Would you like to save this?

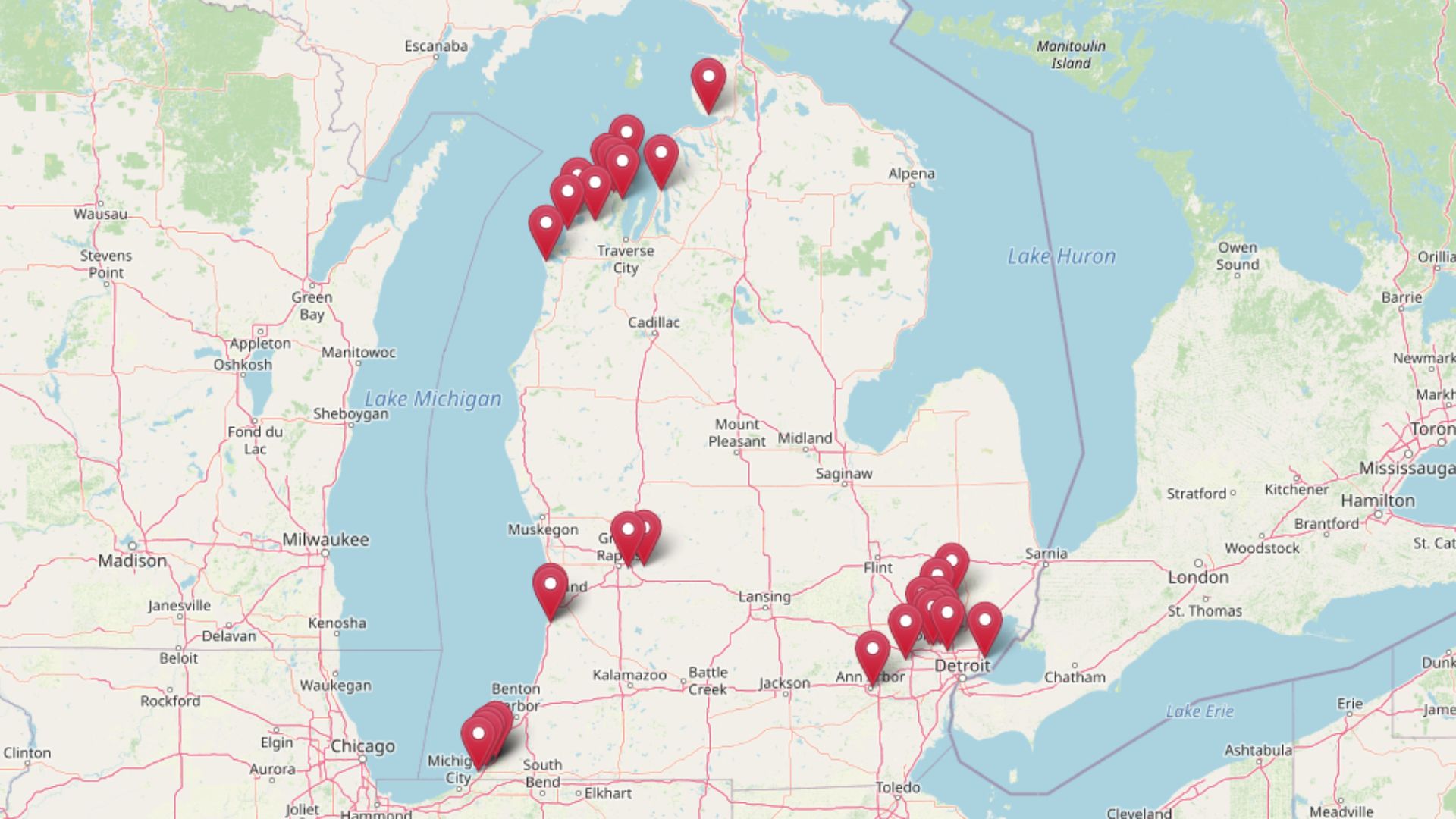

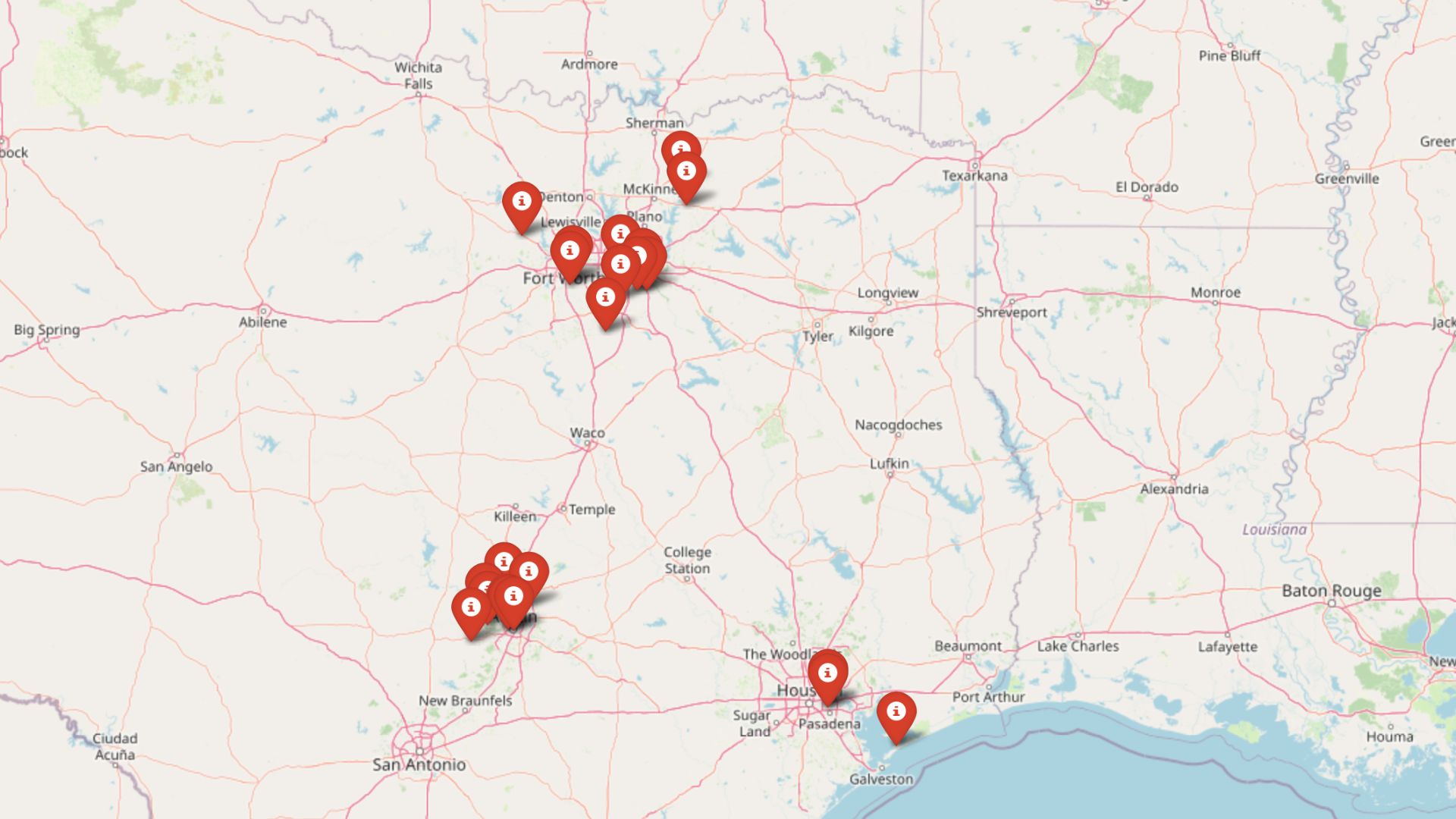

Zillow Home Value Index trends are flashing red across Texas. In 22 communities, warning signs are stacking up—fast. Some towns are priced more than 100% above long-term averages. Others show momentum stalling, inventory piling up, and volatility spiking—all signals that have historically come before sharp housing corrections.

Using 15 years of data and five crash indicators, our model flags these markets as the most at risk, with crash probabilities topping 90%. From high-flying Austin suburbs to fast-changing Dallas neighborhoods, the danger isn’t limited to one income bracket. With rates near 7% and inventory swelling to 2008 levels, the math simply doesn’t hold.

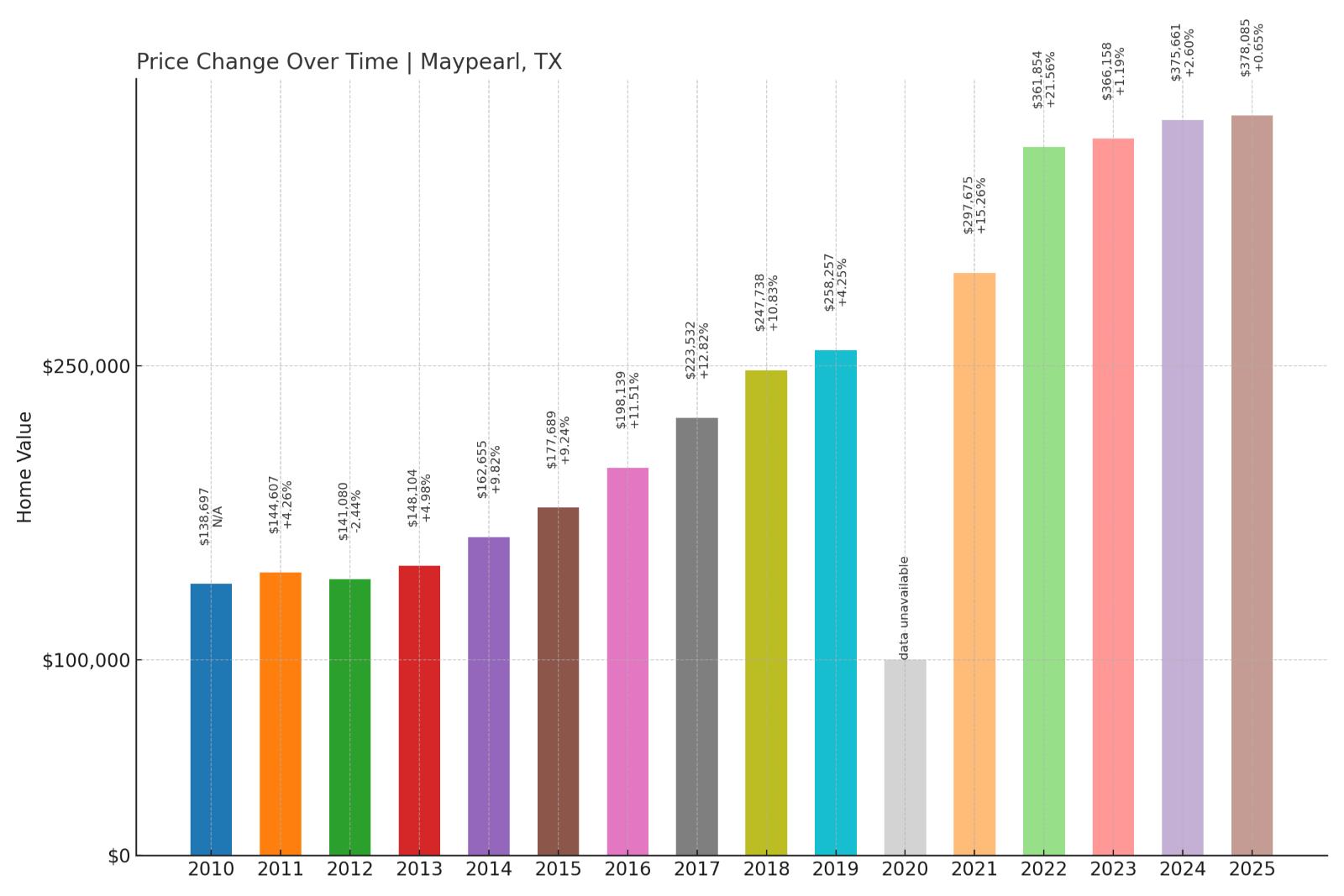

22. Maypearl – Crash Risk Percentage: 90%

- Crash Risk Percentage: 90%

- Historical crashes (8%+ drops): 1

- Worst historical crash: -9.79% (2010)

- Total price increase since 2009: 145.92%

- Overextended above long-term average: 60.30%

- Price volatility (annual swings): 8.08%

- Current 2025 price: $378,085

The data shows Maypearl’s remarkable price surge of nearly 146% since 2009, pushing home values 60% above historical norms. This Ellis County community experienced a significant crash during the Great Recession, losing almost 10% of home values in 2010, demonstrating the market’s susceptibility to broader economic pressures. The current price volatility of over 8% annually suggests ongoing instability that could trigger another correction.

Maypearl – Rural Growth Meets Urban Pressure

Located about 35 miles south of Dallas, Maypearl sits in the heart of Ellis County’s rapidly expanding exurban development. This small town of roughly 1,000 residents has transformed from a quiet farming community into a bedroom community for Dallas commuters, driving the explosive price growth reflected in the data. The town’s proximity to major employment centers like DeSoto and Cedar Hill has attracted families seeking more affordable alternatives to urban living, but current prices suggest the affordability advantage has largely evaporated.

The local housing market relies heavily on new construction and rural acreage developments, making it particularly vulnerable to interest rate fluctuations that affect both builders and buyers. With the median home price now approaching $380,000, Maypearl has entered territory that may prove unsustainable for its traditional buyer base of young families and first-time homeowners. The combination of high volatility and overextension suggests investors and current homeowners should monitor market conditions closely.

