In my analysis of the ten most expensive states to buy a home (including each state’s most expensive city), based on Zillow Home Value Index data from January 1, 2025, I’ve found striking patterns in home value appreciation. The past decade shows remarkable transformations in state-level housing values.

I’ve noted several fascinating patterns: Utah and Washington stand out with the most dramatic long-term appreciation, both exceeding 100% growth since 2015. I found the District of Columbia presents an intriguing anomaly as the only market showing a slight decline (-2.1%) from 2020 to 2024. Despite maintaining the highest absolute values, I see Hawaii’s growth rates have been relatively modest compared to other top markets.

My data shows the period from 2020 to 2024 had significantly compressed growth rates compared to 2015-2020, suggesting market stabilization. Most surprisingly, I noticed the traditionally strong markets of California and New York have shown remarkably similar growth patterns recently, despite their vastly different characteristics.

Here’s the list.

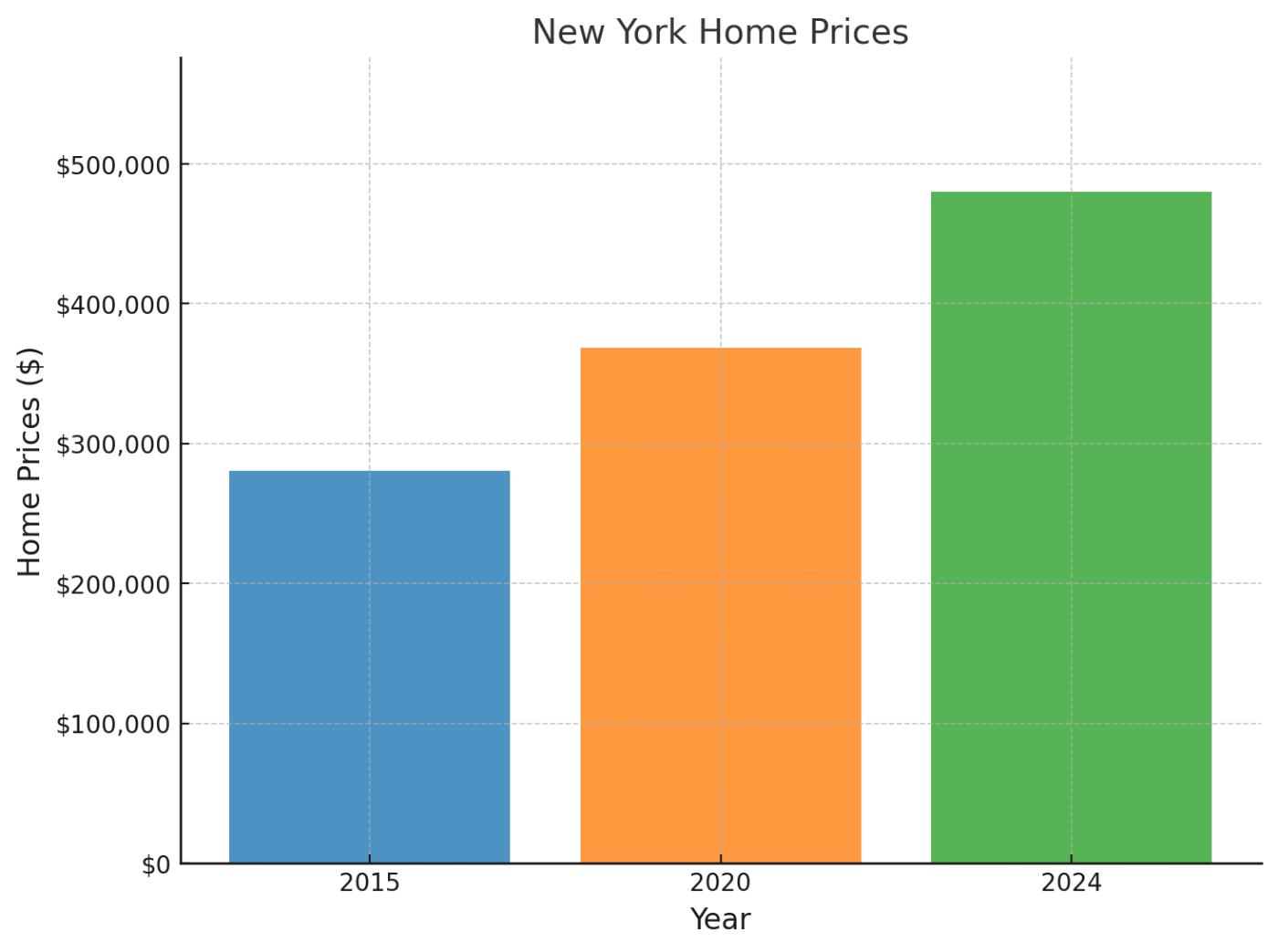

#10. New York

The Empire State’s housing market tells a compelling story of steady appreciation in America’s financial capital. Starting from a December 2015 baseline of $280,475, New York homes surged to $368,403 by December 2020, before reaching $479,976 in December 2024. This trajectory represents a robust 71.1% increase over the nine-year span, with a more moderate 30.3% growth in the post-2020 period, reflecting the market’s maturity and resilience in the face of changing economic conditions.

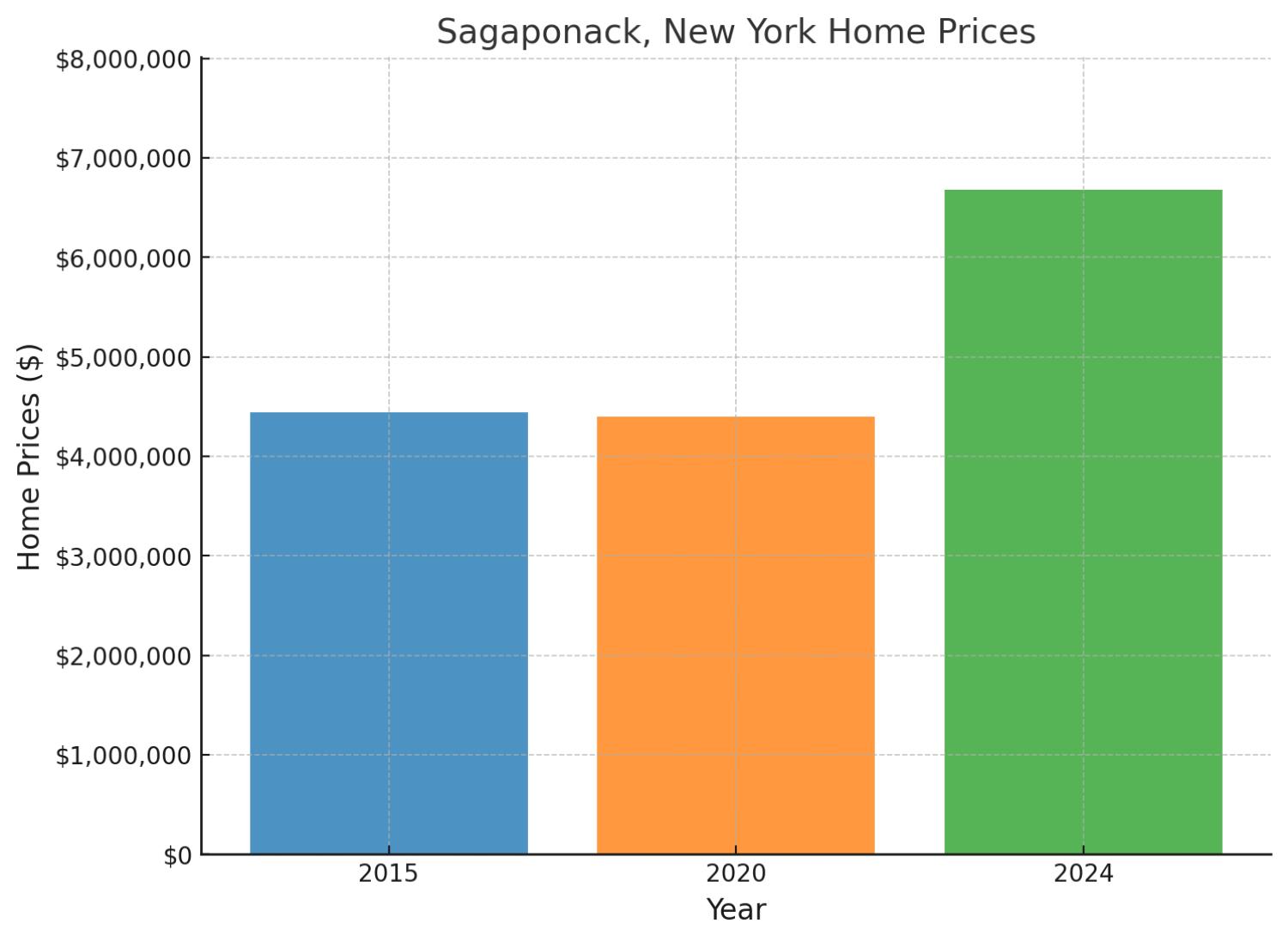

The most expensive town or city in New York: Sagapnack

This Hamptons haven demonstrates the enduring appeal of New York’s premier beach communities, with values reaching $6.68 million by 2024. Interestingly, the market showed remarkable stability at the high end, moving from $4.44 million in 2015 to $4.40 million in 2020, before surging 51.8% in the post-2020 period. The total appreciation of 50.4% since 2015 suggests a market that maintains its exclusivity while avoiding extreme price volatility.

