Would you like to save this?

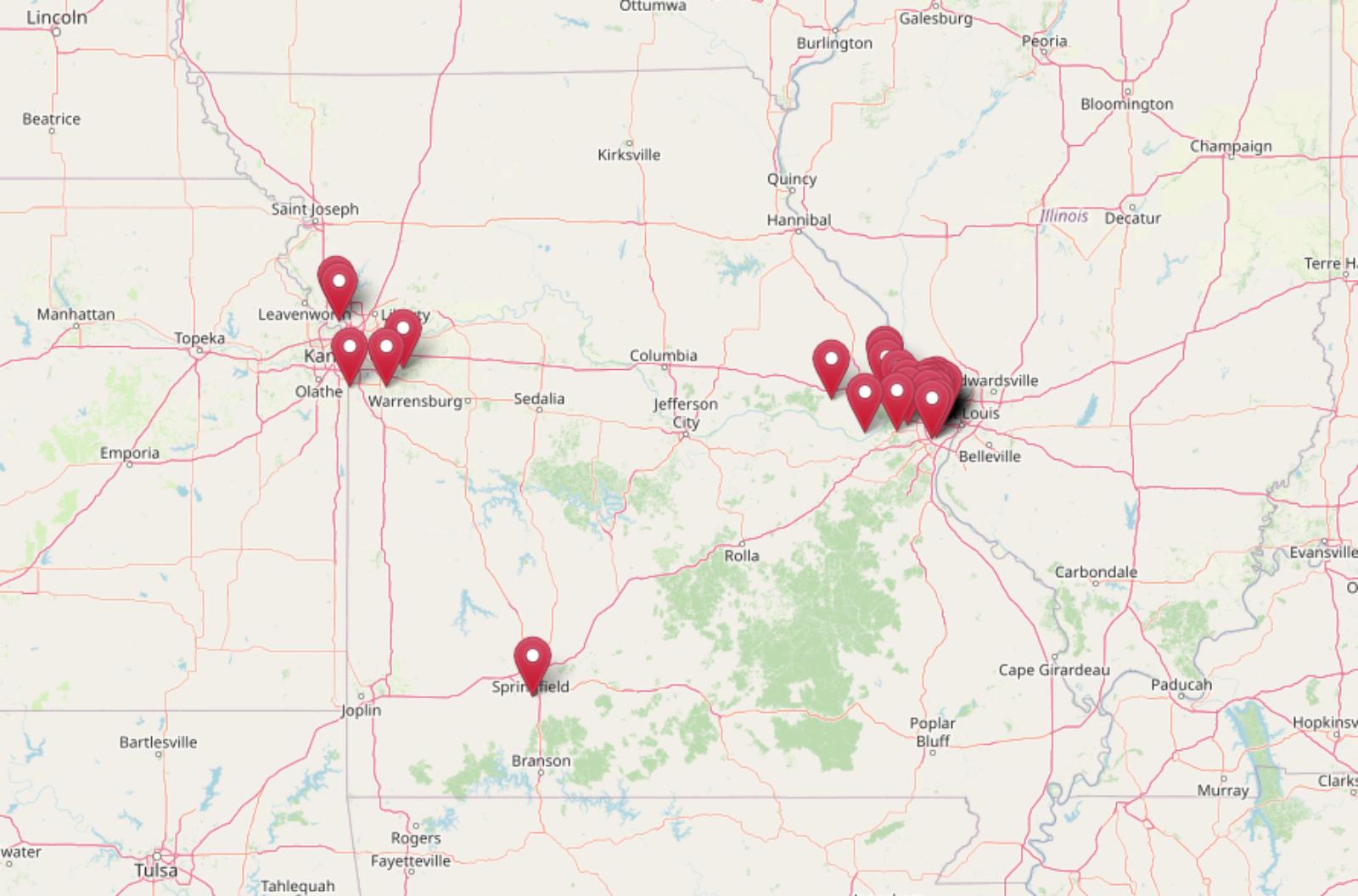

Home values in parts of Missouri have surged dramatically over the past 15 years, with some towns more than doubling in price since 2010. According to the Zillow Home Value Index, the biggest gains are showing up in lake communities, outer suburbs, and fast-growing corridors where demand has outpaced supply. These shifts are changing the game for buyers, pushing formerly affordable towns into the high-price bracket and reshaping the map of desirable places to live.

30. Oakland – 73% Home Price Increase Since 2010

- 2010: $272,453

- 2011: $263,104 (−$9,349, −3.43% from previous year)

- 2012: $257,893 (−$5,211, −1.98% from previous year)

- 2013: $272,826 (+$14,933, +5.79% from previous year)

- 2014: $292,624 (+$19,797, +7.26% from previous year)

- 2015: $296,793 (+$4,170, +1.42% from previous year)

- 2016: $312,463 (+$15,670, +5.28% from previous year)

- 2017: $324,334 (+$11,871, +3.80% from previous year)

- 2018: $338,901 (+$14,566, +4.49% from previous year)

- 2019: $344,671 (+$5,770, +1.70% from previous year)

- 2020: $356,614 (+$11,943, +3.47% from previous year)

- 2021: $400,502 (+$43,888, +12.31% from previous year)

- 2022: $433,219 (+$32,717, +8.17% from previous year)

- 2023: $443,120 (+$9,901, +2.29% from previous year)

- 2024: $458,842 (+$15,722, +3.55% from previous year)

- 2025: $471,272 (+$12,430, +2.71% from previous year)

Oakland’s housing market shows a steady climb from $272,453 in 2010 to $471,272 in 2025, representing solid growth despite some early volatility. The town experienced its most significant gains during 2021-2022, when prices jumped nearly 21% over two years. This growth pattern reflects broader suburban trends where established communities attracted buyers seeking value outside major metropolitan areas.

Oakland – Consistent Growth in North County

Located in St. Louis County, Oakland has maintained steady appeal as a residential community that offers suburban living within reach of urban amenities. The town’s housing market weathered the early 2010s downturn better than many communities, with prices beginning to recover by 2013. Current home values approaching $470,000 reflect the area’s established neighborhoods and proximity to employment centers.

The pandemic years brought Oakland’s most dramatic price increases, with 2021 alone seeing a 12% jump that pushed median values above $400,000 for the first time. This surge aligns with broader market trends where buyers fled urban areas for suburban communities, driving up demand and prices in previously affordable markets across the St. Louis metropolitan region.

29. Dardenne Prairie – 83% Home Price Increase Since 2010

- 2010: $258,563

- 2011: $245,364 (−$13,199, −5.10% from previous year)

- 2012: $242,083 (−$3,280, −1.34% from previous year)

- 2013: $251,672 (+$9,589, +3.96% from previous year)

- 2014: $264,402 (+$12,730, +5.06% from previous year)

- 2015: $271,147 (+$6,744, +2.55% from previous year)

- 2016: $286,803 (+$15,656, +5.77% from previous year)

- 2017: $299,245 (+$12,442, +4.34% from previous year)

- 2018: $307,039 (+$7,794, +2.60% from previous year)

- 2019: $320,350 (+$13,311, +4.34% from previous year)

- 2020: $333,343 (+$12,993, +4.06% from previous year)

- 2021: $383,074 (+$49,731, +14.92% from previous year)

- 2022: $441,532 (+$58,457, +15.26% from previous year)

- 2023: $447,094 (+$5,562, +1.26% from previous year)

- 2024: $461,422 (+$14,329, +3.20% from previous year)

- 2025: $473,481 (+$12,058, +2.61% from previous year)

Dardenne Prairie demonstrates remarkable resilience and growth, climbing from $258,563 in 2010 to nearly $475,000 today. The community experienced its most explosive growth during 2021-2022, when home values surged by over 30% in just two years. This dramatic increase reflects the area’s transformation from an affordable suburban option to a premium market destination.

Dardenne Prairie – St. Charles County’s Rising Star

Kitchen Style?

Situated in St. Charles County, Dardenne Prairie has evolved from a quiet suburban community into one of the region’s most sought-after residential areas. The city’s planned development approach, excellent schools, and family-friendly amenities have attracted waves of new residents, particularly during the pandemic when remote work made location flexibility possible. Home values now approaching $475,000 represent a dramatic shift from the community’s more modest beginnings.

The area’s 30% price surge between 2021-2022 reflects intense buyer competition for Dardenne Prairie’s newer housing stock and superior municipal services. Unlike older suburban communities, Dardenne Prairie benefits from modern infrastructure and careful planning that has maintained property values even as the broader market has cooled. The community’s continued growth suggests sustained demand for quality suburban living in the St. Charles corridor.

