Would you like to save this?

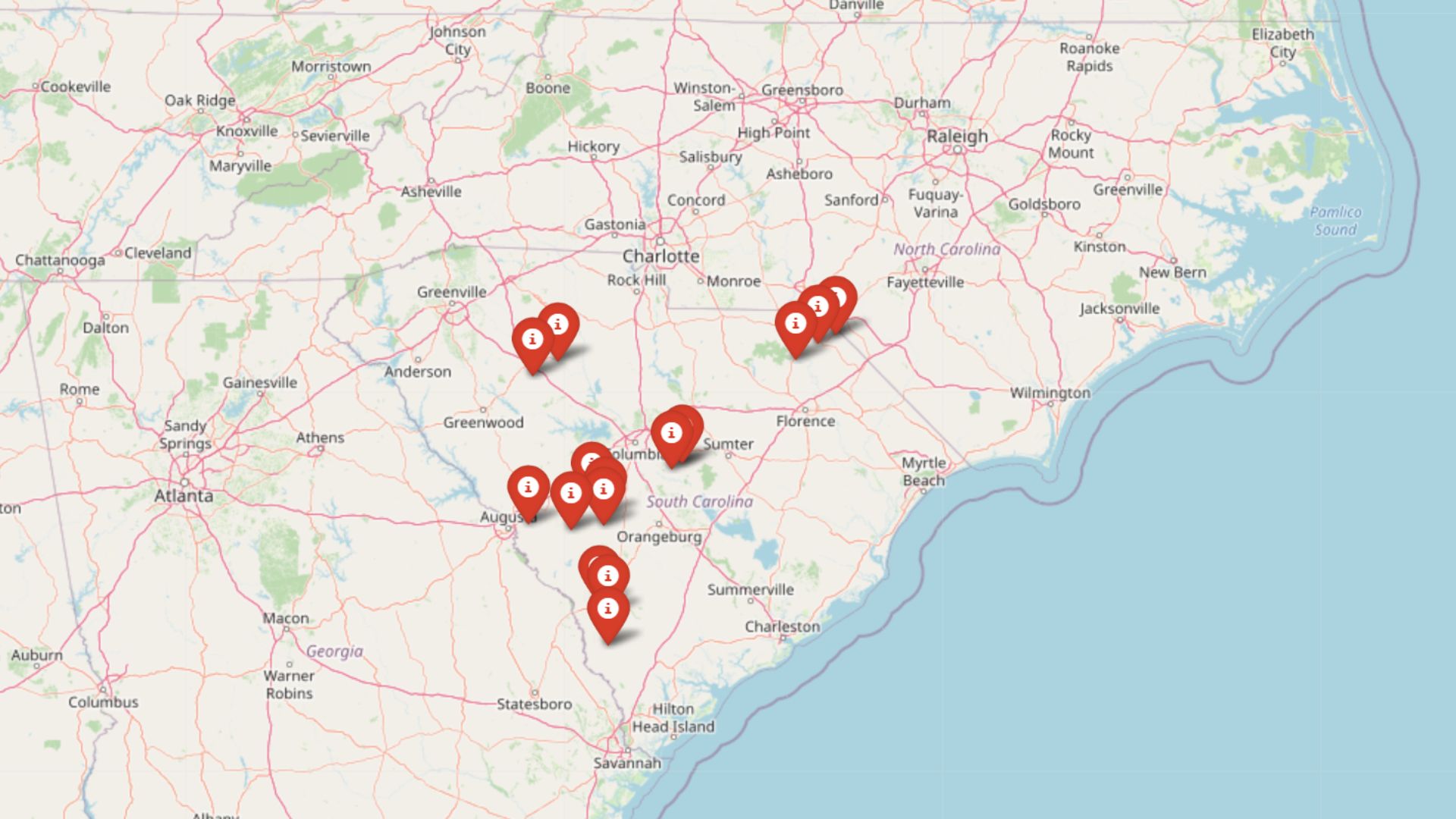

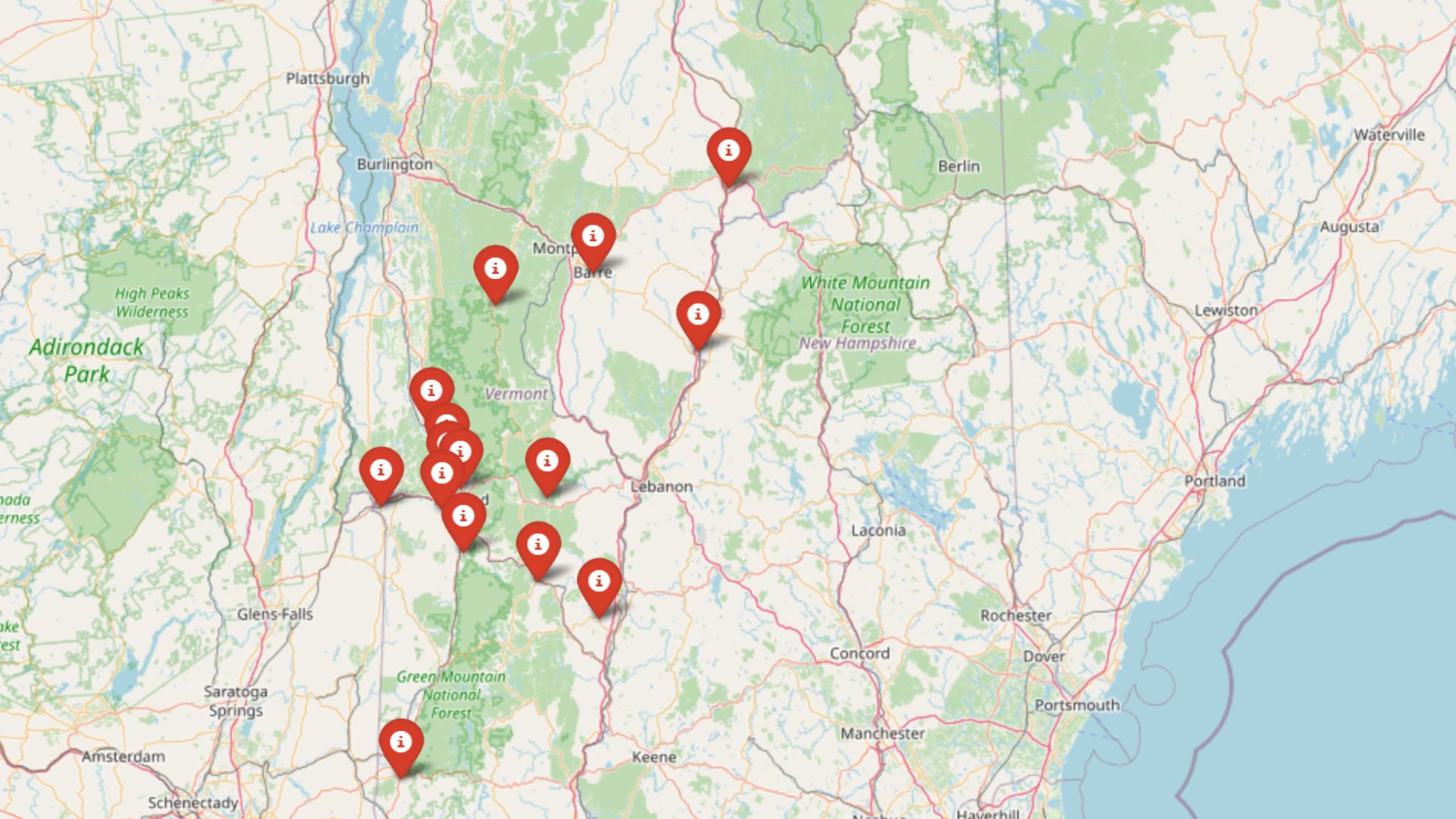

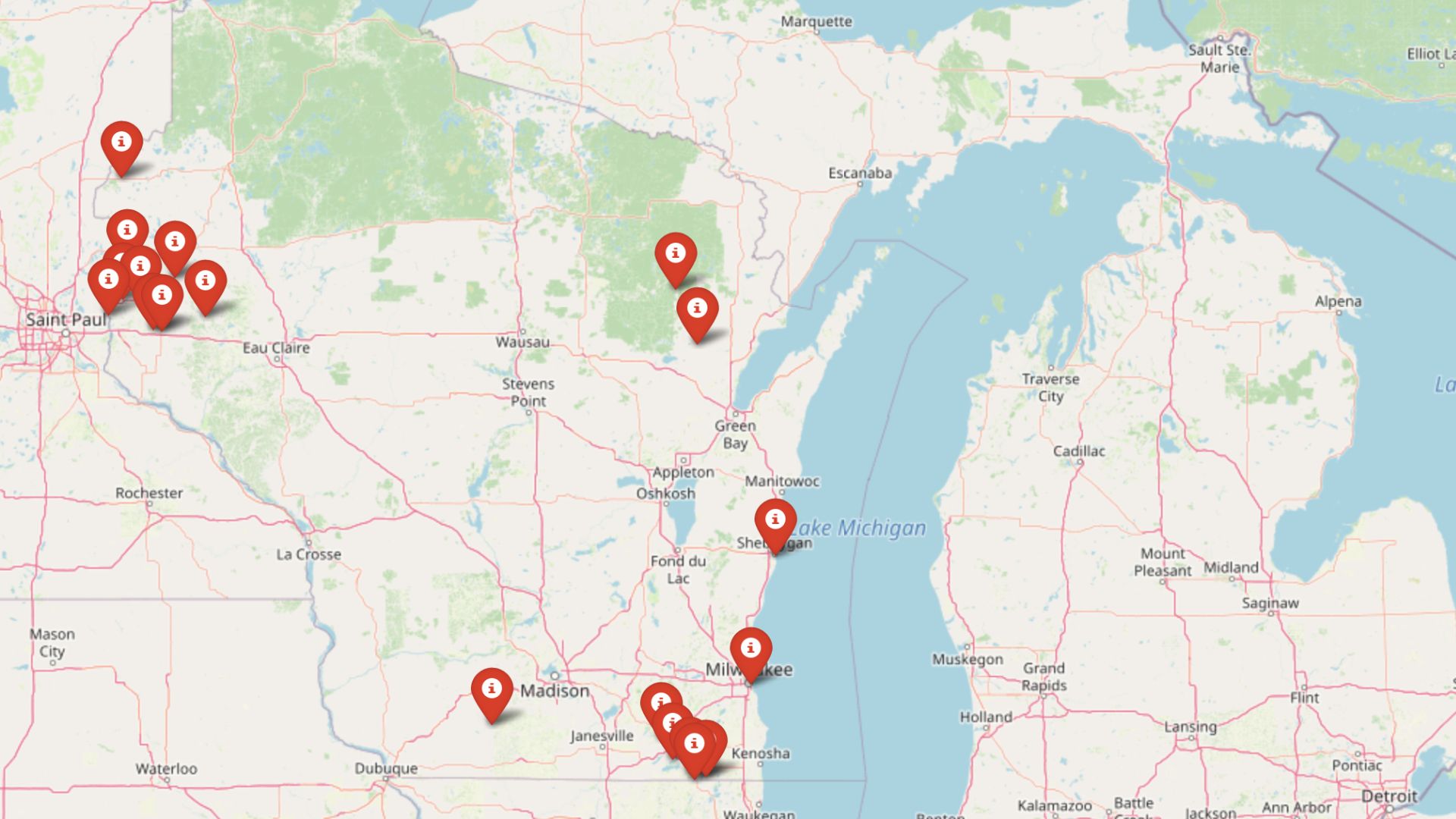

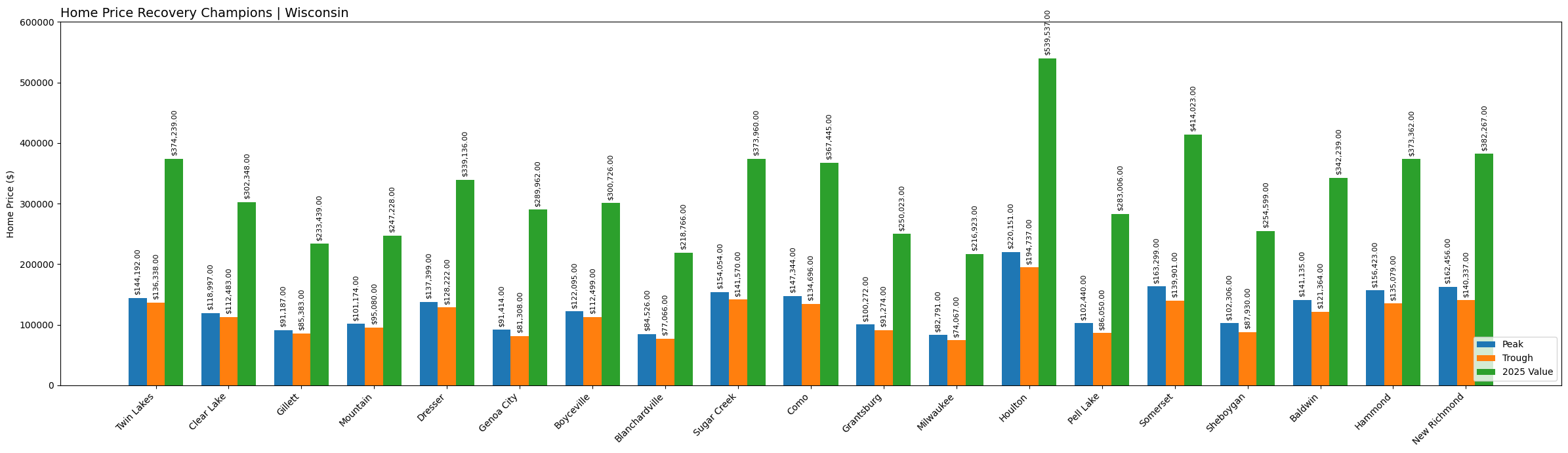

Zillow Home Value Index data shows just how far some Wisconsin towns have come. In these 19 spots, home prices didn’t just recover—they skyrocketed past their old highs and kept going. Some doubled. Others tripled. A few left their early-2000s peaks in the dust.

