Would you like to save this?

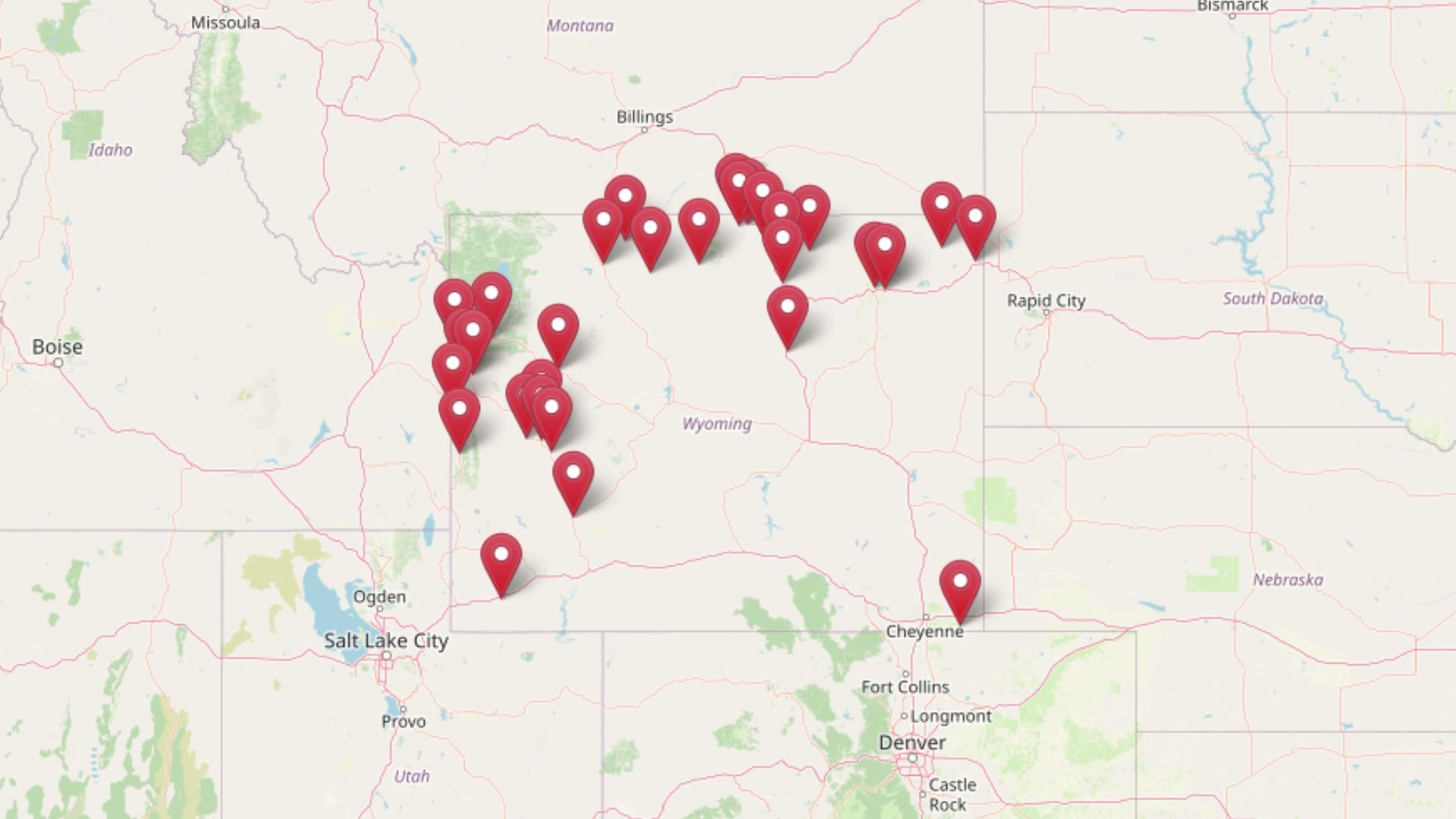

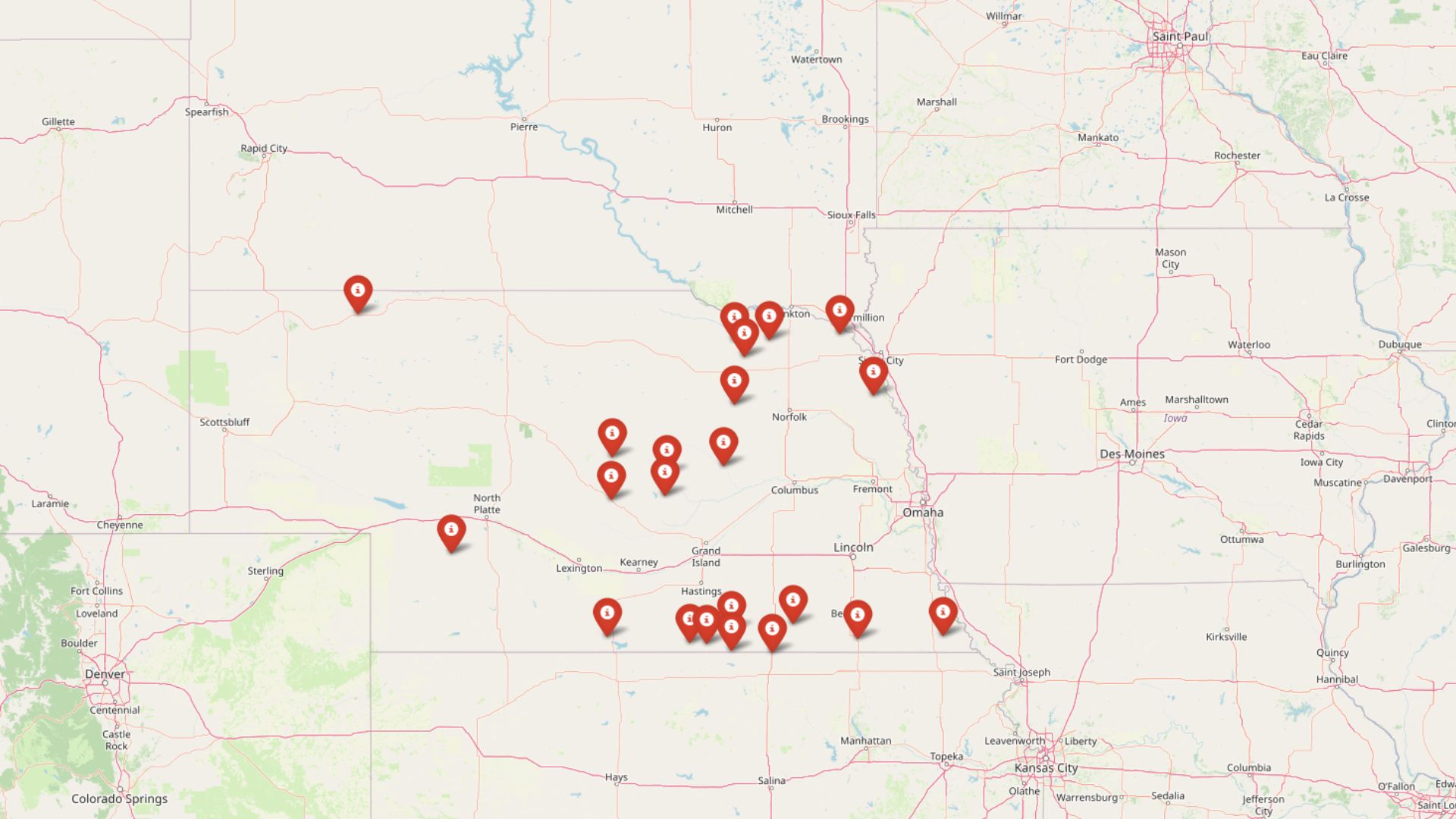

Not every Nebraska town is caught in the rising price wave. According to the Zillow Home Value Index, 22 communities across the state are still offering buyers a solid deal in 2025. From farming centers on the plains to former manufacturing towns finding new identities, these places keep home prices surprisingly low—without sacrificing lifestyle. Whether you’re looking for an affordable first home or a long-term investment, these Nebraska towns show that budget-friendly living is still possible in today’s market.

22. Newcastle – 22.8% Home Price Increase Since 2021

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: $90,122

- 2022: $95,338 (+$5,216, +5.79% from previous year)

- 2023: $103,553 (+$8,215, +8.62% from previous year)

- 2024: $109,760 (+$6,208, +5.99% from previous year)

- 2025: $110,674 (+$913, +0.83% from previous year)

Newcastle has seen a modest but steady climb in home values since 2021, rising nearly 23% over four years. The pace of growth has slowed in the last year, but prices remain above pre-pandemic levels. The current typical home value in Newcastle sits just over $110,000.

Newcastle – Small Size, Steady Growth

Newcastle is a tiny town tucked in the northeastern corner of Nebraska, near the South Dakota border. Its remote location and small population help keep home prices low, while a steady demand for modest housing contributes to its quiet price growth. The town’s housing stock includes older single-family homes, often on larger lots, which appeal to buyers looking for space and value.

Despite its size, Newcastle has experienced consistent year-over-year appreciation since 2021. That may be due in part to its access to nature, with the Missouri River and scenic Loess Hills nearby. For those looking to live away from urban noise and pay far less for a home, Newcastle stands out as a budget-friendly option in northeast Nebraska.

21. Wallace – 52.9% Home Price Increase Since 2014

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: $71,254

- 2015: $69,034 (-$2,220, -3.12% from previous year)

- 2016: $72,118 (+$3,084, +4.47% from previous year)

- 2017: $76,690 (+$4,572, +6.34% from previous year)

- 2018: $81,825 (+$5,135, +6.70% from previous year)

- 2019: $86,472 (+$4,647, +5.68% from previous year)

- 2020: $95,142 (+$8,670, +10.03% from previous year)

- 2021: $106,383 (+$11,241, +11.82% from previous year)

- 2022: $100,181 (-$6,202, -5.83% from previous year)

- 2023: $113,518 (+$13,337, +13.31% from previous year)

- 2024: $113,020 (-$497, -0.44% from previous year)

- 2025: $109,000 (-$4,020, -3.56% from previous year)

Wallace’s home values have grown by nearly 53% since 2014, even with some recent declines. Its peak came in 2023, followed by a soft drop through 2025. Despite that, the town remains one of the more affordable places to buy in Nebraska, with homes averaging just above $109,000.

Wallace – A Rural Bargain with Price Swings

Kitchen Style?

Located in southwestern Nebraska, Wallace is a classic railroad town surrounded by farmland. It’s quiet, with a population under 400, and that rural character is reflected in its real estate market. Price increases were significant leading up to 2021, but there have been notable ups and downs since then. This kind of fluctuation is not uncommon in small towns with low transaction volume.

Even with the recent correction, home values in Wallace remain low compared to the state average. For buyers who can tolerate some volatility in exchange for affordability, it’s an appealing option. Its school system and proximity to Highway 25 make it functional for families and commuters alike.

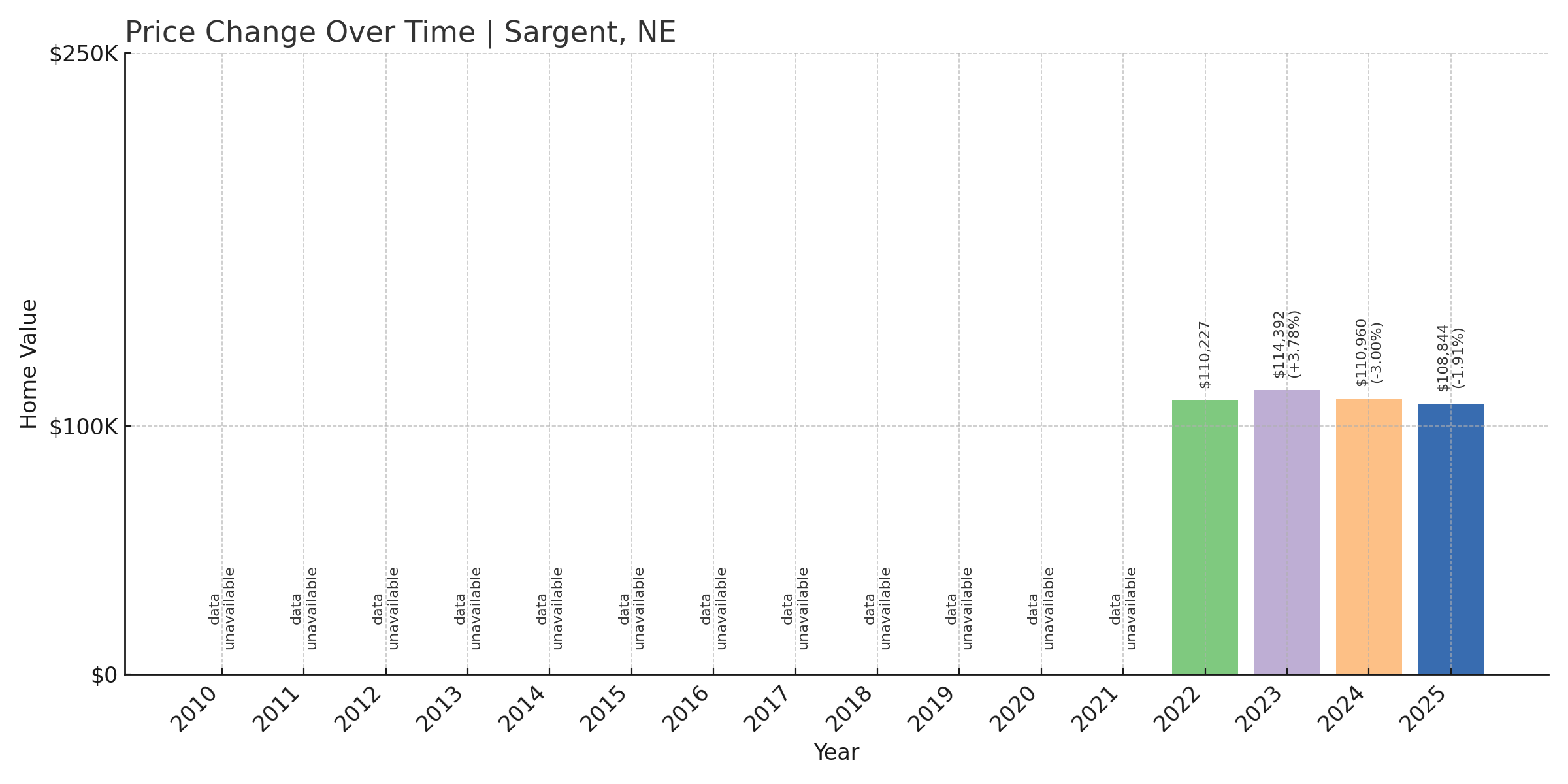

20. Sargent – -1.3% Home Price Decline Since 2022

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: N/A

- 2022: $110,227

- 2023: $114,392 (+$4,165, +3.78% from previous year)

- 2024: $110,960 (-$3,432, -3.00% from previous year)

- 2025: $108,844 (-$2,115, -1.91% from previous year)

After peaking in 2023, home prices in Sargent have dropped slightly for two consecutive years. The typical home value has settled just under $109,000—slightly below its 2022 level. Even so, Sargent remains among the more budget-friendly towns in Nebraska.

