I’ve analyzed the Zillow Home Value Index data to identify the fastest-growing towns in Kentucky from 2016 to 2025. These 25 towns show how widespread appreciation has become, touching rural hamlets, small cities, and tight-knit communities across the state.

Fueled by affordability, improved access, and demand for lower-density living, these towns are seeing double-digit gains in home value. They reflect the broader shift in where and how people want to live—and invest.

This report ranks the towns by percentage growth and outlines the financial upside of each. Whether you’re buying, selling, or holding, these communities offer compelling value stories in Kentucky’s evolving real estate market.

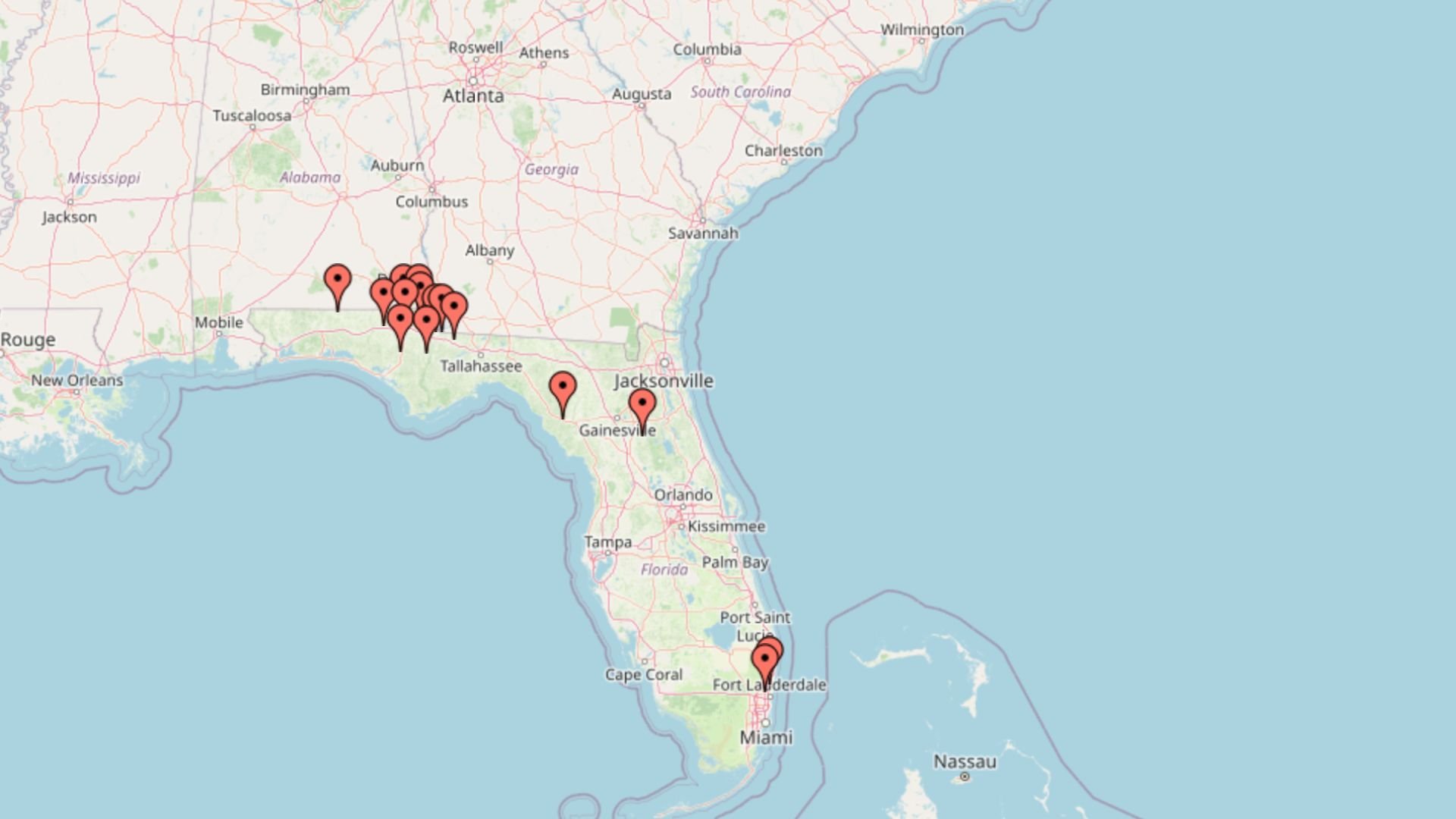

25. Kings Mountain

- % change from 2016 to 2025: 123.38%

- Home value in 2016: $66,210

- Home value in 2017: $71,268

- Home value in 2018: $74,310

- Home value in 2019: $79,584

- Home value in 2020: $84,709

- Home value in 2021: $101,718

- Home value in 2022: $117,653

- Home value in 2023: $125,291

- Home value in 2024: $132,153

- Home value in 2025: $147,903

Kings Mountain’s 123.4% appreciation represents remarkable financial leverage, with modest initial investments yielding over $81,000 in equity creation since 2016. The acceleration beginning in 2020-2021 suggests fundamental market repositioning rather than speculative activity. Current price points remain significantly below replacement costs, suggesting continued appreciation runway before reaching construction parity. Located in Lincoln County with proximity to both Somerset and Danville, Kings Mountain offers accessibility to multiple regional hubs while maintaining the rural affordability that continues attracting both homebuyers and strategic investors.

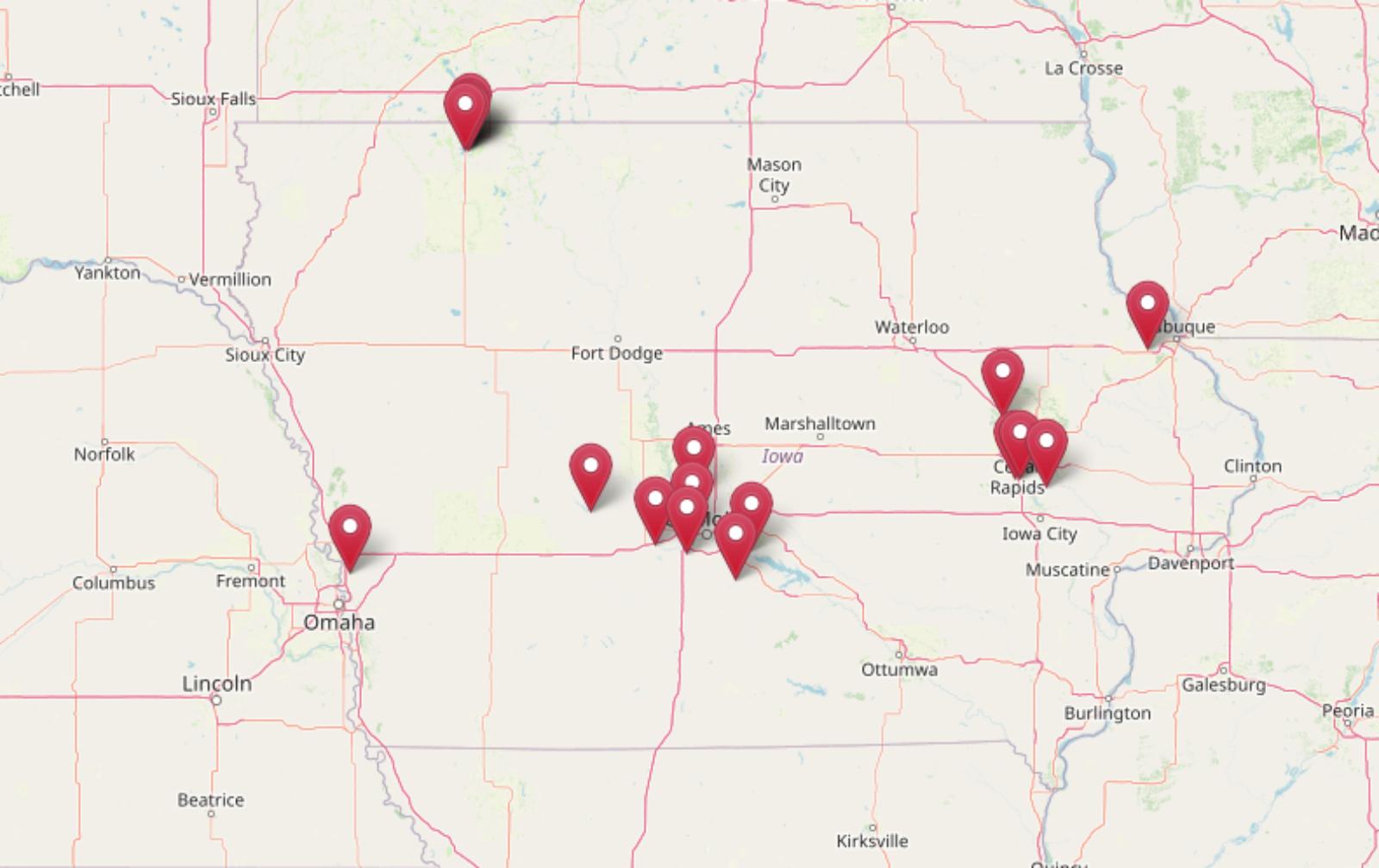

24. Oak Grove

- % change from 2016 to 2025: 123.94%

- Home value in 2016: $91,173

- Home value in 2017: $93,629

- Home value in 2018: $96,999

- Home value in 2019: $103,040

- Home value in 2020: $111,767

- Home value in 2021: $128,093

- Home value in 2022: $151,234

- Home value in 2023: $172,701

- Home value in 2024: $193,438

- Home value in 2025: $204,175

Oak Grove’s real estate market demonstrates exceptional wealth-building capacity, with property values increasing 123.9% while generating over $113,000 in equity growth. The steady appreciation trajectory accelerated significantly after 2020, indicating fundamental market shifts rather than cyclical factors. Investment metrics reveal favorable cash-on-cash return potential even at current valuations, suggesting continued opportunity for strategic capital deployment. This Christian County community benefits from its proximity to Fort Campbell Military Reservation, creating strong rental demand with superior yields compared to larger markets while maintaining price points that continue attracting both military families and investors.

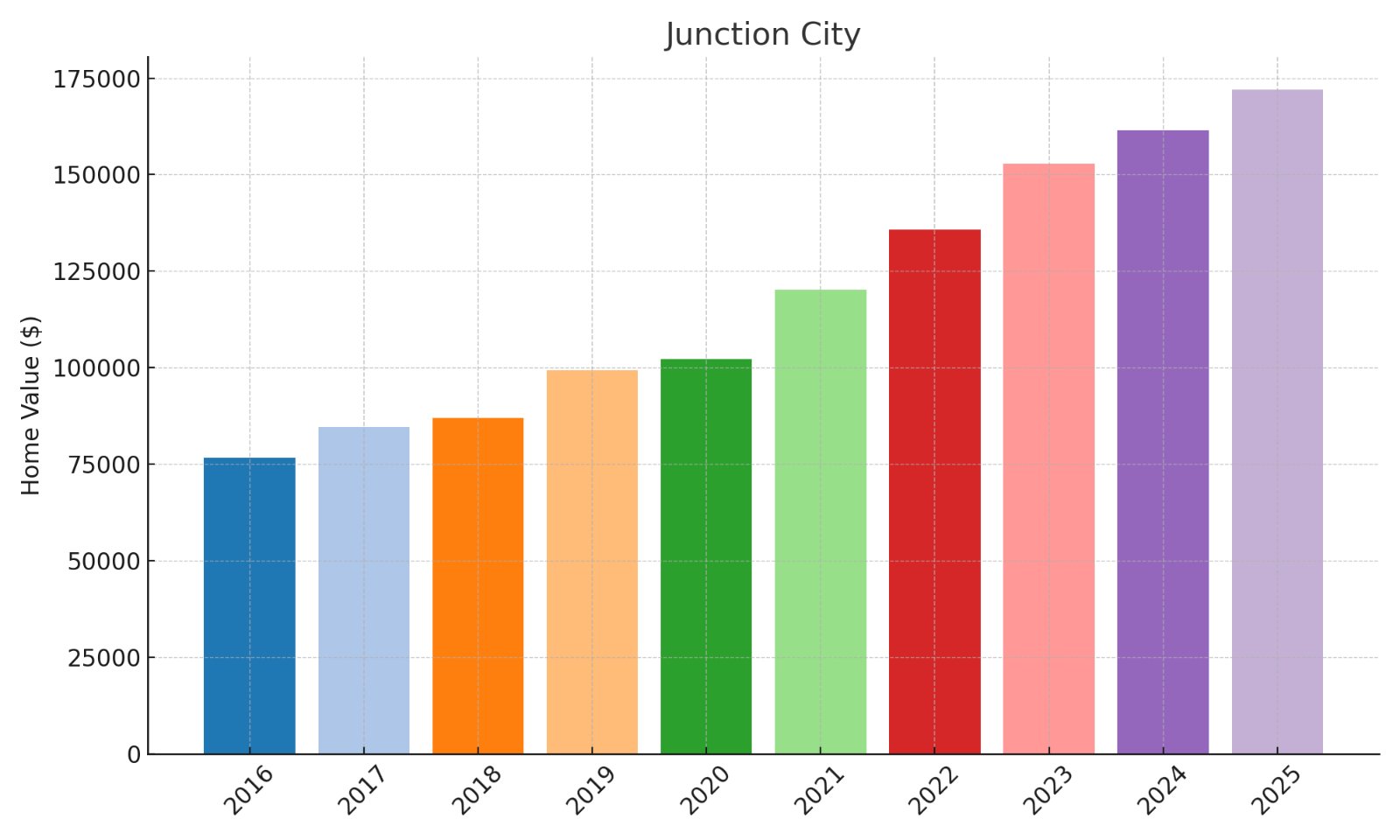

23. Junction City

- % change from 2016 to 2025: 124.71%

- Home value in 2016: $76,543

- Home value in 2017: $84,539

- Home value in 2018: $86,936

- Home value in 2019: $99,369

- Home value in 2020: $102,262

- Home value in 2021: $120,136

- Home value in 2022: $135,692

- Home value in 2023: $152,730

- Home value in 2024: $161,557

- Home value in 2025: $172,004

Junction City’s exceptional 124.7% appreciation demonstrates remarkable wealth-building potential through real estate, with property values generating over $95,000 in equity from a modest initial investment. The acceleration in value growth post-2020 indicates fundamental market repositioning rather than temporary factors. Current price points remain well below replacement costs, suggesting continued upside before reaching construction parity constraints. This Boyle County community offers strategic positioning between Danville and regional economic centers while maintaining housing costs significantly below metropolitan alternatives – a value proposition that continues attracting both primary homebuyers and investors seeking maximum appreciation potential.

