Would you like to save this?

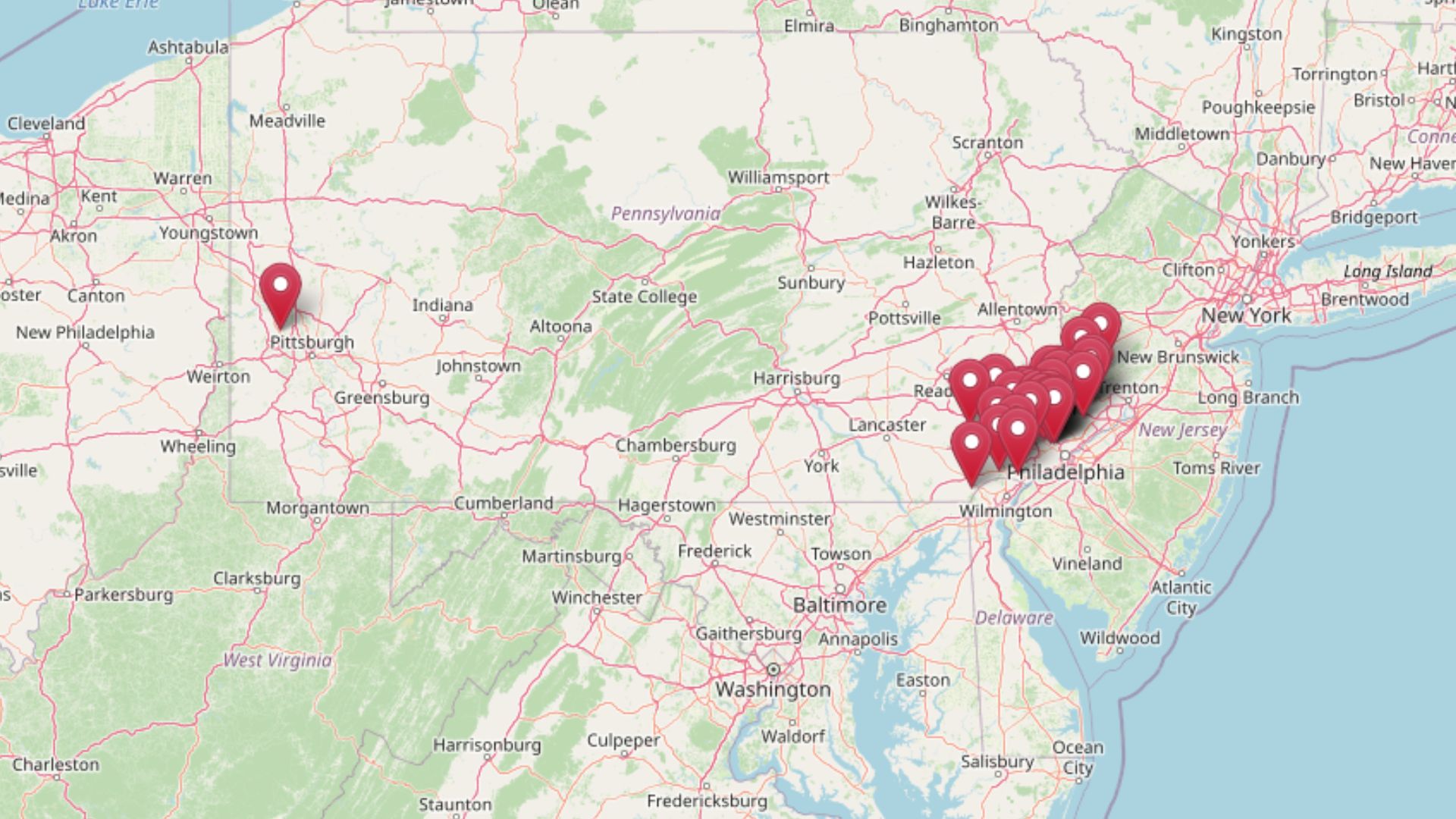

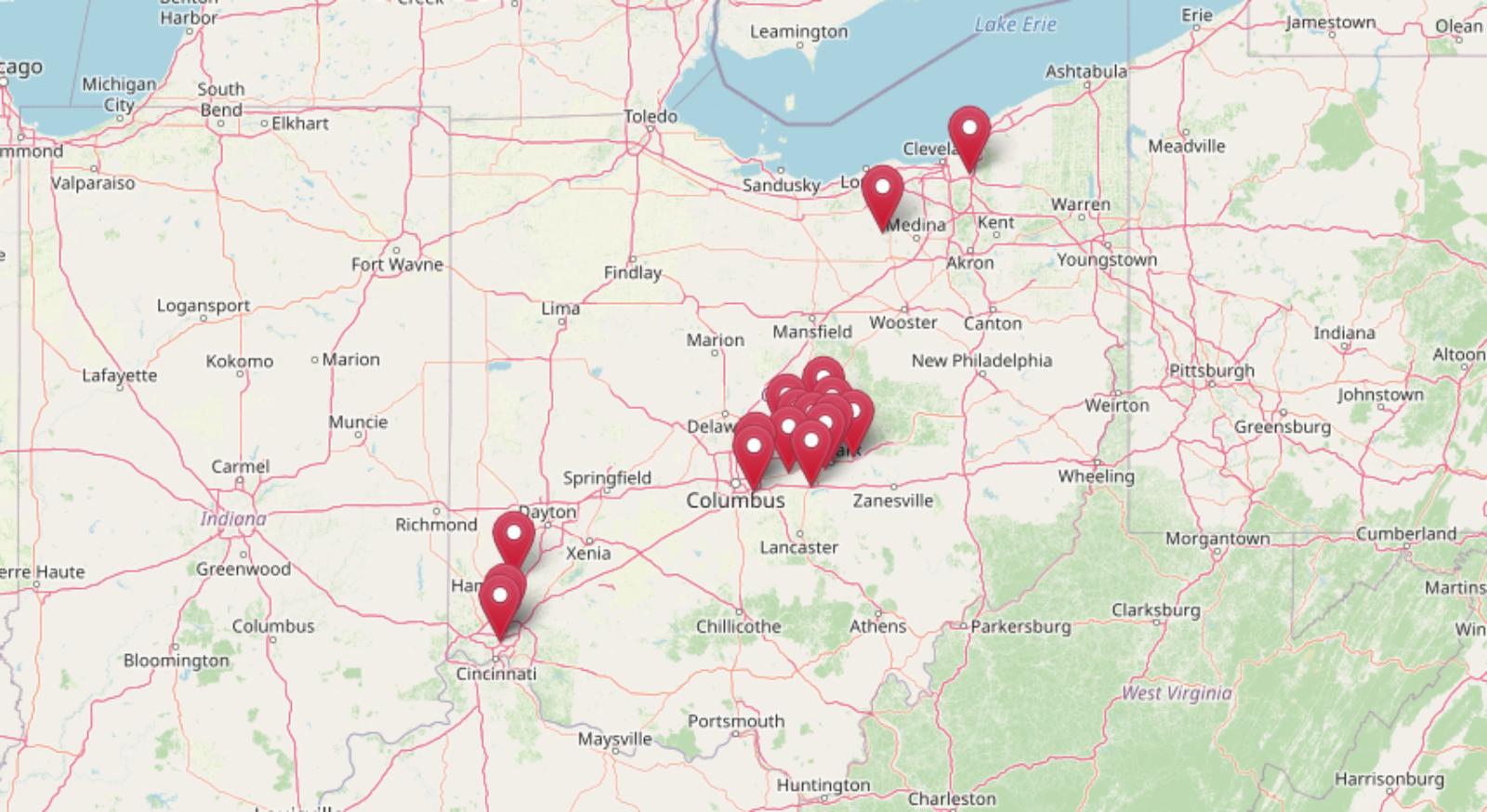

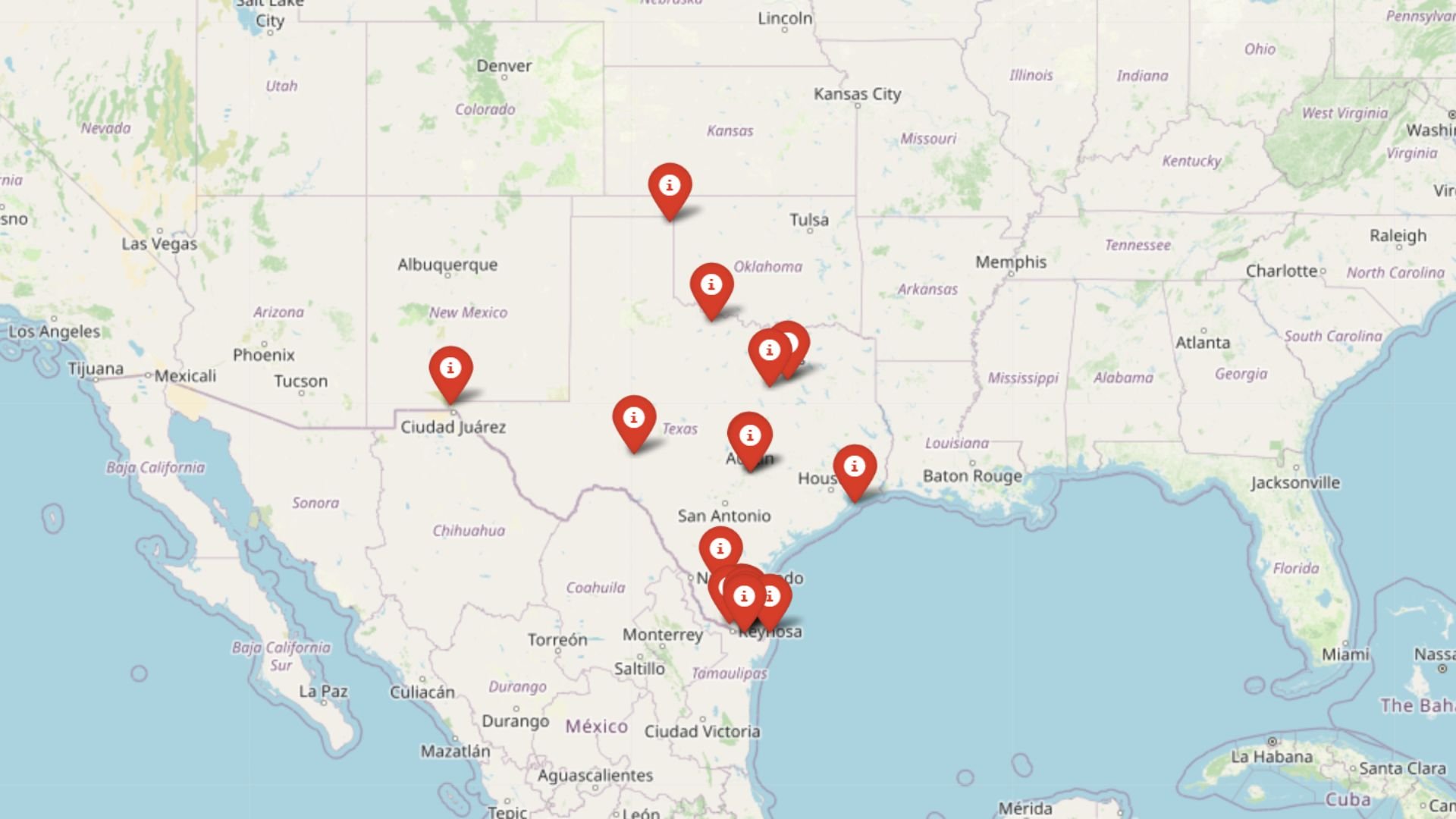

Home prices in parts of Texas are looking wobbly. Using the Zillow Home Value Index and 15 years of historical data, analysts are spotting clear red flags—price spikes that don’t match local incomes, volatile month-to-month shifts, and worrying echoes of past housing crashes. While some towns still look solid, others are flashing the same warning signs seen before earlier price corrections. From small oil towns to sprawling suburbs, here are the places where property values may be standing on shaky ground.

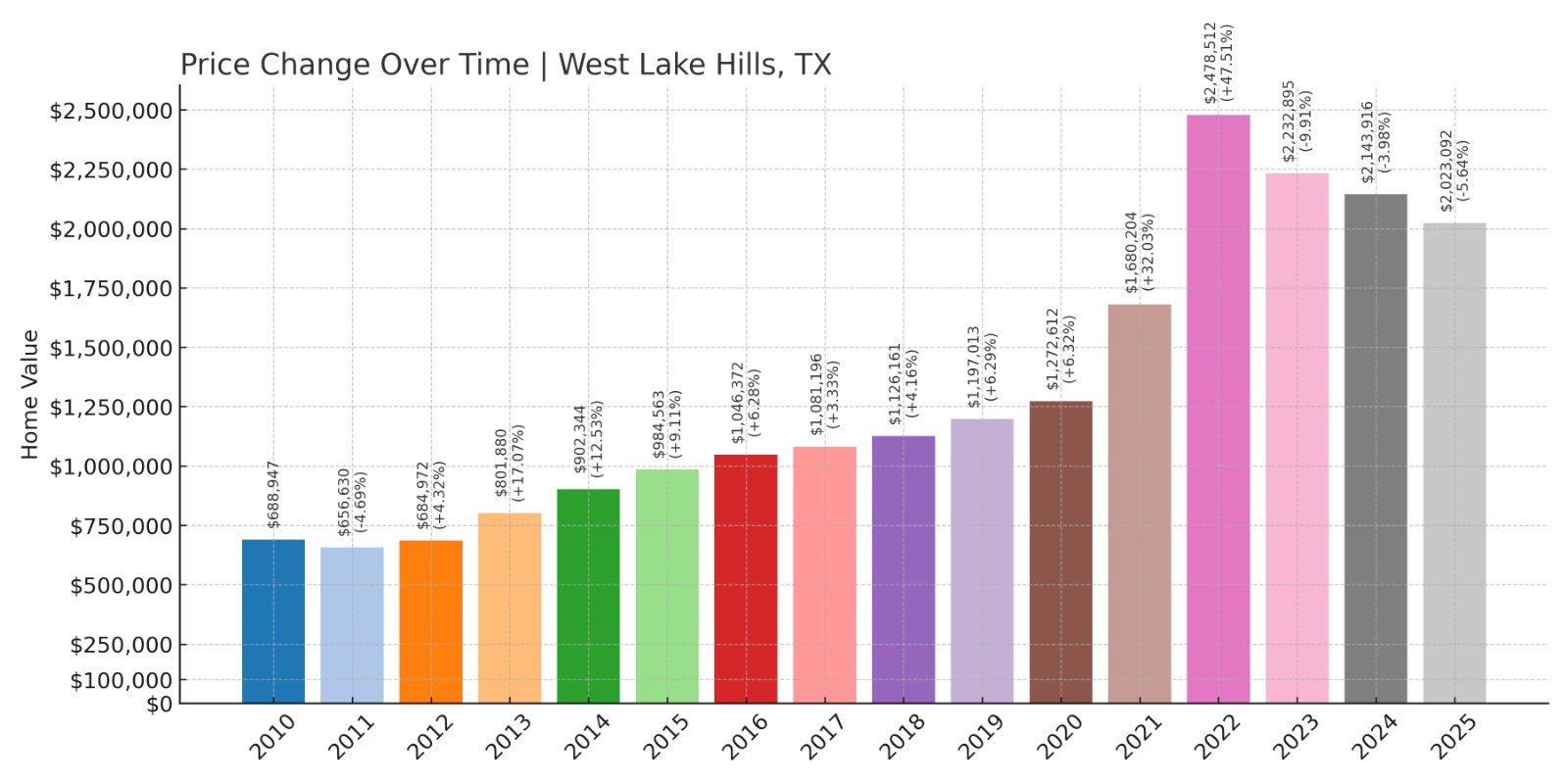

18. West Lake Hills – Crash Risk Percentage: 77.15%

- Crash Risk Percentage: 77.15%

- Historical crashes (8%+ drops): 1

- Worst historical crash: 9.9% (2023)

- Total price increase since 2010: 193.6%

- Overextended above long-term average: 54.1%

- Price volatility (annual swings): 14.9%

- Current 2025 price: $2,023,092

West Lake Hills has seen nearly a 200% rise in home values since 2010, driven by its proximity to Austin and its reputation for luxury living. However, with prices currently over 50% above their long-term average and a history of at least one notable price drop, this affluent area carries risk. The combination of rapid historical growth and high volatility means buyers should be cautious about future corrections here.

West Lake Hills – Upscale Appeal But Volatile Trends

Located just west of Austin, West Lake Hills is known for its rolling hill landscapes and some of the most expensive homes in Texas. The average price now tops $2 million, making it one of the priciest towns in the state. Its single historical crash of nearly 10% in 2023 reflects how sudden market corrections can occur even in desirable areas. High volatility further heightens the risk for homeowners looking for price stability.

This town’s prime location and strong school districts continue to attract buyers, but its significant overextension above long-term averages could become a problem if economic conditions tighten. Potential buyers should keep an eye on Austin’s broader market health, as downturns there often ripple into surrounding towns like West Lake Hills.

