Would you like to save this?

Property prices across Wyoming are flashing warning signs that mirror patterns seen before previous housing corrections. Using the Zillow Home Values Index, analysts have flagged 15 towns showing the same dangerous mix of overextended prices, past crash history, and extreme volatility that typically come before a price correction. In these communities, home values have climbed well beyond sustainable levels, raising concerns about whether local markets can support current prices—or if a sharp drop could be next.

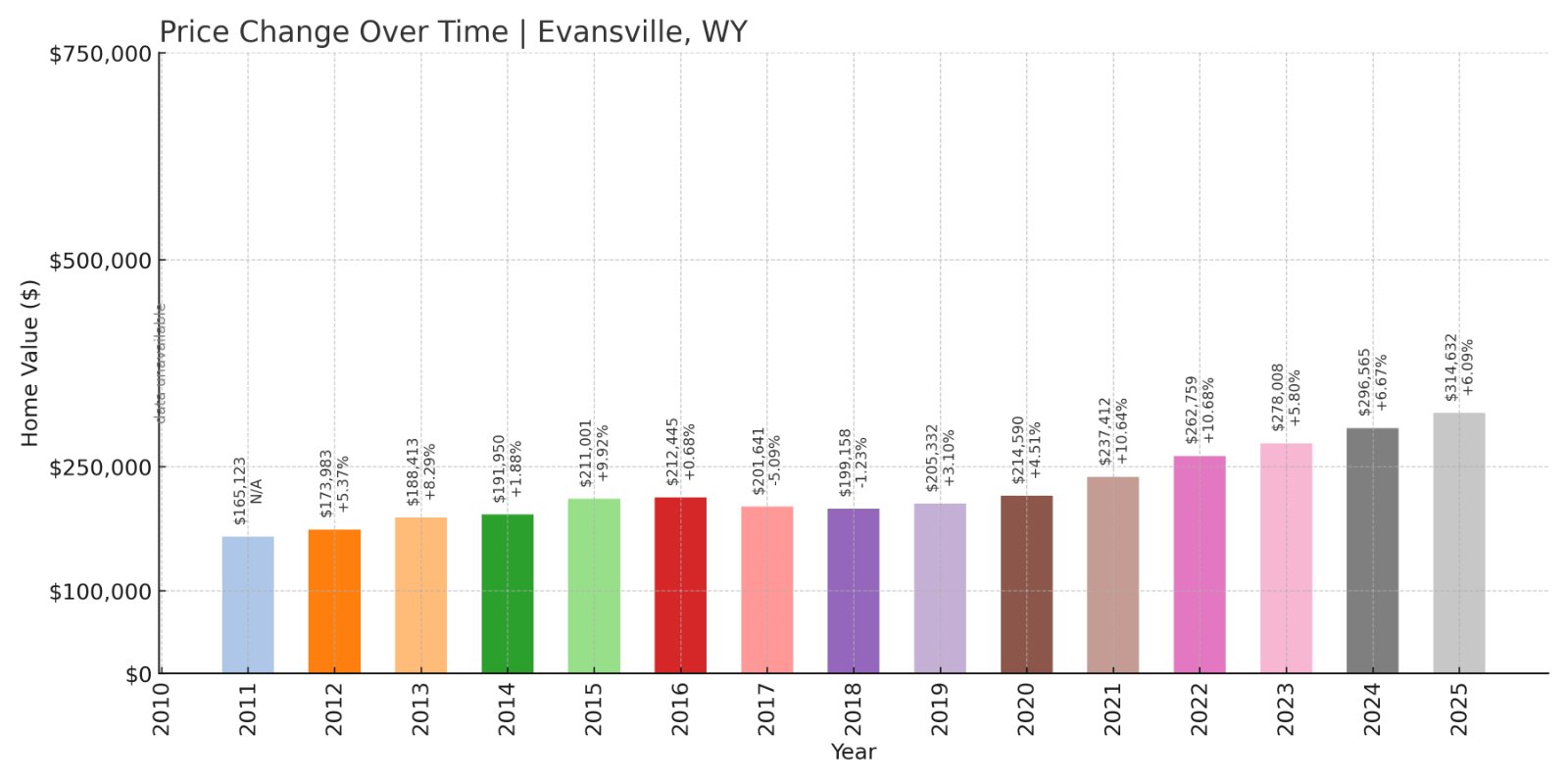

15. Evansville – Crash Risk Percentage: 57.05%

- Crash Risk Percentage: 57.05%

- Historical crashes (8%+): 1

- Worst crash: 5.1% (2017)

- Total ↑ since 2010: nan%

- Overextension: 40.8%

- Volatility: 4.6%

- Current 2025 price: $314,632

Evansville has seen modest price volatility over the years, but with a crash risk of 57.05%, homeowners should take note. Despite only one recorded crash above 5%, the town is currently 40.8% overextended compared to its long-term average. Its 2025 median home price sits at $314,632, suggesting affordability compared to Wyoming’s pricier markets. However, a sharp correction could impact recent buyers significantly.

Evansville – Moderate Overextension Signals Possible Correction

Located just east of Casper, Evansville is known for its proximity to the North Platte River and local parks, making it an appealing spot for families. Its current housing prices have risen over time without dramatic spikes, but the town’s overextension above its historical trend suggests prices may be outpacing fundamentals. Homeowners and potential buyers should consider this risk when assessing property value stability here.

While Evansville offers quiet suburban living with easy access to nearby amenities, its moderate volatility and previous price dip in 2017 indicate it isn’t immune to market corrections. If broader economic conditions tighten or mortgage rates increase, Evansville’s home values could see a pullback to align with longer-term trends.

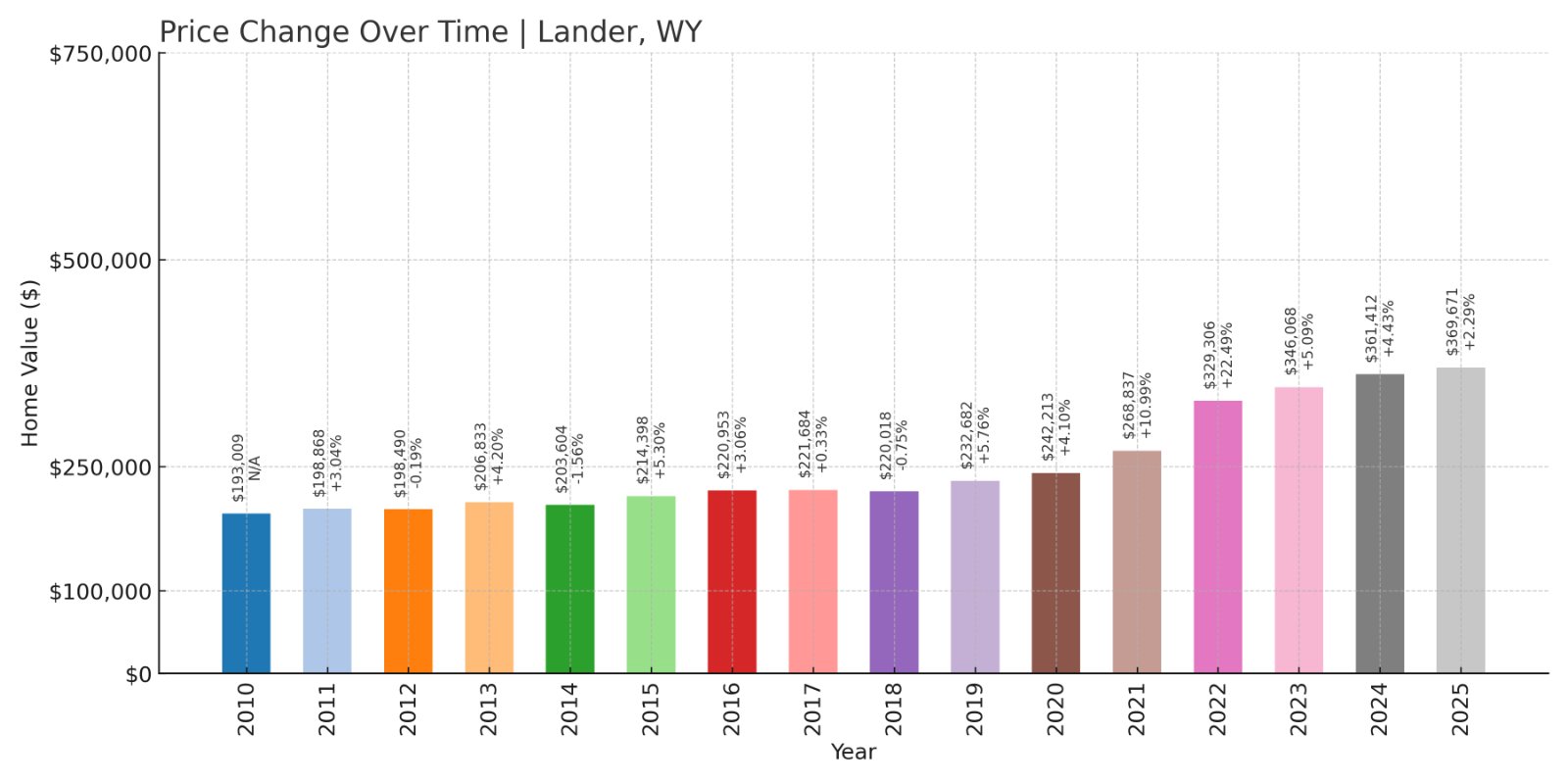

14. Lander – Crash Risk Percentage: 57.10%

- Crash Risk Percentage: 57.10%

- Historical crashes (8%+): 0

- No major crashes recorded

- Total ↑ since 2010: 91.5%

- Overextension: 46.8%

- Volatility: 5.9%

- Current 2025 price: $369,671

Lander has not experienced a major historical price crash, yet its crash risk percentage is relatively high at 57.10%. With nearly a doubling in home prices since 2010 and an overextension of 46.8%, Lander’s market may be peaking. The town’s 2025 home value of $369,671 is above Wyoming’s median, and these factors together could place downward pressure on prices in coming years.