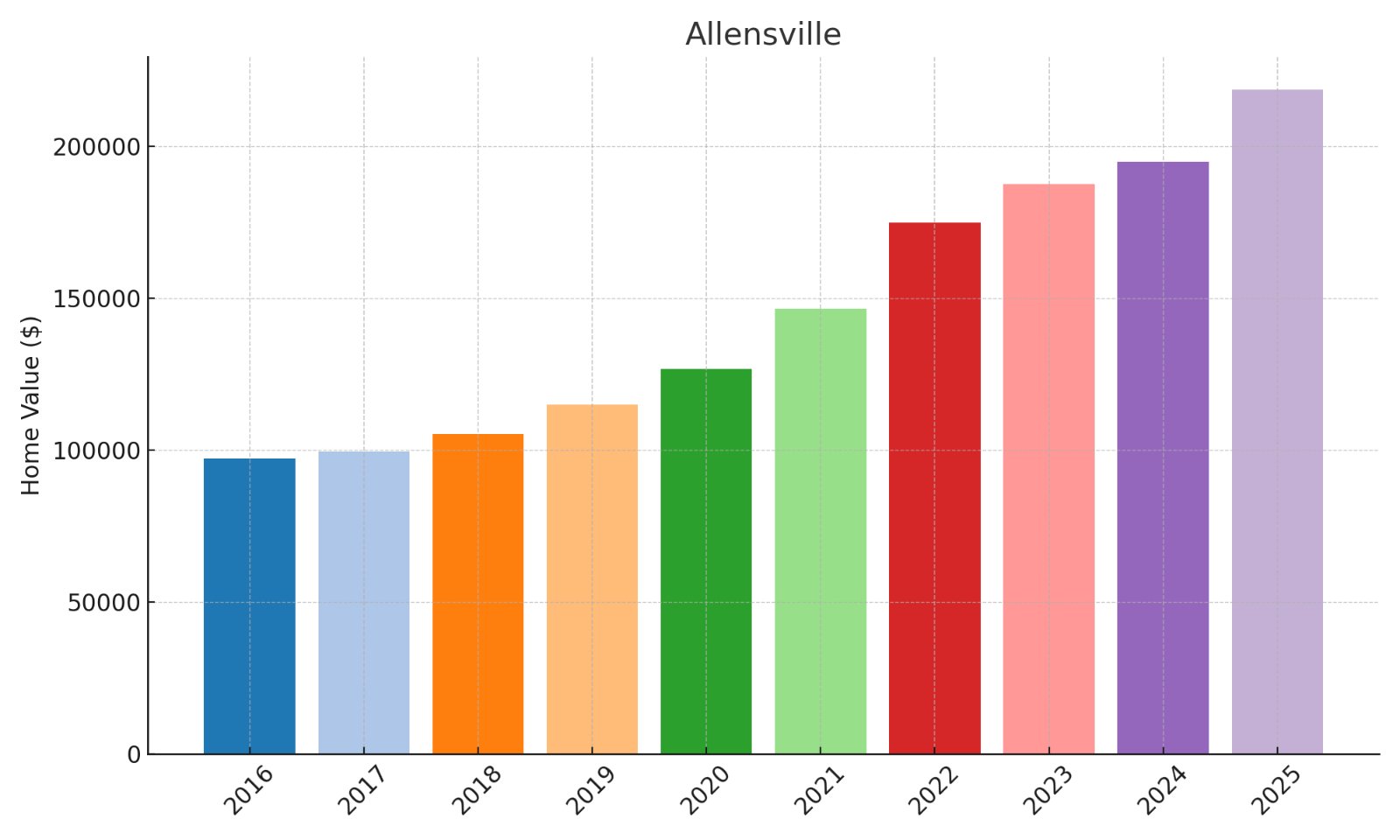

22. Allensville

- % change from 2016 to 2025: 124.82%

- Home value in 2016: $97,283

- Home value in 2017: $99,547

- Home value in 2018: $105,335

- Home value in 2019: $114,872

- Home value in 2020: $126,800

- Home value in 2021: $146,638

- Home value in 2022: $174,881

- Home value in 2023: $187,607

- Home value in 2024: $195,057

- Home value in 2025: $218,714

Allensville’s market performance showcases exceptional wealth accumulation, with property values increasing 124.8% while generating over $121,000 in equity growth. The steady upward trajectory demonstrates remarkable resilience through varying economic conditions and interest rate environments. Investment analysis reveals favorable debt service coverage ratios despite rising valuations, indicating continued opportunity for leveraged returns. This Todd County community offers strategic positioning near the Tennessee border with access to Clarksville and Nashville employment markets while maintaining the rural lifestyle advantages and significantly lower property taxes that continue driving demand and price appreciation.

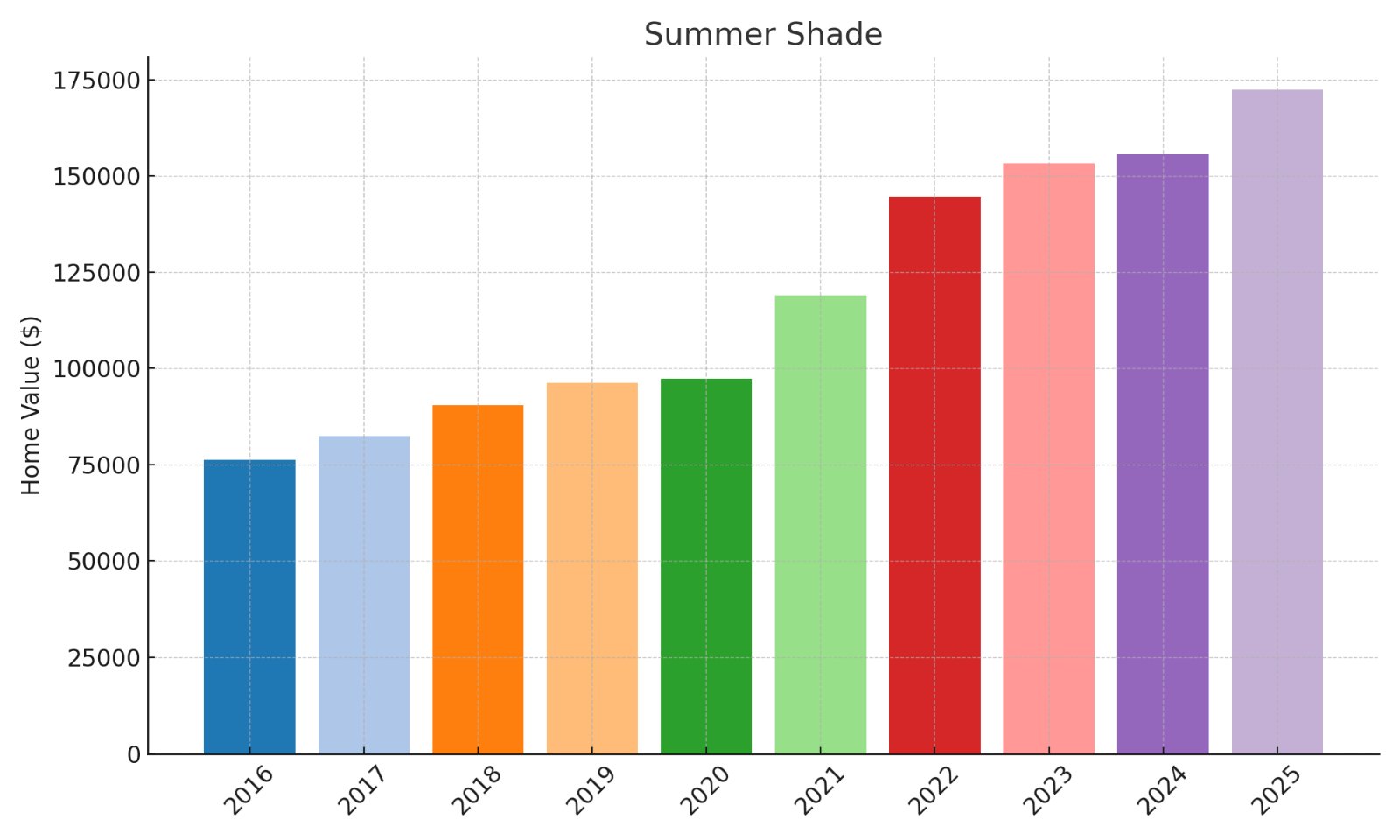

21. Summer Shade

- % change from 2016 to 2025: 126.07%

- Home value in 2016: $76,242

- Home value in 2017: $82,448

- Home value in 2018: $90,432

- Home value in 2019: $96,168

- Home value in 2020: $97,400

- Home value in 2021: $119,005

- Home value in 2022: $144,579

- Home value in 2023: $153,253

- Home value in 2024: $155,663

- Home value in 2025: $172,363

Summer Shade demonstrates exceptional wealth-building through real estate, with 126.1% appreciation generating over $96,000 in equity from a modest initial investment. The dramatic acceleration post-2020 suggests fundamental market shifts driving sustainable value increases rather than speculative activity. Current valuations remain well below replacement costs, suggesting continued upside potential before reaching construction parity. This Metcalfe County community offers rural tranquility with strategic access to Glasgow and regional amenities while maintaining housing costs significantly below state averages – a combination that continues attracting value-conscious buyers seeking both primary residences and vacation properties.

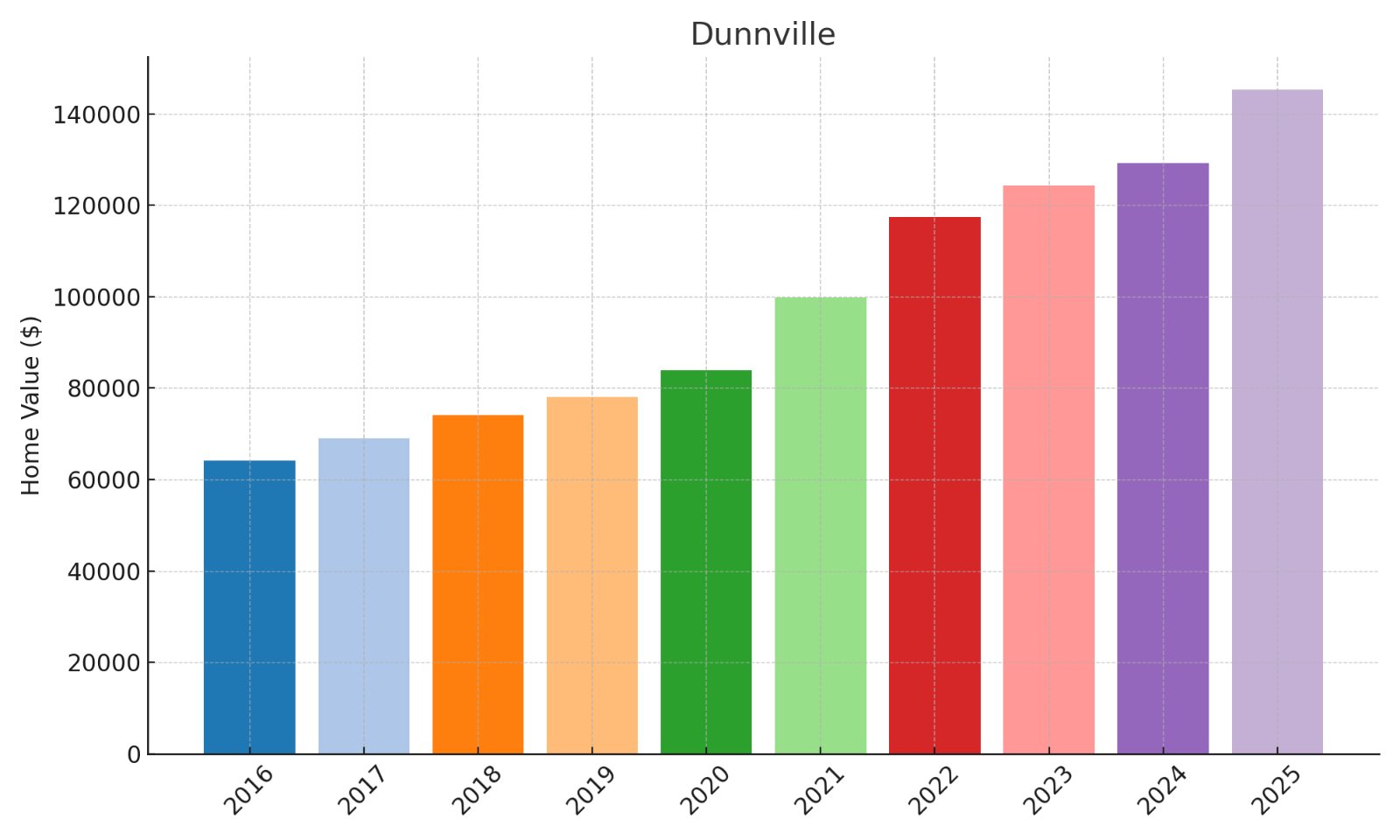

20. Dunnville

- % change from 2016 to 2025: 126.73%

- Home value in 2016: $64,098

- Home value in 2017: $69,008

- Home value in 2018: $74,057

- Home value in 2019: $78,022

- Home value in 2020: $83,848

- Home value in 2021: $99,801

- Home value in 2022: $117,462

- Home value in 2023: $124,320

- Home value in 2024: $129,221

- Home value in 2025: $145,328

Dunnville’s market performance showcases exceptional financial leverage, with property values increasing 126.7% while generating over $81,000 in equity from a low entry point. The steady appreciation curve accelerated significantly post-2020, indicating fundamental market repositioning rather than cyclical factors. Investment metrics reveal favorable cash flow potential relative to acquisition costs, with rental yields remaining attractive despite substantial appreciation. This Casey County community benefits from agricultural economic stability while maintaining housing costs significantly below state averages – creating continued investment opportunities with compelling returns for both homebuyers and strategic real estate investors.

