Would you like to save this?

Florida’s real estate market, once the darling of rapid growth, is showing signs of strain in several communities. According to the latest Zillow Home Value Index, 15 towns across the Sunshine State are exhibiting classic indicators of an impending price correction. Our comprehensive analysis, spanning 15 years of housing data, evaluates five critical risk factors: historical crash patterns, current overextension above long-term averages, price volatility, recent growth momentum, and prevailing market conditions.

These towns aren’t just experiencing minor fluctuations; they’re flashing warning signs reminiscent of past downturns. From escalating insurance premiums and rising inventories to affordability challenges and regulatory changes, multiple forces are converging to create potential vulnerabilities in these markets. Whether you’re a prospective buyer, investor, or homeowner, understanding these risks is crucial in navigating Florida’s evolving housing landscape.

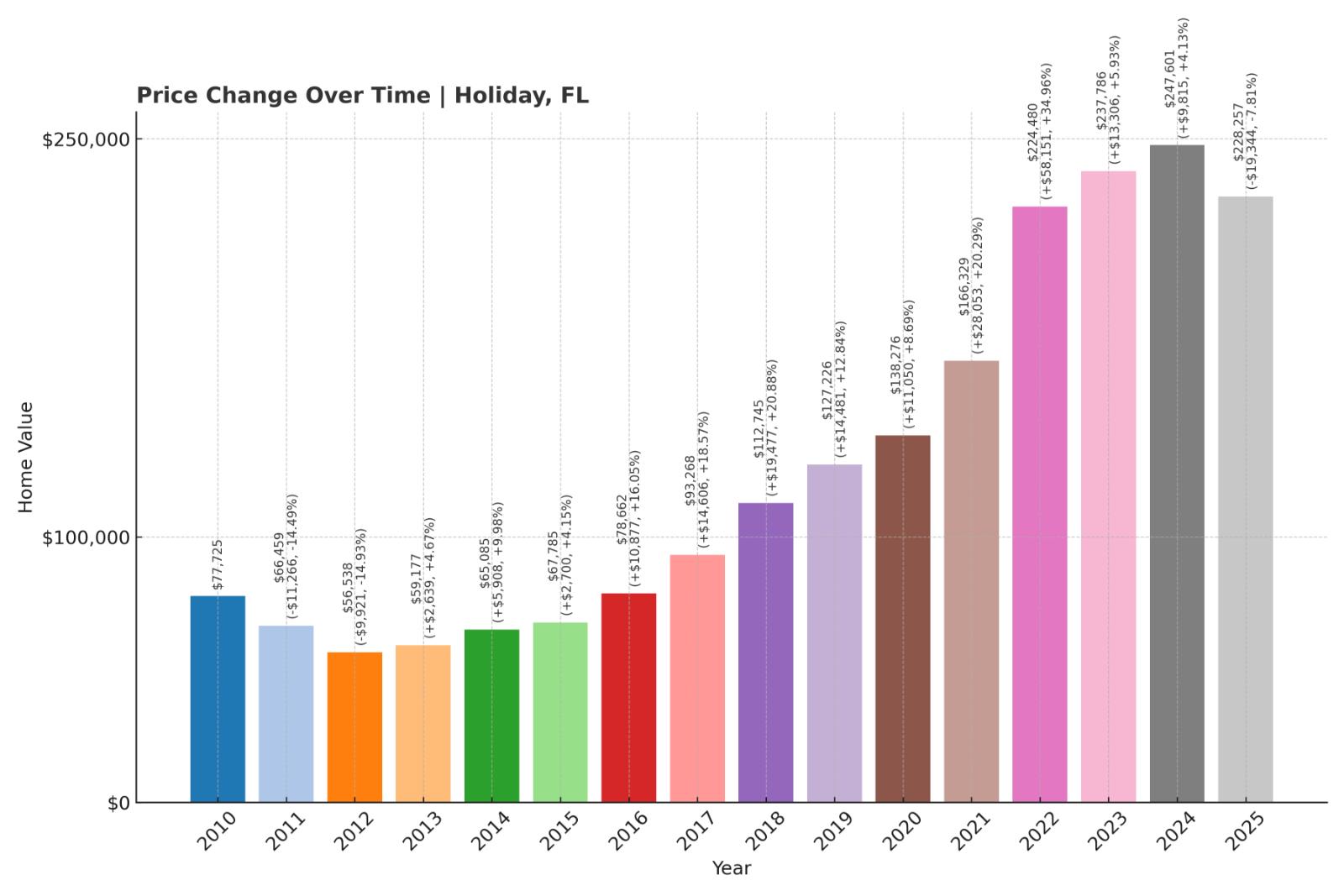

15. Holiday – Crash Risk Percentage: 64.67%

- Crash Risk Percentage: 64.67%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 14.9% (2012)

- Total price increase since 2010: 193.7%

- Overextended above long-term average: 78.4%

- Price volatility (annual swings): 13.1%

- Current 2025 price: $228,257

Holiday sits in Pasco County north of Tampa Bay, where home values have nearly tripled since 2010 despite experiencing two significant crashes totaling more than 8% each. The town’s 78.4% overextension above its long-term average signals dangerous territory for homeowners, especially given its history of volatile swings. This coastal community’s proximity to the Gulf makes it vulnerable to hurricane damage, adding insurance cost pressures that could accelerate price corrections.

Holiday – Repeat Crash Pattern Creates New Vulnerability

Holiday’s housing market demonstrates a troubling pattern of boom-and-bust cycles that historically repeat themselves every 8-10 years. The town experienced its worst crash in 2012 with a 14.9% drop, followed by another significant decline, establishing it as a “repeat offender” in housing corrections. Current prices at $228,257 represent a staggering 193.7% increase since 2010, far outpacing wage growth in this working-class community where many residents commute to Tampa for employment.

The mathematical unsustainability becomes clear when examining Holiday’s fundamentals: local median household income hovers around $45,000, making the current home prices unaffordable for most area workers. Rising insurance costs have become a major factor limiting demand, with hurricane risk driving annual premiums well above state averages. This affordability crisis, combined with the town’s documented history of significant price corrections, creates a perfect storm for another substantial decline.

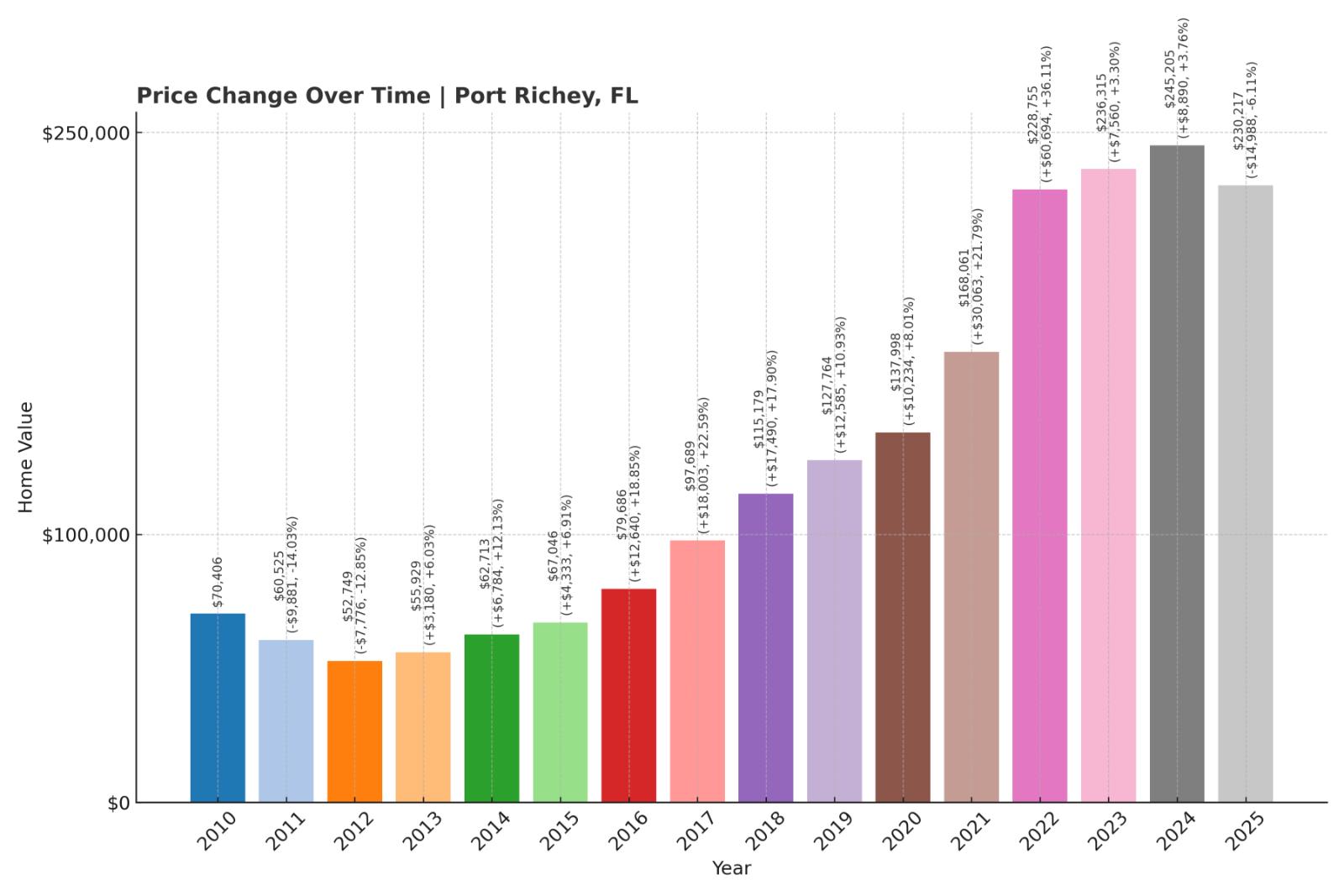

14. Port Richey – Crash Risk Percentage: 65.67%

- Crash Risk Percentage: 65.67%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 14.0% (2011)

- Total price increase since 2010: 227.0%

- Overextended above long-term average: 80.9%

- Price volatility (annual swings): 13.1%

- Current 2025 price: $230,217

Port Richey represents one of Pasco County’s most overextended markets, with prices sitting 80.9% above sustainable long-term trends. This small city along the Pithlachascotee River has seen home values more than triple since 2010, creating an affordability gap that threatens market stability. The town’s waterfront location brings both appeal and risk, with flood insurance requirements adding substantial costs for buyers.