Lander – High Growth But Potential Vulnerability

Nestled near the Wind River Range, Lander is a gateway to outdoor recreation and is known for its vibrant climbing community. This popularity has driven price increases, but its overextension suggests homes may be priced above long-term fundamentals. Buyers hoping for continued rapid appreciation should weigh the possibility of market correction.

Lander’s relatively stable price volatility at 5.9% offers some reassurance, but in markets with fast historical growth like this, adjustments can arrive quickly if economic conditions shift. Current residents may benefit from high equity but should monitor market trends closely in the coming years.

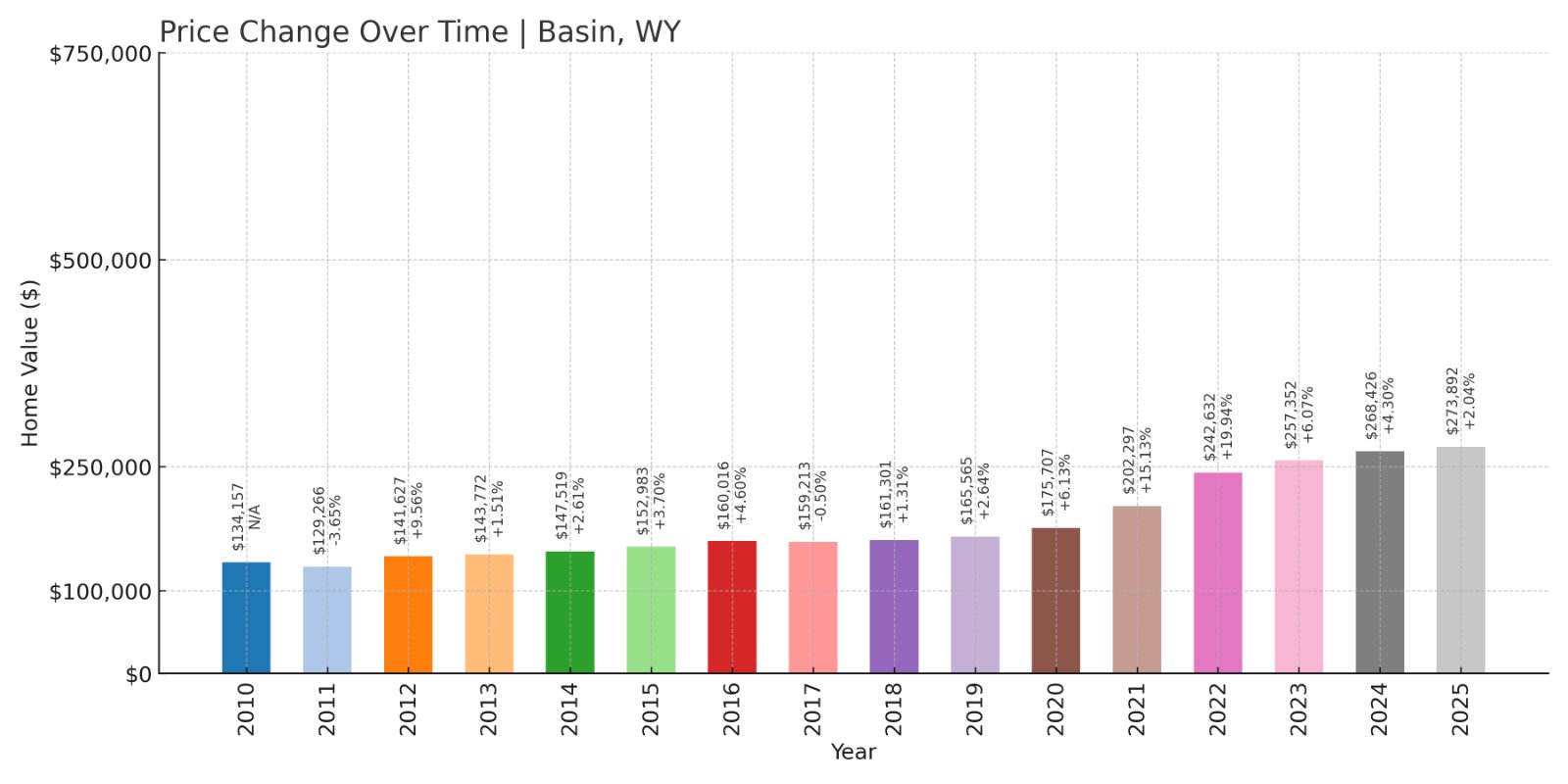

13. Basin

- Crash Risk Percentage: 58.05%

- Historical crashes (8%+): 0

- No major crashes recorded

- Total ↑ since 2010: 104.2%

- Overextension: 50.3%

- Volatility: 6.0%

- Current 2025 price: $273,892

Basin has seen its home values double since 2010, reaching $273,892 in 2025. This small Big Horn County town has no record of major historical crashes, yet its crash risk is elevated due to its 50.3% overextension above the long-term average. The steady price climb suggests solid demand, but this level of overvaluation can increase vulnerability during statewide or national downturns.

Basin – Steady Growth With Correction Risk Looming

Would you like to save this?

Basin serves as the county seat and is known for its agricultural economy and friendly community feel. The rise in housing prices likely reflects stable demand, but a lack of significant previous corrections could leave it exposed if market fundamentals change. Its volatility remains moderate at 6%, reflecting measured annual swings.

Residents appreciate Basin’s small-town lifestyle and proximity to outdoor recreation, but given its relatively low median home price, future buyers should ensure they’re not purchasing at the peak before a potential correction recalibrates market values closer to long-term trends.

