🔥 Would you like to save this?

According to the latest Zillow Home Value Index, Oklahoma remains one of the most affordable states for homebuyers. But even in this budget-friendly market, some towns offer deals that are hard to believe. Scattered across plains, lakesides, and old Route 66 stops, these 19 places stand out for their unusually low home prices. Many are packed with small-town character and surprising amenities, making them more than just affordable—they’re genuinely livable.

19. Fairfax – 149% Home Price Increase Since 2000

- 2010: $29,069 (+310, +1.08% from previous year)

- 2011: $27,726 (-1,344, -4.62% from previous year)

- 2012: $29,306 (+1,580, +5.70% from previous year)

- 2013: $29,458 (+151, +0.52% from previous year)

- 2014: $27,473 (-1,984, -6.74% from previous year)

- 2015: $29,026 (+1,553, +5.65% from previous year)

- 2016: $30,421 (+1,395, +4.81% from previous year)

- 2017: $33,674 (+3,253, +10.69% from previous year)

- 2018: $37,825 (+4,151, +12.33% from previous year)

- 2019: $44,770 (+6,945, +18.36% from previous year)

- 2020: N/A

- 2021: $57,830

- 2022: $60,731 (+2,901, +5.02% from previous year)

- 2023: $61,104 (+373, +0.61% from previous year)

- 2024: $63,148 (+2,044, +3.34% from previous year)

- 2025: $63,369 (+221, +0.35% from previous year)

Home prices in Fairfax started at around $25,462 in 2000 and reached $63,369 by 2025, marking a 148.9% increase. This long-term growth has occurred gradually, with occasional price dips along the way. Still, the market remains one of the most affordable in the state, appealing to buyers seeking both low entry prices and a history of gradual appreciation.

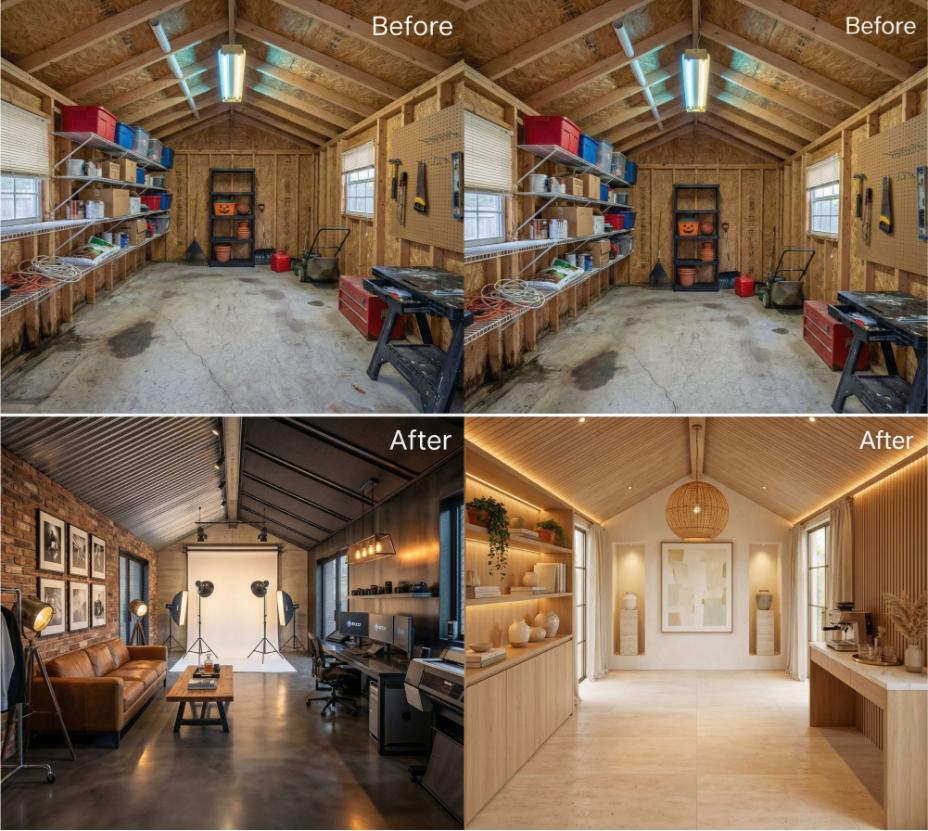

In order to come up with the very specific design ideas, we create most designs with the assistance of state-of-the-art AI interior design software.

