Would you like to save this?

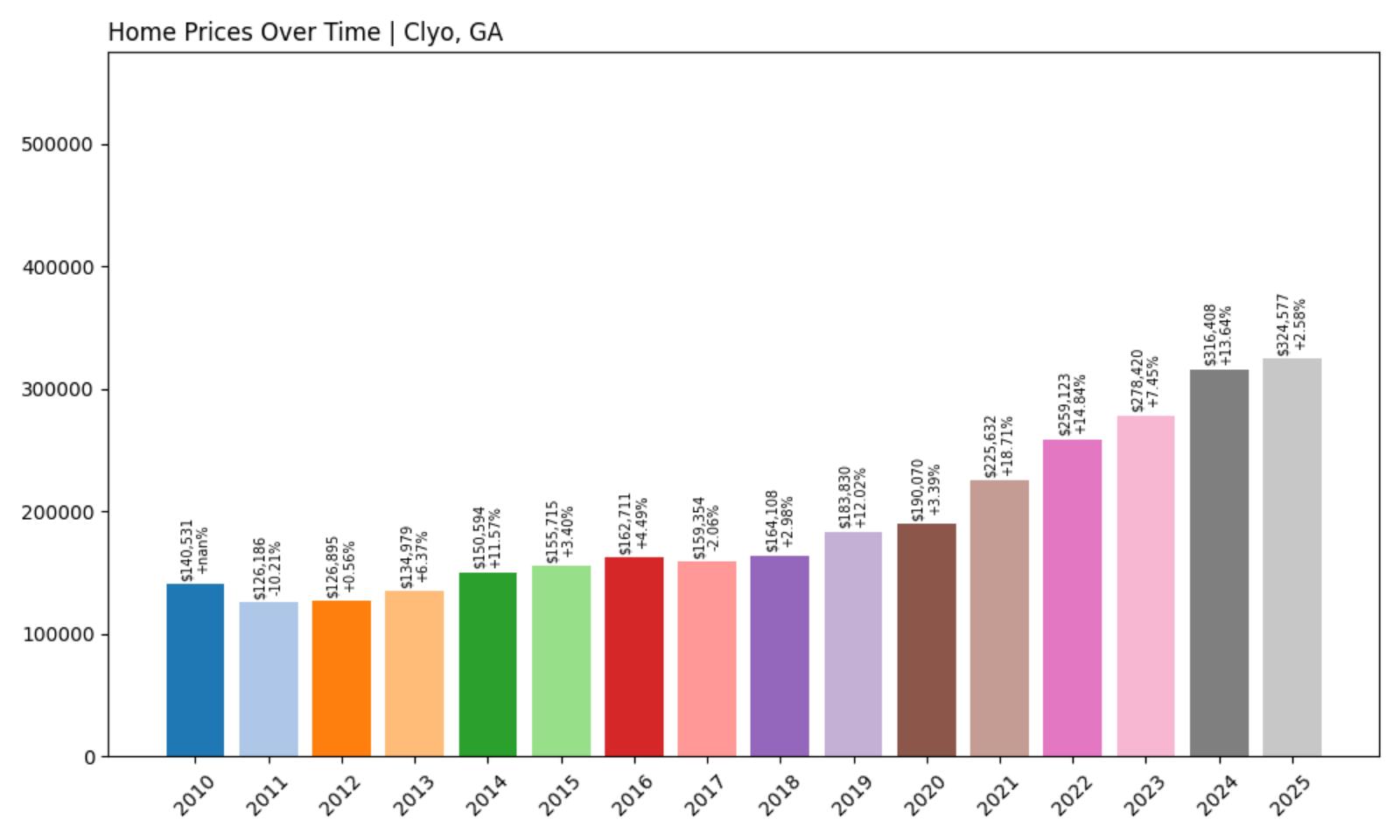

Investor activity is reshaping Georgia’s housing market faster than most families can keep up. According to the Zillow Home Value Index, property prices in some towns have surged far beyond their typical trends—what housing economists call a classic sign of speculative pressure. When prices climb 20% or more above historical growth rates, it usually means investors are circling. That kind of heat can turn formerly affordable communities into battlegrounds, where everyday buyers struggle to compete with deep-pocketed outsiders.

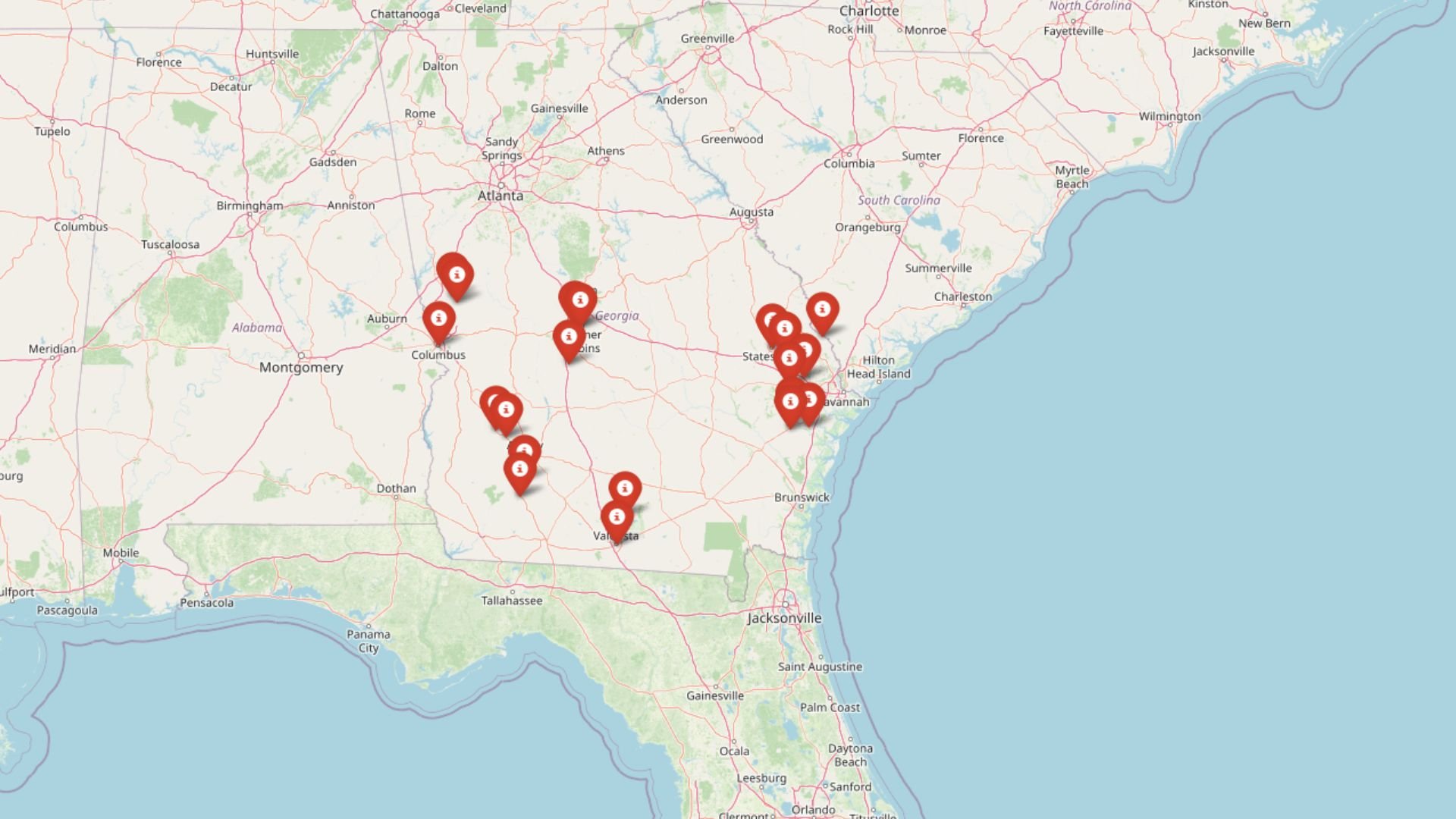

20. Brooklet – Investor Feeding Frenzy Factor 2.16% (July 2025)

- Historical annual growth rate (2012–2022): 8.03%

- Recent annual growth rate (2022–2025): 8.20%

- Investor Feeding Frenzy Factor: 2.16%

- Current 2025 price: $311,904.92

Brooklet shows the most stable price growth pattern among Georgia towns experiencing investor interest. The minimal feeding frenzy factor indicates prices remain closely aligned with historical trends, though the consistently high growth rates above 8% annually suggest strong underlying demand. Current home values near $312,000 reflect steady appreciation without the dramatic spikes seen elsewhere.

Brooklet – Rural Charm Meets Steady Growth

Brooklet sits in Bulloch County, about 30 miles northwest of Savannah, where its rural character attracts families seeking small-town life within reach of urban amenities. The town’s proximity to Georgia Southern University in nearby Statesboro creates steady housing demand from faculty and staff. Historic downtown Brooklet maintains its agricultural roots while benefiting from the economic stability of the university corridor.

The current median price of $311,905 represents consistent appreciation driven by the area’s desirability rather than speculative trading. Local infrastructure improvements and the town’s position along major transportation routes to Savannah have supported steady value increases. Agricultural land surrounding Brooklet continues to transition to residential development, providing new inventory that helps moderate price growth compared to more constrained markets elsewhere in the state.

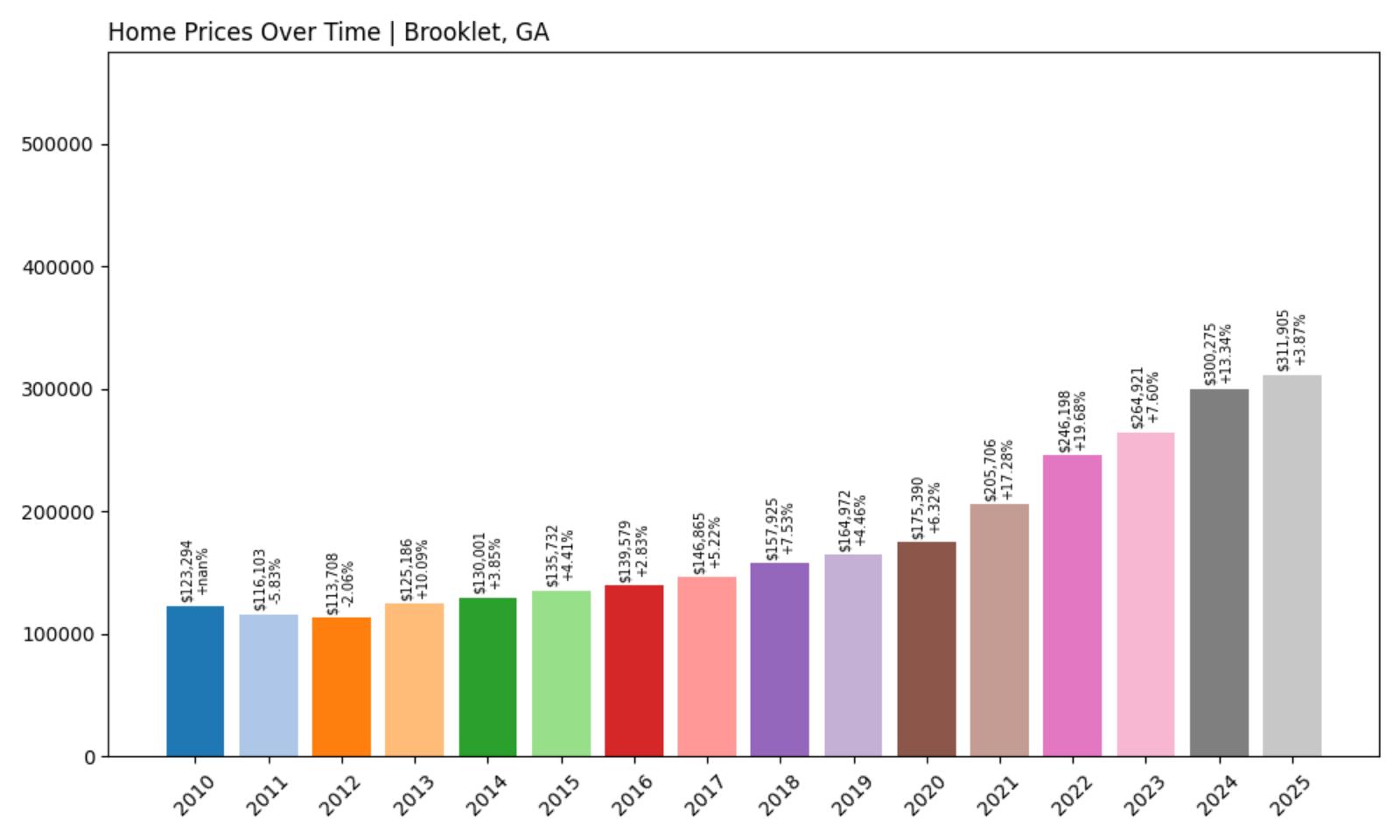

19. Warner Robins – Investor Feeding Frenzy Factor 3.19% (July 2025)

- Historical annual growth rate (2012–2022): 5.60%

- Recent annual growth rate (2022–2025): 5.78%

- Investor Feeding Frenzy Factor: 3.19%

- Current 2025 price: $208,355.97

Warner Robins demonstrates remarkable price stability with minimal deviation from historical growth patterns. The low feeding frenzy factor of just 3.19% indicates organic market conditions rather than speculative pressure, while the current median price of $208,356 offers relative affordability compared to other Georgia markets. This stability reflects the area’s diversified economic base and steady population growth.