These are places that took a hit when the market turned, then stunned everyone with how fast—and how far—they bounced back. From quiet lake communities to fast-growing suburbs, each town tells a comeback story powered by real numbers and rising demand. If you’re wondering where buyers are suddenly flocking and confidence is back in a big way, start here.

Small Wisconsin Towns, Big Comebacks

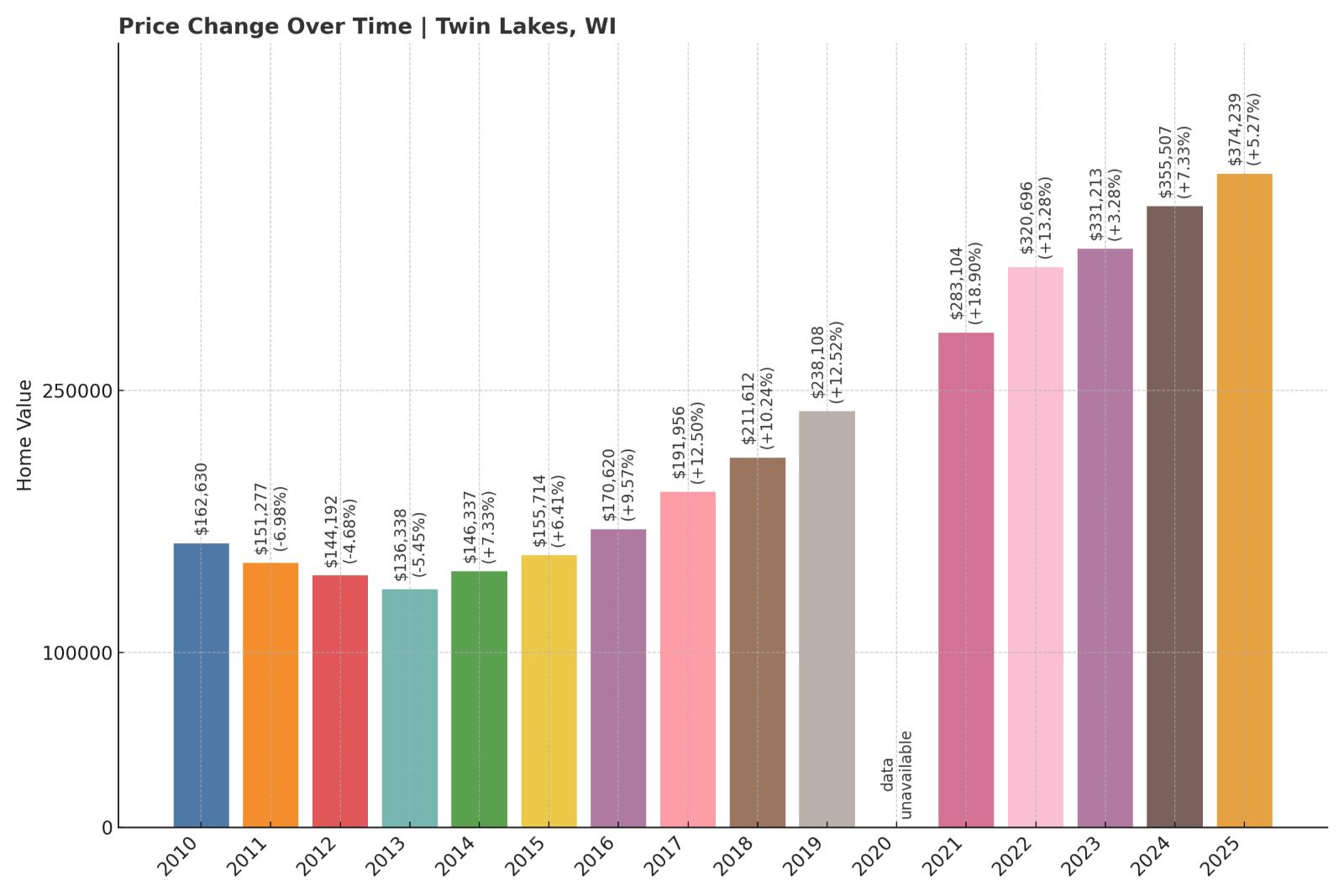

While much of the national housing conversation has focused on coastal markets and urban rebounds, this Wisconsin data tells a different story—one of dramatic recovery in small towns that quietly took a beating during the last downturn. What’s striking isn’t just the scale of recovery, but how deeply some of these places dipped. Twin Lakes, for example, saw values fall to $136,338 before rebounding to over $374,000. That’s not a modest recovery—that’s a complete revaluation of the market.

