🔥 Would you like to save this?

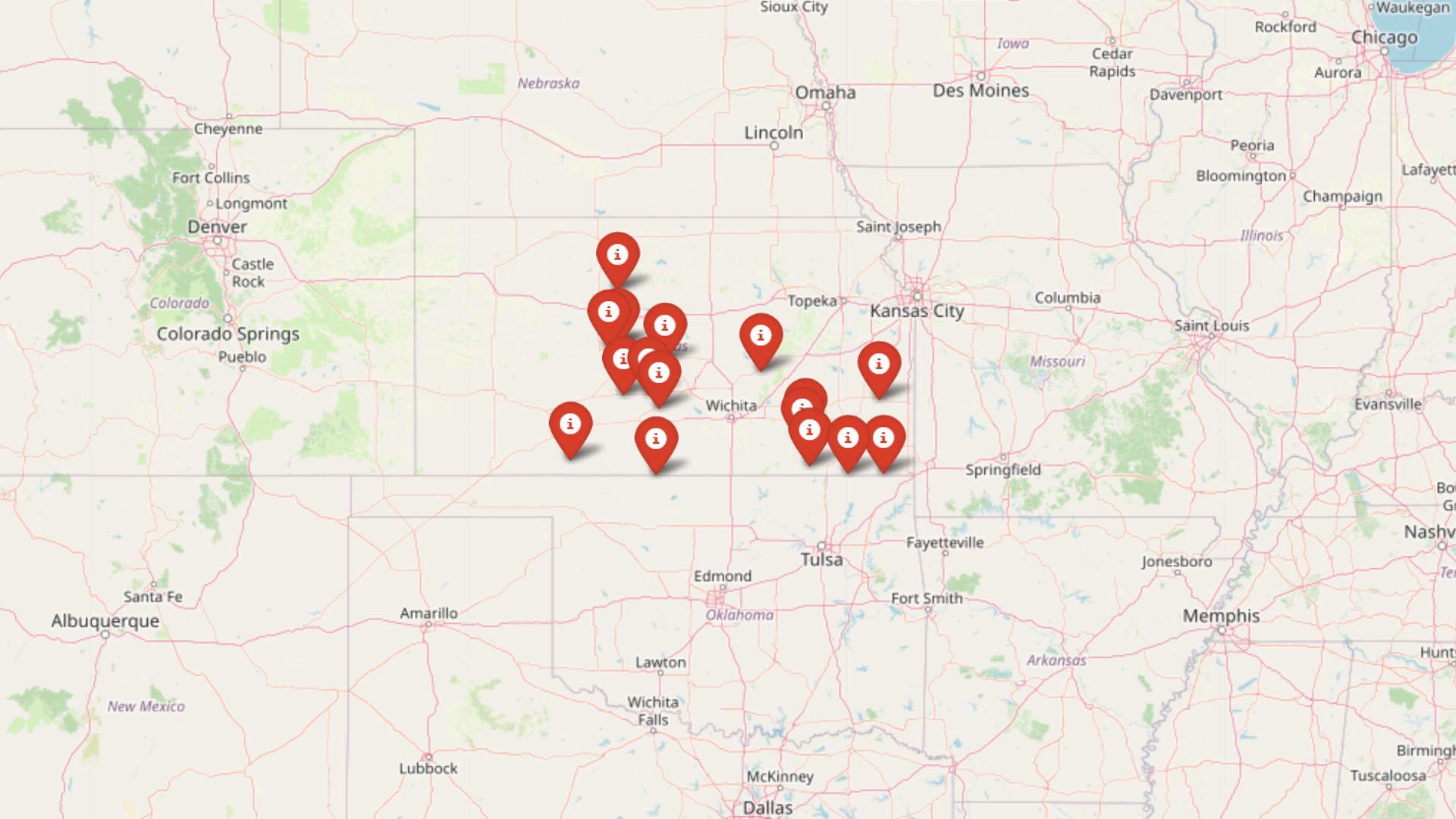

In Kansas, affordable housing isn’t hard to find—you just need to know where to look. Based on the Zillow Home Values Index, 16 towns stand out for offering some of the lowest home prices in the state as of May 2025. From quiet farming communities to small-town suburbs, these places let buyers get far more for their money compared to national trends. Whether you’re after a simple starter home or planning a budget-friendly retirement, these Kansas towns deliver real value without sacrificing local charm.

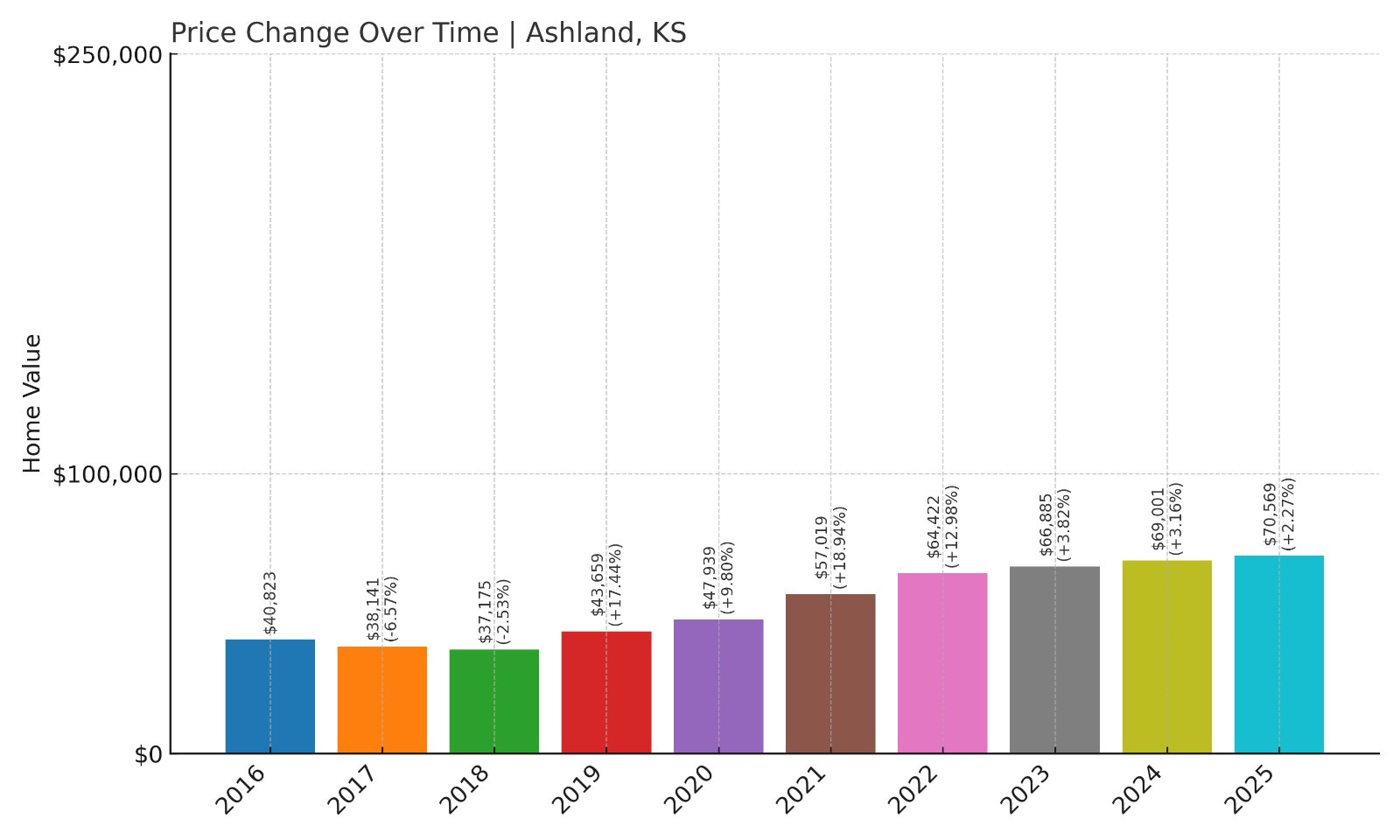

16. Ashland – 71% Home Price Increase Since 2016

- 2016: $40,823

- 2017: $38,141 (-$2,682, -6.57% from previous year)

- 2018: $37,175 (-$967, -2.53% from previous year)

- 2019: $43,659 (+$6,484, +17.44% from previous year)

- 2020: $47,939 (+$4,281, +9.81% from previous year)

- 2021: $57,019 (+$9,079, +18.94% from previous year)

- 2022: $64,422 (+$7,403, +12.98% from previous year)

- 2023: $66,885 (+$2,463, +3.82% from previous year)

- 2024: $69,001 (+$2,116, +3.16% from previous year)

- 2025: $70,569 (+$1,568, +2.27% from previous year)

Home prices in Ashland have grown from $40,823 in 2016 to $70,569 in 2025, a 71% increase over nine years. The largest spike came between 2020 and 2021 when prices jumped by nearly 19%. Growth has remained steady since then, with yearly increases of around 2-3% in recent years.

In order to come up with the very specific design ideas, we create most designs with the assistance of state-of-the-art AI interior design software.

Ashland – Rural Living With Steady Growth

Ashland is located in Clark County in southwest Kansas, known for its wide prairies and cattle ranching heritage. The town’s current median home price of just over $70,000 is far below the state average, making it appealing for buyers who want more space for less money. Its gradual home price increases reflect stable demand from local industries, including agriculture and services supporting surrounding farms.

Despite its remote setting, Ashland offers amenities like a grocery store, schools, and healthcare clinics. Historical landmarks include the Ashland Carnegie Library, opened in 1914 and still in use today. Residents enjoy open skies, quiet neighborhoods, and an unhurried pace of life. With homes still under $75,000, Ashland remains one of Kansas’s most affordable communities in 2025.

