Would you like to save this?

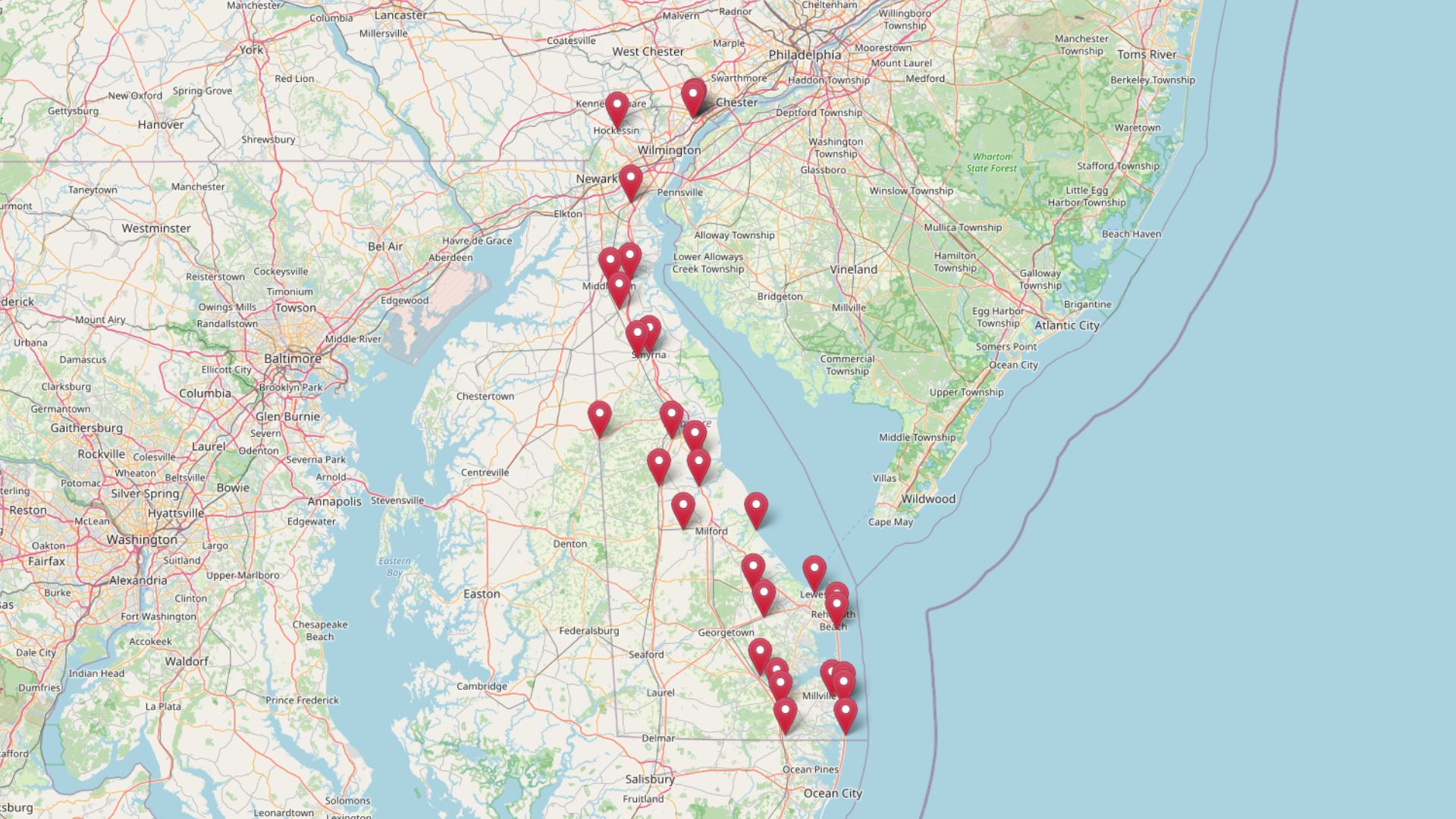

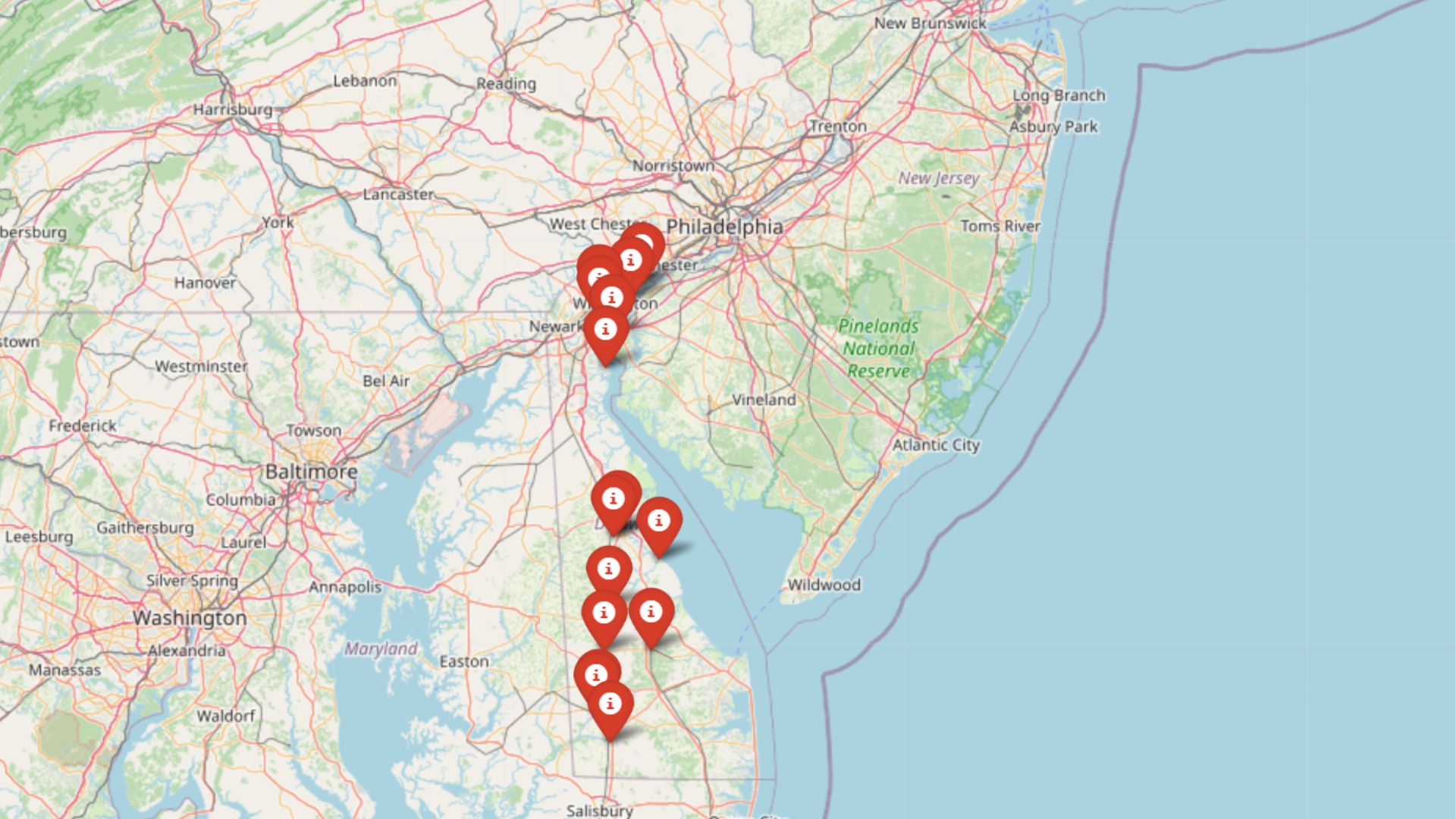

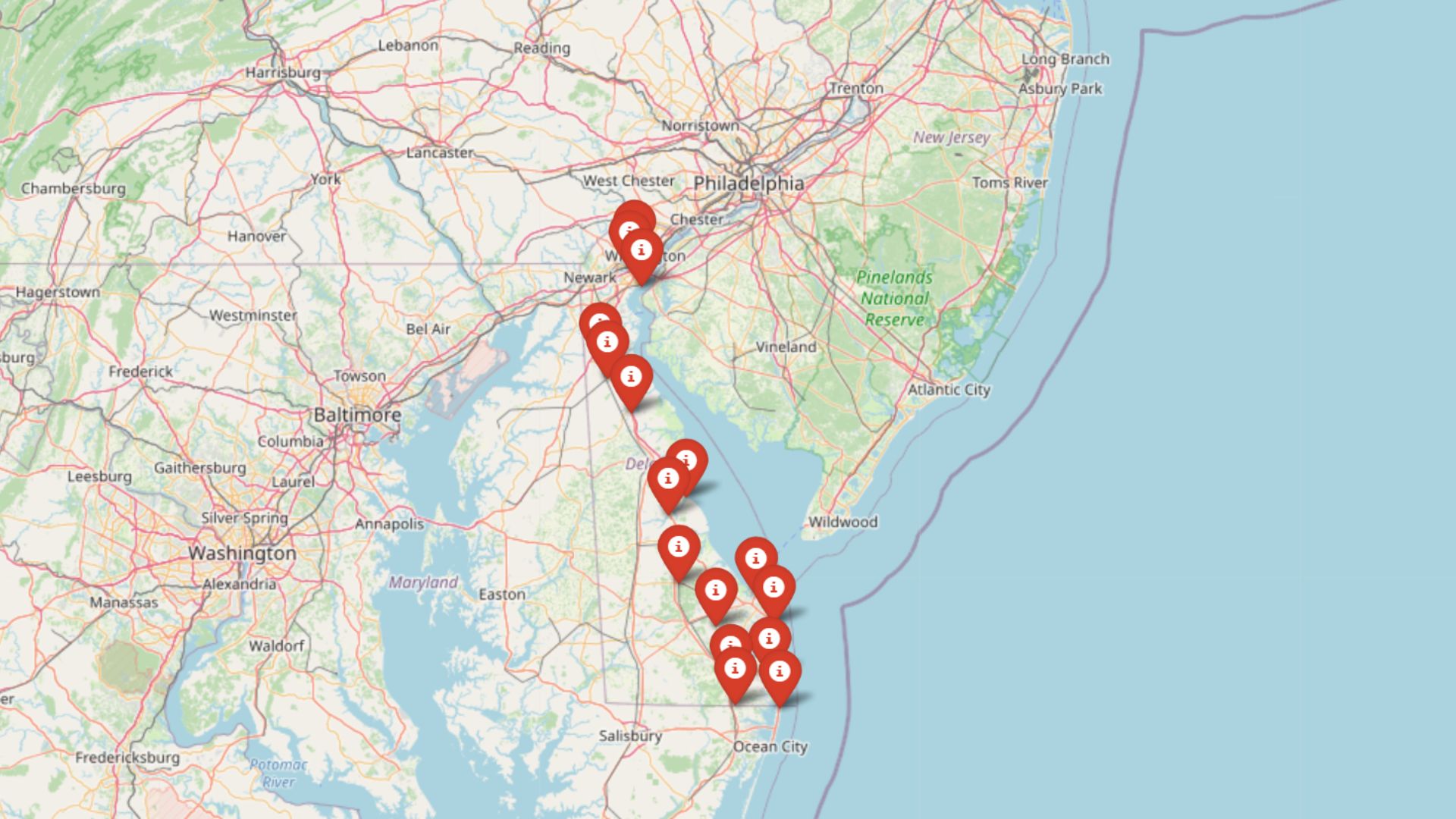

Home values have soared across Delaware in recent years, especially along the coast—but that sharp rise may be setting the stage for a painful fall. Analyzing 15 years of Zillow Home Value Index data, a number of towns are now flashing familiar warning signs: prices climbing too far, too fast; momentum stalling; and past patterns of steep corrections reemerging. In places where home values have surged more than 60% since 2020, the question isn’t just whether a correction is coming—but how deep it could go.

