Would you like to save this?

Wyoming’s housing market shows troubling warning signs that mirror conditions before previous major corrections. Using data from the Zillow Home Value Index, we analyzed 15 years of housing data across Wyoming communities to identify towns displaying classic red flags of an impending price crash.

Our vulnerability assessment examines five critical risk factors: historical crash patterns, current overextension above long-term averages, price volatility levels, recent momentum shifts, and mathematical sustainability of current valuations. Towns scoring highest on multiple indicators face the greatest risk of significant price corrections.

The results reveal a concerning pattern. Several Wyoming communities now sit 40% to 85% above their historical price trends, while others show declining growth momentum after years of unsustainable increases. Most alarming are the repeat offenders – towns that have crashed before and currently display the same warning signals that preceded their previous corrections.

18. Midwest – Crash Risk Percentage: 55%

- Crash Risk Percentage: 55%

- Historical crashes (5%+ drops): 4

- Worst historical crash: -13.2% (2025)

- Total price increase since 2019: -16.6%

- Overextended above long-term average: -20.6%

- Price volatility (annual swings): 14.0%

- Current May 2025 price: $56,954

Midwest stands out as a repeat offender with four documented price crashes exceeding 5% since 2010. The town’s current median home price of $56,954 reflects a troubling -16.6% decline since 2019, making it one of the few Wyoming communities trading below historical norms. Despite being undervalued by 20.6% compared to long-term trends, Midwest’s crash risk remains elevated due to extreme price volatility of 14% annually and its proven track record of sudden corrections.

Midwest – A Market Scarred By Repeated Corrections

Located in north-central Wyoming’s Natrona County, Midwest developed as an oil company town in the early 1900s and remains heavily dependent on energy sector employment. The community’s housing market directly reflects the boom-and-bust cycles of Wyoming’s oil industry, creating extreme vulnerability to economic shifts. Recent years have seen steady population decline as energy jobs disappeared, contributing to the sustained price depression since 2019.

The town’s four historical crashes reveal a pattern of sharp corrections during energy downturns, with the most recent 13.2% drop occurring in 2025 as oil prices fluctuated. While current prices appear mathematically attractive compared to historical peaks, Midwest’s continued dependence on volatile energy sectors and aging infrastructure create ongoing instability. The 14% annual price swings make homeownership particularly risky for buyers seeking stable long-term investments.

17. Lucerne – Crash Risk Percentage: 55%

- Crash Risk Percentage: 55%

- Historical crashes (5%+ drops): 0

- Worst historical crash: No major crashes recorded

- Total price increase since 2015: 89.4%

- Overextended above long-term average: 40.3%

- Price volatility (annual swings): 5.7%

- Current May 2025 price: $353,545

Lucerne presents a different risk profile than crash-prone markets, with no historical corrections exceeding 5% despite a decade of data. However, the community’s 89.4% price surge since 2015 has pushed median values to $353,545, creating dangerous overextension of 40.3% above sustainable long-term trends. The relatively low 5.7% volatility suggests steady growth, but this stability masks the mathematical unsustainability of current valuations.

Lucerne – Rapid Growth Outpacing Economic Fundamentals

Situated in northwestern Wyoming’s Platte County, Lucerne functions as a bedroom community for workers commuting to larger regional centers. The area’s appeal stems from rural character combined with reasonable access to employment hubs, attracting buyers seeking affordable alternatives to expensive urban markets. This demand dynamic has driven the near-doubling of home prices over the past decade, far exceeding local wage growth and economic development.

The community’s lack of major employers or diversified economic base makes current price levels particularly vulnerable to correction. While the area offers scenic mountain views and outdoor recreation access, the 40.3% overextension suggests prices have disconnected from local economic realities. Without significant job creation or income growth to support current valuations, Lucerne faces inevitable downward pressure as buyer affordability constraints tighten.

