Would you like to save this?

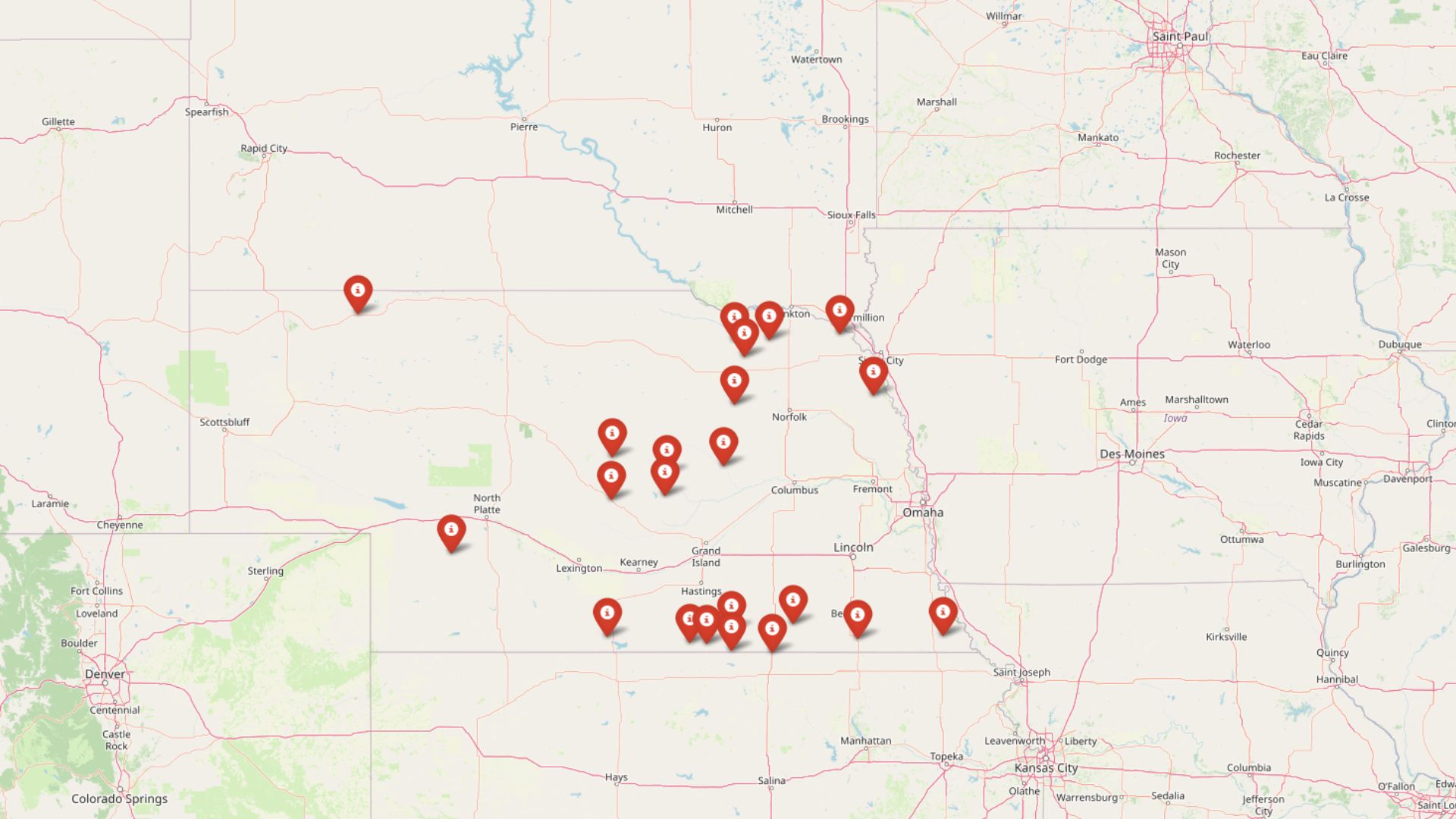

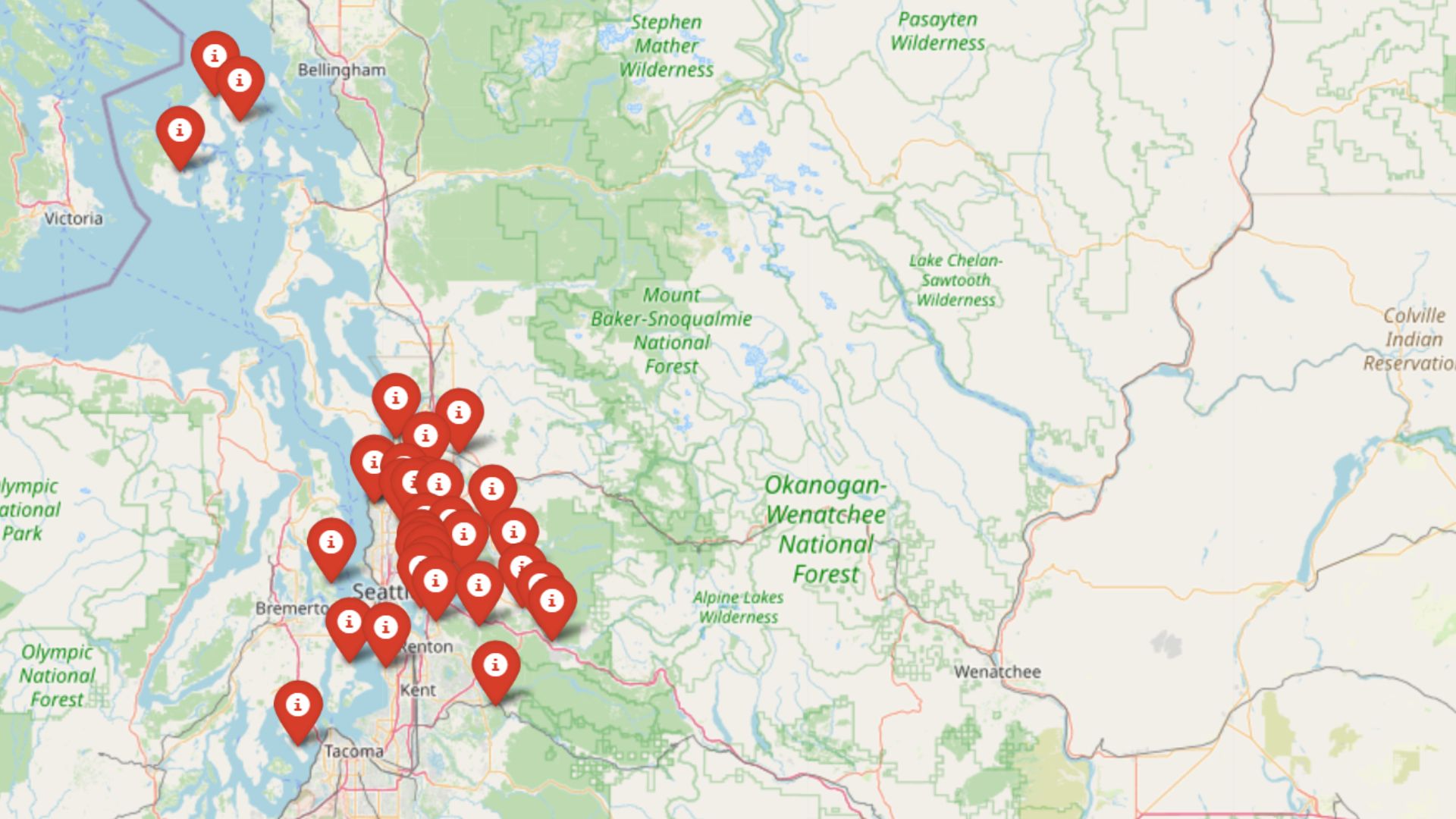

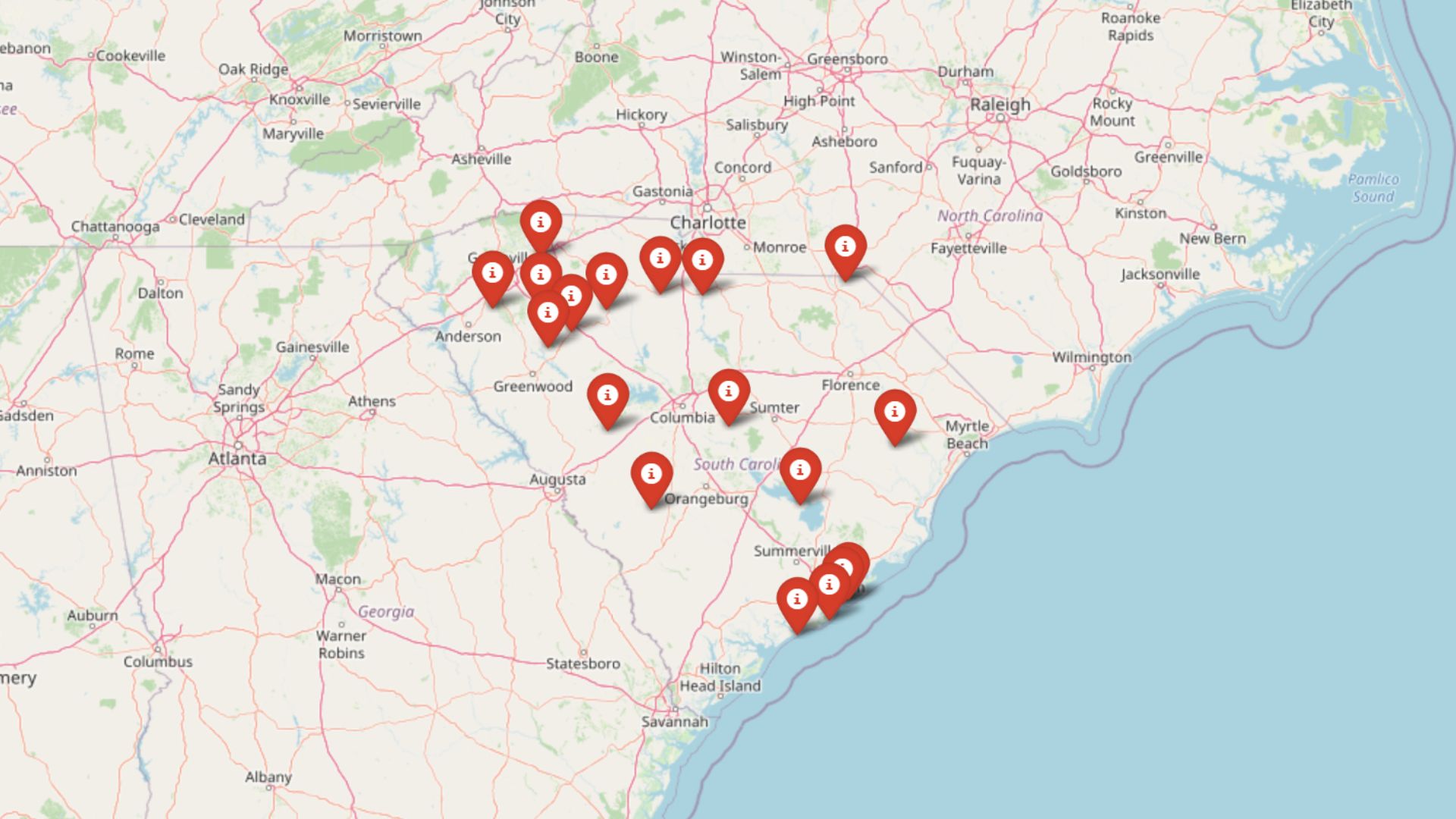

South Carolina’s housing market might look strong, but not every town is as stable as it seems. According to the Zillow Home Value Index, some communities have seen prices rise faster than local demand can support. After analyzing 15 years of price trends, crashes, and volatility data, certain towns stand out for all the wrong reasons. From overextended resort markets to small towns with shaky growth, these 18 places could be the first to see home values drop if the market shifts.

