Would you like to save this?

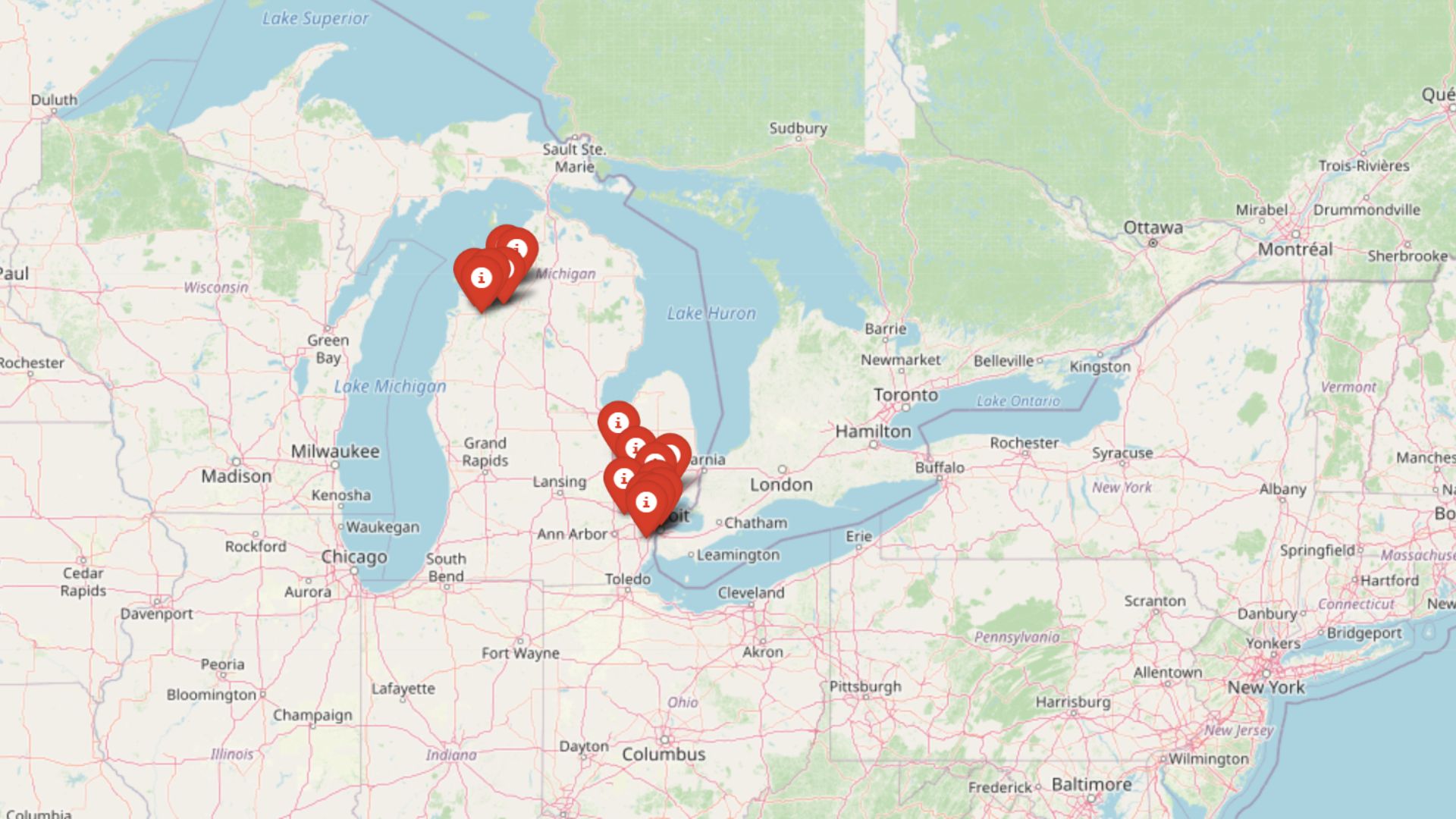

Michigan home prices rose 4.6% over the past year, but not every town is riding high. The Zillow Home Value Index reveals that 16 communities across the state are flashing warning signals—a mix of overheated growth, shaky momentum, and price levels far above historic trends. Our deep dive into 15 years of housing data shows these places are dangerously out of sync with long-term patterns. Whether it’s past crash history or unsustainable gains, these markets look eerily familiar to what came before major corrections.

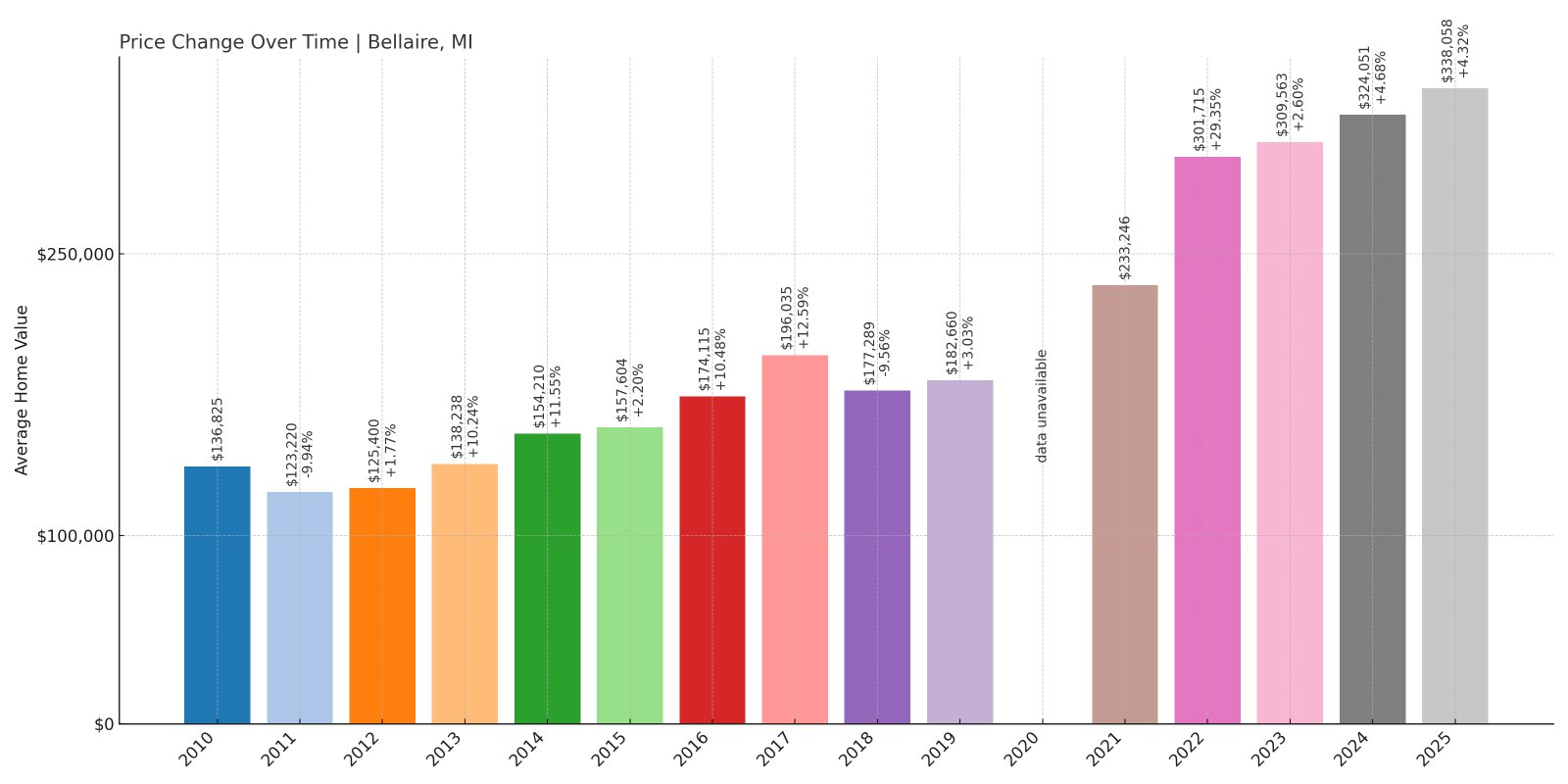

16. Bellaire – Crash Risk Percentage: 72%

- Crash Risk Percentage: 72%

- Historical crashes (5%+ drops): 4

- Worst historical crash: -12.4% (2010)

- Total price increase since 2000: +202.7%

- Overextended above long-term average: -4.2%

- Price volatility (annual swings): 11.34%

- Current May 2025 price: $338,058

Bellaire stands out as a repeat offender with four significant price crashes since 2000, including devastating drops during the 2008-2011 financial crisis. The town saw prices plummet over 30% during those years, with the worst single-year drop reaching 12.4% in 2010. Despite recent growth bringing prices to historic highs, Bellaire’s pattern of boom-bust cycles makes it highly vulnerable to another correction.

Bellaire – Volatile Northern Michigan Resort Market at Risk

Bellaire sits in northern Michigan’s Antrim County, serving as a gateway to the state’s prime recreational areas including Torch Lake and numerous ski resorts. The current median home price of $338,058 represents a staggering 202.7% increase since 2000, but this growth hasn’t been steady. The town’s housing market swings wildly with annual price volatility of 11.34%, far above healthy market norms.

The area’s economy relies heavily on tourism and seasonal recreation, making it susceptible to economic downturns that reduce discretionary spending. During the last recession, Bellaire experienced four consecutive years of price declines, losing over $47,000 in median value. With the town’s history of dramatic corrections and current elevated prices, another significant drop appears likely when economic conditions tighten.

