Would you like to save this?

Ohio’s top-tier housing markets are hitting new highs—and not just in the usual zip codes. According to the latest Zillow Home Value Index, these 20 towns now lead the state in home prices, driven by long-term demand, desirable locations, and steady growth. From wealthy enclaves near Columbus and Cincinnati to upscale communities just outside Cleveland, these are the places where Ohio real estate has gone premium. Each town combines deep roots with rising values—and for buyers looking at the top of the market, they’re as exclusive as it gets.

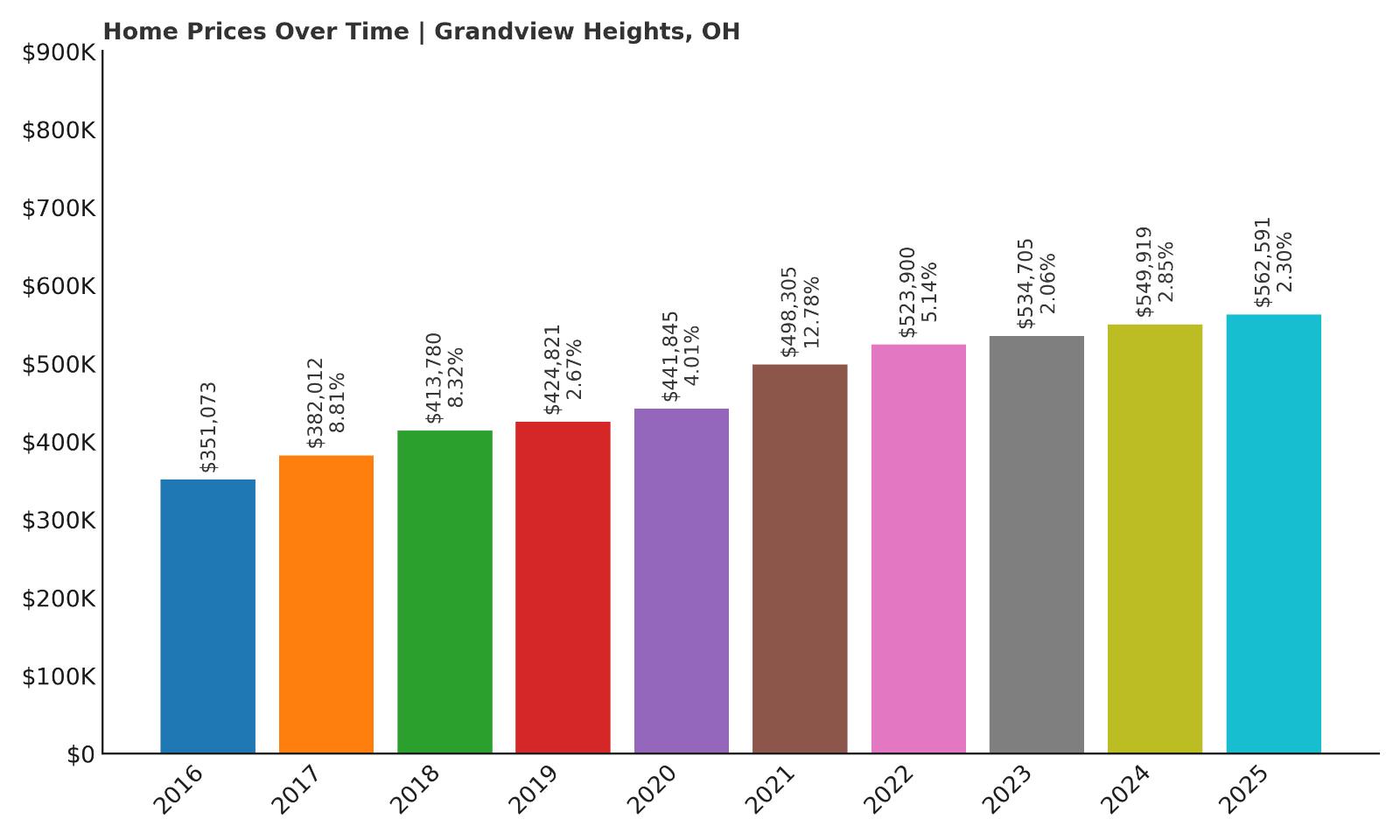

20. Grandview Heights – 60% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $351,073

- 2017: $382,012 (+$30,939, +8.81% from previous year)

- 2018: $413,780 (+$31,768, +8.32% from previous year)

- 2019: $424,821 (+$11,042, +2.67% from previous year)

- 2020: $441,845 (+$17,024, +4.01% from previous year)

- 2021: $498,305 (+$56,460, +12.78% from previous year)

- 2022: $523,900 (+$25,594, +5.14% from previous year)

- 2023: $534,705 (+$10,806, +2.06% from previous year)

- 2024: $549,919 (+$15,214, +2.85% from previous year)

- 2025: $562,591 (+$12,672, +2.30% from previous year)

Grandview Heights has seen home prices climb by 60% since 2016, with values growing steadily nearly every year. After a strong jump in 2021, growth moderated, but prices continued their upward trend. The most recent data from 2025 puts the average home value at $562,591, a significant increase from $351,073 just nine years ago. These consistent gains reflect both demand for housing in desirable inner suburbs and broader appreciation trends around Columbus. Even in years with modest gains, prices never backtracked, reinforcing Grandview Heights as a stable and increasingly premium place to live.

Grandview Heights – Desirable Suburb With a Central Location

Located just west of downtown Columbus, Grandview Heights is a compact, walkable suburb that blends tree-lined residential streets with a vibrant commercial district. It’s known for excellent schools, historic homes, and easy access to the city’s tech and healthcare job centers. The town has become especially popular with young professionals and families looking to stay close to urban life without sacrificing community charm. Grandview Yard, a mixed-use development, has added modern amenities and housing to the area, contributing to price growth. Limited inventory and increasing demand have kept prices climbing steadily year after year.

The city’s commitment to maintaining its small-town feel while embracing smart development has helped preserve its high desirability. The continued appreciation in property values reflects both location and livability, making Grandview Heights one of the most expensive towns in Ohio in 2025.

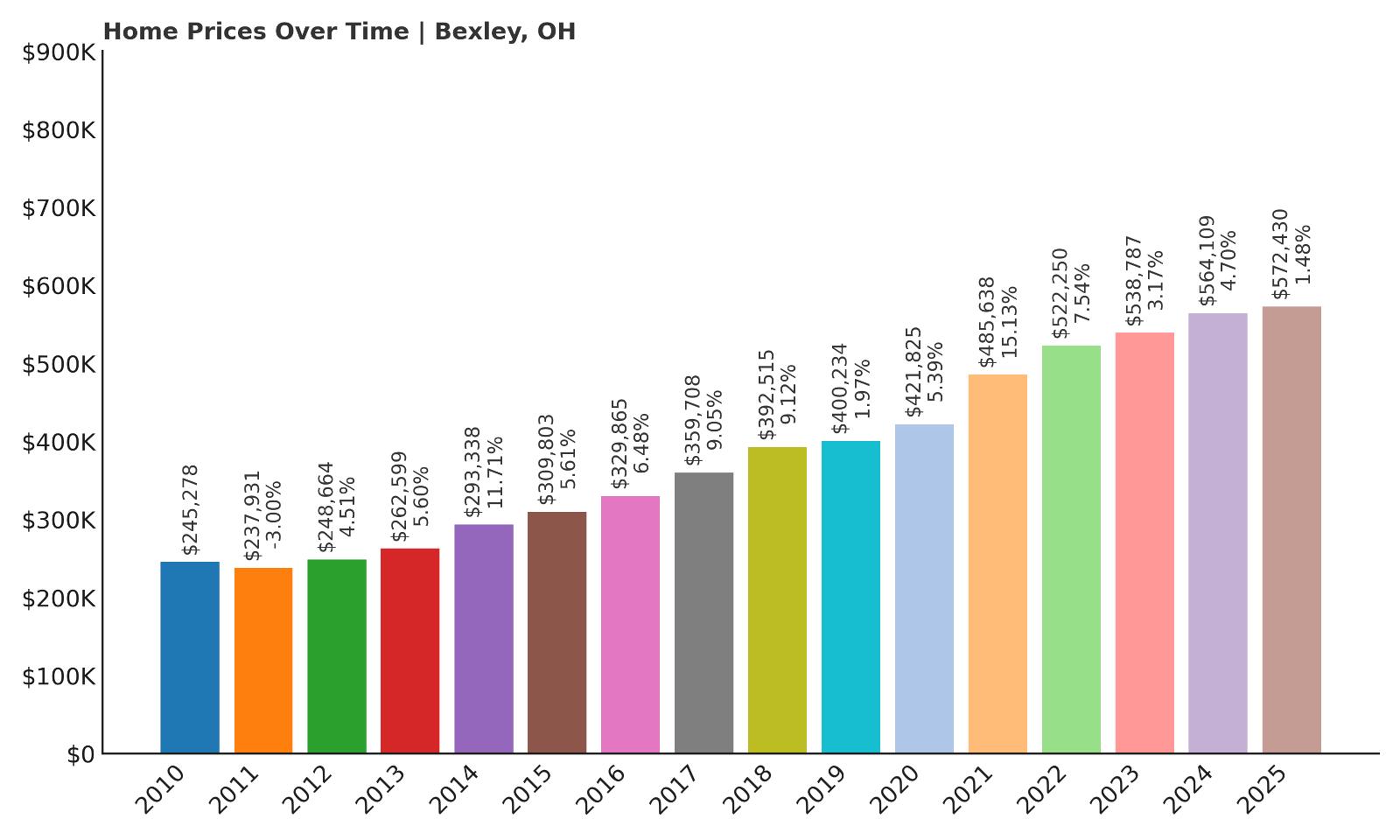

19. Bexley – 133% Home Price Increase Since 2010

- 2010: $245,278

- 2011: $237,931 (-$7,347, -3.00% from previous year)

- 2012: $248,664 (+$10,733, +4.51% from previous year)

- 2013: $262,599 (+$13,935, +5.60% from previous year)

- 2014: $293,338 (+$30,739, +11.71% from previous year)

- 2015: $309,803 (+$16,466, +5.61% from previous year)

- 2016: $329,865 (+$20,062, +6.48% from previous year)

- 2017: $359,708 (+$29,843, +9.05% from previous year)

- 2018: $392,515 (+$32,807, +9.12% from previous year)

- 2019: $400,234 (+$7,720, +1.97% from previous year)

- 2020: $421,825 (+$21,590, +5.39% from previous year)

- 2021: $485,638 (+$63,813, +15.13% from previous year)

- 2022: $522,250 (+$36,612, +7.54% from previous year)

- 2023: $538,787 (+$16,538, +3.17% from previous year)

- 2024: $564,109 (+$25,322, +4.70% from previous year)

- 2025: $572,430 (+$8,321, +1.48% from previous year)

Since 2010, home prices in Bexley have risen over 133%, reflecting steady growth with a few standout years of double-digit gains. 2021 marked the biggest jump, with home values leaping over 15%. While recent years have seen a slower pace, the overall trend remains firmly upward. From under $250K in 2010 to over $570K in 2025, Bexley has established itself as one of central Ohio’s most premium markets. These figures point to both long-term strength and a resilient market even in cooling cycles.

Bexley – Prestige, Schools, and Historic Architecture

Kitchen Style?

Bexley is one of Columbus’s most prestigious suburbs, known for its stately homes, top-ranked public schools, and close proximity to downtown. It’s home to Capital University and the Ohio Governor’s Mansion, and its tree-lined avenues are packed with century-old houses that blend architectural charm with modern updates. The town attracts families, academics, and professionals who value both location and culture. Bexley’s housing stock is relatively fixed, limiting new construction and helping push prices higher as demand grows.

Strong local amenities, a vibrant business district, and walkability continue to drive interest in the area. In 2025, buyers are still paying a premium for the mix of location, reputation, and historical character that defines Bexley real estate.

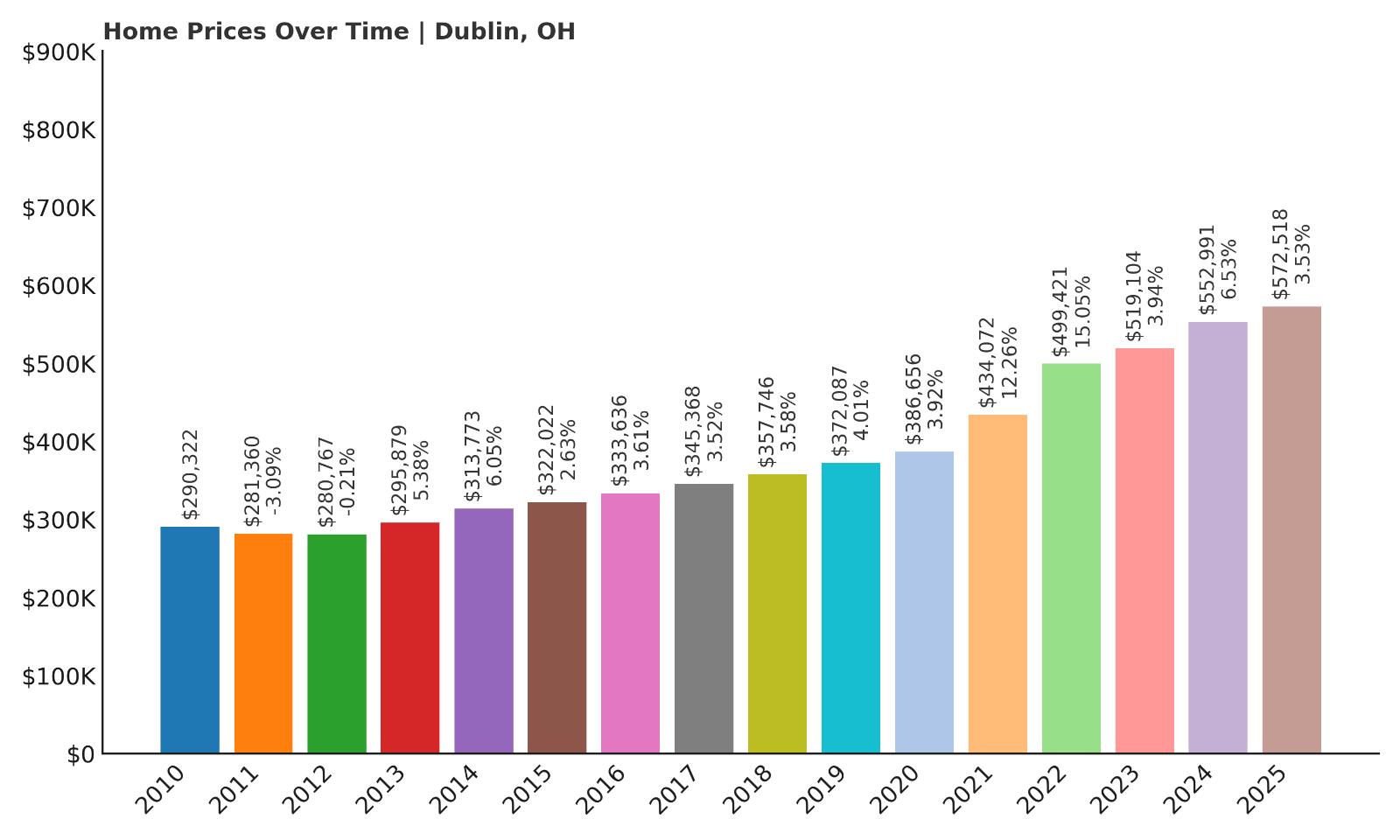

18. Dublin – 97% Home Price Increase Since 2010

- 2010: $290,322

- 2011: $281,360 (-$8,963, -3.09% from previous year)

- 2012: $280,767 (-$592, -0.21% from previous year)

- 2013: $295,879 (+$15,112, +5.38% from previous year)

- 2014: $313,773 (+$17,893, +6.05% from previous year)

- 2015: $322,022 (+$8,250, +2.63% from previous year)

- 2016: $333,636 (+$11,613, +3.61% from previous year)

- 2017: $345,368 (+$11,732, +3.52% from previous year)

- 2018: $357,746 (+$12,378, +3.58% from previous year)

- 2019: $372,087 (+$14,341, +4.01% from previous year)

- 2020: $386,656 (+$14,569, +3.92% from previous year)

- 2021: $434,072 (+$47,416, +12.26% from previous year)

- 2022: $499,421 (+$65,349, +15.05% from previous year)

- 2023: $519,104 (+$19,682, +3.94% from previous year)

- 2024: $552,991 (+$33,887, +6.53% from previous year)

- 2025: $572,518 (+$19,527, +3.53% from previous year)

Dublin’s home values have nearly doubled since 2010, with some of the largest gains occurring in 2021 and 2022. After a modest dip in the early 2010s, prices have grown steadily, with 2022 seeing a 15% jump in just one year. Dublin’s appeal has expanded with the city’s smart development and infrastructure investments. In 2025, the average home costs over $570,000, putting it firmly among Ohio’s top-tier markets. Price gains here have outpaced many neighboring areas, reflecting its desirability and economic momentum.