Fairfax – Affordable Living with Steady Trends

Fairfax is a quiet town in Osage County, surrounded by farmland and known for its historical roots tied to the Osage Nation. It’s a place where real estate still costs a fraction of what you’d pay in most of the country. The stability in home values reflects the slower pace of change here, which many residents value.

With a population under 1,500, Fairfax is best suited for those who want to keep costs low and avoid big-city hustle. Prices have grown steadily since the early 2000s, but this growth hasn’t pushed Fairfax out of the affordability bracket—making it a great place to start a homeownership journey.

18. Buffalo – 61% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $38,510

- 2017: $39,261 (+752, +1.95% from previous year)

- 2018: $39,708 (+447, +1.14% from previous year)

- 2019: $42,370 (+2,662, +6.70% from previous year)

- 2020: N/A

- 2021: $54,029

- 2022: $59,821 (+5,792, +10.72% from previous year)

- 2023: $61,067 (+1,246, +2.08% from previous year)

- 2024: $60,994 (-73, -0.12% from previous year)

- 2025: $61,980 (+986, +1.62% from previous year)

Home prices in Buffalo started at around $38,510 in 2016 and reached $61,980 by 2025, marking a 60.9% increase. The market has seen both modest rises and occasional dips, but overall prices remain well within reach for most buyers. It’s a good place to look if you’re focused on affordability with steady long-term potential.

Buffalo – Affordable Living with Steady Trends

Buffalo is located in Harper County, near the western edge of Oklahoma, and offers a peaceful, rural lifestyle. It’s known for its strong sense of community and wide-open space—attractive to retirees and first-time buyers alike. Services are basic, but home prices reflect the simplicity and value.

Price increases in recent years have been steady but not excessive, driven more by local market dynamics than any major economic changes. For those seeking affordability and minimal competition, Buffalo is a hidden value in the housing market.

17. Terral – 109% Home Price Increase Since 2009

- 2010: $29,380 (-197, -0.67% from previous year)

- 2011: $30,129 (+749, +2.55% from previous year)

- 2012: $30,718 (+589, +1.96% from previous year)

- 2013: $29,041 (-1,677, -5.46% from previous year)

- 2014: $32,200 (+3,159, +10.88% from previous year)

- 2015: $33,961 (+1,761, +5.47% from previous year)

- 2016: $35,293 (+1,332, +3.92% from previous year)

- 2017: $36,236 (+943, +2.67% from previous year)

- 2018: $35,499 (-737, -2.03% from previous year)

- 2019: $39,253 (+3,754, +10.57% from previous year)

- 2020: N/A

- 2021: $52,033

- 2022: $62,353 (+10,320, +19.83% from previous year)

- 2023: $59,529 (-2,824, -4.53% from previous year)

- 2024: $58,112 (-1,417, -2.38% from previous year)

- 2025: $61,829 (+3,717, +6.40% from previous year)

Home prices in Terral started at around $29,577 in 2009 and reached $61,829 by 2025, marking a 109.0% increase. Despite the dramatic rise, housing remains affordable compared to state averages. This increase likely reflects a combination of limited inventory and slow but consistent demand.

Terral – Quiet Town, Strong Value Climb

Terral is a tiny community near the Red River, bordering Texas. Its remote setting hasn’t stopped home values from more than doubling over the past decade and a half. Despite dips along the way, the long-term trend shows strong appreciation.

Living in Terral means embracing rural simplicity, but the price-to-value ratio is hard to beat. With very low property taxes and little competition for listings, it’s attractive to buyers looking to put down roots in a low-cost market with upside.

