🔥 Would you like to save this?

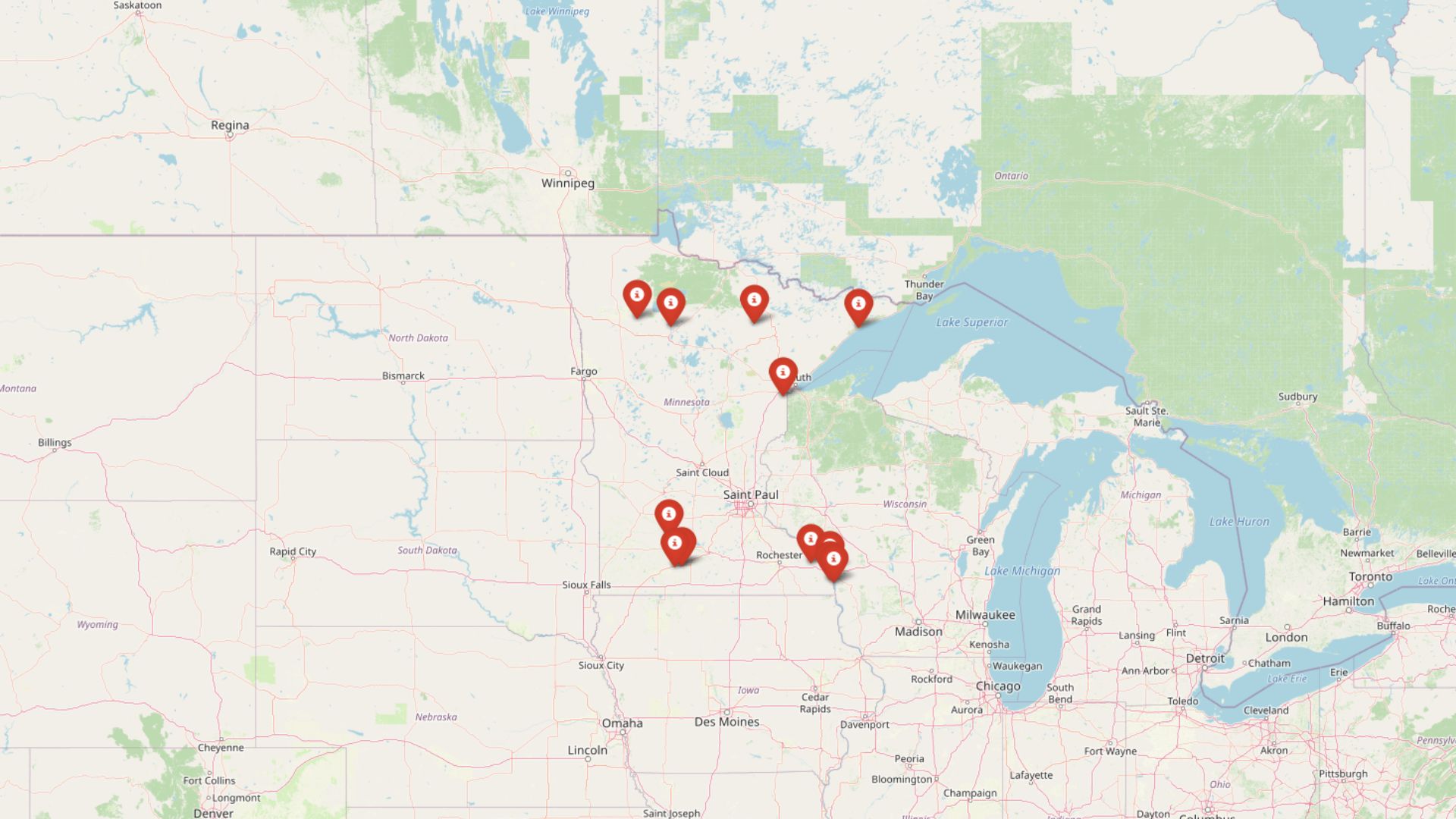

According to the Zillow Home Value Index, home prices in a dozen Minnesota towns are rising at breakneck speed—and not because of steady demand or organic growth. In many cases, price jumps are far outpacing the towns’ long-term trends, pointing to outside investor activity as the driving force. Cash buyers and property speculators are snapping up homes once affordable to working families, reshaping tight-knit communities into high-stakes real estate plays. These are the places where the numbers no longer make sense—and where longtime residents are being pushed to the sidelines.

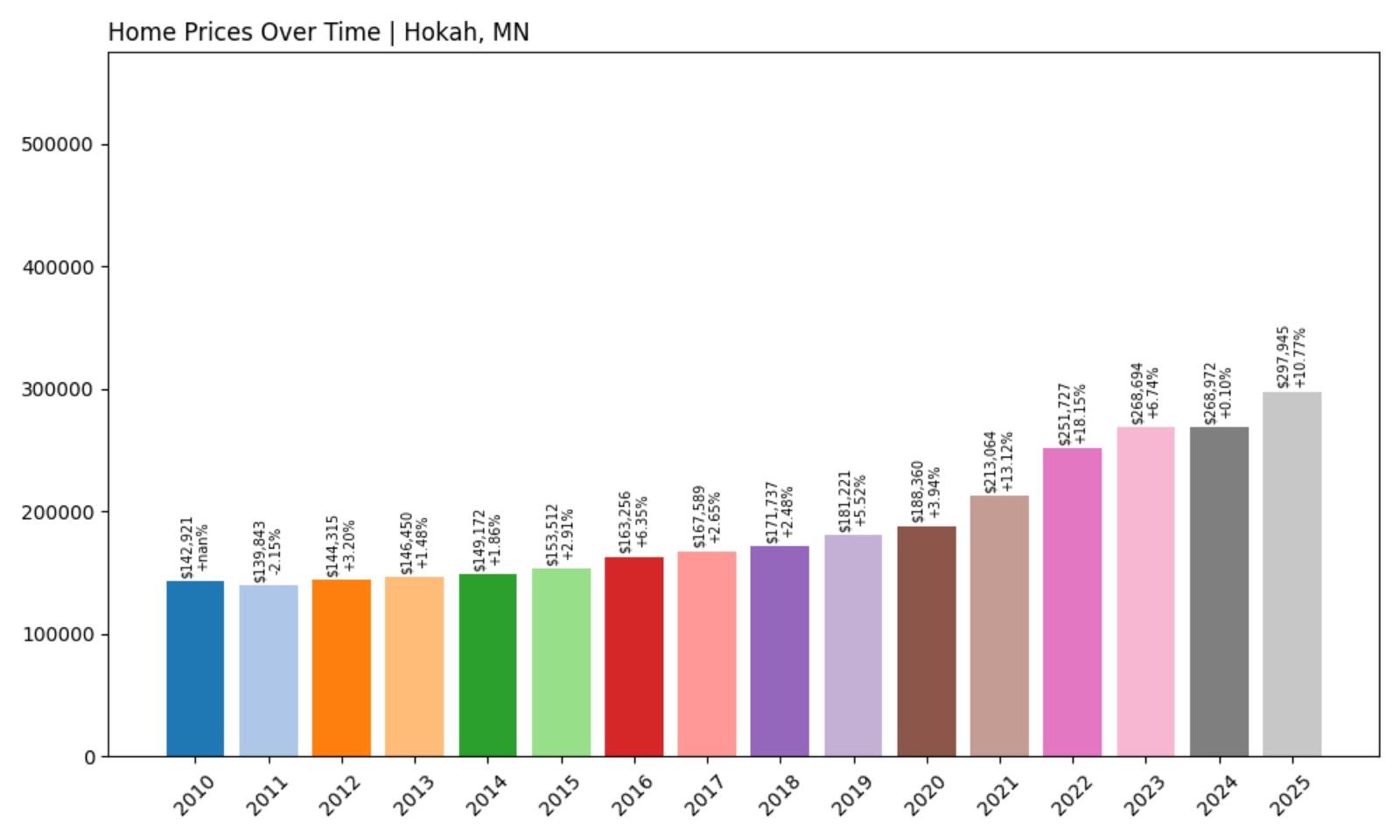

12. Hokah – Investor Feeding Frenzy Factor 1.02% (July 2025)

- Historical annual growth rate (2012–2022): 5.72%

- Recent annual growth rate (2022–2025): 5.78%

- Investor Feeding Frenzy Factor: 1.02%

- Current 2025 price: $297,944.69

Hokah represents the most stable market on this list, with home prices maintaining steady growth that barely exceeds historical patterns. The town’s current median price of $297,945 reflects consistent demand without the dramatic speculation seen elsewhere in Minnesota.

