Would you like to save this?

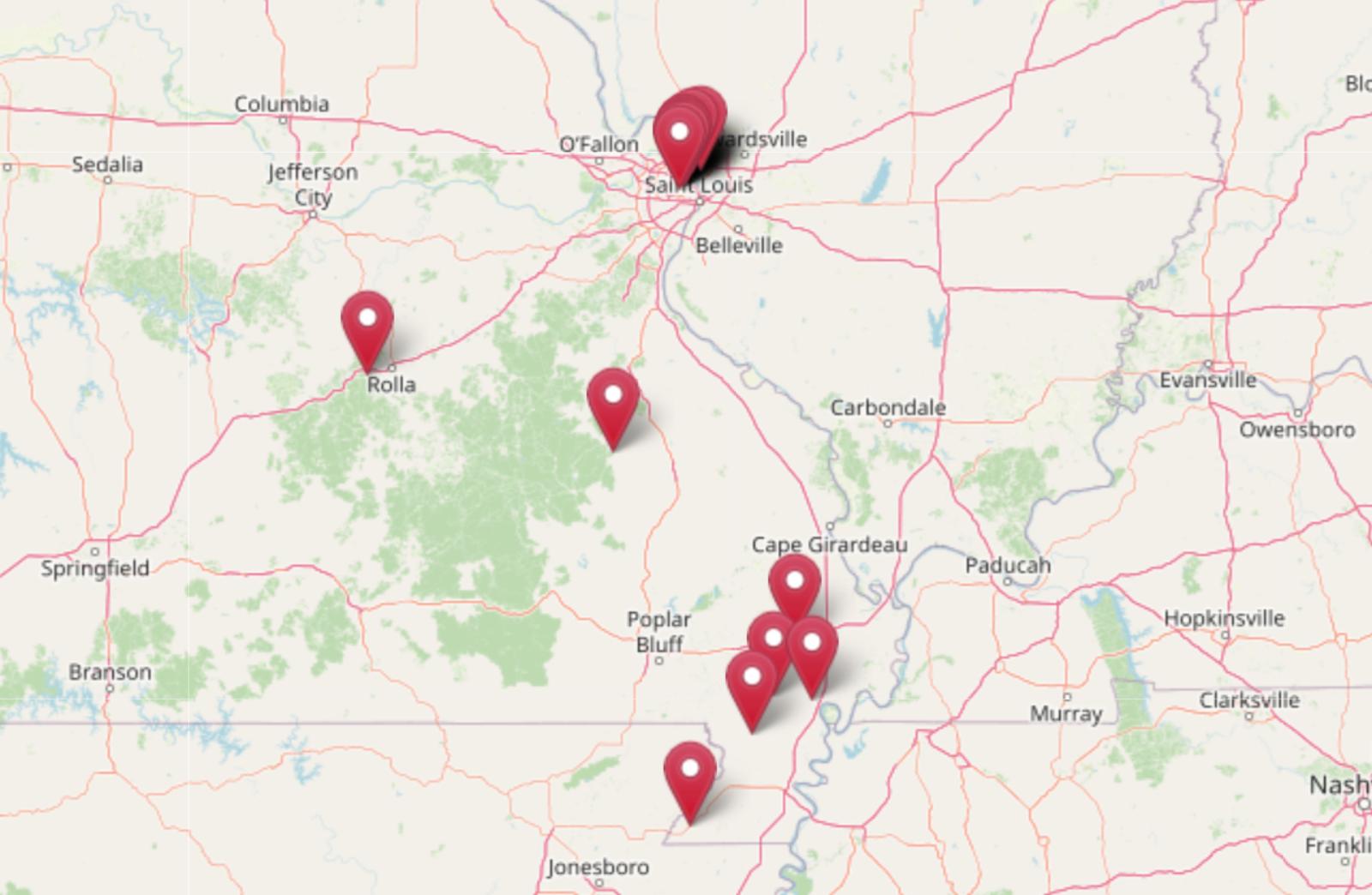

The Zillow Home Value Index shows that while Missouri’s big cities are getting pricier, many smaller towns still offer homes at prices that seem frozen in time. Tucked between farmland, forests, and rivers, these 19 towns are holding onto affordability—even as the rest of the market keeps climbing.

In some places, you can still find homes under $60,000. Whether you’re buying your first house, investing in rentals, or relocating on a budget, these towns stretch your dollar further than you’d think. Some are quietly booming, others are just staying steady—but all of them offer a way into the housing market without breaking the bank.

This list highlights the 19 most affordable towns in Missouri as of May 2025, based on Zillow’s latest housing data. For each one, we’ve included a full year-by-year price history, a percentage growth analysis, and a close-up look at what makes the town’s market tick. You’ll find towns that are growing fast, some that are steady and stable, and a few that have rebounded from major price drops. Whether you’re after long-term growth or just a lower entry point, these are the communities where your dollar still goes the distance.

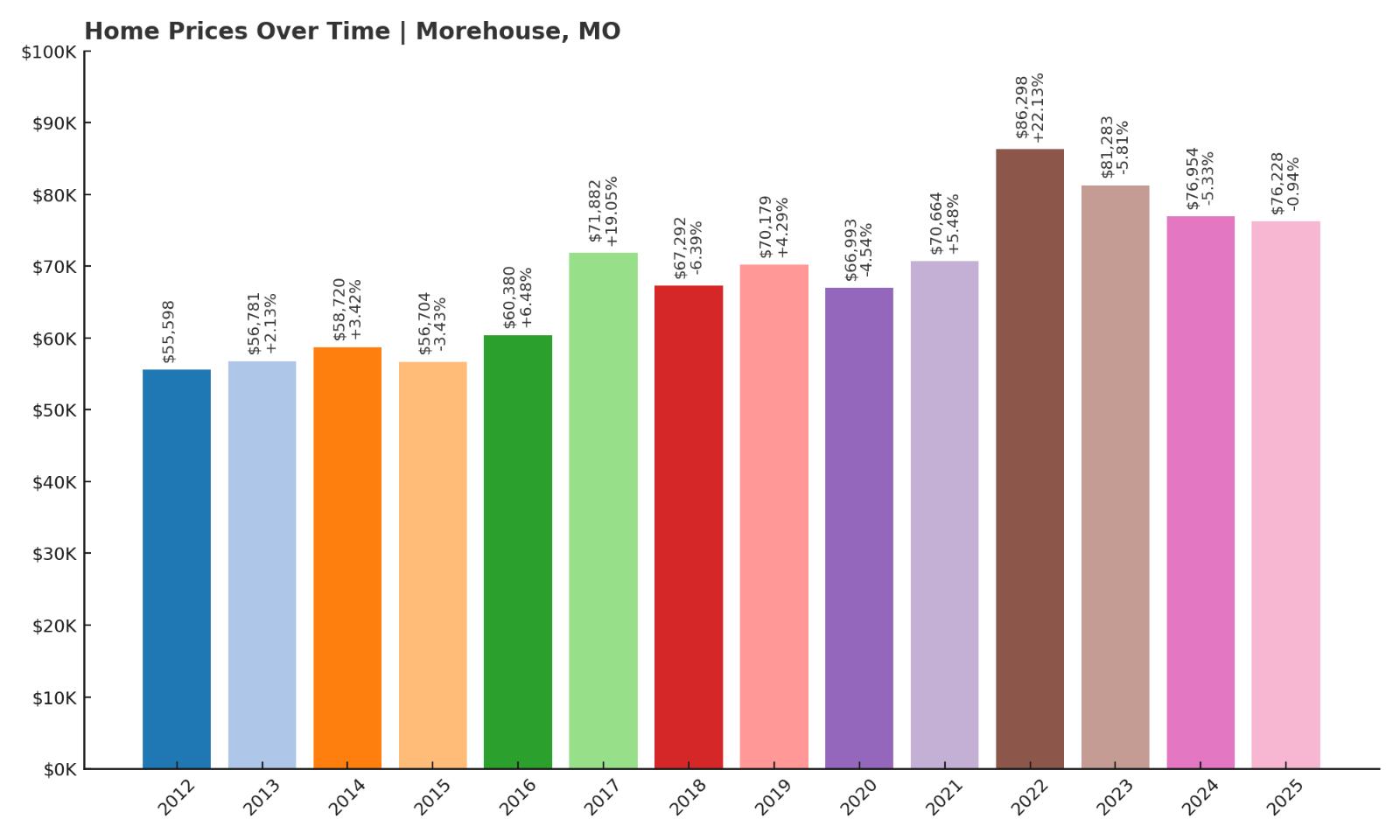

19. Morehouse – 37% Home Price Increase Since 2012

- 2010: N/A

- 2011: N/A

- 2012: $55,598

- 2013: $56,781 (+$1,182, +2.13% from previous year)

- 2014: $58,720 (+$1,940, +3.42% from previous year)

- 2015: $56,704 (-$2,016, -3.43% from previous year)

- 2016: $60,380 (+$3,676, +6.48% from previous year)

- 2017: $71,882 (+$11,502, +19.05% from previous year)

- 2018: $67,292 (-$4,591, -6.39% from previous year)

- 2019: $70,179 (+$2,887, +4.29% from previous year)

- 2020: $66,993 (-$3,186, -4.54% from previous year)

- 2021: $70,664 (+$3,671, +5.48% from previous year)

- 2022: $86,298 (+$15,634, +22.13% from previous year)

- 2023: $81,283 (-$5,015, -5.81% from previous year)

- 2024: $76,954 (-$4,329, -5.33% from previous year)

- 2025: $76,228 (-$726, -0.94% from previous year)

Home prices in Morehouse have followed a bumpy path over the past decade. After beginning at $55,598 in 2012, the market saw modest early growth followed by a few years of decline and sharp increases. The most notable spike occurred in 2017, with a 19% year-over-year increase. Since then, prices have fluctuated, reaching a high of $86,298 in 2022 before falling steadily to $76,228 by May 2025. This makes Morehouse one of the more affordable places to buy a home in Missouri, and the overall 37% increase since 2012 is relatively tame compared to statewide trends.

Morehouse – Quiet Affordability in the Bootheel

Located in the southeast corner of Missouri’s Bootheel region, Morehouse is a small, quiet town with a population of just over 900. Its affordability stems partly from its rural location and limited commercial development. While it doesn’t have the rapid growth or flash of Missouri’s bigger cities, that’s exactly what appeals to buyers looking for inexpensive homes and a slower pace of life. Essential services are available within a short drive, and the town is close to Sikeston for shopping and employment. With home values currently averaging just over $76,000, Morehouse offers a compelling price point for first-time buyers or retirees. The town’s modest volatility over the years suggests a stable market, even if it’s not poised for massive appreciation. In many ways, Morehouse reflects a typical affordable Missouri housing market—underserved, underpriced, and full of untapped potential for the right buyer.