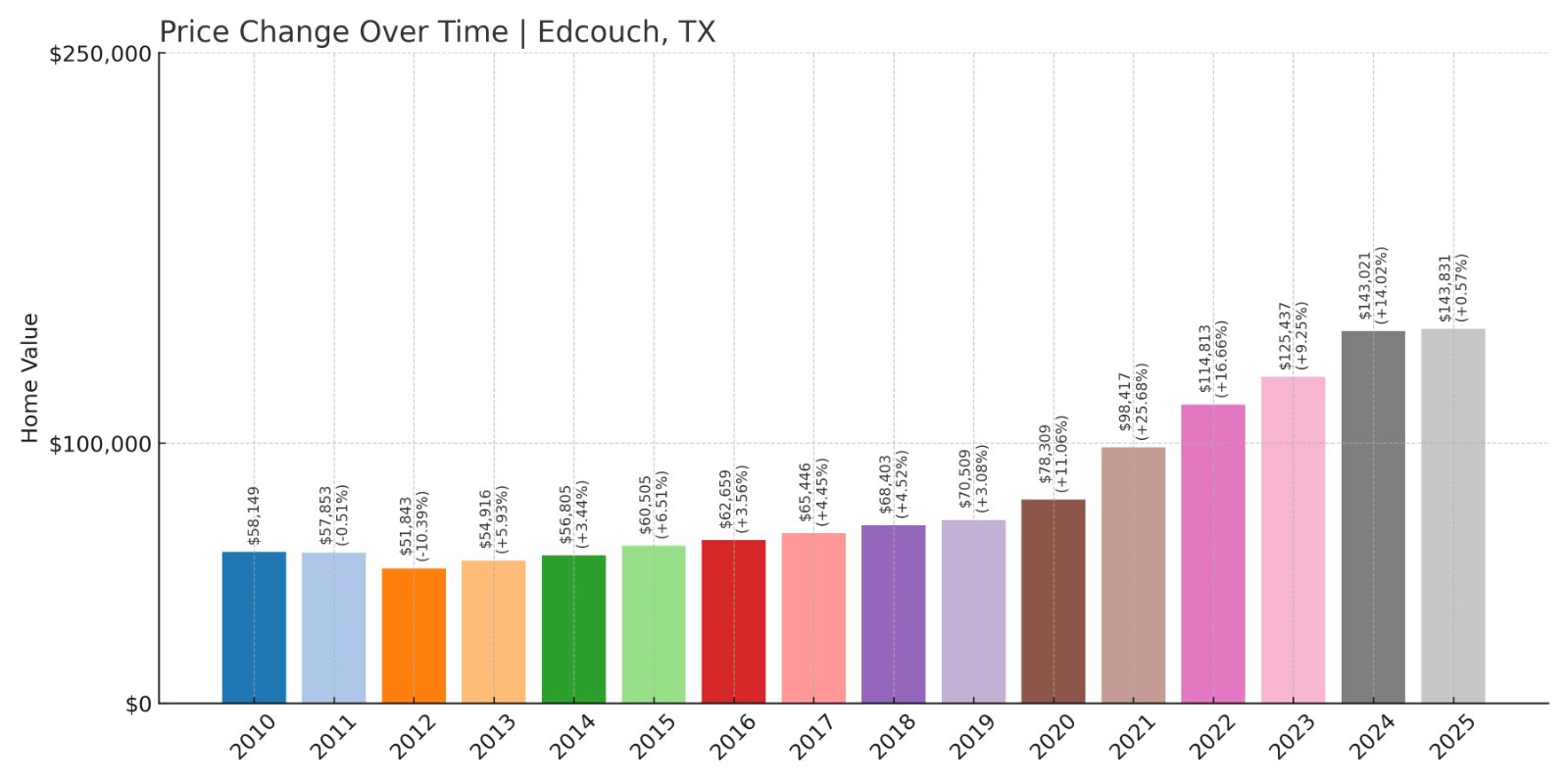

17. Edcouch – Crash Risk Percentage: 77.45%

- Crash Risk Percentage: 77.45%

- Historical crashes (8%+ drops): 1

- Worst historical crash: 10.4% (2012)

- Total price increase since 2010: 147.3%

- Overextended above long-term average: 75.5%

- Price volatility (annual swings): 8.3%

- Current 2025 price: $143,831

Edcouch has seen strong price growth over the past decade, with prices now almost 150% higher than in 2010. However, its overextension above the long-term average at over 75% is a major warning sign. Combined with its history of a crash in 2012, there are clear risks for buyers hoping for stable gains here.

Edcouch – Affordable Living With Underlying Risks

Edcouch is a small town in Hidalgo County, close to the Mexican border. Home values remain relatively affordable compared to state averages, but they have soared in recent years. The town’s worst historical crash of over 10% in 2012 indicates its vulnerability during market shifts. Its current price volatility remains moderate, but high overextension signals that prices may not be sustainable long term.

Residents benefit from proximity to McAllen’s job market and services, but limited local economic diversity can contribute to greater housing market swings. Buyers should be wary of the potential for corrections, especially if broader regional economic trends weaken.

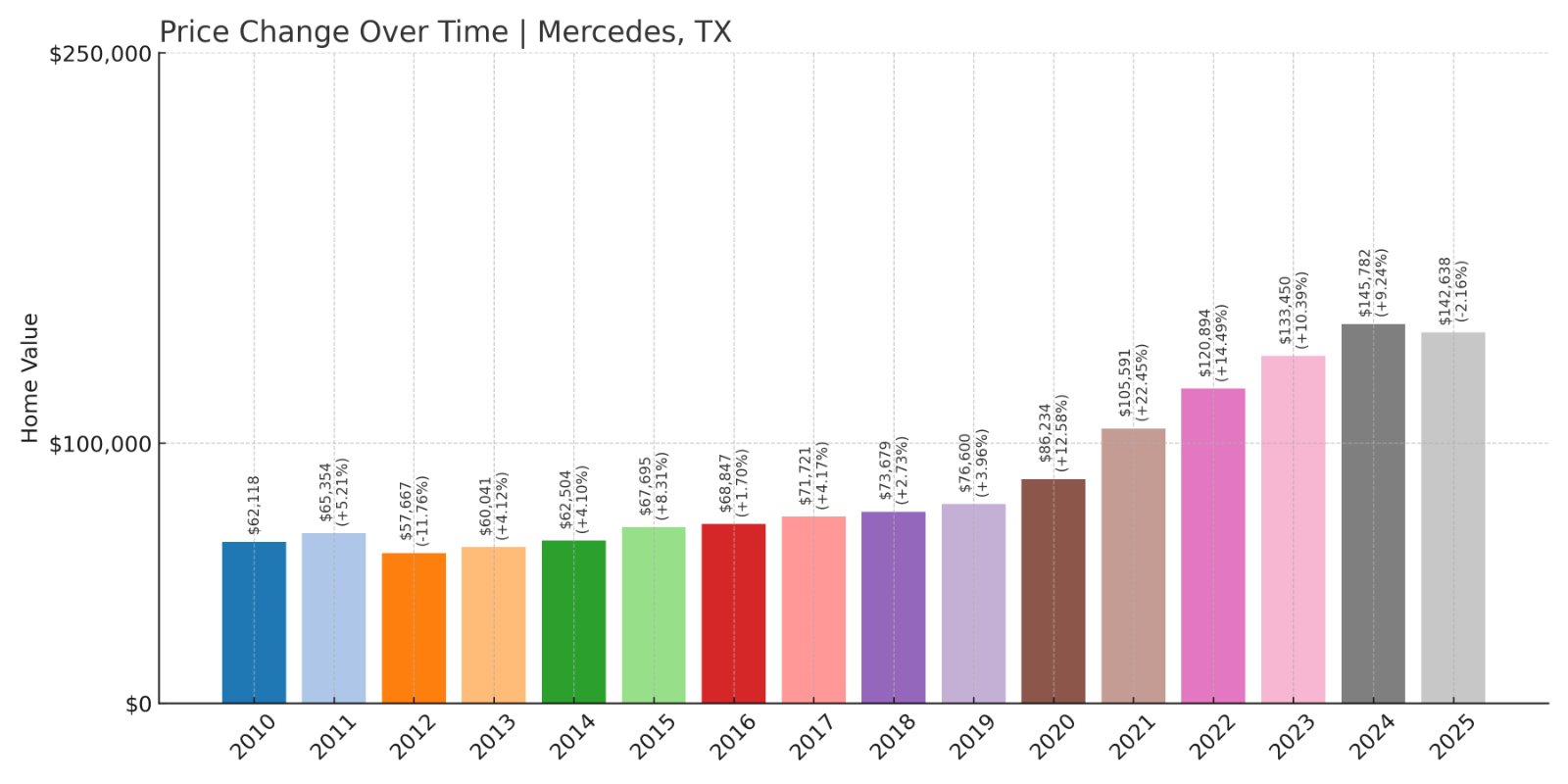

16. Mercedes – Crash Risk Percentage: 77.65%

- Crash Risk Percentage: 77.65%

- Historical crashes (8%+ drops): 1

- Worst historical crash: 11.8% (2012)

- Total price increase since 2010: 129.6%

- Overextended above long-term average: 62.9%

- Price volatility (annual swings): 7.8%

- Current 2025 price: $142,638

Mercedes home prices have risen by nearly 130% since 2010, with a sharp drop of nearly 12% back in 2012 serving as a reminder of market risks. Prices remain significantly overextended, raising concerns about potential corrections ahead.

Mercedes – Steady Growth But Past Crashes Loom

Would you like to save this?

Mercedes, known as the “Queen City of the Valley,” lies in Hidalgo County and is famous for its Rio Grande Valley Livestock Show. Housing prices remain affordable by state standards, but their rapid rise over the past decade puts them at risk. The town’s worst price drop came in 2012 with an 11.8% decline, showing it is not immune to market pressures.

Despite modest volatility compared to other towns, its overextension of nearly 63% above long-term trends indicates possible unsustainable valuations. Buyers looking for stability should weigh these risks against the town’s affordable cost of living and community amenities.

