Would you like to save this?

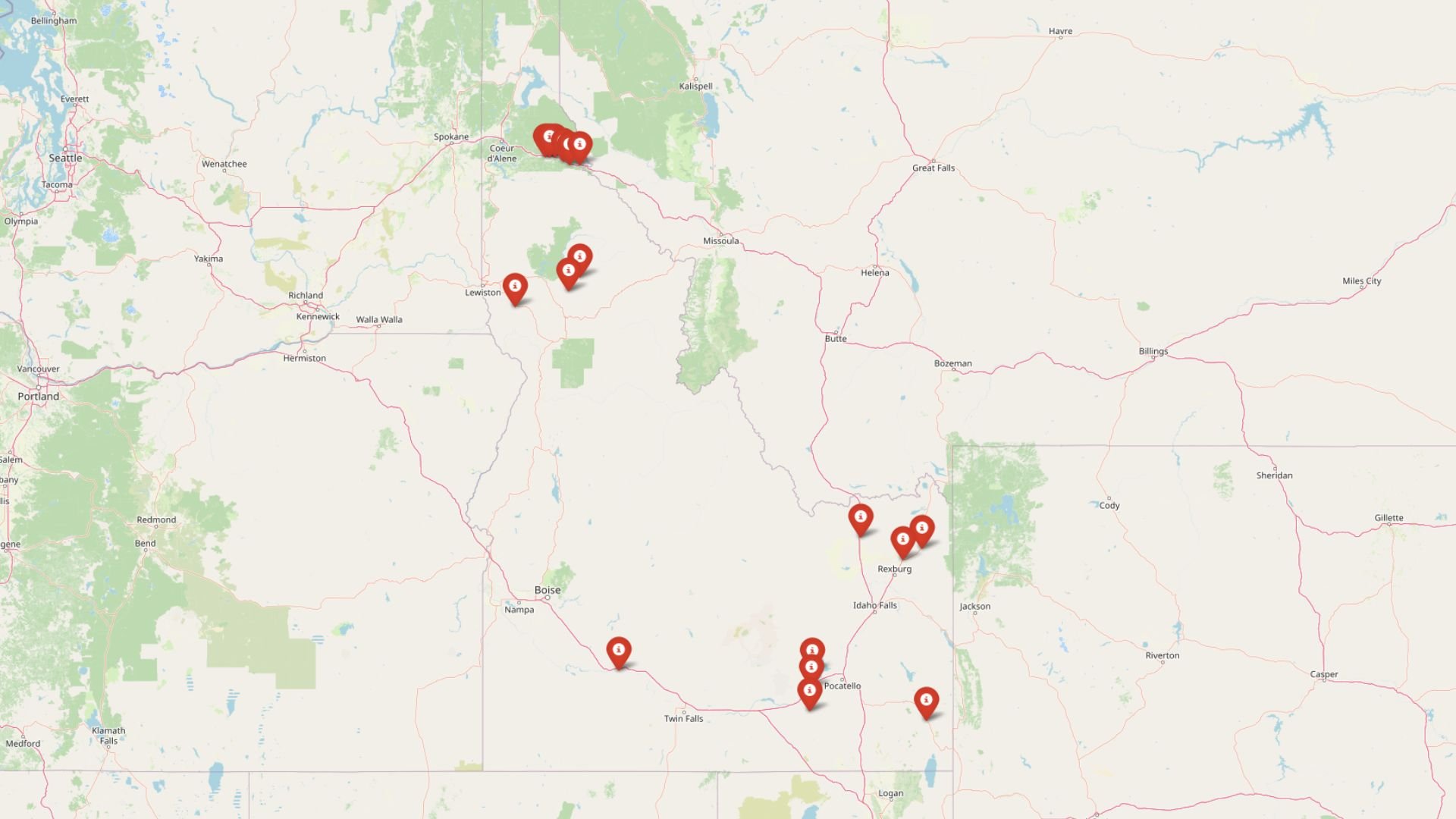

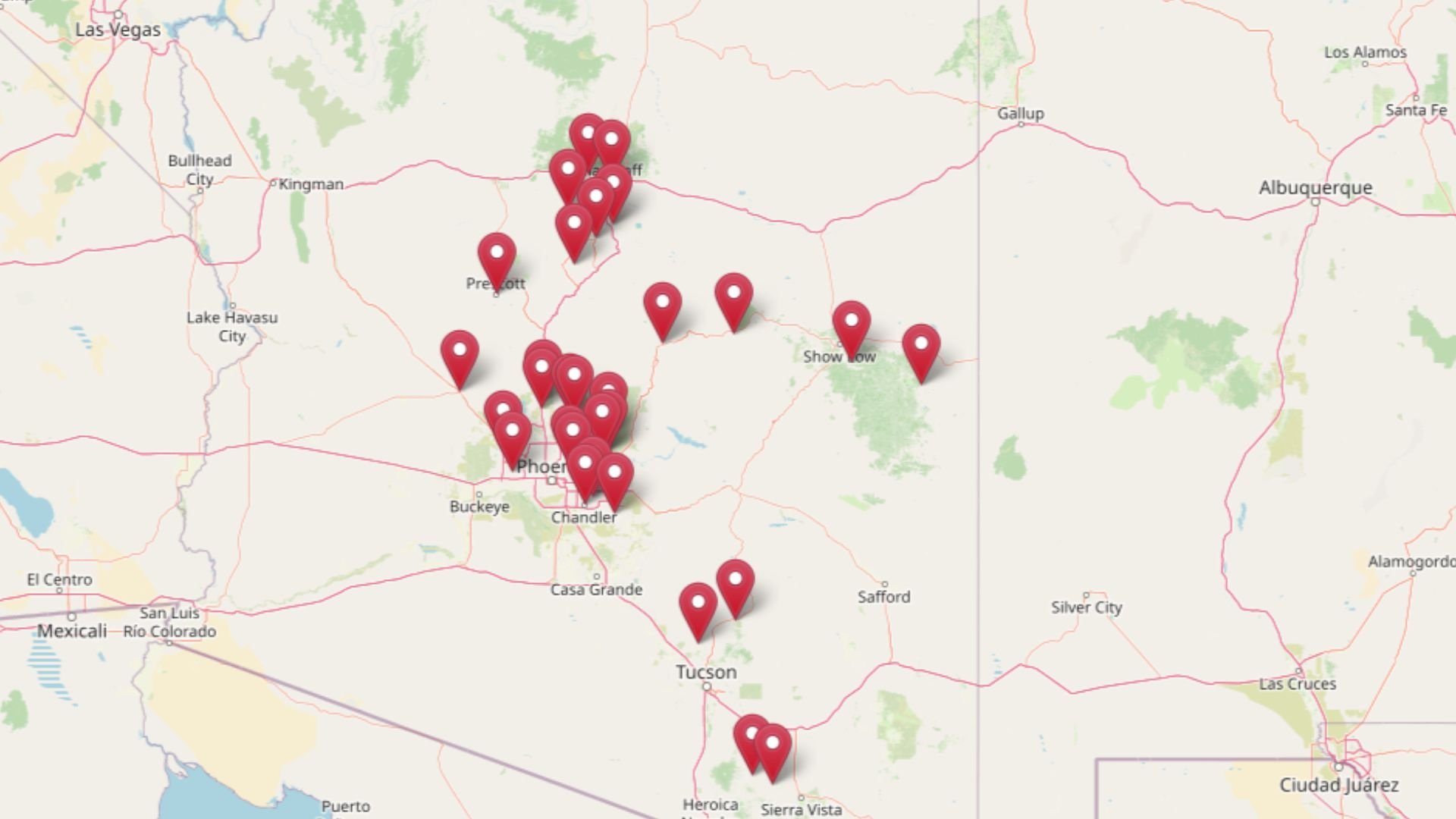

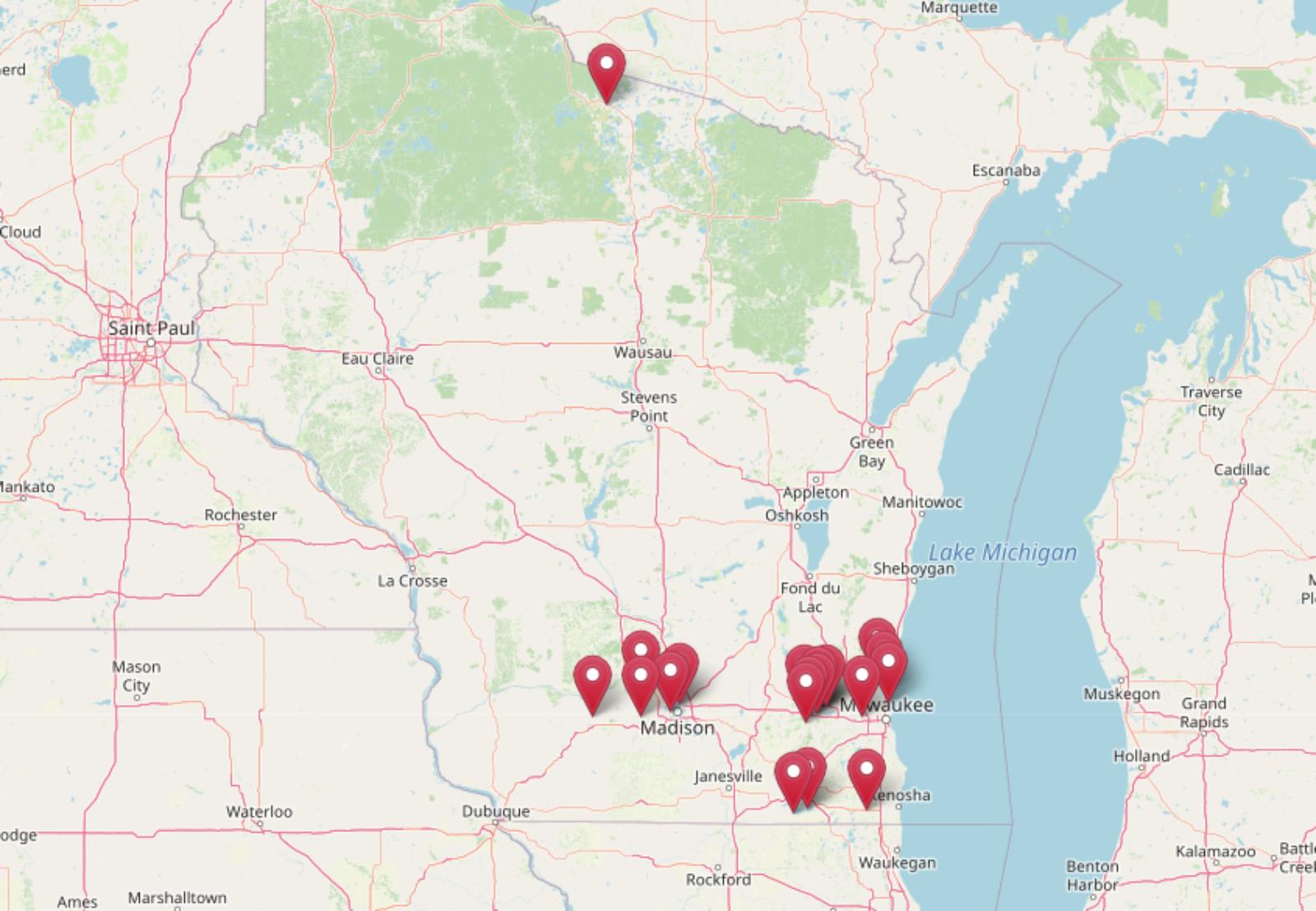

Wyoming’s housing market isn’t just heating up—it’s boiling over in some towns. According to the Zillow Home Value Index, home prices in parts of the state are growing at rates two to three times their historical norms. Investors are snapping up properties in once-quiet communities, fueling rapid price hikes that many local families simply can’t match. From energy towns to tourist hubs, this investor-driven surge is reshaping small-town Wyoming, pushing traditional buyers to the sidelines and transforming once-affordable markets into high-stakes battlegrounds.