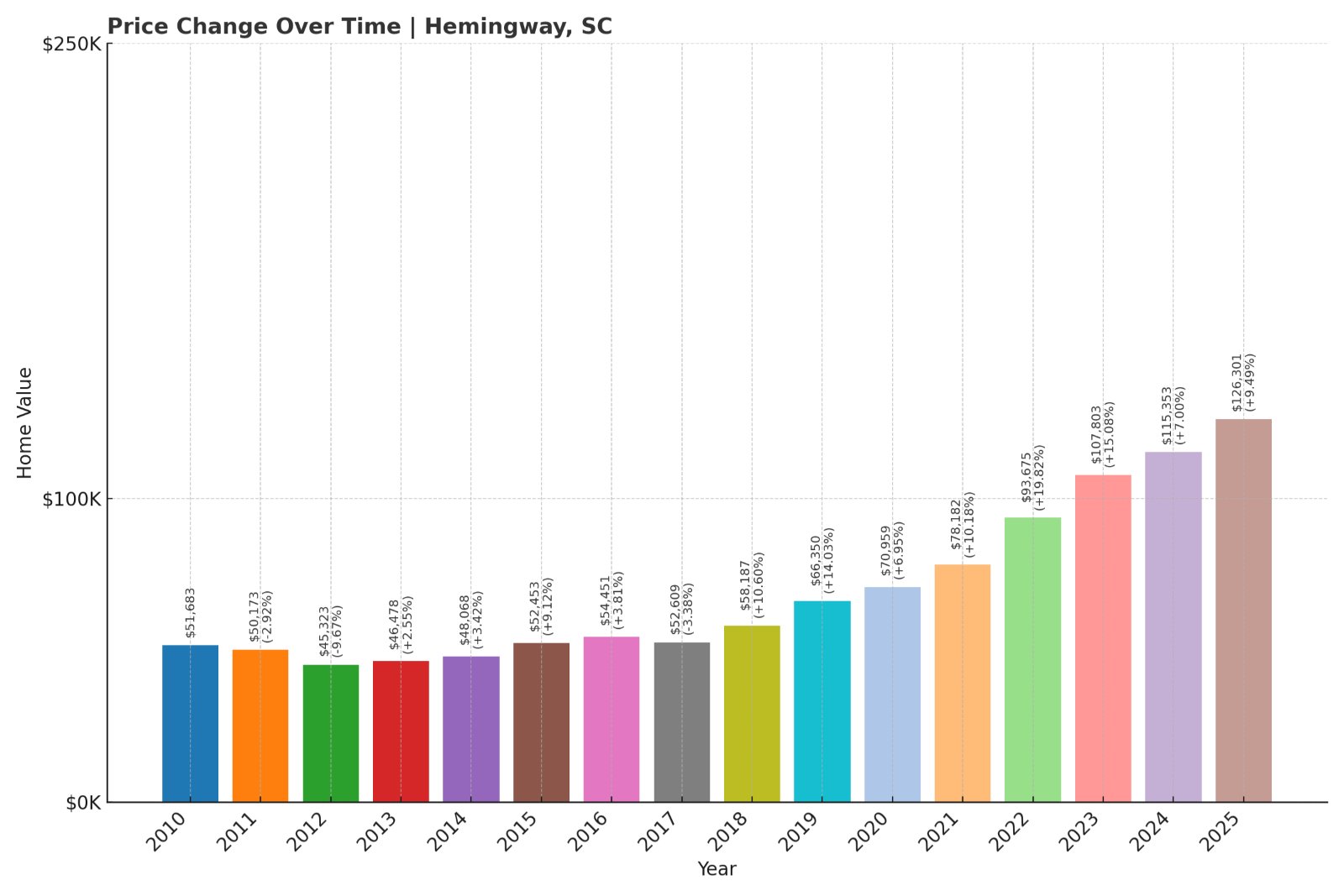

18. Hemingway – Crash Risk Percentage: 73.80%

- Crash Risk Percentage: 73.80%

- Historical crashes (8%+ drops): 1

- Worst historical crash: 9.7% (2012)

- Total price increase since 2010: 144.4%

- Overextended above long-term average: 80.7%

- Price volatility (annual swings): 7.7%

- Current May 2025 price: $126,301

Hemingway – Risky Growth Outpaces Fundamentals

Home values in Hemingway have more than doubled since 2010, but the current price of $126,301 stands nearly 81% above the long-term trend line. That kind of acceleration, especially in a small rural market, often signals a correction ahead. The town has only experienced one major drop in the past, but the combination of high overextension and moderate volatility suggests a fragile base.

Located in Williamsburg County, Hemingway is a quiet town known for its agricultural roots and small-town character. While affordability remains a draw, its limited economic activity and population growth do little to justify the recent price surge. Without strong demand drivers, Hemingway’s sharp rise may prove unsustainable in the long run.

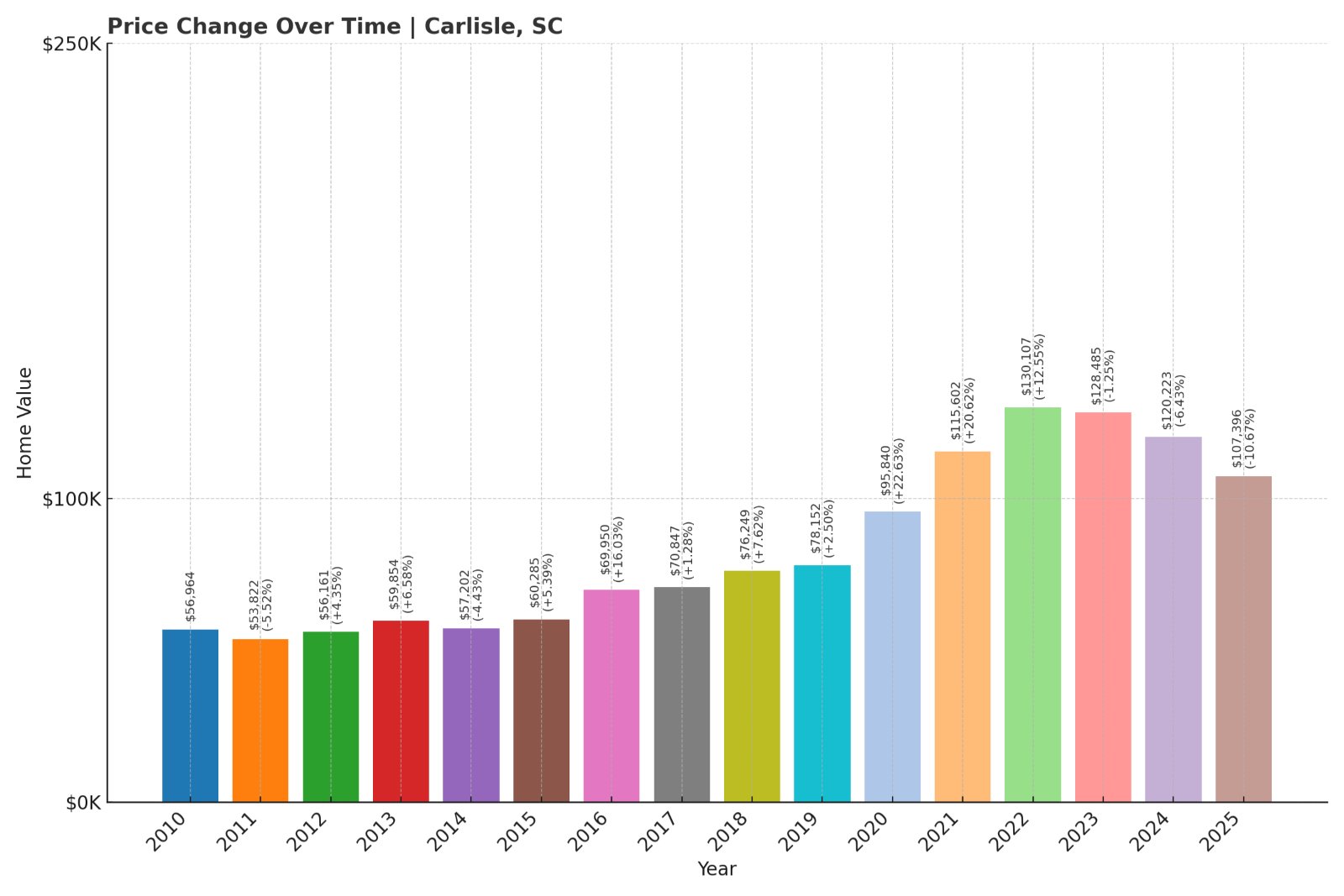

17. Carlisle – Crash Risk Percentage: 74.35%

- Crash Risk Percentage: 74.35%

- Historical crashes (8%+ drops): 1

- Worst historical crash: 10.7% (2025)

- Total price increase since 2010: 88.5%

- Overextended above long-term average: 28.5%

- Price volatility (annual swings): 9.9%

- Current May 2025 price: $107,396

Carlisle – Modest Market Faces Price Instability

Carlisle’s housing market has climbed nearly 89% since 2010, but a recent drop of 10.7% in 2025 points to instability. The current valuation sits nearly 30% above historical pricing trends, raising concerns about sustainability. With volatility nearing double digits, sharp swings in value aren’t uncommon here.

This tiny town in Union County has fewer than 500 residents and a limited housing stock. While low property values may appear attractive, the market’s size and lack of economic drivers make it vulnerable to swings in investor sentiment or local employment shifts. The recent crash may not be a one-time event if underlying conditions don’t improve.

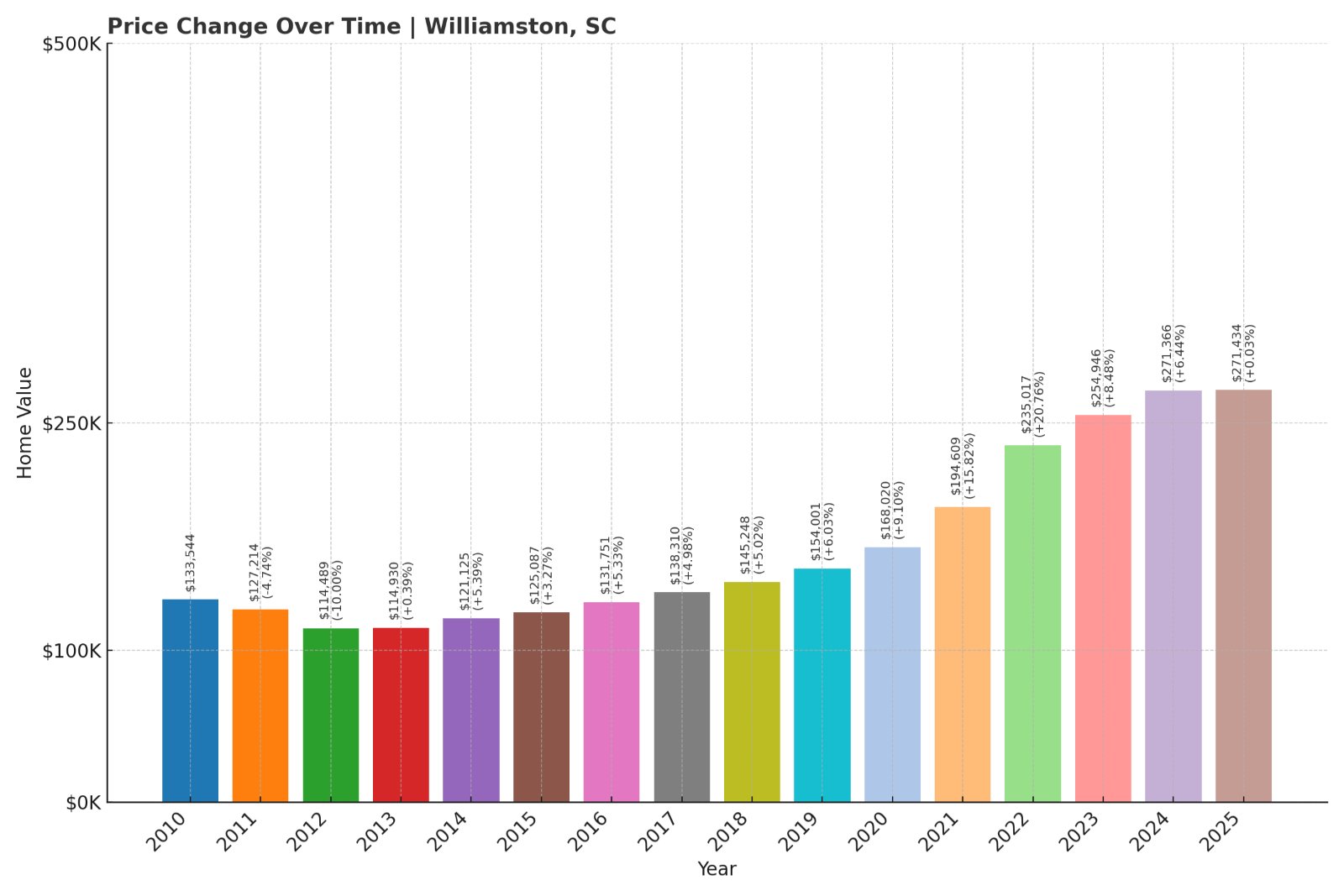

16. Williamston – Crash Risk Percentage: 74.40%

- Crash Risk Percentage: 74.40%

- Historical crashes (8%+ drops): 1

- Worst historical crash: 10.0% (2012)

- Total price increase since 2010: 103.3%

- Overextended above long-term average: 60.8%

- Price volatility (annual swings): 7.4%

- Current May 2025 price: $271,434

Williamston – Prices Surged Ahead of Market Drivers

Would you like to save this?