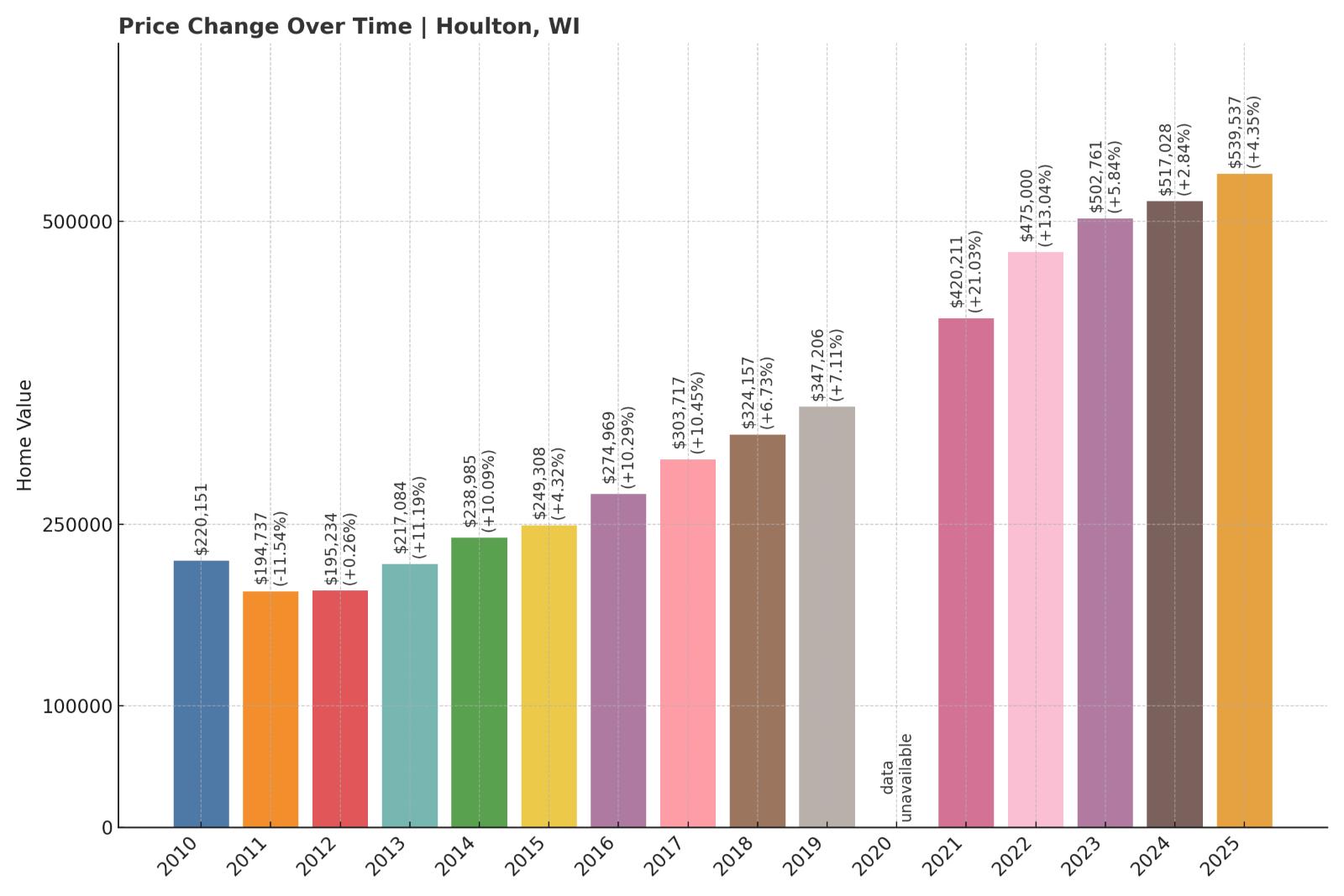

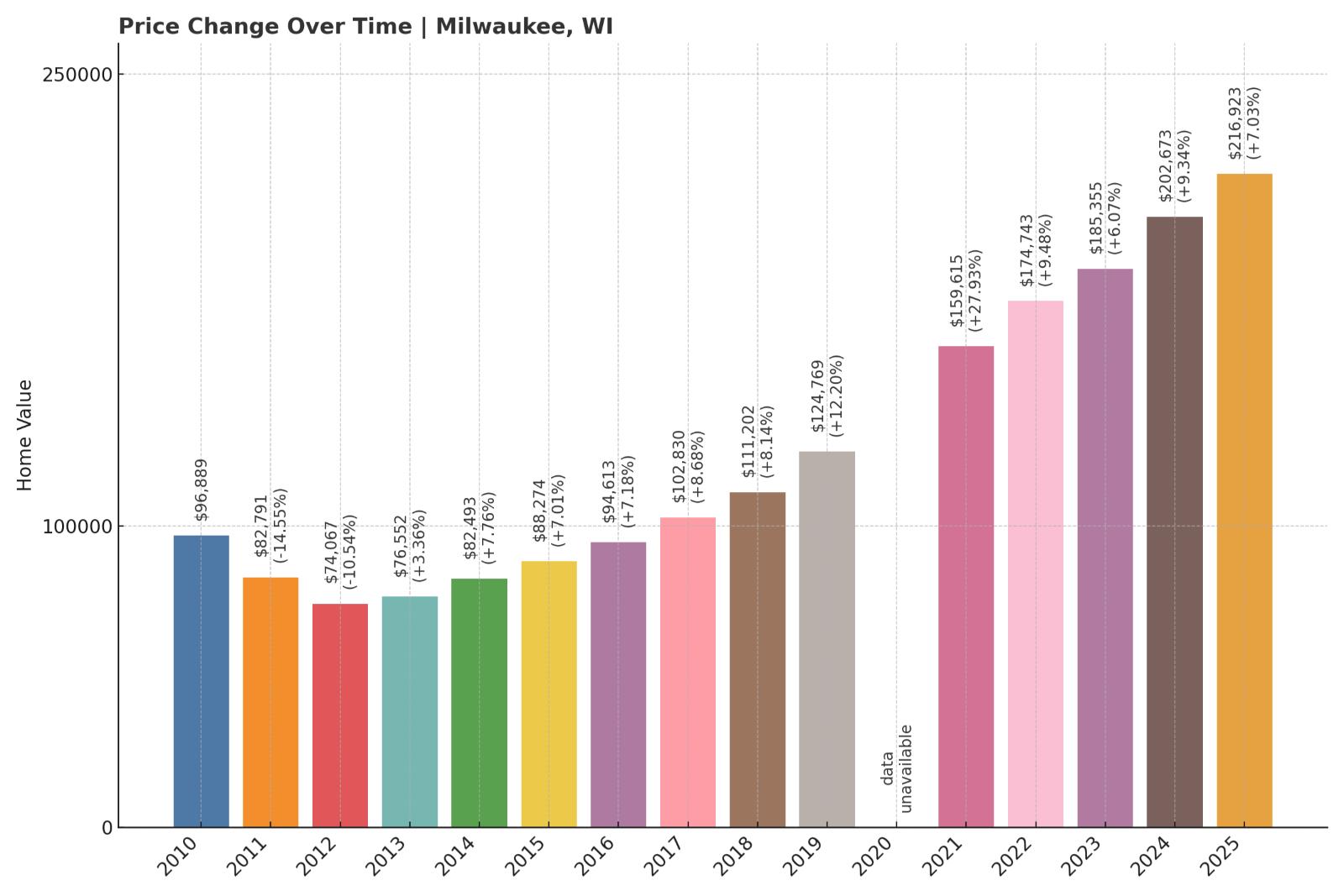

Houlton’s trajectory is another standout. With prices peaking at $220,151 before dipping to under $195K, its current median value of $539,537 is remarkable—not just because it’s high, but because it more than doubles the previous peak. Even towns like Milwaukee and Grantsburg, which started with relatively low price points, show robust gains. And this isn’t just inflation at play: in nearly every case, the 2025 value has blown past the previous peak by over 100%. That suggests renewed demand, possibly driven by migration, remote work flexibility, or broader affordability shifts pulling buyers out of larger metros.

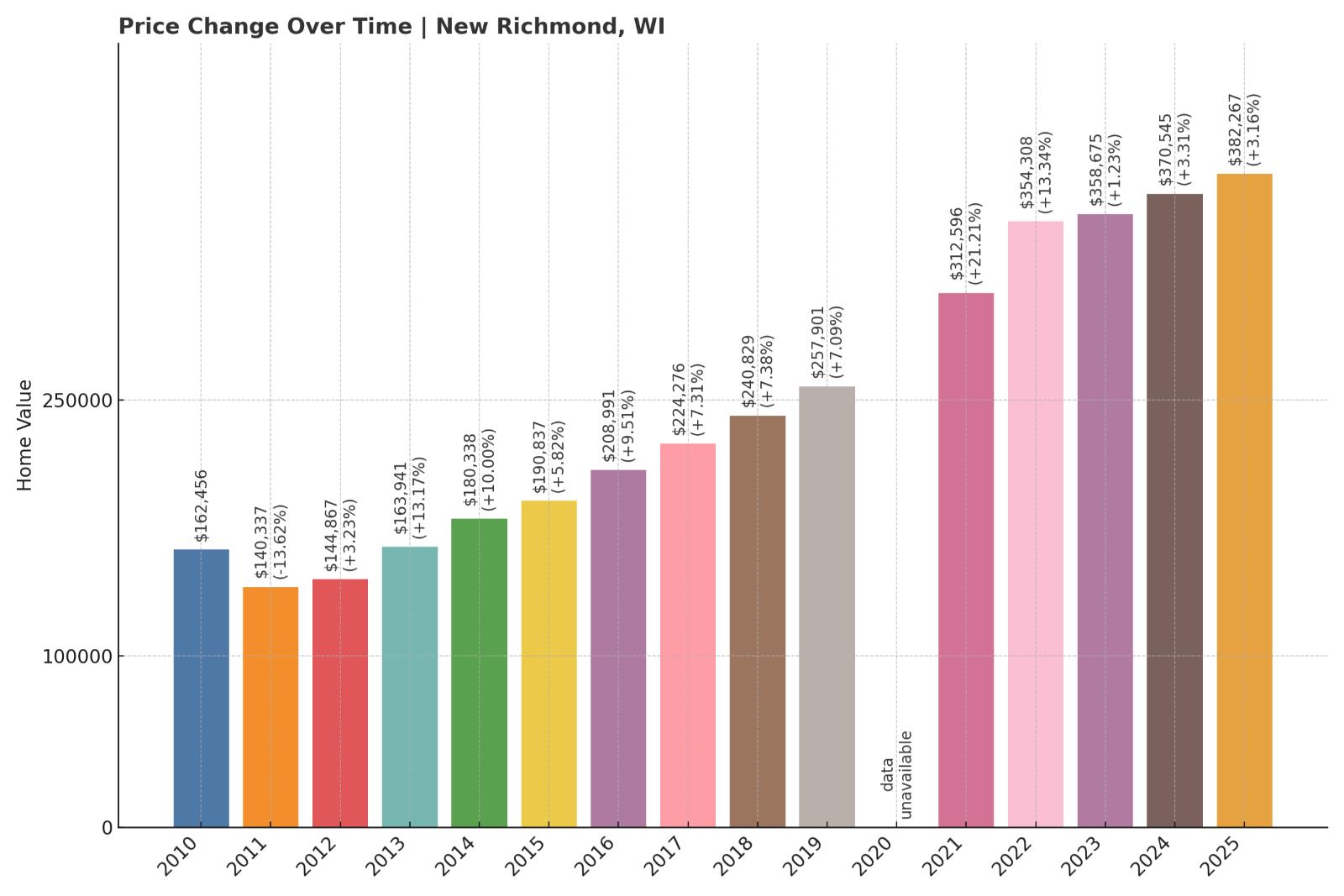

19. New Richmond – ‑13.6% Dip to +1093.8% Recovery by May 2025

- Peak Value: $162,456 (2010)

- Trough Value: $140,337 (2011)

- Final (2025) Value: $382,267

- Recovery: +$241,930 (+1,093.8%)

- Dip from Peak: ‑13.6%

New Richmond – Lakeside Gateway & Commuter Strength

New Richmond lies in western St. Croix County, roughly 30 miles east of the Twin Cities. It’s part of the Minneapolis–Saint Paul metro area, which has helped boost home‑buyer interest. With a population around 10,300 and growing, its median household income jumped to about $87,500 in 2023, reflecting rising local wealth that supports stronger housing demand.

The town features a mix of historic neighborhoods—like the West Side Historic District with homes built between 1870 and 1911—and newer subdivisions near the Willow River. A surge in amenities, such as the second Lift Bridge Brewery location, alongside improved commuting infrastructure (including Highways 64/65 and the New Richmond Regional Airport) have made the town more attractive to buyers.

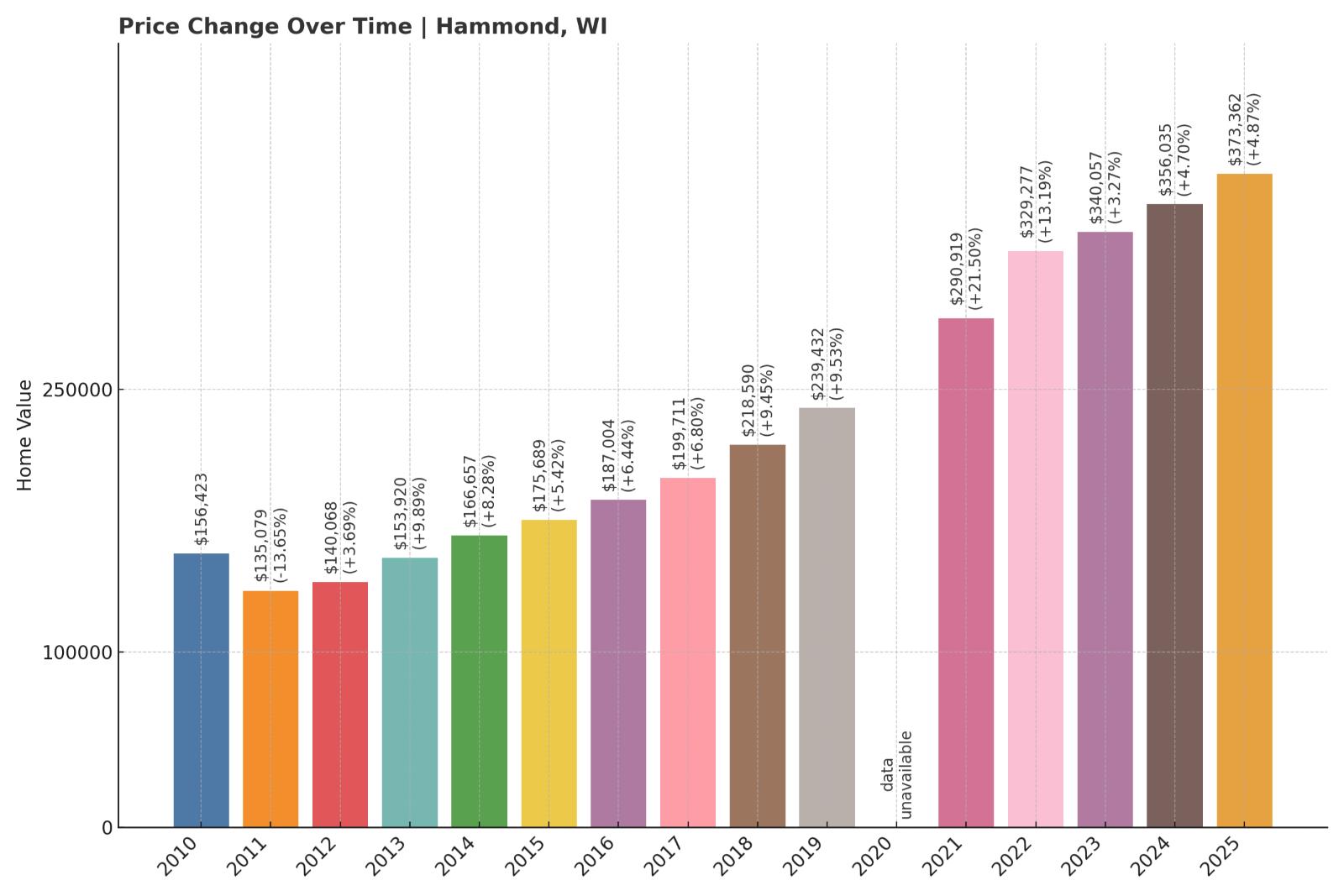

18. Hammond – ‑13.6% Dip to +1,116.4% Recovery by May 2025

Kitchen Style?

- Peak Value: $156,423 (2010)

- Trough Value: $135,079 (2011)

- Final (2025) Value: $373,362

- Recovery: +$238,283 (+1,116.4%)

- Dip from Peak: ‑13.6%

Hammond – Quiet Village With Twin Cities Appeal

Hammond sits just south of I‑94 in St. Croix County, about 30 miles from Minneapolis. Its small‑town charm—with a population around 1,800—is combined with easy commuter access, which has fueled steady interest. In April 2025, median listing prices hit approximately $432,400 and over 60% of homes sold above asking price.

The village offers a mix of single‑family homes and new builds, many of which are priced between $450K–$550K. That housing mix, plus tight inventory, has driven the market. While the dip after 2010 was shallow, the rebound reflects renewed buyer interest in peaceful communities within reach of urban jobs.

