Would you like to save this?

The latest Zillow Home Value Index puts Wyoming’s median home value at $338,888—yet many towns across the state remain well below that mark. These 18 communities offer rare affordability in the Mountain West, blending scenic landscapes with deep roots in ranching, mining, and small-town resilience. Their housing prices reflect more than market forces: they tell a story of local economies in flux, shaped by energy booms, tourism shifts, and decades of adaptation.

18. Marbleton – 18.1% Home Price Increase Since 2017

- 2017: $214,702

- 2018: $201,525 (-$13,177, -6.14% from previous year)

- 2019: $180,497 (-$21,028, -10.43% from previous year)

- 2021: $200,149

- 2022: $199,232 (-$917, -0.46% from previous year)

- 2023: $213,985 (+$14,753, +7.40% from previous year)

- 2024: $232,719 (+$18,734, +8.76% from previous year)

- 2025: $253,485 (+$20,766, +8.93% from previous year)

Marbleton’s housing market demonstrates the volatility common in smaller Wyoming communities, with significant declines from 2017 to 2019 followed by steady recovery. The current median home value of $253,485 represents an 18.1% increase from the 2017 baseline, though the town experienced a notable dip during the late 2010s energy downturn. Recent price acceleration suggests renewed confidence in this western Wyoming community.

Marbleton – Energy Sector Recovery Drives Recent Growth

Located in western Wyoming’s Sublette County, Marbleton sits in the heart of one of America’s most productive natural gas regions. The town’s proximity to the Pinedale Anticline and Jonah Field has historically tied its fortunes to energy extraction, explaining both the dramatic price decline during the natural gas downturn and the recent recovery as commodity prices stabilized. Current home values at $253,485 reflect this renewed optimism in the energy sector.

The community of roughly 1,100 residents benefits from its location along Highway 189, providing easy access to both Jackson and Rock Springs. Marbleton’s rural character appeals to families seeking small-town life while maintaining connection to larger employment centers. The town features basic amenities including a school, post office, and several local businesses that serve the surrounding ranching and energy communities.

Housing market trends in Marbleton closely mirror broader energy sector cycles, with the recent 8.93% annual increase suggesting optimism about long-term natural gas demand. The town’s affordable housing costs, combined with proximity to outdoor recreation opportunities in the Bridger-Teton National Forest, position it as an attractive option for energy workers and retirees seeking mountain west living at accessible prices.

17. Newcastle – 54.0% Home Price Increase Since 2014

- 2014: $161,962

- 2015: $167,629 (+$5,667, +3.50% from previous year)

- 2016: $172,965 (+$5,336, +3.18% from previous year)

- 2017: $169,256 (-$3,709, -2.14% from previous year)

- 2018: $172,756 (+$3,500, +2.07% from previous year)

- 2019: $171,111 (-$1,645, -0.95% from previous year)

- 2021: $194,553

- 2022: $213,804 (+$19,251, +9.89% from previous year)

- 2023: $227,035 (+$13,231, +6.19% from previous year)

- 2024: $237,092 (+$10,057, +4.43% from previous year)

- 2025: $249,391 (+$12,299, +5.19% from previous year)

Newcastle shows remarkable housing market stability with consistent growth over the past decade. Starting from $161,962 in 2014, home values have climbed steadily to $249,391 in May 2025, representing a 54% increase. The market maintained relatively modest annual gains through the 2010s before accelerating during the pandemic era, with particularly strong growth in 2022 when prices jumped nearly 10%.

Newcastle – Black Hills Gateway With Mining Heritage

Nestled in northeastern Wyoming near the South Dakota border, Newcastle serves as a gateway to the Black Hills region while maintaining its identity as a historic mining community. The town of approximately 3,200 residents sits along Highway 16, providing direct access to Mount Rushmore and the broader Black Hills recreation area. This strategic location has helped stabilize the local economy beyond traditional mining activities, contributing to steady home price appreciation.

The community’s economy historically centered on coal mining and oil extraction, but has successfully transitioned toward a more diverse base including tourism services, agriculture, and small manufacturing. Newcastle’s proximity to the Black Hills National Forest provides residents with exceptional access to outdoor recreation, from hiking and fishing to winter sports. The town maintains a full range of amenities including hospitals, schools, and retail services that support both locals and tourists.

Current home values at $249,391 reflect Newcastle’s successful economic transition and appeal as a small city with big-town amenities. The steady 5.19% annual price growth suggests healthy demand driven by both local employment opportunities and the town’s attractiveness to retirees drawn by affordable living costs and outdoor recreation access. Newcastle’s housing market benefits from its role as a regional service center while avoiding the extreme price volatility seen in more tourism-dependent communities.

16. Kemmerer – 60.2% Home Price Increase Since 2016

- 2016: $153,074

- 2017: $147,276 (-$5,798, -3.79% from previous year)

- 2018: $146,112 (-$1,164, -0.79% from previous year)

- 2019: $141,341 (-$4,771, -3.27% from previous year)

- 2021: $157,618

- 2022: $190,591 (+$32,973, +20.92% from previous year)

- 2023: $203,422 (+$12,831, +6.73% from previous year)

- 2024: $213,498 (+$10,076, +4.95% from previous year)

- 2025: $245,136 (+$31,638, +14.82% from previous year)

Kemmerer experienced a dramatic housing market transformation, declining from 2016 to 2019 before launching into spectacular growth. Home values dropped to $141,341 by 2019, only to surge 60.2% to $245,136 by May 2025. The most recent year saw particularly strong gains of 14.82%, suggesting continued momentum in this fossil fuel-rich region of southwestern Wyoming.