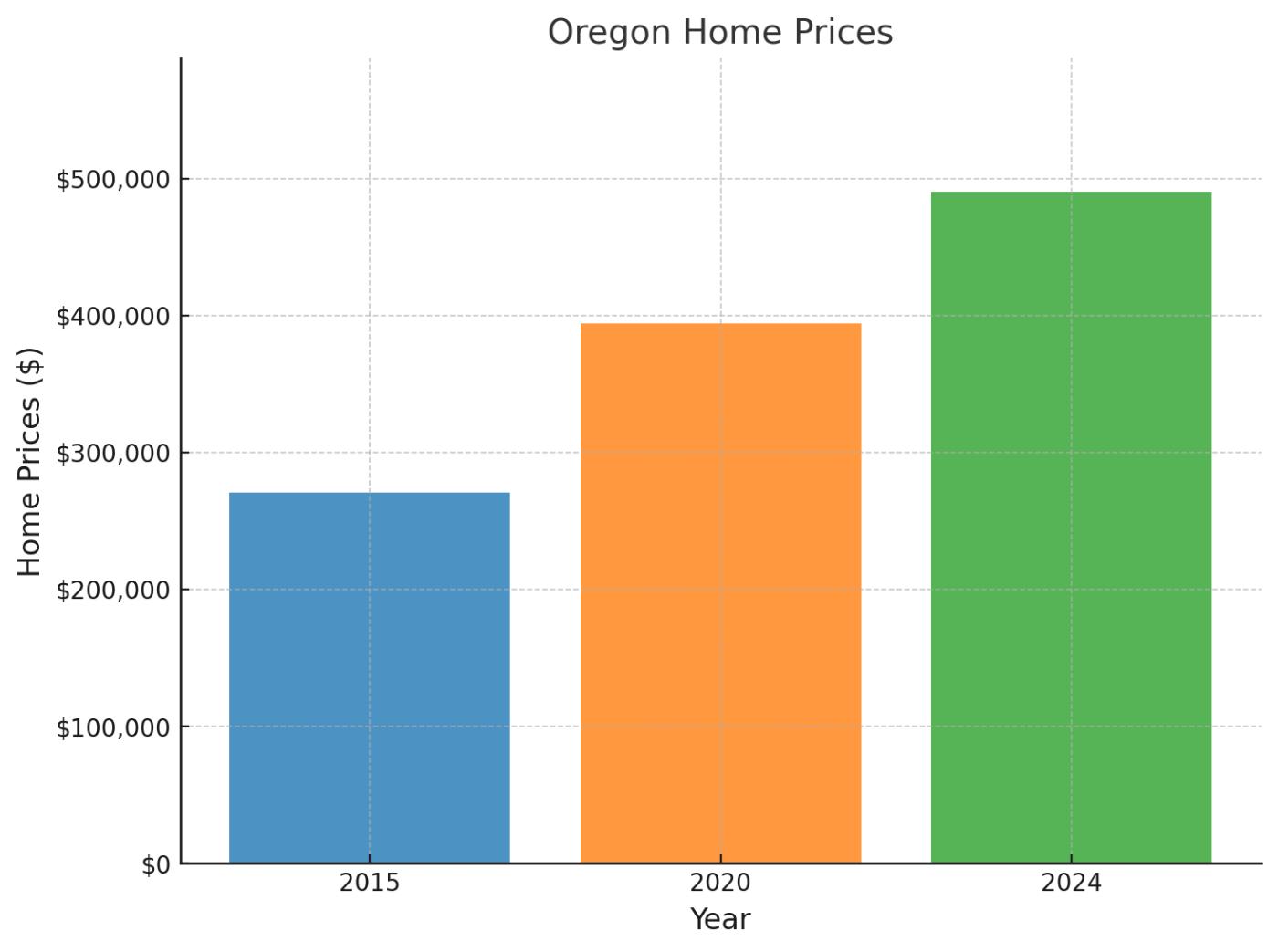

#9. Oregon

A testament to the Pacific Northwest’s enduring appeal, Oregon’s housing market has demonstrated remarkable resilience and growth. From its December 2015 valuation of $270,566, the market climbed to $394,145 by December 2020, ultimately achieving $490,096 by December 2024. This progression marks an impressive 81.1% total appreciation since 2015, though the post-2020 period showed a more modest 24.3% increase, suggesting a potential market normalization phase.

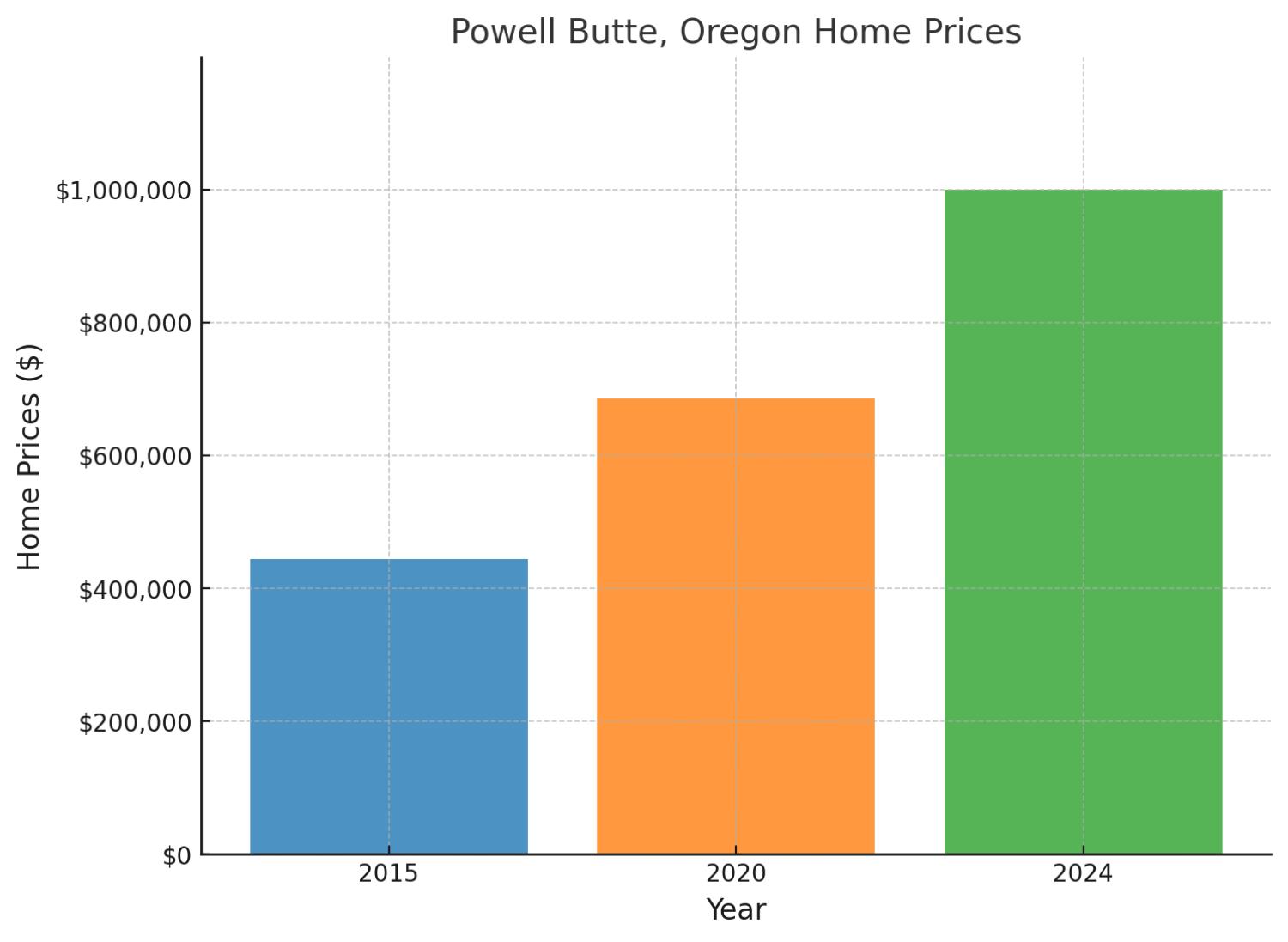

The most expensive town or city in Oregon: Powell Butte

This central Oregon community showcases the dramatic appreciation possible in emerging luxury markets, with values nearly tripling from $444,589 in 2015 to $999,552 in 2024. The 124.8% total appreciation, including a 45.7% increase since 2020’s $685,846 valuation, reflects growing demand for high-end rural properties with mountain views.