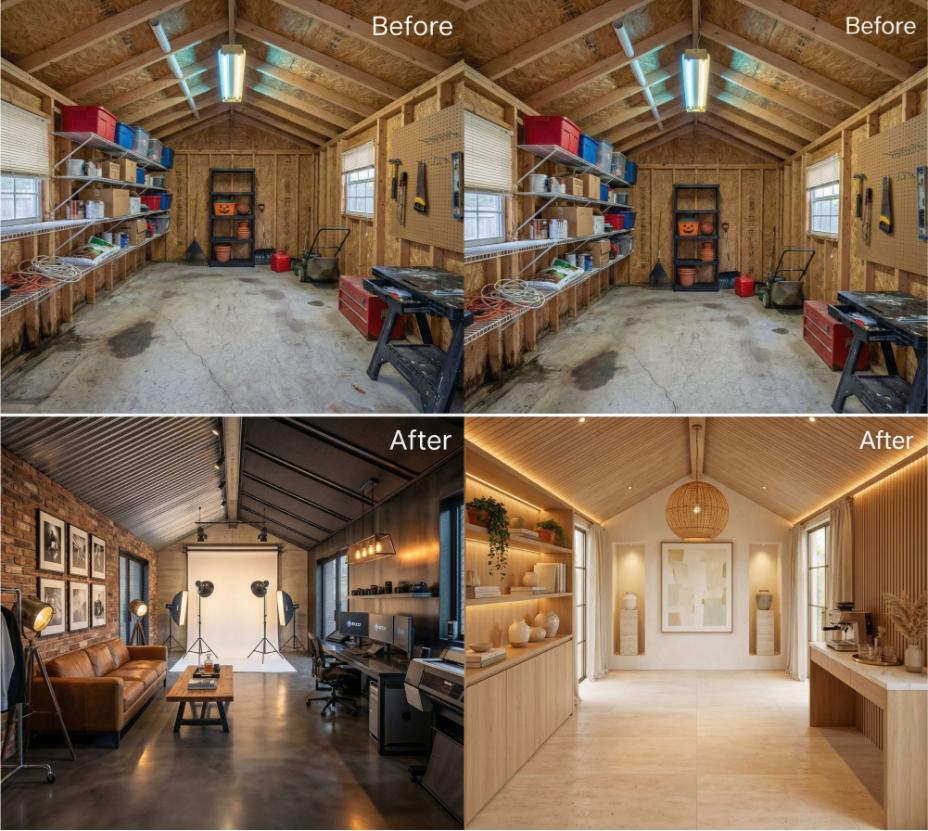

In order to come up with the very specific design ideas, we create most designs with the assistance of state-of-the-art AI interior design software.

Hokah – Steady Growth Along The Mississippi

Hokah sits in Minnesota’s southeastern corner, just minutes from the Iowa border along the Mississippi River. This small Houston County community has maintained remarkably consistent housing appreciation, with recent growth rates of 5.78% barely outpacing its decade-long average of 5.72%. The minimal 1.02% feeding frenzy factor suggests that local market forces, rather than outside speculation, continue to drive property values. The town’s proximity to La Crosse, Wisconsin—just 15 miles northeast—provides residents access to larger employment markets while maintaining small-town affordability.

Hokah’s historic downtown and Mississippi River access have long attracted buyers seeking rural charm without complete isolation. The current median home price of nearly $298,000 reflects steady appreciation driven by genuine housing demand rather than speculative investment. Local real estate patterns show that Hokah’s market remains primarily driven by families and long-term residents rather than investors seeking quick returns. This stability, while positive for existing homeowners, also means the community has largely avoided the dramatic price surges that have made homeownership impossible in other Minnesota towns.

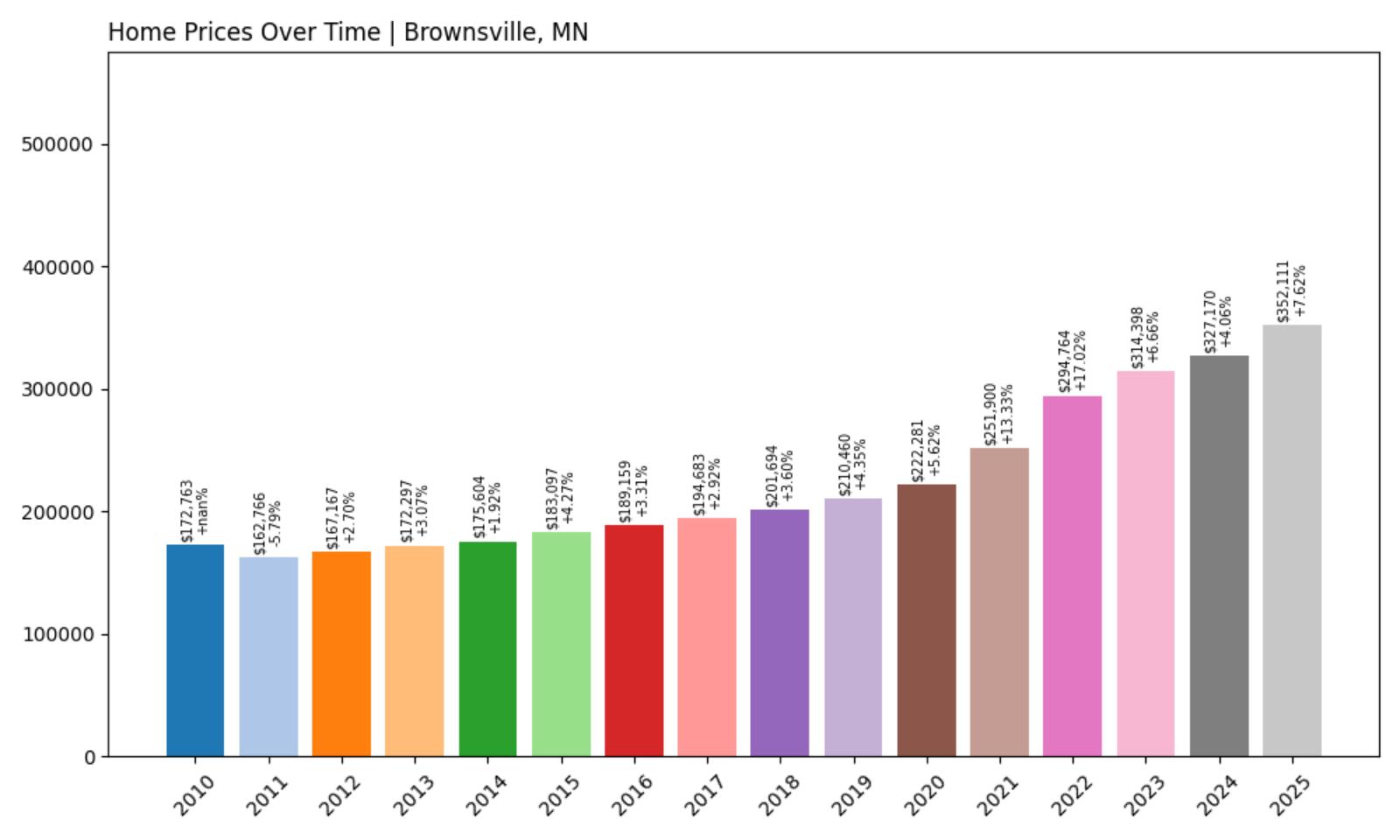

11. Brownsville – Investor Feeding Frenzy Factor 4.61% (July 2025)

- Historical annual growth rate (2012–2022): 5.84%

- Recent annual growth rate (2022–2025): 6.10%

- Investor Feeding Frenzy Factor: 4.61%

- Current 2025 price: $352,110.57

Brownsville shows early signs of speculative pressure with home prices climbing faster than the town’s historical norm. At $352,111, median home values have begun outpacing local wage growth, creating the first warning signs of an investor-driven market shift.

Brownsville – River Town Seeing Price Pressures

Brownsville, located along the Mississippi River in Houston County, has historically been one of Minnesota’s more expensive small towns due to its scenic location and proximity to larger markets. The current median home price of $352,111 represents a significant jump from historical levels, with recent appreciation rates of 6.10% exceeding the town’s decade-long average of 5.84%. This 4.61% feeding frenzy factor indicates that external pressures are beginning to influence what was once a stable local housing market.

Brownsville’s appeal lies in its Mississippi River frontage and historic charm, factors that have increasingly attracted investors seeking undervalued properties in scenic locations. The town’s small size—fewer than 500 residents—means that even modest investor activity can significantly impact overall price trends. The acceleration in home values has begun pricing out some local families, particularly younger residents seeking to purchase their first homes. While the increases aren’t as dramatic as those seen in other Minnesota communities, Brownsville represents an early-stage example of how investor interest can gradually transform small-town housing markets from affordable to exclusive.