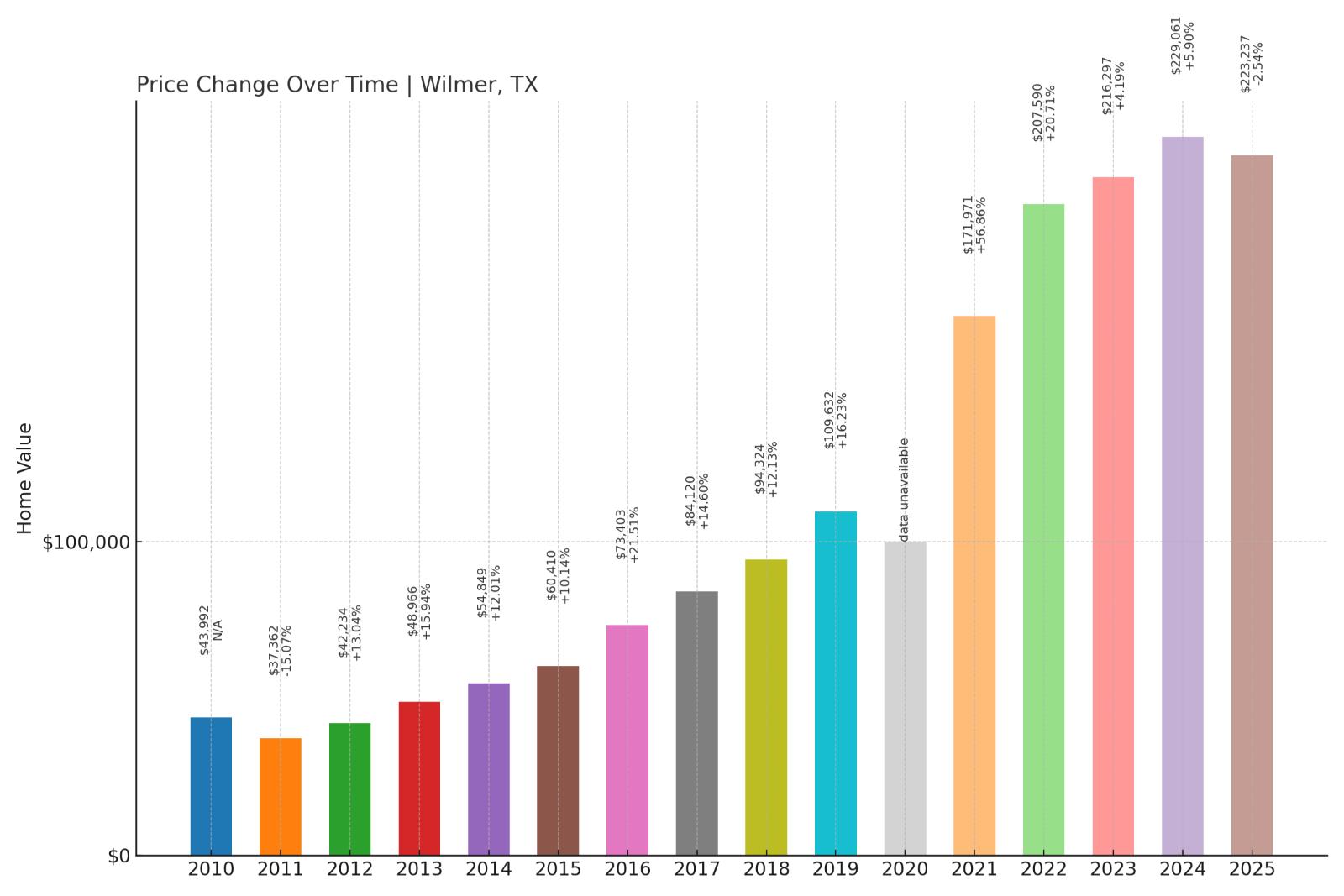

21. Wilmer – Crash Risk Percentage: 90%

- Crash Risk Percentage: 90%

- Historical crashes (8%+ drops): 1

- Worst historical crash: -15.07% (2011)

- Total price increase since 2009: 380.82%

- Overextended above long-term average: 104.82%

- Price volatility (annual swings): 15.08%

- Current 2025 price: $223,237

Wilmer’s housing data reveals extreme market conditions that rank among the most concerning in Texas. The staggering 381% price increase since 2009 has pushed values more than double their historical average, while the brutal 15% crash in 2011 proves this market can correct violently. The exceptionally high volatility of over 15% annually signals a market driven more by speculation than stable fundamentals.

Wilmer – Dallas Suburb Under Extreme Pressure

This small Dallas County city of about 4,000 residents exemplifies the explosive growth pressure facing southern Dallas suburbs. Located just 20 miles southeast of downtown Dallas, Wilmer has become a target for investors and first-time buyers priced out of closer-in neighborhoods. The community’s transformation from rural to suburban has been dramatic, with new subdivisions replacing farmland and pushing home values to levels that seem divorced from local income realities.

The market’s extreme volatility reflects the speculative nature of much recent activity, with flippers and investors contributing to price swings that exceed even volatile tech markets. Current prices above $223,000 represent a disconnect from the area’s median household income and job market, suggesting a correction may be necessary to restore balance. The previous 15% crash demonstrates that when Wilmer’s market turns, it tends to move quickly and severely.

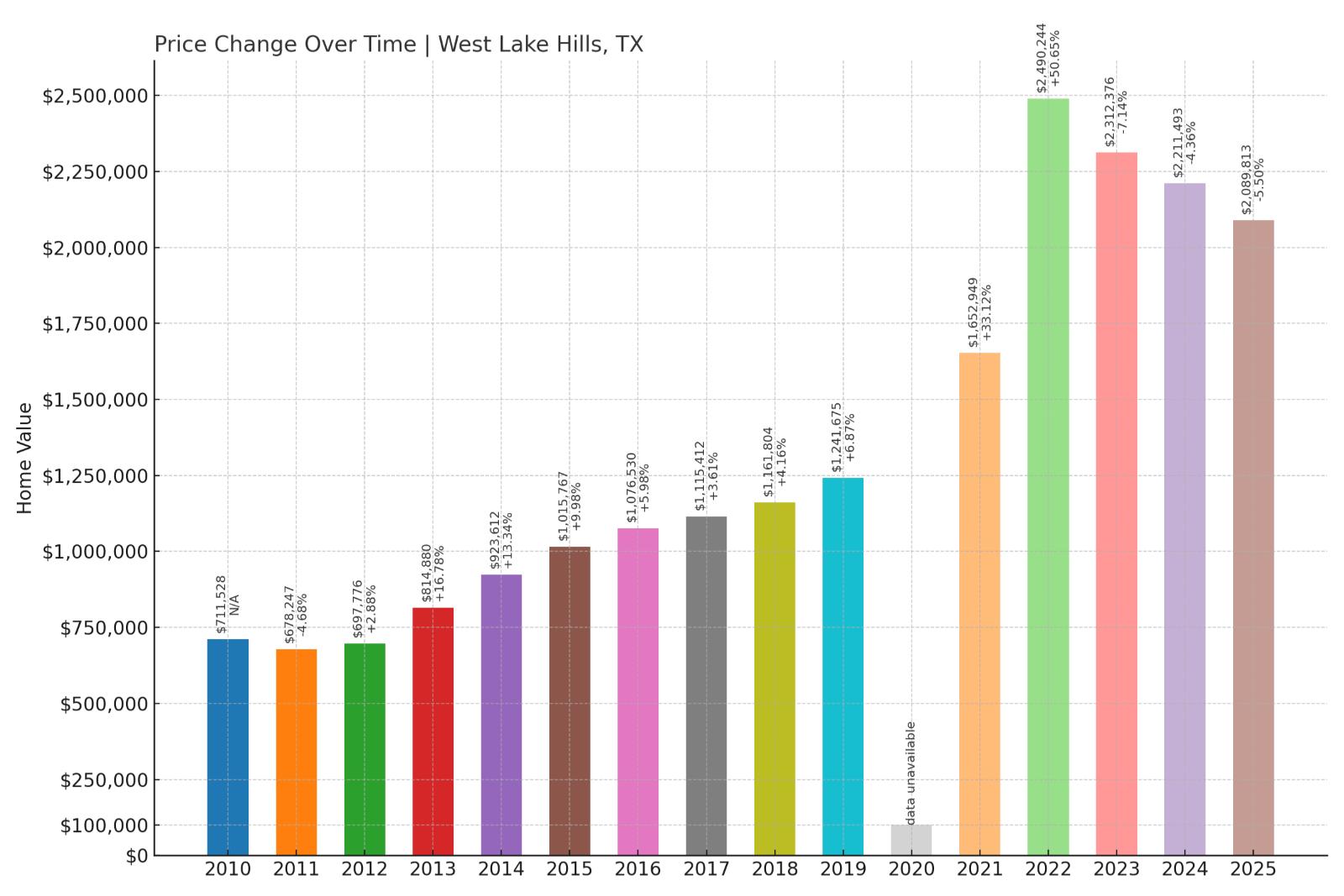

20. West Lake Hills – Crash Risk Percentage: 90%

- Crash Risk Percentage: 90%

- Historical crashes (8%+ drops): 0

- Worst historical crash: No major crashes recorded

- Total price increase since 2000: 272.86%

- Overextended above long-term average: 97.06%

- Price volatility (annual swings): 8.94%

- Current 2025 price: $2,089,813

West Lake Hills presents a fascinating case study in luxury market vulnerability. Despite never experiencing a major crash, the community’s nearly 273% price appreciation since 2000 has pushed median values to over $2 million—almost double historical norms. The lack of historical crashes may actually increase risk, as markets without correction experience often prove most vulnerable when conditions shift.

West Lake Hills – Austin Luxury Market at Peak Extension

Would you like to save this?

This exclusive Austin suburb consistently ranks among Texas’s most expensive residential markets, with homes commanding prices that reflect its reputation as the “Beverly Hills of Austin.” Located just minutes from downtown Austin via the Pennybacker Bridge, West Lake Hills offers Hill Country views and top-rated schools that have attracted tech executives and professionals from Austin’s booming economy. However, the current median price above $2 million represents a significant departure from historical patterns.

The luxury market often leads both upturns and corrections, as high-end buyers typically have more flexibility in timing purchases and sales. With Austin’s tech sector facing headwinds and remote work reducing location premiums, West Lake Hills may be particularly exposed to demand shifts. The 97% overextension above long-term averages suggests even wealthy buyers may increasingly view current prices as excessive, potentially triggering a correction in this prestigious market.

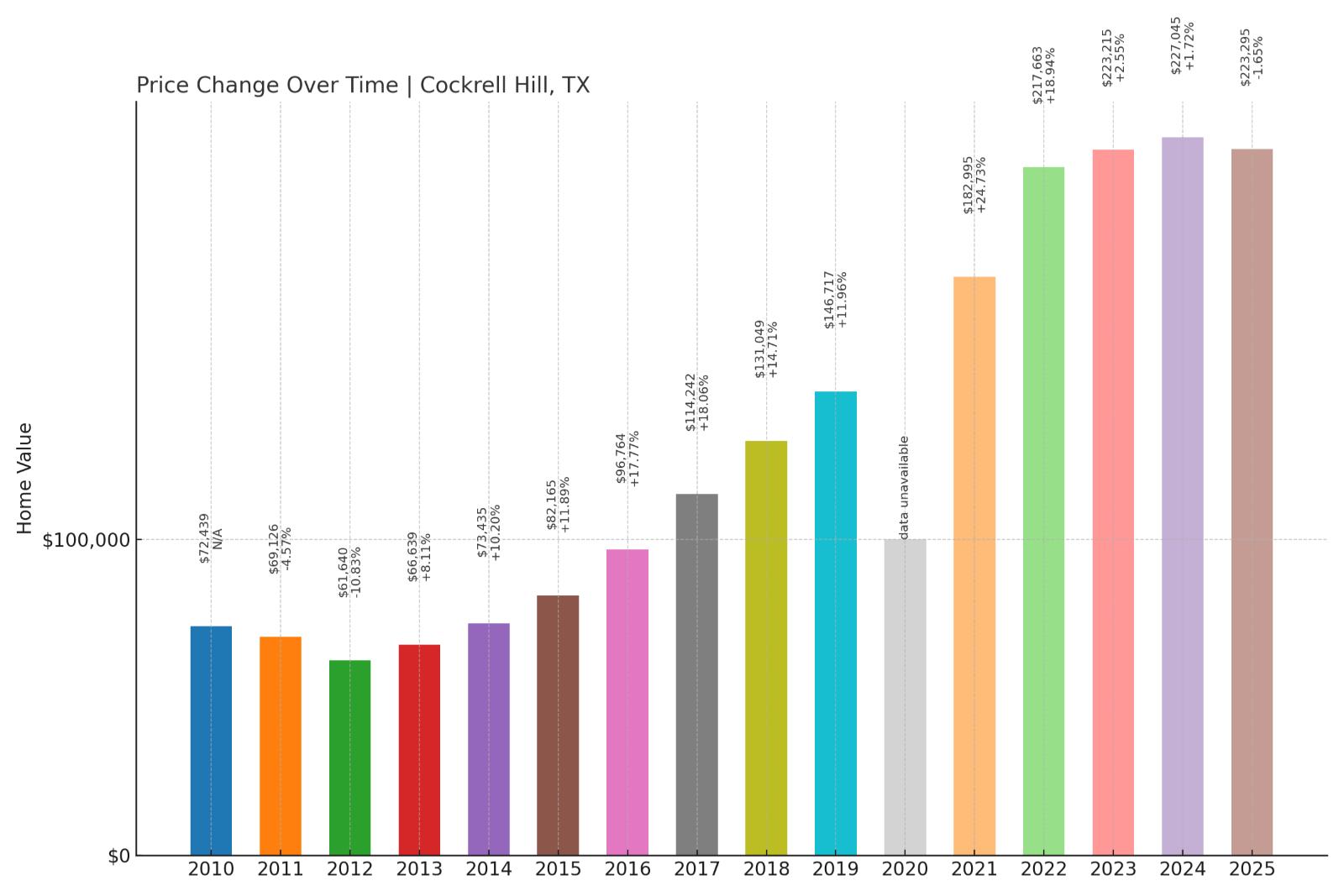

19. Cockrell Hill – Crash Risk Percentage: 90%

- Crash Risk Percentage: 90%

- Historical crashes (8%+ drops): 2

- Worst historical crash: -10.83% (2012)

- Total price increase since 2000: 264.96%

- Overextended above long-term average: 104.60%

- Price volatility (annual swings): 8.58%

- Current 2025 price: $223,295

As a repeat crash offender with two historical declines exceeding 8%, Cockrell Hill’s market shows classic patterns of boom-bust cycles. The 265% price surge since 2000 has created severe overextension at 105% above historical averages, while the community’s crash history proves local market conditions can deteriorate rapidly. The worst crash of nearly 11% in 2012 occurred during the broader housing recovery, suggesting unique local vulnerabilities.

Cockrell Hill – Small City, Big Risk Factors

This tiny Dallas County enclave of fewer than 4,500 residents occupies just 1.2 square miles but punches above its weight in housing market volatility. Completely surrounded by Dallas, Cockrell Hill has benefited from spillover demand as Dallas proper became increasingly expensive. The community’s location near major transportation corridors and proximity to Dallas Love Field has attracted investors seeking affordable entry points into the Dallas market.

However, the market’s history of multiple crashes suggests structural vulnerabilities that persist despite location advantages. The small size of the housing stock means individual transactions can significantly impact median prices, contributing to the observed volatility. With current prices exceeding $223,000, the market has reached levels that may challenge the buying power of traditional residents and first-time buyers who have historically driven demand in this working-class community.

