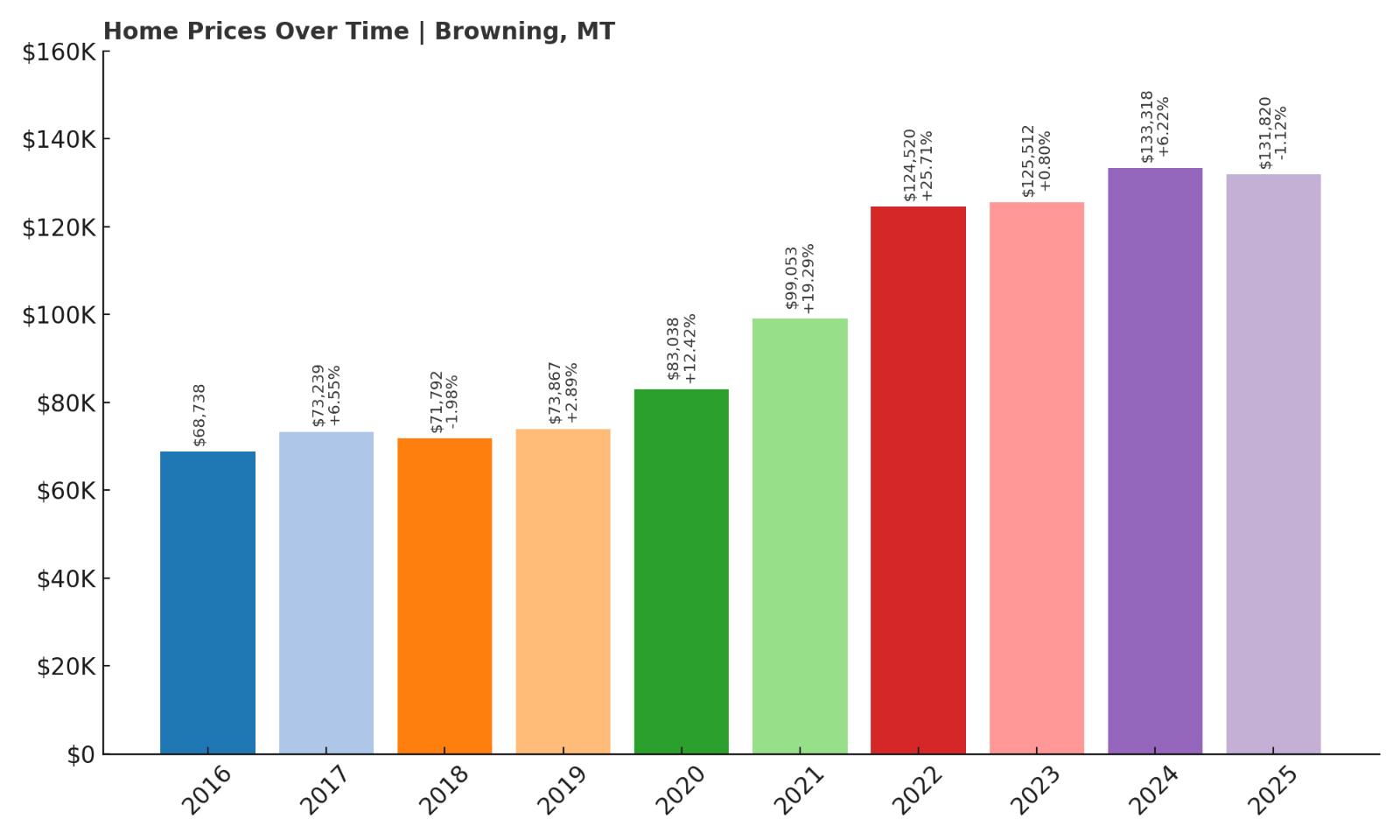

4. Browning – 92% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $68,738

- 2017: $73,239 (+$4,500, +6.55% from previous year)

- 2018: $71,792 ($-1,447, -1.98% from previous year)

- 2019: $73,867 (+$2,075, +2.89% from previous year)

- 2020: $83,038 (+$9,172, +12.42% from previous year)

