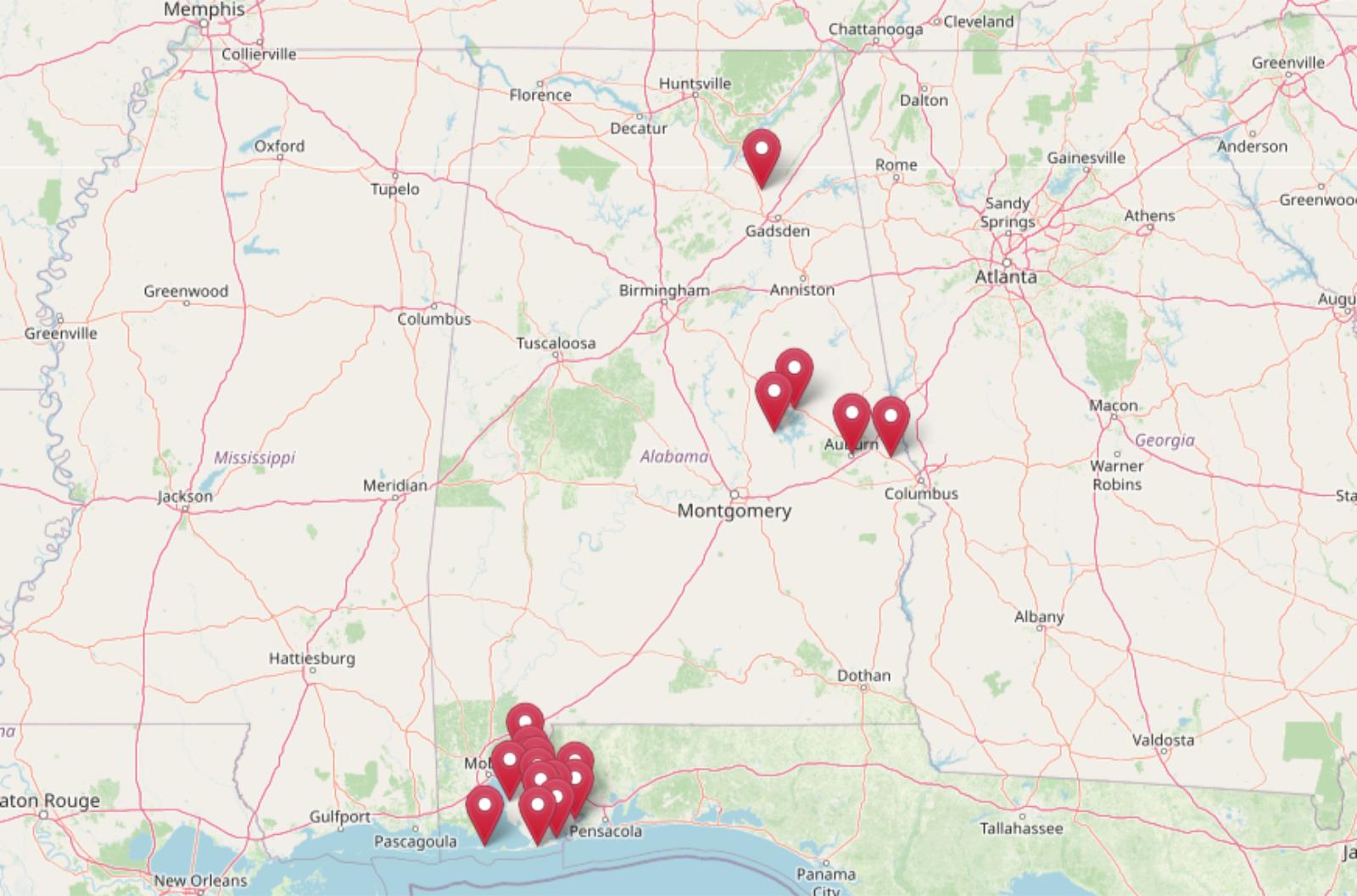

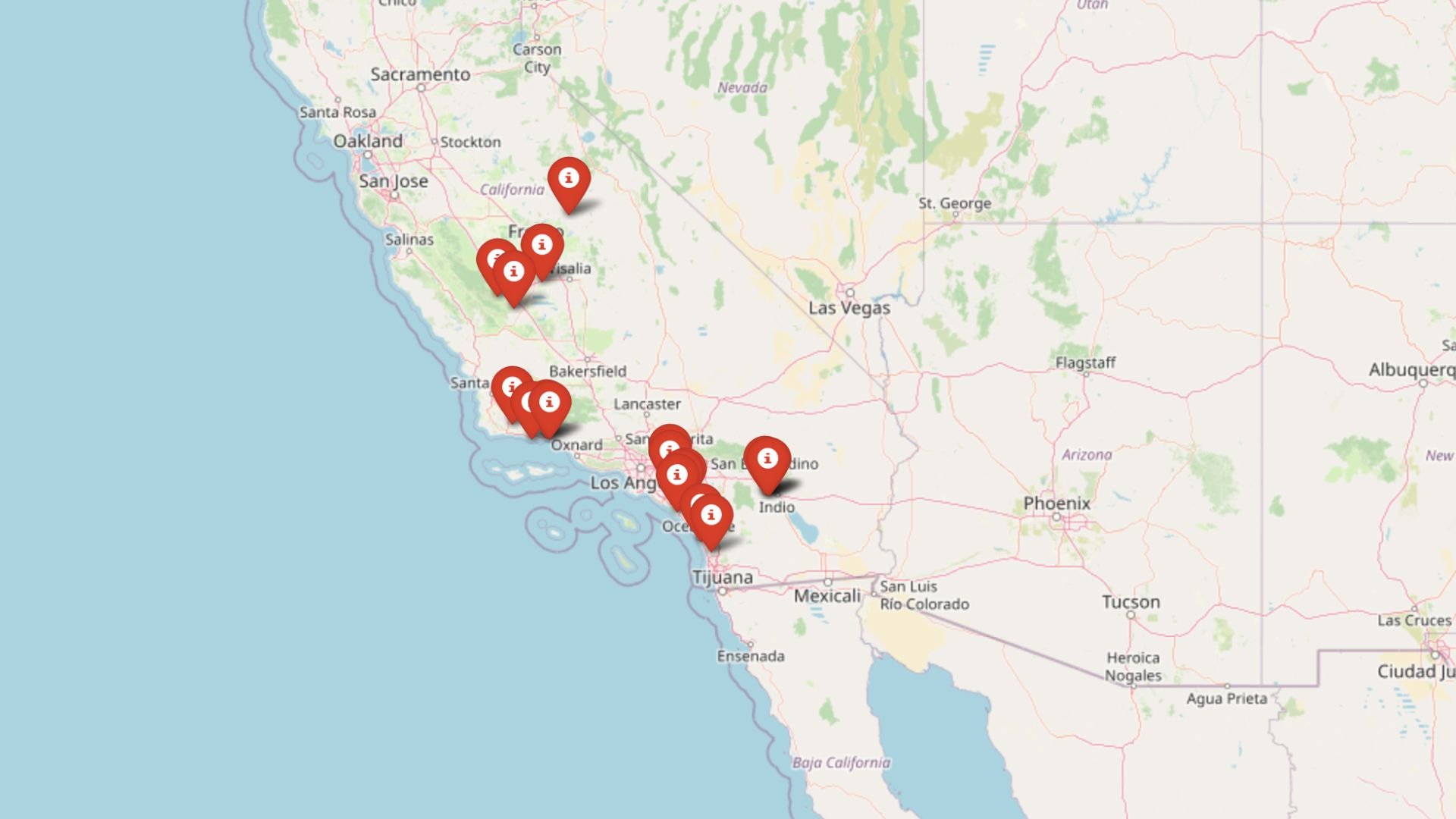

In parts of California, the housing market isn’t just hot—it’s hostile. According to the Zillow Home Value Index, home prices in 18 towns have surged far beyond normal trends, driven by a flood of investor activity. These aren’t luxury hubs—they’re ordinary towns now caught in a speculative storm. As profits pile up for outside buyers, local families are being priced out of their own neighborhoods.

18. Montecito – Investor Feeding Frenzy Factor 154.34% (June 2025)

- Historical annual growth rate (2010–2019): 3.83%

- Recent annual growth rate (2021–2025): 9.74%

- Investor Feeding Frenzy Factor: 154.34%

- Current 2025 price: $5,209,719

Montecito’s transformation from a steady luxury enclave to a speculative hotspot reflects the broader investor-driven chaos reshaping California’s most exclusive communities. The recent acceleration from 3.83% to 9.74% annual growth represents more than a doubling of historical patterns, pushing median home prices beyond $5.2 million. This coastal Santa Barbara County community has become a magnet for celebrity buyers and investment capital, fundamentally altering its character from a quiet residential retreat to a high-stakes investment playground.