16. Riverton – Crash Risk Percentage: 57%

- Crash Risk Percentage: 57%

- Historical crashes (5%+ drops): 2

- Worst historical crash: -5.6% (2012)

- Total price increase since 2010: 42.8%

- Overextended above long-term average: 33.6%

- Price volatility (annual swings): 6.1%

- Current May 2025 price: $258,308

Riverton’s housing market shows moderate but concerning risk signals, with two documented crashes since 2010 and current overextension of 33.6% above historical norms. The median home price of $258,308 represents solid 42.8% growth since 2010, but this appreciation has pushed values beyond sustainable levels given local economic conditions. The town’s 6.1% annual volatility indicates relatively stable price movements, though previous crashes demonstrate vulnerability during economic stress periods.

Riverton – Regional Hub Facing Economic Headwinds

Would you like to save this?

As the largest city in Fremont County with approximately 11,000 residents, Riverton serves as a regional commercial and medical hub for central Wyoming. The community benefits from diverse employment including healthcare, government services, and agriculture, providing more economic stability than single-industry towns. However, the area’s growth has been constrained by limited high-paying job opportunities and competition from larger Wyoming cities for professional talent.

The town’s 2012 housing crash of 5.6% coincided with regional economic uncertainty and demonstrates the market’s susceptibility to corrections. Current price levels 33.6% above long-term averages strain affordability for local workers, particularly given Fremont County’s below-average median incomes. While Riverton’s diversified economy provides some protection, the mathematical overextension combined with historical crash patterns creates elevated risk for potential buyers.

15. Evansville – Crash Risk Percentage: 57%

- Crash Risk Percentage: 57%

- Historical crashes (5%+ drops): 1

- Worst historical crash: -5.0% (2017)

- Total price increase since 2011: 90.3%

- Overextended above long-term average: 40.4%

- Price volatility (annual swings): 5.1%

- Current May 2025 price: $312,784

Evansville’s housing market displays classic warning signs of overheating, with 90.3% price growth since 2011 pushing median values to $312,784. This dramatic appreciation has created dangerous overextension of 40.4% above sustainable long-term trends, while the community’s single recorded crash in 2017 proves prices can correct rapidly. The relatively low 5.1% annual volatility suggests steady growth patterns, but masks the underlying mathematical instability of current valuations.

Evansville – Casper Suburb Riding Unsustainable Growth Wave

Located just east of Casper in Natrona County, Evansville functions primarily as a suburban community for families seeking newer housing and better schools while maintaining access to regional employment centers. The town’s population of roughly 2,500 has grown steadily as Casper workers sought more affordable housing options and modern developments. This suburban migration pattern drove the 90.3% price increase over the past 14 years, far outpacing regional wage growth.

The community’s 2017 housing correction of 5% provides evidence that rapid price appreciation can reverse quickly when economic conditions shift. Current median prices 40.4% above historical trends reflect buyer enthusiasm rather than fundamental economic support, creating vulnerability as affordability constraints tighten. Without major local employers or unique economic advantages, Evansville’s housing market depends heavily on continued Casper-area prosperity and buyer willingness to commute for suburban amenities.

14. Powell – Crash Risk Percentage: 57%

- Crash Risk Percentage: 57%

- Historical crashes (5%+ drops): 0

- Worst historical crash: -3.0% (2011)

- Total price increase since 2010: 106.1%

- Overextended above long-term average: 54.3%

- Price volatility (annual swings): 6.1%

- Current May 2025 price: $422,520

Powell presents one of Wyoming’s most concerning overextension scenarios, with home prices doubling since 2010 to reach $422,520 median values. The staggering 106.1% price growth has pushed the market 54.3% above sustainable long-term trends, creating mathematical unsustainability despite the absence of major historical crashes. The town’s 6.1% annual volatility suggests steady appreciation patterns, but current valuations appear disconnected from local economic fundamentals.

Powell – College Town Pricing Beyond Economic Reality

Home to Northwest College and situated in the scenic Bighorn Basin of northwest Wyoming, Powell benefits from stable employment in education, agriculture, and government services. The college provides steady housing demand from faculty and staff, while the area’s agricultural economy offers some economic diversification. However, the community’s population of approximately 6,500 creates a limited buyer pool to support current price levels that have more than doubled over 15 years.

The 54.3% overextension above long-term averages represents one of Wyoming’s most extreme pricing disconnects relative to local economic capacity. While Powell’s educational anchor provides stability, faculty and staff salaries haven’t increased proportionally to home price appreciation. The combination of extreme overvaluation and limited high-income employment creates significant vulnerability to correction, particularly as regional buyers face affordability constraints and alternative market options.

