Would you like to save this?

Investor activity is warping New York’s housing market in ways few expected. According to the Zillow Home Value Index, 30 towns across the state are seeing price acceleration soar 60% to over 300% beyond their historic trends. That kind of surge doesn’t happen by accident. Economists call it a feeding frenzy—when outside investors flood in, drive up prices, and make it nearly impossible for local families to compete. From the Gilded Age estates of Tuxedo Park to the quiet corners of Carthage, speculation is rewriting the rules of homeownership across the state.

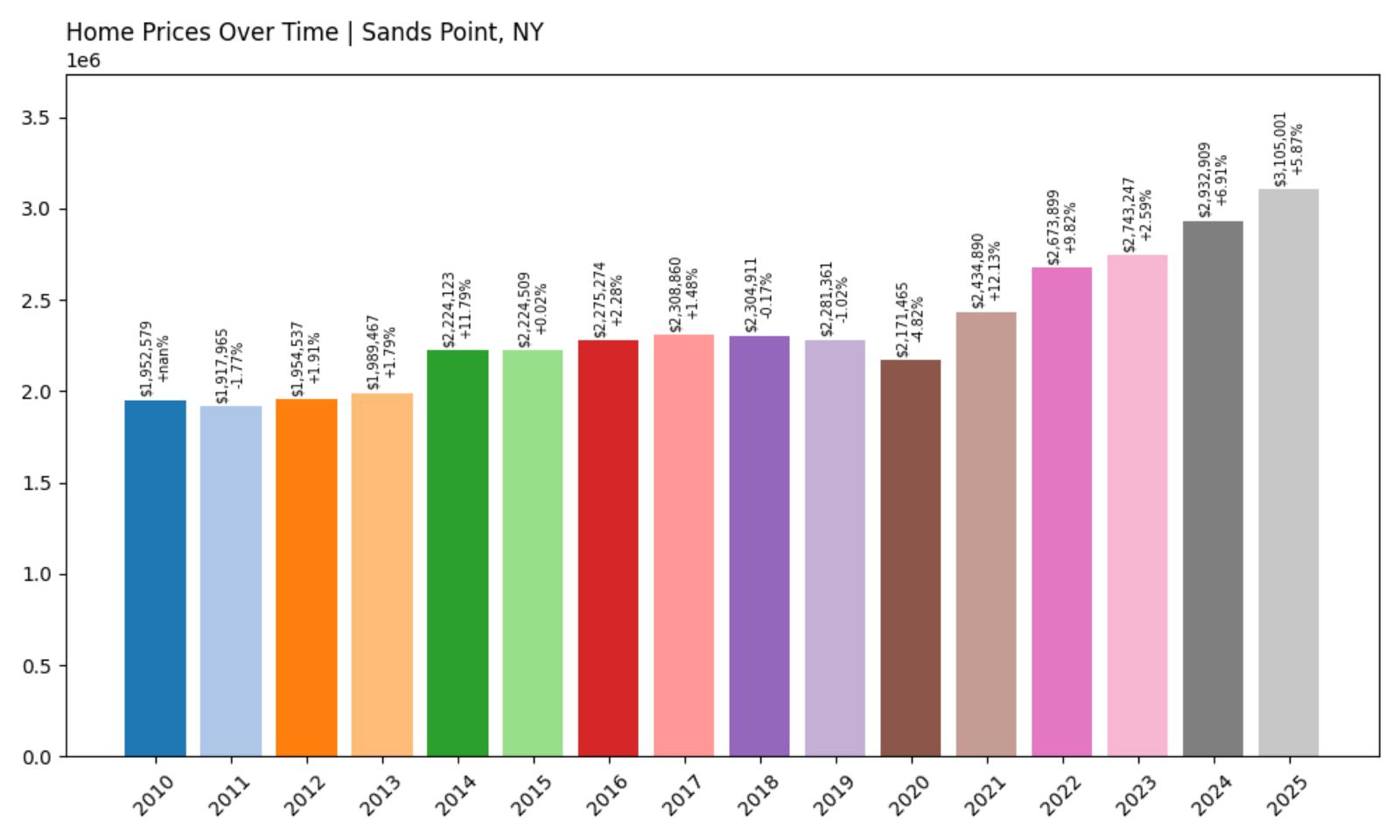

30. Sands Point – Investor Feeding Frenzy Factor 60.48% (July 2025)

- Historical annual growth rate (2012–2022): 3.18%

- Recent annual growth rate (2022–2025): 5.11%

- Investor Feeding Frenzy Factor: 60.48%

- Current 2025 price: $3,105,001.31

Sands Point shows the “mildest” investor feeding frenzy on our list, though the 60% acceleration in price growth still represents significant speculation pressure. With homes now averaging over $3.1 million, this Long Island community demonstrates how even moderate investor activity can push prices beyond local family reach.

Sands Point – Gold Coast Luxury Draws Steady Investment

This affluent village on Long Island’s North Shore has long attracted wealthy buyers, but recent investor activity has pushed median home prices above $3 million for the first time. Located on the Manhasset Bay with direct water access, Sands Point offers proximity to Manhattan while maintaining the exclusivity that made it a favorite retreat for early 20th-century industrialists like the Guggenheims.

The community’s 2,800 residents enjoy some of Nassau County’s most prestigious real estate, with many properties featuring private beaches and yacht moorings. Recent price acceleration reflects growing investor recognition that Gold Coast properties remain undervalued compared to similar luxury markets in the Hamptons, though this speculation increasingly prices out even upper-middle-class families who historically called the area home.

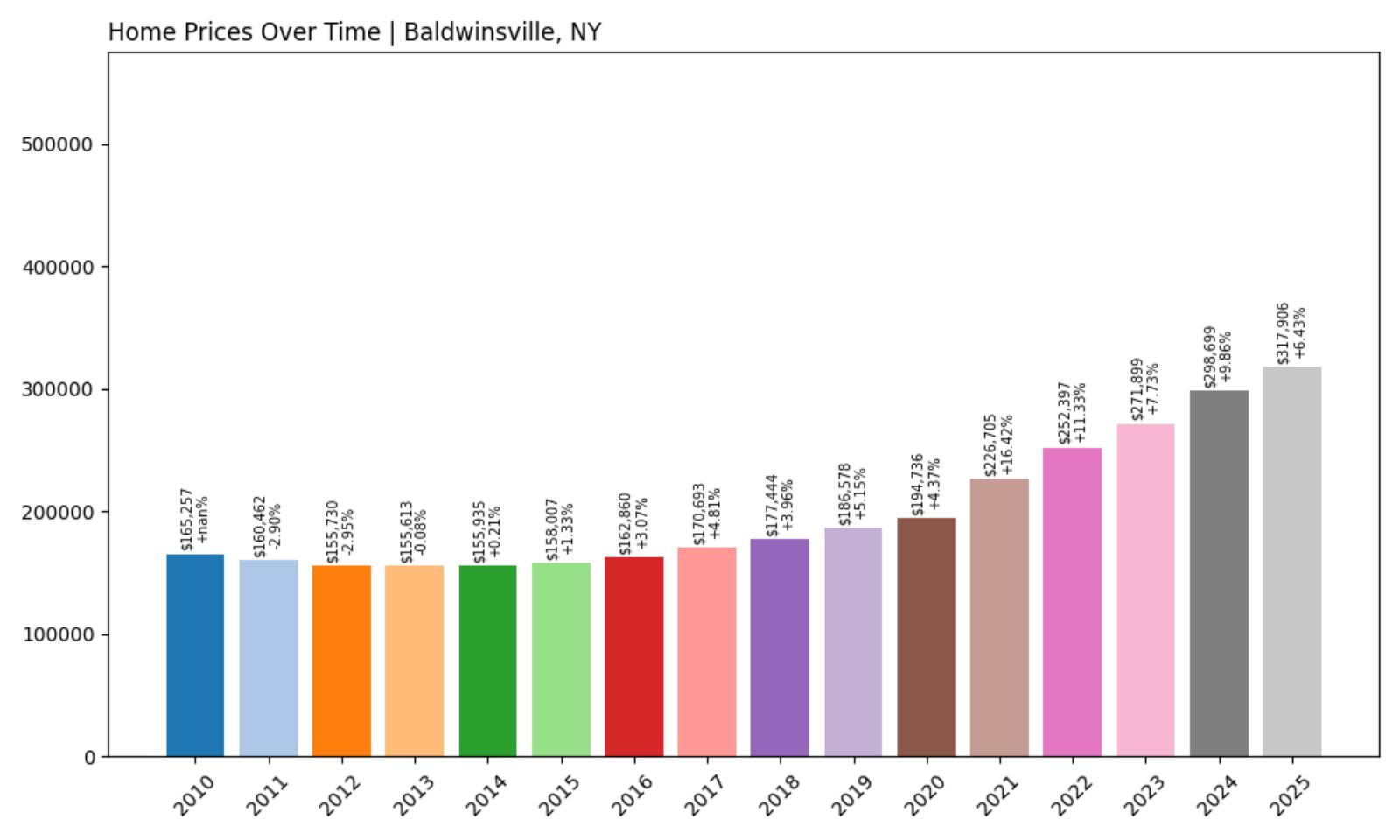

29. Baldwinsville – Investor Feeding Frenzy Factor 61.61% (July 2025)

- Historical annual growth rate (2012–2022): 4.95%

- Recent annual growth rate (2022–2025): 8.00%

- Investor Feeding Frenzy Factor: 61.61%

- Current 2025 price: $317,906.25

Baldwinsville represents how investor speculation has moved beyond luxury markets into middle-class communities. The 61% acceleration in price growth has pushed median home values past $317,000, creating affordability challenges for local families in what was traditionally an accessible Syracuse suburb.

Baldwinsville – Syracuse Suburb Faces Investment Pressure

Kitchen Style?

This Onondaga County community of 7,800 residents sits just northwest of Syracuse, offering small-town charm with easy access to the region’s employment centers. Baldwinsville’s historic village center and well-regarded school district have made it a popular choice for families, but recent investor interest has dramatically altered the housing market dynamics.

The village benefits from its location along the Seneca River, providing recreational opportunities that have attracted both permanent residents and second-home buyers. Local officials report increasing concern about investor-driven price increases outpacing wage growth in the Syracuse metropolitan area, with many young families now priced out of neighborhoods where their parents easily afforded homes just a decade ago.

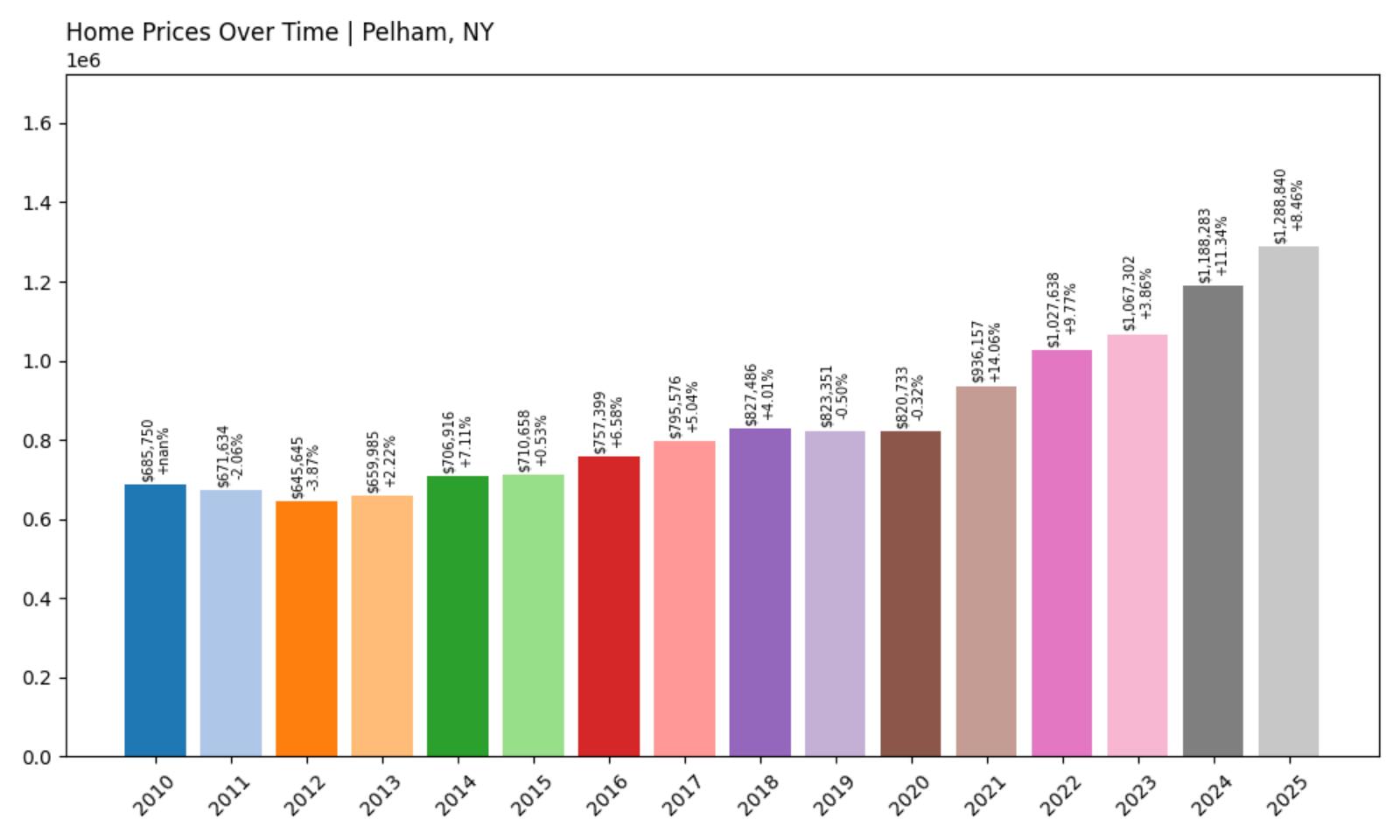

28. Pelham – Investor Feeding Frenzy Factor 64.83% (July 2025)

- Historical annual growth rate (2012–2022): 4.76%

- Recent annual growth rate (2022–2025): 7.84%

- Investor Feeding Frenzy Factor: 64.83%

- Current 2025 price: $1,288,839.66

Pelham’s 65% price acceleration has pushed median home values near $1.3 million, reflecting intense investor interest in this Westchester County community. The dramatic shift from steady 4.8% growth to nearly 8% annual increases demonstrates how speculation can rapidly transform even established suburban markets.

Pelham – Westchester Charm Attracts Heavy Investment

This picturesque village of 12,400 residents offers the perfect combination of small-town character and Manhattan accessibility that investors find irresistible. Located just 20 miles north of Midtown, Pelham provides direct Metro-North railroad service while maintaining tree-lined streets and a walkable downtown that appeals to families seeking suburban tranquility.

The community’s two villages – Pelham and Pelham Manor – feature predominantly single-family homes built in the early-to-mid 20th century, creating the architectural consistency that drives property values. Recent investor activity has particularly focused on properties near the train station, where the 35-minute commute to Grand Central Terminal makes Pelham increasingly attractive to buyers seeking alternatives to pricier Fairfield County markets in Connecticut.