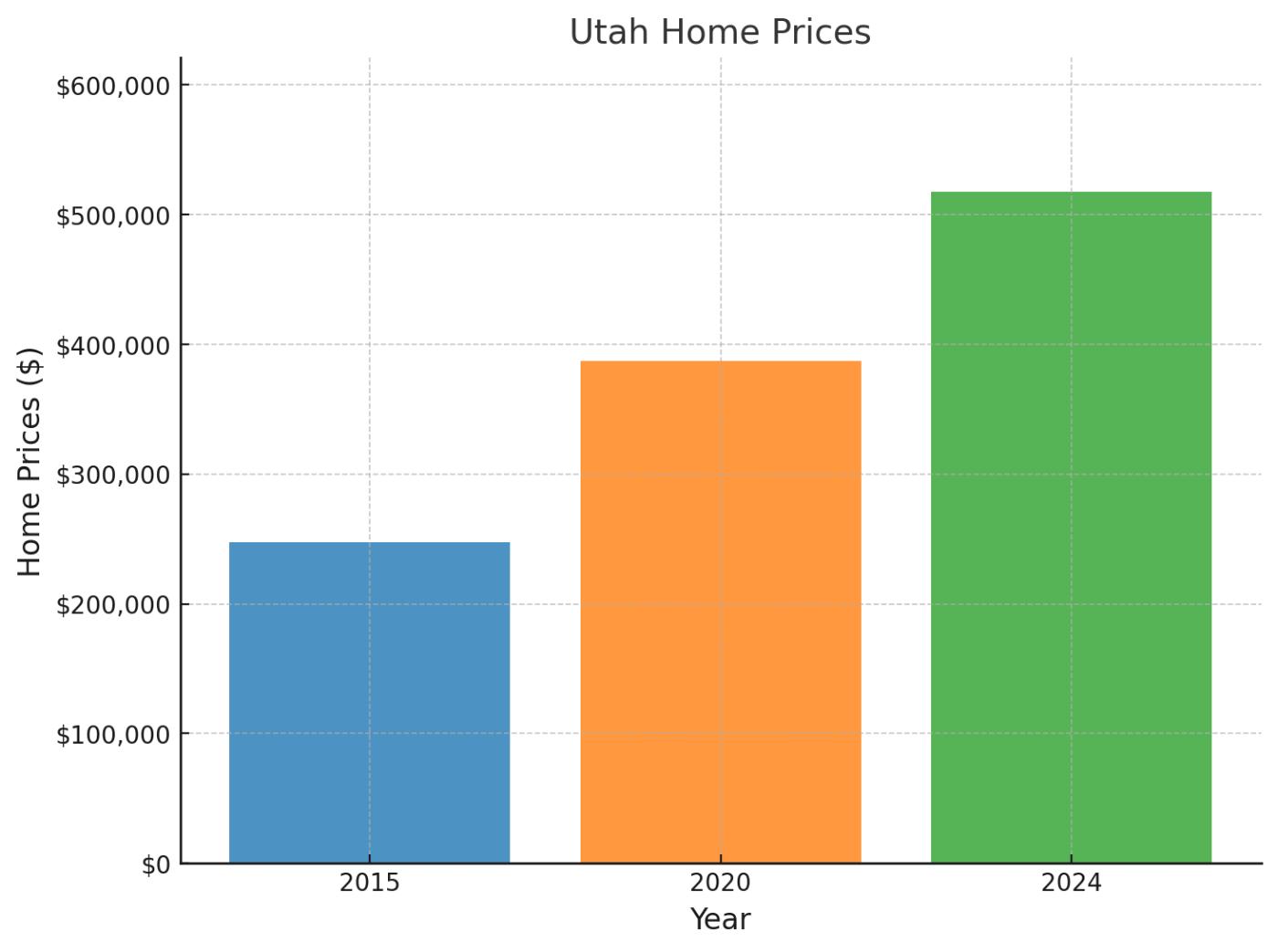

#8. Utah

Utah’s housing market emergence as a powerhouse illustrates the state’s growing economic dynamism and appeal. Beginning at $247,731 in December 2015, values escalated to $387,538 by December 2020, before reaching new heights at $517,506 in December 2024. This remarkable trajectory represents a stunning 108.9% appreciation over nine years, with a solid 33.5% growth in the post-2020 period, making it one of the strongest performers in our analysis.

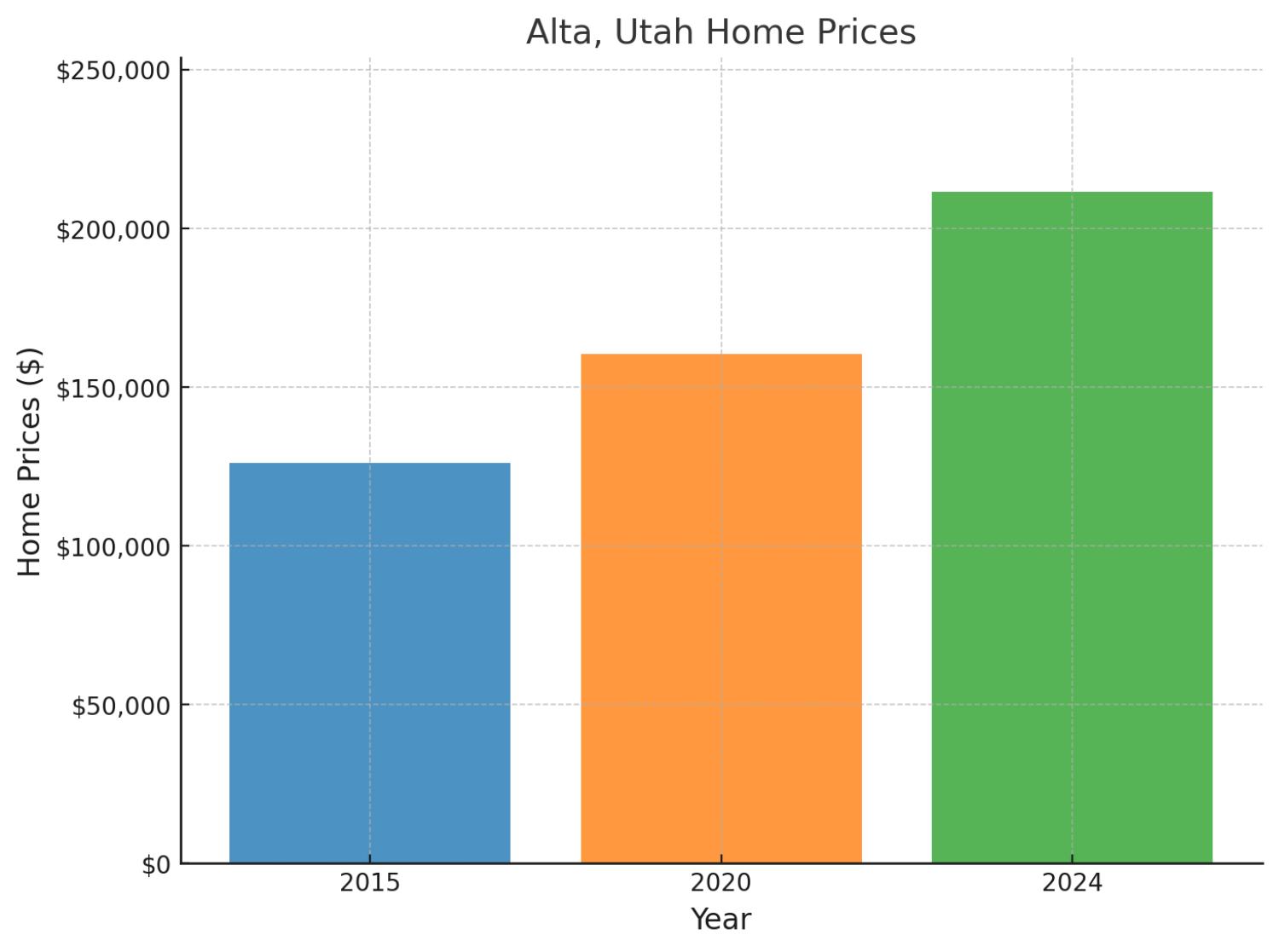

The most expensive town or city in Utah: Alta

This ski resort town shows the most modest absolute values among our tracked markets but maintains healthy appreciation rates. Growing from $126,238 in 2015 to $160,528 in 2020, and reaching $211,494 by 2024, the total appreciation of 67.5% demonstrates the rising appeal of mountain resort communities, with a notable 31.7% increase in the post-2020 period.

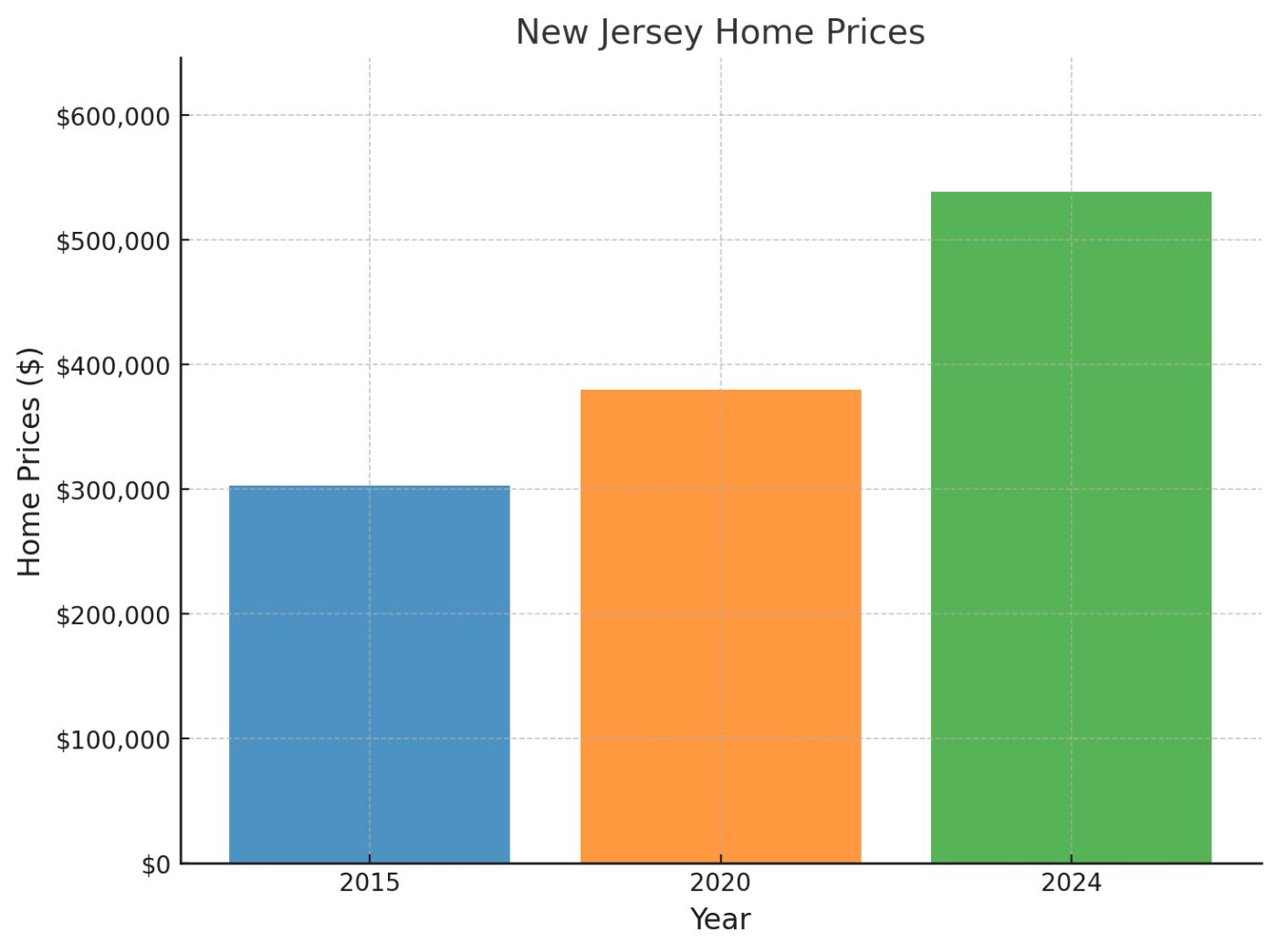

#7. New Jersey

The Garden State’s housing market demonstrates the powerful influence of its proximity to major metropolitan areas. From a December 2015 value of $302,925, New Jersey homes appreciated to $380,073 by December 2020, ultimately reaching $538,363 in December 2024. This evolution represents a strong 77.7% nine-year appreciation, with a notably robust 41.6% growth since 2020, showcasing the state’s increasing attractiveness to homebuyers seeking alternatives to nearby urban centers.