13. Boulder – Crash Risk Percentage: 58%

- Crash Risk Percentage: 58%

- Historical crashes (5%+ drops): 0

- Worst historical crash: -3.9% (2019)

- Total price increase since 2017: 58.6%

- Overextended above long-term average: 29.0%

- Price volatility (annual swings): 6.9%

- Current May 2025 price: $479,090

Boulder’s housing market shows concerning momentum with 58.6% price appreciation since 2017, driving median values to $479,090 in just eight years. While the 29.0% overextension above long-term trends appears more moderate than other at-risk communities, the rapid recent growth rate suggests unsustainable buyer enthusiasm. The 6.9% annual volatility indicates above-average price swings, while the 2019 correction of 3.9% demonstrates the market’s sensitivity to economic shifts.

Boulder – Scenic Community With Rapid Price Acceleration

Located in Sublette County near the Wind River Range, Boulder attracts buyers seeking mountain lifestyle amenities and outdoor recreation access. The small community benefits from proximity to world-class fishing, hunting, and wilderness areas, creating appeal for affluent buyers seeking vacation homes or retirement properties. This recreational demand has driven the dramatic 58.6% price surge since 2017, transforming what was once an affordable rural community into a premium market.

The challenge facing Boulder’s housing market lies in the disconnect between recreational appeal and local economic capacity to support current price levels. With limited year-round employment opportunities and a small permanent population, the market depends heavily on outside buyers with discretionary income. The 2019 price correction of 3.9% hints at vulnerability when economic uncertainty reduces recreational property demand, while current valuations appear increasingly disconnected from regional economic fundamentals.

12. Aladdin – Crash Risk Percentage: 58%

- Crash Risk Percentage: 58%

- Historical crashes (5%+ drops): 0

- Worst historical crash: -4.1% (2023)

- Total price increase since 2016: 101.8%

- Overextended above long-term average: 39.9%

- Price volatility (annual swings): 10.0%

- Current May 2025 price: $507,012

Aladdin’s housing market exhibits explosive growth with home prices more than doubling since 2016 to reach $507,012 median values. The 101.8% appreciation has created significant overextension of 39.9% above sustainable long-term trends, while the 2023 correction of 4.1% suggests the market is already showing signs of instability. High annual volatility of 10.0% indicates substantial price swings that create risk for both buyers and sellers.

Aladdin – Small Town Big Price Gains Face Reality Check

This tiny community in Crook County near the South Dakota border has experienced remarkable housing price transformation despite its remote location and minimal economic base. Aladdin’s population numbers in the hundreds, yet home values have reached levels typically associated with major metropolitan suburbs. The dramatic price appreciation appears driven by unique factors including proximity to Devil’s Tower National Monument and appeal to buyers seeking extreme rural isolation.

The 39.9% overextension above long-term averages combined with recent market volatility suggests current prices have disconnected from economic reality. With virtually no local employment base and dependence on outside buyers, Aladdin’s housing market faces significant vulnerability to economic downturns or shifts in buyer preferences. The 2023 price correction of 4.1% may signal the beginning of a larger adjustment as mathematical overvaluation meets economic constraints.

11. Alcova – Crash Risk Percentage: 60%

- Crash Risk Percentage: 60%

- Historical crashes (5%+ drops): 2

- Worst historical crash: -8.3% (2017)

- Total price increase since 2011: 88.5%

- Overextended above long-term average: 46.1%

- Price volatility (annual swings): 7.1%

- Current May 2025 price: $320,060

Alcova presents elevated crash risk through a combination of historical volatility and dangerous current overextension. The community has experienced two significant corrections since 2011, including a devastating 8.3% crash in 2017, proving the market’s susceptibility to rapid price declines. Current median prices of $320,060 represent strong 88.5% growth since 2011, but this appreciation has pushed valuations 46.1% above sustainable long-term trends.

Alcova – Reservoir Community With Boom-Bust Housing Patterns

Situated along Alcova Reservoir in Natrona County, this small community primarily serves as a recreational and residential area for Casper-region workers seeking lakefront or near-water properties. The area’s appeal centers on water recreation, fishing, and scenic reservoir views that attract both permanent residents and vacation home buyers. However, the limited year-round economic base and dependence on discretionary recreational spending create vulnerability to economic downturns.

