Would you like to save this?

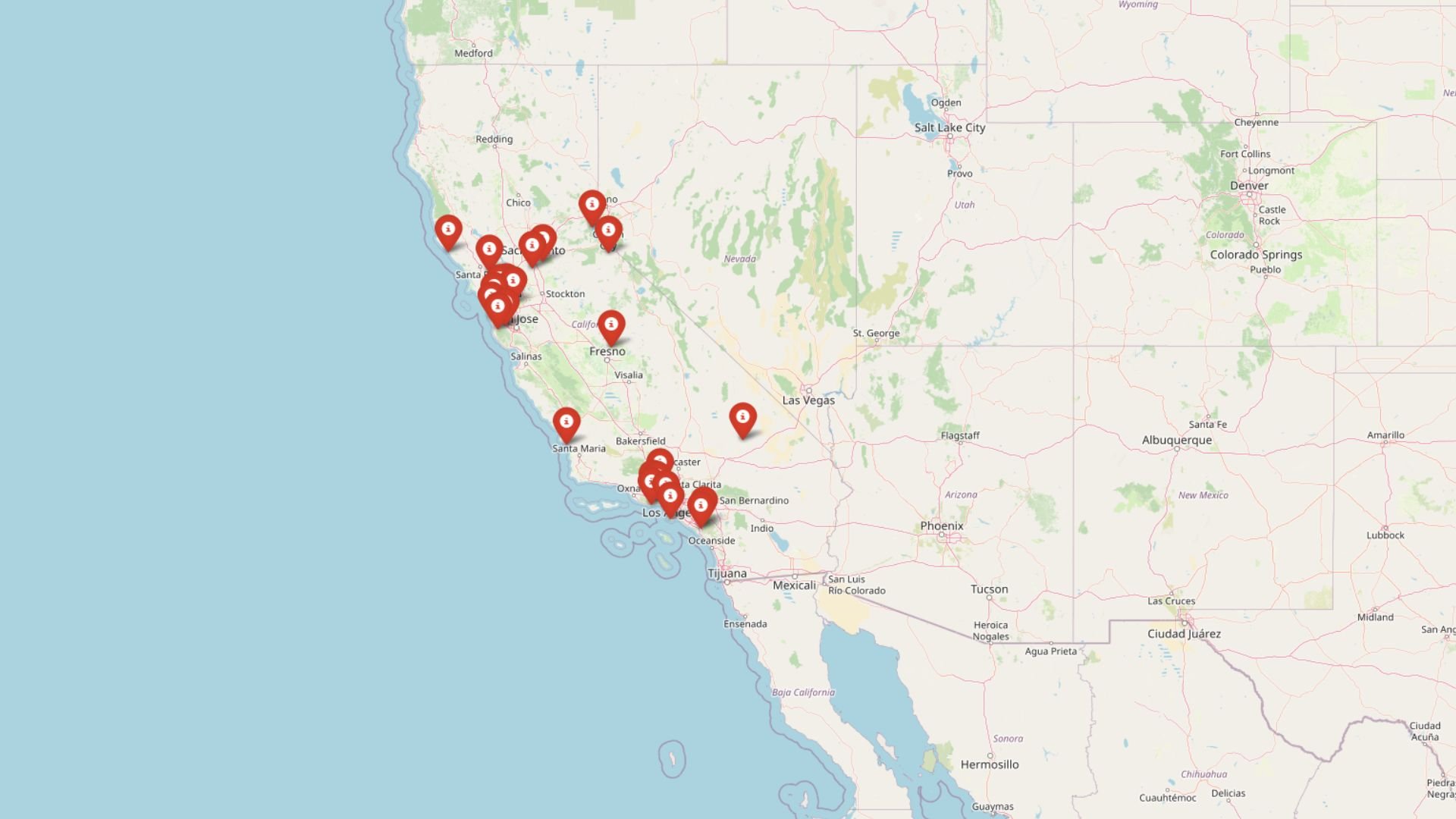

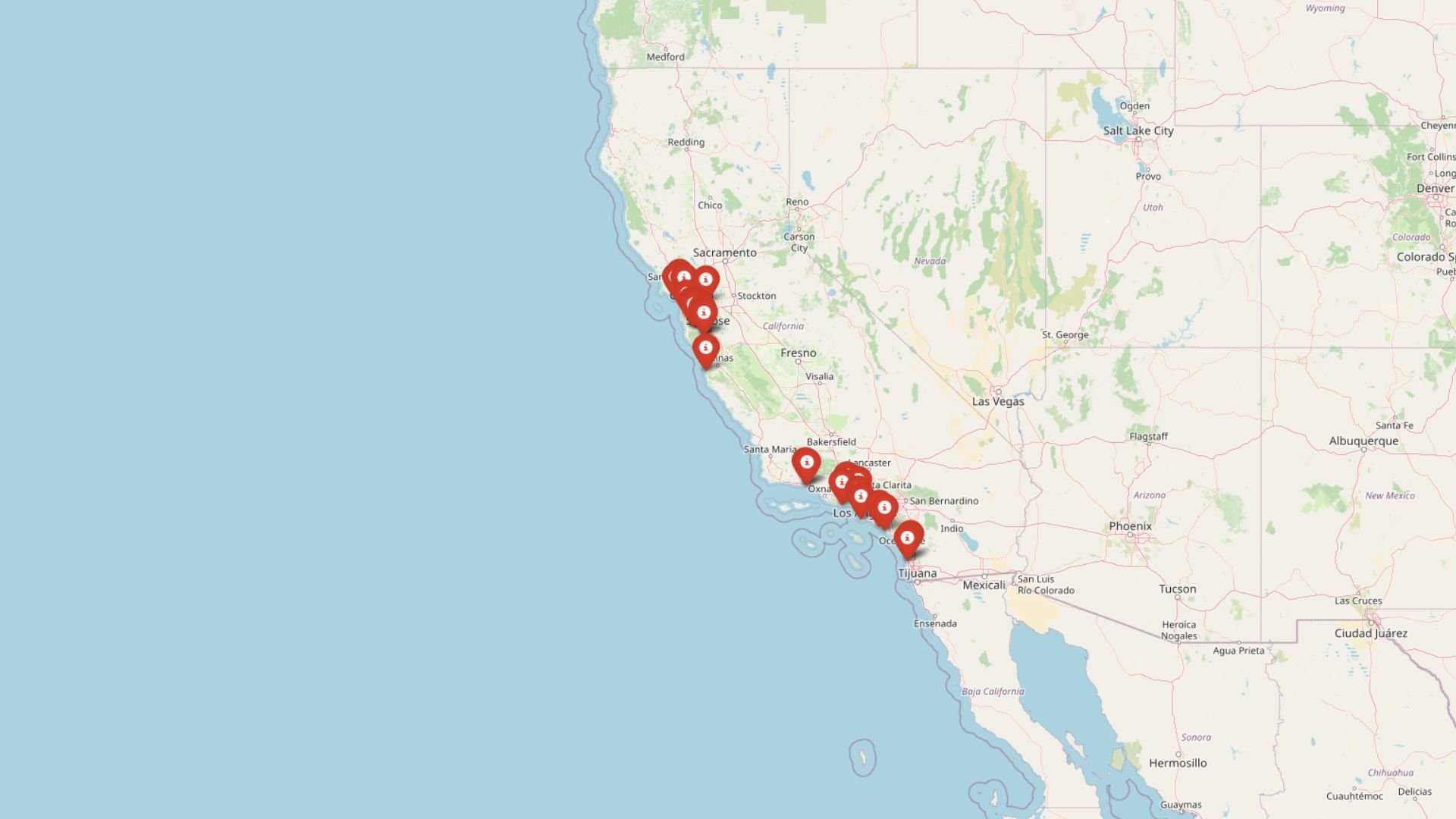

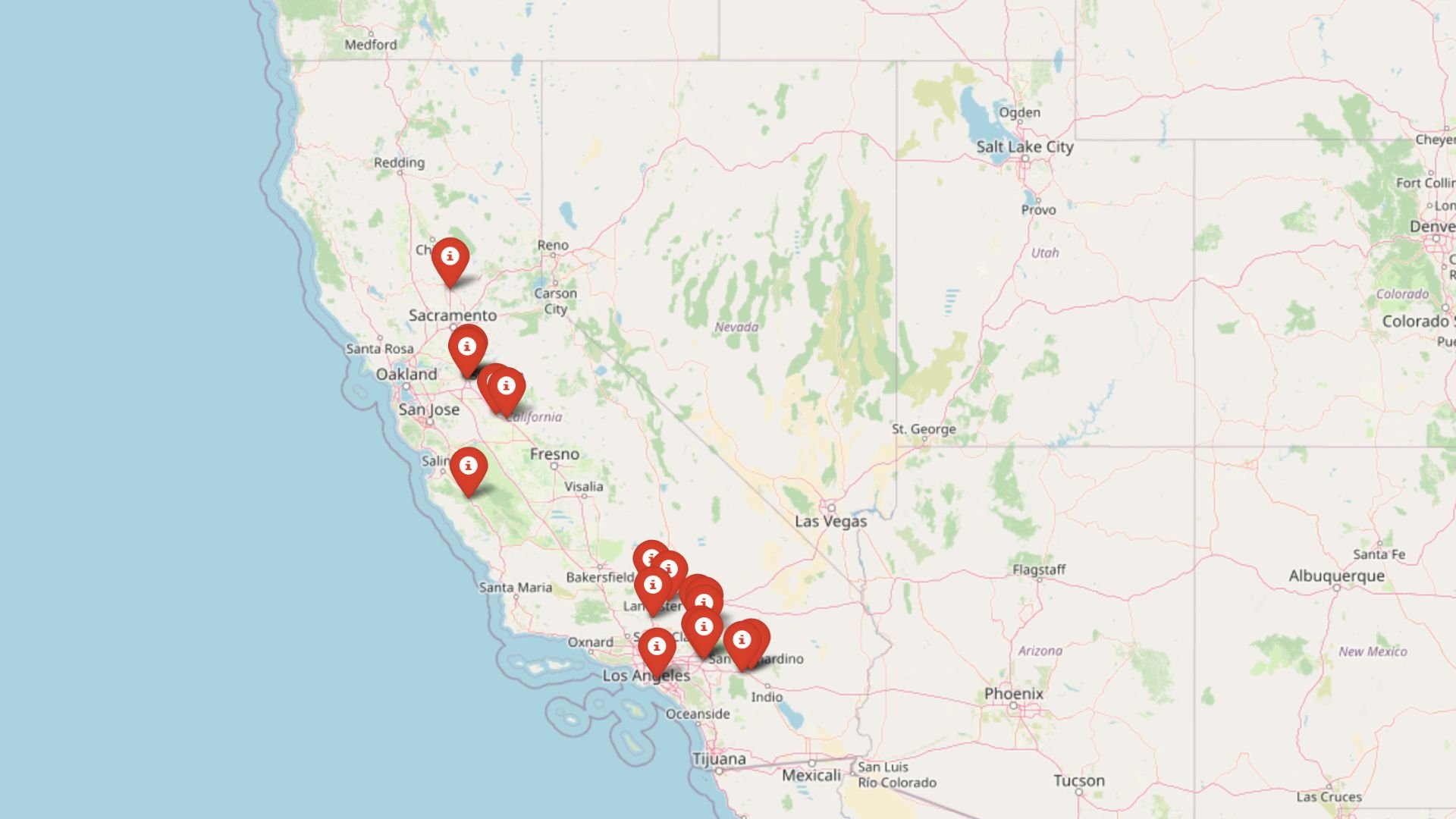

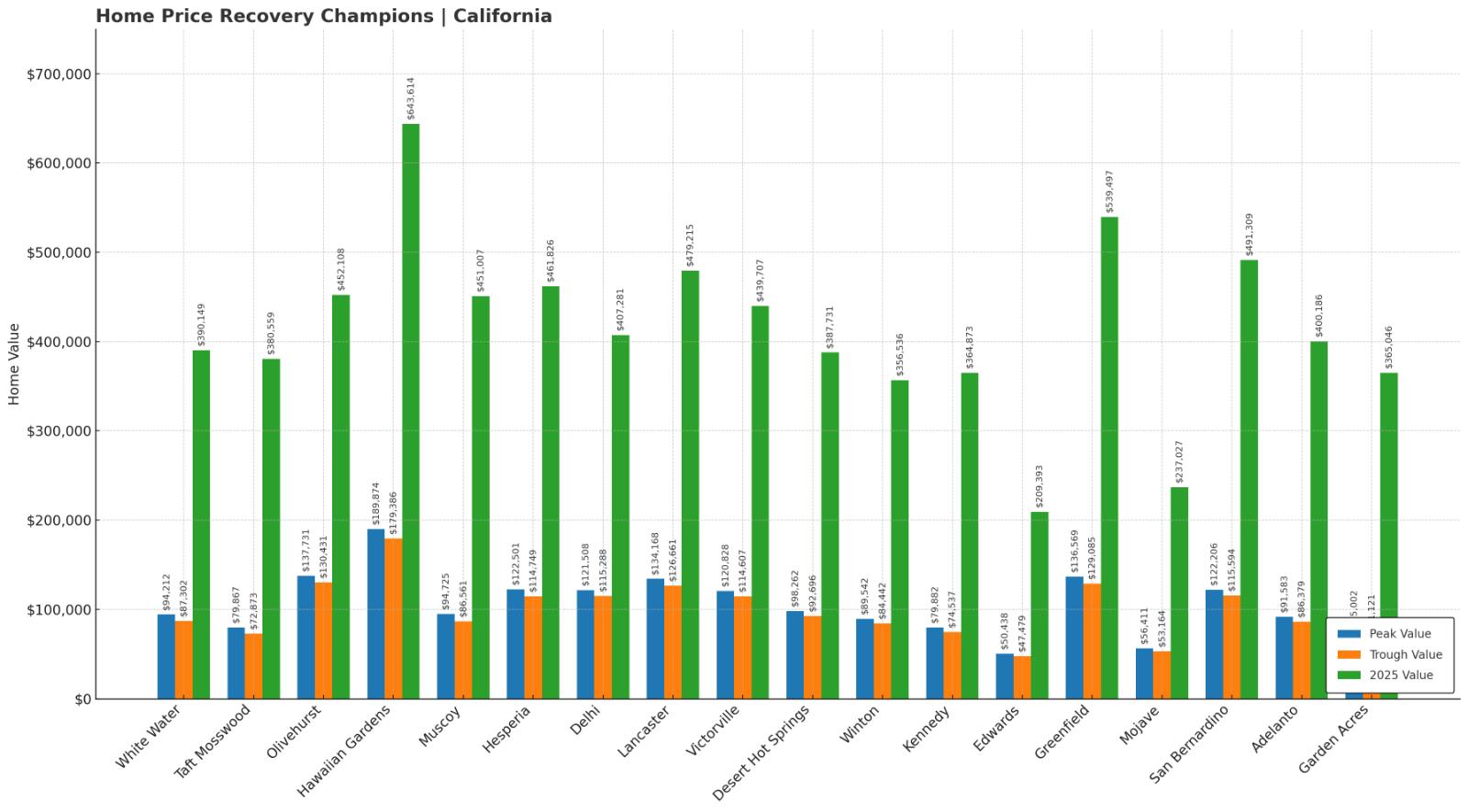

California’s real estate market isn’t just expensive—it’s unpredictable. According to the Zillow Home Value Index, 18 towns that once saw price dips have pulled off some of the state’s biggest comebacks. After modest declines between 2010 and 2013, home prices in these areas have surged, with some climbing more than 7,500% by mid-2025. Driven by California’s housing crunch, migration shifts, and local economic booms, these towns have turned early stumbles into major price rebounds few could have predicted.

California’s Ultimate Bounce-Back Towns Overview

California’s most impressive housing recoveries aren’t happening in Beverly Hills or Palo Alto—they’re playing out in overlooked towns across the Central Valley, the High Desert, and pockets of the Inland Empire. Garden Acres leads the charge with a jaw-dropping 7,575% recovery from its price trough, climbing from a low of $71,121 in 2012 to $365,046 in 2025. Close behind are Adelanto, San Bernardino, and Mojave—all of which saw steep declines during the housing crisis but have since rebounded with gains of over $300,000. These aren’t just rebounds—they’re full-scale reinventions of local housing markets.

What ties these places together is a combination of low entry points, post-recession affordability, and spillover demand from pricier regions. Many of these towns—like Hesperia, Lancaster, and Desert Hot Springs—offer a gateway to larger economic zones while still maintaining relatively modest home values. Investors and buyers who got in during the trough years have seen tremendous returns. And even towns like Edwards or Kennedy, which started from some of the lowest home values in the state, are now posting six-figure gains. These markets show that with the right mix of location, timing, and patience, California’s under-the-radar towns can deliver some of the state’s most impressive real estate returns.

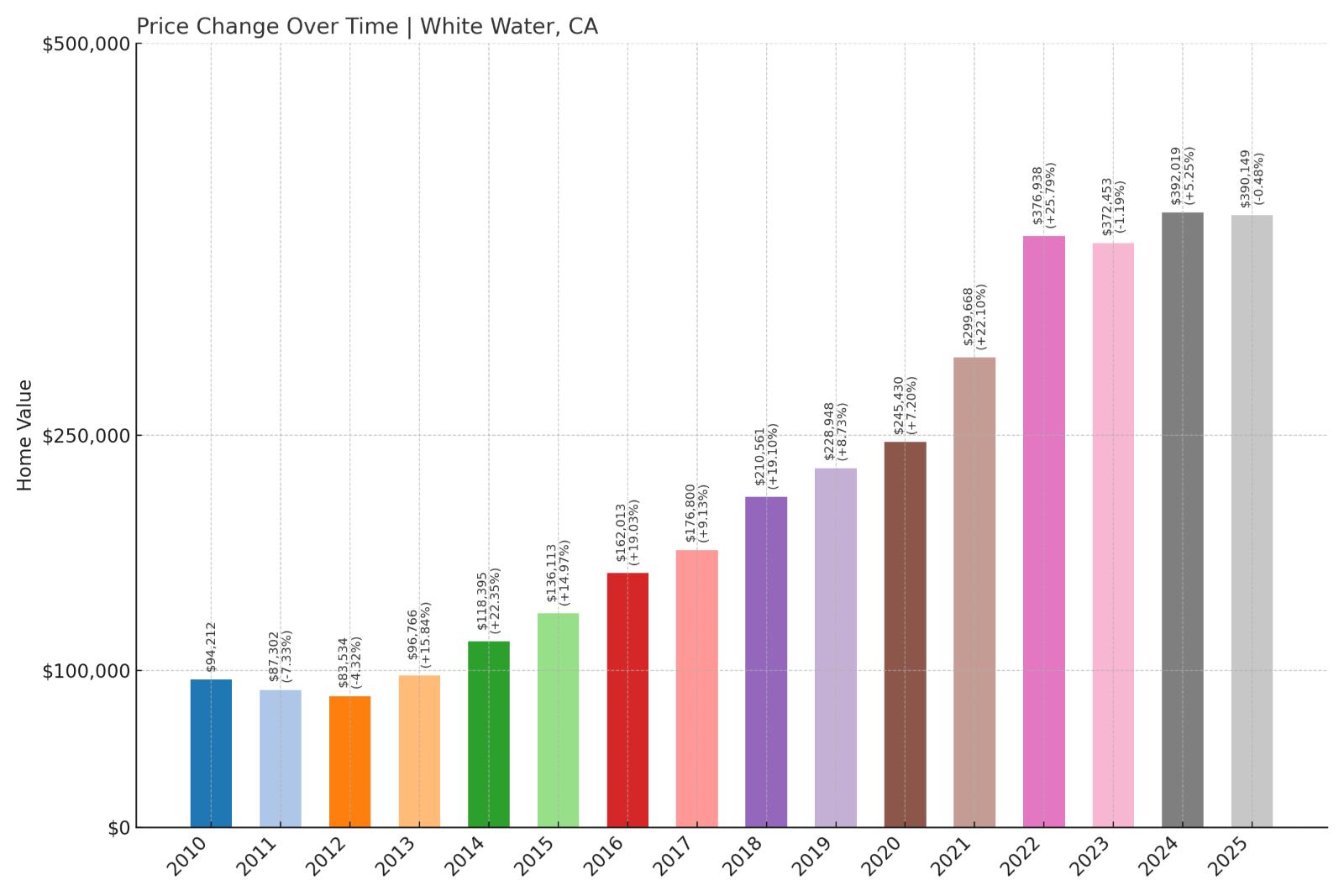

18. White Water – 4% Dip to 4383% Recovery By June 2025

- Peak Value: $94,212 (2010)

- Trough Value: $87,302 (2011)

- Final (2025) Value: $390,149

- Recovery: +$302,847 (+4382.9%)

- Dip from Peak: -7.3%

White Water experienced a brief 7.3% decline from its 2010 peak, but this small setback proved temporary as home values surged to $390,149 by 2025. The recovery represents gains of over $302,000 from the trough, demonstrating how California’s housing market momentum can turn minor corrections into substantial wealth creation. The community’s location in the Coachella Valley has benefited from desert tourism growth and retiree migration patterns that have driven consistent demand.

White Water – Desert Community With Tourist Appeal