Port Richey – Waterfront Premiums Face Reality Check

Port Richey’s positioning along Florida’s Nature Coast attracted pandemic-era buyers seeking affordable waterfront living, but the 227% price surge since 2010 has priced out most local buyers. The city’s modest size—just over 2,800 residents—means limited inventory absorption capacity when demand softens. Recent data shows homes taking longer to sell as buyers balk at prices that have disconnected from local economic fundamentals.

The town’s crash risk intensifies due to its dependence on external buyers rather than local demand. Florida’s net domestic migration fell to +64K in 2024, compared to +314K in 2022, removing the out-of-state buyer pool that drove recent gains. With 14% annual volatility historically and two previous crashes exceeding 8%, Port Richey exhibits the classic warning signs of markets that experience sharp corrections when external demand disappears.

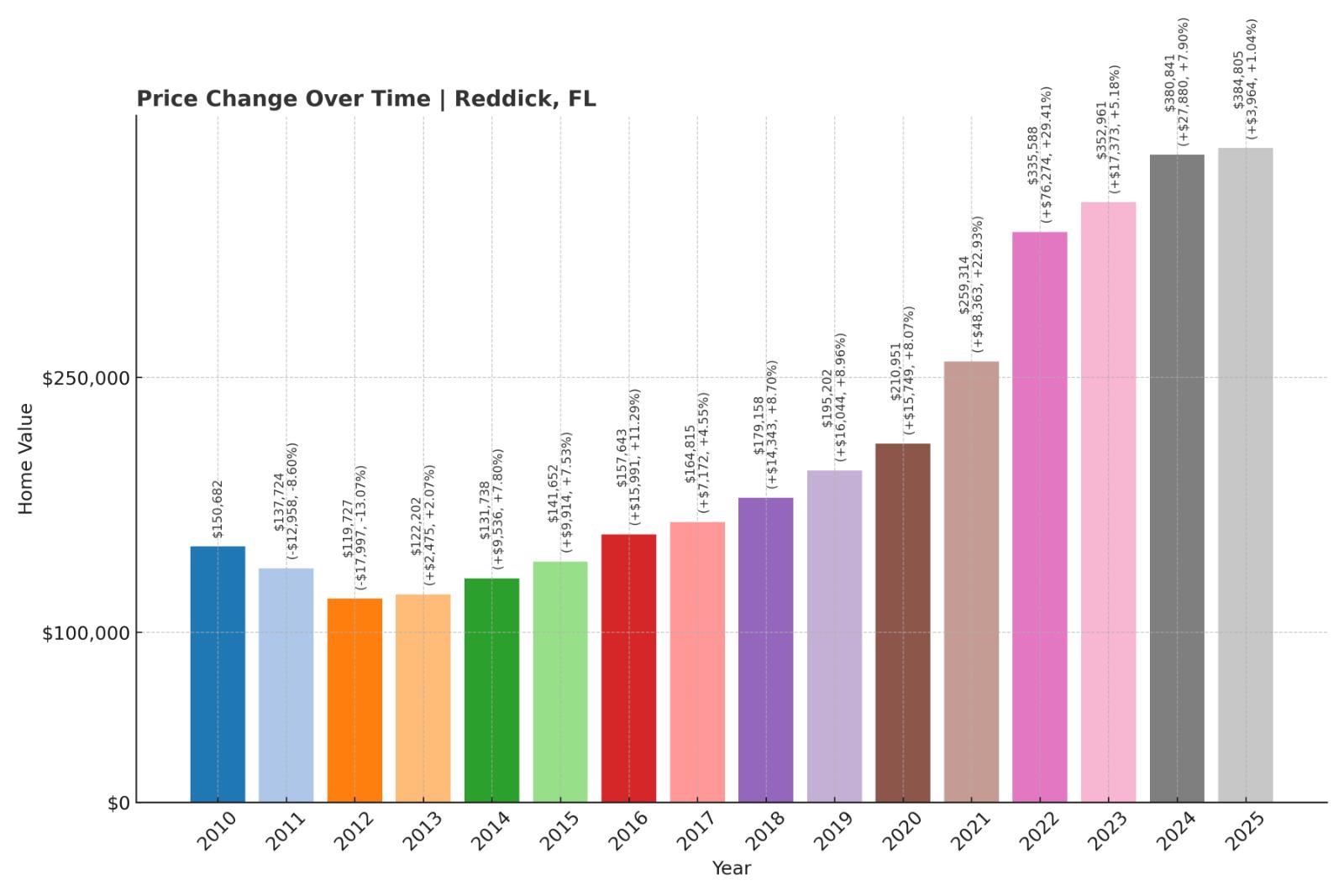

13. Reddick – Crash Risk Percentage: 66.10%

- Crash Risk Percentage: 66.10%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 13.1% (2012)

- Total price increase since 2010: 155.4%

- Overextended above long-term average: 79.8%

- Price volatility (annual swings): 10.0%

- Current 2025 price: $384,805

Reddick, a rural Marion County community known for horse farms and agricultural land, has experienced dramatic gentrification as buyers flee higher-priced markets. The 155% price increase since 2010 represents a fundamental shift from an agricultural economy to residential development, but current prices near $385,000 far exceed local purchasing power. This small town’s limited job base and rural infrastructure strain under residential pressure.

Reddick – Rural Gentrification Hits Affordability Wall

Reddick’s transformation from agricultural community to residential enclave occurred rapidly during the pandemic housing boom, with city buyers seeking rural tranquility driving prices beyond sustainable levels. The town’s location between Gainesville and Ocala attracted commuters, but current median prices approaching $385,000 create impossible math for most area residents whose incomes remain tied to agricultural and service sectors.

The vulnerability stems from Reddick’s narrow economic base and limited infrastructure to support continued residential growth. Markets that experienced 70-90% price increases since the pandemic become extremely vulnerable when conditions shift. With 79.8% overextension above long-term trends and a history of significant corrections, Reddick faces the dual pressure of affordability constraints and infrastructure limitations that typically trigger price reversals in rapidly gentrified rural areas.

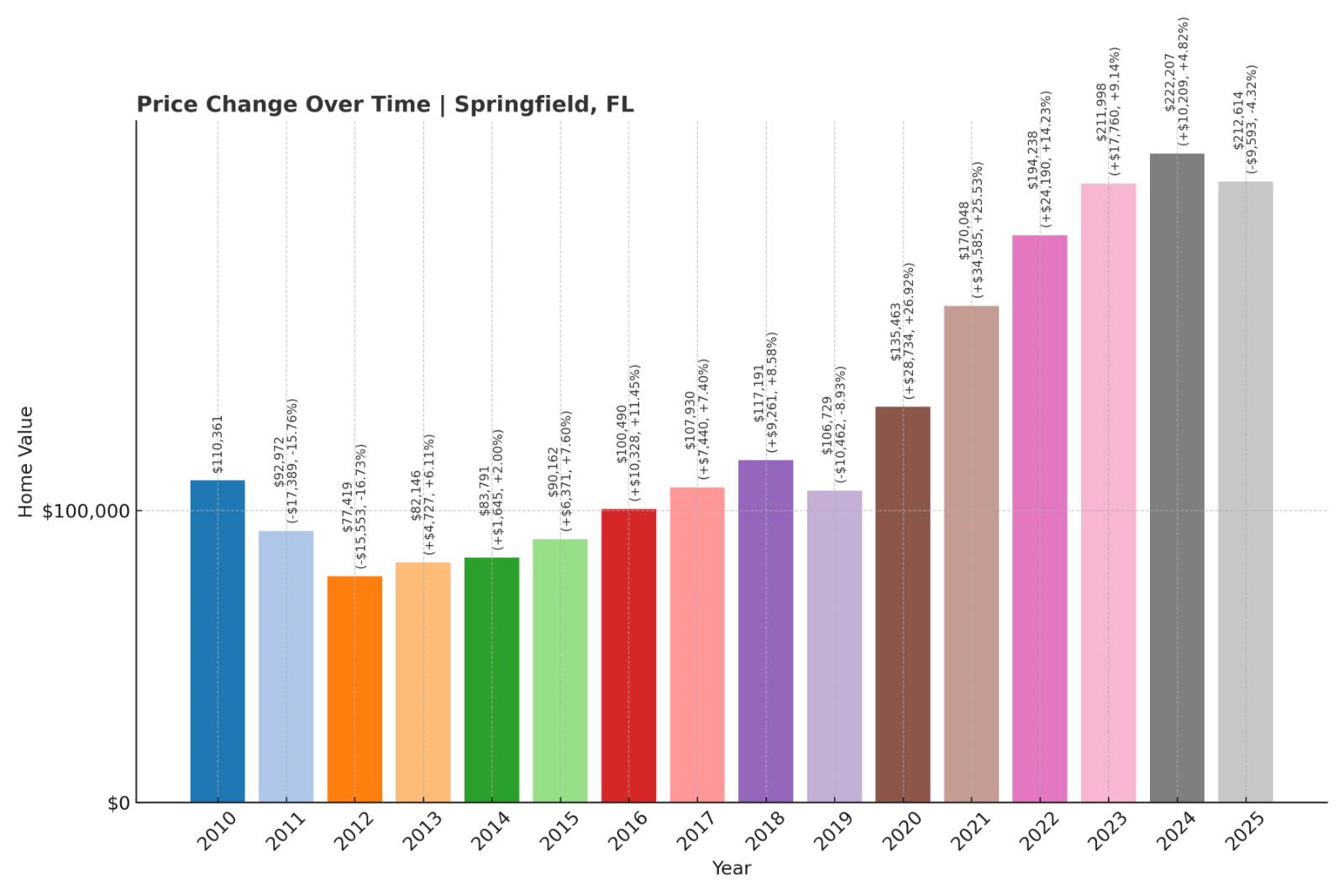

12. Springfield – Crash Risk Percentage: 66.18%

- Crash Risk Percentage: 66.18%

- Historical crashes (8%+ drops): 3

- Worst historical crash: 16.7% (2012)

- Total price increase since 2010: 92.7%

- Overextended above long-term average: 60.8%

- Price volatility (annual swings): 12.3%

- Current 2025 price: $212,614

Springfield in Bay County demonstrates the highest crash frequency on our list with three historical crashes exceeding 8%, including a devastating 16.7% drop in 2012. Despite being Florida’s most affordable market among our 15 towns, the 92.7% price growth since 2010 still outpaces local wage growth. This Panama City area community faces ongoing hurricane risk that adds insurance costs and periodic property damage.

