High-income households (earning $500k or more annually, roughly the top 1% of earners in Kentucky) make a significant impact in the state’s real estate market. What types of properties are these affluent buyers choosing? Are they drawn to specific regions? What are their migration patterns, and what are the influences of interest rates, taxes, and economic conditions on this small but influential set of buyers?

Types of Properties High-Income Buyers Are Purchasing

High-income Kentuckians tend to gravitate toward the upper echelon of the housing market, but their preferences vary by life stage and lifestyle. Many wealthy buyers in their prime earning years have upsized to larger homes with more amenities, while some older affluent buyers have downsized to smaller luxury properties for convenience. In Kentucky, this has translated into successful professionals and executives (often in their 30s, 40s, 50s) buying expansive suburban houses or custom-built estates, while a subset of baby boomers with high incomes have sold sprawling family homes in favor of upscale condos or one-story homes that are easier to maintain.

Luxury Homes and Estates

A common thread is interest in luxury real estate. Houses in the top price brackets (generally the top 5% of the market) have attracted strong demand from $500k+ earners. During 2018–2021, luxury home purchases surged dramatically; nationally, the typical luxury home price hit a record $1.18 million by mid-2024, up ~9% year-over-year.

Kentucky’s high-income buyers contributed to this trend by purchasing properties such as executive mansions in suburbs, gated community homes, and high-end new constructions. In Louisville’s affluent neighborhoods (e.g., Anchorage, Indian Hills, Prospect), many $1M+ homes changed hands, and the city saw a 20% jump in sales of homes priced above $400k in 2022. In fact, in 2021 Louisville’s luxury segment (homes $400k and up) grew 24.2% in sales volume year-over-year.

These buyers often seek features like expansive square footage, modern gourmet kitchens, home offices, and large lots for privacy.

“Homesteads” and Rural Retreats

Uniquely, many wealthy Kentuckians have a penchant for properties that offer land and privacy – estates, horse farms, or “homestead” properties. In the Bluegrass region around Lexington, high-income buyers frequently purchase equestrian farms or country estates. Jessamine County’s town of Nicholasville (a Lexington suburb) has become a magnet for affluent buyers specifically because it offers large parcels of land and estate-style homes.

Luxury houses in Nicholasville typically start around $800,000 and often sit on 1–5 acre lots; in one case, a 22,369 sq. ft. English manor there sold for $4.45 million, the highest-priced home in the area in recent years. The appeal of such properties is the pastoral lifestyle – sprawling homes with horse barns, private lakes, or vineyards are not uncommon acquisitions for top earners, especially those involved in Kentucky’s horse industry or those simply seeking a rural escape.

Urban Luxury and Condos

While Kentucky is largely suburban/rural, its wealthy buyers have also shown interest in select urban luxury developments. In Louisville and Lexington, some high-income individuals (particularly empty-nesters and young professionals without children) have bought luxury condos and penthouses in downtown districts or trendy neighborhoods. These properties offer upscale finishes and walkable city amenities with less upkeep than a house. However, this is a smaller slice of the market compared to standalone homes and estates.

Second Homes and Investment Properties

Although our focus is owner-occupied homes, it’s worth noting that many $500k+ earners also acquired second homes during 2018–2023. The pandemic era fueled interest in vacation properties; affluent Kentuckians bought lake houses and mountain cabins in-state as getaway homes, as well as investing in high-end rental properties.

A striking example is the Red River Gorge area in Eastern Kentucky: this scenic Appalachian locale saw explosive growth in homebuying for vacation use. Vacation rental demand in Red River Gorge jumped 216% from 2019 to 2023, the highest growth rate in the nation for a vacation-home market. Many of those buyers were high-income individuals from within Kentucky or out of state, purchasing luxury cabins and investment properties to capitalize on the tourism boom.

Likewise, lake regions such as Lake Cumberland and Lake Barkley saw increased second-home purchases – affluent families buying waterfront homes for summer use or retirement. These secondary purchases indicate that beyond their primary residence, Kentucky’s wealthy have been actively expanding their real estate portfolios in resort-like parts of the state.