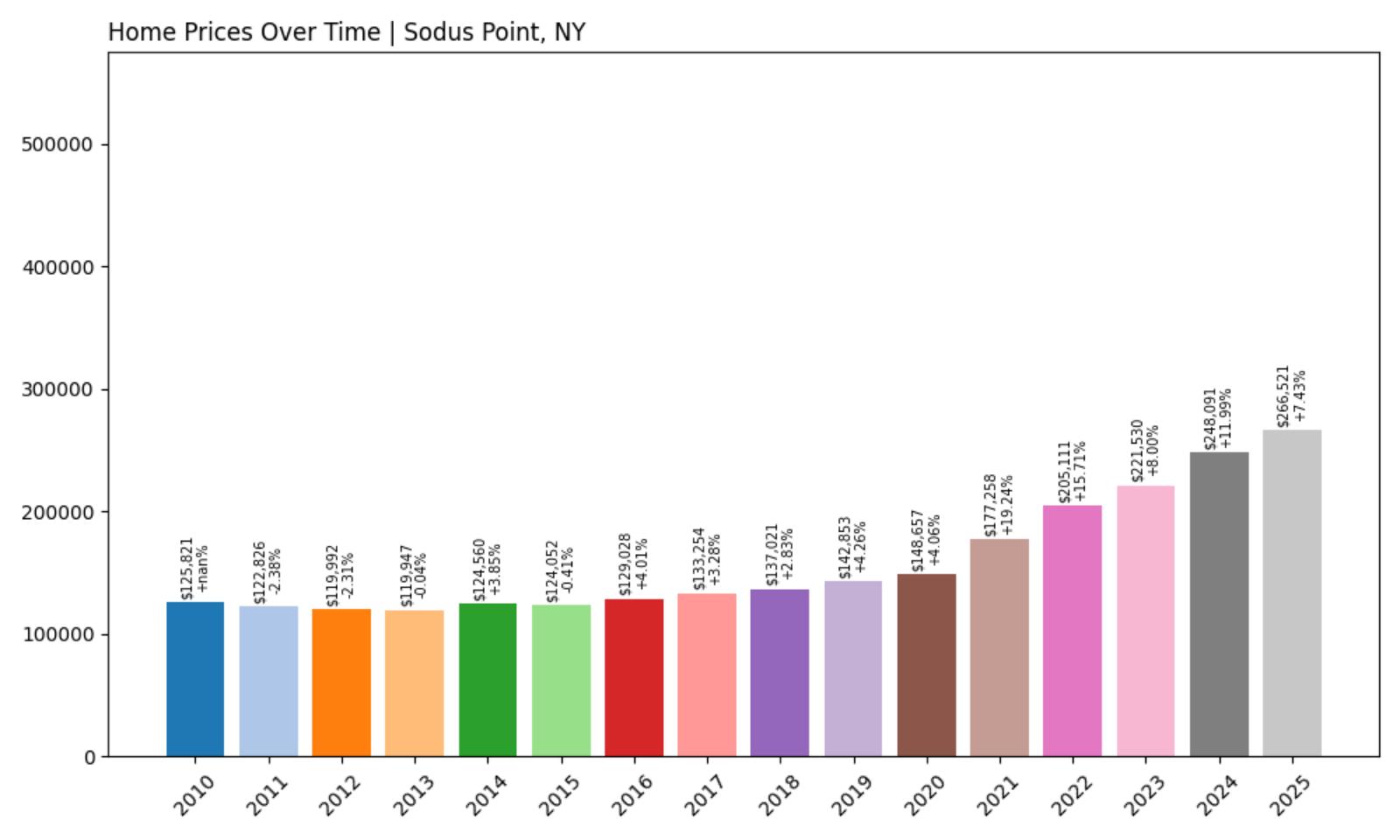

27. Sodus Point – Investor Feeding Frenzy Factor 65.63% (July 2025)

- Historical annual growth rate (2012–2022): 5.51%

- Recent annual growth rate (2022–2025): 9.12%

- Investor Feeding Frenzy Factor: 65.63%

- Current 2025 price: $266,520.73

Sodus Point exemplifies how lakefront communities across upstate New York have become investor targets. The 66% acceleration in price growth has pushed median values past $266,000, representing significant speculation pressure in what was historically an affordable Lake Ontario retreat.

Sodus Point – Lake Ontario Getaway Becomes Investment Focus

This small Wayne County village of just 1,100 residents sits on a natural harbor along Lake Ontario’s southern shore, about 30 miles east of Rochester. Originally developed as a 19th-century resort destination, Sodus Point maintained modest property values for decades until recent investor discovery of its waterfront potential and proximity to growing upstate urban centers.

The community’s appeal centers on its protected harbor, lighthouse, and sandy beaches that provide resort-like amenities at a fraction of East Coast prices. Recent speculation has particularly targeted waterfront properties and historic cottages, with many longtime residents expressing concern that investor-driven price increases threaten the working-class character that has defined the village for generations.

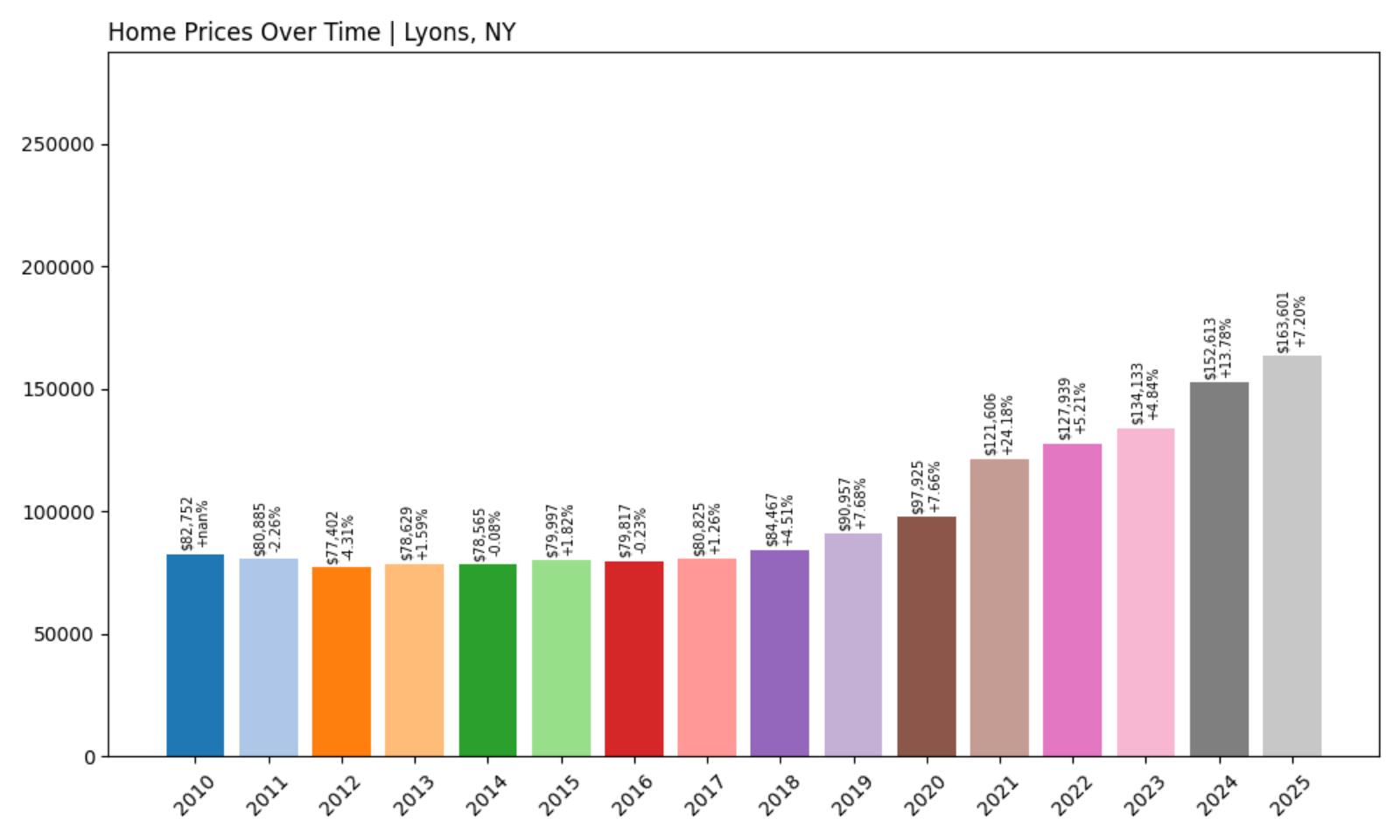

26. Lyons – Investor Feeding Frenzy Factor 65.72% (July 2025)

- Historical annual growth rate (2012–2022): 5.15%

- Recent annual growth rate (2022–2025): 8.54%

- Investor Feeding Frenzy Factor: 65.72%

- Current 2025 price: $163,600.63

Lyons demonstrates how investor feeding frenzies can impact even small rural communities, with price acceleration of nearly 66% pushing median home values past $163,000. This Wayne County village shows how speculation pressure has spread throughout upstate New York’s affordable housing markets.

Lyons – Rural Community Faces Urban Investment Pressure

This village of 3,600 residents along the Erie Canal has experienced unexpected investor attention due to its strategic location between Rochester and Syracuse. Lyons offers authentic small-town living with Victorian-era architecture and proximity to the Finger Lakes region, making it attractive to buyers seeking affordable alternatives to pricier upstate markets.

The community’s revival has been aided by canal tourism and its designation as part of the National Heritage Corridor, bringing increased visibility to what was once a forgotten industrial town. However, recent investor activity has concerned local officials who worry that speculation could disrupt the delicate balance between growth and affordability that has allowed working families to remain in the community despite broader economic challenges facing rural New York.

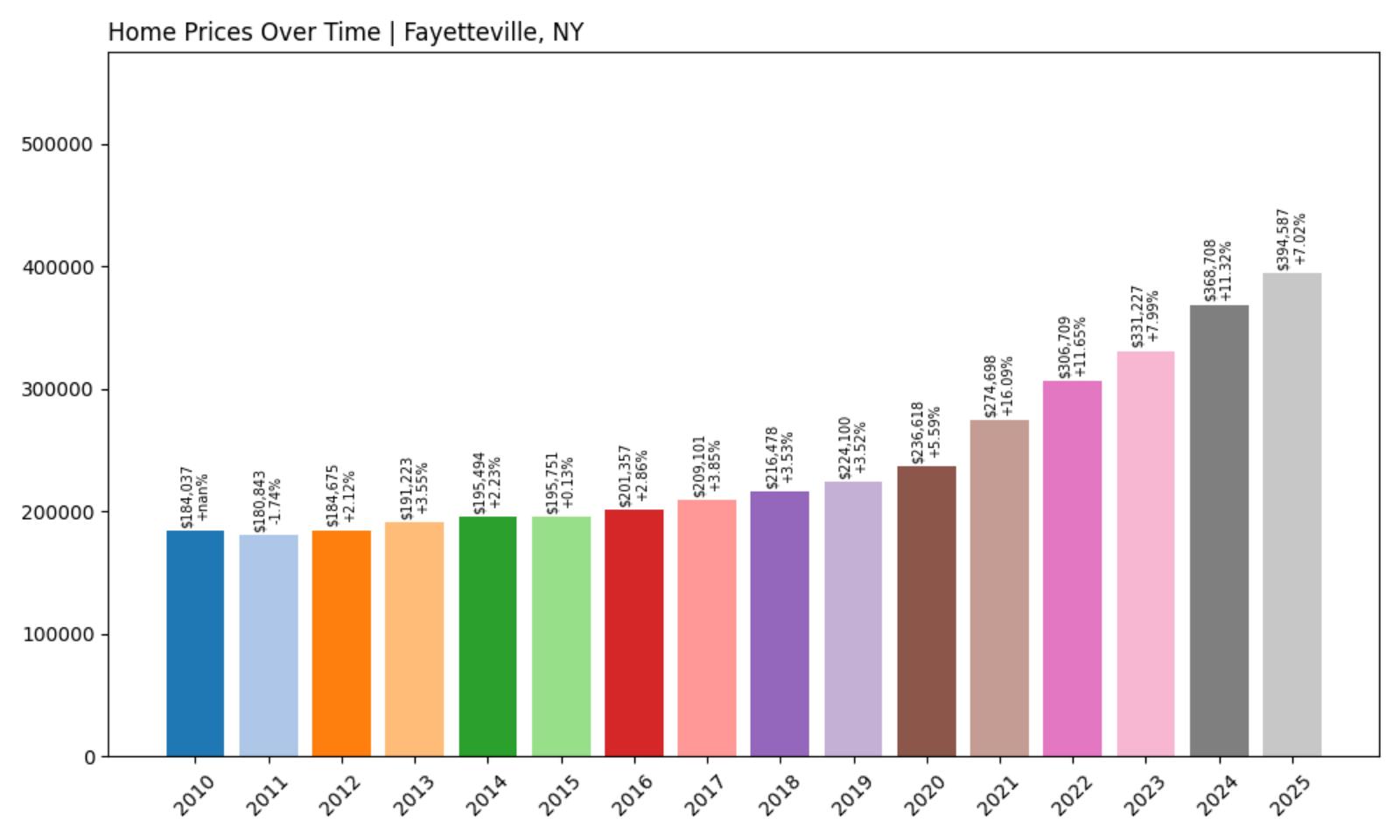

25. Fayetteville – Investor Feeding Frenzy Factor 68.35% (July 2025)

- Historical annual growth rate (2012–2022): 5.20%

- Recent annual growth rate (2022–2025): 8.76%

- Investor Feeding Frenzy Factor: 68.35%

- Current 2025 price: $394,587.11

Fayetteville’s 68% price acceleration reflects intense investor interest in this desirable Syracuse suburb. The jump from 5.2% to nearly 9% annual growth has pushed median home values near $395,000, creating significant affordability challenges for local families.

Fayetteville – Premium Syracuse Suburb Draws Heavy Speculation

This Onondaga County village of 4,400 residents represents one of Central New York’s most sought-after suburban communities, combining excellent schools with proximity to Syracuse University and downtown employment centers. Fayetteville’s tree-lined streets and well-maintained neighborhoods have long attracted families, but recent investor activity has dramatically altered market dynamics.

The community benefits from its location along Limestone Creek and features a mix of historic homes and newer developments that appeal to diverse buyer preferences. Recent speculation has particularly focused on properties within the highly-rated Fayetteville-Manlius school district, with investors recognizing that quality education drives long-term property values in suburban markets throughout upstate New York.

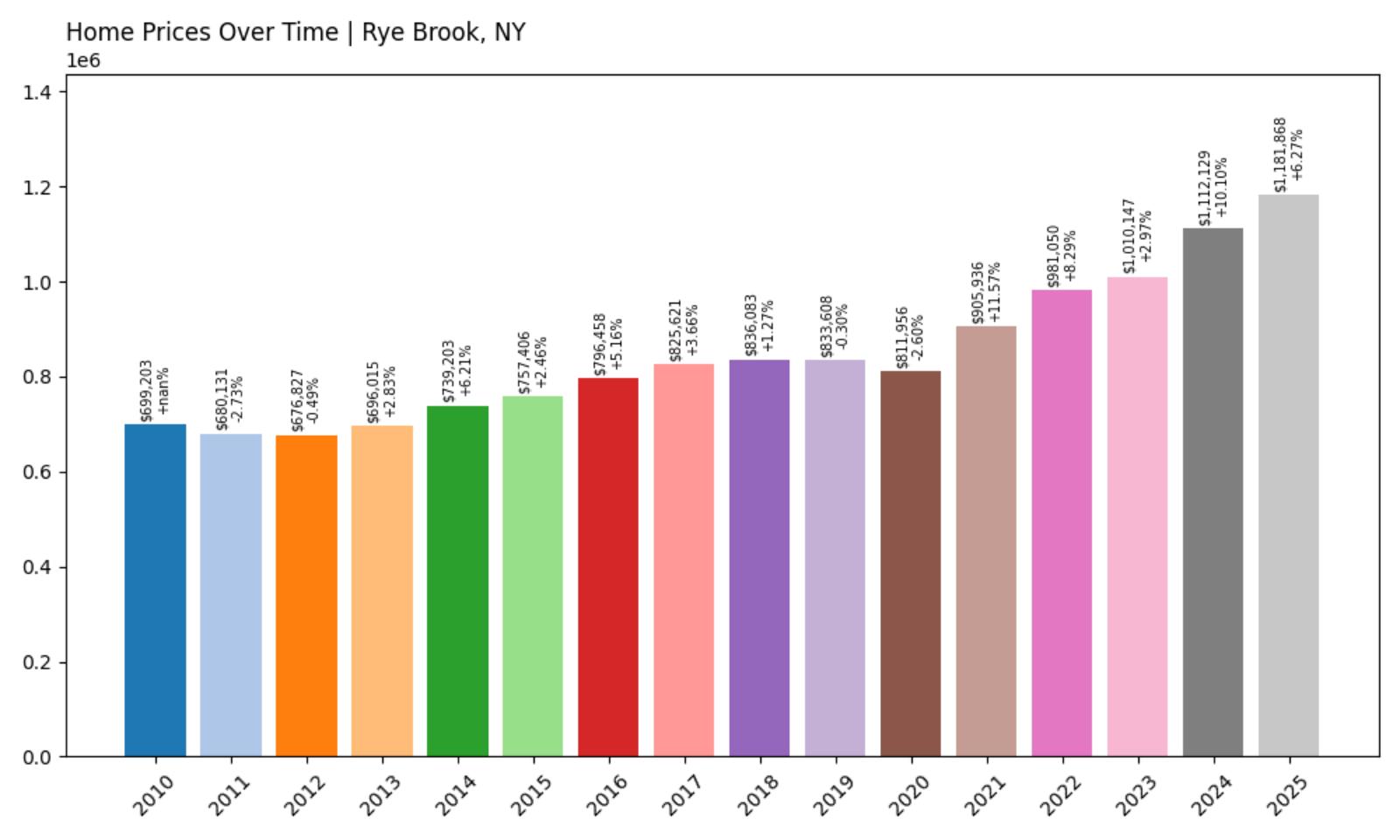

24. Rye Brook – Investor Feeding Frenzy Factor 69.34% (July 2025)

- Historical annual growth rate (2012–2022): 3.78%

- Recent annual growth rate (2022–2025): 6.40%

- Investor Feeding Frenzy Factor: 69.34%

- Current 2025 price: $1,181,867.75

Rye Brook shows nearly 70% price acceleration, pushing median home values close to $1.2 million in this Westchester County community. The dramatic shift from moderate 3.8% growth to over 6% annually demonstrates how investor speculation can rapidly transform suburban markets near major metropolitan areas.