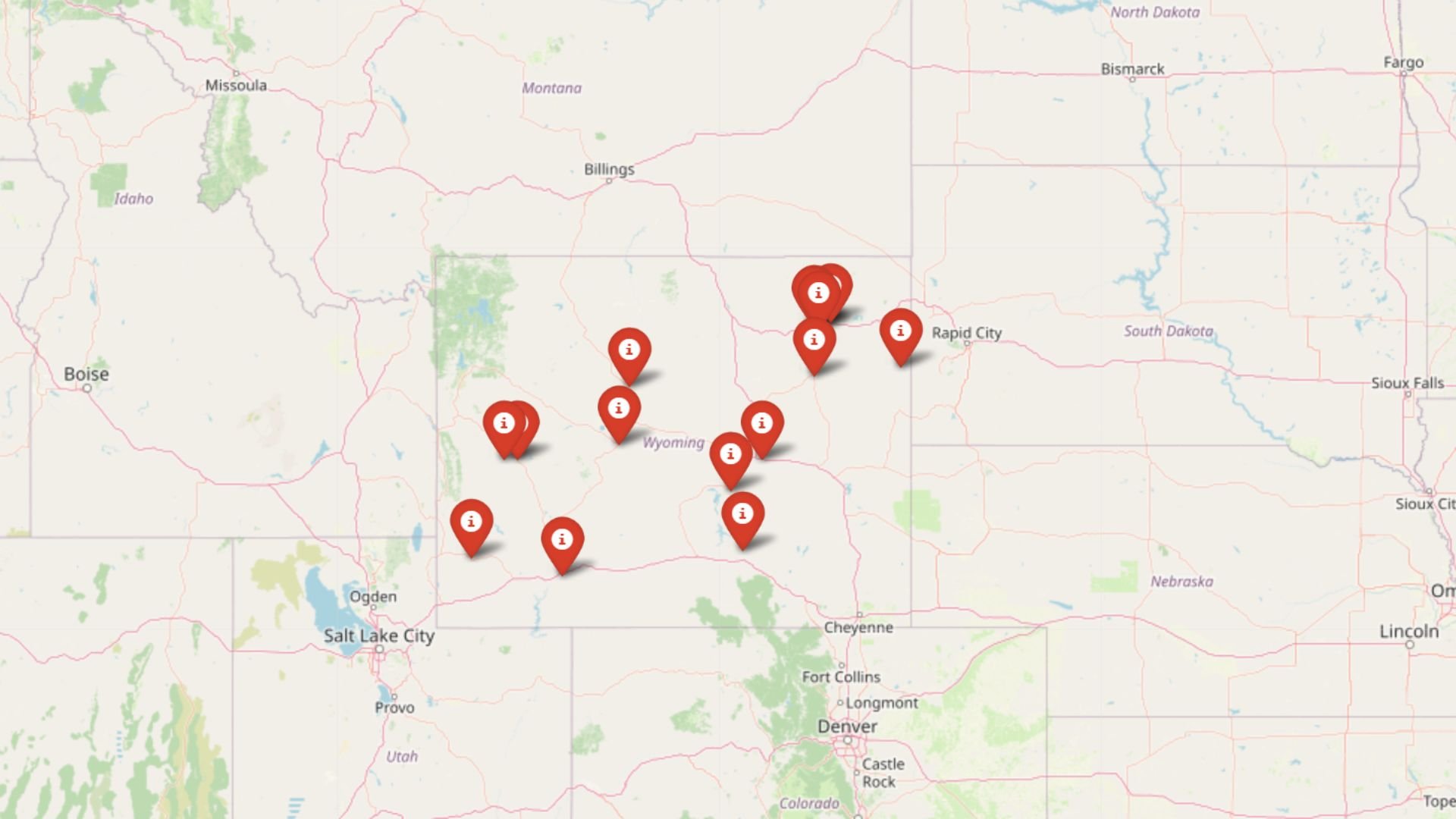

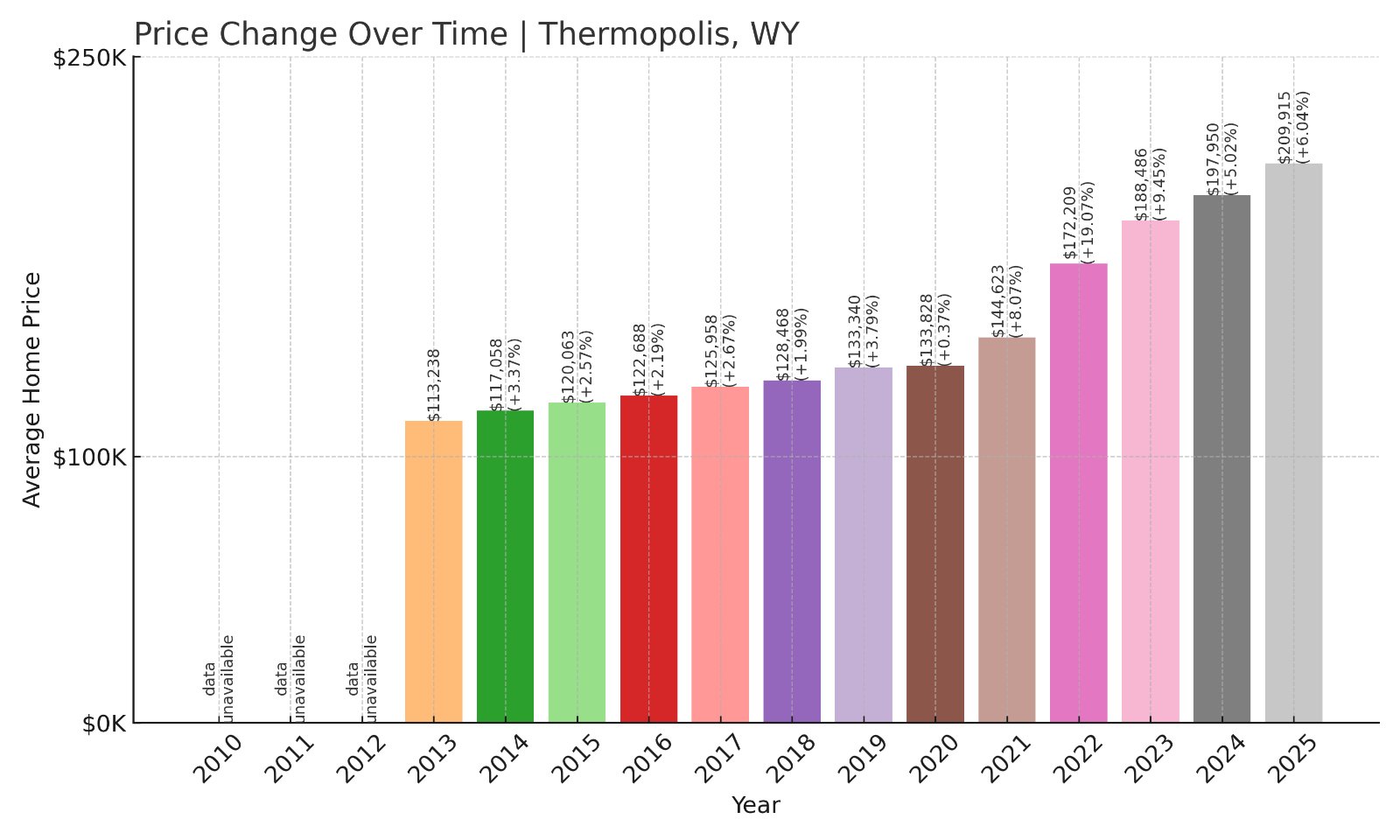

15. Thermopolis – Investor Feeding Frenzy Factor 43.09% (July 2025)

- Historical annual growth rate (2013–2022): 4.77%

- Recent annual growth rate (2022–2025): 6.82%

- Investor Feeding Frenzy Factor: 43.09%

- Current 2025 price: $209,915

Thermopolis begins the list with moderate speculation effects showing price growth acceleration from 4.77% to 6.82% annually, with a median home price of $209,915. This Hot Springs County seat demonstrates how even communities with established tourism economies can experience speculation pressure that exceeds their traditional market patterns.

Thermopolis – Tourism Town Faces New Pressures

Thermopolis holds the distinction of being home to the world’s largest hot springs, making tourism a cornerstone of the local economy alongside agriculture and regional services. The town’s unique geothermal attractions have traditionally supported higher baseline home price appreciation compared to purely agricultural Wyoming communities, reflecting the economic advantages that come with established tourism infrastructure.

The current median price of $209,915 represents the most affordable option among all communities experiencing feeding frenzy conditions, yet even this modest cost level has become subject to speculation pressure that exceeds local economic fundamentals. Thermopolis’ historical appreciation rate of 4.77% annually reflected the community’s tourism advantages while remaining accessible to local workers in hospitality, agriculture, and regional services.

The acceleration to 6.82% annual growth represents more than 40% acceleration that signals growing external interest in tourism-oriented Wyoming communities with established visitor infrastructure. Thermopolis’ 43.09% feeding frenzy factor, while the mildest on our list, still represents significant pressure for a community where local employment traditionally provided sufficient income to support homeownership at reasonable cost levels.

