Would you like to save this?

Wisconsin’s housing market shows troubling signs that echo pre-crash warning signals from previous decades. Using Zillow Home Value Index data spanning 15 years, we analyzed price patterns across hundreds of Wisconsin communities to identify towns displaying classic vulnerability markers.

Our crash risk methodology weighs five critical factors: historical crash frequency, current overextension above long-term averages, recent unsustainable growth rates, momentum loss indicators, and price volatility patterns. Towns scoring highest on multiple risk factors share characteristics with markets that experienced significant corrections in 2008-2012.

The results reveal 18 Wisconsin communities where mathematical indicators suggest prices may face substantial downward pressure. These towns aren’t just expensive—they’re showing the specific combination of overextension, volatility, and momentum shifts that historically precede housing corrections.

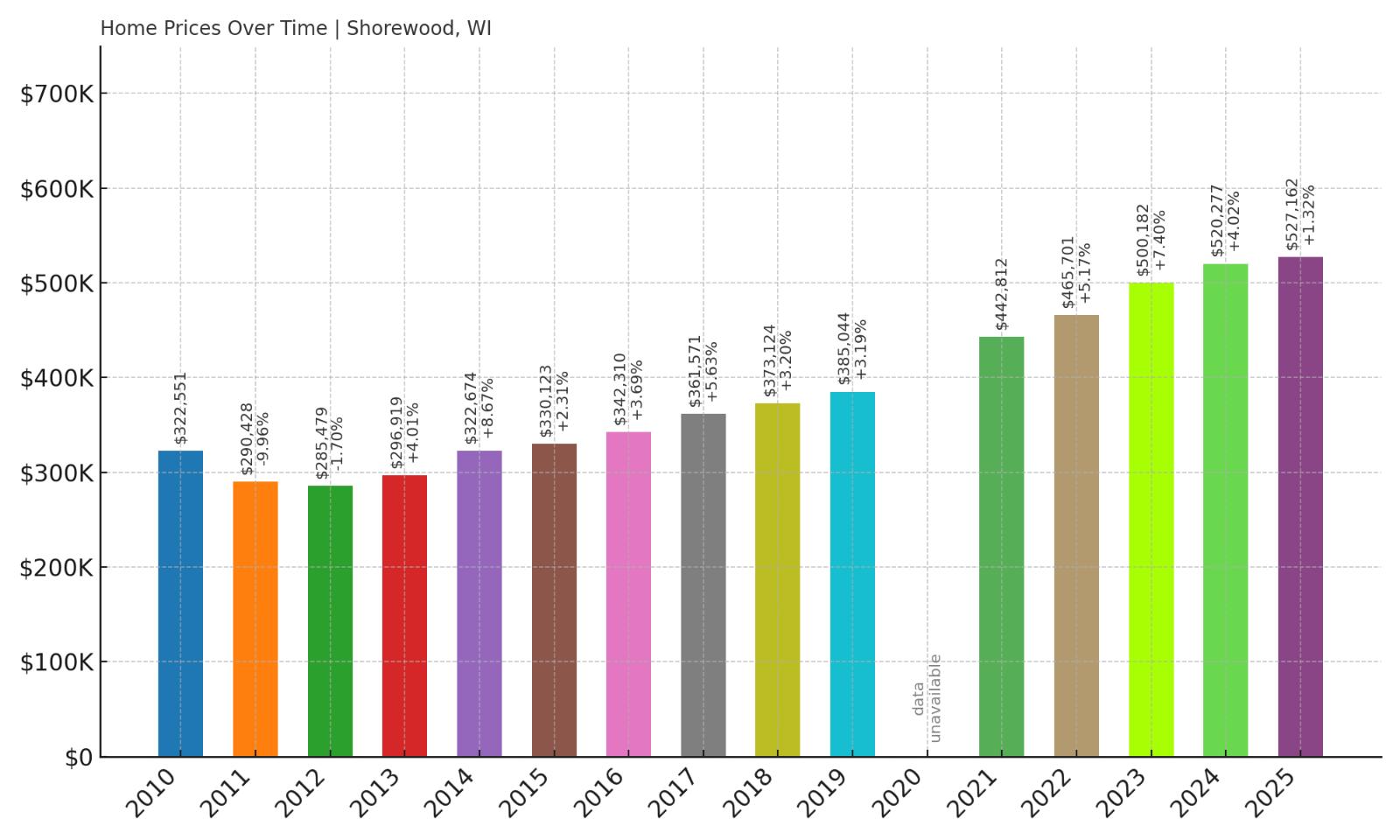

18. Shorewood – Crash Risk Percentage: 67%

- Crash Risk Percentage: 67%

- Historical crashes (8%+ drops): 1

- Worst historical crash: -10.0% (2011)

- Total price increase since 2010: +63.4%

- Overextended above long-term average: +37.1%

- Price volatility (annual swings): 5.4%

- Current May 2025 price: $527,162

Shorewood’s housing market demonstrates concerning patterns that mirror pre-correction warning signs. The community experienced a significant 10% price drop in 2011, proving its vulnerability to market corrections. With current prices sitting 37% above historical averages and total gains of 63% since 2010, the market shows classic overextension characteristics that historically precede downturns.

Shorewood – Lakefront Luxury Meets Market Vulnerability

This affluent Milwaukee County village sits along Lake Michigan’s shoreline, commanding premium prices for its prestigious location and excellent schools. Shorewood’s median home price of $527,162 reflects its status as one of southeastern Wisconsin’s most desirable communities, but this premium positioning creates heightened crash risk when market conditions shift.

The town’s 2011 correction offers a preview of potential future volatility, as lakefront markets often experience amplified price swings during economic uncertainty. Shorewood’s combination of high absolute prices, significant overextension, and proven crash history places it among Wisconsin’s most vulnerable housing markets for the next correction cycle.

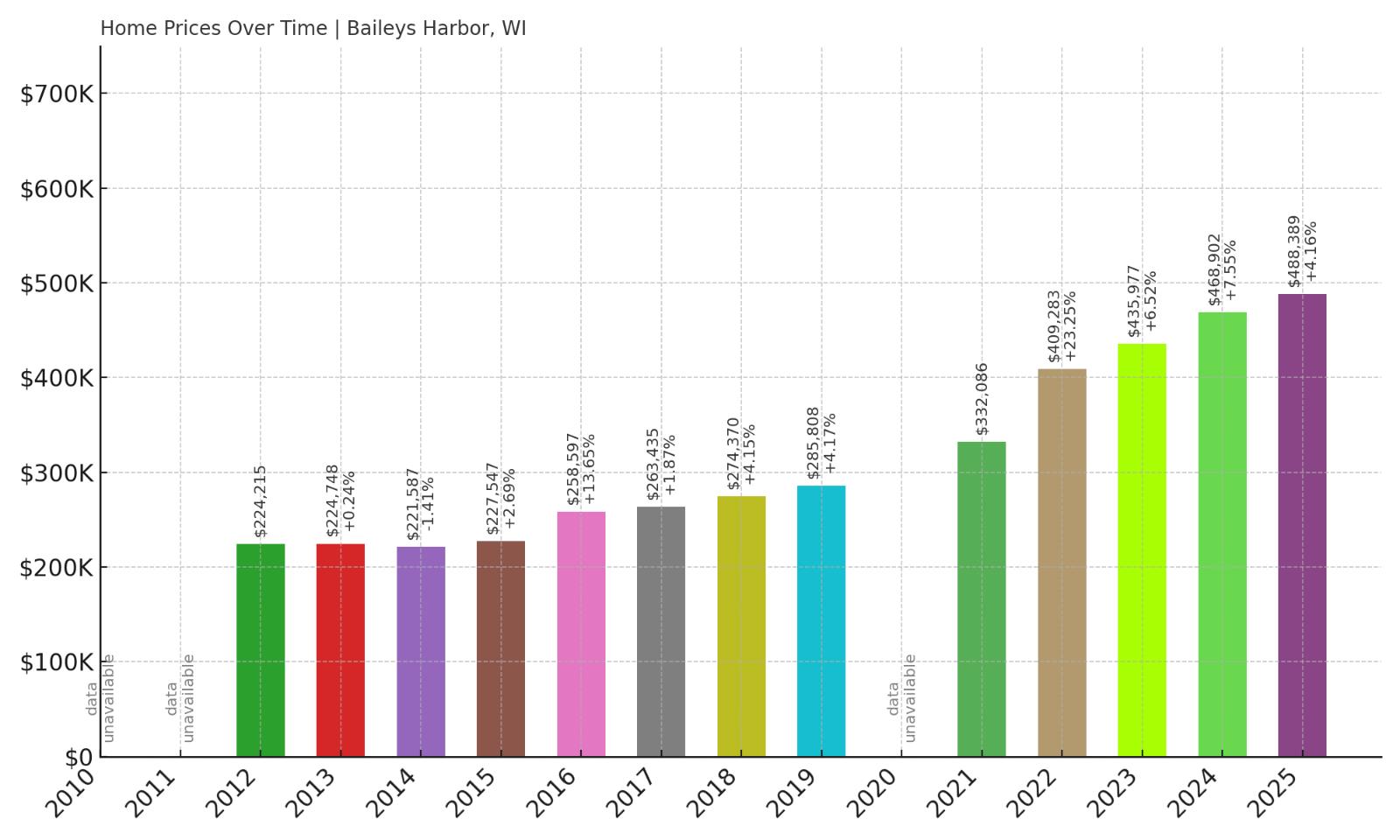

17. Baileys Harbor – Crash Risk Percentage: 68%

- Crash Risk Percentage: 68%

- Historical crashes (8%+ drops): 0

- Worst historical crash: No major crashes recorded

- Total price increase since 2010: 117.8%

- Overextended above long-term average: +54.3%

- Price volatility (annual swings): 7.2%

- Current May 2025 price: $488,389

Baileys Harbor presents a unique risk profile with no historical major crashes but dangerous current overextension. The community sits 54% above its long-term price average despite showing only 117% growth since 2010, indicating recent rapid appreciation that outpaced fundamental value. The 7.2% annual volatility suggests an unstable market prone to sudden corrections.

Baileys Harbor – Door County Gem With Shaky Foundations

Located in Wisconsin’s scenic Door County peninsula, Baileys Harbor attracts buyers seeking vacation homes and retirement properties along Lake Michigan. The town’s $488,389 median price reflects strong demand for waterfront and near-waterfront properties, but the market’s 54% overextension above historical norms creates significant downside risk.

Door County’s seasonal nature amplifies housing market volatility, as vacation home markets typically experience sharper corrections than primary residence areas. Baileys Harbor’s lack of historical crashes may indicate the market hasn’t yet faced a serious stress test, making current buyers particularly vulnerable when economic headwinds eventually arrive.

