Would you like to save this?

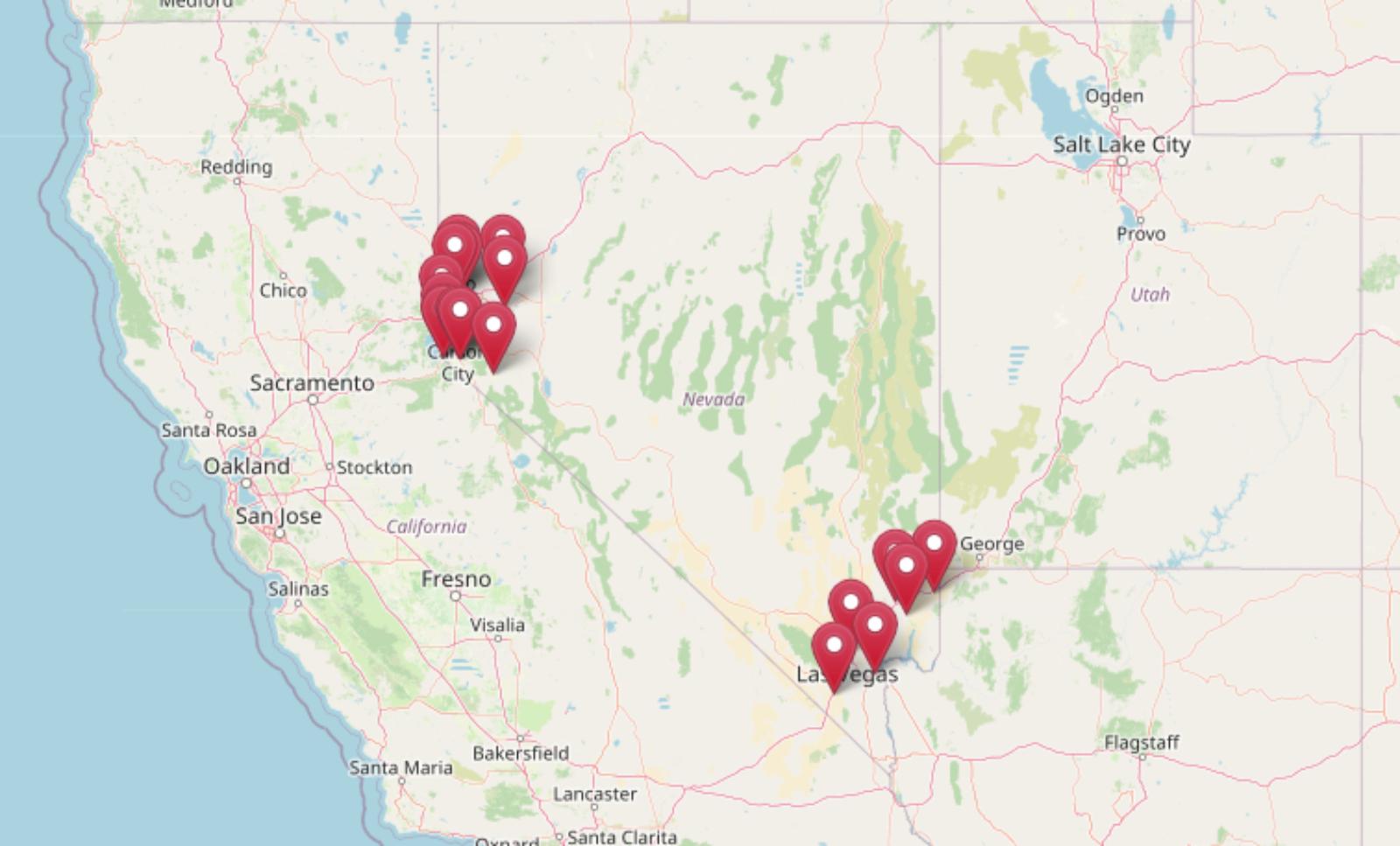

Nevada’s housing market may look strong on the surface, but the numbers tell a different story. According to the Zillow Home Value Index and 15 years of historical data, 18 towns across the state are flashing classic warning signs of an impending price correction. These aren’t soft signals—they’re the same patterns that have preceded previous housing crashes: repeated price drops, extreme overvaluation, sharp momentum loss, and volatility that points to unsustainable growth.