Warner Robins – Air Force Base Anchors Steady Market

Warner Robins benefits from the economic anchor of Robins Air Force Base, which employs over 25,000 military and civilian personnel, creating consistent housing demand without the volatility seen in purely civilian markets. The city’s location in central Georgia provides access to Atlanta, Macon, and other major centers while maintaining affordable living costs. Manufacturing facilities including aerospace and logistics companies complement the military presence. The current median home price of $208,356 reflects the area’s appeal to military families and defense contractors who value stability over speculation.

Recent growth rates tracking closely with historical patterns suggest a mature market where fundamental economic drivers, rather than investor activity, determine pricing. Local schools and family-friendly amenities continue attracting permanent residents who form the backbone of the housing market. The city’s master-planned communities and suburban developments provide ample housing inventory, preventing the supply constraints that often trigger speculative bidding wars. This balanced supply-demand dynamic helps explain why Warner Robins maintains steady appreciation without the dramatic price swings affecting other Georgia markets.

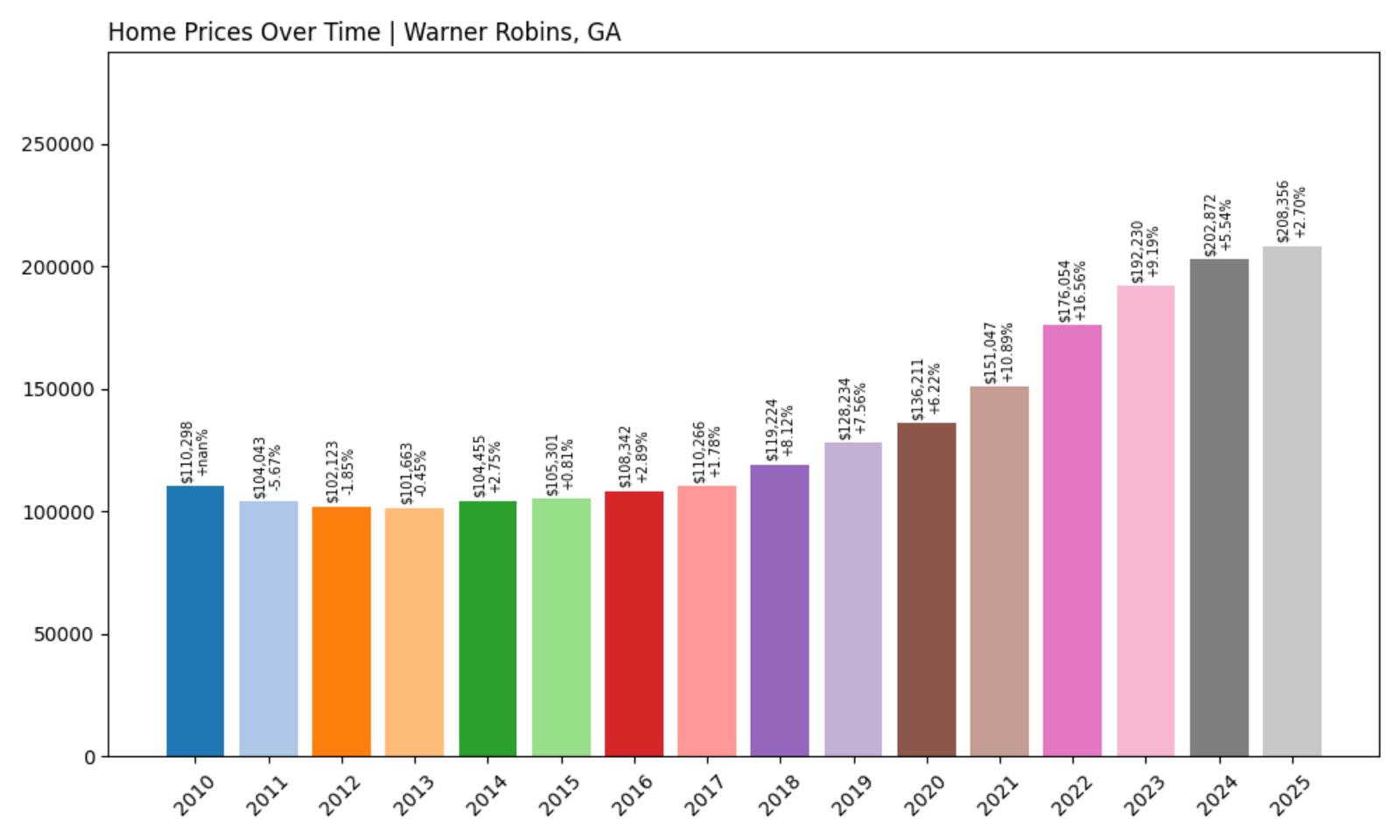

18. Clyo – Investor Feeding Frenzy Factor 5.35% (July 2025)

- Historical annual growth rate (2012–2022): 7.40%

- Recent annual growth rate (2022–2025): 7.80%

- Investor Feeding Frenzy Factor: 5.35%

- Current 2025 price: $324,577.32

Clyo shows modest acceleration above historical growth patterns, with prices rising from an already elevated base of over 7% annually. The feeding frenzy factor of 5.35% suggests early signs of investor interest, though not yet at problematic levels. Current home values averaging $324,577 position Clyo among Georgia’s higher-priced smaller communities.

Clyo – Savannah Spillover Drives Demand

Clyo occupies a strategic position in Effingham County, roughly 30 miles northwest of Savannah, where it captures overflow demand from the coastal city’s expanding metropolitan area. The small town’s rural setting appeals to families seeking space and privacy while maintaining reasonable commuting distance to Savannah’s employment centers. Recent infrastructure improvements along Highway 21 have enhanced connectivity to the coast. The current median price of $324,577 reflects Clyo’s emergence as a bedroom community for Savannah area workers. Historical growth rates above 7% annually indicate sustained demand pressure as coastal Georgia’s population expands inland.

The town’s agricultural heritage provides large lots and custom home opportunities that attract buyers priced out of Savannah’s urban core. Local zoning allows for both residential development and continued agricultural use, creating a unique market dynamic where former farmland transitions to housing. This land use flexibility helps accommodate growing demand while preserving the rural character that initially attracts residents. The modest feeding frenzy factor suggests market conditions remain driven by genuine housing needs rather than speculative investment.

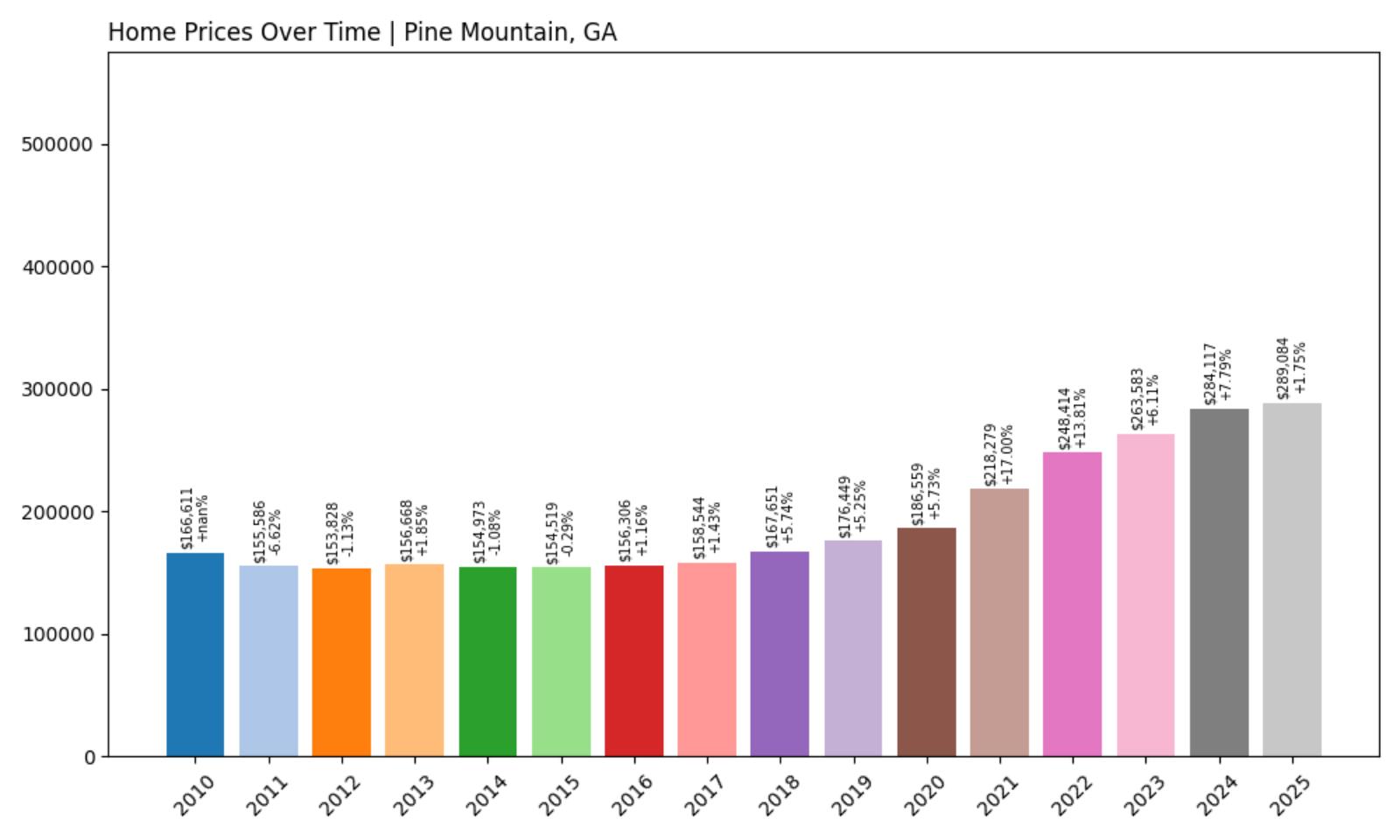

17. Pine Mountain – Investor Feeding Frenzy Factor 5.59% (July 2025)

- Historical annual growth rate (2012–2022): 4.91%

- Recent annual growth rate (2022–2025): 5.18%

- Investor Feeding Frenzy Factor: 5.59%

- Current 2025 price: $289,083.65

Pine Mountain exhibits modest price acceleration with the feeding frenzy factor reaching 5.59%, indicating growing investor attention without extreme speculation. The recent growth rate of 5.18% represents a measured increase from the historical 4.91% baseline. Current median prices near $289,084 reflect the town’s appeal as both a residential community and tourist destination.

Pine Mountain – Resort Town Dynamics

Pine Mountain straddles the Georgia-Alabama border in Harris County, where Callaway Gardens resort and Pine Mountain ski area create unique housing market dynamics. The town serves dual roles as a permanent residential community and seasonal retreat destination, attracting both year-round residents and vacation home buyers. Its proximity to Columbus provides employment opportunities while maintaining a resort town atmosphere. The current median price of $289,084 reflects demand from multiple buyer segments including retirees, vacation home purchasers, and commuters to Columbus. Recent price acceleration above historical norms suggests growing recognition of Pine Mountain’s recreational amenities and lifestyle benefits.

Local hospitality and service sectors support the tourist economy while providing employment for permanent residents. Tourism infrastructure including golf courses, hiking trails, and event venues enhances property values while creating seasonal demand fluctuations. The modest feeding frenzy factor indicates that while investor interest is growing, the market remains primarily driven by end-user demand rather than speculative trading. Pine Mountain’s unique position as both a residential community and tourist destination continues supporting steady appreciation.

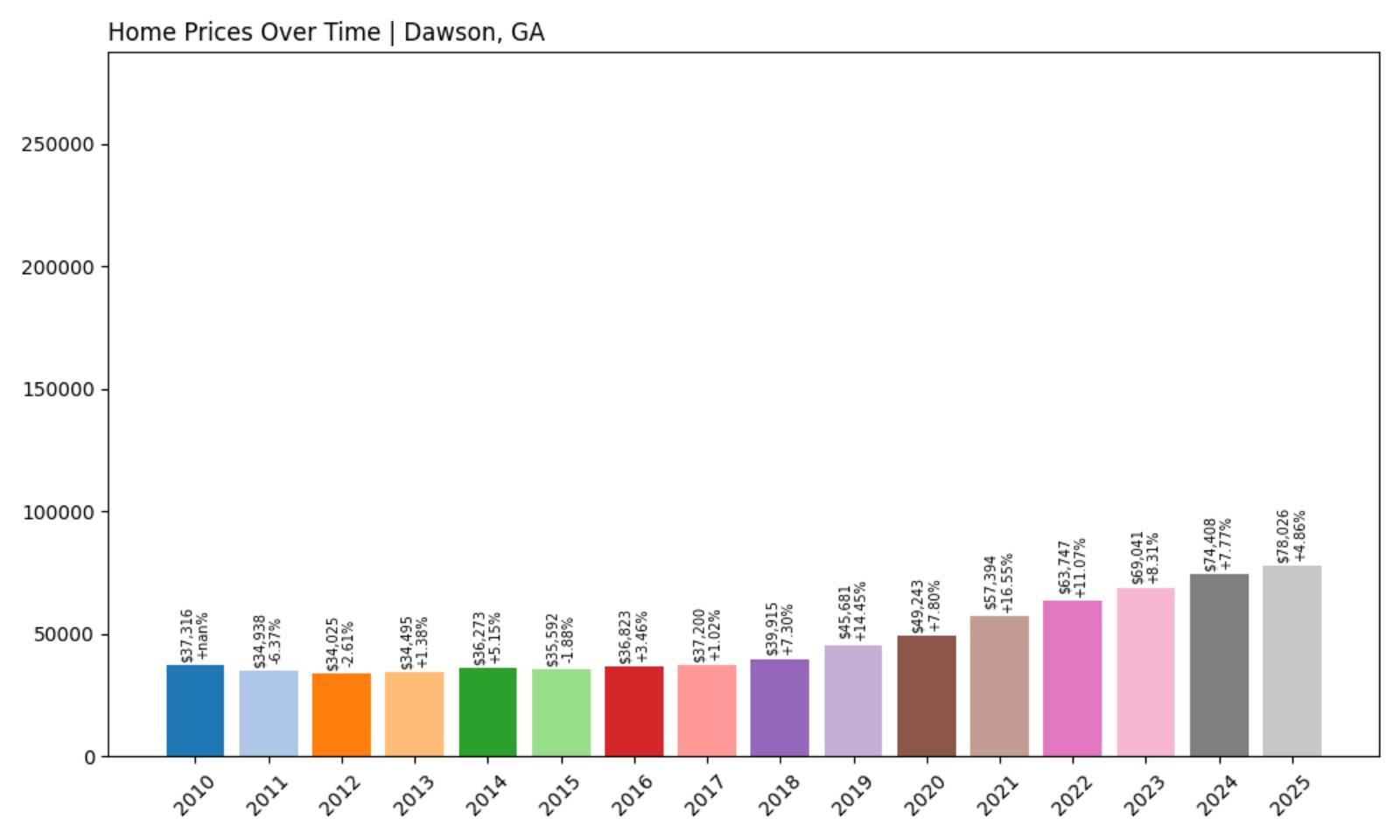

16. Dawson – Investor Feeding Frenzy Factor 7.56% (July 2025)

- Historical annual growth rate (2012–2022): 6.48%

- Recent annual growth rate (2022–2025): 6.97%

- Investor Feeding Frenzy Factor: 7.56%

- Current 2025 price: $78,025.81

Dawson stands out with the lowest median home price at just $78,026, yet shows accelerating growth above historical patterns. The feeding frenzy factor of 7.56% suggests early investor recognition of value opportunities in this affordable market. Despite recent acceleration, growth rates remain moderate compared to other Georgia communities experiencing speculation.