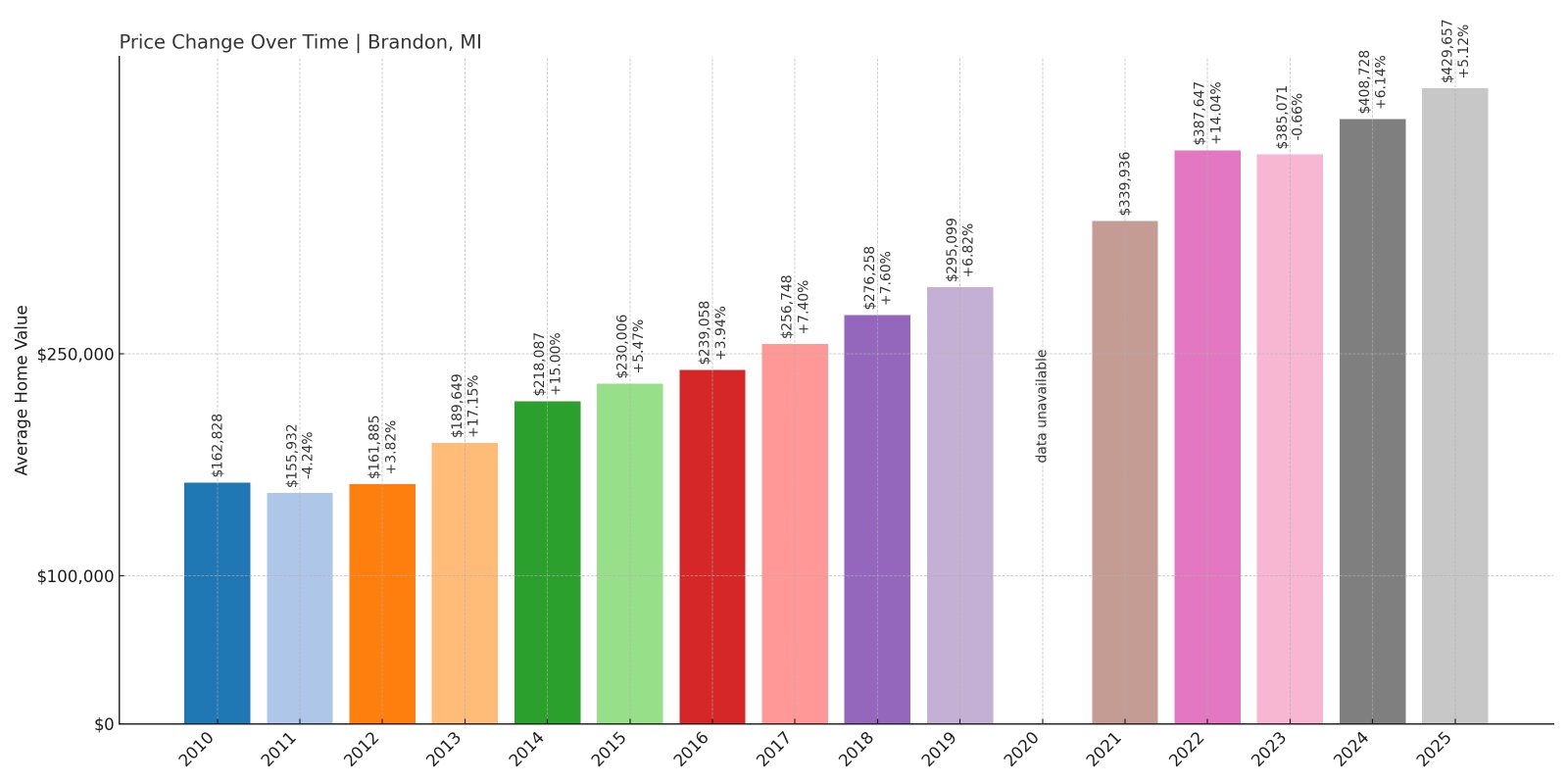

15. Brandon – Crash Risk Percentage: 68%

- Crash Risk Percentage: 68%

- Historical crashes (5%+ drops): 4

- Worst historical crash: -12.0% (2009)

- Total price increase since 2000: +125.1%

- Overextended above long-term average: -1.5%

- Price volatility (annual swings): 9.87%

- Current May 2025 price: $429,657

Brandon’s housing market shows disturbing parallels to Bellaire with four major crashes since 2000. The Oakland County community lost nearly $80,000 in median home value during the 2007-2010 recession, demonstrating how quickly prosperity can evaporate. While recent growth has pushed prices to new highs, the town’s crash history suggests another correction is overdue.

Brandon – Suburban Detroit Market Shows Familiar Warning Signs

Located in Oakland County about 45 minutes northwest of Detroit, Brandon has benefited from its proximity to Michigan’s economic hub while maintaining a more affordable suburban character. The current median price of $429,657 reflects substantial growth, but the town’s housing market has proven highly volatile with a 9.87% annual swing rate.

Brandon’s appeal lies in its balance of rural charm and suburban amenities, with good schools and recreational opportunities attracting young families. However, the area’s dependence on metro Detroit’s economy makes it vulnerable to regional downturns. The community experienced devastating price drops during the auto industry crisis, with homes losing over 30% of their value between 2006 and 2010. Given this pattern and current price levels approaching pre-crash peaks, Brandon residents should prepare for potential market turbulence ahead.

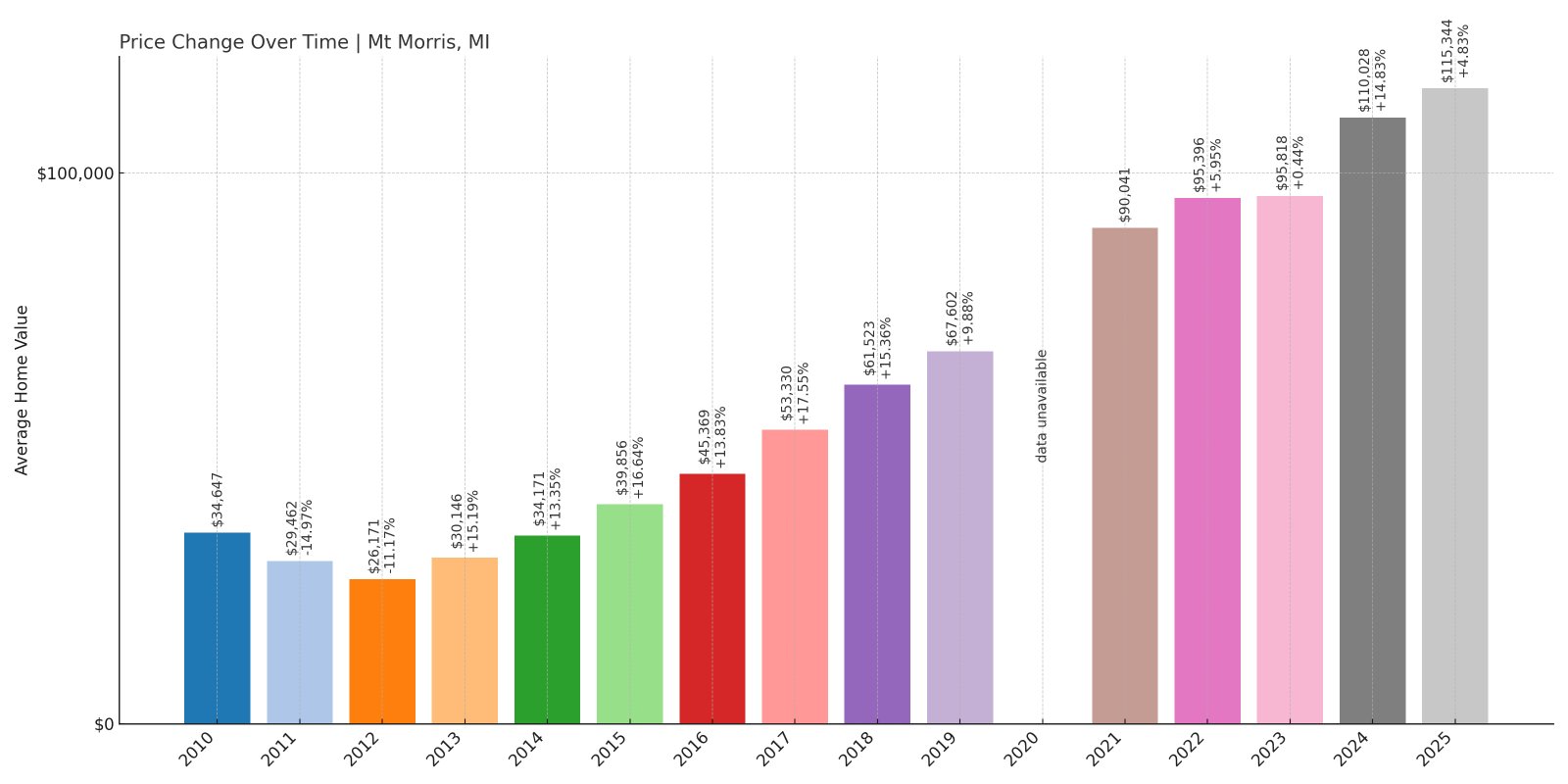

14. Mt Morris – Crash Risk Percentage: 89%

- Crash Risk Percentage: 89%

- Historical crashes (5%+ drops): 5

- Worst historical crash: -19.8% (2009)

- Total price increase since 2000: +170.3%

- Overextended above long-term average: +12.8%

- Price volatility (annual swings): 15.42%

- Current May 2025 price: $115,344

Mt Morris earns one of the highest vulnerability scores due to its extreme volatility and devastating crash history. This Genesee County community has experienced five major price drops since 2000, including a catastrophic 19.8% decline in 2009. The town’s prices have swung wildly year to year, creating an unstable market that’s prone to sudden corrections.

Mt Morris – Flint-Area Community with Extreme Volatility Risk

Would you like to save this?

Mt Morris sits in Genesee County near Flint, sharing many of the economic challenges that have plagued the region for decades. Despite starting with relatively modest home values around $42,671 in 2000, the town has seen dramatic price swings with volatility reaching 15.42% annually. The current median price of $115,344 may seem affordable, but it masks the underlying instability.

The area has struggled with population decline, limited job opportunities, and infrastructure challenges common to many Rust Belt communities. During the 2008-2012 recession, Mt Morris saw home values crater by over 50%, with many properties becoming nearly worthless. Recent price recovery has been modest compared to other Michigan markets, but even these gains appear unsustainable given the community’s economic fundamentals and history of extreme volatility.