Springfield – Hurricane Risk Amplifies Market Volatility

Springfield’s location near Panama City places it directly in Hurricane Alley, with recent storms like Hurricane Michael causing widespread property damage and insurance market disruption. The town’s 16.7% crash in 2012 represented one of Florida’s most severe housing corrections, demonstrating how quickly prices can collapse when external pressures mount. Current prices at $212,614, while relatively affordable, still represent nearly double 2010 levels in an area where median household incomes remain below $40,000.

The combination of hurricane risk, insurance market instability, and historical crash patterns creates multiple vulnerability layers. Home insurance premiums have jumped 33% nationally, but Florida homeowners have been hit even harder, with coastal areas like Springfield seeing insurance costs become unaffordable for many residents. This insurance crisis, combined with the area’s proven susceptibility to major price corrections, suggests another significant decline could occur when market conditions deteriorate.

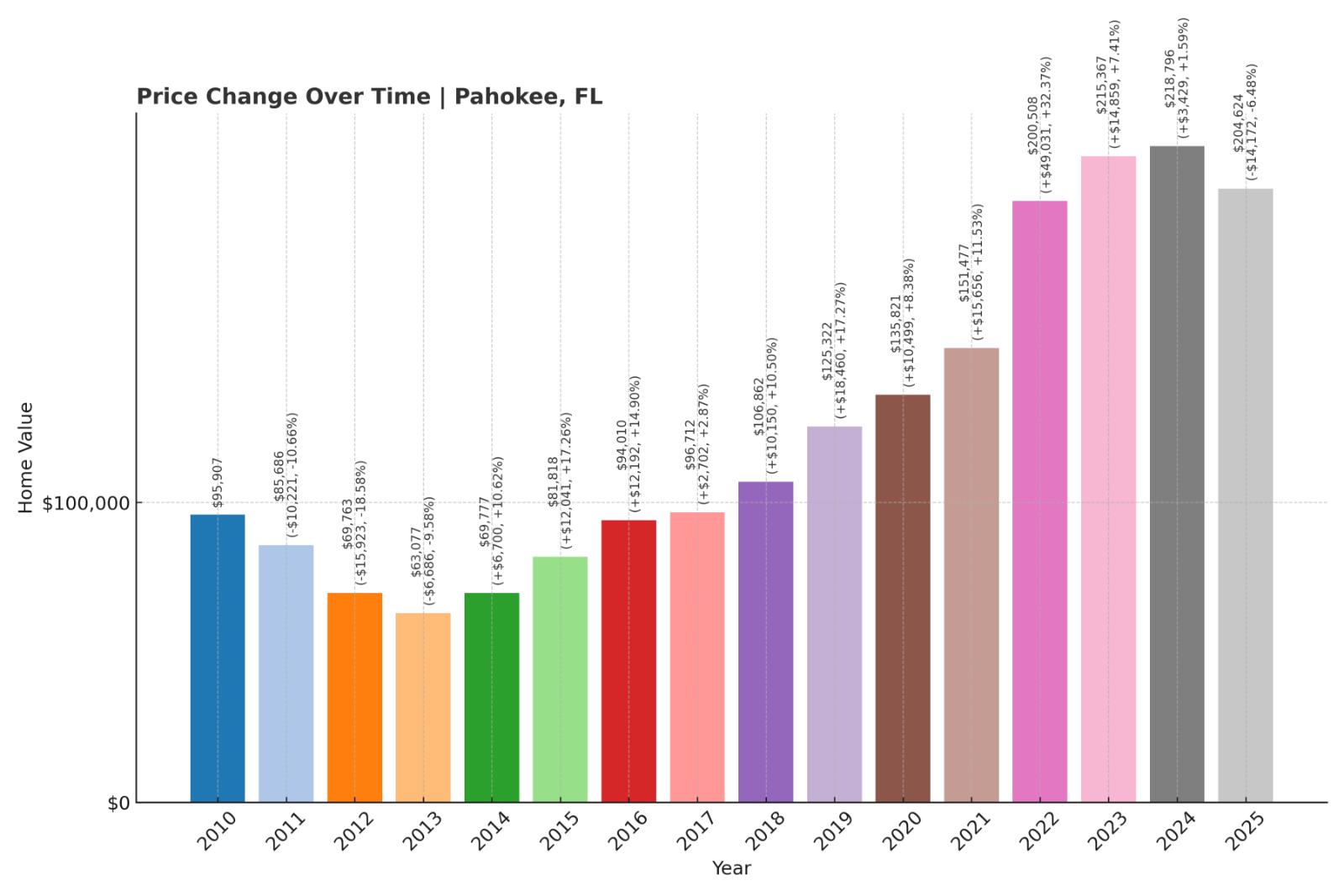

11. Pahokee – Crash Risk Percentage: 66.42%

- Crash Risk Percentage: 66.42%

- Historical crashes (8%+ drops): 3

- Worst historical crash: 18.6% (2012)

- Total price increase since 2010: 113.4%

- Overextended above long-term average: 62.4%

- Price volatility (annual swings): 12.7%

- Current 2025 price: $204,624

Pahokee on Lake Okeechobee’s eastern shore experienced Florida’s second-worst crash on our list with an 18.6% decline in 2012, yet prices have more than doubled since then. This small agricultural town of about 6,000 residents lacks the economic diversity to support sustained high home values. The rural location limits job opportunities while infrastructure constraints restrict development potential.

Pahokee – Agricultural Economy Struggles With Housing Speculation

Pahokee’s economy centers on agriculture and lake-related activities, providing limited high-paying employment to support current housing prices above $200,000. The town’s 18.6% crash in 2012 ranks among the most severe in Florida’s modern history, proving how quickly speculative bubbles can burst in small agricultural communities. Current prices representing 113% growth since 2010 create a disconnect between local wages and housing costs that historically precedes major corrections.

The Lake Okeechobee location brings both recreational appeal and flood risk, with federal water management decisions directly impacting property values. CoreLogic research identifies three Florida markets at “very high” risk—over 70% chance—of price declines in 2025, and Pahokee’s combination of economic vulnerability, disaster risk, and crash history places it among the state’s most precarious housing markets. The mathematical reality suggests prices must adjust downward to match local economic capacity.

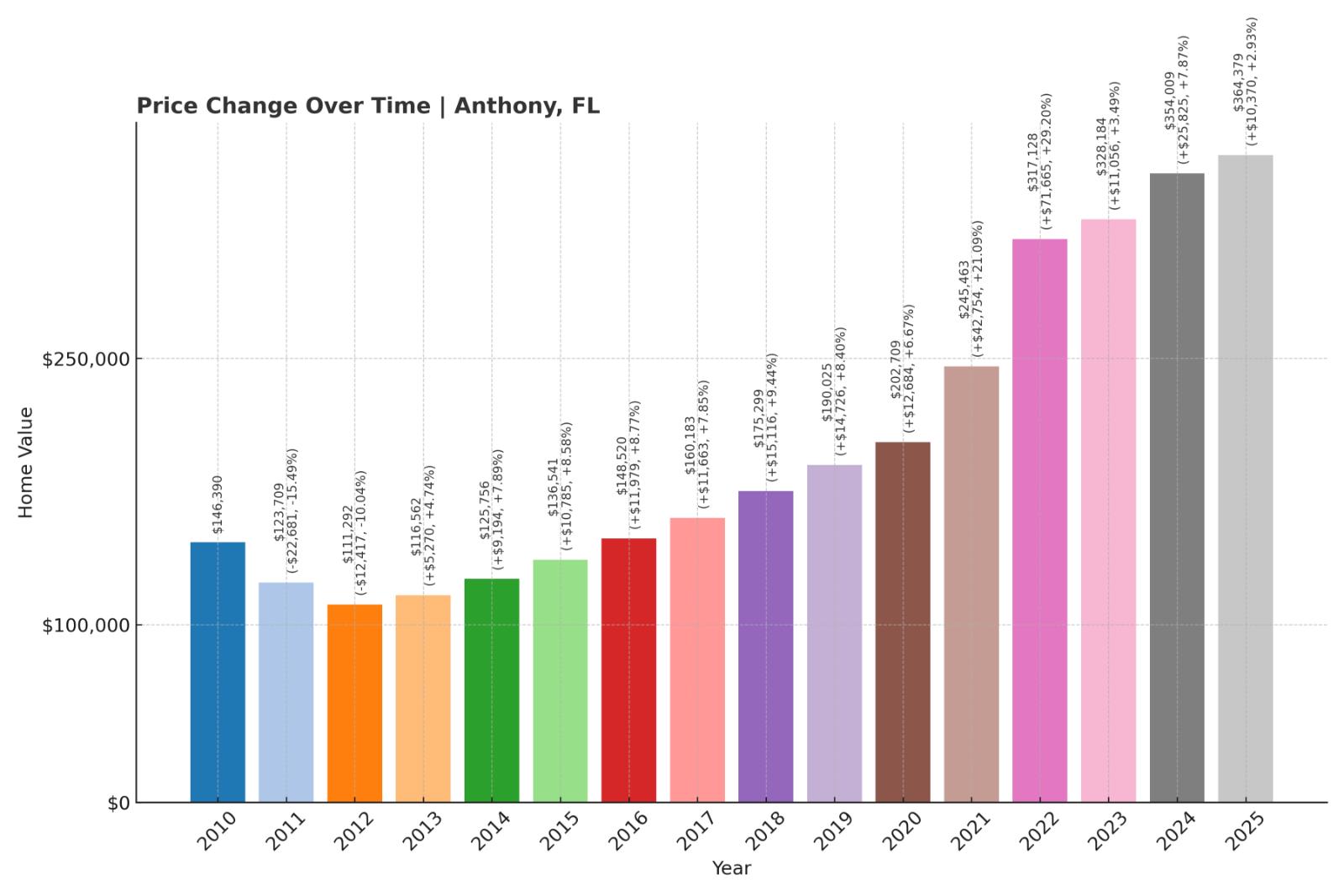

10. Anthony – Crash Risk Percentage: 66.84%

- Crash Risk Percentage: 66.84%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 15.5% (2011)

- Total price increase since 2010: 148.9%

- Overextended above long-term average: 79.6%

- Price volatility (annual swings): 10.1%

- Current 2025 price: $364,379

Anthony in Marion County has seen home values surge 148.9% since 2010, pushing median prices above $364,000 in what was historically an affordable rural community. The town’s location between Gainesville and The Villages attracted retirees and commuters, but current overextension of 79.6% above long-term trends signals dangerous territory. Limited commercial development constrains local employment while growing residential density strains rural infrastructure.

