Would you like to save this?

Home prices across much of Pennsylvania have crept upward in recent years—but there are still towns where buying a house won’t break the bank. Based on the latest data from the Zillow Home Value Index, these 18 towns stand out for their affordable price tags and strong community roots. While they’re not flashy or fast-growing, they offer what many buyers actually want: stability, charm, and a chance to own without drowning in debt. From old steel towns to quiet boroughs, these are the places where homeownership is still a realistic goal in 2025.

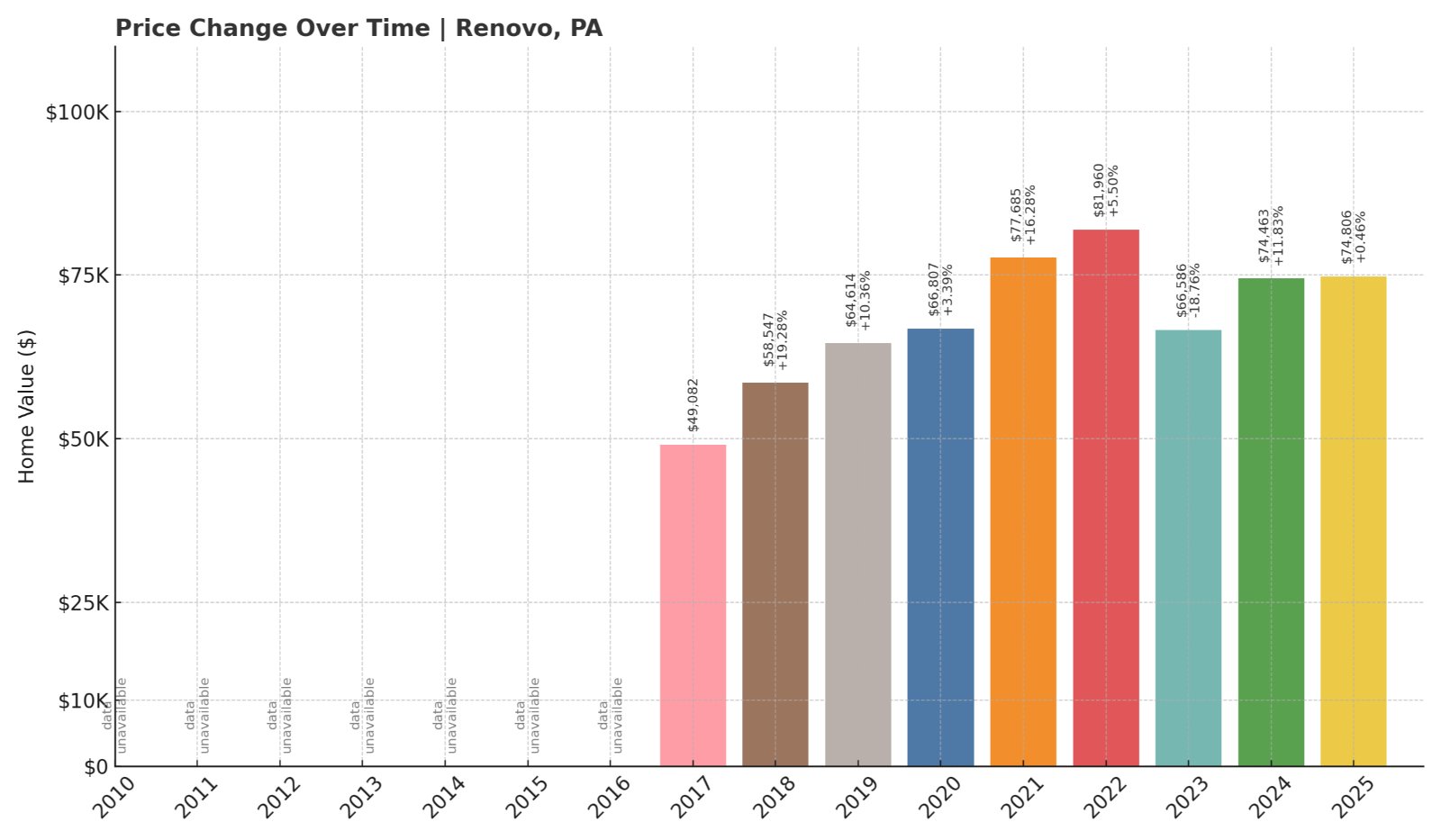

18. Renovo – 52% Home Price Increase Since 2017

- 2017: $49,082

- 2018: $58,547 (+$9,465, +19.28% from previous year)

- 2019: $64,614 (+$6,067, +10.36% from previous year)

- 2020: $66,807 (+$2,193, +3.39% from previous year)

- 2021: $77,685 (+$10,878, +16.28% from previous year)

- 2022: $81,960 (+$4,276, +5.50% from previous year)

- 2023: $66,586 (-$15,374, -18.76% from previous year)

- 2024: $74,463 (+$7,877, +11.83% from previous year)

- 2025: $74,806 (+$343, +0.46% from previous year)

Home prices in Renovo have grown over 52% since 2017, but they’ve still remained among the most affordable in the state. The town experienced a major jump during the pandemic era boom and a slight dip in 2023, before stabilizing again by 2025. While not entirely flat, the price trend shows overall upward movement with some volatility.

Renovo – A Quiet Retreat in North-Central PA

Renovo is tucked away in Clinton County, surrounded by the dense forests of the Sproul State Forest. With a population under 1,000, this small town offers a peaceful lifestyle for those looking to escape city noise. Its isolation may be a challenge for some, but it’s a draw for buyers who prioritize affordability and access to nature.

Once a railroad hub, Renovo’s economy has seen decline and stabilization. Housing demand remains modest, but its access to hiking, fishing, and natural beauty helps sustain interest from buyers looking for rustic charm without high costs. The current median home price sits under $75,000, making it an affordable option for outdoor lovers and retirees alike.

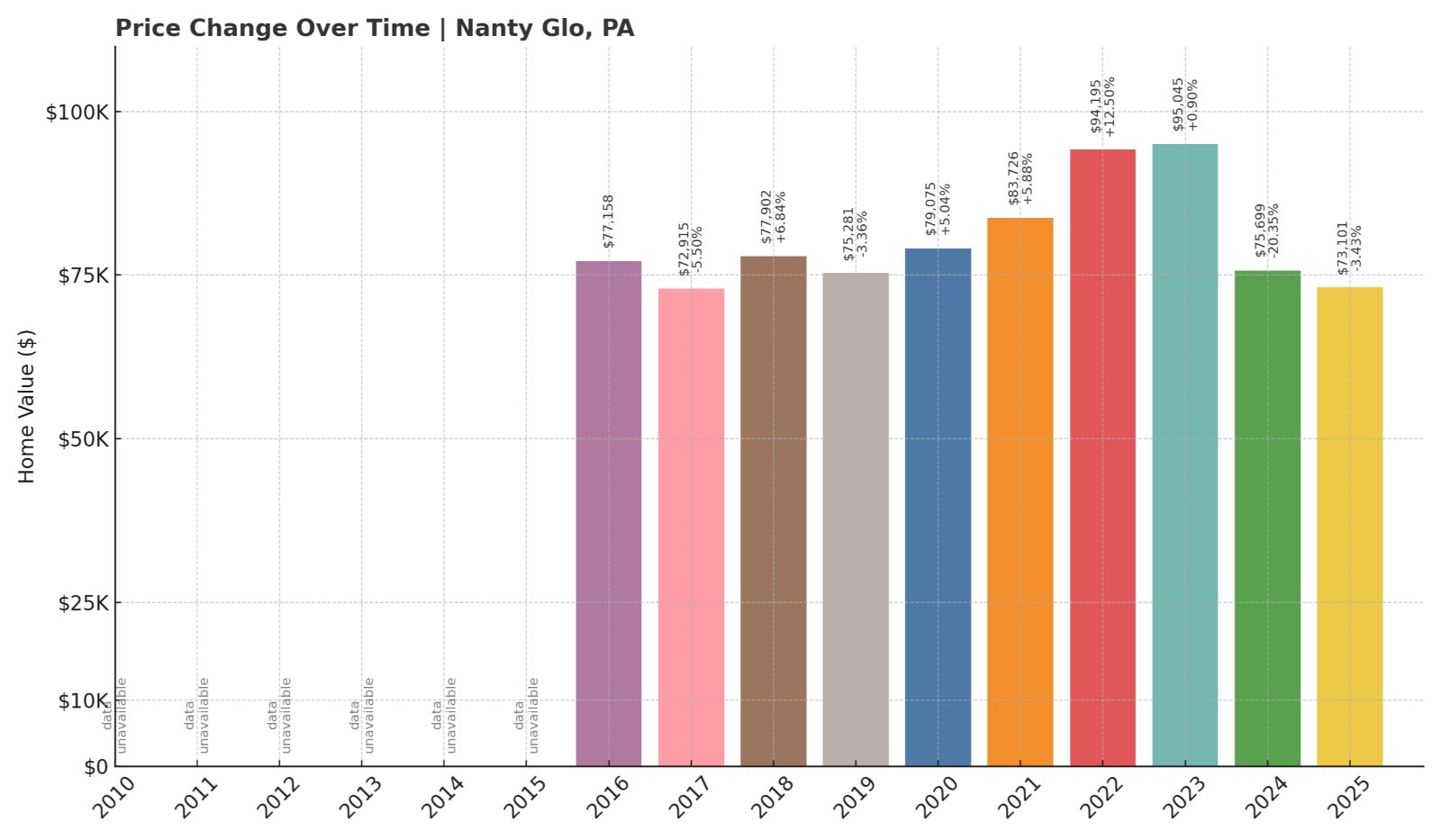

17. Nanty Glo – 5% Home Price Decrease Since 2016

- 2016: $77,158

- 2017: $72,915 (-$4,243, -5.50% from previous year)

- 2018: $77,902 (+$4,987, +6.84% from previous year)

- 2019: $75,281 (-$2,621, -3.36% from previous year)

- 2020: $79,075 (+$3,793, +5.04% from previous year)

- 2021: $83,726 (+$4,651, +5.88% from previous year)

- 2022: $94,195 (+$10,469, +12.50% from previous year)

- 2023: $95,045 (+$850, +0.90% from previous year)

- 2024: $75,699 (-$19,346, -20.35% from previous year)

- 2025: $73,101 (-$2,598, -3.43% from previous year)

Despite some pandemic-era growth, home prices in Nanty Glo have dropped nearly 5% since 2016. The steep decline in 2024 offset several years of modest gains, bringing prices back to where they were nearly a decade ago. It’s a soft market that favors buyers with patience and perspective.

Nanty Glo – Resilient and Affordable

Located in Cambria County, Nanty Glo is a historic coal town with roots tracing back to the early 20th century. Its name comes from a Welsh term meaning “brook of coal,” and the town still carries its heritage with pride. Though industry has declined, Nanty Glo retains its close-knit charm.

The price swings over the years reflect the town’s evolving economy and slower population growth. Still, at just above $73,000 in 2025, homes remain accessible for families, retirees, and investors alike. The town’s parks, trails, and welcoming community make it a practical choice for buyers seeking small-town Pennsylvania living.

