Would you like to save this?

Luxury in Nebraska? Believe it. The Zillow Home Value Index shows that some of the state’s priciest towns now carry home values that wouldn’t look out of place on the coasts. From upscale suburbs near Omaha to small towns where prices have quietly doubled over the years, Nebraska’s housing market is anything but sleepy. Whether you’re riding the equity wave or just shocked at what a three-bedroom now costs, these 34 towns reveal where ‘affordable Midwest living’ doesn’t quite apply anymore.

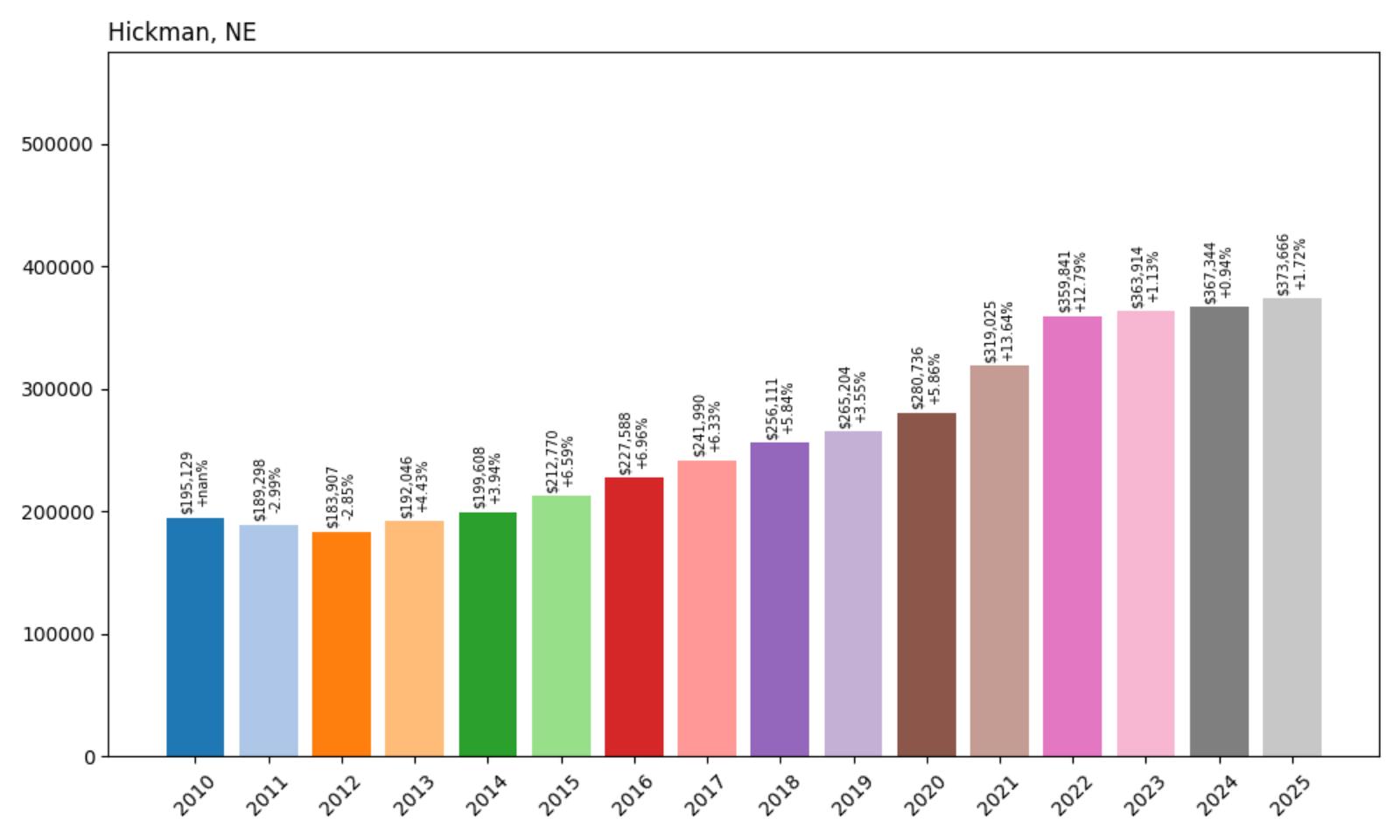

34. Hickman – 91% Home Price Increase Since 2010

- 2010: $195,129

- 2011: $189,298 (−$5,832, −2.99% from previous year)

- 2012: $183,907 (−$5,391, −2.85% from previous year)

- 2013: $192,046 (+$8,139, +4.43% from previous year)

- 2014: $199,608 (+$7,562, +3.94% from previous year)

- 2015: $212,770 (+$13,162, +6.59% from previous year)

- 2016: $227,588 (+$14,818, +6.96% from previous year)

- 2017: $241,990 (+$14,402, +6.33% from previous year)

- 2018: $256,111 (+$14,121, +5.84% from previous year)

- 2019: $265,204 (+$9,094, +3.55% from previous year)

- 2020: $280,736 (+$15,531, +5.86% from previous year)

- 2021: $319,025 (+$38,289, +13.64% from previous year)

- 2022: $359,841 (+$40,816, +12.79% from previous year)

- 2023: $363,914 (+$4,073, +1.13% from previous year)

- 2024: $367,344 (+$3,430, +0.94% from previous year)

- 2025: $373,666 (+$6,322, +1.72% from previous year)

Hickman’s housing market demonstrates a classic pattern of gradual appreciation followed by explosive growth during the pandemic years. After experiencing modest declines in the early 2010s, the town recovered and maintained steady annual increases through the late 2010s. The most dramatic surge occurred between 2021 and 2022, when home values jumped by over $40,000 in consecutive years, representing the largest dollar increases in the town’s recent history.

Hickman – Strategic Location Drives Growth

Located just 15 miles southwest of Lincoln, Hickman has transformed from a quiet agricultural community into a sought-after suburb that offers small-town charm with big-city accessibility. The town’s strategic position along Highway 2 provides residents with an easy commute to Lincoln’s employment centers while maintaining the peaceful atmosphere of rural Nebraska. This proximity to the state capital has been a key driver in the community’s housing appreciation, as families seek more space and lower property taxes outside the city limits.

The steady growth in home values reflects the town’s careful balance of development and preservation. While new construction has increased to meet demand, Hickman has maintained its small-town character through thoughtful planning and community engagement. Current median home prices of $373,666 position Hickman as an affordable alternative to Lincoln proper, though the 91% increase since 2010 suggests this window of affordability may be closing as more buyers discover the community’s advantages.

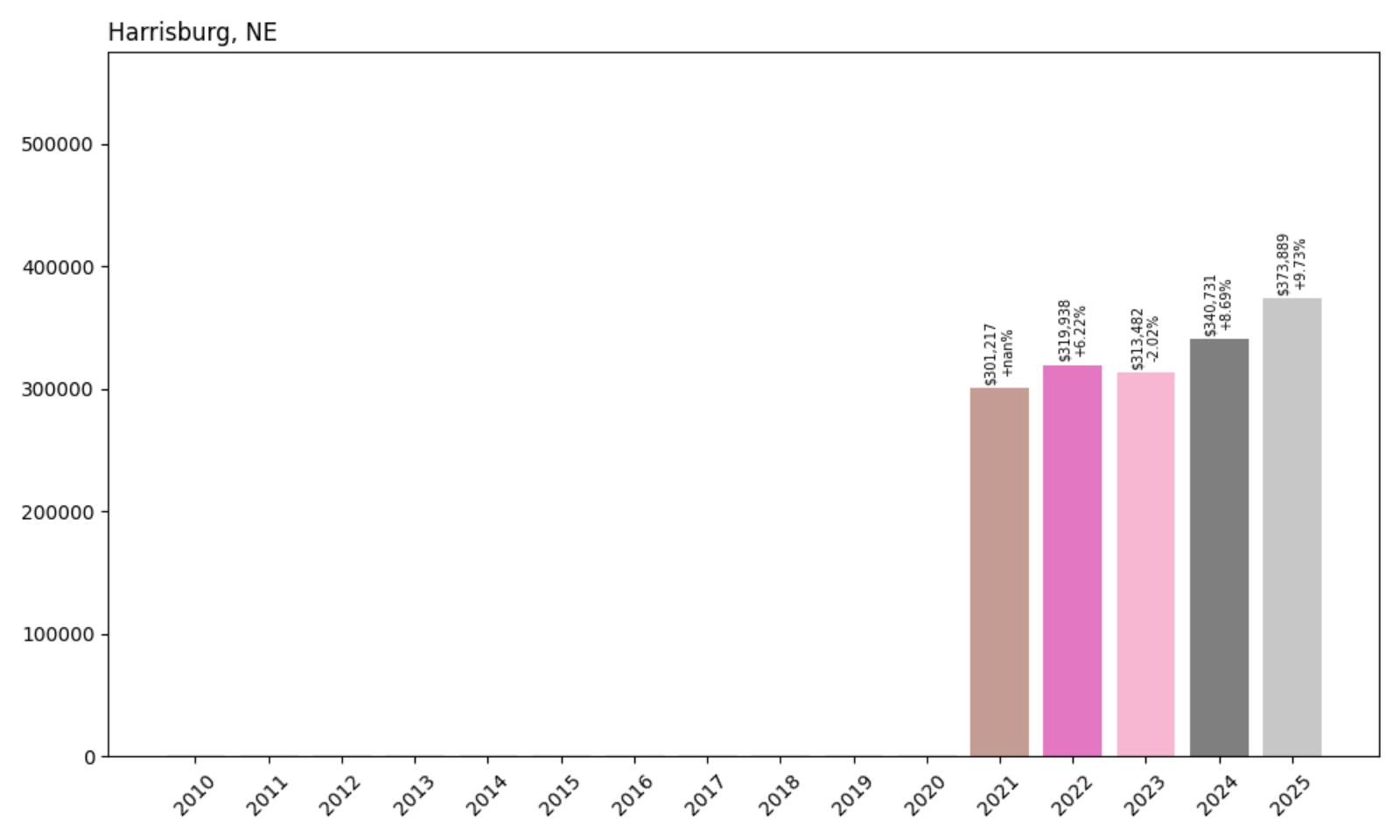

33. Harrisburg – 24% Home Price Increase Since 2021

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: $301,217

- 2022: $319,938 (+$18,721, +6.22% from previous year)

- 2023: $313,482 (−$6,457, −2.02% from previous year)

- 2024: $340,731 (+$27,249, +8.69% from previous year)

- 2025: $373,889 (+$33,158, +9.73% from previous year)

Harrisburg presents a unique case study with limited historical data beginning in 2021, but the available information reveals a volatile yet ultimately upward trajectory. The town experienced a brief correction in 2023 before rebounding with significant gains in both 2024 and 2025, culminating in the strongest annual increase of nearly 10% in the most recent year. This pattern suggests a market that’s still finding its equilibrium as the community establishes itself in the regional housing landscape.

Harrisburg – Emerging Community Shows Promise

As one of Nebraska’s newer incorporated communities, Harrisburg represents the state’s evolving suburban development patterns. Located in the rapidly growing corridor between Omaha and Lincoln, this small community has benefited from increased interest in rural and suburban living, particularly following the pandemic-driven shift toward remote work. The town’s emergence in housing data only since 2021 reflects its recent development as a residential destination, with new construction and infrastructure improvements attracting families seeking modern amenities in a small-town setting.

Current home values of $373,889 represent significant appreciation from the baseline established in 2021, indicating strong demand for properties in this emerging market. The recent surge in values, particularly the $33,000 increase in 2025, suggests that Harrisburg is gaining recognition as a desirable place to live. As the community continues to develop its identity and amenities, property values may continue to rise, making early investment in Harrisburg potentially rewarding for homeowners.

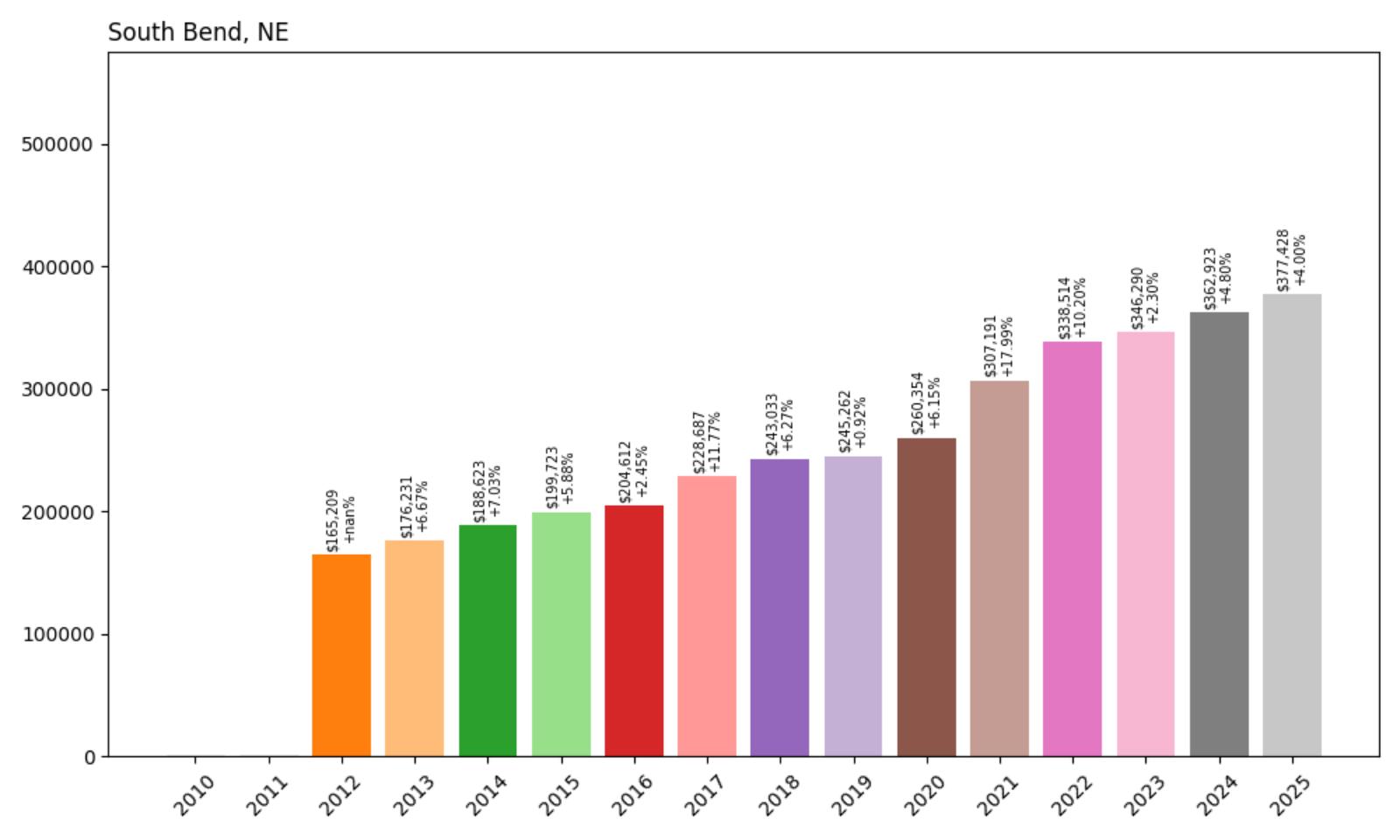

32. South Bend – 128% Home Price Increase Since 2012

- 2010: N/A

- 2011: N/A

- 2012: $165,209

- 2013: $176,231 (+$11,023, +6.67% from previous year)

- 2014: $188,623 (+$12,392, +7.03% from previous year)

- 2015: $199,723 (+$11,100, +5.88% from previous year)

- 2016: $204,612 (+$4,889, +2.45% from previous year)

- 2017: $228,687 (+$24,075, +11.77% from previous year)

- 2018: $243,033 (+$14,346, +6.27% from previous year)

- 2019: $245,262 (+$2,229, +0.92% from previous year)

- 2020: $260,354 (+$15,092, +6.15% from previous year)

- 2021: $307,191 (+$46,837, +17.99% from previous year)

- 2022: $338,514 (+$31,323, +10.20% from previous year)

- 2023: $346,290 (+$7,775, +2.30% from previous year)

- 2024: $362,923 (+$16,633, +4.80% from previous year)

- 2025: $377,428 (+$14,505, +4.00% from previous year)

South Bend’s housing market tells a compelling story of sustained growth punctuated by periods of exceptional appreciation. The town maintained steady increases throughout the 2010s, with particularly strong performance in 2017 when values jumped nearly 12%. The pandemic era brought another surge, with 2021 delivering the largest single-year increase of almost 18%, adding nearly $47,000 to median home values. This dramatic appreciation pattern reflects the community’s growing appeal and limited housing inventory.

South Bend – Small Town Charm Meets Modern Demand

Would you like to save this?

Nestled in Cass County, South Bend exemplifies the small Nebraska community that has successfully attracted buyers seeking authenticity and value. With a population of fewer than 500 residents, this tight-knit community offers the kind of neighborly atmosphere that’s increasingly rare in today’s fast-paced world. The town’s rural setting provides residents with peace and tranquility while remaining accessible to larger communities for employment and shopping needs.

The dramatic 128% price increase since 2012 reflects broader trends in rural real estate, where buyers are willing to pay premium prices for quality homes in well-maintained communities. South Bend’s appeal lies not just in its affordability relative to urban areas, but in its strong community spirit and the quality of life it offers families. The town’s volunteer fire department, community events, and local businesses create a sense of belonging that resonates with buyers seeking more than just a house.

At current values of $377,428, South Bend represents a significant investment opportunity for those who recognized its potential early in the decade. The consistent appreciation pattern suggests a stable market supported by genuine demand rather than speculation. As rural communities continue to gain favor among buyers seeking alternatives to urban living, South Bend’s combination of affordability, community spirit, and growth potential positions it well for continued success.

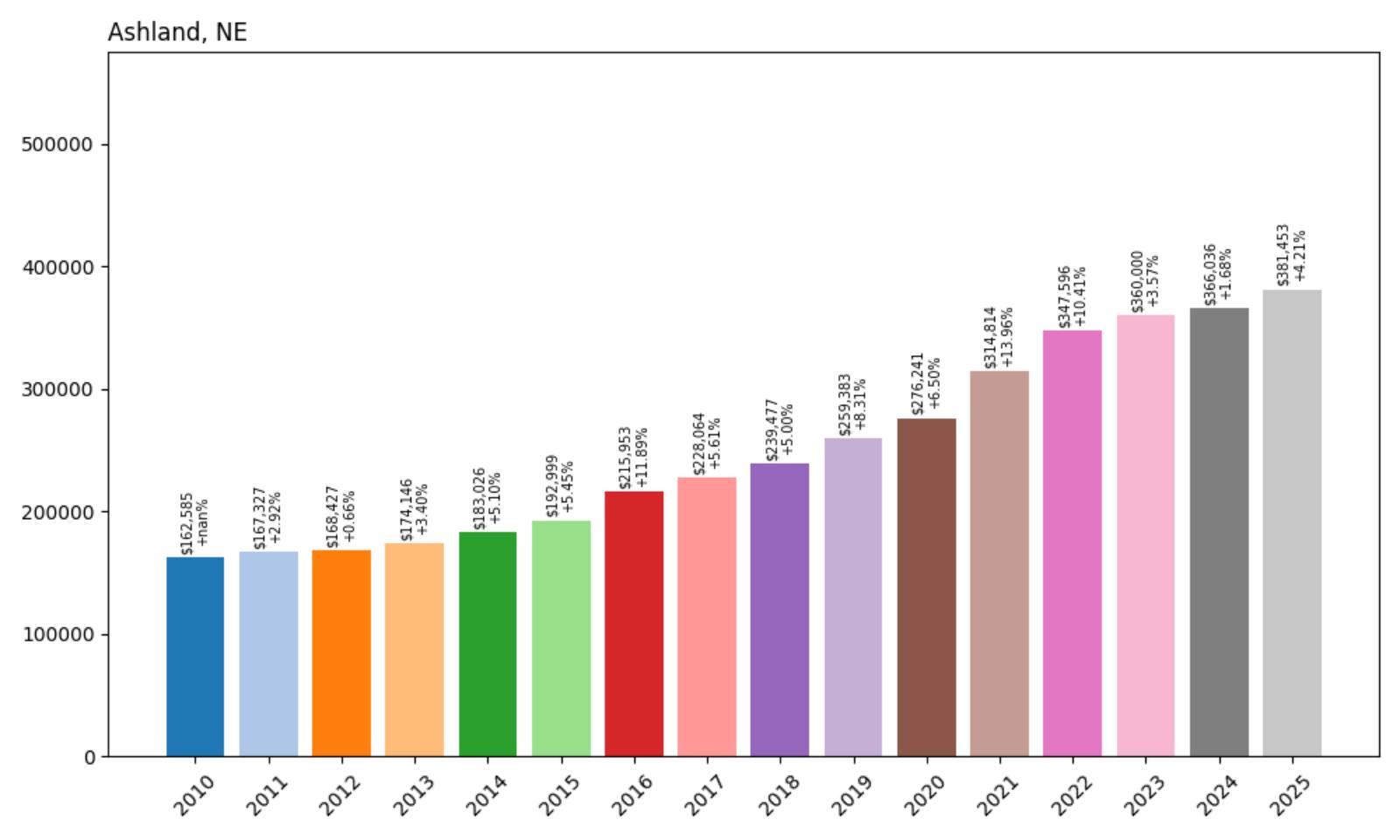

31. Ashland – 135% Home Price Increase Since 2010

- 2010: $162,585

- 2011: $167,327 (+$4,743, +2.92% from previous year)

- 2012: $168,427 (+$1,100, +0.66% from previous year)

- 2013: $174,146 (+$5,719, +3.40% from previous year)

- 2014: $183,026 (+$8,880, +5.10% from previous year)

- 2015: $192,999 (+$9,972, +5.45% from previous year)

- 2016: $215,953 (+$22,955, +11.89% from previous year)

- 2017: $228,064 (+$12,111, +5.61% from previous year)

- 2018: $239,477 (+$11,413, +5.00% from previous year)

- 2019: $259,383 (+$19,907, +8.31% from previous year)

- 2020: $276,241 (+$16,858, +6.50% from previous year)

- 2021: $314,814 (+$38,573, +13.96% from previous year)

- 2022: $347,596 (+$32,782, +10.41% from previous year)

- 2023: $360,000 (+$12,404, +3.57% from previous year)

- 2024: $366,036 (+$6,036, +1.68% from previous year)

- 2025: $381,453 (+$15,417, +4.21% from previous year)

Ashland’s housing market exemplifies the transformation many Nebraska communities experienced over the past 15 years. After modest but steady growth through the 2010s, the town saw exceptional acceleration beginning in 2016 with an 11.89% jump that added nearly $23,000 to median home values. The pandemic years of 2021 and 2022 brought the most dramatic increases, with back-to-back years adding over $38,000 and $32,000 respectively. This 135% cumulative increase represents more than a doubling of home values, positioning Ashland among the state’s most appreciating markets.