Montecito – Celebrity Haven Turned Investment Battlefield

This unincorporated community in Santa Barbara County has long been synonymous with understated wealth and privacy, attracting A-list celebrities and tech moguls seeking refuge from Los Angeles. Located between the Santa Ynez Mountains and the Pacific Ocean, Montecito offers an idyllic setting with sprawling estates, world-class spas, and exclusive country clubs. The area’s Mediterranean climate and natural beauty have made it a coveted destination for those who can afford its astronomical price tags.

The economic impact extends beyond real estate, affecting local businesses that traditionally served year-round residents. As more properties become investment holdings or vacation homes rather than primary residences, the community loses the stable customer base that supported local shops, restaurants, and service providers. This shift from a residential community to an investment asset class represents a fundamental transformation that may be irreversible.

17. Ladera Ranch – Investor Feeding Frenzy Factor 156.62% (June 2025)

- Historical annual growth rate (2010–2019): 3.93%

- Recent annual growth rate (2021–2025): 10.07%

- Investor Feeding Frenzy Factor: 156.62%

- Current 2025 price: $1,390,501

Ladera Ranch exemplifies how master-planned communities have become prime targets for investor speculation, with growth rates jumping from a steady 3.93% to over 10% annually. This Orange County development, designed as an affordable family community, now sees median prices approaching $1.4 million, forcing out the middle-class families it was originally intended to serve. The feeding frenzy has transformed this once-accessible suburb into another playground for investment capital rather than a community for working families.

Ladera Ranch – Master-Planned Community Under Siege

Developed in the early 2000s as an innovative master-planned community in South Orange County, Ladera Ranch was designed to offer families an affordable alternative to the region’s established neighborhoods. The community features extensive parks, recreational facilities, and top-rated schools within the Capistrano Unified School District. Its location along the 5 freeway corridor provides convenient access to both Orange County and San Diego County employment centers.

The investor feeding frenzy has fundamentally altered the community’s demographics and character. Originally marketed to young families with household incomes of $100,000-150,000, the current price levels require incomes exceeding $400,000 to qualify for most mortgages. This dramatic shift has created a community where many longtime residents find themselves equity-rich but unable to afford moving within their own neighborhood, while newcomers are increasingly investors rather than families.

16. Armona – Investor Feeding Frenzy Factor 156.76% (June 2025)

- Historical annual growth rate (2010–2019): 2.70%

- Recent annual growth rate (2021–2025): 6.92%

- Investor Feeding Frenzy Factor: 156.76%

- Current 2025 price: $305,741

Armona represents the troubling spread of investor speculation into California’s most affordable communities, where modest growth rates of 2.70% have exploded to nearly 7% annually. This small Kings County community, once a refuge for working-class families seeking homeownership, now faces a feeding frenzy that threatens to price out its core population. Even at $305,741, these prices represent a devastating increase for a community where median household incomes remain well below state averages.

Armona – Agricultural Town Facing Urban Pressures

Located in California’s Central Valley, Armona is a small unincorporated community in Kings County that has traditionally served as an affordable housing option for agricultural workers and service employees. The town sits in the heart of some of California’s most productive farmland, surrounded by almond orchards, cotton fields, and dairy operations. Its location approximately 45 minutes from Fresno has made it accessible to commuters seeking affordable homeownership.

The feeding frenzy has created a particularly cruel irony in Armona, where many residents work in agriculture – the industry that feeds much of America – yet find themselves priced out of their own community. Local agricultural employers report difficulty retaining workers who can no longer afford to live nearby, forcing longer commutes that strain both family budgets and regional transportation infrastructure. The transformation of this agricultural community into an investment commodity represents a fundamental threat to the Central Valley’s economic ecosystem.

15. Yorba Linda – Investor Feeding Frenzy Factor 157.15% (June 2025)

- Historical annual growth rate (2010–2019): 3.42%

- Recent annual growth rate (2021–2025): 8.79%

- Investor Feeding Frenzy Factor: 157.15%

- Current 2025 price: $1,412,369

Yorba Linda’s transformation from a stable suburban community to an investor battleground illustrates how speculation has penetrated even well-established Orange County neighborhoods. The acceleration from 3.42% to 8.79% annual growth has pushed median prices above $1.4 million, transforming this former bedroom community into an expensive investment target. The feeding frenzy effect has priced out many of the middle-class families who built the community’s reputation for excellent schools and family-friendly amenities.

