Would you like to save this?

The Zillow Home Value Index puts a spotlight on 15 North Dakota towns where home prices in 2025 are still well below the state average. Whether it’s a farm town holding steady or a quiet community rebounding after a dip, these places offer some of the best value in the region. Some are seeing slow growth, others are just now catching a second wind—but all remain surprisingly affordable in a market where deals are getting harder to find. For buyers on a budget, this is where the value still lives.

15. Glen Ullin – 15.6% Home Price Decrease Since 2019

- 2010: $N/A

- 2011: $N/A

- 2012: $N/A

- 2013: $N/A

- 2014: $N/A

- 2015: $N/A

- 2016: $N/A

- 2017: $N/A

- 2018: $N/A

- 2019: $172,479

- 2020: $N/A

- 2021: $160,988

- 2022: $177,014 (+$16,026, +9.95% from previous year)

- 2023: $158,288 (-$18,726, -10.58% from previous year)

- 2024: $151,229 (-$7,059, -4.46% from previous year)

- 2025: $145,634 (-$5,595, -3.70% from previous year)

Glen Ullin’s home prices have slid nearly 16% since 2019, with a sharp dip following a temporary spike in 2022. While the town saw a nearly 10% increase that year, it was followed by three consecutive annual declines. In May 2025, the average home is valued at $145,634, down from a high of $177,014 in 2022. That pattern suggests a market correction after a short-lived surge, returning Glen Ullin to one of the most affordable towns in the state.

Glen Ullin – Quiet Affordability in Western North Dakota

Located in Morton County, Glen Ullin is a small community with a population of fewer than 1,000 residents. The town sits roughly 50 miles west of Bismarck along I-94, offering small-town peace while still being within driving distance of North Dakota’s capital. Known for its agricultural roots and close-knit atmosphere, Glen Ullin maintains a low cost of living and modest housing market.

Recent real estate price fluctuations reflect broader rural trends rather than local economic distress. With home values stabilizing near $145,000, it remains an accessible place for budget-conscious buyers. As prices cool from their 2022 peak, Glen Ullin’s affordability stands out in a region where affordability can vary significantly year to year.

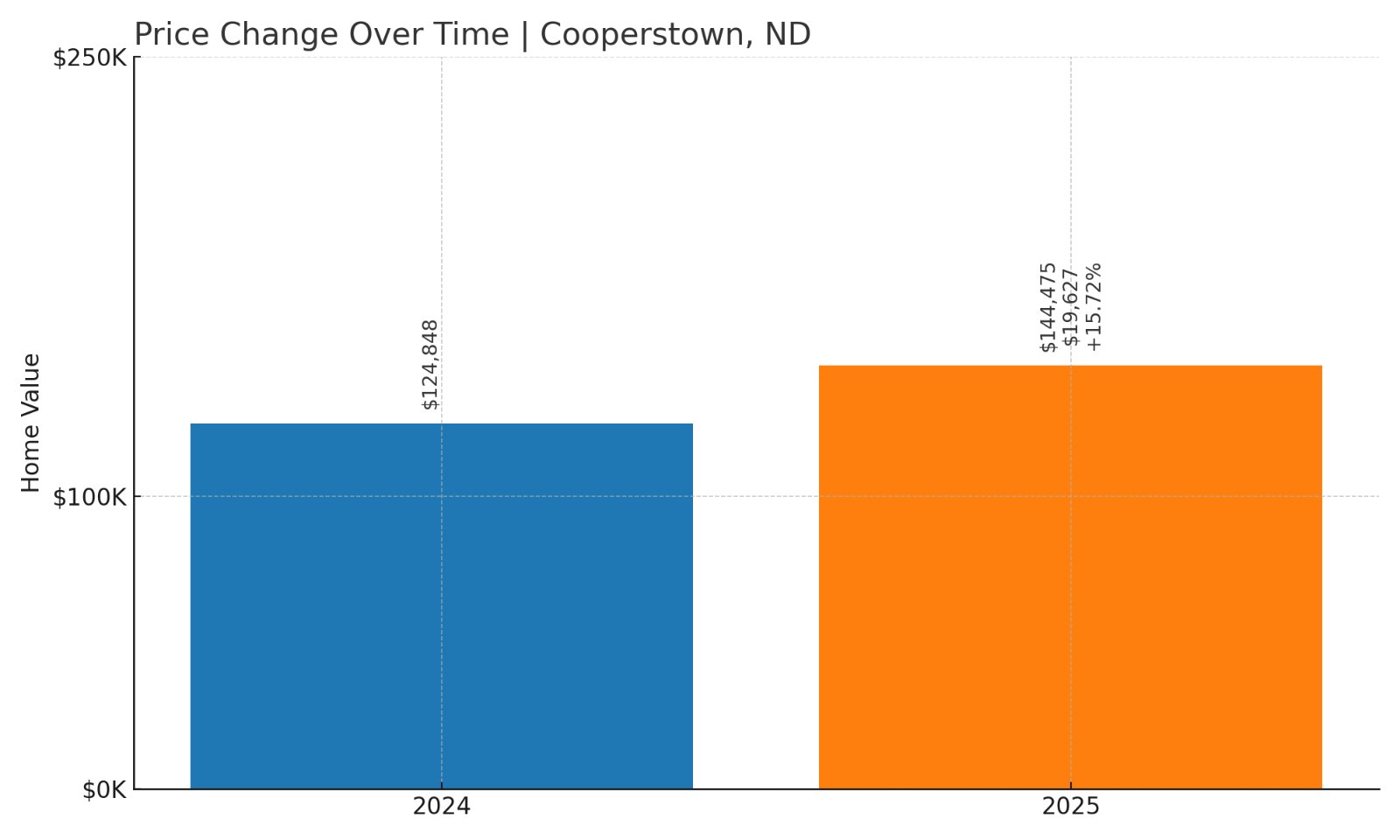

14. Cooperstown – 15.7% Home Price Increase Since May 2024

- 2010: $N/A

- 2011: $N/A

- 2012: $N/A

- 2013: $N/A

- 2014: $N/A

- 2015: $N/A

- 2016: $N/A

- 2017: $N/A

- 2018: $N/A

- 2019: $N/A

- 2020: $N/A

- 2021: $N/A

- 2022: $N/A

- 2023: $N/A

- 2024: $124,848

- 2025: $144,475 (+$19,627, +15.72% from previous year)

Cooperstown saw a major price jump between 2024 and 2025, rising by over $19,000 in a single year. That 15.7% increase marks one of the steepest recent gains on this list. With 2025 home values landing at $144,475, the town remains affordable while showing signs of potential growth.

Cooperstown – A Big Leap in a Small Town

Nestled in Griggs County, Cooperstown is a picturesque farming town with strong Scandinavian heritage and a population of around 1,000. It’s best known for being the “official” location of the Ronald Reagan Minuteman Missile State Historic Site, which draws in Cold War history buffs from around the region. The area combines prairie landscapes with traditional charm.

Though historical housing data is limited prior to 2024, Cooperstown’s recent surge could be linked to increased local interest and the broader affordability of rural North Dakota. A nearly 16% jump in a year suggests growing demand, possibly from retirees, remote workers, or those priced out of larger markets like Fargo and Grand Forks.

13. Leeds – 16.1% Home Price Decrease Since May 2021

- 2010: $N/A

- 2011: $N/A

- 2012: $N/A

- 2013: $N/A

- 2014: $N/A

- 2015: $N/A

- 2016: $N/A

- 2017: $N/A

- 2018: $N/A

- 2019: $N/A

- 2020: $N/A

- 2021: $169,955

- 2022: $170,564 (+$609, +0.36% from previous year)

- 2023: $175,160 (+$4,596, +2.69% from previous year)

- 2024: $150,138 (-$25,022, -14.29% from previous year)

- 2025: $142,625 (-$7,513, -5.00% from previous year)

Leeds experienced steady growth until 2023, peaking at just over $175,000. But prices have tumbled since then, dropping by more than 18% over the next two years. In May 2025, home prices sit at $142,625—still low by national standards, but a clear move downward from recent highs.

