🔥 Would you like to save this?

Wyoming’s real estate market is on fire—and not just in Jackson. The Zillow Home Value Index shows that some towns are seeing price growth that’s wildly outpacing their long-term trends. Measured by the so-called “Investor Feeding Frenzy Factor,” these 18 places have become magnets for buyers chasing big gains. From energy hubs to outdoorsy hotspots, these towns have turned into fast-moving markets where prices aren’t just rising—they’re rocketing.

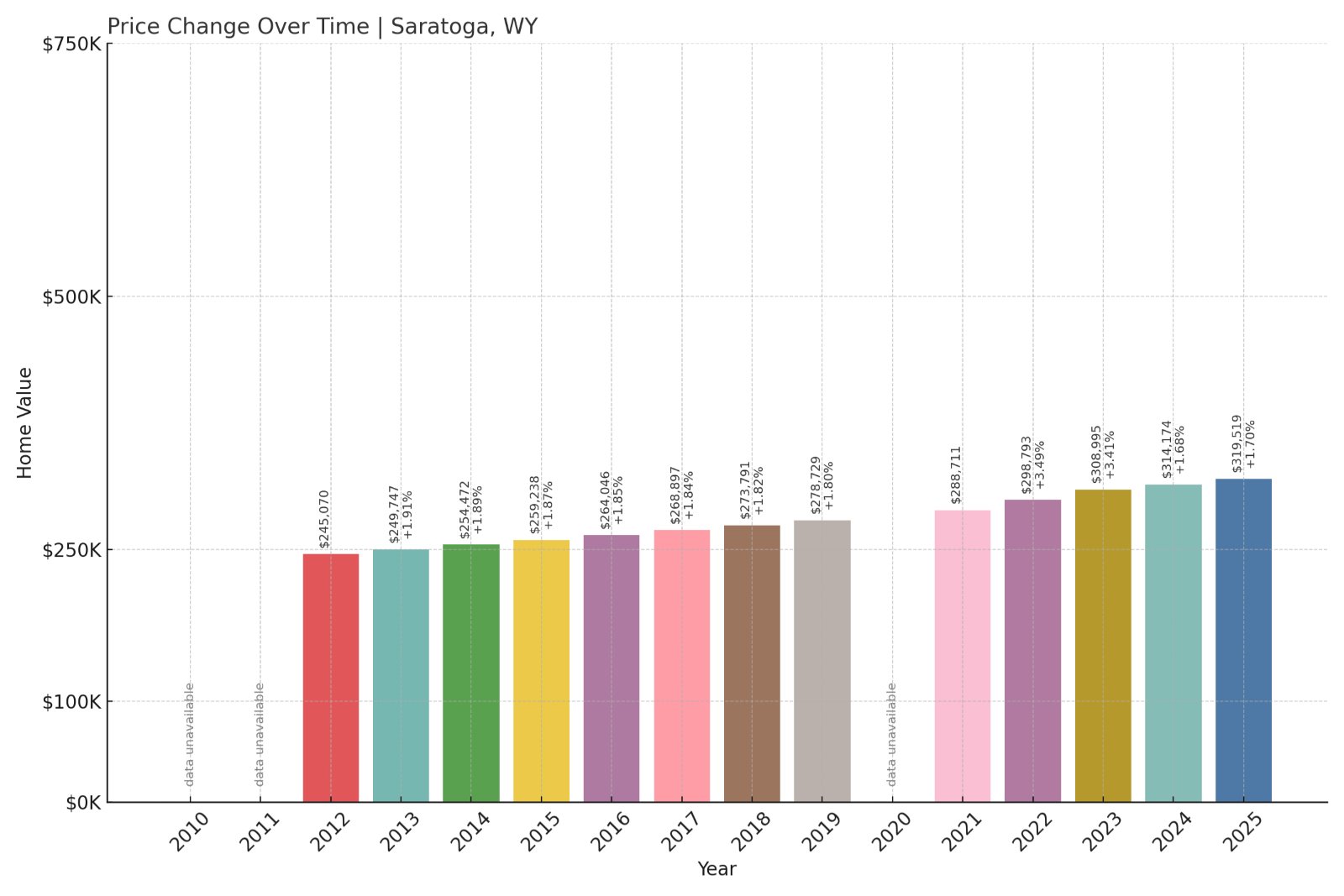

18. Saratoga – 36.5% Investor Feeding Frenzy in June 2025

- Historical annual growth rate (2012–2022): 4.50%

- Recent annual growth rate (2022–2025): 6.14%

- Investor Feeding Frenzy Factor: 36.50%

- Current 2025 price: $319,519.00

Saratoga shows the most moderate price acceleration on this list, yet still demonstrates how Wyoming’s entire housing market has shifted into higher gear. The town’s recent growth rate of 6.14% represents a significant jump from its historical 4.50% annual increases, creating a feeding frenzy factor that signals increased market activity. At $319,519, current home prices reflect both the town’s natural appeal and broader market pressures affecting even Wyoming’s smaller communities.

In order to come up with the very specific design ideas, we create most designs with the assistance of state-of-the-art AI interior design software.

Saratoga – Hot Springs Haven Draws New Interest

Saratoga sits in south-central Wyoming’s Carbon County, known for its natural hot springs and proximity to the Medicine Bow National Forest. The town’s location along the North Platte River has historically attracted visitors seeking outdoor recreation, but recent price increases suggest more permanent interest from buyers. The community’s small size means even modest increases in demand can create noticeable price impacts.

The town’s economy traditionally centered on ranching and tourism, with the hot springs serving as a major draw for visitors from Colorado and other neighboring states. Recent infrastructure improvements and increased remote work flexibility have likely contributed to the 36.5% acceleration in price growth. Saratoga’s relatively affordable entry point compared to Colorado resort towns may be attracting buyers seeking mountain lifestyle at lower costs.

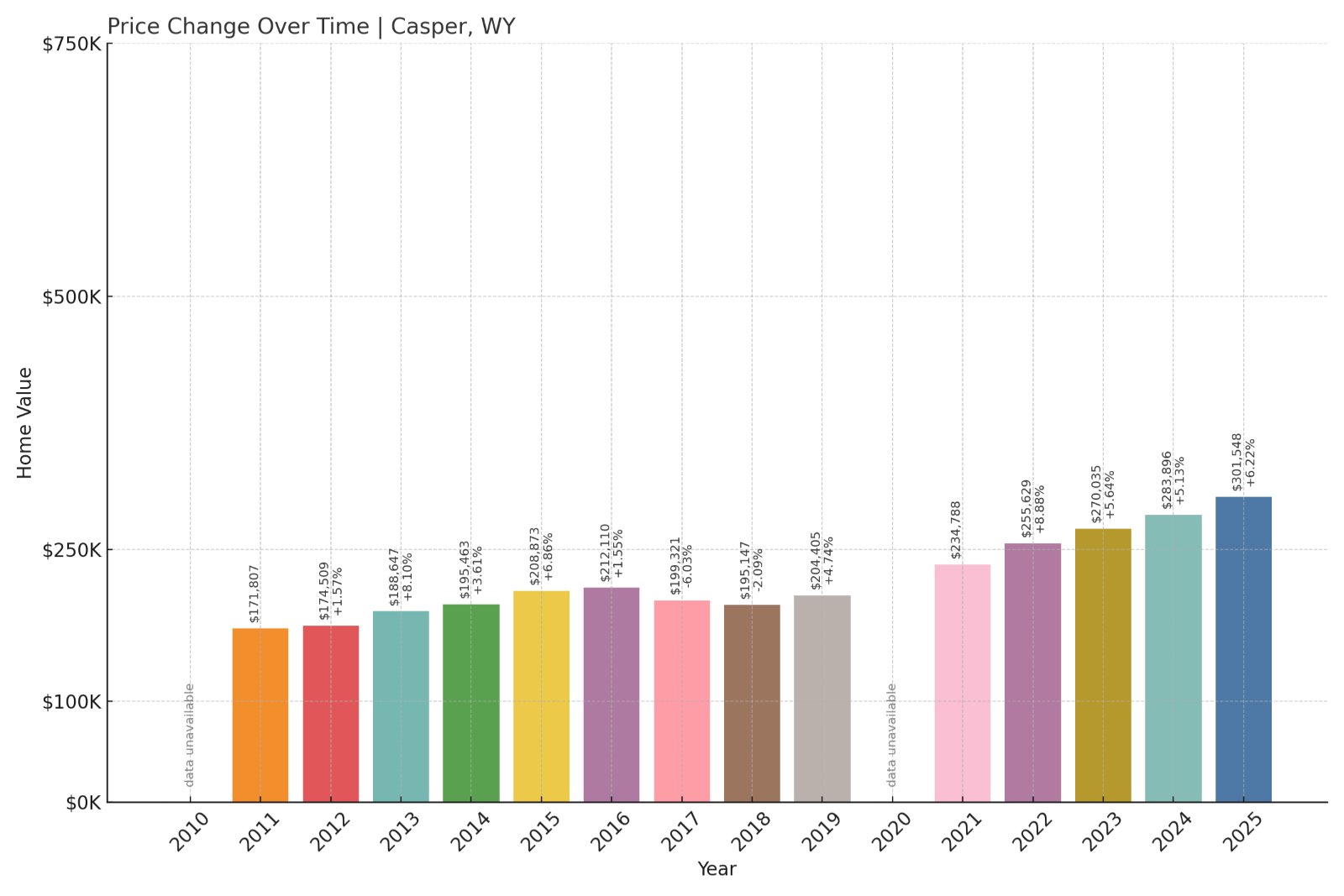

17. Casper – 45.5% Investor Feeding Frenzy in June 2025

- Historical annual growth rate (2012–2022): 3.89%

- Recent annual growth rate (2022–2025): 5.66%

- Investor Feeding Frenzy Factor: 45.48%

- Current 2025 price: $301,548.47

Wyoming’s second-largest city demonstrates how even established urban markets are experiencing accelerated growth patterns. Casper’s jump from 3.89% historical growth to 5.66% recent growth creates a feeding frenzy factor of 45.48%, indicating significant market momentum. The current median price of $301,548 positions Casper as relatively affordable compared to many Western cities, which may be driving increased investor and buyer interest.

Casper – Energy Hub Sees Renewed Investment Interest

Casper serves as Wyoming’s second-largest city and a major energy industry center, with a metro population exceeding 80,000 residents. The city’s economy has historically fluctuated with oil and gas cycles, but recent diversification efforts have created more stability. Located along the North Platte River in central Wyoming, Casper offers urban amenities rare in the state, including a regional medical center, university campus, and cultural facilities.

The 45.5% investor feeding frenzy factor reflects renewed confidence in Casper’s economic prospects as energy markets stabilize and diversify. The city’s established infrastructure, including the regional airport and interstate highway access, makes it attractive to businesses and residents seeking Wyoming’s tax advantages with urban conveniences. Recent commercial developments and housing projects suggest sustained growth momentum beyond traditional energy sector cycles.