Dublin – High-Tech Suburb With Family Appeal

Hunting Valley Town Image

Dublin, northwest of Columbus, is a thriving suburban city best known for its tech-friendly business base, strong public schools, and spacious newer homes. It’s also home to the U.S. headquarters of several major corporations, including Cardinal Health. The city’s rapid growth has been managed through careful urban planning, ensuring green spaces and commuter access remain intact. The Bridge Park development has added a modern, mixed-use center that attracts both residents and tourists. Families, in particular, are drawn to the combination of school quality and suburban comfort.

Dublin’s strong economic base and lifestyle amenities have made it a consistent real estate winner. As new amenities have been added, prices have continued to rise—making it one of the most expensive towns in Ohio today.

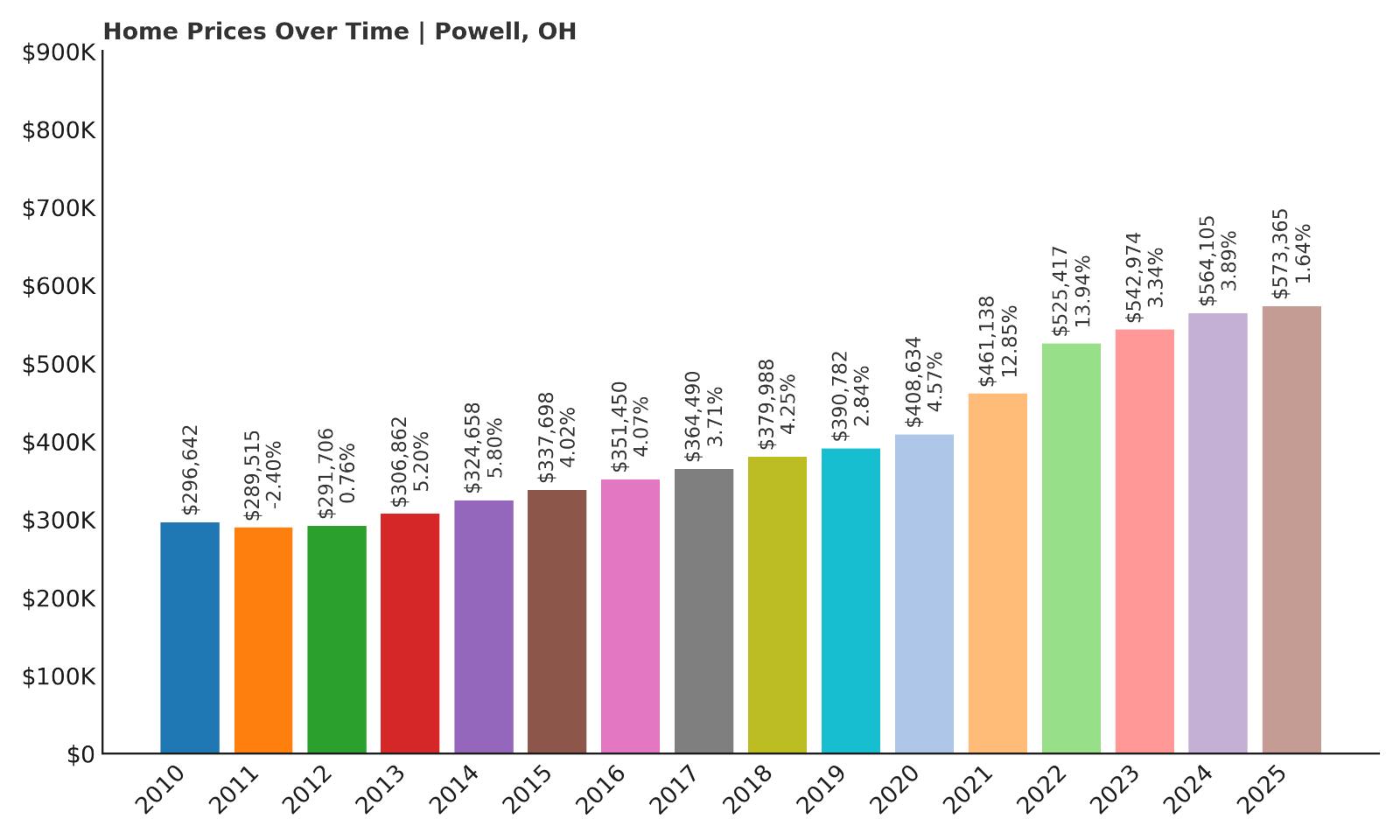

17. Powell – 93% Home Price Increase Since 2010

- 2010: $296,642

- 2011: $289,515 (-$7,127, -2.40% from previous year)

- 2012: $291,706 (+$2,191, +0.76% from previous year)

- 2013: $306,862 (+$15,156, +5.20% from previous year)

- 2014: $324,658 (+$17,796, +5.80% from previous year)

- 2015: $337,698 (+$13,041, +4.02% from previous year)

- 2016: $351,450 (+$13,751, +4.07% from previous year)

- 2017: $364,490 (+$13,040, +3.71% from previous year)

- 2018: $379,988 (+$15,498, +4.25% from previous year)

- 2019: $390,782 (+$10,794, +2.84% from previous year)

- 2020: $408,634 (+$17,851, +4.57% from previous year)

- 2021: $461,138 (+$52,505, +12.85% from previous year)

- 2022: $525,417 (+$64,279, +13.94% from previous year)

- 2023: $542,974 (+$17,557, +3.34% from previous year)

- 2024: $564,105 (+$21,131, +3.89% from previous year)

- 2025: $573,365 (+$9,260, +1.64% from previous year)

Powell has posted an impressive 93% rise in home prices since 2010, nearly doubling in value over 15 years. The most striking gains came in 2021 and 2022, when prices rose over 12% and nearly 14%, respectively. These sharp increases reflect not only national market momentum but also Powell’s increasing popularity as a family-friendly, high-quality suburb. Even in quieter years, price growth remained positive and steady. The average home in Powell was valued at around $296K in 2010, but by 2025, that number jumped to more than $573K. The consistency in year-over-year growth makes Powell one of central Ohio’s most reliable high-end markets. Unlike some volatile areas, Powell’s growth has been gradual, suggesting stable demand. It’s the kind of market that attracts long-term homeowners rather than short-term speculators.

Powell – Family-Friendly Living With a High-End Edge

Powell sits just north of Columbus and blends small-town charm with upscale development. It’s known for its excellent public schools, particularly the Olentangy Local School District, which consistently ranks among Ohio’s best. The town offers a suburban lifestyle with a walkable downtown filled with restaurants, boutiques, and coffee shops. Much of Powell’s housing was built in the past 20 years, which appeals to buyers looking for modern homes on larger lots. Despite the suburban feel, it maintains a close connection to Columbus’s job market, especially in tech and finance. Recreational spaces like the nearby Scioto Reserve Country Club and Highbanks Metro Park add to the quality of life. Powell’s high demand and controlled development pipeline help explain its consistently rising property values. Buyers here are willing to pay a premium for space, school quality, and access to both nature and the city.

The town has also benefited from broader migration trends in Ohio, where families seek larger homes outside of dense urban cores. As more people prioritize quality schools and quieter neighborhoods, Powell continues to see strong interest from buyers moving both within and from outside the state. With a strong civic culture and excellent infrastructure, Powell has earned its place among the top-tier housing markets in Ohio.

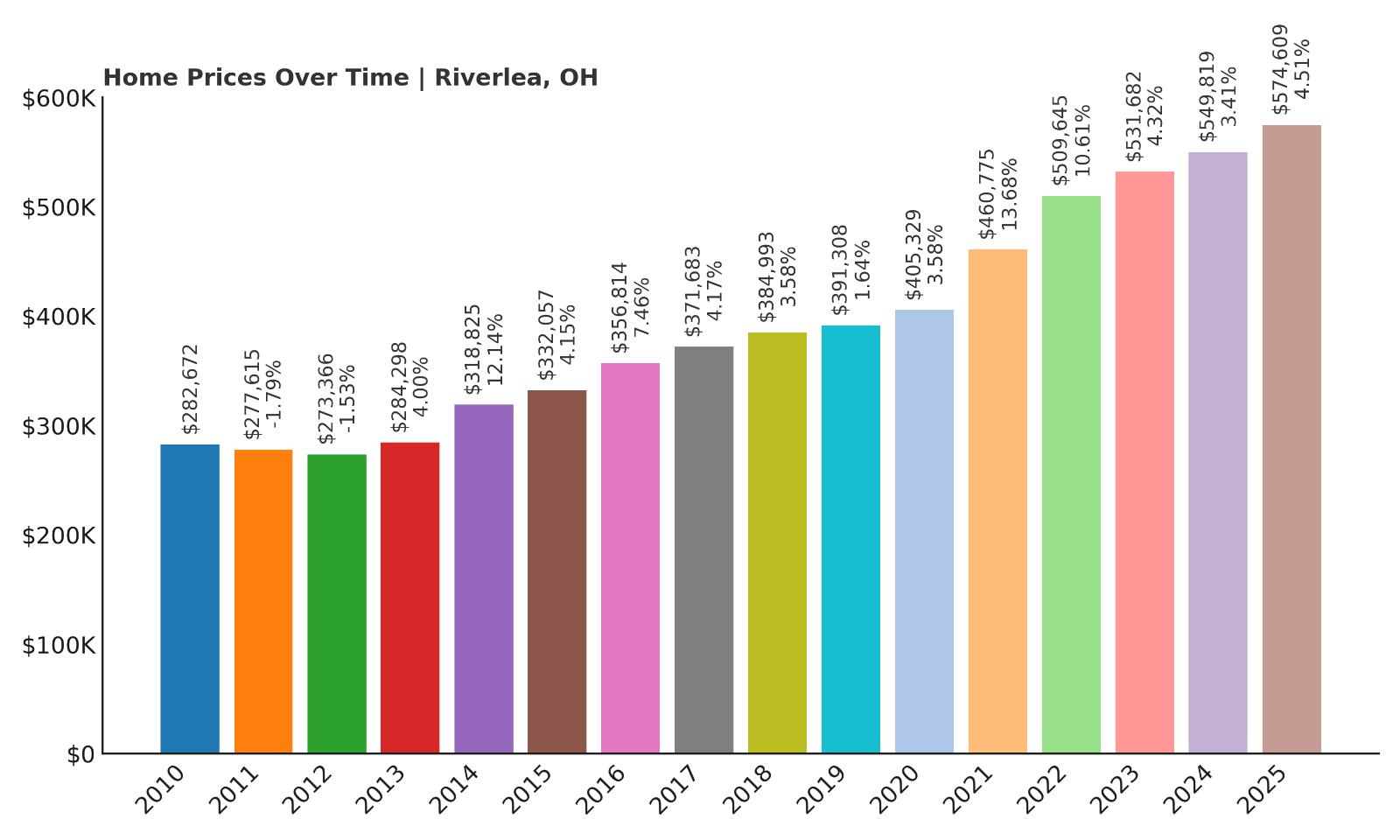

16. Riverlea – 103% Home Price Increase Since 2010

- 2010: $282,672

- 2011: $277,615 (-$5,057, -1.79% from previous year)

- 2012: $273,366 (-$4,249, -1.53% from previous year)

- 2013: $284,298 (+$10,932, +4.00% from previous year)

- 2014: $318,825 (+$34,528, +12.14% from previous year)

- 2015: $332,057 (+$13,231, +4.15% from previous year)

- 2016: $356,814 (+$24,757, +7.46% from previous year)

- 2017: $371,683 (+$14,869, +4.17% from previous year)

- 2018: $384,993 (+$13,311, +3.58% from previous year)

- 2019: $391,308 (+$6,314, +1.64% from previous year)

- 2020: $405,329 (+$14,022, +3.58% from previous year)

- 2021: $460,775 (+$55,446, +13.68% from previous year)

- 2022: $509,645 (+$48,870, +10.61% from previous year)

- 2023: $531,682 (+$22,037, +4.32% from previous year)

- 2024: $549,819 (+$18,137, +3.41% from previous year)

- 2025: $574,609 (+$24,791, +4.51% from previous year)

Riverlea has seen home prices more than double since 2010, with a 103% increase over 15 years. After a slow start and minor declines in the early 2010s, the town quickly picked up momentum with a huge 12% gain in 2014, followed by steady increases each year. The largest leap came in 2021, when prices rose nearly 14% in a single year. By 2025, the average home in Riverlea is valued at over $574,000—up from just $282,000 in 2010. The trend has been strong and steady, without significant dips or volatility, which signals a robust and competitive housing market. Even in 2023–2025, while growth cooled slightly, values still climbed each year. For investors and homeowners alike, the long-term growth has been impressive and consistent.

Riverlea – Quiet, Exclusive, and Centrally Located

Riverlea is a tiny, affluent village tucked between Worthington and Columbus, offering a secluded residential environment while remaining close to major highways and employment centers. It has fewer than 600 residents and only a handful of roads, which adds to its exclusive character. This small footprint has created an extremely limited housing supply, which has helped drive up values as demand outpaces availability. The neighborhood’s charm comes from its mature trees, quiet streets, and spacious single-family homes. While it doesn’t have its own schools, Riverlea is served by the Worthington City School District—one of the most respected in the area.

Its proximity to downtown Columbus, just 15 minutes away, makes it a prime spot for professionals who want space and privacy without sacrificing convenience. Residents benefit from easy access to shops, parks, and services in Worthington, while enjoying the low-profile tranquility Riverlea is known for. This rare mix of peace, prestige, and location has kept Riverlea among the most desirable (and expensive) places to live in central Ohio. As inventory remains tight and interest remains strong, prices are expected to remain elevated through the coming years.

