Would you like to save this?

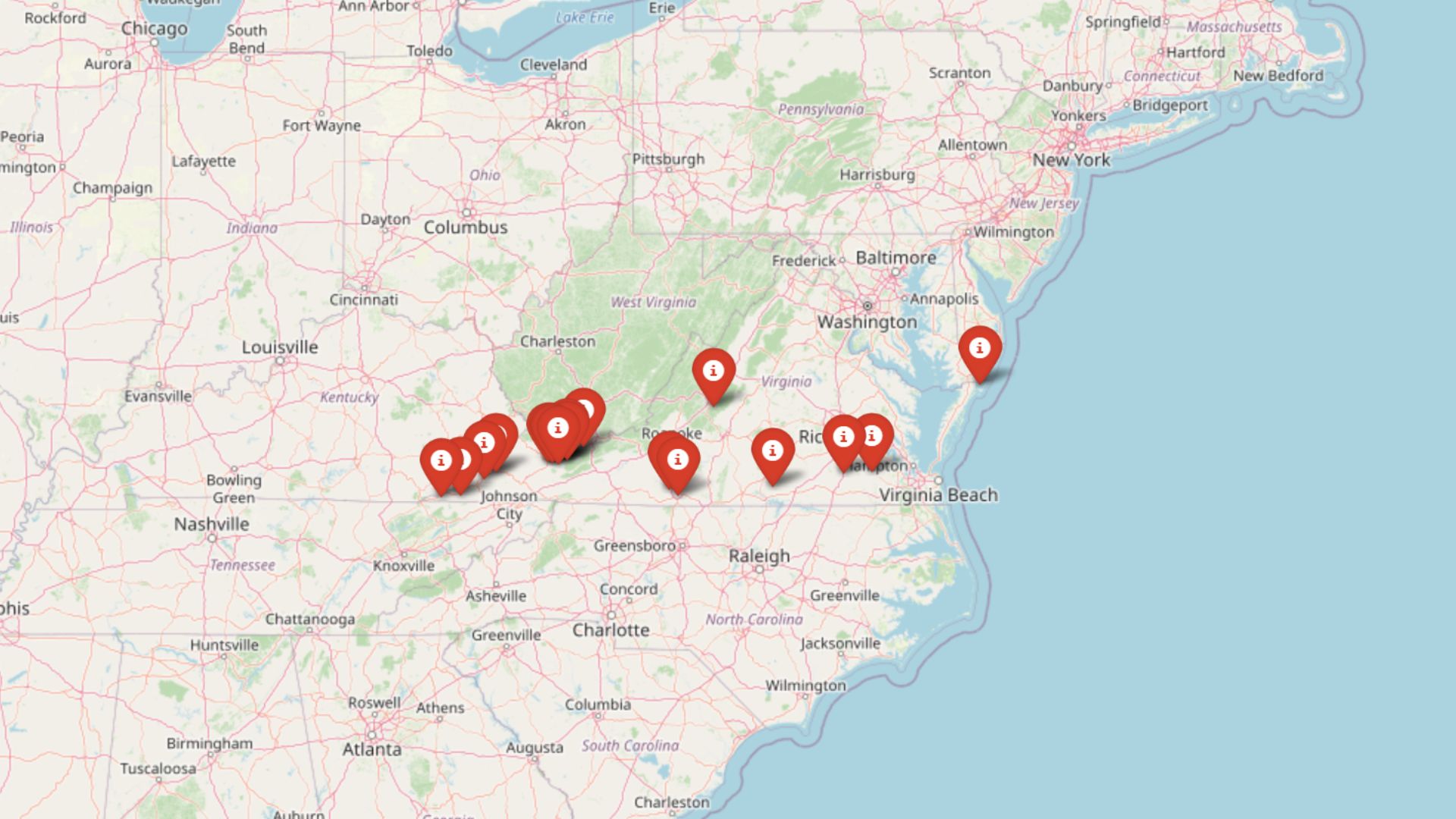

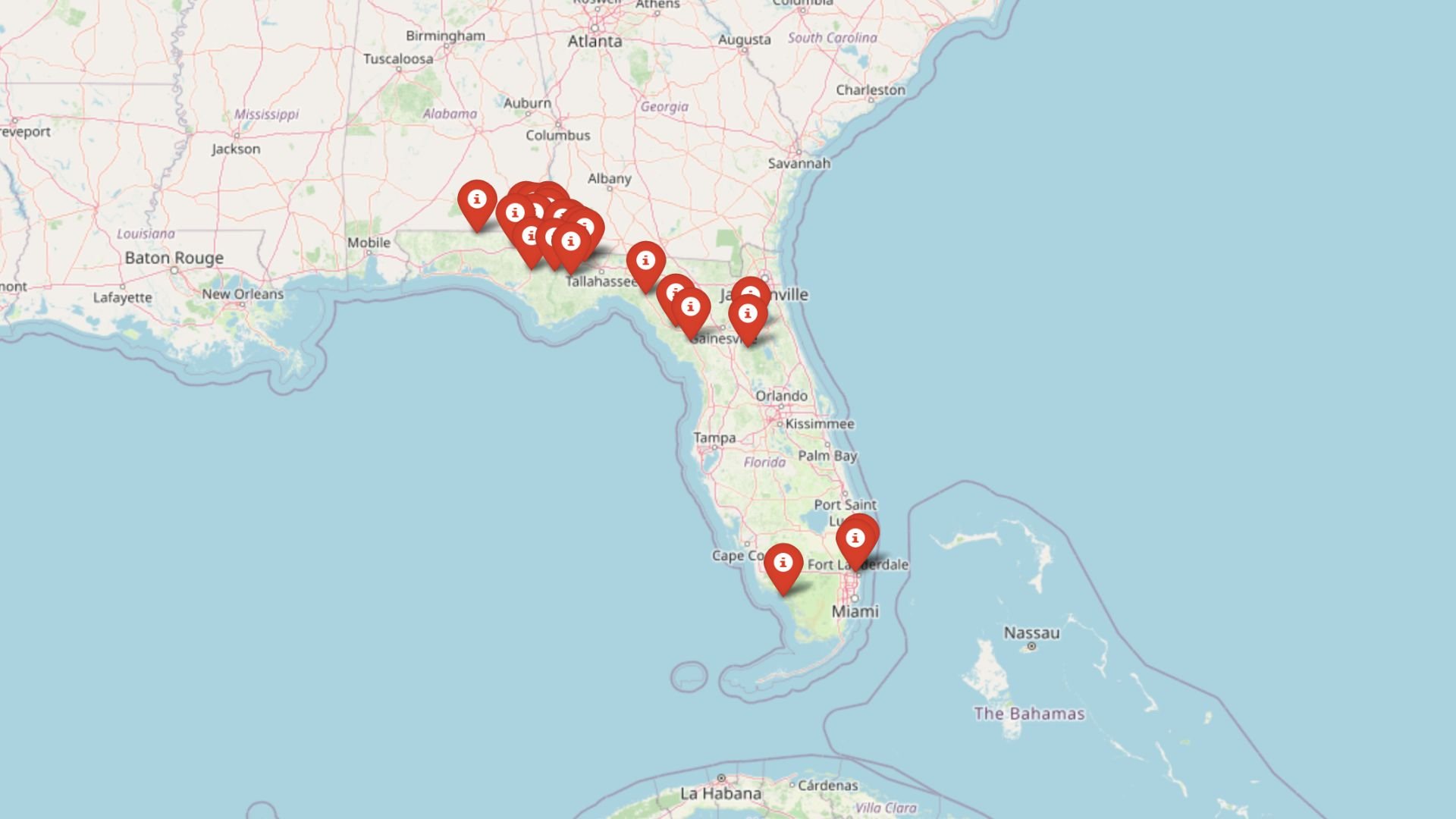

Florida’s housing market might be best known for sky-high condos and millionaire playgrounds, but Zillow’s Home Value Index shows there are still places where buying a house won’t wreck your finances. These 23 towns remain surprisingly affordable in 2025, even as the state’s median home price flirts with $400,000. Some are slow-growing inland cities, others are under-the-radar coastal spots—but all prove you don’t need a trust fund to buy into the Florida dream. Whether you’re scouting for a starter home or just love rooting for the housing underdogs, this list brings the sunshine without the sticker shock.

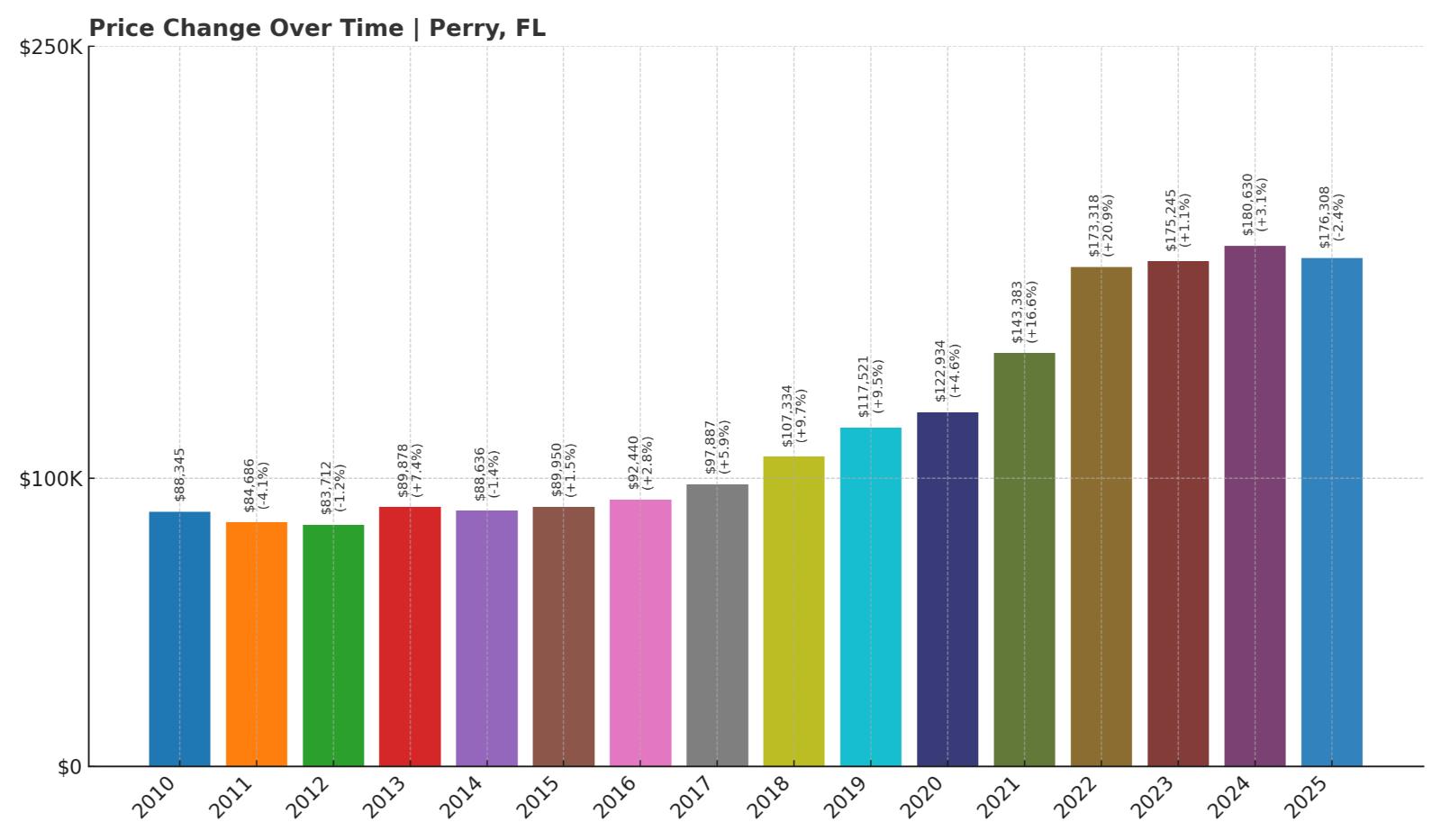

23. Perry – 100% Home Price Increase Since 2010

- 2010: $88,345

- 2011: $84,686 (-$3,660, -4.14% from previous year)

- 2012: $83,712 (-$973, -1.15% from previous year)

- 2013: $89,878 (+$6,166, +7.37% from previous year)

- 2014: $88,636 (-$1,242, -1.38% from previous year)

- 2015: $89,950 (+$1,314, +1.48% from previous year)

- 2016: $92,440 (+$2,491, +2.77% from previous year)

- 2017: $97,887 (+$5,446, +5.89% from previous year)

- 2018: $107,334 (+$9,447, +9.65% from previous year)

- 2019: $117,521 (+$10,187, +9.49% from previous year)

- 2020: $122,934 (+$5,413, +4.61% from previous year)

- 2021: $143,383 (+$20,449, +16.63% from previous year)

- 2022: $173,318 (+$29,935, +20.88% from previous year)

- 2023: $175,245 (+$1,927, +1.11% from previous year)

- 2024: $180,630 (+$5,385, +3.07% from previous year)

- 2025: $176,308 (-$4,322, -2.39% from previous year)

Home prices in Perry have doubled since 2010, rising from just over $88,000 to around $176,000 by 2025. The most dramatic jumps came in the pandemic-era boom years of 2021 and 2022, with gains of over 16% and 20% respectively. Despite a small dip in 2025, Perry’s values have largely stabilized after years of steady growth.

Perry – Small Town Value in North Florida

Perry, located in Taylor County along Florida’s Big Bend, is a traditional North Florida town known for forestry, manufacturing, and a slower pace of life. Its economy has long been tied to natural resources and light industry, keeping home prices affordable compared to coastal cities. Recent increases may reflect both statewide housing pressure and renewed interest in smaller communities with room to grow.

Despite recent volatility, Perry remains one of Florida’s most budget-friendly places to buy a home. With basic amenities, proximity to the Gulf, and access to state parks like Forest Capital Museum State Park, it attracts buyers looking for simplicity and value in a rural setting.

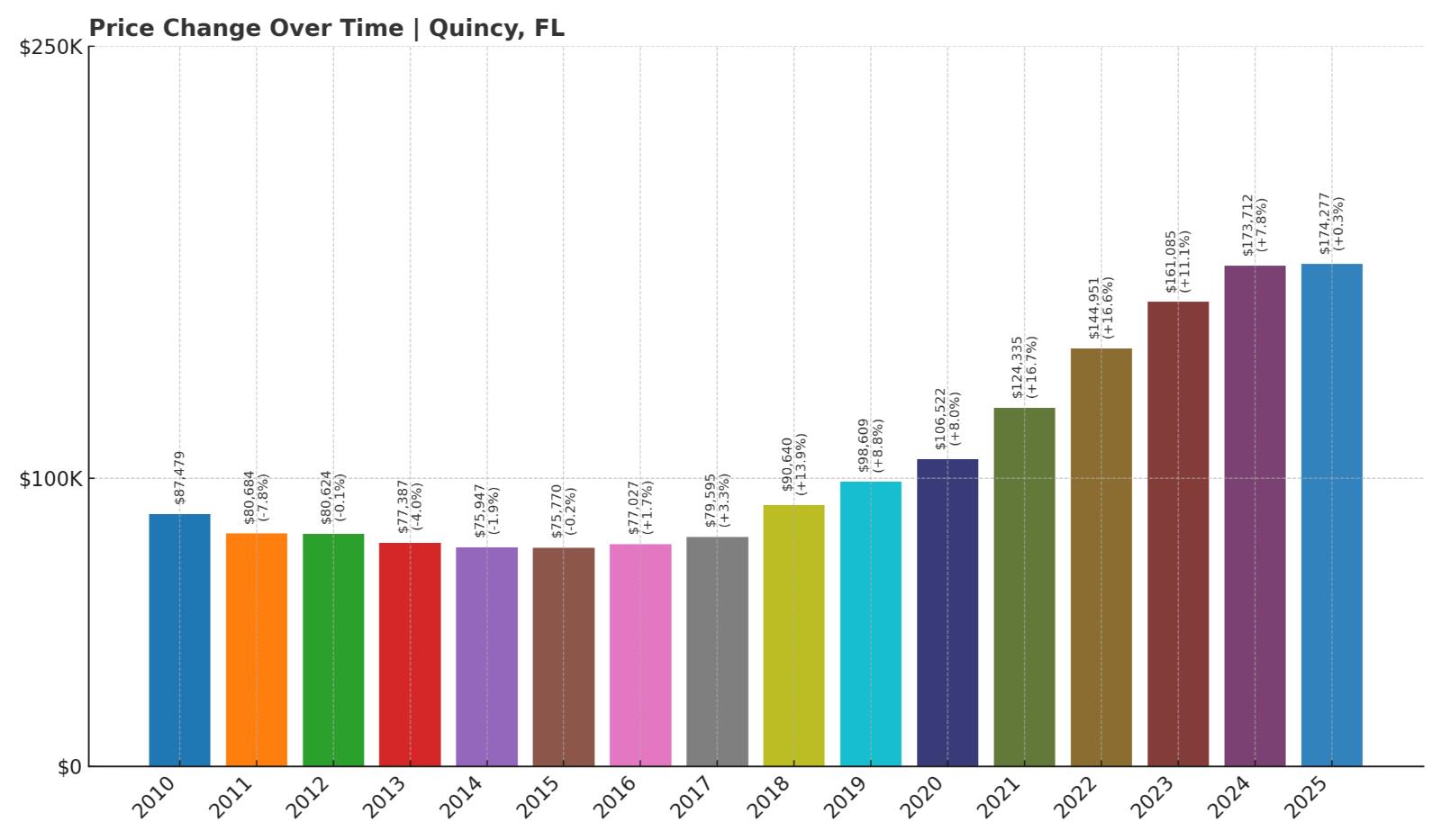

22. Quincy – 99% Home Price Increase Since 2010

- 2010: $87,479

- 2011: $80,684 (-$6,795, -7.77% from previous year)