28. Saint Paul – 86% Home Price Increase Since 2010

- 2010: $255,927

- 2011: $235,313 (−$20,614, −8.05% from previous year)

- 2012: $239,326 (+$4,013, +1.71% from previous year)

- 2013: $250,642 (+$11,316, +4.73% from previous year)

- 2014: $261,430 (+$10,788, +4.30% from previous year)

- 2015: $275,186 (+$13,756, +5.26% from previous year)

- 2016: $294,727 (+$19,541, +7.10% from previous year)

- 2017: $309,767 (+$15,040, +5.10% from previous year)

- 2018: $320,881 (+$11,114, +3.59% from previous year)

- 2019: $337,049 (+$16,168, +5.04% from previous year)

- 2020: $353,046 (+$15,996, +4.75% from previous year)

- 2021: $411,077 (+$58,031, +16.44% from previous year)

- 2022: $462,326 (+$51,249, +12.47% from previous year)

- 2023: $456,494 (−$5,833, −1.26% from previous year)

- 2024: $463,508 (+$7,015, +1.54% from previous year)

- 2025: $476,139 (+$12,631, +2.73% from previous year)

Saint Paul’s journey from $255,927 in 2010 to $476,139 today showcases steady appreciation punctuated by dramatic pandemic-era gains. The community saw its most significant growth during 2021-2022, when values jumped nearly 29% over two years before experiencing a brief correction in 2023. This pattern reflects broader market dynamics where rapid growth was followed by market stabilization.

Saint Paul – Small Town Charm Meets Big Price Growth

Located in St. Charles County, Saint Paul represents the transformation of small Missouri communities into desirable residential markets. The town’s rural character combined with accessibility to metropolitan amenities has made it increasingly attractive to buyers seeking space and value. Current home prices approaching $480,000 mark a dramatic shift from the community’s agricultural roots to its current status as an upscale residential enclave.

The town’s 16% price jump in 2021 alone demonstrates how pandemic-driven migration patterns affected even smaller communities across Missouri. Saint Paul’s appeal lies in its combination of open space, newer housing developments, and proximity to employment centers in St. Charles and St. Louis counties. Despite a brief price correction in 2023, the market has resumed its upward trajectory, suggesting sustained demand for this type of suburban-rural lifestyle.

27. Innsbrook – 230% Home Price Increase Since 2012

- 2012: $145,017

- 2013: $147,128 (+$2,111, +1.46% from previous year)

- 2014: $152,368 (+$5,239, +3.56% from previous year)

- 2015: $160,132 (+$7,764, +5.10% from previous year)

- 2016: $178,501 (+$18,369, +11.47% from previous year)

- 2017: $195,265 (+$16,765, +9.39% from previous year)

- 2018: $208,620 (+$13,354, +6.84% from previous year)

- 2019: $245,927 (+$37,307, +17.88% from previous year)

- 2020: $256,439 (+$10,512, +4.27% from previous year)

- 2021: $342,323 (+$85,884, +33.49% from previous year)

- 2022: $452,605 (+$110,282, +32.22% from previous year)

- 2023: $437,520 (−$15,085, −3.33% from previous year)

- 2024: $452,323 (+$14,803, +3.38% from previous year)

- 2025: $479,033 (+$26,710, +5.91% from previous year)

Innsbrook’s price trajectory represents one of Missouri’s most dramatic housing transformations, skyrocketing from $145,017 in 2012 to nearly $480,000 today. The resort community experienced explosive growth during 2021-2022, when values more than doubled in just two years. Even after a brief correction in 2023, prices have resumed climbing, demonstrating the enduring appeal of this recreational destination.

Innsbrook – Resort Living Drives Spectacular Growth

Nestled in Warren County, Innsbrook began as a recreational lake community but has evolved into a year-round residential destination commanding premium prices. The development’s resort amenities, including golf courses, lakes, and recreational facilities, have attracted both seasonal residents and permanent homeowners seeking a lifestyle-focused community. The stunning price growth from around $145,000 to nearly $480,000 reflects the area’s transformation from a vacation spot to a luxury residential market.

The community’s 65% price surge during 2021-2022 exemplifies how recreational properties became highly sought-after during the pandemic as remote work enabled lifestyle relocations. Innsbrook’s appeal extends beyond its amenities to include its natural setting and escape from urban pressures. Despite some price volatility, the market’s recovery to new highs in 2025 suggests that demand for resort-style living continues to drive values in this unique Missouri community.

26. Olivette – 76% Home Price Increase Since 2010

- 2010: $284,441

- 2011: $269,294 (−$15,147, −5.33% from previous year)

- 2012: $251,825 (−$17,469, −6.49% from previous year)

- 2013: $261,218 (+$9,393, +3.73% from previous year)

- 2014: $284,448 (+$23,230, +8.89% from previous year)

- 2015: $293,372 (+$8,925, +3.14% from previous year)

- 2016: $316,395 (+$23,022, +7.85% from previous year)

- 2017: $328,810 (+$12,415, +3.92% from previous year)

- 2018: $346,391 (+$17,581, +5.35% from previous year)

- 2019: $356,460 (+$10,069, +2.91% from previous year)

- 2020: $369,426 (+$12,966, +3.64% from previous year)

- 2021: $410,618 (+$41,192, +11.15% from previous year)

- 2022: $453,913 (+$43,295, +10.54% from previous year)

- 2023: $469,838 (+$15,925, +3.51% from previous year)

- 2024: $489,312 (+$19,474, +4.14% from previous year)

- 2025: $499,671 (+$10,359, +2.12% from previous year)

Olivette’s steady climb from $284,441 in 2010 to nearly $500,000 today reflects the sustained desirability of this established St. Louis County community. After weathering early-decade declines, the city has maintained consistent growth, with particularly strong gains during 2021-2022. The current price approaching half a million dollars represents the community’s evolution into an upscale suburban market.

Olivette – Inner-Ring Suburb Maintains Premium Status

Located in central St. Louis County, Olivette benefits from its prime location between Clayton and University City, offering residents easy access to employment centers, cultural amenities, and transportation corridors. The community’s mature neighborhoods, excellent schools, and walkable business districts have maintained its appeal despite broader suburban competition. Home values now approaching $500,000 reflect the premium buyers place on established communities with urban conveniences.

The city’s resilient housing market demonstrates how well-located inner-ring suburbs can maintain value through changing economic cycles. Olivette’s 22% price growth during 2021-2022 shows that even established communities benefited from pandemic-era housing demand. The continued appreciation through 2025 suggests that buyers continue to value the combination of location, amenities, and community character that Olivette offers in the competitive St. Louis metropolitan housing market.

25. Fremont Hills – 78% Home Price Increase Since 2010

- 2010: $304,815

- 2011: $274,419 (−$30,396, −9.97% from previous year)

- 2012: $280,638 (+$6,219, +2.27% from previous year)

- 2013: $291,497 (+$10,859, +3.87% from previous year)

- 2014: $300,721 (+$9,224, +3.16% from previous year)

- 2015: $316,312 (+$15,590, +5.18% from previous year)

- 2016: $333,098 (+$16,786, +5.31% from previous year)

- 2017: $326,237 (−$6,861, −2.06% from previous year)

- 2018: $333,208 (+$6,971, +2.14% from previous year)

- 2019: $358,442 (+$25,233, +7.57% from previous year)

- 2020: $367,900 (+$9,458, +2.64% from previous year)

- 2021: $404,176 (+$36,276, +9.86% from previous year)

- 2022: $501,557 (+$97,381, +24.09% from previous year)

- 2023: $510,553 (+$8,996, +1.79% from previous year)

- 2024: $524,345 (+$13,792, +2.70% from previous year)

- 2025: $543,367 (+$19,022, +3.63% from previous year)

Fremont Hills experienced moderate growth through 2021 before exploding with a 24% price jump in 2022, pushing values from around $400,000 to over $500,000 in a single year. The community’s current price of $543,367 represents steady appreciation following that dramatic surge. This pattern shows how some markets experienced delayed but intense pandemic-related price growth.

Fremont Hills – Late Surge Creates Premium Market

Located in St. Louis County, Fremont Hills represents a community that experienced its most significant transformation during the later stages of the pandemic housing boom. While many areas saw peak growth in 2021, Fremont Hills’ explosive 24% increase in 2022 suggests a market that caught fire as buyers expanded their search areas. The community’s current values exceeding $540,000 reflect its emergence as a premium residential destination.

The area’s appeal likely stems from its suburban character combined with accessibility to regional employment and shopping centers. Fremont Hills’ continued appreciation through 2025, with prices climbing another 3.6%, indicates sustained demand even after the initial pandemic surge. This growth pattern demonstrates how certain communities can experience delayed but significant market appreciation as housing demand shifts across metropolitan areas.

24. Augusta – 93% Home Price Increase Since 2010

- 2010: $284,113

- 2011: $261,223 (−$22,890, −8.06% from previous year)

- 2012: $255,164 (−$6,060, −2.32% from previous year)

- 2013: $272,086 (+$16,923, +6.63% from previous year)

- 2014: $288,486 (+$16,399, +6.03% from previous year)

- 2015: $301,617 (+$13,132, +4.55% from previous year)

- 2016: $321,351 (+$19,734, +6.54% from previous year)

- 2017: $335,792 (+$14,441, +4.49% from previous year)

- 2018: $349,700 (+$13,908, +4.14% from previous year)

- 2019: $365,160 (+$15,460, +4.42% from previous year)

- 2020: $377,697 (+$12,537, +3.43% from previous year)

- 2021: $435,961 (+$58,264, +15.43% from previous year)

- 2022: $505,039 (+$69,078, +15.84% from previous year)

- 2023: $506,152 (+$1,114, +0.22% from previous year)

- 2024: $519,163 (+$13,011, +2.57% from previous year)

- 2025: $549,194 (+$30,031, +5.78% from previous year)

Augusta’s remarkable journey from $284,113 in 2010 to $549,194 today demonstrates steady growth culminating in explosive pandemic-era gains. The historic wine country town experienced its most dramatic appreciation during 2021-2022, when values jumped over 31% in two years. A strong 6% gain in 2025 suggests the market remains robust despite earlier volatility.