Yorba Linda – The Land of Gracious Living Under Pressure

Known as “The Land of Gracious Living,” Yorba Linda was incorporated in 1967 and has built a reputation as one of Orange County’s premier family communities. Located in northern Orange County, the city is famous as the birthplace of President Richard Nixon and features the Nixon Presidential Library and Museum. The community’s hillside location provides stunning views and a suburban atmosphere while maintaining proximity to major employment centers in Orange, Anaheim, and Los Angeles.

The city’s excellent schools, low crime rates, and family-oriented amenities have made it a magnet for investors seeking stable rental properties in high-demand areas. The Placentia-Yorba Linda Unified School District consistently ranks among the top performers in California, creating sustained rental demand from families willing to pay premium rents for access to quality education. This educational premium has become a key driver of the investor feeding frenzy.

14. Shaver Lake – Investor Feeding Frenzy Factor 167.80% (June 2025)

- Historical annual growth rate (2010–2019): 1.72%

- Recent annual growth rate (2021–2025): 4.60%

- Investor Feeding Frenzy Factor: 167.80%

- Current 2025 price: $591,633

Shaver Lake demonstrates how remote recreational communities have become unexpected casualties of investor speculation, with growth rates nearly tripling from 1.72% to 4.60% annually. This Sierra Nevada mountain community, once accessible to working families seeking weekend retreats, now sees median prices approaching $600,000. The feeding frenzy has transformed what was once an affordable escape destination into another high-priced investment commodity, pricing out the very families who built its character as a recreational community.

Shaver Lake – Mountain Retreat Becomes Investment Target

Nestled in the Sierra National Forest at 5,370 feet elevation, Shaver Lake is a small mountain community centered around its namesake reservoir. Originally developed as a recreational area for Central Valley residents seeking relief from valley heat, the community features a mix of permanent residents and vacation homes. The area offers year-round outdoor recreation, from fishing and boating in summer to snowmobiling and skiing in winter, making it a popular destination for families throughout the Central Valley.

The speculation has created practical challenges for the small mountain community. Local infrastructure, designed for a population that swelled only on weekends and holidays, now faces year-round pressure from new residents and short-term rental operations. The increased property values have also strained longtime residents who face rising property taxes on fixed incomes, forcing some to sell properties that have been in families for generations. The feeding frenzy threatens to eliminate the community’s character as an accessible recreational destination for working families.

13. Palm Desert – Investor Feeding Frenzy Factor 172.05% (June 2025)

- Historical annual growth rate (2010–2019): 2.35%

- Recent annual growth rate (2021–2025): 6.39%

- Investor Feeding Frenzy Factor: 172.05%

- Current 2025 price: $565,682

Palm Desert exemplifies how desert retirement communities have become prime targets for investor speculation, with annual growth rates jumping from 2.35% to over 6%. This Coachella Valley city, long popular with retirees seeking affordable desert living, now faces median prices exceeding $565,000 that challenge its traditional affordability. The feeding frenzy has transformed this once-accessible retirement destination into another high-stakes investment market, threatening to price out the retirees and seasonal residents who built its economy.

Palm Desert – Desert Oasis Under Investment Pressure

Located in the heart of the Coachella Valley, Palm Desert has evolved from a small desert community into a sophisticated resort city known for its golf courses, shopping, and cultural amenities. The city’s location provides easy access to Palm Springs while maintaining a more affordable alternative to its famous neighbor. Palm Desert’s economy has traditionally centered on tourism, retirement living, and seasonal residents escaping cold northern winters.

The investor feeding frenzy has been fueled by several factors: the area’s growing reputation as a year-round destination, improved infrastructure connecting the desert to major metropolitan areas, and the increasing popularity of short-term vacation rentals. Properties that once served as affordable retirement homes now compete with investment capital seeking to capitalize on the area’s tourism economy. The shift has particularly impacted fixed-income retirees who find themselves unable to afford their own community.

12. Laguna Niguel – Investor Feeding Frenzy Factor 178.58% (June 2025)

- Historical annual growth rate (2010–2019): 4.18%

- Recent annual growth rate (2021–2025): 11.65%

- Investor Feeding Frenzy Factor: 178.58%

- Current 2025 price: $1,465,871

Laguna Niguel showcases how even historically strong markets can be destabilized by investor speculation, with growth rates jumping from 4.18% to nearly 12% annually. This coastal Orange County city now commands median prices approaching $1.5 million, representing a feeding frenzy that has overwhelmed normal market dynamics. The acceleration has transformed this family-oriented community into a high-stakes investment target, pricing out the middle-class professionals who once formed its core population.