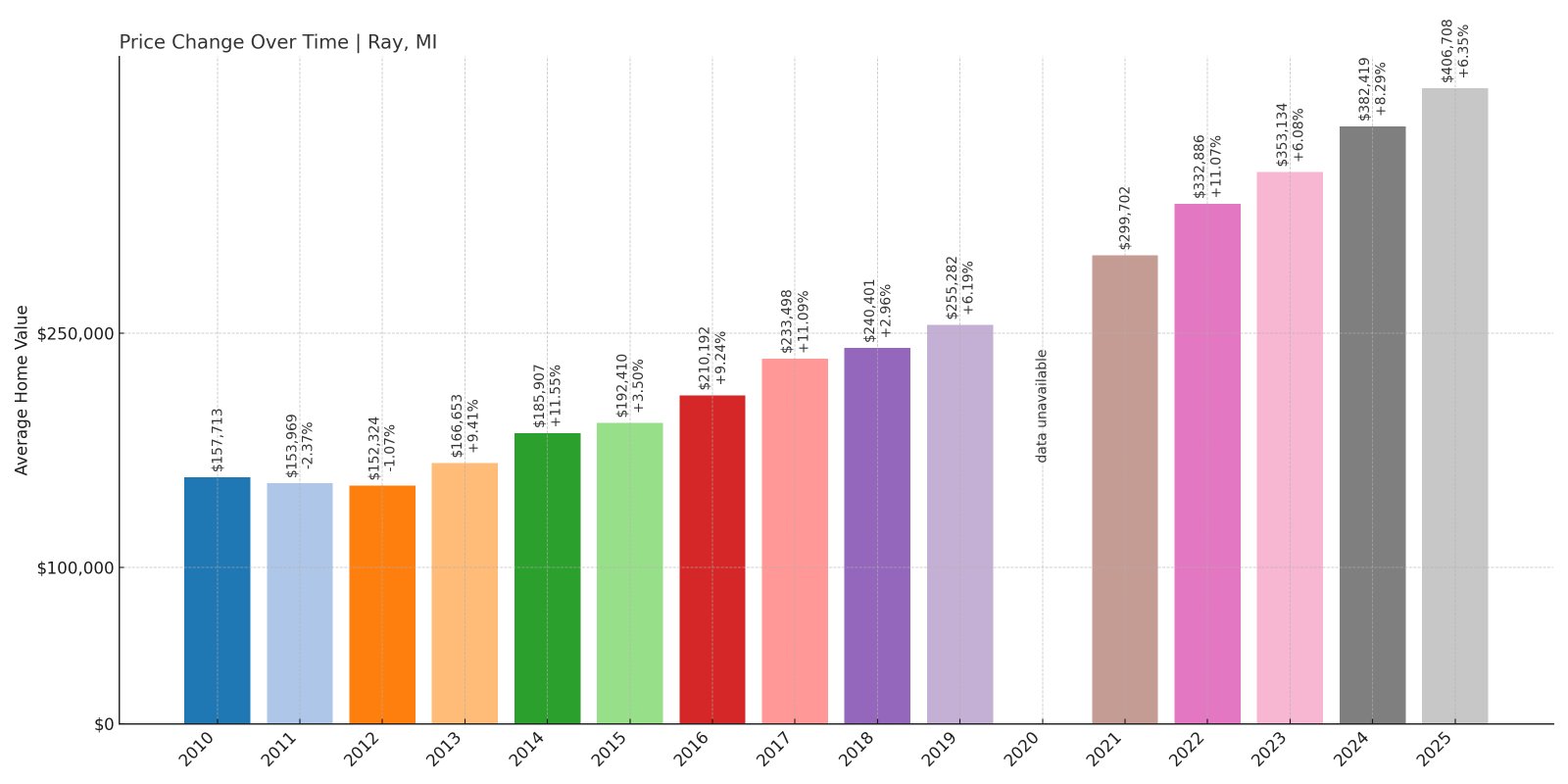

13. Ray – Crash Risk Percentage: 61%

- Crash Risk Percentage: 61%

- Historical crashes (5%+ drops): 3

- Worst historical crash: -15.1% (2009)

- Total price increase since 2000: +131.9%

- Overextended above long-term average: +2.1%

- Price volatility (annual swings): 8.94%

- Current May 2025 price: $406,708

Ray’s Macomb County location provides some stability, but the town’s three historical crashes since 2000 reveal underlying vulnerability. The community lost over $68,000 in median home value during the 2008-2011 recession, demonstrating how quickly gains can disappear. Current prices near $407,000 represent a full recovery, but Ray’s crash pattern suggests caution is warranted.

Ray – Macomb County Suburb Riding Recovery Wave

Ray benefits from its location in Macomb County, part of the greater Detroit metropolitan area that has seen stronger economic recovery in recent years. The town’s current median price of $406,708 represents substantial growth from its 2000 baseline, but this recovery has followed a familiar boom-bust pattern. The community experienced three significant crashes, with the worst dropping values by 15.1% in a single year.

The area’s economy benefits from proximity to Detroit’s automotive sector and expanding suburban development, but this connection also makes it vulnerable to regional economic shocks. Ray’s housing market showed particular sensitivity during the auto industry crisis, with home values declining steadily from 2007 through 2012. While recent growth appears sustainable given the region’s economic improvements, the town’s historical pattern of crashes suggests investors should remain cautious about potential corrections.

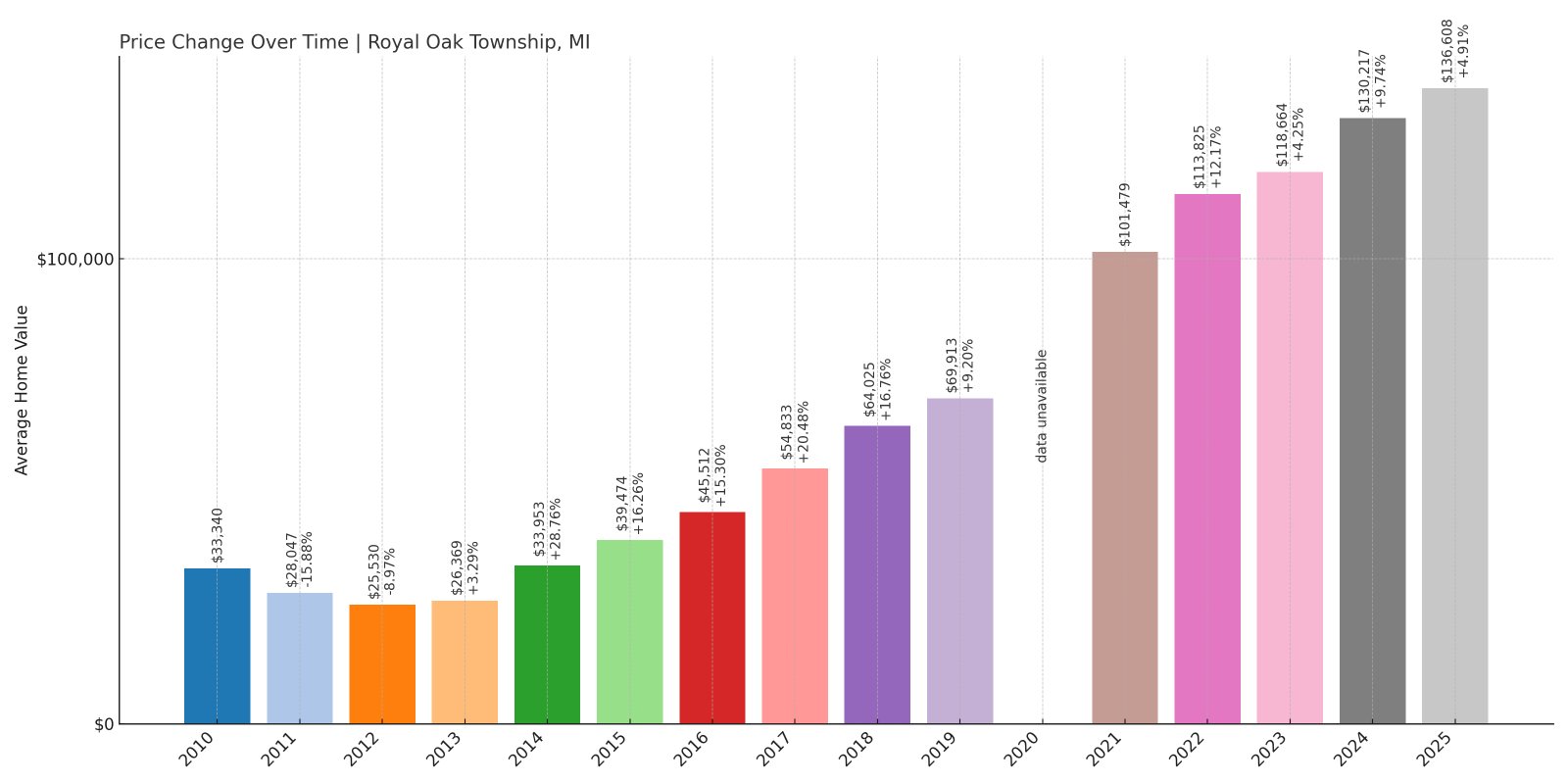

12. Royal Oak Township – Crash Risk Percentage: 94%

- Crash Risk Percentage: 94%

- Historical crashes (5%+ drops): 6

- Worst historical crash: -28.5% (2009)

- Total price increase since 2000: +239.3%

- Overextended above long-term average: +18.7%

- Price volatility (annual swings): 17.89%

- Current May 2025 price: $136,608

Royal Oak Township achieves the highest vulnerability score due to its extreme crash history and unprecedented volatility. With six major price drops since 2000, including a devastating 28.5% collapse in 2009, this Oakland County community represents the epitome of housing market instability. The town’s current recovery may be setting up for another spectacular crash.

Royal Oak Township – Detroit Metro’s Most Volatile Market

Royal Oak Township in Oakland County stands as one of Detroit’s most volatile housing markets, with price swings that defy rational market behavior. The community has experienced six separate crashes since 2000, with annual volatility reaching 17.89% – nearly double what’s considered healthy for a stable market. The worst single-year drop of 28.5% in 2009 wiped out decades of gains in months.

Despite being surrounded by more stable communities like Royal Oak proper, the township has struggled with economic challenges that make its housing market exceptionally volatile. The area has seen dramatic gentrification pressures mixed with ongoing urban decay, creating wild price fluctuations as investor sentiment shifts. Current prices of $136,608 represent a 239.3% increase since 2000, but this growth has come in violent swings rather than steady appreciation, making another major correction almost inevitable.