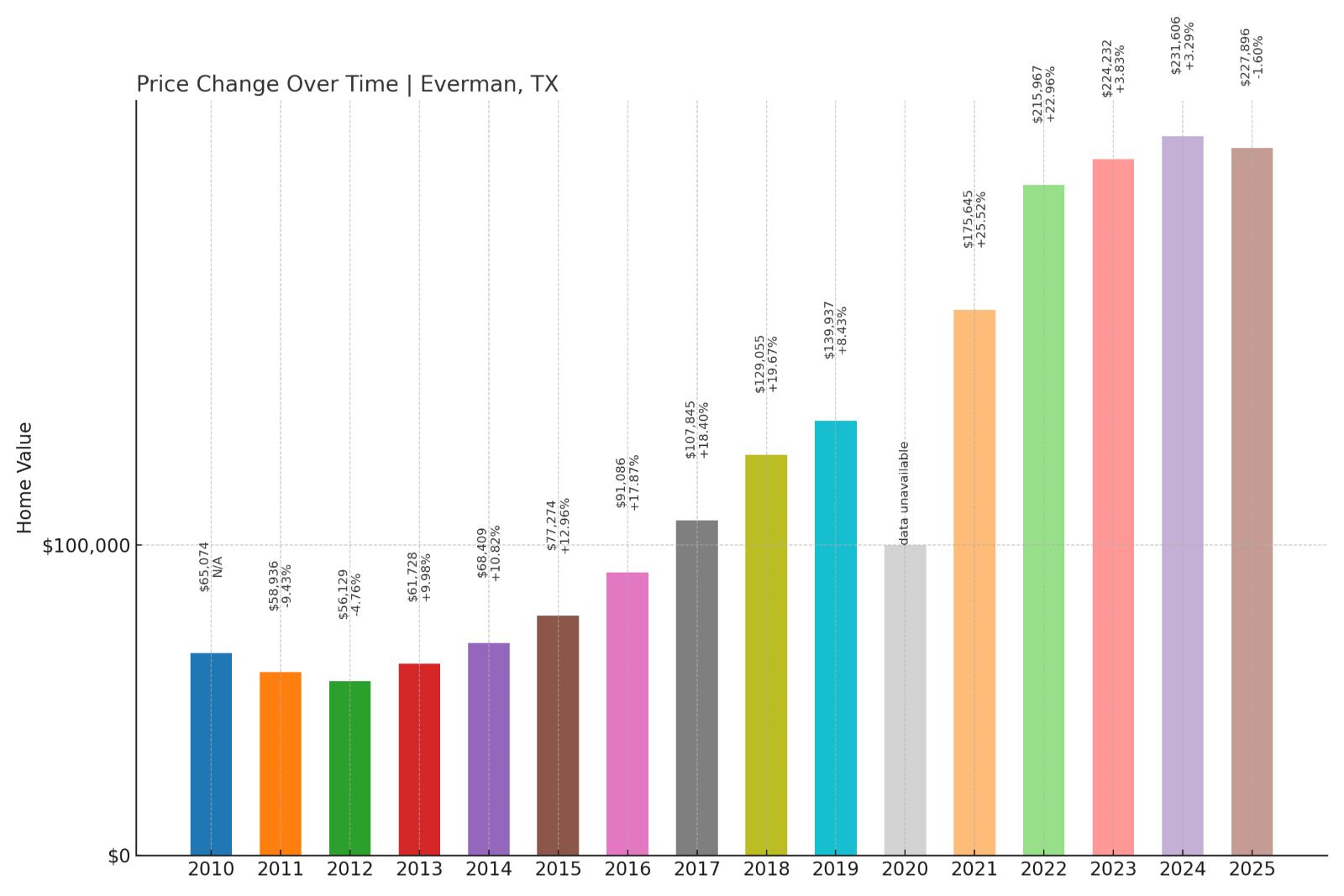

18. Everman – Crash Risk Percentage: 90%

- Crash Risk Percentage: 90%

- Historical crashes (8%+ drops): 2

- Worst historical crash: -10.95% (2009)

- Total price increase since 2000: 287.72%

- Overextended above long-term average: 118.07%

- Price volatility (annual swings): 8.96%

- Current 2025 price: $227,896

Everman’s housing market shows the most extreme overextension in our analysis, with prices 118% above long-term averages following a massive 288% surge since 2000. The community’s history of two major crashes, including an 11% decline during the financial crisis, establishes a clear pattern of market corrections when overheating occurs. Current conditions mirror those preceding previous crashes.

Everman – Fort Worth Suburb at Breaking Point

Located in southern Tarrant County about 12 miles from downtown Fort Worth, Everman has evolved from a rural community into a sought-after suburb for families seeking affordability and good schools. The city of roughly 6,000 residents has experienced intense development pressure as Fort Worth’s growth pushed outward, transforming agricultural land into residential subdivisions and driving the dramatic price appreciation reflected in the data.

The market’s extreme overextension at 118% above historical norms suggests prices have lost touch with local economic fundamentals. Everman’s traditional appeal as an affordable alternative to pricier Fort Worth suburbs becomes questionable when median home prices approach $228,000. The combination of high volatility, crash history, and severe overextension creates a perfect storm for potential correction, particularly if broader economic conditions deteriorate or interest rates remain elevated.

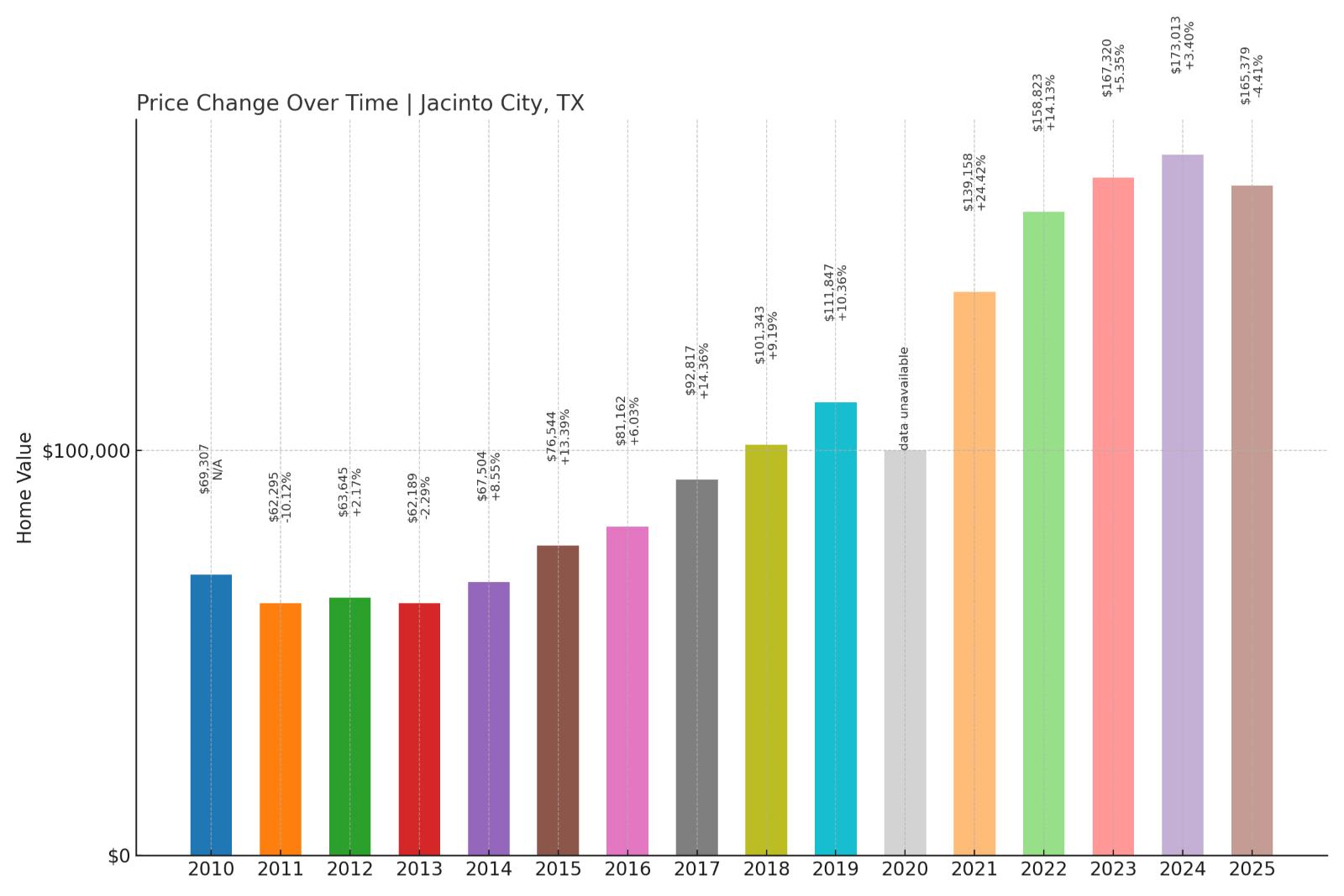

17. Jacinto City – Crash Risk Percentage: 90%

- Crash Risk Percentage: 90%

- Historical crashes (8%+ drops): 2

- Worst historical crash: -10.12% (2011)

- Total price increase since 2000: 205.04%

- Overextended above long-term average: 82.99%

- Price volatility (annual swings): 7.44%

- Current 2025 price: $165,379

Despite having the lowest current median price among our high-risk communities, Jacinto City’s 205% price increase since 2000 has pushed values 83% above historical norms. The market’s history of two crashes exceeding 10% demonstrates vulnerability to external economic pressures. While prices remain relatively affordable compared to other Houston-area markets, the overextension signals potential correction risk.

Jacinto City – Houston Industrial Community Under Pressure

This small Harris County city of about 10,500 residents sits in the heart of Houston’s industrial corridor, surrounded by petrochemical plants, shipping facilities, and manufacturing operations. Jacinto City’s proximity to major employment centers like the Houston Ship Channel and downtown Houston has historically provided stability, but recent price appreciation has outpaced income growth in this working-class community.

The local housing market consists primarily of modest single-family homes and older neighborhoods that have attracted first-time buyers and investors seeking cash flow properties. However, the 83% overextension above historical averages suggests even this traditionally affordable market has been caught up in broader speculation. The community’s history of price corrections during economic downturns reflects its sensitivity to industrial employment cycles and broader Houston economic conditions.

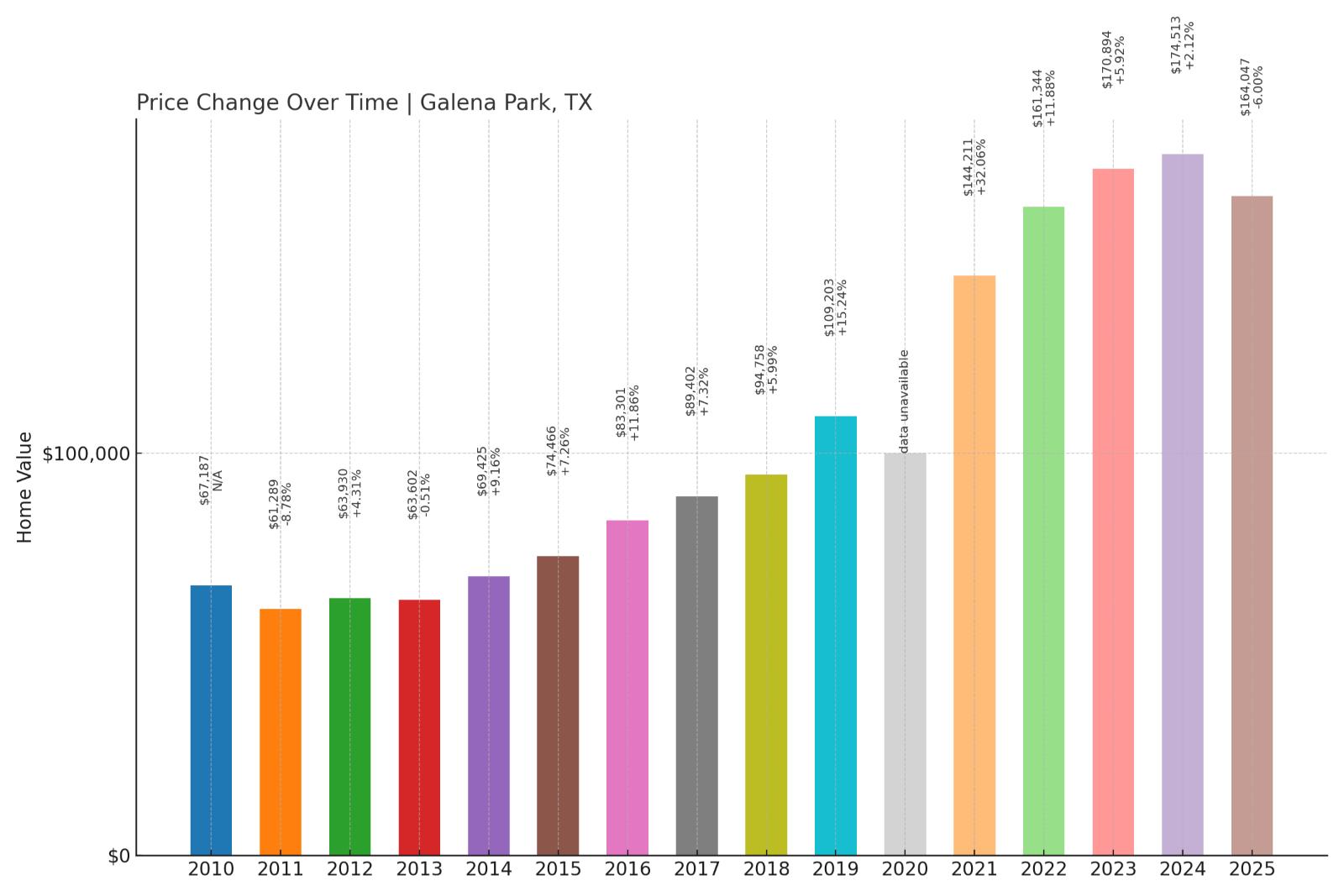

16. Galena Park – Crash Risk Percentage: 90%

- Crash Risk Percentage: 90%

- Historical crashes (8%+ drops): 2

- Worst historical crash: -8.78% (2011)

- Total price increase since 2000: 189.61%

- Overextended above long-term average: 81.28%

- Price volatility (annual swings): 7.29%

- Current 2025 price: $164,047

Galena Park’s 190% price surge since 2000 has created significant overextension at 81% above historical averages, despite maintaining relatively affordable median prices. The community’s crash history includes two major corrections, with the 2011 decline coinciding with broader economic uncertainty. The moderate volatility masks underlying market instability that could trigger another correction.

Galena Park – Houston Gateway Facing Headwinds

Located just east of downtown Houston along the Houston Ship Channel, Galena Park serves as a gateway community for working-class families seeking proximity to major employment centers. This Harris County city of roughly 10,900 residents has benefited from Houston’s economic growth while maintaining relative affordability compared to more established suburbs.

However, the local market’s 81% overextension suggests prices have outrun local economic fundamentals. The community’s industrial base provides employment stability but also exposes residents to cyclical downturns in energy and petrochemical sectors. With median home prices now exceeding $164,000, Galena Park has moved beyond its traditional position as an entry-level market, potentially reducing demand from its core buyer demographic and increasing correction risk.