Rye Brook – Westchester Village Becomes Investment Target

This village of 9,600 residents in southeastern Westchester County offers an ideal combination of suburban tranquility and metropolitan accessibility that has attracted intense investor interest. Located just 30 miles from Manhattan with direct highway access, Rye Brook provides the space and amenities that city-based investors seek for both personal use and rental properties.

The community features predominantly single-family homes on larger lots than typical Westchester suburbs, creating the privacy and space that justify premium prices. Recent investor activity has particularly targeted properties near the Connecticut border, where buyers can access both New York and Connecticut employment markets while enjoying Rye Brook’s excellent schools and recreational facilities including several golf courses and country clubs.

23. Oyster Bay Cove – Investor Feeding Frenzy Factor 72.55% (July 2025)

- Historical annual growth rate (2012–2022): 3.31%

- Recent annual growth rate (2022–2025): 5.71%

- Investor Feeding Frenzy Factor: 72.55%

- Current 2025 price: $2,207,359.85

Oyster Bay Cove demonstrates how luxury Long Island markets have become investor feeding grounds, with 73% price acceleration pushing median home values past $2.2 million. This Nassau County enclave shows how speculation pressure affects even the most exclusive residential communities.

Oyster Bay Cove – Exclusive Enclave Faces Investment Surge

This prestigious village of 2,200 residents on Long Island’s North Shore represents one of New York’s most exclusive residential communities, where waterfront estates and mansion-sized homes have long attracted wealthy families. The recent investor surge reflects growing recognition that Gold Coast properties remain undervalued compared to similar luxury markets, though speculation increasingly prices out even affluent local buyers.

The community’s appeal centers on its protected harbor, private beaches, and proximity to both Manhattan and the Hamptons, creating the perfect storm for investor interest. Many properties feature private docks and extensive grounds that provide the privacy and luxury amenities that drive premium valuations in today’s competitive market for high-end real estate.

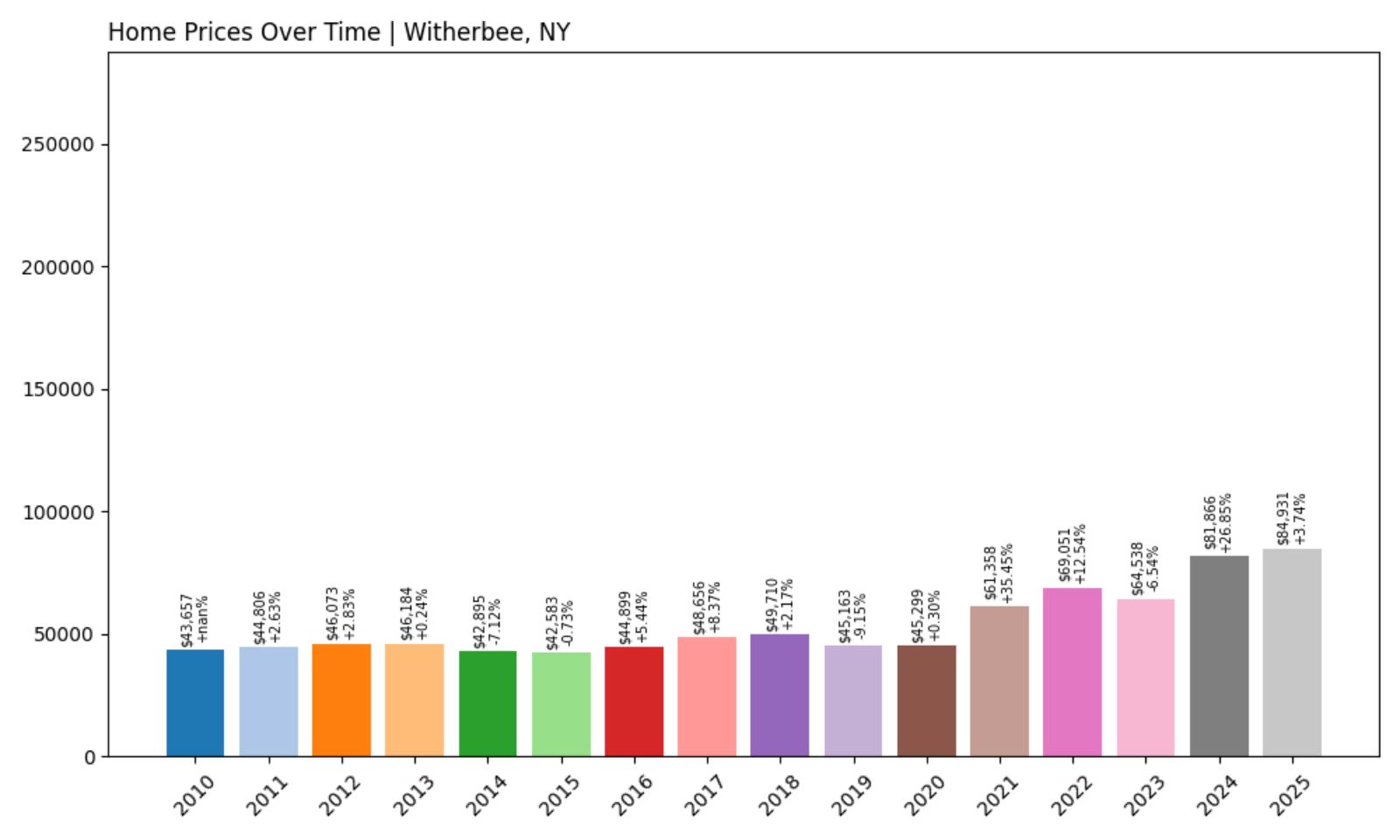

22. Witherbee – Investor Feeding Frenzy Factor 73.00% (July 2025)

- Historical annual growth rate (2012–2022): 4.13%

- Recent annual growth rate (2022–2025): 7.14%

- Investor Feeding Frenzy Factor: 73.00%

- Current 2025 price: $84,931.23

Witherbee represents the most extreme example of speculation in affordable housing markets, with 73% price acceleration affecting a community where median home values remain under $85,000. This Essex County hamlet shows how investor feeding frenzies can impact even the most modest rural markets.

Witherbee – Adirondack Village Sees Unexpected Investment

This tiny Essex County community of fewer than 600 residents sits in the heart of the Adirondack Mountains, where historic iron mining operations once drove the local economy. Witherbee’s recent investor interest stems from its proximity to popular outdoor recreation areas and the growing trend of remote work enabling city dwellers to relocate to scenic rural locations.

The village offers authentic mountain living at prices that remain accessible compared to Vermont or New Hampshire alternatives, though recent speculation threatens this affordability advantage. Many properties feature historic architecture from the mining era, creating unique character that appeals to buyers seeking alternatives to generic suburban developments throughout the region.

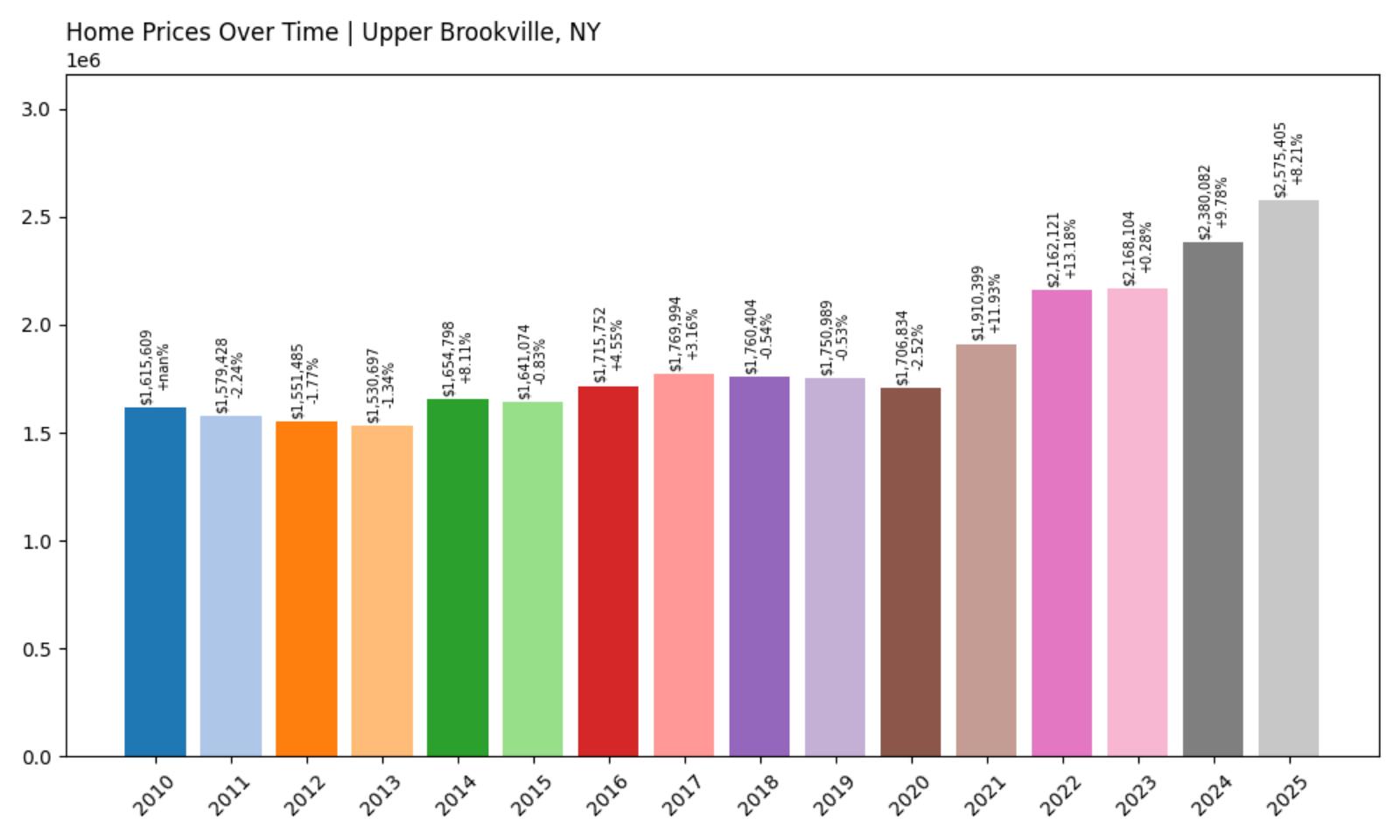

21. Upper Brookville – Investor Feeding Frenzy Factor 77.92% (July 2025)

Would you like to save this?

- Historical annual growth rate (2012–2022): 3.37%

- Recent annual growth rate (2022–2025): 6.00%

- Investor Feeding Frenzy Factor: 77.92%

- Current 2025 price: $2,575,405.22

Upper Brookville shows nearly 78% price acceleration, with median home values now exceeding $2.5 million in this Nassau County village. The dramatic shift from 3.4% to 6% annual growth demonstrates how even established luxury markets can experience intense investor speculation.

Upper Brookville – Gold Coast Estate Community Draws Investment

This exclusive village of 2,100 residents on Long Island’s Gold Coast has long been synonymous with luxury living, featuring sprawling estates and manor homes on multi-acre lots. Upper Brookville’s recent investment surge reflects growing investor recognition that Long Island luxury properties offer better value than comparable markets in the Hamptons or Fairfield County.

The community’s appeal stems from its combination of privacy, prestige, and proximity to Manhattan, with many properties featuring equestrian facilities and extensive grounds that provide resort-like amenities. Recent speculation has particularly focused on waterfront estates and historic properties that offer the unique character and luxury amenities that justify premium valuations in today’s competitive market.

20. Briarcliff Manor – Investor Feeding Frenzy Factor 78.64% (July 2025)

- Historical annual growth rate (2012–2022): 3.57%

- Recent annual growth rate (2022–2025): 6.39%

- Investor Feeding Frenzy Factor: 78.64%

- Current 2025 price: $1,065,470.33

Briarcliff Manor experiences nearly 79% price acceleration, pushing median home values past $1 million for the first time. This Westchester County village demonstrates how investor speculation can rapidly transform even well-established suburban communities with strong local housing markets.

Briarcliff Manor – Hudson Valley Village Becomes Investment Focus

This scenic village of 7,800 residents along the Hudson River has become a prime target for investors seeking Westchester County properties with both natural beauty and Manhattan accessibility. Briarcliff Manor’s combination of riverfront views, historic architecture, and excellent schools creates the perfect storm for investment speculation in today’s competitive suburban market.

The community benefits from its location along the Hudson, providing recreational opportunities and scenic beauty that justify premium prices compared to inland Westchester suburbs. Recent investor activity has particularly focused on properties with river views and historic homes that offer the character and luxury amenities that drive long-term appreciation in prestigious suburban markets.

19. Liverpool – Investor Feeding Frenzy Factor 78.77% (July 2025)

- Historical annual growth rate (2012–2022): 5.09%

- Recent annual growth rate (2022–2025): 9.09%

- Investor Feeding Frenzy Factor: 78.77%

- Current 2025 price: $275,839.12

Liverpool shows 79% price acceleration, with annual growth nearly doubling from 5.1% to over 9%, pushing median home values past $275,000. This Onondaga County community demonstrates how investor speculation has moved beyond luxury markets into middle-class Syracuse suburbs.

Liverpool – Syracuse Suburb Faces Investment Pressure

This village of 2,300 residents northwest of Syracuse has experienced unexpected investor interest due to its combination of small-town character and urban convenience. Liverpool offers access to Syracuse employment centers while maintaining the community feel that appeals to families, though recent speculation threatens the affordability that historically defined the area.

The community’s location along Onondaga Lake provides recreational opportunities that enhance property values, while proximity to major highways offers easy access throughout Central New York. Recent investor activity has particularly targeted waterfront properties and homes within highly-rated school districts, with speculation driven by recognition that Syracuse-area suburbs remain undervalued compared to similar markets in other northeastern metropolitan areas.