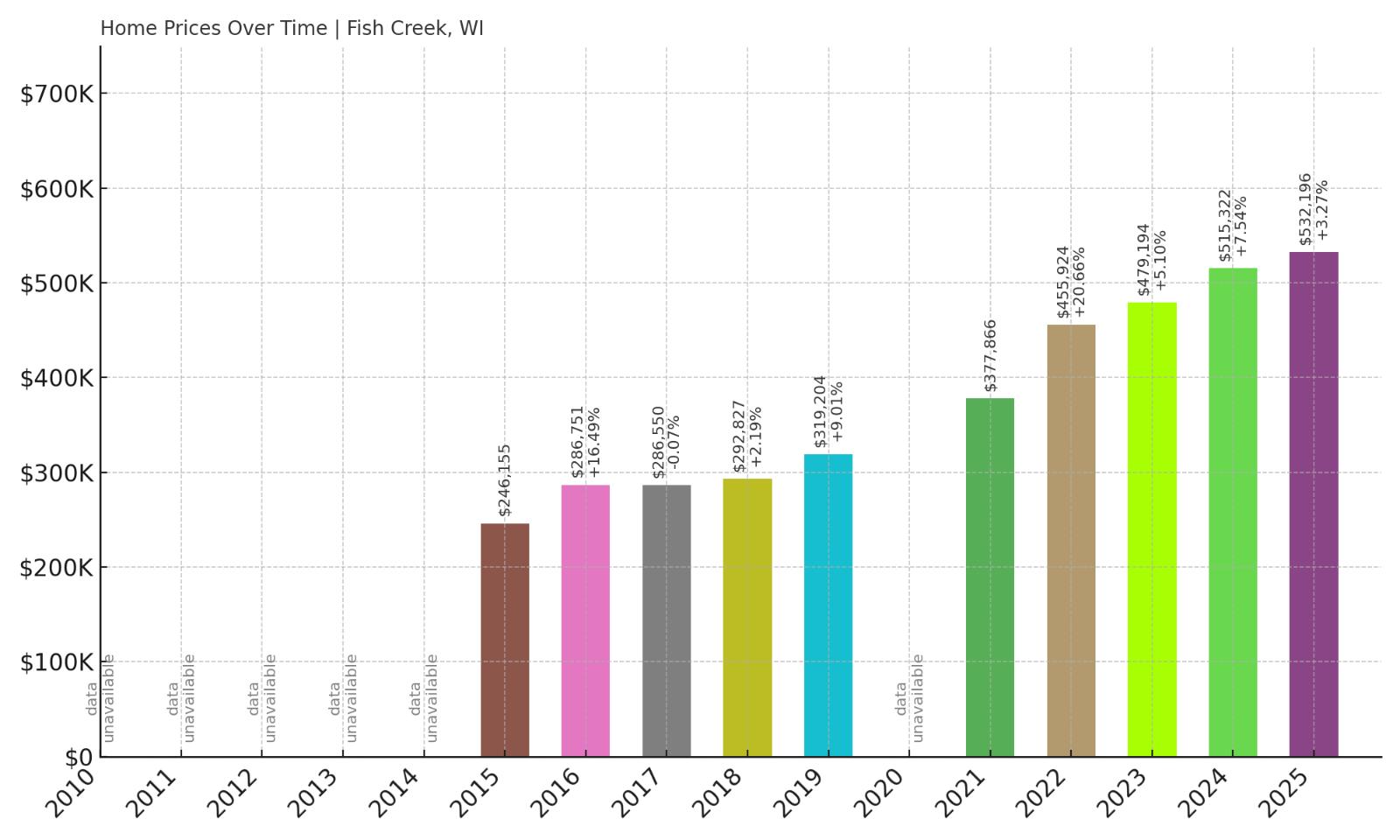

16. Fish Creek – Crash Risk Percentage: 68%

- Crash Risk Percentage: 68%

- Historical crashes (8%+ drops): 0

- Worst historical crash: No major crashes recorded

- Total price increase since 2010: 116.2%

- Overextended above long-term average: +40.3%

- Price volatility (annual swings): 9.2%

- Current May 2025 price: $532,196

Fish Creek exhibits troubling market instability with 9.2% annual price volatility—among the highest in our analysis. Despite showing only 116.2% net growth since 2010, current prices sit 40% above long-term averages, suggesting recent appreciation has disconnected from underlying fundamentals. The absence of historical crashes indicates untested market resilience.

Fish Creek – Tourist Haven With Volatile Price Swings

Would you like to save this?

This charming Door County village serves as a premier tourist destination, with historic charm and Lake Michigan access driving strong real estate demand. Fish Creek’s $532,196 median home price reflects its appeal to vacation home buyers and retirees, but the market’s extreme volatility creates substantial risk for property owners.

The tourism-dependent economy makes Fish Creek particularly vulnerable to economic downturns that reduce discretionary spending on vacation properties. Combined with 40% overextension above historical norms and severe price volatility, the market shows classic signs of a correction waiting to happen when buyer demand inevitably softens.

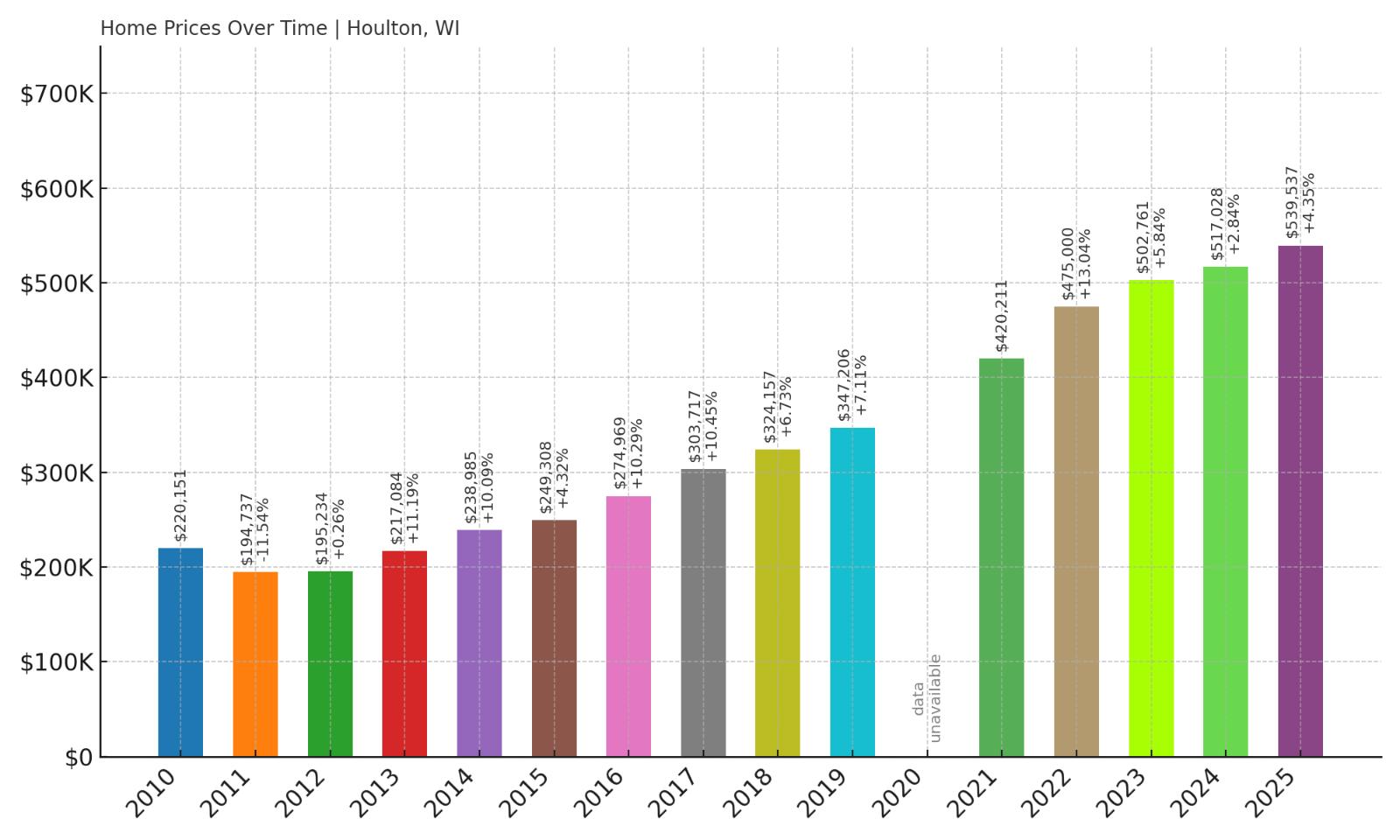

15. Houlton – Crash Risk Percentage: 68%

- Crash Risk Percentage: 68%

- Historical crashes (8%+ drops): 1

- Worst historical crash: -11.5% (2011)

- Total price increase since 2010: +145.1%

- Overextended above long-term average: +61.2%

- Price volatility (annual swings): 8.5%

- Current May 2025 price: $539,537

Houlton represents extreme market overextension with prices 61% above long-term averages following a staggering 145% increase since 2010. The community’s 2011 crash of 11.5% demonstrates vulnerability to corrections, while current overextension levels suggest potential for an even larger correction. High volatility at 8.5% annual swings adds to the instability.

Houlton – Explosive Growth Meets Correction Risk

This small St. Croix County community has experienced extraordinary housing appreciation, with prices more than doubling since 2010 to reach a median of $539,537. Houlton’s proximity to the Twin Cities metropolitan area has driven intense demand as buyers seek suburban alternatives, but this growth appears unsustainable given historical patterns.

The town’s 2011 correction of 11.5% provides a stark reminder of market vulnerability, occurring during less extreme overextension than current levels. With prices now 61% above long-term averages—nearly double the overextension that preceded the previous crash—Houlton faces heightened risk of a significant price correction when market conditions shift.