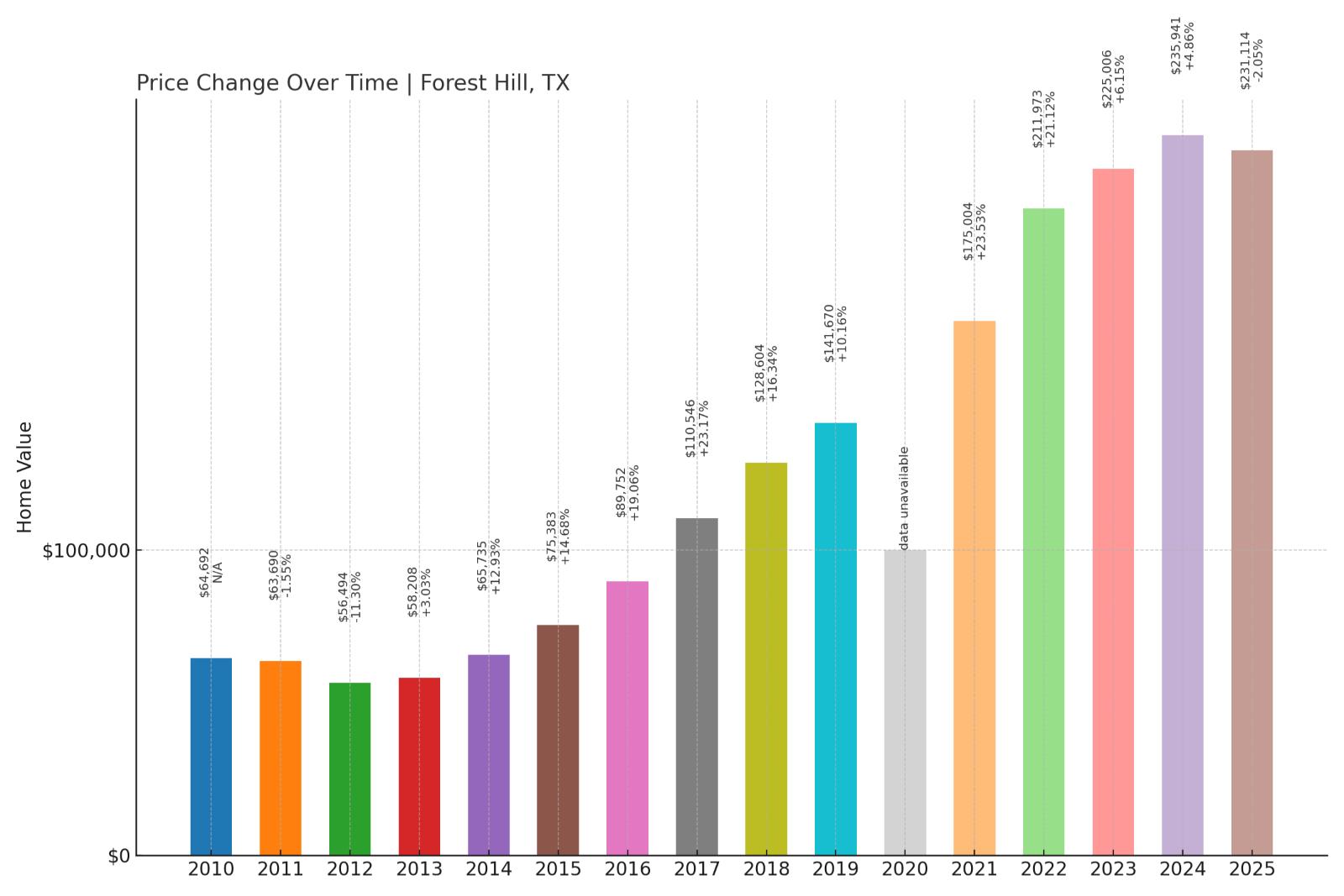

15. Forest Hill – Crash Risk Percentage: 90%

- Crash Risk Percentage: 90%

- Historical crashes (8%+ drops): 2

- Worst historical crash: -11.30% (2012)

- Total price increase since 2000: 289.12%

- Overextended above long-term average: 120.42%

- Price volatility (annual swings): 8.89%

- Current 2025 price: $231,114

Forest Hill exhibits the second-highest overextension in our analysis at 120% above long-term averages, following a staggering 289% price increase since 2000. The community’s crash history includes a devastating 11.3% decline in 2012, proving the market’s vulnerability to corrections. High volatility and extreme overextension create conditions ripe for another significant price adjustment.

Forest Hill – Tarrant County Suburb at Maximum Stretch

This Tarrant County community of about 12,300 residents sits strategically between Fort Worth and Arlington, benefiting from access to multiple employment centers including downtown Fort Worth, Arlington’s entertainment district, and DFW Airport. Forest Hill’s central location has driven intense development pressure and speculation, contributing to the extreme price appreciation reflected in the data.

The market’s 120% overextension represents the most severe departure from historical norms among our analyzed communities, suggesting prices have reached unsustainable levels. The 2012 crash of over 11% occurred during a period of economic recovery elsewhere, indicating specific local vulnerabilities. Current median prices above $231,000 have moved Forest Hill out of the affordable suburban category, potentially reducing demand from families and first-time buyers who traditionally drove local market activity.

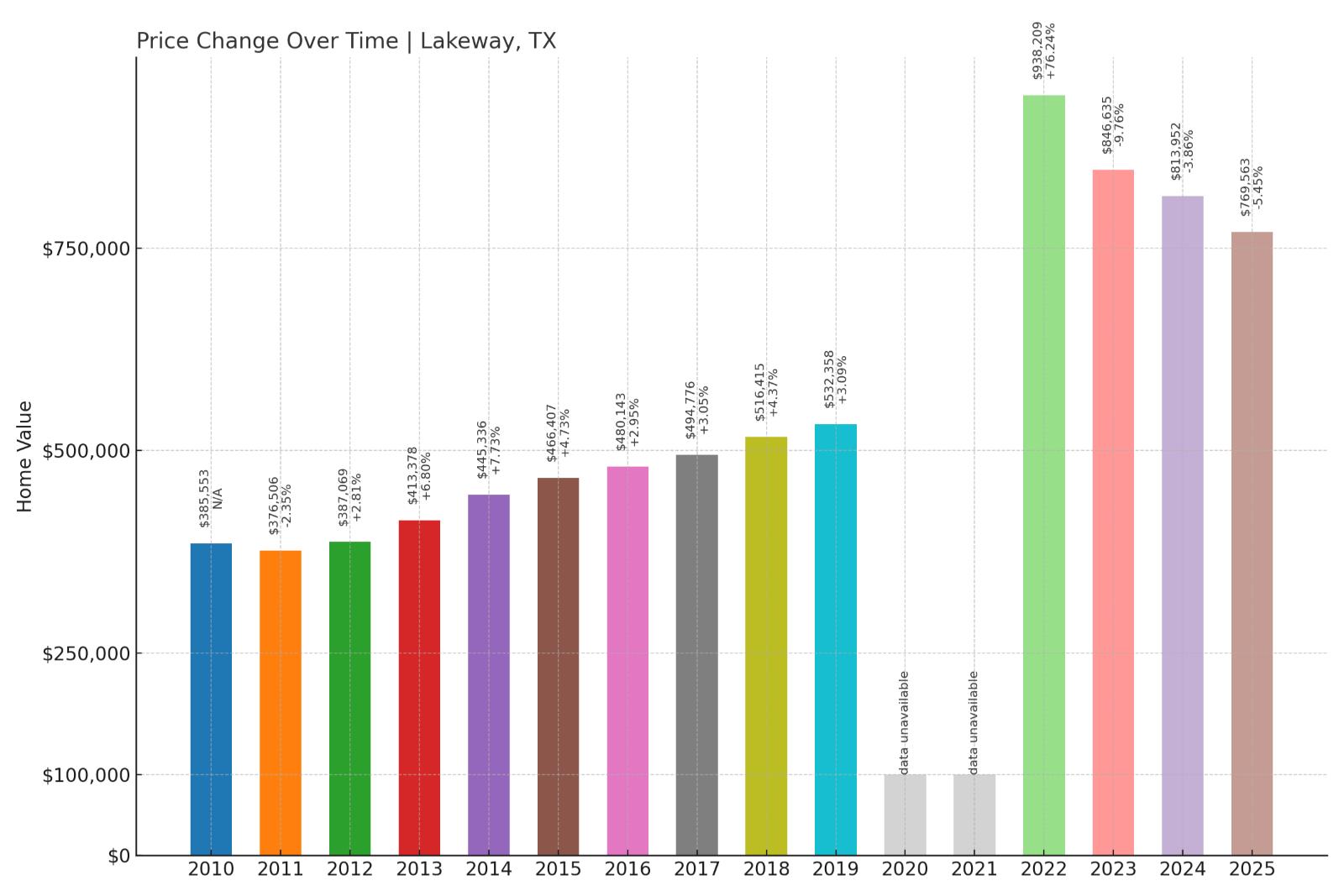

14. Lakeway – Crash Risk Percentage: 90%

- Crash Risk Percentage: 90%

- Historical crashes (8%+ drops): 1

- Worst historical crash: -9.76% (2023)

- Total price increase since 2000: 132.05%

- Overextended above long-term average: 59.74%

- Price volatility (annual swings): 7.60%

- Current 2025 price: $769,563

Lakeway’s recent crash of nearly 10% in 2023 demonstrates that even affluent communities remain vulnerable to market corrections. Despite more moderate overextension at 60% above historical averages, the luxury market’s current median price approaching $770,000 reflects sensitivity to interest rate changes and economic uncertainty. The recent crash history suggests ongoing instability.

Lakeway – Lake Travis Luxury Market Under Stress

Situated on the shores of Lake Travis west of Austin, Lakeway represents one of Central Texas’s premier resort-style communities. This Travis County city of roughly 16,000 residents has attracted retirees, tech professionals, and second-home buyers seeking Hill Country luxury living. The community’s golf courses, marinas, and lake access have historically commanded premium prices, but the 2023 crash reveals cracks in the luxury facade.

The nearly 10% price decline in 2023 occurred as Austin’s tech sector faced headwinds and rising interest rates priced out many luxury buyers. While the 60% overextension appears moderate compared to other communities, the high price point makes Lakeway particularly sensitive to economic shifts that affect discretionary spending. The combination of recent crash history and ongoing market stress suggests this luxury enclave may face continued price pressure.

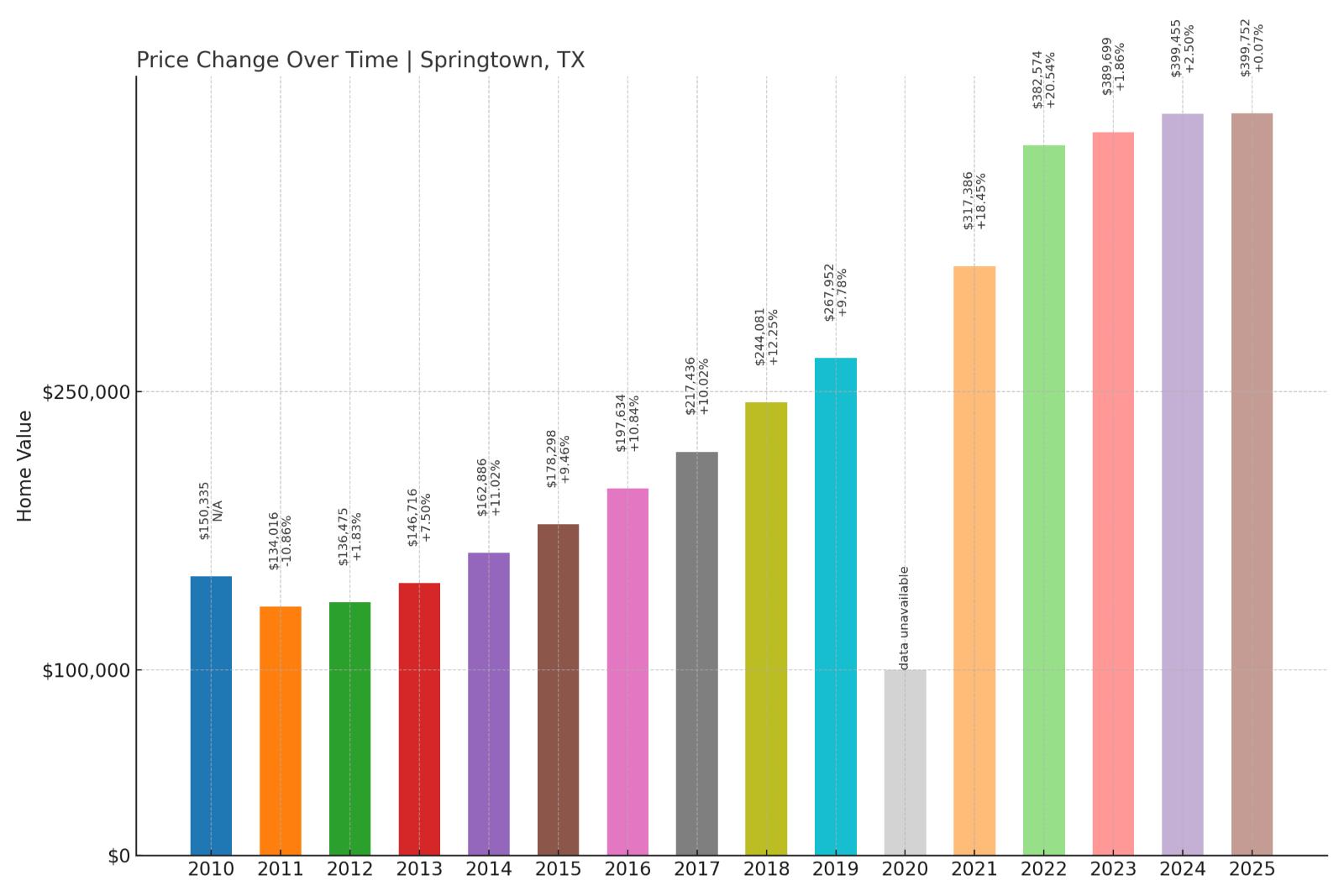

13. Springtown – Crash Risk Percentage: 90%

Would you like to save this?

- Crash Risk Percentage: 90%

- Historical crashes (8%+ drops): 1

- Worst historical crash: -10.86% (2011)

- Total price increase since 2009: 159.01%

- Overextended above long-term average: 64.89%

- Price volatility (annual swings): 8.64%

- Current 2025 price: $399,752

Springtown’s 159% price surge since 2009 has pushed values 65% above historical norms, while the severe 2011 crash of nearly 11% demonstrates the market’s capacity for sharp corrections. Current prices approaching $400,000 represent a dramatic transformation for this traditionally rural community. High volatility suggests ongoing market instability despite recent growth.

Springtown – Parker County Growth Story at Risk

Located in Parker County about 30 miles northwest of Fort Worth, Springtown has transformed from a quiet agricultural community into a popular destination for families seeking rural lifestyle with urban access. This town of roughly 3,000 residents has experienced explosive growth as Fort Worth’s expansion pushed into traditionally rural areas, driving the dramatic price appreciation reflected in the data.

The local market’s vulnerability was exposed during the 2011 crash when prices fell nearly 11%, demonstrating sensitivity to broader economic conditions. Current median prices near $400,000 represent a significant premium for rural living that may prove unsustainable if economic conditions deteriorate. The combination of crash history, overextension, and high volatility suggests Springtown’s rapid growth story may face correction as market conditions normalize.