From luxury Lake Tahoe enclaves like Glenbrook and Incline Village to fast-rising but fragile markets like Fernley and Jean, the signs are hard to ignore. Many of these towns have already weathered multiple price crashes—and now, with price levels far above their long-term trends, the risk is rising again. Whether you’re a homeowner watching equity or an investor eyeing timing, these are the places where cracks may be forming first.

18. Stateline – Crash Risk Percentage: 60%

- Crash Risk Percentage: 60%

- Historical crashes (5%+ drops): 5

- Worst historical crash: -15.6% (2022)

- Total price increase since 2013: +71.8%

- Overextended above long-term average: +39.1%

- Price volatility (annual swings): 13.6%

- Current May 2025 price: $232,647

Stateline shows moderate crash risk with a concerning pattern of volatility that has homeowners on edge. The community has weathered five significant price drops over its recorded history, including a brutal 15.6% crash in 2022 that wiped out tens of thousands in home equity overnight. Despite recovering somewhat, current prices remain 39% above the town’s long-term average, suggesting the market may have overcorrected upward after that recent crash.

Stateline – Volatile Border Town Showing Classic Correction Signals

Straddling the Nevada-California border on the south shore of Lake Tahoe, Stateline has become a poster child for housing market instability. The town’s unique position as a gambling and entertainment hub creates economic cycles that directly impact housing demand, with prices swinging dramatically based on tourism patterns and casino revenues. Current median home values around $233,000 reflect a market that has seen dramatic ups and downs, climbing 72% since 2013 before recent corrections brought reality back into focus. The community’s 13.6% annual price volatility ranks among the highest in our analysis, creating an environment where homeowners never quite know what their property will be worth from year to year. Recent momentum loss in 2025, combined with the town’s history of boom-bust cycles tied to the gaming industry, suggests another significant correction could be approaching. The mathematics are concerning: when a market sits 39% above its historical average with this level of built-in volatility, sharp downward moves become increasingly likely.

17. Silver Springs – Crash Risk Percentage: 60%

- Crash Risk Percentage: 60%

- Historical crashes (5%+ drops): 5

- Worst historical crash: -15.6% (2022)

- Total price increase since 2018: -13.5%

- Overextended above long-term average: +84.9%

- Price volatility (annual swings): 5.3%

- Current May 2025 price: $92,450

Silver Springs presents a troubling case study in market overextension, with current prices sitting a staggering 85% above the town’s long-term average despite recent declines. The community has experienced five major crashes including a devastating 15.6% drop in 2022, yet somehow remains dramatically overvalued by historical standards. This mathematical impossibility suggests either the long-term average is outdated or the market is due for a much larger correction to restore balance.

Silver Springs – Dangerously Overextended Despite Recent Losses

Were You Meant

to Live In?

Located in Lyon County about 30 miles east of Carson City, Silver Springs has evolved from a rural farming community into a bedroom suburb attracting residents seeking affordable alternatives to Reno’s rising costs. However, the numbers tell a disturbing story of a market that has lost touch with economic fundamentals. Even after declining 13.5% since 2018, median home prices around $92,450 remain nearly double what historical trends would suggest is sustainable for this rural Nevada community. The town’s 85% overextension above long-term averages represents one of the most extreme valuations in our analysis, creating conditions ripe for a significant correction. While Silver Springs offers rural charm and relative affordability compared to urban Nevada markets, the mathematical reality suggests current buyers may be purchasing at or near a major peak. The combination of historical crash patterns and extreme overvaluation makes this market particularly vulnerable to external economic shocks that could trigger the next major price decline.

16. Smith – Crash Risk Percentage: 65%

- Crash Risk Percentage: 65%

- Historical crashes (5%+ drops): 5

- Worst historical crash: -12.8% (2012)

- Total price increase since 2010: +118.3%

- Overextended above long-term average: +60.7%

- Price volatility (annual swings): 13.5%

- Current May 2025 price: $268,003

Smith Valley demonstrates how even rural Nevada communities haven’t escaped the housing bubble dynamics plaguing the state. With five historical crashes on record and prices that have more than doubled since 2010, the town shows classic signs of unsustainable appreciation that typically precedes major corrections. The current 61% overextension above long-term averages, combined with high volatility, creates a precarious situation for homeowners.