Dawson – Value Play in Southwest Georgia

Dawson serves as the county seat of Terrell County in southwest Georgia, where agricultural heritage meets modern economic challenges. The town’s location along Highway 82 provides access to Albany and other regional centers while maintaining small-town affordability. Traditional farming communities like Dawson often attract investors seeking undervalued properties with potential for appreciation. The remarkably low median price of $78,026 makes Dawson one of Georgia’s most affordable housing markets, explaining growing investor interest despite the rural location. Recent price acceleration above historical norms indicates outside buyers recognizing value opportunities in a market where many homes trade below $100,000.

Local economic development efforts focus on diversifying beyond agriculture to create sustainable growth. Manufacturing and logistics companies have established operations in the region, providing employment opportunities that support housing demand. The feeding frenzy factor of 7.56% suggests investors are beginning to target Dawson for its combination of low prices and appreciation potential. However, the small population base means even modest investor activity can significantly impact local market dynamics and affordability for longtime residents.

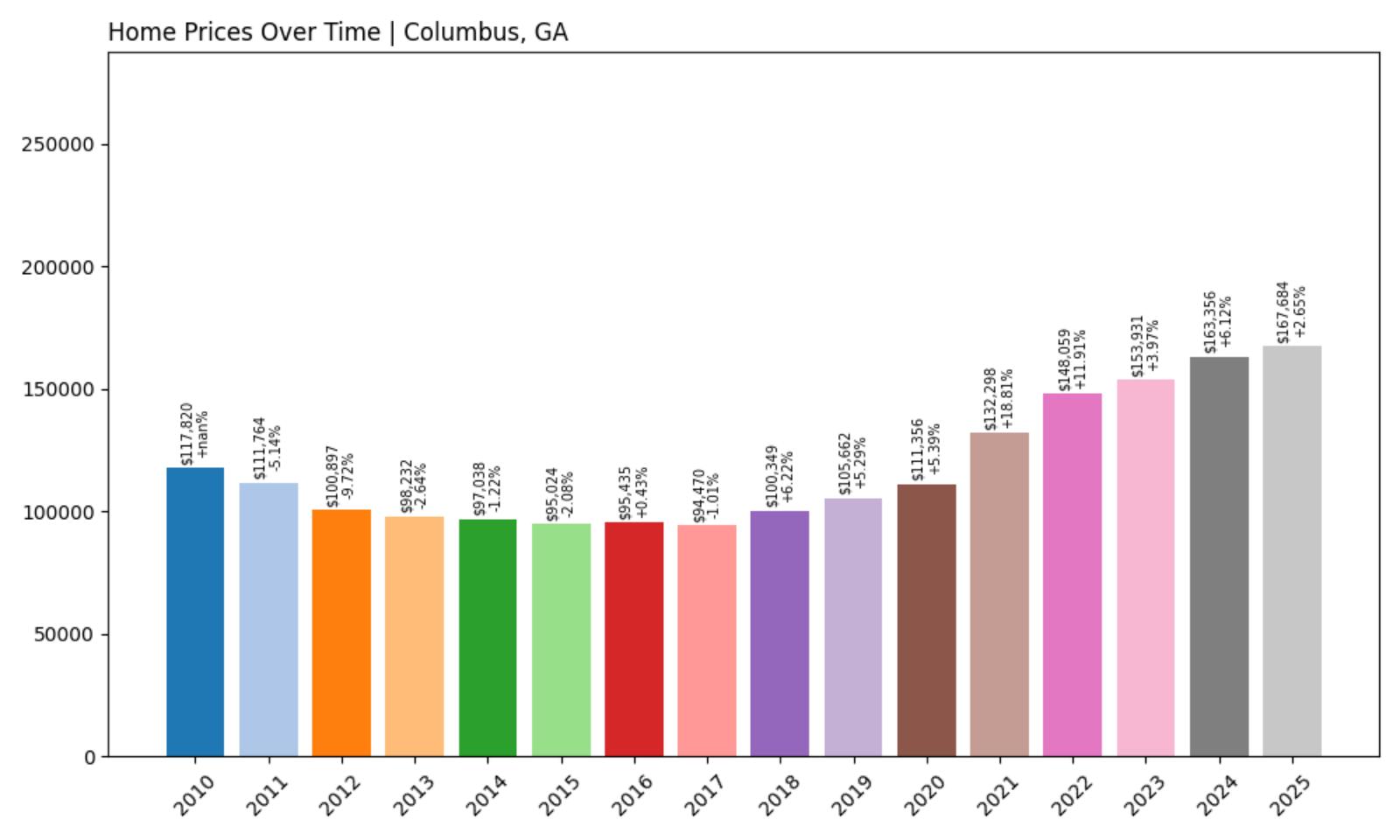

15. Columbus – Investor Feeding Frenzy Factor 8.35% (July 2025)

- Historical annual growth rate (2012–2022): 3.91%

- Recent annual growth rate (2022–2025): 4.24%

- Investor Feeding Frenzy Factor: 8.35%

- Current 2025 price: $167,683.84

Columbus shows growing investor interest with price acceleration pushing the feeding frenzy factor to 8.35%. While recent growth rates remain modest at 4.24%, this represents meaningful acceleration from the historically low 3.91% baseline. The current median price of $167,684 positions Columbus as an affordable major city attracting investor attention.

Columbus – Military Town Gains Investor Focus

Columbus anchors west-central Georgia as the state’s second-largest city, with Fort Moore (formerly Fort Benning) providing economic stability through its massive military presence. The combination of affordable housing, steady employment, and urban amenities creates attractive conditions for both residents and investors. Recent downtown redevelopment and riverfront improvements enhance the city’s investment appeal. The current median price of $167,684 represents exceptional value for a city of Columbus’s size and amenities, explaining growing investor interest. Historical growth rates below 4% annually reflected economic challenges, but recent acceleration suggests renewed confidence in the market.

The military base provides consistent rental demand, making Columbus attractive to buy-and-hold investors. Industrial development along the Chattahoochee River and logistics expansion near the airport create additional employment opportunities beyond the military sector. The feeding frenzy factor of 8.35% indicates early-stage investor discovery of Columbus’s value proposition. Local housing stock includes both historic neighborhoods near downtown and newer suburban developments, providing diverse investment opportunities across price ranges.

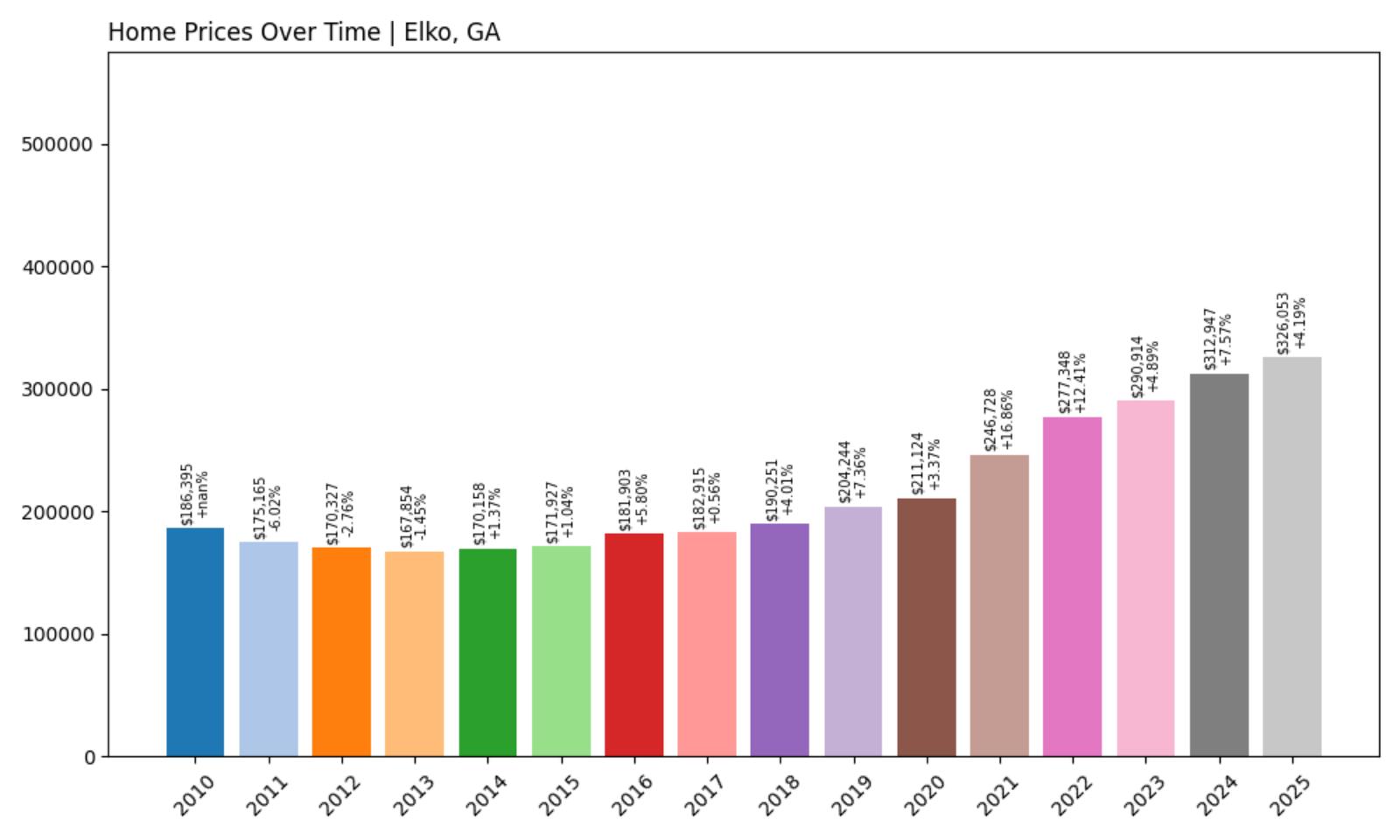

14. Elko – Investor Feeding Frenzy Factor 10.90% (July 2025)

Would you like to save this?

- Historical annual growth rate (2012–2022): 5.00%

- Recent annual growth rate (2022–2025): 5.54%

- Investor Feeding Frenzy Factor: 10.90%

- Current 2025 price: $326,052.82

Elko crosses into double-digit feeding frenzy territory with a factor of 10.90%, indicating notable investor pressure building in this small Houston County community. The modest acceleration from 5.00% to 5.54% growth translates to meaningful price impacts given the high baseline values. Current median prices exceeding $326,000 reflect premium positioning within Georgia’s small-town markets.

Elko – Warner Robins Bedroom Community

Elko functions as an exclusive bedroom community serving Warner Robins and the broader Houston County area, where larger lots and rural settings attract affluent buyers seeking space and privacy. The community’s proximity to Robins Air Force Base creates demand from military officers and defense contractors willing to pay premium prices for superior housing. Local zoning emphasizes low-density residential development maintaining the area’s rural character. The current median price of $326,053 positions Elko among Georgia’s higher-priced small communities, reflecting its appeal to upper-income buyers. Recent price acceleration above historical norms suggests investors are targeting the area for its combination of exclusivity and growth potential.

Large lot sizes and custom home opportunities create a unique market segment within the Warner Robins metropolitan area. Limited housing inventory due to rural zoning and large parcel requirements constrains supply, contributing to price appreciation when demand increases. The feeding frenzy factor of 10.90% indicates growing recognition of Elko’s investment potential among buyers seeking alternatives to more expensive metro Atlanta suburbs. Agricultural heritage combined with suburban amenities creates a distinctive lifestyle product commanding premium pricing.

