Would you like to save this?

Zillow’s Home Value Index shows that while Ohio’s housing market has trended upward since 2010, there are still towns where homebuyers can find real value. As of May 2025, these 17 communities offer some of the lowest median home prices in the state—without skimping on livability or long-term potential. From small towns making quiet comebacks to rural areas with steady demand, these spots prove that affordability in Ohio isn’t extinct. And with growth trends pointing upward, they’re more than just budget buys—they’re smart bets.

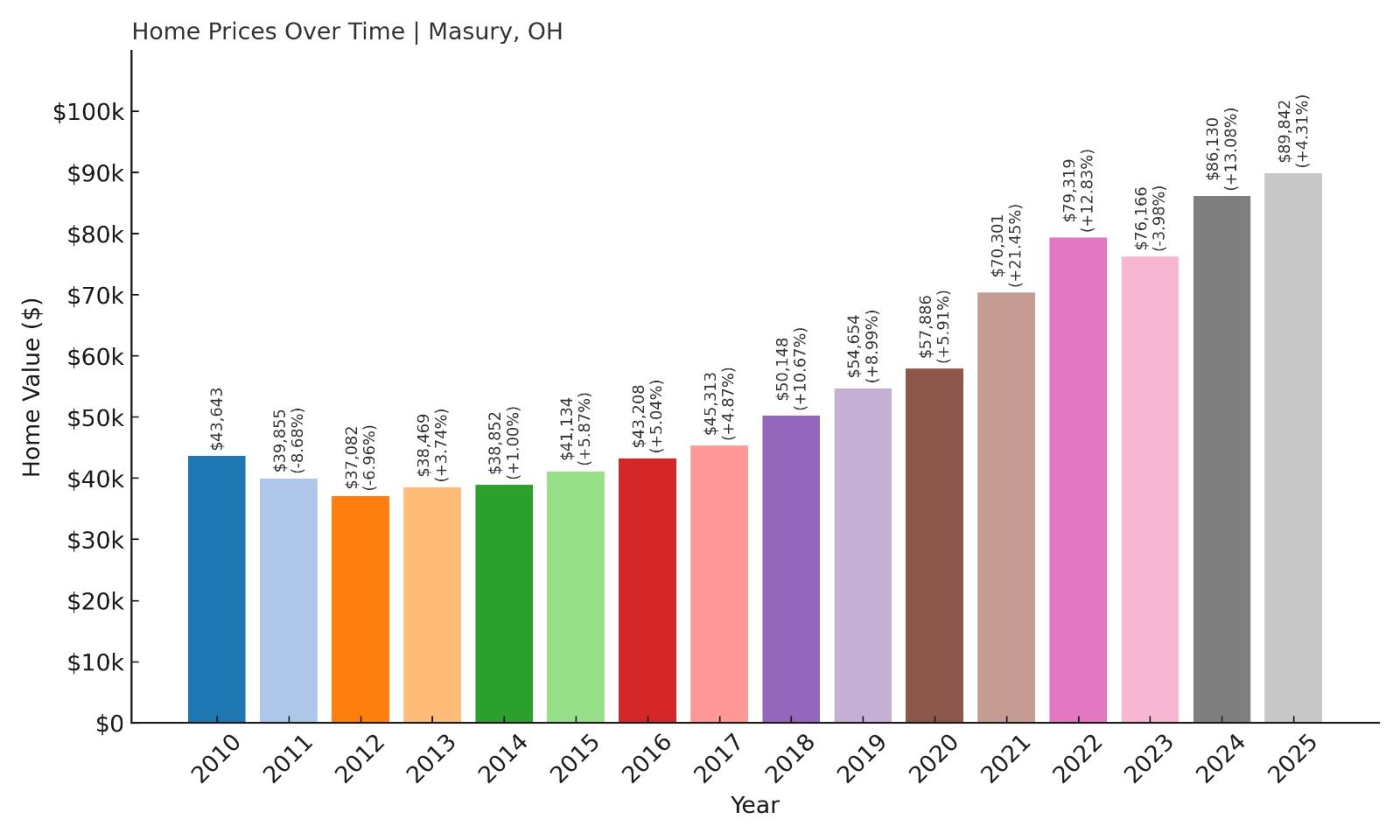

17. Masury – 106% Home Price Increase Since 2010

- 2010: $43,643

- 2011: $39,855 (-$3,788, -8.68% from previous year)

- 2012: $37,082 (-$2,773, -6.96% from previous year)

- 2013: $38,469 (+$1,387, +3.74% from previous year)

- 2014: $38,852 (+$383, +1.00% from previous year)

- 2015: $41,134 (+$2,282, +5.87% from previous year)

- 2016: $43,208 (+$2,074, +5.04% from previous year)

- 2017: $45,313 (+$2,105, +4.87% from previous year)

- 2018: $50,148 (+$4,835, +10.67% from previous year)

- 2019: $54,654 (+$4,506, +8.99% from previous year)

- 2020: $57,886 (+$3,232, +5.91% from previous year)

- 2021: $70,301 (+$12,415, +21.45% from previous year)

- 2022: $79,319 (+$9,018, +12.83% from previous year)

- 2023: $76,166 (-$3,152, -3.97% from previous year)

- 2024: $86,130 (+$9,963, +13.08% from previous year)

- 2025: $89,842 (+$3,712, +4.31% from previous year)

Masury has experienced a remarkable 106% rise in average home values since 2010, climbing from just under $44,000 to nearly $90,000 by 2025. After a rough start in the early 2010s marked by declines in 2011 and 2012, the town rebounded with steady growth. Notably, prices surged between 2020 and 2022, reflecting both broader national housing trends and increased regional demand. Although there was a brief drop in 2023, home values picked back up in 2024 and 2025, ending on a strong note. This price trajectory indicates a market that’s stabilizing and possibly appreciating more sustainably. While homes here remain relatively affordable, the upward trend suggests the window for rock-bottom prices may be closing.

Masury – Affordable Living in a Stable Market

Located in Trumbull County along Ohio’s eastern edge, Masury is a small, quiet community near the Pennsylvania border. It’s often considered a bedroom community for nearby Youngstown and Sharon, PA, giving residents a suburban lifestyle with access to larger job markets. Masury’s affordability makes it appealing to working families and retirees alike. The housing stock includes a mix of older single-family homes, many on spacious lots with established trees, which adds to the area’s charm and value.

Though modest in size, Masury benefits from its proximity to shopping centers and highways without the bustle of urban living. Schools in the area are part of the Brookfield Local School District, and residents enjoy low property taxes compared to neighboring counties. Given the recent upswing in home prices, Masury could be gaining attention from investors and first-time buyers who recognize its potential. Despite its gains, it remains one of the most wallet-friendly towns in Ohio.

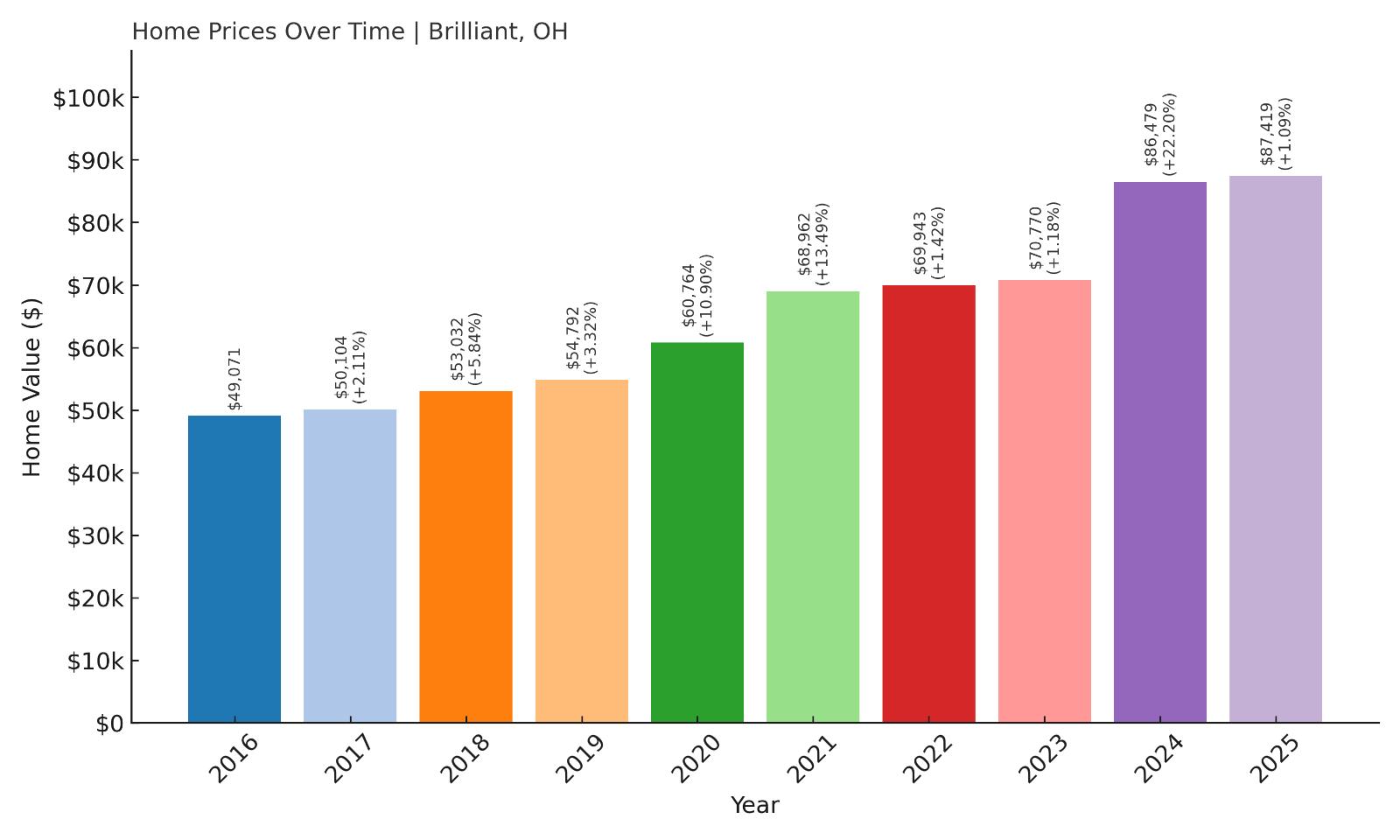

16. Brilliant – 78% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $49,071

- 2017: $50,104 (+$1,033, +2.10% from previous year)

- 2018: $53,032 (+$2,929, +5.85% from previous year)

- 2019: $54,792 (+$1,760, +3.32% from previous year)

- 2020: $60,764 (+$5,972, +10.90% from previous year)

- 2021: $68,962 (+$8,198, +13.49% from previous year)

- 2022: $69,943 (+$981, +1.42% from previous year)

- 2023: $70,770 (+$826, +1.18% from previous year)

- 2024: $86,479 (+$15,710, +22.20% from previous year)

- 2025: $87,419 (+$940, +1.09% from previous year)

Brilliant’s home values have increased by 78% since 2016, a sharp and consistent rise over less than a decade. After a steady climb in the late 2010s, the town saw a significant spike in 2024, with a 22% gain in a single year. That alone pushed prices well into the mid-$80K range, where they’ve held firm into 2025. The lack of volatility and the continued upward trajectory suggest that this small community is becoming more attractive to buyers, even as Ohio’s broader market cools. Importantly, price growth here hasn’t been overly erratic—Brilliant’s housing market has proven both resilient and steady.

Brilliant – A Growing Market in the Ohio Valley

Kitchen Style?

Nestled in Jefferson County near the Ohio River, Brilliant offers small-town appeal with quick access to regional employers in Steubenville and Wheeling, West Virginia. It’s part of the Wells Township area and historically tied to the coal and steel industries that shaped much of the region. With renewed infrastructure and transportation routes, the area has remained attractive for its affordability and location. New buyers are drawn by the low barrier to entry and strong price momentum over the past few years.

The town’s amenities are simple but sufficient—grocery stores, schools, parks, and a strong sense of community. Nearby state routes and U.S. 22 make commuting easy for those working in larger towns but seeking a quieter home base. With home values still below $90K in 2025, Brilliant remains an appealing choice for value-seekers looking to tap into a steadily appreciating market.