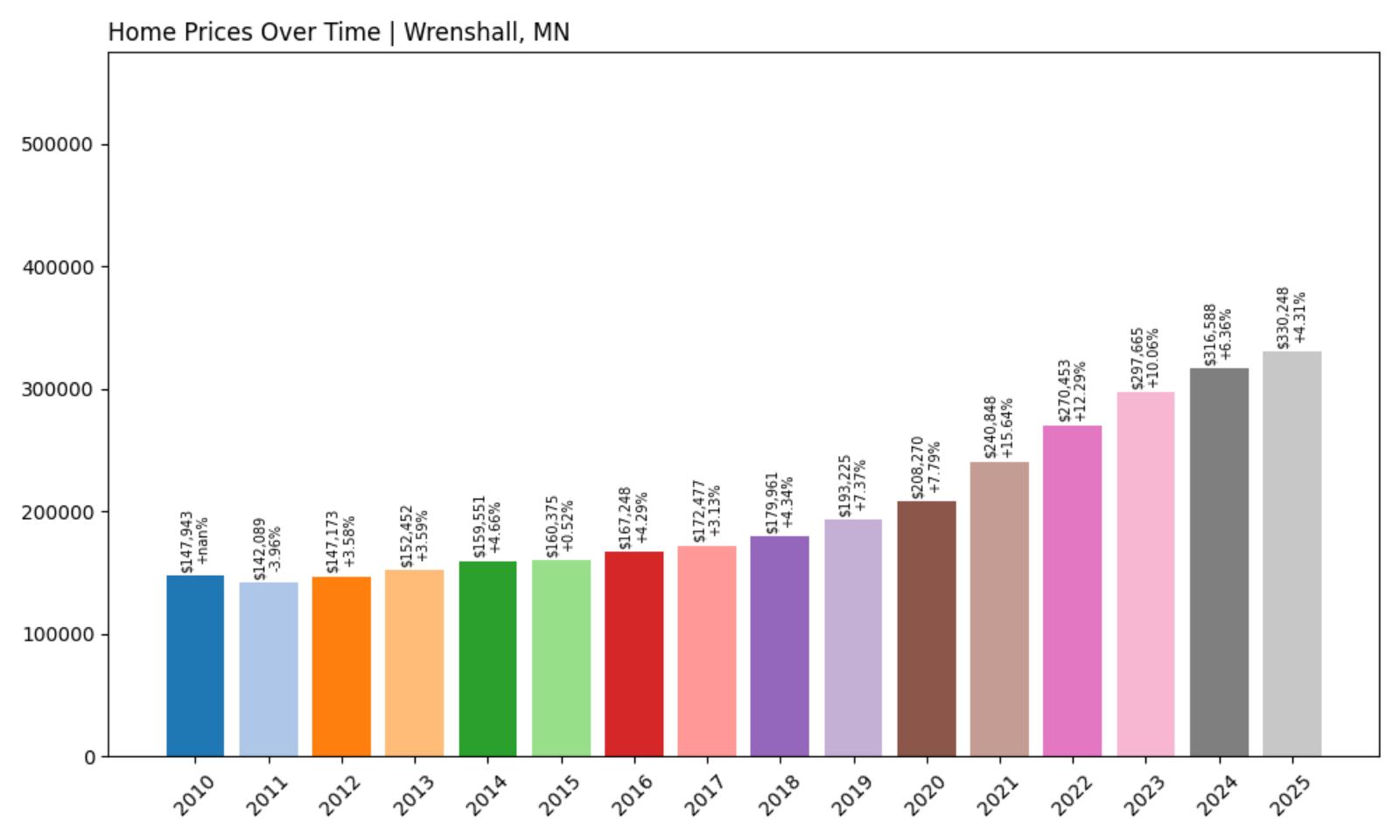

10. Wrenshall – Investor Feeding Frenzy Factor 9.74% (July 2025)

- Historical annual growth rate (2012–2022): 6.27%

- Recent annual growth rate (2022–2025): 6.88%

- Investor Feeding Frenzy Factor: 9.74%

- Current 2025 price: $330,248.07

Wrenshall’s housing market shows clear acceleration beyond historical norms, with the 9.74% feeding frenzy factor indicating growing speculative interest. The current median price of $330,248 reflects increasing pressure on this Carlton County community’s traditionally affordable housing stock.

Wrenshall – Duluth Proximity Drives Speculation

Wrenshall sits strategically between Duluth and the Twin Cities along Highway 210, making it an attractive target for investors seeking properties with growth potential. The town’s recent annual appreciation rate of 6.88% significantly exceeds its historical average of 6.27%, creating a feeding frenzy factor of 9.74% that signals speculative activity is beginning to reshape the local market. Located in Carlton County, Wrenshall offers residents small-town living within commuting distance of Duluth’s employment opportunities. This accessibility has made the community increasingly attractive to investors who recognize that proximity to larger markets often drives long-term property appreciation.

The current median home price of $330,248 represents substantial increases that are beginning to price out local working families. The town’s modest size means that investor purchases have an outsized impact on overall market dynamics. Properties that once sold primarily to local families are increasingly going to buyers seeking investment returns, fundamentally altering the community’s housing accessibility and potentially its long-term character as a place where working families can afford to live.

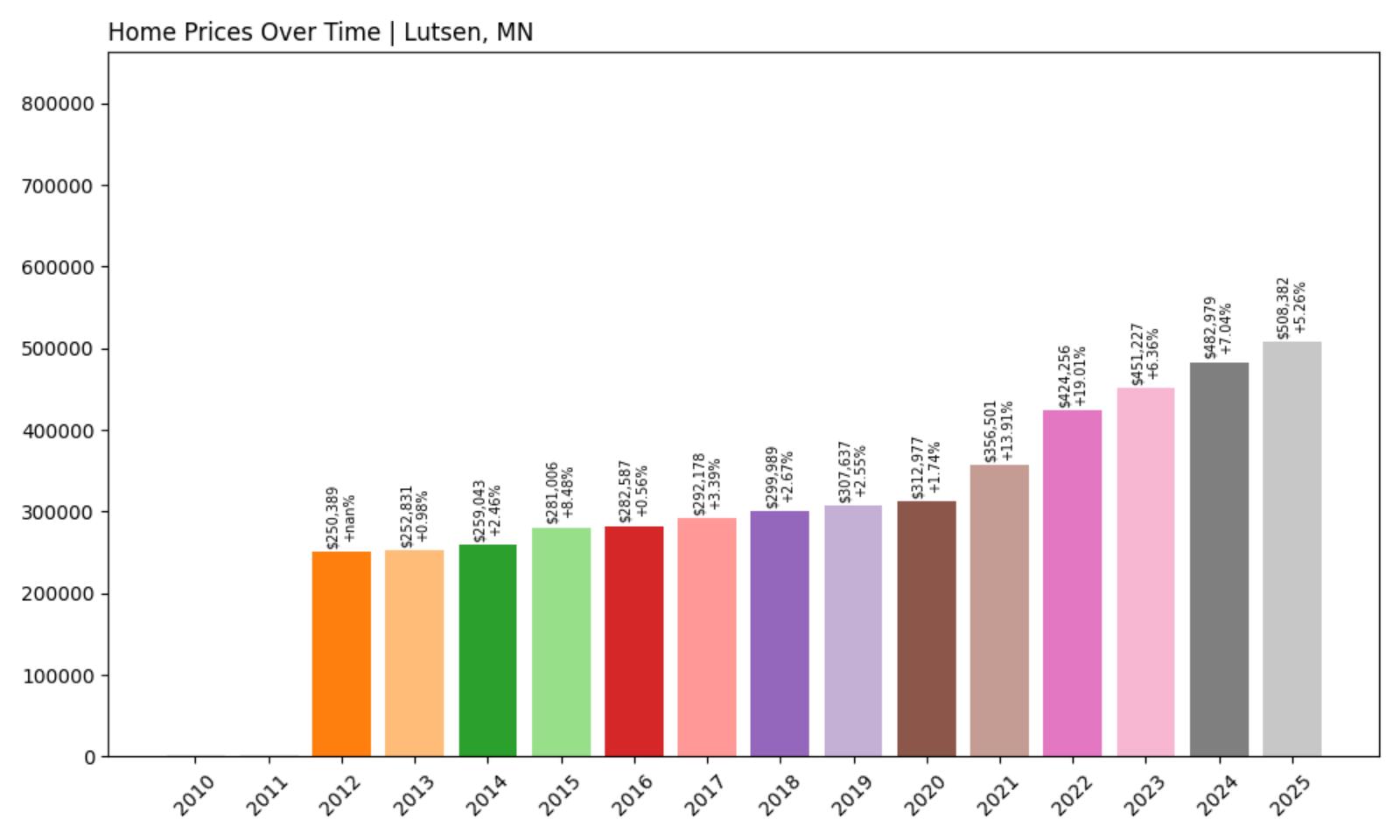

9. Lutsen – Investor Feeding Frenzy Factor 14.79% (July 2025)

- Historical annual growth rate (2012–2022): 5.41%

- Recent annual growth rate (2022–2025): 6.22%

- Investor Feeding Frenzy Factor: 14.79%

- Current 2025 price: $508,381.59

Lutsen’s tourism-driven economy has attracted significant speculative investment, pushing the median home price above $508,000. The 14.79% feeding frenzy factor reflects how resort communities become targets for investors seeking vacation rental properties and second homes.