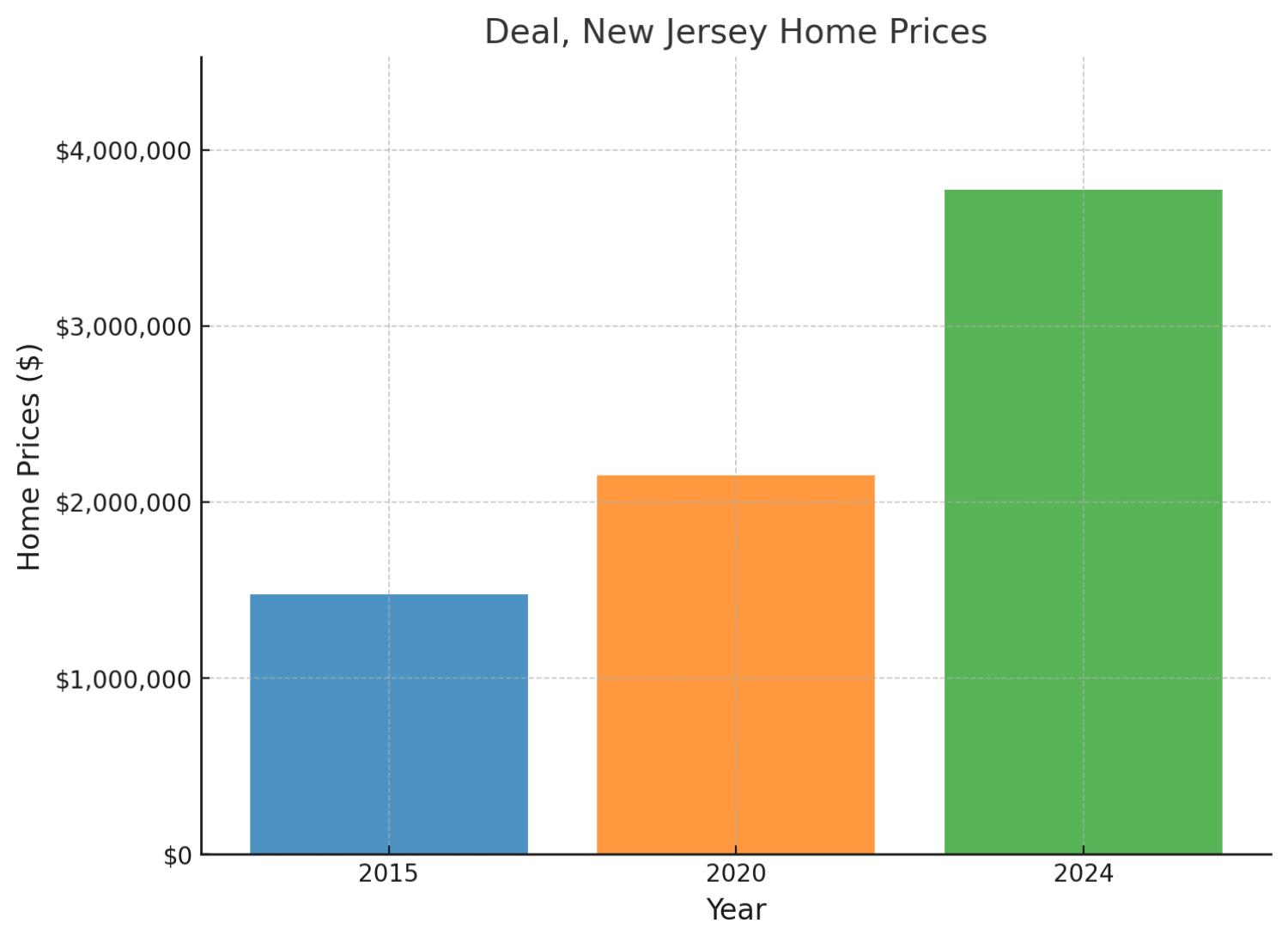

The most expensive town or city in New Jersey: Deal

This oceanfront community has experienced the most dramatic appreciation among our tracked markets, with a stunning 155.4% increase since 2015. From $1.48 million in 2015, values surged to $2.15 million by 2020, before reaching $3.77 million in 2024. The post-2020 growth of 75.3% indicates sustained momentum in this historically wealthy Shore community.

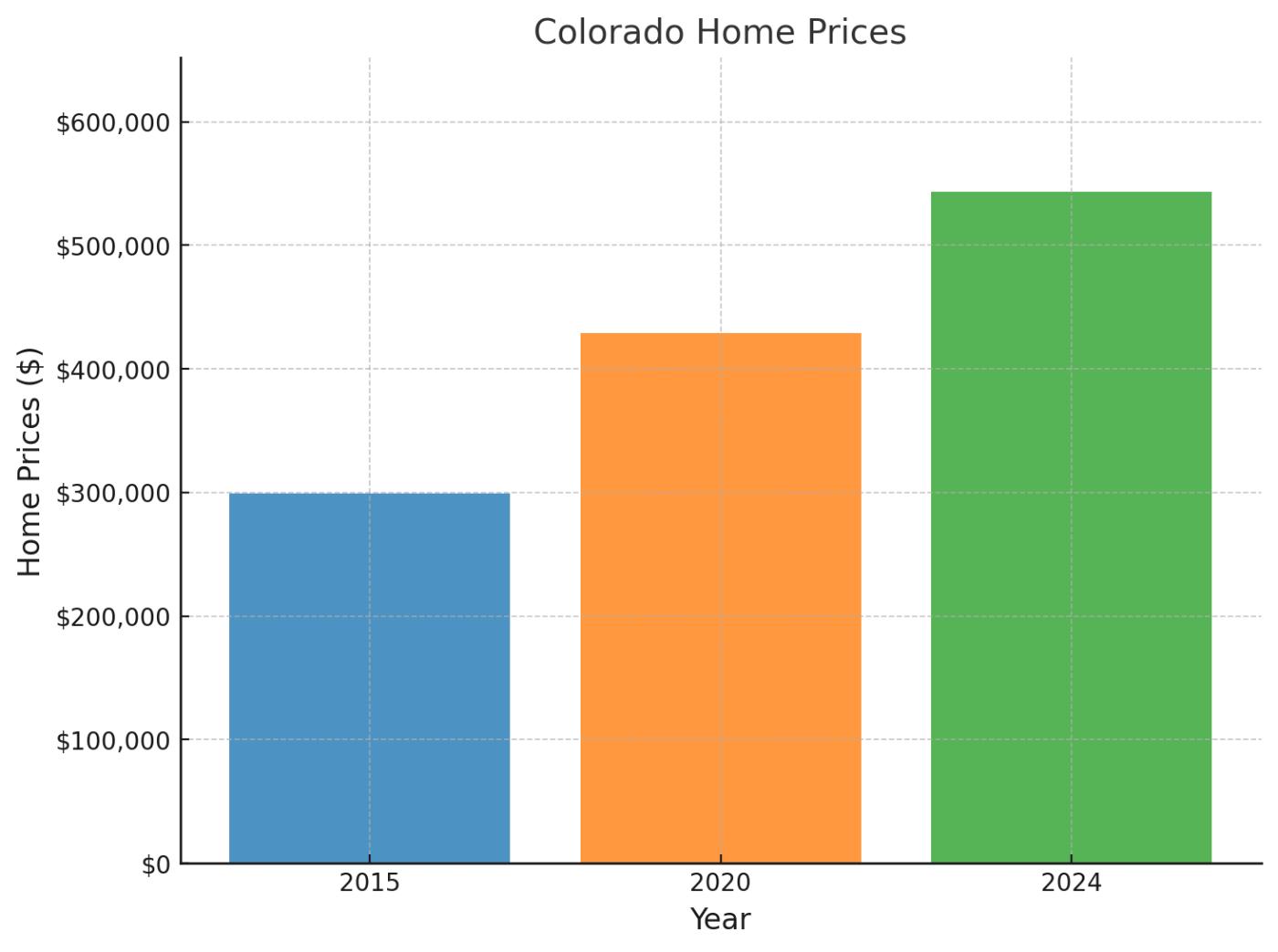

#6. Colorado

The Rocky Mountain state’s housing market reflects its transformation into a major technology and lifestyle destination. Starting at $298,899 in December 2015, values climbed to $428,694 by December 2020, before ascending to $543,106 in December 2024. This progression marks an 81.7% total appreciation since 2015, with a more measured 26.7% growth in the post-2020 period, highlighting the state’s sustained appeal despite market fluctuations.