Kemmerer – Coal Country Comeback Story

Would you like to save this?

Known as the birthplace of J.C. Penney and home to some of the world’s largest coal deposits, Kemmerer sits in Lincoln County where energy extraction drives economic activity. The town’s recent housing boom correlates directly with renewed investment in coal mining operations and the development of advanced coal technologies. Current median home values of $245,136 reflect optimism about the community’s energy future, despite broader national trends away from coal consumption.

The community of roughly 2,600 residents benefits from its location near Fossil Butte National Monument and proximity to excellent fishing and hunting opportunities. Kemmerer serves as a regional hub for southwestern Wyoming, offering medical facilities, schools, and retail services that support surrounding rural areas. The town’s historic downtown maintains its early 20th-century character while adapting to modern economic realities.

Housing market dynamics in Kemmerer demonstrate the continued importance of energy sector employment in rural Wyoming communities. The dramatic 14.82% price increase in the past year suggests strong demand driven by energy worker migration and limited housing supply. For buyers seeking exposure to Wyoming’s energy economy at relatively affordable prices, Kemmerer represents both opportunity and the inherent volatility of resource-dependent markets.

15. Worland – 73.0% Home Price Increase Since 2012

- 2012: $140,977

- 2013: $141,897 (+$920, +0.65% from previous year)

- 2014: $142,855 (+$958, +0.68% from previous year)

- 2015: $145,938 (+$3,083, +2.16% from previous year)

- 2016: $154,371 (+$8,433, +5.78% from previous year)

- 2017: $156,948 (+$2,577, +1.67% from previous year)

- 2018: $157,465 (+$517, +0.33% from previous year)

- 2019: $159,601 (+$2,136, +1.36% from previous year)

- 2021: $177,810

- 2022: $210,433 (+$32,623, +18.35% from previous year)

- 2023: $222,479 (+$12,046, +5.72% from previous year)

- 2024: $231,354 (+$8,875, +3.99% from previous year)

- 2025: $243,979 (+$12,625, +5.46% from previous year)

Worland demonstrates exceptional long-term housing appreciation, with home values climbing from $140,977 in 2012 to $243,979 in May 2025. This 73% increase reflects gradual but consistent growth through the 2010s, followed by acceleration during the pandemic era. The 18.35% jump in 2022 marked the strongest single-year gain, while recent growth has moderated to a healthy 5.46% annual pace.

Worland – Agricultural Hub With Energy Connections

Located in north-central Wyoming’s Bighorn Basin, Worland serves as the commercial center for one of the state’s most productive agricultural regions. The town of approximately 5,100 residents sits along the Bighorn River, where irrigation supports sugar beet farming, alfalfa production, and cattle ranching. This agricultural foundation provides economic stability that has supported steady housing appreciation over more than a decade.

Beyond agriculture, Worland benefits from its position on Highway 20, connecting the Bighorn Basin to regional energy and tourism centers. The community features comprehensive amenities including a regional hospital, community college campus, and full retail services. Worland’s proximity to the Bighorn National Forest and world-class fishing on the Bighorn River adds recreational appeal that attracts both residents and visitors.

Current home values at $243,979 reflect Worland’s successful balance of agricultural stability and economic diversification. The steady 5.46% annual appreciation suggests healthy market fundamentals driven by job growth in agriculture, energy services, and tourism support. For homebuyers seeking small-town character with urban amenities in an outdoor recreation paradise, Worland offers compelling value in Wyoming’s competitive housing market.

14. Greybull – 93.5% Home Price Increase Since 2010

- 2010: $124,656

- 2011: $122,871 (-$1,785, -1.43% from previous year)

- 2012: $132,121 (+$9,250, +7.53% from previous year)

- 2013: $129,706 (-$2,415, -1.83% from previous year)

- 2014: $128,397 (-$1,309, -1.01% from previous year)

- 2015: $133,729 (+$5,332, +4.15% from previous year)

- 2016: $143,280 (+$9,551, +7.14% from previous year)

- 2017: $140,502 (-$2,778, -1.94% from previous year)

- 2018: $140,415 (-$87, -0.06% from previous year)

- 2019: $140,353 (-$62, -0.04% from previous year)

- 2021: $179,335

- 2022: $211,737 (+$32,402, +18.07% from previous year)

- 2023: $225,560 (+$13,823, +6.53% from previous year)

- 2024: $230,275 (+$4,715, +2.09% from previous year)

- 2025: $241,094 (+$10,819, +4.70% from previous year)

Greybull shows impressive long-term housing growth, nearly doubling from $124,656 in 2010 to $241,094 in May 2025. The market experienced moderate volatility through the 2010s before exploding with an 18.07% gain in 2022. Recent appreciation has normalized to 4.70% annually, suggesting the market has found sustainable growth patterns after pandemic-era disruption.