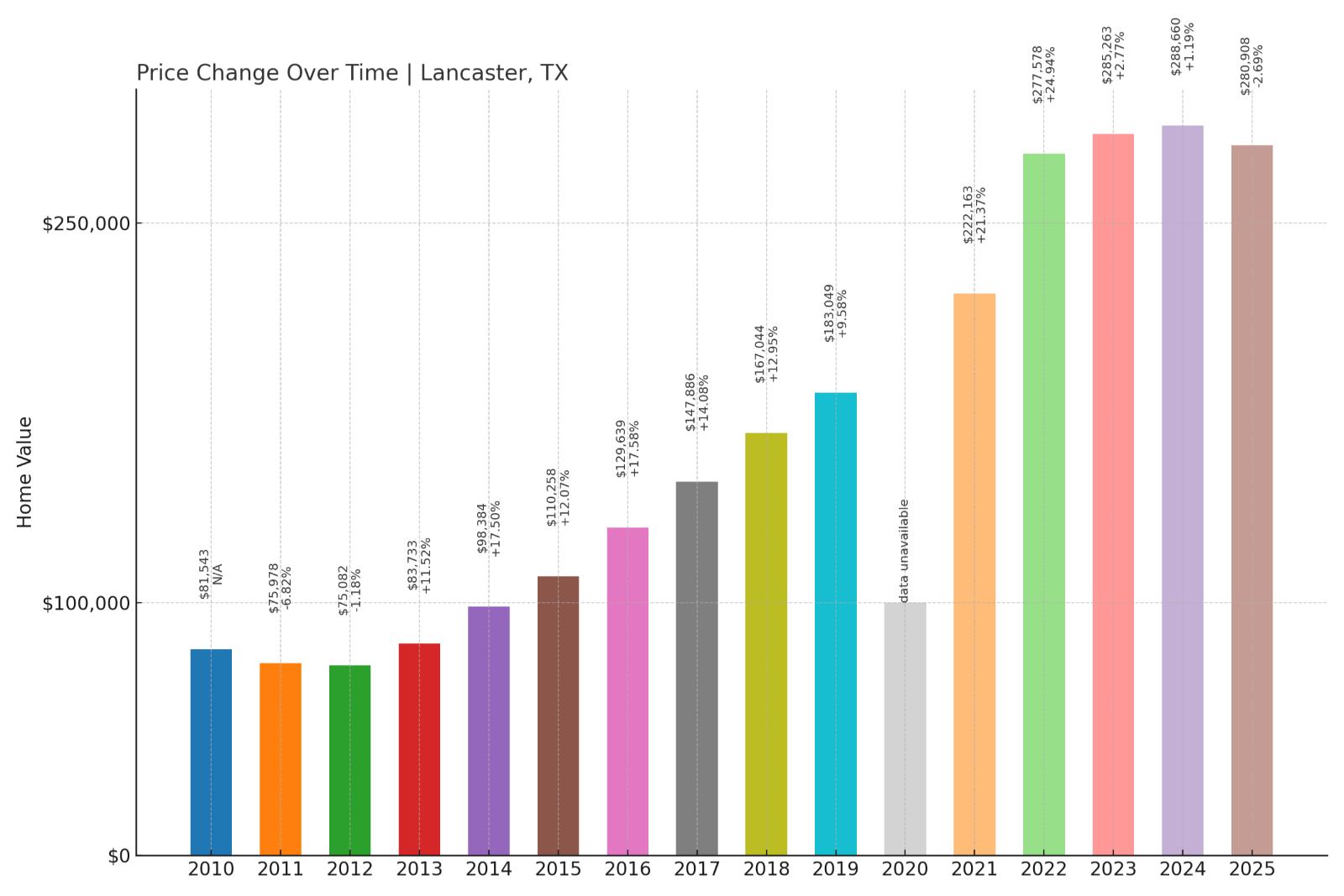

12. Lancaster – Crash Risk Percentage: 90%

- Crash Risk Percentage: 90%

- Historical crashes (8%+ drops): 1

- Worst historical crash: -12.70% (2009)

- Total price increase since 2000: 260.44%

- Overextended above long-term average: 107.17%

- Price volatility (annual swings): 8.20%

- Current 2025 price: $280,908

Lancaster’s brutal 12.7% crash during the financial crisis ranks among the worst in our analysis, while the subsequent 260% price recovery has pushed values 107% above historical averages. This Dallas County suburb demonstrates classic boom-bust patterns, with extreme overextension suggesting conditions for another significant correction. The high volatility reflects ongoing market instability.

Lancaster – Dallas Suburb With Crash DNA

This Dallas County city of about 41,000 residents sits roughly 15 miles south of downtown Dallas, serving as an important suburban community for working and middle-class families. Lancaster’s strategic location and relatively affordable housing have historically attracted first-time buyers and families seeking good schools and suburban amenities within commuting distance of Dallas employment centers.

However, the market’s devastating 12.7% crash in 2009 reveals underlying vulnerabilities that may persist today. The subsequent price recovery of over 260% has pushed values more than double their historical average, creating conditions similar to those preceding the previous crash. Current median prices above $280,000 have moved Lancaster beyond its traditional affordable positioning, potentially reducing demand from its core buyer demographic and increasing correction risk.

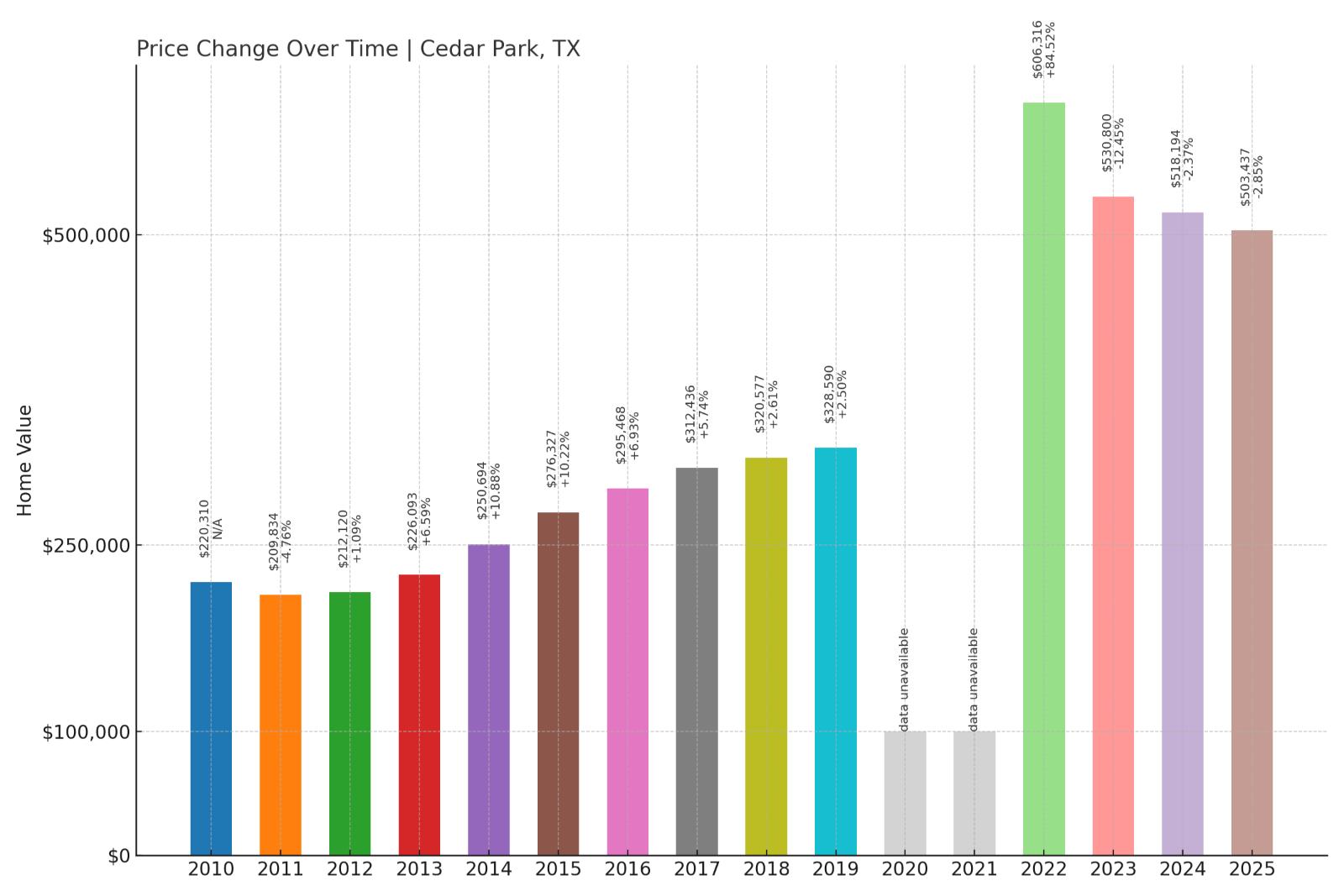

11. Cedar Park – Crash Risk Percentage: 90%

- Crash Risk Percentage: 90%

- Historical crashes (8%+ drops): 1

- Worst historical crash: -12.45% (2023)

- Total price increase since 2000: 169.21%

- Overextended above long-term average: 76.21%

- Price volatility (annual swings): 7.75%

- Current 2025 price: $503,437

Cedar Park’s recent 12.5% crash in 2023 signals serious market stress in this Austin suburb, despite more moderate overextension at 76% above historical averages. The timing of the crash during Austin’s tech sector difficulties highlights vulnerability to economic shifts. Current prices exceeding $503,000 reflect the market’s premium positioning but also its sensitivity to interest rate and employment changes.

Cedar Park – Austin Tech Suburb Feeling the Squeeze

Located in northwest Travis and Williamson counties, Cedar Park represents the epitome of Austin’s suburban boom, growing from a small town to a city of over 80,000 residents. The community’s excellent schools, family-friendly amenities, and proximity to major tech employers like Apple and Meta have driven consistent demand and price appreciation. However, the severe 2023 crash reveals the market’s vulnerability to changing economic conditions.

The 12.5% price decline coincided with layoffs at major tech companies and rising mortgage rates that priced out many buyers. While Cedar Park maintains strong fundamentals including top-rated schools and continued business investment, current median prices above $503,000 may prove unsustainable for many families. The recent crash history combined with ongoing market stress suggests this tech-dependent suburb faces continued correction risk as the Austin economy adjusts.

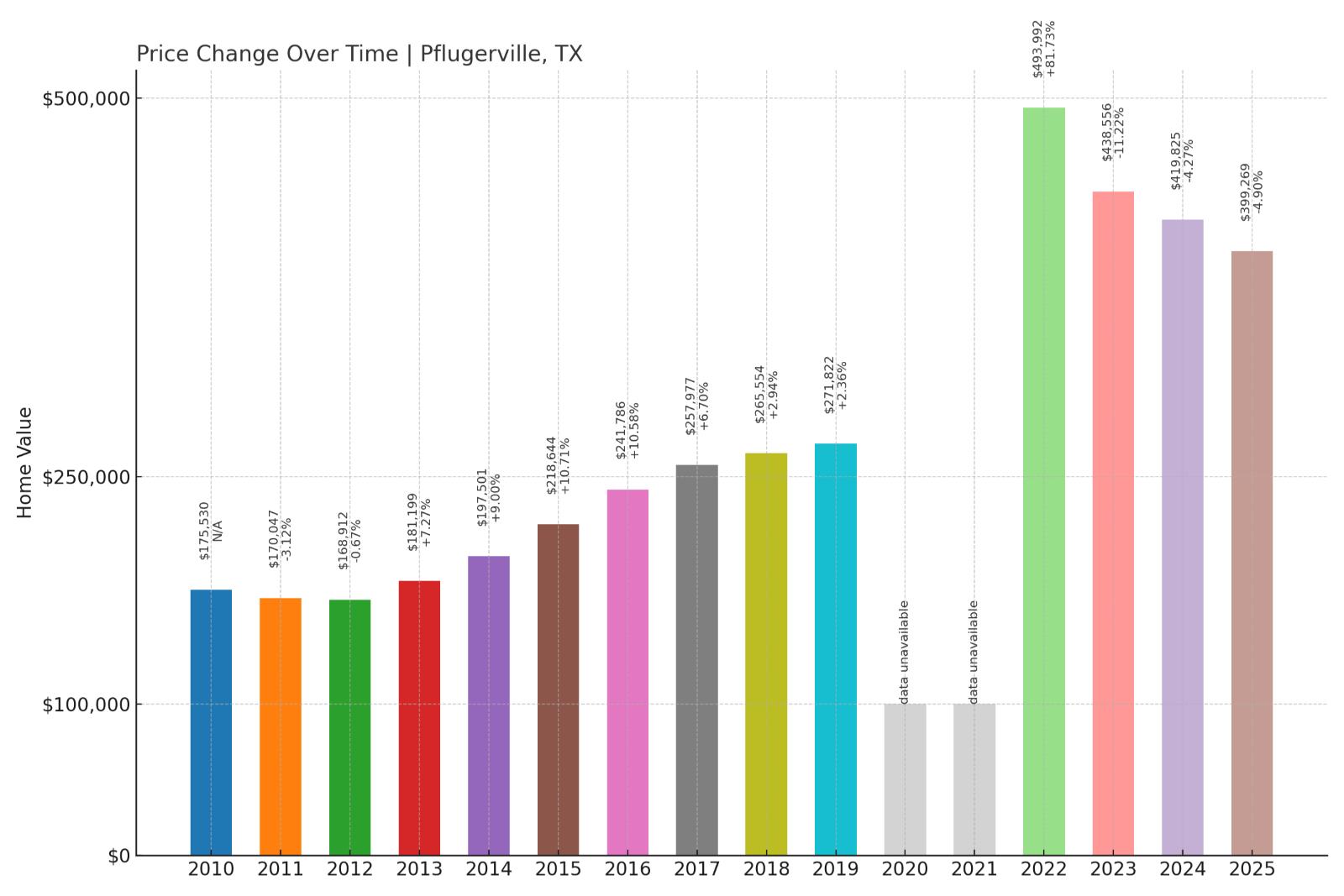

10. Pflugerville – Crash Risk Percentage: 90%

- Crash Risk Percentage: 90%

- Historical crashes (8%+ drops): 1

- Worst historical crash: -11.22% (2023)

- Total price increase since 2000: 144.26%

- Overextended above long-term average: 70.31%

- Price volatility (annual swings): 7.60%

- Current 2025 price: $399,269

Another Austin suburb experiencing recent crash trauma, Pflugerville’s 11.2% decline in 2023 followed the broader pattern of tech-dependent communities. The 144% price increase since 2000 has created 70% overextension above historical norms, while current prices approaching $400,000 reflect the market’s transformation from affordable suburb to premium community. Recent crash history indicates ongoing vulnerability.

Pflugerville – Tech Growth Suburb Facing Reality Check

Situated in Travis and Williamson counties northeast of Austin, Pflugerville has become synonymous with Central Texas’s population boom and economic growth. This city of roughly 70,000 residents has attracted families drawn to new construction, good schools, and proximity to major employers including Samsung’s massive semiconductor facility. However, the 2023 crash of over 11% signals significant market stress.

The dramatic price correction occurred as Austin’s overheated housing market began adjusting to higher interest rates and slowing tech sector growth. While Pflugerville maintains strong fundamentals including continued business investment and population growth, current median prices near $400,000 represent a significant premium that may challenge affordability for traditional buyers. The combination of recent crash history and ongoing economic uncertainty suggests this growth story faces continued correction risk.