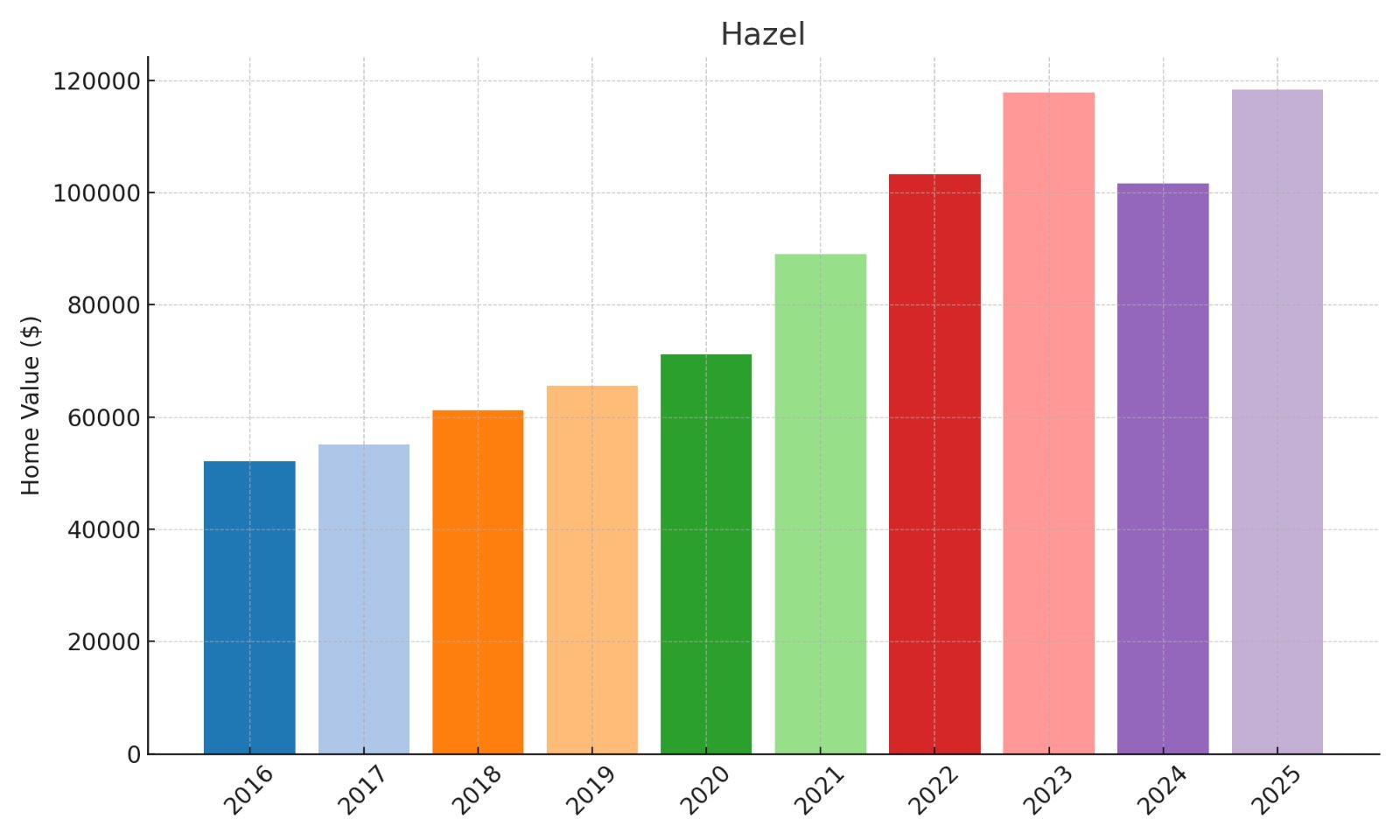

19. Hazel

- % change from 2016 to 2025: 127.34%

- Home value in 2016: $52,046

- Home value in 2017: $55,107

- Home value in 2018: $61,205

- Home value in 2019: $65,555

- Home value in 2020: $71,209

- Home value in 2021: $89,027

- Home value in 2022: $103,221

- Home value in 2023: $117,803

- Home value in 2024: $101,663

- Home value in 2025: $118,323

Hazel demonstrates exceptional ROI potential, with 127.3% appreciation from one of Kentucky’s lowest entry points creating unmatched percentage returns with minimal capital requirements. The consistent value growth trajectory, despite a 2023-2024 correction, indicates resilient demand fundamentals rather than speculative forces. Current valuations remain extraordinarily accessible despite significant appreciation, suggesting continued upside potential. This Calloway County community near the Tennessee border benefits from Murray State University’s economic influence while maintaining significantly lower property taxes and housing costs – creating unparalleled investment opportunity for maximum percentage returns from minimal capital deployment.

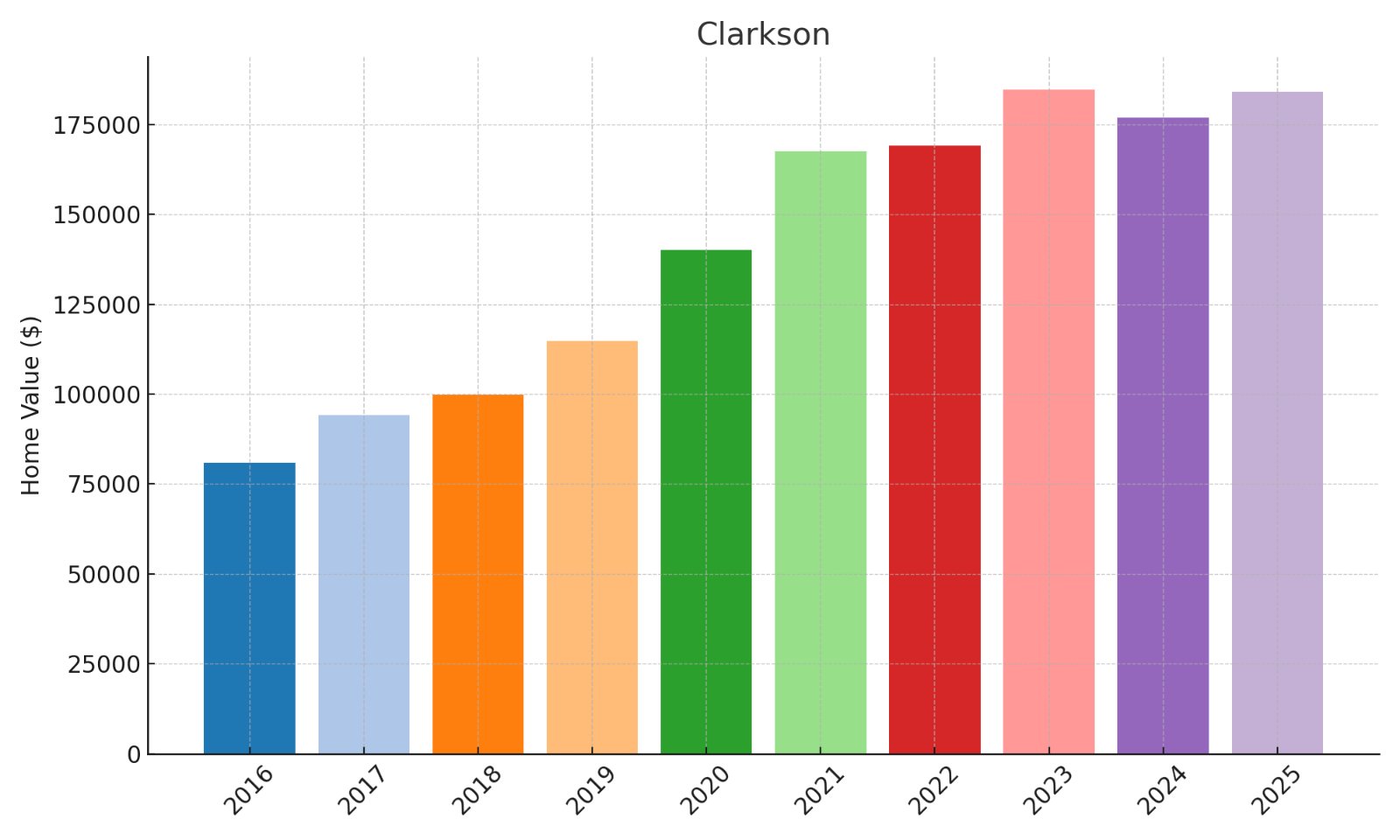

18. Clarkson

- % change from 2016 to 2025: 127.59%

- Home value in 2016: $80,884

- Home value in 2017: $94,204

- Home value in 2018: $99,889

- Home value in 2019: $114,861

- Home value in 2020: $140,080

- Home value in 2021: $167,613

- Home value in 2022: $169,126

- Home value in 2023: $184,685

- Home value in 2024: $176,896

- Home value in 2025: $184,081

Clarkson’s market performance showcases exceptional wealth-building potential, with property values increasing 127.6% while generating over $103,000 in equity growth. The market demonstrated remarkable resilience by quickly recovering from a 2023-2024 correction, suggesting strong underlying demand fundamentals. Investment analysis reveals favorable debt-to-equity optimization potential despite rising valuations, creating opportunities for leveraged returns. This Grayson County community benefits from strategic positioning along the Western Kentucky Parkway with accessibility to multiple regional employment centers while maintaining housing costs significantly below metropolitan alternatives – a combination that continues driving both homebuyer and investor demand.

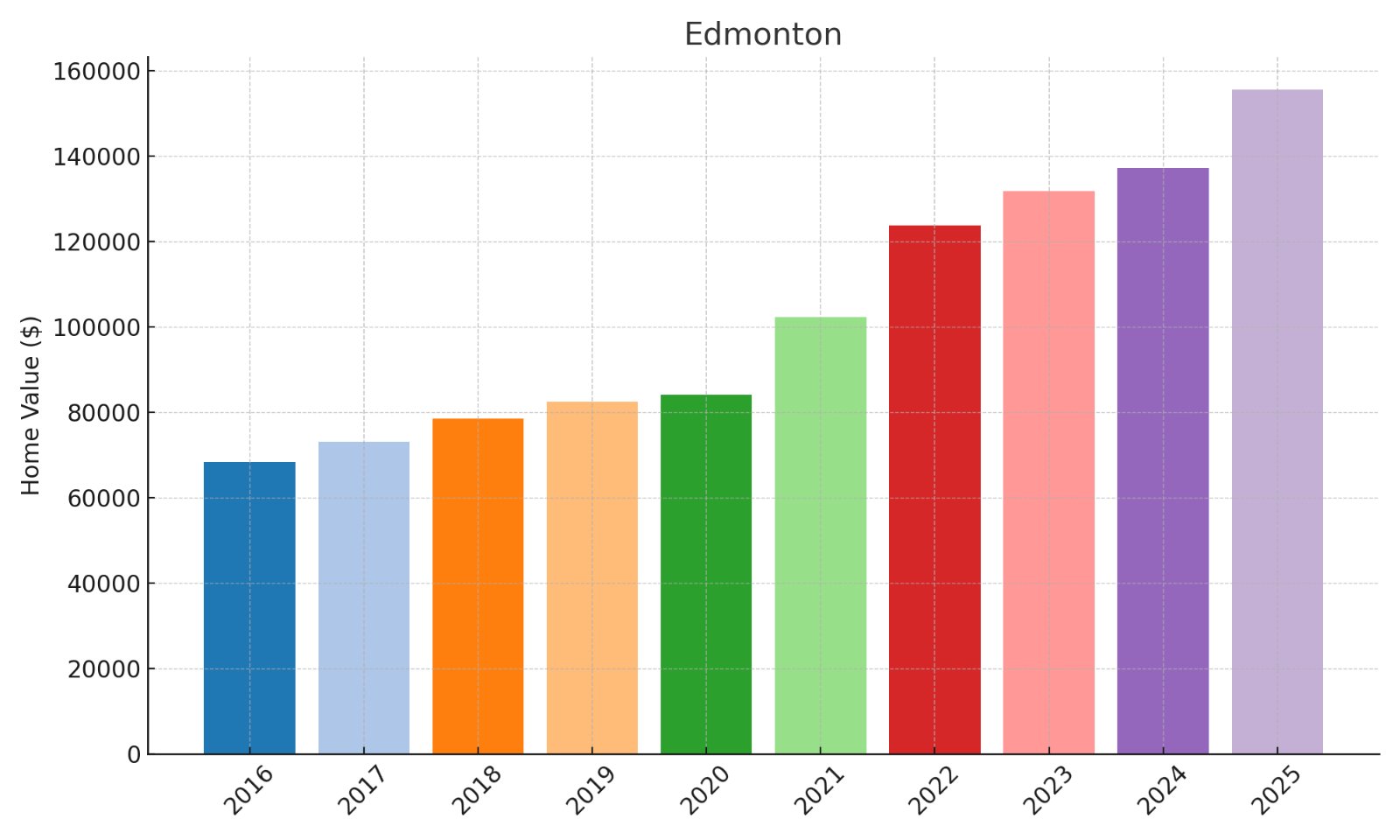

17. Edmonton

- % change from 2016 to 2025: 127.68%

- Home value in 2016: $68,310

- Home value in 2017: $73,007

- Home value in 2018: $78,445

- Home value in 2019: $82,363

- Home value in 2020: $84,035

- Home value in 2021: $102,259

- Home value in 2022: $123,756

- Home value in 2023: $131,739

- Home value in 2024: $137,244

- Home value in 2025: $155,527

Edmonton demonstrates exceptional wealth-building through real estate, with 127.7% appreciation generating over $87,000 in equity from a modest initial investment. The dramatic acceleration post-2020 indicates fundamental market shifts driving sustainable value increases rather than speculative activity. Current valuations remain well below replacement costs, suggesting continued upside potential before reaching construction parity. This Metcalfe County seat benefits from regional economic stability while maintaining housing costs significantly below state averages – a combination that creates compelling investment opportunities with strong returns for both homeowners and strategic real estate investors.