Smith – Rural Valley Riding an Unsustainable Price Wave

Nestled in a high desert valley along the California border, Smith has transformed from an agricultural community into an unexpected beneficiary of California’s housing exodus. The town’s 118% price increase since 2010 reflects the broader Nevada trend of absorbing displaced residents from expensive coastal markets, but current median prices around $268,000 now exceed what local economics can reasonably support. This rural community lacks the job diversity and economic infrastructure to justify such dramatic appreciation. The combination of high volatility and significant overvaluation creates textbook conditions for a housing correction in Smith Valley. While the area offers wide open spaces and lower costs than urban centers, the 13.5% annual price swings suggest a market driven more by speculation than fundamentals. Recent momentum in 2025 may be providing false confidence, but the underlying mathematics point toward an inevitable adjustment that could restore prices closer to historical norms.

15. Minden – Crash Risk Percentage: 65%

Home Stratosphere Guide

Your Personality Already Knows

How Your Home Should Feel

113 pages of room-by-room design guidance built around your actual brain, your actual habits, and the way you actually live.

You might be an ISFJ or INFP designer…

You design through feeling — your spaces are personal, comforting, and full of meaning. The guide covers your exact color palettes, room layouts, and the one mistake your type always makes.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ISTJ or INTJ designer…

You crave order, function, and visual calm. The guide shows you how to create spaces that feel both serene and intentional — without ending up sterile.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ENFP or ESTP designer…

You design by instinct and energy. Your home should feel alive. The guide shows you how to channel that into rooms that feel curated, not chaotic.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ENTJ or ESTJ designer…

You value quality, structure, and things done right. The guide gives you the framework to build rooms that feel polished without overthinking every detail.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

- Crash Risk Percentage: 65%

- Historical crashes (5%+ drops): 5

- Worst historical crash: -12.8% (2012)

- Total price increase since 2010: +105.1%

- Overextended above long-term average: +70.5%

- Price volatility (annual swings): 5.6%

- Current May 2025 price: $475,511

Minden presents a concerning case of steady appreciation that has pushed the market well beyond sustainable levels. The town has doubled home values since 2010, creating a 70% overextension above long-term averages that ranks among the most dangerous in our analysis. While volatility remains relatively modest, the sheer magnitude of overvaluation suggests significant downside risk when market conditions shift.

Minden – Carson Valley’s Overheated Suburban Market

Situated in the scenic Carson Valley just south of Carson City, Minden has become a prime example of how Nevada’s smaller communities have been swept up in statewide housing inflation. The town’s appeal as a suburban alternative with mountain views and proximity to both Reno and Lake Tahoe has driven median prices to $475,511, representing a 105% increase since 2010 that far outpaces local income growth and economic development. This dramatic appreciation has created affordability challenges for longtime residents and essential workers. The 70% overextension above historical averages signals a market that has been artificially inflated by external demand rather than organic local growth. Minden’s relatively low 5.6% volatility might provide false comfort to homeowners, but it also means the market hasn’t had the periodic corrections that could have prevented such extreme overvaluation. When adjustment comes, it may be swift and significant as prices seek to restore mathematical balance with long-term trends.

14. Fernley – Crash Risk Percentage: 67%

- Crash Risk Percentage: 67%

- Historical crashes (5%+ drops): 5

- Worst historical crash: -10.5% (2012)

- Total price increase since 2010: +199.6%

- Overextended above long-term average: +75.5%

- Price volatility (annual swings): 8.1%

- Current May 2025 price: $373,607

Fernley represents one of the most dramatic examples of housing inflation in Nevada, with prices nearly tripling since 2010 to create dangerous overextension conditions. The town shows clear momentum loss in 2025, suggesting the rapid appreciation phase may be ending just as prices reach unsustainable levels. With 75% overextension above long-term averages and a history of significant crashes, conditions are ripe for a major correction.