Lutsen – Resort Town Speculation Soars

Lutsen, nestled along Lake Superior’s North Shore, has long been Minnesota’s premier ski and resort destination, making it a natural target for real estate speculation. The current median home price of $508,382 represents the highest values on this list, driven by investors seeking vacation rental properties and second homes in this scenic Cook County community.

The town’s 14.79% feeding frenzy factor reflects how tourist destinations become magnets for speculative investment that far exceeds local economic fundamentals. While Lutsen’s historical appreciation averaged 5.41% annually, recent growth has accelerated to 6.22%, creating pricing pressures that make homeownership nearly impossible for the service workers who keep the resort economy running. This dynamic creates a troubling cycle where the very people who work in Lutsen’s hotels, restaurants, and ski facilities cannot afford to live in the community. The influx of investment capital has transformed what were once affordable homes for local families into high-priced properties oriented toward tourists and seasonal residents, fundamentally altering the town’s year-round community character.

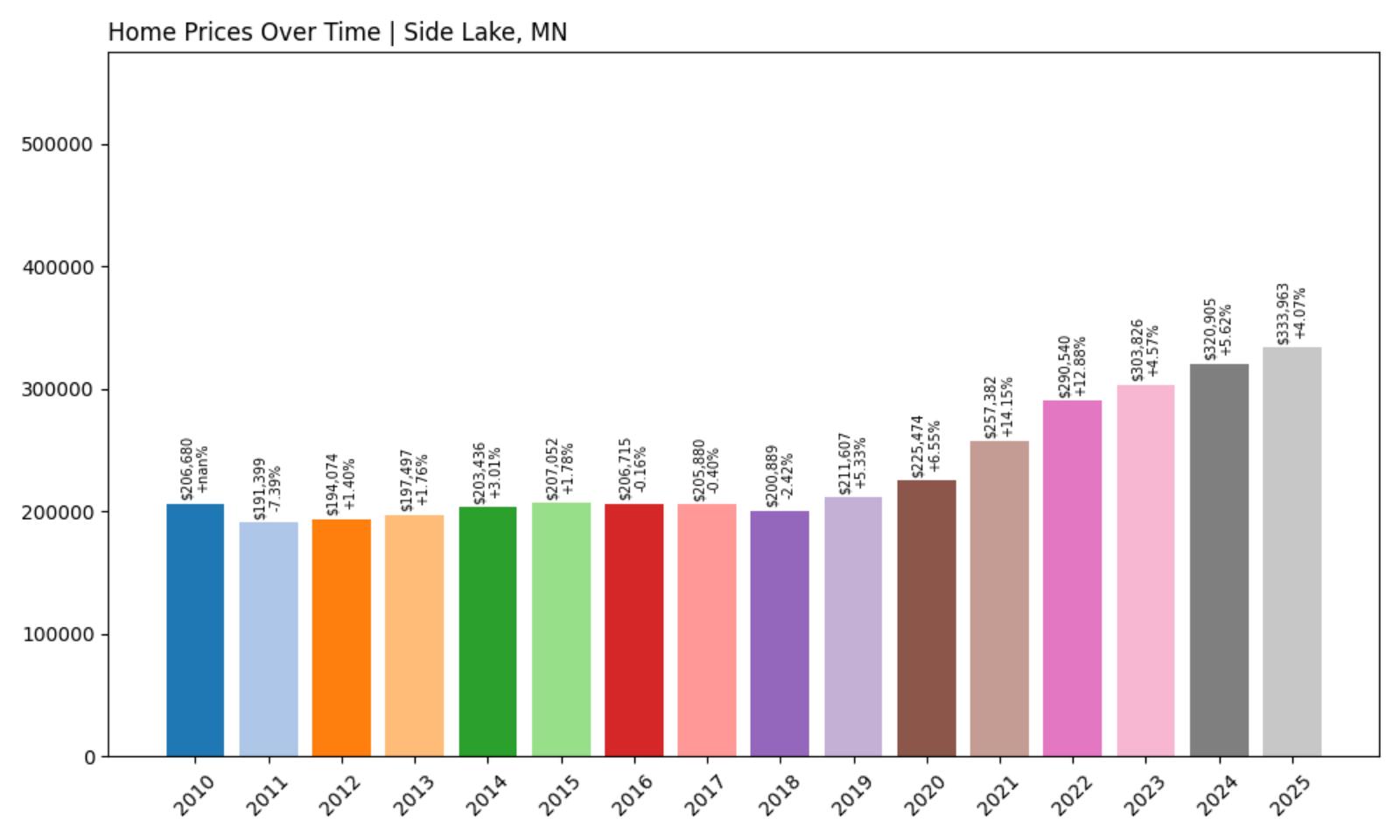

8. Side Lake – Investor Feeding Frenzy Factor 15.42% (July 2025)

- Historical annual growth rate (2012–2022): 4.12%

- Recent annual growth rate (2022–2025): 4.75%

- Investor Feeding Frenzy Factor: 15.42%

- Current 2025 price: $333,962.68

Side Lake demonstrates how even modest price acceleration can create significant affordability challenges in smaller communities. The 15.42% feeding frenzy factor shows that external investment pressures are reshaping this traditionally affordable Itasca County town.

Side Lake – Iron Range Investment Pressure

Side Lake, located in Minnesota’s Iron Range region of Itasca County, has historically offered some of the state’s most affordable housing due to its rural location and distance from major employment centers. However, recent investor interest has begun accelerating price growth beyond what local wages can support, with appreciation jumping from a historical average of 4.12% to 4.75% annually. The town’s 15.42% feeding frenzy factor indicates that outside capital is discovering value in communities once considered too remote for speculation.

Side Lake’s proximity to Superior National Forest and numerous recreational lakes has made it attractive to investors seeking properties for vacation rentals or long-term appreciation plays in Minnesota’s northland. At a current median price of $333,963, homes in Side Lake remain more affordable than many Minnesota communities, but the acceleration in values threatens to price out local families whose incomes haven’t kept pace. This pattern is particularly concerning in Iron Range communities where mining-dependent economies have struggled, making housing affordability crucial for retaining working families in the region.