Augusta – Wine Country Drives Premium Pricing

Situated along the Missouri River in St. Charles County, Augusta holds the distinction of being America’s first designated American Viticultural Area, established in 1980. This historic wine-producing region has leveraged its scenic beauty, recreational opportunities, and proximity to St. Louis to transform from a rural agricultural community into a sought-after residential destination. Current home values approaching $550,000 reflect the premium buyers place on living in this nationally recognized wine region.

The town’s tourism industry, anchored by numerous wineries and bed-and-breakfast establishments, has enhanced property values while creating a unique residential environment. Augusta’s 31% price surge during 2021-2022 reflects increased demand for lifestyle communities offering recreational amenities and natural beauty. The continued strong appreciation in 2025 suggests that the combination of wine country charm, outdoor recreation, and accessibility to metropolitan areas continues to drive demand in this distinctive Missouri market.

23. Glendale – 70% Home Price Increase Since 2010

- 2010: $332,413

- 2011: $319,130 (−$13,282, −4.00% from previous year)

- 2012: $303,368 (−$15,762, −4.94% from previous year)

- 2013: $315,741 (+$12,373, +4.08% from previous year)

- 2014: $343,317 (+$27,576, +8.73% from previous year)

- 2015: $353,576 (+$10,259, +2.99% from previous year)

- 2016: $370,790 (+$17,214, +4.87% from previous year)

- 2017: $380,933 (+$10,143, +2.74% from previous year)

- 2018: $398,192 (+$17,259, +4.53% from previous year)

- 2019: $402,001 (+$3,809, +0.96% from previous year)

- 2020: $417,279 (+$15,278, +3.80% from previous year)

- 2021: $461,886 (+$44,607, +10.69% from previous year)

- 2022: $502,828 (+$40,942, +8.86% from previous year)

- 2023: $526,898 (+$24,070, +4.79% from previous year)

- 2024: $547,241 (+$20,343, +3.86% from previous year)

- 2025: $564,460 (+$17,219, +3.15% from previous year)

Glendale’s steady appreciation from $332,413 in 2010 to $564,460 today reflects the consistent appeal of this established St. Louis County community. Unlike many areas that saw explosive pandemic growth, Glendale maintained more moderate but sustained increases, with values climbing steadily even through 2025. This pattern suggests a stable, mature market with enduring demand.

Glendale – Stable Growth in Established Community

Located in central St. Louis County, Glendale represents one of the region’s most stable and desirable residential communities. The city’s compact size, well-maintained neighborhoods, and strategic location between major employment centers have made it a consistently sought-after address. Current home values exceeding $560,000 reflect the premium buyers place on this established community’s combination of location, character, and municipal services.

Unlike many communities that experienced dramatic pandemic-era volatility, Glendale’s housing market demonstrated remarkable stability with steady but sustainable growth. The city’s continued appreciation through 2025 shows that mature, well-located communities can maintain value growth even as broader markets experience uncertainty. Glendale’s appeal lies in its proven track record as a residential destination that balances suburban amenities with urban accessibility.

22. Grantwood Village – 72% Home Price Increase Since 2010

- 2010: $330,242

- 2011: $331,475 (+$1,234, +0.37% from previous year)

- 2012: $316,638 (−$14,838, −4.48% from previous year)

- 2013: $319,749 (+$3,111, +0.98% from previous year)

- 2014: $342,124 (+$22,376, +7.00% from previous year)

- 2015: $350,758 (+$8,634, +2.52% from previous year)

- 2016: $361,475 (+$10,717, +3.06% from previous year)

- 2017: $368,290 (+$6,815, +1.89% from previous year)

- 2018: $385,185 (+$16,895, +4.59% from previous year)

- 2019: $395,917 (+$10,732, +2.79% from previous year)

- 2020: $417,414 (+$21,497, +5.43% from previous year)

- 2021: $469,799 (+$52,385, +12.55% from previous year)

- 2022: $510,317 (+$40,518, +8.62% from previous year)

- 2023: $531,878 (+$21,562, +4.23% from previous year)

- 2024: $547,037 (+$15,158, +2.85% from previous year)

- 2025: $567,861 (+$20,824, +3.81% from previous year)

Grantwood Village shows remarkable consistency in its growth trajectory, climbing from $330,242 in 2010 to nearly $568,000 today. The community experienced steady appreciation through most periods, with pandemic-era gains during 2021-2022 pushing values above half a million dollars. Continued growth through 2025 demonstrates sustained market strength in this established St. Louis County enclave.

Grantwood Village – Small Community, Big Appreciation

This small but affluent community in St. Louis County has maintained its exclusive character while experiencing substantial home value appreciation. Grantwood Village’s compact size and mature housing stock have created a unique market where limited inventory meets consistent demand from buyers seeking an established neighborhood with character. Current values approaching $570,000 reflect the premium placed on living in this well-regarded residential enclave.

The village’s 21% price growth during the pandemic years demonstrates how even small, established communities benefited from increased housing demand. Grantwood Village’s appeal lies in its combination of suburban tranquility, mature landscaping, and proximity to regional amenities. The continued appreciation through 2025 suggests that buyers continue to value the exclusivity and character that this small community offers within the broader St. Louis metropolitan market.

21. Chesterfield – 65% Home Price Increase Since 2010

Would you like to save this?

- 2010: $343,788

- 2011: $328,804 (−$14,985, −4.36% from previous year)

- 2012: $315,669 (−$13,135, −3.99% from previous year)

- 2013: $327,728 (+$12,059, +3.82% from previous year)

- 2014: $350,377 (+$22,650, +6.91% from previous year)

- 2015: $363,452 (+$13,075, +3.73% from previous year)

- 2016: $381,151 (+$17,699, +4.87% from previous year)

- 2017: $393,122 (+$11,971, +3.14% from previous year)

- 2018: $398,775 (+$5,653, +1.44% from previous year)

- 2019: $403,819 (+$5,044, +1.26% from previous year)

- 2020: $412,183 (+$8,363, +2.07% from previous year)

- 2021: $458,959 (+$46,777, +11.35% from previous year)

- 2022: $505,915 (+$46,955, +10.23% from previous year)

- 2023: $524,177 (+$18,262, +3.61% from previous year)

- 2024: $546,695 (+$22,519, +4.30% from previous year)

- 2025: $569,068 (+$22,373, +4.09% from previous year)

Chesterfield’s steady climb from $343,788 in 2010 to $569,068 today showcases the sustained appeal of this major St. Louis County suburb. The city experienced measured growth through most periods, with notable acceleration during 2021-2022 when values jumped over 22% in two years. Continued strong appreciation through 2025 demonstrates the enduring strength of this established market.

Chesterfield – Major Suburb Maintains Market Leadership

As one of St. Louis County’s largest and most developed suburban communities, Chesterfield has maintained its position as a premier residential destination through careful planning and extensive amenities. The city’s numerous shopping centers, business parks, recreational facilities, and highly-rated schools have created a comprehensive suburban environment that attracts families and professionals. Current home values approaching $570,000 reflect the premium buyers place on Chesterfield’s combination of infrastructure, services, and location.

The community’s 22% price growth during the pandemic years demonstrates how well-established suburbs with strong fundamentals benefited from increased housing demand. Chesterfield’s continued appreciation of over 4% annually through 2025 suggests that mature suburban markets with diverse amenities can maintain growth even as broader markets face uncertainty. The city’s track record of municipal excellence and residential stability continues to drive demand in this competitive regional market.

20. Wildwood – 64% Home Price Increase Since 2010

- 2010: $349,938

- 2011: $335,847 (−$14,091, −4.03% from previous year)

- 2012: $324,344 (−$11,503, −3.43% from previous year)

- 2013: $333,632 (+$9,288, +2.86% from previous year)

- 2014: $355,846 (+$22,214, +6.66% from previous year)

- 2015: $365,780 (+$9,934, +2.79% from previous year)

- 2016: $383,365 (+$17,585, +4.81% from previous year)

- 2017: $393,945 (+$10,581, +2.76% from previous year)

- 2018: $400,784 (+$6,839, +1.74% from previous year)

- 2019: $406,362 (+$5,578, +1.39% from previous year)

- 2020: $414,512 (+$8,150, +2.01% from previous year)

- 2021: $465,852 (+$51,340, +12.39% from previous year)

- 2022: $520,161 (+$54,309, +11.66% from previous year)

- 2023: $536,054 (+$15,893, +3.06% from previous year)

- 2024: $557,958 (+$21,905, +4.09% from previous year)

- 2025: $575,071 (+$17,113, +3.07% from previous year)

Wildwood’s progression from $349,938 in 2010 to $575,071 today reflects steady suburban growth punctuated by significant pandemic-era gains. The community saw dramatic appreciation during 2021-2022, when values surged over 24% in two years, pushing the market above half a million dollars. Continued growth through 2025 demonstrates sustained demand for this western St. Louis County destination.