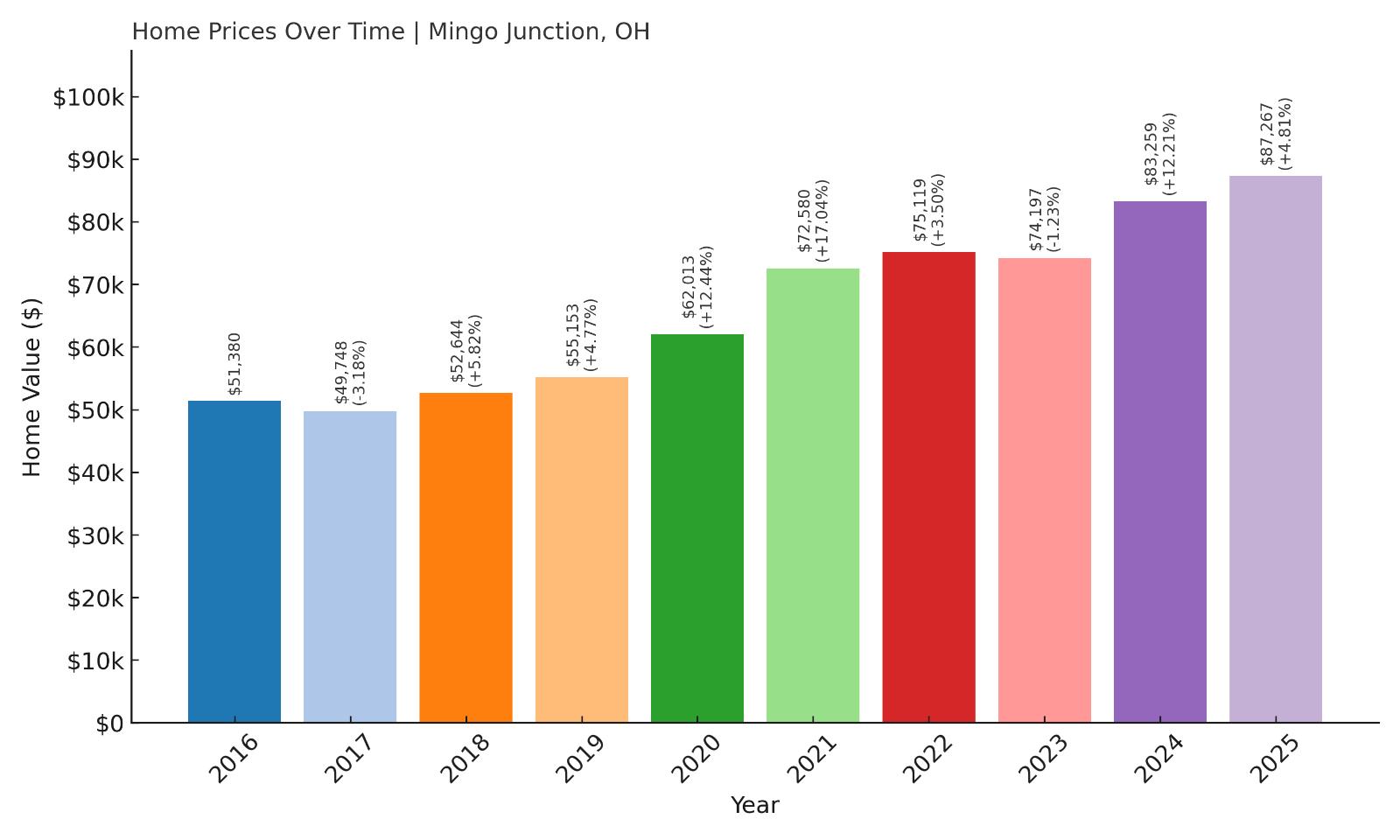

15. Mingo Junction – 70% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $51,380

- 2017: $49,748 (-$1,632, -3.18% from previous year)

- 2018: $52,644 (+$2,896, +5.82% from previous year)

- 2019: $55,153 (+$2,509, +4.77% from previous year)

- 2020: $62,013 (+$6,860, +12.44% from previous year)

- 2021: $72,580 (+$10,567, +17.04% from previous year)

- 2022: $75,119 (+$2,539, +3.50% from previous year)

- 2023: $74,197 (-$922, -1.23% from previous year)

- 2024: $83,259 (+$9,061, +12.21% from previous year)

- 2025: $87,267 (+$4,008, +4.81% from previous year)

Mingo Junction has seen a 70% gain in home values since 2016, thanks to a series of sustained increases over the past several years. While there was a brief dip in 2017 and again in 2023, the overall trend has been positive—especially between 2020 and 2021, when values shot up over 17%. By 2025, average home prices in the town approached $90,000, still well below national averages but a clear signal of growing buyer interest. The data reflects a maturing market that’s attracting attention without pricing out newcomers.

Mingo Junction – A Reviving River Town with Rising Value

Once a major steel-producing hub along the Ohio River, Mingo Junction is undergoing a quiet revival. It’s situated in Jefferson County just south of Steubenville, offering scenic river views, walkable streets, and a nostalgic industrial charm. With former mill land being repurposed and improved local services, it’s drawing interest from buyers who want affordability with upside potential. The area’s mix of older homes and new investment makes it attractive to both residents and investors.

Though job opportunities within the town are limited, its proximity to larger cities helps maintain demand. A growing appreciation for historic architecture and small-town living adds further appeal. Home prices are still modest, but if recent trends continue, Mingo Junction may not stay on affordability lists for long. It’s an interesting place to watch for long-term gains.

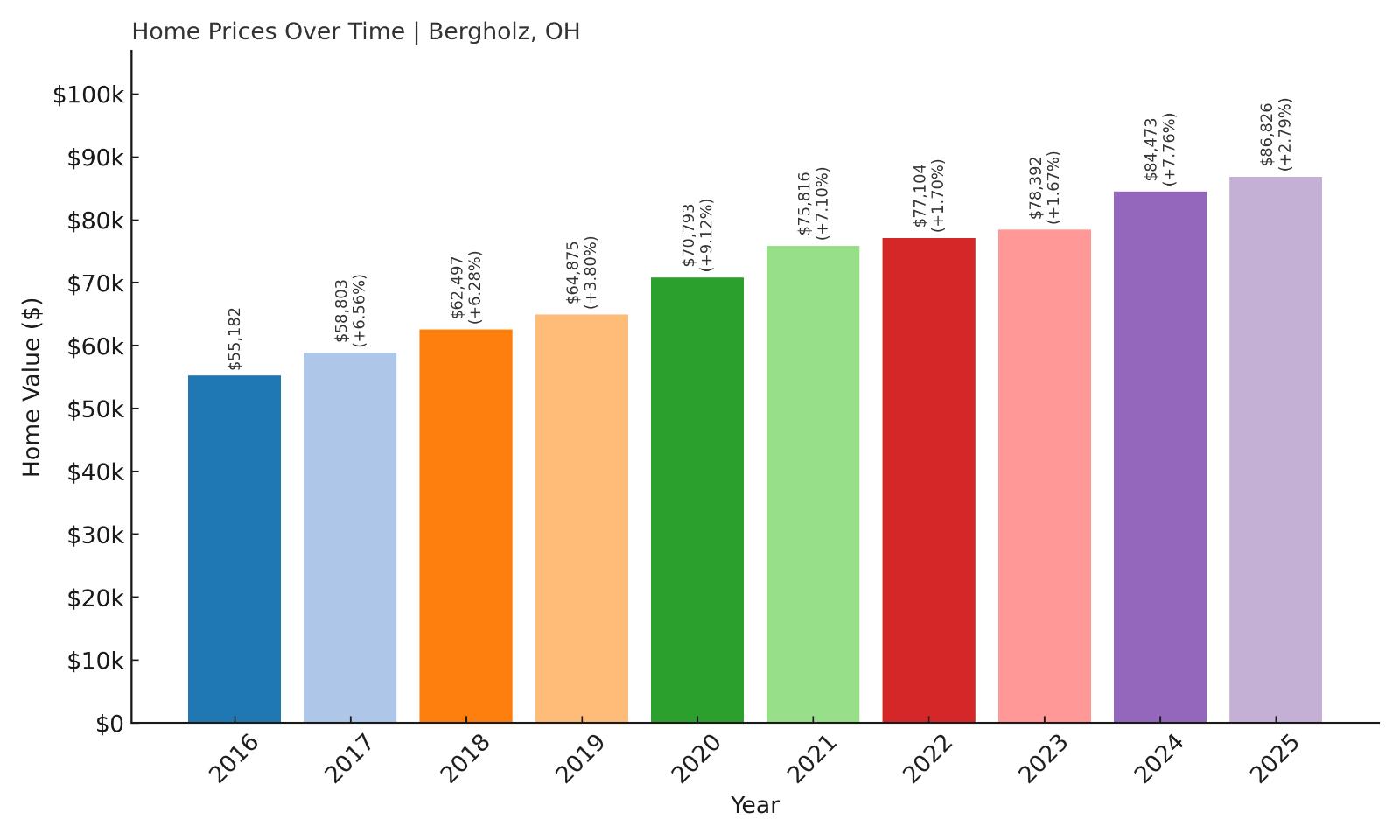

14. Bergholz – 57% Home Price Increase Since 2016

Home Stratosphere Guide

Your Personality Already Knows

How Your Home Should Feel

113 pages of room-by-room design guidance built around your actual brain, your actual habits, and the way you actually live.

You might be an ISFJ or INFP designer…

You design through feeling — your spaces are personal, comforting, and full of meaning. The guide covers your exact color palettes, room layouts, and the one mistake your type always makes.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ISTJ or INTJ designer…

You crave order, function, and visual calm. The guide shows you how to create spaces that feel both serene and intentional — without ending up sterile.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ENFP or ESTP designer…

You design by instinct and energy. Your home should feel alive. The guide shows you how to channel that into rooms that feel curated, not chaotic.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ENTJ or ESTJ designer…

You value quality, structure, and things done right. The guide gives you the framework to build rooms that feel polished without overthinking every detail.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $55,182

- 2017: $58,803 (+$3,621, +6.56% from previous year)

- 2018: $62,497 (+$3,694, +6.28% from previous year)

- 2019: $64,875 (+$2,378, +3.81% from previous year)

- 2020: $70,793 (+$5,918, +9.12% from previous year)

- 2021: $75,816 (+$5,023, +7.10% from previous year)

- 2022: $77,104 (+$1,288, +1.70% from previous year)

- 2023: $78,392 (+$1,288, +1.67% from previous year)

- 2024: $84,473 (+$6,081, +7.76% from previous year)

- 2025: $86,826 (+$2,353, +2.79% from previous year)

Bergholz’s housing market has posted a solid 57% gain since 2016, with prices steadily climbing nearly every year. There have been no major downturns, and the trend is one of consistent, moderate growth. Even during slower years like 2022 and 2023, home values continued to inch upward. That kind of dependable progress suggests a stable housing environment that is responding positively to broader economic conditions. For under $90K in 2025, buyers are getting into a community that has grown without the volatility seen elsewhere.

Bergholz – Small Town Growth Without the Drama

Bergholz is a quiet village in Jefferson County, surrounded by rolling hills and farmland. It’s the kind of place where life moves a little slower, and that’s part of its appeal. The town has seen steady investment over the years, particularly in infrastructure and housing. A reliable school district, walkable streets, and access to basic amenities help support local demand for homes. It may not be flashy, but it offers something increasingly rare—predictable affordability.

The real estate market here is largely composed of older single-family homes, many of which are well-maintained and reasonably sized. Bergholz is especially appealing to retirees or remote workers looking to own without taking on large mortgages. While it’s unlikely to see explosive growth, the data shows it’s a dependable place to put down roots with long-term upside.