Ashland – Historic Crossroads Becomes Modern Haven

Situated in Saunders County along Interstate 80, Ashland occupies a unique position in Nebraska’s landscape as both a historical landmark and a thriving modern community. The town was established in 1870 at the site of a low-water limestone ledge along Salt Creek, which served as an excellent fording site for wagon trains on the Oregon Trail. This strategic location that once aided westward migration now provides residents with exceptional access to both Omaha and Lincoln, making Ashland an increasingly popular choice for commuters seeking small-town charm with metropolitan convenience.

With a current population of approximately 3,083 people and a median household income of $80,948, Ashland has evolved from its agricultural roots into a diverse community that attracts families, young professionals, and retirees. The local economy is anchored by manufacturing, educational services, and healthcare, providing stable employment opportunities while maintaining the community character that residents value. The town’s proximity to major attractions like the Strategic Air and Space Museum and Eugene T. Mahoney State Park adds to its appeal for both residents and visitors.

The remarkable 135% price appreciation since 2010 reflects Ashland’s successful transformation into what many consider one of Nebraska’s premier small communities. Current median home values of $381,453 represent substantial wealth building for long-term residents while attracting new buyers who recognize the value proposition of quality schools, low crime rates, and easy access to urban amenities. As development pressures continue along the I-80 corridor, Ashland’s careful balance of growth and preservation positions it well for continued appreciation.

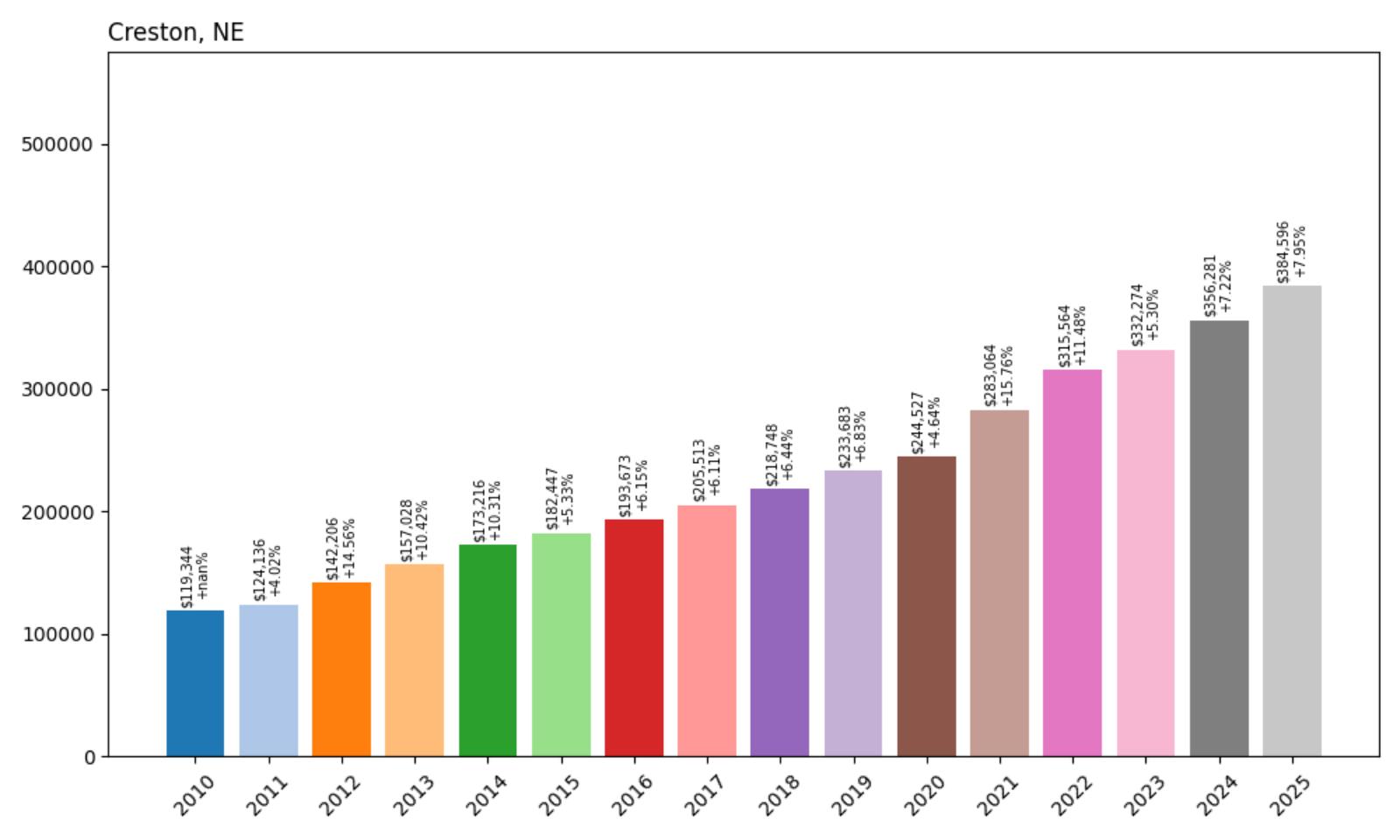

30. Creston – 222% Home Price Increase Since 2010

- 2010: $119,344

- 2011: $124,136 (+$4,792, +4.02% from previous year)

- 2012: $142,206 (+$18,070, +14.56% from previous year)

- 2013: $157,028 (+$14,821, +10.42% from previous year)

- 2014: $173,216 (+$16,189, +10.31% from previous year)

- 2015: $182,447 (+$9,231, +5.33% from previous year)

- 2016: $193,673 (+$11,225, +6.15% from previous year)

- 2017: $205,513 (+$11,841, +6.11% from previous year)

- 2018: $218,748 (+$13,235, +6.44% from previous year)

- 2019: $233,683 (+$14,935, +6.83% from previous year)

- 2020: $244,527 (+$10,845, +4.64% from previous year)

- 2021: $283,064 (+$38,537, +15.76% from previous year)

- 2022: $315,564 (+$32,500, +11.48% from previous year)

- 2023: $332,274 (+$16,710, +5.30% from previous year)

- 2024: $356,281 (+$24,006, +7.22% from previous year)

- 2025: $384,596 (+$28,316, +7.95% from previous year)

Creston stands out as one of Nebraska’s most remarkable housing appreciation stories, with home values more than tripling since 2010. The town experienced exceptional growth in the early 2010s, with consecutive years of double-digit increases from 2012-2014 that established a foundation for sustained appreciation. The pandemic period accelerated this trend, with 2021 delivering the largest single-year increase of nearly 16%. Recent years have maintained strong momentum, with 2025 showing the highest appreciation rate in five years at nearly 8%.

Creston – Small Town Success Story

Located in Platte County in central Nebraska, Creston represents the success story of rural communities that have successfully reinvented themselves in the modern economy. Starting from a median home value of just $119,344 in 2010, the town has attracted buyers seeking affordable alternatives to larger markets while maintaining access to regional employment centers. The community’s rural setting provides residents with space, tranquility, and a strong sense of community that urban areas often lack.

The extraordinary 222% price increase reflects both the town’s initial affordability and its growing recognition as a desirable place to live. Creston’s appeal lies in its combination of low cost of living, quality rural amenities, and proximity to larger communities for employment and services. The consistent year-over-year appreciation demonstrates sustained demand rather than speculative bubbles, suggesting genuine market fundamentals supporting the price growth.

At current values of $384,596, Creston homes have evolved from deeply affordable to competitively priced within the Nebraska market. The recent acceleration in appreciation, particularly the strong 7.95% increase in 2025, indicates continued buyer confidence in the community’s future. For residents who purchased during the early 2010s, the wealth creation has been substantial, while current buyers are betting on Creston’s continued evolution as a premier small-town destination.

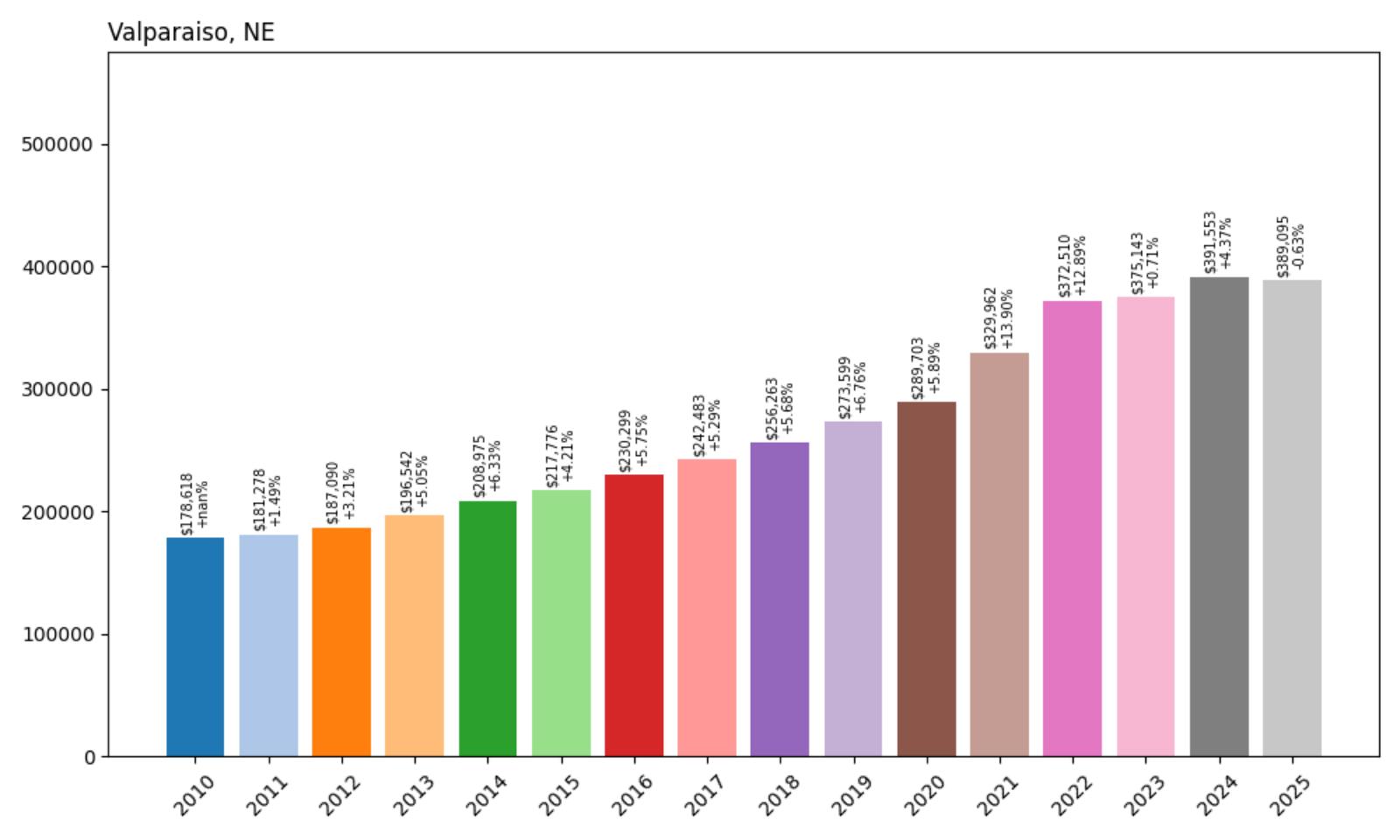

29. Valparaiso – 118% Home Price Increase Since 2010

- 2010: $178,618

- 2011: $181,278 (+$2,660, +1.49% from previous year)

- 2012: $187,090 (+$5,812, +3.21% from previous year)

- 2013: $196,542 (+$9,452, +5.05% from previous year)

- 2014: $208,975 (+$12,433, +6.33% from previous year)

- 2015: $217,776 (+$8,801, +4.21% from previous year)

- 2016: $230,299 (+$12,523, +5.75% from previous year)

- 2017: $242,483 (+$12,184, +5.29% from previous year)

- 2018: $256,263 (+$13,781, +5.68% from previous year)

- 2019: $273,599 (+$17,336, +6.76% from previous year)

- 2020: $289,703 (+$16,103, +5.89% from previous year)

- 2021: $329,962 (+$40,259, +13.90% from previous year)

- 2022: $372,510 (+$42,548, +12.89% from previous year)

- 2023: $375,143 (+$2,633, +0.71% from previous year)

- 2024: $391,553 (+$16,410, +4.37% from previous year)

- 2025: $389,095 (−$2,458, −0.63% from previous year)

Valparaiso’s housing market demonstrates remarkable consistency through most of the tracked period, with steady annual increases that compound to substantial long-term appreciation. The town maintained reliable growth throughout the 2010s, with the pandemic years bringing significant acceleration as 2021 and 2022 saw back-to-back increases of over $40,000. Notably, 2025 marks the first decline in the dataset, with a modest 0.63% decrease that may signal a market correction after years of rapid growth.

Valparaiso – Steady Growth Meets Market Reality

Positioned in Saunders County in eastern Nebraska, Valparaiso has established itself as a stable residential community that appeals to families seeking predictable appreciation and quality of life. The town’s housing market reflects the broader trends affecting rural Nebraska communities, where proximity to larger cities and quality local amenities drive sustained demand. The 118% increase since 2010 represents steady wealth building for homeowners, though the recent slight decline suggests the market may be reaching a natural pause point.

Current median home values of $389,095, despite the recent modest decline, still represent substantial appreciation from the 2010 baseline of $178,618. The slight pullback in 2025 may actually benefit long-term market health by preventing overheating and maintaining affordability for new buyers. For potential buyers, this temporary softening could present an opportunity to enter a market that has demonstrated consistent long-term appreciation potential.

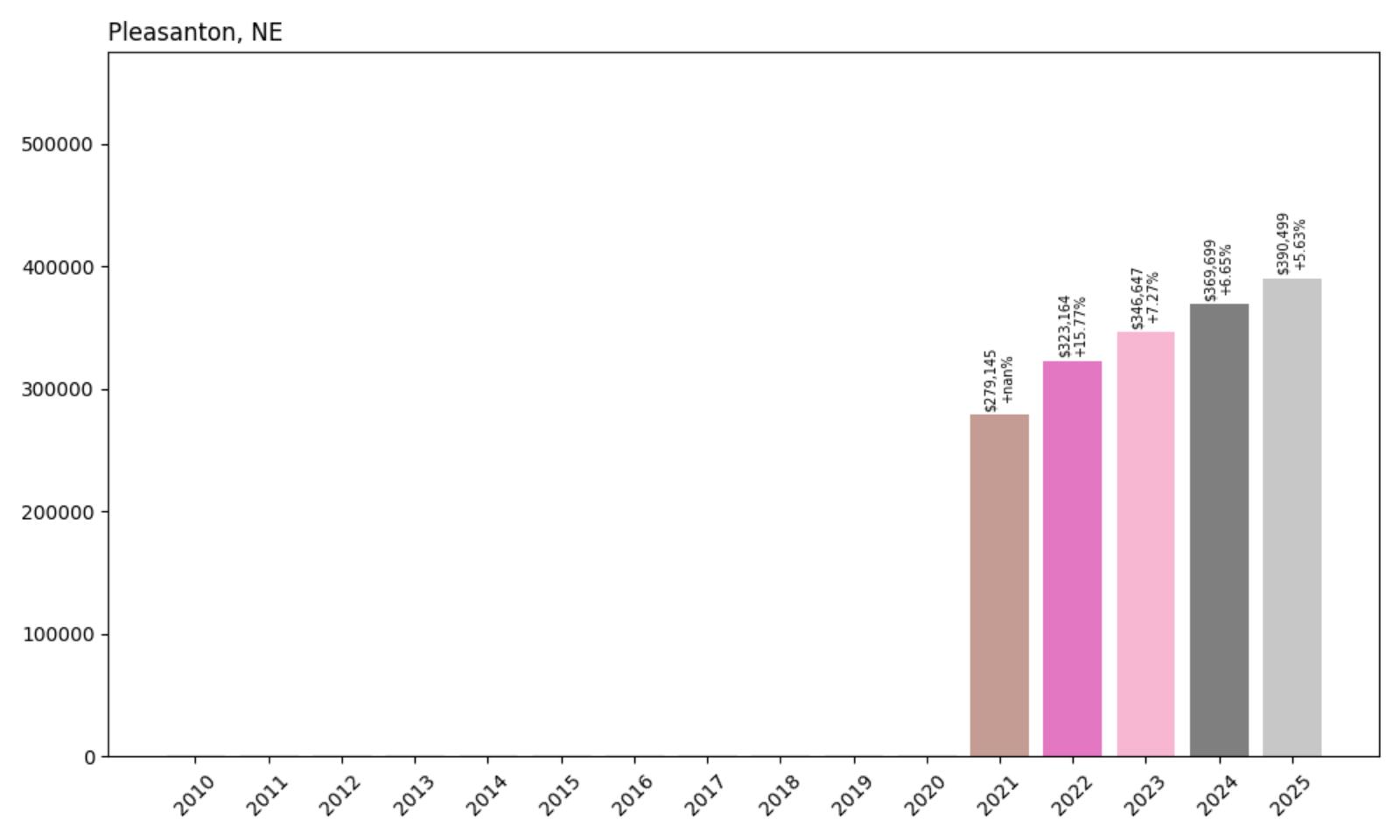

28. Pleasanton – 40% Home Price Increase Since 2021

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: $279,145

- 2022: $323,164 (+$44,018, +15.77% from previous year)

- 2023: $346,647 (+$23,483, +7.27% from previous year)

- 2024: $369,699 (+$23,052, +6.65% from previous year)

- 2025: $390,499 (+$20,800, +5.63% from previous year)

Pleasanton’s housing data, available only from 2021, reveals a community experiencing rapid appreciation in its early years of market establishment. The town posted an impressive 15.77% increase in 2022, adding over $44,000 to median home values in a single year. While growth has moderated since then, the community continues to show healthy appreciation with consistent annual increases averaging around 6-7%. The 40% cumulative increase over just four years indicates strong market momentum and buyer confidence.

Pleasanton – New Market Shows Strong Momentum

As one of the newer communities represented in Nebraska’s housing data, Pleasanton reflects the state’s ongoing development and the creation of new residential markets. The limited historical data beginning in 2021 suggests this may be a recently incorporated community or one that has recently achieved sufficient housing stock to generate reliable market data. The strong initial appreciation rates indicate healthy demand and successful community development that has attracted buyers willing to invest in an emerging market.

The consistent year-over-year growth pattern suggests Pleasanton has successfully established itself as a desirable residential destination. The community’s ability to maintain appreciation rates above 5% annually, even as the initial surge moderates, indicates sustainable market fundamentals rather than speculative buying. This pattern often characterizes successful new developments that offer attractive amenities and strategic positioning within the regional market.

Current median home values of $390,499 position Pleasanton competitively within Nebraska’s housing market, particularly considering the community’s recent emergence. The 40% appreciation since 2021 represents substantial value creation for early residents while establishing price points that reflect the community’s amenities and potential. As Pleasanton continues to develop its identity and infrastructure, the strong foundation established in these early years bodes well for continued market stability and growth.