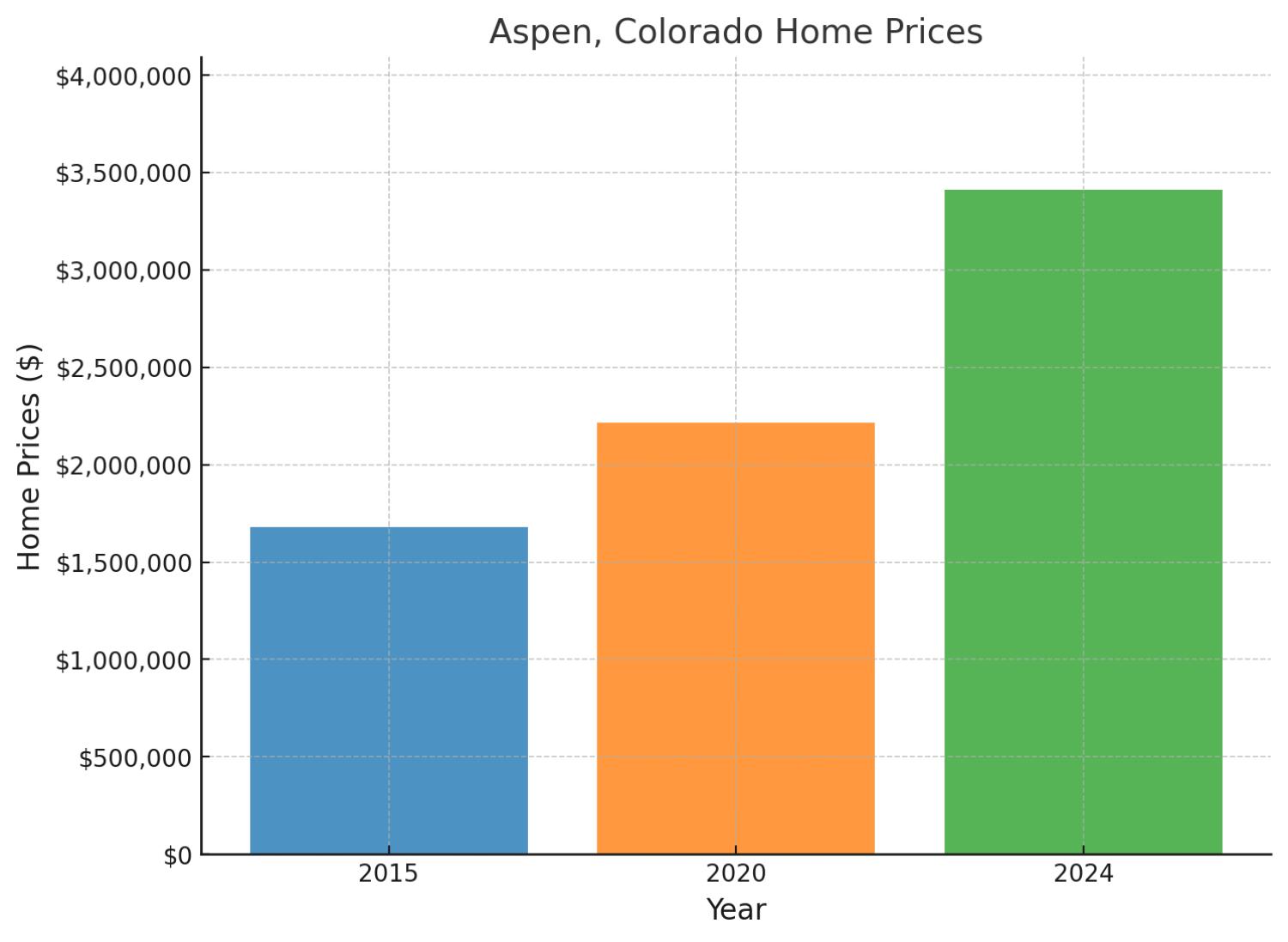

The most expensive town or city in Colorado: Aspen

The renowned ski resort town exemplifies the premium placed on luxury mountain properties, with values reaching $3.41 million in 2024. The growth from $1.68 million in 2015 represents a 103.2% appreciation, with a particularly strong 54.1% surge since 2020’s $2.21 million valuation. These figures reflect Aspen’s enduring appeal to wealthy buyers seeking both winter sports and summer mountain lifestyle.

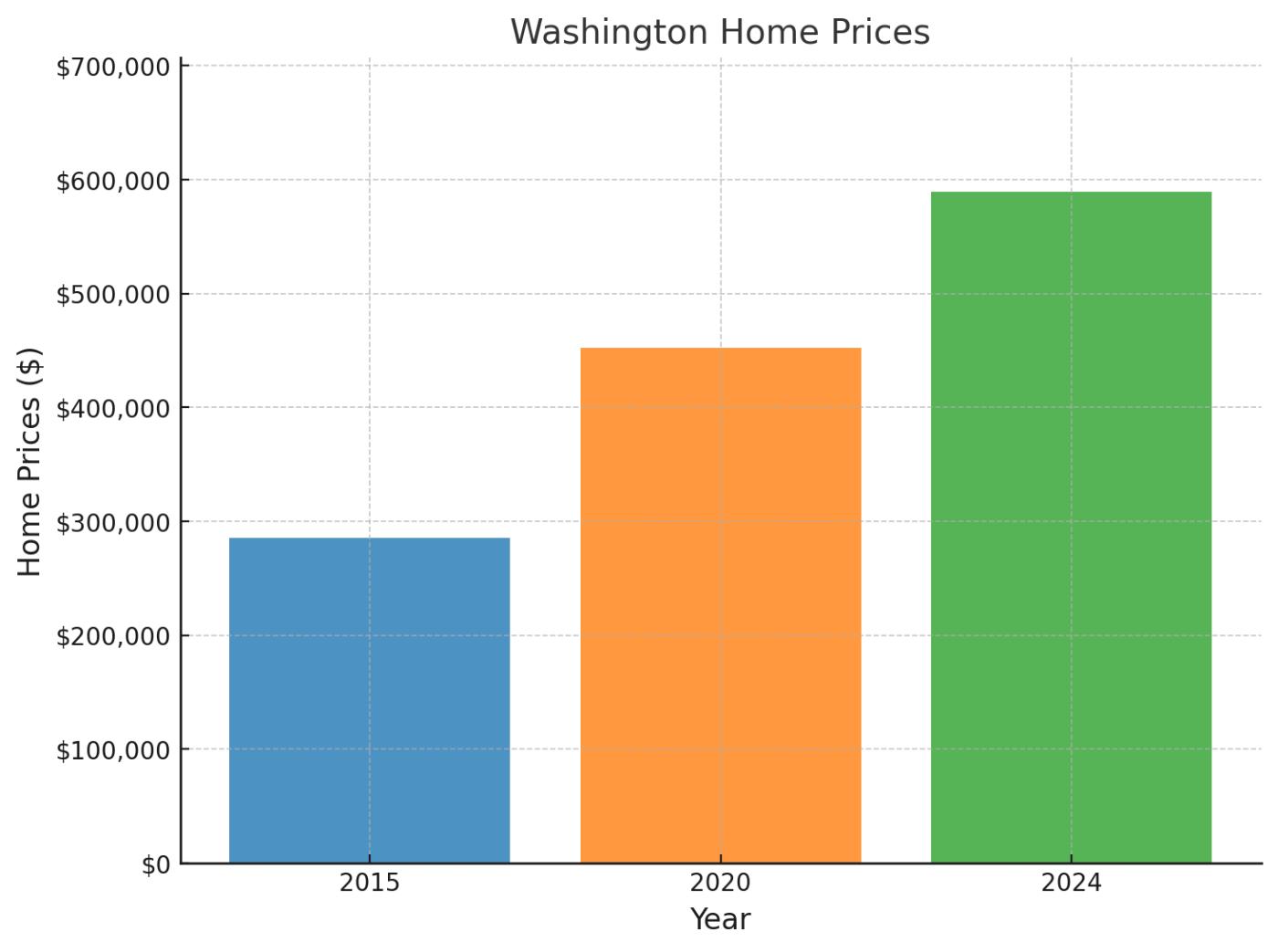

#5. Washington State

Washington’s housing market exemplifies the profound impact of the tech sector on residential real estate values. Beginning at $285,471 in December 2015, the market surged to $452,533 by December 2020, ultimately reaching $589,180 in December 2024. This impressive journey represents a 106.4% total appreciation since 2015, with a 30.2% increase since 2020, underscoring the state’s continued attraction for high-earning professionals.

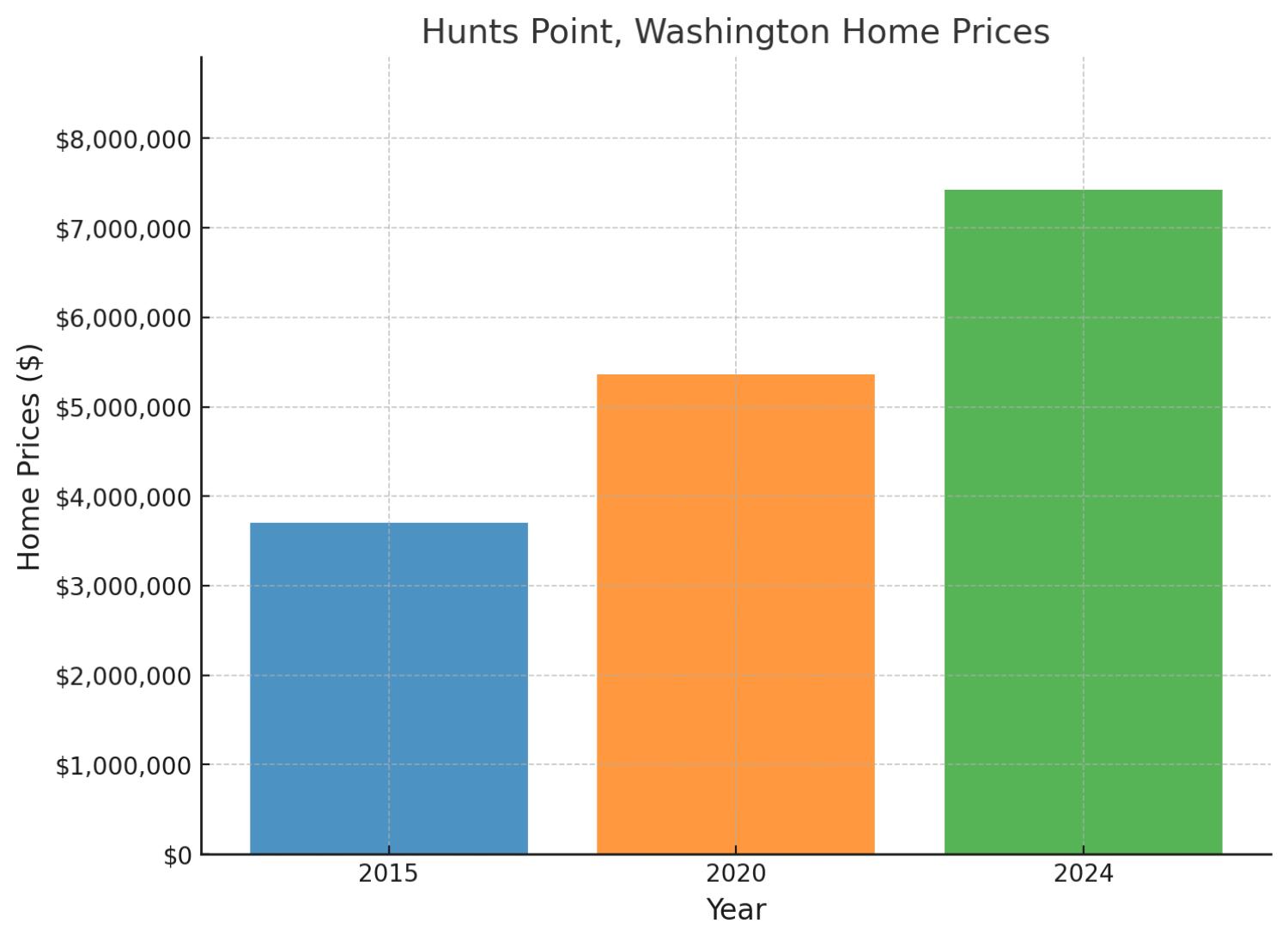

The most expensive town or city in Washington: Hunts Point

This exclusive Seattle suburb has emerged as America’s most expensive city, with home values reaching an astounding $7.42 million by December 2024. The trajectory from $3.71 million in 2015 to $5.36 million in 2020, and finally to its 2024 peak, represents a 100.3% total appreciation. While the post-2020 growth of 38.5% suggests a moderation in price acceleration, the absolute values remain extraordinary for this waterfront enclave of tech wealth and old money.