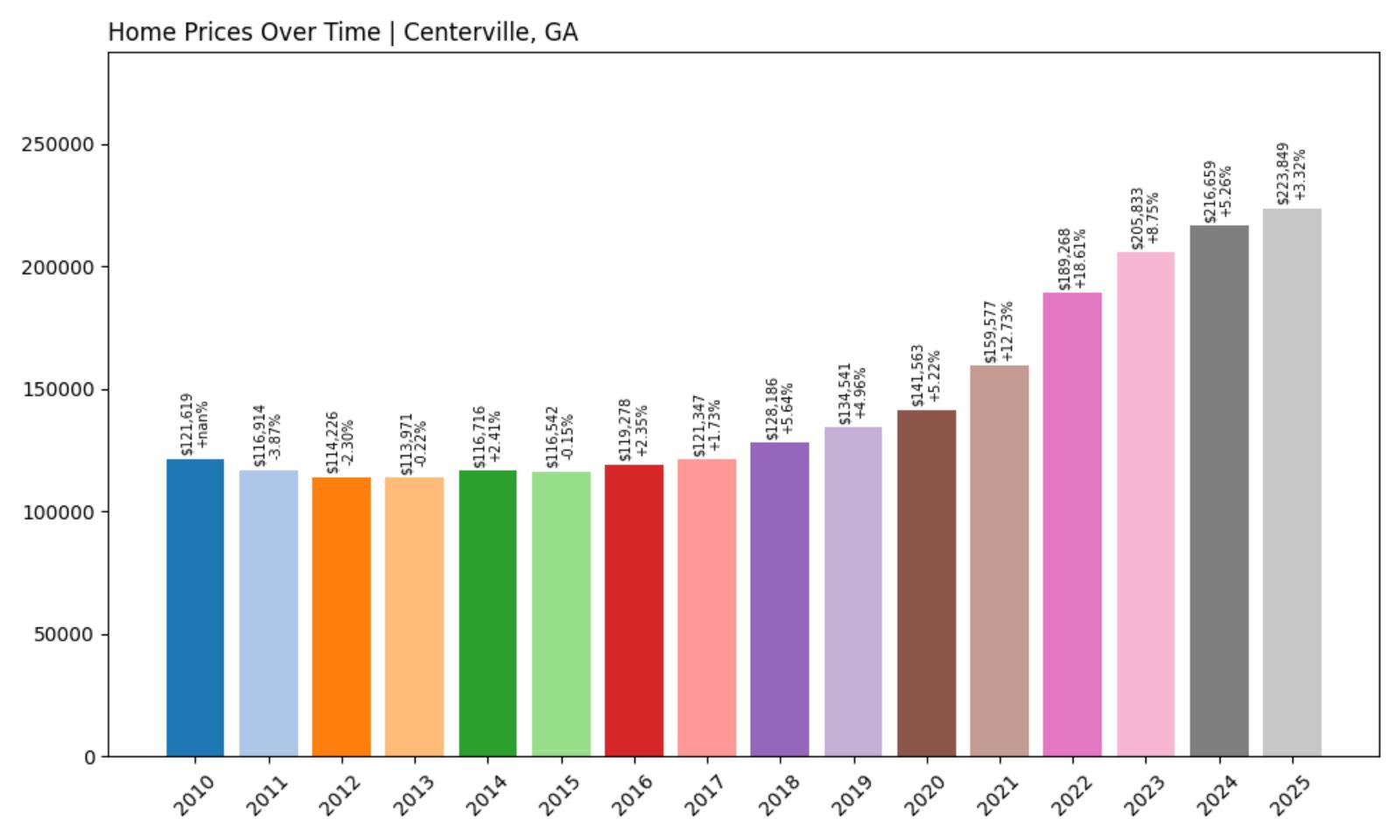

13. Centerville – Investor Feeding Frenzy Factor 11.07% (July 2025)

- Historical annual growth rate (2012–2022): 5.18%

- Recent annual growth rate (2022–2025): 5.75%

- Investor Feeding Frenzy Factor: 11.07%

- Current 2025 price: $223,848.82

Centerville shows accelerating investor interest with the feeding frenzy factor reaching 11.07%, indicating growing speculation in this Houston County community. Price acceleration from 5.18% to 5.75% represents meaningful change in a market with established appreciation patterns. The current median price of $223,849 reflects middle-market positioning attractive to diverse buyer segments.

Centerville – Strategic Location Drives Growth

Centerville occupies a central position in Houston County between Warner Robins and Perry, benefiting from proximity to Robins Air Force Base while maintaining distinct community identity. The city’s location along Interstate 75 provides excellent connectivity throughout Georgia, making it attractive to commuters and businesses. Recent commercial development and retail expansion reflect growing population and economic activity. The current median price of $223,849 offers more accessible entry points compared to premium communities like nearby Elko while still providing suburban amenities. Historical growth rates above 5% annually indicate sustained demand, while recent acceleration suggests investors are recognizing Centerville’s value proposition.

The community combines established neighborhoods with new residential development to accommodate diverse housing needs. Educational quality and family-friendly amenities attract permanent residents who form the housing market foundation, while growing investor interest adds speculative pressure. The feeding frenzy factor of 11.07% signals early-stage investment discovery that could accelerate if economic growth continues. Local government focuses on managed growth to preserve community character while accommodating development pressure.

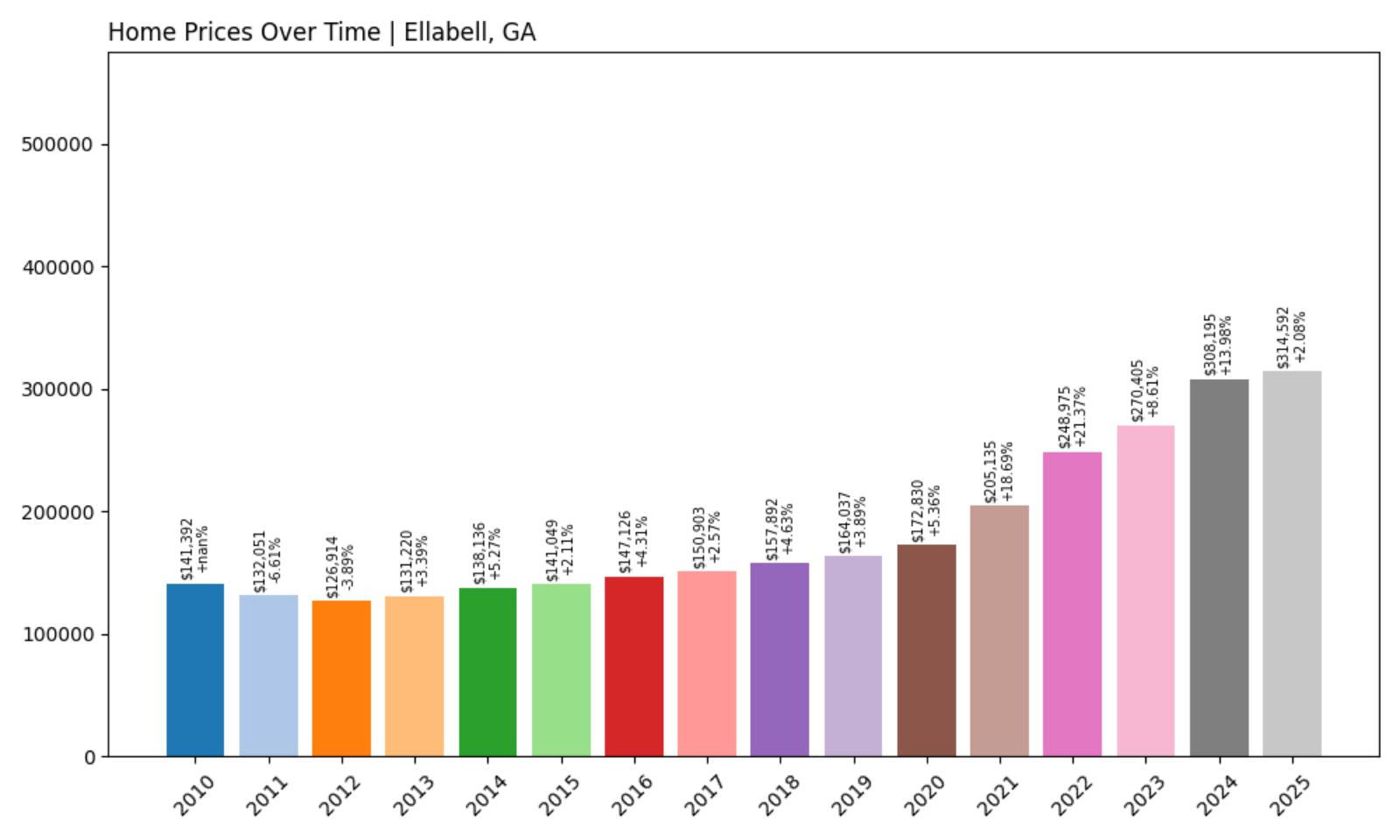

12. Ellabell – Investor Feeding Frenzy Factor 16.34% (July 2025)

- Historical annual growth rate (2012–2022): 6.97%

- Recent annual growth rate (2022–2025): 8.11%

- Investor Feeding Frenzy Factor: 16.34%

- Current 2025 price: $314,592.04

Ellabell enters more serious feeding frenzy territory with a factor of 16.34%, showing significant investor pressure building in this Bryan County community. Price acceleration from an already elevated 6.97% to 8.11% indicates strong market momentum. Current median values exceeding $314,000 position Ellabell among Georgia’s higher-priced small towns despite rural location.

Ellabell – Savannah Metropolitan Expansion

Ellabell sits strategically in Bryan County along Interstate 16, roughly 45 minutes west of Savannah, where it captures metropolitan expansion and commuter demand from the coastal region. The community’s rural setting provides space and affordability relative to Savannah proper while maintaining reasonable access to urban employment centers. Recent population growth reflects broader demographic shifts toward suburban and exurban living. The current median price of $314,592 represents significant appreciation driven by Savannah area spillover demand and growing recognition of Bryan County’s development potential. Historical growth rates approaching 7% annually established strong appreciation trends that recent acceleration has pushed even higher.

Large lots and new construction opportunities attract buyers seeking modern amenities in rural settings. Interstate 16 serves as a critical economic corridor connecting Savannah’s port facilities with inland Georgia, creating logistics and distribution opportunities that support local employment. The feeding frenzy factor of 16.34% indicates investors are actively targeting Ellabell for its combination of growth momentum and relative affordability compared to coastal markets. Limited commercial development maintains the area’s residential character while constraining local employment options.

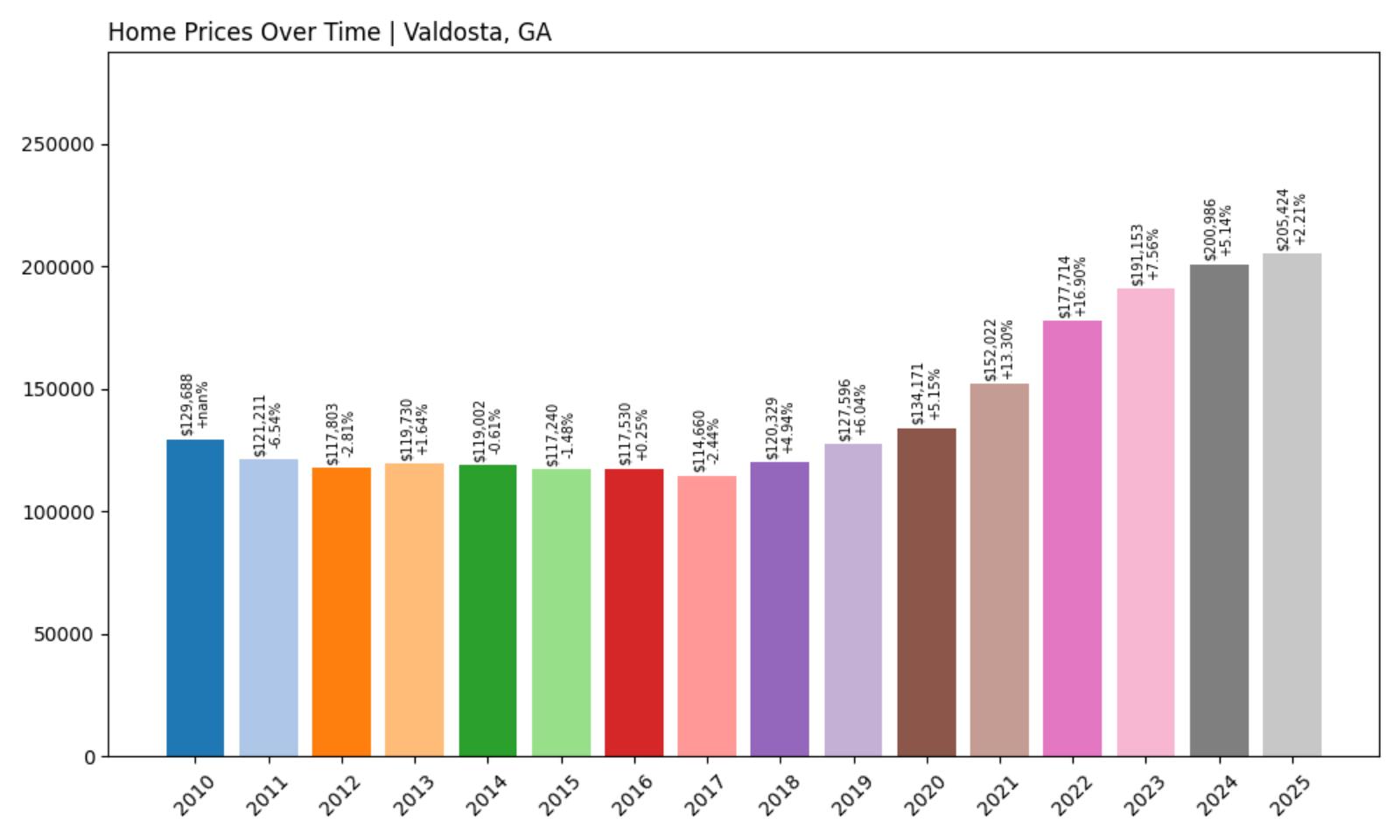

11. Valdosta – Investor Feeding Frenzy Factor 17.90% (July 2025)

- Historical annual growth rate (2012–2022): 4.20%

- Recent annual growth rate (2022–2025): 4.95%

- Investor Feeding Frenzy Factor: 17.90%

- Current 2025 price: $205,424.32

Valdosta shows concerning investor speculation with the feeding frenzy factor approaching 18%, indicating significant pressure on this south Georgia city. While absolute growth rates remain moderate, the acceleration from 4.20% to 4.95% represents meaningful change from historical patterns. Current median prices around $205,424 maintain affordability compared to other Georgia markets experiencing similar speculation.