Leeds – Northern Affordability with a Rural Backbone

Located in Benson County, Leeds is a tiny town surrounded by farmland and prairie, about 100 miles west of Grand Forks. It’s a classic example of rural life in North Dakota, with an economy centered around agriculture and small business. While its population has shrunk slightly over the years, the community remains active and close-knit.

The recent decline in home values might reflect broader regional shifts, including population stagnation and an easing of pandemic-era buyer demand. However, Leeds continues to offer value, especially for those looking for peace, open space, and low overhead costs. With homes priced just over $140,000, it’s a deeply affordable option in 2025.

12. Linton – 11.5% Home Price Increase Since 2017

- 2010: $N/A

- 2011: $N/A

- 2012: $N/A

- 2013: $N/A

- 2014: $N/A

- 2015: $N/A

- 2016: $N/A

- 2017: $124,398

- 2018: $124,256 (-$142, -0.11% from previous year)

- 2019: $115,758 (-$8,498, -6.84% from previous year)

- 2020: $N/A

- 2021: $118,947

- 2022: $126,948 (+$8,001, +6.73% from previous year)

- 2023: $118,185 (-$8,763, -6.90% from previous year)

- 2024: $122,250 (+$4,065, +3.44% from previous year)

- 2025: $138,271 (+$16,021, +13.11% from previous year)

Linton’s housing market has been bumpy over the years, but prices have climbed nearly 12% since 2017. The 2025 value of $138,271 reflects strong growth in the past year, recovering from a dip in 2023. Recent trends suggest renewed interest and growing stability in this small town market.

Linton – Resilient Prices in a County Seat

As the seat of Emmons County, Linton is one of the more established towns in southern North Dakota. With a population hovering near 1,000, it serves as a hub for local commerce, schools, and services in the region. Linton has long attracted residents seeking affordable housing, low taxes, and a slower pace of life.

The housing market here saw significant gains in 2022 and again in 2025, pointing to renewed demand. That could stem from in-state migration or simple affordability compared to larger cities. As of May 2025, home values are up sharply from recent years, placing Linton in the spotlight as a town worth watching.

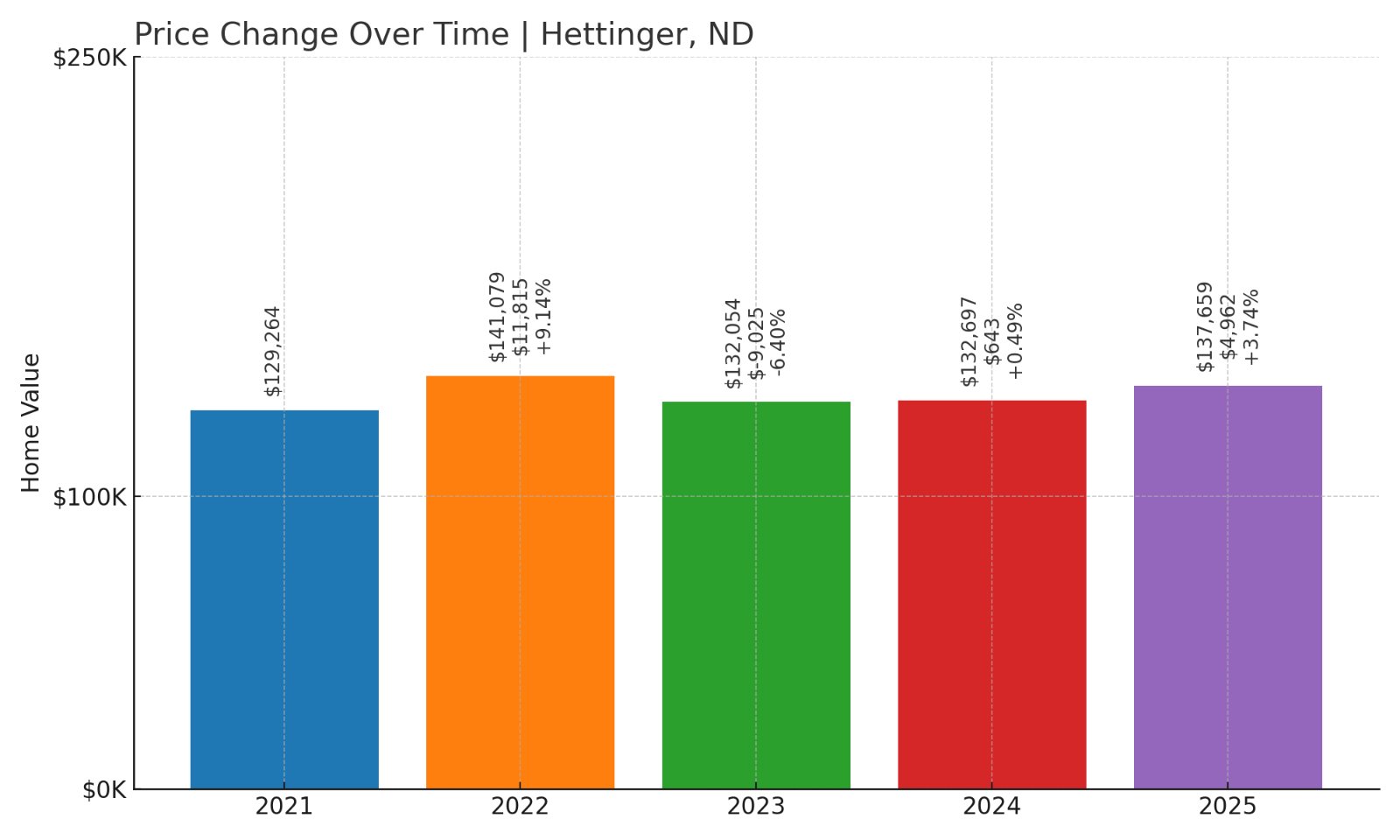

11. Hettinger – 6.5% Home Price Increase Since 2021

- 2010: $N/A

- 2011: $N/A

- 2012: $N/A

- 2013: $N/A

- 2014: $N/A

- 2015: $N/A

- 2016: $N/A

- 2017: $N/A

- 2018: $N/A

- 2019: $N/A

- 2020: $N/A

- 2021: $129,264

- 2022: $141,079 (+$11,815, +9.14% from previous year)

- 2023: $132,054 (-$9,025, -6.40% from previous year)

- 2024: $132,697 (+$643, +0.49% from previous year)

- 2025: $137,659 (+$4,962, +3.74% from previous year)

Hettinger’s home prices have gradually increased since 2021, posting an overall 6.5% gain over four years. While there was a slight dip in 2023, the market rebounded with modest but steady growth in the two years since. Homes now average $137,659 in May 2025—well below national norms, but rising steadily.

Hettinger – Slow Growth, Strong Value

Hettinger, located in Adams County near the South Dakota border, serves as a key trade and medical center for southwestern North Dakota. It’s home to the West River Health Services hospital and several small businesses, making it more economically diverse than many towns of its size.

Its housing market has avoided the dramatic swings seen elsewhere, likely due to its solid service base and agricultural backbone. While price growth hasn’t been explosive, it’s been consistent since 2023. That steadiness—combined with affordability—makes Hettinger one of the more appealing rural towns for long-term buyers in the state.