Home prices in Williamston have more than doubled since 2010, now sitting over 60% above the long-term average. While the town hasn’t seen many major drops, a 10% slide in 2012 remains a red flag. With current values approaching $272,000, there’s a real risk that momentum has pushed prices ahead of fundamentals.

Located in Anderson County, Williamston is a historic mill town with a revitalized downtown and proximity to Greenville. While the region has grown in popularity, this small town’s recent boom may be running out of steam. Without continued inflows of new residents or jobs, homeowners may face downward pressure on values.

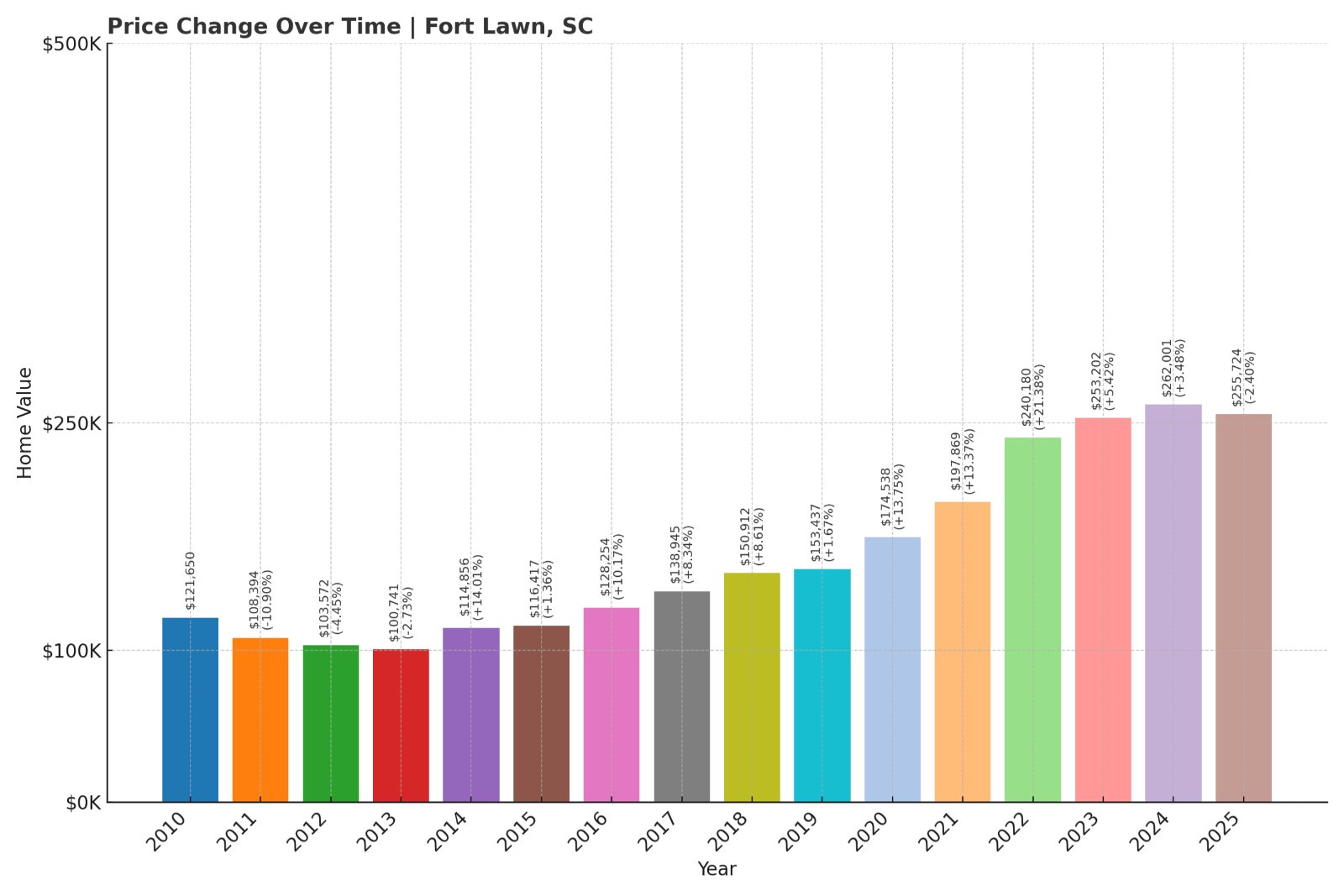

15. Fort Lawn – Crash Risk Percentage: 74.85%

- Crash Risk Percentage: 74.85%

- Historical crashes (8%+ drops): 1

- Worst historical crash: 10.9% (2011)

- Total price increase since 2010: 110.2%

- Overextended above long-term average: 56.1%

- Price volatility (annual swings): 8.6%

- Current May 2025 price: $255,724

Fort Lawn – Big Gains in a Small Market

Prices in Fort Lawn have more than doubled since 2010, and the town is now priced more than 56% above its historical average. That kind of appreciation in a small town without major industry suggests the market could be overheated. With a previous crash in 2011 and annual volatility near 9%, conditions are ripe for a repeat correction.

Sitting in Chester County near the Catawba River, Fort Lawn is a modest community with a population under 1,000. While its location along Highway 9 has sparked some commuter interest, the underlying housing demand may not justify the sharp rise in values. The lack of economic expansion could leave homeowners exposed if prices start to slip.

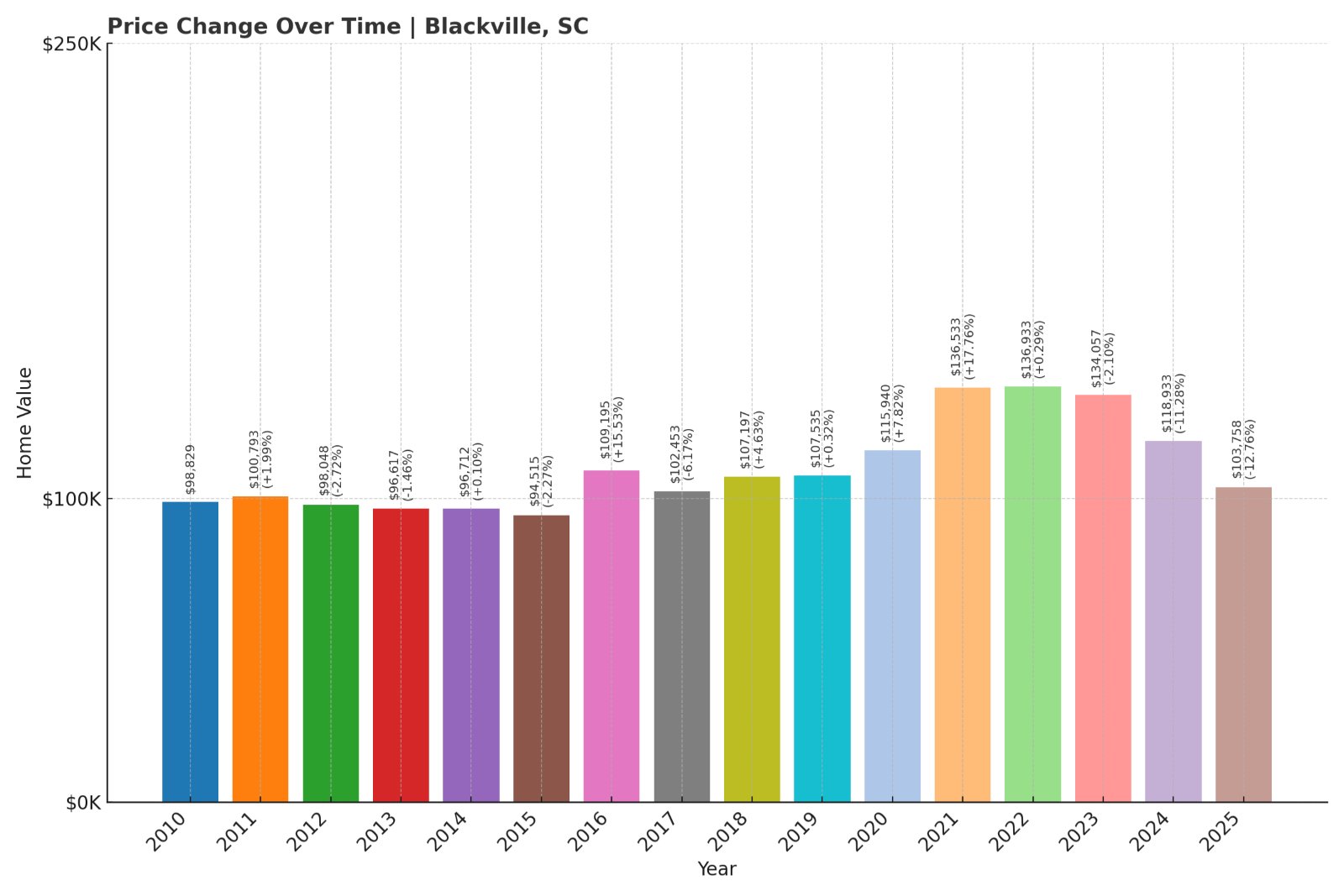

14. Blackville – Crash Risk Percentage: 74.95%

- Crash Risk Percentage: 74.95%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 12.8% (2025)

- Total price increase since 2010: 5.0%

- Overextended above long-term average: -5.6%

- Price volatility (annual swings): 8.4%

- Current May 2025 price: $103,758

Blackville – Prices Flatlining After Sharp Drops

Blackville is an outlier on this list. Despite appearing overvalued by some metrics, it has only gained 5% in value since 2010 and is actually trading below its long-term average. Still, the town has seen two major crashes, including a steep 12.8% drop in 2025. Combined with high volatility, this makes the market unpredictable.

Located in Barnwell County, Blackville has a rich agricultural history and a small population under 2,000. Its low price point may attract budget-conscious buyers, but the lack of steady appreciation and crash-prone past makes it a risky investment. Homeowners hoping for value growth may be disappointed.