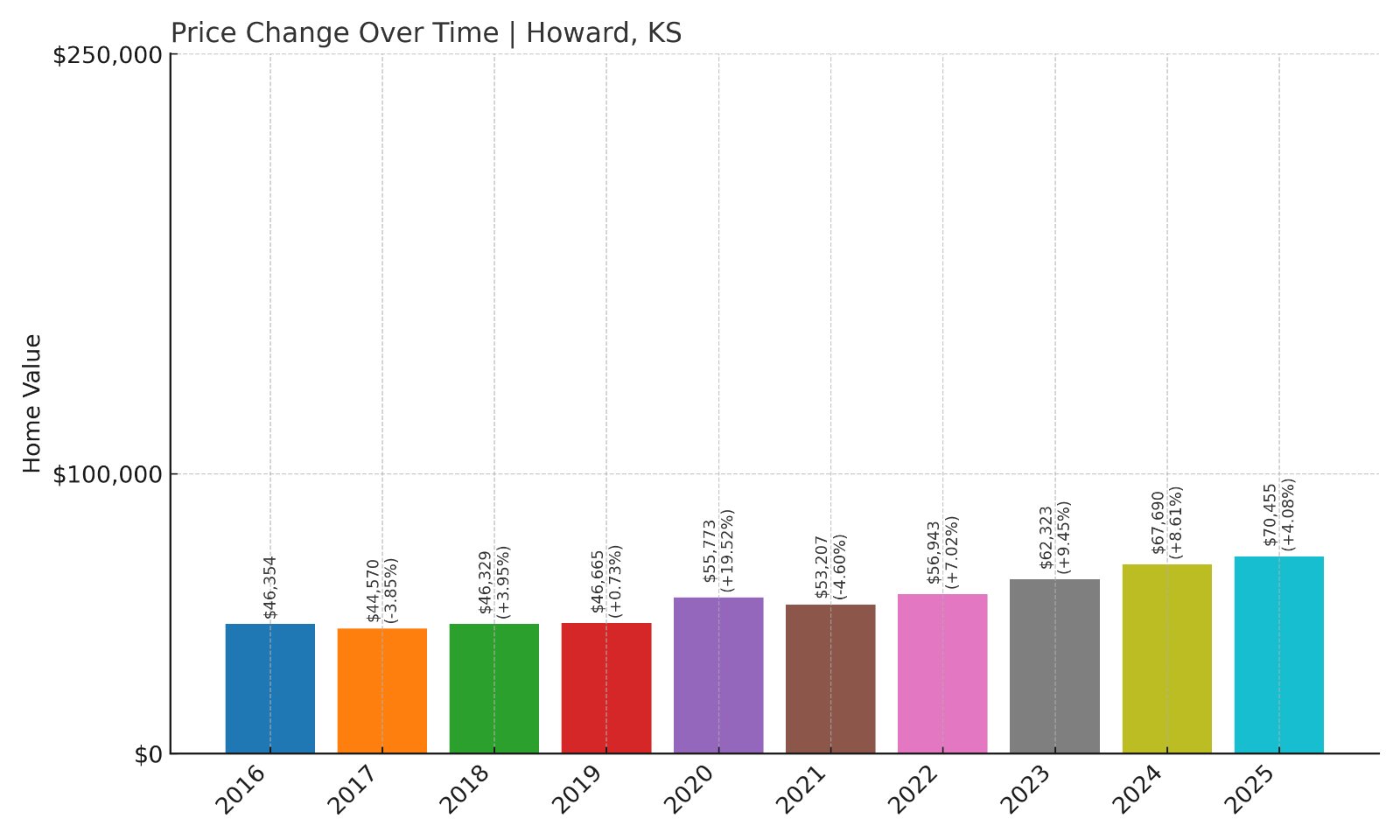

15. Howard – 52% Home Price Increase Since 2016

- 2016: $46,354

- 2017: $44,570 (-$1,784, -3.85% from previous year)

- 2018: $46,329 (+$1,759, +3.95% from previous year)

- 2019: $46,665 (+$335, +0.72% from previous year)

- 2020: $55,773 (+$9,108, +19.52% from previous year)

- 2021: $53,207 (-$2,566, -4.60% from previous year)

- 2022: $56,943 (+$3,736, +7.02% from previous year)

- 2023: $62,323 (+$5,380, +9.45% from previous year)

- 2024: $67,690 (+$5,367, +8.61% from previous year)

- 2025: $70,455 (+$2,765, +4.08% from previous year)

Howard’s median home price rose from $46,354 in 2016 to $70,455 in 2025, representing a 52% increase. Prices jumped nearly 20% in 2020, followed by smaller but steady annual gains, keeping this town affordable yet appreciating in value.

Howard – Affordable Small-Town Charm

Howard is located in Elk County in southeast Kansas. With under 700 residents, it offers a quiet rural lifestyle within an hour of larger regional centers like Independence. Homes average just over $70,000 today, making it an appealing choice for retirees or remote workers seeking peace and affordability.

Facilities include a grocery store, a city lake for fishing, and the historic Elk County Courthouse built in 1907. The local school district serves surrounding rural areas, supporting families looking for small class sizes and community-centered schools. Real estate experts note that stable price increases in Howard reflect gradual demand without speculative spikes, keeping it accessible for local buyers.

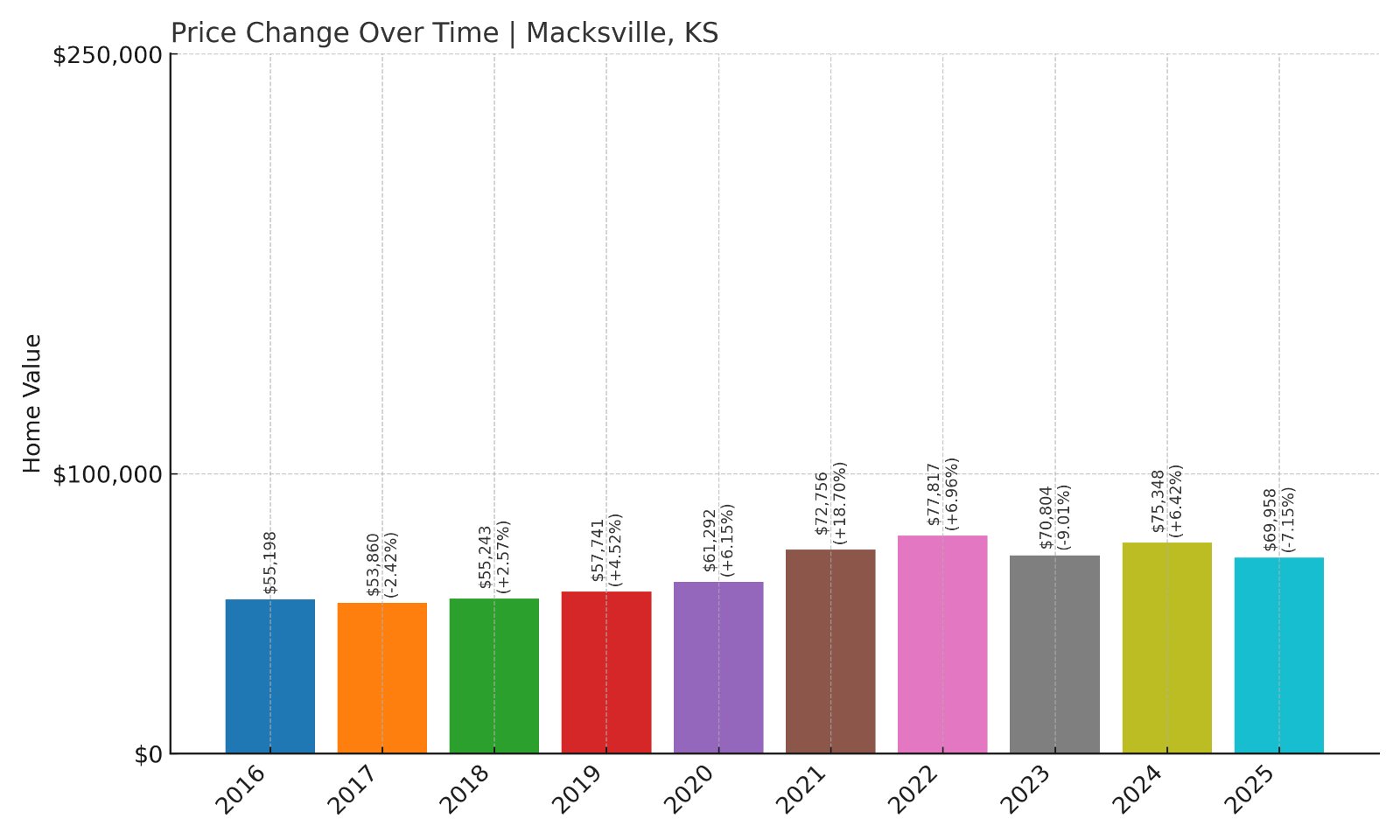

14. Macksville – 27% Home Price Increase Since 2016

- 2016: $55,198

- 2017: $53,860 (-$1,338, -2.42% from previous year)

- 2018: $55,243 (+$1,383, +2.57% from previous year)

- 2019: $57,741 (+$2,497, +4.52% from previous year)

- 2020: $61,292 (+$3,552, +6.15% from previous year)

- 2021: $72,756 (+$11,463, +18.70% from previous year)

- 2022: $77,817 (+$5,062, +6.96% from previous year)

- 2023: $70,804 (-$7,013, -9.01% from previous year)

- 2024: $75,348 (+$4,544, +6.42% from previous year)

- 2025: $69,958 (-$5,390, -7.15% from previous year)

Macksville home prices rose by 27% from $55,198 in 2016 to $69,958 in 2025. The largest spike was in 2021, when prices jumped by nearly 19%. However, recent years have seen minor declines, keeping it affordable for buyers today.

Macksville – Affordable Homes With Rural Benefits

Macksville is in Stafford County in central Kansas, roughly halfway between Wichita and Dodge City. Its current median price near $70,000 is attractive for buyers seeking low housing costs with access to regional highways. Local employers include farms, trucking firms, and small manufacturing facilities.

Key features include its small K-12 school district, local cafes, and proximity to Quivira National Wildlife Refuge, known for birdwatching and nature walks. The town’s housing market saw strong growth through 2021-2022 but recent dips provide a renewed opportunity for budget-conscious buyers to enter the market in 2025.