- 2012: $80,624 (-$60, -0.07% from previous year)

- 2013: $77,387 (-$3,236, -4.01% from previous year)

- 2014: $75,947 (-$1,441, -1.86% from previous year)

- 2015: $75,770 (-$177, -0.23% from previous year)

- 2016: $77,027 (+$1,257, +1.66% from previous year)

- 2017: $79,595 (+$2,569, +3.33% from previous year)

- 2018: $90,640 (+$11,045, +13.88% from previous year)

- 2019: $98,609 (+$7,969, +8.79% from previous year)

- 2020: $106,522 (+$7,913, +8.02% from previous year)

- 2021: $124,335 (+$17,813, +16.72% from previous year)

- 2022: $144,951 (+$20,617, +16.58% from previous year)

- 2023: $161,085 (+$16,134, +11.13% from previous year)

- 2024: $173,712 (+$12,627, +7.84% from previous year)

- 2025: $174,277 (+$566, +0.33% from previous year)

Quincy’s home values have nearly doubled over the past 15 years, following a slow decline through the early 2010s and a sharp turnaround beginning in 2018. The town posted double-digit growth in multiple recent years, and while 2025 shows signs of cooling, the overall trend remains strong.

Quincy – Steady Gains Near the Capital

Kitchen Style?

Quincy is just a 30-minute drive west of Tallahassee in Gadsden County, making it a practical option for commuters seeking lower-cost housing. Long known for its agricultural roots—especially tobacco and tomatoes—Quincy has recently seen more buyers looking to escape higher prices in nearby urban areas.

The town’s recovery since 2018 aligns with broader rural price growth in Florida. With typical home prices still under $175,000, Quincy remains highly affordable by state standards, especially given its location and access to employment in the capital region.

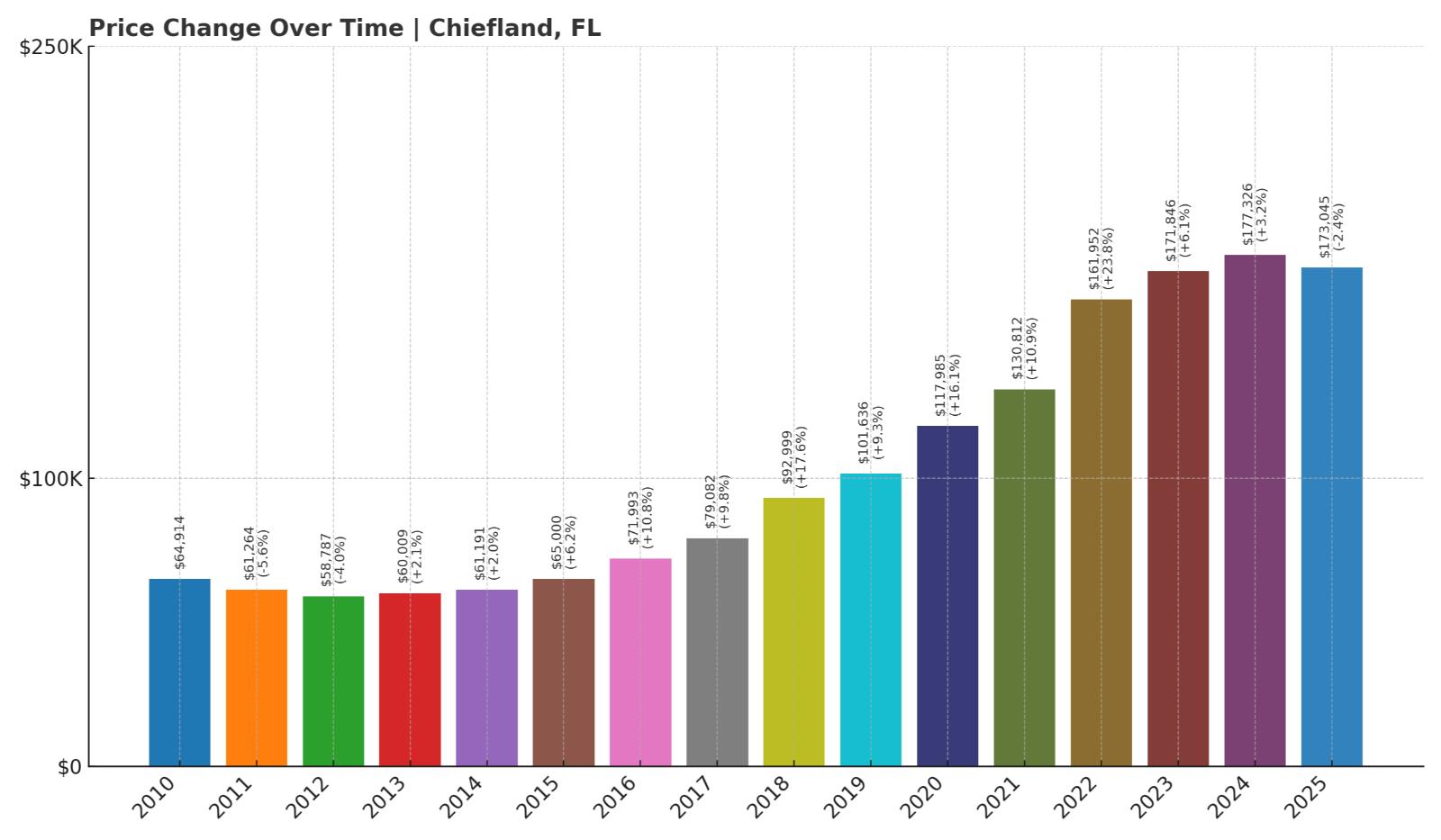

21. Chiefland – 167% Home Price Increase Since 2010

- 2010: $64,914

- 2011: $61,264 (-$3,650, -5.62% from previous year)

- 2012: $58,787 (-$2,476, -4.04% from previous year)

- 2013: $60,009 (+$1,221, +2.08% from previous year)

- 2014: $61,191 (+$1,182, +1.97% from previous year)

- 2015: $65,000 (+$3,809, +6.22% from previous year)

- 2016: $71,993 (+$6,993, +10.76% from previous year)

- 2017: $79,082 (+$7,089, +9.85% from previous year)

- 2018: $92,999 (+$13,917, +17.60% from previous year)

- 2019: $101,636 (+$8,636, +9.29% from previous year)

- 2020: $117,985 (+$16,350, +16.09% from previous year)

- 2021: $130,812 (+$12,826, +10.87% from previous year)

- 2022: $161,952 (+$31,140, +23.81% from previous year)

- 2023: $171,846 (+$9,894, +6.11% from previous year)

- 2024: $177,326 (+$5,479, +3.19% from previous year)

- 2025: $173,045 (-$4,281, -2.41% from previous year)

Chiefland’s home values have jumped more than 160% since 2010, reflecting one of the steepest climbs on this list. Annual growth rates consistently topped 10% from 2016 through 2022, though 2025 marks a slight decline in price after a strong multi-year run.

Chiefland – Big Gains in Levy County

Known as the “Gem of the Suwannee Valley,” Chiefland is located in Levy County near the junction of U.S. Highways 19 and 27. It’s a modest town that serves as a regional commercial center and gateway to nearby springs and state parks. While it lacks the crowds and development of coastal cities, its proximity to nature has grown more appealing in recent years.

Chiefland’s dramatic rise in home values likely stems from increased demand for affordable inland real estate. Even with recent price growth, it remains a budget-conscious option for those drawn to North Central Florida’s quiet charm and natural surroundings.

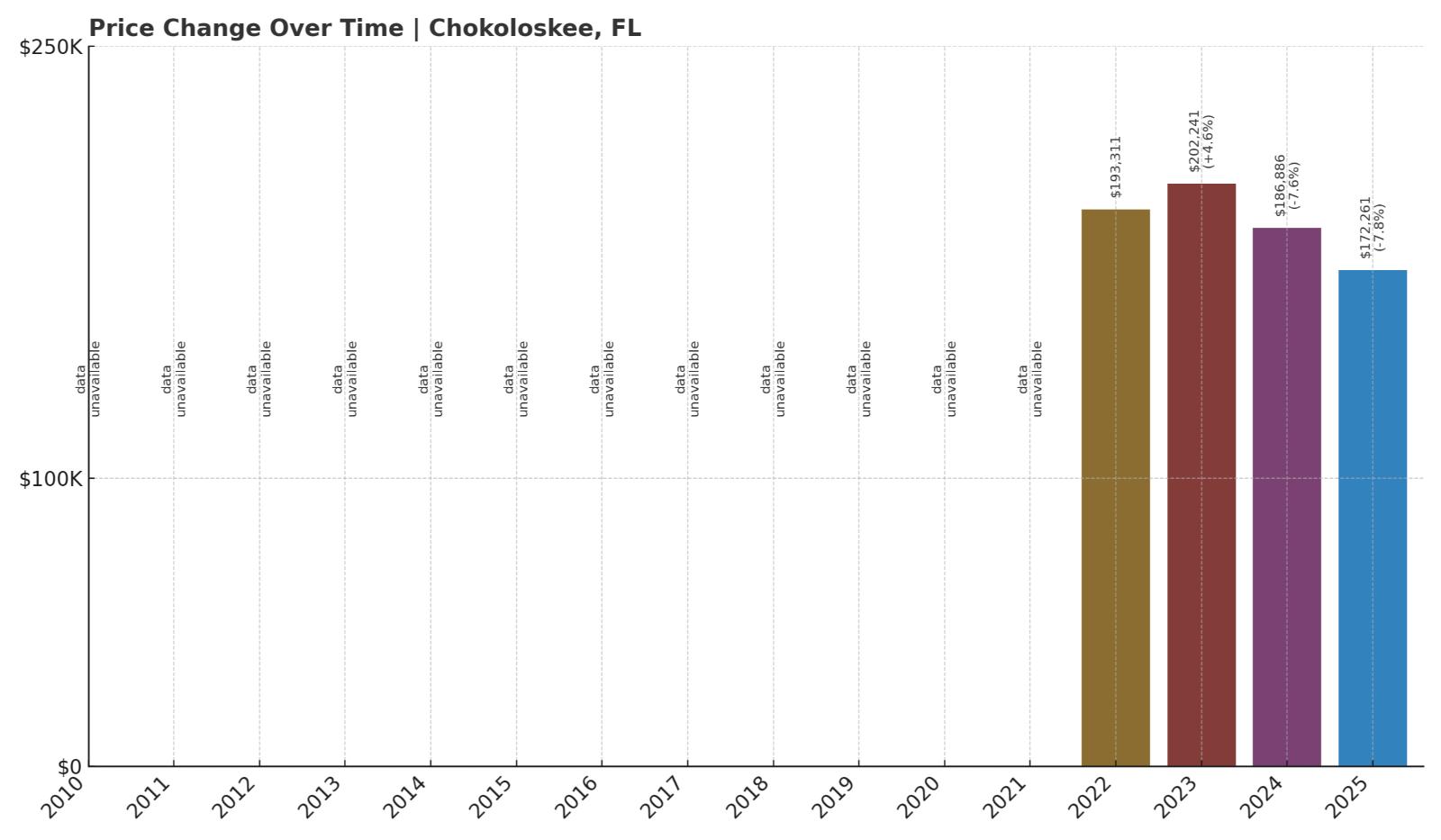

20. Chokoloskee – 11% Home Price Decrease Since 2022

Home Stratosphere Guide

Your Personality Already Knows

How Your Home Should Feel

113 pages of room-by-room design guidance built around your actual brain, your actual habits, and the way you actually live.

You might be an ISFJ or INFP designer…

You design through feeling — your spaces are personal, comforting, and full of meaning. The guide covers your exact color palettes, room layouts, and the one mistake your type always makes.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ISTJ or INTJ designer…

You crave order, function, and visual calm. The guide shows you how to create spaces that feel both serene and intentional — without ending up sterile.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ENFP or ESTP designer…

You design by instinct and energy. Your home should feel alive. The guide shows you how to channel that into rooms that feel curated, not chaotic.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ENTJ or ESTJ designer…

You value quality, structure, and things done right. The guide gives you the framework to build rooms that feel polished without overthinking every detail.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: N/A

- 2022: $193,311

- 2023: $202,241 (+$8,930, +4.62% from previous year)

- 2024: $186,886 (-$15,355, -7.59% from previous year)

- 2025: $172,261 (-$14,626, -7.83% from previous year)

Home prices in Chokoloskee peaked in 2023 but have dropped by over 11% in the last two years. With limited historical data, trends are harder to track, but the recent downturn suggests a cooling market following pandemic-era spikes.

Chokoloskee – Remote and Resilient

Chokoloskee is a small island community in Collier County, tucked away near the Ten Thousand Islands and Everglades National Park. It’s one of the most remote spots on this list, accessible by a single causeway from Everglades City. Its appeal lies in its isolation, access to world-class fishing, and old-Florida atmosphere.

Because of its unique location and limited housing stock, price swings in Chokoloskee can be more volatile. It saw a sharp rise in demand during the early 2020s but has since seen prices decline, likely due to both national market corrections and the high costs of maintaining homes in a flood-prone, hurricane-sensitive area.