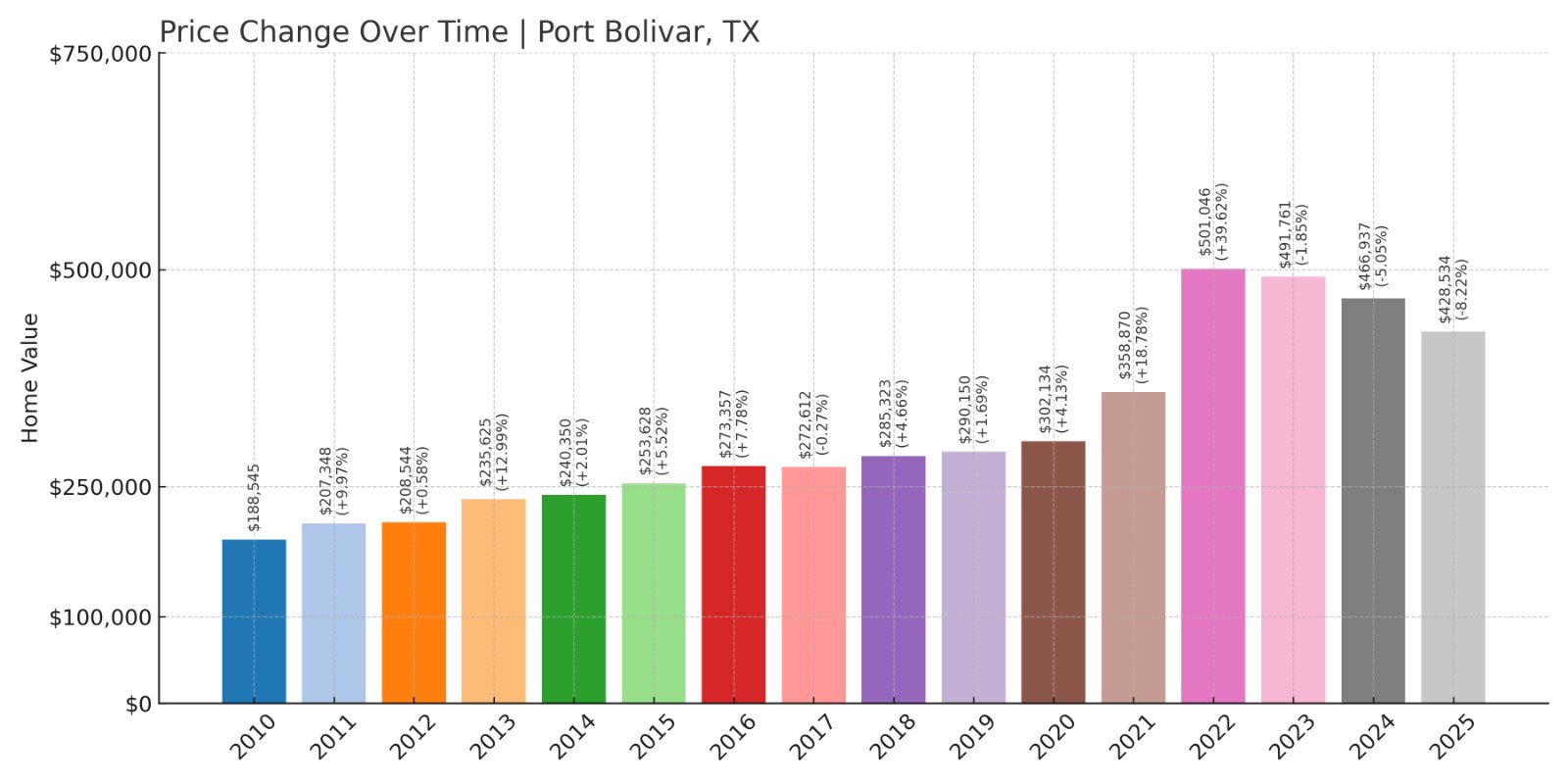

15. Port Bolivar – Crash Risk Percentage: 77.95%

- Crash Risk Percentage: 77.95%

- Historical crashes (8%+ drops): 1

- Worst historical crash: 8.2% (2025)

- Total price increase since 2010: 127.3%

- Overextended above long-term average: 37.0%

- Price volatility (annual swings): 11.5%

- Current 2025 price: $428,534

Port Bolivar’s home prices have more than doubled since 2010, with an 8.2% crash occurring this year alone. Its moderate overextension above long-term trends and high volatility suggest risks for homeowners.

Port Bolivar – Coastal Community Facing Price Swings

Located on the Bolivar Peninsula northeast of Galveston, Port Bolivar offers residents coastal living with easy beach access. Recent years have seen strong price increases, pushing current median home values to over $428,000. However, its recent 8.2% drop in 2025 raises concerns about market stability in this hurricane-prone area.

The town’s price volatility of 11.5% suggests frequent swings, which can be driven by seasonal demand, storm risks, and insurance costs. Buyers should factor in these uncertainties when considering investments here.

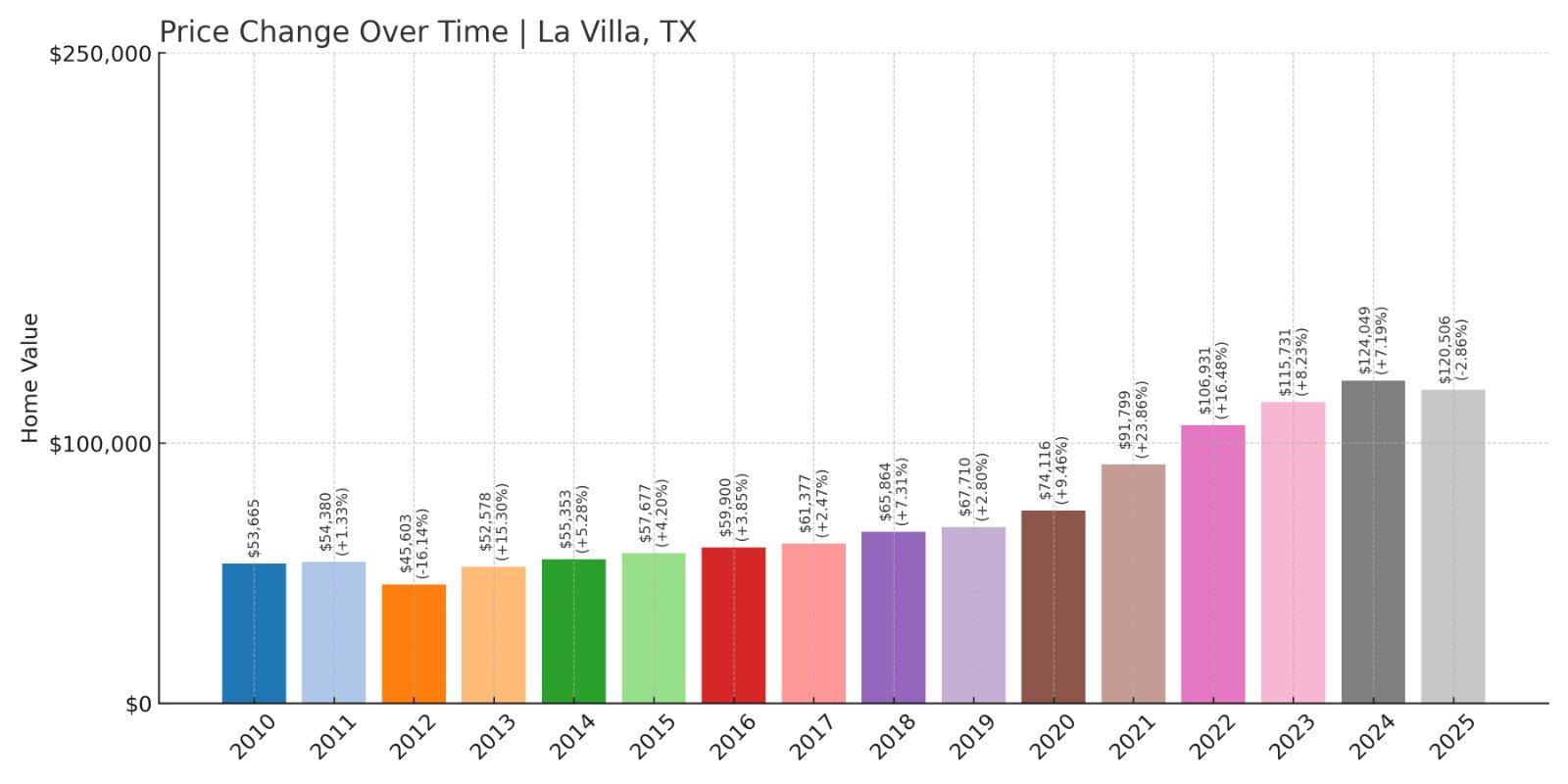

14. La Villa – Crash Risk Percentage: 78.75%

- Crash Risk Percentage: 78.75%

- Historical crashes (8%+ drops): 1

- Worst historical crash: 16.1% (2012)

- Total price increase since 2010: 124.6%

- Overextended above long-term average: 59.7%

- Price volatility (annual swings): 9.1%

- Current 2025 price: $120,506

La Villa’s home prices have risen over 120% since 2010, but its worst crash of 16.1% in 2012 shows its vulnerability. Prices are nearly 60% above long-term averages, highlighting potential risks ahead.

La Villa – Rapid Growth With a History of Losses

La Villa is a small town in Hidalgo County that has seen strong growth in home prices over the past decade. Its median price remains relatively affordable at just over $120,000, but previous sharp declines warn of future risks. In 2012, the town saw a dramatic 16.1% drop in value, signaling its susceptibility to economic shifts.

With price volatility of around 9%, it is less volatile than some markets, but combined with high overextension, buyers should approach with caution. The town offers a quiet rural lifestyle, but limited economic diversification increases vulnerability to broader market downturns.