The 2017 housing crash of 8.3% demonstrates how quickly recreational property markets can correct when buyer enthusiasm wanes or economic stress reduces discretionary spending. Current prices 46.1% above long-term averages suggest another potential correction cycle, particularly given the area’s narrow economic base and dependence on outside buyers. The combination of proven crash history and mathematical overextension creates significant risk for potential property purchasers.

10. Dubois – Crash Risk Percentage: 60%

- Crash Risk Percentage: 60%

- Historical crashes (5%+ drops): 0

- Worst historical crash: -5.0% (2014)

- Total price increase since 2010: 108.9%

- Overextended above long-term average: 59.0%

- Price volatility (annual swings): 8.1%

- Current May 2025 price: $430,930

Dubois represents one of Wyoming’s most mathematically unsustainable housing markets, with home prices more than doubling since 2010 to reach $430,930 median values. The extraordinary 108.9% appreciation has created extreme overextension of 59.0% above long-term sustainable trends, while the 2014 correction of 5.0% proves the market can reverse rapidly. Annual volatility of 8.1% indicates significant price instability that compounds buyer risk.

Dubois – Gateway Town Pricing Beyond Tourist Economics

Located at the entrance to the Wind River Mountains in Fremont County, Dubois serves as a gateway community for Yellowstone-bound tourists and outdoor recreation enthusiasts. The town’s economy depends heavily on seasonal tourism, hunting outfitters, and vacation home ownership, creating economic cycles that don’t support current housing price levels. The area’s dramatic mountain scenery and wildlife viewing opportunities attract affluent buyers, but permanent population remains small.

The 59.0% overextension above long-term averages represents mathematical unsustainability given the community’s limited economic base and seasonal employment patterns. While tourism provides some economic support, service industry wages cannot support median home prices exceeding $430,000. The 2014 price correction demonstrates vulnerability during economic uncertainty, while current overvaluation suggests a larger adjustment may be inevitable as affordability constraints intensify.

