Would you like to save this?

The numbers don’t lie—Zillow’s Home Value Index shows house prices in parts of Alabama have taken off since 2010, especially in spots that used to fly under the radar. From quiet lake towns to fast-growing suburbs, some places have seen home values double or even triple, turning everyday houses into hot property. These 18 towns now rank among the priciest in the state—and each has its own mix of charm, demand, and sky-high price tags.

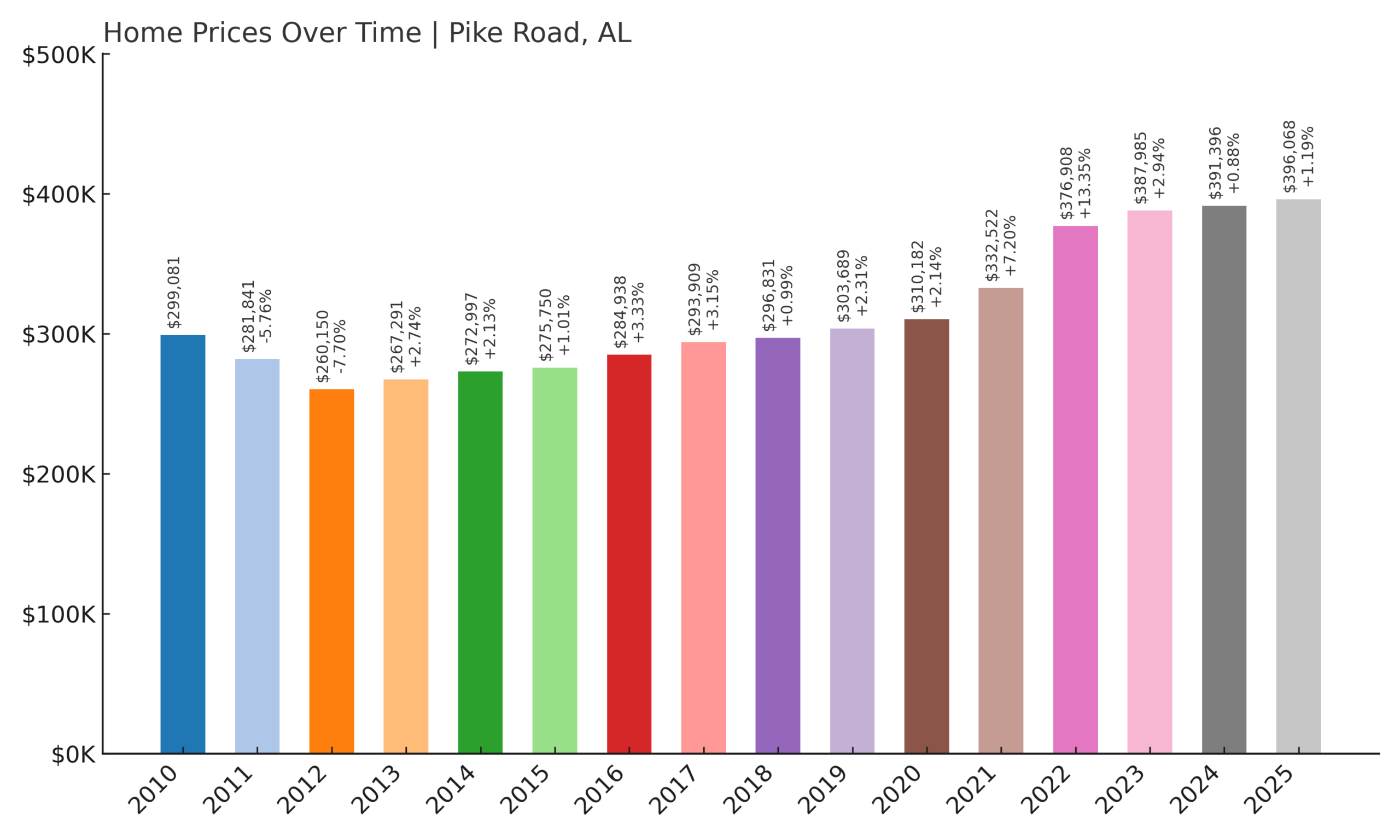

18. Pike Road – 32.4% Home Price Increase Since 2010

- 2010: $299,081

- 2011: $281,841 (-$17,240, -5.76% from previous year)

- 2012: $260,150 (-$21,691, -7.70% from previous year)

- 2013: $267,291 (+$7,141, +2.74% from previous year)

- 2014: $272,997 (+$5,706, +2.13% from previous year)

- 2015: $275,750 (+$2,753, +1.01% from previous year)

- 2016: $284,938 (+$9,188, +3.33% from previous year)

- 2017: $293,909 (+$8,971, +3.15% from previous year)

- 2018: $296,831 (+$2,922, +0.99% from previous year)

- 2019: $303,689 (+$6,858, +2.31% from previous year)

- 2020: $310,182 (+$6,493, +2.14% from previous year)

- 2021: $332,522 (+$22,340, +7.20% from previous year)

- 2022: $376,908 (+$44,386, +13.35% from previous year)

- 2023: $387,985 (+$11,077, +2.94% from previous year)

- 2024: $391,396 (+$3,411, +0.88% from previous year)

- 2025: $396,068 (+$4,672, +1.19% from previous year)

Pike Road’s housing market has grown gradually but steadily over the last 15 years, posting a 32.4% increase since 2010. After a dip during the early 2010s, the market stabilized and began posting modest yearly gains. A sharp uptick occurred between 2020 and 2022, when values jumped by more than 13% in a single year—one of the town’s most active growth periods. While the pace has cooled since then, Pike Road has remained consistently upward trending with low volatility. The current average home value stands just shy of $400,000, reflecting growing demand in the area without extreme fluctuations.

Pike Road – A Growing Suburb Near Montgomery

Pike Road is a small but fast-developing community located just outside Montgomery, Alabama’s capital city. Over the past decade, it has become an increasingly attractive option for families and professionals seeking quiet neighborhoods with access to city amenities. The town has invested heavily in infrastructure and education, including the Pike Road School System, which is one of the top-rated public systems in the region. This reputation for quality education has helped fuel home demand, especially among families with young children. Its blend of rural charm and suburban planning has set it apart from nearby communities that lack cohesive development plans.

Unlike some Alabama markets that saw erratic price spikes, Pike Road’s home values have risen with relative consistency. The town saw its sharpest growth post-2020, likely tied to national shifts in work and living preferences, but avoided the dramatic surges and corrections seen elsewhere. The proximity to Montgomery makes it convenient for commuters, yet Pike Road retains a spacious, semi-rural feel that appeals to buyers who value land and quiet surroundings. With room for continued development and a growing reputation as a family-friendly town, Pike Road is expected to remain a solid performer in the state’s housing market going forward.

17. Auburn – 92.2% Home Price Increase Since 2010

- 2010: $209,123

- 2011: $198,708 (-$10,415, -4.98% from previous year)

- 2012: $198,055 (-$653, -0.33% from previous year)

- 2013: $205,385 (+$7,330, +3.70% from previous year)

- 2014: $210,299 (+$4,914, +2.39% from previous year)

- 2015: $214,130 (+$3,831, +1.82% from previous year)

- 2016: $226,021 (+$11,891, +5.55% from previous year)

- 2017: $243,889 (+$17,868, +7.91% from previous year)

- 2018: $259,401 (+$15,512, +6.36% from previous year)

- 2019: $277,161 (+$17,760, +6.85% from previous year)

- 2020: $285,576 (+$8,415, +3.04% from previous year)

- 2021: $311,622 (+$26,046, +9.12% from previous year)

- 2022: $351,078 (+$39,456, +12.66% from previous year)

- 2023: $369,864 (+$18,786, +5.35% from previous year)

- 2024: $390,679 (+$20,815, +5.63% from previous year)

- 2025: $402,071 (+$11,392, +2.92% from previous year)

Auburn’s housing market has expanded dramatically over the past decade and a half, with prices growing by more than 92% since 2010. The city recovered quickly from a mild downturn in the early 2010s, posting strong year-over-year gains beginning in 2016. The steepest growth came between 2020 and 2022, when values surged by over $65,000 in just two years. Since then, the pace has steadied, with modest annual increases suggesting a more balanced market. The current home price hovers above $400,000, making Auburn one of Alabama’s most consistently rising markets over the long term.

Auburn – University Town with Strong Market Appeal

Were You Meant

to Live In?

Auburn is widely known as the home of Auburn University, a major public research university that helps anchor the city’s economy and housing demand. College towns often enjoy steady real estate growth due to a stable population base and regular turnover in residents. But Auburn has expanded beyond its academic roots. It now boasts a growing job market in healthcare, education, and technology, along with new retail and residential developments that have drawn more permanent residents. With vibrant downtown amenities, parks, and high walkability, the city offers a blend of livability and investment potential.

The consistent demand from students, faculty, retirees, and young families has helped shield Auburn from the volatility seen in smaller markets. New construction on the outskirts has kept pace with population growth, preventing price surges from overheating. That said, the jump from 2020 to 2022 signals that Auburn was not immune to the pandemic-era housing boom. As of 2025, the town continues to see healthy interest from both locals and out-of-state buyers. Its reputation for educational excellence and stable pricing trajectory keeps Auburn on the radar for buyers seeking long-term value in Alabama’s real estate landscape.

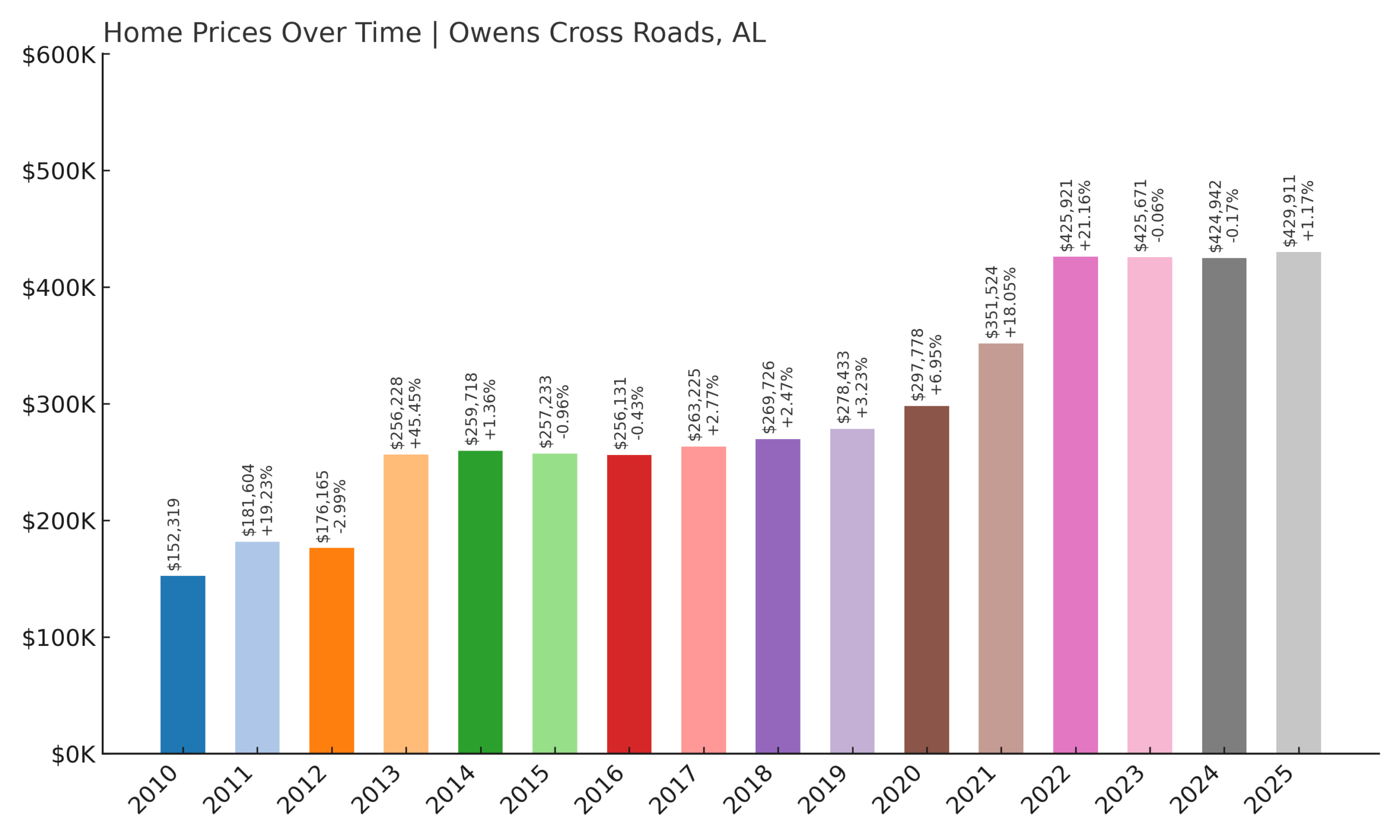

16. Owens Cross Roads – 182.2% Home Price Increase Since 2010

- 2010: $152,319

- 2011: $181,604 (+$29,285, +19.23% from previous year)

- 2012: $176,165 (-$5,439, -2.99% from previous year)

- 2013: $256,228 (+$80,063, +45.45% from previous year)

- 2014: $259,718 (+$3,490, +1.36% from previous year)

- 2015: $257,233 (-$2,485, -0.96% from previous year)

- 2016: $256,131 (-$1,102, -0.43% from previous year)

- 2017: $263,225 (+$7,094, +2.77% from previous year)

- 2018: $269,726 (+$6,501, +2.47% from previous year)

- 2019: $278,433 (+$8,707, +3.23% from previous year)

- 2020: $297,778 (+$19,345, +6.95% from previous year)

- 2021: $351,524 (+$53,746, +18.05% from previous year)

- 2022: $425,921 (+$74,397, +21.16% from previous year)

- 2023: $425,671 (-$250, -0.06% from previous year)

- 2024: $424,942 (-$729, -0.17% from previous year)

- 2025: $429,911 (+$4,969, +1.17% from previous year)

Owens Cross Roads experienced one of the most dramatic price surges in Alabama, with values rising 182.2% since 2010. The most explosive year was 2013, when prices jumped by over 45%—likely the result of new development activity and early regional demand. After leveling out for several years, a second wave of rapid growth hit post-2020. Home values spiked more than $125,000 between 2020 and 2022 alone, signaling intense buyer interest and possibly a wave of in-migration tied to the Huntsville tech boom. Though prices have stabilized recently, the town remains far above its 2010 baseline.

