Would you like to save this?

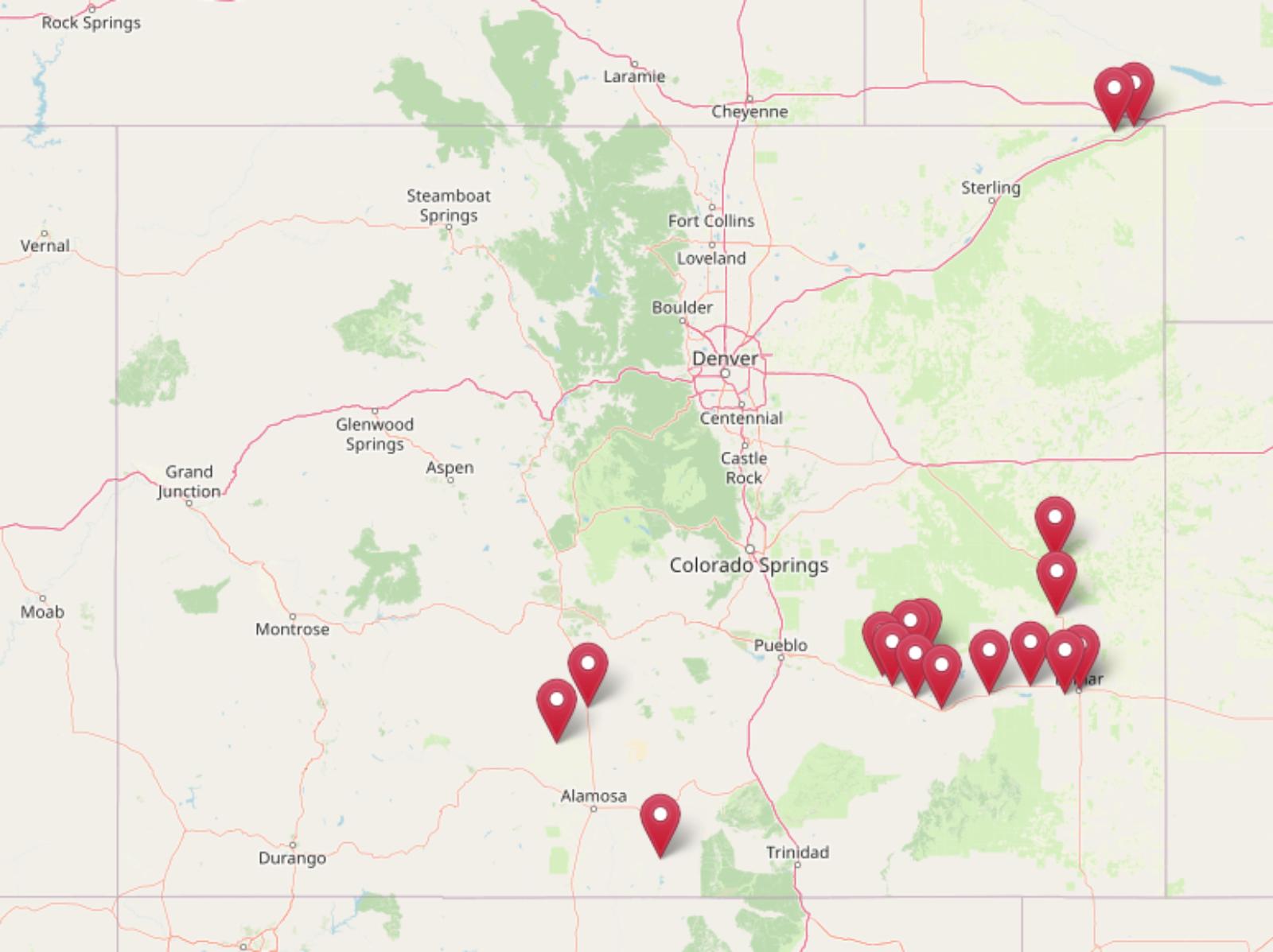

According to the latest Zillow Home Value Index, Colorado home prices are still rising—but some towns remain surprisingly affordable. While big cities like Denver and Boulder top the charts, a handful of smaller communities offer home prices well below the state average. Based on May 2025 data, these 17 towns stand out for having the lowest housing costs in Colorado. From remote mountain hideaways to historic prairie towns, each place on the list includes detailed pricing trends from 2010 to today—offering a clear view of where your dollar still stretches.

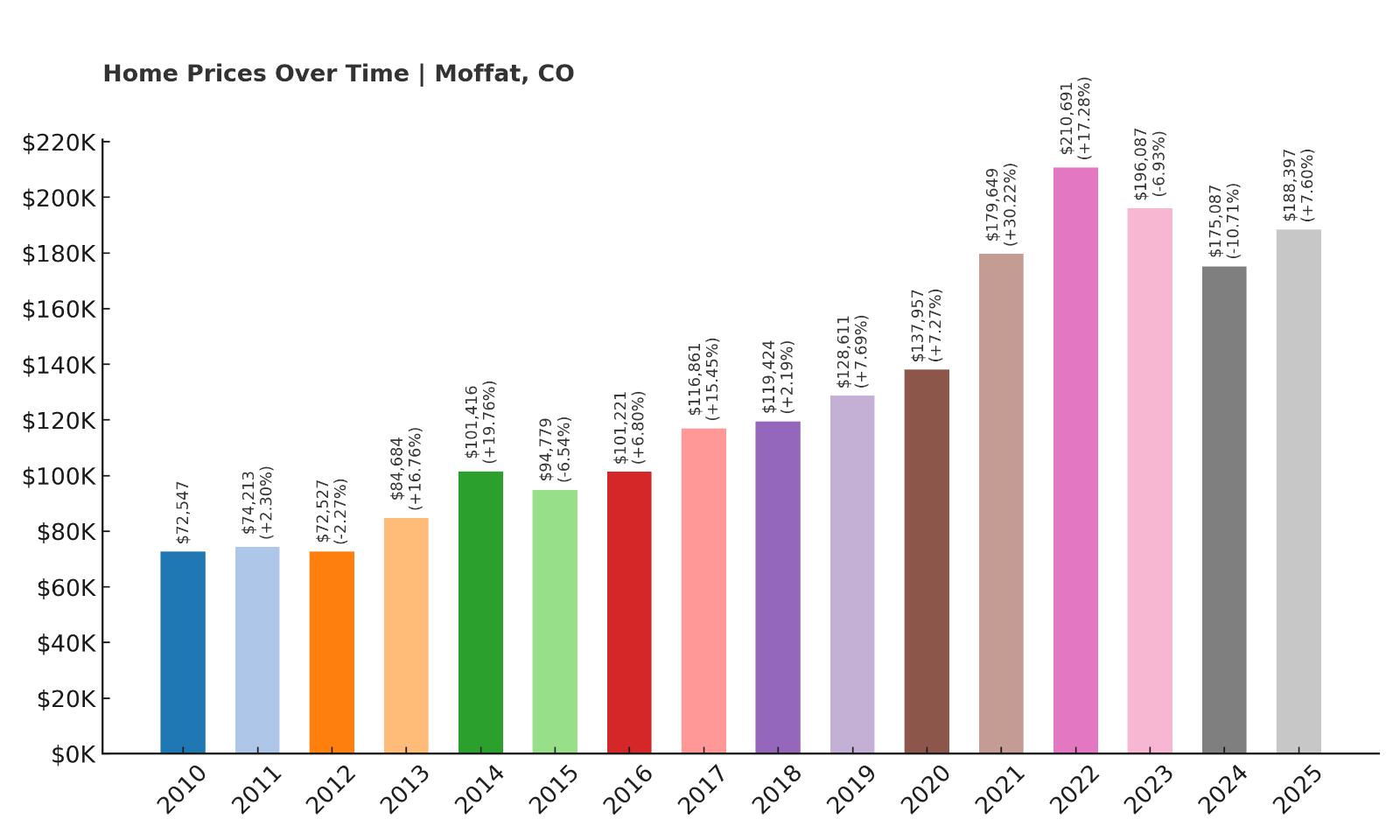

17. Moffat – 160% Home Price Increase Since 2010

- 2010: $72,547

- 2011: $74,213 (+$1,666, +2.30% from previous year)

- 2012: $72,527 (-$1,686, -2.27% from previous year)

- 2013: $84,684 (+$12,157, +16.76% from previous year)

- 2014: $101,416 (+$16,732, +19.76% from previous year)

- 2015: $94,779 (-$6,637, -6.54% from previous year)

- 2016: $101,221 (+$6,442, +6.80% from previous year)

- 2017: $116,861 (+$15,640, +15.45% from previous year)

- 2018: $119,424 (+$2,563, +2.19% from previous year)

- 2019: $128,611 (+$9,187, +7.69% from previous year)

- 2020: $137,957 (+$9,347, +7.27% from previous year)

- 2021: $179,649 (+$41,692, +30.22% from previous year)

- 2022: $210,691 (+$31,042, +17.28% from previous year)

- 2023: $196,087 (-$14,604, -6.93% from previous year)

- 2024: $175,087 (-$21,000, -10.71% from previous year)

- 2025: $188,397 (+$13,310, +7.60% from previous year)

Moffat’s home values have more than doubled since 2010, growing by 160% over the 15-year span. After some early volatility, prices began a more stable upward climb in the mid-2010s. A standout moment came in 2021 with a striking 30% year-over-year gain, likely driven by renewed interest in small-town living. While the past few years brought some correction, the market rebounded in 2025, showing resilience after a dip. Moffat remains a compelling option for budget-conscious buyers who are also eyeing long-term appreciation. With a current average home price of $188,397, it offers strong value even after years of growth.

Moffat – Small Town with Surprising Momentum

Located in the San Luis Valley of south-central Colorado, Moffat is a tiny rural town with fewer than 150 residents — but its real estate market has told a much bigger story. Its appeal comes from wide-open landscapes, mountain views, and quiet living. While local amenities are limited, its affordability and remoteness have drawn in retirees and off-grid enthusiasts.

High home price growth between 2020 and 2022 suggests increased demand, possibly from out-of-state buyers. The steep dip in 2023 and 2024 reflects broader rural market corrections, yet Moffat bounced back by 7.6% in 2025. For those who don’t mind isolation in exchange for affordability and mountain proximity, Moffat offers a truly low-cost foothold in the Colorado housing market.

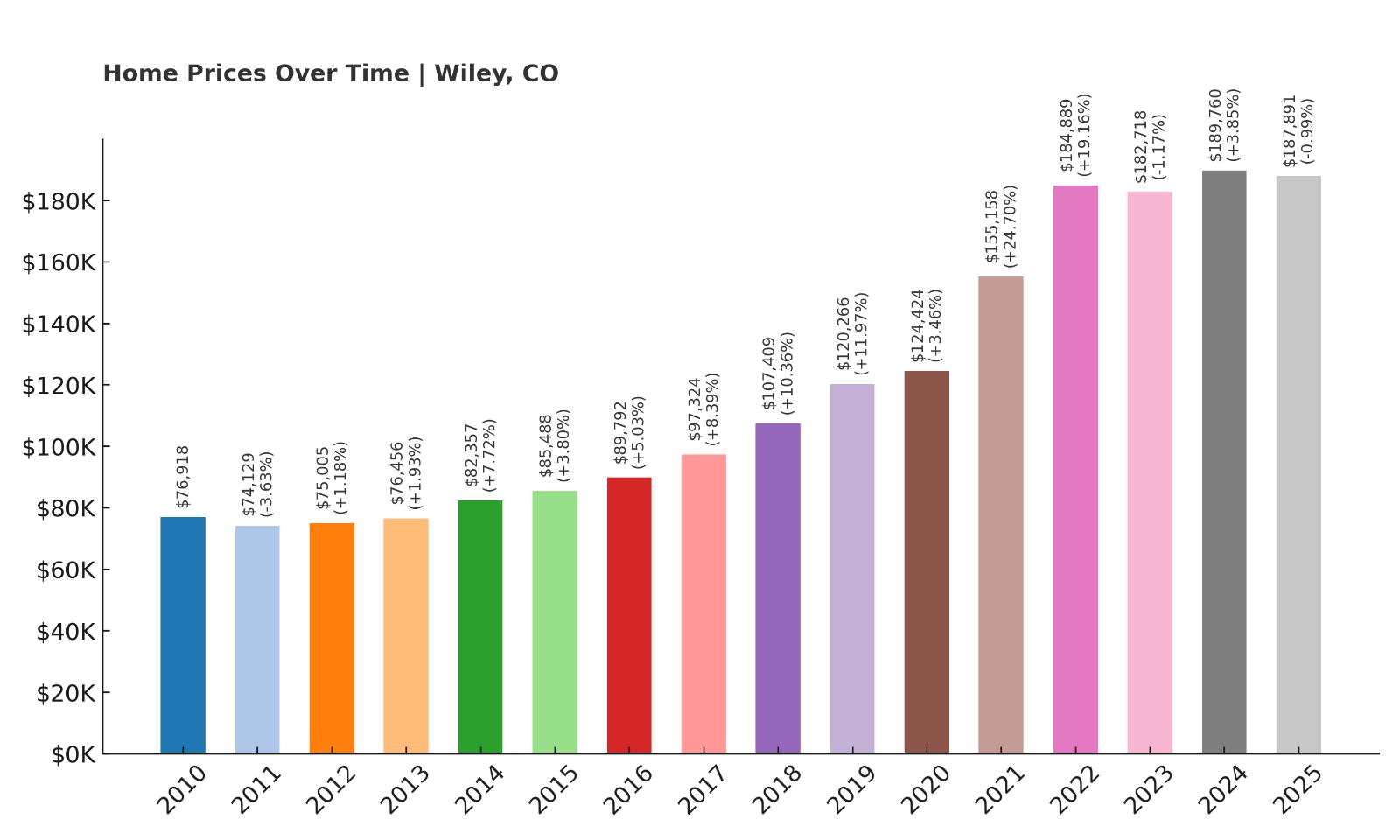

16. Wiley – 144% Home Price Increase Since 2010

- 2010: $76,918

- 2011: $74,129 (-$2,789, -3.63% from previous year)