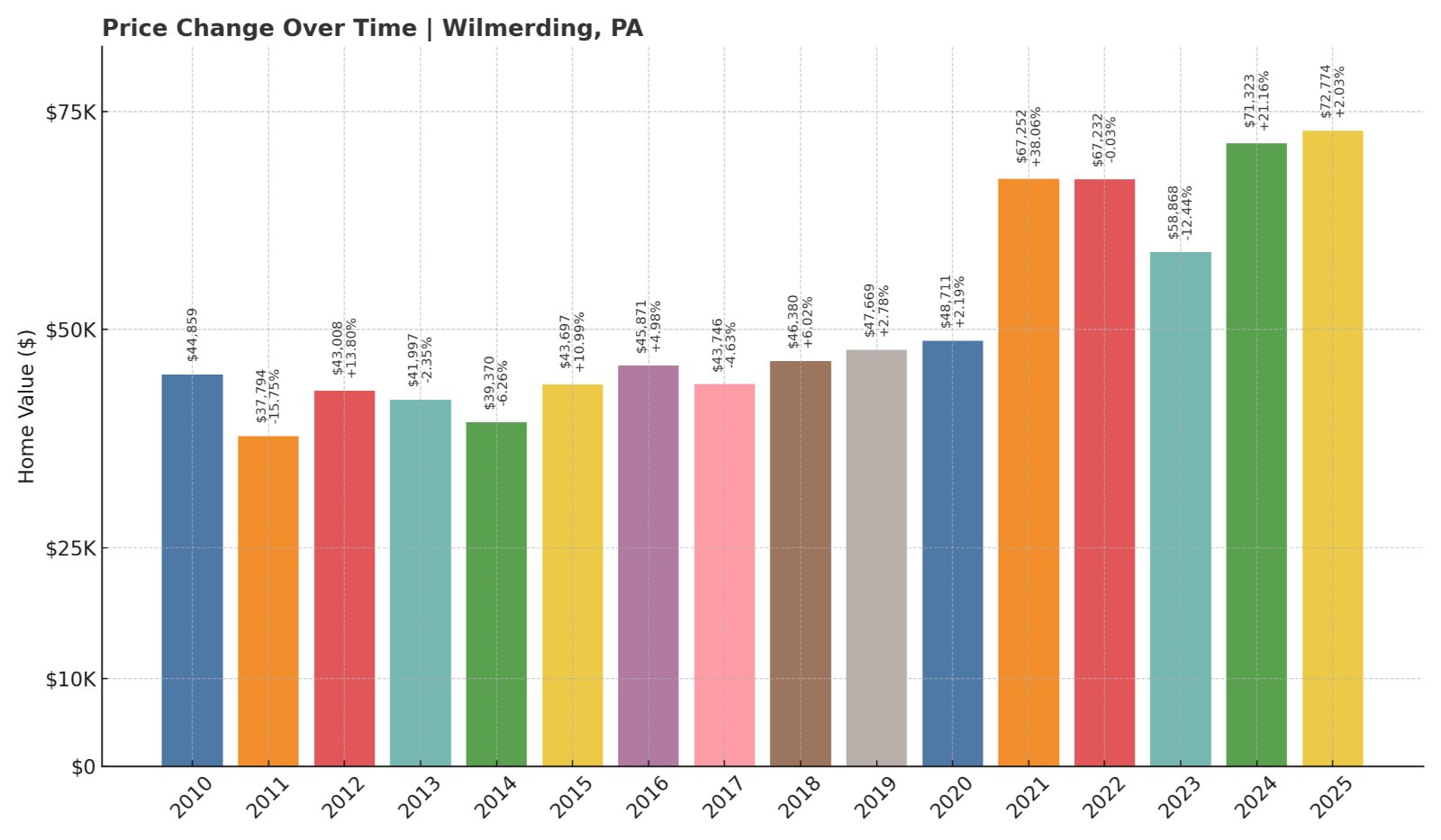

16. Wilmerding – 62% Home Price Increase Since 2010

- 2010: $44,859

- 2011: $37,794 (-$7,065, -15.75% from previous year)

- 2012: $43,008 (+$5,214, +13.79% from previous year)

- 2013: $41,997 (-$1,011, -2.35% from previous year)

- 2014: $39,370 (-$2,627, -6.26% from previous year)

- 2015: $43,697 (+$4,327, +10.99% from previous year)

- 2016: $45,871 (+$2,174, +4.98% from previous year)

- 2017: $43,746 (-$2,125, -4.63% from previous year)

- 2018: $46,380 (+$2,634, +6.02% from previous year)

- 2019: $47,669 (+$1,289, +2.78% from previous year)

- 2020: $48,711 (+$1,042, +2.19% from previous year)

- 2021: $67,252 (+$18,540, +38.06% from previous year)

- 2022: $67,232 (-$20, -0.03% from previous year)

- 2023: $58,868 (-$8,363, -12.44% from previous year)

- 2024: $71,323 (+$12,455, +21.16% from previous year)

- 2025: $72,774 (+$1,451, +2.03% from previous year)

Wilmerding’s home values have jumped over 62% since 2010, with dramatic growth in 2021 and again in 2024. Prices have fluctuated, including a notable dip in 2023, but remain low overall. The town’s recovery from each dip shows resilience and potential for steady appreciation.

Wilmerding – Factory Legacy Meets Price Appeal

Wilmerding, located in Allegheny County just outside Pittsburgh, was once the proud home of Westinghouse Air Brake Company. Its Victorian industrial heritage is still visible in the architecture around town. Though the factory era has passed, the area offers good transit access and affordable real estate.

In 2025, the median price remains under $73,000 — remarkably low for a town with proximity to a major metro area. Its affordability continues to attract first-time homebuyers, especially those commuting to jobs in Pittsburgh. The town’s recent price rebound may be signaling new attention and investment.

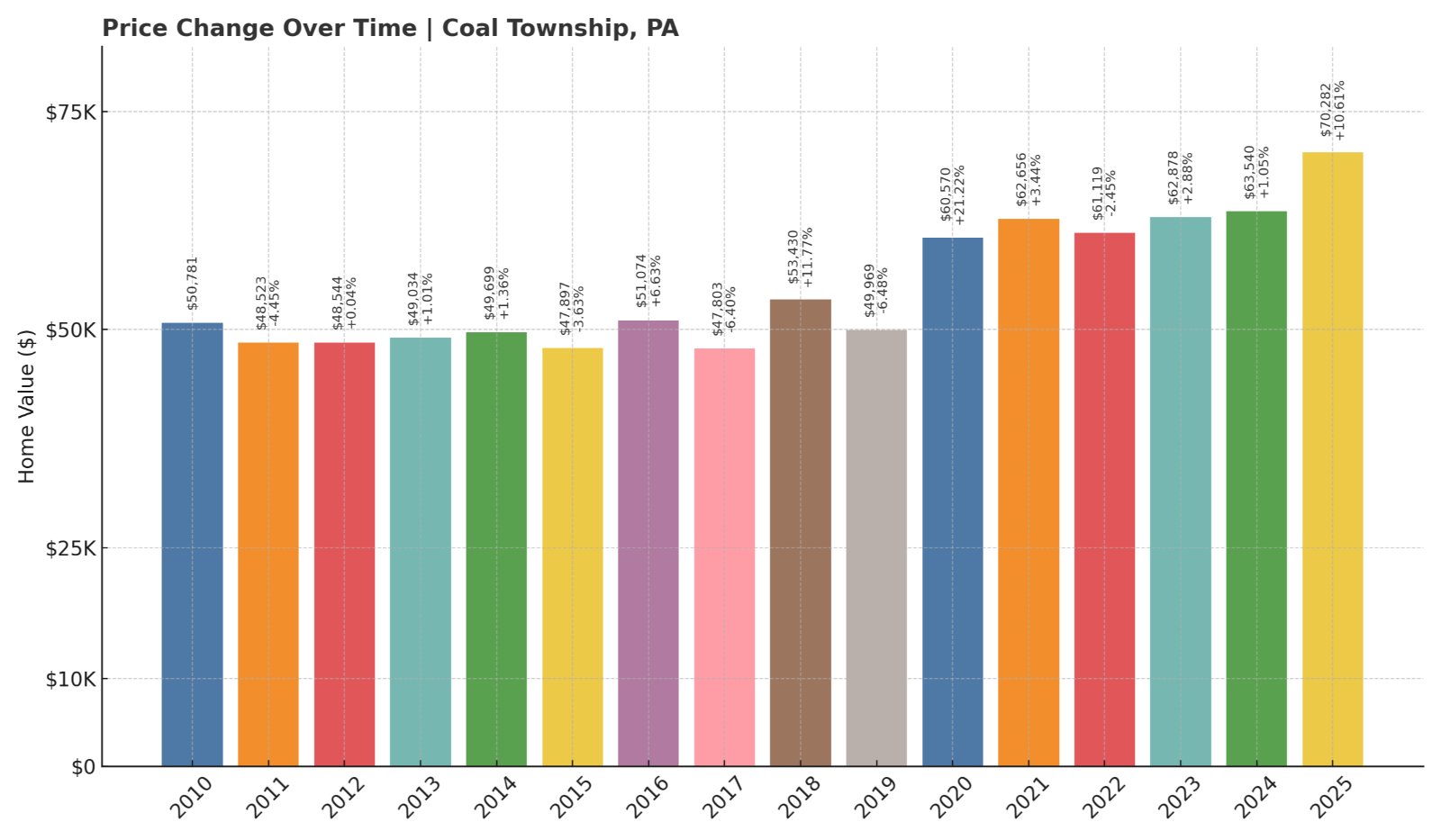

15. Coal Township – 38% Home Price Increase Since 2010

- 2010: $50,781

- 2011: $48,523 (-$2,258, -4.45% from previous year)

- 2012: $48,544 (+$21, +0.04% from previous year)

- 2013: $49,034 (+$490, +1.01% from previous year)

- 2014: $49,699 (+$665, +1.36% from previous year)

- 2015: $47,897 (-$1,802, -3.62% from previous year)

- 2016: $51,074 (+$3,177, +6.63% from previous year)

- 2017: $47,803 (-$3,271, -6.40% from previous year)

- 2018: $53,430 (+$5,628, +11.77% from previous year)

- 2019: $49,969 (-$3,462, -6.48% from previous year)

- 2020: $60,570 (+$10,601, +21.22% from previous year)

- 2021: $62,656 (+$2,086, +3.44% from previous year)

- 2022: $61,119 (-$1,537, -2.45% from previous year)

- 2023: $62,878 (+$1,760, +2.88% from previous year)

- 2024: $63,540 (+$661, +1.05% from previous year)

- 2025: $70,282 (+$6,742, +10.61% from previous year)

Coal Township has gained 38% in home value since 2010, mostly driven by steady appreciation and a jump in 2020. With minimal volatility and modest annual changes, this town offers one of the more stable price trajectories on the list.

Coal Township – An Underrated Value in Central PA

Coal Township is located in Northumberland County and neighbors the city of Shamokin. As the name suggests, the area once thrived on coal mining, which has since declined, leaving behind affordable housing and a slow but consistent market.

In 2025, home prices remain just above $70,000. The town’s accessibility to Route 61 and the low cost of living make it an appealing option for families and fixed-income residents. The price gains over the last few years suggest renewed buyer interest and a potential upward trend.