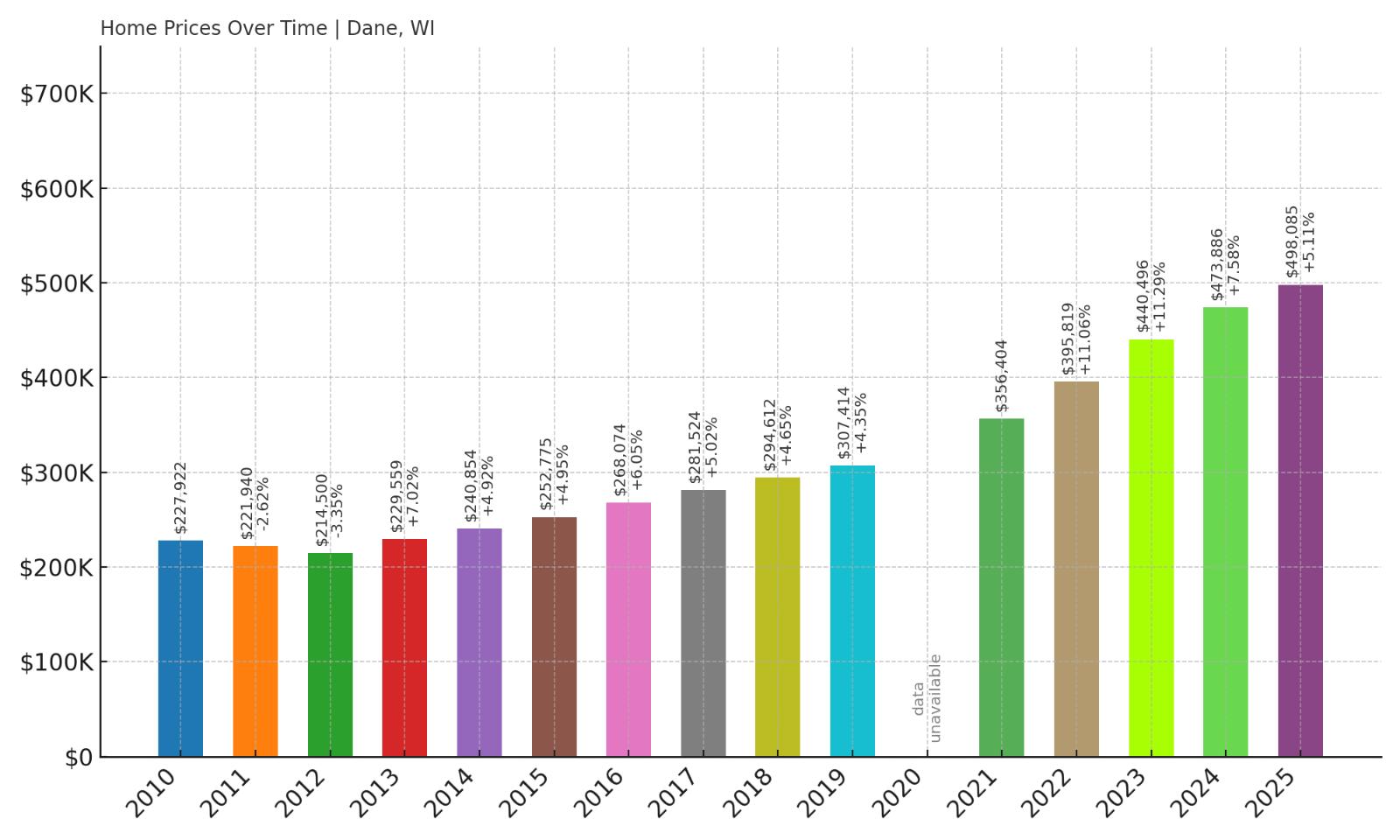

14. Dane – Crash Risk Percentage: 69%

- Crash Risk Percentage: 69%

- Historical crashes (8%+ drops): 0

- Worst historical crash: No major crashes recorded

- Total price increase since 2010: +118.5%

- Overextended above long-term average: +58.8%

- Price volatility (annual swings): 6.7%

- Current May 2025 price: $498,085

Dane shows extreme appreciation with prices rising 118% since 2010, pushing the market 59% above its long-term average. The absence of historical crashes suggests the market hasn’t faced serious stress testing, while current overextension levels indicate substantial downside potential. Moderate volatility of 6.7% reflects underlying market instability.

Dane – Madison Suburb Riding Dangerous Growth Wave

Located in Dane County near Madison, this community has benefited from Wisconsin’s capital city growth and university employment expansion. The town’s $498,085 median price reflects strong demand from professionals and families seeking suburban living with urban access, but the 118% price increase since 2010 appears unsustainable.

Dane’s market shows classic characteristics of a bubble formation, with rapid appreciation disconnected from fundamental economic drivers. The 59% overextension above long-term averages, combined with no historical correction experience, suggests the market lacks resilience mechanisms that could prevent a sharp correction when growth momentum eventually reverses.

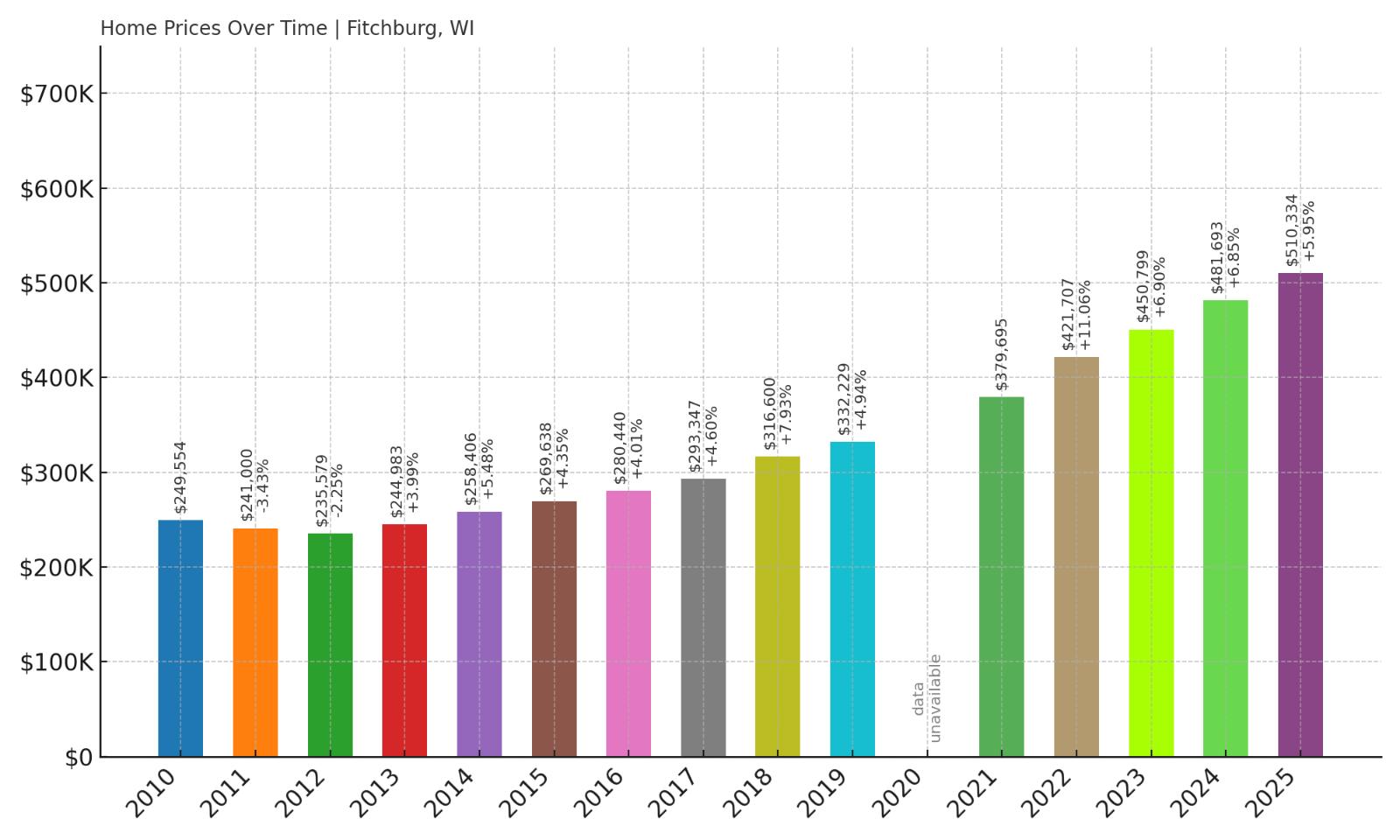

13. Fitchburg – Crash Risk Percentage: 69%

- Crash Risk Percentage: 69%

- Historical crashes (8%+ drops): 0

- Worst historical crash: No major crashes recorded

- Total price increase since 2010: +104.5%

- Overextended above long-term average: +54.1%

- Price volatility (annual swings): 6.1%

- Current May 2025 price: $510,334

Fitchburg demonstrates concerning market dynamics with prices doubling since 2010 and sitting 54% above historical averages. The community has avoided major corrections historically, potentially indicating untested market resilience. Current appreciation levels appear mathematically unsustainable given long-term economic fundamentals.

Fitchburg – Madison Growth Spillover Creates Bubble Risk

This Dane County city serves as a major Madison suburb, attracting families and professionals with excellent schools and suburban amenities. Fitchburg’s $510,334 median home price reflects its desirability, but the 104% appreciation since 2010 suggests prices have risen faster than underlying economic justifications can support.

The Madison metropolitan area’s economic growth has fueled Fitchburg’s housing boom, but current prices sitting 54% above long-term trends indicate potential overreach. Without historical correction experience to guide market expectations, Fitchburg buyers may be unprepared for the significant price adjustments that typically follow such extreme appreciation periods.

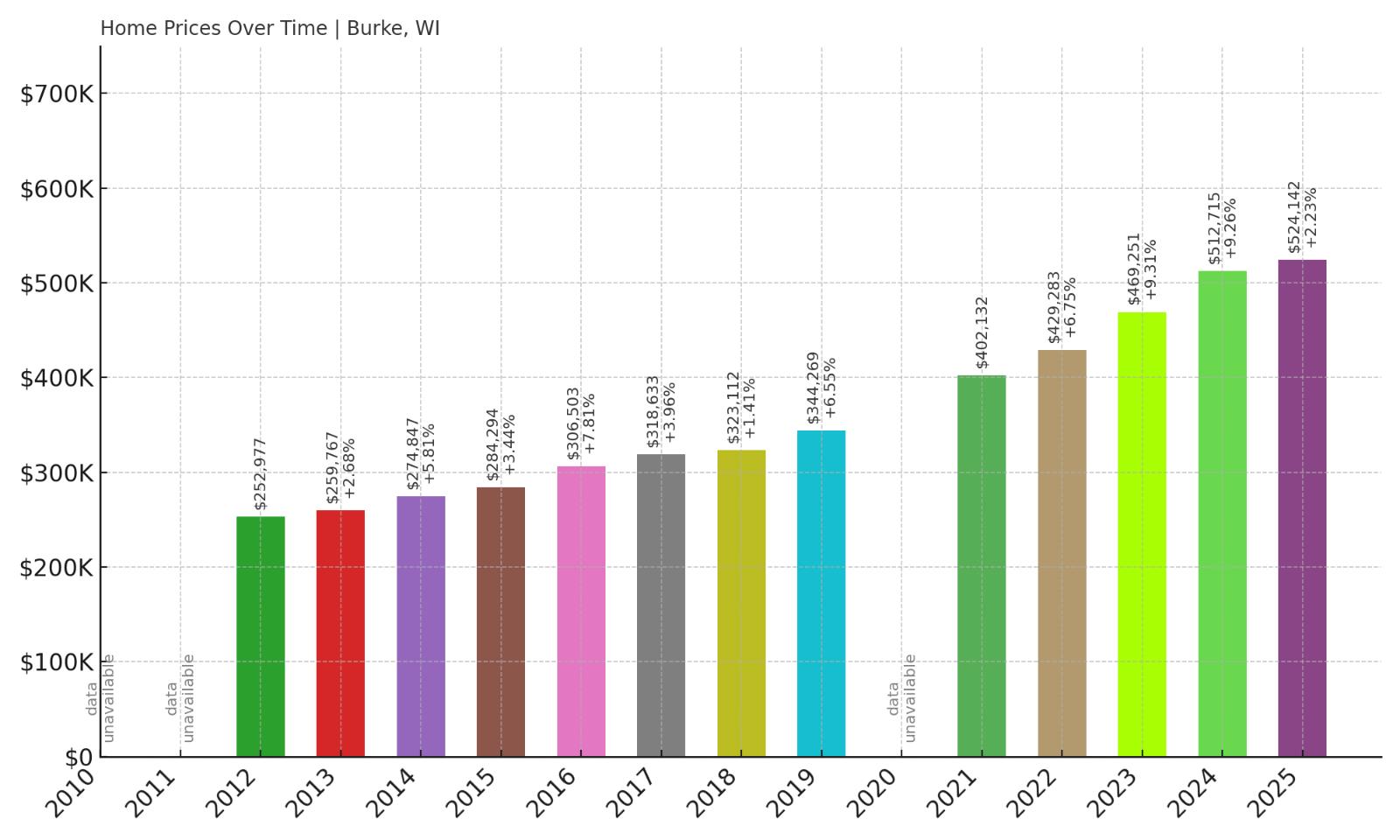

12. Burke – Crash Risk Percentage: 69%

- Crash Risk Percentage: 69%

- Historical crashes (8%+ drops): 0

- Worst historical crash: No major crashes recorded

- Total price increase since 2010: 107.2%

- Overextended above long-term average: +44.9%

- Price volatility (annual swings): 6.3%

- Current May 2025 price: $524,142

Burke presents a concerning disconnect between recent price levels and long-term growth patterns. Despite showing only 107.2% net appreciation since 2010, current prices sit 45% above long-term averages, indicating recent rapid appreciation that may prove unsustainable. The 6.3% volatility suggests underlying market instability despite the apparent price stagnation.