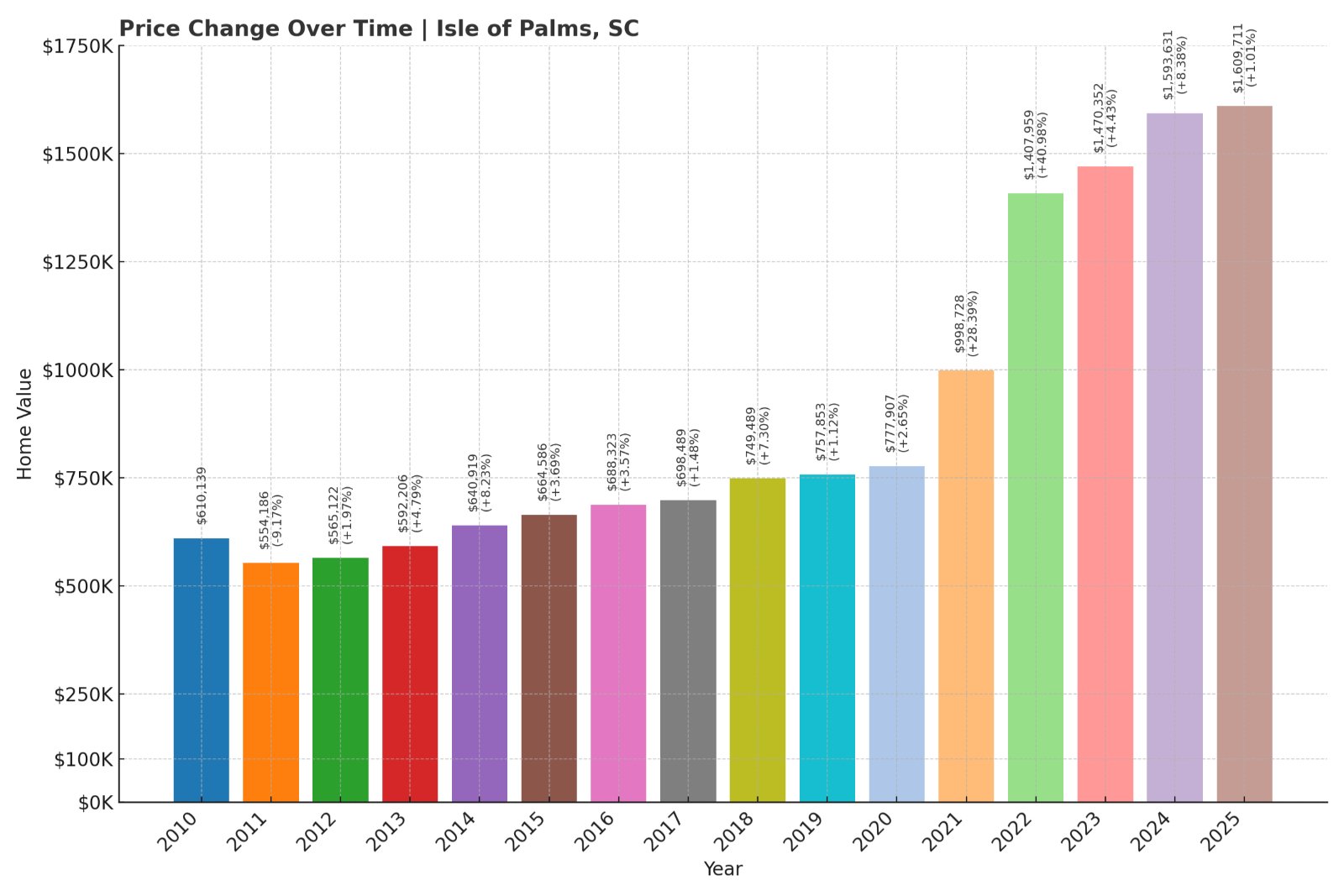

13. Isle of Palms – Crash Risk Percentage: 75.20%

- Crash Risk Percentage: 75.20%

- Historical crashes (8%+ drops): 1

- Worst historical crash: 9.2% (2011)

- Total price increase since 2010: 163.8%

- Overextended above long-term average: 79.1%

- Price volatility (annual swings): 12.1%

- Current May 2025 price: $1,609,710

Isle of Palms – Luxury Market May Be Overstretched

Home prices on Isle of Palms have climbed more than 160% since 2010, and the current median sits above $1.6 million. That puts the island nearly 80% above its long-term pricing trend. For a high-end beach destination with limited housing stock, that level of appreciation raises questions about how much further values can climb—especially if demand cools.

This barrier island northeast of Charleston is one of South Carolina’s most expensive real estate markets. Known for its beaches, golf courses, and oceanfront homes, Isle of Palms draws wealthier buyers—but it also has one of the highest price volatilities in the state. With tourism-driven demand and rising insurance costs, even upscale markets like this aren’t immune to corrections.

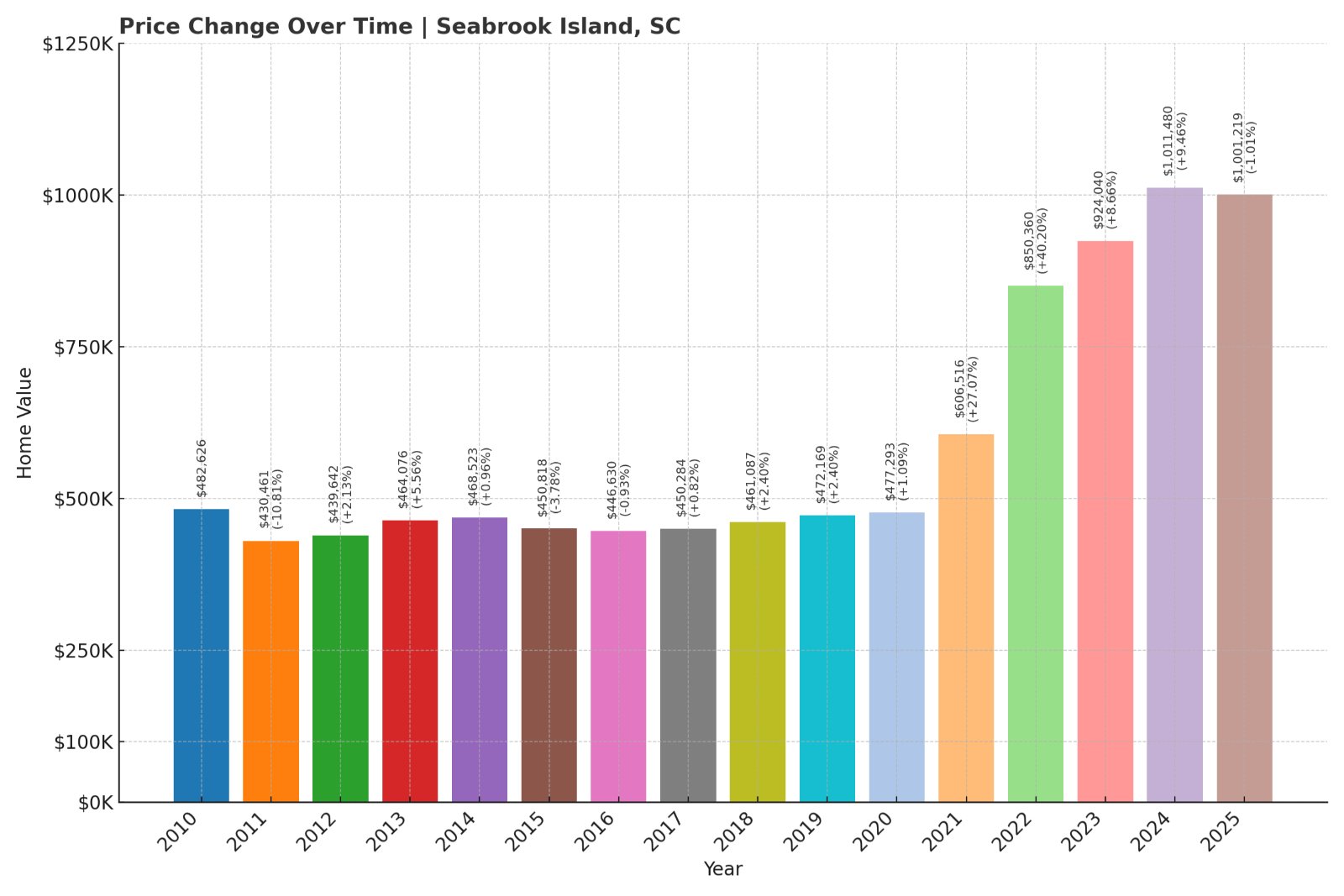

12. Seabrook Island – Crash Risk Percentage: 75.22%

- Crash Risk Percentage: 75.22%

- Historical crashes (8%+ drops): 1

- Worst historical crash: 10.8% (2011)

- Total price increase since 2010: 107.5%

- Overextended above long-term average: 69.7%

- Price volatility (annual swings): 12.6%

- Current May 2025 price: $1,001,219

Seabrook Island – Volatile Values in an Exclusive Market

Seabrook Island’s home values have more than doubled since 2010, with a current median price just over $1 million. The town is nearly 70% above its historic average and carries high annual price volatility, placing it firmly in high-risk territory. Its last major drop came in 2011, but the warning signs are flashing again.

Located adjacent to Kiawah Island southwest of Charleston, Seabrook is a private coastal community with gated access, golf courses, and ocean views. It appeals to retirees and second-home buyers, which makes the market sensitive to shifts in broader economic trends. If higher interest rates or market cooling hit luxury buyers, this upscale enclave could face a downturn.

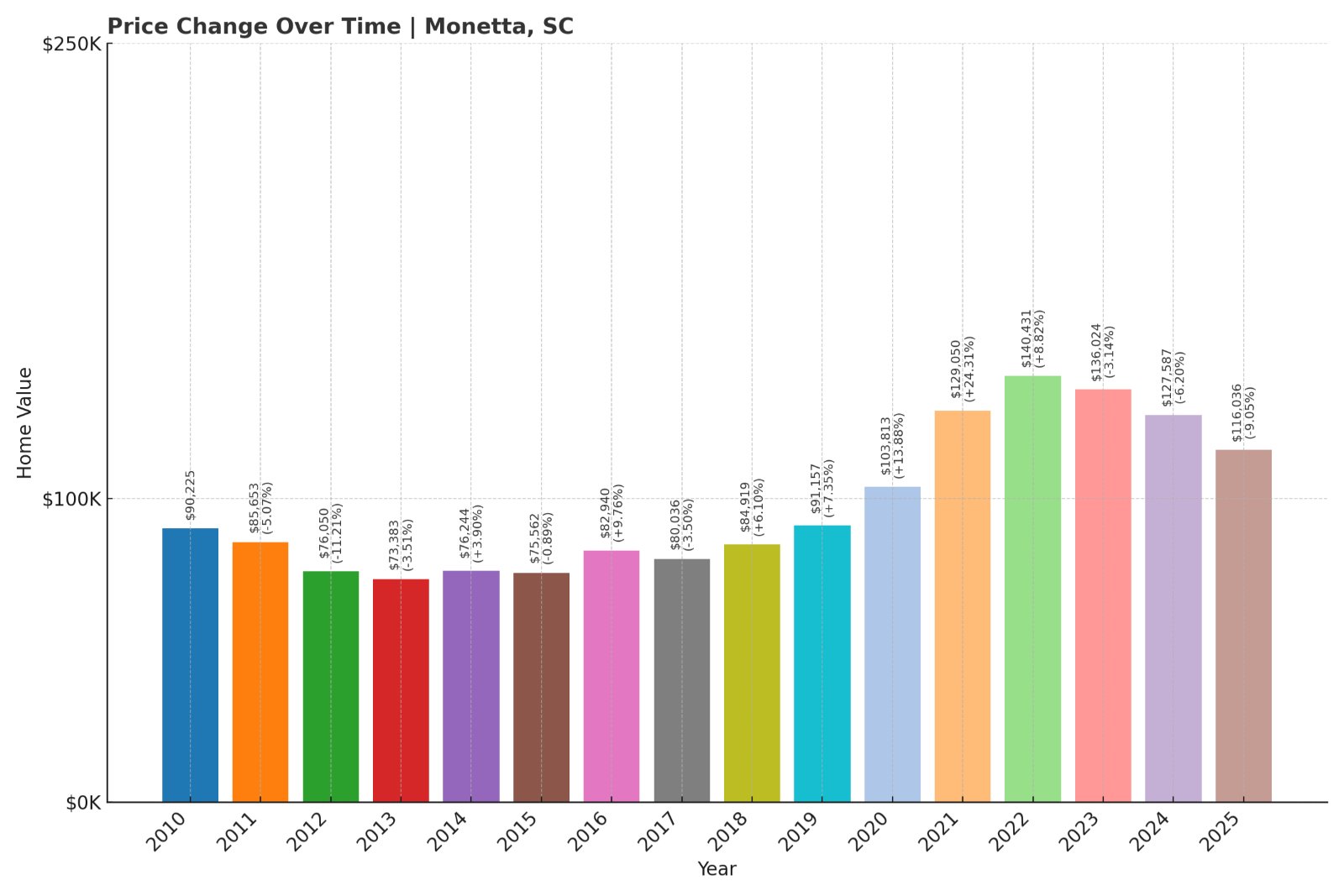

11. Monetta – Crash Risk Percentage: 79.00%

- Crash Risk Percentage: 79.00%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 11.2% (2012)

- Total price increase since 2010: 28.6%

- Overextended above long-term average: 18.3%

- Price volatility (annual swings): 9.7%

- Current May 2025 price: $116,036

Monetta – Modest Gains with Repeat Crashes

Monetta hasn’t seen runaway appreciation like some towns on this list, with home values rising just under 30% since 2010. But that hasn’t kept it safe from volatility—prices fell more than 11% in 2012 and have dipped again in other years. With a price level 18% above its long-term trend and high annual swings, it’s still considered vulnerable.