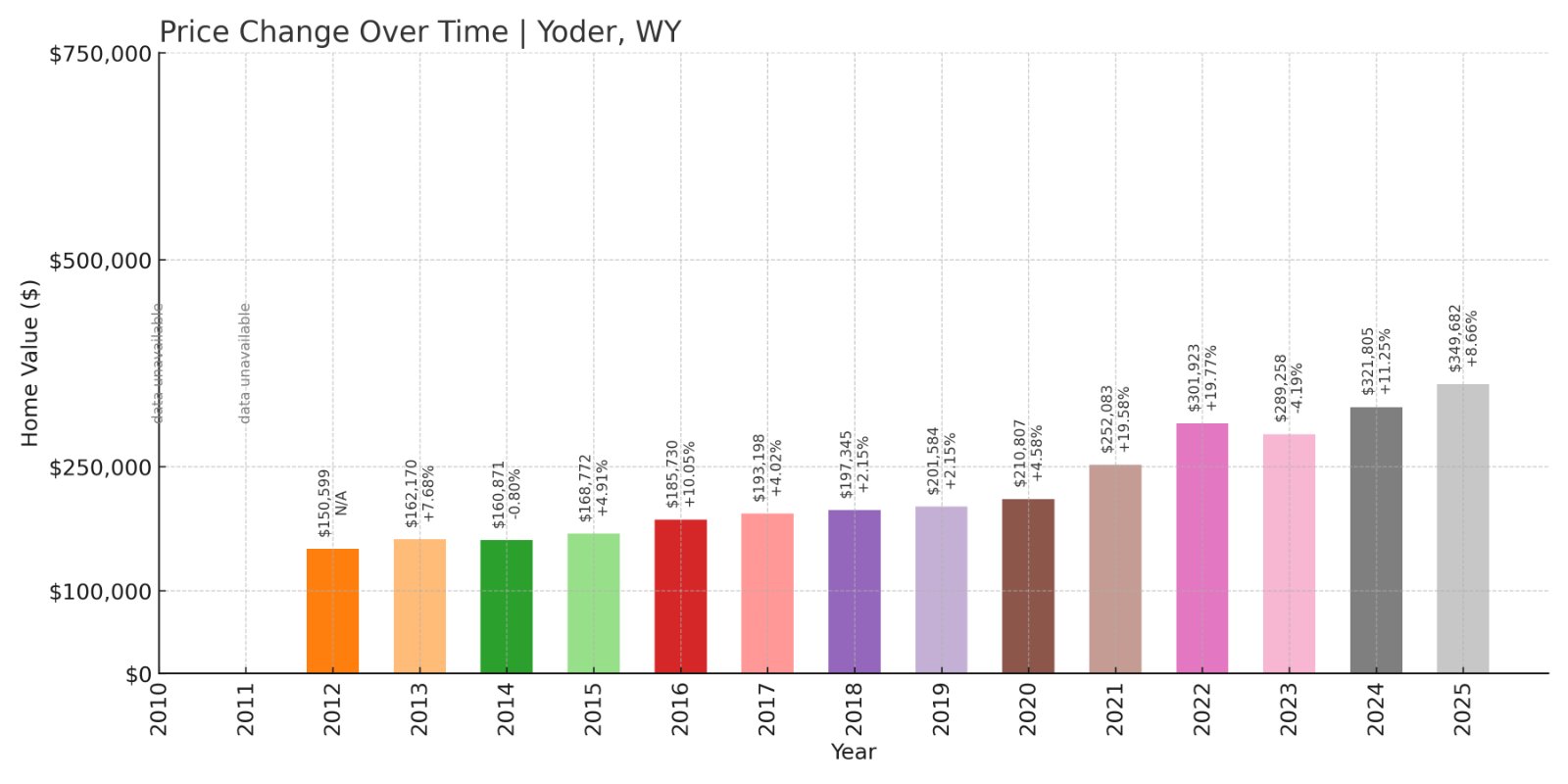

12. Yoder – Crash Risk Percentage: 58.20%

- Crash Risk Percentage: 58.20%

- Historical crashes (8%+): 0

- No major crashes recorded

- Total ↑ since 2010: nan%

- Overextension: 55.6%

- Volatility: 7.1%

- Current 2025 price: $349,682

Yoder’s home prices sit at $349,682 in 2025, with a crash risk percentage of 58.20% despite no major historical crashes. This risk is driven by its high overextension of 55.6% above its long-term average, indicating that current prices may not be sustainable if market conditions shift.

Yoder – Rising Prices Could Face Market Reality Check

Located in Goshen County, Yoder is a small agricultural community known for its quiet streets and farming heritage. The steady climb in prices reflects increased interest in rural living, but without a history of prior price dips, it remains unclear how resilient the town would be to broader market corrections.

Yoder’s moderate volatility of 7.1% suggests some year-to-year price swings, and with the current price level well above long-term norms, there is a risk that the market may adjust downwards if economic conditions tighten or buyer demand softens in the region.

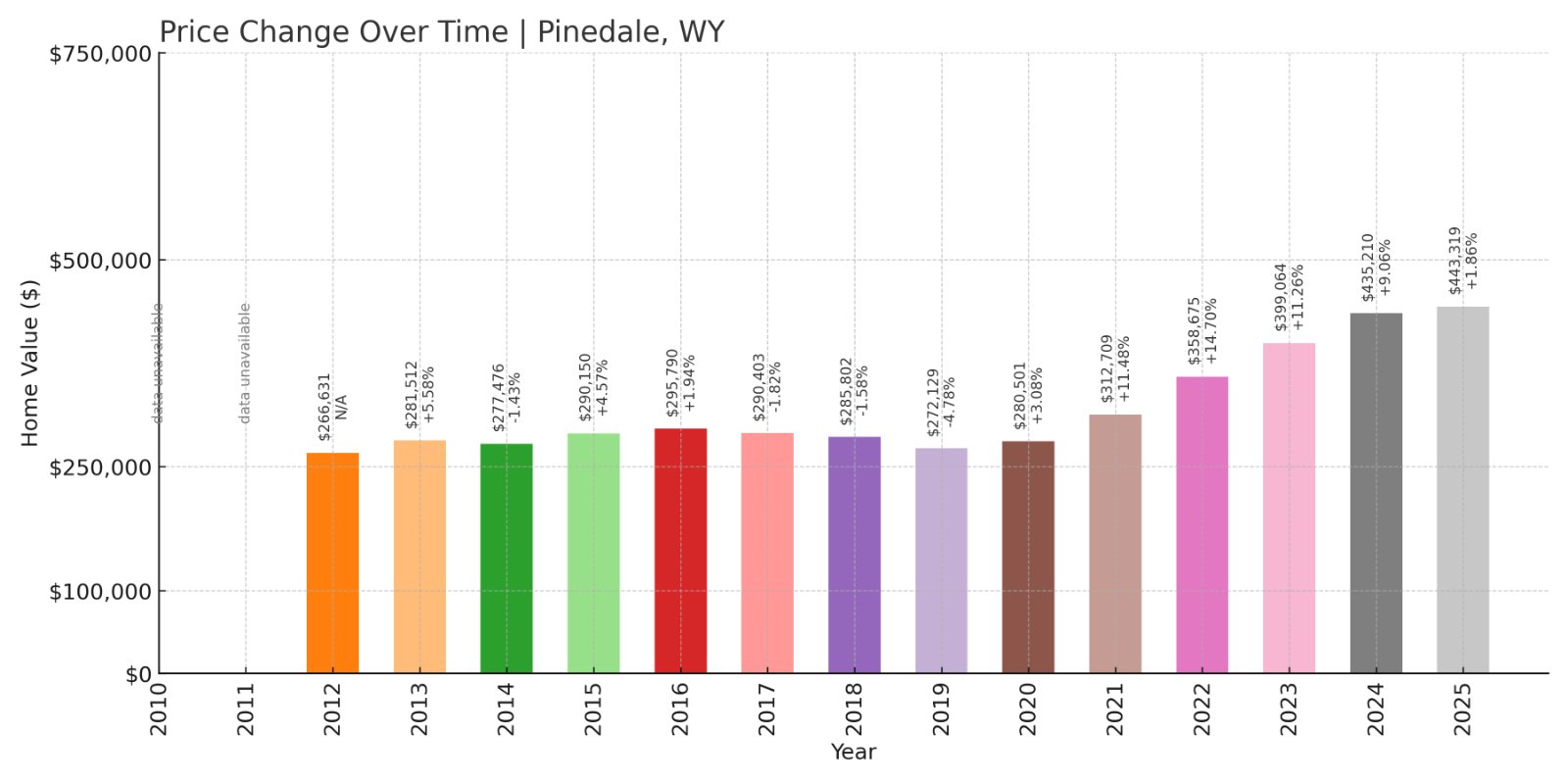

11. Pinedale – Crash Risk Percentage: 59.85%

- Crash Risk Percentage: 59.85%

- Historical crashes (8%+): 0

- No major crashes recorded

- Total ↑ since 2010: nan%

- Overextension: 38.2%

- Volatility: 6.0%

- Current 2025 price: $443,319

Pinedale’s crash risk of 59.85% stands out given its lack of historical crashes. The current median home price is $443,319, with an overextension of 38.2% and moderate volatility of 6%. These factors together suggest potential vulnerability if market conditions deteriorate or regional demand falls.

Pinedale – Strong Prices With Rising Correction Risk

Pinedale is the seat of Sublette County and serves as a gateway to the Wind River Mountains. Its popularity among outdoor enthusiasts and oil and gas workers has driven up prices. However, the market’s current overextension hints that prices could correct downwards if demand softens or employment shifts.

Residents enjoy access to lakes, mountains, and a tight-knit community feel, but buyers should be aware of the risks associated with purchasing in a potentially overvalued market, particularly as Wyoming’s broader economic trends evolve.