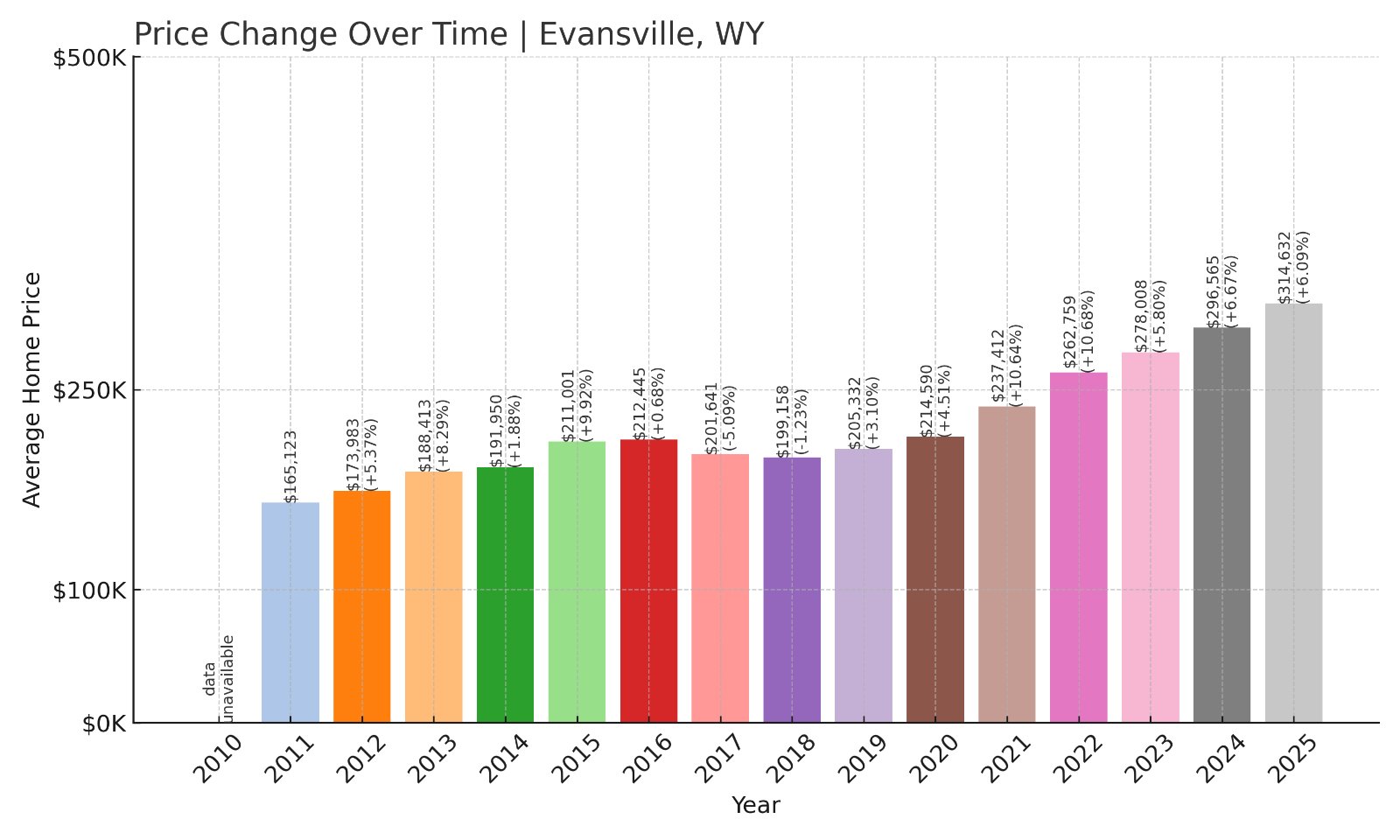

14. Evansville – Investor Feeding Frenzy Factor 47.06% (July 2025)

- Historical annual growth rate (2012–2022): 4.21%

- Recent annual growth rate (2022–2025): 6.19%

- Investor Feeding Frenzy Factor: 47.06%

- Current 2025 price: $314,632

Evansville shows moderate speculation effects with price growth increasing from 4.21% to 6.19% annually, pushing the median home price to $314,632. This Natrona County community demonstrates how areas near larger Wyoming cities can experience measurable speculation pressure even when baseline appreciation rates are already elevated due to regional proximity advantages.

Evansville – Suburban Wyoming Feels Market Heat

Evansville benefits from its location near Casper, Wyoming’s second-largest city, providing residents access to urban employment opportunities while maintaining smaller community advantages. The town has traditionally attracted families seeking suburban Wyoming living with access to regional employment in energy, healthcare, government, and service sectors that support central Wyoming’s economy.

The current median price of $314,632 reflects the premium that buyers have historically placed on communities offering both small-town character and proximity to larger employment centers. Evansville’s baseline appreciation rate of 4.21% annually reflected this geographic advantage while remaining aligned with regional income levels that could support suburban homeownership.

The acceleration to 6.19% annual growth represents nearly 50% acceleration that signals growing speculative interest in communities with suburban advantages and regional proximity. Evansville’s 47.06% feeding frenzy factor, while moderate, still represents measurable pressure that could gradually undermine the community’s traditional appeal to working families seeking suburban Wyoming lifestyle advantages.

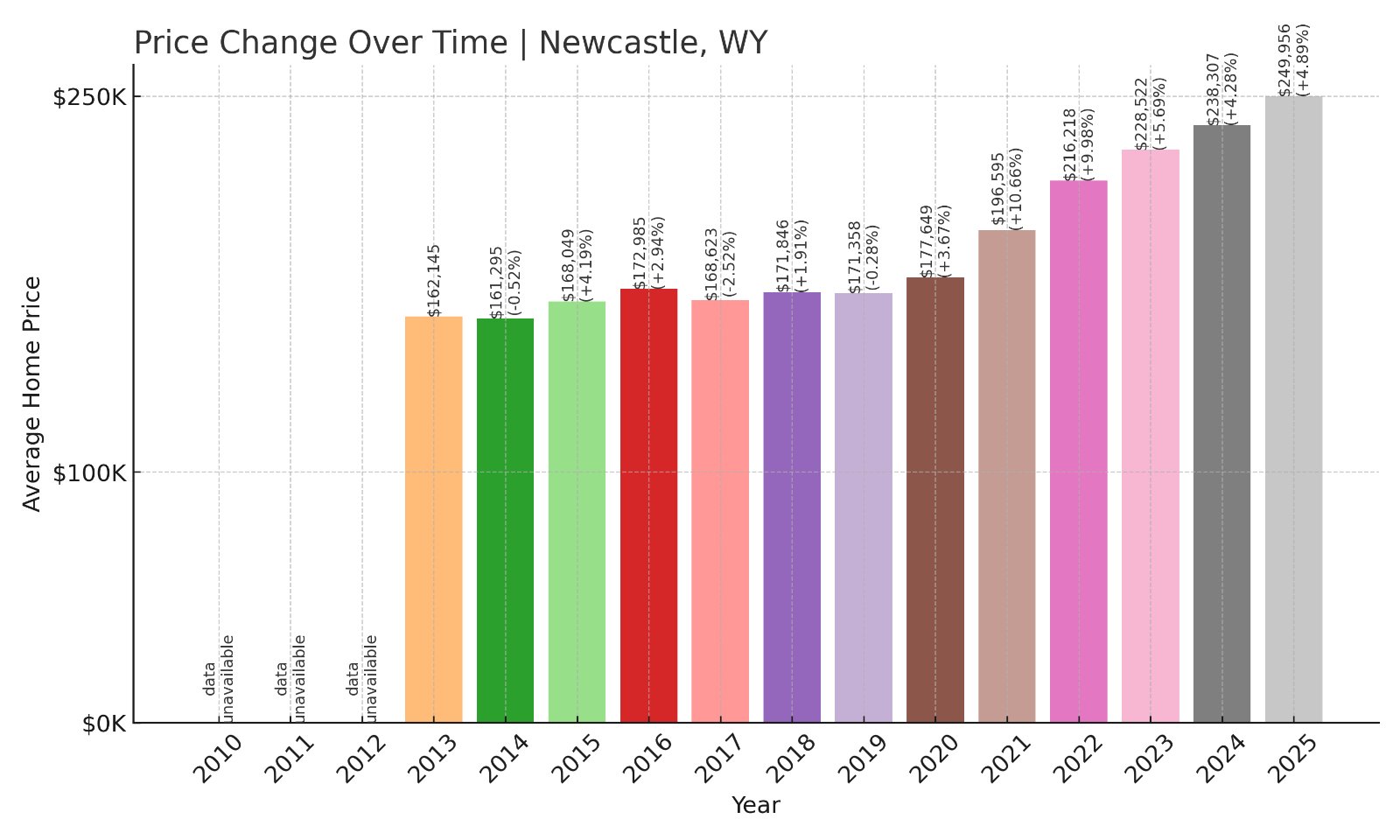

13. Newcastle – Investor Feeding Frenzy Factor 52.40% (July 2025)

- Historical annual growth rate (2013–2022): 3.25%

- Recent annual growth rate (2022–2025): 4.95%

- Investor Feeding Frenzy Factor: 52.40%

- Current 2025 price: $249,956

Newcastle demonstrates moderate speculation pressure with annual price growth accelerating from 3.25% to 4.95%, resulting in a median home price of $249,956. This Weston County community shows how even smaller Wyoming towns near state borders can experience measurable speculation effects that gradually increase housing costs beyond historical patterns.

Newcastle – Border Town Faces Growing Pressure

Would you like to save this?

Newcastle sits in northeastern Wyoming near the South Dakota border, serving as a regional center for agriculture, energy services, and government activities across Weston County. The town’s location provides access to both Wyoming’s energy economy and the agricultural opportunities that have traditionally supported stable, middle-class employment throughout the region.

The current median price of $249,956 represents reasonable cost levels that have historically made homeownership accessible to the range of workers who support Newcastle’s regional economy. The town’s traditional appreciation rate of 3.25% annually aligned well with local economic conditions, allowing families working in agriculture, energy services, and government to build wealth through homeownership.

The acceleration to 4.95% annual growth represents more than 50% acceleration that signals growing external interest in previously stable Wyoming markets. Newcastle’s 52.40% feeding frenzy factor, while the mildest among communities showing substantial speculation effects, still represents measurable pressure that could gradually erode the town’s traditional affordability advantages for working families across northeastern Wyoming.

12. Rock Springs – Investor Feeding Frenzy Factor 56.72% (July 2025)

- Historical annual growth rate (2012–2022): 3.24%

- Recent annual growth rate (2022–2025): 5.07%

- Investor Feeding Frenzy Factor: 56.72%

- Current 2025 price: $297,168

Rock Springs demonstrates moderate speculation effects with price growth increasing from 3.24% to 5.07% annually, pushing the median home price to $297,168. This Sweetwater County community shows how even larger Wyoming cities can experience measurable speculation pressure that gradually erodes traditional affordability advantages for working families.

Rock Springs – Regional Center Feels Market Pressure

Rock Springs serves as a major regional center for southwestern Wyoming, providing employment and services across energy, transportation, and government sectors. The city’s location along Interstate 80 and its role as a regional economic hub have traditionally supported stable housing markets that offered good value for families working in diverse industries throughout Sweetwater County.

The current median price of $297,168 reflects reasonable cost levels that have historically been accessible to the range of workers who support Rock Springs’ diverse economy. The city’s traditional appreciation rate of 3.24% annually aligned well with local wage growth across energy, government, and service sectors, allowing families to achieve homeownership without facing speculative market pressures.

The acceleration to 5.07% annual growth represents more than 50% acceleration that signals growing external interest in Wyoming markets previously considered stable and affordable. Rock Springs’ 56.72% feeding frenzy factor, while moderate, still represents significant pressure that could gradually undermine the city’s traditional role as an affordable regional center for working families across southwestern Wyoming.