Owens Cross Roads – Tech-Driven Growth Outside Huntsville

Owens Cross Roads sits just 15 miles southeast of Huntsville, one of the fastest-growing cities in the South. Its location places it squarely in the path of Huntsville’s expanding economy, especially in aerospace, defense, and tech. As companies like Boeing, Blue Origin, and others have grown their local presence, employees and families have sought out quieter, more affordable communities nearby. Owens Cross Roads fits that bill, offering newer homes, mountain views, and access to trails and natural parks, all within commuting distance of Huntsville’s job centers.

The town has seen substantial residential development in the past decade, transforming it from a rural area into a desirable suburban hub. While early growth was sporadic, the consistent gains since 2017 have positioned Owens Cross Roads as one of Alabama’s most watched housing markets. Even with slight declines in 2023 and 2024, the 2025 figures remain strong, and demand appears stable. The town’s ability to blend affordability, proximity to high-paying jobs, and scenic surroundings gives it a strong foundation heading into the next housing cycle.

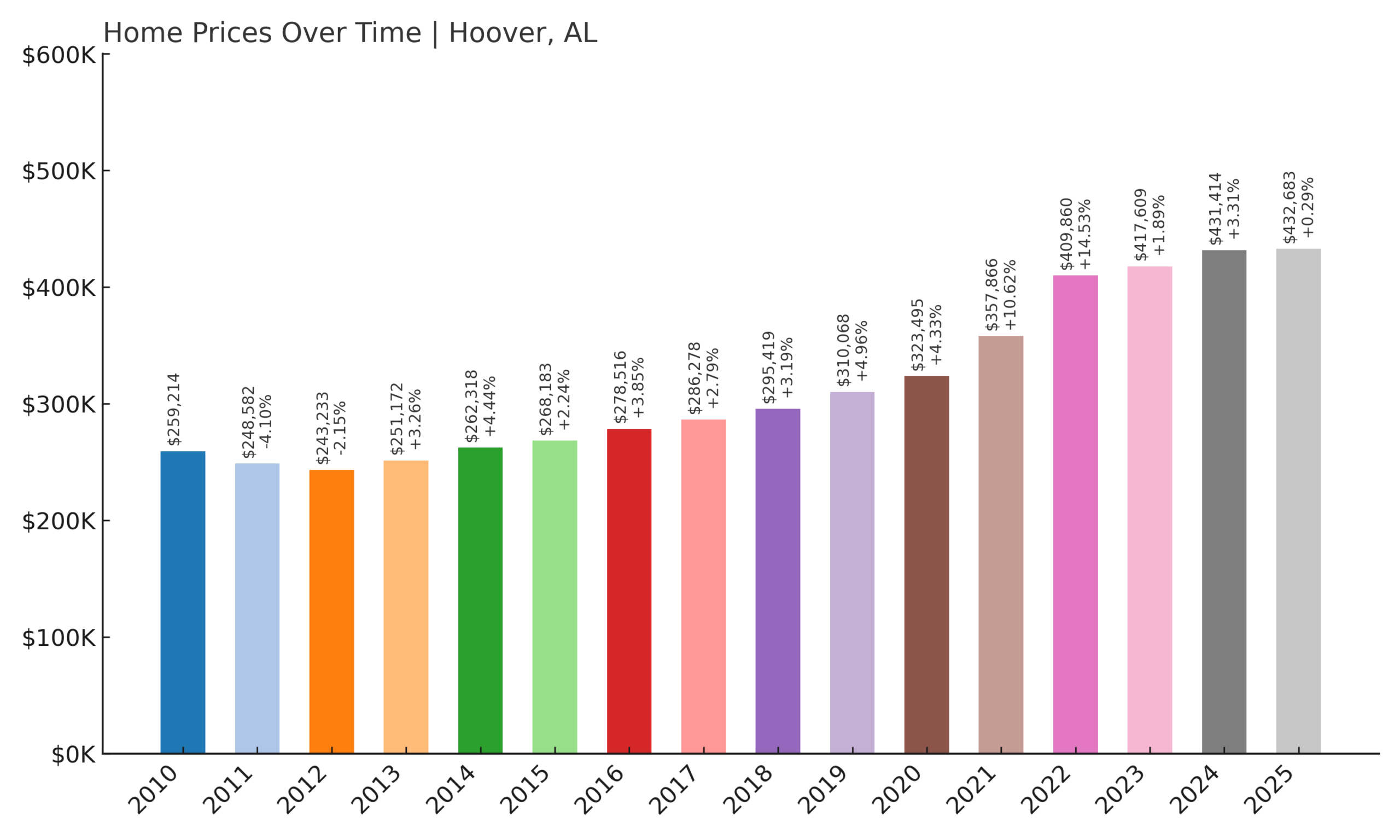

15. Hoover – 66.9% Home Price Increase Since 2010

Home Stratosphere Guide

Your Personality Already Knows

How Your Home Should Feel

113 pages of room-by-room design guidance built around your actual brain, your actual habits, and the way you actually live.

You might be an ISFJ or INFP designer…

You design through feeling — your spaces are personal, comforting, and full of meaning. The guide covers your exact color palettes, room layouts, and the one mistake your type always makes.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ISTJ or INTJ designer…

You crave order, function, and visual calm. The guide shows you how to create spaces that feel both serene and intentional — without ending up sterile.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ENFP or ESTP designer…

You design by instinct and energy. Your home should feel alive. The guide shows you how to channel that into rooms that feel curated, not chaotic.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ENTJ or ESTJ designer…

You value quality, structure, and things done right. The guide gives you the framework to build rooms that feel polished without overthinking every detail.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

- 2010: $259,214

- 2011: $248,582 (-$10,632, -4.10% from previous year)

- 2012: $243,233 (-$5,349, -2.15% from previous year)

- 2013: $251,172 (+$7,939, +3.26% from previous year)

- 2014: $262,318 (+$11,146, +4.44% from previous year)

- 2015: $268,183 (+$5,865, +2.24% from previous year)

- 2016: $278,516 (+$10,333, +3.85% from previous year)

- 2017: $286,278 (+$7,762, +2.79% from previous year)

- 2018: $295,419 (+$9,141, +3.19% from previous year)

- 2019: $310,068 (+$14,649, +4.96% from previous year)

- 2020: $323,495 (+$13,427, +4.33% from previous year)

- 2021: $357,866 (+$34,371, +10.62% from previous year)

- 2022: $409,860 (+$51,994, +14.53% from previous year)

- 2023: $417,609 (+$7,749, +1.89% from previous year)

- 2024: $431,414 (+$13,805, +3.31% from previous year)

- 2025: $432,683 (+$1,269, +0.29% from previous year)

Home prices in Hoover have risen nearly 67% since 2010, marking it as one of Alabama’s more stable and steadily appreciating markets. After some price erosion during the early 2010s, values began climbing again by 2013, gaining momentum every few years. The biggest single-year increases happened between 2020 and 2022, when prices jumped by over $85,000 in just two years—driven by the same pandemic-era demand seen across much of the country. While appreciation has slowed in recent years, 2025’s average value of $432,683 reflects solid long-term growth without sharp volatility or correction. It’s a pattern that suggests sustained desirability and strong fundamentals.

Hoover – One of Birmingham’s Most Popular Suburbs

Hoover is a major suburb of Birmingham and one of the largest cities in the state. Known for its well-regarded school system, family-friendly neighborhoods, and extensive retail offerings—including the Riverchase Galleria—Hoover has long been a magnet for middle- and upper-income households. Its diverse housing stock includes everything from entry-level homes to executive estates, making it accessible to a wide range of buyers. That flexibility has helped the city maintain demand through economic cycles, contributing to the consistent upward trend in prices since the mid-2010s. Its proximity to job centers in Birmingham makes it a top pick for professionals who want suburban convenience with urban access.

The city also benefits from thoughtful planning, a variety of recreational spaces, and an expanding commercial base that adds economic stability. Unlike smaller or more rural towns that saw volatile swings, Hoover’s housing market moved steadily, even during national downturns. The sharp increases in 2021 and 2022 were likely fueled by buyer urgency during the low-interest-rate era, but Hoover has not experienced the kind of steep pullbacks seen elsewhere. In 2025, its housing market appears to be holding firm, supported by infrastructure, location, and a long-standing reputation as one of Alabama’s most livable cities.

14. Arley – 72.7% Home Price Increase Since 2010

- 2010: $264,772

- 2011: $257,588 (-$7,184, -2.71% from previous year)

- 2012: $255,634 (-$1,954, -0.76% from previous year)

- 2013: $254,312 (-$1,322, -0.52% from previous year)

- 2014: $249,384 (-$4,928, -1.94% from previous year)

- 2015: $241,099 (-$8,285, -3.32% from previous year)

- 2016: $247,276 (+$6,177, +2.56% from previous year)

- 2017: $268,343 (+$21,067, +8.52% from previous year)

- 2018: $277,236 (+$8,893, +3.31% from previous year)

- 2019: $283,544 (+$6,308, +2.28% from previous year)

- 2020: $297,397 (+$13,853, +4.89% from previous year)

- 2021: $360,798 (+$63,401, +21.32% from previous year)

- 2022: $413,701 (+$52,903, +14.66% from previous year)

- 2023: $424,739 (+$11,038, +2.67% from previous year)

- 2024: $435,694 (+$10,955, +2.58% from previous year)

- 2025: $457,305 (+$21,611, +4.96% from previous year)

Arley’s housing market followed a unique path over the past 15 years, starting with five years of steady decline before entering a phase of sustained growth. From 2010 through 2015, average home values fell by nearly 10%, reflecting weaker demand or post-recession sluggishness in this more rural part of the state. But beginning in 2016, that trend reversed dramatically. Between 2016 and 2025, prices climbed by more than 85%, with massive spikes during 2021 and 2022 when values soared by over $115,000. As of 2025, Arley’s average home price sits at $457,305—an increase of nearly 73% from its 2010 level, with no signs of a recent pullback.

Arley – Lakefront Living Driving Long-Term Price Gains

Located near the shores of Smith Lake in northwest Alabama, Arley benefits from one of the state’s most desirable natural amenities: access to waterfront property. Smith Lake is one of Alabama’s cleanest and deepest lakes, making it a favorite destination for boating, fishing, and vacation homes. As interest in remote work grew during the pandemic, more buyers began seeking out scenic, less crowded areas like Arley. The explosive price growth in 2021 and 2022 likely reflects this new wave of demand, as more people relocated or purchased second homes near the lake. The surrounding area remains quiet and sparsely populated, adding to its appeal for those seeking privacy and nature.

While Arley lacks the infrastructure of larger cities, that hasn’t deterred demand. Instead, it’s added to the town’s appeal for buyers seeking a retreat from urban life. The town’s housing stock includes both modest homes and high-end lakefront properties, and the latter have driven up average values in recent years. The town’s isolation used to be a drawback, but in today’s housing market, it’s increasingly viewed as a selling point. If demand for waterfront real estate continues, especially among retirees and remote workers, Arley could maintain its price momentum well beyond 2025.