Greybull – Museum Town At The Bighorn Basin Crossroads

Situated at the intersection of Highways 14, 16, and 20 in the Bighorn Basin, Greybull occupies a strategic position as a transportation and services hub. The town of roughly 1,800 residents serves surrounding agricultural areas while building a reputation as a paleontology destination, home to the Greybull Museum and numerous fossil dig sites. This unique combination of practical services and cultural attractions has contributed to steady housing demand and price appreciation.

Greybull’s economy balances traditional agriculture and energy services with emerging tourism related to paleontology and outdoor recreation. The town’s proximity to the Bighorn National Forest and Shell Canyon provides residents with exceptional access to hiking, fishing, and hunting opportunities. Local amenities include schools, medical facilities, and retail services that support both the immediate community and visitors exploring the fossil-rich Bighorn Basin.

Housing values at $241,094 reflect Greybull’s successful positioning as both a practical regional center and an emerging destination for scientific and recreational tourism. The moderate 4.70% annual appreciation suggests healthy fundamentals without speculative excess. For buyers interested in a community with genuine character and growth potential, Greybull offers affordable entry into one of Wyoming’s most geologically fascinating regions.

13. Torrington – 82.6% Home Price Increase Since 2012

- 2012: $128,647

- 2013: $129,925 (+$1,278, +0.99% from previous year)

- 2014: $131,860 (+$1,935, +1.49% from previous year)

- 2015: $133,811 (+$1,951, +1.48% from previous year)

- 2016: $140,739 (+$6,928, +5.18% from previous year)

- 2017: $139,423 (-$1,316, -0.93% from previous year)

- 2018: $143,339 (+$3,916, +2.81% from previous year)

- 2019: $148,291 (+$4,952, +3.45% from previous year)

- 2021: $169,672

- 2022: $200,867 (+$31,195, +18.38% from previous year)

- 2023: $213,195 (+$12,328, +6.14% from previous year)

- 2024: $224,206 (+$11,011, +5.17% from previous year)

- 2025: $234,817 (+$10,611, +4.73% from previous year)

Torrington exhibits steady long-term appreciation with home values rising from $128,647 in 2012 to $234,817 in May 2025, an 82.6% increase over 13 years. The market maintained gradual growth through the 2010s before accelerating dramatically in 2022 with an 18.38% gain. Recent years show healthy but moderated growth around 5% annually, indicating sustainable market conditions.

Torrington – Eastern Gateway Agricultural Center

Located in southeastern Wyoming near the Nebraska border, Torrington serves as the commercial hub for Goshen County’s extensive agricultural operations. The city of approximately 6,500 residents sits in the fertile North Platte River valley, where irrigation supports sugar beet processing, corn production, and cattle feeding operations. This agricultural foundation provides economic stability that has underpinned consistent housing appreciation over more than a decade.

Torrington’s economy centers on agriculture and related processing industries, with the Western Sugar Cooperative plant serving as a major employer. The community benefits from its position on Highway 26, providing access to Colorado’s Front Range markets while maintaining small-town character. Local amenities include Eastern Wyoming College, Goshen County Memorial Hospital, and retail services that support surrounding rural areas.

Current median home values at $234,817 reflect Torrington’s role as a stable agricultural center with diversified economic opportunities. The moderate 4.73% annual appreciation suggests healthy demand supported by steady employment in agriculture, education, and healthcare. For homebuyers seeking affordable small-city living with proximity to outdoor recreation in the Laramie Mountains, Torrington offers excellent value in Wyoming’s eastern agricultural region.

12. Byron – 67.4% Home Price Increase Since 2019

- 2019: $133,005

- 2021: $167,242

- 2022: $193,643 (+$26,401, +15.79% from previous year)

- 2023: $210,769 (+$17,126, +8.84% from previous year)

- 2024: $221,179 (+$10,410, +4.94% from previous year)

- 2025: $222,670 (+$1,491, +0.67% from previous year)

Byron demonstrates remarkable housing market growth in a short timeframe, with values jumping from $133,005 in 2019 to $222,670 in May 2025. This 67.4% increase over six years includes strong gains through 2023, followed by significant cooling with just 0.67% growth in the most recent year. The deceleration suggests the market may be finding equilibrium after rapid pandemic-era appreciation.

Byron – Bighorn Basin Agricultural Community

Nestled in the Bighorn Basin of north-central Wyoming, Byron is a small agricultural community that benefits from productive irrigated farmland and proximity to larger regional centers. The town of fewer than 600 residents sits along the Shoshone River, where water rights support alfalfa production, sugar beet farming, and cattle operations. Byron’s rural character and agricultural economy provide the foundation for its recent housing market growth.

The community’s economy revolves around agriculture, with many residents involved in farming, ranching, or agricultural services. Byron’s location between Cody and Worland provides access to employment and services in larger communities while maintaining the peaceful rural lifestyle that attracts newcomers. The area offers excellent access to outdoor recreation, including fishing on the Shoshone River and hunting in the nearby mountains.

Current home values at $222,670 reflect Byron’s appeal as an affordable rural community with strong agricultural foundations. The recent cooling to 0.67% annual growth suggests the market has absorbed earlier price increases and may be stabilizing. For buyers seeking rural Wyoming living with proximity to outdoor recreation and agricultural opportunities, Byron represents authentic small-town character at accessible prices.