Regional Hotspots for Affluent Homebuyers in Kentucky

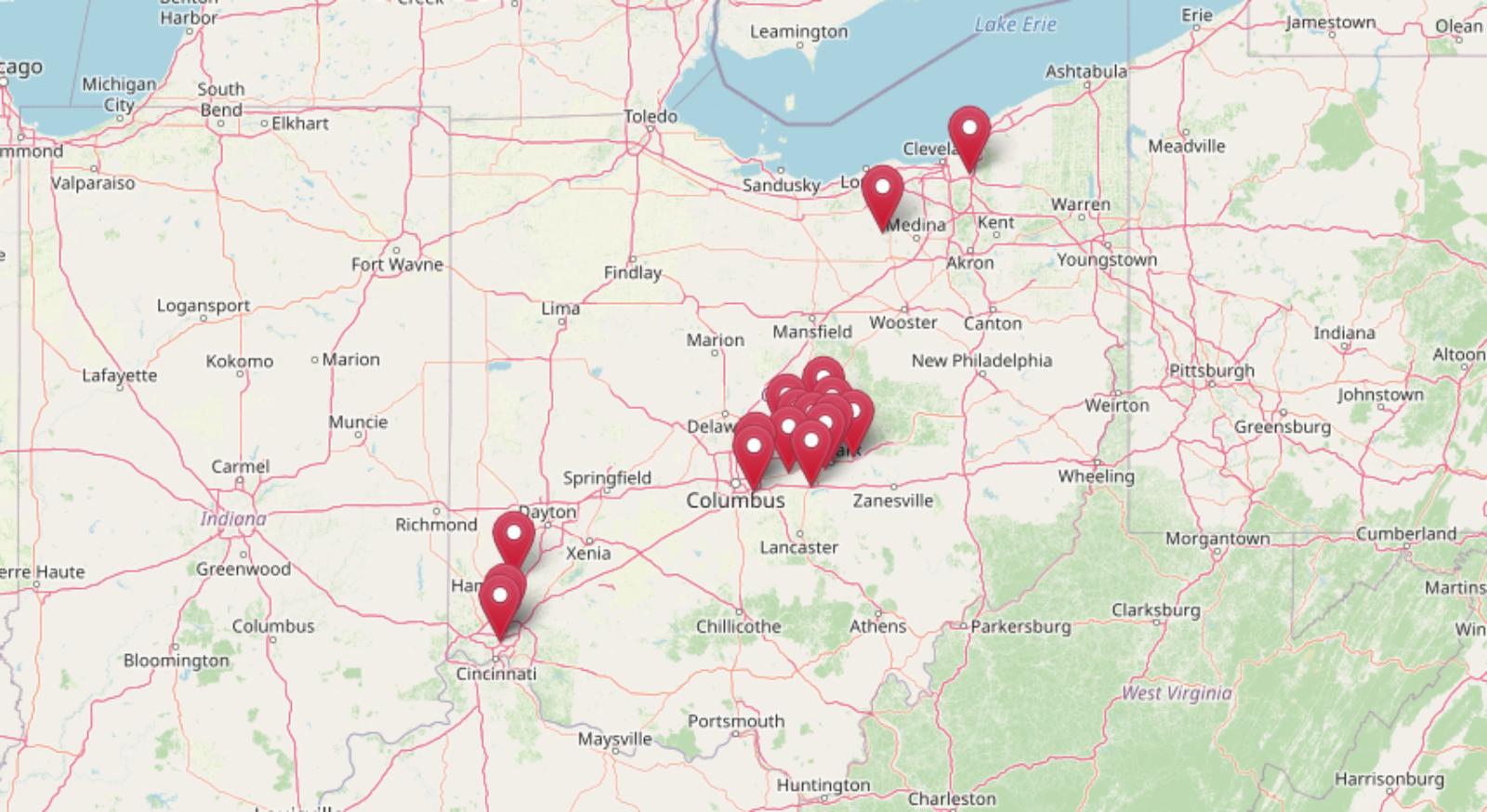

Homebuying trends for the wealthy have not been uniform across Kentucky – they concentrate in certain regions and communities that offer the jobs, amenities, or lifestyle attractive to high earners. From 2018 to 2023, the key hotspots for $500k+ households’ purchases were Louisville, Lexington, Northern Kentucky, and select lake and mountain areas.

Louisville Metro

The Louisville region (Jefferson County and surrounding Oldham, Shelby, Bullitt counties) is Kentucky’s largest metro and a major center of high-income housing activity. Affluent buyers here often come from industries like healthcare, corporate management, and logistics (Louisville is home to Fortune 500 companies and a large medical sector).

They have been purchasing luxury homes primarily in eastern Jefferson County suburbs and nearby upscale enclaves. Areas such as Anchorage, Indian Hills, Prospect, Norton Commons, and Lake Forest have seen consistent demand for $1M+ homes.