Anthony – Retirement Community Premiums Lose Support

Anthony’s proximity to The Villages retirement community drove speculative investment, with developers betting on spillover demand from Florida’s largest active adult community. However, current prices approaching $365,000 exceed what many retirees can afford, especially as fixed incomes struggle with inflation and insurance costs. The 15.5% crash in 2011 demonstrated how quickly this market can correct when demand assumptions prove wrong.

The town’s vulnerability intensifies as retirement migration patterns shift due to climate risks and cost concerns. Climate change could wipe out $1.47 trillion in home values over the next 30 years, with insurance costs rising 29.4% by 2055. Anthony’s rural character limits economic diversity while its dependence on external retirement demand creates instability when demographic trends change. The combination of overextension, limited local economy, and shifting migration patterns creates significant downside risk.

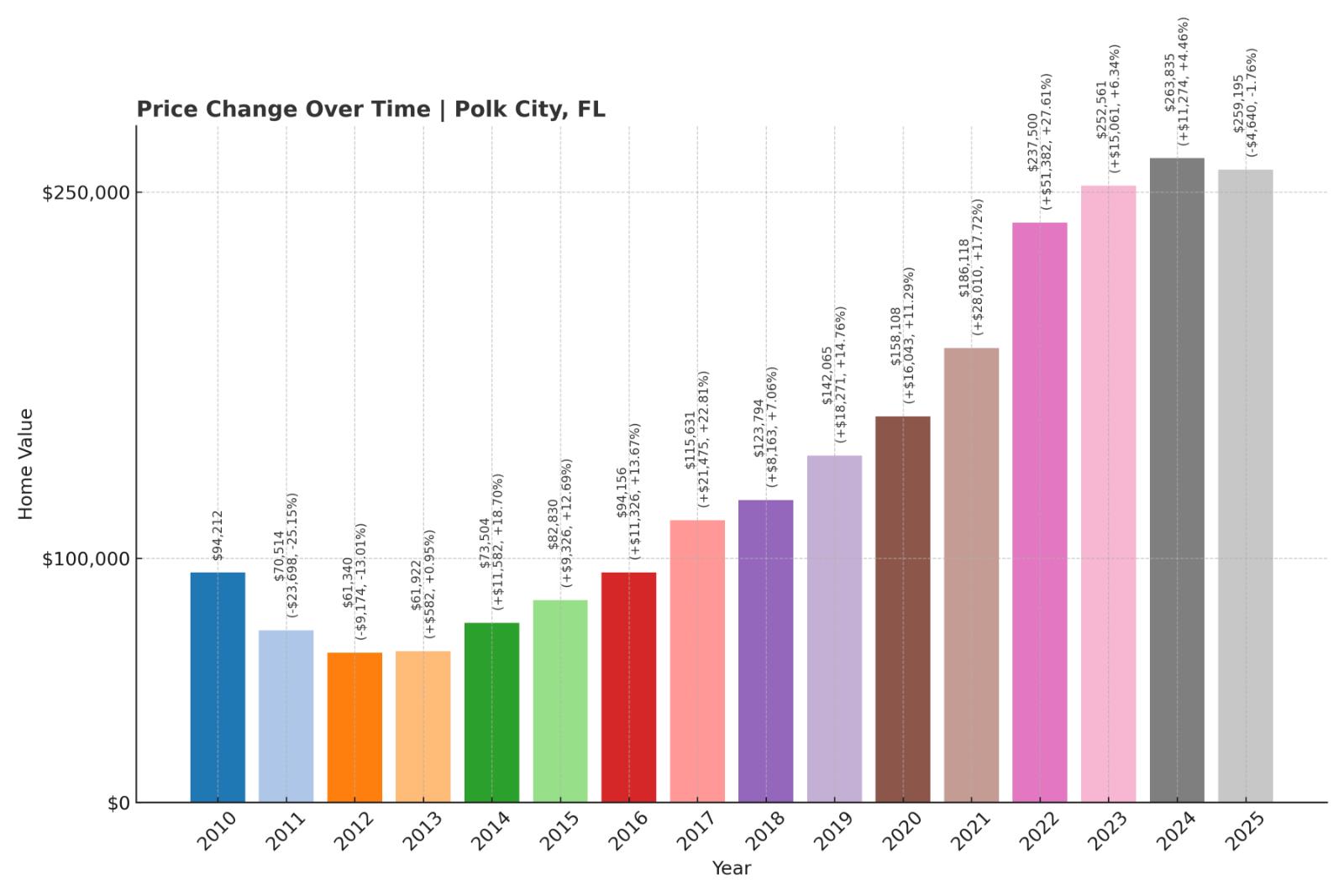

9. Polk City – Crash Risk Percentage: 69.60%

Would you like to save this?

- Crash Risk Percentage: 69.60%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 25.2% (2011)

- Total price increase since 2010: 175.1%

- Overextended above long-term average: 82.1%

- Price volatility (annual swings): 13.2%

- Current 2025 price: $259,195

Polk City holds the record for the worst historical crash on our list with a devastating 25.2% decline in 2011, yet prices have surged 175% since 2010. This Polk County community between Tampa and Orlando became a commuter town, but the 82.1% overextension above long-term averages represents unsustainable pricing. The town’s small size and limited amenities struggle to justify current values near $260,000.

Polk City – Commuter Town Faces Reality Check

Polk City’s transformation into a commuter hub occurred during the pandemic as remote work enabled longer commutes to Tampa and Orlando. The 25.2% crash in 2011 proved this market’s extreme volatility, with prices capable of declining by a quarter in a single year. Current values representing 175% growth since 2010 create affordability challenges for local workers while depending heavily on external employment centers.

The sustainability question becomes critical as remote work policies evolve and commuting costs rise. Rising inventory meets dwindling demand in Florida markets that experienced massive price spikes, creating conditions similar to those preceding Polk City’s previous quarter-value crash. The town’s proven capacity for extreme price volatility, combined with current overextension levels exceeding 80%, suggests another major correction could unfold rapidly when market conditions shift unfavorably.

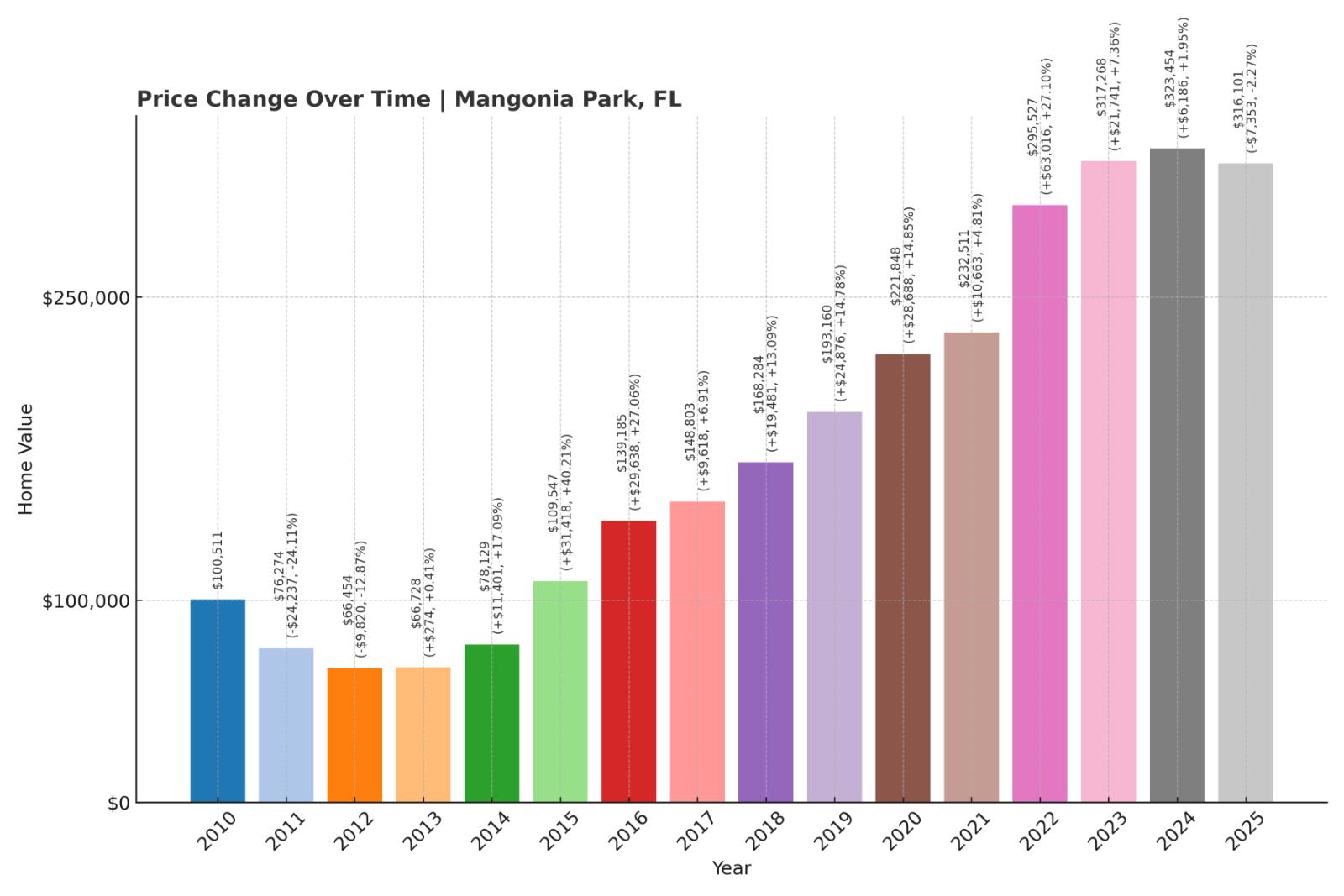

8. Mangonia Park – Crash Risk Percentage: 72.78%

- Crash Risk Percentage: 72.78%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 24.1% (2011)