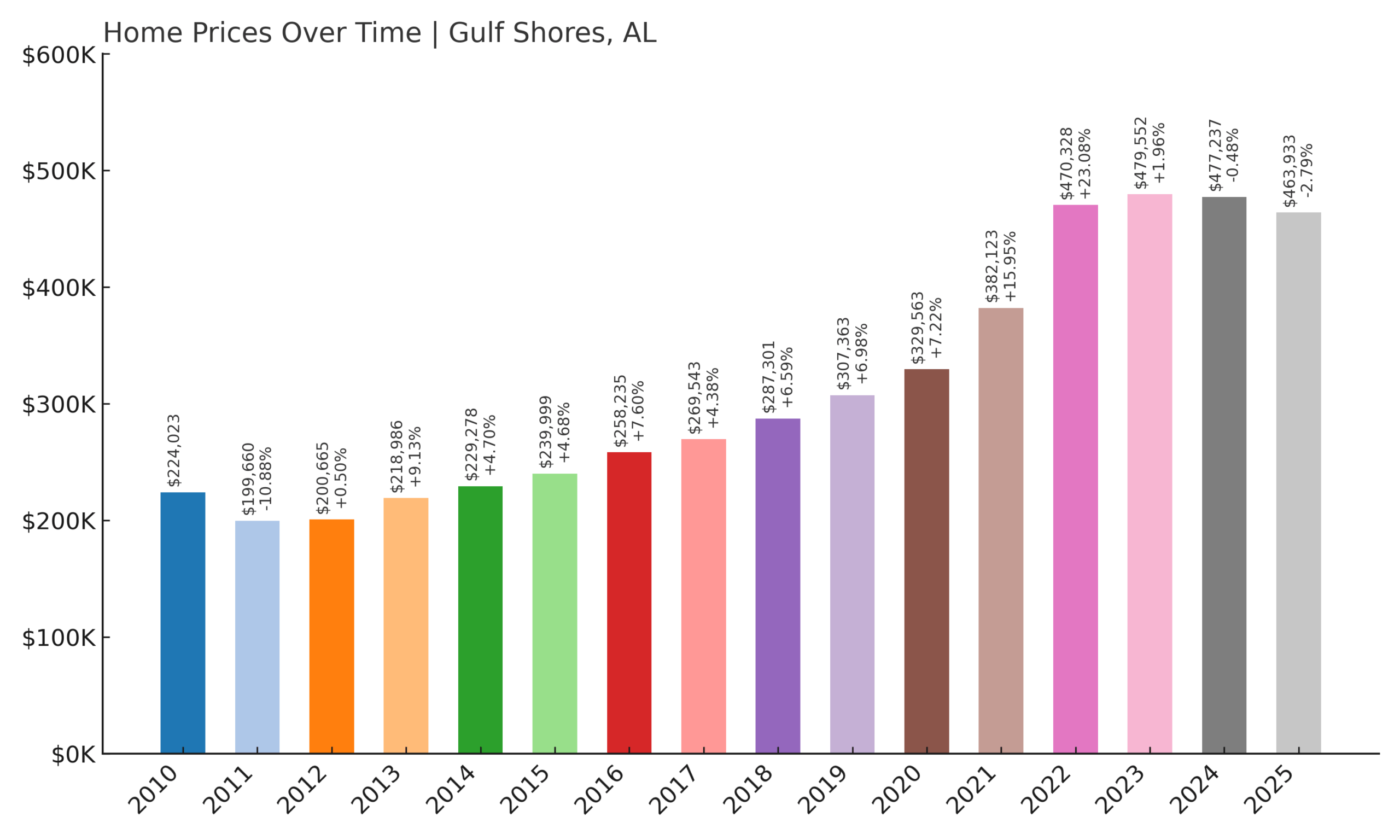

13. Gulf Shores – 107% Home Price Increase Since 2010

- 2010: $224,023

- 2011: $199,660 (-$24,363, -10.88% from previous year)

- 2012: $200,665 (+$1,005, +0.50% from previous year)

- 2013: $218,986 (+$18,321, +9.13% from previous year)

- 2014: $229,278 (+$10,292, +4.70% from previous year)

- 2015: $239,999 (+$10,721, +4.68% from previous year)

- 2016: $258,235 (+$18,236, +7.60% from previous year)

- 2017: $269,543 (+$11,308, +4.38% from previous year)

- 2018: $287,301 (+$17,758, +6.59% from previous year)

- 2019: $307,363 (+$20,062, +6.98% from previous year)

- 2020: $329,563 (+$22,200, +7.22% from previous year)

- 2021: $382,123 (+$52,560, +15.95% from previous year)

- 2022: $470,328 (+$88,205, +23.08% from previous year)

- 2023: $479,552 (+$9,224, +1.96% from previous year)

- 2024: $477,237 (-$2,315, -0.48% from previous year)

- 2025: $463,933 (-$13,304, -2.79% from previous year)

Gulf Shores has experienced over a 107% increase in average home prices since 2010, fueled largely by its popularity as a beach destination and second-home market. The strongest gains came after 2015, with a dramatic price surge between 2020 and 2022 when values jumped by more than $140,000. That period coincided with a national boom in demand for vacation and coastal properties. While the last two years have shown small price declines, the overall trajectory remains steeply upward compared to the pre-2015 market. Even after the recent dip, the average home price in Gulf Shores is more than double its 2010 level.

Gulf Shores – Beachfront Demand Meets Market Cooling

Gulf Shores is one of Alabama’s premier coastal destinations, known for white sand beaches, tourism, and a steady stream of short-term rental income. It has long attracted buyers from across the South, particularly retirees and vacation homeowners. The area’s appeal exploded during the pandemic as more people sought waterfront escapes and flexible living arrangements. That surge pushed values rapidly upward, with average home prices climbing by more than 60% in just two years. The city’s tourism infrastructure—restaurants, entertainment, and recreational activities—helps maintain long-term interest in the local housing market.

However, Gulf Shores is also one of the few towns on this list that saw back-to-back declines in 2024 and 2025, reflecting some cooling after an intense run-up. These slight drops don’t necessarily signal a crash, but rather a correction from the overheated conditions of 2021–2022. Coastal properties can be especially sensitive to broader market shifts, insurance costs, and weather risks. Still, with strong tourism demand and long-term rental appeal, Gulf Shores remains one of Alabama’s most expensive places to own property, and prices are likely to remain elevated even with near-term volatility.

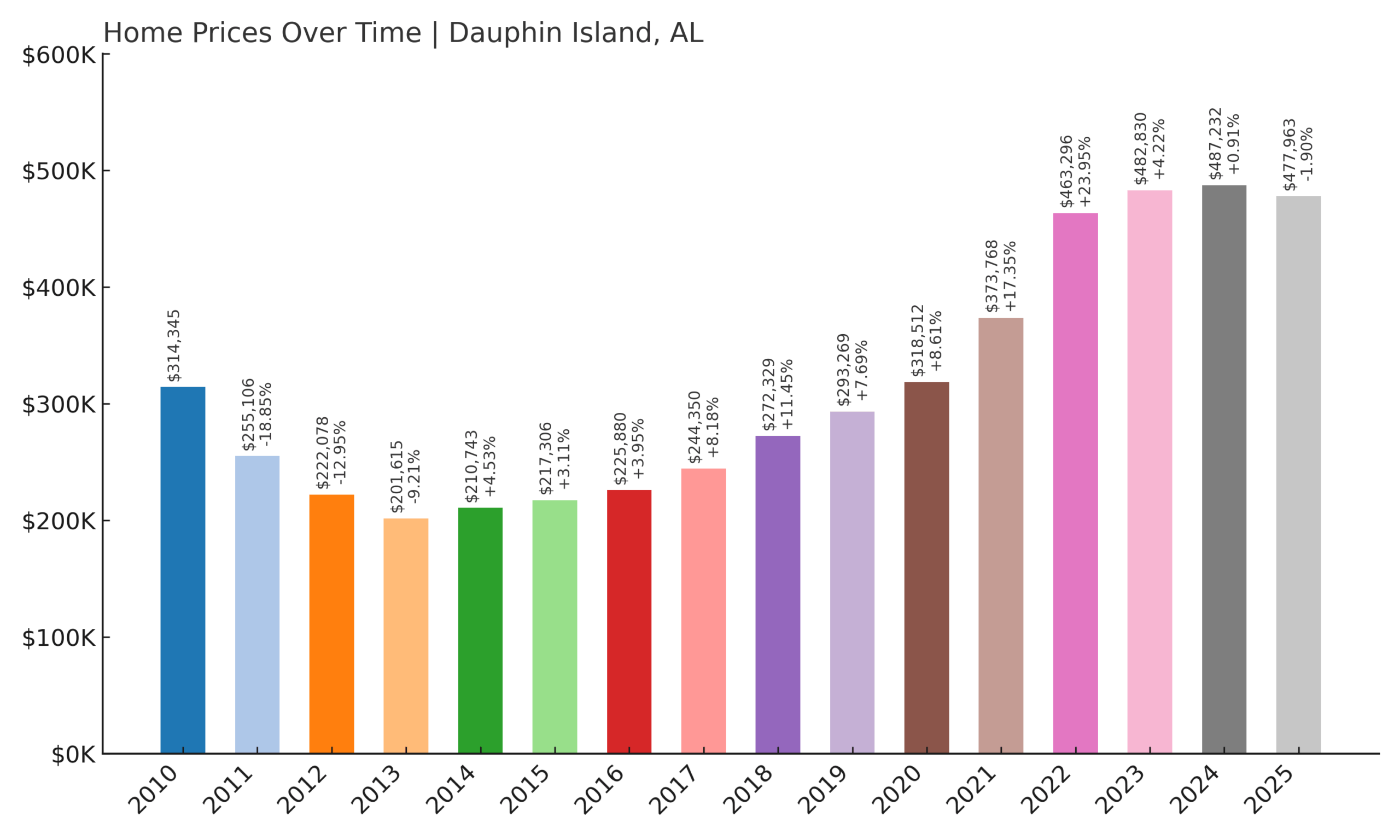

12. Dauphin Island – 52.1% Home Price Increase Since 2010

- 2010: $314,345

- 2011: $255,106 (-$59,239, -18.85% from previous year)

- 2012: $222,078 (-$33,028, -12.95% from previous year)

- 2013: $201,615 (-$20,463, -9.21% from previous year)

- 2014: $210,743 (+$9,128, +4.53% from previous year)

- 2015: $217,306 (+$6,563, +3.11% from previous year)

- 2016: $225,880 (+$8,574, +3.95% from previous year)

- 2017: $244,350 (+$18,470, +8.18% from previous year)

- 2018: $272,329 (+$27,979, +11.45% from previous year)

- 2019: $293,269 (+$20,940, +7.69% from previous year)

- 2020: $318,512 (+$25,243, +8.61% from previous year)

- 2021: $373,768 (+$55,256, +17.35% from previous year)

- 2022: $463,296 (+$89,528, +23.95% from previous year)

- 2023: $482,830 (+$19,534, +4.22% from previous year)

- 2024: $487,232 (+$4,402, +0.91% from previous year)

- 2025: $477,963 (-$9,269, -1.90% from previous year)

Dauphin Island’s housing market has followed a wild ride over the past 15 years. Home prices collapsed by nearly $113,000 from 2010 to 2013, driven by broader economic pressures and the town’s vulnerability to coastal storms and flooding. But after bottoming out in 2013, the island experienced a stunning comeback. From 2014 onward, values grew year after year, culminating in a massive 24% jump in 2022 alone. Although the most recent two years show modest slowing—including a 1.9% decline in 2025—the overall long-term trajectory is upward, with prices rising more than 52% from their 2010 level. It’s one of the strongest rebounds on this list.

Dauphin Island – Recovery Fueled by Coastal Appeal

Dauphin Island sits just off Alabama’s Gulf Coast and is connected to the mainland by a scenic bridge, offering oceanfront views and a laid-back lifestyle. The island is a draw for beachgoers, nature lovers, and those seeking a quiet escape from the bustle of the mainland. While its isolation and exposure to tropical storms make it more vulnerable than inland markets, those same traits also make it uniquely desirable to a subset of buyers. The post-2015 price surge reflects a growing interest in coastal living, second homes, and vacation rentals—particularly as remote work and lifestyle shifts took hold during the pandemic.

Much of the new demand came from out-of-state buyers and retirees who value water access and the slower pace of island life. The rapid appreciation in recent years has also prompted investment in infrastructure and flood mitigation, helping to boost buyer confidence. However, challenges remain. With limited land, rising insurance costs, and climate risks, future appreciation may not be as explosive. Still, for now, Dauphin Island remains one of the highest-priced and most unique housing markets in Alabama, with price levels that reflect its rare and scenic location.

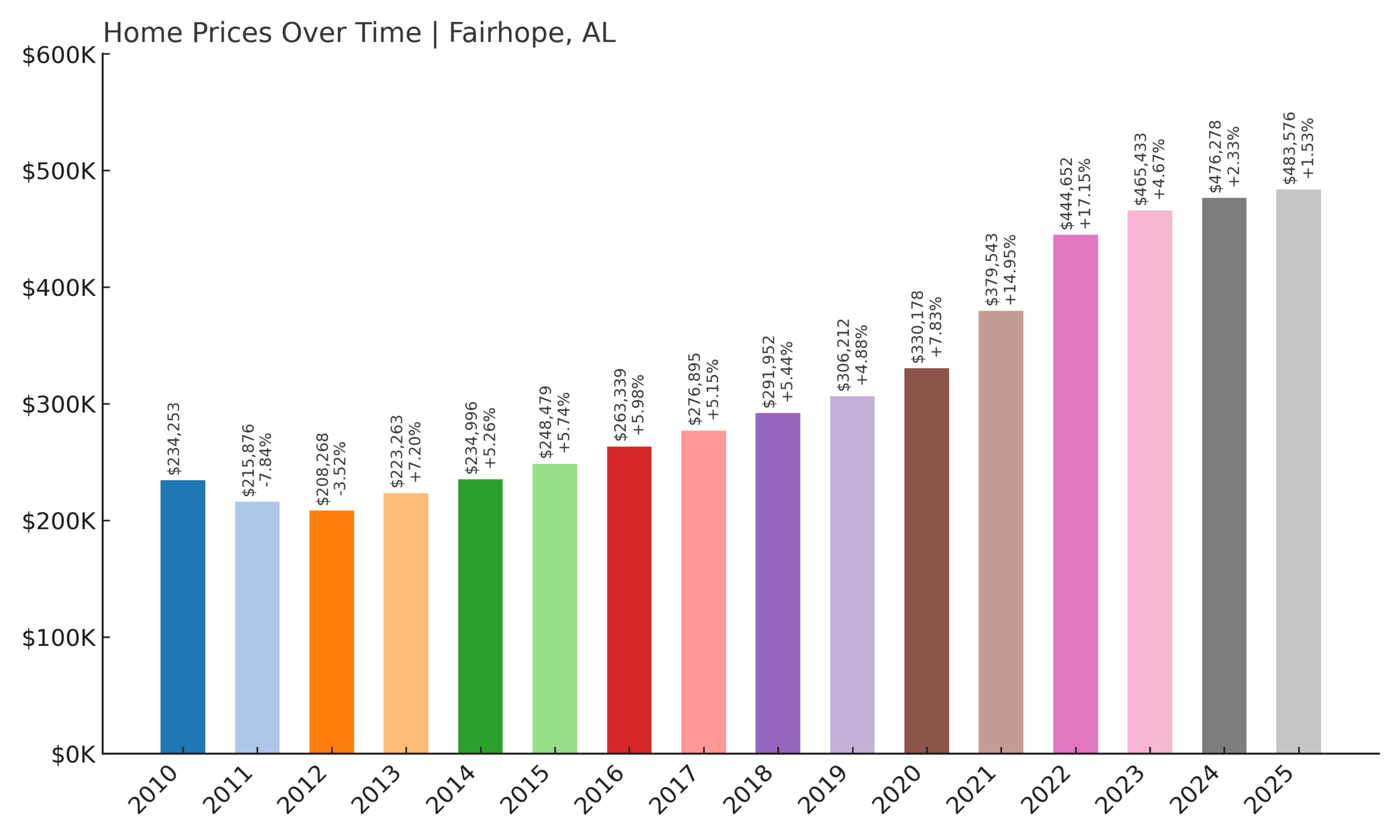

11. Fairhope – 106.4% Home Price Increase Since 2010

- 2010: $234,253

- 2011: $215,876 (-$18,377, -7.84% from previous year)