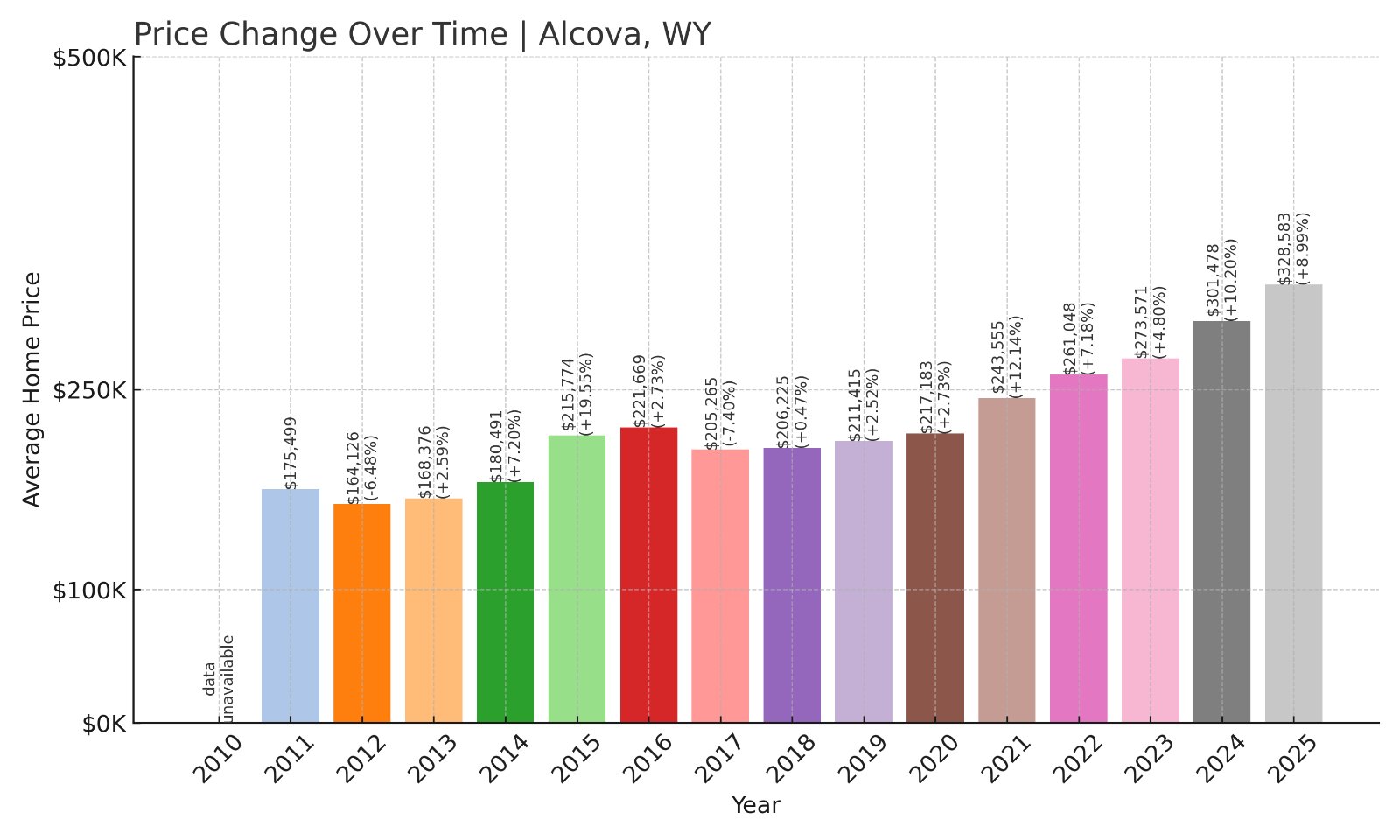

11. Alcova – Investor Feeding Frenzy Factor 67.81% (July 2025)

- Historical annual growth rate (2012–2022): 4.75%

- Recent annual growth rate (2022–2025): 7.97%

- Investor Feeding Frenzy Factor: 67.81%

- Current 2025 price: $328,583

Alcova enters the communities with significant speculation pressure, showing price growth acceleration from 4.75% to 7.97% annually that has pushed median home values to $328,583. This Natrona County community demonstrates how recreation-adjacent areas with higher baseline appreciation can still experience concerning speculation when growth significantly exceeds historical patterns.

Alcova – Reservoir Recreation Meets Real Estate Speculation

Alcova’s location near Alcova Reservoir makes it a popular destination for fishing, boating, and other water recreation activities that have traditionally attracted both residents and visitors to this Natrona County community. The town’s proximity to recreational amenities supported higher baseline home price appreciation compared to many Wyoming communities, reflecting the premium that buyers place on recreation access.

The current median price of $328,583 represents moderate cost levels that have traditionally been accessible to regional workers and recreation enthusiasts seeking Wyoming lifestyle advantages. Alcova’s historical appreciation rate of 4.75% annually reflected the community’s recreational appeal while remaining aligned with regional income levels that could support homeownership.

The acceleration to 7.97% annual growth signals that speculative interest has begun to influence this recreation-oriented community in ways that exceed local economic fundamentals. Alcova’s 67.81% feeding frenzy factor represents significant pressure that could gradually price out local residents who value the community’s recreational lifestyle but depend on regional employment for their purchasing power.

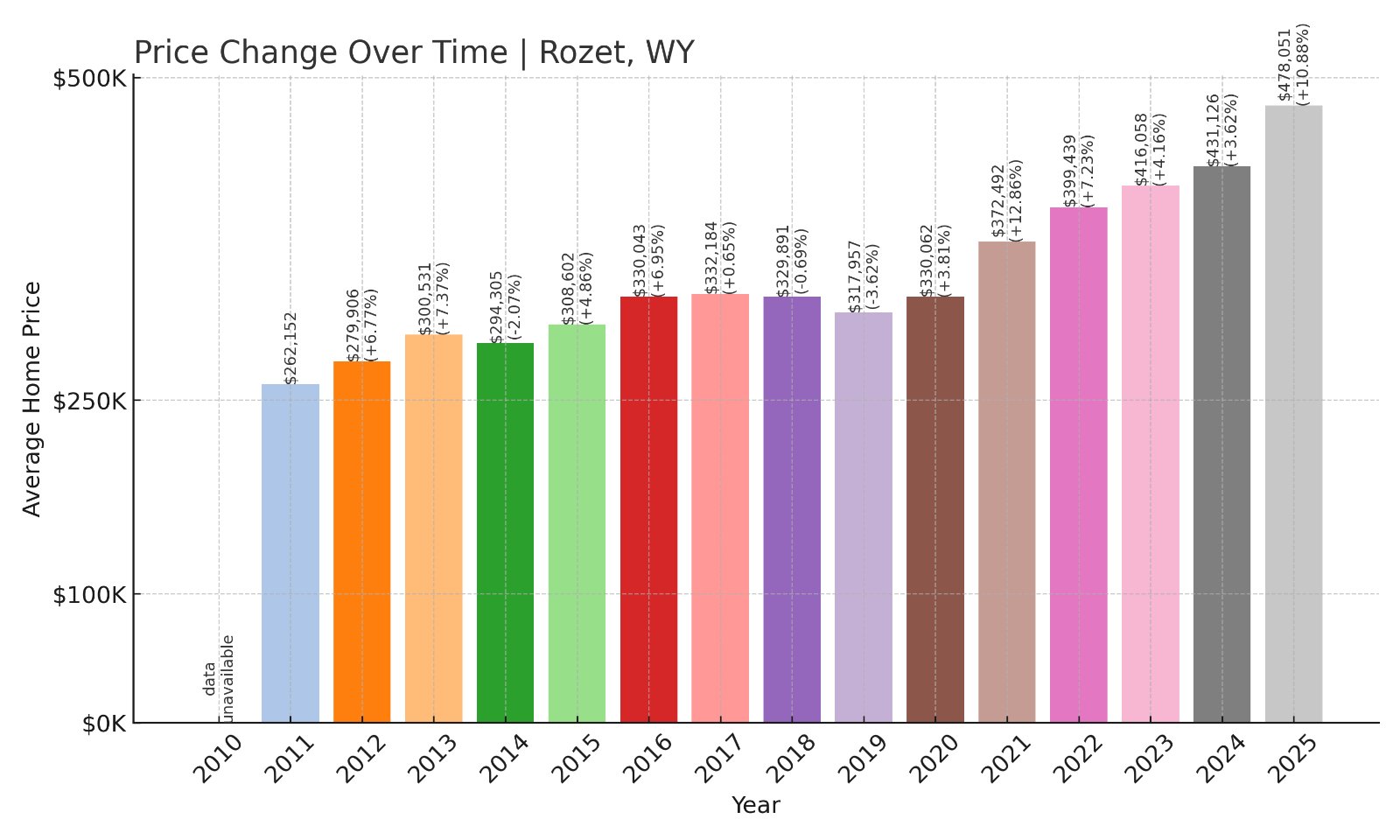

10. Rozet – Investor Feeding Frenzy Factor 70.48% (July 2025)

- Historical annual growth rate (2012–2022): 3.62%

- Recent annual growth rate (2022–2025): 6.17%

- Investor Feeding Frenzy Factor: 70.48%

- Current 2025 price: $478,051

Rozet demonstrates significant speculation pressure with annual price growth accelerating from 3.62% to 6.17%, resulting in a median home price of $478,051. This Campbell County community shows how even areas near major energy centers can experience speculation that pushes housing costs beyond levels supported by local employment income.

Rozet – Energy Proximity Drives Speculation

Rozet benefits from its location in Campbell County near major energy operations that have traditionally provided stable, well-paying employment for local residents. The small community has served as a more affordable alternative to larger energy centers while maintaining access to the good-paying jobs that support Wyoming’s energy economy.

The current median price of $478,051 reflects how speculation has elevated costs in communities that were once considered affordable options for energy workers and their families. Rozet’s historical appreciation rate of 3.62% annually aligned well with the income growth that energy sector employment typically provided, allowing local families to achieve homeownership without competing against external speculation.

The acceleration to 6.17% annual growth represents a 70% increase that signals growing investor interest in communities with energy sector proximity and rural Wyoming lifestyle advantages. This significant feeding frenzy factor threatens to gradually erode the affordability advantage that once made Rozet attractive to working families seeking homeownership in Wyoming’s energy regions.