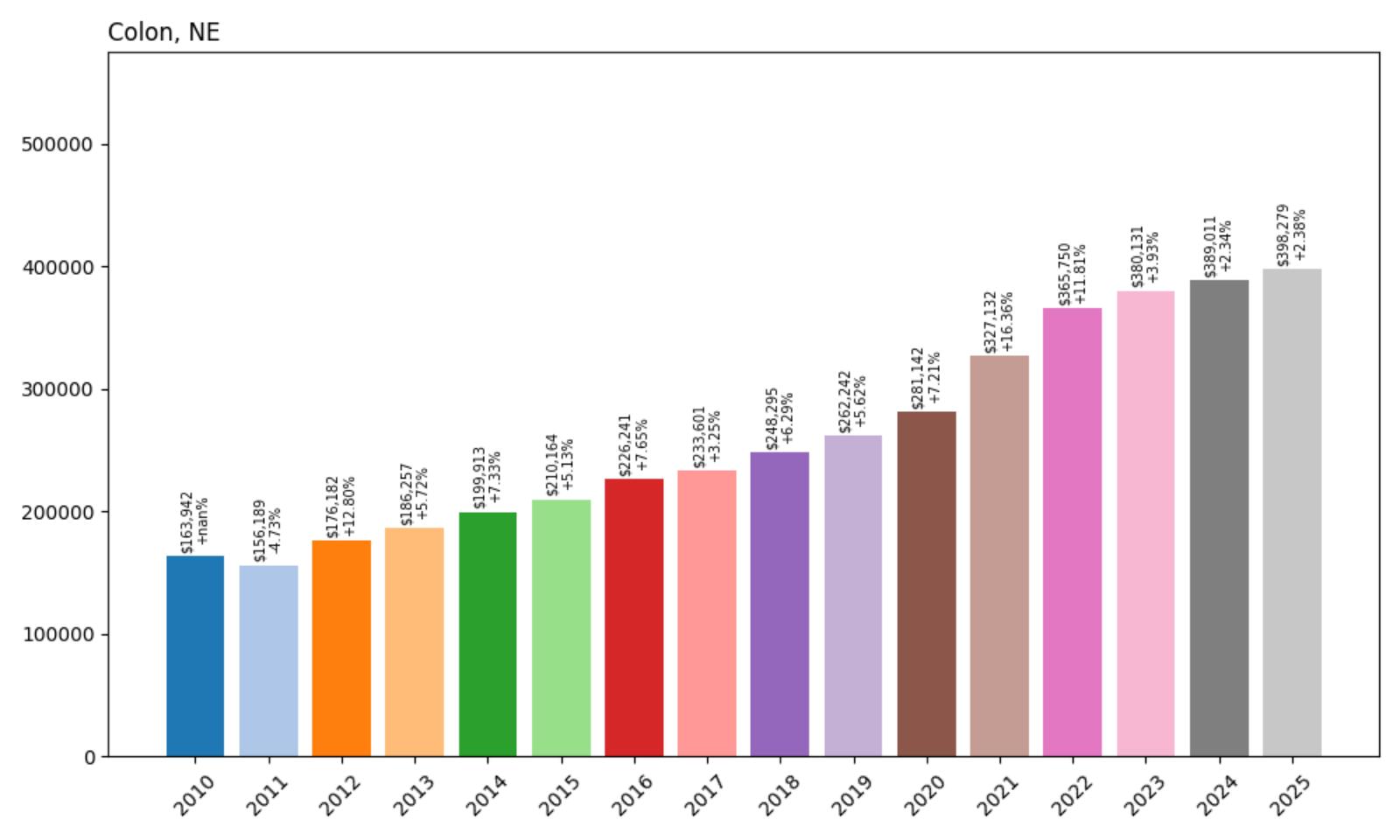

27. Colon – 143% Home Price Increase Since 2010

- 2010: $163,942

- 2011: $156,189 (−$7,753, −4.73% from previous year)

- 2012: $176,182 (+$19,992, +12.80% from previous year)

- 2013: $186,257 (+$10,075, +5.72% from previous year)

- 2014: $199,913 (+$13,656, +7.33% from previous year)

- 2015: $210,164 (+$10,251, +5.13% from previous year)

- 2016: $226,241 (+$16,077, +7.65% from previous year)

- 2017: $233,601 (+$7,360, +3.25% from previous year)

- 2018: $248,295 (+$14,694, +6.29% from previous year)

- 2019: $262,242 (+$13,947, +5.62% from previous year)

- 2020: $281,142 (+$18,900, +7.21% from previous year)

- 2021: $327,132 (+$45,990, +16.36% from previous year)

- 2022: $365,750 (+$38,618, +11.81% from previous year)

- 2023: $380,131 (+$14,381, +3.93% from previous year)

- 2024: $389,011 (+$8,881, +2.34% from previous year)

- 2025: $398,279 (+$9,268, +2.38% from previous year)

Colon’s housing market demonstrates resilience and strong long-term growth despite an early setback in 2011. The community quickly recovered with a remarkable 12.80% surge in 2012 and maintained steady appreciation throughout the decade. The pandemic years brought exceptional growth, with 2021 delivering the strongest performance at over 16% appreciation. While recent years show moderation, the consistent positive trajectory and 143% cumulative increase underscore the community’s fundamental appeal to homebuyers.

Colon – Rural Resilience Drives Long-Term Growth

Ammodramus, Public domain, via Wikimedia Commons

Located in Washington County in eastern Nebraska, Colon represents the success story of small rural communities that have maintained their appeal despite broader demographic trends toward urbanization. The town’s 143% price appreciation since 2010 reflects both its initial affordability and its evolution into a more recognized residential destination. Starting from a median home value of $163,942, Colon has successfully attracted buyers seeking rural amenities, community connection, and value appreciation.

Current median home values of $398,279 represent remarkable wealth creation for long-term residents while positioning Colon as an attractive option for buyers seeking alternatives to higher-priced urban markets. The recent moderation in appreciation rates, while still positive, suggests a maturing market that offers both stability and continued growth potential. For buyers considering rural Nebraska communities, Colon’s track record demonstrates the value proposition of well-positioned small towns in the current real estate environment.

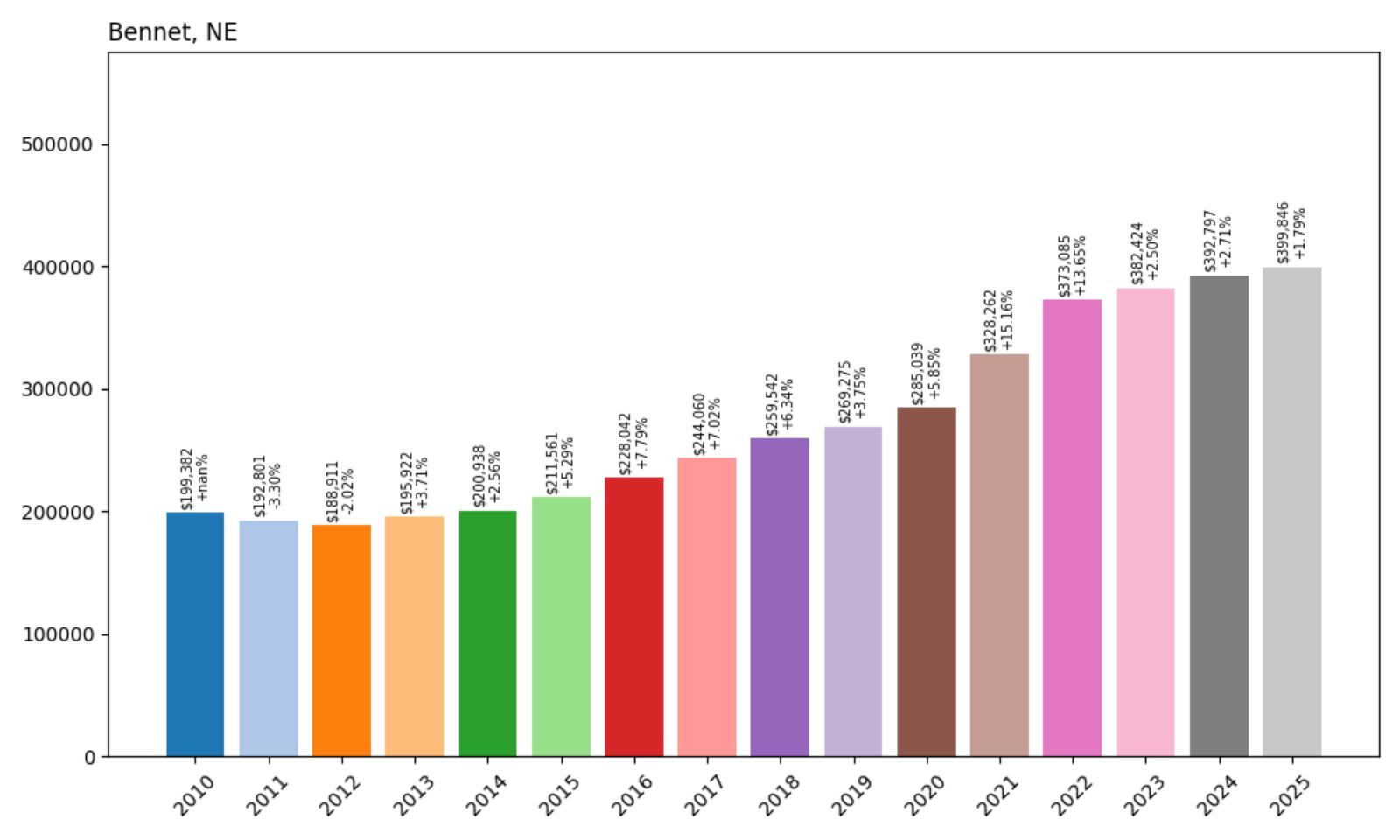

26. Bennet – 101% Home Price Increase Since 2010

- 2010: $199,382

- 2011: $192,801 (−$6,581, −3.30% from previous year)

- 2012: $188,911 (−$3,890, −2.02% from previous year)

- 2013: $195,922 (+$7,011, +3.71% from previous year)

- 2014: $200,938 (+$5,016, +2.56% from previous year)

- 2015: $211,561 (+$10,624, +5.29% from previous year)

- 2016: $228,042 (+$16,481, +7.79% from previous year)

- 2017: $244,060 (+$16,018, +7.02% from previous year)

- 2018: $259,542 (+$15,481, +6.34% from previous year)

- 2019: $269,275 (+$9,733, +3.75% from previous year)

- 2020: $285,039 (+$15,765, +5.85% from previous year)

- 2021: $328,262 (+$43,222, +15.16% from previous year)

- 2022: $373,085 (+$44,823, +13.65% from previous year)

- 2023: $382,424 (+$9,339, +2.50% from previous year)

- 2024: $392,797 (+$10,373, +2.71% from previous year)

- 2025: $399,846 (+$7,049, +1.79% from previous year)

Bennet’s housing market shows a classic recovery and growth pattern, with early struggles in 2011-2012 followed by sustained appreciation that accelerated dramatically during the pandemic years. The community experienced its strongest growth in 2021 and 2022, with consecutive years adding over $43,000 and $44,000 respectively to median home values. While recent growth has moderated to more sustainable levels, the 101% cumulative increase demonstrates the community’s evolution from an affordable rural option to a competitive suburban market.

Bennet – Lincoln Suburb Balances Growth and Character

Located just 10 miles southeast of Lincoln in Lancaster County, Bennet has successfully transformed from a traditional agricultural community into a thriving suburban destination that attracts families seeking small-town charm with urban convenience. The community’s proximity to Nebraska’s capital city provides residents with access to employment, healthcare, and cultural amenities while maintaining the peaceful atmosphere that draws many to rural Nebraska. With a current population of approximately 1,080 residents and a median household income of $100,417, Bennet represents one of the state’s most affluent small communities.

Current median home values of $399,846 reflect Bennet’s success in establishing itself as a premium suburban community within the Lincoln metropolitan area. The 101% appreciation since 2010 represents substantial wealth creation for homeowners while positioning the community competitively within the regional market. As Lincoln continues to grow and development pressures increase, Bennet’s strategic location and established community amenities suggest continued strong demand for housing in this well-positioned suburb.

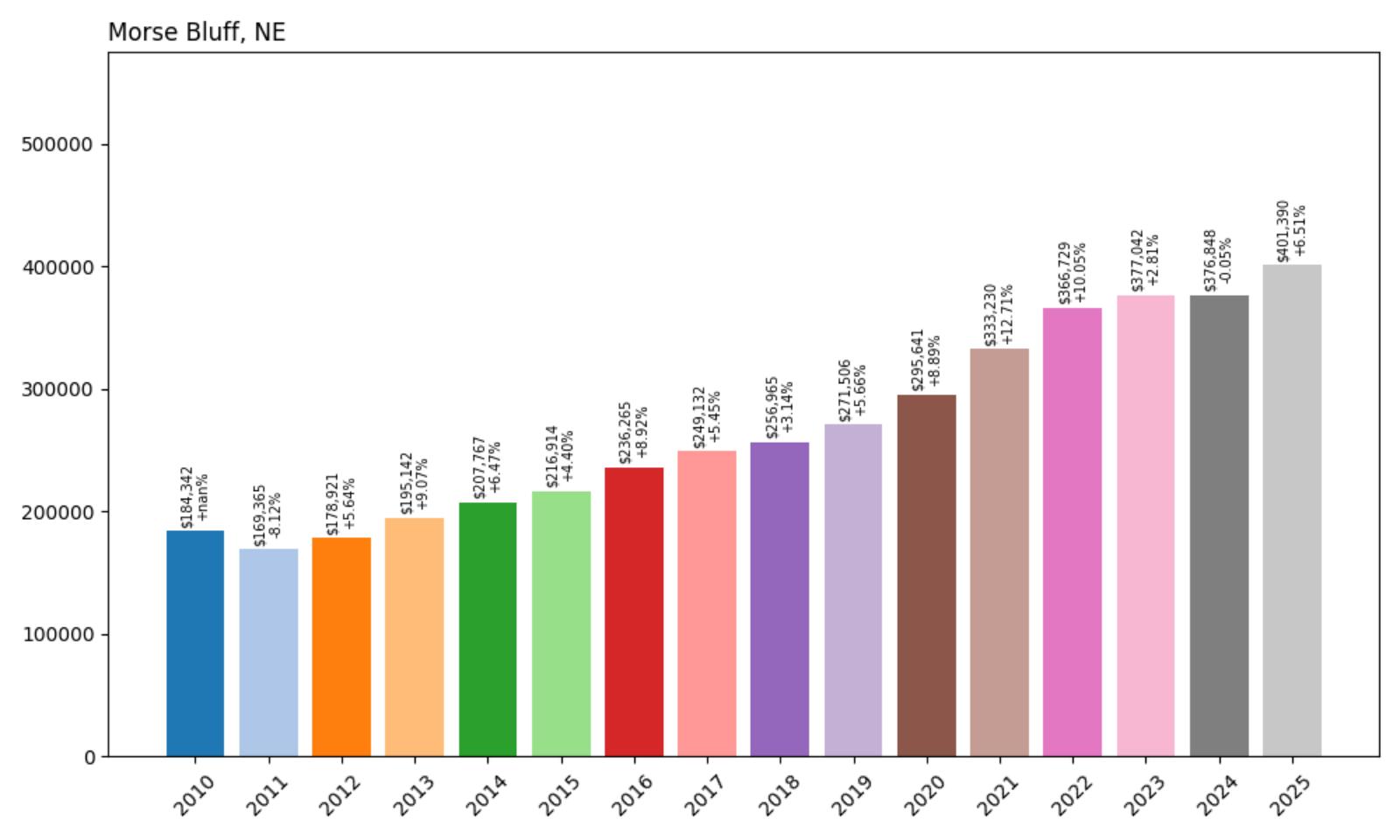

25. Morse Bluff – 118% Home Price Increase Since 2010

Would you like to save this?

- 2010: $184,342

- 2011: $169,365 (−$14,977, −8.12% from previous year)

- 2012: $178,921 (+$9,555, +5.64% from previous year)

- 2013: $195,142 (+$16,221, +9.07% from previous year)

- 2014: $207,767 (+$12,625, +6.47% from previous year)

- 2015: $216,914 (+$9,147, +4.40% from previous year)

- 2016: $236,265 (+$19,351, +8.92% from previous year)

- 2017: $249,132 (+$12,867, +5.45% from previous year)

- 2018: $256,965 (+$7,833, +3.14% from previous year)

- 2019: $271,506 (+$14,541, +5.66% from previous year)

- 2020: $295,641 (+$24,135, +8.89% from previous year)

- 2021: $333,230 (+$37,589, +12.71% from previous year)

- 2022: $366,729 (+$33,500, +10.05% from previous year)

- 2023: $377,042 (+$10,313, +2.81% from previous year)

- 2024: $376,848 (−$194, −0.05% from previous year)

- 2025: $401,390 (+$24,542, +6.51% from previous year)

Morse Bluff’s housing market demonstrates remarkable resilience and long-term growth potential despite experiencing volatility in recent years. After a significant decline in 2011, the community maintained steady appreciation throughout the 2010s before experiencing exceptional growth during the pandemic years. The market showed signs of stabilization in 2024 with a minimal decline, but rebounded strongly in 2025 with over 6% appreciation. This pattern suggests a dynamic market that responds to both local and broader economic conditions while maintaining fundamental strength.

Morse Bluff – Small Town Resilience Meets Market Dynamics

Positioned in Saunders County in eastern Nebraska, Morse Bluff represents the challenges and opportunities facing many small rural communities in the modern housing market. The town’s 118% price appreciation since 2010 reflects its evolution from a deeply affordable rural option to a more recognized residential destination. The community’s small size and rural character provide residents with the authentic Nebraska experience while remaining accessible to larger employment centers and services.

Current median home values of $401,390 position Morse Bluff competitively within Nebraska’s rural housing market, particularly considering the substantial appreciation achieved over the past 15 years. The strong rebound in 2025 suggests continued confidence in the community’s fundamentals and growth potential. For buyers seeking authentic rural experiences with investment potential, Morse Bluff’s track record demonstrates the rewards available to those who recognize value in smaller communities before broader market recognition drives prices higher.

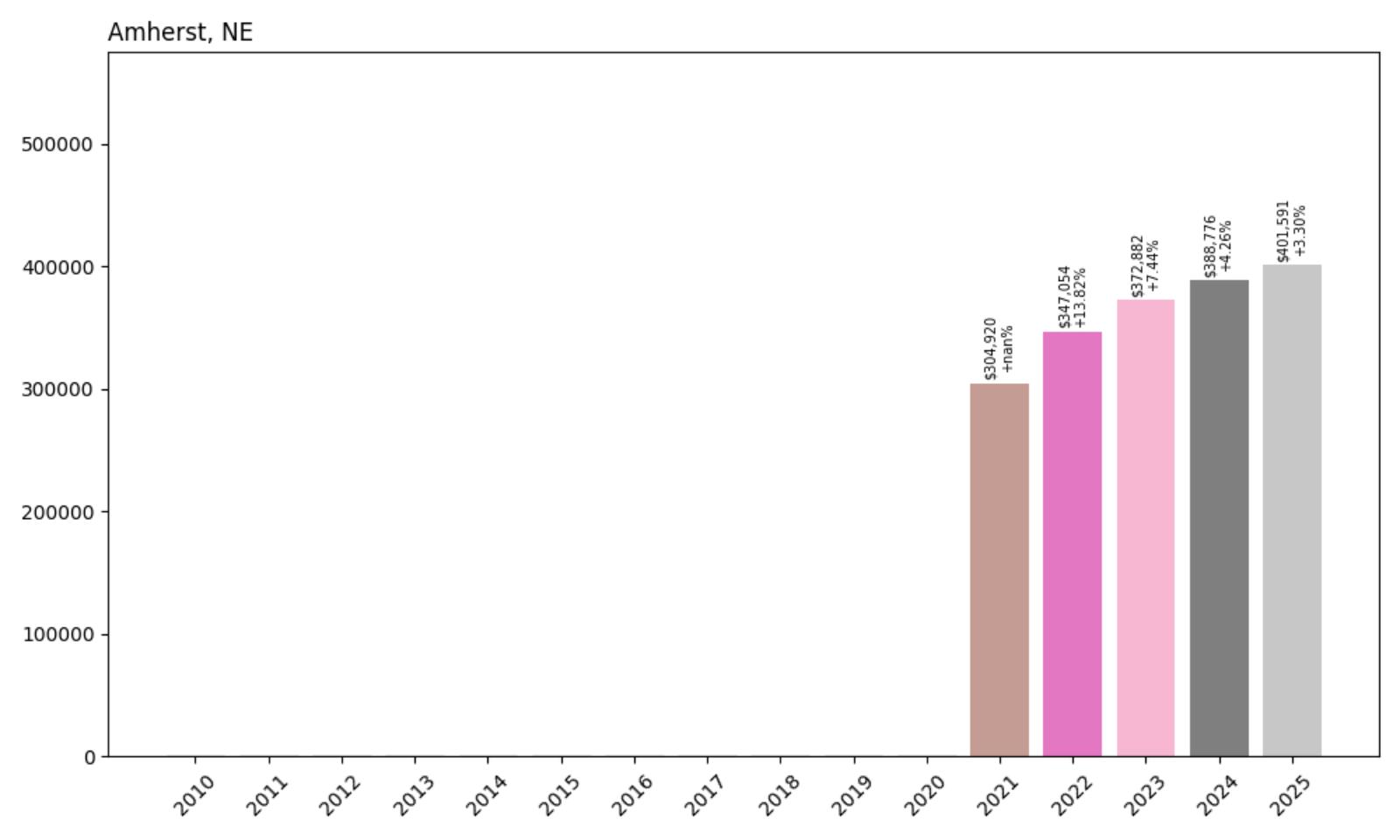

24. Amherst – 32% Home Price Increase Since 2021

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: $304,920

- 2022: $347,054 (+$42,134, +13.82% from previous year)

- 2023: $372,882 (+$25,828, +7.44% from previous year)

- 2024: $388,776 (+$15,894, +4.26% from previous year)

- 2025: $401,591 (+$12,816, +3.30% from previous year)

Amherst’s limited housing data beginning in 2021 reveals a community experiencing steady appreciation as it establishes its presence in the regional housing market. The town demonstrated strong initial growth with a 13.82% increase in 2022, followed by more moderate but consistent annual appreciation. The progressive moderation from 13.82% to 3.30% suggests a market finding its natural equilibrium while maintaining positive momentum. The 32% cumulative increase over four years indicates healthy demand and successful community development.