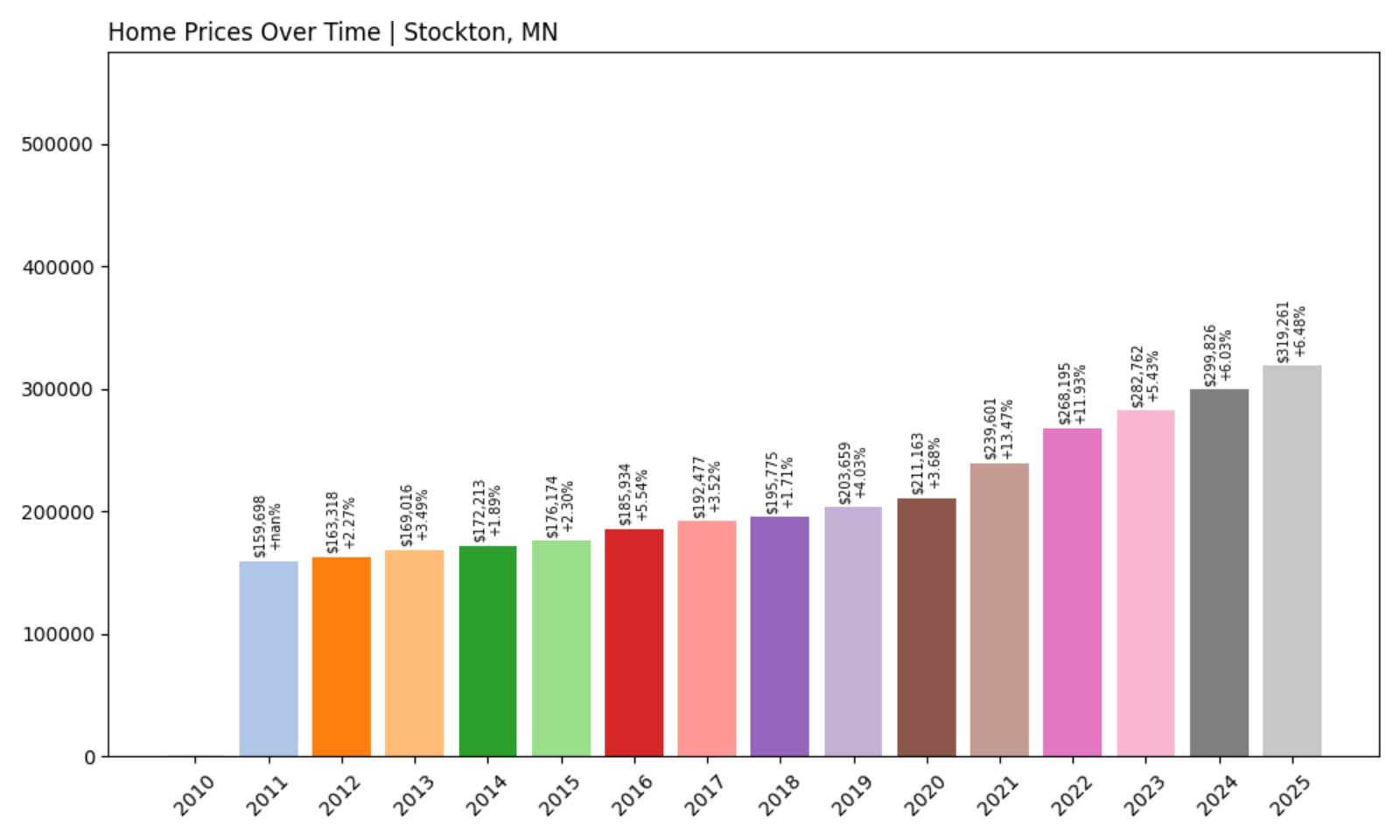

7. Stockton – Investor Feeding Frenzy Factor 17.64% (July 2025)

- Historical annual growth rate (2012–2022): 5.09%

- Recent annual growth rate (2022–2025): 5.98%

- Investor Feeding Frenzy Factor: 17.64%

- Current 2025 price: $319,261.33

Stockton’s 17.64% feeding frenzy factor reveals significant speculative pressure in this Winona County community. With home prices jumping to $319,261, the town exemplifies how investor activity can rapidly transform affordable rural markets.

Stockton – Mississippi Valley Speculation

Stockton sits in the scenic bluff country of southeastern Minnesota along the Mississippi River valley, a location that has increasingly attracted investor attention as buyers seek undervalued properties in picturesque settings. The town’s feeding frenzy factor of 17.64% shows that appreciation has accelerated well beyond historical norms, with recent growth of 5.98% significantly exceeding the decade-long average of 5.09%. This Winona County community has traditionally served as an affordable option for families working in nearby Winona or Rochester, but the current median home price of $319,261 represents substantial increases that threaten this accessibility.

The town’s small size means that investor purchases have an immediate and pronounced impact on overall market dynamics. Stockton’s proximity to major recreational areas and its Mississippi River location make it attractive to investors seeking properties for vacation rentals or long-term appreciation. However, this outside interest is fundamentally altering a housing market that once primarily served local families, creating affordability challenges that could reshape the community’s demographics and economic base.

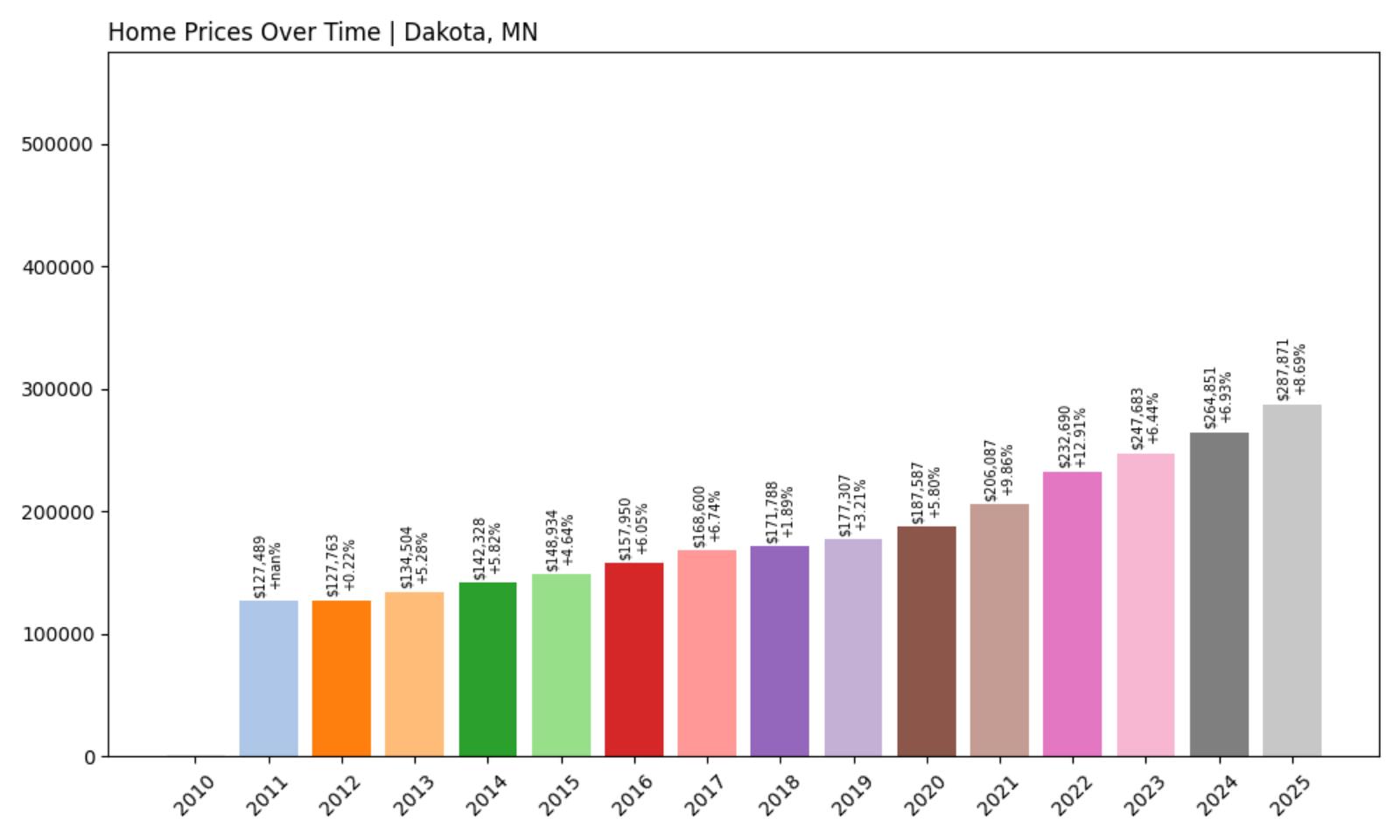

6. Dakota – Investor Feeding Frenzy Factor 18.98% (July 2025)

🔥 Would you like to save this?

- Historical annual growth rate (2012–2022): 6.18%

- Recent annual growth rate (2022–2025): 7.35%

- Investor Feeding Frenzy Factor: 18.98%

- Current 2025 price: $287,870.96

Dakota shows concerning acceleration in home price growth, with the 18.98% feeding frenzy factor indicating strong speculative pressures. Despite a current median price of $287,871, the rapid appreciation threatens to price out local families in this Winona County community.

Dakota – Bluff Country Under Pressure

Dakota, located in Minnesota’s scenic bluff country region of Winona County, has seen its housing market transformed by investor interest seeking undervalued properties in picturesque rural settings. The town’s appreciation rate has jumped from a historical average of 6.18% to 7.35% annually, creating an 18.98% feeding frenzy factor that signals significant speculative activity. The current median home price of $287,871 still represents relative affordability compared to larger Minnesota markets, but the acceleration in values threatens the accessibility that has long characterized this small community.

Dakota’s location among the rolling hills and bluffs of southeastern Minnesota makes it attractive to investors seeking properties for vacation rentals or long-term appreciation in scenic locations. This investor interest is fundamentally reshaping a housing market that once primarily served local farming families and workers in nearby towns. The rapid price acceleration creates particular challenges for young families seeking to establish roots in the community, potentially altering Dakota’s long-term demographic character and economic sustainability as investor-owned properties replace owner-occupied family homes.