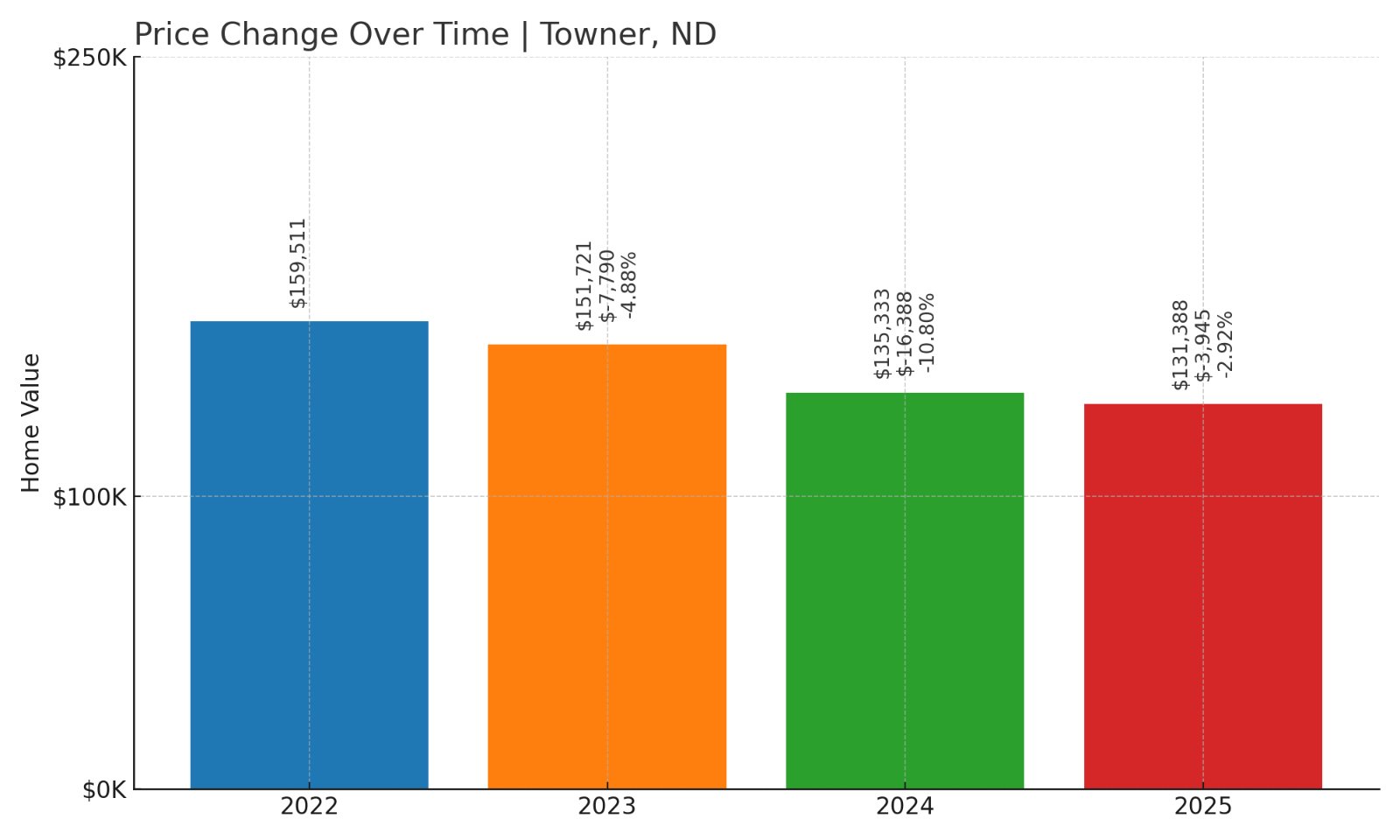

10. Towner – 17.6% Home Price Decrease Since 2022

- 2010: $N/A

- 2011: $N/A

- 2012: $N/A

- 2013: $N/A

- 2014: $N/A

- 2015: $N/A

- 2016: $N/A

- 2017: $N/A

- 2018: $N/A

- 2019: $N/A

- 2020: $N/A

- 2021: $N/A

- 2022: $159,511

- 2023: $151,721 (-$7,790, -4.88% from previous year)

- 2024: $135,333 (-$16,388, -10.80% from previous year)

- 2025: $131,388 (-$3,945, -2.92% from previous year)

Towner’s home prices have dropped nearly 18% since 2022, with the biggest decline occurring between 2023 and 2024. Although the rate of decline slowed in the past year, prices remain well below the recent high of $159,511. With a 2025 value of $131,388, Towner remains an affordable option, especially for those seeking entry-level homes in rural North Dakota.

Towner – Small-Town Charm with Steady Decline

Towner is the county seat of McHenry County and sits in the north-central region of the state. Surrounded by farmland and wetlands, it serves as a hub for agricultural services and rural living. The town is also near J. Clark Salyer National Wildlife Refuge, making it popular with outdoor enthusiasts.

Though home prices have fallen over the past few years, the gradual pace suggests a normalization rather than a collapse. The town’s relatively low housing prices may attract budget-minded buyers looking for a peaceful lifestyle and room to grow. With values hovering around $131,000, Towner continues to be one of the most accessible housing markets in the state.

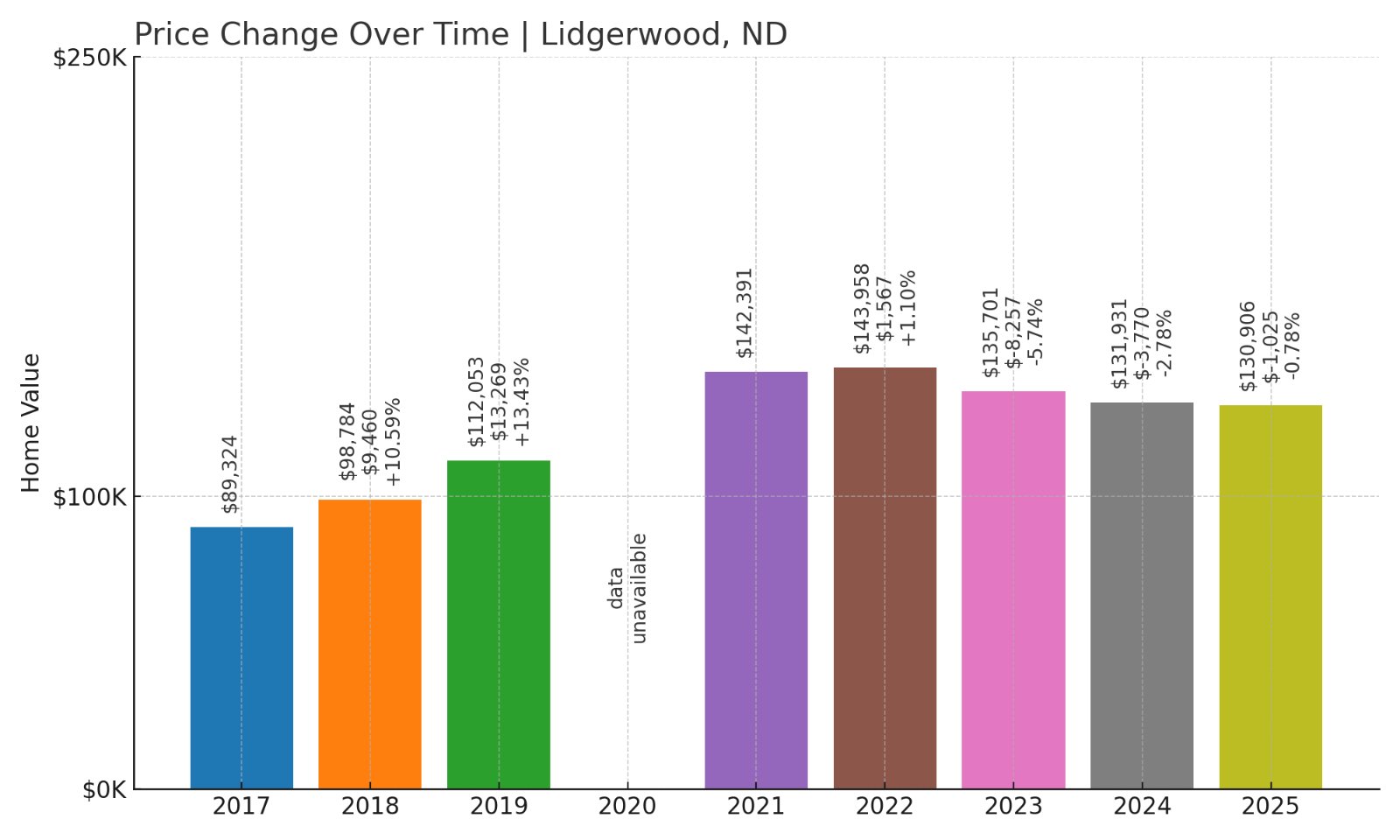

9. Lidgerwood – 46.5% Home Price Increase Since 2017

Would you like to save this?

