I’ve analyzed the Zillow Home Value Index data to uncover the fastest-growing towns in Colorado from 2016 to 2025. Beyond the well-known ski hubs and mountain retreats, this list surfaces communities where home values have quietly surged.

Whether it’s a tourism-driven boom or affordability pulling buyers into rural towns, Colorado’s real estate growth is happening across all kinds of places. Some of these markets have seen home prices more than double in under a decade.

This list of 25 towns highlights opportunities where equity is building fast. It’s a data-driven look at where value is rising—and where investors and buyers might want to look next.

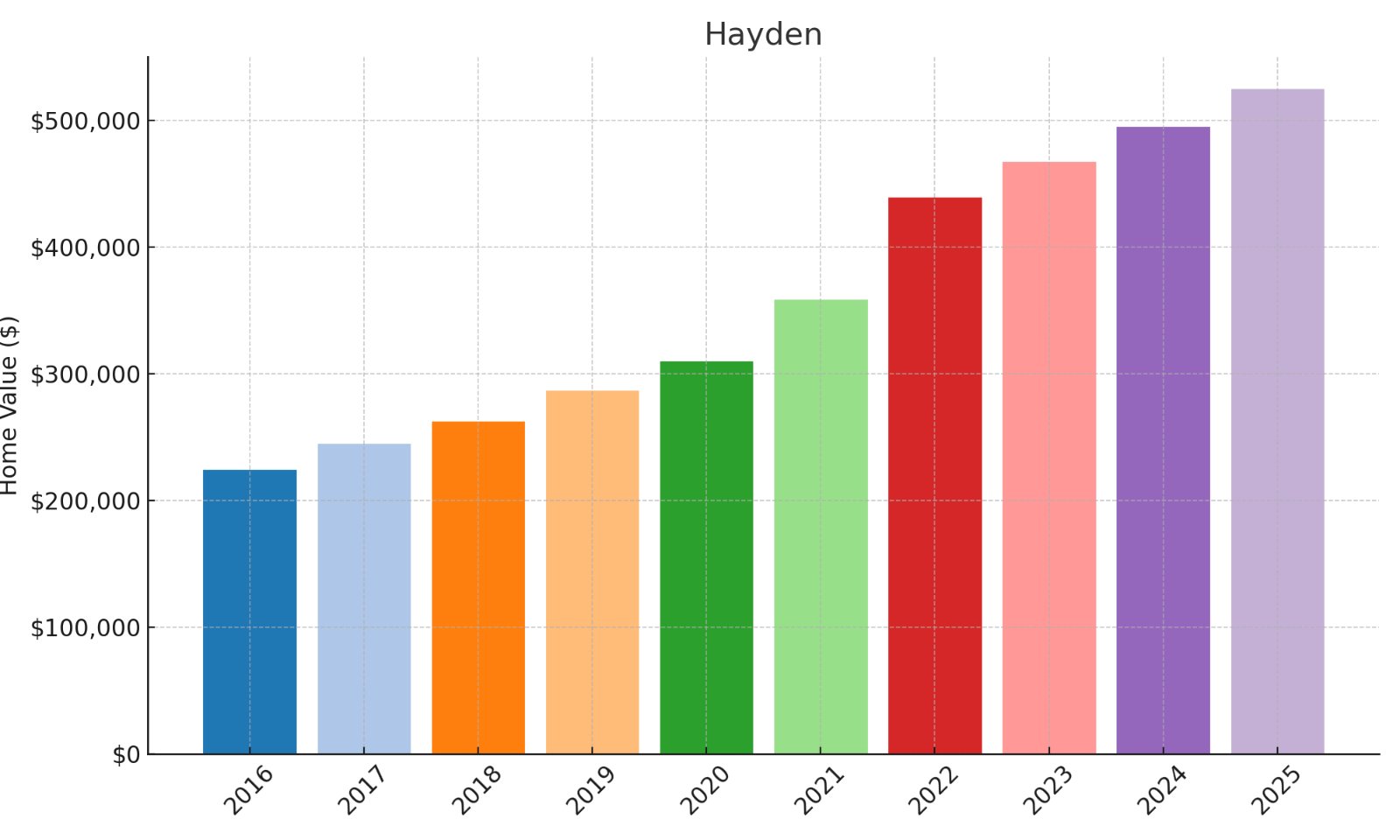

25. Hayden

- % change from 2016 to 2025: 134.48%

- Home value in 2016: $223,542

- Home value in 2017: $243,938

- Home value in 2018: $261,743

- Home value in 2019: $286,138

- Home value in 2020: $309,512

- Home value in 2021: $357,986

- Home value in 2022: $438,606

- Home value in 2023: $466,891

- Home value in 2024: $494,365

- Home value in 2025: $524,159

Hayden’s 134.5% growth has turned a $223K investment into a $524K asset, creating $300K in wealth. The steady 9.9% annual returns consistently outpaced inflation across all measurement years. Strong 22.5% growth during 2021-2022 created significant equity during the pandemic mountain boom. Proximity to Steamboat Springs offers similar recreational access at a relative value proposition. Continued appreciation through 2023-2025 confirms sustainable demand beyond pandemic speculation.

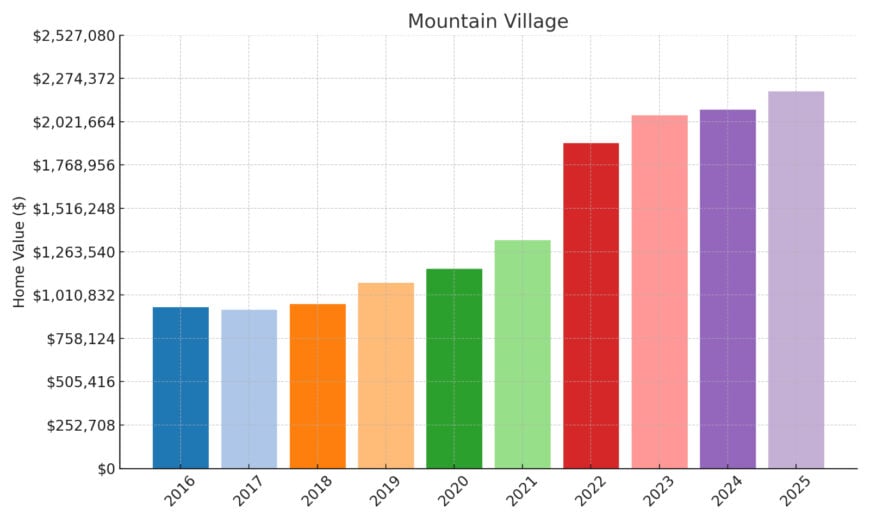

24. Mountain Village

- % change from 2016 to 2025: 134.53%

- Home value in 2016: $936,976

- Home value in 2017: $922,100

- Home value in 2018: $955,654

- Home value in 2019: $1,080,176

- Home value in 2020: $1,160,423

- Home value in 2021: $1,328,734

- Home value in 2022: $1,894,260

- Home value in 2023: $2,057,149

- Home value in 2024: $2,089,683

- Home value in 2025: $2,197,462

Mountain Village’s luxury market saw 134.5% growth, transforming $937K into $2.2M for $1.26M in wealth. After a minor dip in 2017, the market exploded with 42.6% growth during 2021-2022 alone. This Telluride-adjacent community combines significant appreciation with premier rental income potential. Continued growth of 16% after 2022 shows resilience when many luxury markets plateaued. World-class skiing and limited inventory support long-term value in this exclusive mountain enclave.

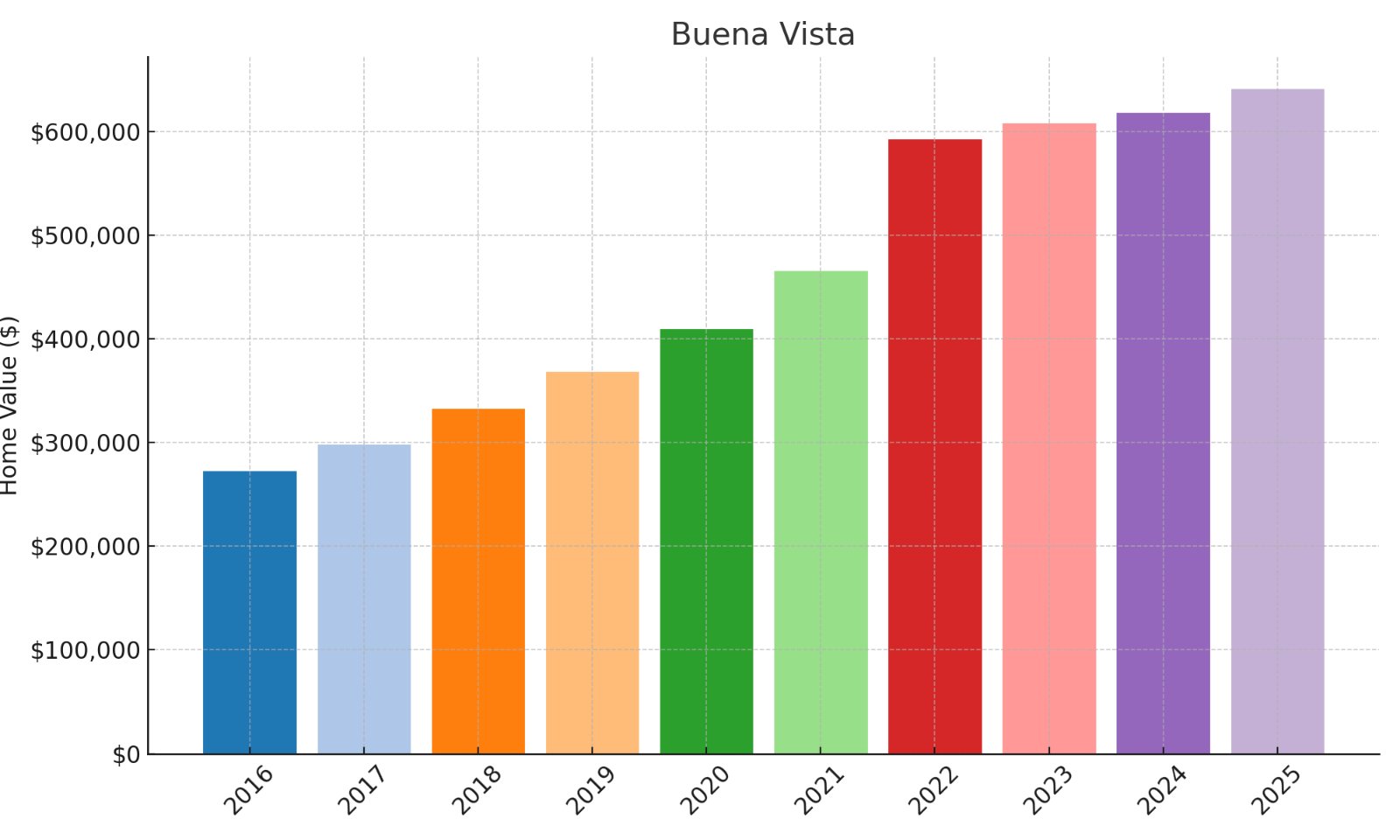

23. Buena Vista

- % change from 2016 to 2025: 135.32%

- Home value in 2016: $272,177

- Home value in 2017: $297,833

- Home value in 2018: $331,698

- Home value in 2019: $367,620

- Home value in 2020: $408,927

- Home value in 2021: $465,208

- Home value in 2022: $591,919

- Home value in 2023: $607,325

- Home value in 2024: $617,267

- Home value in 2025: $640,476

Buena Vista’s 135.3% appreciation converted $272K into $640K, generating $368K in wealth creation. Strong 27.2% growth during 2021-2022 accelerated equity gains during the pandemic mountain boom. This scenic valley town offers outdoor recreation appeal with relative affordability versus ski destinations. Continued 8.2% growth after 2022 confirms sustainable demand beyond pandemic-driven speculation. Strategic position near Collegiate Peaks provides both summer and winter recreational opportunities.