- Total price increase since 2010: 214.5%

- Overextended above long-term average: 77.2%

- Price volatility (annual swings): 15.6%

- Current 2025 price: $316,101

Mangonia Park in Palm Beach County experienced a 24.1% crash in 2011 but has seen prices more than triple since 2010. This small community near West Palm Beach benefits from its South Florida location but faces gentrification pressures that disconnect pricing from local economics. The 15.6% annual volatility ranks among the highest on our list, indicating an unstable market prone to dramatic swings.

Mangonia Park – Gentrification Bubble Nears Breaking Point

Mangonia Park’s rapid gentrification transformed a working-class community into a high-priced residential area, with median values now exceeding $316,000. The 214% price surge since 2010 represents one of the most dramatic increases on our list, creating severe affordability constraints for longtime residents. This small enclave’s proximity to West Palm Beach attracted investors betting on spillover demand, but current pricing disconnects from local wage structures.

The market’s extreme volatility, with 15.6% annual swings and a history of crashes exceeding 20%, signals inherent instability in this gentrified community. Florida’s inventory surge with homes sitting on the market for weeks without going under contract forces sellers to slash prices. Mangonia Park’s combination of speculative pricing, gentrification pressures, and documented crash history creates conditions ripe for another significant correction as market dynamics shift away from speculative investment toward fundamental value.

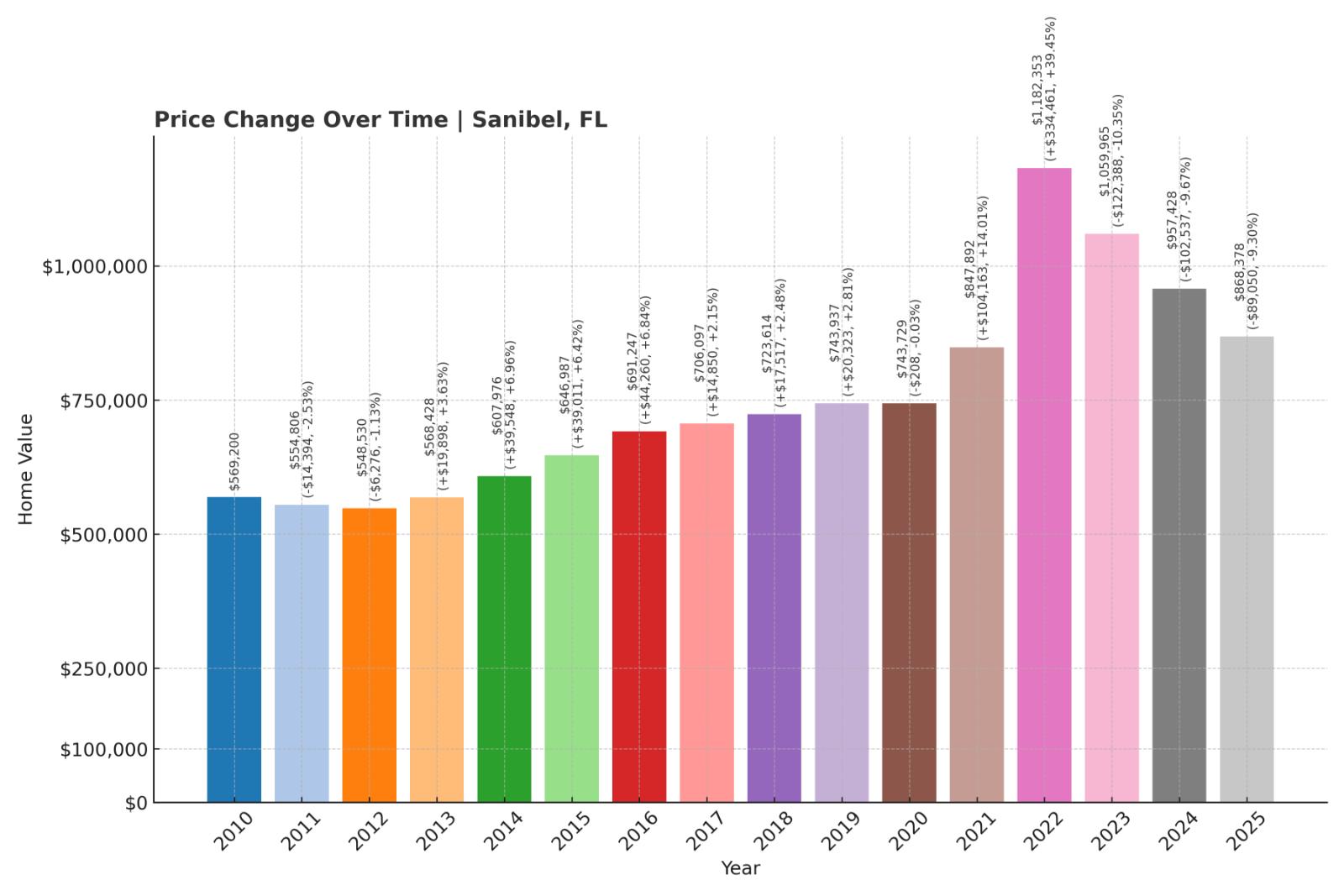

7. Sanibel – Crash Risk Percentage: 75.93%

- Crash Risk Percentage: 75.93%

- Historical crashes (8%+ drops): 3

- Worst historical crash: 10.4% (2023)

- Total price increase since 2010: 52.6%

- Overextended above long-term average: 15.6%

- Price volatility (annual swings): 11.7%

- Current 2025 price: $868,378

Sanibel Island presents a unique case with the highest median price on our list at $868,378, yet moderate overextension levels. The barrier island’s recent 10.4% crash in 2023 reflects ongoing hurricane recovery impacts from Ian’s devastating blow. Three historical crashes demonstrate this luxury market’s sensitivity to external shocks, while the island’s limited land supply creates both scarcity value and vulnerability to natural disasters.

Sanibel – Hurricane Recovery Masks Deeper Vulnerabilities

Sanibel’s luxury real estate market faces the dual challenge of hurricane recovery and changing buyer preferences following 2022’s Hurricane Ian devastation. While current overextension appears modest at 15.6%, the 2023 crash of 10.4% occurred during a supposedly strong market, indicating underlying weakness in this high-end barrier island community. Current median prices approaching $870,000 limit the buyer pool to affluent purchasers increasingly concerned about climate risks.

The island’s vulnerability extends beyond natural disasters to include insurance market disruption and infrastructure limitations. 55 million Americans are predicted to relocate due to weather-related reasons over the next 30 years, potentially reducing demand for high-risk coastal properties like Sanibel. The combination of climate change concerns, insurance costs, and demonstrated crash frequency creates significant downside risk for this luxury market despite its scarcity premium and desirable location.