Laguna Niguel – Coastal Community Caught in Speculation Storm

Incorporated in 1989, Laguna Niguel represents one of Orange County’s newer cities, carefully planned to preserve natural open space while providing family-friendly neighborhoods. Located between the Pacific Ocean and the Santa Ana Mountains, the city offers a unique combination of coastal proximity and suburban amenities. The community’s location provides easy access to pristine beaches at Salt Creek and Dana Point while maintaining the feel of a planned suburban community.

The community faces unique challenges as the feeding frenzy transforms its character. Local schools report increasing enrollment volatility as families are priced out and replaced by renters with different tenure patterns. The city’s extensive park system and recreational facilities, designed for stable family populations, now serve more transient residents who may have different community engagement levels. The speculation threatens to undermine the carefully planned community character that originally attracted investors to the area.

11. Coalinga – Investor Feeding Frenzy Factor 185.06% (June 2025)

- Historical annual growth rate (2010–2019): 2.25%

- Recent annual growth rate (2021–2025): 6.40%

- Investor Feeding Frenzy Factor: 185.06%

- Current 2025 price: $285,988

Coalinga represents the troubling spread of investor speculation into California’s working-class communities, where modest historical growth of 2.25% has exploded to over 6% annually. This Central Valley oil and agriculture town, traditionally offering some of California’s most affordable homeownership opportunities, now faces a feeding frenzy that threatens its core population. Even at $285,988, these prices represent devastating increases for a community where many families work in agriculture and energy sectors.

Coalinga – Oil Town Faces New Economic Pressures

Located in western Fresno County, Coalinga is a small city built around oil production and agriculture, with a population that has traditionally worked in these industries. The city sits in the foothills of the Diablo Range, about 80 miles southwest of Fresno. Coalinga’s economy has historically centered on oil extraction, with several major producers operating in the area, along with agriculture and the presence of West Hills College Coalinga, which provides educational opportunities for the region.

The investor feeding frenzy has created particular hardships in Coalinga, where median household incomes remain well below state averages while housing costs accelerate beyond local earning capacity. Many residents work in oil fields, agriculture, or support services that cannot quickly adjust wages to match housing cost increases. The speculation has begun pricing out families who have lived in the area for generations, disrupting the stable workforce that local industries depend upon.

10. Solvang – Investor Feeding Frenzy Factor 187.69% (June 2025)

- Historical annual growth rate (2010–2019): 2.71%

- Recent annual growth rate (2021–2025): 7.79%

- Investor Feeding Frenzy Factor: 187.69%

- Current 2025 price: $1,380,220

Solvang’s transformation from a charming Danish-themed community to an investor battleground demonstrates how tourism-dependent towns become vulnerable to speculation. Growth rates have jumped from 2.71% to nearly 8% annually, pushing median prices above $1.3 million and fundamentally altering this Santa Barbara County community. The feeding frenzy threatens to eliminate the stable local population that maintains the authentic character which originally attracted tourists and, subsequently, investors.

Solvang – Danish Village Becomes Investment Commodity

Founded in 1911 by Danish immigrants, Solvang has built its identity around its authentic Danish heritage, featuring traditional architecture, bakeries, and cultural attractions. Located in the Santa Ynez Valley, this small city of about 5,000 residents has become a major tourist destination, attracting millions of visitors annually to experience its unique European atmosphere. The community’s tourism economy has traditionally supported local residents through hospitality, retail, and service jobs.

The speculation poses existential threats to Solvang’s unique identity. Many of the local families whose Danish heritage and cultural knowledge maintain the community’s authentic character find themselves unable to afford living in their own town. Local businesses report difficulty staffing restaurants, shops, and hotels as workers are forced to commute from increasingly distant communities. The feeding frenzy risks transforming Solvang from an authentic cultural destination into a hollow tourist attraction staffed by commuters rather than community members.

9. Summerland – Investor Feeding Frenzy Factor 201.54% (June 2025)

- Historical annual growth rate (2010–2019): 3.07%

- Recent annual growth rate (2021–2025): 9.25%

- Investor Feeding Frenzy Factor: 201.54%

- Current 2025 price: $2,963,585

Summerland exemplifies how small coastal communities become prey to investor speculation, with growth rates tripling from 3.07% to over 9% annually. This tiny Santa Barbara County enclave now commands median prices approaching $3 million, representing a feeding frenzy that has completely overwhelmed this beachside community. The speculation has transformed what was once an eccentric artists’ colony into an ultra-expensive investment playground, eliminating any possibility of local workforce housing.