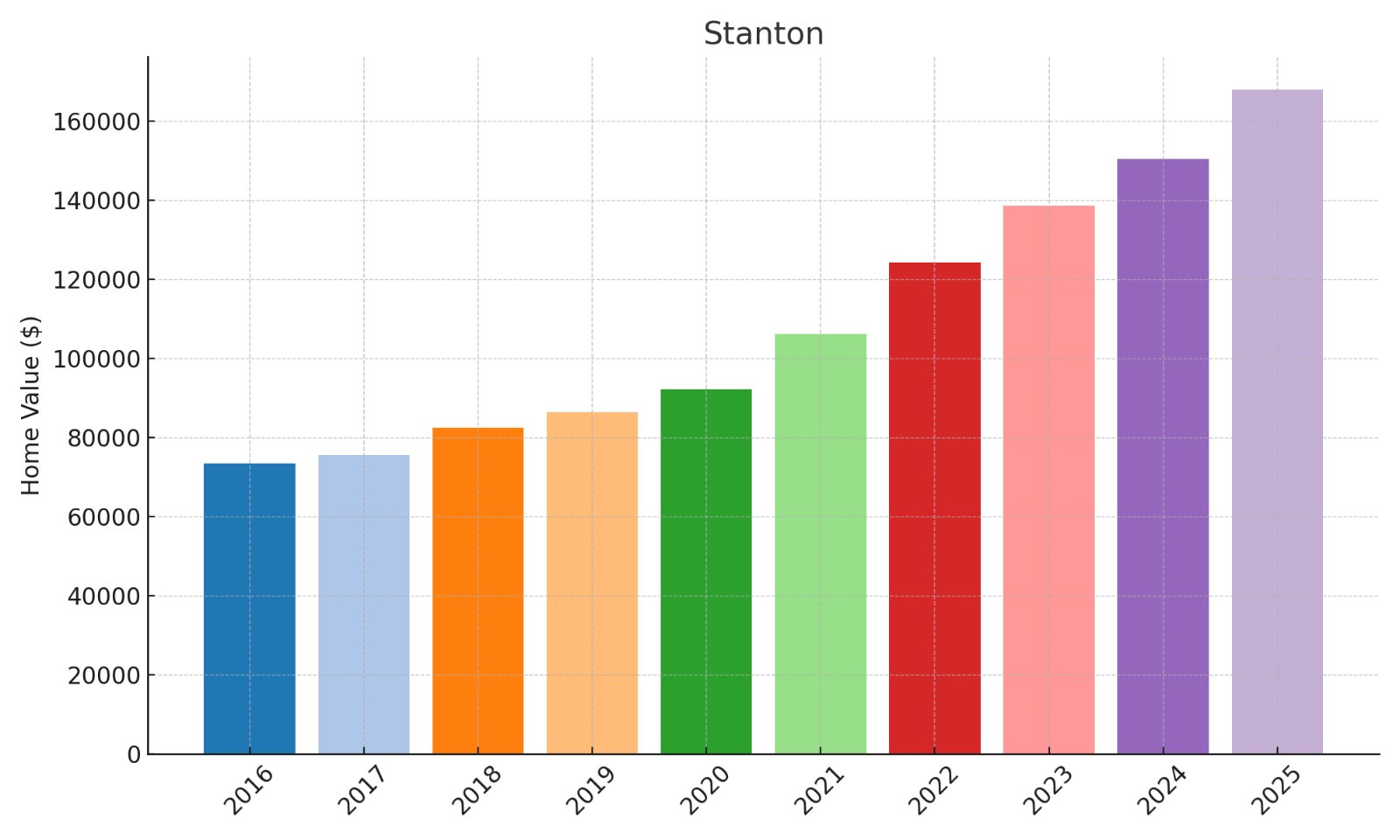

16. Stanton

- % change from 2016 to 2025: 128.56%

- Home value in 2016: $73,448

- Home value in 2017: $75,535

- Home value in 2018: $82,364

- Home value in 2019: $86,329

- Home value in 2020: $92,093

- Home value in 2021: $106,089

- Home value in 2022: $124,239

- Home value in 2023: $138,479

- Home value in 2024: $150,402

- Home value in 2025: $167,876

Stanton’s real estate market demonstrates exceptional investment performance with 128.6% appreciation generating over $94,000 in equity from a modest initial investment. The consistent year-over-year appreciation pattern accelerated significantly post-2020, indicating strengthening market fundamentals rather than cyclical factors. Current price points remain well below replacement costs, suggesting continued upside before reaching construction parity. This Powell County seat offers strategic positioning near the Red River Gorge and Natural Bridge recreational areas, creating vacation rental opportunities with superior yields compared to traditional investments while maintaining affordability that continues attracting both primary homebuyers and investors.

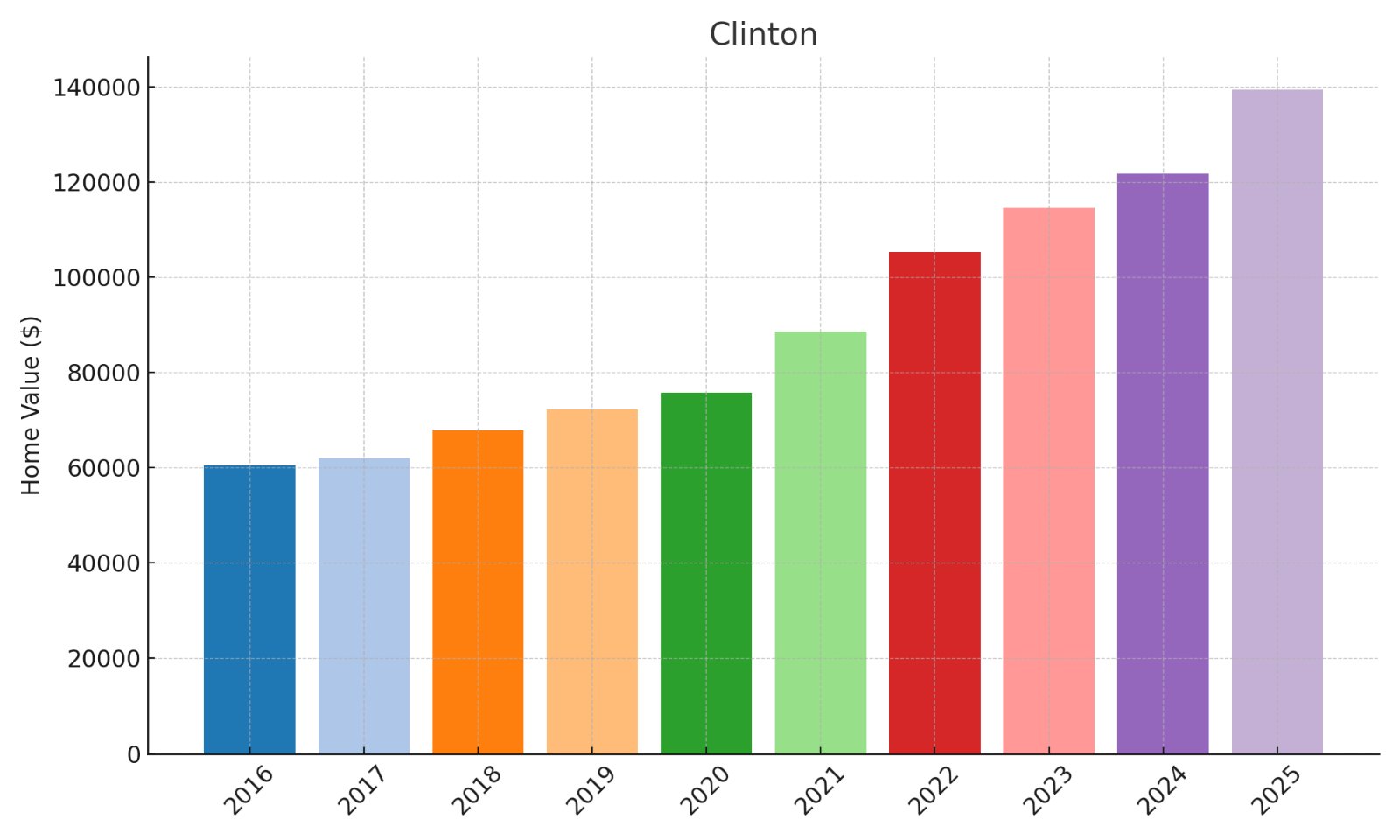

15. Clinton

- % change from 2016 to 2025: 130.57%

- Home value in 2016: $60,456

- Home value in 2017: $62,011

- Home value in 2018: $67,835

- Home value in 2019: $72,234

- Home value in 2020: $75,770

- Home value in 2021: $88,562

- Home value in 2022: $105,359

- Home value in 2023: $114,593

- Home value in 2024: $121,806

- Home value in 2025: $139,393

Clinton’s market performance showcases exceptional wealth-building through real estate leverage, with 130.6% appreciation generating nearly $79,000 in equity from an extraordinarily accessible entry point. The steadily accelerating appreciation curve indicates improving market fundamentals rather than speculative forces. Current valuations remain remarkably affordable despite substantial gains, suggesting continued upside potential before reaching affordability constraints. This Hickman County seat in the Jackson Purchase region benefits from agricultural economic stability while maintaining some of Kentucky’s most accessible price points – a combination that offers unmatched investment potential for maximum percentage returns with minimal capital requirements.

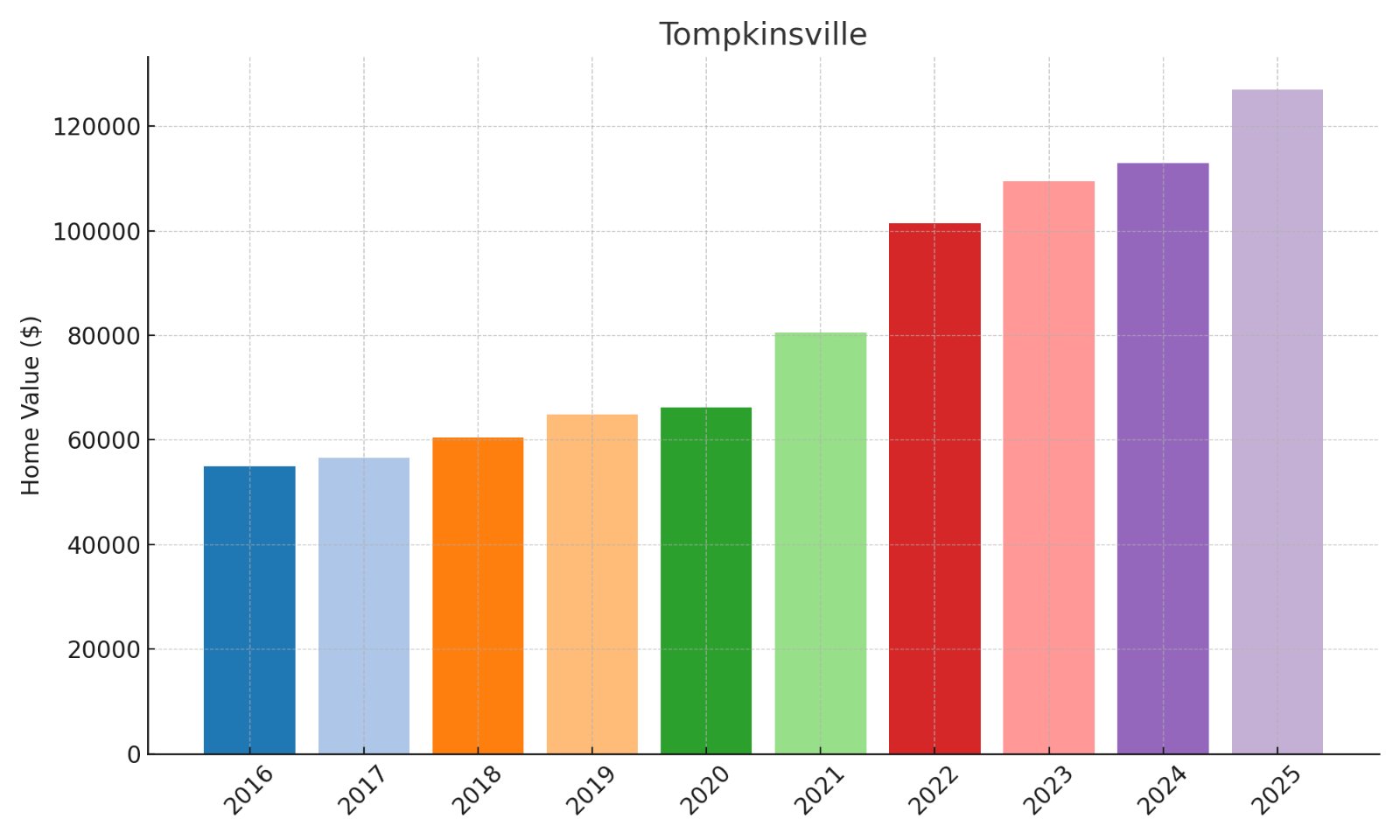

14. Tompkinsville

- % change from 2016 to 2025: 131.23%

- Home value in 2016: $54,908

- Home value in 2017: $56,534

- Home value in 2018: $60,515

- Home value in 2019: $64,884

- Home value in 2020: $66,191

- Home value in 2021: $80,512

- Home value in 2022: $101,394

- Home value in 2023: $109,381

- Home value in 2024: $112,981

- Home value in 2025: $126,965

Tompkinsville demonstrates exceptional financial leverage opportunities with 131.2% appreciation from a low entry point, creating significant wealth-building potential through real estate. The dramatic acceleration post-2020 indicates fundamental market repositioning rather than cyclical appreciation. Investment metrics reveal favorable cash-on-cash returns compared to similar markets, with cap rates remaining attractive despite substantial price increases. This Monroe County seat benefits from its strategic location near Dale Hollow Lake recreational areas while maintaining housing costs significantly below regional averages – a combination that continues attracting both primary homebuyers and strategic investors seeking maximum percentage return potential.