Burke – Stagnant Growth Masks Dangerous Overextension

This small Dane County community near Madison benefits from proximity to the state capital while maintaining a more rural character. Burke’s $524,142 median price appears stable at first glance, but the 45% overextension above historical norms reveals hidden vulnerability that could trigger significant corrections.

The apparent price stability since 2010 may mislead buyers into believing Burke offers safer investment potential than rapidly appreciating markets. However, the substantial overextension above long-term trends suggests previous price gains were excessive, creating downside risk when market conditions inevitably shift toward more sustainable valuation levels.

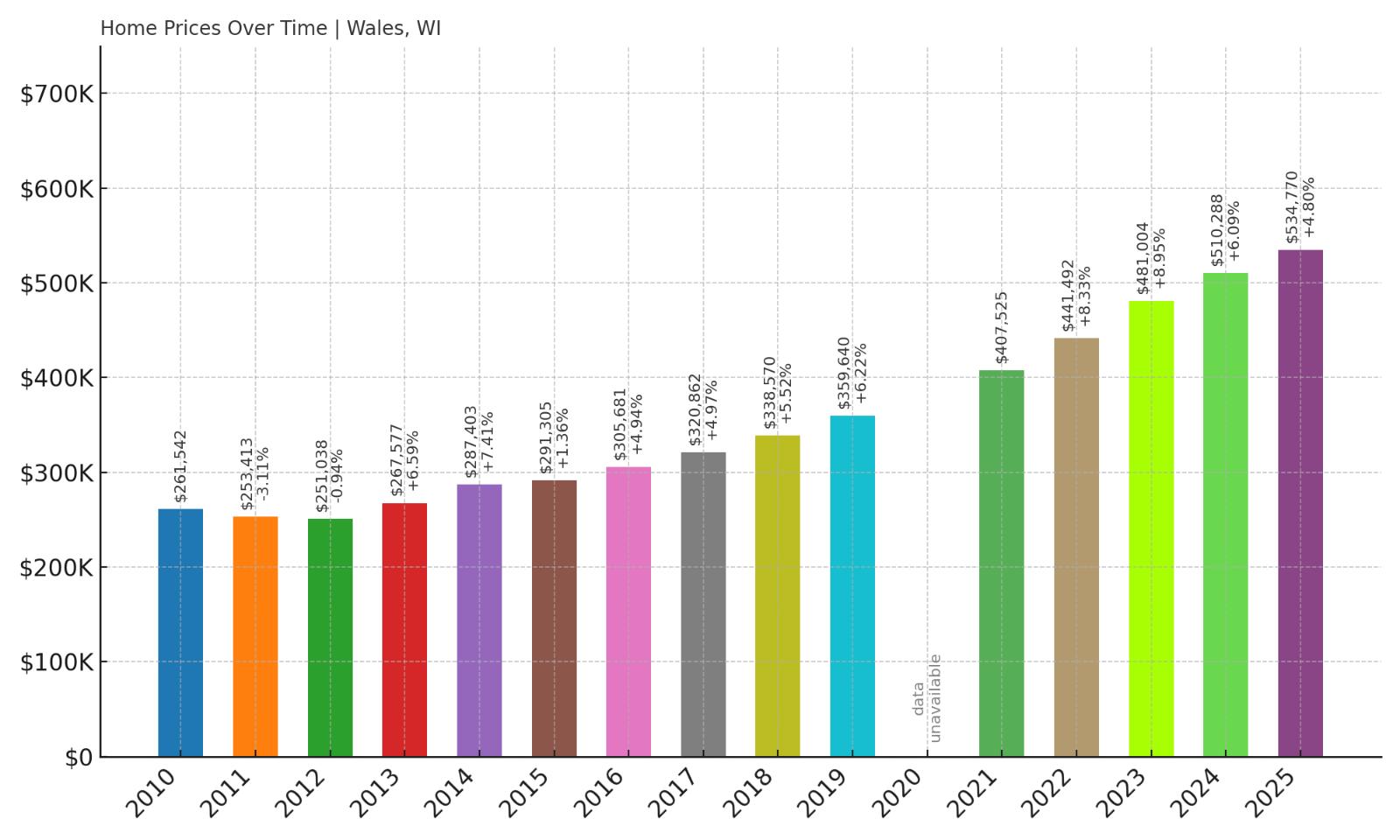

11. Wales – Crash Risk Percentage: 69%

- Crash Risk Percentage: 69%

- Historical crashes (8%+ drops): 0

- Worst historical crash: No major crashes recorded

- Total price increase since 2010: +104.5%

- Overextended above long-term average: +51.0%

- Price volatility (annual swings): 5.9%

- Current May 2025 price: $534,770

Wales shows classic bubble characteristics with prices doubling since 2010 and sitting 51% above long-term averages. The absence of historical corrections suggests untested market resilience during stress periods. Current appreciation levels appear unsustainable given fundamental economic drivers, creating substantial downside risk.

Wales – Waukesha County Suburb Faces Reality Check

Located in Waukesha County west of Milwaukee, Wales attracts suburban families seeking quality schools and community amenities. The town’s $534,770 median price reflects strong demand, but the 104% appreciation since 2010 indicates prices may have risen beyond levels that local economics can sustain long-term.

Wales benefits from Milwaukee metropolitan area growth, but current prices sitting 51% above historical norms suggest the market has overshot sustainable valuation levels. Without previous correction experience to establish price floors or market resilience, the community faces heightened vulnerability when economic conditions inevitably force price adjustments toward historical norms.

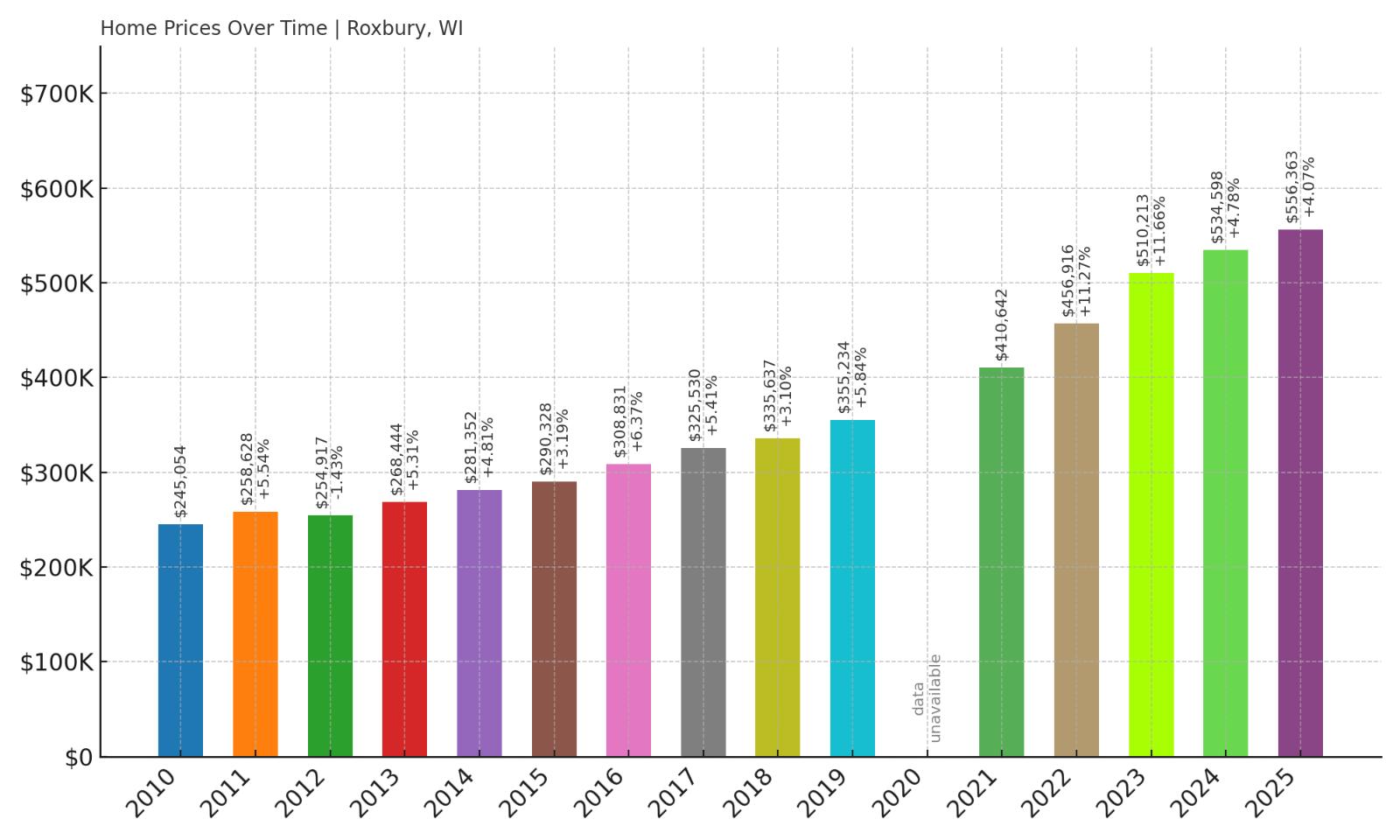

10. Roxbury – Crash Risk Percentage: 69%

- Crash Risk Percentage: 69%

- Historical crashes (8%+ drops): 0

- Worst historical crash: No major crashes recorded

- Total price increase since 2010: +127.0%

- Overextended above long-term average: +54.8%

- Price volatility (annual swings): 6.3%

- Current May 2025 price: $556,363

Roxbury exhibits extreme overvaluation with prices rising 127% since 2010 and sitting 55% above long-term averages. The community lacks historical crash experience, potentially indicating insufficient market mechanisms to prevent or limit corrections. Current price levels appear mathematically unsustainable given long-term economic trends.

Roxbury – Rural Charm Commands Urban Prices

This small Dane County community offers rural living within commuting distance of Madison, attracting buyers seeking country lifestyle with urban employment access. Roxbury’s $556,363 median price reflects premium demand for rural properties, but the 127% appreciation since 2010 suggests prices have risen well beyond sustainable levels.