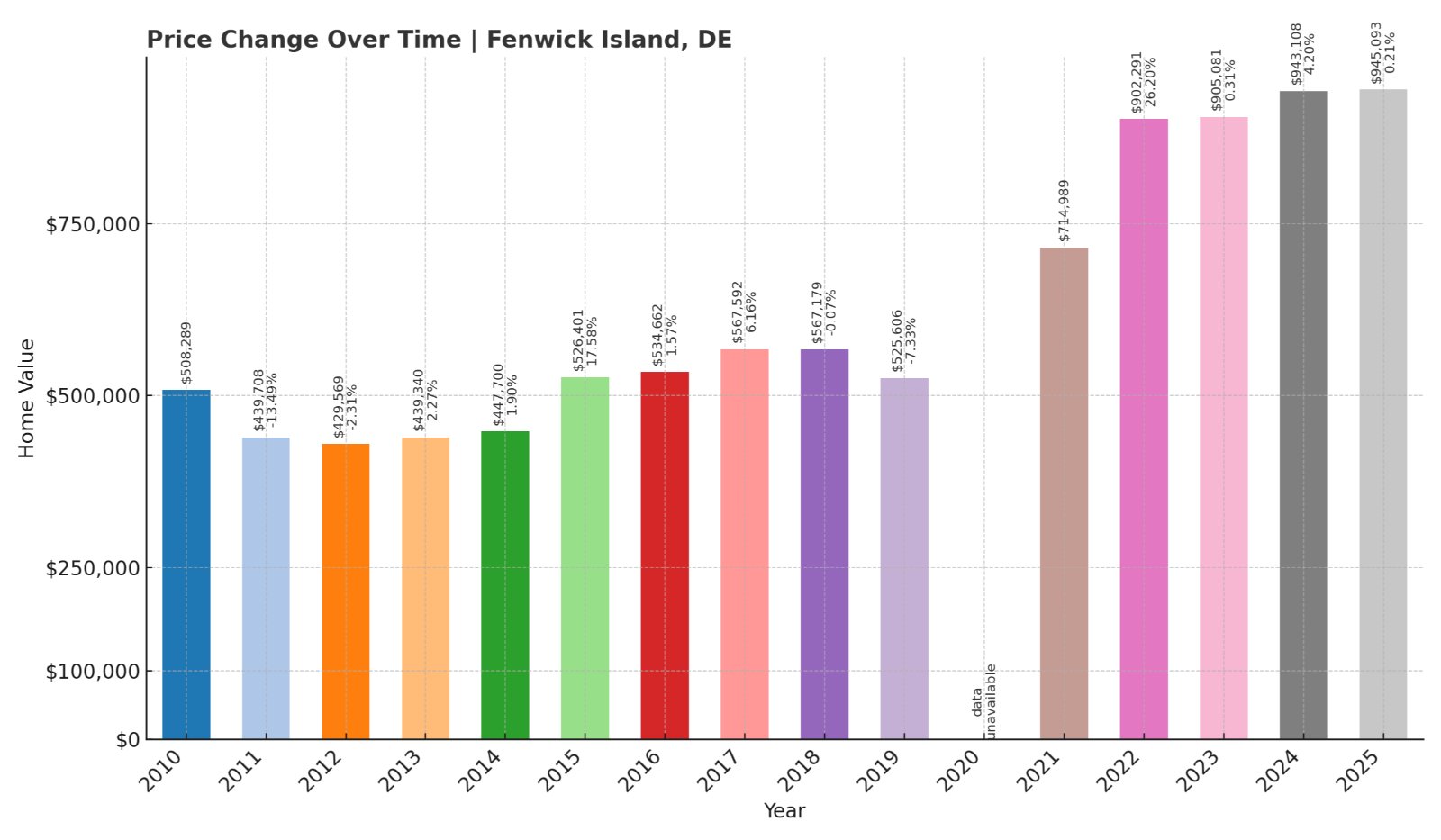

16. Fenwick Island – Crash Risk Percentage: 68%

- Crash Risk Percentage: 68%

- Historical crashes (5%+ drops): 6

- Worst historical crash: -13.49% (2011)

- Total price increase since 2000: +342.6%

- Overextended above long-term average: +45.2%

- Price volatility (annual swings): 18.3%

- Current May 2025 price: $945,093

Fenwick Island shows significant vulnerability with six major price drops exceeding 5% since 2000, including a devastating 13.49% crash in 2011 during the broader financial crisis. The coastal community has experienced extreme volatility, with annual price swings averaging over 18%, making it one of Delaware’s most unpredictable markets. Currently priced at nearly $950,000, homes are trading 45% above their long-term trend line, suggesting prices have outpaced fundamental value drivers.

Fenwick Island – Coastal Volatility Threatens Premium Values

Fenwick Island sits at the southern tip of Delaware’s Atlantic coast, bordering Maryland and offering some of the state’s most exclusive beachfront properties. The town’s economy relies heavily on seasonal tourism and vacation home ownership, creating inherent market instability. Recent price gains have been extraordinary, with values jumping from $525,606 in 2019 to over $945,000 today.

This 80% increase in just six years has pushed the market into dangerous territory. The town’s history of boom-bust cycles, combined with its dependence on discretionary vacation spending, makes it particularly vulnerable to economic downturns. When wealthy buyers reduce luxury purchases, Fenwick Island’s premium market typically experiences the sharpest corrections, as evidenced by the consecutive double-digit drops from 2009 to 2011.

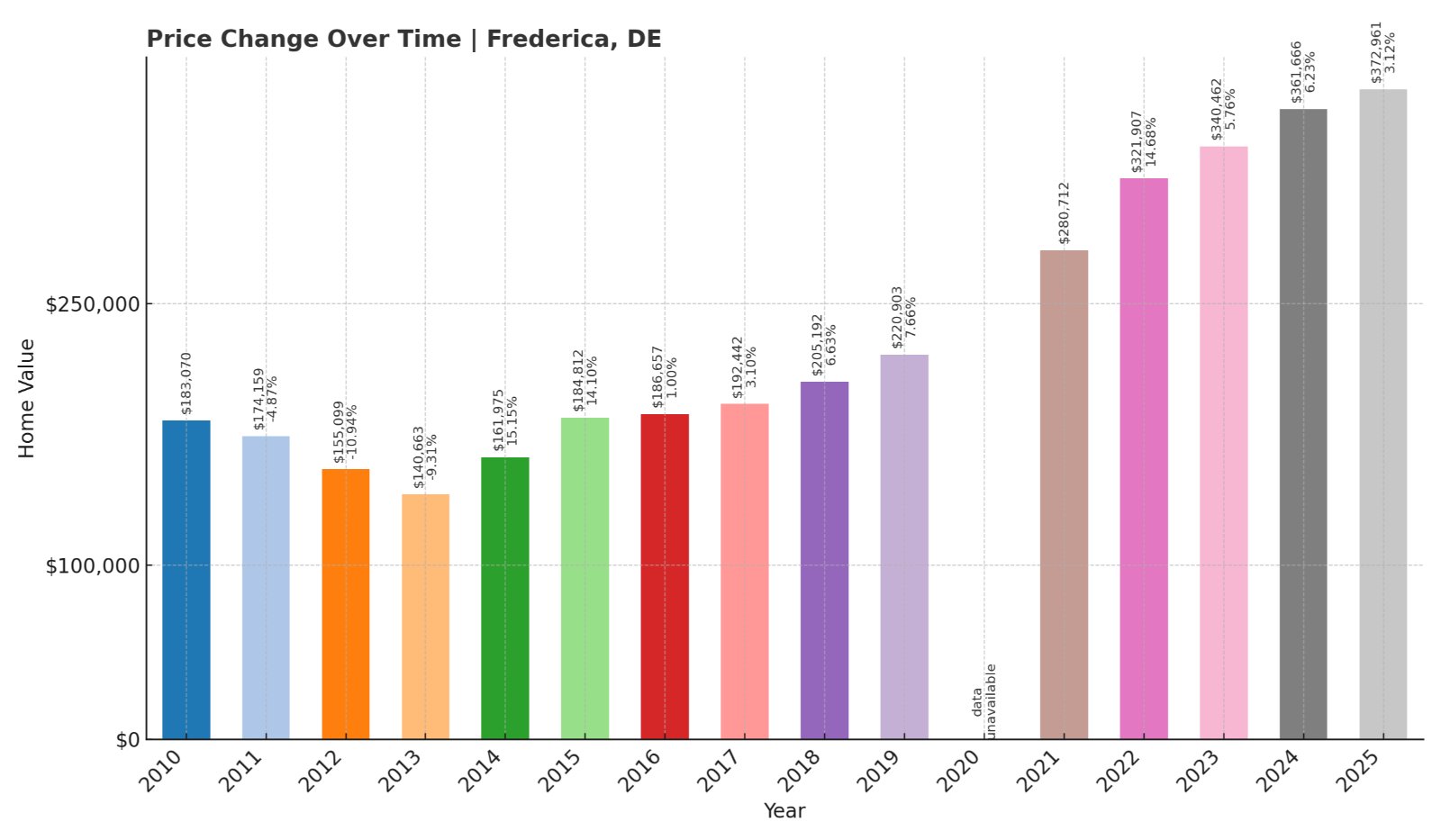

15. Frederica – Crash Risk Percentage: 52%

- Crash Risk Percentage: 52%

- Historical crashes (5%+ drops): 3

- Worst historical crash: -10.94% (2012)

- Total price increase since 2010: +103.8%

- Overextended above long-term average: +28.4%

- Price volatility (annual swings): 11.7%

- Current May 2025 price: $372,961

Frederica’s limited data starting from 2010 shows a pattern of significant volatility, with three major crashes including a severe 10.94% drop in 2012. The town has doubled in value since 2010, rising from $183,070 to over $372,000, representing growth that appears unsustainable. Currently trading 28% above its established trend, the market shows classic signs of overextension.

Frederica – Rural Growth Outpacing Economic Fundamentals

Were You Meant

to Live In?

Located in central Kent County, Frederica is a small town that has benefited from Delaware’s overall housing boom but lacks the economic drivers to support current valuations. The community sits along the Murderkill River and has historically been a quiet agricultural area with limited commercial development. Recent price appreciation has been driven more by spillover demand from more expensive markets than by local economic growth.

The town’s 103% price increase since 2010 far exceeds regional income growth and local development patterns. With limited employment opportunities and few major infrastructure improvements, Frederica’s rapid price gains appear disconnected from fundamental value drivers. The market’s previous crashes during economic stress periods suggest it remains vulnerable to correction when buyer demand softens.