11. Rock River – 44.0% Home Price Increase Since 2018

- 2018: $147,864

- 2019: $142,154 (-$5,710, -3.86% from previous year)

- 2021: $172,188

- 2022: $183,263 (+$11,075, +6.43% from previous year)

- 2023: $184,519 (+$1,256, +0.69% from previous year)

- 2024: $185,316 (+$797, +0.43% from previous year)

- 2025: $212,739 (+$27,423, +14.80% from previous year)

Rock River shows volatile but ultimately positive housing trends, declining from 2018 to 2019 before entering a growth phase that accelerated dramatically in the most recent year. Home values jumped from $147,864 in 2018 to $212,739 in May 2025, a 44% increase despite early weakness. The 14.80% gain in the past year suggests renewed confidence in this small southeastern Wyoming community.

Rock River – Railroad Town With Outdoor Appeal

Located along the Union Pacific Railroad in southeastern Wyoming, Rock River is a small community that has maintained its railroad heritage while adapting to modern economic realities. The town of approximately 230 residents sits between Laramie and Rawlins, providing access to larger employment centers while offering the solitude and outdoor recreation opportunities that characterize rural Wyoming living.

Rock River’s economy has traditionally centered on railroad operations and ranching, with the Union Pacific line providing transportation for agricultural products and energy commodities. The community’s proximity to Medicine Bow National Forest offers exceptional hunting and fishing opportunities, making it attractive to outdoor enthusiasts seeking affordable rural property. Despite its small size, Rock River maintains basic services and a strong sense of community identity.

Housing values at $212,739 reflect renewed interest in rural Wyoming properties, particularly those offering outdoor recreation access and potential for agricultural use. The dramatic 14.80% price increase suggests growing demand from buyers seeking rural retreats or investment properties. For those interested in authentic railroad town character with proximity to national forest lands, Rock River offers unique appeal at accessible price points.

10. La Grange – 92.7% Home Price Increase Since 2012

- 2012: $108,699

- 2013: $111,117 (+$2,418, +2.22% from previous year)

- 2014: $113,084 (+$1,967, +1.77% from previous year)

- 2015: $118,817 (+$5,733, +5.07% from previous year)

- 2016: $129,741 (+$10,924, +9.19% from previous year)

- 2017: $128,636 (-$1,105, -0.85% from previous year)

- 2018: $129,823 (+$1,187, +0.92% from previous year)

- 2019: $128,431 (-$1,392, -1.07% from previous year)

- 2021: $159,239

- 2022: $185,794 (+$26,555, +16.68% from previous year)

- 2023: $189,824 (+$4,030, +2.17% from previous year)

- 2024: $197,461 (+$7,637, +4.02% from previous year)

- 2025: $209,496 (+$12,035, +6.09% from previous year)

La Grange demonstrates impressive long-term housing appreciation, nearly doubling from $108,699 in 2012 to $209,496 in May 2025. The market showed steady but modest growth through the 2010s before accelerating in 2022 with a 16.68% jump. Recent years maintain healthy appreciation around 6% annually, suggesting sustainable growth patterns in this southeastern Wyoming community.

La Grange – Historic Crossroads Community

Situated in southeastern Wyoming along Highway 151, La Grange serves as a small crossroads community that has maintained its agricultural character while benefiting from proximity to larger employment centers. The town of fewer than 300 residents sits in an area where cattle ranching and dryland farming operations take advantage of the high plains environment. This rural setting appeals to those seeking affordable property with agricultural potential.

La Grange’s economy centers on agriculture and related services, with many residents involved in cattle operations or crop production. The community’s location provides access to employment opportunities in nearby Torrington while maintaining the peaceful rural lifestyle that characterizes much of eastern Wyoming. Local amenities are limited but adequate for the small population, with residents often traveling to Torrington or other regional centers for additional services.

Current median home values at $209,496 reflect La Grange’s appeal as an affordable rural community with agricultural foundations and growth potential. The healthy 6.09% annual appreciation suggests steady demand from buyers seeking rural property for agricultural use, recreation, or investment. For those interested in authentic rural Wyoming living with proximity to agricultural opportunities, La Grange offers excellent value in the state’s agricultural heartland.

9. Thermopolis – 85.3% Home Price Increase Since 2013

Would you like to save this?

- 2013: $110,781

- 2014: $115,196 (+$4,415, +3.98% from previous year)

- 2015: $118,032 (+$2,836, +2.46% from previous year)

- 2016: $120,176 (+$2,144, +1.82% from previous year)

- 2017: $123,795 (+$3,619, +3.01% from previous year)

- 2018: $126,920 (+$3,125, +2.52% from previous year)

- 2019: $130,818 (+$3,898, +3.07% from previous year)

- 2021: $140,284

- 2022: $166,796 (+$26,512, +18.90% from previous year)

- 2023: $184,210 (+$17,414, +10.44% from previous year)

- 2024: $193,631 (+$9,421, +5.12% from previous year)

- 2025: $205,231 (+$11,600, +5.99% from previous year)

Thermopolis showcases remarkable housing market consistency, with values climbing steadily from $110,781 in 2013 to $205,231 in May 2025, an 85.3% increase over 12 years. The market maintained modest but consistent growth through the 2010s before accelerating significantly in 2022-2023. Recent appreciation has moderated to a healthy 5.99% annual pace, indicating sustainable market fundamentals.