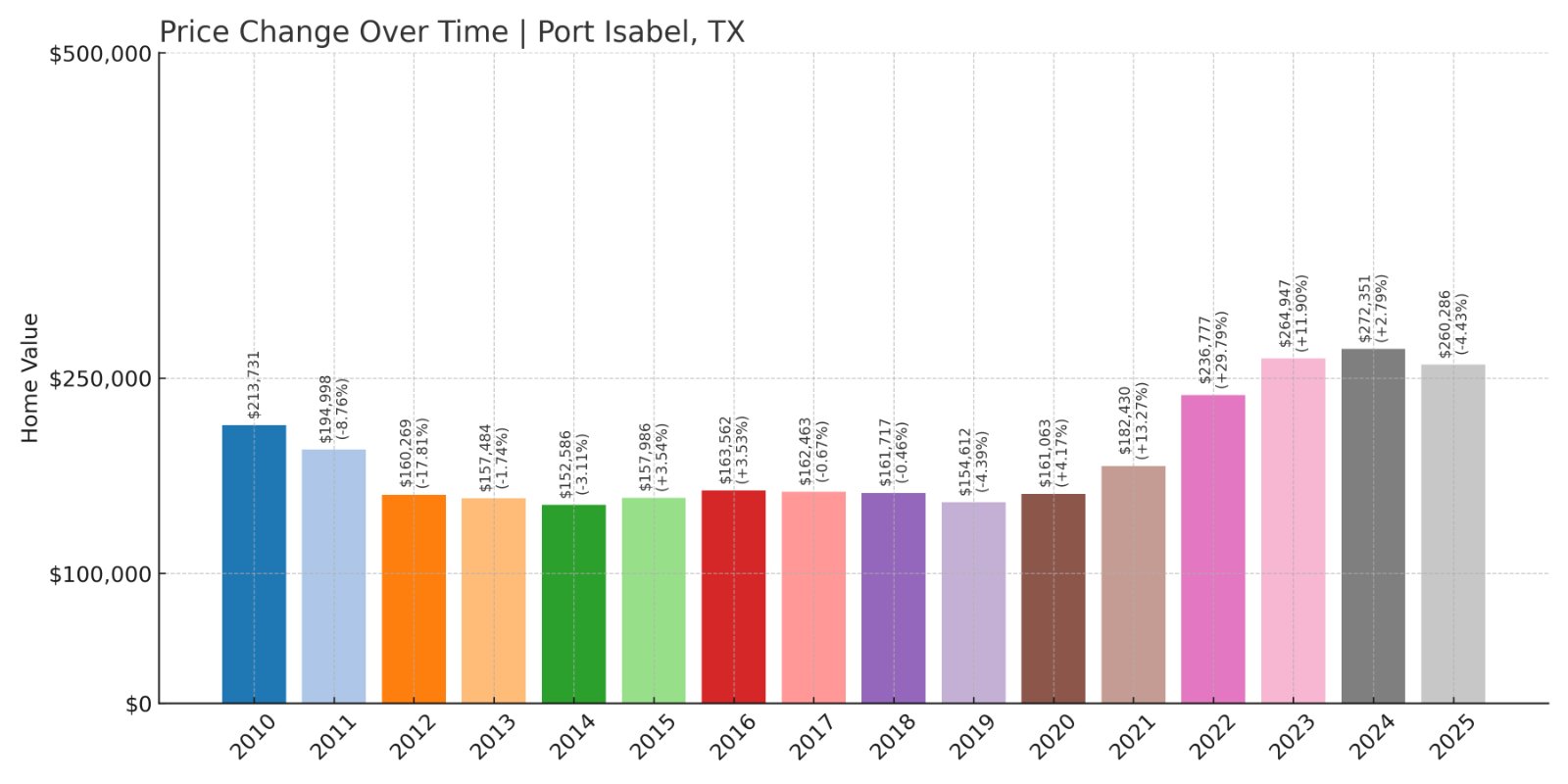

13. Port Isabel – Crash Risk Percentage: 78.80%

- Crash Risk Percentage: 78.80%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 17.8% (2012)

- Total price increase since 2010: 21.8%

- Overextended above long-term average: 36.2%

- Price volatility (annual swings): 10.9%

- Current 2025 price: $260,286

Port Isabel has seen modest price growth of just under 22% since 2010, but its two recorded crashes, including a severe 17.8% drop in 2012, highlight underlying vulnerabilities. Its current overextension and volatility signal possible future declines if market conditions shift.

Port Isabel – Coastal Charm With Market Risks

Port Isabel is located near South Padre Island, serving as a gateway for tourists seeking beaches and fishing. Its median home price is now over $260,000, boosted by waterfront properties and vacation rentals. However, its history of a nearly 18% crash in 2012 shows how reliant the town is on seasonal tourism and regional economic health.

With a price volatility of nearly 11% and overextension above long-term trends, homeowners here face elevated risks. Buyers should factor in local employment reliance on hospitality and the potential impact of hurricane seasons on property values.

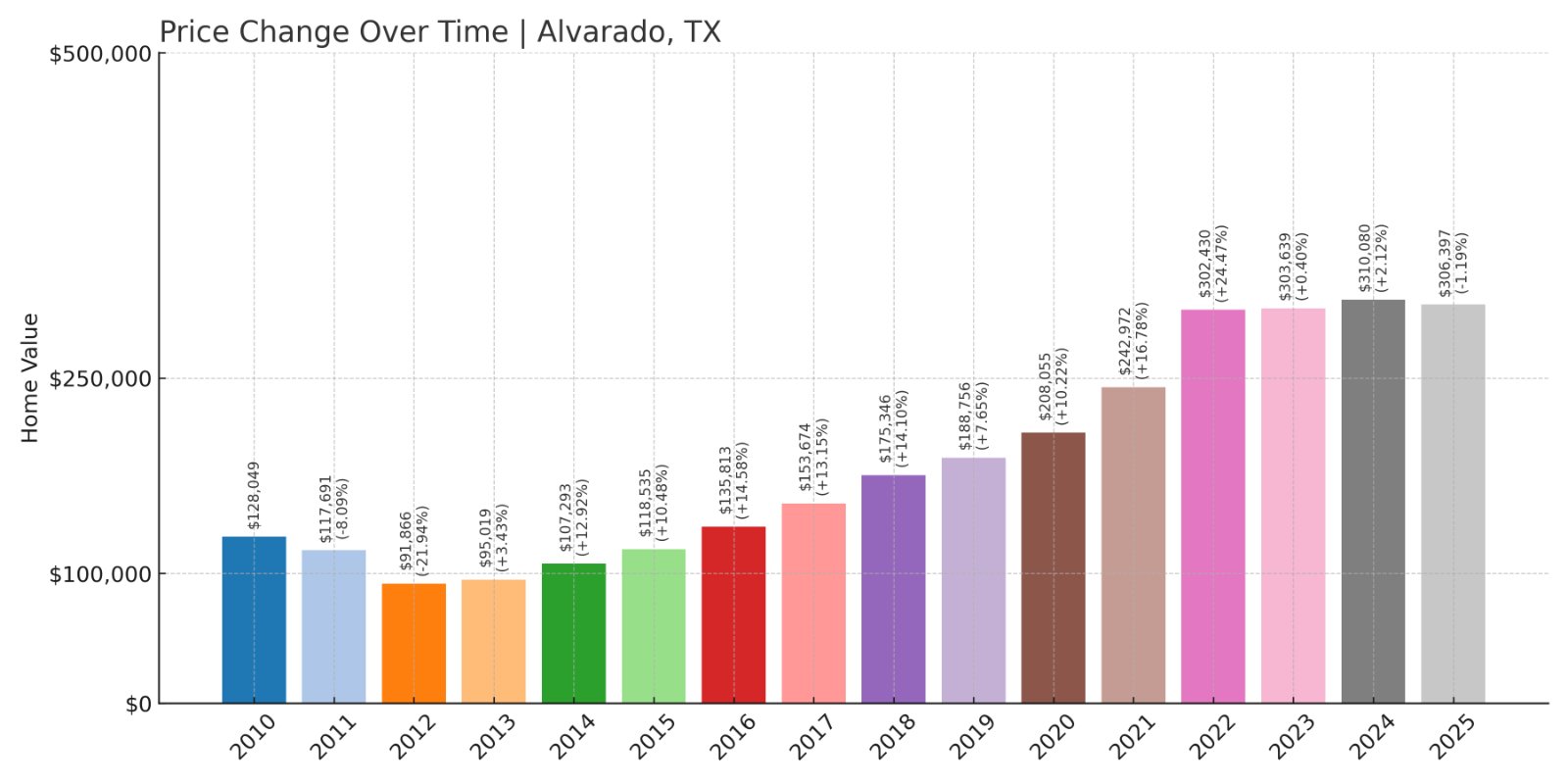

12. Alvarado – Crash Risk Percentage: 79.55%

- Crash Risk Percentage: 79.55%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 21.9% (2012)

- Total price increase since 2010: 139.3%

- Overextended above long-term average: 64.2%

- Price volatility (annual swings): 11.4%

- Current 2025 price: $306,397

Alvarado’s home prices have climbed nearly 140% since 2010, but two major crashes, including a steep 21.9% drop in 2012, indicate vulnerability. High overextension and price volatility add to the risk profile for buyers.

Alvarado – Suburban Growth With Crash History

Alvarado is located south of Fort Worth and has grown as a commuter town. Its current median home price of over $306,000 reflects strong demand for suburban living. However, the town suffered a dramatic crash of nearly 22% in 2012, demonstrating how price gains can reverse during downturns.

Overextension above long-term trends by over 64% and annual price swings of 11.4% suggest its housing market may not be stable. Buyers should consider local employment patterns and potential impacts of rising interest rates before investing here.