- 2012: $75,005 (+$876, +1.18% from previous year)

- 2013: $76,456 (+$1,451, +1.93% from previous year)

- 2014: $82,357 (+$5,900, +7.72% from previous year)

- 2015: $85,488 (+$3,132, +3.80% from previous year)

- 2016: $89,792 (+$4,304, +5.03% from previous year)

- 2017: $97,324 (+$7,532, +8.39% from previous year)

- 2018: $107,409 (+$10,085, +10.36% from previous year)

- 2019: $120,266 (+$12,856, +11.97% from previous year)

- 2020: $124,424 (+$4,159, +3.46% from previous year)

- 2021: $155,158 (+$30,734, +24.70% from previous year)

- 2022: $184,889 (+$29,731, +19.16% from previous year)

- 2023: $182,718 (-$2,172, -1.17% from previous year)

- 2024: $189,760 (+$7,042, +3.85% from previous year)

- 2025: $187,891 (-$1,869, -0.99% from previous year)

Wiley has seen strong and steady growth since 2010, with home prices climbing 144% over the period. The town experienced a massive spike in 2021 and 2022, likely fueled by pandemic-era migration and demand for more space. Though prices dipped slightly in 2023 and 2025, the overall trend remains solid. Current prices hover around $188,000, close to their all-time high, making Wiley one of Colorado’s most stable affordable markets over the long haul.

Wiley – Affordable Homes in Colorado’s Southeast

Were You Meant

to Live In?

Sitting just north of Lamar in southeastern Colorado, Wiley is a quiet agricultural town that offers a low cost of living and peaceful surroundings. With easy access to US Route 287 and just minutes from the Arkansas River, it’s convenient for those commuting to larger nearby towns for work or shopping.

Wiley’s affordability, combined with consistent price growth and minimal market volatility, suggests strong long-term investment potential. Home values grew in double digits through several consecutive years, even as some towns faltered. Its appeal lies in its simplicity and consistent demand from families and rural workers looking for steady, low-cost housing options.

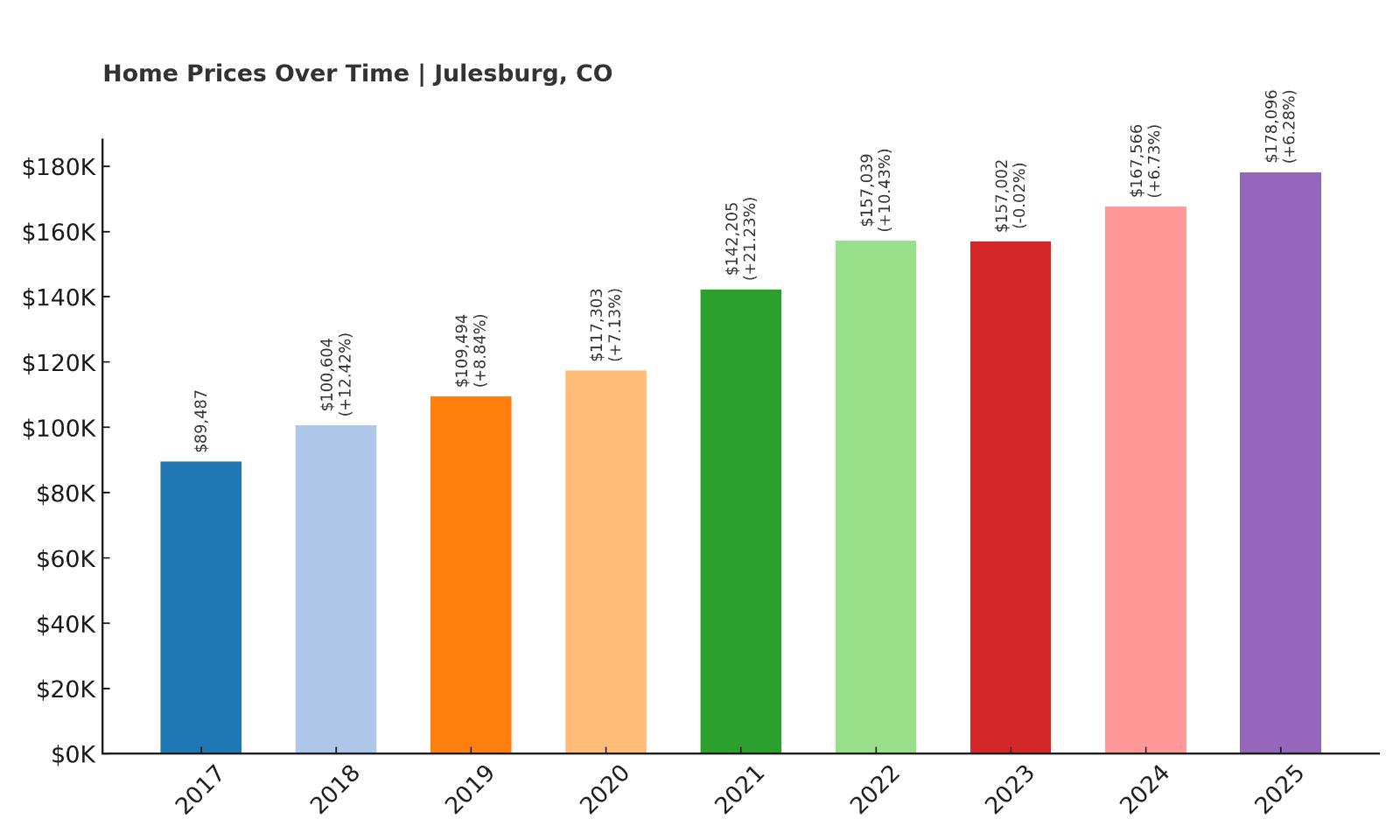

15. Julesburg – 99% Home Price Increase Since 2017

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: $89,487

- 2018: $100,604 (+$11,117, +12.42% from previous year)

- 2019: $109,494 (+$8,890, +8.84% from previous year)

- 2020: $117,303 (+$7,809, +7.13% from previous year)

- 2021: $142,205 (+$24,901, +21.23% from previous year)

- 2022: $157,039 (+$14,834, +10.43% from previous year)

- 2023: $157,002 (-$37, -0.02% from previous year)

- 2024: $167,566 (+$10,563, +6.73% from previous year)

- 2025: $178,096 (+$10,531, +6.28% from previous year)

Julesburg’s home prices have nearly doubled since 2017, reflecting a major upward swing for this northeastern Colorado town. A huge jump in 2021 pushed values past $140K, and they’ve continued a steady climb. The current median sits at $178,096, one of the highest among this affordable group. Despite a brief plateau in 2023, the consistent demand shows buyers are noticing Julesburg’s appeal.

Julesburg – Rural Growth Near the Nebraska Line

Julesburg is tucked away in Colorado’s far northeastern corner, right near the Nebraska state line. Known for its frontier history and laid-back lifestyle, this small town has become more attractive in recent years to remote workers and retirees seeking peace and open space. Despite its location, it has access to I-76, connecting it to bigger markets like Denver and Cheyenne.

The steady rise in property values suggests a quiet but persistent increase in demand. With solid broadband infrastructure and low property taxes, Julesburg has quietly gained traction among buyers priced out of urban areas. Its growth shows that even distant rural communities can thrive with the right combination of access, affordability, and quality of life.

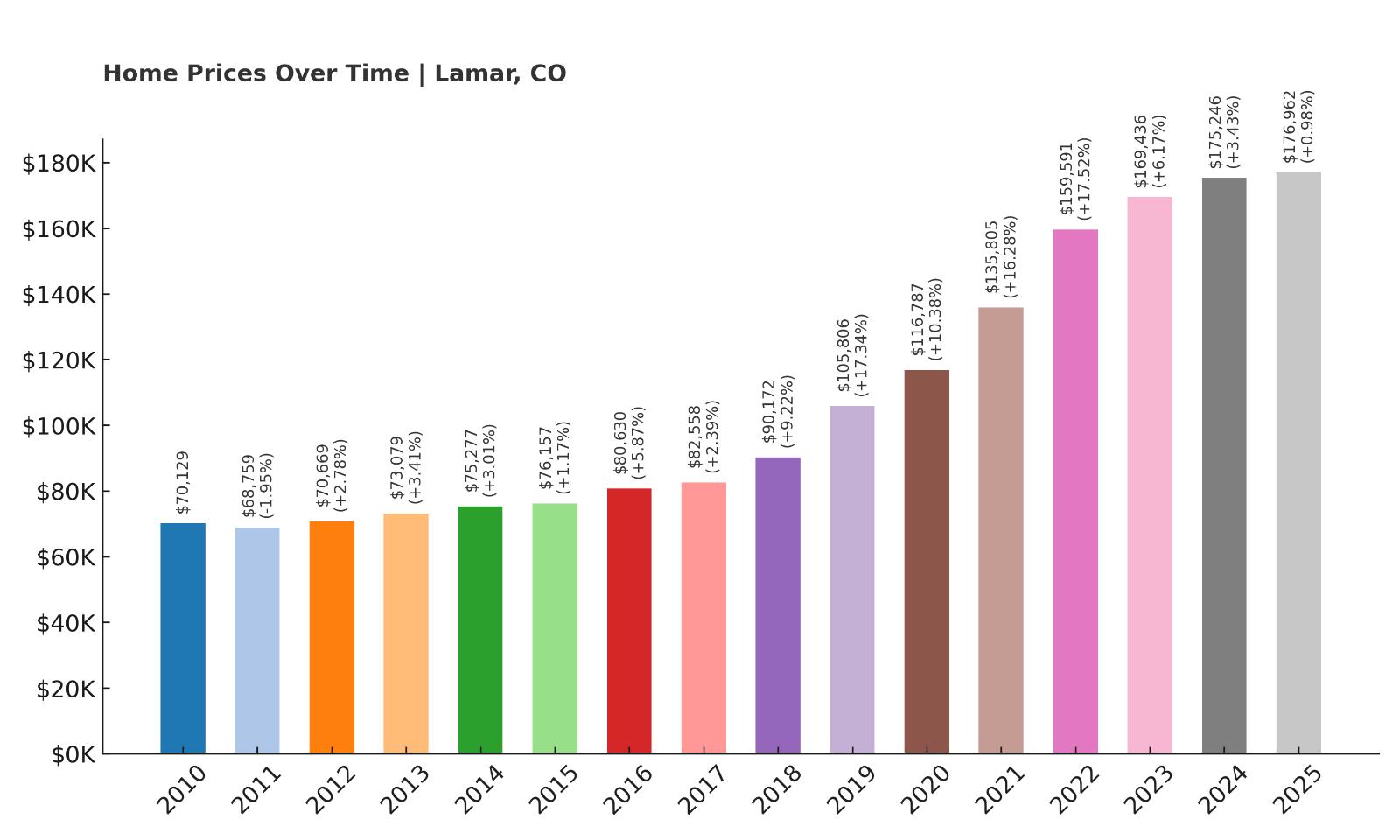

14. Lamar – 152% Home Price Increase Since 2010

Home Stratosphere Guide

Your Personality Already Knows

How Your Home Should Feel

113 pages of room-by-room design guidance built around your actual brain, your actual habits, and the way you actually live.