Fernley – Industrial Town’s Housing Boom Showing Cracks

Located along Interstate 80 between Reno and Fallon, Fernley has experienced explosive growth as a logistics and industrial hub serving northern Nevada. The town’s strategic location has attracted major distribution centers and manufacturing facilities, driving population growth and housing demand that pushed median prices from $124,627 in 2010 to $373,607 today – a staggering 200% increase. However, this growth appears to have created a classic bubble scenario where housing costs have outpaced the economic fundamentals supporting them. The momentum loss evident in 2025 represents a crucial warning signal for Fernley’s overheated market. While industrial development continues, the housing market appears to be running out of steam after years of unsustainable appreciation. The 75% overextension above long-term averages, combined with the town’s history of boom-bust cycles, suggests homeowners should brace for a significant correction that could erase much of the gains accumulated over the past decade.

13. Jean – Crash Risk Percentage: 67%

- Crash Risk Percentage: 67%

- Historical crashes (5%+ drops): 5

- Worst historical crash: -8.7% (2023)

- Total price increase since 2013: +118.1%

- Overextended above long-term average: +71.8%

- Price volatility (annual swings): 8.2%

- Current May 2025 price: $197,641

Jean shows concerning signs of market instability with momentum loss in 2025 occurring just as prices remain dangerously overextended. The small community has seen values more than double since 2013, creating a 72% overextension that appears unsustainable given the town’s limited economic base. Recent volatility and the pattern of historical crashes suggest another significant correction may be approaching.

Jean – Desert Outpost Struggling With Overvaluation

This tiny unincorporated community along Interstate 15 between Las Vegas and the California border has become an unlikely participant in Nevada’s housing boom. Jean’s economy revolves primarily around casino gaming and truck stops serving travelers, creating a narrow economic base that struggles to support median home prices around $197,641. The town’s 118% price increase since 2013 reflects speculative investment rather than organic demand from local economic growth. The momentum loss in 2025 signals that Jean’s artificial housing boom may be reaching its limits. With prices sitting 72% above long-term averages in a community with minimal employment opportunities beyond service sector jobs, the mathematics point toward an inevitable correction. The town’s remote location and limited amenities make it particularly vulnerable to rapid price declines when speculative demand evaporates and market forces restore pricing equilibrium.

12. Boulder City – Crash Risk Percentage: 67%

- Crash Risk Percentage: 67%

- Historical crashes (5%+ drops): 5

- Worst historical crash: -7.5% (2023)

- Total price increase since 2010: +84.4%

- Overextended above long-term average: +58.5%

- Price volatility (annual swings): 14.0%

- Current May 2025 price: $188,478

Boulder City demonstrates how even historically stable communities can develop crash risk through cumulative overvaluation and momentum loss. The town has experienced five historical crashes and shows clear signs of running out of steam in 2025, just as prices remain nearly 60% above sustainable levels. High volatility of 14% annually creates additional instability that could amplify any correction.

Boulder City – Historic Charm Meets Modern Market Volatility

Founded as a company town for Hoover Dam construction workers, Boulder City has evolved into a unique Nevada community that maintains small-town character while serving as a bedroom community for Las Vegas workers. The town’s historic charm and proximity to Lake Mead have driven median prices to $188,478, representing an 84% increase since 2010 that has gradually priced out many long-term residents. The recent momentum loss in 2025 suggests this appreciation cycle may be ending. The combination of 14% annual volatility and 58% overextension creates concerning conditions for Boulder City homeowners. While the town offers recreational amenities and historic appeal, the high price swings indicate a market driven more by speculation than stable demand. The five historical crashes on record demonstrate this community’s vulnerability to broader economic disruptions, and current overvaluation suggests the next correction could be particularly severe.

11. Overton – Crash Risk Percentage: 75%

- Crash Risk Percentage: 75%

- Historical crashes (5%+ drops): 5

- Worst historical crash: -11.2% (2011)

- Total price increase since 2010: +180.6%

- Overextended above long-term average: +63.2%

- Price volatility (annual swings): 15.5%

- Current May 2025 price: $494,660

Overton enters high-risk territory with a 75% crash probability driven by extreme volatility and concerning momentum loss in 2025. The community has nearly tripled home values since 2010, creating a 63% overextension that coincides with clear signals that the appreciation phase is ending. Annual price swings of 15.5% represent some of the highest volatility in our analysis, creating inherent instability.