Valdosta – University Town Attracts Investors

Valdosta anchors south Georgia as home to Valdosta State University, creating steady rental demand that attracts buy-and-hold investors seeking consistent cash flow opportunities. The combination of university enrollment, agricultural processing industries, and regional healthcare facilities provides economic diversity supporting housing demand. Interstate 75 connectivity enhances the city’s appeal as a logistics and distribution hub. The current median price of $205,424 offers attractive entry points for investors compared to more expensive university towns, explaining growing speculative interest.

Historical growth rates below the state average reflected economic challenges, but recent acceleration suggests renewed investor confidence. Student housing demand creates year-round rental opportunities, while faculty and staff provide stable homebuying segments. Regional medical facilities and agricultural processing plants employ thousands of workers who require housing, creating fundamental demand beyond university-related needs. The feeding frenzy factor of 17.90% indicates investors are actively competing for properties, potentially pricing out local families and university employees. Downtown redevelopment efforts and campus expansion projects add to investment appeal while raising concerns about affordability for longtime residents.

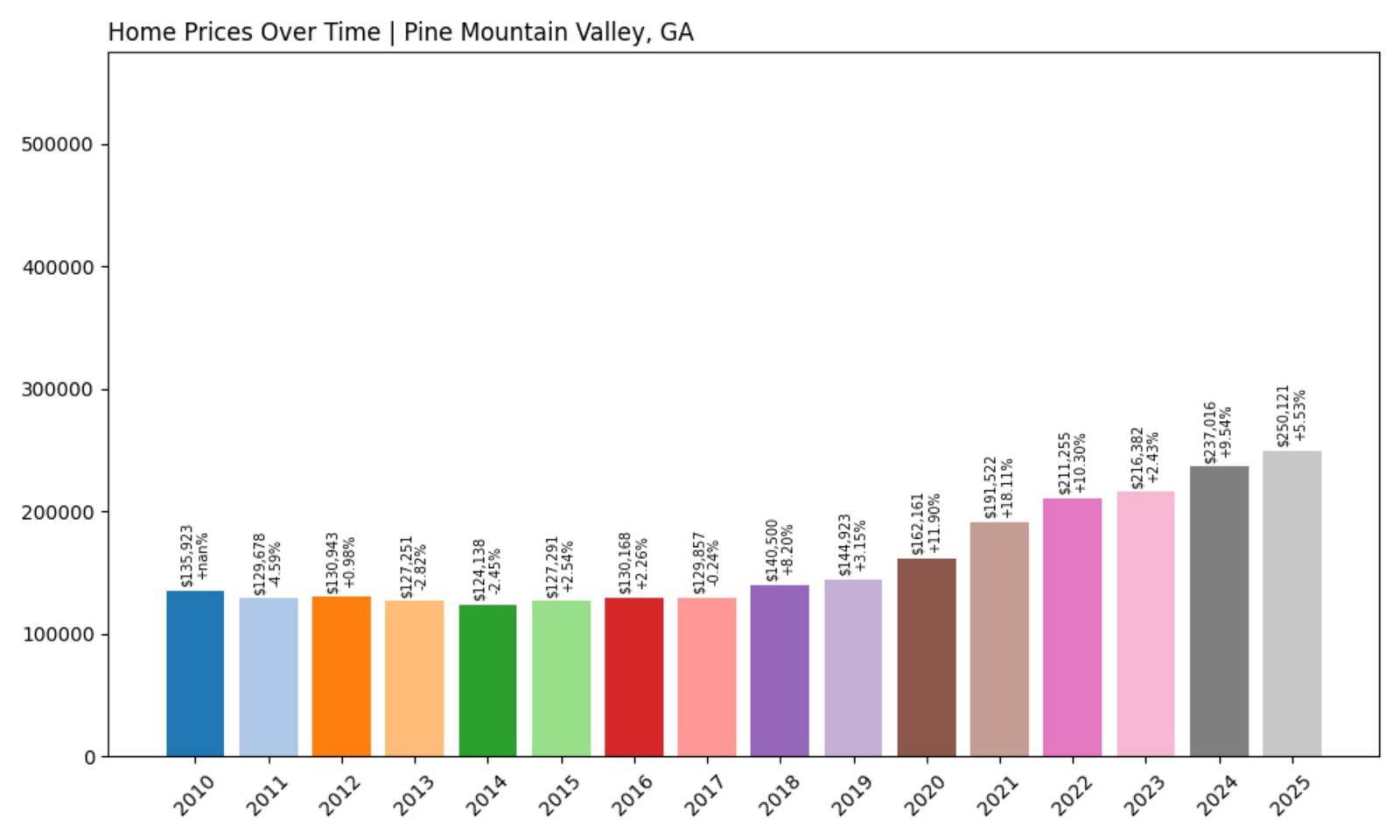

10. Pine Mountain Valley – Investor Feeding Frenzy Factor 18.20% (July 2025)

- Historical annual growth rate (2012–2022): 4.90%

- Recent annual growth rate (2022–2025): 5.79%

- Investor Feeding Frenzy Factor: 18.20%

- Current 2025 price: $250,121.16

Pine Mountain Valley crosses the critical 18% feeding frenzy threshold, indicating serious investor speculation pressuring this Harris County community. Price acceleration from 4.90% to 5.79% may seem modest but represents significant change from established patterns. The current median price of $250,121 reflects growing recognition of the area’s recreational and residential appeal.

Pine Mountain Valley – Recreation Drives Investment

Pine Mountain Valley benefits from proximity to Callaway Gardens and Franklin D. Roosevelt State Park, creating unique market dynamics driven by recreational amenities and tourism infrastructure. The community’s location near Pine Mountain proper provides access to resort facilities while maintaining more affordable housing options. Natural beauty and outdoor recreation opportunities attract both permanent residents and vacation home buyers. The current median price of $250,121 represents middle-market positioning that appeals to diverse buyer segments including retirees, recreational property investors, and Atlanta-area residents seeking weekend retreats.

Recent price acceleration reflects growing awareness of west Georgia’s recreational assets and lifestyle benefits. Lake and mountain access within the broader Pine Mountain area enhances property values and investment appeal. Tourism-related employment provides local economic support, while the area’s natural amenities create long-term appreciation potential that attracts speculative investment. The feeding frenzy factor of 18.20% suggests investors are actively competing for properties, potentially displacing local buyers who cannot match investor cash offers and speed. Limited housing inventory due to topographical constraints and environmental protections intensifies competition when demand increases.

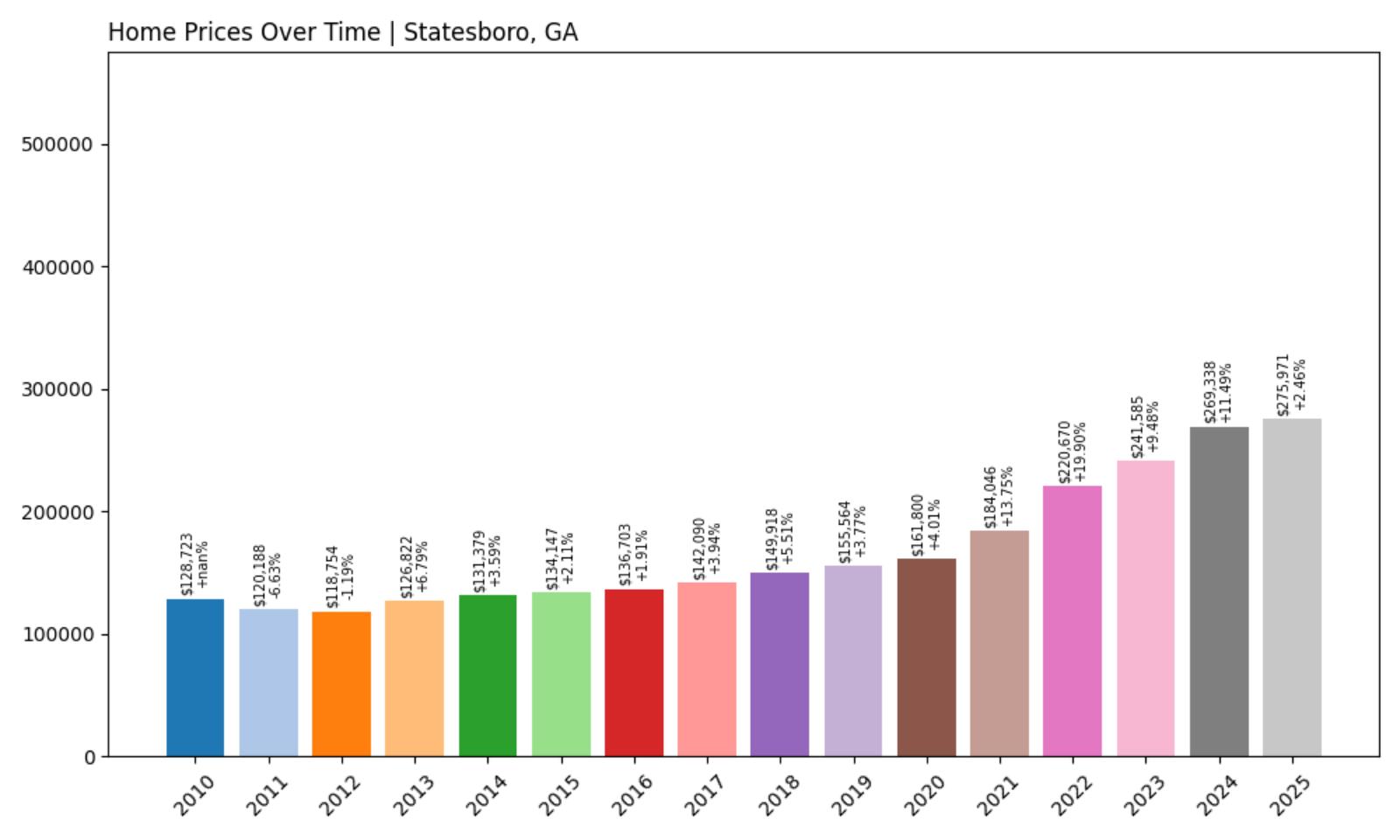

9. Statesboro – Investor Feeding Frenzy Factor 21.07% (July 2025)

- Historical annual growth rate (2012–2022): 6.39%

- Recent annual growth rate (2022–2025): 7.74%

- Investor Feeding Frenzy Factor: 21.07%

- Current 2025 price: $275,970.90

Statesboro enters serious feeding frenzy territory with a factor exceeding 21%, indicating intense investor competition in this university town. Price acceleration from an already strong 6.39% to 7.74% shows momentum building on established appreciation trends. Current median prices approaching $276,000 reflect growing premium positioning despite the college town setting.

Statesboro – Georgia Southern Creates Investment Magnet

Statesboro serves as home to Georgia Southern University, where enrollment exceeding 27,000 students creates massive rental demand that attracts investors from across the Southeast. The combination of consistent student housing needs, faculty employment, and regional economic activity provides multiple revenue streams for property investors. Campus expansion and enrollment growth amplify investment appeal while straining local housing supply. The current median price of $275,971 represents significant appreciation from what were historically affordable levels for a college town.

Student housing demand drives year-round rental opportunities, while university employment provides stable homebuying segments that support property values. Off-campus housing shortages create premium rental rates that justify higher purchase prices for investors. Regional healthcare facilities, agricultural processing, and logistics operations provide economic diversity beyond the university, supporting broader housing demand. The feeding frenzy factor of 21.07% indicates investors are aggressively competing for properties, potentially displacing local families and university employees who cannot match speculative capital. Local government struggles to balance growth accommodation with affordability preservation for community stakeholders.

