Would you like to save this?

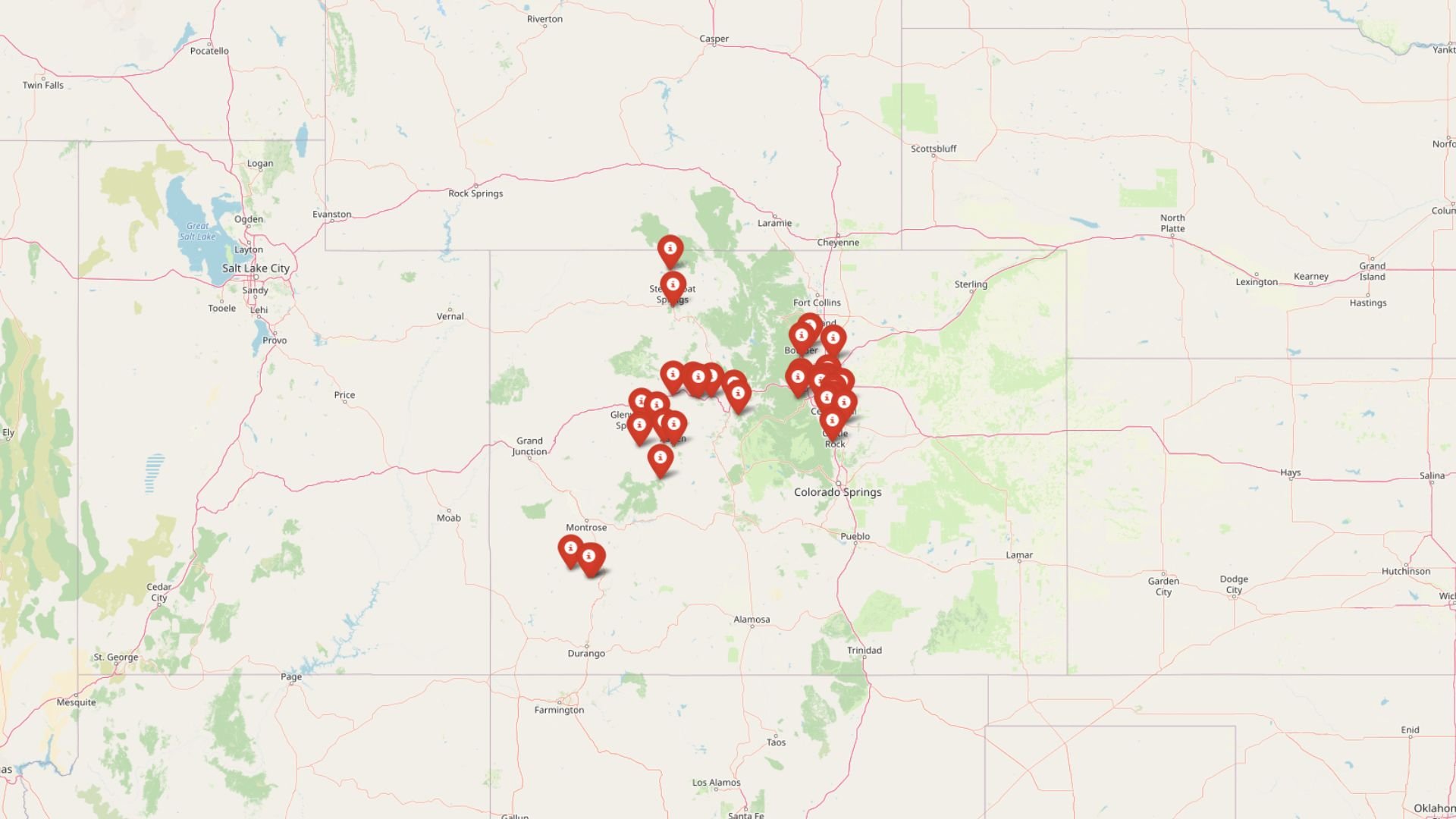

Colorado’s housing market isn’t just hot—it’s breaking records. According to the Zillow Home Value Index, 33 towns across the state now rank among the most expensive in the country, with average home prices often soaring into seven figures. Luxury ski resorts like Aspen and Vail dominate the top spots, driven by second-home buyers and remote workers chasing mountain views. Meanwhile, exclusive Denver suburbs like Cherry Hills Village and Bow Mar offer small-town luxury close to city amenities. In many towns, prices have surged by over 400% since 2010, reshaping Colorado’s real estate map.

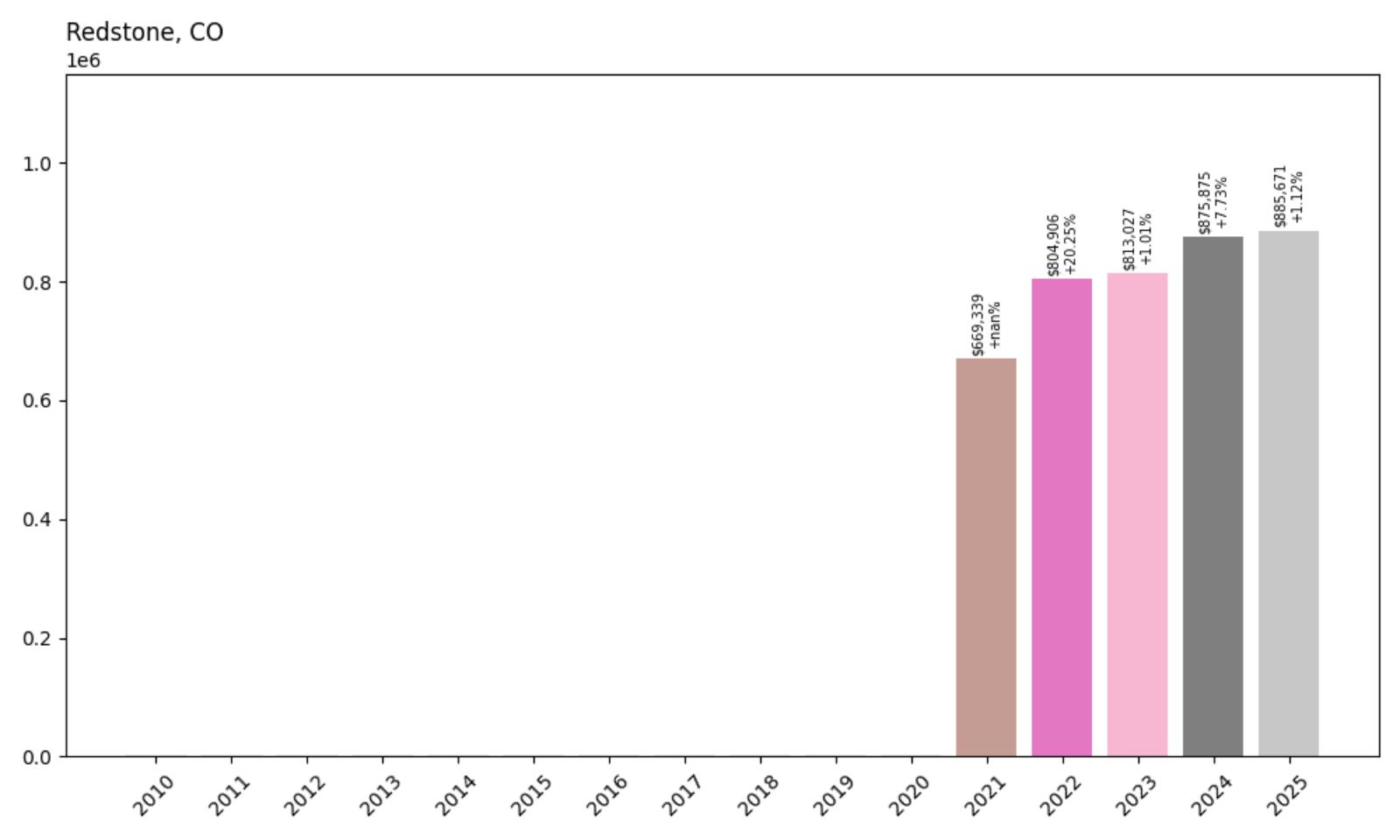

33. Redstone – 32% Home Price Increase Since 2021

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: $669,339

- 2022: $804,906 (+$135,567, +20.25% from previous year)

- 2023: $813,027 (+$8,122, +1.01% from previous year)

- 2024: $875,875 (+$62,847, +7.73% from previous year)

- 2025: $885,671 (+$9,796, +1.12% from previous year)

Redstone shows a relatively modest but steady growth pattern since data became available in 2021. Starting at $669,339 and climbing to $885,671 by 2025, this small mountain community has experienced consistent appreciation. The most dramatic jump occurred in 2022 with a 20% increase, followed by more moderate growth rates. The current price point of $885,671 represents solid value compared to other Colorado mountain towns.

Redstone – Historic Coal Mining Town Turned Luxury Retreat

Redstone, located in the Crystal River Valley about 20 miles south of Carbondale, stands as one of Colorado’s most unique and historically significant communities. This small unincorporated town was founded in 1899 as a company town for the Colorado Fuel and Iron Company, complete with worker housing and the famous Redstone Castle, built by industrialist John Cleveland Osgood.

The town’s transformation from a coal mining community to a luxury mountain retreat reflects broader trends in Colorado’s resort areas. Redstone’s relatively recent appearance in high-end real estate data, starting in 2021, coincides with the pandemic-driven surge in demand for remote mountain properties. The town’s appeal lies in its combination of historical significance, stunning natural setting along the Crystal River, and proximity to outdoor recreation opportunities.

With its current median price of $885,671, Redstone represents an interesting entry point into Colorado’s luxury mountain market. The town’s small size and limited inventory mean that each sale can significantly impact average prices, contributing to the volatility seen in the data. The steady appreciation since 2021 suggests growing recognition of Redstone’s unique character and investment potential among affluent buyers seeking alternatives to more crowded resort destinations.

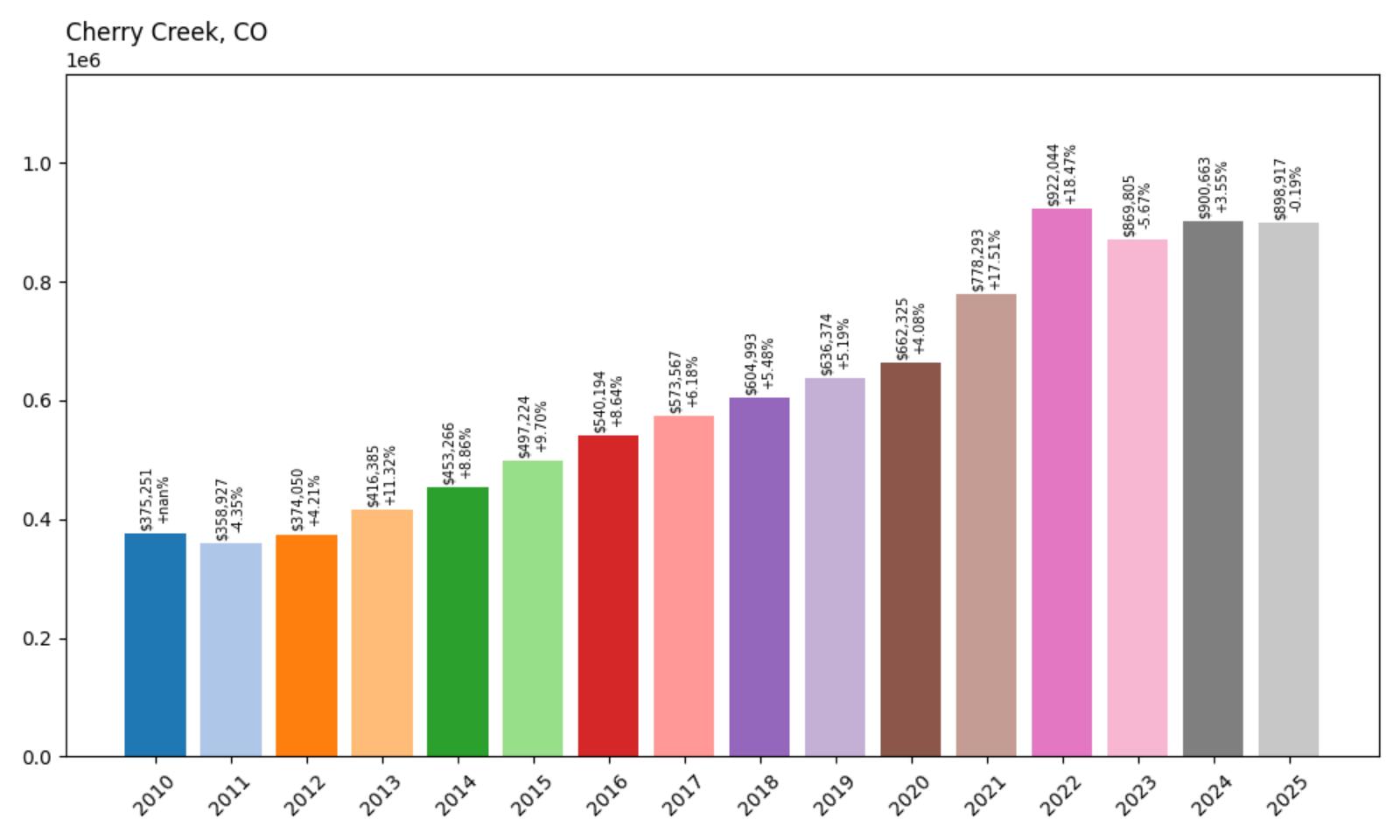

32. Cherry Creek – 140% Home Price Increase Since 2010

- 2010: $375,251

- 2011: $358,927 (−$16,325, −4.35% from previous year)

- 2012: $374,050 (+$15,124, +4.21% from previous year)

- 2013: $416,385 (+$42,335, +11.32% from previous year)

- 2014: $453,266 (+$36,881, +8.86% from previous year)

- 2015: $497,224 (+$43,958, +9.70% from previous year)

- 2016: $540,194 (+$42,970, +8.64% from previous year)

- 2017: $573,567 (+$33,373, +6.18% from previous year)

- 2018: $604,993 (+$31,426, +5.48% from previous year)

- 2019: $636,374 (+$31,382, +5.19% from previous year)

- 2020: $662,325 (+$25,951, +4.08% from previous year)

- 2021: $778,293 (+$115,967, +17.51% from previous year)

- 2022: $922,044 (+$143,751, +18.47% from previous year)

- 2023: $869,805 (−$52,240, −5.67% from previous year)

- 2024: $900,663 (+$30,858, +3.55% from previous year)

- 2025: $898,917 (−$1,745, −0.19% from previous year)

Cherry Creek has demonstrated impressive long-term growth, climbing from $375,251 in 2010 to $898,917 in 2025. The data shows steady appreciation through most of the 2010s, with acceleration during the pandemic years of 2021-2022. The market correction in 2023 and slight decline in 2025 reflect broader cooling trends in Colorado’s high-end markets, though prices remain well above pre-pandemic levels.

Cherry Creek – Denver’s Premier Shopping and Dining District

Cherry Creek represents one of Denver’s most prestigious neighborhoods, centered around the renowned Cherry Creek Shopping Center and the upscale Cherry Creek North district. This area has long been synonymous with luxury retail, fine dining, and affluent urban living, making it a natural draw for high-income professionals and empty nesters seeking walkable luxury.

The neighborhood’s appeal extends beyond shopping and dining to include some of Denver’s most desirable residential properties, from high-rise condominiums to luxury townhomes. The area’s walkability, cultural amenities, and proximity to downtown Denver create a unique urban lifestyle that commands premium prices. The steady appreciation shown in the data, particularly the 140% increase since 2010, reflects the area’s enduring desirability and limited housing supply.

The recent market stabilization, with prices holding near $900,000, suggests Cherry Creek has reached a mature phase in its development cycle. The slight decline in 2025 may reflect broader market corrections rather than fundamental changes in the area’s appeal. Cherry Creek’s position as Denver’s premier luxury retail and residential district ensures continued demand from affluent buyers seeking urban sophistication.

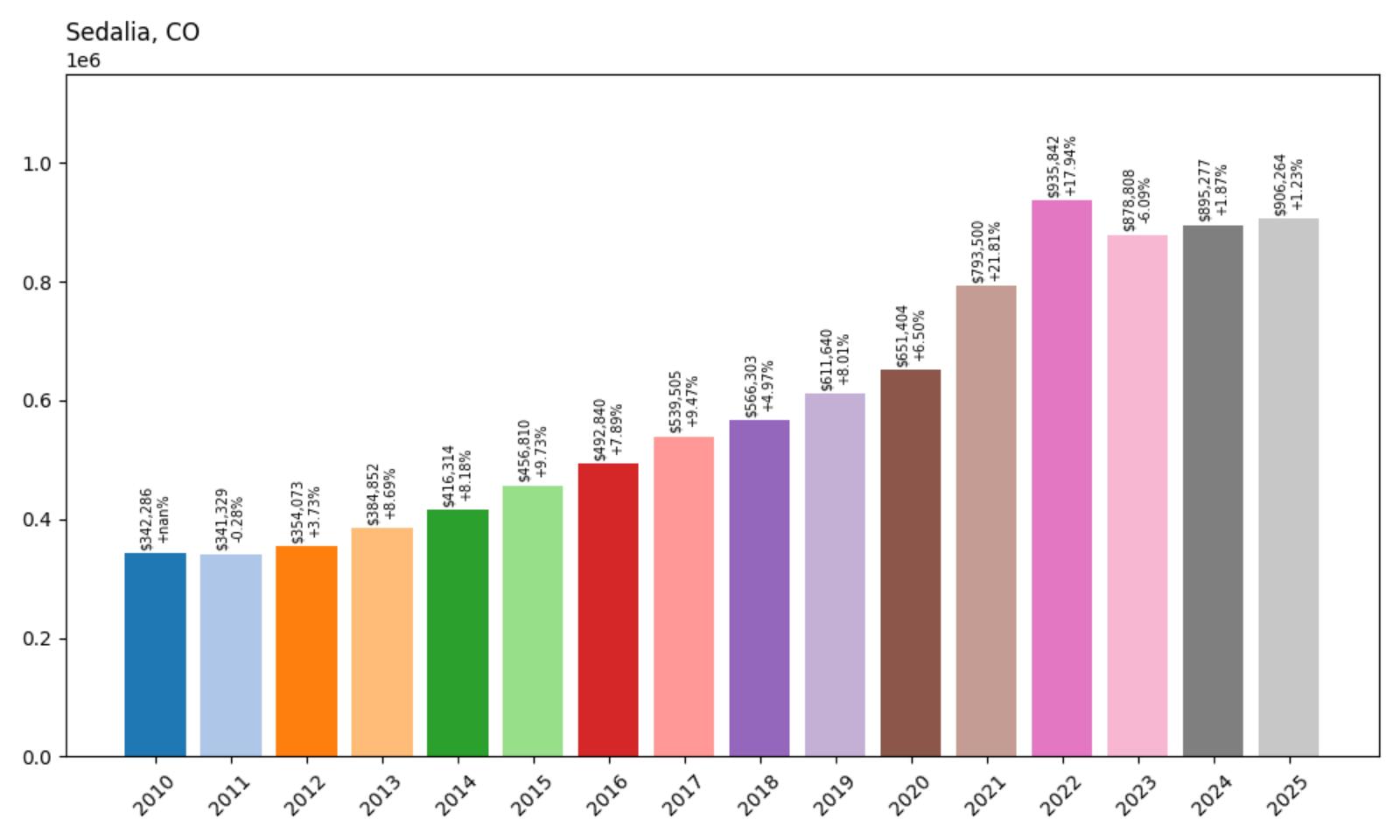

31. Sedalia – 165% Home Price Increase Since 2010

- 2010: $342,286

- 2011: $341,329 (−$957, −0.28% from previous year)

- 2012: $354,073 (+$12,744, +3.73% from previous year)

- 2013: $384,852 (+$30,779, +8.69% from previous year)

- 2014: $416,314 (+$31,462, +8.18% from previous year)

- 2015: $456,810 (+$40,496, +9.73% from previous year)

- 2016: $492,840 (+$36,030, +7.89% from previous year)

- 2017: $539,505 (+$46,665, +9.47% from previous year)

- 2018: $566,303 (+$26,797, +4.97% from previous year)

- 2019: $611,640 (+$45,337, +8.01% from previous year)

- 2020: $651,404 (+$39,764, +6.50% from previous year)

- 2021: $793,500 (+$142,096, +21.81% from previous year)

- 2022: $935,842 (+$142,342, +17.94% from previous year)

- 2023: $878,808 (−$57,033, −6.09% from previous year)

- 2024: $895,277 (+$16,468, +1.87% from previous year)

- 2025: $906,264 (+$10,987, +1.23% from previous year)

Sedalia has experienced remarkable growth, with home prices more than doubling from $342,286 in 2010 to $906,264 in 2025. The community showed consistent appreciation throughout the 2010s, with particularly strong growth in 2017 and 2019. The pandemic years brought explosive growth, with back-to-back increases of over 17% in 2021 and 2022, before moderating in recent years.

Sedalia – Rural Luxury in the Foothills

Sedalia, located in Douglas County about 25 miles south of Denver, represents the epitome of Colorado’s rural luxury market. This small unincorporated community sits in the foothills of the Rocky Mountains, offering residents expansive properties with stunning mountain views while maintaining reasonable access to Denver’s urban amenities.

The area’s appeal stems from its combination of rural privacy and proximity to both Denver and the mountains. Large lots, often measured in acres rather than square feet, allow for custom homes, horse properties, and other rural amenities that attract affluent buyers seeking space and privacy. The 165% price increase since 2010 reflects growing demand for this lifestyle, particularly accelerated by remote work trends during the pandemic.