- 2012: $208,268 (-$7,608, -3.52% from previous year)

- 2013: $223,263 (+$14,995, +7.20% from previous year)

- 2014: $234,996 (+$11,733, +5.26% from previous year)

- 2015: $248,479 (+$13,483, +5.74% from previous year)

- 2016: $263,339 (+$14,860, +5.98% from previous year)

- 2017: $276,895 (+$13,556, +5.15% from previous year)

- 2018: $291,952 (+$15,057, +5.44% from previous year)

- 2019: $306,212 (+$14,260, +4.88% from previous year)

- 2020: $330,178 (+$23,966, +7.83% from previous year)

- 2021: $379,543 (+$49,365, +14.95% from previous year)

- 2022: $444,652 (+$65,109, +17.15% from previous year)

- 2023: $465,433 (+$20,781, +4.67% from previous year)

- 2024: $476,278 (+$10,845, +2.33% from previous year)

- 2025: $483,576 (+$7,298, +1.53% from previous year)

Fairhope’s home values have more than doubled since 2010, growing by 106.4% over the 15-year span. The market initially declined during the early 2010s, but quickly found its footing and began an impressive run of year-over-year increases beginning in 2013. The sharpest appreciation occurred in 2021 and 2022, with gains totaling over $114,000 in just two years. Since then, growth has moderated, but prices continue to rise—albeit at a slower pace. As of 2025, the town’s average home value sits at $483,576, a level that reflects both the area’s long-term desirability and its tight housing inventory.

Fairhope – Coastal Charm with Steady Price Growth

Fairhope sits along the eastern shore of Mobile Bay and has earned a reputation as one of Alabama’s most picturesque and livable towns. Known for its arts community, walkable downtown, and historic homes, Fairhope offers both charm and convenience. Its location near both Mobile and the Gulf Coast makes it a magnet for retirees, young professionals, and families seeking a slower lifestyle without giving up access to city jobs and amenities. The steady stream of buyers has pushed prices steadily upward, and demand remains strong even as other markets cool.

What sets Fairhope apart is its ability to balance growth with preservation. The town has resisted overdevelopment, maintaining a small-town feel that continues to attract well-heeled buyers. Local investment in schools, infrastructure, and parks has further added to its appeal. Though affordability is becoming a challenge, the area’s strong public services and unique cultural scene make it one of Alabama’s most desirable places to live. Looking ahead, Fairhope is likely to remain a premium market, particularly as remote workers and retirees continue to seek out scenic communities that feel both established and livable year-round.

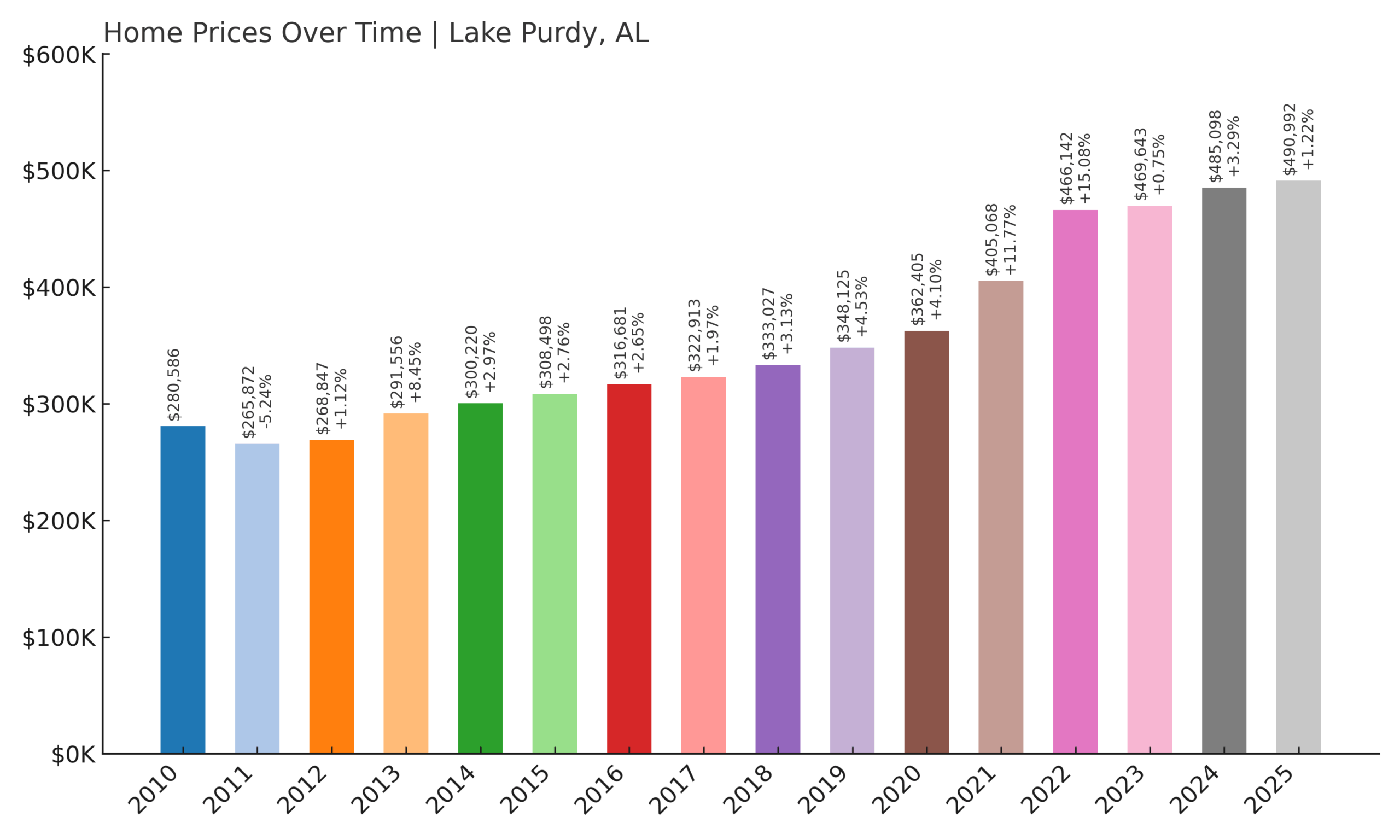

10. Lake Purdy – 74.9% Home Price Increase Since 2010

- 2010: $280,586

- 2011: $265,872 (-$14,714, -5.24% from previous year)

- 2012: $268,847 (+$2,975, +1.12% from previous year)

- 2013: $291,556 (+$22,709, +8.45% from previous year)

- 2014: $300,220 (+$8,664, +2.97% from previous year)

- 2015: $308,498 (+$8,278, +2.76% from previous year)

- 2016: $316,681 (+$8,183, +2.65% from previous year)

- 2017: $322,913 (+$6,232, +1.97% from previous year)

- 2018: $333,027 (+$10,114, +3.13% from previous year)

- 2019: $348,125 (+$15,098, +4.53% from previous year)

- 2020: $362,405 (+$14,280, +4.10% from previous year)

- 2021: $405,068 (+$42,663, +11.77% from previous year)

- 2022: $466,142 (+$61,074, +15.08% from previous year)

- 2023: $469,643 (+$3,501, +0.75% from previous year)

- 2024: $485,098 (+$15,455, +3.29% from previous year)

- 2025: $490,992 (+$5,894, +1.22% from previous year)

Home prices in Lake Purdy have risen by nearly 75% since 2010, with most of the growth coming after 2013. Following a modest decline in the early part of the decade, prices began rising consistently—rarely seeing year-over-year losses. The biggest jumps came in 2021 and 2022, when prices soared by over $100,000 in just two years. This sharp rise reflected broader statewide and national trends during the post-pandemic real estate boom. While growth has since slowed, home values continue edging upward, with the 2025 average price approaching $491,000—more than $210,000 higher than it was 15 years ago.

Lake Purdy – Scenic Living Near Birmingham

Lake Purdy is located just outside Birmingham and offers residents peaceful lakeside living within a short drive of Alabama’s largest metro area. While technically unincorporated, the community has seen rising interest due to its natural beauty, proximity to high-paying jobs, and increasing number of upscale residential developments. Lake access, wooded lots, and scenic views have made it especially popular with buyers seeking space and serenity without sacrificing convenience. The steep rise in values between 2020 and 2022 shows that Lake Purdy was among the locations that benefited most from the remote-work movement and the push for low-density housing.

The area has long flown under the radar compared to other Birmingham suburbs, but that has started to change. As more people move to the region, new construction and rising demand have pushed prices upward, especially for homes with lake frontage or mountain views. While local services and infrastructure are limited compared to incorporated cities, the location and lifestyle continue to draw interest. If development continues at its current pace and demand for semi-rural luxury holds steady, Lake Purdy could become one of the most in-demand housing markets in the Birmingham metro area in the years ahead.

9. Crane Hill – 110.1% Home Price Increase Since 2010

Would you like to save this?

- 2010: $236,598

- 2011: $230,533 (-$6,065, -2.56% from previous year)

- 2012: $235,383 (+$4,850, +2.10% from previous year)

- 2013: $237,385 (+$2,002, +0.85% from previous year)

- 2014: $253,231 (+$15,846, +6.68% from previous year)

- 2015: $261,346 (+$8,115, +3.20% from previous year)

- 2016: $274,367 (+$13,021, +4.98% from previous year)

- 2017: $292,117 (+$17,750, +6.47% from previous year)

- 2018: $310,522 (+$18,405, +6.30% from previous year)

- 2019: $302,719 (-$7,803, -2.51% from previous year)

- 2020: $318,077 (+$15,358, +5.07% from previous year)

- 2021: $381,007 (+$62,930, +19.78% from previous year)

- 2022: $464,362 (+$83,355, +21.88% from previous year)

- 2023: $440,720 (-$23,642, -5.09% from previous year)

- 2024: $469,892 (+$29,172, +6.62% from previous year)

- 2025: $497,040 (+$27,148, +5.78% from previous year)

Home prices in Crane Hill have more than doubled since 2010, rising 110.1% over the 15-year period. The town’s price history tells a story of gradual but steady growth through the mid-2010s, followed by a striking acceleration in the early 2020s. The most dramatic leap came between 2020 and 2022, when average home values jumped by more than $146,000 in just two years—a nearly 46% increase. That explosive growth was briefly interrupted in 2023 with a 5% decline, but prices quickly rebounded in 2024 and 2025. The most recent average of $497,040 represents one of the highest values in rural Alabama and shows strong staying power for a market once seen as a hidden retreat.

Crane Hill – Waterfront Access Fuels Explosive Growth

Crane Hill is a small lakeside community on the western side of Smith Lake, one of Alabama’s most prized recreational waterways. The town has seen a wave of development and buyer interest over the past decade as more Alabamians—and out-of-state buyers—have discovered the appeal of lakefront property. Crane Hill’s relatively low starting prices in the early 2010s allowed room for significant appreciation, and as urban buyers sought out tranquil settings during the pandemic, demand for lake homes in the area surged. Unlike resort markets with large commercial hubs, Crane Hill remains residential in character, which adds to its appeal for second-home buyers and long-term residents alike.

Buyers are drawn to the area not only for its scenery but also for the lifestyle it offers: boating, fishing, kayaking, and quiet evenings along tree-lined shores. While infrastructure is limited, that’s part of the attraction—many residents prefer the rural atmosphere and don’t mind driving a bit farther for amenities. With limited lakefront inventory and a growing reputation for high-quality custom homes, Crane Hill has seen property values climb steadily. Recent corrections are likely due to pricing fatigue rather than a drop in interest. If anything, the strong rebound in 2024 and continued gains in 2025 suggest that demand remains healthy, and the town’s long-term prospects remain bright as buyers continue to prioritize lifestyle and outdoor access.

