Would you like to save this?

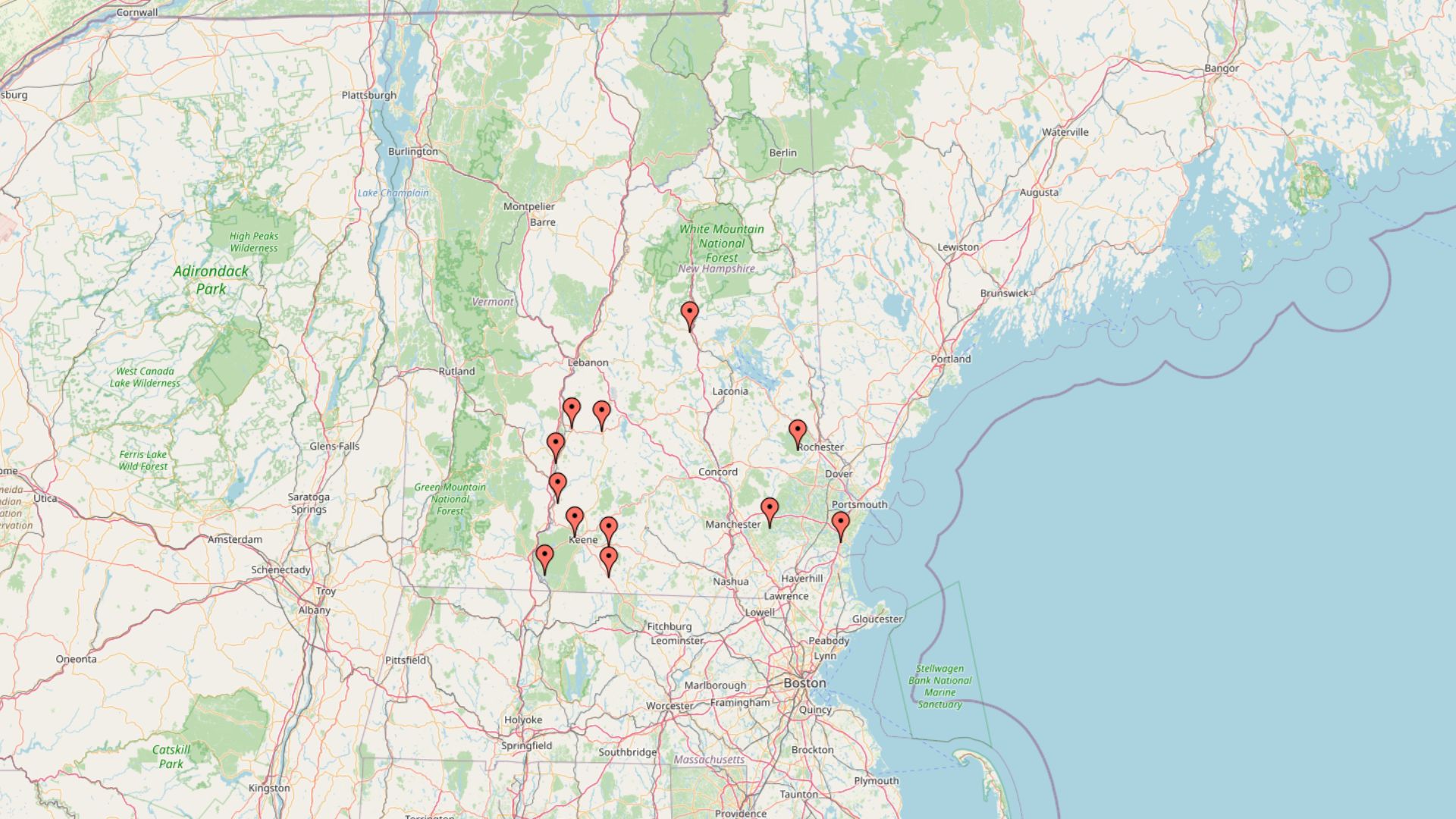

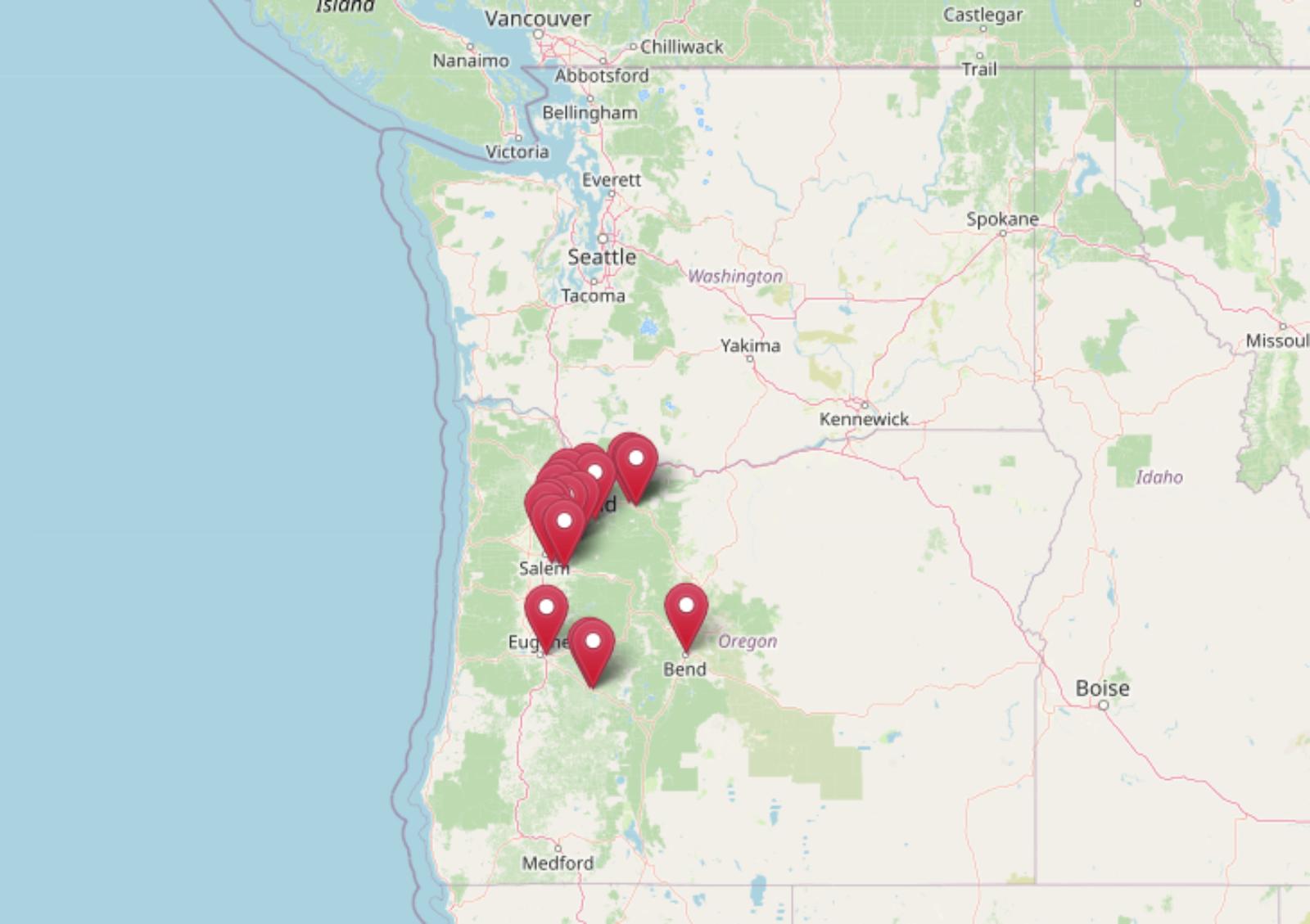

Oregon’s housing market is flashing warning signs that echo the lead-up to previous downturns. According to 15 years of data from the Zillow Home Value Index, these 19 towns show multiple indicators of instability—steep past declines, sharp overvaluation, and a pattern of price swings that suggest a possible correction ahead. Using a risk model based on five key factors, we’ve identified the places most vulnerable to a pricing pullback. These aren’t just cooling markets—they’re the ones with track records of trouble and numbers that no longer add up.

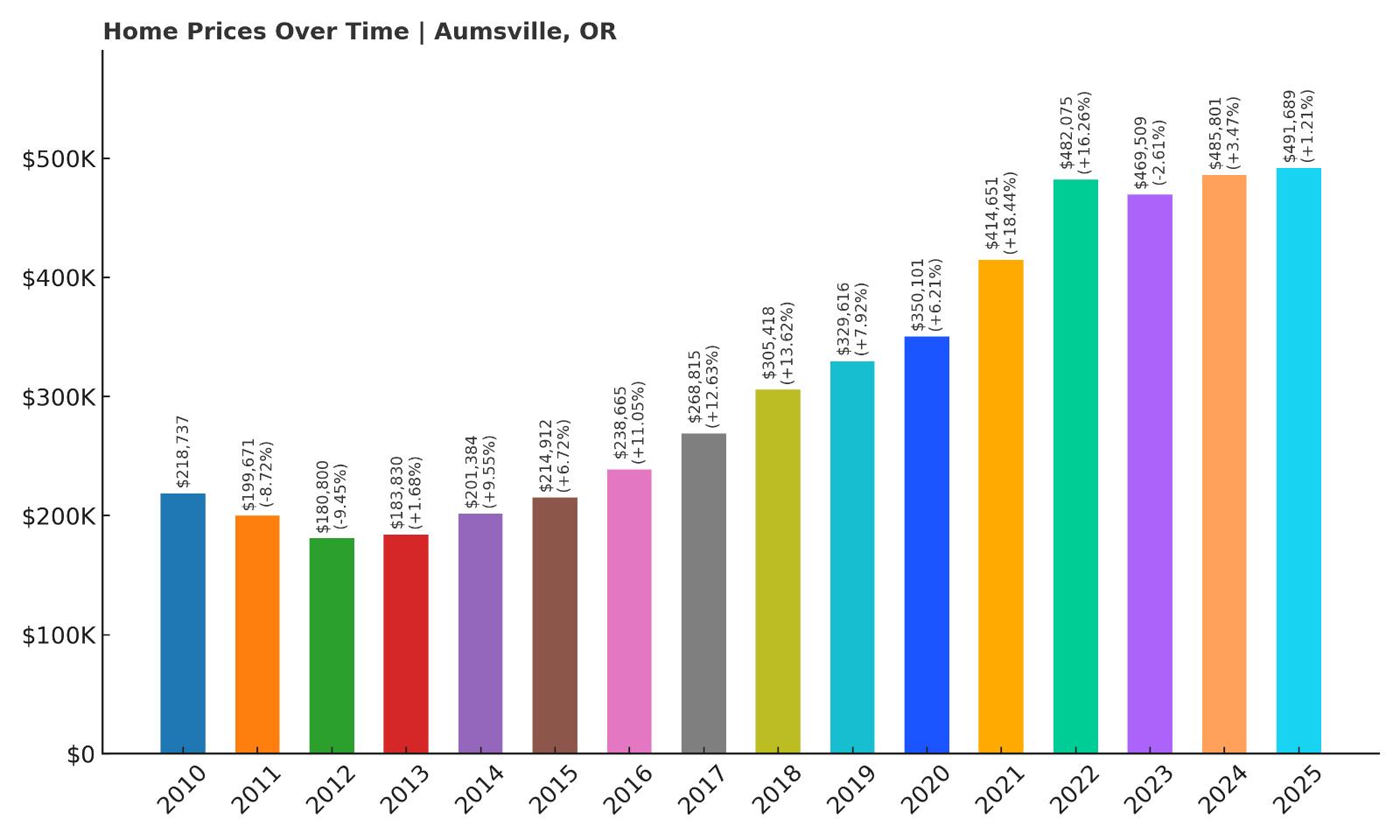

19. Aumsville – Crash Risk Percentage: 72.00%

- Crash Risk Percentage: 72.00%

- Historical crashes (8%+ drops): 2

- Worst historical crash: -9.5% (2012)

- Total price increase since 2010: 124.8%

- Overextended above long-term average: 56.2%

- Price volatility (annual swings): 8.6%

- Current 2025 price: $491,689

Aumsville enters our risk analysis with concerning patterns despite being the lowest-ranked town on this list. The community has experienced two significant crashes since 2010, including a notable 9.5% drop in 2012 that followed an 8.7% decline the previous year. With home values now sitting 56.2% above their long-term average, the market shows signs of dangerous overextension that historically precedes corrections.

Aumsville – Steady Growth Masking Underlying Volatility

Located in Marion County just east of Salem, Aumsville has transformed from a small farming community into a suburban enclave as Oregon’s capital region expanded. The town’s proximity to major employment centers has driven consistent demand, but current prices of $491,689 represent a staggering 124.8% increase since 2010. This growth trajectory, while impressive, shows the kind of acceleration that often proves unsustainable in smaller markets.

The community’s 8.6% annual price volatility reveals an underlying instability beneath the surface growth trends. Aumsville’s housing market demonstrated its vulnerability during the 2011-2012 period when values dropped nearly 18% over two consecutive years, proving that even steady suburban growth can reverse quickly when broader economic conditions shift. With current valuations stretched so far above historical norms, another correction appears mathematically inevitable.