Situated on the border of Aiken and Saluda counties, Monetta is a small rural community with under 300 residents. Its appeal lies in affordability and open land, but limited housing demand also means it’s highly sensitive to shifts in buyer interest. For a market with such a narrow base, any turbulence could result in sharp corrections.

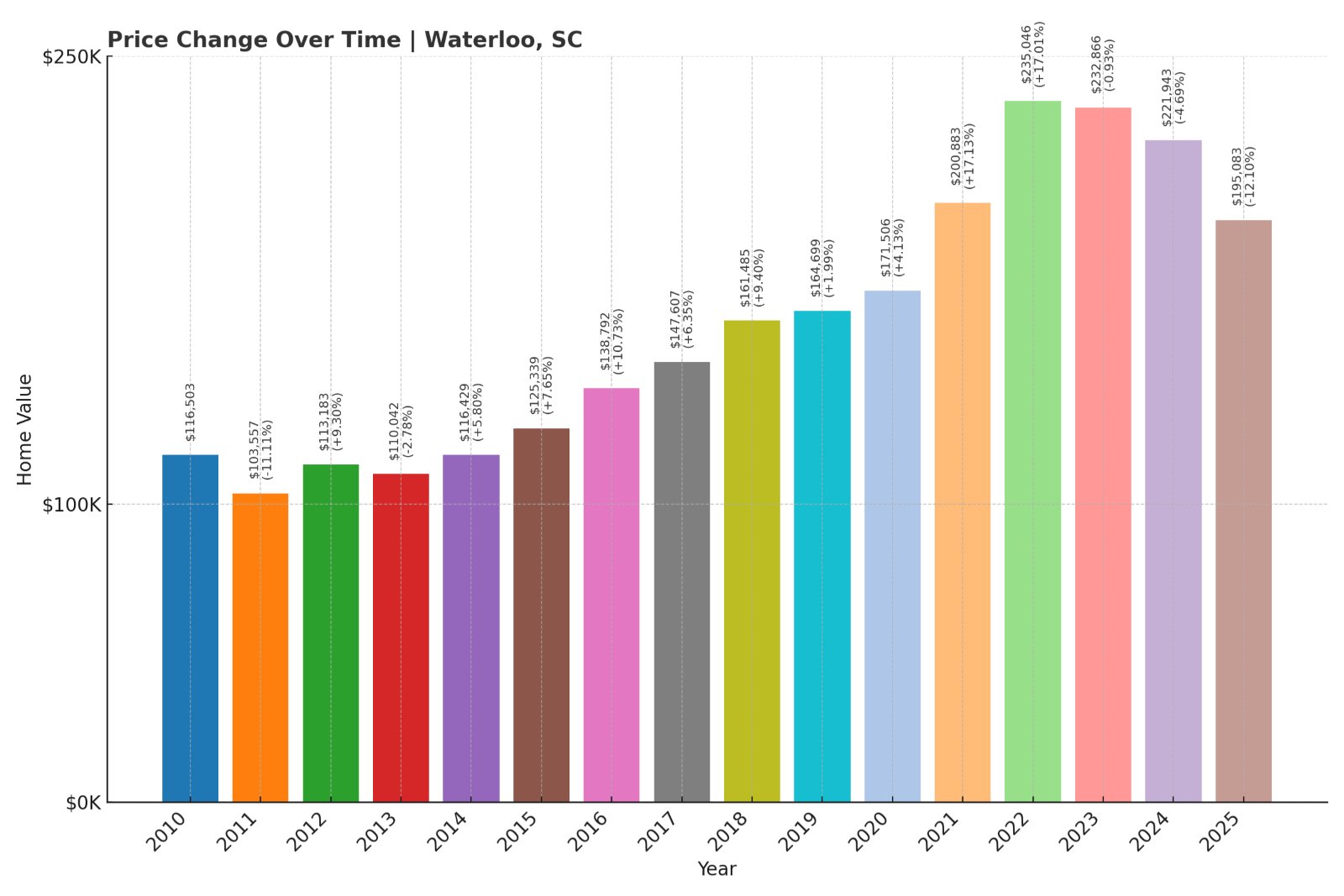

10. Waterloo – Crash Risk Percentage: 79.15%

- Crash Risk Percentage: 79.15%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 12.1% (2025)

- Total price increase since 2010: 67.4%

- Overextended above long-term average: 22.2%

- Price volatility (annual swings): 8.9%

- Current May 2025 price: $195,082

Waterloo – Mid-Tier Market Shows Instability

Waterloo’s current pricing hovers around $195,000, with total gains since 2010 just under 70%. While those numbers seem moderate, the town has experienced two major crashes, including a 12.1% drop in 2025 alone. Values now sit more than 20% above long-term averages, hinting at a possible correction zone.

Located near Lake Greenwood in Laurens County, Waterloo draws attention for its recreational access but has limited economic growth and infrastructure. The local housing stock is older and dispersed, making it prone to pricing swings. With recent turbulence and no clear growth catalyst, this market may face more downside ahead.

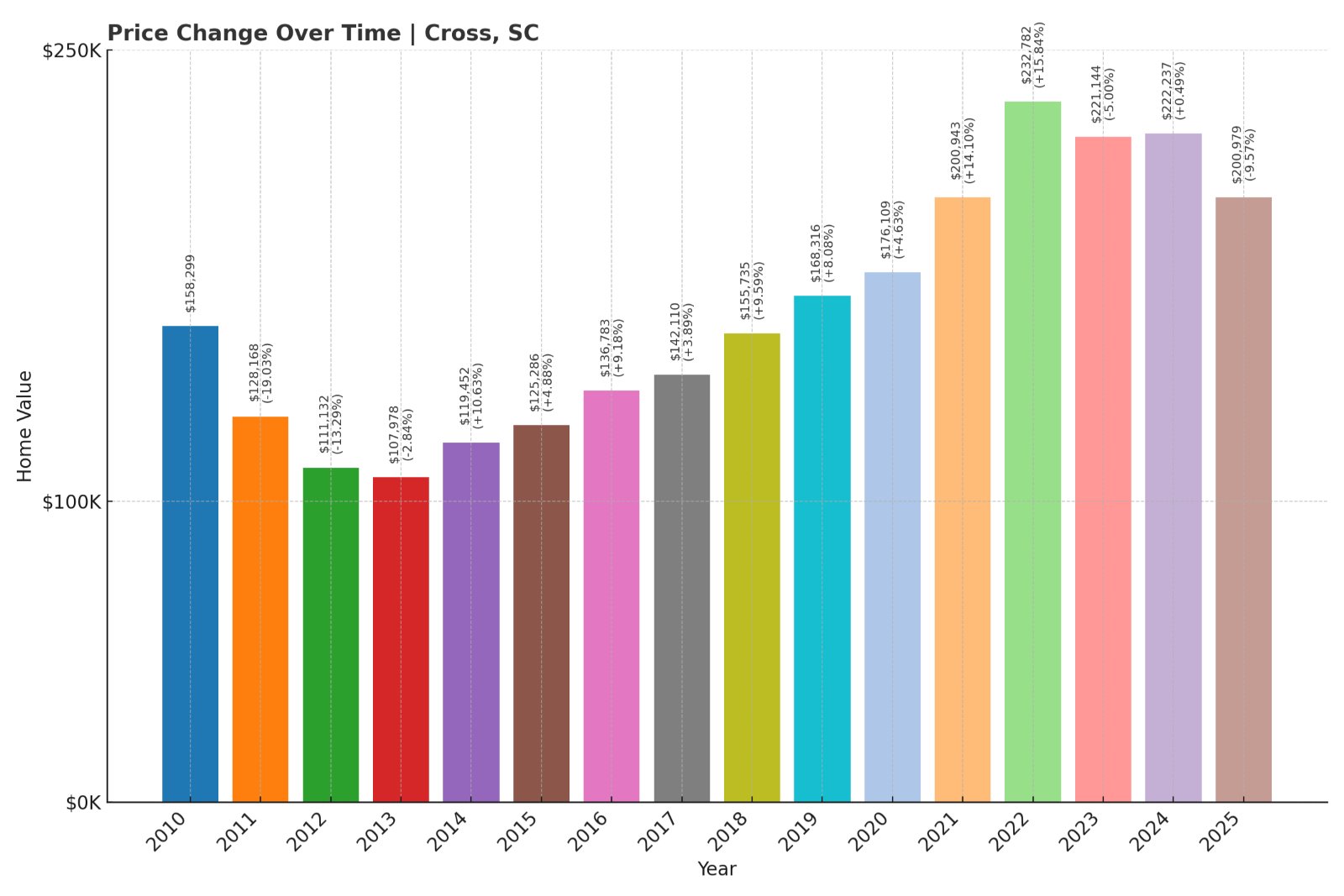

9. Cross – Crash Risk Percentage: 79.55%

Would you like to save this?

- Crash Risk Percentage: 79.55%

- Historical crashes (8%+ drops): 3

- Worst historical crash: 19.0% (2011)

- Total price increase since 2010: 27.0%

- Overextended above long-term average: 23.3%

- Price volatility (annual swings): 10.2%

- Current May 2025 price: $200,979

Cross – History Repeats in a Crash-Prone Market

Cross has one of the worst crash records in the state, with three separate instances of home values dropping 8% or more. Its steepest correction—a 19% plunge—occurred in 2011. Though home values have risen modestly since 2010, the town remains overextended and volatile, with prices now more than 23% above the long-term trend.

This unincorporated community in Berkeley County sits northwest of Lake Moultrie. Known more for outdoor access than residential growth, Cross lacks major employers and has minimal new development. Buyers seeking affordability may land here, but its turbulent price history suggests caution is warranted.