White Water sits in Riverside County’s Coachella Valley, positioned between the San Bernardino Mountains and Joshua Tree National Park. This unincorporated desert community of approximately 7,000 residents serves as a gateway to outdoor recreation areas that attract both tourists and permanent residents seeking affordable desert living.

The area’s economy centers on tourism, with visitors drawn to nearby hot springs, hiking trails, and the famous Cabazon Dinosaurs. White Water’s proximity to Interstate 10 provides easy access to both Los Angeles and Phoenix, making it attractive to remote workers and retirees. The mild winter climate and lower cost of living compared to coastal California markets have fueled steady population growth.

Housing stock consists primarily of manufactured homes, single-family residences, and small ranch properties built between the 1960s and 1990s. The dramatic price recovery reflects broader desert market trends, where communities once considered remote have gained appeal as California’s coastal markets became increasingly expensive. Current median prices around $390,000 remain well below state averages, suggesting continued room for growth.

17. Taft Mosswood – 9% Dip to 4399% Recovery By June 2025

Kitchen Style?

- Peak Value: $79,867 (2010)

- Trough Value: $72,873 (2011)

- Final (2025) Value: $380,559

- Recovery: +$307,686 (+4399.0%)

- Dip from Peak: -8.8%

Taft Mosswood’s housing market dropped 8.8% during the Great Recession but has since delivered extraordinary returns of over 4,300%. The $380,559 median home value represents a gain of more than $307,000 from the 2011 low, showcasing how even small Central Valley communities can generate outsized returns. This agricultural area has benefited from California’s ongoing housing shortage and migration patterns away from expensive coastal markets.

Taft Mosswood – Central Valley Oil Town Transformation

Taft Mosswood lies in Kern County’s oil-rich Midway-Sunset field, where petroleum extraction has shaped the local economy for over a century. This small community of roughly 9,000 residents has traditionally depended on oil industry jobs, but recent years have seen diversification as California’s energy transition creates new economic opportunities.

The town’s location between Bakersfield and the Central Coast provides access to both agricultural and energy markets. Taft has maintained its working-class character with affordable housing stock consisting mainly of single-family homes built between 1940 and 1980. The dramatic price appreciation reflects both local economic stability and broader California housing dynamics.

Recent infrastructure investments in renewable energy projects have attracted new residents and businesses to the area. Solar farms and wind projects now complement traditional oil extraction, providing economic diversity that supports housing demand. At current price levels near $381,000, homes remain accessible to middle-income families, particularly those priced out of coastal markets.