- 2021: $99,053 (+$16,015, +19.29% from previous year)

- 2022: $124,520 (+$25,467, +25.71% from previous year)

- 2023: $125,512 (+$991, +0.80% from previous year)

- 2024: $133,318 (+$7,807, +6.22% from previous year)

- 2025: $131,820 ($-1,498, -1.12% from previous year)

Browning has seen its home values rise by 92% since 2016, growing from just under $69,000 to more than $131,000 in 2025. That trajectory has not been entirely smooth—2018 showed a small dip, and prices declined slightly again in 2025—but the overall trend remains undeniably upward. The strongest period of appreciation came from 2020 to 2022, with gains totaling over $41,000 across two years. These jumps highlight Browning’s emergence as a more desirable location, likely driven by a mix of cultural significance, proximity to Glacier National Park, and increased demand for housing in historically overlooked areas.

Browning – Gateway to Glacier and Blackfeet Culture

Browning is the largest town on the Blackfeet Indian Reservation and serves as the cultural and administrative capital of the Blackfeet Nation. Set along the eastern edge of Glacier National Park, it offers stunning views of the Rocky Mountain Front and access to some of the state’s most iconic natural spaces. Beyond its beauty, Browning plays a vital role in Indigenous governance, education, and healthcare. With a mix of tribal and federal employment, the town has a relatively diverse and stable economic base for its size. Browning is home to several museums, cultural centers, and colleges that help preserve and celebrate Blackfeet heritage, while also attracting visitors and scholars from across the country. As tourism and cultural interest in the region have grown, so too has demand for housing in and around Browning. The dramatic price increases during the early 2020s likely reflect both this increased demand and a limited housing supply. While average prices have dipped slightly in the latest year, the long-term trend suggests ongoing strength in the market. For buyers interested in cultural engagement, natural proximity, and a cost of living well below the state average, Browning is increasingly attractive. At just over $131,000 in 2025, homes here remain deeply affordable, especially when compared to neighboring areas near Glacier Park, where values can be double or triple that amount. Browning stands as a reminder that places of deep cultural importance can also offer meaningful opportunities for affordable homeownership.

