Baby Boomers – generally defined as those born from 1946 to 1964 – have become an increasingly influential force in Minnesota’s housing market over the last five years. Take a look at how Boomers in the North Star State have navigated buying and selling homes from 2018 through 2023, examining statewide trends, regional patterns, motivations behind their moves, and how Minnesota’s trends compare with national patterns.

Statewide Overview: Baby Boomers’ Impact on Minnesota’s Housing Market

Baby Boomers make up a substantial share of Minnesota’s homeowners and have become pivotal in recent home sales. Boomers (now roughly ages 59 to 77) are engaging in real estate transactions at higher rates, both as sellers and buyers, than they were a decade ago. According to NAR’s 2023 report, Boomers accounted for 42% of U.S. home buyers and 53% of home sellers, the most of any generation.

Home Value Appreciation

Home prices in Minnesota surged from 2018 to 2023, boosting homeowners’ net worth. Nationally, home values jumped nearly 47% in five years, and Minnesota saw similar double-digit appreciation. This price growth has been a boon to Boomers who bought their homes years ago at lower prices, enabling many to sell at a profit or leverage equity for new purchases.

Interest Rate Impact

Record-low interest rates through 2021 and then a spike to high rates by 2022 created a unique situation: Boomers who refinanced or bought homes at 3–4% rates are now reluctant to move and give up those loans, contributing to today’s tight inventory.

Aging in Place Trend

A 2024 Redfin survey found that 78% of American Baby Boomer homeowners plan to remain in their current home as they age, by far the most common plan for retirement housing. Minnesota’s Boomers echo this sentiment. The Minnesota Housing Finance Agency notes that the vast majority of older Minnesotans wish to “age in place” in their own homes and communities for as long as possible.

This proclivity to stay put means fewer existing homes being listed for sale, which prolongs the shortage of homes on the market. Would-be younger buyers in Minnesota often face limited choices partly because many Boomers aren’t selling their houses.

Downsizing and Relocation

While many Boomers are staying put, a significant subset are making moves – often cashing in on equity to downsize or relocate for retirement. Those who are selling tend to do so for specific reasons: Boomers most frequently sell because their previous home is too large or because they want to be closer to family and friends.

In Minnesota, family ties and quality of life are strong motivators. Some empty nesters find that the spacious suburban house where they raised children is now more space than they want, prompting a sale and move to something smaller or more convenient.

Buying and Selling: Are Minnesota Boomers Downsizing or Staying Put?

Boomers as Buyers

A striking development in the early 2020s has been the resurgence of Baby Boomers as home buyers. By 2022–2023 Boomers made a comeback, with their share of home purchases jumping from about 29% to 39% in one year, overtaking younger generations.

The primary reasons Boomers purchase homes are to be closer to friends and family, to retire, and to find a smaller, easier-to-manage home. Essentially, many are “downsizing” or relocating for lifestyle reasons. In Minnesota, this often translates to moving from a large single-family house to a townhouse, condo, or smaller single-story house that requires less maintenance.

Preference for Single-Family Living

“Downsizing” doesn’t necessarily mean leaving single-family living. Nearly 20% of home buyers over 60 have been purchasing “senior-related” housing – often age-restricted communities – but the most common property type they chose was a detached single-family home. In other words, even when moving in retirement, many Minnesota Boomers still prefer a house (just a smaller or one-level home), followed by options like condos in small buildings or townhouses.

Boomers as Sellers

Boomers have been the largest cohort of home sellers in the U.S., making up 53% of sellers in 2022–23. In Minnesota, many long-time owners finally decided to sell during the red-hot market of 2020–2022, cashing in on high prices. Typically, those who sold did so because their home no longer fit their needs.

Health and lifestyle factors come into play too – some sell two-story homes to move into one-story layouts, or move from rural homesteads to be nearer to medical facilities. A common scenario in Minnesota has been Boomers selling suburban houses and moving closer to adult children who live in job centers like Minneapolis/St. Paul or regional hubs like Rochester.

The Non-Sellers

At the same time, a huge number of Boomers are not selling – which is itself a trend. With strong sentimental attachments and financial incentives to stay, many Boomers have opted to age in place. Minnesota officials have flagged the aging of the Boomer generation as a looming housing challenge: as this large generation stays in their homes into their 70s and 80s, those homes are effectively off the market for longer periods, tightening supply.