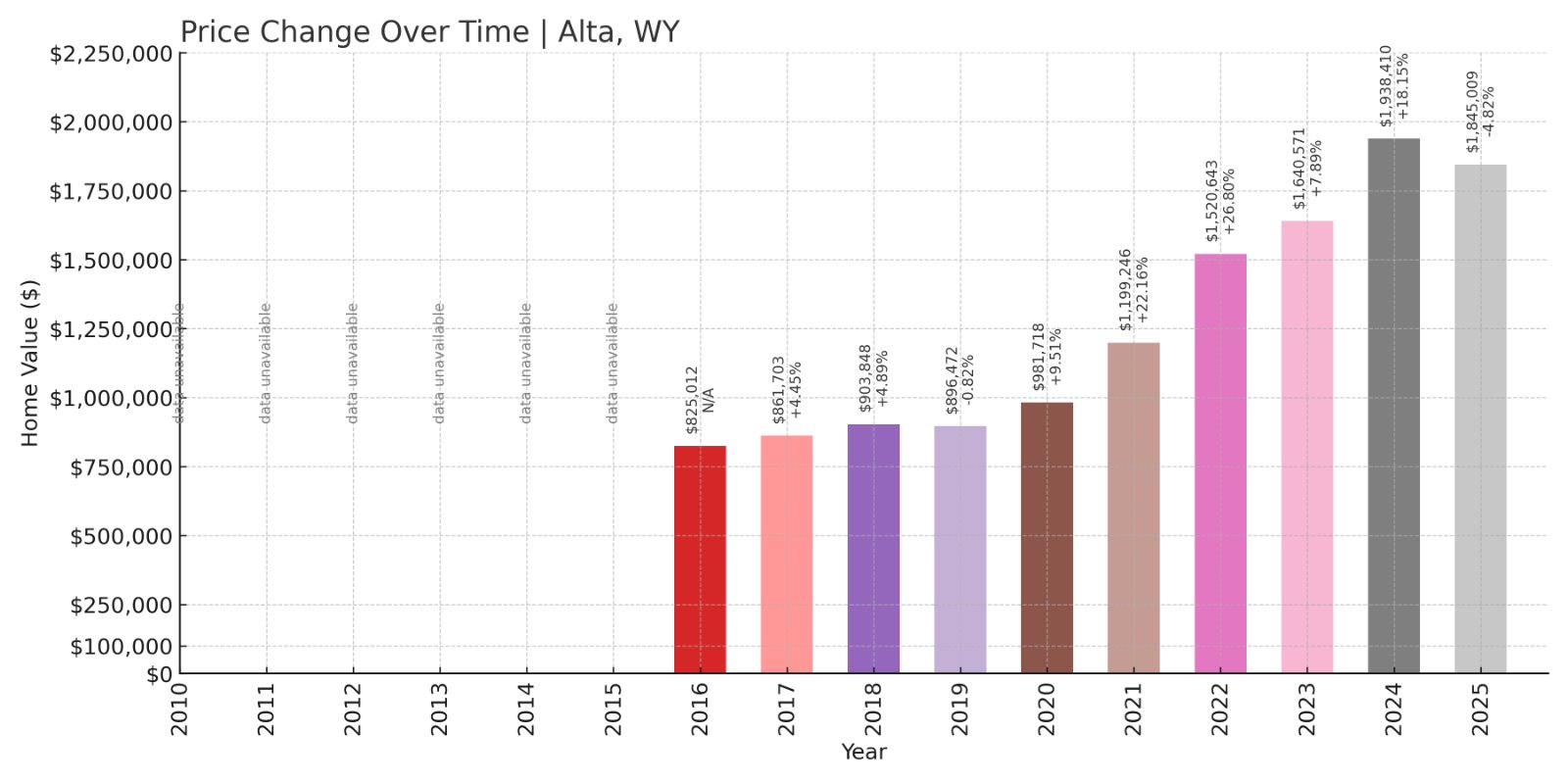

10. Alta – Crash Risk Percentage: 60.20%

- Crash Risk Percentage: 60.20%

- Historical crashes (8%+): 0

- No major crashes recorded

- Total ↑ since 2010: nan%

- Overextension: 46.3%

- Volatility: 10.6%

- Current 2025 price: $1,845,009

Alta shows a high crash risk of 60.20%, despite having no record of major historical crashes. Its median home price in 2025 stands at $1,845,009, making it one of the most expensive towns in Wyoming. With an overextension of 46.3% and a relatively high volatility of 10.6%, prices here may be vulnerable to sharp corrections if buyer demand softens or external economic pressures mount.

Alta – High Prices May Face Market Headwinds

Located on the western edge of Wyoming near the Idaho border, Alta is best known for its proximity to Grand Targhee Resort and stunning views of the Tetons. Its luxurious property market attracts second-home buyers and outdoor enthusiasts, pushing prices far above state averages. However, such high valuations can also create vulnerability, especially if interest rates or resort demand changes.

Alta’s lack of previous crashes might suggest stability, but its high overextension indicates that current price levels exceed long-term trends. Combined with strong price volatility, homeowners and investors should be prepared for potential price corrections if regional market dynamics shift.

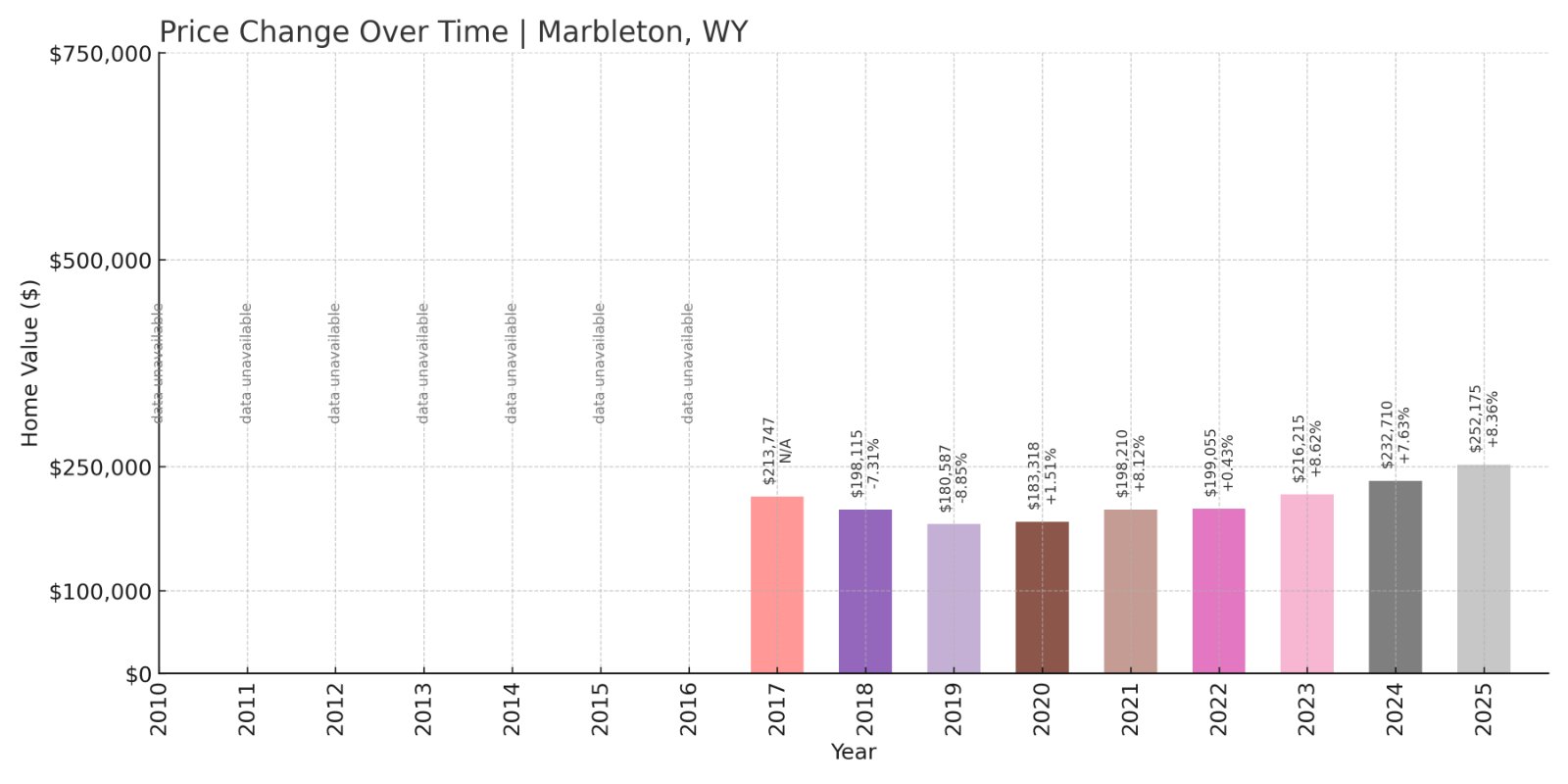

9. Marbleton – Crash Risk Percentage: 60.35%

- Crash Risk Percentage: 60.35%

- Historical crashes (8%+): 2

- Worst crash: 8.8% (2019)

- Total ↑ since 2010: nan%

- Overextension: 21.1%

- Volatility: 7.2%

- Current 2025 price: $252,175

Marbleton has experienced two major historical crashes, with the worst being an 8.8% decline in 2019. Its current home price is $252,175, and its crash risk stands at 60.35%. The town’s relatively low overextension of 21.1% suggests it isn’t as overvalued as some other towns, but its crash history and moderate volatility mean homeowners should remain alert.

Marbleton – Historical Price Drops Suggest Future Risks

Marbleton, located in Sublette County, is a small community with a strong oil and gas industry presence. The town’s economy has traditionally been tied to energy sector trends, which can lead to pronounced swings in housing demand and prices. This reliance on a single industry may explain its previous price crashes.

While Marbleton’s current housing prices remain relatively affordable compared to statewide figures, the town’s prior corrections highlight its vulnerability. Buyers should factor in regional employment trends and energy sector stability when assessing long-term property investments here.