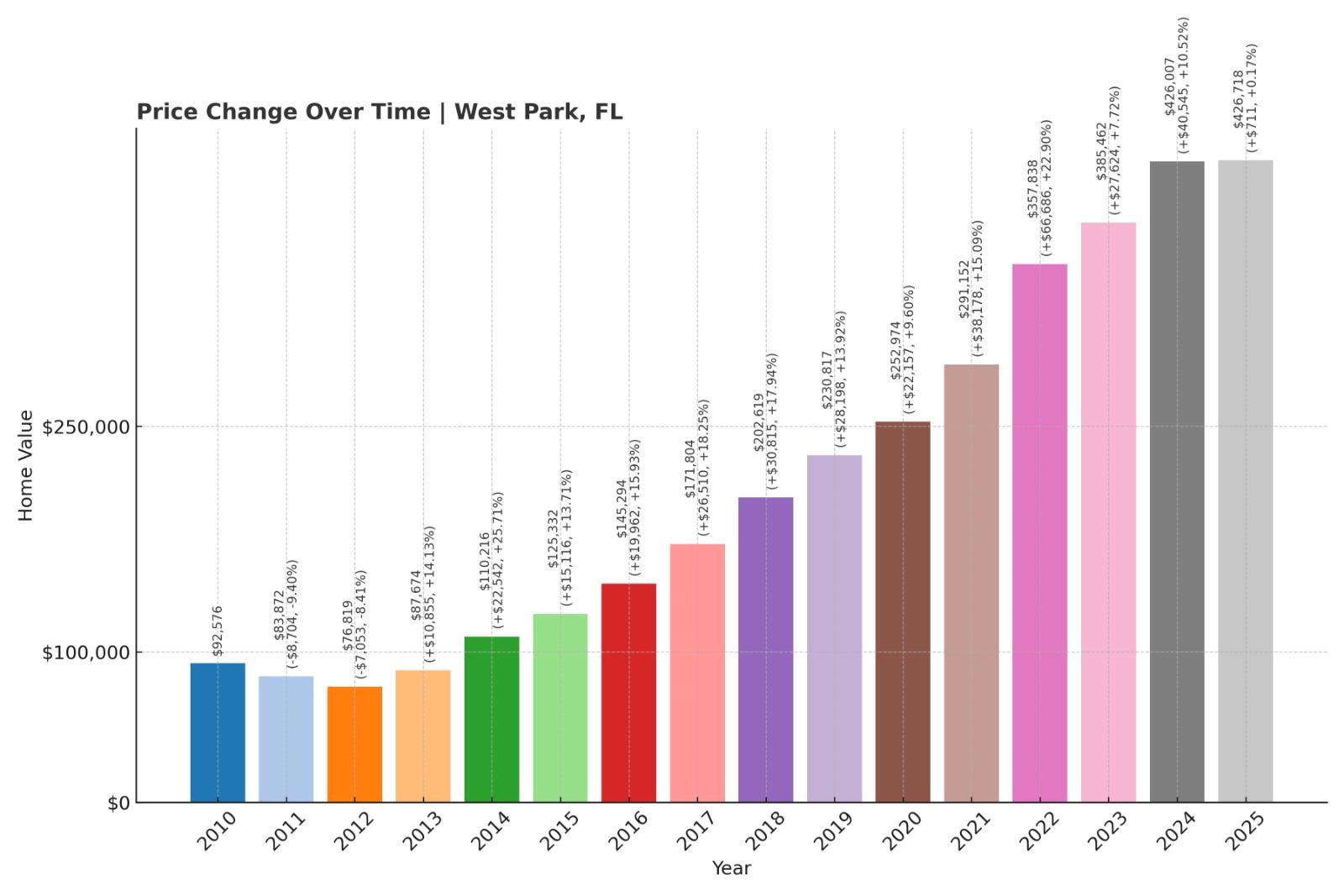

6. West Park – Crash Risk Percentage: 79.07%

- Crash Risk Percentage: 79.07%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 9.4% (2011)

- Total price increase since 2010: 360.9%

- Overextended above long-term average: 96.9%

- Price volatility (annual swings): 9.8%

- Current 2025 price: $426,718

West Park in Broward County leads our list in total price appreciation with a staggering 360.9% increase since 2010, pushing median values above $426,000. The 96.9% overextension above long-term trends represents the most dangerous mathematical unsustainability on our list. This dense urban community near Fort Lauderdale has experienced rapid gentrification that prices out most local workers.

West Park – Speculative Bubble Reaches Critical Mass

West Park’s transformation from affordable working-class community to high-priced residential area represents one of South Florida’s most dramatic gentrification stories. The 360% price surge since 2010 created millionaires among longtime property owners while making homeownership impossible for new local buyers. Current overextension of nearly 97% above sustainable trends represents mathematical unsustainability that historically precedes major corrections.

The community’s small size and urban density create limited supply absorption capacity when demand softens, typically amplifying price swings in both directions. Florida’s adjustment is starting from a much higher peak and faces unique costs like insurance that differentiate it from national trends. West Park’s extreme overextension, combined with South Florida’s broader affordability crisis and rising inventory levels, creates conditions where even small demand shifts could trigger substantial price corrections in this overheated market.

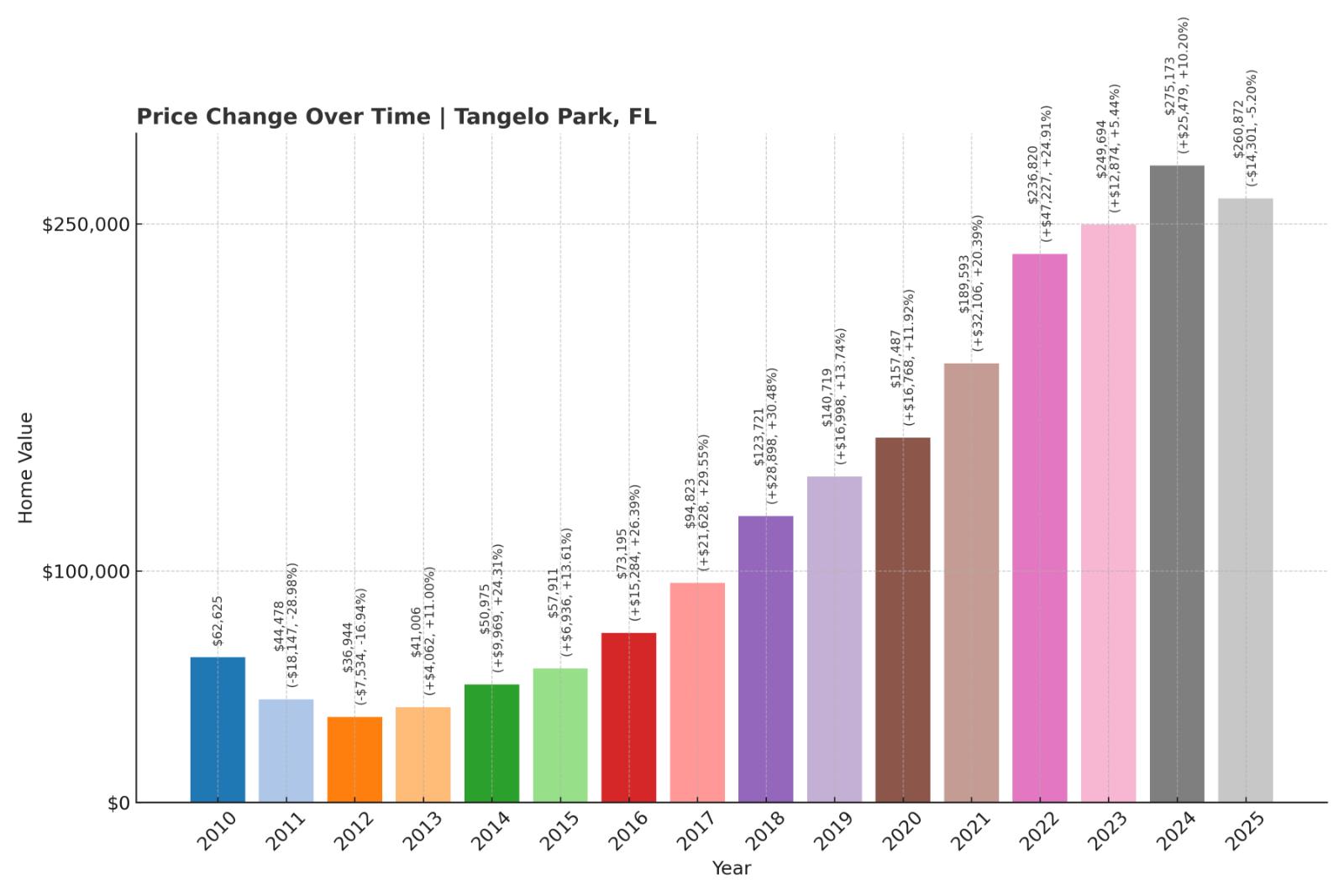

5. Tangelo Park – Crash Risk Percentage: 83.68%

- Crash Risk Percentage: 83.68%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 29.0% (2011)

- Total price increase since 2010: 316.6%

- Overextended above long-term average: 99.1%

- Price volatility (annual swings): 16.5%

- Current 2025 price: $260,872

Tangelo Park near Orlando experienced the second-worst crash in our analysis with a 29% decline in 2011, yet prices have surged 316% since 2010. The 99.1% overextension above long-term averages approaches the mathematical impossibility of being double sustainable values. This small Orange County community’s proximity to tourist attractions drove speculative investment, but current pricing exceeds local economic capacity.

Tangelo Park – Tourism Speculation Faces Economic Reality

Tangelo Park’s location near Orlando’s tourism corridor attracted investors betting on vacation rental potential and spillover demand from theme park workers. However, the 29% crash in 2011 proved this market’s capacity for devastating corrections, with nearly one-third of property values disappearing in a single year. Current prices representing 316% growth since 2010 create affordability barriers for tourism and service workers who form the area’s economic base.

The community’s extreme volatility with 16.5% annual swings reflects an unstable market driven by speculation rather than fundamental demand. Markets like Winter Haven and Tampa are bracing for high risk of price crashes, with vulnerabilities in Central Florida areas that saw explosive growth. Tangelo Park’s proximity to these identified risk zones, combined with its own extreme overextension and crash history, suggests this tourism-adjacent community faces significant downside risk as Florida’s broader housing correction unfolds.