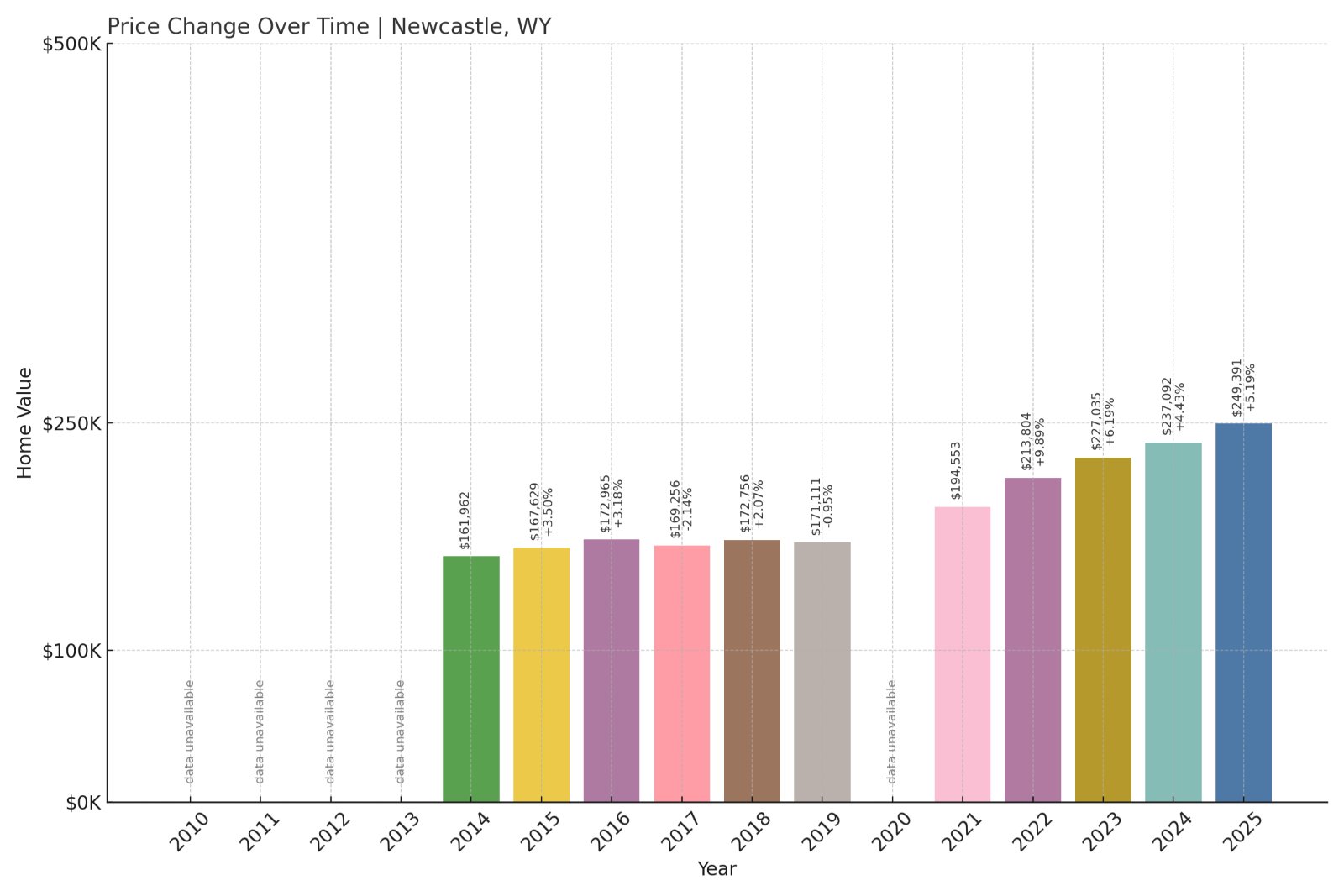

16. Newcastle – 49.1% Investor Feeding Frenzy in June 2025

- Historical annual growth rate (2012–2022): 3.53%

- Recent annual growth rate (2022–2025): 5.27%

- Investor Feeding Frenzy Factor: 49.08%

- Current 2025 price: $249,390.53

Newcastle’s housing market acceleration shows how smaller Wyoming communities are experiencing disproportionate price increases. The town’s recent annual growth of 5.27% significantly exceeds its historical 3.53% rate, creating a feeding frenzy factor approaching 50%. At $249,390, Newcastle offers some of the most affordable housing on this list, which may be attracting value-seeking investors and first-time buyers.

Newcastle – Black Hills Gateway Gains Traction

Newcastle sits in northeastern Wyoming’s Weston County, serving as a gateway to the Black Hills region shared with South Dakota. The town’s proximity to major recreational areas, including Devils Tower National Monument just 27 miles away, has traditionally supported a tourism-based economy. Recent price acceleration suggests growing recognition of Newcastle’s strategic location and development potential.

The community’s location along Highway 16 provides direct access to both Rapid City, South Dakota, and Wyoming’s interior, making it attractive for businesses and residents seeking small-town living with regional connectivity. Newcastle’s relatively low current median price of $249,390 offers significant value compared to similar communities in Colorado or Montana. The 49.1% feeding frenzy factor indicates this value proposition is drawing increased attention from investors and buyers seeking affordable Western living.

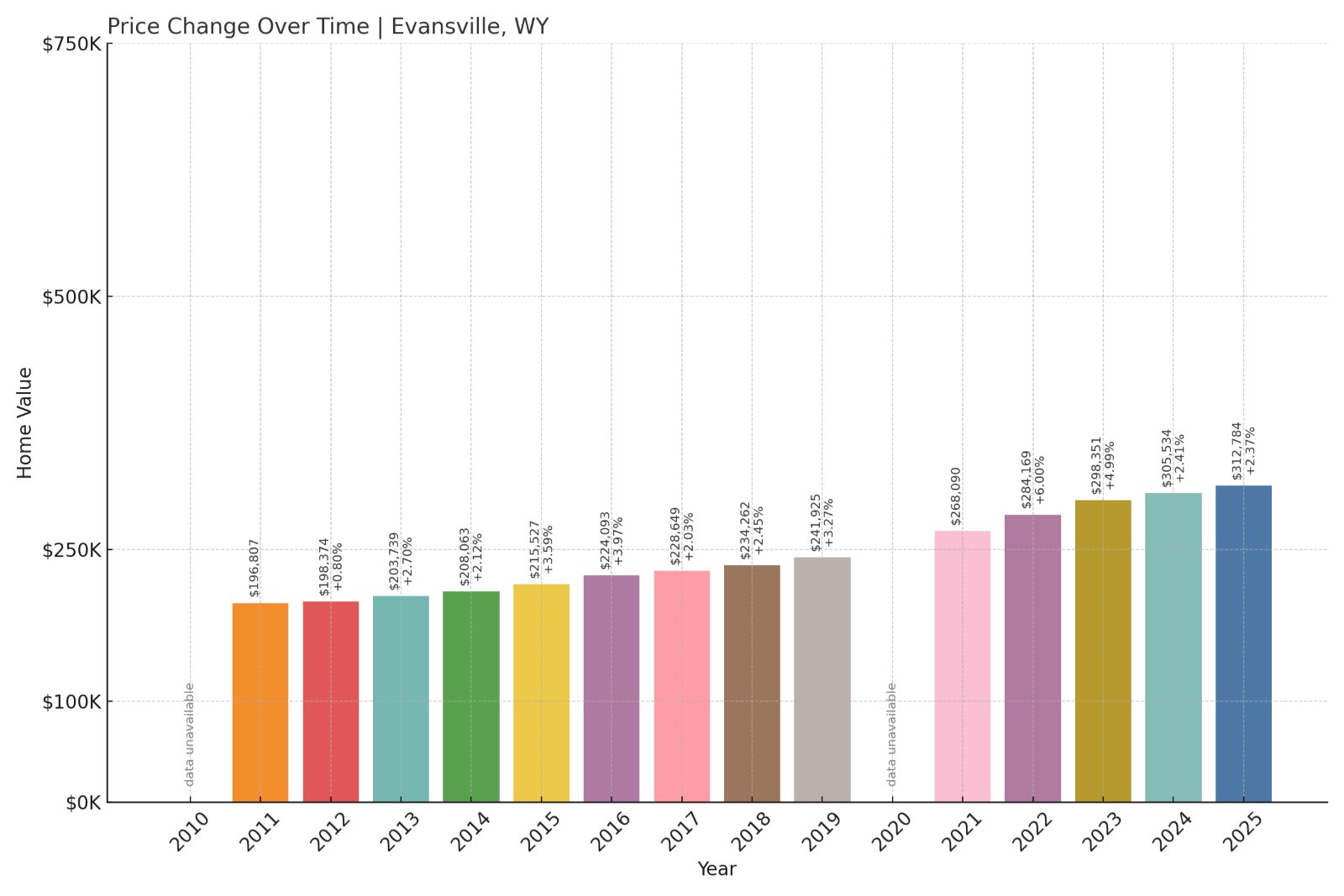

15. Evansville – 51.0% Investor Feeding Frenzy in June 2025

- Historical annual growth rate (2012–2022): 4.21%

- Recent annual growth rate (2022–2025): 6.35%

- Investor Feeding Frenzy Factor: 50.96%

- Current 2025 price: $312,784.00

Evansville crosses the 50% feeding frenzy threshold, indicating substantial market acceleration in this Casper suburb. The community’s growth rate jumped from 4.21% historically to 6.35% recently, creating investor interest that pushes prices above the $300,000 mark. This price point reflects Evansville’s desirable suburban characteristics while remaining accessible compared to markets in neighboring states.

Evansville – Casper Suburb Attracts Family Investment

Evansville functions as a bedroom community for Casper, located just southwest of Wyoming’s second-largest city in Natrona County. The town offers suburban amenities with small-town character, including highly rated schools that attract families seeking quality education options. Its proximity to Casper provides employment opportunities while maintaining a distinct community identity.

The 51.0% investor feeding frenzy factor reflects Evansville’s appeal to both families and investors recognizing suburban growth potential. The current median price of $312,784 positions the community as a premium option within the Casper metropolitan area, justified by superior schools and newer housing developments. Recent construction activity and commercial development suggest sustained growth momentum as more buyers discover Evansville’s combination of suburban convenience and Wyoming’s favorable tax environment.