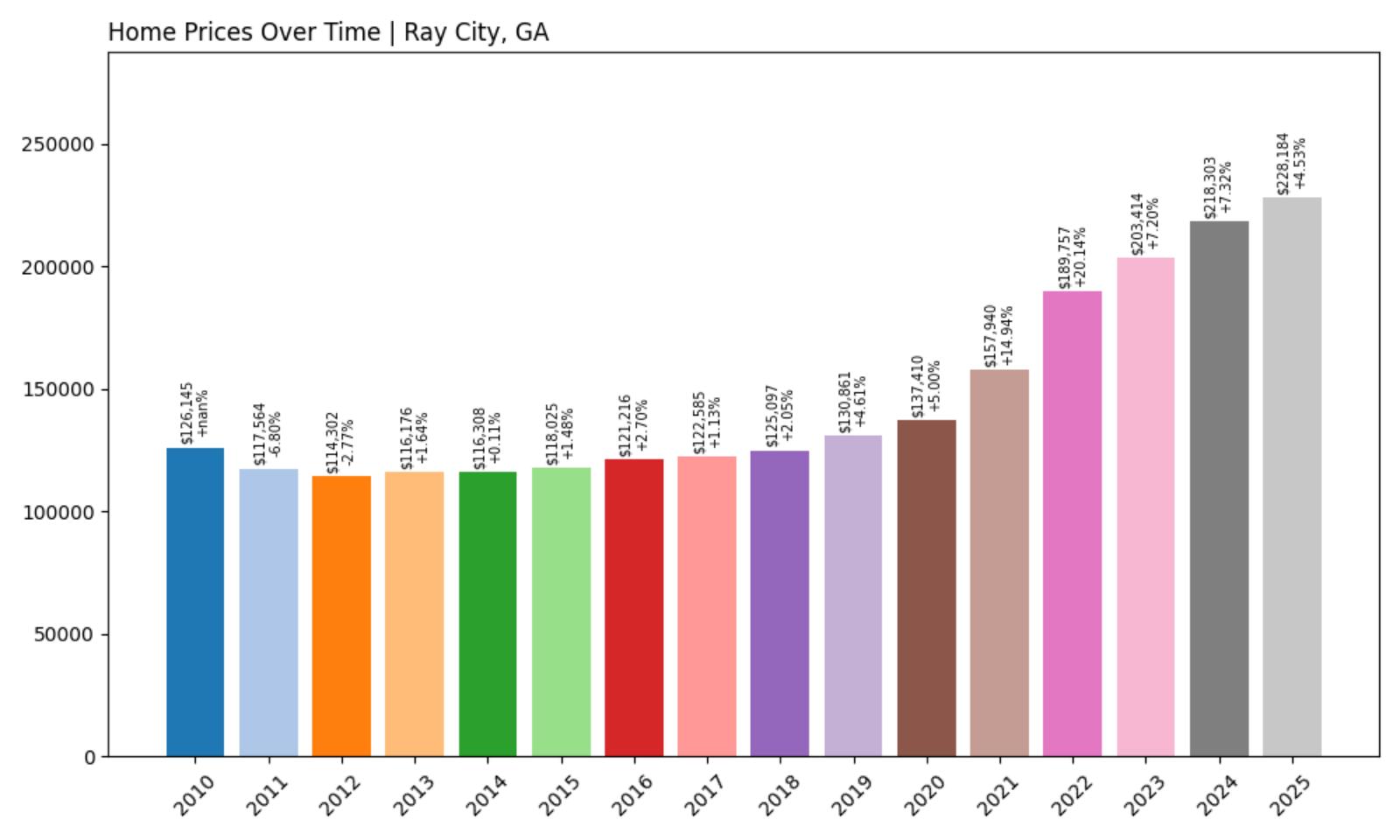

8. Ray City – Investor Feeding Frenzy Factor 21.93% (July 2025)

Would you like to save this?

- Historical annual growth rate (2012–2022): 5.20%

- Recent annual growth rate (2022–2025): 6.34%

- Investor Feeding Frenzy Factor: 21.93%

- Current 2025 price: $228,183.50

Ray City demonstrates intense investor pressure with the feeding frenzy factor approaching 22%, indicating speculation is overwhelming this small Berrien County community. Price acceleration from 5.20% to 6.34% represents significant change from historical norms in a rural market. The current median price of $228,184 reflects growing premium positioning for what remains a small agricultural town.

Ray City – Agricultural Heritage Meets Speculation

Ray City sits in south-central Georgia’s agricultural heartland, where traditional farming communities increasingly attract investors seeking undervalued properties with appreciation potential. The town’s location provides access to Valdosta and other regional centers while maintaining rural affordability that appeals to buyers priced out of urban markets. Agricultural land conversion to residential use creates new housing opportunities and investment potential. The current median price of $228,184 represents substantial appreciation from historically modest levels, driven by investor recognition of value opportunities in rural Georgia markets.

Limited housing inventory due to the small population base means even modest investor activity significantly impacts local pricing and availability. Traditional agricultural economy provides stable employment while new residents bring outside income and spending. Interstate and highway access facilitates commuting to larger employment centers, expanding the potential buyer pool beyond local residents. The feeding frenzy factor of 21.93% indicates aggressive investor competition that risks displacing longtime residents who built the community. Small-town character and rural lifestyle amenities create unique value propositions that justify higher prices to certain buyer segments while challenging local affordability.

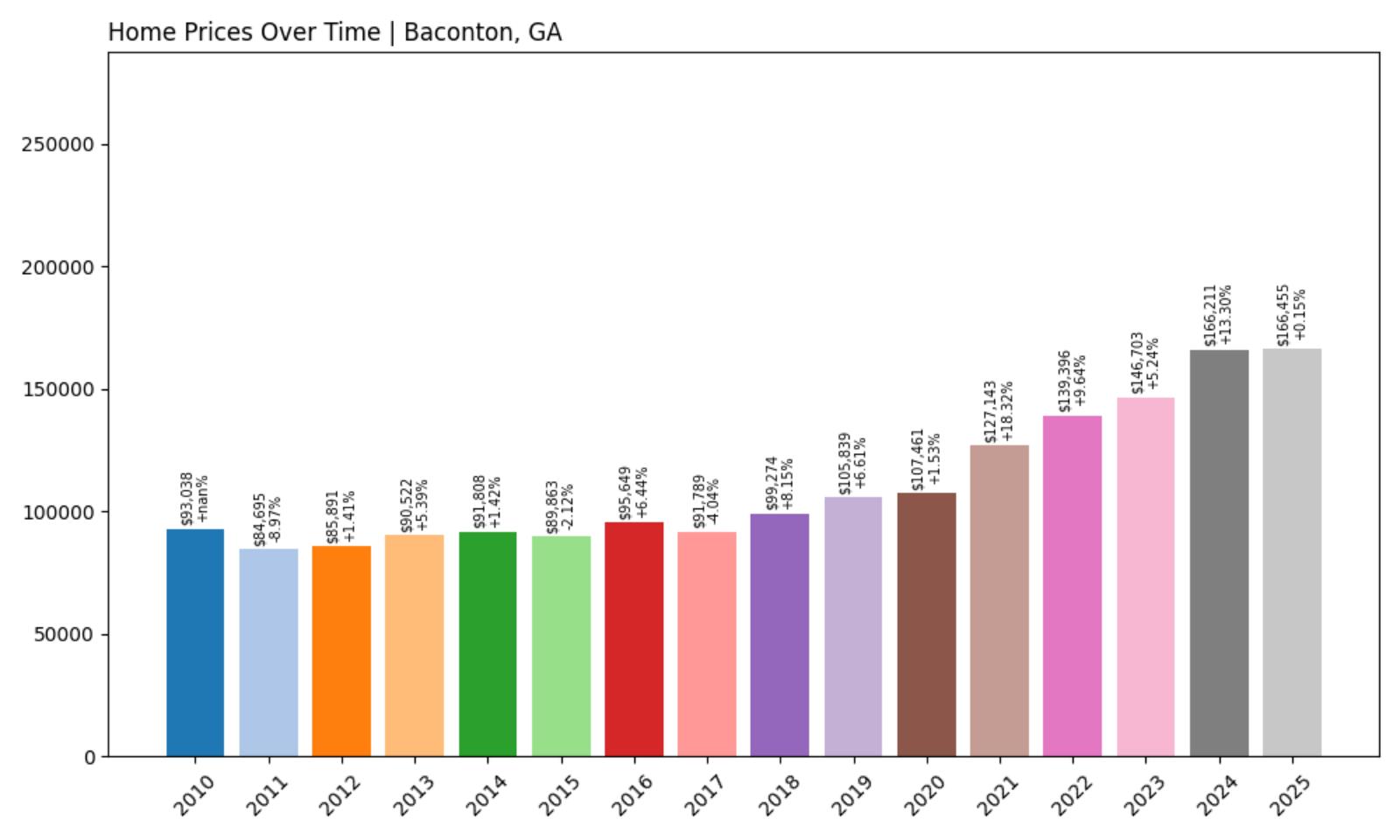

7. Baconton – Investor Feeding Frenzy Factor 22.78% (July 2025)

- Historical annual growth rate (2012–2022): 4.96%

- Recent annual growth rate (2022–2025): 6.09%

- Investor Feeding Frenzy Factor: 22.78%

- Current 2025 price: $166,454.88

Baconton faces significant investor pressure with the feeding frenzy factor exceeding 22%, indicating speculation is transforming this small Mitchell County community. Price acceleration from 4.96% to 6.09% represents meaningful change in a historically stable rural market. Despite recent increases, the current median price of $166,455 maintains relative affordability that continues attracting speculative interest.

Baconton – Value Hunting in Southwest Georgia

Baconton represents classic value-hunting territory for investors seeking maximum appreciation potential in Georgia’s most affordable markets. The small Mitchell County community maintains agricultural roots while benefiting from proximity to Albany and Thomasville’s larger economic centers. Low baseline property values create significant upside potential when outside investment capital discovers previously overlooked markets. The current median price of $166,455 exemplifies the affordability that attracts investors to rural southwest Georgia communities. Traditional farming and agricultural processing provide local employment, while the area’s low cost of living appeals to retirees and remote workers.

Limited housing inventory means investor activity quickly impacts pricing and availability for local residents. Highway access to Albany, Thomasville, and other regional centers expands employment opportunities beyond the immediate area, supporting residential demand from commuters. The feeding frenzy factor of 22.78% indicates investors are actively targeting Baconton despite its rural location and small size. Agricultural heritage and small-town character provide lifestyle amenities that justify premium pricing to certain buyer segments while challenging traditional affordability.

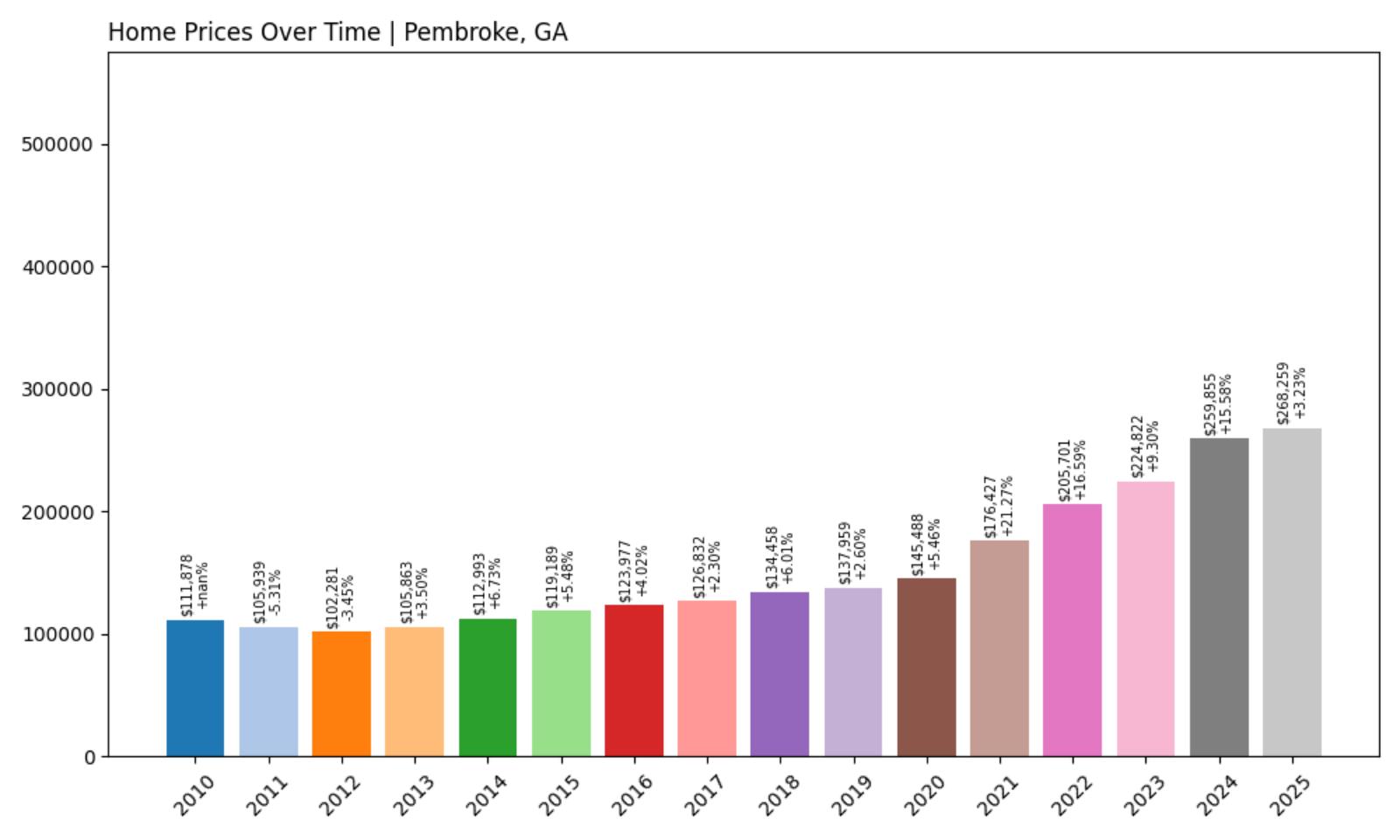

6. Pembroke – Investor Feeding Frenzy Factor 27.88% (July 2025)

- Historical annual growth rate (2012–2022): 7.24%

- Recent annual growth rate (2022–2025): 9.25%

- Investor Feeding Frenzy Factor: 27.88%

- Current 2025 price: $268,259.34

Pembroke shows extreme investor speculation with the feeding frenzy factor approaching 28%, indicating intense competition overwhelming this Bryan County community. Price acceleration from an already elevated 7.24% to 9.25% demonstrates momentum building on established appreciation trends. Current median prices exceeding $268,000 reflect premium positioning driven by speculative pressure.