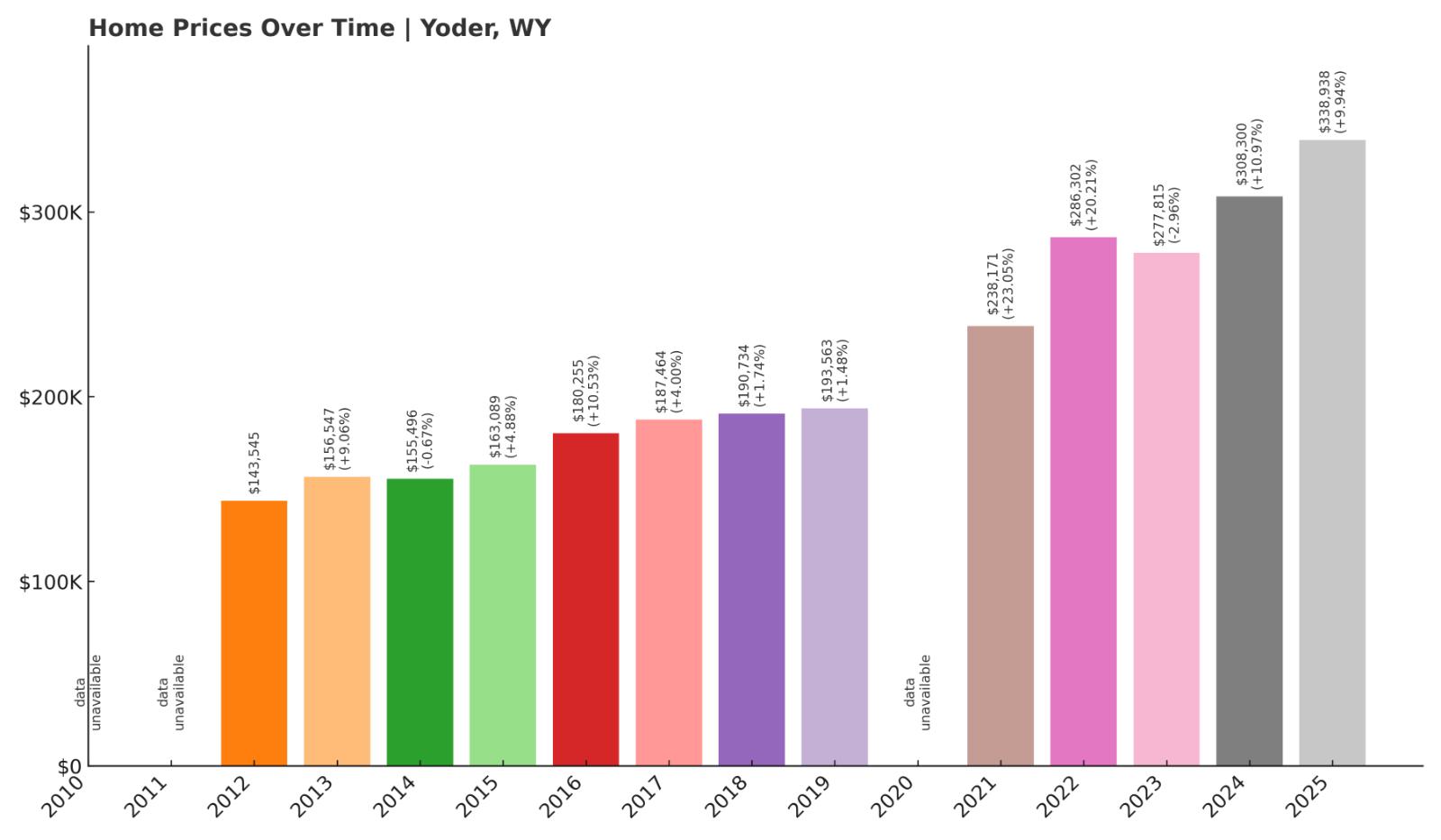

9. Yoder – Crash Risk Percentage: 62%

Would you like to save this?

- Crash Risk Percentage: 62%

- Historical crashes (5%+ drops): 0

- Worst historical crash: -3.0% (2023)

- Total price increase since 2012: 136.1%

- Overextended above long-term average: 56.2%

- Price volatility (annual swings): 7.6%

- Current May 2025 price: $338,938

Yoder displays one of Wyoming’s most dramatic price appreciation stories, with home values surging 136.1% since 2012 to reach $338,938 median prices. This extraordinary growth has pushed the market 56.2% above sustainable long-term trends, creating dangerous mathematical overextension. The recent 2023 correction of 3.0% suggests the market is beginning to show strain, while 7.6% annual volatility indicates above-average price instability.

Yoder – Agricultural Community With Unsustainable Price Surge

This small agricultural community in Goshen County has experienced remarkable housing market transformation despite maintaining its rural farming character. Yoder’s economy remains rooted in agriculture and livestock operations, with limited high-paying employment opportunities to support the dramatic price appreciation of recent years. The community’s appeal appears to stem from affordable rural living combined with reasonable access to larger regional centers.

The 136.1% price surge since 2012 represents a complete disconnect from local agricultural wages and economic fundamentals. With current median prices exceeding $338,000, homeownership has become increasingly challenging for local farm workers and young families traditionally comprising the community’s core population. The 56.2% overextension combined with recent price volatility suggests a significant correction may be necessary to restore mathematical balance between housing costs and local economic capacity.

8. Cora – Crash Risk Percentage: 63%

- Crash Risk Percentage: 63%

- Historical crashes (5%+ drops): 0

- Worst historical crash: -3.0% (2019)

- Total price increase since 2017: 62.0%

- Overextended above long-term average: 27.4%

- Price volatility (annual swings): 8.0%

- Current May 2025 price: $597,349

Cora’s housing market shows concerning rapid acceleration with 62.0% price growth since 2017, pushing median values to $597,349 in just eight years. While the 27.4% overextension above long-term trends appears more moderate than other high-risk communities, the rapid appreciation rate and high volatility of 8.0% annually create instability. The 2019 correction of 3.0% demonstrates market sensitivity to economic changes, suggesting vulnerability to larger adjustments.