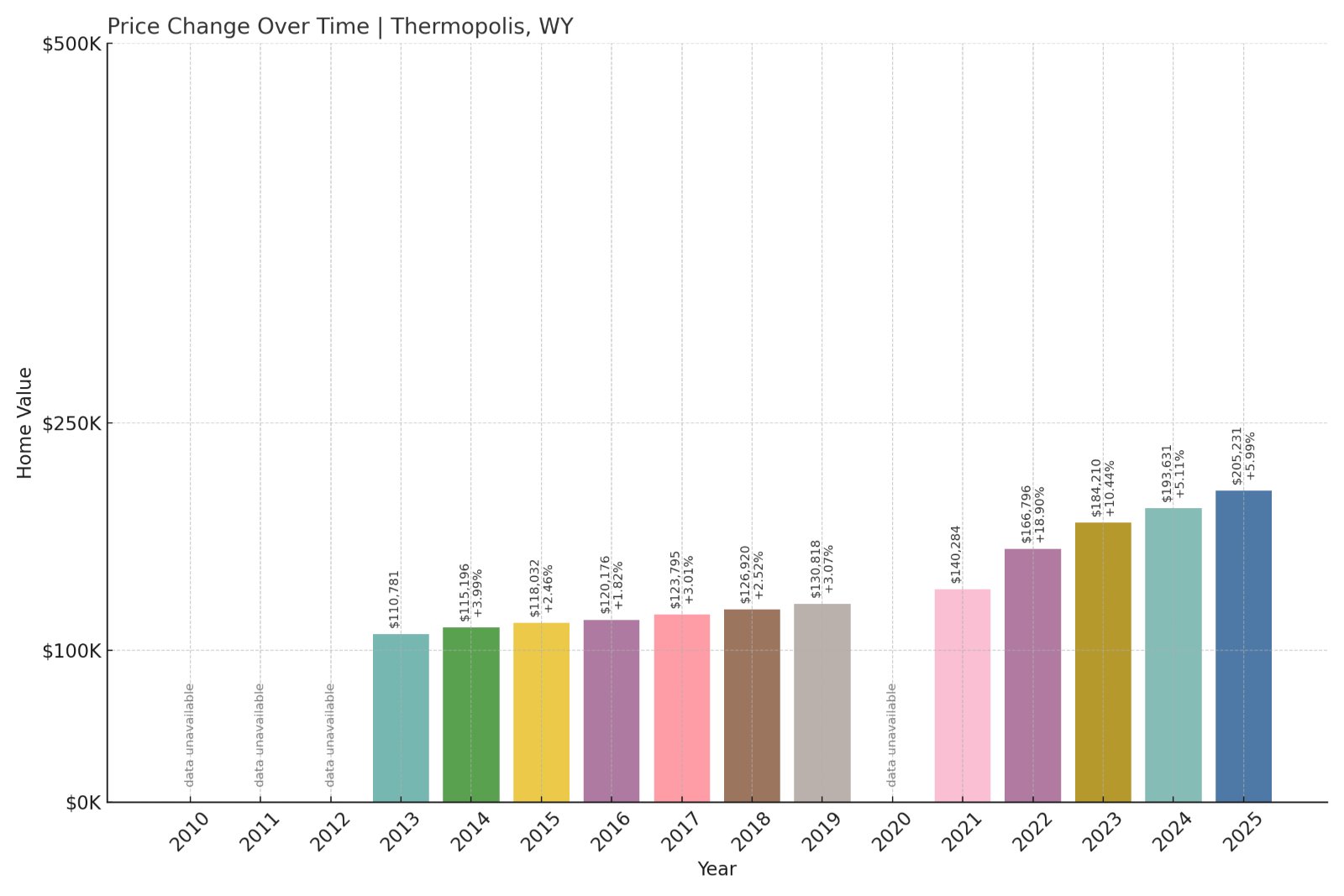

14. Thermopolis – 53.8% Investor Feeding Frenzy in June 2025

- Historical annual growth rate (2012–2022): 4.65%

- Recent annual growth rate (2022–2025): 7.16%

- Investor Feeding Frenzy Factor: 53.84%

- Current 2025 price: $205,230.72

Thermopolis demonstrates how tourism-dependent communities are experiencing unexpected price acceleration. The town’s recent growth rate of 7.16% represents a substantial increase from its 4.65% historical average, creating a feeding frenzy factor exceeding 53%. At $205,230, Thermopolis offers the lowest median price among these 18 communities, potentially attracting value investors and buyers priced out of other markets.

Thermopolis – Hot Springs Tourism Fuels Growth

Thermopolis sits in central Wyoming’s Hot Springs County, famous for having the world’s largest mineral hot springs. The town’s economy centers on tourism, with Hot Springs State Park serving as the primary attraction drawing visitors year-round. The community’s location along the Bighorn River provides additional recreational opportunities including fishing and rafting.

The 53.8% investor feeding frenzy factor suggests growing recognition of Thermopolis’s tourism potential and lifestyle appeal. The extremely affordable median price of $205,230 creates opportunities for investors seeking rental properties in a proven tourism market. Recent improvements to tourism infrastructure and increased marketing of Wyoming’s outdoor recreation opportunities may be driving new buyer interest in this historically overlooked community.

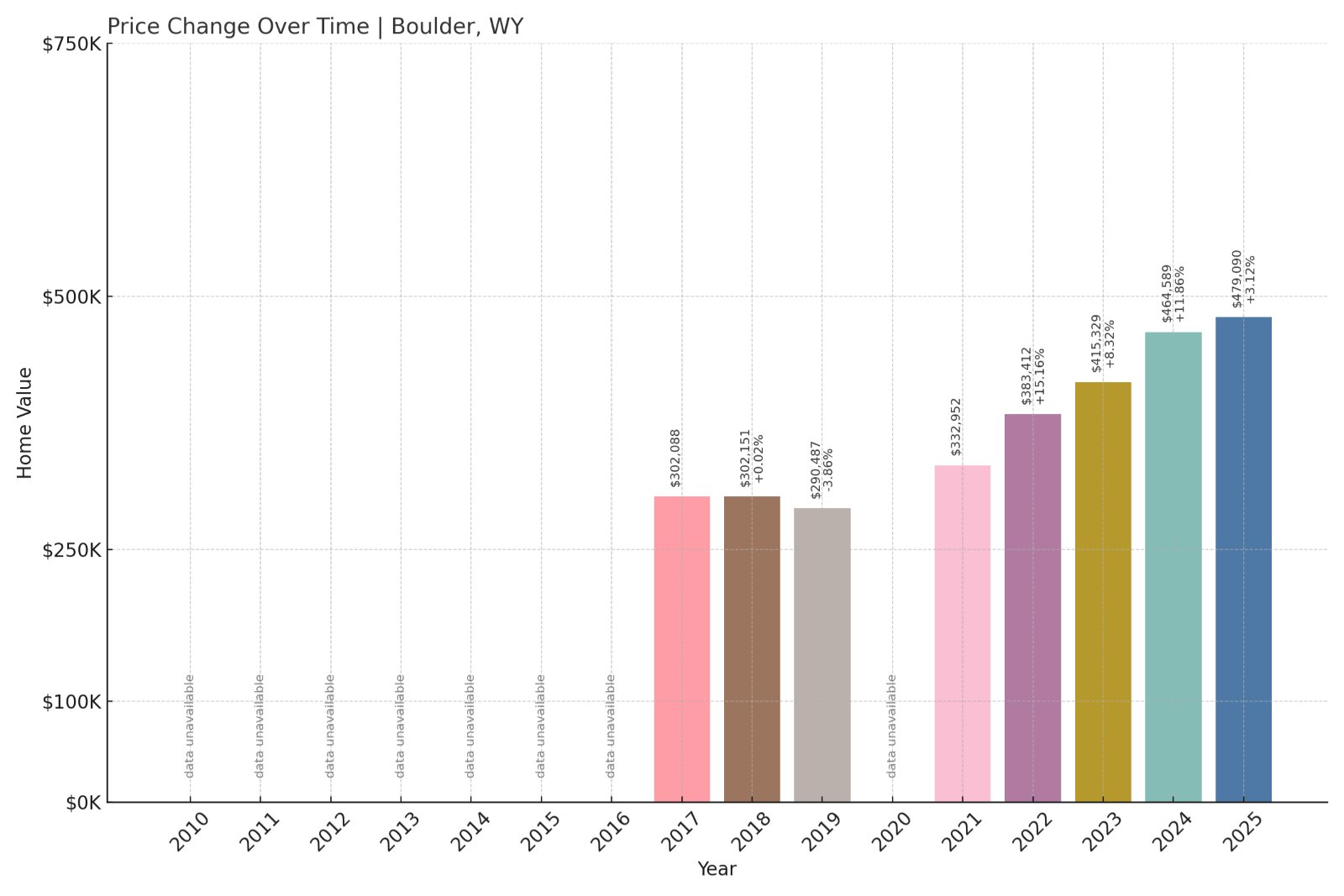

13. Boulder – 57.9% Investor Feeding Frenzy in June 2025

- Historical annual growth rate (2012–2022): 4.88%

- Recent annual growth rate (2022–2025): 7.71%

- Investor Feeding Frenzy Factor: 57.86%

- Current 2025 price: $479,089.81

Boulder’s market acceleration approaches 58%, indicating intense investor interest in this mountain community. The town’s recent annual growth of 7.71% significantly exceeds its historical 4.88% rate, pushing median prices to $479,089. This price level reflects Boulder’s mountain location and recreational amenities, creating a feeding frenzy among buyers seeking Wyoming mountain living.

Boulder – Wind River Mountain Access Drives Premium Prices

Boulder sits in Sublette County at the foot of the Wind River Mountains, providing direct access to some of Wyoming’s most spectacular wilderness areas. The community serves as a gateway to the Bridger Wilderness and numerous hiking, fishing, and hunting opportunities. Its elevation and mountain setting create a distinctly different environment from Wyoming’s plains communities.

The 57.9% investor feeding frenzy factor reflects Boulder’s unique position in Wyoming’s housing market, offering mountain amenities at prices below comparable Colorado communities. The current median price of $479,089 represents significant value for mountain property, especially considering the area’s proximity to world-class outdoor recreation. Recent increases in remote work and lifestyle-focused relocations have likely contributed to accelerated demand for Boulder’s limited housing inventory.

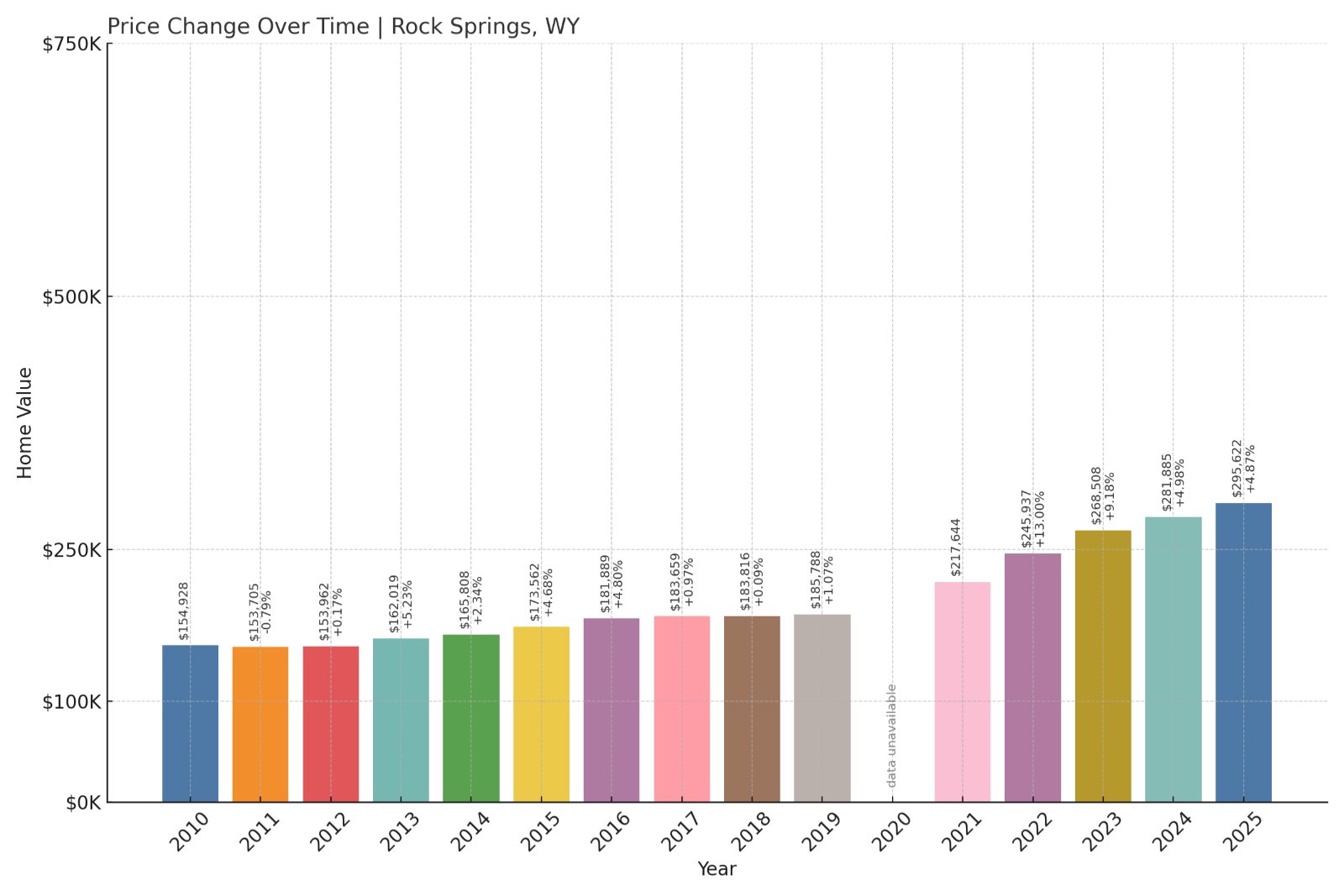

12. Rock Springs – 61.0% Investor Feeding Frenzy in June 2025

🔥 Would you like to save this?