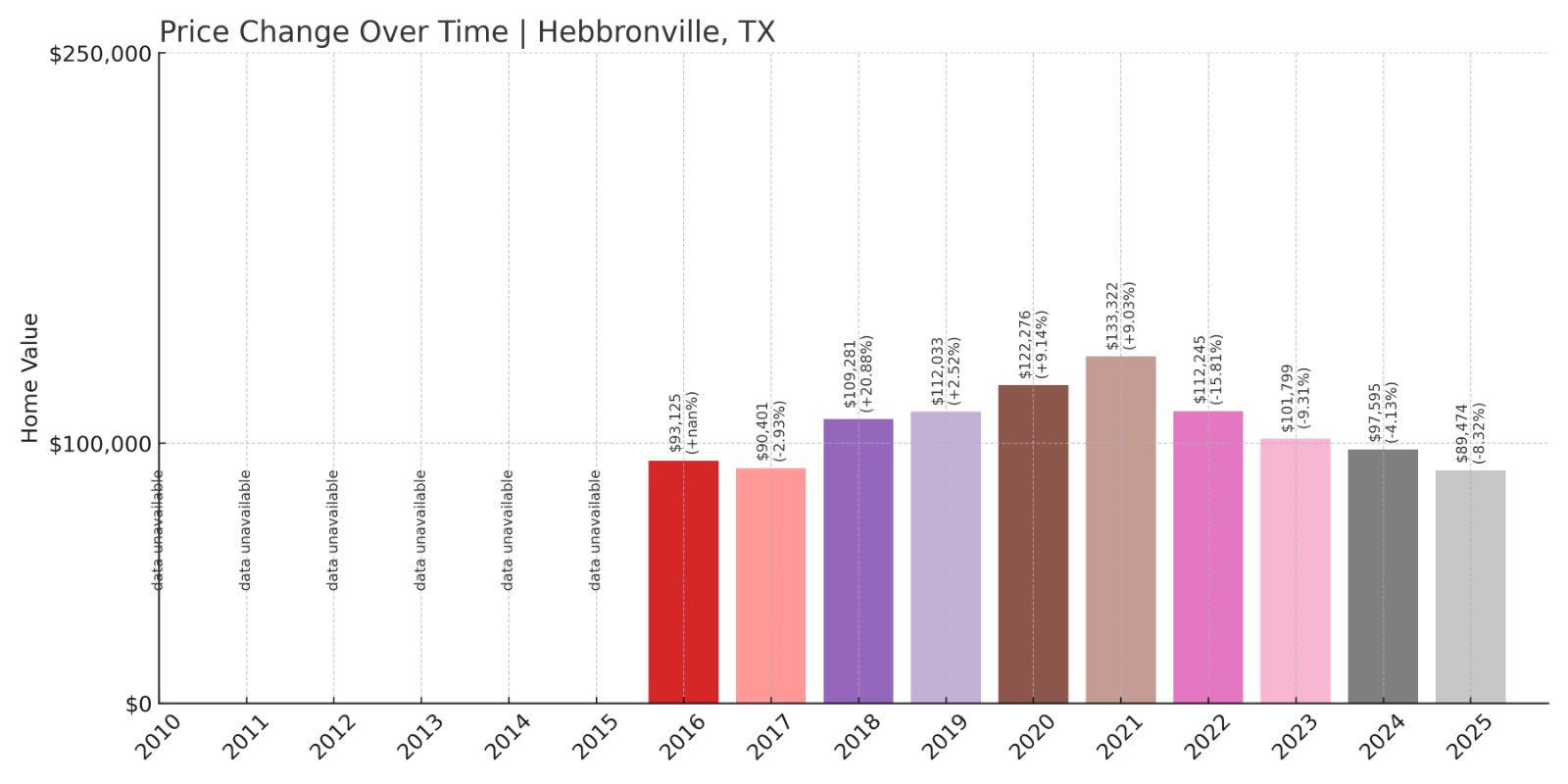

11. Hebbronville – Crash Risk Percentage: 79.95%

- Crash Risk Percentage: 79.95%

- Historical crashes (8%+ drops): 3

- Worst historical crash: 15.8% (2022)

- Total price increase since 2016: -3.9%

- Overextended above long-term average: -15.7%

- Price volatility (annual swings): 11.4%

- Current 2025 price: $89,474

Hebbronville has experienced three major price crashes, including a 15.8% drop in 2022. Prices have declined nearly 4% since 2016, showing little long-term growth and suggesting persistent market weakness.

Hebbronville – Market Stagnation Signals Caution

Hebbronville is a small town in Jim Hogg County near the Mexican border. It has historically served as a ranching and oil service community. Home prices remain affordable at under $90,000, but the town’s three crashes and lack of growth indicate a weak housing market.

Its negative overextension shows prices are actually below long-term averages, which might appeal to bargain hunters. However, combined with limited local economic development and high volatility, Hebbronville carries risks for buyers seeking long-term value appreciation.

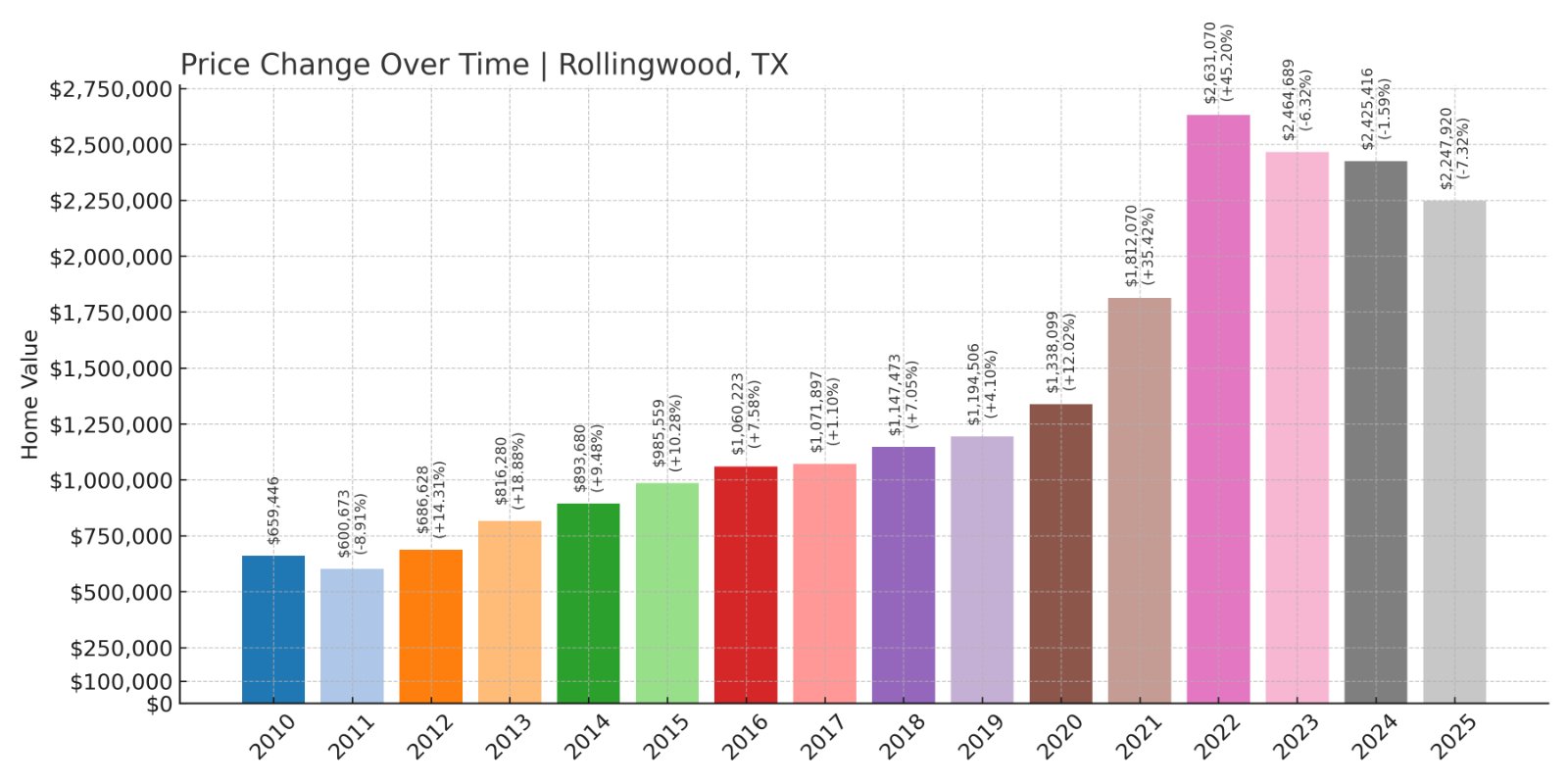

10. Rollingwood – Crash Risk Percentage: 79.97%

- Crash Risk Percentage: 79.97%

- Historical crashes (8%+ drops): 1

- Worst historical crash: 8.9% (2011)

- Total price increase since 2010: 240.9%

- Overextended above long-term average: 63.2%

- Price volatility (annual swings): 15.0%

- Current 2025 price: $2,247,920

Rollingwood has seen exceptional price growth of nearly 241% since 2010. Its single recorded crash was in 2011 with an 8.9% drop. However, current high overextension and volatility may put homeowners at risk of future corrections.

Rollingwood – Austin’s Luxury Neighbor With Rising Risks

Rollingwood is a wealthy enclave west of downtown Austin, known for its exclusive homes and strong school districts. Median prices exceed $2.2 million, driven by proximity to the city’s tech and professional job hubs. However, the town’s history of price drops shows even luxury markets aren’t immune to downturns.

Its high volatility at 15% and overextension over 63% above trend highlight sustainability concerns. Buyers should consider Austin’s broader economic health and luxury market demand trends when evaluating purchases here.