Thermopolis – Hot Springs Tourism And Agricultural Balance

Located in central Wyoming along the Bighorn River, Thermopolis is famous for hosting the world’s largest mineral hot springs and serves as the seat of Hot Springs County. The town of approximately 2,900 residents has successfully balanced its role as a tourist destination with traditional agricultural and energy sector employment. This economic diversification has supported steady housing appreciation while maintaining affordability compared to other western tourism destinations.

Thermopolis benefits from year-round tourism driven by Hot Springs State Park and the Wyoming Dinosaur Center, creating employment opportunities beyond traditional rural industries. The community features comprehensive amenities including hospitals, schools, and retail services that support both residents and visitors. The town’s location provides excellent access to outdoor recreation, including world-class fishing on the Bighorn River and hunting in the surrounding mountains.

Current home values at $205,231 reflect Thermopolis’s unique position as an affordable community with tourism infrastructure and natural amenities. The steady 5.99% appreciation suggests healthy demand from both local buyers and those seeking second homes or retirement properties. For homebuyers interested in a community with natural attractions, recreational opportunities, and tourism-related economic activity, Thermopolis offers compelling value in Wyoming’s competitive market.

8. Rawlins – 38.8% Home Price Increase Since 2010

- 2010: $143,815

- 2011: $142,543 (-$1,272, -0.88% from previous year)

- 2012: $134,298 (-$8,245, -5.78% from previous year)

- 2013: $145,541 (+$11,243, +8.37% from previous year)

- 2014: $151,646 (+$6,105, +4.19% from previous year)

- 2015: $161,196 (+$9,550, +6.30% from previous year)

- 2016: $169,050 (+$7,854, +4.87% from previous year)

- 2017: $165,083 (-$3,967, -2.35% from previous year)

- 2018: $164,096 (-$987, -0.60% from previous year)

- 2019: $166,377 (+$2,281, +1.39% from previous year)

- 2021: $174,753

- 2022: $186,652 (+$11,899, +6.81% from previous year)

- 2023: $189,822 (+$3,170, +1.70% from previous year)

- 2024: $188,629 (-$1,193, -0.63% from previous year)

- 2025: $199,622 (+$10,993, +5.83% from previous year)

Rawlins shows a complex housing pattern with early volatility followed by steady growth through the mid-2010s and recent market fluctuations. Home values rose from $143,815 in 2010 to $199,622 in May 2025, representing a 38.8% increase over 15 years. The market peaked around 2016 before moderating, with recent growth resuming at 5.83% annually after a slight decline in 2024.

Rawlins – Prison Town And Transportation Hub

Located in south-central Wyoming along Interstate 80, Rawlins serves as both a major transportation corridor and the site of the Wyoming State Penitentiary. The city of approximately 8,200 residents benefits from diverse employment including corrections, transportation, energy, and government services. This economic mix has provided relative stability during commodity price cycles that affect many Wyoming communities, contributing to steady long-term housing appreciation.

Rawlins functions as a regional service center for Carbon County, offering comprehensive amenities including Memorial Hospital of Carbon County, Western Wyoming Community College, and retail services. The community’s location along I-80 makes it a natural stopping point for cross-country travelers while providing residents with easy access to larger cities. Outdoor recreation opportunities abound in the nearby Medicine Bow and Sierra Madre mountains, offering excellent hunting, fishing, and winter sports.

Current median home values at $199,622 reflect Rawlins’s role as a stable regional center with diverse economic foundations. The recent 5.83% appreciation suggests renewed confidence following a brief market cooling period. For homebuyers seeking a larger community with urban amenities and proximity to outdoor recreation, Rawlins offers good value among Wyoming’s more substantial cities while maintaining affordability compared to resort communities.

7. Shoshoni – 62.2% Home Price Increase Since 2018

- 2018: $121,795

- 2019: $129,530 (+$7,735, +6.35% from previous year)

- 2021: $156,769

- 2022: $181,074 (+$24,305, +15.50% from previous year)

- 2023: $185,581 (+$4,507, +2.49% from previous year)

- 2024: $189,073 (+$3,492, +1.88% from previous year)

- 2025: $197,582 (+$8,509, +4.50% from previous year)

Shoshoni demonstrates strong housing market growth over a relatively short data period, with values climbing from $121,795 in 2018 to $197,582 in May 2025. This 62.2% increase includes particularly strong growth in 2022 when prices jumped 15.50%. Recent years show more moderate but steady appreciation around 4.5% annually, suggesting the market has found sustainable growth patterns.

Shoshoni – Wind River Basin Energy And Agriculture

Situated in central Wyoming’s Wind River Basin, Shoshoni serves as a small community that benefits from both energy development and agricultural activities. The town of roughly 650 residents sits at the intersection of Highways 20 and 26, providing access to regional employment centers while maintaining its rural character. The area’s energy resources and agricultural potential have attracted investment and population growth, contributing to recent housing appreciation.

Shoshoni’s economy balances traditional ranching with energy sector employment, as the Wind River Basin contains significant oil and gas reserves. The community’s location provides access to employment in nearby Riverton while offering the affordable living and rural lifestyle that appeals to many Wyoming residents. Local amenities are limited but adequate for the small population, with residents often traveling to larger communities for additional services.

Housing values at $197,582 reflect Shoshoni’s appeal as an affordable community with access to energy sector employment and agricultural opportunities. The moderate 4.50% annual appreciation suggests healthy demand from buyers seeking rural property with potential for appreciation. For those interested in small-town Wyoming living with proximity to energy development and outdoor recreation, Shoshoni offers authentic rural character at accessible prices.