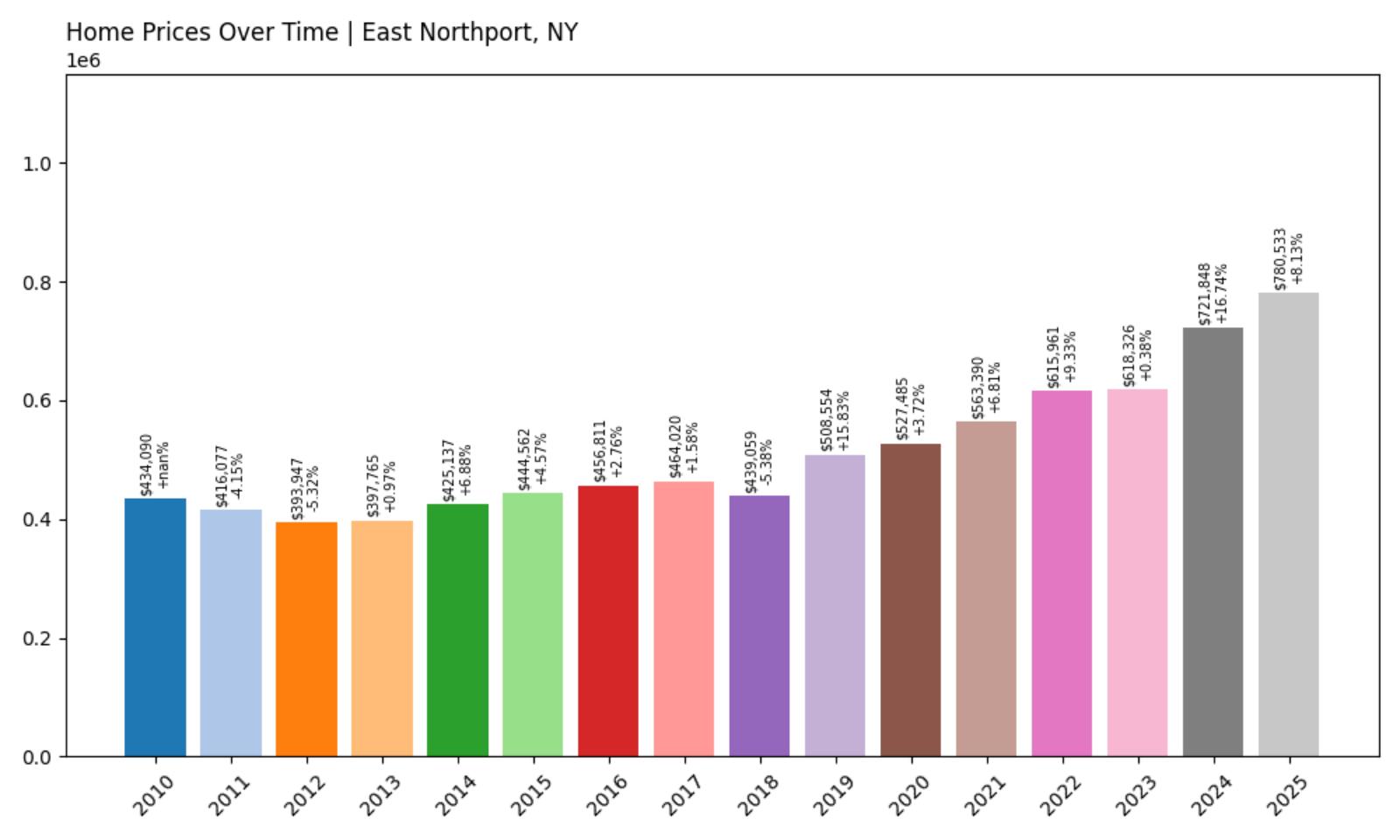

18. East Northport – Investor Feeding Frenzy Factor 79.67% (July 2025)

- Historical annual growth rate (2012–2022): 4.57%

- Recent annual growth rate (2022–2025): 8.21%

- Investor Feeding Frenzy Factor: 79.67%

- Current 2025 price: $780,532.54

East Northport experiences nearly 80% price acceleration, with median home values approaching $781,000 as investor interest transforms this Suffolk County community. The dramatic shift from 4.6% to over 8% annual growth demonstrates how speculation pressure has spread throughout Long Island’s suburban markets.

East Northport – Long Island Suburb Becomes Investment Target

DanTD, CC BY-SA 4.0, via Wikimedia Commons

This Suffolk County community of 20,200 residents has become a focal point for investors seeking Long Island properties that offer suburban amenities without Hamptons-level prices. East Northport’s combination of good schools, established neighborhoods, and reasonable commuting distance to Manhattan creates the market conditions that drive investment speculation.

The community features predominantly single-family homes built in the post-war suburban boom, providing the space and character that appeals to both families and investors. Recent speculation has particularly focused on properties near the Long Island Rail Road, where the 90-minute commute to Manhattan makes East Northport increasingly attractive to buyers priced out of closer-in Nassau County markets.

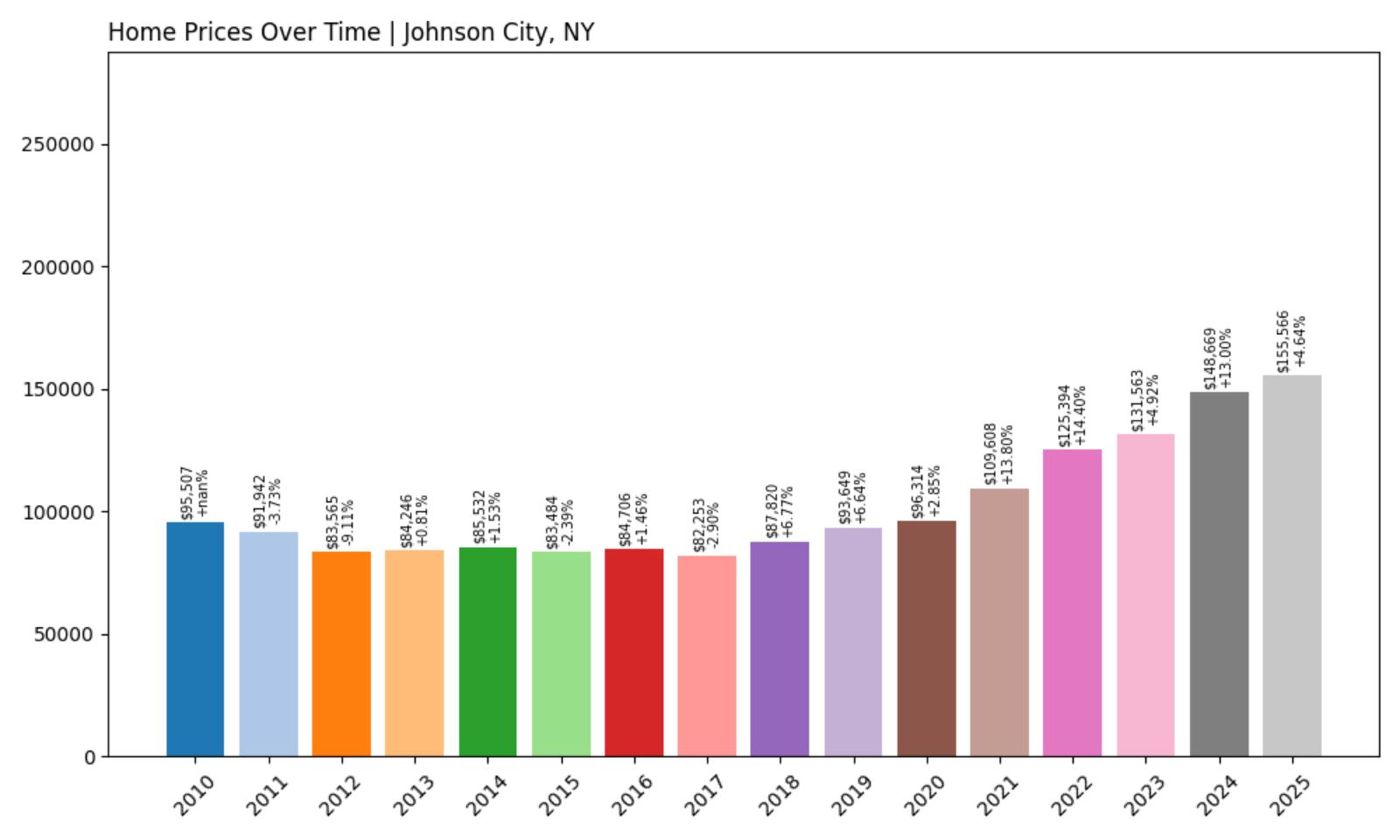

17. Johnson City – Investor Feeding Frenzy Factor 79.91% (July 2025)

- Historical annual growth rate (2012–2022): 4.14%

- Recent annual growth rate (2022–2025): 7.45%

- Investor Feeding Frenzy Factor: 79.91%

- Current 2025 price: $155,566.11

Johnson City rounds out the communities with nearly 80% price acceleration, though median home values remain relatively affordable at $155,566. This Broome County village demonstrates how investor speculation has reached even modest upstate markets where housing traditionally remained accessible to working families.

Johnson City – Triple Cities Community Faces Investment Surge

This village of 15,200 residents forms part of the Triple Cities area along with Binghamton and Endicott, creating a regional employment center that has attracted unexpected investor interest. Johnson City’s combination of affordable housing, urban amenities, and proximity to major universities makes it appealing to investors seeking rental property opportunities in upstate markets.

The community benefits from its history as a planned industrial town, featuring well-designed neighborhoods and public spaces that provide character often missing in purely residential suburban developments. Recent speculation has particularly targeted multi-family properties and homes near SUNY Binghamton, with investors recognizing the stable rental demand created by the area’s educational institutions and healthcare employers.

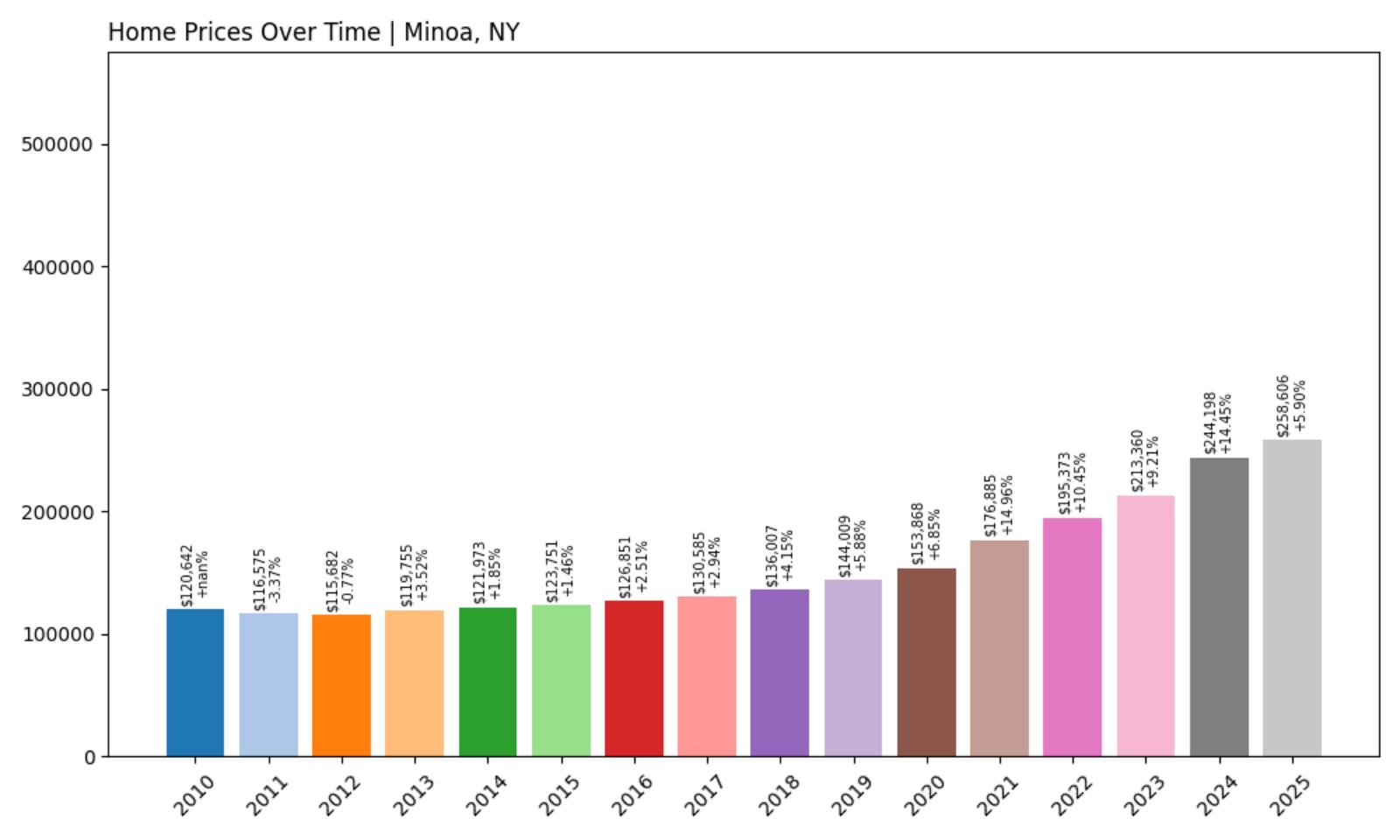

16. Minoa – Investor Feeding Frenzy Factor 82.09% (July 2025)

- Historical annual growth rate (2012–2022): 5.38%

- Recent annual growth rate (2022–2025): 9.80%

- Investor Feeding Frenzy Factor: 82.09%

- Current 2025 price: $258,606.46

Minoa crosses the 82% price acceleration threshold, with annual growth jumping from 5.4% to nearly 10% and pushing median home values past $258,000. This Onondaga County village shows how investor feeding frenzies can rapidly transform small suburban communities throughout Central New York.

Minoa – Syracuse Area Village Experiences Investment Boom

This village of 3,500 residents east of Syracuse has become an unexpected investor target due to its combination of small-town charm and regional accessibility. Minoa offers the community feel that appeals to families while providing easy access to Syracuse employment centers and major highways connecting to other upstate metropolitan areas.

The community’s appeal stems from its well-maintained neighborhoods and active local government that has successfully preserved village character while accommodating growth. Recent investor activity has particularly focused on single-family homes within walking distance of the village center, with speculation driven by recognition that Syracuse-area communities offer significant value compared to similar markets in other northeastern states.

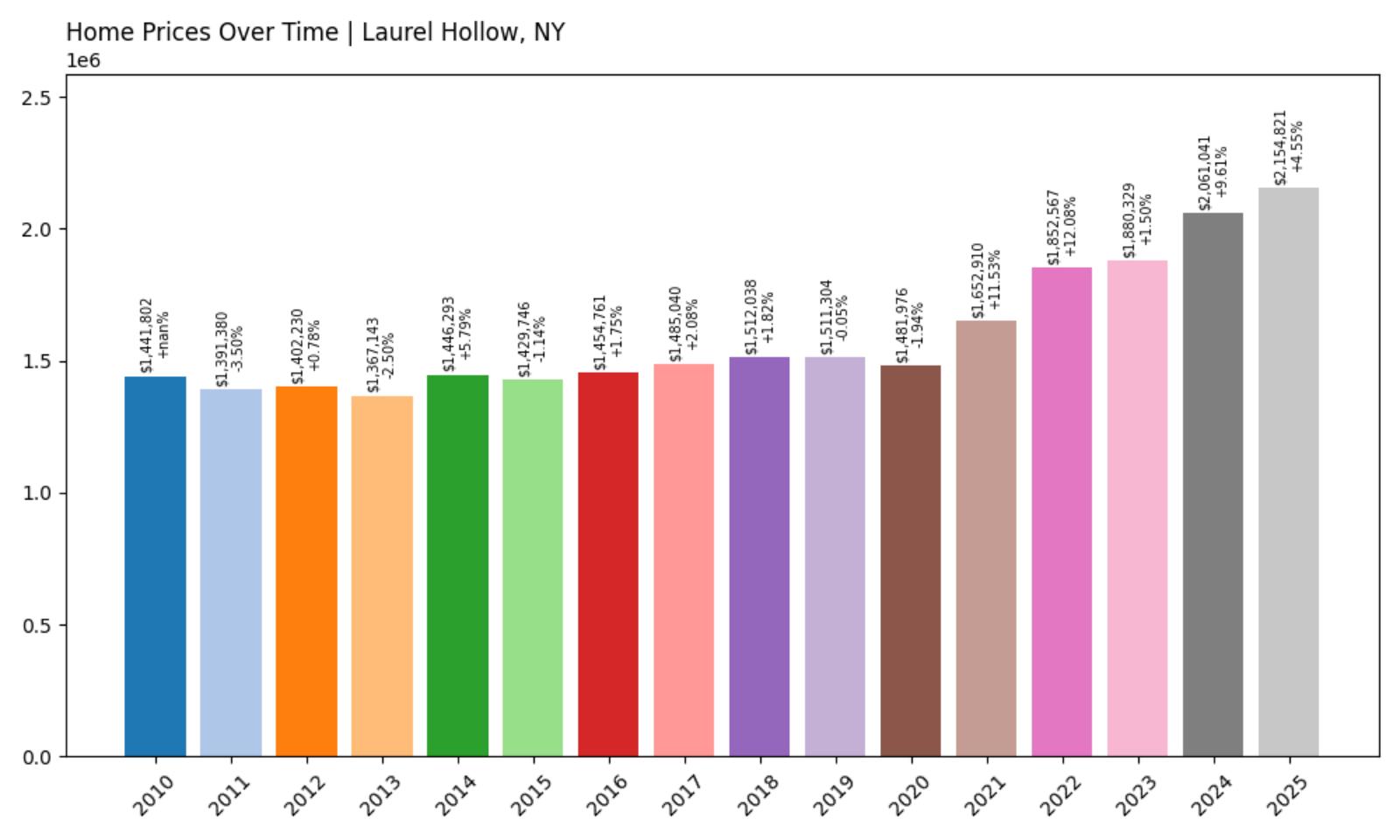

15. Laurel Hollow – Investor Feeding Frenzy Factor 82.95% (July 2025)

- Historical annual growth rate (2012–2022): 2.82%

- Recent annual growth rate (2022–2025): 5.17%

- Investor Feeding Frenzy Factor: 82.95%

- Current 2025 price: $2,154,820.78

Laurel Hollow shows 83% price acceleration despite already premium pricing, with median home values exceeding $2.1 million in this Nassau County village. The dramatic shift from 2.8% to over 5% annual growth demonstrates how investor speculation affects even the most exclusive Long Island communities.