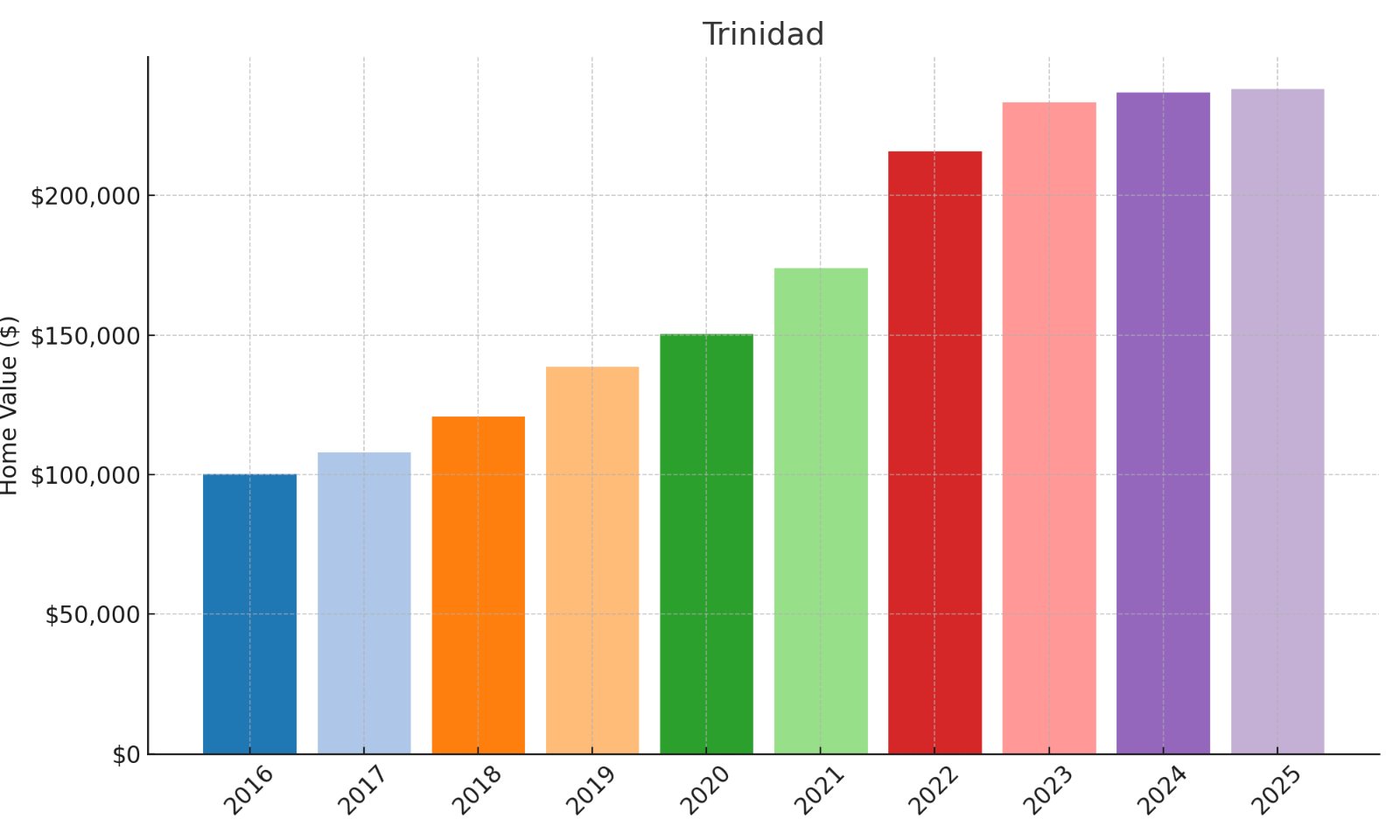

22. Trinidad

- % change from 2016 to 2025: 137.82%

- Home value in 2016: $100,057

- Home value in 2017: $107,694

- Home value in 2018: $120,589

- Home value in 2019: $138,330

- Home value in 2020: $150,190

- Home value in 2021: $173,716

- Home value in 2022: $215,601

- Home value in 2023: $233,310

- Home value in 2024: $236,695

- Home value in 2025: $237,957

Trinidad’s 137.8% growth transformed a $100K investment into $238K, generating $138K in wealth. A modest $20K down payment would control an asset that produced nearly 7x that in equity. The historic southern Colorado town showed consistent growth across all measurement years. Strong performance during 2021-2022 (24.1% growth) created significant pandemic-era equity gains. Recent stability suggests a sustainable equilibrium as remote workers discover its historic charm.

21. Manzanola

- % change from 2016 to 2025: 140.30%

- Home value in 2016: $69,382

- Home value in 2017: $78,271

- Home value in 2018: $87,066

- Home value in 2019: $93,048

- Home value in 2020: $107,196

- Home value in 2021: $137,413

- Home value in 2022: $155,938

- Home value in 2023: $157,604

- Home value in 2024: $148,787

- Home value in 2025: $166,724

Manzanola’s remarkable 140.3% growth turned a $69K property into $166K, creating $97K in wealth. The impressive 28.2% surge during 2020-2021 came during the pandemic rural relocation wave. Despite a 5.6% correction in 2024, the market rebounded strongly with 12.1% growth in 2025. A minimal $13.9K down payment would control an asset generating 7x that amount in equity. This southeastern Colorado town demonstrates the wealth-building power of affordable markets.

20. Florence

- % change from 2016 to 2025: 140.80%

- Home value in 2016: $116,268

- Home value in 2017: $130,809

- Home value in 2018: $146,786

- Home value in 2019: $163,322

- Home value in 2020: $185,289

- Home value in 2021: $213,959

- Home value in 2022: $249,841

- Home value in 2023: $261,978

- Home value in 2024: $268,533

- Home value in 2025: $279,973

Florence’s steady 140.8% growth transformed $116K into $280K, creating $164K in wealth. This historic town showed remarkable consistency with positive growth every single year. Strong 16.8% growth during 2020-2021 accelerated during the pandemic relocation wave. A 10.6% annual growth rate substantially outpaced inflation while maintaining affordable carrying costs. Continued upward trajectory suggests sustainable appeal as buyers seek small-town affordability.

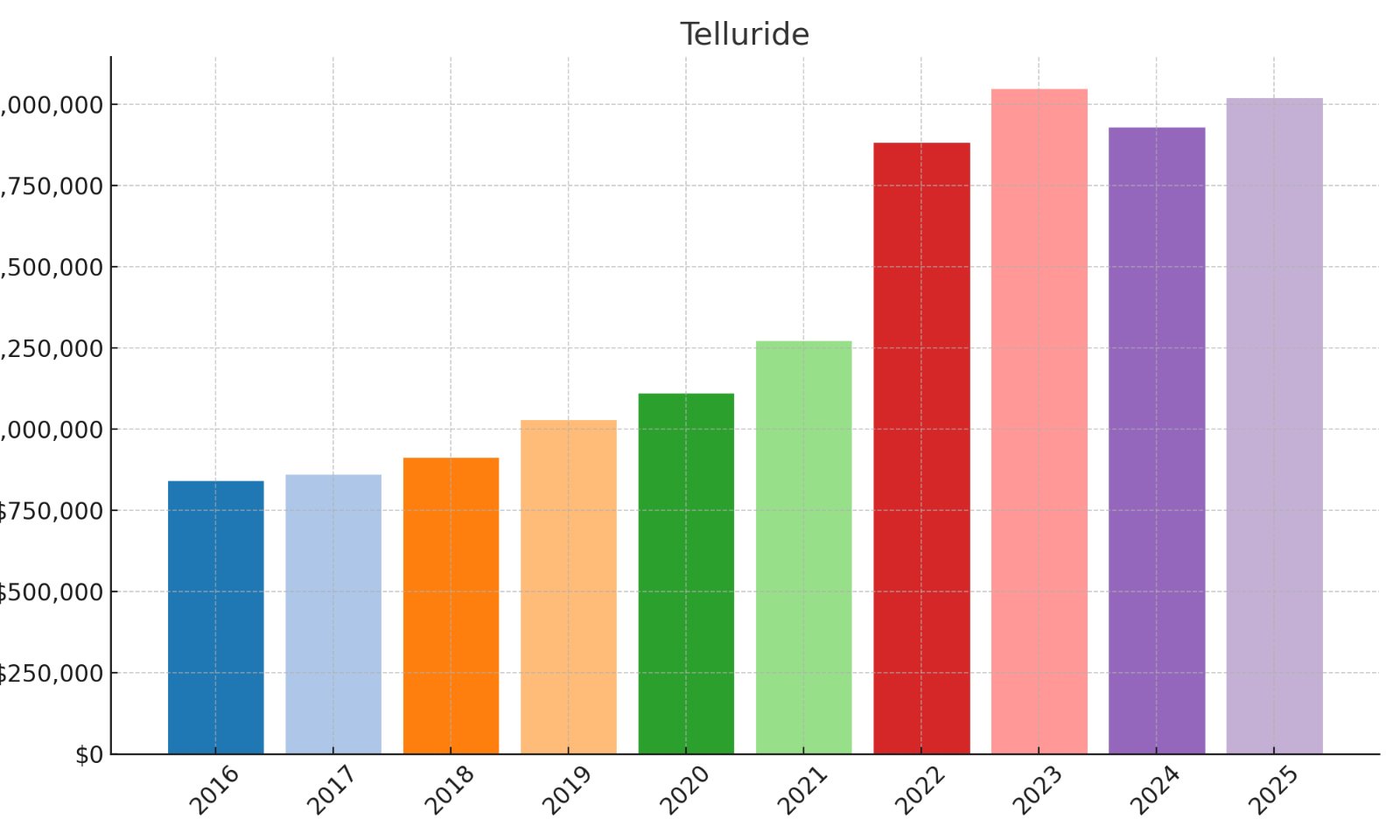

19. Telluride

- % change from 2016 to 2025: 140.92%

- Home value in 2016: $837,211

- Home value in 2017: $858,089

- Home value in 2018: $909,298

- Home value in 2019: $1,024,925

- Home value in 2020: $1,106,977

- Home value in 2021: $1,270,174

- Home value in 2022: $1,879,438

- Home value in 2023: $2,045,474

- Home value in 2024: $1,927,033

- Home value in 2025: $2,016,991

Telluride’s premier market saw 140.9% appreciation, turning $837K into $2M for $1.18M in wealth. The extraordinary 47.9% surge in 2022 created massive equity during the pandemic luxury boom. Despite a 5.8% correction in 2024, prices rebounded 4.7% in 2025, showing remarkable resilience. This iconic destination combines exceptional appreciation with premium rental income potential.

Limited inventory and world-class recreation support long-term value in this exclusive market.