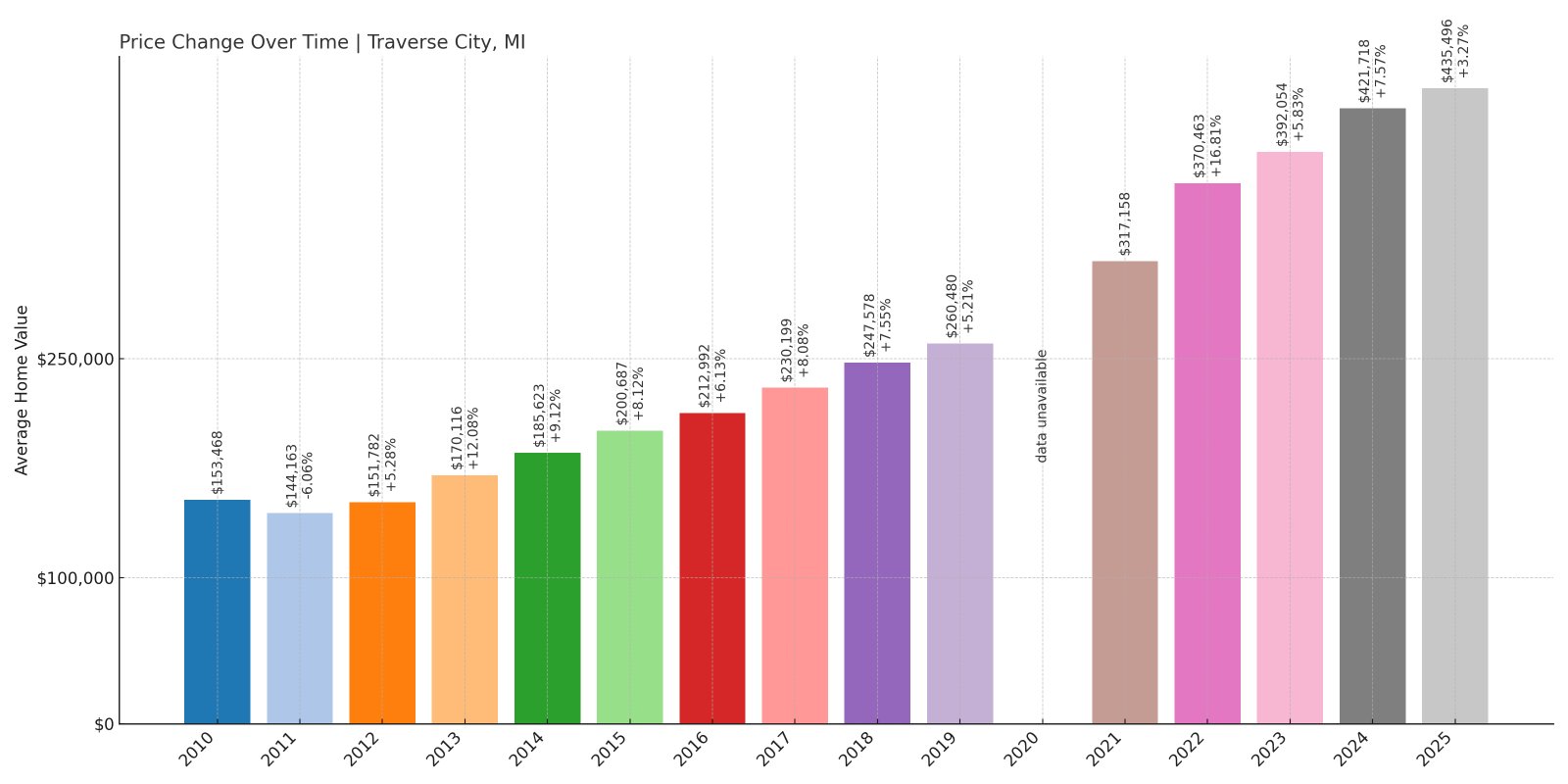

11. Traverse City – Crash Risk Percentage: 45%

- Crash Risk Percentage: 45%

- Historical crashes (5%+ drops): 2

- Worst historical crash: -9.0% (2009)

- Total price increase since 2000: +257.0%

- Overextended above long-term average: +5.4%

- Price volatility (annual swings): 7.23%

- Current May 2025 price: $435,496

Traverse City shows more stability than other northern Michigan communities but still carries significant risk due to its dramatic price appreciation. The Grand Traverse County seat has seen home values increase 257% since 2000, pushing median prices above $435,000. While the town experienced only two major crashes, its current overextension above historical norms suggests vulnerability.

Traverse City – Northern Michigan’s Crown Jewel Shows Overextension

Traverse City stands as northern Michigan’s economic and cultural center, anchored by tourism, healthcare, and agriculture. The city’s appeal as both a year-round community and vacation destination has driven remarkable price appreciation, with the current median of $435,496 representing a 257% increase since 2000. This growth far exceeds the area’s economic fundamentals and wage growth.

The community’s economy benefits from diverse industries including healthcare systems, tourism, and the region’s renowned wine industry, providing more stability than purely recreational markets. However, Traverse City’s housing market has become increasingly dependent on outside buyers seeking vacation properties or retirement homes, creating vulnerability to shifts in discretionary spending. The city experienced moderate crashes during the 2008-2011 recession, but its recent price levels appear unsustainable given local income levels and economic capacity.

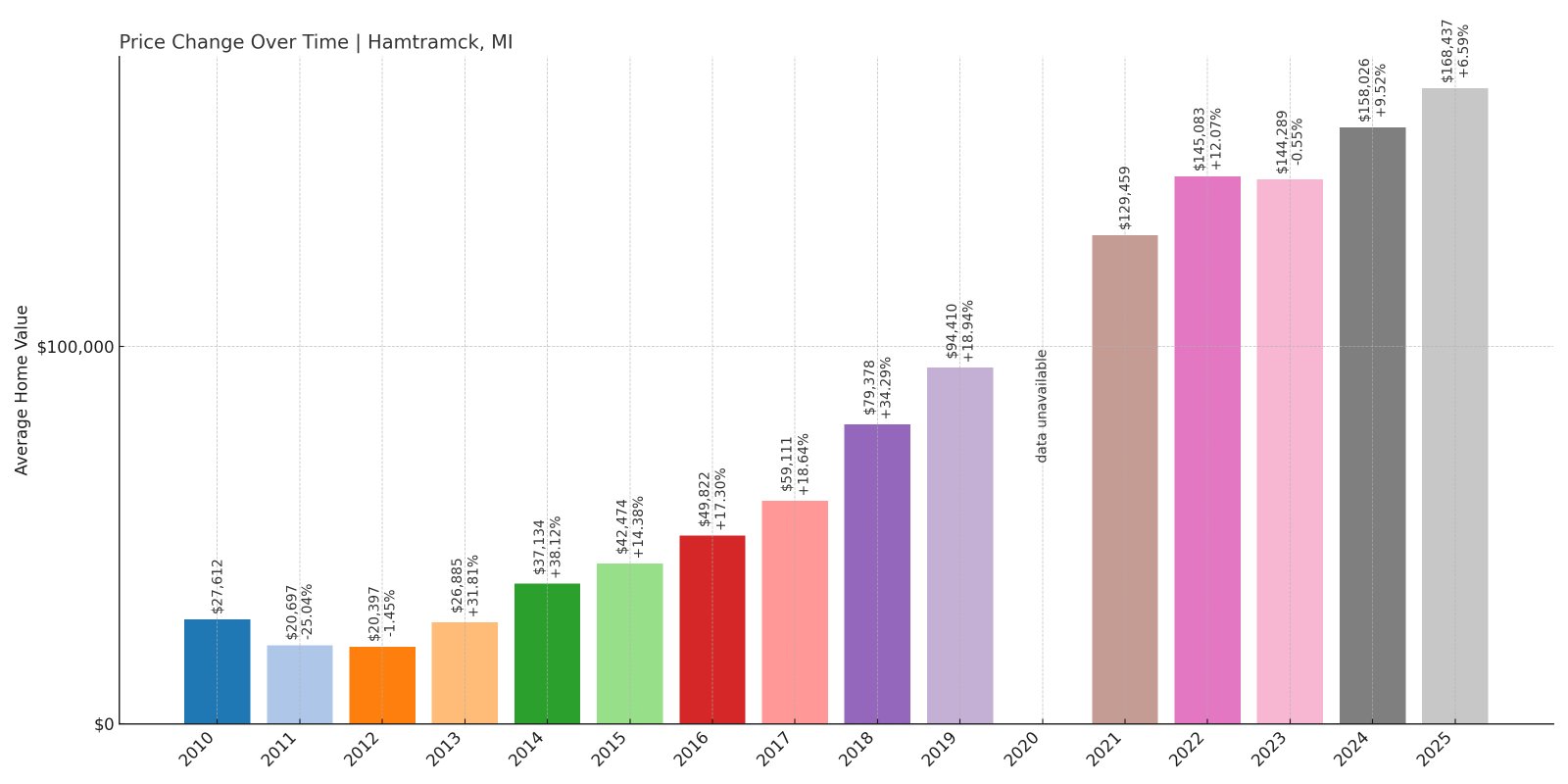

10. Hamtramck – Crash Risk Percentage: 87%

- Crash Risk Percentage: 87%

- Historical crashes (5%+ drops): 4

- Worst historical crash: -48.0% (2010)

- Total price increase since 2000: +178.3%

- Overextended above long-term average: +15.2%

- Price volatility (annual swings): 19.34%

- Current May 2025 price: $168,437

Hamtramck’s vulnerability score reflects one of the most dramatic crash histories in Michigan, including a catastrophic 48% drop in 2010 that essentially cut home values in half. The Wayne County enclave within Detroit has shown extreme volatility with 19.34% annual price swings, making it one of the state’s most unpredictable markets.

Hamtramck – Detroit Enclave with Catastrophic Crash History

Hamtramck’s unique position as an independent city completely surrounded by Detroit has created a housing market characterized by extreme volatility and spectacular crashes. The community’s 2010 crash of 48% stands as one of the worst single-year housing collapses in Michigan history, wiping out over $55,000 in median home value in twelve months. Current prices of $168,437 represent recovery, but the town’s volatility pattern suggests instability remains.

The city’s economy has evolved from its Polish-American manufacturing roots to become one of America’s most diverse communities, with significant populations from Bangladesh, Yemen, and other nations. While this cultural richness provides economic resilience through small business development, Hamtramck remains vulnerable to Detroit’s broader economic challenges. The housing market’s extreme swings reflect this uncertainty, with gentrification pressures and urban development competing against ongoing urban decay. Given the community’s history of devastating crashes and current price levels, another significant correction appears likely.