Boomers today typically own their home for a median of 13 to 16 years before selling – much longer tenures than younger generations – reflecting how settled they’ve been. The decision not to sell has broader implications: fewer move-up opportunities for younger families and a growing need to retrofit existing houses to be senior-accessible.

Downsizing vs. Staying Put

Overall, the statewide trend is that downsizing is happening, but not at the mass scale one might expect given the number of Boomers reaching retirement. Many Minnesota Boomers are downsizing and selling the “family home” to move into a condo, townhouse, or smaller house, but a large share are delaying that move or foregoing it entirely.

In a Redfin survey of Baby Boomers, 78% said they plan to stay in their current home indefinitely, while 20% said they would consider moving to a 55+ senior community. This indicates the majority favor staying put, while a minority are actively considering downsizing into senior-oriented developments.

Regional Differences: Urban, Suburban, and Rural Patterns

Housing decisions among Baby Boomers can vary widely depending on location within Minnesota. The experiences of a Minneapolis empty nester versus a farmer in rural Roseau County can be quite different.

Twin Cities Metro (Urban/Suburban)

The Minneapolis–St. Paul metro, home to over half the state’s population, naturally contains a huge number of Boomer homeowners. Many of these are in suburban communities, where they bought homes in the 1980s–2000s. As of the early 2020s, a large share of those family-sized suburban homes are still occupied by their Boomer owners whose children have grown.

According to a Redfin analysis, Boomers with empty nests own over a quarter of the Twin Cities homes that have three or more bedrooms. This is a significant statistic – it means a lot of the larger housing inventory around the metro is effectively tied up by older owners.

Within the Twin Cities, there’s also a split between city and suburb Boomer preferences. In Minnesota, Boomers in their 60s, perhaps still active and recently retired, sometimes leave big-city or suburban life for a quieter small-town setting. Meanwhile, Boomers in their 70s who are moving often choose suburban locales or first-ring city neighborhoods where healthcare, shopping, and family are nearby.

Regional Cities (Duluth, Rochester, St. Cloud, etc.)

Minnesota’s regional cities each have their own Boomer stories. Rochester, for instance, has the world-renowned Mayo Clinic, which makes it a magnet for healthcare professionals and patients alike. It was even named one of Forbes’ top 25 cities to retire in 2024. Many Boomers in southeastern Minnesota choose to stay in or near Rochester specifically to be close to high-quality medical care as they age.