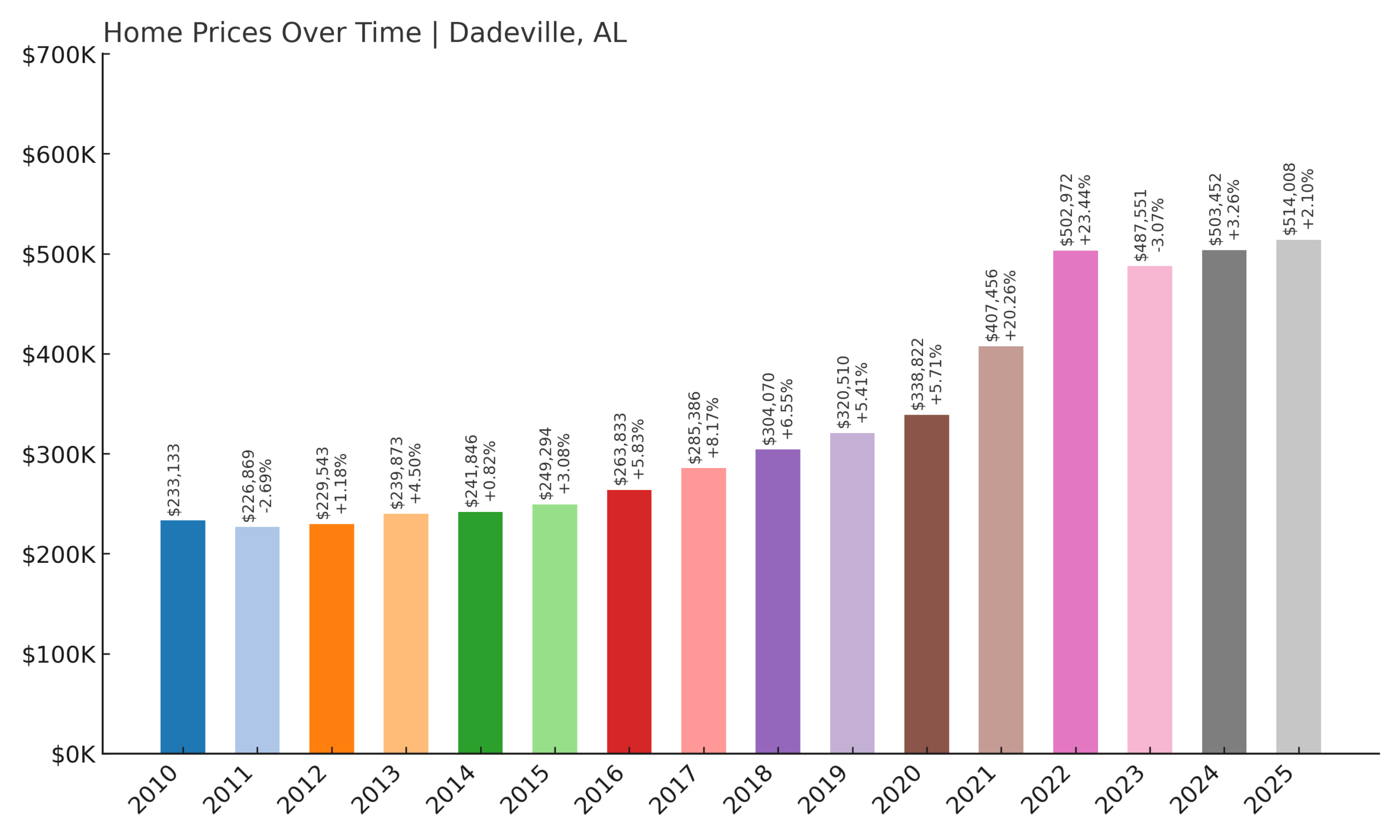

8. Dadeville – 120.4% Home Price Increase Since 2010

- 2010: $233,133

- 2011: $226,869 (-$6,264, -2.69% from previous year)

- 2012: $229,543 (+$2,674, +1.18% from previous year)

- 2013: $239,873 (+$10,330, +4.50% from previous year)

- 2014: $241,846 (+$1,973, +0.82% from previous year)

- 2015: $249,294 (+$7,448, +3.08% from previous year)

- 2016: $263,833 (+$14,539, +5.83% from previous year)

- 2017: $285,386 (+$21,553, +8.17% from previous year)

- 2018: $304,070 (+$18,684, +6.55% from previous year)

- 2019: $320,510 (+$16,440, +5.41% from previous year)

- 2020: $338,822 (+$18,312, +5.71% from previous year)

- 2021: $407,456 (+$68,634, +20.26% from previous year)

- 2022: $502,972 (+$95,516, +23.44% from previous year)

- 2023: $487,551 (-$15,421, -3.07% from previous year)

- 2024: $503,452 (+$15,901, +3.26% from previous year)

- 2025: $514,008 (+$10,556, +2.10% from previous year)

Dadeville’s home prices have soared by 120.4% since 2010, driven by a combination of long-term interest in Lake Martin properties and a dramatic post-2020 boom. The town’s housing market remained relatively quiet through the mid-2010s, with steady but not spectacular increases. However, beginning in 2016, the pace picked up significantly, and values exploded between 2020 and 2022—rising by nearly $165,000 in just two years. Even after a minor pullback in 2023, prices resumed an upward path, ending at an average of $514,008 in 2025. That figure ranks among the highest for a small town in central Alabama, particularly one not anchored by a major metro area.

Dadeville – Lake Martin’s Rising Real Estate Star

Located on the eastern banks of Lake Martin, Dadeville has gained a reputation as one of Alabama’s most desirable places to live and vacation. Lake Martin is among the largest man-made lakes in the U.S., and its 750 miles of shoreline offer endless recreational possibilities. Dadeville’s share of that shoreline has long been a draw, but in recent years, the town has seen a major shift in perception—from sleepy retreat to serious investment opportunity. High-end developments, vacation rentals, and second-home construction have pushed prices sharply upward, especially as wealthy buyers from Birmingham, Atlanta, and even Nashville look to buy into lake living.

What sets Dadeville apart is its ability to combine resort-style amenities with small-town charm. Residents enjoy access to marinas, golf courses, and waterfront dining, yet the town itself retains a quiet, family-friendly vibe. The boom in 2021 and 2022 may have been accelerated by remote work, but much of the underlying demand has remained. While there was a brief price correction in 2023, the rebound in 2024 and continued rise in 2025 show that interest has not faded. With limited waterfront inventory and strong word-of-mouth appeal, Dadeville seems poised for continued price strength—especially if Lake Martin continues to draw regional and national attention.

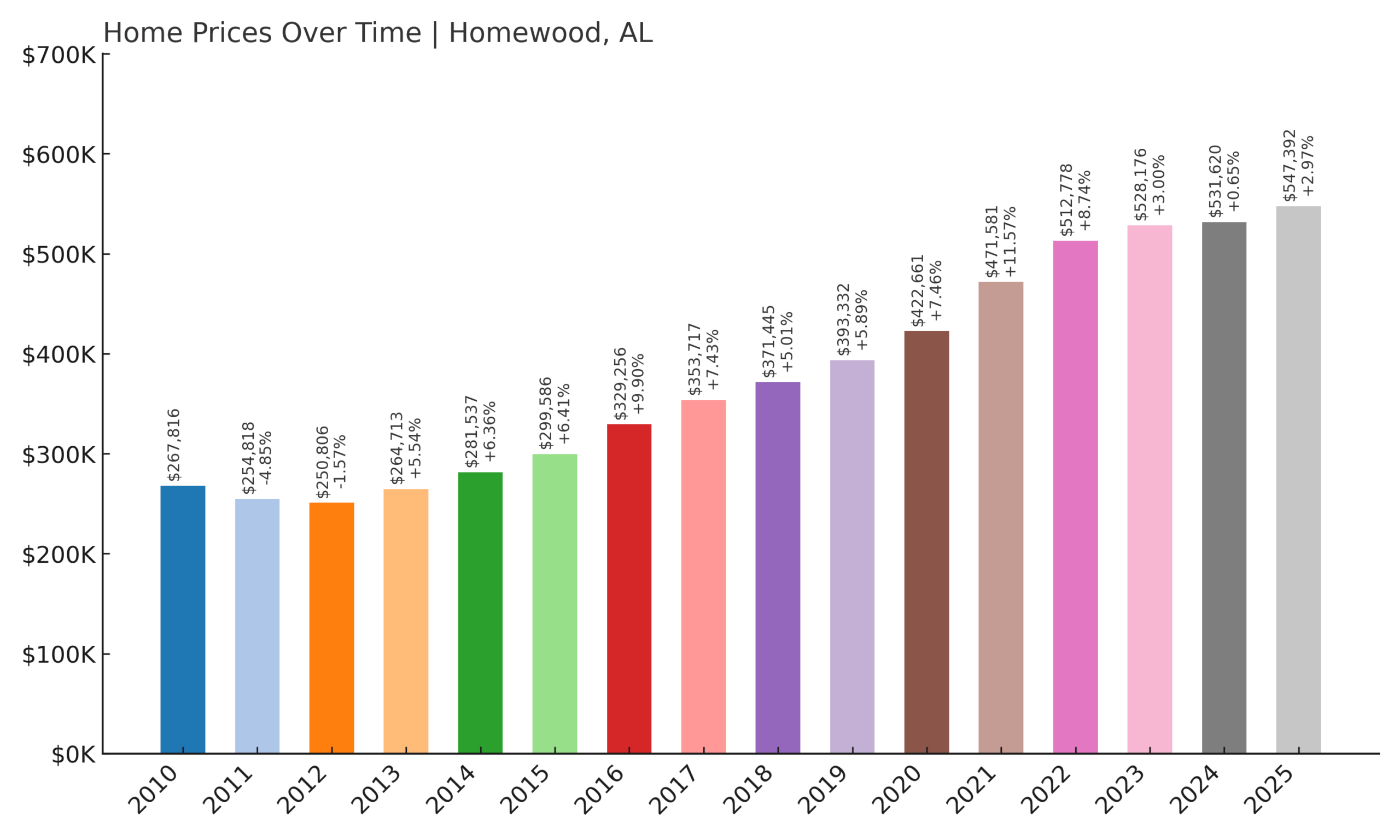

7. Homewood – 104.4% Home Price Increase Since 2010

- 2010: $267,816

- 2011: $254,818 (-$12,998, -4.85% from previous year)

- 2012: $250,806 (-$4,012, -1.57% from previous year)

- 2013: $264,713 (+$13,907, +5.54% from previous year)

- 2014: $281,537 (+$16,824, +6.36% from previous year)

- 2015: $299,586 (+$18,049, +6.41% from previous year)

- 2016: $329,256 (+$29,670, +9.90% from previous year)

- 2017: $353,717 (+$24,461, +7.43% from previous year)

- 2018: $371,445 (+$17,728, +5.01% from previous year)

- 2019: $393,332 (+$21,887, +5.89% from previous year)

- 2020: $422,661 (+$29,329, +7.46% from previous year)

- 2021: $471,581 (+$48,920, +11.57% from previous year)

- 2022: $512,778 (+$41,197, +8.74% from previous year)

- 2023: $528,176 (+$15,398, +3.00% from previous year)

- 2024: $531,620 (+$3,444, +0.65% from previous year)

- 2025: $547,392 (+$15,772, +2.97% from previous year)

Homewood has seen its average home value grow by more than 104% since 2010, turning it into one of the Birmingham metro area’s most sought-after real estate markets. After a brief downturn early in the decade, prices surged consistently year after year, driven by high demand and limited inventory. Between 2016 and 2022 alone, home values rose by more than $180,000—an astonishing figure for a town of its size. Even as the national market began to cool in 2023 and 2024, Homewood kept rising, ending 2025 with an average price of $547,392. This long-term strength underscores the town’s exceptional appeal among families, professionals, and investors alike.

Homewood – Birmingham’s In-Demand Urban Suburb

Located just minutes south of downtown Birmingham, Homewood blends city convenience with neighborhood charm. The town’s walkable streets, excellent public schools, and attractive housing stock have made it a top destination for families and young professionals. Its commercial corridors offer independent shops, restaurants, and breweries, creating a vibrant community atmosphere that stands out in central Alabama. Demand has steadily outpaced supply for much of the past decade, pushing prices higher even during years when surrounding areas remained flat. Homewood has become a clear choice for buyers who want proximity to city jobs without sacrificing quality of life.

Part of what makes Homewood so attractive is its architectural diversity and thoughtful urban planning. From historic bungalows to modern infill developments, the town offers a wide range of homes within a compact footprint. Redevelopment and revitalization have played a major role in pushing prices upward, but longtime residents have also stayed put, keeping turnover relatively low. This has led to high competition for available listings and consistently strong appreciation. With home prices continuing to rise into 2025 and no major signs of oversupply, Homewood remains one of the most competitive and high-performing real estate markets in the state.