16. Mangum – 0% Home Price Change Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $60,501

- 2017: $54,023 (-6,478, -10.71% from previous year)

- 2018: $54,411 (+388, +0.72% from previous year)

- 2019: $53,734 (-677, -1.24% from previous year)

- 2020: N/A

- 2021: $49,052

- 2022: $57,911 (+8,859, +18.06% from previous year)

- 2023: $61,669 (+3,758, +6.49% from previous year)

- 2024: $66,485 (+4,817, +7.81% from previous year)

- 2025: $60,497 (-5,988, -9.01% from previous year)

Home prices in Mangum were $60,501 in 2016 and stood at $60,497 in 2025—a flat trajectory over the long term. Though there were notable swings along the way, the overall picture is one of affordability and stability. It’s a clear example of a market where growth and risk are both low.

Mangum – Stability in a Small-Town Market

Mangum, in Greer County, is a small agricultural town in southwestern Oklahoma. Known for its historic downtown and quiet pace of life, it has seen minimal net change in housing prices over the past decade, even with some volatility year to year.

The town appeals to budget-conscious buyers who want a home without stretching their finances. Housing supply remains relatively stable, and the lack of rapid growth means it’s unlikely to face sudden price spikes—an appealing factor for long-term planning.

15. Blackwell – 91% Home Price Increase Since 2000

- 2010: $34,873 (-503, -1.42% from previous year)

- 2011: $34,290 (-583, -1.67% from previous year)

- 2012: $34,594 (+303, +0.88% from previous year)

- 2013: $35,543 (+950, +2.75% from previous year)

- 2014: $35,470 (-73, -0.21% from previous year)

- 2015: $38,636 (+3,166, +8.93% from previous year)

- 2016: $38,994 (+358, +0.93% from previous year)

- 2017: $36,809 (-2,185, -5.60% from previous year)

- 2018: $37,307 (+498, +1.35% from previous year)

- 2019: $39,749 (+2,442, +6.55% from previous year)

- 2020: N/A

- 2021: $51,113

- 2022: $57,337 (+6,224, +12.18% from previous year)

- 2023: $57,361 (+24, +0.04% from previous year)

- 2024: $61,143 (+3,782, +6.59% from previous year)

- 2025: $59,919 (-1,224, -2.00% from previous year)

Home prices in Blackwell started at around $31,378 in 2000 and reached $59,919 by 2025, marking a 91.0% increase. It’s one of the more significant increases among Oklahoma’s affordable towns, suggesting strong long-term interest while still keeping price points accessible.

Blackwell – Affordable Growth with a Small-Town Feel

Blackwell is a former railroad town in Kay County with a rich history and an active downtown. It’s grown slowly over the years, but its affordability continues to make it attractive to first-time buyers and families moving from higher-cost markets.

Even with price increases, homes in Blackwell remain under $60,000 on average—far below national levels. The town has preserved its appeal with steady development and stable infrastructure, while still offering value for long-term homeowners.

13. Tipton – 103% Home Price Increase Since 2010

- 2010: $29,300

- 2011: $29,458 (+157, +0.54% from previous year)

- 2012: $29,751 (+294, +1.00% from previous year)

- 2013: $29,604 (-147, -0.49% from previous year)

- 2014: $30,033 (+428, +1.45% from previous year)

- 2015: $30,861 (+828, +2.76% from previous year)

- 2016: $35,549 (+4,688, +15.19% from previous year)

- 2017: $34,395 (-1,154, -3.25% from previous year)

- 2018: $36,195 (+1,800, +5.23% from previous year)

- 2019: $36,716 (+521, +1.44% from previous year)

- 2020: N/A

- 2021: $47,949

- 2022: $61,043 (+13,094, +27.31% from previous year)

- 2023: $61,140 (+97, +0.16% from previous year)

- 2024: $58,865 (-2,275, -3.72% from previous year)

- 2025: $59,439 (+574, +0.98% from previous year)

Home prices in Tipton started at around $29,300 in 2010 and reached $59,439 by 2025, marking a 102.9% increase. This steady climb reflects long-term appeal and affordability that continues to attract new buyers. While prices have cooled slightly in the last couple of years, they remain accessible and below national averages.