- Historical annual growth rate (2012–2022): 3.27%

- Recent annual growth rate (2022–2025): 5.26%

- Investor Feeding Frenzy Factor: 60.95%

- Current 2025 price: $295,621.75

Rock Springs crosses the 60% feeding frenzy threshold, showing dramatic acceleration in a traditionally stable market. The city’s recent growth rate of 5.26% represents a significant jump from its modest 3.27% historical average, indicating substantial new market activity. At $295,621, Rock Springs maintains affordability while experiencing investment pressure that suggests recognition of its strategic value.

Rock Springs – Transportation Hub Gains Strategic Recognition

Rock Springs serves as a major transportation and energy center in southwestern Wyoming’s Sweetwater County. The city sits at the intersection of Interstate 80 and Highway 191, making it a crucial logistics hub for regional commerce. Union Pacific Railroad operations and the region’s energy extraction industries have historically driven the local economy.

The 61.0% investor feeding frenzy factor suggests growing appreciation for Rock Springs’ strategic location and infrastructure advantages. The city’s position along Interstate 80 provides direct connections to major Western markets, while its energy industry experience offers economic diversification opportunities. Recent improvements to commercial facilities and the regional airport enhance Rock Springs’ appeal to businesses and investors seeking Wyoming’s tax advantages with superior transportation access.

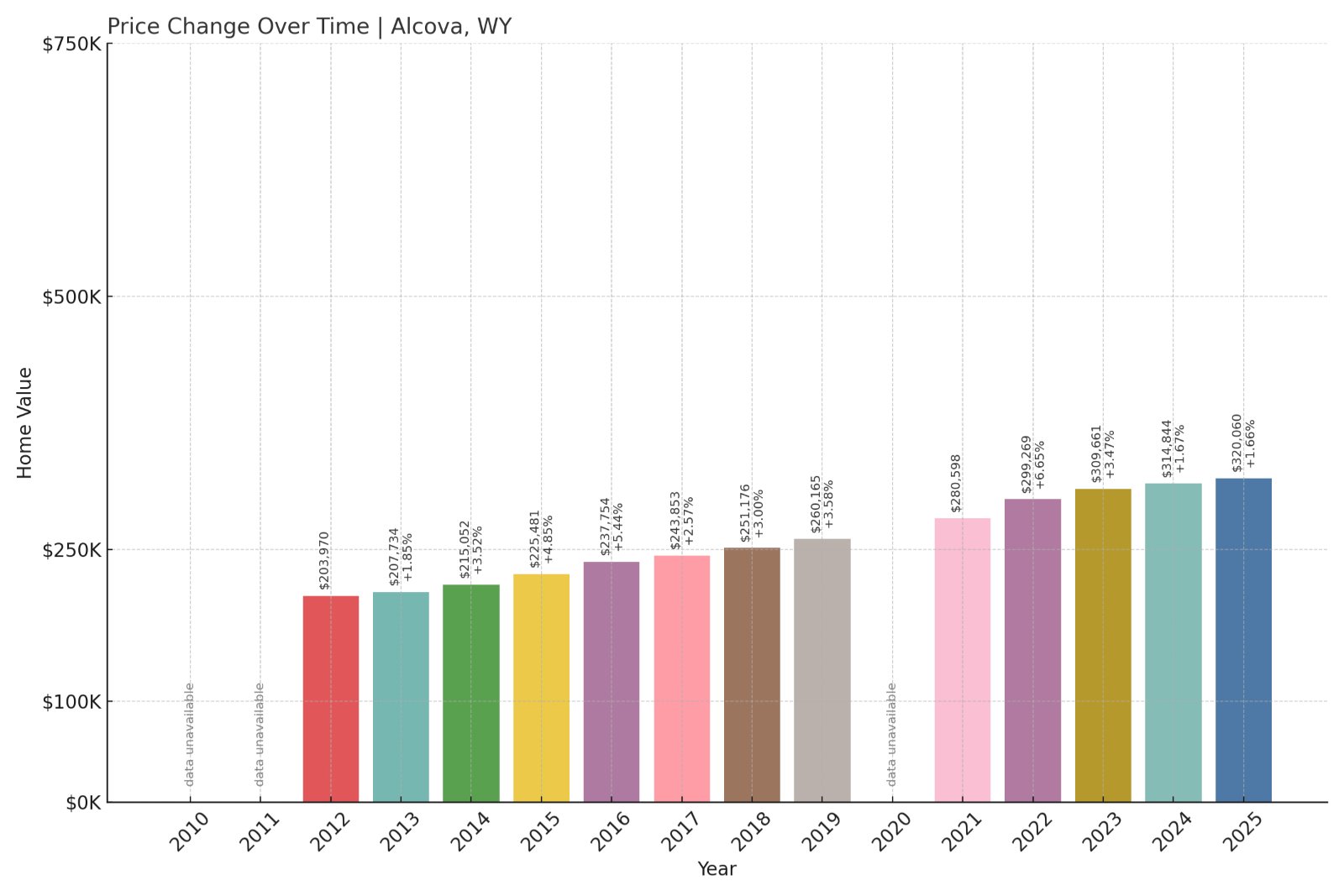

11. Alcova – 72.5% Investor Feeding Frenzy in June 2025

- Historical annual growth rate (2012–2022): 4.71%

- Recent annual growth rate (2022–2025): 8.13%

- Investor Feeding Frenzy Factor: 72.54%

- Current 2025 price: $320,060.00

Alcova’s feeding frenzy factor exceeds 72%, indicating intense market acceleration in this recreation-focused community. The area’s recent growth rate of 8.13% nearly doubles its historical 4.71% average, pushing median prices to $320,060. This dramatic acceleration suggests Alcova has attracted significant attention from investors and lifestyle buyers seeking waterfront opportunities.

Alcova – Reservoir Recreation Creates Investment Buzz

Alcova centers around Alcova Reservoir, a popular recreation destination in central Wyoming’s Natrona County. The community sits about 30 miles southwest of Casper, offering lakefront living with easy access to urban amenities. Alcova Reservoir provides boating, fishing, and water sports opportunities rare in Wyoming’s typically arid landscape.

The 72.5% investor feeding frenzy factor reflects growing demand for Wyoming recreational properties as buyers seek lifestyle opportunities. The current median price of $320,060 represents significant value for waterfront property, especially compared to similar recreational communities in Colorado or Utah. Recent development of vacation rental properties and seasonal homes suggests investors recognize Alcova’s potential as Wyoming’s premier water recreation destination.

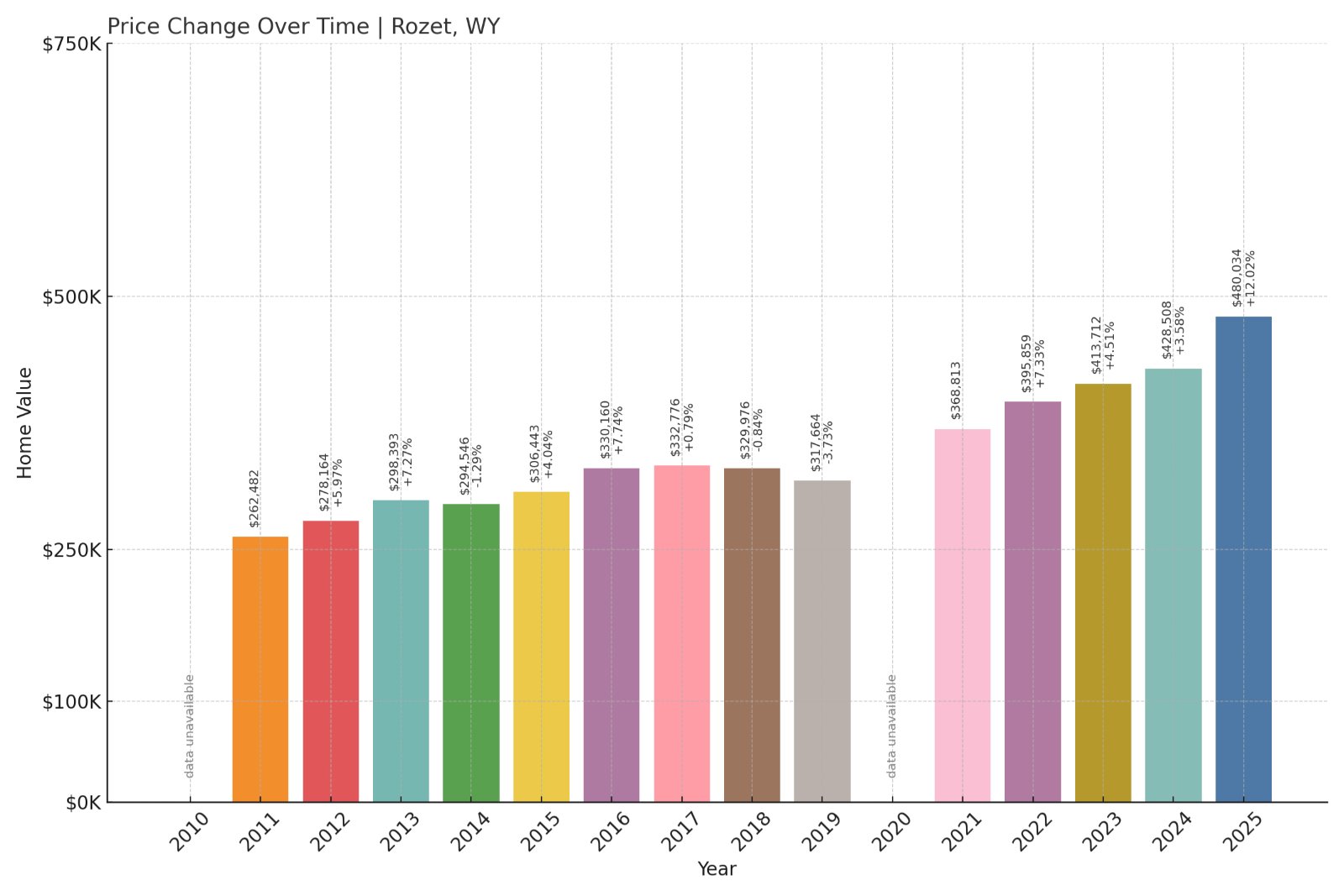

10. Rozet – 84.8% Investor Feeding Frenzy in June 2025

- Historical annual growth rate (2012–2022): 3.59%

- Recent annual growth rate (2022–2025): 6.64%

- Investor Feeding Frenzy Factor: 84.82%

- Current 2025 price: $480,034.10

Rozet’s feeding frenzy factor approaches 85%, showing dramatic price acceleration in this small Campbell County community. The town’s recent growth rate of 6.64% significantly exceeds its historical 3.59% average, pushing median prices to $480,034. This high price point reflects Rozet’s proximity to energy industry activity and limited housing supply meeting increased demand.