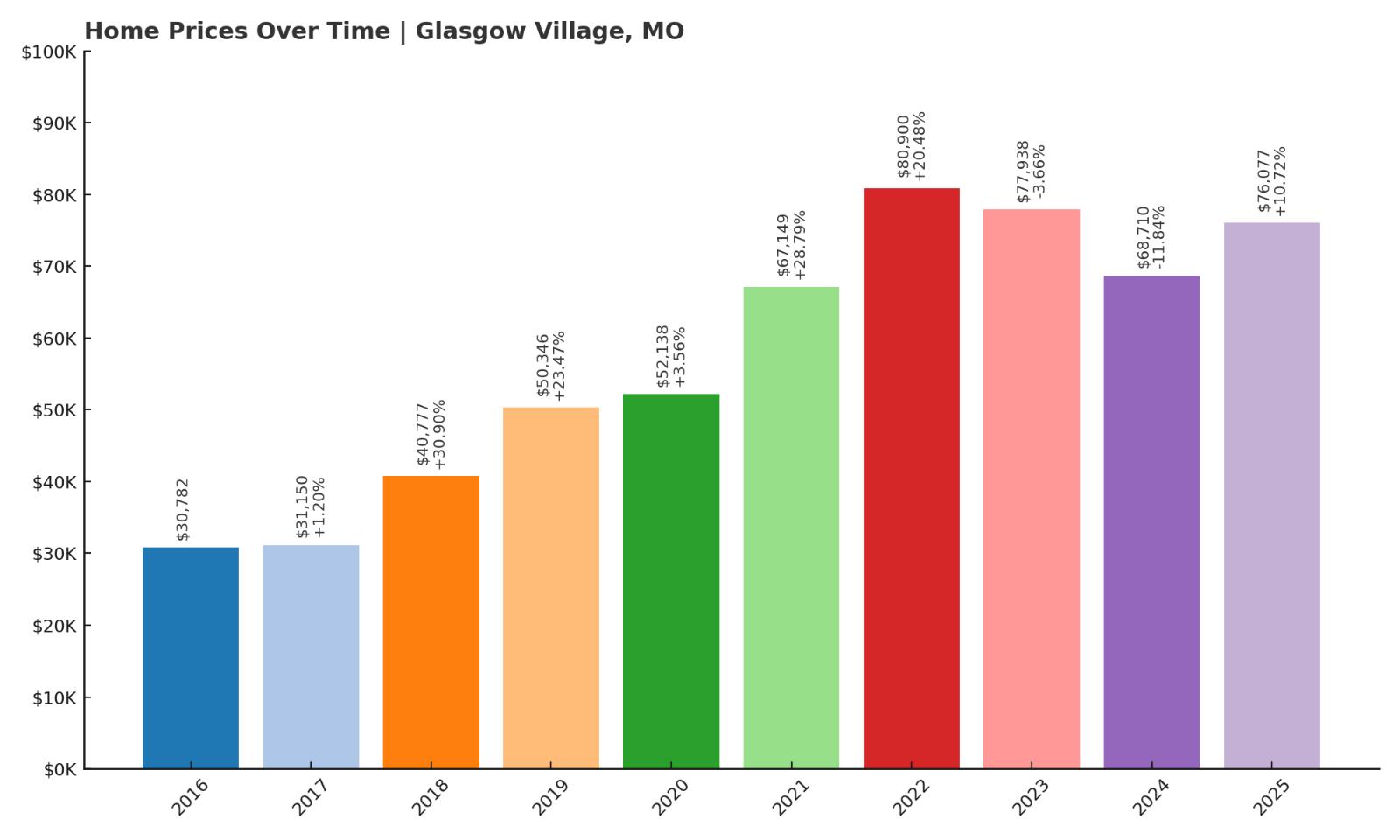

18. Glasgow Village – 147% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $30,782

- 2017: $31,150 (+$369, +1.20% from previous year)

- 2018: $40,777 (+$9,626, +30.90% from previous year)

- 2019: $50,346 (+$9,569, +23.47% from previous year)

- 2020: $52,138 (+$1,792, +3.56% from previous year)

- 2021: $67,149 (+$15,011, +28.79% from previous year)

- 2022: $80,900 (+$13,751, +20.48% from previous year)

- 2023: $77,938 (-$2,962, -3.66% from previous year)

- 2024: $68,710 (-$9,228, -11.84% from previous year)

- 2025: $76,077 (+$7,367, +10.72% from previous year)

Glasgow Village has undergone significant appreciation since 2016, with prices more than doubling. The strongest jumps occurred between 2017 and 2022, when the average home price rose from roughly $31,000 to over $80,000. A brief correction in 2023 and 2024 brought prices down temporarily, but a rebound in 2025 lifted values again. Despite the volatility, the overall increase of 147% since 2016 makes this one of Missouri’s fastest-growing affordable markets in recent years.

Glasgow Village – Rapid Gains Near St. Louis

Situated in north St. Louis County, Glasgow Village is a suburban enclave with urban convenience. Once overlooked, the area has seen renewed interest due to its proximity to downtown St. Louis and the affordability of its housing stock. That interest helped spark major home value gains during the pandemic-era housing boom, driven by investors and first-time buyers alike. Today’s median price of around $76,000 remains accessible despite its substantial growth. The village offers access to schools, transit, and job centers while keeping price tags below most metro-area alternatives. For buyers who want the balance of affordability and access, Glasgow Village remains a strong candidate, albeit one that’s seen sharper fluctuations than rural counterparts.

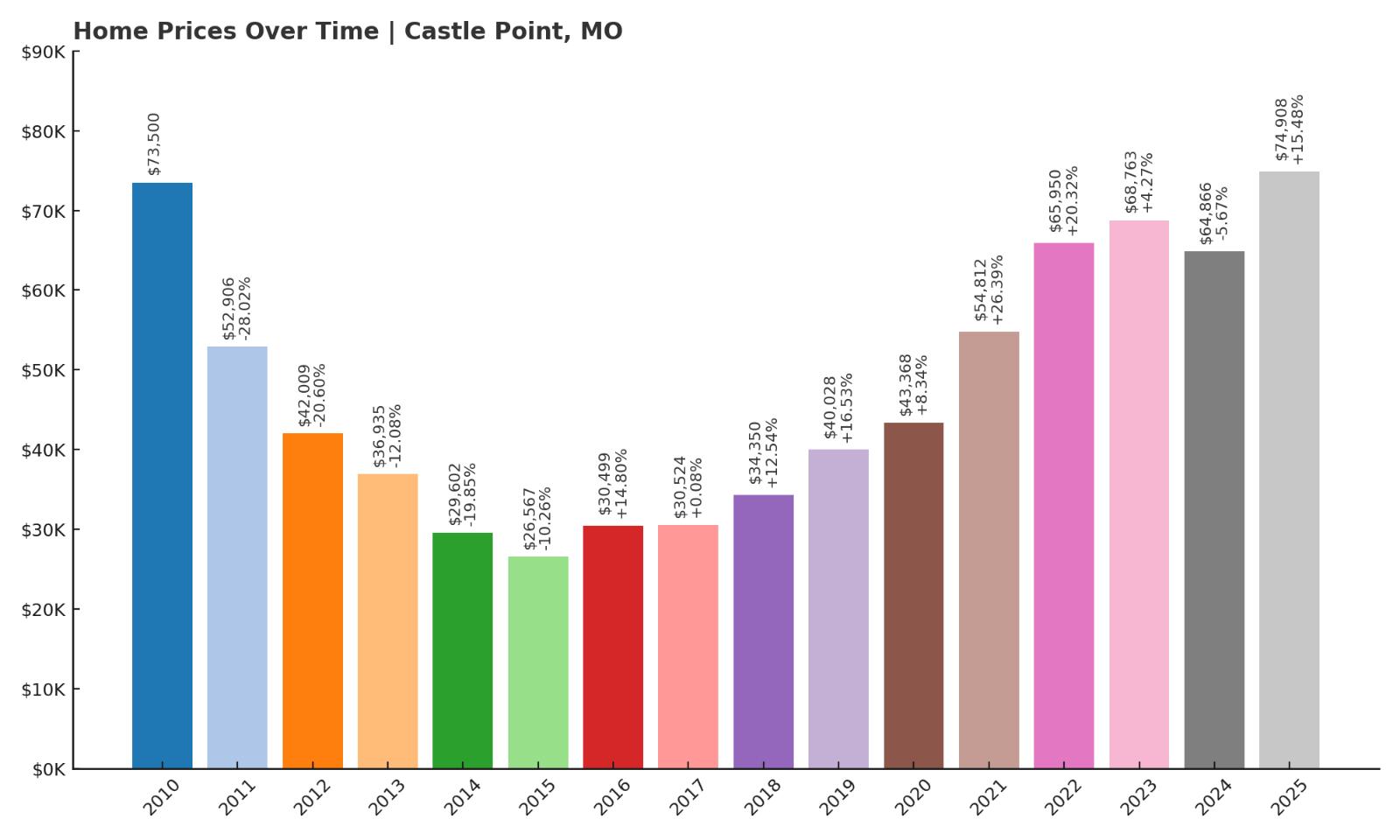

17. Castle Point – 75% Home Price Increase Since 2010

- 2010: $73,500

- 2011: $52,906 (-$20,594, -28.02% from previous year)

- 2012: $42,009 (-$10,897, -20.60% from previous year)

- 2013: $36,935 (-$5,074, -12.08% from previous year)

- 2014: $29,602 (-$7,333, -19.85% from previous year)

- 2015: $26,567 (-$3,036, -10.26% from previous year)

- 2016: $30,499 (+$3,932, +14.80% from previous year)

- 2017: $30,524 (+$25, +0.08% from previous year)

- 2018: $34,350 (+$3,826, +12.54% from previous year)

- 2019: $40,028 (+$5,677, +16.53% from previous year)

- 2020: $43,368 (+$3,340, +8.34% from previous year)

- 2021: $54,812 (+$11,444, +26.39% from previous year)

- 2022: $65,950 (+$11,138, +20.32% from previous year)

- 2023: $68,763 (+$2,813, +4.27% from previous year)

- 2024: $64,866 (-$3,897, -5.67% from previous year)

- 2025: $74,908 (+$10,042, +15.48% from previous year)

Castle Point’s price history reads like a rollercoaster. The town suffered major losses from 2010 to 2015, with values plummeting from $73,500 to just $26,567. But since 2016, Castle Point has rebounded dramatically, nearly tripling in value by 2025. With a recent value of $74,908, the town has almost returned to its 2010 level, but now with a more resilient price curve and sustained demand.

Castle Point – A Market Bouncing Back from the Brink

Would you like to save this?