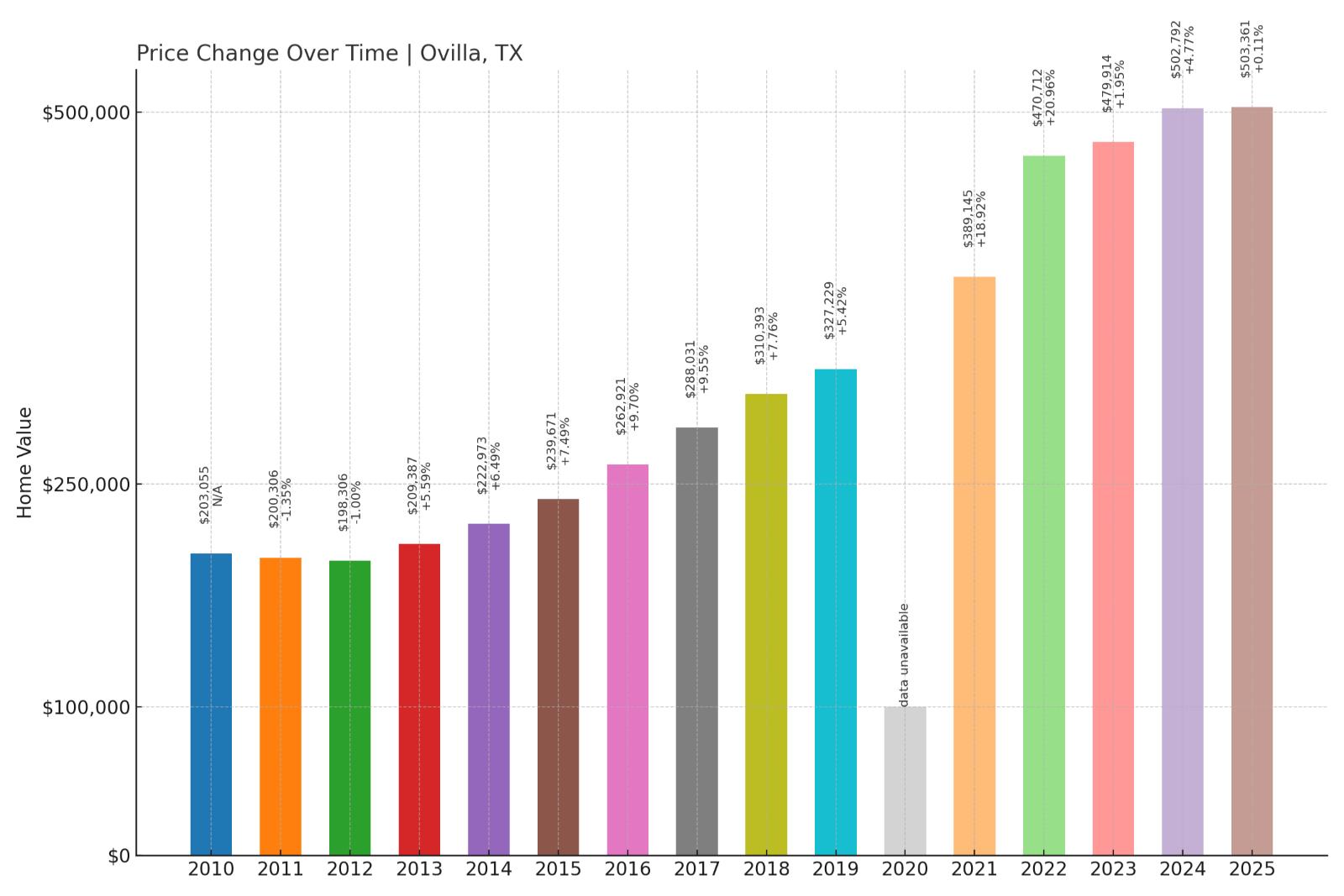

9. Ovilla – Crash Risk Percentage: 92%

- Crash Risk Percentage: 92%

- Historical crashes (8%+ drops): 1

- Worst historical crash: -8.12% (2009)

- Total price increase since 2000: 183.68%

- Overextended above long-term average: 86.08%

- Price volatility (annual swings): 6.34%

- Current 2025 price: $503,361

Ovilla’s 92% crash risk reflects substantial overextension at 86% above historical averages following a 184% price surge since 2000. While the community experienced a more moderate 8% crash during the financial crisis, current price levels exceeding $503,000 have moved this Dallas County suburb into premium territory. The elevated crash risk score suggests vulnerability despite lower historical volatility.

Ovilla – Dallas Exurb Reaching Price Limits

This small Dallas County city of roughly 4,000 residents sits about 20 miles south of downtown Dallas, representing the furthest edge of suburban expansion. Ovilla has attracted families seeking new construction and rural atmosphere while maintaining access to Dallas employment opportunities. The community’s location along major transportation corridors has facilitated growth but also contributed to speculative pressure driving recent price appreciation.

Current median prices exceeding $503,000 represent a dramatic transformation for this traditionally affordable exurban community. The 86% overextension above historical averages suggests prices have lost connection with local economic fundamentals and buyer capacity. While Ovilla avoided the severe crashes experienced by other communities during the financial crisis, current conditions create elevated risk as the market faces pressure from rising interest rates and cooling demand in the Dallas area.

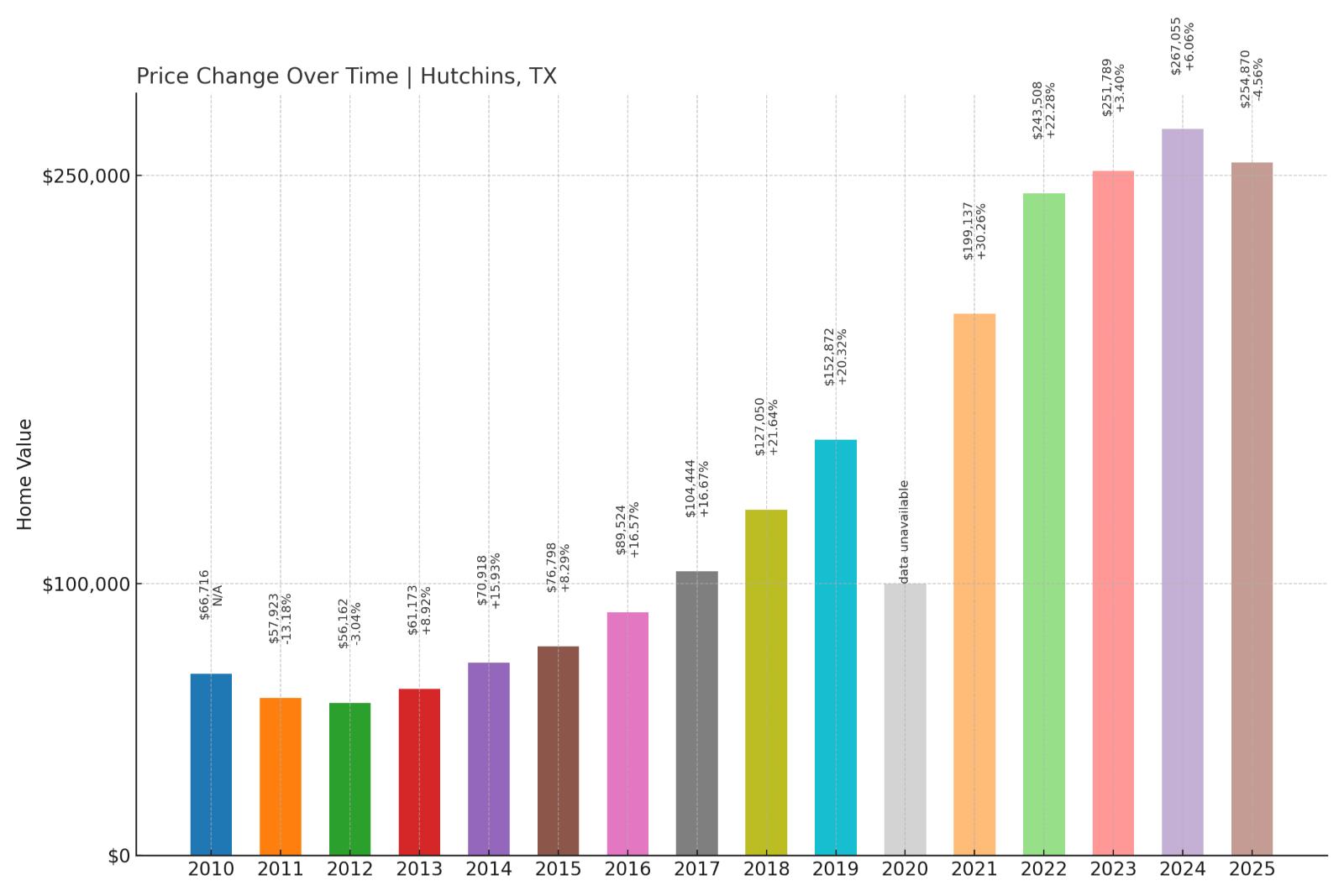

8. Hutchins – Crash Risk Percentage: 92%

- Crash Risk Percentage: 92%

- Historical crashes (8%+ drops): 2

- Worst historical crash: -13.18% (2011)

- Total price increase since 2000: 307.26%

- Overextended above long-term average: 127.08%

- Price volatility (annual swings): 10.17%

- Current 2025 price: $254,870

Hutchins exhibits the most extreme market conditions in our analysis, with prices 127% above historical averages following a massive 307% surge since 2000. The community’s crash history includes two major corrections, with the worst exceeding 13% in 2011. Exceptionally high volatility above 10% annually signals a market driven by speculation rather than stable fundamentals, creating maximum crash risk.

Hutchins – Dallas Suburb at Maximum Risk

Located in southern Dallas County, this small city of about 5,500 residents represents the most extreme case of housing market overextension in our analysis. Hutchins has experienced intense development pressure as Dallas proper became increasingly expensive, driving investors and first-time buyers to seek opportunities in outlying communities. However, the resulting price appreciation has created unsustainable market conditions.

The devastating 13.2% crash in 2011 demonstrates this market’s vulnerability to rapid corrections when conditions deteriorate. Current overextension of 127% above historical averages represents the most severe departure from normal pricing patterns among all analyzed communities. The combination of extreme overextension, crash history, and high volatility creates maximum risk conditions that suggest significant correction potential if broader economic pressures emerge or local demand patterns shift.

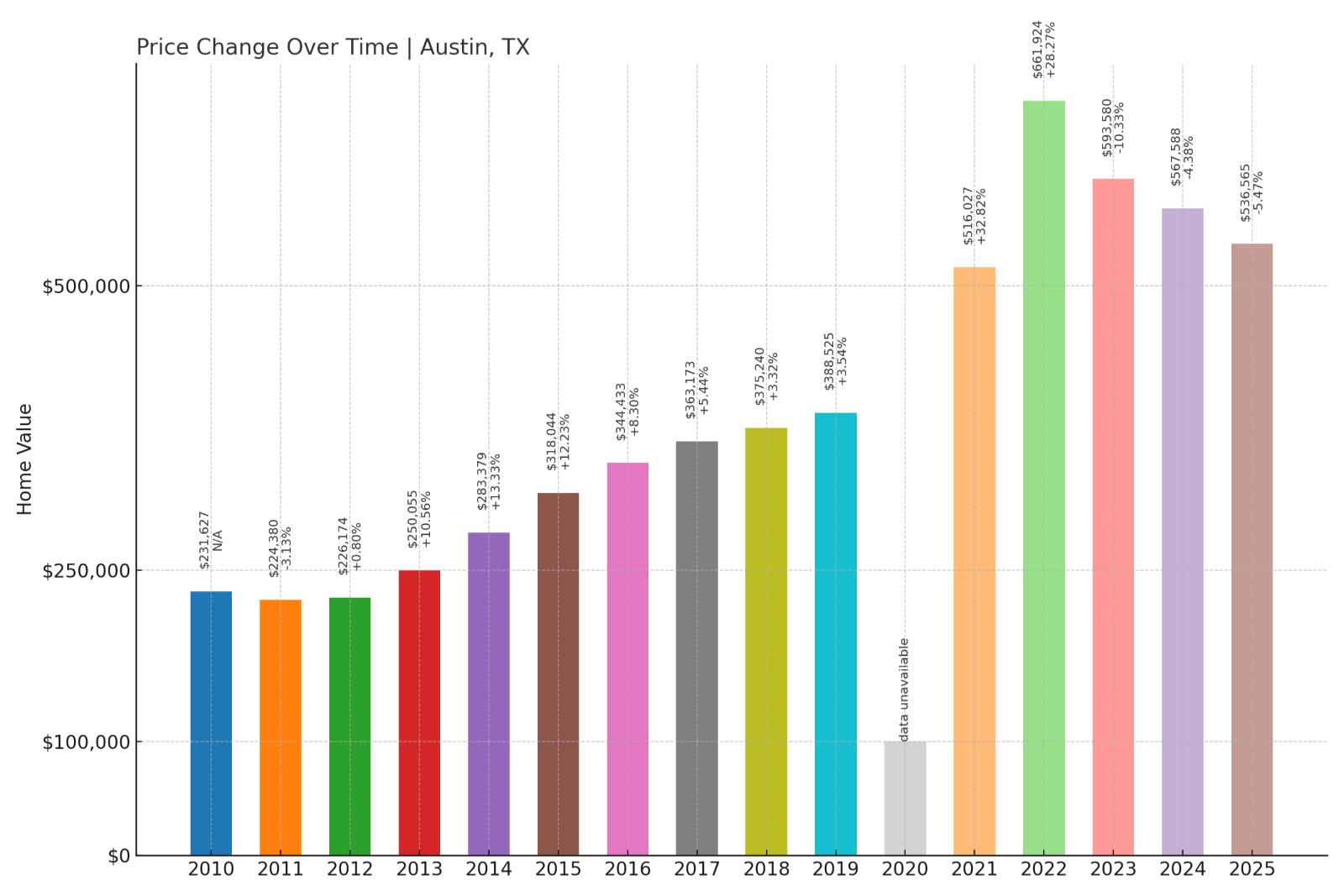

7. Austin – Crash Risk Percentage: 92%

- Crash Risk Percentage: 92%

- Historical crashes (8%+ drops): 1

- Worst historical crash: -10.33% (2023)

- Total price increase since 2000: 165.08%

- Overextended above long-term average: 66.15%

- Price volatility (annual swings): 6.93%

- Current 2025 price: $536,565

The Texas capital’s 92% crash risk reflects the recent reality check delivered by 2023’s 10.3% price decline. Despite being a major metropolitan area, Austin’s 165% price surge since 2000 pushed values 66% above historical norms before the correction. The crash coincided with tech sector layoffs and rising interest rates, demonstrating vulnerability despite the city’s economic diversity. Current median prices exceeding $536,000 remain elevated following the correction.

Austin – Capital City Faces Tech Reality Check

As Texas’s capital and the heart of the state’s technology boom, Austin has experienced unprecedented growth over the past two decades. The city’s transformation from a quirky college town to a major tech hub attracted companies like Apple, Google, Meta, and Tesla, driving massive population growth and housing demand. However, the 2023 crash of over 10% reveals the market’s vulnerability to economic shifts and overvaluation.

The price correction occurred as the tech sector faced widespread layoffs, venture capital funding dried up, and rising mortgage rates priced out many buyers. While Austin maintains strong economic fundamentals including diverse industries, major university presence, and continued business relocations, current median prices above $536,000 may still exceed sustainable levels for many residents. The recent crash history combined with ongoing market adjustments suggests Texas’s tech capital remains vulnerable to further corrections as economic conditions evolve.