Wildwood – Suburban Expansion Drives Value Growth

Located in western St. Louis County, Wildwood represents the ongoing suburban expansion that has characterized the region’s development patterns. The city’s newer housing stock, abundant green space, and family-oriented amenities have made it a popular destination for buyers seeking modern suburban living. Current home values exceeding $575,000 reflect the premium placed on newer communities with contemporary infrastructure and planning.

Wildwood’s appeal extends beyond its residential offerings to include extensive parks, recreational facilities, and proximity to regional employment centers. The city’s 24% price surge during 2021-2022 demonstrates how newer suburban communities with strong fundamentals attracted increased buyer interest during the pandemic housing boom. The continued appreciation through 2025 suggests that Wildwood’s combination of modern amenities and suburban character continues to resonate with homebuyers in the competitive St. Louis metropolitan market.

19. Flint Hill – 91% Home Price Increase Since 2013

- 2013: $304,341

- 2014: $318,080 (+$13,739, +4.51% from previous year)

- 2015: $332,242 (+$14,162, +4.45% from previous year)

- 2016: $352,706 (+$20,464, +6.16% from previous year)

- 2017: $370,499 (+$17,793, +5.04% from previous year)

- 2018: $383,008 (+$12,509, +3.38% from previous year)

- 2019: $399,899 (+$16,891, +4.41% from previous year)

- 2020: $414,781 (+$14,882, +3.72% from previous year)

- 2021: $474,601 (+$59,820, +14.42% from previous year)

- 2022: $540,721 (+$66,120, +13.93% from previous year)

- 2023: $548,263 (+$7,542, +1.39% from previous year)

- 2024: $559,423 (+$11,160, +2.04% from previous year)

- 2025: $581,539 (+$22,116, +3.95% from previous year)

Flint Hill’s remarkable journey from $304,341 in 2013 to $581,539 today represents consistent appreciation culminating in explosive pandemic-era growth. The community experienced steady gains through 2020 before seeing dramatic jumps during 2021-2022, when values increased over 28% in two years. Strong growth resuming in 2025 with a 4% gain suggests continued market momentum.

Flint Hill – Consistent Growth Creates Premium Market

This St. Charles County community has emerged as one of the region’s success stories, transforming from a modest residential area into a premium market destination. Flint Hill’s steady appreciation through the 2010s, followed by dramatic pandemic-era gains, reflects the area’s growing appeal among buyers seeking newer suburban communities with room for growth. Current values approaching $582,000 mark a significant transformation for this developing area.

The community’s 28% price surge during 2021-2022 demonstrates how emerging suburban markets benefited from increased housing demand as buyers expanded their geographic search areas. Flint Hill’s appeal likely stems from its combination of newer housing stock, developing amenities, and accessibility to regional employment centers. The strong 4% appreciation in 2025 suggests that this market continues to attract buyers seeking value and growth potential in the expanding St. Charles County corridor.

18. Parkville – 74% Home Price Increase Since 2010

- 2010: $340,296

- 2011: $311,721 (−$28,575, −8.40% from previous year)

- 2012: $321,297 (+$9,576, +3.07% from previous year)

- 2013: $338,080 (+$16,783, +5.22% from previous year)

- 2014: $356,286 (+$18,206, +5.39% from previous year)

- 2015: $366,874 (+$10,589, +2.97% from previous year)

- 2016: $380,718 (+$13,843, +3.77% from previous year)

- 2017: $401,716 (+$20,998, +5.52% from previous year)

- 2018: $410,634 (+$8,918, +2.22% from previous year)

- 2019: $421,877 (+$11,242, +2.74% from previous year)

- 2020: $431,193 (+$9,316, +2.21% from previous year)

- 2021: $495,160 (+$63,968, +14.84% from previous year)

- 2022: $567,004 (+$71,844, +14.51% from previous year)

- 2023: $564,989 (−$2,015, −0.36% from previous year)

- 2024: $581,620 (+$16,631, +2.94% from previous year)

- 2025: $593,065 (+$11,445, +1.97% from previous year)

Parkville’s growth from $340,296 in 2010 to $593,065 today showcases steady appreciation punctuated by dramatic pandemic-era gains. The historic college town experienced its most significant growth during 2021-2022, when values surged nearly 30% over two years. A brief correction in 2023 was followed by renewed growth, demonstrating market resilience in this established community.

Parkville – Historic Charm Meets Modern Demand

Located along the Missouri River in Platte County, Parkville combines historic charm with modern amenities, creating a unique residential market that appeals to diverse buyers. The city’s picturesque downtown, antique shops, and proximity to Park University contribute to its distinctive character, while its location near Kansas City provides employment accessibility. Current home values approaching $600,000 reflect the premium buyers place on communities that offer both character and convenience.

The town’s 29% price surge during 2021-2022 demonstrates how communities with unique appeal benefited from pandemic-era housing demand as buyers sought distinctive places to live. Parkville’s brief price correction in 2023 followed by renewed growth suggests a market finding its equilibrium after rapid appreciation. The combination of historic character, educational presence, and regional accessibility continues to drive demand in this distinctive Missouri river town.

17. Weatherby Lake – 129% Home Price Increase Since 2010

- 2010: $259,739

- 2011: $240,763 (−$18,976, −7.31% from previous year)

- 2012: $250,772 (+$10,010, +4.16% from previous year)

- 2013: $281,926 (+$31,153, +12.42% from previous year)

- 2014: $309,988 (+$28,063, +9.95% from previous year)

- 2015: $321,425 (+$11,436, +3.69% from previous year)

- 2016: $324,555 (+$3,130, +0.97% from previous year)

- 2017: $347,103 (+$22,547, +6.95% from previous year)

- 2018: $364,036 (+$16,933, +4.88% from previous year)

- 2019: $379,414 (+$15,378, +4.22% from previous year)

- 2020: $390,921 (+$11,507, +3.03% from previous year)

- 2021: $460,105 (+$69,185, +17.70% from previous year)

- 2022: $535,278 (+$75,173, +16.34% from previous year)

- 2023: $549,011 (+$13,733, +2.57% from previous year)

- 2024: $563,767 (+$14,755, +2.69% from previous year)

- 2025: $593,629 (+$29,863, +5.30% from previous year)

Weatherby Lake’s transformation from $259,739 in 2010 to $593,629 today represents one of Missouri’s most dramatic housing market success stories. The private lake community experienced extraordinary growth during 2021-2022, when values surged over 34% in two years, fundamentally changing the market dynamics. Strong continued growth through 2025 with a 5.3% gain demonstrates sustained premium demand.

Weatherby Lake – Private Community Commands Premium Prices

This exclusive private lake community in Clay and Platte counties has evolved from an affordable recreational destination into one of the Kansas City area’s most sought-after residential markets. Weatherby Lake’s appeal centers on its private lake access, gated community atmosphere, and recreational amenities that create a resort-like living environment. The stunning price appreciation from around $260,000 to nearly $600,000 reflects the transformation of this community into a luxury residential destination.

The community’s 34% price surge during 2021-2022 exemplifies how unique residential offerings became highly prized during the pandemic as buyers sought lifestyle-focused communities. Weatherby Lake’s private amenities, including the lake itself, marina facilities, and exclusive access, create scarcity that drives premium pricing. The strong 5.3% appreciation in 2025 suggests that demand for this type of exclusive community living continues to grow, making Weatherby Lake one of Missouri’s most distinctive and valuable residential markets.

16. Sunset Hills – 74% Home Price Increase Since 2010

- 2010: $347,653

- 2011: $332,013 (−$15,640, −4.50% from previous year)

- 2012: $324,863 (−$7,150, −2.15% from previous year)

- 2013: $336,026 (+$11,164, +3.44% from previous year)

- 2014: $365,069 (+$29,043, +8.64% from previous year)

- 2015: $376,986 (+$11,917, +3.26% from previous year)

- 2016: $396,061 (+$19,076, +5.06% from previous year)

- 2017: $411,209 (+$15,148, +3.82% from previous year)

- 2018: $421,278 (+$10,068, +2.45% from previous year)

- 2019: $429,640 (+$8,362, +1.99% from previous year)

- 2020: $445,322 (+$15,682, +3.65% from previous year)

- 2021: $497,152 (+$51,830, +11.64% from previous year)

- 2022: $545,488 (+$48,336, +9.72% from previous year)

- 2023: $570,871 (+$25,383, +4.65% from previous year)

- 2024: $587,932 (+$17,061, +2.99% from previous year)

- 2025: $605,545 (+$17,613, +3.00% from previous year)

Sunset Hills demonstrates steady appreciation from $347,653 in 2010 to $605,545 today, with consistent gains throughout most periods. The community experienced significant growth during 2021-2022, when values jumped over 21% in two years, but maintained steady appreciation even after the pandemic surge. Current prices exceeding $600,000 reflect this established community’s premium status in the St. Louis market.