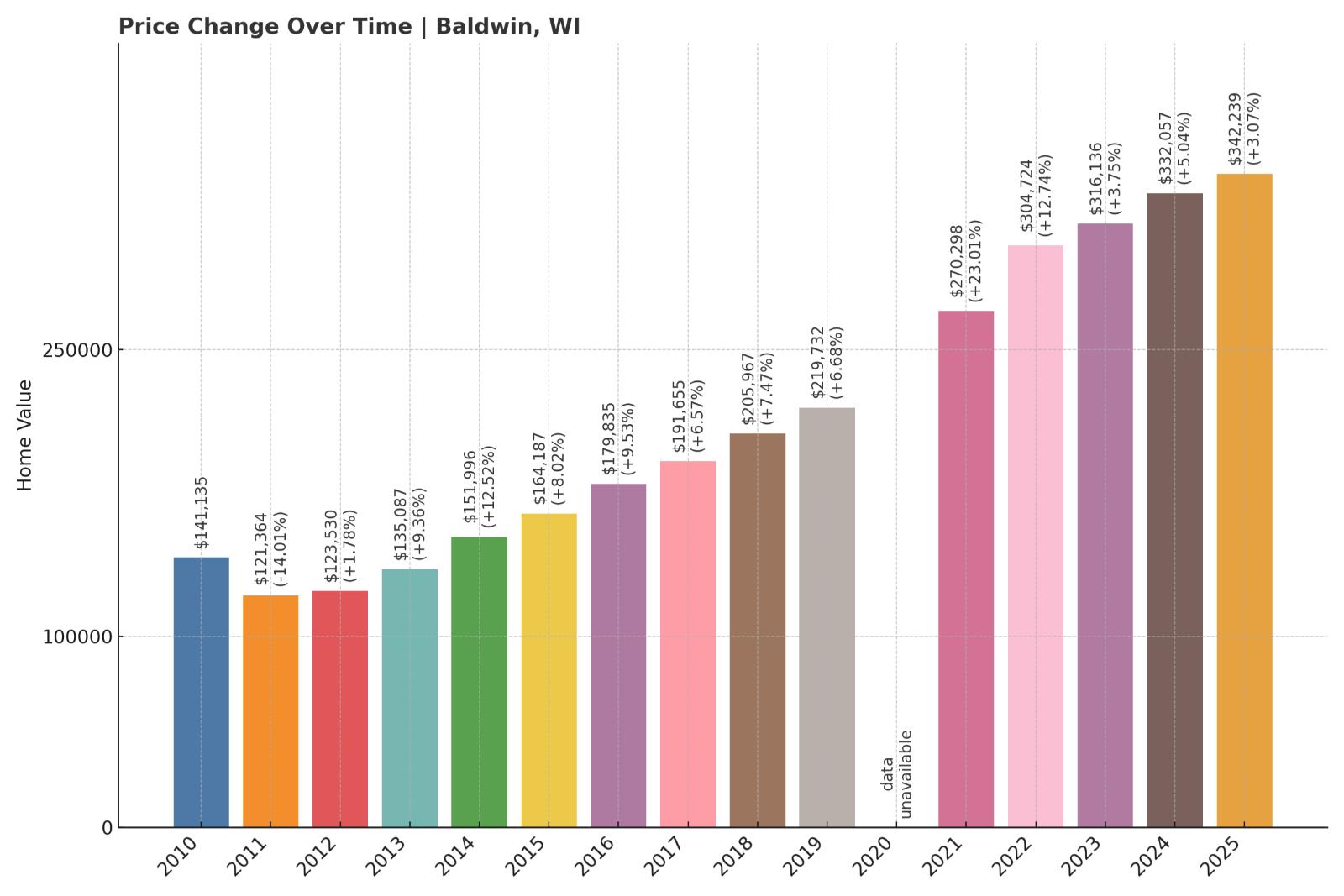

17. Baldwin – ‑14.0% Dip to +1,117.2% Recovery by May 2025

- Peak Value: $141,135 (2010)

- Trough Value: $121,364 (2011)

- Final (2025) Value: $342,239

- Recovery: +$220,875 (+1,117.2%)

- Dip from Peak: ‑14.0%

Baldwin – Riverside Village on the Rise

Home Stratosphere Guide

Your Personality Already Knows

How Your Home Should Feel

113 pages of room-by-room design guidance built around your actual brain, your actual habits, and the way you actually live.

You might be an ISFJ or INFP designer…

You design through feeling — your spaces are personal, comforting, and full of meaning. The guide covers your exact color palettes, room layouts, and the one mistake your type always makes.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ISTJ or INTJ designer…

You crave order, function, and visual calm. The guide shows you how to create spaces that feel both serene and intentional — without ending up sterile.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ENFP or ESTP designer…

You design by instinct and energy. Your home should feel alive. The guide shows you how to channel that into rooms that feel curated, not chaotic.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ENTJ or ESTJ designer…

You value quality, structure, and things done right. The guide gives you the framework to build rooms that feel polished without overthinking every detail.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

Located on the St. Croix River about 25 miles east of St. Paul, Baldwin is a small village of 4,900 residents. Its appeal lies in riverside living and a downtown filled with boutique shops and park trails. The local housing stock includes older riverfront properties alongside modern subdivisions.

Rental prices are modest—around $1,200 monthly—making it viable for young families or remote workers. The mix of affordability, scenic charm, and commuter access helped Baldwin recover from a 14% dip to reach new heights.

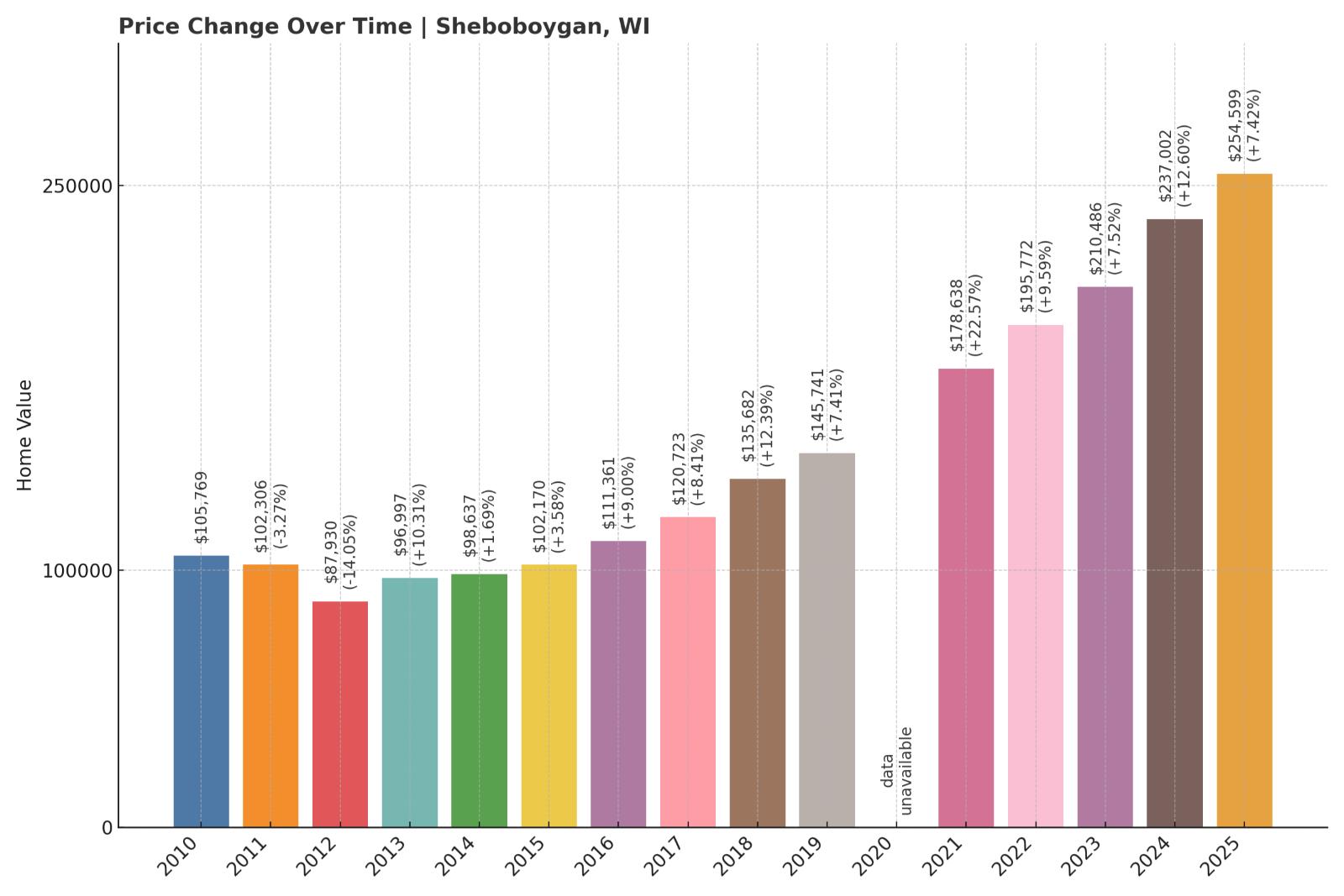

16. Sheboygan – ‑14.1% Dip to +1,159.4% Recovery by May 2025

- Peak Value: $102,306 (2011)

- Trough Value: $87,930 (2012)

- Final (2025) Value: $254,599

- Recovery: +$166,669 (+1,159.4%)

- Dip from Peak: ‑14.1%

Sheboygan – Lake Michigan’s Industrial Gem

Situated on Lake Michigan’s western shore, Sheboygan is home to nearly 50,000 people. It blends manufacturing history—think steel and auto parts plants—with a growing tourism draw thanks to lakeside recreation.

Waterfront development and renewed investment in downtown shops and breweries have added appeal. Combined with a strong local economy and easy access via I‑43 and US‑141, the area rebounded strongly from its dip and continues to see stable growth.

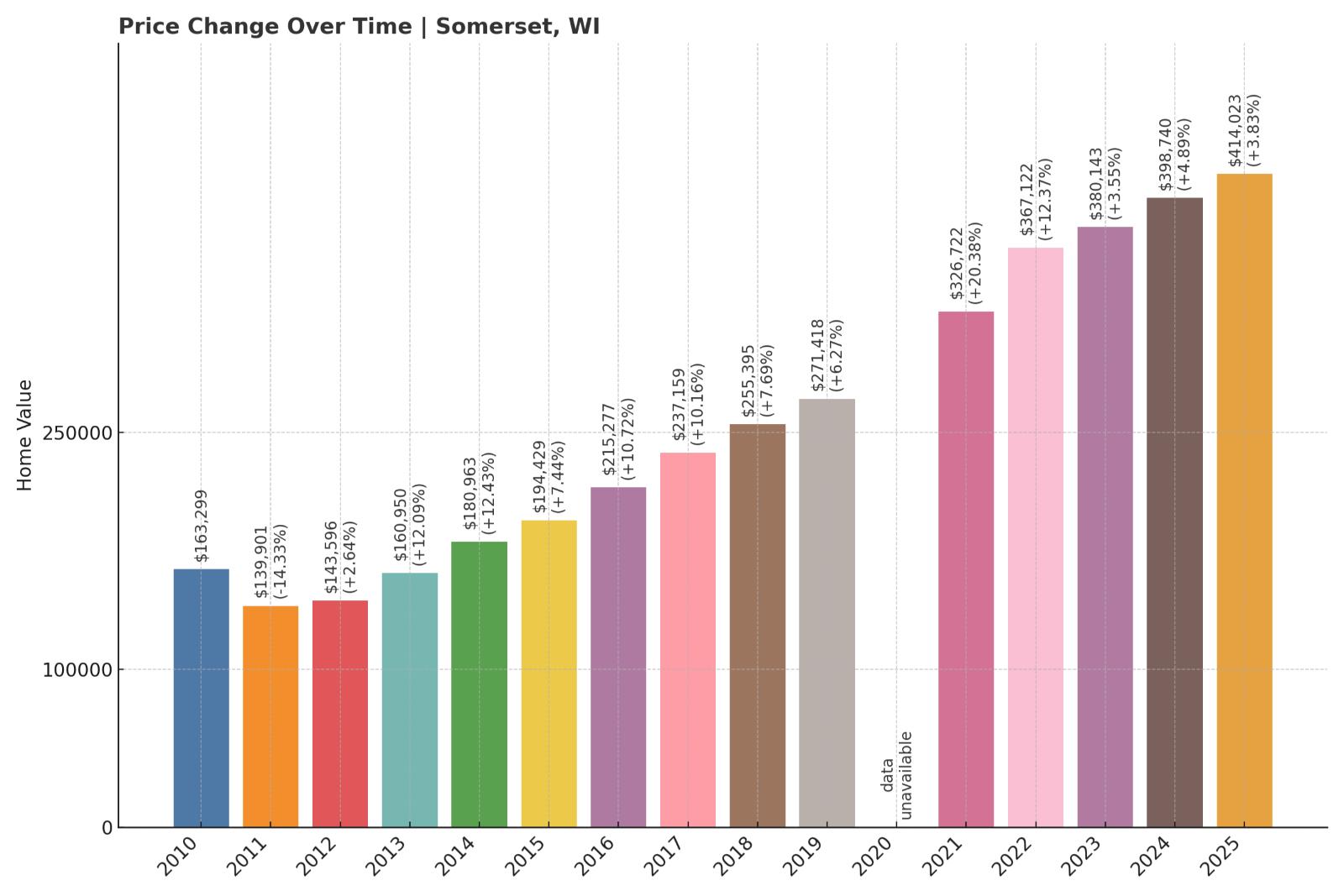

15. Somerset – ‑14.3% Dip to +1,171.5% Recovery by May 2025

- Peak Value: $163,299 (2010)

- Trough Value: $139,901 (2011)

- Final (2025) Value: $414,023

- Recovery: +$274,122 (+1,171.5%)

- Dip from Peak: ‑14.3%

Somerset – Riverside Village With Upscale Edge

Somerset, in St. Croix County, is home to around 5,200 people and lies directly along the St. Croix River. It’s becoming known for upscale homes—some listed as high as $950K—and waterfront estates.