Sargent – Quiet Living with Modest Corrections

Sargent is nestled in central Nebraska’s Custer County and often flies under the radar. It’s a farming community with a small-town feel, and while home values briefly climbed in 2023, they’ve eased back since. The local market is likely adjusting after a brief demand uptick that pushed prices higher than usual.

With no major employers or population spikes, prices in Sargent tend to reflect real, local conditions rather than speculation. That helps explain its affordability and stability. The town is home to historic buildings and easy access to outdoor recreation, adding to its appeal for retirees and remote workers seeking low-cost housing in a peaceful setting.

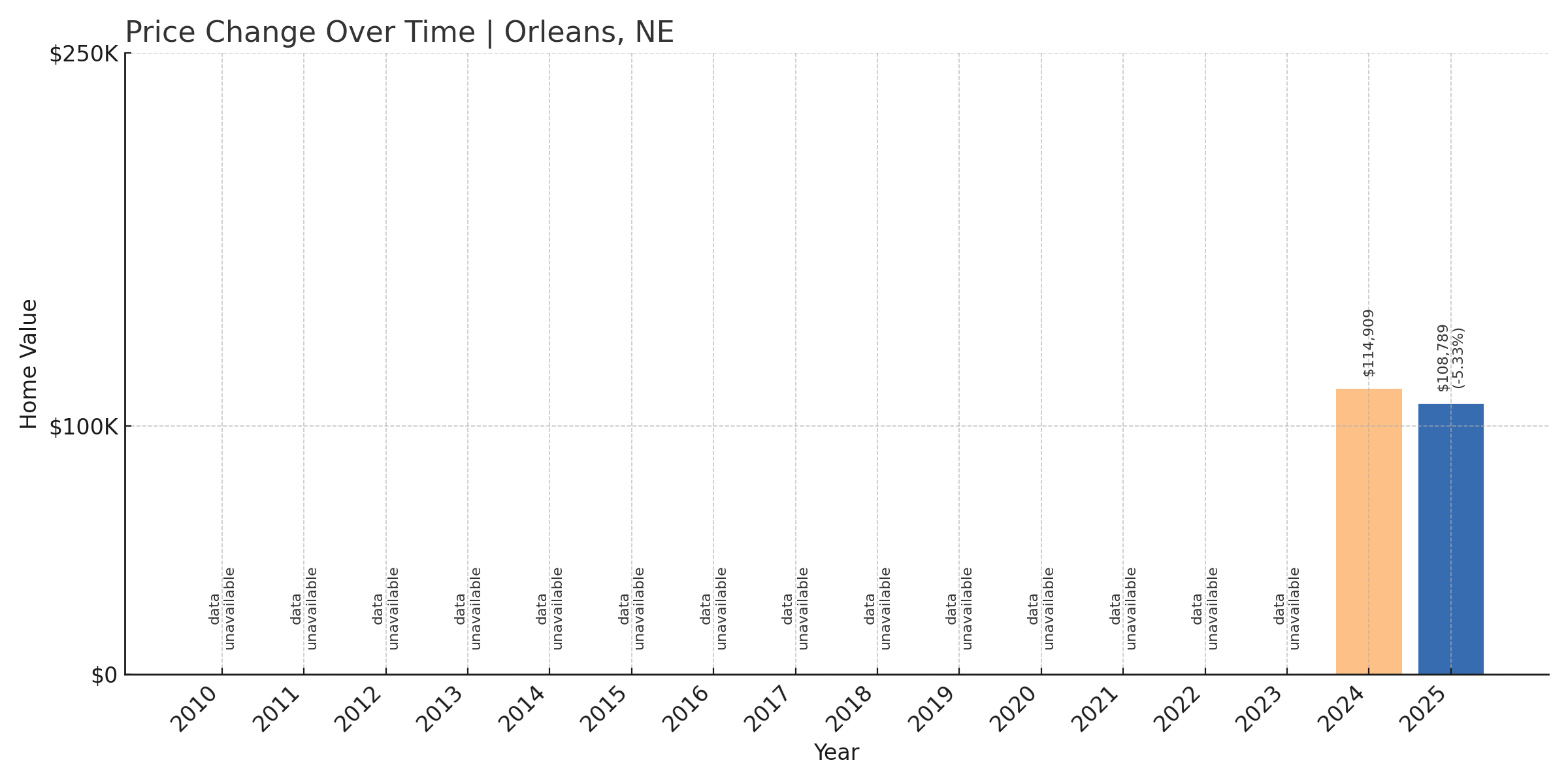

19. Orleans – -5.33% Home Price Decline Since 2024

Home Stratosphere Guide

Your Personality Already Knows

How Your Home Should Feel

113 pages of room-by-room design guidance built around your actual brain, your actual habits, and the way you actually live.

You might be an ISFJ or INFP designer…

You design through feeling — your spaces are personal, comforting, and full of meaning. The guide covers your exact color palettes, room layouts, and the one mistake your type always makes.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ISTJ or INTJ designer…

You crave order, function, and visual calm. The guide shows you how to create spaces that feel both serene and intentional — without ending up sterile.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ENFP or ESTP designer…

You design by instinct and energy. Your home should feel alive. The guide shows you how to channel that into rooms that feel curated, not chaotic.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ENTJ or ESTJ designer…

You value quality, structure, and things done right. The guide gives you the framework to build rooms that feel polished without overthinking every detail.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: N/A

- 2022: N/A

- 2023: N/A

- 2024: $114,909

- 2025: $108,789 (-$6,120, -5.33% from previous year)

With only two years of recorded data, Orleans has already seen a drop of over 5% in home values. The average price has declined from just under $115,000 in 2024 to $108,789 this year. While limited data makes trend analysis harder, the dip is notable.

Orleans – Sparse Data, Recent Decline

Orleans is a small village near Nebraska’s southern border in Harlan County. Like many rural communities in the state, it has a small population and limited housing turnover. That makes any price movement stand out more, especially when there are only a few transactions annually.

The drop from 2024 to 2025 suggests a softening market, but Orleans’ location and quiet lifestyle still make it attractive to those seeking affordability and simplicity. Its proximity to Harlan County Reservoir adds appeal for fishing and boating enthusiasts.

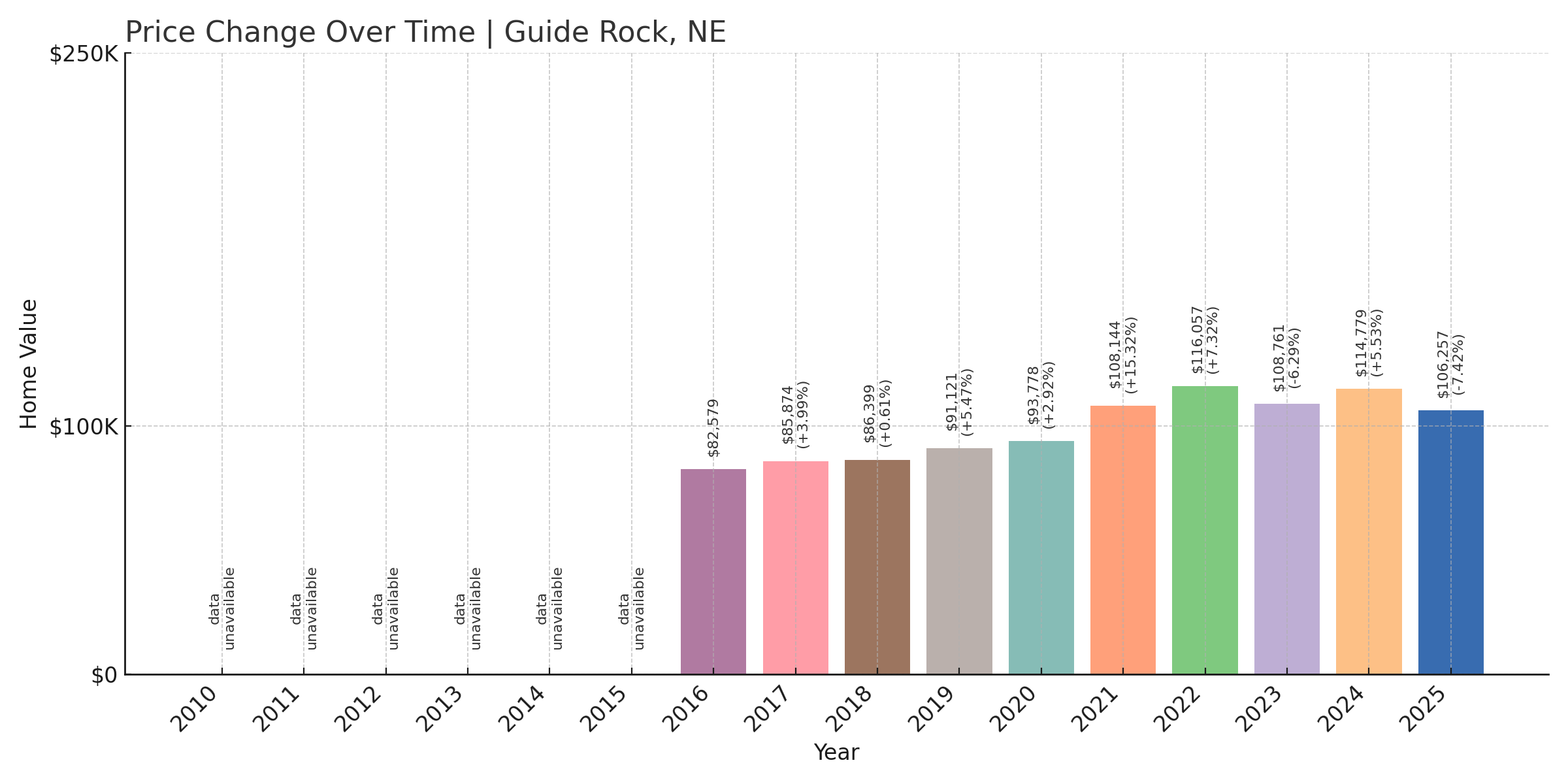

18. Guide Rock – 28.7% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $82,579

- 2017: $85,874 (+$3,295, +3.99% from previous year)

- 2018: $86,399 (+$524, +0.61% from previous year)

- 2019: $91,121 (+$4,723, +5.47% from previous year)

- 2020: $93,778 (+$2,657, +2.92% from previous year)

- 2021: $108,144 (+$14,366, +15.32% from previous year)

- 2022: $116,057 (+$7,913, +7.32% from previous year)

- 2023: $108,761 (-$7,296, -6.29% from previous year)

- 2024: $114,779 (+$6,018, +5.53% from previous year)

- 2025: $106,257 (-$8,522, -7.42% from previous year)

Guide Rock has had a bumpy ride since 2016. After peaking above $116,000 in 2022, values have pulled back by nearly $10,000. Still, home prices have risen nearly 29% since 2016, showing long-term growth despite recent volatility.

Guide Rock – Long-Term Rise with Recent Drops

Sitting in south-central Nebraska near the Kansas border, Guide Rock blends agricultural heritage with small-town quiet. Home values have gone up significantly over the past decade but have dipped in recent years—likely a result of cooling demand post-2022.

Despite the back-to-back declines in 2023 and 2025, the town’s location near U.S. Route 136 and local scenic bluffs keep it on the radar for affordable home seekers. Guide Rock’s recent downturn may present buying opportunities for those looking for inexpensive housing with long-term upside.