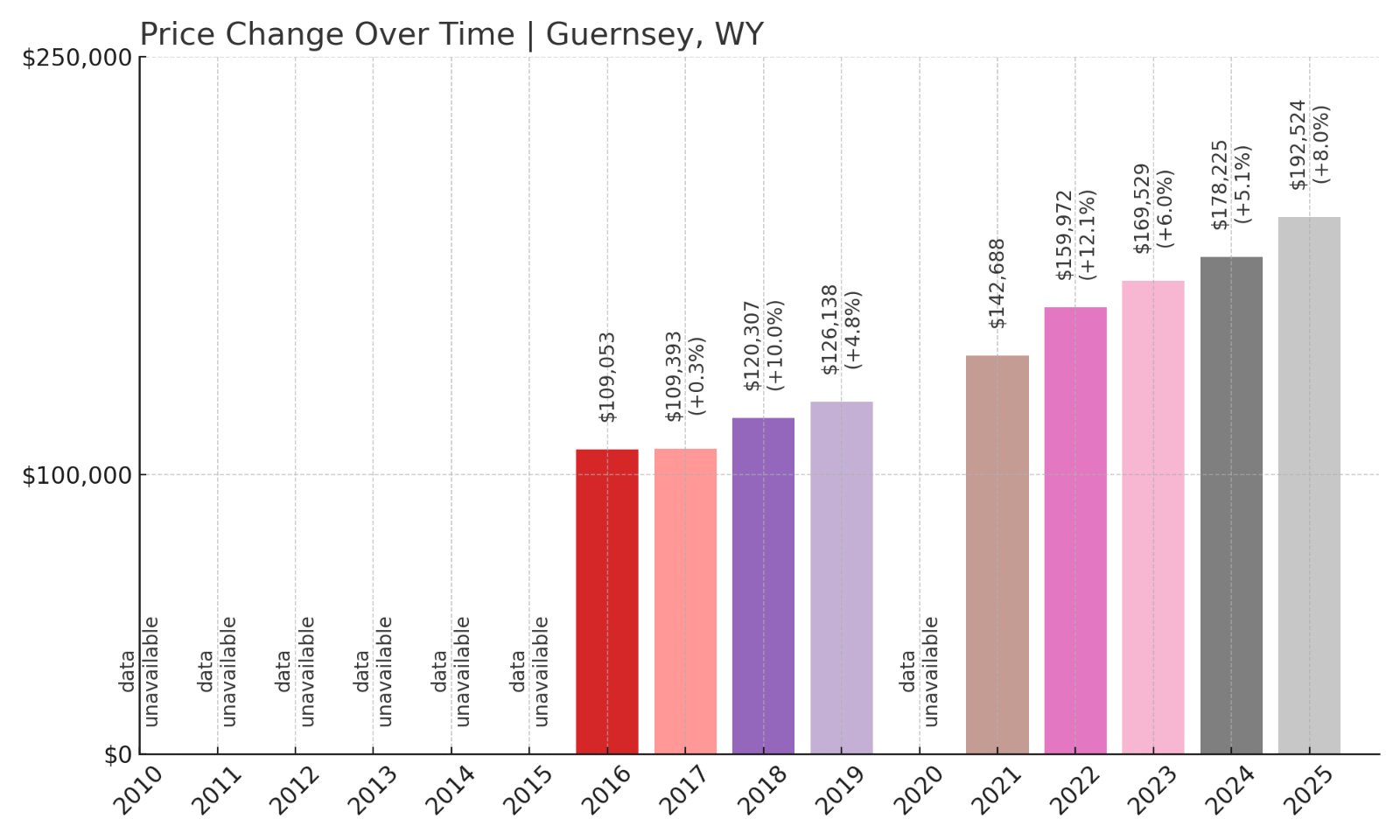

6. Guernsey – 76.6% Home Price Increase Since 2016

- 2016: $109,053

- 2017: $109,393 (+$340, +0.31% from previous year)

- 2018: $120,307 (+$10,914, +9.98% from previous year)

- 2019: $126,138 (+$5,831, +4.85% from previous year)

- 2021: $142,688

- 2022: $159,972 (+$17,284, +12.11% from previous year)

- 2023: $169,529 (+$9,557, +5.98% from previous year)

- 2024: $178,225 (+$8,696, +5.13% from previous year)

- 2025: $192,524 (+$14,299, +8.02% from previous year)

Guernsey shows impressive housing growth, with values rising from $109,053 in 2016 to $192,524 in May 2025, a 76.6% increase over nine years. The market demonstrated steady acceleration through the period, with particularly strong gains in recent years. The 8.02% appreciation in the past year suggests continued momentum in this southeastern Wyoming community near historic Oregon Trail sites.

Guernsey – Oregon Trail Heritage And Recreation

Located in southeastern Wyoming along the North Platte River, Guernsey is a small community rich in western history and natural beauty. The town of approximately 1,100 residents sits near Guernsey State Park and historic Oregon Trail sites, including the famous wagon wheel ruts at Register Cliff. This combination of historical significance and recreational opportunities has attracted both permanent residents and seasonal visitors, supporting steady housing appreciation.