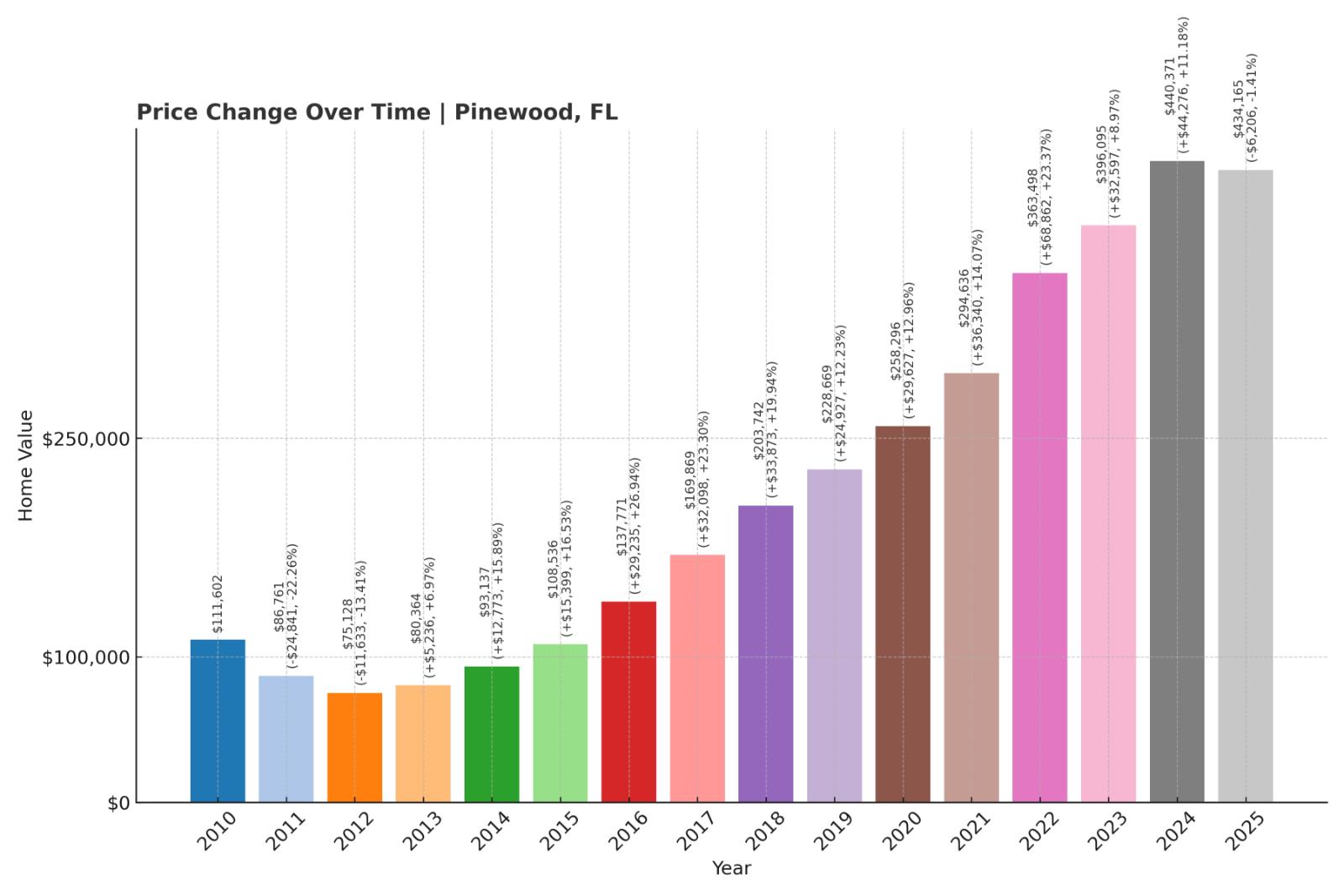

4. Pinewood – Crash Risk Percentage: 87.69%

- Crash Risk Percentage: 87.69%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 22.3% (2011)

- Total price increase since 2010: 289.0%

- Overextended above long-term average: 99.5%

- Price volatility (annual swings): 13.1%

- Current 2025 price: $434,165

Pinewood in Miami-Dade County shows 99.5% overextension above long-term trends, essentially meaning homes cost double their sustainable values. The 289% price increase since 2010 pushed median values above $434,000 in what was historically an affordable urban community. This dense residential area near Miami faces gentrification pressures that created wealth for some while displacing many longtime residents.

Pinewood – Miami Gentrification Reaches Breaking Point

Pinewood’s rapid transformation reflects broader Miami-area gentrification pressures, with investors betting on spillover demand from high-priced coastal markets. The 22.3% crash in 2011 demonstrated this community’s vulnerability to external economic shocks, yet current overextension approaching 100% above trend suggests even greater risk today. Median prices above $434,000 exceed what most area workers can afford, creating artificial demand dependent on external investment and speculation.

The mathematical unsustainability becomes evident when examining local economic fundamentals: median household incomes in Pinewood remain below $45,000, making current home prices unaffordable for typical residents. Several major insurers have cut coverage in disaster-prone Florida areas while premiums have risen beyond what many can afford. This insurance crisis, combined with extreme overextension and gentrification pressures, creates multiple vectors for significant price corrections as artificial demand dissipates and fundamental economics reassert themselves.

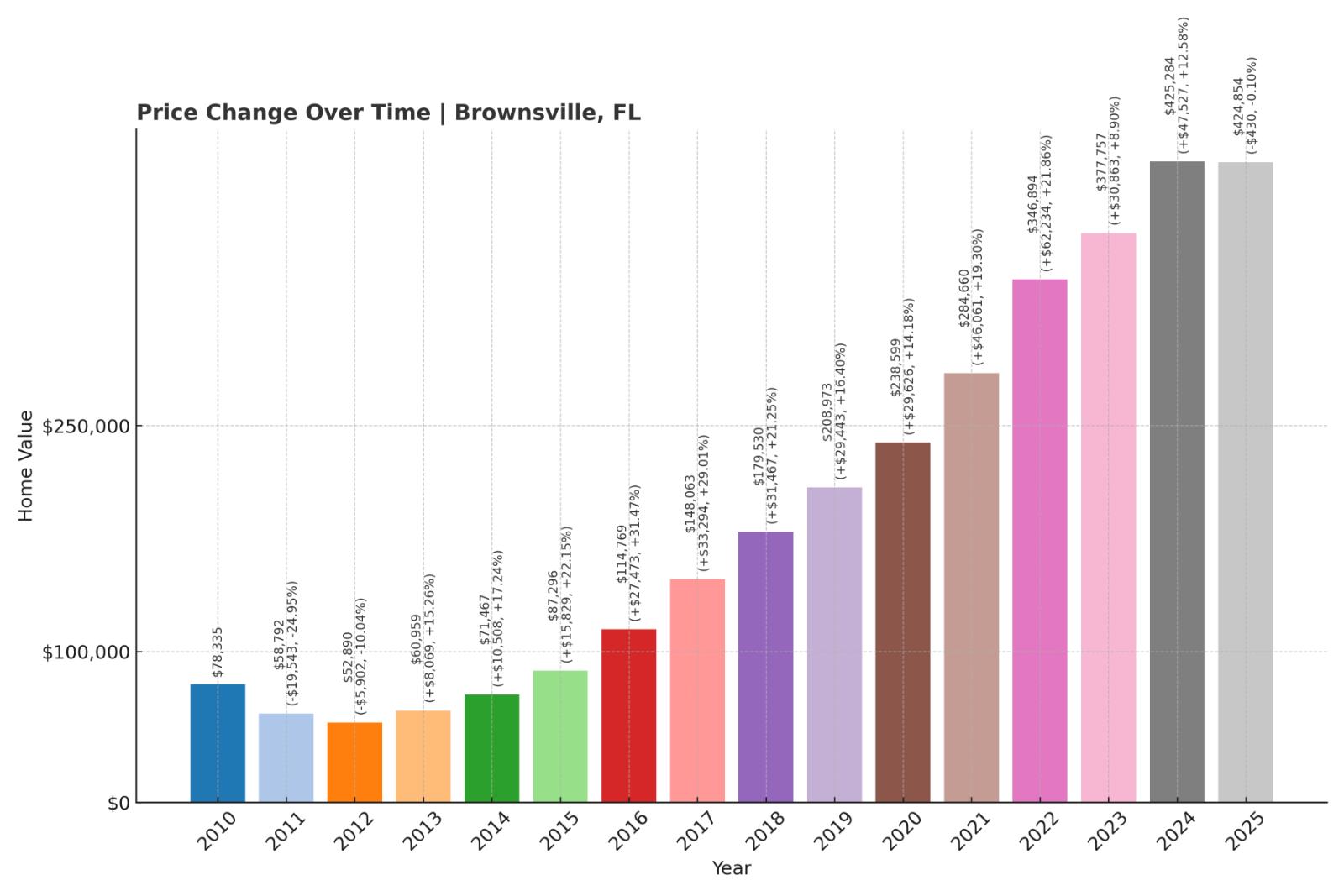

3. Brownsville – Crash Risk Percentage: 90.06%

Would you like to save this?

- Crash Risk Percentage: 90.06%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 24.9% (2011)

- Total price increase since 2010: 442.4%

- Overextended above long-term average: 115.2%

- Price volatility (annual swings): 14.3%

- Current 2025 price: $424,854

Brownsville takes the record for price appreciation with a stunning 442% increase since 2010, pushing values above $424,000 in this Miami-Dade community. The 115.2% overextension means homes cost more than double their sustainable long-term values—a level of overvaluation that defies economic gravity. This working-class neighborhood has experienced dramatic gentrification that created millionaires while displacing thousands of longtime residents.

Brownsville – Gentrification Bubble Exceeds All Historical Precedents

Brownsville’s 442% price surge represents the most extreme gentrification in our analysis, transforming an affordable working-class community into an unaffordable investment playground. The 24.9% crash in 2011 proved this market’s capacity for devastating corrections, yet current overextension exceeding 115% above trend suggests far greater downside risk today. Local median incomes around $35,000 cannot support median home prices above $424,000, creating mathematical impossibility that speculation temporarily masks.

The community’s vulnerability extends beyond affordability to include the broader Miami housing market instability and insurance crisis affecting urban areas. Without higher influx of deep-pocketed buyers from up North, Florida home prices have had to rely more on local incomes. Brownsville’s dependence on external investment and speculation, combined with extreme overextension and documented crash history, creates the perfect storm for a major price correction as market dynamics shift toward fundamental economic capacity rather than speculative demand.