Amherst – Emerging Market Finds Its Footing

As one of the newer entries in Nebraska’s housing data, Amherst represents the ongoing development of residential markets in smaller communities across the state. The appearance of reliable housing data beginning in 2021 suggests either recent incorporation or the achievement of sufficient housing stock to generate meaningful market statistics. Located in Buffalo County in central Nebraska, Amherst benefits from its position within the state’s agricultural heartland while developing its identity as a residential destination.

Current median home values of $401,591 position Amherst competitively within Nebraska’s emerging housing markets, particularly considering the community’s recent establishment in regional real estate data. The 32% appreciation since 2021, while substantial, reflects the natural progression of a community finding its market value as amenities and infrastructure develop. For buyers interested in ground-floor opportunities in developing communities, Amherst’s track record suggests potential for continued stable appreciation as the town further establishes its regional presence.

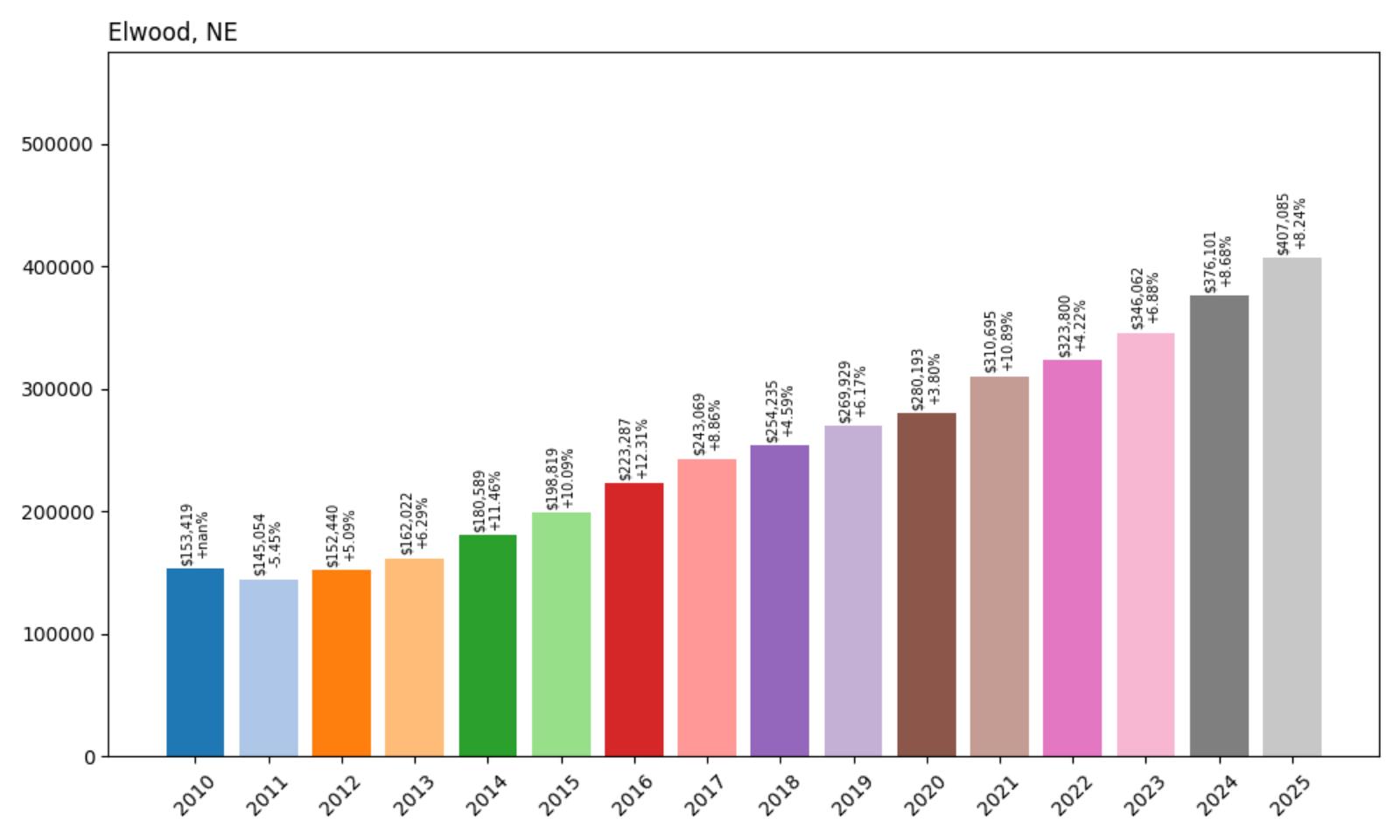

23. Elwood – 165% Home Price Increase Since 2010

- 2010: $153,419

- 2011: $145,054 (−$8,365, −5.45% from previous year)

- 2012: $152,440 (+$7,386, +5.09% from previous year)

- 2013: $162,022 (+$9,582, +6.29% from previous year)

- 2014: $180,589 (+$18,567, +11.46% from previous year)

- 2015: $198,819 (+$18,230, +10.09% from previous year)

- 2016: $223,287 (+$24,467, +12.31% from previous year)

- 2017: $243,069 (+$19,782, +8.86% from previous year)

- 2018: $254,235 (+$11,166, +4.59% from previous year)

- 2019: $269,929 (+$15,694, +6.17% from previous year)

- 2020: $280,193 (+$10,264, +3.80% from previous year)

- 2021: $310,695 (+$30,503, +10.89% from previous year)

- 2022: $323,800 (+$13,105, +4.22% from previous year)

- 2023: $346,062 (+$22,262, +6.88% from previous year)

- 2024: $376,101 (+$30,039, +8.68% from previous year)

- 2025: $407,085 (+$30,983, +8.24% from previous year)

Elwood presents one of the most impressive appreciation stories in Nebraska’s housing market, with home values increasing by 165% since 2010. The town experienced exceptional growth during the mid-2010s, with three consecutive years of double-digit appreciation from 2014-2016 that established strong momentum. Recent years have shown renewed acceleration, with 2024 and 2025 delivering the largest dollar increases on record at over $30,000 annually. This pattern suggests both fundamental market strength and increasing recognition of the community’s value proposition.

Elwood – Exceptional Growth Story Continues

Located in Gosper County in south-central Nebraska, Elwood has emerged as one of the state’s most successful small-town housing markets, transforming from one of the most affordable communities to a competitively priced destination. The 165% appreciation represents extraordinary wealth creation for homeowners who recognized the community’s potential early in the decade. Starting from a median home value of just $153,419 in 2010, Elwood has attracted buyers seeking rural amenities, community connection, and significant appreciation potential.

Current median home values of $407,085 represent a remarkable transformation from the community’s affordable roots while maintaining competitiveness within the regional market. The recent acceleration in appreciation, with back-to-back years of 8%+ growth, suggests continued strong demand and limited inventory that supports pricing power. For buyers seeking communities with proven appreciation potential and authentic rural character, Elwood’s track record demonstrates the potential rewards of investing in well-positioned small towns before broader market recognition.

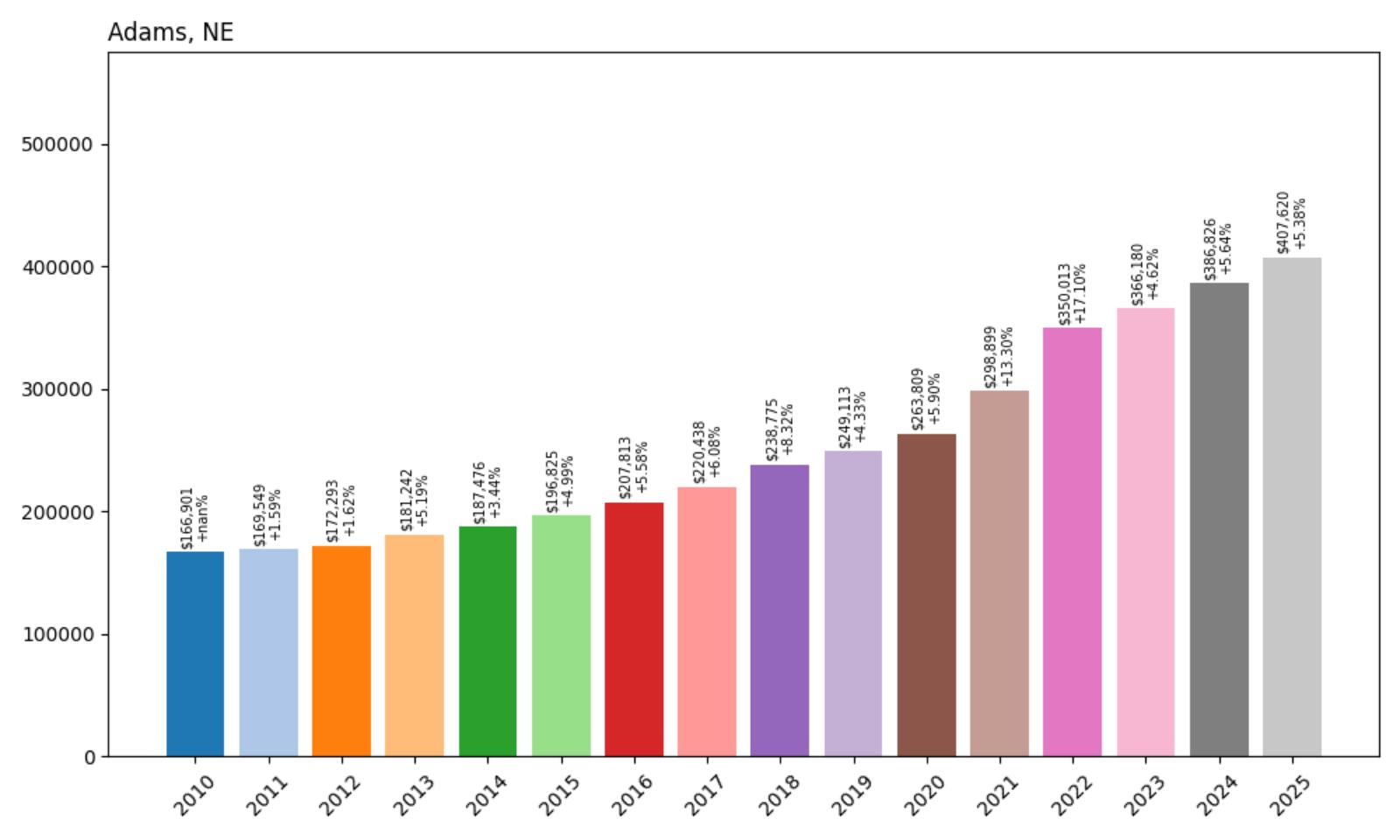

22. Adams – 144% Home Price Increase Since 2010

- 2010: $166,901

- 2011: $169,549 (+$2,648, +1.59% from previous year)

- 2012: $172,293 (+$2,744, +1.62% from previous year)

- 2013: $181,242 (+$8,949, +5.19% from previous year)

- 2014: $187,476 (+$6,235, +3.44% from previous year)

- 2015: $196,825 (+$9,348, +4.99% from previous year)

- 2016: $207,813 (+$10,988, +5.58% from previous year)

- 2017: $220,438 (+$12,625, +6.08% from previous year)

- 2018: $238,775 (+$18,337, +8.32% from previous year)

- 2019: $249,113 (+$10,339, +4.33% from previous year)

- 2020: $263,809 (+$14,696, +5.90% from previous year)

- 2021: $298,899 (+$35,090, +13.30% from previous year)

- 2022: $350,013 (+$51,114, +17.10% from previous year)

- 2023: $366,180 (+$16,166, +4.62% from previous year)

- 2024: $386,826 (+$20,646, +5.64% from previous year)

- 2025: $407,620 (+$20,794, +5.38% from previous year)

Adams demonstrates exceptional consistency in housing appreciation, with positive growth in every year tracked and no significant downturns throughout the 15-year period. The community achieved its strongest performance in 2022 with a remarkable 17.10% increase that added over $51,000 to median home values. While growth has moderated since then, the town continues to deliver solid appreciation above 5% annually. The 144% cumulative increase represents more than a doubling of home values, establishing Adams among Nebraska’s most successful small-town housing markets.

Adams – Consistent Growth Builds Long-Term Value

Positioned in Gage County in southeastern Nebraska, Adams has established itself as a model of steady, sustainable housing appreciation that rewards long-term homeowners while attracting new residents seeking value and stability. The community’s remarkable track record of 15 consecutive years of appreciation reflects both strong local fundamentals and effective community development that maintains appeal across different market conditions. Starting from a modest median home value of $166,901 in 2010, Adams has evolved into a recognized destination for buyers seeking rural Nebraska living with investment potential.

Current median home values of $407,620 reflect Adams’ successful evolution from an affordable rural option to a competitive small-town market that delivers both lifestyle benefits and financial returns. The 144% appreciation since 2010 represents substantial wealth creation for homeowners while establishing price points that remain attractive relative to urban alternatives. For buyers seeking communities with proven track records of consistent appreciation and strong fundamentals, Adams demonstrates the value proposition of well-managed small-town markets in Nebraska’s housing landscape.

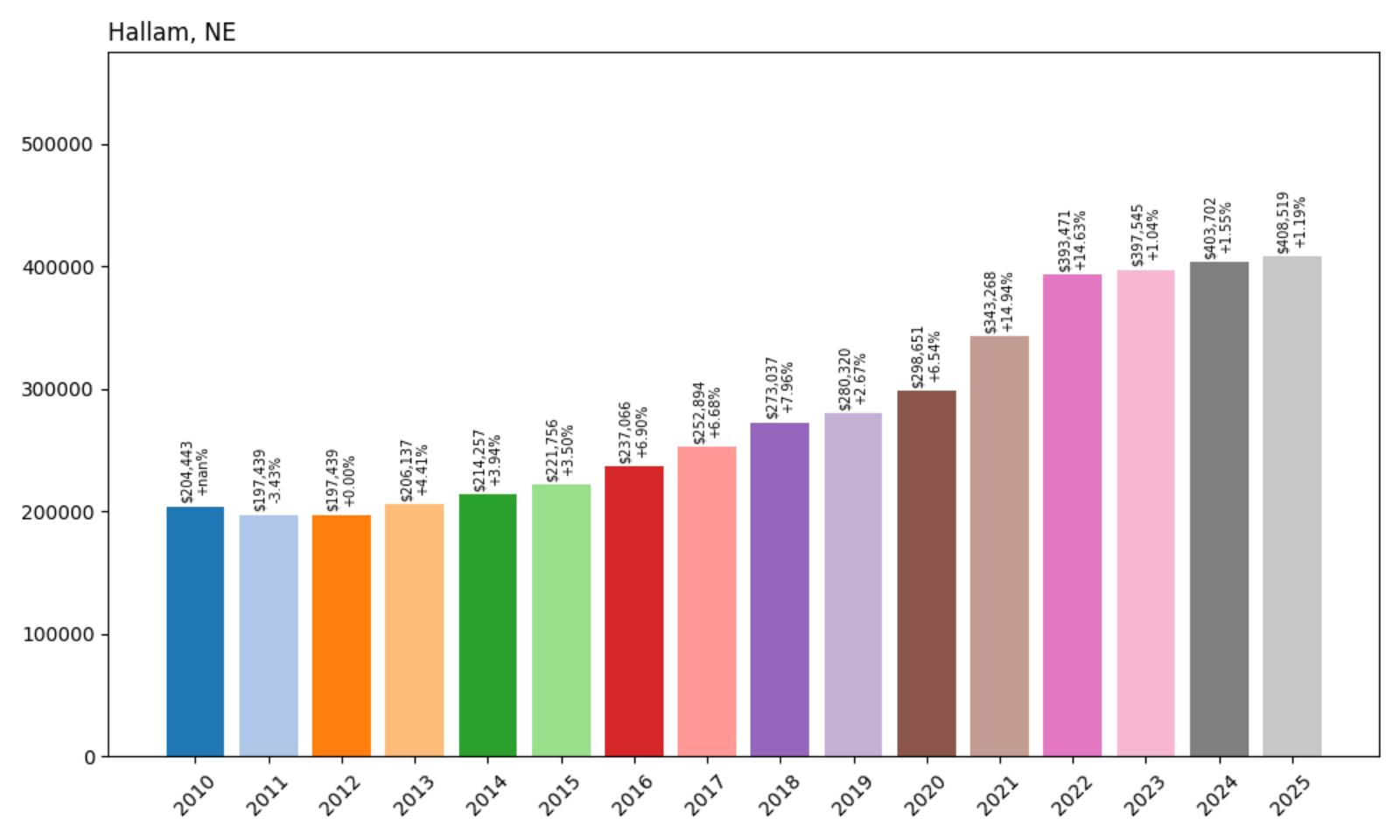

21. Hallam – 100% Home Price Increase Since 2010

- 2010: $204,443

- 2011: $197,439 (−$7,005, −3.43% from previous year)

- 2012: $197,439 (+$0, +0.00% from previous year)

- 2013: $206,137 (+$8,698, +4.41% from previous year)

- 2014: $214,257 (+$8,120, +3.94% from previous year)

- 2015: $221,756 (+$7,499, +3.50% from previous year)

- 2016: $237,066 (+$15,310, +6.90% from previous year)

- 2017: $252,894 (+$15,828, +6.68% from previous year)

- 2018: $273,037 (+$20,143, +7.96% from previous year)

- 2019: $280,320 (+$7,283, +2.67% from previous year)

- 2020: $298,651 (+$18,331, +6.54% from previous year)

- 2021: $343,268 (+$44,617, +14.94% from previous year)

- 2022: $393,471 (+$50,203, +14.63% from previous year)

- 2023: $397,545 (+$4,074, +1.04% from previous year)

- 2024: $403,702 (+$6,157, +1.55% from previous year)

- 2025: $408,519 (+$4,818, +1.19% from previous year)

Hallam’s housing market demonstrates remarkable resilience and steady long-term appreciation, achieving an exact doubling of home values since 2010. The community experienced early challenges with a decline in 2011 and flat performance in 2012, but recovered to maintain consistent growth throughout the remainder of the decade. The pandemic years brought exceptional acceleration, with 2021 and 2022 delivering the largest increases on record at nearly 15% annually. Recent years show a natural moderation as the market matures, but the 100% cumulative increase represents significant wealth creation for homeowners.

Hallam – Small Village, Big Appreciation

Located in Lancaster County as part of the Lincoln Metropolitan Statistical Area, Hallam represents the success story of Nebraska’s smallest communities in attracting investment and residential interest. With a current population of approximately 292 residents, this tiny village has achieved outsized housing appreciation through its combination of rural charm, proximity to Lincoln, and strong community character. The village was originally platted in 1892 when the Chicago, Rock Island and Pacific Railroad was extended to the area, and its name derives from a transcription error at the post office that changed “Hallau” (after the Swiss hometown of early settler Jacob Schadd) to “Hallam.”

Despite its small size, Hallam offers residents a high quality of life with a median household income of $96,250 and low poverty rates of just 3.7%. The community’s appeal lies in its authentic small-town atmosphere while maintaining convenient access to Lincoln’s employment opportunities and amenities. The village’s 81.9% homeownership rate reflects the stability and commitment of residents who have chosen this rural lifestyle. With an average commute time of 34.9 minutes to Lincoln, Hallam provides an attractive alternative for those seeking space and tranquility without sacrificing career opportunities.

Current median home values of $408,519 represent a remarkable achievement for a community that started the decade at $204,443. The 100% appreciation demonstrates that even the smallest Nebraska communities can deliver substantial returns when they offer genuine lifestyle benefits and strategic positioning. The recent moderation in appreciation rates suggests a market finding its natural equilibrium while maintaining the fundamental appeal that has driven consistent demand. For buyers seeking authentic rural experiences with proven appreciation potential, Hallam’s track record illustrates the investment potential in well-positioned small communities.