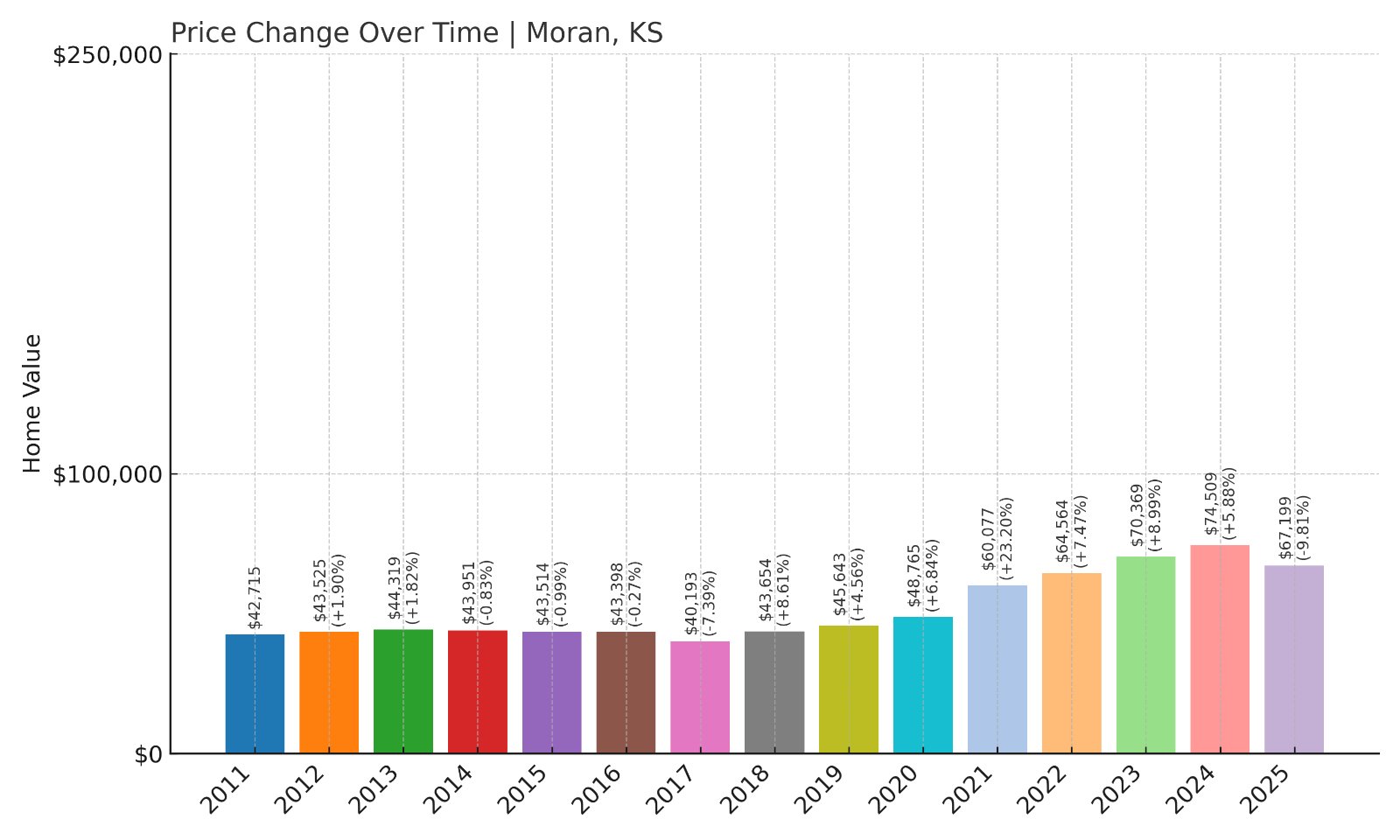

13. Moran – 57% Home Price Increase Since 2011

- 2011: $42,715

- 2012: $43,525 (+$810, +1.90% from previous year)

- 2013: $44,319 (+$794, +1.82% from previous year)

- 2014: $43,951 (-$368, -0.83% from previous year)

- 2015: $43,514 (-$436, -0.99% from previous year)

- 2016: $43,398 (-$116, -0.27% from previous year)

- 2017: $40,193 (-$3,205, -7.38% from previous year)

- 2018: $43,654 (+$3,460, +8.61% from previous year)

- 2019: $45,643 (+$1,989, +4.56% from previous year)

- 2020: $48,765 (+$3,122, +6.84% from previous year)

- 2021: $60,077 (+$11,312, +23.20% from previous year)

- 2022: $64,564 (+$4,487, +7.47% from previous year)

- 2023: $70,369 (+$5,805, +8.99% from previous year)

- 2024: $74,509 (+$4,141, +5.88% from previous year)

- 2025: $67,199 (-$7,310, -9.81% from previous year)

Moran’s home values increased from $42,715 in 2011 to $67,199 in 2025, a 57% rise. The largest jump was in 2021, with over 23% growth. A recent decline in 2025 may create opportunities for buyers this year.

Moran – Historic Roots and Small-Town Life

Moran is located in Allen County, southeast Kansas, near US Highway 59. Its housing market remains among the state’s most affordable, with current median prices under $70,000. The town is known for its historic downtown, local park, and easy access to larger towns like Iola for shopping and medical care.

Founded in the late 1800s, Moran retains its small-town identity with community events and a historic water tower. The decline in prices from 2024 to 2025 may reflect market corrections after several years of growth. Overall, Moran offers buyers a mix of affordable homes and traditional Kansas charm.

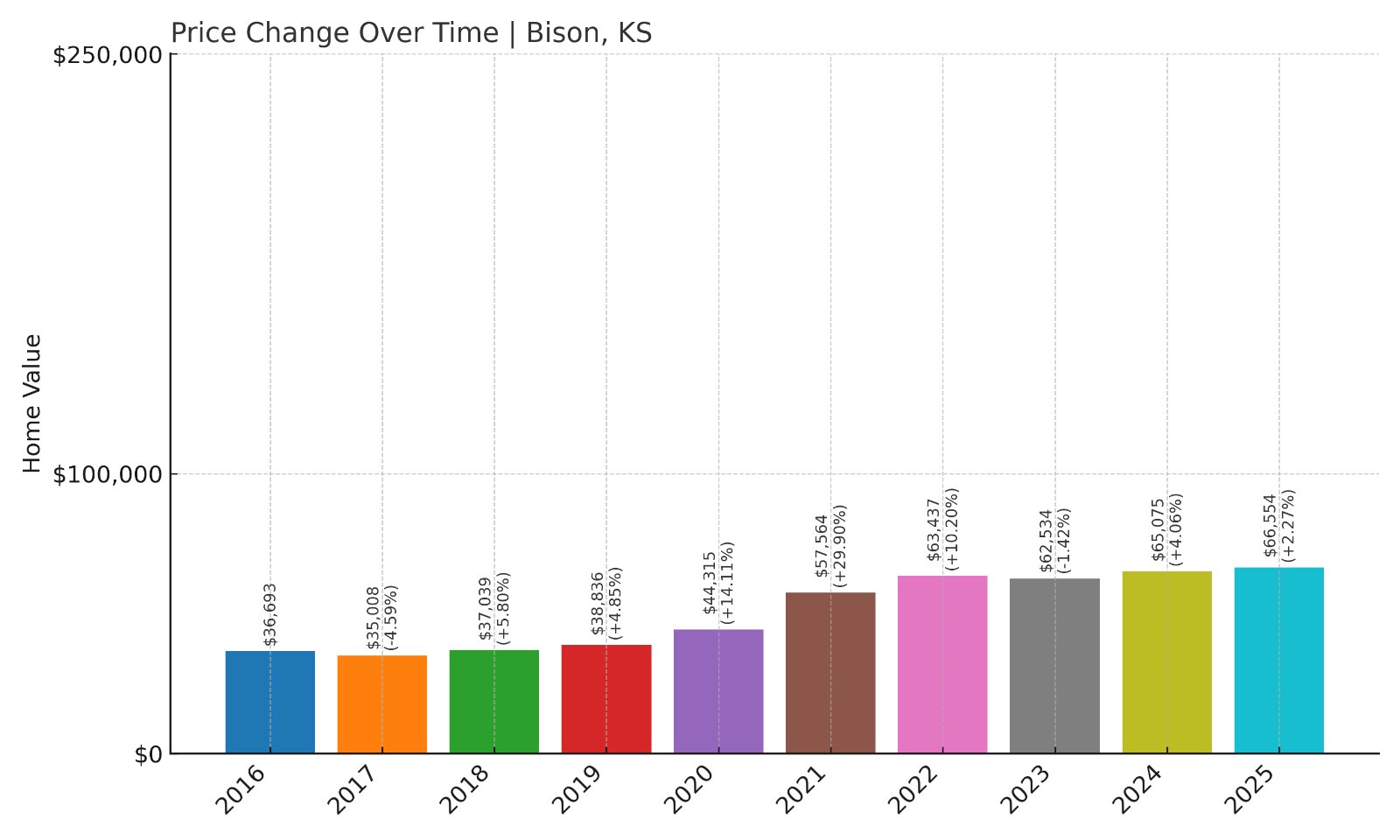

12. Bison – 81% Home Price Increase Since 2016

- 2016: $36,693

- 2017: $35,008 (-$1,685, -4.59% from previous year)

- 2018: $37,039 (+$2,031, +5.80% from previous year)

- 2019: $38,836 (+$1,797, +4.85% from previous year)

- 2020: $44,315 (+$5,479, +14.11% from previous year)

- 2021: $57,564 (+$13,248, +29.90% from previous year)

- 2022: $63,437 (+$5,873, +10.20% from previous year)

- 2023: $62,534 (-$903, -1.42% from previous year)

- 2024: $65,075 (+$2,542, +4.06% from previous year)

- 2025: $66,554 (+$1,479, +2.27% from previous year)

Bison’s median home price rose by 81% from $36,693 in 2016 to $66,554 in 2025. Major jumps occurred in 2020 and 2021, including a nearly 30% spike in 2021 alone. Prices have continued to grow modestly since then.

Bison – Small Town With Rapid Price Gains

Bison is located in Rush County, central Kansas. Its name reflects the area’s Great Plains heritage and historical bison populations. The town has a population under 250, giving it a tightly knit community feel with low cost of living.

The strong housing price growth since 2016 shows buyers increasingly value rural Kansas towns for affordability and simplicity. Residents benefit from proximity to larger hubs like Hays for shopping and medical care while enjoying the quiet of small-town life. With prices under $67,000, Bison remains one of the most affordable yet appreciating markets in Kansas.