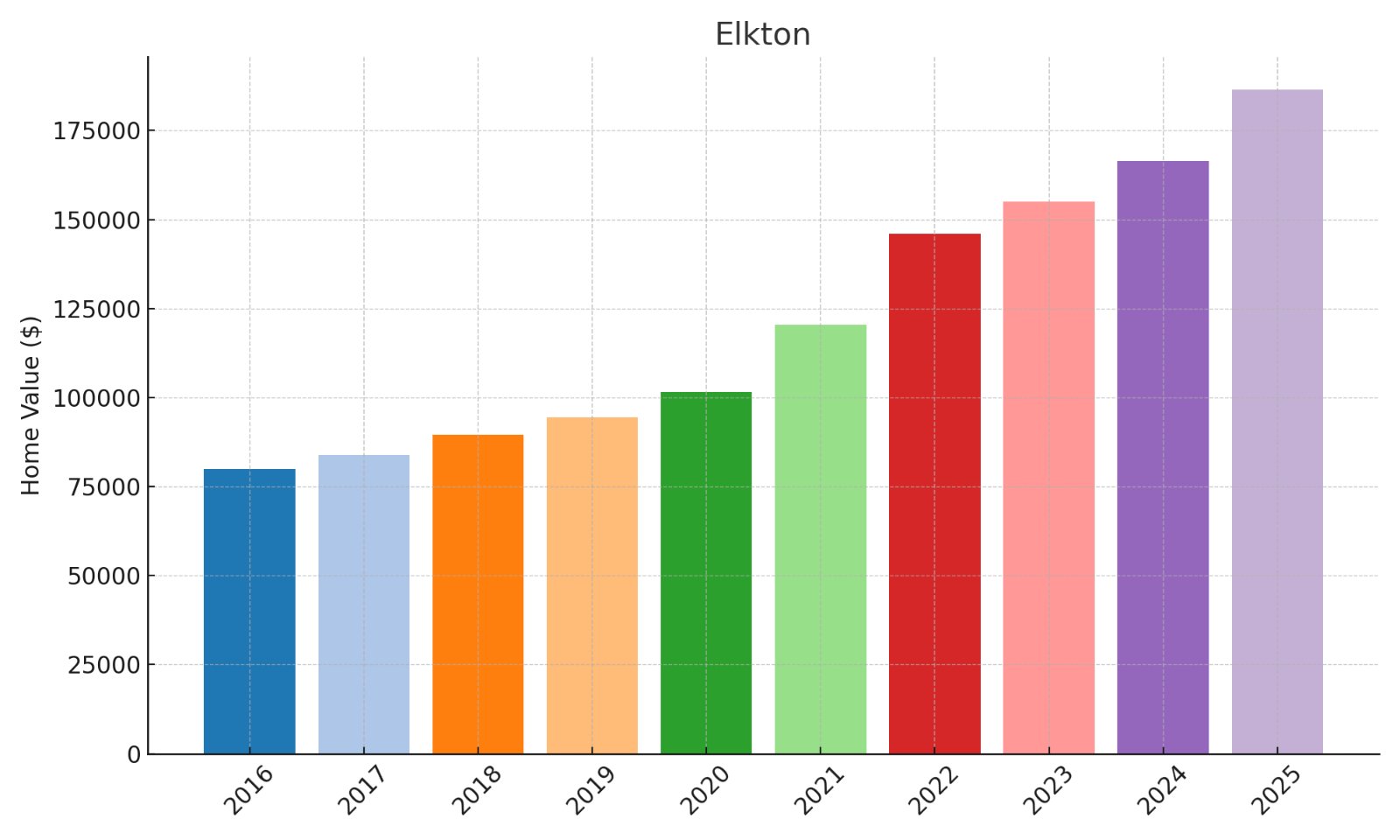

13. Elkton

- % change from 2016 to 2025: 133.15%

- Home value in 2016: $79,982

- Home value in 2017: $83,826

- Home value in 2018: $89,510

- Home value in 2019: $94,519

- Home value in 2020: $101,637

- Home value in 2021: $120,404

- Home value in 2022: $145,985

- Home value in 2023: $155,127

- Home value in 2024: $166,466

- Home value in 2025: $186,475

Elkton’s market performance reveals exceptional wealth-building dynamics, with 133.1% appreciation generating over $106,000 in equity from a modest initial investment. The steady growth trajectory accelerated significantly post-2020, indicating structural market shifts rather than cyclical factors. Investment metrics show favorable debt service coverage ratios despite rising valuations, suggesting continued opportunity for leveraged returns. This Todd County seat offers strategic positioning between Bowling Green and Nashville employment markets while maintaining significantly lower property taxes and housing costs than either metropolitan area – a combination that continues driving demand from both homebuyers and investors.

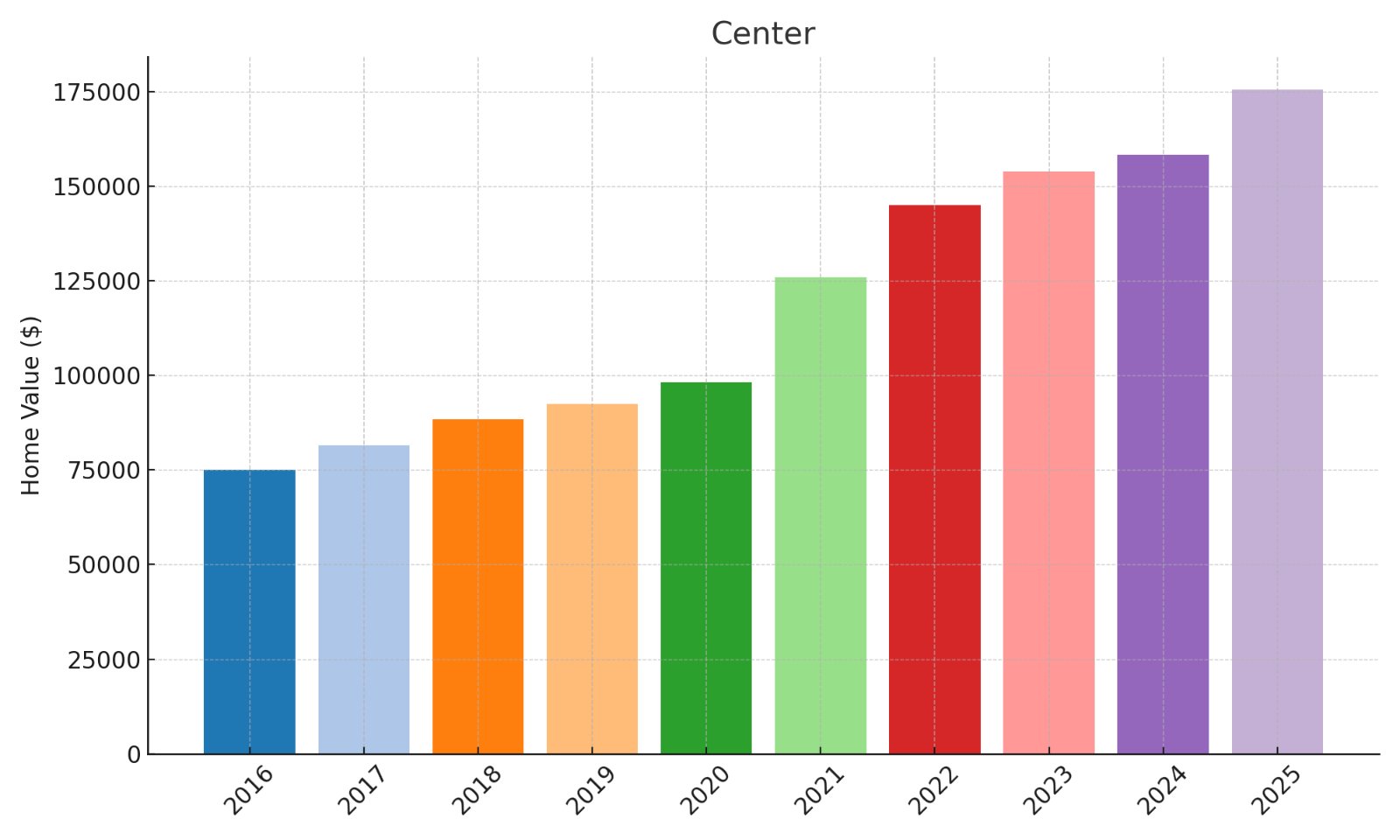

12. Center

- % change from 2016 to 2025: 133.78%

- Home value in 2016: $75,099

- Home value in 2017: $81,476

- Home value in 2018: $88,395

- Home value in 2019: $92,490

- Home value in 2020: $98,292

- Home value in 2021: $126,010

- Home value in 2022: $145,011

- Home value in 2023: $153,906

- Home value in 2024: $158,405

- Home value in 2025: $175,565

Center’s real estate market demonstrates exceptional investment performance with 133.8% appreciation generating over $100,000 in equity from a modest initial investment. The dramatic acceleration post-2020 indicates fundamental market repositioning rather than cyclical factors. Current valuations remain well below replacement costs, suggesting continued upside before reaching construction parity limits. This Metcalfe County community offers strategic positioning relative to regional economic centers while maintaining housing costs significantly below metropolitan alternatives – a combination that continues attracting both primary homebuyers and investors seeking maximum appreciation potential with minimal capital requirements.

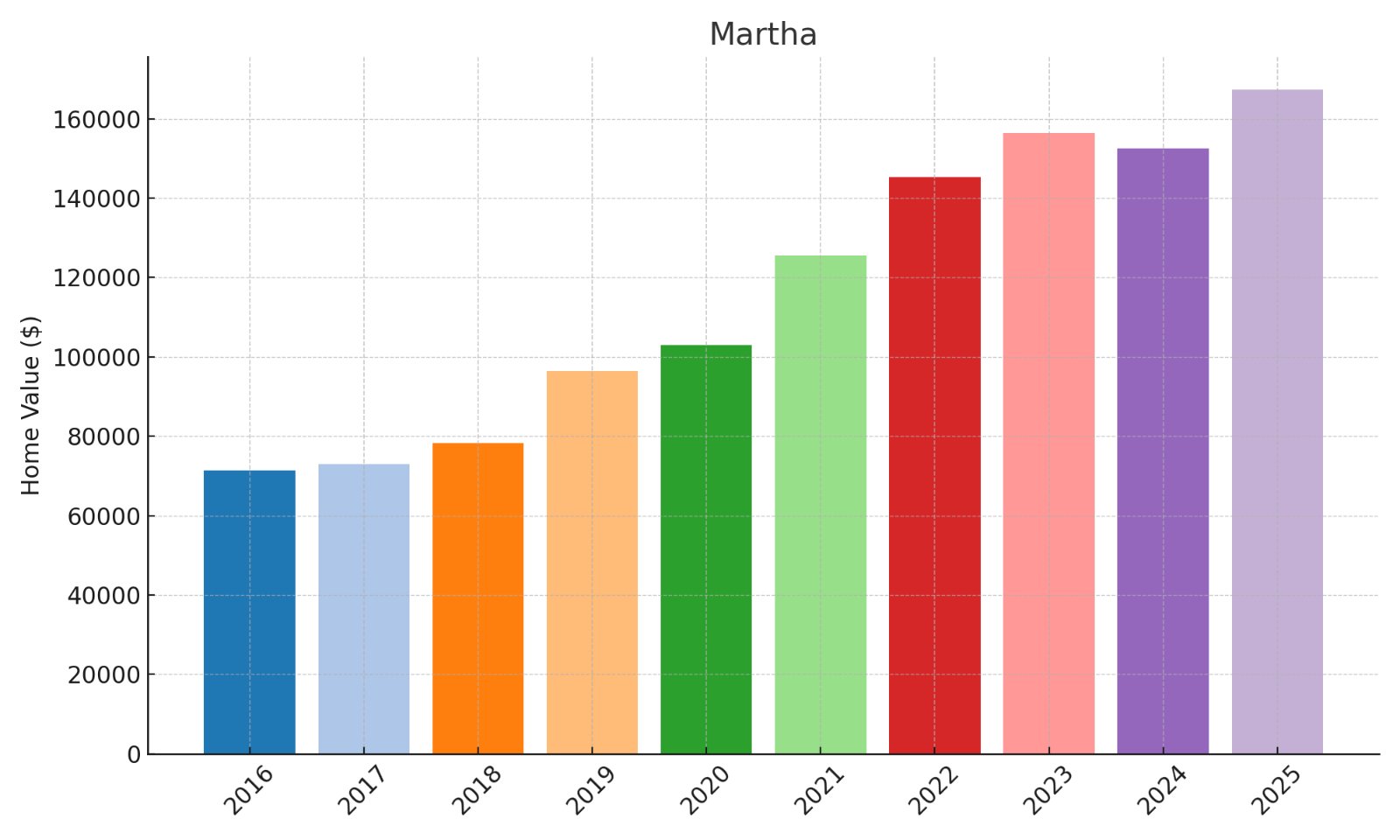

11. Martha

- % change from 2016 to 2025: 134.57%

- Home value in 2016: $71,344

- Home value in 2017: $72,982

- Home value in 2018: $78,254

- Home value in 2019: $96,468

- Home value in 2020: $103,034

- Home value in 2021: $125,617

- Home value in 2022: $145,335

- Home value in 2023: $156,484

- Home value in 2024: $152,544

- Home value in 2025: $167,353

Martha’s market performance demonstrates exceptional wealth-building potential, with 134.6% appreciation generating over $96,000 in equity from a modest initial investment. The market showed impressive resilience by quickly recovering from a 2023-2024 correction, suggesting strong underlying demand fundamentals. Investment analysis reveals favorable price-to-rent ratios despite substantial appreciation, indicating continued opportunity for cash flow investors. This Lawrence County community in eastern Kentucky offers strategic positioning near regional employment centers while maintaining housing costs significantly below metropolitan alternatives – a combination that continues attracting both homebuyers and strategic investors seeking maximum appreciation potential.

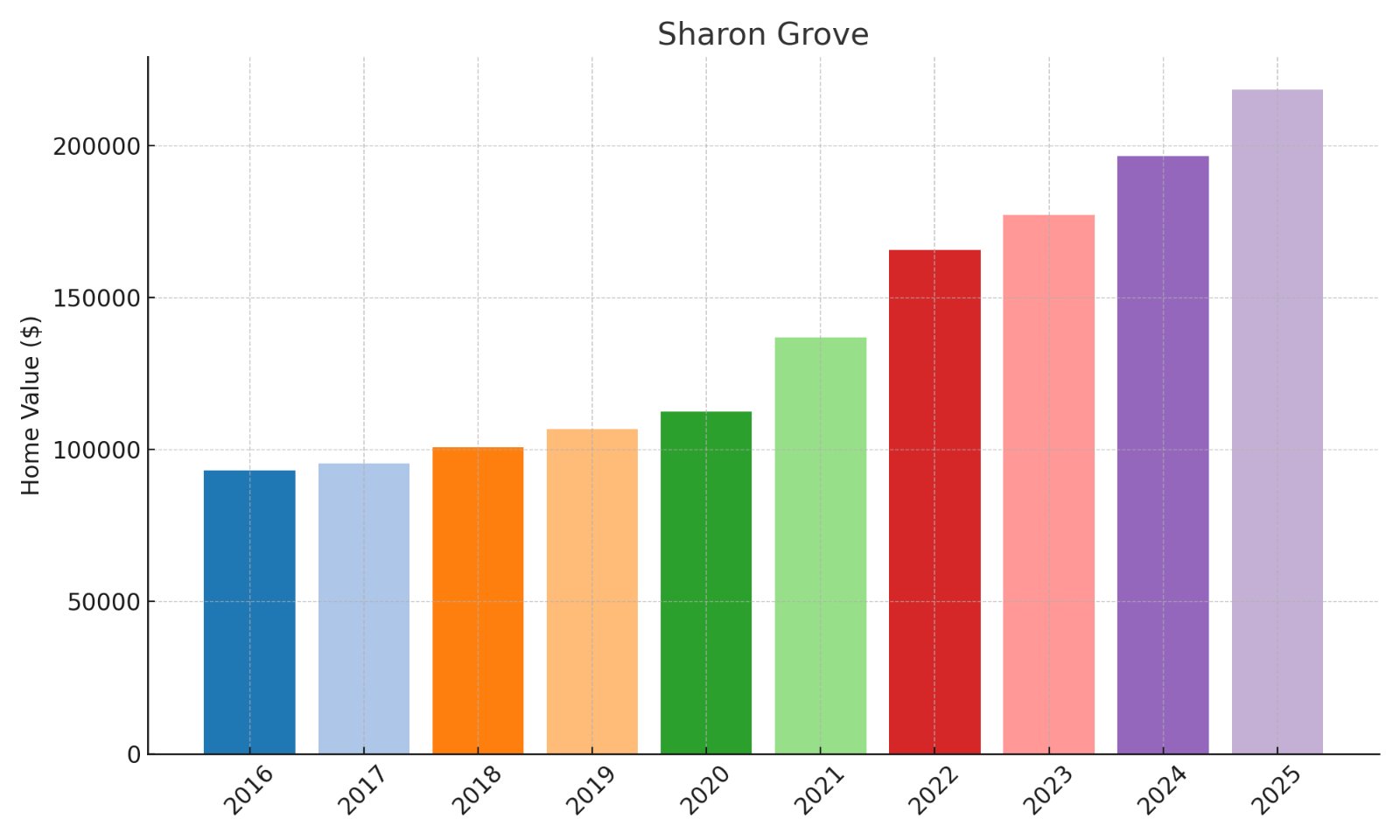

10. Sharon Grove

- % change from 2016 to 2025: 134.70%

- Home value in 2016: $93,030

- Home value in 2017: $95,436

- Home value in 2018: $100,762

- Home value in 2019: $106,735

- Home value in 2020: $112,553

- Home value in 2021: $136,918

- Home value in 2022: $165,659

- Home value in 2023: $177,139

- Home value in 2024: $196,504

- Home value in 2025: $218,345

Sharon Grove’s remarkable market performance showcases exceptional wealth-building potential, with property values increasing 134.7% while generating over $125,000 in equity growth. The steady acceleration in appreciation rates indicates strengthening market fundamentals rather than approaching saturation. Investment metrics reveal favorable debt-to-equity optimization potential for leveraged purchases despite rising valuations. This Todd County community offers strategic positioning between Bowling Green and regional employment centers while maintaining the rural lifestyle amenities and significantly lower property taxes that continue driving demand from both primary homebuyers and strategic investors seeking superior investment returns.