Sunset Hills – Established Community Commands Premium

Located in South St. Louis County, Sunset Hills has maintained its reputation as one of the region’s most desirable suburban communities through decades of careful development and municipal excellence. The city’s mature neighborhoods, excellent schools, and extensive recreational facilities have created a comprehensive suburban environment that attracts families and professionals seeking an established community. Current home values exceeding $605,000 reflect the substantial premium buyers place on this well-regarded suburban destination.

The community’s 21% price growth during the pandemic years demonstrates how established suburbs with strong fundamentals benefited from increased housing demand. Sunset Hills’ continued steady appreciation through 2025 shows that mature communities with proven track records can maintain growth even as broader markets face uncertainty. The city’s combination of location, amenities, and municipal services continues to justify premium pricing in the competitive St. Louis County residential market.

15. Lake Lotawana – 120% Home Price Increase Since 2010

- 2010: $276,501

- 2011: $249,976 (−$26,525, −9.59% from previous year)

- 2012: $260,920 (+$10,944, +4.38% from previous year)

- 2013: $276,693 (+$15,772, +6.04% from previous year)

- 2014: $307,106 (+$30,413, +10.99% from previous year)

- 2015: $325,662 (+$18,556, +6.04% from previous year)

- 2016: $350,754 (+$25,092, +7.70% from previous year)

- 2017: $377,462 (+$26,709, +7.61% from previous year)

- 2018: $408,926 (+$31,464, +8.34% from previous year)

- 2019: $441,680 (+$32,754, +8.01% from previous year)

- 2020: $488,288 (+$46,608, +10.55% from previous year)

- 2021: $558,082 (+$69,794, +14.29% from previous year)

- 2022: $622,068 (+$63,986, +11.47% from previous year)

- 2023: $597,760 (−$24,308, −3.91% from previous year)

- 2024: $595,362 (−$2,398, −0.40% from previous year)

- 2025: $608,746 (+$13,384, +2.25% from previous year)

Lake Lotawana’s journey from $276,501 in 2010 to $608,746 today showcases dramatic appreciation with some recent volatility. The lake community experienced consistent strong growth through 2022, when values peaked above $622,000, followed by a brief correction in 2023-2024. Recovery in 2025 demonstrates the enduring appeal of this recreational destination despite market fluctuations.

Lake Lotawana – Resort Community Sees Premium Pricing

This private lake community in Jackson County has transformed from an accessible recreational destination into one of the Kansas City area’s most expensive residential markets. Lake Lotawana’s appeal centers on its private 740-acre lake, exclusive community amenities, and resort-like atmosphere that provides year-round recreational opportunities. The dramatic price appreciation from around $276,000 to over $608,000 reflects the increasing value placed on lifestyle-focused communities with unique amenities.

The community’s strong growth through 2022, followed by a price correction and subsequent recovery, illustrates the volatility that can affect premium recreational markets. Lake Lotawana’s brief correction in 2023-2024 likely reflected broader market adjustments rather than fundamental changes in community appeal. The recovery in 2025 suggests that demand for exclusive lake living continues to support premium pricing, making Lake Lotawana one of Missouri’s most distinctive and valuable residential communities.

14. Crystal Lake Park – 77% Home Price Increase Since 2010

- 2010: $345,341

- 2011: $330,672 (−$14,670, −4.25% from previous year)

- 2012: $326,639 (−$4,032, −1.22% from previous year)

- 2013: $340,282 (+$13,643, +4.18% from previous year)

- 2014: $362,252 (+$21,970, +6.46% from previous year)

- 2015: $370,987 (+$8,735, +2.41% from previous year)

- 2016: $389,863 (+$18,877, +5.09% from previous year)

- 2017: $402,900 (+$13,037, +3.34% from previous year)

- 2018: $426,595 (+$23,695, +5.88% from previous year)

- 2019: $428,054 (+$1,459, +0.34% from previous year)

- 2020: $435,471 (+$7,417, +1.73% from previous year)

- 2021: $480,341 (+$44,871, +10.30% from previous year)

- 2022: $536,629 (+$56,288, +11.72% from previous year)

- 2023: $560,585 (+$23,956, +4.46% from previous year)

- 2024: $581,796 (+$21,211, +3.78% from previous year)

- 2025: $612,071 (+$30,275, +5.20% from previous year)

Crystal Lake Park shows steady growth from $345,341 in 2010 to $612,071 today, with particularly strong gains during and after the pandemic years. The community experienced notable acceleration during 2021-2022, when values jumped over 22% in two years, and has continued strong appreciation through 2025 with a 5.2% gain. This growth pattern reflects sustained demand for this established community.

Crystal Lake Park – Consistent Appeal Drives Continued Growth

Located in St. Louis County, Crystal Lake Park represents an established suburban community that has maintained consistent appeal through changing market conditions. The area’s mature neighborhoods, proximity to regional amenities, and suburban character have created a stable residential market that attracts buyers seeking an established community with proven value retention. Current home values exceeding $612,000 reflect the premium placed on this well-regarded suburban destination.

The community’s 22% price growth during 2021-2022, followed by continued strong appreciation through 2025, demonstrates how established suburban communities with solid fundamentals can maintain momentum even as broader markets experience uncertainty. Crystal Lake Park’s 5.2% growth in 2025 suggests that buyers continue to value the stability and character that mature suburban communities offer. The area’s sustained growth reflects its position as a reliable residential investment in the competitive St. Louis County market.

13. Weldon Spring – 81% Home Price Increase Since 2010

- 2010: $340,757

- 2011: $323,260 (−$17,498, −5.13% from previous year)

- 2012: $321,516 (−$1,743, −0.54% from previous year)

- 2013: $330,736 (+$9,220, +2.87% from previous year)

- 2014: $349,050 (+$18,314, +5.54% from previous year)

- 2015: $360,608 (+$11,557, +3.31% from previous year)

- 2016: $375,027 (+$14,419, +4.00% from previous year)

- 2017: $389,503 (+$14,476, +3.86% from previous year)

- 2018: $398,862 (+$9,359, +2.40% from previous year)

- 2019: $414,006 (+$15,144, +3.80% from previous year)

- 2020: $430,217 (+$16,211, +3.92% from previous year)

- 2021: $492,571 (+$62,354, +14.49% from previous year)

- 2022: $560,243 (+$67,671, +13.74% from previous year)

- 2023: $569,587 (+$9,344, +1.67% from previous year)

- 2024: $593,020 (+$23,433, +4.11% from previous year)

- 2025: $618,101 (+$25,081, +4.23% from previous year)

Weldon Spring’s growth from $340,757 in 2010 to $618,101 today demonstrates steady appreciation culminating in dramatic pandemic-era gains. The community experienced its most significant growth during 2021-2022, when values surged over 28% in two years, pushing the market above half a million dollars. Strong continued growth through 2025 with over 4% appreciation shows sustained market momentum.

Weldon Spring – Strategic Location Drives Premium Growth

Located in St. Charles County, Weldon Spring has emerged as one of the region’s most desirable suburban communities through its combination of excellent schools, newer housing stock, and strategic location between St. Charles and St. Louis counties. The city’s planned development approach and family-oriented amenities have attracted waves of new residents seeking modern suburban living with accessibility to regional employment centers. Current home values exceeding $618,000 reflect the substantial premium buyers place on this well-planned community.

The area’s 28% price surge during 2021-2022 demonstrates how communities with strong fundamentals and growth potential benefited from increased housing demand during the pandemic. Weldon Spring’s continued strong appreciation through 2025 suggests that the combination of quality schools, newer infrastructure, and regional accessibility continues to drive buyer interest. The community’s sustained growth reflects its successful positioning as a premium suburban destination in the expanding St. Charles County corridor.

12. Creve Coeur – 69% Home Price Increase Since 2010

Would you like to save this?

- 2010: $366,833

- 2011: $350,098 (−$16,735, −4.56% from previous year)

- 2012: $339,036 (−$11,062, −3.16% from previous year)

- 2013: $354,502 (+$15,465, +4.56% from previous year)

- 2014: $382,666 (+$28,164, +7.94% from previous year)

- 2015: $393,176 (+$10,510, +2.75% from previous year)

- 2016: $406,186 (+$13,010, +3.31% from previous year)

- 2017: $417,931 (+$11,745, +2.89% from previous year)

- 2018: $431,323 (+$13,392, +3.20% from previous year)

- 2019: $441,251 (+$9,928, +2.30% from previous year)

- 2020: $458,480 (+$17,228, +3.90% from previous year)

- 2021: $509,964 (+$51,484, +11.23% from previous year)

- 2022: $560,673 (+$50,709, +9.94% from previous year)

- 2023: $578,068 (+$17,395, +3.10% from previous year)

- 2024: $600,918 (+$22,850, +3.95% from previous year)

- 2025: $620,607 (+$19,689, +3.28% from previous year)

Creve Coeur’s climb from $366,833 in 2010 to $620,607 today showcases consistent appreciation in one of St. Louis County’s most established communities. The city experienced steady growth through most periods, with notable acceleration during 2021-2022 when values jumped over 21% in two years. Continued steady appreciation through 2025 demonstrates the enduring appeal of this well-positioned suburban community.