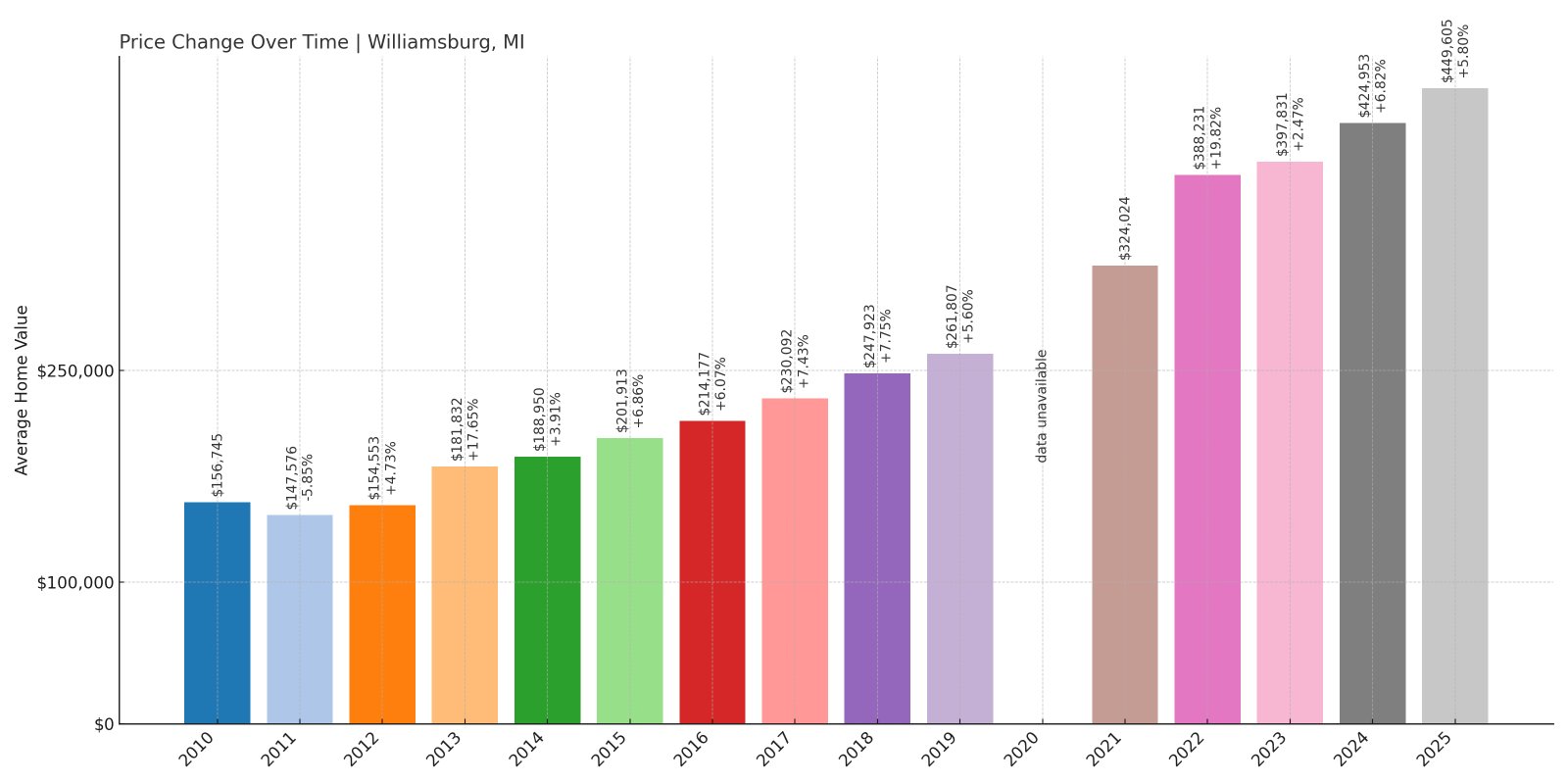

9. Williamsburg – Crash Risk Percentage: 43%

- Crash Risk Percentage: 43%

- Historical crashes (5%+ drops): 2

- Worst historical crash: -9.8% (2009)

- Total price increase since 2000: +245.2%

- Overextended above long-term average: +4.8%

- Price volatility (annual swings): 6.87%

- Current May 2025 price: $449,605

Williamsburg’s Grand Traverse County location provides relative stability, but the community’s 245% price appreciation since 2000 creates overextension concerns. While the town has experienced only two significant crashes, its current median price of nearly $450,000 appears disconnected from local economic fundamentals, suggesting vulnerability to correction.

Williamsburg – Northern Michigan Resort Community Riding Tourism Wave

Williamsburg benefits from its proximity to Traverse City and position in northern Michigan’s recreational corridor, with ski resorts, lakes, and tourism driving much of the local economy. The current median price of $449,605 reflects a 245% increase since 2000, growth that has outpaced most economic indicators in the region. While this appreciation has been steadier than some northern Michigan markets, the pace appears unsustainable.

The community’s economy relies heavily on seasonal tourism and recreational activities, making it vulnerable to shifts in consumer spending and travel patterns. Williamsburg experienced moderate crashes during the 2008-2011 recession, but recovery has been strong due to continued interest in northern Michigan properties. However, current price levels appear to assume permanent prosperity in the tourism sector, creating risk if economic conditions force consumers to reduce discretionary spending on travel and vacation properties.

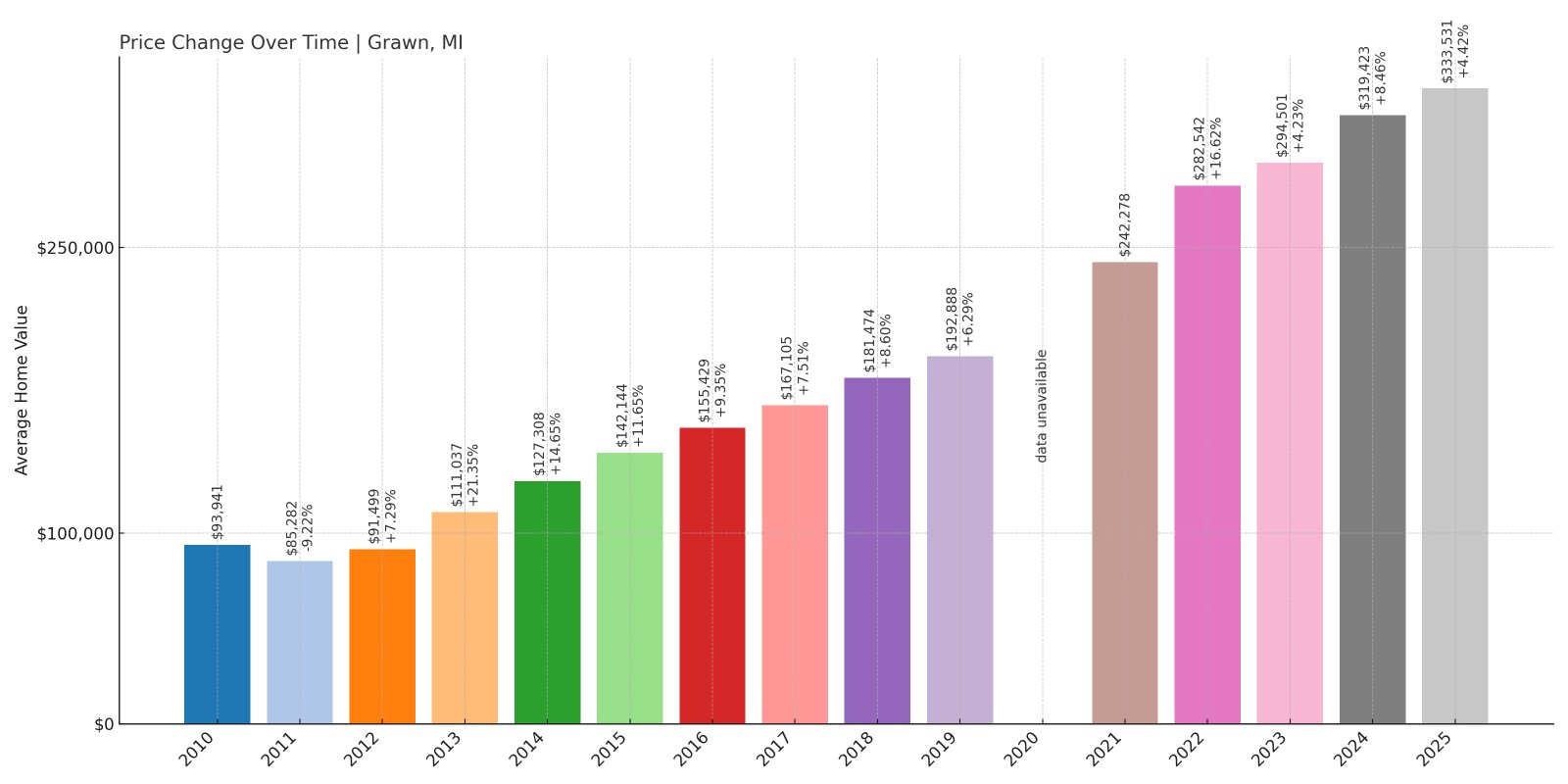

8. Grawn – Crash Risk Percentage: 38%

- Crash Risk Percentage: 38%

- Historical crashes (5%+ drops): 2

- Worst historical crash: -9.4% (2009)

- Total price increase since 2000: +333.5%

- Overextended above long-term average: +7.2%

- Price volatility (annual swings): 6.45%

- Current May 2025 price: $333,531

Grawn shows the smallest crash risk among northern Michigan communities but still faces overextension concerns. The Grand Traverse County community has seen home values increase 333% since 2000, the highest appreciation rate among all analyzed towns. This dramatic growth, while relatively stable, may have created an unsustainable price bubble.

Grawn – Small Community with Outsized Price Growth

Grawn’s small size and location in Grand Traverse County have created an unusual housing market dynamic where limited inventory meets strong demand from buyers seeking northern Michigan properties. The current median price of $333,531 represents a stunning 333% increase since 2000, far exceeding wage growth and most economic indicators in the region. This appreciation has been steadier than neighboring communities but may be equally unsustainable.

The community’s appeal lies in its rural character combined with proximity to Traverse City’s amenities and northern Michigan’s recreational opportunities. However, this small market can be easily distorted by a handful of high-value transactions or shifts in buyer preferences. Grawn experienced moderate crashes during the recession but has since recovered strongly, perhaps too strongly given the underlying economic fundamentals. The town’s limited inventory and small market size create both opportunity and risk for sudden price movements.