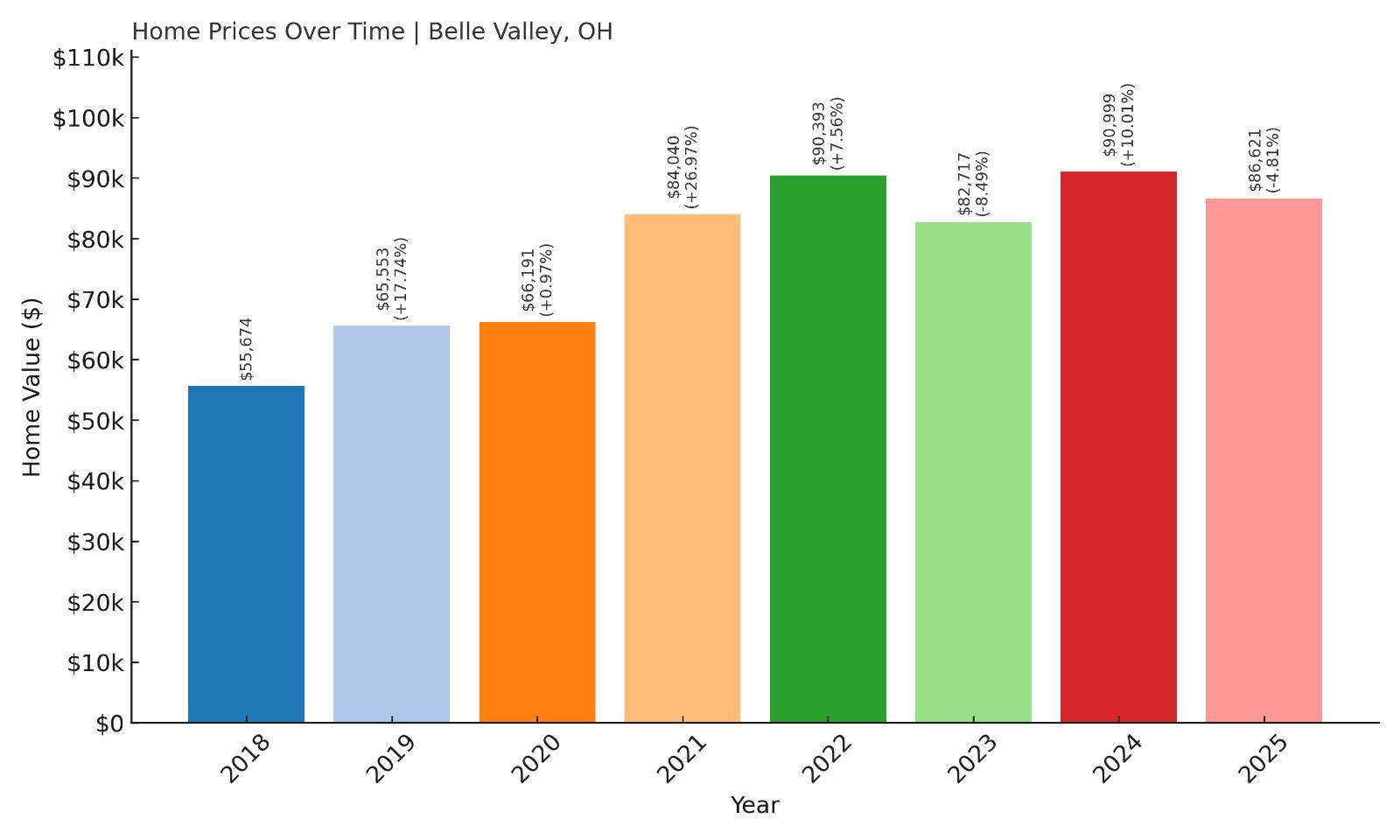

13. Belle Valley – 55% Home Price Increase Since 2018

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: $55,674

- 2019: $65,553 (+$9,879, +17.74% from previous year)

- 2020: $66,191 (+$638, +0.97% from previous year)

- 2021: $84,040 (+$17,849, +26.97% from previous year)

- 2022: $90,393 (+$6,353, +7.56% from previous year)

- 2023: $82,717 (-$7,676, -8.49% from previous year)

- 2024: $90,999 (+$8,282, +10.01% from previous year)

- 2025: $86,621 (-$4,377, -4.81% from previous year)

Belle Valley has seen a 55% increase in home prices since 2018, with some dramatic swings along the way. A huge 27% jump in 2021 drove prices into the $80K range, followed by some minor volatility. While values dipped slightly in 2023 and again in 2025, the broader upward trend remains intact. This market might not be the most predictable, but it offers significant potential for buyers who can tolerate a little price fluctuation. Even at its peak, Belle Valley remains one of the more affordable towns in Ohio.

Belle Valley – Big Swings in a Tiny Market

Located in Noble County, Belle Valley is a tiny village with a big story. Its housing market has been unusually active in recent years, perhaps due to growing interest in southeastern Ohio from buyers priced out of other regions. The area features modest homes, peaceful neighborhoods, and access to outdoor attractions like Seneca Lake and Wayne National Forest. It’s the kind of place people seek out for its quiet simplicity and scenic backdrop.

Belle Valley’s real estate surge could also reflect regional investment and improvements in local amenities. Though small in population, the village is served by the Rolling Hills Local School District and is just off I-77, making it reasonably accessible. Buyers looking for long-term value may appreciate the area’s rebound from 2023 dips and overall growth since 2018. If demand stays consistent, it could see another price wave in the near future.

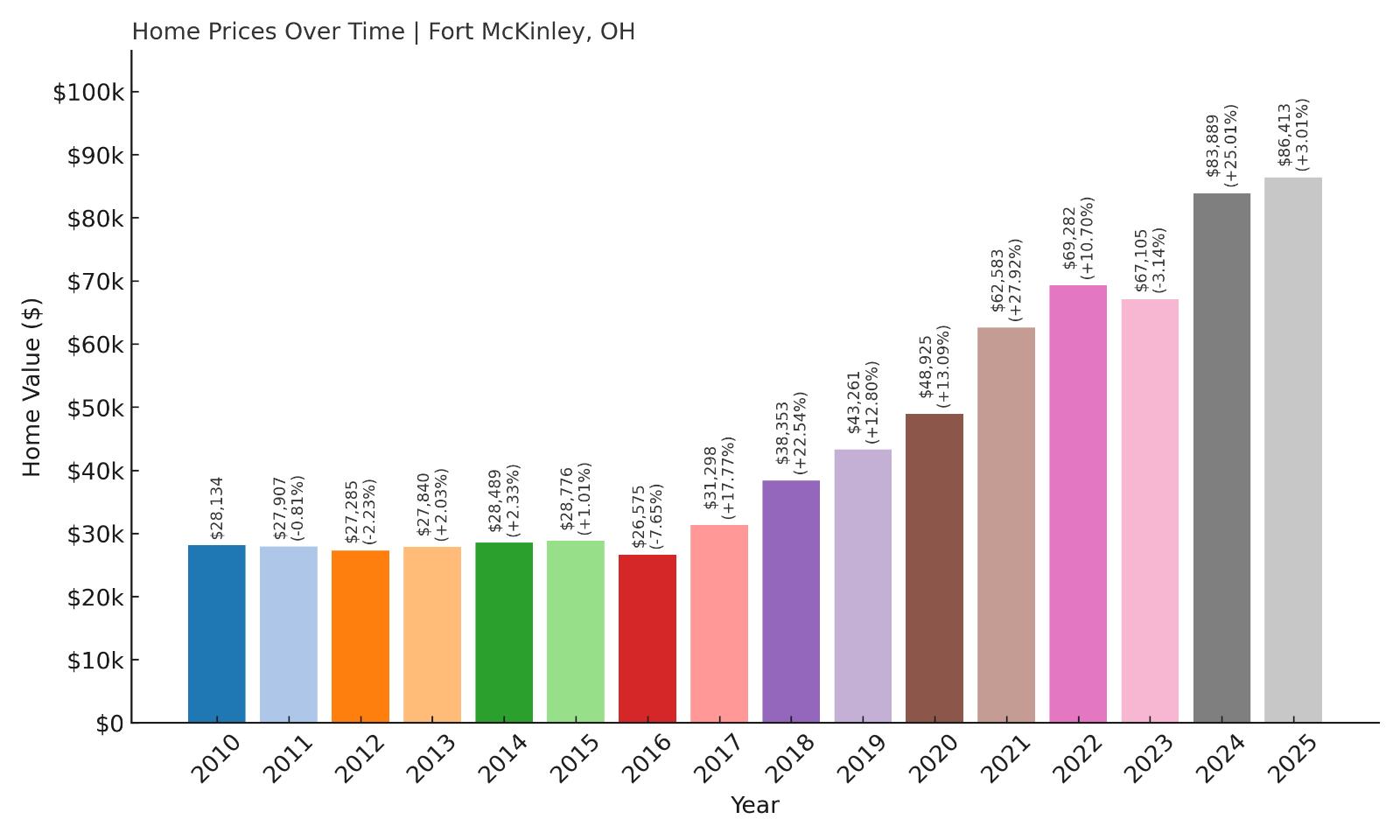

12. Fort McKinley – 207% Home Price Increase Since 2010

- 2010: $28,134

- 2011: $27,907 (-$226, -0.80% from previous year)

- 2012: $27,285 (-$623, -2.23% from previous year)

- 2013: $27,840 (+$555, +2.04% from previous year)

- 2014: $28,489 (+$649, +2.33% from previous year)

- 2015: $28,776 (+$287, +1.01% from previous year)

- 2016: $26,575 (-$2,201, -7.65% from previous year)

- 2017: $31,298 (+$4,723, +17.77% from previous year)

- 2018: $38,353 (+$7,055, +22.54% from previous year)

- 2019: $43,261 (+$4,908, +12.80% from previous year)

- 2020: $48,925 (+$5,664, +13.09% from previous year)

- 2021: $62,583 (+$13,658, +27.92% from previous year)

- 2022: $69,282 (+$6,699, +10.70% from previous year)

- 2023: $67,105 (-$2,177, -3.14% from previous year)

- 2024: $83,889 (+$16,784, +25.01% from previous year)

- 2025: $86,413 (+$2,524, +3.01% from previous year)

Fort McKinley’s housing market has surged 207% since 2010, making it one of the fastest-rising affordable markets in the state. What started as a long period of minimal change and even decline in the early 2010s turned into an explosive rise from 2017 onward. The real jump began in 2018, and from there, prices steadily accelerated each year. Between 2020 and 2021, prices jumped by nearly 28%, and another massive spike followed in 2024 with a 25% gain. While there was a brief dip in 2023, the general trend is sharply upward. Despite this growth, Fort McKinley remains budget-friendly, with average homes still well under $90K in 2025. The data suggests increasing buyer confidence and growing demand in this market. The growth appears sustained, not speculative, which bodes well for buyers seeking both affordability and long-term appreciation.

Fort McKinley – A Rising Star in Montgomery County

Located just outside Dayton in Montgomery County, Fort McKinley has quietly become one of the most intriguing real estate stories in southwestern Ohio. Once overshadowed by neighboring suburbs, this small census-designated place has benefited from Dayton’s broader urban revitalization and affordable housing push. As the city invested in infrastructure and schools, nearby communities like Fort McKinley saw renewed interest from buyers seeking access to Dayton without the higher price tags. With a mix of older brick homes and newer developments, the housing stock is varied and appealing to young families, retirees, and first-time buyers. The town’s proximity to I-75 and U.S. Route 35 makes commuting easy, while local amenities—including parks, schools, and nearby retail—make day-to-day life convenient and pleasant.

One of Fort McKinley’s key advantages is its pricing floor. Even after years of appreciation, homes here remain far more affordable than in comparable areas elsewhere in Ohio. That affordability, paired with the significant rise in property values, has made it attractive for investors looking for stable returns and residents who want long-term equity growth. Schools in the area are served by the Dayton Public Schools system, and there’s increasing collaboration with nearby districts on community enrichment programs. The market here doesn’t feel overheated; rather, it reflects a place catching up after years of being undervalued. In 2025, Fort McKinley represents one of the best examples in Ohio of how a community can turn slow, steady investment into sustainable home price growth while remaining accessible to buyers on a budget.