Sedalia’s current median price of $906,264 positions it as an attractive alternative to more expensive mountain communities while still providing the mountain lifestyle many Colorado residents seek. The recent price stabilization suggests the market has reached a new equilibrium, though the area’s limited inventory and desirable location continue to support premium valuations.

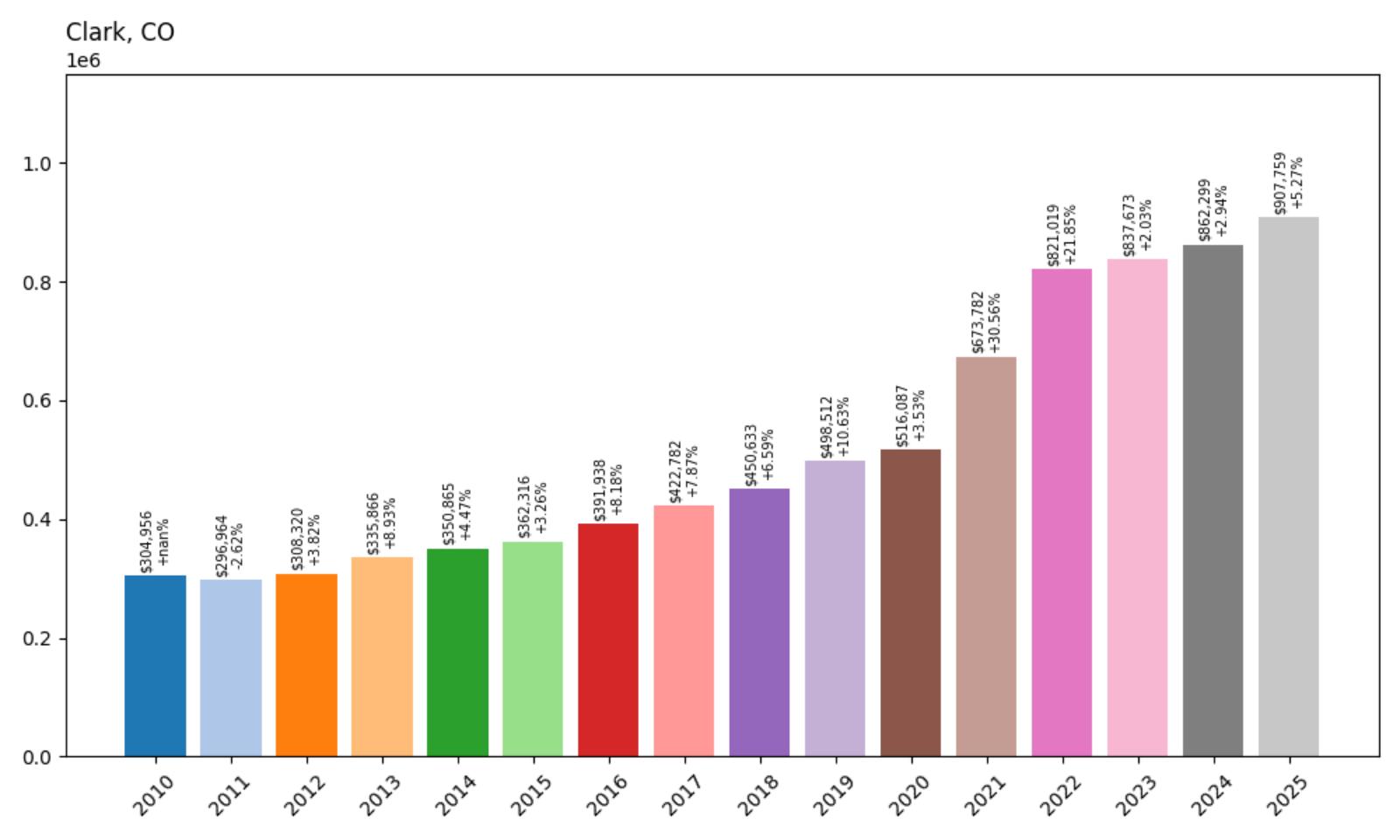

30. Clark – 198% Home Price Increase Since 2010

- 2010: $304,956

- 2011: $296,964 (−$7,992, −2.62% from previous year)

- 2012: $308,320 (+$11,356, +3.82% from previous year)

- 2013: $335,866 (+$27,545, +8.93% from previous year)

- 2014: $350,865 (+$14,999, +4.47% from previous year)

- 2015: $362,316 (+$11,451, +3.26% from previous year)

- 2016: $391,938 (+$29,621, +8.18% from previous year)

- 2017: $422,782 (+$30,845, +7.87% from previous year)

- 2018: $450,633 (+$27,850, +6.59% from previous year)

- 2019: $498,512 (+$47,880, +10.63% from previous year)

- 2020: $516,087 (+$17,575, +3.53% from previous year)

- 2021: $673,782 (+$157,695, +30.56% from previous year)

- 2022: $821,019 (+$147,236, +21.85% from previous year)

- 2023: $837,673 (+$16,655, +2.03% from previous year)

- 2024: $862,299 (+$24,626, +2.94% from previous year)

- 2025: $907,759 (+$45,460, +5.27% from previous year)

Clark has achieved extraordinary growth, nearly tripling in value from $304,956 in 2010 to $907,759 in 2025. The community experienced steady but moderate growth through most of the 2010s before exploding during the pandemic years. The massive 30% increase in 2021 followed by another 22% jump in 2022 reflects the intense demand for rural mountain properties during COVID-19.

Clark – Remote Mountain Community with Authentic Western Character

Clark, located in Routt County near Steamboat Springs, represents one of Colorado’s most authentic mountain communities. This small town, situated in the Elk River Valley, maintains much of its original ranching and mining character while attracting affluent buyers seeking genuine Western lifestyle experiences away from the crowds of more developed resort areas.

The community’s remarkable 198% price increase since 2010 reflects a broader trend of buyers discovering smaller, more authentic mountain towns as alternatives to expensive resort destinations. Clark’s appeal lies in its combination of genuine Western heritage, outdoor recreation opportunities, and relative affordability compared to nearby Steamboat Springs. The area offers excellent fishing, hunting, and hiking, along with vast open spaces that provide privacy and tranquility.

The recent acceleration in growth, particularly the 5.27% increase in 2025, suggests Clark continues to attract buyers even as other markets cool. The town’s limited inventory and unique character create a competitive market environment that supports continued appreciation. For buyers seeking an authentic mountain experience without the commercialization of major ski resorts, Clark represents an increasingly valuable option.

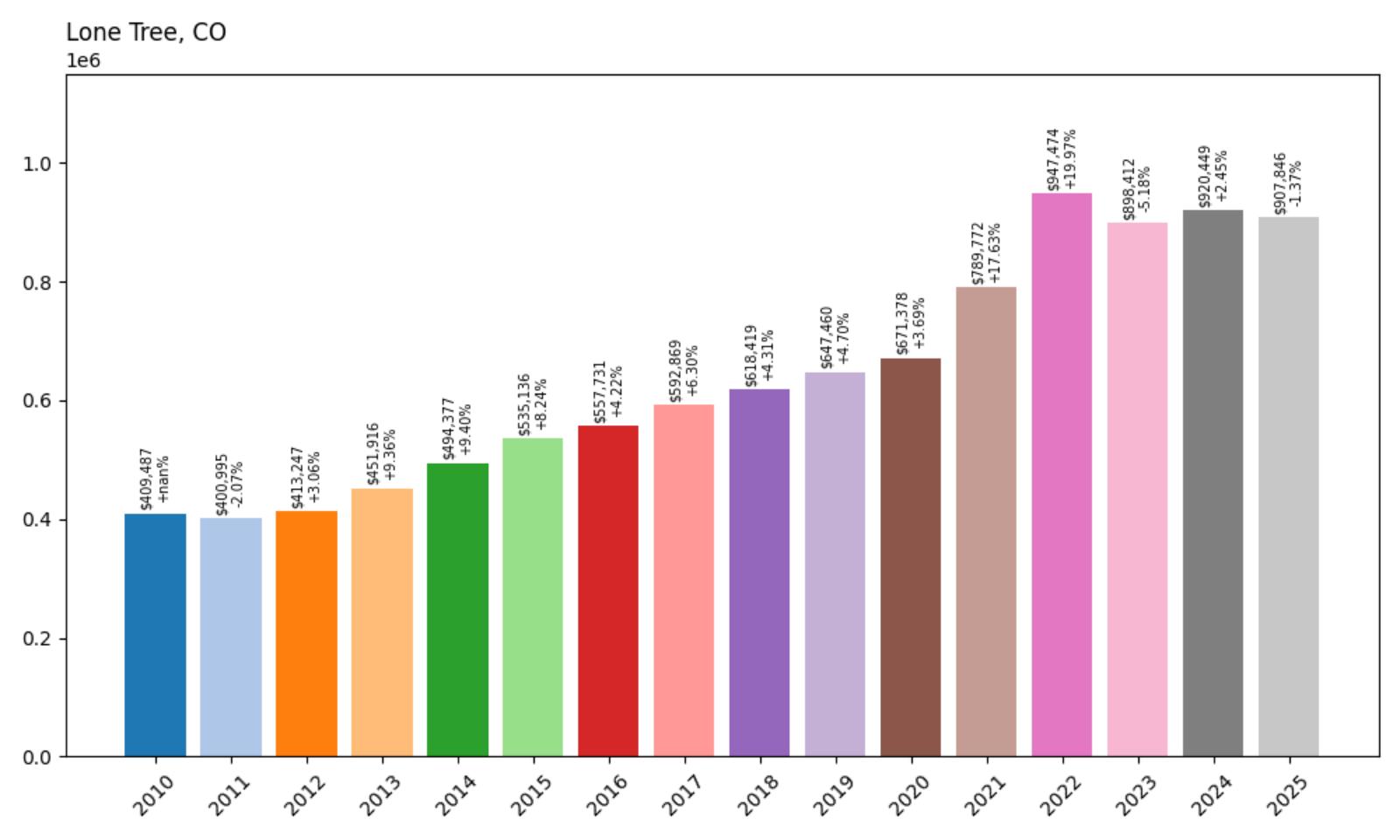

29. Lone Tree – 122% Home Price Increase Since 2010

- 2010: $409,487

- 2011: $400,995 (−$8,491, −2.07% from previous year)

- 2012: $413,247 (+$12,252, +3.06% from previous year)

- 2013: $451,916 (+$38,669, +9.36% from previous year)

- 2014: $494,377 (+$42,461, +9.40% from previous year)

- 2015: $535,136 (+$40,758, +8.24% from previous year)

- 2016: $557,731 (+$22,595, +4.22% from previous year)

- 2017: $592,869 (+$35,138, +6.30% from previous year)

- 2018: $618,419 (+$25,550, +4.31% from previous year)

- 2019: $647,460 (+$29,041, +4.70% from previous year)

- 2020: $671,378 (+$23,919, +3.69% from previous year)

- 2021: $789,772 (+$118,394, +17.63% from previous year)

- 2022: $947,474 (+$157,702, +19.97% from previous year)

- 2023: $898,412 (−$49,061, −5.18% from previous year)

- 2024: $920,449 (+$22,037, +2.45% from previous year)

- 2025: $907,846 (−$12,603, −1.37% from previous year)

Lone Tree has demonstrated strong long-term appreciation, more than doubling from $409,487 in 2010 to $907,846 in 2025. The city showed consistent growth through the 2010s, with particularly strong years in 2013-2015. The pandemic years brought significant acceleration, with consecutive increases of nearly 18% and 20% in 2021-2022. Recent market cooling has resulted in modest declines, but prices remain well above pre-pandemic levels.

Lone Tree – Master-Planned Community Excellence

Lone Tree, located in Douglas County approximately 20 miles south of downtown Denver, represents one of Colorado’s most successful master-planned communities. The city has grown from a small town to a thriving suburban community of over 15,000 residents, known for its excellent schools, upscale shopping, and well-planned neighborhoods that blend seamlessly with the natural landscape.

The community’s appeal extends beyond its residential offerings to include the Park Meadows Mall, one of Colorado’s premier shopping destinations, and numerous corporate headquarters that have relocated to the area. The city’s commitment to maintaining high development standards and preserving open space has created a desirable environment that attracts affluent families and professionals seeking suburban luxury with urban conveniences.

The current median price of $907,846 reflects Lone Tree’s position as a premium suburban market that offers excellent value compared to more expensive mountain communities. The recent modest decline in 2025 likely reflects broader market corrections rather than fundamental changes in the area’s desirability. Lone Tree’s strong schools, planned development, and strategic location continue to support long-term property values.

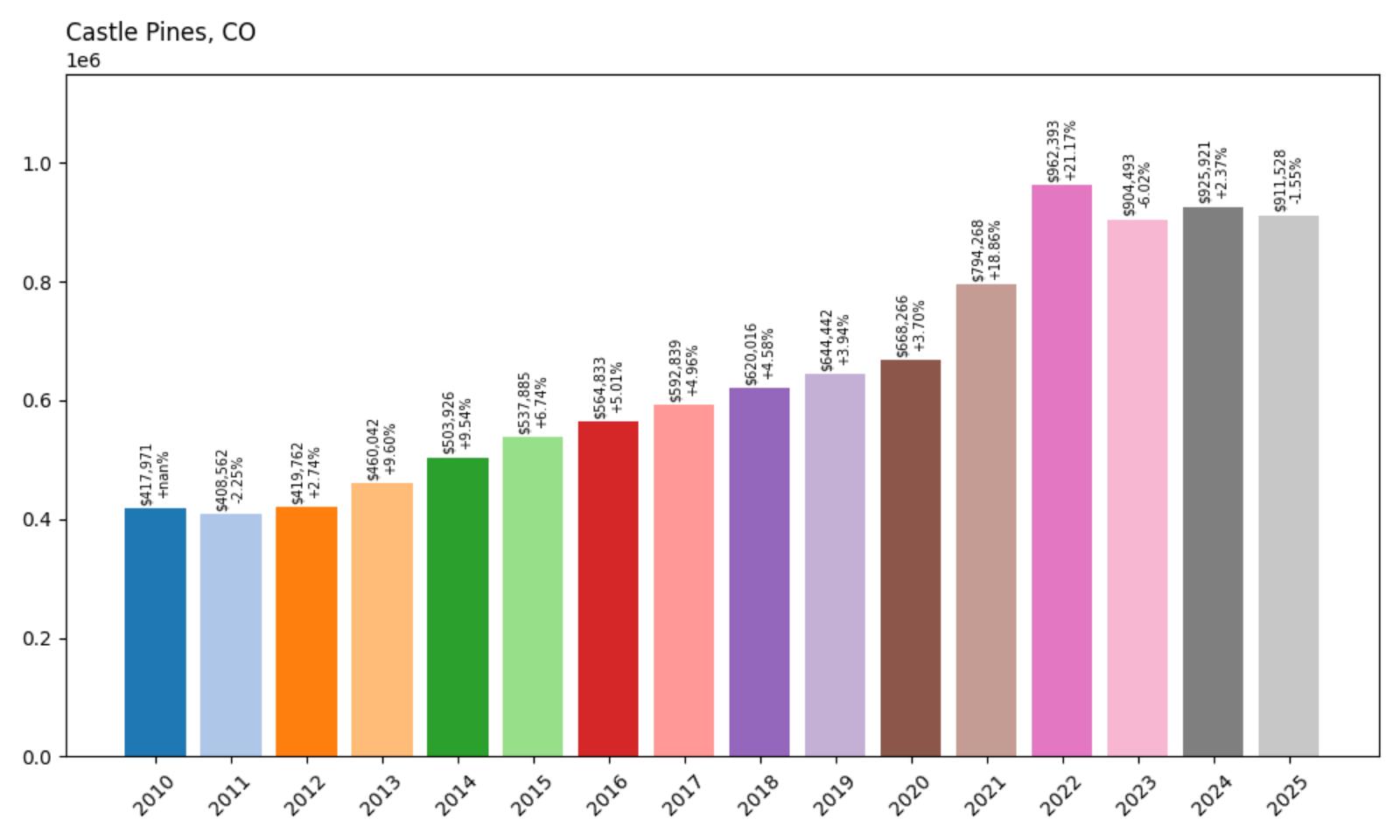

28. Castle Pines – 118% Home Price Increase Since 2010

- 2010: $417,971

- 2011: $408,562 (−$9,409, −2.25% from previous year)

- 2012: $419,762 (+$11,200, +2.74% from previous year)

- 2013: $460,042 (+$40,280, +9.60% from previous year)

- 2014: $503,926 (+$43,884, +9.54% from previous year)

- 2015: $537,885 (+$33,960, +6.74% from previous year)

- 2016: $564,833 (+$26,947, +5.01% from previous year)

- 2017: $592,839 (+$28,006, +4.96% from previous year)

- 2018: $620,016 (+$27,177, +4.58% from previous year)

- 2019: $644,442 (+$24,426, +3.94% from previous year)

- 2020: $668,266 (+$23,825, +3.70% from previous year)

- 2021: $794,268 (+$126,002, +18.86% from previous year)

- 2022: $962,393 (+$168,125, +21.17% from previous year)

- 2023: $904,493 (−$57,900, −6.02% from previous year)

- 2024: $925,921 (+$21,428, +2.37% from previous year)

- 2025: $911,528 (−$14,393, −1.55% from previous year)

Castle Pines has achieved solid growth, more than doubling from $417,971 in 2010 to $911,528 in 2025. The community showed remarkably consistent appreciation throughout the 2010s, with annual increases rarely exceeding 10%. The pandemic years brought significant acceleration, with increases of 19% and 21% in 2021-2022. Recent market adjustments have resulted in modest declines, but the overall trajectory remains strongly positive.

Castle Pines – Golf Course Community with Mountain Views

Castle Pines, located in Douglas County about 25 miles south of Denver, stands as one of Colorado’s premier golf course communities. The city is built around the world-renowned Castle Pines Golf Club, which has hosted numerous PGA Tour events and attracts golf enthusiasts from around the world. The community’s elevated location provides stunning views of the Rocky Mountains while maintaining convenient access to Denver’s business districts.

The area’s development has been carefully planned to preserve the natural beauty of the landscape while providing luxury amenities and services. Castle Pines combines upscale residential neighborhoods with excellent schools, making it particularly attractive to affluent families. The community’s reputation for quality construction, well-maintained properties, and strong homeowners’ associations has helped maintain property values even during market downturns.

The current median price of $911,528 reflects Castle Pines’ position as a mature, established luxury community that offers stability and long-term value. The recent modest decline in 2025 appears to be part of broader market corrections rather than community-specific issues. Castle Pines’ combination of golf course amenities, mountain views, and proximity to Denver ensures continued demand from affluent buyers seeking suburban luxury.

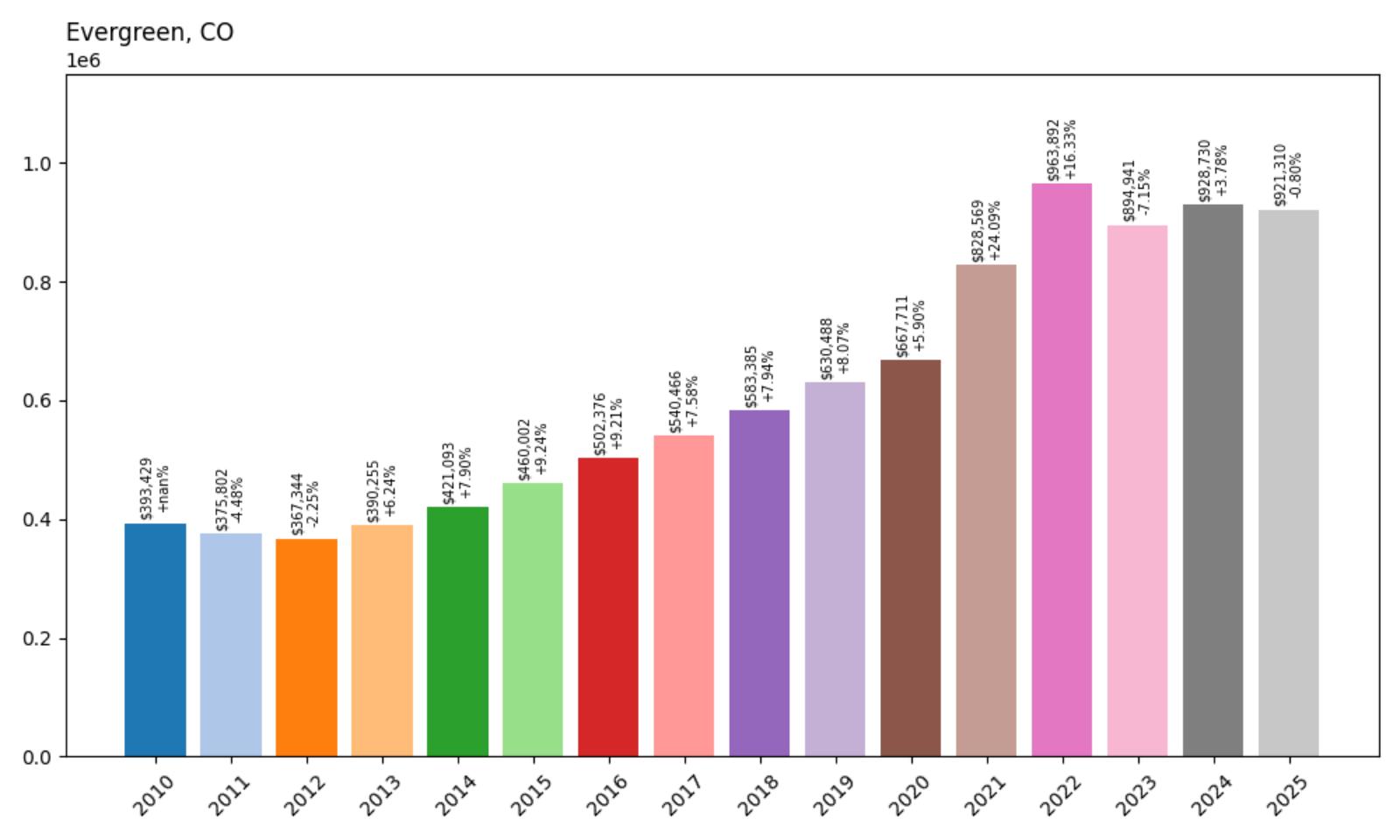

27. Evergreen – 134% Home Price Increase Since 2010

Would you like to save this?