Overton – Agricultural Town Caught in Speculation Cycle

Located in the Moapa Valley northeast of Las Vegas, Overton has traditionally served as an agricultural center in Nevada’s desert landscape. However, the town’s proximity to Lake Mead recreation areas and its position as an alternative to expensive Las Vegas suburbs has attracted speculative investment that pushed median prices to $494,660 – a 181% increase since 2010. This dramatic appreciation far exceeds what the local agricultural economy can support. The 15.5% annual volatility signals a market driven by boom-bust cycles rather than steady organic growth. Overton’s momentum loss in 2025 appears particularly ominous given the town’s limited economic diversity and dependence on external demand from Las Vegas commuters and recreational property buyers. When market sentiment shifts, communities like Overton with narrow economic bases often experience the most severe corrections as speculative demand evaporates quickly.

10. Moapa – Crash Risk Percentage: 77%

- Crash Risk Percentage: 77%

- Historical crashes (5%+ drops): 5

- Worst historical crash: -11.9% (2011)

- Total price increase since 2010: +203.0%

- Overextended above long-term average: +63.9%

- Price volatility (annual swings): 10.9%

- Current May 2025 price: $453,502

Moapa reaches the high-risk category with prices that have tripled since 2010, creating massive overextension relative to the local economy. The town shows momentum loss in 2025 just as prices remain more than 60% above sustainable levels, suggesting the speculative phase is ending. The combination of extreme appreciation and current overvaluation creates textbook conditions for a significant correction.

Moapa – Desert Community’s Unsustainable Price Explosion

This small community in the Moapa Valley has become an extreme example of Nevada’s housing bubble dynamics, with median prices soaring from $149,652 in 2010 to $453,502 today – a remarkable 203% increase that defies economic logic. Moapa’s economy relies primarily on agriculture and some renewable energy development, creating a narrow foundation that cannot reasonably support such dramatic housing inflation. The town’s remote location and limited amenities make current valuations appear particularly disconnected from fundamentals. The momentum loss evident in 2025 represents a critical inflection point for Moapa’s overheated market. With prices sitting 64% above long-term averages and a history of double-digit crashes, the mathematics strongly suggest a major correction is approaching. The town’s 11% annual volatility, while moderate compared to some markets, still indicates underlying instability that could amplify any downward movement once market sentiment shifts away from speculative investment.

9. Gardnerville – Crash Risk Percentage: 77%

Would you like to save this?

- Crash Risk Percentage: 77%

- Historical crashes (5%+ drops): 5

- Worst historical crash: -5.9% (2011)

- Total price increase since 2010: +47.6%

- Overextended above long-term average: +73.5%

- Price volatility (annual swings): 13.6%

- Current May 2025 price: $351,696

Gardnerville shows high crash risk despite more modest historical appreciation, with the concerning factor being a massive 73% overextension above long-term averages combined with momentum loss in 2025. The town’s 13.6% volatility and pattern of historical crashes create additional instability that could amplify any correction when it comes.

Gardnerville – Carson Valley’s Overextended Market

Situated in the Carson Valley adjacent to Minden, Gardnerville has benefited from its scenic location and proximity to both Lake Tahoe and Carson City. However, current median prices around $351,696 represent a 73% overextension above the town’s historical average, creating one of the most dangerous overvaluation scenarios in our analysis. While total appreciation since 2010 appears more modest at 48%, the mathematical relationship to long-term trends suggests prices have been artificially inflated well beyond sustainable levels. The momentum loss in 2025 signals that Gardnerville’s gradual appreciation phase may be ending just as overvaluation reaches critical levels. The town’s 13.6% annual volatility indicates underlying market instability that could trigger rapid price adjustments once external demand softens. Gardnerville’s appeal as a rural alternative to urban Nevada markets may not be sufficient to sustain current pricing levels if broader economic conditions deteriorate or speculative investment patterns shift.