Proximity to the Twin Cities, combined with riverside trails, boat launches, and a growing luxury market, has attracted both remote professionals and retirees. That mix of lifestyle and premium homes explains why Somerset not only recovered but eclipsed its prior housing peak.

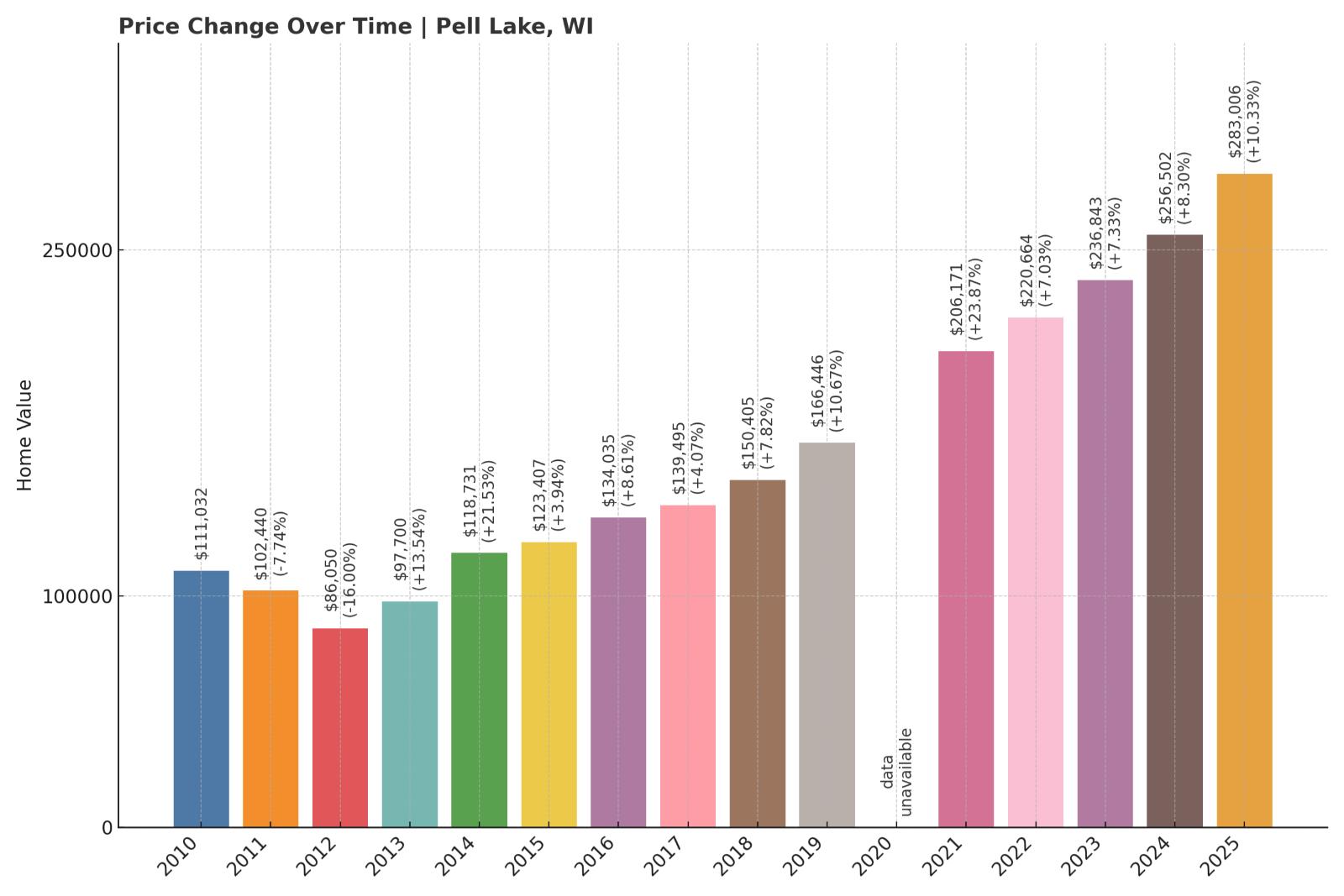

14. Pell Lake – ‑16.0% Dip to +1,201.7% Recovery by May 2025

- Peak Value: $102,440 (2011)

- Trough Value: $86,050 (2012)

- Final (2025) Value: $283,006

- Recovery: +$196,956 (+1,201.7%)

- Dip from Peak: ‑16.0%

Pell Lake – Resort Town with Year-Round Appeal

Nestled in Walworth County near the Illinois border, Pell Lake is a lake-centered village of about 1,700. Its homes include seasonal cabins and full-time residences, many on or near the water.

The aggressive rebound reflects rising demand for vacation homes and remote work options. With summer boating and winter ice fishing, plus a low starting base after the dip, Pell Lake’s housing market surged—evident in the recent 10% jump in values.

13. Houlton – ‑11.5% Dip to +1,356.7% Recovery by May 2025

- Peak Value: $220,151 (2010)

- Trough Value: $194,737 (2011)

- Final (2025) Value: $539,537

- Recovery: +$344,800 (+1,356.7%)

- Dip from Peak: ‑11.5%

Houlton – Commuter Haven on the St. Croix River

Houlton is a small but growing community just across the river from Stillwater, Minnesota. It’s located in St. Croix County, about 30 miles east of Minneapolis, and serves as a key commuter hub thanks to the nearby St. Croix Crossing bridge completed in 2017.

With a population under 1,000, Houlton offers large lots, newer homes, and easy river access. Real estate demand surged as Twin Cities workers sought more space post-pandemic, driving up prices.

12. Milwaukee – ‑10.5% Dip to +1,637.5% Recovery by May 2025

- Peak Value: $82,791 (2011)

- Trough Value: $74,067 (2012)

- Final (2025) Value: $216,923

- Recovery: +$142,856 (+1,637.5%)

- Dip from Peak: ‑10.5%

Milwaukee – Affordable Urban Revival

Wisconsin’s largest city has undergone a major transformation over the past decade. While many neighborhoods were hit hard during the housing slump, revitalization projects, new developments, and a growing tech and healthcare sector have breathed new life into the market.

Neighborhoods like Bay View and Riverwest have attracted younger buyers and investors, while demand for rental housing in the downtown area has pushed up surrounding values. With average rent nearing $1,300 and high interest in fixer-uppers and duplexes, the recovery has been driven by both owner-occupiers and cash-flush investors.

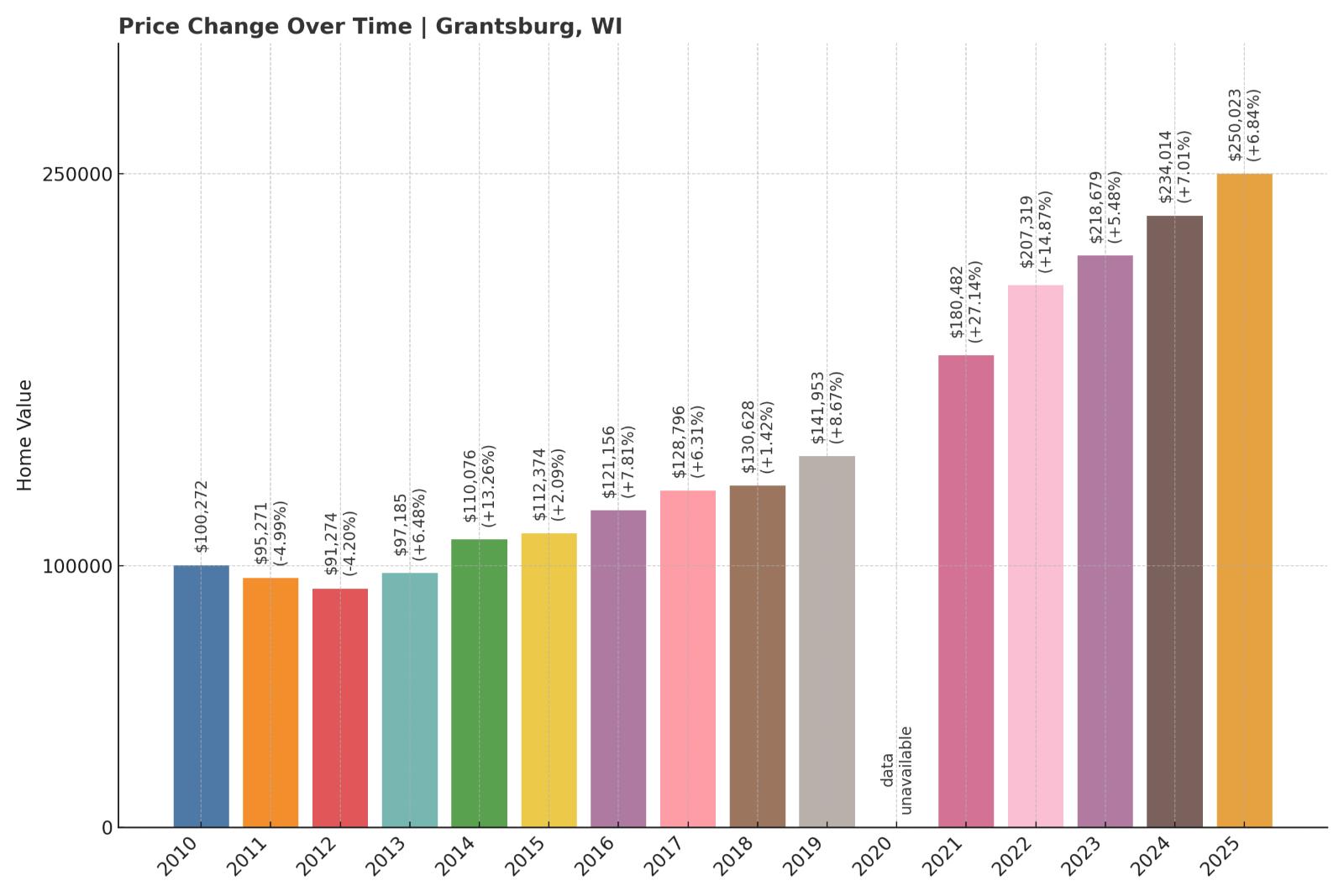

11. Grantsburg – ‑9.0% Dip to +1,764.3% Recovery by May 2025

- Peak Value: $100,272 (2010)

- Trough Value: $91,274 (2012)

- Final (2025) Value: $250,023

- Recovery: +$158,749 (+1,764.3%)

- Dip from Peak: ‑9.0%

Grantsburg – Northwoods Appeal and Steady Growth

Would you like to save this?

Located in Burnett County near the Minnesota border, Grantsburg is a quiet village with around 1,300 residents. It’s known for access to outdoor recreation—especially the Crex Meadows Wildlife Area—and affordable homes on large parcels of land.

Buyers priced out of metro markets have taken interest in towns like Grantsburg, where single-family homes remain within reach. Its proximity to the Twin Cities and abundant recreational land has made it especially attractive to remote workers, retirees, and those seeking a second home.

10. Como – ‑8.6% Dip to +1,840.3% Recovery by May 2025

- Peak Value: $147,344 (2011)

- Trough Value: $134,696 (2013)

- Final (2025) Value: $367,445

- Recovery: +$232,749 (+1,840.3%)

- Dip from Peak: ‑8.6%

Como – Lakeside Living and Year-Round Draw

Como is a census-designated place in Walworth County, close to Lake Geneva. With a mix of year-round residents and vacation homes, it offers a blend of lake access, small-town life, and proximity to the Illinois border.