Guernsey’s economy benefits from tourism related to its Oregon Trail heritage, recreational activities at Guernsey Reservoir, and proximity to agricultural operations. The community serves as a gateway to outdoor recreation including boating, fishing, hunting, and camping. Despite its small size, Guernsey maintains basic services and a strong community identity centered around its historical significance and natural amenities.

Current home values at $192,524 reflect Guernsey’s unique appeal as a historically significant community with excellent recreational access. The strong 8.02% annual appreciation suggests growing demand from buyers seeking rural property with tourism potential and outdoor recreation access. For those interested in western history and outdoor lifestyle at affordable prices, Guernsey offers authentic frontier character with modern conveniences.

5. Hudson – 24.5% Home Price Increase Since 2021

- 2021: $130,054

- 2022: $150,702 (+$20,648, +15.88% from previous year)

- 2023: $159,696 (+$8,994, +5.97% from previous year)

- 2024: $159,423 (-$273, -0.17% from previous year)

- 2025: $161,916 (+$2,493, +1.56% from previous year)

Hudson shows modest housing growth over a short data period, with values rising from $130,054 in 2021 to $161,916 in May 2025. This 24.5% increase includes strong initial growth in 2022, followed by market cooling and recent stabilization. The 1.56% appreciation in the past year suggests the market has found equilibrium after earlier volatility in this small western Wyoming community.

Hudson – Small Town Energy And Agriculture

Situated in western Wyoming’s Fremont County, Hudson is a small community that reflects the economic patterns typical of rural Wyoming towns. The community of fewer than 500 residents sits in an area where agriculture and energy development provide the primary economic foundation. Hudson’s rural character and affordable housing costs appeal to those seeking small-town living while maintaining access to employment in larger regional centers.

Hudson’s economy centers on agriculture, with cattle ranching and hay production serving as traditional economic anchors. The community’s proximity to energy development areas provides additional employment opportunities for residents willing to commute. Local amenities are limited but adequate for the small population, with residents often traveling to Lander or other regional centers for comprehensive services and shopping.

Housing values at $161,916 represent some of the most affordable options in Wyoming’s housing market, making Hudson attractive to first-time homebuyers and those seeking rural property investment opportunities. The modest 1.56% annual appreciation suggests stable market conditions without speculative pressure. For buyers seeking authentic small-town Wyoming living at the most accessible price points, Hudson offers rural character and potential for agricultural use.

4. Lusk – 50.0% Home Price Increase Since 2016

- 2016: $88,416

- 2017: $88,175 (-$241, -0.27% from previous year)

- 2018: $90,131 (+$1,956, +2.22% from previous year)

- 2019: $90,190 (+$59, +0.07% from previous year)

- 2021: $111,339

- 2022: $126,481 (+$15,142, +13.60% from previous year)

- 2023: $123,254 (-$3,227, -2.55% from previous year)

- 2024: $125,471 (+$2,217, +1.80% from previous year)

- 2025: $132,644 (+$7,173, +5.72% from previous year)

Lusk demonstrates significant long-term housing appreciation despite market volatility, with values climbing from $88,416 in 2016 to $132,644 in May 2025. This 50% increase includes periods of stagnation through 2019, strong pandemic-era growth, and recent stabilization with healthy 5.72% annual appreciation. The market shows resilience in this northeastern Wyoming agricultural community.

Lusk – Eastern Plains Agricultural Center

Located in northeastern Wyoming near the Nebraska border, Lusk serves as the seat of Niobrara County and a regional center for extensive cattle ranching operations. The town of approximately 1,500 residents sits in the heart of Wyoming’s eastern plains, where large-scale ranching operations take advantage of vast grasslands and proximity to corn belt markets. This agricultural foundation provides economic stability that has supported steady housing appreciation over the long term.

Lusk’s economy centers almost entirely on agriculture, with cattle ranching, hay production, and agricultural services providing the primary employment base. The community features comprehensive rural amenities including Niobrara County Memorial Hospital, schools, and retail services that support surrounding ranch operations. The town’s location along Highway 20 provides access to regional markets while maintaining the authentic rural character that defines eastern Wyoming.

Current median home values at $132,644 represent exceptional affordability in Wyoming’s housing market, making Lusk attractive to those seeking rural property for agricultural use or investment. The healthy 5.72% annual appreciation suggests steady demand from buyers interested in authentic ranch country living. For homebuyers seeking the most affordable entry point into Wyoming’s agricultural economy, Lusk offers genuine ranch town character with room for growth.

3. Hanna – 79.2% Home Price Increase Since 2010

- 2010: $66,985

- 2011: $65,604 (-$1,381, -2.06% from previous year)

- 2012: $61,966 (-$3,638, -5.55% from previous year)

- 2013: $64,683 (+$2,717, +4.38% from previous year)

- 2014: $66,077 (+$1,394, +2.15% from previous year)

- 2015: $62,387 (-$3,690, -5.58% from previous year)

- 2016: $63,854 (+$1,467, +2.35% from previous year)

- 2017: $65,376 (+$1,522, +2.38% from previous year)

- 2018: $71,890 (+$6,514, +9.97% from previous year)

- 2019: $70,875 (-$1,015, -1.41% from previous year)

- 2021: $75,288

- 2022: $82,719 (+$7,431, +9.87% from previous year)

- 2023: $101,825 (+$19,106, +23.10% from previous year)

- 2024: $116,745 (+$14,920, +14.65% from previous year)

- 2025: $120,024 (+$3,279, +2.81% from previous year)

Hanna shows dramatic housing market transformation, with values climbing from $66,985 in 2010 to $120,024 in May 2025, a 79.2% increase over 15 years. The market experienced significant volatility through the 2010s before exploding with exceptional growth in recent years, particularly the 23.10% jump in 2023. Recent moderation to 2.81% growth suggests the market may be stabilizing after rapid appreciation.