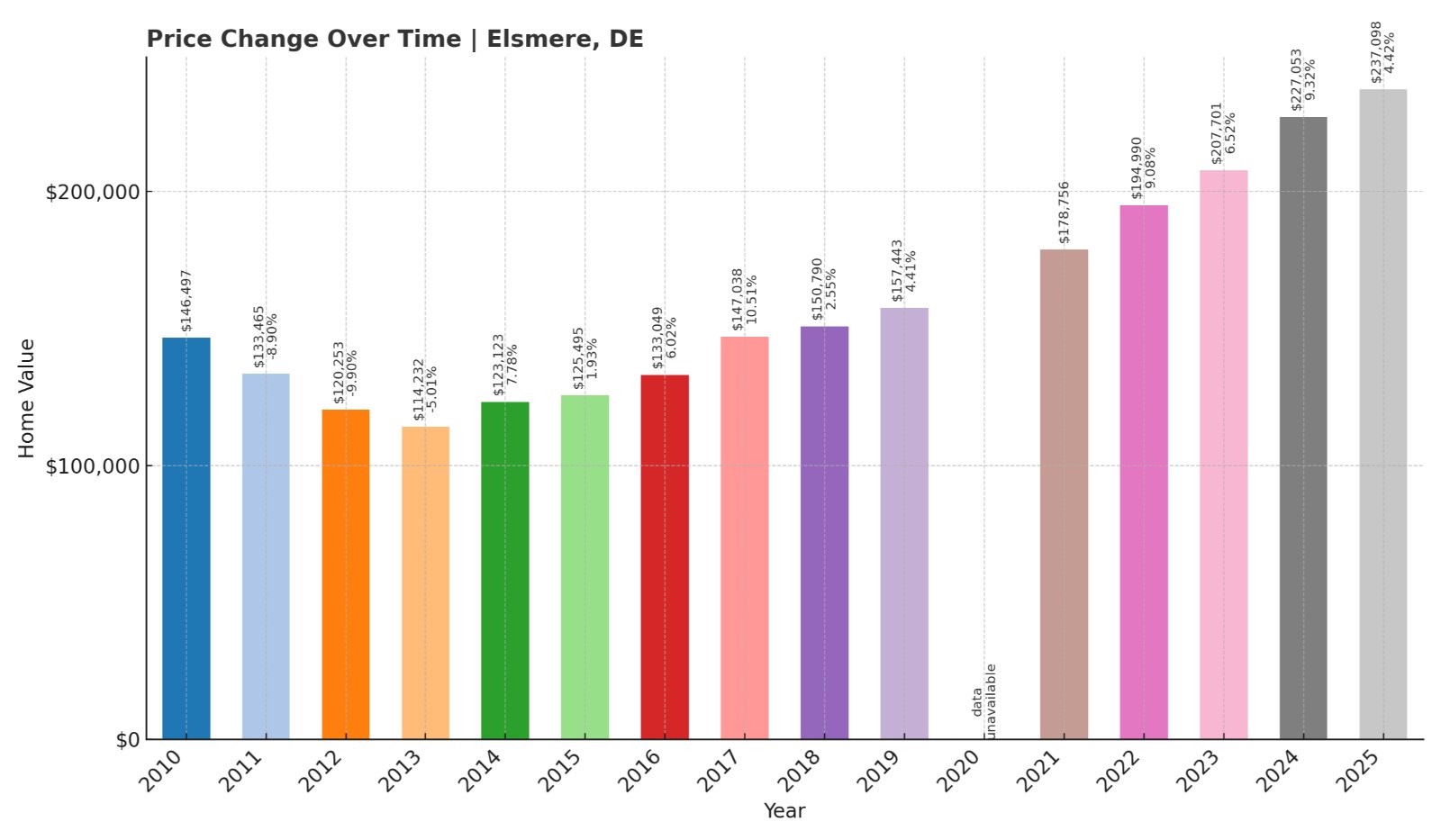

14. Elsmere – Crash Risk Percentage: 58%

- Crash Risk Percentage: 58%

- Historical crashes (5%+ drops): 5

- Worst historical crash: -9.90% (2012)

- Total price increase since 2000: +189.7%

- Overextended above long-term average: +22.1%

- Price volatility (annual swings): 8.9%

- Current May 2025 price: $237,098

Elsmere has experienced five significant crashes since 2000, demonstrating a pattern of repeated market corrections. The worst decline occurred in 2012 with a 9.90% drop, followed by additional crashes during economic stress periods. Despite being one of Delaware’s more affordable markets at $237,098, the town is currently trading 22% above its long-term average, indicating overvaluation even at modest price levels.

Elsmere – Working-Class Market Vulnerable to Economic Shifts

Elsmere is a small borough in New Castle County, positioned between Wilmington and Newark along Route 13. The community has traditionally served as an affordable housing option for working-class families, with many residents employed in nearby industrial and service sectors. The town’s housing stock consists primarily of older single-family homes and rowhouses built in the mid-20th century.

Recent price appreciation has pushed many homes beyond the reach of traditional local buyers, creating market instability. The 189% increase since 2000 has outpaced wage growth in the region, making the market dependent on outside buyers and investor activity. Elsmere’s history of multiple crashes suggests it’s particularly sensitive to economic downturns that affect working-class employment, and current overextension leaves little cushion for market stress.

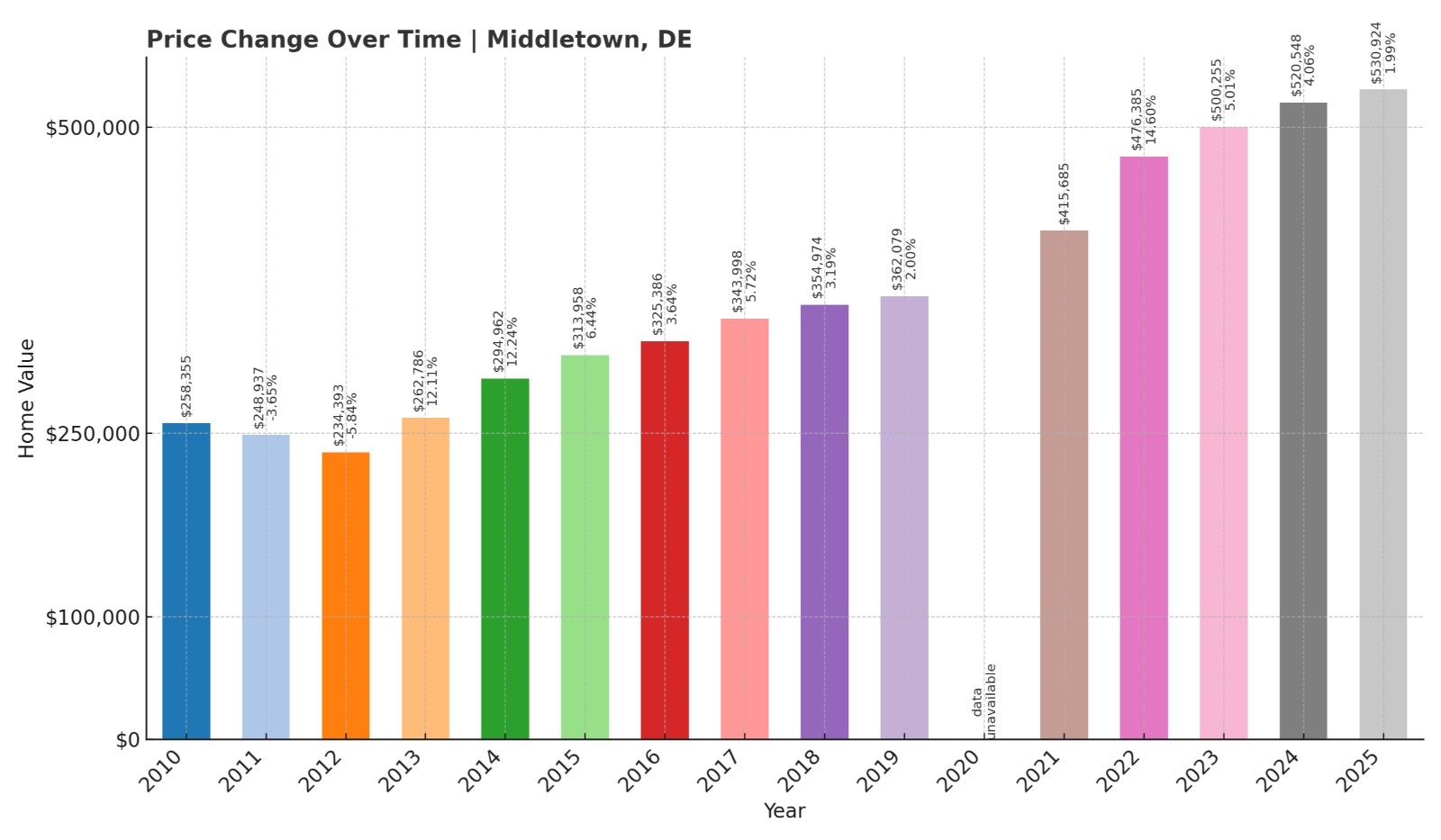

13. Middletown – Crash Risk Percentage: 45%

Home Stratosphere Guide

Your Personality Already Knows

How Your Home Should Feel

113 pages of room-by-room design guidance built around your actual brain, your actual habits, and the way you actually live.

You might be an ISFJ or INFP designer…

You design through feeling — your spaces are personal, comforting, and full of meaning. The guide covers your exact color palettes, room layouts, and the one mistake your type always makes.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ISTJ or INTJ designer…

You crave order, function, and visual calm. The guide shows you how to create spaces that feel both serene and intentional — without ending up sterile.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ENFP or ESTP designer…

You design by instinct and energy. Your home should feel alive. The guide shows you how to channel that into rooms that feel curated, not chaotic.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ENTJ or ESTJ designer…

You value quality, structure, and things done right. The guide gives you the framework to build rooms that feel polished without overthinking every detail.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

- Crash Risk Percentage: 45%

- Historical crashes (5%+ drops): 3

- Worst historical crash: -9.49% (2009)

- Total price increase since 2000: +221.6%

- Overextended above long-term average: +15.8%

- Price volatility (annual swings): 6.4%

- Current May 2025 price: $530,924

Middletown has experienced three major corrections since 2000, including a sharp 9.49% decline in 2009 during the financial crisis. The town has seen substantial growth, with home values increasing 221% from $165,052 in 2000 to over $530,000 today. Currently priced 15.8% above its long-term trend, the market shows moderate overextension that could trigger correction during economic stress.

Middletown – Suburban Boom Town Facing Growth Limits

Middletown has transformed from a small rural community into one of Delaware’s fastest-growing suburban areas, benefiting from its strategic location between Wilmington and Dover. The town has experienced massive residential development over the past two decades, with new subdivisions and commercial centers reshaping the landscape. Major employers in the region include Amazon distribution facilities and various logistics companies.

Despite strong economic fundamentals, Middletown’s rapid growth has created infrastructure challenges and pushed home prices beyond many local incomes. The 221% price increase since 2000 reflects both legitimate development and speculative activity. With new construction beginning to slow and mortgage rates affecting affordability, the market faces potential cooling that could expose overvaluation in recent sales.