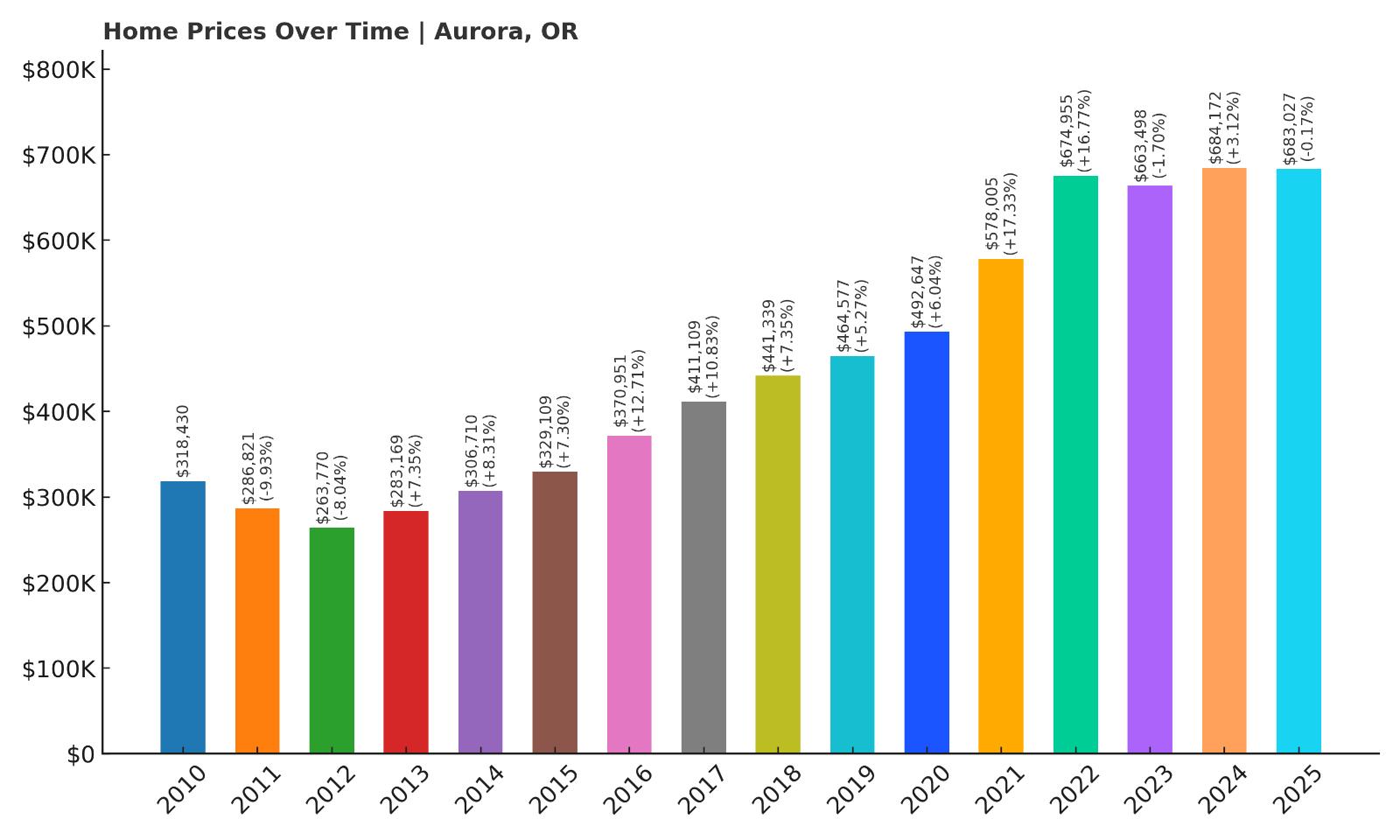

18. Aurora – Crash Risk Percentage: 73.28%

- Crash Risk Percentage: 73.28%

- Historical crashes (8%+ drops): 2

- Worst historical crash: -9.9% (2011)

- Total price increase since 2010: 114.5%

- Overextended above long-term average: 50.7%

- Price volatility (annual swings): 8.1%

- Current 2025 price: $683,027

Aurora’s crash risk profile reflects a market that has experienced significant historical volatility while reaching concerning overvaluation levels. The town suffered two major crashes since 2010, with the worst decline reaching nearly 10% in 2011, followed by additional losses that created a cumulative 17% drop over two years. Despite recovering strongly, current prices now sit 50.7% above the long-term average, suggesting another correction cycle may be approaching.

Aurora – Premium Location Driving Unsustainable Valuations

This historic Marion County community sits strategically between Portland and Salem, making it attractive to commuters seeking rural character with urban access. Aurora’s antique shops, annual colony days festival, and agricultural heritage have created a unique market appeal that helped drive the 114.5% price increase since 2010. However, current median values of $683,027 represent a dramatic departure from the town’s historically affordable character.

The community’s 8.1% annual volatility reflects the tension between its desirable location and limited housing stock, creating dramatic price swings when demand shifts. Aurora’s previous crash experience demonstrates how quickly premium small-town markets can correct when economic pressures mount, and with current valuations so far above historical norms, the mathematical probability of another significant decline appears increasingly likely.

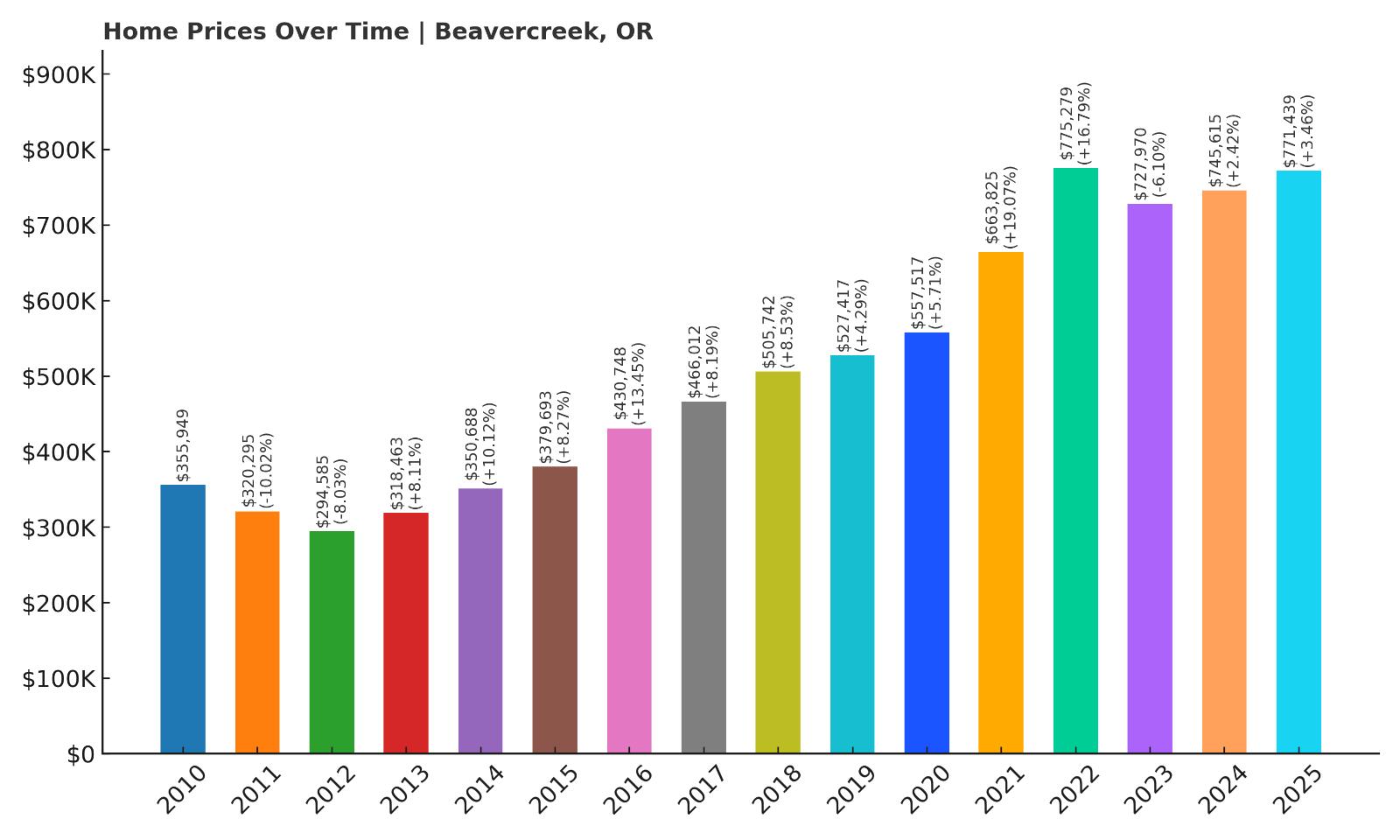

17. Beavercreek – Crash Risk Percentage: 74.56%

- Crash Risk Percentage: 74.56%

- Historical crashes (8%+ drops): 2

- Worst historical crash: -10.0% (2011)

- Total price increase since 2010: 116.7%

- Overextended above long-term average: 50.7%

- Price volatility (annual swings): 8.8%

- Current 2025 price: $771,439

Beavercreek shows troubling signs of market instability with two historical crashes and current valuations that stretch mathematical sustainability. The community experienced its worst decline in 2011 with a 10% drop, followed by additional losses that created significant wealth destruction for homeowners. Today’s prices of $771,439 represent a 116.7% increase since 2010, but this growth has pushed valuations 50.7% above long-term averages into dangerous territory.

Beavercreek – Suburban Premium Creating Correction Risk

Would you like to save this?

Located in Clackamas County southeast of Portland, Beavercreek offers a suburban lifestyle with rural amenities that has attracted families seeking larger lots and newer construction. The area’s excellent schools and proximity to major employment centers fueled consistent demand, but the 8.8% annual volatility reveals concerning instability beneath the growth story. Recent development has transformed former agricultural land into upscale neighborhoods, fundamentally altering the community’s character and price structure.

The community’s crash history during 2011-2012, when values dropped over 18% cumulatively, demonstrates how quickly suburban premium markets can reverse when broader economic conditions deteriorate. With current home values now significantly overextended above historical trends and volatility remaining elevated, Beavercreek appears positioned for another correction cycle that could eliminate years of gains for recent buyers.

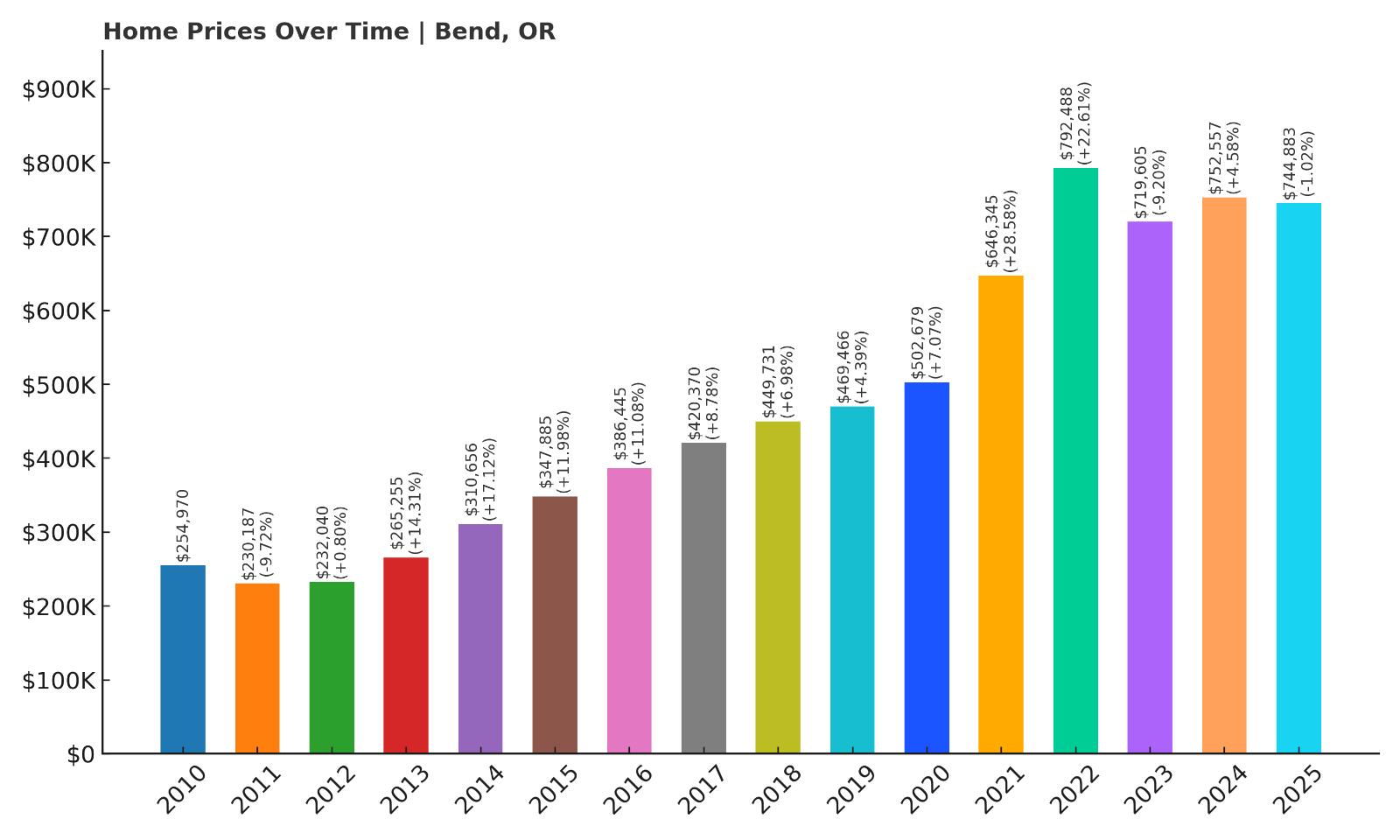

16. Bend – Crash Risk Percentage: 75.83%

- Crash Risk Percentage: 75.83%

- Historical crashes (8%+ drops): 2

- Worst historical crash: -9.7% (2011)

- Total price increase since 2010: 192.1%

- Overextended above long-term average: 58.4%

- Price volatility (annual swings): 10.5%

- Current 2025 price: $744,883

Bend presents one of the most concerning risk profiles in our analysis, combining extreme price appreciation with dangerous overextension levels. The resort town has experienced two major crashes since 2010, but more alarming is the 192.1% price increase that has pushed current valuations 58.4% above sustainable levels. The 10.5% annual volatility represents the highest instability measure among our analyzed communities, suggesting significant correction potential.