8. Sparks – Crash Risk Percentage: 77%

- Crash Risk Percentage: 77%

- Historical crashes (5%+ drops): 5

- Worst historical crash: -9.8% (2011)

- Total price increase since 2010: +79.8%

- Overextended above long-term average: +75.2%

- Price volatility (annual swings): 13.3%

- Current May 2025 price: $190,187

Sparks demonstrates how even major urban areas can develop severe crash risk through overextension and momentum loss. The city has seen significant appreciation since 2010, but current prices sit 75% above long-term averages while showing clear momentum loss in 2025. High volatility of 13.3% and a history of crashes create additional risk factors that suggest a significant correction may be approaching.

Sparks – Reno Suburb’s Dangerous Overvaluation

As Reno’s largest suburb, Sparks has long served as an affordable alternative for families and workers in the Truckee Meadows region. However, current median prices around $190,187 represent a 75% overextension above historical norms that has transformed this working-class community into an unaffordable market for many local residents. The 80% appreciation since 2010, while significant, pales in comparison to the mathematical overextension that suggests prices have been driven by speculation rather than local economic fundamentals. The momentum loss in 2025 appears particularly concerning for Sparks given its role as a bedroom community dependent on Reno’s economic health. The city’s 13.3% annual volatility indicates an unstable market that could experience rapid price declines if regional economic conditions deteriorate. With five historical crashes on record and current extreme overvaluation, Sparks appears positioned for a significant correction that could restore prices closer to levels that local wages and economic activity can reasonably support.

7. North Las Vegas – Crash Risk Percentage: 77%

- Crash Risk Percentage: 77%

- Historical crashes (5%+ drops): 5

- Worst historical crash: -4.4% (2024)

- Total price increase since 2013: +46.4%

- Overextended above long-term average: +80.7%

- Price volatility (annual swings): 13.3%

- Current May 2025 price: $187,967

North Las Vegas presents one of the most extreme overextension scenarios in our analysis, with prices sitting an alarming 81% above long-term averages despite relatively modest total appreciation. The momentum loss in 2025 coincides with this extreme overvaluation, creating conditions that historically precede significant market corrections. High volatility adds to the instability.

North Las Vegas – Working-Class Community Priced Out of Reality

This traditionally affordable Las Vegas suburb has become a cautionary tale of how housing speculation can transform working-class communities. Current median prices around $187,967 represent an 81% overextension above historical norms, making North Las Vegas one of the most mathematically overvalued markets in Nevada. While total appreciation since 2013 appears modest at 46%, the relationship to long-term trends reveals a market that has been artificially inflated well beyond what local wages and economic conditions can support. The momentum loss evident in 2025 signals that speculative demand may be weakening just as prices reach unsustainable levels. North Las Vegas has historically served essential workers, service employees, and families seeking affordable alternatives to central Las Vegas, but current pricing has effectively priced out much of the community’s traditional resident base. The combination of 13.3% volatility and extreme overvaluation creates conditions where even minor economic disruptions could trigger substantial price corrections.

6. Sun Valley – Crash Risk Percentage: 77%

- Crash Risk Percentage: 77%

- Historical crashes (5%+ drops): 5

- Worst historical crash: -11.6% (2011)

- Total price increase since 2010: +167.8%

- Overextended above long-term average: +84.8%

- Price volatility (annual swings): 12.1%

- Current May 2025 price: $383,063

Sun Valley exhibits extreme overvaluation with prices sitting 85% above long-term averages after nearly tripling since 2010. The momentum loss in 2025 occurs just as the market reaches dangerous overextension levels, creating a perfect storm for a major correction. The community’s history of significant crashes and ongoing volatility amplify the risk.

Sun Valley – Reno Suburb’s Speculative Bubble

Located just north of Reno, Sun Valley has transformed from an affordable community into a speculative investment target that has pushed median prices to $383,063 – a staggering 168% increase since 2010. This dramatic appreciation has created an 85% overextension above long-term averages, representing one of the most extreme overvaluation scenarios in our analysis. The transformation has fundamentally altered the character of this working-class community as longtime residents are priced out by speculative investment. The momentum loss in 2025 represents a critical warning signal for Sun Valley’s overheated market. With 12.1% annual volatility and a history of double-digit crashes, the community shows classic patterns of boom-bust cycles that typically end with sharp corrections. The mathematical impossibility of sustaining prices 85% above historical norms suggests that significant downward adjustment is not just possible but probable, particularly if broader economic conditions deteriorate or speculative investment patterns shift away from secondary Nevada markets.