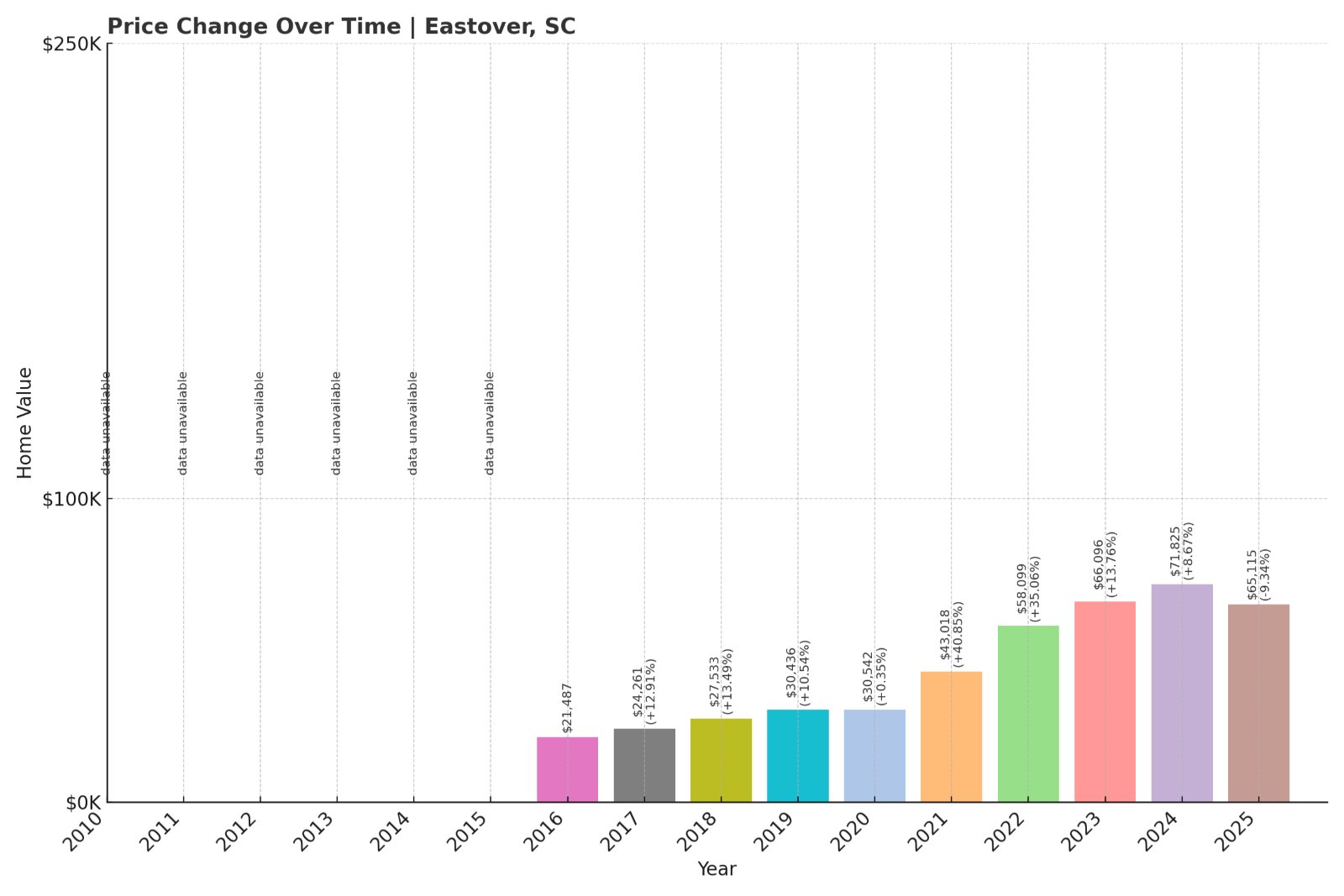

8. Eastover – Crash Risk Percentage: 80.20%

- Crash Risk Percentage: 80.20%

- Historical crashes (8%+ drops): 1

- Worst historical crash: 9.3% (2025)

- Total price increase since 2016: 203.1%

- Overextended above long-term average: 48.5%

- Price volatility (annual swings): 15.6%

- Current May 2025 price: $65,115

Eastover – Extreme Volatility in a Low-Cost Market

Eastover’s price volatility is among the highest in the state, with annual swings topping 15%. Home prices have more than tripled since 2016, despite a recent drop of over 9% in 2025. With a current median value just over $65,000, this market is highly reactive and already sits 48% above its historical average.

Located in Richland County southeast of Columbia, Eastover is a small rural town with limited commercial development and modest population growth. The affordability may attract investors, but the combination of price spikes and sharp corrections signals a fragile and reactive market. Eastover’s gains have little to anchor them, making future declines a real possibility.

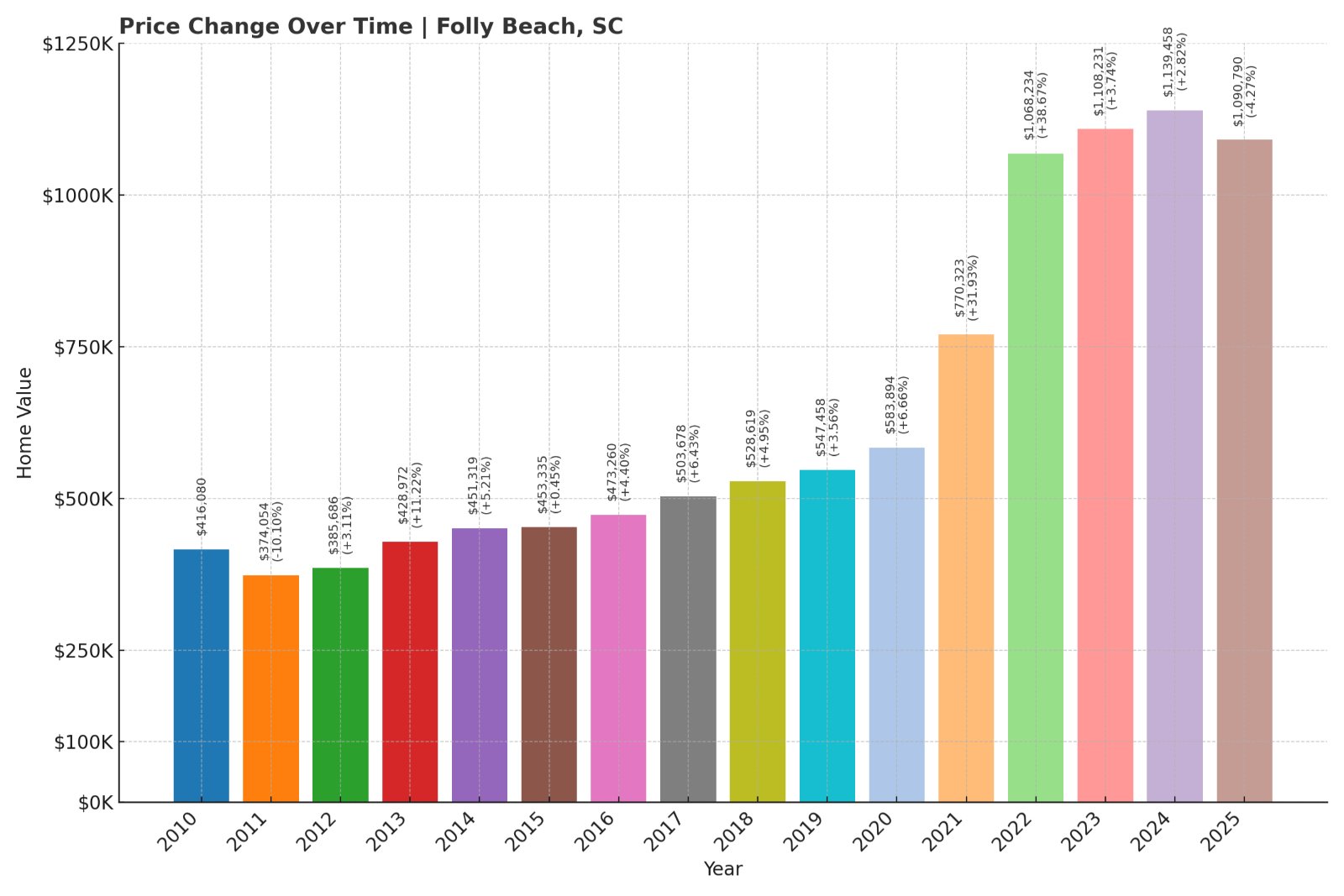

7. Folly Beach – Crash Risk Percentage: 81.25%

- Crash Risk Percentage: 81.25%

- Historical crashes (8%+ drops): 1

- Worst historical crash: 10.1% (2011)

- Total price increase since 2010: 162.2%

- Overextended above long-term average: 69.1%

- Price volatility (annual swings): 12.5%

- Current May 2025 price: $1,090,790

Folly Beach – Surfside Popularity Meets Market Pressure

Folly Beach has seen tremendous growth since 2010, with home prices climbing more than 160% and now topping $1 million. But that growth comes with risk—the market is nearly 70% above its long-term average and shows above-average price volatility. A 10% drop in 2011 still looms in the data as a cautionary flag.

This barrier island is known for its laid-back surf culture, restaurants, and proximity to Charleston. It’s a favorite for vacationers and investors alike, which can drive prices upward quickly—but also leave the market exposed when demand slows. Folly’s popularity is undeniable, but the fundamentals may not support continued appreciation at this pace.

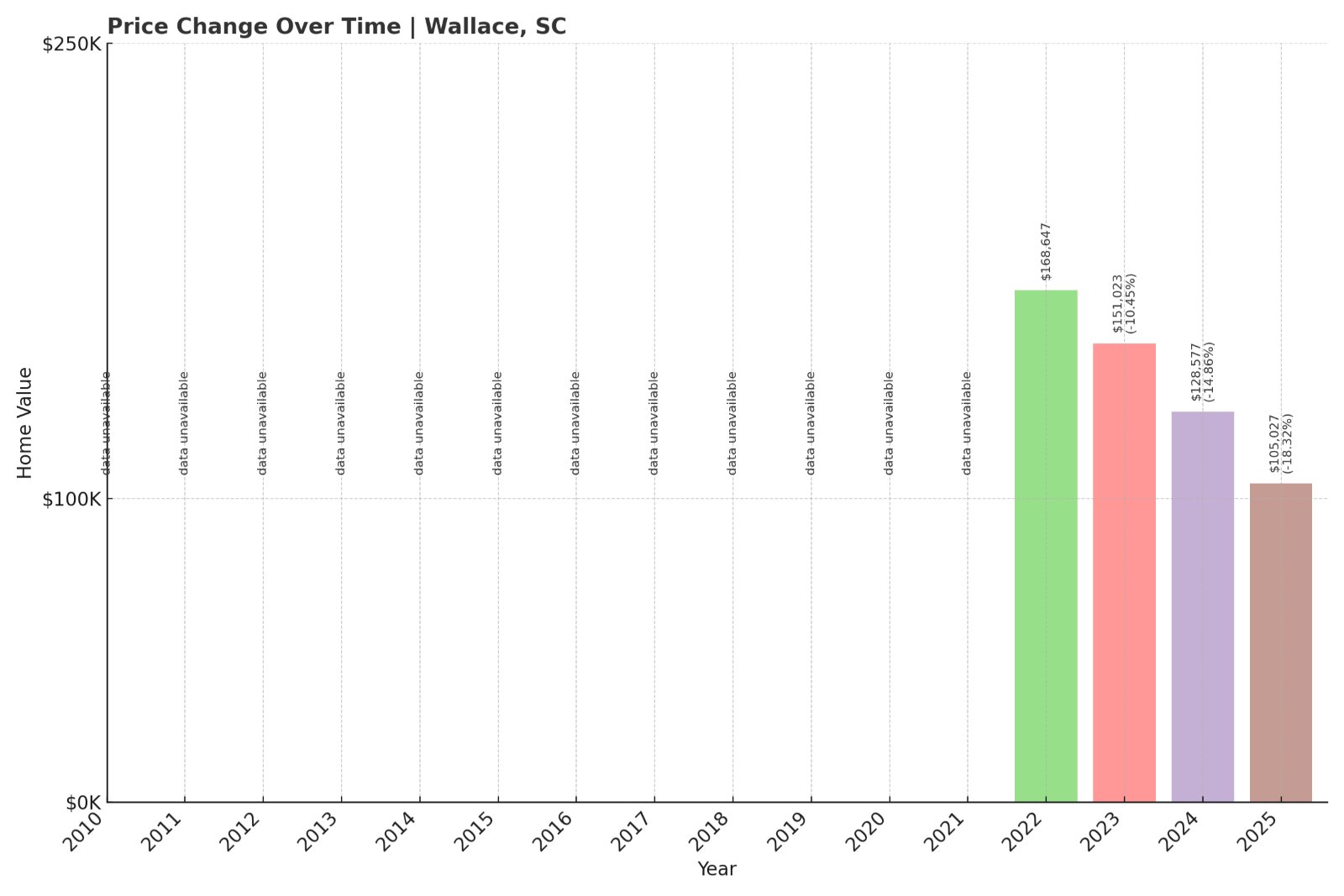

6. Wallace – Crash Risk Percentage: 81.80%

- Crash Risk Percentage: 81.80%

- Historical crashes (8%+ drops): 3

- Worst historical crash: 18.3% (2025)

- Total price increase since 2022: -37.7%

- Overextended above long-term average: -24.1%

- Price volatility (annual swings): 3.9%

- Current May 2025 price: $105,027

Wallace – Reeling from Recent Price Collapse

Wallace has seen its home values plummet nearly 38% in just a few years, and the worst crash came in 2025 with an 18.3% drop. This town is now priced well below its long-term average, signaling a serious correction already underway. Although annual volatility is relatively low, the overall trend points downward.