Bend – Resort Market Speculation Driving Dangerous Overvaluation

This Central Oregon destination has transformed from an affordable outdoor recreation hub into one of the state’s most expensive housing markets, with median prices now approaching $745,000. Bend’s combination of recreational amenities, natural beauty, and remote work trends created unprecedented demand that drove nearly 200% price appreciation since 2010. However, this explosive growth has fundamentally disconnected housing costs from local employment opportunities and historical market relationships.

The community’s extreme volatility reflects the speculative nature of resort market dynamics, where investment demand and lifestyle buyers create dramatic price swings. Bend’s previous crash experience, including a 9.7% single-year decline, demonstrates how quickly recreational markets can correct when external demand shifts or economic conditions deteriorate. With current valuations so far above mathematical sustainability and volatility remaining at concerning levels, another significant correction appears not just possible but probable.

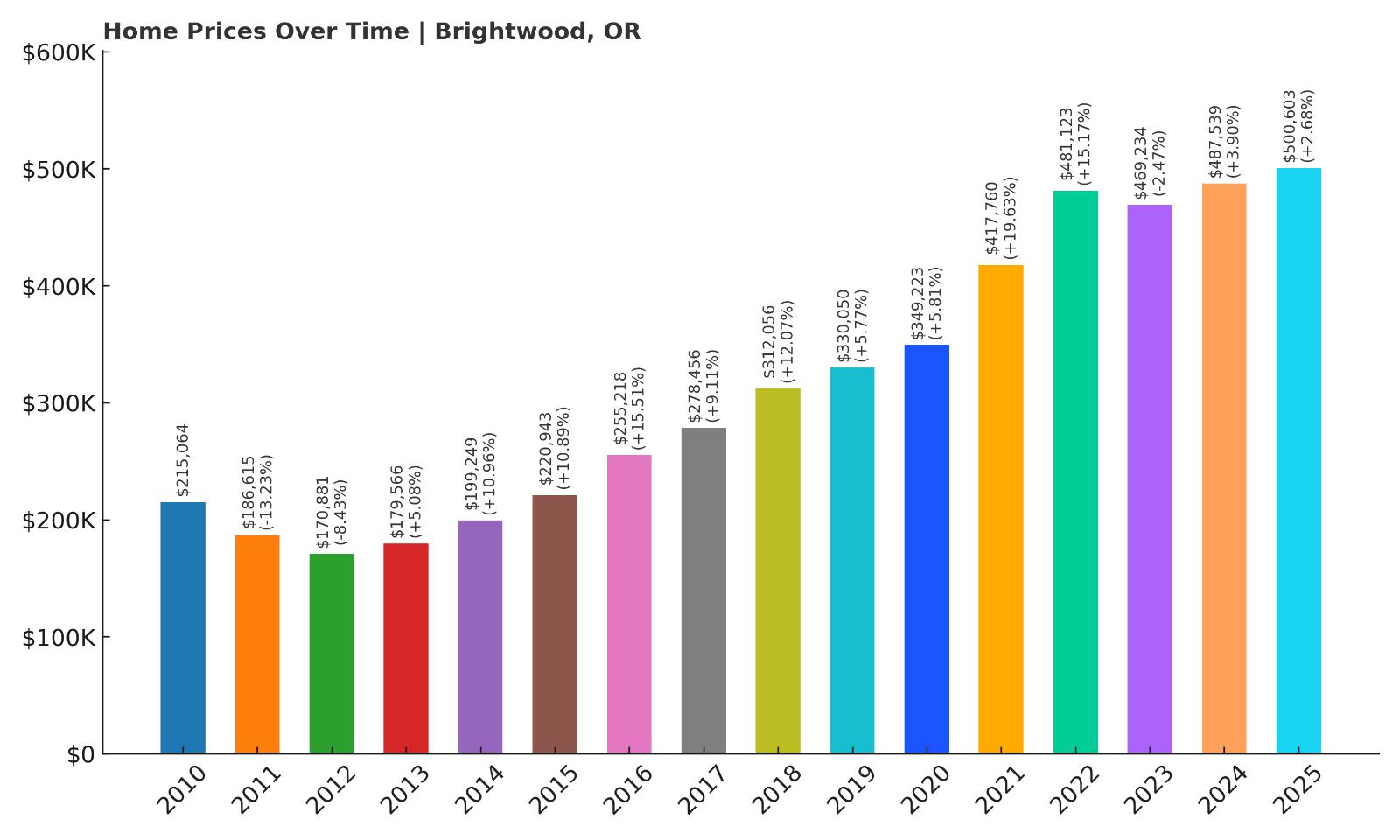

15. Brightwood – Crash Risk Percentage: 77.11%

- Crash Risk Percentage: 77.11%

- Historical crashes (8%+ drops): 2

- Worst historical crash: -13.2% (2011)

- Total price increase since 2010: 132.8%

- Overextended above long-term average: 58.5%

- Price volatility (annual swings): 9.4%

- Current 2025 price: $500,603

Brightwood shows particularly dangerous crash risk indicators, including the second-worst historical decline in our analysis at 13.2% in 2011. Despite recovering from that devastating correction, current prices have surged 132.8% since 2010, pushing valuations 58.5% above sustainable levels. The community’s 9.4% annual volatility suggests continued instability that could trigger another significant correction cycle.

Brightwood – Mountain Community Facing Speculation-Driven Overvaluation

Located in the Mount Hood corridor east of Portland, Brightwood serves as a gateway community for recreational enthusiasts and weekend home buyers seeking mountain proximity. The area’s scenic beauty and outdoor recreation access have attracted significant investment interest, driving median prices to over $500,000 despite limited local employment opportunities. This disconnect between housing costs and local economic fundamentals creates inherent instability that manifests in extreme price volatility.

The community’s devastating 2011 crash, when values plummeted over 13% in a single year, illustrates how quickly mountain real estate markets can correct when speculative demand evaporates. Brightwood’s dependence on external buyers and investment activity makes it particularly vulnerable to broader economic shifts or changes in recreational property demand. With current valuations stretched so far above historical norms and volatility remaining elevated, another major correction appears increasingly likely as mathematical overextension reaches unsustainable levels.

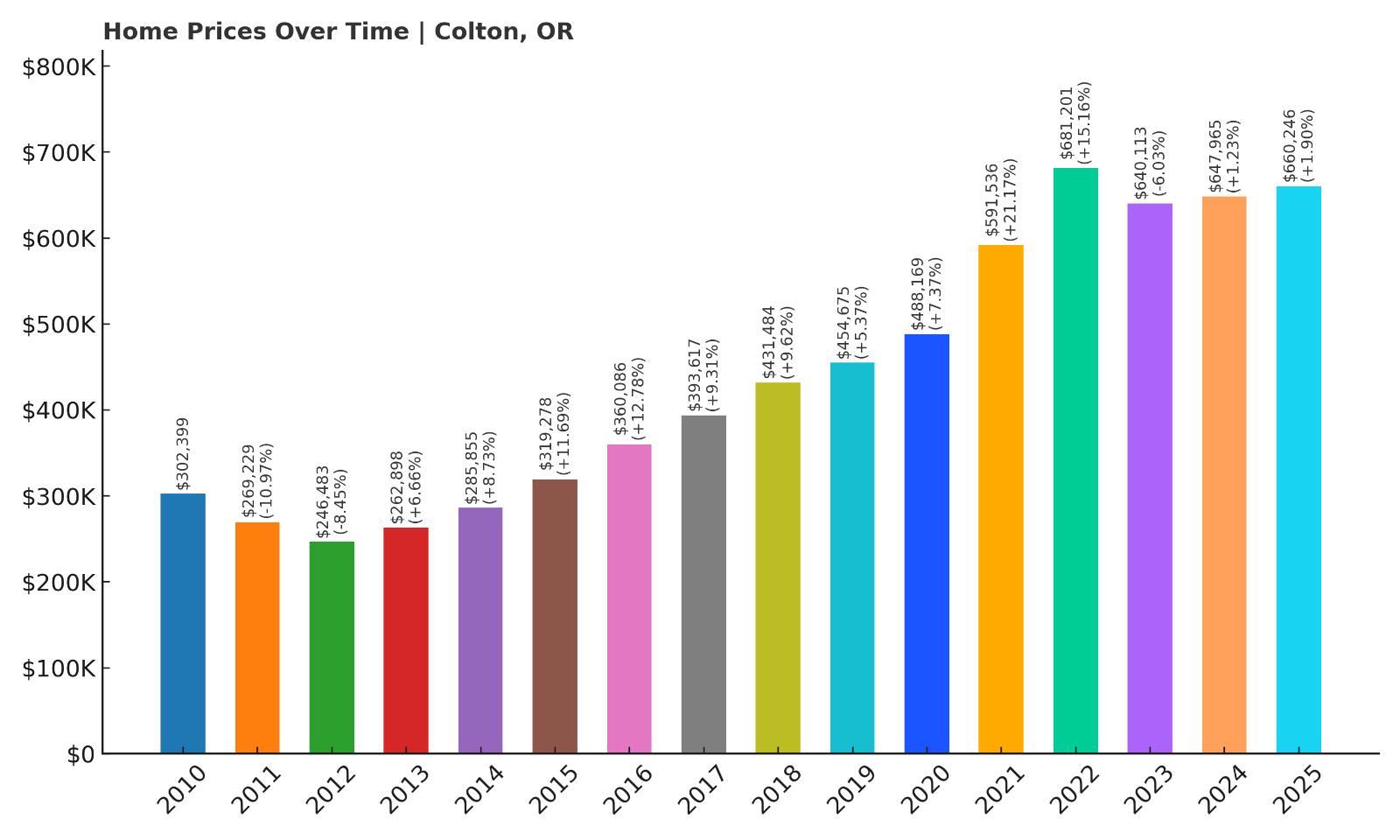

14. Colton – Crash Risk Percentage: 78.39%

- Crash Risk Percentage: 78.39%

- Historical crashes (8%+ drops): 2

- Worst historical crash: -11.0% (2011)

- Total price increase since 2010: 118.3%

- Overextended above long-term average: 50.2%

- Price volatility (annual swings): 9.1%

- Current 2025 price: $660,246

Colton demonstrates concerning crash risk through its combination of historical volatility and current overvaluation. The community experienced two significant corrections since 2010, with the worst reaching 11% in 2011, part of a cumulative 19% decline over two years. Current prices of $660,246 represent a 118.3% increase since the market bottom, but this recovery has pushed valuations 50.2% above sustainable levels, creating conditions ripe for another correction.

Colton – Rural Character Attracting Unsustainable Premium Pricing

This small Clackamas County community offers rural living within commuting distance of Portland, attracting buyers seeking larger properties and mountain proximity. Colton’s forest setting and recreational access have created unique market appeal, but the 9.1% annual volatility reveals underlying instability as demand fluctuates with broader economic conditions. The area’s limited housing stock amplifies price swings when buyer sentiment shifts, creating dramatic boom and bust cycles.

The community’s severe 2011-2012 correction demonstrates how quickly rural premium markets can reverse when economic pressures mount or commuting patterns change. With current median values now significantly overextended above historical norms and volatility remaining elevated, Colton appears positioned for another correction cycle that could eliminate substantial equity gains for recent buyers. The mathematical overextension combined with historical crash patterns suggests significant downside risk in the near term.