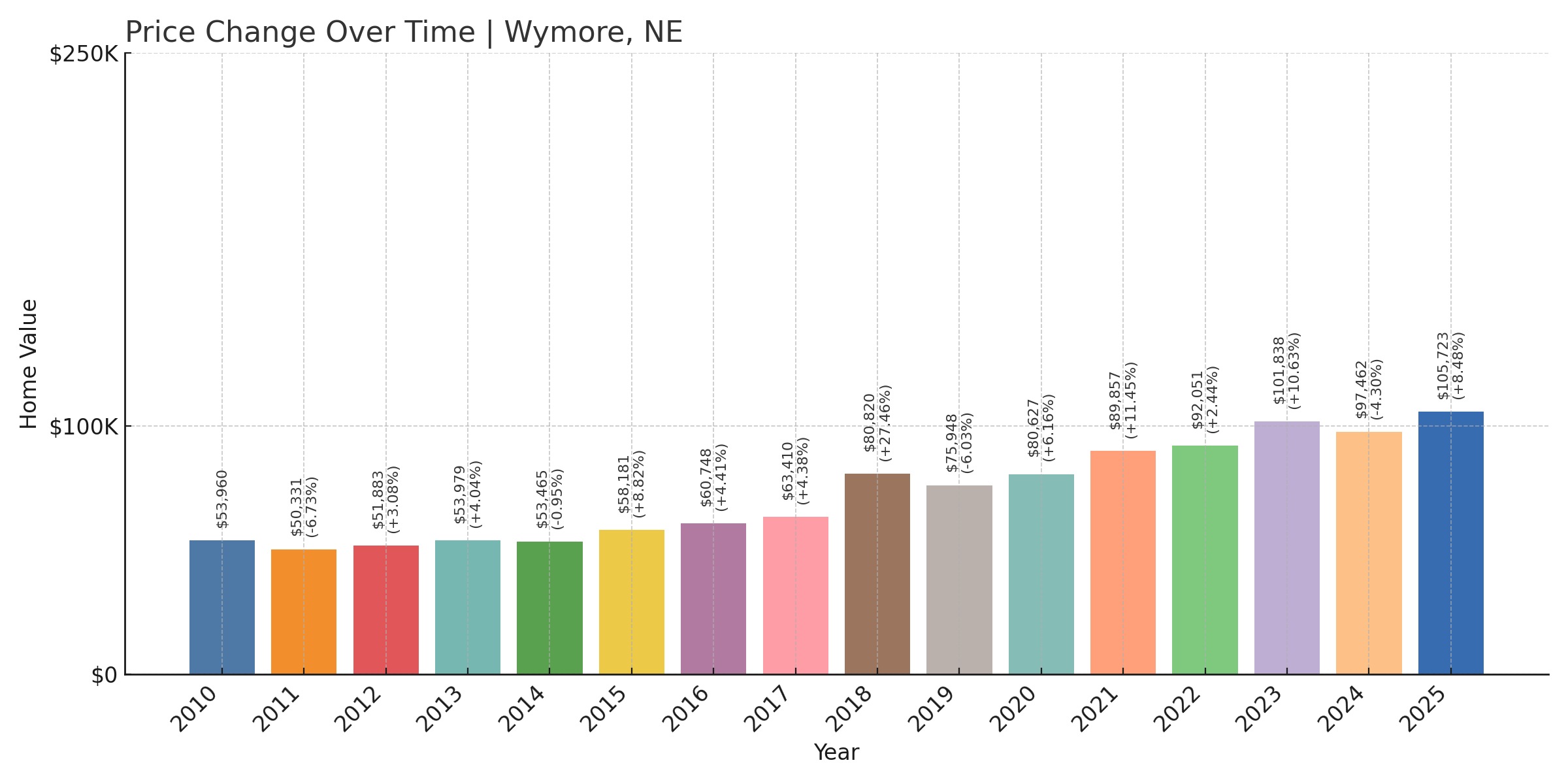

17. Wymore – 95.9% Home Price Increase Since 2010

- 2010: $53,960

- 2011: $50,331 (-$3,629, -6.73% from previous year)

- 2012: $51,883 (+$1,552, +3.08% from previous year)

- 2013: $53,979 (+$2,096, +4.04% from previous year)

- 2014: $53,465 (-$514, -0.95% from previous year)

- 2015: $58,181 (+$4,716, +8.82% from previous year)

- 2016: $60,748 (+$2,567, +4.41% from previous year)

- 2017: $63,410 (+$2,662, +4.38% from previous year)

- 2018: $80,820 (+$17,409, +27.45% from previous year)

- 2019: $75,948 (-$4,872, -6.03% from previous year)

- 2020: $80,627 (+$4,679, +6.16% from previous year)

- 2021: $89,857 (+$9,230, +11.45% from previous year)

- 2022: $92,051 (+$2,194, +2.44% from previous year)

- 2023: $101,838 (+$9,788, +10.63% from previous year)

- 2024: $97,462 (-$4,376, -4.30% from previous year)

- 2025: $105,723 (+$8,261, +8.48% from previous year)

Home values in Wymore have nearly doubled since 2010, climbing from around $54,000 to nearly $106,000. The market has seen some dips, particularly in 2019 and 2024, but those were followed by strong rebounds. The overall trend remains solidly upward.

Wymore – Price Growth Driven by Value Appeal

Wymore, located in southeastern Nebraska near the Kansas border, has seen a surprising amount of real estate movement for a small town. Known for its historic downtown and proximity to the Blue River, it offers affordable homes with architectural charm that’s tough to find elsewhere at this price point.

The town’s affordability, along with its manageable distance to Beatrice and Lincoln, may be driving the long-term increase in home values. After a few years of minor corrections, Wymore’s housing market surged again in 2025, making it one of the more dynamic towns on this list.

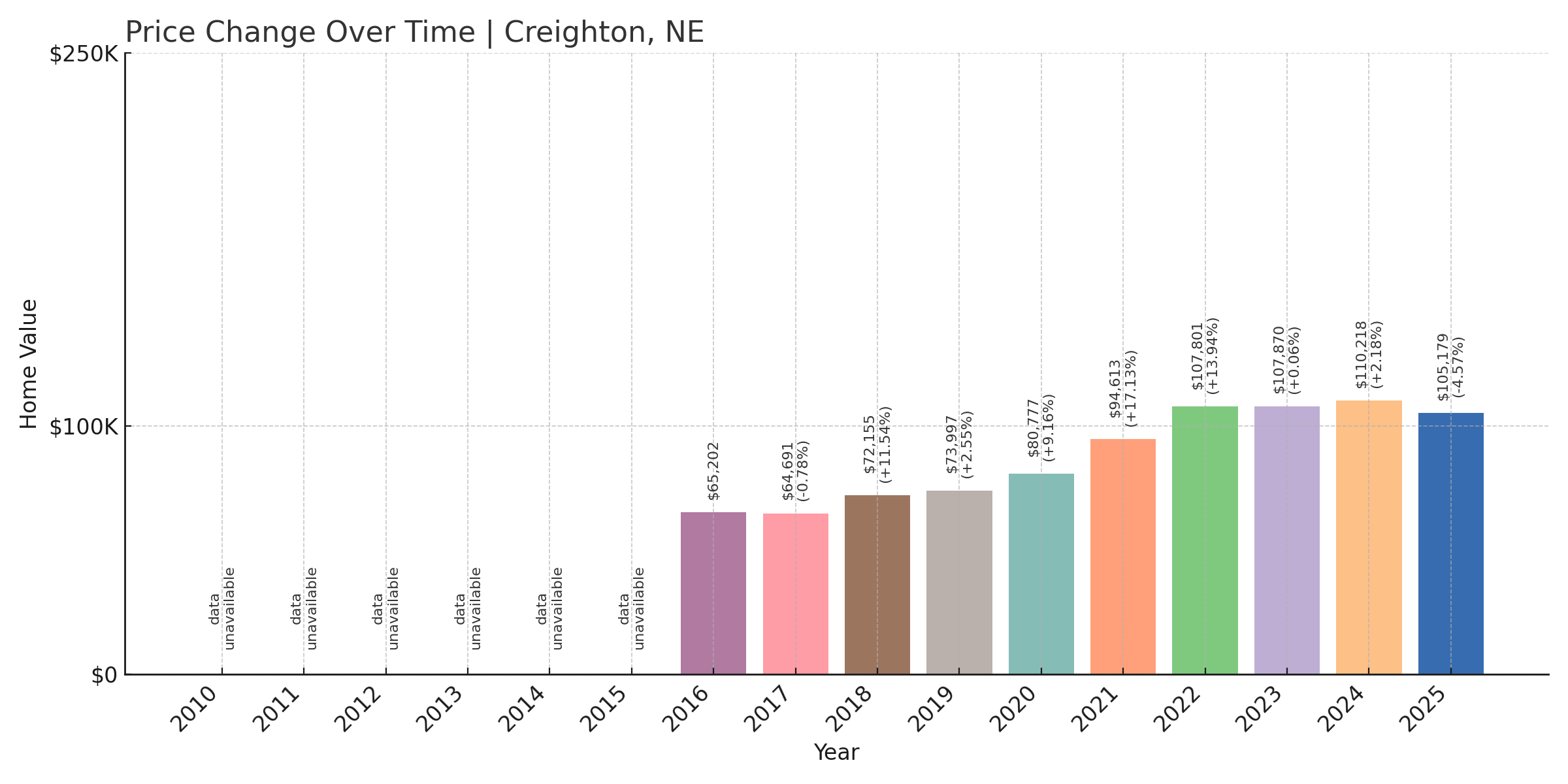

16. Creighton – 61.3% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $65,202

- 2017: $64,691 (-$511, -0.78% from previous year)

- 2018: $72,155 (+$7,464, +11.54% from previous year)

- 2019: $73,997 (+$1,843, +2.55% from previous year)

- 2020: $80,777 (+$6,780, +9.16% from previous year)

- 2021: $94,613 (+$13,836, +17.13% from previous year)

- 2022: $107,801 (+$13,188, +13.94% from previous year)

- 2023: $107,870 (+$69, +0.06% from previous year)

- 2024: $110,218 (+$2,348, +2.18% from previous year)

- 2025: $105,179 (-$5,039, -4.57% from previous year)

Since 2016, home prices in Creighton have climbed more than 60%, peaking in 2024 before falling slightly this year. Despite the recent dip, the town’s long-term trend remains positive, with home values sitting around $105,000 in 2025.

Creighton – Long-Term Growth, Minor Setback

Creighton sits in northeastern Nebraska and serves as a small regional hub for the surrounding farming communities. Its economy benefits from local businesses and medical services that support nearby rural areas. This stability likely contributed to the steady climb in home values over the past decade.

The slight drop in 2025 comes after several years of rapid appreciation. That could simply be a market correction after a strong run. With its blend of rural charm, local infrastructure, and affordability, Creighton remains a solid option for buyers looking for long-term value in a small-town setting.

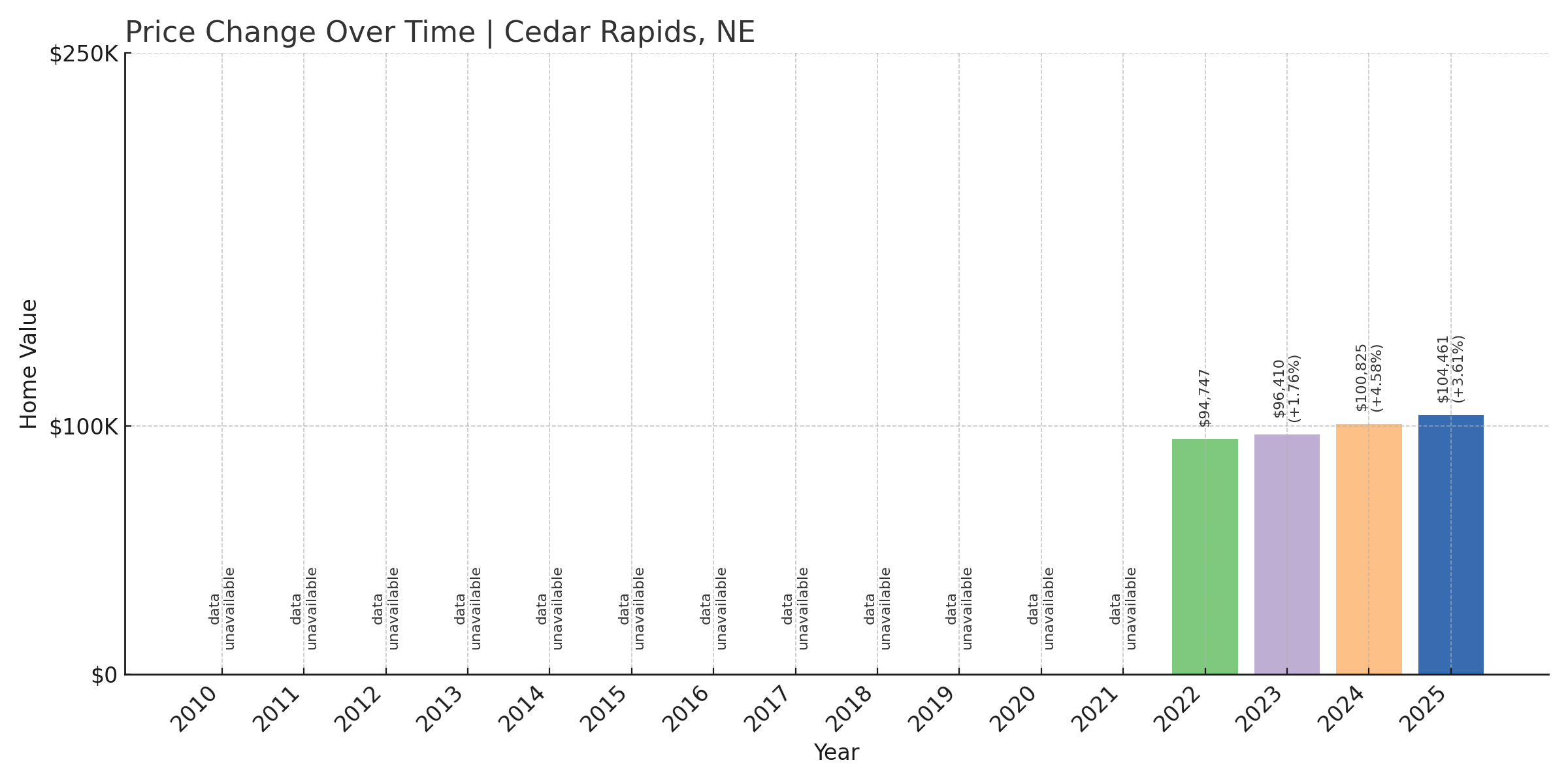

15. Cedar Rapids – 10.2% Home Price Increase Since 2022

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: N/A

- 2022: $94,747

- 2023: $96,410 (+$1,663, +1.76% from previous year)

- 2024: $100,825 (+$4,415, +4.58% from previous year)

- 2025: $104,461 (+$3,636, +3.61% from previous year)

Since 2022, home prices in Cedar Rapids have increased just over 10%, with each year showing positive gains. The current typical home value is $104,461—still well below the statewide average, keeping it affordable even after three straight years of growth.

Cedar Rapids – Quiet and Consistently Rising

Cedar Rapids is located in Boone County in east-central Nebraska, and while it shares its name with a much larger city in Iowa, this Nebraska version is much quieter. It’s primarily agricultural, with a handful of small businesses supporting local residents.

With limited supply and slow, steady demand, prices have risen without major volatility. The consistent upward trend suggests the market is balancing affordability with modest appreciation—something buyers looking for long-term stability often prioritize.