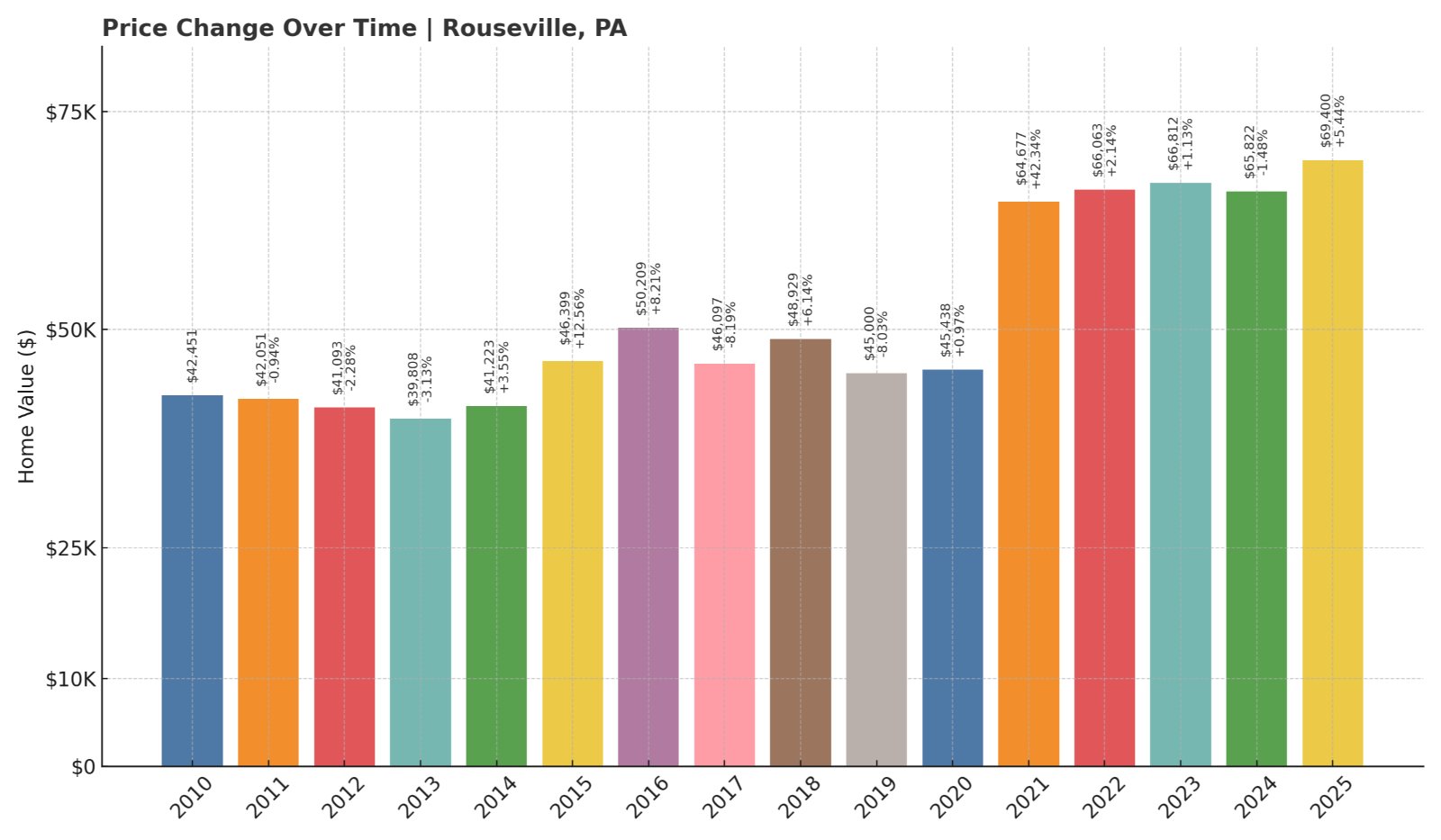

14. Rouseville – 63% Home Price Increase Since 2010

- 2010: $42,451

- 2011: $42,051 (-$400, -0.94% from previous year)

- 2012: $41,093 (-$958, -2.28% from previous year)

- 2013: $39,808 (-$1,285, -3.13% from previous year)

- 2014: $41,223 (+$1,416, +3.56% from previous year)

- 2015: $46,399 (+$5,176, +12.56% from previous year)

- 2016: $50,209 (+$3,809, +8.21% from previous year)

- 2017: $46,097 (-$4,112, -8.19% from previous year)

- 2018: $48,929 (+$2,832, +6.14% from previous year)

- 2019: $45,000 (-$3,929, -8.03% from previous year)

- 2020: $45,438 (+$438, +0.97% from previous year)

- 2021: $64,677 (+$19,240, +42.34% from previous year)

- 2022: $66,063 (+$1,386, +2.14% from previous year)

- 2023: $66,812 (+$748, +1.13% from previous year)

- 2024: $65,822 (-$989, -1.48% from previous year)

- 2025: $69,400 (+$3,578, +5.44% from previous year)

Home prices in Rouseville are up 63% since 2010, with the biggest gains occurring in 2021. The market has held steady since, with only minor fluctuations. This trend points to sustainable growth without volatility, a good sign for cautious buyers.

Rouseville – Oil Boom Legacy and Affordable Homes

Rouseville is located in Venango County and played a small role in the early oil boom of the 19th century. Today, it’s a quiet town with around 500 residents and offers some of the most affordable home prices in the region.

With current prices under $70,000, the town draws buyers looking for budget-friendly options near Oil City. It’s not a hub of economic activity, but the affordability, safety, and quiet living make Rouseville a good fit for buyers prioritizing value over buzz.

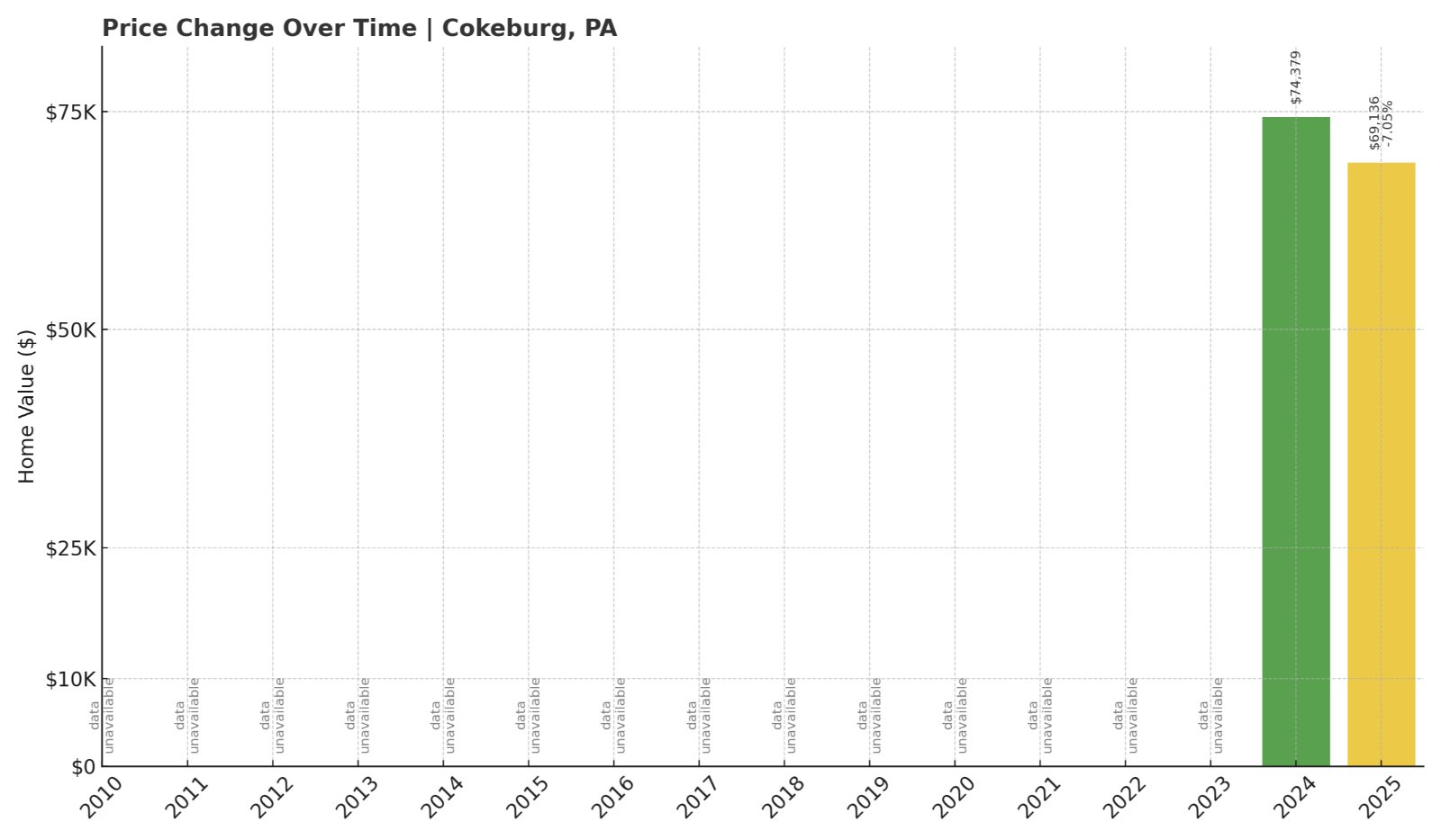

13. Cokeburg – 7% Home Price Decrease Since 2024

- 2024: $74,379

- 2025: $69,136 (-$5,242, -7.05% from previous year)

Cokeburg saw a notable drop of just over 7% in home prices from 2024 to 2025. While the available data is limited, the decline may present an opportunity for buyers looking to enter a market that could rebound. As of 2025, prices remain below $70,000—well under state and national averages.

Cokeburg – Small-Town Feel with Big Affordability

Cokeburg is a borough in Washington County, located roughly midway between Pittsburgh and the West Virginia border. It’s a former coal and coke community with a proud working-class history and a population of around 600. Though small, the town has held onto its community identity over the years.

The recent drop in home values could be due to local market corrections or changes in inventory, but with proximity to the Mon Valley and major routes like I-70, the town holds potential. With homes now averaging around $69,000, Cokeburg is a good candidate for buyers seeking affordability without moving far from urban centers.

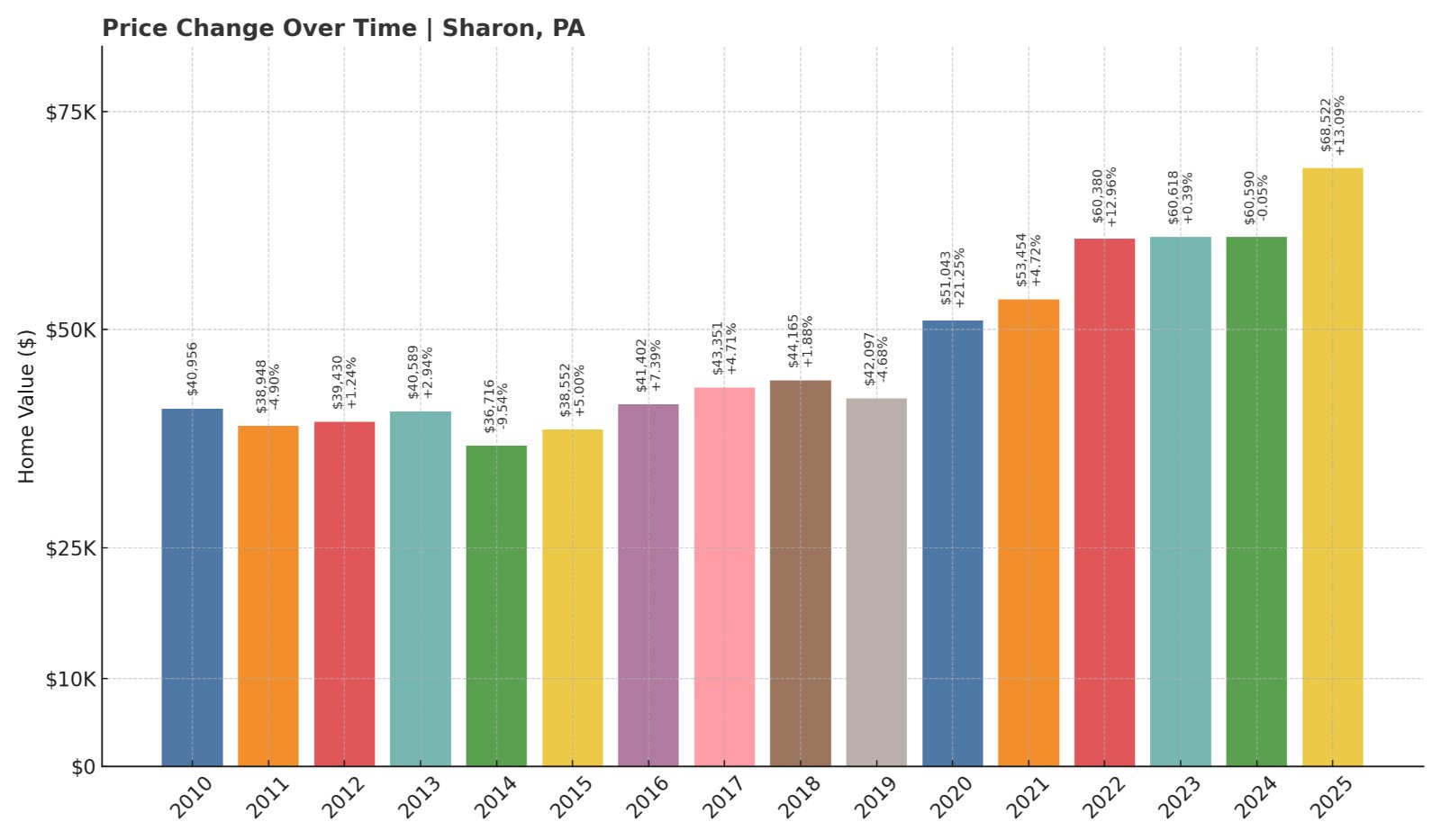

12. Sharon – 67% Home Price Increase Since 2010

Would you like to save this?