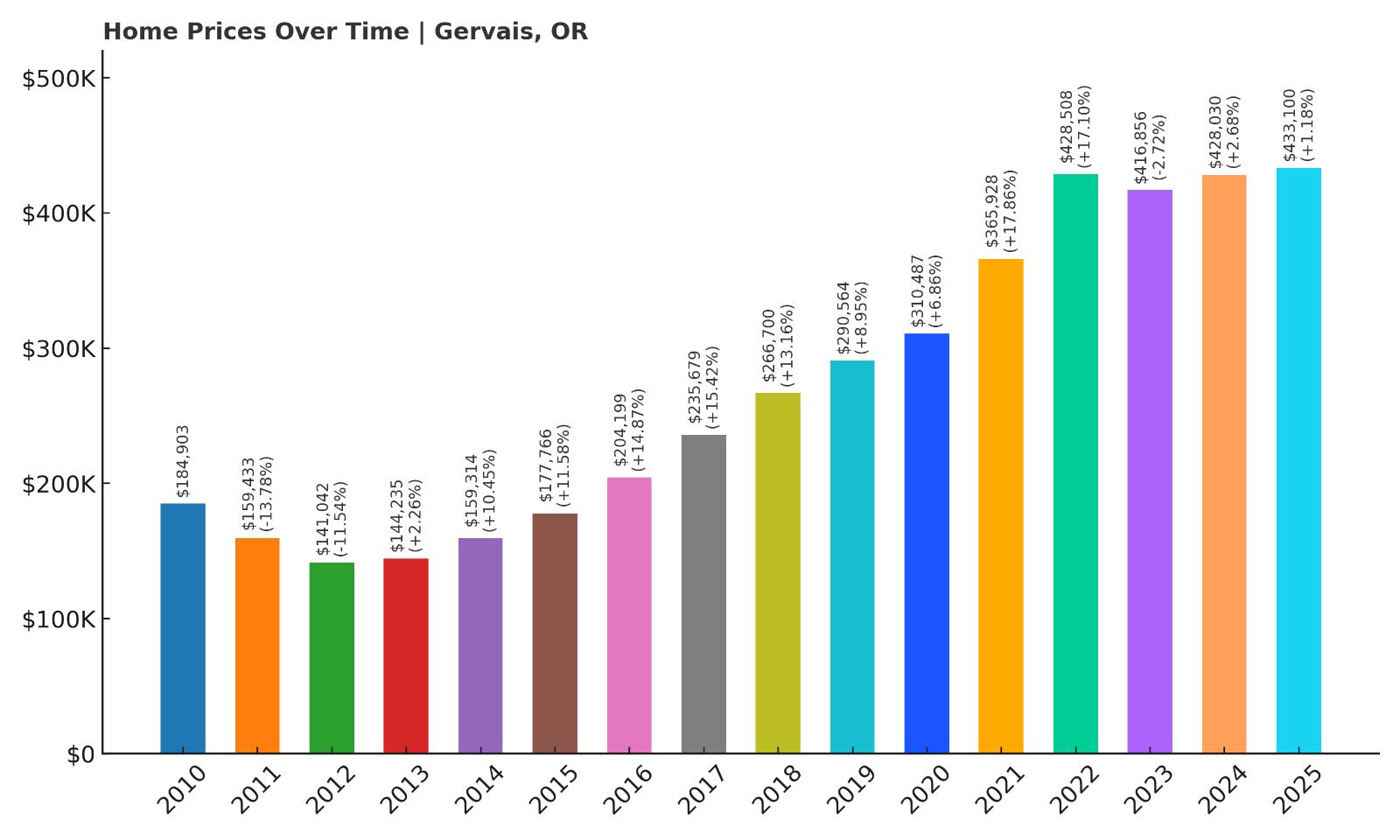

13. Gervais – Crash Risk Percentage: 79.67%

- Crash Risk Percentage: 79.67%

- Historical crashes (8%+ drops): 2

- Worst historical crash: -13.8% (2011)

- Total price increase since 2010: 134.2%

- Overextended above long-term average: 59.4%

- Price volatility (annual swings): 10.0%

- Current 2025 price: $433,100

Gervais presents one of the most alarming crash risk profiles in our analysis, featuring the worst single-year historical decline at 13.8% in 2011. Despite this devastating correction, prices have surged 134.2% since 2010, pushing current valuations 59.4% above sustainable levels. The community’s 10.0% annual volatility indicates continued instability that could trigger another severe correction cycle similar to its previous crash experience.

Gervais – Agricultural Community Experiencing Dangerous Speculation

Located in Marion County between Salem and Portland, Gervais maintains its agricultural character while experiencing intense development pressure from urban expansion. The community’s transformation from farming town to suburban alternative has attracted significant investment interest, driving median prices above $433,000 despite limited local amenities or employment opportunities. This fundamental disconnect between housing costs and local economic conditions creates inherent market instability.

The town’s catastrophic 2011 crash, when values dropped nearly 14% in a single year, exemplifies how quickly agricultural communities can correct when speculative demand disappears. Gervais faced additional declines in 2012, creating cumulative losses exceeding 25% that wiped out years of equity gains. With current valuations now stretched even further above historical norms and volatility remaining at concerning levels, another major correction appears not just possible but mathematically inevitable as overextension reaches unsustainable extremes.

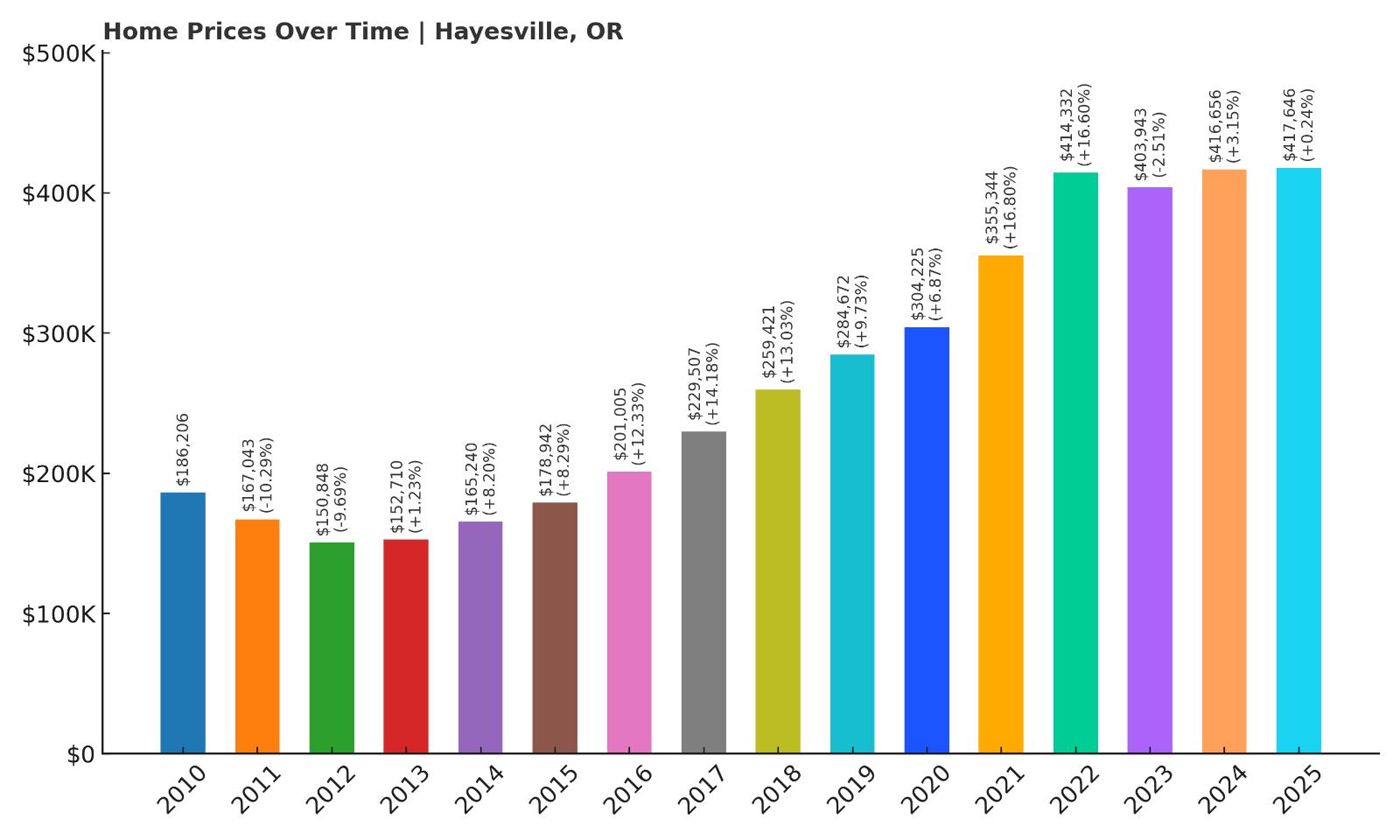

12. Hayesville – Crash Risk Percentage: 80.94%

- Crash Risk Percentage: 80.94%

- Historical crashes (8%+ drops): 2

- Worst historical crash: -10.3% (2011)

- Total price increase since 2010: 124.3%

- Overextended above long-term average: 55.9%

- Price volatility (annual swings): 8.9%

- Current 2025 price: $417,646

Hayesville ranks high on our crash risk analysis due to its combination of historical corrections and dangerous current overvaluation. The community experienced two significant crashes since 2010, with the worst reaching 10.3% in 2011, contributing to nearly 20% cumulative losses over two years. Current prices of $417,646 represent a 124.3% increase since the bottom, but this recovery has stretched valuations 55.9% above sustainable levels, creating conditions for another correction.

Hayesville – Suburban Growth Creating Overextension Risk

This Marion County community serves as a suburban alternative to Salem, offering newer housing developments and family-oriented amenities that have attracted steady population growth. Hayesville’s proximity to major employment centers and quality schools created consistent demand that drove substantial price appreciation, but the 8.9% annual volatility reveals underlying market instability. The area’s rapid development has transformed agricultural land into residential subdivisions, fundamentally altering supply and demand dynamics.

The community’s severe correction during 2011-2012 demonstrates how suburban markets can reverse quickly when broader economic conditions deteriorate or buyer sentiment shifts. With current home values now significantly overextended above historical trends and volatility remaining elevated, Hayesville appears positioned for another correction cycle that could impact recent buyers significantly. The mathematical overextension combined with proven crash vulnerability suggests substantial downside risk exists in the current market environment.

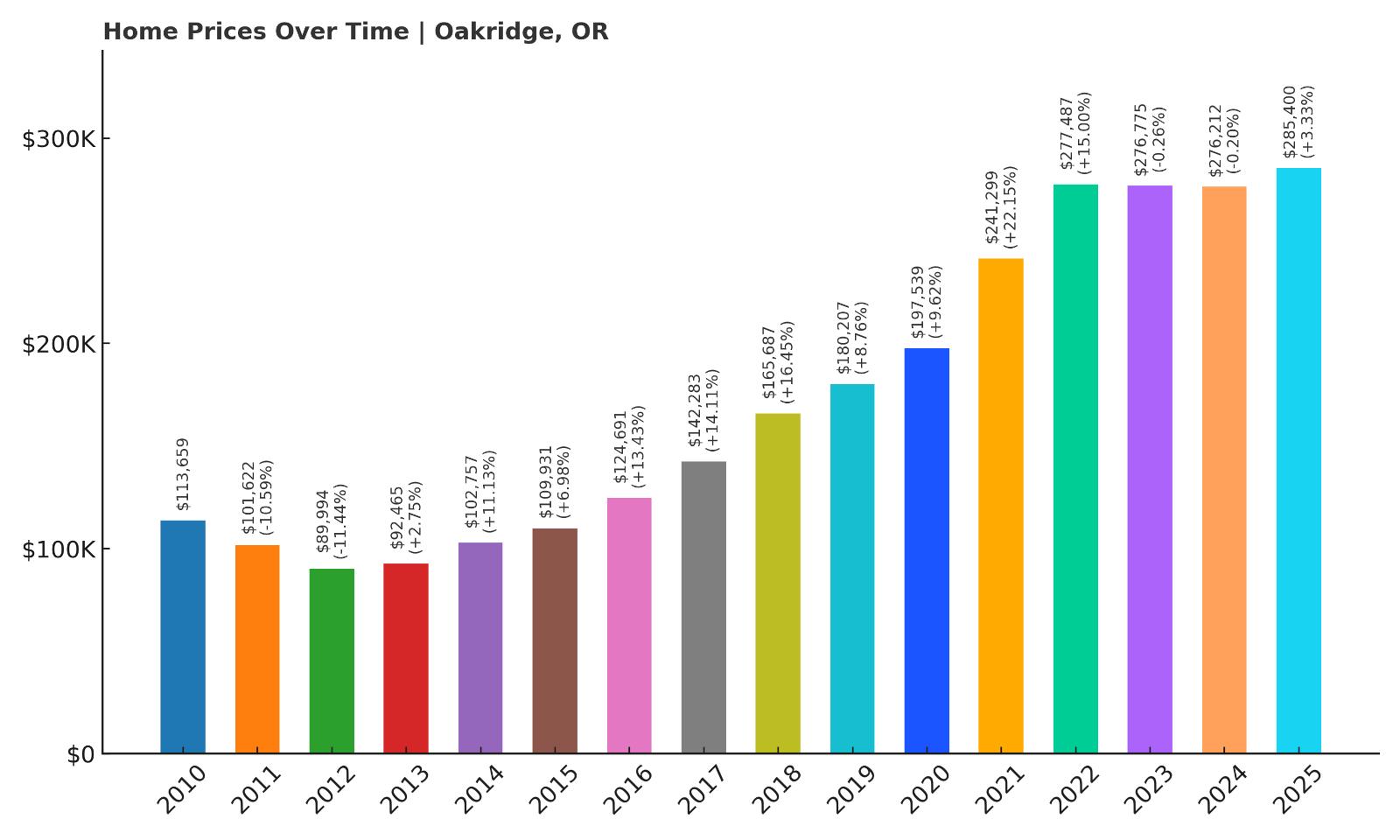

11. Oakridge – Crash Risk Percentage: 82.22%

- Crash Risk Percentage: 82.22%

- Historical crashes (8%+ drops): 2

- Worst historical crash: -11.4% (2012)

- Total price increase since 2010: 151.1%

- Overextended above long-term average: 64.4%

- Price volatility (annual swings): 9.7%

- Current 2025 price: $285,400

Oakridge shows extremely concerning crash risk indicators, with the highest overextension level at 64.4% above long-term averages and explosive 151.1% price growth since 2010. Despite starting from a lower price base of around $113,000, the community has experienced two major crashes and maintains 9.7% annual volatility that suggests continued instability. Current prices of $285,400 represent a dramatic departure from historical affordability levels.