Rozet – Energy Proximity Drives Premium Values

Rozet sits in northeastern Wyoming’s Campbell County, heart of the Powder River Basin energy region. The community’s proximity to major coal mining and oil extraction operations has created economic opportunities that support higher housing values. Limited housing inventory in this small community amplifies price impacts from increased buyer interest.

The 84.8% investor feeding frenzy factor indicates strong recognition of Rozet’s strategic position within Wyoming’s energy corridor. The current median price of $480,034 reflects premium values justified by energy industry employment opportunities and limited housing supply. Recent energy sector investments and infrastructure improvements suggest continued demand pressure on Rozet’s limited residential inventory.

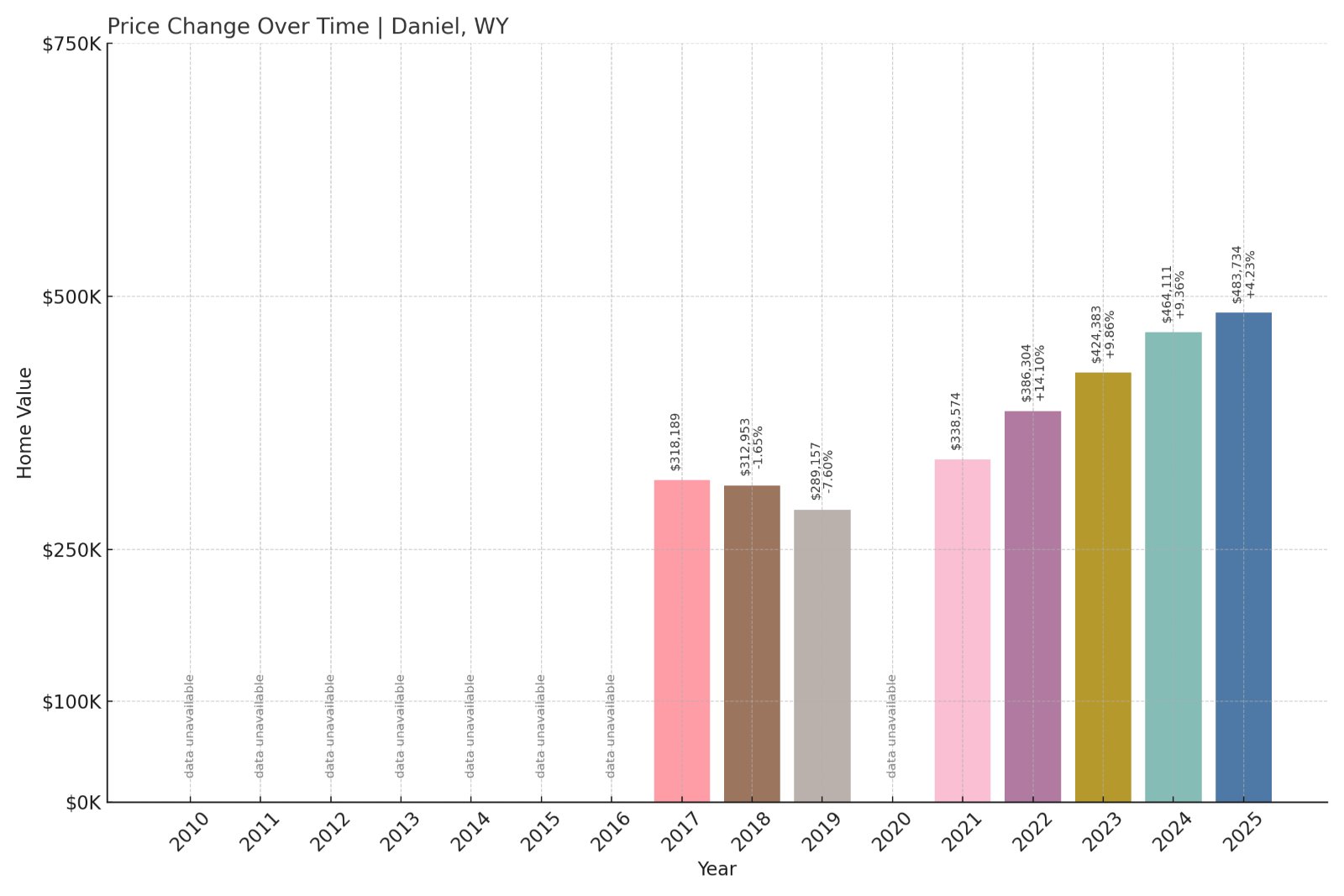

9. Daniel – 96.8% Investor Feeding Frenzy in June 2025

- Historical annual growth rate (2012–2022): 3.96%

- Recent annual growth rate (2022–2025): 7.79%

- Investor Feeding Frenzy Factor: 96.80%

- Current 2025 price: $483,734.34

Daniel’s feeding frenzy factor approaches 97%, indicating near-doubling of historical growth rates. The community’s recent annual growth of 7.79% represents a dramatic acceleration from its 3.96% historical average, pushing median prices to $483,734. This price level reflects Daniel’s mountain location and limited housing supply meeting increased recreational demand.

Daniel – Gateway to Jackson Hole Backcountry

Daniel sits in Sublette County’s Upper Green River Valley, serving as a gateway to the Greater Yellowstone Ecosystem. The community provides access to world-class fishing, hunting, and wilderness recreation while maintaining authentic Western character. Its location offers proximity to Jackson Hole amenities without resort town pricing.

The 96.8% investor feeding frenzy factor reflects growing recognition of Daniel’s strategic position as an affordable alternative to Jackson Hole’s expensive market. The current median price of $483,734 represents significant value for mountain property with wilderness access, especially compared to similar communities in Colorado or Idaho. Recent increases in outdoor recreation popularity and remote work flexibility have likely contributed to accelerated buyer interest in Daniel’s limited housing inventory.

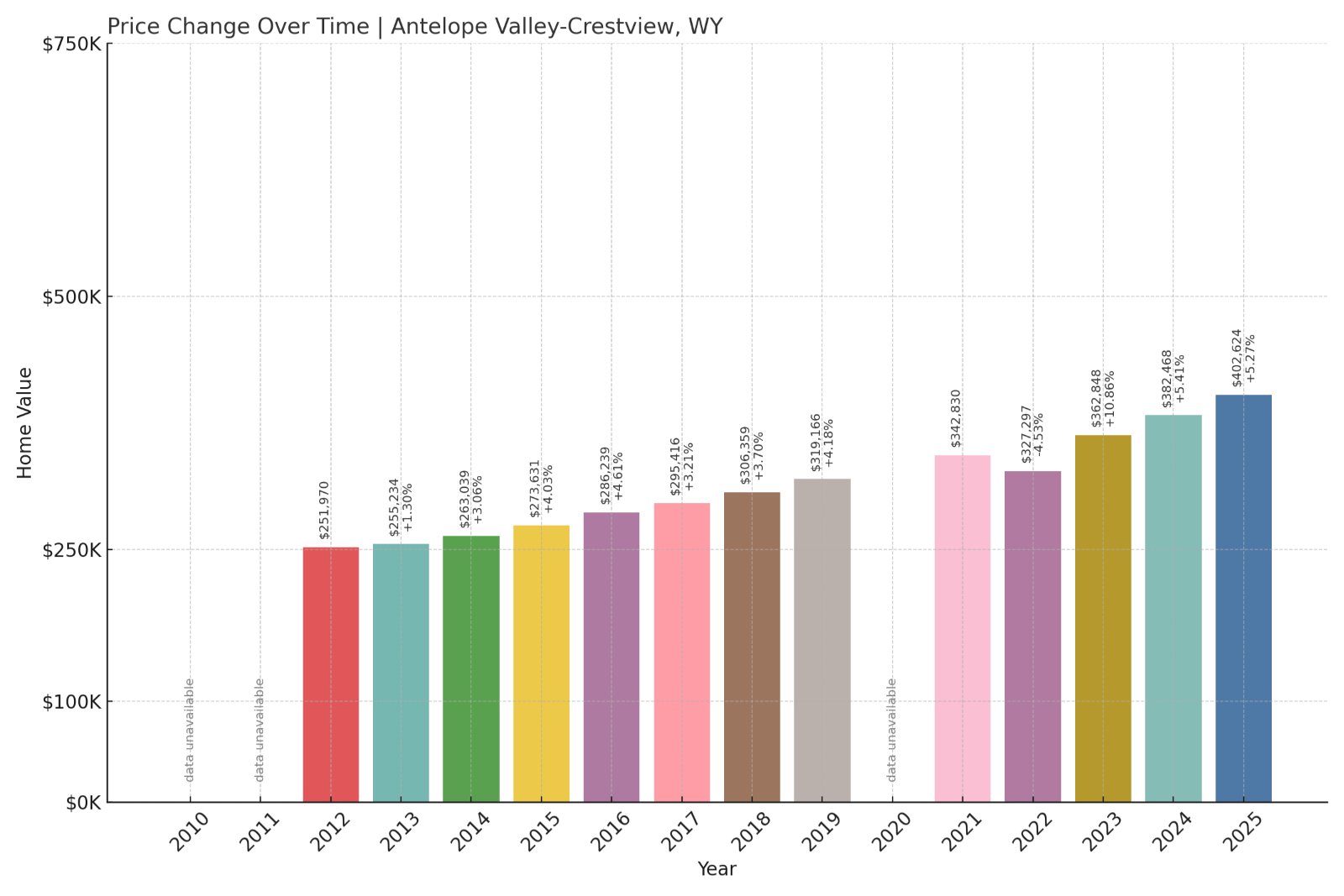

8. Antelope Valley-Crestview – 103.6% Investor Feeding Frenzy in June 2025

- Historical annual growth rate (2012–2022): 3.51%

- Recent annual growth rate (2022–2025): 7.15%

- Investor Feeding Frenzy Factor: 103.56%

- Current 2025 price: $402,624.23

Antelope Valley-Crestview crosses the 100% feeding frenzy threshold, indicating recent growth rates more than double historical averages. The area’s recent annual growth of 7.15% represents a dramatic acceleration from its 3.51% historical rate, pushing median prices to $402,624. This price acceleration suggests significant new market recognition and investment activity.

Antelope Valley-Crestview – Suburban Growth Exceeds Expectations

Antelope Valley-Crestview represents suburban development in Converse County, providing residential options for workers in Wyoming’s energy and agriculture sectors. The community’s growth reflects broader suburban expansion trends as buyers seek newer housing with modern amenities. Its location provides small-town living with access to regional employment centers.

The 103.6% investor feeding frenzy factor indicates dramatic market recognition of suburban Wyoming’s investment potential. The current median price of $402,624 reflects premium values for newer suburban development, justified by superior amenities and strategic location. Recent commercial development and infrastructure improvements suggest sustained growth momentum as Wyoming’s suburban markets mature.