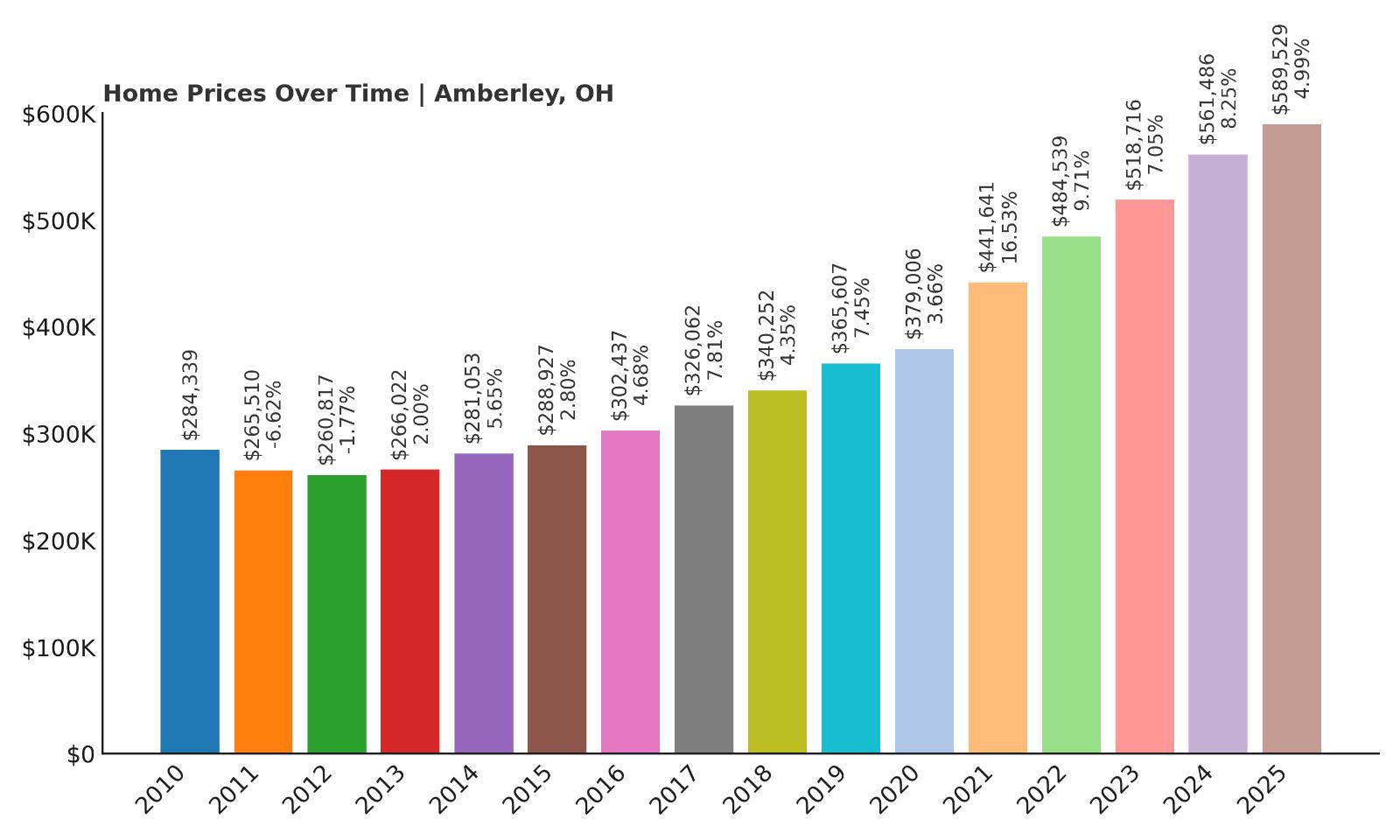

15. Amberley – 107% Home Price Increase Since 2010

- 2010: $284,339

- 2011: $265,510 (-$18,830, -6.62% from previous year)

- 2012: $260,817 (-$4,693, -1.77% from previous year)

- 2013: $266,022 (+$5,205, +2.00% from previous year)

- 2014: $281,053 (+$15,031, +5.65% from previous year)

- 2015: $288,927 (+$7,874, +2.80% from previous year)

- 2016: $302,437 (+$13,510, +4.68% from previous year)

- 2017: $326,062 (+$23,625, +7.81% from previous year)

- 2018: $340,252 (+$14,189, +4.35% from previous year)

- 2019: $365,607 (+$25,356, +7.45% from previous year)

- 2020: $379,006 (+$13,399, +3.66% from previous year)

- 2021: $441,641 (+$62,635, +16.53% from previous year)

- 2022: $484,539 (+$42,898, +9.71% from previous year)

- 2023: $518,716 (+$34,176, +7.05% from previous year)

- 2024: $561,486 (+$42,770, +8.25% from previous year)

- 2025: $589,529 (+$28,043, +4.99% from previous year)

Amberley has seen home prices more than double since 2010, with an impressive 107% increase over 15 years. Early in the decade, the market experienced minor dips, but the momentum began building steadily after 2013. Notably, 2021 marked a breakout year, with a jump of over 16%, followed by continued strong growth in the years that followed. The town’s average home value climbed from roughly $284,000 in 2010 to nearly $590,000 in 2025. The consistent appreciation reflects both rising demand and the limited availability of high-end homes in the area. Amberley’s housing stock features spacious lots and mid-century architectural styles, both of which have gained renewed popularity. Price gains over the last few years have also been supported by rising incomes and strong interest in suburban living near Cincinnati. While the rate of increase has softened slightly since 2022, the overall growth trajectory remains strong and steady.

Amberley – Large Homes, Green Space, and Close to Cincinnati

Amberley Village is a leafy, upscale suburb located just a short drive from downtown Cincinnati. Known for its wide streets, mature trees, and sprawling homes, the area offers a tranquil retreat for families and professionals alike. Many properties sit on half-acre or larger lots, a rarity in the region, adding to the town’s appeal. The village prides itself on its residential character, with limited commercial development and strong local services, including a dedicated police department and maintenance crew. Residents enjoy nearby access to French Park and the Cincinnati Country Day School, both of which are major draws for buyers looking for high-quality lifestyle options. Additionally, Amberley’s Jewish community has deep roots in the area, contributing to a strong sense of tradition and cultural identity.

With quick access to I-71 and I-75, Amberley offers an easy commute to Cincinnati’s business districts, hospitals, and universities. That combination of space, privacy, and proximity has become increasingly attractive in recent years. As younger families move into older homes and renovate them, values continue to rise, making Amberley one of Hamilton County’s most sought-after and stable housing markets in 2025.

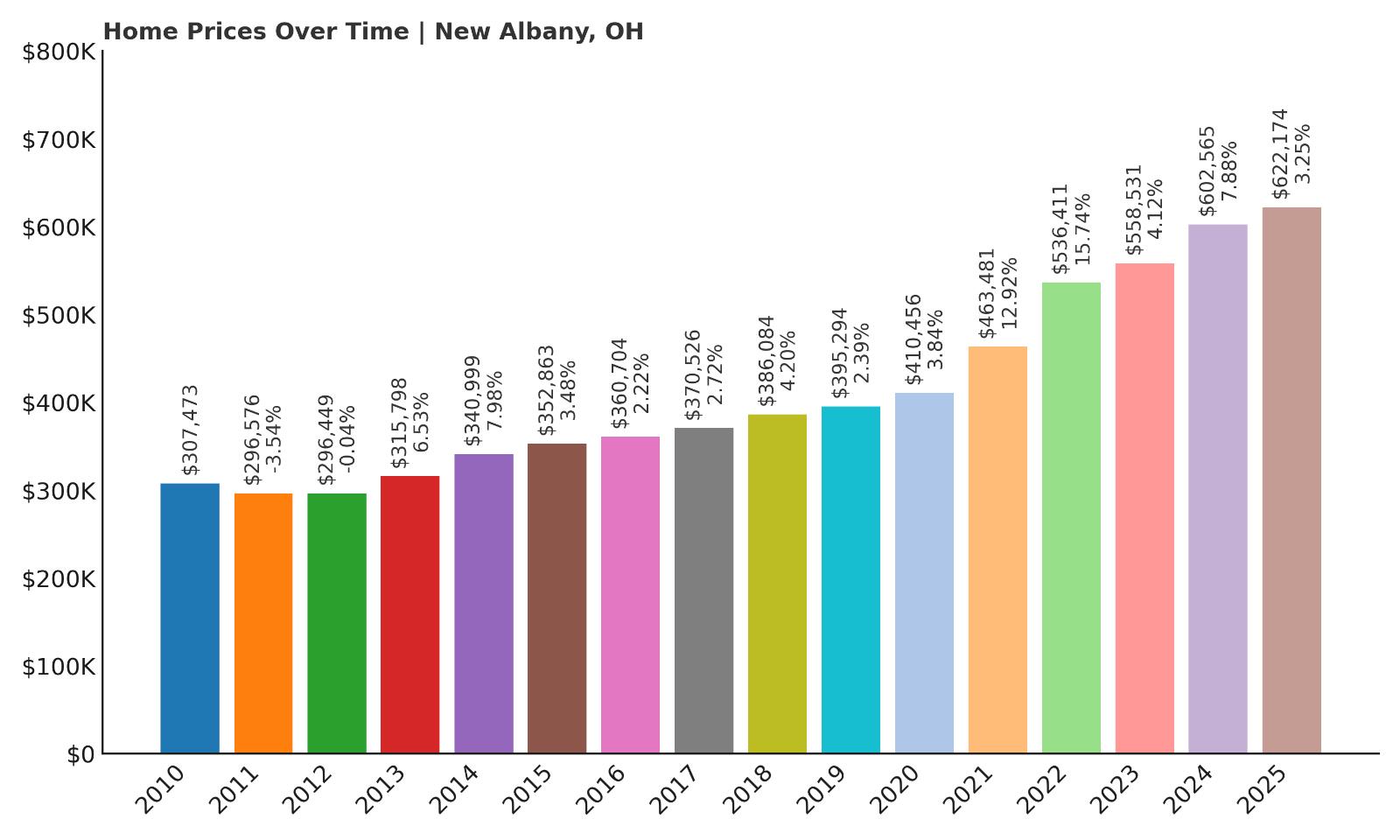

14. New Albany – 102% Home Price Increase Since 2010

- 2010: $307,473

- 2011: $296,576 (-$10,898, -3.54% from previous year)

- 2012: $296,449 (-$126, -0.04% from previous year)

- 2013: $315,798 (+$19,348, +6.53% from previous year)

- 2014: $340,999 (+$25,202, +7.98% from previous year)

- 2015: $352,863 (+$11,864, +3.48% from previous year)

- 2016: $360,704 (+$7,841, +2.22% from previous year)

- 2017: $370,526 (+$9,822, +2.72% from previous year)

- 2018: $386,084 (+$15,558, +4.20% from previous year)

- 2019: $395,294 (+$9,210, +2.39% from previous year)

- 2020: $410,456 (+$15,162, +3.84% from previous year)

- 2021: $463,481 (+$53,026, +12.92% from previous year)

- 2022: $536,411 (+$72,930, +15.74% from previous year)

- 2023: $558,531 (+$22,120, +4.12% from previous year)

- 2024: $602,565 (+$44,034, +7.88% from previous year)

- 2025: $622,174 (+$19,609, +3.25% from previous year)

New Albany has experienced a remarkable rise in home prices over the last 15 years, with values more than doubling since 2010. The most significant jumps came in 2021 and 2022, when values surged nearly 13% and 16%, respectively. As of 2025, the average home in New Albany now costs over $622,000—compared to just $307,000 in 2010. Early price growth was steady but moderate, reflecting stable demand, but the past five years have seen an acceleration driven by major corporate investments in the region. The arrival of Intel’s chip manufacturing project just outside New Albany sparked a wave of economic activity that’s helped push housing demand—and prices—even higher. Meanwhile, year-over-year gains since 2023 have remained solid, indicating that growth is continuing even after the biggest spikes.

New Albany – Master-Planned Growth and Corporate Magnet

New Albany is often cited as one of Ohio’s most successful master-planned communities. Located northeast of Columbus, it combines traditional architecture, manicured neighborhoods, and high-end amenities with a strategic business park that’s attracted national and international employers. The town is home to a growing number of executives, particularly those in tech and biotech fields. The New Albany-Plain Local School District is consistently ranked among the best in the state, which further drives interest from families. Residents benefit from extensive greenways, leisure trails, and a cohesive town center anchored by restaurants, boutiques, and performing arts spaces. The community also features top-tier health facilities and is just a short drive from Easton Town Center, one of Ohio’s largest upscale retail areas.

New Albany’s home prices reflect not just wealth but sustained, thoughtful growth. With high-quality infrastructure, a strong tax base, and proactive zoning, the town is well-positioned for continued appreciation. Whether it’s new builds in luxury subdivisions or historic homes near the town square, demand has remained high across property types, placing New Albany firmly in the top tier of Ohio real estate markets.

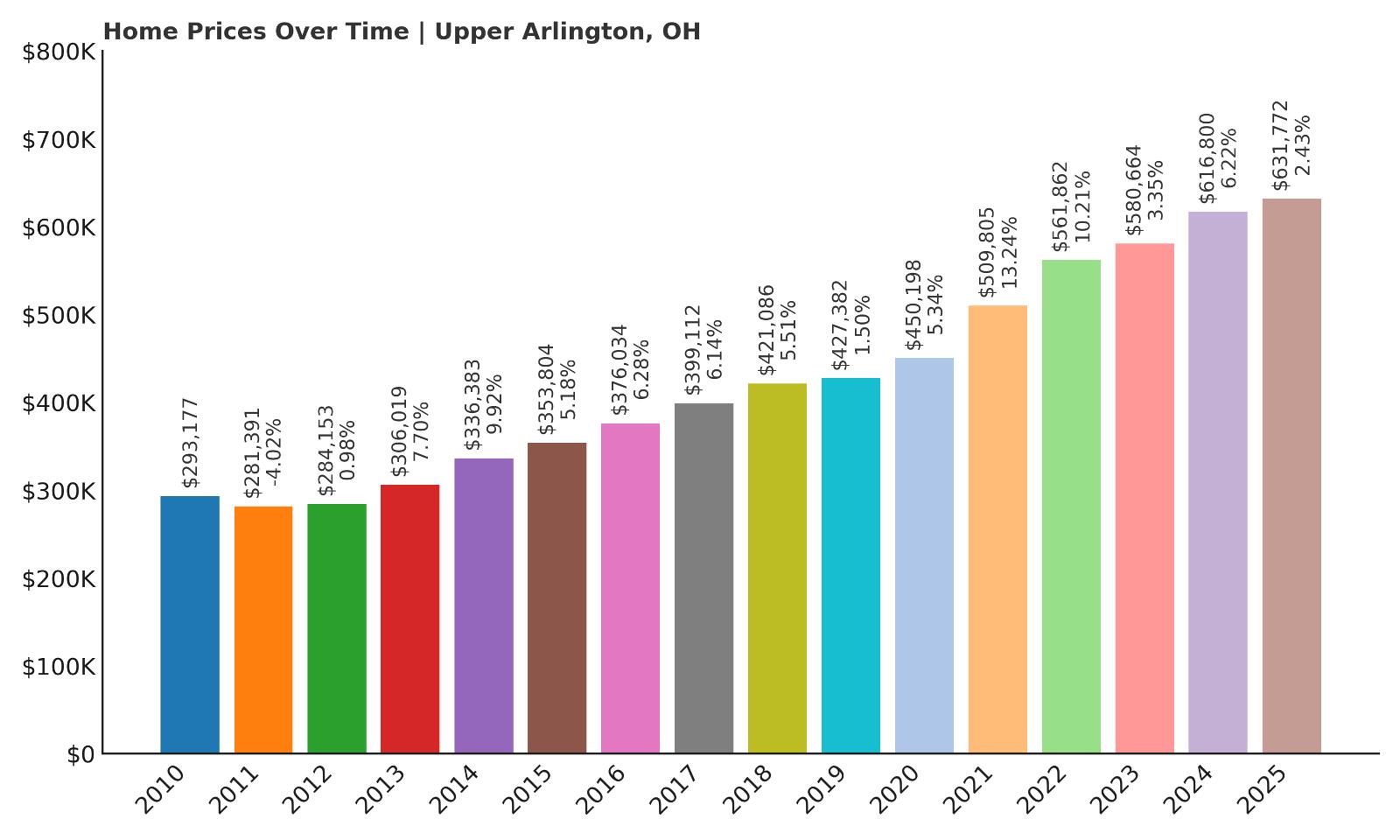

13. Upper Arlington – 115% Home Price Increase Since 2010

- 2010: $293,177

- 2011: $281,391 (-$11,786, -4.02% from previous year)

- 2012: $284,153 (+$2,762, +0.98% from previous year)

- 2013: $306,019 (+$21,866, +7.70% from previous year)

- 2014: $336,383 (+$30,363, +9.92% from previous year)

- 2015: $353,804 (+$17,422, +5.18% from previous year)

- 2016: $376,034 (+$22,230, +6.28% from previous year)

- 2017: $399,112 (+$23,078, +6.14% from previous year)

- 2018: $421,086 (+$21,974, +5.51% from previous year)

- 2019: $427,382 (+$6,296, +1.50% from previous year)

- 2020: $450,198 (+$22,816, +5.34% from previous year)

- 2021: $509,805 (+$59,607, +13.24% from previous year)

- 2022: $561,862 (+$52,057, +10.21% from previous year)

- 2023: $580,664 (+$18,802, +3.35% from previous year)

- 2024: $616,800 (+$36,136, +6.22% from previous year)

- 2025: $631,772 (+$14,972, +2.43% from previous year)

Upper Arlington has seen a 115% increase in home values since 2010, driven by both its prime location and exceptional community amenities. Following some slight stagnation early in the decade, the market began picking up speed around 2013. From that point forward, nearly every year has brought steady price increases, with standout jumps in 2021 and 2022. By 2025, the average home is valued at over $631,000, compared to just $293,000 in 2010. The strong growth reflects high demand, especially among families and professionals seeking access to Columbus’s job centers. Even during years when the broader market slowed, Upper Arlington continued to post solid gains. Its ability to weather national fluctuations reinforces its status as one of the most reliable high-end markets in the state.