Oakridge – Recreational Demand Driving Dangerous Overvaluation

Located in Lane County along the Cascade Mountains, Oakridge serves as a gateway to outdoor recreation and has attracted significant attention from remote workers and recreational property buyers. The community’s mountain biking trails, forest access, and natural beauty created unprecedented demand that drove prices up over 150% since 2010. However, this explosive growth has disconnected housing costs from local employment opportunities in what remains primarily a rural service economy.

The town’s previous crashes, including an 11.4% single-year decline in 2012, demonstrate how quickly recreational markets can correct when external demand shifts or economic conditions deteriorate. Oakridge’s dependence on tourism and recreational activities makes it particularly vulnerable to economic downturns or changes in lifestyle preferences that drove recent speculation. With valuations now stretched 64.4% above mathematical sustainability and volatility remaining at dangerous levels, another severe correction appears increasingly probable as market fundamentals reassert themselves.

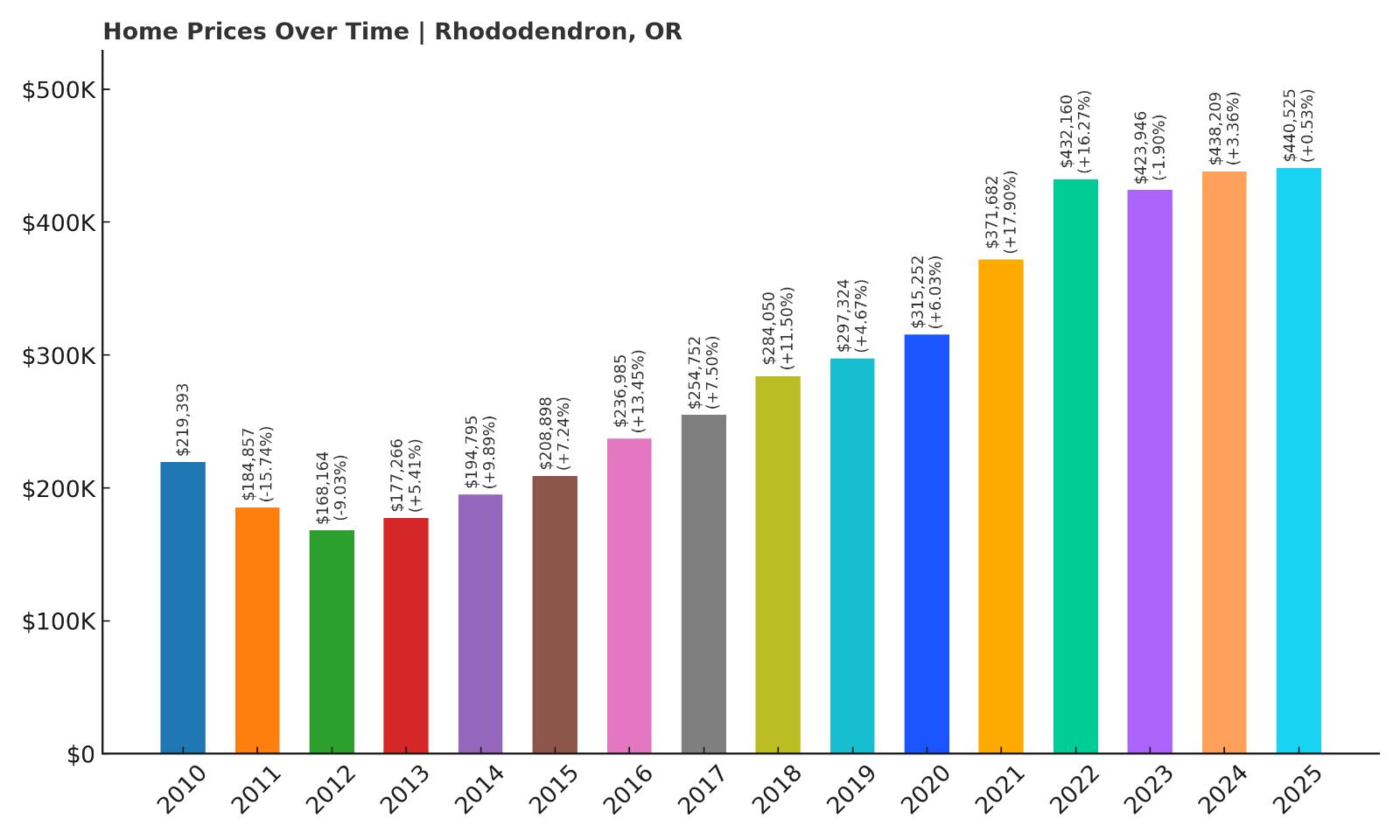

10. Rhododendron – Crash Risk Percentage: 83.50%

Would you like to save this?

- Crash Risk Percentage: 83.50%

- Historical crashes (8%+ drops): 2

- Worst historical crash: -15.7% (2011)

- Total price increase since 2010: 100.8%

- Overextended above long-term average: 51.6%

- Price volatility (annual swings): 8.7%

- Current 2025 price: $440,525

Rhododendron enters the top 10 crash risk communities with a devastating historical correction of 15.7% in 2011, the worst single-year decline in our analysis. Despite this severe crash, prices have doubled since 2010, pushing current valuations 51.6% above sustainable levels. The community’s 8.7% annual volatility indicates continued market instability that could trigger another significant correction cycle given the mathematical overextension.

Rhododendron – Mountain Resort Community Facing Speculation Bubble

This small Clackamas County community in the Mount Hood corridor has transformed from an affordable mountain retreat into a high-priced recreational destination. Rhododendron’s proximity to ski areas, hiking trails, and natural beauty attracted significant investment from Portland-area buyers seeking weekend homes and remote work locations. Current median prices above $440,000 represent a dramatic departure from the community’s historically affordable character as a working-class mountain town.

The area’s catastrophic 2011 crash, when values plummeted nearly 16% in a single year, illustrates the extreme volatility inherent in recreational property markets. Rhododendron’s dependence on external buyers and seasonal demand creates inherent instability that manifests in dramatic price swings when economic conditions shift or buyer preferences change. With current valuations significantly overextended above historical norms and the community’s proven vulnerability to severe corrections, another major crash appears mathematically probable as speculation-driven demand inevitably moderates.

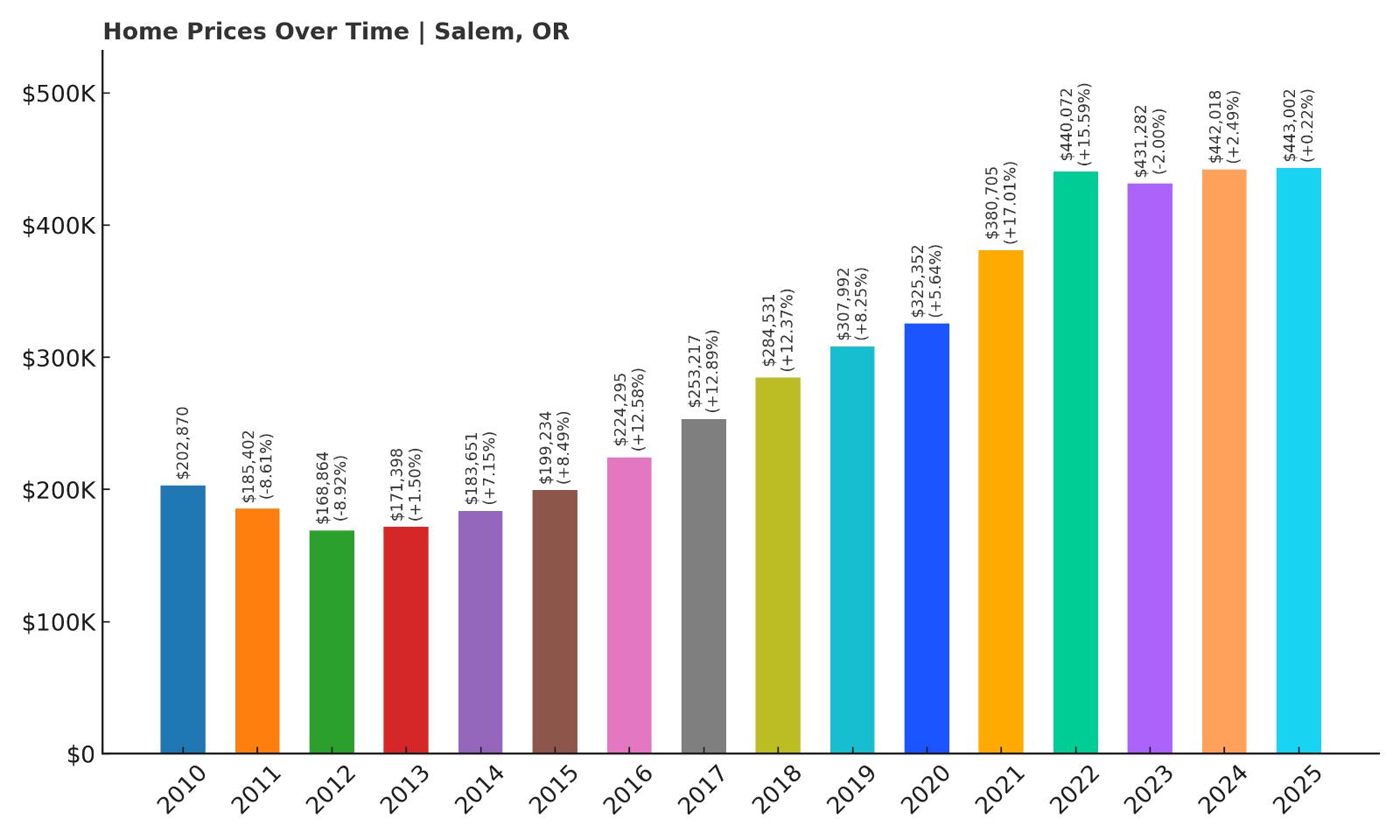

9. Salem – Crash Risk Percentage: 84.78%

- Crash Risk Percentage: 84.78%

- Historical crashes (8%+ drops): 2

- Worst historical crash: -8.9% (2012)

- Total price increase since 2010: 118.4%

- Overextended above long-term average: 52.6%

- Price volatility (annual swings): 8.2%

- Current 2025 price: $443,002

Salem, Oregon’s capital city, ranks ninth in crash risk despite its role as a major employment center and government hub. The city experienced two crashes since 2010, with cumulative losses exceeding 17% during 2011-2012 that demonstrated even stable government markets can correct significantly. Current prices of $443,002 represent a 118.4% increase since the bottom, pushing valuations 52.6% above sustainable levels despite the area’s economic diversity.

Salem – Government Stability Cannot Prevent Market Correction Risk

As Oregon’s capital and third-largest city, Salem benefits from stable government employment and diverse economic activity that typically provides housing market stability. However, the 8.2% annual volatility reveals underlying instability despite the government employment base, suggesting that broader market forces can overwhelm local economic fundamentals. The city’s growth as a regional center has attracted significant development and investment interest that contributed to dangerous price appreciation.

Salem’s previous correction experience proves that even cities with stable employment bases remain vulnerable to housing market cycles when valuations become mathematically unsustainable. The capital city’s 17% cumulative decline during 2011-2012 eliminated years of equity gains for homeowners and demonstrated that government employment cannot insulate markets from broader correction pressures. With current prices now stretched significantly above historical norms, another correction cycle appears likely as mathematical overextension reaches levels that historically precede major declines.