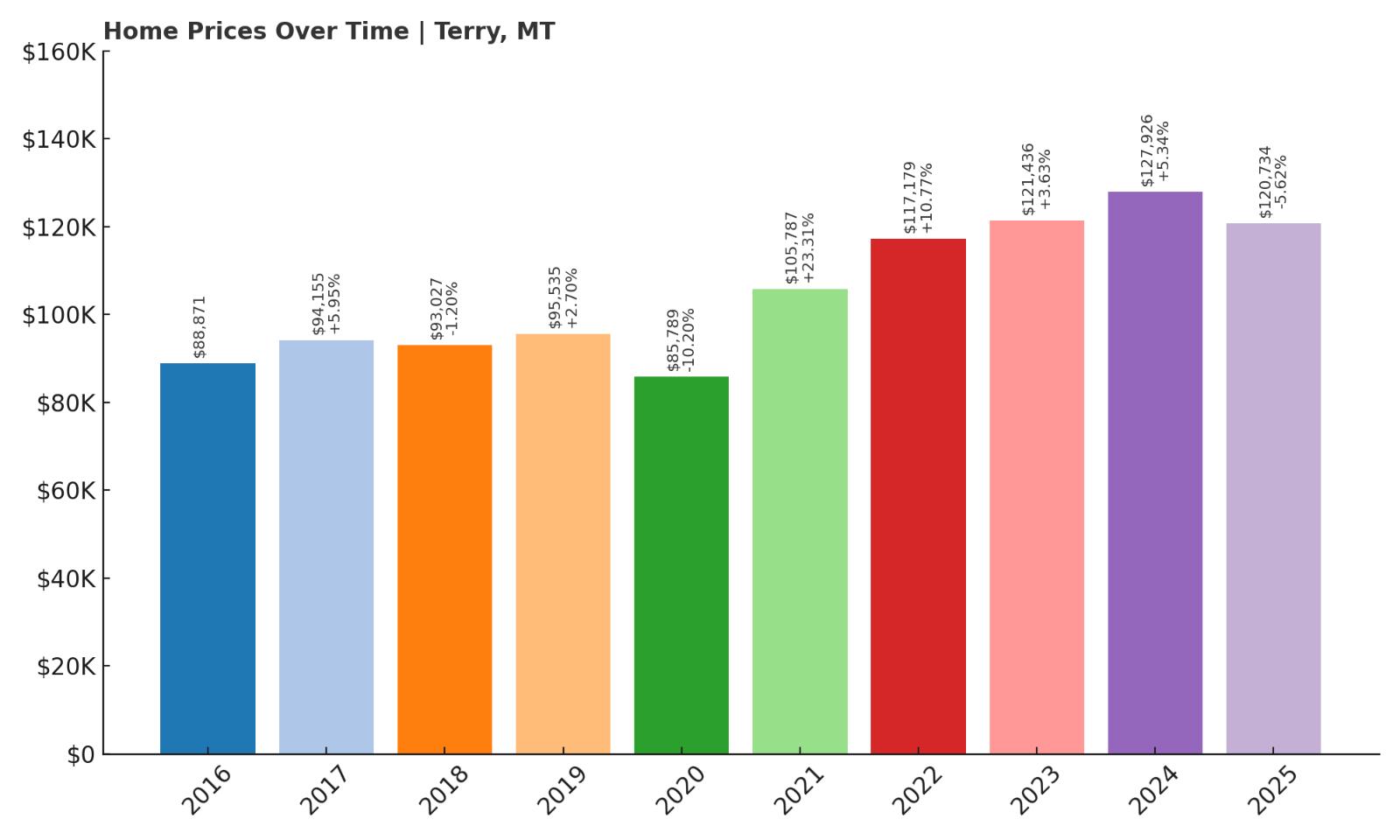

3. Terry – 36% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $88,871

- 2017: $94,155 (+$5,284, +5.95% from previous year)

- 2018: $93,027 ($-1,129, -1.20% from previous year)

- 2019: $95,535 (+$2,509, +2.70% from previous year)

- 2020: $85,789 ($-9,746, -10.20% from previous year)

- 2021: $105,787 (+$19,998, +23.31% from previous year)

- 2022: $117,179 (+$11,391, +10.77% from previous year)

- 2023: $121,436 (+$4,257, +3.63% from previous year)

- 2024: $127,926 (+$6,490, +5.34% from previous year)

- 2025: $120,734 ($-7,192, -5.62% from previous year)

Terry’s housing market has grown by 36% since 2016, rising from just under $89,000 to $120,734 in 2025. While that may seem modest compared to other towns on this list, it’s important to note that Terry experienced a significant 10% decline in 2020 before bouncing back sharply in the following two years. Prices surged by nearly $31,000 from 2020 to 2022, a trend that shows just how responsive even small-town markets can be to broader economic shifts. Though 2025 saw a modest decline, Terry’s overall trajectory remains positive, with recent values still above pre-pandemic levels. This suggests that demand has normalized but not disappeared—an encouraging sign for long-term stability.

Terry – A Tranquil Stop With Historic Significance

Terry is the county seat of Prairie County, located in eastern Montana near the Yellowstone River. Though home to only a few hundred residents, Terry holds a special place in Montana’s historical and cultural landscape. It’s best known for its connection to famed western photographer Evelyn Cameron, whose early-20th-century homestead and archives draw niche tourism and academic interest to this day. The town boasts a library, a museum, basic services, and easy access to I-94, making it both peaceful and passable. While isolated by modern standards, Terry remains a key waypoint on the state’s eastern plains, offering big skies, friendly neighbors, and a deep sense of continuity with Montana’s past. The recent housing data paints a picture of a market finding its equilibrium. Terry’s affordability has long made it appealing to retirees, artists, and those seeking an ultra-quiet lifestyle. The post-2020 gains likely reflect a wider national trend—where people moved away from cities during the pandemic, looking for space and simplicity. Terry may never see explosive price growth, but that’s part of its appeal. Its stability, combined with a cost of living well below the state average, makes it a practical and emotionally rewarding place to call home. With a 2025 home value of around $120,000, Terry continues to offer attainable housing in a setting that prizes heritage, landscape, and calm over hustle and trends.