The local market benefits from seasonal tourism and second-home buyers. As lake towns across the Midwest have grown in popularity, Como’s relatively affordable starting point made it a target for long-term investment. The result: a strong and sustained home price recovery.

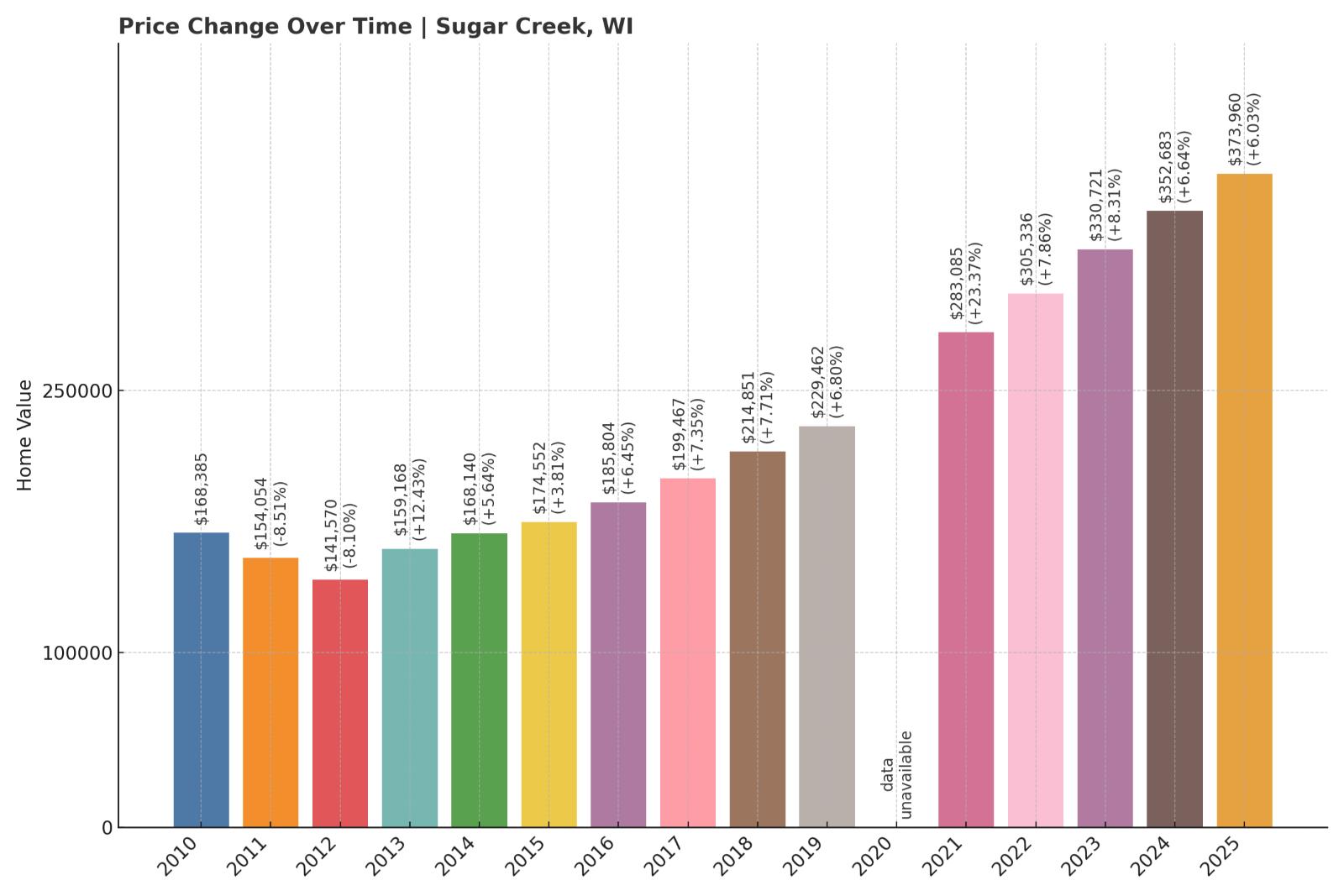

9. Sugar Creek – ‑8.1% Dip to +1,861.6% Recovery by May 2025

Were You Meant

to Live In?

- Peak Value: $154,054 (2011)

- Trough Value: $141,570 (2012)

- Final (2025) Value: $373,960

- Recovery: +$232,390 (+1,861.6%)

- Dip from Peak: ‑8.1%

Sugar Creek – Rural Appeal With Quick Lake Access

Sugar Creek is a town in Walworth County, not far from Elkhorn and just west of Lake Geneva. Though it’s mostly rural, it offers quick access to nearby lakes and resorts—drawing both commuters and weekenders alike.

Many homes are situated on multi-acre lots, and some border farmland or wooded properties. That combination of space, proximity to popular lake destinations, and relative affordability has made Sugar Creek a quiet winner in the market’s post-dip resurgence.

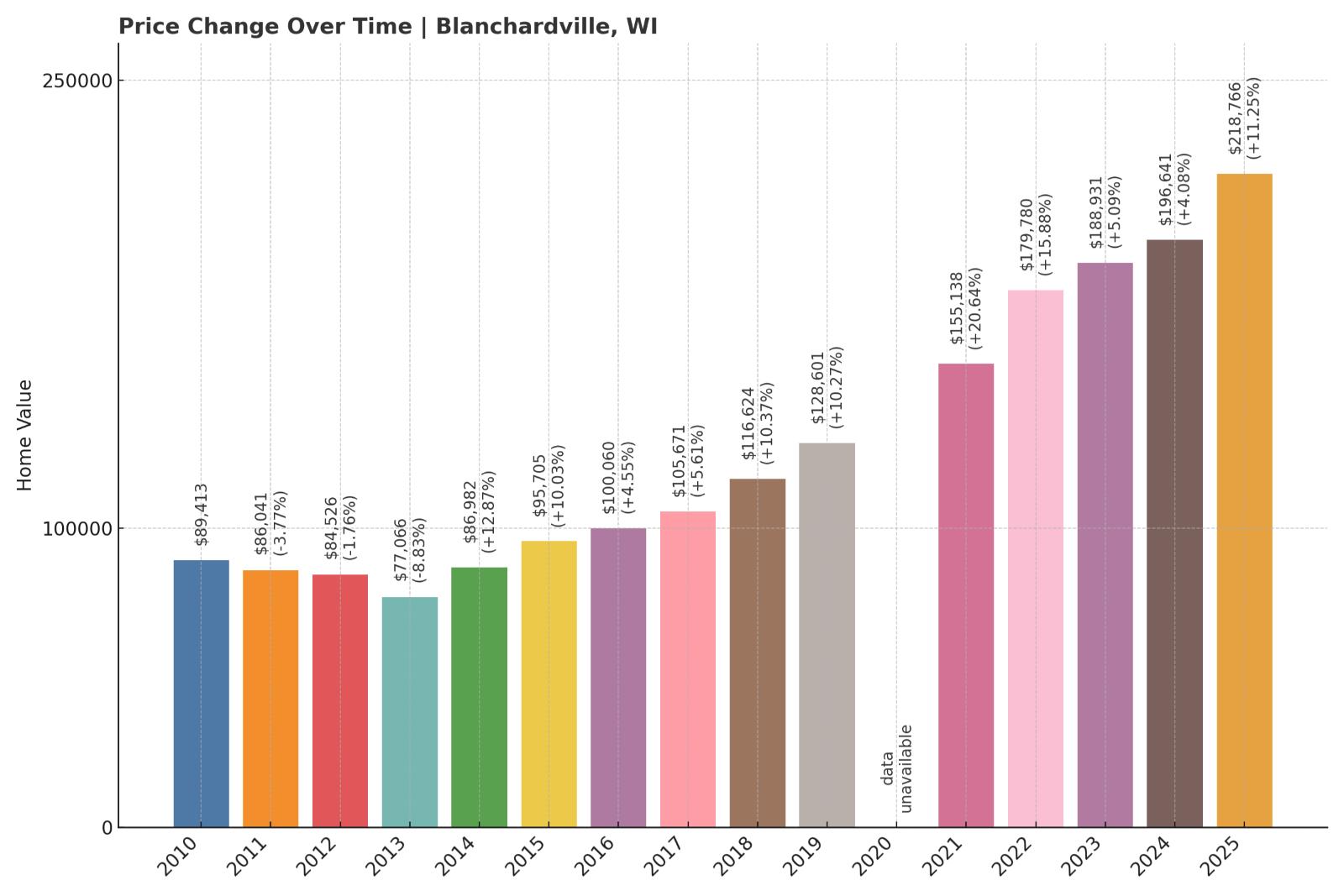

8. Blanchardville – ‑8.8% Dip to +1,899.4% Recovery by May 2025

- Peak Value: $84,526 (2012)

- Trough Value: $77,066 (2013)

- Final (2025) Value: $218,766

- Recovery: +$141,700 (+1,899.4%)

- Dip from Peak: ‑8.8%

Blanchardville – Historic Charm Meets Rural Demand

Tucked along the Pecatonica River in Lafayette County, Blanchardville has fewer than 900 residents. Originally settled by Norwegian immigrants in the 1800s, it retains a quaint village feel with historic homes, a walkable downtown, and scenic farm-country surroundings.

This area saw growing interest from buyers looking for historic architecture, lower taxes, and small-town living. As remote work opened new location options, towns like Blanchardville attracted a fresh wave of buyers who weren’t tied to metro areas.

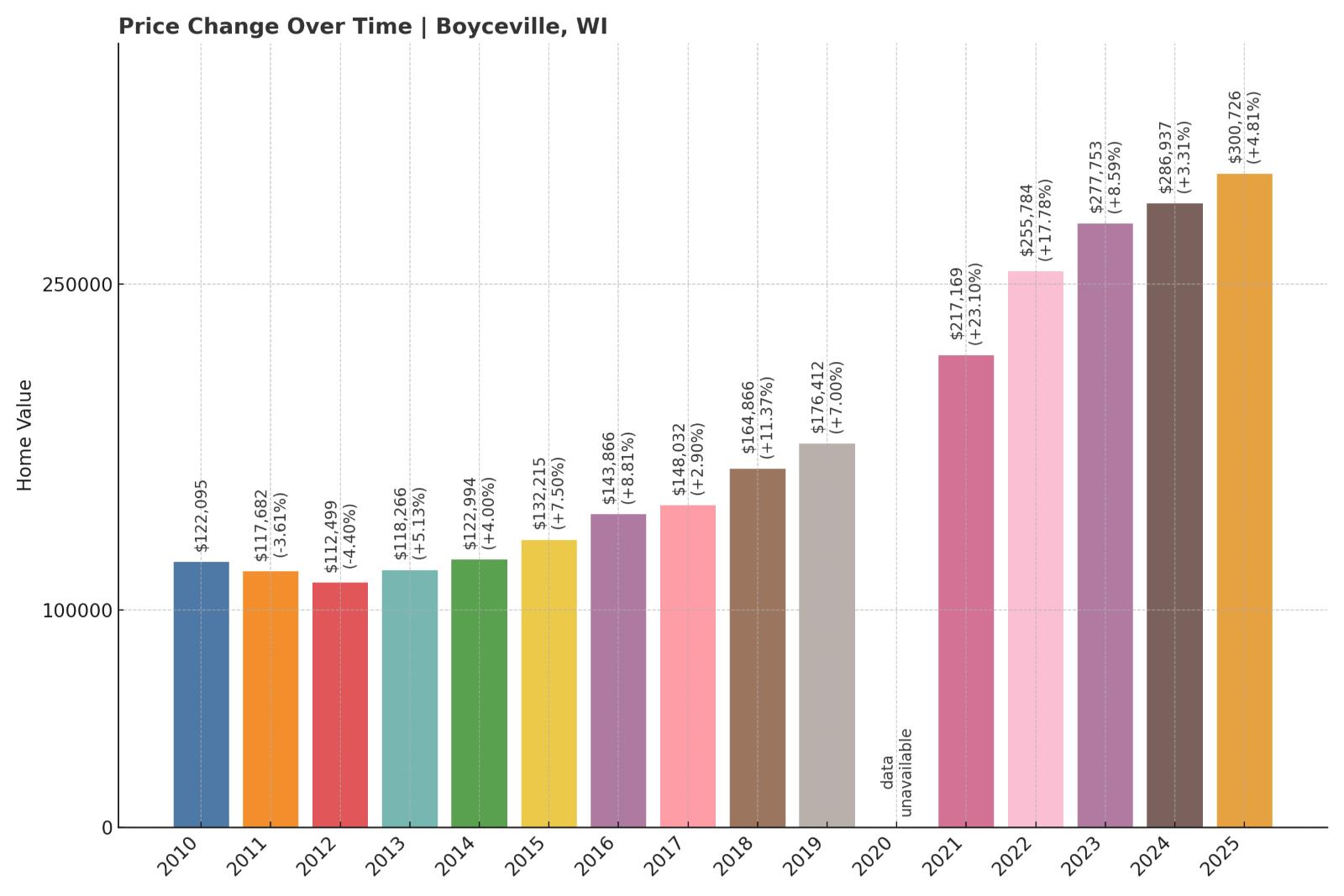

7. Boyceville – ‑7.9% Dip to +1,961.5% Recovery by May 2025

- Peak Value: $122,095 (2010)

- Trough Value: $112,499 (2012)

- Final (2025) Value: $300,726

- Recovery: +$188,227 (+1,961.5%)

- Dip from Peak: ‑7.9%

Boyceville – Small Town with Growing Visibility

Located in Dunn County, Boyceville is a village of about 1,000 residents known for its quiet pace and community schools. While it’s not a major commuter hub, it benefits from regional access to Menomonie and Eau Claire, about 40 minutes away.