- 2010: $393,429

- 2011: $375,802 (−$17,627, −4.48% from previous year)

- 2012: $367,344 (−$8,458, −2.25% from previous year)

- 2013: $390,255 (+$22,911, +6.24% from previous year)

- 2014: $421,093 (+$30,838, +7.90% from previous year)

- 2015: $460,002 (+$38,908, +9.24% from previous year)

- 2016: $502,376 (+$42,374, +9.21% from previous year)

- 2017: $540,466 (+$38,090, +7.58% from previous year)

- 2018: $583,385 (+$42,919, +7.94% from previous year)

- 2019: $630,488 (+$47,103, +8.07% from previous year)

- 2020: $667,711 (+$37,223, +5.90% from previous year)

- 2021: $828,569 (+$160,858, +24.09% from previous year)

- 2022: $963,892 (+$135,324, +16.33% from previous year)

- 2023: $894,941 (−$68,951, −7.15% from previous year)

- 2024: $928,730 (+$33,790, +3.78% from previous year)

- 2025: $921,310 (−$7,420, −0.80% from previous year)

Evergreen has experienced substantial growth, more than doubling from $393,429 in 2010 to $921,310 in 2025. The community endured a difficult period in 2011-2012 before beginning a steady recovery and growth phase. The pandemic years brought remarkable acceleration, with a 24% increase in 2021 followed by 16% in 2022. Recent market corrections have resulted in modest declines, but prices remain well above historical levels.

Evergreen – Mountain Living with Metro Access

Evergreen, nestled in the foothills of Jefferson County about 30 miles west of Denver, represents the perfect balance between mountain living and metropolitan access. This historic community, established in the 1860s, has evolved from a logging and summer resort town into one of Colorado’s most desirable mountain communities, offering residents a true mountain lifestyle without sacrificing urban conveniences.

The town’s appeal stems from its stunning natural setting around Evergreen Lake, surrounded by towering pines and dramatic rock formations. The area offers year-round outdoor recreation opportunities, from hiking and fishing in summer to cross-country skiing in winter. The combination of mountain beauty and reasonable commuting distance to Denver has made Evergreen increasingly attractive to remote workers and professionals seeking to escape urban life.

The current median price of $921,310 reflects Evergreen’s transformation from a modest mountain community to a premium residential market. The 134% price increase since 2010 demonstrates the area’s growing appeal, particularly during the pandemic when demand for mountain properties surged. Despite recent modest declines, Evergreen’s unique combination of natural beauty, community character, and accessibility continues to support strong property values.

26. Larkspur – 127% Home Price Increase Since 2010

- 2010: $419,837

- 2011: $405,330 (−$14,507, −3.46% from previous year)

- 2012: $405,791 (+$461, +0.11% from previous year)

- 2013: $437,127 (+$31,336, +7.72% from previous year)

- 2014: $469,780 (+$32,653, +7.47% from previous year)

- 2015: $500,249 (+$30,469, +6.49% from previous year)

- 2016: $528,707 (+$28,458, +5.69% from previous year)

- 2017: $572,831 (+$44,124, +8.35% from previous year)

- 2018: $610,610 (+$37,779, +6.60% from previous year)

- 2019: $638,960 (+$28,350, +4.64% from previous year)

- 2020: $668,609 (+$29,650, +4.64% from previous year)

- 2021: $814,759 (+$146,149, +21.86% from previous year)

- 2022: $977,583 (+$162,824, +19.98% from previous year)

- 2023: $911,235 (−$66,348, −6.79% from previous year)

- 2024: $947,469 (+$36,234, +3.98% from previous year)

- 2025: $951,730 (+$4,260, +0.45% from previous year)

Larkspur has shown impressive growth, more than doubling from $419,837 in 2010 to $951,730 in 2025. The community demonstrated remarkable consistency through the 2010s, with steady annual increases rarely exceeding 8%. The pandemic years brought explosive growth, with back-to-back increases of nearly 22% and 20% in 2021-2022. Recent market stabilization has resulted in modest growth, suggesting the market has reached a new equilibrium.

Larkspur – Historic Railroad Town Turned Luxury Enclave

Larkspur, located in Douglas County along the historic Denver and Rio Grande Railroad line, represents one of Colorado’s most charming small-town success stories. This unincorporated community, situated about 25 miles south of Denver, has transformed from a modest railroad stop into an exclusive residential enclave that attracts affluent buyers seeking small-town character with big-city access.

The area’s appeal lies in its combination of rural character and suburban convenience, with large lots and custom homes nestled among rolling hills and mature trees. Larkspur’s location along the Front Range provides stunning mountain views while maintaining easy access to Denver via Highway 85. The community’s historic railroad heritage is preserved through various landmarks and the continued presence of the railroad line that helped establish the town.

The current median price of $951,730 reflects Larkspur’s evolution into a premium residential market that offers an alternative to more crowded suburban developments. The 127% price increase since 2010 demonstrates the area’s growing recognition among affluent buyers seeking privacy and space. The recent price stabilization suggests the market has reached maturity, though the area’s limited inventory and desirable location continue to support strong valuations.

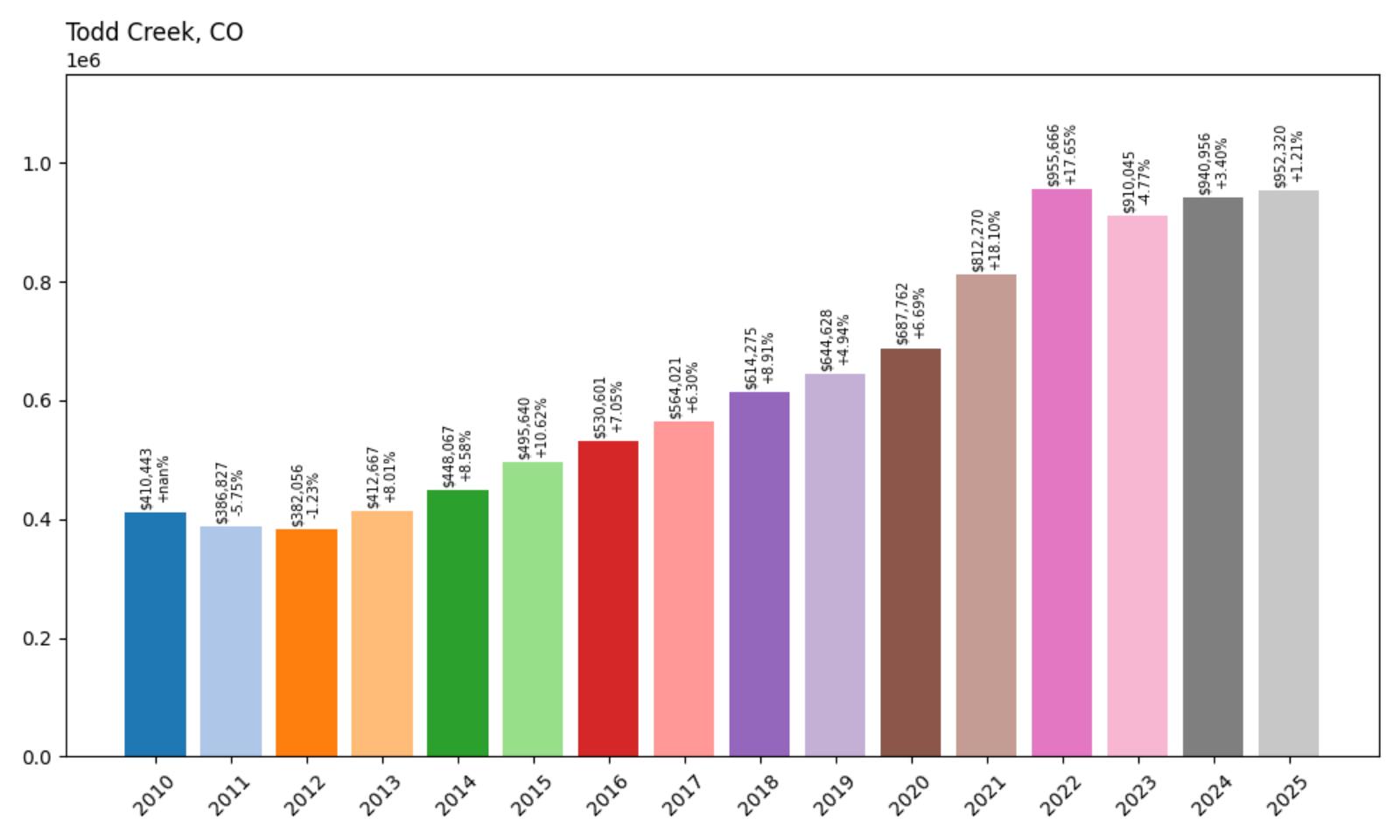

25. Todd Creek – 132% Home Price Increase Since 2010

- 2010: $410,443

- 2011: $386,827 (−$23,616, −5.75% from previous year)

- 2012: $382,056 (−$4,770, −1.23% from previous year)

- 2013: $412,667 (+$30,610, +8.01% from previous year)

- 2014: $448,067 (+$35,400, +8.58% from previous year)

- 2015: $495,640 (+$47,573, +10.62% from previous year)

- 2016: $530,601 (+$34,961, +7.05% from previous year)

- 2017: $564,021 (+$33,420, +6.30% from previous year)

- 2018: $614,275 (+$50,254, +8.91% from previous year)

- 2019: $644,628 (+$30,353, +4.94% from previous year)

- 2020: $687,762 (+$43,134, +6.69% from previous year)

- 2021: $812,270 (+$124,508, +18.10% from previous year)

- 2022: $955,666 (+$143,396, +17.65% from previous year)

- 2023: $910,045 (−$45,621, −4.77% from previous year)

- 2024: $940,956 (+$30,911, +3.40% from previous year)

- 2025: $952,320 (+$11,364, +1.21% from previous year)

Todd Creek has demonstrated strong appreciation, more than doubling from $410,443 in 2010 to $952,320 in 2025. After a challenging start in 2011-2012, the community experienced consistent growth through the 2010s with particularly strong performance in 2015 and 2018. The pandemic years brought significant acceleration with consecutive increases of 18% and 18% in 2021-2022. Recent market adjustments have resulted in more modest growth, indicating market maturation.

Todd Creek – Equestrian Community with Rural Charm

Todd Creek, located in Adams County northwest of Denver, represents one of Colorado’s premier equestrian communities. This rural enclave, situated about 20 miles from downtown Denver, has maintained its agricultural character while attracting affluent buyers seeking large properties suitable for horses and other livestock. The area’s rolling terrain and spacious lots make it ideal for those wanting a rural lifestyle without sacrificing urban accessibility.

The community’s appeal extends beyond its equestrian amenities to include stunning views of the Rocky Mountains and proximity to outdoor recreation opportunities. Todd Creek’s location provides easy access to both Denver’s business districts and the mountains, making it attractive to professionals who value rural living. The area’s zoning allows for agricultural uses, supporting the community’s horse-friendly character that sets it apart from typical suburban developments.

The current median price of $952,320 reflects Todd Creek’s position as a premium rural residential market that offers unique amenities and lifestyle opportunities. The 132% price increase since 2010 demonstrates the growing demand for equestrian properties and rural luxury near major metropolitan areas. The recent modest growth suggests the market has stabilized at a higher level, supported by the area’s limited inventory and specialized appeal.

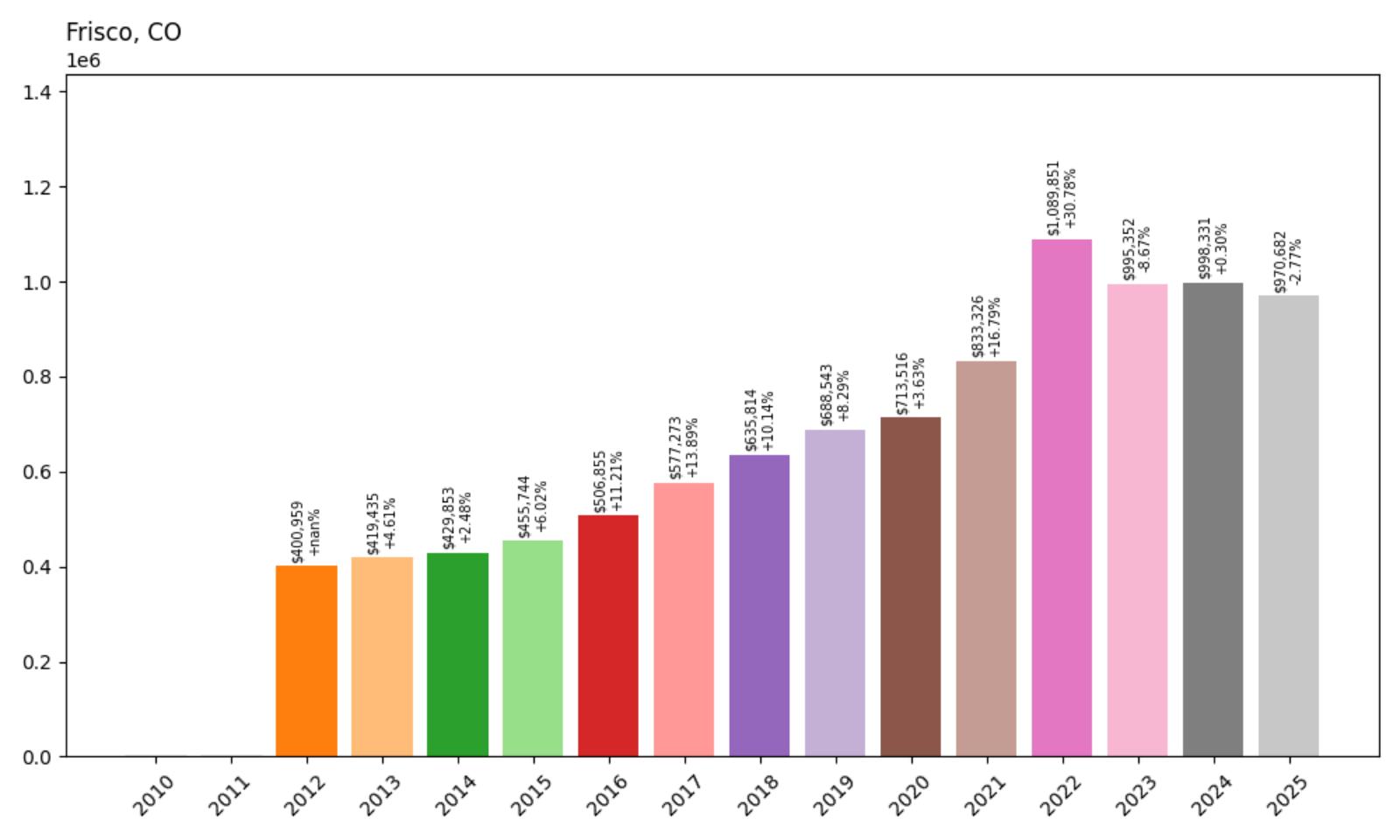

24. Frisco – 142% Home Price Increase Since 2012

- 2010: N/A

- 2011: N/A

- 2012: $400,959

- 2013: $419,435 (+$18,476, +4.61% from previous year)

- 2014: $429,853 (+$10,417, +2.48% from previous year)

- 2015: $455,744 (+$25,891, +6.02% from previous year)

- 2016: $506,855 (+$51,111, +11.21% from previous year)

- 2017: $577,273 (+$70,417, +13.89% from previous year)

- 2018: $635,814 (+$58,541, +10.14% from previous year)

- 2019: $688,543 (+$52,729, +8.29% from previous year)

- 2020: $713,516 (+$24,974, +3.63% from previous year)

- 2021: $833,326 (+$119,810, +16.79% from previous year)

- 2022: $1,089,851 (+$256,524, +30.78% from previous year)

- 2023: $995,352 (−$94,498, −8.67% from previous year)

- 2024: $998,331 (+$2,978, +0.30% from previous year)

- 2025: $970,682 (−$27,649, −2.77% from previous year)

Frisco has shown remarkable growth since data became available in 2012, climbing from $400,959 to $970,682 in 2025. The community demonstrated consistent appreciation through the 2010s, with particularly strong years in 2016-2017 when prices jumped significantly. The pandemic brought explosive growth, with a massive 31% increase in 2022. Recent market corrections have resulted in modest declines, but prices remain well above pre-pandemic levels.

Frisco – Gateway to Summit County Recreation

Smallbones, Public domain, via Wikimedia Commons

Frisco, located in Summit County at an elevation of 9,097 feet, serves as the gateway to some of Colorado’s most renowned ski resorts and outdoor recreation areas. This historic mining town, situated along the shores of Dillon Reservoir, has evolved into a year-round destination that attracts outdoor enthusiasts and second-home buyers seeking mountain lifestyle experiences.

The town’s strategic location provides easy access to four major ski areas: Keystone, Breckenridge, Arapahoe Basin, and Copper Mountain, making it particularly attractive to skiing and snowboarding enthusiasts. During summer months, the area offers world-class hiking, biking, boating, and fishing opportunities. Frisco’s more affordable housing compared to nearby Breckenridge and Vail has made it increasingly popular among buyers seeking mountain living without premium resort pricing.

The current median price of $970,682 reflects Frisco’s position as a relatively accessible entry point into Summit County’s luxury mountain market. The 142% price increase since 2012 demonstrates the town’s growing appeal as a year-round mountain destination. The recent modest decline in 2025 may reflect broader market corrections in mountain resort areas, though Frisco’s unique combination of location, amenities, and relative affordability continues to support strong demand.

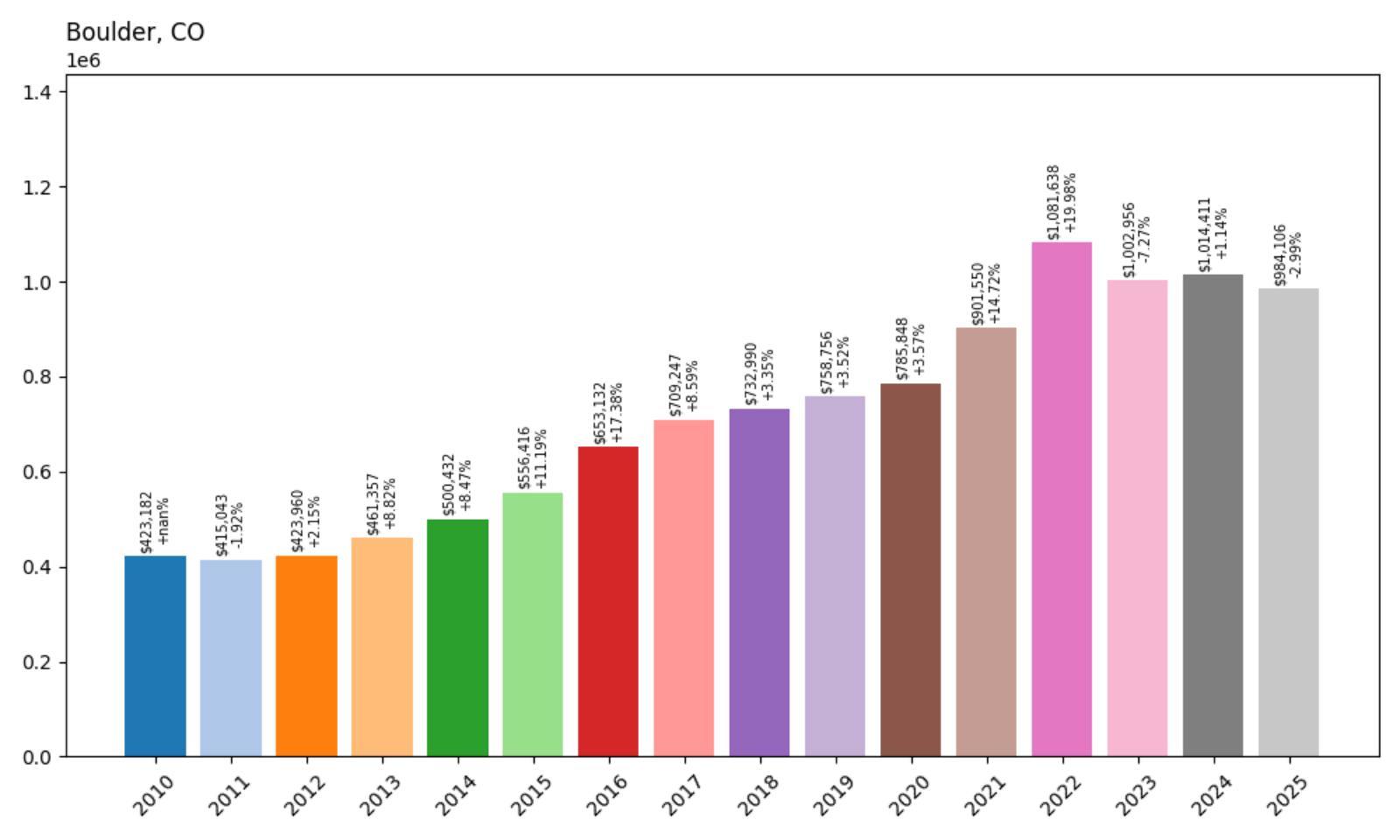

23. Boulder – 133% Home Price Increase Since 2010

- 2010: $423,182

- 2011: $415,043 (−$8,139, −1.92% from previous year)

- 2012: $423,960 (+$8,917, +2.15% from previous year)

- 2013: $461,357 (+$37,397, +8.82% from previous year)

- 2014: $500,432 (+$39,075, +8.47% from previous year)

- 2015: $556,416 (+$55,984, +11.19% from previous year)

- 2016: $653,132 (+$96,716, +17.38% from previous year)

- 2017: $709,247 (+$56,115, +8.59% from previous year)

- 2018: $732,990 (+$23,743, +3.35% from previous year)

- 2019: $758,756 (+$25,767, +3.52% from previous year)

- 2020: $785,848 (+$27,092, +3.57% from previous year)

- 2021: $901,550 (+$115,701, +14.72% from previous year)

- 2022: $1,081,638 (+$180,089, +19.98% from previous year)

- 2023: $1,002,956 (−$78,683, −7.27% from previous year)

- 2024: $1,014,411 (+$11,456, +1.14% from previous year)

- 2025: $984,106 (−$30,305, −2.99% from previous year)

Boulder has achieved substantial growth, more than doubling from $423,182 in 2010 to $984,106 in 2025. The city showed steady appreciation through the 2010s, with a particularly strong year in 2016 when prices jumped 17%. The pandemic years brought significant acceleration, with increases of 15% and 20% in 2021-2022. Recent market cooling has resulted in modest declines, but Boulder remains one of Colorado’s most expensive markets.