The town’s rural character typically provides some insulation from urban market volatility, but current overextension of 55% above long-term averages creates vulnerability regardless of location advantages. Without historical correction experience to guide market expectations, Roxbury faces particular risk of sharp price adjustments when buyer demand inevitably moderates.

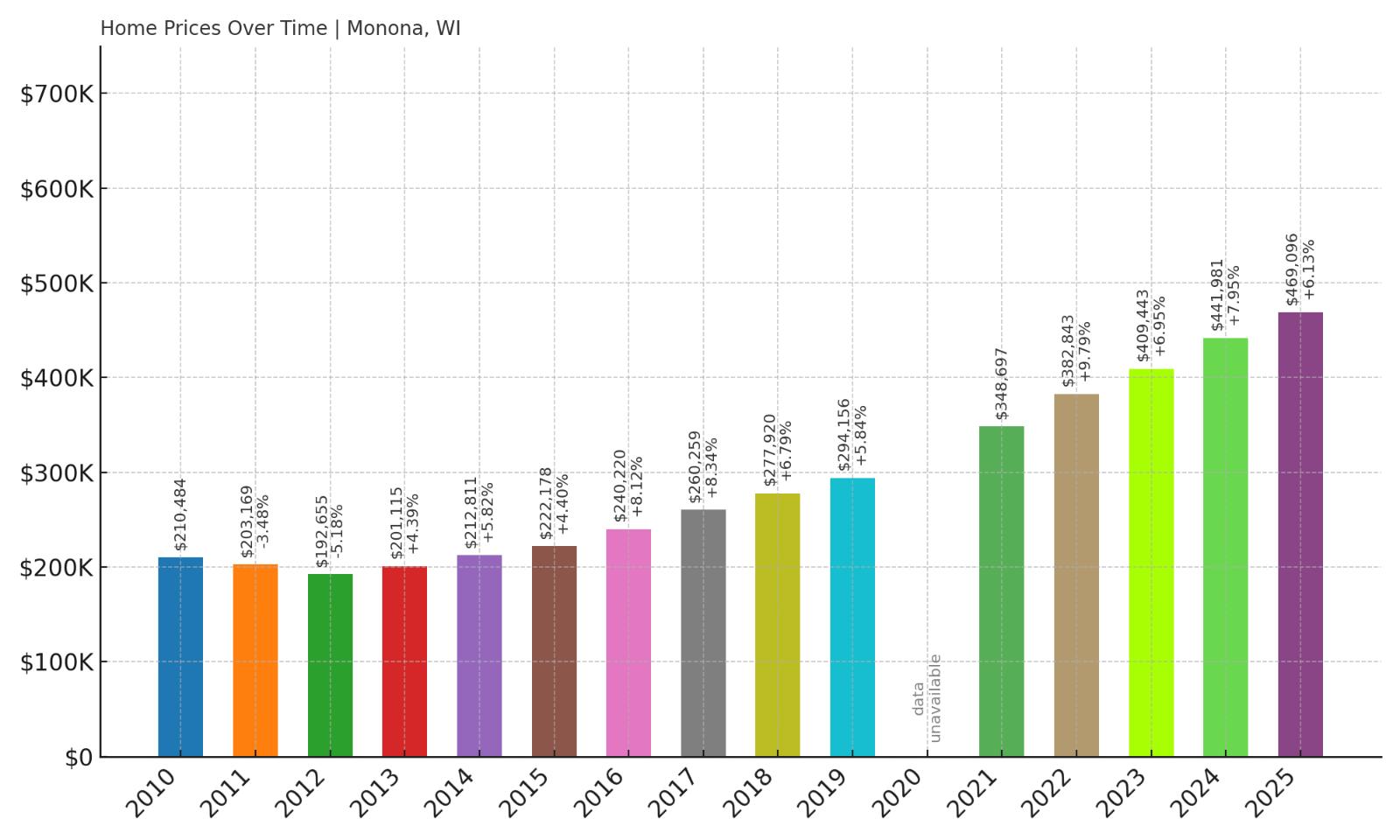

9. Monona – Crash Risk Percentage: 72%

Would you like to save this?

- Crash Risk Percentage: 72%

- Historical crashes (8%+ drops): 0

- Worst historical crash: No major crashes recorded

- Total price increase since 2010: +122.9%

- Overextended above long-term average: +61.1%

- Price volatility (annual swings): 7.3%

- Current May 2025 price: $469,096

Monona shows severe market overextension with prices rising 123% since 2010 and sitting 61% above long-term averages—among the highest overextension levels in our analysis. The 7.3% annual volatility indicates underlying market instability, while the absence of historical corrections suggests untested resilience during stress periods.

Monona – Madison Lakefront Living At Precarious Prices

This Dane County city sits on Lake Monona adjacent to Madison, offering lakefront amenities and urban proximity that command premium prices. Monona’s $469,096 median reflects its desirable location, but the 123% price increase since 2010 appears disconnected from fundamental economic justifications.

The community’s lakefront location typically provides price stability during market corrections, but current overextension of 61% above historical norms—combined with 7.3% annual volatility—suggests even premium locations face correction risk. Monona’s lack of historical crash experience may leave current buyers unprepared for the significant adjustments that typically follow such extreme appreciation periods.

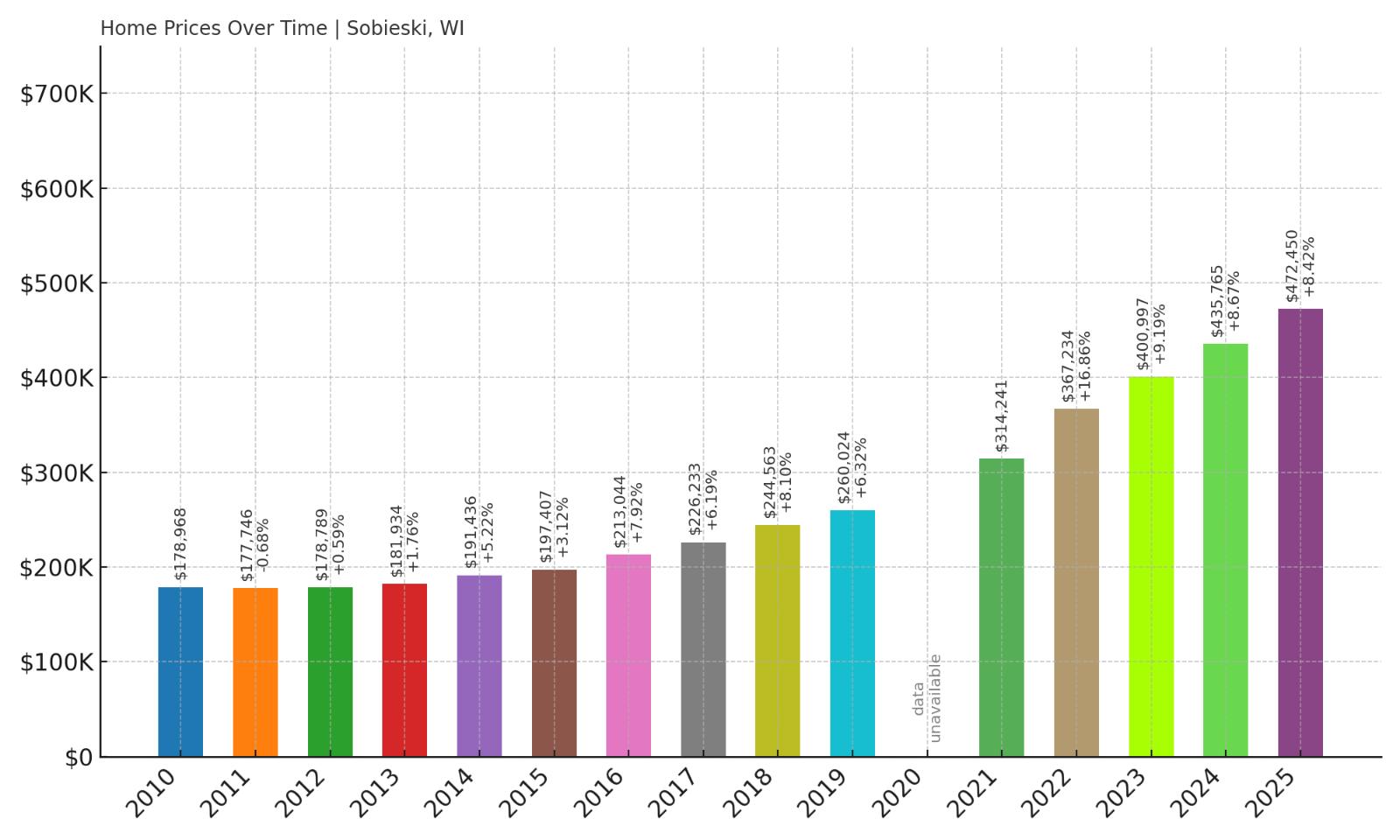

8. Sobieski – Crash Risk Percentage: 72%

- Crash Risk Percentage: 72%

- Historical crashes (8%+ drops): 0

- Worst historical crash: No major crashes recorded

- Total price increase since 2010: +164.0%

- Overextended above long-term average: +75.4%

- Price volatility (annual swings): 7.4%

- Current May 2025 price: $472,450

Sobieski represents the most extreme overextension in our analysis, with prices sitting 75% above long-term averages following a staggering 164% increase since 2010. The community shows no historical crash experience despite current overvaluation levels that far exceed those that triggered previous corrections elsewhere. High volatility of 7.4% adds to the instability.

Sobieski – Extreme Appreciation Creates Maximum Risk

This small Oconto County community has experienced extraordinary housing appreciation that defies traditional market logic, with prices increasing 164% since 2010 to reach a median of $472,450. Sobieski’s rural location makes such extreme appreciation particularly concerning, as rural markets typically lack the economic drivers to sustain such growth.

The town’s 75% overextension above long-term averages represents the highest risk level in our analysis, suggesting prices have reached mathematically unsustainable levels. Without historical correction experience to establish market floors, Sobieski faces potential for severe price adjustments when market conditions force alignment with long-term economic fundamentals.