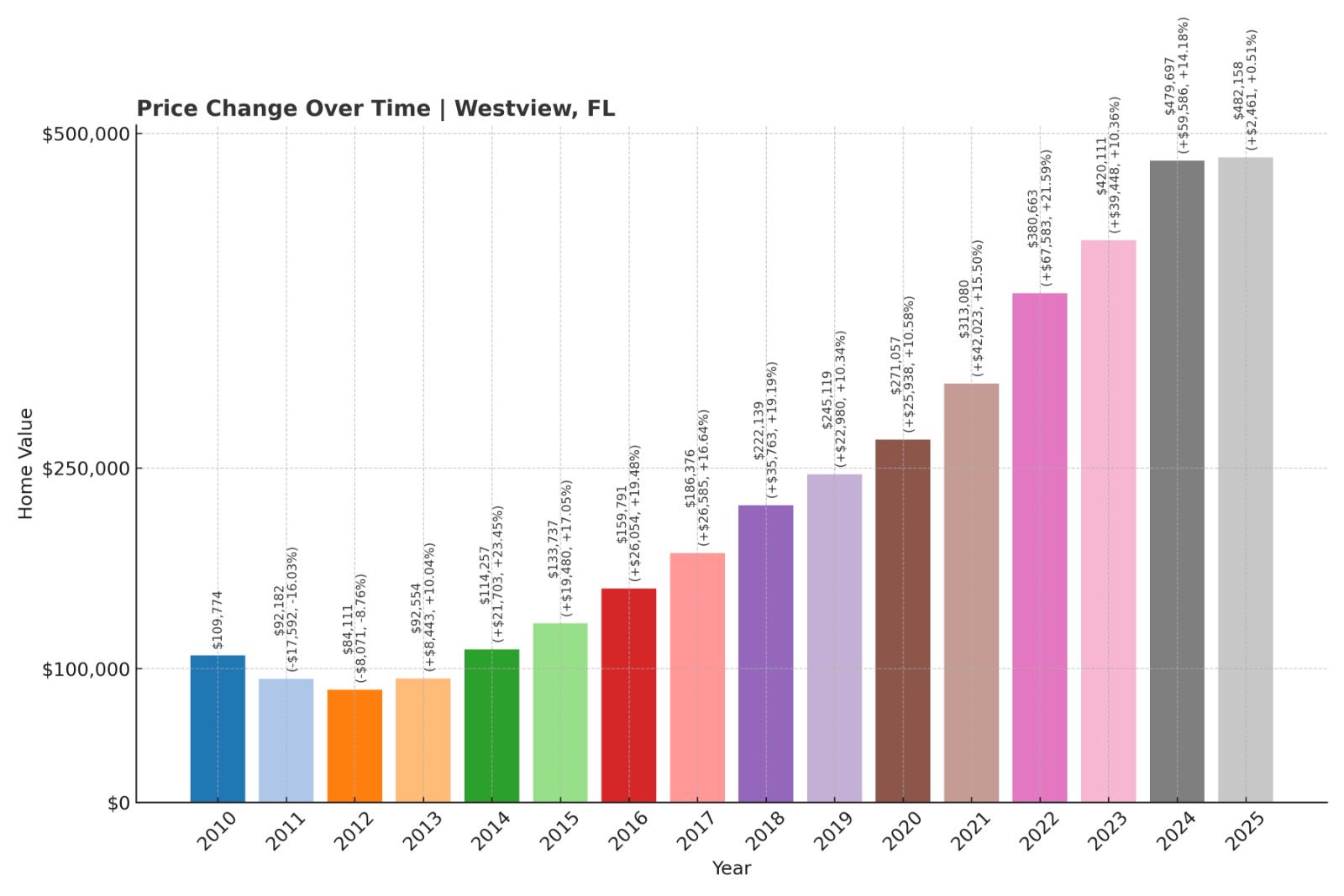

2. Westview – Crash Risk Percentage: 90.10%

- Crash Risk Percentage: 90.10%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 16.0% (2011)

- Total price increase since 2010: 339.2%

- Overextended above long-term average: 103.7%

- Price volatility (annual swings): 10.8%

- Current 2025 price: $482,158

Westview in Miami-Dade County has a median price of $482,158, representing 339% growth since 2010. The 103.7% overextension means homes cost more than double their sustainable values in this urban community. Despite lower historical volatility than some peers, the extreme overvaluation and disconnect from local economics creates significant vulnerability. This densely populated neighborhood has transformed from an affordable working-class area into a high-priced residential market through systematic gentrification pressures.

Westview – Gentrification Pricing Defies Economic Logic

Westview’s meteoric rise to nearly half-million-dollar median prices occurred through rapid gentrification that fundamentally altered the community’s economic character. The 339% price increase since 2010 created wealth for existing property owners while making homeownership mathematically impossible for most area workers earning typical Miami-Dade service sector wages. Local median household incomes remain around $42,000, creating a stark disconnect where monthly mortgage payments would consume more than 75% of gross income even with substantial down payments.

The community’s crash risk intensifies due to its dependence on external investment rather than organic local demand. Miami’s broader housing market shows clear stress signals, with eight out of eleven major Florida markets recording negative annual price changes in recent data. Westview’s extreme overextension above sustainable trends, combined with Miami-Dade’s insurance crisis where premiums have increased 400% in five years, creates multiple pressure points. When speculative demand evaporates and fundamental economics reassert themselves, markets with 100%+ overextension historically experience corrections proportional to their artificial inflation levels.

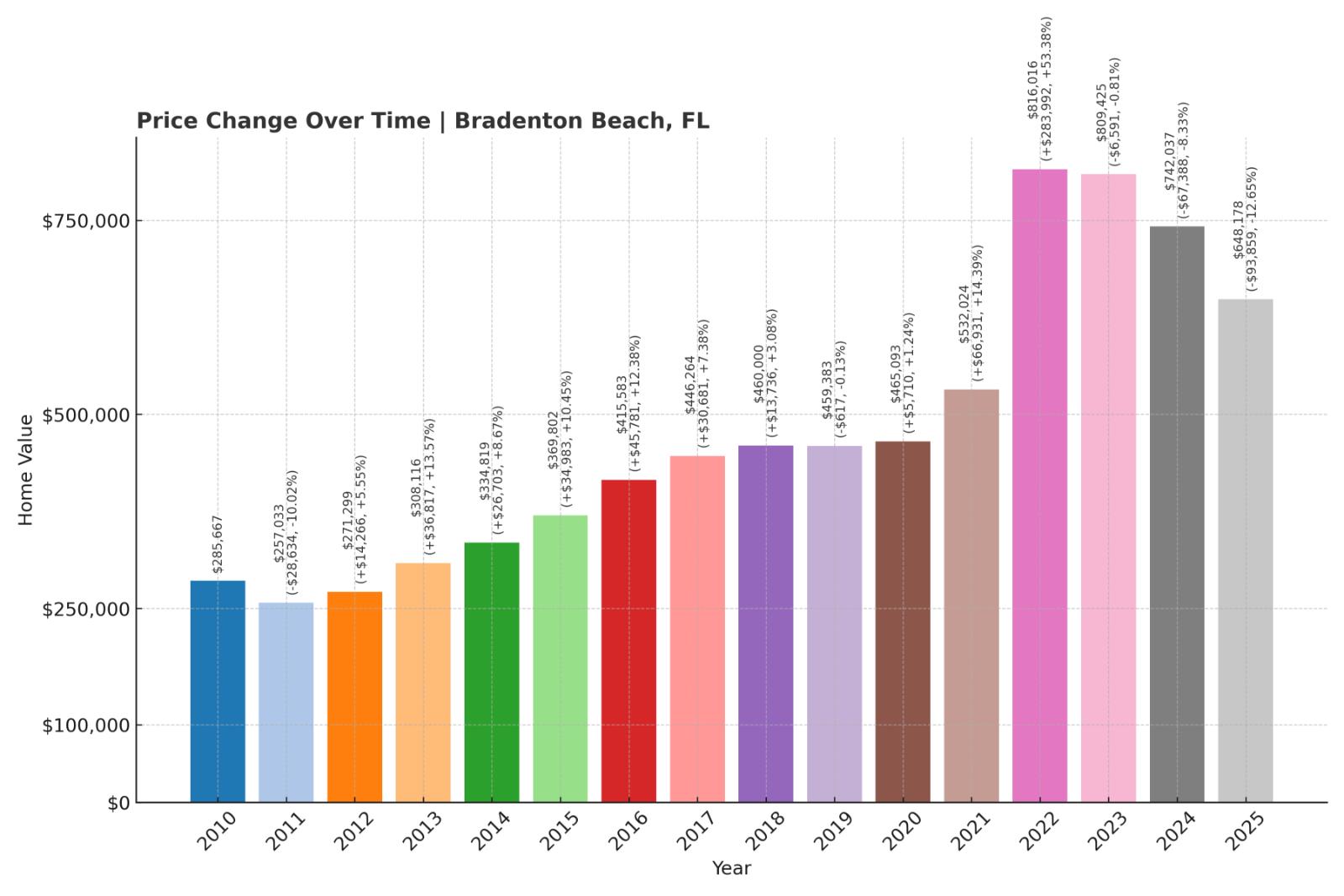

1. Bradenton Beach – Crash Risk Percentage: 90.31%

- Crash Risk Percentage: 90.31%

- Historical crashes (8%+ drops): 3

- Worst historical crash: 12.6% (2025)

- Total price increase since 2010: 126.9%

- Overextended above long-term average: 36.1%

- Price volatility (annual swings): 15.0%

- Current 2025 price: $648,178

Bradenton Beach tops our crash risk list despite moderate overextension levels due to three historical crashes and a devastating 12.6% decline already occurring in 2025. The coastal location creates both premium appeal and substantial vulnerability, with hurricane risk, flood concerns, and infrastructure limitations constraining long-term sustainability. Limited land supply amplifies price volatility in both directions, making corrections swift and severe when they occur.

Bradenton Beach – Active Crash Reveals Structural Weakness

State Library and Archives of Florida, Public domain, via Wikimedia Commons

Bradenton Beach’s current 12.6% crash in 2025 serves as a canary in the coal mine for Florida’s luxury coastal markets, occurring despite relatively stable conditions in other real estate sectors. This barrier island’s median prices above $648,000 represent more than double 2010 levels, yet the ongoing correction suggests fundamental buyer resistance has emerged even among affluent purchasers typically drawn to waterfront properties. The timing of this crash—during a period when many markets remain stable—indicates deep structural problems rather than temporary market fluctuations.

The island’s vulnerability extends far beyond current price levels to encompass mounting climate and insurance challenges that increasingly deter sophisticated buyers. Bradenton Beach’s three-crash history proves this market’s extreme sensitivity to external pressures, while current conditions—rising inventory, insurance costs exceeding $15,000 annually for many properties, and reduced migration to Florida—create a perfect storm. The ongoing correction likely represents the beginning rather than the end of a more substantial price adjustment as climate realities and economic fundamentals override speculative demand for high-risk coastal properties.