Boulder – College Town Innovation Hub

Boulder, home to the University of Colorado and nestled against the dramatic backdrop of the Flatirons, represents one of Colorado’s most unique and desirable communities. This city of approximately 108,000 residents has successfully balanced its identity as a college town with its role as a major technology and innovation hub, attracting both students and high-tech professionals who value education, outdoor recreation, and progressive community values.

The city’s appeal extends far beyond its university connections to include world-class outdoor recreation opportunities, a thriving downtown area, and a commitment to environmental sustainability that has made it a model for other communities. Boulder’s strict growth controls and open space preservation have limited housing supply while maintaining the area’s natural beauty, contributing to consistent upward pressure on home prices. The presence of numerous technology companies and research institutions provides a stable economic base that supports high property values.

The current median price of $984,106 reflects Boulder’s position as one of Colorado’s premier markets, where demand consistently exceeds supply. The 133% price increase since 2010 demonstrates the city’s enduring appeal to affluent buyers seeking a unique combination of intellectual stimulation, outdoor recreation, and progressive community values. Despite recent modest declines, Boulder’s fundamental appeal and supply constraints continue to support premium pricing.

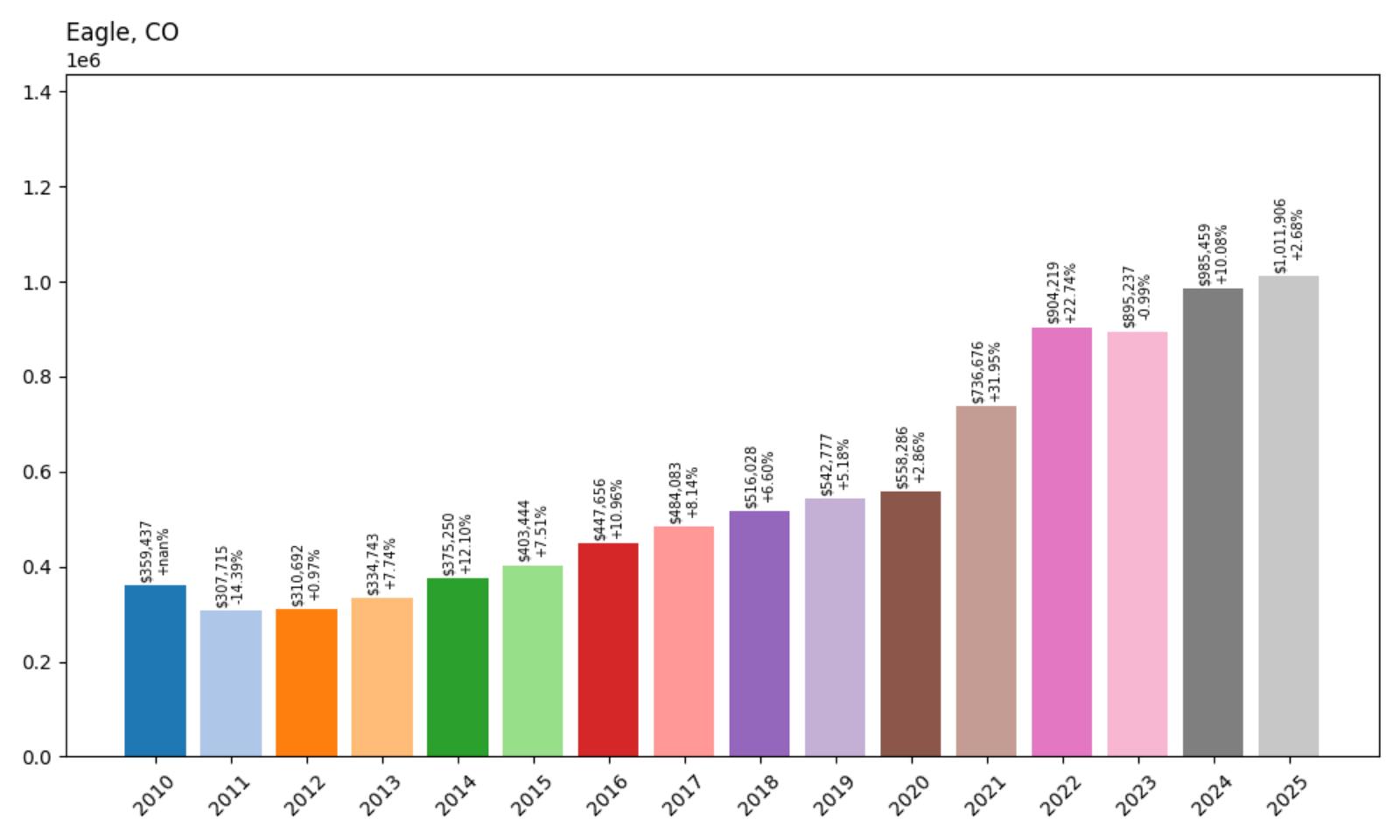

22. Eagle – 182% Home Price Increase Since 2010

- 2010: $359,437

- 2011: $307,715 (−$51,722, −14.39% from previous year)

- 2012: $310,692 (+$2,977, +0.97% from previous year)

- 2013: $334,743 (+$24,052, +7.74% from previous year)

- 2014: $375,250 (+$40,507, +12.10% from previous year)

- 2015: $403,444 (+$28,194, +7.51% from previous year)

- 2016: $447,656 (+$44,212, +10.96% from previous year)

- 2017: $484,083 (+$36,427, +8.14% from previous year)

- 2018: $516,028 (+$31,945, +6.60% from previous year)

- 2019: $542,777 (+$26,750, +5.18% from previous year)

- 2020: $558,286 (+$15,508, +2.86% from previous year)

- 2021: $736,676 (+$178,390, +31.95% from previous year)

- 2022: $904,219 (+$167,543, +22.74% from previous year)

- 2023: $895,237 (−$8,982, −0.99% from previous year)

- 2024: $985,459 (+$90,222, +10.08% from previous year)

- 2025: $1,011,906 (+$26,447, +2.68% from previous year)

Eagle has experienced dramatic transformation, nearly tripling from $359,437 in 2010 to $1,011,906 in 2025. The community endured a severe downturn in 2011 before beginning a steady recovery that accelerated through the 2010s. The pandemic years brought explosive growth, with massive increases of 32% and 23% in 2021-2022. Recent years have shown continued strength, with significant growth in 2024 and modest appreciation in 2025.

Eagle – Vail Valley’s Affordable Alternative

Jeffrey Beall, CC BY 4.0, via Wikimedia Commons

Eagle, located in Eagle County about 30 miles west of Vail, represents one of the Vail Valley’s most accessible communities for both residents and visitors. This town of approximately 7,000 people has maintained its small-town character while benefiting from proximity to world-class ski resorts and outdoor recreation opportunities. Eagle’s location along the Colorado River and Interstate 70 provides easy access to Vail, Beaver Creek, and other mountain destinations.

The community’s appeal stems from its combination of mountain lifestyle amenities and relative affordability compared to nearby resort towns. Eagle offers a more authentic mountain community experience, with local businesses, community events, and a strong sense of civic pride. The area’s year-round recreation opportunities, from skiing and snowboarding in winter to hiking, fishing, and river activities in summer, attract both full-time residents and second-home buyers.

The current median price of $1,011,906 reflects Eagle’s evolution from a modest mountain town to a premium residential market. The remarkable 182% price increase since 2010 demonstrates the growing recognition of Eagle as an attractive alternative to more expensive Vail Valley communities. The continued appreciation in 2024-2025 suggests strong ongoing demand for the community’s unique combination of mountain lifestyle and relative accessibility.

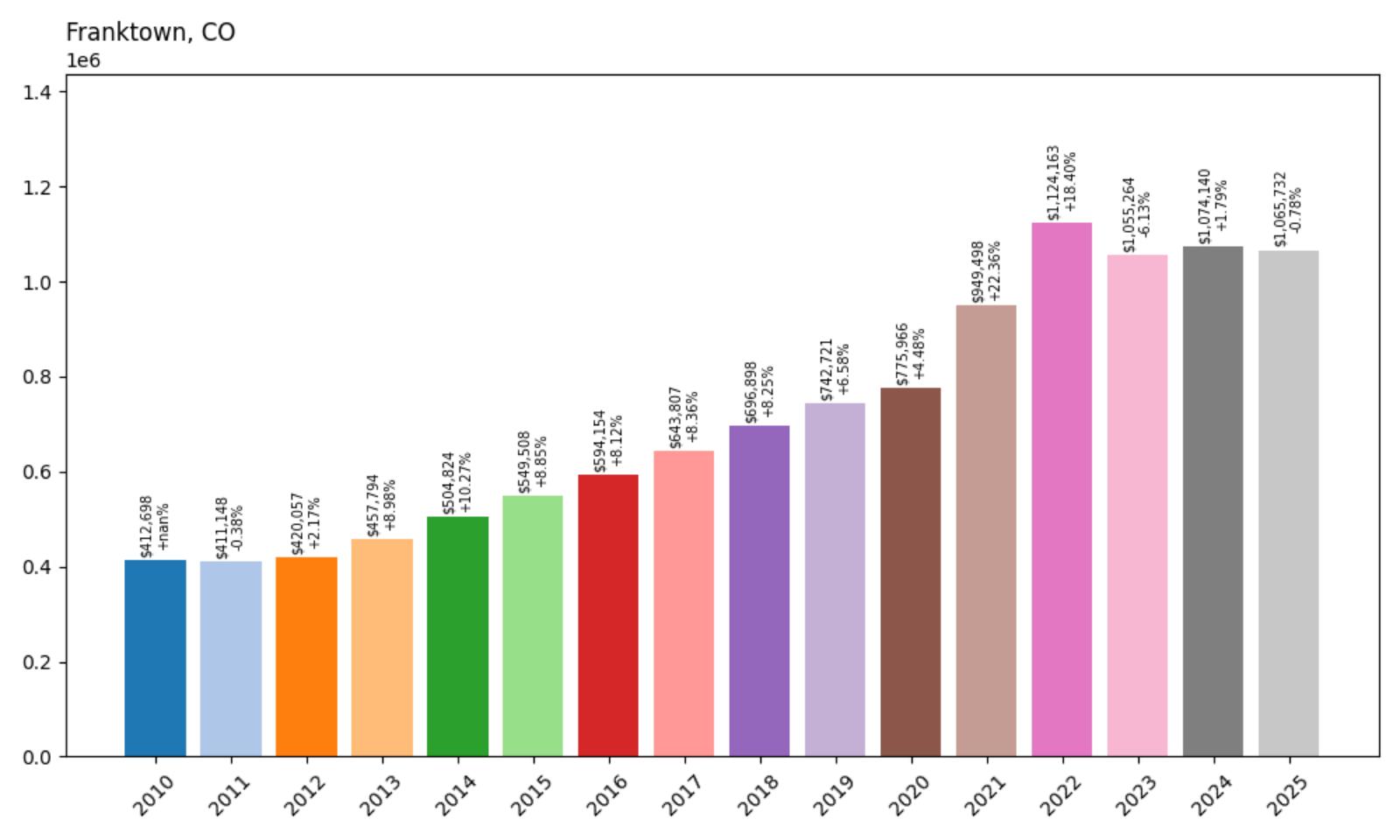

21. Franktown – 158% Home Price Increase Since 2010

Would you like to save this?

- 2010: $412,698

- 2011: $411,148 (−$1,550, −0.38% from previous year)

- 2012: $420,057 (+$8,910, +2.17% from previous year)

- 2013: $457,794 (+$37,737, +8.98% from previous year)

- 2014: $504,824 (+$47,029, +10.27% from previous year)

- 2015: $549,508 (+$44,684, +8.85% from previous year)

- 2016: $594,154 (+$44,645, +8.12% from previous year)

- 2017: $643,807 (+$49,653, +8.36% from previous year)

- 2018: $696,898 (+$53,091, +8.25% from previous year)

- 2019: $742,721 (+$45,822, +6.58% from previous year)

- 2020: $775,966 (+$33,245, +4.48% from previous year)

- 2021: $949,498 (+$173,532, +22.36% from previous year)

- 2022: $1,124,163 (+$174,665, +18.40% from previous year)

- 2023: $1,055,264 (−$68,898, −6.13% from previous year)

- 2024: $1,074,140 (+$18,876, +1.79% from previous year)

- 2025: $1,065,732 (−$8,408, −0.78% from previous year)

Franktown has demonstrated exceptional growth, more than doubling from $412,698 in 2010 to $1,065,732 in 2025. The community showed remarkably consistent appreciation throughout the 2010s, with annual increases typically ranging from 8-10%. The pandemic years brought significant acceleration, with increases of 22% and 18% in 2021-2022. Recent market adjustments have resulted in modest declines, but the overall trajectory remains strongly positive.

Franktown – Historic Ranch Community

Franktown, located in Douglas County about 25 miles southeast of Denver, represents one of Colorado’s most authentic ranch communities that has successfully preserved its Western heritage while attracting affluent buyers seeking rural luxury. This small unincorporated community, established in the 1860s, maintains its historic character through preserved ranch properties and a strong commitment to agricultural traditions.

The area’s appeal lies in its combination of historic significance, rural character, and proximity to Denver’s metropolitan amenities. Franktown’s large lots and ranch-style properties attract buyers seeking equestrian facilities, private retreats, and the authentic Western lifestyle that has defined Colorado’s identity. The community’s location along the historic Cherokee Trail and its preservation of original ranch structures provide a unique connection to Colorado’s pioneer heritage.

The current median price of $1,065,732 reflects Franktown’s transformation into a premium rural residential market that offers exclusivity and authentic Western living. The 158% price increase since 2010 demonstrates the growing value placed on historic properties and rural lifestyle amenities. Despite recent modest declines, Franktown’s unique character and limited inventory continue to support strong property values among buyers seeking genuine ranch living experiences.

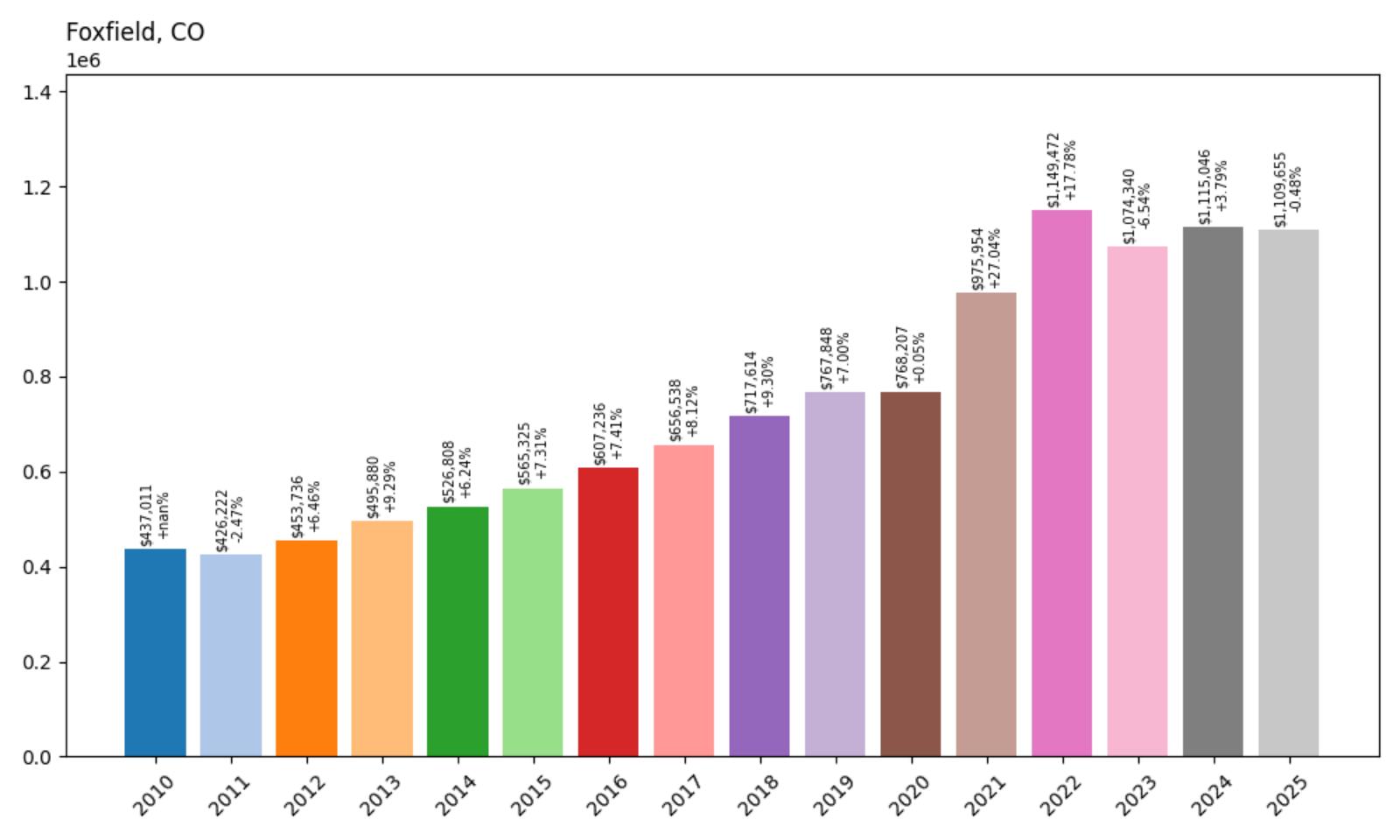

20. Foxfield – 154% Home Price Increase Since 2010

- 2010: $437,011

- 2011: $426,222 (−$10,789, −2.47% from previous year)

- 2012: $453,736 (+$27,514, +6.46% from previous year)

- 2013: $495,880 (+$42,144, +9.29% from previous year)

- 2014: $526,808 (+$30,928, +6.24% from previous year)

- 2015: $565,325 (+$38,517, +7.31% from previous year)

- 2016: $607,236 (+$41,910, +7.41% from previous year)

- 2017: $656,538 (+$49,302, +8.12% from previous year)

- 2018: $717,614 (+$61,077, +9.30% from previous year)

- 2019: $767,848 (+$50,234, +7.00% from previous year)

- 2020: $768,207 (+$358, +0.05% from previous year)

- 2021: $975,954 (+$207,747, +27.04% from previous year)

- 2022: $1,149,472 (+$173,518, +17.78% from previous year)

- 2023: $1,074,340 (−$75,132, −6.54% from previous year)

- 2024: $1,115,046 (+$40,705, +3.79% from previous year)

- 2025: $1,109,655 (−$5,391, −0.48% from previous year)

Foxfield has shown impressive growth, more than doubling from $437,011 in 2010 to $1,109,655 in 2025. The community demonstrated strong and consistent appreciation throughout the 2010s, with particularly robust years in 2017-2018. The pandemic brought explosive growth, with a massive 27% increase in 2021 followed by 18% in 2022. Recent market corrections have resulted in modest declines, but prices remain well above pre-pandemic levels.

Foxfield – Equestrian Estate Living

Foxfield, located in Arapahoe County about 20 miles southeast of Denver, stands as one of Colorado’s premier equestrian communities. This small city of approximately 700 residents has maintained its rural character and commitment to horse-friendly living while attracting affluent buyers seeking luxury estate properties with extensive acreage and equestrian facilities.

The community’s appeal centers on its unique zoning that requires minimum lot sizes of 2.5 acres, ensuring privacy and space for horses and other rural amenities. Foxfield’s location provides easy access to Denver’s business districts while maintaining a distinctly rural atmosphere that includes horse trails, open spaces, and agricultural uses. The city’s strong commitment to preserving its equestrian character has created a unique residential environment that attracts horse enthusiasts and those seeking rural luxury.

The current median price of $1,109,655 reflects Foxfield’s position as a premium equestrian real estate market that offers exclusivity and specialized amenities. The 154% price increase since 2010 demonstrates the growing demand for equestrian properties and rural luxury near major metropolitan areas. Despite recent modest declines, Foxfield’s unique character, large lot requirements, and limited inventory continue to support strong property values among buyers seeking authentic rural living experiences.