Even during the market shifts of the pandemic, Louisville’s high-end remained robust – the city’s net inflow of out-of-state homebuyers more than doubled (+113%) in 2020, as remote workers from pricier cities chose Louisville for its affordability. This migration influx included affluent professionals who injected new demand for top-tier properties.

Louisville’s luxury market set records in 2021–2022: nearly 234 homes sold for over $1 million in one recent 12-month period, an unprecedented volume historically. High-income buyers in Louisville have also shown interest in the downtown/Waterfront Park area condos and renovated historic homes in neighborhoods like Old Louisville and the Highlands, though the bulk prefer suburban estates.

Lexington and the Bluegrass Region

Lexington (Fayette County), Kentucky’s second-largest city, and its surrounding Bluegrass region form another core area for high-income home purchases. Lexington’s economy (healthcare, education, tech, and especially the thoroughbred horse industry) produces many wealthy residents and attracts others from out of state.

Affluent buyers in 2018–2023 targeted both luxury subdivisions in Lexington and estate properties in the horse country just outside the city. Exclusive Lexington neighborhoods like Beaumont, Hartland, and Chevy Chase saw million-dollar home sales to local executives and newcomers (University of Kentucky physicians, tech entrepreneurs, etc.), while downtown Lexington had a few luxury condo offerings as well.

However, a defining trend has been high earners moving a bit further out to get more land. Counties adjacent to Fayette – Jessamine, Woodford, Scott, Bourbon – experienced a surge in luxury transactions. Farms in these areas often sell for millions, and upscale golf communities (like those around Keene Trace Golf Club in Nicholasville) attracted wealthy buyers seeking new construction on acreage.

Similarly, Woodford County (home to scenic horse farms and bourbon distilleries) saw multi-million-dollar farm estates trade hands, often purchased by out-of-state millionaires investing in Kentucky horse farms or countryside retreats.

Northern Kentucky (Cincinnati Suburbs)

Northern Kentucky, comprising counties like Boone, Kenton, and Campbell, is part of the Cincinnati metropolitan area. It has increasingly drawn high-income homebuyers, particularly those who work in Cincinnati’s business sectors but prefer Kentucky’s lower taxes and suburban charm.

Neighborhoods such as Edgewood, Fort Mitchell, and parts of Boone County (e.g., Triple Crown Country Club area) feature custom luxury homes that have been popular among executives. During 2018–2023, Northern Kentucky benefitted from the broader Cincinnati-region housing boom.

High earners from Ohio crossed the river for newer mansions with more land, and local professionals (like Procter & Gamble or Kroger execs, whose offices are in Cincinnati) bought homes in NKY to take advantage of Kentucky’s 5% (now 4%) income tax versus Ohio’s higher rates.

The growth of the Cincinnati/NKY economy – e.g., Amazon’s huge air hub at CVG Airport in Boone County – also introduced more high-salary individuals to the NKY housing market. In places like Hebron, Union, and Villa Hills, we saw properties in the $600k–$1M range selling quickly.

Lake and Mountain Resort Regions

Affluent buyers have extended their influence to Kentucky’s recreational regions, notably the lake districts and Appalachian foothills. Lake Cumberland, Dale Hollow Lake, and Kentucky Lake are examples of areas where wealthy individuals picked up vacation homes.

These regions experienced a jump in activity especially in 2020–2021, when remote work allowed more weekend escapes. Some high earners from Louisville or Lexington acquired second houses along Lake Cumberland’s shoreline (around Somerset or Russell County) – often sizable log homes or contemporary lakefront builds that serve as family vacation compounds.

In the Appalachian eastern part of the state, the Red River Gorge became a surprising hotspot. Realtors report that demand for properties in Red River Gorge and similar outdoor destinations “exploded” post-2020, with home prices surging as investors and second-home seekers bought up cabins.

This trend was partially driven by out-of-state investors (some from as far as California or Texas) looking to profit from Airbnb rentals in these scenic areas, but also by local high-income families seeking safe, drivable vacation spots during COVID. The result is that previously quiet rural counties (Powell, Wolfe, etc., home to the Gorge) saw record real estate activity at the high end of their market.

Demographic and Migration Trends of Affluent Buyers

Age and Generation Trends

A major theme of 2018–2023 is the influence of the baby boomer generation in the housing market. Baby Boomers (born 1946–1964), now in their late 50s to 70s, not only control significant wealth but also became the largest share of home buyers nationwide in 2022 (at 39%).