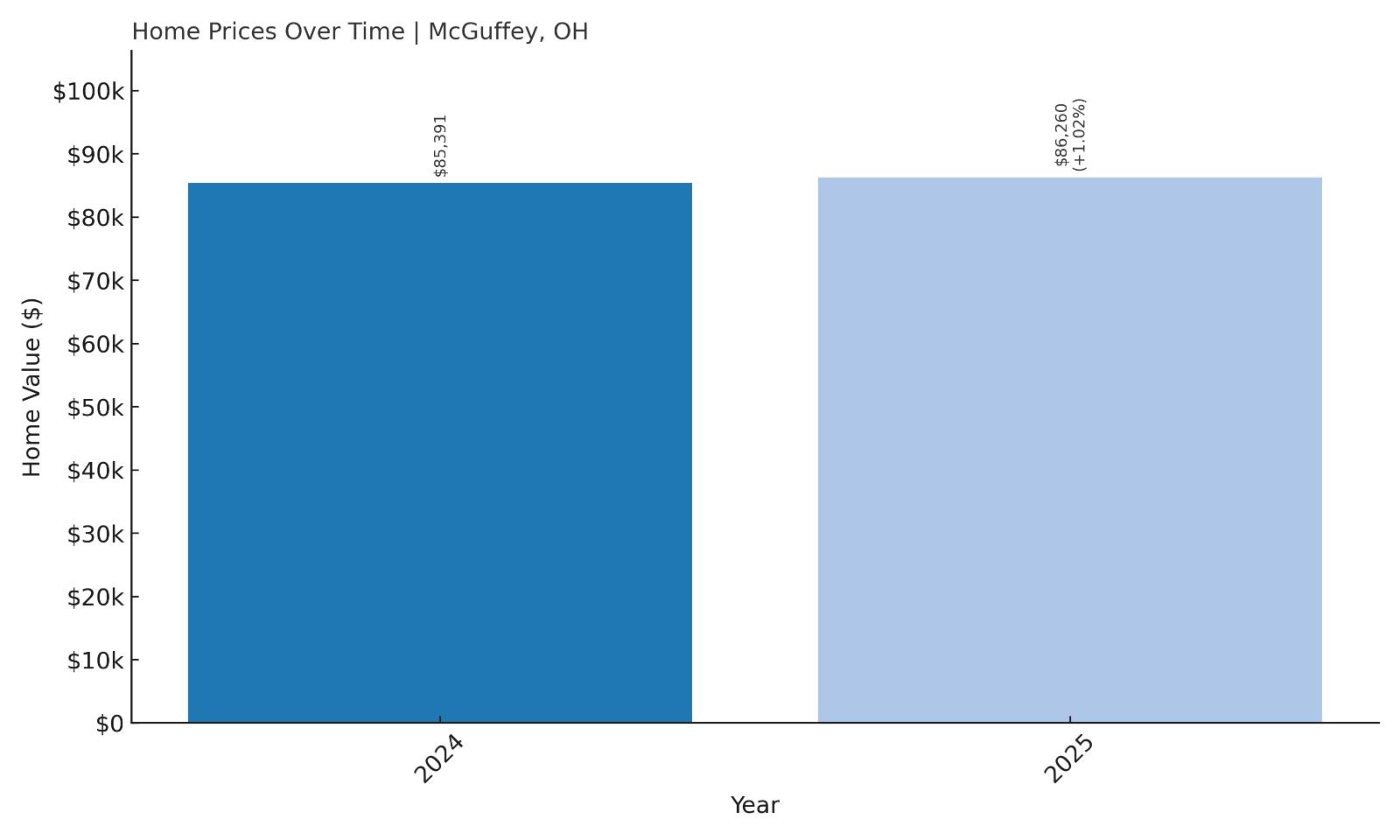

11. McGuffey – 1% Home Price Increase Since 2024

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: N/A

- 2022: N/A

- 2023: N/A

- 2024: $85,391

- 2025: $86,260 (+$869, +1.02% from previous year)

With limited historical data available, McGuffey shows only a modest 1% increase between 2024 and 2025. That said, its most recent valuation at just over $86,000 in 2025 places it among the most affordable towns in the state. While the lack of data makes it harder to track long-term trends, the recent value points to a relatively stable market that’s starting to gain traction. The price suggests a community with low cost of entry that may have only recently begun to show up on the radar for buyers. It remains to be seen whether this growth will continue, but its current standing suggests opportunity. The absence of earlier data could mean the market has been stagnant or undertracked, not necessarily unappealing. For now, McGuffey stands out as an affordable place with room to grow and potential for upward movement in the near future.

McGuffey – A Quiet Village With Newfound Momentum

McGuffey is a small village in Hardin County, tucked into the rural heart of west-central Ohio. Known for its peaceful pace and classic Midwest charm, the town is home to just a few hundred residents. Its low housing costs are among the lowest in the region, yet it’s well-connected via State Route 195 and close to Ada and Kenton for work, shopping, and schools. Much of McGuffey’s housing stock consists of older homes on larger lots, often with detached garages or small barns, appealing to those who value space and self-sufficiency. The town’s affordability is bolstered by low property taxes and utility costs, making it a great choice for fixed-income residents or young couples starting out.

Though it may not offer a bustling downtown or major employers, McGuffey’s appeal lies in its simplicity and potential. The slow introduction of growth, seen in the 2025 price increase, may be part of a broader trend as remote work and rural migration continue to reshape Ohio’s housing market. For those seeking a home base with stability, quiet surroundings, and the chance to build equity without massive upfront costs, McGuffey offers a compelling case. If local investment or buyer interest increases, this village could see more sustained appreciation in the years ahead.

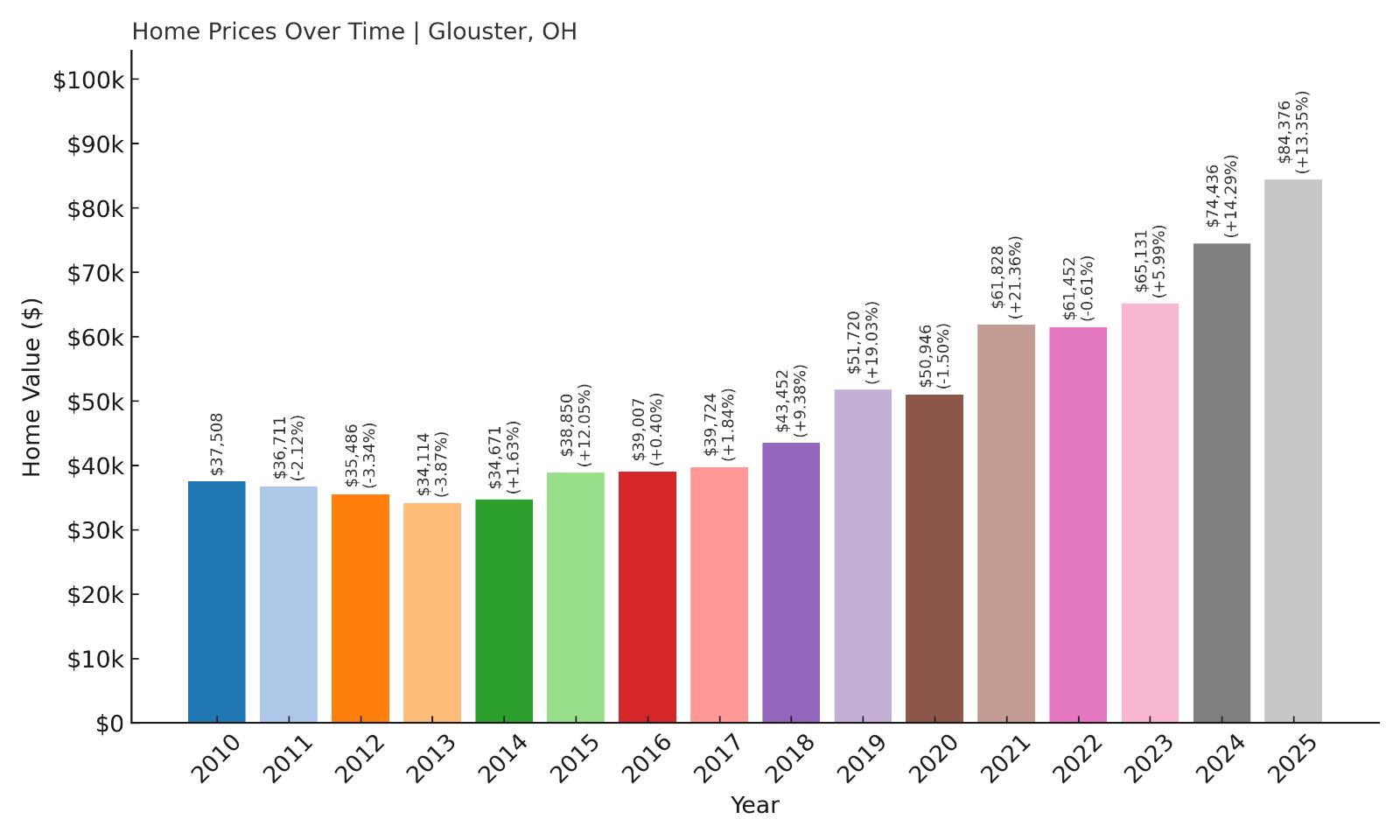

10. Glouster – 125% Home Price Increase Since 2010

- 2010: $37,508

- 2011: $36,711 (-$797, -2.12% from previous year)

- 2012: $35,486 (-$1,226, -3.34% from previous year)

- 2013: $34,114 (-$1,372, -3.87% from previous year)

- 2014: $34,671 (+$558, +1.64% from previous year)

- 2015: $38,850 (+$4,178, +12.05% from previous year)

- 2016: $39,007 (+$157, +0.40% from previous year)

- 2017: $39,724 (+$717, +1.84% from previous year)

- 2018: $43,452 (+$3,728, +9.39% from previous year)

- 2019: $51,720 (+$8,268, +19.03% from previous year)

- 2020: $50,946 (-$774, -1.50% from previous year)

- 2021: $61,828 (+$10,882, +21.36% from previous year)

- 2022: $61,452 (-$376, -0.61% from previous year)

- 2023: $65,131 (+$3,678, +5.99% from previous year)

- 2024: $74,436 (+$9,305, +14.29% from previous year)

- 2025: $84,376 (+$9,941, +13.35% from previous year)

Glouster’s home prices have more than doubled since 2010, with a dramatic 125% increase over that time. The early years saw slow movement, even declines, but since 2015, the market has been on an unmistakable upward trajectory. Particularly strong years like 2019, 2021, and 2025 each posted gains of over 13%, with buyers likely drawn to the town’s balance of affordability and proximity to outdoor recreation areas. There were a couple of mild pullbacks in 2020 and 2022, but those dips were short-lived. Glouster’s current average price of $84,376 in 2025 still puts it firmly in the “affordable” category, especially when considering its trajectory and continued momentum. Overall, it’s a case study in how small Appalachian communities can experience healthy, long-term growth.

Glouster – Appalachian Charm Meets Upward Mobility

Situated in Athens County near the Wayne National Forest, Glouster is a classic Appalachian town with deep roots and a close-knit community feel. Once a center of coal mining, it now offers a mix of historic homes, newer builds, and access to some of southeast Ohio’s most scenic landscapes. The town is just a short drive from Ohio University in Athens, giving residents the option to commute for work or school. Glouster is especially popular with outdoor enthusiasts, thanks to its proximity to Burr Oak State Park, hiking trails, and fishing spots. Those amenities, combined with affordable housing, are helping attract new buyers who want value and lifestyle.

Economic activity has remained relatively modest, but there’s been steady public investment in infrastructure and housing over the past decade. Schools are part of the Trimble Local School District, and the area has benefited from regional support programs aimed at rural revitalization. Many homes offer front porches, generous yards, and quiet streets, ideal for both retirees and remote workers. The recent growth in home prices suggests Glouster is no longer under the radar, and while it remains affordable, that may not last long. This is a town to watch, especially as southeast Ohio continues to evolve in the post-industrial era.