Summerland – Bohemian Beach Town Loses Its Soul

Summerland is a small unincorporated community in Santa Barbara County, located along Highway 101 between Santa Barbara and Carpinteria. Originally developed in the 1880s as a spiritualist colony, the community has maintained a bohemian character with beach cottages, antique shops, and artist studios. The town’s location on a bluff overlooking the Pacific Ocean provides stunning coastal views while maintaining a quirky, small-town atmosphere that has attracted artists, writers, and free spirits for over a century.

The investor feeding frenzy has been particularly devastating to Summerland’s unique character. The community’s small scale – with only a few hundred residents – makes it especially vulnerable to speculation. Beach cottages that once housed local artists and service workers now sell for millions to investors and wealthy buyers seeking coastal trophy properties. The transformation has effectively eliminated the creative community that gave Summerland its distinctive identity.

8. Isla Vista – Investor Feeding Frenzy Factor 223.93% (June 2025)

- Historical annual growth rate (2010–2019): 1.99%

- Recent annual growth rate (2021–2025): 6.43%

- Investor Feeding Frenzy Factor: 223.93%

- Current 2025 price: $1,496,298

Isla Vista represents an extreme case of investor speculation overwhelming a college community, with growth rates jumping from under 2% to over 6% annually. This UC Santa Barbara adjacent community now faces median prices approaching $1.5 million, creating a feeding frenzy that threatens to eliminate affordable student housing. The speculation has transformed this traditionally affordable college town into an expensive investment target, potentially undermining the university’s ability to provide accessible education.

Isla Vista – College Town Turned Investment Battlefield

Isla Vista is an unincorporated community in Santa Barbara County, located immediately adjacent to the UC Santa Barbara campus. Home to approximately 23,000 residents, most of whom are UCSB students, the community has traditionally provided affordable housing options for college students through a mix of apartments, shared houses, and small residential units. The area’s beachfront location and proximity to campus have made it an integral part of the UCSB experience for generations of students.

The speculation poses serious threats to the university community’s ecosystem. As affordable student housing disappears, UCSB faces pressure to provide more on-campus housing while students are forced to seek accommodations farther from campus, creating transportation and community challenges. Local businesses that depended on student customers find their market disrupted as the residential population changes. The feeding frenzy threatens to undermine the university town character that made Isla Vista attractive to both students and investors.

7. Avenal – Investor Feeding Frenzy Factor 232.22% (June 2025)

- Historical annual growth rate (2010–2019): 2.20%

- Recent annual growth rate (2021–2025): 7.31%

- Investor Feeding Frenzy Factor: 232.22%

- Current 2025 price: $252,585

Avenal demonstrates the devastating impact of investor speculation on California’s most vulnerable communities, where growth rates have more than tripled from 2.20% to over 7% annually. This small Kings County city, historically serving as one of California’s last affordable homeownership markets, now faces a feeding frenzy that threatens to eliminate opportunities for working families. Even at $252,585, these prices represent catastrophic increases for a community where many residents work in agriculture and correctional services.

Avenal – Prison Town Faces Housing Crisis

Located in Kings County in California’s Central Valley, Avenal is a small city of approximately 15,000 residents whose economy centers around agriculture and the presence of Avenal State Prison, one of California’s largest correctional facilities. The city has traditionally provided affordable housing for correctional officers, agricultural workers, and service employees who support the local economy. Its location along Interstate 5 provides access to larger Central Valley cities while maintaining small-town affordability.

The investor feeding frenzy has created particular hardships for Avenal’s working families. Many residents work in correctional services or agriculture – sectors with stable but modest wages that cannot quickly adjust to housing cost increases. The speculation has begun pricing out families who form the backbone of the local economy, creating staffing challenges for both the prison system and agricultural operations that depend on local workers.

6. Rancho Santa Fe – Investor Feeding Frenzy Factor 264.74% (June 2025)

- Historical annual growth rate (2010–2019): 2.89%

- Recent annual growth rate (2021–2025): 10.53%

- Investor Feeding Frenzy Factor: 264.74%

- Current 2025 price: $4,309,533

Rancho Santa Fe exemplifies how even ultra-wealthy communities can experience investor feeding frenzies, with growth rates jumping from 2.89% to over 10% annually. This exclusive San Diego County enclave now commands median prices exceeding $4.3 million, representing speculation that has reached astronomical levels even by luxury market standards. The feeding frenzy has transformed this already exclusive community into an even more rarified investment commodity, accessible only to global wealth.