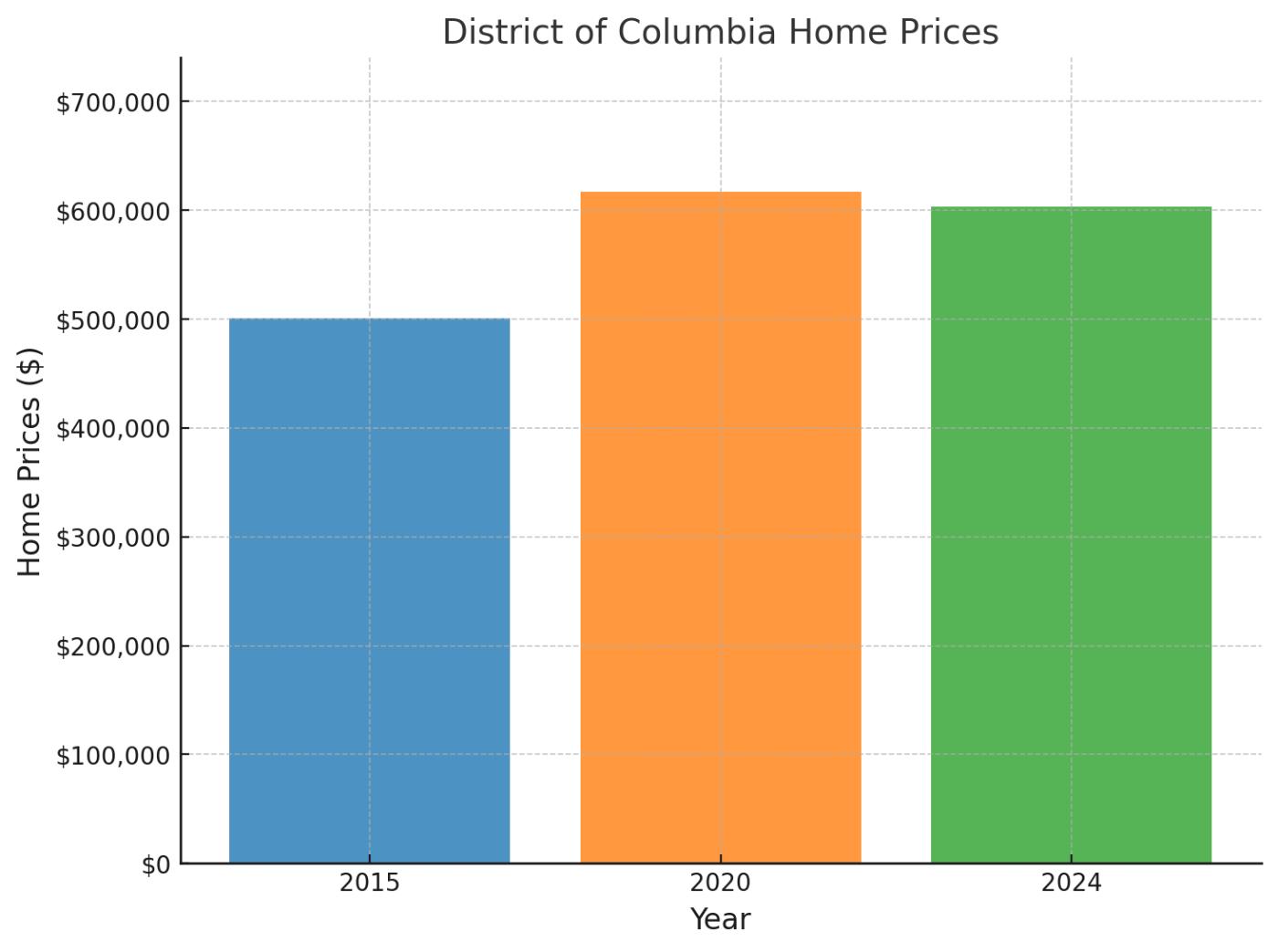

#4. District of Columbia

The nation’s capital presents a unique case study in housing market dynamics within a geographically constrained area. From $500,823 in December 2015, values rose to $616,881 by December 2020, before slightly retreating to $603,665 in December 2024. This unusual pattern shows a modest 20.5% appreciation since 2015 and a rare -2.1% decline since 2020, highlighting the market’s distinctive characteristics and challenges.

The most expensive town or city in the District of Columbia: Washington, D.C.

The nation’s capital presents a unique case study, being the only market to show a slight decline (-2.1%) since 2020, with values moving from $616,899 to $603,762 in 2024. However, the longer-term trend remains positive, with 20.6% growth since 2015’s $500,659 valuation, reflecting the stability of this government-centered market.

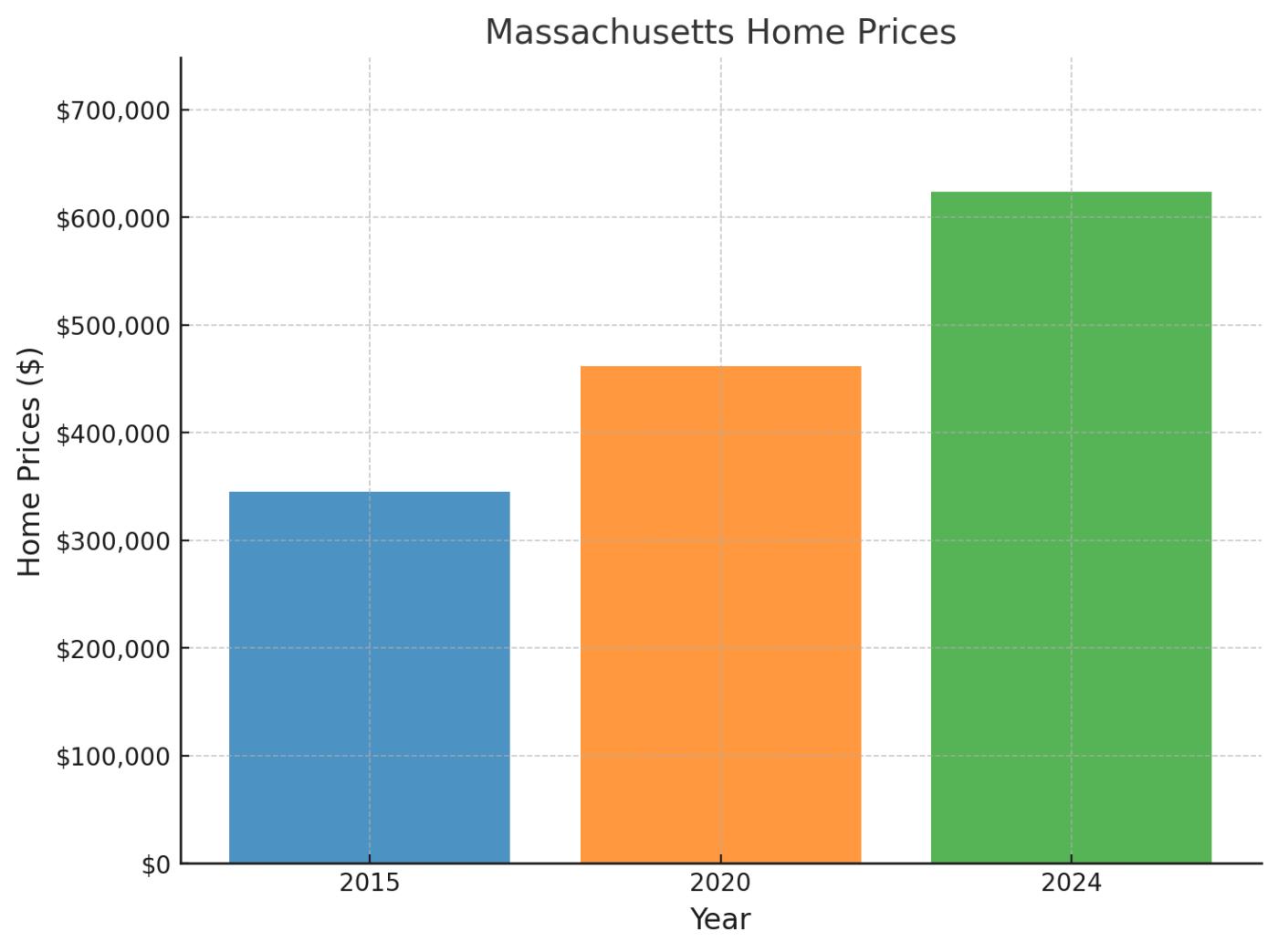

#3. Massachusetts

The Bay State’s housing market reflects its position as a global education and technology hub. Starting at $345,340 in December 2015, values increased to $461,409 by December 2020, before climbing to $623,582 in December 2024. This progression represents an impressive 80.6% appreciation over nine years, with a solid 35.1% growth since 2020, demonstrating the market’s sustained strength and attractiveness to high-skilled professionals.