Upper Arlington – Historic Prestige and Top Schools Near Columbus

Upper Arlington is one of central Ohio’s most established and affluent suburbs. Located directly northwest of downtown Columbus, the city offers a mix of classic architecture, upscale shopping, and some of the state’s top-rated public schools. Its tree-lined neighborhoods are filled with well-maintained homes from the early and mid-20th century, many of which have been renovated to modern standards while preserving their historic charm. The community is known for its civic engagement, excellent parks system, and access to cultural amenities like the Upper Arlington Public Library and the Lane Avenue shopping district. Residents enjoy quick access to The Ohio State University and major hospitals, making it especially attractive to university staff and medical professionals.

The town’s home values reflect not just its location but also a strong local identity that’s been carefully maintained over decades. New developments are rare, which limits supply and helps maintain high demand. As more families and professionals prioritize neighborhoods with long-standing reputations for quality and stability, Upper Arlington continues to command a premium—and shows no signs of slowing down.

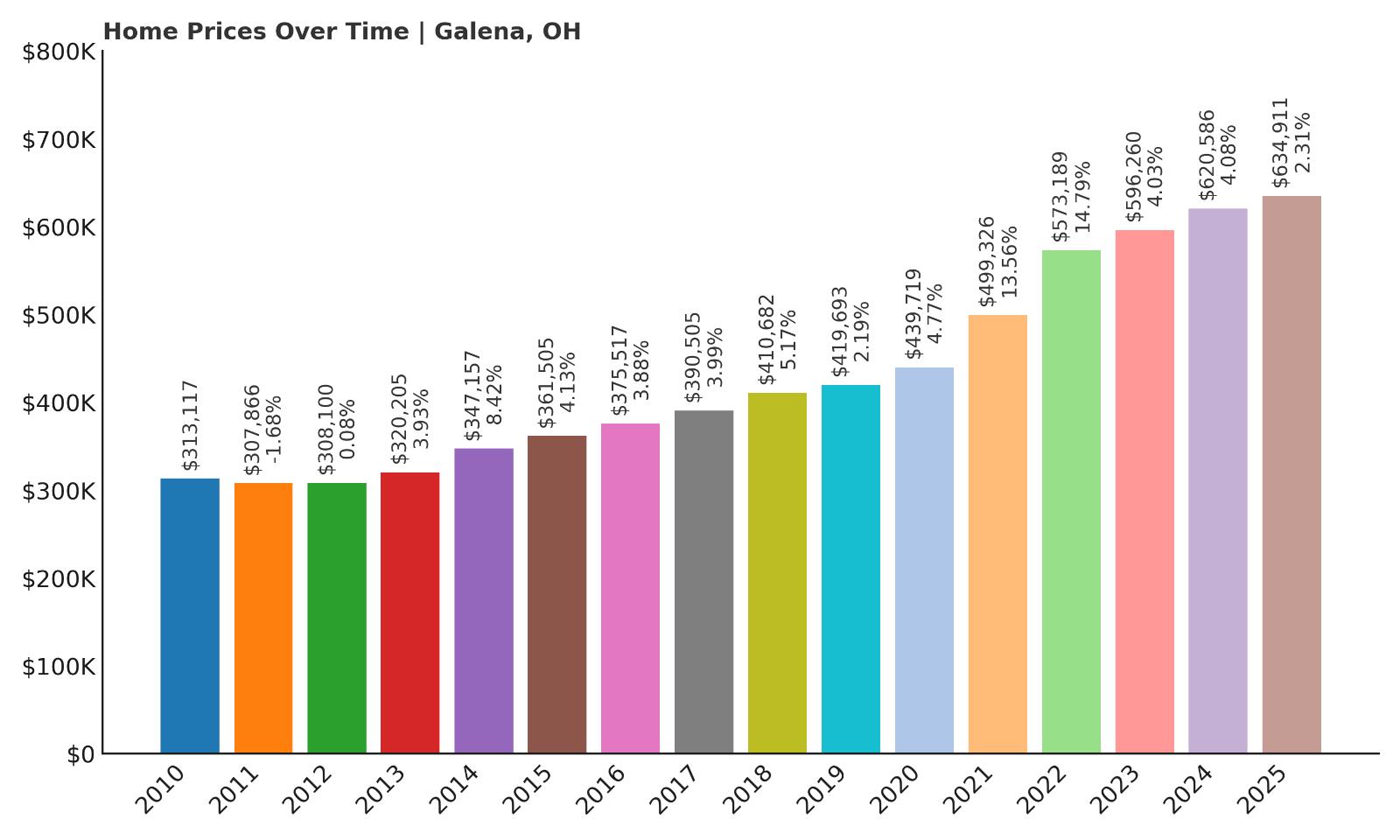

12. Galena – 103% Home Price Increase Since 2010

- 2010: $313,117

- 2011: $307,866 (-$5,251, -1.68% from previous year)

- 2012: $308,100 (+$235, +0.08% from previous year)

- 2013: $320,205 (+$12,104, +3.93% from previous year)

- 2014: $347,157 (+$26,952, +8.42% from previous year)

- 2015: $361,505 (+$14,347, +4.13% from previous year)

- 2016: $375,517 (+$14,012, +3.88% from previous year)

- 2017: $390,505 (+$14,989, +3.99% from previous year)

- 2018: $410,682 (+$20,177, +5.17% from previous year)

- 2019: $419,693 (+$9,010, +2.19% from previous year)

- 2020: $439,719 (+$20,026, +4.77% from previous year)

- 2021: $499,326 (+$59,607, +13.56% from previous year)

- 2022: $573,189 (+$73,863, +14.79% from previous year)

- 2023: $596,260 (+$23,070, +4.02% from previous year)

- 2024: $620,586 (+$24,326, +4.08% from previous year)

- 2025: $634,911 (+$14,325, +2.31% from previous year)

Galena’s home prices have climbed by over 103% since 2010, with some of the fastest growth occurring in the past five years. From a value of around $313,000 in 2010, the town now averages over $634,000 per home in 2025. The most dramatic jumps occurred in 2021 and 2022, where double-digit gains pushed Galena higher on the list of Ohio’s most expensive markets. While growth has slowed slightly since then, the upward trend remains steady and notable. Its strong performance reflects not just housing demand but also a growing appeal among buyers who want space, access to nature, and proximity to Columbus. The town’s market is considered resilient, with few price drops and long-term appreciation patterns that outpace many larger suburbs. This combination makes Galena a top destination for buyers looking to invest in real estate that holds and grows value.

Galena – Rural Charm Meets Rapid Growth

Located in Delaware County, Galena sits just northeast of Columbus and has become a magnet for homebuyers looking for both tranquility and convenience. While Galena maintains a small-town atmosphere, it’s part of the fast-growing Big Walnut School District, which attracts families from across central Ohio. The area is known for scenic lakes, wooded trails, and its proximity to Hoover Reservoir, offering a lifestyle that blends nature with accessibility. Over the past decade, new housing developments have expanded the town’s footprint, while careful zoning has helped preserve its rural feel. That balance has made it particularly attractive to professionals and retirees alike who want open space without sacrificing modern amenities.

Galena’s growth has been fueled by broader trends in Delaware County, one of the fastest-growing counties in the state. As more people move out of Columbus in search of quieter living, Galena continues to benefit. Its rapid rise in home prices speaks to strong demand, limited supply, and a reputation for high-quality living—factors that are likely to keep it near the top of Ohio’s housing market for years to come.

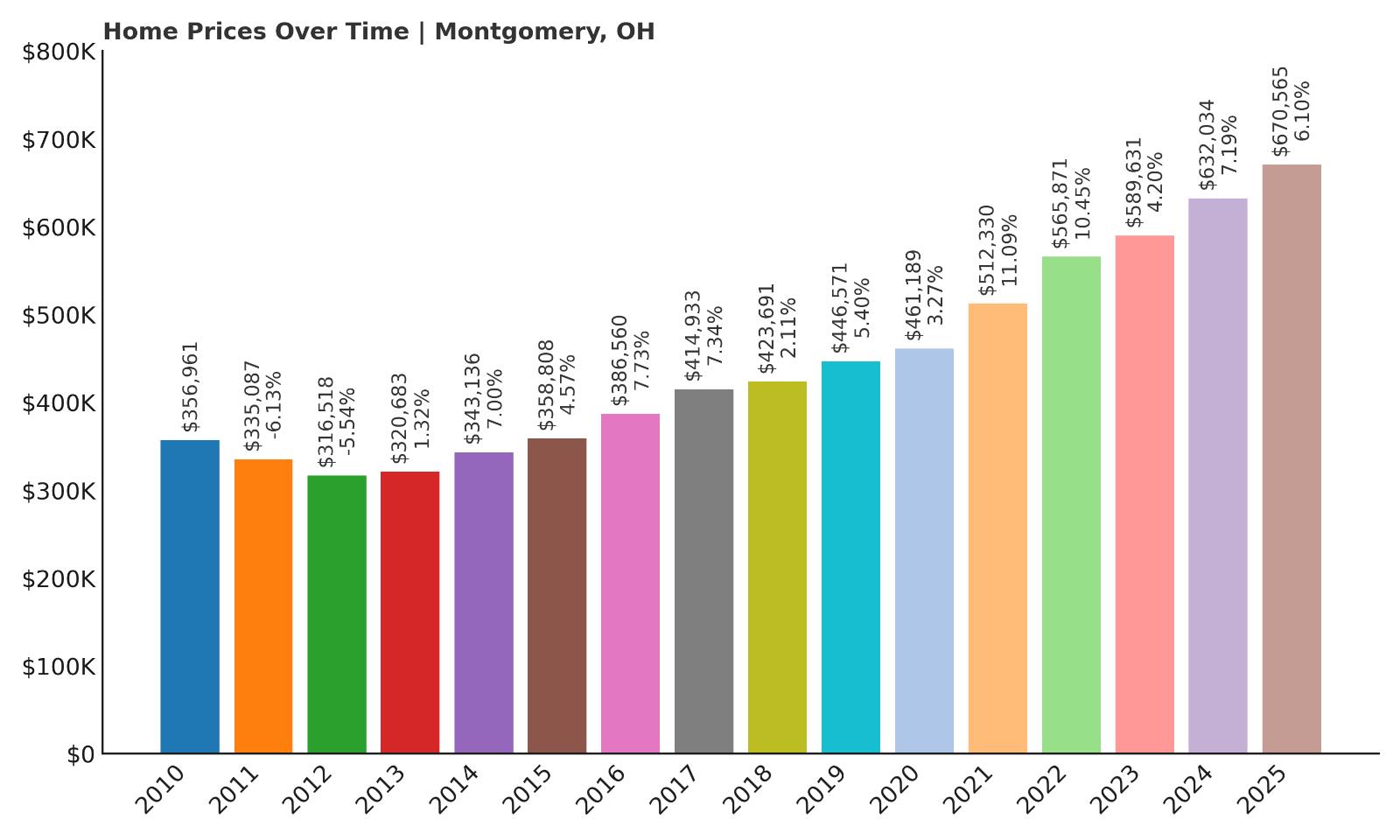

11. Montgomery – 88% Home Price Increase Since 2010

Would you like to save this?

- 2010: $356,961

- 2011: $335,087 (-$21,874, -6.13% from previous year)

- 2012: $316,518 (-$18,568, -5.54% from previous year)

- 2013: $320,683 (+$4,164, +1.32% from previous year)

- 2014: $343,136 (+$22,453, +7.00% from previous year)

- 2015: $358,808 (+$15,672, +4.57% from previous year)

- 2016: $386,560 (+$27,752, +7.73% from previous year)

- 2017: $414,933 (+$28,373, +7.34% from previous year)

- 2018: $423,691 (+$8,758, +2.11% from previous year)

- 2019: $446,571 (+$22,880, +5.40% from previous year)

- 2020: $461,189 (+$14,618, +3.27% from previous year)

- 2021: $512,330 (+$51,141, +11.09% from previous year)

- 2022: $565,871 (+$53,541, +10.45% from previous year)

- 2023: $589,631 (+$23,760, +4.20% from previous year)

- 2024: $632,034 (+$42,402, +7.19% from previous year)

- 2025: $670,565 (+$38,531, +6.10% from previous year)

Montgomery has posted an 88% rise in home values since 2010, with much of the growth occurring steadily year after year. After a slow start in the early 2010s, prices began gaining momentum around 2014 and haven’t looked back. By 2025, average home prices in Montgomery have surged to over $670,000—up from $356,000 in 2010. The biggest gains came between 2020 and 2022, a period marked by pandemic-related housing shifts and increased demand for suburban living. While growth has tapered somewhat since then, the trend continues to favor appreciation. Montgomery’s housing market is considered one of the most stable in the Cincinnati area, with consistent buyer interest and little price volatility. That reliability has helped the city remain one of the most desirable and expensive towns in southern Ohio.

Montgomery – Classic Suburb With Strong Schools and Stability

Montgomery is an upscale suburb located just northeast of Cincinnati. Known for its classic homes, excellent schools, and vibrant town center, the city has long been a favorite among professionals and families. The Sycamore Community School District, which serves the area, is among the highest-rated in Ohio, regularly drawing buyers who prioritize education quality. Montgomery also boasts a historic downtown district filled with restaurants, boutiques, and community spaces, giving it a charming yet functional core. Despite its suburban feel, it offers easy highway access to downtown Cincinnati, making it convenient for commuters across industries.

Montgomery’s long-standing appeal lies in its balance of tradition and progress. The city has modernized without losing its character, and local zoning policies have ensured that development enhances rather than overwhelms existing neighborhoods. The continued demand, coupled with limited housing turnover, has pushed prices upward over the past decade. In 2025, it’s clear that Montgomery isn’t just stable—it’s growing stronger, with values reflecting a market that buyers trust and admire.