You might be an ISFJ or INFP designer…

You design through feeling — your spaces are personal, comforting, and full of meaning. The guide covers your exact color palettes, room layouts, and the one mistake your type always makes.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ISTJ or INTJ designer…

You crave order, function, and visual calm. The guide shows you how to create spaces that feel both serene and intentional — without ending up sterile.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ENFP or ESTP designer…

You design by instinct and energy. Your home should feel alive. The guide shows you how to channel that into rooms that feel curated, not chaotic.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ENTJ or ESTJ designer…

You value quality, structure, and things done right. The guide gives you the framework to build rooms that feel polished without overthinking every detail.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

- 2010: $70,129

- 2011: $68,759 (-$1,370, -1.95% from previous year)

- 2012: $70,669 (+$1,910, +2.78% from previous year)

- 2013: $73,079 (+$2,410, +3.41% from previous year)

- 2014: $75,277 (+$2,198, +3.01% from previous year)

- 2015: $76,157 (+$880, +1.17% from previous year)

- 2016: $80,630 (+$4,473, +5.87% from previous year)

- 2017: $82,558 (+$1,928, +2.39% from previous year)

- 2018: $90,172 (+$7,614, +9.22% from previous year)

- 2019: $105,806 (+$15,634, +17.34% from previous year)

- 2020: $116,787 (+$10,981, +10.38% from previous year)

- 2021: $135,805 (+$19,018, +16.28% from previous year)

- 2022: $159,591 (+$23,786, +17.52% from previous year)

- 2023: $169,436 (+$9,845, +6.17% from previous year)

- 2024: $175,246 (+$5,810, +3.43% from previous year)

- 2025: $176,962 (+$1,716, +0.98% from previous year)

Lamar’s real estate story is one of long-term, consistent growth. With a 152% rise in home prices since 2010, the town has steadily appreciated without the wild swings seen elsewhere. It experienced particularly strong growth between 2018 and 2022, with gains of over 10% annually. At $176,962, Lamar offers one of the strongest appreciation histories among Colorado’s affordable towns.

Lamar – A Steady Riser in the Arkansas Valley

Lamar serves as a regional hub in southeastern Colorado, with a population of around 7,500. It’s a full-service town with schools, a hospital, retail, and a municipal airport — rare assets for a town this size. Its strategic location on US-50 and US-287 makes it a key connector across the plains.

Its steady price gains reflect this role as an economic anchor in the region. The city’s investment in downtown revitalization, local education, and infrastructure likely supports its rising home values. Buyers looking for a balanced market with proven value over time would do well to keep Lamar on their shortlist.

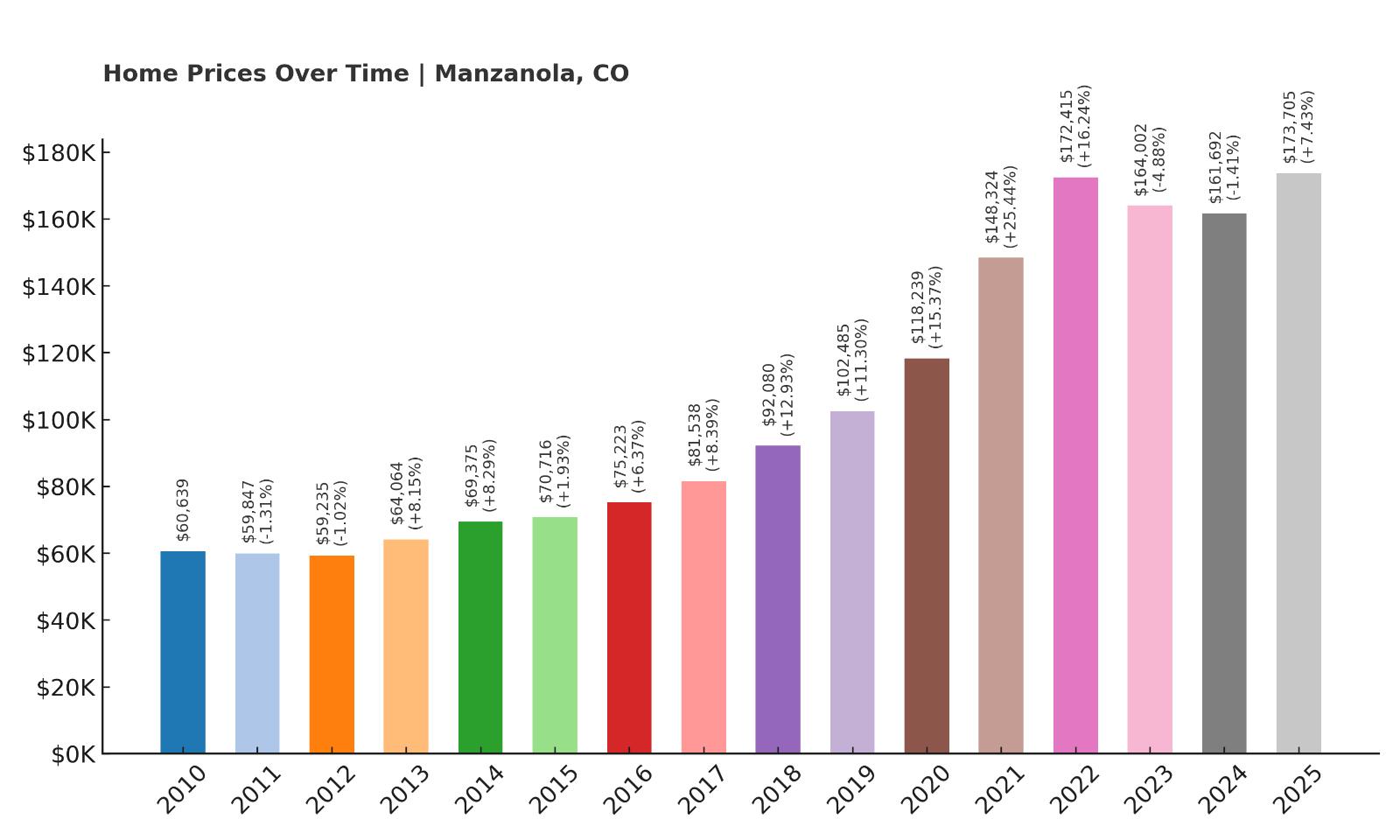

13. Manzanola – 186% Home Price Increase Since 2010

- 2010: $60,639

- 2011: $59,847 (-$792, -1.31% from previous year)

- 2012: $59,235 (-$612, -1.02% from previous year)

- 2013: $64,064 (+$4,829, +8.15% from previous year)

- 2014: $69,375 (+$5,311, +8.29% from previous year)

- 2015: $70,716 (+$1,341, +1.93% from previous year)

- 2016: $75,223 (+$4,508, +6.37% from previous year)

- 2017: $81,538 (+$6,315, +8.39% from previous year)

- 2018: $92,080 (+$10,542, +12.93% from previous year)

- 2019: $102,485 (+$10,405, +11.30% from previous year)

- 2020: $118,239 (+$15,753, +15.37% from previous year)

- 2021: $148,324 (+$30,086, +25.44% from previous year)

- 2022: $172,415 (+$24,091, +16.24% from previous year)

- 2023: $164,002 (-$8,414, -4.88% from previous year)

- 2024: $161,692 (-$2,310, -1.41% from previous year)

- 2025: $173,705 (+$12,013, +7.43% from previous year)

Manzanola’s home values have nearly tripled since 2010, marking a remarkable 186% increase over 15 years. Prices stayed fairly flat in the early 2010s, but starting in 2016, the town entered a period of sustained and impressive growth. Several years posted double-digit annual gains, including a dramatic 25% jump in 2021. Although values dipped slightly in 2023 and 2024, they bounced back in 2025 with a solid 7.4% increase. With homes now averaging just under $174,000, Manzanola still offers affordability paired with a very strong history of appreciation — a combination that is increasingly rare across the state.

Manzanola – Small-Town Resilience on the Plains

Manzanola is a compact town in Otero County, located along the Arkansas River and just off Highway 50 between La Junta and Fowler. With fewer than 500 residents, it has a tight-knit rural feel but retains access to key services in neighboring towns. Its agricultural roots run deep, and many residents still work in farming, ranching, or support industries. This stable economic base has helped support the housing market, even during periods of broader volatility elsewhere.

The sharp increase in home values between 2020 and 2022 suggests outside interest may have grown during the remote work era, especially from those looking for inexpensive, livable towns with room to grow. Despite a modest correction in 2023 and 2024, Manzanola rebounded quickly, reflecting continued underlying demand. It’s an appealing option for those who want low home prices with upside potential, without sacrificing the charm and steadiness of a well-rooted rural community.

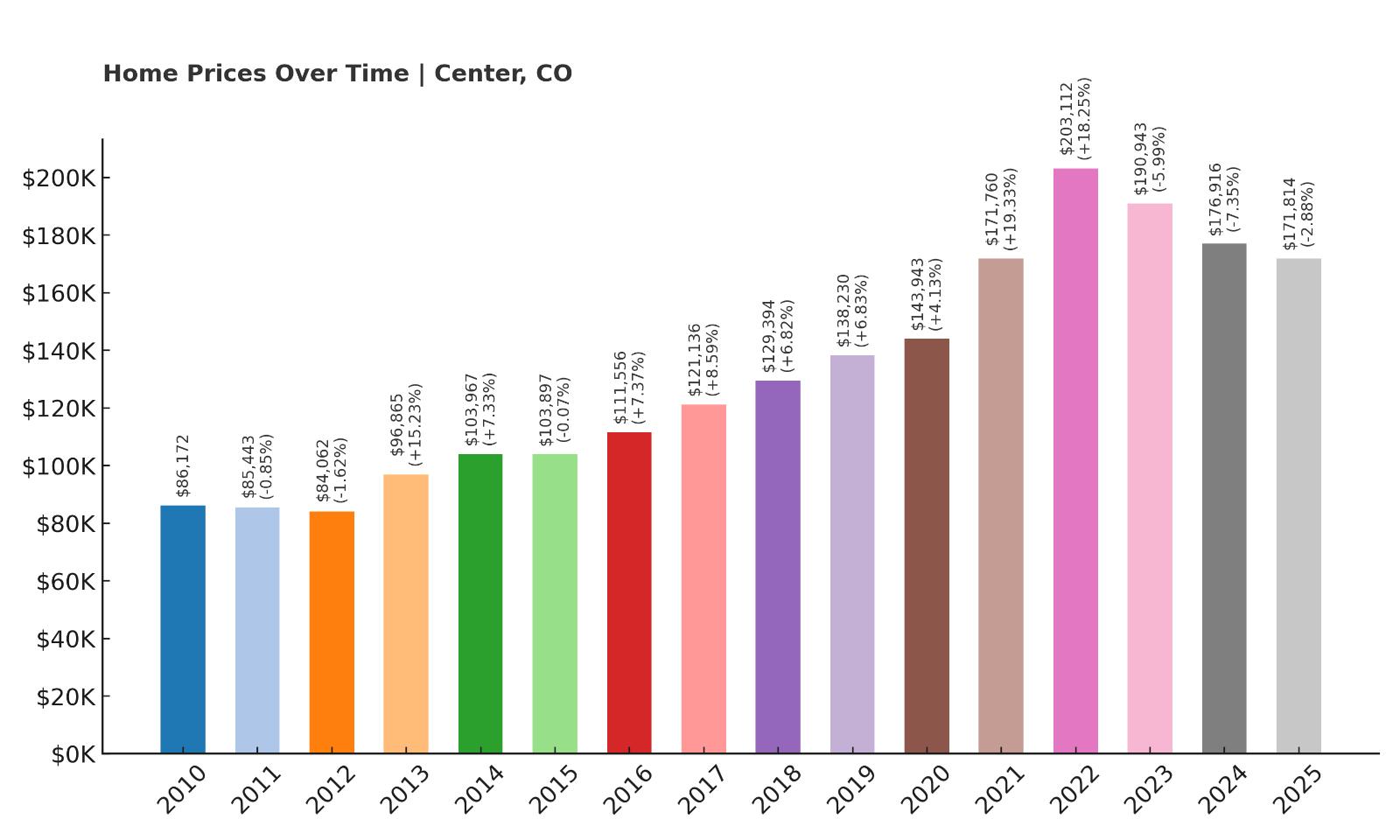

12. Center – 99% Home Price Increase Since 2010

- 2010: $86,172

- 2011: $85,443 (-$729, -0.85% from previous year)

- 2012: $84,062 (-$1,381, -1.62% from previous year)

- 2013: $96,865 (+$12,803, +15.23% from previous year)

- 2014: $103,967 (+$7,102, +7.33% from previous year)

- 2015: $103,897 (-$70, -0.07% from previous year)

- 2016: $111,556 (+$7,658, +7.37% from previous year)

- 2017: $121,136 (+$9,580, +8.59% from previous year)

- 2018: $129,394 (+$8,258, +6.82% from previous year)

- 2019: $138,230 (+$8,836, +6.83% from previous year)

- 2020: $143,943 (+$5,713, +4.13% from previous year)

- 2021: $171,760 (+$27,817, +19.33% from previous year)

- 2022: $203,112 (+$31,352, +18.25% from previous year)

- 2023: $190,943 (-$12,169, -5.99% from previous year)

- 2024: $176,916 (-$14,027, -7.35% from previous year)

- 2025: $171,814 (-$5,102, -2.88% from previous year)

Center has had a dynamic home price history, nearly doubling its values since 2010. The town saw modest gains in the early years, followed by a major boost from 2020 onward. During the pandemic period, prices surged more than 35% in just two years, fueled by shifts in housing demand. Even with some recent cooling, the average home price in 2025 still sits at over $171,000, far above its 2010 baseline. These gains point to a market that benefited from both organic growth and outside interest, although recent declines may be giving buyers a bit more leverage again.