Tipton – Big Gains in a Budget-Friendly Market

Tipton, located in Tillman County, is one of the more remote communities on this list, which has helped keep housing prices grounded. Known for its agricultural history and open landscapes, it’s a quiet place with steady housing demand and a low cost of living.

The town has seen a solid price appreciation over the years, likely due to limited inventory and consistent local interest. Tipton remains a strong candidate for buyers who want long-term value without competition from aggressive markets.

12. Hobart – 56% Home Price Increase Since 2016

🔥 Would you like to save this?

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $37,153

- 2017: $36,299 (-853, -2.30% from previous year)

- 2018: $37,898 (+1,598, +4.40% from previous year)

- 2019: $38,391 (+493, +1.30% from previous year)

- 2020: N/A

- 2021: $46,894

- 2022: $55,122 (+8,227, +17.54% from previous year)

- 2023: $51,136 (-3,986, -7.23% from previous year)

- 2024: $59,918 (+8,782, +17.17% from previous year)

- 2025: $58,010 (-1,908, -3.18% from previous year)

Home prices in Hobart started at around $37,153 in 2016 and reached $58,010 by 2025, marking a 56.1% increase. The local market has shown resilience despite a few short-term declines, and prices remain far below national levels. Hobart is a practical option for buyers seeking affordability without sacrificing long-term equity potential.

Hobart – Steady Growth in Western Oklahoma

Located in Kiowa County, Hobart has remained one of the more stable housing markets in western Oklahoma. Its central location and access to basic amenities make it a reliable place to buy a home, especially for families and retirees looking for peace and quiet.

Prices have risen steadily in recent years, with occasional corrections. Hobart’s growth has been organic, fueled by modest local demand rather than speculative interest, keeping the town affordable while still appreciating in value.

11. Eldorado – 72% Home Price Increase Since 2000

- 2010: $36,704 (-1,723, -4.48% from previous year)

- 2011: $38,049 (+1,345, +3.66% from previous year)

- 2012: $37,873 (-175, -0.46% from previous year)

- 2013: $41,180 (+3,307, +8.73% from previous year)

- 2014: $41,980 (+799, +1.94% from previous year)

- 2015: $42,865 (+886, +2.11% from previous year)

- 2016: $43,826 (+961, +2.24% from previous year)

- 2017: $42,486 (-1,340, -3.06% from previous year)

- 2018: $45,521 (+3,034, +7.14% from previous year)

- 2019: $47,546 (+2,025, +4.45% from previous year)

- 2020: N/A

- 2021: $48,986

- 2022: $59,253 (+10,267, +20.96% from previous year)

- 2023: $51,436 (-7,817, -13.19% from previous year)

- 2024: $56,611 (+5,175, +10.06% from previous year)

- 2025: $57,483 (+872, +1.54% from previous year)

Home prices in Eldorado began at $33,464 in 2000 and rose to $57,483 by 2025—a 71.8% increase. Despite the occasional downturn, including a sharp drop in 2023, prices have shown resilience. The long-term trend points toward affordability with a slow but clear path of growth.

Eldorado – Long-Term Growth with Quiet Charm

Eldorado sits near Oklahoma’s southwestern border with Texas and is one of the smallest towns on this list. It’s a place where time moves slowly and where real estate remains accessible even for modest budgets. Local housing supply is limited, which may partly explain the steady rise in value.

While there’s little flash in Eldorado’s real estate scene, its long-term growth and low starting prices make it a smart option for buyers who prioritize value and stability over speculation or rapid gains.