- 2010: $40,956

- 2011: $38,948 (-$2,008, -4.90% from previous year)

- 2012: $39,430 (+$482, +1.24% from previous year)

- 2013: $40,589 (+$1,158, +2.94% from previous year)

- 2014: $36,716 (-$3,872, -9.54% from previous year)

- 2015: $38,552 (+$1,835, +5.00% from previous year)

- 2016: $41,402 (+$2,851, +7.39% from previous year)

- 2017: $43,351 (+$1,949, +4.71% from previous year)

- 2018: $44,165 (+$814, +1.88% from previous year)

- 2019: $42,097 (-$2,068, -4.68% from previous year)

- 2020: $51,043 (+$8,946, +21.25% from previous year)

- 2021: $53,454 (+$2,411, +4.72% from previous year)

- 2022: $60,380 (+$6,926, +12.96% from previous year)

- 2023: $60,618 (+$238, +0.39% from previous year)

- 2024: $60,590 (-$28, -0.05% from previous year)

- 2025: $68,522 (+$7,932, +13.09% from previous year)

Since 2010, home prices in Sharon have jumped by 67%, driven by strong growth in 2020 and a renewed surge in 2025. Price dips in 2014 and 2019 slowed things down temporarily, but the long-term trend has been upward. Today, prices remain affordable by state standards.

Sharon – A River Town Making a Comeback

Sharon, located in Mercer County near the Ohio border, is known for its revitalizing downtown and historic charm. Once a major steel and manufacturing hub, the city has gradually transformed into a center for small business, arts, and music. Despite these efforts, the real estate market remains accessible for budget buyers.

At under $70,000 in 2025, Sharon’s homes offer excellent value, particularly for those interested in city amenities on a small-town scale. Projects to rejuvenate public spaces and promote tourism have brought renewed interest to the area, suggesting potential for future price growth.

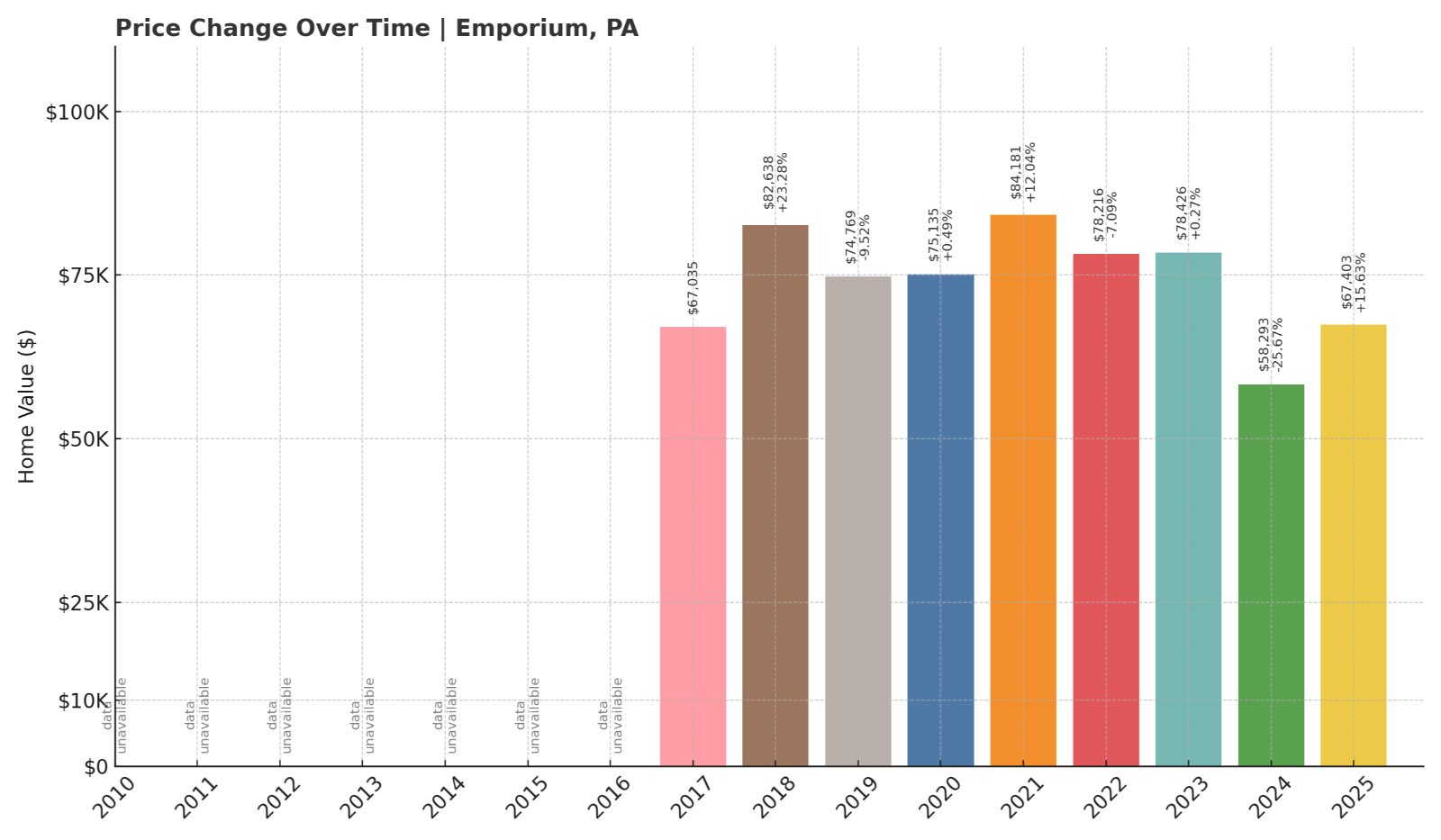

11. Emporium – 0.5% Home Price Increase Since 2017

- 2017: $67,035

- 2018: $82,638 (+$15,603, +23.28% from previous year)

- 2019: $74,769 (-$7,869, -9.52% from previous year)

- 2020: $75,135 (+$366, +0.49% from previous year)

- 2021: $84,181 (+$9,045, +12.04% from previous year)

- 2022: $78,216 (-$5,965, -7.09% from previous year)

- 2023: $78,426 (+$210, +0.27% from previous year)

- 2024: $58,293 (-$20,132, -25.67% from previous year)

- 2025: $67,403 (+$9,110, +15.63% from previous year)

Emporium’s home prices in 2025 are almost exactly where they were in 2017, with less than 1% overall growth. That said, the town has seen big swings—including a 25% drop in 2024 and a 15% recovery the following year—making it a market full of potential opportunities for savvy buyers.

Emporium – Scenic and Affordable in Pennsylvania Wilds

Emporium is the county seat of Cameron County and sits in the heart of the Pennsylvania Wilds. Known for its forests, wildlife, and solitude, the town is ideal for those seeking a rural lifestyle far from big-city hustle. With fewer than 2,000 residents, it’s a tight-knit community with a slower pace of life.

Though housing prices have moved erratically, 2025’s average of just over $67,000 makes Emporium one of the cheapest towns in the region. The combination of affordable property and scenic surroundings makes it particularly attractive for retirees or remote workers drawn to nature.

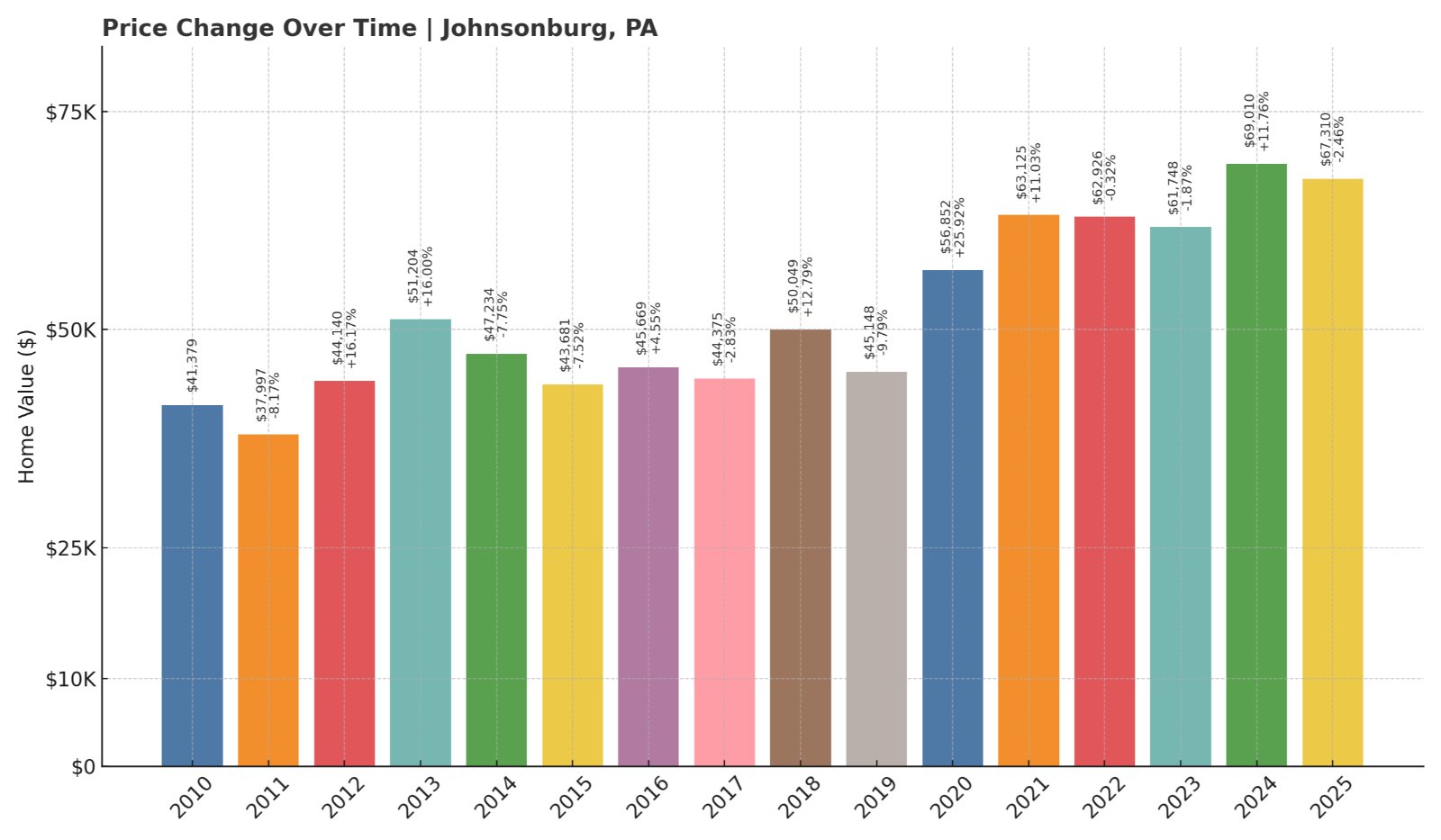

10. Johnsonburg – 62% Home Price Increase Since 2010

- 2010: $41,379

- 2011: $37,997 (-$3,382, -8.17% from previous year)

- 2012: $44,140 (+$6,142, +16.16% from previous year)

- 2013: $51,204 (+$7,065, +16.00% from previous year)

- 2014: $47,234 (-$3,970, -7.75% from previous year)

- 2015: $43,681 (-$3,553, -7.52% from previous year)

- 2016: $45,669 (+$1,988, +4.55% from previous year)

- 2017: $44,375 (-$1,293, -2.83% from previous year)

- 2018: $50,049 (+$5,674, +12.79% from previous year)

- 2019: $45,148 (-$4,901, -9.79% from previous year)

- 2020: $56,852 (+$11,704, +25.92% from previous year)

- 2021: $63,125 (+$6,272, +11.03% from previous year)

- 2022: $62,926 (-$199, -0.32% from previous year)

- 2023: $61,748 (-$1,178, -1.87% from previous year)

- 2024: $69,010 (+$7,262, +11.76% from previous year)

- 2025: $67,310 (-$1,701, -2.46% from previous year)

Johnsonburg’s home values have increased by 62% since 2010, showing a strong long-term rise despite a few setbacks along the way. The steep gains in 2020 and 2024 more than made up for earlier losses. As of 2025, prices remain accessible under $70,000.