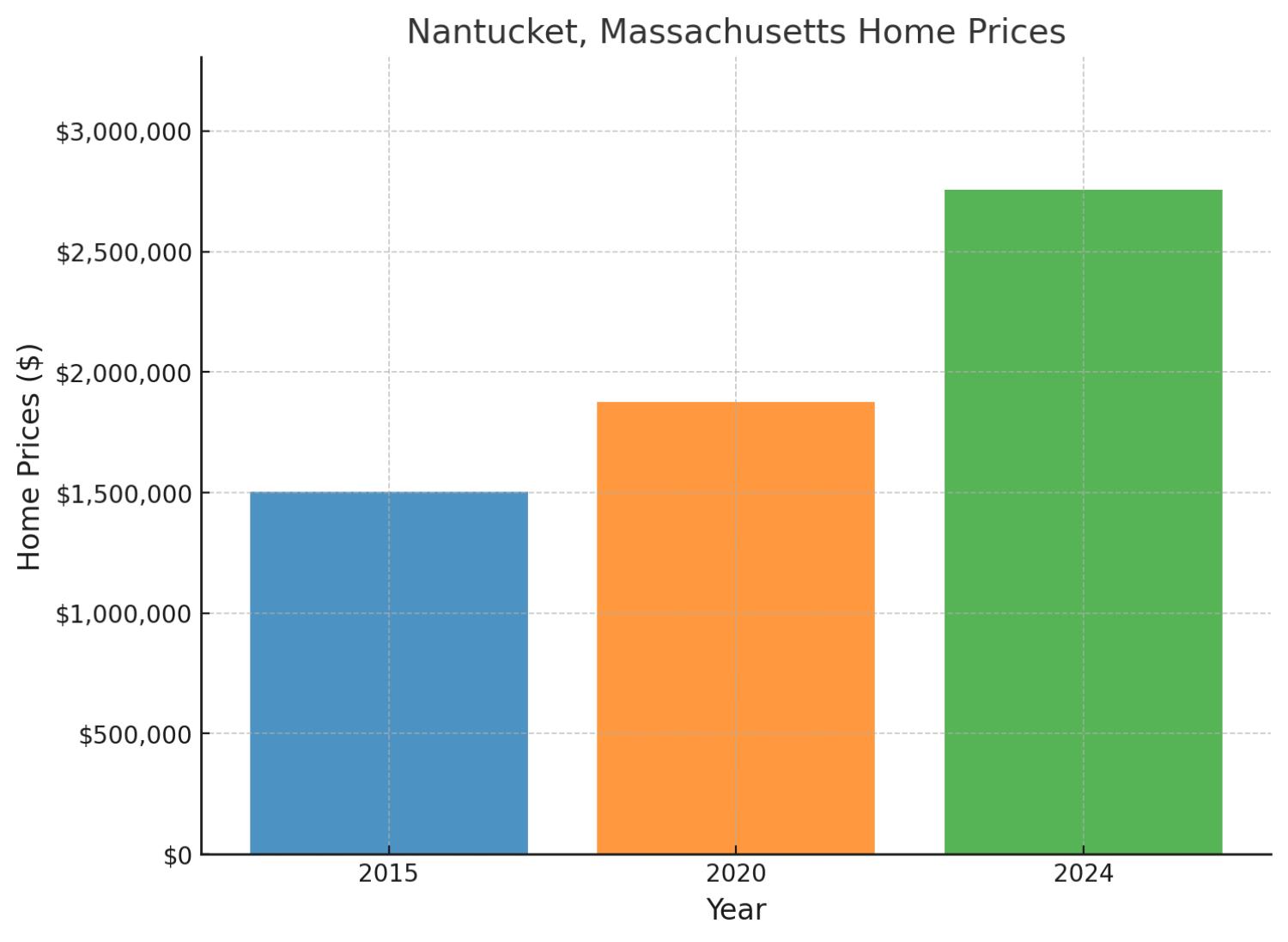

The most expensive town or city in Massachusetts: Nantucket

This historic island destination has seen values climb to $2.76 million by 2024, marking an 83.2% increase from its 2015 value of $1.50 million. The post-2020 growth of 47% from $1.88 million demonstrates the sustained appeal of this exclusive summer colony, combining historic charm with limited supply.

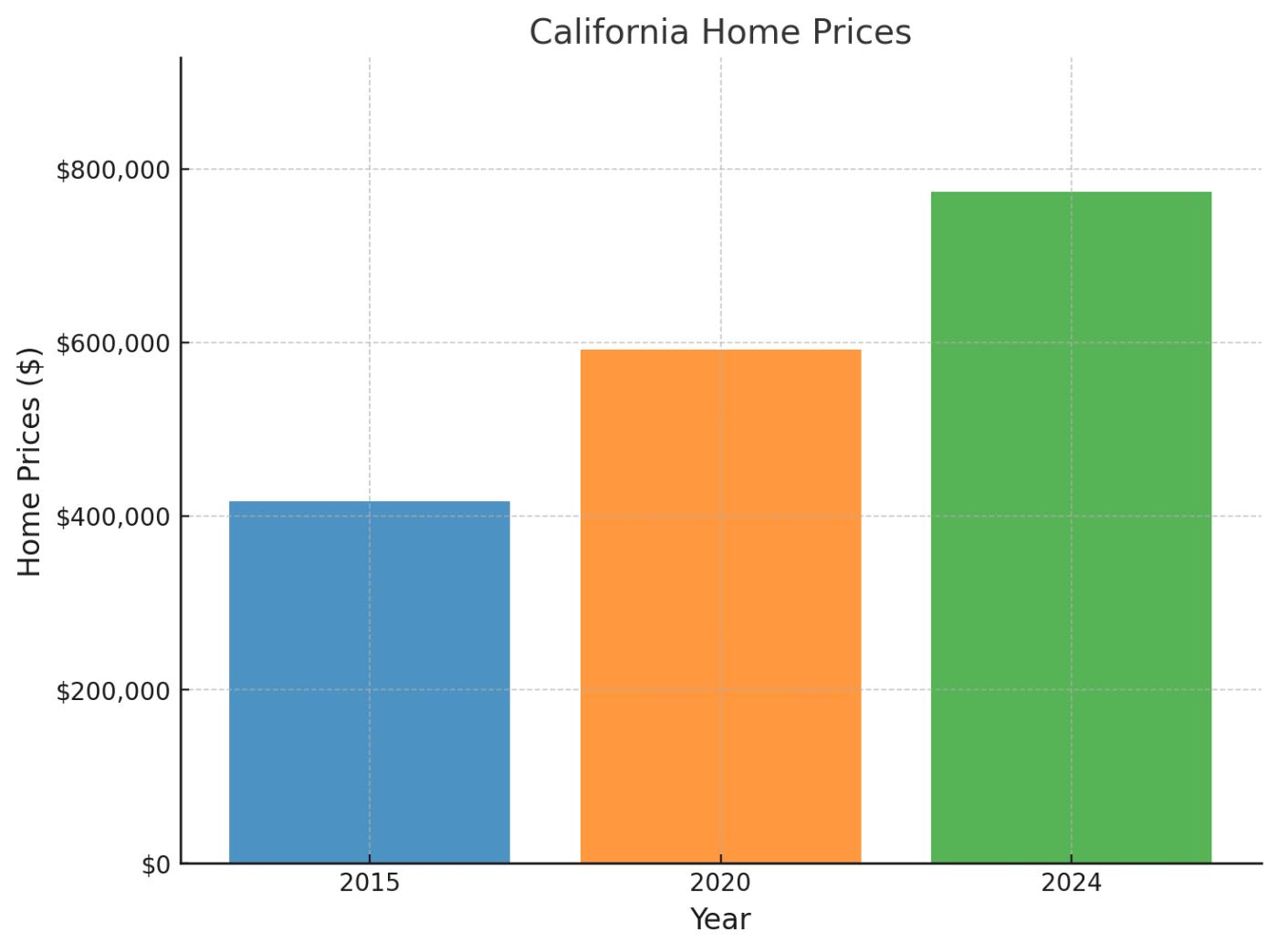

#2. California

The Golden State’s housing market continues to exemplify the premium commanded by coastal lifestyle and economic opportunity. From $416,767 in December 2015, values surged to $591,510 by December 2020, ultimately reaching $773,263 in December 2024. This trajectory represents a robust 85.5% appreciation since 2015, with a 30.7% increase since 2020, reflecting California’s enduring appeal despite affordability challenges.

