Would you like to save this?

Overpaying for a home doesn’t always become obvious the day you close—it often reveals itself slowly, through subtle signs in your neighborhood that something doesn’t add up. Maybe your utility bills skyrocket, the local schools underperform, or every new listing on your street lingers on the market while yours cost a premium.

These red flags can chip away at both your enjoyment of daily life and your long-term investment, leaving you wondering if you bought into a dream or an expensive illusion. To help you spot the warning signals, here are 22 unmistakable signs you may have paid more than your neighborhood is really worth.

22. High Utility Bills Drain Value

One of the most frustrating ways to realize you may have overpaid is when your monthly utility bills feel more like a second mortgage. Many older neighborhoods are packed with homes that lack proper insulation, rely on outdated HVAC systems, and have leaky plumbing or water-guzzling landscaping.

While you can invest in upgrades, some houses are built in ways that make efficiency improvements expensive or even impractical. When energy costs are consistently higher than those in comparable areas, it’s a clear sign your home’s premium price tag didn’t buy long-term savings.

21. Inconsistent Curb Appeal Hurts Value

Neighborhood charm is fragile, and nothing kills it faster than visual whiplash from one house to the next. If one property is a gleaming new build while the house beside it is visibly crumbling, buyers start to worry about the long-term trajectory of the area.

This patchwork look makes it harder to sell for top dollar since curb appeal is judged collectively, not just individually. Paying a premium to live in a neighborhood where aesthetics are inconsistent often feels like buying into potential that isn’t guaranteed to pay off.

20. Land Value Outweighs Home Value

When the majority of what you paid is tied to the dirt under your home rather than the structure itself, you’re essentially gambling on future appreciation. This speculative premium can collapse if development slows or demand cools in your area. Buyers who discover that their home’s assessed land value outweighs its building value often find it harder to justify their purchase. In a cooling market, that imbalance can turn your “investment” into an overpriced liability.

19. Retail Churn Signals Weak Demand

Nothing signals instability in a neighborhood like constant retail turnover. If your “up-and-coming” area can’t hold onto restaurants, shops, or grocery stores, it suggests weak consumer demand and shaky community support. This not only makes day-to-day living less convenient but also undermines your home’s resale appeal. Paying extra to live in a place where businesses never seem to last is often a sign you bought into hype, not substance.

18. Aging Utilities Create Daily Headaches

If your lights flicker every storm or your neighborhood is littered with patched pipes and sagging power lines, you may be living in a system on borrowed time. Infrastructure is expensive to fix, and if the city or utility company has no clear funding plan, those costs may eventually trickle down to residents. Buyers who pay top dollar often expect reliable basics, yet crumbling utilities can tank neighborhood desirability fast. Overpaying for a house in an area with obvious infrastructure decline feels like buying a luxury car with bald tires.

17. Essential Services Are Pulling Back

Would you like to save this?