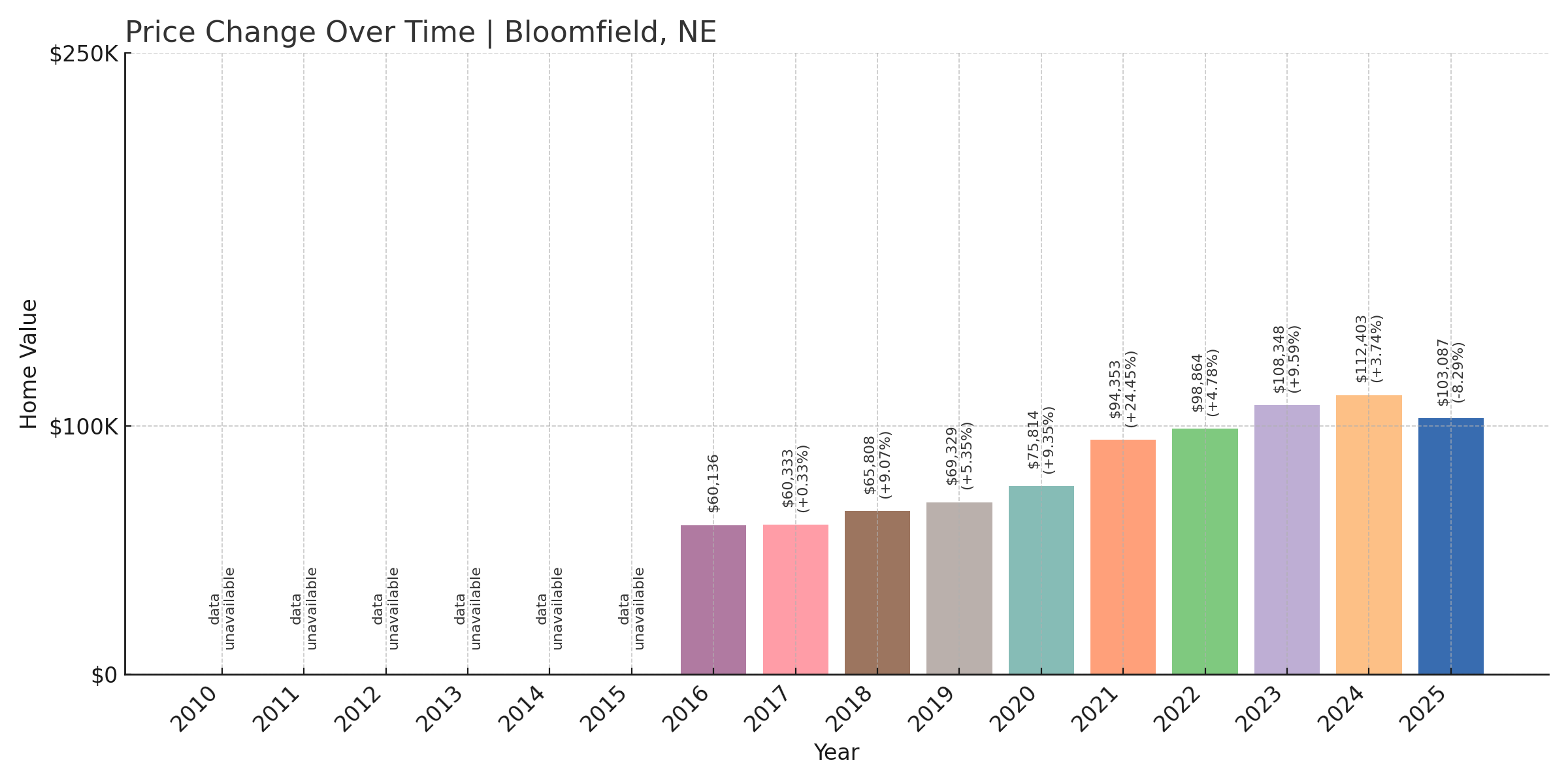

14. Bloomfield – 71.5% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $60,136

- 2017: $60,333 (+$197, +0.33% from previous year)

- 2018: $65,808 (+$5,475, +9.07% from previous year)

- 2019: $69,329 (+$3,521, +5.35% from previous year)

- 2020: $75,814 (+$6,486, +9.35% from previous year)

- 2021: $94,353 (+$18,539, +24.45% from previous year)

- 2022: $98,864 (+$4,510, +4.78% from previous year)

- 2023: $108,348 (+$9,484, +9.59% from previous year)

- 2024: $112,403 (+$4,055, +3.74% from previous year)

- 2025: $103,087 (-$9,315, -8.29% from previous year)

Bloomfield’s home values have increased by over 70% since 2016, but 2025 marks its first notable downturn in years. After peaking in 2024, prices dropped by over 8%, bringing the average home value down to just above $103,000.

Bloomfield – High Climb, Cooling Off

Located in Knox County in northeast Nebraska, Bloomfield offers a close-knit rural atmosphere with a number of essential services, including a hospital and schools. Its housing market surged between 2016 and 2024, especially during the pandemic-era boom years.

While the decline in 2025 is one of the steeper drops on this list, it’s not out of step with broader statewide trends. Prices remain well above where they were a few years ago, and that’s a sign that demand hasn’t vanished—just cooled slightly after rapid appreciation.

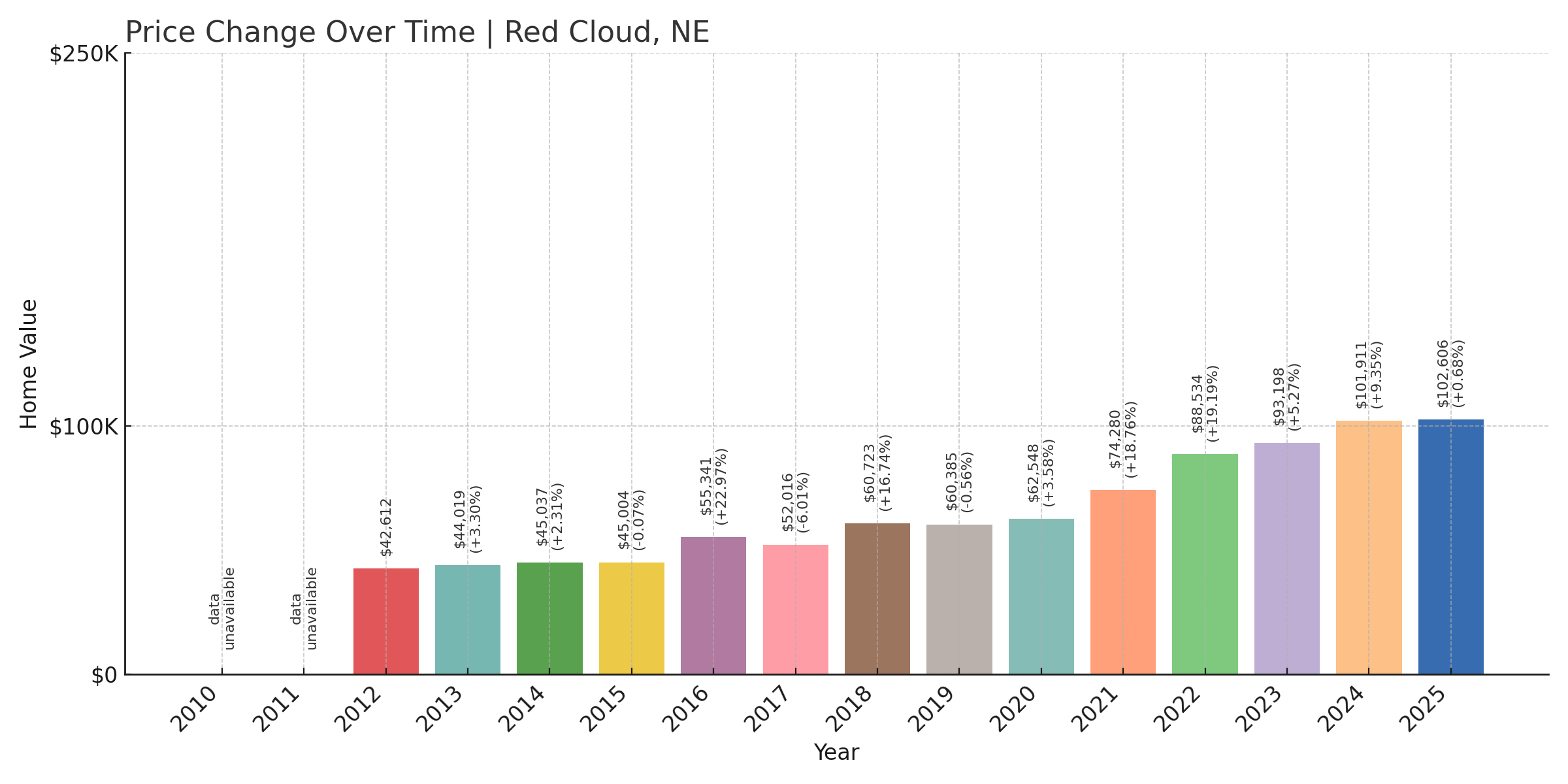

13. Red Cloud – 140.8% Home Price Increase Since 2012

Would you like to save this?

- 2010: N/A

- 2011: N/A

- 2012: $42,612

- 2013: $44,019 (+$1,407, +3.30% from previous year)

- 2014: $45,037 (+$1,018, +2.31% from previous year)

- 2015: $45,004 (-$33, -0.07% from previous year)

- 2016: $55,341 (+$10,336, +22.97% from previous year)

- 2017: $52,016 (-$3,325, -6.01% from previous year)

- 2018: $60,723 (+$8,707, +16.74% from previous year)

- 2019: $60,385 (-$338, -0.56% from previous year)

- 2020: $62,548 (+$2,162, +3.58% from previous year)

- 2021: $74,280 (+$11,732, +18.76% from previous year)

- 2022: $88,534 (+$14,254, +19.19% from previous year)

- 2023: $93,198 (+$4,664, +5.27% from previous year)

- 2024: $101,911 (+$8,713, +9.35% from previous year)

- 2025: $102,606 (+$695, +0.68% from previous year)

Red Cloud’s housing market has surged since 2012, with home values climbing nearly 141%. After strong gains in recent years, prices have stabilized in 2025, rising just 0.68% from the year before. Typical home values now sit at $102,606.

Red Cloud – Literary Legacy and Real Growth

Red Cloud is best known as the hometown of author Willa Cather, and the literary tourism that surrounds her legacy gives the town a cultural profile far bigger than its population suggests. It’s also seen substantial price appreciation over the past decade—likely due in part to its charming historic housing stock.

While 2025’s growth was minimal, the market appears to have entered a phase of equilibrium after years of large increases. For buyers interested in small-town charm and homes with character, Red Cloud offers both at a relatively low price point.

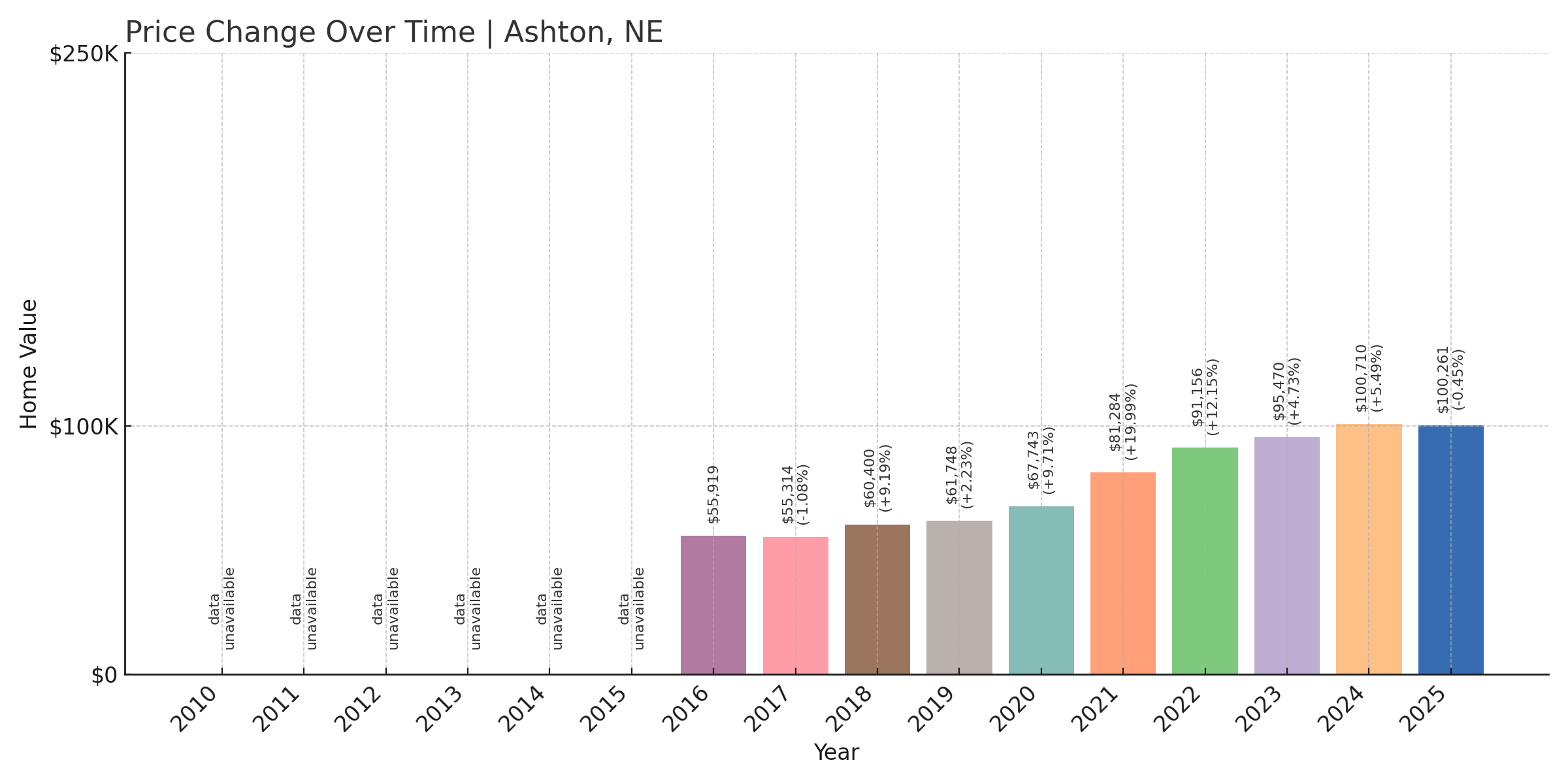

12. Ashton – 79.3% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $55,919

- 2017: $55,314 (-$605, -1.08% from previous year)

- 2018: $60,400 (+$5,086, +9.19% from previous year)

- 2019: $61,748 (+$1,348, +2.23% from previous year)

- 2020: $67,743 (+$5,994, +9.71% from previous year)

- 2021: $81,284 (+$13,542, +19.99% from previous year)

- 2022: $91,156 (+$9,871, +12.14% from previous year)

- 2023: $95,470 (+$4,315, +4.73% from previous year)

- 2024: $100,710 (+$5,239, +5.49% from previous year)

- 2025: $100,261 (-$449, -0.45% from previous year)

Home values in Ashton have surged more than 79% since 2016, though growth appears to have finally plateaued in 2025 with a small decline. That stability may offer some reassurance for buyers after years of rapid increases.