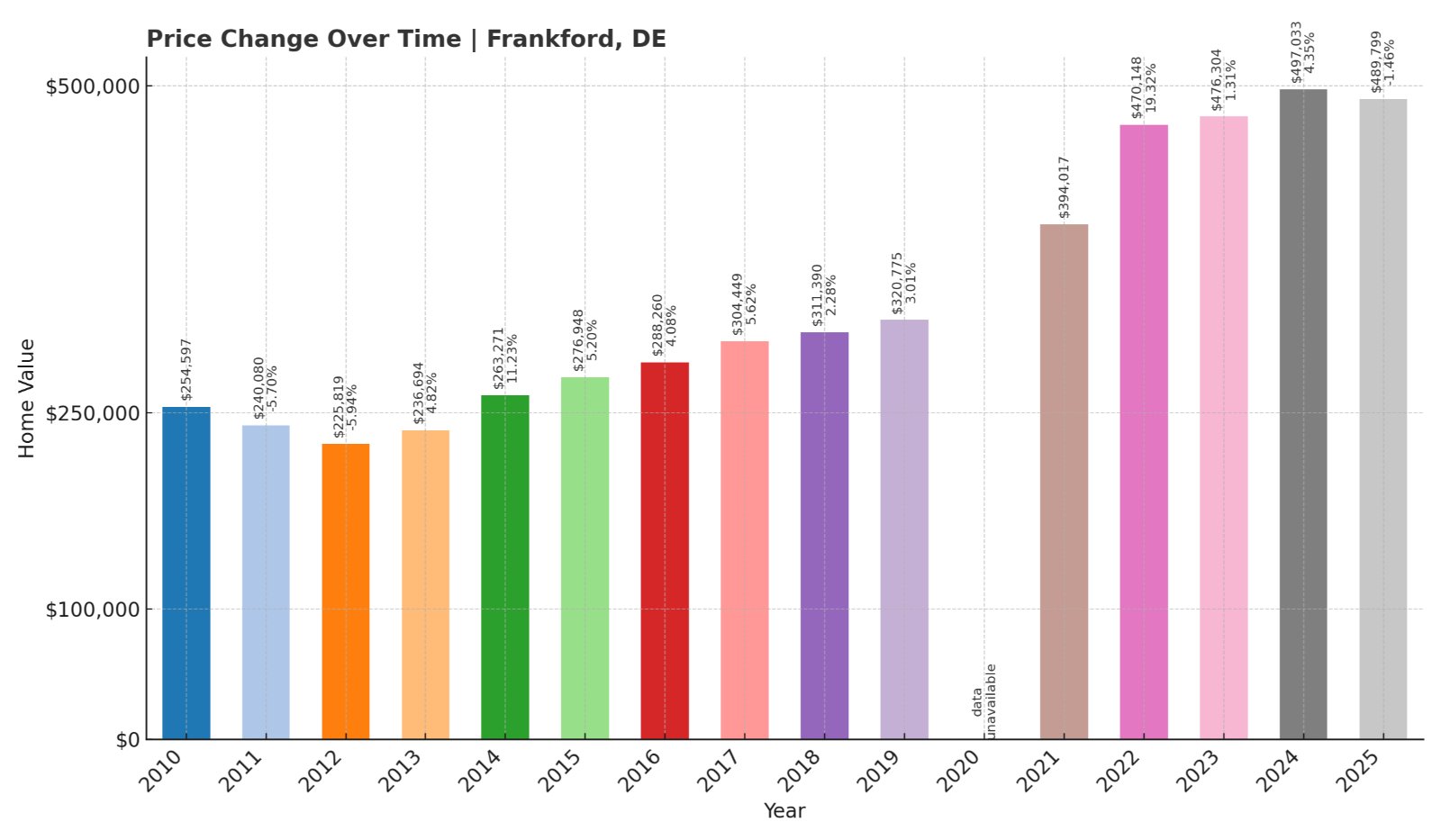

12. Frankford – Crash Risk Percentage: 61%

- Crash Risk Percentage: 61%

- Historical crashes (5%+ drops): 6

- Worst historical crash: -12.58% (2009)

- Total price increase since 2000: +265.2%

- Overextended above long-term average: +31.7%

- Price volatility (annual swings): 10.2%

- Current May 2025 price: $489,799

Frankford presents high crash risk with six major price drops since 2000, including a severe 12.58% decline in 2009. The town has experienced extreme volatility and is currently trading 31.7% above its long-term average. Recent price momentum has stalled, with values declining 1.46% in 2025 after years of growth, suggesting the market may be entering a correction phase.

Frankford – Coastal Spillover Market Losing Steam

Frankford is located in inland Sussex County, serving as a more affordable alternative to Delaware’s expensive coastal towns. The community has benefited from buyers seeking lower-cost options while maintaining access to beach areas just 15 minutes away. Local agriculture and small businesses provide some economic stability, but the area lacks major employment centers.

The town’s 265% price increase since 2000 has been driven largely by coastal market spillover rather than local economic growth. Current prices approaching $490,000 have stretched affordability for area residents, making the market dependent on outside buyers. With six historical crashes and recent price declines already beginning, Frankford appears to be entering a correction cycle that could accelerate if coastal demand continues softening.

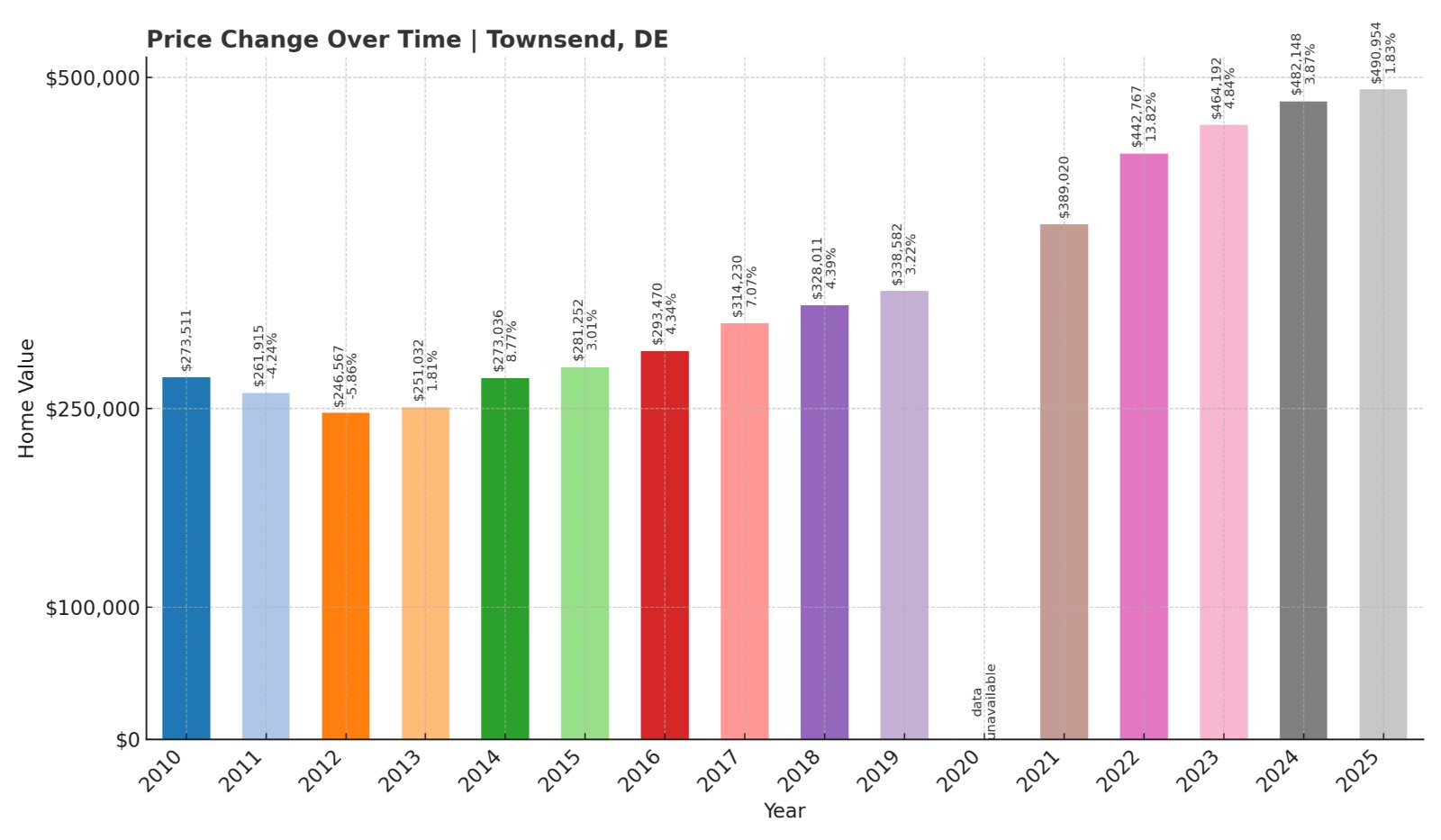

11. Townsend – Crash Risk Percentage: 48%

- Crash Risk Percentage: 48%

- Historical crashes (5%+ drops): 3

- Worst historical crash: -8.08% (2009)

- Total price increase since 2000: +191.0%

- Overextended above long-term average: +18.3%

- Price volatility (annual swings): 6.8%

- Current May 2025 price: $490,954

Townsend shows moderate crash risk with three significant corrections since 2000, including an 8.08% drop during the 2009 financial crisis. The town has nearly tripled in value from $168,748 in 2000 to almost $491,000 today. Currently trading 18.3% above trend, the market displays overextension that could lead to correction during economic uncertainty.

Townsend – Agricultural Town Transformed by Development

Townsend sits in southern New Castle County, historically known for agriculture but increasingly developed as a suburban community. The town benefits from proximity to major employment centers in Wilmington and Dover while maintaining a rural character. Recent development has included new residential subdivisions and improved infrastructure connecting to major highways.

The 191% price appreciation since 2000 reflects both legitimate growth and speculative activity as developers have transformed farmland into housing developments. While the town offers good value compared to closer-in suburbs, current prices approaching $491,000 have stretched beyond many local incomes. The market’s history of corrections during economic stress, combined with current overextension, suggests vulnerability to price adjustments.

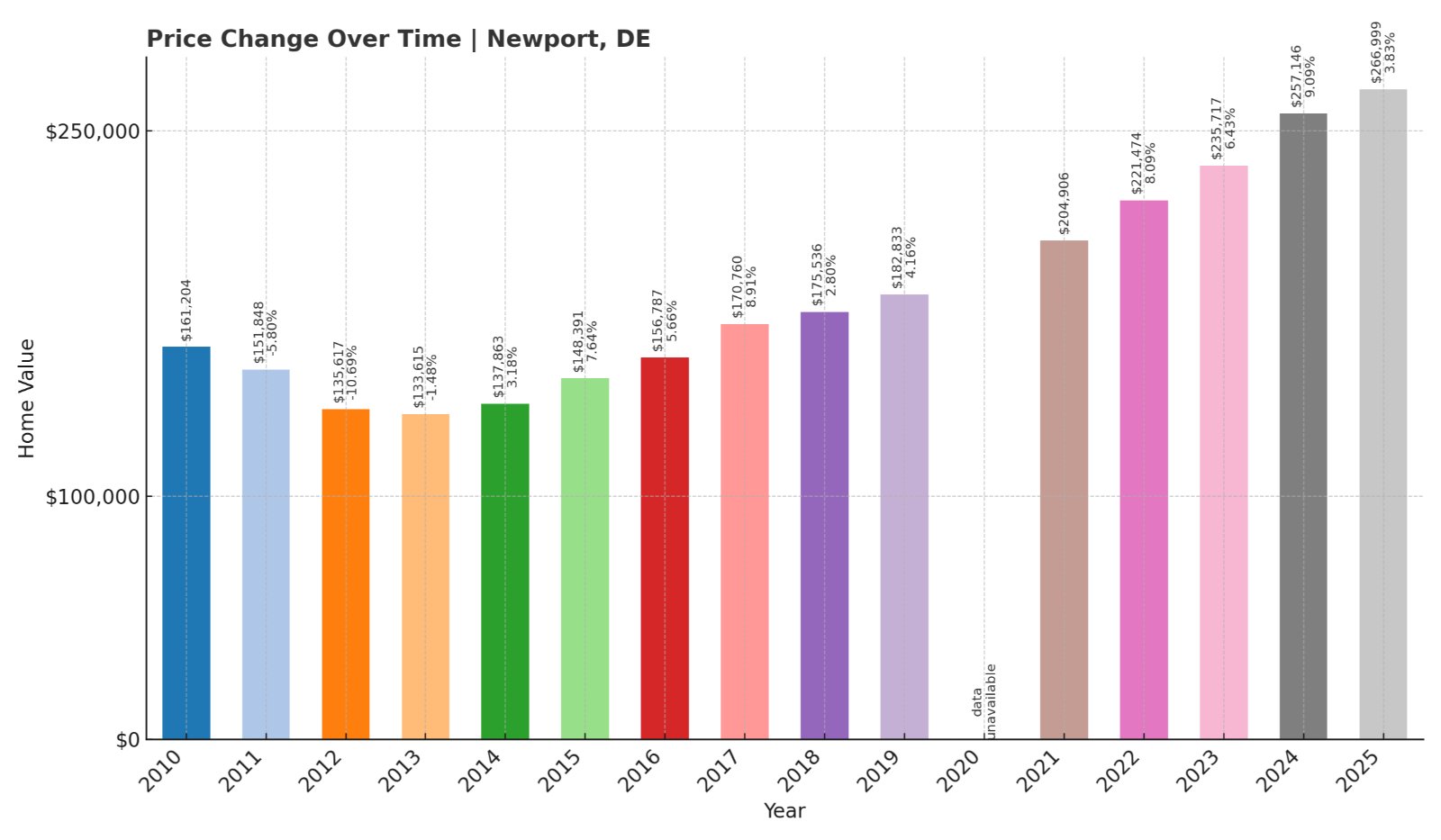

10. Newport – Crash Risk Percentage: 55%

- Crash Risk Percentage: 55%

- Historical crashes (5%+ drops): 4

- Worst historical crash: -10.69% (2012)

- Total price increase since 2000: +180.1%

- Overextended above long-term average: +25.4%

- Price volatility (annual swings): 5.8%

- Current May 2025 price: $266,999

Newport has crashed four times since 2000, with the worst decline reaching 10.69% in 2012. Despite being one of Delaware’s more affordable markets at $266,999, the town is currently trading 25.4% above its long-term trend. The pattern of repeated corrections suggests underlying market instability that persists regardless of price level.