Cora – Mountain Paradise With Premium Price Reality

Nestled in Sublette County near the Bridger-Teton National Forest, Cora attracts buyers seeking mountain lifestyle amenities and access to world-class outdoor recreation. The community’s proximity to Jackson Hole and Yellowstone National Park creates appeal for affluent buyers seeking vacation properties or retirement homes in a more affordable alternative to premium resort markets. This positioning has driven the rapid 62.0% price appreciation since 2017.

However, median home prices approaching $600,000 strain the definition of affordability, particularly given the area’s limited permanent employment base and seasonal economic patterns. The community’s small size and dependence on discretionary buyer demand create vulnerability during economic downturns when recreational property purchases decline. While the 27.4% overextension appears manageable, the rapid price acceleration and high volatility suggest the market may be approaching unsustainable levels relative to local economic fundamentals.

7. Cody – Crash Risk Percentage: 65%

- Crash Risk Percentage: 65%

- Historical crashes (5%+ drops): 0

- Worst historical crash: No major crashes recorded

- Total price increase since 2010: 127.2%

- Overextended above long-term average: 61.7%

- Price volatility (annual swings): 5.3%

- Current May 2025 price: $499,237

Cody presents extreme overvaluation risk with home prices more than doubling since 2010 to reach $499,237 median values. The massive 127.2% price appreciation has created dangerous overextension of 61.7% above sustainable long-term trends, representing one of Wyoming’s most mathematically unstable housing markets. Despite relatively low 5.3% annual volatility suggesting steady growth patterns, current valuations appear completely disconnected from local economic capacity.

Cody – Tourism Gateway With Unsustainable Housing Economics

As the eastern gateway to Yellowstone National Park and home to approximately 10,000 residents, Cody benefits from substantial tourism traffic and cultural attractions including the Buffalo Bill Center of the West. The community’s economy combines tourism, agriculture, and energy sectors, providing more diversification than many Wyoming towns. However, the dramatic housing price appreciation has far exceeded growth in local wages and economic activity, creating affordability challenges for working residents.

The 61.7% overextension above long-term averages represents mathematical unsustainability regardless of the community’s tourism appeal and economic diversity. While Yellowstone proximity creates ongoing buyer interest, median home prices approaching half a million dollars strain affordability for tourism workers, government employees, and other local professionals. Without corresponding increases in local wages or significant economic expansion, Cody’s housing market faces inevitable downward pressure as fundamental economics reassert influence over speculative pricing.

6. Daniel – Crash Risk Percentage: 68%

- Crash Risk Percentage: 68%

- Historical crashes (5%+ drops): 1

- Worst historical crash: -7.6% (2019)

- Total price increase since 2017: 52.0%

- Overextended above long-term average: 28.3%

- Price volatility (annual swings): 8.1%

- Current May 2025 price: $483,734

Daniel exhibits high crash risk through a combination of proven market volatility and rapid recent price acceleration. The community experienced a significant 7.6% correction in 2019, demonstrating vulnerability to economic shocks, while 52.0% price growth since 2017 has pushed median values to $483,734. Although the 28.3% overextension appears moderate, the high 8.1% annual volatility and recent crash history create elevated risk for potential buyers.

Daniel – Small Mountain Community With Big Price Swings

Located in Lincoln County near the Idaho border, Daniel serves as a small mountain community with economy based on ranching, recreation, and seasonal tourism. The area’s proximity to wilderness areas and outdoor recreation opportunities attracts buyers seeking rural mountain lifestyle, but the permanent population remains small and economic opportunities limited. The 2019 housing crash of 7.6% coincided with broader economic uncertainty and demonstrates the market’s sensitivity to external conditions.

Current median prices approaching $484,000 represent a significant burden for local workers in agriculture, tourism, and service industries that form the community’s economic base. While the 28.3% overextension above long-term trends appears manageable compared to other high-risk markets, the combination of proven crash history and limited local economic capacity creates vulnerability. The high price volatility of 8.1% annually suggests ongoing market instability that compounds risk for both buyers and sellers.