Located in Marlboro County near the North Carolina border, Wallace is a quiet rural area with limited housing stock and low population density. With no major economic anchors or growth drivers, the housing market here may continue to decline. Its recent sharp drop suggests that any remaining value is unstable and potentially falling further.

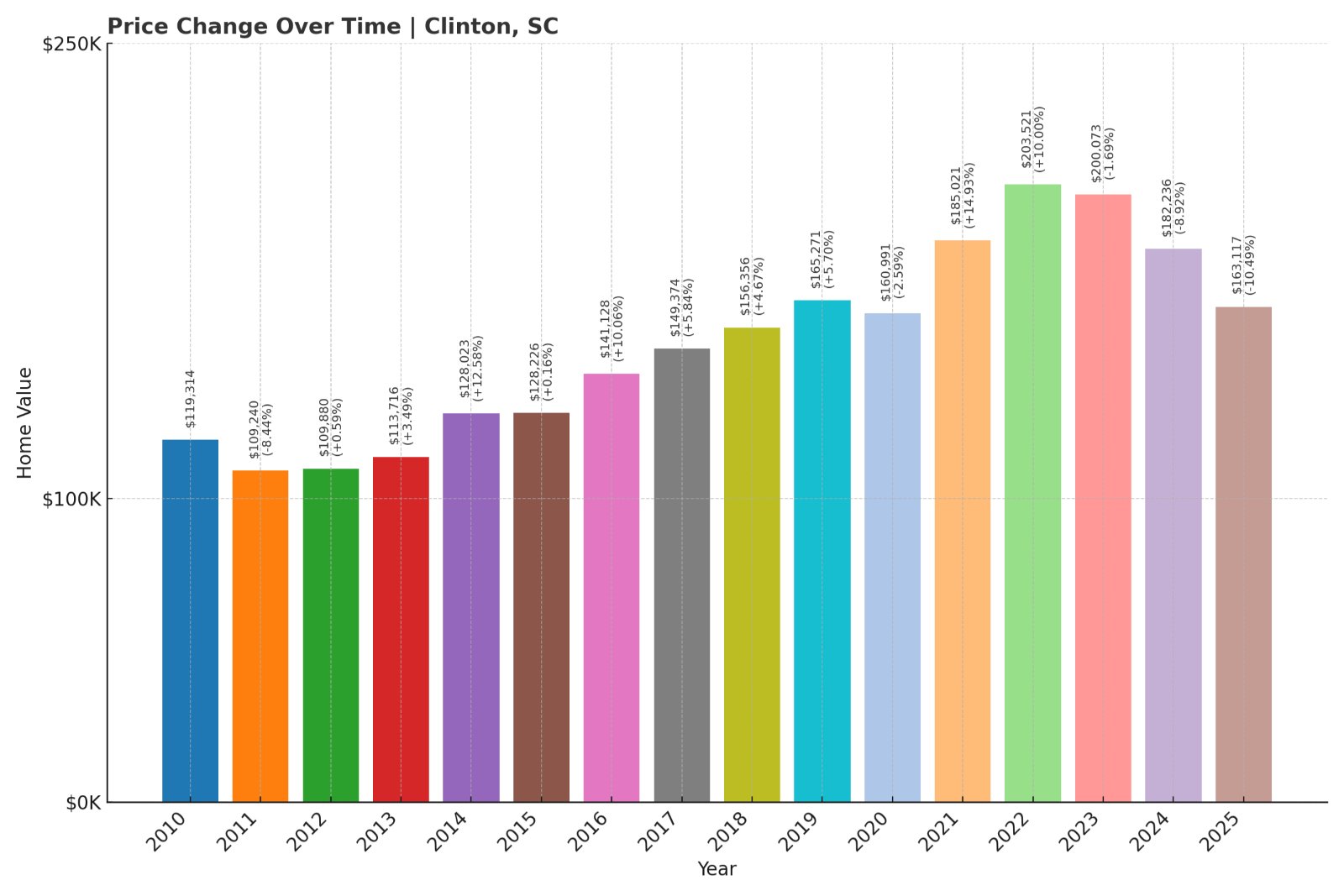

5. Clinton – Crash Risk Percentage: 82.80%

- Crash Risk Percentage: 82.80%

- Historical crashes (8%+ drops): 3

- Worst historical crash: 10.5% (2025)

- Total price increase since 2010: 36.7%

- Overextended above long-term average: 8.0%

- Price volatility (annual swings): 7.9%

- Current May 2025 price: $163,117

Clinton – Underwhelming Growth, Repeated Drops

Clinton’s housing market has posted modest gains since 2010, with prices rising just under 37%. But despite this restrained growth, the town has experienced three sizable crashes—including a recent 10.5% drop in 2025. Prices remain slightly overextended at 8% above long-term trends, suggesting more downside could follow.

Home to Presbyterian College and located in Laurens County, Clinton has a mix of historic charm and small-town economy. The town hasn’t seen the rapid appreciation of other areas, but its vulnerability comes from inconsistent demand and frequent dips. Buyers should be cautious: this market has a pattern of trouble during downturns.

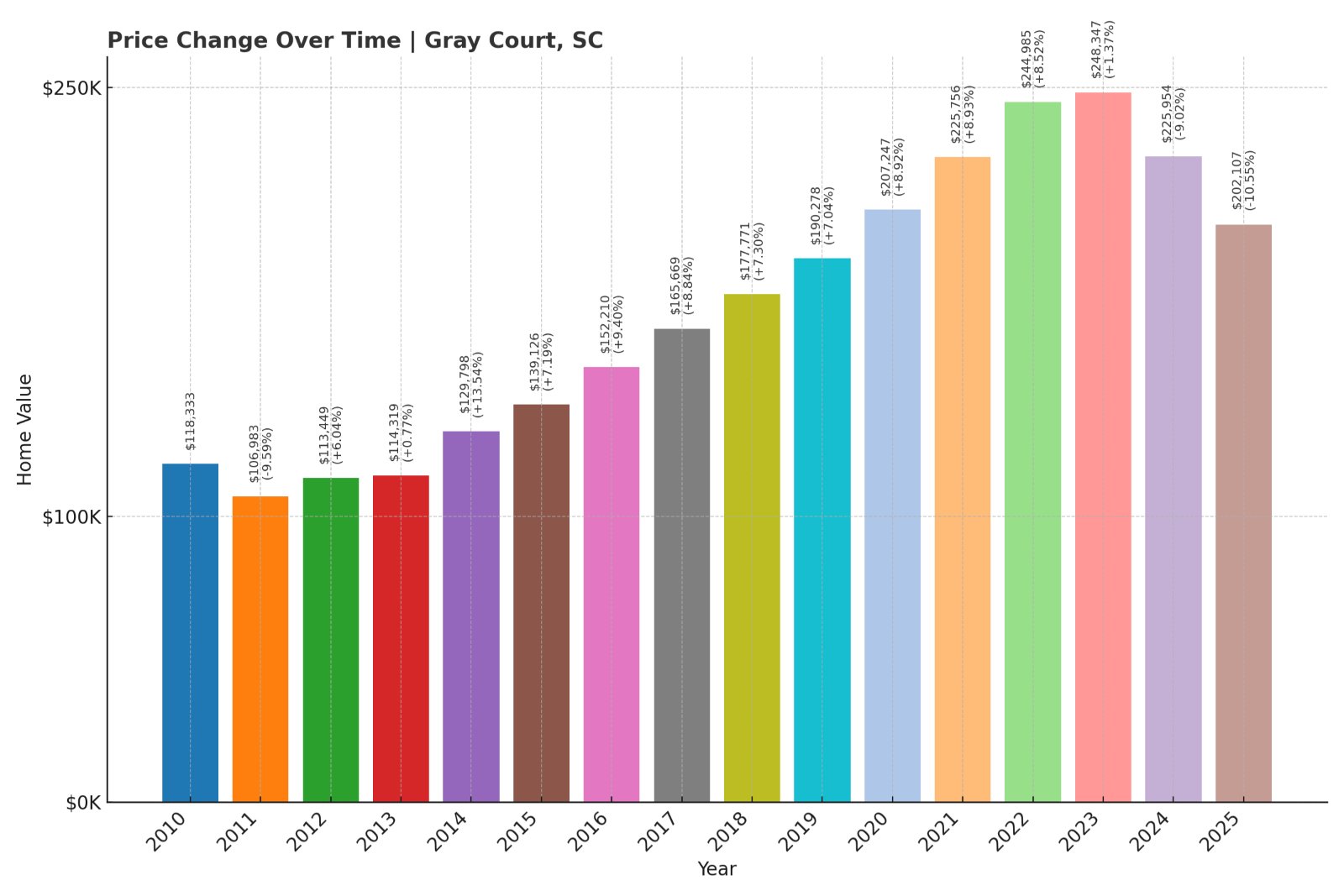

4. Gray Court – Crash Risk Percentage: 83.00%

- Crash Risk Percentage: 83.00%

- Historical crashes (8%+ drops): 3

- Worst historical crash: 10.6% (2025)

- Total price increase since 2010: 70.8%

- Overextended above long-term average: 17.1%

- Price volatility (annual swings): 7.7%

- Current May 2025 price: $202,107

Gray Court – Long-Term Risk in a Mid-Tier Market

Gray Court has seen home prices rise by about 71% since 2010, landing at just over $202,000. While that might sound moderate compared to hot spots, it masks a troubling crash history: the town has seen three major price drops, with the worst occurring in 2025. It also remains nearly 17% above its historical trendline.

Situated in Laurens County, Gray Court offers easy access to Greenville but hasn’t seen the same infrastructure or population growth. Its housing market behaves erratically, and without major developments or stable job growth, it may continue to fluctuate. Buyers in this area should be aware of its history of sharp corrections.