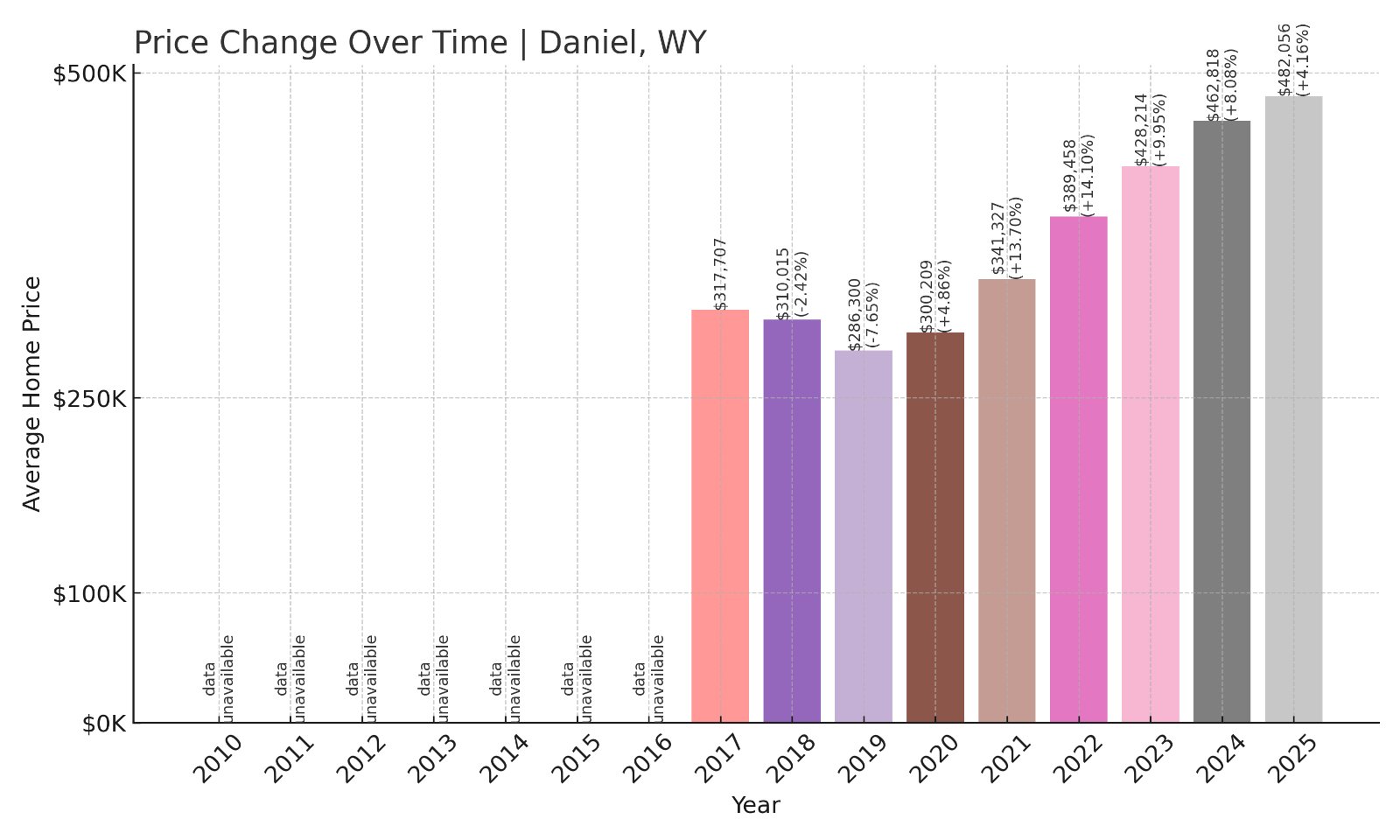

9. Daniel – Investor Feeding Frenzy Factor 77.29% (July 2025)

- Historical annual growth rate (2017–2022): 4.16%

- Recent annual growth rate (2022–2025): 7.37%

- Investor Feeding Frenzy Factor: 77.29%

- Current 2025 price: $482,056

Daniel shows high speculation pressure with price acceleration that has increased annual growth from 4.16% to 7.37%, pushing the median home price to $482,056. This Sublette County community demonstrates how even areas with higher baseline growth rates can experience concerning speculation when recent acceleration significantly exceeds historical patterns.

Daniel – Small Town With Big Price Pressures

Daniel sits in Sublette County near some of Wyoming’s most prized outdoor recreation areas, including proximity to Jackson Hole and world-class hunting and fishing opportunities. The small community has traditionally attracted residents who value rural Wyoming living combined with access to natural amenities, supporting higher baseline home price appreciation than many Wyoming towns.

The current median price of $482,056 represents the highest absolute cost among communities in the high speculation category, reflecting the premium that buyers place on locations offering exceptional outdoor recreation access. Daniel’s economy has historically centered around agriculture, energy services, and recreation-related activities that supported the higher baseline appreciation rate of 4.16% annually.

The acceleration to 7.37% annual growth signals that external speculation has begun to influence this small community’s market in ways that exceed local economic fundamentals. Daniel’s 77% feeding frenzy factor represents substantial pressure that could gradually price out local families who depend on traditional Wyoming industries for their housing purchasing power.

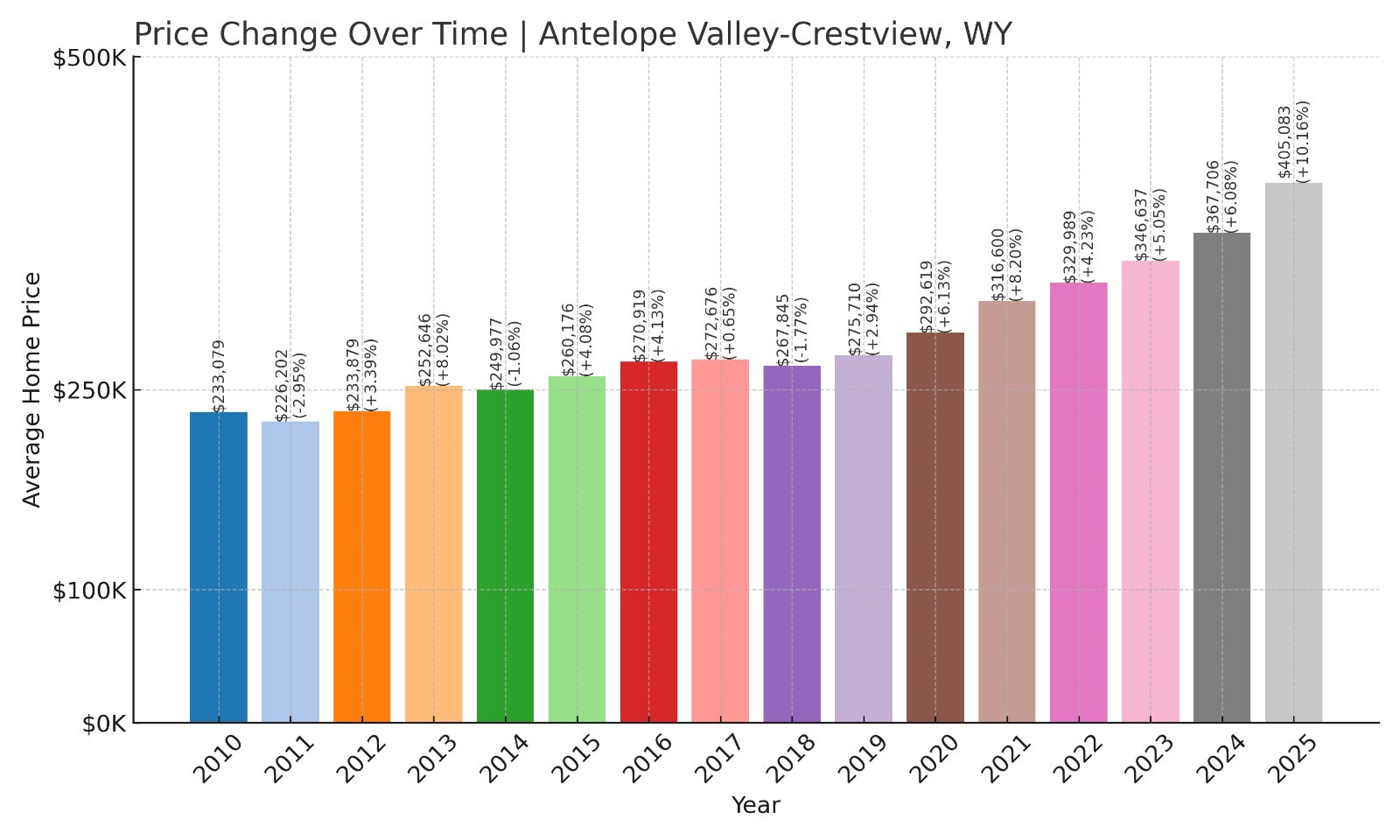

8. Antelope Valley-Crestview – Investor Feeding Frenzy Factor 101.95% (July 2025)

- Historical annual growth rate (2012–2022): 3.50%

- Recent annual growth rate (2022–2025): 7.07%

- Investor Feeding Frenzy Factor: 101.95%

- Current 2025 price: $405,083

Antelope Valley-Crestview crosses the threshold into extreme feeding frenzy territory with price growth that has doubled from 3.50% to 7.07% annually. The community’s median price of $405,083 represents one of the higher absolute costs among Wyoming’s distorted markets, reflecting how certain areas face pressure from investors seeking premium properties in scenic locations.

Antelope Valley-Crestview – Scenic Setting Attracts Speculation

Antelope Valley-Crestview benefits from a scenic Wyoming location that combines natural beauty with reasonable proximity to regional economic centers. The community has traditionally attracted residents seeking a balance between outdoor recreation opportunities and access to employment in larger Wyoming cities, supporting steady home price appreciation that reflected local economic conditions.

The current median price of $405,083 positions this community among the more expensive speculative targets in Wyoming, suggesting that investors particularly value locations that offer scenic amenities and recreation access. The historical growth rate of 3.50% annually supported a stable market where local residents could compete effectively for housing based on regional employment income.

The acceleration to 7.07% annual appreciation represents exactly double the historical rate, creating the textbook definition of feeding frenzy conditions where external speculation overwhelms local market fundamentals. This 101.95% feeding frenzy factor threatens to price out residents who depend on local and regional employment, potentially transforming a balanced community into a playground for outside investors.