Newport – Industrial Town Facing Economic Transitions

Newport is a small community in New Castle County with a history tied to industrial and manufacturing activities. The town sits along major transportation corridors and has benefited from proximity to Wilmington’s employment opportunities. However, the local economy has faced challenges as traditional manufacturing has declined and been replaced by service sector jobs.

The 180% price increase since 2000 has outpaced local wage growth, making homeownership increasingly difficult for area workers. At $266,999, homes remain more affordable than many Delaware markets, but current overextension suggests even these modest prices may be unsustainable. Newport’s four historical crashes indicate the market is particularly sensitive to economic downturns affecting working-class employment.

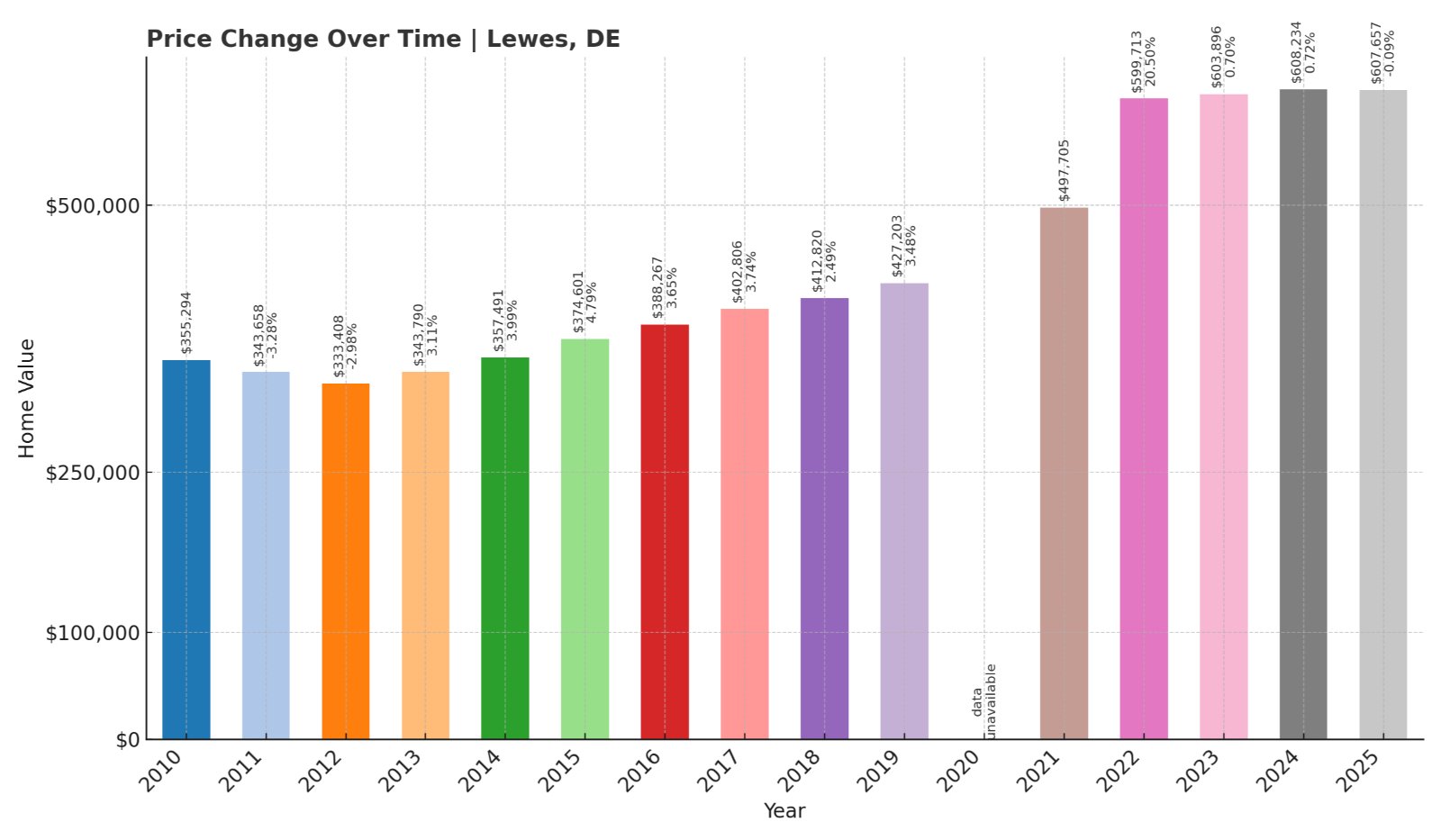

9. Lewes – Crash Risk Percentage: 42%

- Crash Risk Percentage: 42%

- Historical crashes (5%+ drops): 1

- Worst historical crash: -9.09% (2009)

- Total price increase since 2000: +236.9%

- Overextended above long-term average: +12.4%

- Price volatility (annual swings): 5.9%

- Current May 2025 price: $607,657

Lewes shows moderate crash risk despite having only one major historical correction, a 9.09% drop in 2009. The town has experienced steady appreciation, increasing 236.9% since 2000 to reach over $607,000. Currently trading 12.4% above trend, the market shows moderate overextension but appears more stable than other coastal communities.

Lewes – Historic Coastal Town with Tourism Economy

Lewes is one of Delaware’s oldest communities, founded in 1631 and serving as a major tourist destination with historic charm and beach access. The town hosts the Cape Henlopen ferry terminal connecting to New Jersey and features numerous historic sites, restaurants, and cultural attractions. Its economy relies heavily on tourism, seasonal residents, and retirees attracted to coastal living.

The 236% price increase since 2000 reflects both the town’s desirability and limited housing inventory due to historic preservation restrictions. At over $607,000, homes have become expensive even for affluent buyers, but the market has shown relative stability compared to other coastal areas. The single major crash in 2009 suggests the market may be more resilient, though current overextension still poses risks during economic downturns.

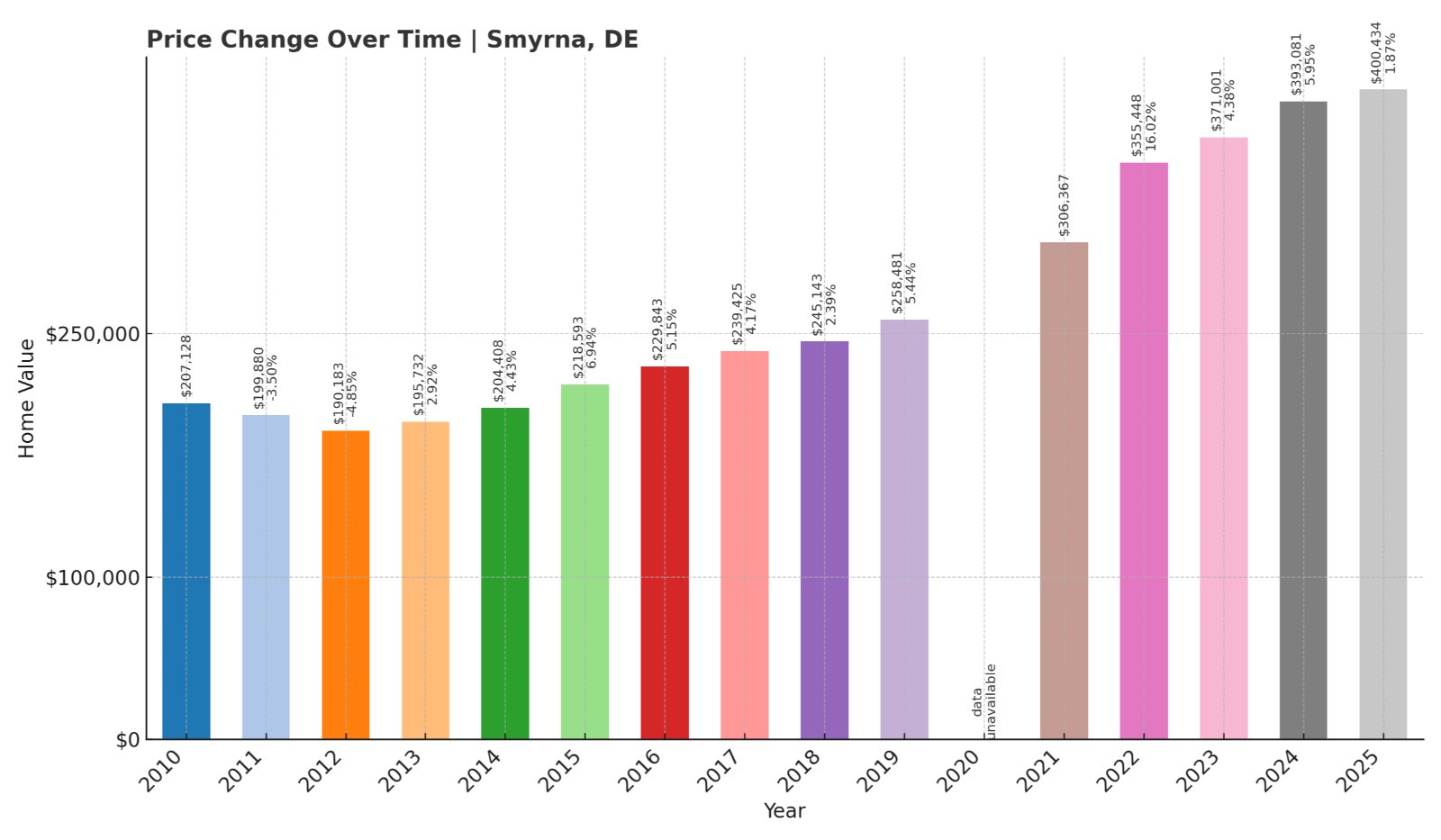

8. Smyrna – Crash Risk Percentage: 49%

- Crash Risk Percentage: 49%

- Historical crashes (5%+ drops): 4

- Worst historical crash: -10.45% (2006)

- Total price increase since 2000: +173.1%

- Overextended above long-term average: +19.7%

- Price volatility (annual swings): 7.2%

- Current May 2025 price: $400,434

Smyrna has experienced four major crashes since 2000, with the worst being a 10.45% drop in 2006, unusually occurring before the broader housing crisis. The town shows moderate volatility and is currently trading nearly 20% above its long-term average. Despite recent steady growth, the pattern of repeated corrections suggests underlying market vulnerability.

Smyrna – Central Delaware Hub with Mixed Signals

Smyrna is strategically located in central Kent County, serving as a regional commercial and residential hub between Wilmington and Dover. The town has benefited from its position along major transportation corridors and proximity to Dover Air Force Base, providing economic stability. Local amenities include shopping centers, schools, and recreational facilities that attract families seeking affordable suburban living.

The 173% price increase since 2000 has been more moderate than many Delaware communities, but current prices at $400,434 still represent significant appreciation. The town’s four historical crashes, including the unusual 2006 decline that preceded the national housing crisis, suggest local market vulnerabilities. Current overextension of nearly 20% above trend indicates prices may have risen faster than local economic fundamentals can support.