- 2010: $N/A

- 2011: $N/A

- 2012: $N/A

- 2013: $N/A

- 2014: $N/A

- 2015: $N/A

- 2016: $N/A

- 2017: $89,324

- 2018: $98,784 (+$9,460, +10.59% from previous year)

- 2019: $112,053 (+$13,269, +13.43% from previous year)

- 2020: $N/A

- 2021: $142,391

- 2022: $143,958 (+$1,567, +1.10% from previous year)

- 2023: $135,701 (-$8,257, -5.74% from previous year)

- 2024: $131,931 (-$3,770, -2.78% from previous year)

- 2025: $130,906 (-$1,025, -0.78% from previous year)

Lidgerwood has seen a large overall increase in home values since 2017, despite a recent three-year decline. The 2025 home price of $130,906 is still nearly 47% higher than it was eight years ago. While the market has cooled slightly, values have held relatively steady in recent years, showing resilience in a fluctuating rural market.

Lidgerwood – Big Growth in a Small Package

Located in Richland County near the southeastern border with Minnesota, Lidgerwood is a farming town with deep community ties. It’s about 30 miles from Wahpeton and is known for its historic downtown and community events. Despite its small size, the town has drawn attention with its steadily rising home values over the past decade.

The strong gains from 2017 to 2021 reflect growing demand and likely a short supply of available homes. While prices have dipped a bit in recent years, the drops have been minor. With a 2025 median home price just over $130,000, Lidgerwood is still among the most affordable communities in the state and one with potential for renewed growth.

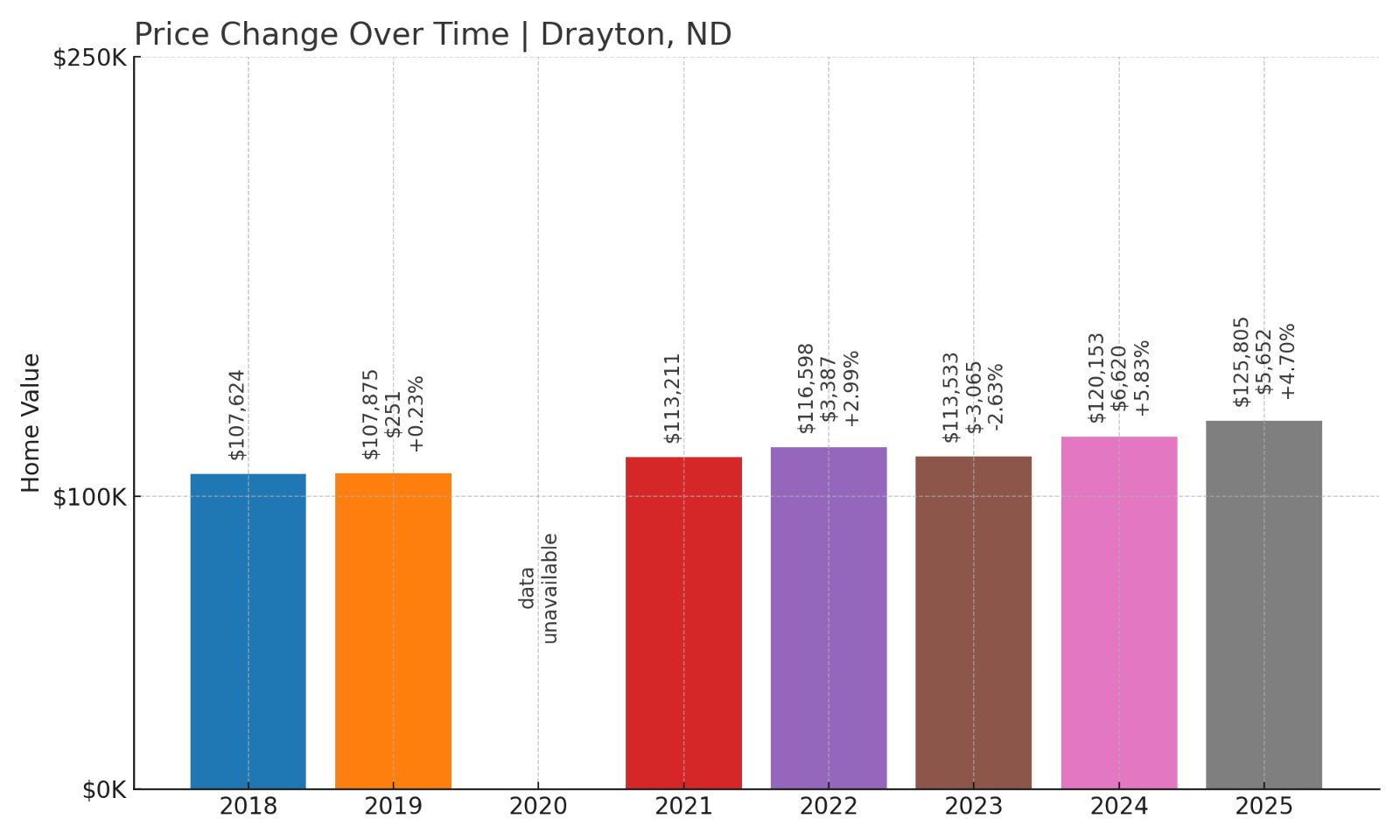

8. Drayton – 16.9% Home Price Increase Since 2018

- 2010: $N/A

- 2011: $N/A

- 2012: $N/A

- 2013: $N/A

- 2014: $N/A

- 2015: $N/A

- 2016: $N/A

- 2017: $N/A

- 2018: $107,624

- 2019: $107,875 (+$251, +0.23% from previous year)

- 2020: $N/A

- 2021: $113,211

- 2022: $116,598 (+$3,387, +2.99% from previous year)

- 2023: $113,533 (-$3,065, -2.63% from previous year)

- 2024: $120,153 (+$6,620, +5.83% from previous year)

- 2025: $125,805 (+$5,652, +4.70% from previous year)

Drayton’s home prices have grown steadily since 2018, rising nearly 17% over that time. With modest gains in recent years, the current value of $125,805 in May 2025 shows a stable upward trend. The market has recovered from minor dips and seems to be gaining traction once again.

Drayton – Consistent Growth in a Historic River Town

Situated along the Red River in northeastern North Dakota, Drayton is part of Pembina County and lies close to the Minnesota border. The town is known for its scenic river views, agricultural heritage, and the Drayton Dam recreation area. It has a small population but maintains strong community involvement and infrastructure.

Drayton’s housing market reflects that stability. While growth hasn’t been explosive, it’s been dependable—a rare trait in fluctuating rural markets. With home values now topping $125,000, Drayton is affordable yet appealing to families and individuals looking for consistency and charm.