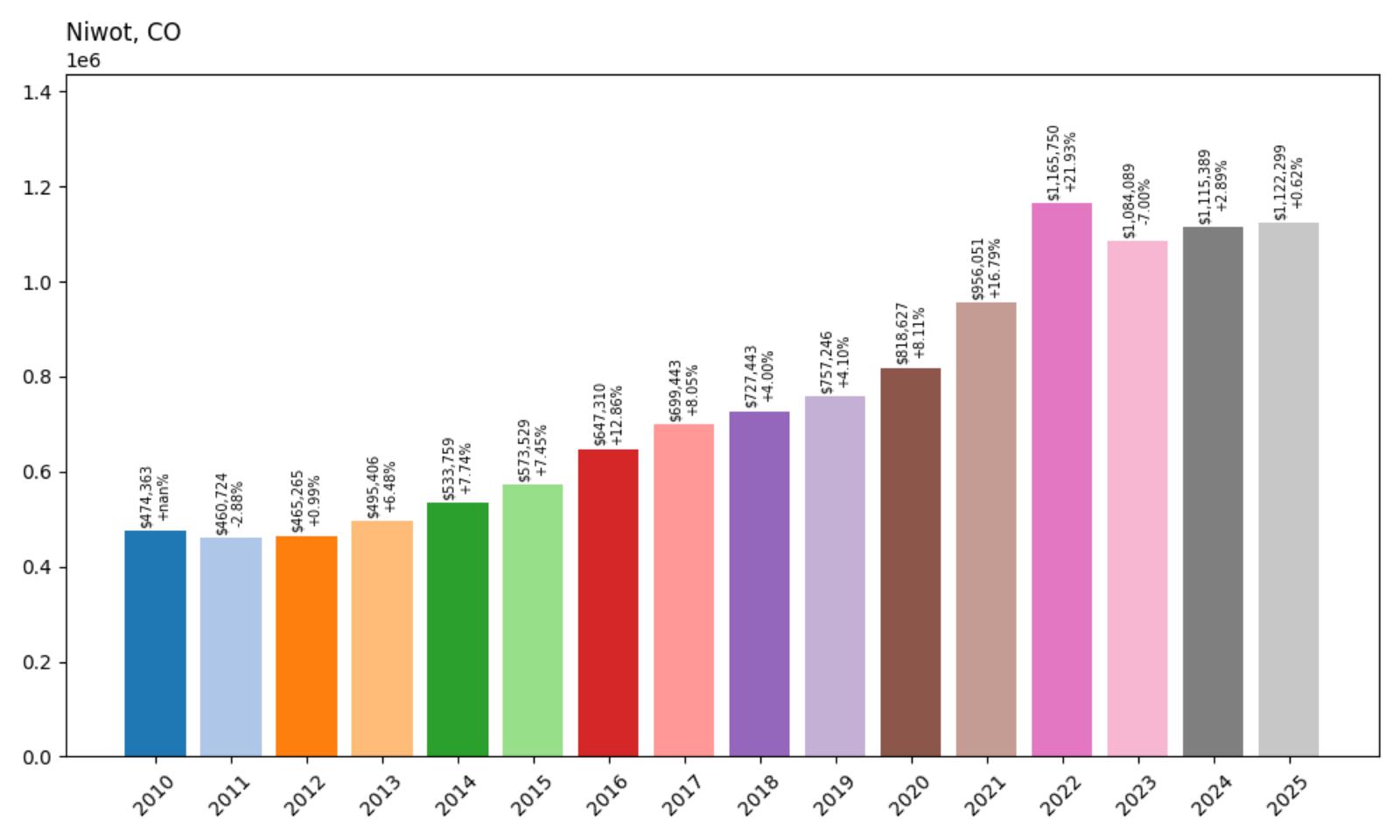

19. Niwot – 137% Home Price Increase Since 2010

- 2010: $474,363

- 2011: $460,724 (−$13,639, −2.88% from previous year)

- 2012: $465,265 (+$4,541, +0.99% from previous year)

- 2013: $495,406 (+$30,141, +6.48% from previous year)

- 2014: $533,759 (+$38,353, +7.74% from previous year)

- 2015: $573,529 (+$39,770, +7.45% from previous year)

- 2016: $647,310 (+$73,781, +12.86% from previous year)

- 2017: $699,443 (+$52,134, +8.05% from previous year)

- 2018: $727,443 (+$27,999, +4.00% from previous year)

- 2019: $757,246 (+$29,804, +4.10% from previous year)

- 2020: $818,627 (+$61,380, +8.11% from previous year)

- 2021: $956,051 (+$137,425, +16.79% from previous year)

- 2022: $1,165,750 (+$209,698, +21.93% from previous year)

- 2023: $1,084,089 (−$81,660, −7.00% from previous year)

- 2024: $1,115,389 (+$31,300, +2.89% from previous year)

- 2025: $1,122,299 (+$6,910, +0.62% from previous year)

Niwot has achieved substantial growth, more than doubling from $474,363 in 2010 to $1,122,299 in 2025. The community showed steady appreciation through the 2010s, with a particularly strong year in 2016 when prices jumped nearly 13%. The pandemic years brought significant acceleration, with increases of 17% and 22% in 2021-2022. Recent market stabilization has resulted in modest growth, suggesting the market has reached a new equilibrium.

Niwot – Small Town Charm Near Boulder

Niwot, located in Boulder County about 15 miles northeast of Boulder, represents one of Colorado’s most charming small towns that has successfully preserved its historic character while benefiting from proximity to the Boulder metropolitan area. This unincorporated community of approximately 4,000 residents maintains a strong sense of community identity centered around its historic downtown area and agricultural heritage.

The town’s appeal lies in its combination of small-town atmosphere and access to Boulder’s cultural, educational, and economic opportunities. Niwot’s historic downtown features local businesses, restaurants, and community events that foster a strong sense of place. The area’s location provides easy access to outdoor recreation opportunities in the nearby foothills while maintaining reasonable commuting distances to Boulder and Denver.

The current median price of $1,122,299 reflects Niwot’s transformation from a modest agricultural community to a premium residential market that offers small-town living with metropolitan access. The 137% price increase since 2010 demonstrates the growing value placed on authentic community character and proximity to Boulder’s amenities. The recent price stabilization suggests the market has reached maturity, though the area’s unique character and limited inventory continue to support strong property values.

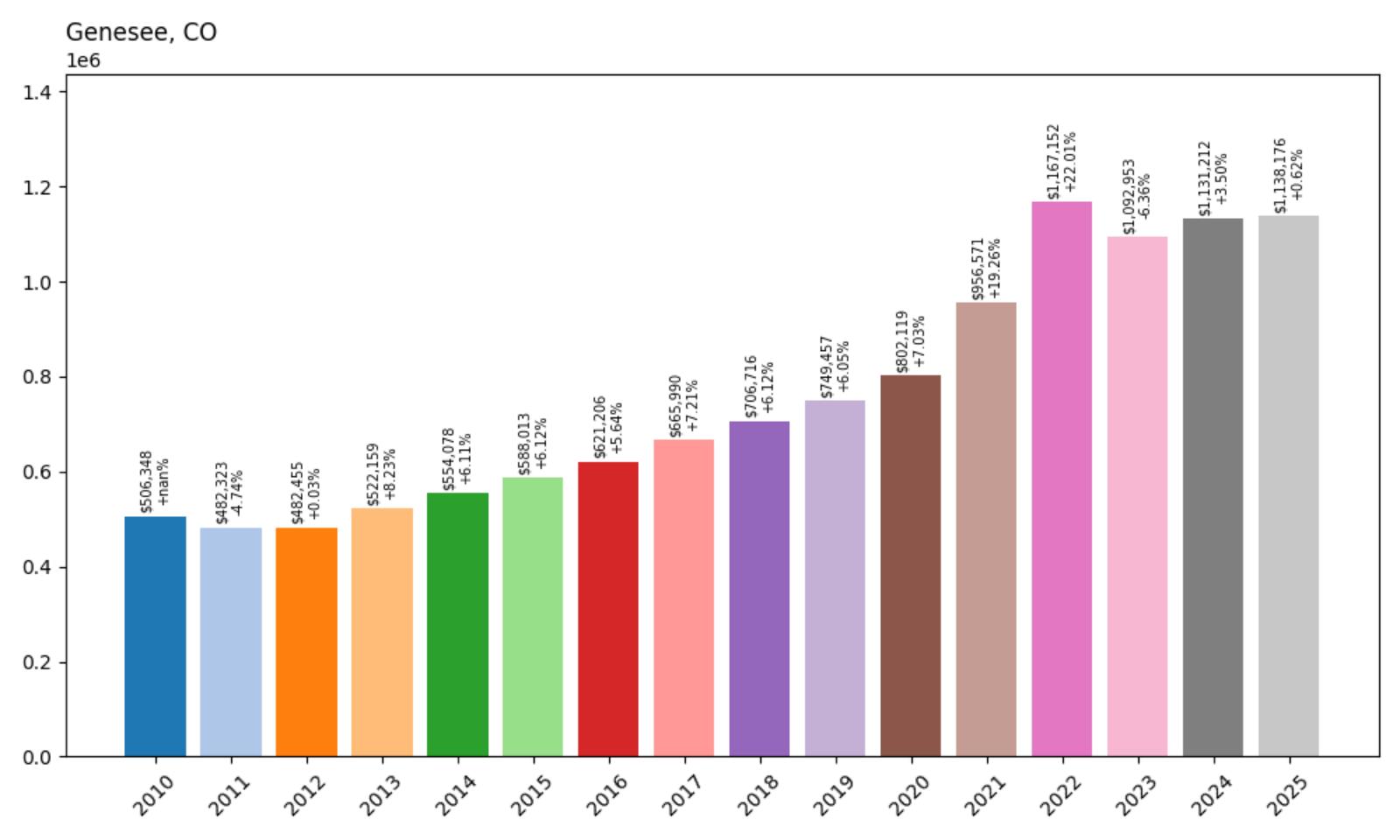

18. Genesee – 125% Home Price Increase Since 2010

- 2010: $506,348

- 2011: $482,323 (−$24,025, −4.74% from previous year)

- 2012: $482,455 (+$133, +0.03% from previous year)

- 2013: $522,159 (+$39,704, +8.23% from previous year)

- 2014: $554,078 (+$31,919, +6.11% from previous year)

- 2015: $588,013 (+$33,935, +6.12% from previous year)

- 2016: $621,206 (+$33,193, +5.64% from previous year)

- 2017: $665,990 (+$44,784, +7.21% from previous year)

- 2018: $706,716 (+$40,727, +6.12% from previous year)

- 2019: $749,457 (+$42,740, +6.05% from previous year)

- 2020: $802,119 (+$52,663, +7.03% from previous year)

- 2021: $956,571 (+$154,452, +19.26% from previous year)

- 2022: $1,167,152 (+$210,581, +22.01% from previous year)

- 2023: $1,092,953 (−$74,199, −6.36% from previous year)

- 2024: $1,131,212 (+$38,260, +3.50% from previous year)

- 2025: $1,138,176 (+$6,963, +0.62% from previous year)

Genesee has demonstrated solid growth, more than doubling from $506,348 in 2010 to $1,138,176 in 2025. The community showed remarkably consistent appreciation throughout the 2010s, with annual increases typically ranging from 5-7%. The pandemic years brought significant acceleration, with increases of 19% and 22% in 2021-2022. Recent market adjustments have resulted in modest growth, indicating market stabilization at higher levels.

Genesee – Historic Mountain Community

Genesee, located in Jefferson County about 20 miles west of Denver, represents one of Colorado’s most historic and unique mountain communities. This small unincorporated area, established in the 1890s, sits at an elevation of approximately 7,200 feet and offers residents stunning mountain views and a sense of historic continuity that is rare in Colorado’s rapidly changing landscape.

The community’s appeal stems from its combination of mountain living and reasonable access to Denver’s metropolitan amenities. Genesee’s location along US Highway 40 provides scenic beauty and outdoor recreation opportunities while maintaining commutable distances to the city. The area’s historic character is preserved through original buildings and community traditions that create a unique sense of place among Colorado’s mountain communities.

The current median price of $1,138,176 reflects Genesee’s position as a premium mountain residential market that offers both historic charm and modern amenities. The 125% price increase since 2010 demonstrates the growing value placed on authentic mountain communities with easy metropolitan access. The recent modest growth suggests the market has reached a stable equilibrium, though the area’s unique character and limited inventory continue to support strong property values.

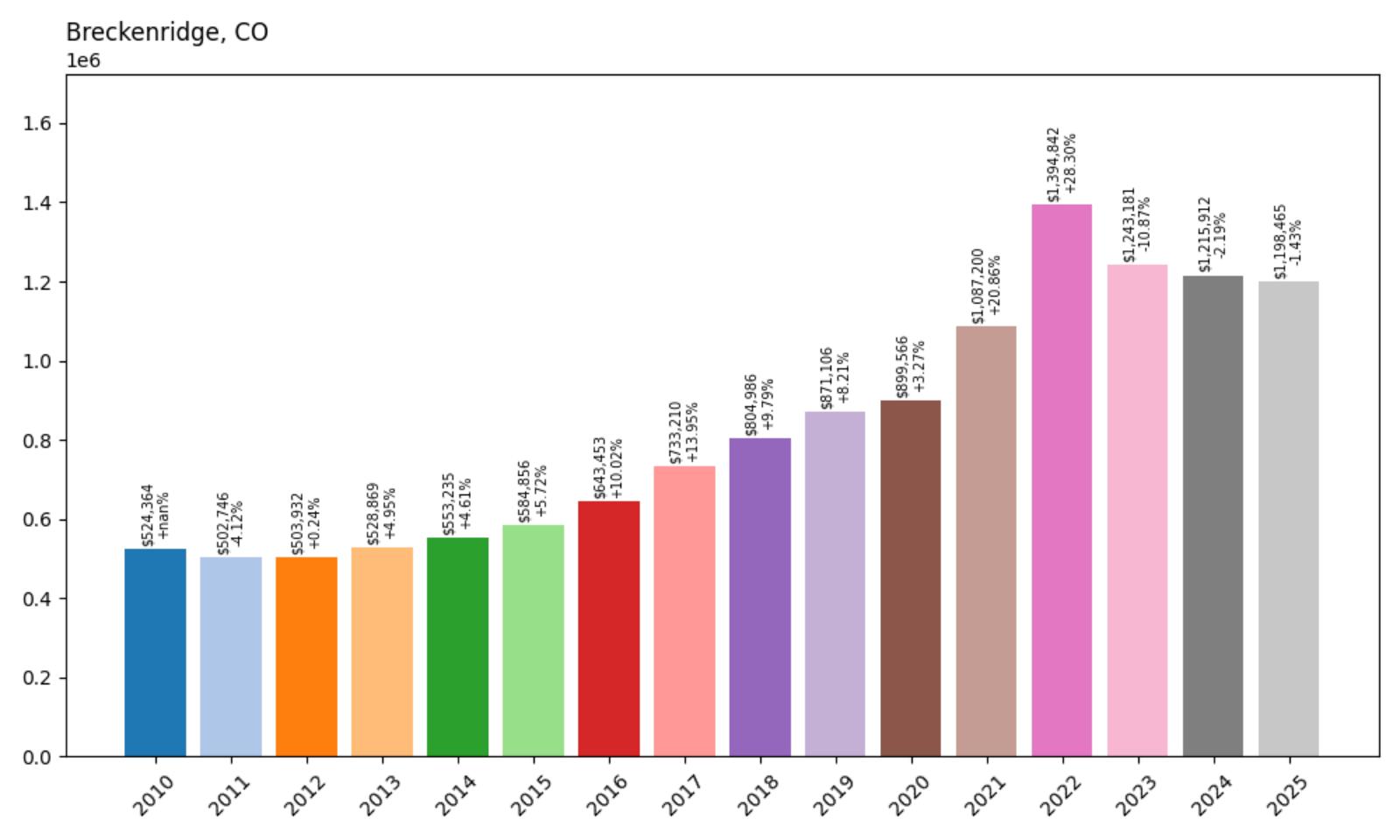

17. Breckenridge – 129% Home Price Increase Since 2010

- 2010: $524,364

- 2011: $502,746 (−$21,618, −4.12% from previous year)

- 2012: $503,932 (+$1,186, +0.24% from previous year)

- 2013: $528,869 (+$24,936, +4.95% from previous year)

- 2014: $553,235 (+$24,366, +4.61% from previous year)

- 2015: $584,856 (+$31,621, +5.72% from previous year)

- 2016: $643,453 (+$58,598, +10.02% from previous year)

- 2017: $733,210 (+$89,757, +13.95% from previous year)

- 2018: $804,986 (+$71,776, +9.79% from previous year)

- 2019: $871,106 (+$66,120, +8.21% from previous year)

- 2020: $899,566 (+$28,459, +3.27% from previous year)

- 2021: $1,087,200 (+$187,634, +20.86% from previous year)

- 2022: $1,394,842 (+$307,642, +28.30% from previous year)

- 2023: $1,243,181 (−$151,661, −10.87% from previous year)

- 2024: $1,215,912 (−$27,268, −2.19% from previous year)

- 2025: $1,198,465 (−$17,448, −1.43% from previous year)

Breckenridge has shown strong long-term growth, more than doubling from $524,364 in 2010 to $1,198,465 in 2025. The resort town demonstrated steady appreciation through the 2010s, with acceleration beginning in 2016-2017. The pandemic years brought explosive growth, with increases of 21% and 28% in 2021-2022. Recent market corrections have resulted in consecutive declines, but prices remain well above pre-pandemic levels.

Breckenridge – World-Class Ski Resort and Historic Mining Town

Would you like to save this?

Breckenridge, located in Summit County at 9,600 feet elevation, represents one of Colorado’s most iconic ski destinations and historic mining towns. This community of approximately 5,000 year-round residents has successfully balanced its role as a world-class ski resort with preservation of its Victorian-era mining heritage, creating a unique destination that attracts both winter sports enthusiasts and history buffs.

The town’s appeal extends beyond its renowned ski slopes to include a vibrant historic downtown district, year-round festivals, and extensive summer recreation opportunities. Breckenridge’s Four O’Clock Run allows skiers to ski directly from the mountain to downtown, while the historic Main Street offers shopping, dining, and entertainment that rival any major city. The area’s combination of world-class skiing, historic charm, and modern amenities creates an unparalleled mountain resort experience.

The current median price of $1,198,465 reflects Breckenridge’s position as a premium ski resort market, though recent declines suggest some cooling from pandemic-era peaks. The 129% price increase since 2010 demonstrates the enduring appeal of this world-renowned destination. The recent price adjustments may reflect broader corrections in luxury resort markets, though Breckenridge’s unique combination of skiing, history, and amenities continues to support strong long-term demand.

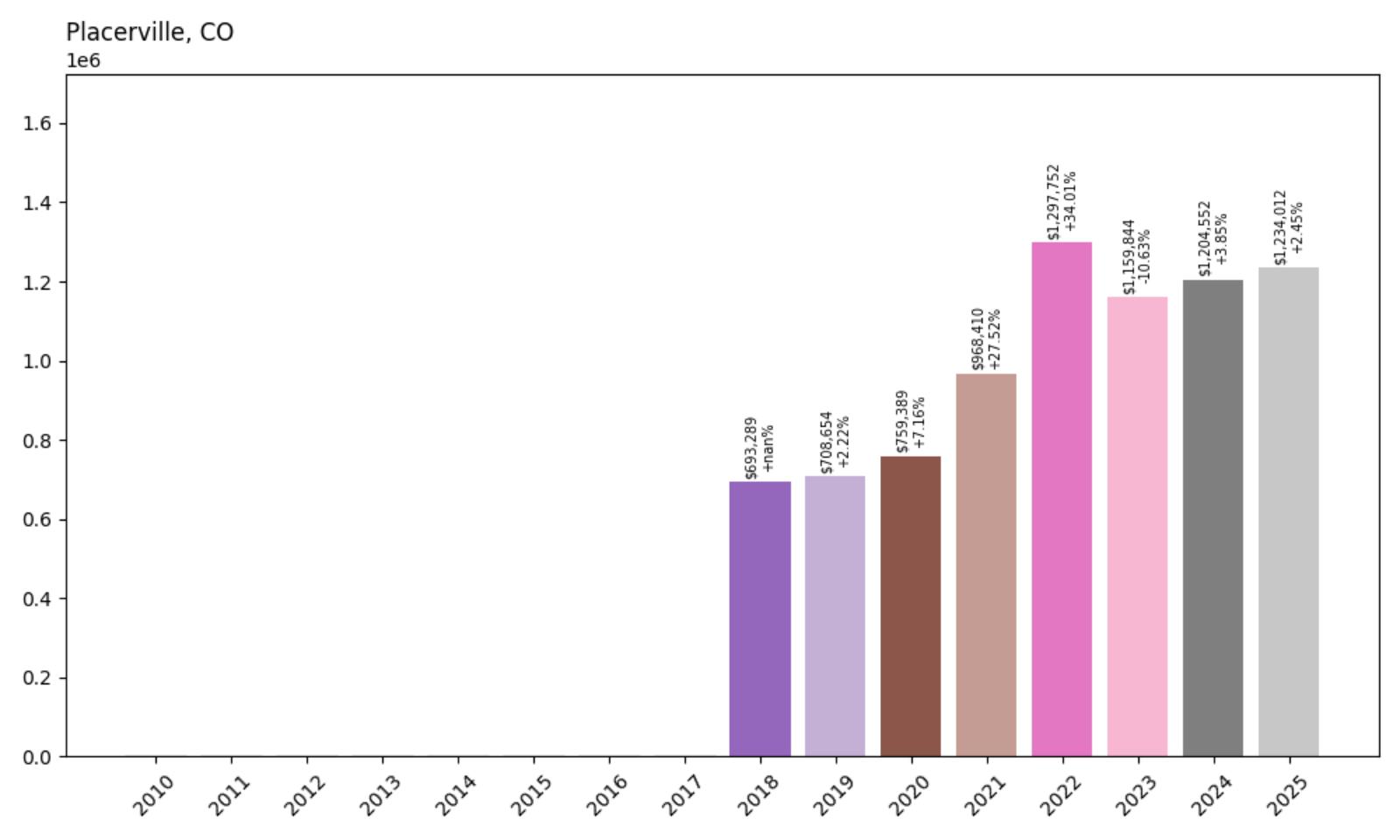

16. Placerville – 78% Home Price Increase Since 2018

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: $693,289

- 2019: $708,654 (+$15,365, +2.22% from previous year)

- 2020: $759,389 (+$50,735, +7.16% from previous year)

- 2021: $968,410 (+$209,021, +27.52% from previous year)

- 2022: $1,297,752 (+$329,342, +34.01% from previous year)

- 2023: $1,159,844 (−$137,908, −10.63% from previous year)

- 2024: $1,204,552 (+$44,708, +3.85% from previous year)

- 2025: $1,234,012 (+$29,460, +2.45% from previous year)

Placerville has experienced remarkable growth since data became available in 2018, climbing from $693,289 to $1,234,012 in 2025. The community showed modest growth in 2019-2020 before exploding during the pandemic years, with massive increases of 28% and 34% in 2021-2022. Recent market corrections resulted in a significant decline in 2023, but prices have stabilized and resumed modest growth in 2024-2025.