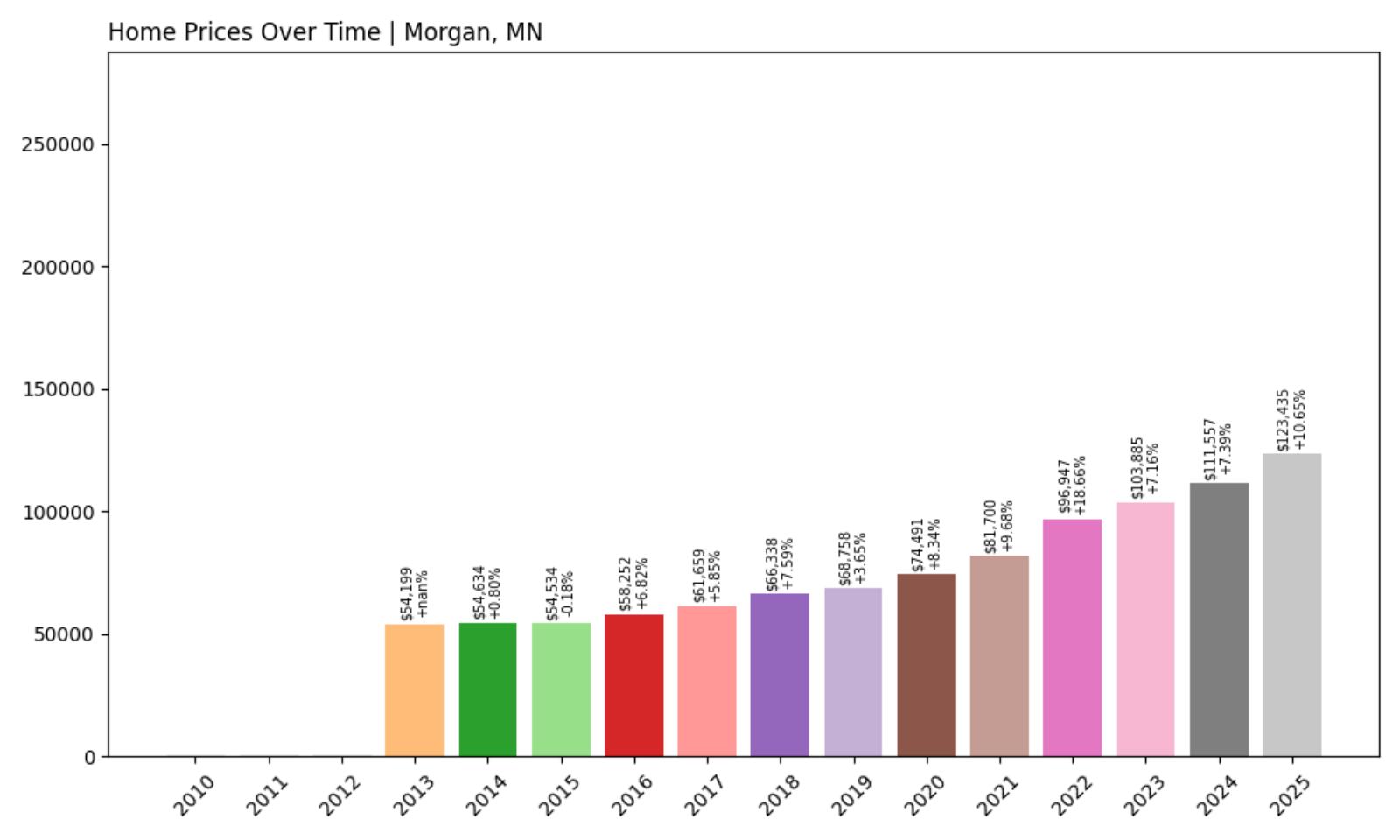

5. Morgan – Investor Feeding Frenzy Factor 25.62% (July 2025)

- Historical annual growth rate (2012–2022): 6.67%

- Recent annual growth rate (2022–2025): 8.38%

- Investor Feeding Frenzy Factor: 25.62%

- Current 2025 price: $123,434.86

Morgan demonstrates how even communities with very affordable housing can experience dramatic speculative pressure. The 25.62% feeding frenzy factor shows significant acceleration despite the current median price of just $123,435, indicating investors are targeting undervalued markets.

Morgan – Rural Investment Surge

Morgan, a small Redwood County community in southwestern Minnesota, exemplifies how investors are increasingly targeting rural towns with extremely affordable housing for speculative opportunities. Despite maintaining a median home price of just $123,435—among the lowest in the state—the town has experienced dramatic acceleration in appreciation rates, jumping from 6.67% historically to 8.38% recently. This 25.62% feeding frenzy factor represents one of the most significant speculative pressures on the list, showing that investors are discovering value even in Minnesota’s most remote agricultural communities.

Morgan’s location in the state’s farming heartland traditionally kept housing costs low to support agricultural workers and rural families, but outside investment is rapidly changing this dynamic. The concerning aspect of Morgan’s market transformation is that even very affordable housing is becoming targets for speculation. Properties that once provided entry-level homeownership opportunities for farming families and rural workers are increasingly being purchased by investors who recognize that dramatic percentage gains are possible when starting from such low baseline values, potentially pricing out the very families these communities depend on for their economic survival.

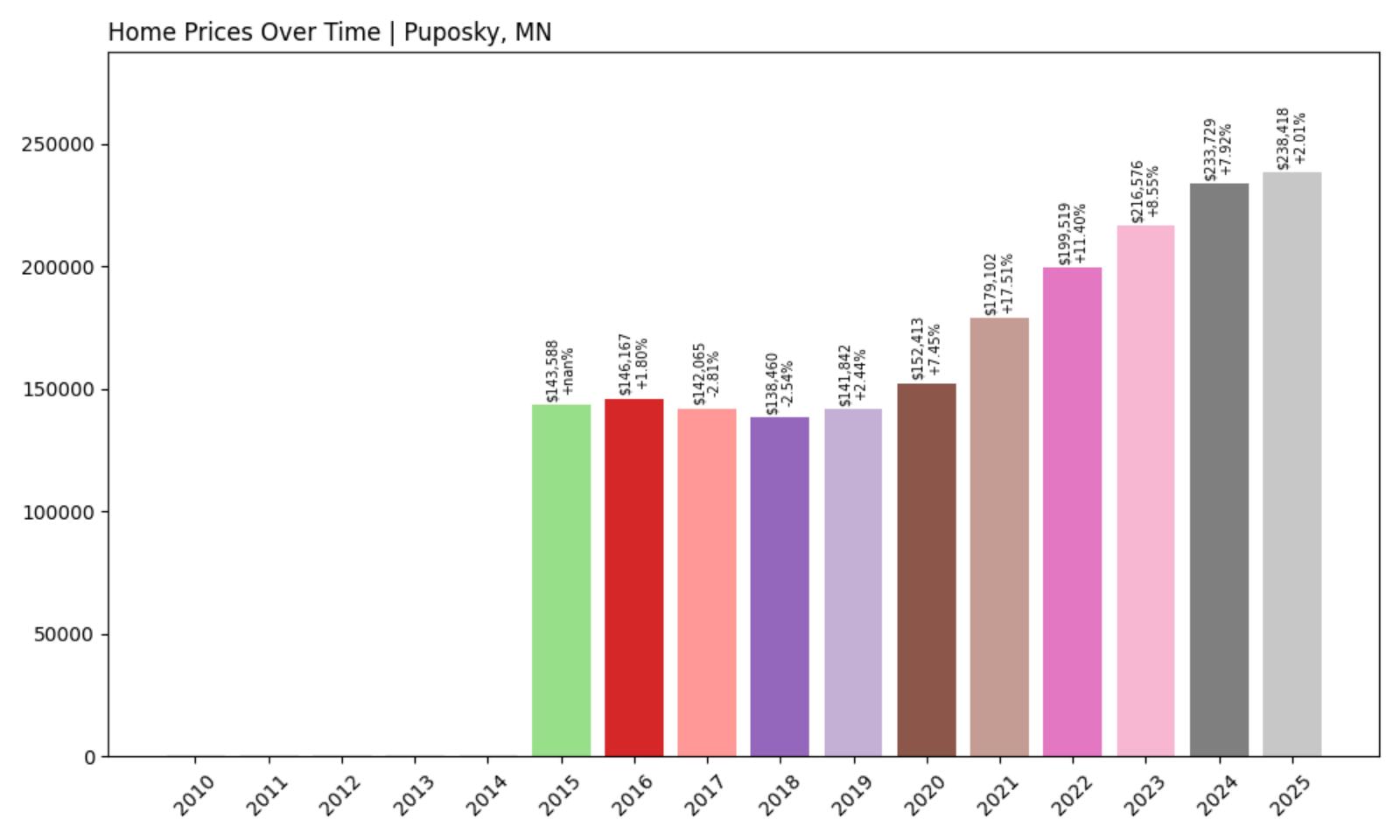

4. Puposky – Investor Feeding Frenzy Factor 27.13% (July 2025)

- Historical annual growth rate (2012–2022): 4.81%

- Recent annual growth rate (2022–2025): 6.12%

- Investor Feeding Frenzy Factor: 27.13%

- Current 2025 price: $238,418.23

Puposky shows dramatic speculation with a 27.13% feeding frenzy factor as investors discover this remote Beltrami County community. The current median price of $238,418 reflects rapid acceleration that threatens affordability in this traditionally low-cost northern Minnesota town.