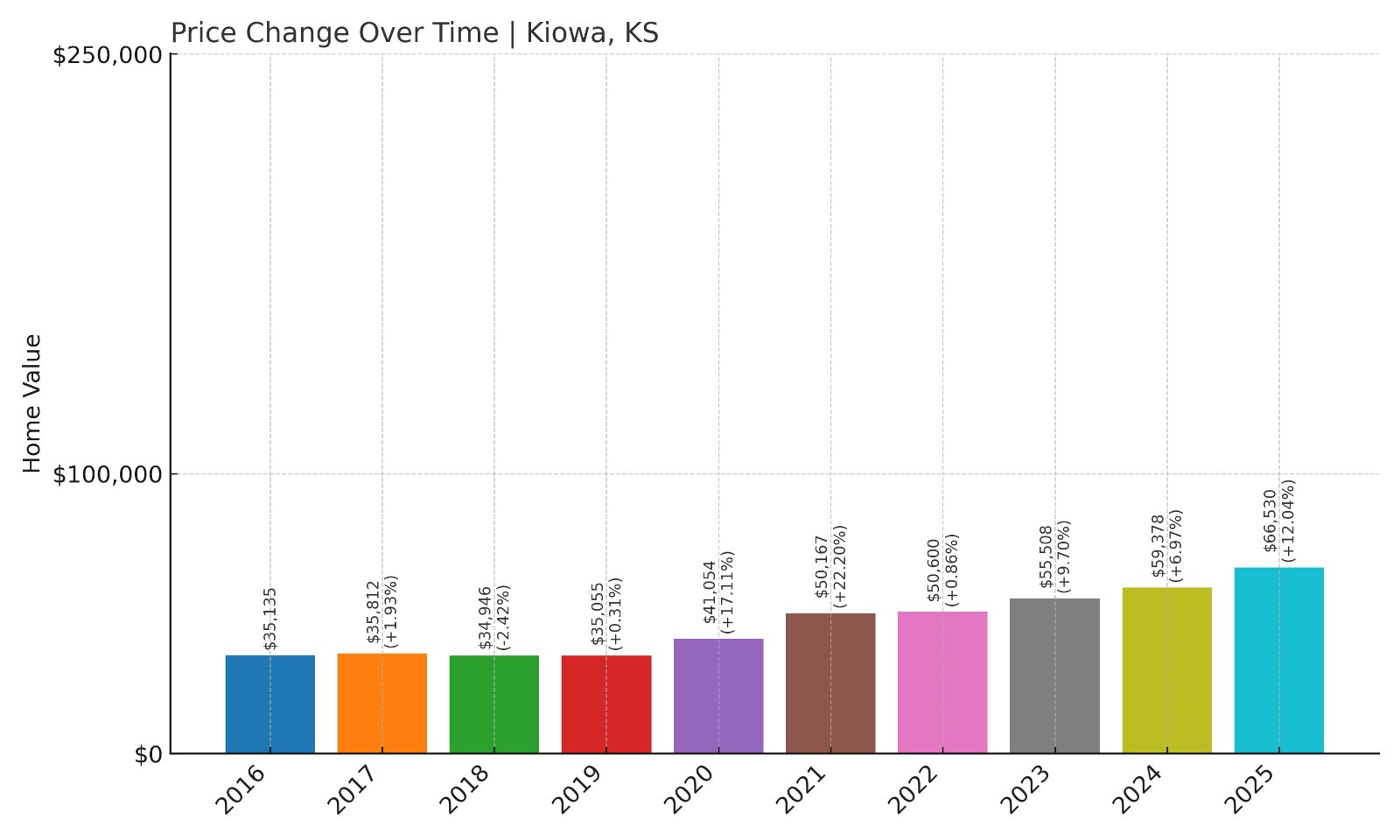

11. Kiowa – 89% Home Price Increase Since 2016

- 2016: $35,135

- 2017: $35,812 (+$678, +1.93% from previous year)

- 2018: $34,946 (-$866, -2.42% from previous year)

- 2019: $35,055 (+$109, +0.31% from previous year)

- 2020: $41,054 (+$5,998, +17.11% from previous year)

- 2021: $50,167 (+$9,114, +22.20% from previous year)

- 2022: $50,600 (+$433, +0.86% from previous year)

- 2023: $55,508 (+$4,907, +9.70% from previous year)

- 2024: $59,378 (+$3,870, +6.97% from previous year)

- 2025: $66,530 (+$7,152, +12.05% from previous year)

Kiowa’s median home price nearly doubled from $35,135 in 2016 to $66,530 in 2025, an 89% increase overall. The largest jumps were between 2019 and 2021, with strong annual growth continuing in recent years.

Kiowa – Steady Growth and Local Amenities

Kiowa is located in Barber County, near the Oklahoma border in south-central Kansas. Its current median home price of about $66,500 is affordable compared to state averages while reflecting significant recent gains. This town offers local shops, schools, and proximity to recreational areas like Barber State Fishing Lake.

Founded in the late 1800s, Kiowa maintains a traditional main street and active community life with events like Pioneer Days. Price jumps from 2020 to 2021 were driven by buyer interest in small-town living during the pandemic, and growth has remained consistent since. For buyers looking for affordable housing with basic amenities, Kiowa continues to provide value in 2025.

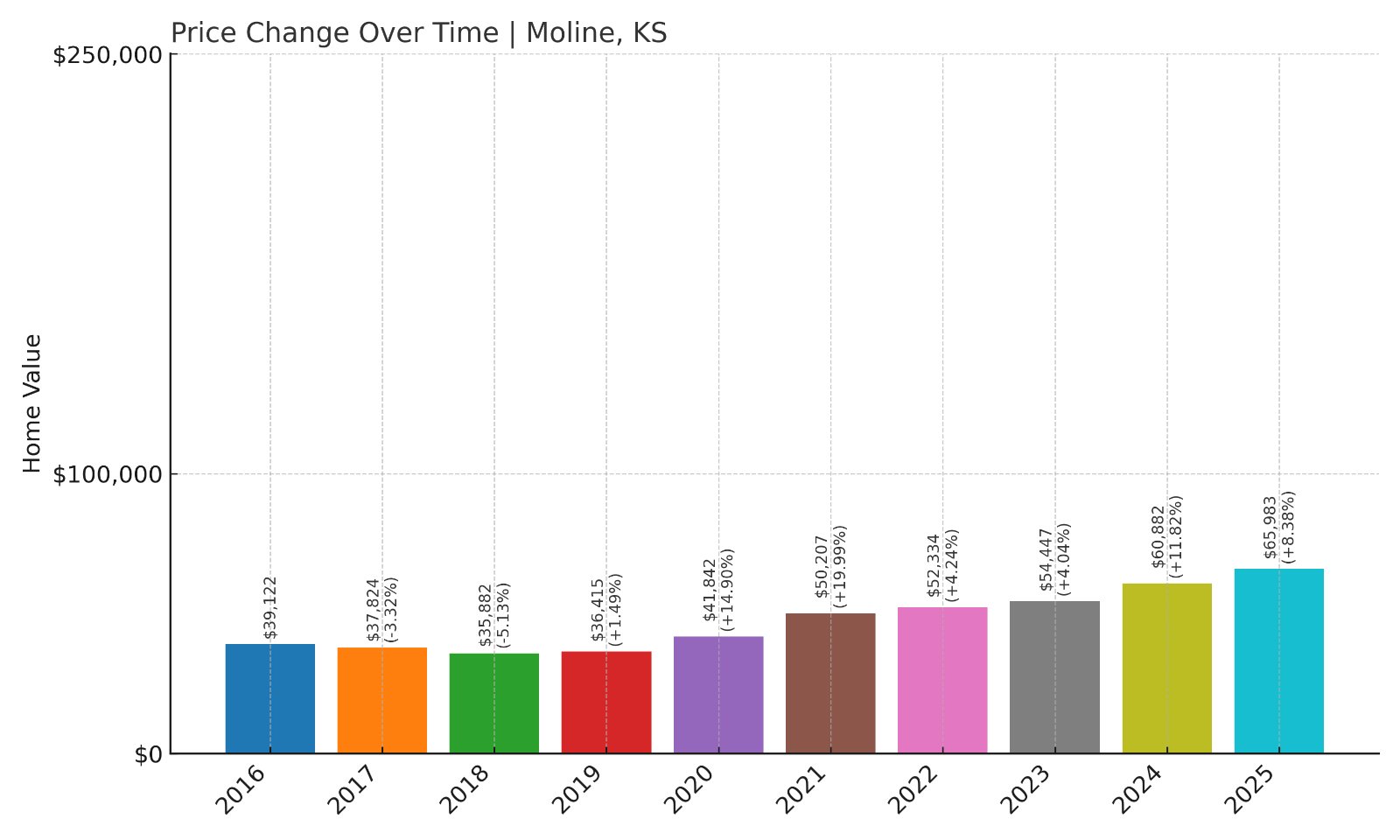

10. Moline – 69% Home Price Increase Since 2016

🔥 Would you like to save this?

- 2016: $39,122

- 2017: $37,824 (-$1,298, -3.32% from previous year)

- 2018: $35,882 (-$1,943, -5.14% from previous year)

- 2019: $36,415 (+$534, +1.49% from previous year)

- 2020: $41,842 (+$5,427, +14.90% from previous year)

- 2021: $50,207 (+$8,365, +19.99% from previous year)

- 2022: $52,334 (+$2,127, +4.24% from previous year)

- 2023: $54,447 (+$2,113, +4.04% from previous year)

- 2024: $60,882 (+$6,435, +11.82% from previous year)

- 2025: $65,983 (+$5,100, +8.38% from previous year)

Moline’s home prices increased by 69% from $39,122 in 2016 to $65,983 in 2025. Notable growth came in 2020 and 2021, with strong single-digit gains continuing through 2025.

Moline – Small Town With Significant Appreciation

Moline is situated in Elk County in southeastern Kansas. Known as the “City of Stone Bridges” due to its historic stone arch bridge built in 1904, Moline combines history with affordability. Its current home price of nearly $66,000 is appealing for retirees, families, and investors seeking value growth in smaller markets.

Local attractions include the Moline Waterfall and city park, drawing visitors from nearby towns. Housing price increases in the early 2020s were driven by low inventory and modest demand. Moline remains affordable while showing consistent appreciation, making it an attractive option in 2025.

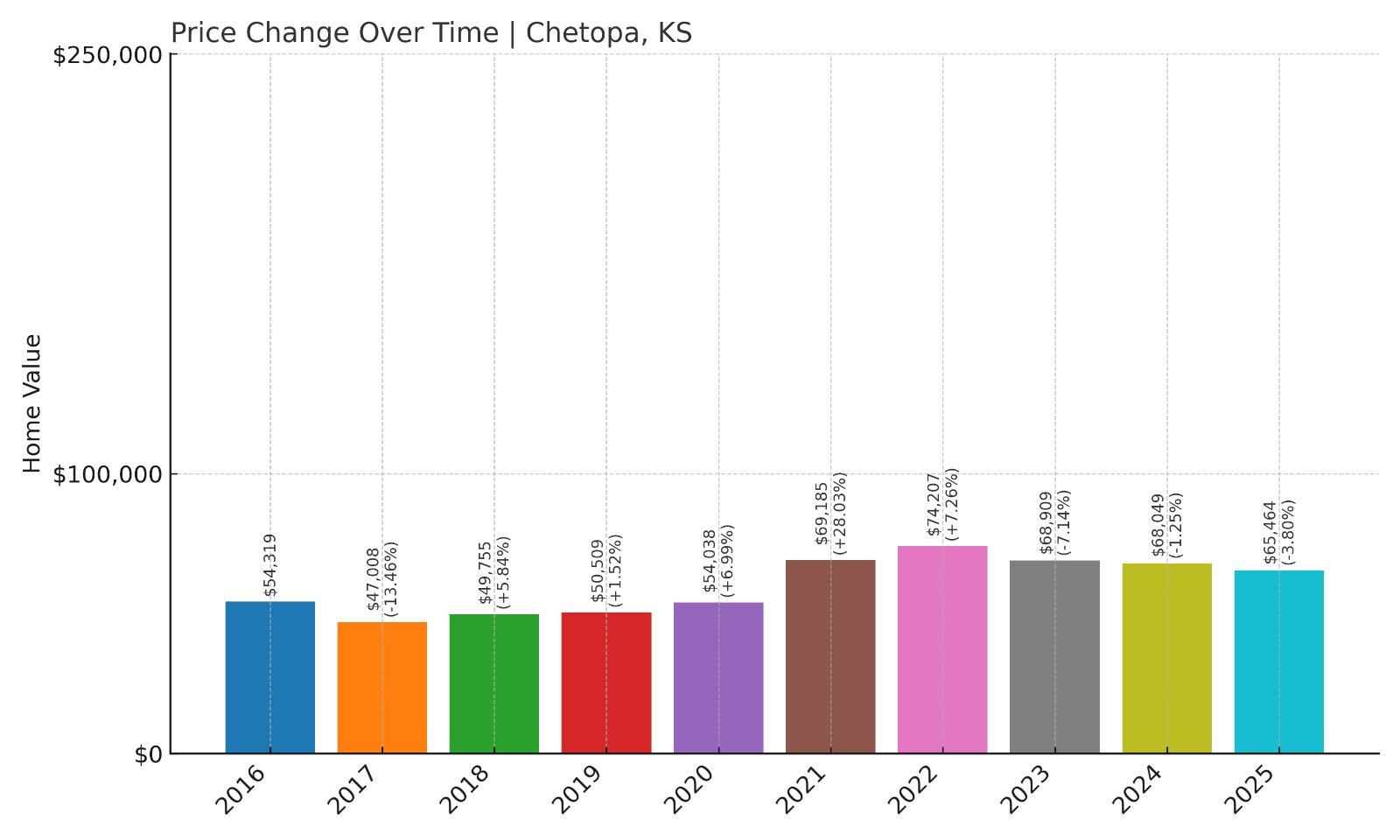

9. Chetopa – 21% Home Price Increase Since 2016

- 2016: $54,319

- 2017: $47,008 (-$7,311, -13.46% from previous year)