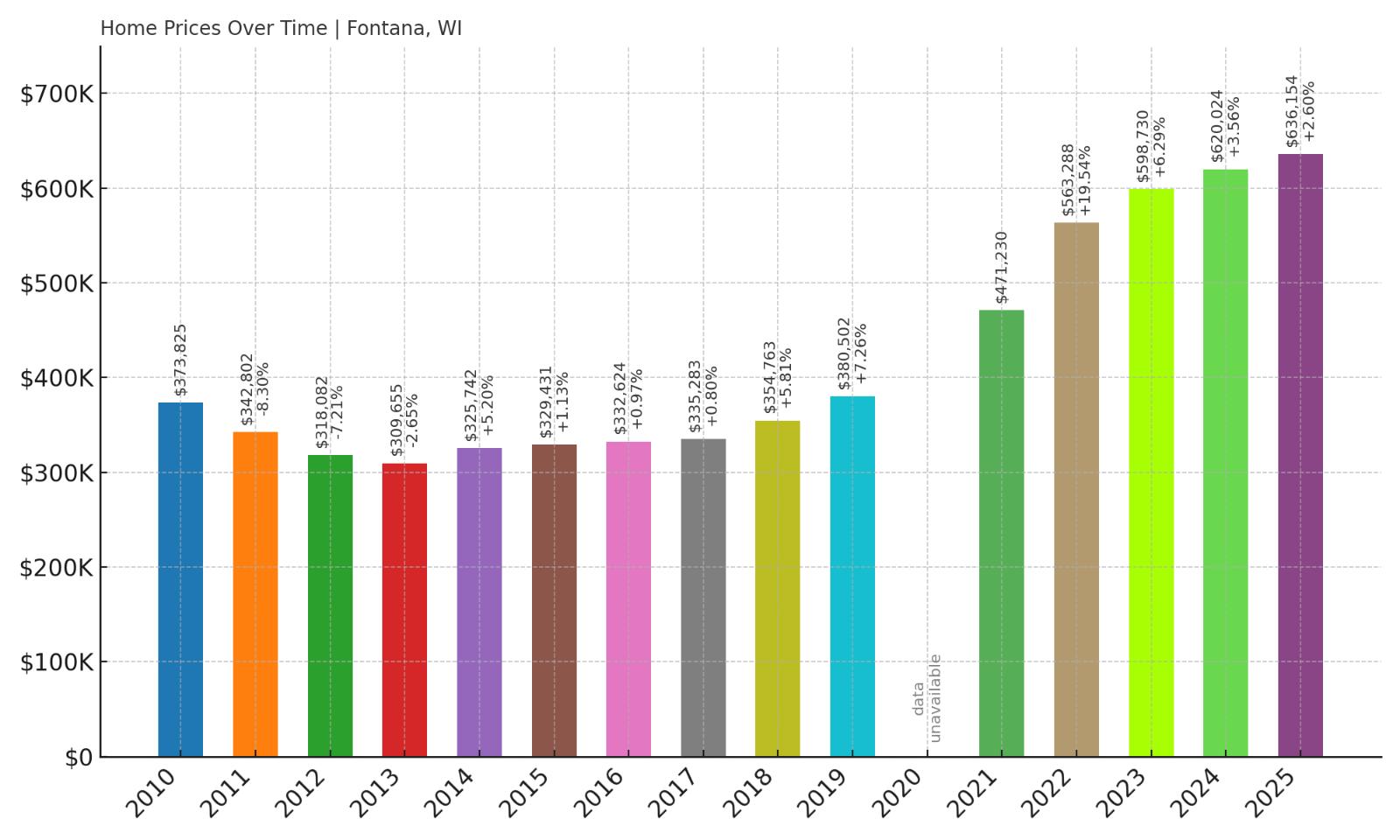

7. Fontana – Crash Risk Percentage: 72%

- Crash Risk Percentage: 72%

- Historical crashes (8%+ drops): 1

- Worst historical crash: -8.3% (2011)

- Total price increase since 2010: +70.2%

- Overextended above long-term average: +51.7%

- Price volatility (annual swings): 6.8%

- Current May 2025 price: $636,154

Fontana combines historical crash vulnerability with current dangerous overextension, creating compounded risk factors. The community’s 2011 correction of 8.3% demonstrates market volatility during stress periods, while current prices sitting 52% above long-term averages suggest even greater correction potential. The $636,154 median price represents the highest absolute value among the mid-range vulnerable communities.

Fontana – Lake Geneva Luxury Meets Historical Volatility

Located on Lake Geneva in Walworth County, Fontana commands premium prices for its luxury lakefront properties and resort community atmosphere. The town’s $636,154 median price reflects strong demand for recreational and vacation homes, but also creates heightened exposure to market corrections that typically affect luxury and vacation properties more severely.

Fontana’s 2011 crash provides a template for potential future corrections, occurring during less extreme overextension than current levels. With prices now 52% above long-term averages compared to pre-crash conditions, the community faces risk of a more severe correction than its historical 8.3% decline when market conditions inevitably shift toward more sustainable valuations.

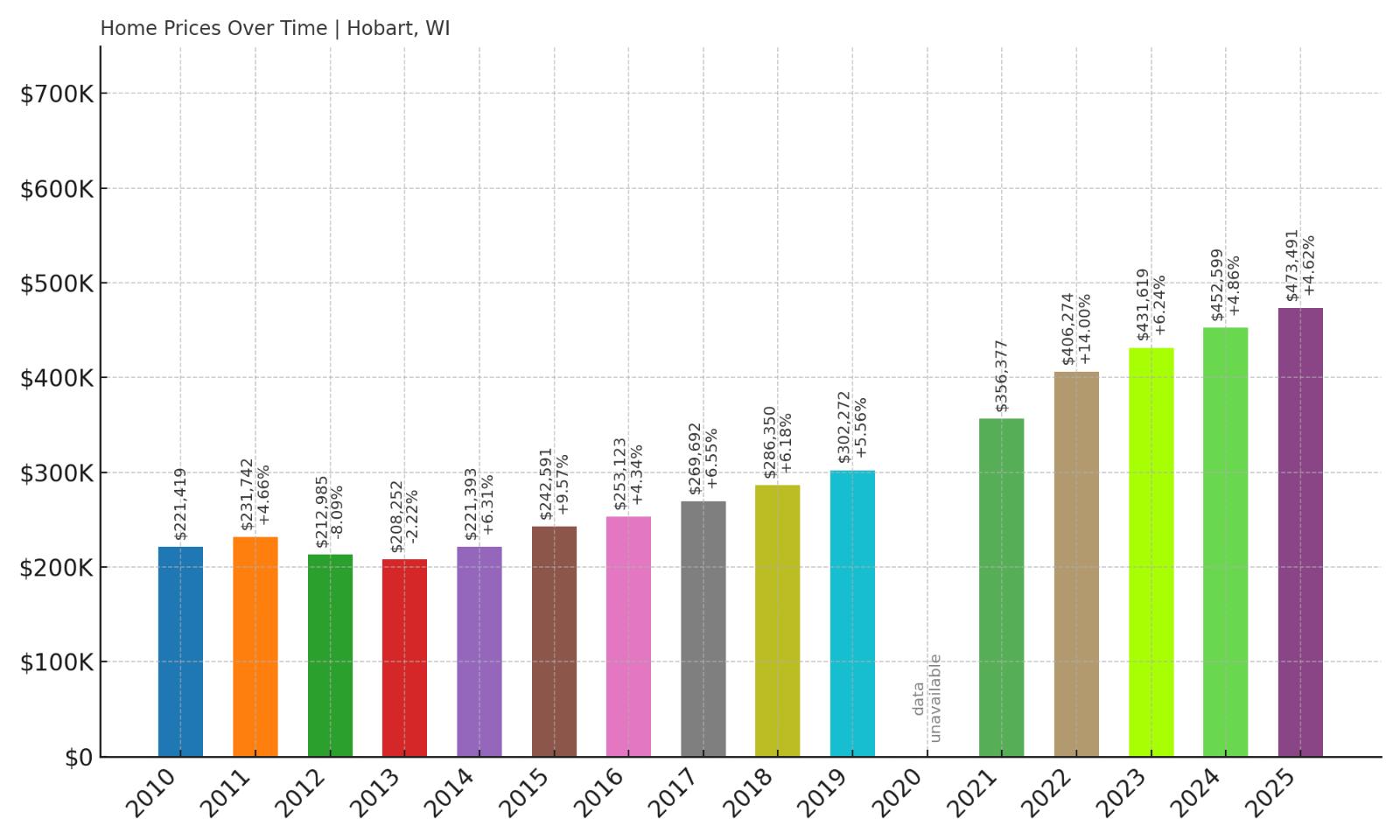

6. Hobart – Crash Risk Percentage: 73%

- Crash Risk Percentage: 73%

- Historical crashes (8%+ drops): 1

- Worst historical crash: -8.1% (2012)

- Total price increase since 2010: +113.8%

- Overextended above long-term average: +55.4%

- Price volatility (annual swings): 7.2%

- Current May 2025 price: $473,491

Hobart demonstrates proven crash vulnerability with its 2012 correction of 8.1%, combined with current extreme overvaluation. Prices have risen 114% since 2010 and sit 55% above long-term averages, creating conditions ripe for another correction. The 7.2% annual volatility indicates ongoing market instability that could amplify any downturn.

Hobart – Green Bay Suburb With Proven Crash Risk

This Brown County community serves as a growing suburb of Green Bay, attracting families and professionals seeking newer housing developments and quality schools. Hobart’s $473,491 median price reflects strong demand, but the 114% appreciation since 2010 combined with historical crash experience creates a particularly concerning risk profile.

The town’s 2012 correction of 8.1% occurred during less extreme overextension than current conditions, where prices sit 55% above long-term averages. This historical precedent suggests Hobart’s market lacks adequate mechanisms to prevent corrections, potentially leading to an even more severe downturn when current overvaluation levels prove unsustainable.