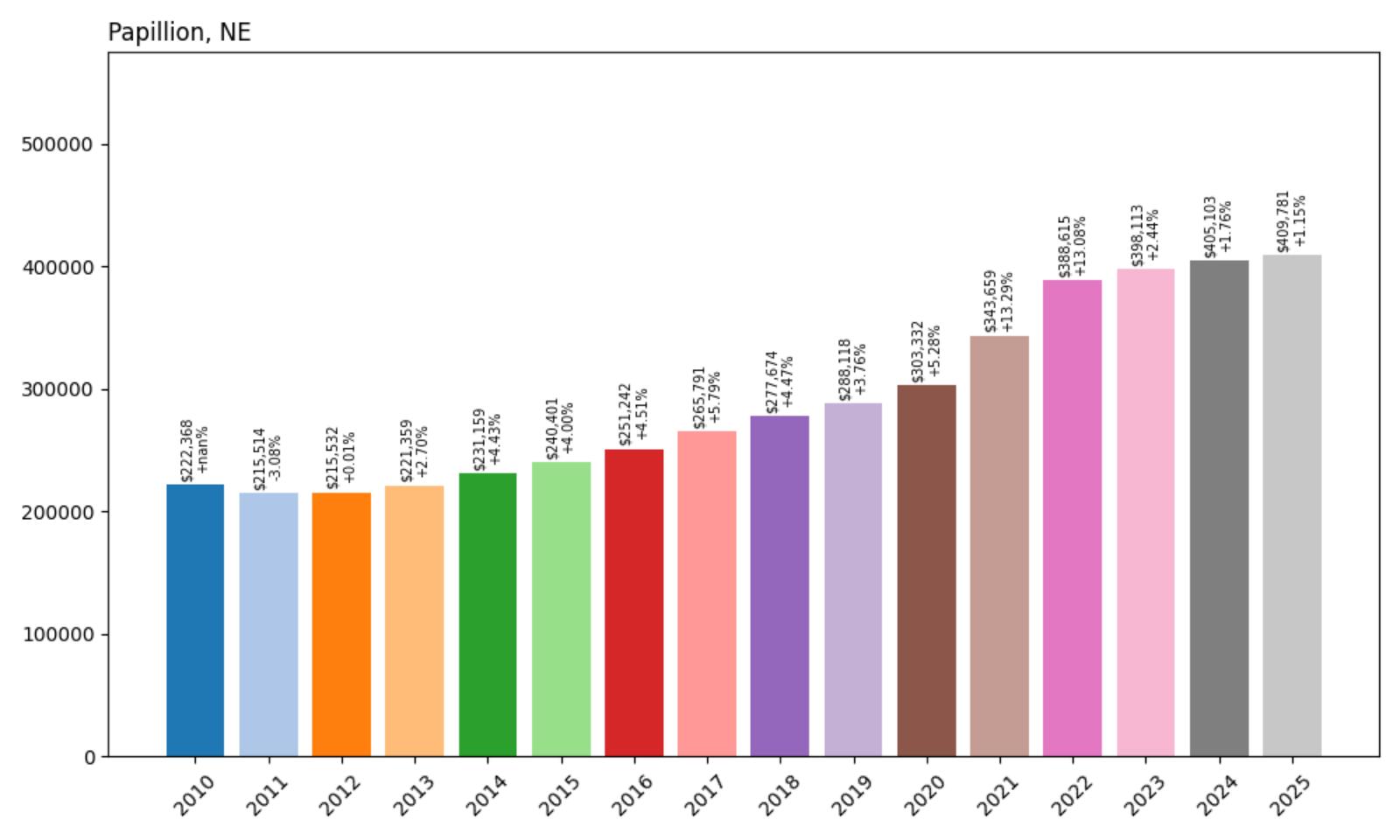

20. Papillion – 84% Home Price Increase Since 2010

- 2010: $222,368

- 2011: $215,514 (−$6,854, −3.08% from previous year)

- 2012: $215,532 (+$18, +0.01% from previous year)

- 2013: $221,359 (+$5,826, +2.70% from previous year)

- 2014: $231,159 (+$9,800, +4.43% from previous year)

- 2015: $240,401 (+$9,242, +4.00% from previous year)

- 2016: $251,242 (+$10,841, +4.51% from previous year)

- 2017: $265,791 (+$14,550, +5.79% from previous year)

- 2018: $277,674 (+$11,882, +4.47% from previous year)

- 2019: $288,118 (+$10,444, +3.76% from previous year)

- 2020: $303,332 (+$15,214, +5.28% from previous year)

- 2021: $343,659 (+$40,328, +13.29% from previous year)

- 2022: $388,615 (+$44,955, +13.08% from previous year)

- 2023: $398,113 (+$9,498, +2.44% from previous year)

- 2024: $405,103 (+$6,990, +1.76% from previous year)

- 2025: $409,781 (+$4,679, +1.15% from previous year)

Papillion’s housing market reflects the stability and steady growth characteristic of established suburban communities. After early struggles in 2011-2012, the city maintained consistent annual appreciation throughout the decade before experiencing significant acceleration during the pandemic years. The 2021-2022 period brought the strongest performance with back-to-back years of over 13% appreciation, adding nearly $85,000 to median home values. Recent years show a natural cooling as the market stabilizes, but the 84% cumulative increase demonstrates the community’s fundamental strength and appeal.

Papillion – Suburban Stability Meets Market Dynamics

As one of Nebraska’s largest suburbs and a key component of the Omaha metropolitan area, Papillion has established itself as a premier residential destination that combines suburban amenities with excellent schools and strategic location. The city’s position in Sarpy County provides residents with easy access to Omaha’s employment centers while maintaining the community feel and quality of life that attracts families. Papillion’s well-developed infrastructure, parks system, and civic amenities create an environment that consistently attracts homebuyers seeking established suburban living.

Current median home values of $409,781 position Papillion competitively within the Omaha metropolitan housing market while reflecting the premium buyers are willing to pay for the community’s amenities and reputation. The 84% appreciation since 2010 represents solid wealth building for homeowners while maintaining accessibility for buyers seeking established suburban communities. As the Omaha metro continues to grow and development pressures increase, Papillion’s established character and strategic location suggest continued strength in the housing market.

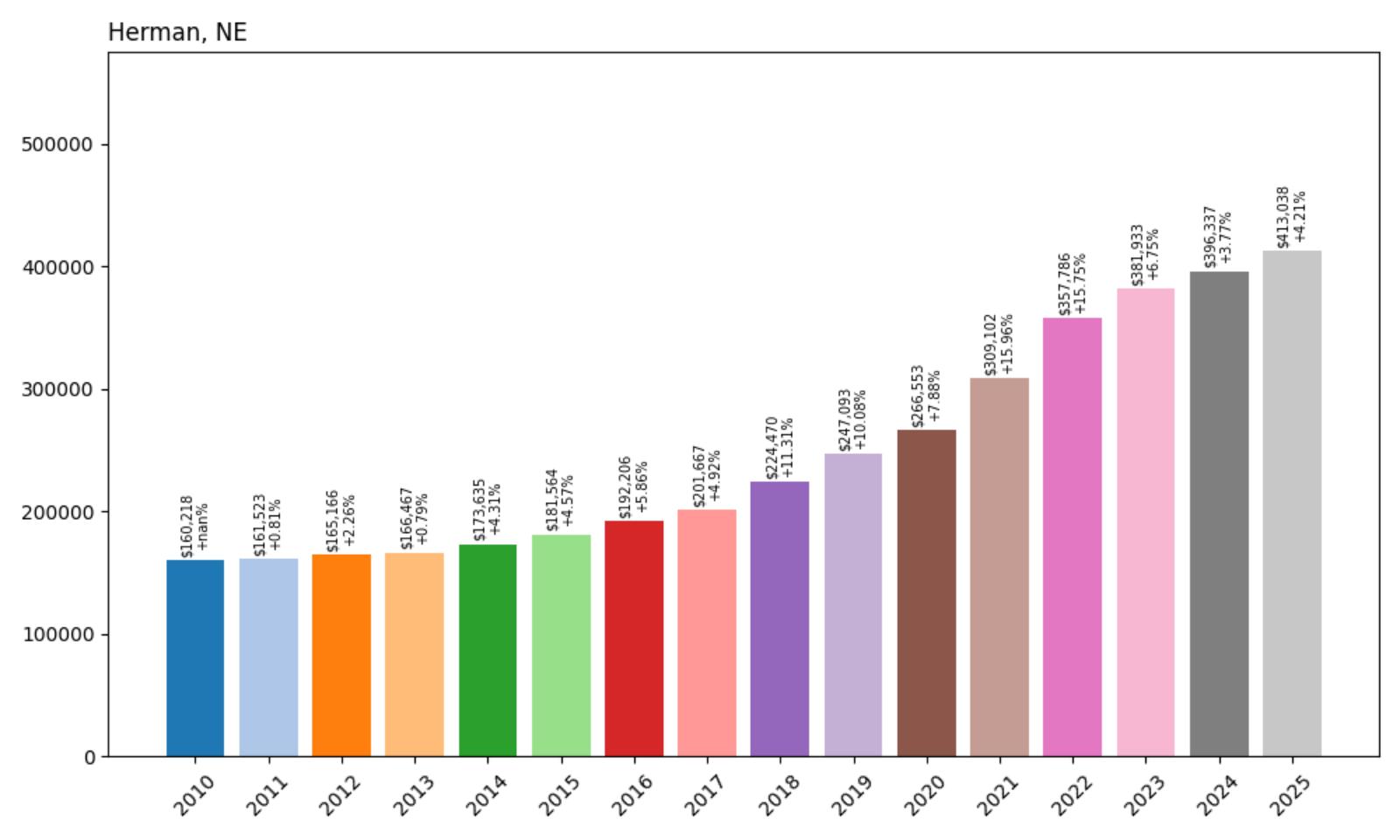

19. Herman – 158% Home Price Increase Since 2010

- 2010: $160,218

- 2011: $161,523 (+$1,305, +0.81% from previous year)

- 2012: $165,166 (+$3,643, +2.26% from previous year)

- 2013: $166,467 (+$1,301, +0.79% from previous year)

- 2014: $173,635 (+$7,168, +4.31% from previous year)

- 2015: $181,564 (+$7,929, +4.57% from previous year)

- 2016: $192,206 (+$10,642, +5.86% from previous year)

- 2017: $201,667 (+$9,461, +4.92% from previous year)

- 2018: $224,470 (+$22,804, +11.31% from previous year)

- 2019: $247,093 (+$22,623, +10.08% from previous year)

- 2020: $266,553 (+$19,460, +7.88% from previous year)

- 2021: $309,102 (+$42,549, +15.96% from previous year)

- 2022: $357,786 (+$48,684, +15.75% from previous year)

- 2023: $381,933 (+$24,148, +6.75% from previous year)

- 2024: $396,337 (+$14,403, +3.77% from previous year)

- 2025: $413,038 (+$16,702, +4.21% from previous year)

Herman presents one of Nebraska’s most impressive housing appreciation stories, with home values increasing by 158% since 2010. The community experienced modest growth in the early 2010s before accelerating significantly in 2018-2019 with consecutive years of double-digit appreciation. The pandemic years brought exceptional growth, with 2021 and 2022 delivering the strongest performance at nearly 16% annually. While recent years show moderation, the sustained positive momentum and 158% cumulative increase demonstrate the community’s transformation from an affordable rural option to a recognized residential destination.

Herman – Rural Transformation Success Story

Located in Washington County in eastern Nebraska, Herman exemplifies the successful transformation of small rural communities in the modern housing market. Starting from one of the most affordable median home values in 2010 at just $160,218, the town has attracted buyers seeking rural amenities, community connection, and significant appreciation potential. The community’s agricultural heritage and small-town character provide residents with authentic Nebraska living while maintaining reasonable access to regional employment centers and services.

Current median home values of $413,038 represent a complete transformation from Herman’s position as one of Nebraska’s most affordable communities to a competitively priced rural destination. The recent reacceleration in appreciation, with 2025 showing over 4% growth, suggests continued buyer confidence and limited inventory that supports pricing power. For buyers seeking rural Nebraska communities with proven track records of exceptional appreciation, Herman’s 158% increase demonstrates the potential rewards of investing in well-positioned small towns.

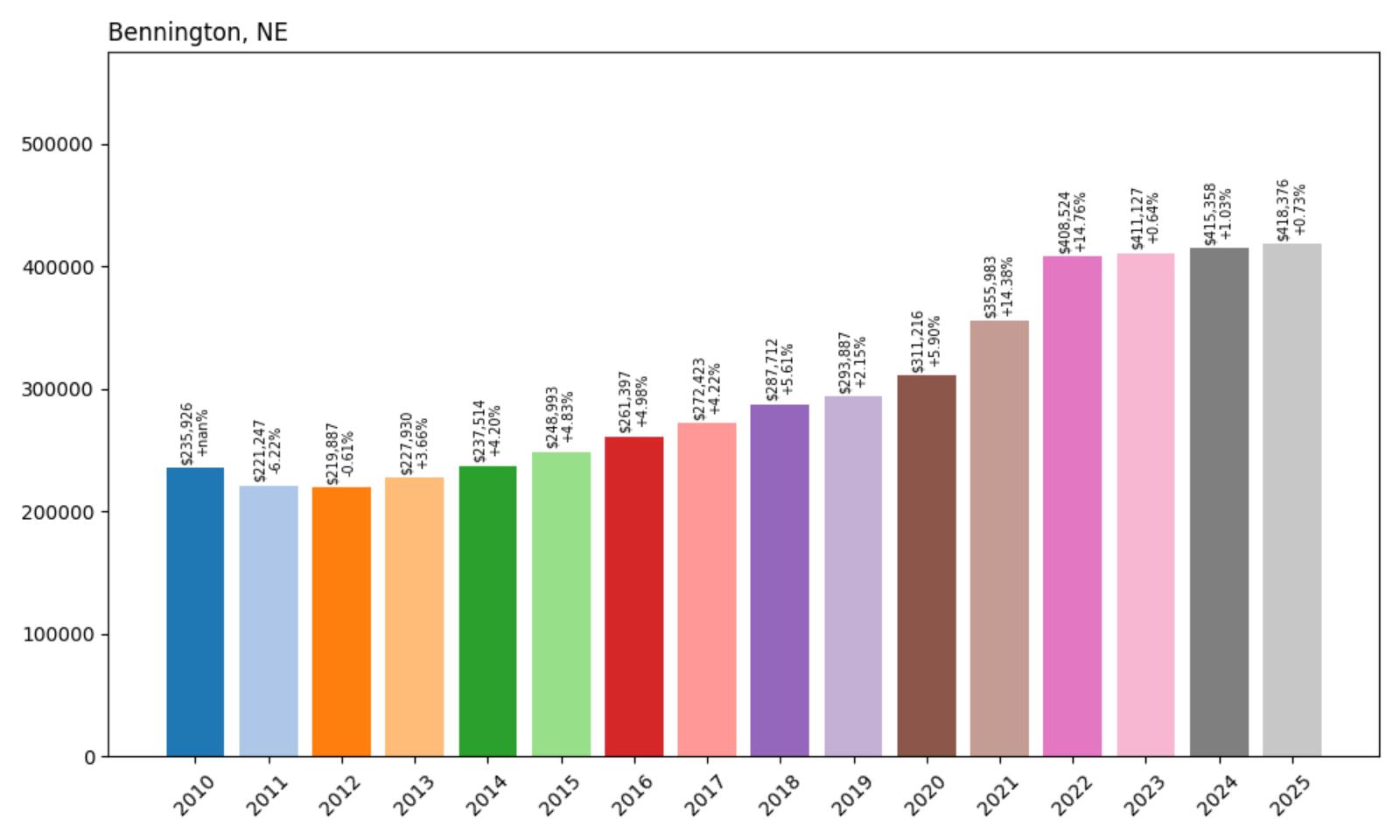

18. Bennington – 77% Home Price Increase Since 2010

- 2010: $235,926

- 2011: $221,247 (−$14,679, −6.22% from previous year)

- 2012: $219,887 (−$1,359, −0.61% from previous year)

- 2013: $227,930 (+$8,043, +3.66% from previous year)

- 2014: $237,514 (+$9,584, +4.20% from previous year)

- 2015: $248,993 (+$11,480, +4.83% from previous year)

- 2016: $261,397 (+$12,404, +4.98% from previous year)

- 2017: $272,423 (+$11,026, +4.22% from previous year)

- 2018: $287,712 (+$15,289, +5.61% from previous year)

- 2019: $293,887 (+$6,175, +2.15% from previous year)

- 2020: $311,216 (+$17,329, +5.90% from previous year)

- 2021: $355,983 (+$44,767, +14.38% from previous year)

- 2022: $408,524 (+$52,541, +14.76% from previous year)

- 2023: $411,127 (+$2,604, +0.64% from previous year)

- 2024: $415,358 (+$4,231, +1.03% from previous year)

- 2025: $418,376 (+$3,018, +0.73% from previous year)

Bennington’s housing market demonstrates the characteristics of a mature suburban community with steady long-term appreciation punctuated by periods of exceptional growth. After experiencing early declines in 2011-2012, the city recovered and maintained consistent annual increases throughout the late 2010s. The pandemic years brought remarkable acceleration, with 2021 and 2022 adding nearly $100,000 to median home values in consecutive years. Recent performance shows stabilization at higher price levels, with the 77% cumulative increase reflecting the community’s established position in the Omaha metropolitan market.

Bennington – Established Suburban Excellence

As one of the Omaha metropolitan area’s most established suburban communities, Bennington has built a reputation for quality schools, family-friendly neighborhoods, and strong civic leadership that consistently attracts homebuyers seeking suburban stability. Located in Douglas County, the city benefits from excellent access to Omaha’s employment centers while maintaining its own distinct community identity and small-town feel. Bennington’s well-developed infrastructure, recreational amenities, and commitment to planned growth have created an environment that appeals to families across multiple generations.

Current median home values of $418,376 reflect Bennington’s position as a premium suburban destination within the Omaha metropolitan housing market. The 77% appreciation since 2010 represents solid wealth creation for homeowners while establishing price points that reflect the community’s amenities and desirability. As one of the region’s most established suburban communities, Bennington’s housing market benefits from both its proven track record and its continued appeal to buyers seeking quality suburban living with metropolitan convenience.

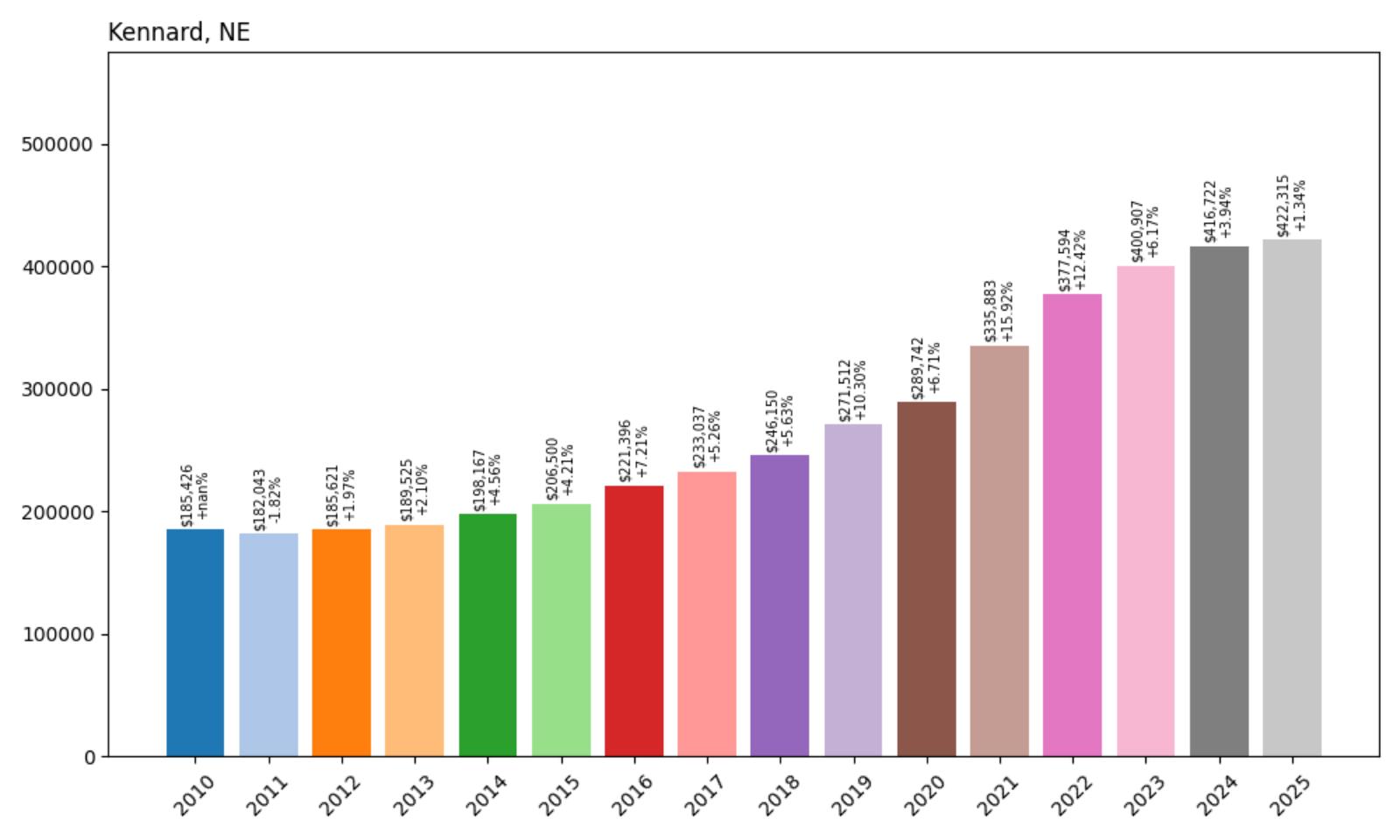

17. Kennard – 128% Home Price Increase Since 2010

- 2010: $185,426

- 2011: $182,043 (−$3,383, −1.82% from previous year)

- 2012: $185,621 (+$3,578, +1.97% from previous year)

- 2013: $189,525 (+$3,904, +2.10% from previous year)

- 2014: $198,167 (+$8,642, +4.56% from previous year)

- 2015: $206,500 (+$8,333, +4.21% from previous year)

- 2016: $221,396 (+$14,896, +7.21% from previous year)

- 2017: $233,037 (+$11,641, +5.26% from previous year)

- 2018: $246,150 (+$13,113, +5.63% from previous year)

- 2019: $271,512 (+$25,362, +10.30% from previous year)

- 2020: $289,742 (+$18,230, +6.71% from previous year)

- 2021: $335,883 (+$46,140, +15.92% from previous year)

- 2022: $377,594 (+$41,711, +12.42% from previous year)

- 2023: $400,907 (+$23,313, +6.17% from previous year)

- 2024: $416,722 (+$15,814, +3.94% from previous year)

- 2025: $422,315 (+$5,593, +1.34% from previous year)

Kennard’s housing market showcases steady long-term appreciation with periods of exceptional growth, achieving a 128% increase since 2010. The community maintained modest but consistent growth through the early-to-mid 2010s before accelerating significantly in 2019 with over 10% appreciation. The pandemic years brought outstanding performance, with 2021 delivering nearly 16% growth and 2022 adding over 12%. While recent years show natural moderation as the market matures, the sustained positive trajectory demonstrates the community’s fundamental appeal and investment potential.