- 2018: $49,755 (+$2,747, +5.84% from previous year)

- 2019: $50,509 (+$754, +1.52% from previous year)

- 2020: $54,038 (+$3,529, +6.99% from previous year)

- 2021: $69,185 (+$15,146, +28.03% from previous year)

- 2022: $74,207 (+$5,022, +7.26% from previous year)

- 2023: $68,909 (-$5,298, -7.14% from previous year)

- 2024: $68,049 (-$860, -1.25% from previous year)

- 2025: $65,464 (-$2,585, -3.80% from previous year)

Chetopa’s home prices rose by 21% from $54,319 in 2016 to $65,464 in 2025, with the largest jump in 2021 followed by minor declines in recent years, keeping prices affordable today.

Chetopa – Rural Affordability With Historic Character

Chetopa is located in Labette County, southeast Kansas, near the Oklahoma and Missouri borders. Its current median home price of about $65,000 remains below state averages, attracting buyers who value low cost of living with small-town amenities.

Known as the “Gateway to Kansas,” Chetopa has a rich history dating back to the Osage Nation and early Kansas settlements. The town offers fishing on the Neosho River and a quiet pace of life with basic services. Its housing market reflects modest demand, with price dips since 2022 providing opportunities for budget-conscious buyers in 2025.

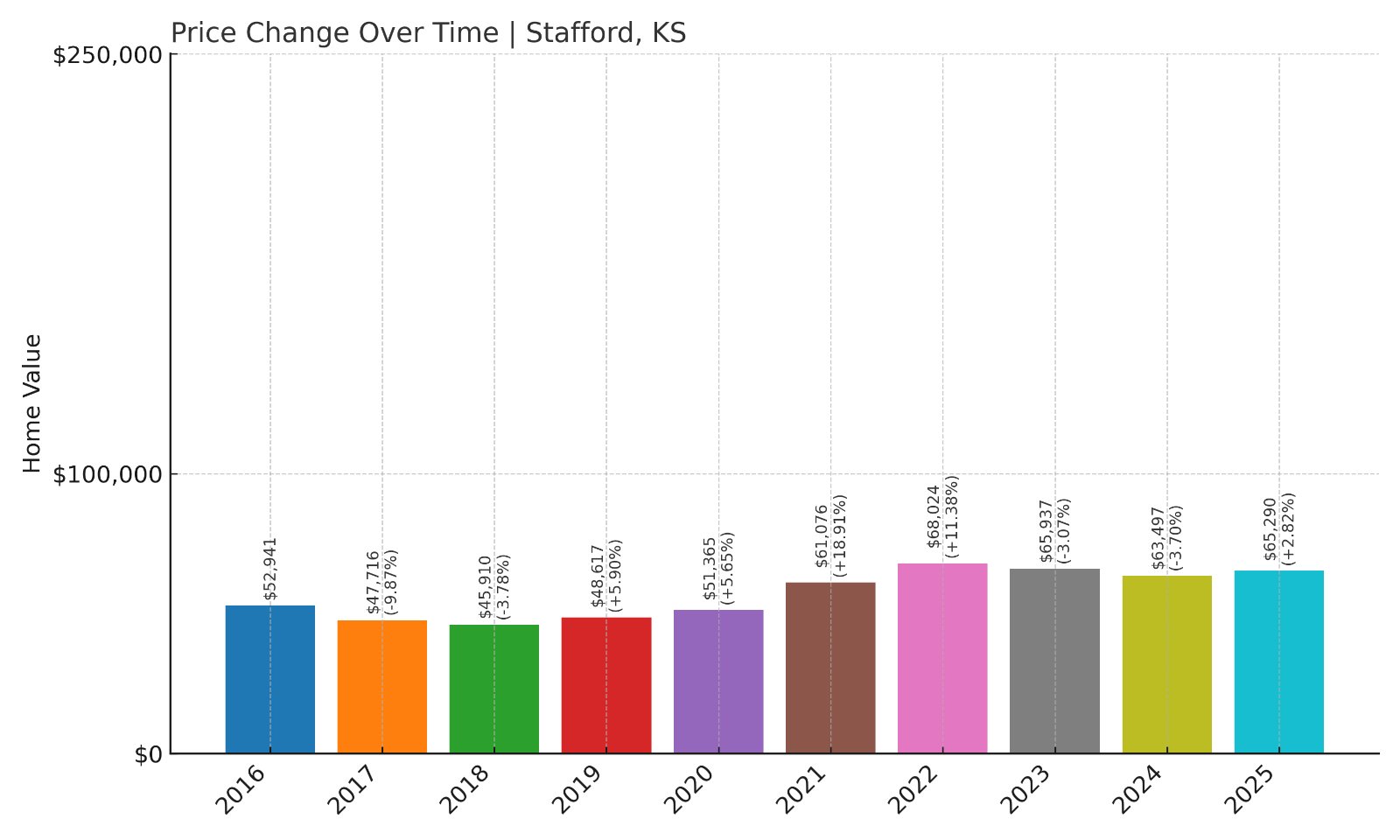

8. Stafford – 23% Home Price Increase Since 2016

- 2016: $52,941

- 2017: $47,716 (-$5,225, -9.87% from previous year)

- 2018: $45,910 (-$1,806, -3.78% from previous year)

- 2019: $48,617 (+$2,707, +5.90% from previous year)

- 2020: $51,365 (+$2,748, +5.65% from previous year)

- 2021: $61,076 (+$9,711, +18.91% from previous year)

- 2022: $68,024 (+$6,948, +11.38% from previous year)

- 2023: $65,937 (-$2,087, -3.07% from previous year)

- 2024: $63,497 (-$2,440, -3.70% from previous year)

- 2025: $65,290 (+$1,793, +2.82% from previous year)

Stafford’s median home price increased by 23% from $52,941 in 2016 to $65,290 in 2025. The strongest growth occurred between 2020 and 2022, with slight declines in recent years keeping prices stable.

Stafford – Stability With Affordable Prices

Stafford is located in Stafford County, central Kansas, approximately an hour west of Hutchinson. With a current median price of about $65,000, it offers affordable options for homebuyers seeking quiet communities with historical significance.

The town features the Stafford County Flour Mills, known for its Hudson Cream Flour, and historic downtown buildings. Growth in home prices from 2020 to 2022 reflects market activity driven by low mortgage rates and interest in rural living. Recent small declines have stabilized prices, making Stafford an affordable option with a strong community feel in 2025.

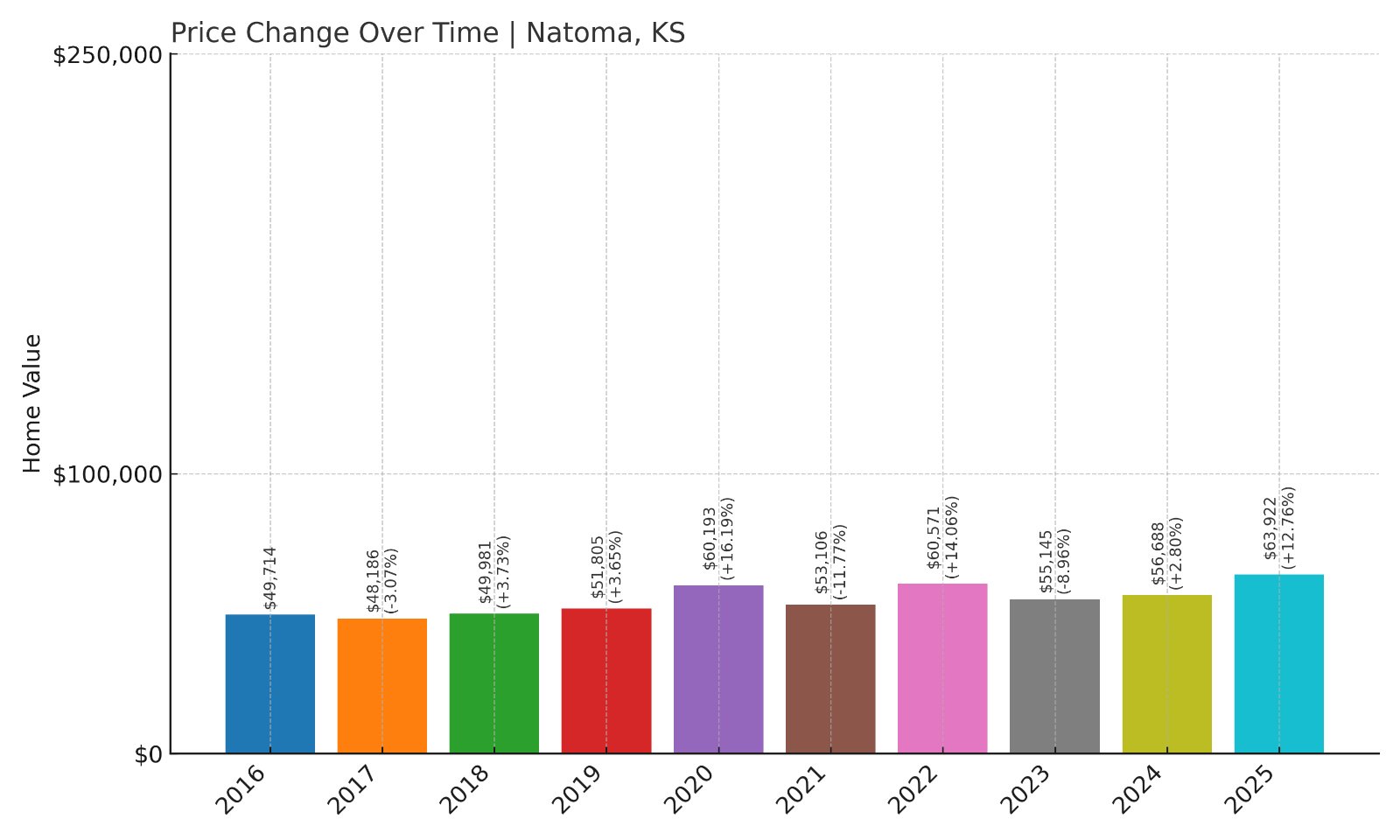

7. Natoma – 29% Home Price Increase Since 2016

- 2016: $49,714

- 2017: $48,186 (-$1,528, -3.07% from previous year)

- 2018: $49,981 (+$1,795, +3.73% from previous year)

- 2019: $51,805 (+$1,824, +3.65% from previous year)

- 2020: $60,193 (+$8,388, +16.19% from previous year)

- 2021: $53,106 (-$7,086, -11.77% from previous year)

- 2022: $60,571 (+$7,465, +14.06% from previous year)

- 2023: $55,145 (-$5,426, -8.96% from previous year)

- 2024: $56,688 (+$1,543, +2.80% from previous year)

- 2025: $63,922 (+$7,233, +12.76% from previous year)

Natoma’s median home price grew by 29% from $49,714 in 2016 to $63,922 in 2025. Prices have fluctuated, with the largest increases in 2020 and 2025, offsetting previous dips.