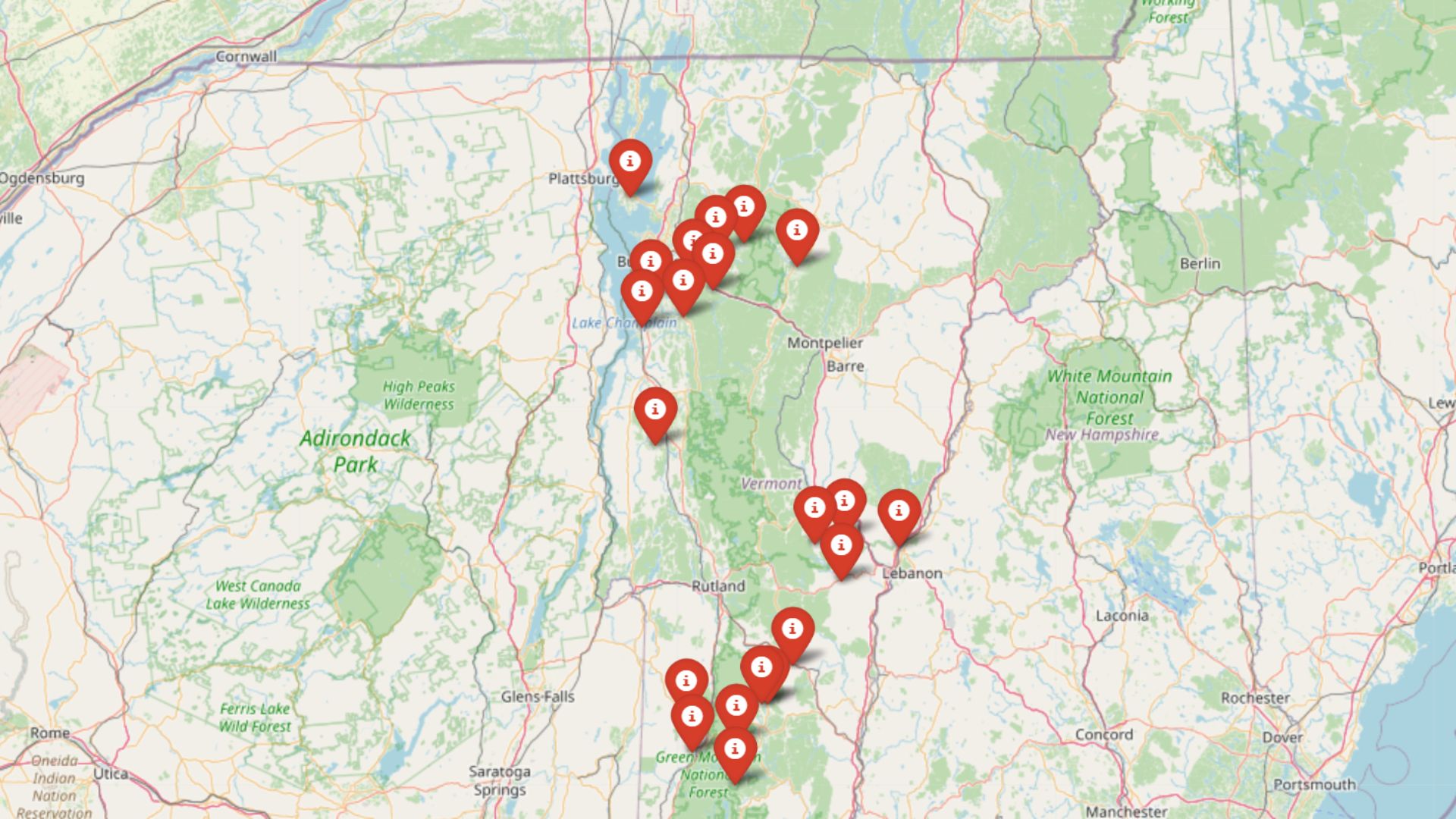

Duluth, the major port city on Lake Superior, has traditionally had an older-than-average population. It offers scenic beauty and a slower pace, which appeals to some retirees. While Duluth doesn’t see as large an influx of newcomers as warmer-climate areas, many Boomers from the Arrowhead region and even the Twin Cities have considered Duluth (or nearby North Shore communities) for retirement.

Other regional cities like St. Cloud, Mankato, and Moorhead have seen modest Boomer downsizing activity as well. These cities often serve as hubs where retirees from rural counties relocate to be closer to hospitals and shopping. Interestingly, Boomers living in Minnesota’s large outstate cities reported high satisfaction with their personal and community life and showed less interest in moving for services or amenities than those in smaller towns.