In Kentucky, many high-income buyers are indeed boomers – think of a 60-year-old business owner buying a luxury condo in Louisville after selling their company, or a 65-year-old doctor moving to a smaller lakefront home for retirement. These affluent boomers often already lived in Kentucky (downsizing or relocating within the state), and their purchases have added to demand for low-maintenance luxury (condos, new single-story homes) as well as second homes for recreation.

Because boomers are often repeat buyers with ample equity, they can make competitive all-cash offers, outbidding younger buyers. This dynamic was seen clearly in 2020–2023: Baby boomers had the upper hand in the home buying market, as their share of home purchases jumped from 29% to 39% in one year. In Kentucky’s context, that means a sizeable portion of high-end home sales – whether it’s a $1.5M farm or a downtown loft – went to boomers either upgrading their lifestyle or retiring in style.

In contrast, younger high-income buyers (Gen X and Millennials earning $500k+) are fewer but have grown slightly in number, especially as certain industries (tech, advanced manufacturing, healthcare administration) expand in Kentucky. These buyers, often in their 30s or 40s, are typically dual-income professional couples or entrepreneurs.

They have been behind the purchases of family-oriented luxury homes – for example, a 40-year-old software executive and their spouse buying a 5-bedroom house in Oldham County for good schools and acreage. While millennials as a whole have struggled with affordability, those at the top income tier have moved into Kentucky’s elite neighborhoods.

Migration Patterns

Kentucky historically is not a top destination for out-of-state movers compared to Sun Belt states, but the pandemic changed mobility nationwide and created new migration flows. Remote work enabled some high earners from high-cost regions (New York, Chicago, California) to relocate to lower-cost states like Kentucky.

Louisville, for example, saw a 113% increase in net inbound migration inquiries in 2020 – many of those interested were from pricier cities looking at Kentucky’s affordable mansions. Indeed, a portion of luxury home purchases in 2021–22 were made by newcomers: e.g., an executive from Chicago moving to Louisville’s East End, or a finance professional from New York buying a Lexington horse farm after discovering they could work remotely.

That said, Kentucky’s overall migration balance for the wealthy is a bit complex. IRS tax migration data indicates that between 2020 and 2021 Kentucky actually gained a small number of tax filers from interstate moves, but it lost aggregate income – meaning the people who left had higher incomes on average than those who came.

This suggests some high-income Kentuckians relocated out (potentially to Florida, Tennessee, or other low-tax states), while the inbound migrants, though adding population, weren’t quite as wealthy. The net effect is a slight brain drain at the very top end even as moderate-income population grows.

Nevertheless, Kentucky’s lower cost of living remains a selling point to attract affluent remote workers. With recent state tax reforms (Kentucky cut its flat income tax from 5% to 4.5% in 2023 and then to 4% in 2024), the state is positioning itself to be more competitive in luring high earners.

Influence of Interest Rates, Tax Policies, and Economic Conditions

Interest Rate Impact

Perhaps the most dramatic factor was the trajectory of mortgage rates. In 2018, 30-year mortgage rates averaged around 4.7%, which was historically low but rising at the time, causing a slight cooldown in housing. By 2019, rates dipped to ~4.1%, then plummeted to record lows in 2020–2021 due to Federal Reserve cuts and pandemic uncertainty. The average 30-year rate hit an all-time low of just 2.65% in January 2021.

These ultra-low rates significantly boosted the purchasing power of buyers. High-income households took advantage: many refinanced to sub-3% rates or bought new homes with cheap financing. Low rates also made owning second homes more feasible (monthly costs were minimal relative to their incomes).

However, the tide turned in 2022. Faced with high inflation, the Fed’s rate hikes pushed mortgage rates sharply upward. By late 2022, 30-year rates exceeded 6%, and in 2023 they fluctuated in the 6–7% range, even touching about 7.8% in October 2023. This rapid rise had a cooling effect on the housing market, including the high-end segment.

Even wealthy buyers become more cautious when financing costs double. In Kentucky, late 2022 saw some luxury listings linger longer and price growth moderate as the pool of buyers thinned. One particular effect was the “lock-in” phenomenon: many homeowners who had locked in ultra-low rates were reluctant to sell and give up that rate for a new 6-7% loan.

Nonetheless, it’s important to note that all-cash purchases are more common in the luxury tier, which cushions the impact of rates. Many affluent buyers either pay cash or make very large down payments. In Kentucky, a significant share of $1M+ sales have been cash transactions (often by boomers using equity or out-of-state cash buyers).