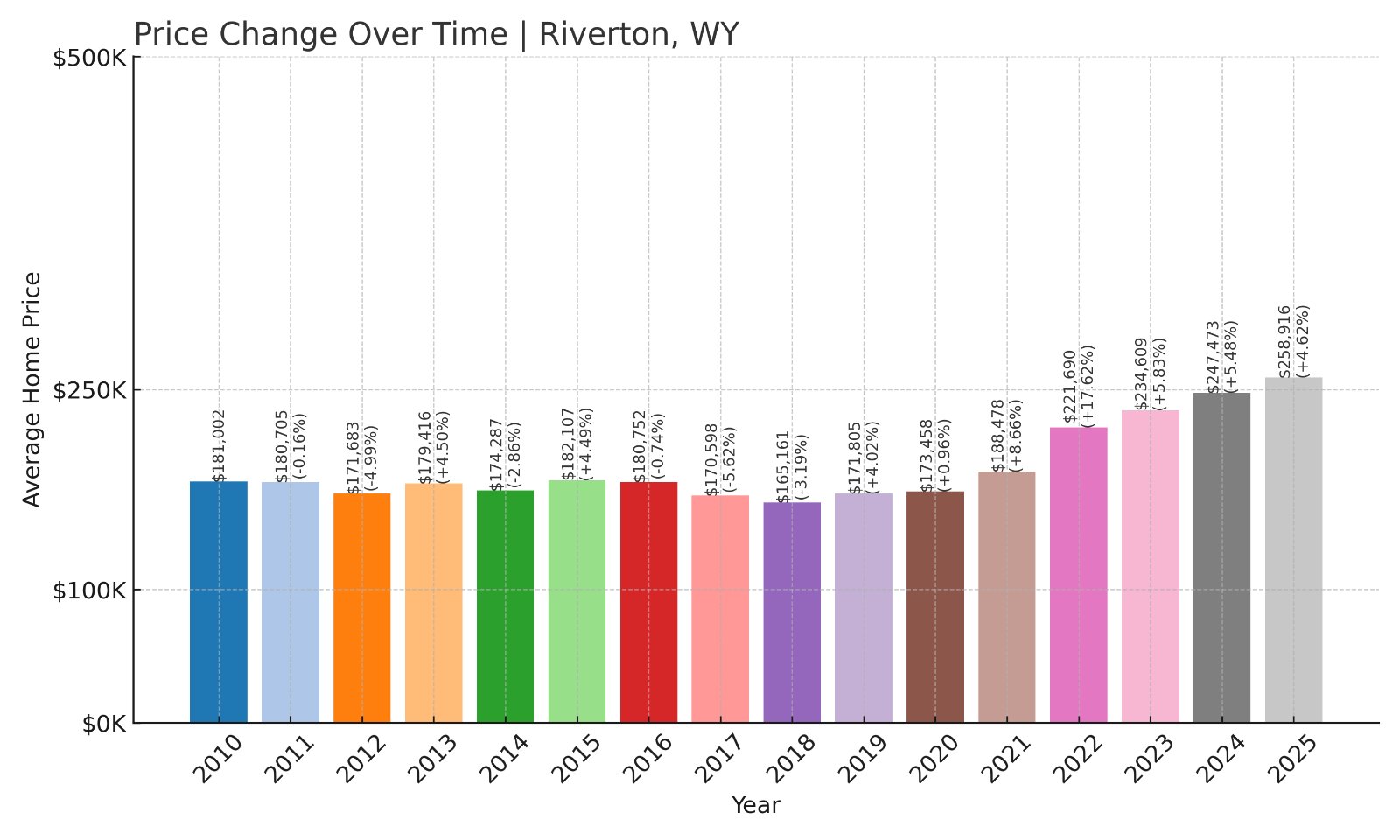

7. Riverton – Investor Feeding Frenzy Factor 105.09% (July 2025)

- Historical annual growth rate (2012–2022): 2.59%

- Recent annual growth rate (2022–2025): 5.31%

- Investor Feeding Frenzy Factor: 105.09%

- Current 2025 price: $258,916

Riverton shows extreme feeding frenzy acceleration, with price growth more than doubling from 2.59% to 5.31% annually. The Fremont County community’s median price of $258,916 reflects how speculation has begun to impact even mid-sized Wyoming cities that traditionally offered stable housing markets for diverse local economies.

Riverton – Regional Hub Feels Speculation Pressure

Riverton serves as a regional center for central Wyoming, providing services and economic opportunities for surrounding agricultural and energy communities. Located in Fremont County, the city has historically maintained a diverse economy that includes agriculture, energy services, healthcare, and government employment, creating stable demand for housing that supported conservative price appreciation.

The current median price of $258,916 represents a concerning shift from the community’s traditional market stability. Riverton’s economy has long provided the kind of steady, middle-class employment that supported homeownership at affordable levels, with historical price growth of 2.59% annually allowing families to build wealth without facing speculative pressure.

The acceleration to 5.31% annual growth signals that external investment activity has begun to influence local market conditions in ways that threaten long-term affordability. Riverton’s 105% feeding frenzy factor represents a doubling of price pressure that could gradually price out local families who depend on regional employment for their housing purchasing power.

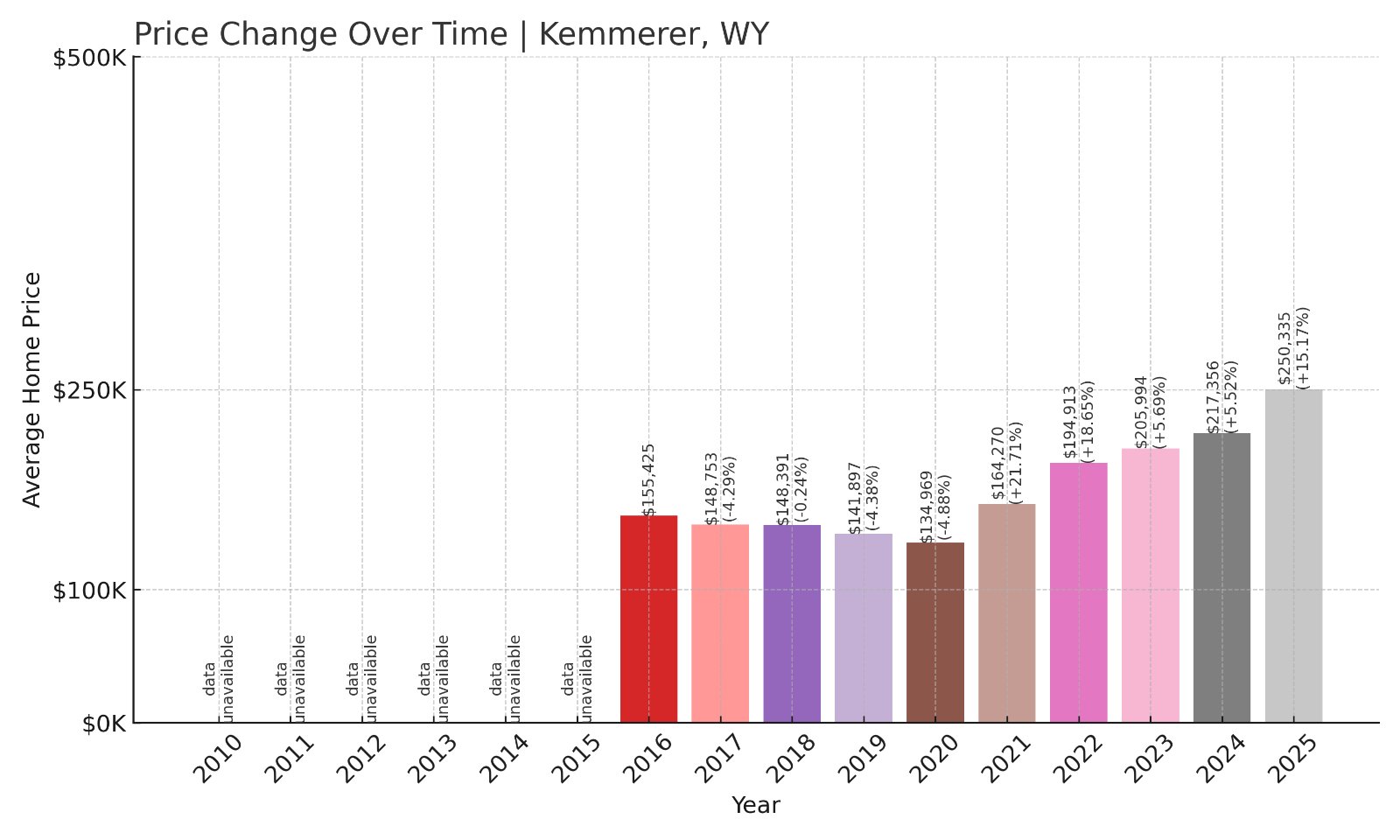

6. Kemmerer – Investor Feeding Frenzy Factor 126.24% (July 2025)

Would you like to save this?

- Historical annual growth rate (2016–2022): 3.85%

- Recent annual growth rate (2022–2025): 8.70%

- Investor Feeding Frenzy Factor: 126.24%

- Current 2025 price: $250,335

Kemmerer demonstrates extreme speculation pressure with annual price growth more than doubling from 3.85% to 8.70%, pushing median home values to $250,335. This Lincoln County seat shows how even historically stable Wyoming communities can experience rapid speculation-driven price distortions that threaten traditional affordability for working families.

Kemmerer – Historic Coal Town Faces Modern Speculation

Kemmerer holds a special place in Wyoming history as the birthplace of J.C. Penney and a longtime coal mining center that helped power the American West. Located in southwestern Wyoming near the Utah border, the Lincoln County seat has maintained its small-town character while serving as a regional economic hub for energy, agriculture, and government services.

The town’s current median price of $250,335 reflects how investor activity has begun to overwhelm local market fundamentals that previously supported steady but modest home price appreciation. Kemmerer’s economy traditionally centered around coal mining, government employment, and regional services, providing stable incomes that aligned with the historical 3.85% annual price growth.

The recent acceleration to 8.70% annual appreciation signals growing speculative pressure that threatens the community’s affordability advantage. Local families who have depended on traditional Wyoming industries now face housing costs that increasingly reflect investor demand rather than local earning potential, potentially transforming this historic coal town into another casualty of Wyoming’s housing speculation crisis.

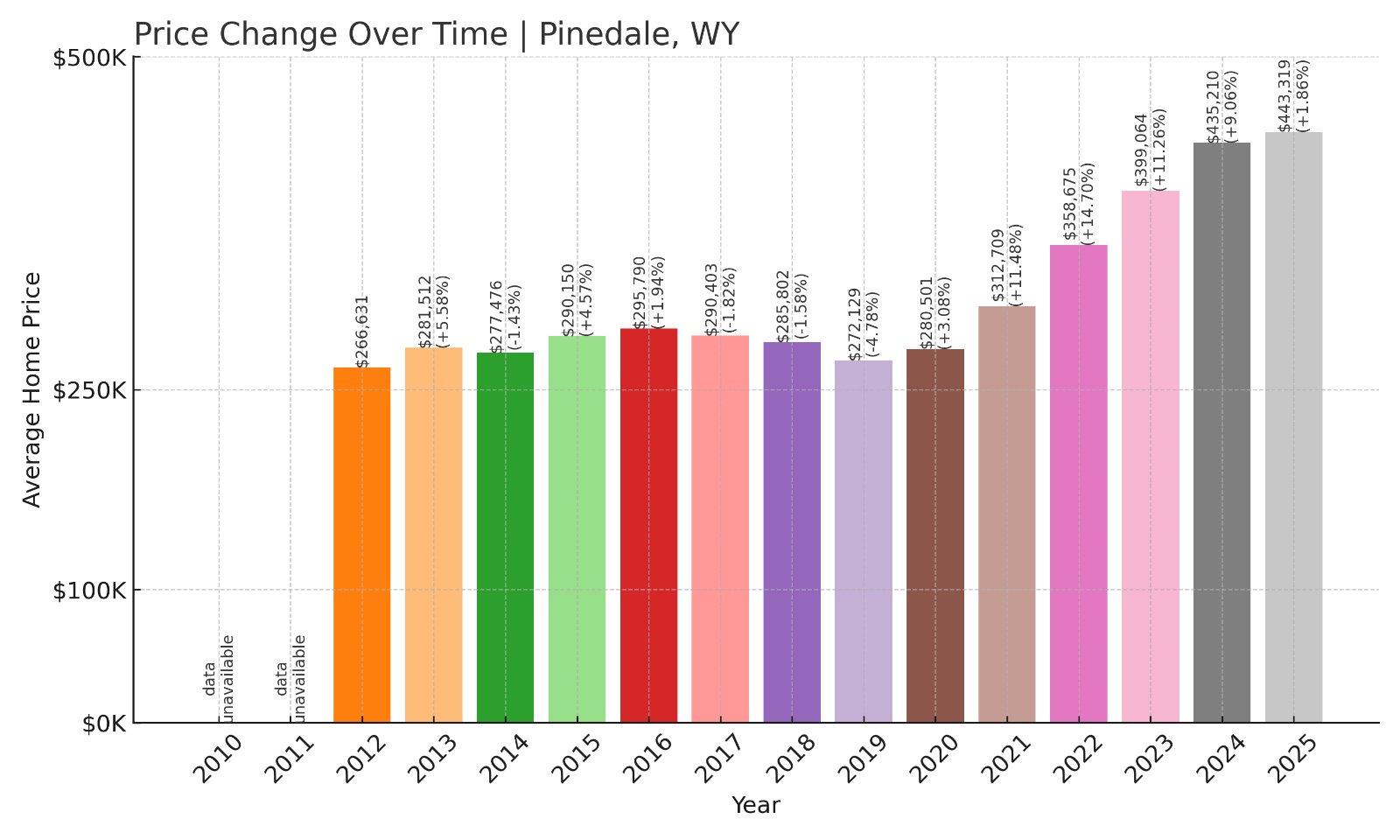

5. Pinedale – Investor Feeding Frenzy Factor 143.12% (July 2025)

- Historical annual growth rate (2012–2022): 3.01%

- Recent annual growth rate (2022–2025): 7.32%

- Investor Feeding Frenzy Factor: 143.12%

- Current 2025 price: $443,319

Pinedale enters the top five most distorted markets with a median home price of $443,319 that reflects how recreation economy communities face unique speculation pressures. The Sublette County town has experienced price growth acceleration from 3.01% to 7.32% annually, creating severe affordability challenges for local workers in tourism, energy, and traditional Wyoming industries.