Creve Coeur – Strategic Location Sustains Premium Market

Located in central St. Louis County, Creve Coeur has long been recognized as one of the region’s premier suburban communities, offering an ideal combination of location, amenities, and municipal excellence. The city’s proximity to major employment centers, excellent schools, and extensive recreational facilities have made it a consistently sought-after destination for families and professionals. Current home values exceeding $620,000 reflect the substantial premium buyers place on this established community’s proven track record and comprehensive amenities.

The community’s 21% price growth during the pandemic years demonstrates how well-established suburbs with strong fundamentals attracted increased buyer interest during periods of market volatility. Creve Coeur’s continued steady appreciation through 2025 shows that mature communities with excellent infrastructure and services can maintain growth momentum even as broader markets face uncertainty. The city’s combination of location, quality of life, and municipal services continues to justify premium pricing in the competitive St. Louis County residential market.

11. Warson Woods – 69% Home Price Increase Since 2010

- 2010: $397,229

- 2011: $375,939 (−$21,290, −5.36% from previous year)

- 2012: $351,238 (−$24,701, −6.57% from previous year)

- 2013: $368,474 (+$17,236, +4.91% from previous year)

- 2014: $401,742 (+$33,268, +9.03% from previous year)

- 2015: $411,751 (+$10,010, +2.49% from previous year)

- 2016: $439,532 (+$27,781, +6.75% from previous year)

- 2017: $447,229 (+$7,696, +1.75% from previous year)

- 2018: $466,720 (+$19,491, +4.36% from previous year)

- 2019: $469,146 (+$2,426, +0.52% from previous year)

- 2020: $484,031 (+$14,885, +3.17% from previous year)

- 2021: $537,924 (+$53,892, +11.13% from previous year)

- 2022: $593,280 (+$55,356, +10.29% from previous year)

- 2023: $618,056 (+$24,776, +4.18% from previous year)

- 2024: $643,797 (+$25,741, +4.16% from previous year)

- 2025: $670,614 (+$26,817, +4.17% from previous year)

Warson Woods demonstrates remarkable consistency in its appreciation, climbing from $397,229 in 2010 to $670,614 today. The exclusive community experienced steady growth through most periods, with significant acceleration during 2021-2022 when values jumped over 21% in two years. Strong continued growth through 2025 with over 4% annual appreciation shows sustained demand for this premium enclave.

Warson Woods – Exclusive Community Commands Premium

This small, exclusive community in St. Louis County has maintained its status as one of the region’s most prestigious residential addresses through careful planning and exceptional municipal services. Warson Woods’ appeal lies in its combination of privacy, security, and proximity to regional amenities, creating a unique residential environment that attracts affluent buyers seeking an upscale suburban lifestyle. Current home values exceeding $670,000 reflect the substantial premium placed on exclusivity and quality in this well-regarded enclave.

The community’s 21% price growth during the pandemic years, followed by sustained 4% annual appreciation through 2025, demonstrates how exclusive communities with limited housing stock can maintain strong value growth. Warson Woods’ continued appreciation reflects the ongoing demand for premium residential communities that offer both privacy and accessibility. The area’s track record of steady value growth and municipal excellence continues to attract buyers willing to pay premium prices for this distinctive suburban lifestyle.

10. Des Peres – 77% Home Price Increase Since 2010

- 2010: $389,098

- 2011: $374,590 (−$14,508, −3.73% from previous year)

- 2012: $366,075 (−$8,515, −2.27% from previous year)

- 2013: $381,642 (+$15,568, +4.25% from previous year)

- 2014: $415,123 (+$33,481, +8.77% from previous year)

- 2015: $422,832 (+$7,709, +1.86% from previous year)

- 2016: $443,211 (+$20,379, +4.82% from previous year)

- 2017: $459,146 (+$15,935, +3.60% from previous year)

- 2018: $474,164 (+$15,018, +3.27% from previous year)

- 2019: $477,773 (+$3,609, +0.76% from previous year)

- 2020: $492,496 (+$14,723, +3.08% from previous year)

- 2021: $551,778 (+$59,282, +12.04% from previous year)

- 2022: $610,282 (+$58,504, +10.60% from previous year)

- 2023: $630,441 (+$20,158, +3.30% from previous year)

- 2024: $661,191 (+$30,750, +4.88% from previous year)

- 2025: $687,657 (+$26,467, +4.00% from previous year)

Des Peres shows steady appreciation from $389,098 in 2010 to $687,657 today, with consistent growth through most market cycles. The community experienced significant acceleration during 2021-2022, when values surged over 22% in two years, pushing the market well above $600,000. Strong continued growth through 2025 demonstrates the sustained appeal of this established St. Louis County destination.

Des Peres – Comprehensive Amenities Drive Premium Pricing

Located in west St. Louis County, Des Peres has established itself as one of the region’s most comprehensive suburban communities, offering an extensive array of municipal services, recreational facilities, and commercial amenities. The city’s Lodge Des Peres recreational complex, extensive park system, and proximity to major shopping and employment centers have created a full-service suburban environment that attracts families and professionals. Current home values approaching $690,000 reflect the substantial premium buyers place on communities that offer comprehensive lifestyle amenities.

The community’s 22% price growth during the pandemic years demonstrates how established suburbs with extensive amenities benefited from increased buyer demand for comprehensive residential environments. Des Peres’ continued strong appreciation through 2025 with 4% annual growth shows that communities offering complete lifestyle packages can maintain premium pricing. The city’s combination of recreational facilities, municipal services, and strategic location continues to justify its position among the region’s most expensive residential markets.

9. Lake Winnebago – 115% Home Price Increase Since 2010

- 2010: $373,989

- 2011: $349,375 (−$24,614, −6.58% from previous year)

- 2012: $318,916 (−$30,459, −8.72% from previous year)

- 2013: $335,978 (+$17,062, +5.35% from previous year)

- 2014: $375,600 (+$39,622, +11.79% from previous year)

- 2015: $411,586 (+$35,987, +9.58% from previous year)

- 2016: $435,161 (+$23,575, +5.73% from previous year)

- 2017: $469,823 (+$34,662, +7.97% from previous year)

- 2018: $521,029 (+$51,206, +10.90% from previous year)

- 2019: $570,056 (+$49,027, +9.41% from previous year)

- 2020: $589,010 (+$18,954, +3.32% from previous year)

- 2021: $643,740 (+$54,730, +9.29% from previous year)

- 2022: $777,766 (+$134,026, +20.82% from previous year)

- 2023: $774,887 (−$2,879, −0.37% from previous year)

- 2024: $758,683 (−$16,204, −2.09% from previous year)

- 2025: $804,474 (+$45,791, +6.04% from previous year)

Lake Winnebago’s transformation from $373,989 in 2010 to $804,474 today represents extraordinary growth with notable volatility. The private lake community experienced consistent strong appreciation through 2022, when values peaked above $777,000 following a dramatic 21% surge. After brief corrections in 2023-2024, the market has rebounded strongly with a 6% gain in 2025, demonstrating resilience in this premium recreational market.

Lake Winnebago – Exclusive Lake Living Commands Top Prices

This exclusive private lake community in Clay County has evolved into one of the Kansas City area’s most expensive residential destinations, offering members access to a pristine 185-acre lake and comprehensive recreational amenities. Lake Winnebago’s appeal centers on its private club atmosphere, water sports opportunities, and gated community exclusivity that creates a resort-like living environment. The dramatic price appreciation from around $374,000 to over $804,000 reflects the transformation of this community into a luxury residential market.

The community’s explosive 21% price surge in 2022, followed by market corrections and subsequent recovery, illustrates the volatility that can affect high-end recreational properties. Lake Winnebago’s brief price adjustments in 2023-2024 likely reflected broader luxury market dynamics rather than fundamental changes in community appeal. The strong 6% rebound in 2025 suggests that demand for exclusive lake living continues to support premium pricing, making Lake Winnebago one of Missouri’s most distinctive and valuable residential communities.

8. Clayton – 54% Home Price Increase Since 2010

- 2010: $554,519

- 2011: $530,926 (−$23,594, −4.25% from previous year)

- 2012: $501,029 (−$29,896, −5.63% from previous year)

- 2013: $512,892 (+$11,863, +2.37% from previous year)

- 2014: $558,596 (+$45,704, +8.91% from previous year)

- 2015: $580,460 (+$21,864, +3.91% from previous year)

- 2016: $617,091 (+$36,631, +6.31% from previous year)

- 2017: $632,141 (+$15,051, +2.44% from previous year)

- 2018: $651,086 (+$18,945, +3.00% from previous year)

- 2019: $671,470 (+$20,384, +3.13% from previous year)

- 2020: $692,463 (+$20,993, +3.13% from previous year)

- 2021: $742,712 (+$50,248, +7.26% from previous year)

- 2022: $790,939 (+$48,227, +6.49% from previous year)

- 2023: $790,952 (+$13, +0.00% from previous year)

- 2024: $830,228 (+$39,276, +4.97% from previous year)

- 2025: $856,159 (+$25,931, +3.12% from previous year)

Clayton’s growth from $554,519 in 2010 to $856,159 today reflects the measured appreciation of an already established premium market. The regional economic center experienced steady growth through most periods, with moderate acceleration during 2021-2022 when values climbed nearly 14% over two years. A brief plateau in 2023 was followed by renewed growth, demonstrating market stability in this urban core community.