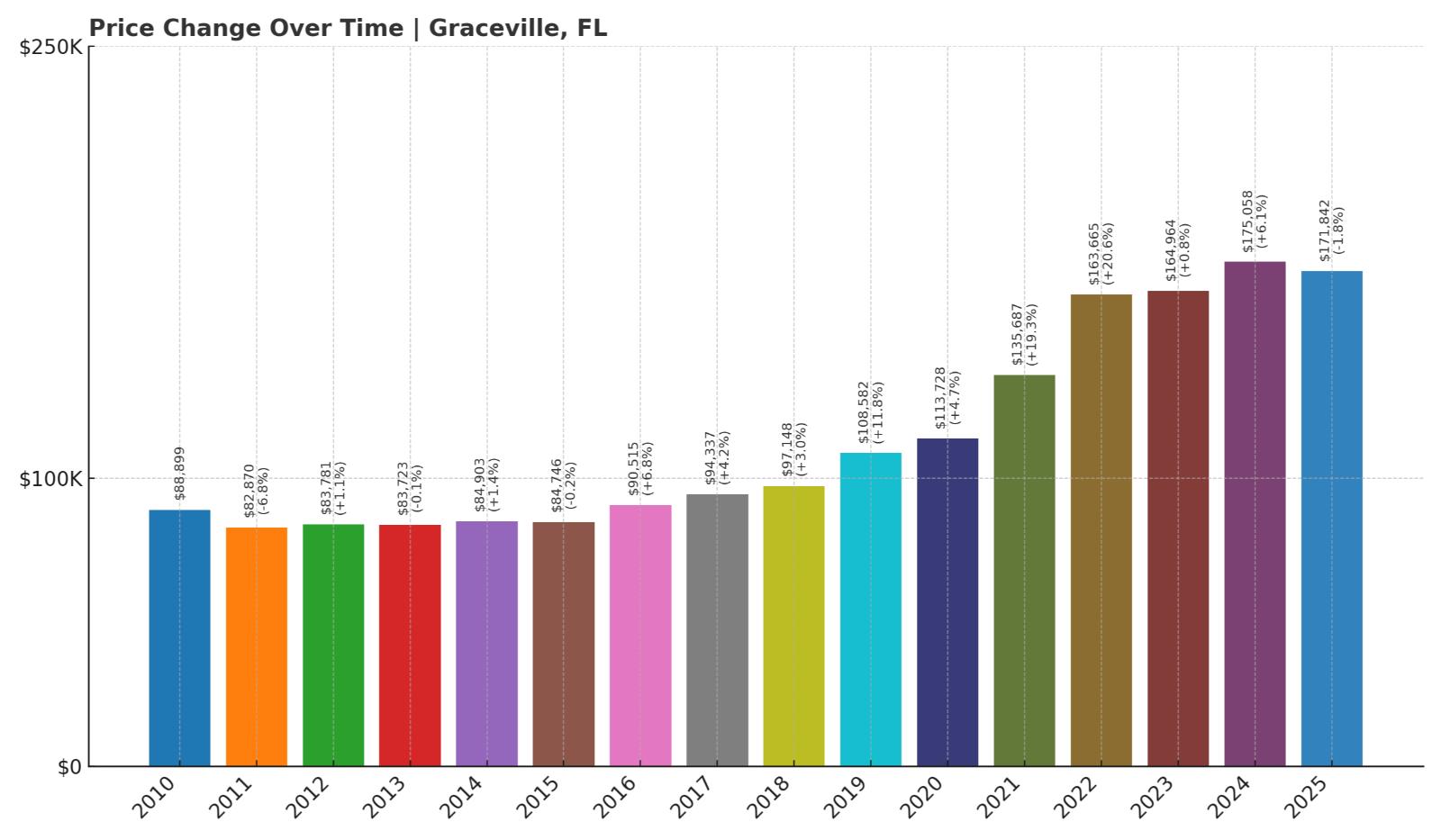

19. Graceville – 93% Home Price Increase Since 2010

- 2010: $88,899

- 2011: $82,870 (-$6,029, -6.78% from previous year)

- 2012: $83,781 (+$911, +1.10% from previous year)

- 2013: $83,723 (-$58, -0.07% from previous year)

- 2014: $84,903 (+$1,180, +1.41% from previous year)

- 2015: $84,746 (-$156, -0.18% from previous year)

- 2016: $90,515 (+$5,769, +6.81% from previous year)

- 2017: $94,337 (+$3,821, +4.22% from previous year)

- 2018: $97,148 (+$2,812, +2.98% from previous year)

- 2019: $108,582 (+$11,434, +11.77% from previous year)

- 2020: $113,728 (+$5,145, +4.74% from previous year)

- 2021: $135,687 (+$21,959, +19.31% from previous year)

- 2022: $163,665 (+$27,978, +20.62% from previous year)

- 2023: $164,964 (+$1,299, +0.79% from previous year)

- 2024: $175,058 (+$10,094, +6.12% from previous year)

- 2025: $171,842 (-$3,215, -1.84% from previous year)

Graceville’s home prices have risen 93% since 2010, driven by strong gains between 2019 and 2022. The pace slowed in recent years, with slight drops in 2023 and 2025, but the town remains solidly affordable compared to Florida’s coastal markets.

Graceville – Panhandle Affordability

Situated in the Florida Panhandle near the Alabama border, Graceville is a small agricultural community with deep local roots. It offers a mix of small-town life, local schools, and regional colleges. The town’s affordability has been consistent, even as other parts of the state saw prices skyrocket.

Its appeal is largely regional, serving locals and those looking for quiet living near the Alabama state line. With homes still well under $175,000 on average, Graceville is one of North Florida’s most budget-conscious options for homebuyers.

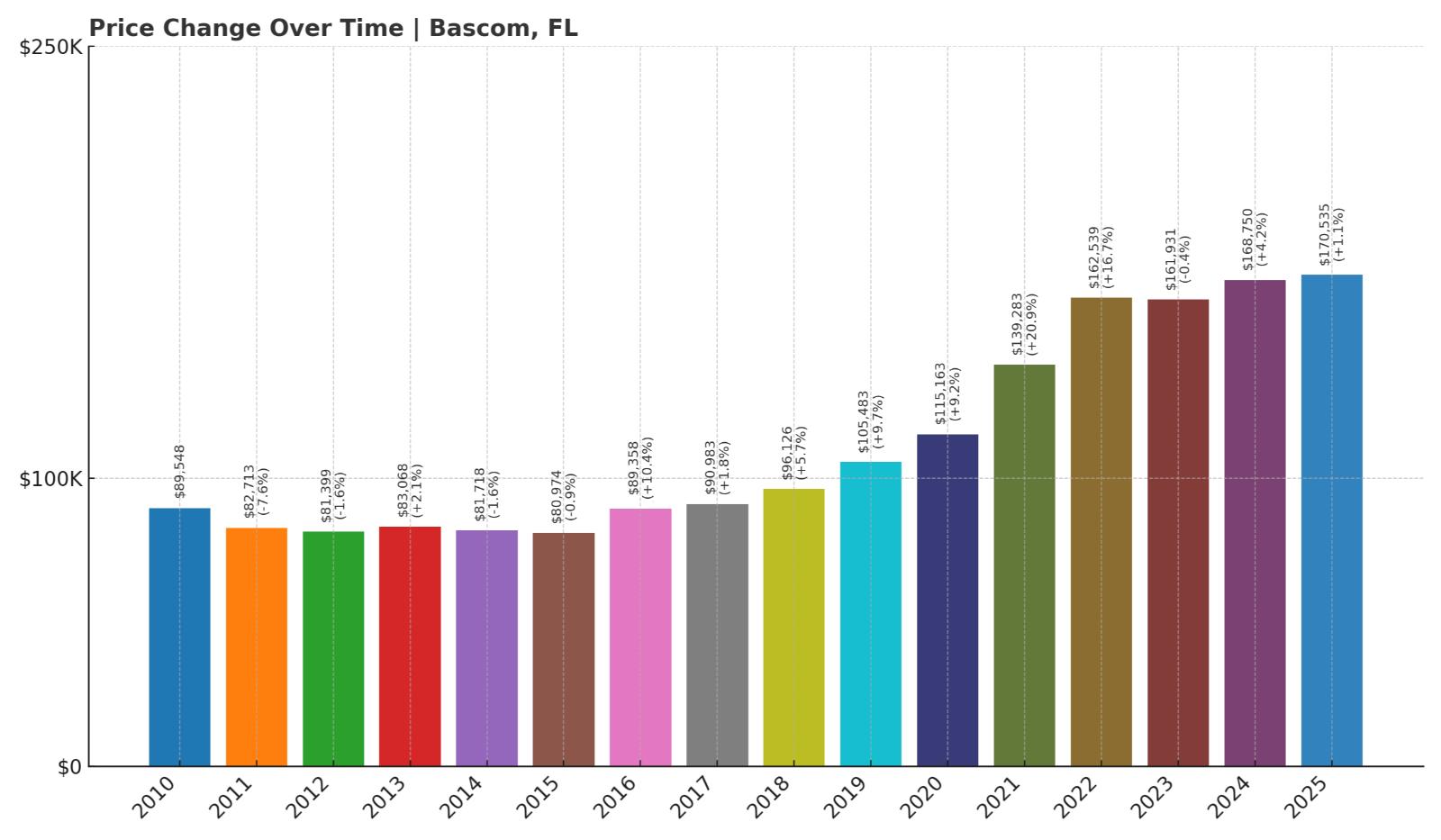

18. Bascom – 90% Home Price Increase Since 2010

- 2010: $89,548

- 2011: $82,713 (-$6,835, -7.63% from previous year)

- 2012: $81,399 (-$1,314, -1.59% from previous year)

- 2013: $83,068 (+$1,669, +2.05% from previous year)

- 2014: $81,718 (-$1,350, -1.62% from previous year)

- 2015: $80,974 (-$745, -0.91% from previous year)

- 2016: $89,358 (+$8,385, +10.35% from previous year)

- 2017: $90,983 (+$1,625, +1.82% from previous year)

- 2018: $96,126 (+$5,143, +5.65% from previous year)

- 2019: $105,483 (+$9,357, +9.73% from previous year)

- 2020: $115,163 (+$9,680, +9.18% from previous year)

- 2021: $139,283 (+$24,120, +20.94% from previous year)

- 2022: $162,539 (+$23,257, +16.70% from previous year)

- 2023: $161,931 (-$609, -0.37% from previous year)

- 2024: $168,750 (+$6,820, +4.21% from previous year)

- 2025: $170,535 (+$1,785, +1.06% from previous year)

Home values in Bascom have climbed from just under $90,000 in 2010 to over $170,000 in 2025. Gains were strongest from 2019 to 2022, with back-to-back double-digit increases. The market has cooled in recent years, but prices are still edging upward.

Bascom – Quiet Panhandle Growth

Bascom is a tiny rural community in Jackson County, bordering Georgia and Alabama. It’s one of the smallest towns on this list by population, but it has experienced steady interest during Florida’s affordability crunch, especially during the pandemic housing surge.

The limited inventory and its appeal as a peaceful, countryside retreat may have driven the town’s value surge. With housing still under $175,000, Bascom remains an attractive option for buyers looking to settle in Florida’s far northwestern reaches.

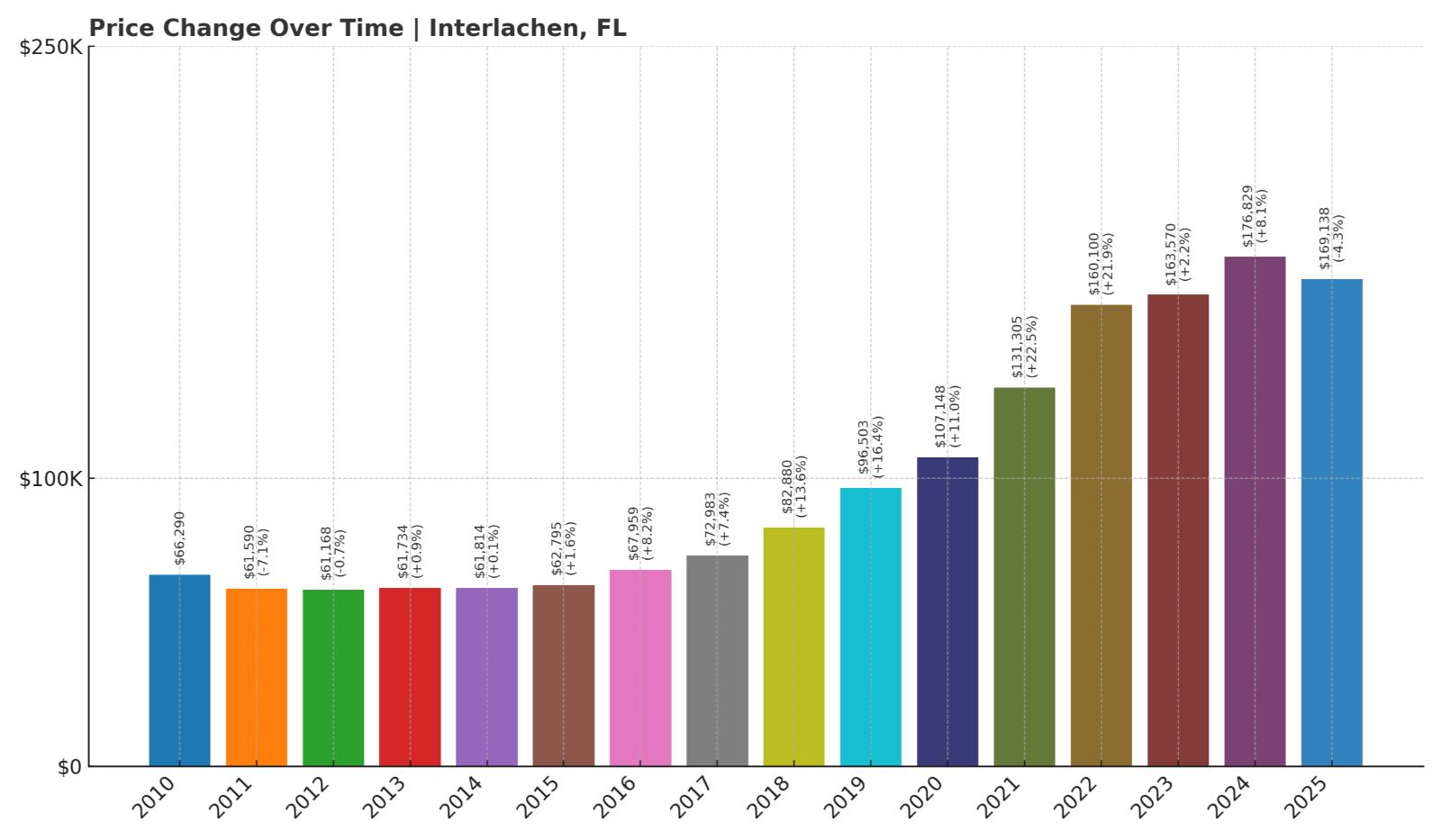

17. Interlachen – 155% Home Price Increase Since 2010

- 2010: $66,290

- 2011: $61,590 (-$4,699, -7.09% from previous year)

- 2012: $61,168 (-$422, -0.69% from previous year)

- 2013: $61,734 (+$565, +0.92% from previous year)

- 2014: $61,814 (+$80, +0.13% from previous year)

- 2015: $62,795 (+$982, +1.59% from previous year)

- 2016: $67,959 (+$5,163, +8.22% from previous year)

- 2017: $72,983 (+$5,024, +7.39% from previous year)

- 2018: $82,880 (+$9,897, +13.56% from previous year)

- 2019: $96,503 (+$13,623, +16.44% from previous year)

- 2020: $107,148 (+$10,644, +11.03% from previous year)

- 2021: $131,305 (+$24,158, +22.55% from previous year)

- 2022: $160,100 (+$28,795, +21.93% from previous year)

- 2023: $163,570 (+$3,470, +2.17% from previous year)

- 2024: $176,829 (+$13,258, +8.11% from previous year)

- 2025: $169,138 (-$7,691, -4.35% from previous year)

Interlachen has seen its home values more than double since 2010, fueled by substantial year-over-year increases from 2018 through 2022. While 2025 marks a slight decline, the town’s affordability continues to appeal to buyers priced out of larger markets.

Interlachen – Inland Affordability Near Gainesville

Located in Putnam County between Gainesville and Palatka, Interlachen offers a quiet, rural alternative for buyers who want space without the high costs of urban centers. The town’s name means “between the lakes,” a fitting description for a region dotted with freshwater bodies and forested land.

Home values surged as demand for more secluded, low-cost housing intensified during the pandemic. Even with a small setback in 2025, Interlachen remains an affordable destination for those seeking privacy and a slower lifestyle in North Central Florida.