Johnsonburg – Affordable Living in Elk County

Located in Elk County, Johnsonburg sits along the Clarion River and has a long history in the paper and lumber industries. It’s a small town with deep roots, surrounded by woodlands and known for outdoor recreation, especially kayaking and fishing.

While its economy has contracted over the decades, housing prices have stayed low and demand modest. For buyers interested in natural beauty and small-town living, Johnsonburg offers surprising value and stability. The price dip in 2025 may represent a short-term adjustment rather than a larger trend.

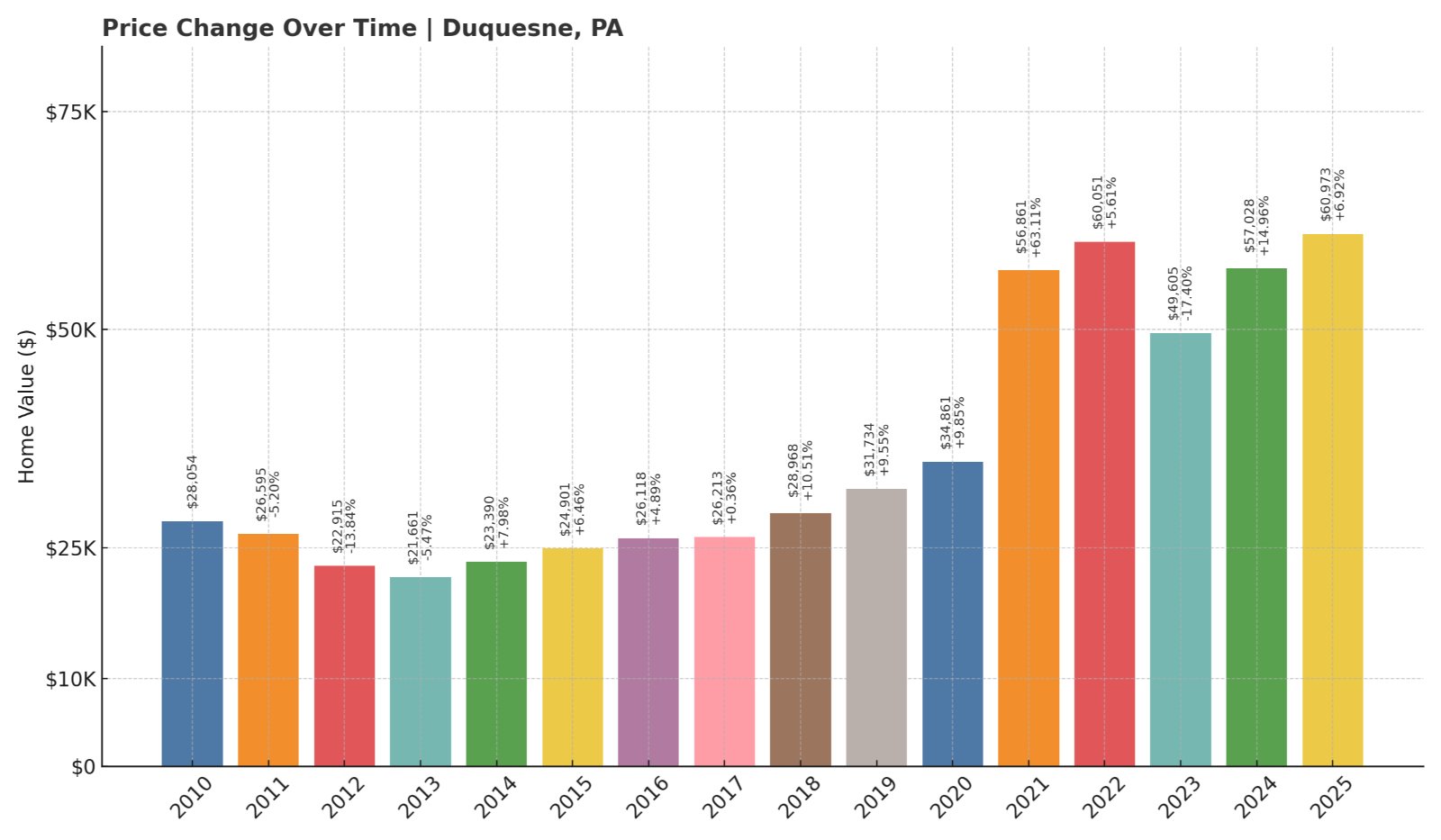

9. Duquesne – 117% Home Price Increase Since 2010

- 2010: $28,054

- 2011: $26,595 (-$1,459, -5.20% from previous year)

- 2012: $22,915 (-$3,679, -13.83% from previous year)

- 2013: $21,661 (-$1,254, -5.47% from previous year)

- 2014: $23,390 (+$1,729, +7.98% from previous year)

- 2015: $24,901 (+$1,511, +6.46% from previous year)

- 2016: $26,118 (+$1,216, +4.88% from previous year)

- 2017: $26,213 (+$95, +0.36% from previous year)

- 2018: $28,968 (+$2,755, +10.51% from previous year)

- 2019: $31,734 (+$2,767, +9.55% from previous year)

- 2020: $34,861 (+$3,127, +9.85% from previous year)

- 2021: $56,861 (+$22,000, +63.11% from previous year)

- 2022: $60,051 (+$3,189, +5.61% from previous year)

- 2023: $49,605 (-$10,446, -17.40% from previous year)

- 2024: $57,028 (+$7,424, +14.97% from previous year)

- 2025: $60,973 (+$3,945, +6.92% from previous year)

Duquesne’s home values have more than doubled since 2010—up 117%. After significant losses in the early 2010s, the town saw explosive growth from 2020 onward, especially in 2021. Despite some turbulence, prices remain very low by statewide standards.

Duquesne – Budget-Friendly Living Minutes from Pittsburgh

Duquesne is located just eight miles southeast of downtown Pittsburgh, perched on the Monongahela River. Once a steel manufacturing powerhouse, it’s now a quiet residential community undergoing slow revitalization. Its access to the city and low cost of housing have made it increasingly attractive to first-time homebuyers and investors alike.

With average home prices sitting around $61,000 in 2025, Duquesne remains one of the most affordable towns within commuting distance of Pittsburgh. Infrastructure improvements and nearby development projects have contributed to modest upward momentum without pricing out longtime residents.

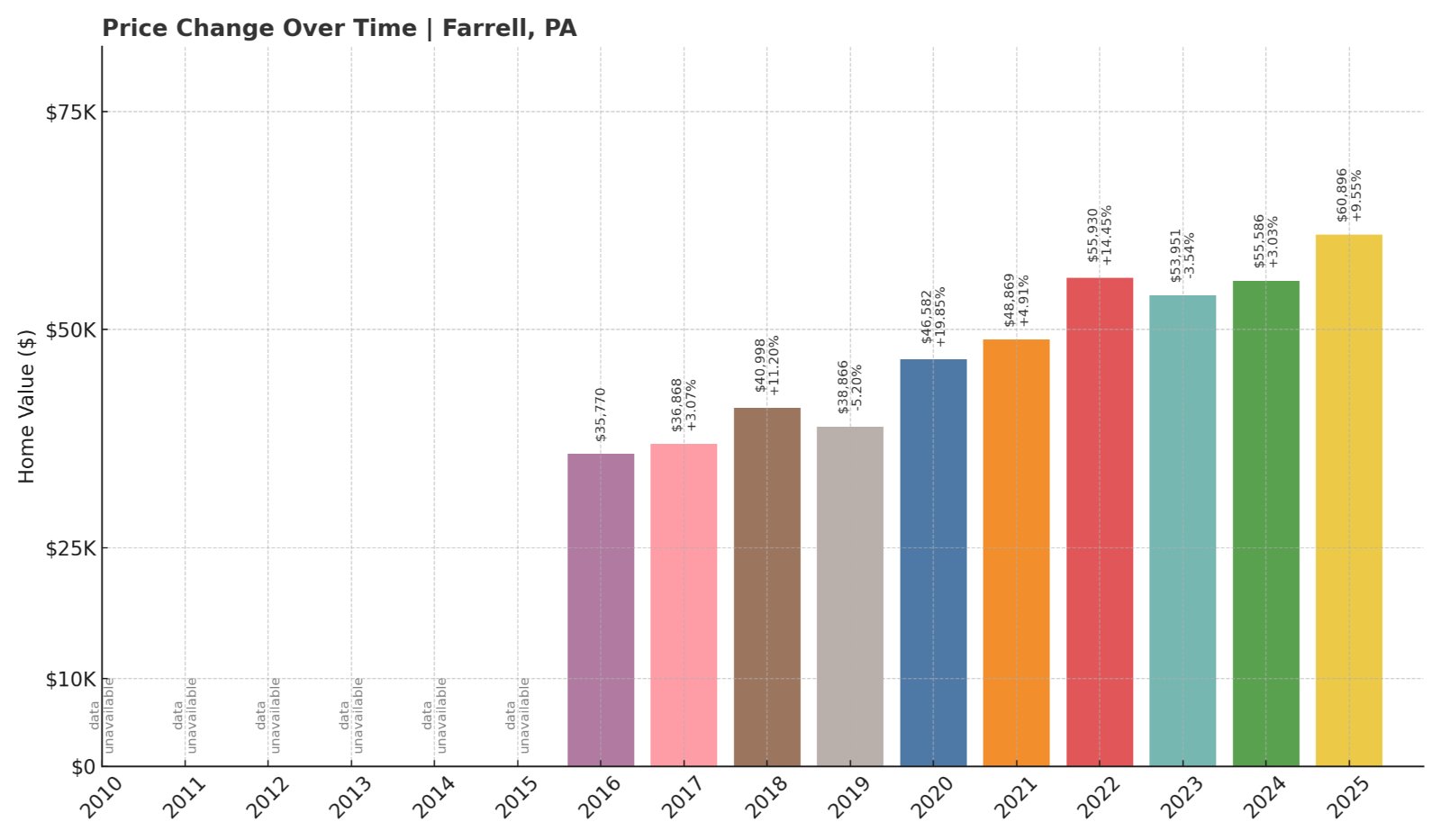

8. Farrell – 70% Home Price Increase Since 2016

- 2016: $35,770

- 2017: $36,868 (+$1,099, +3.07% from previous year)

- 2018: $40,998 (+$4,130, +11.20% from previous year)

- 2019: $38,866 (-$2,132, -5.20% from previous year)

- 2020: $46,582 (+$7,716, +19.85% from previous year)

- 2021: $48,869 (+$2,286, +4.91% from previous year)

- 2022: $55,930 (+$7,062, +14.45% from previous year)

- 2023: $53,951 (-$1,979, -3.54% from previous year)

- 2024: $55,586 (+$1,635, +3.03% from previous year)

- 2025: $60,896 (+$5,310, +9.55% from previous year)

Farrell has experienced a 70% rise in home values since 2016, with growth peaking in 2020 and continuing steadily through 2025. Despite a few short dips, the market trend is largely positive, and prices remain well below the state median.