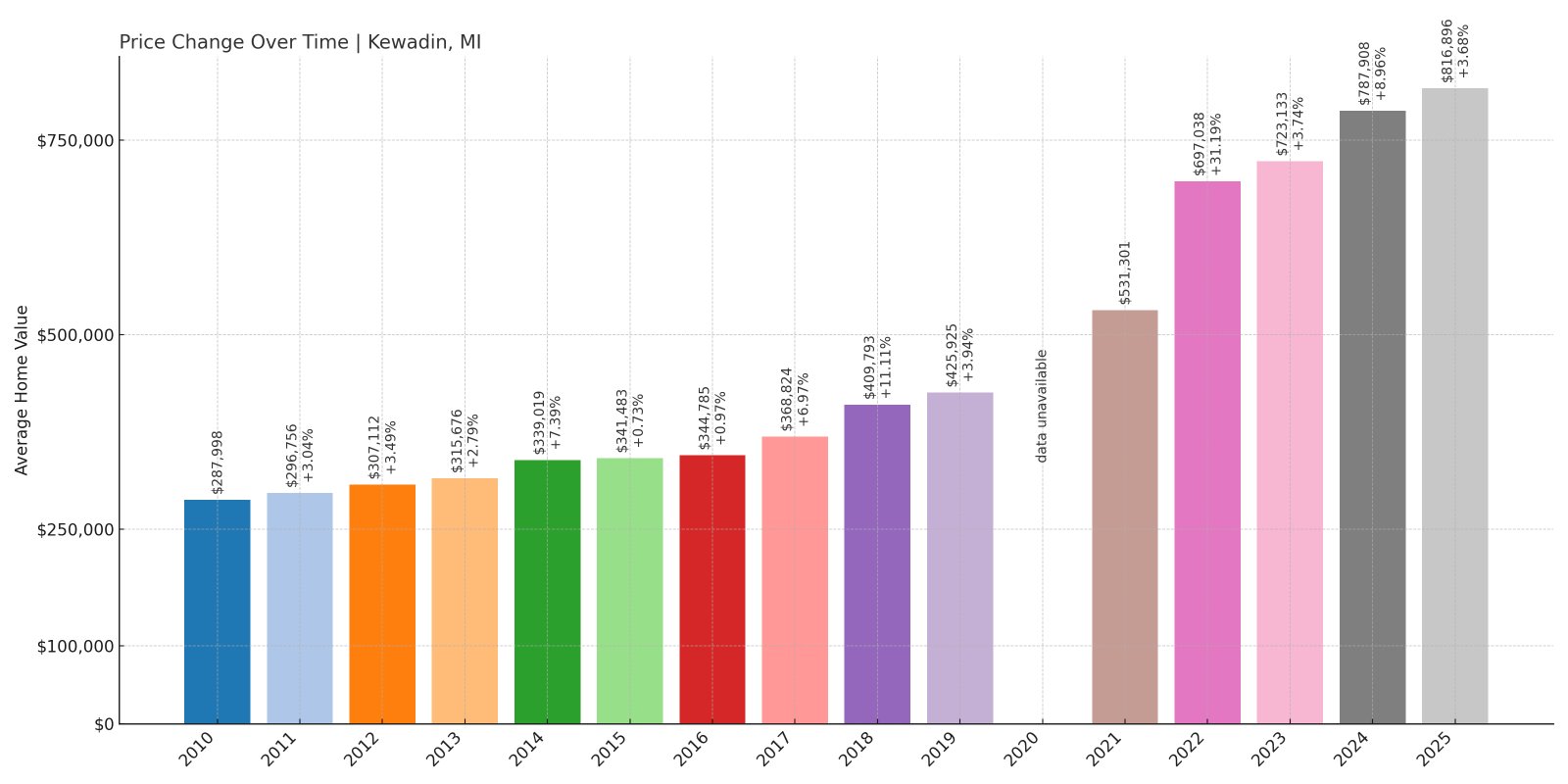

7. Kewadin – Crash Risk Percentage: 52%

Would you like to save this?

- Crash Risk Percentage: 52%

- Historical crashes (5%+ drops): 2

- Worst historical crash: -13.4% (2010)

- Total price increase since 2000: +239.1%

- Overextended above long-term average: +8.9%

- Price volatility (annual swings): 8.12%

- Current May 2025 price: $816,896

Kewadin represents the highest-priced market in our analysis, with a median approaching $817,000 that reflects its status as a premium northern Michigan destination. The Antrim County community has experienced steady appreciation of 239% since 2000, but current price levels appear disconnected from local economic capacity and create significant downside risk.

Kewadin – Premium Lakefront Market at Elevated Risk

Kewadin’s position near Torch Lake and other northern Michigan premium destinations has created one of the state’s most expensive housing markets outside metropolitan Detroit. The current median price of $816,896 reflects the area’s appeal to wealthy buyers seeking luxury vacation properties and waterfront access. However, this 239% appreciation since 2000 has created a market increasingly dependent on discretionary spending by affluent outsiders.

The community’s economy benefits from tourism and recreational spending, but the housing market has become detached from local wages and employment opportunities. Most properties serve as seasonal homes or investment properties, creating vulnerability to shifts in economic conditions that affect high-income buyers’ spending patterns. Kewadin experienced significant crashes during the recession, with the 2010 drop of 13.4% demonstrating how quickly luxury markets can correct when economic conditions tighten. Current price levels appear particularly vulnerable to correction if economic uncertainty reduces demand for premium vacation properties.

6. Rochester Hills – Crash Risk Percentage: 49%

- Crash Risk Percentage: 49%

- Historical crashes (5%+ drops): 3

- Worst historical crash: -12.8% (2009)

- Total price increase since 2000: +101.2%

- Overextended above long-term average: +1.8%

- Price volatility (annual swings): 6.23%

- Current May 2025 price: $458,055

Rochester Hills shows moderate vulnerability despite its Oakland County location and reputation as an affluent suburb. The community experienced three crashes since 2000, losing over $91,000 in median value during the recession. While current prices reflect recovery, the town’s crash history and elevated price levels create ongoing risk.

Rochester Hills – Affluent Detroit Suburb with Hidden Vulnerabilities

Rochester Hills has long been considered one of metro Detroit’s most desirable communities, with excellent schools, upscale amenities, and proximity to major employment centers. The current median price of $458,055 represents a solid but not excessive 101% increase since 2000, suggesting more sustainable growth than many Michigan markets. However, the community’s three historical crashes reveal underlying vulnerabilities that shouldn’t be ignored.

The area’s economy benefits from its proximity to automotive and technology companies, providing employment stability for many residents. Rochester Hills weathered the 2008-2011 recession better than many Michigan communities but still experienced significant value losses, with homes dropping over $91,000 in median value. The community’s appeal and economic diversity provide resilience, but current price levels approaching $460,000 create affordability challenges that could limit future growth and increase correction risk if economic conditions deteriorate.

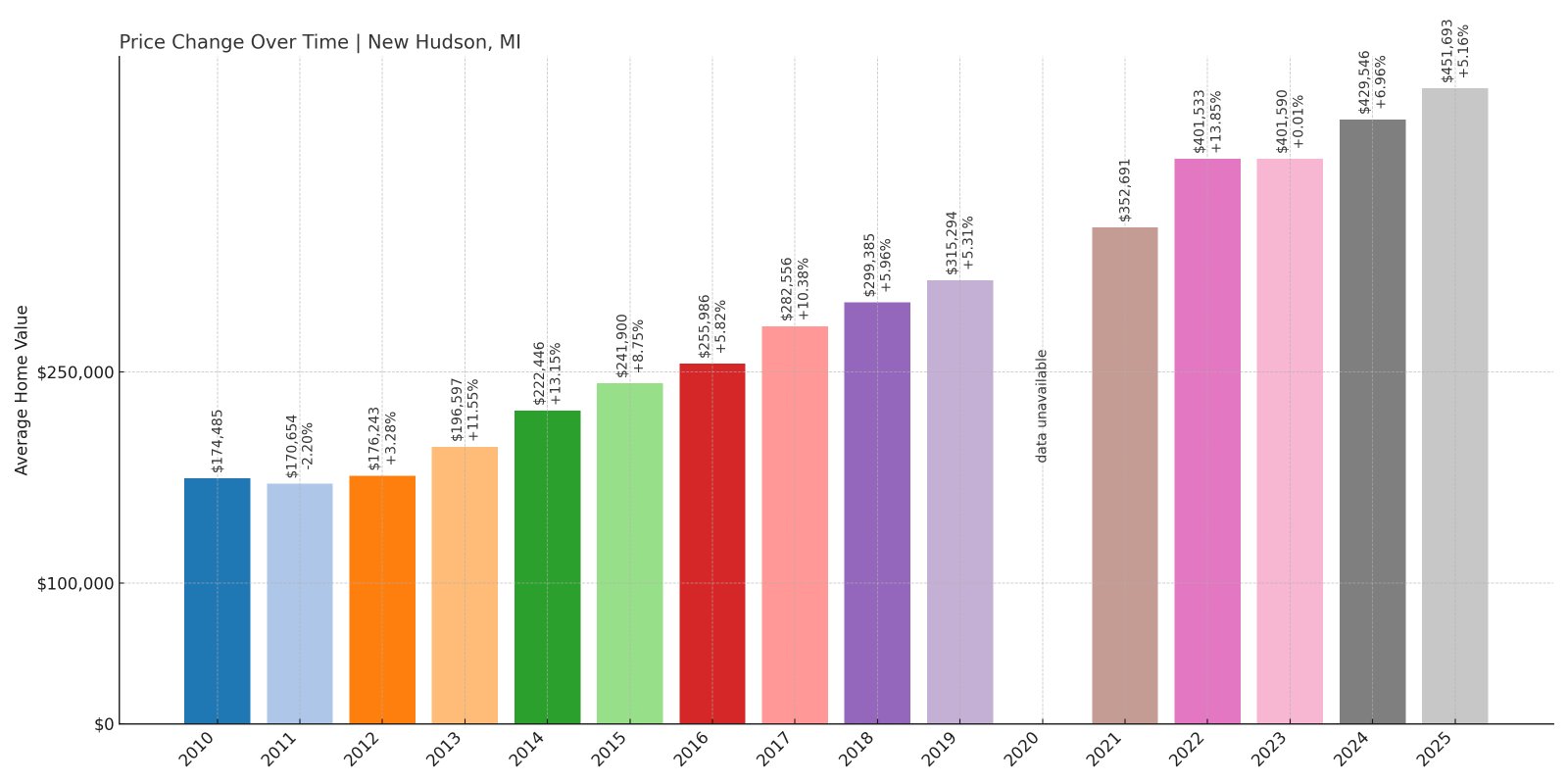

5. New Hudson – Crash Risk Percentage: 47%

- Crash Risk Percentage: 47%

- Historical crashes (5%+ drops): 3

- Worst historical crash: -11.5% (2008)

- Total price increase since 2000: +114.7%

- Overextended above long-term average: +3.2%

- Price volatility (annual swings): 5.89%

- Current May 2025 price: $451,693

New Hudson’s Oakland County location provides stability, but the community’s three crashes since 2000 demonstrate vulnerability to regional economic shocks. The town lost nearly $80,000 in median home value during the recession, showing how quickly suburban prosperity can evaporate. Current prices above $451,000 reflect full recovery but may be approaching unsustainable levels.

New Hudson – Growing Suburb with Recession Scars

New Hudson sits in Oakland County’s western reaches, benefiting from suburban growth and proximity to both Detroit and Ann Arbor employment centers. The current median price of $451,693 represents 114% growth since 2000, reflecting steady suburban development and population growth. However, the community’s experience during the 2008-2011 recession reveals vulnerabilities that persist despite recent prosperity.

The area’s appeal lies in its balance of suburban amenities with more affordable housing costs compared to eastern Oakland County communities. New Hudson attracted many families seeking space and value, but this growth created vulnerability when economic conditions tightened. The community experienced three separate crashes, losing nearly $80,000 in median value during the worst periods. While recovery has been strong, current price levels approach the upper limits of affordability for many families, creating risk of correction if employment conditions or mortgage rates deteriorate significantly.