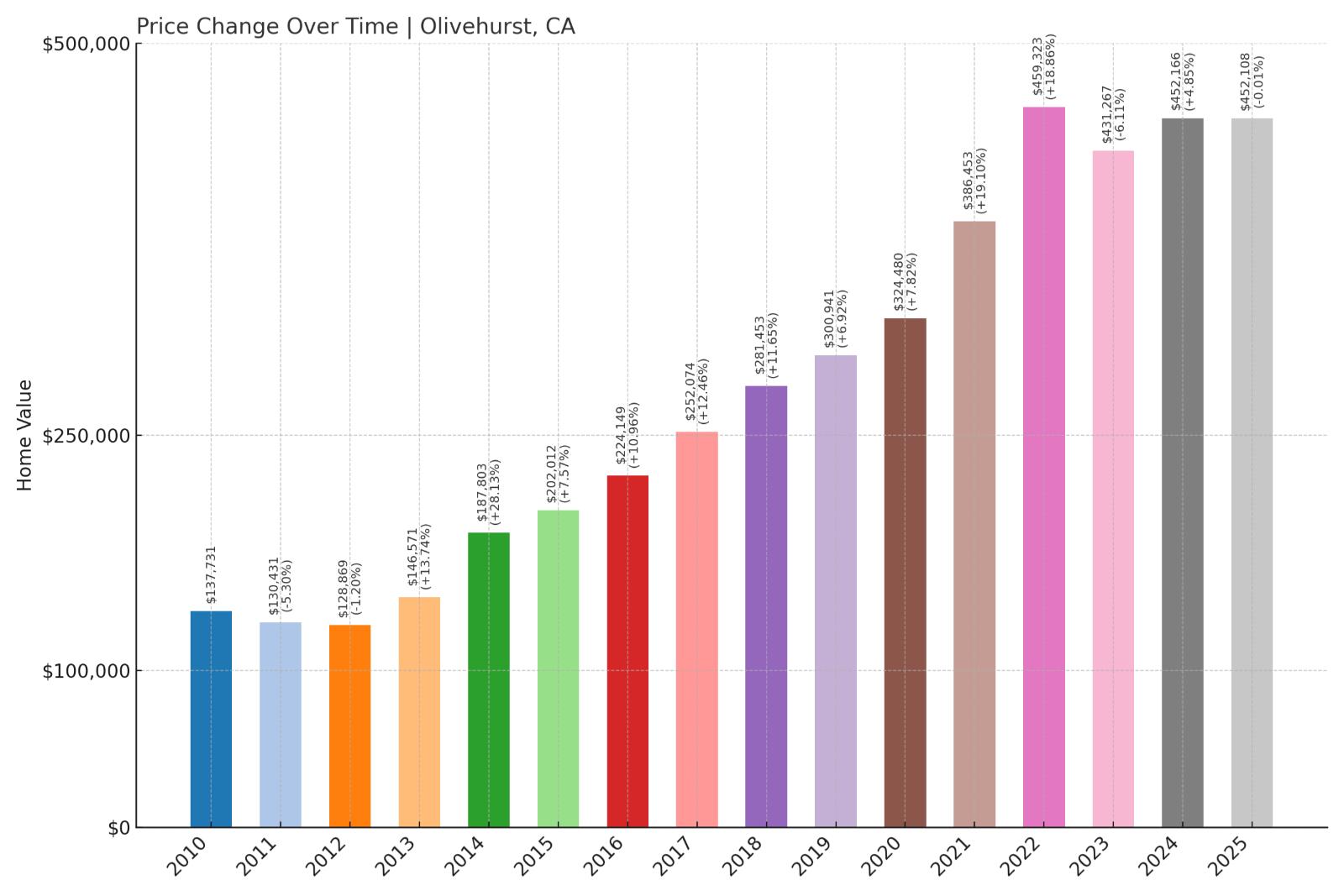

16. Olivehurst – 5% Dip to 4407% Recovery By June 2025

- Peak Value: $137,731 (2010)

- Trough Value: $130,431 (2011)

- Final (2025) Value: $452,108

- Recovery: +$321,677 (+4406.5%)

- Dip from Peak: -5.3%

Olivehurst experienced just a 5.3% price decline but has since generated over 4,400% recovery gains, with median home values reaching $452,108. The community’s location in Yuba County positions it as an affordable alternative to Sacramento and Bay Area markets, driving consistent demand from commuters and families seeking lower housing costs. This agricultural area has maintained steady growth despite its rural character.

Olivehurst – Sacramento Valley Agricultural Hub

Home Stratosphere Guide

Your Personality Already Knows

How Your Home Should Feel

113 pages of room-by-room design guidance built around your actual brain, your actual habits, and the way you actually live.

You might be an ISFJ or INFP designer…

You design through feeling — your spaces are personal, comforting, and full of meaning. The guide covers your exact color palettes, room layouts, and the one mistake your type always makes.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ISTJ or INTJ designer…

You crave order, function, and visual calm. The guide shows you how to create spaces that feel both serene and intentional — without ending up sterile.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ENFP or ESTP designer…

You design by instinct and energy. Your home should feel alive. The guide shows you how to channel that into rooms that feel curated, not chaotic.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ENTJ or ESTJ designer…

You value quality, structure, and things done right. The guide gives you the framework to build rooms that feel polished without overthinking every detail.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

Olivehurst occupies prime agricultural land in Yuba County’s Sacramento Valley, approximately 40 miles north of Sacramento. This unincorporated community of about 14,000 residents has evolved from a purely agricultural settlement into a bedroom community for workers commuting to nearby metropolitan areas.

The local economy combines traditional farming with newer logistics and distribution centers that have located along Highway 70 and Highway 65 corridors. Olivehurst’s affordable housing market attracts families and retirees who want small-town living within driving distance of urban amenities. Most housing consists of single-family ranch homes built between 1960 and 2000 on larger lots.

Transportation improvements and job growth in surrounding areas have supported steady population increases. The community maintains its rural character while benefiting from proximity to Marysville and Yuba City employment centers. Current median prices around $452,000 remain competitive compared to Sacramento’s suburban markets, supporting continued appreciation potential.

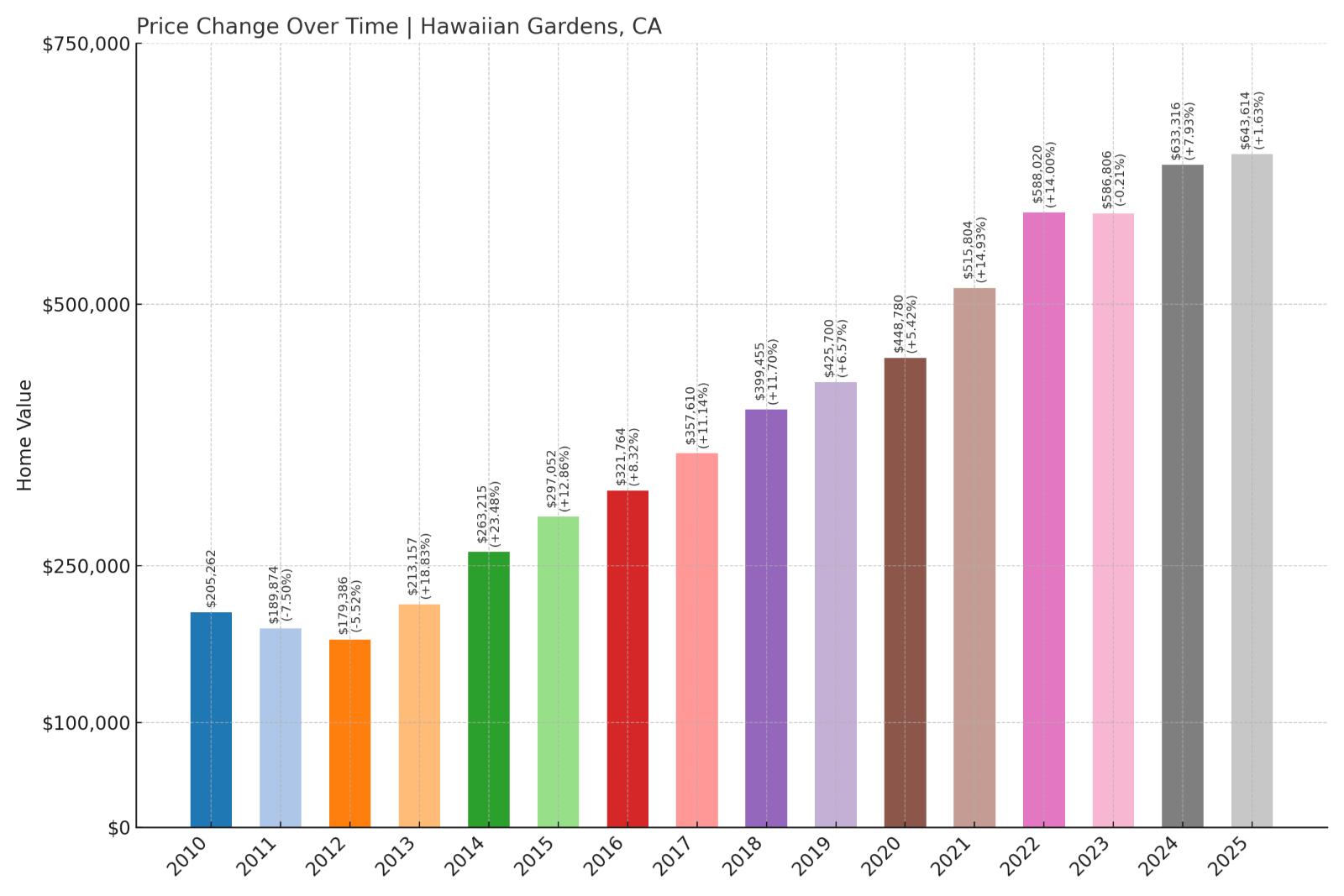

15. Hawaiian Gardens – 6% Dip to 4426% Recovery By June 2025

- Peak Value: $189,874 (2011)

- Trough Value: $179,386 (2012)

- Final (2025) Value: $643,614

- Recovery: +$464,228 (+4426.0%)

- Dip from Peak: -5.5%

Hawaiian Gardens saw a modest 5.5% dip in 2012 but has since achieved remarkable recovery with home values reaching $643,614, representing gains of over $464,000. This Los Angeles County community benefits from its strategic location between Long Beach and Anaheim, making it attractive to buyers seeking affordability within the greater LA metropolitan area. The dramatic appreciation reflects the broader housing shortage across Southern California.

Hawaiian Gardens – Los Angeles County Affordable Enclave

Hawaiian Gardens sits in southeastern Los Angeles County, a 1.0 square mile city with approximately 14,500 residents. This predominantly Latino community maintains a small-town atmosphere despite being surrounded by larger urban areas including Long Beach, Lakewood, and Cerritos.

The city’s economy centers around the Hawaiian Gardens Casino, which provides significant employment and tax revenue for local services. Residential areas feature modest single-family homes and apartments built primarily between 1950 and 1980. The compact community benefits from excellent freeway access via Interstate 605 and Highway 91.

Housing demand stems from the city’s central location within Los Angeles County, offering relatively affordable options for workers employed throughout the region. Current median prices around $644,000 remain below county averages while providing homeowners substantial equity gains. The community’s stability and location continue to attract families seeking homeownership in expensive Southern California.

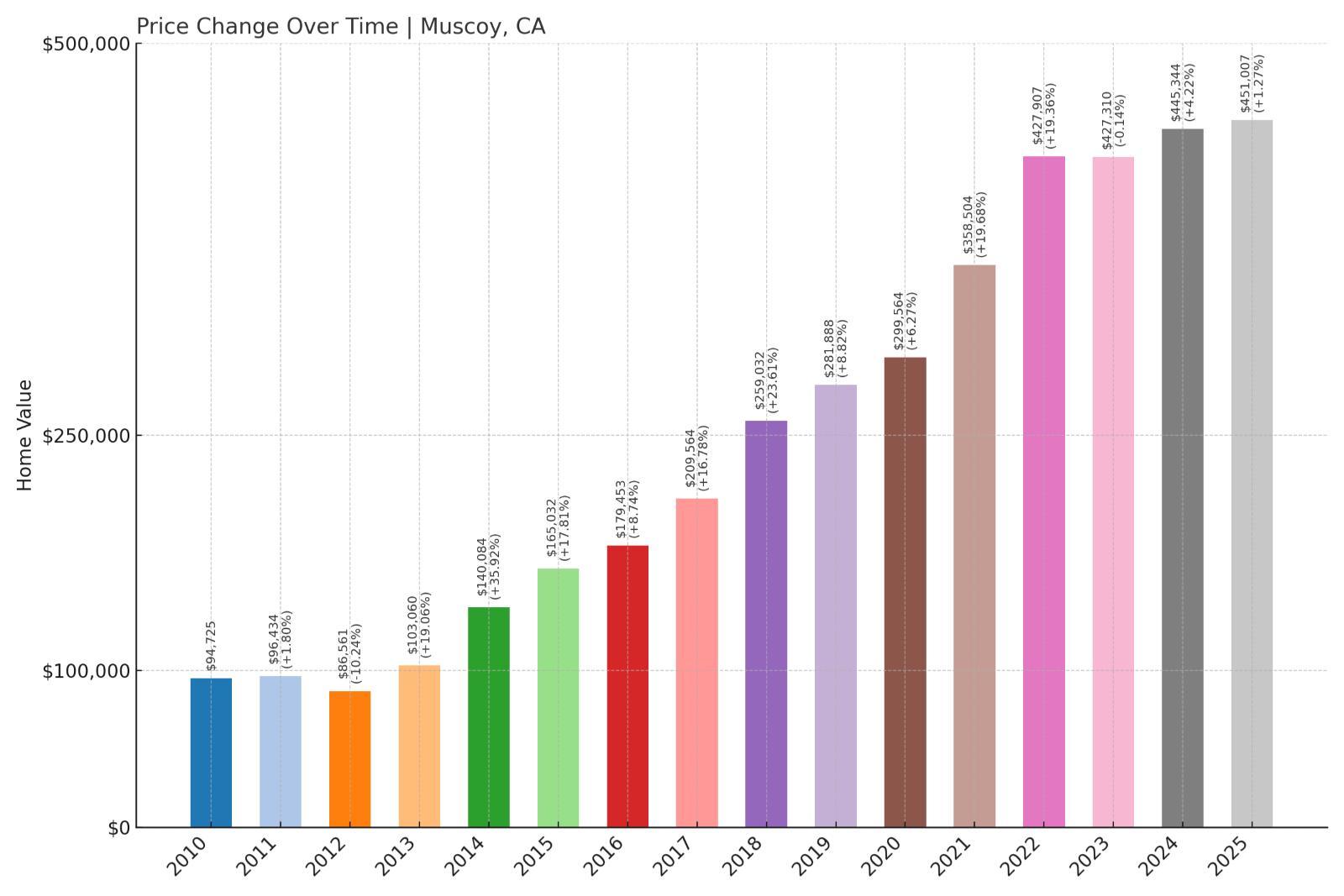

14. Muscoy – 9% Dip to 4464% Recovery By June 2025

- Peak Value: $94,725 (2010)

- Trough Value: $86,561 (2012)

- Final (2025) Value: $451,007

- Recovery: +$364,446 (+4464.1%)

- Dip from Peak: -8.6%

Muscoy endured an 8.6% price decline during the recession but has since delivered extraordinary returns exceeding 4,400%. Home values now average $451,007, representing gains of over $364,000 from the 2012 trough. This San Bernardino County community has benefited from the Inland Empire’s logistics boom and growing demand for affordable housing within commuting distance of Los Angeles.