Laurel Hollow – Gold Coast Village Attracts Heavy Investment

This exclusive village of 1,950 residents on Long Island’s North Shore has long been synonymous with luxury living, featuring sprawling estates and waterfront properties that have attracted wealthy families for generations. Laurel Hollow’s recent investment surge reflects growing investor recognition that Gold Coast properties offer unique value propositions in today’s competitive luxury market.

The community’s appeal centers on its combination of privacy, natural beauty, and proximity to Manhattan, with many properties featuring private beaches and extensive grounds that provide resort-like amenities. Recent speculation has particularly focused on waterfront estates and historic properties that offer the character and luxury amenities that justify premium valuations in competitive high-end real estate markets.

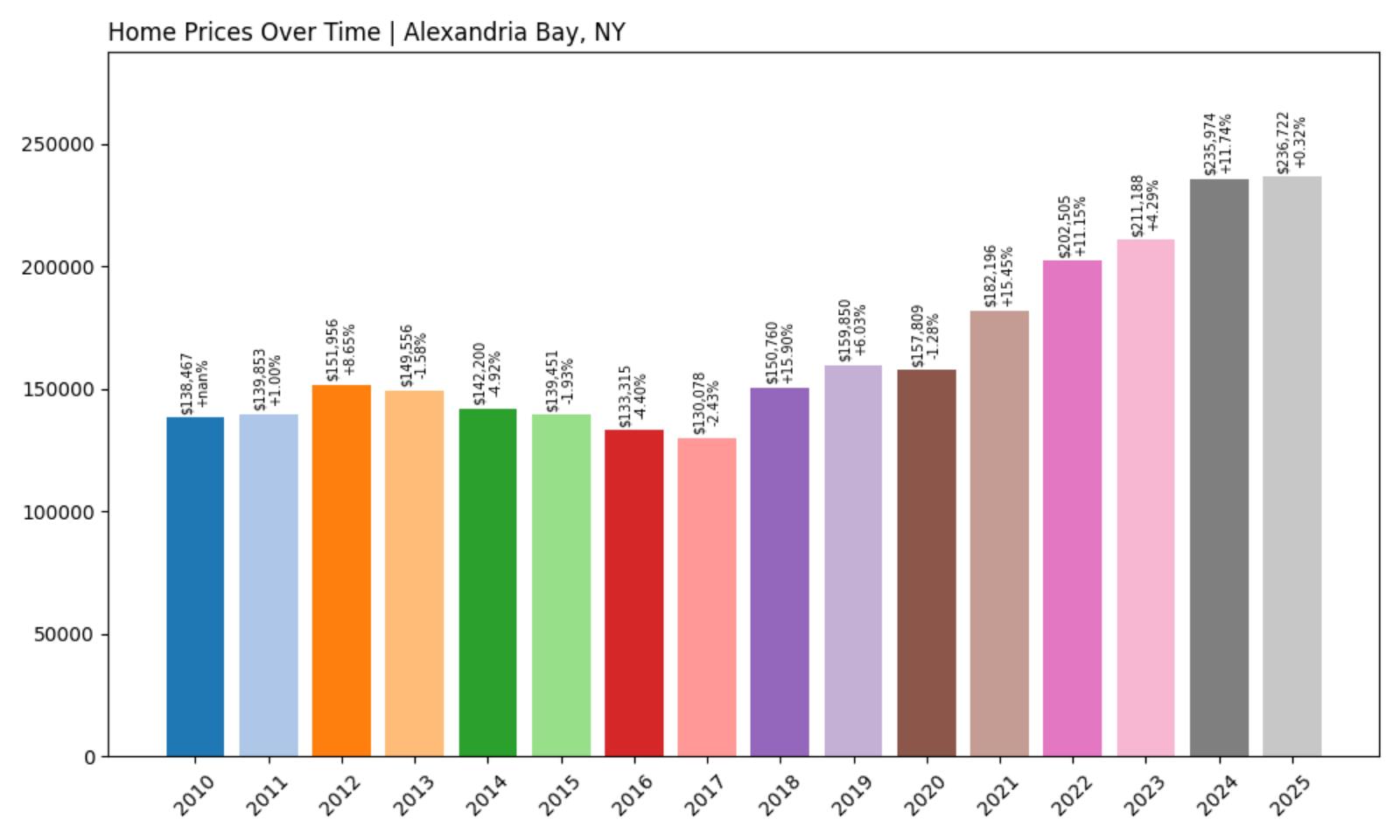

14. Alexandria Bay – Investor Feeding Frenzy Factor 83.36% (July 2025)

- Historical annual growth rate (2012–2022): 2.91%

- Recent annual growth rate (2022–2025): 5.34%

- Investor Feeding Frenzy Factor: 83.36%

- Current 2025 price: $236,722.04

Alexandria Bay reaches 83% price acceleration, with annual growth nearly doubling from 2.9% to over 5% and pushing median home values past $236,000. This Jefferson County village demonstrates how investor speculation has reached even remote resort communities along the Canadian border.

Alexandria Bay – Thousand Islands Resort Town Faces Investment Pressure

This village of 1,100 residents sits at the heart of the Thousand Islands region, where the St. Lawrence River creates one of New York’s most scenic recreational areas. Alexandria Bay’s recent investor interest stems from its unique combination of natural beauty, recreational opportunities, and proximity to both U.S. and Canadian markets that create year-round tourism potential.

The community has long served as a summer resort destination, with many properties featuring historic architecture and waterfront access that appeals to both seasonal residents and rental property investors. Recent speculation has particularly targeted commercial properties and multi-family buildings that can capitalize on the area’s growing tourism industry, though local residents worry that investment pressure threatens the working-class character that has defined the village for generations.

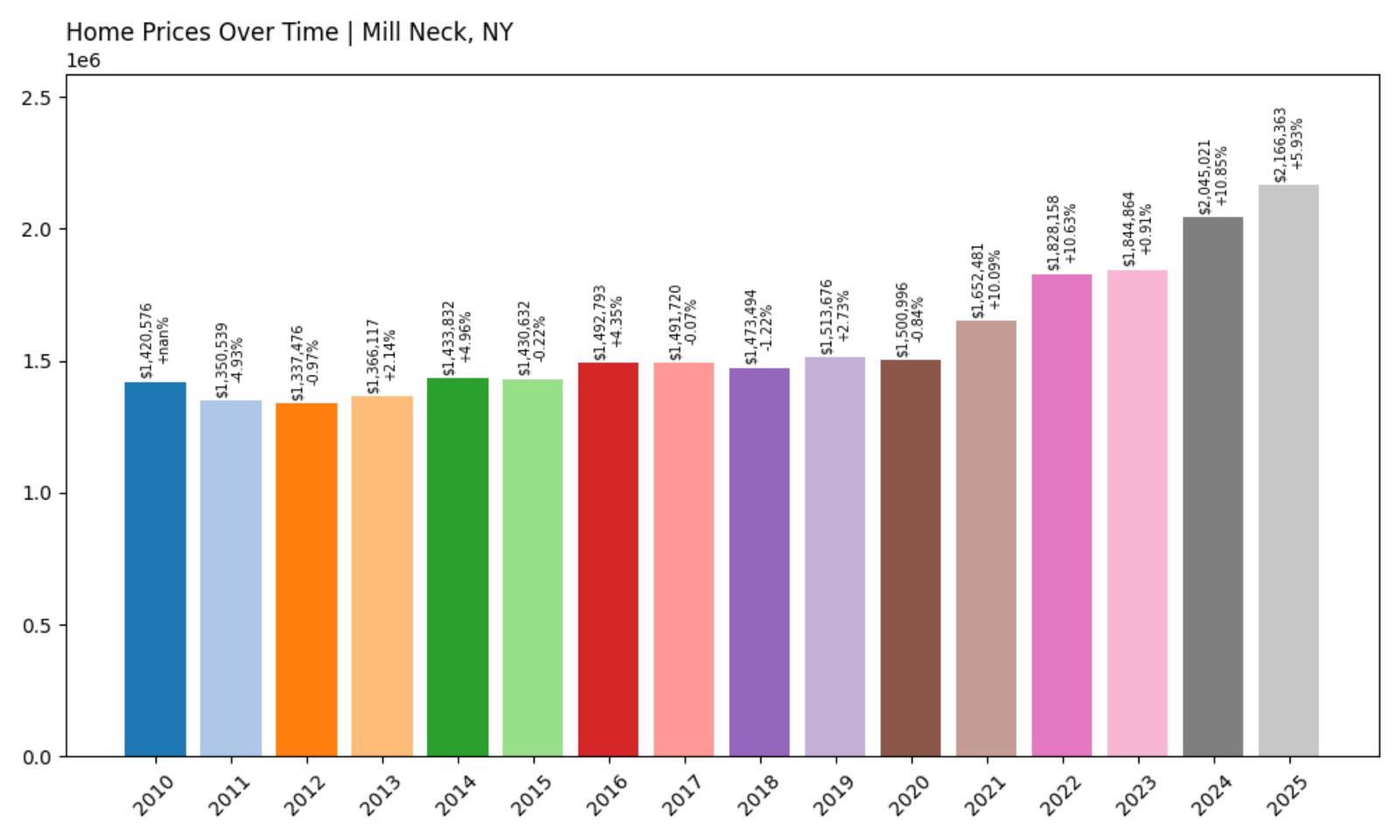

13. Mill Neck – Investor Feeding Frenzy Factor 83.37% (July 2025)

- Historical annual growth rate (2012–2022): 3.17%

- Recent annual growth rate (2022–2025): 5.82%

- Investor Feeding Frenzy Factor: 83.37%

- Current 2025 price: $2,166,363.14

Mill Neck shows 83% price acceleration, pushing median home values past $2.1 million in this Nassau County village. The jump from 3.2% to nearly 6% annual growth demonstrates how investor speculation has intensified throughout Long Island’s luxury residential markets.

Mill Neck – Exclusive Long Island Village Draws Investment

This village of 1,000 residents on Long Island’s Gold Coast represents one of New York’s most exclusive residential communities, where waterfront estates and mansion-sized homes have long attracted wealthy families seeking privacy and luxury. Mill Neck’s recent investment surge reflects growing recognition that Long Island luxury properties remain undervalued compared to similar markets in the Hamptons or Connecticut’s Gold Coast.

The community’s appeal stems from its protected harbor, private beaches, and proximity to both Manhattan and regional airports, creating the perfect combination of accessibility and exclusivity. Recent speculation has particularly focused on waterfront properties and historic estates that offer the unique character and luxury amenities that drive long-term appreciation in premium residential markets.

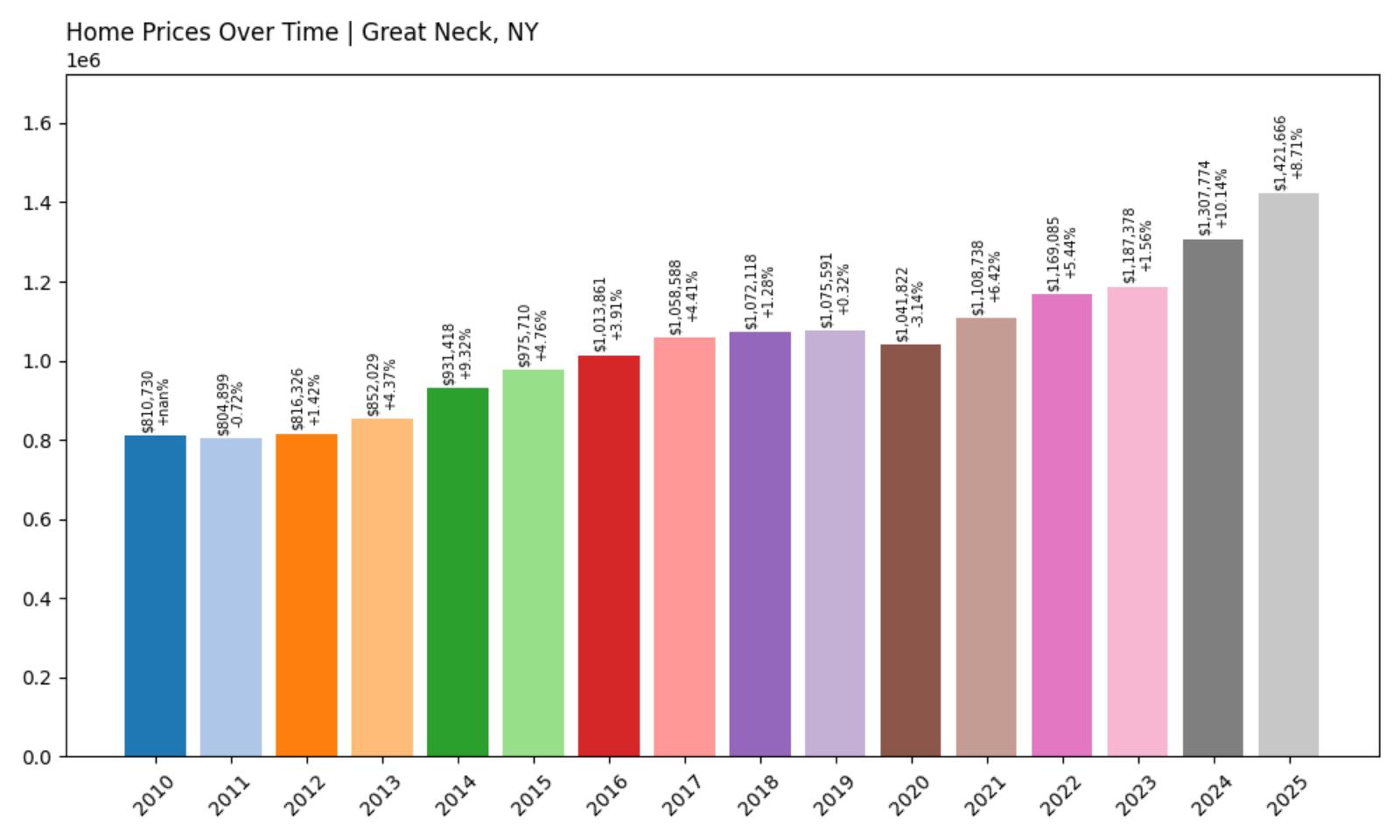

12. Great Neck – Investor Feeding Frenzy Factor 84.24% (July 2025)

Would you like to save this?

- Historical annual growth rate (2012–2022): 3.66%

- Recent annual growth rate (2022–2025): 6.74%

- Investor Feeding Frenzy Factor: 84.24%

- Current 2025 price: $1,421,665.56

Great Neck demonstrates 84% price acceleration, with median home values approaching $1.4 million as investor interest transforms this Nassau County peninsula. The dramatic shift from 3.7% to nearly 7% annual growth shows how speculation pressure has intensified throughout Long Island’s established suburban markets.

Great Neck – Long Island Peninsula Becomes Investment Hotspot

This peninsula community of 10,500 residents has become a prime target for investors seeking Long Island properties that combine suburban amenities with Manhattan accessibility. Great Neck’s location on the Long Island Sound provides waterfront living opportunities while maintaining the excellent schools and cultural amenities that justify premium suburban pricing.

The community benefits from direct Long Island Rail Road service to Manhattan, making the 45-minute commute attractive to city-based professionals and investors alike. Recent speculation has particularly focused on waterfront properties and homes within the highly-rated Great Neck school district, with investors recognizing that established suburban communities with water access remain undervalued compared to similar markets in Westchester County or Connecticut.