Pembroke – Savannah Corridor Under Siege

Pembroke sits strategically in Bryan County along the Interstate 16 corridor connecting Savannah to inland Georgia, making it a prime target for investors capitalizing on metropolitan expansion and logistics growth. The community’s proximity to Fort Moore and Savannah’s port facilities creates multiple demand drivers that justify investor interest. Recent population growth reflects broader demographic shifts toward exurban living. The current median price of $268,259 represents dramatic appreciation from previously affordable levels, driven by Savannah area spillover and investor recognition of the I-16 corridor’s development potential. Historical growth rates above 7% annually established strong appreciation trends that recent acceleration has pushed into extreme territory.

Limited housing inventory due to rural zoning constraints intensifies competition when speculative demand increases. Logistics and distribution facilities along the interstate corridor provide employment opportunities while attracting additional investment capital to the region. The feeding frenzy factor of 27.88% indicates investors are aggressively targeting Pembroke, creating bidding wars that price out local families and first-time buyers. Rural character and small-town amenities provide lifestyle benefits that justify premium pricing while undermining traditional affordability for longtime residents.

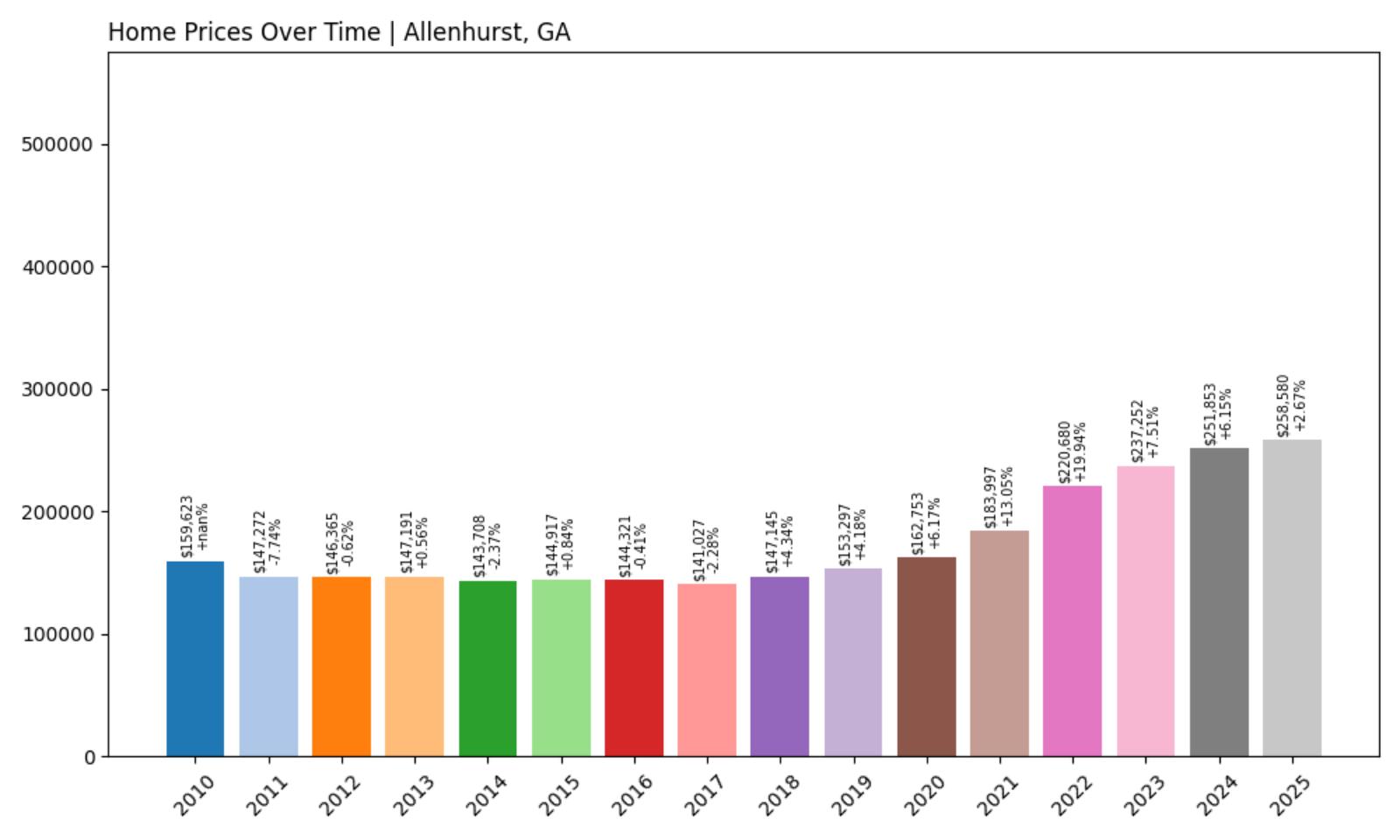

5. Allenhurst – Investor Feeding Frenzy Factor 29.43% (July 2025)

- Historical annual growth rate (2012–2022): 4.19%

- Recent annual growth rate (2022–2025): 5.43%

- Investor Feeding Frenzy Factor: 29.43%

- Current 2025 price: $258,579.95

Allenhurst faces severe investor speculation with the feeding frenzy factor approaching 30%, indicating extreme pressure on this small Liberty County community. While absolute growth rates remain moderate, the acceleration from 4.19% to 5.43% represents dramatic change from historical patterns. Current median prices near $258,580 reflect speculative premium pricing in what remains a rural setting.

Allenhurst – Coastal Proximity Drives Frenzy

Allenhurst benefits from strategic positioning in Liberty County, roughly 45 minutes from Savannah’s coast, where it captures spillover demand from Georgia’s expensive coastal markets. The community’s rural character appeals to buyers seeking space and privacy while maintaining access to coastal employment and recreational opportunities. Recent infrastructure improvements enhance connectivity to major population centers. The current median price of $258,580 represents substantial appreciation from historically modest levels in this agricultural area. Investor interest stems from the combination of coastal proximity, relative affordability, and potential for continued appreciation as coastal Georgia’s population grows.

Limited development and rural zoning create supply constraints that amplify price impacts when speculative demand increases. Military personnel from nearby Fort Stewart and Hunter Army Airfield create additional housing demand, while coastal tourism employment provides service sector opportunities. The feeding frenzy factor of 29.43% indicates extreme investor competition that threatens to displace longtime residents who cannot compete with cash offers and speculative capital. Small community size means even modest investor activity dramatically impacts local housing availability and pricing.

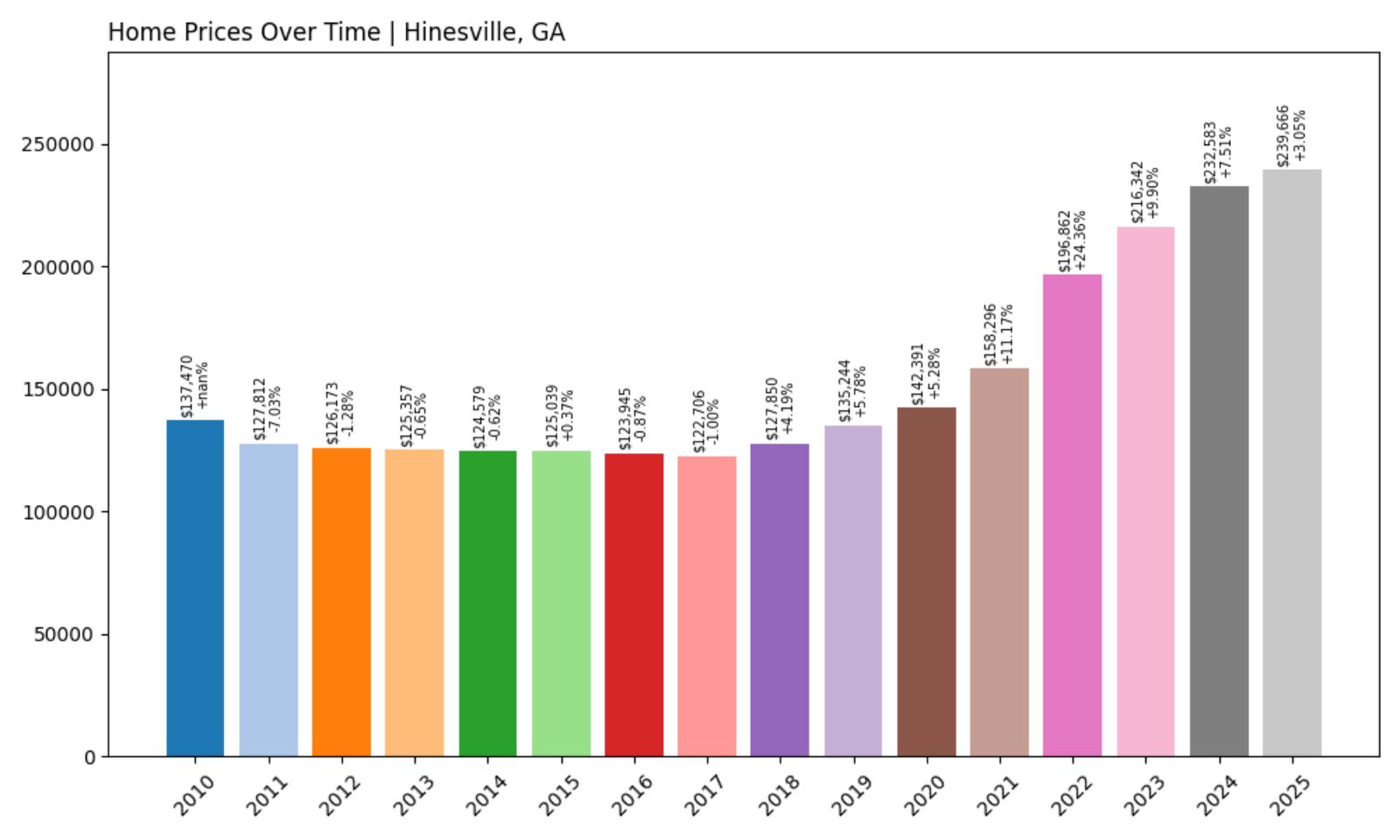

4. Hinesville – Investor Feeding Frenzy Factor 49.00% (July 2025)

- Historical annual growth rate (2012–2022): 4.55%

- Recent annual growth rate (2022–2025): 6.78%

- Investor Feeding Frenzy Factor: 49.00%

- Current 2025 price: $239,665.59

Hinesville experiences extreme investor speculation with the feeding frenzy factor approaching 49%, indicating a full-scale investment assault on this Liberty County military town. Price acceleration from 4.55% to 6.78% represents massive change in market dynamics. Despite speculation, the current median price of $239,666 maintains relative affordability that continues fueling investor interest.

Hinesville – Military Town Under Investment Siege

Would you like to save this?

Hinesville serves Fort Stewart, one of the largest military installations in the United States, creating consistent rental demand that attracts investors seeking reliable cash flow from military housing allowances. The combination of 20,000+ military personnel, defense contractors, and civilian employees provides diverse tenant pools that justify investor confidence. Recent base expansion and modernization projects amplify investment appeal. The current median price of $239,666 offers attractive entry points for investors targeting military rental markets, where housing allowances provide guaranteed rent payments. Military families frequently relocate, creating steady tenant turnover and rental opportunities that appeal to buy-and-hold investors.

Base housing shortages force personnel into private rental markets, supporting premium rental rates. Geographic proximity to Savannah expands employment opportunities beyond the military base, while coastal access provides recreational amenities that enhance rental appeal. The feeding frenzy factor of 49% indicates investors are overwhelming local housing markets, creating bidding wars that displace military families and civilian employees seeking homeownership. Local government struggles to balance economic benefits of investment activity with housing affordability for community stakeholders.

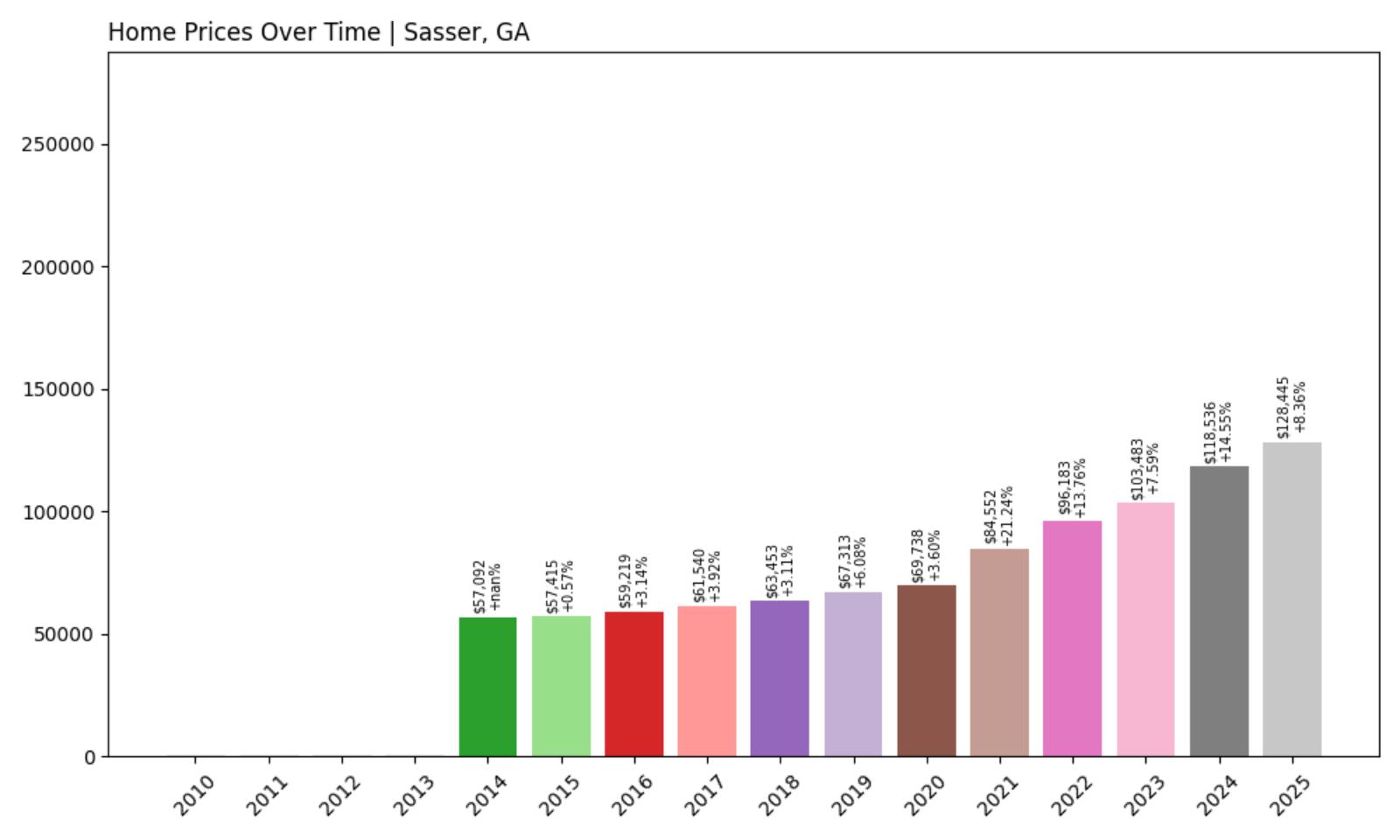

3. Sasser – Investor Feeding Frenzy Factor 50.24% (July 2025)

- Historical annual growth rate (2012–2022): 6.74%

- Recent annual growth rate (2022–2025): 10.12%

- Investor Feeding Frenzy Factor: 50.24%

- Current 2025 price: $128,445.50

Sasser faces catastrophic investor speculation with the feeding frenzy factor exceeding 50%, indicating complete market distortion in this small Terrell County community. Price acceleration from 6.74% to over 10% represents extreme change that transforms market fundamentals. The remarkably low median price of $128,446 explains intense investor interest in what appears to be maximum value opportunity.