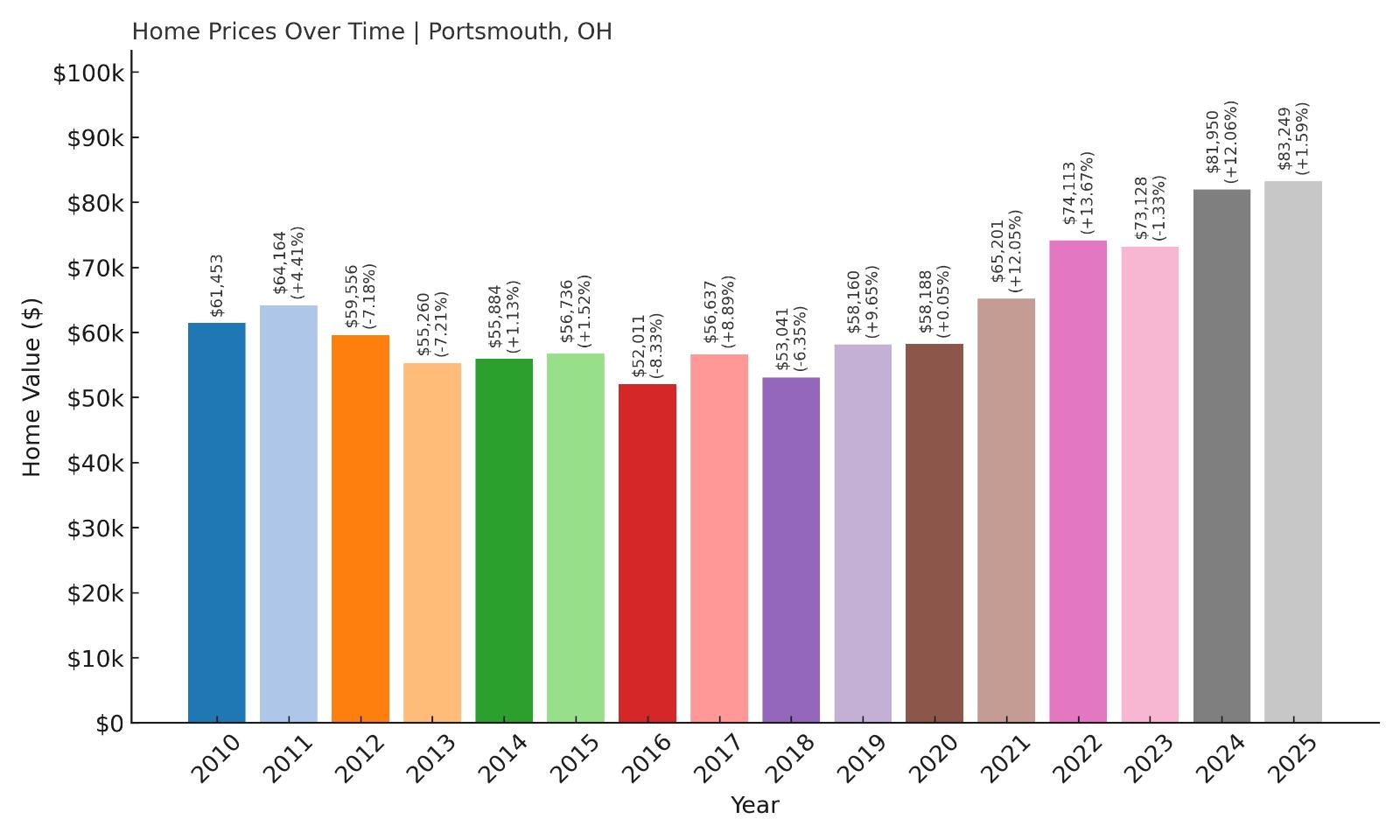

9. Portsmouth – 35% Home Price Increase Since 2010

- 2010: $61,453

- 2011: $64,164 (+$2,711, +4.41% from previous year)

- 2012: $59,556 (-$4,608, -7.18% from previous year)

- 2013: $55,260 (-$4,296, -7.21% from previous year)

- 2014: $55,884 (+$624, +1.13% from previous year)

- 2015: $56,736 (+$852, +1.53% from previous year)

- 2016: $52,011 (-$4,725, -8.33% from previous year)

- 2017: $56,637 (+$4,626, +8.90% from previous year)

- 2018: $53,041 (-$3,596, -6.35% from previous year)

- 2019: $58,160 (+$5,119, +9.65% from previous year)

- 2020: $58,188 (+$28, +0.05% from previous year)

- 2021: $65,201 (+$7,013, +12.05% from previous year)

- 2022: $74,113 (+$8,912, +13.67% from previous year)

- 2023: $73,128 (-$985, -1.33% from previous year)

- 2024: $81,950 (+$8,822, +12.06% from previous year)

- 2025: $83,249 (+$1,299, +1.59% from previous year)

Portsmouth has experienced a modest 35% increase in home values since 2010, with much of that growth concentrated in the past five years. After early volatility, the market began to recover in 2017 and has since shown consistent strength, with standout years like 2022 and 2024 posting double-digit gains. Despite dips in 2012, 2013, and 2016, Portsmouth’s average home price reached $83,249 in 2025. This rebound shows renewed interest in the town and suggests increased stability in the housing market. The more recent uptrend indicates demand is growing, though affordability remains strong. Portsmouth is one of the few towns in the state with both riverfront charm and entry-level pricing. The town has managed to turn years of market uncertainty into a steady climb, appealing to both buyers and investors looking for reliable value in southern Ohio.

Portsmouth – Riverfront Revival and Affordable Growth

Portsmouth is located along the Ohio River in Scioto County and serves as a regional hub for surrounding rural communities. Once a thriving industrial city, Portsmouth has faced economic challenges in recent decades but has steadily pushed for revitalization. New investments in downtown infrastructure, healthcare facilities, and riverfront parks have brought new life to the city. The Southern Ohio Medical Center, Shawnee State University, and several arts and culture organizations provide employment and activity hubs. Its charming downtown and historic neighborhoods add to its appeal, especially for buyers seeking character homes at accessible prices. Housing ranges from brick Craftsman homes to mid-century ranches, often on quiet streets with mature trees.

Portsmouth’s affordability remains a draw, particularly for those relocating from larger metro areas. It’s also one of the few small cities in Ohio offering riverfront views without premium pricing. With continued state and federal funding for redevelopment and infrastructure, Portsmouth appears poised for a gradual resurgence. Residents enjoy access to the Appalachian foothills, local colleges, and events like the River Days Festival, which help foster civic pride. While not immune to broader economic pressures, the housing market here shows real signs of stabilization and growth. The gains seen in the last five years reflect both local effort and renewed outside interest in a city that’s long been undervalued.

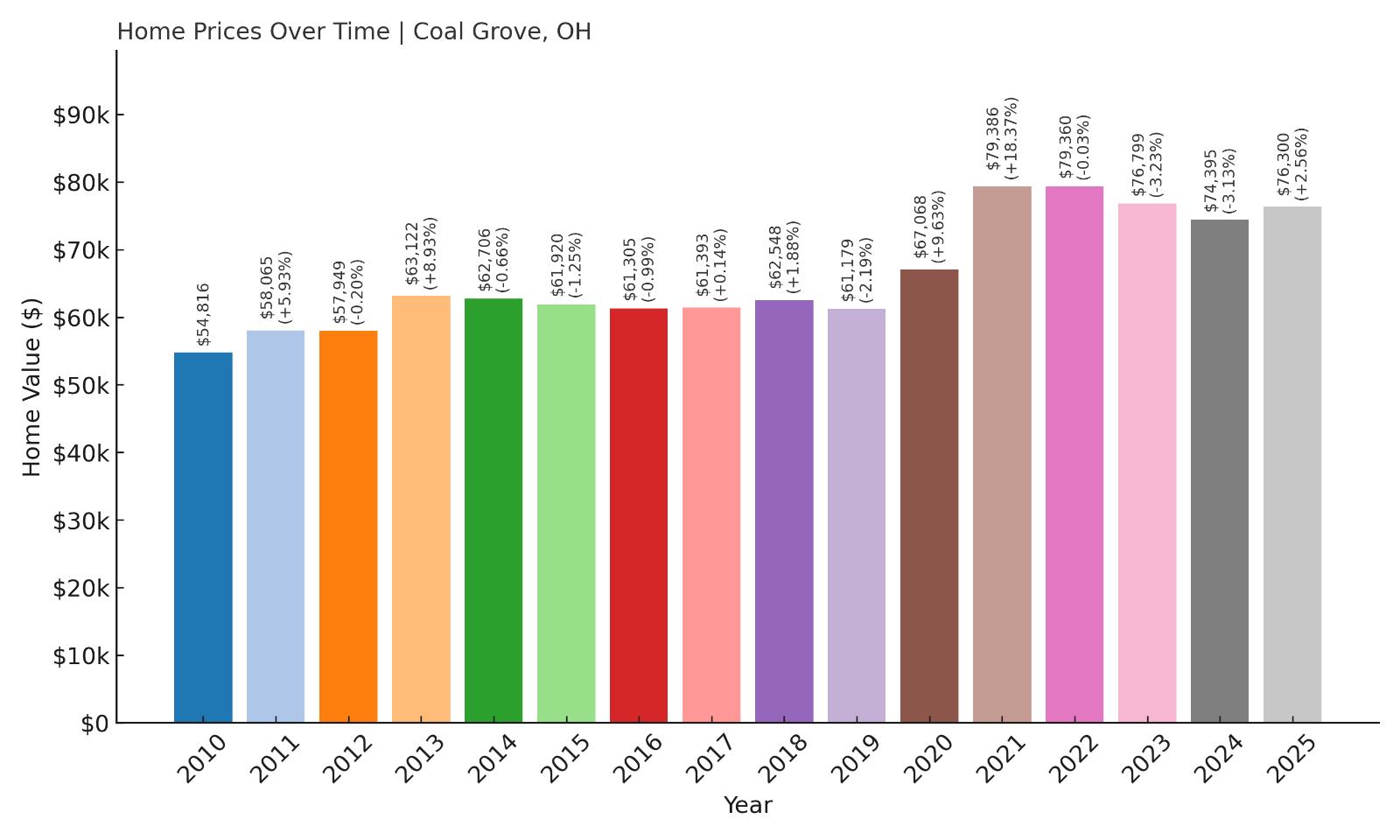

8. Coal Grove – 39% Home Price Increase Since 2010

Would you like to save this?

- 2010: $54,816

- 2011: $58,065 (+$3,249, +5.93% from previous year)

- 2012: $57,949 (-$116, -0.20% from previous year)

- 2013: $63,122 (+$5,173, +8.93% from previous year)

- 2014: $62,706 (-$416, -0.66% from previous year)

- 2015: $61,920 (-$787, -1.25% from previous year)

- 2016: $61,305 (-$614, -0.99% from previous year)

- 2017: $61,393 (+$88, +0.14% from previous year)

- 2018: $62,548 (+$1,154, +1.88% from previous year)

- 2019: $61,179 (-$1,369, -2.19% from previous year)

- 2020: $67,068 (+$5,888, +9.62% from previous year)

- 2021: $79,386 (+$12,319, +18.37% from previous year)

- 2022: $79,360 (-$26, -0.03% from previous year)

- 2023: $76,799 (-$2,562, -3.23% from previous year)

- 2024: $74,395 (-$2,404, -3.13% from previous year)

- 2025: $76,300 (+$1,905, +2.56% from previous year)

Coal Grove has seen a total price appreciation of 39% since 2010, marked by ups and downs that reflect broader market forces. After reaching a peak in 2021 with a sharp 18% rise, the market has cooled slightly, with mild declines in three consecutive years before bouncing back in 2025. Still, home values remain well under $80,000, keeping the village firmly in the “affordable” category. The earlier gains, especially between 2019 and 2021, suggest increased interest during the pandemic-era housing shift, when buyers prioritized space and low-density areas. Even with some pullback, Coal Grove remains an attractive option for those looking to enter the housing market without breaking the bank. If the market continues to stabilize in 2025 and beyond, the long-term outlook remains positive.

Coal Grove – Budget-Friendly Homes by the Ohio River

Coal Grove is located in Lawrence County, tucked between Ironton and the West Virginia border, offering affordable living with easy access to the Ohio River. This small village is part of the Huntington-Ashland metropolitan area, giving it proximity to urban amenities while maintaining a quiet, residential atmosphere. With just a few thousand residents, the town is known for its peaceful environment, family-owned businesses, and walkable neighborhoods. The school system is part of Dawson-Bryant Local Schools, and the community regularly rallies around local events and sports teams. Housing here includes a mix of modest ranches, older two-story homes, and some river-view properties that are surprisingly affordable. Its affordability and natural setting appeal especially to families, retirees, and remote workers seeking small-town comfort with modern convenience.

Coal Grove’s real estate story is one of stability more than speculation. The village has not seen major commercial development, but its location near Ironton, Ashland, and Huntington means residents are never far from job centers, hospitals, and shopping. Infrastructure improvements, such as bridge and road upgrades, have made commuting easier, while its riverfront location adds recreational perks. While it may not be a fast-growing market, it has proven to be resilient. The 2025 uptick in price could mark the start of another growth cycle, or at least a leveling-off after minor corrections. For buyers priced out of nearby metros, Coal Grove remains a solid option with plenty of potential and a strong sense of place.