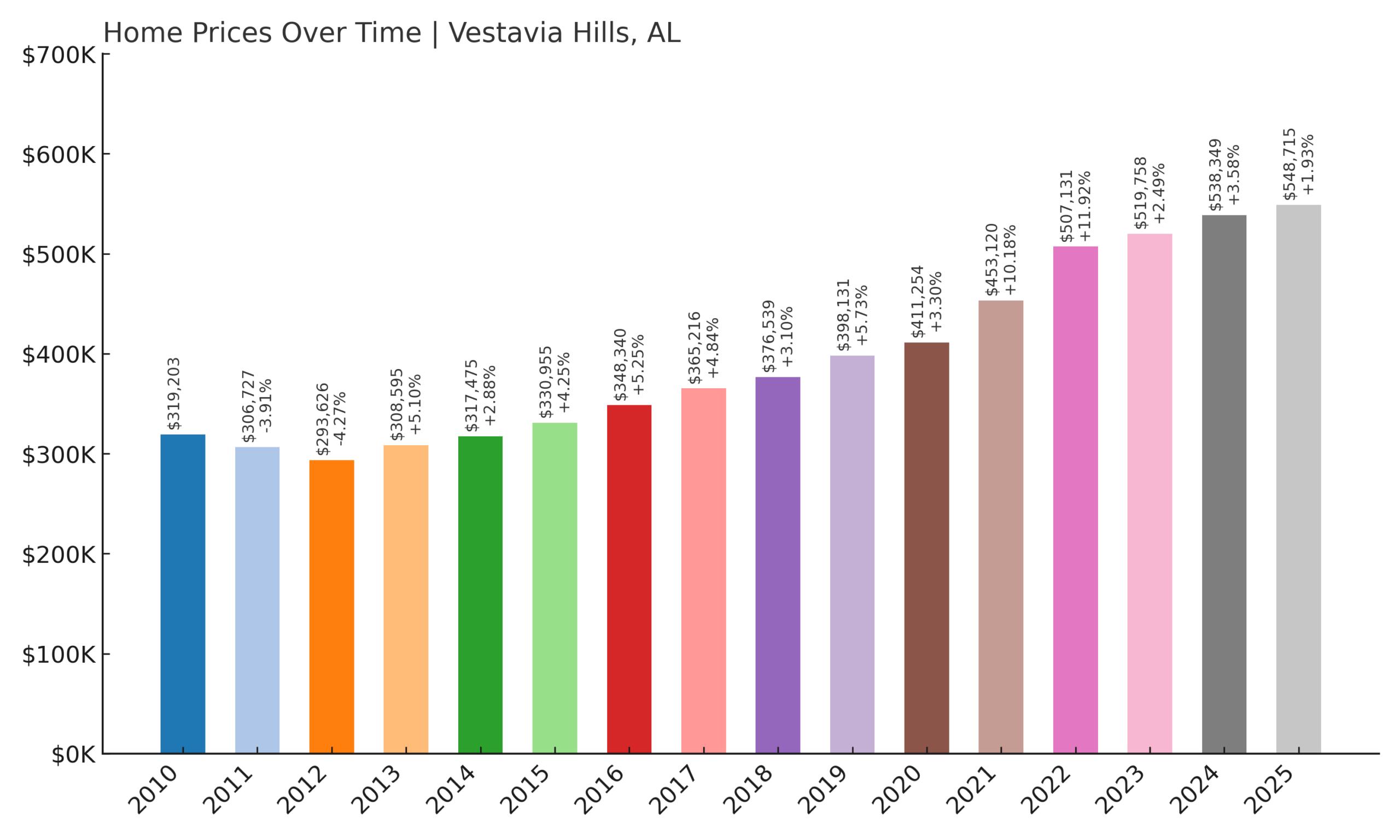

6. Vestavia Hills – 71.9% Home Price Increase Since 2010

- 2010: $319,203

- 2011: $306,727 (-$12,476, -3.91% from previous year)

- 2012: $293,626 (-$13,101, -4.27% from previous year)

- 2013: $308,595 (+$14,969, +5.10% from previous year)

- 2014: $317,475 (+$8,880, +2.88% from previous year)

- 2015: $330,955 (+$13,480, +4.25% from previous year)

- 2016: $348,340 (+$17,385, +5.25% from previous year)

- 2017: $365,216 (+$16,876, +4.84% from previous year)

- 2018: $376,539 (+$11,323, +3.10% from previous year)

- 2019: $398,131 (+$21,592, +5.73% from previous year)

- 2020: $411,254 (+$13,123, +3.30% from previous year)

- 2021: $453,120 (+$41,866, +10.18% from previous year)

- 2022: $507,131 (+$54,011, +11.92% from previous year)

- 2023: $519,758 (+$12,627, +2.49% from previous year)

- 2024: $538,349 (+$18,591, +3.58% from previous year)

- 2025: $548,715 (+$10,366, +1.93% from previous year)

Vestavia Hills has seen a home price increase of nearly 72% over the past 15 years, with prices rising from just over $319,000 in 2010 to almost $549,000 in 2025. While the early 2010s saw a small slump following the Great Recession, the market quickly rebounded by 2013 and then entered a long, stable climb. The most aggressive growth came between 2020 and 2022, where prices jumped by over $95,000 across two years. Though the pace has moderated slightly since then, the market continues to edge upward, with 2025 prices higher than ever. These gains are not just large in scale—they reflect a real shift in how valuable this community has become, both to buyers in Alabama and those relocating from other states.

Vestavia Hills – Birmingham’s Premier Family Enclave

Vestavia Hills is widely considered one of the most prestigious and livable suburbs in Alabama. Situated along the southern ridgeline of Birmingham, it’s a community known for its excellent public schools, manicured neighborhoods, and high property standards. The town’s hilly terrain offers scenic views of the city and surrounding woodlands, and its proximity to downtown Birmingham makes it especially attractive to high-income professionals who want quick access to work without giving up privacy or space. Residents also benefit from top-tier public services, vibrant parks and trails, and a range of well-maintained civic amenities that contribute to the town’s long-standing appeal.

Beyond its infrastructure and location, what really sets Vestavia Hills apart is its consistency. Home values rarely dip, and the area has largely avoided the boom-and-bust cycles seen in more speculative real estate markets. Buyers here are often long-term homeowners rather than flippers or short-term renters, which has kept the community stable even during periods of national market uncertainty. Its blend of quiet luxury and suburban convenience makes it a perennial favorite for families and retirees alike. The sustained growth in home prices over the last decade is not an anomaly—it’s a reflection of strong fundamentals, continued demand, and limited inventory in one of Alabama’s most established real estate hubs.

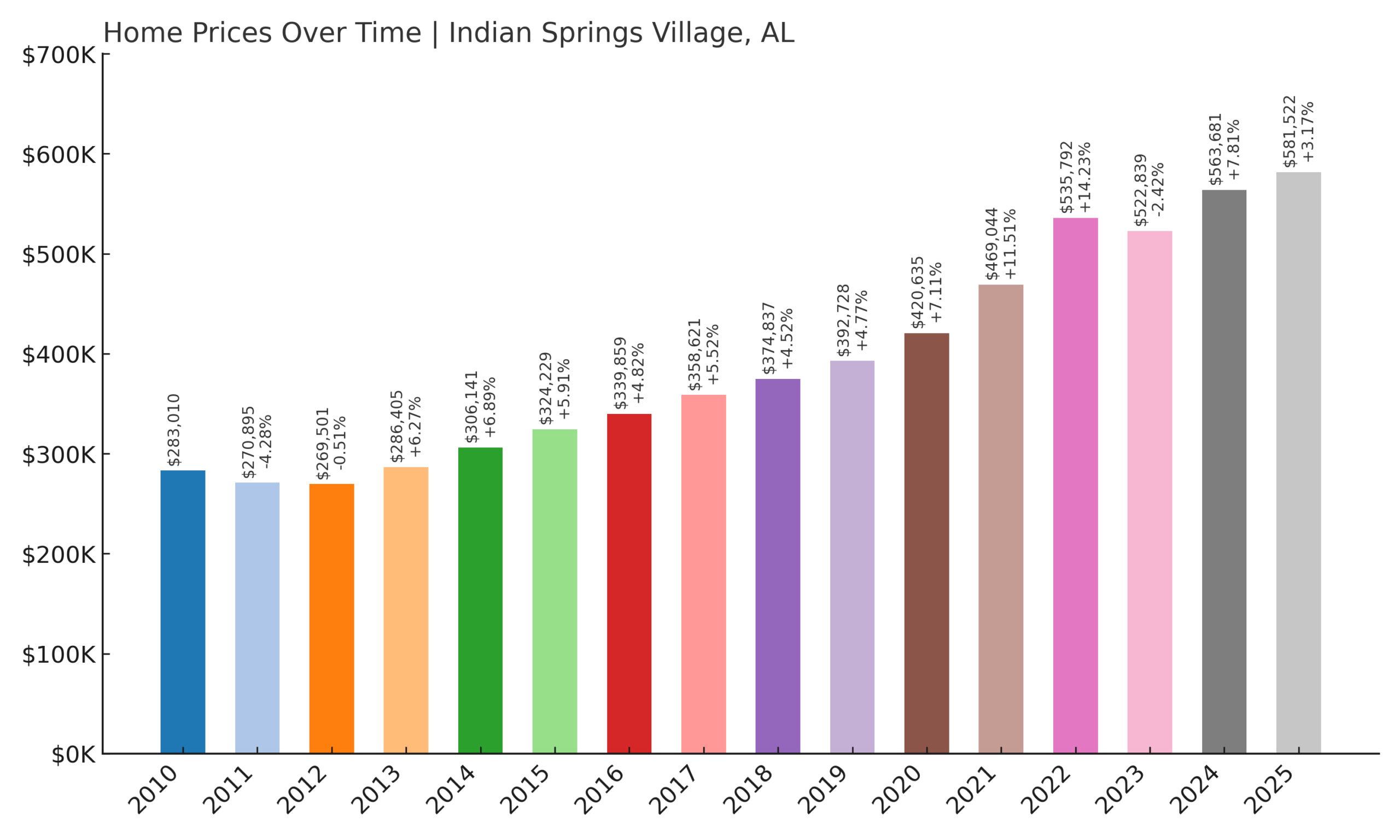

5. Indian Springs Village – 105.5% Home Price Increase Since 2010

- 2010: $283,010

- 2011: $270,895 (-$12,115, -4.28% from previous year)

- 2012: $269,501 (-$1,394, -0.51% from previous year)

- 2013: $286,405 (+$16,904, +6.27% from previous year)

- 2014: $306,141 (+$19,736, +6.89% from previous year)

- 2015: $324,229 (+$18,088, +5.91% from previous year)

- 2016: $339,859 (+$15,630, +4.82% from previous year)

- 2017: $358,621 (+$18,762, +5.52% from previous year)

- 2018: $374,837 (+$16,216, +4.52% from previous year)

- 2019: $392,728 (+$17,891, +4.77% from previous year)

- 2020: $420,635 (+$27,907, +7.11% from previous year)

- 2021: $469,044 (+$48,409, +11.51% from previous year)

- 2022: $535,792 (+$66,748, +14.23% from previous year)

- 2023: $522,839 (-$12,953, -2.42% from previous year)

- 2024: $563,681 (+$40,842, +7.81% from previous year)

- 2025: $581,522 (+$17,841, +3.17% from previous year)

Indian Springs Village has seen its home values increase by more than 105% since 2010, driven by strong regional demand and limited supply. Prices hovered around the $270,000–$300,000 mark for the first half of the decade, but began climbing sharply starting in 2016. The most substantial growth occurred between 2020 and 2022, when home values increased by over $115,000 across two years. After a brief dip in 2023, the market bounced back with force, adding another $58,000 to average home prices by 2025. This level of long-term appreciation highlights the town’s shift from a quiet suburb to a premium destination within Alabama’s housing market.

Indian Springs Village – Spacious Homes and Rural Privacy

Indian Springs Village offers something that’s becoming increasingly rare: privacy, space, and wooded landscapes, all within close proximity to a major metropolitan area. Located just south of Hoover and Vestavia Hills, the town maintains strict zoning and land-use controls that favor larger lots, fewer developments, and preservation of green space. This has made it extremely popular among high-income buyers seeking a more rural lifestyle without venturing far from city conveniences. Properties here are often custom-built and well-maintained, and the local government is known for emphasizing environmental conservation and community input in planning decisions.

That combination of exclusivity and accessibility has made Indian Springs one of the fastest-rising real estate markets in the Birmingham metro region. While it lacks the commercial density of neighboring suburbs, its residents are not typically seeking walkable amenities—they’re looking for retreat-style living, privacy, and long-term stability. The town’s real estate is also viewed as a hedge against urban overdevelopment, particularly as Birmingham’s suburban sprawl continues. With limited room for expansion, inventory remains tight and prices are expected to remain elevated. The town’s careful growth strategy has preserved its identity while simultaneously fueling demand, making it one of the most resilient and desirable markets in the state.