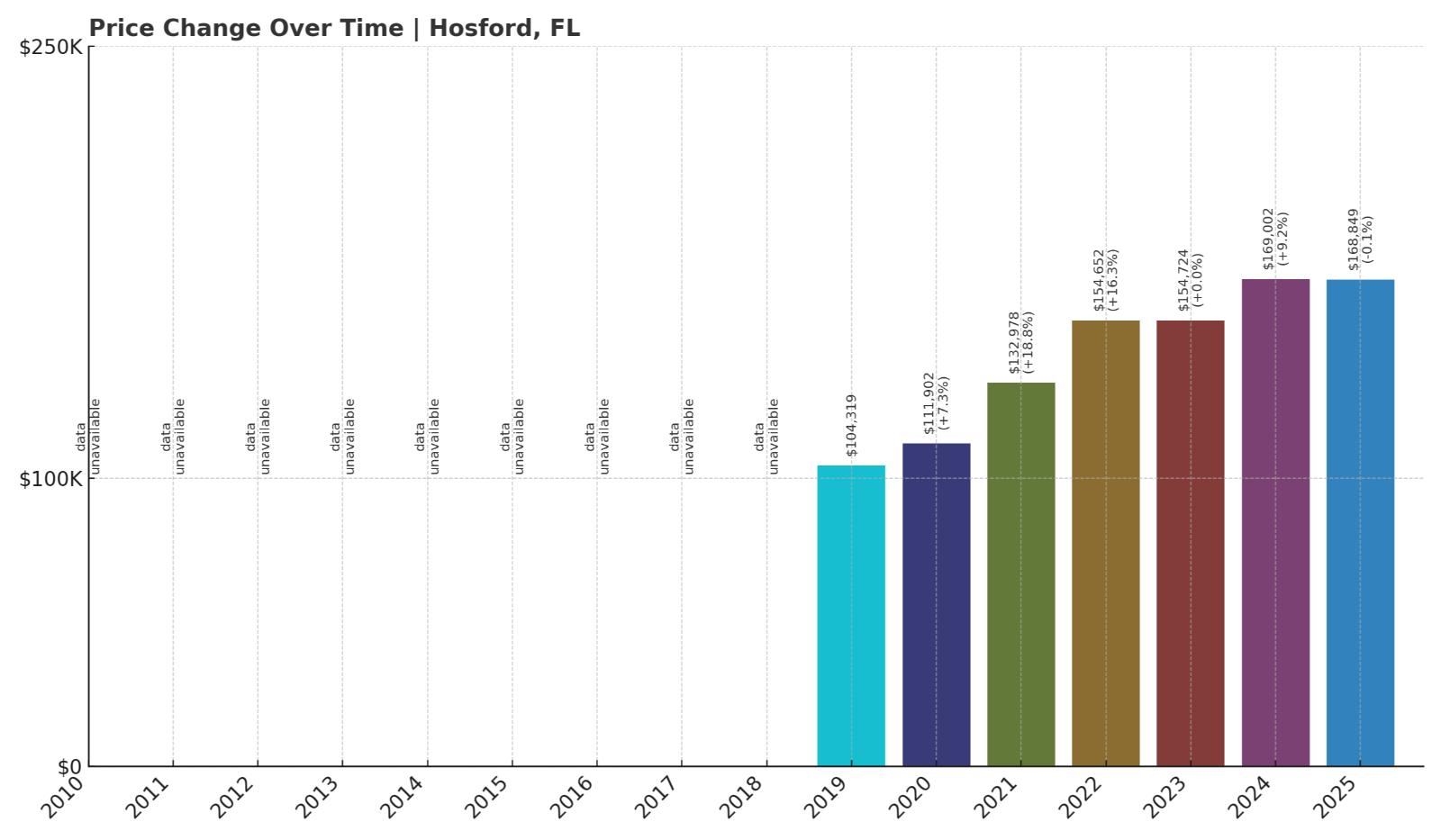

16. Hosford – 62% Home Price Increase Since 2019

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: $104,319

- 2020: $111,902 (+$7,584, +7.27% from previous year)

- 2021: $132,978 (+$21,076, +18.83% from previous year)

- 2022: $154,652 (+$21,674, +16.30% from previous year)

- 2023: $154,724 (+$72, +0.05% from previous year)

- 2024: $169,002 (+$14,277, +9.23% from previous year)

- 2025: $168,849 (-$152, -0.09% from previous year)

Since 2019, Hosford’s typical home value has risen by over 60%. The strongest growth happened from 2020 to 2022, with price increases tapering off by 2023 and remaining relatively flat through 2025.

Hosford – A Quiet Corner of Liberty County

Hosford is a small, unincorporated community in Liberty County, west of Tallahassee. Known for its pine forests and wildlife areas, the town remains largely untouched by large-scale development. Its housing market is small, but steady growth in recent years reflects broader interest in North Florida’s quieter locales.

The recent plateau in prices suggests the market may have caught up with demand. Still, with home prices under $170,000, Hosford remains well below Florida’s average, appealing to those who value space, quiet, and affordability.

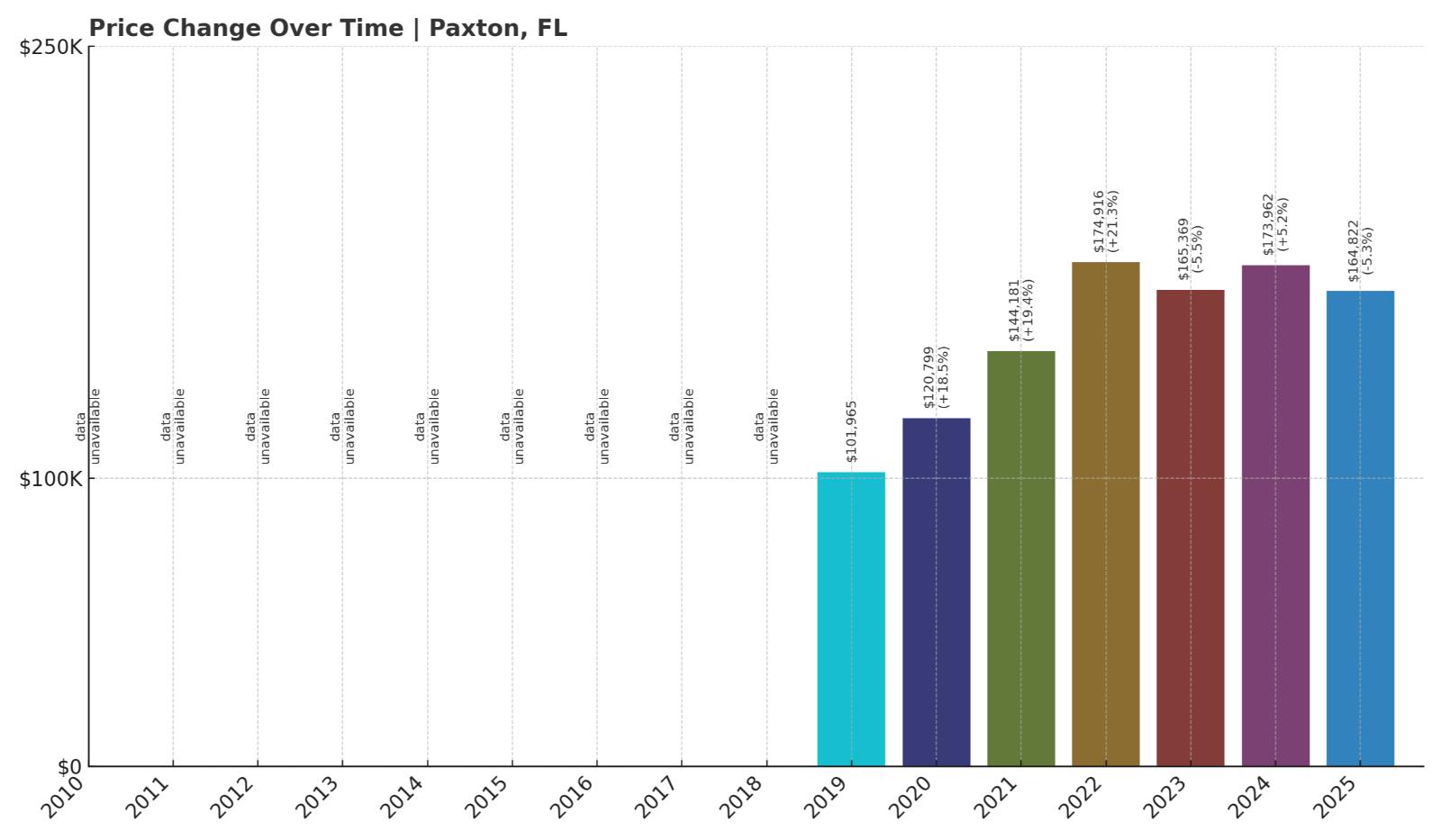

15. Paxton – 62% Home Price Increase Since 2019

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: $101,965

- 2020: $120,799 (+$18,834, +18.47% from previous year)

- 2021: $144,181 (+$23,382, +19.36% from previous year)

- 2022: $174,916 (+$30,735, +21.32% from previous year)

- 2023: $165,369 (-$9,547, -5.46% from previous year)

- 2024: $173,962 (+$8,593, +5.20% from previous year)

- 2025: $164,822 (-$9,140, -5.25% from previous year)

Home prices in Paxton rose dramatically between 2019 and 2022, gaining over 70% in just three years. While the market has declined slightly in both 2023 and 2025, values remain well above pre-pandemic levels.

Paxton – Florida’s Northernmost Town

Perched along the Alabama border in Walton County, Paxton is Florida’s northernmost municipality. The town is quiet and rural, situated near Lake Jackson and surrounded by farmland and pine forest. While it’s far from major cities, the low cost of living and scenic surroundings attract long-term residents and retirees.

Paxton’s recent ups and downs reflect its small housing market, where modest fluctuations in demand can swing prices. Even with its recent dip, home values remain affordable, with typical prices under $165,000 in 2025.

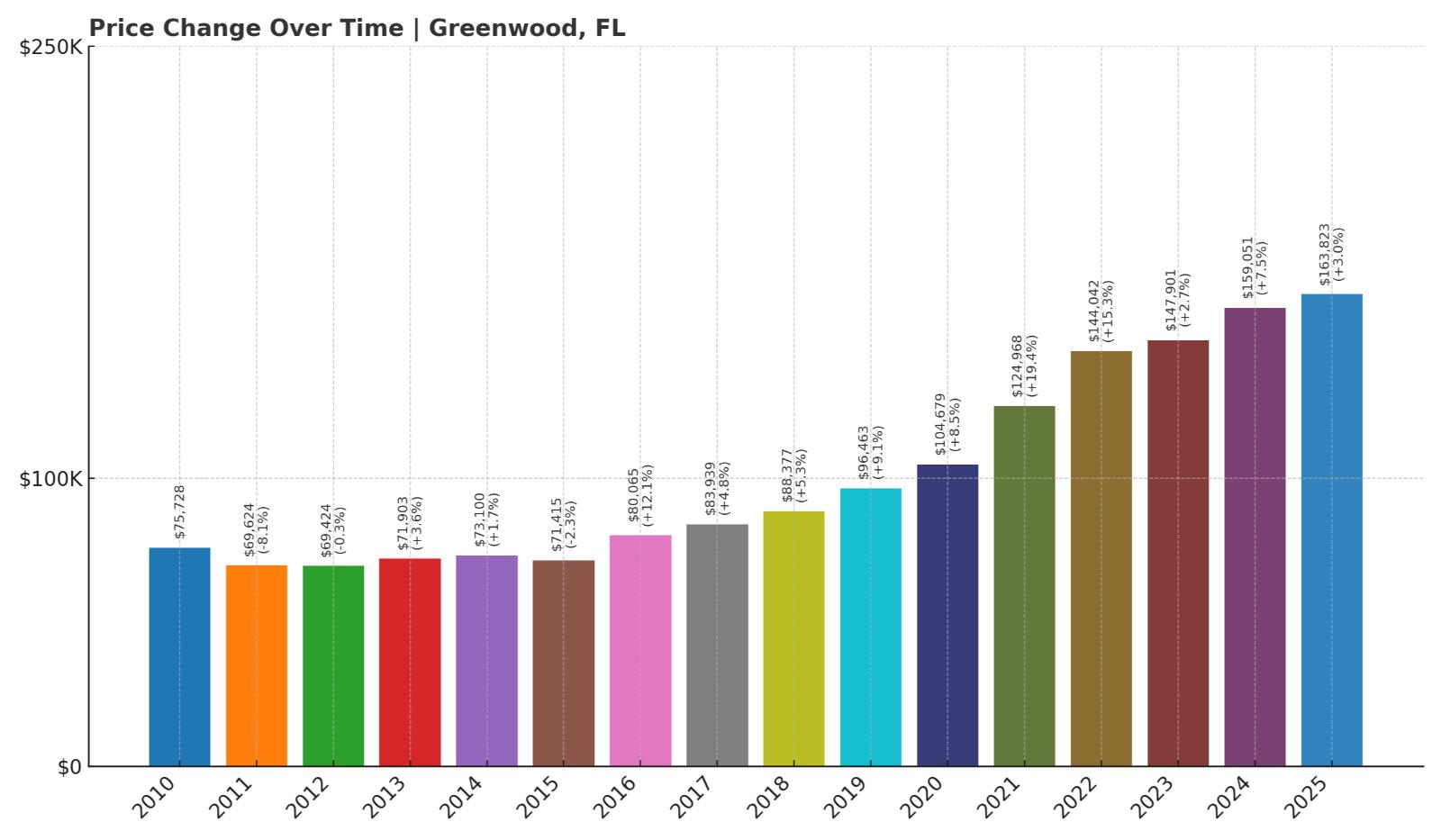

14. Greenwood – 116% Home Price Increase Since 2010

Would you like to save this?

- 2010: $75,728

- 2011: $69,624 (-$6,104, -8.06% from previous year)

- 2012: $69,424 (-$200, -0.29% from previous year)

- 2013: $71,903 (+$2,479, +3.57% from previous year)

- 2014: $73,100 (+$1,197, +1.66% from previous year)

- 2015: $71,415 (-$1,684, -2.30% from previous year)

- 2016: $80,065 (+$8,650, +12.11% from previous year)

- 2017: $83,939 (+$3,874, +4.84% from previous year)

- 2018: $88,377 (+$4,438, +5.29% from previous year)

- 2019: $96,463 (+$8,086, +9.15% from previous year)

- 2020: $104,679 (+$8,215, +8.52% from previous year)

- 2021: $124,968 (+$20,290, +19.38% from previous year)

- 2022: $144,042 (+$19,074, +15.26% from previous year)

- 2023: $147,901 (+$3,859, +2.68% from previous year)

- 2024: $159,051 (+$11,150, +7.54% from previous year)

- 2025: $163,823 (+$4,771, +3.00% from previous year)

Greenwood’s home prices have more than doubled since 2010, climbing steadily in nearly every year since. The gains have been especially strong since 2020, with consistent year-over-year increases.

Greenwood – Rural Stability in Jackson County

Greenwood is a small town in Jackson County, surrounded by farmland and longleaf pine forest. It’s known for its peaceful rural setting and historic buildings. While small in size, it has experienced growing interest from buyers looking for inexpensive land and homes.

With typical home values now around $160,000, Greenwood remains affordable while offering a strong track record of appreciation. Its central location in Florida’s Panhandle gives it quiet appeal without being completely isolated from larger markets like Marianna or Dothan, Alabama.

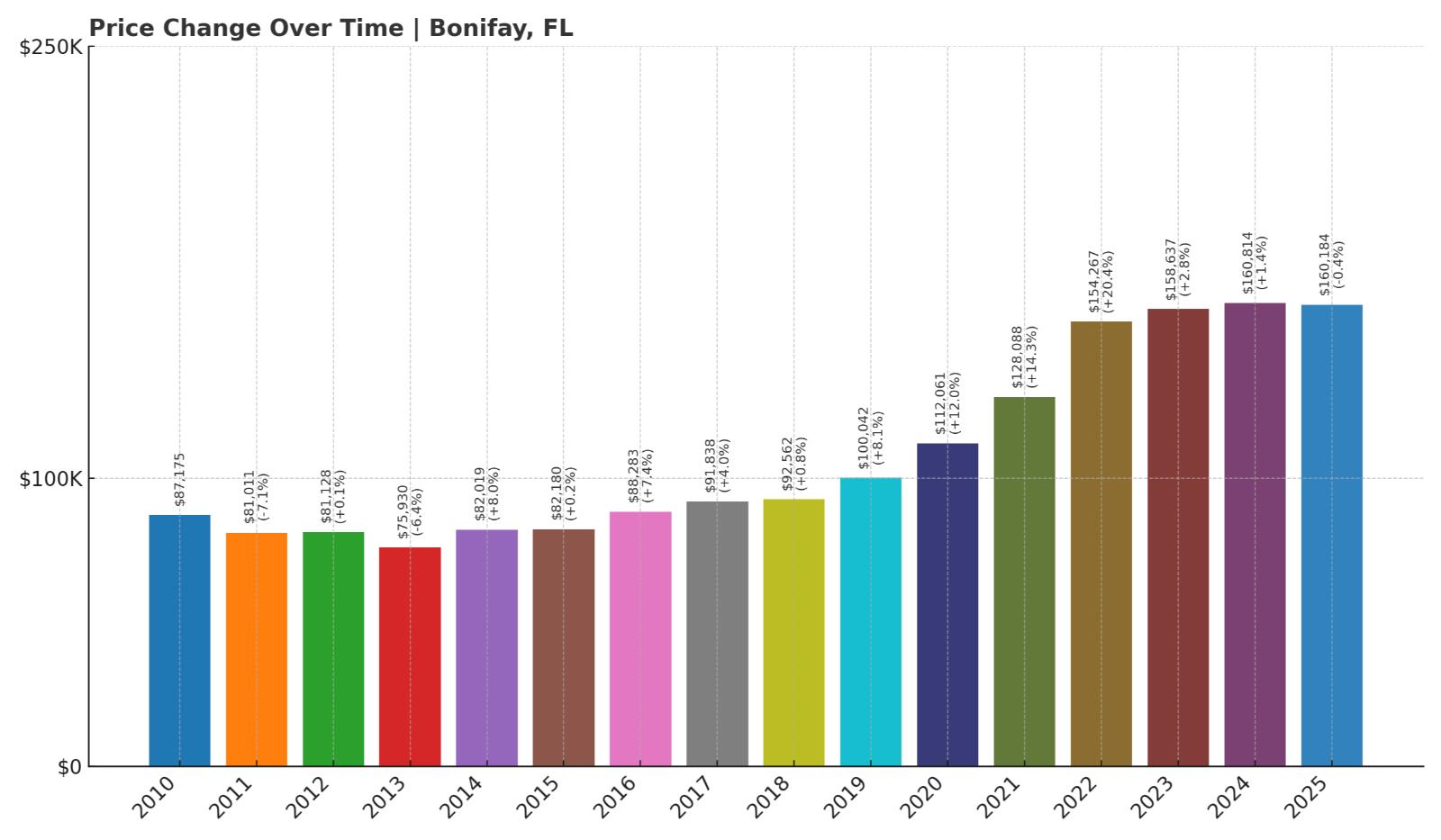

13. Bonifay – 84% Home Price Increase Since 2010

- 2010: $87,175

- 2011: $81,011 (-$6,165, -7.07% from previous year)

- 2012: $81,128 (+$118, +0.15% from previous year)

- 2013: $75,930 (-$5,198, -6.41% from previous year)

- 2014: $82,019 (+$6,089, +8.02% from previous year)

- 2015: $82,180 (+$161, +0.20% from previous year)

- 2016: $88,283 (+$6,103, +7.43% from previous year)

- 2017: $91,838 (+$3,555, +4.03% from previous year)

- 2018: $92,562 (+$724, +0.79% from previous year)

- 2019: $100,042 (+$7,480, +8.08% from previous year)

- 2020: $112,061 (+$12,019, +12.01% from previous year)

- 2021: $128,088 (+$16,028, +14.30% from previous year)

- 2022: $154,267 (+$26,179, +20.44% from previous year)

- 2023: $158,637 (+$4,369, +2.83% from previous year)

- 2024: $160,814 (+$2,177, +1.37% from previous year)

- 2025: $160,184 (-$629, -0.39% from previous year)

Bonifay’s home prices rose by 84% between 2010 and 2025, with a particularly sharp climb from 2019 to 2022. More recent years show a slowdown, with modest gains and a slight drop in 2025. Still, home values remain much higher than a decade ago.