Castle Point is part of the Greater St. Louis metro, and its housing market reflects the dramatic swings seen in some inner-ring suburbs. The area was hit hard by the foreclosure crisis and saw prices bottom out by the mid-2010s. But with increased investment and slow-but-steady demand, it’s been climbing back up since 2016. The recent 15% jump in 2025 alone underscores renewed interest and momentum. Though not without its challenges, Castle Point’s housing affordability remains one of its biggest draws. Its location gives residents access to the job market and services of St. Louis without the city’s higher prices. With its strong upward trend in recent years, it’s an option worth watching for investors and price-conscious buyers alike.

16. Lilbourn – 126% Home Price Increase Since 2010

- 2010: $32,830

- 2011: $31,482 (-$1,349, -4.11% from previous year)

- 2012: $32,958 (+$1,476, +4.69% from previous year)

- 2013: $30,929 (-$2,028, -6.15% from previous year)

- 2014: $32,168 (+$1,238, +4.00% from previous year)

- 2015: $33,699 (+$1,532, +4.76% from previous year)

- 2016: $36,845 (+$3,145, +9.33% from previous year)

- 2017: $39,426 (+$2,581, +7.01% from previous year)

- 2018: $43,560 (+$4,134, +10.49% from previous year)

- 2019: $49,892 (+$6,332, +14.54% from previous year)

- 2020: $51,438 (+$1,546, +3.10% from previous year)

- 2021: $51,816 (+$378, +0.74% from previous year)

- 2022: $67,493 (+$15,677, +30.25% from previous year)

- 2023: $70,973 (+$3,480, +5.16% from previous year)

- 2024: $75,194 (+$4,221, +5.95% from previous year)

- 2025: $74,316 (-$878, -1.17% from previous year)

Lilbourn has seen steady and impressive growth in home values over the past 15 years, rising from just under $33,000 in 2010 to over $74,000 in 2025. While there were occasional dips — such as in 2013 and again in 2025 — the overall trajectory has been consistently upward. Notably, the town saw a dramatic 30% increase in 2022, one of the sharpest one-year jumps in the entire list. Price growth has since cooled slightly, but values remain high relative to the town’s baseline. That long-term growth points to increasing interest and perhaps a tightening supply. Lilbourn may not be on the radar of most buyers, but its affordability and solid appreciation make it worth closer inspection. The town’s performance outpaces many larger communities in the state. Even with minor volatility, the market appears relatively stable and appealing for budget-conscious buyers.

Lilbourn – Affordable Growth in Southeast Missouri

Located in New Madrid County, Lilbourn is a small town with a strong agricultural base and an extremely low cost of living. Its housing market has been quietly gaining traction over the last decade, especially since 2016, as new buyers enter the market seeking homes under $80,000. The town benefits from its proximity to U.S. Route 62 and access to nearby commercial hubs like Sikeston and New Madrid, providing residents with shopping and employment options while still enjoying rural quiet. Schools and basic services are close by, and the town’s layout is compact and easy to navigate. While there aren’t flashy amenities or booming industries, what Lilbourn offers is consistency, affordability, and slow-burn growth. The strong value gains over time reflect the broader trend of migration toward smaller, cheaper towns that offer financial breathing room. With the median home now priced around $74,000 and solid gains in recent years, Lilbourn remains one of Missouri’s most attractive affordable markets for buyers who value price stability and long-term potential over immediate excitement.

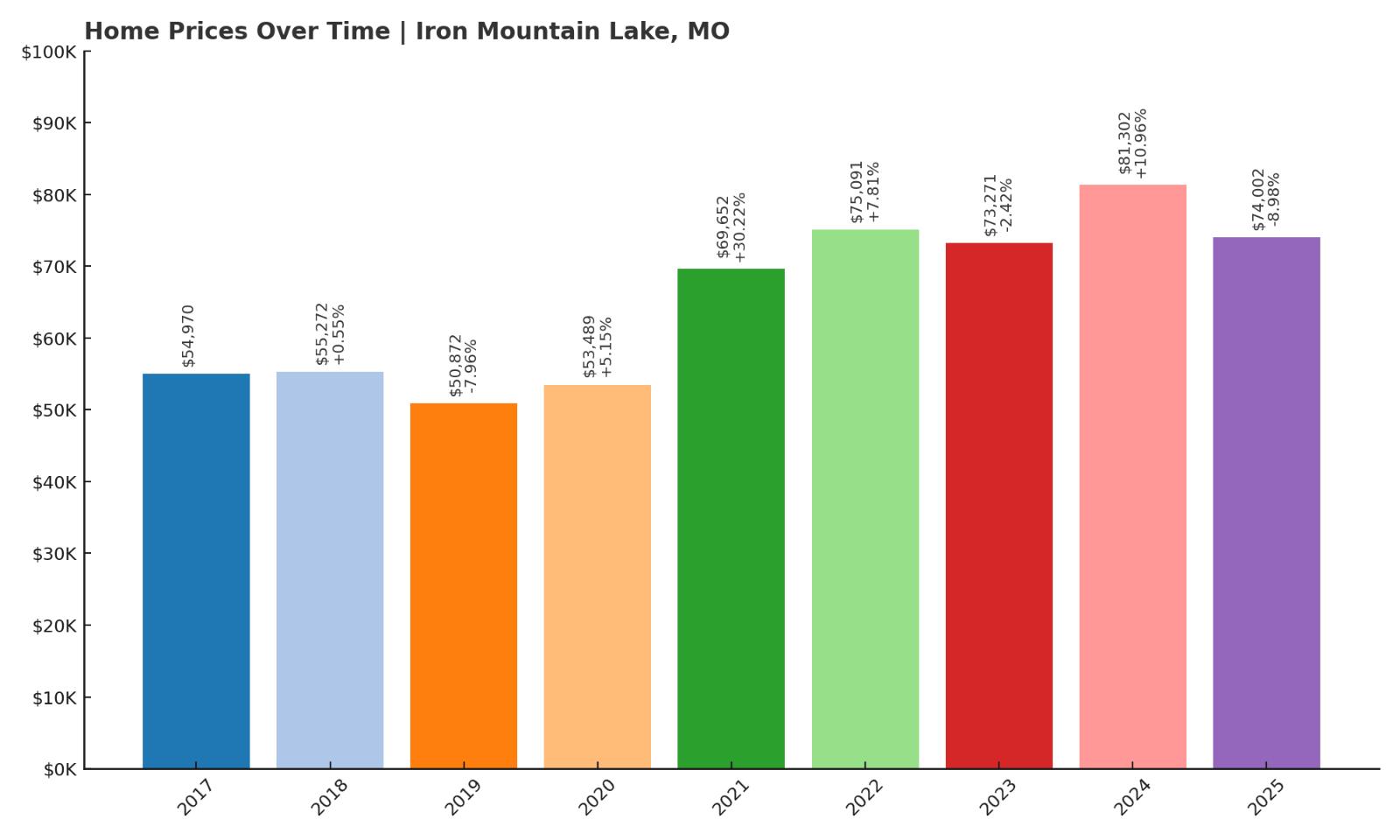

15. Iron Mountain Lake – 35% Home Price Increase Since 2017

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: $54,970

- 2018: $55,272 (+$302, +0.55% from previous year)

- 2019: $50,872 (-$4,401, -7.96% from previous year)

- 2020: $53,489 (+$2,618, +5.15% from previous year)

- 2021: $69,652 (+$16,163, +30.22% from previous year)

- 2022: $75,091 (+$5,438, +7.81% from previous year)

- 2023: $73,271 (-$1,820, -2.42% from previous year)

- 2024: $81,302 (+$8,031, +10.96% from previous year)

- 2025: $74,002 (-$7,300, -8.98% from previous year)

Iron Mountain Lake entered Zillow’s data coverage in 2017 and has shown a complex trajectory since then. The initial years saw relatively flat movement, followed by a sharp drop in 2019. However, that was quickly erased with a dramatic 30% jump in 2021 — one of the strongest one-year increases across any Missouri town on this list. The recent volatility, with a nearly 9% drop in 2025, may give some buyers pause, but the overall gain since 2017 remains significant. The average home price has grown by over $19,000 in eight years, landing at $74,002. This rise reflects both external market forces and renewed attention on rural lake communities. For investors or buyers willing to ride out the swings, the trend over time still looks promising. It’s affordable but far from stagnant.

Iron Mountain Lake – Scenic Living With Market Swings

Iron Mountain Lake is nestled in the rolling terrain of St. Francois County, surrounded by natural beauty and peaceful woodlands. The lake that gives the town its name is the centerpiece of the community, offering recreational opportunities like boating, fishing, and picnicking that appeal to outdoor enthusiasts. Though small and somewhat remote, the town’s affordability and proximity to Farmington — just 20 minutes away — make it appealing for retirees and those seeking a quiet life within driving distance of services. Part of what’s driving recent interest is the shift toward more rural living, particularly among remote workers and older buyers leaving expensive metro areas. While the town’s price fluctuations can be dramatic, they also indicate a market in flux — one that’s drawing attention and reshaping slowly. For under $75,000, buyers can find lakeside living at a fraction of what they’d pay elsewhere in the state. Iron Mountain Lake is a place where affordability and scenery converge — if you’re willing to accept some unpredictability in return.

14. Newburg – 95% Home Price Increase Since 2019

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: $37,071

- 2020: $38,830 (+$1,759, +4.74% from previous year)

- 2021: $51,551 (+$12,720, +32.76% from previous year)

- 2022: $57,184 (+$5,633, +10.93% from previous year)

- 2023: $64,970 (+$7,787, +13.62% from previous year)

- 2024: $67,591 (+$2,621, +4.03% from previous year)

- 2025: $72,229 (+$4,638, +6.86% from previous year)

Newburg has experienced a remarkable resurgence in home prices since 2019. What began as a modest market at just $37,071 has nearly doubled in value in under six years. While the most dramatic rise came in 2021 — when values soared more than 32% in a single year — the overall trend has remained positive and steady. Price gains in recent years have continued at a healthy pace, with consistent single-digit growth between 2022 and 2025. By May 2025, the typical home is valued at just over $72,000, reflecting a 95% increase from the first year with data. This kind of movement is often seen in towns where prices were historically undervalued and are now catching up with broader demand. For buyers seeking an affordable entry point with upside, Newburg shows strong momentum.