7. Middleport – 29% Home Price Increase Since 2012

- 2010: N/A

- 2011: N/A

- 2012: $57,130

- 2013: $60,441 (+$3,312, +5.80% from previous year)

- 2014: $67,532 (+$7,090, +11.73% from previous year)

- 2015: $67,253 (-$279, -0.41% from previous year)

- 2016: $62,838 (-$4,414, -6.56% from previous year)

- 2017: $50,744 (-$12,095, -19.25% from previous year)

- 2018: $54,080 (+$3,337, +6.58% from previous year)

- 2019: $54,516 (+$435, +0.80% from previous year)

- 2020: $64,153 (+$9,638, +17.68% from previous year)

- 2021: $73,958 (+$9,805, +15.28% from previous year)

- 2022: $75,449 (+$1,491, +2.02% from previous year)

- 2023: $68,692 (-$6,757, -8.96% from previous year)

- 2024: $72,837 (+$4,145, +6.03% from previous year)

- 2025: $73,906 (+$1,069, +1.47% from previous year)

Middleport has seen a 29% increase in home prices since 2012, with notable ups and downs along the way. The town’s market experienced sharp gains in 2014 and 2020–2021, followed by some turbulence, especially in 2017 and 2023. Despite those setbacks, Middleport has shown resilience, with home prices bouncing back in 2024 and holding steady into 2025. At just under $74,000, the average home remains very affordable, especially given the property size and location along the Ohio River. This kind of fluctuation is typical in smaller markets but is offset here by a broader upward trend over the last decade. For buyers who don’t mind a little variability in exchange for long-term potential, Middleport offers a compelling value proposition. The housing stock is stable, and the most recent gains suggest renewed confidence from buyers.

Middleport – Scenic Riverside Living with Historic Roots

Middleport is located in Meigs County, tucked along the Ohio River in southeastern Ohio. It’s the oldest town in the county and has a history dating back to the early 1800s, with a rich past in river commerce and local industry. Today, it retains a lot of that charm, with historic downtown buildings, walkable riverfront paths, and older homes full of character. The town is surrounded by natural beauty, including access to boating, fishing, and nearby forests, making it a quiet haven for those who enjoy outdoor living. While Middleport is somewhat remote, it benefits from its proximity to Pomeroy and Gallipolis, and offers essential amenities like grocery stores, schools, and a community hospital. The housing market here consists of single-family homes, many with river views or large yards, and prices remain far lower than other waterfront towns in Ohio.

Recent years have seen renewed interest in the town, particularly among buyers seeking affordable riverfront property and retirees looking for peaceful surroundings. The sharp price increase in 2020 and 2021 may reflect pandemic-era migration, with buyers trading cities for quieter places with access to nature. While prices dipped in 2023, the bounce-back in 2024 suggests confidence remains strong. Middleport’s affordability, paired with scenic views and small-town character, is likely to continue attracting a niche but growing pool of buyers. It’s not a high-growth boomtown, but rather a place where slow, organic appreciation is gradually restoring property values to their potential.

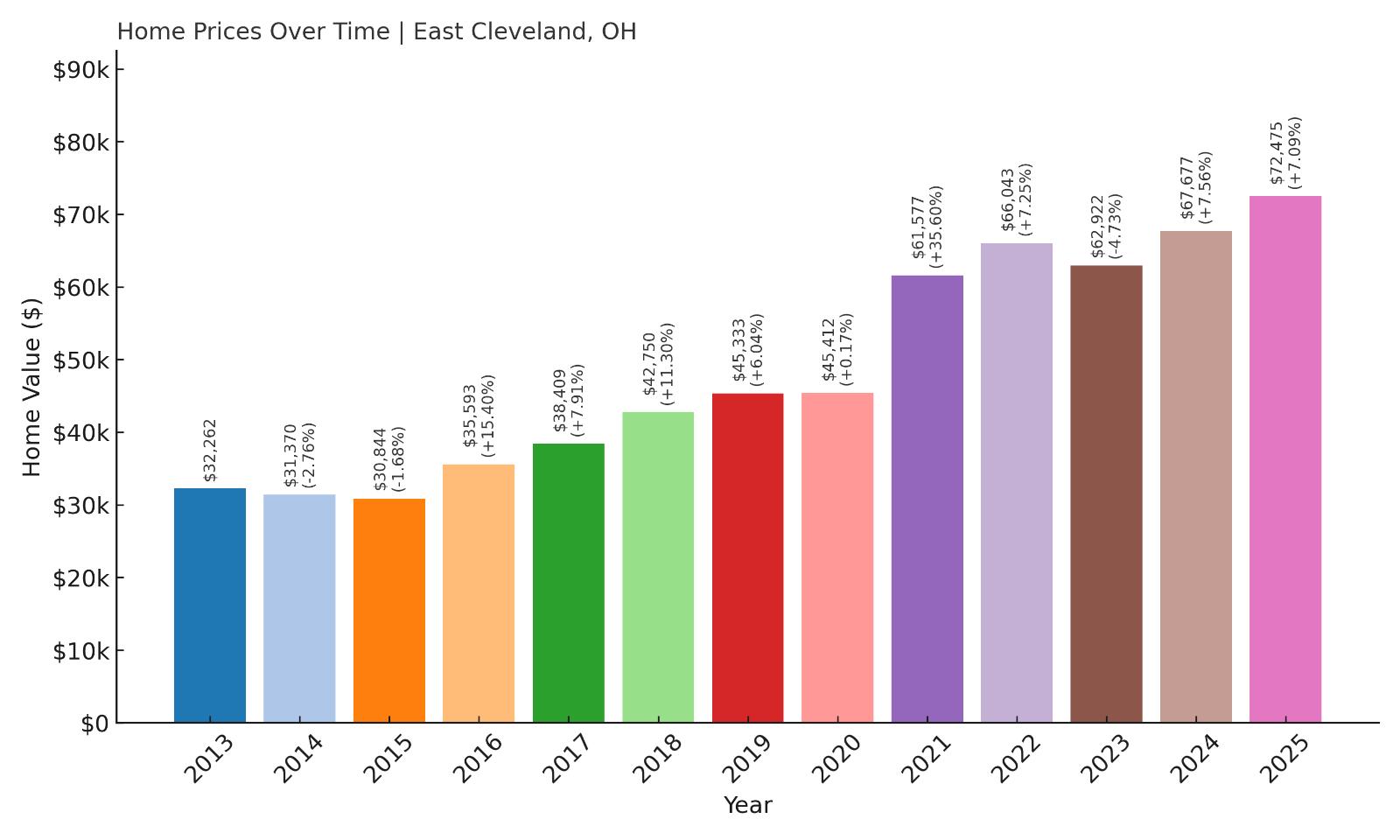

6. East Cleveland – 125% Home Price Increase Since 2013

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: $32,262

- 2014: $31,370 (-$892, -2.76% from previous year)

- 2015: $30,844 (-$526, -1.68% from previous year)

- 2016: $35,593 (+$4,749, +15.40% from previous year)

- 2017: $38,409 (+$2,816, +7.91% from previous year)

- 2018: $42,750 (+$4,340, +11.30% from previous year)

- 2019: $45,333 (+$2,583, +6.04% from previous year)

- 2020: $45,412 (+$79, +0.17% from previous year)

- 2021: $61,577 (+$16,165, +35.60% from previous year)

- 2022: $66,043 (+$4,466, +7.25% from previous year)

- 2023: $62,922 (-$3,121, -4.73% from previous year)

- 2024: $67,677 (+$4,755, +7.56% from previous year)

- 2025: $72,475 (+$4,797, +7.09% from previous year)

Since 2013, East Cleveland has experienced a remarkable 125% increase in home prices, driven by steady gains and some standout years like 2021, which saw a 35% jump. Despite a few corrections in 2014, 2015, and 2023, the market has remained generally bullish, ending 2025 with homes averaging just over $72,000. What’s striking is that the town remains one of the most affordable areas in Cuyahoga County, even with such large percentage gains. The data suggests renewed interest in this long-overlooked suburb of Cleveland, perhaps driven by proximity to jobs, transit, and more expensive neighboring areas. While volatility remains a factor, the overall trajectory is clearly upward. Buyers looking for affordability close to a major metro may find East Cleveland increasingly appealing.

East Cleveland – Urban Affordability Near Cleveland’s Core

East Cleveland sits just east of downtown Cleveland and has long been known for its historic homes, tree-lined streets, and challenging economic conditions. Yet in recent years, there have been signs of revitalization. As housing prices in Cleveland proper rise, more buyers are looking to adjacent areas like East Cleveland for opportunity. The area offers easy access to University Circle, Case Western Reserve University, and the Cleveland Clinic, making it attractive for those seeking proximity to major employers without downtown price tags. The city is rich in history and architecture, with grand old homes that can often be purchased for a fraction of their rebuild cost. Public transportation access, including several RTA rail stops, adds to its appeal for those commuting without a car.

While East Cleveland has faced disinvestment and infrastructure challenges, it’s also seen pockets of improvement led by local organizations and community groups. Some neighborhoods have experienced renovation activity and increased homeownership, and the consistent price gains over the past decade point to renewed interest. That said, affordability remains one of the area’s defining features—making it an entry point for buyers priced out of other Cleveland neighborhoods. Investors and first-time homeowners are taking notice, and if broader redevelopment efforts continue, East Cleveland could see even more substantial appreciation in the years to come. It’s a place where value and location converge—still rough around the edges, but undeniably on the move.

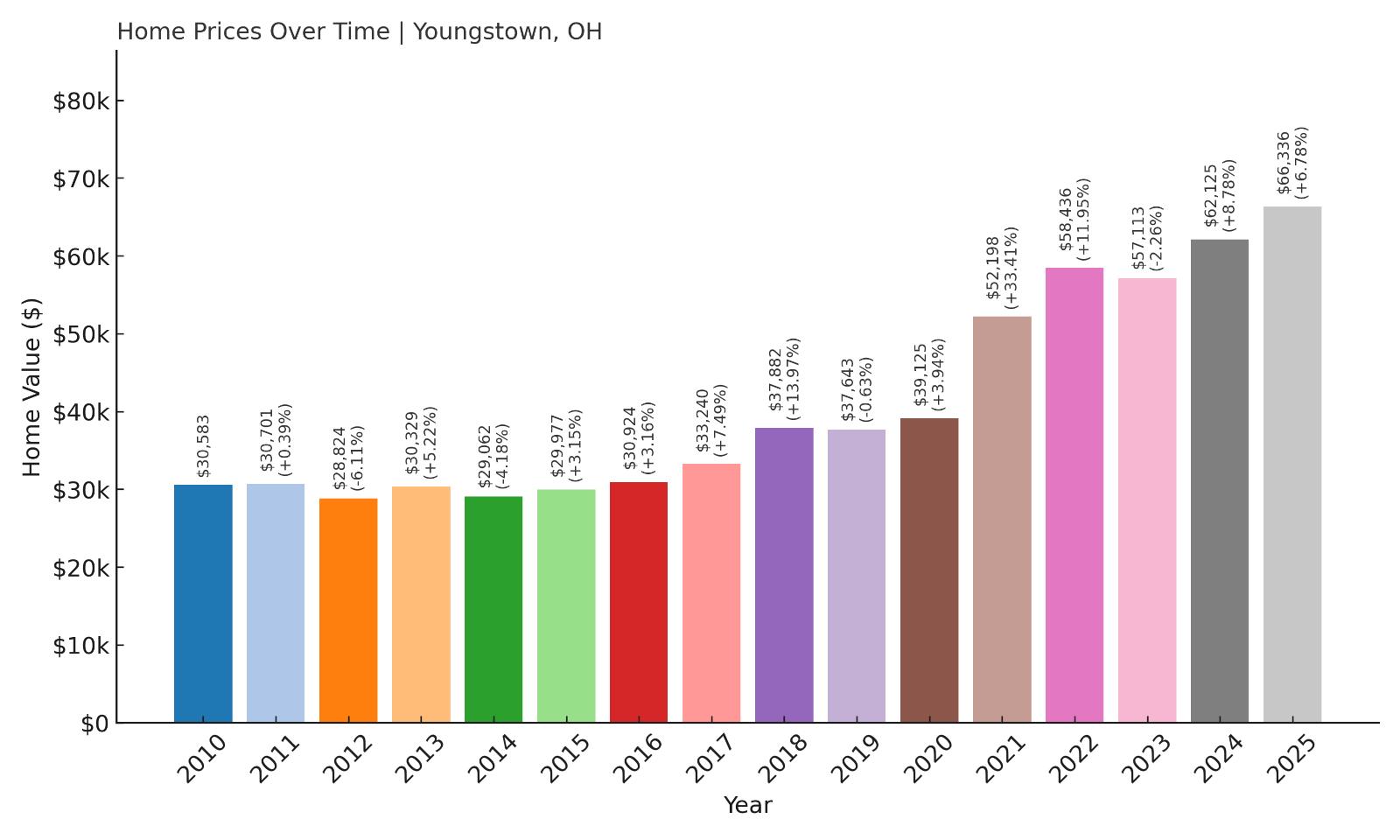

5. Youngstown – 117% Home Price Increase Since 2010

- 2010: $30,583

- 2011: $30,701 (+$118, +0.39% from previous year)