Bonifay – Slow and Steady in Holmes County

Were You Meant

to Live In?

Located in Holmes County near the Alabama line, Bonifay is a classic small-town Florida community. It’s known for its agricultural roots and the annual Northwest Florida Championship Rodeo. The area offers affordable housing, open land, and a relaxed lifestyle that has drawn new buyers seeking to escape higher prices elsewhere.

Bonifay’s recent growth came amid broader rural demand during the pandemic years. Though the market has cooled slightly, its typical home price remains under $165,000, making it a consistently affordable choice in the Florida Panhandle.

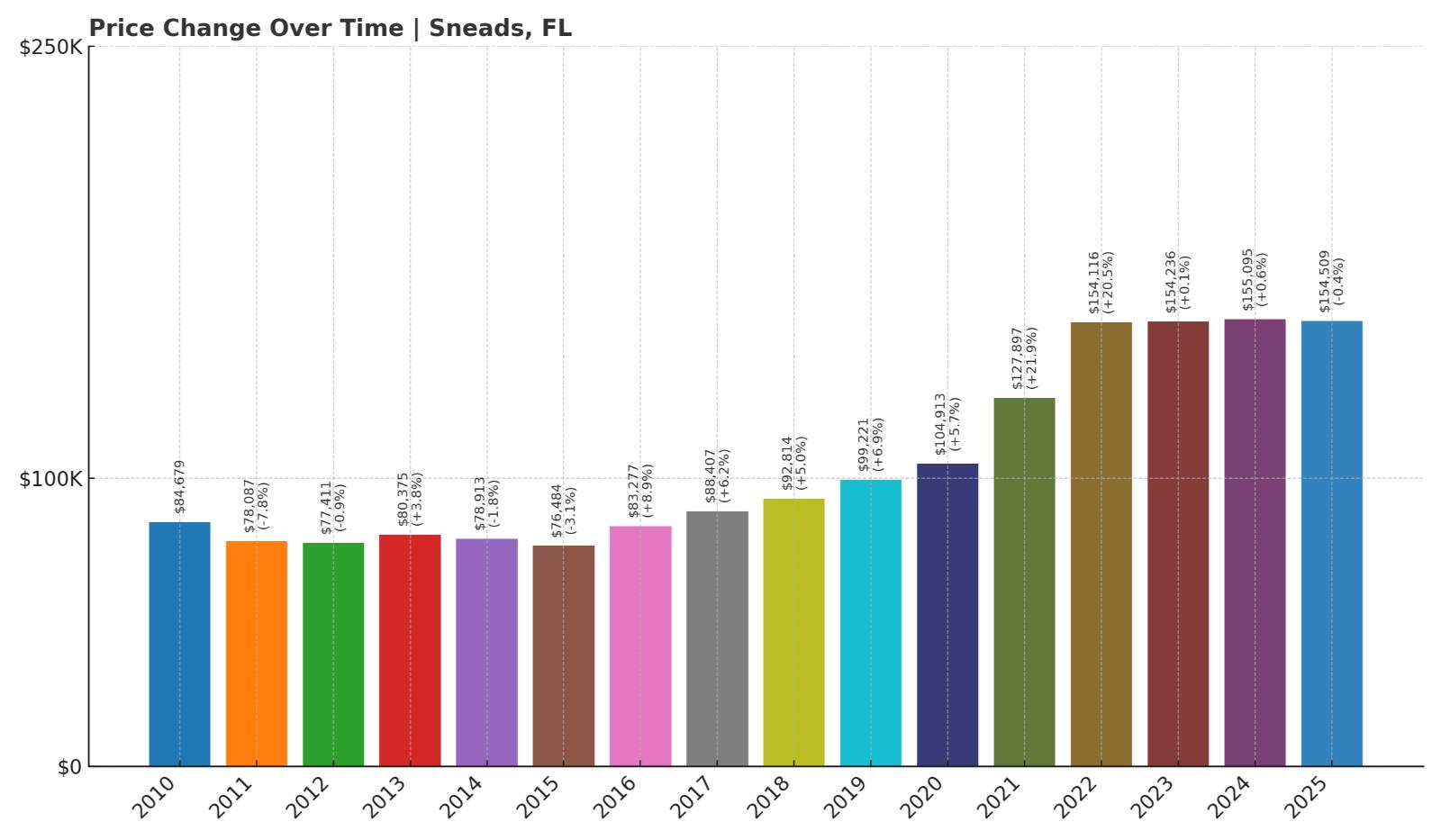

12. Sneads – 82% Home Price Increase Since 2010

- 2010: $84,679

- 2011: $78,087 (-$6,592, -7.78% from previous year)

- 2012: $77,411 (-$676, -0.87% from previous year)

- 2013: $80,375 (+$2,964, +3.83% from previous year)

- 2014: $78,913 (-$1,462, -1.82% from previous year)

- 2015: $76,484 (-$2,429, -3.08% from previous year)

- 2016: $83,277 (+$6,793, +8.88% from previous year)

- 2017: $88,407 (+$5,130, +6.16% from previous year)

- 2018: $92,814 (+$4,407, +4.98% from previous year)

- 2019: $99,221 (+$6,407, +6.90% from previous year)

- 2020: $104,913 (+$5,692, +5.74% from previous year)

- 2021: $127,897 (+$22,984, +21.91% from previous year)

- 2022: $154,116 (+$26,219, +20.50% from previous year)

- 2023: $154,236 (+$120, +0.08% from previous year)

- 2024: $155,095 (+$859, +0.56% from previous year)

- 2025: $154,509 (-$586, -0.38% from previous year)

Sneads saw home values rise more than 80% over the past 15 years, with the biggest leaps between 2020 and 2022. Since then, prices have largely plateaued. As of 2025, the typical home price is just over $154,000.

Sneads – Lakeside Living on a Budget

Sneads sits near the banks of Lake Seminole in Jackson County, not far from the Georgia border. With its access to fishing, boating, and quiet neighborhoods, the town has become increasingly attractive for buyers wanting a peaceful lifestyle without a big price tag.

The post-2020 boom in rural and water-adjacent properties pushed Sneads’ prices up quickly. While growth has slowed, homes remain reasonably priced, and the area’s natural appeal ensures it continues to draw buyers.

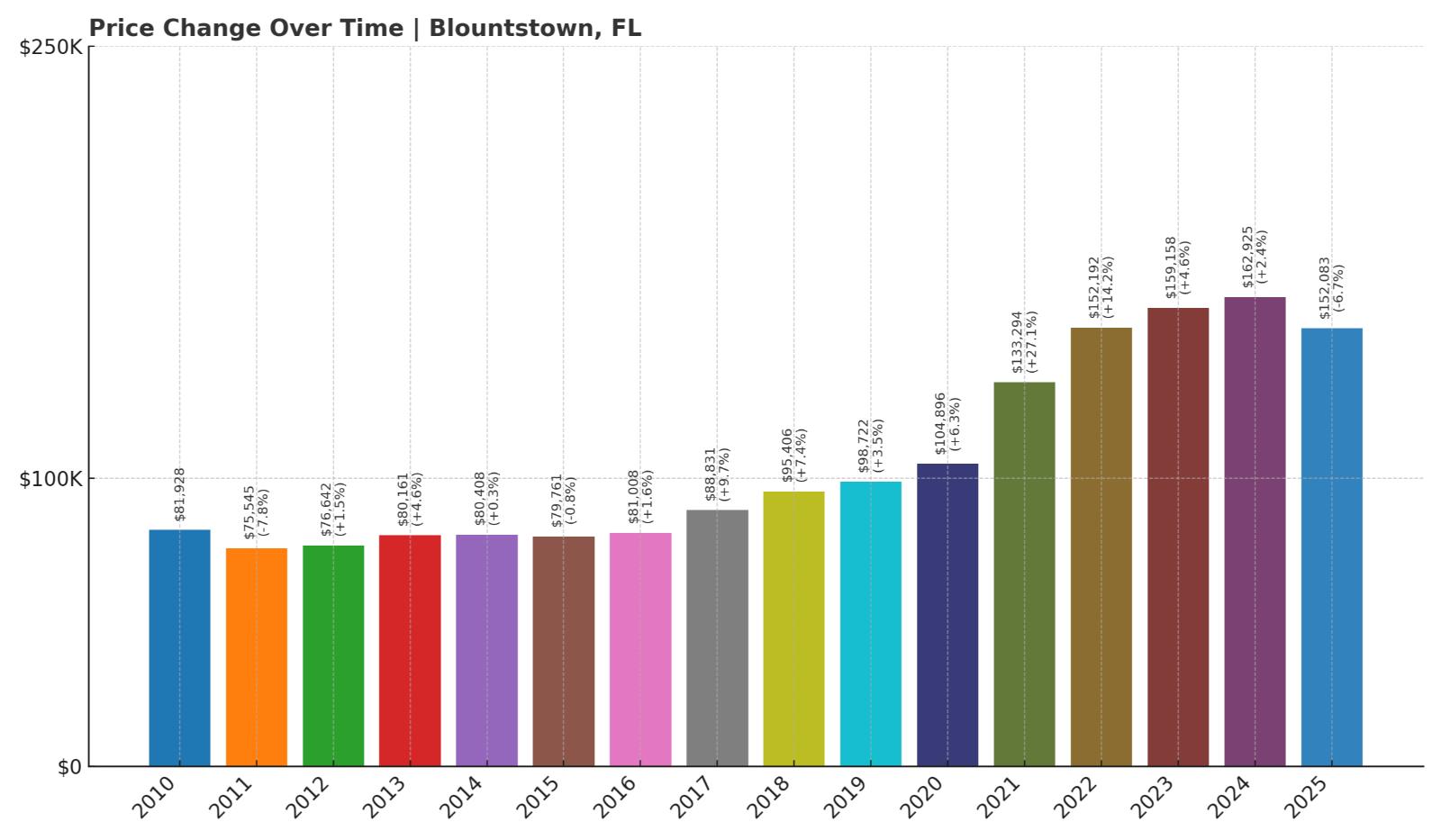

11. Blountstown – 86% Home Price Increase Since 2010

- 2010: $81,928

- 2011: $75,545 (-$6,383, -7.79% from previous year)

- 2012: $76,642 (+$1,097, +1.45% from previous year)

- 2013: $80,161 (+$3,519, +4.59% from previous year)

- 2014: $80,408 (+$247, +0.31% from previous year)

- 2015: $79,761 (-$647, -0.80% from previous year)

- 2016: $81,008 (+$1,247, +1.56% from previous year)

- 2017: $88,831 (+$7,823, +9.66% from previous year)

- 2018: $95,406 (+$6,575, +7.40% from previous year)

- 2019: $98,722 (+$3,316, +3.48% from previous year)

- 2020: $104,896 (+$6,174, +6.25% from previous year)

- 2021: $133,294 (+$28,398, +27.07% from previous year)

- 2022: $152,192 (+$18,898, +14.18% from previous year)

- 2023: $159,158 (+$6,967, +4.58% from previous year)

- 2024: $162,925 (+$3,766, +2.37% from previous year)

- 2025: $152,083 (-$10,841, -6.65% from previous year)

Home prices in Blountstown are up 86% since 2010, with significant increases in 2021 and 2022. The market cooled sharply in 2025 with a 6.65% drop, but overall values remain much higher than a decade ago.

Blountstown – Calhoun County’s Affordable Hub

Blountstown, the county seat of Calhoun County, is located in Florida’s Panhandle along the Apalachicola River. It’s a quiet community with local schools, small businesses, and a strong sense of place. Affordable home prices have made it attractive to both families and retirees seeking value in a small-town environment.

Although recent declines reflect broader state market corrections, the town’s gains over the past 10 years make it one of the most improved on this list. Home prices remain under $155,000 in 2025, offering plenty of bang for the buck.