Newburg – Small Town Resurgence in the Ozarks

Newburg is located in south-central Missouri’s Phelps County, tucked along the Little Piney River and just a short drive from Rolla. It’s a classic railroad town with a rich transportation history, once serving as a key point along the Frisco Railroad. Though it remains small — with a population under 500 — Newburg offers access to natural beauty, including trails, bluffs, and river views that are increasingly attractive to buyers wanting space and scenery. The community is also adjacent to Mark Twain National Forest, which enhances its appeal for outdoor lovers. What makes Newburg especially interesting is its proximity to Missouri University of Science and Technology in Rolla, which provides employment, rental demand, and amenities within reach. As a result, the town benefits from a quiet lifestyle while still enjoying spillover growth from a larger city. The recent uptick in housing prices likely reflects that blend of accessibility and escape. With homes still priced far below the state average, Newburg offers a compelling choice for those who want affordable homeownership without sacrificing natural surroundings or connection to services.

13. Jennings – 36% Home Price Increase Since 2010

- 2010: $68,501

- 2011: $50,740 (-$17,761, -25.93% from previous year)

- 2012: $37,737 (-$13,003, -25.63% from previous year)

- 2013: $33,957 (-$3,780, -10.02% from previous year)

- 2014: $30,929 (-$3,028, -8.92% from previous year)

- 2015: $30,107 (-$822, -2.66% from previous year)

- 2016: $29,813 (-$294, -0.98% from previous year)

- 2017: $29,720 (-$93, -0.31% from previous year)

- 2018: $37,388 (+$7,668, +25.80% from previous year)

- 2019: $41,742 (+$4,354, +11.65% from previous year)

- 2020: $44,174 (+$2,432, +5.83% from previous year)

- 2021: $55,386 (+$11,212, +25.38% from previous year)

- 2022: $64,979 (+$9,593, +17.32% from previous year)

- 2023: $69,270 (+$4,292, +6.60% from previous year)

- 2024: $64,725 (-$4,546, -6.56% from previous year)

- 2025: $70,915 (+$6,190, +9.56% from previous year)

Jennings’ housing market tells a story of recovery. After losing nearly 60% of its home value between 2010 and 2017, the town reversed course with a string of strong gains starting in 2018. The rebound was particularly sharp from 2020 to 2022, when values climbed more than 47% in just two years. As of 2025, the typical home is priced at $70,915 — roughly 36% above where it was in 2010. Though that growth may not sound dramatic compared to other towns on this list, it’s significant given how deep the earlier losses were. Jennings now finds itself on a more stable footing, with solid single-digit growth returning after a dip in 2024. The trajectory suggests cautious optimism and renewed confidence in the area’s long-term value.

Jennings – Bouncing Back Near St. Louis

Jennings is a first-ring suburb of St. Louis, located just northwest of the city. Historically an industrial and working-class area, Jennings has faced economic challenges in recent decades, but it has also become a focus for revitalization efforts. Proximity to downtown, major highways, and job centers makes it an attractive option for buyers looking to enter the St. Louis housing market without the high price tag. Recent investments in infrastructure and housing development have helped turn things around slowly, contributing to rising home values. Many homes in Jennings are modest, mid-century structures — brick ranches and bungalows — with spacious yards and access to public transportation. The town has begun to attract both individual homeowners and small-scale investors who see opportunity in its still-low prices. At around $71,000, the average home here remains well below Missouri’s statewide median, yet its strategic location gives it growth potential others may lack. For buyers priced out of more popular suburbs, Jennings offers a second chance at homeownership near the metro core.

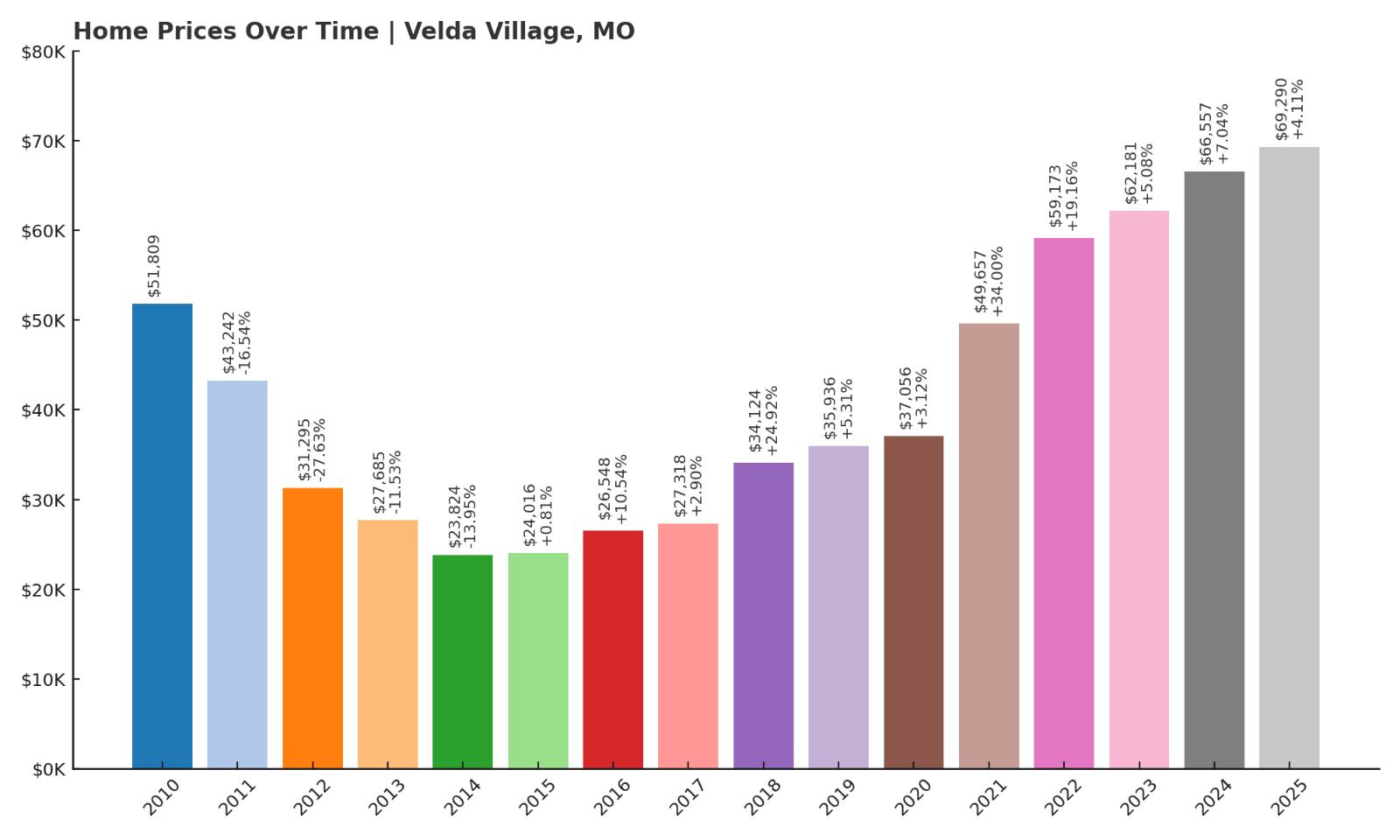

12. Velda Village – 34% Home Price Increase Since 2010

- 2010: $51,809

- 2011: $43,242 (-$8,567, -16.54% from previous year)

- 2012: $31,295 (-$11,947, -27.63% from previous year)

- 2013: $27,685 (-$3,610, -11.53% from previous year)

- 2014: $23,824 (-$3,861, -13.95% from previous year)

- 2015: $24,016 (+$192, +0.81% from previous year)

- 2016: $26,548 (+$2,531, +10.54% from previous year)

- 2017: $27,318 (+$770, +2.90% from previous year)

- 2018: $34,124 (+$6,806, +24.92% from previous year)

- 2019: $35,936 (+$1,812, +5.31% from previous year)

- 2020: $37,056 (+$1,120, +3.12% from previous year)

- 2021: $49,657 (+$12,600, +34.00% from previous year)

- 2022: $59,173 (+$9,516, +19.16% from previous year)

- 2023: $62,181 (+$3,008, +5.08% from previous year)

- 2024: $66,557 (+$4,376, +7.04% from previous year)

- 2025: $69,290 (+$2,733, +4.11% from previous year)

Velda Village has quietly climbed back from a deep housing downturn in the early 2010s. After hitting a low in 2014, home prices began to recover slowly, with a few standout years — including 2018 and 2021 — when values surged more than 20% and 30%, respectively. The result is a 34% increase since 2010, despite a rocky start. Growth has become more predictable in recent years, with consistent low-to-mid single-digit increases since 2022. At $69,290 in 2025, the market remains very affordable and shows signs of long-term health. For those focused on gradual appreciation with minimal risk, Velda Village now represents a more balanced market than it did a decade ago.

Velda Village – A Gradual Comeback in North St. Louis County

Velda Village is a small residential municipality nestled in North St. Louis County. Like many neighboring communities, it saw housing prices fall sharply after the financial crisis, but those declines have largely reversed in the past five years. Part of the recovery is due to its location — close enough to major highways and employment centers, yet far enough to maintain lower price points. The housing stock here consists mostly of modest single-family homes on tree-lined streets, many of which have undergone renovations in recent years. What sets Velda Village apart is its sense of local identity and ongoing improvement. Several neighborhood groups have contributed to small-scale revitalization efforts, and new buyers are beginning to take notice. With homes still priced under $70,000, the area remains an attractive entry point for young families, downsizers, and budget-minded buyers. The combination of affordability, location, and recent price stabilization make Velda Village a quiet success story in the evolving St. Louis suburban landscape.

11. Beverly Hills – 182% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $24,524

- 2017: $23,382 (-$1,143, -4.66% from previous year)

- 2018: $31,476 (+$8,094, +34.62% from previous year)

- 2019: $38,405 (+$6,929, +22.01% from previous year)

- 2020: $37,685 (-$720, -1.87% from previous year)

- 2021: $50,905 (+$13,220, +35.08% from previous year)

- 2022: $58,596 (+$7,691, +15.11% from previous year)

- 2023: $58,707 (+$111, +0.19% from previous year)

- 2024: $62,730 (+$4,023, +6.85% from previous year)

- 2025: $69,289 (+$6,559, +10.46% from previous year)

Beverly Hills has recorded some of the most dramatic housing gains in the state since 2016. The market kicked off at just $24,524 that year, then surged more than 34% in 2018 and again in 2021. These leaps, paired with strong mid-teen gains and steady growth since, have pushed the average home price to $69,289 in 2025 — a remarkable 182% increase in just nine years. What’s notable is that after such aggressive appreciation, the market has remained resilient. Only one year — 2020 — posted a minor decline, and recent figures suggest renewed upward movement. While the current price still ranks among the lowest in Missouri, the rate of change points to a market in high demand, especially among bargain hunters and investors looking for sharp returns.