5. Bunkerville – Crash Risk Percentage: 77%

- Crash Risk Percentage: 77%

- Historical crashes (5%+ drops): 5

- Worst historical crash: -12.2% (2011)

- Total price increase since 2010: +260.0%

- Overextended above long-term average: +90.6%

- Price volatility (annual swings): 11.0%

- Current May 2025 price: $394,056

Bunkerville shows the most extreme overextension in our analysis at 91% above long-term averages, combined with massive 260% appreciation since 2010. The momentum loss in 2025 coincides with this dangerous overvaluation, creating conditions that virtually guarantee a significant correction. The small community’s narrow economic base cannot support such inflated valuations.

Bunkerville – Rural Community’s Impossible Valuation

This small rural community along the Virgin River has become the poster child for Nevada’s housing speculation bubble, with median prices exploding from $109,470 in 2010 to $394,056 today – an impossible 260% increase that defies all economic logic. The 91% overextension above long-term averages represents the most extreme overvaluation in our entire analysis, creating a mathematical impossibility that cannot be sustained by local economic conditions. Bunkerville’s economy relies primarily on agriculture and some tourism related to nearby recreation areas, creating a narrow foundation that cannot reasonably support current housing costs. The momentum loss in 2025 signals that speculative demand may finally be exhausting itself, setting the stage for a dramatic correction that could erase much of the artificial gains accumulated over the past decade. With 11% annual volatility and a history of double-digit crashes, Bunkerville appears positioned for one of the most severe housing corrections in Nevada when market forces inevitably restore pricing equilibrium.

4. Zephyr Cove – Crash Risk Percentage: 77%

- Crash Risk Percentage: 77%

- Historical crashes (5%+ drops): 5

- Worst historical crash: -11.0% (2011)

- Total price increase since 2010: +160.1%

- Overextended above long-term average: +72.3%

- Price volatility (annual swings): 5.1%

- Current May 2025 price: $601,029

Zephyr Cove demonstrates how even luxury Lake Tahoe markets can develop severe crash risk through overextension and momentum loss. The community has seen values increase 160% since 2010, creating a 72% overextension above sustainable levels. The momentum loss in 2025 suggests the luxury market appreciation phase may be ending, creating vulnerability for a significant correction.

Zephyr Cove – Lake Tahoe Luxury Market Losing Steam

Nestled on the eastern shore of Lake Tahoe, Zephyr Cove represents one of Nevada’s most prestigious residential communities with its stunning lake access and luxury home market. However, current median prices around $601,029 reflect a 160% increase since 2010 that has pushed the market 72% above long-term averages, creating dangerous overvaluation even for this exclusive lakefront location. The luxury market’s momentum loss in 2025 suggests that even high-end buyers may be reaching their limits. While Zephyr Cove’s relatively low 5.1% volatility might suggest market stability, the momentum loss combined with extreme overvaluation creates concerning conditions for luxury homeowners. Lake Tahoe markets are particularly vulnerable to economic disruptions as they depend heavily on discretionary spending by wealthy buyers who can quickly shift investment strategies. The community’s five historical crashes demonstrate that even prestigious locations are not immune to market corrections when valuations become disconnected from underlying demand fundamentals.

3. Reno – Crash Risk Percentage: 82%

- Crash Risk Percentage: 82%

- Historical crashes (5%+ drops): 6

- Worst historical crash: -12.0% (2011)

- Total price increase since 2010: +121.3%

- Overextended above long-term average: +80.2%

- Price volatility (annual swings): 11.0%

- Current May 2025 price: $1,170,238

Reno enters the highest risk category with an 82% crash probability driven by severe overextension and momentum loss occurring simultaneously. Nevada’s second-largest city has seen prices more than double since 2010, creating an 80% overextension above sustainable levels. With six historical crashes on record and clear momentum loss in 2025, conditions are ripe for a major urban market correction.