10. Waynoka – 54% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $37,255

- 2017: $34,402 (-2,853, -7.66% from previous year)

- 2018: $32,122 (-2,280, -6.63% from previous year)

- 2019: $34,422 (+2,300, +7.16% from previous year)

- 2020: N/A

- 2021: $42,870

- 2022: $48,630 (+5,760, +13.44% from previous year)

- 2023: $48,333 (-297, -0.61% from previous year)

- 2024: $54,187 (+5,854, +12.11% from previous year)

- 2025: $57,309 (+3,121, +5.76% from previous year)

Home prices in Waynoka started at $37,255 in 2016 and grew to $57,309 by 2025—an increase of 53.8%. After a brief slump in the late 2010s, prices surged again, showing renewed interest in the town’s affordability and location.

Waynoka – Sand Dunes and Steady Climb

Waynoka is known for its proximity to Little Sahara State Park, one of Oklahoma’s unique tourist attractions. That visibility, along with its small population and stable housing market, has helped lift prices in recent years without pushing them out of reach.

It’s the kind of place that attracts off-road enthusiasts, retirees, and budget-minded homebuyers alike. Waynoka’s modest size and recreation-based economy mean prices move slowly—but the upward trend remains solid.

9. Weleetka – 212% Home Price Increase Since 2000

- 2010: $28,309 (+943, +3.45% from previous year)

- 2011: $29,165 (+856, +3.02% from previous year)

- 2012: $29,184 (+19, +0.06% from previous year)

- 2013: $29,728 (+545, +1.87% from previous year)

- 2014: $29,662 (-66, -0.22% from previous year)

- 2015: $31,047 (+1,385, +4.67% from previous year)

- 2016: $35,881 (+4,834, +15.57% from previous year)

- 2017: $32,991 (-2,890, -8.05% from previous year)

- 2018: $35,106 (+2,115, +6.41% from previous year)

- 2019: $36,807 (+1,701, +4.85% from previous year)

- 2020: N/A

- 2021: $44,985

- 2022: $51,216 (+6,232, +13.85% from previous year)

- 2023: $56,330 (+5,113, +9.98% from previous year)

- 2024: $61,094 (+4,764, +8.46% from previous year)

- 2025: $56,775 (-4,319, -7.07% from previous year)

Home prices in Weleetka started at around $18,199 in 2000 and reached $56,775 by 2025, marking a 212.0% increase. Despite some volatility, the overall trend shows strong long-term appreciation while still staying well below statewide averages. It’s a market that balances affordability with meaningful equity growth.

Weleetka – Fast-Growing but Still Affordable

Weleetka is a small town in Okfuskee County with a big history and an unmistakably rural charm. With home values that have more than tripled since 2000, it’s one of the fastest risers among Oklahoma’s affordable towns—yet still remains within reach for first-time buyers and investors.

This growth may reflect renewed regional interest and improved connectivity to larger job markets. Even with recent fluctuations, Weleetka offers a strong case for those seeking long-term value in a market that’s still considered off the radar for most big-city buyers.

8. Holdenville – 146% Home Price Increase Since 2015

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: $28,612

- 2016: $33,884 (+$5,272, +18.43% from previous year)

- 2017: $33,466 (-$418, -1.23% from previous year)

- 2018: $36,533 (+$3,067, +9.16% from previous year)

- 2019: $37,889 (+$1,356, +3.71% from previous year)

- 2020: N/A

- 2021: $50,421

- 2022: $57,954 (+$7,533, +14.94% from previous year)

- 2023: $53,416 (-$4,538, -7.83% from previous year)

- 2024: $58,058 (+$4,642, +8.69% from previous year)

- 2025: $56,740 (-$1,318, -2.27% from previous year)

Holdenville has experienced shifts in home values over time. These price movements reflect Zillow’s Home Value Index data and are useful for tracking affordability trends. Missing values indicate unavailable records for those years.