Center – Agriculture Hub with Real Value

Located in the San Luis Valley, Center is aptly named — both geographically and economically — as a center of Colorado’s potato-growing region. This agricultural focus gives the town its economic base, with many residents working in farming and food processing. While it’s not a tourism magnet, Center’s proximity to mountain views and fertile fields makes it a pragmatic choice for families and local workers. Public schools, modest retail options, and an airport nearby contribute to its functionality without raising prices unnecessarily.

The sharp rise in values in 2020–2022 suggests strong interest in rural properties during the remote work boom, while the more recent declines reflect broader post-pandemic corrections. With its solid housing stock and essential services, Center continues to serve those who want reliable housing costs in a work-focused town — and investors may appreciate the long-term resilience despite recent dips.

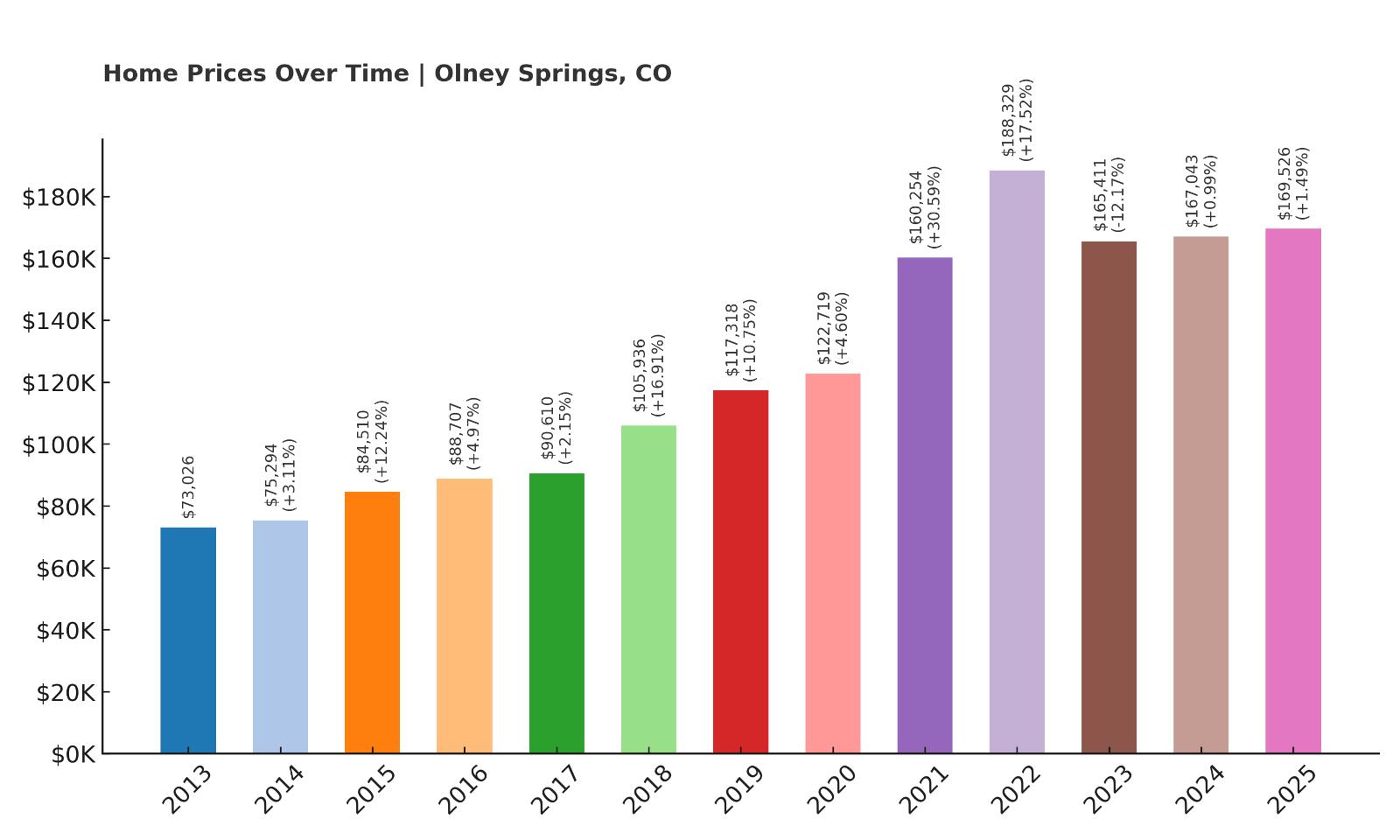

11. Olney Springs – 132% Home Price Increase Since 2013

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: $73,026

- 2014: $75,294 (+$2,268, +3.11% from previous year)

- 2015: $84,510 (+$9,216, +12.24% from previous year)

- 2016: $88,707 (+$4,197, +4.97% from previous year)

- 2017: $90,610 (+$1,903, +2.15% from previous year)

- 2018: $105,936 (+$15,326, +16.91% from previous year)

- 2019: $117,318 (+$11,383, +10.75% from previous year)

- 2020: $122,719 (+$5,401, +4.60% from previous year)

- 2021: $160,254 (+$37,535, +30.59% from previous year)

- 2022: $188,329 (+$28,075, +17.52% from previous year)

- 2023: $165,411 (-$22,918, -12.17% from previous year)

- 2024: $167,043 (+$1,632, +0.99% from previous year)

- 2025: $169,526 (+$2,483, +1.49% from previous year)

Olney Springs has shown significant price appreciation since data became available in 2013, with home values climbing over 130%. The strongest gains came during 2020–2022, when values jumped more than 50% in just two years. The town experienced a correction in 2023, shedding about 12%, but it stabilized in the years that followed. With 2025 prices settling just under $170,000, the town continues to offer one of the lowest-cost entry points for Colorado real estate while holding onto much of its prior growth.

Olney Springs – Tiny but Rising on the Radar

Olney Springs is a very small town in Crowley County, tucked between Pueblo and La Junta. It has fewer than 400 residents and only a handful of businesses, yet that hasn’t kept it from seeing sharp home price increases in recent years. Many buyers are drawn by the ultra-low property taxes, small-town lifestyle, and opportunities to live rurally while still being within range of larger cities like Pueblo.

The huge leap in property values between 2020 and 2022 may reflect a spike in demand from buyers fleeing urban centers, though the 2023 dip signals that demand has cooled slightly. Still, prices have leveled off without falling much further. Olney Springs remains a viable choice for buyers looking to get land and housing for well under $200,000, while still benefiting from prior appreciation trends and potential long-term upside.

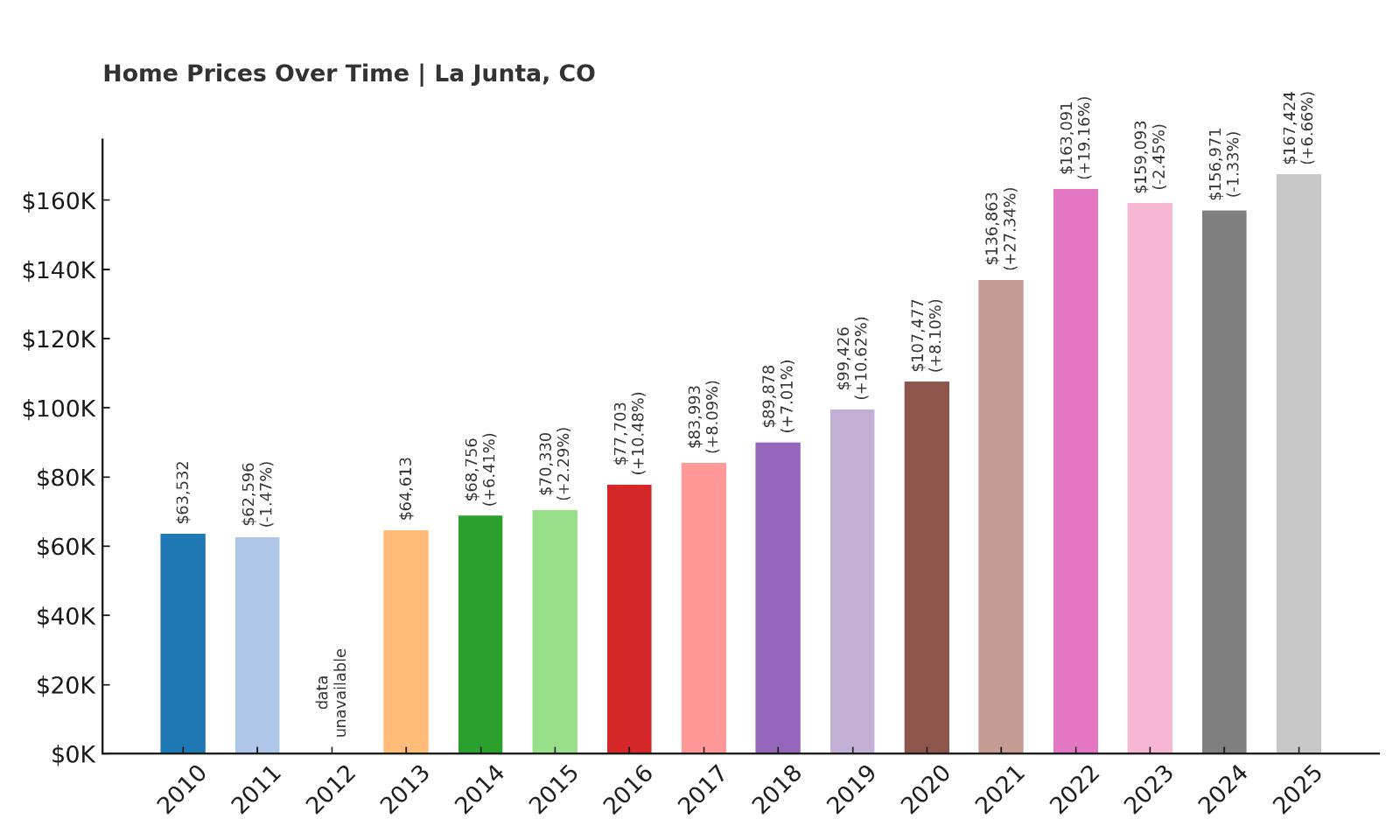

10. La Junta – 163% Home Price Increase Since 2010

- 2010: $63,532

- 2011: $62,596 (-$936, -1.47% from previous year)

- 2012: N/A

- 2013: $64,613

- 2014: $68,756 (+$4,143, +6.41% from previous year)

- 2015: $70,330 (+$1,574, +2.29% from previous year)

- 2016: $77,703 (+$7,374, +10.48% from previous year)

- 2017: $83,993 (+$6,290, +8.09% from previous year)

- 2018: $89,878 (+$5,884, +7.01% from previous year)

- 2019: $99,426 (+$9,548, +10.62% from previous year)

- 2020: $107,477 (+$8,051, +8.10% from previous year)

- 2021: $136,863 (+$29,387, +27.34% from previous year)

- 2022: $163,091 (+$26,227, +19.16% from previous year)

- 2023: $159,093 (-$3,998, -2.45% from previous year)

- 2024: $156,971 (-$2,121, -1.33% from previous year)

- 2025: $167,424 (+$10,453, +6.66% from previous year)

La Junta stands out for having one of the strongest long-term growth patterns in this entire roundup. Prices rose over 160% since 2010, with especially sharp jumps from 2020 to 2022. Even when facing national cooling trends, the town held its ground with only mild corrections. In 2025, home values rebounded again, topping $167,000. That makes La Junta both an affordable option and one with a clearly demonstrated history of price resilience and momentum.

La Junta – Regional Anchor with Growth Potential

As the county seat of Otero County, La Junta plays a key role in southeastern Colorado. It’s a mid-sized town by rural standards, with a population of about 7,000 and a wide range of services: schools, a hospital, shopping centers, and a historic Amtrak stop. It’s located on US Highway 50, a major east-west corridor, making it more connected than many of its neighbors.

La Junta’s steady rise in home prices reflects both organic population growth and outside investor interest. Its role as a service hub, combined with relatively affordable prices, has helped insulate it from sharper market swings. Buyers looking for stability, infrastructure, and low entry costs often find La Junta one of the most appealing options in the Arkansas Valley region.