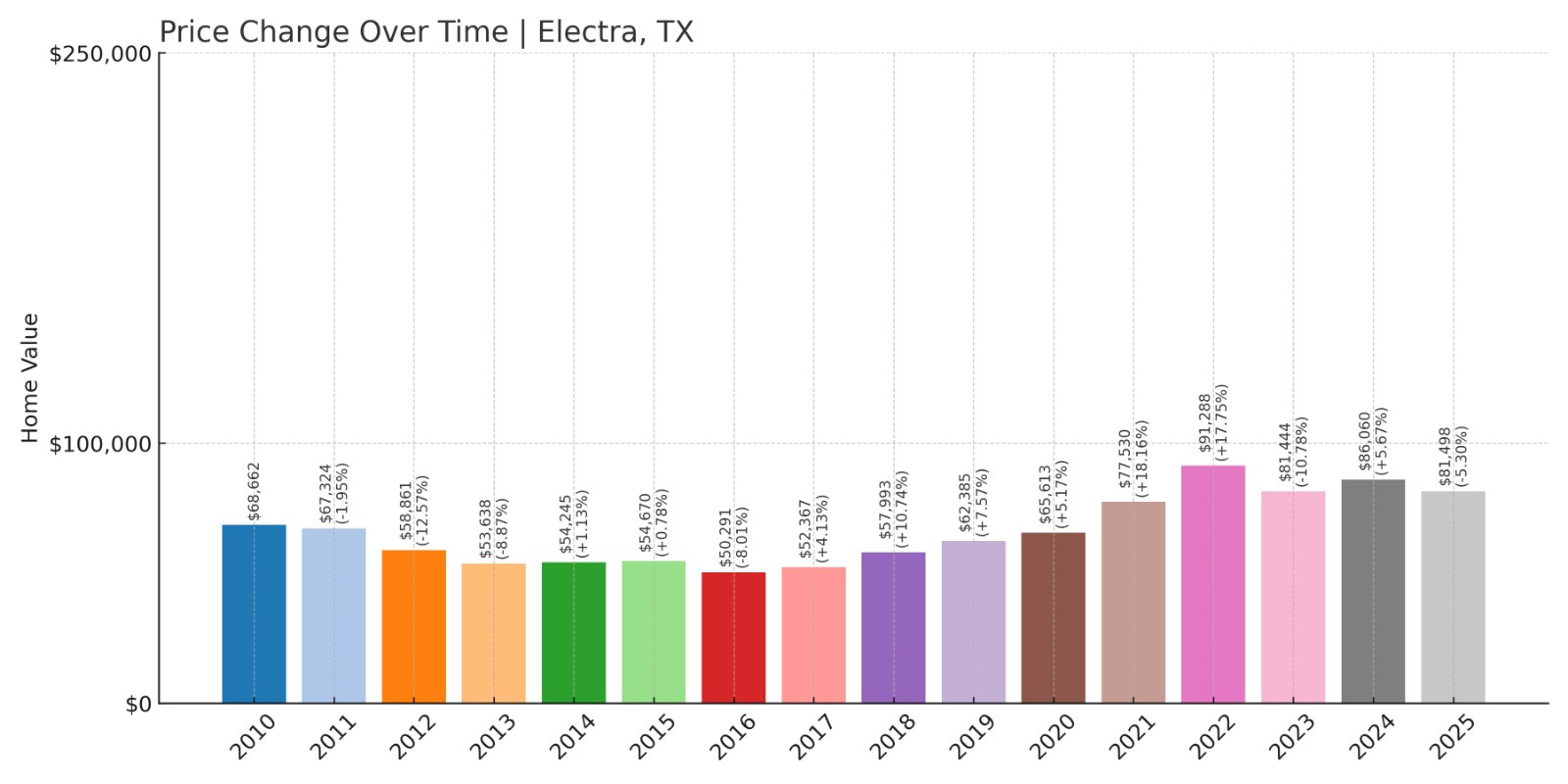

9. Electra – Crash Risk Percentage: 80.80%

Would you like to save this?

- Crash Risk Percentage: 80.80%

- Historical crashes (8%+ drops): 4

- Worst historical crash: 12.6% (2012)

- Total price increase since 2010: 18.7%

- Overextended above long-term average: 22.6%

- Price volatility (annual swings): 9.7%

- Current 2025 price: $81,498

Electra has experienced four price crashes since 2010, including a 12.6% decline in 2012. Its modest long-term growth combined with frequent downturns indicates market instability.

Electra – Oil Town With Shaky Market History

Electra is located west of Wichita Falls and has roots as an oil boomtown. Current median home prices remain low at just over $81,000, reflecting limited economic growth. The town’s history of four major crashes underscores its housing market fragility.

While prices are affordable, buyers should be aware that volatility and limited diversification increase risks of future price declines, especially if regional oil and energy markets contract further.

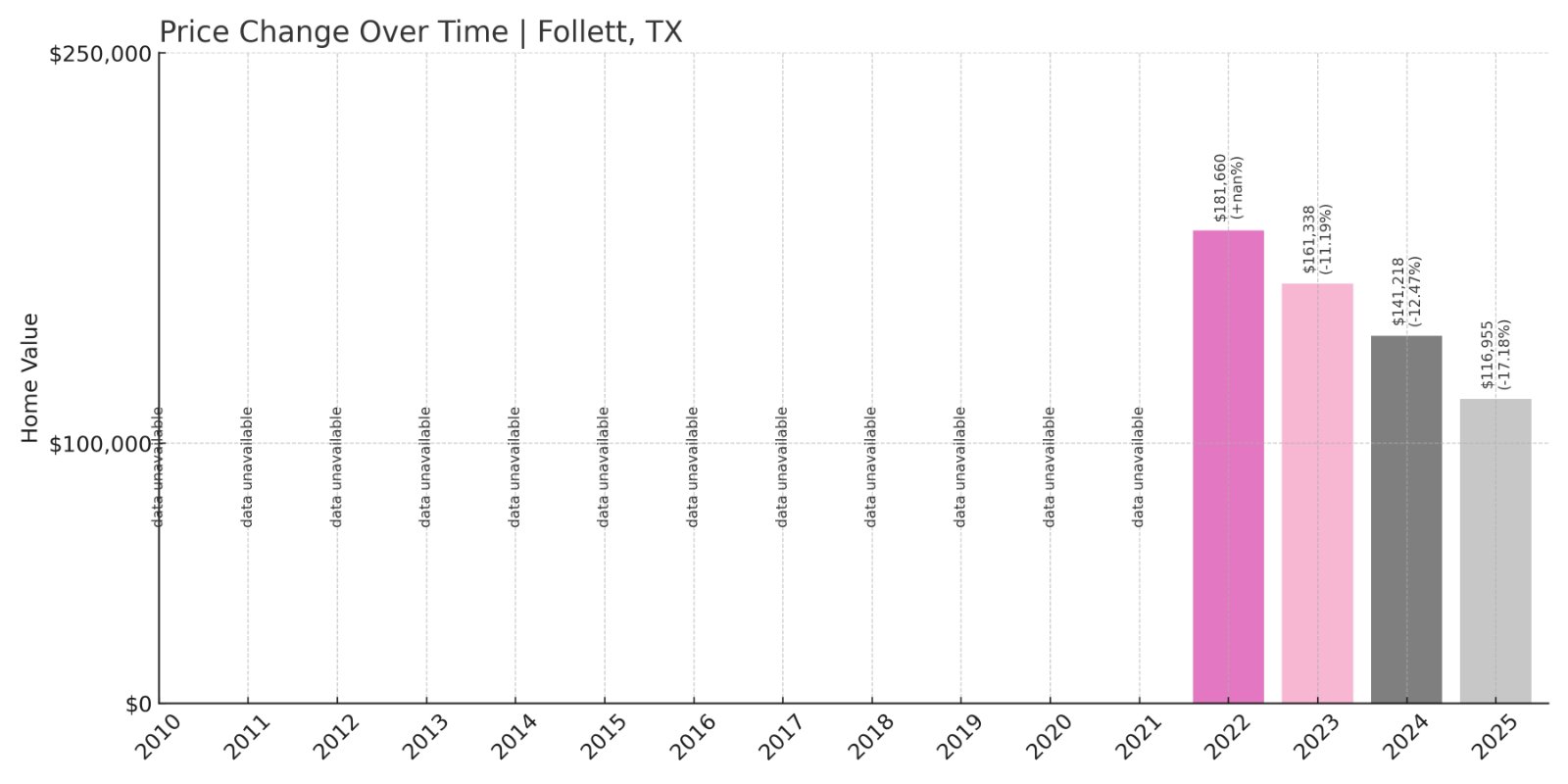

8. Follett – Crash Risk Percentage: 81.00%

- Crash Risk Percentage: 81.00%

- Historical crashes (8%+ drops): 3

- Worst historical crash: 17.2% (2025)

- Total price increase since 2022: -35.6%

- Overextended above long-term average: -22.2%

- Price volatility (annual swings): 3.2%

- Current 2025 price: $116,955

Follett has faced three major crashes, including a severe 17.2% decline this year alone. Prices have dropped over 35% since 2022, and the market is currently priced below long-term averages, indicating ongoing weakness.

Follett – Declining Market Signals Persistent Struggles

Follett is a small town in the northeastern Texas Panhandle near the Oklahoma border. Historically an agricultural hub, its housing market has been under pressure, with prices falling significantly in recent years. The worst crash this year has further eroded homeowner equity.

With low price volatility compared to other towns, changes tend to happen slowly, but continued declines raise concerns about recovery. Buyers looking for appreciation may find limited upside here unless economic conditions improve locally or regionally.