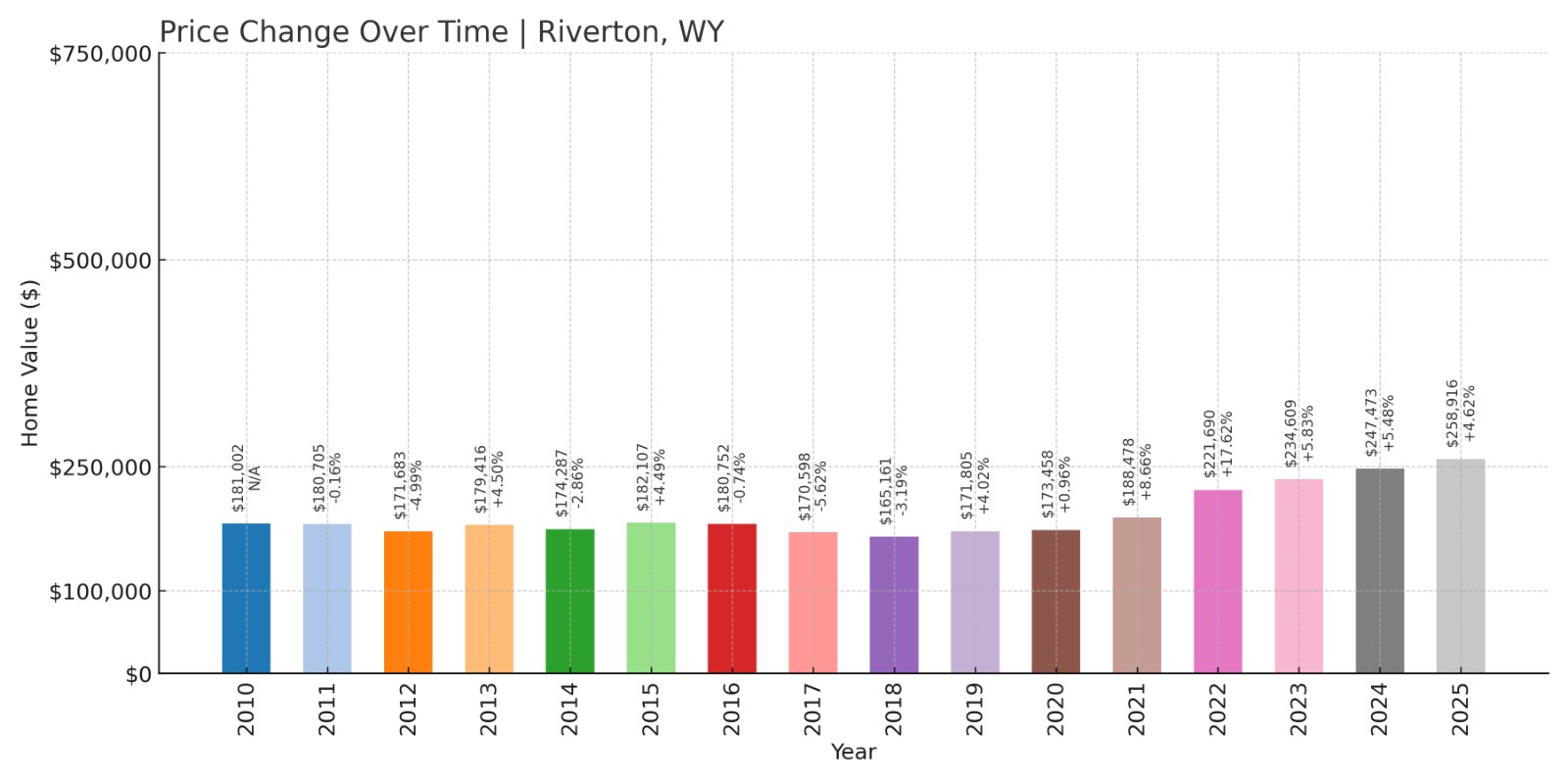

8. Riverton – Crash Risk Percentage: 64.35%

- Crash Risk Percentage: 64.35%

- Historical crashes (8%+): 1

- Worst crash: 5.6% (2017)

- Total ↑ since 2010: 43.0%

- Overextension: 34.4%

- Volatility: 6.0%

- Current 2025 price: $258,916

Riverton’s home prices have climbed 43% since 2010, reaching $258,916 in 2025. With a crash risk of 64.35% and one recorded price drop of 5.6% in 2017, the town shows signs of vulnerability. Its overextension of 34.4% indicates current prices are above long-term averages, raising the risk of future corrections.

Riverton – Solid Growth May Face Future Market Adjustments

As a regional hub in Fremont County, Riverton offers amenities including Central Wyoming College and regional healthcare facilities, making it a central trade area. This steady demand has helped support home prices, but over time, local economic shifts could test market stability here.

Riverton’s moderate volatility indicates measured price swings, yet its significant overextension suggests buyers should remain cautious. Continued growth depends on regional employment opportunities and stable population trends to maintain current housing market valuations.

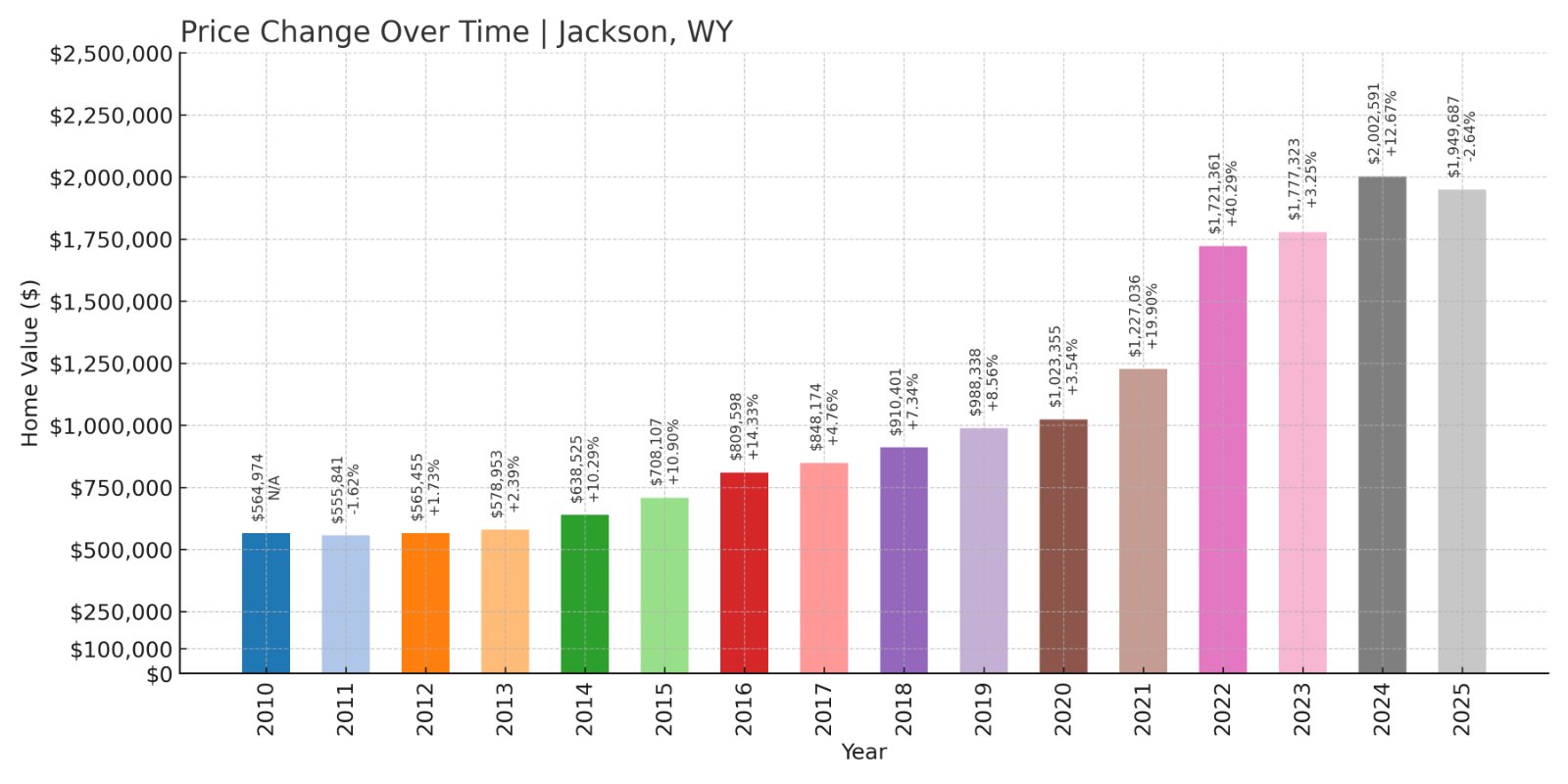

7. Jackson – Crash Risk Percentage: 66.95%

- Crash Risk Percentage: 66.95%

- Historical crashes (8%+): 0

- No major crashes recorded

- Total ↑ since 2010: 245.1%

- Overextension: 84.9%

- Volatility: 10.6%

- Current 2025 price: $1,949,687

Jackson’s home prices have surged by an extraordinary 245.1% since 2010, reaching nearly $2 million in 2025. Despite no major historical crashes, its crash risk is high at 66.95%, largely due to its overextension of 84.9% above long-term trends and significant price volatility of 10.6%.