Beverly Hills – A Small Suburb Seeing Big Gains

Beverly Hills is a compact inner-ring suburb in north St. Louis County, known for its close proximity to downtown and easy access to major roads. Though small in size and population, the town’s affordability and location have made it increasingly attractive to first-time homebuyers, especially during the housing rush of the past few years. Investors have also taken note, spurring light renovation and property flipping activity across many blocks. Much of the housing stock here consists of older single-story homes with good structural bones but modest updates, which keeps prices low but livable. What has helped Beverly Hills thrive lately is the migration of budget-conscious buyers away from pricier metro areas toward suburbs with untapped potential. With housing values growing at a rapid pace and the average home still well under $70,000, the area remains one of the most accessible options within a short commute to St. Louis. For buyers willing to bet on continued neighborhood improvement, Beverly Hills offers affordability with an upward trajectory that’s hard to ignore.

10. Pagedale – 24% Home Price Increase Since 2010

Would you like to save this?

- 2010: $54,353

- 2011: $37,579 (-$16,774, -30.86% from previous year)

- 2012: $35,723 (-$1,856, -4.94% from previous year)

- 2013: $30,278 (-$5,445, -15.24% from previous year)

- 2014: $28,859 (-$1,419, -4.69% from previous year)

- 2015: $26,210 (-$2,649, -9.18% from previous year)

- 2016: $27,132 (+$922, +3.52% from previous year)

- 2017: $28,977 (+$1,845, +6.80% from previous year)

- 2018: $34,359 (+$5,382, +18.57% from previous year)

- 2019: $38,202 (+$3,843, +11.18% from previous year)

- 2020: $38,668 (+$466, +1.22% from previous year)

- 2021: $49,647 (+$10,979, +28.39% from previous year)

- 2022: $57,092 (+$7,446, +15.00% from previous year)

- 2023: $58,553 (+$1,461, +2.56% from previous year)

- 2024: $63,141 (+$4,588, +7.84% from previous year)

- 2025: $67,428 (+$4,287, +6.79% from previous year)

Pagedale’s housing journey has been one of sharp decline followed by steady redemption. Between 2010 and 2015, home prices were slashed by over 50%, dropping to a low of $26,210. But starting in 2016, the market began a cautious climb, accelerating rapidly in 2021 and 2022, when home values jumped a combined 43%. As of 2025, the average price sits at $67,428 — a 24% increase from where it all began in 2010. While that figure might seem modest, it marks an important recovery after years of instability. The town’s affordability and recent upward movement suggest a market that has regained its footing and is likely to continue improving if current trends hold.

Pagedale – Affordable Homes with City Access

Pagedale is a long-standing suburb located just west of St. Louis, offering quick access to the city via Page Avenue and nearby I-70. Despite a history of disinvestment, the area has seen renewed interest thanks to low housing costs and its location within the inner metro. Pagedale is part of the “24:1” initiative — a regional redevelopment strategy involving 24 municipalities aiming to rebuild economic strength and community infrastructure in North St. Louis County. As a result, new developments and civic investments have slowly begun reshaping the area. What makes Pagedale appealing to budget-focused buyers is its blend of proximity and price. It offers urban access at a fraction of urban prices. Housing stock tends to be older but serviceable, with modest upgrades offering significant value. With average home prices below $70,000 and growth stabilizing in recent years, Pagedale represents an opportunity for buyers who want to be close to city amenities without overspending. If broader revitalization efforts continue, its housing market could see further upside in the years ahead.

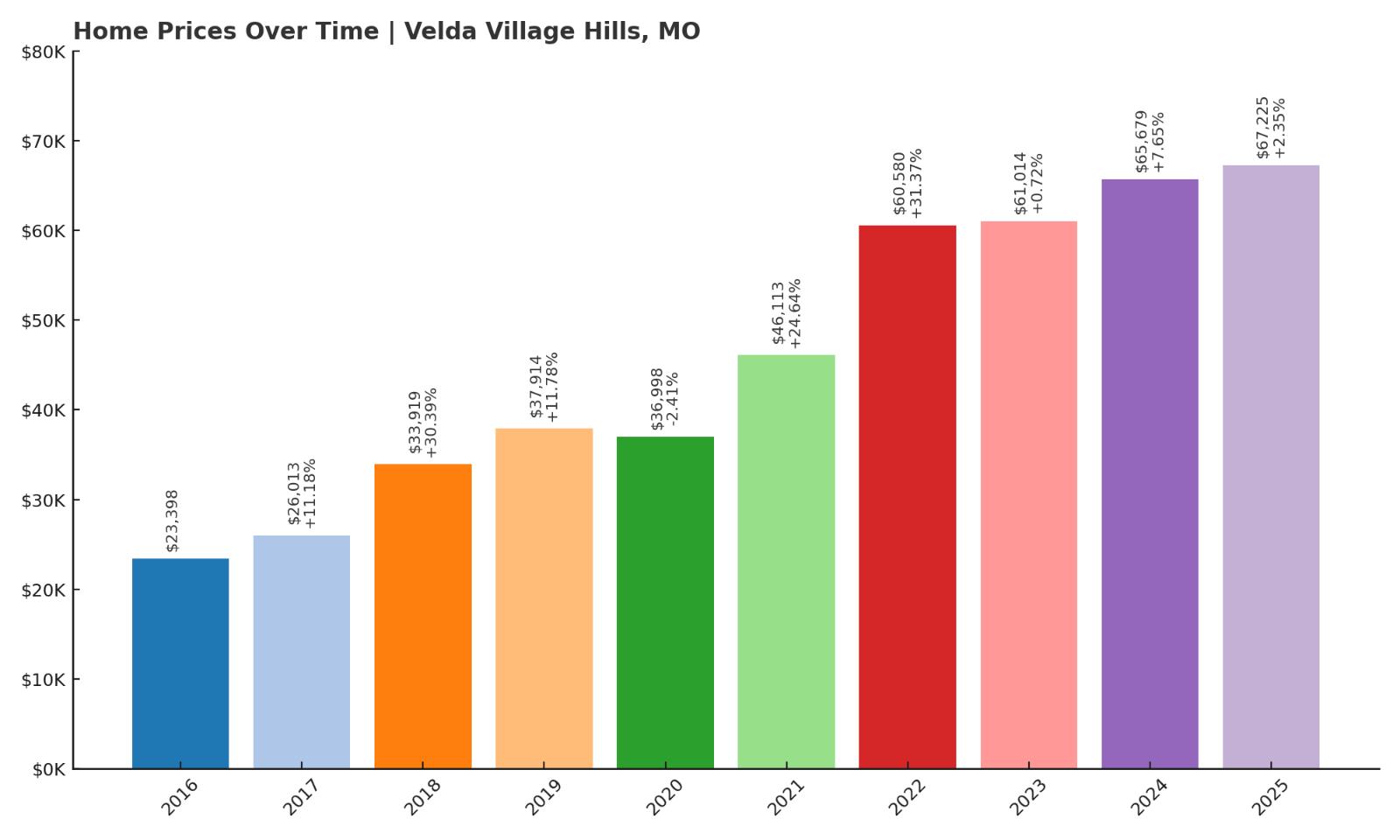

9. Velda Village Hills – 187% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $23,398

- 2017: $26,013 (+$2,615, +11.18% from previous year)

- 2018: $33,919 (+$7,905, +30.39% from previous year)

- 2019: $37,914 (+$3,995, +11.78% from previous year)

- 2020: $36,998 (-$915, -2.41% from previous year)

- 2021: $46,113 (+$9,115, +24.64% from previous year)

- 2022: $60,580 (+$14,467, +31.37% from previous year)

- 2023: $61,014 (+$434, +0.72% from previous year)

- 2024: $65,679 (+$4,665, +7.65% from previous year)

- 2025: $67,225 (+$1,546, +2.35% from previous year)

Velda Village Hills has emerged as one of Missouri’s highest-performing affordable markets, with a 187% increase in home prices since 2016. The growth has been rapid, especially between 2021 and 2022, when values jumped over 31%. Though the pace of gains has slowed in recent years, the town continues to post positive movement — up another 2.35% in 2025. Starting from a base of just $23,398, Velda Village Hills now averages $67,225 per home, offering clear evidence of investor activity, demand growth, or broader metro area spillover effects. The growth may not be dramatic every year, but it’s reliable — and it’s transformed the town’s housing market from stagnant to one of steady expansion.

Velda Village Hills – Strong Value in a Compact Community

Velda Village Hills is a small enclave in north-central St. Louis County, surrounded by other municipalities in the inner-ring suburbs. Though often overlooked, its location close to major roads and transit lines makes it a quietly convenient place to live. Like many towns in the area, it was hit hard during the housing crash, but it’s rebounded thanks in part to its manageable size and improving housing stock. The area has seen renewed interest from homebuyers who want to stay near the city but pay less than half of what they’d spend elsewhere. Homes in Velda Village Hills tend to be compact — mostly brick single-family residences built in the mid-20th century — and many have been updated in recent years. The neighborhood is gaining traction with first-time buyers, retirees, and rental investors looking for solid yield potential. At under $70,000 on average, it’s still one of Missouri’s most affordable urban-adjacent communities. That low entry point, combined with proven appreciation, makes Velda Village Hills a standout on this list.