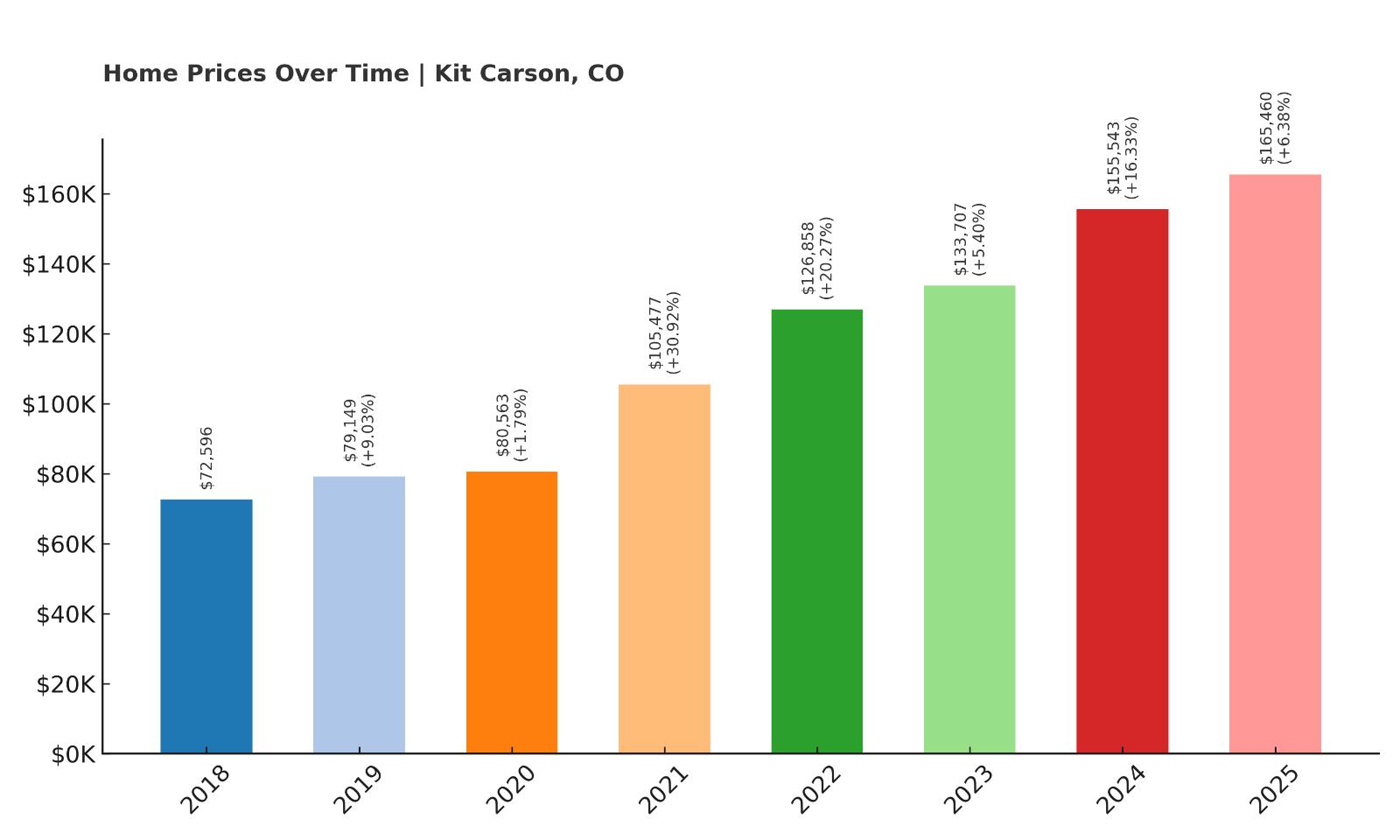

9. Kit Carson – 128% Home Price Increase Since 2018

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: $72,596

- 2019: $79,149 (+$6,553, +9.03% from previous year)

- 2020: $80,563 (+$1,414, +1.79% from previous year)

- 2021: $105,477 (+$24,914, +30.92% from previous year)

- 2022: $126,858 (+$21,381, +20.27% from previous year)

- 2023: $133,707 (+$6,850, +5.40% from previous year)

- 2024: $155,543 (+$21,835, +16.33% from previous year)

- 2025: $165,460 (+$9,917, +6.38% from previous year)

Kit Carson’s home prices have skyrocketed over the past seven years, jumping more than 128% since 2018. While early data is limited, the available years paint a clear picture of consistent and increasingly aggressive value growth. The sharpest surges came during 2021 and 2022, with back-to-back annual increases of over 20%. That rapid appreciation has continued at a slower but still strong pace, culminating in a 2025 average of $165,460. For a town this small and remote, this growth trajectory is particularly notable and suggests increasing interest from buyers looking outside traditional urban cores.

Kit Carson – A High Plains Boom in Eastern Colorado

Kit Carson is located in the eastern plains of Colorado, not far from the Kansas border. It’s a classic rural town with a population under 300, known for its wide-open skies, peaceful farmland, and traditional values. While Kit Carson might not be on many relocation shortlists, the housing market tells a different story — one of significant interest and value appreciation in recent years. That’s likely due in part to rising property prices elsewhere in Colorado, pushing more buyers to explore lesser-known but promising alternatives like this one.

Despite its remote location, Kit Carson offers a small K-12 school district, local stores, and essential services that meet the needs of its tight-knit community. The town is also served by U.S. Highway 287, a major corridor that improves accessibility to larger hubs. The recent price surge indicates that buyers are beginning to recognize the tradeoff between rural simplicity and affordable home ownership, especially as the cost of living climbs statewide. For those seeking a long-term hold with potential upside, Kit Carson is quietly becoming a rural investment to watch.

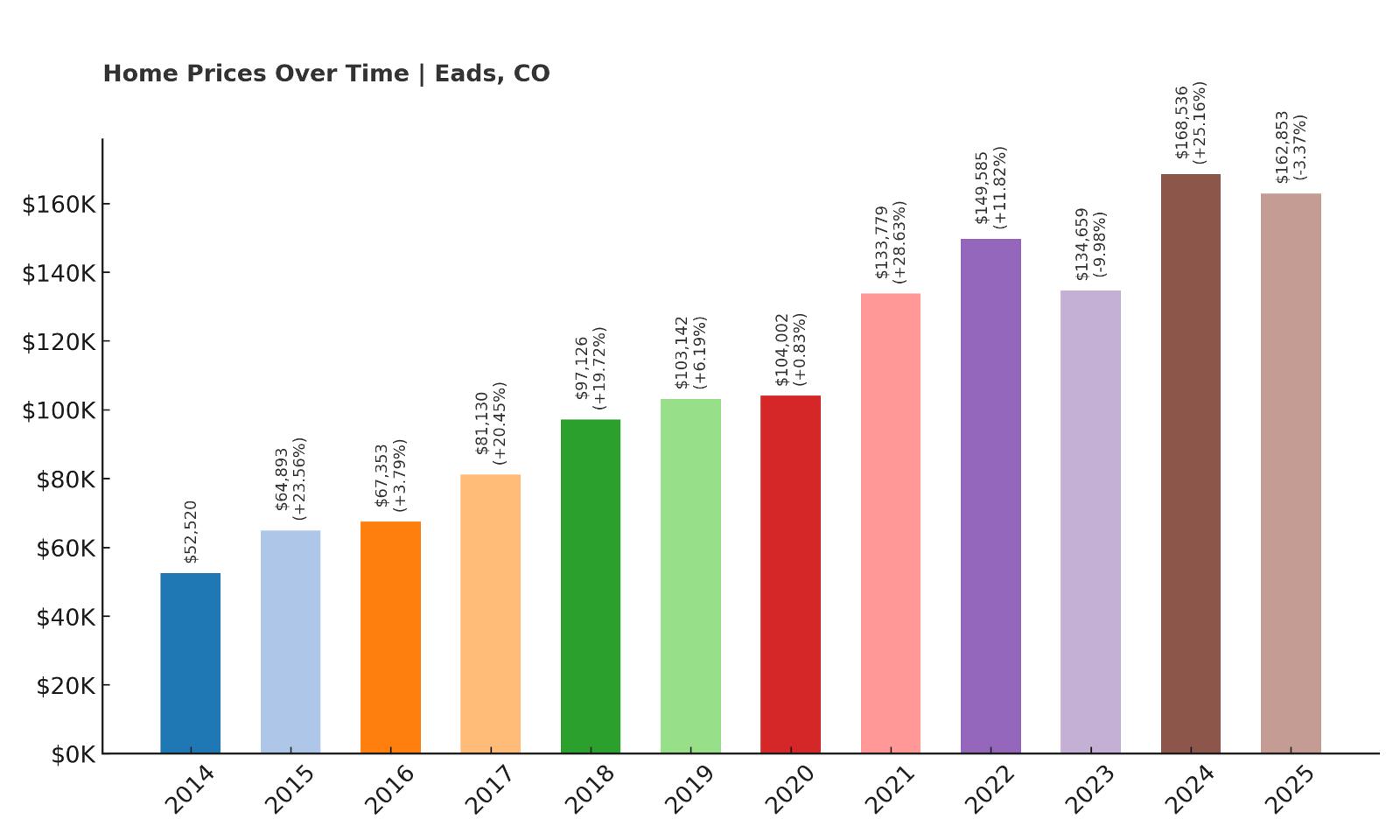

8. Eads – 210% Home Price Increase Since 2014

Would you like to save this?

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: $52,520

- 2015: $64,893 (+$12,374, +23.56% from previous year)

- 2016: $67,353 (+$2,460, +3.79% from previous year)

- 2017: $81,130 (+$13,776, +20.45% from previous year)

- 2018: $97,126 (+$15,996, +19.72% from previous year)

- 2019: $103,142 (+$6,017, +6.19% from previous year)

- 2020: $104,002 (+$860, +0.83% from previous year)

- 2021: $133,779 (+$29,776, +28.63% from previous year)

- 2022: $149,585 (+$15,806, +11.82% from previous year)

- 2023: $134,659 (-$14,926, -9.98% from previous year)

- 2024: $168,536 (+$33,877, +25.16% from previous year)

- 2025: $162,853 (-$5,683, -3.37% from previous year)

Eads has delivered one of the strongest overall performances in the entire affordability ranking, with a 210% increase in home prices since 2014. The town saw substantial appreciation from 2015 to 2018, followed by another major wave during the pandemic housing surge. A slight dip in 2023 didn’t stop the market from roaring back with a massive 25% gain in 2024, pushing prices to their current average of $162,853. This is a town where value isn’t just holding — it’s accelerating, driven by long-term demand and buyer confidence in rural price stability.

Eads – A Quiet County Seat with Big Gains

Eads is the county seat of Kiowa County and one of the larger small towns in Colorado’s southeastern plains. With a population of about 600, Eads offers more infrastructure than you might expect: a K-12 school system, healthcare services, a public library, and regional government offices. It’s situated along U.S. Highway 287 and serves as a local hub for ranchers, farmers, and residents in the surrounding rural areas. The town’s small but functional economy is supported by agriculture, education, and public service roles, which provide a steady base for long-term growth.

The home price surge in Eads mirrors trends seen in other towns where affordability and utility overlap. Rather than being a speculative boomtown, Eads has earned its gains from consistent local demand and increased attention from out-of-area buyers looking for more space. The rebound from the 2023 price dip shows that confidence in the local market remains strong, especially as prices in urban Colorado continue to push buyers eastward. For investors or homeowners wanting affordability with proven growth, Eads is a strong contender worth a deeper look.

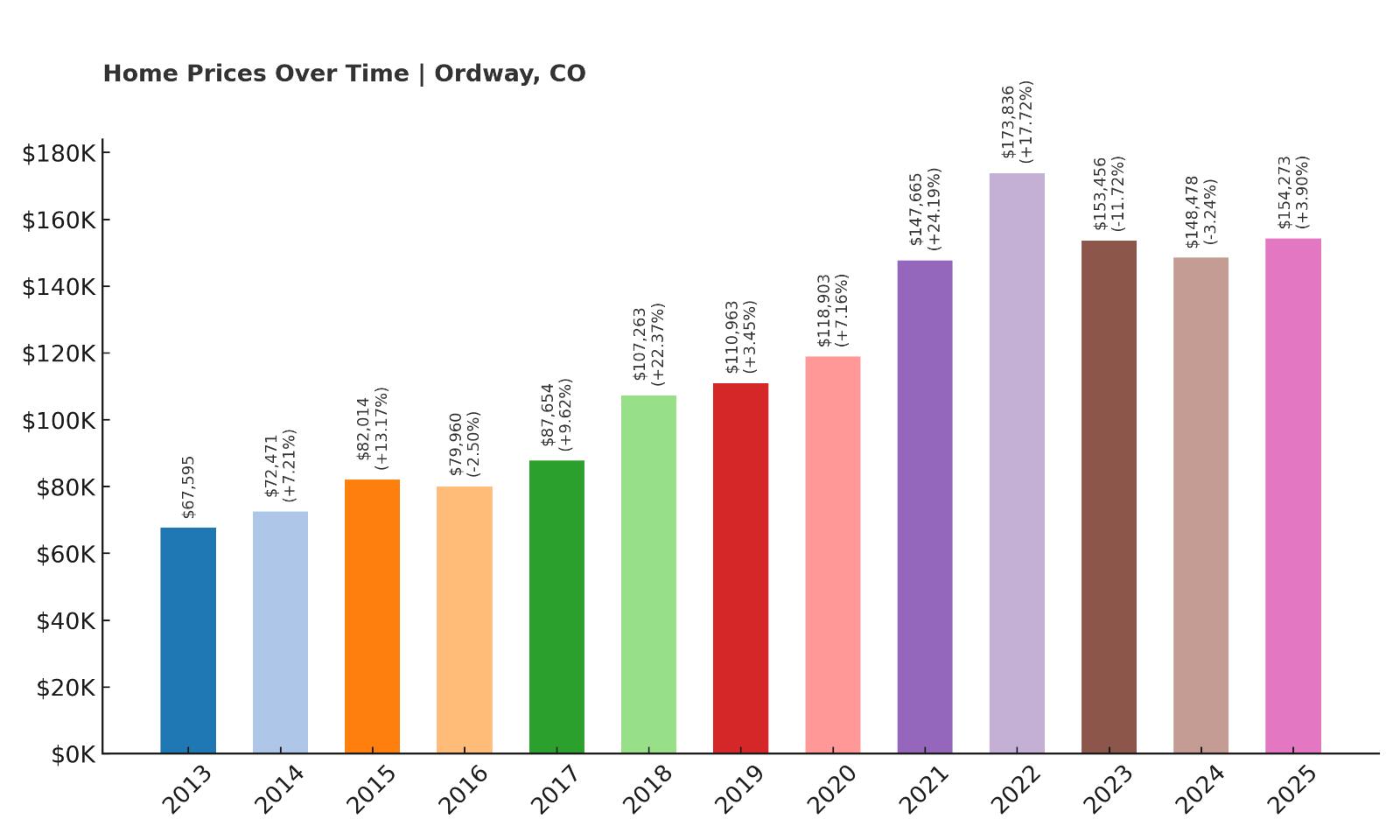

7. Ordway – 128% Home Price Increase Since 2013

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: $67,595

- 2014: $72,471 (+$4,876, +7.21% from previous year)