Kennard – Small Town Big Returns

Located in Washington County in eastern Nebraska, Kennard represents the success of small rural communities that have successfully adapted to changing demographics and housing preferences. The town’s 128% appreciation since 2010 reflects its transformation from an affordable rural option to a recognized residential destination that attracts buyers seeking authentic small-town living with significant investment potential. Starting from a modest median home value of $185,426, Kennard has proven that strategic location and community character can drive substantial value creation over time.

Current median home values of $422,315 represent remarkable wealth creation for long-term residents while positioning Kennard as an attractive option for buyers seeking small-town Nebraska living with proven appreciation potential. The recent moderation in growth rates, while still positive, suggests a market finding its natural equilibrium after years of exceptional performance. For buyers considering rural Nebraska communities, Kennard’s track record demonstrates the investment potential available in well-positioned small towns that offer both lifestyle benefits and financial returns.

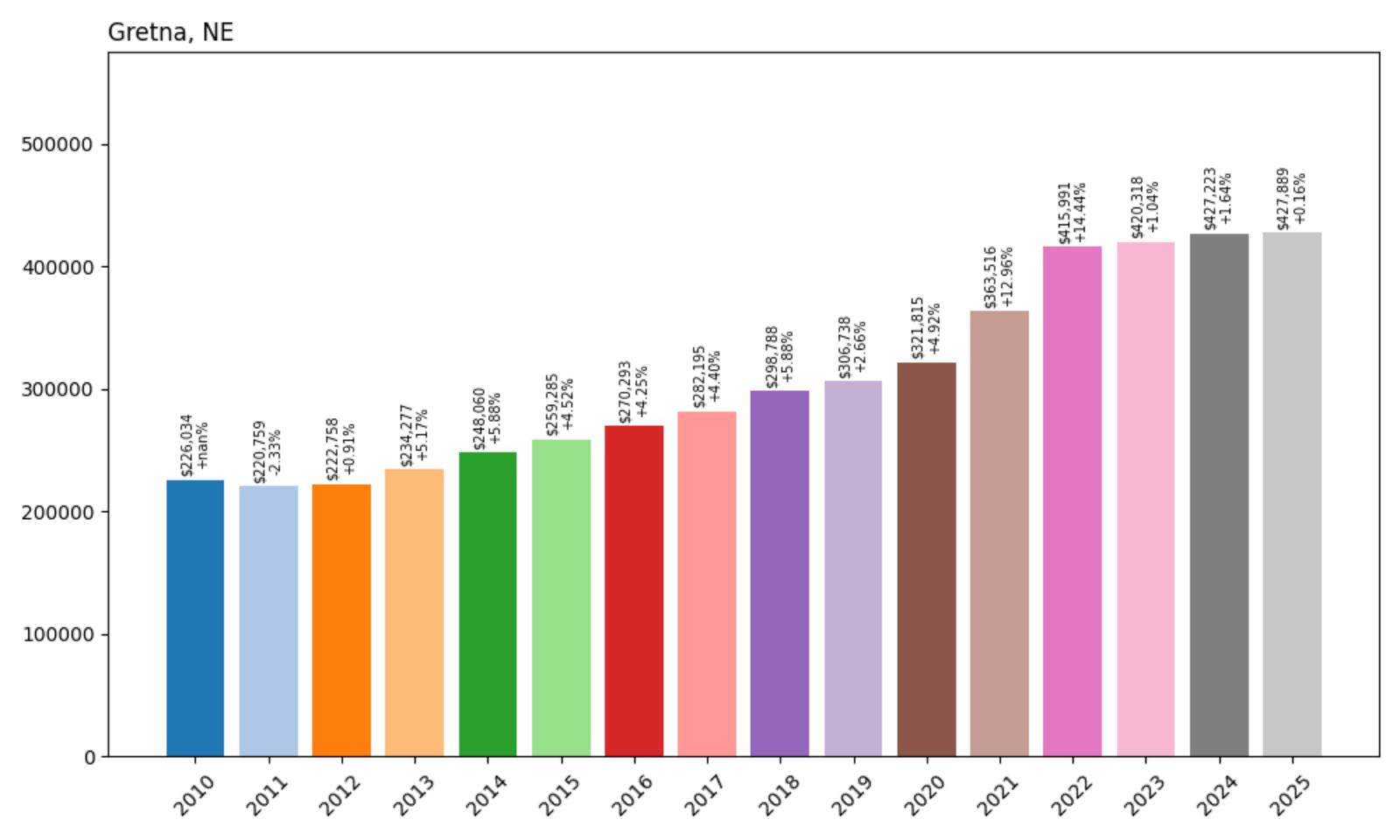

16. Gretna – 89% Home Price Increase Since 2010

- 2010: $226,034

- 2011: $220,759 (−$5,275, −2.33% from previous year)

- 2012: $222,758 (+$1,998, +0.91% from previous year)

- 2013: $234,277 (+$11,520, +5.17% from previous year)

- 2014: $248,060 (+$13,783, +5.88% from previous year)

- 2015: $259,285 (+$11,224, +4.52% from previous year)

- 2016: $270,293 (+$11,008, +4.25% from previous year)

- 2017: $282,195 (+$11,902, +4.40% from previous year)

- 2018: $298,788 (+$16,593, +5.88% from previous year)

- 2019: $306,738 (+$7,950, +2.66% from previous year)

- 2020: $321,815 (+$15,077, +4.92% from previous year)

- 2021: $363,516 (+$41,702, +12.96% from previous year)

- 2022: $415,991 (+$52,475, +14.44% from previous year)

- 2023: $420,318 (+$4,327, +1.04% from previous year)

- 2024: $427,223 (+$6,905, +1.64% from previous year)

- 2025: $427,889 (+$666, +0.16% from previous year)

Gretna’s housing market reflects the characteristics of a premium suburban destination that has achieved steady long-term appreciation while maintaining stability through various market cycles. The community demonstrated remarkable consistency throughout the 2010s with annual appreciation rates typically ranging from 4-6%. The pandemic years brought exceptional performance, with 2021 and 2022 adding nearly $95,000 to median home values in consecutive years. Recent years show stabilization at higher price levels, with minimal growth suggesting a mature market that has reached equilibrium. The 89% cumulative increase represents substantial wealth creation for homeowners.

Gretna – Premium Suburban Destination

As one of the Omaha metropolitan area’s most desirable suburban communities, Gretna has established itself as a premier destination for families seeking excellent schools, modern amenities, and strategic location. Located in Sarpy County, the city has grown rapidly from its railroad origins in 1886 to become a thriving community of over 9,000 residents with a median household income of $118,765. Gretna’s appeal lies in its combination of small-town charm and metropolitan accessibility, offering residents high-quality schools, recreational facilities, and a strong sense of community while maintaining easy access to Omaha’s employment centers.

Current median home values of $427,889 position Gretna at the premium end of the Omaha metropolitan housing market, reflecting the community’s reputation for quality and desirability. The 89% appreciation since 2010 represents solid wealth building for homeowners while establishing price points that reflect the community’s comprehensive amenities and strategic location. As one of the region’s fastest-growing communities, with ongoing infrastructure investments including a $50 million recreational complex, Gretna’s housing market benefits from both established appeal and continued development that supports long-term value retention.

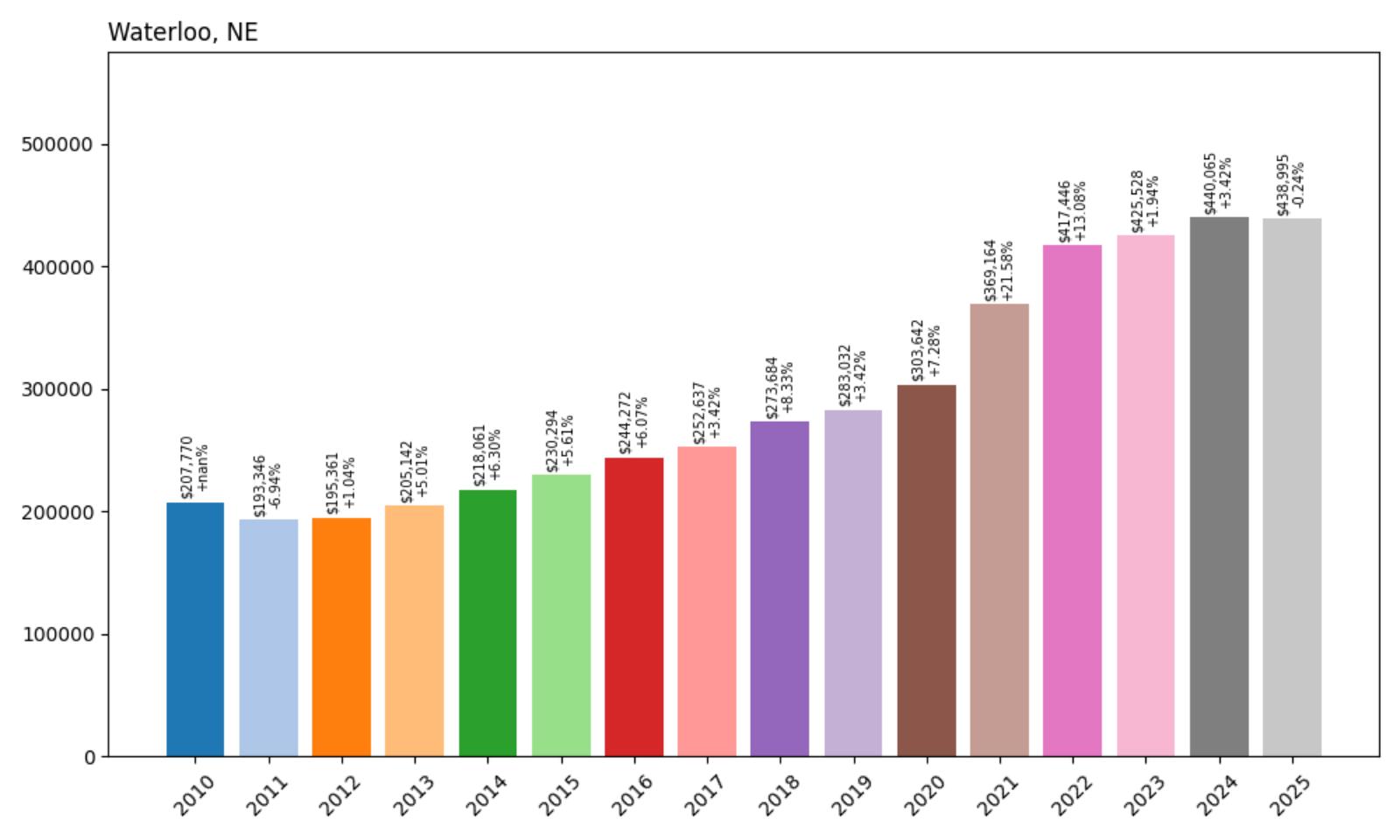

15. Waterloo – 111% Home Price Increase Since 2010

- 2010: $207,770

- 2011: $193,346 (−$14,424, −6.94% from previous year)

- 2012: $195,361 (+$2,016, +1.04% from previous year)

- 2013: $205,142 (+$9,781, +5.01% from previous year)

- 2014: $218,061 (+$12,919, +6.30% from previous year)

- 2015: $230,294 (+$12,233, +5.61% from previous year)

- 2016: $244,272 (+$13,978, +6.07% from previous year)

- 2017: $252,637 (+$8,364, +3.42% from previous year)

- 2018: $273,684 (+$21,048, +8.33% from previous year)

- 2019: $283,032 (+$9,348, +3.42% from previous year)

- 2020: $303,642 (+$20,610, +7.28% from previous year)

- 2021: $369,164 (+$65,522, +21.58% from previous year)

- 2022: $417,446 (+$48,282, +13.08% from previous year)

- 2023: $425,528 (+$8,082, +1.94% from previous year)

- 2024: $440,065 (+$14,537, +3.42% from previous year)

- 2025: $438,995 (−$1,070, −0.24% from previous year)

Waterloo’s housing market demonstrates exceptional long-term appreciation punctuated by periods of remarkable growth, achieving a 111% increase since 2010. After recovering from early challenges in 2011, the community maintained steady annual appreciation through the 2010s before experiencing extraordinary acceleration during the pandemic years. The 2021 performance stands out with a remarkable 21.58% increase, representing one of the strongest single-year appreciations in the dataset. The slight decline in 2025 marks the first negative year since the initial recovery, potentially signaling a natural market correction after years of exceptional growth.

Waterloo – Small Town Big Gains

Positioned in Douglas County within the Omaha metropolitan area, Waterloo represents the success story of smaller communities that have benefited from suburban expansion and changing residential preferences. The town’s strategic location provides residents with small-town charm while maintaining reasonable access to Omaha’s employment centers and amenities. Waterloo’s appeal lies in its combination of rural atmosphere, community connection, and proximity to urban conveniences that attract families seeking alternatives to traditional suburban developments.

The community’s remarkable 111% appreciation reflects broader trends in the housing market where buyers are willing to travel further from urban centers in exchange for space, affordability, and authentic community experiences. Waterloo’s development has been organic and measured, avoiding the pitfalls of rapid speculation while building genuine value based on lifestyle benefits. The town’s small size allows for the kind of neighborly atmosphere and community engagement that many buyers increasingly value in today’s fast-paced world.

Current median home values of $438,995, despite the recent modest decline, still represent extraordinary wealth creation from the 2010 baseline of $207,770. The slight pullback in 2025 may actually benefit long-term market health by providing a pause after years of rapid appreciation, potentially creating opportunities for new buyers while allowing the market to consolidate gains. For buyers seeking communities with proven appreciation potential and authentic small-town character, Waterloo’s track record demonstrates the rewards available to those who recognize value in well-positioned smaller communities.

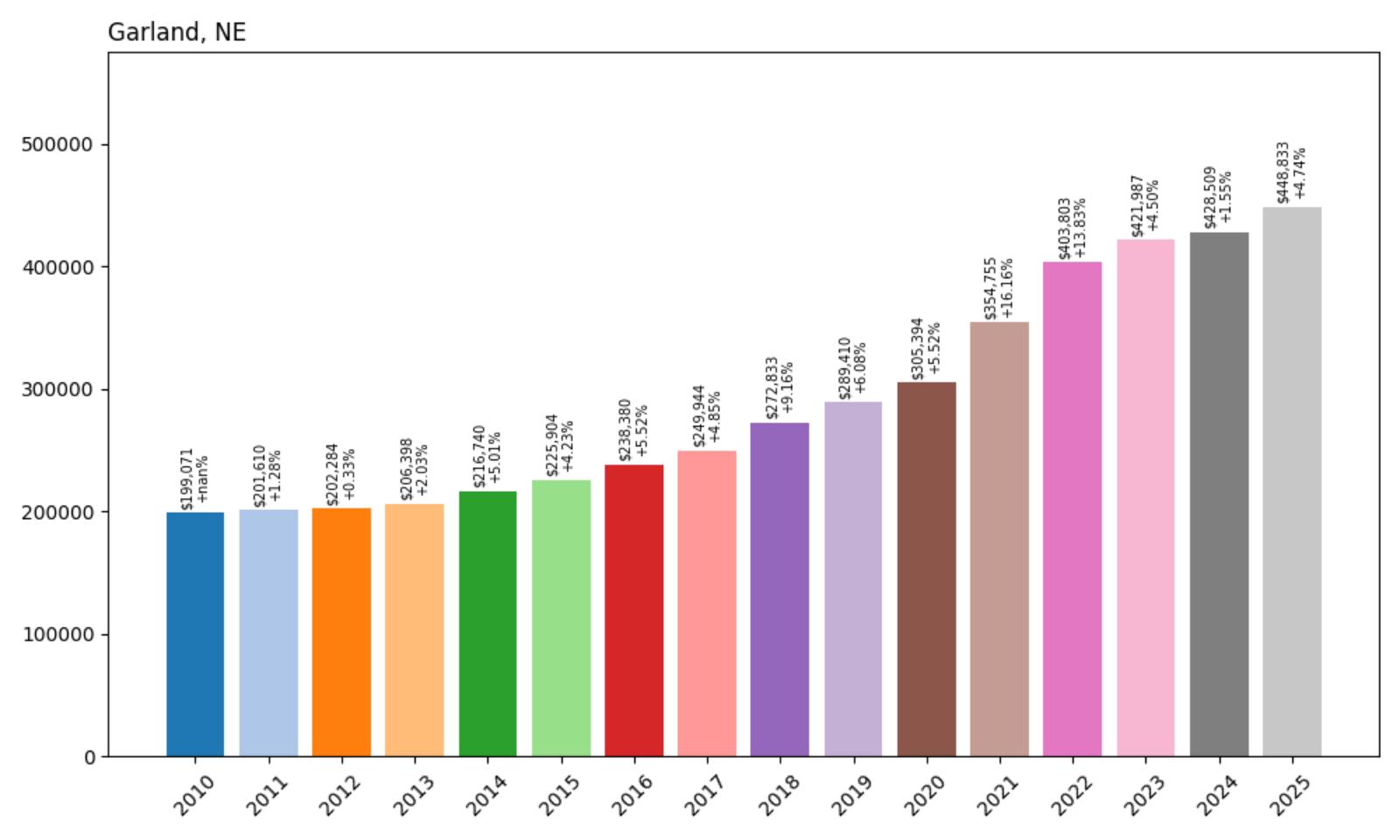

14. Garland – 125% Home Price Increase Since 2010

- 2010: $199,071

- 2011: $201,610 (+$2,540, +1.28% from previous year)

- 2012: $202,284 (+$674, +0.33% from previous year)

- 2013: $206,398 (+$4,114, +2.03% from previous year)

- 2014: $216,740 (+$10,342, +5.01% from previous year)

- 2015: $225,904 (+$9,165, +4.23% from previous year)

- 2016: $238,380 (+$12,475, +5.52% from previous year)

- 2017: $249,944 (+$11,565, +4.85% from previous year)

- 2018: $272,833 (+$22,889, +9.16% from previous year)

- 2019: $289,410 (+$16,577, +6.08% from previous year)

- 2020: $305,394 (+$15,984, +5.52% from previous year)

- 2021: $354,755 (+$49,361, +16.16% from previous year)

- 2022: $403,803 (+$49,048, +13.83% from previous year)

- 2023: $421,987 (+$18,184, +4.50% from previous year)

- 2024: $428,509 (+$6,522, +1.55% from previous year)

- 2025: $448,833 (+$20,323, +4.74% from previous year)

Garland’s housing market exemplifies steady, consistent appreciation that has delivered substantial long-term returns for homeowners. The community maintained modest but positive growth through the early 2010s before accelerating significantly in 2018 with over 9% appreciation. The pandemic years brought exceptional performance, with 2021 and 2022 delivering back-to-back years of over 16% and 13% growth respectively. Recent performance shows continued strength, with 2025 posting nearly 5% appreciation that suggests sustained market momentum. The 125% cumulative increase represents more than a doubling of home values.

Garland – Consistent Growth Delivers Results

Located in Seward County in southeastern Nebraska, Garland has established itself as a model of sustainable housing appreciation that rewards long-term homeowners while attracting new residents seeking rural living with investment potential. The community’s remarkable track record of 15 consecutive years of positive appreciation reflects strong local fundamentals and effective community development that maintains appeal across different market conditions. Starting from a modest median home value of $199,071 in 2010, Garland has evolved into a recognized destination for buyers seeking authentic Nebraska rural living.

Current median home values of $448,833 reflect Garland’s successful evolution from an affordable rural option to a competitive small-town market that delivers both lifestyle benefits and financial returns. The 125% appreciation since 2010 represents substantial wealth creation for homeowners while establishing price points that remain attractive relative to urban alternatives. The recent reacceleration in appreciation, with 2025 showing strong 4.74% growth, suggests continued buyer confidence and market strength that positions Garland well for future performance.