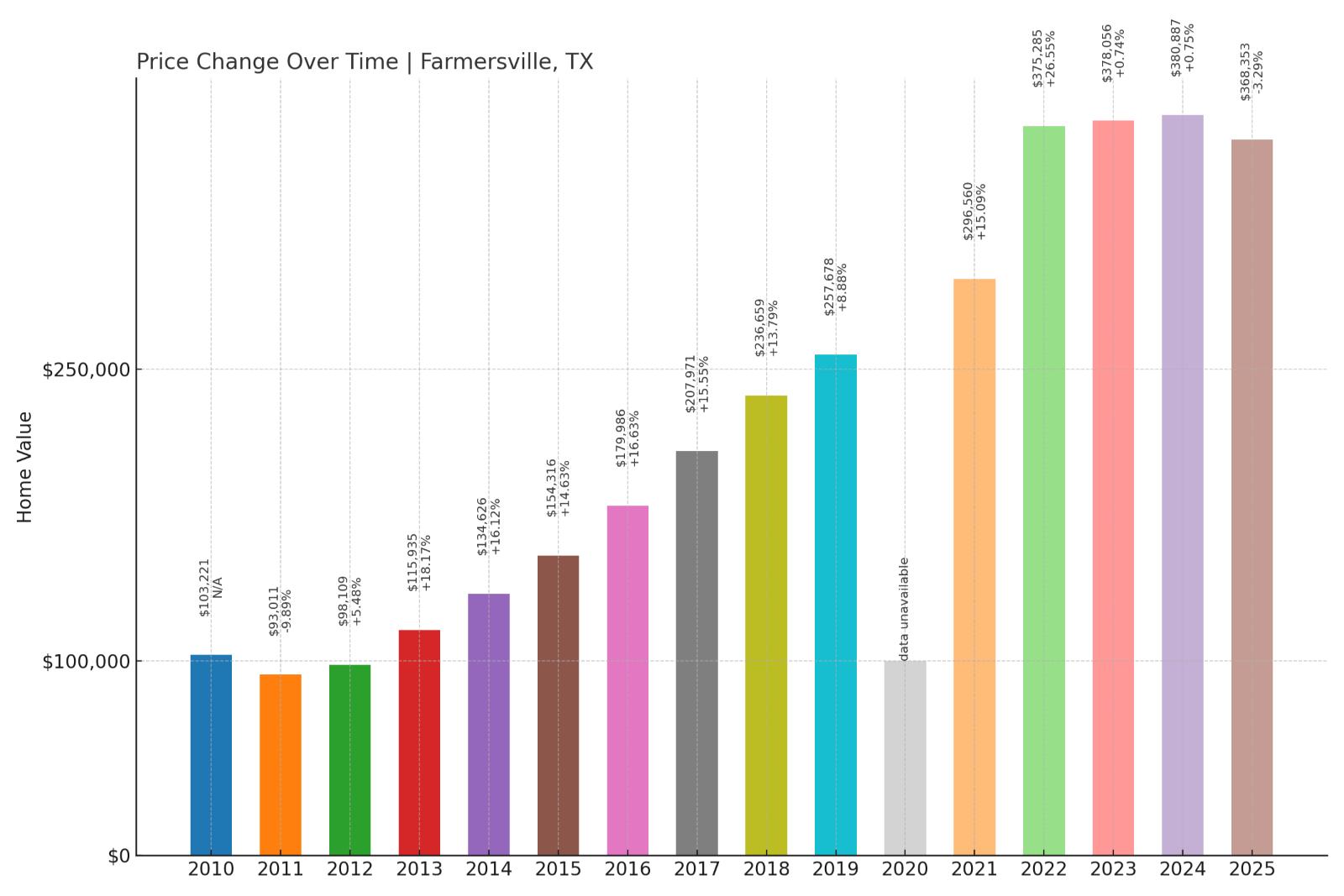

6. Farmersville – Crash Risk Percentage: 95%

- Crash Risk Percentage: 95%

- Historical crashes (8%+ drops): 3

- Worst historical crash: -14.45% (2007)

- Total price increase since 2000: 157.99%

- Overextended above long-term average: 93.98%

- Price volatility (annual swings): 9.16%

- Current 2025 price: $368,353

Farmersville earns the highest 95% crash risk classification due to its history as a serial crash offender with three major corrections exceeding 8%. The devastating 14.5% decline in 2007 represents one of the worst crashes in our analysis, occurring before the broader financial crisis. Current overextension at 94% above historical averages following a 158% price surge creates conditions ripe for another significant correction.

Farmersville – Collin County’s Crash-Prone Market

Located in Collin County about 45 miles northeast of Dallas, Farmersville has struggled with housing market instability despite benefiting from the broader Dallas-Fort Worth growth story. This town of roughly 3,500 residents has experienced multiple boom-bust cycles, with the devastating 2007 crash of 14.5% occurring even before the national financial crisis fully materialized. The early timing suggests unique local vulnerabilities that persist today.

The market’s pattern of repeated corrections indicates structural problems that go beyond normal cyclical adjustments. Current median prices approaching $368,400 combined with 94% overextension above historical norms create conditions similar to those preceding previous crashes. The high volatility and crash history suggest investors and homeowners should exercise extreme caution, as this market has demonstrated a clear propensity for severe corrections when economic or local conditions deteriorate.

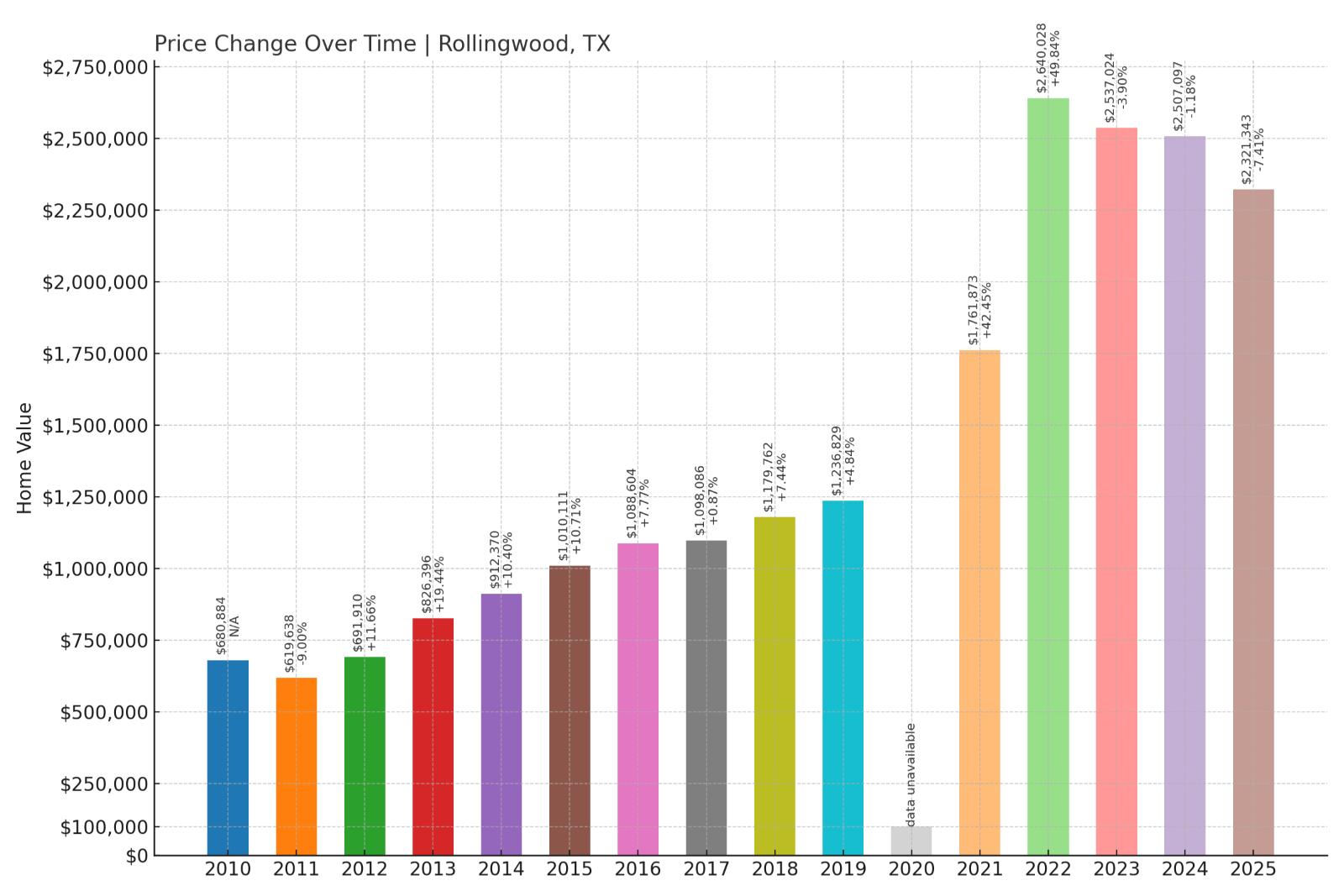

5. Rollingwood – Crash Risk Percentage: 95%

- Crash Risk Percentage: 95%

- Historical crashes (8%+ drops): 1

- Worst historical crash: -8.99% (2011)

- Total price increase since 2002: 320.40%

- Overextended above long-term average: 105.16%

- Price volatility (annual swings): 10.18%

- Current 2025 price: $2,321,343

This exclusive Austin enclave commands the highest median price in our analysis at over $2.3 million, reflecting extreme luxury market conditions. The staggering 320% price increase since 2002 has pushed values 105% above historical averages, while high volatility exceeding 10% annually signals an unstable market. Despite only one historical crash, the extreme overextension and volatility create maximum risk conditions.

Rollingwood – Ultra-Luxury Market at Breaking Point

This tiny Travis County city of fewer than 1,500 residents represents Austin’s most exclusive residential enclave, with tree-lined streets and proximity to both downtown Austin and Lake Austin. Rollingwood’s ultra-luxury positioning has attracted tech executives, celebrities, and wealthy professionals, driving the explosive price appreciation that has pushed median values above $2.3 million. However, such extreme pricing creates inherent instability.

The luxury market often proves most volatile during economic shifts, as high-end buyers typically have more flexibility in timing decisions and may quickly retreat when conditions deteriorate. The 320% price surge since 2002 represents one of the most dramatic appreciations in Texas, pushing values more than double their historical average. The combination of extreme overextension, high volatility, and ultra-luxury pricing suggests this market faces significant correction risk as Austin’s economy adjusts to post-boom realities.

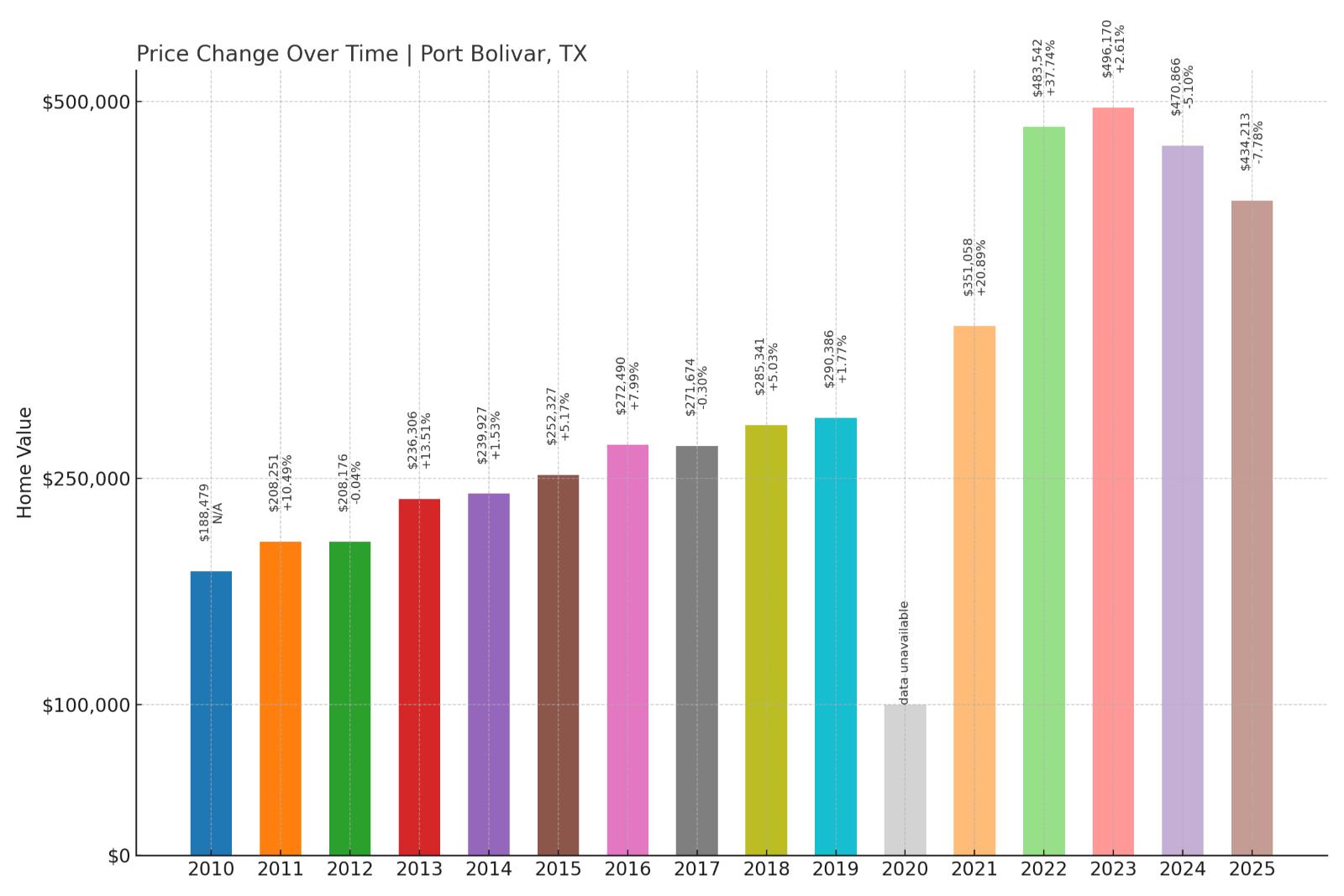

4. Port Bolivar – Crash Risk Percentage: 95%

- Crash Risk Percentage: 95%

- Historical crashes (8%+ drops): 2

- Worst historical crash: -11.32% (2010)

- Total price increase since 2001: 149.70%

- Overextended above long-term average: 61.78%

- Price volatility (annual swings): 8.26%

- Current 2025 price: $434,213

This Galveston County coastal community’s 95% crash risk reflects its history of multiple corrections and exposure to unique environmental risks. The severe 11.3% crash in 2010 coincided with ongoing recovery from Hurricane Ike, highlighting vulnerability to both economic and natural disasters. Current overextension at 62% above historical averages may seem moderate, but coastal location creates additional risk factors not captured in purely financial metrics.

Port Bolivar – Coastal Paradise With Storm Clouds

Located on the Bolivar Peninsula across Galveston Bay from Galveston Island, Port Bolivar represents Texas’s coastal lifestyle at its most appealing and most vulnerable. This unincorporated community has attracted retirees, second-home buyers, and fishing enthusiasts drawn to Gulf Coast living and relatively affordable waterfront access. However, the combination of hurricane exposure and market volatility creates unique risks.

The devastating impact of Hurricane Ike in 2008 followed by the 11.3% housing crash in 2010 demonstrates how natural disasters can compound economic pressures in coastal markets. Current median prices exceeding $434,000 reflect the premium for coastal living but also create affordability challenges for traditional buyers. The intersection of environmental risk, economic vulnerability, and overextended pricing suggests this coastal paradise faces multiple correction triggers that could impact values simultaneously.