Muscoy – Inland Empire Logistics Gateway

Muscoy is an unincorporated community in San Bernardino County with approximately 11,000 residents, located just northwest of the city of San Bernardino. The area has traditionally served as an affordable housing option for working-class families, with a predominantly Latino population and strong community ties.

The local economy benefits from the Inland Empire’s massive logistics and distribution industry, with major warehouses and transportation hubs providing employment opportunities. Muscoy’s proximity to Interstate 215 and Interstate 10 makes it attractive to workers employed throughout the region. Housing consists mainly of single-family homes and mobile home parks built between 1960 and 1990.

Recent years have seen increased investment in the area as San Bernardino County experiences population growth and economic development. The community’s strategic location between major freeways and employment centers supports continued housing demand. Current median prices around $451,000 remain accessible to middle-income families while reflecting the dramatic appreciation seen throughout Southern California.

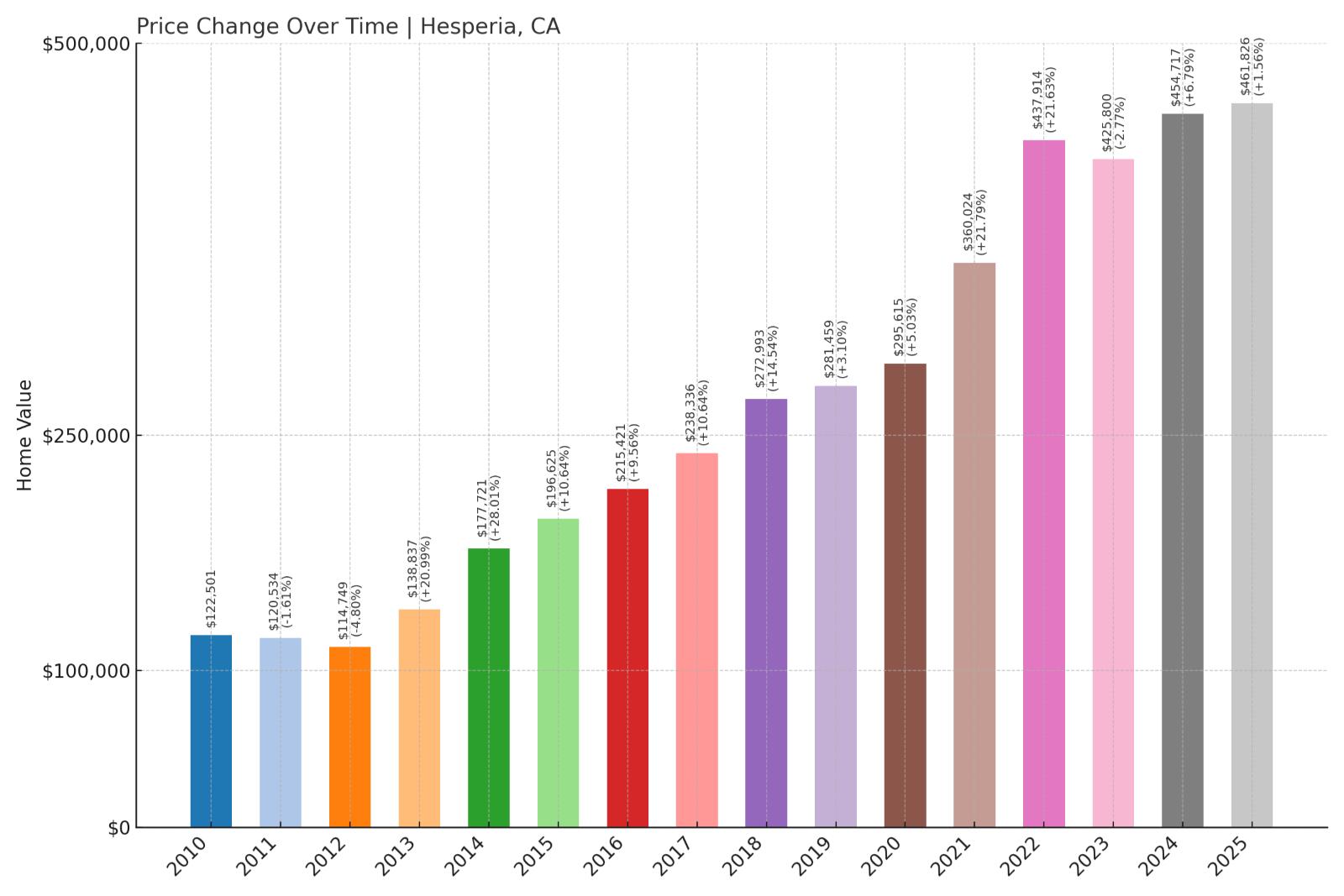

13. Hesperia – 6% Dip to 4478% Recovery By June 2025

- Peak Value: $122,501 (2010)

- Trough Value: $114,749 (2012)

- Final (2025) Value: $461,826

- Recovery: +$347,077 (+4477.6%)

- Dip from Peak: -6.3%

Hesperia’s housing market dipped 6.3% from its 2010 peak but has since rebounded spectacularly to $461,826, delivering recovery gains exceeding 4,400%. This High Desert city has emerged as a major beneficiary of California’s housing crisis, attracting residents seeking affordability and space. The dramatic appreciation reflects strong population growth and limited housing supply in the region.

Hesperia – High Desert Growth Engine

Hesperia anchors the Victor Valley in San Bernardino County’s High Desert region, with a population of approximately 95,000 residents. Located about 70 miles northeast of Los Angeles, the city has transformed from a small desert community into one of California’s fastest-growing suburban markets.

The city’s economy benefits from its strategic location along Interstate 15, the main corridor connecting Los Angeles to Las Vegas. Major employers include logistics companies, retail operations, and government services. Hesperia’s affordable housing market attracts families priced out of coastal areas, driving consistent population growth and housing demand.

Recent development has focused on master-planned communities with modern amenities, while older neighborhoods feature ranch-style homes built during the 1980s and 1990s growth period. The city’s current median price of $462,000 remains well below state averages while offering residents access to outdoor recreation in the nearby San Bernardino Mountains and Mojave Desert.

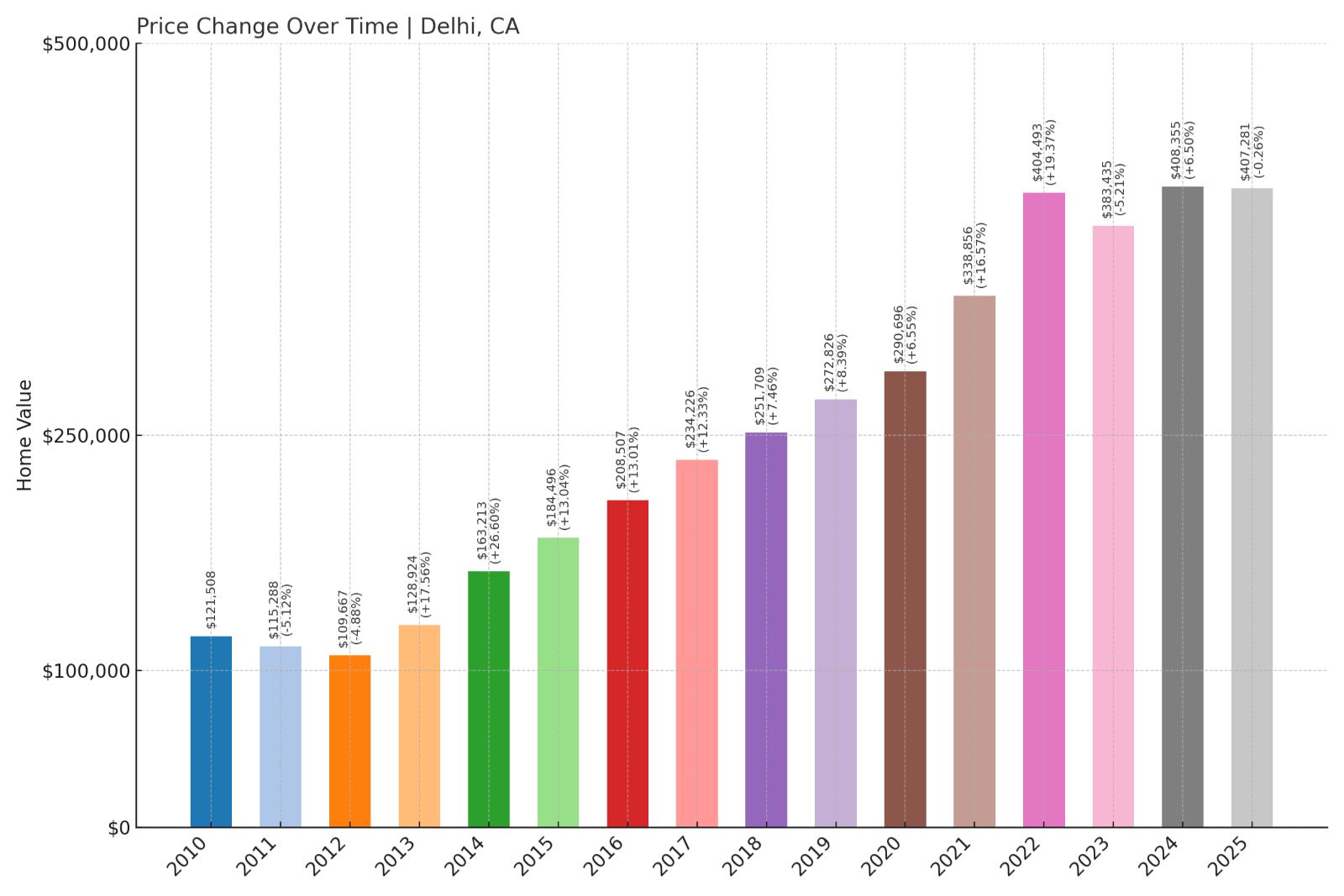

12. Delhi – 5% Dip to 4695% Recovery By June 2025

- Peak Value: $121,508 (2010)

- Trough Value: $115,288 (2011)

- Final (2025) Value: $407,281

- Recovery: +$291,993 (+4694.6%)

- Dip from Peak: -5.1%

Delhi experienced a minimal 5.1% price drop but has since achieved remarkable recovery gains of nearly 4,700%, with median home values reaching $407,281. This Central Valley agricultural community has benefited from California’s ongoing housing shortage and population migration to more affordable inland areas. The recovery demonstrates how even small rural markets can generate substantial returns during periods of statewide housing scarcity.

Delhi – Central Valley Agricultural Center

Delhi is a small unincorporated community in Merced County with approximately 11,000 residents, situated in the heart of California’s Central Valley agricultural region. The area has historically depended on farming, particularly dairy operations, almonds, and various crops that thrive in the Mediterranean climate.

The community’s character remains decidedly rural, with many residents employed in agriculture or commuting to nearby Turlock and Merced for work. Housing consists primarily of single-family homes on larger lots, many built between 1970 and 2000 to accommodate families working in local agriculture. The area maintains strong ties to its Portuguese and Mexican immigrant heritage.