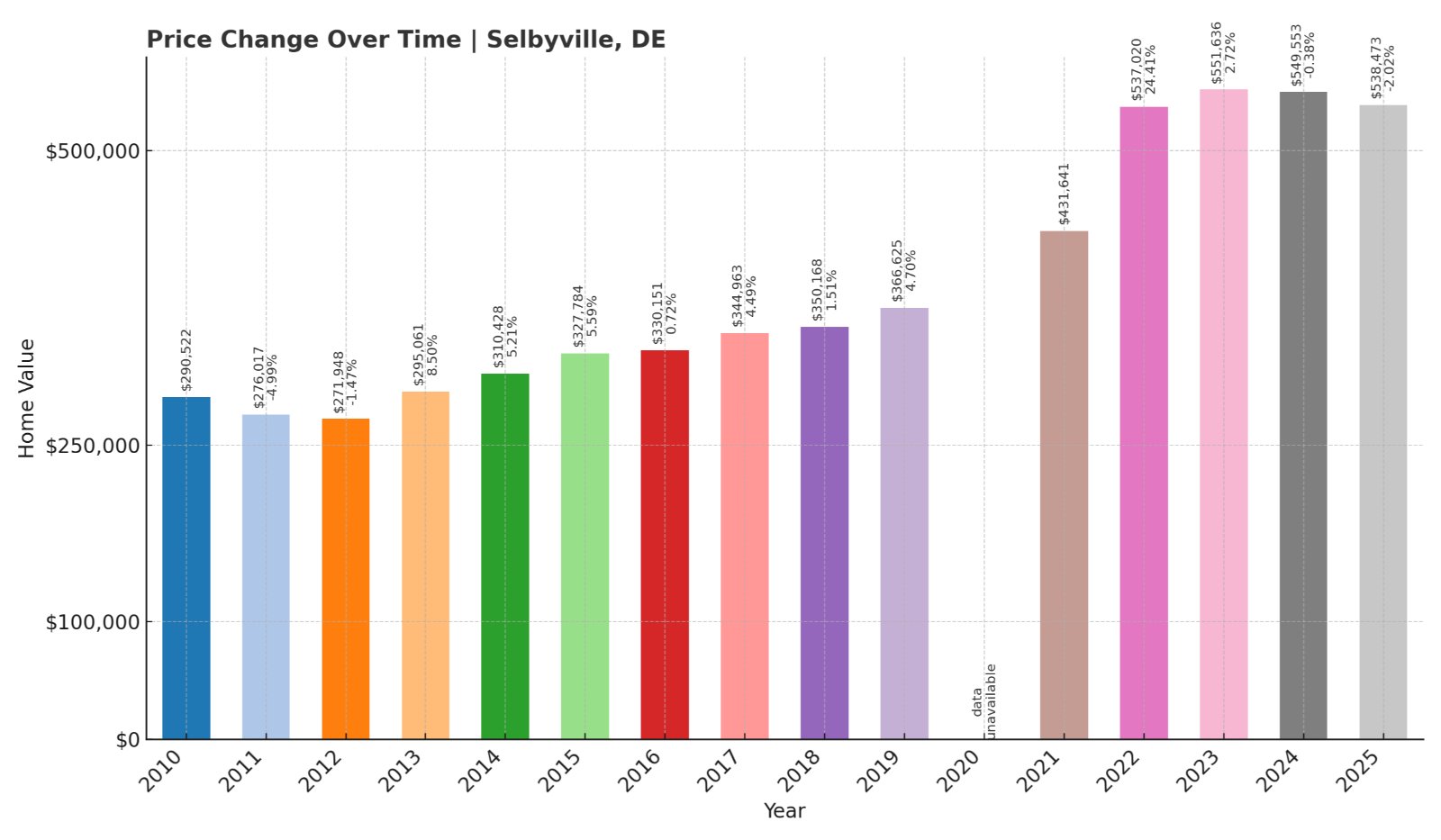

7. Selbyville – Crash Risk Percentage: 64%

Would you like to save this?

- Crash Risk Percentage: 64%

- Historical crashes (5%+ drops): 4

- Worst historical crash: -13.69% (2009)

- Total price increase since 2000: +289.8%

- Overextended above long-term average: +33.5%

- Price volatility (annual swings): 9.8%

- Current May 2025 price: $538,473

Selbyville presents high crash risk with four major corrections including a devastating 13.69% crash in 2009. The town has experienced nearly 290% price growth since 2000 and is currently trading over 33% above its long-term average. Recent momentum has stalled, with prices declining 2.02% in 2025, potentially signaling the start of a correction.

Selbyville – Coastal Gateway Market Under Pressure

Selbyville sits in southern Sussex County near the Maryland border, serving as a gateway community to Delaware’s popular beach destinations. The town has traditionally been an affordable option for those seeking access to coastal amenities without premium beachfront prices. Local economy includes agriculture, small businesses, and service industries supporting the broader coastal tourism sector.

The massive 289% price increase since 2000 has transformed Selbyville from an affordable community into a market approaching $540,000. This appreciation has been driven primarily by coastal spillover demand rather than local economic development. With four historical crashes and current prices declining, the market appears vulnerable to further correction as buyer demand shifts and affordability concerns mount.

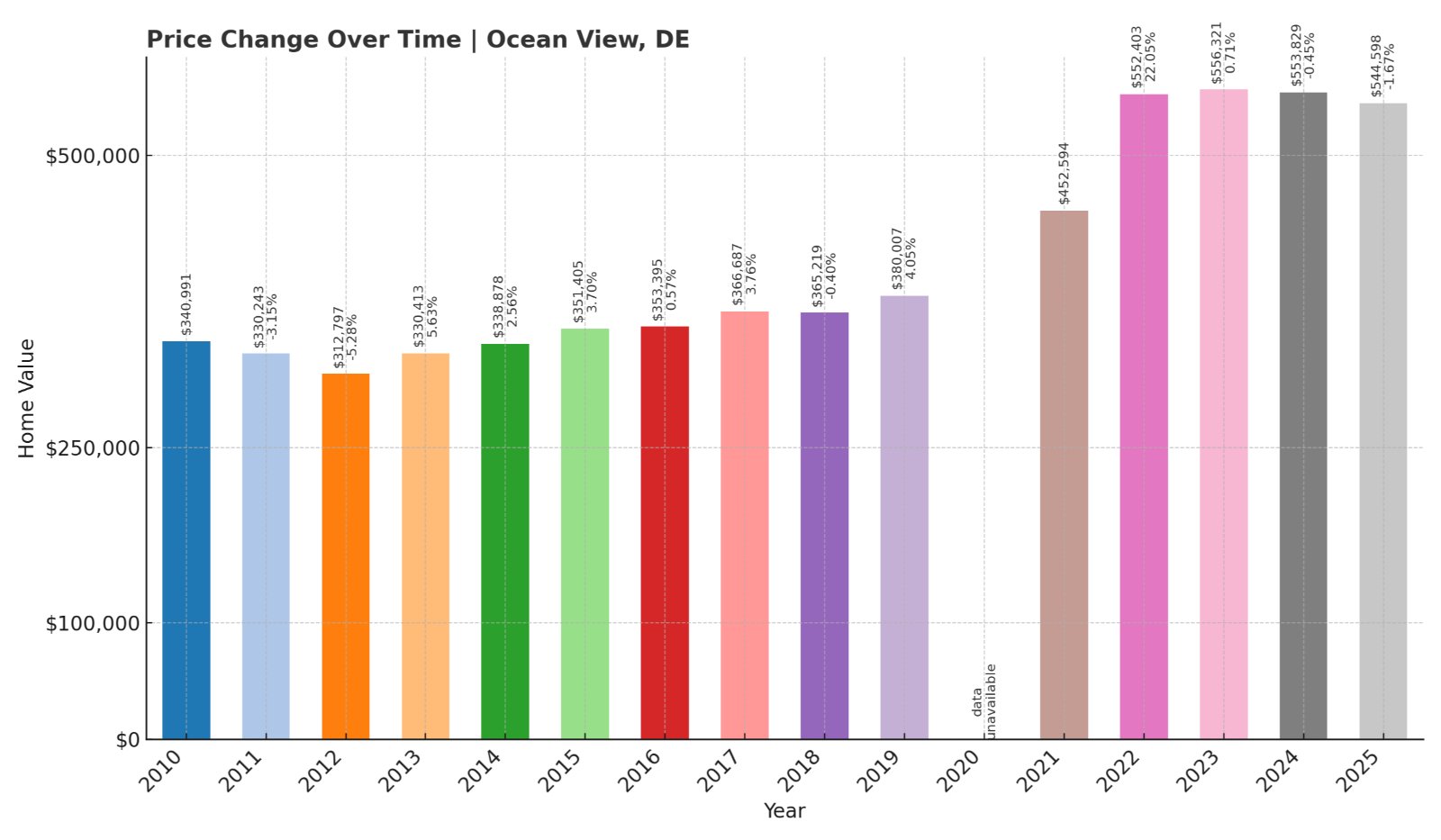

6. Ocean View – Crash Risk Percentage: 59%

- Crash Risk Percentage: 59%

- Historical crashes (5%+ drops): 3

- Worst historical crash: -10.82% (2010)

- Total price increase since 2000: +213.1%

- Overextended above long-term average: +26.8%

- Price volatility (annual swings): 8.1%

- Current May 2025 price: $544,598

Ocean View shows significant crash risk with three major corrections since 2000, including a severe 10.82% drop in 2010. The coastal community has more than tripled in value from $173,989 in 2000 to over $544,000 today. Currently trading 26.8% above its long-term trend, the market shows dangerous overextension with recent price declines beginning.

Ocean View – Coastal Community Facing Affordability Crisis

Ocean View is located in southeastern Sussex County, positioned between the Delaware Bay and Atlantic Ocean coastal areas. The community has grown rapidly as buyers seek more affordable alternatives to premium beachfront locations while maintaining access to water activities and coastal lifestyle. The town features a mix of year-round residents and seasonal properties.

The 213% price increase since 2000 has pushed homes well beyond the reach of many local workers and traditional buyers. At over $544,000, the market has become dependent on outside buyers and investors, creating volatility during economic uncertainty. Recent price declines of 1.67% in 2025 suggest the market may be entering a correction phase, particularly concerning given the town’s history of significant crashes during previous economic stress periods.