Farrell – Steady Growth in a Former Steel Town

Located in Mercer County, Farrell was once known for its robust steel industry. Although those days have passed, the town has been working to reposition itself with a focus on health care, small business, and education. It shares a school district with neighboring Sharon and benefits from its proximity to Youngstown and Pittsburgh.

As of 2025, the median home value in Farrell is around $61,000, making it a very attractive option for buyers priced out of larger towns. Its modest but consistent gains suggest the potential for further improvement without significant risk of sudden market shifts.

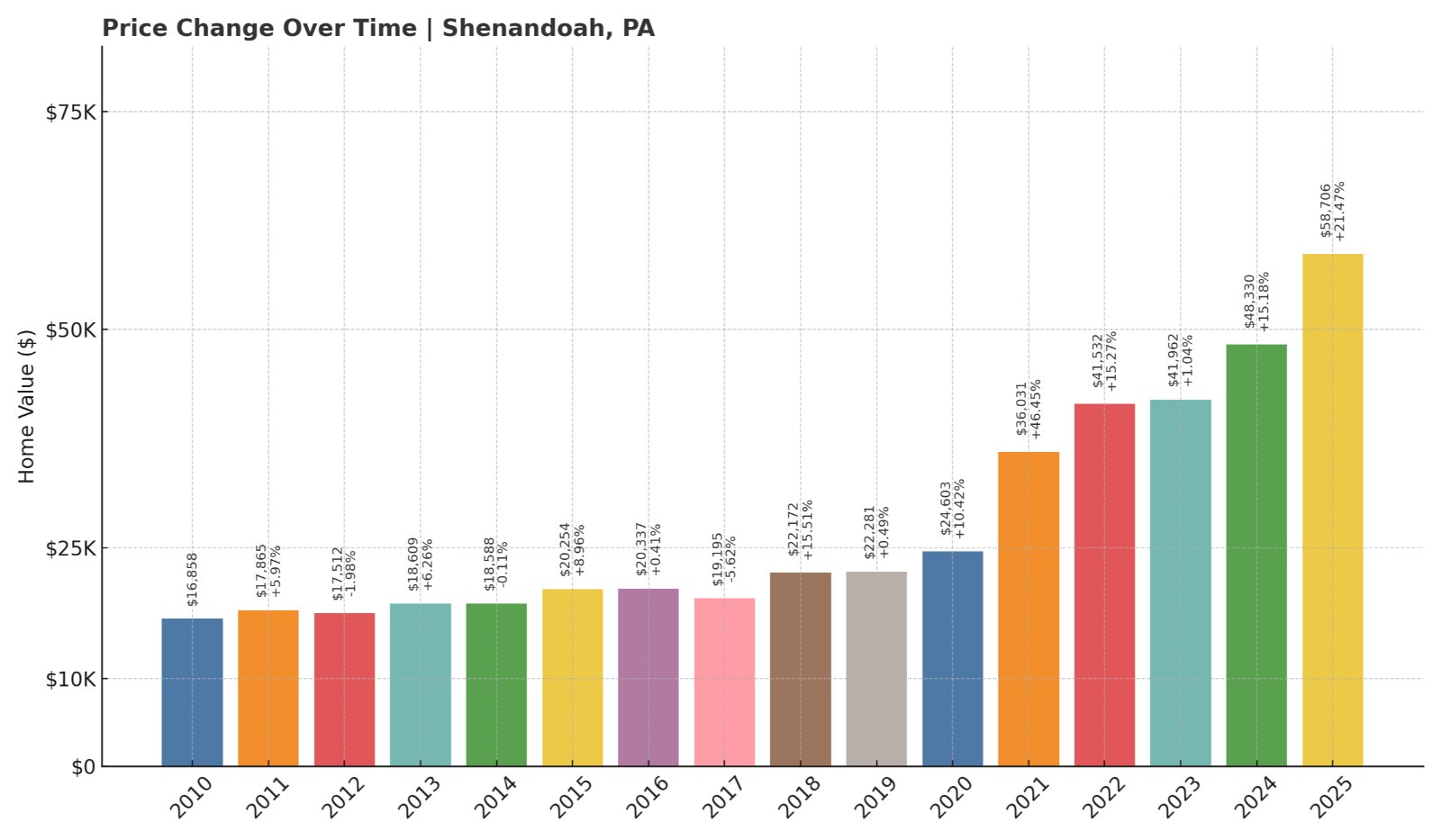

7. Shenandoah – 248% Home Price Increase Since 2010

- 2010: $16,858

- 2011: $17,865 (+$1,007, +5.97% from previous year)

- 2012: $17,512 (-$353, -1.98% from previous year)

- 2013: $18,609 (+$1,098, +6.27% from previous year)

- 2014: $18,588 (-$22, -0.12% from previous year)

- 2015: $20,254 (+$1,666, +8.96% from previous year)

- 2016: $20,337 (+$83, +0.41% from previous year)

- 2017: $19,195 (-$1,142, -5.62% from previous year)

- 2018: $22,172 (+$2,978, +15.51% from previous year)

- 2019: $22,281 (+$109, +0.49% from previous year)

- 2020: $24,603 (+$2,322, +10.42% from previous year)

- 2021: $36,031 (+$11,428, +46.45% from previous year)

- 2022: $41,532 (+$5,501, +15.27% from previous year)

- 2023: $41,962 (+$430, +1.04% from previous year)

- 2024: $48,330 (+$6,368, +15.17% from previous year)

- 2025: $58,706 (+$10,376, +21.47% from previous year)

Shenandoah’s housing market has seen massive growth—home values have surged by nearly 250% since 2010. After gradual growth through the 2010s, prices shot up during and after the pandemic. Despite the increases, the town still offers homes under $60,000.

Shenandoah – Historic Character, Modern Opportunity

Shenandoah is a borough in Schuylkill County, situated in the heart of Pennsylvania’s anthracite coal region. Known for its Eastern European heritage and old-world architecture, the town has been attracting new attention as an affordable destination for homebuyers.

The housing market has seen some of the most dramatic gains in the state in recent years, yet it remains highly accessible. With a 2025 median price around $59,000, Shenandoah represents a compelling mix of rich history and affordable investment potential.

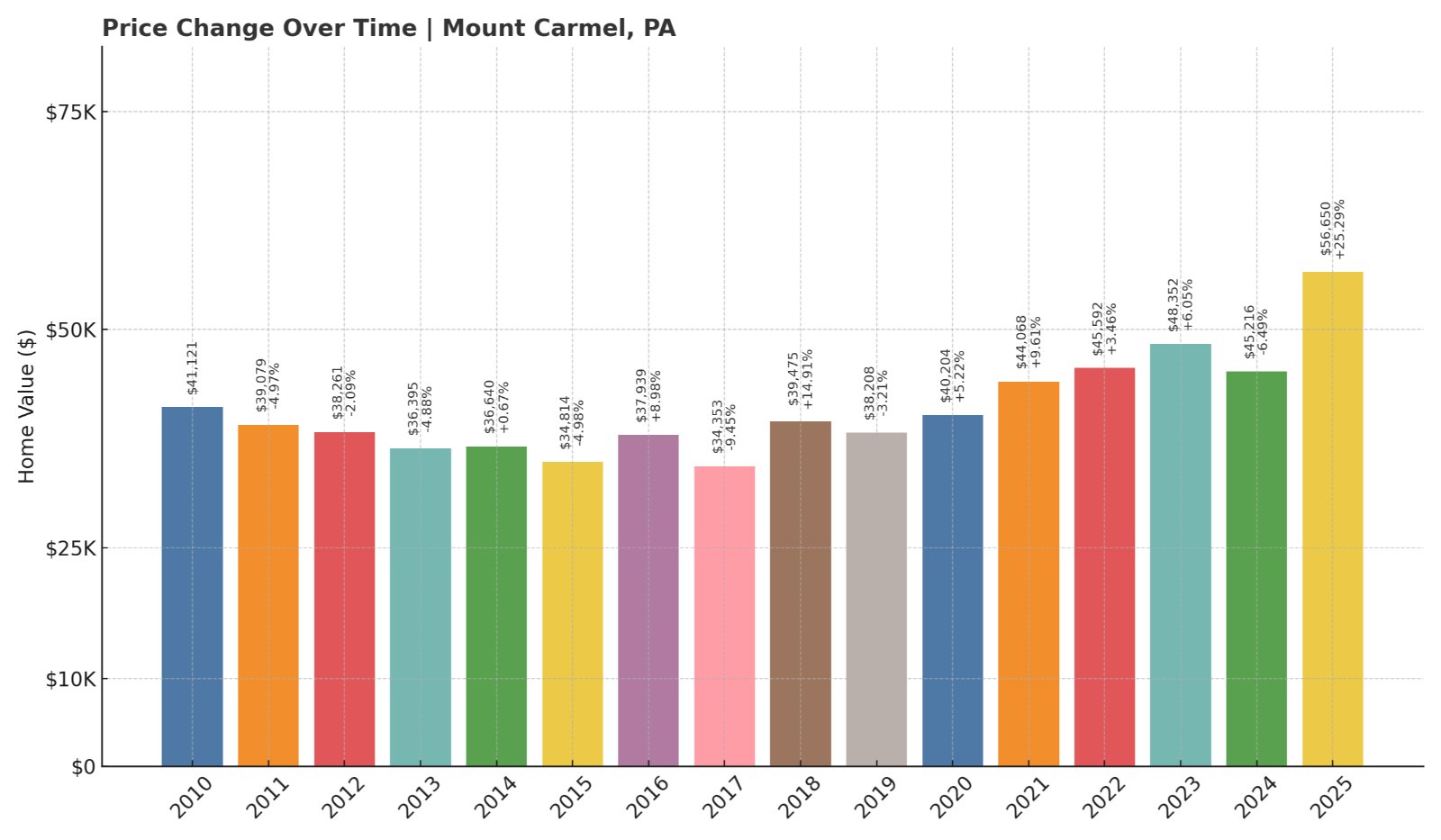

6. Mount Carmel – 37% Home Price Increase Since 2010

Would you like to save this?

- 2010: $41,121

- 2011: $39,079 (-$2,042, -4.97% from previous year)

- 2012: $38,261 (-$817, -2.09% from previous year)

- 2013: $36,395 (-$1,866, -4.88% from previous year)

- 2014: $36,640 (+$245, +0.67% from previous year)

- 2015: $34,814 (-$1,826, -4.98% from previous year)

- 2016: $37,939 (+$3,125, +8.98% from previous year)

- 2017: $34,353 (-$3,586, -9.45% from previous year)

- 2018: $39,475 (+$5,122, +14.91% from previous year)

- 2019: $38,208 (-$1,267, -3.21% from previous year)

- 2020: $40,204 (+$1,997, +5.23% from previous year)

- 2021: $44,068 (+$3,864, +9.61% from previous year)

- 2022: $45,592 (+$1,524, +3.46% from previous year)

- 2023: $48,352 (+$2,760, +6.05% from previous year)

- 2024: $45,216 (-$3,136, -6.49% from previous year)

- 2025: $56,650 (+$11,433, +25.29% from previous year)

Home prices in Mount Carmel are up 37% since 2010, with a particularly strong rebound in 2025 after a dip the year before. While the town has seen ups and downs, the overall trend is upward—and still highly affordable.

Mount Carmel – Growing Demand in a Historic Coal Town

Mount Carmel, also in Northumberland County, shares many characteristics with its regional neighbors—coal town roots, tight-knit community, and affordable housing. Its downtown area and surrounding neighborhoods are seeing more interest from buyers looking for value and potential.

With home values now in the mid-$50,000s, Mount Carmel offers budget-friendly ownership with access to local schools, small shops, and outdoor recreation. The jump in 2025 may reflect shifting demand or reduced housing inventory, signaling a possible trend toward longer-term appreciation.