Ashton – High Growth, Now Leveling Off

Were You Meant

to Live In?

Ashton is a small town in Sherman County with a rich Polish heritage and quiet rural setting. Over the past decade, it’s seen a notable run-up in home values, driven by low inventory and demand for affordable homes in Nebraska’s interior.

The nearly 80% gain since 2016 reflects how even out-of-the-way towns can benefit from broader housing market momentum. Ashton’s price leveling in 2025 may mark a new phase of stability, with typical home prices now holding steady at just above $100,000.

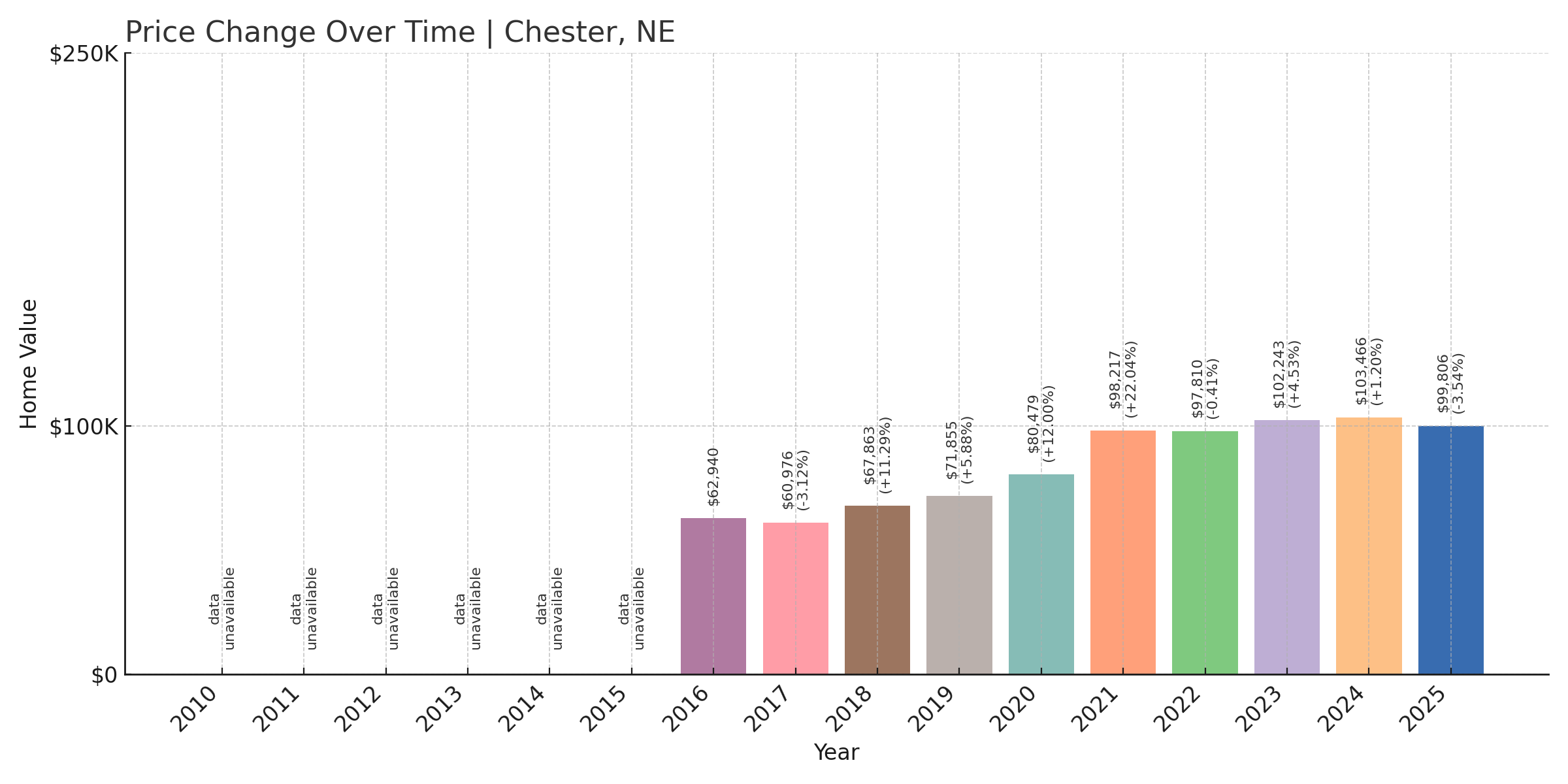

11. Chester – 58.6% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $62,940

- 2017: $60,976 (-$1,964, -3.12% from previous year)

- 2018: $67,863 (+$6,887, +11.29% from previous year)

- 2019: $71,855 (+$3,992, +5.88% from previous year)

- 2020: $80,479 (+$8,624, +12.00% from previous year)

- 2021: $98,217 (+$17,738, +22.04% from previous year)

- 2022: $97,810 (-$407, -0.41% from previous year)

- 2023: $102,243 (+$4,433, +4.53% from previous year)

- 2024: $103,466 (+$1,223, +1.20% from previous year)

- 2025: $99,806 (-$3,660, -3.54% from previous year)

Chester’s housing market has grown nearly 59% since 2016, even with a recent dip. After peaking in 2024, prices declined slightly this year. The current typical home value is just under $100,000.

Chester – Rural Affordability with Modest Fluctuations

Located near the Kansas border in Thayer County, Chester is best known as the birthplace of Sixteen Candles playwright and director John Hughes. Its size and location make it a quiet place to live, with minimal development but a strong sense of local pride.

Price trends in Chester reflect broader patterns in rural Nebraska: steady growth with occasional downturns. Even with this year’s decline, values remain far above where they were just a few years ago, signaling long-term demand for small-town affordability.

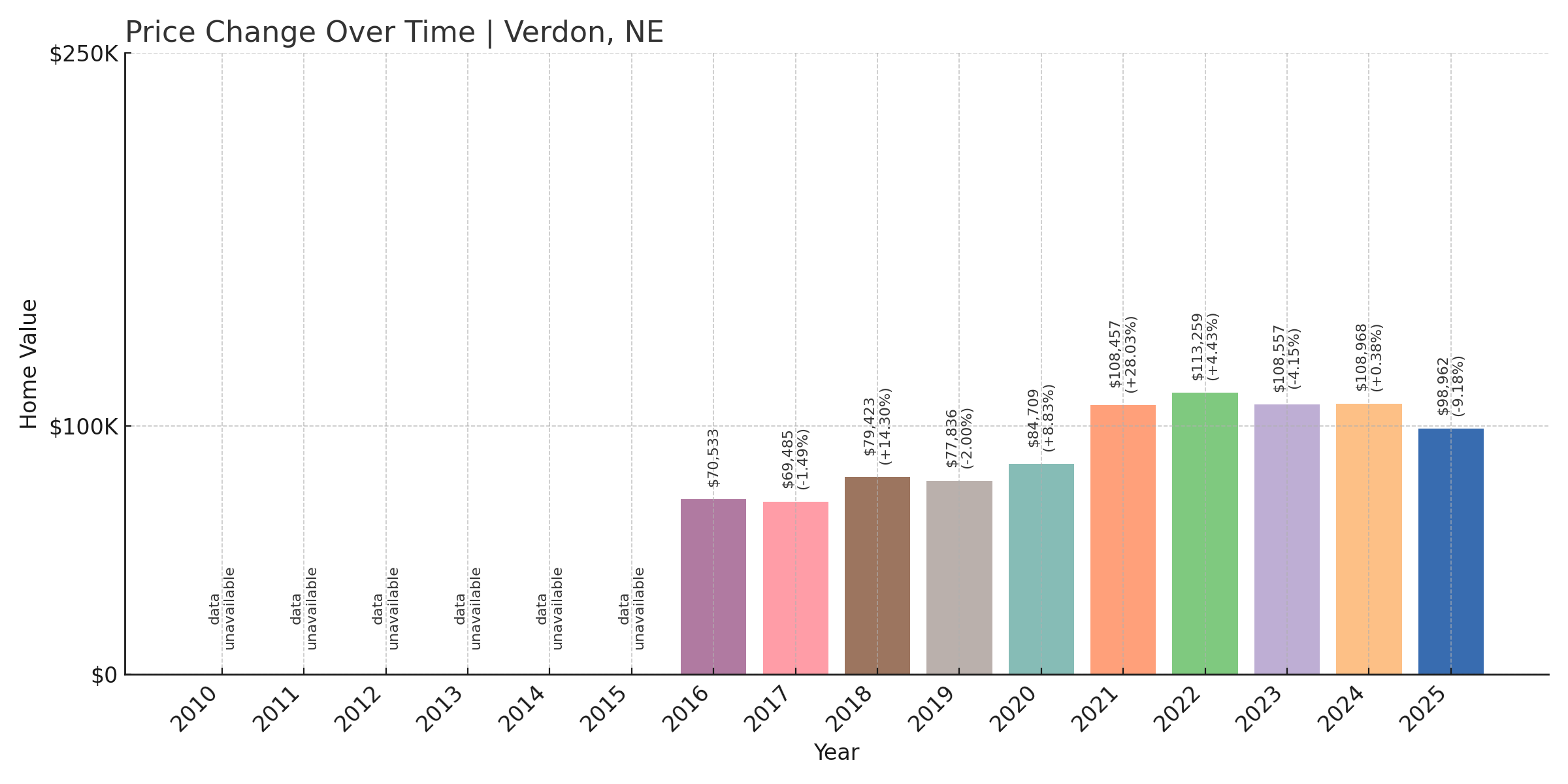

10. Verdon – 40.3% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $70,533

- 2017: $69,485 (-$1,049, -1.49% from previous year)

- 2018: $79,423 (+$9,938, +14.30% from previous year)

- 2019: $77,836 (-$1,587, -2.00% from previous year)

- 2020: $84,709 (+$6,873, +8.83% from previous year)

- 2021: $108,457 (+$23,749, +28.04% from previous year)

- 2022: $113,259 (+$4,802, +4.43% from previous year)

- 2023: $108,557 (-$4,703, -4.15% from previous year)

- 2024: $108,968 (+$411, +0.38% from previous year)

- 2025: $98,962 (-$10,005, -9.18% from previous year)

Verdon’s home values have risen over 40% since 2016, though 2025 brought a steep 9% drop—the largest single-year decline for the town. Even so, prices remain well above where they started nearly a decade ago.

Verdon – Pandemic-Era Peak, Post-Boom Correction

Verdon is a tiny village in Richardson County, located in Nebraska’s southeastern corner. It saw one of its biggest surges in home values in 2021, likely influenced by national buying trends and limited local inventory.

But the gains have since partially reversed. With few homes available and a low transaction volume, even one or two property sales can swing averages sharply. For buyers seeking ultra-low-cost housing, Verdon remains a contender—especially after this year’s price drop.

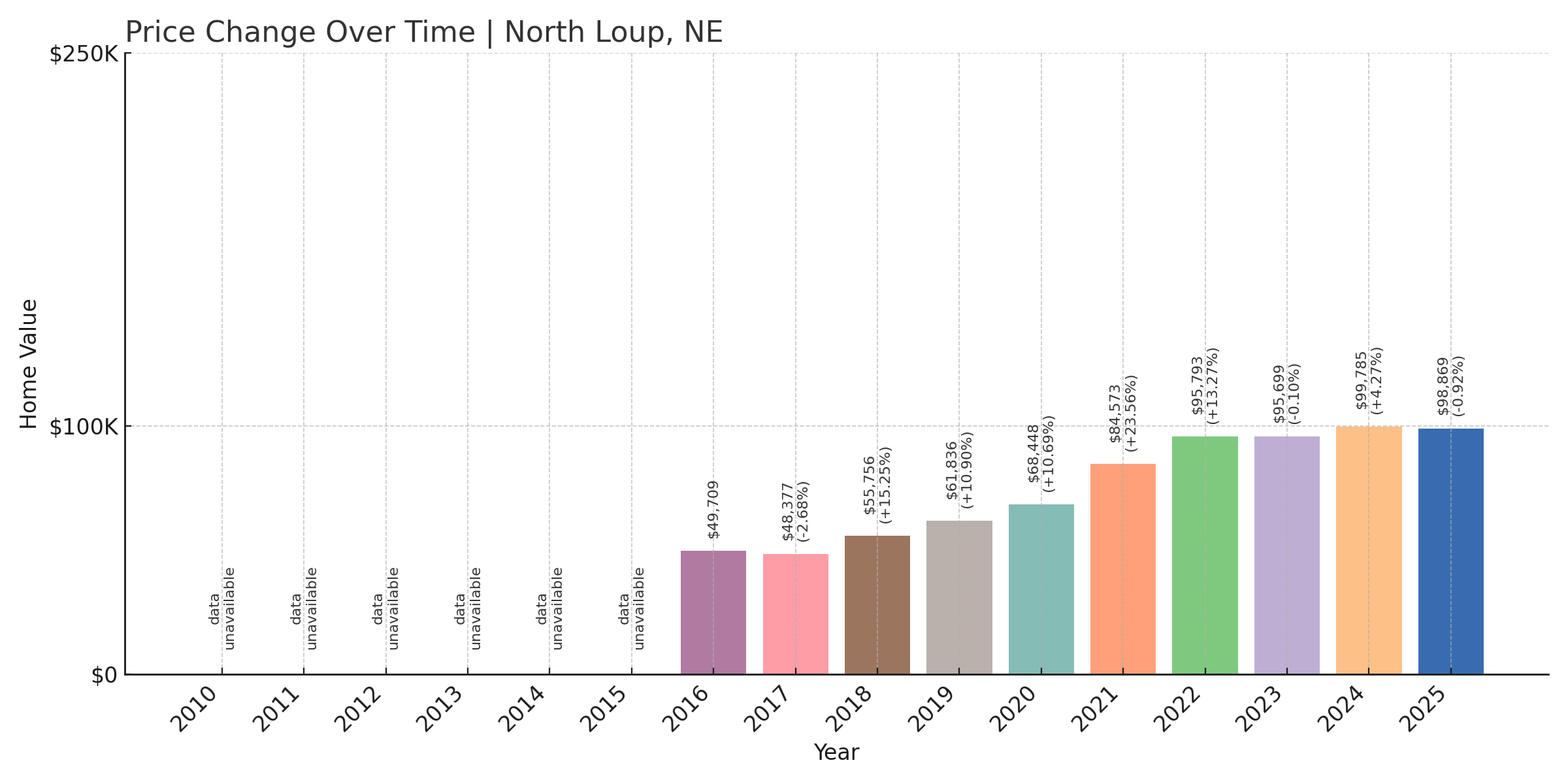

9. North Loup – 98.9% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $49,709

- 2017: $48,377 (-$1,332, -2.68% from previous year)

- 2018: $55,756 (+$7,379, +15.25% from previous year)

- 2019: $61,836 (+$6,080, +10.91% from previous year)

- 2020: $68,448 (+$6,613, +10.69% from previous year)

- 2021: $84,573 (+$16,124, +23.56% from previous year)

- 2022: $95,793 (+$11,220, +13.27% from previous year)

- 2023: $95,699 (-$94, -0.10% from previous year)

- 2024: $99,785 (+$4,086, +4.27% from previous year)

- 2025: $98,869 (-$916, -0.92% from previous year)

Since 2016, home values in North Loup have nearly doubled, growing from under $50,000 to just under $99,000. The growth has been steady, though the last two years have been more stable with modest fluctuations.