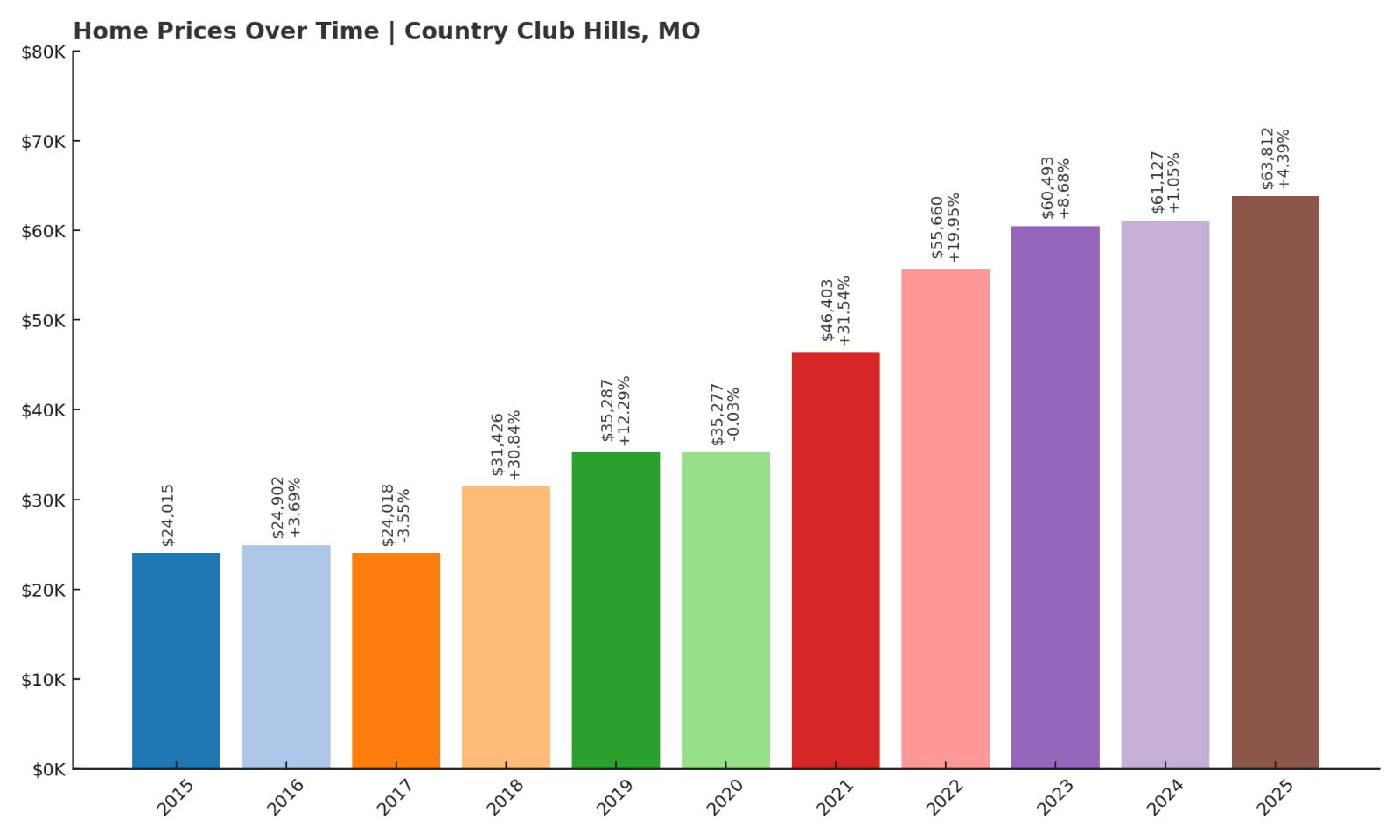

6. Country Club Hills – 166% Home Price Increase Since 2015

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: $24,015

- 2016: $24,902 (+$887, +3.69% from previous year)

- 2017: $24,018 (-$883, -3.55% from previous year)

- 2018: $31,426 (+$7,407, +30.84% from previous year)

- 2019: $35,287 (+$3,861, +12.29% from previous year)

- 2020: $35,277 (-$10, -0.03% from previous year)

- 2021: $46,403 (+$11,126, +31.54% from previous year)

- 2022: $55,660 (+$9,257, +19.95% from previous year)

- 2023: $60,493 (+$4,833, +8.68% from previous year)

- 2024: $61,127 (+$634, +1.05% from previous year)

- 2025: $63,812 (+$2,685, +4.39% from previous year)

Since entering the dataset in 2015, Country Club Hills has seen its housing prices climb from $24,015 to $63,812 in 2025 — a 166% increase in just a decade. That growth has been driven by a series of strong jumps, particularly in 2018 and 2021 when prices leapt by over 30% each year. More recent growth has been steadier but still positive, with moderate gains posted annually since 2022. Despite some mild volatility, the overall trajectory reflects increased demand and strengthening fundamentals in this small, densely developed suburb. The area’s affordability has remained a major draw, especially for buyers priced out of nearby St. Louis communities.

Country Club Hills – Steady Growth in North St. Louis County

Country Club Hills lies just north of St. Louis in a compact footprint that spans less than a half-square mile. The town features modest, single-family homes — many built in the postwar period — and benefits from easy access to key roads like Lucas and Hunt Road and Highway 70. Despite its small size, the community is part of a broader effort in North County to revitalize aging infrastructure and improve housing stock. Its consistent growth in recent years suggests these efforts may be gaining traction with buyers. Housing values remain far below the state average, but the appreciation since 2015 shows that affordability here is no longer going unnoticed. Country Club Hills appeals to buyers seeking starter homes or investment properties within reach of metro jobs. With prices averaging under $64,000 and upward momentum intact, the town continues to offer one of the region’s lowest-cost points of entry for aspiring homeowners looking to build equity.

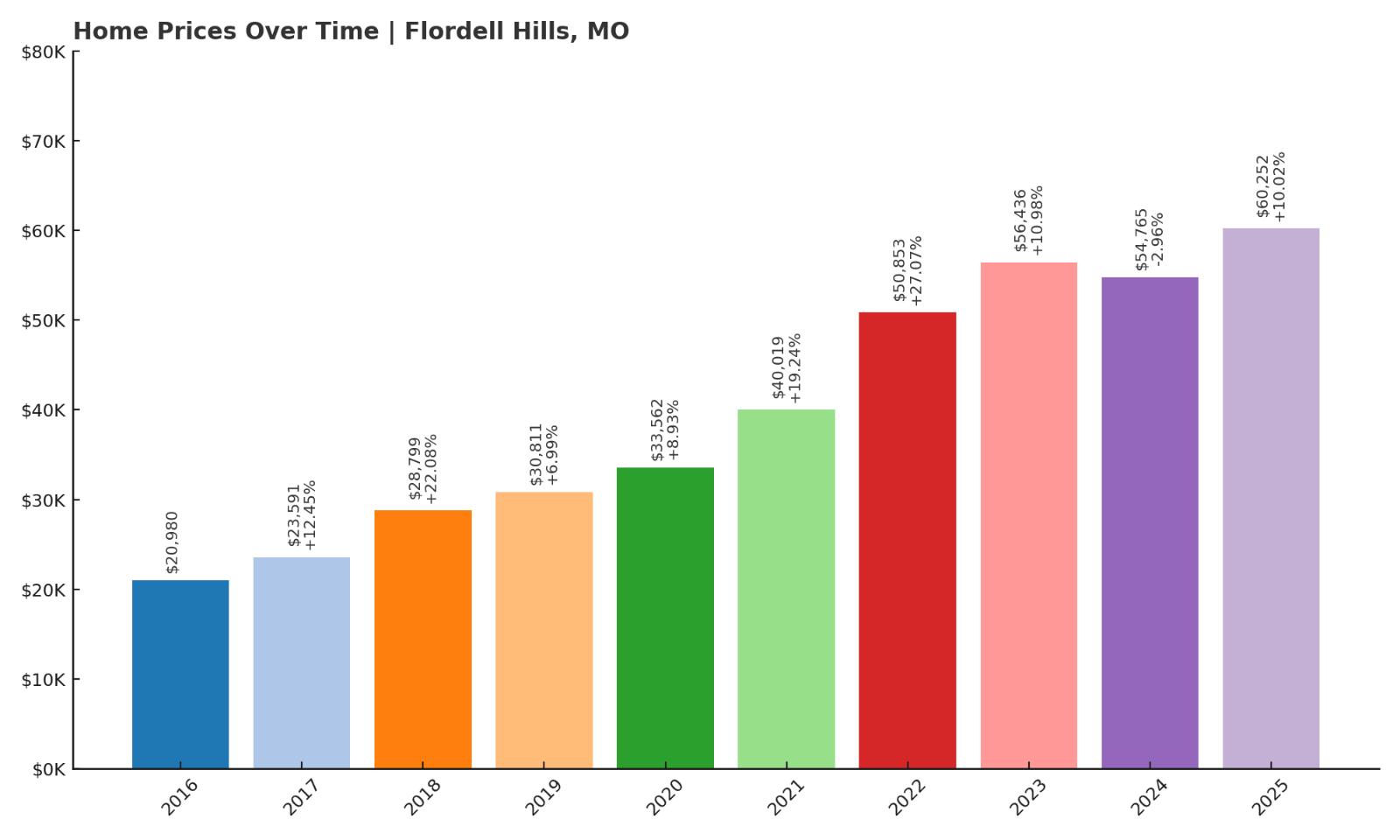

5. Flordell Hills – 187% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $20,980

- 2017: $23,591 (+$2,611, +12.45% from previous year)

- 2018: $28,799 (+$5,208, +22.08% from previous year)

- 2019: $30,811 (+$2,012, +6.99% from previous year)

- 2020: $33,562 (+$2,751, +8.93% from previous year)

- 2021: $40,019 (+$6,457, +19.24% from previous year)

- 2022: $50,853 (+$10,834, +27.07% from previous year)

- 2023: $56,436 (+$5,583, +10.98% from previous year)

- 2024: $54,765 (-$1,671, -2.96% from previous year)

- 2025: $60,252 (+$5,487, +10.02% from previous year)

Flordell Hills has emerged as one of the top performers among Missouri’s most affordable towns, with home values rising from $20,980 in 2016 to $60,252 in 2025 — a 187% increase. The town posted significant gains year after year, particularly between 2020 and 2022, when prices surged by over 50% in just two years. Although a brief dip occurred in 2024, the market rebounded quickly, with a strong 10% increase in 2025. The overall trend is clear: this is a housing market experiencing sustained growth despite its low baseline. With the average home still priced well under $65,000, Flordell Hills is quickly moving from overlooked to in-demand.

Flordell Hills – One of Missouri’s Hottest Budget Markets

Located in north St. Louis County, Flordell Hills is a small town of fewer than 1,000 residents, surrounded by similar-sized communities. While its footprint is small, its housing momentum is big — driven by investors, young buyers, and renters-turned-owners seeking low prices and manageable homes. The neighborhood features mostly older brick homes with one to three bedrooms, perfect for buyers on a budget or those looking to renovate. Flordell Hills is part of a broader pattern in the St. Louis metro area, where previously undervalued suburbs are catching the attention of cost-conscious shoppers. Public transit access and proximity to commercial corridors help keep the area connected, while limited supply keeps competition high. With values increasing at one of the fastest paces statewide, Flordell Hills stands out as a prime example of rapid price appreciation in a town that, not long ago, was entirely off the radar.