Holdenville – Budget-Friendly Real Estate

Holdenville is a small city in Hughes County, located in east-central Oklahoma. Historically a farming and oil town, it retains a quiet, rural character while offering essential services like schools, a hospital, and small businesses. Despite being affordable, it has seen a steady increase in home prices, signaling a modest return for buyers and investors alike. Recent price trends show resilience, with minor fluctuations and a general upward trajectory. Its proximity to State Highway 48 gives residents access to nearby larger towns without sacrificing the cost advantages of rural living. With basic infrastructure in place and community institutions intact, Holdenville is an excellent entry point for those seeking low-cost property. Buyers can expect long-term value without the volatility seen in more urban markets.

7. Ringling – 116% Home Price Increase Since 2010

- 2010: $25,208

- 2011: $25,421 (+$213, +0.84% from previous year)

- 2012: $25,545 (+$124, +0.49% from previous year)

- 2013: $25,760 (+$215, +0.84% from previous year)

- 2014: $25,725 (-$35, -0.14% from previous year)

- 2015: $29,114 (+$3,389, +13.17% from previous year)

- 2016: $30,730 (+$1,616, +5.55% from previous year)

- 2017: $32,010 (+$1,280, +4.17% from previous year)

- 2018: $30,240 (-$1,770, -5.53% from previous year)

- 2019: $32,559 (+$2,319, +7.67% from previous year)

- 2020: N/A

- 2021: $35,034

- 2022: $48,209 (+$13,175, +37.61% from previous year)

- 2023: $54,127 (+$5,918, +12.28% from previous year)

- 2024: $53,862 (-$265, -0.49% from previous year)

- 2025: $54,488 (+$626, +1.16% from previous year)

Ringling has experienced shifts in home values over time. These price movements reflect Zillow’s Home Value Index data and are useful for tracking affordability trends. Missing values indicate unavailable records for those years.

Ringling – Budget-Friendly Real Estate

Ringling is located in Jefferson County, near the southern border of Oklahoma, and has a deep history tied to ranching and oil exploration. It remains a small but active community with modest real estate values and a stable local economy. Home price trends show consistent if slow growth, with values generally remaining below state averages. This has made Ringling attractive to retirees, first-time buyers, and anyone seeking property away from urban centers. The town benefits from a tight-knit population and access to outdoor spaces that add to its rural appeal. Its housing market has stayed stable, and recent price increases suggest incremental demand growth. Overall, Ringling offers great value for those looking for an affordable small-town lifestyle with historical roots and reliable home equity potential.

6. Hollis – 98% Home Price Increase Since 2011

🔥 Would you like to save this?

- 2010: N/A

- 2014: $39,585

- 2015: $39,069 (-$516, -1.30% from previous year)

- 2016: $43,697 (+$4,628, +11.85% from previous year)

- 2017: $43,943 (+$246, +0.56% from previous year)

- 2018: $47,290 (+$3,347, +7.62% from previous year)

- 2019: $46,900 (-$390, -0.82% from previous year)

- 2020: N/A

- 2021: $53,183

- 2022: $54,082 (+$899, +1.69% from previous year)

- 2023: $52,549 (-$1,533, -2.83% from previous year)

- 2024: $46,248 (-$6,301, -11.99% from previous year)

- 2025: $51,340 (+$5,092, +11.01% from previous year)

Hollis has experienced shifts in home values over time. These price movements reflect Zillow’s Home Value Index data and are useful for tracking affordability trends. Missing values indicate unavailable records for those years.

Hollis – Budget-Friendly Real Estate

Hollis is the county seat of Harmon County and lies near Oklahoma’s western edge. It’s a rural town with a strong agricultural background, especially in cotton farming and livestock. Home prices have grown steadily over the years, though they remain among the lowest in the state. The real estate market in Hollis offers stability for buyers who value long-term affordability over short-term returns. Essential services, local schools, and a few commercial businesses support the local economy. The housing stock is primarily older single-family homes, many of which have appreciated modestly. For those looking for a quiet life in a close-knit community, Hollis delivers both charm and value.