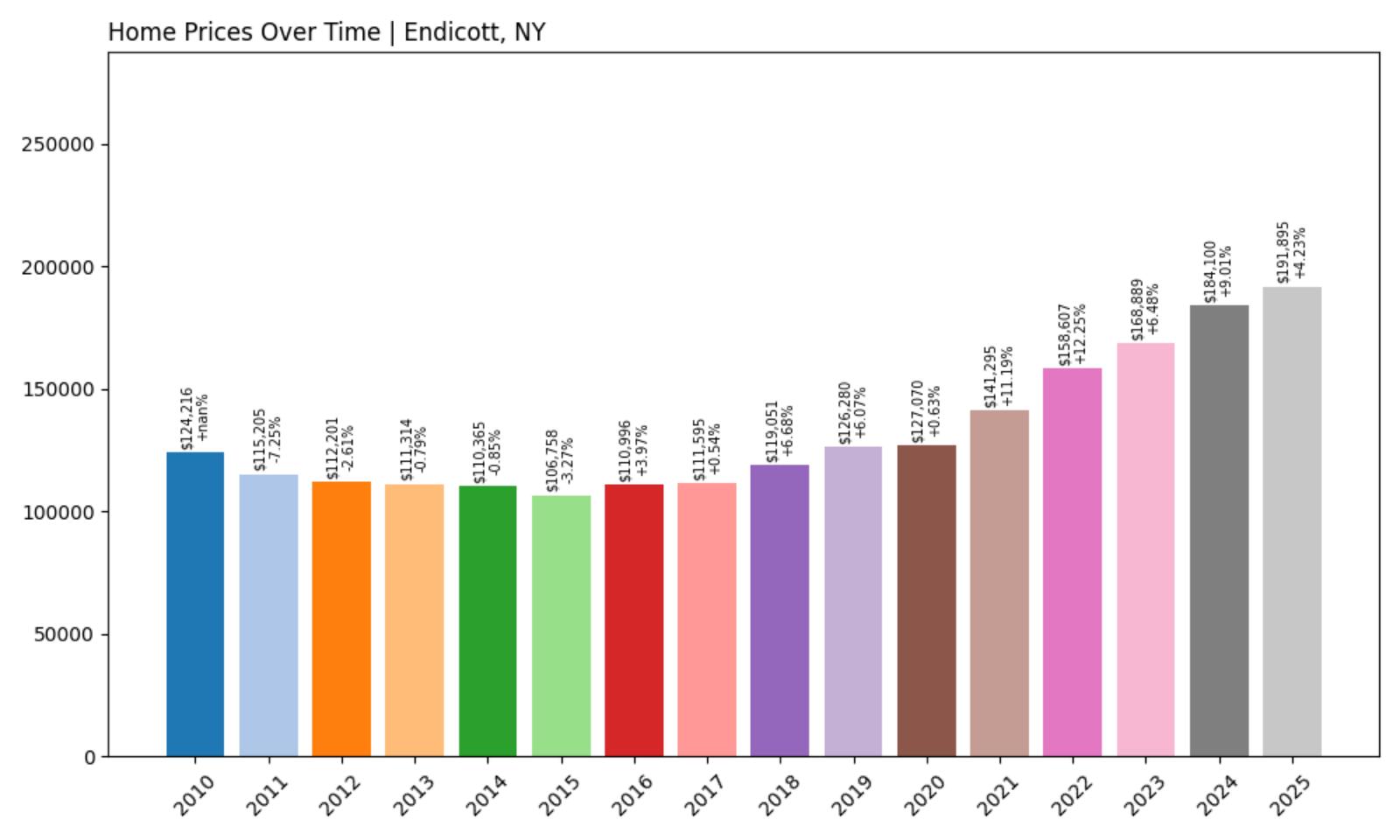

11. Endicott – Investor Feeding Frenzy Factor 86.16% (July 2025)

- Historical annual growth rate (2012–2022): 3.52%

- Recent annual growth rate (2022–2025): 6.56%

- Investor Feeding Frenzy Factor: 86.16%

- Current 2025 price: $191,895.28

Endicott reaches 86% price acceleration while maintaining relatively affordable median home values at $191,895. This Broome County village demonstrates how investor feeding frenzies can impact working-class communities where housing traditionally remained accessible to local families.

Endicott – Triple Cities Community Experiences Investment Surge

This village of 13,400 residents forms part of the Triple Cities area with Binghamton and Johnson City, creating a regional employment hub that has attracted unexpected investor attention. Endicott’s combination of affordable housing, established neighborhoods, and proximity to major employers makes it appealing to investors seeking rental property opportunities in upstate markets.

The community benefits from its history as a planned industrial town, featuring well-designed neighborhoods and public amenities that provide character often missing in purely residential developments. Recent investor activity has particularly targeted multi-family properties and homes near major employers like Lockheed Martin, with speculation driven by recognition that the Triple Cities area offers stable employment and rental demand at prices far below comparable northeastern markets.

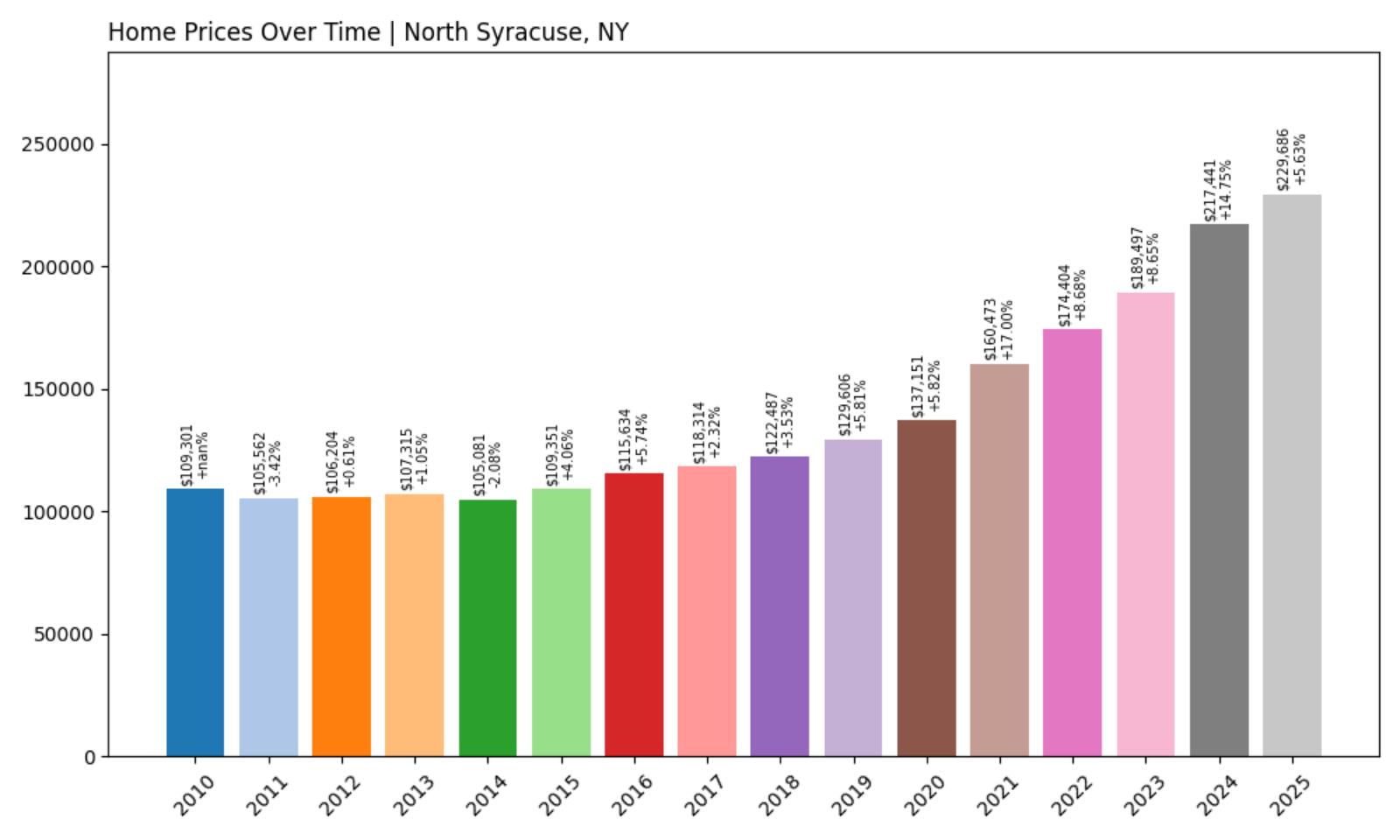

10. North Syracuse – Investor Feeding Frenzy Factor 89.03% (July 2025)

- Historical annual growth rate (2012–2022): 5.09%

- Recent annual growth rate (2022–2025): 9.61%

- Investor Feeding Frenzy Factor: 89.03%

- Current 2025 price: $229,686.22

North Syracuse breaks into the top 10 with 89% price acceleration, nearly doubling annual growth from 5.1% to over 9% and pushing median home values past $229,000. This Onondaga County village shows how investor speculation has reached suburban communities throughout the Syracuse metropolitan area.

North Syracuse – Syracuse Suburb Faces Major Investment Pressure

This village of 6,800 residents north of Syracuse has experienced intense investor interest due to its combination of suburban amenities and urban accessibility. North Syracuse offers established neighborhoods, good schools, and easy access to regional employment centers, creating the market conditions that drive investment speculation in upstate communities.

The community’s appeal stems from its location along major transportation corridors and proximity to Syracuse University, providing both residential stability and rental property potential. Recent speculation has particularly focused on single-family homes within walking distance of shopping centers and schools, with investors recognizing that Syracuse-area suburbs offer significant value compared to similar markets throughout the Northeast corridor.

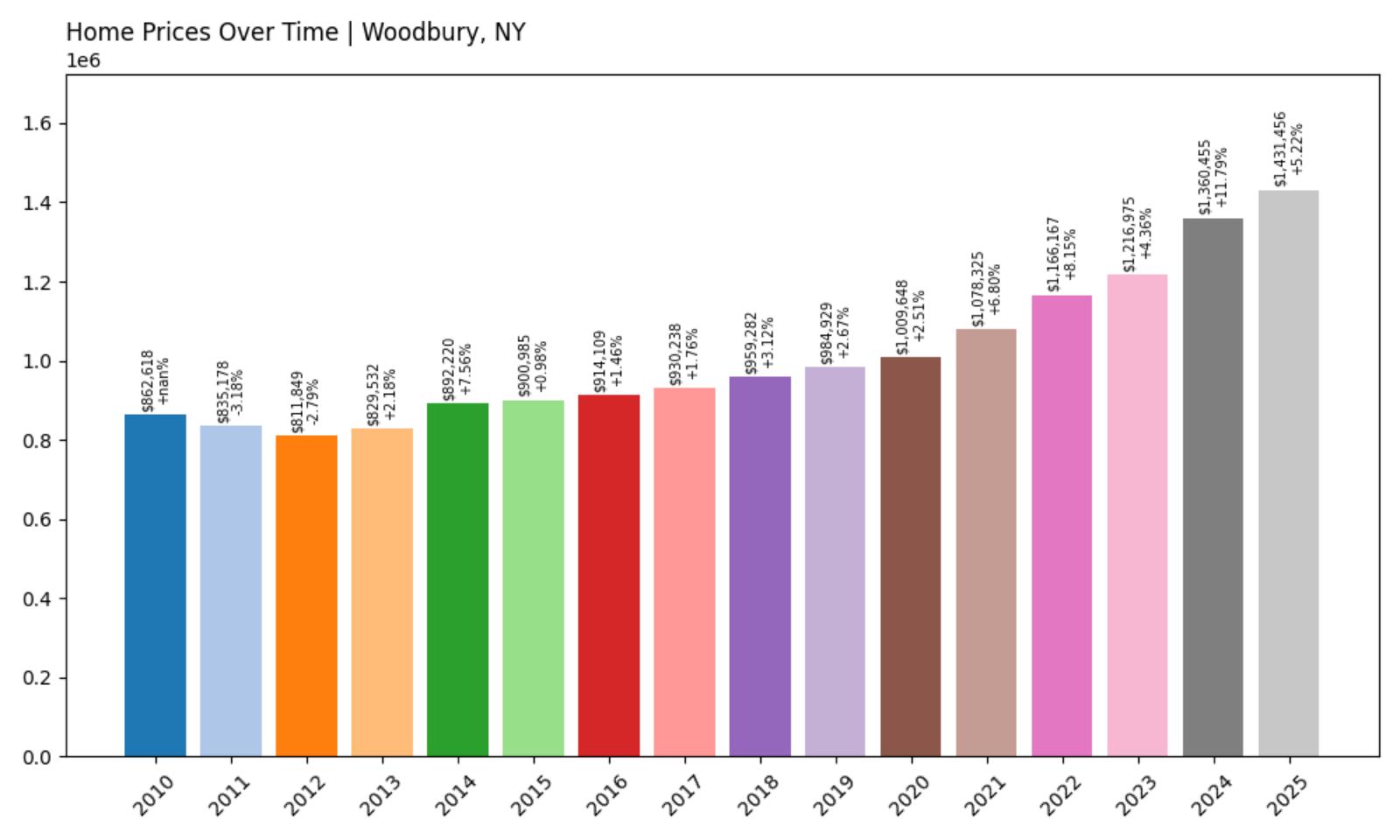

9. Woodbury – Investor Feeding Frenzy Factor 91.73% (July 2025)

- Historical annual growth rate (2012–2022): 3.69%

- Recent annual growth rate (2022–2025): 7.07%

- Investor Feeding Frenzy Factor: 91.73%

- Current 2025 price: $1,431,455.76

Woodbury enters the top 10 with nearly 92% price acceleration, pushing median home values past $1.4 million in this Nassau County community. The dramatic shift from 3.7% to over 7% annual growth demonstrates how investor speculation has intensified throughout Long Island’s premium suburban markets.

Woodbury – Long Island Community Becomes Investment Focus

This Nassau County community of 10,700 residents has become a prime target for investors seeking Long Island properties that offer suburban tranquility with metropolitan accessibility. Woodbury’s combination of excellent schools, established neighborhoods, and proximity to both Manhattan and regional employment centers creates the perfect storm for investment speculation.

The community features predominantly single-family homes on larger lots than typical Long Island suburbs, providing the space and privacy that justify premium prices in today’s competitive market. Recent investor activity has particularly focused on properties within highly-rated school districts and homes with easy highway access, recognizing that established suburban communities with quality amenities remain undervalued compared to similar markets in Westchester County.

8. Endwell – Investor Feeding Frenzy Factor 106.80% (July 2025)

- Historical annual growth rate (2012–2022): 3.75%

- Recent annual growth rate (2022–2025): 7.75%

- Investor Feeding Frenzy Factor: 106.80%

- Current 2025 price: $210,534.18

Endwell breaks the 100% acceleration barrier with 107% price growth acceleration, more than doubling from 3.8% to nearly 8% annually while maintaining median home values around $210,000. This Broome County community demonstrates how intense investor speculation has reached even modest upstate markets.

Endwell – Triple Cities Village Experiences Investment Boom

This village of 11,400 residents completes the Triple Cities area with Binghamton and Johnson City, creating a regional economic center that has attracted significant investor attention. Endwell’s combination of affordable housing, suburban amenities, and proximity to major employers like Binghamton University makes it particularly appealing to investors seeking stable rental markets.

The community benefits from its well-planned suburban development and access to recreational facilities that enhance quality of life without dramatically increasing housing costs. Recent speculation has particularly targeted single-family homes and small multi-family properties, with investors recognizing that the Triple Cities area offers employment stability and rental demand at prices that remain far below comparable northeastern metropolitan markets.