Clayton – Urban Core Commands Premium Pricing

As the county seat of St. Louis County and a major regional business center, Clayton represents the pinnacle of urban living in the St. Louis metropolitan area. The city’s concentration of corporate headquarters, high-end retail, fine dining, and cultural amenities creates a sophisticated urban environment that attracts professionals and affluent residents. Current home values exceeding $856,000 reflect the substantial premium placed on living in this established urban core with its unparalleled access to employment, entertainment, and transportation.

Clayton’s moderate but consistent price growth during the pandemic years demonstrates how established urban markets with strong economic fundamentals maintained stability while suburban areas experienced more dramatic volatility. The city’s brief price plateau in 2023 followed by renewed growth suggests a mature market finding equilibrium at premium levels. Clayton’s continued appeal lies in its unique combination of urban sophistication, economic vitality, and residential convenience that cannot be replicated in suburban settings.

7. Clarkson Valley – 55% Home Price Increase Since 2010

- 2010: $584,233

- 2011: $555,887 (−$28,346, −4.85% from previous year)

- 2012: $529,796 (−$26,091, −4.69% from previous year)

- 2013: $546,736 (+$16,940, +3.20% from previous year)

- 2014: $577,851 (+$31,116, +5.69% from previous year)

- 2015: $588,291 (+$10,440, +1.81% from previous year)

- 2016: $609,327 (+$21,036, +3.58% from previous year)

- 2017: $612,555 (+$3,228, +0.53% from previous year)

- 2018: $618,403 (+$5,847, +0.95% from previous year)

- 2019: $631,440 (+$13,038, +2.11% from previous year)

- 2020: $647,645 (+$16,205, +2.57% from previous year)

- 2021: $738,432 (+$90,787, +14.02% from previous year)

- 2022: $835,142 (+$96,710, +13.10% from previous year)

- 2023: $852,626 (+$17,484, +2.09% from previous year)

- 2024: $880,053 (+$27,427, +3.22% from previous year)

- 2025: $907,899 (+$27,846, +3.16% from previous year)

Clarkson Valley’s appreciation from $584,233 in 2010 to $907,899 today demonstrates steady growth in an already premium market. The exclusive community experienced modest gains through 2020 before explosive growth during 2021-2022, when values surged over 27% in two years. Continued strong appreciation through 2025 shows sustained demand for this upscale suburban enclave.

Clarkson Valley – Exclusive Suburb Reaches Near-Million-Dollar Market

Located in western St. Louis County, Clarkson Valley represents one of the region’s most exclusive suburban communities, offering large lots, custom homes, and an upscale residential environment that attracts affluent buyers. The community’s combination of privacy, prestige, and proximity to regional amenities has created a distinctive market that commands premium pricing. Current home values approaching $908,000 reflect the substantial premium placed on exclusive suburban living in this well-regarded enclave.

The community’s dramatic 27% price surge during 2021-2022 demonstrates how exclusive suburban markets with limited inventory benefited from increased demand for luxury residential options during the pandemic. Clarkson Valley’s continued strong appreciation through 2025 shows that high-end suburban communities can maintain growth momentum even as broader markets face uncertainty. The area’s approach to the million-dollar threshold reflects its evolution into one of Missouri’s most expensive and exclusive residential destinations.

6. Town and Country – 62% Home Price Increase Since 2010

- 2010: $692,568

- 2011: $658,177 (−$34,391, −4.97% from previous year)

- 2012: $630,606 (−$27,571, −4.19% from previous year)

- 2013: $650,611 (+$20,005, +3.17% from previous year)

- 2014: $695,334 (+$44,723, +6.87% from previous year)

- 2015: $720,162 (+$24,828, +3.57% from previous year)

- 2016: $743,488 (+$23,325, +3.24% from previous year)

- 2017: $756,906 (+$13,418, +1.80% from previous year)

- 2018: $772,288 (+$15,381, +2.03% from previous year)

- 2019: $779,447 (+$7,160, +0.93% from previous year)

- 2020: $789,313 (+$9,865, +1.27% from previous year)

- 2021: $887,732 (+$98,419, +12.47% from previous year)

- 2022: $1,006,541 (+$118,810, +13.38% from previous year)

- 2023: $1,026,942 (+$20,401, +2.03% from previous year)

- 2024: $1,078,929 (+$51,987, +5.06% from previous year)

- 2025: $1,123,738 (+$44,809, +4.15% from previous year)

Town and Country’s climb from $692,568 in 2010 to over $1.1 million today represents steady appreciation in an established luxury market. The prestigious community experienced measured growth through 2020 before dramatic acceleration during 2021-2022, when values surged over 25% to break the million-dollar barrier. Continued strong growth through 2025 demonstrates sustained demand at the highest price levels.

Town and Country – Luxury Market Breaks Million-Dollar Threshold

As one of St. Louis County’s most prestigious communities, Town and Country has long represented the pinnacle of suburban luxury living in the region. The city’s expansive estates, exclusive country clubs, and upscale commercial districts create a comprehensive luxury environment that attracts the area’s most affluent residents. Current home values exceeding $1.1 million reflect the substantial premium placed on living in this established luxury market with its unparalleled amenities and prestige.

The community’s breakthrough into seven-figure territory during the pandemic years demonstrates how ultra-high-end markets benefited from increased wealth concentration and lifestyle changes. Town and Country’s continued strong appreciation through 2025 shows that luxury communities with established prestige can maintain growth even at elevated price levels. The city’s position as the region’s premier luxury residential destination continues to attract buyers willing to pay premium prices for the ultimate in suburban exclusivity and sophistication.

5. Frontenac – 66% Home Price Increase Since 2010

- 2010: $736,323

- 2011: $702,334 (−$33,989, −4.62% from previous year)

- 2012: $661,573 (−$40,761, −5.80% from previous year)

- 2013: $679,852 (+$18,279, +2.76% from previous year)

- 2014: $725,484 (+$45,633, +6.71% from previous year)

- 2015: $738,962 (+$13,478, +1.86% from previous year)

- 2016: $770,238 (+$31,276, +4.23% from previous year)

- 2017: $784,546 (+$14,307, +1.86% from previous year)

- 2018: $807,592 (+$23,046, +2.94% from previous year)

- 2019: $809,391 (+$1,799, +0.22% from previous year)

- 2020: $847,762 (+$38,371, +4.74% from previous year)

- 2021: $953,413 (+$105,651, +12.46% from previous year)

- 2022: $1,076,561 (+$123,148, +12.92% from previous year)

- 2023: $1,105,134 (+$28,574, +2.65% from previous year)

- 2024: $1,167,319 (+$62,185, +5.63% from previous year)

- 2025: $1,220,551 (+$53,232, +4.56% from previous year)

Frontenac’s growth from $736,323 in 2010 to over $1.2 million today showcases steady appreciation in an ultra-premium market. The historic luxury community experienced measured growth through 2020 before explosive acceleration during 2021-2022, when values surged over 25% to exceed one million dollars. Continued strong appreciation through 2025 demonstrates sustained demand at the highest price levels in Missouri.

Frontenac – Historic Luxury Commands Top Pricing

As one of Missouri’s most historic and prestigious communities, Frontenac has maintained its status as an ultra-luxury residential destination for over a century. The city’s grand estates, historic architecture, and exclusive country club culture create a unique residential environment that represents the pinnacle of St. Louis area luxury living. Current home values exceeding $1.2 million reflect the extraordinary premium placed on living in this established luxury enclave with its unmatched prestige and heritage.

The community’s 25% price surge during the pandemic years, pushing values well above one million dollars, demonstrates how historic luxury markets benefited from increased demand for prestigious residential addresses. Frontenac’s continued strong appreciation through 2025 shows that ultra-high-end communities with established pedigree can maintain growth momentum even at elevated price levels. The city’s combination of historic significance, architectural distinction, and social prestige continues to attract the region’s most affluent buyers willing to pay premium prices for this irreplaceable luxury lifestyle.

4. Westwood – 70% Home Price Increase Since 2010

- 2010: $717,853

- 2011: $689,346 (−$28,506, −3.97% from previous year)

- 2012: $658,272 (−$31,075, −4.51% from previous year)

- 2013: $677,681 (+$19,409, +2.95% from previous year)

- 2014: $749,657 (+$71,976, +10.62% from previous year)

- 2015: $773,765 (+$24,108, +3.22% from previous year)

- 2016: $805,777 (+$32,013, +4.14% from previous year)

- 2017: $803,410 (−$2,367, −0.29% from previous year)

- 2018: $831,602 (+$28,192, +3.51% from previous year)

- 2019: $860,751 (+$29,149, +3.51% from previous year)

- 2020: $891,517 (+$30,766, +3.57% from previous year)

- 2021: $998,524 (+$107,007, +12.00% from previous year)

- 2022: $1,126,145 (+$127,621, +12.78% from previous year)

- 2023: $1,150,325 (+$24,180, +2.15% from previous year)

- 2024: $1,220,727 (+$70,402, +6.12% from previous year)

- 2025: $1,222,958 (+$2,231, +0.18% from previous year)

Westwood’s appreciation from $717,853 in 2010 to over $1.2 million today demonstrates steady growth in an established luxury market. The exclusive community experienced consistent gains through 2020 before dramatic acceleration during 2021-2022, when values surged nearly 25% to exceed one million dollars. After reaching peak appreciation in 2024, the market has stabilized in 2025, suggesting equilibrium at these premium levels.