Natoma – Rural Housing With Moderate Gains

Natoma is in Osborne County in north-central Kansas, a small community known for its welcoming neighborhoods and quiet environment. Its current median price of around $64,000 remains below statewide averages, attracting buyers seeking peaceful rural living.

The town is located near the Saline River, offering residents opportunities for fishing and outdoor recreation. Housing price growth has been driven by periodic demand spikes, particularly in 2020 and 2025. For buyers looking for small-town Kansas life with moderate price appreciation, Natoma remains a viable option in 2025.

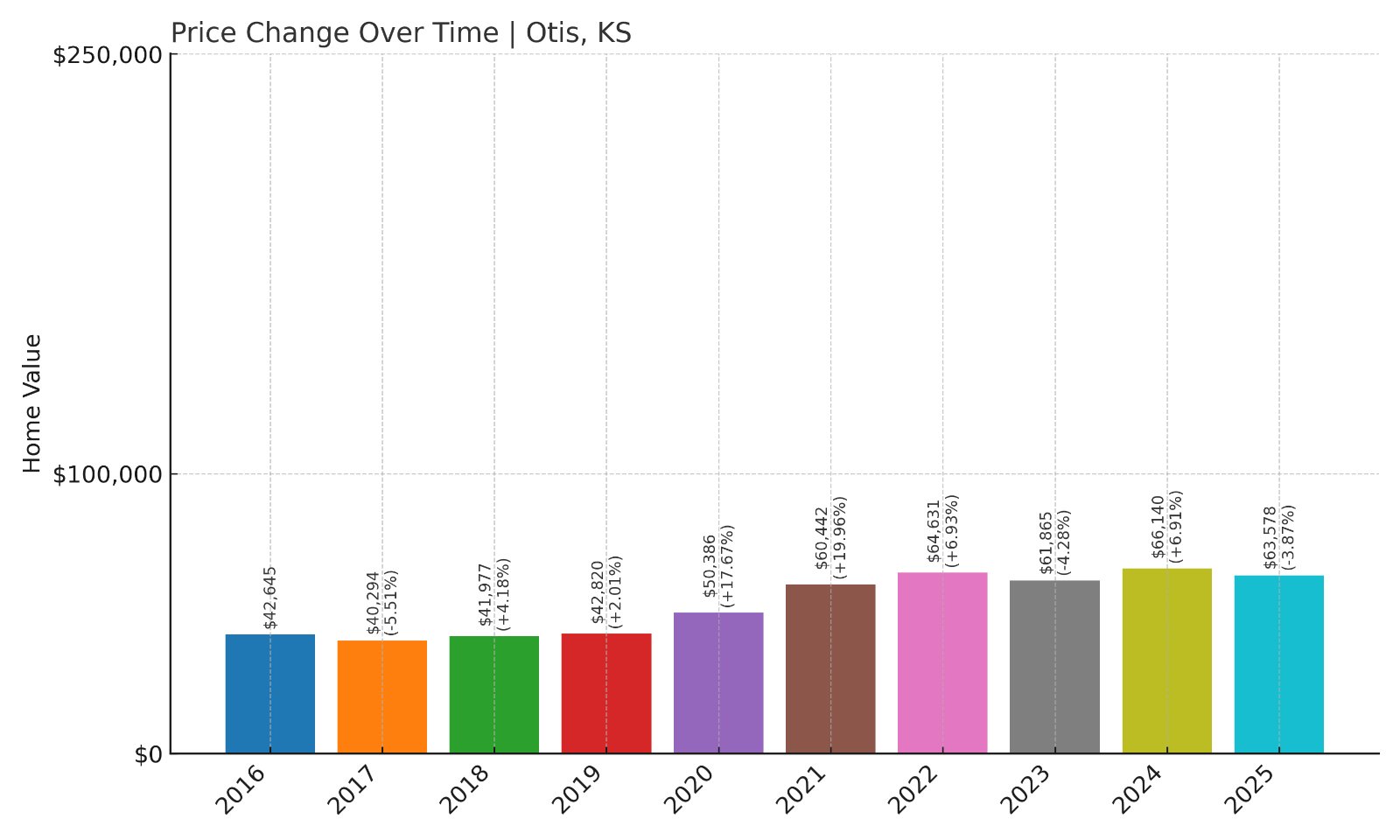

6. Otis – 49% Home Price Increase Since 2016

- 2016: $42,645

- 2017: $40,294 (-$2,351, -5.51% from previous year)

- 2018: $41,977 (+$1,682, +4.17% from previous year)

- 2019: $42,820 (+$844, +2.01% from previous year)

- 2020: $50,386 (+$7,565, +17.67% from previous year)

- 2021: $60,442 (+$10,057, +19.96% from previous year)

- 2022: $64,631 (+$4,189, +6.93% from previous year)

- 2023: $61,865 (-$2,766, -4.28% from previous year)

- 2024: $66,140 (+$4,274, +6.91% from previous year)

- 2025: $63,578 (-$2,561, -3.87% from previous year)

Otis saw home prices rise from $42,645 in 2016 to $63,578 in 2025, a 49% increase. The strongest growth came in 2020 and 2021, with slight declines in recent years keeping homes affordable.

Otis – Affordable Homes and Community Life

Otis is located in Rush County, central Kansas, and is best known for its oil and gas storage facilities, which support the local economy. The town’s median home price of under $64,000 makes it accessible for buyers seeking budget-friendly options in 2025.

Residents enjoy a quiet setting with nearby hunting, farming, and rural businesses providing employment opportunities. Housing prices surged between 2020 and 2021, reflecting renewed interest in smaller markets during the pandemic. Today, modest price corrections keep Otis homes among the most affordable in Kansas.

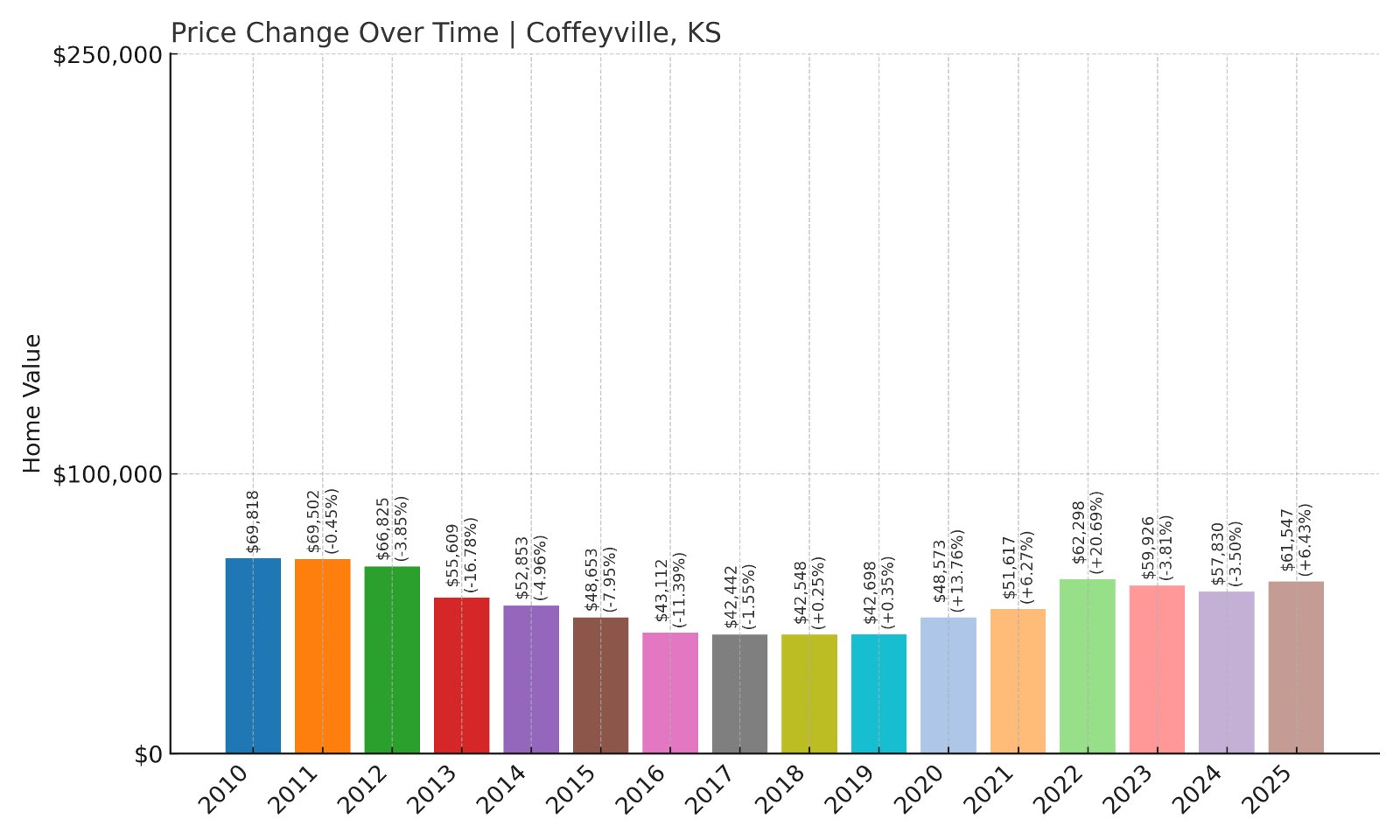

5. Coffeyville – 40% Home Price Decline Since 2010

- 2010: $69,818

- 2011: $69,502 (-$317, -0.45% from previous year)

- 2012: $66,825 (-$2,676, -3.85% from previous year)

- 2013: $55,609 (-$11,216, -16.78% from previous year)

- 2014: $52,853 (-$2,757, -4.96% from previous year)

- 2015: $48,653 (-$4,200, -7.95% from previous year)

- 2016: $43,112 (-$5,541, -11.39% from previous year)

- 2017: $42,442 (-$670, -1.55% from previous year)

- 2018: $42,548 (+$106, +0.25% from previous year)

- 2019: $42,698 (+$150, +0.35% from previous year)

- 2020: $48,573 (+$5,875, +13.76% from previous year)

- 2021: $51,617 (+$3,044, +6.27% from previous year)

- 2022: $62,298 (+$10,681, +20.69% from previous year)

- 2023: $59,926 (-$2,371, -3.81% from previous year)

- 2024: $57,830 (-$2,097, -3.50% from previous year)

- 2025: $61,547 (+$3,718, +6.43% from previous year)

Coffeyville’s home prices declined 40% from $69,818 in 2010 to $61,547 in 2025. After steep falls in the early 2010s, prices have partially recovered in recent years.