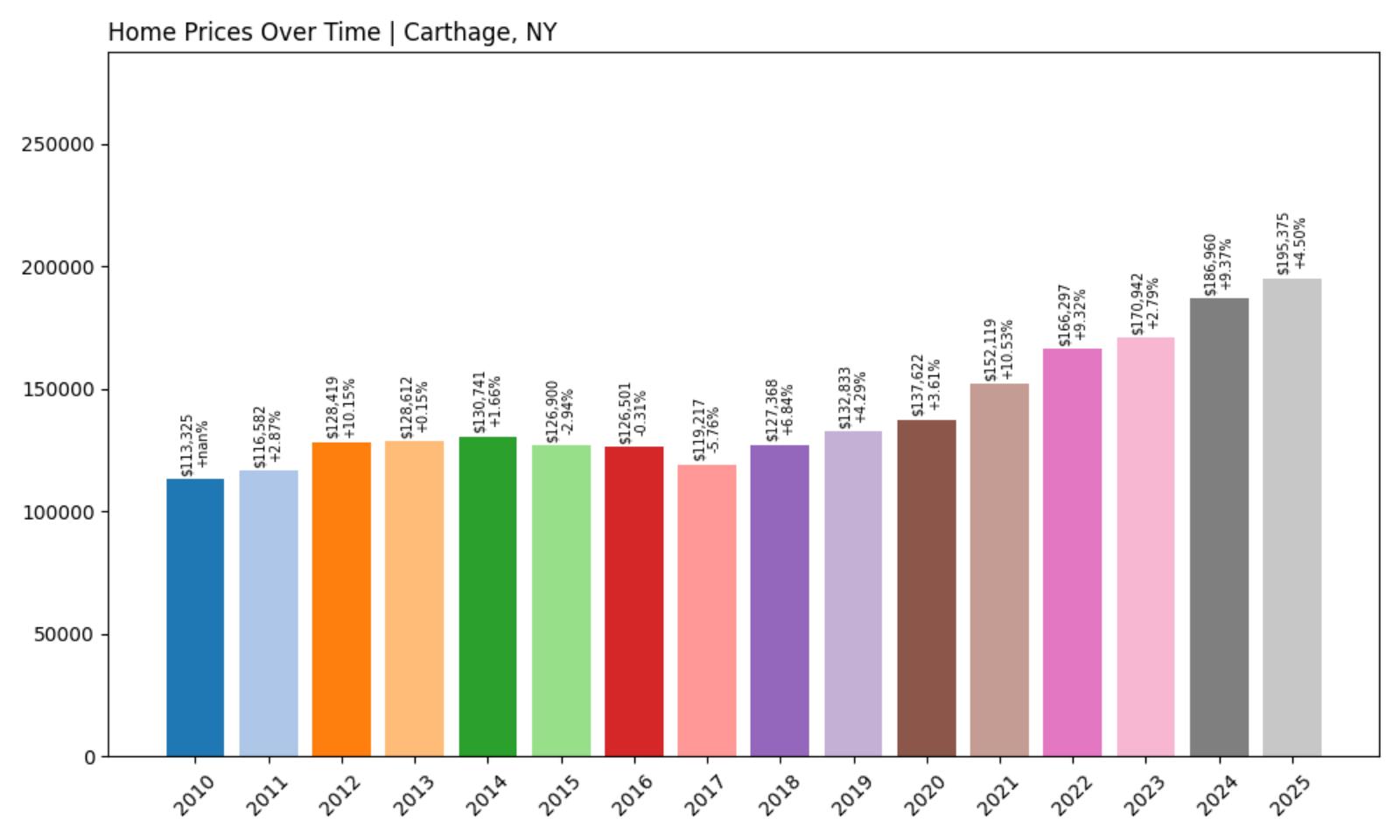

7. Carthage – Investor Feeding Frenzy Factor 110.76% (July 2025)

- Historical annual growth rate (2012–2022): 2.62%

- Recent annual growth rate (2022–2025): 5.52%

- Investor Feeding Frenzy Factor: 110.76%

- Current 2025 price: $195,375.21

Carthage shows 111% price acceleration despite maintaining affordable median home values around $195,000, demonstrating how investor feeding frenzies can impact even remote upstate communities. The more than doubling of annual growth rates from 2.6% to over 5% represents one of the most dramatic speculation surges in rural New York.

Carthage – North Country Village Faces Unexpected Investment

This Jefferson County village of 3,700 residents near the Canadian border has experienced surprising investor interest due to its proximity to Fort Drum military installation and growing outdoor recreation tourism. Carthage offers authentic small-town living with access to the Adirondack Mountains and Thousand Islands region, creating appeal for both seasonal residents and rental property investors.

The community’s strategic location along major highways connecting to both military and recreational destinations has driven recent speculation, particularly in multi-family properties that can serve both permanent residents and seasonal visitors. Local officials express concern that investor-driven price increases could disrupt the affordable housing that has historically allowed working families and military personnel to remain in the North Country despite limited economic opportunities.

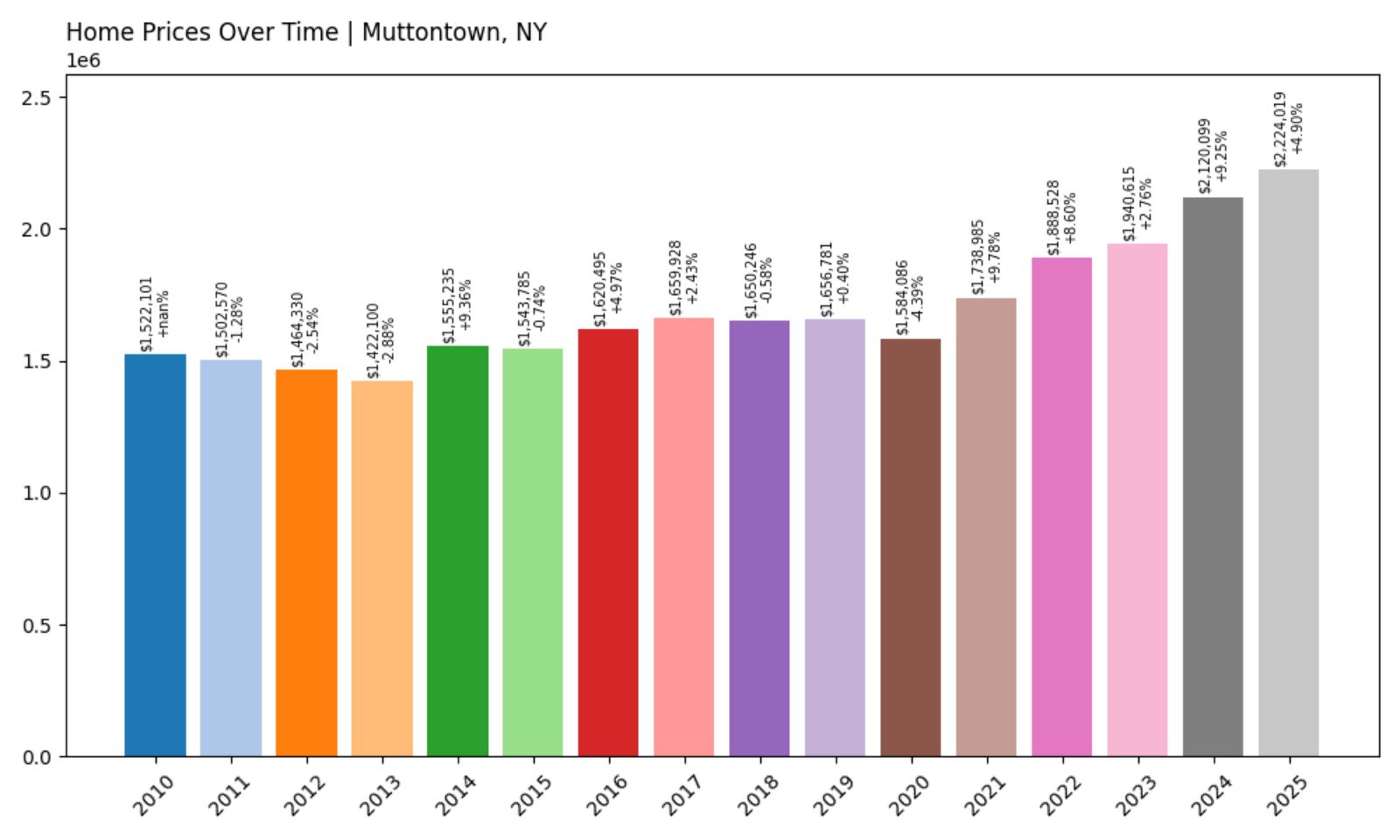

6. Muttontown – Investor Feeding Frenzy Factor 117.41% (July 2025)

- Historical annual growth rate (2012–2022): 2.58%

- Recent annual growth rate (2022–2025): 5.60%

- Investor Feeding Frenzy Factor: 117.41%

- Current 2025 price: $2,224,018.95

Muttontown achieves 117% price acceleration, more than doubling annual growth rates while pushing median home values past $2.2 million. This Nassau County village demonstrates how investor speculation has reached extreme levels even in Long Island’s most exclusive residential communities.

Muttontown – Exclusive Long Island Enclave Attracts Heavy Investment

This village of 3,500 residents on Long Island’s Gold Coast represents one of New York’s most prestigious residential communities, where sprawling estates and equestrian properties have long attracted wealthy families seeking privacy and luxury. Muttontown’s recent investment surge reflects growing investor recognition that Long Island luxury properties offer unique value propositions compared to similar markets in the Hamptons or Fairfield County.

The community’s appeal centers on its rural character within suburban proximity to Manhattan, with many properties featuring horse farms, private recreational facilities, and extensive grounds that provide resort-like amenities. Recent speculation has particularly focused on estate properties and historic homes that offer the character and luxury amenities that justify premium valuations in today’s competitive high-end real estate market.

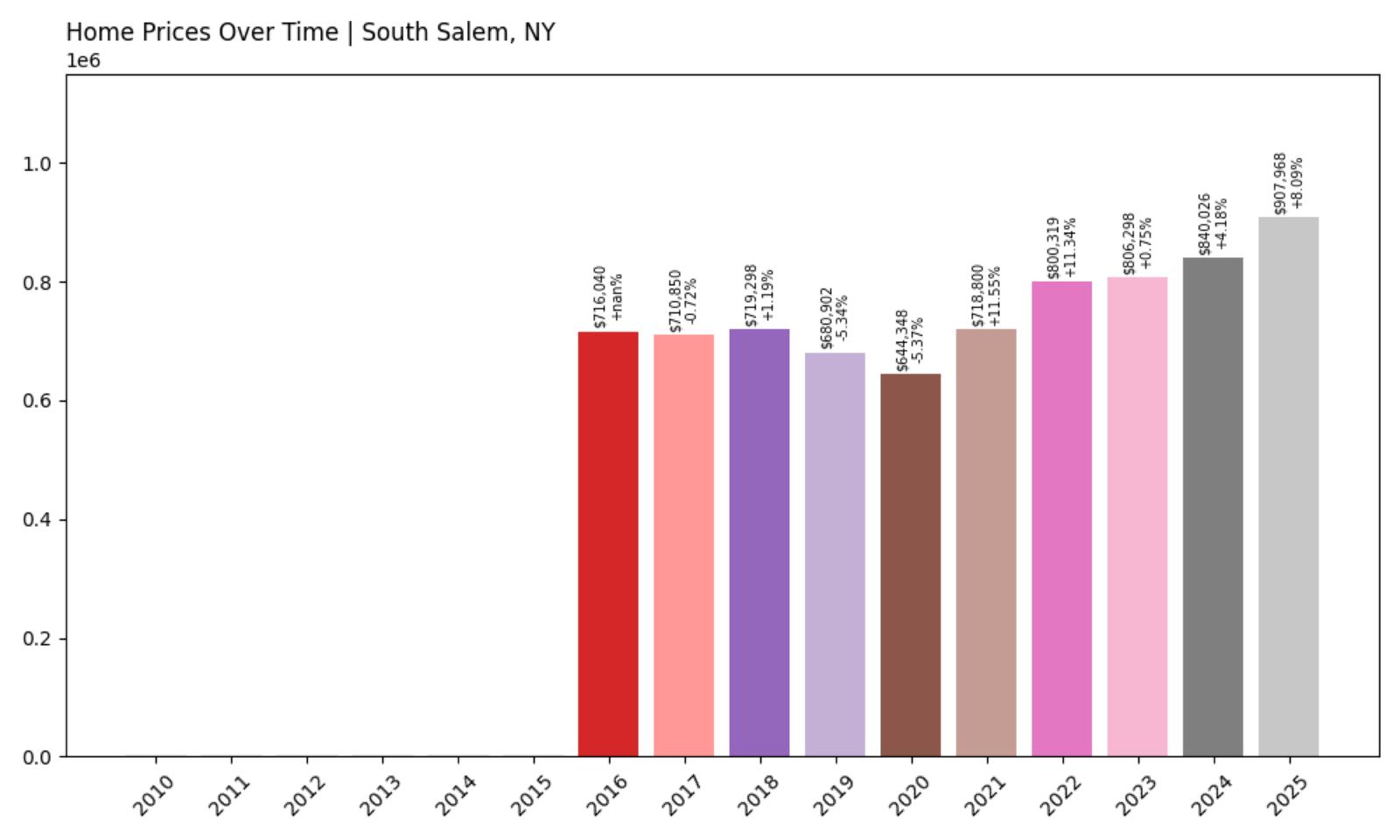

5. South Salem – Investor Feeding Frenzy Factor 129.52% (July 2025)

- Historical annual growth rate (2012–2022): 1.87%

- Recent annual growth rate (2022–2025): 4.30%

- Investor Feeding Frenzy Factor: 129.52%

- Current 2025 price: $907,968.26

South Salem reaches 130% price acceleration despite moderate absolute growth rates, with median home values approaching $908,000 in this Westchester County hamlet. The dramatic shift from 1.9% to over 4% annual growth demonstrates how investor speculation can rapidly transform even rural luxury markets.

South Salem – Westchester Hamlet Becomes Investment Target

This hamlet of 5,400 residents in northern Westchester County has become an unexpected investor focus due to its combination of rural character and metropolitan accessibility. South Salem offers large-lot properties and equestrian facilities while maintaining reasonable access to Manhattan and regional employment centers, creating the market conditions that drive luxury speculation.

The community’s appeal stems from its preserved rural character and proximity to the Connecticut border, providing access to both New York and Connecticut employment markets. Recent investor activity has particularly targeted estate properties and homes with acreage, recognizing that rural Westchester communities offer space and privacy that justify premium prices compared to more densely developed suburban alternatives throughout the region.

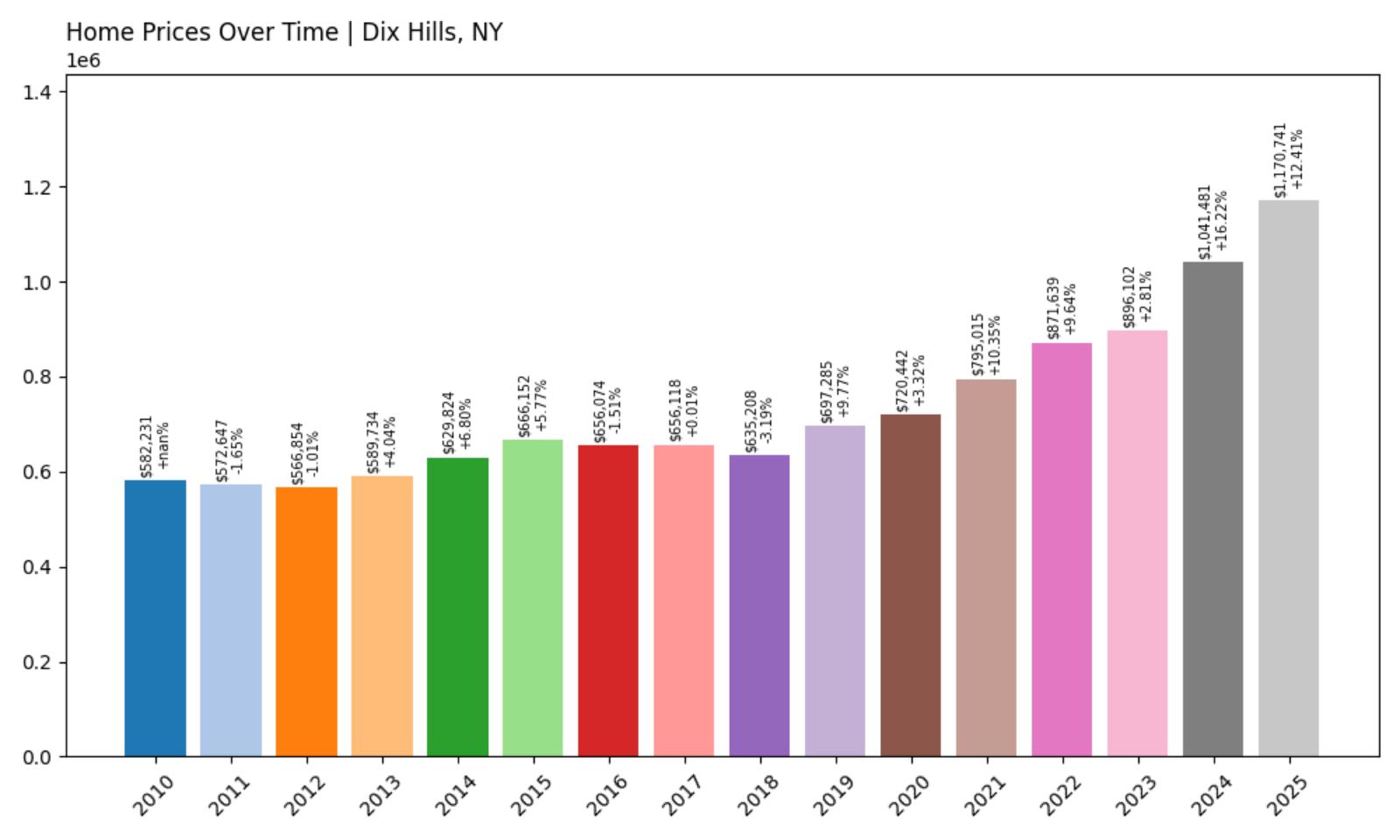

4. Dix Hills – Investor Feeding Frenzy Factor 135.03% (July 2025)

- Historical annual growth rate (2012–2022): 4.40%

- Recent annual growth rate (2022–2025): 10.33%

- Investor Feeding Frenzy Factor: 135.03%

- Current 2025 price: $1,170,741.32

Dix Hills achieves 135% price acceleration with the highest absolute growth rate on our list, jumping from 4.4% to over 10% annually and pushing median home values past $1.1 million. This Suffolk County community demonstrates how investor speculation can create explosive price growth even in established suburban markets.