Westwood – Exclusive Enclave Reaches Luxury Plateau

This small, exclusive community in St. Louis County represents one of the region’s most prestigious residential addresses, offering privacy, security, and upscale living in a carefully planned environment. Westwood’s appeal lies in its combination of exclusivity, architectural quality, and proximity to regional amenities, creating a distinctive luxury market that attracts affluent buyers seeking the ultimate in suburban sophistication. Current home values exceeding $1.2 million reflect the extraordinary premium placed on living in this elite residential enclave.

The community’s dramatic 25% price surge during the pandemic years, followed by market stabilization in 2025, illustrates how ultra-high-end markets can experience both explosive growth and subsequent equilibrium. Westwood’s minimal appreciation in 2025 suggests the market may be finding its ceiling at current price levels, reflecting broader luxury market dynamics. The community’s position among Missouri’s most expensive residential destinations demonstrates the enduring appeal of exclusive suburban living for the state’s most affluent residents.

3. Village of Loch Lloyd – 106% Home Price Increase Since 2010

- 2010: $603,827

- 2011: $568,492 (−$35,335, −5.85% from previous year)

- 2012: $501,492 (−$66,999, −11.79% from previous year)

- 2013: $528,701 (+$27,208, +5.43% from previous year)

- 2014: $654,788 (+$126,087, +23.85% from previous year)

- 2015: $686,252 (+$31,464, +4.81% from previous year)

- 2016: $744,142 (+$57,890, +8.44% from previous year)

- 2017: $782,809 (+$38,667, +5.20% from previous year)

- 2018: $791,404 (+$8,595, +1.10% from previous year)

- 2019: $860,800 (+$69,395, +8.77% from previous year)

- 2020: $855,597 (−$5,203, −0.60% from previous year)

- 2021: $918,018 (+$62,421, +7.30% from previous year)

- 2022: $1,099,904 (+$181,886, +19.81% from previous year)

- 2023: $1,126,361 (+$26,456, +2.41% from previous year)

- 2024: $1,145,784 (+$19,423, +1.72% from previous year)

- 2025: $1,244,293 (+$98,509, +8.60% from previous year)

Village of Loch Lloyd’s transformation from $603,827 in 2010 to over $1.2 million today represents extraordinary growth with notable volatility. The exclusive golf community weathered significant early losses before experiencing dramatic recovery and growth, culminating in explosive pandemic-era gains. A remarkable 8.6% surge in 2025 demonstrates continued momentum in this ultra-premium market, making it one of Missouri’s fastest-appreciating luxury destinations.

Village of Loch Lloyd – Golf Community Reaches Elite Status

Located in Cass County near the Kansas-Missouri border, Village of Loch Lloyd has evolved from an upscale golf community into one of the region’s most exclusive residential destinations. The community’s championship golf course, luxury amenities, and gated environment create a resort-like atmosphere that attracts affluent buyers seeking a premier lifestyle community. The stunning price appreciation from around $604,000 to over $1.2 million reflects the transformation of this community into an ultra-luxury residential market.

The community’s remarkable 20% price surge in 2022, followed by an exceptional 8.6% gain in 2025, demonstrates how exclusive communities with unique amenities can maintain explosive growth even at elevated price levels. Village of Loch Lloyd’s appeal extends beyond its golf facilities to include its private club atmosphere, security, and exclusivity that creates scarcity in the luxury market. The community’s position as one of Missouri’s most expensive residential destinations reflects the premium buyers place on lifestyle-focused living with world-class amenities.

2. Ladue – 58% Home Price Increase Since 2010

- 2010: $825,163

- 2011: $792,366 (−$32,796, −3.97% from previous year)

- 2012: $748,497 (−$43,870, −5.54% from previous year)

- 2013: $768,722 (+$20,225, +2.70% from previous year)

- 2014: $824,919 (+$56,197, +7.31% from previous year)

- 2015: $835,797 (+$10,878, +1.32% from previous year)

- 2016: $853,001 (+$17,204, +2.06% from previous year)

- 2017: $858,001 (+$5,000, +0.59% from previous year)

- 2018: $883,690 (+$25,689, +2.99% from previous year)

- 2019: $893,197 (+$9,508, +1.08% from previous year)

- 2020: $909,050 (+$15,853, +1.77% from previous year)

- 2021: $1,013,350 (+$104,300, +11.47% from previous year)

- 2022: $1,139,337 (+$125,987, +12.43% from previous year)

- 2023: $1,178,663 (+$39,326, +3.45% from previous year)

- 2024: $1,249,622 (+$70,959, +6.02% from previous year)

- 2025: $1,305,262 (+$55,640, +4.45% from previous year)

Ladue’s climb from $825,163 in 2010 to over $1.3 million today reflects measured appreciation in Missouri’s most prestigious residential market. The legendary luxury community experienced steady but modest growth through 2020 before significant acceleration during 2021-2022, when values surged nearly 24% to exceed one million dollars. Continued strong appreciation through 2025 demonstrates sustained demand at the very highest price levels in the state.

Ladue – Missouri’s Premier Luxury Destination

As Missouri’s most famous and prestigious residential community, Ladue has maintained its legendary status as the ultimate address for the state’s elite for over a century. Located in St. Louis County, the city’s grand estates, tree-lined streets, and exclusive country clubs create an unparalleled luxury environment that represents the pinnacle of Midwest sophistication. Current home values exceeding $1.3 million reflect the extraordinary premium placed on living in this iconic community with its unmatched reputation and social standing.

The community’s 24% price surge during the pandemic years, pushing values well above one million dollars, demonstrates how established luxury markets with irreplaceable prestige benefited from increased wealth concentration. Ladue’s continued strong appreciation through 2025 shows that communities with legendary status can maintain growth momentum even at the highest price levels. The city’s position as Missouri’s most expensive and prestigious residential destination reflects its unique combination of history, exclusivity, and social cachet that cannot be replicated elsewhere in the state.

1. Huntleigh – 51% Home Price Increase Since 2010

- 2010: $1,575,578

- 2011: $1,448,085 (−$127,493, −8.09% from previous year)

- 2012: $1,368,002 (−$80,083, −5.53% from previous year)

- 2013: $1,395,012 (+$27,010, +1.97% from previous year)

- 2014: $1,505,175 (+$110,163, +7.90% from previous year)

- 2015: $1,555,148 (+$49,973, +3.32% from previous year)

- 2016: $1,612,605 (+$57,457, +3.69% from previous year)

- 2017: $1,603,762 (−$8,843, −0.55% from previous year)

- 2018: $1,627,792 (+$24,030, +1.50% from previous year)

- 2019: $1,660,706 (+$32,914, +2.02% from previous year)

- 2020: $1,721,014 (+$60,309, +3.63% from previous year)

- 2021: $1,942,489 (+$221,474, +12.87% from previous year)

- 2022: $2,179,168 (+$236,680, +12.18% from previous year)

- 2023: $2,136,741 (−$42,428, −1.95% from previous year)

- 2024: $2,288,214 (+$151,473, +7.09% from previous year)

- 2025: $2,380,807 (+$92,593, +4.05% from previous year)

Huntleigh’s extraordinary journey from $1.58 million in 2010 to nearly $2.4 million today represents the ultimate in Missouri luxury real estate. The ultra-exclusive community experienced significant early volatility before steady growth culminating in dramatic pandemic-era gains during 2021-2022, when values surged over 25% to exceed $2 million. After a brief correction in 2023, strong recovery through 2025 demonstrates sustained demand at the very apex of the luxury market.

Huntleigh – Missouri’s Ultra-Luxury Pinnacle

Representing the absolute pinnacle of Missouri residential real estate, Huntleigh stands as the state’s most exclusive and expensive community. This tiny enclave in St. Louis County consists of grand estates and mansions that house the region’s most affluent residents, creating an ultra-luxury environment unmatched anywhere else in the Midwest. Current home values approaching $2.4 million reflect the extraordinary premium placed on living in this ultimate luxury destination with its unparalleled exclusivity and prestige.

The community’s remarkable price trajectory, including a 25% surge during the pandemic years that pushed values above $2 million, demonstrates how ultra-high-end markets can experience both dramatic volatility and exceptional growth. Huntleigh’s brief correction in 2023 followed by strong recovery illustrates the resilience of markets at the very top of the luxury spectrum. The community’s position as Missouri’s most expensive residential destination, with homes approaching $2.4 million, reflects the ultimate expression of luxury living in the Show-Me State and represents a market segment that operates by its own exclusive dynamics.

Haven't Seen Yet

Curated from our most popular plans. Click any to explore.