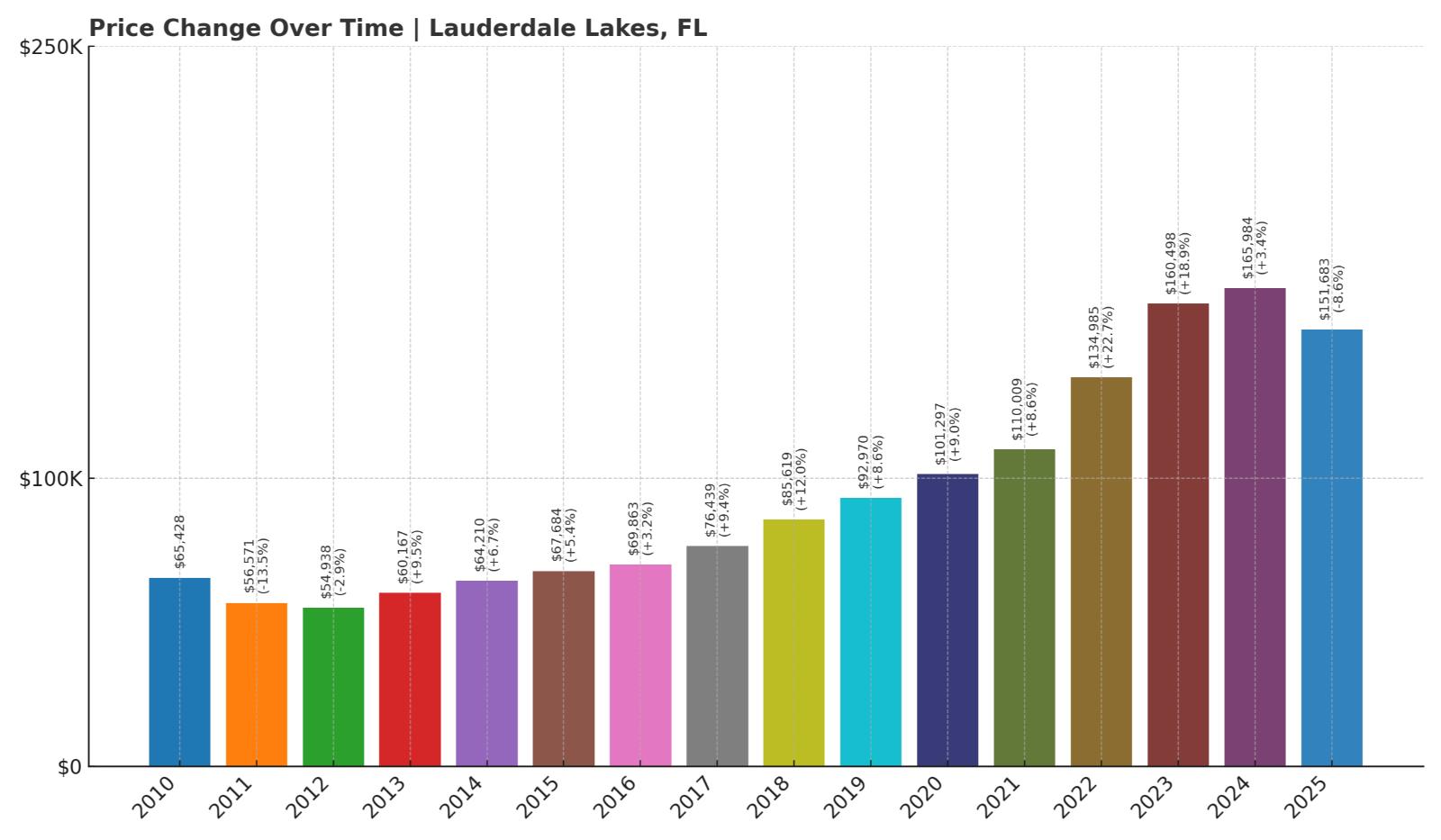

10. Lauderdale Lakes – 132% Home Price Increase Since 2010

- 2010: $65,428

- 2011: $56,571 (-$8,857, -13.54% from previous year)

- 2012: $54,938 (-$1,633, -2.89% from previous year)

- 2013: $60,167 (+$5,229, +9.52% from previous year)

- 2014: $64,210 (+$4,043, +6.72% from previous year)

- 2015: $67,684 (+$3,474, +5.41% from previous year)

- 2016: $69,863 (+$2,179, +3.22% from previous year)

- 2017: $76,439 (+$6,576, +9.41% from previous year)

- 2018: $85,619 (+$9,180, +12.01% from previous year)

- 2019: $92,970 (+$7,351, +8.59% from previous year)

- 2020: $101,297 (+$8,326, +8.96% from previous year)

- 2021: $110,009 (+$8,712, +8.60% from previous year)

- 2022: $134,985 (+$24,976, +22.70% from previous year)

- 2023: $160,498 (+$25,513, +18.90% from previous year)

- 2024: $165,984 (+$5,486, +3.42% from previous year)

- 2025: $151,683 (-$14,301, -8.62% from previous year)

Lauderdale Lakes experienced a sharp rebound from its post-recession lows, gaining 132% in home value since 2010. After peaking in 2023, prices have declined, though they remain above pre-pandemic levels.

Lauderdale Lakes – Urban Affordability in Broward County

Lauderdale Lakes is part of the Fort Lauderdale metro area and offers a more affordable alternative to nearby coastal cities. With a diverse population and convenient access to major highways and job centers, the city has grown in popularity over the past decade.

Although home values dipped in 2025, the city’s strong fundamentals and location keep it relevant for budget-conscious buyers seeking proximity to South Florida’s job markets and amenities without paying premium prices.

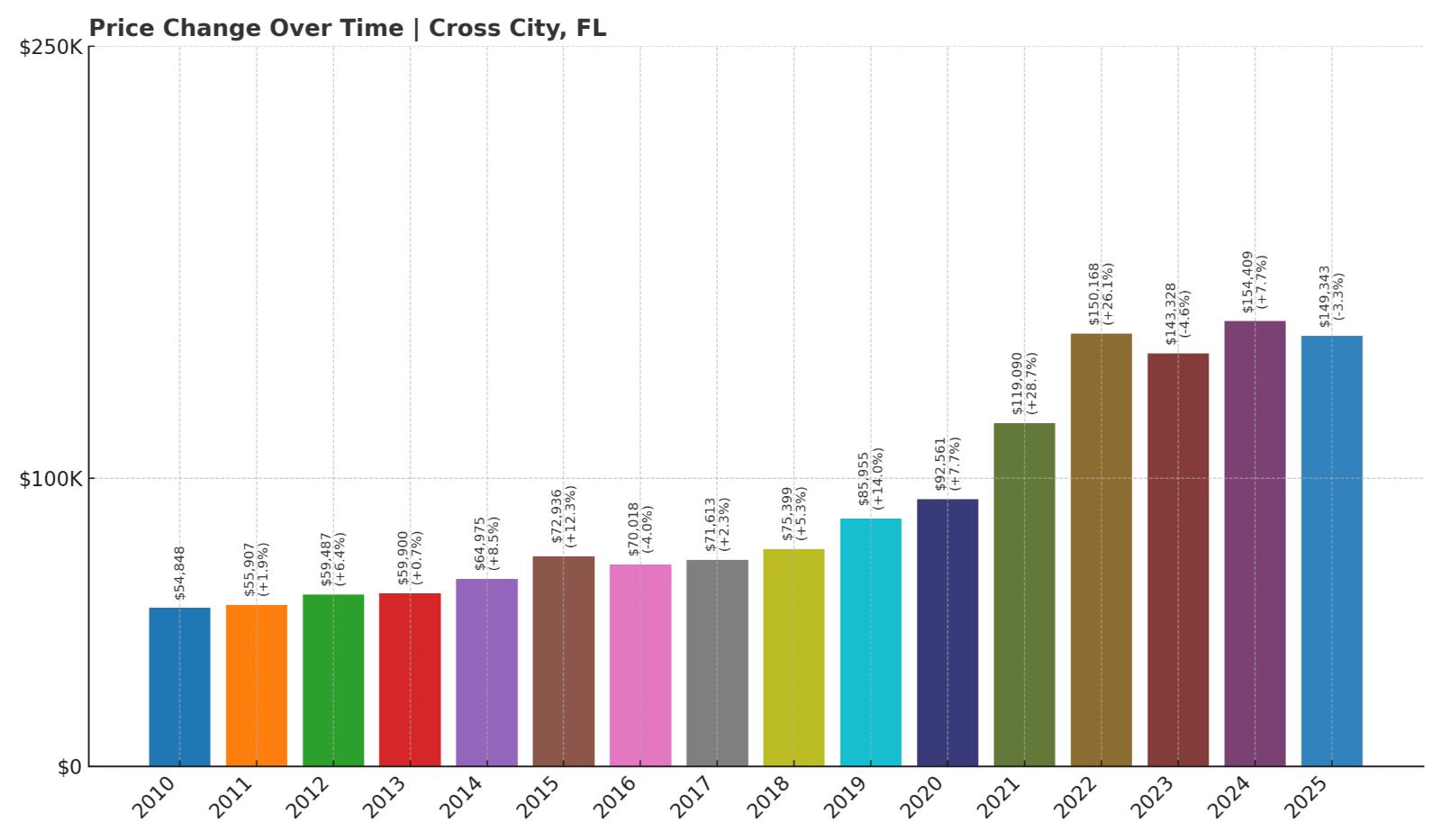

9. Cross City – 172% Home Price Increase Since 2010

- 2010: $54,848

- 2011: $55,907 (+$1,059, +1.93% from previous year)

- 2012: $59,487 (+$3,581, +6.40% from previous year)

- 2013: $59,900 (+$412, +0.69% from previous year)

- 2014: $64,975 (+$5,075, +8.47% from previous year)

- 2015: $72,936 (+$7,962, +12.25% from previous year)

- 2016: $70,018 (-$2,919, -4.00% from previous year)

- 2017: $71,613 (+$1,595, +2.28% from previous year)

- 2018: $75,399 (+$3,786, +5.29% from previous year)

- 2019: $85,955 (+$10,556, +14.00% from previous year)

- 2020: $92,561 (+$6,606, +7.69% from previous year)

- 2021: $119,090 (+$26,529, +28.66% from previous year)

- 2022: $150,168 (+$31,078, +26.10% from previous year)

- 2023: $143,328 (-$6,840, -4.56% from previous year)

- 2024: $154,409 (+$11,081, +7.73% from previous year)

- 2025: $149,343 (-$5,066, -3.28% from previous year)

Cross City saw a massive 172% jump in home prices from 2010 to 2025. Prices climbed especially fast during 2020–2022 but have since fluctuated, with modest declines in two of the last three years.

Cross City – Big Gains in Dixie County

As the seat of Dixie County, Cross City is a rural Gulf Coast community that has seen outsized growth in home values. Its proximity to natural areas like the Lower Suwannee National Wildlife Refuge and low cost of living continue to attract attention.

While price drops in 2023 and 2025 signal market corrections, Cross City remains extremely affordable and appealing to those looking for a coastal-adjacent lifestyle without coastal prices.

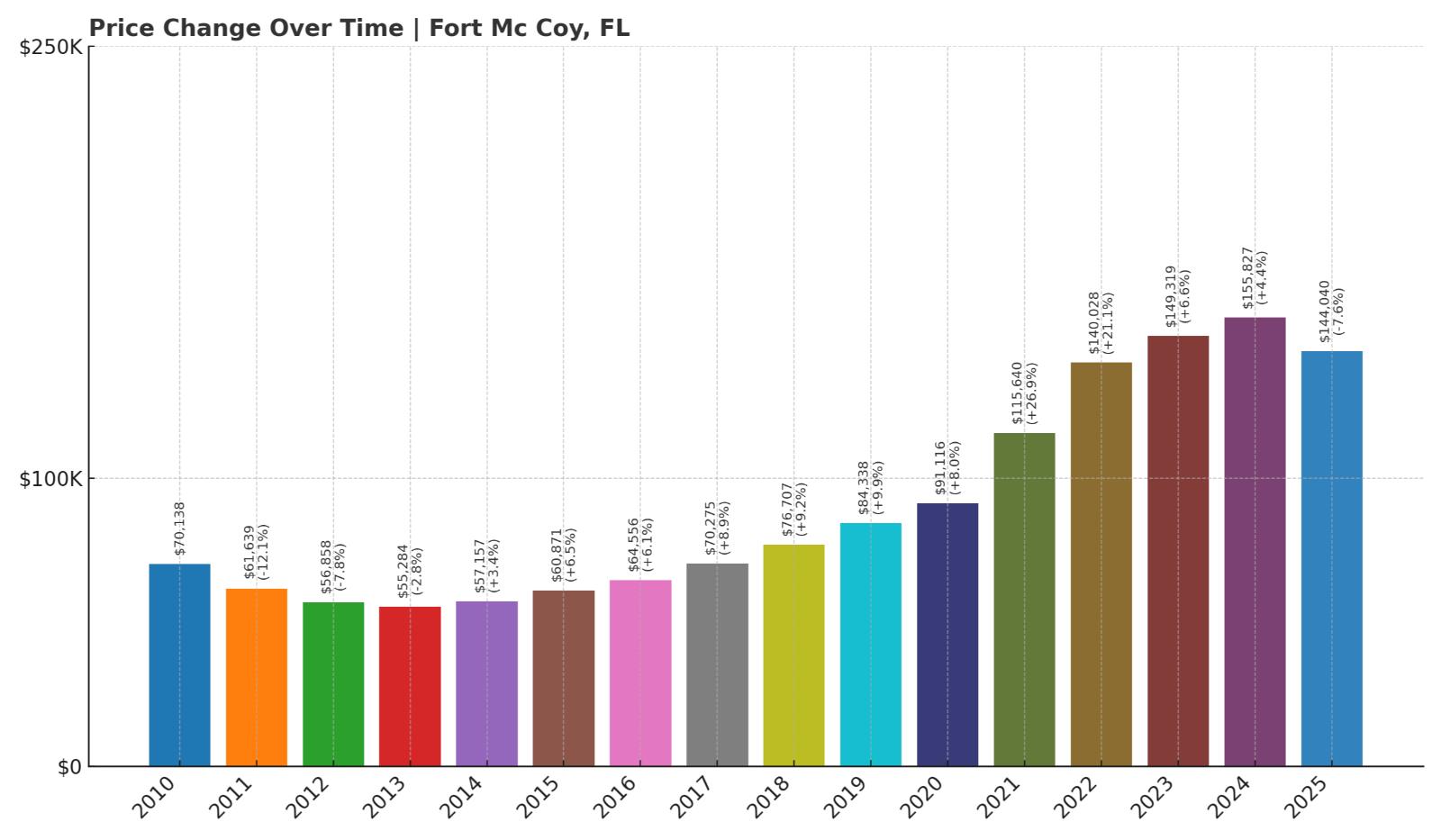

8. Fort Mc Coy – 105% Home Price Increase Since 2010

- 2010: $70,138

- 2011: $61,639 (-$8,499, -12.12% from previous year)

- 2012: $56,858 (-$4,781, -7.76% from previous year)

- 2013: $55,284 (-$1,574, -2.77% from previous year)

- 2014: $57,157 (+$1,873, +3.39% from previous year)

- 2015: $60,871 (+$3,713, +6.50% from previous year)

- 2016: $64,556 (+$3,686, +6.05% from previous year)

- 2017: $70,275 (+$5,719, +8.86% from previous year)

- 2018: $76,707 (+$6,432, +9.15% from previous year)

- 2019: $84,338 (+$7,631, +9.95% from previous year)

- 2020: $91,116 (+$6,777, +8.04% from previous year)

- 2021: $115,640 (+$24,525, +26.92% from previous year)

- 2022: $140,028 (+$24,388, +21.09% from previous year)

- 2023: $149,319 (+$9,291, +6.63% from previous year)

- 2024: $155,827 (+$6,508, +4.36% from previous year)

- 2025: $144,040 (-$11,787, -7.56% from previous year)

Fort Mc Coy home values more than doubled over 15 years, climbing from about $70,000 in 2010 to over $144,000 in 2025. The biggest increases came between 2020 and 2022, with prices surging by more than 48% over just two years. A notable decline in 2025 reflects a broader cooling trend after the rapid gains.

Fort Mc Coy – Rural Growth in Central Florida’s Forest Belt

Located in northeastern Marion County, Fort Mc Coy sits on the edge of the Ocala National Forest. Known for its deep woods, freshwater springs, and outdoor lifestyle, the area has attracted those seeking seclusion, affordability, and access to nature. It’s not a traditional suburban area, and that’s precisely the draw for many buyers.

During the post-2020 housing surge, the town saw major price increases driven by demand for rural homes. While the 2025 dip shows the market adjusting, Fort Mc Coy remains a desirable—and relatively low-cost—option for those prioritizing land and privacy over proximity to urban centers.