Hanna – Mining Heritage And Energy Transition

Located in south-central Wyoming along Highway 30, Hanna is a former coal mining town that has experienced remarkable economic and housing market revival. The community of approximately 800 residents has historical ties to Union Pacific Railroad coal operations and has successfully transitioned toward diverse economic activities including wind energy development and tourism. This economic transformation explains the dramatic housing appreciation as the community attracts new residents and investment.

Hanna’s economy has evolved from traditional coal mining toward renewable energy, with several wind farms operating in the surrounding area. The town’s proximity to the Sierra Madre Mountains provides excellent outdoor recreation opportunities, including hunting, fishing, and off-road vehicle access. Despite its small size, Hanna maintains basic services and has benefited from infrastructure improvements that support both residents and visitors exploring the region.

Housing values at $120,024 reflect Hanna’s successful economic transition and growing appeal as an affordable mountain community. The recent moderation in price growth suggests the market has absorbed earlier rapid appreciation and may be finding sustainable levels. For buyers seeking an authentic former mining town with outdoor recreation access and potential for continued growth, Hanna offers unique character at still-affordable prices.

2. Superior – 12.6% Home Price Decrease Since 2016

- 2016: $95,271

- 2017: $82,300 (-$12,971, -13.62% from previous year)

- 2018: $78,134 (-$4,166, -5.06% from previous year)

- 2019: $79,819 (+$1,685, +2.16% from previous year)

- 2021: $92,585

- 2022: $91,767 (-$818, -0.88% from previous year)

- 2023: $87,641 (-$4,126, -4.49% from previous year)

- 2024: $84,243 (-$3,398, -3.88% from previous year)

- 2025: $83,198 (-$1,045, -1.24% from previous year)

Superior presents a unique housing market pattern among Wyoming communities, with values declining from $95,271 in 2016 to $83,198 in May 2025, a 12.6% decrease over nine years. The market has shown persistent weakness with only brief recovery periods, making it one of the few Wyoming communities experiencing ongoing price declines. This trend reflects economic challenges in this former mining community.

Superior – Mining Legacy And Economic Challenges

Located in southwestern Wyoming’s Sweetwater County, Superior is a small former coal mining town that has struggled with economic transition as mining operations ceased. The community of fewer than 300 residents faces the challenges common to many former extraction industry towns, including population decline and limited economic diversification. These factors explain the ongoing housing market weakness and declining property values.

Superior’s economy has been severely impacted by the closure of coal mining operations that once provided the community’s economic foundation. Limited employment opportunities have led to outmigration, reducing housing demand and contributing to price declines. The town’s remote location and lack of economic alternatives have made recovery difficult, though the extremely low housing costs may eventually attract buyers seeking affordable rural property.

Current home values at $83,198 represent among the most affordable housing in Wyoming, though buyers should carefully consider the economic challenges facing the community. The ongoing price declines suggest limited near-term appreciation potential, making Superior primarily suitable for cash buyers seeking minimal investment or those interested in supporting community revitalization efforts. For the right buyer, Superior offers authentic small-town character at unprecedented affordability.

1. Midwest – 16.6% Home Price Decrease Since 2019

- 2019: $68,272

- 2021: $85,167

- 2022: $79,672 (-$5,495, -6.45% from previous year)

- 2023: $74,975 (-$4,697, -5.89% from previous year)

- 2024: $65,583 (-$9,392, -12.53% from previous year)

- 2025: $56,954 (-$8,629, -13.15% from previous year)

Midwest shows the most challenging housing market conditions among Wyoming communities, with values declining from $68,272 in 2019 to $56,954 in May 2025. This 16.6% decrease includes accelerating declines in recent years, with the 13.15% drop in the past year representing severe market stress. These conditions reflect significant economic challenges in this former oil industry town.

Midwest – Oil Boom Legacy And Economic Struggle

Located in central Wyoming’s Natrona County, Midwest is a small community that experienced both boom and bust cycles tied to oil industry development. The town of approximately 400 residents was established during early 20th-century oil discoveries but has struggled as production shifted to other areas and extraction methods changed. The dramatic housing price declines reflect ongoing population loss and limited economic opportunities.

Midwest’s economy was historically centered on oil production and refining operations, but changes in the energy industry have left the community with few viable economic alternatives. The town’s small size and remote location have made economic diversification difficult, leading to continued outmigration and declining housing demand. Basic services remain limited, with residents often traveling to Casper for comprehensive amenities and employment opportunities.

Housing values at $56,954 represent the absolute bottom of Wyoming’s affordable housing market, though potential buyers should carefully evaluate the community’s long-term viability. The accelerating price declines suggest ongoing economic distress that may continue until new economic opportunities emerge. For buyers willing to accept significant risk, Midwest offers the state’s most affordable housing, though investment potential appears limited without substantial economic revival efforts.