Recent housing appreciation reflects broader trends affecting Central Valley communities, where buyers seek affordable alternatives to expensive coastal markets. Delhi’s proximity to major highways and agricultural employment centers supports steady demand. Current median prices around $407,000 provide good value for families seeking homeownership in a stable rural environment.

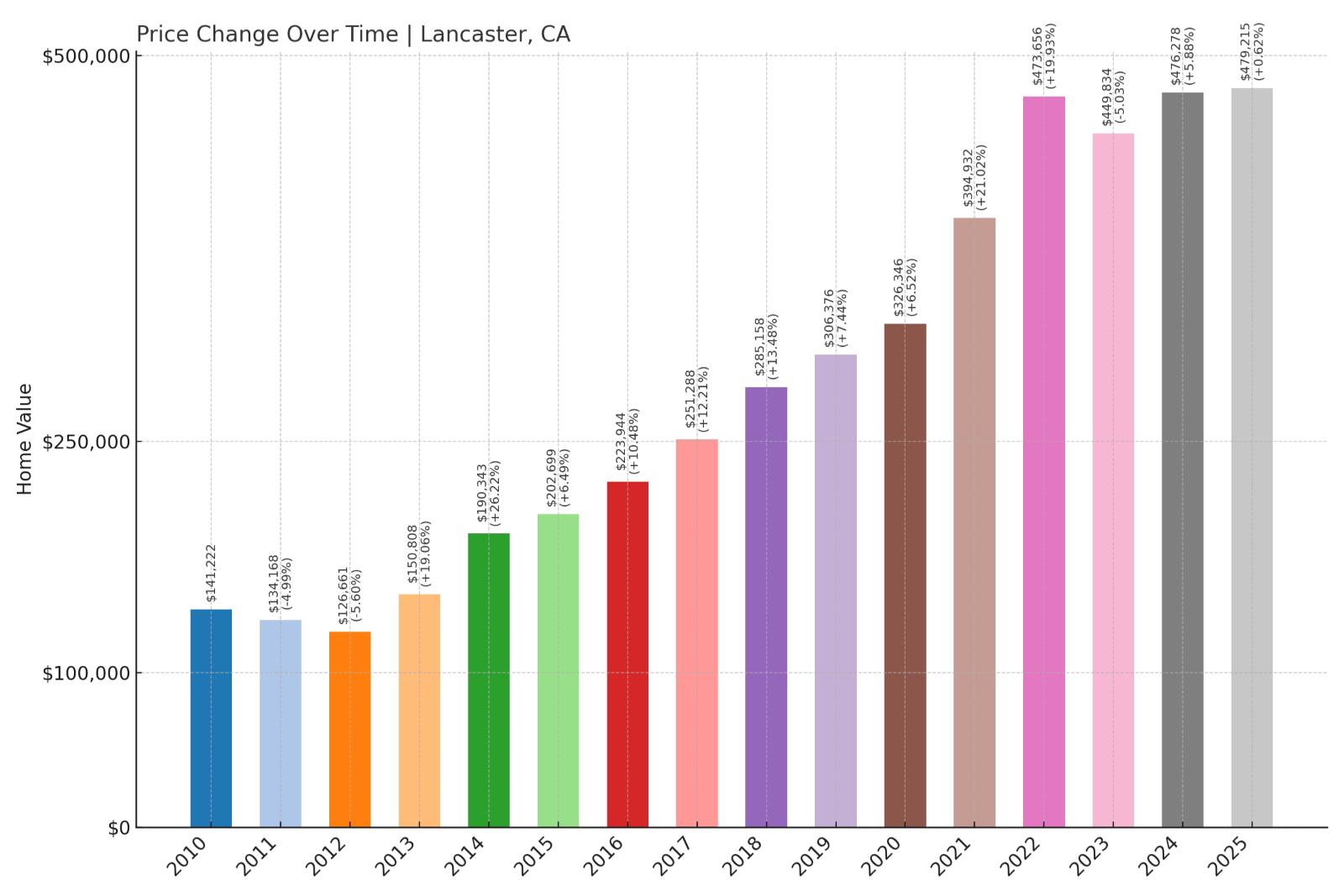

11. Lancaster – 6% Dip to 4696% Recovery By June 2025

- Peak Value: $134,168 (2011)

- Trough Value: $126,661 (2012)

- Final (2025) Value: $479,215

- Recovery: +$352,554 (+4696.3%)

- Dip from Peak: -5.6%

Lancaster saw home values dip 5.6% in 2012 but has since delivered exceptional recovery gains of over 4,600%, with median prices reaching $479,215. This Antelope Valley city has evolved from an aerospace-dependent community into a diverse suburban market attracting families and retirees. The dramatic appreciation reflects both local economic growth and the broader Southern California housing shortage.

Lancaster – Antelope Valley Aerospace Hub

Lancaster serves as the largest city in the Antelope Valley with approximately 175,000 residents, located about 70 miles northeast of downtown Los Angeles. The city has deep ties to the aerospace industry, with Edwards Air Force Base and multiple defense contractors providing high-paying jobs that support local housing demand.

The local economy has diversified beyond aerospace to include solar energy, logistics, and healthcare services. Lancaster’s commitment to renewable energy has attracted green technology companies and positioned the city as a leader in sustainable development. Housing stock ranges from older ranch homes built during the 1980s boom to newer master-planned communities.

Transportation improvements and job growth have supported steady population increases, while the city’s affordable housing market remains attractive to Los Angeles area commuters. Current median prices around $479,000 provide good value within the greater Los Angeles metropolitan area, supporting continued appreciation potential as the region faces ongoing housing shortages.

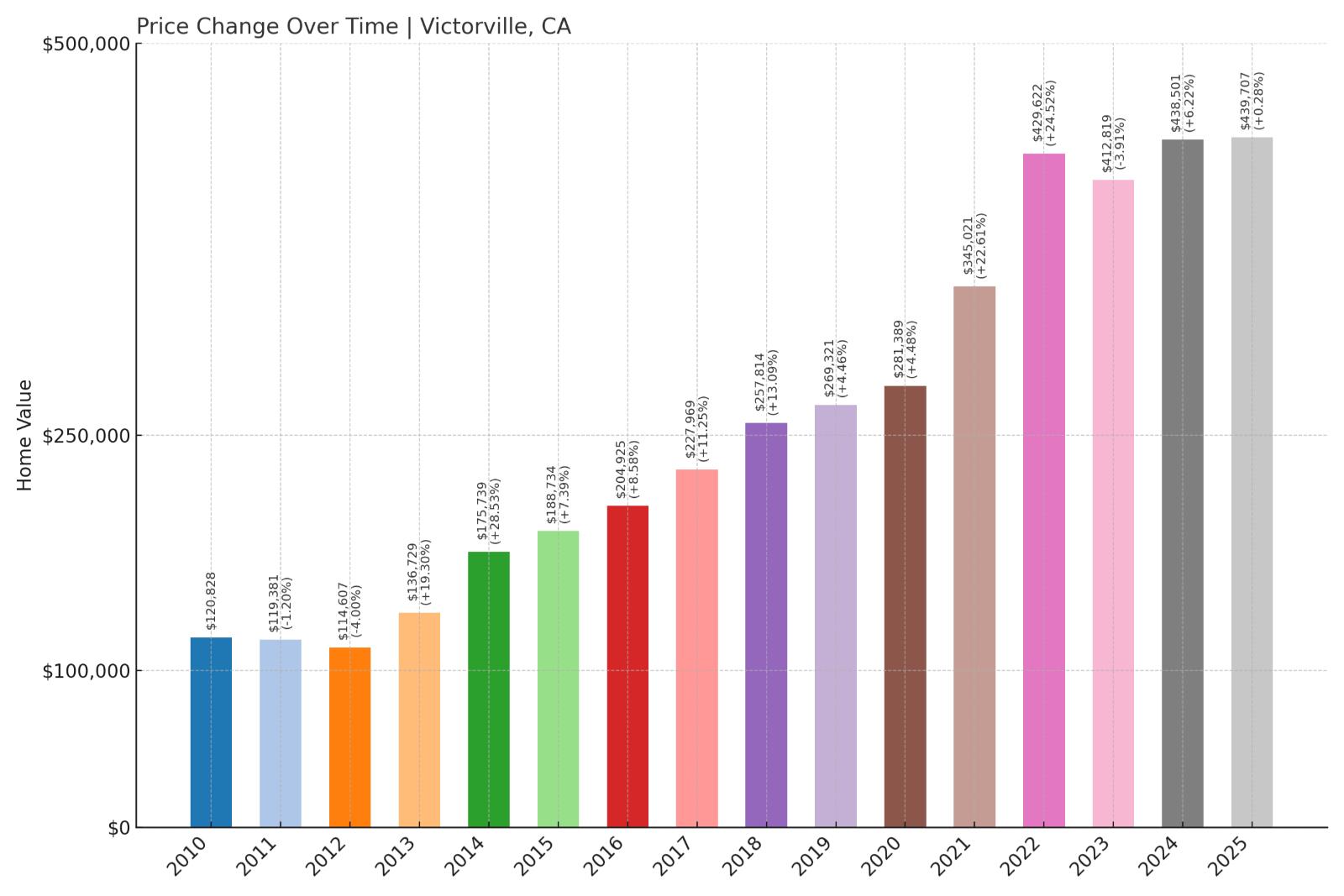

10. Victorville – 5% Dip to 5226% Recovery By June 2025

- Peak Value: $120,828 (2010)

- Trough Value: $114,607 (2012)

- Final (2025) Value: $439,707

- Recovery: +$325,100 (+5226.4%)

- Dip from Peak: -5.1%

Victorville’s housing market declined just 5.1% from its 2010 peak but has since generated extraordinary recovery gains exceeding 5,200%. Current median home values of $439,707 represent gains of over $325,000 from the 2012 trough, showcasing the High Desert’s emergence as a major growth market. This transformation reflects population migration from expensive coastal areas and the region’s strategic location along major transportation corridors.

Victorville – High Desert Regional Center

Would you like to save this?

Victorville stands as the High Desert’s largest city with approximately 135,000 residents, serving as the commercial and cultural hub of the Victor Valley region. Located along Interstate 15 between Los Angeles and Las Vegas, the city has become a major logistics center and popular destination for families seeking affordable housing.

The city’s economy benefits from its strategic location, with numerous distribution centers, retail operations, and transportation companies providing employment. Victorville’s housing market offers everything from manufactured home communities to upscale master-planned developments. The city has invested heavily in infrastructure and amenities to support its growing population.

Recent years have seen continued population growth as residents move from expensive coastal markets to the High Desert’s affordable communities. Current median prices around $440,000 remain competitive within Southern California, while the city’s improving amenities and job market support ongoing appreciation. The presence of major retailers and entertainment venues has enhanced Victorville’s appeal as a residential destination.