- 2015: $82,014 (+$9,543, +13.17% from previous year)

- 2016: $79,960 (-$2,054, -2.50% from previous year)

- 2017: $87,654 (+$7,694, +9.62% from previous year)

- 2018: $107,263 (+$19,609, +22.37% from previous year)

- 2019: $110,963 (+$3,700, +3.45% from previous year)

- 2020: $118,903 (+$7,939, +7.16% from previous year)

- 2021: $147,665 (+$28,762, +24.19% from previous year)

- 2022: $173,836 (+$26,172, +17.72% from previous year)

- 2023: $153,456 (-$20,380, -11.72% from previous year)

- 2024: $148,478 (-$4,978, -3.24% from previous year)

- 2025: $154,273 (+$5,795, +3.90% from previous year)

Ordway’s housing market has more than doubled since 2013, climbing 128% over the span of 12 years. The town experienced rapid growth from 2017 through 2022, with annual double-digit increases that lifted the average home price to over $170,000 by 2022. After a cooling-off period in 2023 and 2024, prices began rising again in 2025, ending at $154,273. This pattern suggests that while the market is maturing, it still retains potential for long-term value appreciation, especially in comparison to pricier towns across the state.

Ordway – A Compact Town With Stable Appeal

Ordway is the county seat of Crowley County and home to just under 1,100 people. While small, it plays a pivotal role in the area’s government, services, and small business community. Ordway benefits from its central location in the Arkansas River Valley and access to highways that link it with Pueblo and La Junta. Despite its modest size, it offers residents schools, grocery options, a library, and parks — all features that make it more livable than many towns of comparable population.

Its home price history shows that interest in Ordway isn’t a passing trend. The town’s appeal lies in its balanced mix of low prices, livable amenities, and accessibility. Though prices dipped during the 2023 correction, the market quickly showed signs of life again in 2025. Buyers seeking stable rural property with a proven growth record and access to regional services will find that Ordway offers genuine value without sacrificing quality of life.

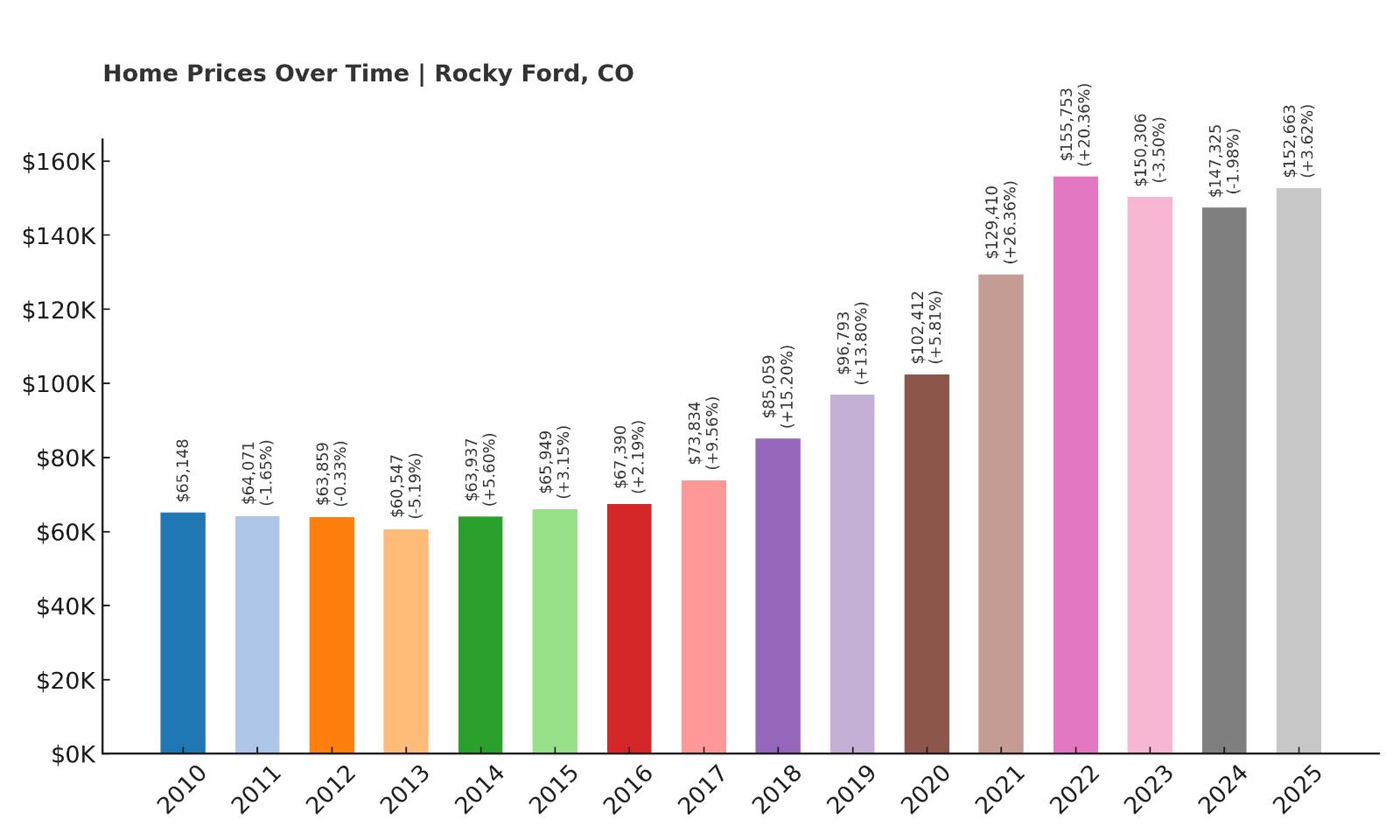

6. Rocky Ford – 134% Home Price Increase Since 2010

- 2010: $65,148

- 2011: $64,071 (-$1,077, -1.65% from previous year)

- 2012: $63,859 (-$213, -0.33% from previous year)

- 2013: $60,547 (-$3,312, -5.19% from previous year)

- 2014: $63,937 (+$3,391, +5.60% from previous year)

- 2015: $65,949 (+$2,012, +3.15% from previous year)

- 2016: $67,390 (+$1,441, +2.19% from previous year)

- 2017: $73,834 (+$6,444, +9.56% from previous year)

- 2018: $85,059 (+$11,225, +15.20% from previous year)

- 2019: $96,793 (+$11,734, +13.80% from previous year)

- 2020: $102,412 (+$5,619, +5.81% from previous year)

- 2021: $129,410 (+$26,998, +26.36% from previous year)

- 2022: $155,753 (+$26,343, +20.36% from previous year)

- 2023: $150,306 (-$5,447, -3.50% from previous year)

- 2024: $147,325 (-$2,981, -1.98% from previous year)

- 2025: $152,663 (+$5,337, +3.62% from previous year)

Rocky Ford’s home prices have surged by 134% since 2010, reflecting a long and steady upward march with only modest corrections in recent years. While there were a few bumps early on — including slight dips in 2011 through 2013 — prices began picking up pace around 2015. Between 2020 and 2022, the town experienced a dramatic jump, with home values rising over 50% in just two years. Although values slightly cooled in 2023 and 2024, they regained traction in 2025, climbing to an average of $152,663. This indicates a maturing but resilient market that remains a smart buy for budget-conscious homeowners and investors.

Rocky Ford – Agricultural Hub with Staying Power

Rocky Ford is a historic agricultural town in Otero County, best known for its melon farming and warm community spirit. Located along U.S. Highway 50 and served by the BNSF railway, the town is well-connected despite its rural setting. The economy revolves around agriculture, food processing, and regional trade, providing a stable employment base for residents. It also has schools, a hospital, public parks, and cultural events that enrich local life. These community features have helped keep demand for housing relatively consistent, especially as urban prices elsewhere in Colorado ballooned over the past decade.

Buyers are drawn to Rocky Ford not only for its affordability but also for its sense of place. The local charm, agricultural heritage, and year-round sunshine create an environment where small-town living still thrives. The recent price correction was modest and short-lived, signaling that the market has retained much of its strength even as broader trends shifted. For those who want to live in a place where affordability meets real economic roots, Rocky Ford continues to be a compelling choice.

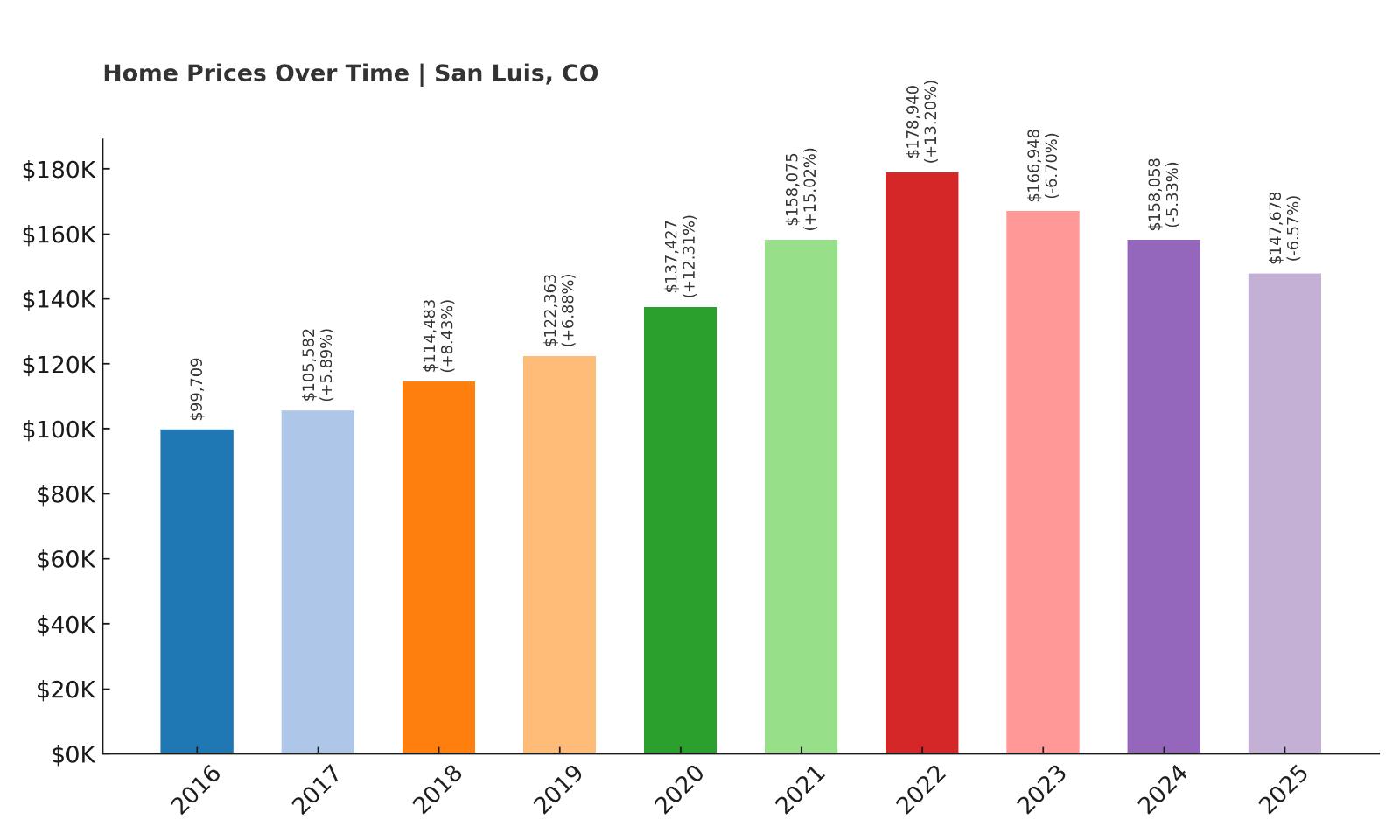

5. San Luis – 48% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $99,709

- 2017: $105,582 (+$5,873, +5.89% from previous year)

- 2018: $114,483 (+$8,901, +8.43% from previous year)

- 2019: $122,363 (+$7,881, +6.88% from previous year)

- 2020: $137,427 (+$15,064, +12.31% from previous year)

- 2021: $158,075 (+$20,648, +15.02% from previous year)

- 2022: $178,940 (+$20,865, +13.20% from previous year)

- 2023: $166,948 (-$11,992, -6.70% from previous year)

- 2024: $158,058 (-$8,890, -5.33% from previous year)

- 2025: $147,678 (-$10,380, -6.57% from previous year)

San Luis has experienced a mixed housing journey, with values rising steadily from 2016 to 2022 before facing three consecutive years of decline. Even so, the town’s average home price in 2025 — $147,678 — is still 48% higher than it was in 2016. That means the market has retained much of the appreciation gained during the housing boom, even after a prolonged cooling. The biggest growth spurt occurred between 2020 and 2022, when values shot up by more than $40,000. Since then, the price drops have likely been a necessary correction rather than a crash, and the current price point still makes San Luis one of the more affordable options on this list.