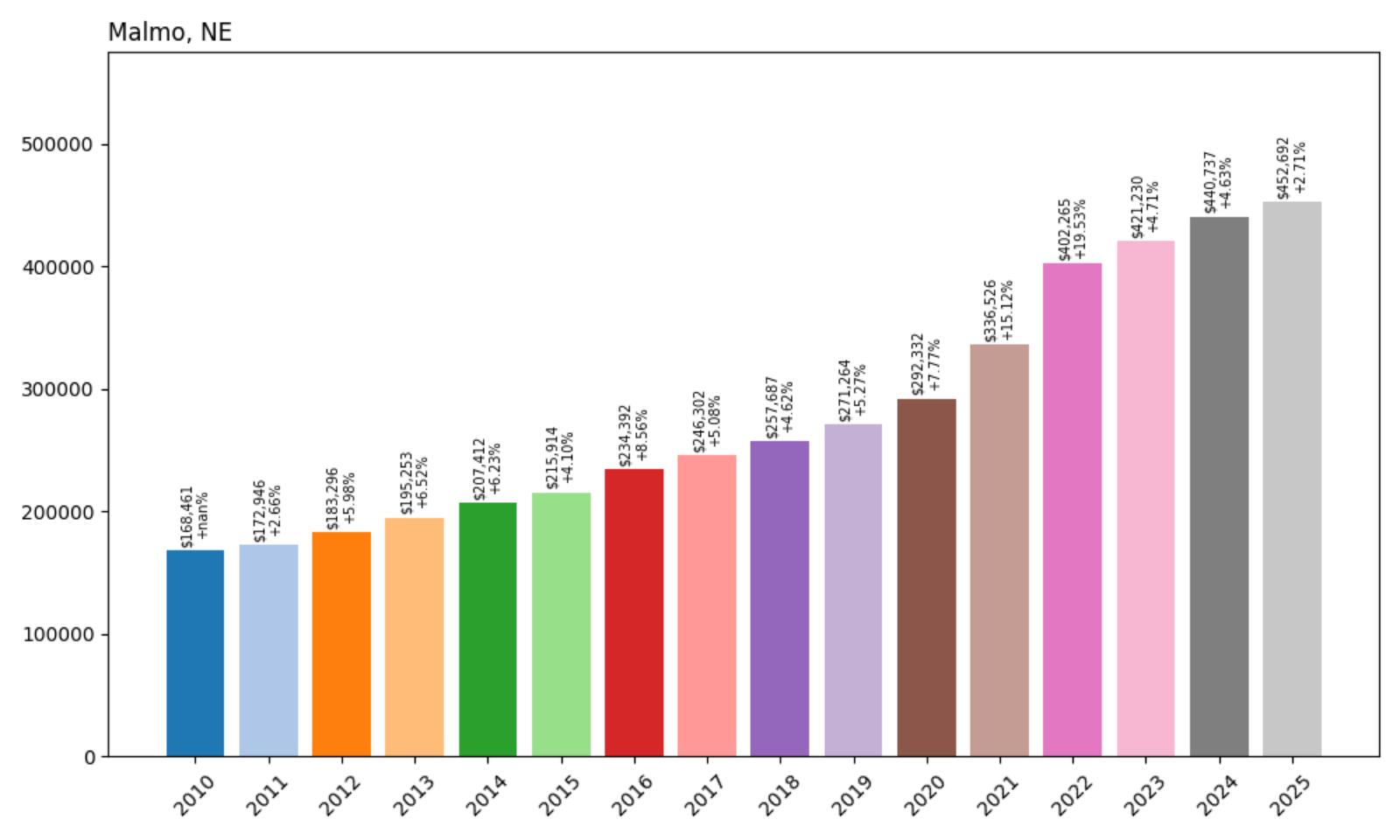

13. Malmo – 169% Home Price Increase Since 2010

- 2010: $168,461

- 2011: $172,946 (+$4,485, +2.66% from previous year)

- 2012: $183,296 (+$10,350, +5.98% from previous year)

- 2013: $195,253 (+$11,957, +6.52% from previous year)

- 2014: $207,412 (+$12,159, +6.23% from previous year)

- 2015: $215,914 (+$8,502, +4.10% from previous year)

- 2016: $234,392 (+$18,477, +8.56% from previous year)

- 2017: $246,302 (+$11,911, +5.08% from previous year)

- 2018: $257,687 (+$11,385, +4.62% from previous year)

- 2019: $271,264 (+$13,577, +5.27% from previous year)

- 2020: $292,332 (+$21,068, +7.77% from previous year)

- 2021: $336,526 (+$44,194, +15.12% from previous year)

- 2022: $402,265 (+$65,739, +19.53% from previous year)

- 2023: $421,230 (+$18,966, +4.71% from previous year)

- 2024: $440,737 (+$19,507, +4.63% from previous year)

- 2025: $452,692 (+$11,955, +2.71% from previous year)

Malmo stands out as one of Nebraska’s most successful housing appreciation stories, with home values increasing by an extraordinary 169% since 2010. The community demonstrated consistent positive growth throughout the entire tracking period, with no negative years recorded. The 2022 performance was particularly exceptional, delivering a remarkable 19.53% increase that added nearly $66,000 to median home values in a single year. While recent growth has moderated to more sustainable levels, the sustained positive trajectory and 169% cumulative increase represent outstanding wealth creation for homeowners.

Malmo – Outstanding Rural Success

Located in Saunders County in eastern Nebraska, Malmo represents the pinnacle of small-town housing success, transforming from one of the state’s most affordable communities to a recognized destination that attracts buyers seeking rural living with exceptional investment potential. Starting from a modest median home value of just $168,461 in 2010, the town has consistently outperformed broader market trends through its combination of rural charm, strategic location, and authentic community character that increasingly appeals to modern homebuyers.

Current median home values of $452,692 represent a remarkable transformation that places Malmo among Nebraska’s premier small-town housing markets. The 169% appreciation since 2010 demonstrates extraordinary wealth creation for long-term residents while attracting new buyers who recognize the community’s unique combination of rural authenticity and investment potential. For buyers seeking small-town Nebraska communities with proven track records of exceptional appreciation, Malmo’s performance illustrates the substantial returns available to those who invest in well-positioned rural destinations.

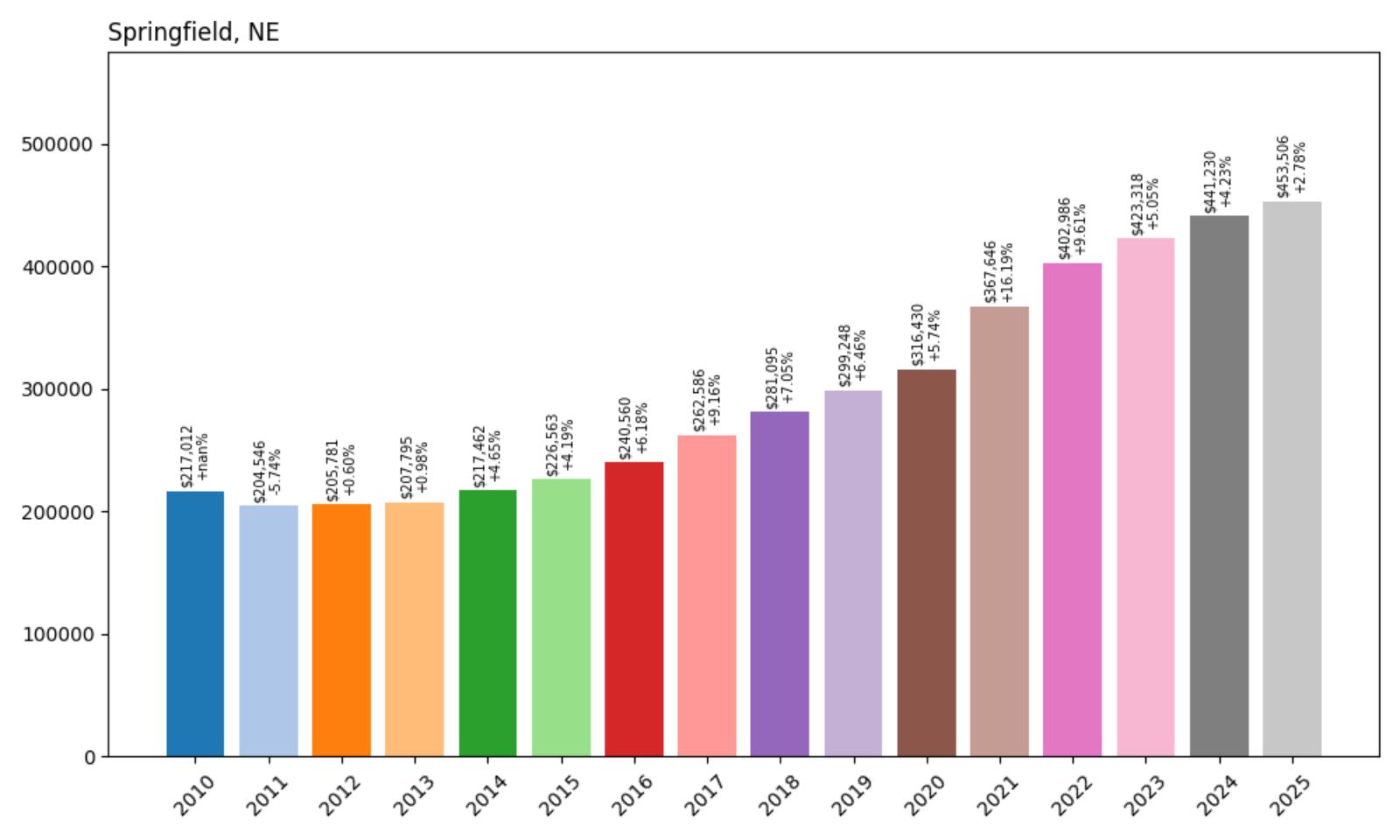

12. Springfield – 109% Home Price Increase Since 2010

- 2010: $217,012

- 2011: $204,546 (−$12,465, −5.74% from previous year)

- 2012: $205,781 (+$1,235, +0.60% from previous year)

- 2013: $207,795 (+$2,014, +0.98% from previous year)

- 2014: $217,462 (+$9,667, +4.65% from previous year)

- 2015: $226,563 (+$9,102, +4.19% from previous year)

- 2016: $240,560 (+$13,997, +6.18% from previous year)

- 2017: $262,586 (+$22,026, +9.16% from previous year)

- 2018: $281,095 (+$18,509, +7.05% from previous year)

- 2019: $299,248 (+$18,153, +6.46% from previous year)

- 2020: $316,430 (+$17,182, +5.74% from previous year)

- 2021: $367,646 (+$51,216, +16.19% from previous year)

- 2022: $402,986 (+$35,340, +9.61% from previous year)

- 2023: $423,318 (+$20,332, +5.05% from previous year)

- 2024: $441,230 (+$17,912, +4.23% from previous year)

- 2025: $453,506 (+$12,276, +2.78% from previous year)

Springfield’s housing market demonstrates strong recovery and sustained appreciation, achieving a 109% increase since 2010 despite early challenges. After experiencing a significant decline in 2011, the community recovered and maintained steady growth throughout the remainder of the decade. The 2017 performance was particularly strong with over 9% appreciation, followed by consistent annual increases. The pandemic years brought exceptional growth, with 2021 delivering the strongest performance at over 16% appreciation. Recent years show continued positive momentum, with the 109% cumulative increase representing substantial wealth creation.

Springfield – Steady Recovery Leads to Strong Performance

Located in Sarpy County as part of the Omaha metropolitan area, Springfield has established itself as an attractive suburban alternative that combines small-town character with metropolitan accessibility. The community’s housing market reflects its strategic positioning within the region, offering residents quality schools, recreational amenities, and a strong sense of community while maintaining convenient access to Omaha’s employment centers and urban conveniences. Springfield’s appeal lies in its balance of suburban amenities and small-town atmosphere that attracts families seeking alternatives to traditional urban living.

Current median home values of $453,506 position Springfield competitively within the Omaha metropolitan housing market while reflecting the premium buyers are willing to pay for the community’s combination of suburban convenience and small-town character. The 109% appreciation since 2010 represents substantial wealth building for homeowners while establishing price points that reflect the community’s amenities and strategic location. As the Omaha metro continues to expand, Springfield’s established character and proven appreciation record suggest continued strength in the housing market.

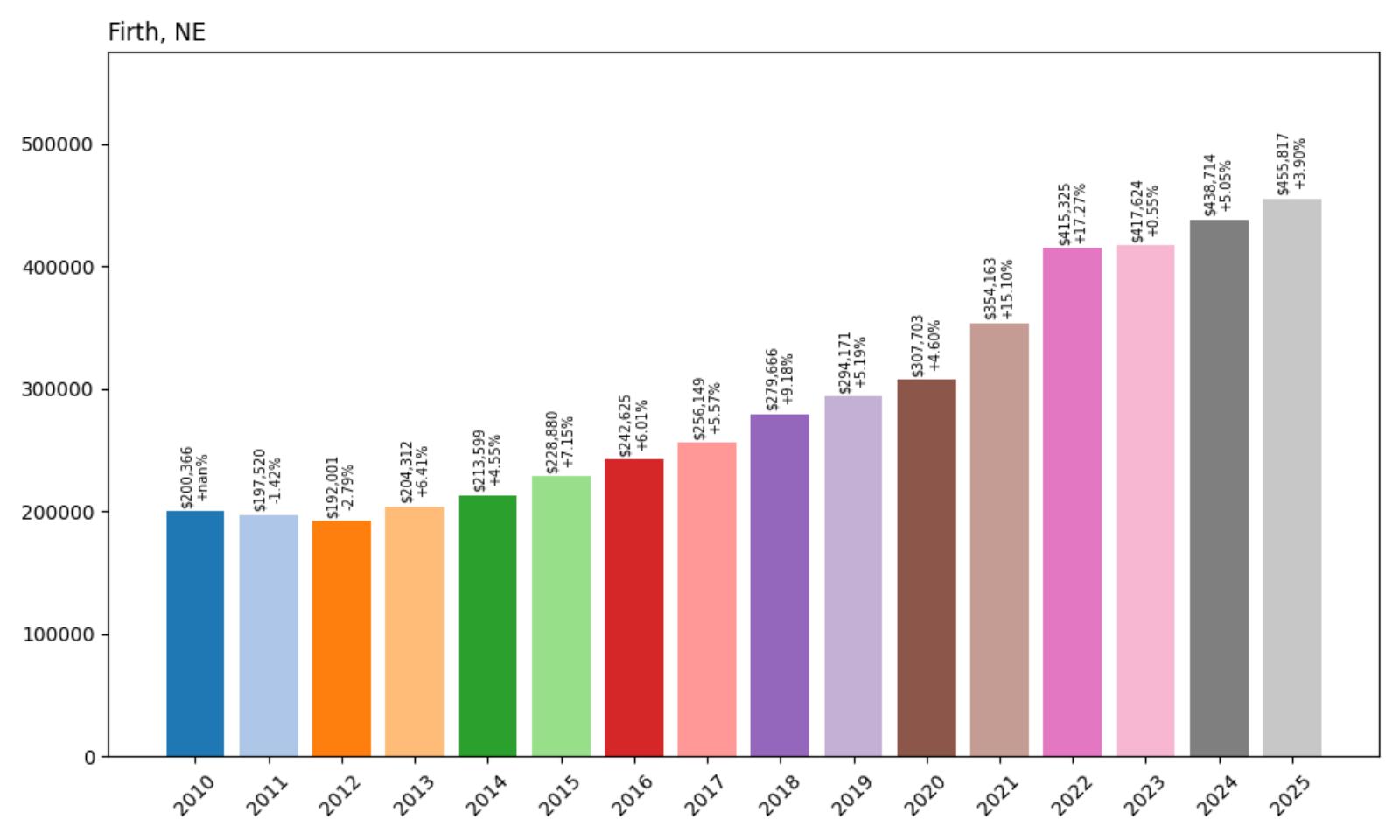

11. Firth – 127% Home Price Increase Since 2010

- 2010: $200,366

- 2011: $197,520 (−$2,847, −1.42% from previous year)

- 2012: $192,001 (−$5,519, −2.79% from previous year)

- 2013: $204,312 (+$12,311, +6.41% from previous year)

- 2014: $213,599 (+$9,288, +4.55% from previous year)

- 2015: $228,880 (+$15,281, +7.15% from previous year)

- 2016: $242,625 (+$13,744, +6.01% from previous year)

- 2017: $256,149 (+$13,524, +5.57% from previous year)

- 2018: $279,666 (+$23,517, +9.18% from previous year)

- 2019: $294,171 (+$14,506, +5.19% from previous year)

- 2020: $307,703 (+$13,532, +4.60% from previous year)

- 2021: $354,163 (+$46,460, +15.10% from previous year)

- 2022: $415,325 (+$61,162, +17.27% from previous year)

- 2023: $417,624 (+$2,299, +0.55% from previous year)

- 2024: $438,714 (+$21,090, +5.05% from previous year)

- 2025: $455,817 (+$17,103, +3.90% from previous year)

Firth’s housing market demonstrates remarkable resilience and long-term appreciation, achieving a 127% increase since 2010 despite early challenges. After recovering from declines in 2011-2012, the community maintained steady growth throughout the decade before experiencing exceptional acceleration during the pandemic years. The 2022 performance was particularly outstanding, delivering over 17% appreciation and adding more than $61,000 to median home values. Recent years show continued strength with solid annual gains, demonstrating the community’s sustained appeal and market fundamentals.

Firth – Rural Resilience Pays Dividends

Located in Lancaster County southeast of Lincoln, Firth represents the success story of small Nebraska communities that have maintained their rural character while attracting buyers seeking authentic small-town living with significant appreciation potential. The town’s 127% price increase reflects its evolution from an affordable rural option to a recognized residential destination that appeals to families seeking space, community connection, and investment returns. Firth’s agricultural heritage and small-town atmosphere provide residents with the authentic Nebraska experience while maintaining reasonable access to Lincoln’s employment centers.

Current median home values of $455,817 represent extraordinary wealth creation for homeowners who recognized Firth’s potential early in its appreciation cycle. The 127% increase since 2010 demonstrates the substantial returns available in well-positioned rural communities that offer both lifestyle benefits and investment potential. As Lincoln continues to expand and development pressures increase throughout Lancaster County, Firth’s combination of rural charm, proven appreciation, and strategic location positions it well for continued market success.

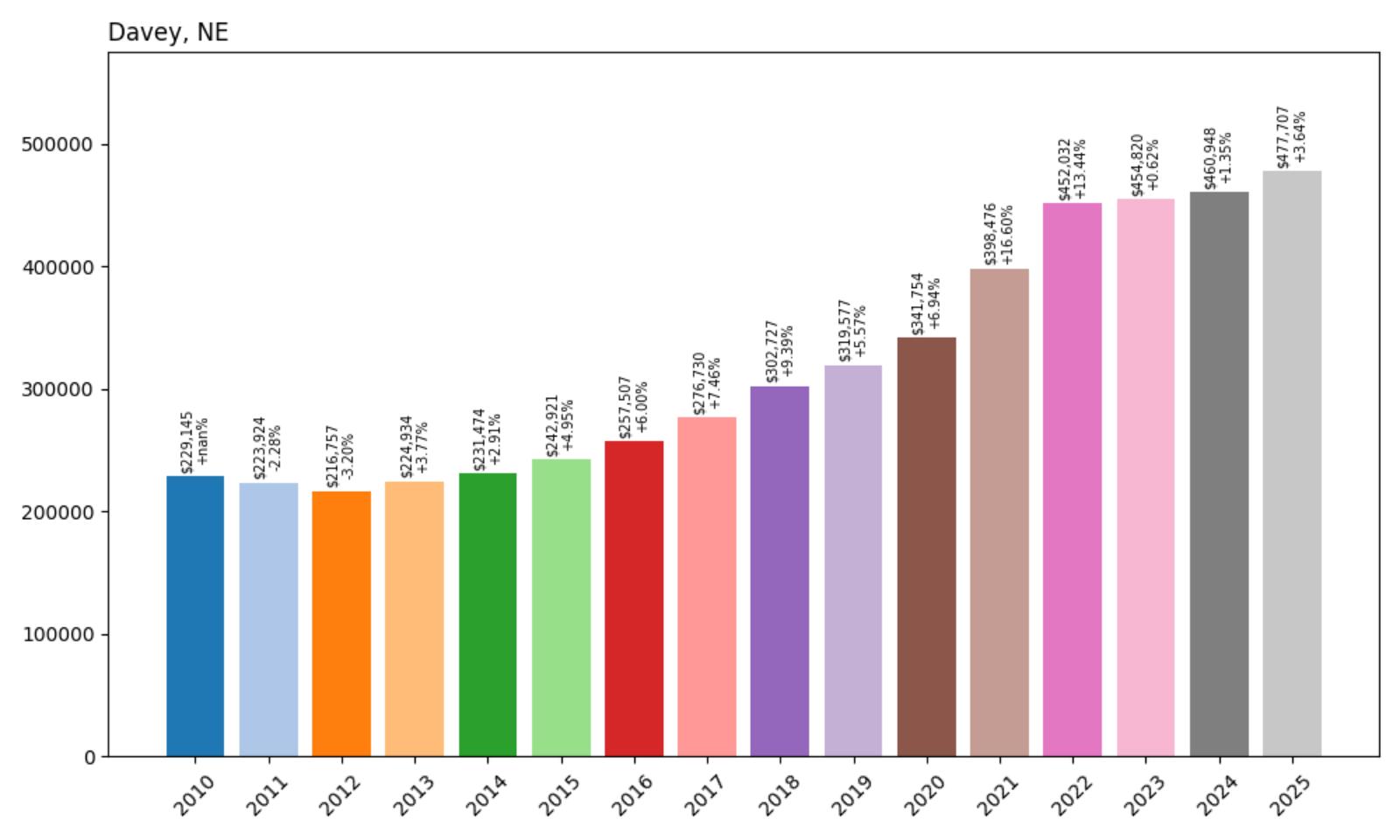

10. Davey – 108% Home Price Increase Since 2010

- 2010: $229,145

- 2011: $223,924 (−$5,221, −2.28% from previous year)

- 2012: $216,757 (−$7,167, −3.20% from previous year)

- 2013: $224,934 (+$8,176, +3.77% from previous year)

- 2014: $231,474 (+$6,541, +2.91% from previous year)

- 2015: $242,921 (+$11,447, +4.95% from previous year)

- 2016: $257,507 (+$14,586, +6.00% from previous year)

- 2017: $276,730 (+$19,223, +7.46% from previous year)

- 2018: $302,727 (+$25,997, +9.39% from previous year)

- 2019: $319,577 (+$16,850, +5.57% from previous year)

- 2020: $341,754 (+$22,177, +6.94% from previous year)

- 2021: $398,476 (+$56,721, +16.60% from previous year)

- 2022: $452,032 (+$53,556, +13.44% from previous year)

- 2023: $454,820 (+$2,788, +0.62% from previous year)

- 2024: $460,948 (+$6,128, +1.35% from previous year)

- 2025: $477,707 (+$16,759, +3.64% from previous year)

Davey’s housing market showcases steady long-term appreciation that accelerated dramatically during the pandemic years, achieving a 108% increase since 2010. After recovering from early decade challenges, the community maintained consistent growth through the 2010s before experiencing exceptional performance in 2021 and 2022 with back-to-back years adding over $110,000 to median home values. Recent years show stabilization with continued positive growth, demonstrating the community’s fundamental strength and appeal to homebuyers seeking rural living with investment potential.