Rancho Santa Fe – Exclusive Enclave Reaches New Heights

Rancho Santa Fe is an unincorporated community in San Diego County, consistently ranked among the wealthiest communities in the United States. Originally developed in the 1920s as a luxury residential community with Spanish Colonial Revival architecture, the area features large estates on multi-acre lots with strict architectural controls that maintain its distinctive character. The community is home to tech executives, celebrities, and business leaders who value privacy and exclusivity.

Even in this ultra-exclusive market, the feeding frenzy creates broader economic effects. Local service businesses that traditionally employed residents living in more modest nearby communities find their workforce increasingly distant as supporting populations are priced out of the region. The community’s character as a residential enclave faces pressure as more properties become investment holdings rather than primary residences. The speculation has pushed prices beyond levels that even maintain the community’s traditional character of occupied luxury homes.

5. Indian Wells – Investor Feeding Frenzy Factor 274.70% (June 2025)

- Historical annual growth rate (2010–2019): 2.50%

- Recent annual growth rate (2021–2025): 9.37%

- Investor Feeding Frenzy Factor: 274.70%

- Current 2025 price: $1,415,654

Indian Wells showcases how desert resort communities have become prime targets for investor speculation, with growth rates jumping from 2.50% to over 9% annually. This Coachella Valley city, known for its luxury resorts and golf courses, now commands median prices exceeding $1.4 million, representing a feeding frenzy that has overwhelmed traditional market dynamics. The speculation has transformed this resort destination from an accessible luxury market into an ultra-expensive investment playground, pricing out many longtime residents and seasonal visitors.

Indian Wells – Desert Resort Paradise Under Investment Siege

Located in the Coachella Valley, Indian Wells is a small city renowned for its luxury resorts, world-class golf courses, and the Indian Wells Tennis Garden, which hosts the BNP Paribas Open. The city has built its reputation as a premier desert destination, attracting affluent retirees, seasonal residents, and tourists seeking upscale desert living. Its location provides stunning mountain views and year-round sunshine while maintaining proximity to Palm Springs and other valley attractions.

The investor feeding frenzy has been fueled by the city’s tourism infrastructure and potential for luxury vacation rentals. Properties near championship golf courses and five-star resorts command premium prices from investors seeking to capitalize on the area’s reputation. The speculation has intensified as more buyers recognize Indian Wells as an undervalued luxury market compared to coastal California destinations, driving competition that far exceeds historical patterns.

4. Coto de Caza – Investor Feeding Frenzy Factor 292.09% (June 2025)

- Historical annual growth rate (2010–2019): 2.97%

- Recent annual growth rate (2021–2025): 11.66%

- Investor Feeding Frenzy Factor: 292.09%

- Current 2025 price: $2,033,439

Coto de Caza represents an extreme case of investor speculation overwhelming a gated community, with growth rates exploding from under 3% to nearly 12% annually. This Orange County enclave now commands median prices exceeding $2 million, creating a feeding frenzy that has pushed prices beyond the reach of even highly successful professionals. The speculation has transformed this family-oriented gated community into a high-stakes investment target, fundamentally altering its character and accessibility.

Coto de Caza – Gated Community Becomes Investment Fortress

Coto de Caza is a guard-gated community in Orange County, originally developed as an upscale family destination with extensive recreational amenities. The community features golf courses, equestrian facilities, hiking trails, and family-friendly amenities within a secure, controlled environment. Located in the foothills between Orange County and Riverside County, Coto de Caza has traditionally attracted affluent families seeking privacy and recreational opportunities while maintaining reasonable access to employment centers.

The transformation affects the community’s social fabric and recreational programs. Many activities and organizations that depended on stable family populations find their participation declining as residential turnover increases. The equestrian facilities, youth programs, and community events that defined Coto de Caza’s family character face disruption as the resident population becomes more transient and investment-focused. The feeding frenzy threatens to hollow out the community engagement that originally made the development attractive.

3. Rancho Mirage – Investor Feeding Frenzy Factor 292.48% (June 2025)

- Historical annual growth rate (2010–2019): 2.16%

- Recent annual growth rate (2021–2025): 8.49%

- Investor Feeding Frenzy Factor: 292.48%

- Current 2025 price: $863,159

Rancho Mirage demonstrates how desert communities have become battlegrounds for investor speculation, with growth rates quadrupling from 2.16% to over 8% annually. This Coachella Valley city, traditionally popular with retirees and seasonal residents, now faces median prices exceeding $863,000 that challenge its accessibility. The feeding frenzy has transformed this desert retreat from an affordable luxury alternative into another high-priced investment target, threatening to eliminate the middle-class retirees who built its community character.