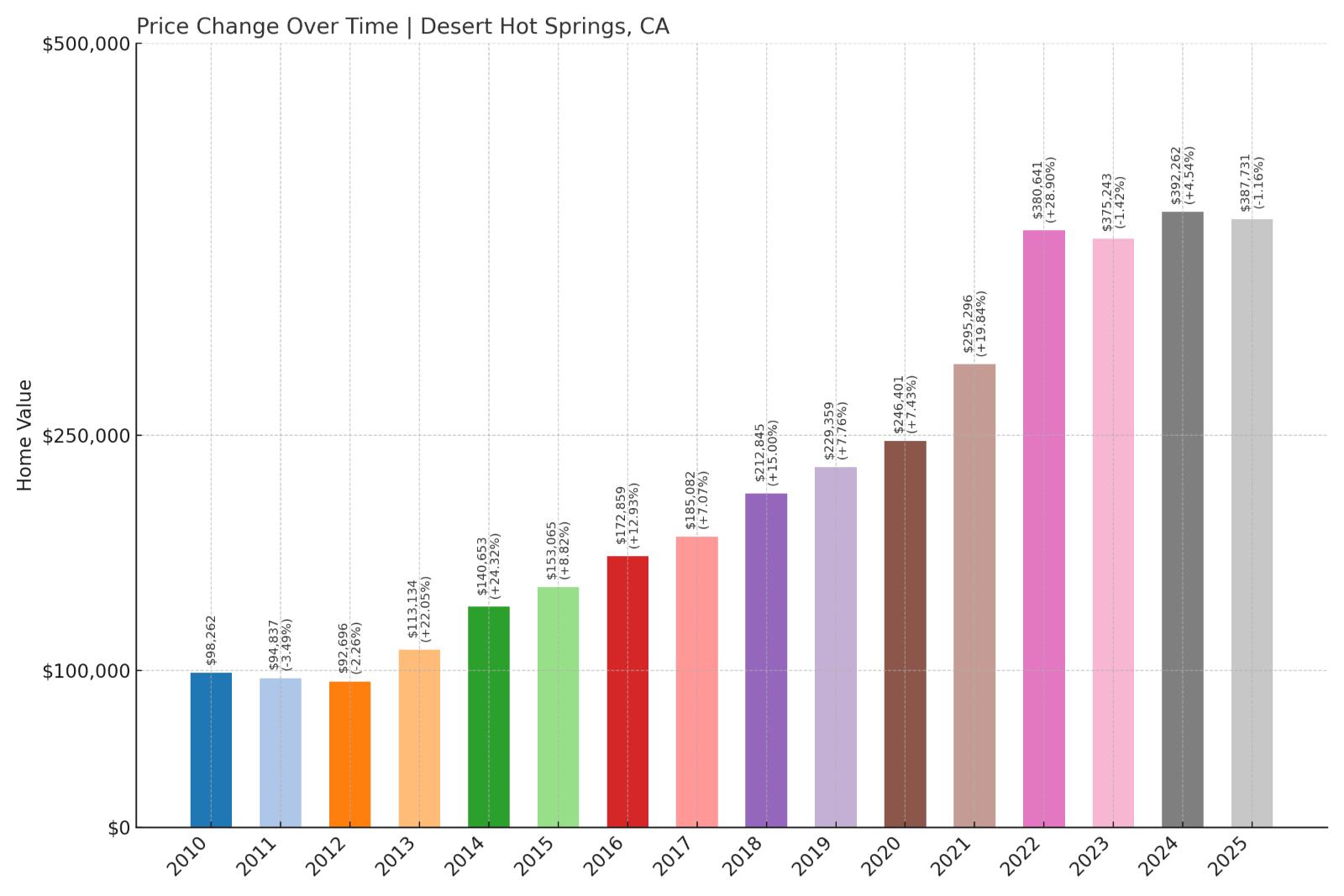

9. Desert Hot Springs – 6% Dip to 5301% Recovery By June 2025

- Peak Value: $98,262 (2010)

- Trough Value: $92,696 (2012)

- Final (2025) Value: $387,731

- Recovery: +$295,035 (+5301.3%)

- Dip from Peak: -5.7%

Desert Hot Springs experienced a 5.7% price decline during the recession but has since achieved remarkable recovery with gains exceeding 5,300%. Current median home values of $387,731 represent a gain of nearly $295,000 from the 2012 trough, demonstrating how this Riverside County desert community has benefited from California’s housing boom and tourism growth.

Desert Hot Springs – Coachella Valley Spa Destination

Desert Hot Springs sits in Riverside County’s Coachella Valley with approximately 29,000 residents, renowned for its natural hot springs and spa resorts. The city’s unique geography provides stunning mountain views and access to outdoor recreation while maintaining affordable housing compared to nearby Palm Springs.

The local economy centers on tourism, with numerous spa resorts and hotels attracting visitors year-round. Cannabis cultivation has also become a significant economic driver following legalization, bringing new businesses and jobs to the area. Housing stock includes everything from mobile home parks to luxury desert retreats.

Recent years have seen increased development as investors recognize the city’s potential for growth. Desert Hot Springs benefits from its proximity to Palm Springs while offering lower property values and development costs. Current median prices around $388,000 remain attractive to both residents and investors seeking exposure to the Coachella Valley’s continued expansion.

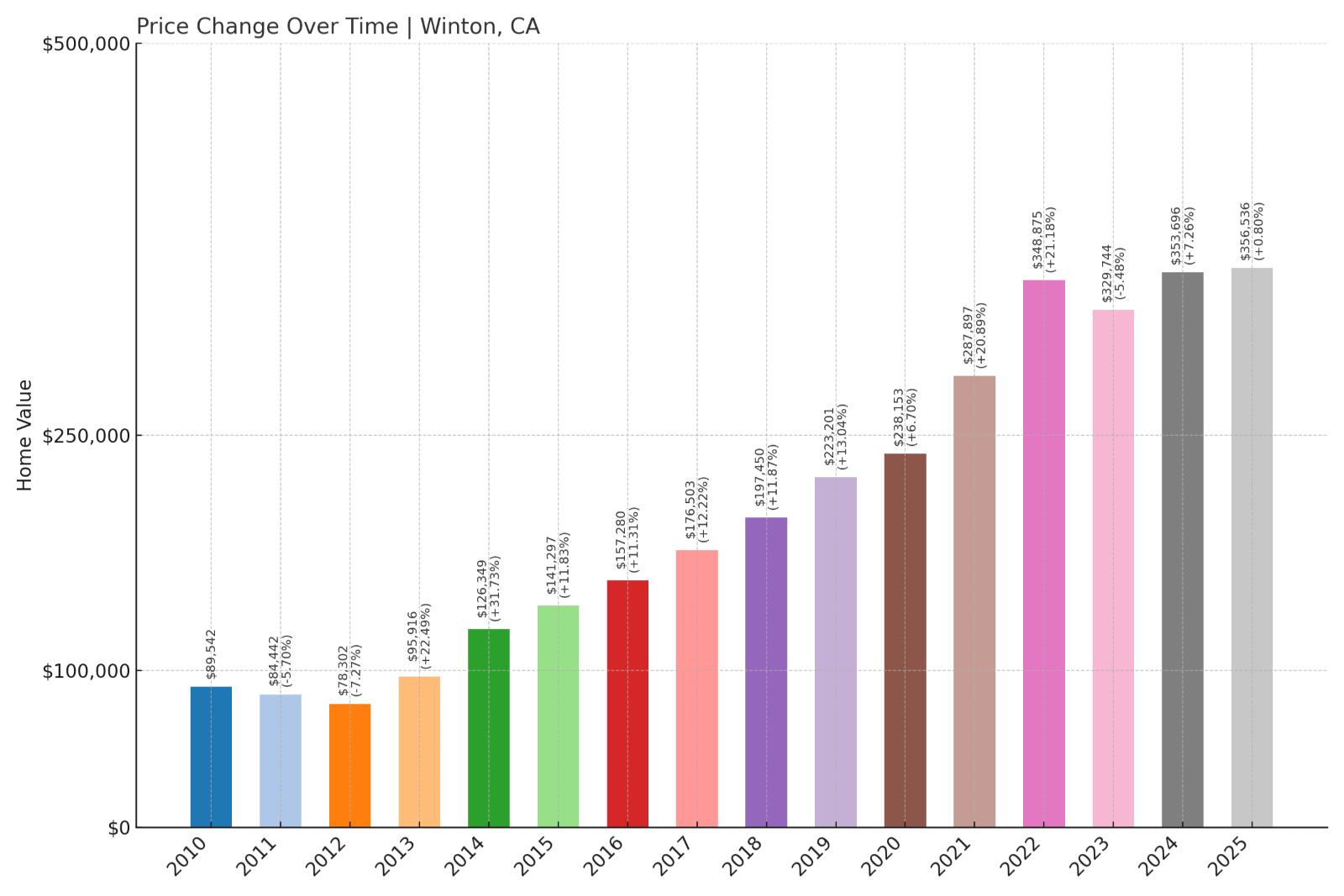

8. Winton – 6% Dip to 5335% Recovery By June 2025

- Peak Value: $89,542 (2010)

- Trough Value: $84,442 (2011)

- Final (2025) Value: $356,536

- Recovery: +$272,094 (+5335.3%)

- Dip from Peak: -5.7%

Winton’s housing market dipped 5.7% from its 2010 peak but has since delivered exceptional recovery gains of over 5,300%. Current median home values of $356,536 represent gains of more than $272,000 from the trough, showcasing how Central Valley agricultural communities have benefited from California’s housing shortage and population migration patterns.

Winton – Central Valley Agricultural Community

Winton is a small unincorporated community in Merced County with approximately 11,000 residents, situated in California’s productive Central Valley agricultural region. The area maintains its rural character while serving as an affordable housing option for families working in agriculture and nearby cities.

The local economy revolves around farming operations, particularly almonds, dairy, and row crops that benefit from the area’s fertile soil and irrigation infrastructure. Many residents commute to Merced, Modesto, or other Central Valley cities for employment while enjoying small-town living. Housing consists mainly of single-family homes on larger lots.

Winton’s dramatic price appreciation reflects broader trends affecting Central Valley communities, where buyers priced out of coastal markets seek affordable alternatives. The area’s agricultural heritage and community character continue to attract families seeking homeownership in a stable rural environment. Current median prices around $357,000 provide good value for Central Valley buyers.

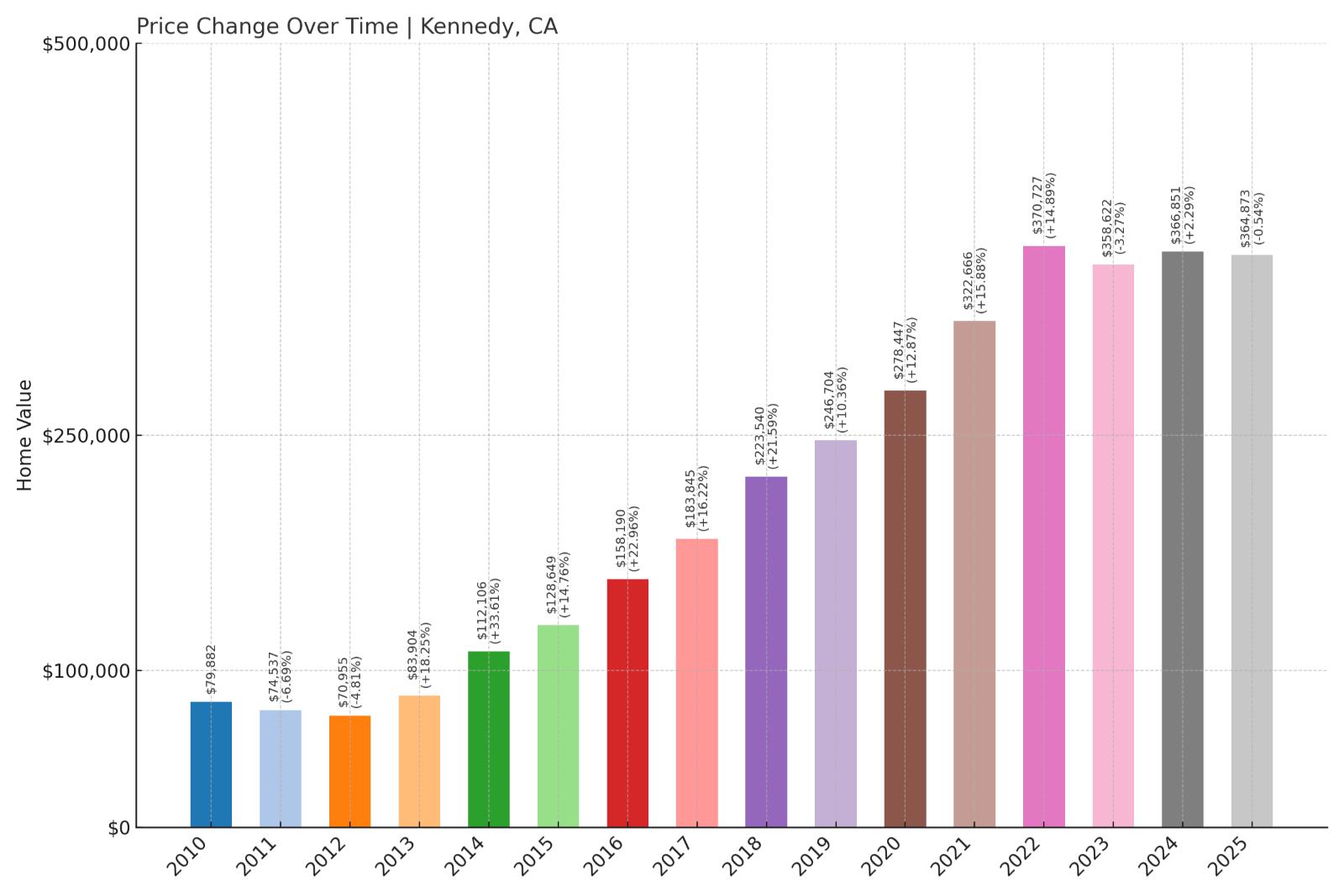

7. Kennedy – 7% Dip to 5432% Recovery By June 2025

- Peak Value: $79,882 (2010)

- Trough Value: $74,537 (2011)

- Final (2025) Value: $364,873

- Recovery: +$290,336 (+5432.2%)

- Dip from Peak: -6.7%

Kennedy experienced a 6.7% decline from its 2010 peak but has since generated extraordinary recovery gains exceeding 5,400%. Current median home values of $364,873 represent gains of over $290,000 from the 2011 trough, demonstrating how small Central Valley communities can deliver outsized returns during periods of statewide housing scarcity.