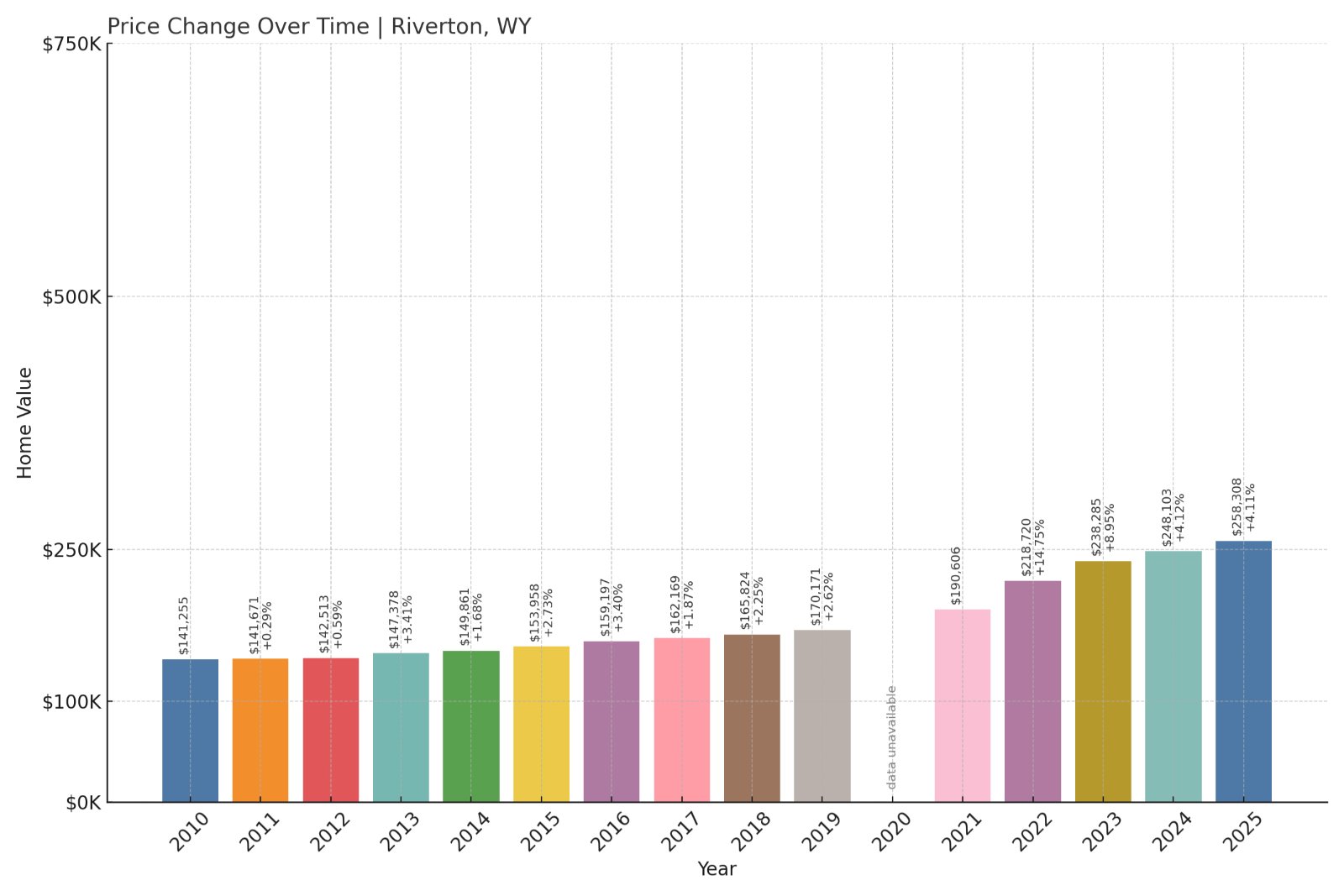

7. Riverton – 128.0% Investor Feeding Frenzy in June 2025

- Historical annual growth rate (2012–2022): 2.50%

- Recent annual growth rate (2022–2025): 5.70%

- Investor Feeding Frenzy Factor: 127.99%

- Current 2025 price: $258,307.69

Riverton’s feeding frenzy factor exceeds 128%, showing the most dramatic acceleration of any larger Wyoming community. The city’s recent growth rate of 5.70% more than doubles its historical 2.50% average, yet maintains a median price of just $258,307. This combination of dramatic acceleration and affordability creates compelling investment opportunities.

Riverton – Wind River Valley Hub Awakens

Riverton serves as the commercial center for Wyoming’s Wind River Valley in Fremont County, supporting agriculture, energy, and tourism industries. The city’s location near the Wind River Indian Reservation and proximity to mountain recreation areas provides diverse economic opportunities. Recent infrastructure improvements and business development have enhanced Riverton’s regional importance.

The 128.0% investor feeding frenzy factor reflects growing recognition of Riverton’s strategic value and development potential. The current median price of $258,307 offers exceptional affordability for a regional center, creating opportunities for investors and families seeking Wyoming lifestyle at accessible prices. Recent commercial projects and housing developments suggest sustained momentum as buyers discover Riverton’s combination of small-town character and regional amenities.

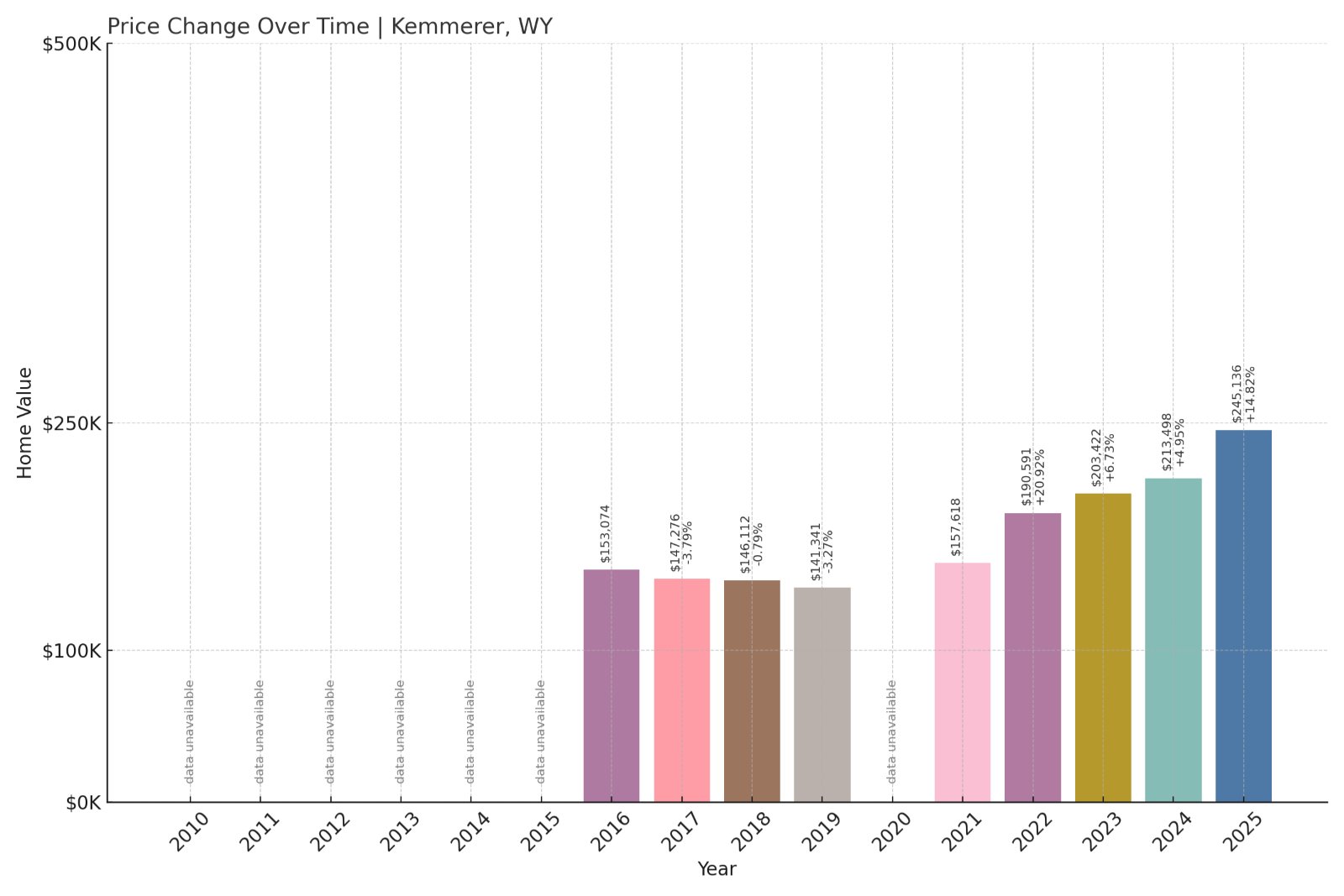

6. Kemmerer – 135.2% Investor Feeding Frenzy in June 2025

🔥 Would you like to save this?

- Historical annual growth rate (2012–2022): 3.72%

- Recent annual growth rate (2022–2025): 8.75%

- Investor Feeding Frenzy Factor: 135.18%

- Current 2025 price: $245,136.19

Kemmerer’s feeding frenzy factor exceeds 135%, indicating massive market acceleration in this historic coal town. The community’s recent growth rate of 8.75% represents more than double its historical 3.72% average, while maintaining an affordable median price of $245,136. This dramatic acceleration at low price points creates significant investor interest.

Kemmerer – Coal Heritage Meets Modern Opportunity

Kemmerer sits in southwestern Wyoming’s Lincoln County, known as the birthplace of J.C. Penney and home to significant coal reserves. The town’s economy has traditionally centered on coal mining and railroad operations, but recent diversification efforts have created new opportunities. Its location near the Utah border provides access to additional markets and recreation areas.

The 135.2% investor feeding frenzy factor reflects growing confidence in Kemmerer’s economic transition and development potential. The current median price of $245,136 offers exceptional value for small-town Wyoming living, attracting investors and families priced out of other Western markets. Recent energy sector developments and tourism investments suggest Kemmerer is successfully diversifying beyond traditional coal dependence.