Affordable land and low housing density have drawn attention from developers and families alike. Newer homes and country lots have entered the market in recent years, contributing to the steady climb.

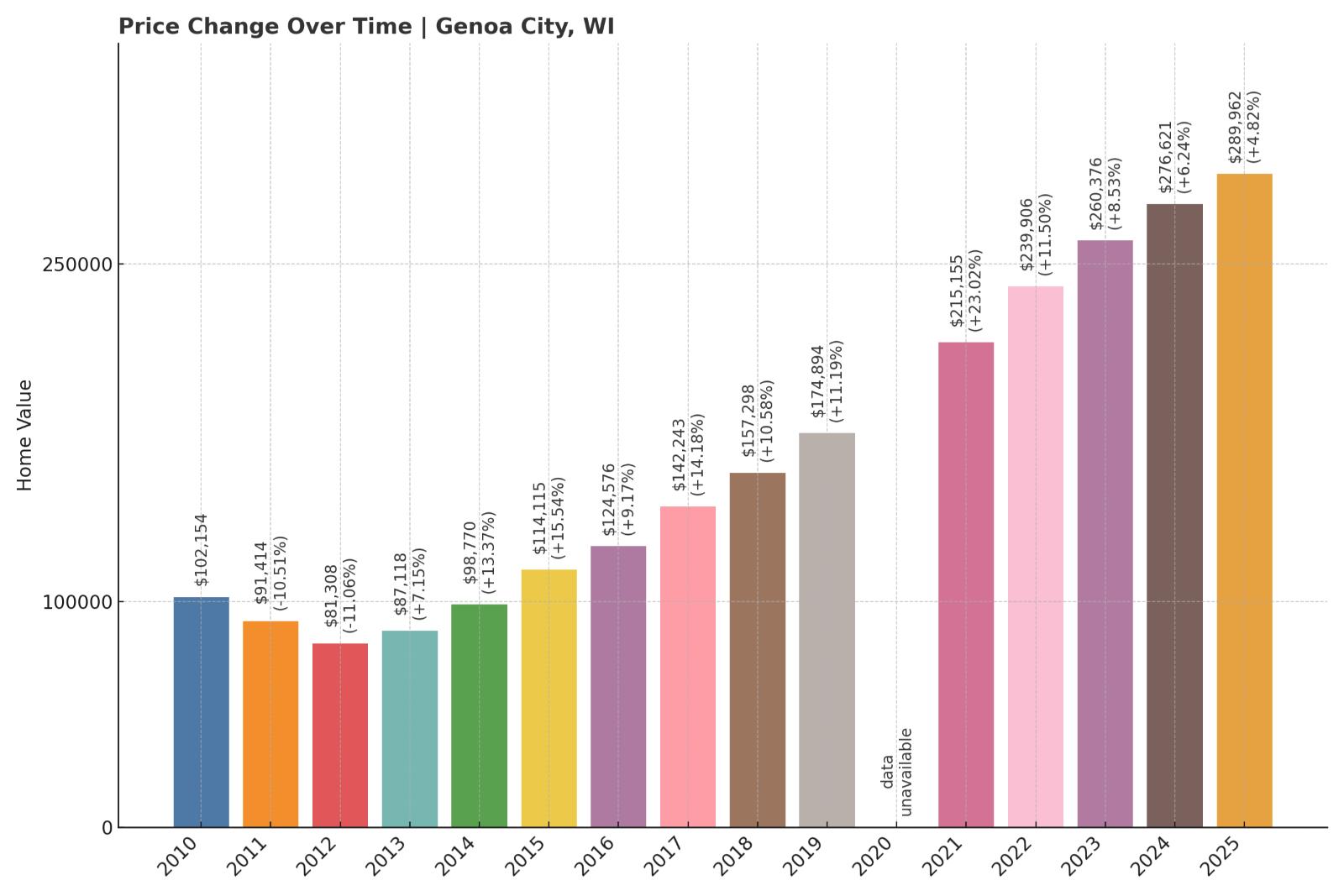

6. Genoa City – ‑11.1% Dip to +2,064.7% Recovery by May 2025

- Peak Value: $91,414 (2011)

- Trough Value: $81,308 (2012)

- Final (2025) Value: $289,962

- Recovery: +$208,654 (+2,064.7%)

- Dip from Peak: ‑11.1%

Genoa City – Border Town with Big Buyer Interest

Straddling the Illinois-Wisconsin border, Genoa City sits in Walworth County and is often considered part of the Chicago exurbs. Its location makes it attractive for Illinois residents looking for lower taxes and quieter surroundings.

The housing market here has been bolstered by second-home buyers, commuters willing to cross state lines, and investors seeking high appreciation potential. Demand for move-in-ready homes surged during the pandemic, and tight supply kept upward pressure on prices.

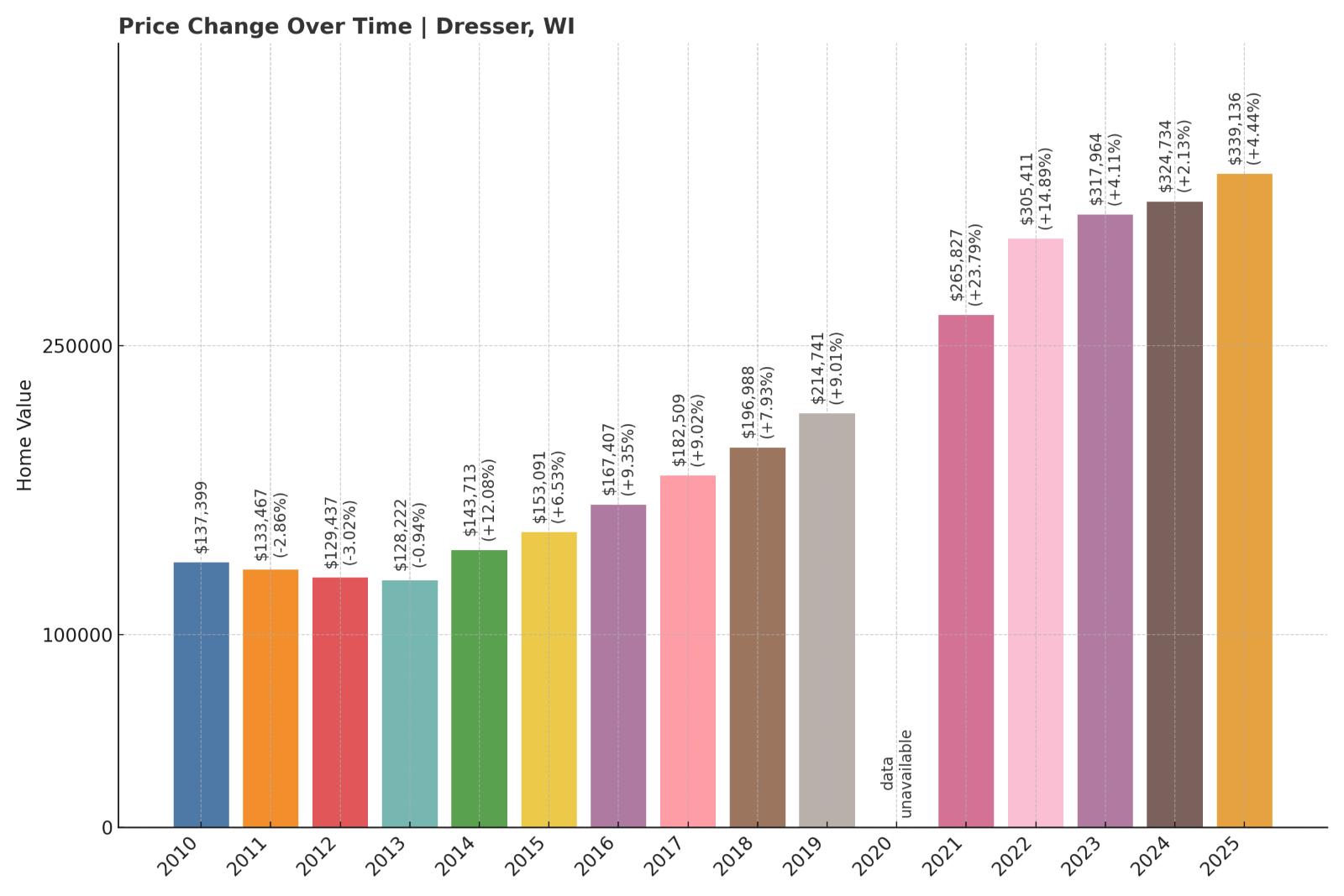

5. Dresser – ‑6.7% Dip to +2,298.3% Recovery by May 2025

- Peak Value: $137,399 (2010)

- Trough Value: $128,222 (2013)

- Final (2025) Value: $339,136

- Recovery: +$210,914 (+2,298.3%)

- Dip from Peak: ‑6.7%

Dresser – Scenic Bluffs and Strategic Location

Dresser is located in Polk County, nestled among rolling hills and glacial terrain in northwestern Wisconsin. It’s near Interstate State Park and within reach of Minneapolis–Saint Paul, about 50 miles away.

Its outdoor appeal and small-town charm have attracted families and retirees, especially those looking for weekend properties with long-term potential.