Placerville – Historic Mining Town Reborn

Placerville, located in San Miguel County near Telluride, represents one of Colorado’s most authentic and recently discovered mountain communities. This small historic mining town, established in the 1870s during the gold rush era, has experienced a renaissance as buyers seek alternatives to more crowded and expensive resort destinations like nearby Telluride.

The community’s appeal lies in its combination of genuine mining heritage, stunning mountain scenery, and relative affordability compared to major ski resorts. Placerville’s location along the San Miguel River provides access to world-class outdoor recreation opportunities while maintaining a sense of authenticity that has been lost in many commercialized mountain towns. The area’s recent emergence in real estate data reflects growing recognition of its unique character and investment potential.

The current median price of $1,234,012 represents a dramatic transformation from the community’s modest beginnings to a premium mountain market. The 78% price increase since 2018 demonstrates the rapid discovery and appreciation of this hidden gem. The recent price stabilization following the pandemic surge suggests the market has found a new equilibrium, though the area’s limited inventory and authentic character continue to support strong demand among buyers seeking genuine mountain living experiences.

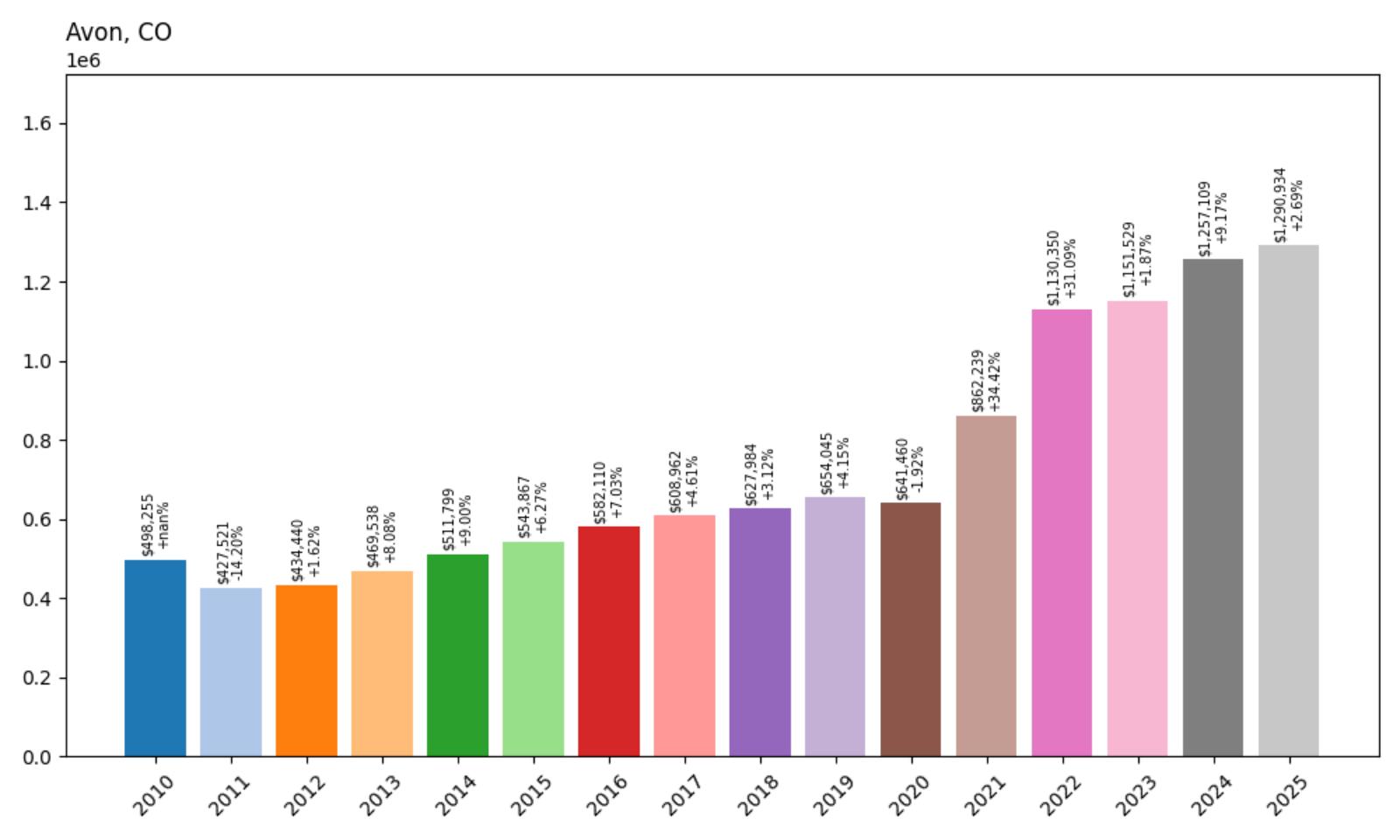

15. Avon – 159% Home Price Increase Since 2010

- 2010: $498,255

- 2011: $427,521 (−$70,735, −14.20% from previous year)

- 2012: $434,440 (+$6,919, +1.62% from previous year)

- 2013: $469,538 (+$35,098, +8.08% from previous year)

- 2014: $511,799 (+$42,261, +9.00% from previous year)

- 2015: $543,867 (+$32,068, +6.27% from previous year)

- 2016: $582,110 (+$38,243, +7.03% from previous year)

- 2017: $608,962 (+$26,852, +4.61% from previous year)

- 2018: $627,984 (+$19,022, +3.12% from previous year)

- 2019: $654,045 (+$26,061, +4.15% from previous year)

- 2020: $641,460 (−$12,585, −1.92% from previous year)

- 2021: $862,239 (+$220,779, +34.42% from previous year)

- 2022: $1,130,350 (+$268,111, +31.09% from previous year)

- 2023: $1,151,529 (+$21,179, +1.87% from previous year)

- 2024: $1,257,109 (+$105,580, +9.17% from previous year)

- 2025: $1,290,934 (+$33,825, +2.69% from previous year)

Avon has demonstrated impressive recovery and growth, climbing from $498,255 in 2010 to $1,290,934 in 2025. The community endured a severe downturn in 2011 before beginning a steady recovery through the 2010s. The pandemic years brought explosive growth, with massive increases of 34% and 31% in 2021-2022. Recent years have shown continued strength, with significant growth in 2024 and modest appreciation in 2025.

Avon – Gateway to Beaver Creek Resort

Avon, located in Eagle County at the base of Beaver Creek Resort, represents one of Colorado’s most strategically positioned mountain communities. This town of approximately 6,000 residents serves as the gateway to the exclusive Beaver Creek ski resort while offering more accessible housing options than the resort itself. Avon’s location along Interstate 70 provides convenient access to Vail and other mountain destinations.

The community’s appeal stems from its combination of resort amenities and year-round mountain lifestyle opportunities. Avon offers direct access to world-class skiing, hiking, and outdoor recreation while maintaining a more authentic mountain town atmosphere than purely resort-focused communities. The area’s growing retail and dining scene, combined with its proximity to luxury resorts, creates a unique balance of accessibility and exclusivity.

The current median price of $1,290,934 reflects Avon’s evolution from a modest mountain town to a premium resort-adjacent market. The remarkable 159% price increase since 2010 demonstrates the growing recognition of Avon’s value proposition as an accessible entry point to the Vail Valley luxury market. The continued appreciation in recent years suggests strong ongoing demand for the community’s unique combination of resort access and mountain authenticity.

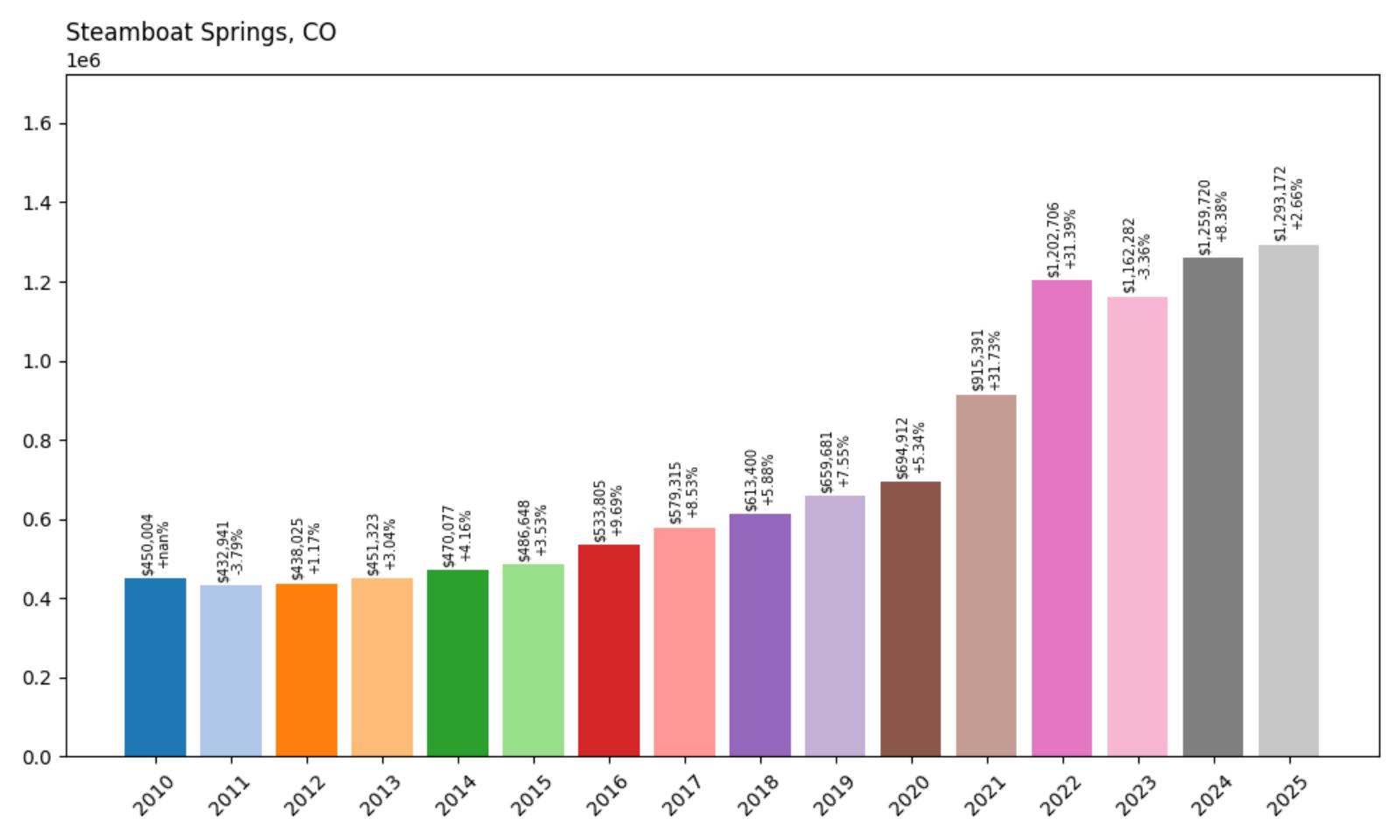

14. Steamboat Springs – 187% Home Price Increase Since 2010

- 2010: $450,004

- 2011: $432,941 (−$17,063, −3.79% from previous year)

- 2012: $438,025 (+$5,084, +1.17% from previous year)

- 2013: $451,323 (+$13,297, +3.04% from previous year)

- 2014: $470,077 (+$18,754, +4.16% from previous year)

- 2015: $486,648 (+$16,572, +3.53% from previous year)

- 2016: $533,805 (+$47,157, +9.69% from previous year)

- 2017: $579,315 (+$45,510, +8.53% from previous year)

- 2018: $613,400 (+$34,085, +5.88% from previous year)

- 2019: $659,681 (+$46,281, +7.55% from previous year)

- 2020: $694,912 (+$35,231, +5.34% from previous year)

- 2021: $915,391 (+$220,478, +31.73% from previous year)

- 2022: $1,202,706 (+$287,315, +31.39% from previous year)

- 2023: $1,162,282 (−$40,424, −3.36% from previous year)

- 2024: $1,259,720 (+$97,438, +8.38% from previous year)

- 2025: $1,293,172 (+$33,451, +2.66% from previous year)

Steamboat Springs has achieved remarkable growth, nearly tripling from $450,004 in 2010 to $1,293,172 in 2025. The resort town showed steady but modest appreciation through most of the 2010s before accelerating in 2016-2017. The pandemic years brought explosive growth, with consecutive increases of over 31% in 2021-2022. Recent years have shown continued strength, with significant growth in 2024 and modest appreciation in 2025.

Steamboat Springs – Year-Round Resort Paradise

Steamboat Springs, located in Routt County in northwestern Colorado, stands as one of the state’s premier year-round resort destinations. This community of approximately 13,000 residents has successfully maintained its authentic Western character while developing into a world-class ski resort and summer recreation hub. The area’s natural hot springs, extensive ski terrain, and summer activities create a unique four-season destination.

The town’s appeal extends beyond its ski slopes to include a vibrant downtown area, extensive summer recreation opportunities, and a strong sense of community that sets it apart from more commercialized resort destinations. Steamboat Springs’ “Ski Town USA” designation reflects its deep skiing heritage, while its summer offerings include world-class mountain biking, hiking, and fishing. The area’s combination of Western authenticity and resort amenities creates a distinctive mountain lifestyle experience.

The current median price of $1,293,172 reflects Steamboat Springs’ position as a premium four-season resort market. The remarkable 187% price increase since 2010 demonstrates the growing recognition of the area’s year-round appeal and authentic mountain character. The continued appreciation in recent years, even following pandemic-era surges, suggests strong ongoing demand for this unique combination of resort amenities and Western authenticity.

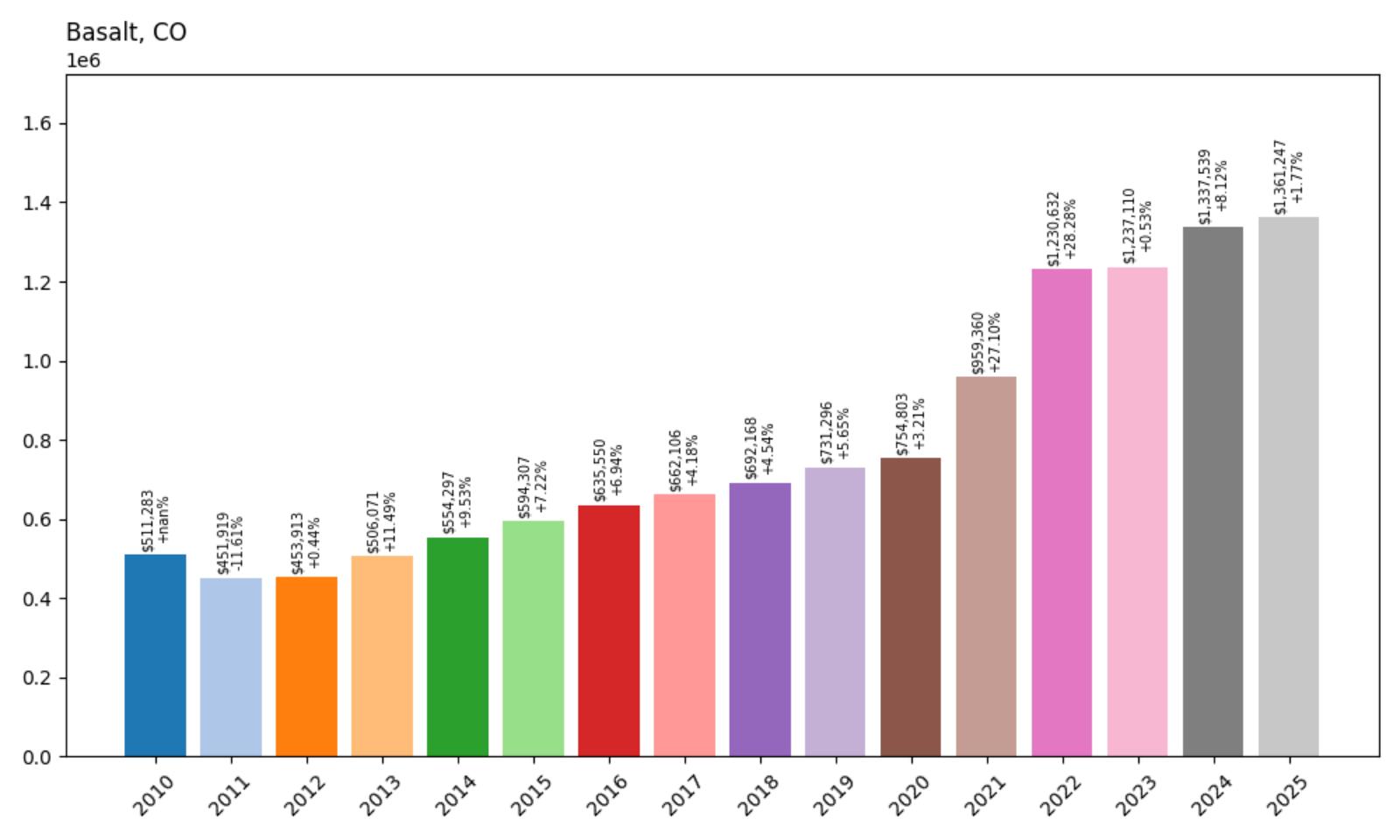

13. Basalt – 166% Home Price Increase Since 2010

- 2010: $511,283

- 2011: $451,919 (−$59,363, −11.61% from previous year)

- 2012: $453,913 (+$1,993, +0.44% from previous year)

- 2013: $506,071 (+$52,159, +11.49% from previous year)

- 2014: $554,297 (+$48,226, +9.53% from previous year)

- 2015: $594,307 (+$40,009, +7.22% from previous year)

- 2016: $635,550 (+$41,244, +6.94% from previous year)

- 2017: $662,106 (+$26,555, +4.18% from previous year)

- 2018: $692,168 (+$30,062, +4.54% from previous year)

- 2019: $731,296 (+$39,129, +5.65% from previous year)

- 2020: $754,803 (+$23,507, +3.21% from previous year)

- 2021: $959,360 (+$204,557, +27.10% from previous year)

- 2022: $1,230,632 (+$271,272, +28.28% from previous year)

- 2023: $1,237,110 (+$6,479, +0.53% from previous year)

- 2024: $1,337,539 (+$100,428, +8.12% from previous year)

- 2025: $1,361,247 (+$23,708, +1.77% from previous year)

Basalt has shown impressive long-term growth, more than doubling from $511,283 in 2010 to $1,361,247 in 2025. The community recovered from an initial decline in 2011 and demonstrated steady appreciation through the 2010s. The pandemic years brought explosive growth, with massive increases of 27% and 28% in 2021-2022. Recent years have shown continued strength, with significant growth in 2024 and modest appreciation in 2025.

Basalt – Roaring Fork Valley Gateway

Basalt, located in Eagle County along the Roaring Fork River, serves as a crucial gateway to the Roaring Fork Valley and its world-famous resort destinations. This town of approximately 4,000 residents has evolved from a modest railroad and ranching community into a significant residential hub for workers and residents of nearby Aspen and Snowmass Village, offering more affordable housing options while maintaining easy access to luxury resort amenities.

The community’s appeal stems from its strategic location along Highway 82, providing direct access to Aspen while offering a more authentic mountain town experience. Basalt’s location at the confluence of the Roaring Fork and Fryingpan rivers creates exceptional fishing and outdoor recreation opportunities, while its proximity to multiple ski areas makes it attractive to winter sports enthusiasts. The town has worked to maintain its character while accommodating growth driven by the nearby resort economy.

The current median price of $1,361,247 reflects Basalt’s transformation from a working-class mountain town to a premium residential market serving the greater Aspen area. The 166% price increase since 2010 demonstrates the spillover effect from Aspen’s luxury market and the growing recognition of Basalt’s value proposition. The continued appreciation in recent years suggests strong ongoing demand for this unique combination of mountain authenticity and resort area access.