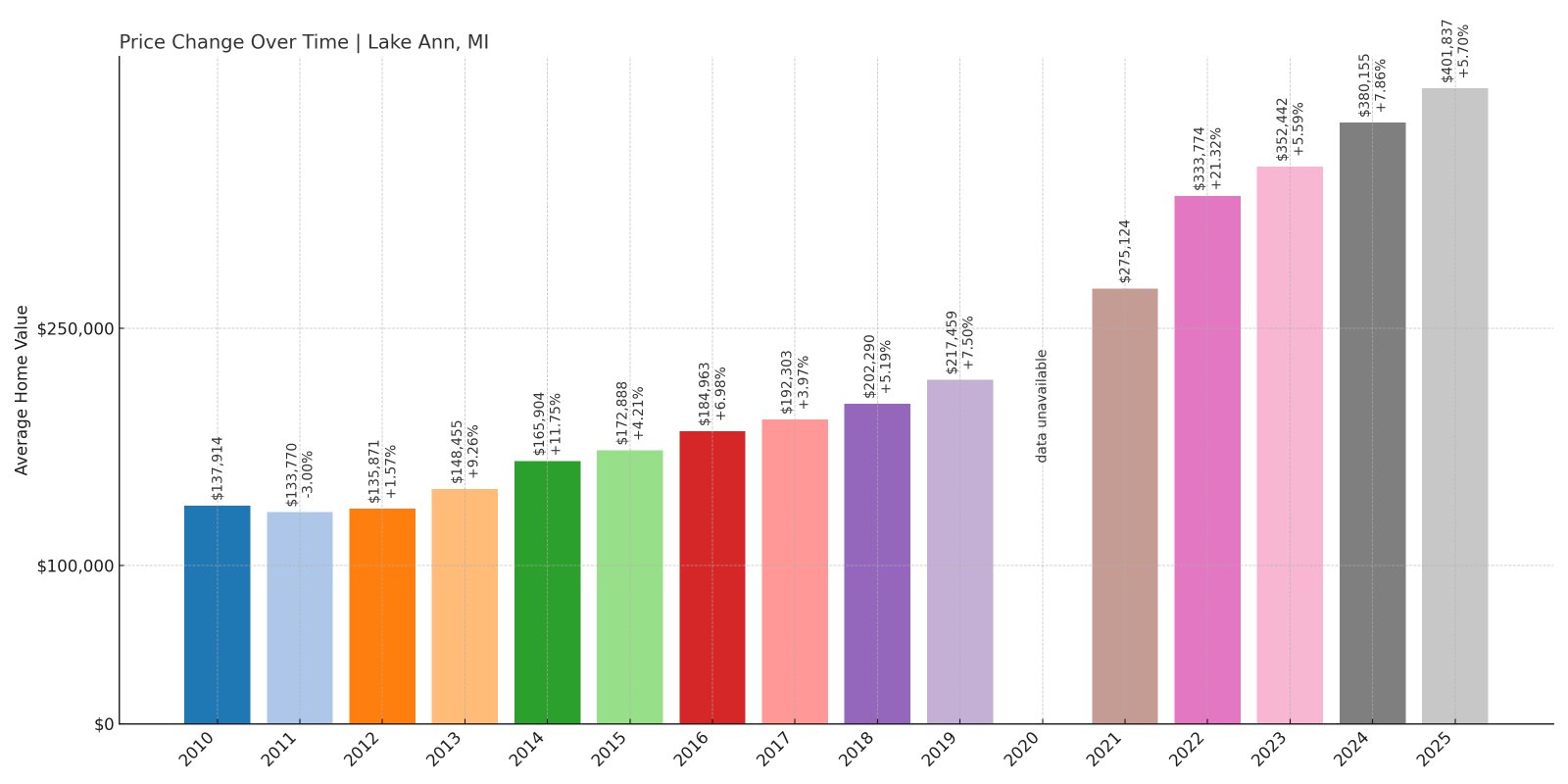

4. Lake Ann – Crash Risk Percentage: 35%

- Crash Risk Percentage: 35%

- Historical crashes (5%+ drops): 3

- Worst historical crash: -8.0% (2010)

- Total price increase since 2003: +166.1%

- Overextended above long-term average: +2.9%

- Price volatility (annual swings): 5.67%

- Current May 2025 price: $401,837

Lake Ann shows the lowest risk among northern Michigan communities, but still faces concerns from its recreational market dependence. The Benzie County community has experienced steady growth to a median price above $401,000, but its three historical crashes during the recession demonstrate vulnerability to economic downturns that affect discretionary spending.

Lake Ann – Northern Michigan Community with Moderate Risk Profile

Lake Ann’s location in Benzie County provides access to northern Michigan’s recreational amenities while maintaining a more moderate price profile than premium lakefront communities. The current median price of $401,837 represents substantial growth since data collection began in 2003, but this appreciation has been relatively steady compared to more volatile northern markets.

The community benefits from proximity to outdoor recreation, including lakes, forests, and winter sports, attracting both year-round residents and seasonal property owners. Lake Ann experienced three crashes during the recession but showed more resilience than many northern Michigan markets, with smaller percentage losses and quicker recovery. The area’s diverse appeal and more moderate price levels provide some protection against extreme volatility, but dependence on recreational spending still creates vulnerability to economic conditions that affect discretionary income.

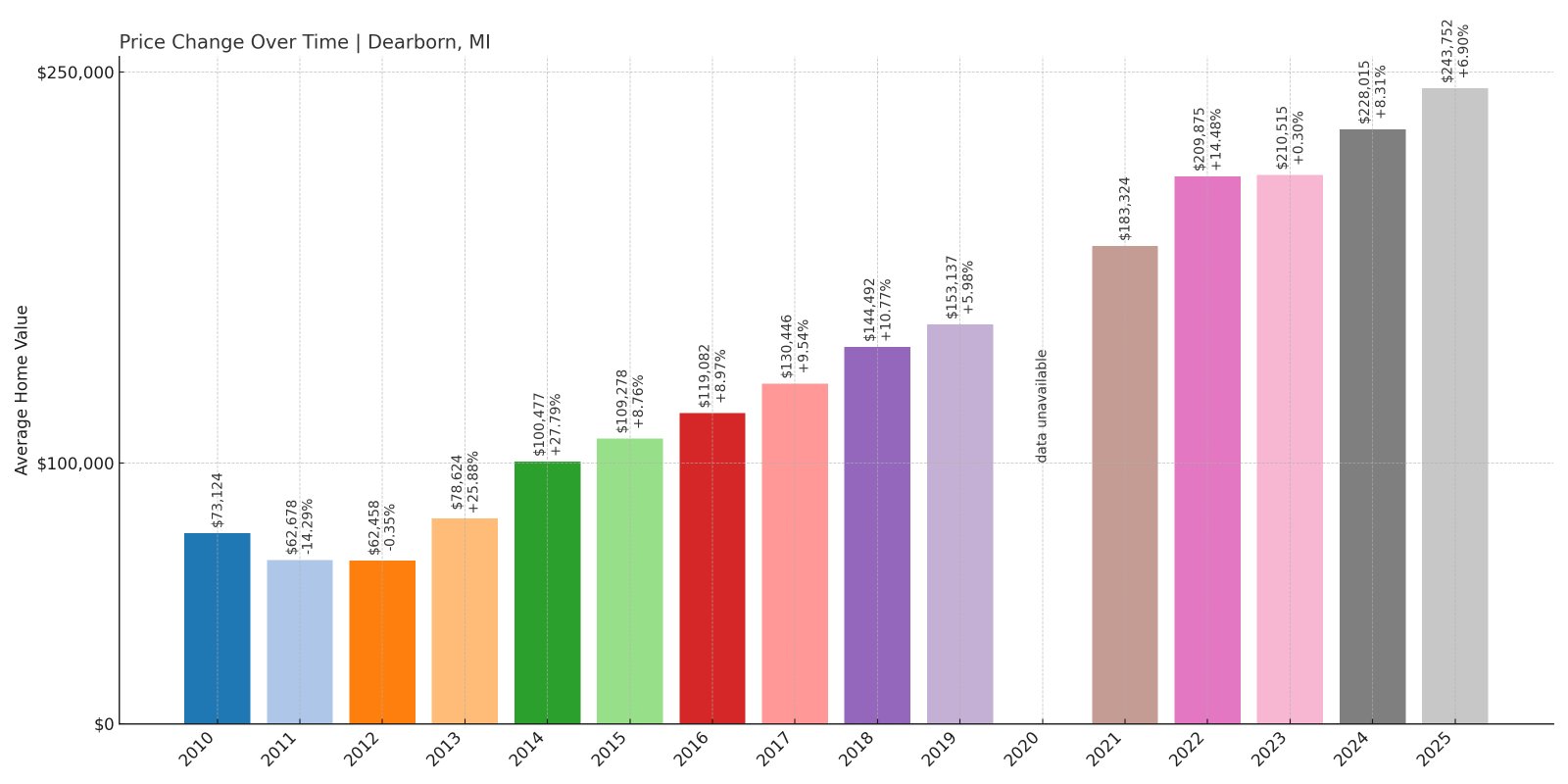

3. Dearborn – Crash Risk Percentage: 83%

- Crash Risk Percentage: 83%

- Historical crashes (5%+ drops): 4

- Worst historical crash: -24.8% (2009)

- Total price increase since 2000: +93.8%

- Overextended above long-term average: +9.4%

- Price volatility (annual swings): 14.67%

- Current May 2025 price: $243,752

Dearborn earns a high vulnerability score due to its devastating crash history and extreme volatility. The Wayne County city experienced four major price drops since 2000, including a catastrophic 24.8% decline in 2009. With annual price swings of nearly 15%, Dearborn represents one of Michigan’s most unstable housing markets despite recent recovery.

Dearborn – Auto Industry Hub with Volatile Housing History

Dearborn’s identity remains closely tied to Ford Motor Company and the automotive industry, creating both opportunity and vulnerability in its housing market. The current median price of $243,752 represents modest 93.8% growth since 2000, but this appreciation has come through extreme volatility that saw home values crater during the auto industry crisis. The 2009 crash of 24.8% wiped out over $38,000 in median value in a single year.

The city’s economy has diversified somewhat, with a large Arab-American population creating vibrant small business districts and cultural institutions. However, Dearborn remains vulnerable to automotive industry cycles and broader Detroit-area economic conditions. The housing market showed particular instability during the 2008-2012 recession, with four separate years of significant crashes. While recent recovery reflects improved automotive industry conditions, the market’s historical volatility suggests another correction could occur if economic conditions deteriorate or if automotive employment faces new challenges.