Davey – Consistent Growth Builds Value

Situated in Lancaster County within the Lincoln metropolitan area, Davey represents the appeal of small rural communities that offer authentic Nebraska living while maintaining connectivity to urban employment centers. The town’s 108% appreciation reflects its successful positioning as a residential destination that attracts buyers seeking rural amenities, community connection, and solid investment returns. Davey’s small-town character and agricultural heritage provide residents with space, tranquility, and the strong community bonds that characterize Nebraska’s best rural communities.

Current median home values of $477,707 represent substantial wealth creation for homeowners while positioning Davey competitively within Lancaster County’s rural housing market. The 108% appreciation since 2010 demonstrates the investment potential available in well-positioned small communities that offer both authentic rural experiences and reasonable access to urban amenities. The recent reacceleration in appreciation suggests continued buyer confidence and market strength that supports Davey’s position as a desirable rural destination.

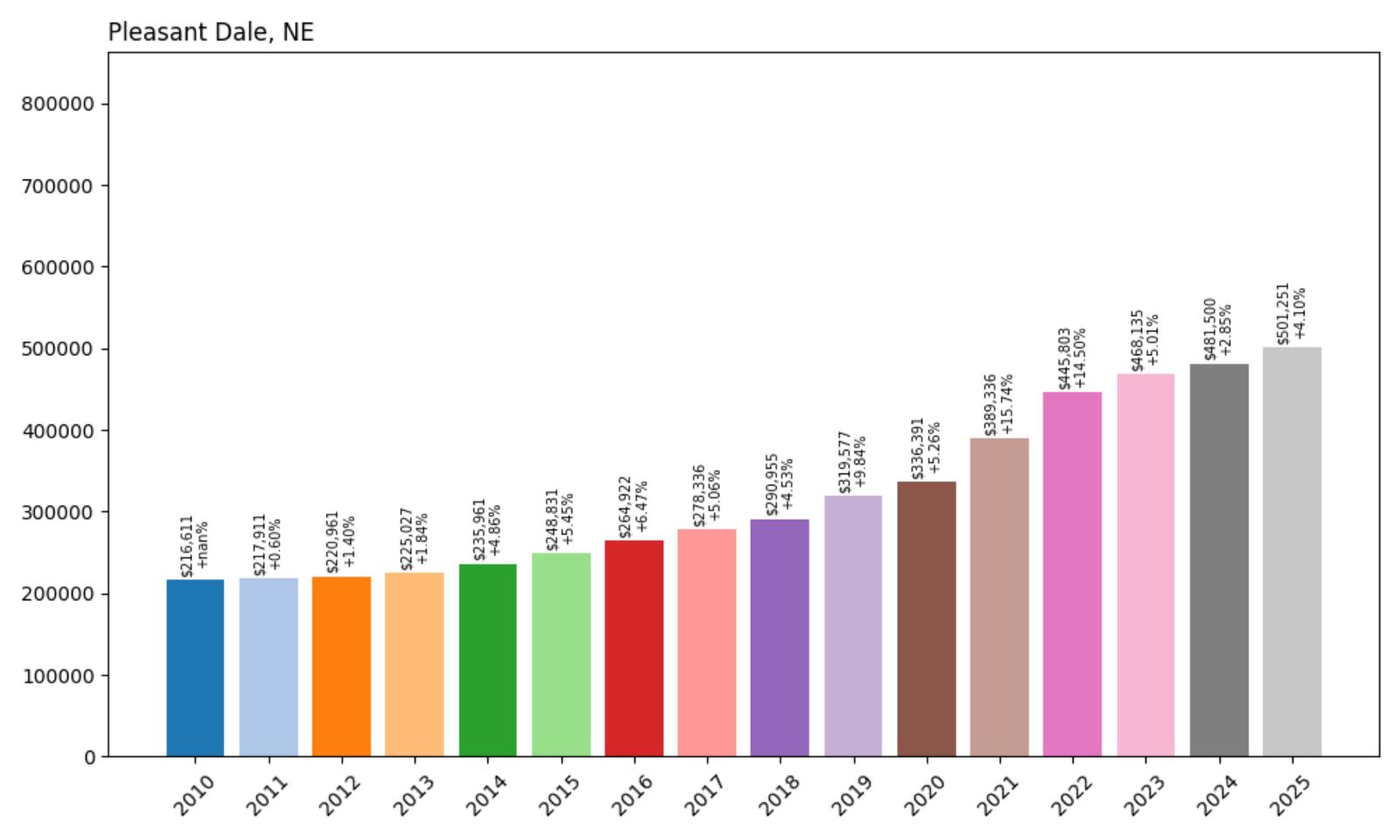

9. Pleasant Dale – 131% Home Price Increase Since 2010

- 2010: $216,611

- 2011: $217,911 (+$1,300, +0.60% from previous year)

- 2012: $220,961 (+$3,050, +1.40% from previous year)

- 2013: $225,027 (+$4,066, +1.84% from previous year)

- 2014: $235,961 (+$10,934, +4.86% from previous year)

- 2015: $248,831 (+$12,870, +5.45% from previous year)

- 2016: $264,922 (+$16,092, +6.47% from previous year)

- 2017: $278,336 (+$13,414, +5.06% from previous year)

- 2018: $290,955 (+$12,619, +4.53% from previous year)

- 2019: $319,577 (+$28,622, +9.84% from previous year)

- 2020: $336,391 (+$16,814, +5.26% from previous year)

- 2021: $389,336 (+$52,945, +15.74% from previous year)

- 2022: $445,803 (+$56,467, +14.50% from previous year)

- 2023: $468,135 (+$22,332, +5.01% from previous year)

- 2024: $481,500 (+$13,365, +2.85% from previous year)

- 2025: $501,251 (+$19,751, +4.10% from previous year)

Pleasant Dale exemplifies consistent, steady appreciation that has delivered exceptional long-term returns, achieving a 131% increase since 2010. The community demonstrated remarkable stability through the early 2010s with modest but positive annual growth before accelerating significantly in 2019. The pandemic years brought outstanding performance, with 2021 and 2022 adding over $109,000 to median home values in consecutive years. Recent performance shows continued strength with solid annual gains, indicating sustained market momentum and buyer confidence.

Pleasant Dale – Steady Excellence Delivers Results

Located in Seward County in southeastern Nebraska, Pleasant Dale has established itself as a premier small-town destination that consistently delivers both lifestyle benefits and financial returns for homeowners. The community’s 131% appreciation reflects its successful combination of rural charm, strategic location, and authentic Nebraska living that increasingly appeals to buyers seeking alternatives to urban markets. Pleasant Dale’s agricultural heritage and small-town character provide residents with space, community connection, and the quality of life that defines Nebraska’s most desirable rural communities.

Current median home values of $501,251 represent remarkable wealth creation and position Pleasant Dale among Nebraska’s premier small-town housing markets. The 131% appreciation since 2010 demonstrates the substantial returns available to those who invest in well-positioned rural communities that offer authentic experiences and solid fundamentals. Recent performance, including the strong 4.10% gain in 2025, suggests continued buyer confidence and market strength that supports Pleasant Dale’s position as a desirable investment and lifestyle destination.

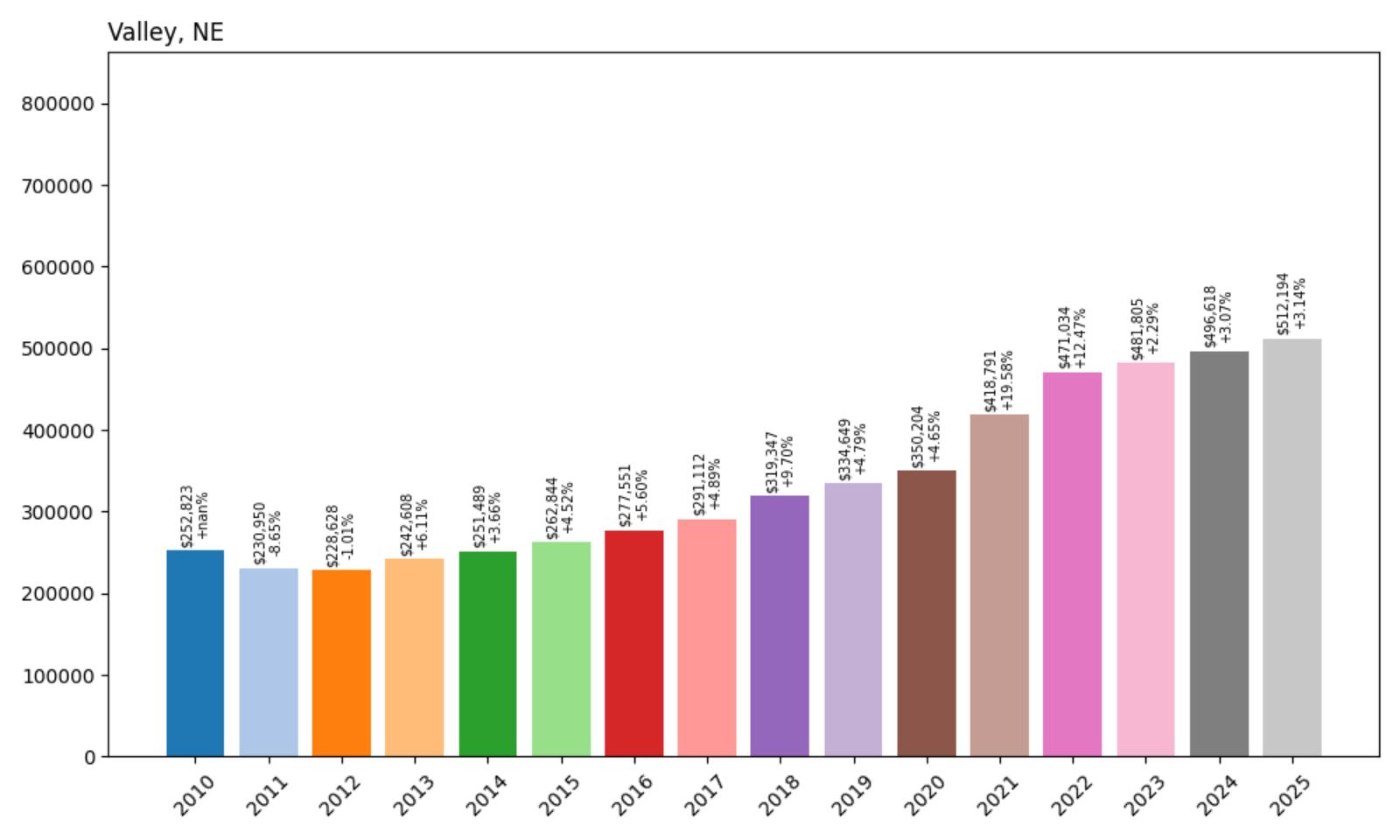

8. Valley – 103% Home Price Increase Since 2010

- 2010: $252,823

- 2011: $230,950 (−$21,872, −8.65% from previous year)

- 2012: $228,628 (−$2,322, −1.01% from previous year)

- 2013: $242,608 (+$13,980, +6.11% from previous year)

- 2014: $251,489 (+$8,881, +3.66% from previous year)

- 2015: $262,844 (+$11,355, +4.52% from previous year)

- 2016: $277,551 (+$14,707, +5.60% from previous year)

- 2017: $291,112 (+$13,561, +4.89% from previous year)

- 2018: $319,347 (+$28,235, +9.70% from previous year)

- 2019: $334,649 (+$15,302, +4.79% from previous year)

- 2020: $350,204 (+$15,555, +4.65% from previous year)

- 2021: $418,791 (+$68,587, +19.58% from previous year)

- 2022: $471,034 (+$52,243, +12.47% from previous year)

- 2023: $481,805 (+$10,771, +2.29% from previous year)

- 2024: $496,618 (+$14,813, +3.07% from previous year)

- 2025: $512,194 (+$15,576, +3.14% from previous year)

Valley’s housing market demonstrates remarkable resilience and long-term appreciation, achieving a 103% increase since 2010 despite significant early challenges. After experiencing a substantial decline in 2011, the community recovered and maintained steady growth throughout the remainder of the decade. The 2021 performance was exceptional, delivering nearly 20% appreciation in a single year. Recent years show continued positive momentum with solid annual gains, reflecting the community’s fundamental appeal and strategic positioning within the Omaha metropolitan area.

Valley – Metropolitan Suburb Delivers Strong Returns

Positioned in Douglas County as part of the Omaha metropolitan area, Valley has established itself as an attractive suburban destination that combines small-town character with metropolitan accessibility. The community’s housing market reflects its strategic location within the region, offering residents quality amenities and convenient access to Omaha’s employment centers while maintaining a distinct community identity. Valley’s appeal lies in its balance of suburban convenience and small-town atmosphere that attracts families seeking alternatives to traditional urban living.

Current median home values of $512,194 position Valley competitively within the Omaha metropolitan housing market while reflecting the premium buyers are willing to pay for the community’s combination of suburban convenience and small-town character. The 103% appreciation since 2010 represents substantial wealth building for homeowners while establishing price points that reflect the community’s amenities and strategic location. As the Omaha metro continues to expand, Valley’s established character and proven appreciation record suggest continued strength in the housing market.

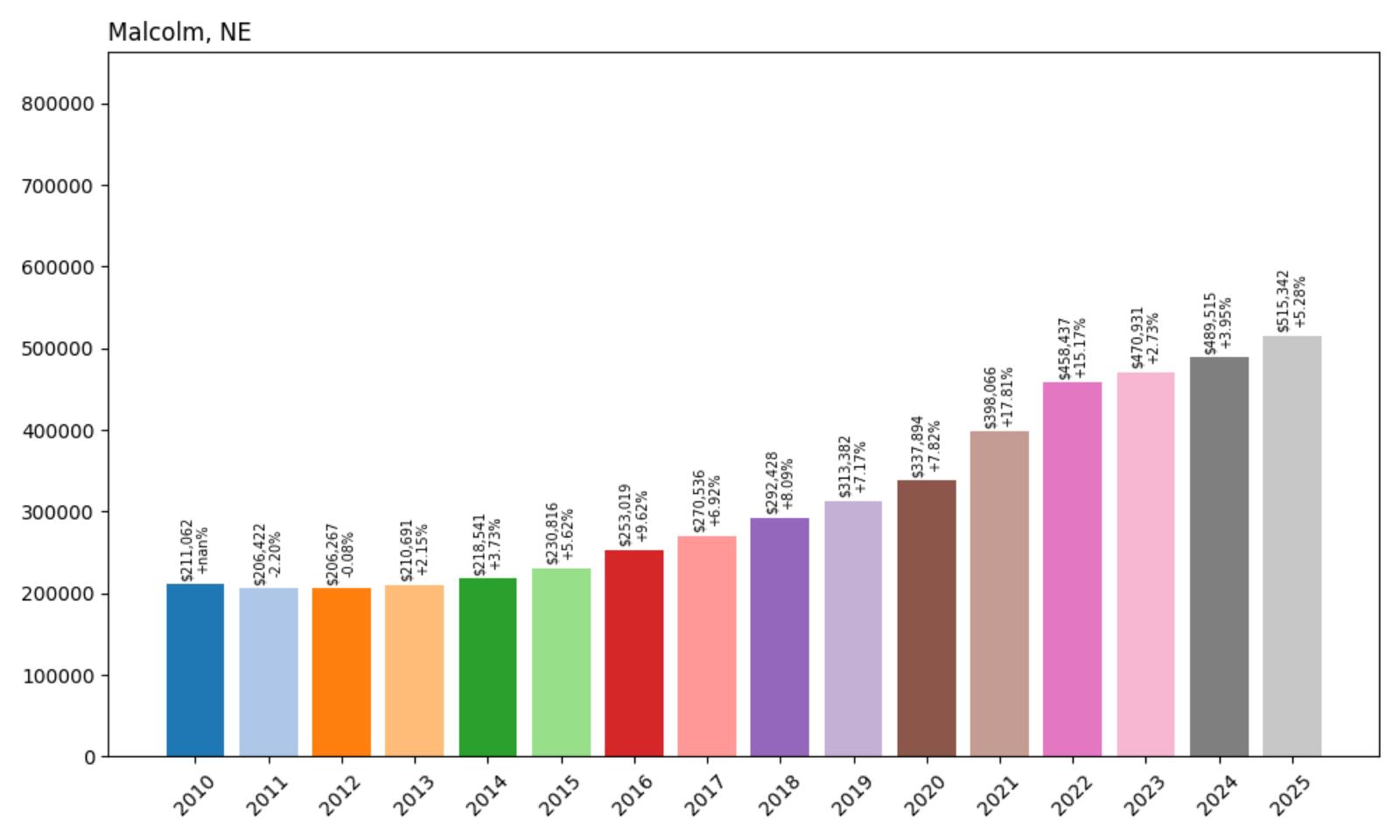

7. Malcolm – 144% Home Price Increase Since 2010

- 2010: $211,062

- 2011: $206,422 (−$4,639, −2.20% from previous year)

- 2012: $206,267 (−$155, −0.08% from previous year)

- 2013: $210,691 (+$4,424, +2.15% from previous year)

- 2014: $218,541 (+$7,850, +3.73% from previous year)

- 2015: $230,816 (+$12,275, +5.62% from previous year)

- 2016: $253,019 (+$22,203, +9.62% from previous year)

- 2017: $270,536 (+$17,517, +6.92% from previous year)

- 2018: $292,428 (+$21,892, +8.09% from previous year)

- 2019: $313,382 (+$20,954, +7.17% from previous year)

- 2020: $337,894 (+$24,512, +7.82% from previous year)

- 2021: $398,066 (+$60,172, +17.81% from previous year)

- 2022: $458,437 (+$60,371, +15.17% from previous year)

- 2023: $470,931 (+$12,494, +2.73% from previous year)

- 2024: $489,515 (+$18,584, +3.95% from previous year)

- 2025: $515,342 (+$25,827, +5.28% from previous year)

Malcolm’s housing market showcases exceptional long-term appreciation, achieving a remarkable 144% increase since 2010. After modest challenges in the early 2010s, the community experienced outstanding acceleration beginning in 2016 with nearly 10% appreciation. The momentum continued through the decade, with the pandemic years delivering exceptional performance including consecutive years in 2021 and 2022 that added over $120,000 to median home values. Recent performance shows continued strength with accelerating growth, demonstrating sustained market momentum and buyer confidence.

Malcolm – Outstanding Rural Performance

Located in Lancaster County southeast of Lincoln, Malcolm has emerged as one of Nebraska’s most successful small-town housing markets, transforming from an affordable rural option to a premium destination that attracts buyers seeking authentic small-town living with exceptional investment potential. The community’s 144% appreciation reflects its strategic positioning within Lancaster County’s growing residential market and its successful preservation of rural character while accommodating modern housing needs and preferences.

Current median home values of $515,342 represent extraordinary wealth creation for homeowners and position Malcolm among Nebraska’s premier small-town housing markets. The 144% appreciation since 2010 demonstrates the substantial returns available to those who recognize value in well-positioned rural communities before broader market recognition drives prices higher. The recent acceleration in appreciation, with 2025 showing over 5% growth, suggests continued buyer confidence and limited inventory that supports Malcolm’s position as a top-performing rural destination.