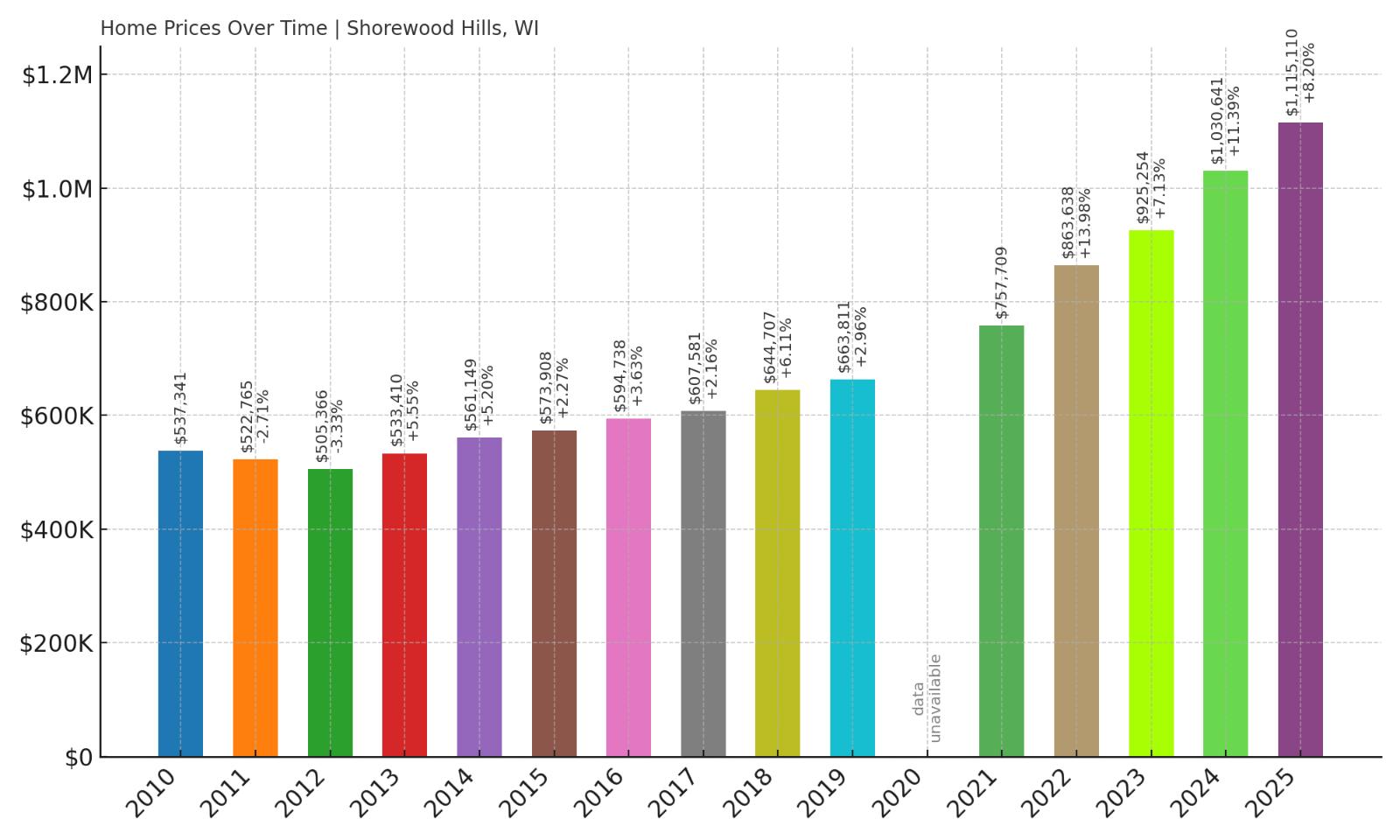

5. Shorewood Hills – Crash Risk Percentage: 74%

- Crash Risk Percentage: 74%

- Historical crashes (8%+ drops): 0

- Worst historical crash: No major crashes recorded

- Total price increase since 2010: +107.5%

- Overextended above long-term average: +60.3%

- Price volatility (annual swings): 6.3%

- Current May 2025 price: $1,115,110

Shorewood Hills represents luxury market vulnerability with a median price exceeding $1.1 million—by far the highest in our analysis. Prices have risen 108% since 2010 and sit 60% above long-term averages, creating extreme overextension in the state’s most expensive housing market. The absence of historical crashes suggests untested resilience at these price levels.

Shorewood Hills – Million-Dollar Market Faces Gravity

This exclusive Dane County village adjacent to Madison commands the highest home prices in Wisconsin, with a median of $1,115,110 reflecting its status as the state’s premier luxury community. Shorewood Hills attracts affluent professionals and executives, but current prices appear disconnected from even high-income economic fundamentals.

Luxury markets typically experience amplified volatility during corrections, as discretionary buyers quickly withdraw when economic conditions tighten. The community’s 60% overextension above long-term averages, combined with no historical correction experience to establish price floors, creates potential for severe adjustments when market conditions force alignment with sustainable valuation levels.

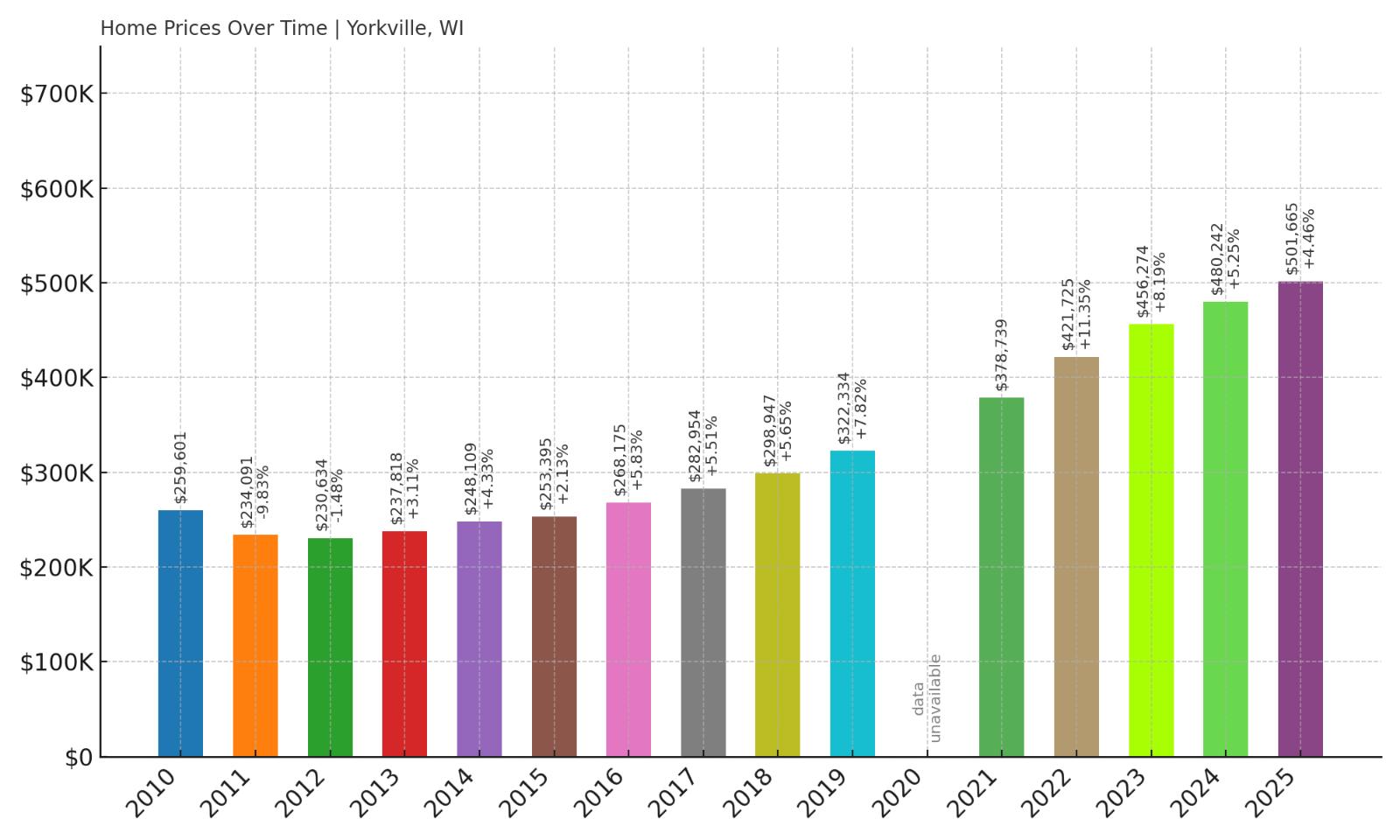

4. Yorkville – Crash Risk Percentage: 75%

- Crash Risk Percentage: 75%

- Historical crashes (8%+ drops): 1

- Worst historical crash: -9.8% (2011)

- Total price increase since 2010: +93.2%

- Overextended above long-term average: +54.4%

- Price volatility (annual swings): 6.6%

- Current May 2025 price: $501,665

Yorkville combines historical crash vulnerability with current dangerous overextension, creating heightened correction risk. The community’s 2011 decline of 9.8% demonstrates market fragility during stress periods, while current prices sitting 54% above long-term averages suggest conditions for an even larger correction. The 93% appreciation since 2010 appears unsustainable.

Yorkville – Racine County Growth Meets Historical Reality

This Racine County community has attracted suburban development and population growth, driving the 93% price appreciation since 2010 that pushed median values to $501,665. Yorkville’s location between Milwaukee and Chicago creates demand from commuters, but current overvaluation levels suggest prices have outpaced economic fundamentals.

The town’s 2011 correction of nearly 10% provides a concerning precedent, occurring during less extreme overextension than current conditions. With prices now 54% above long-term averages—higher than pre-crash levels—Yorkville faces potential for a more severe correction when market dynamics inevitably shift toward more sustainable pricing patterns.

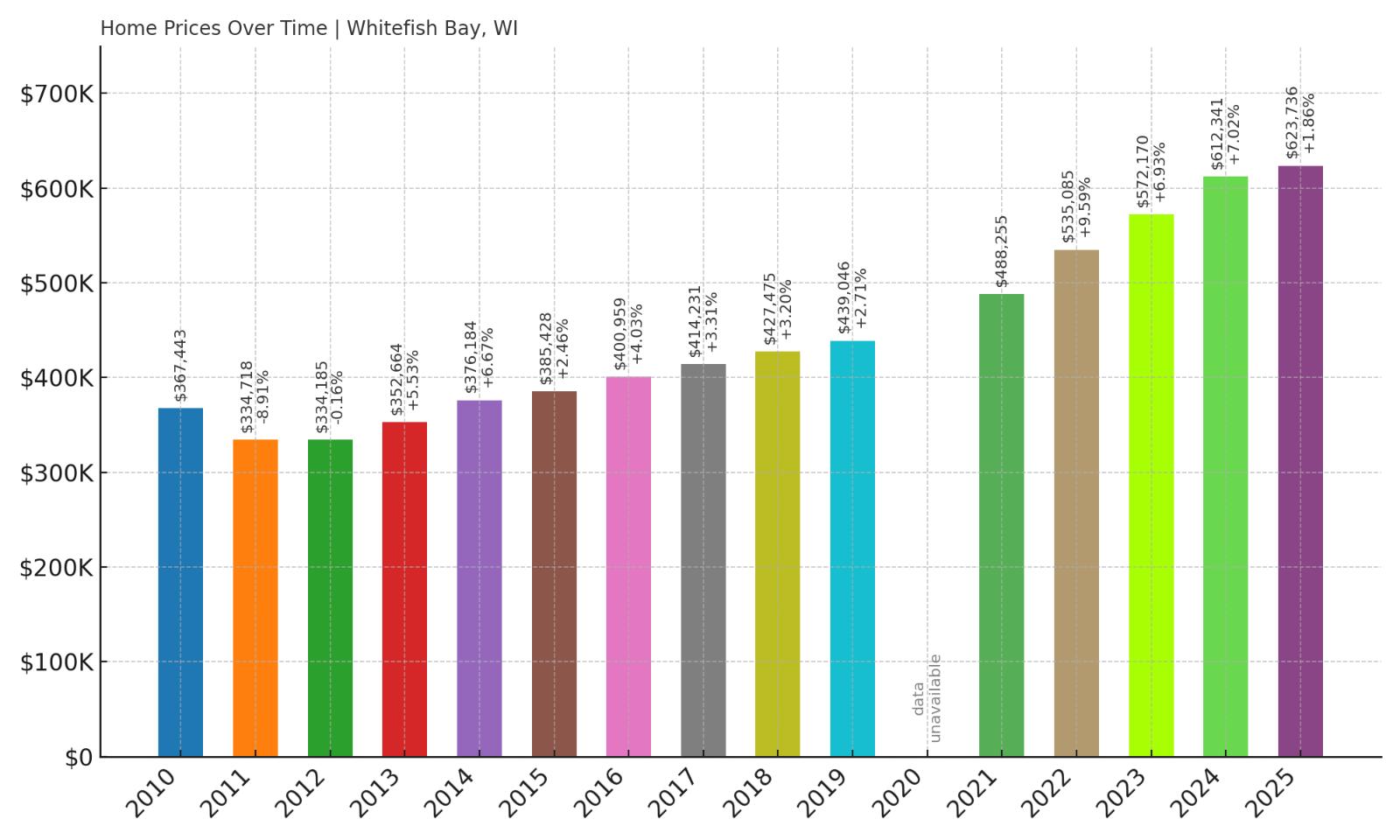

3. Whitefish Bay – Crash Risk Percentage: 75%

- Crash Risk Percentage: 75%

- Historical crashes (8%+ drops): 1

- Worst historical crash: -8.9% (2011)

- Total price increase since 2010: +69.8%

- Overextended above long-term average: +40.4%

- Price volatility (annual swings): 5.3%

- Current May 2025 price: $623,736

Whitefish Bay presents a concerning combination of proven crash history and current overvaluation, despite appearing less extreme than other vulnerable markets. The community’s 2011 correction of 8.9% occurred during lower overextension than current levels, where prices sit 40% above long-term averages. The $623,736 median price creates additional vulnerability in absolute terms.