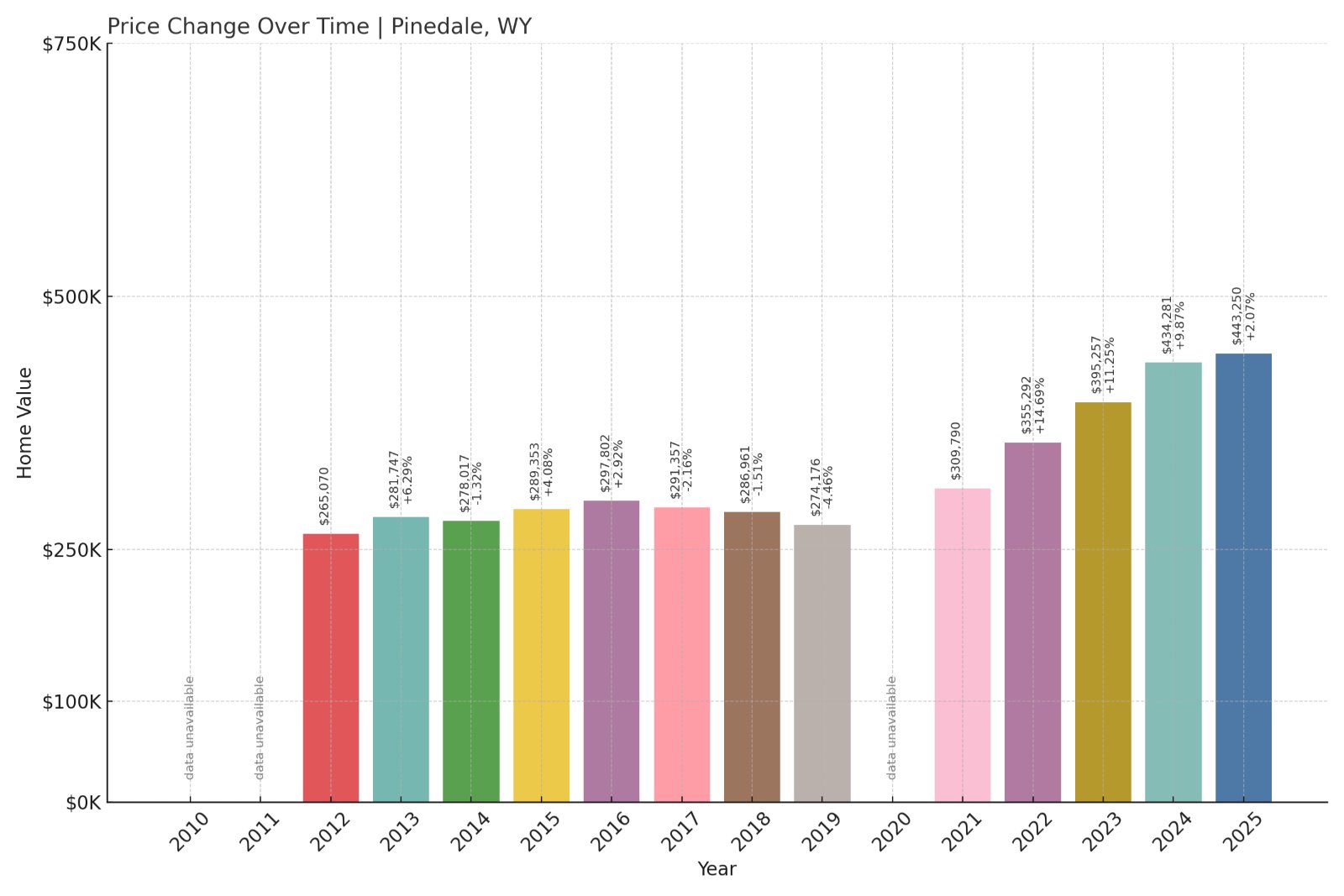

5. Pinedale – 157.4% Investor Feeding Frenzy in June 2025

- Historical annual growth rate (2012–2022): 2.97%

- Recent annual growth rate (2022–2025): 7.65%

- Investor Feeding Frenzy Factor: 157.39%

- Current 2025 price: $443,249.92

Pinedale’s feeding frenzy factor exceeds 157%, showing dramatic price acceleration in this mountain gateway community. The town’s recent growth rate of 7.65% represents more than double its historical 2.97% average, pushing median prices to $443,249. This price level reflects Pinedale’s strategic location and recreational appeal meeting increased demand.

Pinedale – Gateway to Wind River Mountains

Pinedale sits in Sublette County at the foot of the Wind River Mountains, serving as a primary access point to the Bridger Wilderness. The town’s economy combines energy industry activity with outdoor recreation tourism, creating diverse economic opportunities. Its location provides world-class fishing, hunting, and wilderness access within minutes of town.

The 157.4% investor feeding frenzy factor reflects growing recognition of Pinedale’s unique combination of mountain lifestyle and economic opportunity. The current median price of $443,249 represents significant value for mountain property with wilderness access, especially compared to similar communities in Colorado or Idaho. Recent increases in outdoor recreation popularity and energy sector activity have combined to create unprecedented demand for Pinedale’s limited housing inventory.

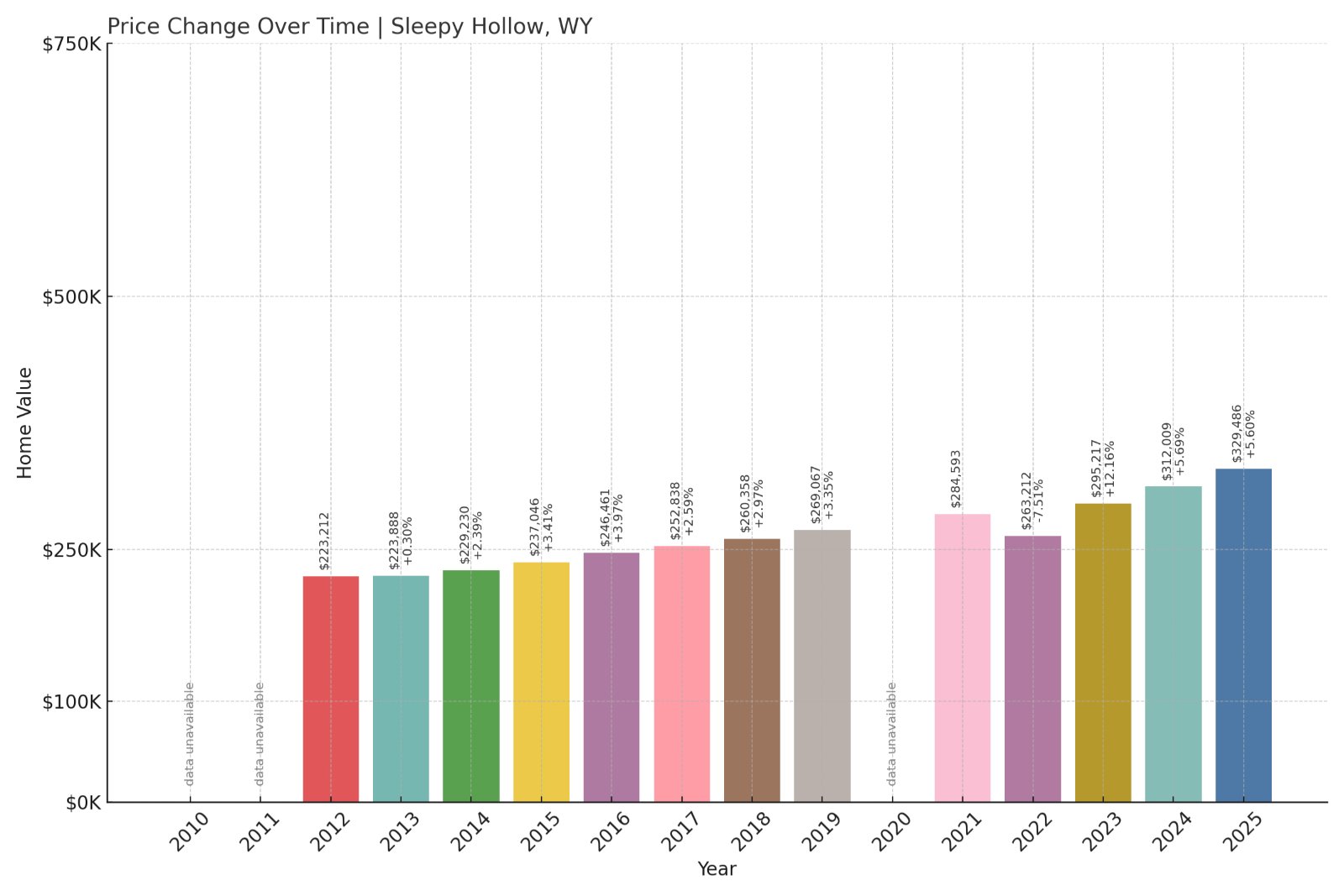

4. Sleepy Hollow – 265.1% Investor Feeding Frenzy in June 2025

- Historical annual growth rate (2012–2022): 2.13%

- Recent annual growth rate (2022–2025): 7.77%

- Investor Feeding Frenzy Factor: 265.05%

- Current 2025 price: $329,485.86

Sleepy Hollow’s feeding frenzy factor exceeds 265%, showing the most dramatic price acceleration of any community on this list. The area’s recent growth rate of 7.77% represents more than triple its historical 2.13% average, pushing median prices to $329,485. This extraordinary acceleration indicates intense investor and buyer interest in this previously quiet community.

Sleepy Hollow – Suburban Explosion Defies Expectations

Sleepy Hollow represents suburban development that has experienced unprecedented growth acceleration. The community’s transformation from a slow-growth area to one of Wyoming’s hottest markets reflects broader suburban expansion trends. Its suburban character attracts families and investors seeking modern amenities with Wyoming’s tax advantages.

The 265.1% investor feeding frenzy factor indicates the most dramatic market transformation on this entire list. The current median price of $329,485 reflects rapid appreciation in what was previously a stable, affordable community. Recent development activity and continued buyer interest suggest this suburban Wyoming community has fundamentally shifted from a quiet residential area to a recognized investment opportunity.

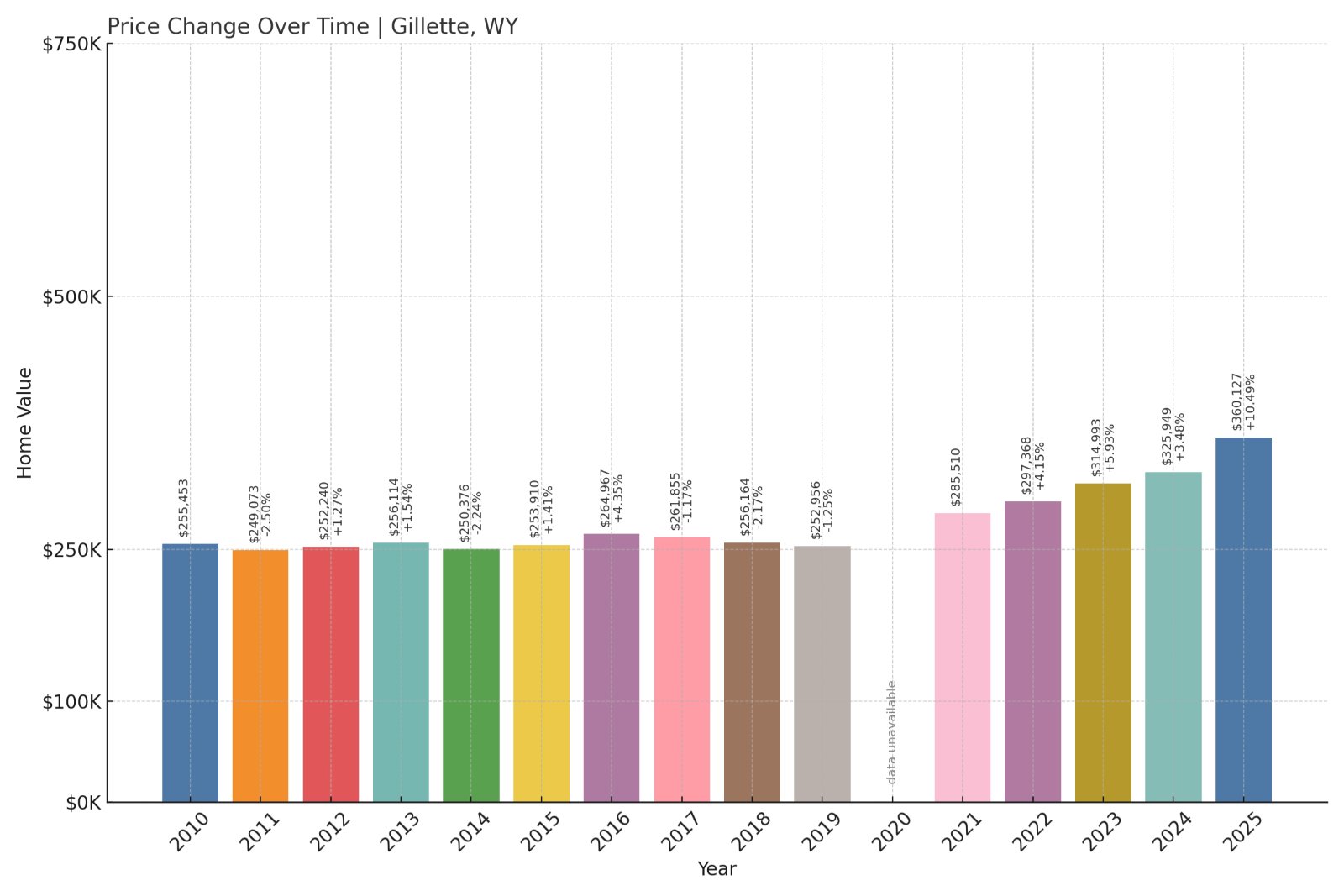

3. Gillette – 297.2% Investor Feeding Frenzy in June 2025

- Historical annual growth rate (2012–2022): 1.66%

- Recent annual growth rate (2022–2025): 6.59%

- Investor Feeding Frenzy Factor: 297.16%

- Current 2025 price: $360,127.20

Gillette’s feeding frenzy factor approaches 300%, showing extraordinary price acceleration in Wyoming’s energy capital. The city’s recent growth rate of 6.59% represents nearly four times its historical 1.66% average, pushing median prices to $360,127. This dramatic acceleration indicates massive new recognition of Gillette’s investment potential after years of market stability.