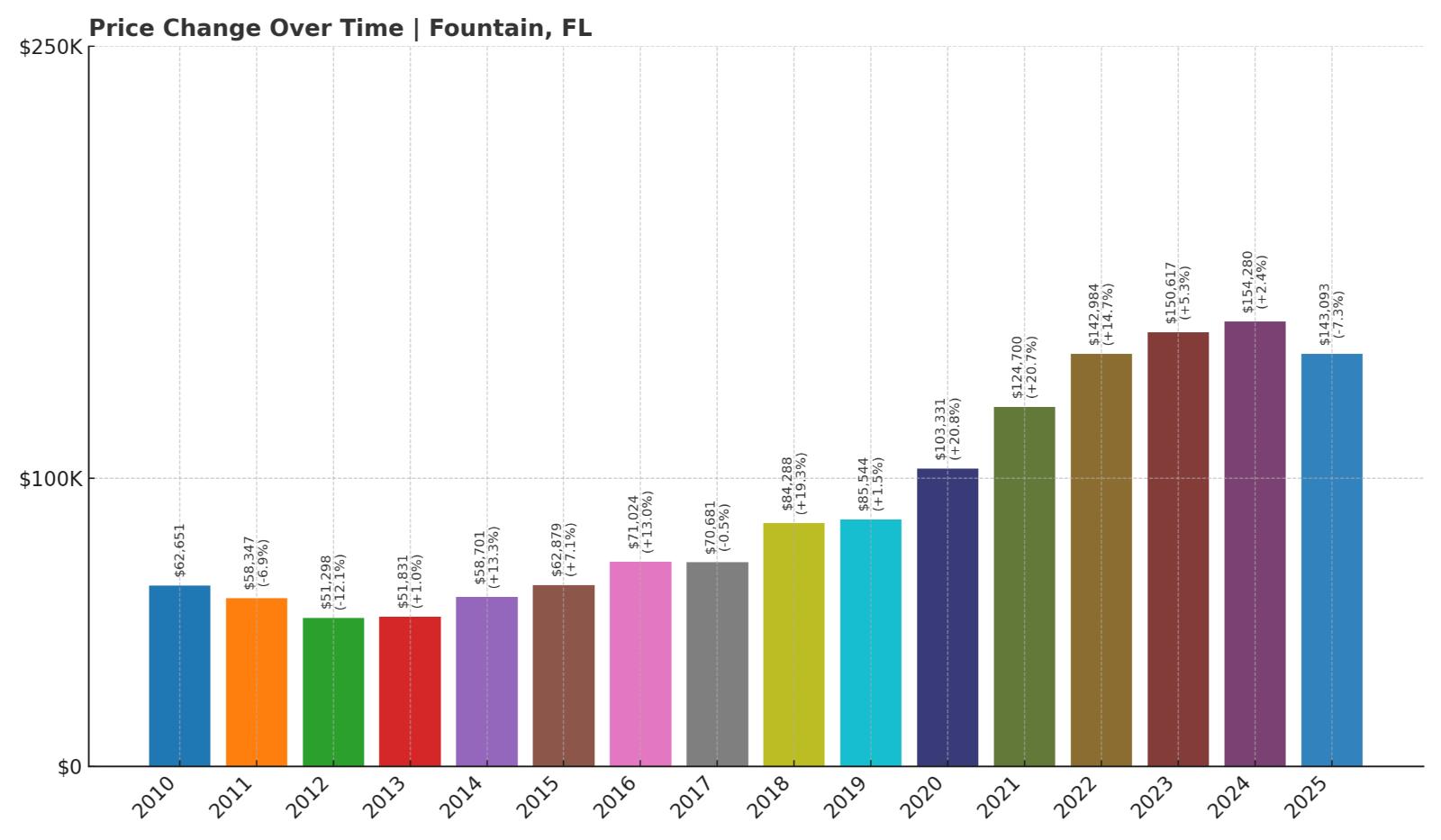

7. Fountain – 128% Home Price Increase Since 2010

- 2010: $62,651

- 2011: $58,347 (-$4,303, -6.87% from previous year)

- 2012: $51,298 (-$7,050, -12.08% from previous year)

- 2013: $51,831 (+$533, +1.04% from previous year)

- 2014: $58,701 (+$6,870, +13.25% from previous year)

- 2015: $62,879 (+$4,179, +7.12% from previous year)

- 2016: $71,024 (+$8,145, +12.95% from previous year)

- 2017: $70,681 (-$343, -0.48% from previous year)

- 2018: $84,288 (+$13,607, +19.25% from previous year)

- 2019: $85,544 (+$1,256, +1.49% from previous year)

- 2020: $103,331 (+$17,787, +20.79% from previous year)

- 2021: $124,700 (+$21,370, +20.68% from previous year)

- 2022: $142,984 (+$18,284, +14.66% from previous year)

- 2023: $150,617 (+$7,633, +5.34% from previous year)

- 2024: $154,280 (+$3,662, +2.43% from previous year)

- 2025: $143,093 (-$11,187, -7.25% from previous year)

Fountain’s typical home value has soared from about $63,000 in 2010 to just over $143,000 in 2025—a 128% increase. The steepest gains came from 2020 through 2022, when prices jumped by over $40,000. After peaking in 2024, prices dipped sharply in 2025, but still remain historically high.

Fountain – Big Swings in a Low-Density Market

Fountain is an unincorporated community in Bay County, northeast of Panama City. It sits near the intersection of US-231 and State Road 20, offering access to both the coast and interior Panhandle. The area is sparsely populated, with large lots and a rural feel that appeals to budget-conscious buyers wanting space without congestion.

The town’s dramatic home price rise during the pandemic years reflects broader interest in non-urban areas with development potential. The 2025 price drop may suggest overcorrection, but Fountain still offers some of the most affordable housing in the region, especially for those willing to drive a bit farther for services or coastlines.

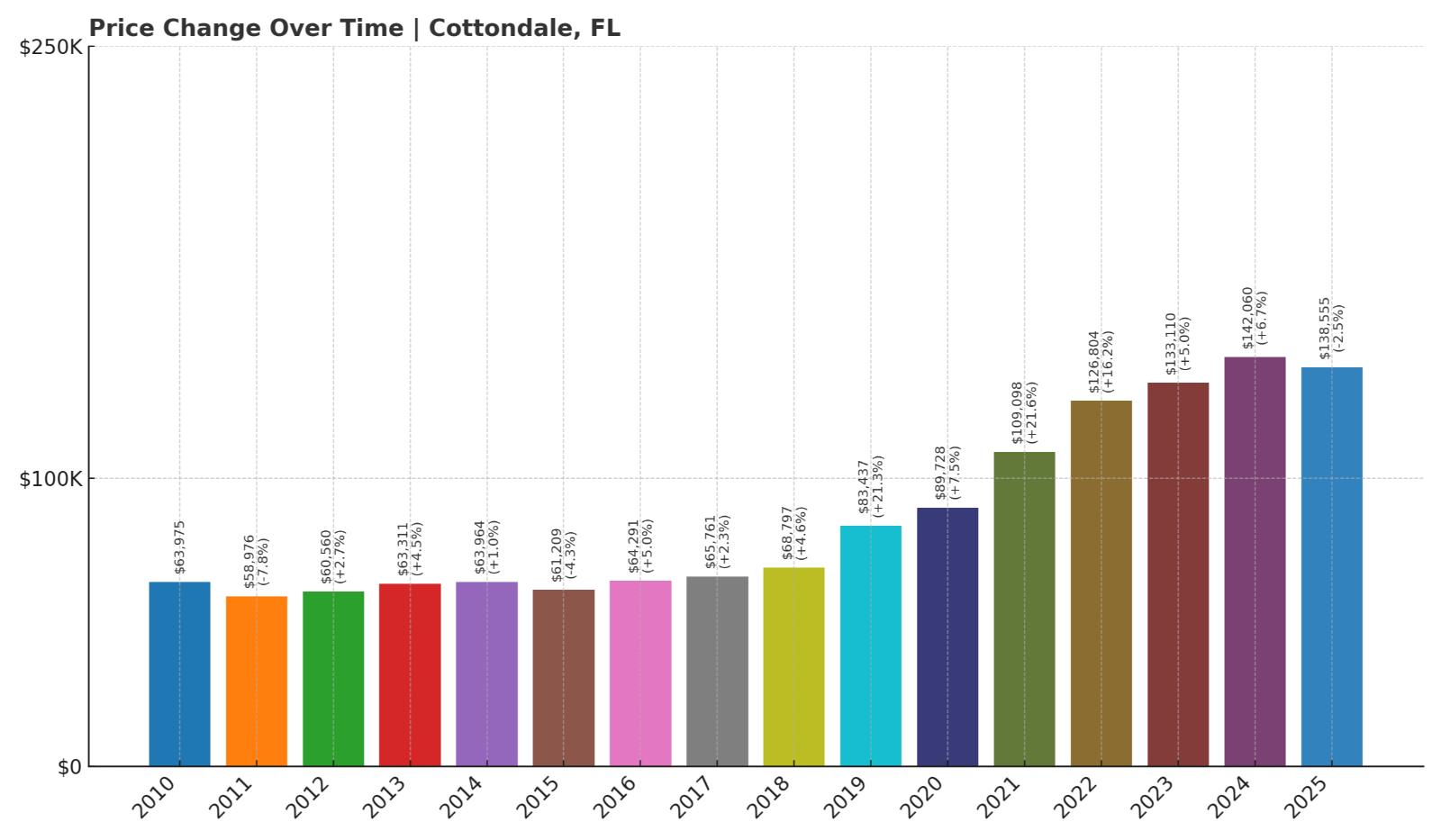

6. Cottondale – 117% Home Price Increase Since 2010

- 2010: $63,975

- 2011: $58,976 (-$4,999, -7.81% from previous year)

- 2012: $60,560 (+$1,585, +2.69% from previous year)

- 2013: $63,311 (+$2,751, +4.54% from previous year)

- 2014: $63,964 (+$653, +1.03% from previous year)

- 2015: $61,209 (-$2,756, -4.31% from previous year)

- 2016: $64,291 (+$3,082, +5.04% from previous year)

- 2017: $65,761 (+$1,470, +2.29% from previous year)

- 2018: $68,797 (+$3,036, +4.62% from previous year)

- 2019: $83,437 (+$14,640, +21.28% from previous year)

- 2020: $89,728 (+$6,291, +7.54% from previous year)

- 2021: $109,098 (+$19,370, +21.59% from previous year)

- 2022: $126,804 (+$17,706, +16.23% from previous year)

- 2023: $133,110 (+$6,306, +4.97% from previous year)

- 2024: $142,060 (+$8,950, +6.72% from previous year)

- 2025: $138,555 (-$3,505, -2.47% from previous year)

Home values in Cottondale have more than doubled since 2010, increasing from around $64,000 to nearly $139,000. The biggest price gains came between 2019 and 2022. While 2025 brought a small decline, the long-term trend still shows solid growth.

Cottondale – Small-Town Growth in Jackson County

Cottondale is a quiet town near I-10 in Jackson County, offering convenient access to Panama City and Tallahassee while maintaining its rural character. It’s a modest, working-class community where housing remains accessible, and prices have appreciated steadily in recent years.

Its affordability, paired with reasonable proximity to larger cities, has made it a practical choice for homebuyers looking for value. With typical home prices below $140,000, Cottondale continues to offer one of the most accessible markets in Florida.

5. Malone – 76% Home Price Increase Since 2010

Would you like to save this?

- 2010: $74,344

- 2011: $68,752 (-$5,592, -7.52% from previous year)

- 2012: $67,641 (-$1,111, -1.62% from previous year)

- 2013: $67,531 (-$110, -0.16% from previous year)

- 2014: $64,000 (-$3,530, -5.23% from previous year)

- 2015: $65,139 (+$1,139, +1.78% from previous year)

- 2016: $68,562 (+$3,423, +5.26% from previous year)

- 2017: $75,031 (+$6,469, +9.43% from previous year)

- 2018: $74,371 (-$660, -0.88% from previous year)

- 2019: $81,744 (+$7,373, +9.91% from previous year)

- 2020: $87,490 (+$5,746, +7.03% from previous year)

- 2021: $108,371 (+$20,882, +23.87% from previous year)

- 2022: $124,653 (+$16,282, +15.02% from previous year)

- 2023: $129,604 (+$4,951, +3.97% from previous year)

- 2024: $135,446 (+$5,842, +4.51% from previous year)

- 2025: $130,879 (-$4,567, -3.37% from previous year)

Malone’s home values are up more than 75% since 2010, with some of the strongest growth occurring in 2021 and 2022. The last year brought a small decline, but overall prices have remained well above historical levels.

Malone – Agricultural Affordability Near the Georgia Border

Malone is a tiny town located in the northeast corner of Jackson County, not far from the Georgia line. Known for farming, sports, and its close-knit community, Malone has long been one of the most affordable places to own property in the region.

The recent home price surge was driven in part by broader statewide trends and demand for lower-cost housing. Even after a modest drop in 2025, homes in Malone still average just over $130,000, making it one of the best values in Florida for buyers seeking space and stability in a rural setting.

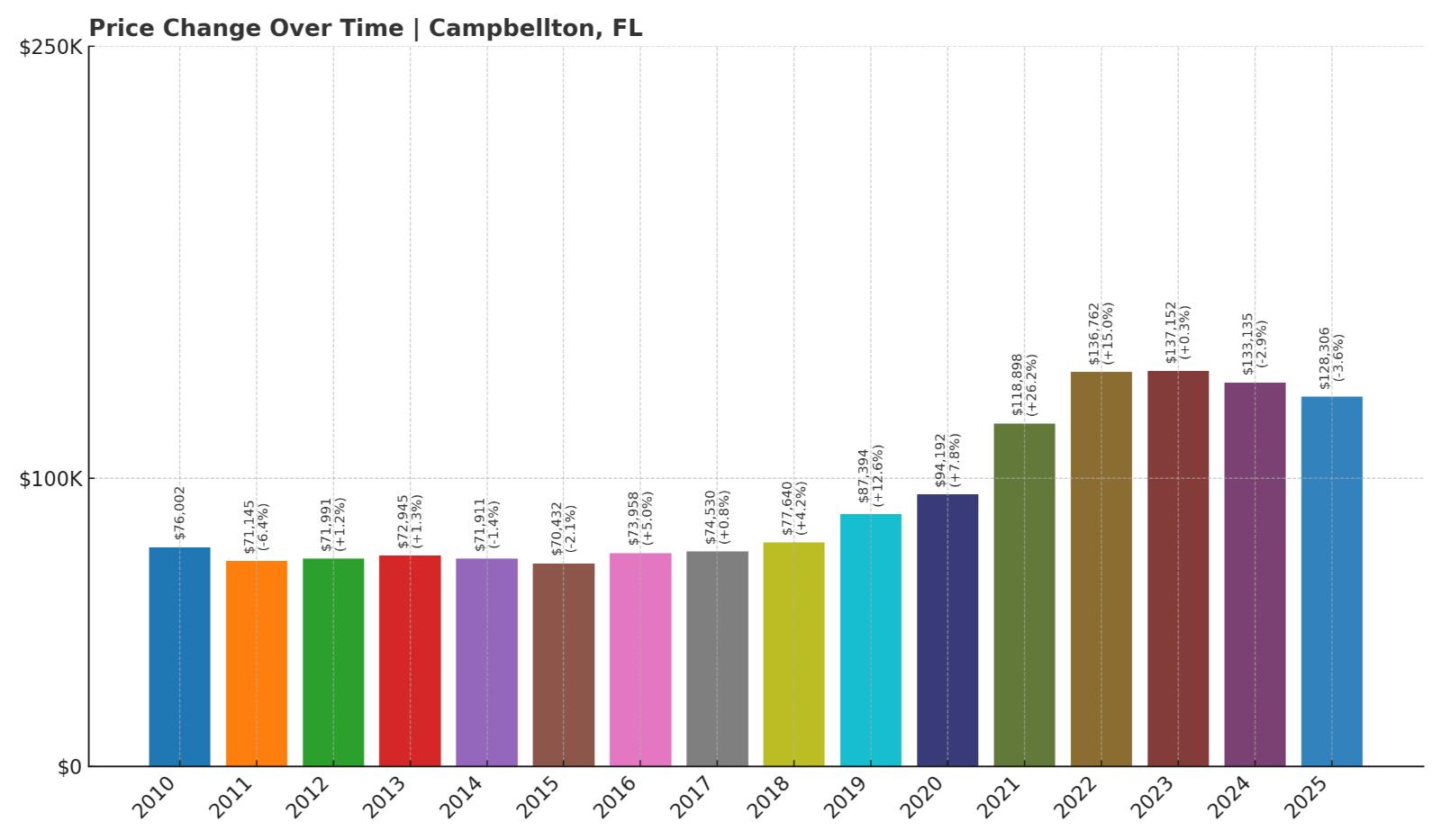

4. Campbellton – 69% Home Price Increase Since 2010

- 2010: $76,002

- 2011: $71,145 (-$4,857, -6.39% from previous year)

- 2012: $71,991 (+$846, +1.19% from previous year)

- 2013: $72,945 (+$955, +1.33% from previous year)

- 2014: $71,911 (-$1,034, -1.42% from previous year)

- 2015: $70,432 (-$1,479, -2.06% from previous year)

- 2016: $73,958 (+$3,526, +5.01% from previous year)

- 2017: $74,530 (+$573, +0.77% from previous year)

- 2018: $77,640 (+$3,110, +4.17% from previous year)

- 2019: $87,394 (+$9,754, +12.56% from previous year)

- 2020: $94,192 (+$6,798, +7.78% from previous year)

- 2021: $118,898 (+$24,706, +26.23% from previous year)

- 2022: $136,762 (+$17,863, +15.02% from previous year)

- 2023: $137,152 (+$391, +0.29% from previous year)

- 2024: $133,135 (-$4,017, -2.93% from previous year)

- 2025: $128,306 (-$4,829, -3.63% from previous year)

Home prices in Campbellton are up nearly 70% since 2010. After a major spike in 2021 and 2022, prices have dipped slightly the past two years. The 2025 value remains well above pre-pandemic levels, at just over $128,000.

Campbellton – Tiny Town, Strong Price Growth

Campbellton is one of Florida’s smallest towns, located in the rural northwest corner of Jackson County near the Alabama border. Its low housing density and open farmland have helped maintain affordability while still offering room for growth. With limited housing inventory, even modest market interest can influence prices.