Tax Policy Influence

Tax changes in this period had mixed effects on high-income homebuyers. The most notable federal change was the 2018 Tax Cuts and Jobs Act, which capped the SALT (state and local tax) deduction at $10,000 and limited the mortgage interest deduction to mortgages up to $750k (down from $1M previously).

For wealthy homeowners, especially those in high-tax states, this was a potential deterrent to owning very expensive homes. However, Kentucky’s property taxes and home prices are moderate enough that many owners didn’t hit the SALT cap hard (a $1M home in Kentucky might have ~$12k in property taxes – partially above the cap).

The SALT cap did not bite Kentucky as sharply as it did, say, New York or Illinois. In fact, one outcome of the SALT cap was that some wealthy individuals in high-tax states decided to relocate to lower-tax states.

State tax policy, meanwhile, turned increasingly favorable for high earners in Kentucky. In 2018 the state implemented a flat income tax (5%), and in 2022–2023 the legislature approved further cuts to the income tax rate. The rate dropped to 4.5% in January 2023 and 4.0% in January 2024, with plans to potentially lower it to 0% over time if revenue targets are met.

For someone earning $500k, a full percentage point cut represents $5,000 in annual tax savings – not game-changing relative to their income, but certainly a positive. This policy trend sends a strong signal to high-income individuals that Kentucky wants to be a competitive place for them to live and invest.

Economic & Wealth Conditions

Pre-pandemic (2018–2019), the economy was strong with low unemployment, which meant high earners felt secure to make major purchases. The stock market’s rise through 2019 likely boosted the wealth of many affluent Kentuckians (401ks, investments), enabling larger down payments or the purchase of additional properties.

When the COVID-19 pandemic hit in 2020, there was initial fear of a housing crash, but instead the opposite occurred: the combination of stimulus money, surging stock market in latter 2020, and lifestyle changes caused a housing market boom. Wealthy households actually saw significant gains – by mid-2021, U.S. homeowner equity reached record highs.

This increased equity gave high-income homeowners more leverage to buy another home or trade up (they could sell their current home for a hefty profit and plow that equity into a new purchase). Moreover, many high-income occupations transitioned to remote work smoothly, so job loss was less of an issue for this class; in fact, higher-income employment rebounded quickly.

Come 2022, the economic picture shifted to inflation and uncertainty. Rapid inflation (which hit 40-year highs in 2022) can erode purchasing power, but for high earners it also meant wage increases in some cases and a push to invest in hard assets like real estate as an inflation hedge.

However, the stock market decline in 2022 (S&P 500 fell ~19% that year) did have a psychological and real effect: some wealthy individuals’ portfolios took a hit, which could reduce the liquidity or appetite for buying real estate.

By 2023, as inflation started cooling but rates remained high, the economy in Kentucky was stable (low unemployment ~4%). High earners were still financially capable but perhaps more cautious – the era of frenzied bidding wars cooled. Realtors observed a return to more normal negotiation at the high end, with luxury homes spending a bit longer on market in 2023 than in 2021.

Comparing 2018–2023 vs. 2008–2017 Trends

Market Conditions Contrast

The 2008–2012 period was defined by the housing crash and slow recovery. High-income buyers then were often in wait-and-see mode. Many already owned homes and saw their property values dip or stagnate after 2008, so they were less inclined to “trade up” during the recession. Jumbo financing was also harder to obtain in the early 2010s as banks tightened credit.

From 2013 to 2017, conditions improved significantly. Low interest rates and recovering stock wealth led more affluent buyers back into the market. However, that period’s growth was steady and modest. Luxury home sales growth rarely exceeded single digits annually in the first half of the 2010s.

Contrast that with 2018–2023: we saw explosive spikes. In late 2020, luxury home sales were up 60%+ year-over-year – nearly quadruple the pre-pandemic growth rate. Such a meteoric jump has no parallel in the 2008–2017 span.

Furthermore, price appreciation in 2008–2017 was relatively subdued for high-end homes – Kentucky’s median prices were rising but at perhaps 2–5% per year. In 2018–2023, we saw double-digit annual gains in luxury prices around 2020-2021.

Demographic Shifts

In 2008–2017, the primary high-income buyers were Gen X and Baby Boomers in their working years. Millennials were mostly too young to be in the $500k+ bracket until the late 2010s. By 2018–2023, the cohort had aged: Boomers moved into retirement age, Gen X became the new executives, and older Millennials began to appear among high earners.