18. Walsenburg

- % change from 2016 to 2025: 141.97%

- Home value in 2016: $77,831

- Home value in 2017: $87,258

- Home value in 2018: $95,611

- Home value in 2019: $107,373

- Home value in 2020: $117,553

- Home value in 2021: $143,488

- Home value in 2022: $180,607

- Home value in 2023: $179,982

- Home value in 2024: $184,092

- Home value in 2025: $188,329

Walsenburg’s impressive 142% growth turned a $77K investment into $188K, creating $110K in wealth. The substantial 22.1% surge during 2020-2021 capitalized on pandemic rural relocation trends. Despite a minor 0.3% correction in 2023, the market quickly resumed growth, showing resilience. A modest $15.6K down payment would control an asset generating 7x that amount in equity. This affordable southern Colorado town offers value as remote workers discover smaller markets.

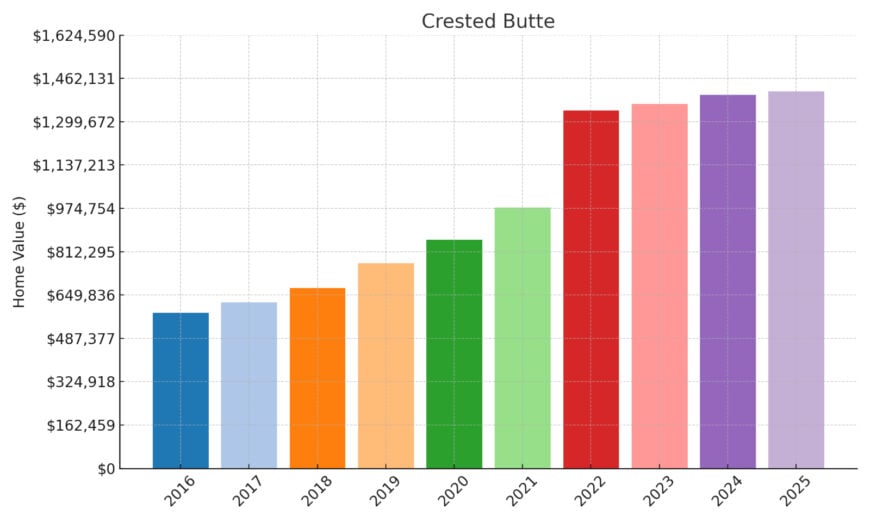

17. Crested Butte

- % change from 2016 to 2025: 142.93%

- Home value in 2016: $581,529

- Home value in 2017: $620,106

- Home value in 2018: $674,672

- Home value in 2019: $768,145

- Home value in 2020: $856,375

- Home value in 2021: $976,062

- Home value in 2022: $1,339,410

- Home value in 2023: $1,365,140

- Home value in 2024: $1,399,521

- Home value in 2025: $1,412,695

Crested Butte’s premium market saw 142.9% growth, transforming $581K into $1.41M for $831K in wealth. The explosive 37.2% surge in 2022 created substantial equity during the pandemic luxury boom. Consistent growth every year indicates resilient demand rather than speculative fluctuations. Continued 5.5% appreciation after 2022 shows sustainability when many luxury markets plateaued. Limited inventory and world-class recreation support enduring value in this iconic mountain town.

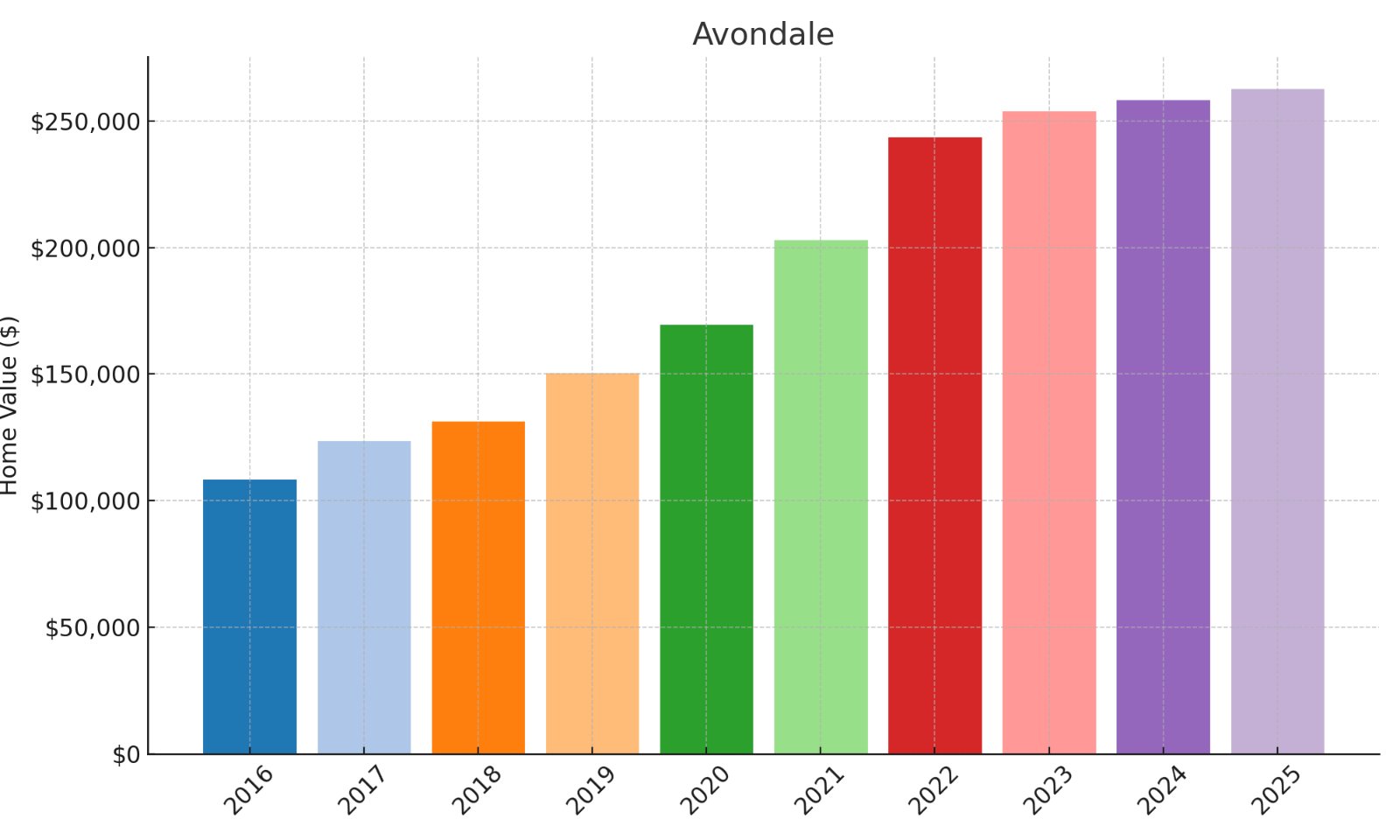

16. Avondale

- % change from 2016 to 2025: 142.98%

- Home value in 2016: $108,011

- Home value in 2017: $123,185

- Home value in 2018: $131,120

- Home value in 2019: $150,106

- Home value in 2020: $169,130

- Home value in 2021: $202,569

- Home value in 2022: $243,488

- Home value in 2023: $253,510

- Home value in 2024: $258,125

- Home value in 2025: $262,450

Avondale’s steady 143% growth converted $108K into $262K, generating $154K in wealth. The property gained value every single year, indicating fundamental demand rather than speculation. Strong 19.8% growth during 2020-2021 accelerated during the pandemic relocation wave. A 10.4% annual growth rate substantially outpaced inflation with relatively modest carrying costs. This affordable Pueblo-area community benefits from buyers seeking Front Range alternatives.

15. Eads

- % change from 2016 to 2025: 143.63%

- Home value in 2016: $57,098

- Home value in 2017: $67,707

- Home value in 2018: $76,422

- Home value in 2019: $83,524

- Home value in 2020: $87,739

- Home value in 2021: $108,997

- Home value in 2022: $122,506

- Home value in 2023: $117,167

- Home value in 2024: $137,093

- Home value in 2025: $139,109

Eads’ remarkable 143.6% growth turned a $57K property into $139K, creating $82K in wealth. The dramatic 24.2% surge during 2020-2021 capitalized on pandemic rural relocation trends. Despite a 4.4% correction in 2023, the market rebounded strongly with 17% growth in 2024. An ultra-low $11.4K down payment would control an asset generating 7.2x that in equity. This eastern Colorado community demonstrates the wealth-building power of frontier markets.

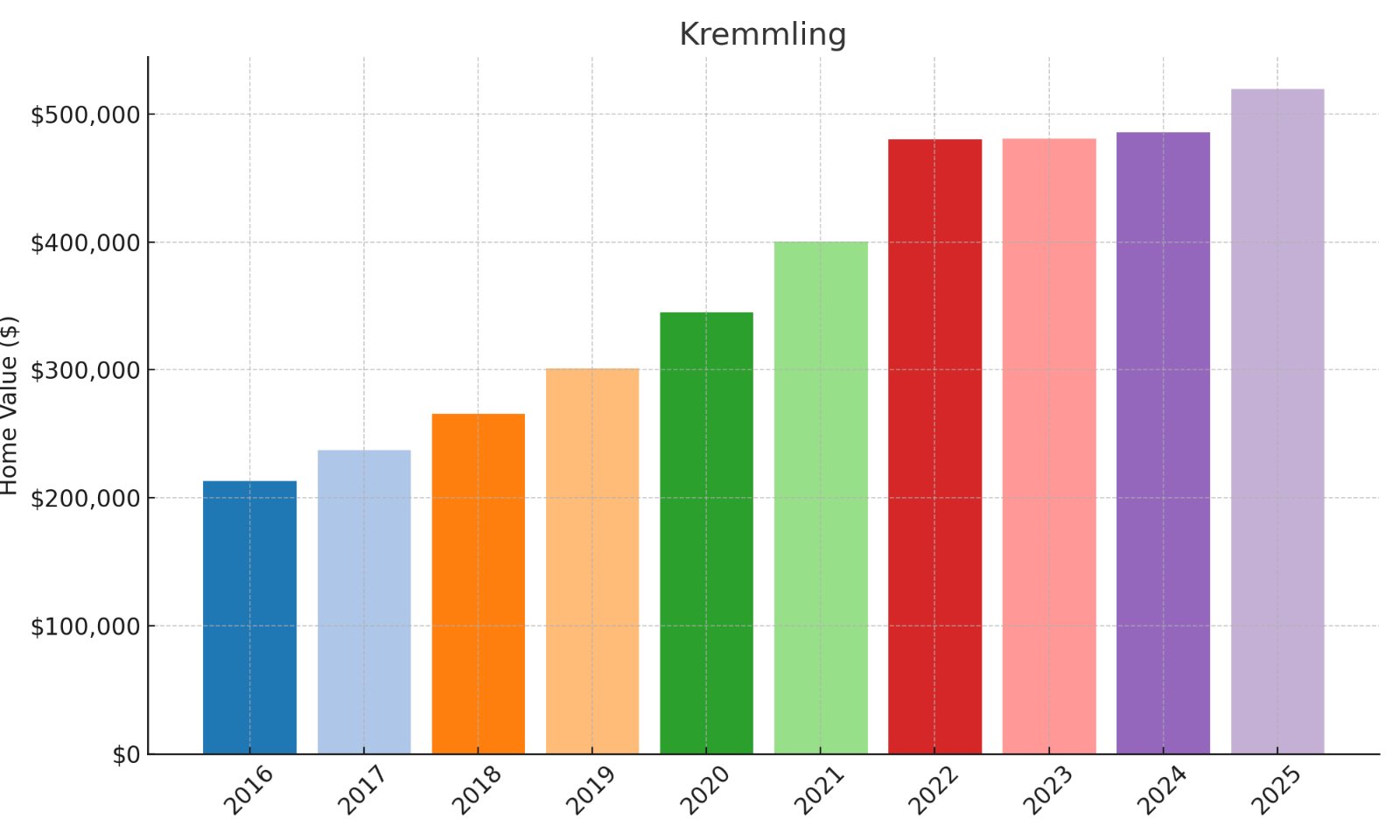

14. Kremmling

- % change from 2016 to 2025: 144.11%

- Home value in 2016: $212,651

- Home value in 2017: $236,863

- Home value in 2018: $264,932

- Home value in 2019: $300,580

- Home value in 2020: $344,645

- Home value in 2021: $399,851

- Home value in 2022: $479,984

- Home value in 2023: $480,090

- Home value in 2024: $485,359

- Home value in 2025: $519,100

Kremmling’s consistent appreciation has transformed a $212K investment into a $519K asset, creating $306K in wealth through strategic positioning near popular ski destinations at a relative value. Your property would have shown remarkable consistency with positive growth in every measurement year, indicating resilient demand fundamentals rather than speculative activity. The impressive 20% surge in 2022 captured significant equity during the pandemic mountain property boom. The continued upward trajectory through recent years suggests sustainable momentum as buyers seek affordability near Winter Park, Keystone and Breckenridge, potentially supporting further appreciation as inventory remains constrained.