Rural Areas

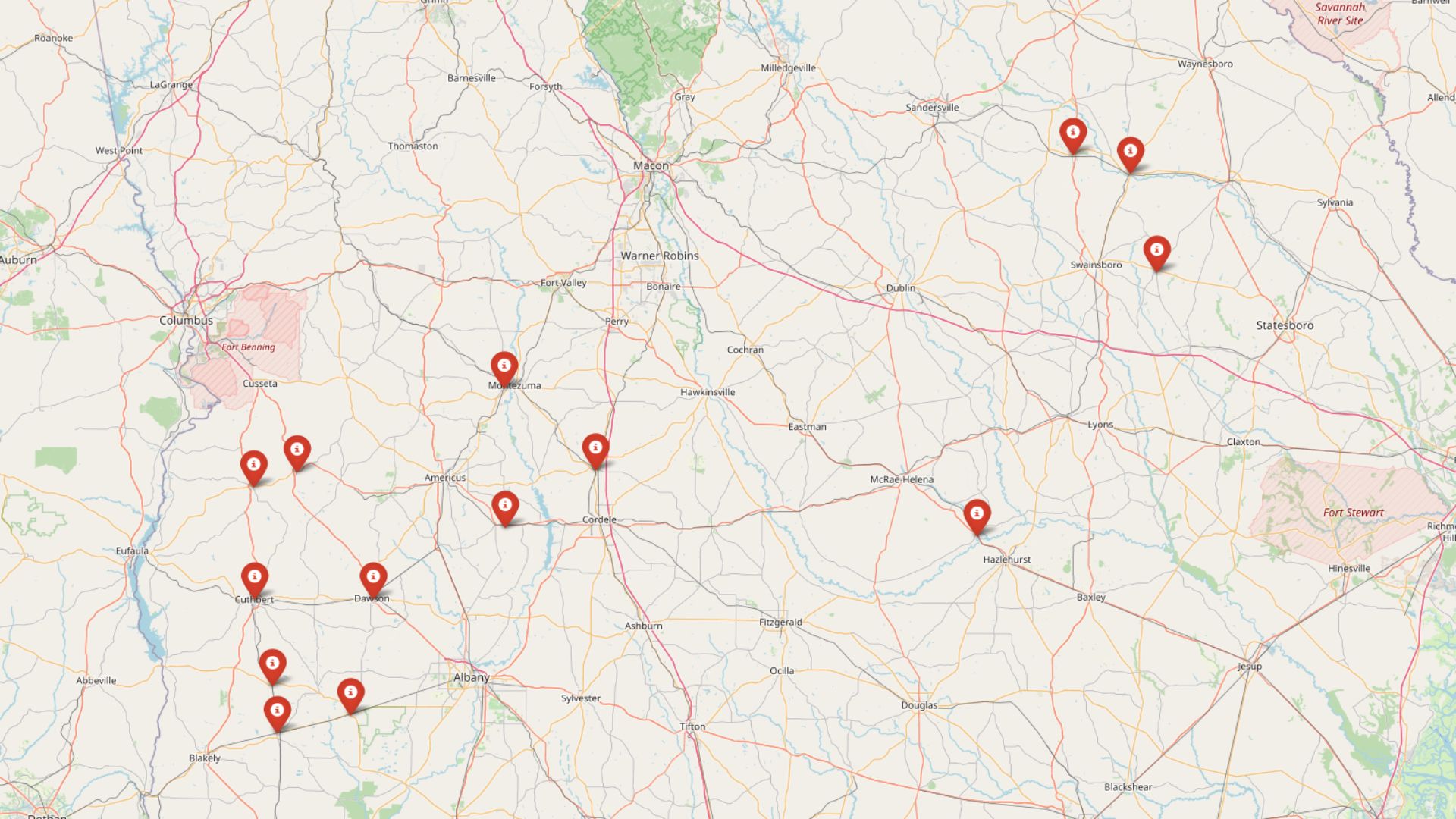

In rural Minnesota (small towns and farming communities), the Boomer trend is strongly skewed toward aging in place, often by necessity. Rural counties have been growing older as young people move out, leaving a higher concentration of older adults. State demographer Susan Brower pointed out that between 2010 and 2015, 55 of Minnesota’s 87 counties saw an increase in the share of households with someone age 65+.

Many rural Boomers live in homes they’ve occupied for decades (family farms, homesteads, etc.) and they often prefer to remain as long as health allows. Rural Boomers expressed an especially high desire to stay put, with 42% expecting to remain in the same community and home for 20+ more years.

The challenges in rural areas include lack of alternative housing options and limited access to services. There may not be a convenient condo or senior community to move to even if one wanted – and the nearest hospital or clinic might be far. The Minnesota Housing report notes that providing housing that keeps seniors in their community with access to care will be “particularly challenging in rural areas.”

Relocations Out of State

A notable number of Minnesota’s Boomers leave the state entirely upon retirement, usually in search of sunnier winters. Census data confirms that Minnesota experiences net outbound migration of older residents to traditional retirement havens.

The top destinations for Minnesotans aged 65+ moving out of state are Arizona, Florida, Wisconsin, Texas, and California. Arizona and Florida, in particular, attract many retirees with their warm weather – it’s common to hear of Minnesotans buying homes in Phoenix, Tucson, or the Gulf Coast of Florida.

Price Ranges, Property Types, and Financing Trends

Home Prices and Price Segments

The period 2018–2023 was marked by significant home price appreciation in Minnesota. This affected Boomers in two ways: it increased the value of the homes they owned, and it raised the bar for any new home they might want to buy.

Minnesota Realtors’ data for 2023 illustrates this divergence: home sales under $300,000 fell by 8.5% (year-over-year), while sales over $1 million rose by 12.3%. This suggests that the lower-end market was cooling due to lack of inventory and high mortgage rates, whereas the luxury market (where many buyers are older, wealthier individuals, likely including Boomers) was quite active.

Because a lot of Boomers are in comfortable financial positions, we see them participating more on the high end of the market than the low end. A retiree who has substantial equity might splurge on a “dream home” for retirement, whether that’s a cabin on a lake or a condo with skyline views.

Inventory Types – Single-Family vs Condo/Townhome

As mentioned, a lot of Boomers continue to favor single-family homes, even when they move. In Minnesota, single-family houses have always been the dominant form of housing, and that hasn’t changed for Boomers.