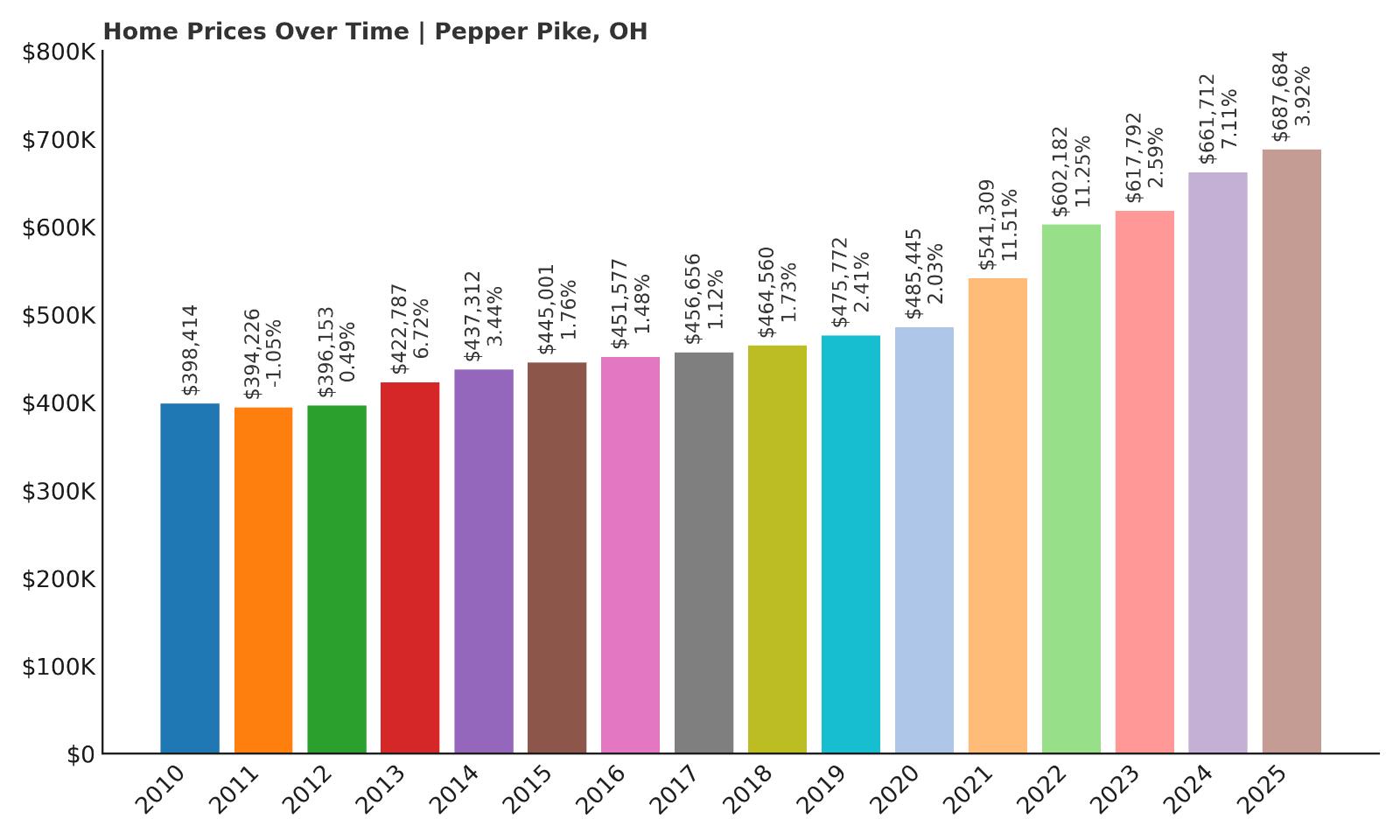

10. Pepper Pike – 72% Home Price Increase Since 2010

- 2010: $398,414

- 2011: $394,226 (-$4,188, -1.05% from previous year)

- 2012: $396,153 (+$1,927, +0.49% from previous year)

- 2013: $422,787 (+$26,633, +6.72% from previous year)

- 2014: $437,312 (+$14,525, +3.44% from previous year)

- 2015: $445,001 (+$7,690, +1.76% from previous year)

- 2016: $451,577 (+$6,575, +1.48% from previous year)

- 2017: $456,656 (+$5,079, +1.12% from previous year)

- 2018: $464,560 (+$7,904, +1.73% from previous year)

- 2019: $475,772 (+$11,212, +2.41% from previous year)

- 2020: $485,445 (+$9,673, +2.03% from previous year)

- 2021: $541,309 (+$55,864, +11.51% from previous year)

- 2022: $602,182 (+$60,873, +11.25% from previous year)

- 2023: $617,792 (+$15,610, +2.59% from previous year)

- 2024: $661,712 (+$43,920, +7.11% from previous year)

- 2025: $687,684 (+$25,972, +3.93% from previous year)

Pepper Pike’s home prices have risen by 72% since 2010, driven by slow but steady increases across most of the decade, punctuated by a sharp spike in 2021 and 2022. The area started off the 2010s with modest growth, reflecting a market that was already on the high end, but appreciation accelerated significantly as buyers flocked to suburban luxury. From just under $400,000 in 2010, the average home value now stands at nearly $688,000 in 2025. These gains were particularly strong between 2020 and 2022, when the market surged in response to renewed interest in low-density, high-quality suburbs. While the pace has cooled slightly since then, values continue to climb year over year, cementing Pepper Pike’s status as one of northeastern Ohio’s most exclusive addresses.

Pepper Pike – Quiet Luxury in Cleveland’s Green Belt

Located about 15 miles east of downtown Cleveland, Pepper Pike is known for its sprawling properties, quiet wooded neighborhoods, and strong civic engagement. It’s part of the Orange City School District, which is consistently recognized for academic excellence and a student-centered approach. The town offers an ideal balance of privacy and accessibility, with upscale shopping at nearby Beachwood Place and recreational amenities like golf courses, parks, and private clubs. Many homes in Pepper Pike are custom-built and situated on large lots, which appeal to buyers seeking space and tranquility without sacrificing proximity to the city’s economic and medical centers.

The architectural mix ranges from contemporary estates to well-preserved mid-century designs, and zoning regulations help maintain the low-density character that residents value. Pepper Pike’s strong reputation for quality of life has made it a go-to destination for doctors, executives, and retirees alike. As demand remains steady and inventory limited, housing prices are likely to stay elevated. The town’s refined, understated appeal continues to make it a standout in the Cleveland metro area housing market.

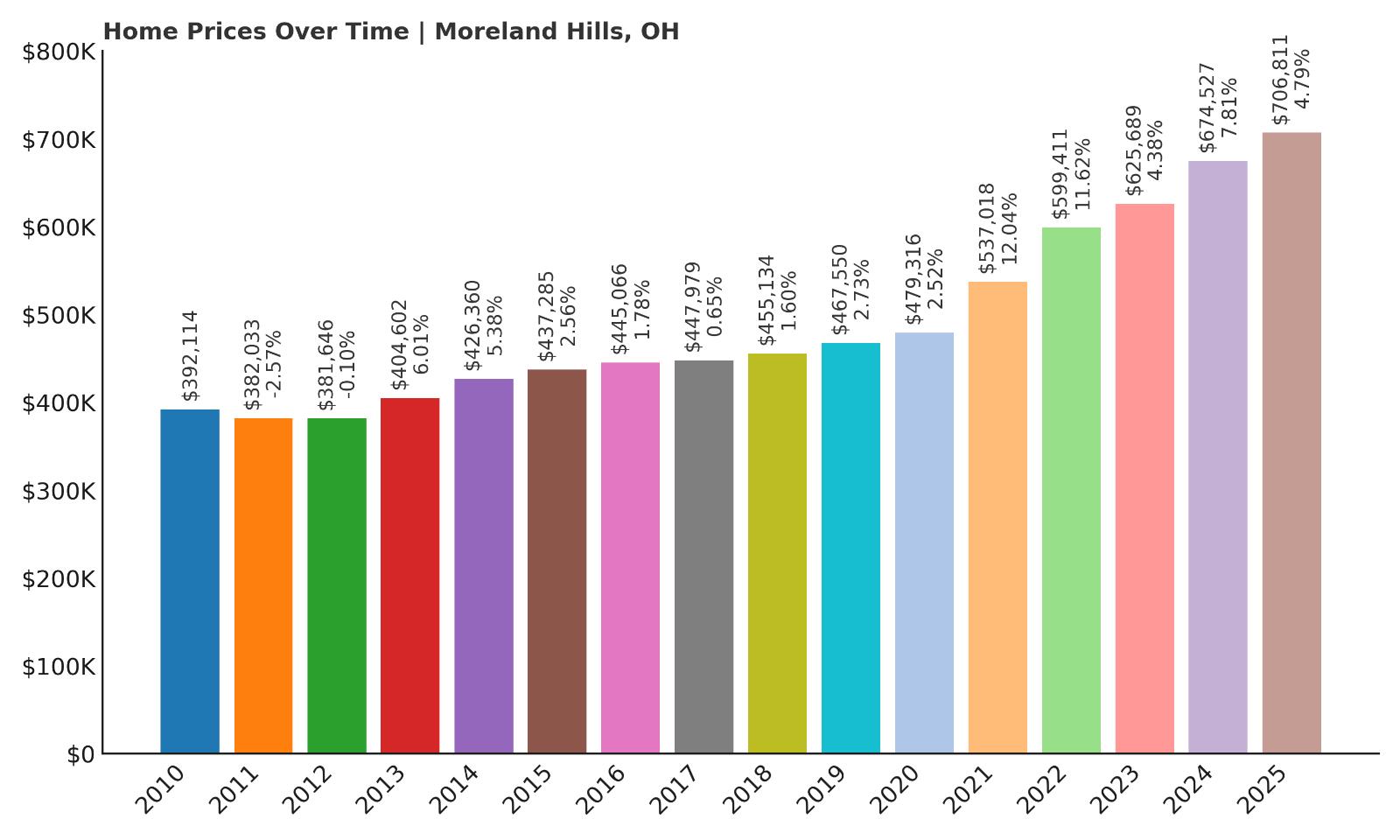

9. Moreland Hills – 80% Home Price Increase Since 2010

- 2010: $392,114

- 2011: $382,033 (-$10,081, -2.57% from previous year)

- 2012: $381,646 (-$387, -0.10% from previous year)

- 2013: $404,602 (+$22,956, +6.01% from previous year)

- 2014: $426,360 (+$21,758, +5.38% from previous year)

- 2015: $437,285 (+$10,925, +2.56% from previous year)

- 2016: $445,066 (+$7,781, +1.78% from previous year)

- 2017: $447,979 (+$2,913, +0.65% from previous year)

- 2018: $455,134 (+$7,154, +1.60% from previous year)

- 2019: $467,550 (+$12,417, +2.73% from previous year)

- 2020: $479,316 (+$11,766, +2.52% from previous year)

- 2021: $537,018 (+$57,701, +12.04% from previous year)

- 2022: $599,411 (+$62,394, +11.62% from previous year)

- 2023: $625,689 (+$26,278, +4.38% from previous year)

- 2024: $674,527 (+$48,837, +7.81% from previous year)

- 2025: $706,811 (+$32,284, +4.79% from previous year)

Moreland Hills has recorded an 80% increase in average home values since 2010, reflecting a long period of steady appreciation punctuated by notable surges in the early 2020s. From around $392,000 in 2010 to over $706,000 in 2025, the town’s housing market has grown significantly, particularly during the boom years of 2021 and 2022 when double-digit annual growth became the norm. Even after that wave, values continued to rise, showing the staying power of this market. Unlike more volatile areas, Moreland Hills has maintained a relatively smooth growth curve, appealing to homeowners who prioritize long-term investment security. With its large properties and highly desirable location, demand here has remained high even as other markets have cooled slightly.

Moreland Hills – Estate Living Near the City

Moreland Hills is located in Cuyahoga County and offers an upscale, semi-rural lifestyle just 20 minutes from downtown Cleveland. It’s best known for its wooded lots, large estate-style homes, and scenic surroundings that provide a peaceful escape from urban life. The area is served by the Orange City School District and benefits from proximity to private institutions like University School and Hathaway Brown. Many homes in Moreland Hills are custom-built and sit on multi-acre properties, with a mix of classic and contemporary architectural styles that reflect the town’s affluent character. Despite its secluded feel, the community is close to major highways, upscale shopping, and top-tier medical centers, making it a convenient choice for professionals and families.

The village is also known for its environmental focus, with nature preserves and protected green space enhancing its rural aesthetic. This commitment to land preservation has limited development and helped drive up property values. Moreland Hills continues to attract discerning buyers who want privacy, prestige, and proximity—all of which contribute to the town’s strong real estate performance in 2025 and beyond.

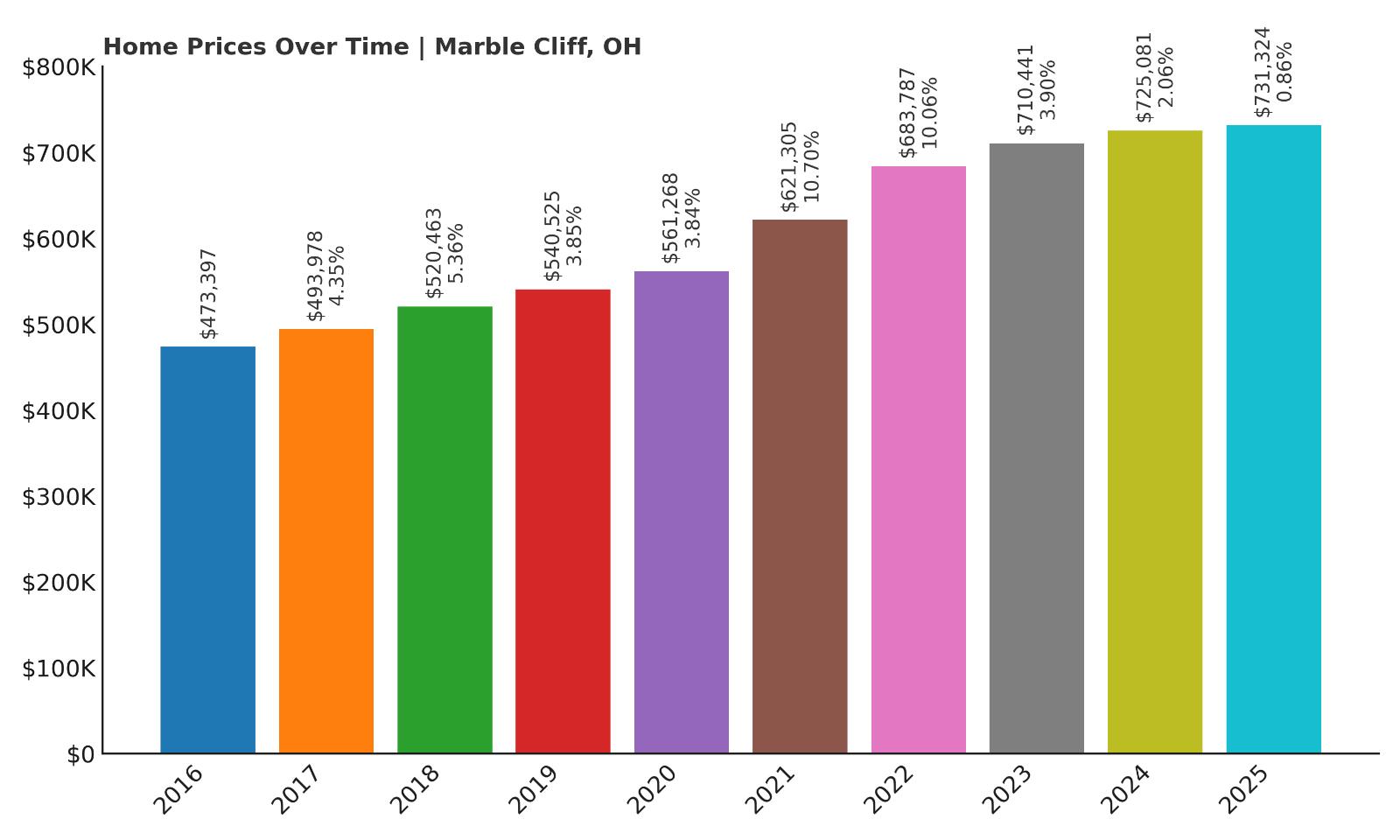

8. Marble Cliff – 54% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $473,397

- 2017: $493,978 (+$20,580, +4.35% from previous year)

- 2018: $520,463 (+$26,485, +5.36% from previous year)

- 2019: $540,525 (+$20,062, +3.85% from previous year)

- 2020: $561,268 (+$20,744, +3.84% from previous year)

- 2021: $621,305 (+$60,037, +10.70% from previous year)

- 2022: $683,787 (+$62,481, +10.06% from previous year)

- 2023: $710,441 (+$26,654, +3.90% from previous year)

- 2024: $725,081 (+$14,640, +2.06% from previous year)

- 2025: $731,324 (+$6,243, +0.86% from previous year)

Since 2016, Marble Cliff’s home values have increased by 54%, a strong performance for a small, tightly held community. The town saw consistent 3–5% annual increases until 2021 and 2022, when prices jumped by over 10% each year. Although the rate of growth has slowed since 2023, prices have continued to edge upward, landing at an average of over $731,000 in 2025. Given Marble Cliff’s compact size and extremely limited housing inventory, even modest demand can drive significant price changes. The market here tends to move gradually due to the low turnover of homes, which contributes to price stability and consistent value growth over time. It’s a quiet but solid performer in Ohio’s luxury housing scene.