Puposky – Northern Minnesota Speculation

Puposky, a small Beltrami County community in northern Minnesota, has become an unlikely target for real estate speculation despite its remote location and historically modest housing costs. The town’s feeding frenzy factor of 27.13% reflects dramatic acceleration as appreciation rates jumped from 4.81% historically to 6.12% recently, representing a significant shift in market dynamics.

Located in Minnesota’s northland among lakes and forests, Puposky traditionally offered some of the state’s most affordable housing, with the current median price of $238,418 still reflecting relative accessibility. However, the rapid appreciation threatens to price out local families whose incomes are tied to the region’s natural resource economy and limited employment opportunities. The speculative interest in Puposky appears driven by investors seeking undervalued properties in recreational areas, particularly those with lake access and proximity to state and national forests. This outside investment is transforming what was once a stable market serving local families into a speculative target, creating affordability challenges that could fundamentally alter the community’s character and economic base.

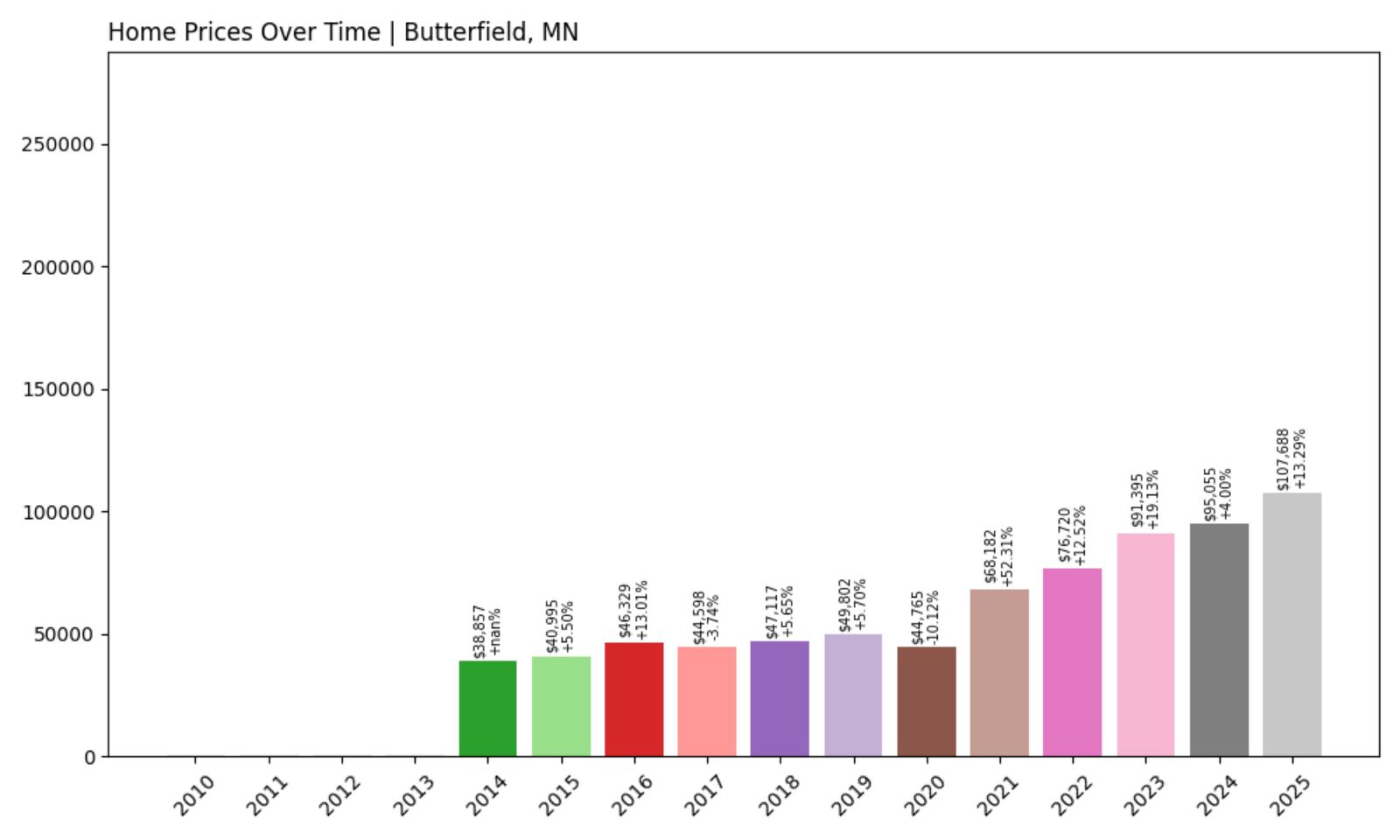

3. Butterfield – Investor Feeding Frenzy Factor 34.82% (July 2025)

- Historical annual growth rate (2012–2022): 8.88%

- Recent annual growth rate (2022–2025): 11.97%

- Investor Feeding Frenzy Factor: 34.82%

- Current 2025 price: $107,687.59

Butterfield exhibits extreme speculative pressure with a 34.82% feeding frenzy factor, even though the median home price remains just $107,688. This Watonwan County town shows how investors target the lowest-priced markets for maximum percentage returns.

Butterfield – Extreme Rural Speculation

Butterfield, located in south-central Minnesota’s Watonwan County, represents one of the most dramatic examples of investor speculation targeting extremely affordable rural markets. Despite maintaining the lowest median home price on this list at just $107,688, the town has experienced explosive growth acceleration, with appreciation jumping from an already-high 8.88% historically to an unsustainable 11.97% recently. The 34.82% feeding frenzy factor reveals that investors have discovered this small agricultural community as an opportunity for dramatic percentage returns.

Butterfield’s location in Minnesota’s farming heartland traditionally kept housing costs extremely low to support agricultural workers and rural families, but speculative investment is rapidly transforming this market dynamic. This investor interest in such an affordable market creates particularly troubling implications for local families. Properties that once provided entry-level homeownership opportunities for farming families and rural workers are increasingly being purchased by investors who recognize that dramatic gains are possible when starting from such low baseline values. The speculation threatens to eliminate the very housing affordability that has allowed working families to remain in rural agricultural communities.