Gillette – Energy Capital Roars Back to Life

Gillette serves as the heart of Wyoming’s Powder River Basin energy region in Campbell County. The city’s economy centers on coal mining, oil extraction, and natural gas production, making it one of America’s major energy centers. Recent market acceleration suggests renewed confidence in energy sector stability and growth prospects.

The 297.2% investor feeding frenzy factor reflects dramatic market recognition of Gillette’s strategic importance and development potential. The current median price of $360,127 remains affordable for a major energy center, creating opportunities for investors and workers seeking Wyoming lifestyle with urban amenities. Recent energy sector investments and infrastructure improvements have restored confidence in Gillette’s long-term prospects, driving unprecedented housing demand.

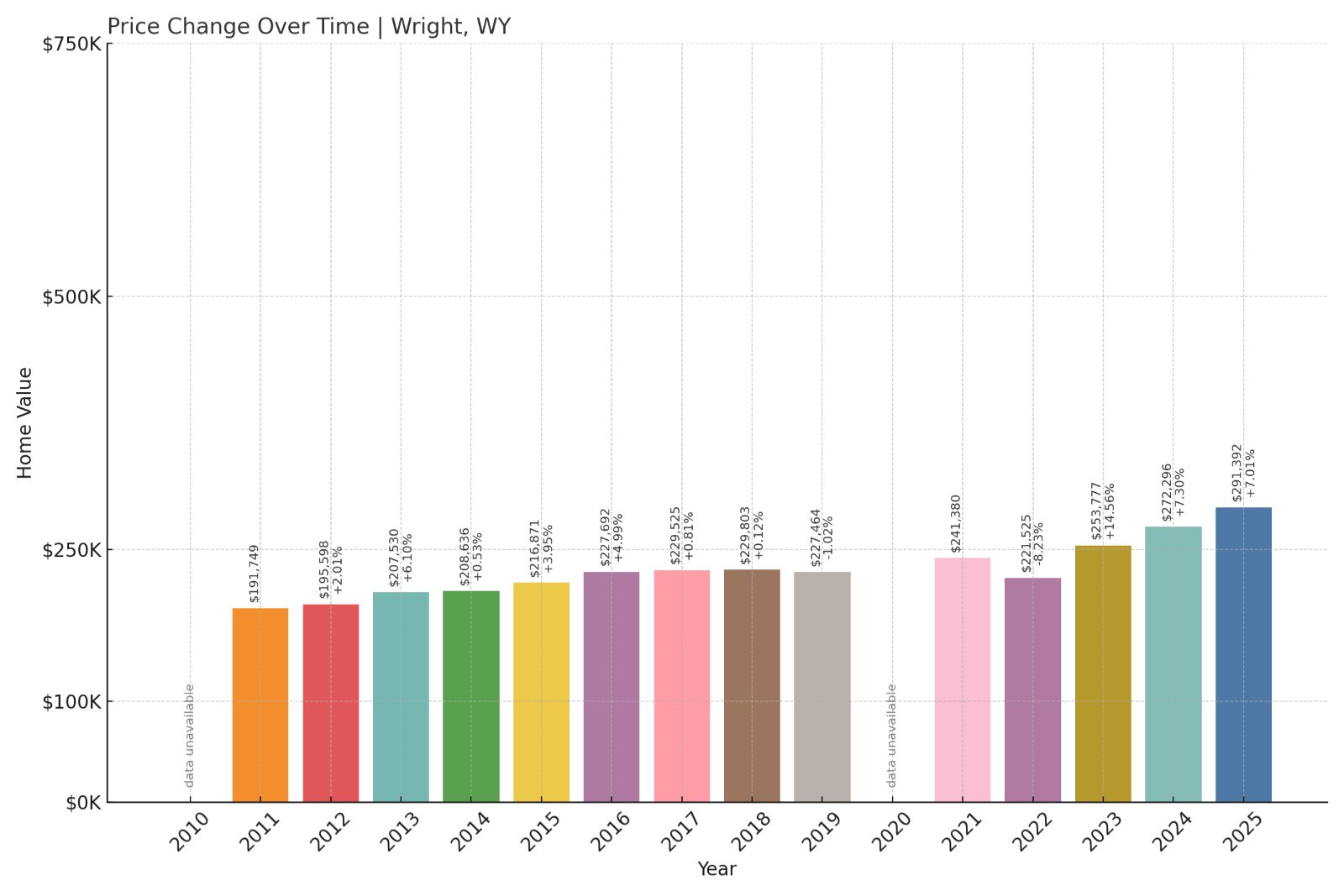

2. Wright – 308.4% Investor Feeding Frenzy in June 2025

- Historical annual growth rate (2012–2022): 2.34%

- Recent annual growth rate (2022–2025): 9.57%

- Investor Feeding Frenzy Factor: 308.37%

- Current 2025 price: $291,391.81

Wright’s feeding frenzy factor exceeds 308%, indicating the second-most dramatic price acceleration in Wyoming. The town’s recent growth rate of 9.57% represents more than four times its historical 2.34% average, while maintaining a median price of $291,391. This combination of extraordinary acceleration and affordability creates compelling investment dynamics.

Wright – Coal Town Transformation Shocks Markets

🔥 Would you like to save this?

Wright sits in Campbell County’s heart of coal country, built specifically to support energy extraction operations. The town’s economy has traditionally fluctuated with coal markets, but recent price acceleration suggests fundamental market changes. Its proximity to major mining operations provides employment opportunities that support higher housing values.

The 308.4% investor feeding frenzy factor indicates the second-most dramatic market transformation in Wyoming. The current median price of $291,391 offers exceptional value for an energy industry community, attracting investors recognizing Wright’s strategic position. Recent energy sector stability and infrastructure investments have created renewed confidence in Wright’s economic prospects, driving unprecedented housing demand in this previously overlooked community.

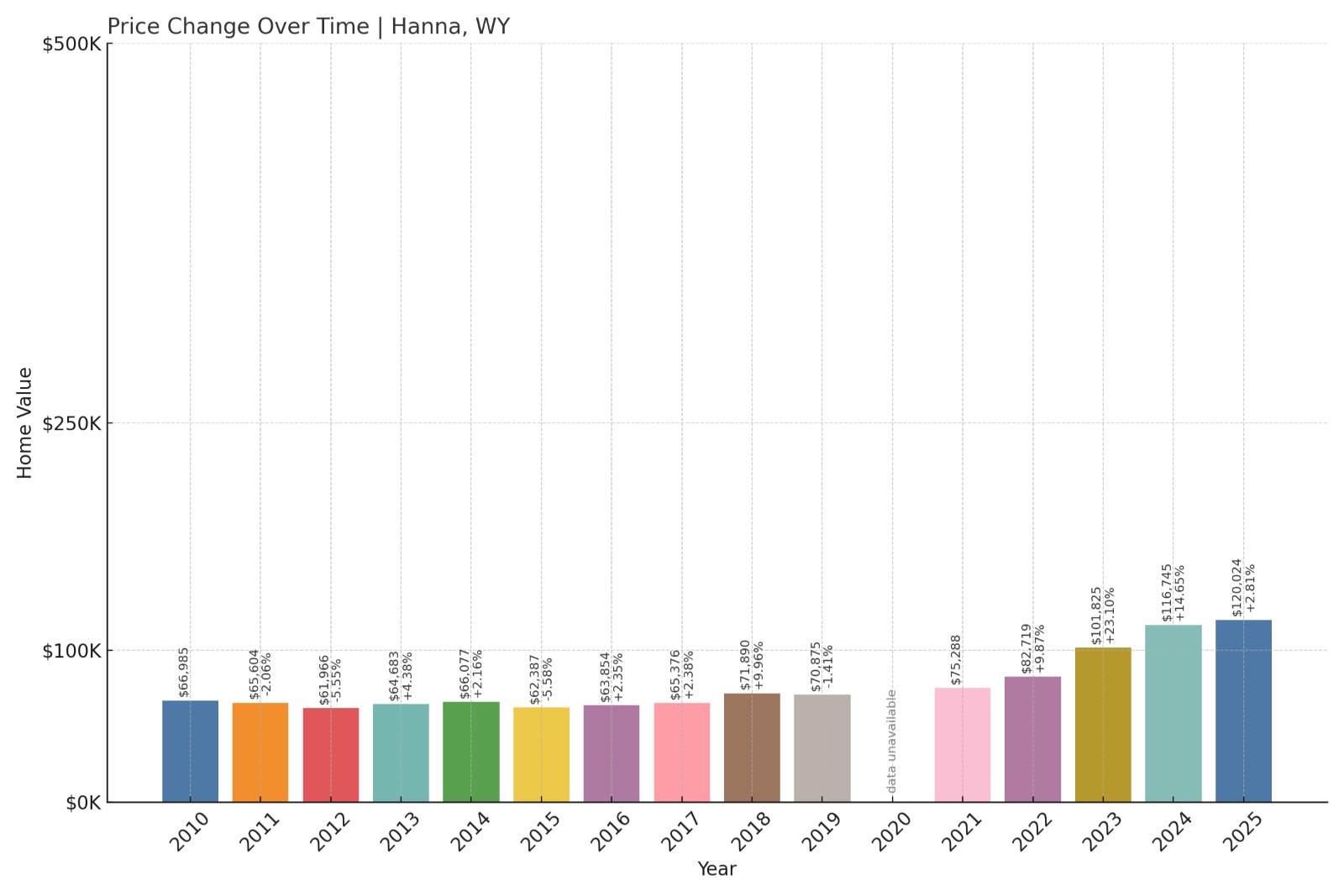

1. Hanna – 350.8% Investor Feeding Frenzy in June 2025

- Historical annual growth rate (2012–2022): 2.93%

- Recent annual growth rate (2022–2025): 13.21%

- Investor Feeding Frenzy Factor: 350.77%

- Current 2025 price: $120,024.01

Hanna claims the top spot with a feeding frenzy factor exceeding 350%, showing the most dramatic price acceleration in Wyoming. The town’s recent growth rate of 13.21% represents more than four times its historical 2.93% average, yet maintains the lowest median price on this list at just $120,024. This extraordinary combination of massive acceleration and extreme affordability creates unique investment opportunities.

Hanna – Wyoming’s Biggest Housing Market Surprise

Hanna sits in Carbon County along Interstate 80, historically dependent on coal mining and railroad operations. The town’s small size means even modest increases in demand create dramatic price impacts, but recent acceleration suggests fundamental market recognition. Its location along the major transcontinental highway provides strategic transportation access.

The 350.8% investor feeding frenzy factor represents the most dramatic housing market transformation in Wyoming, indicating investors and buyers have discovered exceptional value in this previously overlooked community. The current median price of $120,024 offers the most affordable entry point among Wyoming’s hot markets, creating opportunities for first-time buyers and value investors. Recent transportation improvements and Wyoming’s favorable business climate may be driving new recognition of Hanna’s strategic potential along the Interstate 80 corridor.