Reno – The Biggest City’s Biggest Risk

As Nevada’s second-largest city and the economic hub of northern Nevada, Reno’s housing market has become dangerously disconnected from local economic realities. Current median prices around $1.17 million represent a 121% increase since 2010 that has transformed this traditionally middle-class city into an unaffordable market for most residents. The 80% overextension above long-term averages signals a market driven by speculation and external investment rather than organic local demand. The momentum loss evident in 2025 appears particularly ominous for Reno given its role as a regional economic center. With six historical crashes on record – more than any other community in our analysis – Reno has demonstrated repeated vulnerability to boom-bust cycles that tend to amplify during broader economic downturns. The city’s 11% annual volatility, combined with extreme current overvaluation, creates conditions where even minor economic disruptions could trigger substantial price corrections that ripple throughout northern Nevada’s interconnected markets.

2. Incline Village – Crash Risk Percentage: 87%

- Crash Risk Percentage: 87%

- Historical crashes (5%+ drops): 5

- Worst historical crash: -12.8% (2023)

- Total price increase since 2010: +127.3%

- Overextended above long-term average: +77.5%

- Price volatility (annual swings): 10.6%

- Current May 2025 price: $2,700,861

Incline Village reaches critical risk levels with an 87% crash probability reflecting extreme luxury market conditions. The prestigious Lake Tahoe community has seen prices increase 127% since 2010 while remaining 78% above sustainable levels. Recent momentum loss in 2025, combined with a history of significant crashes, creates near-certain conditions for a major correction in this ultra-high-end market.

Incline Village – Lake Tahoe’s Luxury Bubble Ready to Burst

Perched on the crystal-clear waters of Lake Tahoe’s north shore, Incline Village represents the pinnacle of Nevada luxury living with median home prices reaching $2.7 million. However, this exclusive community has become a textbook example of luxury market overextension, with current valuations sitting 78% above long-term averages despite already massive appreciation since 2010. The recent 12.8% crash in 2023 provided a preview of the volatility that luxury markets face when economic conditions shift, yet prices remain dangerously elevated above sustainable levels. The momentum loss in 2025 signals that even ultra-wealthy buyers may be reaching their limits in this rarified market. Incline Village’s 10.6% annual volatility reflects the inherent instability of luxury markets that depend on discretionary spending by the wealthy, who can quickly shift investment strategies during economic uncertainty. With five historical crashes on record and current extreme overvaluation, this prestigious community appears positioned for a correction that could rival or exceed the 2023 decline, potentially erasing years of artificial appreciation.

1. Glenbrook – Crash Risk Percentage: 87%

- Crash Risk Percentage: 87%

- Historical crashes (5%+ drops): 5

- Worst historical crash: -18.5% (2024)

- Total price increase since 2010: +3,101.6%

- Overextended above long-term average: +61.9%

- Price volatility (annual swings): 12.1%

- Current May 2025 price: $2,700,861

Glenbrook tops our risk analysis with an 87% crash probability driven by astronomical appreciation and ongoing momentum loss. The ultra-exclusive Lake Tahoe community has seen prices increase an impossible 3,102% since 2010, creating a speculative bubble of epic proportions. Despite recent corrections including an 18.5% crash in 2024, prices remain 62% above sustainable levels with clear momentum loss continuing in 2025.

Glenbrook – The Ultimate Luxury Market Catastrophe

Located on Lake Tahoe’s pristine east shore, Glenbrook represents the most extreme example of housing speculation in our entire analysis. Current median prices around $2.7 million reflect an absolutely impossible 3,102% increase since 2010, transforming what was once an $84,358 median market into a multi-million-dollar luxury enclave. This astronomical appreciation defies all mathematical logic and economic fundamentals, creating a speculative bubble that appears destined for dramatic correction. The devastating 18.5% crash in 2024 provided a stark preview of Glenbrook’s vulnerability, yet prices remain 62% above long-term sustainable levels with momentum loss continuing into 2025. The community’s 12.1% annual volatility reflects the extreme instability inherent in ultra-luxury markets driven by speculative investment rather than organic demand. With five historical crashes on record and current valuations that exist in complete disconnection from any reasonable economic foundation, Glenbrook appears positioned for a correction of historic proportions that could erase much of the artificial appreciation accumulated over the past decade.