North Loup – Steady Appreciation in Valley County

North Loup is located along the North Loup River in central Nebraska’s Valley County. It’s a quiet community known for its annual popcorn festival and agricultural roots. With modest homes and a low cost of living, it’s no surprise that demand has slowly pushed prices upward.

The housing market here hasn’t shown the sharp volatility seen in some other towns. Instead, North Loup offers a picture of gradual appreciation—an appealing pattern for those looking for affordability without the risk of big swings.

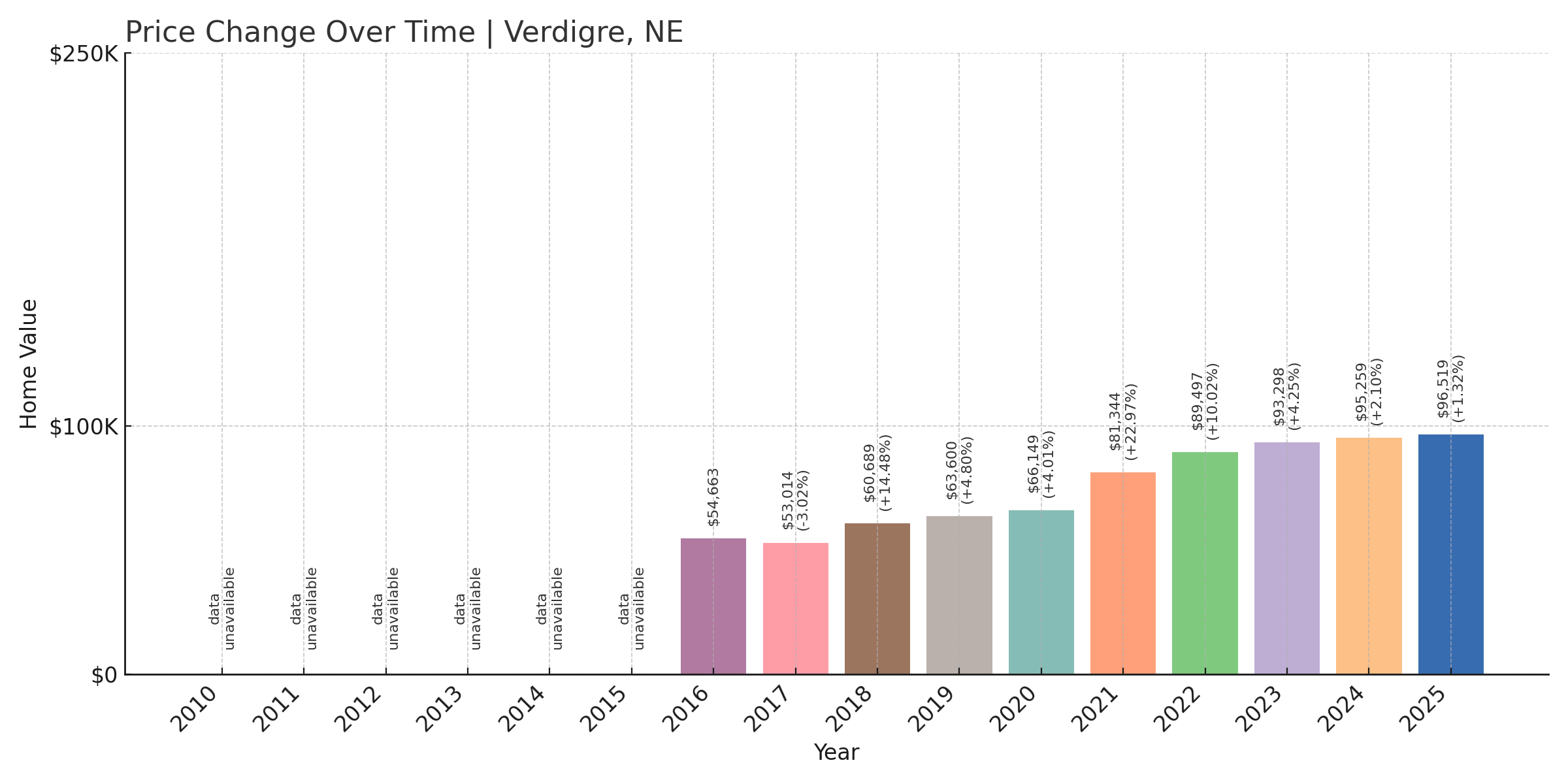

8. Verdigre – 76.5% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $54,663

- 2017: $53,014 (-$1,649, -3.02% from previous year)

- 2018: $60,689 (+$7,676, +14.48% from previous year)

- 2019: $63,600 (+$2,910, +4.80% from previous year)

- 2020: $66,149 (+$2,549, +4.01% from previous year)

- 2021: $81,344 (+$15,195, +22.97% from previous year)

- 2022: $89,497 (+$8,153, +10.02% from previous year)

- 2023: $93,298 (+$3,801, +4.25% from previous year)

- 2024: $95,259 (+$1,961, +2.10% from previous year)

- 2025: $96,519 (+$1,260, +1.32% from previous year)

Home prices in Verdigre have grown by more than 76% since 2016. The rate of growth has slowed in recent years, but values have continued to rise consistently each year, reaching $96,519 in 2025.

Verdigre – Steady Growth in a Cultural Enclave

Verdigre is located in Knox County and is known for its strong Czech heritage, celebrated annually with the Kolach Days festival. This cultural identity, along with its scenic rural surroundings, makes it a unique and appealing place to live—especially for buyers seeking small-town charm and affordable housing.

Verdigre’s home price growth has been steady and resilient, even during years when other small towns saw declines. The modest yet consistent increases point to a market with stable demand and limited inventory. At under $100,000, it remains one of Nebraska’s most affordable towns with year-over-year appreciation.

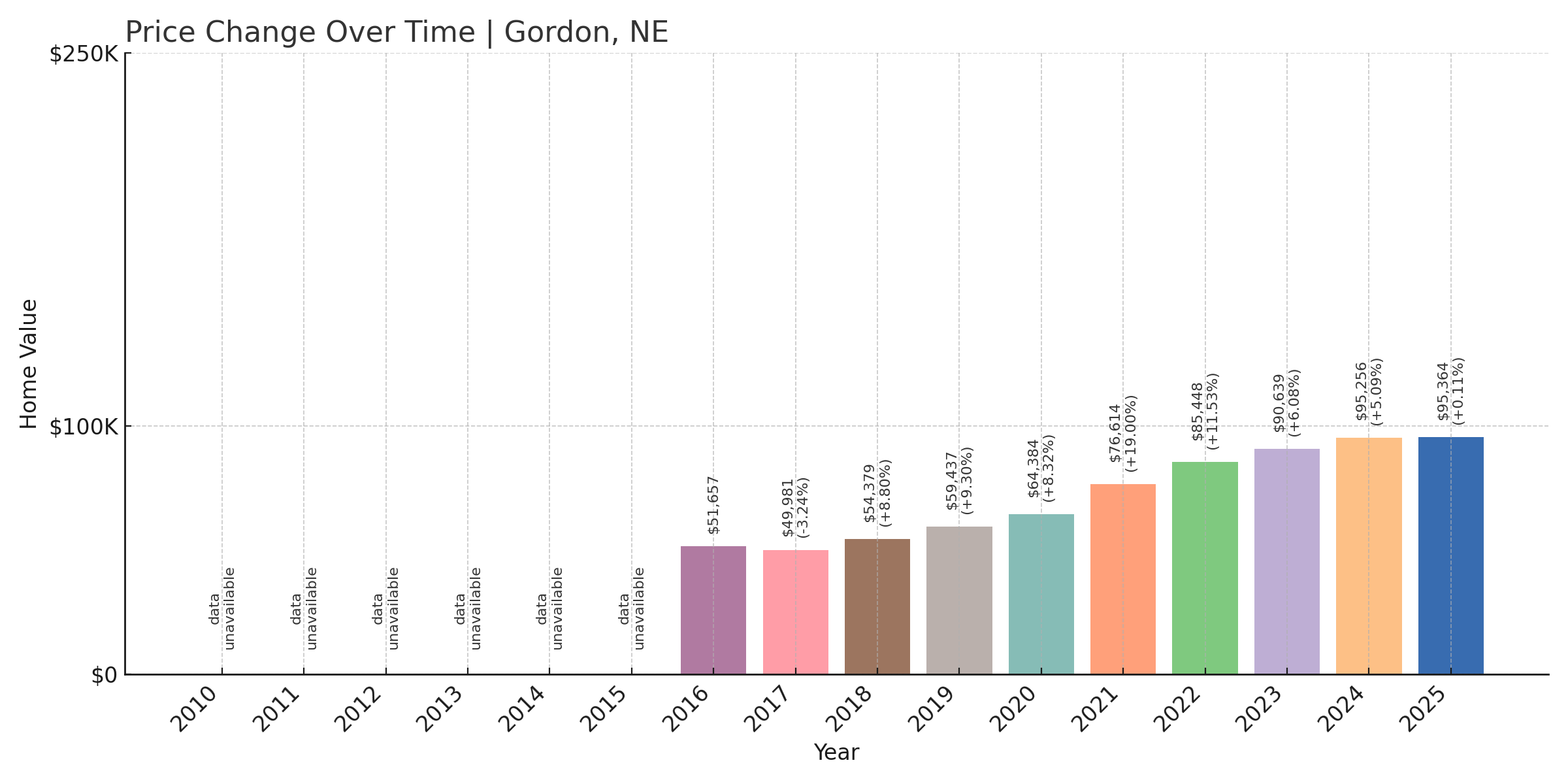

7. Gordon – 84.6% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $51,657

- 2017: $49,981 (-$1,677, -3.25% from previous year)

- 2018: $54,379 (+$4,399, +8.80% from previous year)

- 2019: $59,437 (+$5,058, +9.30% from previous year)

- 2020: $64,384 (+$4,947, +8.32% from previous year)

- 2021: $76,614 (+$12,230, +19.00% from previous year)

- 2022: $85,448 (+$8,833, +11.53% from previous year)

- 2023: $90,639 (+$5,191, +6.08% from previous year)

- 2024: $95,256 (+$4,618, +5.09% from previous year)

- 2025: $95,364 (+$108, +0.11% from previous year)

Home values in Gordon have climbed nearly 85% since 2016, reaching $95,364 in 2025. While the most recent year showed very little growth, the long-term upward trajectory remains solid.

Gordon – Slow and Steady Price Appreciation

Gordon is located in northwest Nebraska, serving as a key town for the surrounding ranching and farming areas of Sheridan County. Its small-town charm and access to essential services make it a practical home base for residents who work in agriculture or nearby towns.

The consistent home value increases over the past several years suggest a reliable, if modest, level of demand. Gordon remains a strong option for those looking to buy under $100,000 while avoiding dramatic price swings.