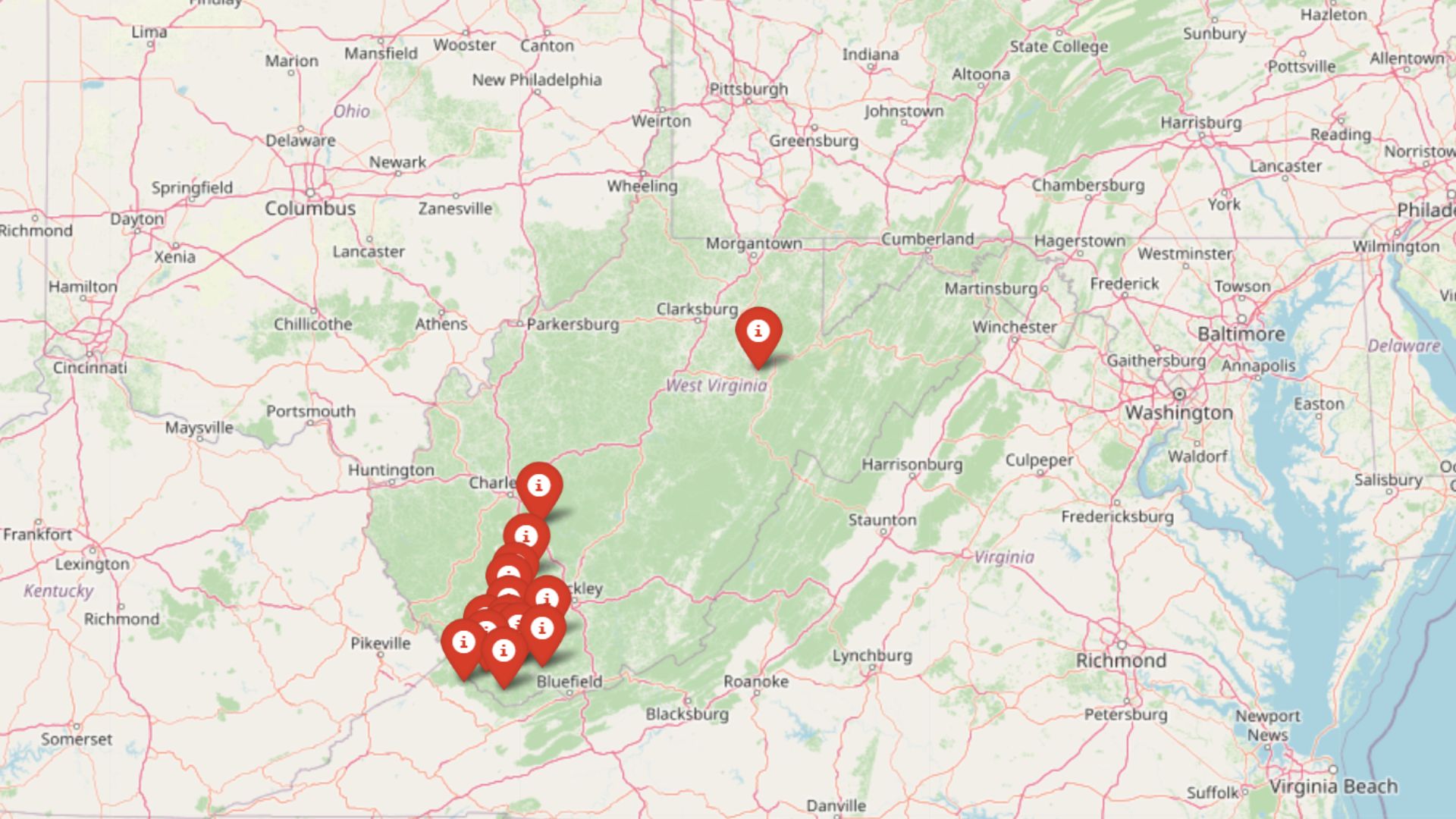

A shrinking service map is one of the strongest indicators you paid more than you should have. If schools are consolidating, hospitals are reducing their services, or community centers are closing, it signals long-term decline. These changes force residents to drive farther for essentials, eroding quality of life and making the neighborhood less appealing to future buyers. Paying a premium in an area where services are literally disappearing is a hard pill to swallow.

16. Zoning Brings Incompatible Neighbors

Neighborhoods can change quickly when zoning laws allow new and unexpected developments. If a quiet residential street suddenly finds itself next to a late-night bar or a small factory, property values can take a hit. These shifts bring noise, traffic, and a loss of the atmosphere you paid extra to enjoy. Overpaying for a home only to watch incompatible land uses creep in is like investing in tranquility that evaporates overnight.

15. Traffic Jams Create a Time Tax

A beautiful home loses its shine when every trip out the door means fighting gridlock. Neighborhoods that looked fine on a map can become unbearable once daily bottlenecks and clogged intersections dominate your schedule. Over time, the wasted hours add up, making you wonder if the extra money you paid was worth it. When your lifestyle is defined by traffic instead of comfort, you’ve probably overpaid for the wrong location.

14. Homes Struggle to Resell Quickly

Overpayment often becomes crystal clear when you see neighbors struggling to sell their homes. If listings in your area repeatedly get price cuts or expire unsold, it’s a red flag for future resale value. A sluggish local market means your property is less liquid, even if you bought at a premium. Paying top dollar for a home in a slow-moving neighborhood makes it harder to exit without taking a financial hit.

13. Parking Problems Add Daily Stress

Parking headaches are one of those unglamorous details buyers often overlook until it’s too late. If you’re constantly circling for a spot or juggling confusing permit systems, the inconvenience chips away at the value of your purchase. Visitors may dread coming over, and future buyers may hesitate if they see the same problem. Overpaying in a neighborhood where parking is a daily battle is like buying a house with a hidden tax on your time and sanity.

12. Persistent Nuisances Lower Desirability

Noise and environmental nuisances are the unspoken deal-breakers of real estate. A home directly under a flight path or next to a rail line can feel tolerable for a few days, but the constant disruption wears on you quickly.