Kennedy – Small Town Central Valley Living

Kennedy is a tiny unincorporated community in San Joaquin County with fewer than 4,000 residents, maintaining a distinctly rural character in California’s Central Valley. This agricultural area has preserved its small-town atmosphere while benefiting from proximity to larger employment centers in Stockton and Modesto.

The local economy depends heavily on agriculture, with residents working in farming operations or commuting to nearby cities for employment. Housing consists primarily of single-family homes on larger lots, many built between 1960 and 1990 to accommodate rural families. The community maintains strong ties and a close-knit social fabric.

Kennedy’s remarkable price appreciation reflects the broader California housing shortage’s impact on even the smallest communities. Buyers seeking affordable homeownership have discovered these rural areas offer good value and quality of life. Current median prices around $365,000 remain accessible while providing substantial equity gains for long-term residents.

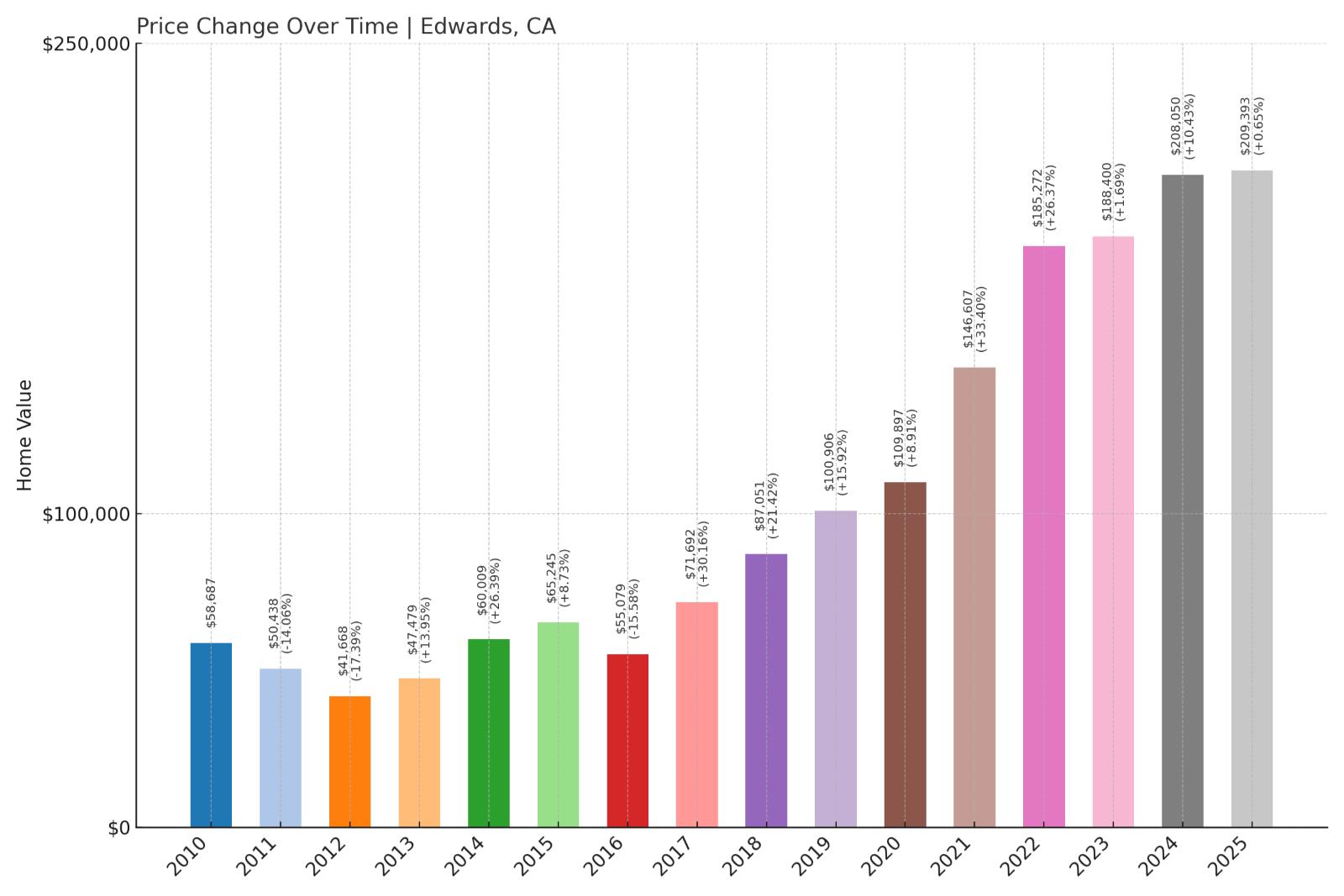

6. Edwards – 6% Dip to 5472% Recovery By June 2025

- Peak Value: $50,438 (2011)

- Trough Value: $47,479 (2013)

- Final (2025) Value: $209,393

- Recovery: +$161,914 (+5471.5%)

- Dip from Peak: -5.9%

Edwards saw home values decline 5.9% from 2011 to 2013 but has since achieved remarkable recovery with gains exceeding 5,400%. Current median prices of $209,393 represent gains of over $161,000 from the trough, showcasing how even remote desert communities can generate substantial returns. This Kern County area benefits from aerospace employment and affordable housing demand.

Edwards – Aerospace Community Gateway

Air Force photo by Bryce Bennett, Public domain, via Wikimedia Commons

Edwards is a small unincorporated community in Kern County with approximately 3,000 residents, located near Edwards Air Force Base in the Mojave Desert. The area serves primarily as a residential community for aerospace workers and military personnel stationed at the nearby base.

The local economy depends heavily on Edwards Air Force Base and related aerospace activities, providing stable, high-paying employment that supports local housing demand. The community features modest single-family homes and mobile home parks designed to accommodate military families and civilian contractors. Desert living offers affordable housing and access to outdoor recreation.

Recent years have seen steady demand as the aerospace industry continues operations at Edwards Air Force Base. The community’s affordable housing market attracts workers seeking homeownership near their employment. Current median prices around $209,000 remain among the most affordable in California while reflecting the substantial appreciation seen throughout the state.

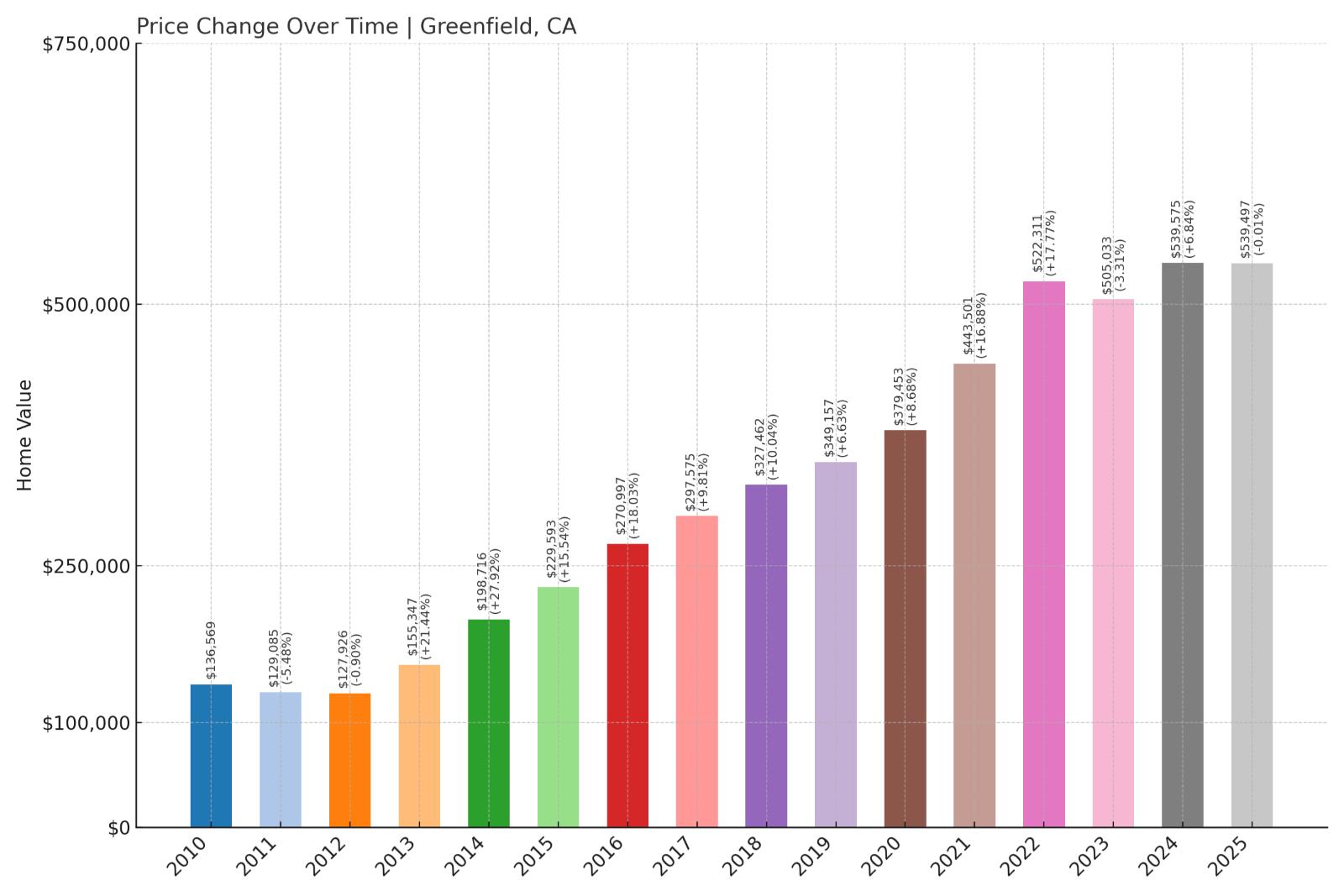

5. Greenfield – 5% Dip to 5484% Recovery By June 2025

- Peak Value: $136,569 (2010)

- Trough Value: $129,085 (2011)

- Final (2025) Value: $539,497

- Recovery: +$410,412 (+5484.1%)

- Dip from Peak: -5.5%

Greenfield experienced a modest 5.5% price decline but has since delivered exceptional recovery gains approaching 5,500%. Current median home values of $539,497 represent gains of over $410,000 from the 2011 trough, demonstrating how this Monterey County agricultural city has benefited from Central Coast population growth and housing demand.

Greenfield – Salinas Valley Agricultural Hub

Greenfield serves as an agricultural center in Monterey County’s Salinas Valley with approximately 18,000 residents. Known as the “Salad Bowl of America,” this region produces significant portions of the nation’s lettuce, spinach, and other leafy greens. The city maintains its agricultural character while serving nearby farming operations.

The local economy revolves around agriculture and food processing, providing employment for many residents while others commute to Salinas, Monterey, or other Central Coast cities. Housing consists mainly of single-family homes and apartments built to accommodate agricultural workers and their families. The city has a predominantly Latino population with strong community ties.

Greenfield’s dramatic price appreciation reflects its location within the expensive Central Coast region, where housing demand consistently exceeds supply. The city offers relative affordability compared to Monterey and Carmel while providing access to employment and amenities throughout the region. Current median prices around $539,000 remain competitive for Central Coast markets while delivering substantial returns to homeowners.