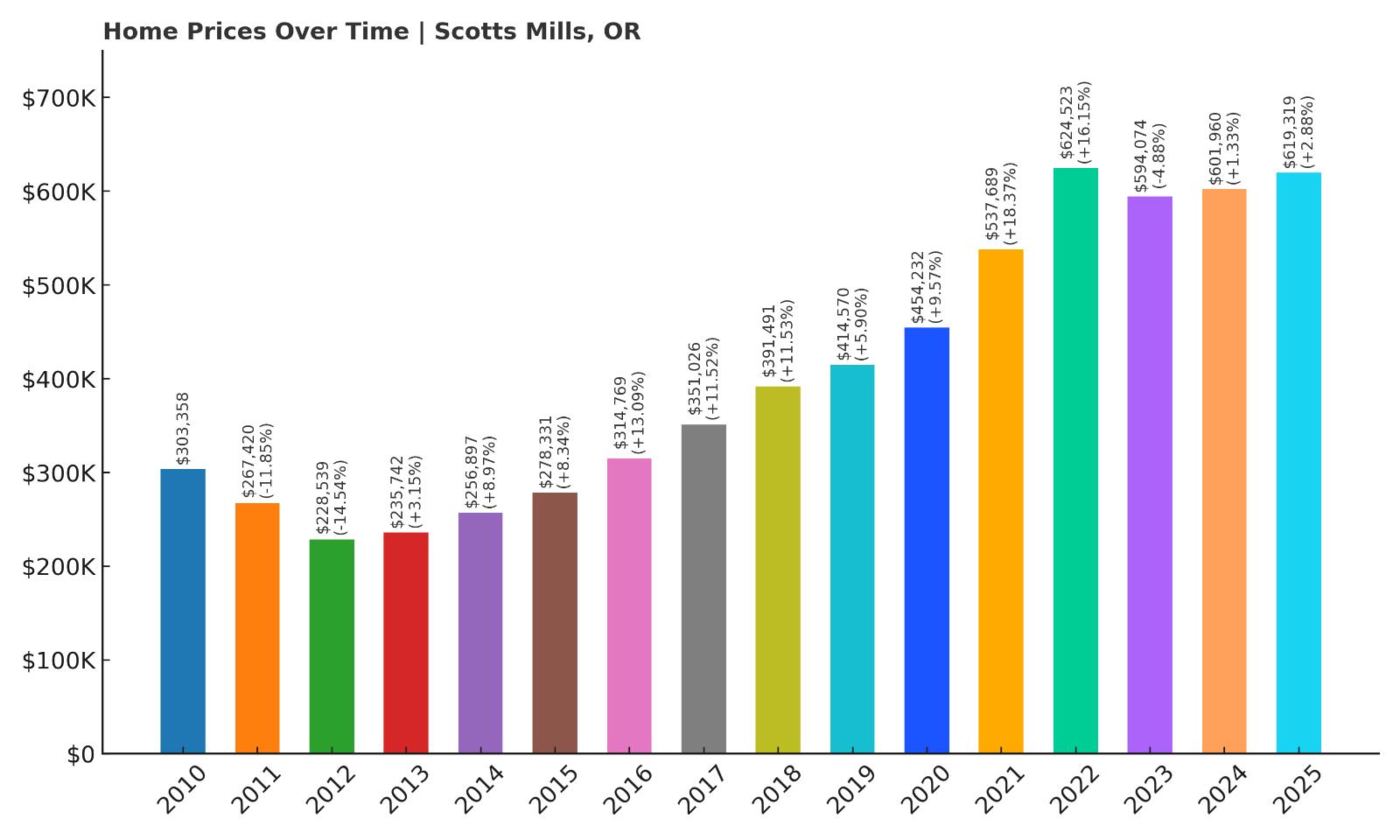

8. Scotts Mills – Crash Risk Percentage: 86.06%

- Crash Risk Percentage: 86.06%

- Historical crashes (8%+ drops): 2

- Worst historical crash: -14.5% (2012)

- Total price increase since 2010: 104.2%

- Overextended above long-term average: 53.1%

- Price volatility (annual swings): 9.5%

- Current 2025 price: $619,319

Scotts Mills demonstrates extremely high crash risk through its combination of severe historical corrections and dangerous current overvaluation. The community suffered a devastating 14.5% decline in 2012, part of cumulative losses exceeding 25% over two years that wiped out substantial homeowner equity. Despite doubling since 2010, current prices of $619,319 sit 53.1% above sustainable levels, while 9.5% annual volatility suggests continued instability.

Scotts Mills – Small Town Premium Creating Correction Vulnerability

This small Marion County community has evolved from a rural mill town into an upscale enclave attracting buyers seeking small-town character with urban accessibility. Scotts Mills’ historic charm and proximity to both Salem and Portland created unique market appeal that drove substantial price appreciation, but the transformation has fundamentally altered the community’s affordability profile. Current median values above $619,000 represent a dramatic departure from the town’s working-class heritage.

The community’s severe 2012 crash, when values dropped over 14% in a single year, demonstrates how quickly small-town premium markets can correct when economic pressures mount or buyer sentiment shifts. Scotts Mills’ limited housing stock amplifies price volatility as demand fluctuates, creating boom and bust cycles that can devastate homeowner equity. With current valuations significantly overextended above historical norms and volatility remaining at concerning levels, another major correction appears increasingly probable as mathematical sustainability limits are approached.

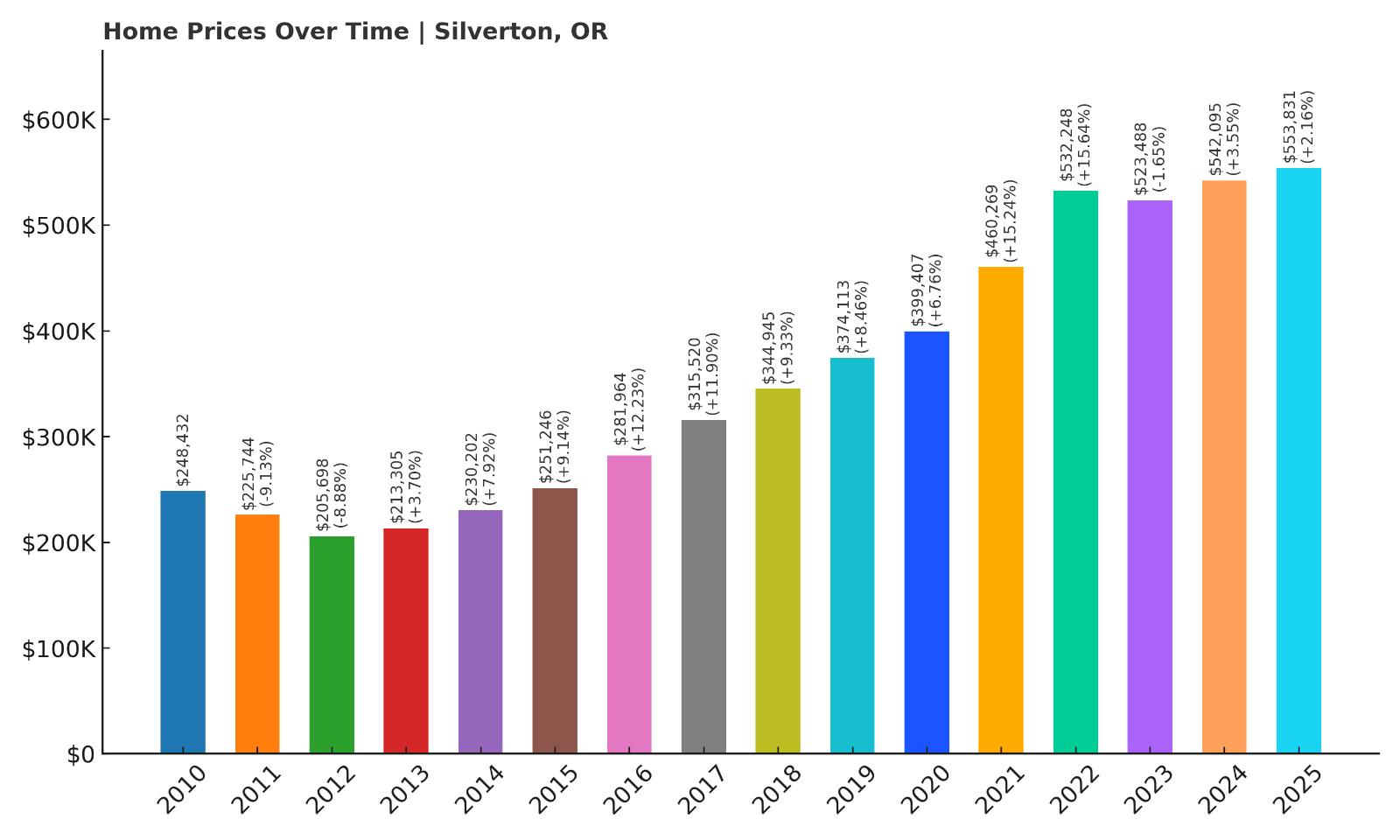

7. Silverton – Crash Risk Percentage: 87.33%

- Crash Risk Percentage: 87.33%

- Historical crashes (8%+ drops): 2

- Worst historical crash: -9.1% (2011)

- Total price increase since 2010: 122.9%

- Overextended above long-term average: 55.4%

- Price volatility (annual swings): 8.4%

- Current 2025 price: $553,831

Silverton ranks seventh in crash risk with concerning overvaluation levels and a history of significant corrections. The community experienced two major crashes since 2010, with cumulative losses approaching 18% during 2011-2012 that demonstrated the market’s vulnerability to broader economic pressures. Current prices of $553,831 represent a 122.9% increase since the bottom, but this recovery has pushed valuations 55.4% above sustainable levels, creating conditions ripe for another correction.

Silverton – Historic Charm Driving Unsustainable Price Appreciation

Located in Marion County’s Cascade foothills, Silverton combines historic charm with natural beauty that has attracted significant buyer interest from the Portland metropolitan area. The community’s Victorian architecture, annual festivals, and proximity to Silver Falls State Park created unique market appeal that drove substantial price appreciation over the past decade. However, the 8.4% annual volatility reveals underlying instability as demand fluctuates with broader economic conditions and buyer preferences.

The town’s previous correction experience, including nearly 18% cumulative losses during 2011-2012, demonstrates how quickly historic communities can correct when premium pricing becomes unsustainable or economic conditions deteriorate. Silverton’s dependence on external buyers seeking lifestyle amenities makes it particularly vulnerable to shifts in discretionary spending or commuting patterns that could reduce demand pressure. With current valuations stretched significantly above historical norms, another correction cycle appears mathematically inevitable as overextension reaches levels that historically trigger major market adjustments.

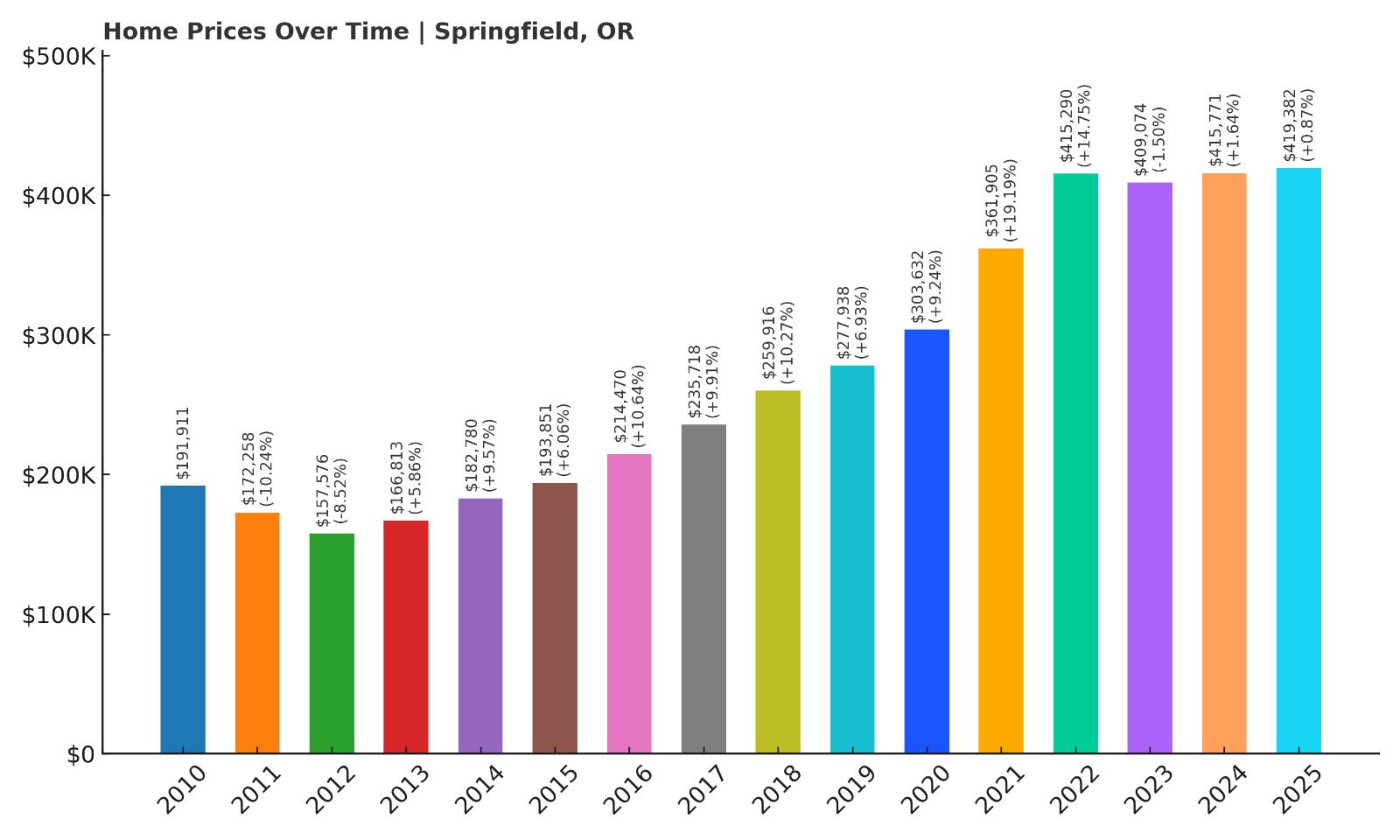

6. Springfield – Crash Risk Percentage: 88.61%

- Crash Risk Percentage: 88.61%

- Historical crashes (8%+ drops): 2

- Worst historical crash: -10.2% (2011)

- Total price increase since 2010: 118.5%

- Overextended above long-term average: 53.3%

- Price volatility (annual swings): 8.3%

- Current 2025 price: $419,382

Springfield enters the top six crash risk communities with dangerous overvaluation levels despite its role as a regional economic center. The city experienced two significant crashes since 2010, with the worst reaching 10.2% in 2011 as part of cumulative losses exceeding 18% over two years. Current prices of $419,382 represent a 118.5% increase since the market bottom, pushing valuations 53.3% above sustainable levels while maintaining concerning 8.3% annual volatility.

Springfield – Industrial Base Cannot Prevent Housing Market Vulnerability

As Lane County’s second-largest city and part of the Eugene-Springfield metropolitan area, Springfield maintains a diverse economic base centered on manufacturing, healthcare, and education that typically provides housing market stability. However, the city’s proximity to the University of Oregon and Eugene has created development pressure that contributed to dangerous price appreciation exceeding local economic fundamentals. The 8.3% annual volatility suggests underlying market instability despite the diversified employment base.