San Luis – Historic Significance Meets Modern Affordability

San Luis holds the unique distinction of being the oldest town in Colorado, founded in 1851. Nestled in Costilla County near the New Mexico border, this town blends a rich cultural legacy with quiet, high-altitude living. It’s surrounded by scenic beauty, including the Sangre de Cristo Mountains, and offers a strong sense of heritage through its adobe architecture, historic churches, and enduring Hispanic traditions. Despite its small size, the town serves as a cultural anchor for the region and continues to attract both long-time residents and newcomers drawn to its authenticity.

From a real estate standpoint, San Luis stands out for its affordability and scenic surroundings. The recent drop in prices may actually provide an opportunity for buyers to enter the market after years of steep increases. Many of the homes here are modest but full of character, and with average prices still under $150,000, San Luis remains one of the most attainable places to live in Colorado. For those who value tranquility, history, and access to nature — without breaking the bank — San Luis may be a perfect fit.

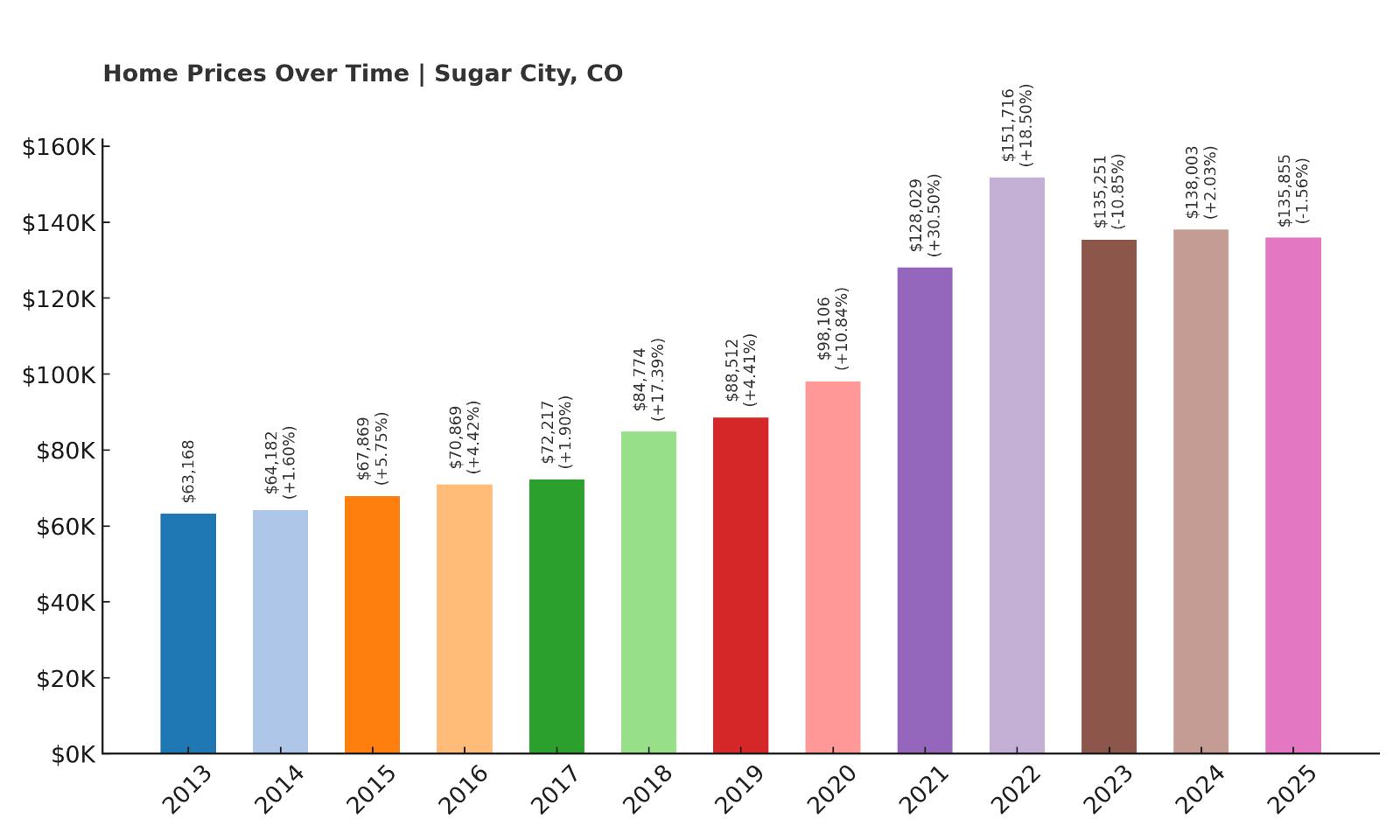

4. Sugar City – 115% Home Price Increase Since 2013

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: $63,168

- 2014: $64,182 (+$1,013, +1.60% from previous year)

- 2015: $67,869 (+$3,687, +5.75% from previous year)

- 2016: $70,869 (+$3,000, +4.42% from previous year)

- 2017: $72,217 (+$1,349, +1.90% from previous year)

- 2018: $84,774 (+$12,556, +17.39% from previous year)

- 2019: $88,512 (+$3,738, +4.41% from previous year)

- 2020: $98,106 (+$9,594, +10.84% from previous year)

- 2021: $128,029 (+$29,923, +30.50% from previous year)

- 2022: $151,716 (+$23,687, +18.50% from previous year)

- 2023: $135,251 (-$16,465, -10.85% from previous year)

- 2024: $138,003 (+$2,752, +2.03% from previous year)

- 2025: $135,855 (-$2,149, -1.56% from previous year)

Sugar City’s home values have climbed by 115% since 2013, with much of that growth coming in a very short time window between 2020 and 2022. During those two years alone, prices jumped by nearly 55%. While the last three years have seen modest corrections, including a dip of nearly 11% in 2023, the market has since stabilized, and home prices remain far above pre-pandemic levels. The current 2025 average of $135,855 keeps Sugar City among the cheapest towns in Colorado — even after years of big gains.

Sugar City – Resilient and Under-the-Radar

Sugar City is a tiny town in Crowley County, named after the sugar beet factory that once powered its economy. While the factory is long gone, the community has endured — offering rural peace, a tight-knit population, and some of the most affordable housing in the state. With a population of under 300, Sugar City has a simple lifestyle that appeals to those seeking distance from crowded metros. While amenities are basic, it does provide the fundamentals: small local government, residential plots with yards, and easy access to nearby towns like Ordway or La Junta.

The jump in prices during the early 2020s likely came from buyers looking for quiet and affordability, especially as prices elsewhere spiraled out of reach. That rapid growth has cooled in recent years, but it has not collapsed. In fact, Sugar City appears to have stabilized at a higher baseline. This suggests that while the boom is over, there’s a new normal for property values — and it’s one that still offers excellent value per dollar. For those who don’t mind a small town with minimal frills, Sugar City continues to represent one of the lowest-cost ways to buy into Colorado’s housing market.

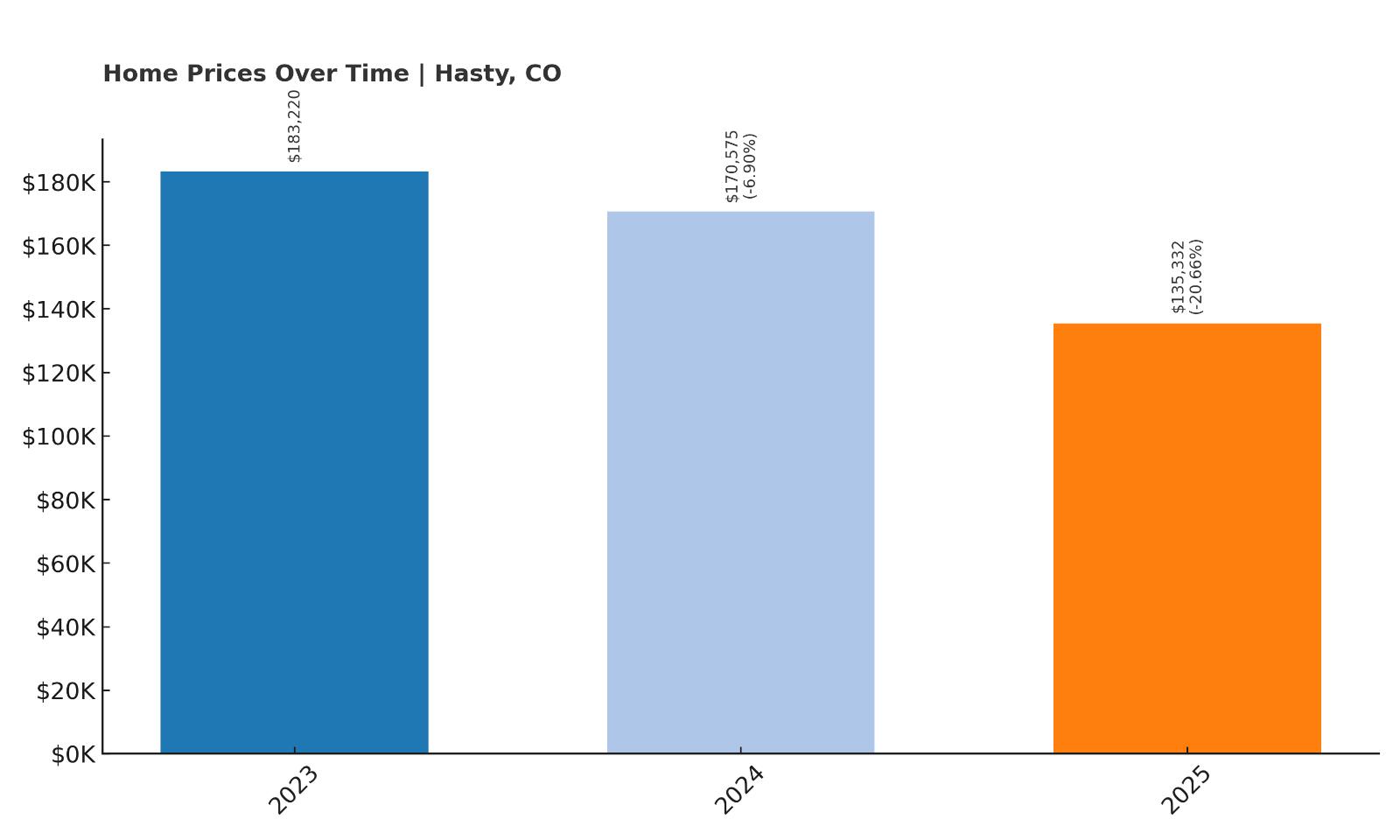

3. Hasty – 26% Home Price Decrease Since 2023

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: N/A

- 2022: N/A

- 2023: $183,220

- 2024: $170,575 (-$12,645, -6.90% from previous year)

- 2025: $135,332 (-$35,243, -20.66% from previous year)

Hasty’s available housing data begins in 2023, making it the most recent addition to this affordability list — but even in that short time, the shift has been dramatic. Home prices have fallen by more than 26% in just two years, dropping from $183,220 in 2023 to $135,332 in 2025. This steep decline could indicate an overcorrection following a brief spike or reflect shifting demand in a very small, rural market. Whatever the cause, the end result is a sharp return to affordability. In 2025, Hasty ranks as one of the least expensive towns in Colorado for buyers seeking substantial price relief in a quiet setting.