4. Wellston – 110% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

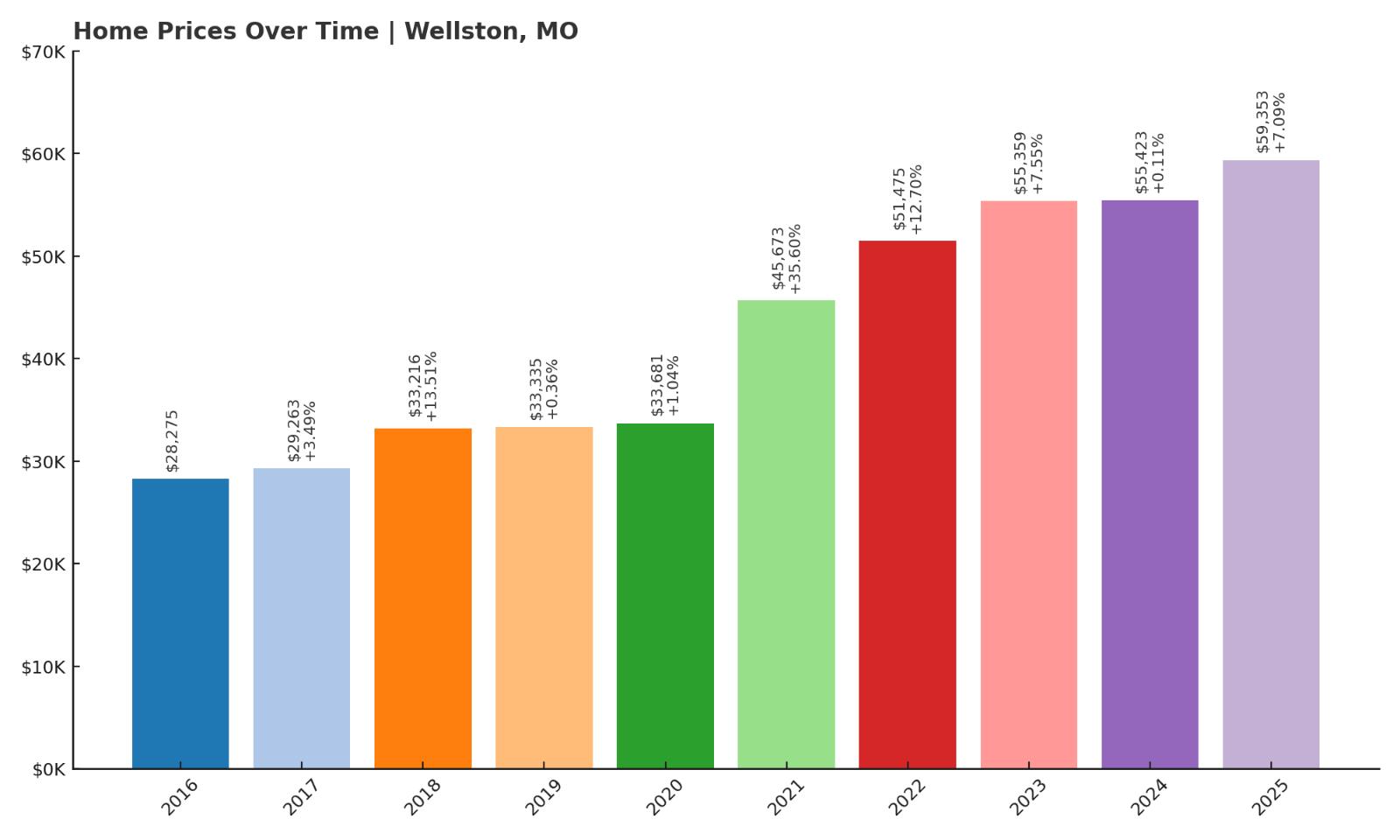

- 2016: $28,275

- 2017: $29,263 (+$988, +3.49% from previous year)

- 2018: $33,216 (+$3,953, +13.51% from previous year)

- 2019: $33,335 (+$119, +0.36% from previous year)

- 2020: $33,681 (+$346, +1.04% from previous year)

- 2021: $45,673 (+$11,992, +35.60% from previous year)

- 2022: $51,475 (+$5,802, +12.70% from previous year)

- 2023: $55,359 (+$3,885, +7.55% from previous year)

- 2024: $55,423 (+$64, +0.11% from previous year)

- 2025: $59,353 (+$3,930, +7.09% from previous year)

Wellston has more than doubled its average home value since 2016, rising from $28,275 to $59,353 in 2025. The steepest growth occurred in 2021, when the market jumped more than 35% in a single year. Since then, gains have become more modest but consistent, suggesting that the market is entering a more stable, sustainable phase. Even at its current price point, Wellston remains well below the Missouri median, offering room for further appreciation. While some years have seen flat growth, the long-term pattern is clear: the town has moved past its economic bottom and is rebuilding — slowly but surely — its real estate appeal.

Wellston – From Decline to Revival Near the City Core

Wellston is a historically industrial suburb located directly adjacent to St. Louis’s western boundary. Once a thriving center for manufacturing and transportation, the town suffered population and job losses over several decades. But in recent years, renewed interest in affordable housing near the city core has brought fresh attention to Wellston. The area is served by Metrolink light rail, making it one of the more transit-accessible communities on this list — a major selling point for commuters and residents without cars. Ongoing economic challenges remain, but efforts by nonprofit groups and local leaders to improve infrastructure and attract development are beginning to bear fruit. With a housing stock that includes spacious lots and traditional homes, Wellston presents an opportunity for buyers seeking value and growth potential. At around $59,000, the average home remains within reach for many — and rising values signal a shift in perception about what this community could become in the near future.

3. Pine Lawn – 147% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

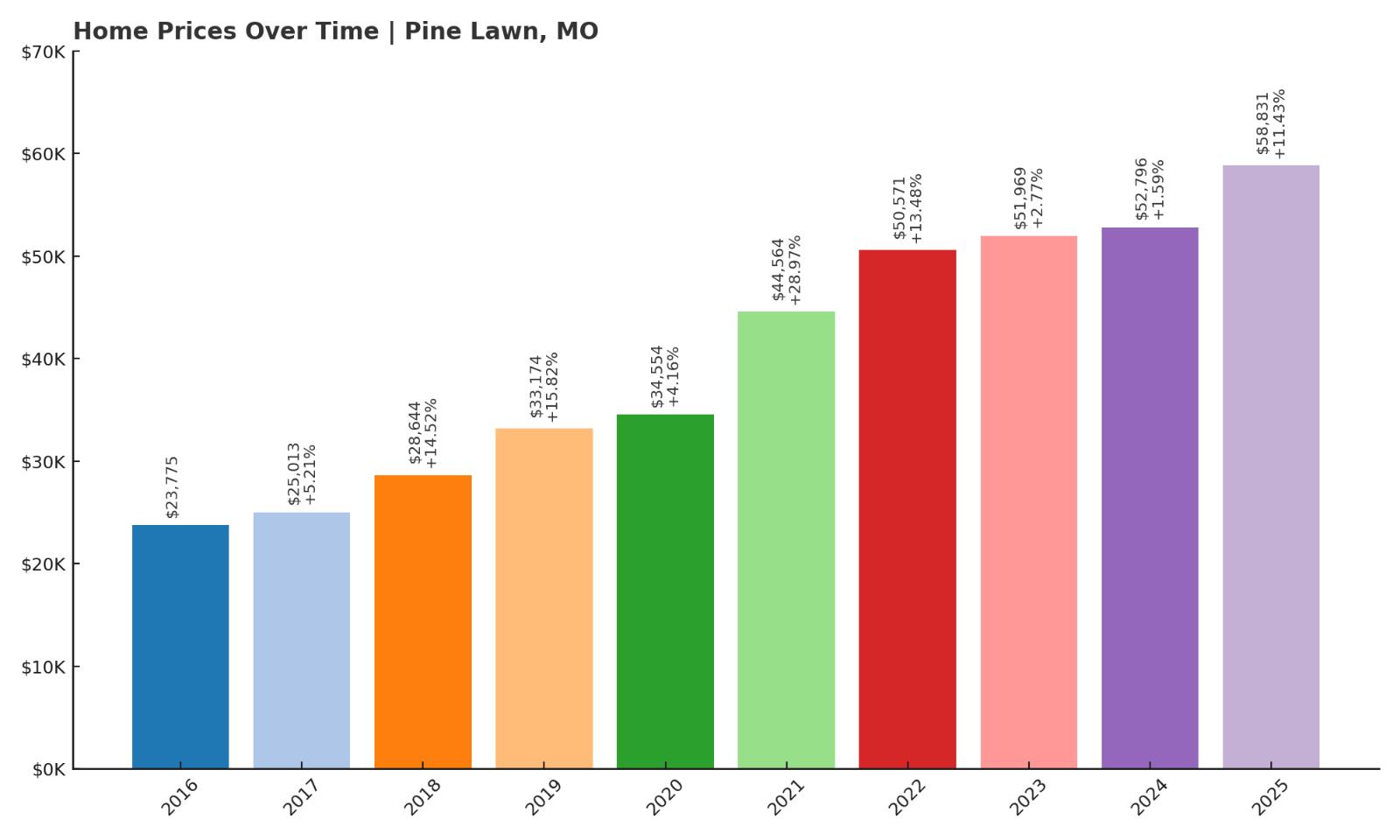

- 2016: $23,775

- 2017: $25,013 (+$1,238, +5.21% from previous year)

- 2018: $28,644 (+$3,631, +14.52% from previous year)

- 2019: $33,174 (+$4,530, +15.82% from previous year)

- 2020: $34,554 (+$1,379, +4.16% from previous year)

- 2021: $44,564 (+$10,010, +28.97% from previous year)

- 2022: $50,571 (+$6,007, +13.48% from previous year)

- 2023: $51,969 (+$1,398, +2.77% from previous year)

- 2024: $52,796 (+$827, +1.59% from previous year)

- 2025: $58,831 (+$6,035, +11.43% from previous year)

Pine Lawn’s housing market has surged nearly 150% since 2016, rising from $23,775 to $58,831 in 2025. The most dramatic acceleration came in 2021 and 2022, with consecutive double-digit percentage increases. Even as that growth has slowed slightly in recent years, values continue to climb. The town’s low base value and steady improvements in livability have made it a magnet for budget-conscious buyers and small investors. At just under $59,000, the average home remains extremely affordable, especially for its proximity to downtown St. Louis. Pine Lawn’s trajectory shows the power of sustained community momentum and affordability-driven demand.

Pine Lawn – A Community on the Rise

Pine Lawn is located in the inner suburbs of north St. Louis County, covering just over half a square mile. For years, the town faced underinvestment and instability, but that narrative is beginning to shift. New homebuyers, small-scale flippers, and renters transitioning to ownership have all helped fuel the market’s growth. The town is served by public transportation and major highways, making it easily accessible from across the region. The compact nature of Pine Lawn makes it walkable and relatively dense, which can appeal to buyers who prefer an urban feel without the price tag. Many homes are small but functional, and renovations have become increasingly common as more investors target the area. As of 2025, Pine Lawn stands as one of Missouri’s fastest-growing affordable housing markets — not because of flash or spectacle, but because its fundamentals are improving year after year.