These issues also permanently limit your resale pool, since buyers who can afford better will likely go elsewhere. Paying premium prices for a property with unavoidable nuisances is a classic sign of overpayment.

11. Short-Term Rentals Erode Stability

When a large portion of your neighborhood consists of short-term rentals, the sense of community quickly erodes. Permanent residents often move out, leaving behind a revolving door of strangers and less accountability for upkeep. This instability not only makes day-to-day life less pleasant but also drags down long-term resale potential. Paying extra for a “vibrant” area that’s actually overrun by temporary tenants is a sure sign of overspending.

10. Oversupply from New Construction Looms

Buying into a neighborhood right before a major building boom often means you paid the “scarcity premium” too early. Once dozens or hundreds of new homes hit the market, the added supply pushes down demand for older properties. While the promise of growth can look exciting, it often means resale values stagnate for years. Overpaying in a neighborhood poised for oversupply is like buying at the peak of a bubble.

9. Few Amenities Despite High Prices

Neighborhoods that command high prices are typically those where daily life is convenient. If you find yourself driving 20 minutes just to grab milk or get to a park, you may have overpaid for the privilege. Buyers increasingly value walkability and nearby amenities, so a lack of them hurts resale appeal. Paying a premium for an area without everyday convenience often leaves you questioning what exactly your money bought.

8. Crime Rates Rise Above Average

Crime data doesn’t lie, and rising trends are often masked by clever real estate marketing. If your neighborhood’s crime rate is climbing faster than the broader city, you’ve essentially paid extra to live in an area on the decline. This not only affects your peace of mind but also scares off future buyers. Paying top dollar to live somewhere with worsening safety statistics is one of the clearest signs of overpayment.

7. Weak Schools for the Price Range

For many buyers, school quality is a top factor in home selection. If your neighborhood schools consistently underperform compared to similarly priced areas, it means your dollars didn’t stretch as far as they should have. Families with options will look elsewhere, limiting your home’s future resale pool. Overpaying in a neighborhood with weak schools feels like buying champagne but getting tap water.

6. Rent-to-Price Ratios Don’t Add Up

One way to check if you overpaid is by comparing purchase prices to rental values. If renting the same home would cost dramatically less, it’s a sign that ownership is overpriced relative to local demand. This imbalance often points to a bubble where appreciation, not fundamentals, is driving prices. Overpaying in such a market leaves you vulnerable when growth slows or reverses.

5. Low Appraisal Compared to Purchase Price

Appraisals can be a sobering reality check when they come in well below what you just paid. Lenders use them to gauge true market value, so if yours falls short, it means you may have shelled out more than the home is worth. This gap can also hurt refinancing options and make future resale tricky. Overpaying becomes crystal clear when a professional’s valuation doesn’t match your purchase price.

4. Insurance Premiums Are Sky-High

Would you like to save this?

Skyrocketing insurance costs can quickly erode any financial sense in your home purchase. Whether it’s due to natural disaster risks or crime rates, high premiums mean your neighborhood is viewed as higher-risk than others. Future buyers will notice these costs too, making resale more difficult. Paying extra for a home that comes with hefty insurance bills is a textbook case of overpayment.

3. HOA Fees and Assessments Pile Up

Living in an HOA can provide perks, but expensive dues and surprise assessments can turn your home into a money pit. If your neighborhood requires constant cash infusions to fix neglected common areas, you’re essentially subsidizing bad management. Buyers eventually factor these extra costs into their offers, which drags down resale values. Overpaying for a home tied to a financially shaky HOA is like signing up for endless hidden fees.

2. Property Taxes Spike After Purchase

Sticker shock doesn’t end at closing—sometimes it arrives with your first tax bill. If your property gets reassessed at a significantly higher value than your neighbors, you’ve locked yourself into inflated carrying costs. This not only strains your monthly budget but also makes your home less attractive to future buyers. Overpaying at purchase often reveals itself in painful property tax bills you can’t escape.

1. Comps Reveal Lower Price Per Foot

Perhaps the clearest sign you overpaid is when comparable homes nearby sell for significantly less on a price-per-square-foot basis. This metric strips away emotions and shows whether your deal made financial sense. If your home stands out as the outlier in a neighborhood, it’s a tough reality check for both you and future buyers. Paying more than the going rate for essentially the same product is the textbook definition of overpayment.