2. Nashua – 53% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $77,916

- 2017: $76,072 ($-1,843, -2.37% from previous year)

- 2018: $78,358 (+$2,286, +3.00% from previous year)

- 2019: $83,001 (+$4,643, +5.92% from previous year)

- 2020: $91,873 (+$8,872, +10.69% from previous year)

- 2021: $109,537 (+$17,664, +19.23% from previous year)

- 2022: $127,957 (+$18,419, +16.82% from previous year)

- 2023: $121,048 ($-6,908, -5.40% from previous year)

- 2024: $123,182 (+$2,134, +1.76% from previous year)

- 2025: $119,351 ($-3,831, -3.11% from previous year)

Home values in Nashua have grown 53% since 2016, though the journey has been uneven. After an initial decline in 2017, the town saw steady growth through 2022, including an exceptional run from 2020–2022 when values rose by nearly $36,000. However, a market cooldown followed, with minor declines in 2023 and 2025. Still, with values well above pre-pandemic levels and a 2025 average of $119,351, Nashua remains one of the state’s most affordable towns with real long-term potential. The small fluctuations in recent years reflect a market settling into post-boom normalcy—a process seen across many rural areas.

Nashua – A Hidden Corner Along the Hi-Line

Nashua is a quiet town in Valley County, nestled between Glasgow and Fort Peck Lake along U.S. Route 2. With a population under 300, it’s easy to miss on the map, but those who stop find a laid-back community with welcoming residents and a surprisingly active civic culture. The town has its own schools, volunteer fire department, and access to fishing and outdoor recreation at Fort Peck Reservoir—a major draw in the warmer months. The BNSF Railway still runs through town, and Amtrak stops nearby, making it more connected than many towns its size. The result is a place that offers both seclusion and practicality, a rare combination in today’s housing landscape. The sharp price gains between 2020 and 2022 reflect broader shifts in Montana’s rural markets, particularly as urban affordability wanes and remote work continues. Nashua’s appeal lies in its stability and lifestyle, offering buyers a more predictable environment without the speculative frenzy of tourist-driven towns. Even with minor pullbacks in 2023 and 2025, the town’s market shows durability and resilience. With homes still priced below $120,000, Nashua represents an extraordinary value for those looking to buy into a community that offers tranquility, community values, and access to Montana’s natural riches—all without the steep price tag.