5. Hanna – Crash Risk Percentage: 68%

- Crash Risk Percentage: 68%

- Historical crashes (5%+ drops): 2

- Worst historical crash: -5.6% (2015)

- Total price increase since 2010: 79.2%

- Overextended above long-term average: 55.7%

- Price volatility (annual swings): 7.6%

- Current May 2025 price: $120,024

Hanna presents unique crash risk characteristics with two documented corrections since 2010 and extreme current overextension despite relatively low absolute prices. The median home value of $120,024 appears affordable compared to other Wyoming markets, but represents 79.2% appreciation since 2010 that has pushed prices 55.7% above sustainable long-term trends. The community’s proven track record of corrections, including a 5.6% crash in 2015, demonstrates vulnerability to rapid downturns.

Hanna – Coal Town Facing Economic Reality

This small Carbon County community built around coal mining has struggled with the decline of Wyoming’s coal industry, creating fundamental challenges for housing market stability. Hanna’s economy historically depended on coal extraction and related employment, but mine closures and reduced coal demand have eliminated many high-paying jobs. Despite these economic headwinds, housing prices have continued rising, creating a disconnect between local economic capacity and property values.

The 55.7% overextension above long-term averages appears particularly dangerous given the community’s declining economic base and population outmigration as coal jobs disappear. While absolute prices remain Wyoming’s most affordable, the mathematical overvaluation combined with economic uncertainty creates significant downside risk. The history of two previous crashes demonstrates how quickly prices can correct when economic reality conflicts with speculative valuations, suggesting another adjustment cycle may be approaching.

4. Alta – Crash Risk Percentage: 70%

- Crash Risk Percentage: 70%

- Historical crashes (5%+ drops): 0

- Worst historical crash: -4.3% (2025)

- Total price increase since 2016: 123.0%

- Overextended above long-term average: 44.1%

- Price volatility (annual swings): 12.2%

- Current May 2025 price: $1,914,976

Alta exhibits extreme crash risk through a combination of astronomical price levels and dangerous market instability. Home values have more than doubled since 2016 to reach an extraordinary $1,914,976 median, while the recent 4.3% correction in 2025 suggests the market is already showing strain. The massive 12.2% annual volatility creates enormous price swings that compound risk, while the 44.1% overextension above long-term trends indicates mathematical unsustainability at these premium levels.

Alta – Ultra-Premium Pricing In Rarified Mountain Air

Situated in Teton County near the Idaho border and Jackson Hole ski area, Alta represents one of Wyoming’s most exclusive and expensive residential markets. The community attracts ultra-wealthy buyers seeking luxury mountain properties with ski access and proximity to Jackson’s amenities, creating a market driven entirely by discretionary luxury spending rather than local economic fundamentals. The 123% price appreciation since 2016 reflects intense competition among affluent buyers for limited premium properties.

However, median prices approaching $2 million place Alta in rarified territory where even minor economic disruptions can trigger significant corrections as discretionary luxury spending evaporates. The 2025 correction of 4.3% may signal the beginning of a larger adjustment as economic uncertainty affects high-end property demand. With virtually no local employment to support these price levels and complete dependence on outside wealth, Alta’s housing market faces extreme vulnerability to any shift in luxury buyer sentiment or broader economic conditions.

3. Jackson – Crash Risk Percentage: 72%

- Crash Risk Percentage: 72%

- Historical crashes (5%+ drops): 0

- Worst historical crash: -2.6% (2025)

- Total price increase since 2010: 242.7%

- Overextended above long-term average: 85.0%

- Price volatility (annual swings): 11.2%

- Current May 2025 price: $1,984,657

Jackson presents perhaps Wyoming’s most dangerous housing bubble with astronomical 242.7% price growth since 2010 driving median values to nearly $2 million. The extreme 85.0% overextension above long-term trends represents mathematical unsustainability at unprecedented levels, while the recent 2.6% correction in 2025 suggests early signs of market strain. High annual volatility of 11.2% creates massive price swings that amplify risk in this ultra-premium market segment.

Jackson – Resort Town Bubble Approaching Breaking Point

As the heart of Jackson Hole’s world-renowned ski resort and luxury tourism industry, Jackson has become one of America’s most expensive housing markets outside major metropolitan areas. The community attracts billionaires, celebrities, and ultra-wealthy individuals seeking luxury mountain retreats, creating intense competition for limited housing inventory. This dynamic has driven the extraordinary 242.7% price appreciation over 15 years, completely disconnecting home values from any local economic fundamentals.