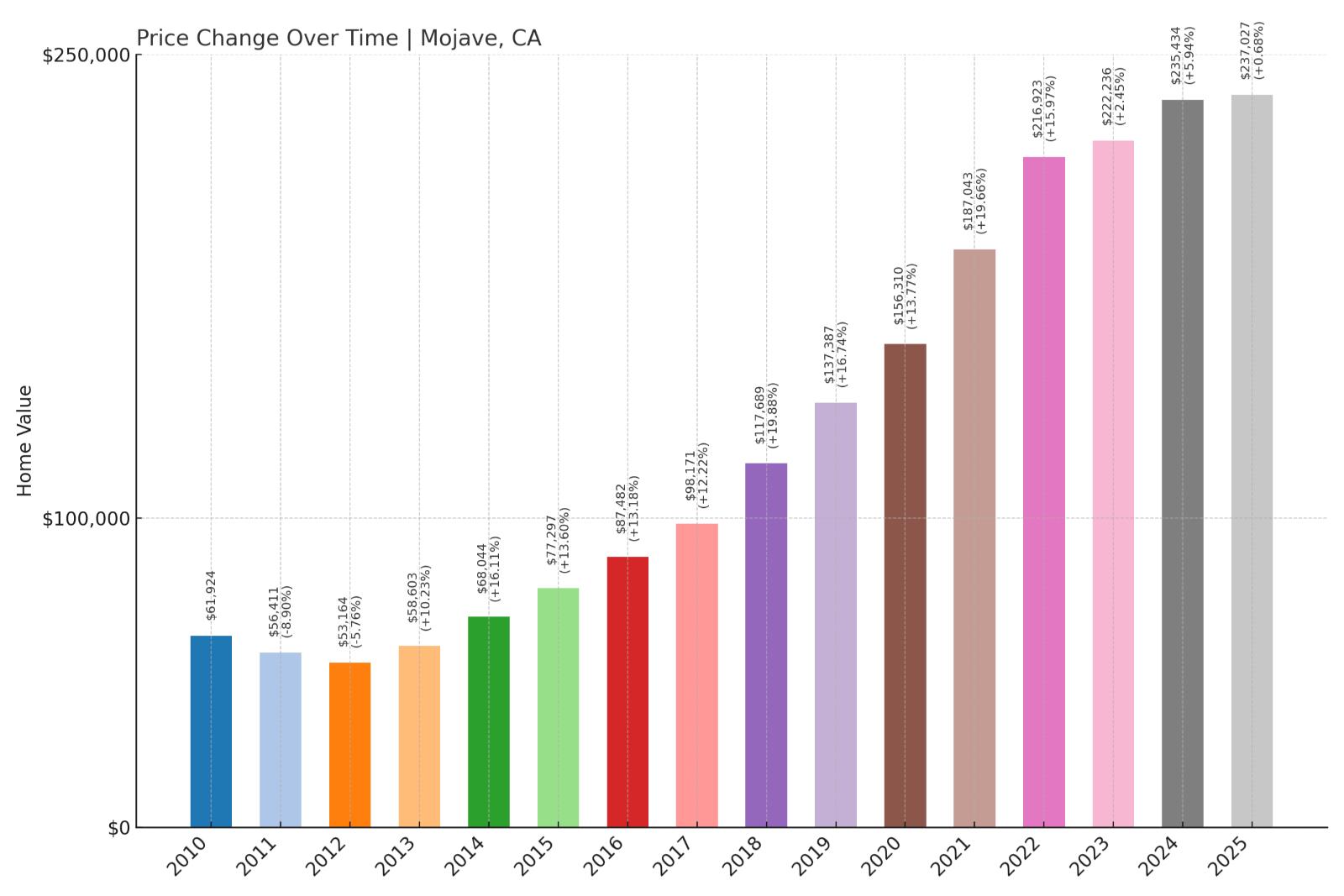

4. Mojave – 6% Dip to 5663% Recovery By June 2025

- Peak Value: $56,411 (2011)

- Trough Value: $53,164 (2012)

- Final (2025) Value: $237,027

- Recovery: +$183,863 (+5663.4%)

- Dip from Peak: -5.8%

Mojave’s housing market declined 5.8% from its 2011 peak but has since achieved extraordinary recovery gains exceeding 5,600%. Current median home values of $237,027 represent gains of over $183,000 from the trough, showcasing how this Kern County desert community has transformed from an affordable outpost into a sought-after location for renewable energy workers and aerospace employees.

Mojave – Desert Aerospace And Energy Center

Mojave is a small city in Kern County with approximately 4,200 residents, strategically located in the Mojave Desert along Highway 58. The community has emerged as a hub for aerospace testing and renewable energy development, attracting workers and businesses to this once-remote desert location.

The local economy centers on the Mojave Air and Space Port, where companies like Virgin Galactic and Scaled Composites conduct aerospace research and testing. Large-scale solar and wind energy projects have also brought new employment and investment to the area. Housing consists primarily of single-family homes and mobile home parks designed for aerospace and energy workers.

Recent years have seen increased interest from buyers seeking affordable desert living near high-tech employment opportunities. Mojave’s strategic location provides access to both Los Angeles metropolitan area jobs and emerging aerospace industries. Current median prices around $237,000 remain among California’s most affordable while reflecting substantial appreciation driven by economic diversification and population growth.

3. San Bernardino – 5% Dip to 5682% Recovery By June 2025

- Peak Value: $122,206 (2011)

- Trough Value: $115,594 (2012)

- Final (2025) Value: $491,309

- Recovery: +$375,715 (+5681.9%)

- Dip from Peak: -5.4%

San Bernardino experienced a modest 5.4% price decline but has since delivered remarkable recovery gains approaching 5,700%. Current median home values of $491,309 represent gains of over $375,000 from the 2012 trough, demonstrating how this major Inland Empire city has benefited from Southern California’s logistics boom and population growth. The dramatic appreciation reflects both economic recovery and regional housing shortages.

San Bernardino – Inland Empire Economic Hub

San Bernardino serves as the county seat and economic center of San Bernardino County with approximately 222,000 residents. Located about 60 miles east of Los Angeles, the city anchors the Inland Empire region and has experienced significant economic growth driven by logistics, healthcare, and education sectors.

The city’s economy benefits from its strategic location at the intersection of major freeways, making it a hub for distribution and logistics operations. Major employers include Amazon, UPS, and numerous healthcare systems. San Bernardino is also home to California State University San Bernardino, which provides stability and attracts students and faculty to the housing market.

Housing stock ranges from historic neighborhoods near downtown to newer suburban developments in the foothills. The city has invested heavily in downtown revitalization and infrastructure improvements to support continued growth. Current median prices around $491,000 remain competitive within Southern California while reflecting the substantial appreciation seen throughout the Inland Empire as residents seek affordable alternatives to coastal markets.

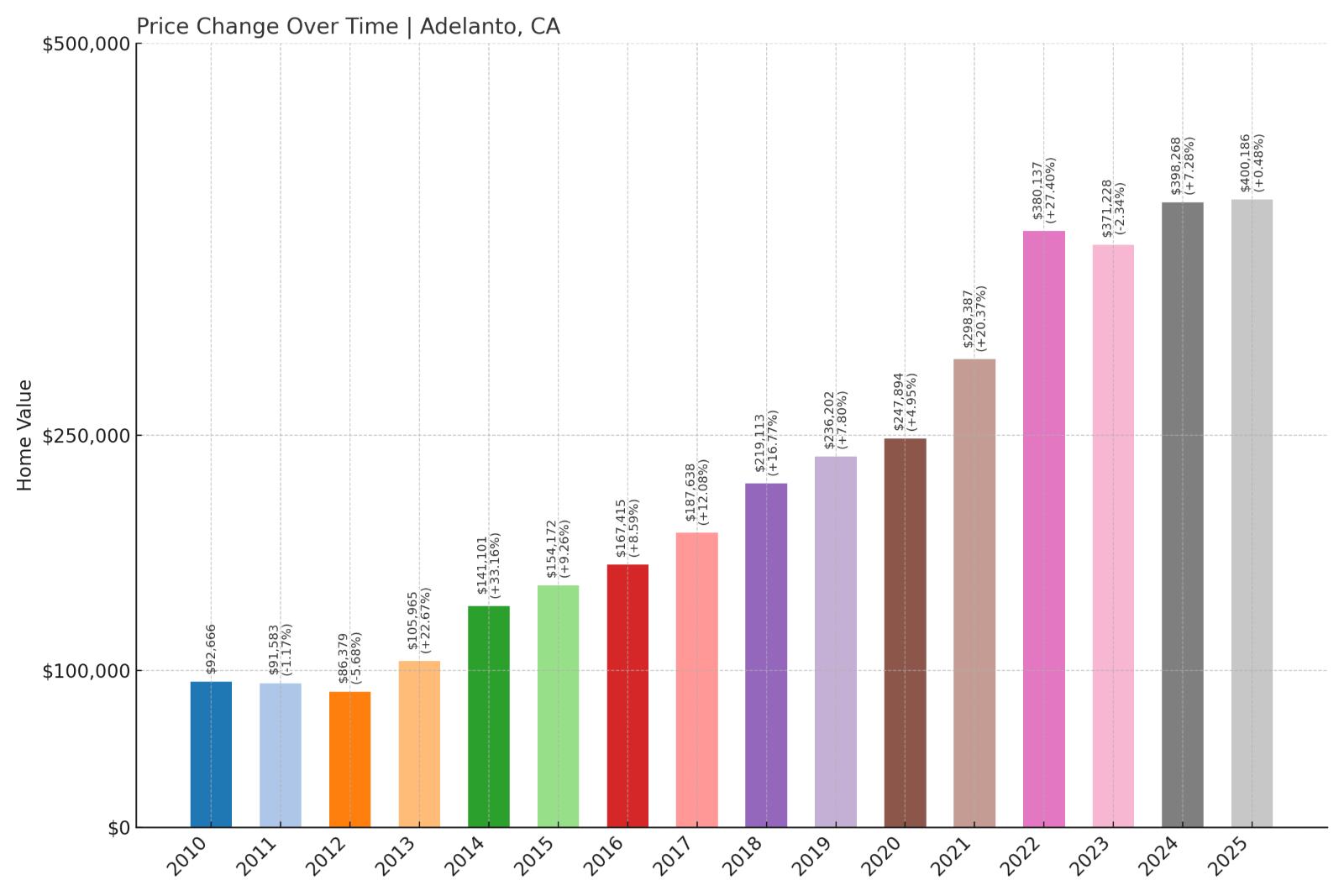

2. Adelanto – 6% Dip to 6030% Recovery By June 2025

- Peak Value: $91,583 (2011)

- Trough Value: $86,379 (2012)

- Final (2025) Value: $400,186

- Recovery: +$313,807 (+6029.8%)

- Dip from Peak: -5.7%

Adelanto saw home values decline 5.7% from 2011 to 2012 but has since achieved extraordinary recovery with gains exceeding 6,000%. Current median home values of $400,186 represent gains of over $313,000 from the trough, showcasing how this High Desert city has transformed from an affordable outpost into a major growth market. The recovery reflects population migration from expensive coastal areas and the region’s emergence as a logistics hub.

Adelanto – High Desert Growth Destination

Adelanto is a rapidly growing city in San Bernardino County with approximately 38,000 residents, located in the Victor Valley region of the High Desert. Originally founded as a planned community in 1915, Adelanto has evolved from a small desert town into one of California’s fastest-growing suburban markets.

The city’s economy has diversified significantly, with major employers including logistics companies, cannabis cultivation operations, and detention facilities that provide stable employment. Adelanto’s strategic location along Highway 395 provides access to both Los Angeles metropolitan area jobs and Nevada markets. The city has actively promoted business development and population growth.

Recent housing development has focused on affordable single-family communities that attract families priced out of coastal markets. The median household income of approximately $68,000 supports steady housing demand, while current median prices around $400,000 remain competitive within Southern California. The city’s commitment to growth and economic development positions it for continued appreciation as the High Desert region expands.

1. Garden Acres – 5% Dip to 7575% Recovery By June 2025

- Peak Value: $75,002 (2011)

- Trough Value: $71,121 (2012)

- Final (2025) Value: $365,046

- Recovery: +$293,925 (+7574.9%)

- Dip from Peak: -5.2%

Garden Acres experienced a minimal 5.2% price decline but has since achieved the most remarkable recovery of any California community, with gains approaching 7,600%. Current median home values of $365,046 represent gains of nearly $294,000 from the 2012 trough, demonstrating how this San Joaquin County agricultural community has benefited from Central Valley population growth and housing demand. The extraordinary appreciation showcases the potential returns available in California’s overlooked rural markets.

Garden Acres – Central Valley Agricultural Heritage

Would you like to save this?

Garden Acres is a census-designated place in San Joaquin County with approximately 10,600 residents, situated in California’s productive Central Valley agricultural region. Known locally as “Okieville,” this community maintains strong ties to its agricultural heritage while serving as an affordable housing option for Central Valley workers.

The area’s economy centers on agriculture, with many residents employed in farming operations, food processing, or related industries. Garden Acres benefits from its location near major highways and proximity to Stockton, providing access to employment throughout the Central Valley. The community features predominantly single-family homes on larger lots, many built to accommodate agricultural workers and their families.

Garden Acres’ record-breaking price appreciation reflects the broader California housing shortage’s impact on even the most affordable rural communities. The area’s 49% White and 37% Hispanic population maintains a strong sense of community while benefiting from increasing property values. Current median prices around $365,000 provide good value for Central Valley buyers while delivering extraordinary returns to long-term homeowners who weathered the modest price decline and held through the subsequent boom.