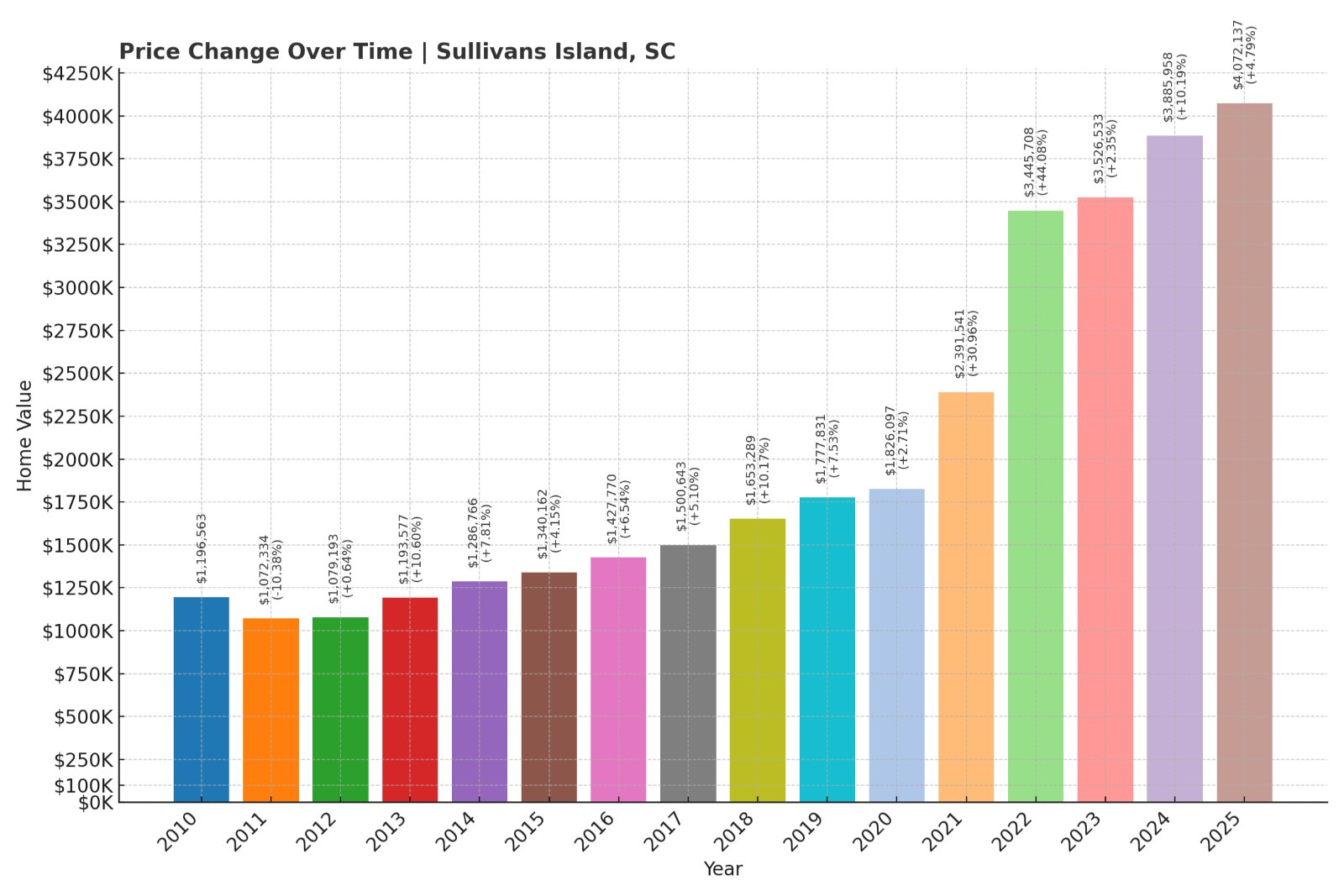

3. Sullivans Island – Crash Risk Percentage: 85.25%

- Crash Risk Percentage: 85.25%

- Historical crashes (8%+ drops): 1

- Worst historical crash: 10.4% (2011)

- Total price increase since 2010: 240.3%

- Overextended above long-term average: 99.4%

- Price volatility (annual swings): 12.9%

- Current May 2025 price: $4,072,137

Sullivans Island – Price Surge Nearing a Breaking Point

Sullivans Island tops the charts for overextension, with current home values nearly double the long-term average. Since 2010, prices have climbed more than 240%, pushing the median value to over $4 million. High volatility and a prior double-digit drop in 2011 highlight that even elite markets aren’t immune to sharp corrections.

Just northeast of Charleston, Sullivans Island is one of South Carolina’s most coveted—and expensive—beachfront enclaves. But its desirability doesn’t guarantee immunity from downturns. With home values far beyond fundamentals and a market driven largely by wealth migration and second-home demand, the risk of a price correction here is significant, especially if economic conditions shift.

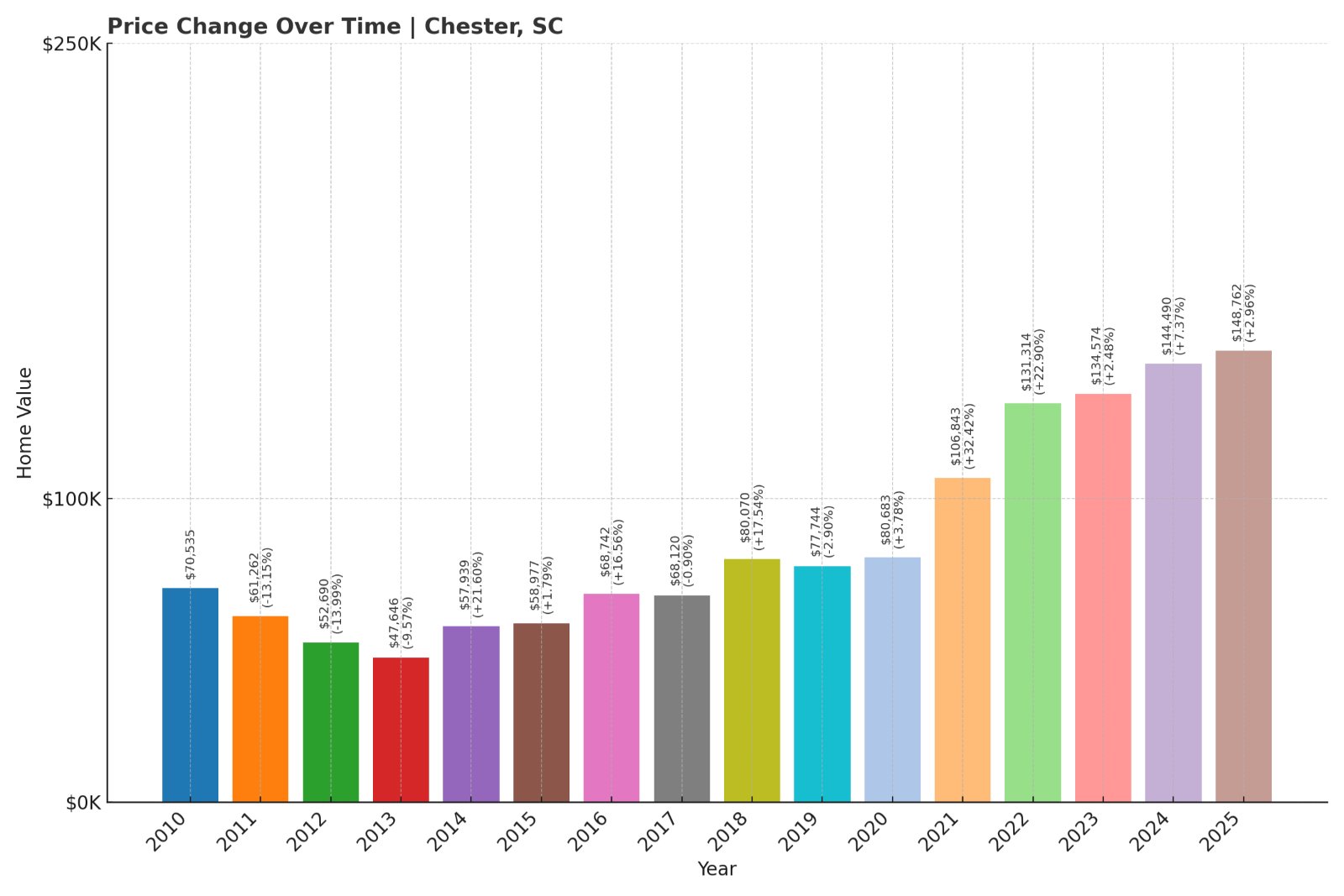

2. Chester – Crash Risk Percentage: 87.85%

- Crash Risk Percentage: 87.85%

- Historical crashes (8%+ drops): 3

- Worst historical crash: 14.0% (2012)

- Total price increase since 2010: 110.9%

- Overextended above long-term average: 71.2%

- Price volatility (annual swings): 13.8%

- Current May 2025 price: $148,762

Chester – Repeated Drops, Heavy Overextension

Chester has suffered three significant crashes in the past 15 years, the worst being a 14% drop in 2012. Despite that, prices have more than doubled since 2010 and currently sit over 71% above the town’s long-term average. With volatility nearly 14%, Chester’s housing market is one of the most unstable on this list.

Located between Columbia and Charlotte, Chester was once a textile hub but has struggled with economic decline. Recent housing demand may be driven by affordability rather than lasting fundamentals. Without sustained job growth or investment, its elevated home prices may be especially vulnerable to another correction.

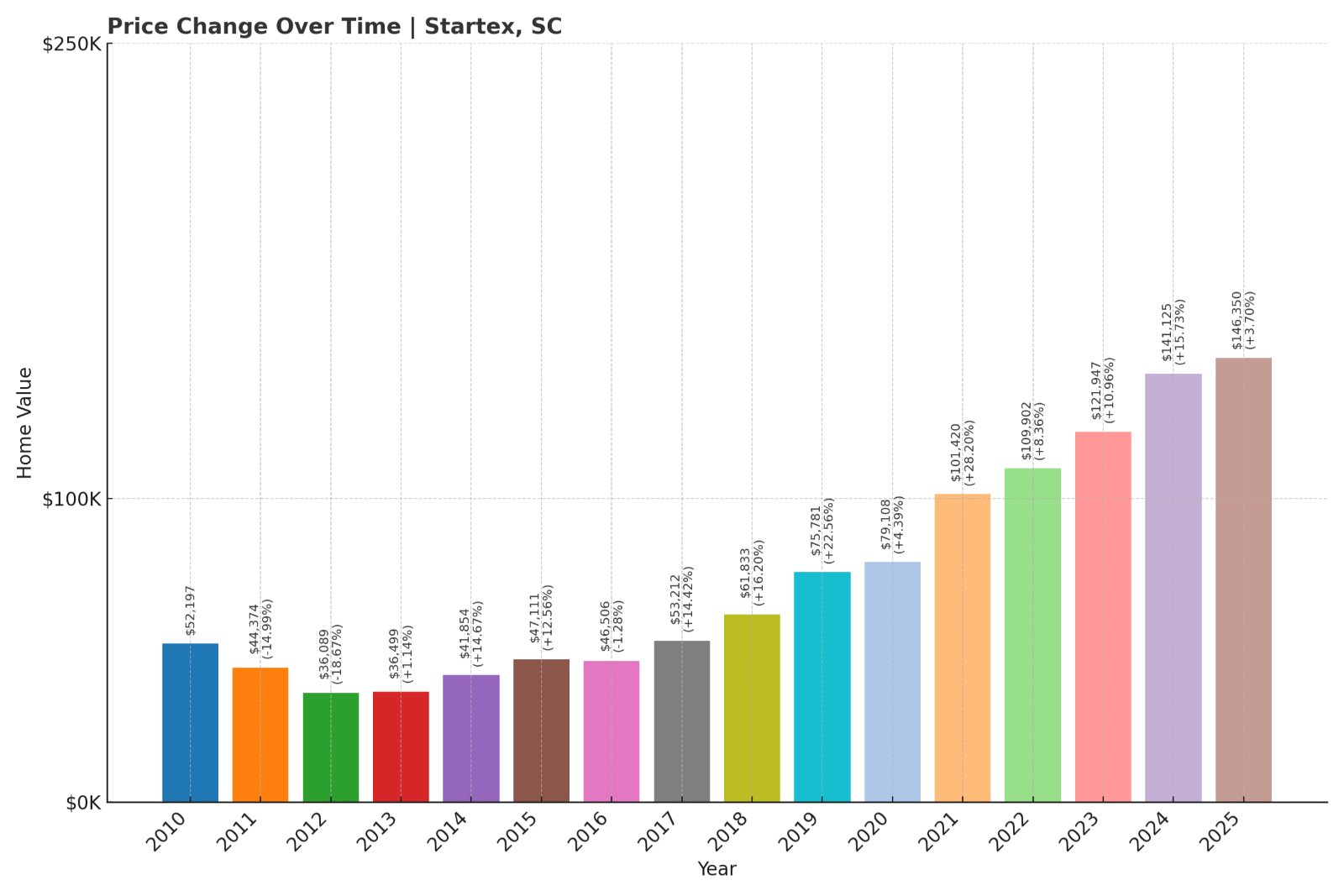

1. Startex – Crash Risk Percentage: 95.00%

- Crash Risk Percentage: 95.00%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 18.7% (2012)

- Total price increase since 2010: 180.4%

- Overextended above long-term average: 95.9%

- Price volatility (annual swings): 12.7%

- Current May 2025 price: $146,350

Startex – South Carolina’s Riskiest Housing Market

With the highest crash risk percentage in the state and nearly 96% overextension, Startex tops this list for good reason. Home prices have surged 180% since 2010, and the market experienced two large crashes, including a brutal 18.7% drop in 2012. Current prices have far outpaced local fundamentals.

This small community in Spartanburg County was once a textile mill town. Though located near major transit routes, Startex has little in the way of new infrastructure or growth industries. The sharp rise in home values appears speculative—and given the town’s history of volatility, it’s a textbook candidate for a future correction.