The 85.0% overextension above long-term averages represents the most extreme mathematical instability in Wyoming’s housing market, suggesting an inevitable correction of massive proportions. While Jackson’s resort appeal provides ongoing demand from wealthy buyers, median prices approaching $2 million place the market in territory where even affluent purchasers face affordability constraints. The combination of extreme overvaluation, high volatility, and complete dependence on discretionary luxury spending creates conditions for a potentially devastating price collapse when economic uncertainty affects high-end property demand.

2. Moran – Crash Risk Percentage: 73%

- Crash Risk Percentage: 73%

- Historical crashes (5%+ drops): 0

- Worst historical crash: No major crashes recorded

- Total price increase since 2016: 126.7%

- Overextended above long-term average: 43.9%

- Price volatility (annual swings): 10.1%

- Current May 2025 price: $1,687,456

Moran displays extreme crash vulnerability through a combination of explosive price growth and dangerous market instability despite no recorded major corrections. Home values have more than doubled since 2016 to reach $1,687,456 median prices, while the 43.9% overextension above sustainable trends creates mathematical unsustainability. The high 10.1% annual volatility indicates substantial price swings that compound risk in this ultra-premium market segment with virtually no local economic support.

Moran – Wilderness Gateway With Luxury Price Disconnect

Located at the entrance to Grand Teton National Park in Teton County, Moran occupies a unique position as both a wilderness gateway and luxury residential enclave. The community’s appeal stems from unparalleled access to pristine wilderness areas combined with proximity to Jackson Hole’s resort amenities, attracting affluent buyers seeking exclusive mountain properties. However, the tiny permanent population and absence of significant local employment create complete dependence on outside wealth to sustain current price levels.

The 126.7% price appreciation since 2016 has pushed median values to levels that bear no relationship to local economic capacity or employment opportunities. With current prices exceeding $1.6 million, Moran has become accessible only to the ultra-wealthy, creating extreme vulnerability to any shift in luxury buyer sentiment or broader economic conditions. The 43.9% overextension combined with high volatility suggests the market has reached unsustainable levels where even minor economic disruptions could trigger significant corrections in this discretionary luxury segment.

1. Wilson – Crash Risk Percentage: 87%

- Crash Risk Percentage: 87%

- Historical crashes (5%+ drops): 1

- Worst historical crash: -10.3% (2011)

- Total price increase since 2010: 219.7%

- Overextended above long-term average: 82.4%

- Price volatility (annual swings): 11.3%

- Current May 2025 price: $3,217,229

Wilson represents Wyoming’s highest crash risk with a perfect storm of danger signals including proven crash history, extreme overvaluation, and astronomical price levels. The community’s devastating 10.3% crash in 2011 demonstrates vulnerability to rapid corrections, while current median prices exceeding $3.2 million reflect completely unsustainable appreciation of 219.7% since 2010. The extreme 82.4% overextension above long-term trends combined with high 11.3% volatility creates conditions for a potentially catastrophic price collapse.

Wilson – Ultra-Luxury Bubble With Crash History

As Jackson Hole’s most exclusive residential enclave, Wilson attracts the world’s wealthiest individuals seeking ultra-luxury mountain properties with unparalleled privacy and amenities. The community’s median home price exceeding $3.2 million places it among America’s most expensive housing markets, driven entirely by competition among billionaires and ultra-high-net-worth buyers. This rarified market segment operates completely independent of local economic fundamentals, creating extreme vulnerability to shifts in luxury spending patterns.

The 2011 crash of 10.3% provides stark evidence that even ultra-premium markets can experience rapid, devastating corrections when economic conditions shift. Current prices 82.4% above long-term sustainable trends represent the most extreme mathematical overvaluation in Wyoming, suggesting an inevitable adjustment of massive proportions. The combination of proven crash history, astronomical price levels, and complete dependence on discretionary ultra-luxury spending creates conditions where Wilson faces the highest probability of significant price collapse among all Wyoming communities. When economic uncertainty affects ultra-high-net-worth spending decisions, Wilson’s housing market lacks any fundamental economic support to prevent severe corrections.