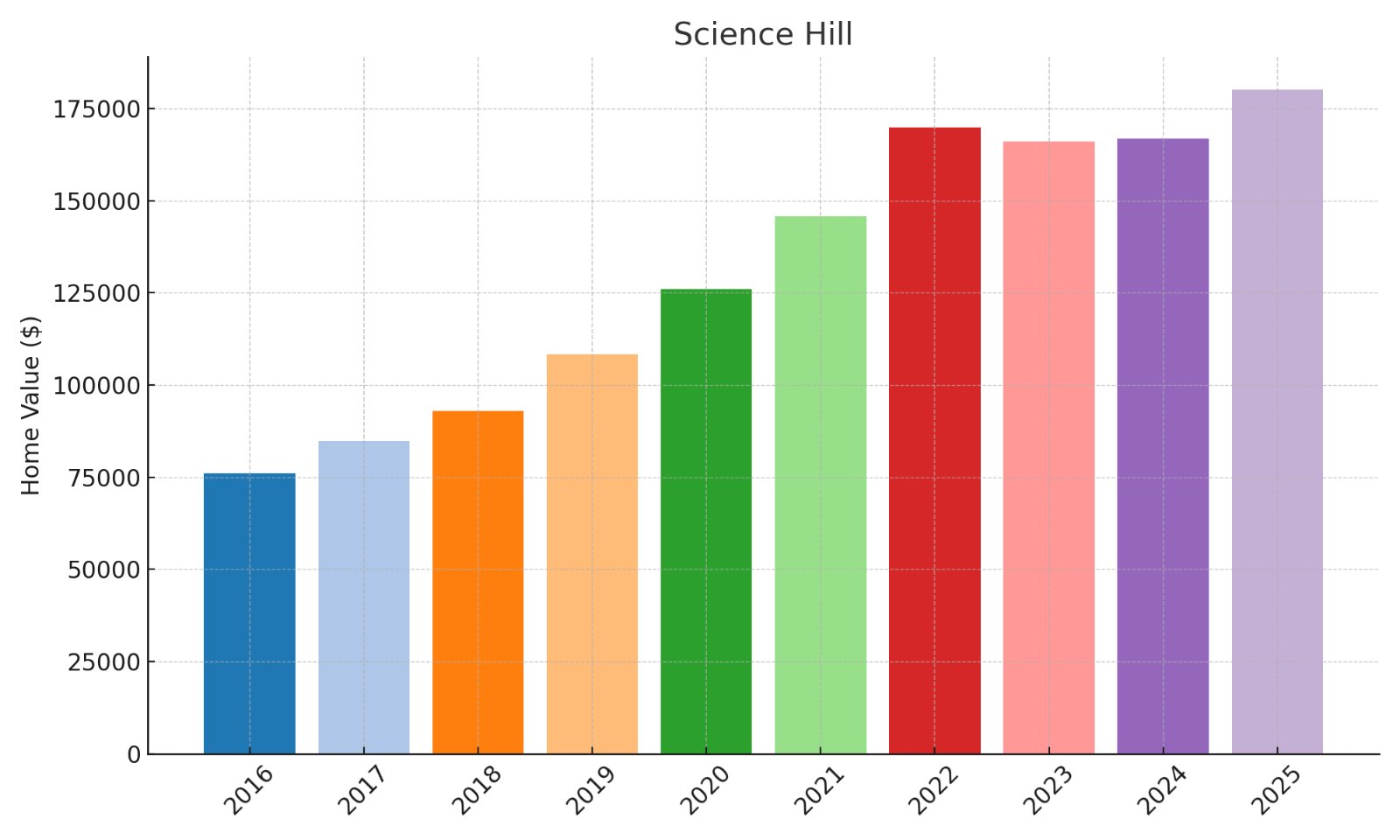

9. Science Hill

- % change from 2016 to 2025: 136.72%

- Home value in 2016: $76,103

- Home value in 2017: $84,915

- Home value in 2018: $92,940

- Home value in 2019: $108,307

- Home value in 2020: $126,072

- Home value in 2021: $145,811

- Home value in 2022: $169,992

- Home value in 2023: $166,078

- Home value in 2024: $166,893

- Home value in 2025: $180,152

Science Hill’s exceptional market performance generated remarkable wealth creation, with 136.7% appreciation yielding over $104,000 in equity from a modest initial investment. The market demonstrated remarkable resilience by stabilizing after a minor 2022-2023 correction before resuming its upward trajectory. Investment analysis shows favorable cash-on-cash return potential even at current valuations, suggesting continued opportunity for strategic capital deployment. This Pulaski County community offers accessibility to Somerset’s economic hub while maintaining significantly lower property taxes and housing costs – a combination that continues attracting both primary homebuyers and investors seeking maximum appreciation potential with reasonable entry points.

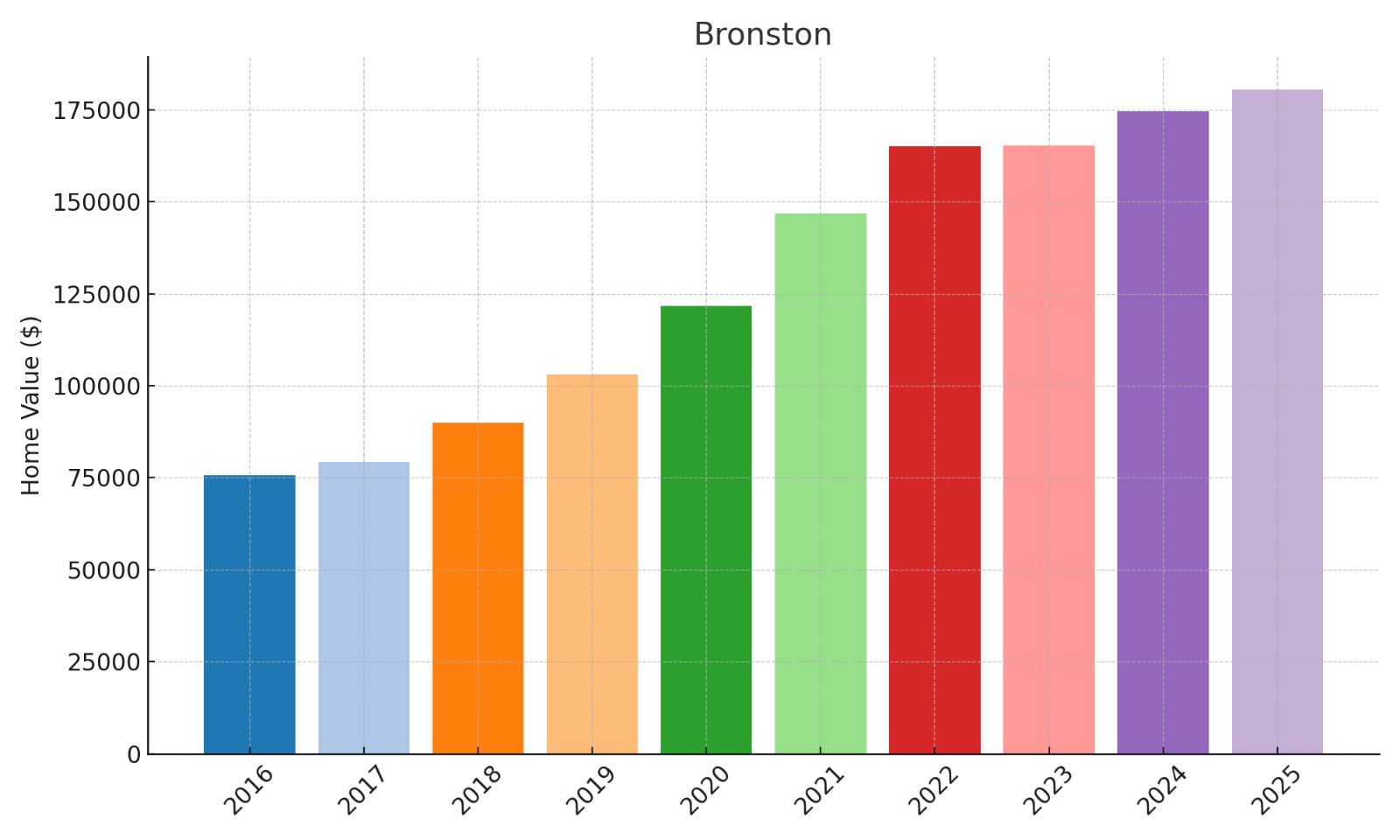

8. Bronston

- % change from 2016 to 2025: 138.72%

- Home value in 2016: $75,614

- Home value in 2017: $79,319

- Home value in 2018: $89,959

- Home value in 2019: $103,153

- Home value in 2020: $121,642

- Home value in 2021: $146,785

- Home value in 2022: $165,136

- Home value in 2023: $165,253

- Home value in 2024: $174,576

- Home value in 2025: $180,507

Bronston’s remarkable market performance showcases exceptional wealth-building potential, with property values increasing 138.7% while generating nearly $105,000 in equity from a modest initial investment. The market successfully navigated a 2022-2023 plateau before resuming its upward trajectory, demonstrating fundamental strength rather than speculative dynamics. Current valuations remain below replacement costs, suggesting continued upside potential before reaching construction parity. This Pulaski County community benefits from proximity to Lake Cumberland recreational amenities, creating vacation rental opportunities with superior yields compared to traditional investments while maintaining the affordability that continues attracting both primary homebuyers and strategic investors.

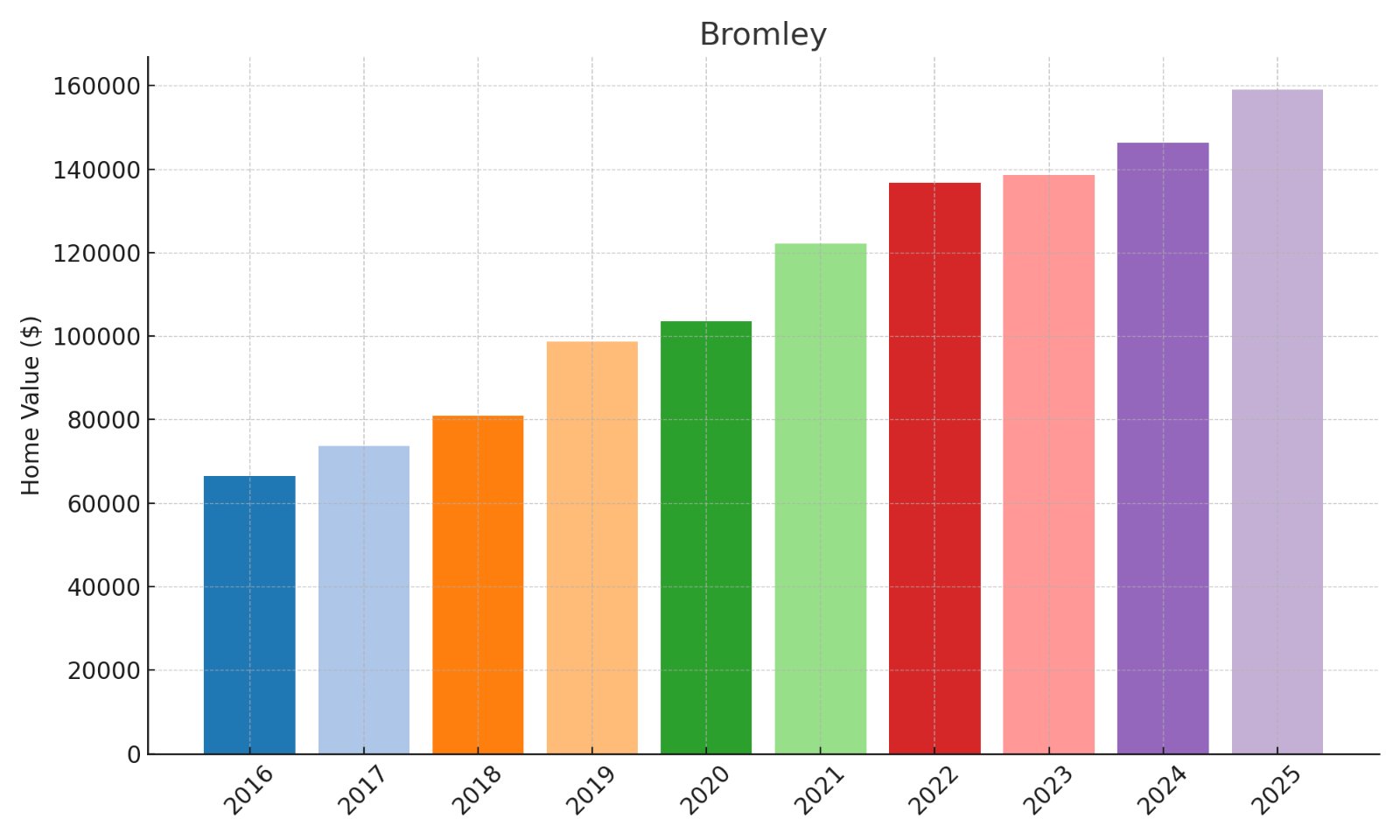

7. Bromley

- % change from 2016 to 2025: 139.46%

- Home value in 2016: $66,412

- Home value in 2017: $73,697

- Home value in 2018: $80,842

- Home value in 2019: $98,721

- Home value in 2020: $103,628

- Home value in 2021: $122,168

- Home value in 2022: $136,699

- Home value in 2023: $138,553

- Home value in 2024: $146,295

- Home value in 2025: $159,030

Bromley demonstrates exceptional wealth-creation through real estate, with 139.5% appreciation generating over $92,000 in equity from a modest initial investment. The market showed impressive resilience by maintaining its upward trajectory despite experiencing more measured growth during 2022-2023, suggesting strong underlying demand fundamentals. Investment metrics reveal favorable price-to-income ratios despite substantial appreciation, indicating continued upside potential. This Kenton County community in northern Kentucky offers strategic positioning near Cincinnati’s job market while maintaining significantly lower property taxes than Ohio – a combination that creates compelling cross-border arbitrage opportunities for both homebuyers and investors seeking maximum appreciation potential.