Additionally, buyer expectations evolved: the 2018–23 buyer demanded smart-home features, home offices, and outdoor amenities (partly driven by COVID lifestyle), whereas a 2010 buyer might have been content with a traditional luxury home. Builders responded accordingly in each era.

Migration Patterns Then and Now

From 2008–2017, Kentucky was mostly seeing out-migration or neutral migration of its highest earners – for instance, some might leave for larger metros or retirement elsewhere. There was little inbound migration from expensive cities; if anything, the 2010s saw young professionals leaving Kentucky for job opportunities on the coasts.

In 2018–2023, this trend somewhat flipped, at least temporarily: Remote work and a newfound geographic flexibility made Kentucky more of a destination for some. So compared to the earlier period, Kentucky in 2020–21 had a notable influx of out-of-state affluent buyers that was largely absent in 2008–17.

Housing Supply Differences

After the 2008 crisis, there was actually an excess of high-end homes in some markets (builders had overbuilt luxury subdivisions in the mid-2000s). Kentucky wasn’t overbuilt to the same extent as Las Vegas or Florida, but through the early 2010s, buyers had decent inventory to choose from in the luxury bracket.

By the late 2010s, however, construction of new homes (especially luxury custom homes) had not kept up with the growing economy. Thus 2018–2023 started with a tight supply of quality homes, which only got tighter due to the surge in demand and then the rate lock-in (people not selling).

This inventory crunch was far more acute than anything seen in 2008–2017, resulting in bidding wars that became common in 2020–21 even for million-dollar homes (some selling above list price), whereas in 2008–2017, high-end homes often sold below asking after longer marketing periods.

Conclusion

From upsizing into suburban mansions to snapping up rural estates and luxury condos, Kentucky’s highest earners have significantly shaped the state’s housing landscape in 2018–2023. They concentrated on luxury single-family homes and expansive properties, fueling record growth in the upscale market.

Louisville and Lexington remained their primary arenas – with million-dollar listings frequently exchanging hands – while secondary markets like Northern Kentucky and resort areas (lakes and the Red River Gorge) also saw an uptick thanks to these buyers’ interest in second homes and investments.

Demographically, the action was driven largely by older, established professionals (often baby boomers), though remote work opened the door for some new, younger affluent migrants to call Kentucky home. External forces like historically low interest rates, a roaring stock market, and pandemic lifestyle shifts supercharged their homebuying through 2021, in contrast to the more cautious activity seen in the early 2010s post-recession.

By 2022–2023, higher interest rates and economic normalization cooled the frenzy, yet Kentucky’s high-income buyers remained engaged – often leveraging cash or equity – and continued to purchase homes at a pace that kept the luxury segment resilient. Compared to 2008–2017, the recent trends show higher volatility but also higher peaks in demand and prices for top-tier properties.

In essence, Kentucky’s wealthy households have proven to be both opportunistic and strategic in their real estate decisions: taking advantage of favorable conditions to upgrade or diversify their holdings, while adjusting to challenges like rising rates by either pausing or paying cash. Their preferences for certain property types and locations have reinforced patterns (e.g., the dominance of Louisville’s East End or Lexington’s horse country for luxury living), but also created new “hotspots” in areas once off the radar (such as the Appalachian cabin market).

Going forward, as economic conditions evolve, this cohort will likely continue to exert outsized influence – their financial capacity gives them flexibility whether the market is hot or cold. The 2018–2023 period demonstrated just how impactful high-income buyers can be when unleashed by low borrowing costs and wealth gains. Even as the market transitions to a cooler phase, Kentucky’s real estate sector will watch this group closely, knowing that a swing in their sentiment can shape statewide housing trends.

References

- Santa Barbara, Louisville and Buffalo Have Soared in Popularity With Out-of-Town Homebuyers Since the Pandemic Began – Redfin

- The Surprising Appalachian Hot Spots That Are ‘Very Profitable’ for Short-Term Rental Investors – Realtor.com

- Luxury Home Prices Spike 9% to All-Time High – Redfin

- Housing Market Roundup Dec. 24, 2020: Luxury Home Sales Surge a Record 61%, Quadrupling Pre-Pandemic Growth – Mortgage Bankers Association Newslink

- The Small Kentucky Town Luring Affluent Home Buyers – Mansion Global

- 2023 Home Buyers and Sellers Generational Trends Report – National Association of Realtors

- How Do Taxes Affect Interstate Migration? – Tax Foundation

- KY real estate sales top $829 million in January; buyers and sellers continue to ‘engage with confidence’ – Northern Kentucky Tribune