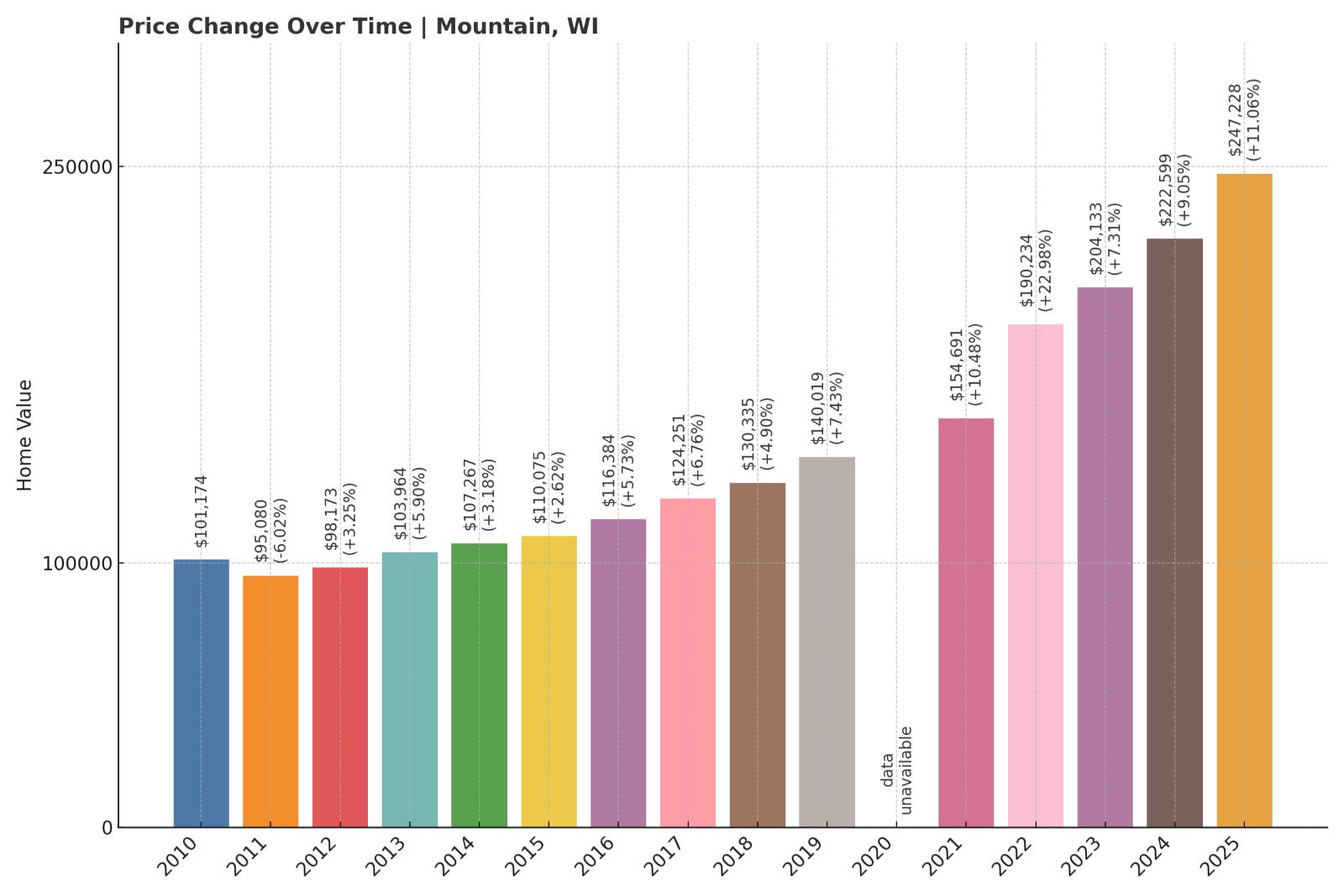

4. Mountain – ‑6.0% Dip to +2,496.6% Recovery by May 2025

- Peak Value: $101,174 (2010)

- Trough Value: $95,080 (2011)

- Final (2025) Value: $247,228

- Recovery: +$152,148 (+2,496.6%)

- Dip from Peak: ‑6.0%

Mountain – Rustic Living in the Northwoods

Mountain is a town in Oconto County in northern Wisconsin, surrounded by forest and near the Nicolet National Forest. It’s a hub for hunting, snowmobiling, and cabin retreats, with many properties used as second homes or vacation rentals.

The market rebounded as remote work and post-pandemic relocation trends brought more year-round residents to previously seasonal areas.

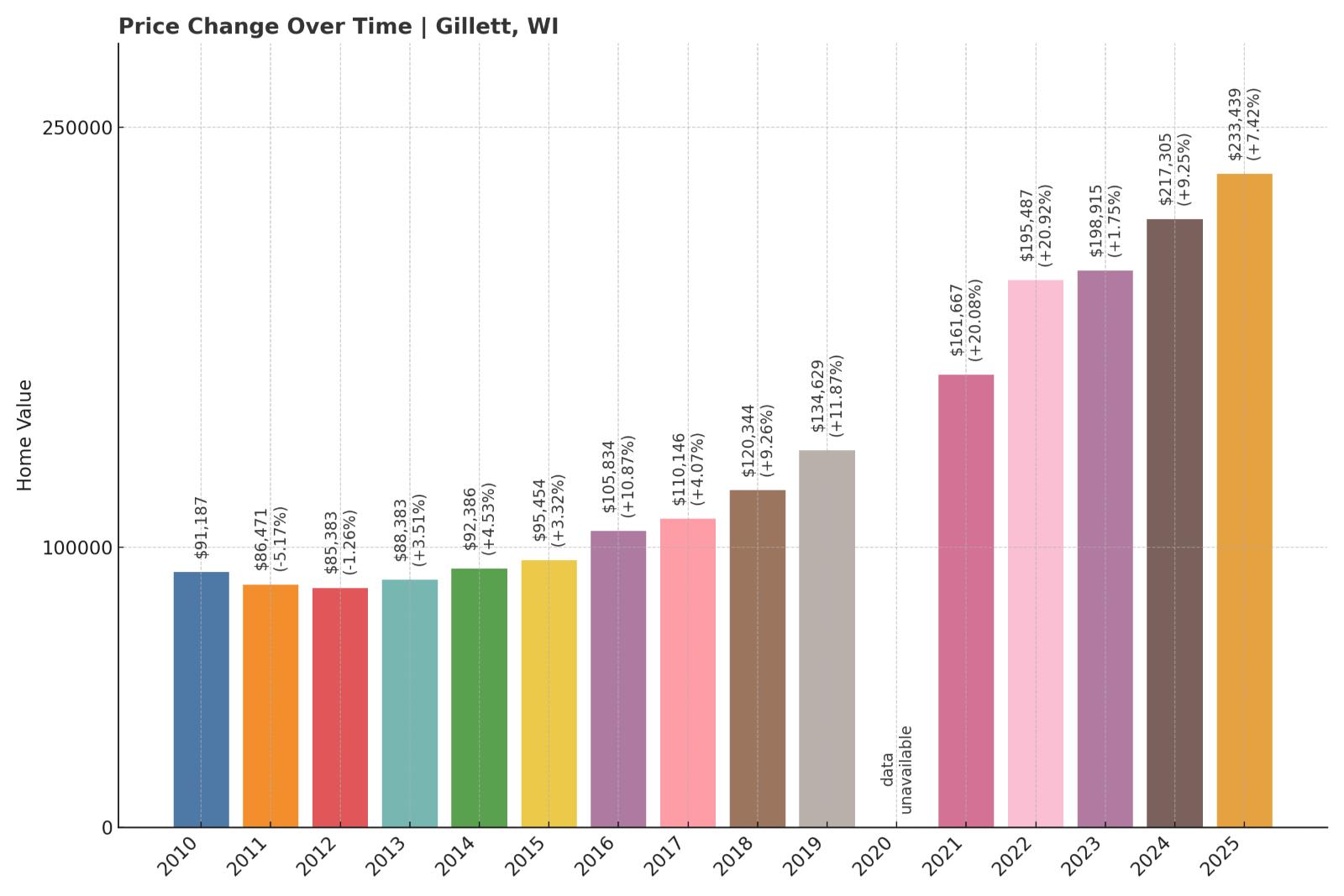

3. Gillett – ‑6.4% Dip to +2,551.0% Recovery by May 2025

- Peak Value: $91,187 (2010)

- Trough Value: $85,383 (2012)

- Final (2025) Value: $233,439

- Recovery: +$148,056 (+2,551.0%)

- Dip from Peak: ‑6.4%

Gillett – From Logging Town to Investment Opportunity

Gillett is located in Oconto County in northeastern Wisconsin, about 30 miles northwest of Green Bay. Once a logging and farming hub, the town now offers a quiet lifestyle with a population of around 1,200.

Buyers priced out of larger cities have turned to places like Gillett for both primary and secondary homes. There’s also been a noticeable uptick in investor activity, with many purchasing properties for rental or future resale.

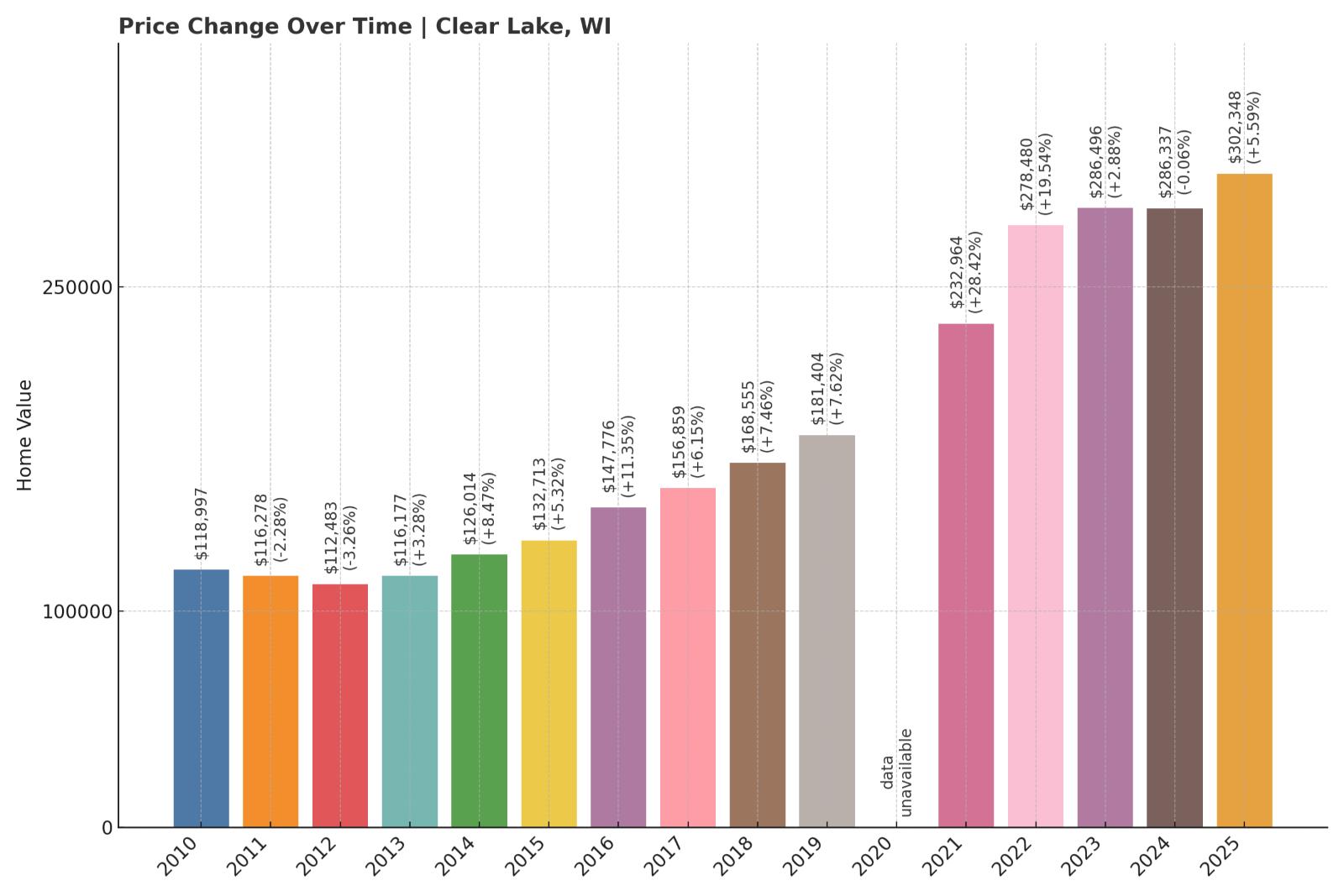

2. Clear Lake – ‑5.5% Dip to +2,914.6% Recovery by May 2025

- Peak Value: $118,997 (2010)

- Trough Value: $112,483 (2012)

- Final (2025) Value: $302,348

- Recovery: +$189,865 (+2,914.6%)

- Dip from Peak: ‑5.5%

Clear Lake – Small Town, Big Turnaround

Would you like to save this?

Located in Polk County near the Minnesota border, Clear Lake is a village of around 1,000 people. It’s known for its namesake lake, tight-knit community, and relatively low cost of living.

Many homes in Clear Lake are single-family properties on large lots, and some newer builds have come online in recent years. Demand from commuters and remote workers has remained strong.

1. Twin Lakes – ‑5.4% Dip to +3,028.9% Recovery by May 2025

- Peak Value: $144,192 (2012)

- Trough Value: $136,338 (2013)

- Final (2025) Value: $374,239

- Recovery: +$237,901 (+3,028.9%)

- Dip from Peak: ‑5.4%

Twin Lakes – High Demand in a Resort Town Setting

Twin Lakes is a resort-friendly village in Kenosha County near the Illinois border. With two large lakes—Lake Mary and Lake Elizabeth—the area is popular for boating, fishing, and summer tourism. Its location, just over an hour from Chicago, makes it a prime destination for vacationers and second-home buyers.Over the last decade, Twin Lakes has seen a rise in higher-end home construction along the lakefront and a shift toward year-round residency. These factors, combined with limited inventory and consistently strong seasonal demand, have sent home values soaring.