2. Arbyrd – 20% Home Price Decrease Since 2022

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: N/A

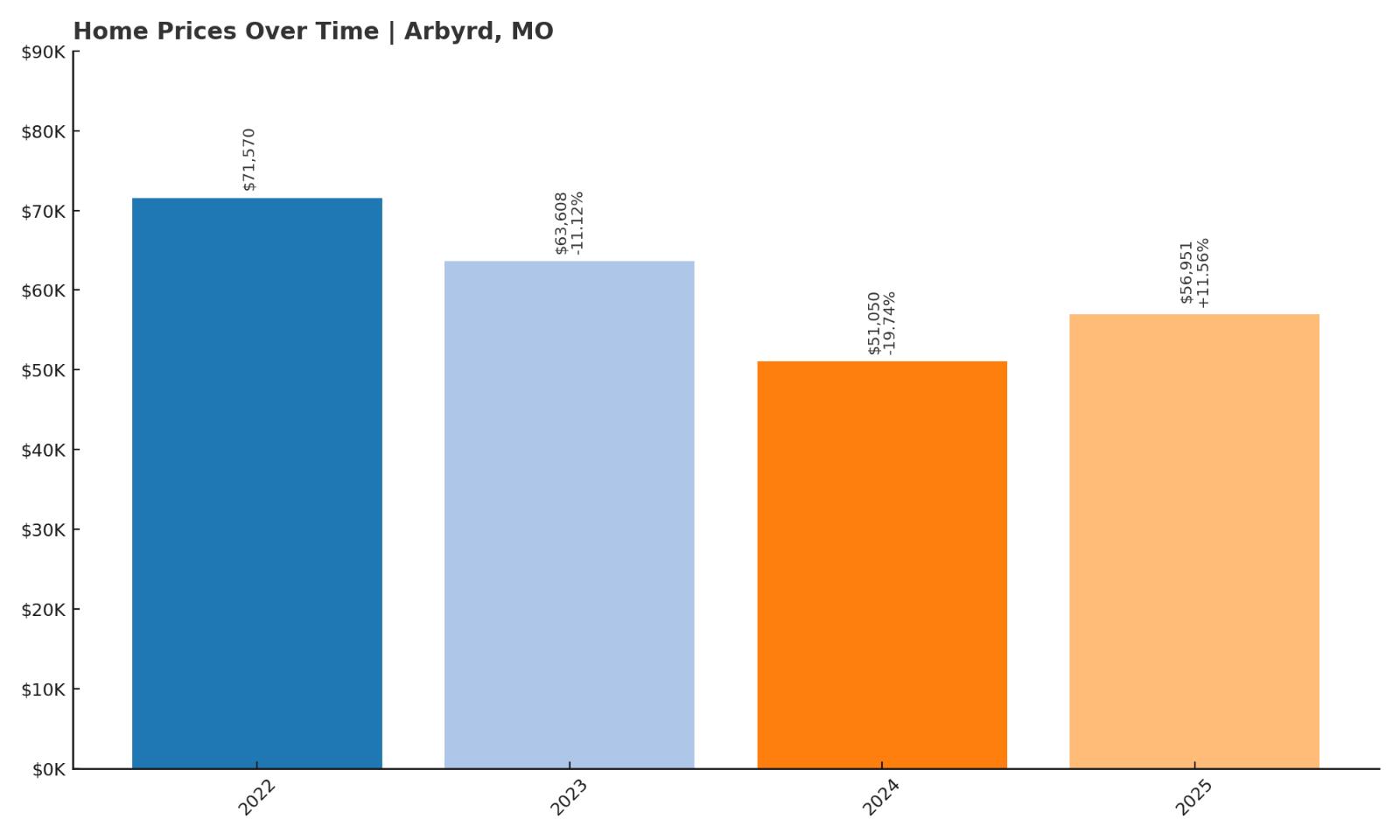

- 2022: $71,570

- 2023: $63,608 (-$7,962, -11.12% from previous year)

- 2024: $51,050 (-$12,558, -19.74% from previous year)

- 2025: $56,951 (+$5,901, +11.56% from previous year)

Arbyrd stands out from the rest of this list for a very different reason — home values have actually declined overall since Zillow began tracking them in 2022. Prices fell sharply in 2023 and 2024, dropping from $71,570 to just over $51,000. Although 2025 brought a healthy 11% rebound, the town is still down about 20% from its starting point. This type of trend could point to local economic instability, oversupply, or simply price correction after a brief pandemic-era spike. Even so, prices remain extremely low compared to the state average, keeping Arbyrd firmly in the affordable category. Buyers should approach with care — the market has yet to show sustained momentum — but the potential for recovery is there. The latest bump in prices may signal a turning point, or it may be short-lived. Either way, it’s one of Missouri’s least expensive towns to watch closely.

Arbyrd – A Deeply Discounted Market in the Bootheel

Located in the state’s far southeastern Bootheel region, Arbyrd is a quiet agricultural town with a population under 400. It sits just a few miles from the Arkansas border and is surrounded by farmland and rural backroads. The town is small and isolated, which helps explain the limited housing demand and recent price fluctuations. But for buyers who prioritize land and low costs over amenities and access, Arbyrd represents one of the cheapest property markets in Missouri. The town’s volatility may concern some buyers, but its ultra-low pricing could also present opportunity — especially if values stabilize or local activity increases. With average prices hovering near $57,000, Arbyrd is accessible even to those with modest budgets. For long-term investors or rural lifestyle seekers, it may be worth watching to see whether the recent rebound continues into future years.

1. Hillsdale – 124% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

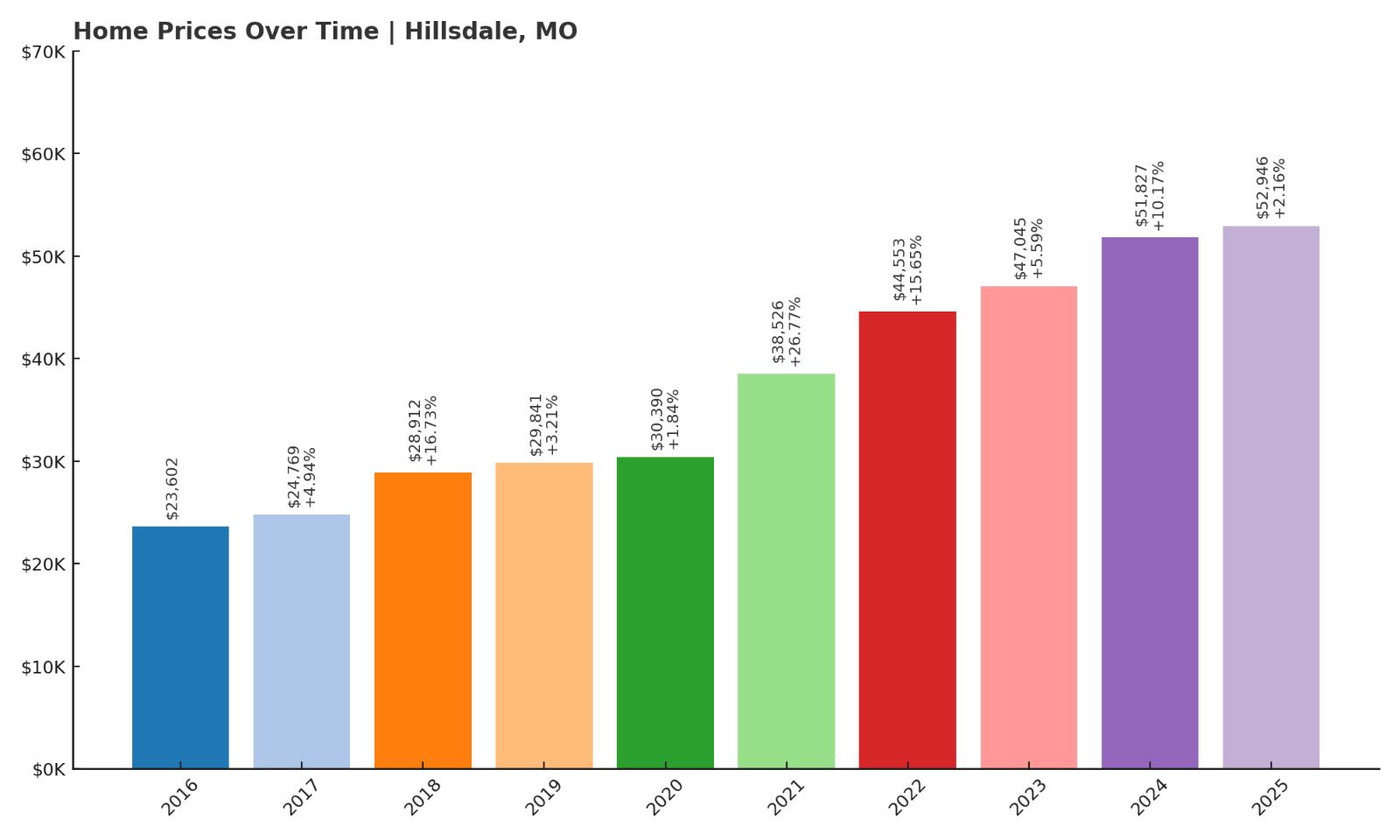

- 2016: $23,602

- 2017: $24,769 (+$1,167, +4.94% from previous year)

- 2018: $28,912 (+$4,143, +16.73% from previous year)

- 2019: $29,841 (+$929, +3.21% from previous year)

- 2020: $30,390 (+$549, +1.84% from previous year)

- 2021: $38,526 (+$8,136, +26.77% from previous year)

- 2022: $44,553 (+$6,028, +15.65% from previous year)

- 2023: $47,045 (+$2,492, +5.59% from previous year)

- 2024: $51,827 (+$4,782, +10.17% from previous year)

- 2025: $52,946 (+$1,118, +2.16% from previous year)

Hillsdale leads this list of Missouri’s most affordable towns with an impressive 124% rise in home values since 2016. Starting at just $23,602, the town’s housing market has more than doubled in nine years, reaching $52,946 in 2025. The largest single-year jump came in 2021, when prices rose nearly 27% — signaling a wave of demand that has continued, albeit more moderately, through 2025. What makes Hillsdale’s growth even more striking is that it has occurred without wild volatility; most years have seen stable, incremental gains. For a town still priced well under $55,000, that consistency combined with long-term appreciation offers major appeal for both buyers and investors.

Hillsdale – St. Louis Affordability at Its Peak

Hillsdale sits just northwest of downtown St. Louis, wedged between other low-cost inner-ring suburbs. Its housing stock is similar to that of neighboring towns — modest single-family homes with basic layouts and minimal frills — but what sets it apart is its price-to-growth ratio. Hillsdale has remained among the lowest-cost municipalities in Missouri while also posting top-tier appreciation. The area’s affordability makes it particularly attractive to first-time buyers, lower-income households, and landlords seeking rental income with low upfront costs. Despite some of the economic challenges that have historically affected the region, Hillsdale’s housing market is showing signs of real momentum. The steady improvements in price indicate growing confidence, and its location near major roads and public transit gives it a geographic advantage. For those looking to buy property in Missouri at the lowest possible cost while still seeing tangible returns, Hillsdale tops the list for good reason.