However, there has been increasing interest in townhomes and condominiums among Boomers who do choose to move, especially in the Twin Cities area. These options offer the advantage of exterior maintenance handled by an association – a big plus for older adults who tire of shoveling snow or mowing lawns.

Many 55+ consumers look for “one-level living”, which is why townhomes (often one-story or with a main-floor primary suite) are popular. A local developer observation is that condos can be “perfect for Baby Boomers” looking to travel and not worry about a house.

National stats from NAR reinforce that detached single-family homes are still the top choice across all generations, including Boomers, but Boomers are slightly more likely than younger buyers to buy condos.

Financing and Cash Purchases

Perhaps the biggest differentiator in how Boomers approach the housing market versus younger generations is in financing. Boomers tend to have substantial equity and savings, enabling many of them to buy homes with little or no mortgage.

More than half of older Boomers (ages 70–78) purchased their next home entirely with cash, and about 2 out of 5 younger Boomers (60–69) did the same. This is an extraordinary statistic that highlights Boomers’ financial advantage: they can often sell an existing home and use the proceeds to cover the full cost of a new, typically smaller home.

In Minnesota’s markets, this means Boomers often have the upper hand in bidding wars – a cash offer from a Boomer seller-turned-buyer can be very competitive. Realtors noted that cash purchases nationally hit their highest level in 2023 (about one-third of all sales) since 2014, partly due to downsizing Boomers paying cash.

Even when Boomers do finance, they often make large down payments. Many use proceeds from the sale of their previous home directly as a down payment on the next. This means Boomers are less sensitive to the high mortgage rates that emerged in 2022–2023 – if you only need a small loan, a 6–7% interest rate is less of a deterrent.

From a selling standpoint, Boomers often enjoy a debt-free position on their homes. Many entering retirement have paid off their mortgages (or have very little left), which means the sale is mostly equity. This provides tremendous flexibility – they can buy another home for cash, help their children with down payments, or invest the proceeds.

Comparing 2018–2023 with 2008–2017

The last five years have, in many ways, been the culmination of trends building during the prior decade.

Recovery from the Great Recession

The 2008 housing crash hit many Boomers at a sensitive time – some were nearing retirement and saw home values plunge. During 2008–2012, many Boomers stayed put because it was difficult to sell without incurring a loss. By 2013–2017, the market recovered, and Boomers cautiously began to sell and move again.

By contrast, 2018–2023 saw a seller’s market most of the time, offering Boomers a great opportunity to list homes and get top dollar. The result: far more Boomer listings and moves in the early 2020s than back in the early 2010s.

Demographic Age Progression

In 2008, the youngest Boomers were around 44 and the oldest 62 – many were still in the workforce, raising kids, or not yet thinking of retirement housing. By 2023, those youngest Boomers are nearly 60 and the oldest are pushing 80.

This shift means the bulk of Boomers have now crossed traditional retirement age, whereas in the previous decade they were largely under 65. Naturally, housing behavior changed: earlier, more Boomers were trading up or relocating for jobs; now, more are focused on downsizing or aging in place.

Shift in Buyer Share

Throughout roughly 2014–2019, Millennials were the largest share of home buyers nationally. But 2022–2023 flipped this – Boomers’ share of home purchases rose sharply, reaching 39–42% by 2023, which is higher than at any point in the prior decade.

During 2008–2017, Boomers gradually downsized and some moved out of state, but they didn’t typically out-buy younger groups. Now, thanks to factors like cash leverage and urgency to relocate for retirement, Boomers have become a driving force in home sales again.

Inventory and Construction

The 2010s in Minnesota saw relatively low levels of new home construction (a hangover from the recession), and that shortage became very apparent by the 2020s. One key difference is that in 2008–2017, it was somewhat easier for a Boomer to find a downsizing option because the market wasn’t as tight.

By 2018–2023, Minnesota’s housing shortage was more acute. Boomers looking for the “perfect” downsized home often had to compete for the few available, or wait for new construction. Some decided to stay put rather than enter a frenzied market.

Minnesota vs. National Trends

How do Minnesota’s Baby Boomer housing trends compare to what’s happening nationally? In many respects, Minnesota aligns with broader U.S. patterns – yet there are a few distinctive differences.