Prices surged in 2021 as buyers looked farther afield for bargains, and while the past two years have brought declines, values remain historically high. For buyers prioritizing low cost and rural quiet, Campbellton remains one of Florida’s most affordable choices.

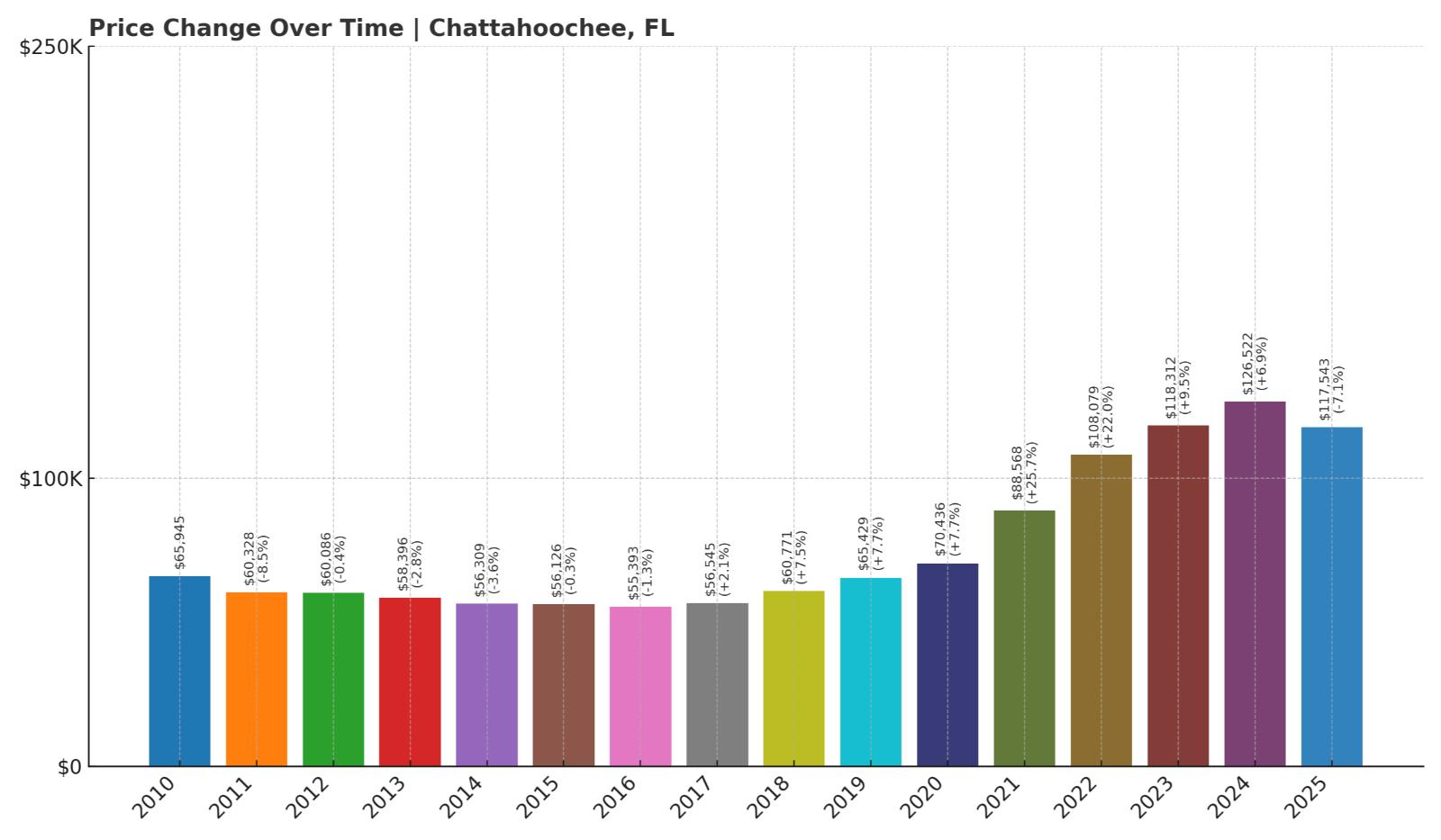

3. Chattahoochee – 78% Home Price Increase Since 2010

- 2010: $65,945

- 2011: $60,328 (-$5,618, -8.52% from previous year)

- 2012: $60,086 (-$242, -0.40% from previous year)

- 2013: $58,396 (-$1,690, -2.81% from previous year)

- 2014: $56,309 (-$2,087, -3.57% from previous year)

- 2015: $56,126 (-$183, -0.33% from previous year)

- 2016: $55,393 (-$732, -1.30% from previous year)

- 2017: $56,545 (+$1,151, +2.08% from previous year)

- 2018: $60,771 (+$4,226, +7.47% from previous year)

- 2019: $65,429 (+$4,658, +7.66% from previous year)

- 2020: $70,436 (+$5,007, +7.65% from previous year)

- 2021: $88,568 (+$18,132, +25.74% from previous year)

- 2022: $108,079 (+$19,511, +22.03% from previous year)

- 2023: $118,312 (+$10,234, +9.47% from previous year)

- 2024: $126,522 (+$8,209, +6.94% from previous year)

- 2025: $117,543 (-$8,978, -7.10% from previous year)

Chattahoochee’s home prices climbed steadily after years of stagnation, jumping nearly 80% since 2010. Most of the growth came after 2020, with a correction in 2025 that brought values slightly down to around $117,500.

Chattahoochee – A River Town on the Rise

Perched along the Apalachicola River in Gadsden County, Chattahoochee is steeped in history and known for its riverfront charm and scenic setting. It’s one of the few towns in this ranking to show real estate value growth after a long flat period.

The town’s proximity to both Alabama and Georgia, along with state parks and natural landscapes, have made it more attractive in recent years. Despite the recent drop, prices remain much higher than a decade ago—and homes still cost well below the Florida average.

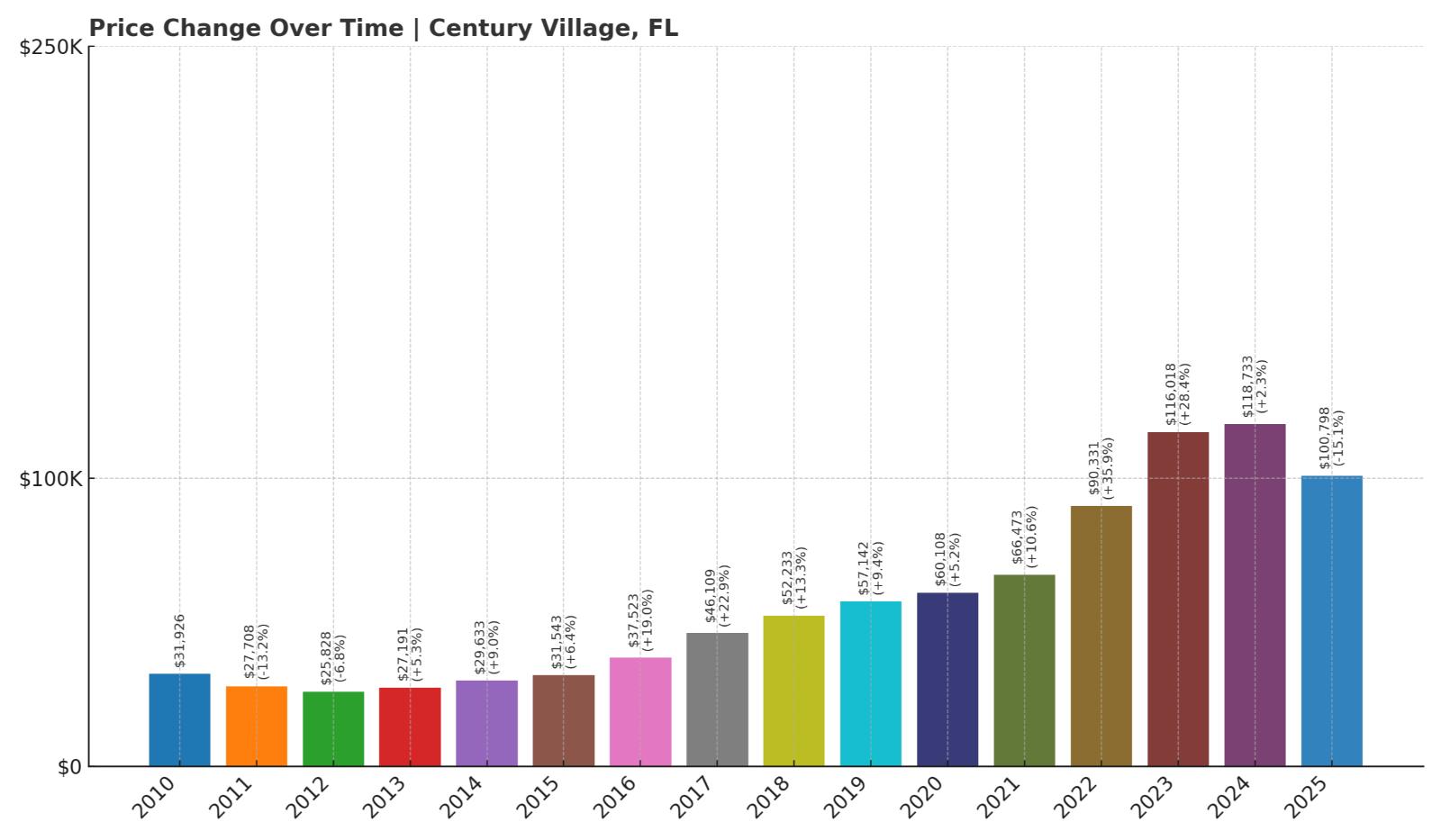

2. Century Village – 216% Home Price Increase Since 2010

- 2010: $31,926

- 2011: $27,708 (-$4,218, -13.21% from previous year)

- 2012: $25,828 (-$1,880, -6.79% from previous year)

- 2013: $27,191 (+$1,364, +5.28% from previous year)

- 2014: $29,633 (+$2,442, +8.98% from previous year)

- 2015: $31,543 (+$1,910, +6.44% from previous year)

- 2016: $37,523 (+$5,980, +18.96% from previous year)

- 2017: $46,109 (+$8,586, +22.88% from previous year)

- 2018: $52,233 (+$6,124, +13.28% from previous year)

- 2019: $57,142 (+$4,909, +9.40% from previous year)

- 2020: $60,108 (+$2,966, +5.19% from previous year)

- 2021: $66,473 (+$6,365, +10.59% from previous year)

- 2022: $90,331 (+$23,859, +35.89% from previous year)

- 2023: $116,018 (+$25,687, +28.44% from previous year)

- 2024: $118,733 (+$2,714, +2.34% from previous year)

- 2025: $100,798 (-$17,935, -15.11% from previous year)

Century Village experienced explosive growth in home values, soaring by over 215% since 2010. Most of that increase came after 2016, peaking in 2023. Prices corrected sharply in 2025, but the typical home still costs more than triple what it did 15 years ago.

Century Village – South Florida’s Condo Bargain

Century Village is a retirement-focused community in Palm Beach County. Its appeal comes from modestly priced condos and a wide range of amenities tailored to older adults, including shuttle service, fitness centers, pools, and social activities.

During the housing rush of 2021–2023, the area became a hot spot for buyers seeking affordable South Florida living. Although 2025 brought a sharp correction, prices remain well above pre-pandemic levels, keeping Century Village one of the cheapest options in Palm Beach County.

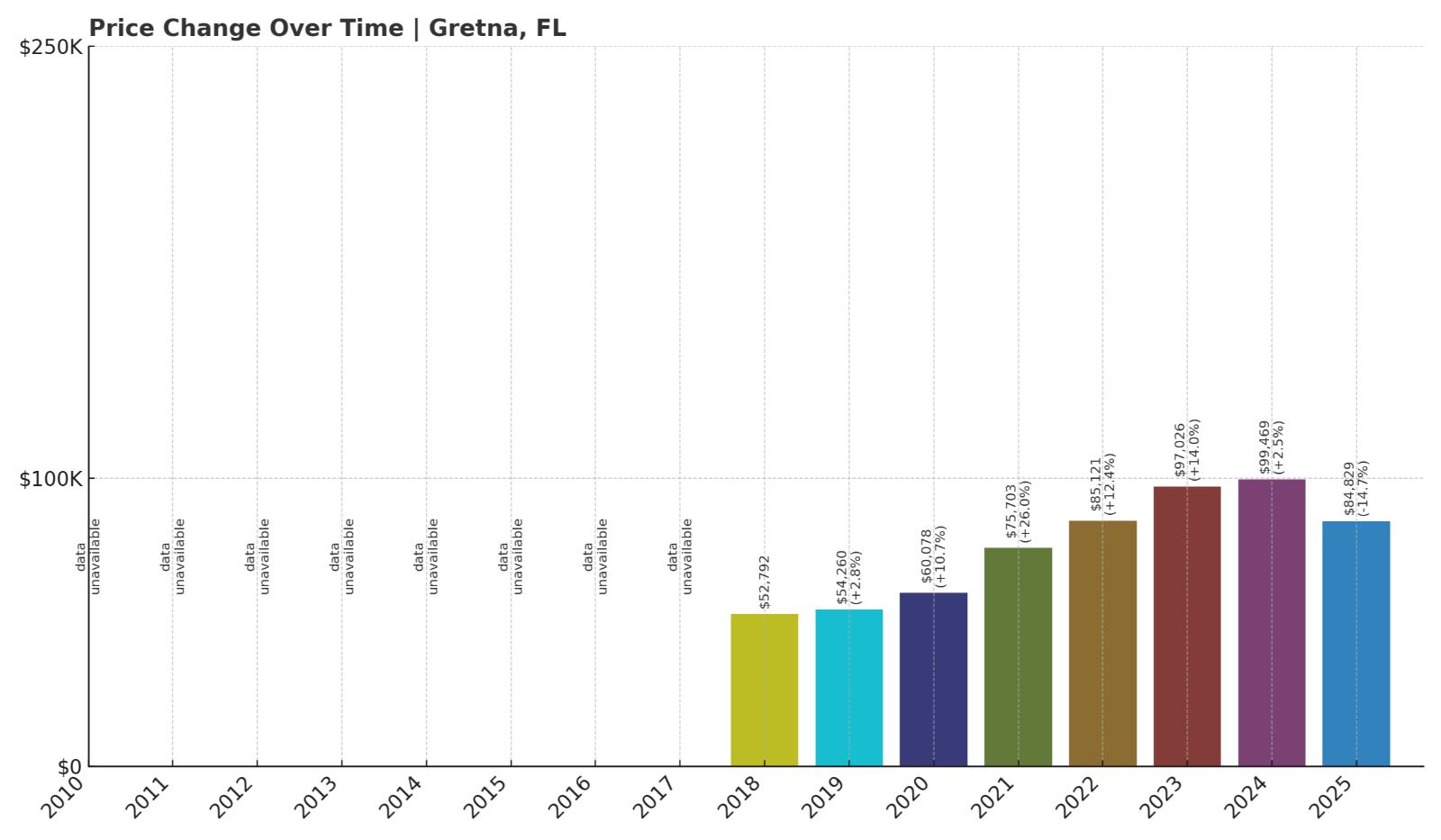

1. Gretna – 61% Home Price Increase Since 2018

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: $52,792

- 2019: $54,260 (+$1,468, +2.78% from previous year)

- 2020: $60,078 (+$5,818, +10.72% from previous year)

- 2021: $75,703 (+$15,625, +26.01% from previous year)

- 2022: $85,121 (+$9,418, +12.44% from previous year)

- 2023: $97,026 (+$11,905, +13.99% from previous year)

- 2024: $99,469 (+$2,443, +2.52% from previous year)

- 2025: $84,829 (-$14,640, -14.72% from previous year)

Gretna saw a steep rise in home values after 2018, with prices increasing by over 60% through 2025. The town experienced large year-over-year gains through 2023 before falling significantly in 2025. Despite that drop, homes here remain the cheapest in Florida.

Gretna – Florida’s Most Affordable Town

Gretna is a small city in Gadsden County, just west of Quincy. With deep roots in agriculture and a tight-knit community, it offers an affordable lifestyle within driving distance of Tallahassee. Despite its proximity to the capital, Gretna has kept prices remarkably low.

The 2025 price decline may reflect national trends and local market corrections, but with typical home values under $85,000, Gretna tops the list as the most affordable town in Florida. For budget-conscious buyers seeking rural quiet near city resources, it’s hard to beat.