Pinedale – Gateway To Recreation Becomes Speculation Target

Pinedale serves as a gateway to some of Wyoming’s most spectacular outdoor recreation, including proximity to the Wind River Range and world-class fishing opportunities. Located in Sublette County, the town has traditionally balanced energy sector employment with tourism and recreation-based economic activity, creating a diverse local economy that supported steady home price appreciation.

The current median price of $443,319 represents the highest absolute cost among the top speculation targets, reflecting how recreation-adjacent communities face particular pressure from investors seeking vacation properties and rental investments. Pinedale’s natural beauty and recreation access make it attractive to outside buyers who may not depend on local employment for their purchasing power.

The 143% feeding frenzy factor represents dangerous acceleration that threatens local affordability. Energy workers, tourism employees, and other residents who depend on local wages increasingly find themselves competing against investors and out-of-state buyers who view Pinedale properties as lifestyle purchases rather than primary residences.

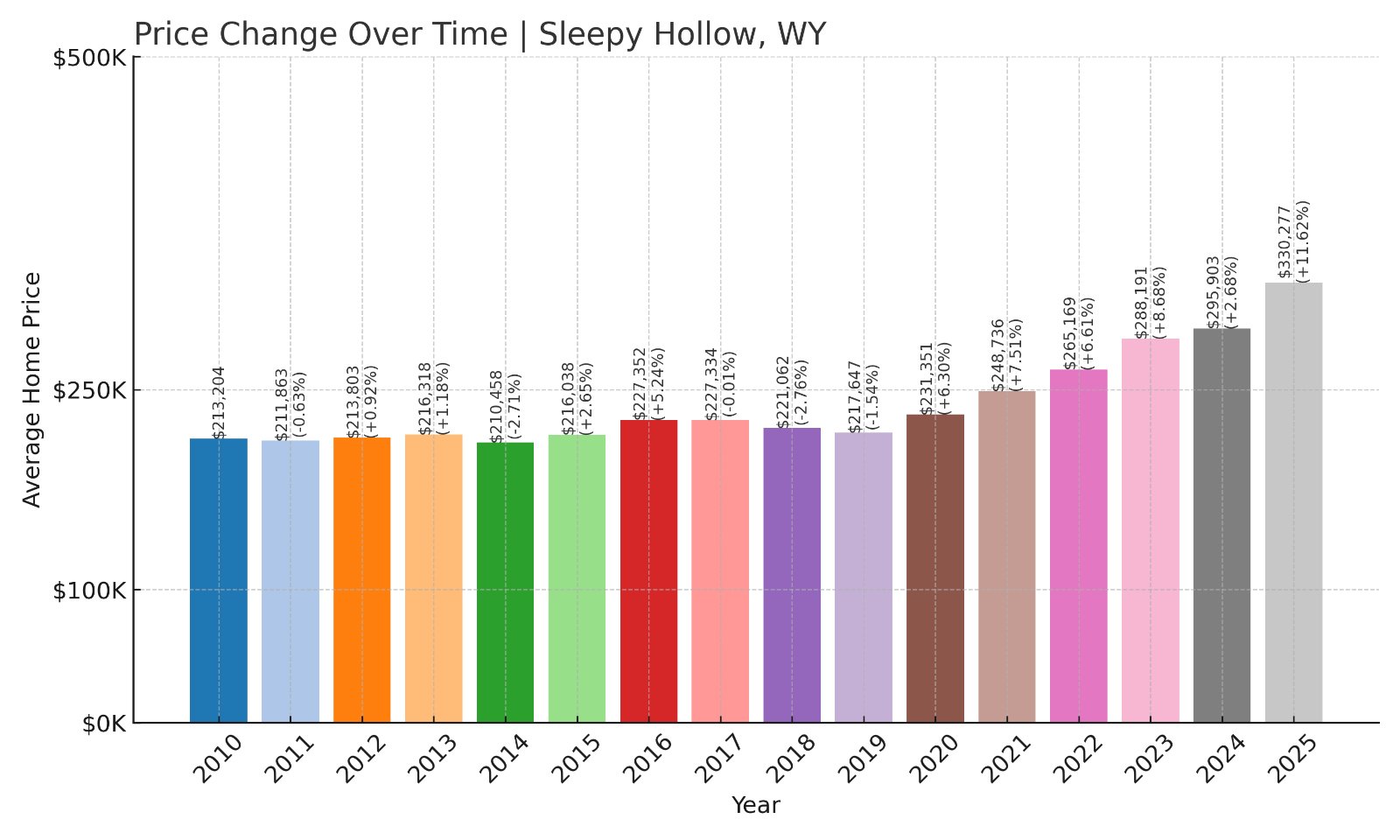

4. Sleepy Hollow – Investor Feeding Frenzy Factor 248.88% (July 2025)

- Historical annual growth rate (2012–2022): 2.18%

- Recent annual growth rate (2022–2025): 7.59%

- Investor Feeding Frenzy Factor: 248.88%

- Current 2025 price: $330,277

Sleepy Hollow’s ironic name belies the aggressive speculation that has transformed this Carbon County community into one of Wyoming’s most distorted housing markets. Recent price growth of 7.59% annually represents more than triple the community’s historical 2.18% appreciation rate, pushing median values to $330,277. This acceleration exemplifies how investor feeding frenzies can rapidly price out local families from small Wyoming towns.

Sleepy Hollow – Small Town Awakens to Big Speculation

Sleepy Hollow sits in south-central Wyoming’s Carbon County, a region where small communities have traditionally offered affordable alternatives to larger cities while maintaining access to outdoor recreation and natural beauty. The town’s location between major population centers has made it an attractive target for investors seeking undervalued properties in scenic Wyoming locations.

The current median price of $330,277 reflects how external speculation has fundamentally altered local market dynamics. Sleepy Hollow’s economy has historically been modest and stable, supporting the conservative 2.18% annual home price appreciation that allowed local families to achieve homeownership without competing against outside investors.

The dramatic acceleration to 7.59% annual growth signals that speculative forces have overwhelmed the community’s natural market conditions. This 248% feeding frenzy factor threatens to transform Sleepy Hollow from an affordable small town into a speculative commodity, displacing families who have depended on Wyoming’s traditionally reasonable housing costs.

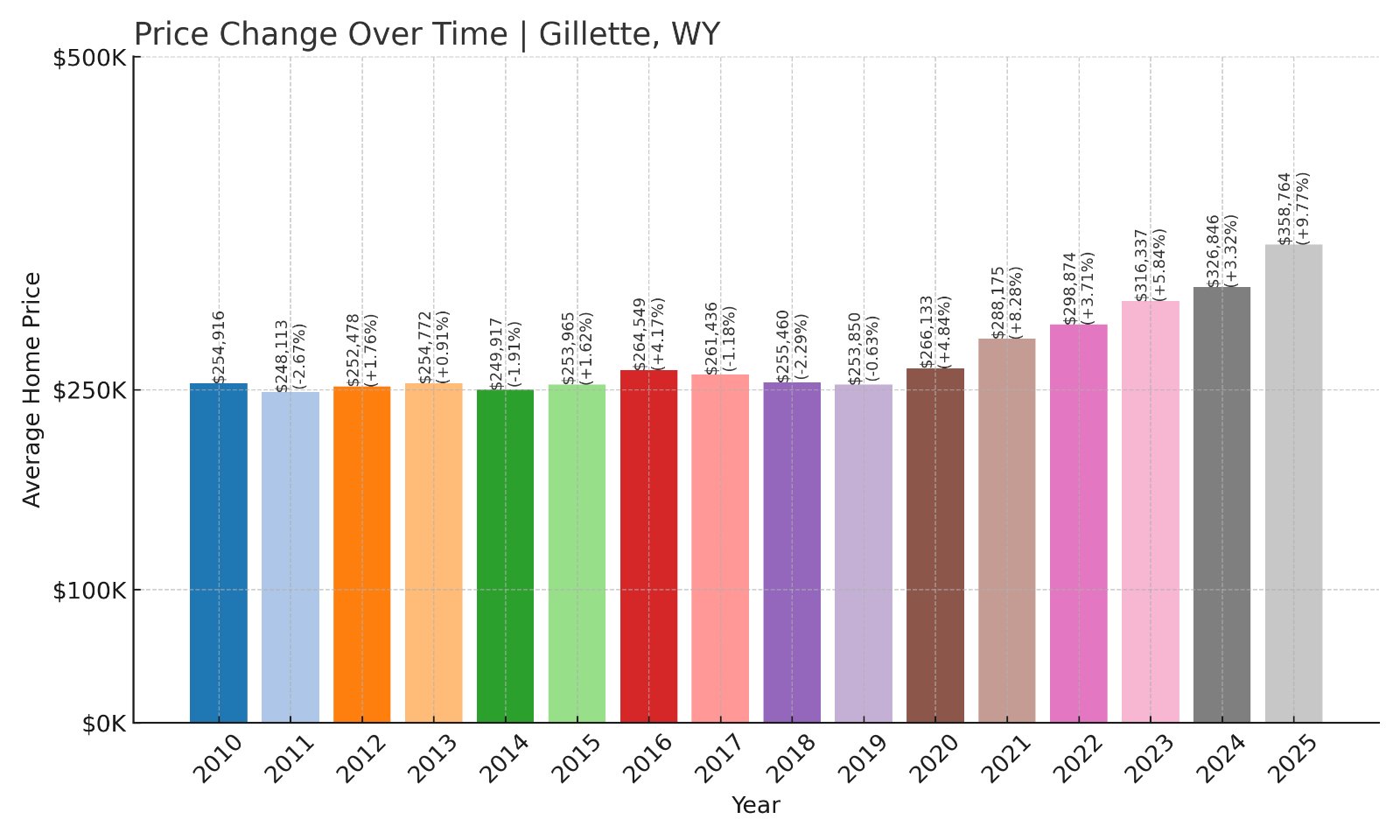

3. Gillette – Investor Feeding Frenzy Factor 268.97% (July 2025)

- Historical annual growth rate (2012–2022): 1.70%

- Recent annual growth rate (2022–2025): 6.28%

- Investor Feeding Frenzy Factor: 268.97%

- Current 2025 price: $358,764

Gillette’s transformation from steady energy hub to speculative target shows how investor feeding frenzies can destabilize even larger Wyoming communities. The Campbell County seat has seen price growth accelerate from a historically conservative 1.70% to 6.28% annually, pushing median home values to $358,764. This dramatic shift threatens the affordability that once made Gillette attractive to energy workers and their families.