7. Turtle Lake – 6.1% Home Price Increase Since 2022

- 2010: $N/A

- 2011: $N/A

- 2012: $N/A

- 2013: $N/A

- 2014: $N/A

- 2015: $N/A

- 2016: $N/A

- 2017: $N/A

- 2018: $N/A

- 2019: $N/A

- 2020: $N/A

- 2021: $N/A

- 2022: $116,940

- 2023: $119,384 (+$2,444, +2.09% from previous year)

- 2024: $124,093 (+$4,709, +3.94% from previous year)

- 2025: $124,099 (+$6, +0.00% from previous year)

Turtle Lake’s home prices have crept upward by just over 6% since 2022, with consistent annual growth. Prices have essentially flattened in the past year, but the current value of $124,099 in 2025 shows continued affordability. It’s a slow but positive trend in a steady rural market.

Turtle Lake – Stability in Central North Dakota

Located in McLean County, Turtle Lake is a quiet community known for its access to outdoor recreation, including nearby wildlife areas and fishing lakes. The town’s population is small, but it serves as a local center for farming families and retirees alike.

The town’s stable housing prices reflect its overall economic predictability. While some communities see large swings, Turtle Lake has maintained a modest but steady rise in home values. For buyers seeking predictable costs and a low-stress environment, this central North Dakota town remains a solid choice in 2025.

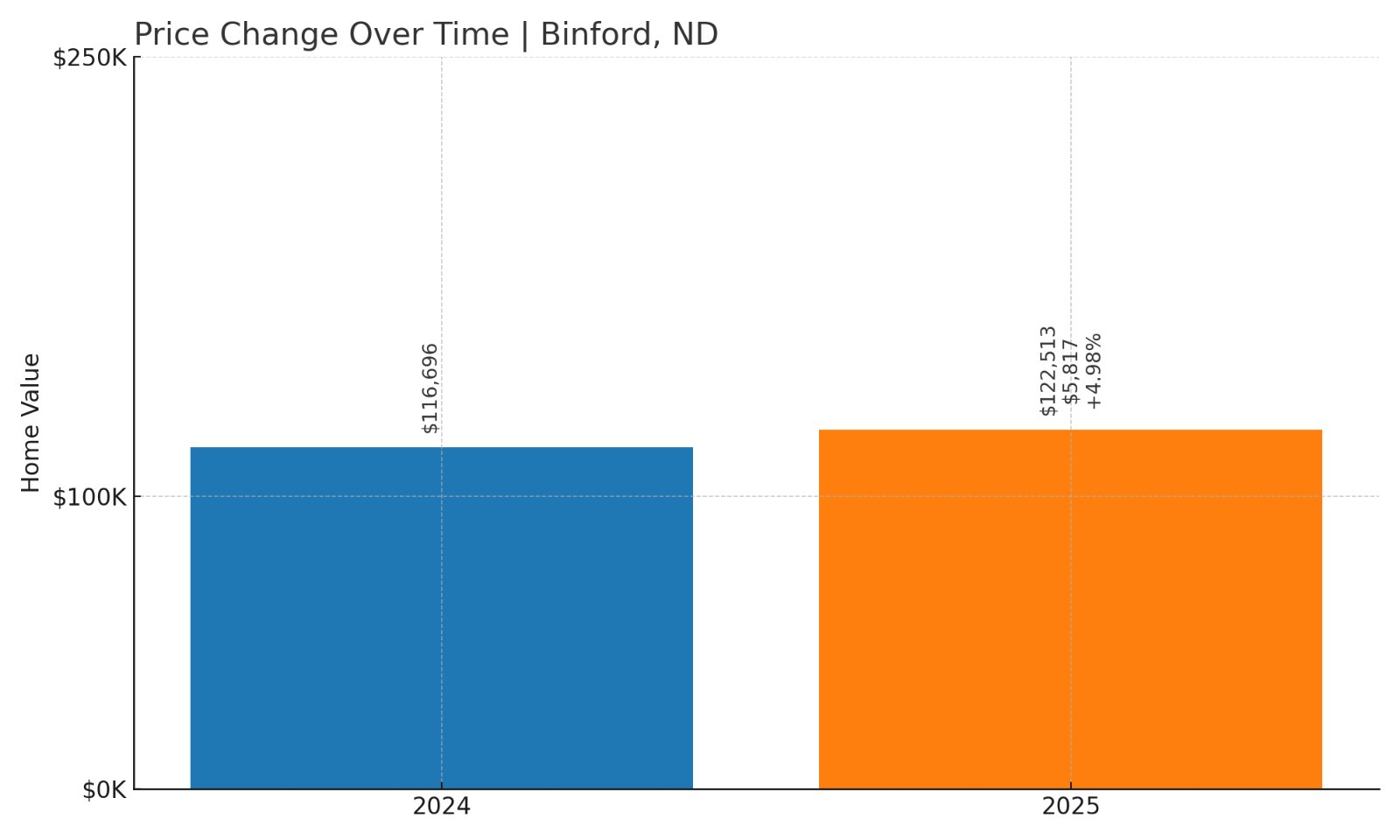

6. Binford – 4.9% Home Price Increase Since 2024

- 2010: $N/A

- 2011: $N/A

- 2012: $N/A

- 2013: $N/A

- 2014: $N/A

- 2015: $N/A

- 2016: $N/A

- 2017: $N/A

- 2018: $N/A

- 2019: $N/A

- 2020: $N/A

- 2021: $N/A

- 2022: $N/A

- 2023: $N/A

- 2024: $116,696

- 2025: $122,513 (+$5,817, +4.98% from previous year)

With a nearly 5% increase in home prices from 2024 to 2025, Binford has shown a promising uptick in a very short time. While we don’t have earlier data, the jump to $122,513 this year suggests the town is gaining value, possibly catching up after years of market stagnation or simply reflecting new demand.

Binford – A Quiet Surge in Griggs County

Binford, located in Griggs County, is one of North Dakota’s smallest towns, with a population of fewer than 200 residents. Despite its size, it has a strong sense of local identity and community spirit. The town is surrounded by farmland and is known for its Binford Days summer celebration, which draws visitors from around the region.

The sudden increase in home prices may reflect limited housing stock or a few key sales in a small market. Even so, with prices still hovering just above $120,000, Binford remains deeply affordable compared to both state and national averages. It’s a prime candidate for buyers looking to settle somewhere quiet and off the radar—at least for now.