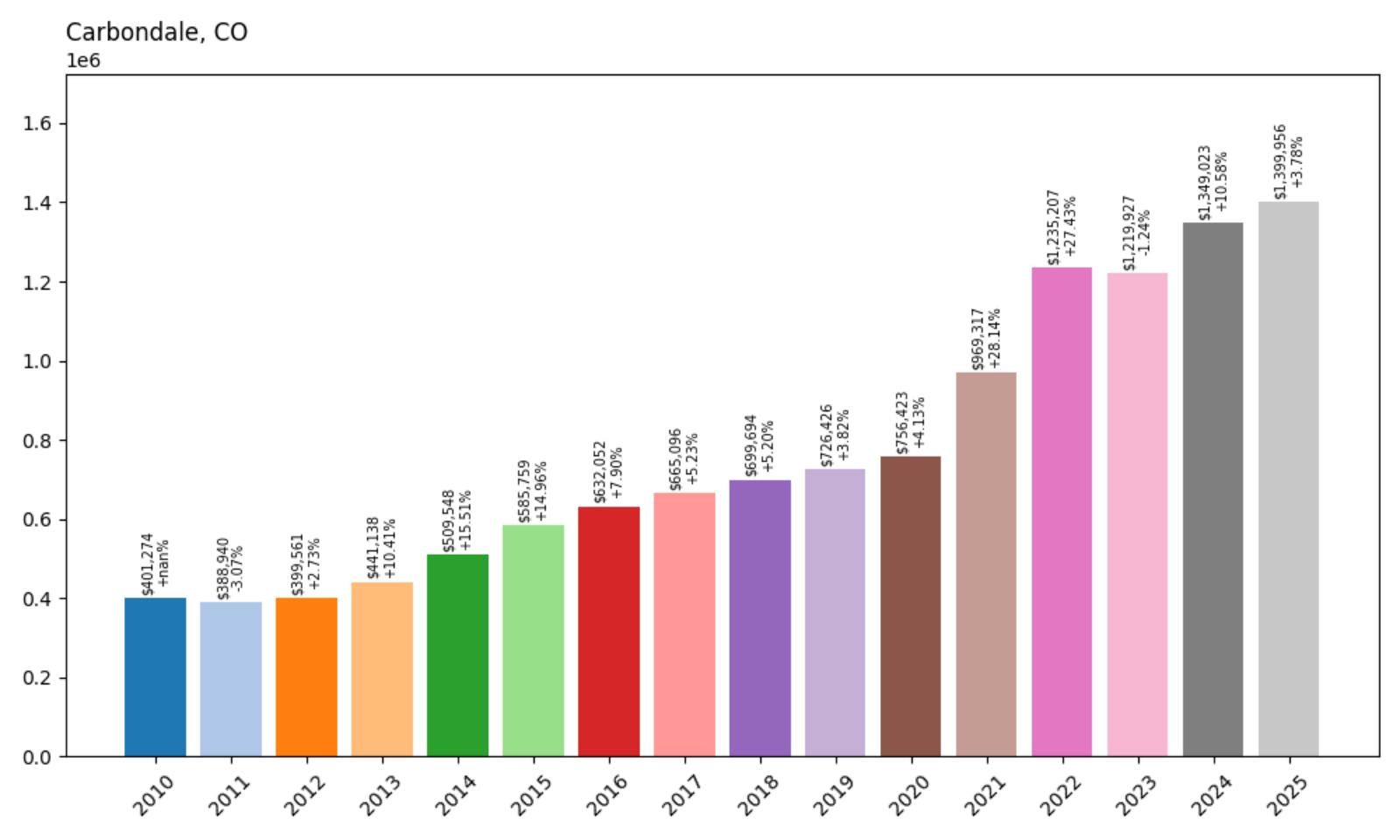

12. Carbondale – 249% Home Price Increase Since 2010

- 2010: $401,274

- 2011: $388,940 (−$12,334, −3.07% from previous year)

- 2012: $399,561 (+$10,622, +2.73% from previous year)

- 2013: $441,138 (+$41,576, +10.41% from previous year)

- 2014: $509,548 (+$68,410, +15.51% from previous year)

- 2015: $585,759 (+$76,211, +14.96% from previous year)

- 2016: $632,052 (+$46,293, +7.90% from previous year)

- 2017: $665,096 (+$33,044, +5.23% from previous year)

- 2018: $699,694 (+$34,598, +5.20% from previous year)

- 2019: $726,426 (+$26,732, +3.82% from previous year)

- 2020: $756,423 (+$29,997, +4.13% from previous year)

- 2021: $969,317 (+$212,894, +28.14% from previous year)

- 2022: $1,235,207 (+$265,889, +27.43% from previous year)

- 2023: $1,219,927 (−$15,279, −1.24% from previous year)

- 2024: $1,349,023 (+$129,096, +10.58% from previous year)

- 2025: $1,399,956 (+$50,933, +3.78% from previous year)

Carbondale has achieved extraordinary growth, nearly tripling from $401,274 in 2010 to $1,399,956 in 2025. The community showed particularly strong acceleration beginning in 2014-2015, with double-digit increases for several consecutive years. The pandemic years brought explosive growth, with massive increases of 28% and 27% in 2021-2022. Recent years have shown continued strength, with significant growth in 2024 and modest appreciation in 2025.

Carbondale – Creative Community in the Roaring Fork Valley

Carbondale, located in Garfield County along the Roaring Fork River, has emerged as one of Colorado’s most vibrant and creative mountain communities. This town of approximately 7,000 residents has successfully balanced its role as a bedroom community for Aspen with its own distinct identity as an arts and culture hub. The area’s commitment to affordable housing, local businesses, and community events has created a unique mountain town atmosphere that attracts both full-time residents and second-home buyers.

The community’s appeal extends beyond its proximity to Aspen to include a thriving arts scene, numerous festivals, and a strong commitment to sustainability and local agriculture. Carbondale’s location provides access to world-class skiing, hiking, and fishing while maintaining a more affordable and authentic mountain lifestyle than nearby resort destinations. The town’s Third Street Center and various community events foster a strong sense of local identity and civic engagement.

The current median price of $1,399,956 reflects Carbondale’s dramatic transformation from an affordable mountain town to a premium residential market. The remarkable 249% price increase since 2010 demonstrates the spillover effect from Aspen’s luxury market and the growing recognition of Carbondale’s unique community character. The continued appreciation in recent years suggests strong ongoing demand for this distinctive combination of mountain lifestyle, cultural amenities, and relative authenticity.

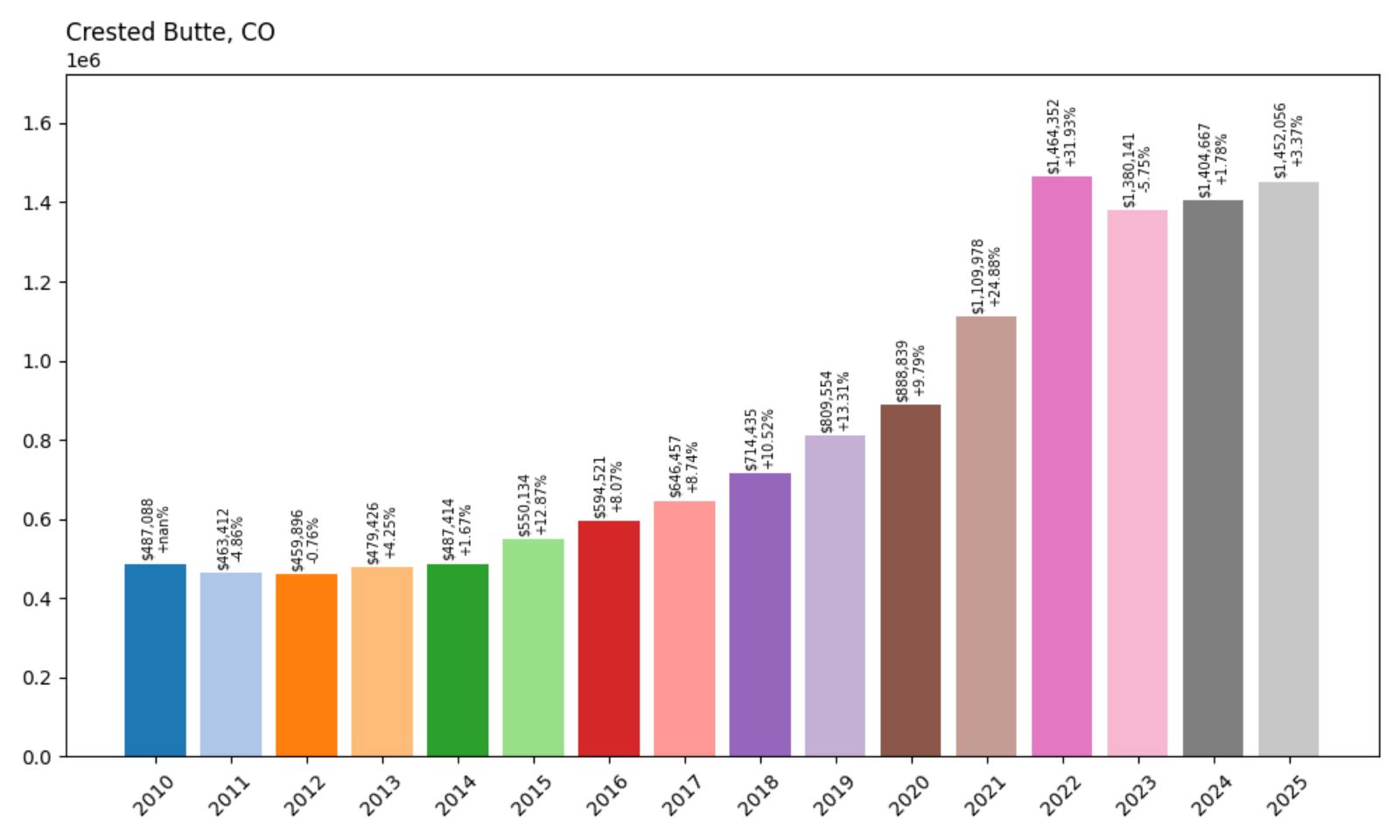

11. Crested Butte – 198% Home Price Increase Since 2010

- 2010: $487,088

- 2011: $463,412 (−$23,676, −4.86% from previous year)

- 2012: $459,896 (−$3,517, −0.76% from previous year)

- 2013: $479,426 (+$19,531, +4.25% from previous year)

- 2014: $487,414 (+$7,988, +1.67% from previous year)

- 2015: $550,134 (+$62,719, +12.87% from previous year)

- 2016: $594,521 (+$44,387, +8.07% from previous year)

- 2017: $646,457 (+$51,936, +8.74% from previous year)

- 2018: $714,435 (+$67,978, +10.52% from previous year)

- 2019: $809,554 (+$95,119, +13.31% from previous year)

- 2020: $888,839 (+$79,285, +9.79% from previous year)

- 2021: $1,109,978 (+$221,139, +24.88% from previous year)

- 2022: $1,464,352 (+$354,374, +31.93% from previous year)

- 2023: $1,380,141 (−$84,211, −5.75% from previous year)

- 2024: $1,404,667 (+$24,526, +1.78% from previous year)

- 2025: $1,452,056 (+$47,389, +3.37% from previous year)

Crested Butte has demonstrated remarkable growth, nearly tripling from $487,088 in 2010 to $1,452,056 in 2025. The community showed steady acceleration beginning in 2015, with particularly strong years in 2018-2019 when prices increased by double digits. The pandemic years brought explosive growth, with massive increases of 25% and 32% in 2021-2022. Recent market adjustments have been modest, with the community showing continued appreciation in 2024-2025.

Crested Butte – Wildflower Capital of Colorado

Crested Butte, located in Gunnison County at an elevation of 8,885 feet, stands as one of Colorado’s most pristine and authentic mountain communities. This historic mining town, known as the “Wildflower Capital of Colorado,” has maintained its Victorian-era character while developing into a premier ski and mountain biking destination. The area’s remote location and commitment to preserving its natural environment have created a unique mountain experience that attracts outdoor enthusiasts and those seeking authentic mountain living.

The community’s appeal lies in its combination of world-class outdoor recreation opportunities and genuine mountain town atmosphere. Crested Butte’s legendary wildflower displays, extensive skiing terrain, and world-renowned mountain biking trails create year-round appeal for outdoor enthusiasts. The town’s isolation from major metropolitan areas has helped preserve its character while creating a tight-knit community atmosphere that sets it apart from more commercialized resort destinations.

The current median price of $1,452,056 reflects Crested Butte’s evolution from a modest mountain town to a premium destination market. The remarkable 198% price increase since 2010 demonstrates the growing recognition of the area’s unique natural beauty and authentic mountain character. The continued appreciation in recent years suggests strong ongoing demand for this rare combination of pristine mountain environment and genuine community atmosphere.

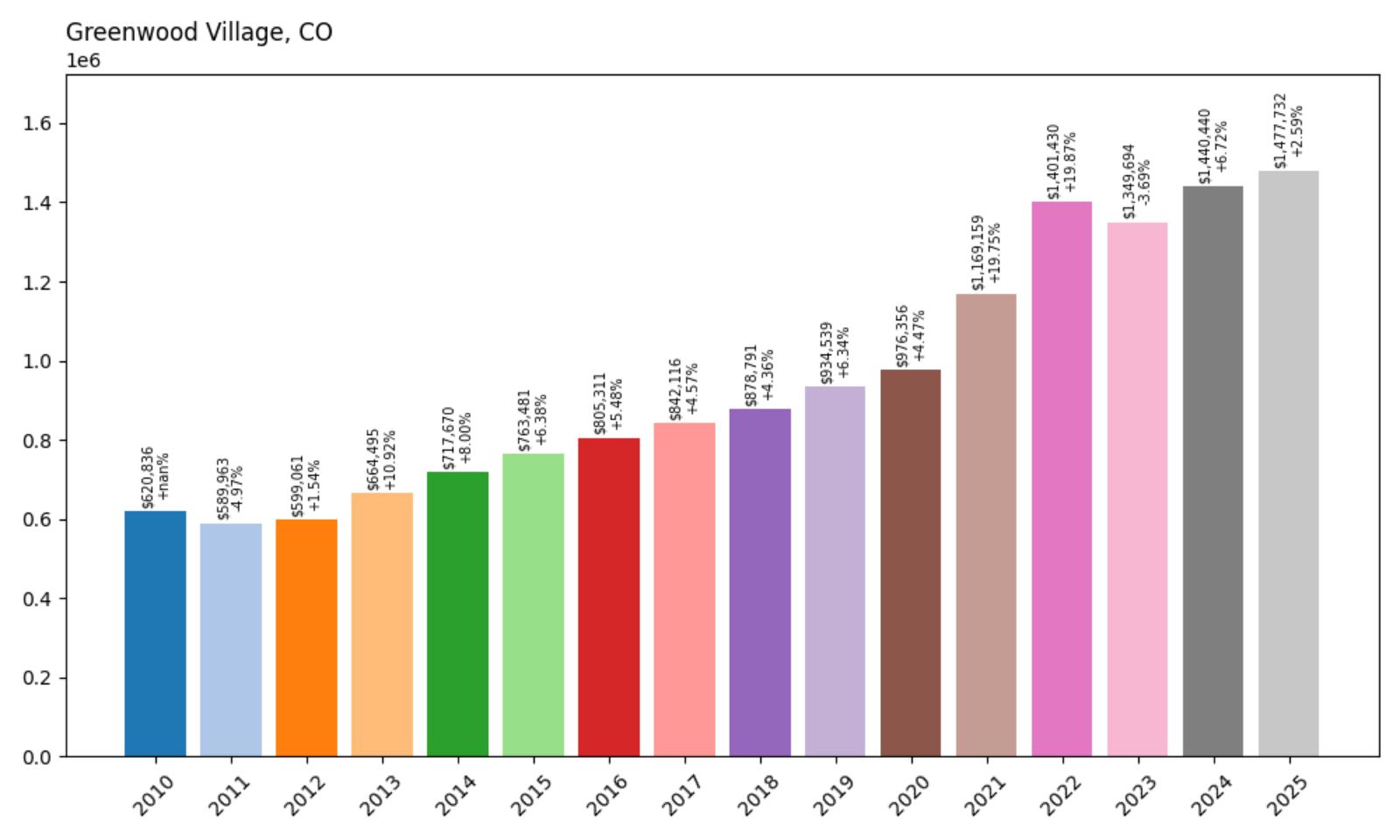

10. Greenwood Village – 138% Home Price Increase Since 2010

- 2010: $620,836

- 2011: $589,963 (−$30,873, −4.97% from previous year)

- 2012: $599,061 (+$9,098, +1.54% from previous year)

- 2013: $664,495 (+$65,434, +10.92% from previous year)

- 2014: $717,670 (+$53,175, +8.00% from previous year)

- 2015: $763,481 (+$45,811, +6.38% from previous year)

- 2016: $805,311 (+$41,830, +5.48% from previous year)

- 2017: $842,116 (+$36,805, +4.57% from previous year)

- 2018: $878,791 (+$36,674, +4.36% from previous year)

- 2019: $934,539 (+$55,749, +6.34% from previous year)

- 2020: $976,356 (+$41,816, +4.47% from previous year)

- 2021: $1,169,159 (+$192,804, +19.75% from previous year)

- 2022: $1,401,430 (+$232,271, +19.87% from previous year)

- 2023: $1,349,694 (−$51,737, −3.69% from previous year)

- 2024: $1,440,440 (+$90,746, +6.72% from previous year)

- 2025: $1,477,732 (+$37,291, +2.59% from previous year)

Greenwood Village has achieved substantial growth, more than doubling from $620,836 in 2010 to $1,477,732 in 2025. The community showed remarkably consistent appreciation throughout the 2010s, with steady annual increases typically ranging from 4-6%. The pandemic years brought significant acceleration, with increases of nearly 20% in both 2021 and 2022. Recent years have shown continued strength, with significant growth in 2024 and modest appreciation in 2025.

Greenwood Village – Corporate Headquarters and Luxury Living

Greenwood Village, located in Arapahoe County in the Denver Tech Center area, represents one of Colorado’s most prestigious corporate and residential communities. This city of approximately 15,000 residents has successfully attracted numerous Fortune 500 companies and high-tech businesses while maintaining an upscale residential character that appeals to executives and affluent professionals seeking luxury suburban living.

The community’s appeal stems from its strategic location in the Denver Tech Center, one of the largest suburban business districts in the United States. Greenwood Village’s commitment to high-quality development standards, excellent schools, and abundant green space has created a premium residential environment that attracts corporate executives and high-income families. The area’s proximity to the Denver Technological Center provides convenient access to major employers while maintaining a suburban atmosphere.

The current median price of $1,477,732 reflects Greenwood Village’s position as one of Colorado’s premier executive residential markets. The 138% price increase since 2010 demonstrates the area’s enduring appeal to affluent professionals and the stability provided by its diverse economic base. The continued appreciation in recent years suggests strong ongoing demand for this unique combination of corporate convenience and luxury residential amenities.

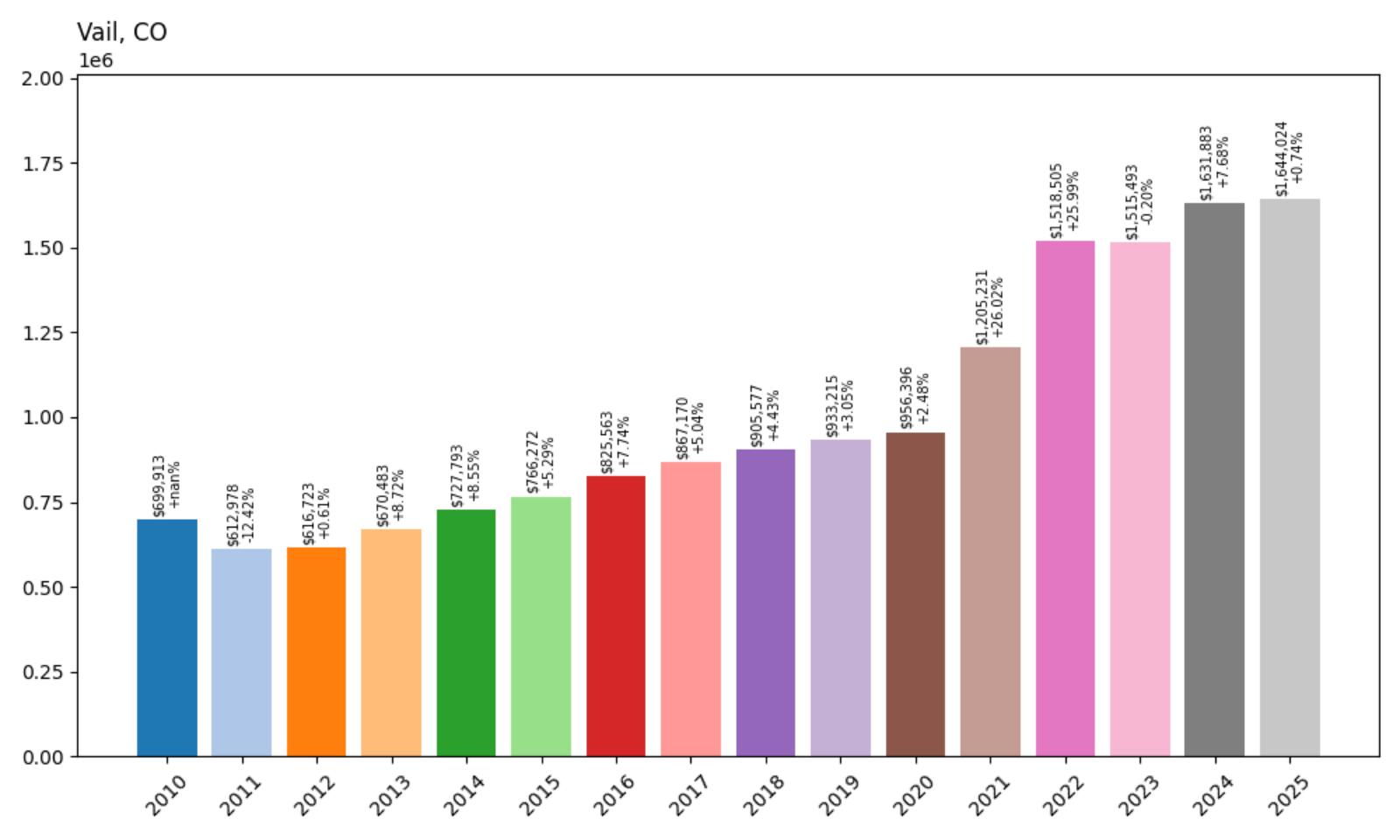

9. Vail – 135% Home Price Increase Since 2010

- 2010: $699,913

- 2011: $612,978 (−$86,935, −12.42% from previous year)

- 2012: $616,723 (+$3,745, +0.61% from previous year)

- 2013: $670,483 (+$53,760, +8.72% from previous year)

- 2014: $727,793 (+$57,310, +8.55% from previous year)

- 2015: $766,272 (+$38,479, +5.29% from previous year)

- 2016: $825,563 (+$59,291, +7.74% from previous year)

- 2017: $867,170 (+$41,607, +5.04% from previous year)

- 2018: $905,577 (+$38,407, +4.43% from previous year)

- 2019: $933,215 (+$27,638, +3.05% from previous year)

- 2020: $956,396 (+$23,181, +2.48% from previous year)

- 2021: $1,205,231 (+$248,834, +26.02% from previous year)

- 2022: $1,518,505 (+$313,274, +25.99% from previous year)

- 2023: $1,515,493 (−$3,011, −0.20% from previous year)

- 2024: $1,631,883 (+$116,389, +7.68% from previous year)

- 2025: $1,644,024 (+$12,141, +0.74% from previous year)

Vail has shown strong long-term growth, more than doubling from $699,913 in 2010 to $1,644,024 in 2025. The resort town endured a significant decline in 2011 before beginning steady recovery through the 2010s. The pandemic years brought explosive growth, with massive increases of 26% in both 2021 and 2022. Recent years have shown continued strength, with significant growth in 2024 and modest appreciation in 2025.