Springfield’s severe 2011-2012 correction, when values dropped over 18% cumulatively, proved that even cities with industrial employment bases remain vulnerable to housing market cycles when valuations become mathematically unsustainable. The correction eliminated years of equity gains and demonstrated how quickly regional markets can adjust when broader economic pressures mount. With current prices now significantly overextended above historical norms, another correction appears increasingly likely as mathematical limits approach levels that historically precede major market adjustments.

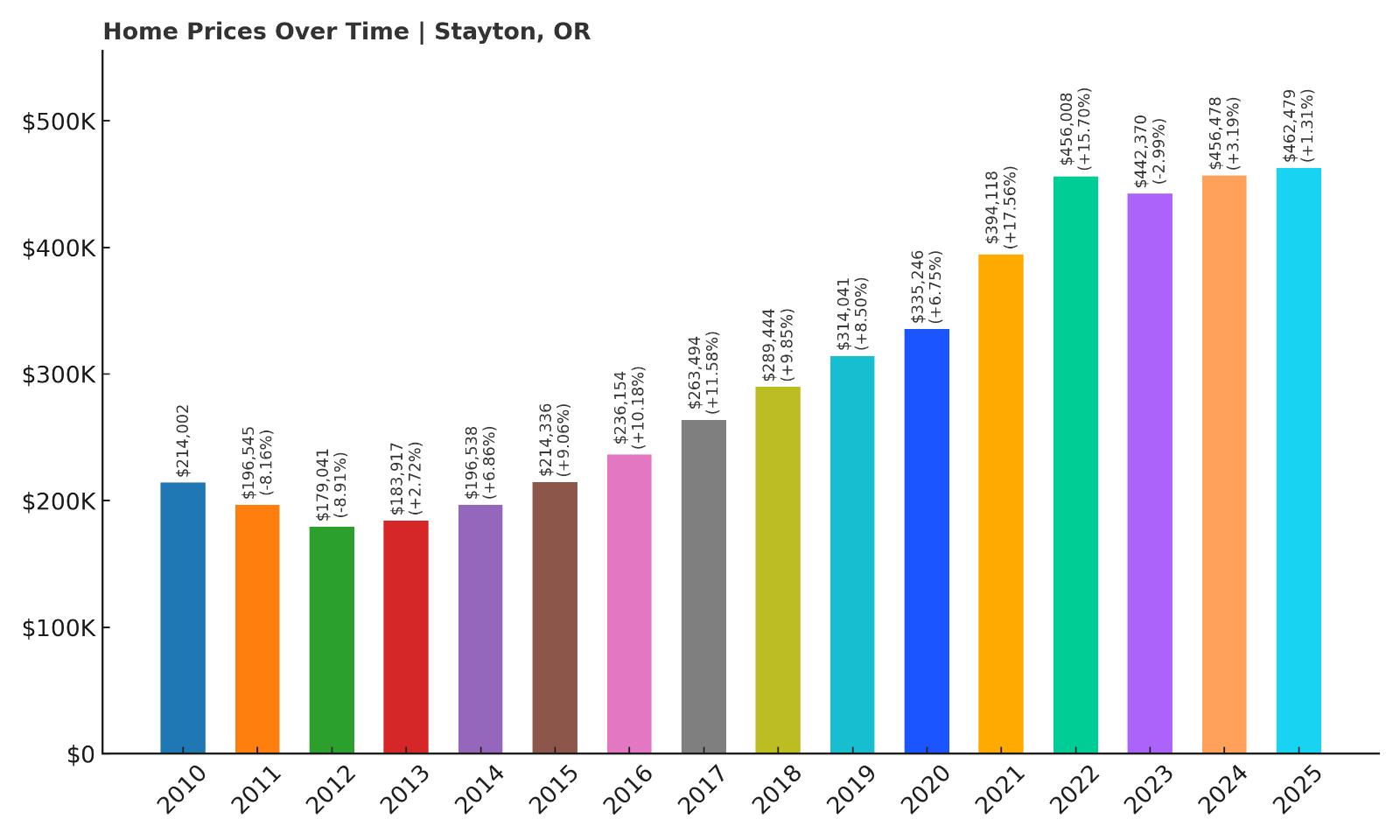

5. Stayton – Crash Risk Percentage: 89.89%

- Crash Risk Percentage: 89.89%

- Historical crashes (8%+ drops): 2

- Worst historical crash: -8.9% (2012)

- Total price increase since 2010: 116.1%

- Overextended above long-term average: 53.1%

- Price volatility (annual swings): 8.2%

- Current 2025 price: $462,479

Stayton ranks fifth in crash risk with nearly 90% probability of correction based on our mathematical analysis. The community experienced two crashes since 2010, with cumulative losses approaching 17% during 2011-2012 that demonstrated significant market vulnerability. Current prices of $462,479 represent a 116.1% increase since the bottom, but this recovery has pushed valuations 53.1% above sustainable levels while maintaining 8.2% annual volatility that suggests continued instability.

Stayton – Regional Growth Hub Facing Overextension Risk

Located in Marion County along the North Santiam River, Stayton serves as a regional center for the surrounding agricultural and timber communities while attracting suburban development from Salem-area growth. The city’s combination of small-town character and regional amenities created steady demand that drove substantial price appreciation, but current valuations have stretched far beyond local economic fundamentals. The community’s transformation from agricultural service center to suburban alternative has fundamentally altered its housing market dynamics.

Stayton’s previous correction experience, including nearly 17% cumulative losses during the last major cycle, demonstrates how regional centers can correct significantly when broader economic pressures mount or development speculation moderates. The city’s dependence on external buyers seeking affordability alternatives to larger metropolitan areas makes it vulnerable to shifts in commuting patterns or economic conditions that could reduce demand pressure. With current prices now significantly overextended above historical norms and the community’s proven correction vulnerability, another major adjustment appears mathematically inevitable as sustainability limits approach.

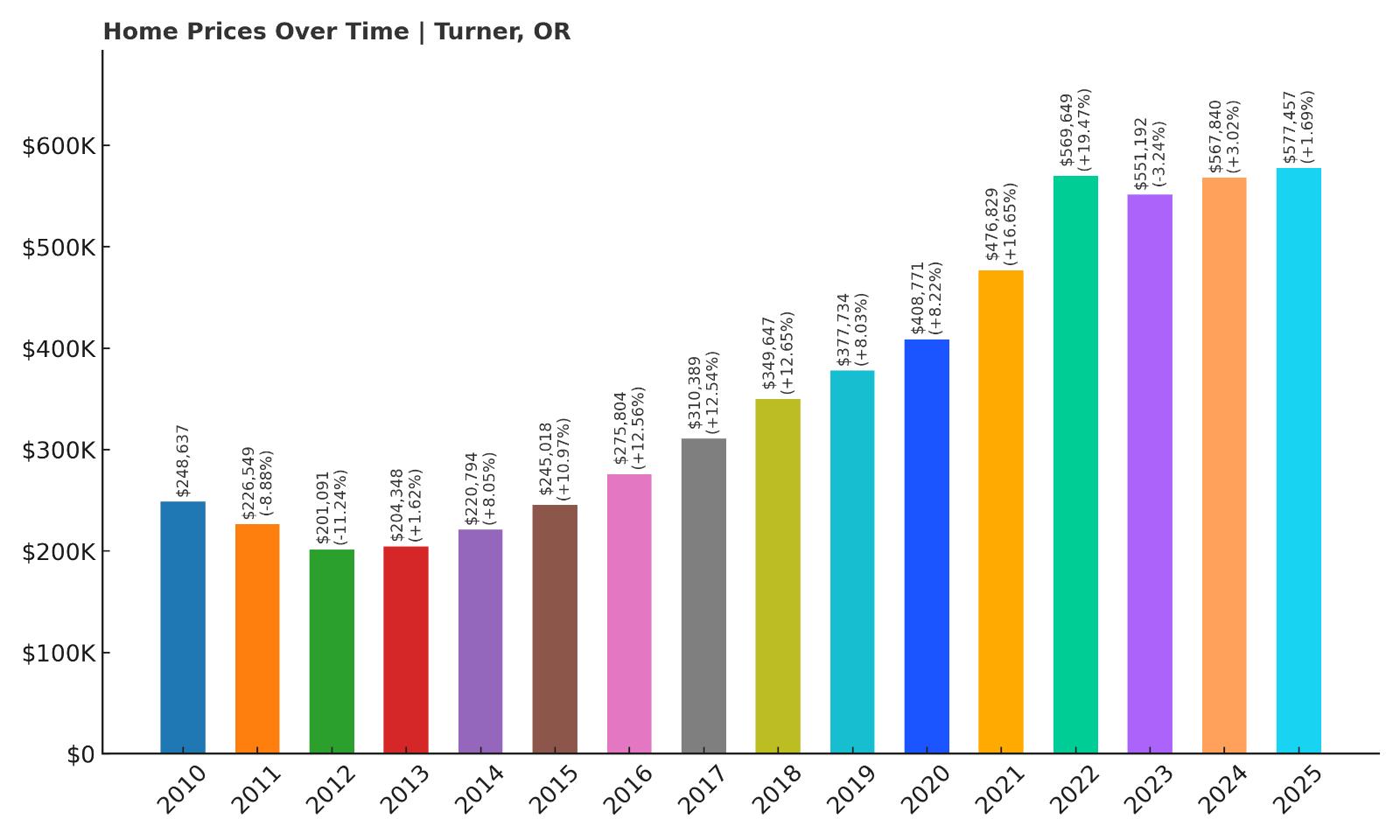

4. Turner – Crash Risk Percentage: 91.17%

- Crash Risk Percentage: 91.17%

- Historical crashes (8%+ drops): 2

- Worst historical crash: -11.2% (2012)

- Total price increase since 2010: 132.2%

- Overextended above long-term average: 59.0%

- Price volatility (annual swings): 9.3%

- Current 2025 price: $577,457

Turner ranks fourth with extremely high crash risk exceeding 91% based on dangerous overvaluation and severe historical corrections. The community suffered devastating losses during 2011-2012, with the worst single-year decline reaching 11.2%, contributing to cumulative drops exceeding 19% that wiped out years of homeowner equity. Current prices of $577,457 represent a 132.2% increase since the bottom, pushing valuations 59.0% above sustainable levels with concerning 9.3% annual volatility.

Turner – Agricultural Transformation Creating Bubble Conditions

This small Marion County community has experienced dramatic transformation from agricultural service center to upscale suburban enclave as Salem metropolitan growth expanded eastward. Turner’s rural character combined with modern development has attracted significant buyer interest, but current median values above $577,000 represent a fundamental departure from the community’s working agricultural heritage. The 9.3% annual volatility reflects the tension between rural character and suburban pricing that creates inherent market instability.

The town’s catastrophic 2012 correction, when values dropped over 11% in a single year as part of a broader 19% decline, demonstrates how quickly agricultural communities can correct when speculative demand disappears or economic conditions deteriorate. Turner’s limited housing stock amplifies price volatility as external demand fluctuates, creating boom and bust cycles that can devastate local homeowner equity. With valuations now stretched 59% above mathematical sustainability and the community’s proven vulnerability to severe corrections, another major crash appears not just probable but inevitable as market fundamentals reassert themselves.

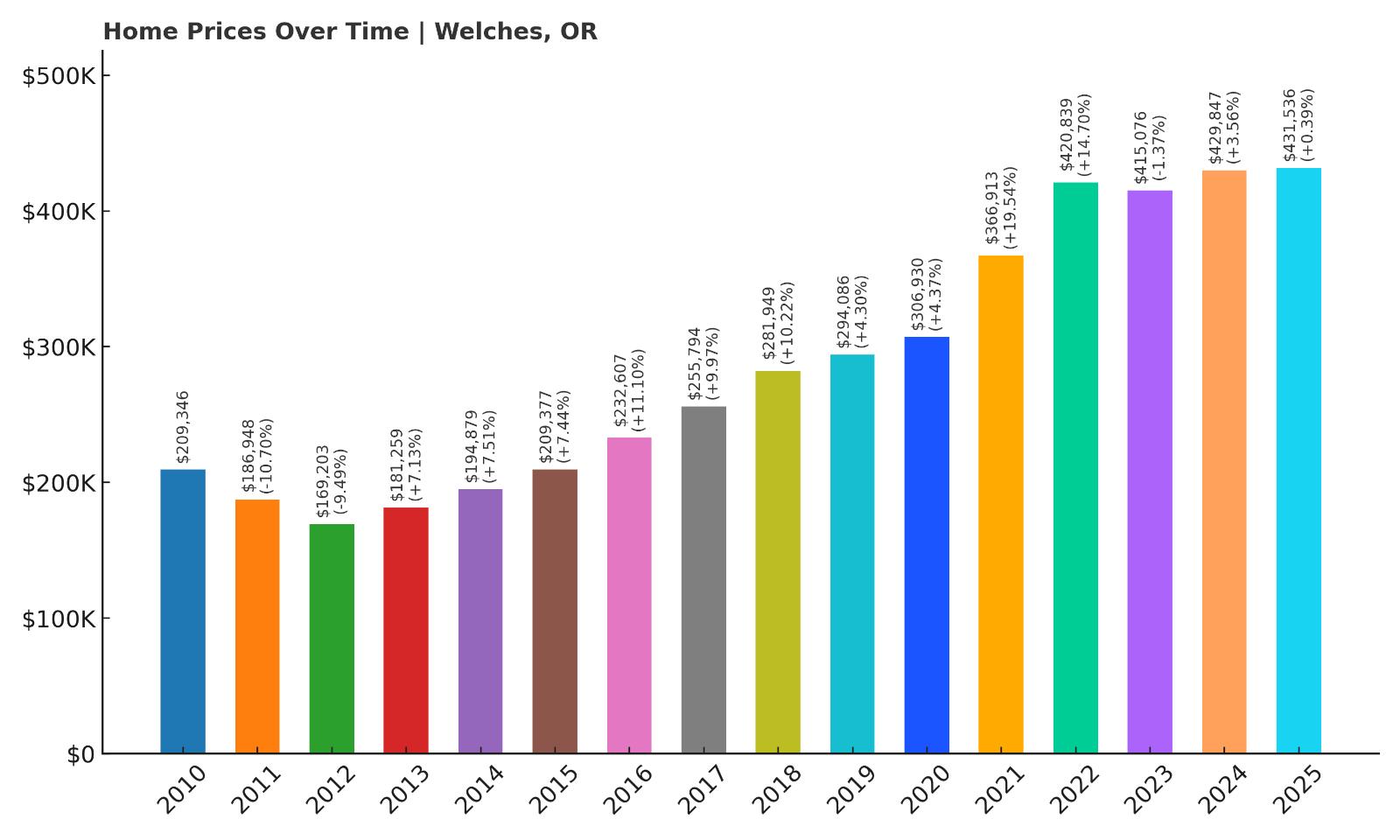

3. Welches – Crash Risk Percentage: 92.44%

- Crash Risk Percentage: 92.44%

- Historical crashes (8%+ drops): 2

- Worst historical crash: -10.7% (2011)