Coffeyville – Historic Industry and Affordable Homes

Coffeyville is located in Montgomery County, southeast Kansas, along the Verdigris River. Known historically for its oil refineries and as the site where the Dalton Gang was captured in 1892, it has seen economic shifts reflected in home prices.

Today, the median price of about $61,500 makes Coffeyville one of the state’s most affordable towns. The community features Coffeyville Community College, a historic downtown, and local employers in manufacturing and logistics. Recent home price increases since 2020 suggest stabilizing demand in this affordable market.

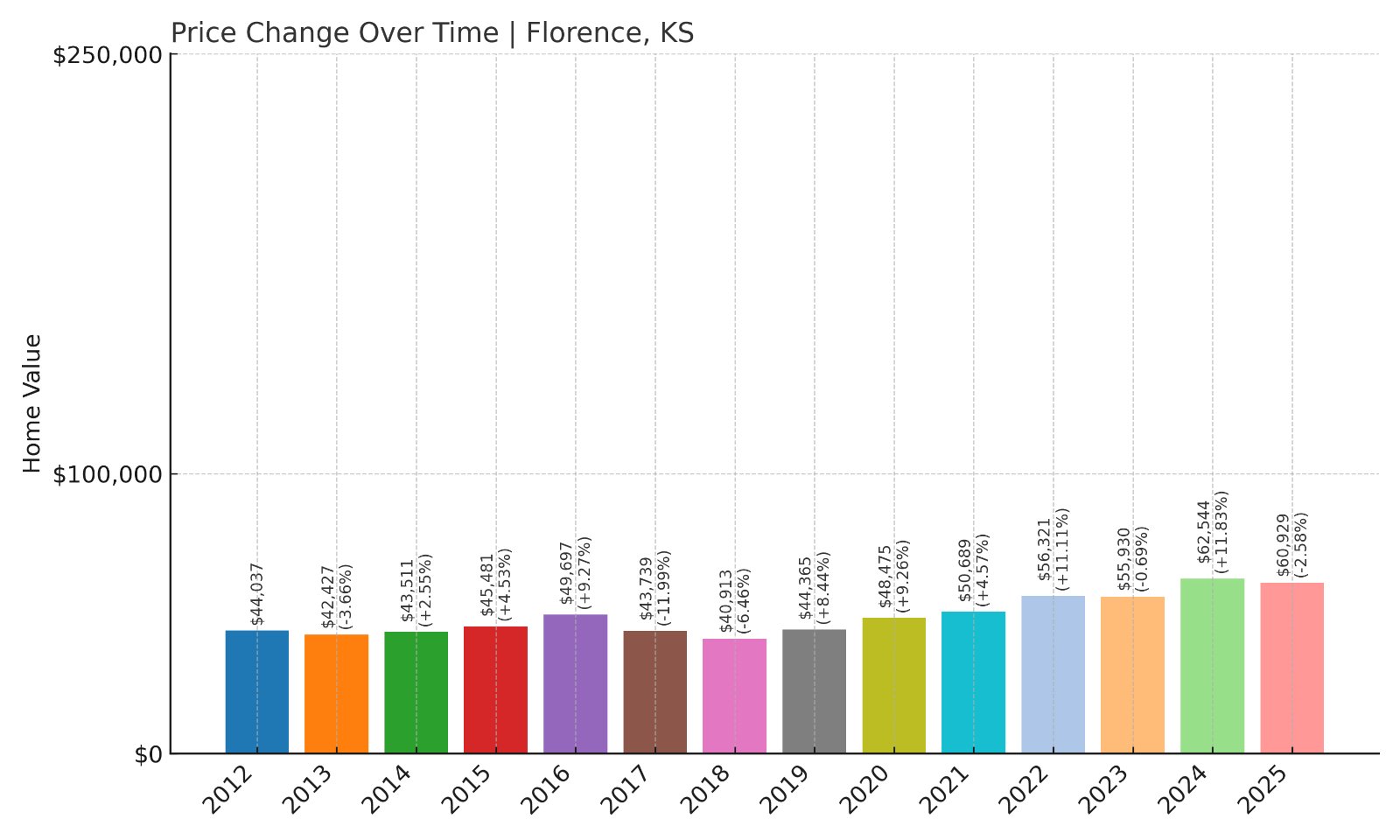

4. Florence – 38% Home Price Increase Since 2012

🔥 Would you like to save this?

- 2012: $44,037

- 2013: $42,427 (-$1,610, -3.66% from previous year)

- 2014: $43,511 (+$1,084, +2.56% from previous year)

- 2015: $45,481 (+$1,970, +4.53% from previous year)

- 2016: $49,697 (+$4,216, +9.27% from previous year)

- 2017: $43,739 (-$5,958, -11.99% from previous year)

- 2018: $40,913 (-$2,826, -6.46% from previous year)

- 2019: $44,365 (+$3,452, +8.44% from previous year)

- 2020: $48,475 (+$4,110, +9.26% from previous year)

- 2021: $50,689 (+$2,214, +4.57% from previous year)

- 2022: $56,321 (+$5,631, +11.11% from previous year)

- 2023: $55,930 (-$391, -0.69% from previous year)

- 2024: $62,544 (+$6,615, +11.83% from previous year)

- 2025: $60,929 (-$1,616, -2.58% from previous year)

Florence’s home prices rose by 38% from $44,037 in 2012 to $60,929 in 2025. Prices dipped in 2023 and 2025 after strong gains between 2020 and 2022.

Florence – Historic Town With Budget-Friendly Homes

Florence is located in Marion County, central Kansas. Known for its historic railroad depot and 19th-century architecture, Florence offers affordable living with a rich local history. Its current median home price of around $61,000 remains accessible for buyers.

The town features antique shops, small cafes, and proximity to Marion Reservoir for outdoor activities. Housing price increases over the last decade reflect stable demand despite occasional dips. Florence remains one of Kansas’s affordable options for buyers seeking small-town living with historical character.

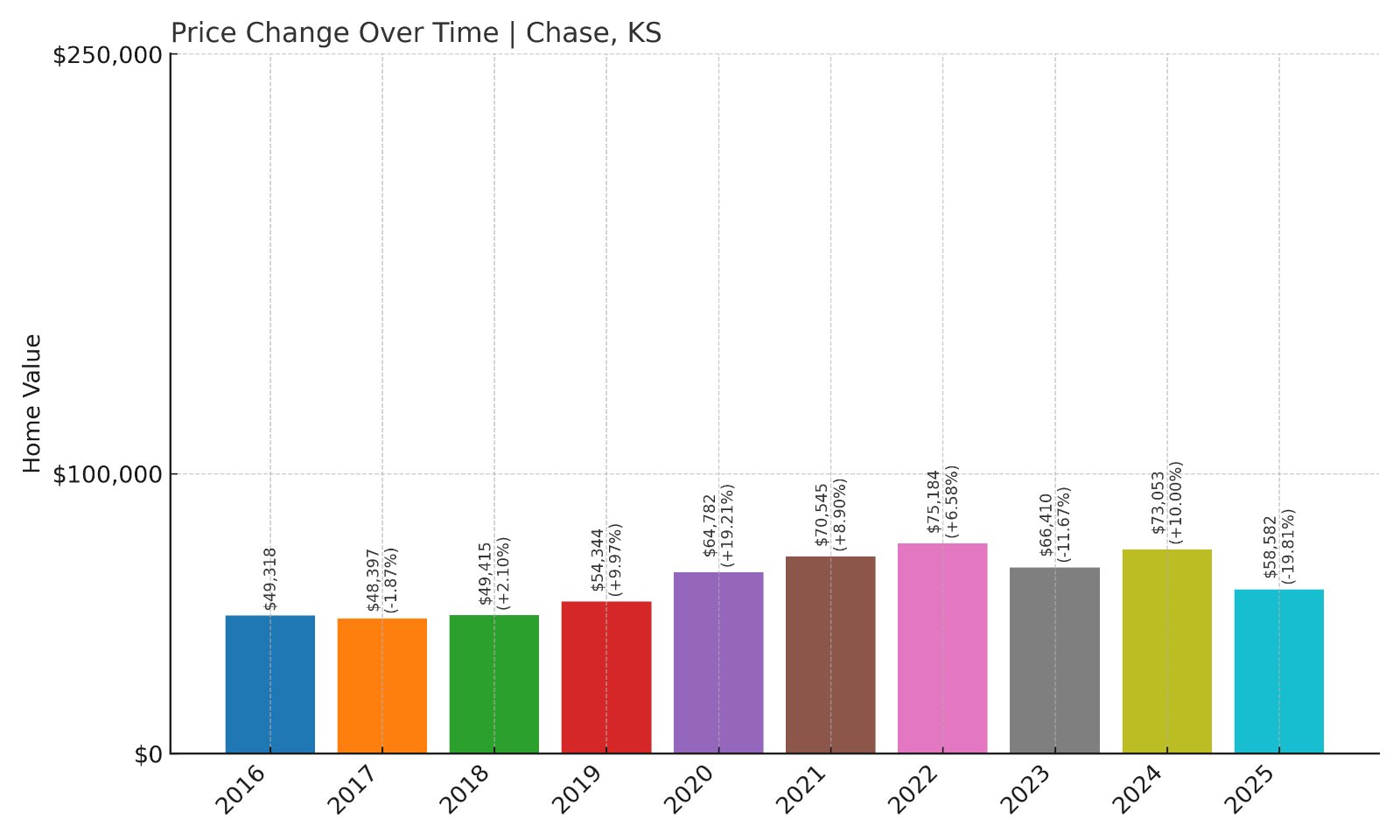

3. Chase – 19% Home Price Increase Since 2016

- 2016: $49,318

- 2017: $48,397 (-$921, -1.87% from previous year)

- 2018: $49,415 (+$1,018, +2.10% from previous year)

- 2019: $54,344 (+$4,929, +9.97% from previous year)

- 2020: $64,782 (+$10,439, +19.21% from previous year)

- 2021: $70,545 (+$5,763, +8.90% from previous year)

- 2022: $75,184 (+$4,640, +6.58% from previous year)

- 2023: $66,410 (-$8,775, -11.67% from previous year)

- 2024: $73,053 (+$6,643, +10.00% from previous year)

- 2025: $58,582 (-$14,471, -19.81% from previous year)

Chase’s home prices rose 19% from $49,318 in 2016 to $58,582 in 2025. Prices peaked in 2022 before dropping sharply in 2025, keeping the market affordable today.