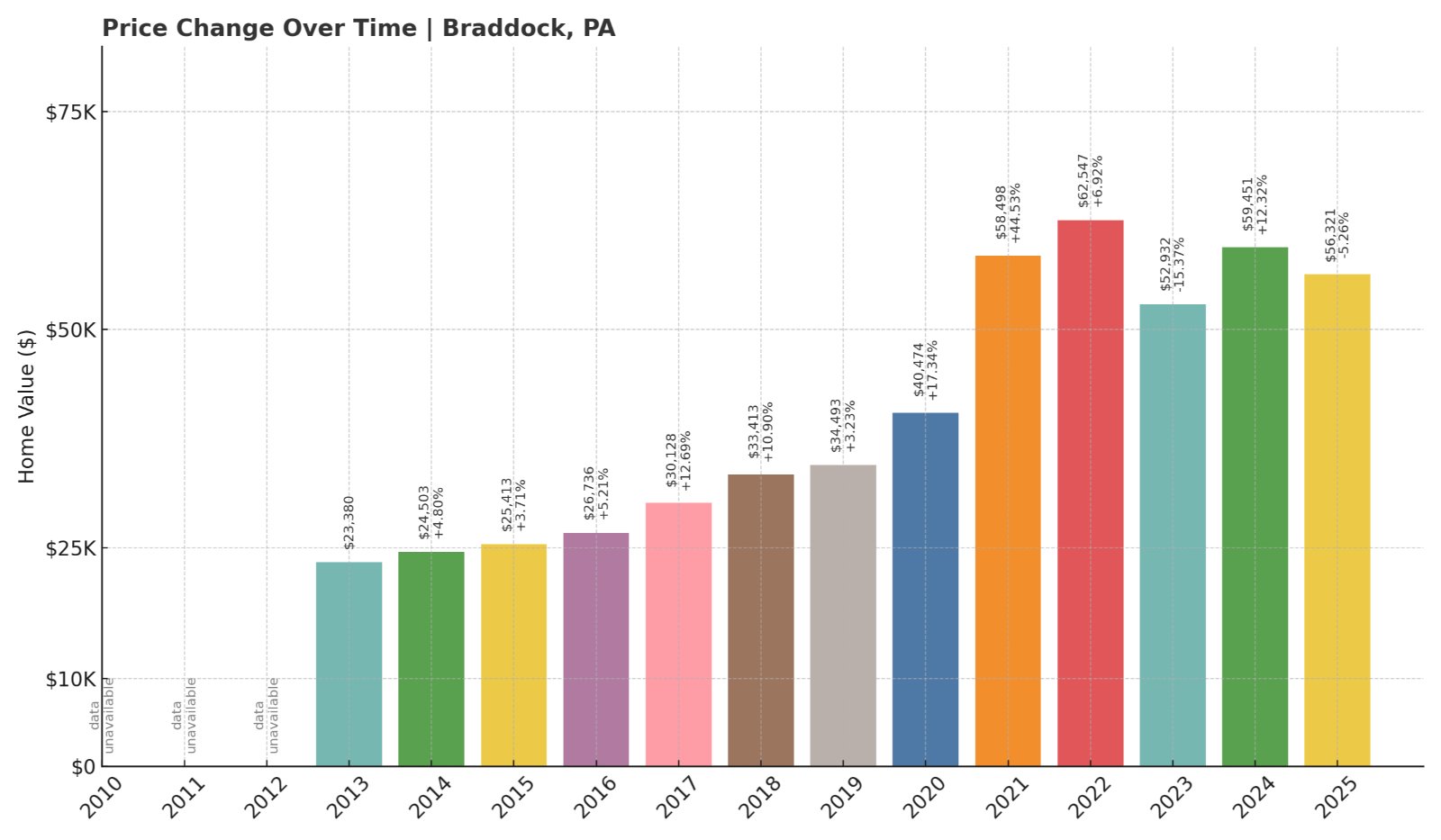

5. Braddock – 141% Home Price Increase Since 2013

- 2013: $23,380

- 2014: $24,503 (+$1,123, +4.80% from previous year)

- 2015: $25,413 (+$910, +3.71% from previous year)

- 2016: $26,736 (+$1,322, +5.20% from previous year)

- 2017: $30,128 (+$3,392, +12.69% from previous year)

- 2018: $33,413 (+$3,285, +10.90% from previous year)

- 2019: $34,493 (+$1,080, +3.23% from previous year)

- 2020: $40,474 (+$5,981, +17.34% from previous year)

- 2021: $58,498 (+$18,024, +44.53% from previous year)

- 2022: $62,547 (+$4,049, +6.92% from previous year)

- 2023: $52,932 (-$9,615, -15.37% from previous year)

- 2024: $59,451 (+$6,519, +12.32% from previous year)

- 2025: $56,321 (-$3,129, -5.26% from previous year)

Braddock’s home prices have climbed 141% since 2013, peaking in 2021 and remaining strong despite some recent dips. This long-term rise reflects the town’s gradual turnaround and its appeal to buyers seeking low prices close to Pittsburgh.

Braddock – Rebuilding History on the Monongahela

Located just east of Pittsburgh along the Monongahela River, Braddock is a town with deep industrial roots and a story of reinvention. Once home to Andrew Carnegie’s first steel mill, it experienced decades of economic hardship before efforts to revitalize the community gained momentum in the 2010s and 2020s.

Despite some volatility, Braddock’s 2025 home values—averaging just over $56,000—are still accessible to many buyers. The town is known for its artistic and cultural energy, led by community initiatives and adaptive reuse of historic spaces. For homebuyers seeking affordability and grit-to-growth potential, Braddock continues to stand out.

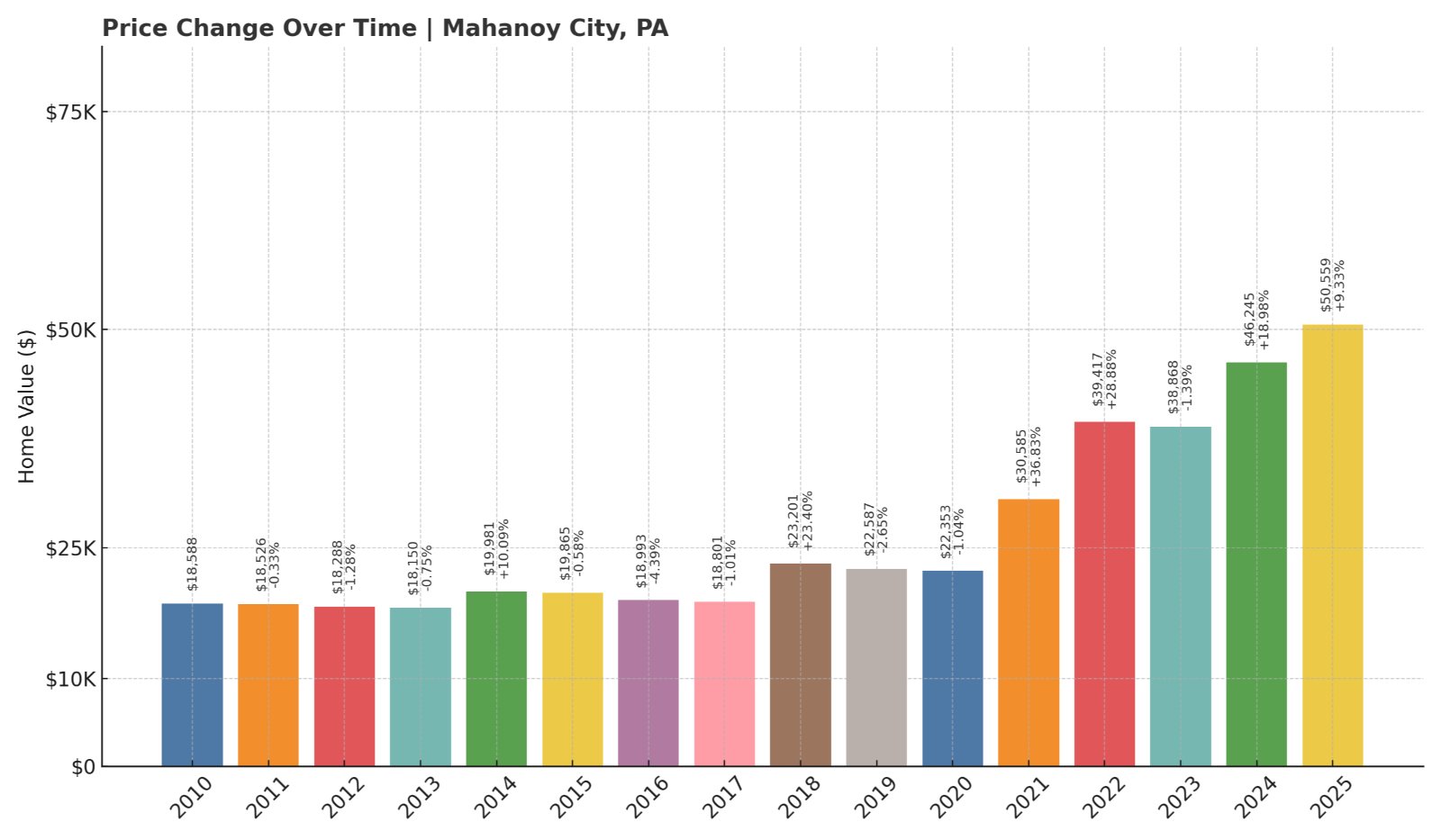

4. Mahanoy City – 172% Home Price Increase Since 2010

- 2010: $18,588

- 2011: $18,526 (-$62, -0.33% from previous year)

- 2012: $18,288 (-$238, -1.29% from previous year)

- 2013: $18,150 (-$138, -0.75% from previous year)

- 2014: $19,981 (+$1,831, +10.09% from previous year)

- 2015: $19,865 (-$116, -0.58% from previous year)

- 2016: $18,993 (-$871, -4.39% from previous year)

- 2017: $18,801 (-$192, -1.01% from previous year)

- 2018: $23,201 (+$4,399, +23.40% from previous year)

- 2019: $22,587 (-$613, -2.64% from previous year)

- 2020: $22,353 (-$234, -1.03% from previous year)

- 2021: $30,585 (+$8,231, +36.82% from previous year)

- 2022: $39,417 (+$8,832, +28.88% from previous year)

- 2023: $38,868 (-$549, -1.39% from previous year)

- 2024: $46,245 (+$7,377, +18.98% from previous year)

- 2025: $50,559 (+$4,314, +9.33% from previous year)

Mahanoy City has seen home prices rise by more than 170% since 2010, with sharp gains in recent years. The market saw especially strong growth in 2021 and 2022, followed by more modest increases. Prices remain below $51,000, even after this substantial appreciation.

Mahanoy City – Coal Country Revival

Nestled in Schuylkill County, Mahanoy City is one of many Pennsylvania towns shaped by the anthracite coal industry. After years of stagnation, the area has become more attractive to buyers seeking inexpensive homes, historic architecture, and small-town life.

With prices still among the lowest in the state, the town’s accessibility and increasing stability are encouraging signs for both homeowners and investors. In 2025, home values average just over $50,000—proof that affordable ownership is still possible in Pennsylvania.