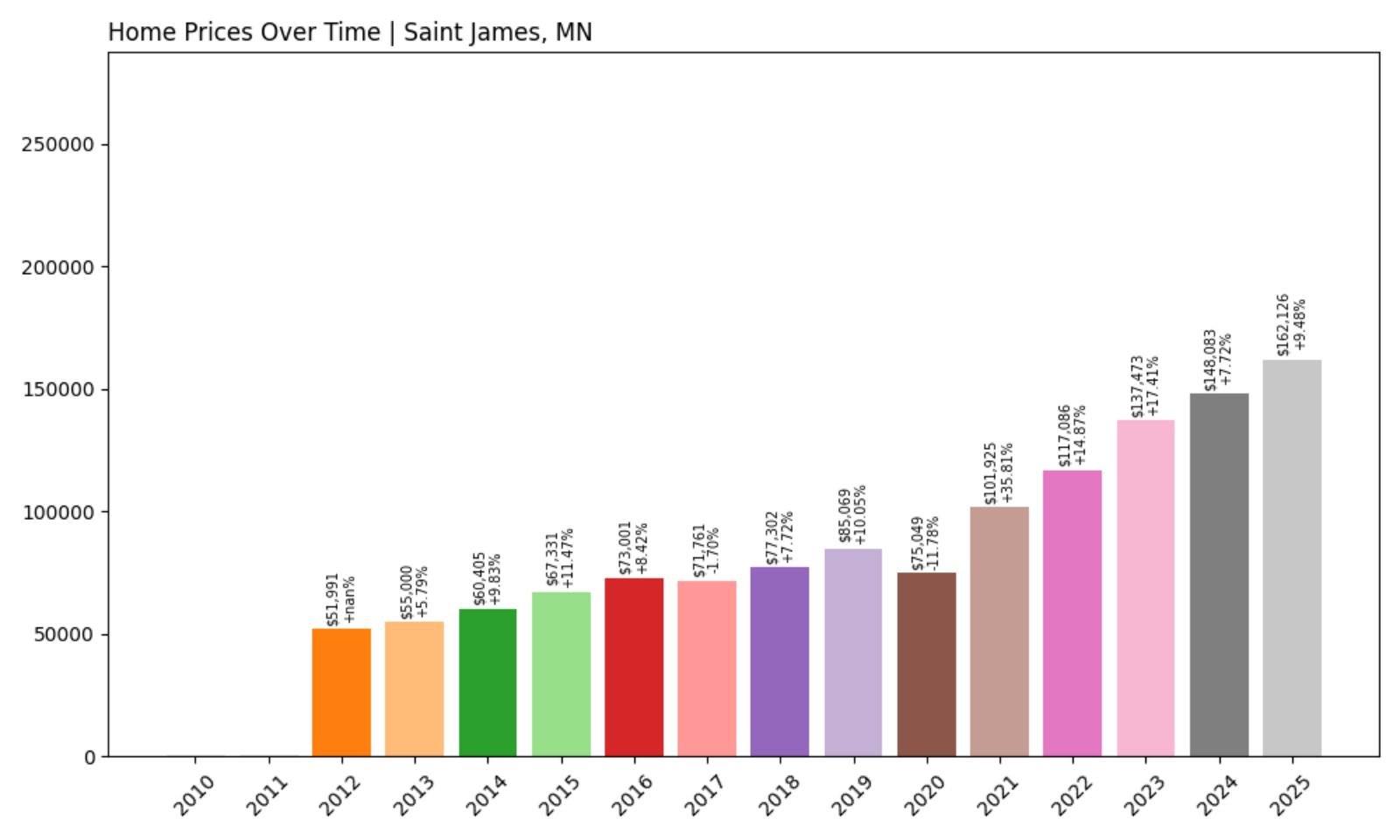

2. Saint James – Investor Feeding Frenzy Factor 35.50% (July 2025)

- Historical annual growth rate (2012–2022): 8.46%

- Recent annual growth rate (2022–2025): 11.46%

- Investor Feeding Frenzy Factor: 35.50%

- Current 2025 price: $162,125.86

Saint James shows severe speculative pressure with a 35.50% feeding frenzy factor as investors target this affordable Watonwan County market. The current median price of $162,126 reflects dramatic acceleration that threatens to eliminate traditional affordability for local families.

Saint James – Agricultural Community Under Siege

Saint James, the largest community on this list with approximately 4,500 residents, demonstrates how even substantial rural towns cannot escape investor speculation targeting affordable Minnesota markets. Located in Watonwan County in south-central Minnesota, the town has experienced dramatic price acceleration with appreciation jumping from 8.46% historically to 11.46% recently, creating a devastating 35.50% feeding frenzy factor. The current median home price of $162,126 reflects substantial increases that threaten the affordability that has long made Saint James an attractive option for families working in agriculture and related industries.

As a regional center for farming communities, Saint James traditionally provided accessible homeownership opportunities for workers whose incomes are tied to agricultural cycles and commodity prices. Investor interest appears driven by recognition that regional centers like Saint James offer infrastructure and amenities that smaller rural towns lack, while still maintaining dramatically lower prices than urban markets. However, this speculation is fundamentally altering the housing accessibility that has allowed working families to remain in rural Minnesota, potentially undermining the economic foundation of agricultural communities that depend on retaining local workers and families.

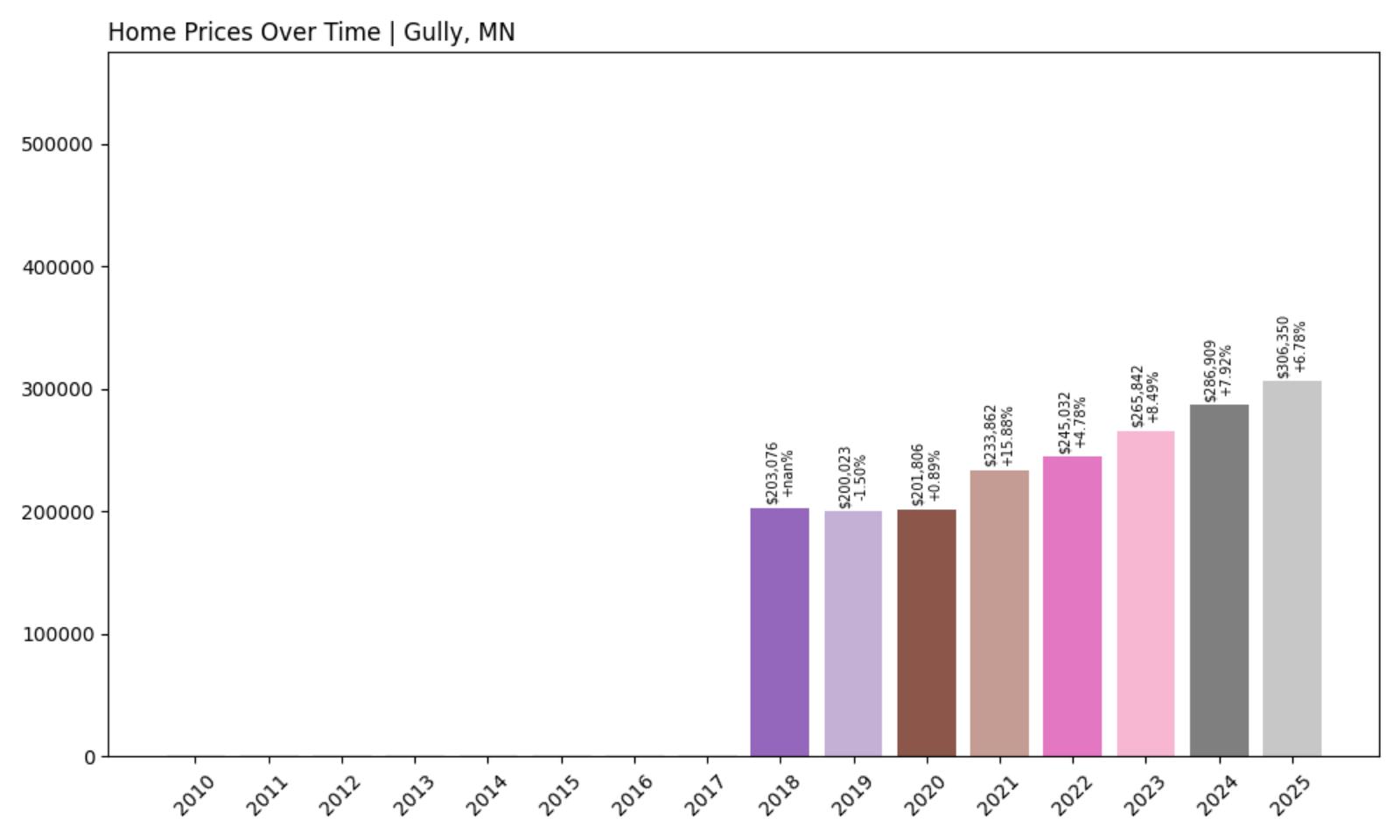

1. Gully – Investor Feeding Frenzy Factor 60.78% (July 2025)

- Historical annual growth rate (2012–2022): 4.81%

- Recent annual growth rate (2022–2025): 7.73%

- Investor Feeding Frenzy Factor: 60.78%

- Current 2025 price: $306,350.42

Gully tops the list with an extreme 60.78% feeding frenzy factor, showing devastating speculative pressure in this Polk County community. The current median price of $306,350 reflects dramatic acceleration that exemplifies how investor activity can completely transform small-town housing markets.

Gully – Speculation Reaches Crisis Levels

Gully, a small Polk County community in northwestern Minnesota, represents the most extreme example of investor speculation reshaping rural housing markets in the state. The town’s 60.78% feeding frenzy factor reveals that appreciation has accelerated far beyond any reasonable connection to local economic fundamentals, with growth jumping from 4.81% historically to 7.73% recently.

Located in Minnesota’s agricultural northwest, Gully traditionally offered affordable housing for farming families and workers in the region’s potato and sugar beet operations. However, the current median home price of $306,350 reflects dramatic increases that have fundamentally altered the town’s accessibility for local families whose incomes remain tied to agricultural cycles and commodity prices. The extreme speculation in Gully appears to represent investors seeking maximum percentage returns in undervalued rural markets, recognizing that even modest absolute price increases translate to significant gains when starting from low baseline values. This investor activity has created a crisis of affordability that threatens the very survival of working families in rural agricultural communities, potentially undermining the economic foundation that has sustained these towns for generations.