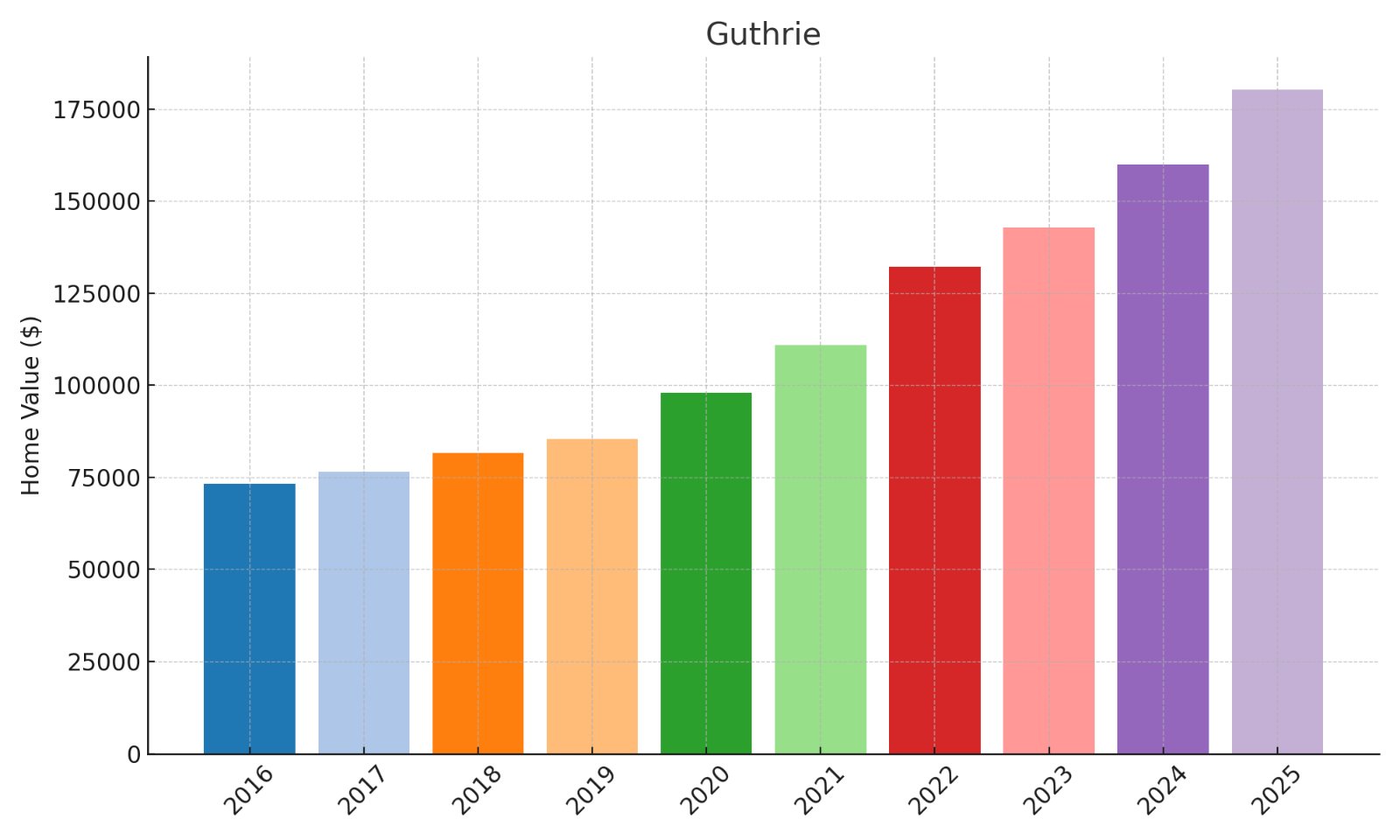

6. Guthrie

- % change from 2016 to 2025: 146.17%

- Home value in 2016: $73,214

- Home value in 2017: $76,526

- Home value in 2018: $81,659

- Home value in 2019: $85,403

- Home value in 2020: $98,005

- Home value in 2021: $110,958

- Home value in 2022: $132,102

- Home value in 2023: $142,738

- Home value in 2024: $159,997

- Home value in 2025: $180,232

Guthrie’s exceptional market performance showcases remarkable wealth-building potential, with 146.2% appreciation generating over $107,000 in equity from a modest initial investment. The consistent acceleration in growth rates post-2019 indicates strengthening market fundamentals rather than temporary factors. Investment analysis reveals favorable debt service coverage ratios despite rising valuations, creating opportunities for leveraged returns. This Todd County community offers strategic positioning on the Kentucky-Tennessee border with easy access to Clarksville and Nashville employment markets while maintaining significantly lower property taxes than Tennessee – a value proposition that creates cross-border arbitrage opportunities continuing to drive both homebuyer and investor demand.

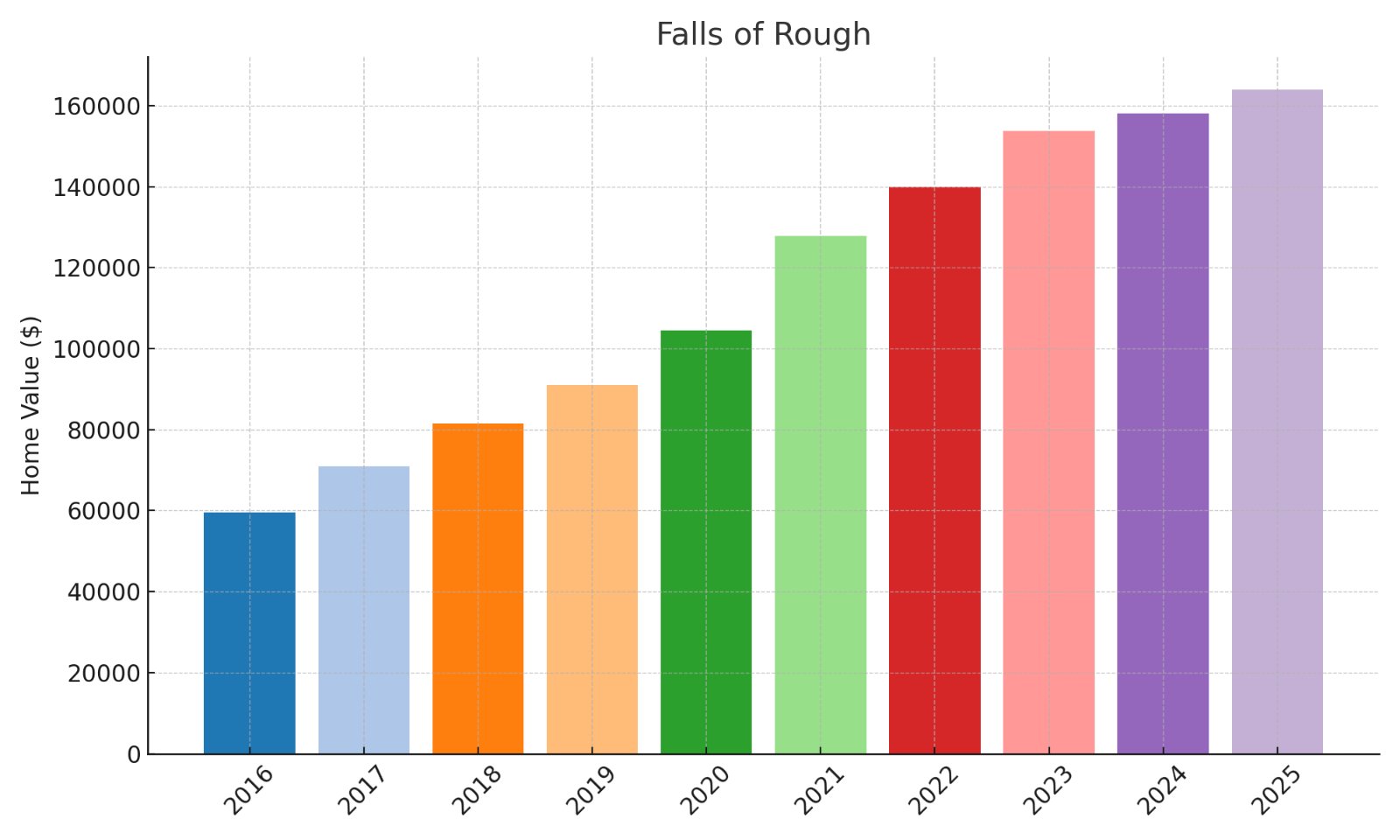

5. Falls of Rough

- % change from 2016 to 2025: 175.35%

- Home value in 2016: $59,548

- Home value in 2017: $70,923

- Home value in 2018: $81,462

- Home value in 2019: $91,108

- Home value in 2020: $104,523

- Home value in 2021: $127,836

- Home value in 2022: $140,004

- Home value in 2023: $153,858

- Home value in 2024: $158,166

- Home value in 2025: $163,964

Falls of Rough demonstrates extraordinary wealth-building through real estate leverage, with 175.3% appreciation creating exceptional percentage returns and over $104,000 in equity from a modest initial investment. The dramatic and consistent value increases indicate fundamental market repositioning rather than speculative forces. Current valuations remain well below replacement costs, suggesting continued upside potential before reaching construction parity. This Grayson County community benefits from proximity to Rough River Lake recreational amenities, creating vacation rental opportunities with superior yields compared to traditional investments while maintaining the affordability that continues attracting both primary homebuyers and strategic investors seeking maximum appreciation potential.

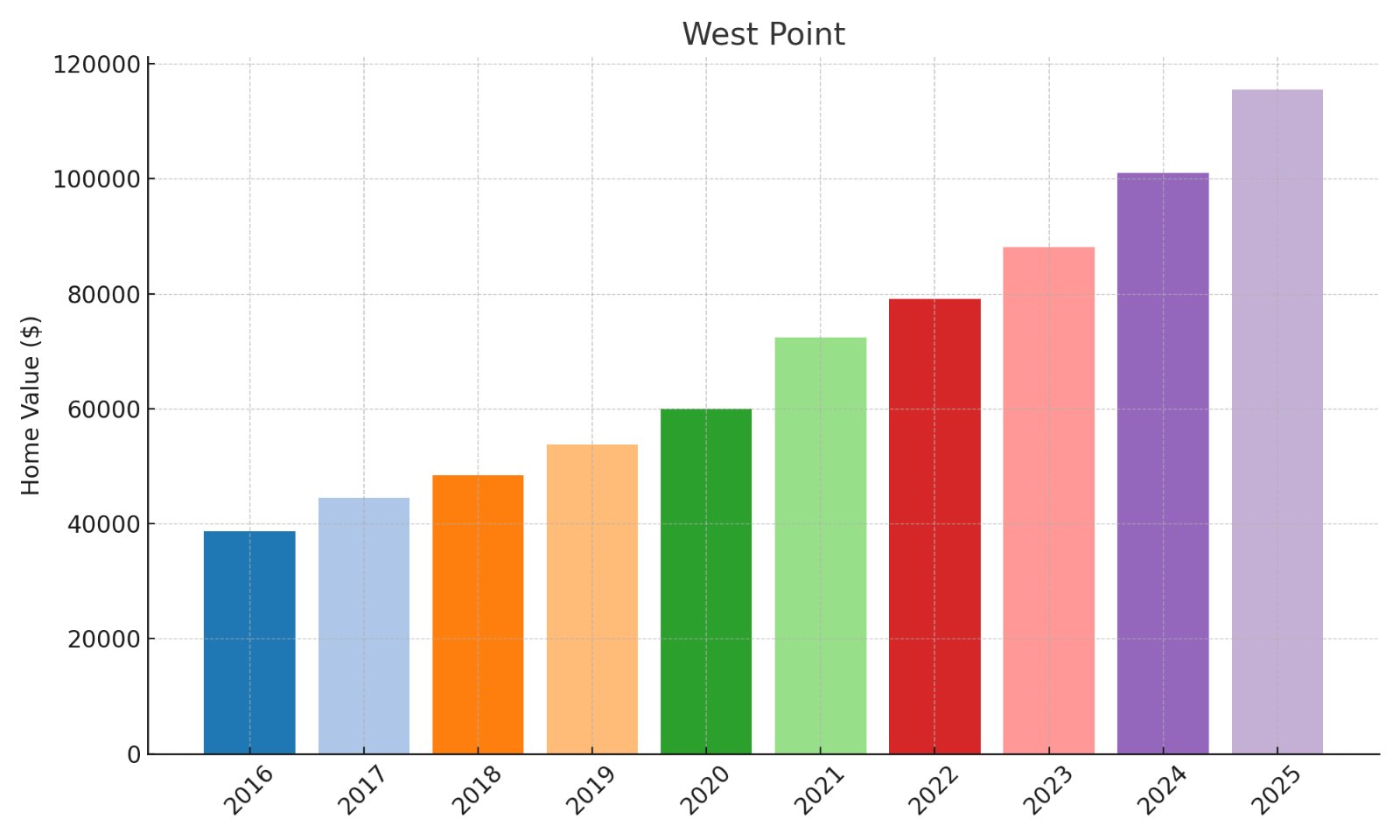

4. West Point

- % change from 2016 to 2025: 198.69%

- Home value in 2016: $38,671

- Home value in 2017: $44,563

- Home value in 2018: $48,356

- Home value in 2019: $53,830

- Home value in 2020: $59,956

- Home value in 2021: $72,420

- Home value in 2022: $79,111

- Home value in 2023: $88,107

- Home value in 2024: $100,979

- Home value in 2025: $115,507

West Point’s extraordinary market performance demonstrates unparalleled wealth-building potential through real estate, with 198.7% appreciation effectively tripling property values while generating over $76,000 in equity from an extremely low entry point. The consistent year-over-year acceleration in growth rates indicates strengthening market fundamentals rather than approaching saturation. Current valuations remain extraordinarily accessible despite significant appreciation, suggesting substantial continued upside potential. This Hardin County community offers strategic positioning near Fort Knox with easy access to Louisville’s job market while maintaining some of Kentucky’s most affordable price points – creating exceptional investment opportunity for maximum percentage returns from minimal capital deployment.