5. Wetumka – 76% Home Price Increase Since 2015

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: $34,177

- 2016: $35,714 (+$1,537, +4.50% from previous year)

- 2017: $36,199 (+$485, +1.36% from previous year)

- 2018: $37,672 (+$1,473, +4.07% from previous year)

- 2019: $38,000 (+$328, +0.87% from previous year)

- 2020: N/A

- 2021: $50,292

- 2022: $54,457 (+$4,165, +8.28% from previous year)

- 2023: $52,384 (-$2,073, -3.81% from previous year)

- 2024: $54,329 (+$1,945, +3.71% from previous year)

- 2025: $50,740 (-$3,589, -6.61% from previous year)

Wetumka has experienced shifts in home values over time. These price movements reflect Zillow’s Home Value Index data and are useful for tracking affordability trends. Missing values indicate unavailable records for those years.

Wetumka – Budget-Friendly Real Estate

Wetumka is situated in Hughes County and offers a glimpse into small-town life in central Oklahoma. Known for its annual Sucker Day festival, the town embraces its cultural traditions and community spirit. Property prices here have increased gradually, making it a cost-effective place to enter the housing market. The market shows some volatility in recent years but overall trends indicate a reasonably stable investment. Wetumka has access to basic services including public schools and grocery outlets, though residents often travel to nearby towns for larger purchases or medical care. The town’s housing stock is modest, with many homes priced well below state and national averages. For homebuyers looking to settle in a quiet, friendly community with potential for appreciation, Wetumka offers an affordable opportunity with charm and heritage.

4. Jet – 61% Home Price Increase Since 2015

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $38,312

- 2017: $38,606 (+$294, +0.77% from previous year)

- 2018: $43,851 (+$5,245, +13.59% from previous year)

- 2019: $42,211 (-$1,640, -3.74% from previous year)

- 2020: N/A

- 2021: $54,024

- 2022: $59,182 (+$5,158, +9.55% from previous year)

- 2023: $52,231 (-$6,951, -11.75% from previous year)

- 2024: $51,537 (-$694, -1.33% from previous year)

- 2025: $50,031 (-$1,506, -2.92% from previous year)

Jet has experienced shifts in home values over time. These price movements reflect Zillow’s Home Value Index data and are useful for tracking affordability trends. Missing values indicate unavailable records for those years.

Jet – Budget-Friendly Real Estate

Jet, located in Alfalfa County in northwestern Oklahoma, is known for its proximity to the Great Salt Plains. It’s a tiny community with a population of just a few hundred, yet its housing market has seen notable price fluctuations. While prices rose sharply in the late 2010s, recent years have shown declines, possibly due to limited inventory or market corrections. Still, Jet offers some of the lowest real estate prices in the state, attracting those seeking ultra-affordable property. The town’s remote location makes it ideal for outdoor enthusiasts and seasonal residents. It’s quiet, rural, and largely agricultural, with limited infrastructure — but that’s part of its appeal. Jet remains one of the most accessible property markets in Oklahoma in terms of cost, especially for buyers who value space and solitude over urban convenience.

3. Frederick – 86% Home Price Increase Since 2010

- 2010: $28,352

- 2011: $29,431 (+$1,079, +3.81% from previous year)

- 2012: $29,386 (-$45, -0.15% from previous year)

- 2013: $32,435 (+$3,049, +10.38% from previous year)

- 2014: $30,795 (-$1,640, -5.06% from previous year)

- 2015: $33,014 (+$2,219, +7.20% from previous year)

- 2016: $33,865 (+$851, +2.58% from previous year)

- 2017: $34,654 (+$789, +2.33% from previous year)

- 2018: $34,102 (-$552, -1.59% from previous year)

- 2019: $36,536 (+$2,434, +7.14% from previous year)

- 2020: N/A

- 2021: $41,974

- 2022: $47,644 (+$5,670, +13.51% from previous year)

- 2023: $52,872 (+$5,228, +10.97% from previous year)

- 2024: $52,922 (+$50, +0.09% from previous year)

- 2025: $49,773 (-$3,149, -5.95% from previous year)

Frederick has experienced shifts in home values over time. These price movements reflect Zillow’s Home Value Index data and are useful for tracking affordability trends. Missing values indicate unavailable records for those years.