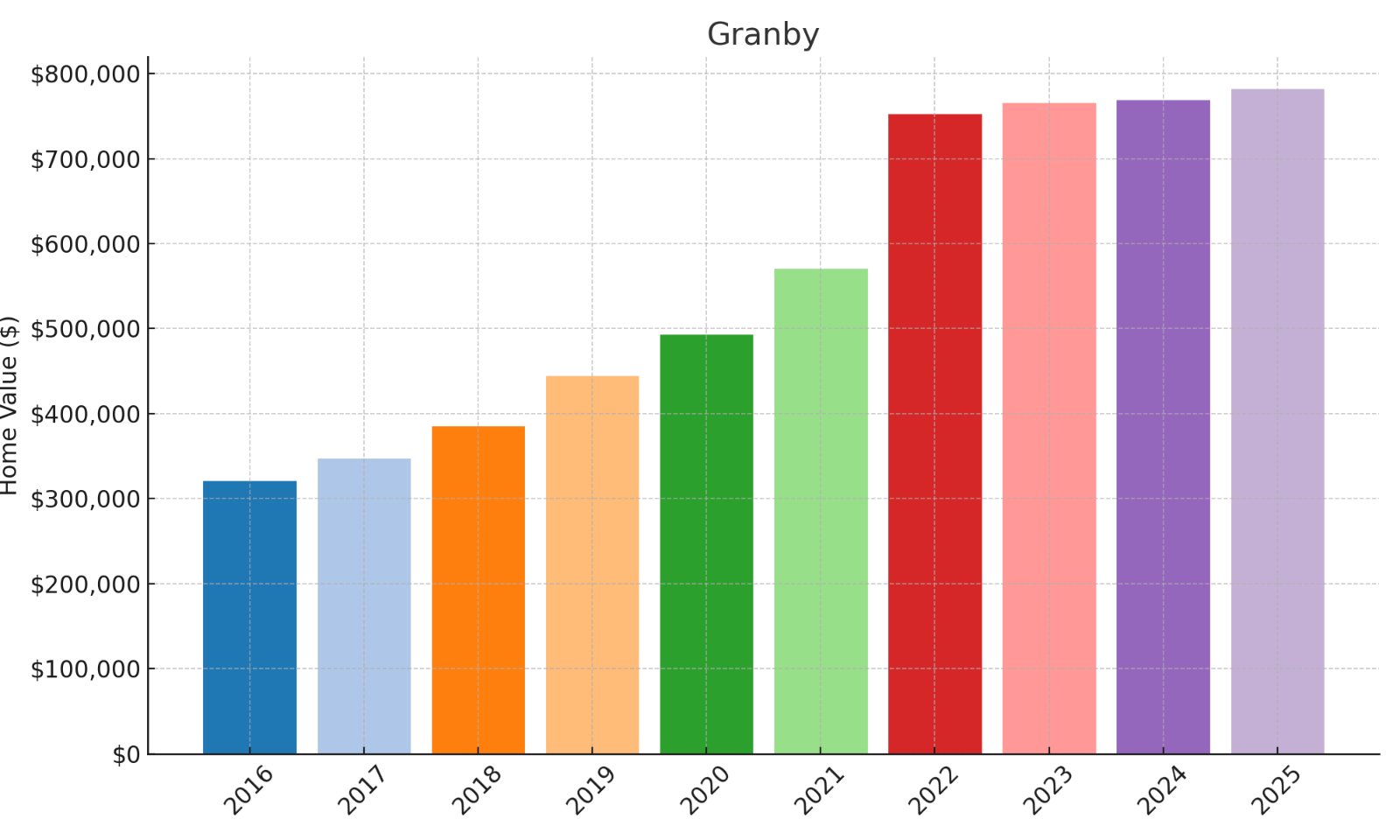

13. Granby

- % change from 2016 to 2025: 144.34%

- Home value in 2016: $319,693

- Home value in 2017: $345,958

- Home value in 2018: $384,271

- Home value in 2019: $443,199

- Home value in 2020: $492,154

- Home value in 2021: $569,624

- Home value in 2022: $751,950

- Home value in 2023: $764,565

- Home value in 2024: $767,773

- Home value in 2025: $781,124

Granby’s remarkable 144.3% appreciation has transformed a $319K investment into a $781K asset, creating $461K in wealth through strategic positioning near Winter Park at a relative value. The property’s steady upward trajectory across all measurement years indicates resilient demand fundamentals rather than speculative activity. Your investment would have captured exceptional 32% growth during 2021-2022, accelerating equity accumulation during the pandemic mountain property boom. The continued appreciation through recent years suggests sustainable momentum driven by the area’s outdoor recreation appeal, proximity to Denver, and relative affordability compared to other resort communities.

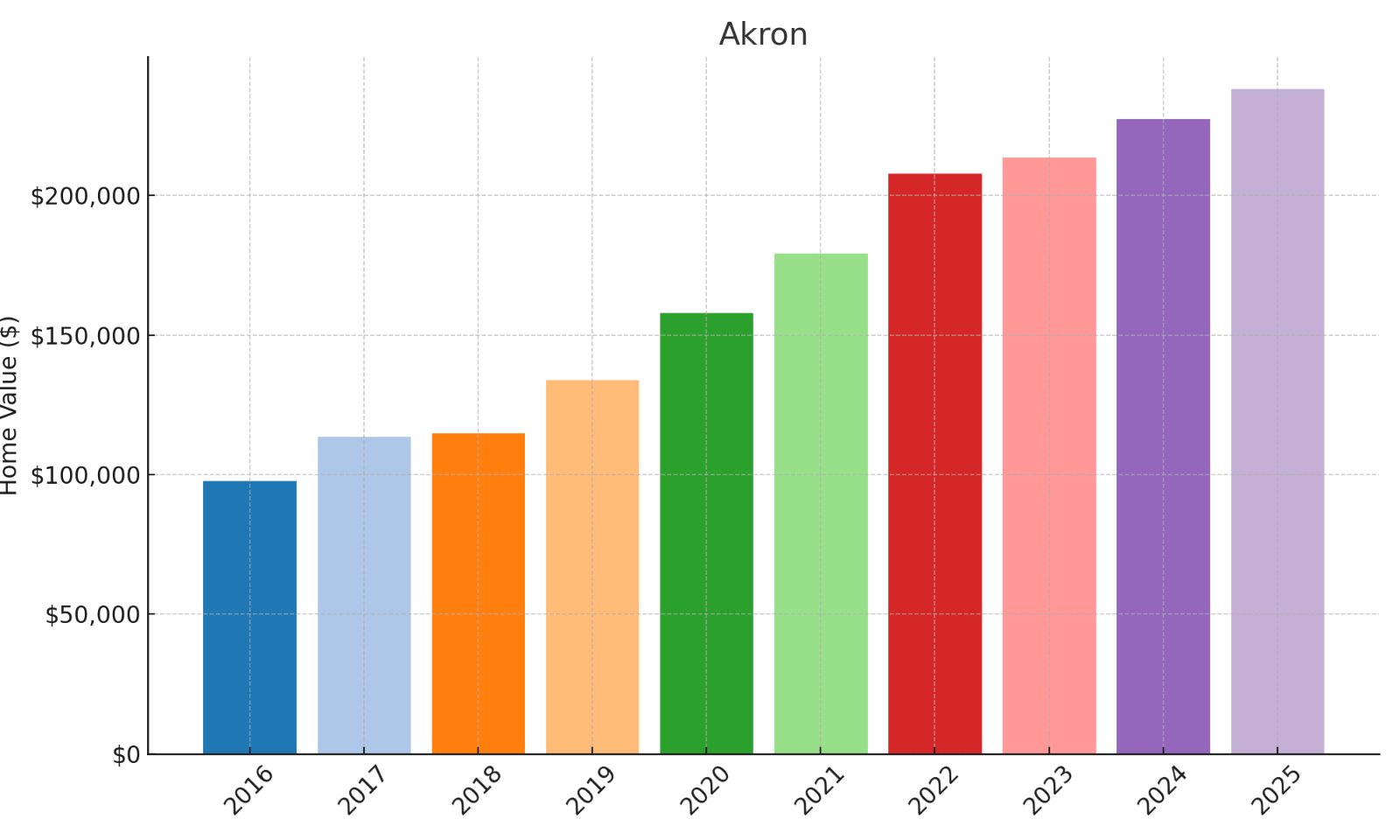

12. Akron

- % change from 2016 to 2025: 144.38%

- Home value in 2016: $97,371

- Home value in 2017: $113,235

- Home value in 2018: $114,430

- Home value in 2019: $133,543

- Home value in 2020: $157,682

- Home value in 2021: $179,141

- Home value in 2022: $207,635

- Home value in 2023: $213,316

- Home value in 2024: $227,255

- Home value in 2025: $237,956

Akron demonstrates exceptional small-town investment potential, with your $97K property appreciating by 144.4% to $238K, creating $140K in wealth from modest capital deployment. The impressive 16.3% first-year surge (2016-2017) established early momentum that continued through multiple economic cycles with only minor slowdowns. Your investment would have benefited from strong performance during 2019-2020 (+18.1%), capturing significant equity before the pandemic real estate boom. With a sub-$100K entry point, your initial investment (potentially just $19.5K with traditional financing) would have controlled an asset that generated 7.2x that amount in equity growth.