Jackson – Sky-High Prices With Market Correction Risks

Jackson is famed for its luxury real estate, ski resorts, and status as a gateway to Grand Teton and Yellowstone National Parks. This global appeal has driven prices far above statewide norms, attracting high-net-worth buyers seeking vacation or second homes. However, prices this elevated can be susceptible to sharp corrections if demand weakens.

The combination of extreme overextension and double-digit volatility suggests homeowners here should prepare for possible market adjustments. While Jackson remains a prime destination, its housing market shows classic signs of prices outpacing sustainable long-term growth.

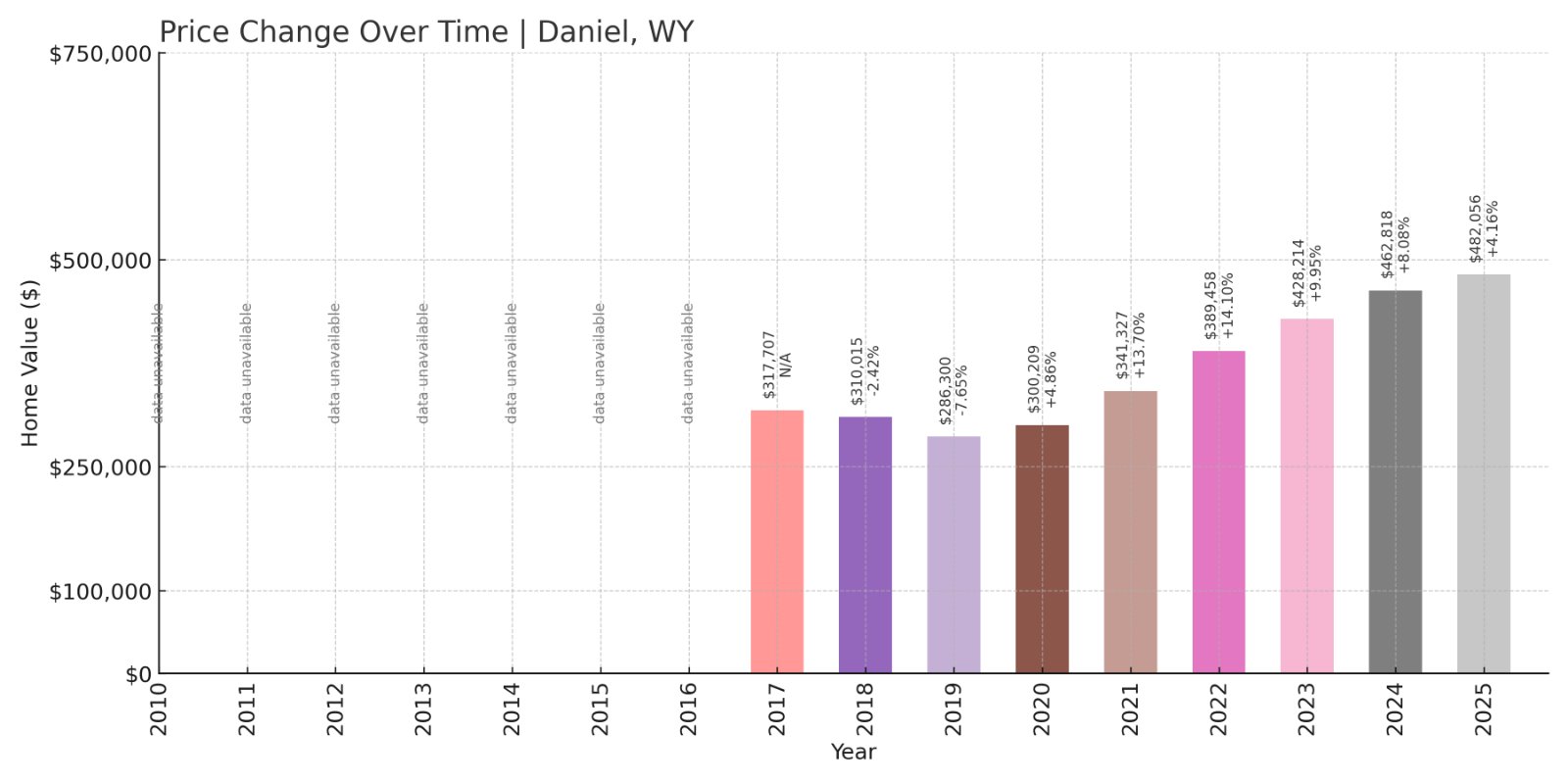

6. Daniel – Crash Risk Percentage: 67.35%

Would you like to save this?

- Crash Risk Percentage: 67.35%

- Historical crashes (8%+): 1

- Worst crash: 7.6% (2019)

- Total ↑ since 2010: nan%

- Overextension: 30.8%

- Volatility: 7.6%

- Current 2025 price: $482,056

Daniel’s housing market shows a crash risk of 67.35%, with one historical price drop of 7.6% in 2019. Its current median home price is $482,056, supported by an overextension of 30.8% and moderate price volatility. These factors indicate potential vulnerability if market conditions tighten in coming years.

Daniel – Historical Volatility and Regional Market Pressures

Daniel is a small unincorporated community in Sublette County, known for its rural ranching heritage and open landscapes. While housing demand here is limited, regional oil and gas activities can influence property values, leading to fluctuations over time.

Daniel’s previous price dip in 2019 demonstrates how quickly market conditions can change in smaller communities. With prices currently above long-term averages, homeowners should remain aware of local economic shifts that could impact market stability.

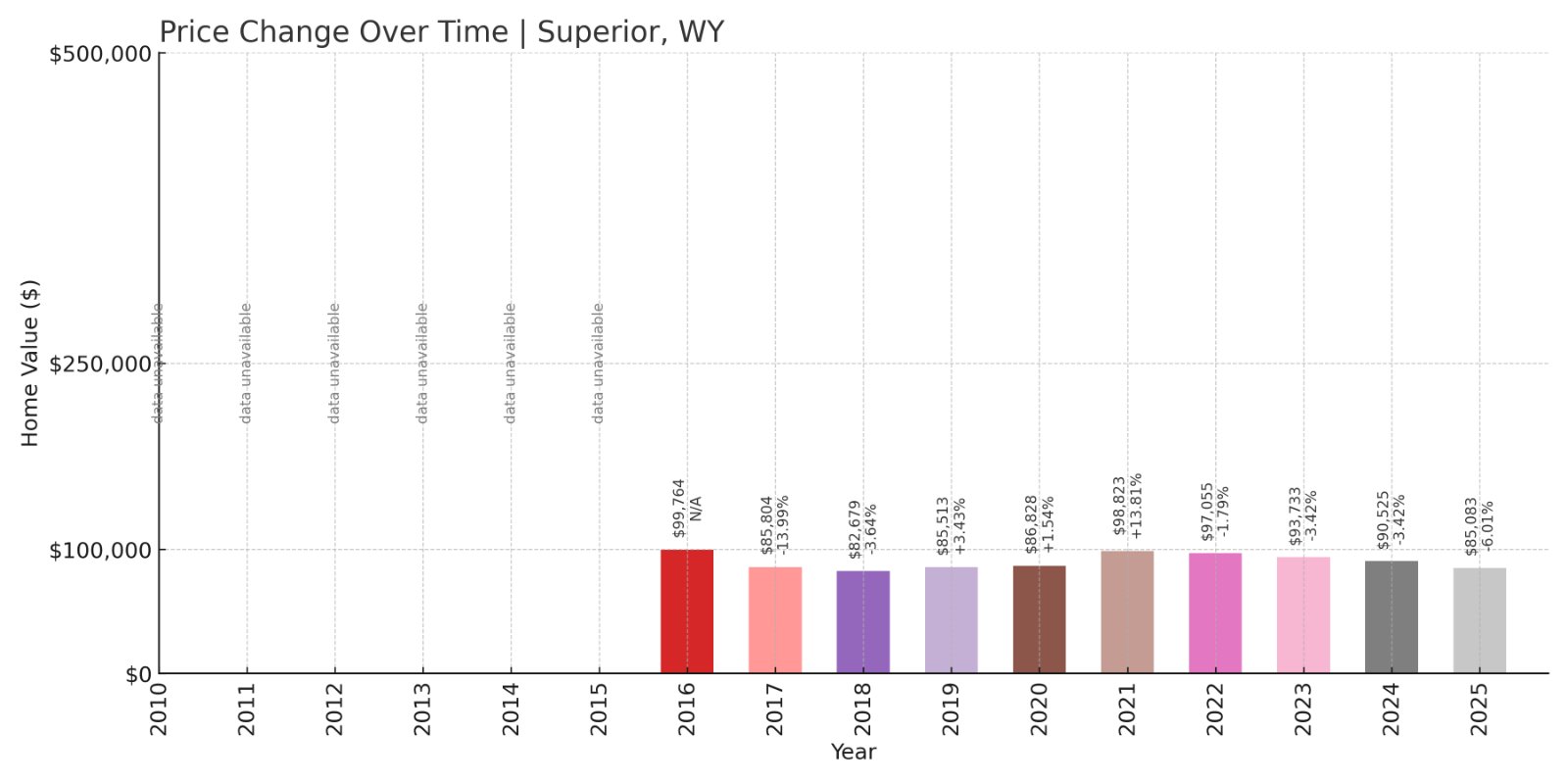

5. Superior – Crash Risk Percentage: 68.55%

- Crash Risk Percentage: 68.55%

- Historical crashes (8%+): 2

- Worst crash: 14.0% (2017)