Gillette – Energy Capital Loses Its Affordability Edge

Gillette bills itself as the “Energy Capital of the Nation,” and for decades the city lived up to that title by providing good-paying energy jobs alongside affordable housing. The largest city in Campbell County, Gillette serves as the economic hub for Wyoming’s Powder River Basin coal industry and has become increasingly important for oil and gas operations.

The current median price of $358,764 represents a concerning departure from the city’s historical role as an affordable place for energy workers to establish roots. Gillette’s economy traditionally supported steady but modest home price appreciation of 1.70% annually, which allowed families to build wealth while maintaining reasonable housing costs relative to energy sector wages.

Recent investor speculation has accelerated price growth to levels that threaten Gillette’s competitive advantage in attracting and retaining energy workers. The 268% feeding frenzy factor indicates that external capital has overwhelmed local market conditions, potentially forcing longtime residents to compete with investors for housing in their own community.

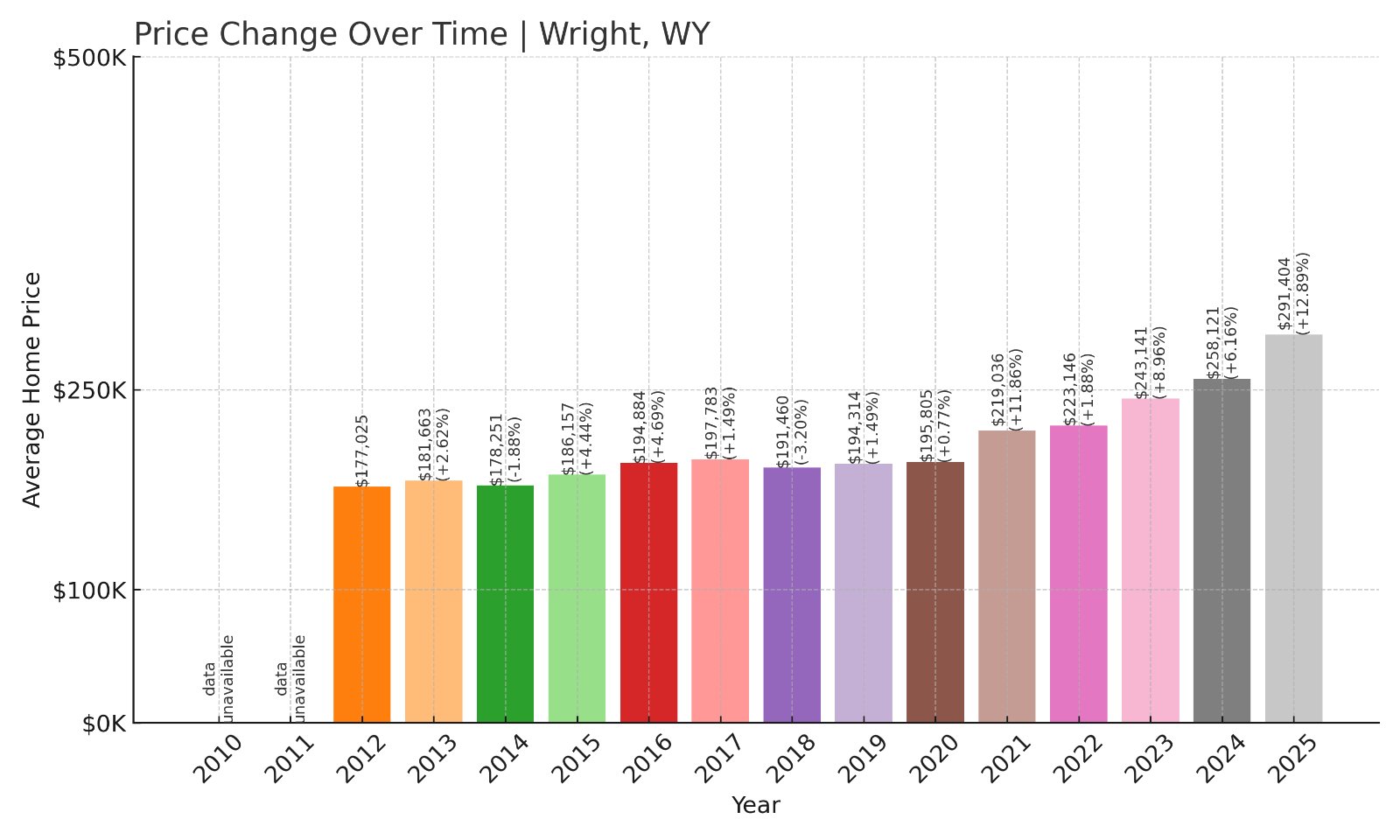

2. Wright – Investor Feeding Frenzy Factor 297.19% (July 2025)

- Historical annual growth rate (2012–2022): 2.34%

- Recent annual growth rate (2022–2025): 9.30%

- Investor Feeding Frenzy Factor: 297.19%

- Current 2025 price: $291,404

Wright demonstrates how even energy boomtowns can fall victim to investor speculation that completely overwhelms local economic fundamentals. The Campbell County community has experienced price growth nearly triple its historical norm, pushing the median home price to $291,404. This represents a devastating departure from the stable 2.34% annual appreciation that previously aligned with local energy sector wages.

Wright – Energy Boom Turns Into Housing Bubble

Wright emerged as a planned coal mining community in the 1970s, designed to house workers for the nearby mines that helped power America’s energy needs. Located about 35 miles south of Gillette in Campbell County, the town was built with a specific purpose: providing affordable housing for energy workers and their families.

The community’s current median price of $291,404 reflects how external speculation has inflated values far beyond what local energy wages can support. Wright’s economy revolves around coal mining operations at nearby facilities, with household incomes traditionally growing at rates that supported the historical 2.34% annual home price appreciation.

The recent acceleration to 9.30% annual growth creates a dangerous disconnect between housing costs and local earning potential. Energy workers who once could afford to buy homes in Wright now find themselves priced out by investor activity that treats their community as a financial instrument rather than a place where working families build their lives.

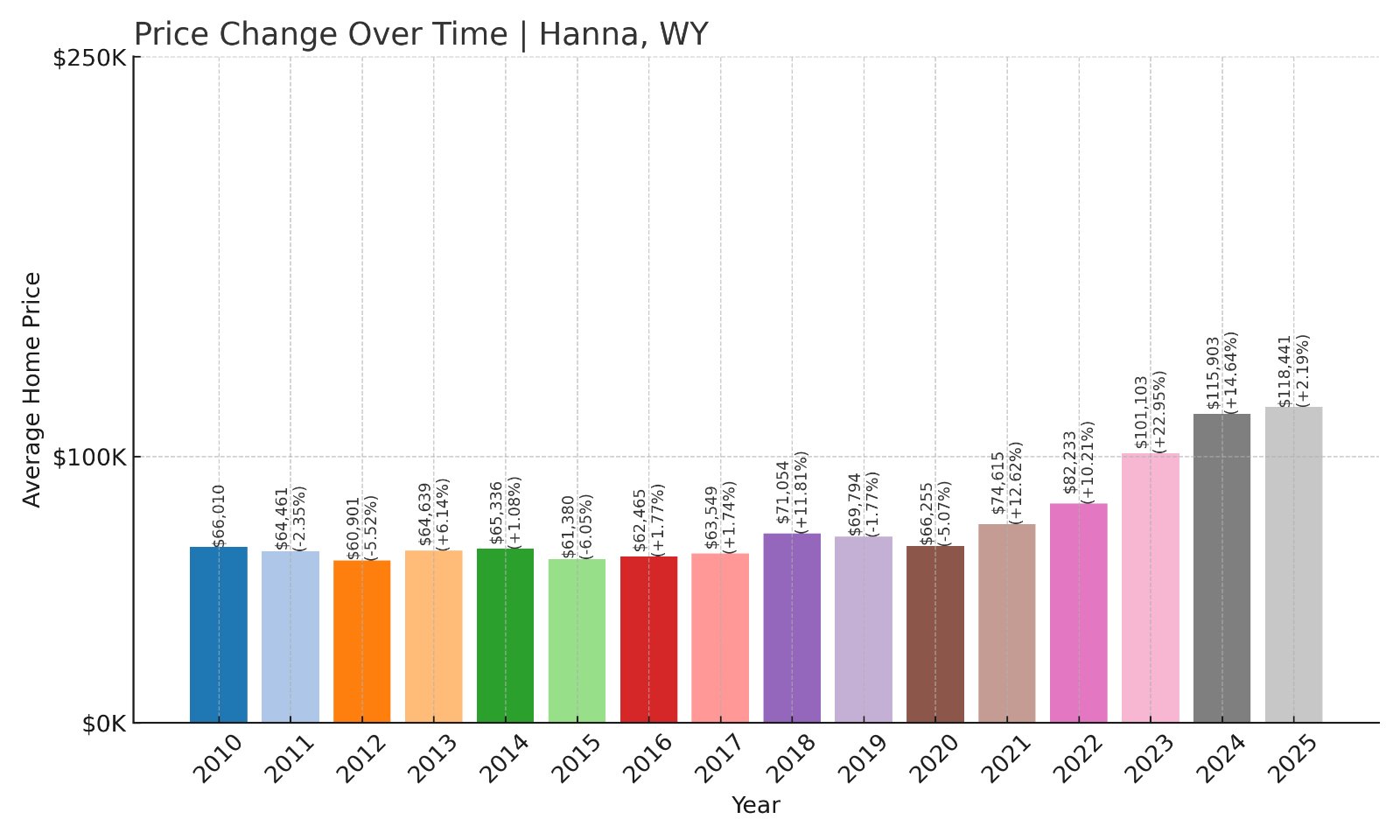

1. Hanna – Investor Feeding Frenzy Factor 324.18% (July 2025)

- Historical annual growth rate (2012–2022): 3.05%

- Recent annual growth rate (2022–2025): 12.93%

- Investor Feeding Frenzy Factor: 324.18%

- Current 2025 price: $118,441

Hanna tops Wyoming’s most distorted housing markets with recent price growth more than quadruple its historical rate. The small Carbon County town has seen its modest median home price of $118,441 become the epicenter of the state’s most aggressive speculation. This massive acceleration from a historically steady 3% annual appreciation to nearly 13% represents the most extreme feeding frenzy conditions found anywhere in Wyoming.

Hanna – Coal Legacy Meets Modern Speculation

Hanna sits in south-central Wyoming along the Union Pacific Railroad route, a location that historically made it a vital coal mining hub. The town’s proximity to major transportation corridors and its position between Cheyenne and Rawlins has attracted outside attention from investors seeking undervalued properties in strategically located communities.

Despite its current median price remaining the lowest among the top five most distorted markets, Hanna’s 324% feeding frenzy factor signals that external speculation has completely overwhelmed local market fundamentals. The town’s economy traditionally depended on coal mining and railroad operations, industries that provided stable but modest wage growth that aligned with the historical 3% annual appreciation.

Recent investor activity has disconnected housing costs from local income potential, creating an affordability crisis for families whose livelihoods depend on traditional Wyoming industries. The dramatic price acceleration threatens to transform this working-class community into a speculative commodity rather than a place where local families can build generational wealth.