Chase – Affordability With Volatile Price Trends

Chase is located in Rice County, central Kansas, and is a small agricultural town with strong ties to wheat farming. Its current median home price of about $58,500 is among the lowest in the state.

Despite rapid price growth from 2019 to 2022, recent declines reflect limited buyer demand in a small market. Chase’s affordability, quiet setting, and proximity to larger cities like Hutchinson continue to make it a feasible choice for budget-focused buyers in 2025.

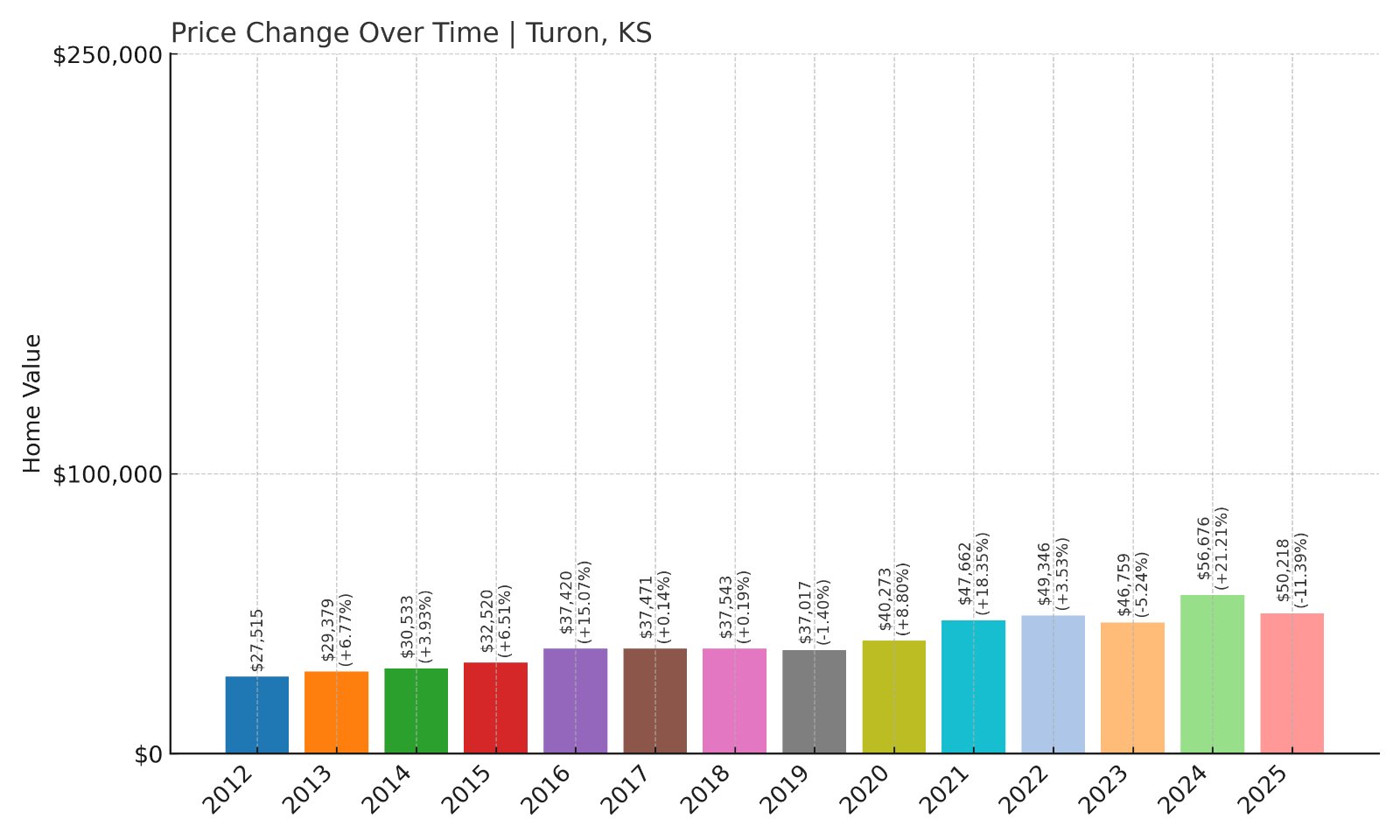

2. Turon – 82% Home Price Increase Since 2012

- 2012: $27,515

- 2013: $29,379 (+$1,864, +6.77% from previous year)

- 2014: $30,533 (+$1,154, +3.93% from previous year)

- 2015: $32,520 (+$1,987, +6.51% from previous year)

- 2016: $37,420 (+$4,900, +15.07% from previous year)

- 2017: $37,471 (+$51, +0.14% from previous year)

- 2018: $37,543 (+$71, +0.19% from previous year)

- 2019: $37,017 (-$525, -1.40% from previous year)

- 2020: $40,273 (+$3,255, +8.79% from previous year)

- 2021: $47,662 (+$7,389, +18.35% from previous year)

- 2022: $49,346 (+$1,685, +3.53% from previous year)

- 2023: $46,759 (-$2,587, -5.24% from previous year)

- 2024: $56,676 (+$9,916, +21.21% from previous year)

- 2025: $50,218 (-$6,457, -11.39% from previous year)

Turon’s median home price increased by 82% from $27,515 in 2012 to $50,218 in 2025. Prices peaked in 2024 before dropping in 2025, keeping homes budget-friendly today.

Turon – Low-Cost Housing With Rural Appeal

Turon is located in Reno County, south-central Kansas. Its current median price of just over $50,000 makes it one of the most affordable towns statewide. The community is small, with under 400 residents, and offers basic services, schools, and proximity to Hutchinson for jobs and healthcare.

Housing prices have fluctuated over the last decade, with sharp gains in some years driven by buyer demand and renovations of older properties. For buyers seeking an extremely low cost of living with traditional Kansas rural life, Turon remains a strong choice in 2025.

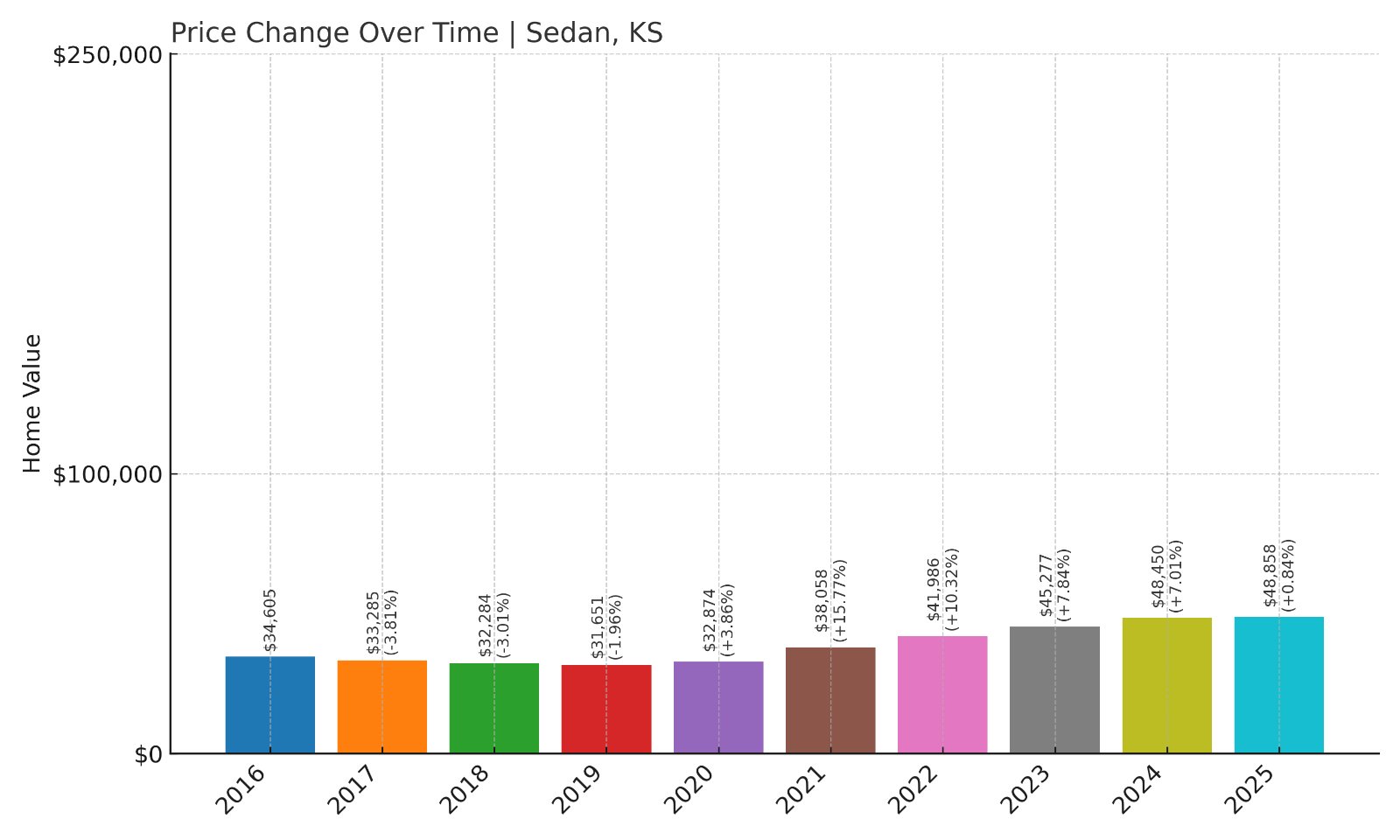

1. Sedan – 41% Home Price Increase Since 2016

- 2016: $34,605

- 2017: $33,285 (-$1,321, -3.82% from previous year)

- 2018: $32,284 (-$1,001, -3.01% from previous year)

- 2019: $31,651 (-$632, -1.96% from previous year)

- 2020: $32,874 (+$1,223, +3.86% from previous year)

- 2021: $38,058 (+$5,184, +15.77% from previous year)

- 2022: $41,986 (+$3,928, +10.32% from previous year)

- 2023: $45,277 (+$3,291, +7.84% from previous year)

- 2024: $48,450 (+$3,173, +7.01% from previous year)

- 2025: $48,858 (+$408, +0.84% from previous year)

Sedan’s median home price increased 41% from $34,605 in 2016 to $48,858 in 2025. The largest growth occurred from 2020 to 2022, with steady but smaller gains in recent years.

Sedan – Affordable Homes and Historic Heritage

Sedan is located in Chautauqua County in southeast Kansas and is known for its beautiful downtown lined with historic brick buildings. Its current median price of under $49,000 is among the lowest in the state, appealing to retirees and first-time buyers.

The town features historic sites such as the Emmett Kelly Museum, honoring the famous circus clown born here, and offers nearby nature attractions like the Hollow and Red Buffalo Ranch. Sedan’s stable and affordable housing market makes it an ideal choice for those seeking small-town Kansas living on a budget in 2025.