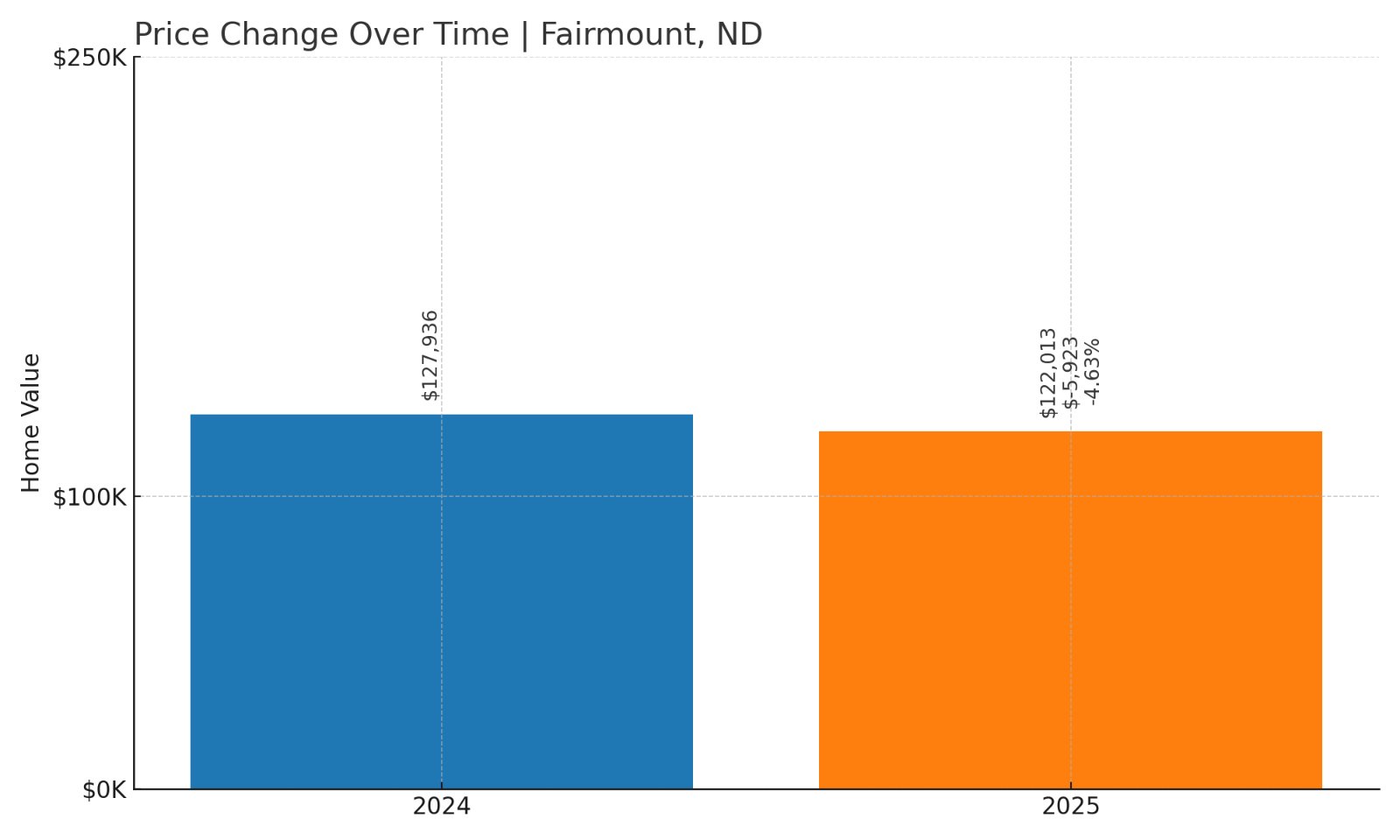

5. Fairmount – 4.6% Home Price Decrease Since 2024

- 2010: $N/A

- 2011: $N/A

- 2012: $N/A

- 2013: $N/A

- 2014: $N/A

- 2015: $N/A

- 2016: $N/A

- 2017: $N/A

- 2018: $N/A

- 2019: $N/A

- 2020: $N/A

- 2021: $N/A

- 2022: $N/A

- 2023: $N/A

- 2024: $127,936

- 2025: $122,013 (-$5,923, -4.63% from previous year)

Fairmount’s home prices have slipped by nearly 5% over the past year. The 2025 median value now sits at $122,013, down from $127,936 in 2024. While that’s a modest decrease, it’s enough to place Fairmount among the more affordable communities in the state this year.

Fairmount – Affordable Living Near the Minnesota Border

Fairmount lies in Richland County at the southeastern edge of North Dakota, close to the Minnesota border. The town is quiet and rural but still within reach of Wahpeton and the Twin Cities metro area if needed. It has a small school district and is centered around farming and family-owned businesses.

The decline in home values may be part of a short-term shift rather than a long-term trend, especially in a town with a small housing inventory. The market here remains accessible, and Fairmount’s location could offer a unique opportunity for buyers wanting low prices with relative proximity to larger regional hubs.

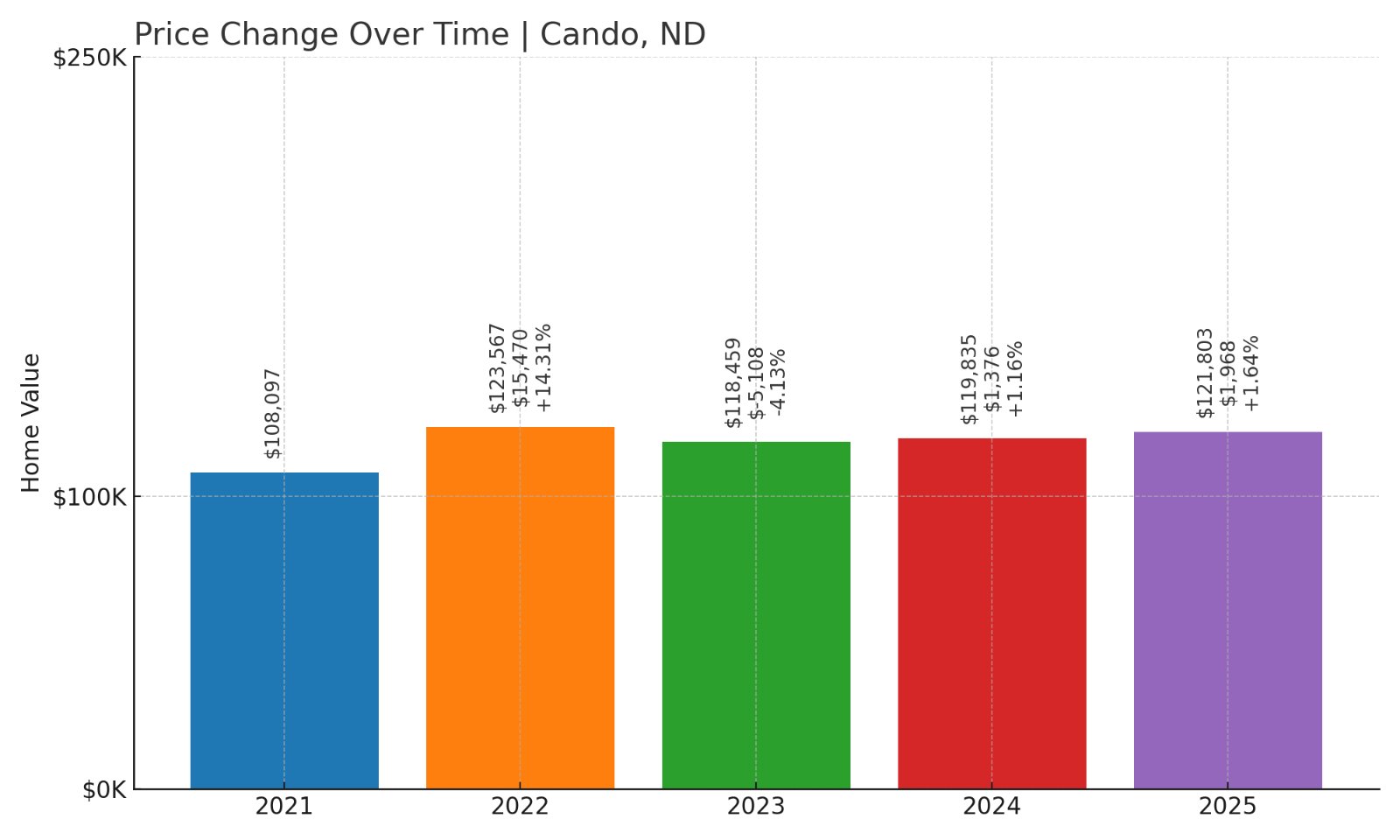

4. Cando – 12.7% Home Price Increase Since 2021

- 2010: $N/A

- 2011: $N/A

- 2012: $N/A

- 2013: $N/A

- 2014: $N/A

- 2015: $N/A

- 2016: $N/A

- 2017: $N/A

- 2018: $N/A

- 2019: $N/A

- 2020: $N/A

- 2021: $108,097

- 2022: $123,567 (+$15,470, +14.31% from previous year)

- 2023: $118,459 (-$5,108, -4.13% from previous year)

- 2024: $119,835 (+$1,376, +1.16% from previous year)

- 2025: $121,803 (+$1,968, +1.64% from previous year)

Cando has enjoyed a 12.7% increase in home values since 2021, despite a small dip in 2023. As of May 2025, the average home price is $121,803. The recent upward trend, even if slow, signals steady demand in this affordable market.