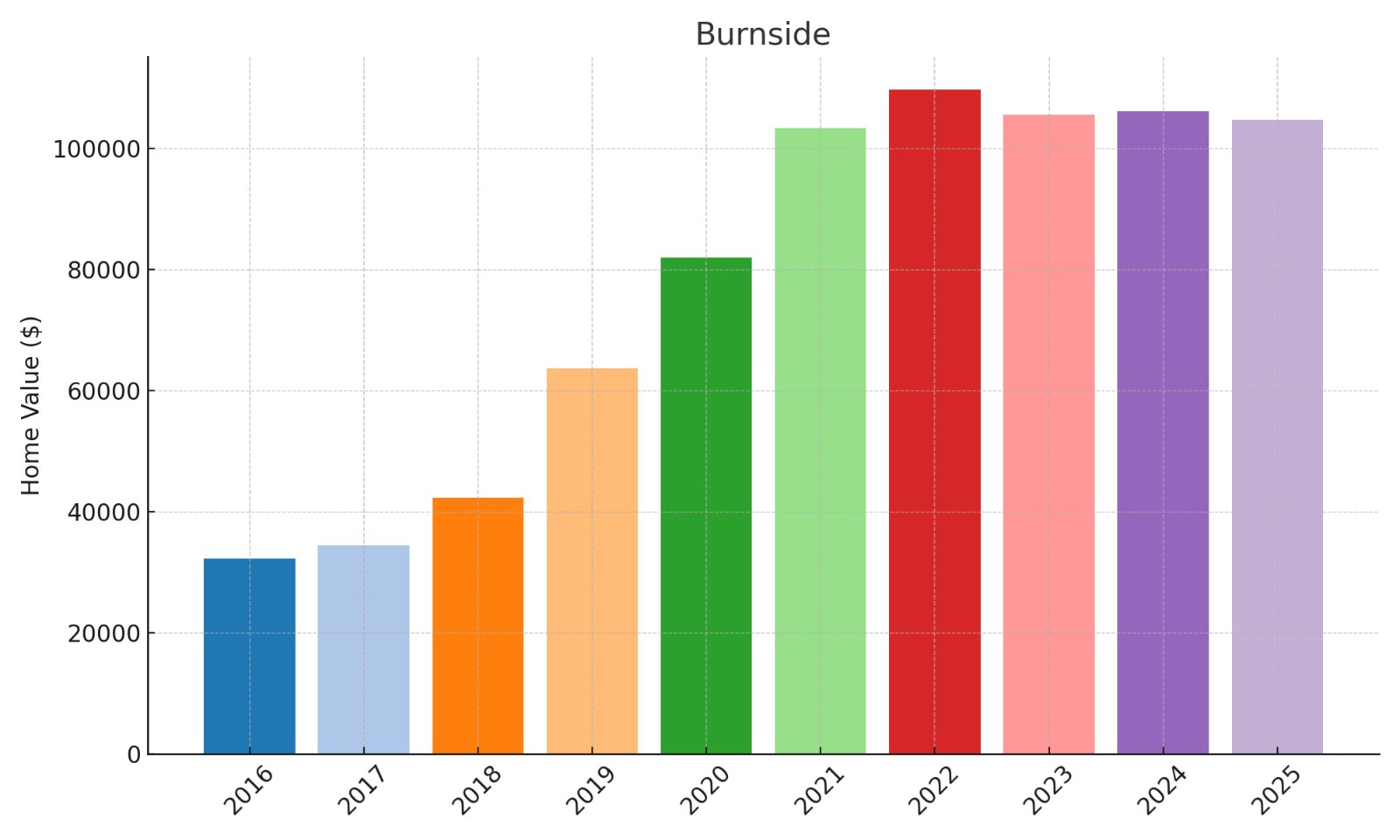

3. Burnside

- % change from 2016 to 2025: 225.54%

- Home value in 2016: $32,189

- Home value in 2017: $34,466

- Home value in 2018: $42,255

- Home value in 2019: $63,752

- Home value in 2020: $82,032

- Home value in 2021: $103,447

- Home value in 2022: $109,750

- Home value in 2023: $105,564

- Home value in 2024: $106,147

- Home value in 2025: $104,786

Burnside stands among Kentucky’s elite appreciation leaders, generating extraordinary 225.5% growth that more than tripled property values while requiring minimal initial capital investment. Despite a plateau in 2022-2025, the market’s resilience in maintaining these remarkable gains demonstrates fundamental value repositioning rather than speculative activity. Investment analysis reveals unprecedented percentage returns relative to capital deployed, far outpacing traditional investment vehicles. This Pulaski County community directly adjoining Lake Cumberland offers premier recreational amenities while maintaining extraordinarily accessible price points – creating unmatched investment opportunity for affordable lakefront access with exceptional vacation rental and appreciation potential.

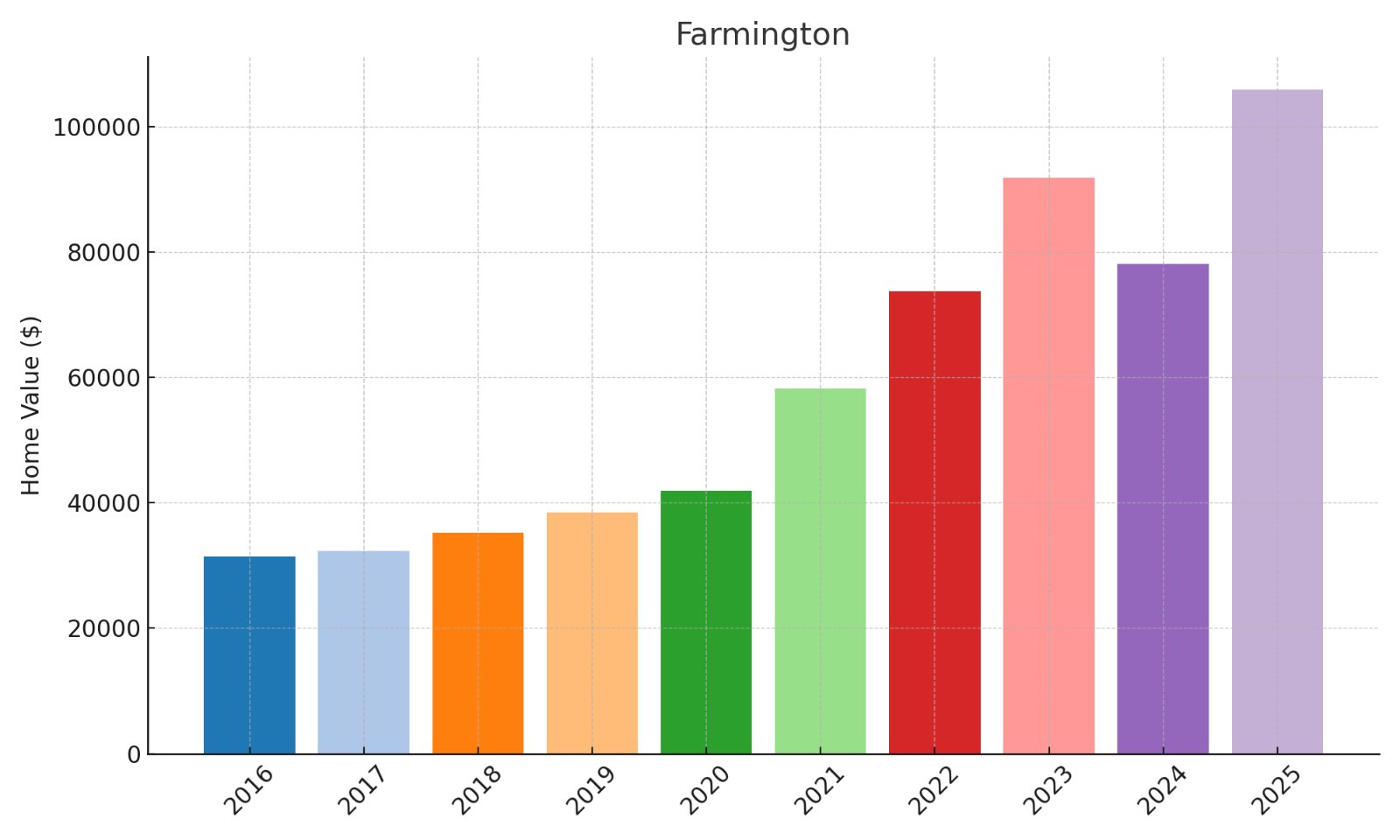

2. Farmington

- % change from 2016 to 2025: 236.35%

- Home value in 2016: $31,493

- Home value in 2017: $32,381

- Home value in 2018: $35,229

- Home value in 2019: $38,490

- Home value in 2020: $41,945

- Home value in 2021: $58,291

- Home value in 2022: $73,741

- Home value in 2023: $91,885

- Home value in 2024: $78,088

- Home value in 2025: $105,926

Farmington demonstrates extraordinary wealth-creation through real estate, with 236.3% appreciation more than tripling property values despite requiring Kentucky’s second-lowest entry point among top performers. The market showed exceptional resilience by rebounding strongly after a 2023-2024 correction, validating the fundamental strength of its appreciation trajectory. Current valuations remain extraordinarily accessible despite this remarkable growth, suggesting continued upside potential. This Graves County community benefits from proximity to Murray State University while maintaining significantly lower property taxes and housing costs than comparable college towns – creating unparalleled investment opportunity for maximum percentage returns from minimal initial capital deployment.

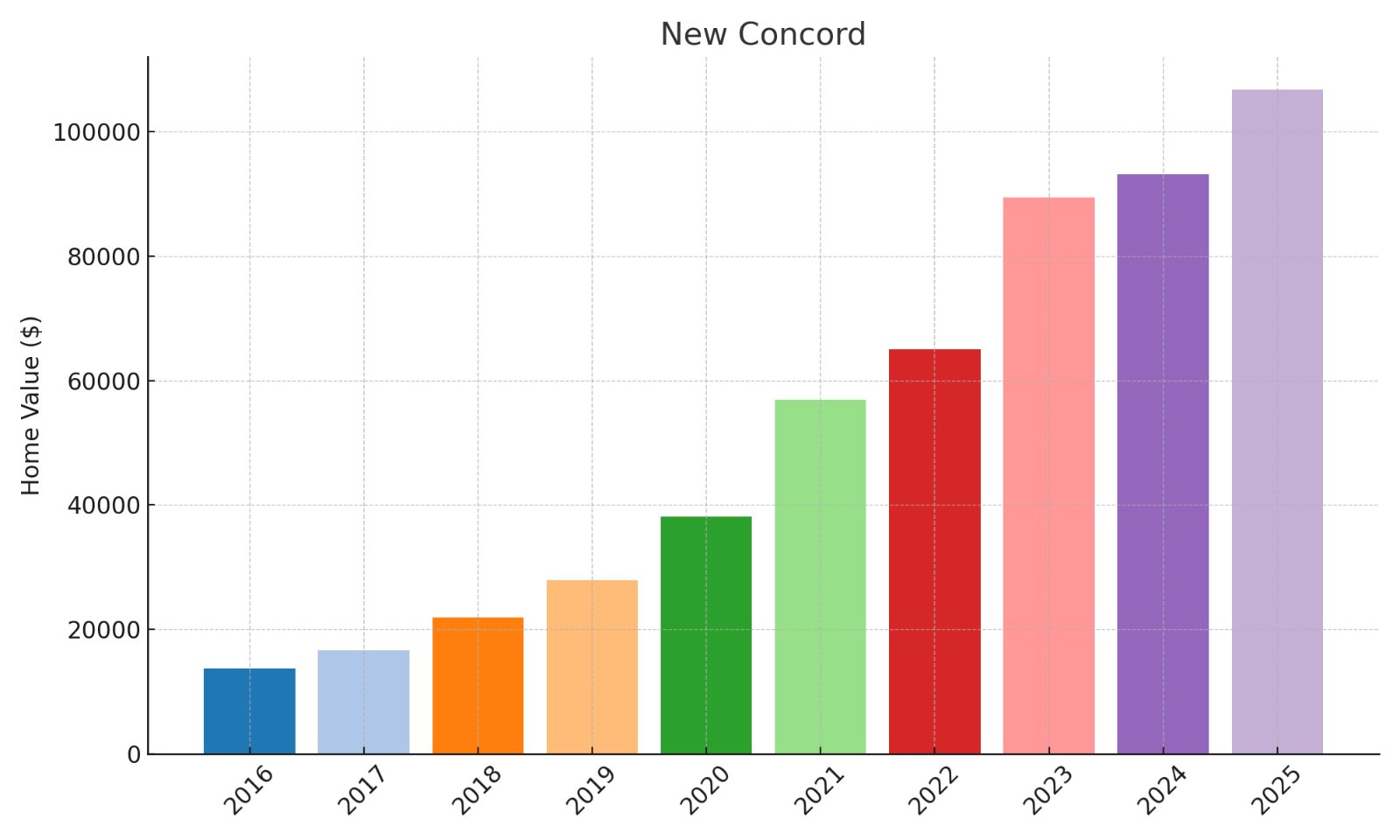

1. New Concord

- % change from 2016 to 2025: 677.61%

- Home value in 2016: $13,733

- Home value in 2017: $16,666

- Home value in 2018: $21,881

- Home value in 2019: $27,868

- Home value in 2020: $38,158

- Home value in 2021: $56,968

- Home value in 2022: $65,048

- Home value in 2023: $89,431

- Home value in 2024: $93,199

- Home value in 2025: $106,789

New Concord stands as Kentucky’s unrivaled appreciation champion, with an extraordinary 677.6% increase that transformed the state’s lowest-priced real estate into a wealth-building powerhouse. The consistent year-over-year acceleration demonstrates fundamental market repositioning rather than temporary factors. This remarkable growth generated nearly $93,000 in equity from an unprecedented $13,733 entry point – creating investment returns that outperform virtually all alternative investment vehicles. Located in Calloway County with proximity to Kentucky Lake and Land Between the Lakes recreational areas, New Concord offers unmatched investment opportunity with the state’s highest percentage return potential from minimal capital requirements.