Rancho Mirage – Desert Dreams Meet Investment Reality

Situated in the heart of the Coachella Valley, Rancho Mirage has built its identity as “The Playground of Presidents,” having hosted numerous political leaders and celebrities at its luxury resorts and private clubs. The city offers a more affordable alternative to nearby Indian Wells and Palm Desert while maintaining access to world-class golf, dining, and cultural amenities. Its location provides stunning desert and mountain views in a setting that has attracted retirees and seasonal residents for decades.

The investor feeding frenzy has been driven by recognition of Rancho Mirage as an undervalued market within the prestigious Coachella Valley. Properties that once provided accessible luxury for middle-class retirees now compete with investment capital seeking to capitalize on the area’s growing reputation. The speculation has been particularly intense for properties near golf courses and with mountain views, as investors recognize the limited supply of such premium locations.

2. Villa Park – Investor Feeding Frenzy Factor 299.22% (June 2025)

- Historical annual growth rate (2010–2019): 2.82%

- Recent annual growth rate (2021–2025): 11.25%

- Investor Feeding Frenzy Factor: 299.22%

- Current 2025 price: $2,307,838

Villa Park exemplifies how exclusive suburban enclaves have become victims of extreme investor speculation, with growth rates exploding from 2.82% to over 11% annually. This tiny Orange County city now commands median prices exceeding $2.3 million, representing a feeding frenzy that has reached nearly 300% of historical norms. The speculation has transformed this family-oriented community into an ultra-expensive investment target, eliminating accessibility for all but the wealthiest buyers and investors.

Villa Park – Small City, Massive Speculation

Villa Park holds the distinction of being Orange County’s smallest incorporated city, with approximately 5,800 residents living in a community that emphasizes large lots and estate-style living. Founded in 1962, the city is largely zoned for single-family residences on lots that average about 20,000 square feet, or 1⁄2 acre, in size. The median household income is $204,750 with a median property value of $1.69M and a homeownership rate of 88.2%. The community’s character revolves around privacy, large properties, and minimal commercial development.

The investor feeding frenzy has been particularly devastating due to Villa Park’s extremely limited housing stock. Within the city limits there is one small shopping center, and the city has winding streets with few sidewalks and limited street lights. When fewer than 2,000 housing units exist in the entire city, even modest investor activity can create dramatic price swings. The speculation has intensified as investors recognize Villa Park’s rarity – one of the few remaining Orange County communities where large lots and privacy remain available, albeit at astronomical prices.

1. Carlsbad – Investor Feeding Frenzy Factor 1,224.54% (June 2025)

- Historical annual growth rate (2010–2019): 0.78%

- Recent annual growth rate (2021–2025): 10.28%

- Investor Feeding Frenzy Factor: 1,224.54%

- Current 2025 price: $1,237,171

Carlsbad represents the most extreme case of investor feeding frenzy in California, with growth rates exploding from under 1% to over 10% annually – a staggering 1,224% increase over historical patterns. This San Diego County coastal city now commands median prices exceeding $1.2 million, creating a speculative bubble that has completely overwhelmed normal market dynamics. The feeding frenzy has transformed this once-accessible beach community into a high-stakes investment battleground, eliminating any possibility of affordability for working families.

Carlsbad – Beach City Becomes Investment Tsunami

Carlsbad is a beach city in the North County area of San Diego County, California, located 35 miles north of downtown San Diego and 87 miles south of downtown Los Angeles. With a population of 112,542 and a median household income of $139,326, the city has traditionally attracted families seeking coastal living with access to major employment centers. The city is known as “Titanium Valley” because of its golf manufacturing industry, with companies like Callaway Golf, TaylorMade, Cobra Golf, and Titleist all located there.

The investor feeding frenzy has been driven by Carlsbad’s unique combination of coastal location, business-friendly environment, and family amenities. The city features attractions like Legoland California and is home to the nation’s largest desalination plant. The dramatic price acceleration from minimal historical growth to double-digit annual increases represents one of the most extreme speculative bubbles documented in California housing markets. Properties that experienced virtually no appreciation for a decade suddenly became hot investment targets, creating unprecedented price volatility.