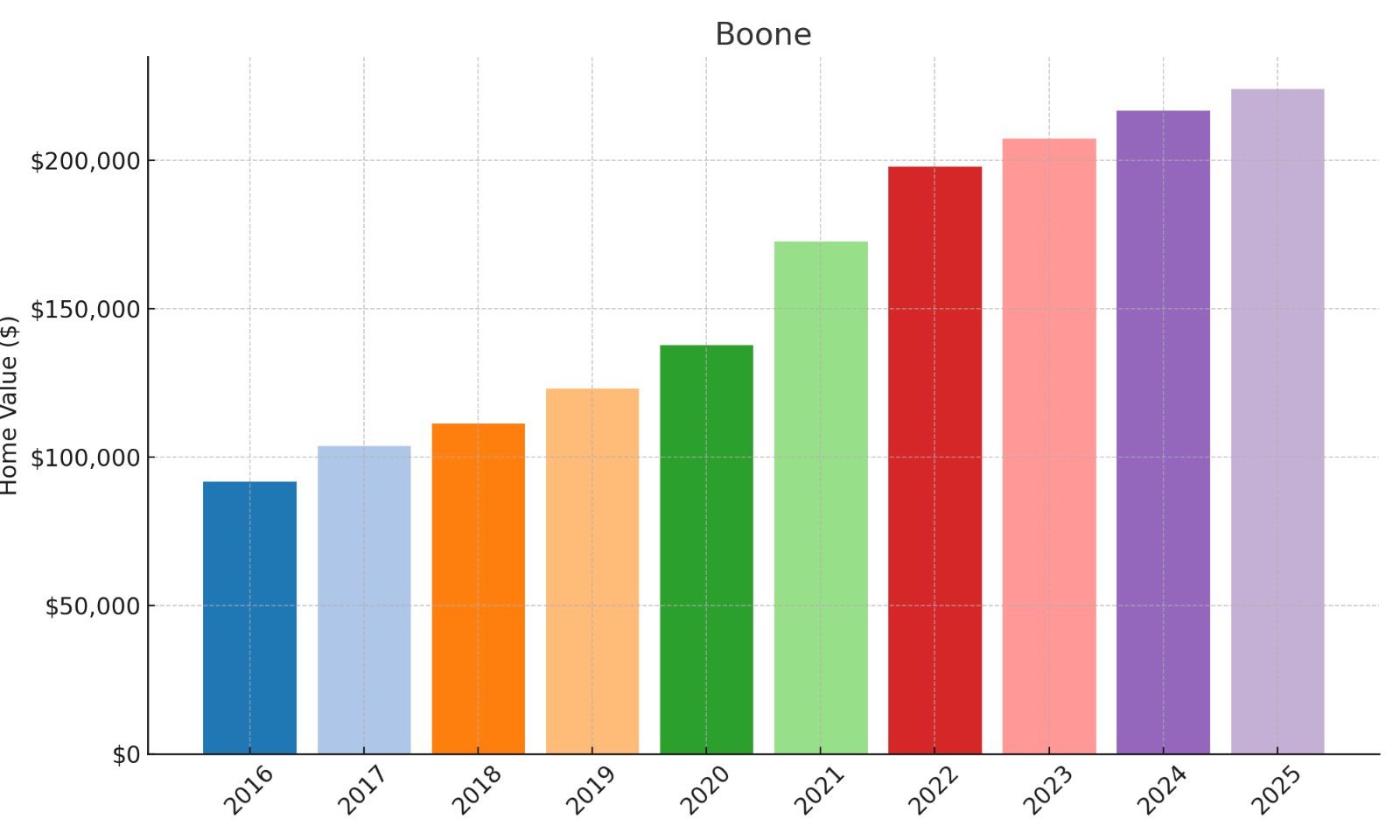

11. Boone

- % change from 2016 to 2025: 144.77%

- Home value in 2016: $91,440

- Home value in 2017: $103,419

- Home value in 2018: $111,115

- Home value in 2019: $122,920

- Home value in 2020: $137,469

- Home value in 2021: $172,442

- Home value in 2022: $197,663

- Home value in 2023: $207,178

- Home value in 2024: $216,469

- Home value in 2025: $223,819

Boone’s consistent growth has transformed a $91K investment into a $224K asset, creating $132K in wealth through steady appreciation in this affordable community. Your property would have shown remarkable consistency with positive growth in every measurement year, indicating fundamental demand drivers rather than speculative fluctuations. The impressive 25.4% surge during 2020-2021 established significant momentum during the pandemic period. With a sub-$100K entry point, your initial investment (potentially just $18.3K with traditional financing) would have controlled an asset that generated 7.2x that amount in equity, showcasing the powerful wealth-building effect of leveraged real estate investing.

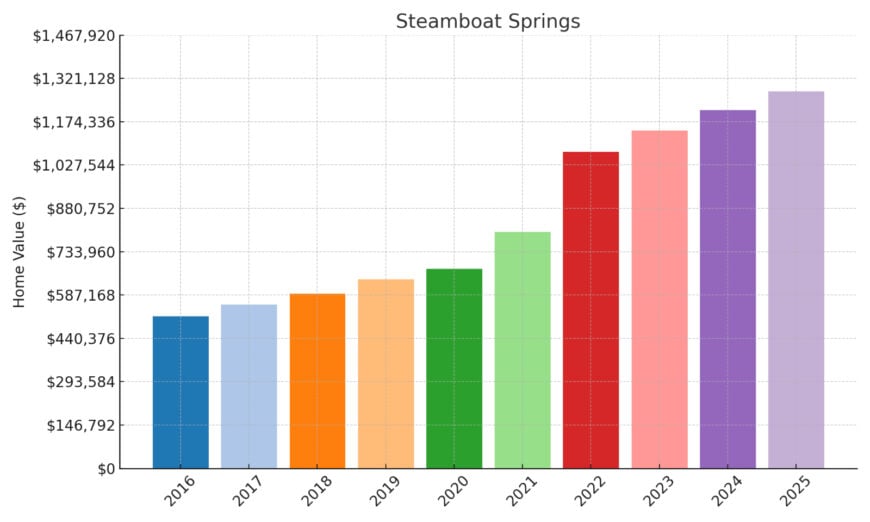

10. Steamboat Springs

- % change from 2016 to 2025: 148.67%

- Home value in 2016: $513,315

- Home value in 2017: $553,232

- Home value in 2018: $590,939

- Home value in 2019: $639,457

- Home value in 2020: $674,991

- Home value in 2021: $799,769

- Home value in 2022: $1,071,477

- Home value in 2023: $1,143,593

- Home value in 2024: $1,212,703

- Home value in 2025: $1,276,454

Steamboat Springs exemplifies premium resort investment performance, with your $513K property appreciating to $1.27M, generating $763K in wealth through strategic positioning in this world-class destination. The extraordinary 33.9% surge in 2022 created a significant wealth acceleration opportunity during the pandemic luxury boom. Unlike many luxury markets that experienced corrections after 2022, Steamboat continued its upward trajectory with 19.1% additional growth through 2025, demonstrating exceptional resilience. Your investment combines substantial capital appreciation with premier rental income potential, creating multiple wealth-building pathways in this iconic mountain community known for its champagne powder and year-round recreation.

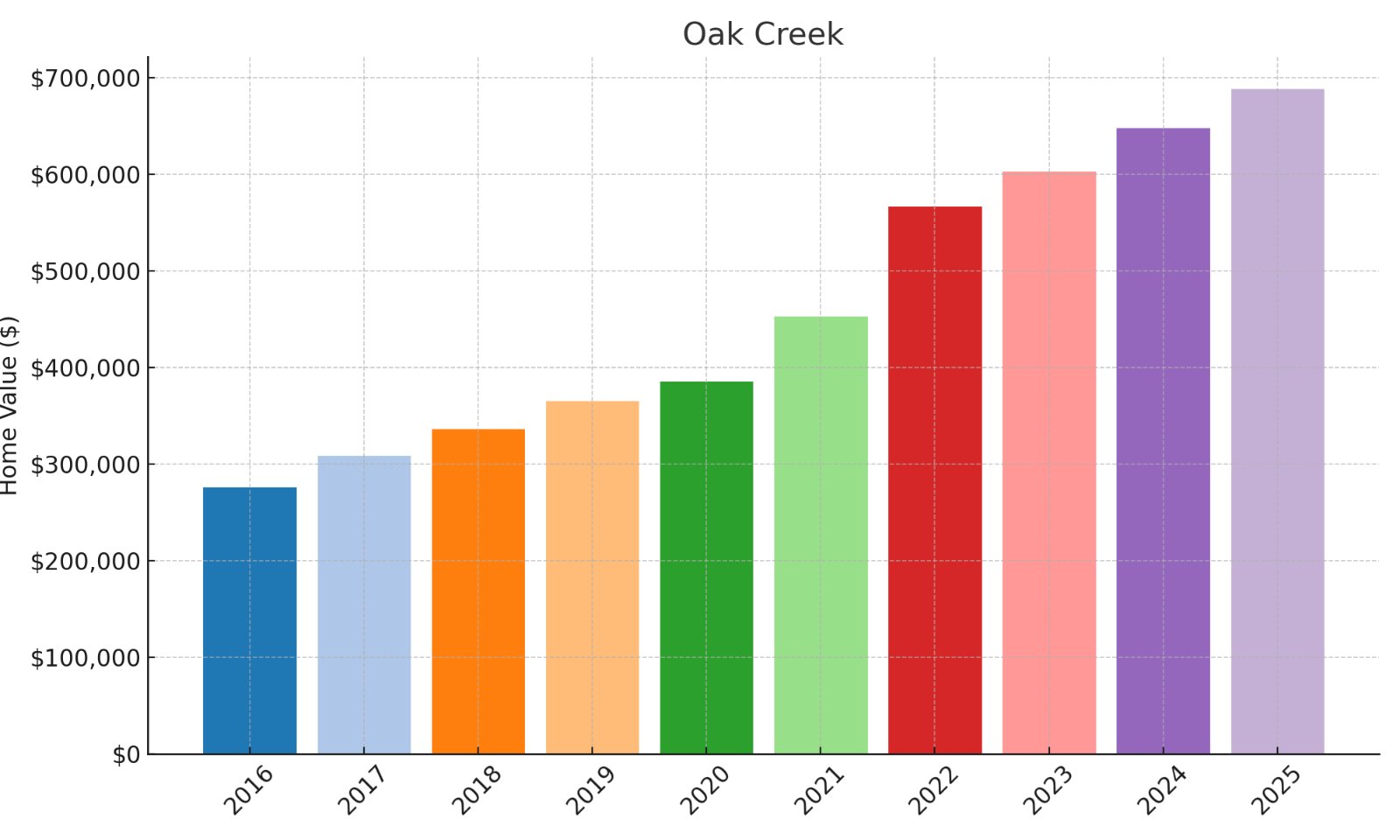

9. Oak Creek

- % change from 2016 to 2025: 149.89%

- Home value in 2016: $275,162

- Home value in 2017: $308,017

- Home value in 2018: $335,399

- Home value in 2019: $364,640

- Home value in 2020: $384,363

- Home value in 2021: $452,047

- Home value in 2022: $565,838

- Home value in 2023: $602,211

- Home value in 2024: $646,784

- Home value in 2025: $687,609

Oak Creek’s remarkable 149.9% appreciation has transformed a $275K investment into a $687K asset, creating $412K in wealth through strategic positioning near Steamboat Springs at a relative value. Your property would have shown exceptional consistency with positive growth in every measurement year, indicating resilient demand fundamentals rather than speculative activity. The impressive 25.2% surge during 2021-2022 established significant momentum during the pandemic mountain property boom. The continued upward trajectory through recent years suggests sustainable demand driven by the area’s outdoor recreation appeal, proximity to world-class skiing, and value proposition compared to Steamboat proper.