Marble Cliff – Exclusive Village With Limited Inventory

Marble Cliff is one of the smallest incorporated villages in Ohio, nestled between Upper Arlington and Grandview Heights near Columbus. Its tiny footprint and longstanding homes make it a rare and highly desirable place to live. The area is known for its early 20th-century estates, manicured gardens, and tree-lined streets that exude quiet elegance. With no room for major expansion, the real estate market here is defined by scarcity, which drives prices higher as demand persists. Homes that do come on the market are often snapped up quickly, especially by buyers looking to stay close to central Columbus without sacrificing space or architectural character.

Residents enjoy access to top-tier schools, walkable neighborhoods, and close proximity to parks and shopping. Marble Cliff’s village governance also contributes to its charm, with a strong focus on preservation and civic pride. These factors combine to keep housing demand high and supply low, reinforcing its place among the most expensive and exclusive housing markets in the state.

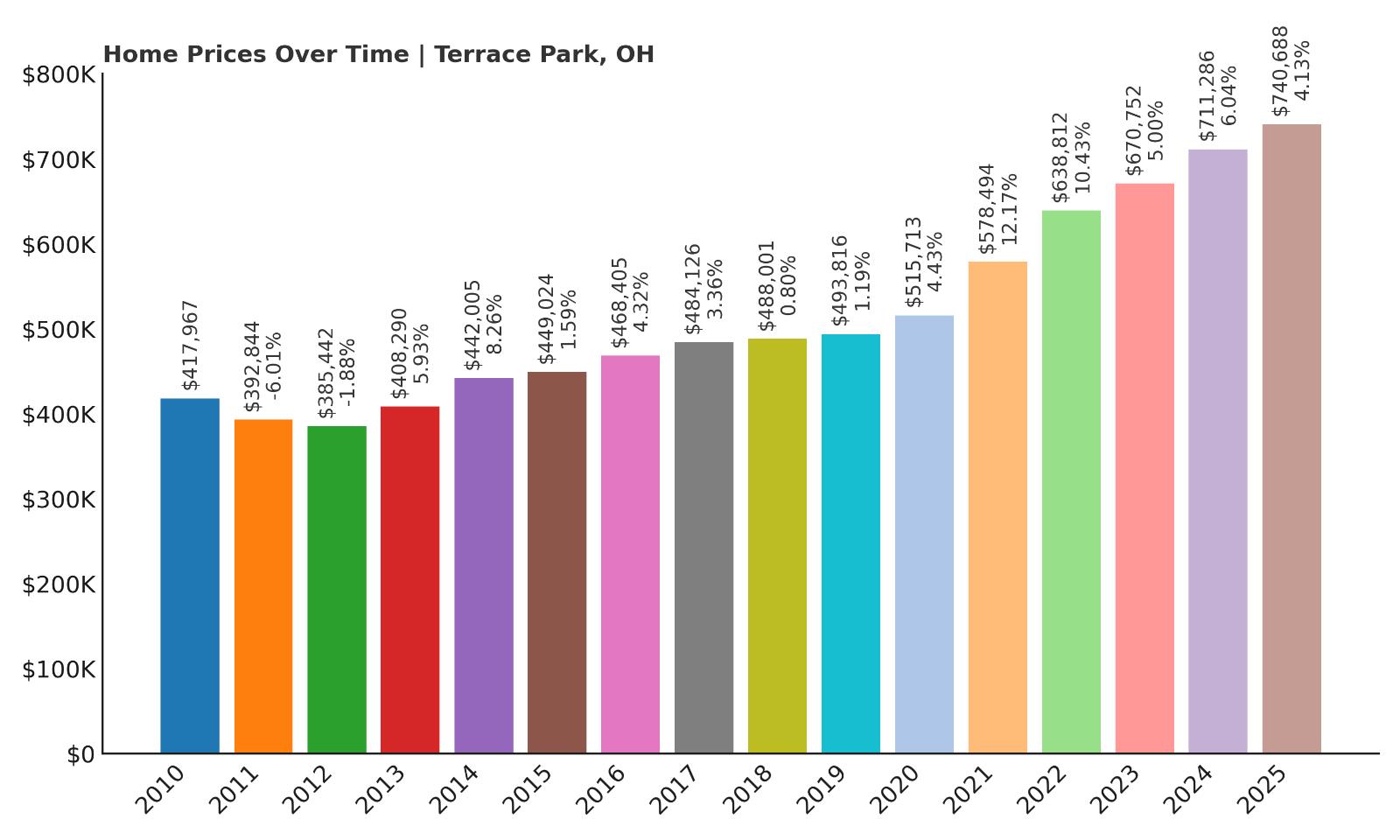

7. Terrace Park – 77% Home Price Increase Since 2010

- 2010: $417,967

- 2011: $392,844 (-$25,123, -6.01% from previous year)

- 2012: $385,442 (-$7,402, -1.88% from previous year)

- 2013: $408,290 (+$22,847, +5.93% from previous year)

- 2014: $442,005 (+$33,716, +8.26% from previous year)

- 2015: $449,024 (+$7,019, +1.59% from previous year)

- 2016: $468,405 (+$19,380, +4.32% from previous year)

- 2017: $484,126 (+$15,722, +3.36% from previous year)

- 2018: $488,001 (+$3,875, +0.80% from previous year)

- 2019: $493,816 (+$5,815, +1.19% from previous year)

- 2020: $515,713 (+$21,897, +4.43% from previous year)

- 2021: $578,494 (+$62,781, +12.17% from previous year)

- 2022: $638,812 (+$60,318, +10.43% from previous year)

- 2023: $670,752 (+$31,940, +5.00% from previous year)

- 2024: $711,286 (+$40,534, +6.04% from previous year)

- 2025: $740,688 (+$29,401, +4.13% from previous year)

Terrace Park has seen home prices jump by 77% since 2010, with particularly rapid growth since 2020. In 2021 and 2022 alone, values rose by over 12% and 10%, respectively, adding nearly $125,000 in value in just two years. After a slow start with minor declines at the beginning of the decade, prices picked up steam from 2013 onward, supported by steady buyer demand. The 2025 average home price in Terrace Park is now above $740,000, compared to under $420,000 in 2010. The town’s appreciation has been remarkably stable in recent years, with increases even during periods when some markets plateaued. That resilience is likely tied to its blend of heritage homes, school quality, and close-knit community atmosphere. For those looking for consistent returns in a high-quality neighborhood, Terrace Park offers both security and growth potential.

Terrace Park – Historic Homes and Riverfront Living Near Cincinnati

Terrace Park is a picturesque village located along the banks of the Little Miami River, just outside Cincinnati. It’s one of the city’s most charming and affluent suburbs, known for its walkability, community involvement, and historic 19th-century homes. Many properties are beautifully restored and sit on tree-shaded streets, giving the town a timeless, storybook feel. The Mariemont City School District serves the area and is widely regarded as one of the best in Ohio, attracting families who place a premium on education. Residents enjoy riverfront parks, community events, and quick access to the city via US-50 or nearby I-275, making it a convenient option for commuters who want peace and character in equal measure.

There’s very little new construction in Terrace Park, and that scarcity has driven up housing values over time. The housing stock is both architecturally distinct and well-maintained, and buyers often compete for the few homes that do hit the market. This consistent demand, coupled with strong community appeal and proximity to Cincinnati’s cultural and job centers, has helped propel Terrace Park into the upper echelon of Ohio’s real estate markets.

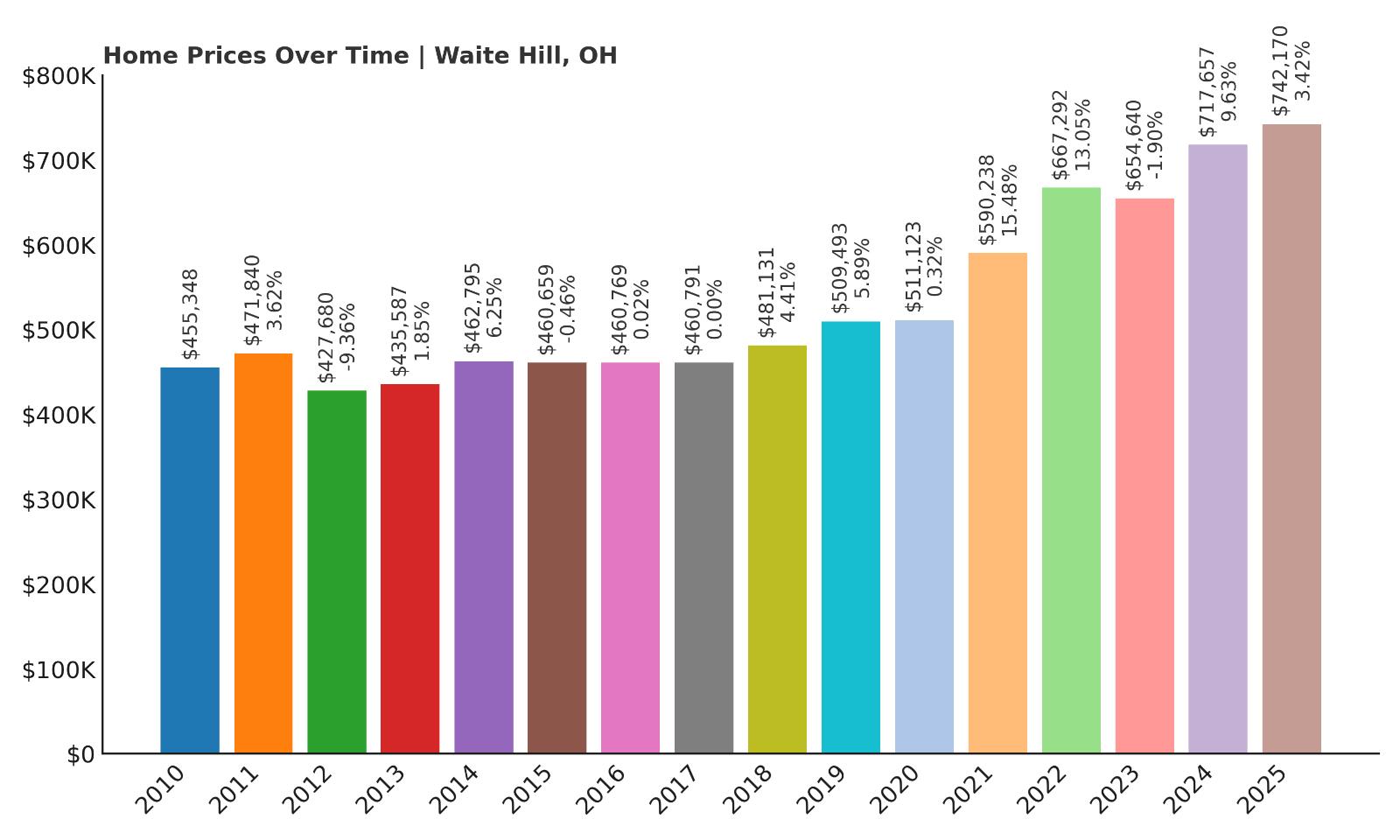

6. Waite Hill – 63% Home Price Increase Since 2010

- 2010: $455,348

- 2011: $471,840 (+$16,492, +3.62% from previous year)

- 2012: $427,680 (-$44,160, -9.36% from previous year)

- 2013: $435,587 (+$7,906, +1.85% from previous year)

- 2014: $462,795 (+$27,208, +6.25% from previous year)

- 2015: $460,659 (-$2,136, -0.46% from previous year)

- 2016: $460,769 (+$110, +0.02% from previous year)

- 2017: $460,791 (+$22, +0.00% from previous year)

- 2018: $481,131 (+$20,340, +4.41% from previous year)

- 2019: $509,493 (+$28,362, +5.89% from previous year)

- 2020: $511,123 (+$1,630, +0.32% from previous year)

- 2021: $590,238 (+$79,115, +15.48% from previous year)

- 2022: $667,292 (+$77,054, +13.05% from previous year)

- 2023: $654,640 (-$12,652, -1.90% from previous year)

- 2024: $717,657 (+$63,017, +9.63% from previous year)

- 2025: $742,170 (+$24,513, +3.42% from previous year)

Waite Hill’s home values have increased by 63% since 2010, but the path to that growth has been anything but linear. After early dips and flat years in the mid-2010s, the market saw explosive growth beginning in 2021, with two back-to-back years of double-digit gains. From $455,000 in 2010, the average home price now stands at over $742,000 in 2025. Although 2023 saw a brief decline, prices rebounded sharply the following year, signaling sustained demand. The town’s limited inventory and large estate-style properties have made it a niche market with consistently high values. It’s the kind of place where homes are fewer but significantly more valuable, and even small fluctuations in demand can have a noticeable impact on pricing. Over the long term, Waite Hill has shown that it can deliver strong value appreciation while preserving its elite reputation.

Waite Hill – Secluded Estate Living in Lake County

Waite Hill is a quiet, upscale village located east of Cleveland in Lake County, known for its sprawling estates and emphasis on land conservation. The town covers roughly seven square miles but has fewer than 500 residents, giving it one of the lowest population densities in the region. Most homes in Waite Hill are situated on multi-acre lots, surrounded by wooded preserves and rolling hills. The zoning laws here are designed to preserve that low-density character, which has made Waite Hill a haven for those seeking privacy, prestige, and pastoral beauty. Despite its rural atmosphere, the village is only 25 minutes from downtown Cleveland, making it a practical choice for professionals and executives working in the city.

Local governance is small and efficient, focusing on maintaining the area’s serene quality and protecting green space. As a result, new development is rare, and when homes do sell, they often command premium prices due to their size, location, and architectural distinction. The combination of exclusivity and access makes Waite Hill one of northeast Ohio’s most distinctive housing markets—and one where values are expected to hold firm for years to come.