Cando – A Steady Climb in the Heart of Towner County

Cando, the county seat of Towner County, sits in north-central North Dakota and is home to around 1,000 people. It markets itself as the “Duck Capital of North Dakota” and offers a blend of outdoor life, small-town convenience, and essential services like healthcare, schools, and a regional airport.

After a big gain in 2022, the town experienced a brief price correction before returning to growth. The real estate market here shows resilience, and the affordability factor remains strong. For those seeking consistent value in a stable town, Cando may be a smart place to start a home search.

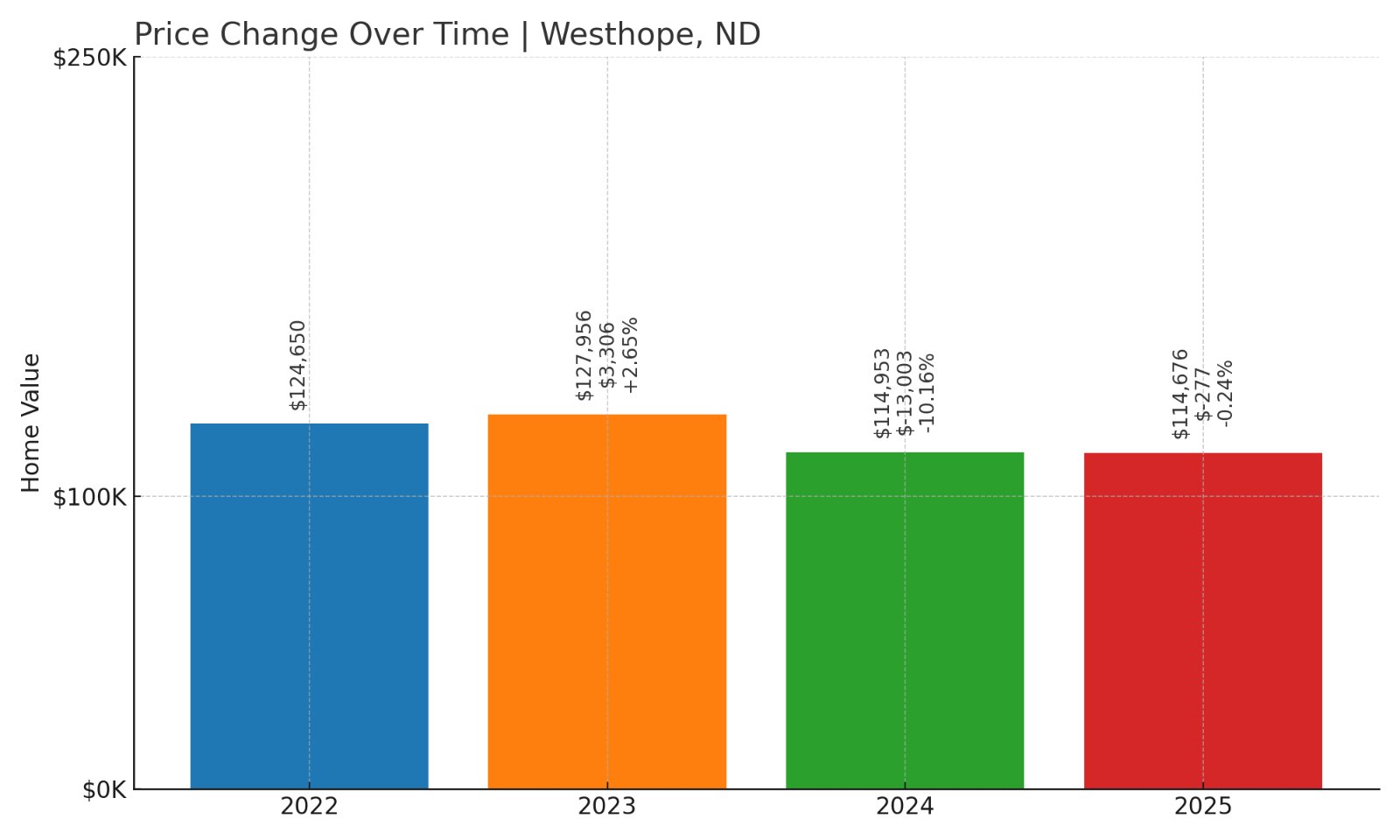

3. Westhope – 8% Home Price Decrease Since 2022

Would you like to save this?

- 2010: $N/A

- 2011: $N/A

- 2012: $N/A

- 2013: $N/A

- 2014: $N/A

- 2015: $N/A

- 2016: $N/A

- 2017: $N/A

- 2018: $N/A

- 2019: $N/A

- 2020: $N/A

- 2021: $N/A

- 2022: $124,650

- 2023: $127,956 (+$3,306, +2.65% from previous year)

- 2024: $114,953 (-$13,003, -10.16% from previous year)

- 2025: $114,676 (-$277, -0.24% from previous year)

Westhope’s housing prices have dropped 8% since 2022, following a rollercoaster that included a solid increase and a sharp correction. In May 2025, the average home is valued at $114,676. Despite the volatility, prices appear to be stabilizing.

Westhope – Price Swings in the Prairie North

Located in Bottineau County near the Canadian border, Westhope is a small farming town with a strong sense of place. Its remote location hasn’t stopped it from experiencing price fluctuations in recent years—likely due to a small number of home transactions affecting averages in a tight market.

That volatility aside, the town remains extremely affordable. Its 2025 price level places it among the cheapest in the state, and for buyers willing to trade proximity for peace, Westhope’s prices may be too good to ignore.