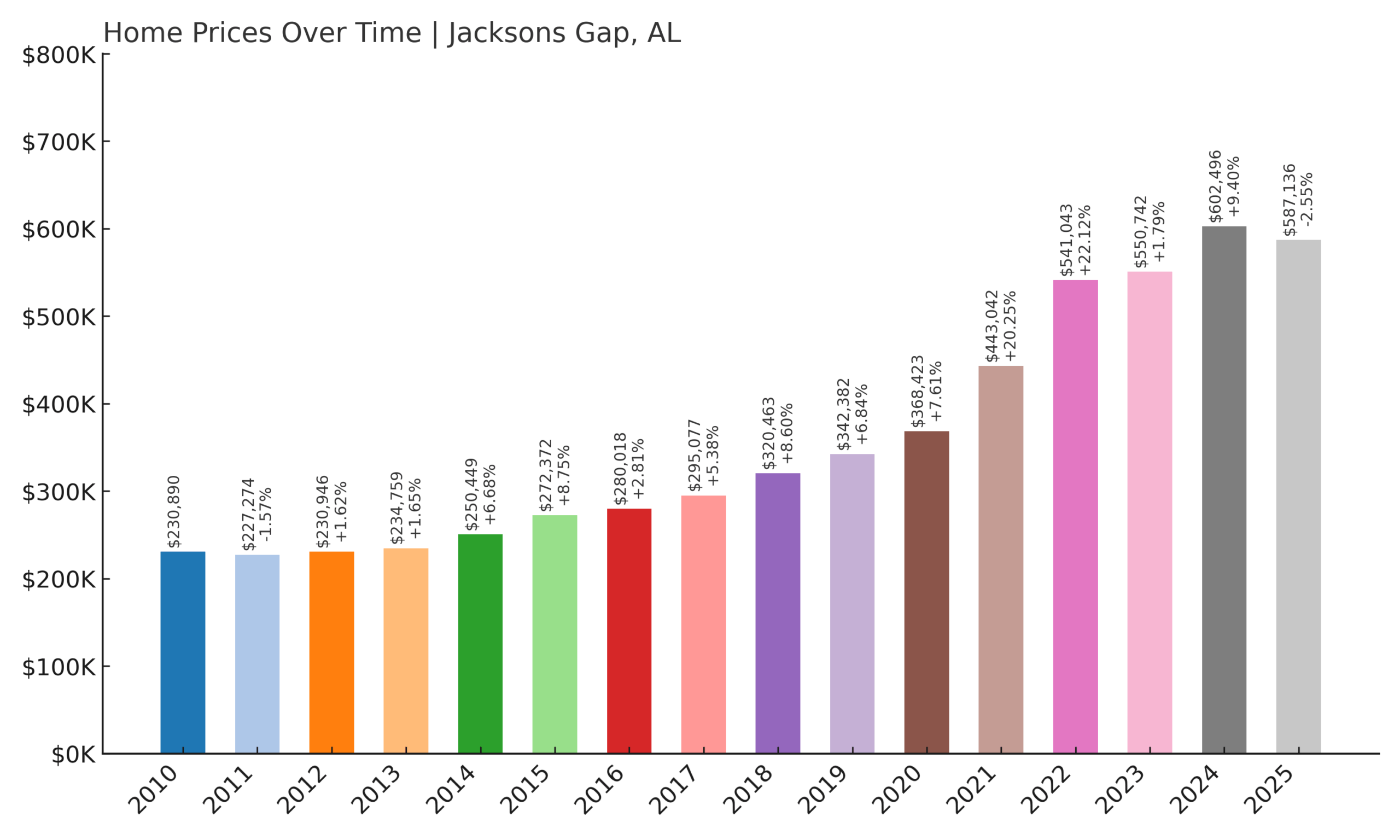

4. Jacksons Gap – 154.4% Home Price Increase Since 2010

- 2010: $230,890

- 2011: $227,274 (-$3,616, -1.57% from previous year)

- 2012: $230,946 (+$3,672, +1.62% from previous year)

- 2013: $234,759 (+$3,813, +1.65% from previous year)

- 2014: $250,449 (+$15,690, +6.68% from previous year)

- 2015: $272,372 (+$21,923, +8.75% from previous year)

- 2016: $280,018 (+$7,646, +2.81% from previous year)

- 2017: $295,077 (+$15,059, +5.38% from previous year)

- 2018: $320,463 (+$25,386, +8.60% from previous year)

- 2019: $342,382 (+$21,919, +6.84% from previous year)

- 2020: $368,423 (+$26,041, +7.61% from previous year)

- 2021: $443,042 (+$74,619, +20.25% from previous year)

- 2022: $541,043 (+$98,001, +22.12% from previous year)

- 2023: $550,742 (+$9,699, +1.79% from previous year)

- 2024: $602,496 (+$51,754, +9.40% from previous year)

- 2025: $587,136 (-$15,360, -2.55% from previous year)

Jacksons Gap has experienced one of the most dramatic price increases in the entire state, with average home values rising by 154.4% since 2010. While early growth was moderate, the market picked up steam after 2015 and then exploded in the early 2020s. The two-year period from 2020 to 2022 alone added nearly $173,000 to the average home price—an increase of more than 47%. Even though prices dipped slightly in 2025 following a sharp rise the year before, the market remains far above its historical averages. These gains reflect strong demand for lake-adjacent property and a growing reputation as a desirable retreat for high-end buyers.

Jacksons Gap – Small Town, Big Water Views

Located on the northern shores of Lake Martin, Jacksons Gap offers residents sweeping waterfront vistas and a quiet, semi-rural environment. Though small in population, the town has become a magnet for high-dollar real estate buyers seeking second homes or full-time residences with direct lake access. Much of the housing inventory consists of custom homes built to take advantage of the views and natural terrain, and many properties are tucked away in secluded pockets of forested shoreline. This low-density layout adds to the town’s exclusivity and helps explain why prices have risen so quickly—there simply aren’t many properties like these left.

The area has also benefited from Lake Martin’s growing popularity across the Southeast. As Birmingham, Atlanta, and Montgomery buyers seek scenic weekend retreats within driving distance, Jacksons Gap has emerged as a prime target. The local government has kept development in check, preserving the town’s natural charm while encouraging thoughtful growth. While the recent price dip may reflect the broader market’s adjustment after a frenzied 2020–2022 period, Jacksons Gap’s long-term fundamentals remain strong. Its combination of location, scarcity, and lifestyle appeal keeps demand high, and it’s likely the town will continue to attract buyers willing to pay a premium for peace, privacy, and water access.

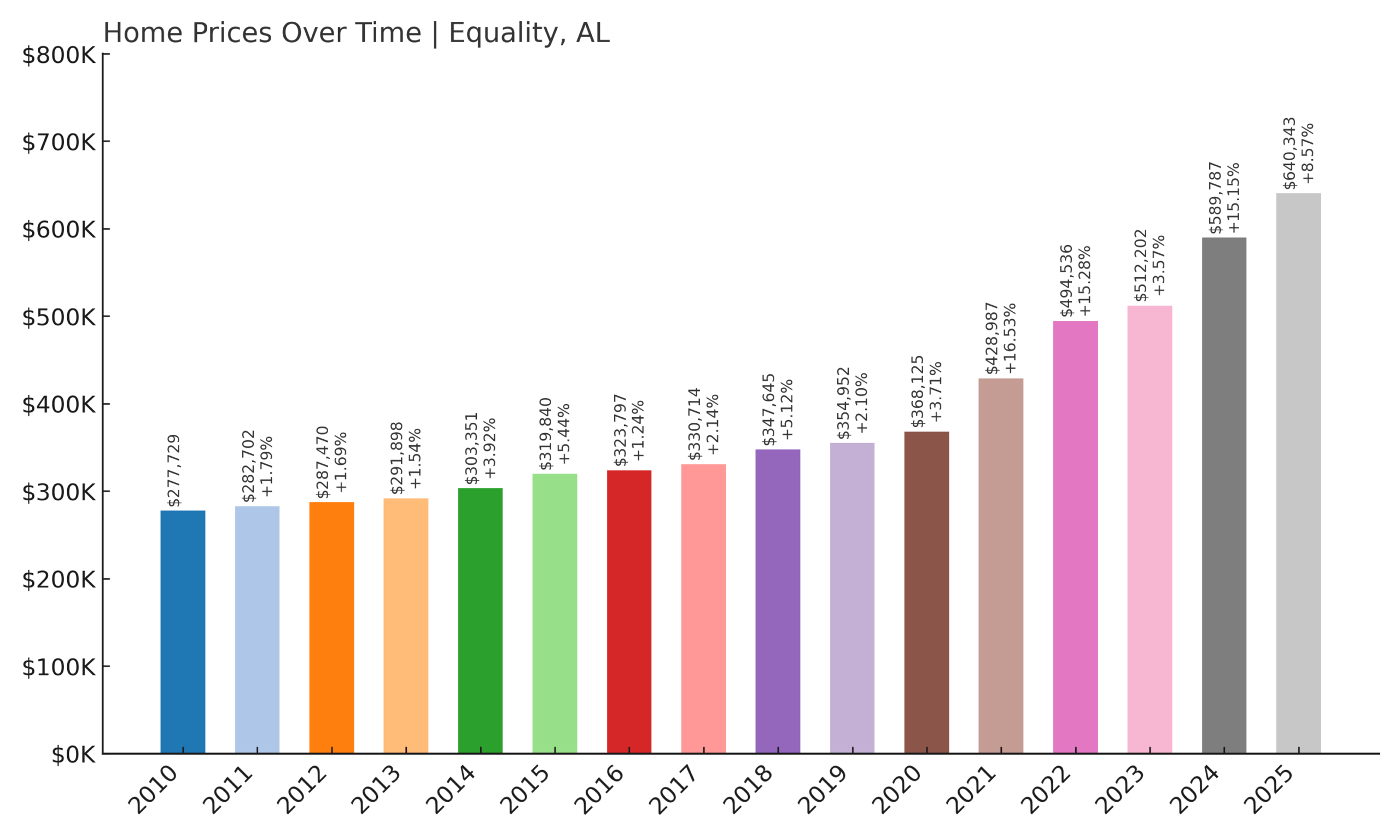

3. Equality – 130.5% Home Price Increase Since 2010

- 2010: $277,729

- 2011: $282,702 (+$4,973, +1.79% from previous year)

- 2012: $287,470 (+$4,768, +1.69% from previous year)

- 2013: $291,898 (+$4,428, +1.54% from previous year)

- 2014: $303,351 (+$11,453, +3.92% from previous year)

- 2015: $319,840 (+$16,489, +5.44% from previous year)

- 2016: $323,797 (+$3,957, +1.24% from previous year)

- 2017: $330,714 (+$6,917, +2.14% from previous year)

- 2018: $347,645 (+$16,931, +5.12% from previous year)

- 2019: $354,952 (+$7,307, +2.10% from previous year)

- 2020: $368,125 (+$13,173, +3.71% from previous year)

- 2021: $428,987 (+$60,862, +16.53% from previous year)

- 2022: $494,536 (+$65,549, +15.28% from previous year)

- 2023: $512,202 (+$17,666, +3.57% from previous year)

- 2024: $589,787 (+$77,585, +15.15% from previous year)

- 2025: $640,343 (+$50,556, +8.57% from previous year)

Home values in Equality have surged over the last 15 years, climbing from $277,729 in 2010 to $640,343 in 2025. That’s a 130.5% increase, one of the highest in Alabama. During the early 2010s, price growth was modest—hovering around 1–2% annually—reflecting slow but steady demand in a mostly rural market. But a shift began around 2015, when prices started to accelerate. By 2020, the groundwork had been laid for a much more aggressive growth trajectory, and the market capitalized on it. From 2020 onward, the town experienced several years of double-digit growth. Prices jumped by more than $60,000 in 2021, then another $65,000 in 2022. The upward trend didn’t let up, with home values continuing to climb steadily into 2025. What’s remarkable is how consistent the appreciation was—even modest years were bookended by huge jumps. This points to rising interest in the area as a long-term home base, not just as a seasonal or second-home market. By 2025, average home values in Equality are well into the $600,000 range, a milestone few rural communities in the state have reached. Unlike boom-and-bust cycles in some high-growth towns, Equality’s pricing gains appear resilient. There were no significant corrections, and each year added more value than the last. Even when the broader market began to cool in 2024 and 2025, this town continued gaining ground. That makes Equality an outlier in the best way—its growth was sustained, real, and backed by lifestyle-driven demand rather than hype. For buyers tracking long-term appreciation, Equality’s market sends a strong signal that this once-overlooked community now commands real attention.

Equality – Remote, Scenic, and Rapidly Valued

Located in Coosa County near the shores of Lake Martin, Equality is a quiet, forested community that has become one of Alabama’s most surprising real estate success stories. The town has no formal commercial district and minimal infrastructure, but that’s precisely what attracts many of its residents. Equality appeals to those who want seclusion, space, and lake access—all without the crowding or cost that defines other lake communities. It sits within easy driving distance of Montgomery and Birmingham but feels completely disconnected from urban life. That isolation has become a premium selling point, especially among affluent retirees and remote workers. There’s a growing demand for homes that offer both privacy and proximity to water, and Equality checks both boxes.

Part of the town’s value growth stems from limited inventory and expansive lake frontage, which creates built-in scarcity. Buyers are increasingly choosing large-acreage plots and custom homes over cookie-cutter subdivisions, and Equality offers some of the last remaining options in central Alabama for doing just that. The views are pristine, the lake is clear and clean, and the surrounding forest adds to the sense of retreat. While services are limited and cell signal can be spotty in parts, those trade-offs are part of the package. For many buyers, the allure lies in escaping exactly what most other towns offer. In a state where affordability once reigned supreme, Equality shows that when location and lifestyle align, even small communities can become luxury markets.