Aging in Place

National surveys consistently show a strong desire among Boomers to age in place. Minnesota is no exception; if anything, Minnesota’s Boomers may be even more inclined to stay put due to high homeownership rates and community ties.

Minnesota’s own data echoes this and highlights the challenge it poses: housing turnover is slowing everywhere, and especially in Minnesota’s rural areas where alternatives are few. So Minnesota is very much part of the national “Boomers aren’t moving” phenomenon that experts say is contributing to the inventory shortage across the country.

Boomers’ Share of Homeowners

Minnesota has a somewhat younger age profile compared to some states like Florida or Arizona. Consequently, the share of homes owned by Boomers is slightly lower in Minnesota than the national average.

As of 2023, Americans aged 55 and up owned 54% of all owner-occupied homes nationwide – a majority. In Minnesota, Boomers head about 35.6% of homeowner households. This lower percentage puts Minnesota among the states with the smallest share of Boomer homeowners.

Outbound Migration of Retirees

Nationally, states like Florida, Arizona, the Carolinas, and Texas have been receiving Boomer migrants, while Northern states often lose them. Minnesota fits the pattern of a “donor” state for retirees. The net migration of Minnesota Boomers is outward, whereas nationally there’s a redistribution.

This is similar to other Upper Midwest states. One could say Minnesota’s Boomer housing market is a bit more contracted because some portion of its Boomers leave and sell their homes. In contrast, states like Florida have expanded Boomer markets with influxes of retiree buyers.

Home Equity and Financing Usage

Across the U.S., Boomers are using their accumulated home equity advantage. Minnesota Boomers are no different – they have benefited from decades of generally rising home values. The tendency for Boomers to buy with cash or large down payments is a nationwide trend that absolutely holds in Minnesota.

Minnesota’s historically high homeownership rate (hovering around 72%, above the U.S. average) means more Boomers here had homes to gain equity in, compared to some states with lower homeownership. So a larger proportion of Minnesota Boomers are in a position to buy their next home outright.

Housing Preferences

Culturally, Minnesota Boomers may have slightly different preferences than those in Sunbelt states. For example, a Boomer in Florida might be keen on a home in a golf community or a condo by the beach. In Minnesota, interest in things like lakefront property or cabins for summer is a bit of a local flavor.

Additionally, Minnesota Boomers, like many Midwesterners, often prefer single-family homes and may be less inclined to move into high-rise condos than Boomers in, say, New York City or Miami. But these are subtle differences. On the whole, the desire for a smaller, accessible home and good community is universal.

Market Influence

National real estate analysts have talked about Boomers “prolonging the housing shortage” by staying put, and about Boomers outbidding Millennials for homes due to their cash advantage. Both phenomena are visible in Minnesota.

One could argue Minnesota’s shortage is also influenced by other factors (under-building, etc.), but Boomers aging in place is indeed a contributor as noted by local Realtor associations. And cases of multiple offer situations being won by an older buyer with a cash offer have been noted by agents in Minnesota’s competitive markets.

In summary, Minnesota’s Boomer housing trends do not dramatically deviate from the national narrative – if you read a headline about Boomers driving the housing market or causing inventory woes, it very much applies to Minnesota. The differences are mostly of scale and context: Minnesota has a somewhat smaller proportion of Boomer homeowners than retirement-heavy states, and it experiences a notable outflow of retirees. But the core behaviors (aging in place, downsizing carefully, using equity, and prioritizing community/family in decisions) are right in line with what Boomers across America are doing.

References

- More Than Three-Quarters of Baby Boomers Plan to Stay In Their Home As They Grow Older — Redfin

- Flexing Their Equity, Baby Boomers Are Driving the Housing Market — National Association of REALTORS®

- Home Buyers and Sellers Generational Trends — National Association of REALTORS®

- Journeys to and from the North Star State: Understanding Minnesota’s Complex Migration Patterns in the 21st Century — Minnesota Department of Employment and Economic Development

- Downsizing tips from Minneapolis, St. Paul empty nesters — Axios Twin Cities

- Baby Boomer-Dominant Housing Markets — Construction Coverage

- Minnesota realtors issue annual report on the housing market — KSTP.com 5 Eyewitness News

- How baby boomers are driving the housing market — HomesMSP Real Estate Minneapolis

- Latest census data finds state growing more educated, rural areas aging — Star Tribune

- Forbes names Rochester as one of the best 25 cities to retire in — Bring Me The News

- Condos are Perfect for Baby Boomers — Meyer Place at Ferndale