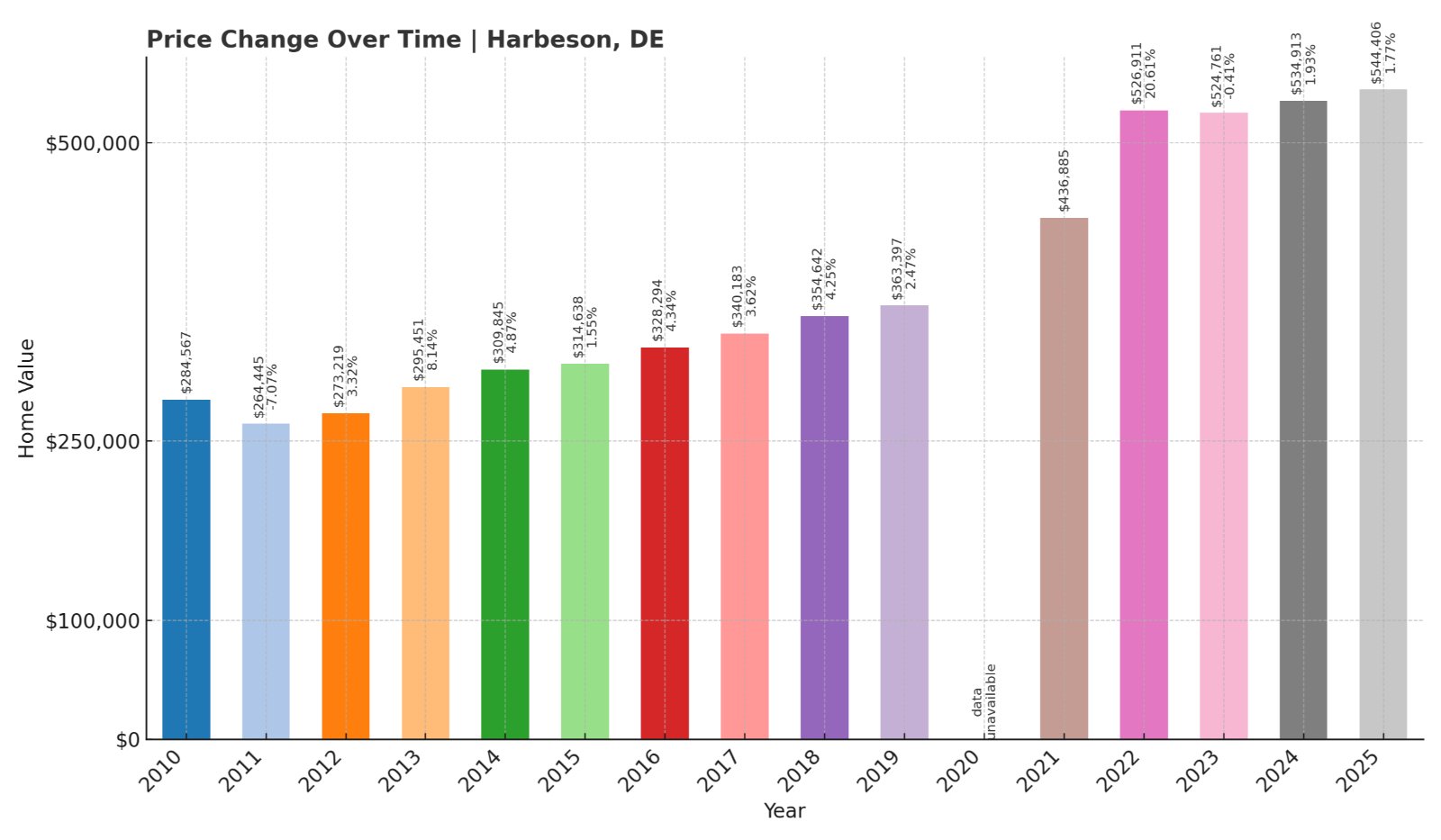

5. Harbeson – Crash Risk Percentage: 46%

- Crash Risk Percentage: 46%

- Historical crashes (5%+ drops): 2

- Worst historical crash: -8.60% (2009)

- Total price increase since 2000: +280.6%

- Overextended above long-term average: +14.9%

- Price volatility (annual swings): 7.4%

- Current May 2025 price: $544,406

Harbeson shows moderate crash risk with two significant corrections since 2000, including an 8.60% decline in 2009. The town has experienced massive growth, increasing 280% from $143,006 in 2000 to over $544,000 today. Currently trading 14.9% above trend, the market shows moderate overextension but has demonstrated relative stability compared to other coastal areas.

Harbeson – Inland Coastal Access Market

Harbeson is located in inland Sussex County, offering more affordable access to Delaware’s popular coastal destinations. The community has benefited from buyers seeking lower prices while maintaining reasonable commuting distance to beach towns and employment centers. Local amenities include rural character, open space, and developing suburban infrastructure.

The 280% price appreciation since 2000 reflects the area’s transformation from rural agricultural land to suburban residential development. At $544,406, homes have reached price levels that challenge local affordability but remain below premium coastal markets. The town’s relatively limited crash history suggests some market stability, though current overextension and dependence on coastal spillover demand create vulnerability during economic downturns.

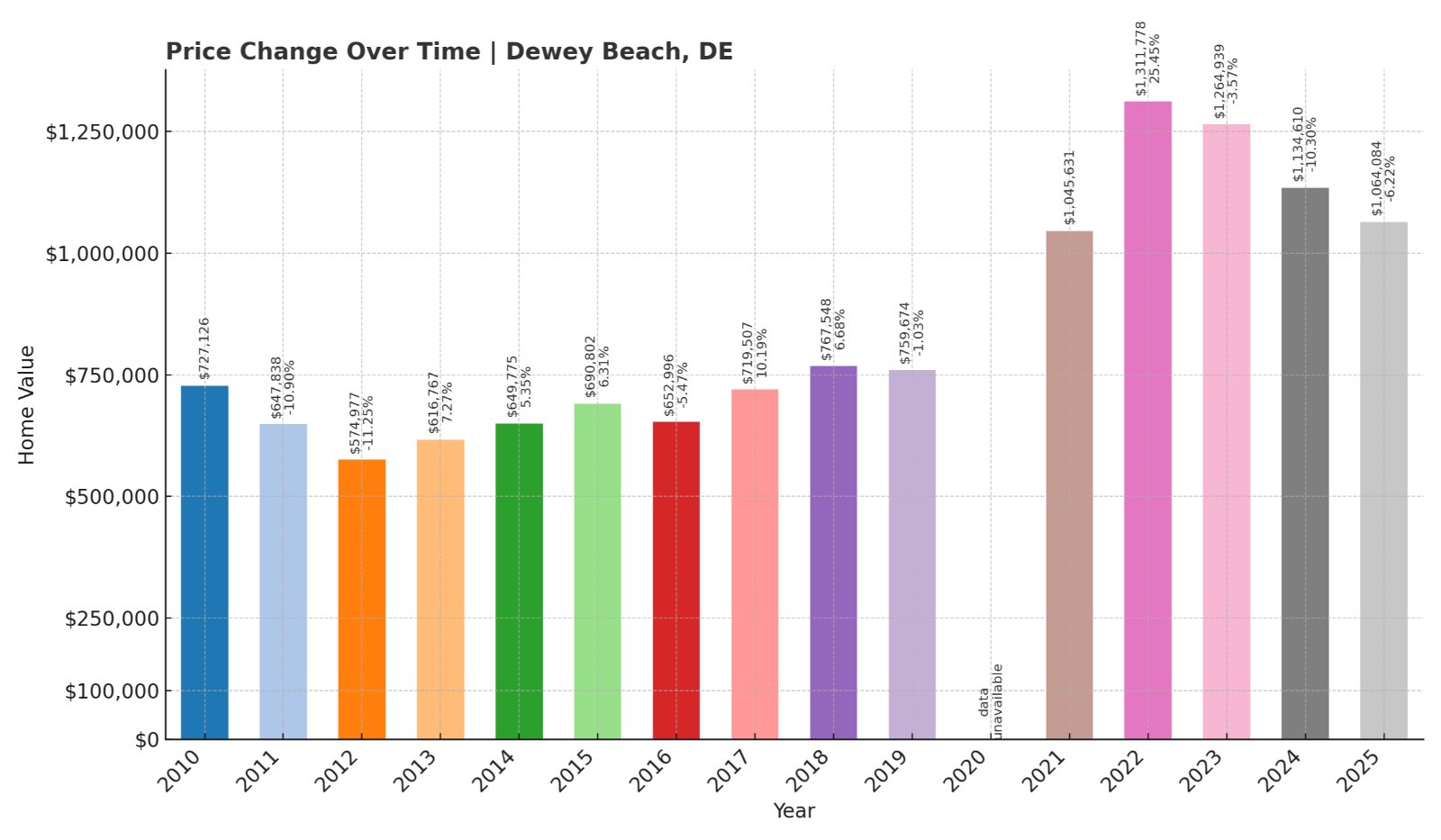

4. Dewey Beach – Crash Risk Percentage: 71%

- Crash Risk Percentage: 71%

- Historical crashes (5%+ drops): 4

- Worst historical crash: -11.25% (2012)

- Total price increase since 2000: +366.1%

- Overextended above long-term average: +38.7%

- Price volatility (annual swings): 15.2%

- Current May 2025 price: $1,064,084

Dewey Beach presents the second-highest crash risk with four major corrections and extreme volatility averaging over 15% annually. The premier beach town has experienced massive appreciation, rising 366% since 2000 to over $1 million. Currently trading nearly 39% above trend and experiencing recent declines of 6.22% in 2025, the market shows clear signs of correction beginning.

Dewey Beach – Premium Resort Market in Decline

Dewey Beach is one of Delaware’s most exclusive coastal communities, known for its vibrant nightlife, pristine beaches, and luxury vacation properties. The town attracts wealthy buyers from the Mid-Atlantic region seeking premium beachfront experiences. The local economy depends entirely on tourism, seasonal residents, and vacation rental activity, creating extreme market sensitivity to economic conditions.

The 366% price increase since 2000 has pushed median values over $1 million, pricing out all but the wealthiest buyers. Recent price declines accelerating to over 6% in 2025 suggest the market correction is already underway. The town’s dependence on discretionary luxury spending makes it particularly vulnerable during economic uncertainty, as evidenced by four previous crashes when affluent buyers reduced vacation property purchases.

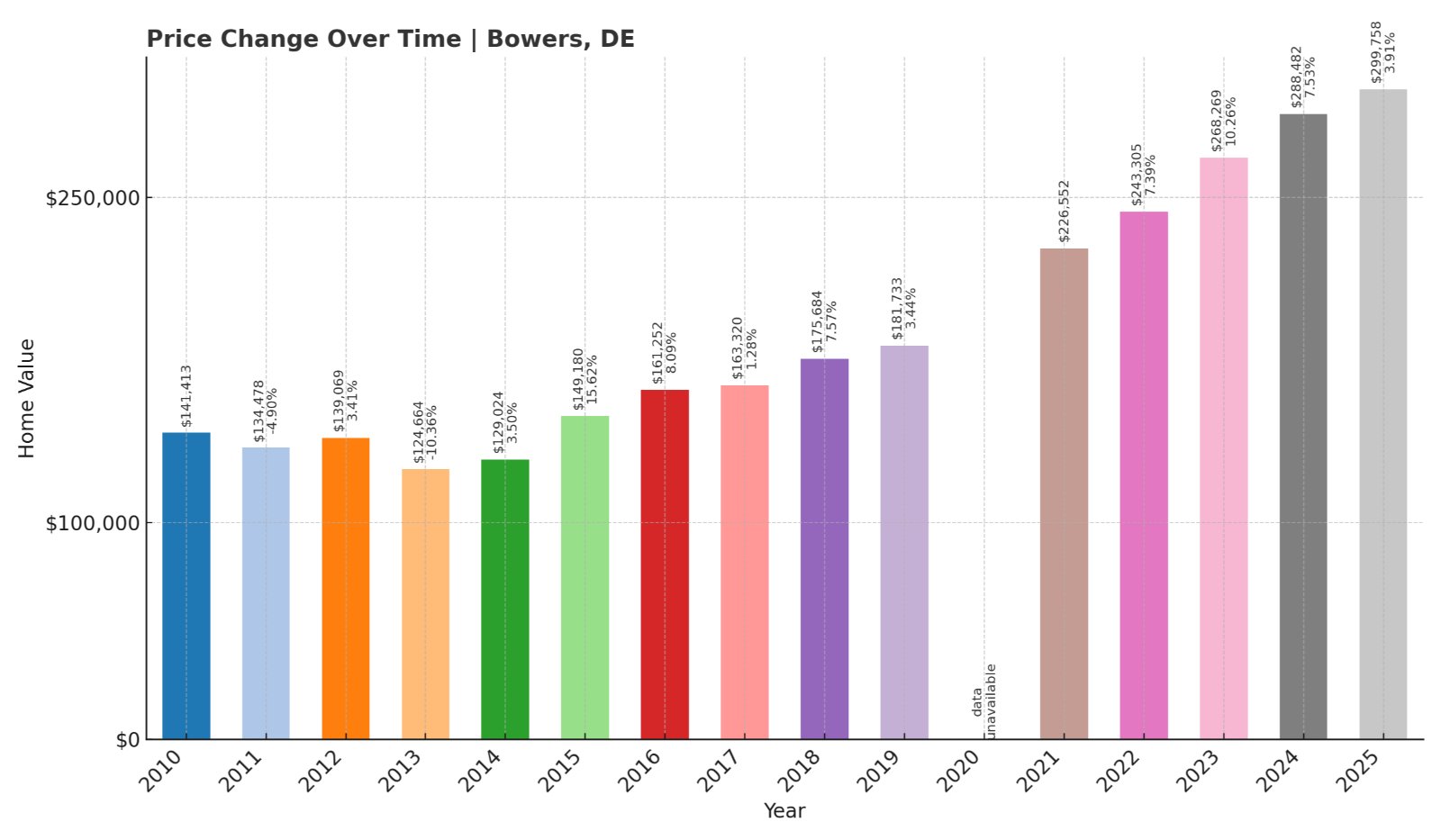

3. Bowers – Crash Risk Percentage: 63%

- Crash Risk Percentage: 63%

- Historical crashes (5%+ drops): 1

- Worst historical crash: -10.36% (2013)

- Total price increase since 2010: +112.0%

- Overextended above long-term average: +35.2%

- Price volatility (annual swings): 8.7%

- Current May 2025 price: $299,758

Bowers shows high crash risk despite limited historical data starting from 2010. The town experienced a severe 10.36% crash in 2013 and has doubled in value since 2010. Currently trading over 35% above its established trend, the market shows extreme overextension that suggests significant correction potential during economic stress.