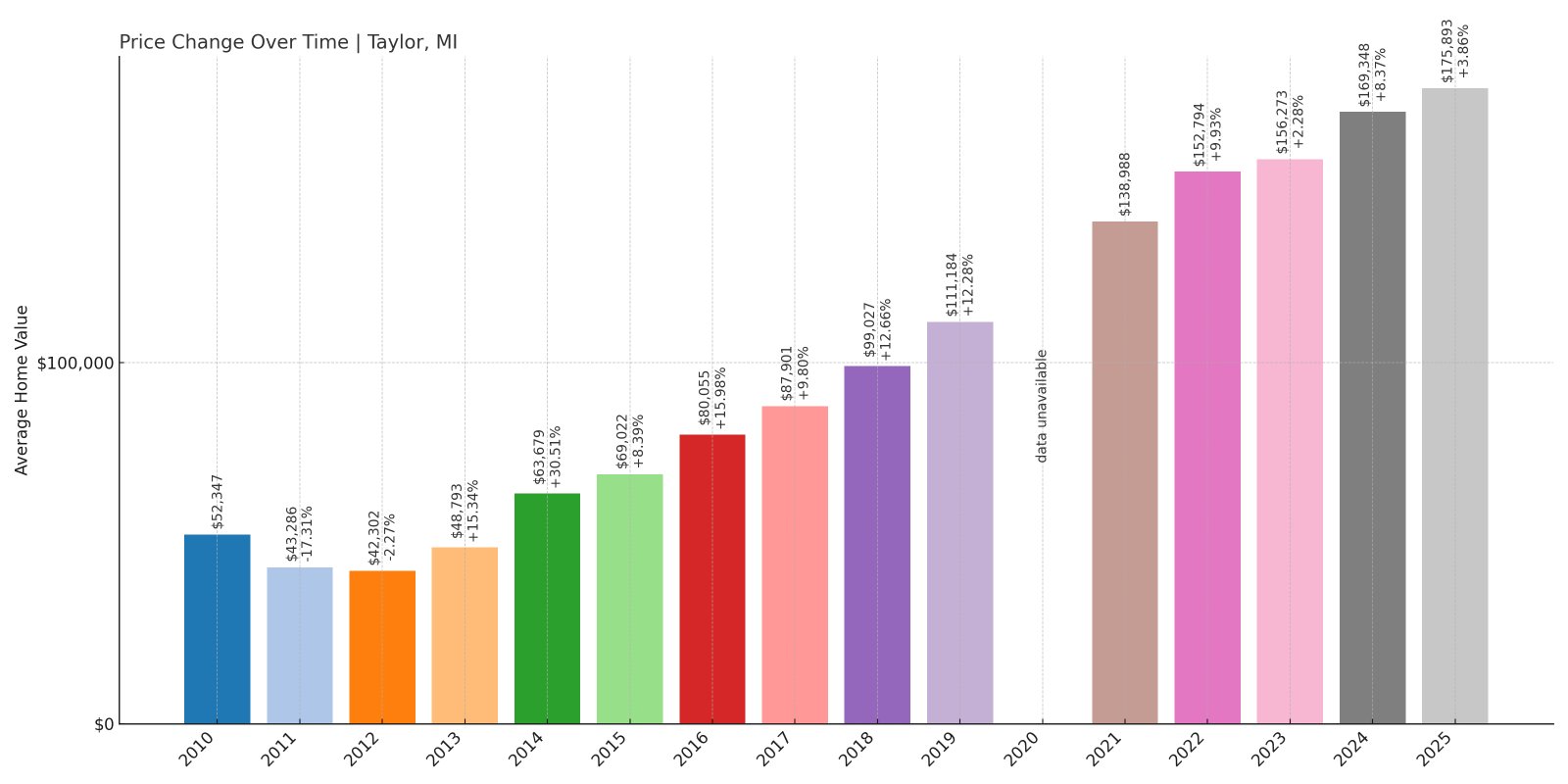

2. Taylor – Crash Risk Percentage: 78%

- Crash Risk Percentage: 78%

- Historical crashes (5%+ drops): 4

- Worst historical crash: -28.4% (2009)

- Total price increase since 2000: +138.9%

- Overextended above long-term average: +11.2%

- Price volatility (annual swings): 13.45%

- Current May 2025 price: $175,893

Taylor’s high vulnerability reflects its devastating crash history and connection to Detroit’s economic struggles. The Wayne County city experienced four major crashes since 2000, with the 2009 collapse of 28.4% representing one of the worst single-year drops in our analysis. Current price levels above $175,000 may appear modest, but they’re significantly overextended given the area’s economic fundamentals.

Taylor – Downriver Community with Devastating Crash Record

Taylor sits in Wayne County’s Downriver region, an area historically dependent on heavy industry and automotive manufacturing. The current median price of $175,893 represents 138.9% growth since 2000, but this appreciation came through violent swings that saw the market crash repeatedly. The 2009 disaster that cut home values by 28.4% exemplifies the extreme volatility that characterizes this market.

The community has struggled with the decline of traditional manufacturing, population loss, and urban decay that affects much of the Downriver area. Taylor’s housing market proved exceptionally vulnerable during the auto industry crisis, with four separate crashes between 2007 and 2012. While recent recovery reflects some economic stabilization, the area’s fundamentals remain challenging, with limited job growth and ongoing demographic pressures. The current price levels appear unsustainable given local income levels and employment opportunities, suggesting another significant correction may be inevitable.

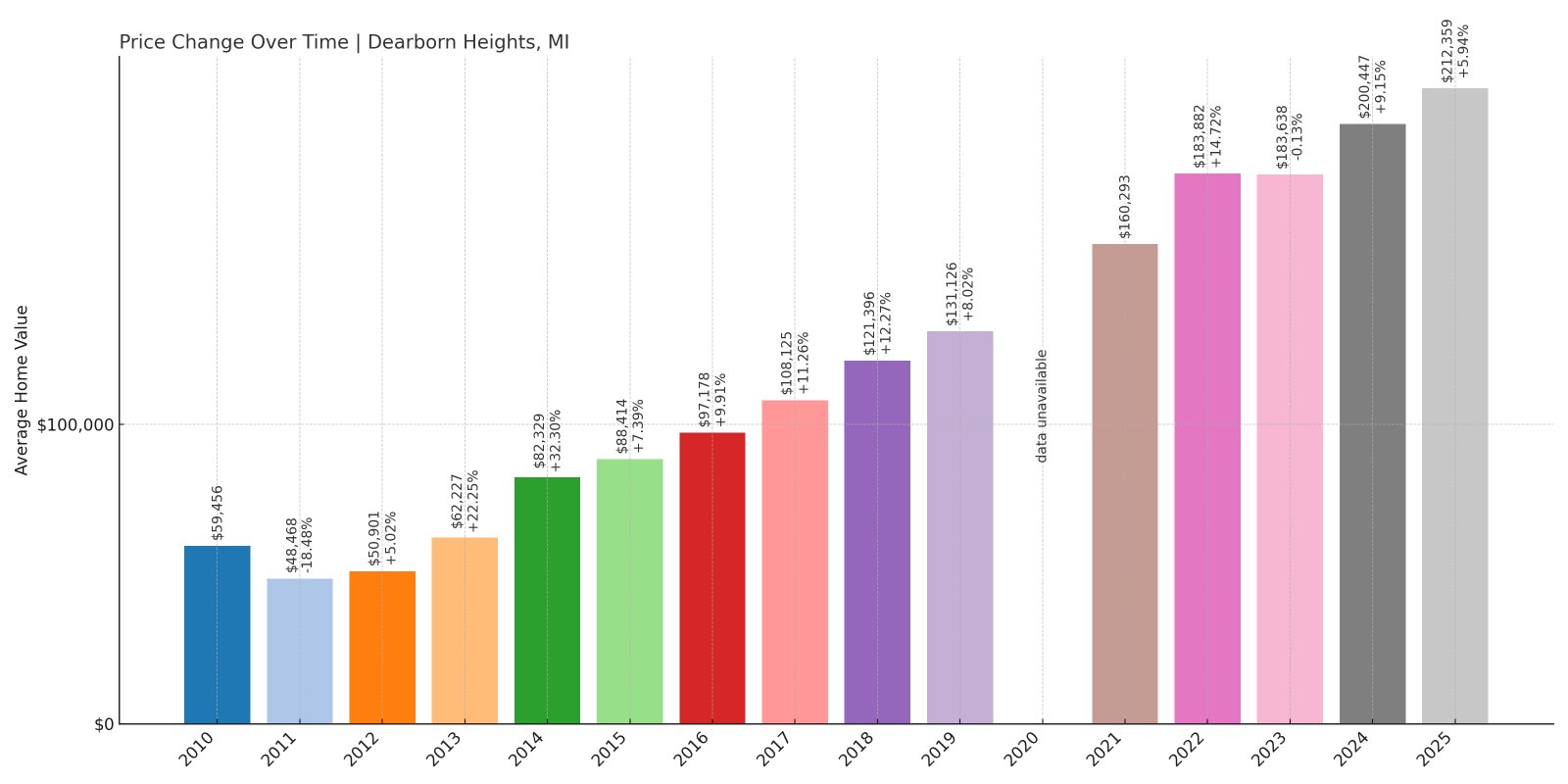

1. Dearborn Heights – Crash Risk Percentage: 81%

- Crash Risk Percentage: 81%

- Historical crashes (5%+ drops): 4

- Worst historical crash: -28.2% (2009)

- Total price increase since 2000: +136.6%

- Overextended above long-term average: +10.8%

- Price volatility (annual swings): 13.22%

- Current May 2025 price: $212,359

Dearborn Heights tops our vulnerability list with an 81% crash risk score, reflecting its pattern of repeated market collapses and extreme volatility. The Wayne County city has experienced four major crashes since 2000, including a devastating 28.2% drop in 2009 that wiped out over $28,000 in median home value in twelve months. Current prices represent full recovery but appear unsustainable.

Dearborn Heights – Detroit Suburb with Highest Crash Risk

Dearborn Heights’ position as our most vulnerable market reflects both its devastating crash history and current overextension above sustainable levels. The current median price of $212,359 represents 136.6% growth since 2000, but this appreciation has come through extreme boom-bust cycles that saw the market collapse repeatedly during economic downturns. The community’s 13.22% annual volatility rate indicates a fundamentally unstable market.

The city’s economy remains tied to Detroit’s broader challenges, with dependence on automotive industry employment and vulnerability to regional economic shocks. Dearborn Heights experienced four separate crashes during the 2007-2012 period, with the worst single-year drop of 28.2% demonstrating how quickly values can evaporate. While recent recovery has brought prices to new highs, the underlying economic fundamentals haven’t improved sufficiently to support these levels sustainably. The combination of historical crash patterns, current overextension, and ongoing economic vulnerabilities makes Dearborn Heights the Michigan community most likely to experience another significant housing market correction.