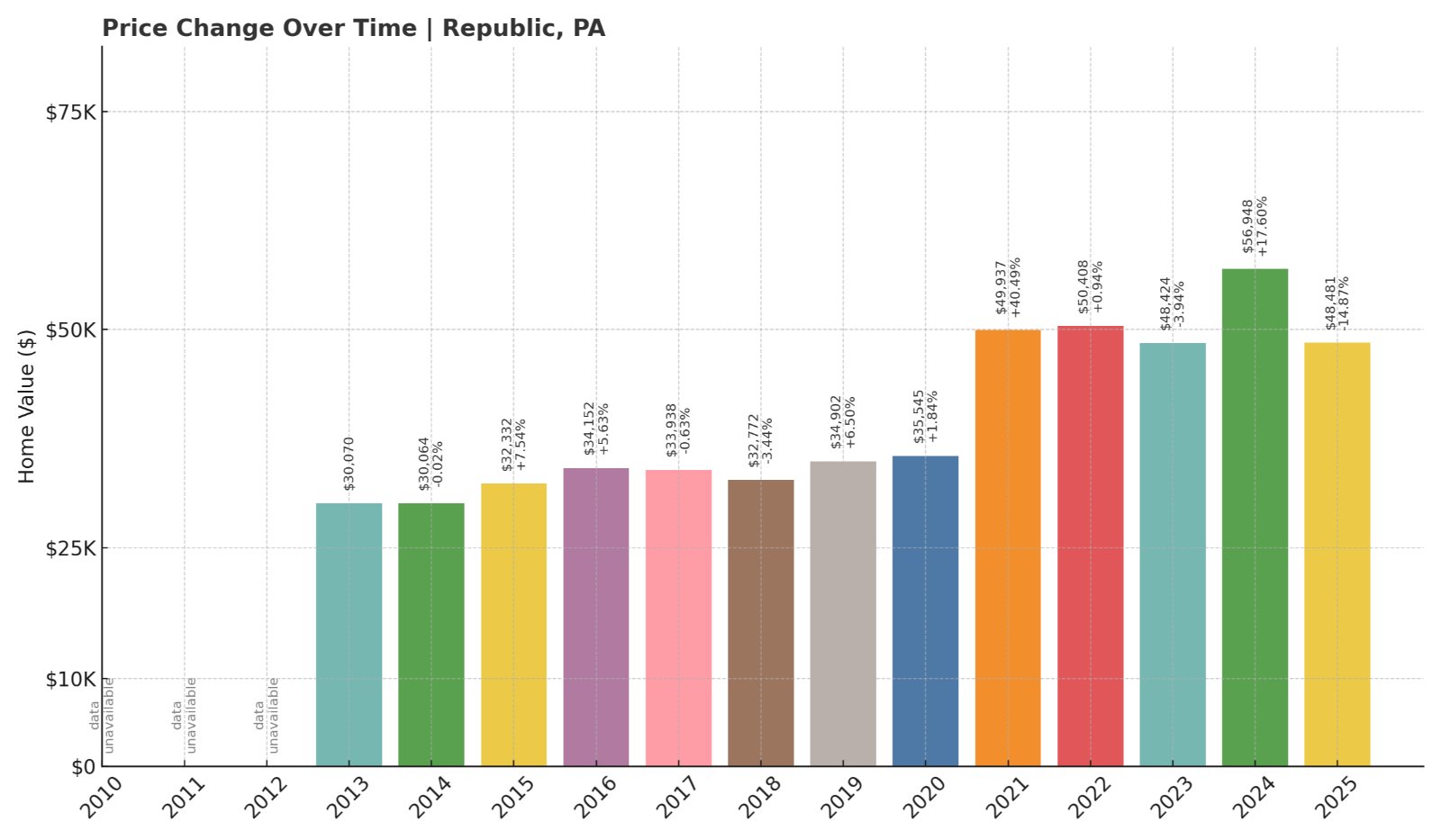

3. Republic – 61% Home Price Increase Since 2013

- 2013: $30,070

- 2014: $30,064 (-$7, -0.02% from previous year)

- 2015: $32,332 (+$2,268, +7.54% from previous year)

- 2016: $34,152 (+$1,820, +5.63% from previous year)

- 2017: $33,938 (-$214, -0.63% from previous year)

- 2018: $32,772 (-$1,165, -3.43% from previous year)

- 2019: $34,902 (+$2,130, +6.50% from previous year)

- 2020: $35,545 (+$643, +1.84% from previous year)

- 2021: $49,937 (+$14,392, +40.49% from previous year)

- 2022: $50,408 (+$470, +0.94% from previous year)

- 2023: $48,424 (-$1,984, -3.94% from previous year)

- 2024: $56,948 (+$8,524, +17.60% from previous year)

- 2025: $48,481 (-$8,467, -14.87% from previous year)

Home values in Republic have risen by 61% since 2013, with the biggest jump coming in 2021. Though 2025 saw a notable drop, the market still shows long-term growth and attractive affordability for entry-level buyers.

Republic – Rural Value in Fayette County

Republic is a quiet community in Fayette County, about 50 miles south of Pittsburgh. It’s largely residential, with a mix of older homes and a history tied to coal mining. The town remains small, with just over 1,000 residents, and its housing stock reflects years of slow, modest change.

At under $49,000 in 2025, home prices are low even by rural standards. For buyers with flexibility, Republic offers an affordable alternative in a peaceful setting—close enough to Uniontown and other job centers to maintain appeal for commuters.

2. Donora – 2.4% Home Price Increase Since 2010

- 2010: $45,385

- 2011: $48,421 (+$3,036, +6.69% from previous year)

- 2012: $37,600 (-$10,820, -22.35% from previous year)

- 2013: $37,858 (+$258, +0.69% from previous year)

- 2014: $37,757 (-$102, -0.27% from previous year)

- 2015: $38,347 (+$591, +1.56% from previous year)

- 2016: $35,194 (-$3,153, -8.22% from previous year)

- 2017: $34,049 (-$1,145, -3.25% from previous year)

- 2018: $37,433 (+$3,384, +9.94% from previous year)

- 2019: $37,824 (+$391, +1.04% from previous year)

- 2020: $44,770 (+$6,946, +18.36% from previous year)

- 2021: $57,174 (+$12,404, +27.71% from previous year)

- 2022: $56,801 (-$372, -0.65% from previous year)

- 2023: $51,286 (-$5,515, -9.71% from previous year)

- 2024: $56,975 (+$5,689, +11.09% from previous year)

- 2025: $46,494 (-$10,481, -18.40% from previous year)

Donora’s home values are up just 2.4% since 2010, reflecting a turbulent market with wide swings. While prices surged in 2021 and 2024, they have since dropped, bringing the market back near its 2010 levels.

Donora – Steel Legacy and Affordable Homes

Donora sits in Washington County along the Monongahela River, and like several others on this list, its history is tied to steel production. Once a thriving industrial center, the town has struggled with population loss but retains appeal thanks to its scenic views and historic character.

Despite fluctuations, Donora’s 2025 home prices—averaging $46,000—remain accessible. The ups and downs in the market may create buying opportunities for those willing to wait for long-term appreciation or for families looking for inexpensive housing in a quiet town.

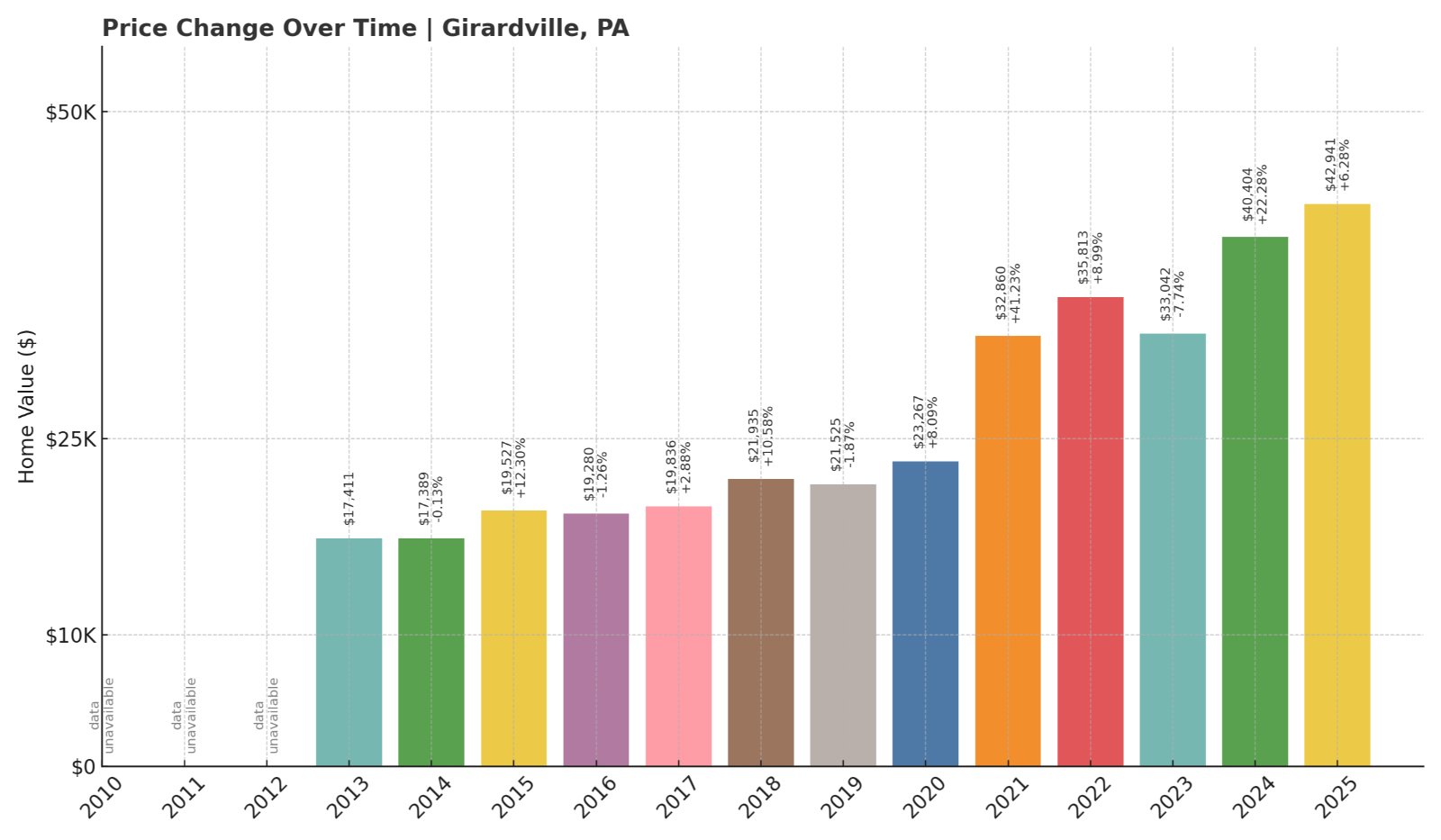

1. Girardville – 147% Home Price Increase Since 2013

Would you like to save this?

- 2013: $17,411

- 2014: $17,389 (-$22, -0.13% from previous year)

- 2015: $19,527 (+$2,139, +12.30% from previous year)

- 2016: $19,280 (-$247, -1.27% from previous year)

- 2017: $19,836 (+$555, +2.88% from previous year)

- 2018: $21,935 (+$2,099, +10.58% from previous year)

- 2019: $21,525 (-$409, -1.87% from previous year)

- 2020: $23,267 (+$1,742, +8.09% from previous year)

- 2021: $32,860 (+$9,594, +41.23% from previous year)

- 2022: $35,813 (+$2,953, +8.99% from previous year)

- 2023: $33,042 (-$2,771, -7.74% from previous year)

- 2024: $40,404 (+$7,362, +22.28% from previous year)

- 2025: $42,941 (+$2,537, +6.28% from previous year)

Girardville’s home prices have risen nearly 150% since 2013, making it the top-ranked affordable town in this roundup. Though values have fluctuated, the trend is clearly upward—driven by small gains most years and standout jumps in 2021 and 2024.

Girardville – Tiny Borough, Big Price Gains

Located in Schuylkill County, Girardville is a former coal town with fewer than 1,500 residents. The community is compact, walkable, and surrounded by rolling hills. While it lacks major employers or shopping centers, its simplicity and quiet charm appeal to buyers seeking an ultra-affordable entry point.

With a 2025 average home value of just under $43,000, Girardville has among the lowest prices in the state—but the strong appreciation suggests buyers are beginning to take notice. It’s proof that even the smallest towns can see big housing shifts.