- Total ↑ since 2010: nan%

- Overextension: -6.1%

- Volatility: 7.6%

- Current 2025 price: $85,083

Superior has a crash risk of 68.55% with two recorded historical crashes, the worst being a significant 14% drop in 2017. Its current median home price is just $85,083, making it among the most affordable in Wyoming. However, its negative overextension of -6.1% suggests prices are actually below long-term trends, yet the history of sharp drops and moderate volatility raise caution for buyers.

Superior – Low Prices With a Record of Sharp Corrections

Located in Sweetwater County, Superior is a former mining town with a small population and limited housing market activity. Its low prices reflect both its economic history and its limited demand, but the town’s two major price crashes show vulnerability to economic shifts, especially in employment or regional housing trends.

While its current prices may seem like a bargain, Superior’s crash history suggests buyers should approach with care. Any decline in regional employment or resident base could lead to renewed price corrections, impacting homeowners’ equity positions.

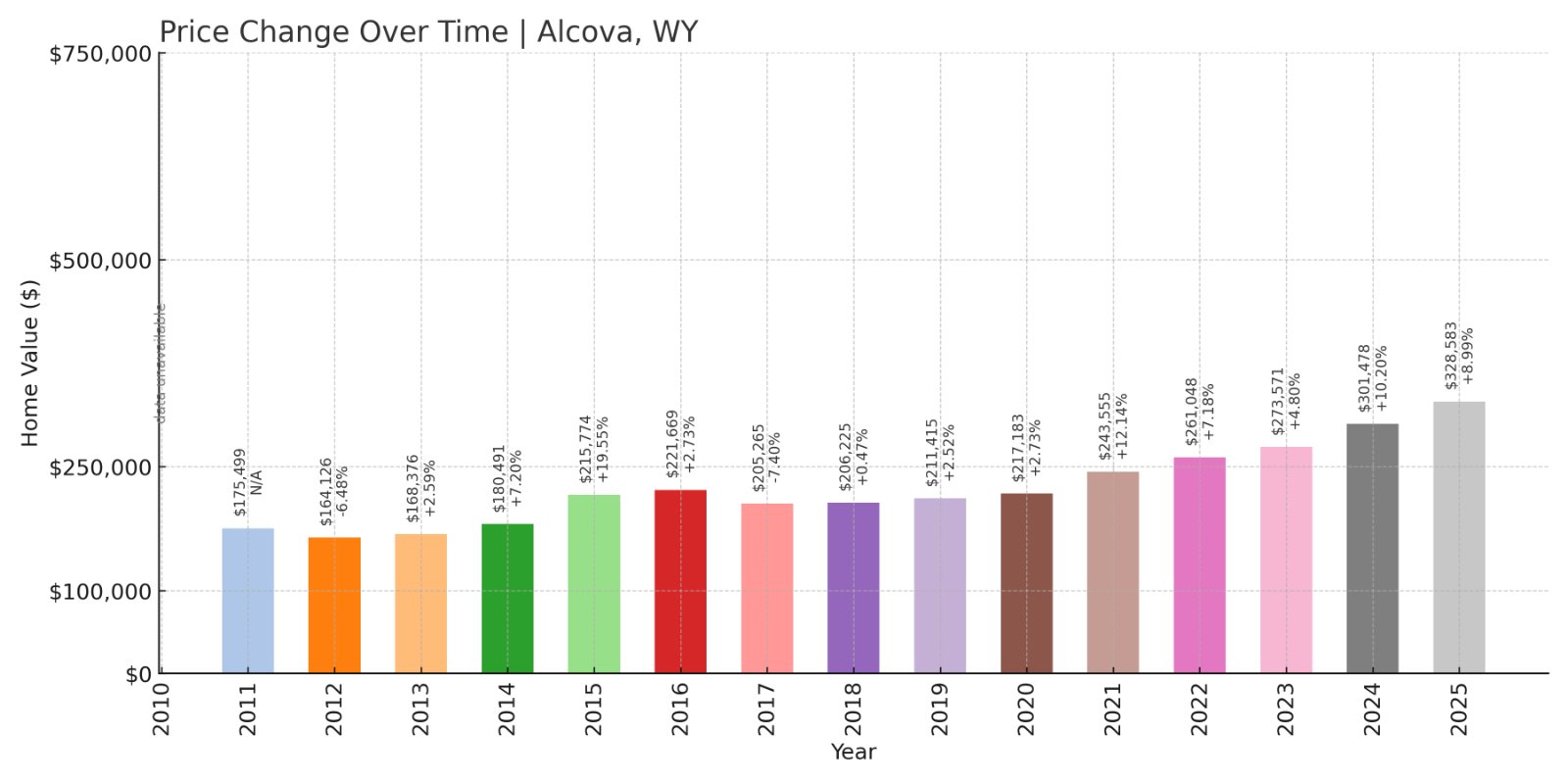

4. Alcova – Crash Risk Percentage: 74.35%

- Crash Risk Percentage: 74.35%

- Historical crashes (8%+): 2

- Worst crash: 7.4% (2017)

- Total ↑ since 2010: nan%

- Overextension: 46.1%

- Volatility: 7.0%

- Current 2025 price: $328,583

Alcova holds a crash risk of 74.35% with two previous price drops, including a 7.4% decline in 2017. Its median home price in 2025 is $328,583 with an overextension of 46.1%, suggesting prices are well above long-term averages. Combined with its moderate volatility, this could expose owners to future price declines if demand softens.

Alcova – Popular Recreation Spot With Market Vulnerability

Alcova is known for its reservoir, recreation areas, and proximity to Casper, attracting vacation homeowners and seasonal visitors. This recreational appeal supports its housing market, but reliance on tourism and vacation demand can also create market swings when economic conditions tighten.

With a history of prior price drops and elevated current valuations, Alcova homeowners and potential buyers should factor in the risks of correction, especially if recreational property demand decreases in the coming years.

3. Wilson – Crash Risk Percentage: 76.95%

- Crash Risk Percentage: 76.95%

- Historical crashes (8%+): 1

- Worst crash: 9.4% (2011)

- Total ↑ since 2010: 225.6%

- Overextension: 82.4%

- Volatility: 10.5%

- Current 2025 price: $3,159,373

Wilson has seen prices soar 225.6% since 2010, with a current median home price of over $3.1 million. Its crash risk sits at 76.95%, driven by an overextension of 82.4% above long-term averages and high volatility. The town has experienced one major price drop of 9.4% back in 2011.

Wilson – Luxury Market With High Correction Risk

Wilson, located just west of Jackson, is known for its luxury homes, access to outdoor recreation, and proximity to Teton Village and ski resorts. These factors drive high demand and sky-high prices, but such elevated valuations also mean vulnerability to sudden corrections if luxury buyer demand shifts.

The combination of significant overextension and previous crash history suggests Wilson’s market could face adjustments if economic or regional conditions change, making it a risky bet for buyers expecting continued rapid appreciation.