- 2012: $28,824 (-$1,877, -6.11% from previous year)

- 2013: $30,329 (+$1,505, +5.22% from previous year)

- 2014: $29,062 (-$1,267, -4.18% from previous year)

- 2015: $29,977 (+$916, +3.15% from previous year)

- 2016: $30,924 (+$947, +3.16% from previous year)

- 2017: $33,240 (+$2,316, +7.49% from previous year)

- 2018: $37,882 (+$4,642, +13.96% from previous year)

- 2019: $37,643 (-$238, -0.63% from previous year)

- 2020: $39,125 (+$1,482, +3.94% from previous year)

- 2021: $52,198 (+$13,073, +33.41% from previous year)

- 2022: $58,436 (+$6,238, +11.95% from previous year)

- 2023: $57,113 (-$1,323, -2.26% from previous year)

- 2024: $62,125 (+$5,011, +8.77% from previous year)

- 2025: $66,336 (+$4,212, +6.78% from previous year)

Youngstown’s home prices have jumped 117% since 2010, reflecting a remarkable turnaround for one of Ohio’s most historically hard-hit cities. The early years showed slow or even negative movement, but the 2020s brought strong appreciation—particularly in 2021, which alone saw a 33% increase. Prices have steadily climbed ever since, ending 2025 at $66,336. While still very affordable by national standards, this number marks real momentum for a city once defined by economic decline. The price increases signal growing confidence in Youngstown’s long-term potential, driven by downtown investment, job growth in tech and advanced manufacturing, and increasing attention from first-time buyers. Despite a dip in 2023, the market quickly rebounded, suggesting stability is returning. It’s one of Ohio’s clearest examples of a comeback story in progress.

Youngstown – A Post-Industrial Comeback Gaining Speed

Youngstown is the seat of Mahoning County and part of the broader Youngstown–Warren metro area. Once a powerhouse of steel and manufacturing, the city experienced decades of economic contraction following the industrial collapse in the late 20th century. But in recent years, revitalization efforts have taken hold. Downtown Youngstown has seen major redevelopment, including new apartments, restaurants, and entertainment venues. Youngstown State University continues to expand its footprint, and emerging sectors like additive manufacturing and clean energy have begun to reshape the local job landscape. Despite these advances, home prices remain among the lowest of any mid-sized U.S. city, offering a rare opportunity for ownership at entry-level prices.

The housing stock here is diverse, ranging from century-old brick homes to postwar suburban ranches. In many neighborhoods, properties are still priced under $70,000—even after the recent run-up. That affordability has attracted investors, remote workers, and families seeking low housing costs and community-based living. Public-private partnerships have helped fund infrastructure and school improvements, and crime has decreased in key areas. Youngstown is no longer just a cautionary tale—it’s a city proving that recovery is possible, even after decades of decline. For homebuyers willing to bet on the future, it represents one of the state’s best value propositions with growing momentum and a story that’s far from over.

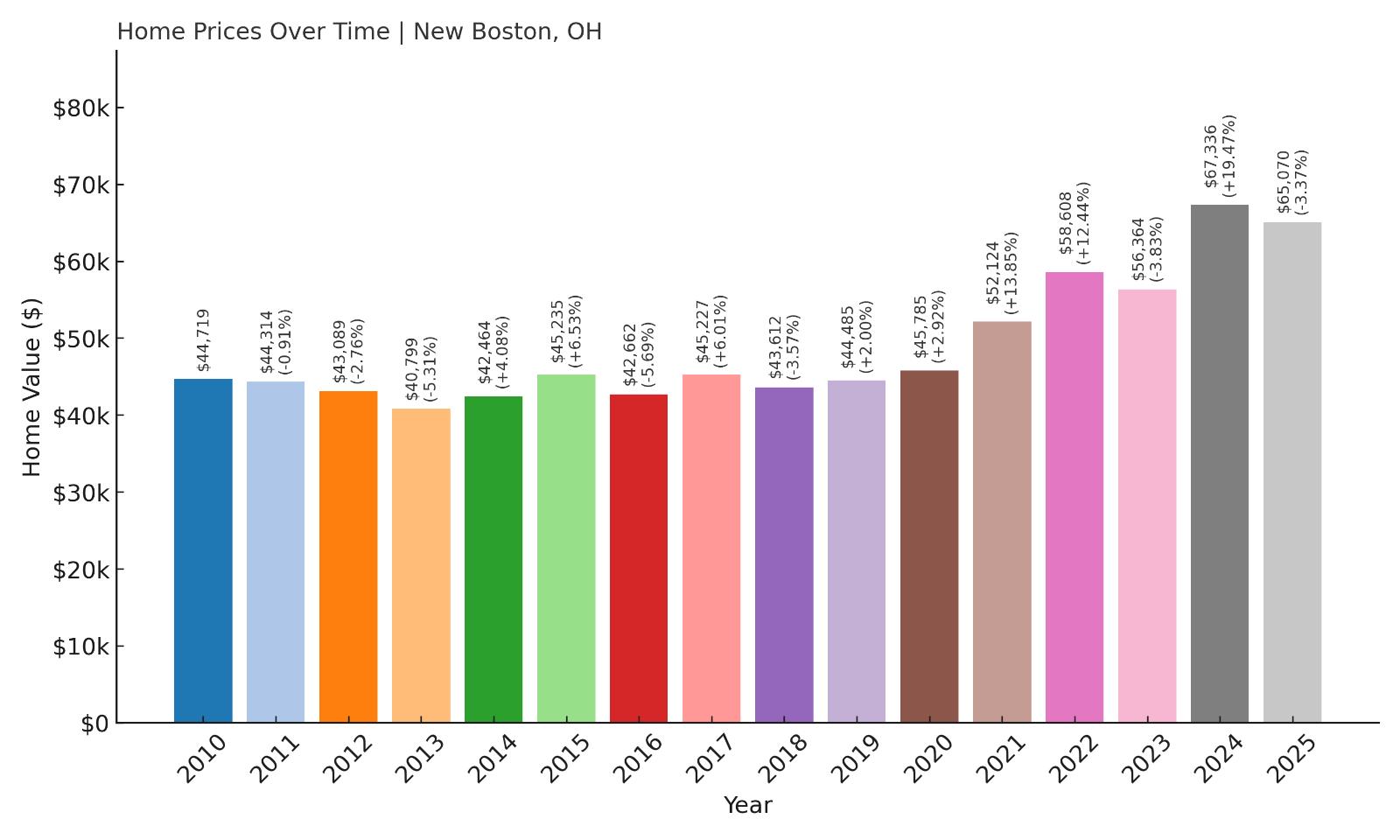

4. New Boston – 46% Home Price Increase Since 2010

- 2010: $44,719

- 2011: $44,314 (-$405, -0.91% from previous year)

- 2012: $43,089 (-$1,225, -2.76% from previous year)

- 2013: $40,799 (-$2,290, -5.32% from previous year)

- 2014: $42,464 (+$1,665, +4.08% from previous year)

- 2015: $45,235 (+$2,771, +6.52% from previous year)

- 2016: $42,662 (-$2,573, -5.69% from previous year)

- 2017: $45,227 (+$2,565, +6.01% from previous year)

- 2018: $43,612 (-$1,615, -3.57% from previous year)

- 2019: $44,485 (+$873, +2.00% from previous year)

- 2020: $45,785 (+$1,300, +2.92% from previous year)

- 2021: $52,124 (+$6,339, +13.84% from previous year)

- 2022: $58,608 (+$6,484, +12.44% from previous year)

- 2023: $56,364 (-$2,245, -3.83% from previous year)

- 2024: $67,336 (+$10,972, +19.47% from previous year)

- 2025: $65,070 (-$2,266, -3.37% from previous year)

New Boston’s home prices have risen 46% since 2010, with much of that growth concentrated in the past five years. After a sluggish and sometimes volatile first half of the decade, the market began to heat up in 2021, with double-digit annual gains in 2021, 2022, and 2024. Even with minor dips in 2023 and 2025, the average home value remains over $65,000—well within reach for most buyers. The price gains show growing interest in this compact river town, especially as affordability in nearby areas diminishes. New Boston’s performance over time reflects both resilience and late-blooming momentum. While it isn’t a high-growth hotbed, it’s proving to be a strong contender for steady appreciation and budget-friendly living along the Ohio River.

New Boston – Compact, Affordable, and on the Rise

New Boston is a small village in Scioto County that punches above its weight when it comes to convenience and livability. Nestled along the Ohio River and bordering the city of Portsmouth, it offers easy access to shopping, schools, and services while maintaining its own distinct identity. The town is walkable, with a grid-like layout and several parks and recreational spaces nearby. Residents benefit from being close to U.S. Route 52 and a range of retail outlets, making it surprisingly accessible despite its small size. New Boston Local School District serves the area and is regarded as a close-knit educational environment. Housing is modest and mostly consists of single-story homes and postwar builds, many of which have been maintained or renovated in recent years.

As affordability disappears in other Ohio river towns, New Boston is attracting more attention from first-time buyers, especially those seeking value without sacrificing accessibility. It offers a rare mix of low prices and infrastructure, including public transit links to Portsmouth and nearby shopping centers. The town’s recent price surges, particularly in 2024, suggest increased activity in the local housing market and stronger demand overall. While prices remain modest compared to state or national averages, the trend is upward, and homes in good condition are becoming harder to find. New Boston’s location, affordability, and improving appeal may turn it into a quiet success story over the next several years.

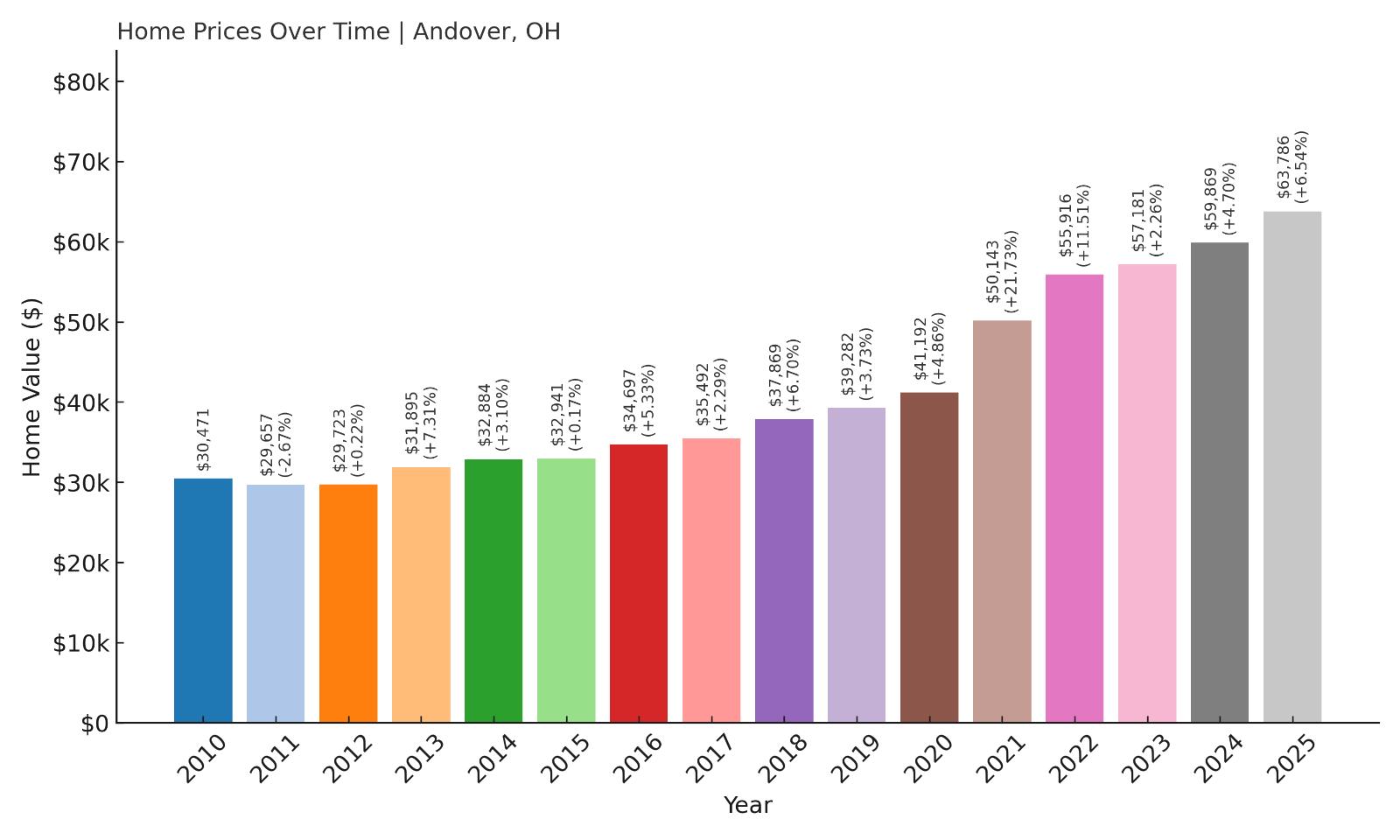

3. Andover – 109% Home Price Increase Since 2010

- 2010: $30,471

- 2011: $29,657 (-$814, -2.67% from previous year)