Sasser – Extreme Value Play Gone Wrong

Sasser represents the ultimate small-town value play, where rock-bottom property prices attract investors seeking maximum appreciation potential in Georgia’s most affordable markets. The tiny Terrell County community maintains agricultural roots while suffering from economic challenges that historically kept property values suppressed. Investor discovery of these ultra-low prices creates immediate speculation despite limited local economic prospects. The current median price of $128,446 exemplifies extreme affordability that triggers investor feeding frenzies when discovered by outside capital. Many properties trade below $100,000, creating entry points that justify speculative risk even in economically challenged rural areas.

Agricultural heritage and small population base mean limited housing inventory that amplifies price impacts when investment demand materializes. Limited local employment opportunities beyond agriculture and basic services create economic vulnerability, yet investors bet on long-term appreciation potential driven by statewide growth trends. The feeding frenzy factor of 50.24% indicates speculation has completely overwhelmed organic market forces, pricing out local residents who depend on ultra-affordable housing. Small community size means investor activity dramatically alters local demographics and economic relationships.

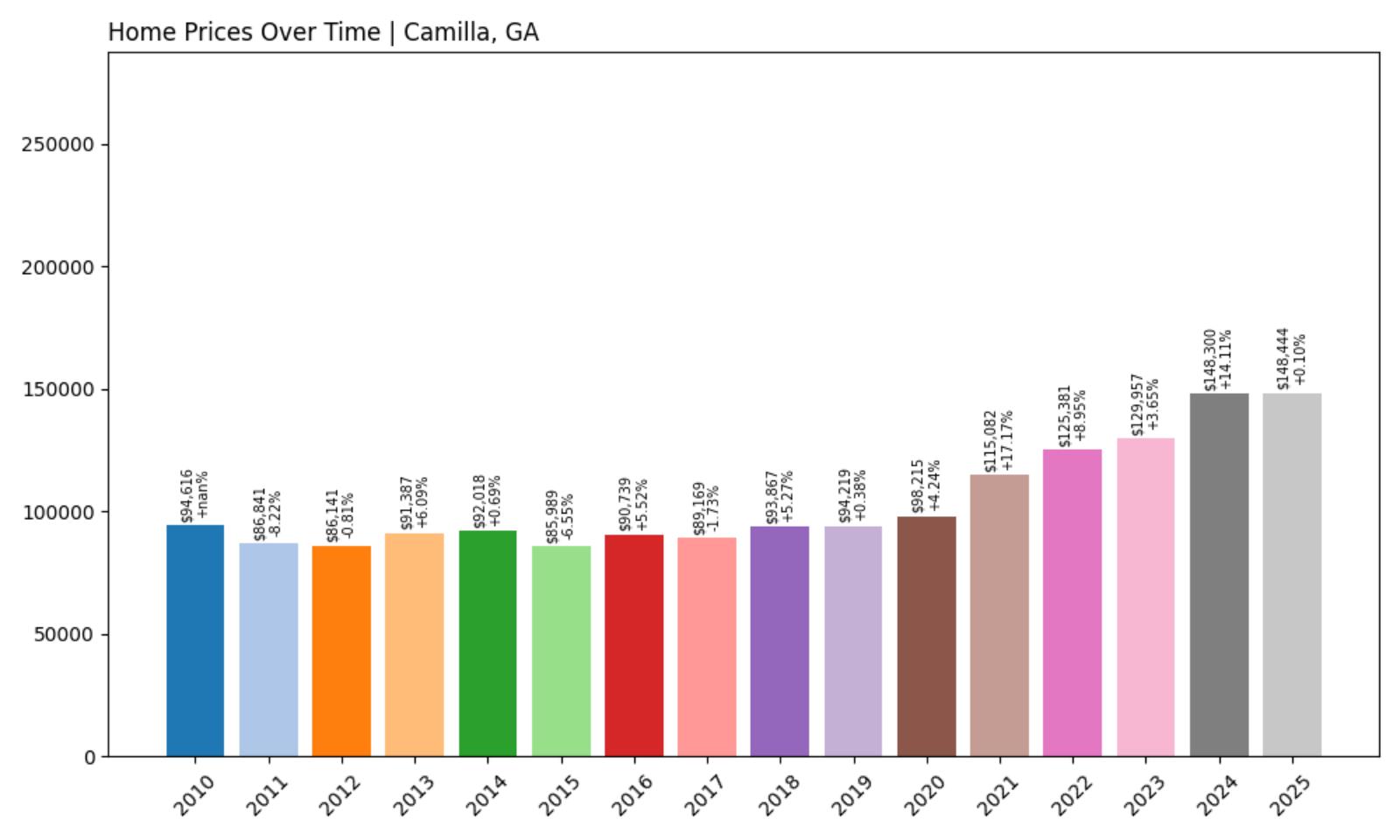

2. Camilla – Investor Feeding Frenzy Factor 51.36% (July 2025)

- Historical annual growth rate (2012–2022): 3.83%

- Recent annual growth rate (2022–2025): 5.79%

- Investor Feeding Frenzy Factor: 51.36%

- Current 2025 price: $148,444.03

Camilla endures severe investor speculation with the feeding frenzy factor exceeding 51%, indicating systematic market manipulation in this Mitchell County seat. Price acceleration from a historically low 3.83% to 5.79% represents fundamental transformation of market dynamics. The current median price of $148,444 maintains extreme affordability that perpetuates speculative interest.

Camilla – County Seat Under Speculative Attack

Camilla serves as Mitchell County’s government center, providing administrative employment and regional services that create basic economic stability in southwest Georgia’s agricultural region. The courthouse, government offices, and related professional services support local employment while the town’s central location provides access to Albany, Thomasville, and other regional centers. Historical economic challenges kept property values suppressed until recent investor discovery. The current median price of $148,444 represents dramatic appreciation from even lower baseline levels, driven by investors recognizing extreme value opportunities in county seat communities.

Government employment provides stability that justifies investor confidence, while the town’s administrative functions ensure continued relevance and basic economic activity. Regional healthcare and educational services complement government employment. Agricultural processing and farming operations in the broader county provide additional economic support, though mechanization limits employment growth. The feeding frenzy factor of 51.36% indicates investors are systematically targeting Camilla properties, creating speculation that overwhelms local buyers and longtime residents. County seat status provides institutional stability that appeals to long-term investors while recent price acceleration attracts short-term speculators.

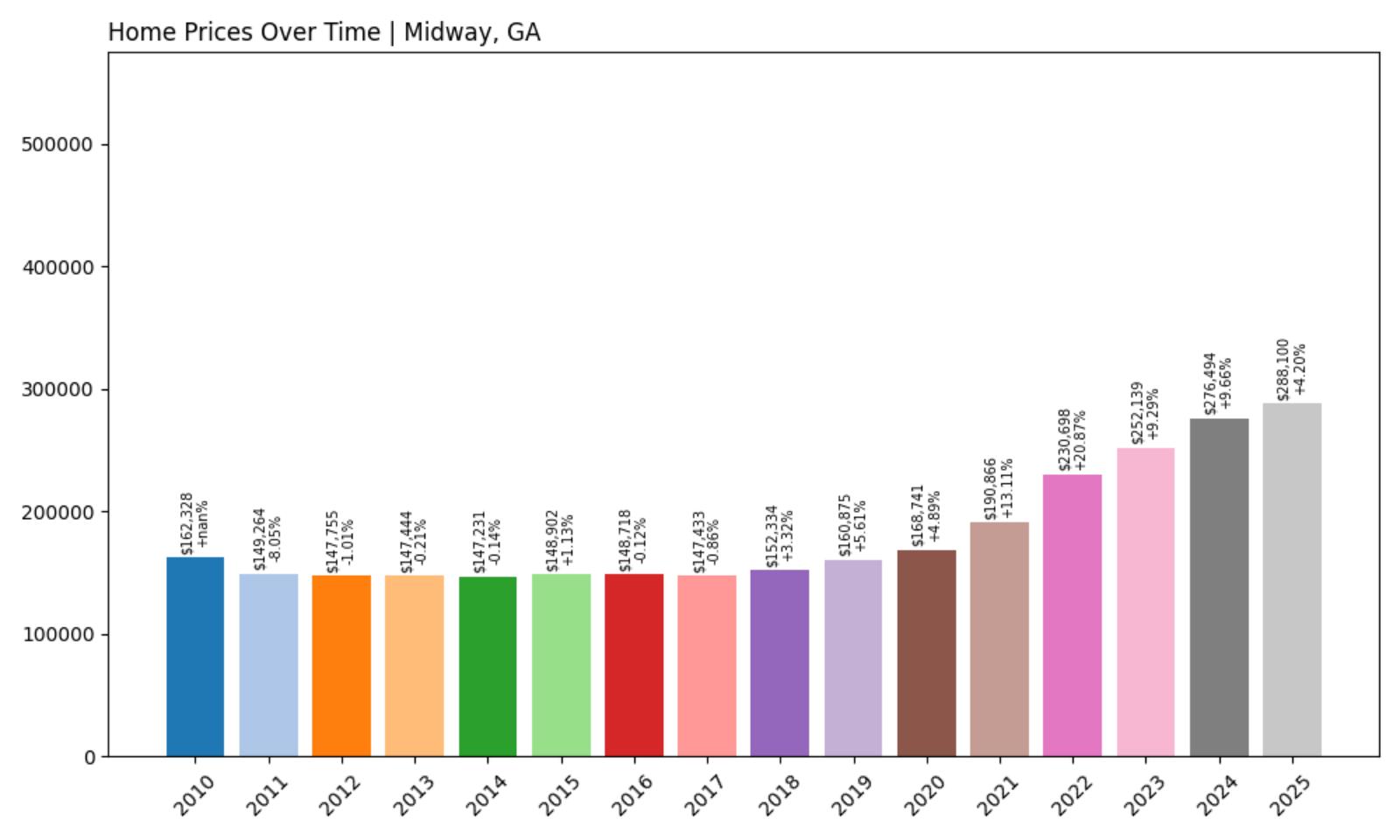

1. Midway – Investor Feeding Frenzy Factor 68.73% (July 2025)

- Historical annual growth rate (2012–2022): 4.56%

- Recent annual growth rate (2022–2025): 7.69%

- Investor Feeding Frenzy Factor: 68.73%

- Current 2025 price: $288,099.55

Midway suffers the most extreme investor speculation in Georgia with a feeding frenzy factor approaching 69%, indicating complete market destruction by speculative capital. Price acceleration from 4.56% to 7.69% represents unprecedented change that eliminates local buyer participation. Despite speculation, the current median price of $288,100 reflects the community’s desirable coastal proximity and development potential.

Midway – Coastal Community Consumed by Speculation

Midway occupies prime real estate in Liberty County between Savannah and the Georgia coast, where its strategic location creates extreme investor interest in what remains one of Georgia’s most developable coastal areas. The historic community benefits from proximity to both Savannah’s employment centers and coastal recreational opportunities while maintaining more affordable entry points than direct beachfront markets. Recent infrastructure improvements enhance accessibility and development potential. The current median price of $288,100 represents massive appreciation driven by investor recognition of Midway’s coastal development potential and metropolitan access. Historical growth rates below 5% annually reflected the area’s rural character, but recent acceleration to nearly 8% indicates speculative capital has discovered the market. Proximity to Savannah International Airport and port facilities creates additional economic opportunities.

Military presence from nearby Fort Stewart and coastal tourism provide diverse economic support, while the area’s natural beauty and recreational access justify premium pricing. The catastrophic feeding frenzy factor of 68.73% indicates investors have completely overwhelmed local housing markets, creating bidding wars that eliminate homeownership opportunities for local families and service workers. Speculation threatens to transform Midway from a working community into an investment playground where longtime residents become economic refugees in their own hometown.