Vail – World-Renowned Ski Resort Destination

Vail, located in Eagle County at the base of Vail Mountain, stands as one of the world’s most prestigious ski resort destinations. This community of approximately 5,000 year-round residents has developed into a global luxury destination that attracts wealthy visitors and second-home buyers from around the world. The resort’s European-inspired village design, world-class skiing, and luxury amenities create an unparalleled mountain resort experience.

The town’s appeal extends beyond its legendary ski slopes to include upscale shopping, fine dining, and cultural events that rival major metropolitan areas. Vail’s back bowls and extensive terrain provide some of the best skiing in North America, while summer activities include hiking, mountain biking, and numerous festivals. The area’s commitment to luxury and exclusivity has created a unique destination that consistently ranks among the world’s top ski resorts.

The current median price of $1,644,024 reflects Vail’s position as a premier global luxury destination, though this figure represents entry-level pricing in one of the world’s most expensive ski markets. The 135% price increase since 2010 demonstrates the resort’s enduring appeal to wealthy international buyers and the scarcity of available properties. The continued appreciation in recent years suggests strong ongoing demand for this rare combination of world-class skiing and luxury resort amenities.

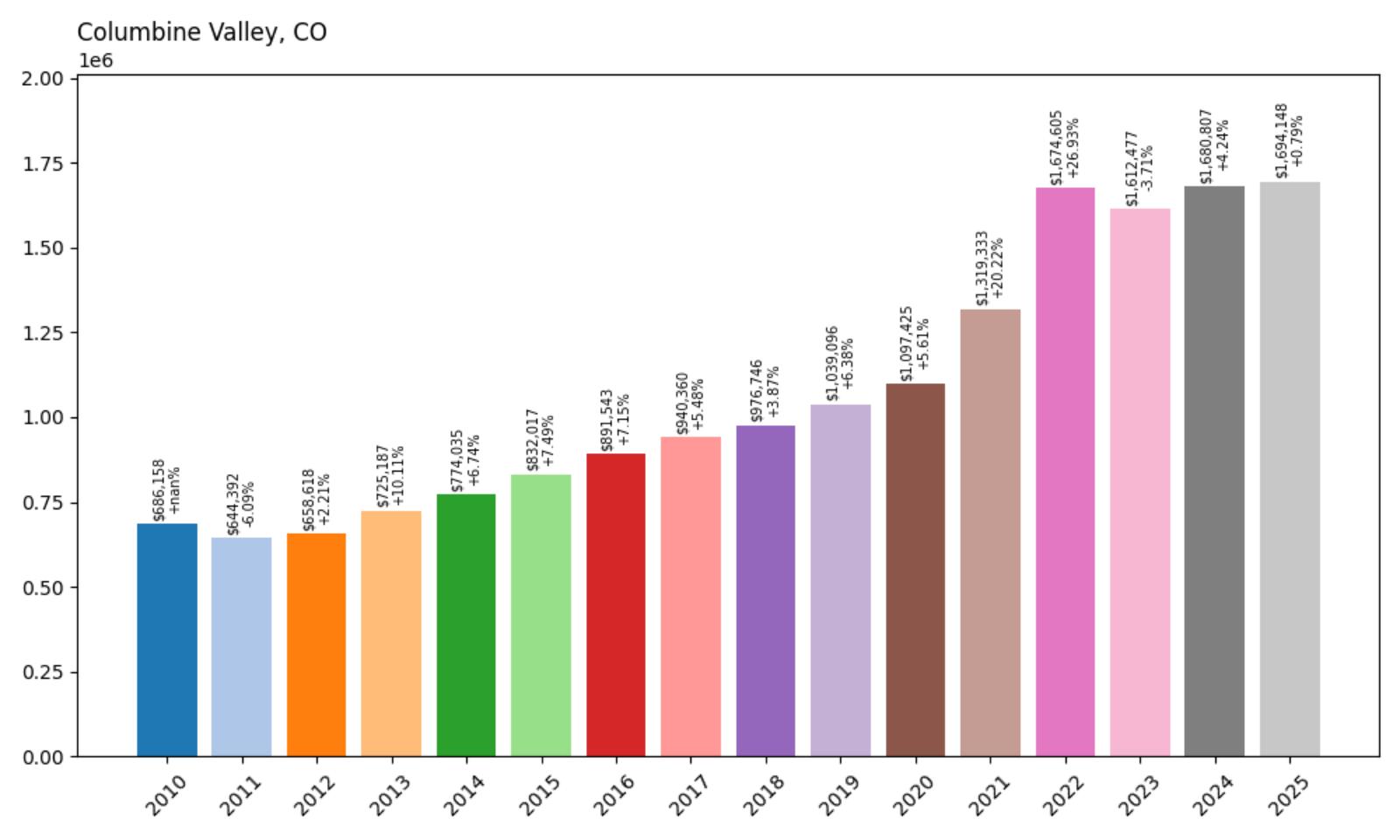

8. Columbine Valley – 147% Home Price Increase Since 2010

- 2010: $686,158

- 2011: $644,392 (−$41,765, −6.09% from previous year)

- 2012: $658,618 (+$14,225, +2.21% from previous year)

- 2013: $725,187 (+$66,570, +10.11% from previous year)

- 2014: $774,035 (+$48,847, +6.74% from previous year)

- 2015: $832,017 (+$57,982, +7.49% from previous year)

- 2016: $891,543 (+$59,525, +7.15% from previous year)

- 2017: $940,360 (+$48,818, +5.48% from previous year)

- 2018: $976,746 (+$36,386, +3.87% from previous year)

- 2019: $1,039,096 (+$62,349, +6.38% from previous year)

- 2020: $1,097,425 (+$58,329, +5.61% from previous year)

- 2021: $1,319,333 (+$221,908, +20.22% from previous year)

- 2022: $1,674,605 (+$355,272, +26.93% from previous year)

- 2023: $1,612,477 (−$62,129, −3.71% from previous year)

- 2024: $1,680,807 (+$68,331, +4.24% from previous year)

- 2025: $1,694,148 (+$13,341, +0.79% from previous year)

Columbine Valley has demonstrated impressive growth, nearly doubling from $686,158 in 2010 to $1,694,148 in 2025. The community showed remarkably consistent appreciation throughout the 2010s, with steady annual increases typically ranging from 5-7%. The pandemic years brought significant acceleration, with increases of 20% and 27% in 2021-2022. Recent market adjustments have been modest, with continued appreciation in 2024-2025.

Columbine Valley – Elite Suburban Enclave

Columbine Valley, located in Jefferson and Arapahoe counties southwest of Denver, represents one of Colorado’s most exclusive suburban communities. This small city of approximately 1,400 residents has maintained its character as an elite residential enclave with large lots, custom homes, and strict development standards that preserve the area’s upscale atmosphere and natural beauty.

The community’s appeal lies in its combination of exclusivity, privacy, and proximity to Denver’s amenities. Columbine Valley’s large lot requirements, often exceeding one acre, provide residents with substantial privacy and space for custom homes and extensive landscaping. The area’s location provides convenient access to Denver while maintaining a secluded, residential character that appeals to affluent buyers seeking suburban luxury.

The current median price of $1,694,148 reflects Columbine Valley’s position as one of Colorado’s most exclusive residential markets. The 147% price increase since 2010 demonstrates the enduring appeal of this elite community and the premium placed on privacy and exclusivity. The continued appreciation in recent years suggests strong ongoing demand for this rare combination of suburban luxury and metropolitan access.

7. Edwards – 173% Home Price Increase Since 2010

- 2010: $628,579

- 2011: $539,693 (−$88,887, −14.14% from previous year)

- 2012: $539,980 (+$288, +0.05% from previous year)

- 2013: $562,210 (+$22,230, +4.12% from previous year)

- 2014: $603,816 (+$41,606, +7.40% from previous year)

- 2015: $638,457 (+$34,641, +5.74% from previous year)

- 2016: $684,400 (+$45,943, +7.20% from previous year)

- 2017: $722,124 (+$37,724, +5.51% from previous year)

- 2018: $749,950 (+$27,825, +3.85% from previous year)

- 2019: $779,029 (+$29,079, +3.88% from previous year)

- 2020: $756,396 (−$22,633, −2.91% from previous year)

- 2021: $1,092,792 (+$336,396, +44.47% from previous year)

- 2022: $1,451,392 (+$358,600, +32.82% from previous year)

- 2023: $1,498,263 (+$46,872, +3.23% from previous year)

- 2024: $1,673,949 (+$175,686, +11.73% from previous year)

- 2025: $1,715,600 (+$41,651, +2.49% from previous year)

Edwards has shown remarkable transformation, nearly tripling from $628,579 in 2010 to $1,715,600 in 2025. The community endured a severe decline in 2011 before beginning steady recovery through the 2010s. The pandemic years brought explosive growth, with massive increases of 44% and 33% in 2021-2022. Recent years have shown continued strength, with significant growth in 2024 and modest appreciation in 2025.

Edwards – Vail Valley’s Modern Mountain Community

Edwards, located in Eagle County between Vail and Beaver Creek, represents one of Colorado’s most successful modern mountain communities. This unincorporated area of approximately 10,000 residents has evolved from a modest valley town into a thriving residential and commercial center that serves as the primary population base for the Vail Valley’s resort economy.

The community’s appeal stems from its combination of mountain lifestyle amenities and year-round residential character. Edwards offers more affordable housing options than Vail or Beaver Creek while providing easy access to world-class skiing and summer recreation. The area’s Riverfront Village development, extensive trail system, and community amenities create a modern mountain living experience that attracts both full-time residents and second-home buyers.

The current median price of $1,715,600 reflects Edwards’ dramatic transformation from a working-class valley town to a premium mountain residential market. The remarkable 173% price increase since 2010 demonstrates the spillover effect from nearby luxury resorts and the growing recognition of Edwards as a desirable mountain community. The continued appreciation in recent years suggests strong ongoing demand for this unique combination of mountain lifestyle and residential community amenities.

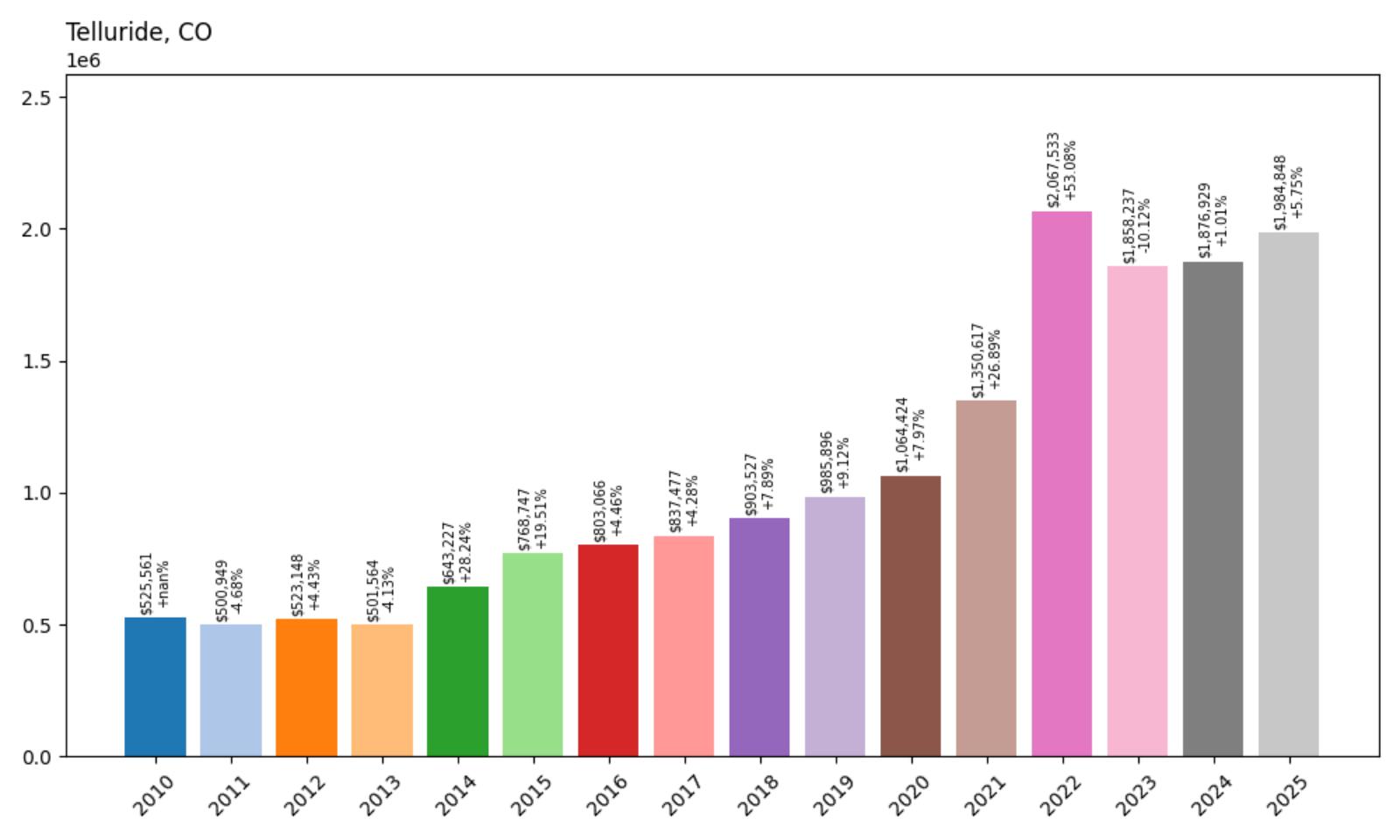

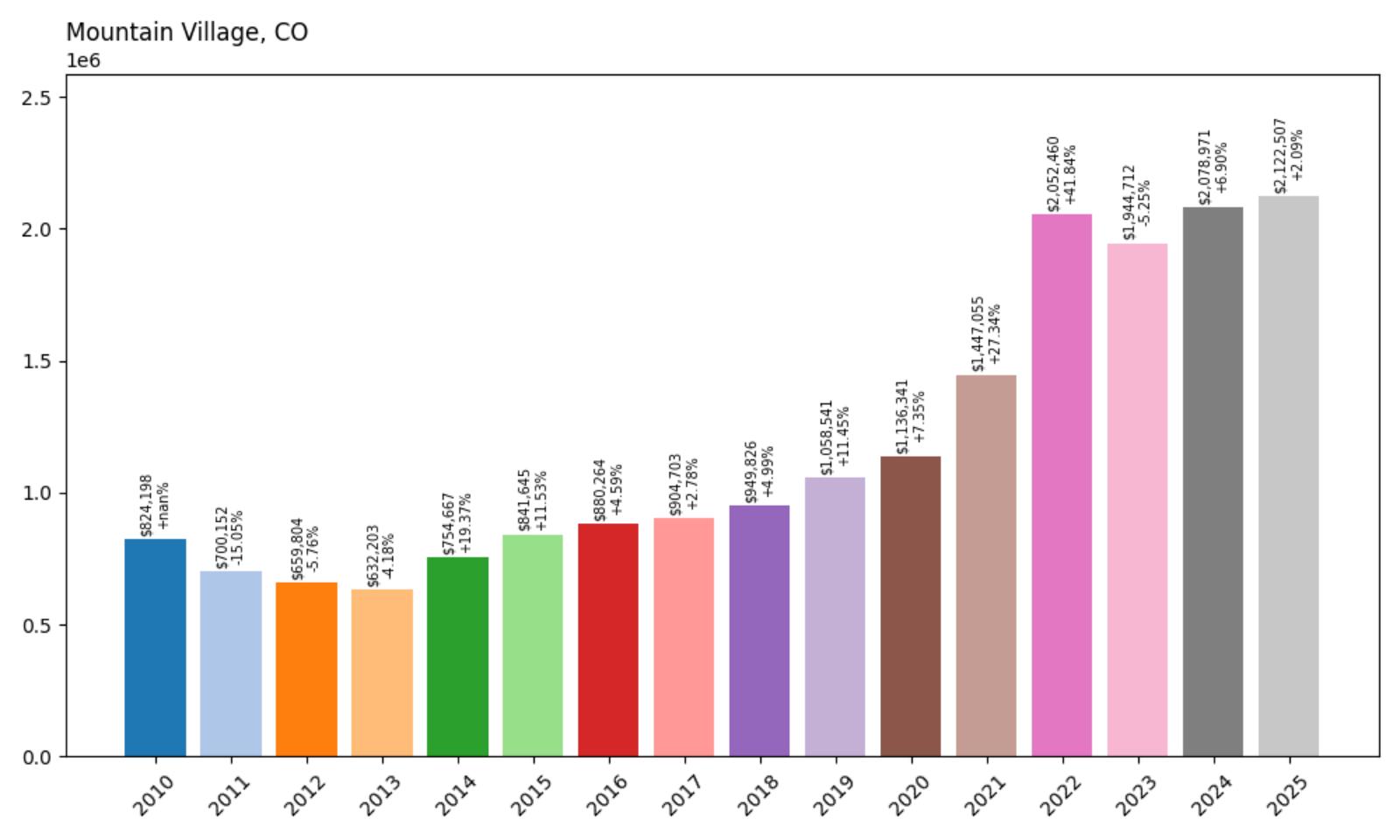

6. Telluride – 278% Home Price Increase Since 2010

- 2010: $525,561

- 2011: $500,949 (−$24,612, −4.68% from previous year)

- 2012: $523,148 (+$22,199, +4.43% from previous year)

- 2013: $501,564 (−$21,585, −4.13% from previous year)

- 2014: $643,227 (+$141,663, +28.24% from previous year)

- 2015: $768,747 (+$125,519, +19.51% from previous year)

- 2016: $803,066 (+$34,319, +4.46% from previous year)

- 2017: $837,477 (+$34,411, +4.28% from previous year)

- 2018: $903,527 (+$66,050, +7.89% from previous year)

- 2019: $985,896 (+$82,369, +9.12% from previous year)

- 2020: $1,064,424 (+$78,528, +7.97% from previous year)

- 2021: $1,350,617 (+$286,193, +26.89% from previous year)

- 2022: $2,067,533 (+$716,916, +53.08% from previous year)

- 2023: $1,858,237 (−$209,296, −10.12% from previous year)

- 2024: $1,876,929 (+$18,692, +1.01% from previous year)

- 2025: $1,984,848 (+$107,919, +5.75% from previous year)

Telluride has achieved extraordinary growth, nearly quadrupling from $525,561 in 2010 to $1,984,848 in 2025. The resort town showed volatile performance in the early 2010s before beginning steady acceleration in 2014. The pandemic years brought explosive growth, with increases of 27% and 53% in 2021-2022. Recent market adjustments have been modest, with continued appreciation in 2024-2025.

Telluride – Box Canyon Beauty and Ski Resort Luxury

Telluride, located in San Miguel County at 8,750 feet elevation, stands as one of Colorado’s most spectacular and exclusive ski resort destinations. This historic mining town of approximately 2,500 residents sits in a box canyon surrounded by towering peaks, creating one of the most dramatic and beautiful settings of any ski resort in the world. The combination of stunning natural beauty, world-class skiing, and authentic mining heritage creates an unparalleled mountain resort experience.