- 2012: $29,723 (+$66, +0.22% from previous year)

- 2013: $31,895 (+$2,172, +7.31% from previous year)

- 2014: $32,884 (+$989, +3.10% from previous year)

- 2015: $32,941 (+$57, +0.17% from previous year)

- 2016: $34,697 (+$1,756, +5.33% from previous year)

- 2017: $35,492 (+$795, +2.29% from previous year)

- 2018: $37,869 (+$2,378, +6.70% from previous year)

- 2019: $39,282 (+$1,413, +3.73% from previous year)

- 2020: $41,192 (+$1,909, +4.86% from previous year)

- 2021: $50,143 (+$8,952, +21.73% from previous year)

- 2022: $55,916 (+$5,773, +11.51% from previous year)

- 2023: $57,181 (+$1,265, +2.26% from previous year)

- 2024: $59,869 (+$2,688, +4.70% from previous year)

- 2025: $63,786 (+$3,917, +6.54% from previous year)

Andover’s home values have increased by 109% since 2010, thanks to steady appreciation and especially strong gains over the last five years. There were no major drops in this 15-year span, only incremental growth—making it one of the most stable markets on this list. Prices accelerated significantly from 2020 onward, with back-to-back double-digit gains in 2021 and 2022, followed by continued growth into 2025. Even at just under $64,000, the average home in Andover remains highly affordable. This consistent climb suggests the market is healthy and demand is rising slowly but surely. For buyers looking for long-term value in a quiet setting, Andover offers affordability without volatility—a rarity in today’s housing landscape.

Andover – Quiet Growth in Ohio’s Far Northeast

Andover is a village in Ashtabula County, close to the Pennsylvania border and just a short drive from Pymatuning Lake and State Park. It’s a small, scenic town popular with seasonal visitors and retirees who appreciate the lake culture, boating opportunities, and laid-back pace of life. The local economy is modest, with small businesses and tourism providing the bulk of jobs, but its charm lies in simplicity and nature. Andover’s housing is typically ranch-style or cottage-like homes, many within walking distance to green spaces or water features. The school system is small and community-oriented, and the town has a reputation for being friendly and safe.

What makes Andover notable in the real estate data is how consistent its growth has been. While many towns on this list saw ups and downs, Andover’s market never dipped meaningfully. That makes it an especially attractive destination for risk-averse buyers and retirees who want to protect their investment. The rising prices in recent years reflect increased interest, possibly from buyers looking to escape urban areas while staying within a few hours’ drive of Cleveland or Erie. As Pymatuning’s popularity grows and infrastructure continues to improve, Andover’s housing market is likely to remain on a gentle but firm upward path.

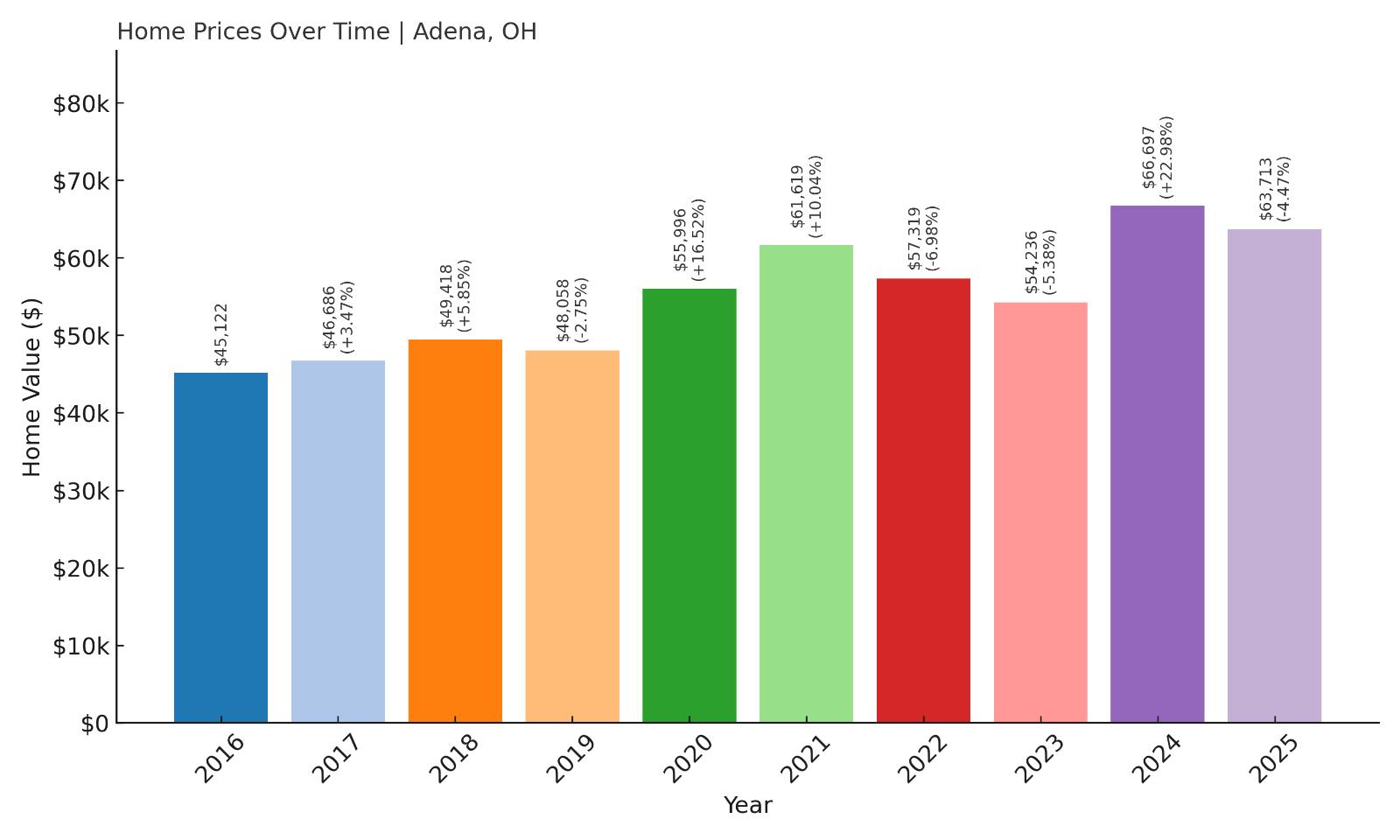

2. Adena – 41% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $45,122

- 2017: $46,686 (+$1,564, +3.47% from previous year)

- 2018: $49,418 (+$2,732, +5.85% from previous year)

- 2019: $48,058 (-$1,360, -2.75% from previous year)

- 2020: $55,996 (+$7,938, +16.52% from previous year)

- 2021: $61,619 (+$5,623, +10.04% from previous year)

- 2022: $57,319 (-$4,300, -6.98% from previous year)

- 2023: $54,236 (-$3,083, -5.38% from previous year)

- 2024: $66,697 (+$12,460, +22.97% from previous year)

- 2025: $63,713 (-$2,984, -4.47% from previous year)

Adena’s home values have grown 41% since 2016, with a particularly sharp spike in 2024 following a couple of correction years. While the market saw declines in 2019, 2022, and 2023, the strong bounce-backs suggest a community with underlying demand. Even with its dips, the long-term price increase points to potential, especially for budget-minded buyers. In 2025, homes average just over $63,000, giving buyers access to a tight-knit village with attractive pricing and upside. The year-to-year swings reflect the volatility typical in very small towns, but the overall story is one of appreciation and resilience. With continued investment or regional migration, Adena may continue its path of gradual housing recovery.

Adena – Small Town with Steady Upside

Adena is a quiet village in Jefferson County, near the border with Belmont County in eastern Ohio. It’s a rural community with fewer than 1,000 residents and a deep history tied to coal mining and farming. Today, it’s known for its low housing costs, scenic surroundings, and slow pace of life. Most homes are modest, single-family structures with decent lot sizes and traditional Midwestern charm. The local school system is part of the Buckeye Local Schools, and amenities are limited, but essential services are available in nearby towns like Cadiz or St. Clairsville. Residents appreciate the quiet, the close community bonds, and the affordability that’s hard to match elsewhere.

Adena’s recent price growth likely reflects a combination of regional real estate interest and internal improvements in housing stock. While the market may not attract large-scale developers or fast-paced change, it offers a slow and steady appeal for those looking to buy a home without high pressure or big spending. For remote workers, retirees, or anyone tired of city costs, Adena could be a smart long-term bet. The 2024 spike suggests there’s some buyer momentum—even if the 2025 dip indicates a cooling-off period. Either way, Adena remains one of Ohio’s most affordable places to own a home.

1. Drexel – 77% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $33,842

- 2017: $33,585 (-$257, -0.76% from previous year)

- 2018: $38,150 (+$4,566, +13.59% from previous year)

- 2019: $45,257 (+$7,107, +18.63% from previous year)

- 2020: $45,486 (+$228, +0.50% from previous year)

- 2021: $55,568 (+$10,082, +22.17% from previous year)

- 2022: $61,714 (+$6,146, +11.06% from previous year)

- 2023: $56,319 (-$5,395, -8.74% from previous year)

- 2024: $68,056 (+$11,737, +20.84% from previous year)

- 2025: $59,912 (-$8,145, -11.97% from previous year)

Drexel has experienced a 77% increase in home values since 2016, marked by major spikes in 2019, 2021, and 2024. These sharp gains, however, were tempered by equally significant corrections in 2023 and 2025, suggesting some volatility in the local housing market. At $59,912 in 2025, home prices remain among the lowest in the state, making Drexel the most affordable town on this list. Despite its fluctuations, the long-term trend remains positive. The rapid growth years point to strong demand at times, and even with the most recent drop, values are still well above where they were just a few years ago. Drexel’s affordability and sharp movements make it attractive for both investors and buyers seeking long-term upside.

Drexel – Ohio’s Most Affordable Town Still Has Room to Grow

Drexel is a small, unincorporated community in Montgomery County near Dayton, often considered part of the suburban fringe. It’s primarily residential, with older housing stock and a working-class character. Its location near major Dayton corridors makes it appealing to commuters or first-time homebuyers seeking budget options with decent access to the city. Public services are provided through Trotwood or Dayton agencies, and infrastructure is basic but improving. While it doesn’t have a central downtown or major commercial development, Drexel benefits from its proximity to shopping centers, schools, and public transit options. Its housing consists mostly of modest ranch homes, some in need of updates but offering good space for the price.

Affordability is Drexel’s strongest selling point. Even after its strongest year in 2024, homes remained under $70,000—rare for any metro-adjacent community in Ohio. The market’s recent decline in 2025 may reflect broader economic caution or simply a correction from earlier growth. Still, the underlying value is hard to ignore. As buyers continue to be priced out of Dayton’s core neighborhoods, Drexel could benefit from spillover demand. For now, it remains the cheapest place to buy in the state, and its long-term trajectory suggests it may not stay that way for long.