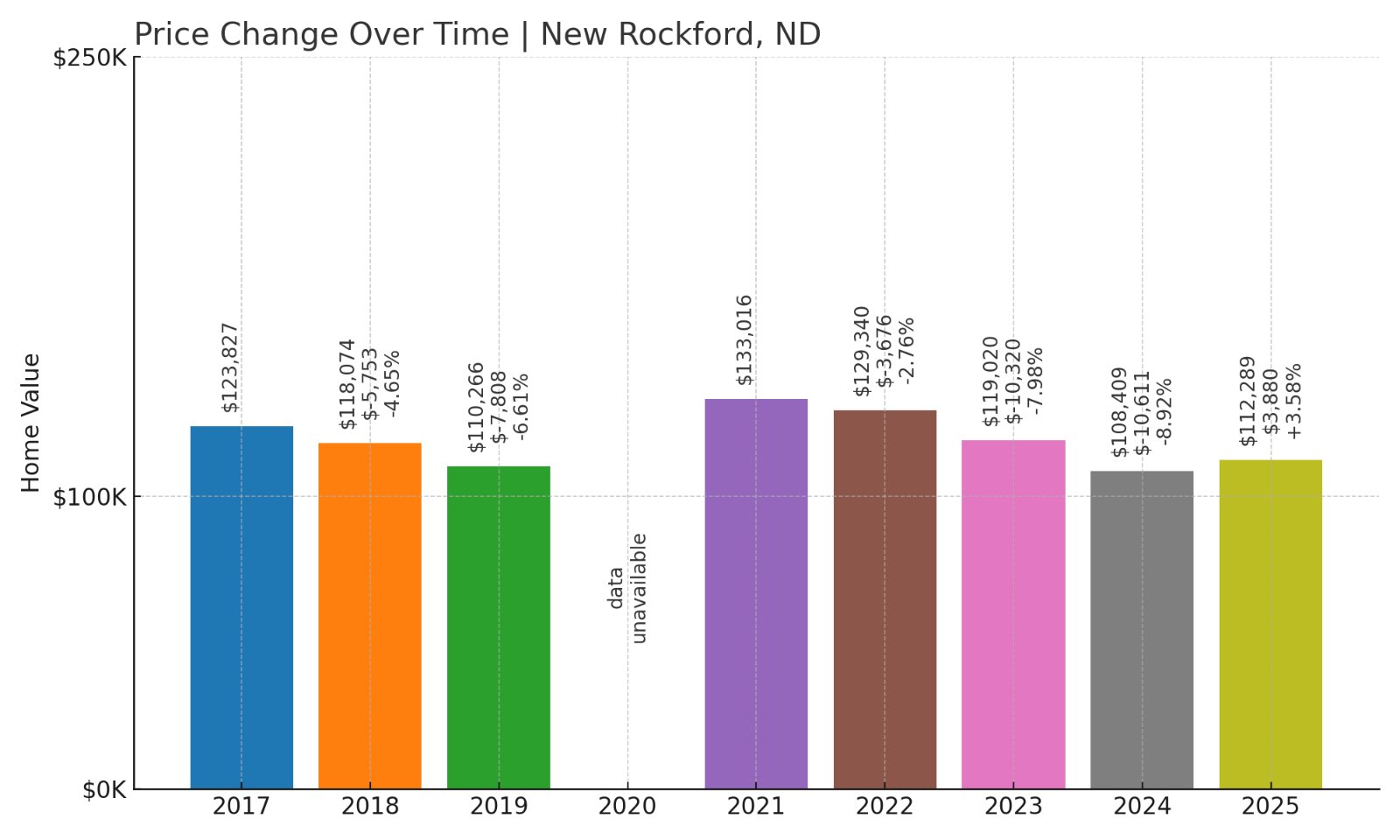

2. New Rockford – 9.3% Home Price Decrease Since 2021

- 2010: $N/A

- 2011: $N/A

- 2012: $N/A

- 2013: $N/A

- 2014: $N/A

- 2015: $N/A

- 2016: $N/A

- 2017: $123,827

- 2018: $118,074 (-$5,753, -4.65% from previous year)

- 2019: $110,266 (-$7,808, -6.61% from previous year)

- 2020: $N/A

- 2021: $133,016

- 2022: $129,340 (-$3,676, -2.76% from previous year)

- 2023: $119,020 (-$10,320, -7.98% from previous year)

- 2024: $108,409 (-$10,611, -8.92% from previous year)

- 2025: $112,289 (+$3,880, +3.58% from previous year)

New Rockford saw significant price declines after a peak in 2021, falling nearly 9.3% by 2025. However, the most recent data shows a modest rebound. With a 2025 home value of $112,289, this town remains one of the most budget-friendly in the state.

New Rockford – A Bump in the Road, or the Bottom?

Situated in Eddy County, New Rockford is a rural town along U.S. Route 281. It features a historic opera house, parks, and access to nearby natural attractions. The town’s economy is rooted in agriculture, education, and healthcare.

Price declines after 2021 may have reflected overvaluation or broader market correction, but the uptick in 2025 is a good sign for potential stabilization. For buyers seeking value in a community with history and heart, New Rockford offers a compelling case.

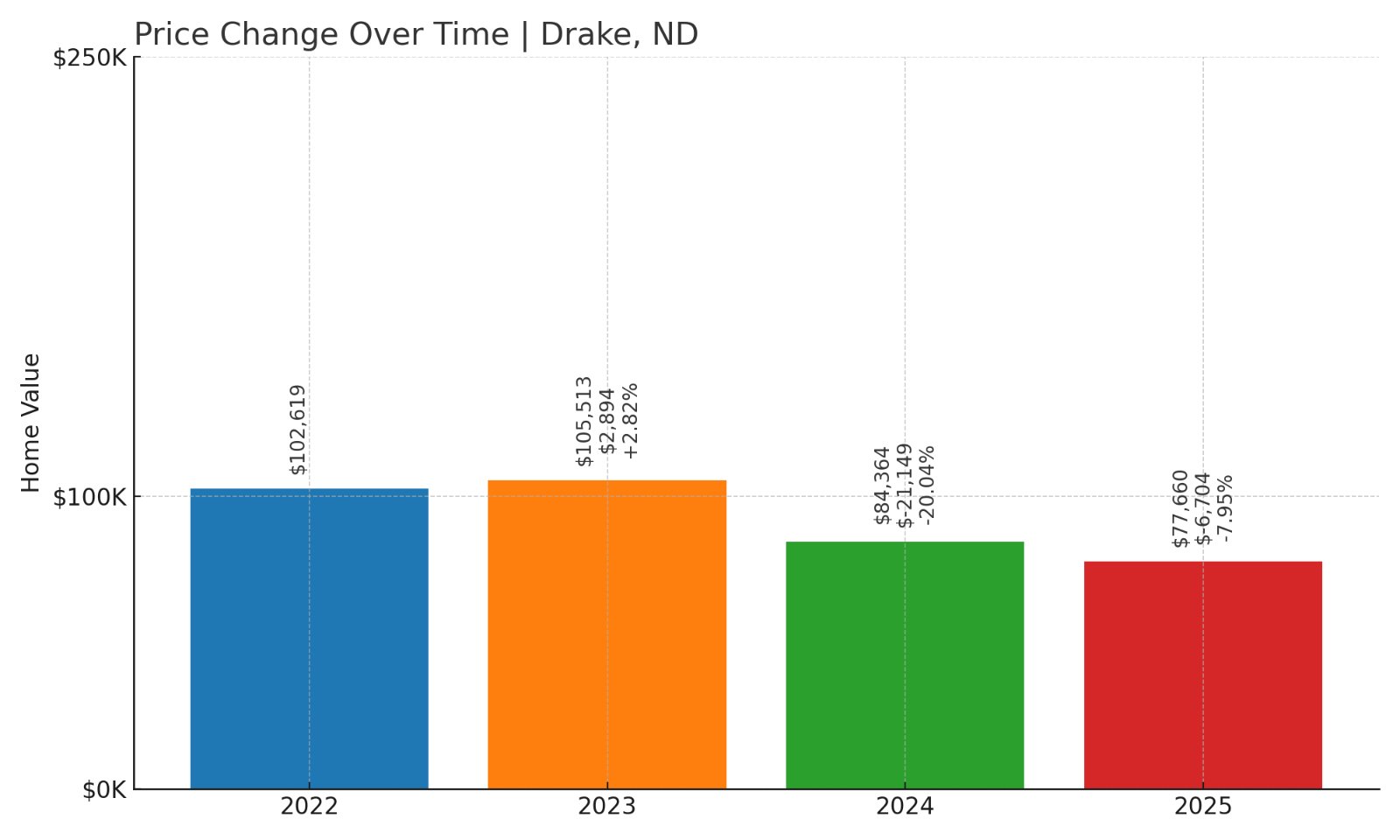

1. Drake – 24.3% Home Price Decrease Since 2022

- 2010: $N/A

- 2011: $N/A

- 2012: $N/A

- 2013: $N/A

- 2014: $N/A

- 2015: $N/A

- 2016: $N/A

- 2017: $N/A

- 2018: $N/A

- 2019: $N/A

- 2020: $N/A

- 2021: $N/A

- 2022: $102,619

- 2023: $105,513 (+$2,894, +2.82% from previous year)

- 2024: $84,364 (-$21,149, -20.04% from previous year)

- 2025: $77,660 (-$6,704, -7.95% from previous year)

Drake has experienced the steepest decline in home prices among the towns on this list, dropping 24.3% since 2022. With a 2025 home value of just $77,660, it’s currently the most affordable town in North Dakota by this measure.

Drake – Deep Affordability in a Tight Market

Located in McHenry County, Drake is a very small town with a population under 300. It’s part of the Velva Public School District and is surrounded by open farmland. While the town is quiet and remote, it maintains basic amenities for rural living.

The sharp drop in home values could be attributed to low sales volume or changing demand. But for prospective homeowners with a tight budget, Drake now represents one of the best opportunities in the state to buy property at a very low cost. Whether it’s a market correction or a long-term dip, it’s an affordable entry point in 2025.