Bowers – Small Community with Outsized Risk

Bowers is a small community in Kent County with limited economic base and housing stock. The town’s coastal proximity has attracted buyers seeking affordable alternatives to more expensive beach markets. Despite its small size, Bowers has experienced significant price volatility and substantial appreciation that appears disconnected from local economic fundamentals.

The 112% price increase since 2010 has pushed values to nearly $300,000, representing massive appreciation for a small rural community. The extreme overextension of 35% above trend, combined with the town’s history of sharp corrections, suggests high vulnerability to price declines. Limited local employment and economic activity make the market particularly dependent on outside buyers and vulnerable to broader economic shifts.

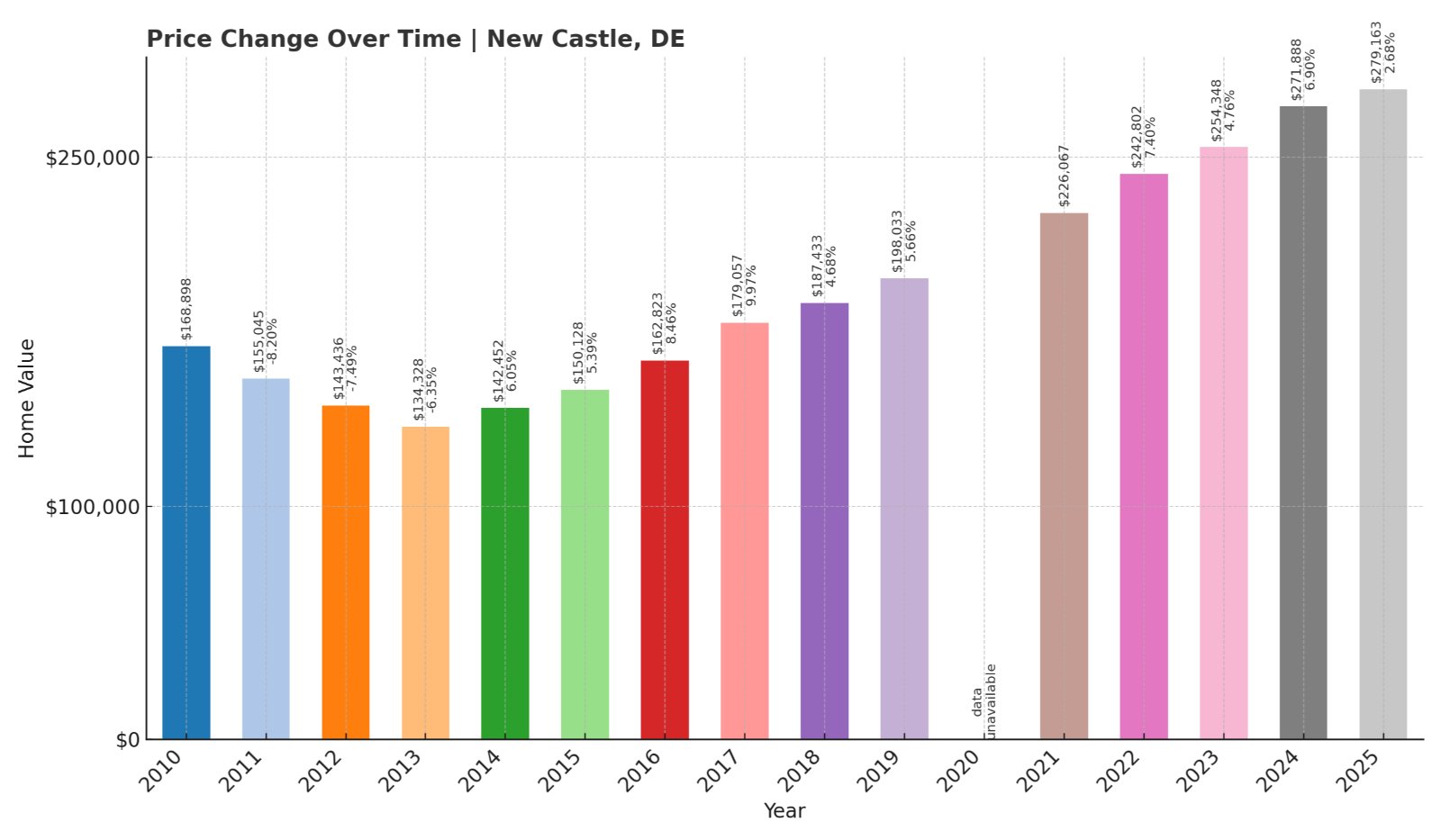

2. New Castle – Crash Risk Percentage: 57%

- Crash Risk Percentage: 57%

- Historical crashes (5%+ drops): 5

- Worst historical crash: -8.84% (2009)

- Total price increase since 2000: +163.4%

- Overextended above long-term average: +21.3%

- Price volatility (annual swings): 6.1%

- Current May 2025 price: $279,163

New Castle has experienced five crashes since 2000, demonstrating a pattern of repeated market corrections. The worst decline reached 8.84% in 2009, followed by additional crashes during various economic stress periods. Currently trading 21.3% above its long-term average at $279,163, the market shows overextension despite being more affordable than many Delaware communities.

New Castle – Historic Town with Modern Market Challenges

New Castle is one of Delaware’s most historic communities, featuring colonial architecture and serving as the original capital of the Delaware colony. The town sits along the Delaware River south of Wilmington, offering both historical character and proximity to major employment centers. Despite its historic significance, the local economy faces challenges from industrial decline and limited commercial development.

The 163% price increase since 2000 has been more moderate than many Delaware markets, but current overextension suggests even these gains may be unsustainable. At $279,163, homes remain relatively affordable, but the town’s five historical crashes indicate underlying market instability. The pattern of repeated corrections suggests New Castle is particularly sensitive to economic downturns affecting regional employment and buyer confidence.

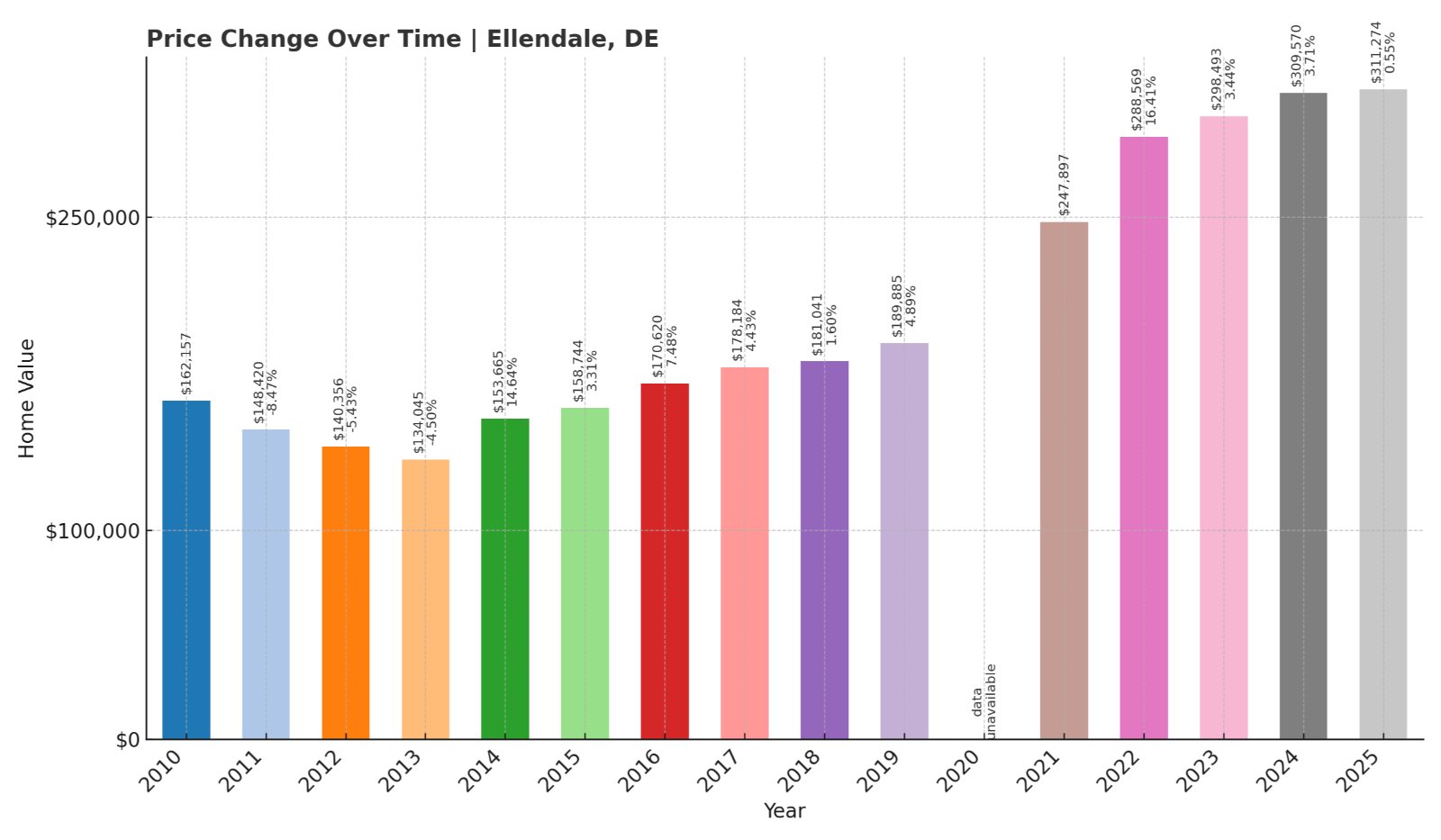

1. Ellendale – Crash Risk Percentage: 66%

- Crash Risk Percentage: 66%

- Historical crashes (5%+ drops): 6

- Worst historical crash: -8.69% (2010)

- Total price increase since 2000: +291.9%

- Overextended above long-term average: +29.8%

- Price volatility (annual swings): 11.4%

- Current May 2025 price: $311,274

Ellendale presents extremely high crash risk with six major corrections since 2000, tying for the most crashes among Delaware communities. The town has experienced significant volatility and massive price growth of nearly 292% since 2000. Currently trading almost 30% above its long-term average, the market shows dangerous overextension with momentum slowing to just 0.55% growth in 2025.

Ellendale – Rural Community with Chronic Market Instability

Ellendale is a small rural community in southern Sussex County with limited economic base and infrastructure. The town has traditionally been agricultural but has attracted buyers seeking affordable housing options within commuting distance of larger employment centers. Despite its rural character, Ellendale has experienced extreme price volatility and substantial appreciation that appears unsustainable.

The massive 291% price increase since 2000 has transformed an affordable rural community into a market approaching $311,000, pricing out many traditional local buyers. The town’s six historical crashes demonstrate chronic market instability that persists across different economic cycles. With current overextension approaching 30% and growth momentum stalling, Ellendale appears highly vulnerable to significant price correction when broader economic conditions deteriorate.