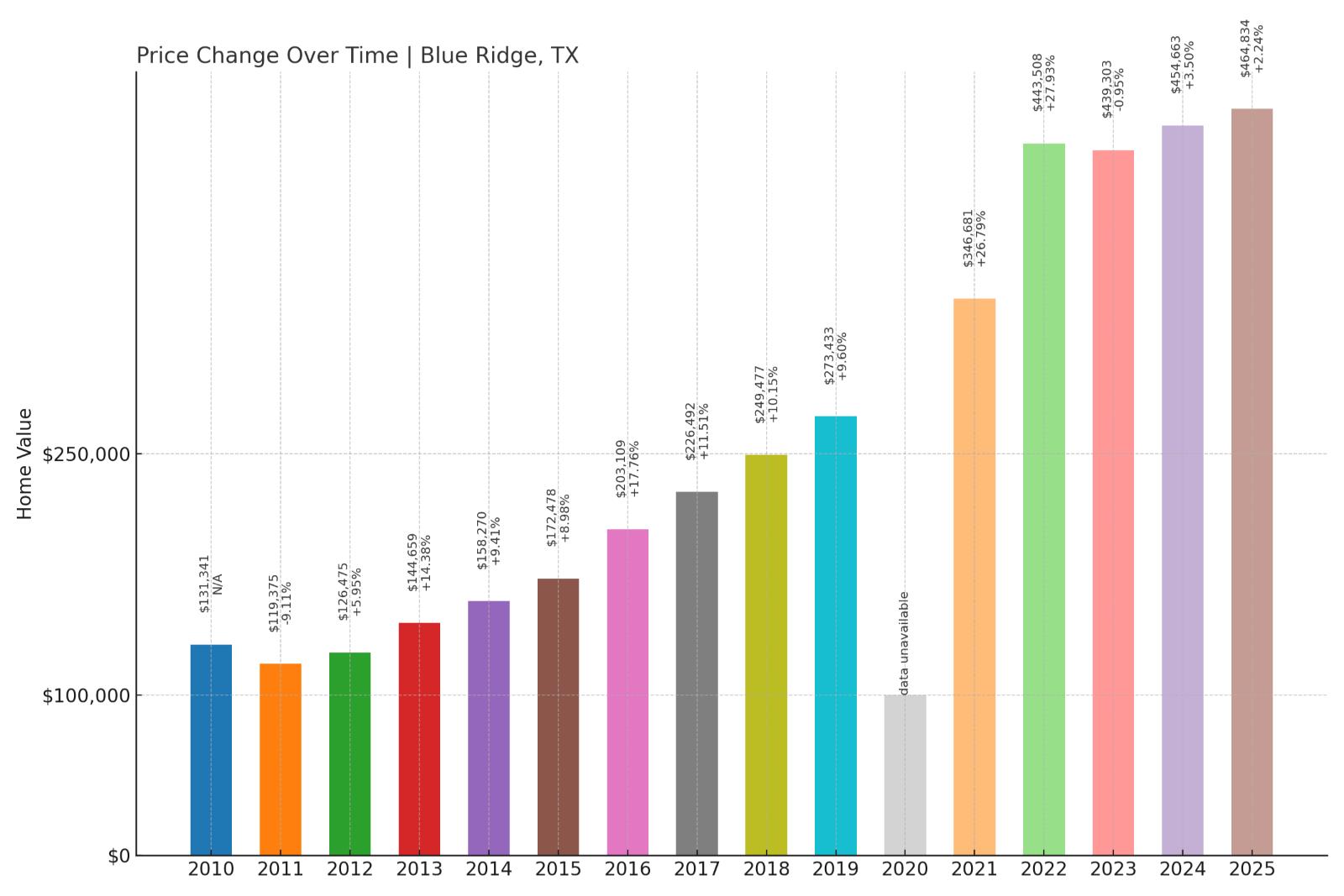

3. Blue Ridge – Crash Risk Percentage: 95%

- Crash Risk Percentage: 95%

- Historical crashes (8%+ drops): 1

- Worst historical crash: -9.11% (2011)

- Total price increase since 2000: 281.73%

- Overextended above long-term average: 119.92%

- Price volatility (annual swings): 8.08%

- Current 2025 price: $464,834

Blue Ridge’s 95% crash risk stems from extreme overextension at nearly 120% above historical averages following a massive 282% price surge since 2000. This Collin County community ranks second-highest in overextension among all analyzed markets, while the 2011 crash of over 9% proves vulnerability to corrections. Current median prices approaching $465,000 reflect dramatic transformation from rural to premium suburban market.

Blue Ridge – Collin County’s Overextended Frontier

Situated in northeast Collin County about 50 miles from downtown Dallas, Blue Ridge represents the outer edge of Dallas-Fort Worth suburban expansion. This small town of roughly 900 residents has transformed from agricultural community to sought-after rural suburb, attracting families seeking large lots, new construction, and small-town atmosphere within commuting distance of Dallas employment centers.

However, the 282% price appreciation since 2000 has pushed values nearly 120% above historical norms, creating the second-most extreme overextension in our analysis. Current median prices approaching $465,000 represent a dramatic departure from the community’s rural roots and traditional affordability. The combination of extreme overextension, crash history, and transformation from affordable rural market to premium suburb suggests significant correction risk as market conditions normalize and buyer preferences potentially shift.

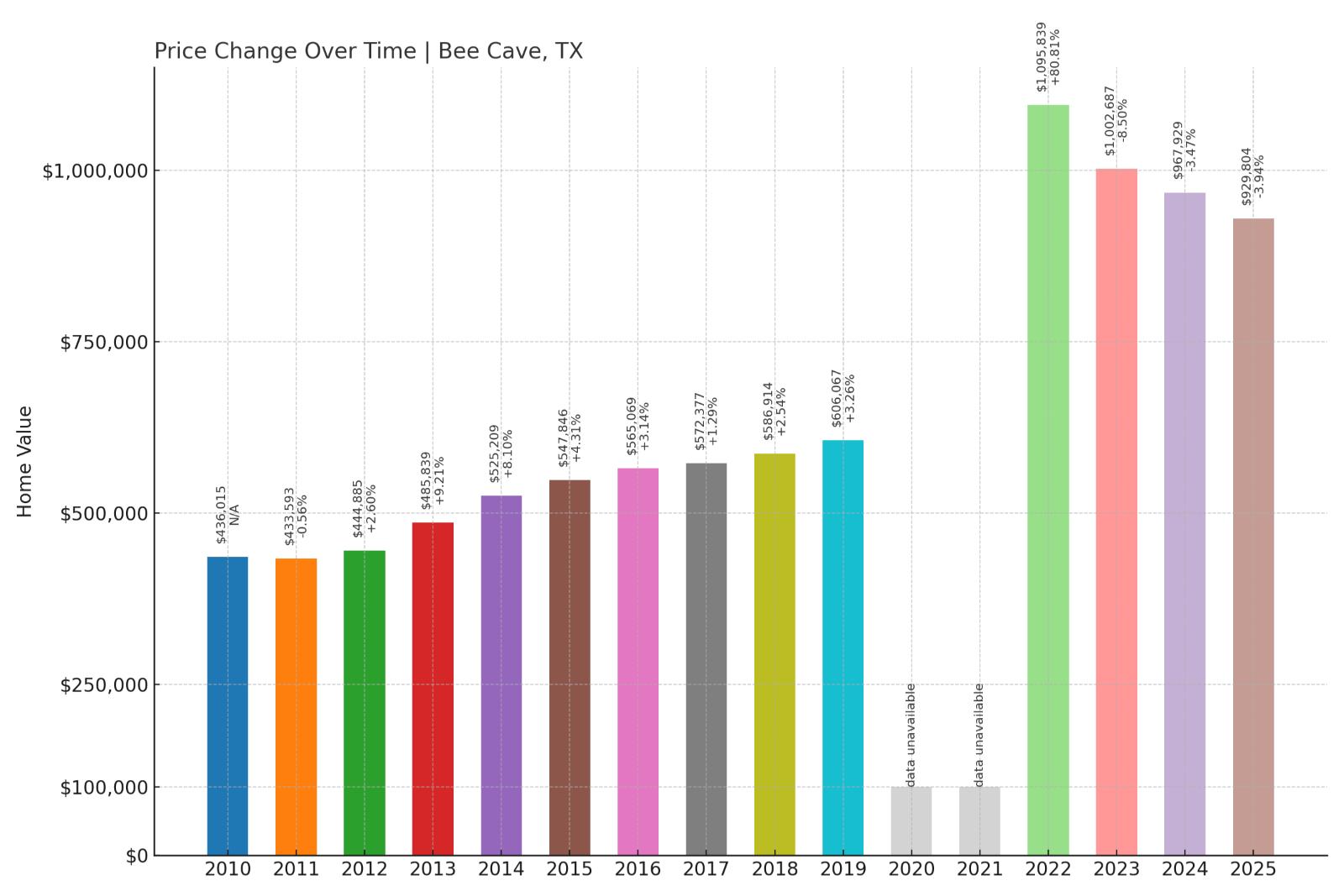

2. Bee Cave – Crash Risk Percentage: 95%

- Crash Risk Percentage: 95%

- Historical crashes (8%+ drops): 1

- Worst historical crash: -8.50% (2023)

- Total price increase since 2000: 145.88%

- Overextended above long-term average: 66.46%

- Price volatility (annual swings): 7.27%

- Current 2025 price: $929,804

Despite more moderate overextension at 66% above historical averages, Bee Cave’s 95% crash risk reflects the luxury market’s inherent volatility and recent correction history. The 2023 crash of 8.5% coincided with Austin’s broader market adjustment, while current median prices approaching $930,000 maintain ultra-luxury positioning. The combination of recent crash history and high price point creates ongoing vulnerability.

Bee Cave – Austin Luxury Suburb Under Pressure

Located in Travis County west of Austin, Bee Cave has established itself as one of Central Texas’s premier luxury suburban communities. This city of roughly 8,000 residents offers Hill Country scenery, top-rated schools, and proximity to Lake Travis recreation, attracting affluent families and professionals from Austin’s booming economy. The community’s upscale shopping and dining destinations have reinforced its luxury positioning.

However, the 2023 crash of 8.5% reveals vulnerability in even well-positioned luxury markets when economic conditions shift. The correction coincided with tech sector struggles and rising interest rates that particularly impact high-end buyers relying on jumbo mortgages. While current median prices near $930,000 maintain the community’s luxury status, they also create sensitivity to economic changes that affect discretionary spending and high-income employment. The recent crash history suggests this luxury market remains vulnerable to further corrections.

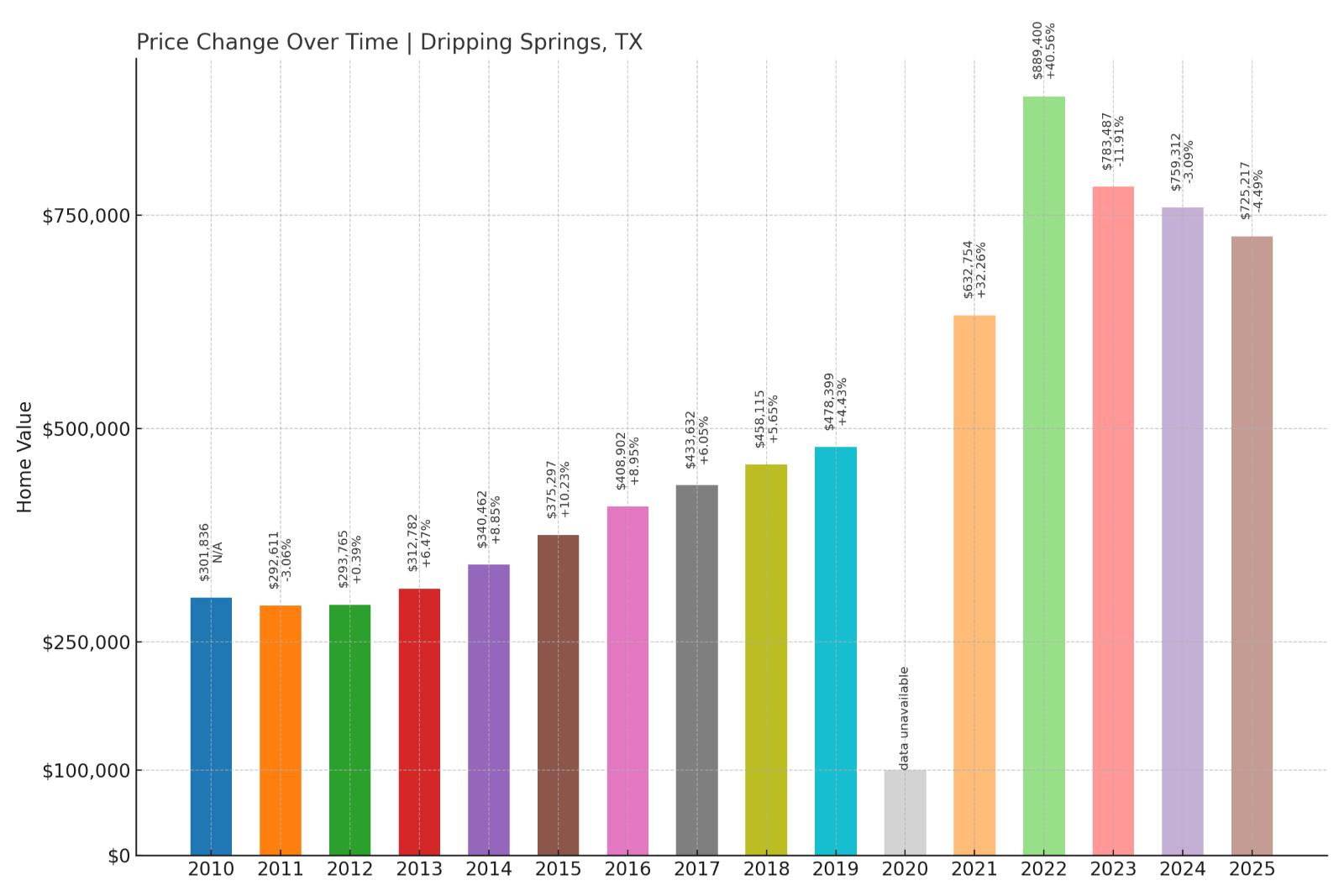

1. Dripping Springs – Crash Risk Percentage: 95%

- Crash Risk Percentage: 95%

- Historical crashes (8%+ drops): 1

- Worst historical crash: -11.91% (2023)

- Total price increase since 2000: 218.10%

- Overextended above long-term average: 79.01%

- Price volatility (annual swings): 7.84%

- Current 2025 price: $725,217

Topping our crash risk rankings, Dripping Springs experienced the most severe recent correction at nearly 12% in 2023, demonstrating acute vulnerability to market shifts. The 218% price surge since 2000 has pushed values 79% above historical norms, while current median prices exceeding $725,000 reflect luxury market positioning. The brutal recent crash combined with substantial overextension creates maximum risk conditions.

Dripping Springs – Hill Country Haven Faces Reality

Known as the “Gateway to the Hill Country,” this Hays County community of roughly 5,000 residents has become synonymous with Austin’s luxury suburban expansion. Located about 25 miles west of downtown Austin, Dripping Springs offers rolling hills, oak trees, and rural atmosphere that has attracted tech executives, celebrities, and affluent families seeking Hill Country lifestyle with urban access. The community’s wineries, outdoor recreation, and scenic beauty have reinforced its premium positioning.