Frederick – Budget-Friendly Real Estate

Frederick, the county seat of Tillman County, sits in southwestern Oklahoma and serves as a regional hub for surrounding farming communities. It offers amenities like a hospital, public schools, and a regional airport — rare among towns in this price bracket. Over the years, home values have trended upward with a few dips, suggesting a healthy if modestly paced real estate market. The area has a strong agricultural presence and a few light industrial operations, which support the local economy. Housing in Frederick is predominantly single-family homes, many on large lots, and remains very affordable compared to state and national averages. With a sense of community and low cost of living, the town offers an appealing lifestyle for families and retirees alike. Recent price growth signals increasing demand, especially from buyers looking for value in rural Oklahoma.

2. Grandfield – 53% Home Price Increase Since 2010

- 2010: $29,578

- 2011: $31,464 (+$1,886, +6.38% from previous year)

- 2012: $29,512 (-$1,952, -6.20% from previous year)

- 2013: $31,602 (+$2,090, +7.08% from previous year)

- 2014: $31,451 (-$151, -0.48% from previous year)

- 2015: $32,224 (+$773, +2.46% from previous year)

- 2016: $35,343 (+$3,119, +9.68% from previous year)

- 2017: $32,512 (-$2,831, -8.01% from previous year)

- 2018: $31,879 (-$633, -1.95% from previous year)

- 2019: $31,068 (-$811, -2.54% from previous year)

- 2020: N/A

- 2021: $38,176

- 2022: $42,447 (+$4,271, +11.19% from previous year)

- 2023: $40,672 (-$1,775, -4.18% from previous year)

- 2024: $42,706 (+$2,034, +5.00% from previous year)

- 2025: $45,247 (+$2,541, +5.95% from previous year)

Grandfield has experienced shifts in home values over time. These price movements reflect Zillow’s Home Value Index data and are useful for tracking affordability trends. Missing values indicate unavailable records for those years.

Grandfield – Budget-Friendly Real Estate

🔥 Would you like to save this?

Grandfield is a small community located in southwestern Oklahoma’s Tillman County, near the Texas border. It has a rich history rooted in oil production and agriculture, and while its population has declined over time, the housing market has remained relatively stable. Recent home price trends show steady if gradual growth, with notable upticks in recent years. The town offers a public school, library, and a few small businesses, though many residents commute to nearby towns for work and shopping. Homes in Grandfield are typically older, detached properties on large lots — perfect for families seeking space without the high costs found in cities. Property prices remain among the lowest in the state, making it a strategic buy for those prioritizing affordability. For investors or homeowners who value price stability and small-town life, Grandfield delivers excellent long-term value.

1. Davidson – 14% Home Price Increase Since 2022

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: N/A

- 2022: $39,522

- 2023: $40,577 (+$1,055, +2.67% from previous year)

- 2024: $43,122 (+$2,545, +6.27% from previous year)

- 2025: $41,831 (-$1,291, -2.99% from previous year)

Davidson has experienced shifts in home values over time. These price movements reflect Zillow’s Home Value Index data and are useful for tracking affordability trends. Missing values indicate unavailable records for those years.

Davidson – Budget-Friendly Real Estate

Davidson is the most affordable town on this list, located in Tillman County in far southwestern Oklahoma. Data availability is limited, but recent figures suggest low volatility and gradual price growth. This small town is primarily residential with little commercial infrastructure, though basic needs are met locally or in nearby Frederick. It’s the kind of place where land and home prices are still accessible to working-class families and retirees. Its secluded nature means minimal noise, traffic, or development pressure — and that appeals to those seeking peace and simplicity. Despite being one of the smallest and least populated areas in the state, Davidson shows signs of gradual appreciation, which could benefit long-term holders. For budget-conscious buyers looking for a tranquil, rural environment, Davidson presents an incredibly low barrier to homeownership in Oklahoma.