Hasty – Lake Views and Low Prices on the Eastern Plains

Hasty is a tiny town located in Bent County, close to the popular John Martin Reservoir State Park — one of southeastern Colorado’s most underappreciated outdoor destinations. The town has a population of fewer than 200 and functions more as a close-knit rural enclave than a typical residential center. Its proximity to the reservoir makes it popular among anglers, boaters, and nature lovers who appreciate the peaceful pace of life in this region. While amenities are sparse, the location offers something that many other affordable towns can’t: direct access to a major recreational area and open skies that stretch for miles.

The sharp drop in prices since 2023 may be due to a one-time spike followed by a market correction, or it could reflect declining demand from second-home buyers who previously targeted lakeside property during the height of the pandemic. Still, the town’s appeal remains for anyone looking for quiet, rural living with outdoor amenities just minutes away. As of 2025, Hasty represents a serious value proposition — and an opportunity to buy low in an area that may see renewed interest in the future if remote living trends rebound.

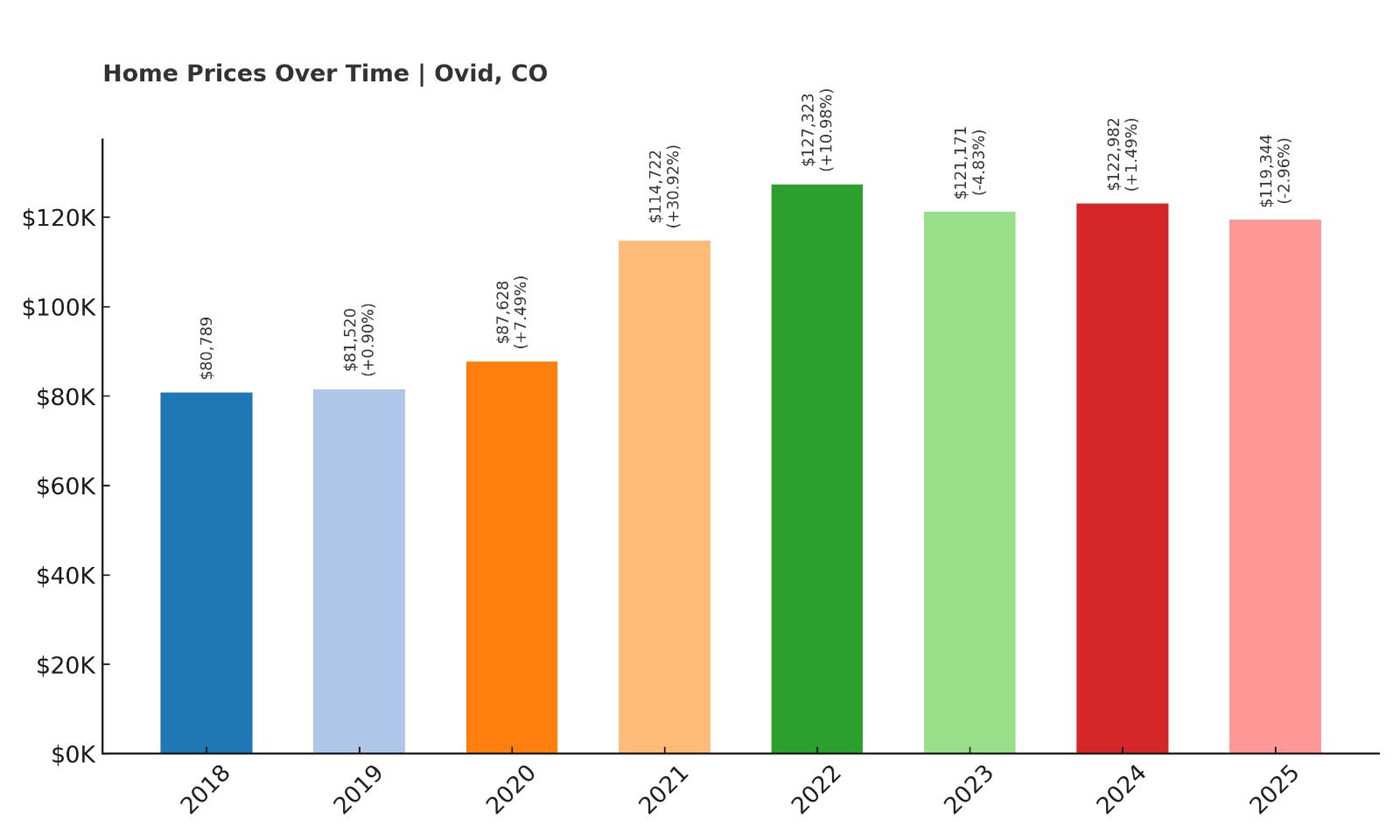

2. Ovid – 48% Home Price Increase Since 2018

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: $80,789

- 2019: $81,520 (+$731, +0.90% from previous year)

- 2020: $87,628 (+$6,108, +7.49% from previous year)

- 2021: $114,722 (+$27,093, +30.92% from previous year)

- 2022: $127,323 (+$12,602, +10.98% from previous year)

- 2023: $121,171 (-$6,152, -4.83% from previous year)

- 2024: $122,982 (+$1,811, +1.49% from previous year)

- 2025: $119,344 (-$3,638, -2.96% from previous year)

Ovid has seen a modest but significant 48% increase in home values since 2018, even after accounting for a recent three-year cooling trend. The biggest jump came in 2021, when home values soared by over 30% — likely a result of pandemic-fueled migration patterns and growing interest in remote, affordable towns. Since then, the market has adjusted downward slightly, with minor losses in both 2023 and 2025. Still, with an average home price of just $119,344 in 2025, Ovid remains one of the most affordable towns in the entire state, even after nearly five years of steady gains.

Ovid – Quiet Living Near the Nebraska Border

Ovid is located in Sedgwick County at the very northeastern tip of Colorado, just a few miles from the Nebraska state line. This quiet farming town has a population under 400 and maintains a calm, rural character. The economy centers on agriculture and small local businesses, and while the amenities are limited, residents value the space, tranquility, and tight-knit community Ovid offers. It’s a place where life moves slowly and predictably, making it ideal for retirees, small families, or anyone looking to leave behind the congestion of more urban environments.

Despite its low profile, Ovid’s home values rose sharply between 2020 and 2022 before settling into a more stable phase. That suggests it wasn’t immune to the wave of remote-worker relocation that affected so many other rural towns in Colorado. As of 2025, prices have softened slightly, offering renewed opportunity for bargain hunters. For those who are comfortable with its location and lifestyle, Ovid represents one of the most affordable housing markets in the entire state — with a respectable record of appreciation to back it up.

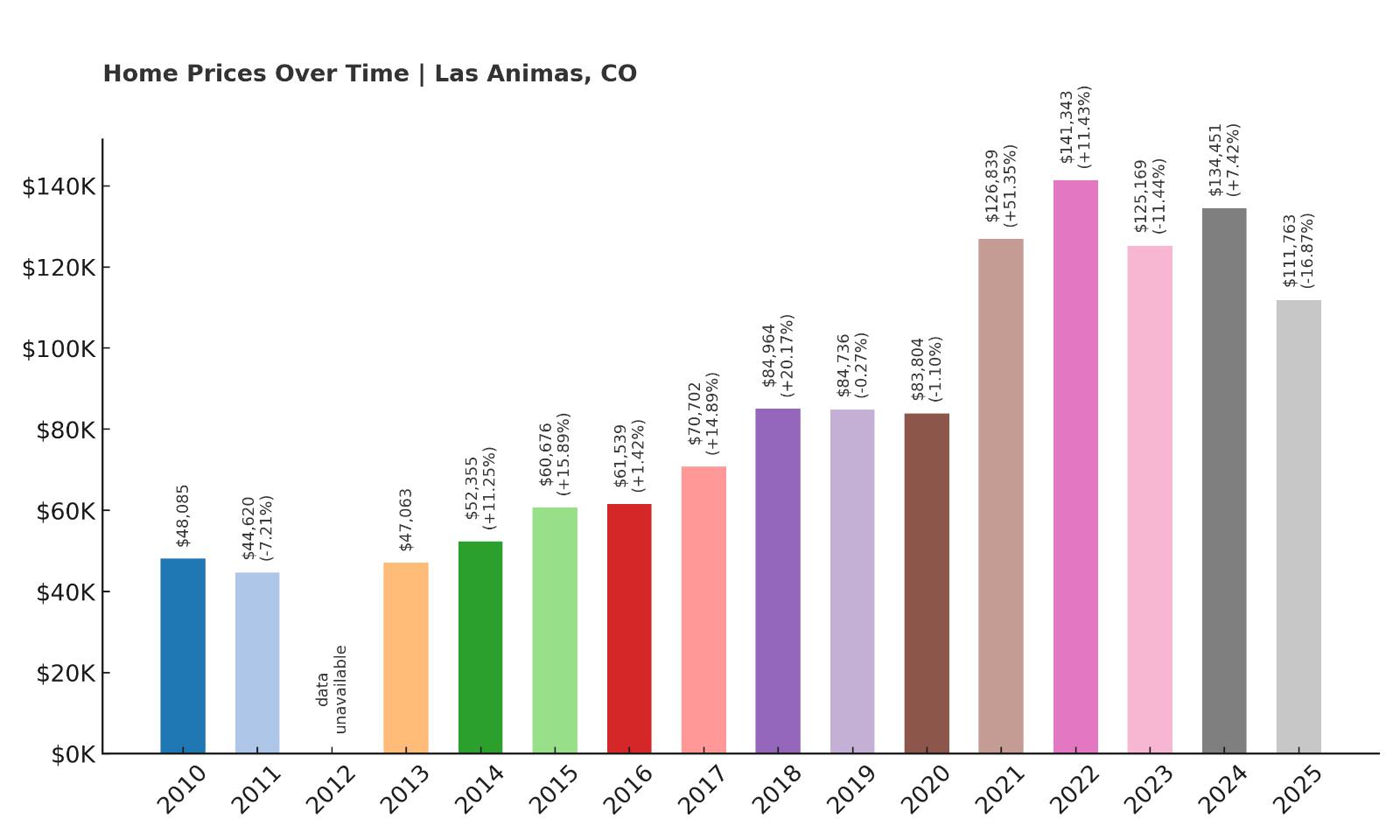

1. Las Animas – 132% Home Price Increase Since 2010

- 2010: $48,085

- 2011: $44,620 (-$3,465, -7.21% from previous year)

- 2012: N/A

- 2013: $47,063

- 2014: $52,355 (+$5,292, +11.25% from previous year)

- 2015: $60,676 (+$8,320, +15.89% from previous year)

- 2016: $61,539 (+$863, +1.42% from previous year)

- 2017: $70,702 (+$9,163, +14.89% from previous year)

- 2018: $84,964 (+$14,261, +20.17% from previous year)

- 2019: $84,736 (-$228, -0.27% from previous year)

- 2020: $83,804 (-$932, -1.10% from previous year)

- 2021: $126,839 (+$43,036, +51.35% from previous year)

- 2022: $141,343 (+$14,504, +11.43% from previous year)

- 2023: $125,169 (-$16,174, -11.44% from previous year)

- 2024: $134,451 (+$9,282, +7.42% from previous year)

- 2025: $111,763 (-$22,688, -16.87% from previous year)

Las Animas tops this list with the lowest average home price in 2025 — just $111,763. Over the long term, home values have increased 132% since 2010, with especially steep gains in 2021. However, the past few years have been volatile. After peaking in 2022, prices have dropped for two out of the last three years, erasing some of the explosive pandemic-era gains. Despite this correction, homes in Las Animas are still worth more than twice what they were in 2010, proving that even the most affordable markets can show long-term appreciation when demand rises — even briefly.

Las Animas – Colorado’s Cheapest Housing Market in 2025

Las Animas is a small city in Bent County, located along the Arkansas River in southeastern Colorado. With a population of around 2,000, it functions as a regional service center for smaller farming communities nearby. The town includes basic amenities like schools, shops, parks, and medical facilities — making it more developed than many other towns on this list. Its location on U.S. Highway 50 and close proximity to John Martin Reservoir also help increase its visibility and access. Despite its infrastructure, home prices remain incredibly low, which is why it ranks at the very bottom of Colorado’s affordability index for 2025.

Las Animas saw a sharp spike in prices during the housing surge of 2021 and 2022, followed by a significant correction. However, its price history suggests that even small towns with limited economic growth can benefit from statewide housing trends. Now that prices have come back down, buyers once again have a chance to purchase property at rates that are well below the state average. Whether you’re a first-time buyer, a retiree on a budget, or a long-term investor looking for value, Las Animas offers the most affordable entry point into Colorado real estate in 2025 — and a chance to buy low, just as the market starts to stabilize again.