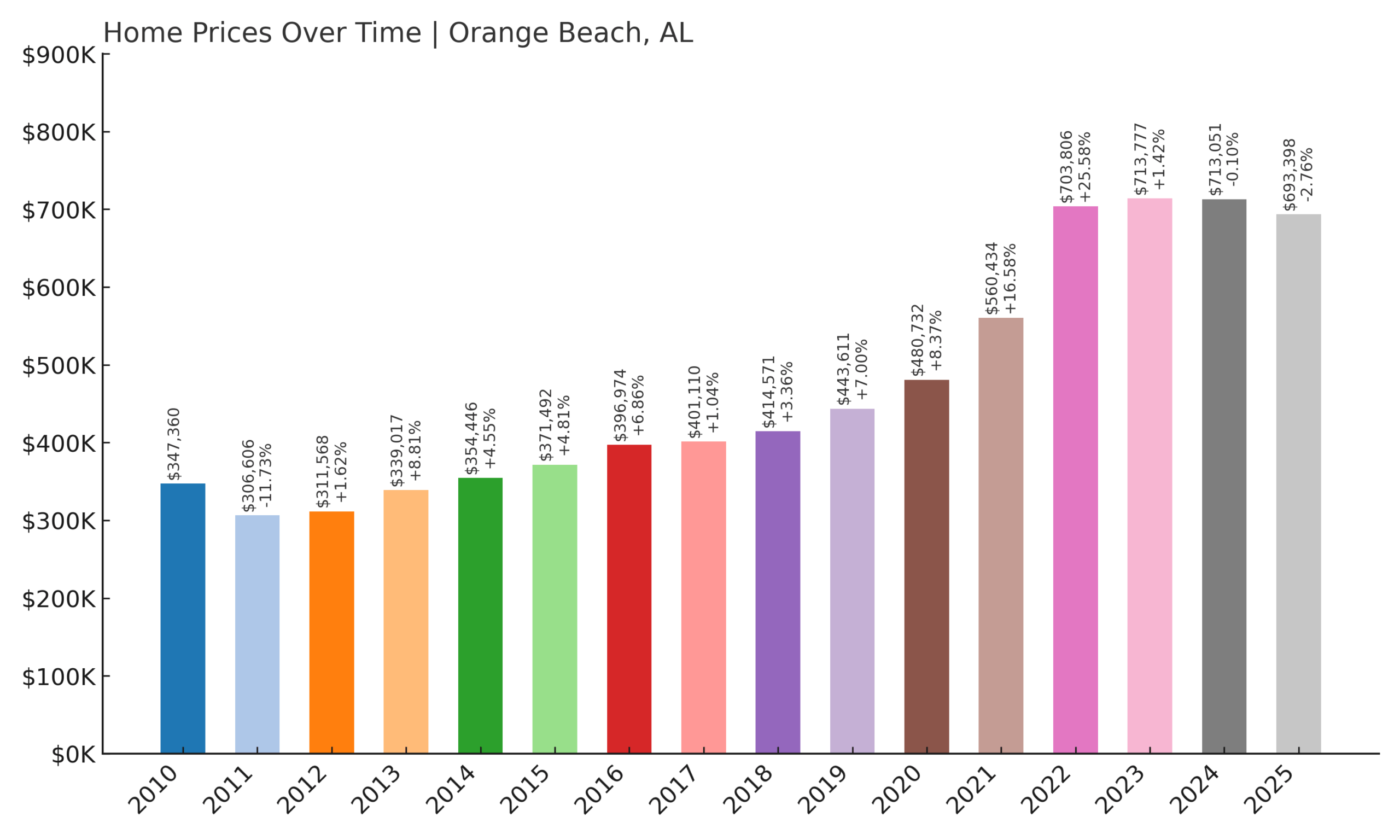

2. Orange Beach – 99.5% Home Price Increase Since 2010

- 2010: $347,360

- 2011: $306,606 (-$40,754, -11.73% from previous year)

- 2012: $311,568 (+$4,962, +1.62% from previous year)

- 2013: $339,017 (+$27,449, +8.81% from previous year)

- 2014: $354,446 (+$15,429, +4.55% from previous year)

- 2015: $371,492 (+$17,046, +4.81% from previous year)

- 2016: $396,974 (+$25,482, +6.86% from previous year)

- 2017: $401,110 (+$4,136, +1.04% from previous year)

- 2018: $414,571 (+$13,461, +3.36% from previous year)

- 2019: $443,611 (+$29,040, +7.00% from previous year)

- 2020: $480,732 (+$37,121, +8.37% from previous year)

- 2021: $560,434 (+$79,702, +16.58% from previous year)

- 2022: $703,806 (+$143,372, +25.58% from previous year)

- 2023: $713,777 (+$9,971, +1.42% from previous year)

- 2024: $713,051 (-$726, -0.10% from previous year)

- 2025: $693,398 (-$19,653, -2.76% from previous year)

Home values in Orange Beach have nearly doubled since 2010, climbing from $347,360 to $693,398 over 15 years. That 99.5% increase places it among the state’s most dynamic real estate markets. The early part of the decade saw some volatility, including a dip in 2011, but growth rebounded quickly. From 2012 through 2020, prices climbed at a steady pace, helped by strong tourism and increasing investment in short-term rentals. Each year brought respectable gains, but the real story kicked off in the early 2020s. Between 2020 and 2022, Orange Beach experienced two of its biggest jumps ever. Prices leapt by $79,000 in 2021 and another $143,000 in 2022. These increases were driven by soaring demand for beach property during the pandemic, as remote work became the norm and coastal towns saw massive spikes in interest. Orange Beach, with its mix of condo units and single-family homes, became a hotspot for second-home buyers and investors alike. Even after these massive gains, prices remained relatively flat through 2023 and 2024 before dipping slightly in 2025—a natural correction after such aggressive growth. Despite that slight pullback, Orange Beach retains almost all of its post-pandemic gains and continues to command premium pricing. Its performance over the last 15 years has been both powerful and resilient. The town has proved that coastal real estate in Alabama is no longer a budget buy—it’s a luxury asset. Orange Beach didn’t just benefit from national trends; it helped define them for Alabama’s coast. Investors, homeowners, and second-home seekers all continue to see value here, and with good reason.

Orange Beach – Alabama’s Gulffront Powerhouse

Orange Beach is a premier destination on Alabama’s Gulf Coast, known for its pristine beaches, high-rise condos, and thriving short-term rental scene. It’s not just a place to vacation—it’s a serious real estate market. Located just east of Gulf Shores, Orange Beach offers a more upscale, resort-style atmosphere with top-tier amenities. Boating, deep-sea fishing, dining, and festivals all contribute to its year-round appeal. Over the last decade, infrastructure has expanded to meet the demand, with new marinas, restaurants, and condos dotting the coastline. That development, coupled with sustained interest from out-of-state buyers, has driven home values higher than nearly any other coastal town in the region.

The town’s appeal stretches far beyond Alabama. Buyers come from Texas, Tennessee, Georgia, and even the Midwest, drawn by rental income opportunities and beachfront access that’s still more affordable than Florida. The availability of waterfront condos makes the market accessible, but prices have steadily moved north of $600,000 for many properties. Hurricane risk remains a consideration, but it hasn’t deterred growth or development. Orange Beach has established itself as a long-term winner—one that’s likely to remain at the top of Alabama’s coastal housing market for years to come.

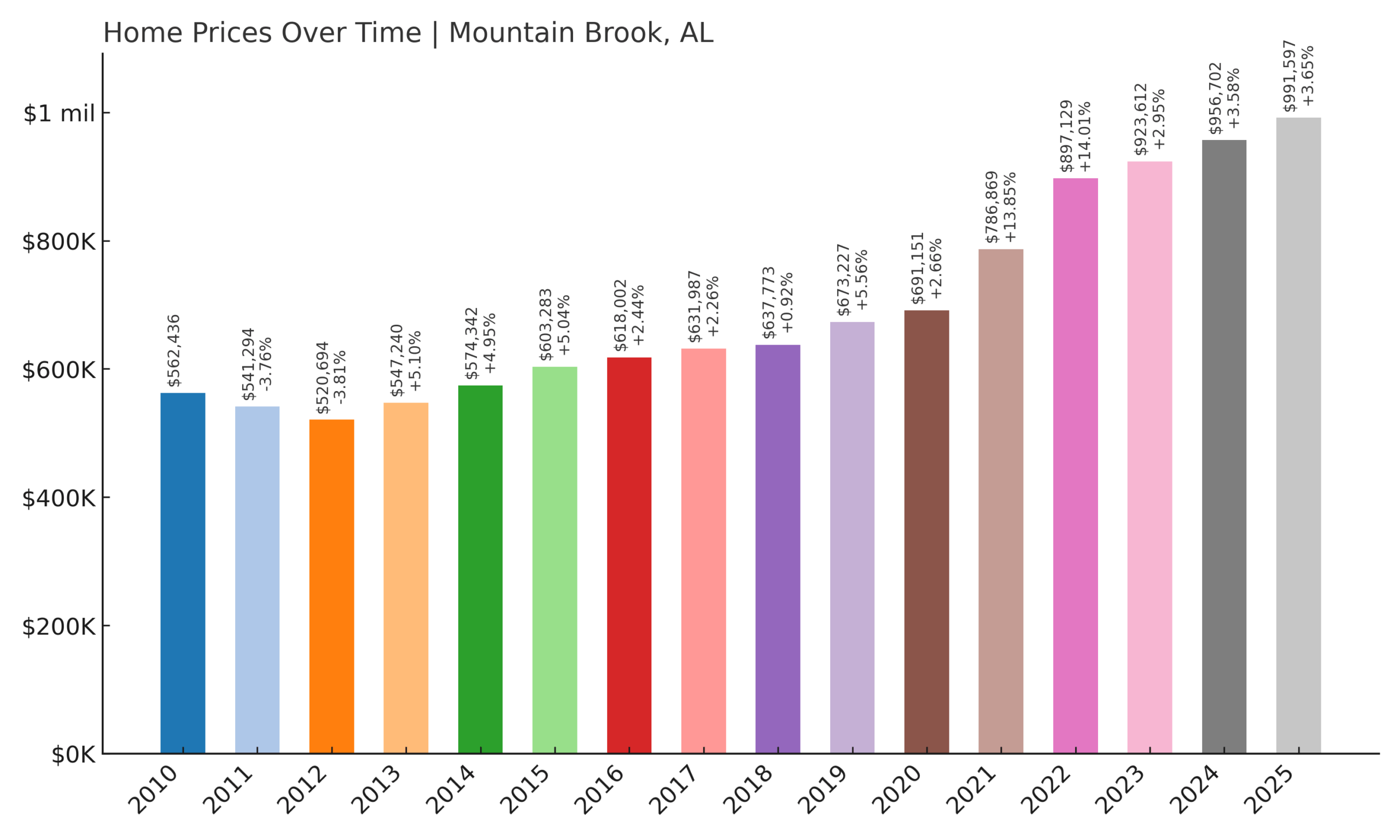

1. Mountain Brook – 75.9% Home Price Increase Since 2010

- 2010: $562,436

- 2011: $541,294 (-$21,142, -3.76% from previous year)

- 2012: $520,694 (-$20,600, -3.81% from previous year)

- 2013: $547,240 (+$26,546, +5.10% from previous year)

- 2014: $574,342 (+$27,102, +4.95% from previous year)

- 2015: $603,283 (+$28,941, +5.04% from previous year)

- 2016: $618,002 (+$14,719, +2.44% from previous year)

- 2017: $631,987 (+$13,985, +2.26% from previous year)

- 2018: $637,773 (+$5,786, +0.92% from previous year)

- 2019: $673,227 (+$35,454, +5.56% from previous year)

- 2020: $691,151 (+$17,924, +2.66% from previous year)

- 2021: $786,869 (+$95,718, +13.85% from previous year)

- 2022: $897,129 (+$110,260, +14.01% from previous year)

- 2023: $923,612 (+$26,483, +2.95% from previous year)

- 2024: $956,702 (+$33,090, +3.58% from previous year)

- 2025: $991,597 (+$34,895, +3.65% from previous year)

Mountain Brook began the 2010s with a slight downturn in home values, as the effects of the 2008 housing crash continued to ripple through the early part of the decade. Prices fell for two consecutive years, dipping from $562,436 in 2010 to $520,694 in 2012. But starting in 2013, the market rebounded sharply and never looked back. Gains from that point forward were steady and strong, with year-over-year increases that rarely dipped below 2%. By 2015, the town had not only recovered from its losses but was setting new records for home values. The most substantial growth occurred during the post-pandemic years, when the town’s appeal soared among high-income professionals seeking space, amenities, and school quality. Between 2020 and 2022 alone, home prices jumped over $205,000. These increases were fueled by both lifestyle shifts and limited housing supply. Mountain Brook has strict zoning rules and almost no land available for new development, meaning demand consistently outpaces inventory. In high-demand years, even modest homes received multiple offers above asking price—further pushing the market to new highs. As of May 2025, the average home in Mountain Brook is valued at $991,597—up 75.9% from 2010. What sets the town apart isn’t just the price level, but the consistency of its growth. Even during national slowdowns or periods of economic uncertainty, Mountain Brook’s housing market has remained stable and upward-trending. The town’s combination of location, reputation, and community structure provides a kind of insulation against larger market volatility. For families looking for long-term value—and the lifestyle that comes with it—Mountain Brook continues to be the most desirable and dependable choice in Alabama.

Mountain Brook – Alabama’s Most Prestigious Address

Mountain Brook sits just southeast of downtown Birmingham and is widely regarded as the most prestigious residential community in the state. Developed in the 1920s as a planned “garden suburb,” it was designed with curving roads, green space, and elegant homes that blend into the natural landscape. That original vision has been carefully maintained for over a century. Today, the town is home to some of Alabama’s wealthiest families, top-performing public schools, and a tight-knit community with very low turnover. Property here is more than real estate—it’s a long-term investment in neighborhood identity. Many homes are passed down through generations, and when new inventory does hit the market, it’s quickly snapped up at premium prices. Buyers are paying not just for square footage, but for entry into a unique, tightly held community.

Beyond the homes themselves, Mountain Brook offers unmatched lifestyle benefits. Its village-style retail districts—Crestline, Mountain Brook Village, and English Village—are walkable, upscale, and carefully curated to avoid national chains. The town’s public schools are consistently rated among the best in Alabama, making it a magnet for families willing to pay a premium for education and stability. Tree-lined streets, extensive parks, and country clubs add to the town’s appeal. While it’s located just minutes from Birmingham’s urban core, Mountain Brook maintains a separate identity that feels calm, exclusive, and deeply rooted. For nearly a century, this community has set the standard for Alabama’s high-end housing market—and its nearly million-dollar average home value in 2025 is just the latest proof of that enduring status.