Dix Hills – Long Island Suburb Experiences Investment Explosion

This Suffolk County community of 26,900 residents has become ground zero for Long Island investment speculation, with price growth rates that exceed even Manhattan luxury markets. Dix Hills offers the perfect combination of excellent schools, established neighborhoods, and reasonable commuting distance that drives intense investor competition in today’s suburban housing market.

The community’s appeal stems from its highly-rated school district and predominantly single-family housing stock that provides the space and amenities families seek when leaving urban markets. Recent speculation has particularly focused on homes within walking distance of schools and shopping centers, with investors recognizing that established Long Island suburbs with quality amenities offer better long-term appreciation potential than comparable markets in other northeastern metropolitan areas.

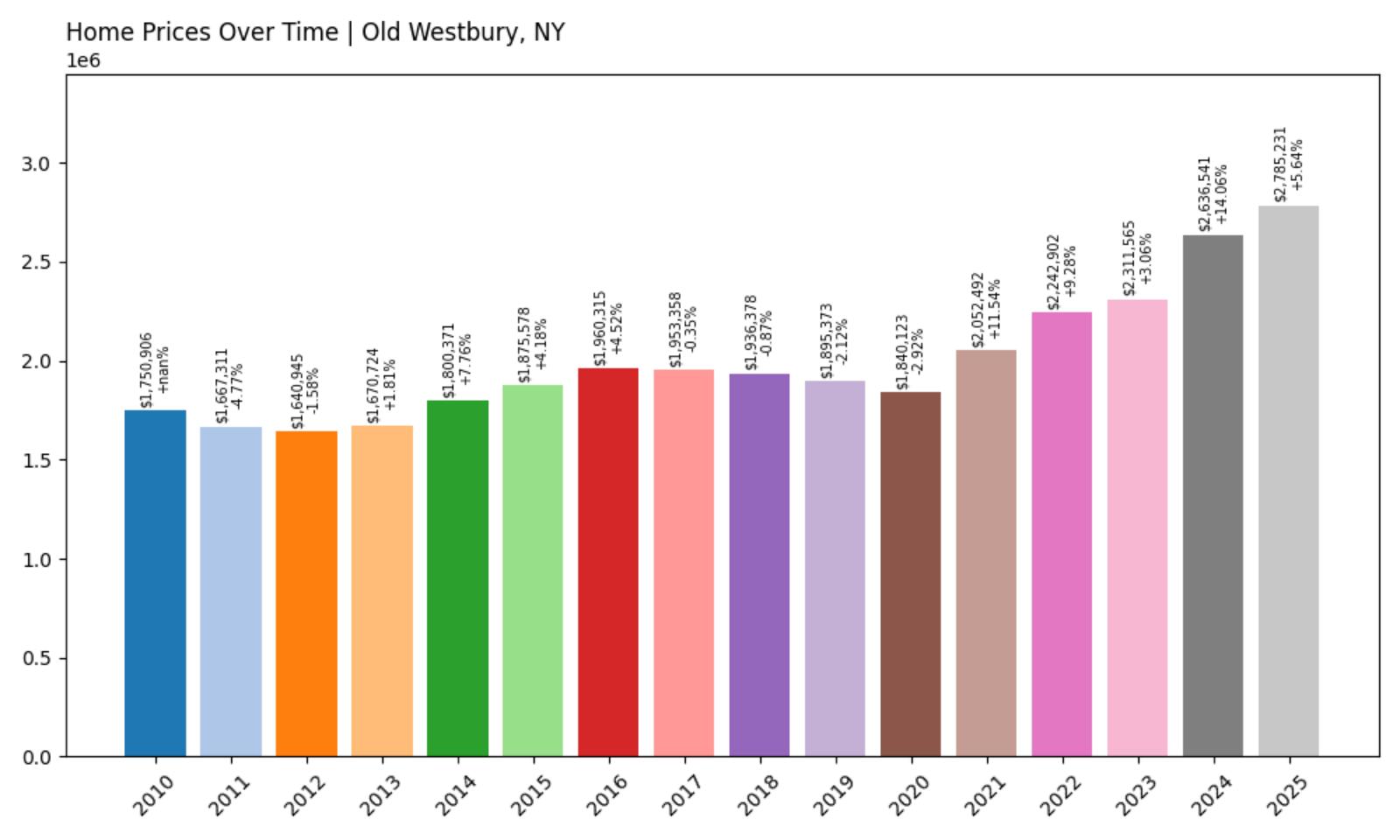

3. Old Westbury – Investor Feeding Frenzy Factor 135.82% (July 2025)

- Historical annual growth rate (2012–2022): 3.17%

- Recent annual growth rate (2022–2025): 7.49%

- Investor Feeding Frenzy Factor: 135.82%

- Current 2025 price: $2,785,231.42

Old Westbury takes third place with 136% price acceleration, pushing median home values past $2.7 million in this Nassau County village. The dramatic shift from 3.2% to nearly 7.5% annual growth represents one of the most extreme examples of luxury market speculation in New York State.

Old Westbury – Gold Coast Village Faces Investment Frenzy

This village of 4,700 residents on Long Island’s Gold Coast represents the pinnacle of luxury residential communities, where mansion-sized estates and sprawling grounds have attracted wealthy families for over a century. Old Westbury’s recent investment surge reflects growing investor recognition that Long Island luxury properties remain significantly undervalued compared to similar markets in the Hamptons, Fairfield County, or Manhattan.

The community’s appeal centers on its combination of privacy, prestige, and proximity to Manhattan, with many properties featuring equestrian facilities, private recreational amenities, and architectural significance that justify ultra-premium pricing. Recent speculation has particularly focused on historic estates and waterfront properties that offer the unique character and luxury amenities that drive long-term appreciation in the most exclusive residential markets.

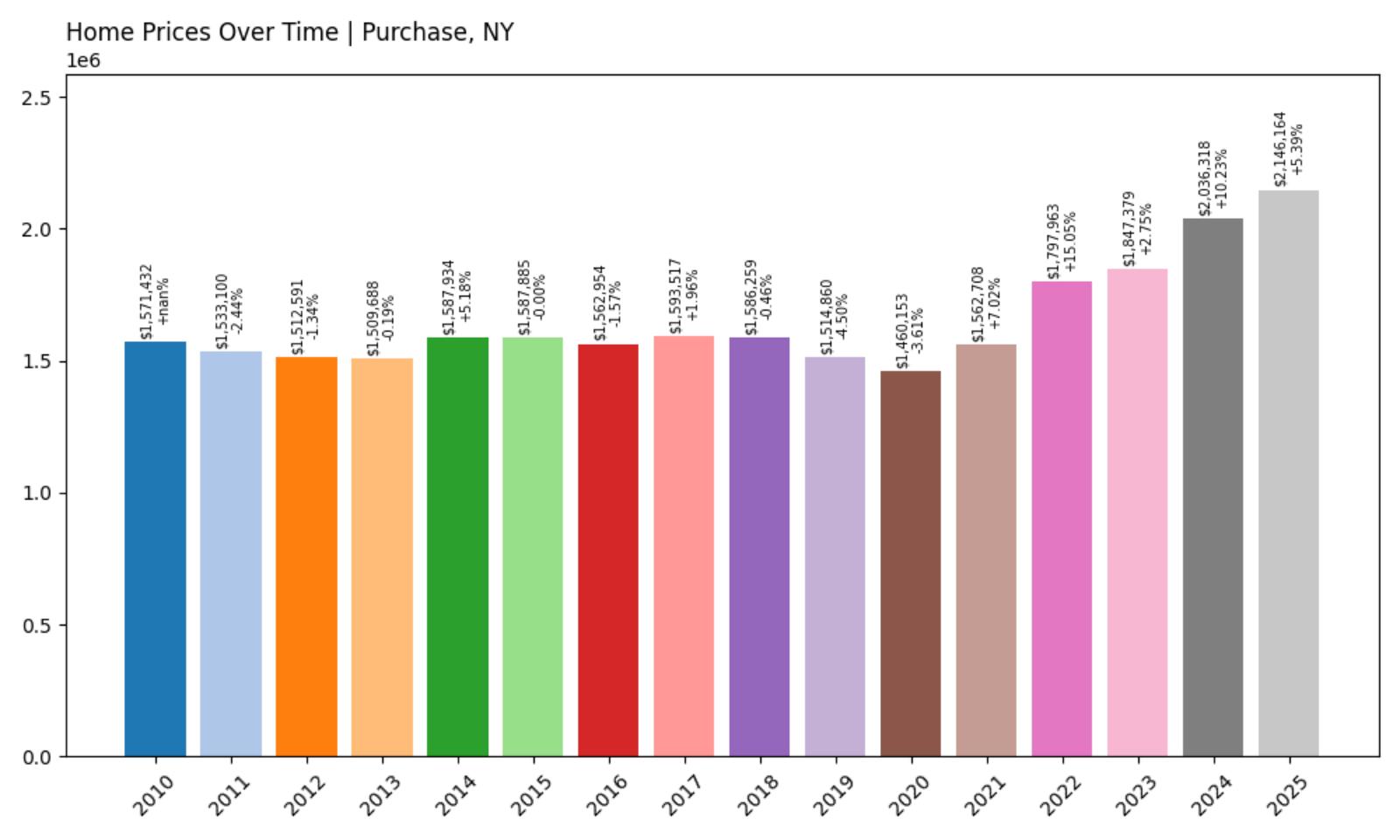

2. Purchase – Investor Feeding Frenzy Factor 248.67% (July 2025)

- Historical annual growth rate (2012–2022): 1.74%

- Recent annual growth rate (2022–2025): 6.08%

- Investor Feeding Frenzy Factor: 248.67%

- Current 2025 price: $2,146,163.86

Purchase claims second place with an extraordinary 249% price acceleration, transforming from minimal 1.7% growth to over 6% annually and pushing median home values past $2.1 million. This Westchester County hamlet demonstrates how investor speculation can create unprecedented market distortions even in already premium communities.

Purchase – Westchester Hamlet Becomes Investment Battleground

This hamlet of 4,100 residents in Harrison, New York has become the epicenter of Westchester County’s most intense investment speculation. Purchase combines corporate headquarters presence, excellent schools, and proximity to both Manhattan and regional airports, creating the perfect storm for investor competition that has fundamentally altered local housing dynamics.

The community’s unique appeal stems from its planned development around major corporations like PepsiCo and Mastercard, providing employment stability while maintaining residential exclusivity. Recent speculation has particularly focused on properties within the Purchase school district and homes with easy highway access, with investors recognizing that corporate-anchored communities offer both rental stability and long-term appreciation potential that justify aggressive bidding strategies.

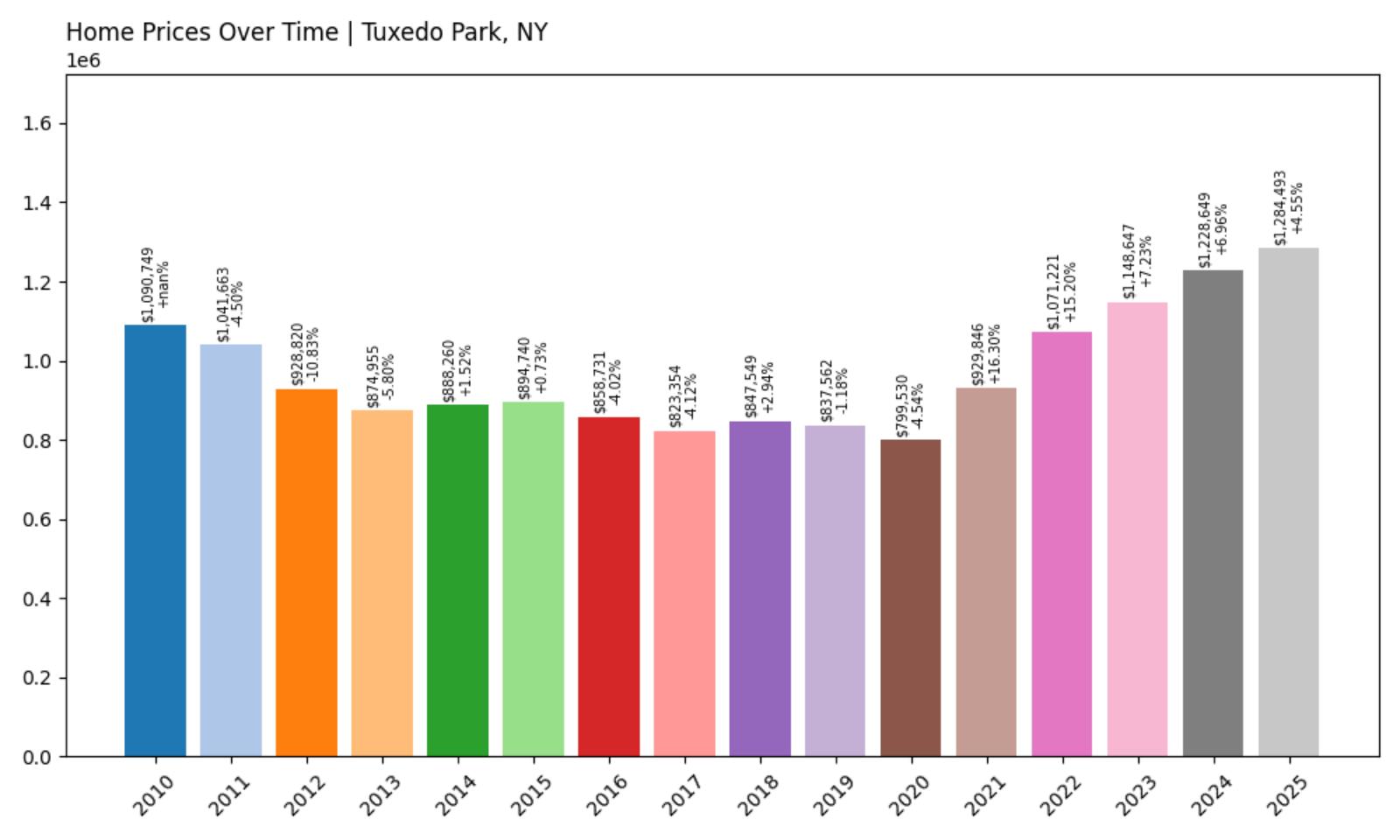

1. Tuxedo Park – Investor Feeding Frenzy Factor 334.29% (July 2025)

- Historical annual growth rate (2012–2022): 1.44%

- Recent annual growth rate (2022–2025): 6.24%

- Investor Feeding Frenzy Factor: 334.29%

- Current 2025 price: $1,284,492.68

Tuxedo Park tops our list with an unprecedented 334% price acceleration, representing the most extreme investor feeding frenzy in New York State. The dramatic transformation from barely 1.4% annual growth to over 6% has pushed median home values past $1.2 million, creating a textbook example of speculative market distortion.

Tuxedo Park – America’s First Gated Community Becomes Speculation Ground Zero

This exclusive gated community of 3,400 residents in Orange County has become the epicenter of New York’s most intense housing speculation, where investor competition has created price dynamics that exceed even Manhattan luxury markets. Originally developed in the 1880s as America’s first planned community for the wealthy, Tuxedo Park maintained stable pricing for over a century until recent investor discovery transformed it into a speculative battleground.

The village’s appeal stems from its unique combination of historical significance, natural beauty, and proximity to both Manhattan and the Hudson Valley’s growing tech corridor. Recent speculation has particularly focused on lakefront properties and historic estates that offer the exclusivity and character that justify ultra-premium pricing in today’s competitive luxury market. Local residents report that investor activity has fundamentally altered community dynamics, with many longtime families unable to compete with cash-heavy speculation that treats homes as investment vehicles rather than family residences.

Haven't Seen Yet

Curated from our most popular plans. Click any to explore.