- Total price increase since 2010: 106.1%

- Overextended above long-term average: 50.5%

- Price volatility (annual swings): 8.1%

- Current 2025 price: $431,536

Welches ranks third in crash risk with over 92% probability of correction based on our comprehensive analysis. The Mount Hood corridor community experienced two major crashes since 2010, with the worst reaching 10.7% in 2011 as part of cumulative losses approaching 19% over two years. Despite doubling since 2010, current prices of $431,536 sit 50.5% above sustainable levels, while 8.1% annual volatility indicates continued market instability in this recreational property market.

Welches – Resort Community Speculation Reaching Breaking Point

Located in Clackamas County’s Mount Hood corridor, Welches serves as a gateway to year-round recreation including skiing, hiking, and mountain biking that has attracted intense buyer interest from Portland metropolitan area residents. The community’s natural beauty and recreational amenities created unique market appeal, but the transformation from affordable mountain retreat to high-priced resort destination has fundamentally altered local market dynamics. Current valuations reflect speculation-driven demand rather than local economic fundamentals.

The area’s severe 2011-2012 correction, when values dropped nearly 19% cumulatively, illustrates the extreme volatility inherent in recreational property markets that depend on external buyers and discretionary spending. Welches’ vulnerability to economic downturns or shifts in recreational preferences makes it particularly susceptible to dramatic price corrections when speculative demand moderates. With current prices significantly overextended above historical norms and the community’s proven correction vulnerability, another major crash appears mathematically certain as sustainability limits have been exceeded by dangerous margins.

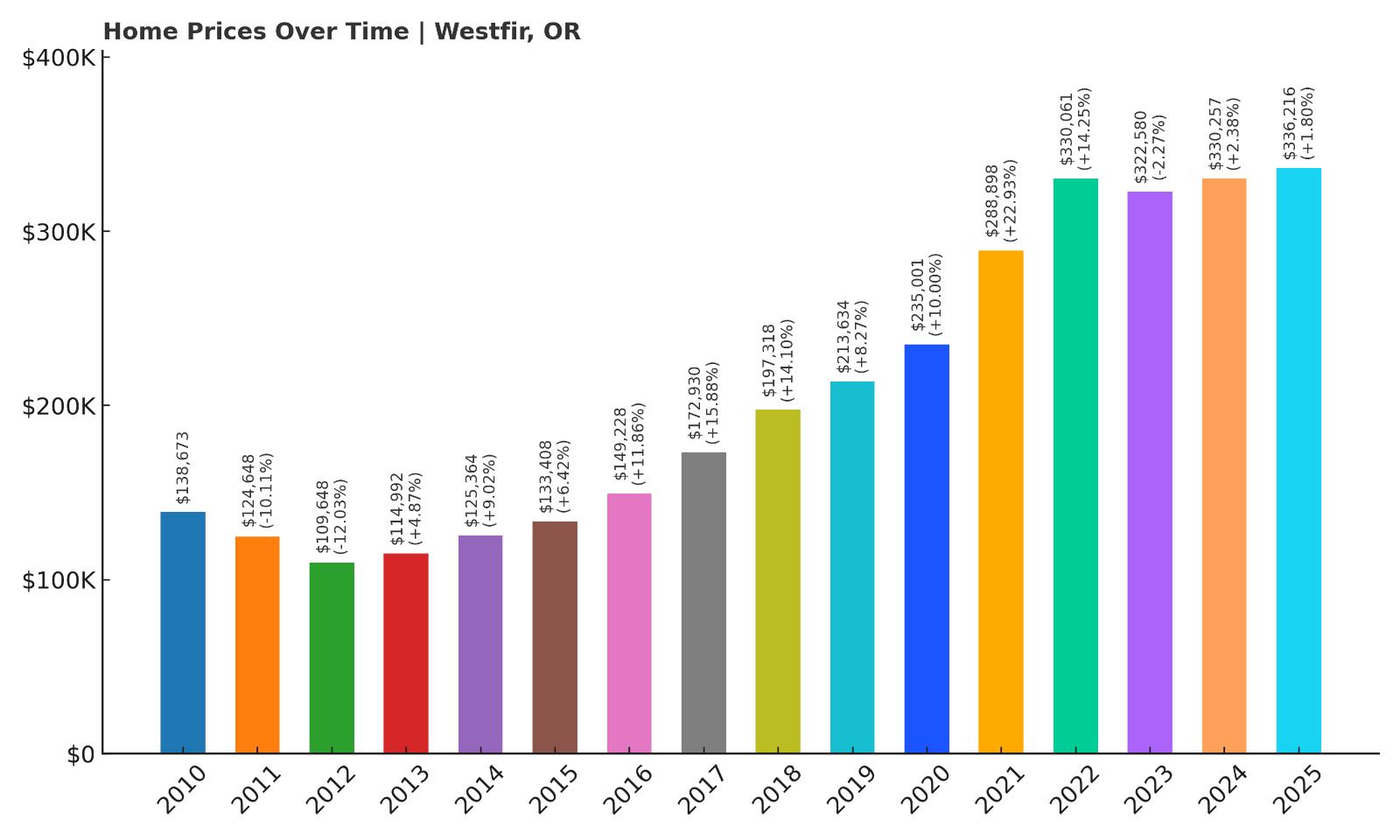

2. Westfir – Crash Risk Percentage: 93.72%

- Crash Risk Percentage: 93.72%

- Historical crashes (8%+ drops): 2

- Worst historical crash: -12.0% (2012)

- Total price increase since 2010: 142.5%

- Overextended above long-term average: 61.9%

- Price volatility (annual swings): 9.7%

- Current 2025 price: $336,216

Westfir ranks second with nearly 94% crash risk probability due to extreme overvaluation and severe historical corrections. The small Lane County community suffered devastating losses during 2011-2012, including a 12% single-year decline that contributed to cumulative drops exceeding 22% and eliminated years of homeowner equity. Current prices of $336,216 represent a staggering 142.5% increase since 2010, pushing valuations 61.9% above sustainable levels with dangerous 9.7% annual volatility.

Westfir – Extreme Overextension in Isolated Mountain Community

This tiny Lane County community in the Cascade Mountains has experienced the most extreme overvaluation in our analysis, with current prices stretched nearly 62% above mathematical sustainability despite limited local amenities or economic activity. Westfir’s isolation and minimal population have created a thin market where small changes in demand create dramatic price volatility, as evidenced by the 9.7% annual swings that rank among the highest in our study. The community’s transformation from timber town to recreational property market has disconnected prices from local economic reality.

The town’s catastrophic 2012 crash, when values plummeted 12% in a single year as part of a broader 22% decline, demonstrates how quickly isolated markets can correct when external demand disappears or economic conditions deteriorate. Westfir’s dependence on recreational buyers and investment activity makes it extremely vulnerable to broader economic shifts or changes in lifestyle preferences that drove recent speculation. With valuations now stretched to the most dangerous levels in our analysis and proven vulnerability to severe corrections, another major crash appears not just probable but mathematically inevitable as current pricing has no sustainable foundation.

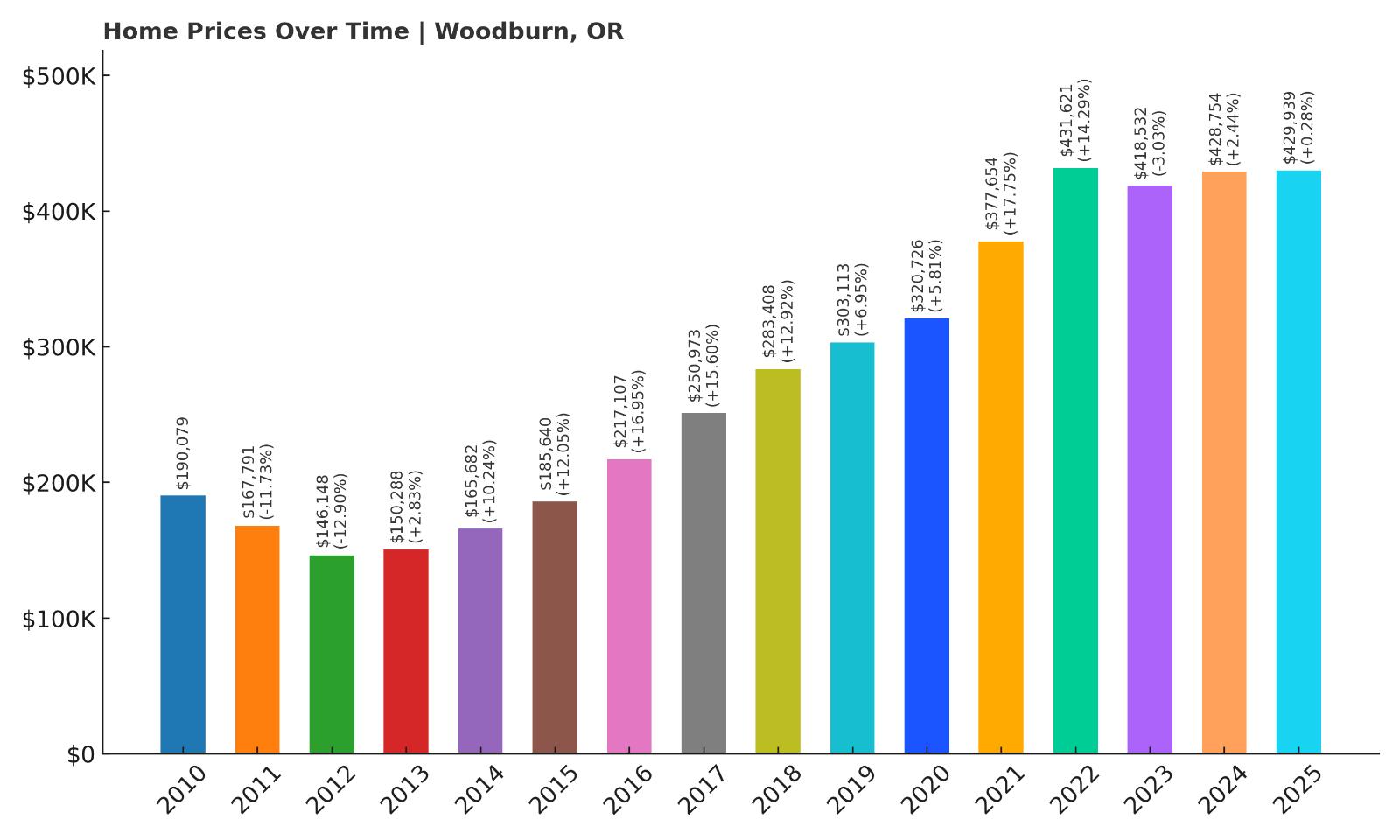

1. Woodburn – Crash Risk Percentage: 95.00%

- Crash Risk Percentage: 95.00%

- Historical crashes (8%+ drops): 2

- Worst historical crash: -12.9% (2012)

- Total price increase since 2010: 126.2%

- Overextended above long-term average: 54.0%

- Price volatility (annual swings): 9.7%

- Current 2025 price: $429,939

Woodburn tops our crash risk analysis with a 95% probability of correction, representing the most dangerous housing market conditions in Oregon. The community experienced the worst historical crash in our study at 12.9% in 2012, part of devastating cumulative losses exceeding 24% that eliminated years of homeowner wealth. Current prices of $429,939 represent a 126.2% increase since the bottom, pushing valuations 54% above sustainable levels while maintaining extremely concerning 9.7% annual volatility.

Woodburn – Agricultural Community Facing Inevitable Correction

Located in Marion County south of Portland, Woodburn serves as a regional agricultural center that has attracted intense development pressure as metropolitan growth expanded southward. The community’s proximity to major employment centers combined with relatively affordable housing created substantial buyer interest, but current median values above $429,000 represent a fundamental disconnect from local agricultural wages and economic conditions. The 9.7% annual volatility reflects severe market instability as external demand fluctuates.