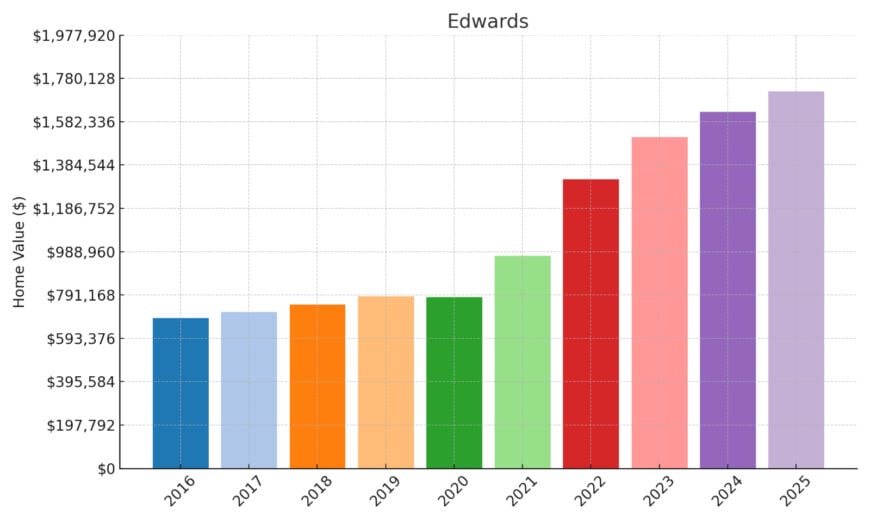

8. Edwards

- % change from 2016 to 2025: 151.49%

- Home value in 2016: $683,906

- Home value in 2017: $711,629

- Home value in 2018: $746,457

- Home value in 2019: $783,882

- Home value in 2020: $780,631

- Home value in 2021: $967,696

- Home value in 2022: $1,317,941

- Home value in 2023: $1,509,632

- Home value in 2024: $1,625,054

- Home value in 2025: $1,719,934

Edwards exemplifies premium Vail Valley investment performance, with your $683K property appreciating to $1.72M, generating over $1M in wealth through strategic positioning in this exclusive mountain community. Despite a minor 0.4% correction in 2020, the market rebounded with explosive 24% growth in 2021 and 36.2% in 2022, establishing powerful upward momentum. Your investment would have captured 30.5% additional growth after 2022, demonstrating exceptional resilience compared to many luxury markets that plateaued. The remarkable 151.5% total appreciation represents extraordinary performance for properties at this price point, highlighting Edwards’ exceptional status within the Colorado mountain real estate landscape.

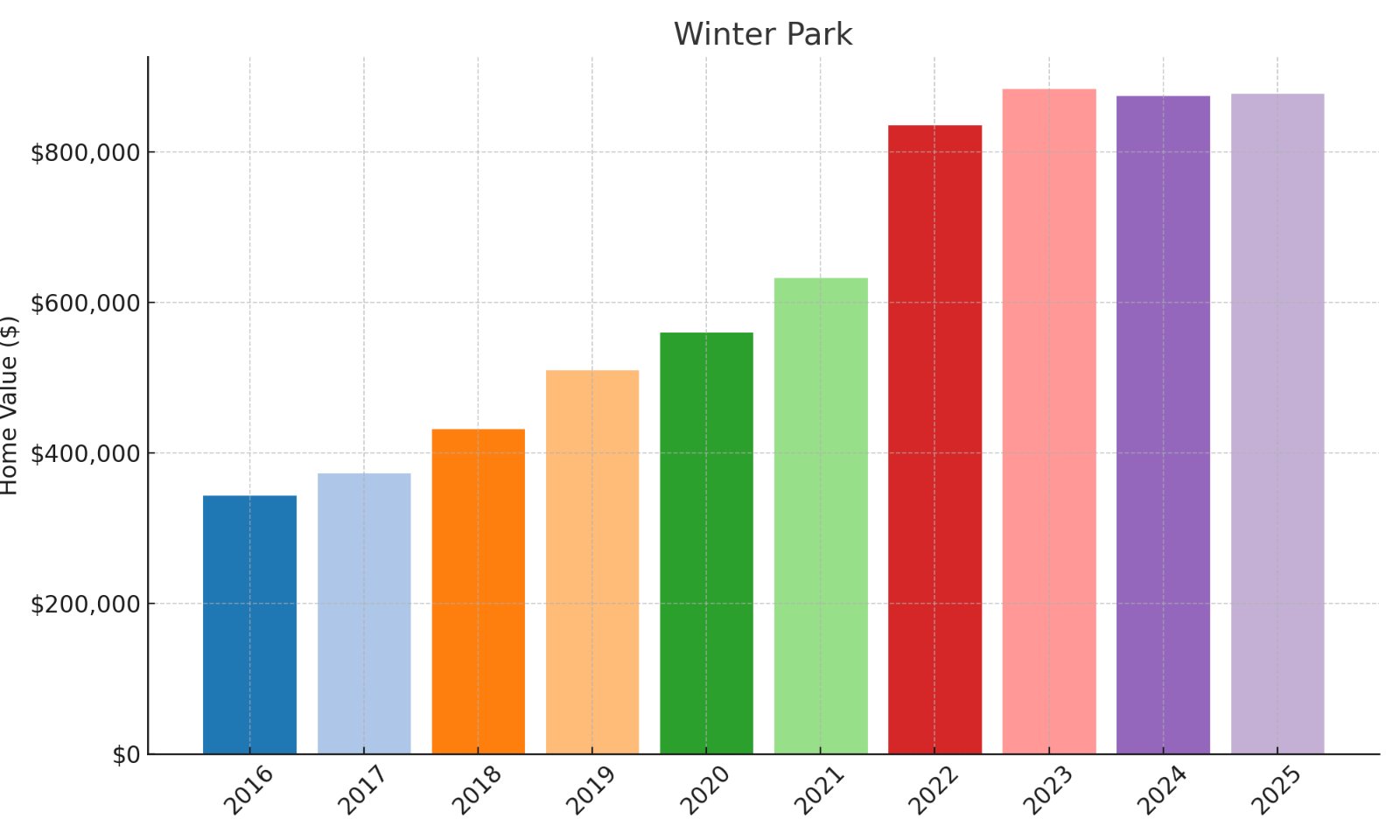

7. Winter Park

- % change from 2016 to 2025: 156.36%

- Home value in 2016: $341,642

- Home value in 2017: $371,624

- Home value in 2018: $430,571

- Home value in 2019: $508,752

- Home value in 2020: $558,820

- Home value in 2021: $631,925

- Home value in 2022: $834,017

- Home value in 2023: $882,727

- Home value in 2024: $873,100

- Home value in 2025: $875,840

Winter Park’s exceptional 156.4% appreciation has transformed a $341K investment into an $875K asset, creating $534K in wealth through strategic positioning in this premier ski destination. The property’s consistent upward trajectory in the pre-pandemic years indicates fundamental demand drivers rather than merely pandemic-related speculation. Your investment would have benefited from extraordinary 32% growth during 2021-2022, capturing significant equity during the mountain property boom. Despite a minor 1.1% correction in 2024, the market stabilized in 2025, suggesting a sustainable equilibrium after years of exceptional growth in this iconic resort community with both summer and winter recreational appeal.

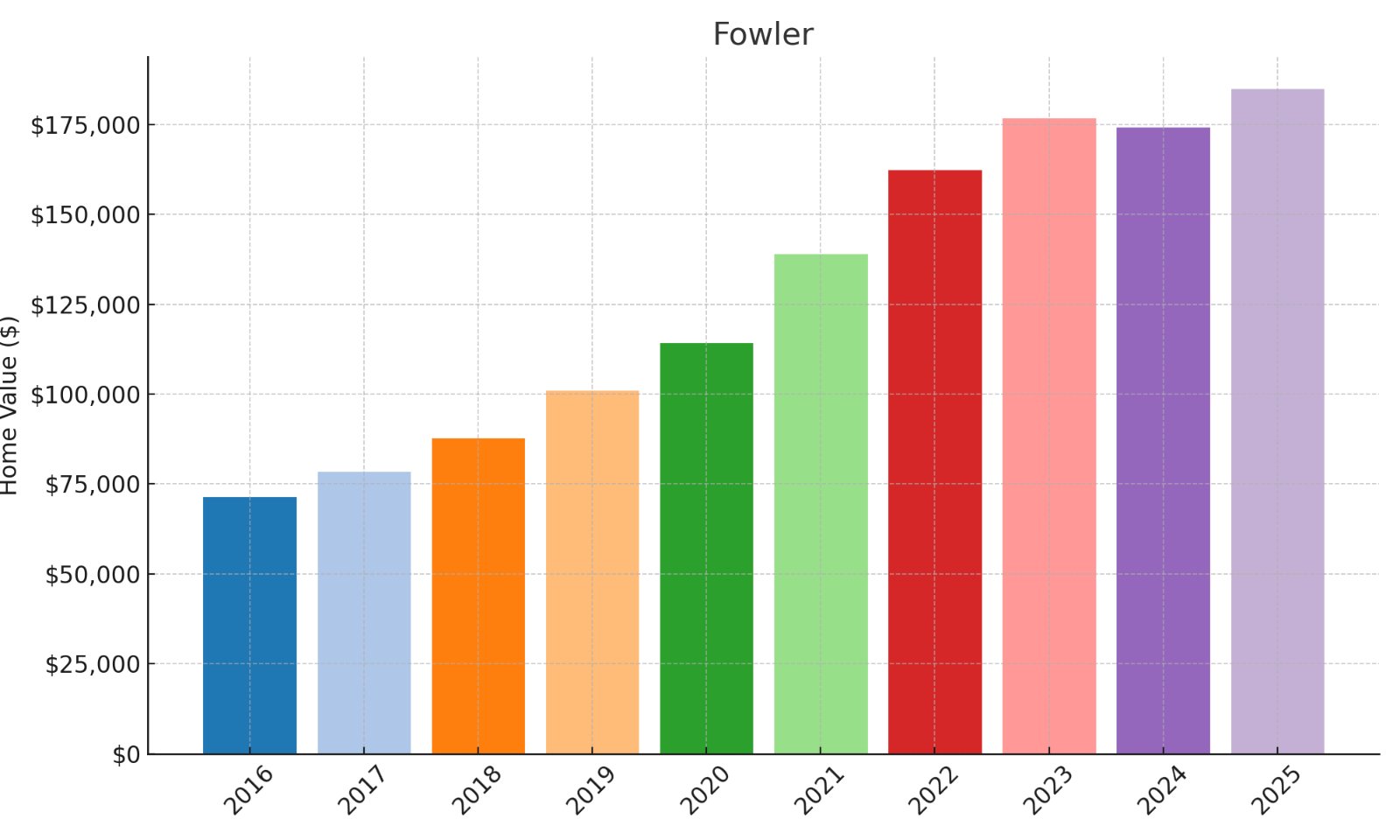

6. Fowler

- % change from 2016 to 2025: 159.72%

- Home value in 2016: $71,111

- Home value in 2017: $78,208

- Home value in 2018: $87,615

- Home value in 2019: $100,751

- Home value in 2020: $113,952

- Home value in 2021: $138,793

- Home value in 2022: $162,125

- Home value in 2023: $176,533

- Home value in 2024: $174,004

- Home value in 2025: $184,688

Fowler demonstrates exceptional small-town investment potential, with your $71K property appreciating by 159.7% to $184K, creating $113K in wealth from minimal capital deployment. The property’s consistent upward trajectory across multiple years indicates fundamental demand drivers rather than speculative fluctuations. Despite a minor 1.4% correction in 2024, the market rebounded strongly with 6.1% growth in 2025, showing remarkable resilience. With an ultra-low entry point (potentially just $14.2K with 20% down), you would have controlled an asset that generated 8x that amount in equity, representing extraordinary leveraged returns in this affordable southeastern Colorado community.