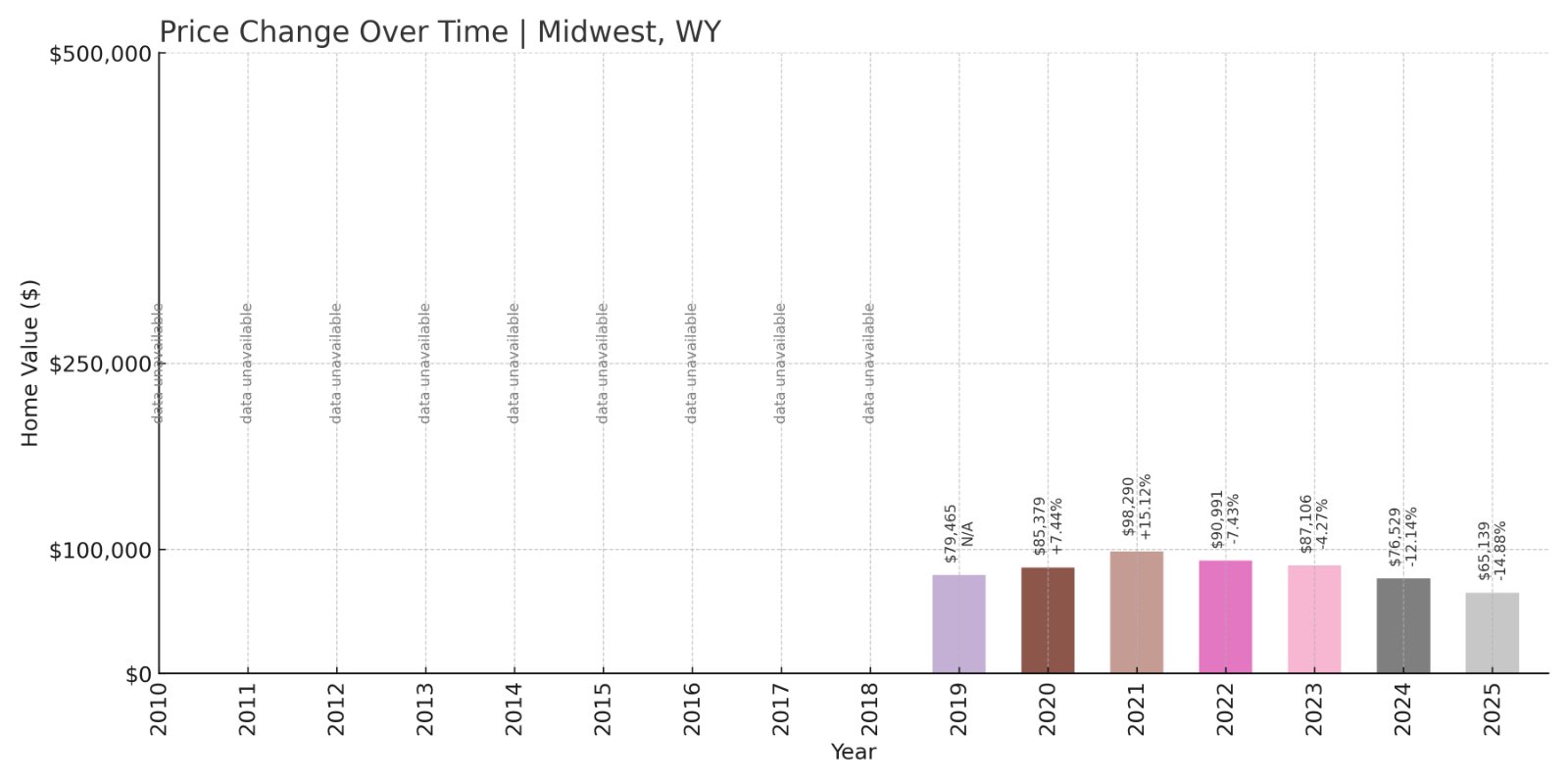

2. Midwest – Crash Risk Percentage: 87.70%

- Crash Risk Percentage: 87.70%

- Historical crashes (8%+): 3

- Worst crash: 14.9% (2025)

- Total ↑ since 2010: nan%

- Overextension: -21.8%

- Volatility: 11.7%

- Current 2025 price: $65,139

Midwest has a very high crash risk of 87.70% with three major price crashes on record, the worst being a steep 14.9% drop in 2025. Its current median home price is just $65,139, and its negative overextension of -21.8% indicates prices are below historical trends. Despite this, its extremely high volatility suggests the town’s housing market remains unstable.

Midwest – Low Prices But Extreme Market Volatility

Located north of Casper, Midwest is a small oil town with a long history tied to regional energy production. This dependence creates significant economic swings that ripple into housing prices. The steep decline in 2025 shows the town’s vulnerability when oil and gas demand falters.

While Midwest’s low prices may seem appealing, its market instability and history of sharp corrections present real risks for homeowners and buyers looking for long-term stability and equity growth.

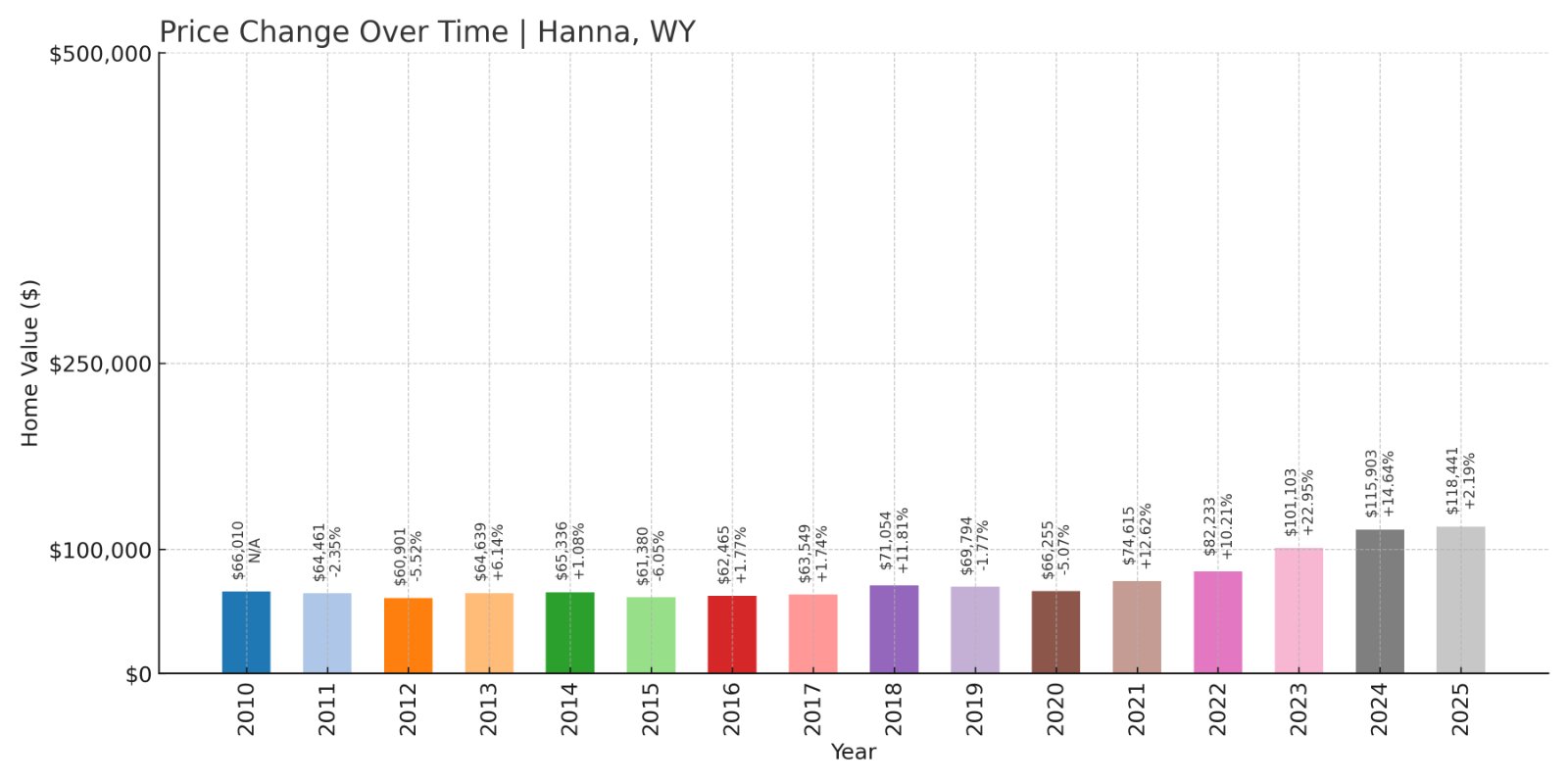

1. Hanna – Crash Risk Percentage: 95.00%

- Crash Risk Percentage: 95.00%

- Historical crashes (8%+): 3

- Worst crash: 6.1% (2015)

- Total ↑ since 2010: 79.4%

- Overextension: 56.9%

- Volatility: 8.5%

- Current 2025 price: $118,441

Hanna ranks highest for crash risk at a staggering 95.00%. With three historical crashes and a worst decline of 6.1% in 2015, its market shows persistent vulnerability. Its median home price of $118,441 in 2025 reflects affordability, but an overextension of 56.9% above long-term averages and its 8.5% volatility indicate that prices may not be sustainable.

Hanna – Consistent Crash History Signals Future Risk

Hanna, located in Carbon County, has a mining heritage that has shaped its economy and housing market over the decades. Employment fluctuations and shifting population trends have contributed to its unstable real estate performance, resulting in multiple past price drops.

Current homeowners should remain cautious of the potential for future corrections given the town’s high overextension and repeated history of crashes. Buyers should consider these risks alongside Hanna’s community amenities and local economic opportunities before investing.