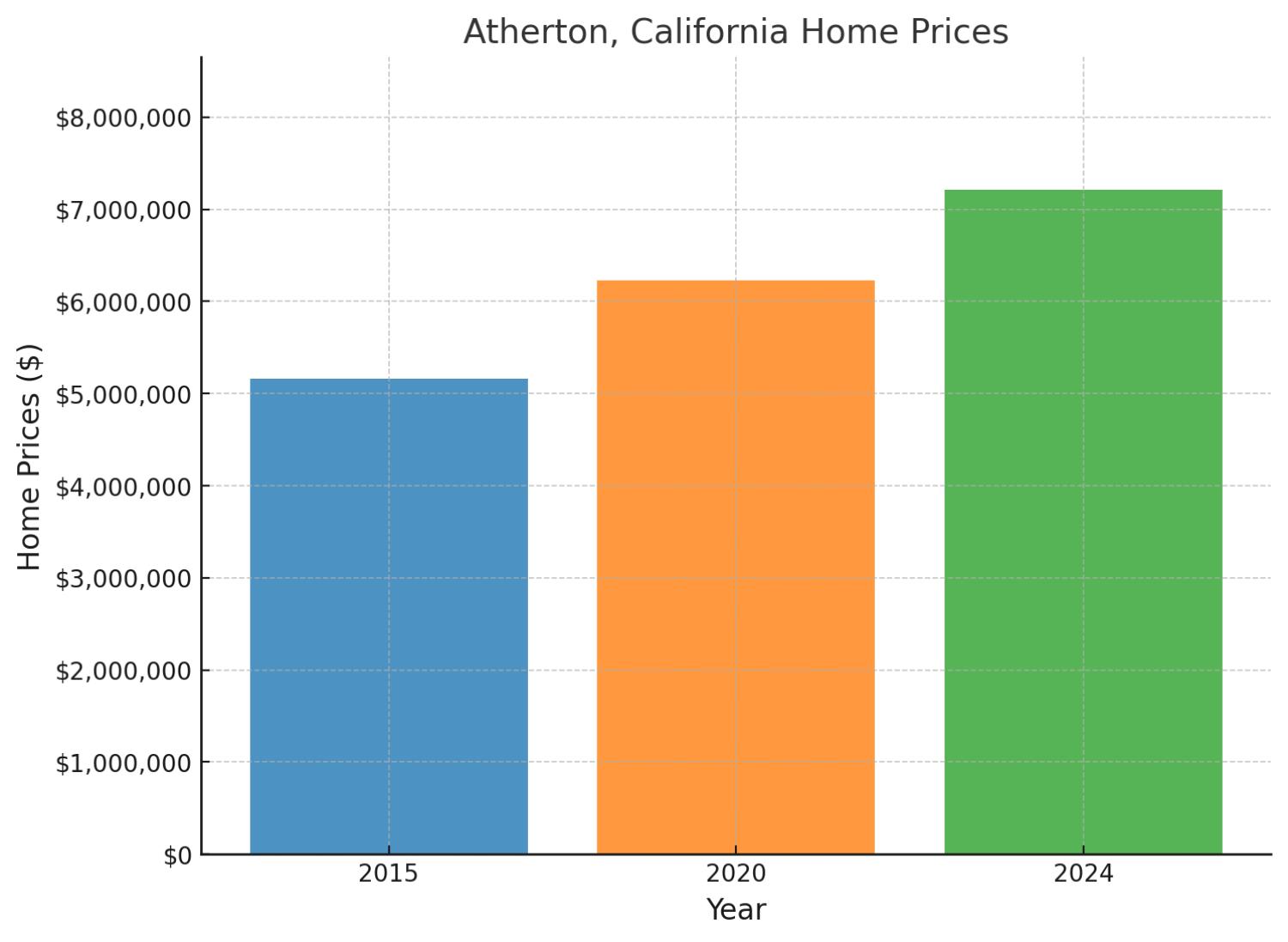

The most expensive town or city in California: Atherton

Silicon Valley’s crown jewel of real estate maintains its position among America’s priciest markets, reaching $7.21 million by 2024. The city’s growth pattern is unique, showing more modest appreciation rates (39.8% since 2015) despite sky-high absolute values. The post-2020 increase of just 15.8% suggests a maturing market, moving from $5.16 million in 2015 to $6.22 million in 2020 before reaching its 2024 peak.

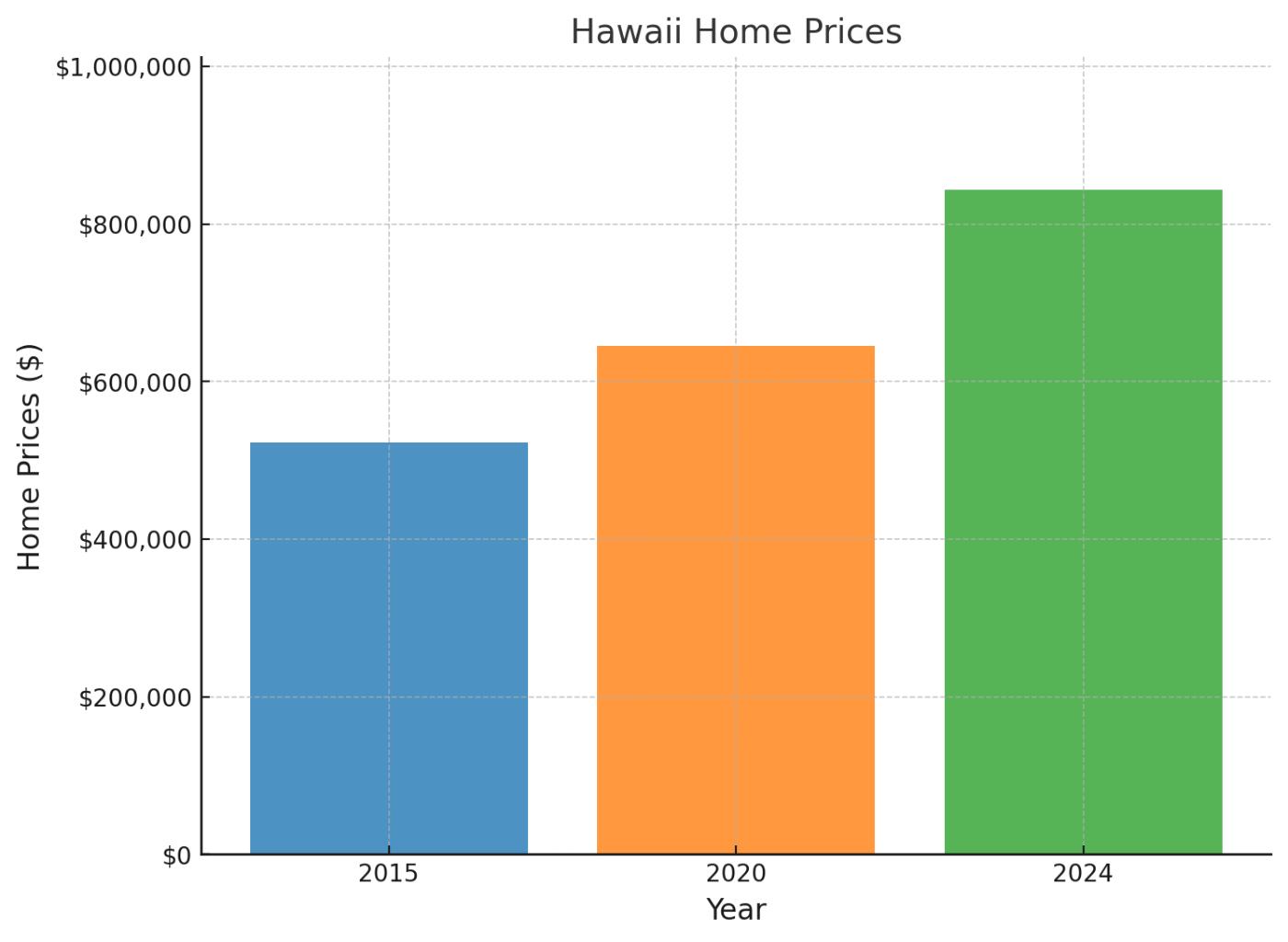

#1. Hawaii

The Aloha State maintains its position as America’s most expensive housing market, reflecting its unique appeal and limited supply. Beginning at $522,374 in December 2015, values rose to $645,469 by December 2020, before reaching $843,185 in December 2024. This progression shows a 61.4% appreciation since 2015 and a 30.6% increase since 2020, demonstrating that even at premium price points, Hawaii’s market continues to appreciate substantially.

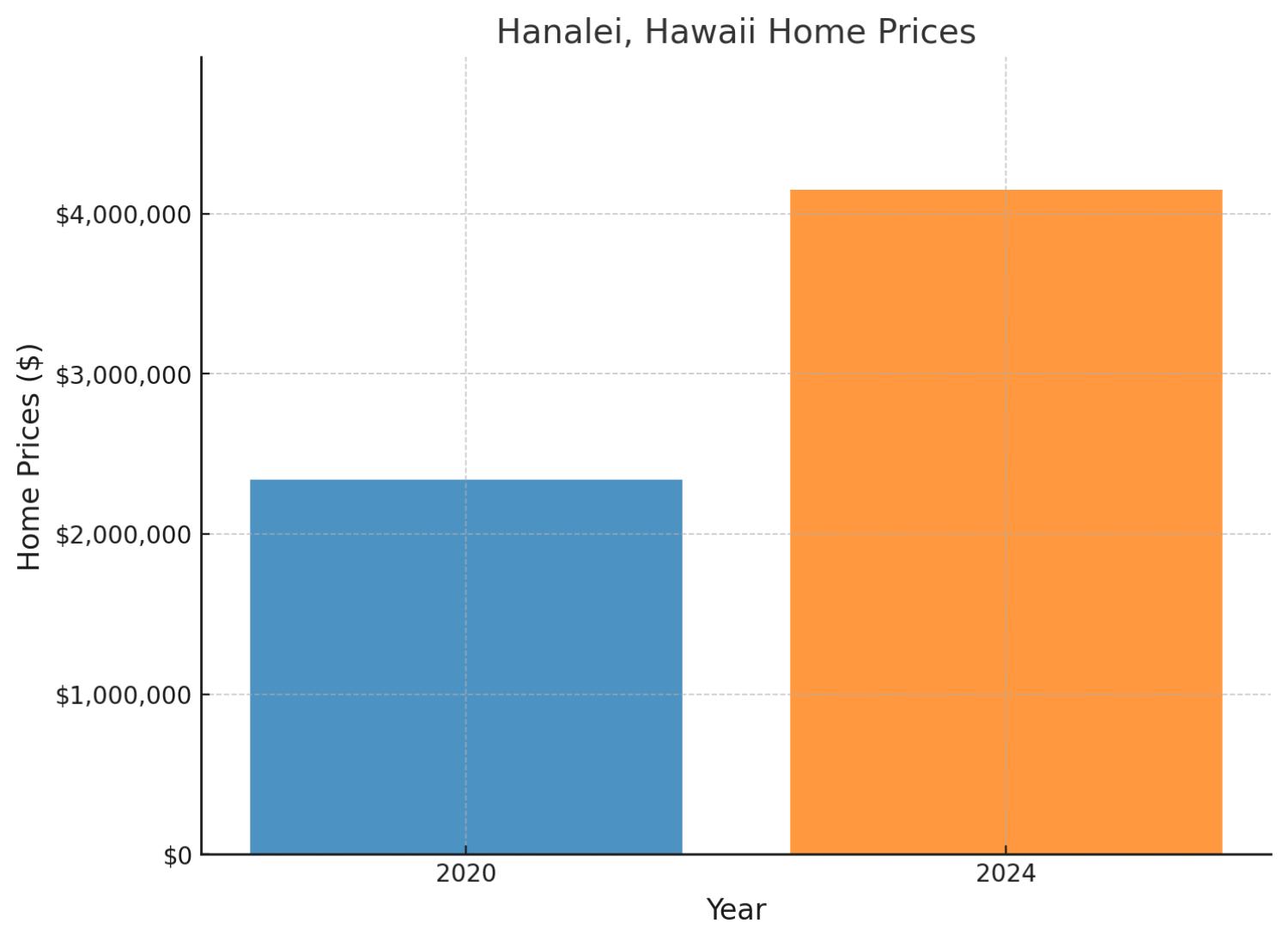

The most expensive town or city in Hawaii: Hanalei

This tropical paradise on Kauai’s north shore showcases the premium commanded by Hawaii’s most exclusive locations, reaching $4.15 million in 2024. The dramatic post-2020 surge of 77.3% from $2.34 million demonstrates the intense demand for luxury tropical properties in the post-pandemic era. While 2015 data is unavailable, the recent growth trajectory suggests Hanalei’s position as a premier luxury market will likely strengthen.