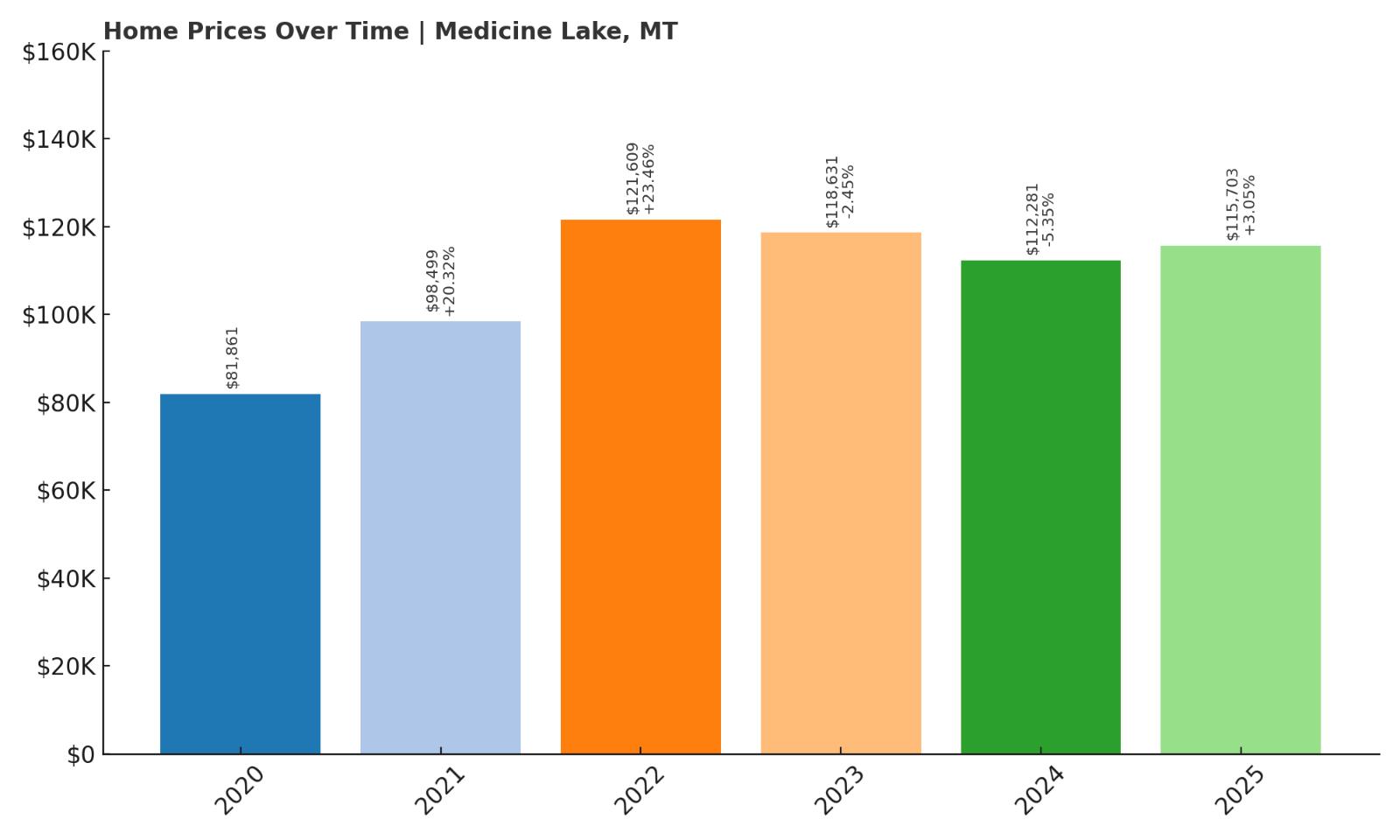

1. Medicine Lake – 41% Home Price Increase Since 2020

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: $81,861

- 2021: $98,499 (+$16,637, +20.32% from previous year)

- 2022: $121,609 (+$23,111, +23.46% from previous year)

- 2023: $118,631 ($-2,979, -2.45% from previous year)

- 2024: $112,281 ($-6,350, -5.35% from previous year)

- 2025: $115,703 (+$3,422, +3.05% from previous year)

Medicine Lake tops this list as the most affordable town in Montana in 2025, with a current home value of just $115,703. Since 2020, home prices have increased by 41%, mostly driven by sharp gains in 2021 and 2022 totaling nearly $40,000. However, this was followed by two years of mild declines and only a modest recovery in 2025. The overall pattern suggests a market that may have briefly overheated and is now finding its equilibrium. Even with these fluctuations, the town remains deeply affordable, and price levels are still far above where they were five years ago—making it a compelling destination for long-term buyers.

Medicine Lake – Secluded Serenity in the Northeast

Medicine Lake is located in Sheridan County in northeastern Montana, just a few miles from the North Dakota border. Named for the nearby lake and wildlife refuge, the town offers unmatched peace and access to nature. It’s a prime destination for bird watchers, anglers, and anyone who appreciates open water, wide skies, and quiet days. The town itself is tiny, with just over 200 residents, but it includes essential services like a school, post office, and a small grocery outlet. Life here is slow and seasonal, defined more by the land than by any hustle or trend. For homebuyers who want space, affordability, and a chance to step outside the noise of modern life, Medicine Lake delivers. The recent price trajectory—with large early gains and later stabilization—suggests a market that experienced a surge of interest but is now leveling into a more sustainable rhythm. That makes now a potentially excellent entry point for new buyers, particularly those drawn to rural lifestyles or working remotely. With one of the lowest average home prices in the entire state, and access to scenic public lands right outside town, Medicine Lake is more than just a dot on the map—it’s a genuine opportunity for simple, rooted living in Montana’s overlooked northeast corner.