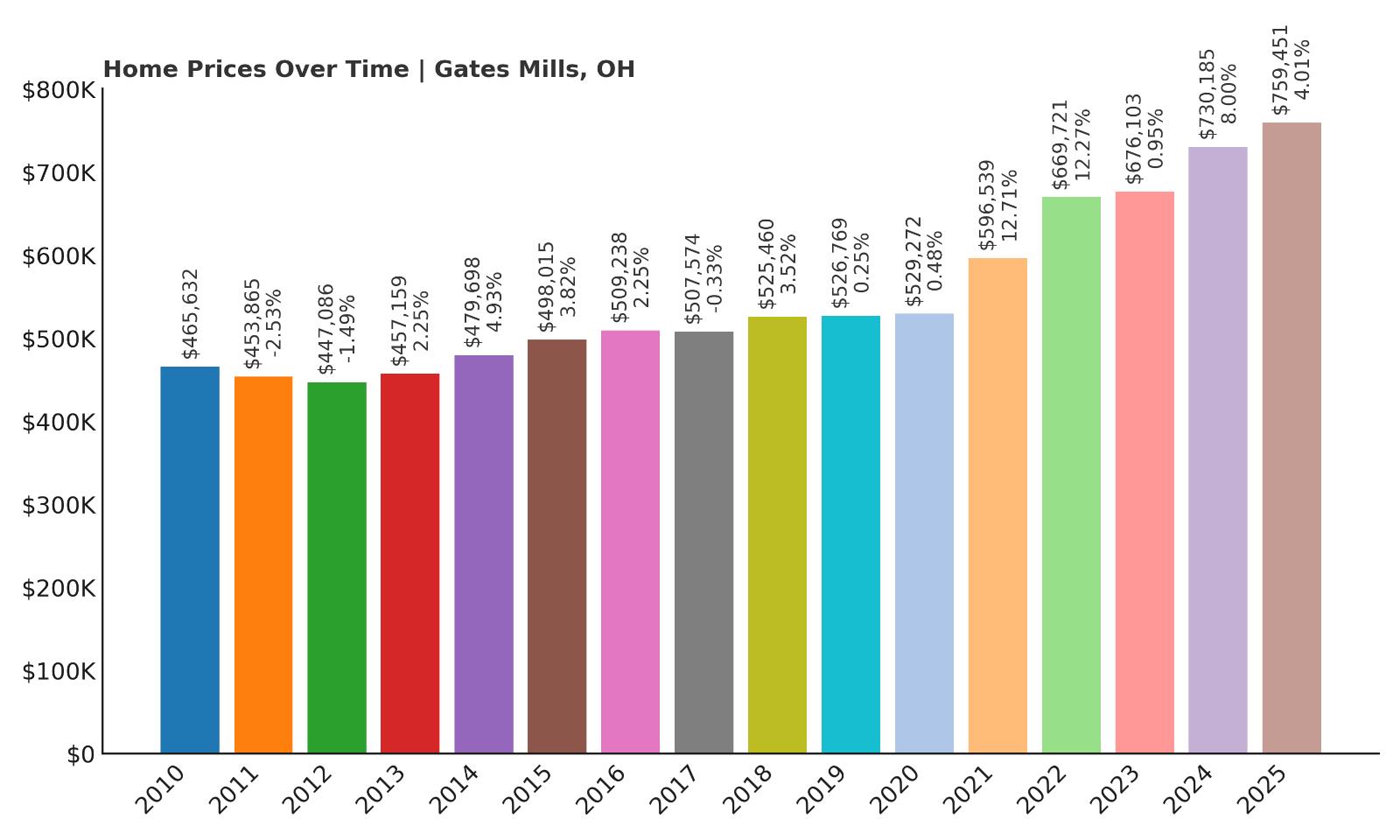

5. Gates Mills – 63% Home Price Increase Since 2010

- 2010: $465,632

- 2011: $453,865 (-$11,767, -2.53% from previous year)

- 2012: $447,086 (-$6,779, -1.49% from previous year)

- 2013: $457,159 (+$10,073, +2.25% from previous year)

- 2014: $479,698 (+$22,539, +4.93% from previous year)

- 2015: $498,015 (+$18,317, +3.82% from previous year)

- 2016: $509,238 (+$11,223, +2.25% from previous year)

- 2017: $507,574 (-$1,664, -0.33% from previous year)

- 2018: $525,460 (+$17,885, +3.52% from previous year)

- 2019: $526,769 (+$1,310, +0.25% from previous year)

- 2020: $529,272 (+$2,502, +0.47% from previous year)

- 2021: $596,539 (+$67,268, +12.71% from previous year)

- 2022: $669,721 (+$73,181, +12.27% from previous year)

- 2023: $676,103 (+$6,382, +0.95% from previous year)

- 2024: $730,185 (+$54,082, +8.00% from previous year)

- 2025: $759,451 (+$29,266, +4.01% from previous year)

Gates Mills has seen home values rise by 63% since 2010, reflecting steady upward movement with standout spikes in the last five years. After modest gains for much of the 2010s, the market took off between 2020 and 2022, with consecutive double-digit price increases. From an average of $465,000 in 2010, home prices have now surpassed $759,000 in 2025. Despite some fluctuations, including a small dip in 2017, the overall trajectory is clearly positive. Price growth has been supported by the area’s exclusivity, architectural richness, and access to top-tier schools and natural surroundings. Unlike fast-growing suburban markets, Gates Mills offers a quieter, more gradual form of appreciation—ideal for long-term homeowners. The recent resurgence in demand has breathed new life into this historic enclave and elevated its standing on the state’s list of priciest towns.

Gates Mills – Historic Elegance in Cleveland’s Countryside

Gates Mills is one of Ohio’s most picturesque and historic communities, located in eastern Cuyahoga County along the Chagrin River. Originally settled in the early 1800s, it has retained much of its rural charm through strict zoning and preservation efforts. The village is dotted with colonial-era homes, equestrian estates, and scenic byways that feel a world away from nearby urban sprawl. Residents are drawn to its excellent school systems—including the Orange and Mayfield districts—and proximity to private academies such as Hawken and University School. Gates Mills also boasts cultural richness, home to artists, writers, and academics who value its serenity and natural beauty.

In addition to its visual appeal, the town benefits from its convenient location just 30 minutes from downtown Cleveland, with access to upscale shopping and hospitals. Properties here are rarely on the market, which adds to their value and exclusivity. With a tradition of quality over quantity and a strong sense of community pride, Gates Mills remains one of northeast Ohio’s most refined residential markets, where home prices reflect both character and consistency.

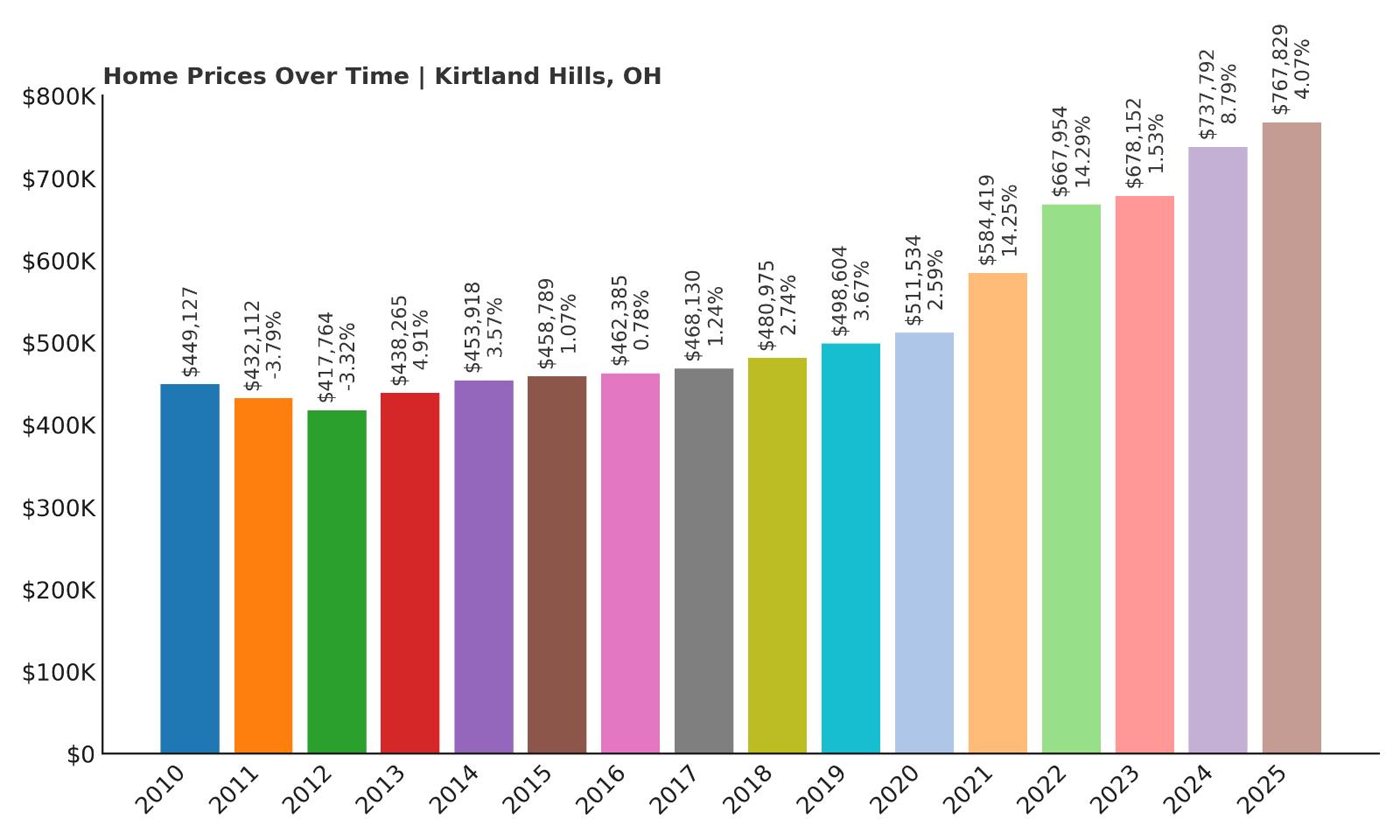

4. Kirtland Hills – 71% Home Price Increase Since 2010

- 2010: $449,127

- 2011: $432,112 (-$17,015, -3.79% from previous year)

- 2012: $417,764 (-$14,348, -3.32% from previous year)

- 2013: $438,265 (+$20,502, +4.91% from previous year)

- 2014: $453,918 (+$15,652, +3.57% from previous year)

- 2015: $458,789 (+$4,871, +1.07% from previous year)

- 2016: $462,385 (+$3,596, +0.78% from previous year)

- 2017: $468,130 (+$5,745, +1.24% from previous year)

- 2018: $480,975 (+$12,846, +2.74% from previous year)

- 2019: $498,604 (+$17,629, +3.67% from previous year)

- 2020: $511,534 (+$12,930, +2.59% from previous year)

- 2021: $584,419 (+$72,884, +14.25% from previous year)

- 2022: $667,954 (+$83,536, +14.29% from previous year)

- 2023: $678,152 (+$10,198, +1.53% from previous year)

- 2024: $737,792 (+$59,640, +8.79% from previous year)

- 2025: $767,829 (+$30,037, +4.07% from previous year)

Kirtland Hills has seen home values rise by 71% since 2010, driven by dramatic growth in the early 2020s. From a baseline of around $449,000, home prices in the village surged to nearly $768,000 by 2025. Though early years showed slow or even negative movement, appreciation ramped up considerably starting in 2021, with back-to-back increases of more than 14% in 2021 and 2022. These gains were fueled by increased demand for larger properties and a desire for more space amid remote work trends. Even after the initial boom, values have continued to grow steadily, reinforcing the town’s reputation as one of the most desirable places to live in northeast Ohio. The consistent appreciation, combined with a low number of sales, makes it one of the region’s more exclusive and resilient markets.

Kirtland Hills – Secluded Woods and High-Value Estates

Kirtland Hills is a heavily wooded, low-density community in Lake County, just east of Cleveland. Known for its sprawling lots, private roads, and tranquil setting, the town has become a favorite for high-net-worth individuals who value discretion and natural beauty. Homes here are often set back from the road and range from elegant farmhouses to expansive modern estates. The Holden Arboretum, one of the largest botanical gardens in the country, is located nearby and adds to the rural, park-like charm of the area. Residents also enjoy close proximity to Lake Erie, golf courses, and the quiet sophistication of surrounding towns like Waite Hill and Gates Mills.

Kirtland Hills offers a rare blend of privacy and convenience, with downtown Cleveland accessible in under 40 minutes. Strict zoning ensures that open space is preserved, and development is carefully managed. This makes each home more valuable, both for its land and its location. In 2025, buyers continue to pay a premium for access to this secluded enclave, where luxury and nature are perfectly intertwined.

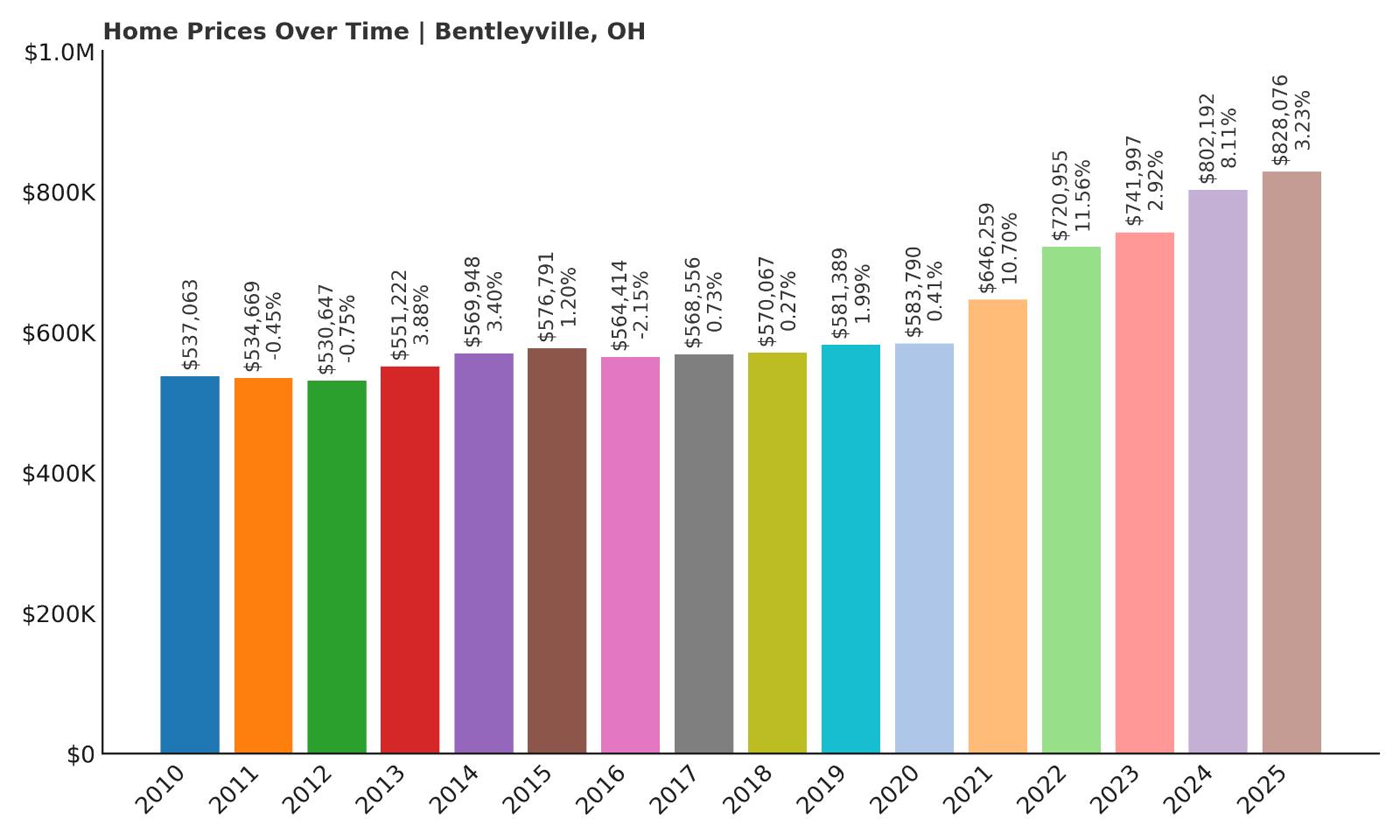

3. Bentleyville – 54% Home Price Increase Since 2010

- 2010: $537,063

- 2011: $534,669 (-$2,393, -0.45% from previous year)

- 2012: $530,647 (-$4,022, -0.75% from previous year)

- 2013: $551,222 (+$20,575, +3.88% from previous year)

- 2014: $569,948 (+$18,725, +3.40% from previous year)

- 2015: $576,791 (+$6,844, +1.20% from previous year)

- 2016: $564,414 (-$12,378, -2.15% from previous year)

- 2017: $568,556 (+$4,142, +0.73% from previous year)

- 2018: $570,067 (+$1,511, +0.27% from previous year)

- 2019: $581,389 (+$11,322, +1.99% from previous year)

- 2020: $583,790 (+$2,401, +0.41% from previous year)

- 2021: $646,259 (+$62,469, +10.70% from previous year)

- 2022: $720,955 (+$74,696, +11.56% from previous year)

- 2023: $741,997 (+$21,041, +2.92% from previous year)

- 2024: $802,192 (+$60,195, +8.11% from previous year)

- 2025: $828,076 (+$25,884, +3.23% from previous year)

Bentleyville has seen a 54% increase in home values since 2010, with most of that growth taking place since 2020. After a decade of modest changes—some years flat, others with small declines—prices surged between 2021 and 2024. From an average of $537,000 in 2010, Bentleyville homes now command over $828,000 in 2025. Price growth was particularly strong in 2022, with an increase of more than 11%. These gains reflect a shift in buyer preferences toward quiet, wooded communities with large homes and easy access to amenities. Bentleyville’s relatively low turnover and large-lot homes make it an attractive market for affluent buyers looking for both privacy and proximity to Cleveland’s eastern suburbs.