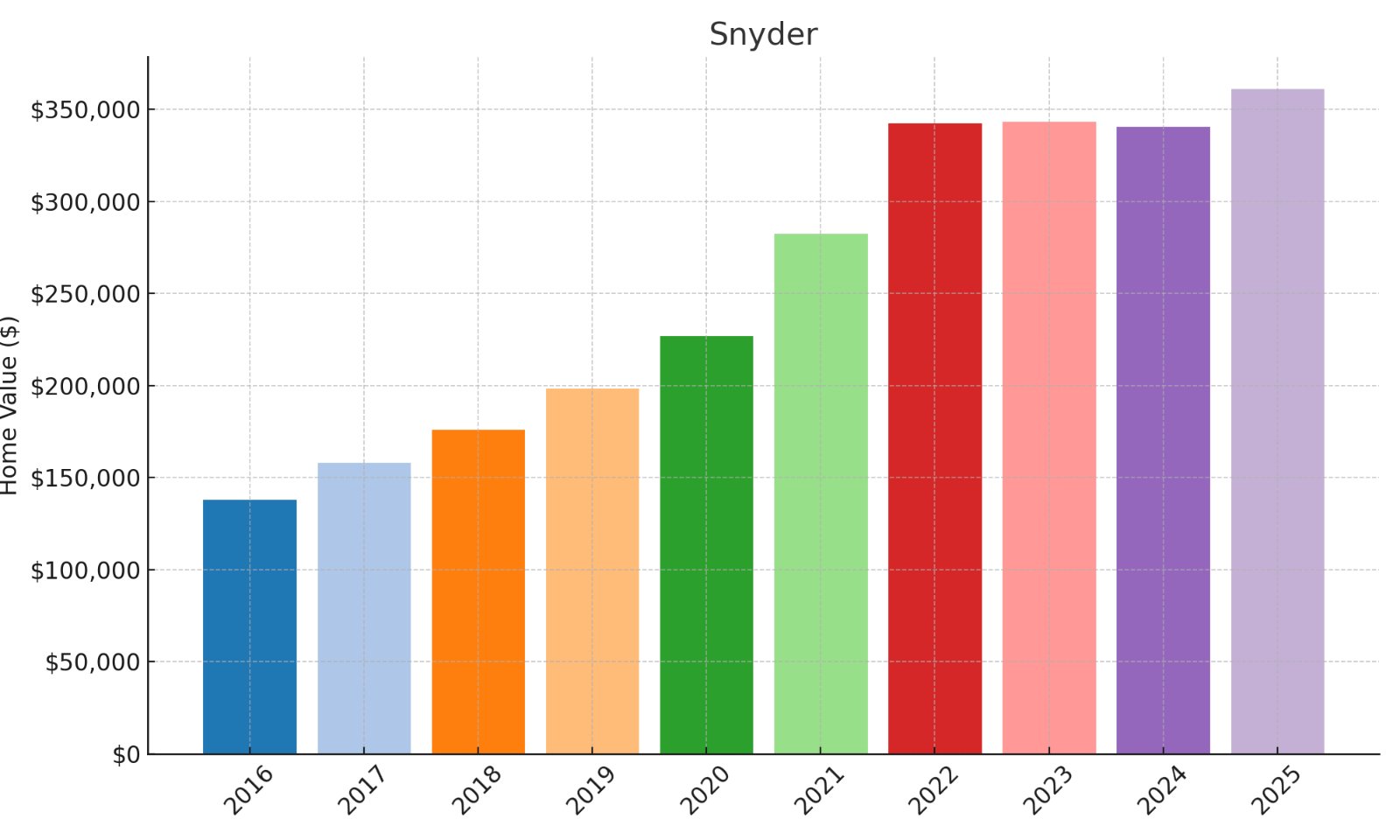

5. Snyder

- % change from 2016 to 2025: 162.61%

- Home value in 2016: $137,379

- Home value in 2017: $157,518

- Home value in 2018: $175,569

- Home value in 2019: $198,176

- Home value in 2020: $226,717

- Home value in 2021: $282,047

- Home value in 2022: $342,298

- Home value in 2023: $342,785

- Home value in 2024: $340,102

- Home value in 2025: $360,770

Snyder’s impressive 162.6% growth has turned a $137K investment into a $360K asset, creating $223K in wealth. The dramatic 24.4% surge during 2020-2021 created significant momentum during the pandemic relocation wave. Despite minor corrections in 2023-2024, the market rebounded strongly with 6.1% growth in 2025.

Your initial downpayment of just $27K (assuming 20% down) would control an asset generating 8x that in equity. This northeastern Colorado community shows resilience with an 11.3% annual growth rate, far outpacing inflation.

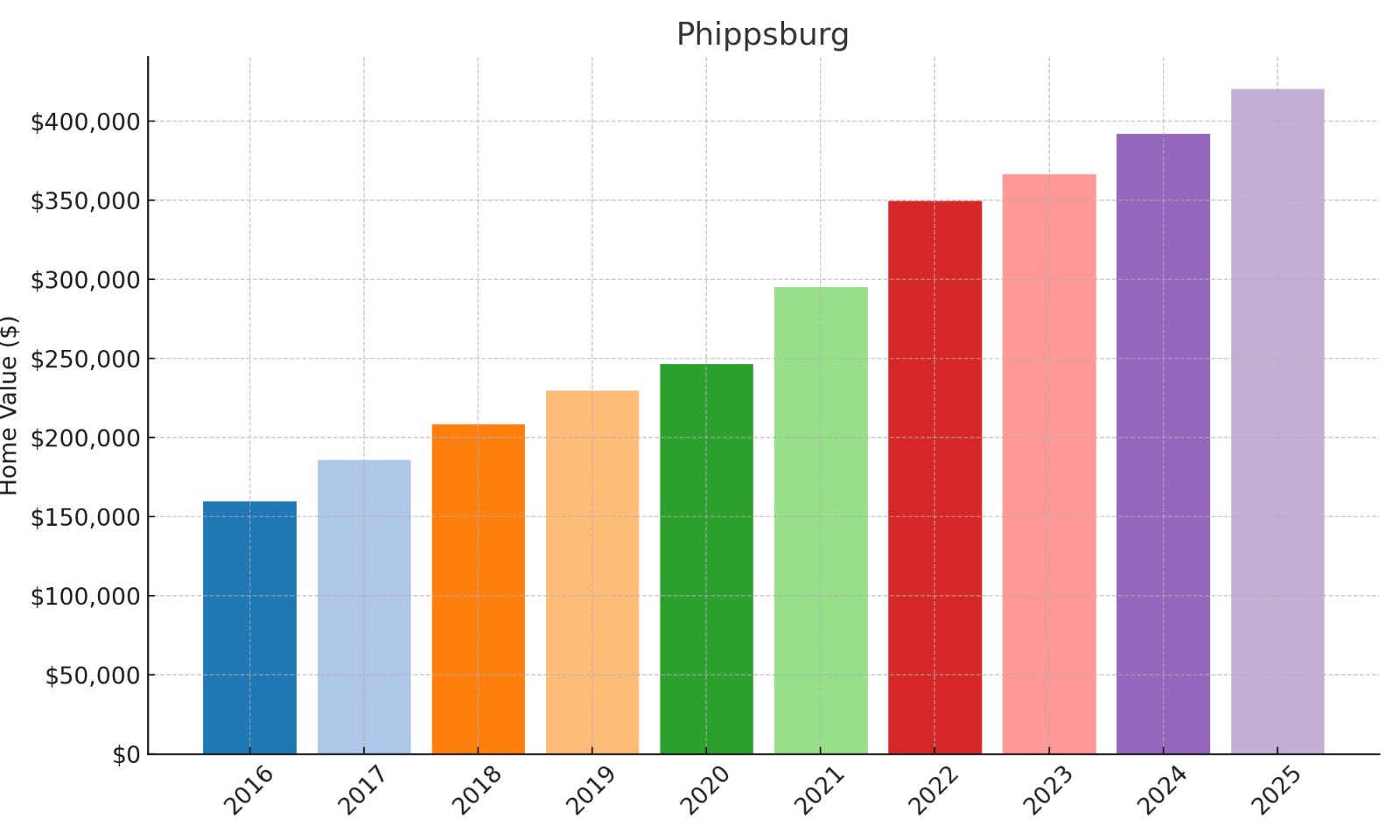

4. Phippsburg

- % change from 2016 to 2025: 163.64%

- Home value in 2016: $159,203

- Home value in 2017: $185,411

- Home value in 2018: $208,014

- Home value in 2019: $229,238

- Home value in 2020: $245,664

- Home value in 2021: $294,689

- Home value in 2022: $348,894

- Home value in 2023: $365,800

- Home value in 2024: $391,380

- Home value in 2025: $419,725

Phippsburg’s remarkable 163.6% growth converted a $159K investment into a $419K asset, generating $260K in equity.Your property gained value every single year, indicating resilient fundamental demand rather than speculation. The 20% surge during 2020-2021 accelerated momentum during the pandemic mountain property boom. Continued growth through 2022-2025 shows sustained demand driven by proximity to Steamboat Springs. This represents an excellent value play compared to Steamboat proper with similar recreational access.