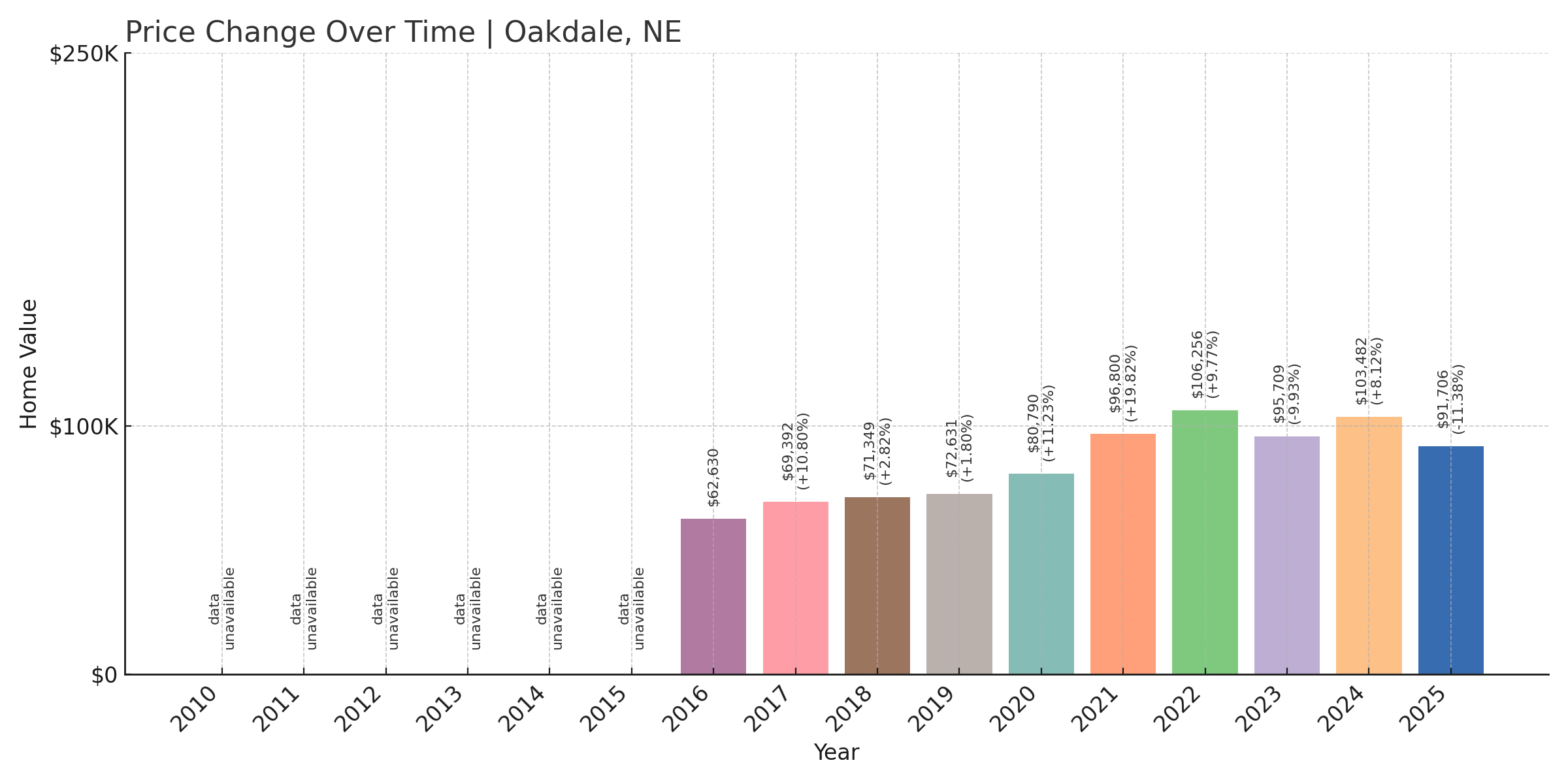

6. Oakdale – 46.4% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $62,630

- 2017: $69,392 (+$6,762, +10.80% from previous year)

- 2018: $71,349 (+$1,957, +2.82% from previous year)

- 2019: $72,631 (+$1,282, +1.80% from previous year)

- 2020: $80,790 (+$8,159, +11.23% from previous year)

- 2021: $96,800 (+$16,010, +19.82% from previous year)

- 2022: $106,256 (+$9,457, +9.77% from previous year)

- 2023: $95,709 (-$10,547, -9.93% from previous year)

- 2024: $103,482 (+$7,773, +8.12% from previous year)

- 2025: $91,706 (-$11,776, -11.38% from previous year)

Oakdale’s housing market has been a rollercoaster in recent years, with a significant rise followed by sharp corrections. Even with a steep 11% decline in 2025, prices remain up 46% from their 2016 level.

Oakdale – Peaks, Dips, and Value

Located in Antelope County in northeastern Nebraska, Oakdale is a quiet village with a long farming tradition. Its housing market surged during the pandemic, reflecting broader statewide trends, but has corrected sharply over the past few years.

While volatility may concern some buyers, others may see the current dip as an opportunity to purchase well below recent highs. At under $92,000, Oakdale offers rural affordability with potential for future gains if prices rebound.

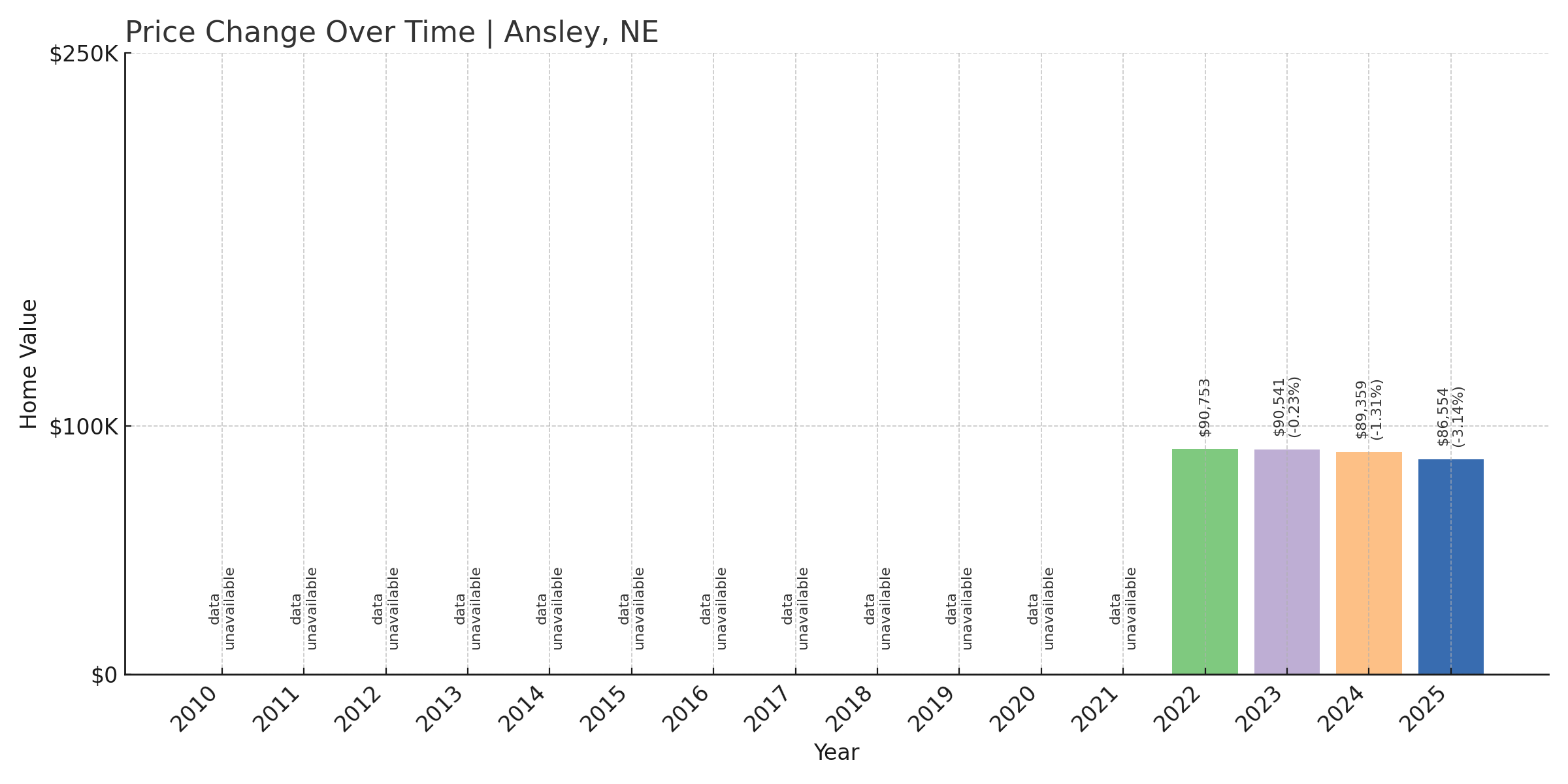

5. Ansley – 4.6% Home Price Decline Since 2022

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: N/A

- 2022: $90,753

- 2023: $90,541 (-$212, -0.23% from previous year)

- 2024: $89,359 (-$1,182, -1.31% from previous year)

- 2025: $86,554 (-$2,805, -3.14% from previous year)

Ansley’s home values have declined nearly 5% since 2022, now sitting at $86,554. While it hasn’t seen the explosive growth of other towns, it remains one of the cheapest markets in the state.

Ansley – Stable Prices and Consistent Affordability

Ansley is a village in Custer County, centrally located within the state. It’s a quiet, no-frills community with a low cost of living and basic amenities. Its housing market reflects that stability, with slow-moving trends rather than dramatic changes.

The recent softening of prices may reflect local economic shifts or simply fewer home sales. Still, Ansley’s values remain accessible for entry-level buyers or those seeking to downsize affordably in a low-pressure market.

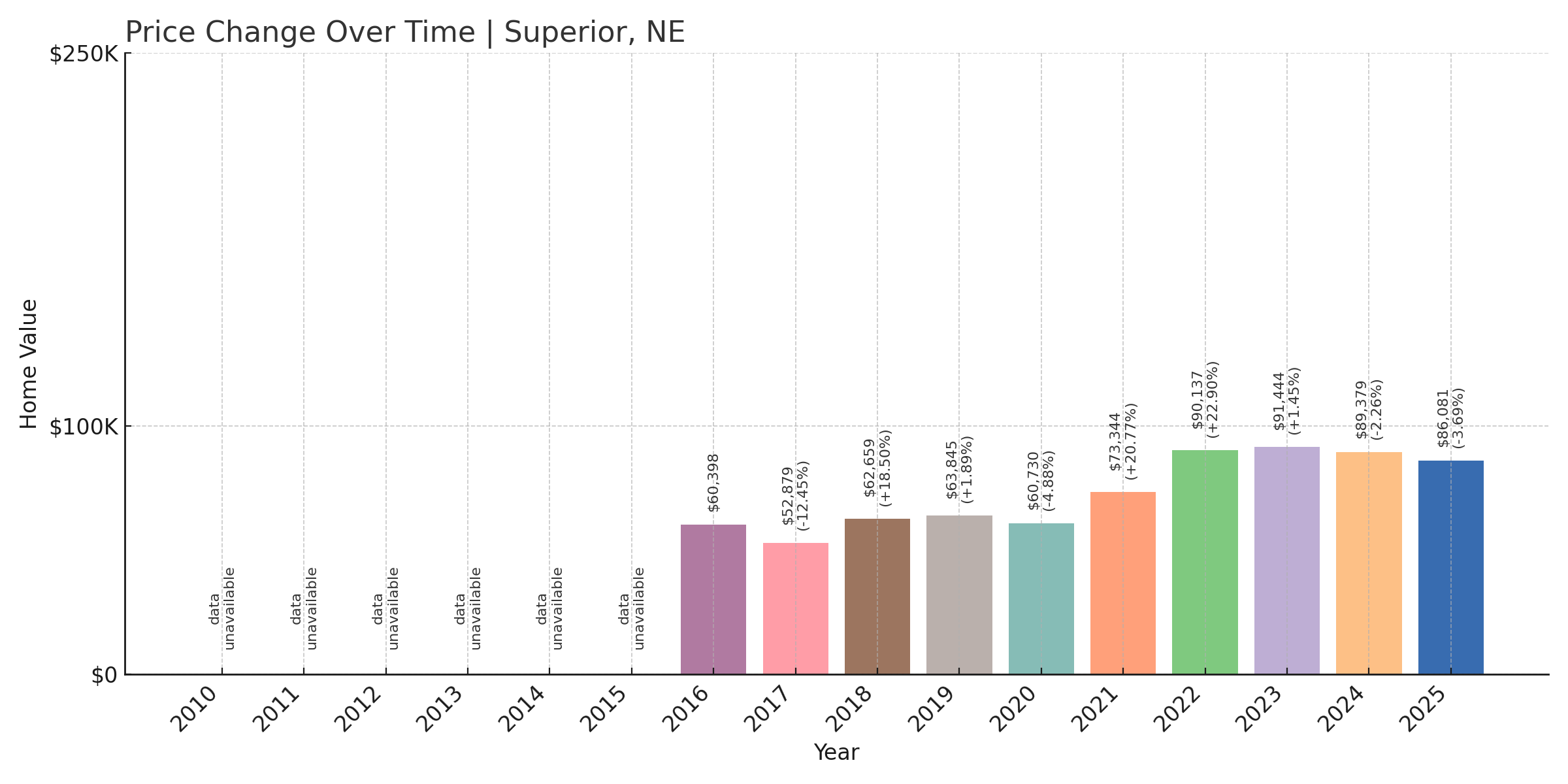

4. Superior – 42.5% Home Price Increase Since 2016

Would you like to save this?

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $60,398

- 2017: $52,879 (-$7,518, -12.45% from previous year)

- 2018: $62,659 (+$9,780, +18.49% from previous year)

- 2019: $63,845 (+$1,186, +1.89% from previous year)

- 2020: $60,730 (-$3,115, -4.88% from previous year)

- 2021: $73,344 (+$12,614, +20.77% from previous year)

- 2022: $90,137 (+$16,792, +22.90% from previous year)

- 2023: $91,444 (+$1,307, +1.45% from previous year)

- 2024: $89,379 (-$2,065, -2.26% from previous year)

- 2025: $86,081 (-$3,298, -3.69% from previous year)

Superior has seen home prices grow more than 42% since 2016, even with back-to-back annual declines in 2024 and 2025. It now ranks as one of the most affordable towns in Nebraska, with homes averaging $86,081.

Superior – Price Gains Followed by Cooling

Located in Nuckolls County, Superior sits near the Kansas border and once billed itself as the “Victorian Capital of Nebraska.” That historic charm may have helped attract buyers during the pandemic boom, but prices have since cooled off.

Even with recent drops, Superior’s long-term gains remain intact. Buyers today may find themselves purchasing at a relative discount compared to just a few years ago, with room for future growth if demand rebounds.