Whitefish Bay – Milwaukee’s Premium Suburb Shows Cracks

This prestigious Milwaukee County village maintains its reputation as one of southeastern Wisconsin’s most desirable communities, with excellent schools and lakefront access driving the $623,736 median price. Whitefish Bay’s affluent character typically provides market stability, but current conditions suggest potential vulnerability.

The community’s 2011 correction demonstrates that even premium locations aren’t immune to market forces during stress periods. With current prices 40% above long-term averages—higher than pre-crash conditions—Whitefish Bay faces risk of another correction when market dynamics shift, potentially more severe than the historical 8.9% decline given increased overextension levels.

Wisconsin Housing Crash Risk Analysis – Continuation

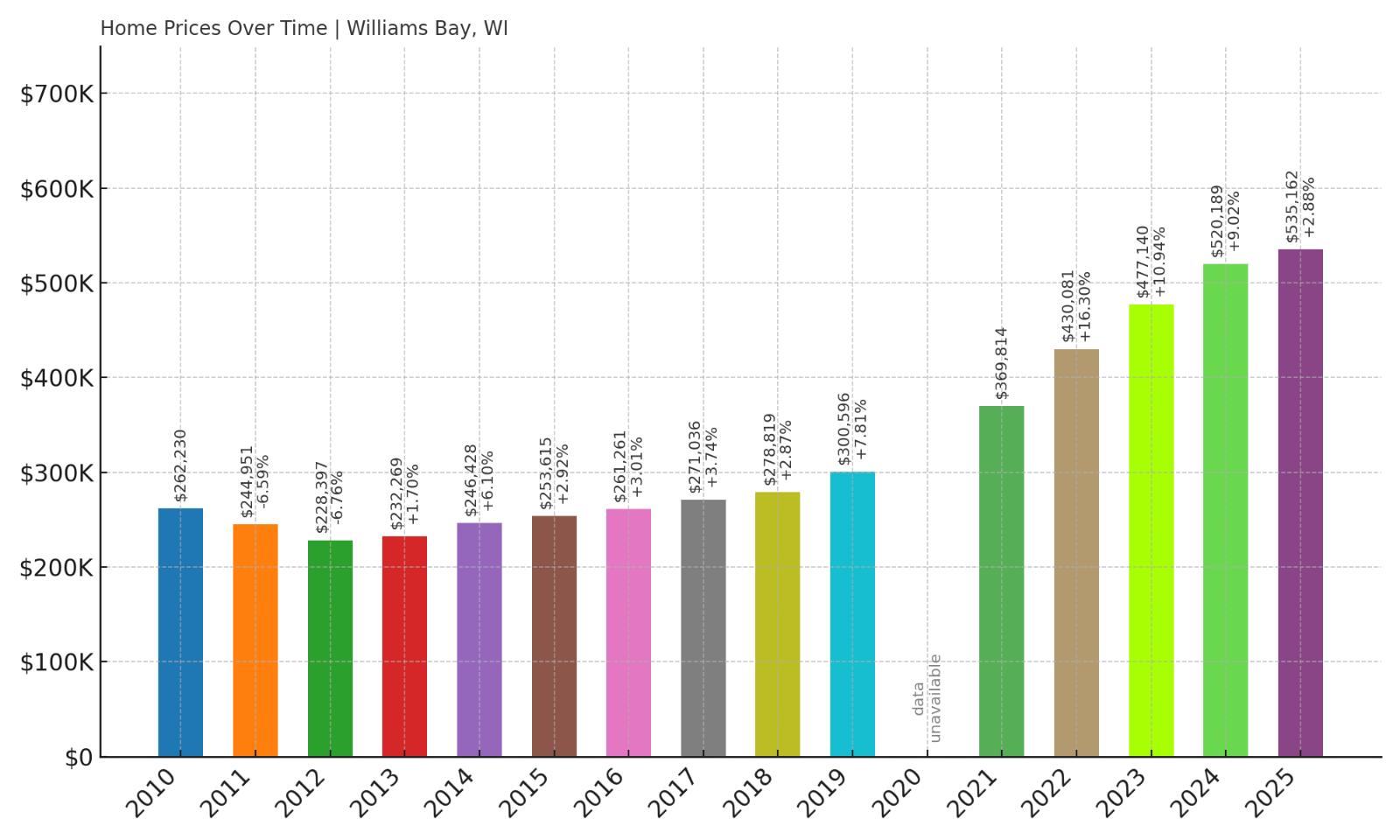

2. Williams Bay – Crash Risk Percentage: 77%

- Crash Risk Percentage: 77%

- Historical crashes (8%+ drops): 0

- Worst historical crash: No major crashes recorded

- Total price increase since 2010: +104.1%

- Overextended above long-term average: +63.4%

- Price volatility (annual swings): 7.4%

- Current May 2025 price: $535,162

Williams Bay shows extreme overextension with prices sitting 63% above long-term averages following a 104% increase since 2010. The community has no recorded major crashes, suggesting untested market resilience at current overvaluation levels. The 7.4% annual volatility indicates significant market instability that could amplify any correction.

Williams Bay – Lake Geneva Resort Market Hits Danger Zone

This Walworth County community sits on the shores of Lake Geneva, attracting vacation home buyers and wealthy retirees seeking lakefront living. Williams Bay’s $535,162 median price reflects the premium commanded by Geneva Lake properties, but the 104% appreciation since 2010 suggests prices have disconnected from underlying economic fundamentals.

Resort and vacation home markets typically experience amplified volatility during economic downturns, as discretionary buyers quickly exit when conditions tighten. The town’s 63% overextension above historical norms—combined with no crash experience to establish market floors—creates substantial vulnerability when economic pressures eventually force price corrections in luxury recreational markets.

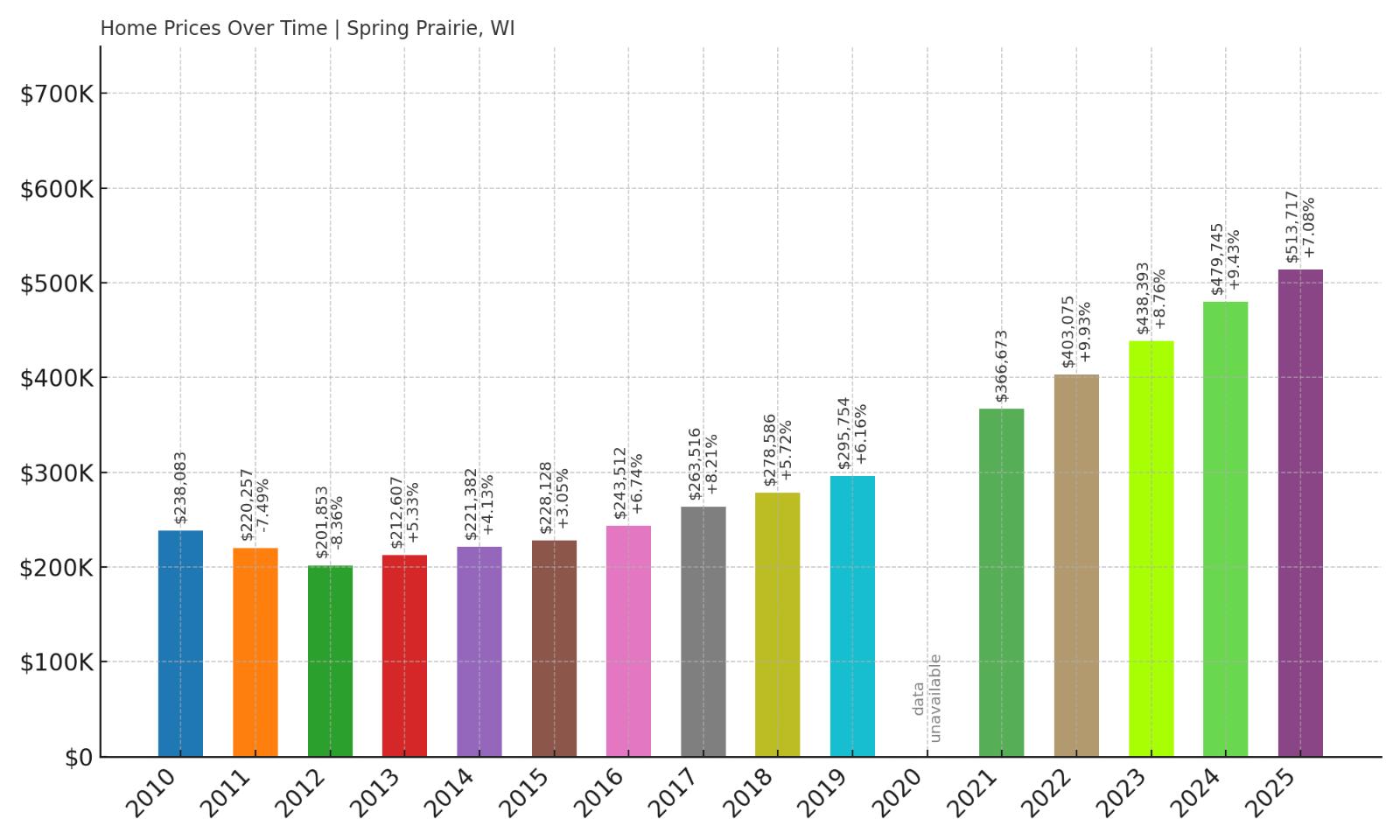

1. Spring Prairie – Crash Risk Percentage: 87%

- Crash Risk Percentage: 87%

- Historical crashes (8%+ drops): 1

- Worst historical crash: -8.4% (2012)

- Total price increase since 2010: +115.8%

- Overextended above long-term average: +67.3%

- Price volatility (annual swings): 8.2%

- Current May 2025 price: $513,717

Spring Prairie emerges as Wisconsin’s most vulnerable housing market, combining extreme overextension with proven crash history and high volatility. The community’s 2012 correction of 8.4% occurred during far less extreme conditions than today, where prices sit 67% above long-term averages after rising 116% since 2010. The 8.2% annual volatility indicates severe market instability.

Spring Prairie – Wisconsin’s Most Dangerous Housing Market

This small Walworth County community has experienced the most dangerous combination of risk factors in our analysis, with prices more than doubling since 2010 to reach a median of $513,717. Spring Prairie’s location near Lake Geneva has attracted suburban development and vacation home investment, but current overvaluation levels appear mathematically unsustainable.

The town’s 2012 crash of 8.4% provides a concerning preview of market vulnerability, occurring when overextension levels were far lower than today’s extreme 67% above long-term averages. With current conditions showing every warning sign that historically precedes major corrections—extreme overextension, proven crash history, and severe volatility—Spring Prairie represents the highest risk for significant price declines when Wisconsin’s housing market inevitably faces its next stress test.