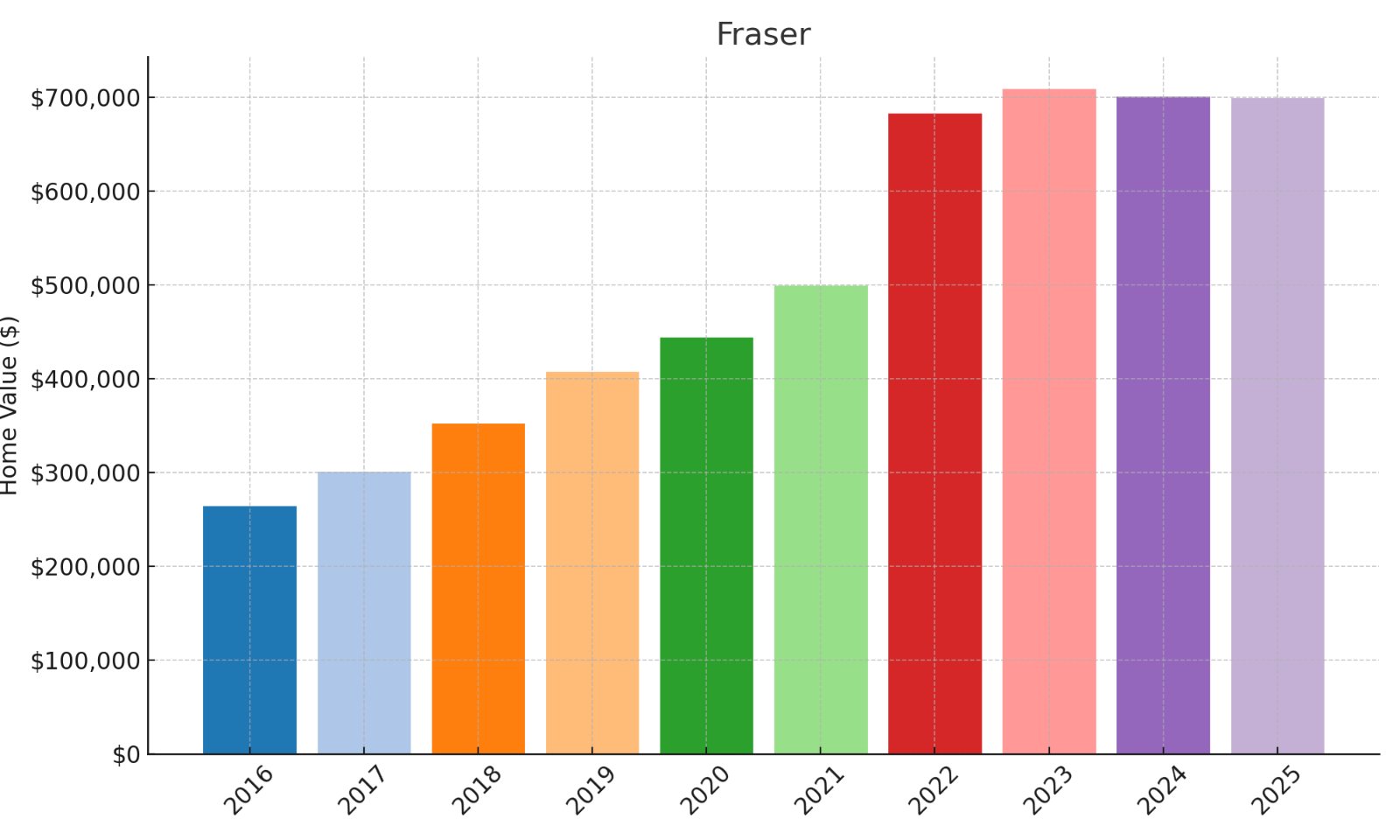

3. Fraser

- % change from 2016 to 2025: 165.40%

- Home value in 2016: $263,245

- Home value in 2017: $300,071

- Home value in 2018: $351,614

- Home value in 2019: $406,423

- Home value in 2020: $443,466

- Home value in 2021: $498,801

- Home value in 2022: $682,409

- Home value in 2023: $708,339

- Home value in 2024: $700,105

- Home value in 2025: $698,660

Fraser’s exceptional 165.4% growth transformed a $263K investment into $698K, creating $435K in wealth. Strong 17.1% first-year appreciation (2016-2017) established momentum well before pandemic speculation. The explosive 36.8% growth during 2021-2022 captured significant equity during the mountain property boom. Despite minor corrections in 2024-2025 totaling 1.4%, your property maintains substantial equity. This Winter Park-adjacent community benefits from world-class skiing and year-round recreational appeal.

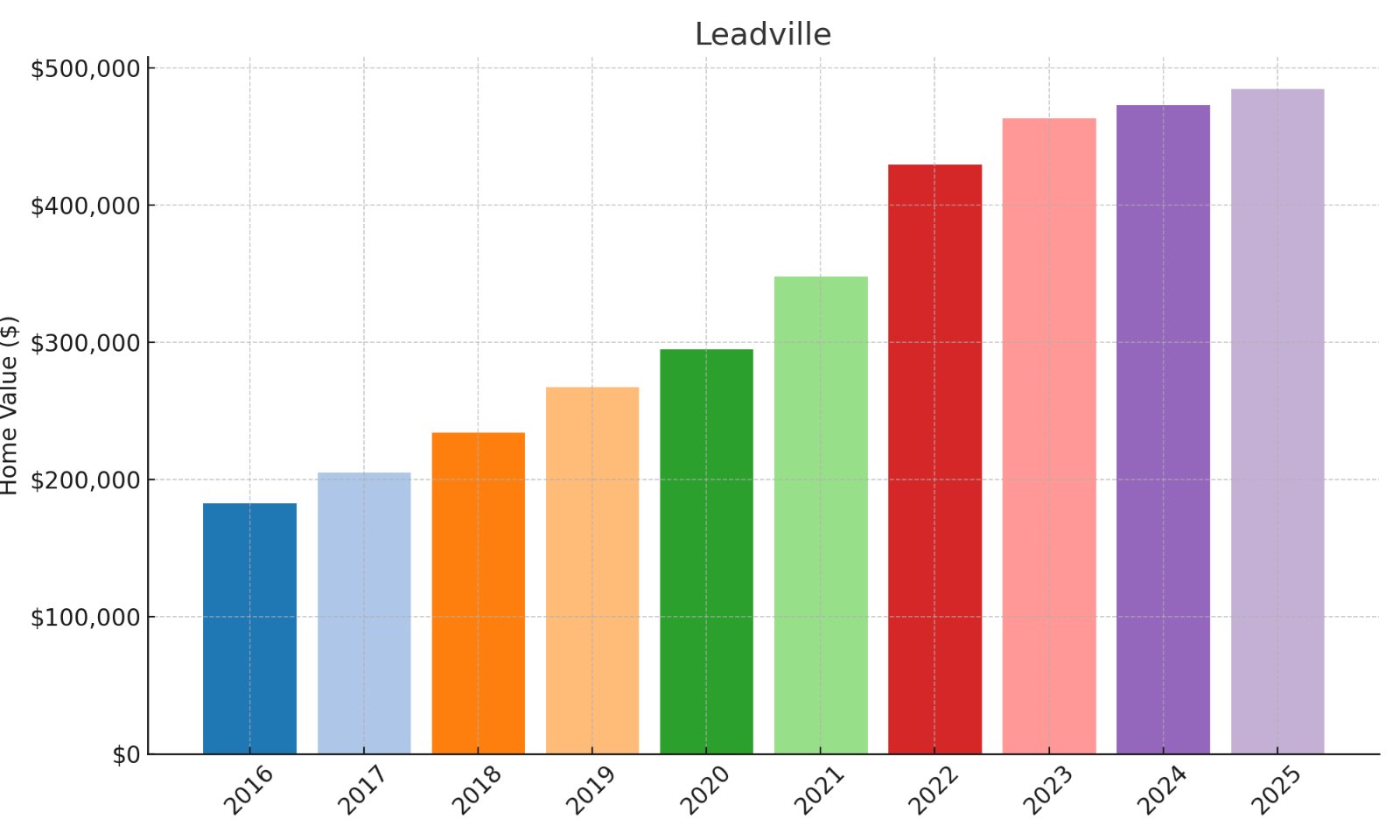

2. Leadville

- % change from 2016 to 2025: 166.24%

- Home value in 2016: $181,775

- Home value in 2017: $204,188

- Home value in 2018: $233,472

- Home value in 2019: $266,543

- Home value in 2020: $294,425

- Home value in 2021: $347,278

- Home value in 2022: $428,869

- Home value in 2023: $462,541

- Home value in 2024: $472,416

- Home value in 2025: $483,959

Leadville’s outstanding 166.2% appreciation has turned $181K into $484K, generating $302K in wealth. Your property would show consistent growth every year, indicating strong fundamental demand. The impressive 23.5% jump during 2021-2022 created substantial momentum during the mountain boom. America’s highest incorporated city offers historic charm with relative affordability compared to nearby ski areas.

Continued appreciation through 2023-2025 confirms sustainable demand beyond pandemic-driven speculation.

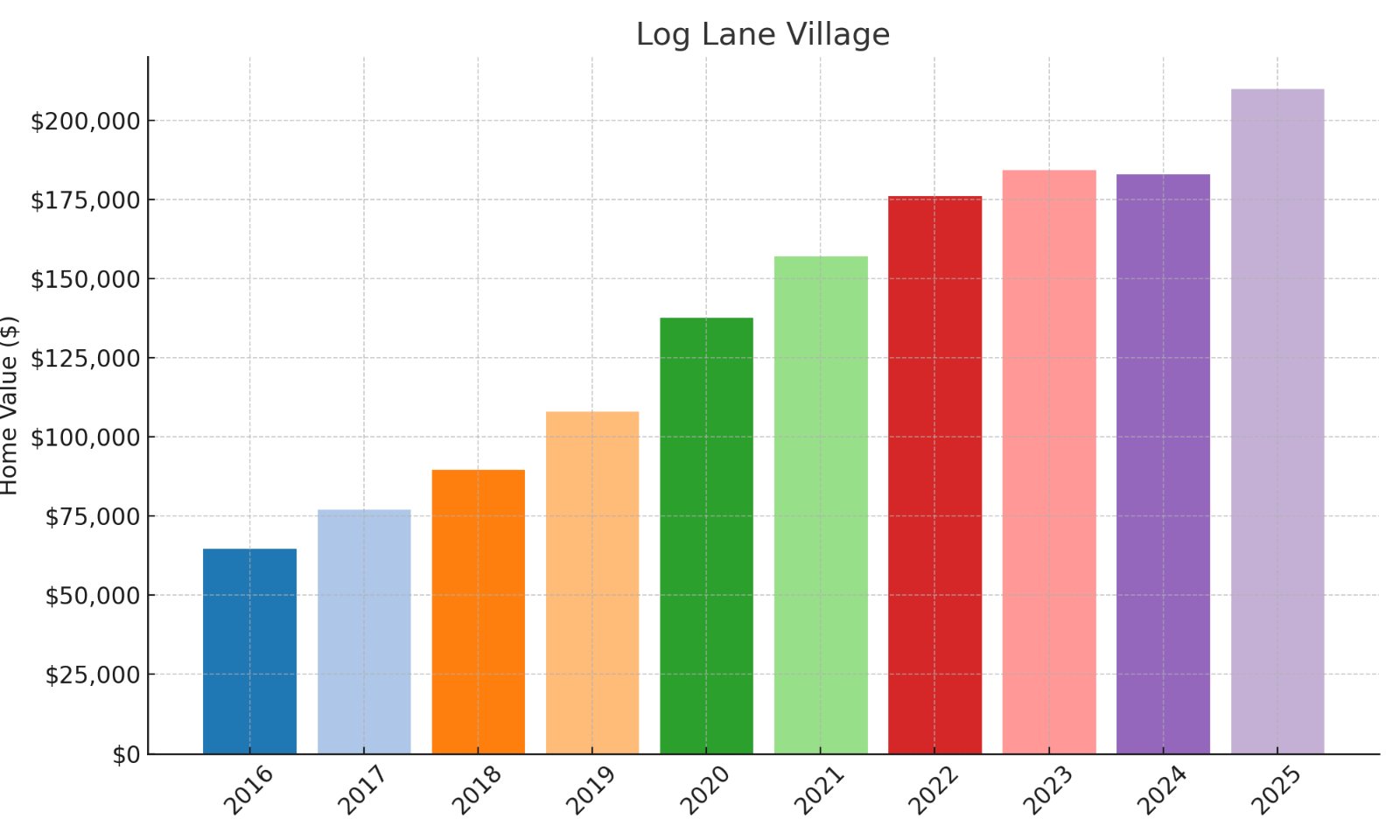

1. Log Lane Village

- % change from 2016 to 2025: 225.16%

- Home value in 2016: $64,472

- Home value in 2017: $76,755

- Home value in 2018: $89,383

- Home value in 2019: $107,718

- Home value in 2020: $137,451

- Home value in 2021: $156,736

- Home value in 2022: $175,781

- Home value in 2023: $184,071

- Home value in 2024: $182,671

- Home value in 2025: $209,637

Log Lane Village leads Colorado with extraordinary 225.2% growth, turning $64K into $209K for $145K in wealth. An ultra-low entry (just $12.9K with 20% down) would control an asset generating 11.2x that in equity. Despite a slight 0.8% dip in 2024, the market rebounded impressively with 14.8% growth in 2025. This northeastern Colorado community shows remarkably consistent performance across multiple years. With 12.5% compound annual growth, this affordable market has far outpaced traditional investments.