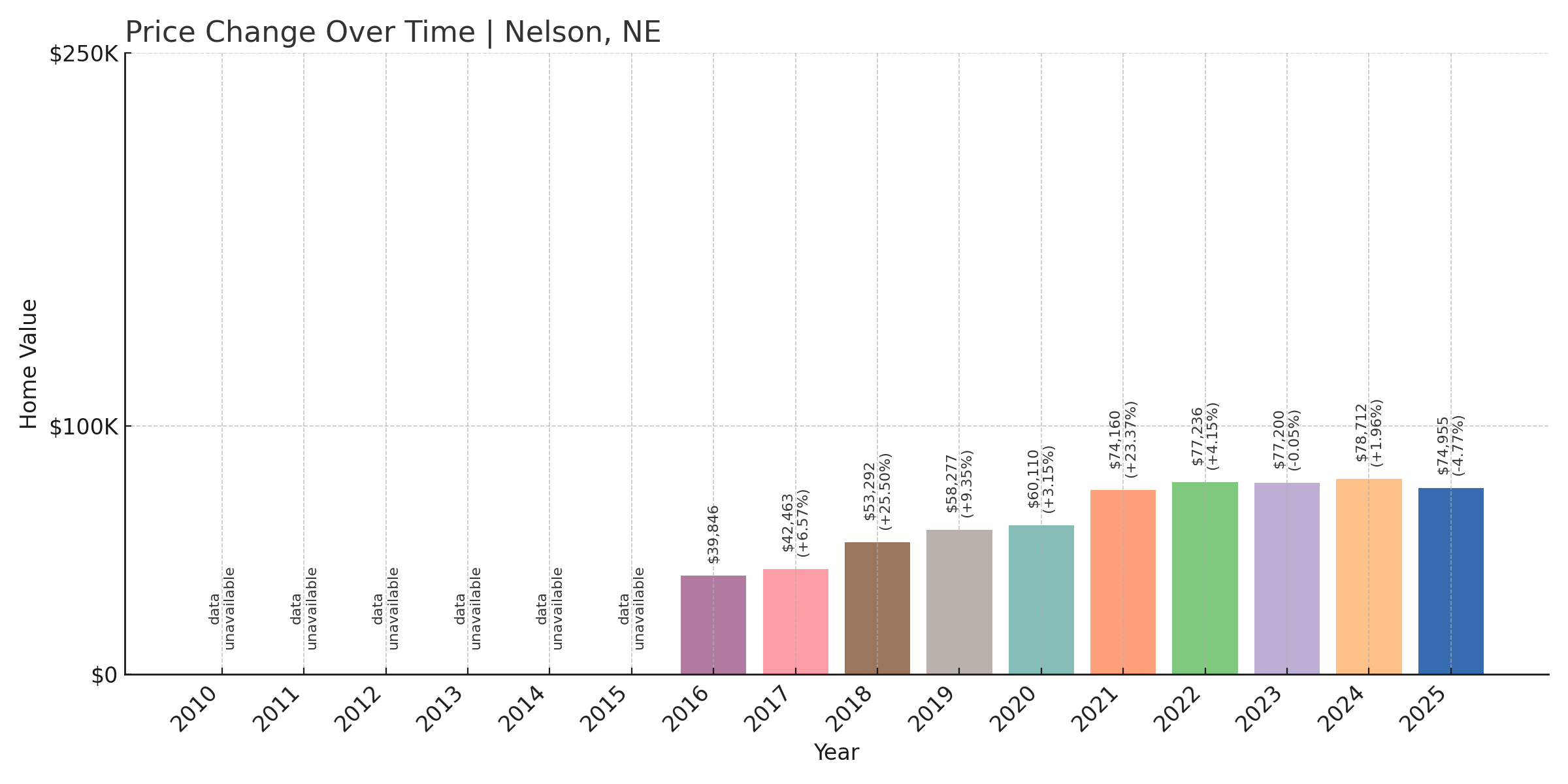

3. Nelson – 88.2% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $39,846

- 2017: $42,463 (+$2,617, +6.57% from previous year)

- 2018: $53,292 (+$10,829, +25.50% from previous year)

- 2019: $58,277 (+$4,985, +9.35% from previous year)

- 2020: $60,110 (+$1,833, +3.14% from previous year)

- 2021: $74,160 (+$14,050, +23.37% from previous year)

- 2022: $77,236 (+$3,076, +4.15% from previous year)

- 2023: $77,200 (-$36, -0.05% from previous year)

- 2024: $78,712 (+$1,513, +1.96% from previous year)

- 2025: $74,955 (-$3,757, -4.77% from previous year)

Home values in Nelson have grown nearly 90% since 2016, though 2025 brought a nearly 5% decline. With a current average home price just under $75,000, it remains one of the cheapest markets in Nebraska.

Nelson – Big Gains on a Low Base

Also located in Nuckolls County, Nelson is a tiny town with big housing market movement. Its prices nearly doubled in just a few years—likely driven by extremely low inventory and a few above-average sales.

The recent dip brings some balance, but homes here remain very affordable by state and national standards. Buyers looking for a low entry point with long-term upside might find Nelson to be a compelling option.

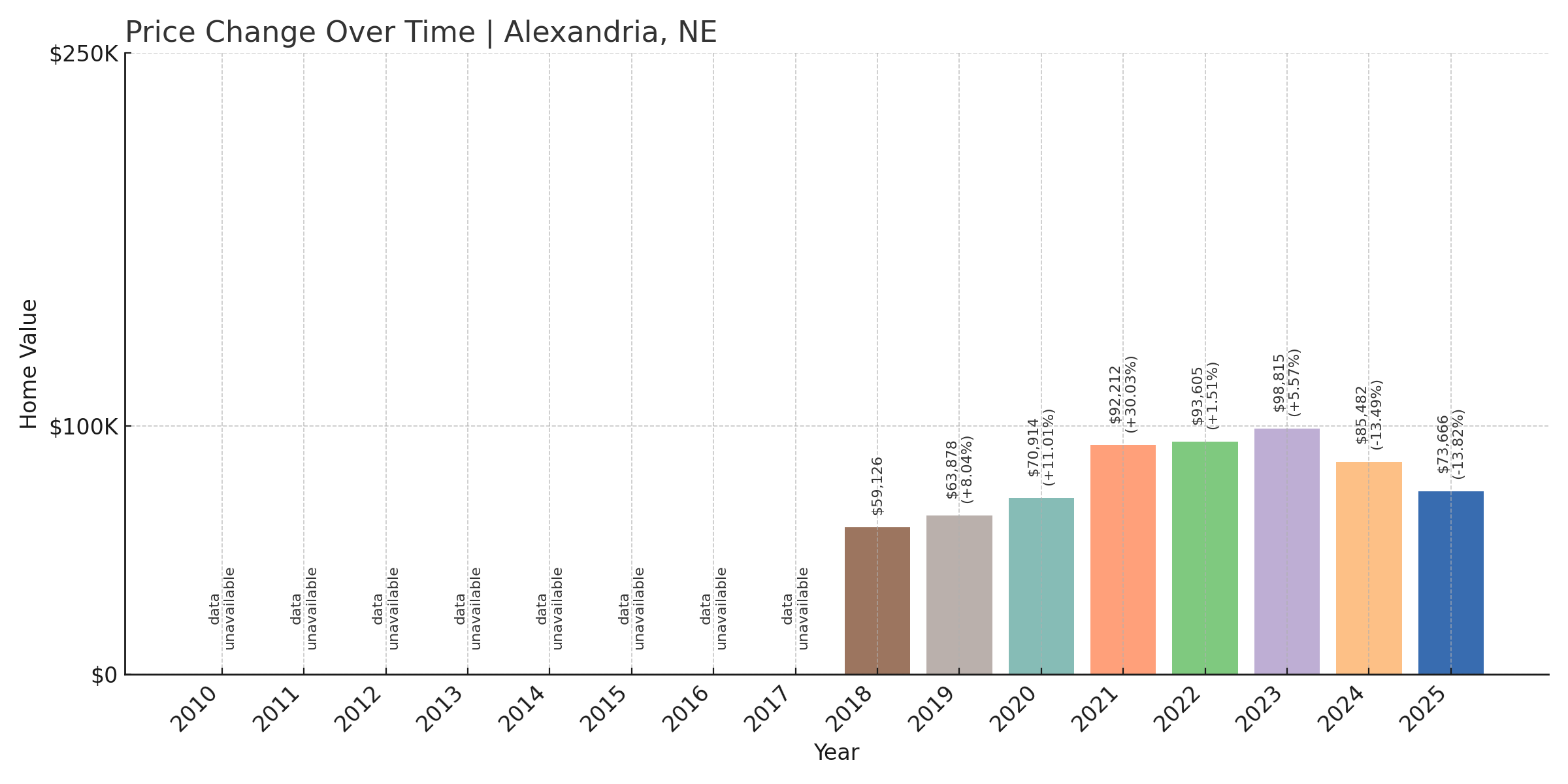

2. Alexandria – 24.6% Home Price Increase Since 2018

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: $59,126

- 2019: $63,878 (+$4,752, +8.04% from previous year)

- 2020: $70,914 (+$7,036, +11.02% from previous year)

- 2021: $92,212 (+$21,297, +30.03% from previous year)

- 2022: $93,605 (+$1,394, +1.51% from previous year)

- 2023: $98,815 (+$5,210, +5.57% from previous year)

- 2024: $85,482 (-$13,333, -13.49% from previous year)

- 2025: $73,666 (-$11,816, -13.82% from previous year)

Alexandria’s home prices grew significantly between 2018 and 2023, but the past two years have reversed those gains. After two double-digit declines, average values are back to around $73,666.

Alexandria – Rapid Rise, Steep Fall

Alexandria is a village in Thayer County with fewer than 100 residents. Its price history shows how small-town markets can swing dramatically in either direction due to limited transactions.

The recent pullback may offer opportunities for buyers seeking deeply discounted prices. The town’s rural setting and extremely low price point make it one of Nebraska’s most accessible real estate markets.

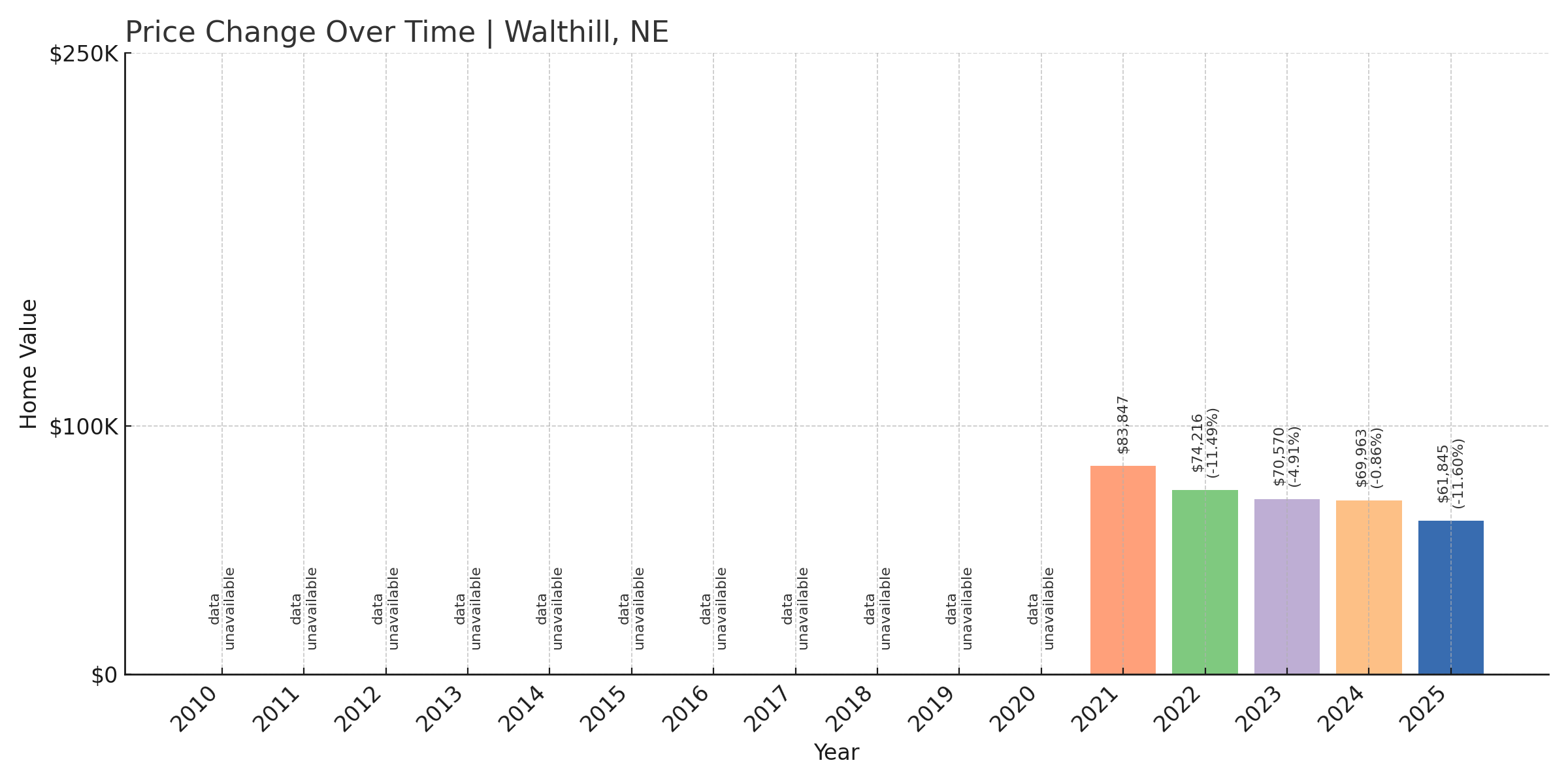

1. Walthill – 26.2% Home Price Decline Since 2021

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: $83,847

- 2022: $74,216 (-$9,631, -11.49% from previous year)

- 2023: $70,570 (-$3,646, -4.91% from previous year)

- 2024: $69,963 (-$607, -0.86% from previous year)

- 2025: $61,845 (-$8,118, -11.60% from previous year)

Walthill’s home values have declined more than 26% since 2021, with prices falling every year for four straight years. The 2025 average of $61,845 makes it the least expensive town in Nebraska by typical home value.

Walthill – Nebraska’s Most Affordable Housing Market

Walthill is located in Thurston County within the boundaries of the Omaha Reservation. It has faced ongoing economic challenges, and the housing data reflects that reality. The consistent price declines may stem from limited demand, aging housing stock, or broader regional factors.

For buyers looking purely for price, Walthill tops the list. But the town’s economic context is important to understand before investing. With values this low, some buyers may see long-term opportunity—if revitalization efforts take hold in future years.