Bentleyville – Woodland Privacy With Luxury Appeal

Bentleyville is a small, upscale village in Cuyahoga County, known for its large homes, forested lots, and tranquil atmosphere. It’s located near Chagrin Falls, one of northeast Ohio’s most scenic small towns, and shares access to excellent school districts and a strong local culture. Many homes in Bentleyville are custom builds, and several neighborhoods include private drives and secluded settings. The South Chagrin Reservation of the Cleveland Metroparks runs along the village, offering hiking, fishing, and nature access right outside residents’ doors. While not densely populated, the area is well connected via nearby freeways and sits within reach of major hospitals and shopping destinations.

Bentleyville’s charm lies in its simplicity—no commercial districts, minimal traffic, and a focus on quiet, spacious living. This lifestyle, combined with a limited housing supply and sustained demand from higher-income buyers, has driven its rise into Ohio’s top three most expensive housing markets in 2025.

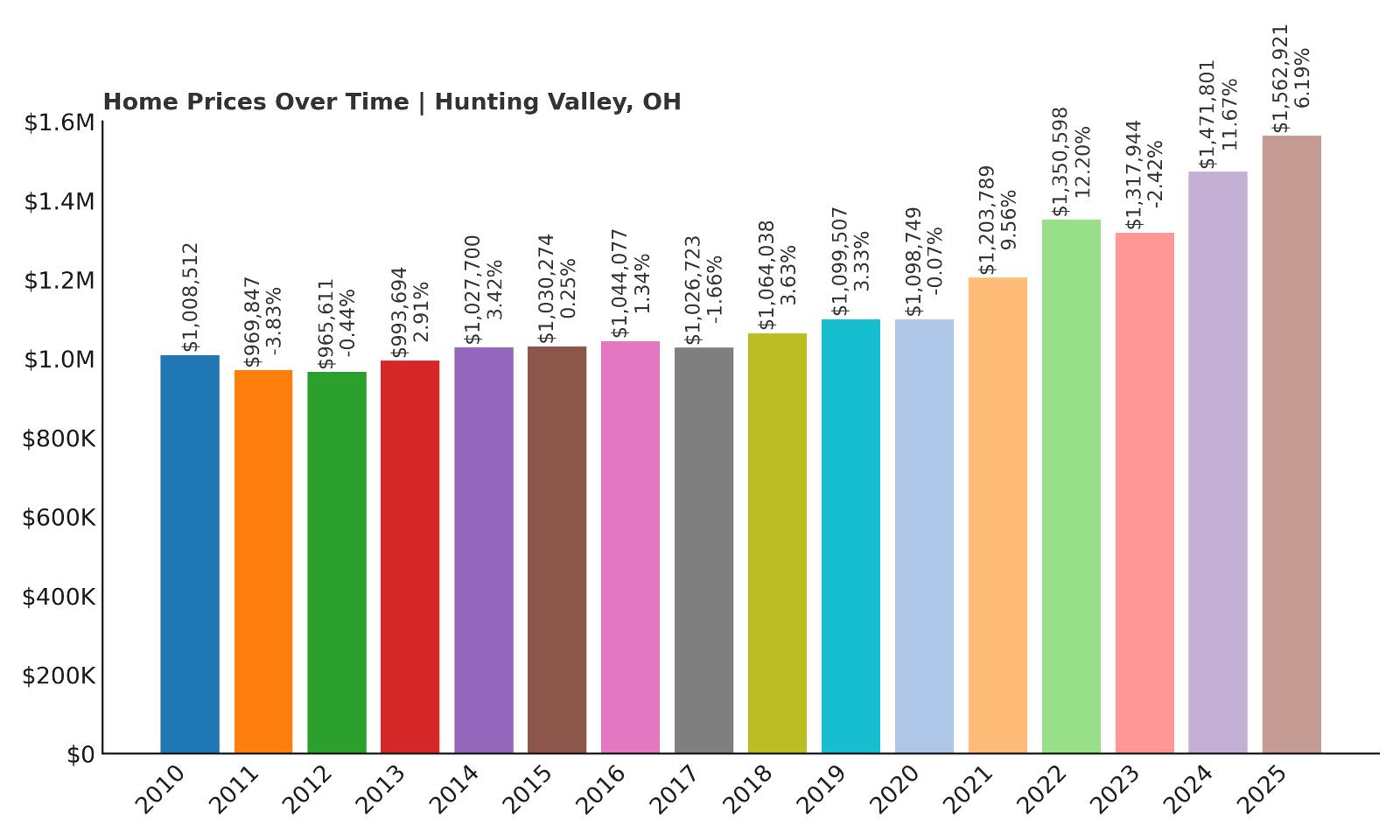

2. Hunting Valley – 55% Home Price Increase Since 2010

Would you like to save this?

- 2010: $1,008,512

- 2011: $969,847 (-$38,665, -3.83% from previous year)

- 2012: $965,611 (-$4,236, -0.44% from previous year)

- 2013: $993,694 (+$28,083, +2.91% from previous year)

- 2014: $1,027,700 (+$34,005, +3.42% from previous year)

- 2015: $1,030,274 (+$2,575, +0.25% from previous year)

- 2016: $1,044,077 (+$13,803, +1.34% from previous year)

- 2017: $1,026,723 (-$17,354, -1.66% from previous year)

- 2018: $1,064,038 (+$37,314, +3.63% from previous year)

- 2019: $1,099,507 (+$35,470, +3.33% from previous year)

- 2020: $1,098,749 (-$759, -0.07% from previous year)

- 2021: $1,203,789 (+$105,040, +9.56% from previous year)

- 2022: $1,350,598 (+$146,810, +12.20% from previous year)

- 2023: $1,317,944 (-$32,654, -2.42% from previous year)

- 2024: $1,471,801 (+$153,856, +11.67% from previous year)

- 2025: $1,562,921 (+$91,120, +6.19% from previous year)

Hunting Valley has experienced a 55% rise in home prices since 2010, moving from just over $1 million to nearly $1.56 million in 2025. Despite a few years of minor dips, especially in 2011 and 2023, the overall trajectory has remained upward. The most notable growth occurred between 2021 and 2024, when the market posted three large jumps totaling nearly $400,000 in added value. That kind of appreciation is rare, especially in towns where homes are already priced over the million-dollar mark. These price increases reflect both the exclusivity of the market and the low availability of inventory. The village is known for multi-acre estates and some of the most expensive residential land in Ohio. Because turnover is low, price movements can be dramatic when even a small surge in demand occurs. Hunting Valley’s average home value in 2025 puts it just behind Indian Hill for the most expensive real estate in the state.

Hunting Valley – Seclusion, Prestige, and Million-Dollar Homes

Hunting Valley is the definition of secluded luxury. Tucked between Geauga and Cuyahoga counties, this small village of fewer than 800 residents occupies one of Ohio’s most idyllic landscapes. The homes here aren’t just expensive—they’re architectural statements, ranging from modern mansions to historic estates, often hidden behind gated entrances and winding forested drives. Many properties span 5 to 15 acres or more, offering a level of privacy and scale rarely found even in high-end suburbs. The village is also home to portions of the Cleveland Metroparks’ North Chagrin Reservation and the Chagrin River, which further enhance its natural beauty and restrict commercial encroachment. In addition, Hunting Valley benefits from zoning that severely limits development, ensuring the town maintains its rural elegance and ultra-low density for generations to come.

Residents are often drawn from Cleveland’s executive and professional elite, as well as national buyers seeking a Midwest base with serene surroundings. The nearby communities of Gates Mills and Pepper Pike offer upscale shopping and dining, but Hunting Valley itself remains purely residential—deliberately so. It’s served by the highly rated Orange and West Geauga school districts, and it also sits near private institutions like University School. The village’s infrastructure is built to match its exclusivity, with well-maintained private roads, local patrols, and a reputation for discretion. In a state where even high-end markets can fluctuate, Hunting Valley stands out for its long-term stability and timeless appeal. As of 2025, it remains one of the most rarefied and highest-priced real estate markets in Ohio, with values and prestige that continue to climb.

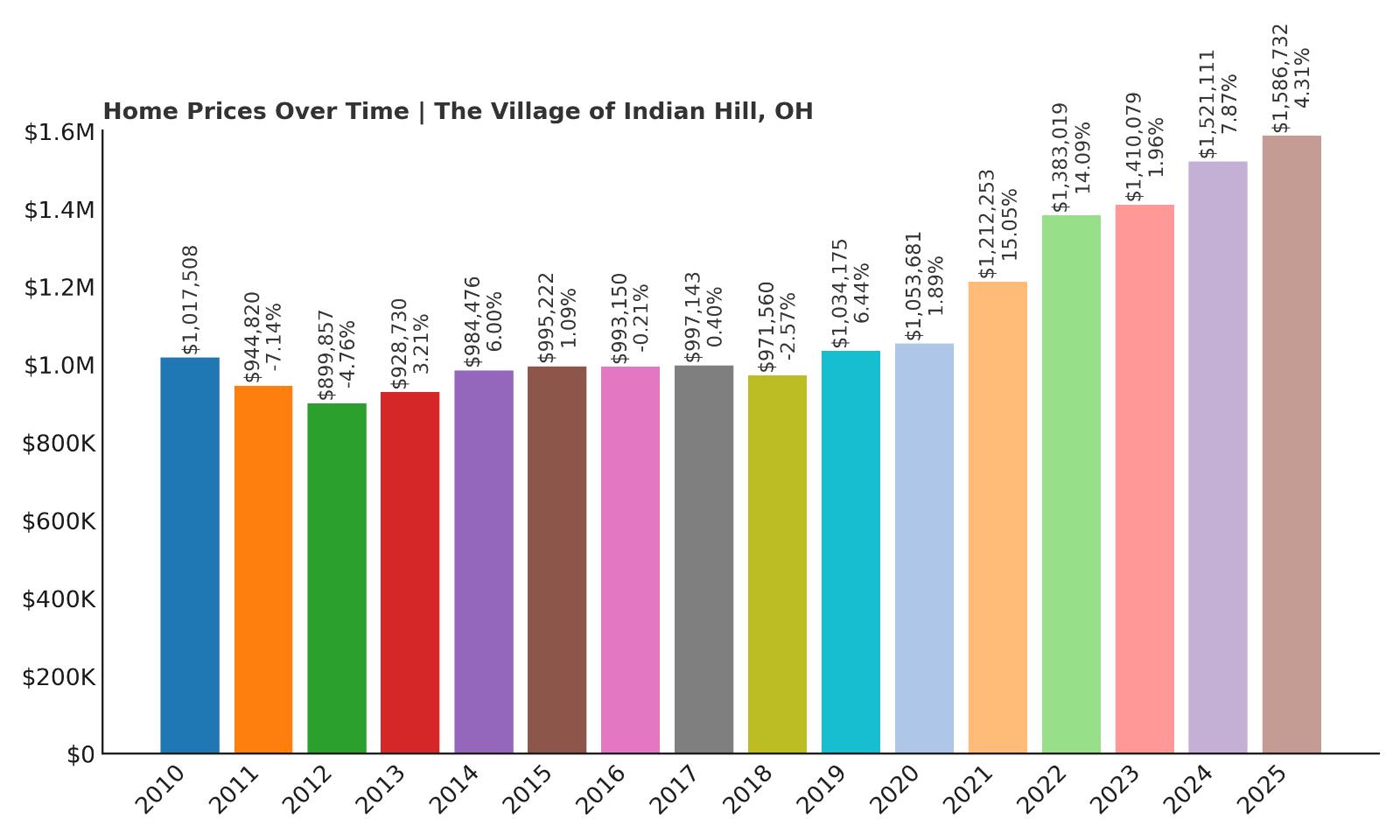

1. The Village of Indian Hill – 56% Home Price Increase Since 2010

- 2010: $1,017,508

- 2011: $944,820 (-$72,689, -7.14% from previous year)

- 2012: $899,857 (-$44,962, -4.76% from previous year)

- 2013: $928,730 (+$28,873, +3.21% from previous year)

- 2014: $984,476 (+$55,746, +6.00% from previous year)

- 2015: $995,222 (+$10,746, +1.09% from previous year)

- 2016: $993,150 (-$2,072, -0.21% from previous year)

- 2017: $997,143 (+$3,993, +0.40% from previous year)

- 2018: $971,560 (-$25,583, -2.57% from previous year)

- 2019: $1,034,175 (+$62,615, +6.44% from previous year)

- 2020: $1,053,681 (+$19,506, +1.89% from previous year)

- 2021: $1,212,253 (+$158,572, +15.05% from previous year)

- 2022: $1,383,019 (+$170,766, +14.09% from previous year)

- 2023: $1,410,079 (+$27,061, +1.96% from previous year)

- 2024: $1,521,111 (+$111,032, +7.87% from previous year)

- 2025: $1,586,732 (+$65,620, +4.31% from previous year)

The Village of Indian Hill holds the top spot in Ohio’s housing market, with average home values reaching over $1.58 million in 2025. That’s up 56% from 2010, with especially strong growth over the last five years. Between 2021 and 2022 alone, home prices rose more than $329,000—a staggering jump even in the high-end market. Indian Hill has experienced occasional soft years, such as in 2012 and 2018, but its long-term trend is clearly upward. This is a market that responds quickly to demand and commands enduring prestige. Homes here tend to stay in families for generations, and available listings are often competitive. In terms of absolute value, Indian Hill is Ohio’s most expensive town, topping even exclusive enclaves like Hunting Valley and Marble Cliff.

The Village of Indian Hill – Ohio’s Crown Jewel of Real Estate

The Village of Indian Hill, just northeast of Cincinnati, is synonymous with wealth, heritage, and prestige. It’s one of the only places in Ohio where average home prices regularly exceed $1.5 million, and many estates here go far beyond that. Originally developed in the early 20th century as a rural retreat for Cincinnati’s elite, Indian Hill remains a strictly residential community that feels worlds away from the city despite being just a 20-minute drive away. Properties here often span five acres or more and include equestrian facilities, private tennis courts, and architect-designed mansions. The village’s zoning protects its low-density charm—there’s no commercial development allowed within Indian Hill’s boundaries. Instead, the town preserves its bucolic character through winding lanes, horse trails, and forested greenways that buffer the community from the outside world.

Indian Hill is served by the Indian Hill Exempted Village School District, consistently ranked among the best public systems in the state. Many residents also send their children to elite private schools in Cincinnati. The town has its own police and fire departments, and its infrastructure is meticulously maintained. A blend of old money and new affluence, the area attracts executives, entrepreneurs, and longtime Cincinnati families who value discretion and legacy. The real estate market here is less about turnover and more about stewardship, with homes passed down or held long-term. In 2025, Indian Hill remains a market unto itself—one that defines luxury real estate in Ohio and continues to appreciate in both value and reputation.

Haven't Seen Yet

Curated from our most popular plans. Click any to explore.