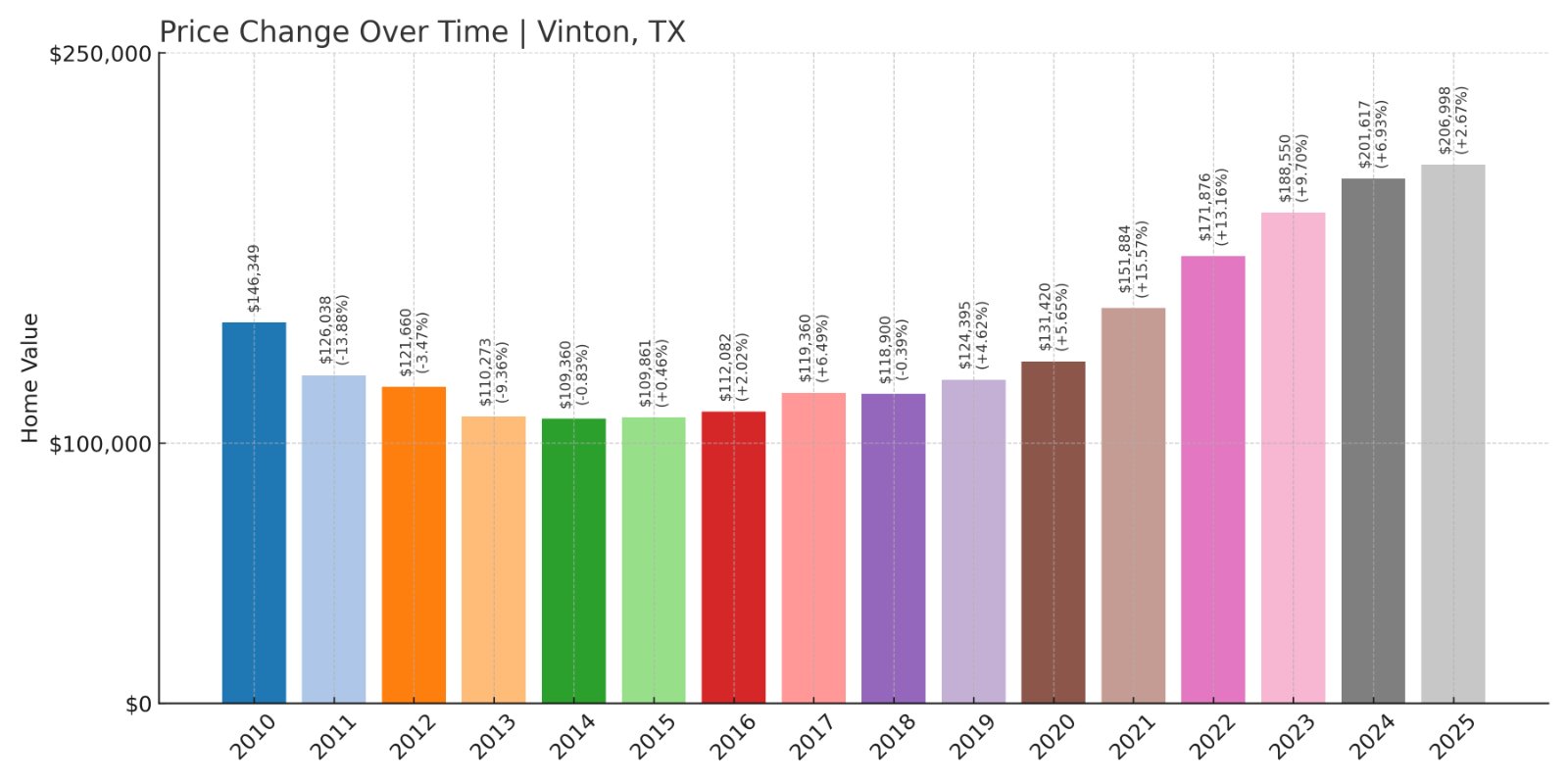

7. Vinton – Crash Risk Percentage: 81.35%

- Crash Risk Percentage: 81.35%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 13.9% (2011)

- Total price increase since 2010: 41.4%

- Overextended above long-term average: 47.2%

- Price volatility (annual swings): 7.8%

- Current 2025 price: $206,998

Vinton has experienced two price crashes since 2010, including a nearly 14% drop in 2011. Its prices are up just over 40% since 2010, and nearly 50% above long-term averages, indicating potential overvaluation.

Vinton – Border Proximity With Price Risks

Vinton is located in El Paso County near the New Mexico border. The town benefits from its location along I-10, providing access to El Paso’s job market. Its current median home price is just over $206,000, which remains affordable compared to major metro areas.

However, its historical crashes and current overextension above trend raise caution for buyers expecting steady appreciation. Volatility is moderate, but price corrections remain possible, especially if regional employment or border trade slow down.

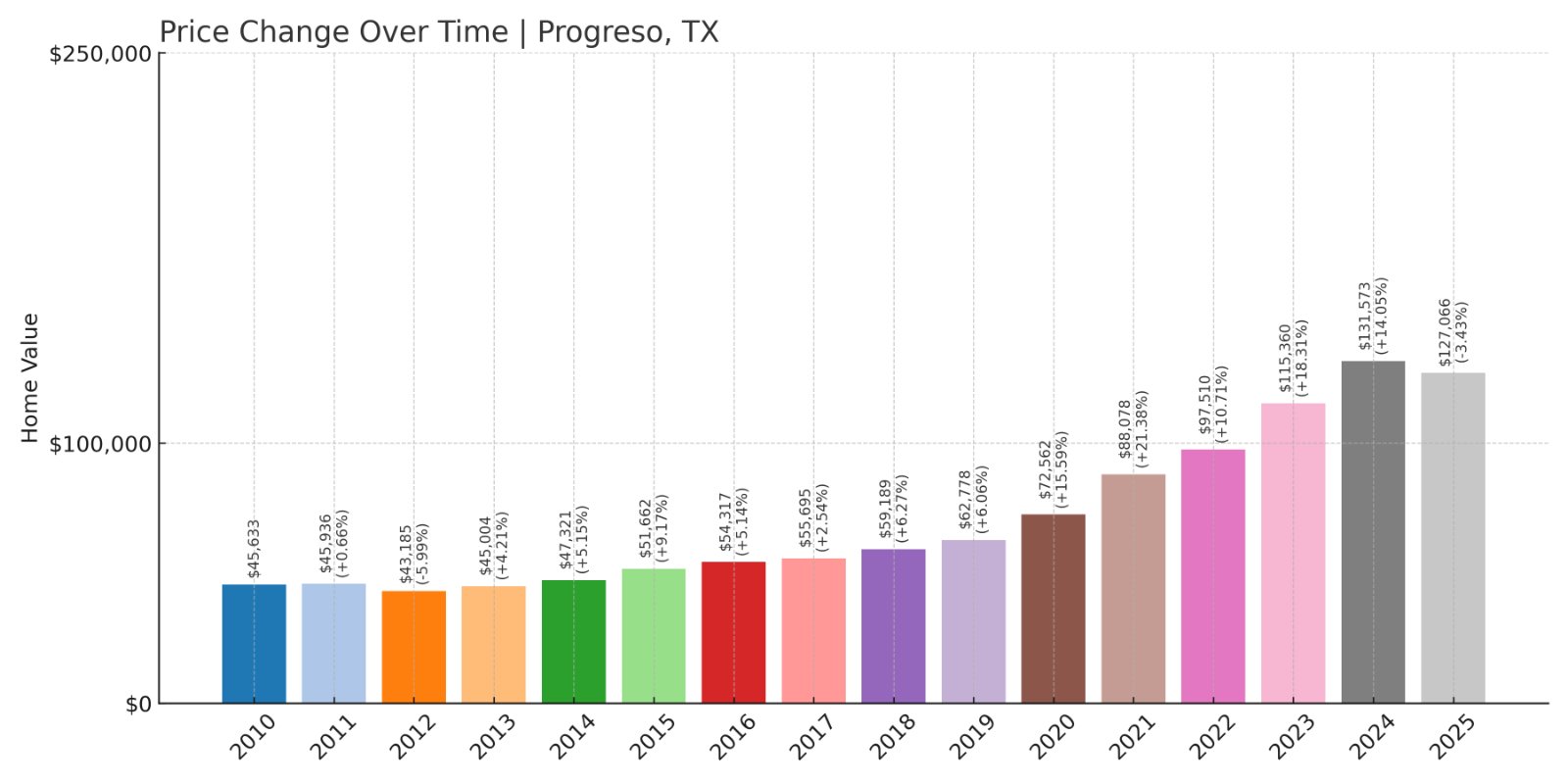

6. Progreso – Crash Risk Percentage: 82.85%

- Crash Risk Percentage: 82.85%

- Historical crashes (8%+ drops): 0

- No major crashes recorded

- Total price increase since 2010: 178.5%

- Overextended above long-term average: 77.9%

- Price volatility (annual swings): 7.7%

- Current 2025 price: $127,066

Progreso has enjoyed significant price growth of over 175% since 2010, with no recorded major crashes. However, it is nearly 78% above long-term averages, indicating prices may have outpaced fundamentals.

Progreso – Strong Growth But Potential Overheating

Progreso is a small border town in Hidalgo County. Its housing market has grown rapidly due to cross-border commerce and affordable land. Median home prices remain modest at around $127,000, appealing to local families and buyers from nearby McAllen.

While the town has avoided major price crashes, high overextension raises questions about sustainability. Buyers should monitor economic trends affecting border trade, as any slowdown could dampen demand and trigger corrections.

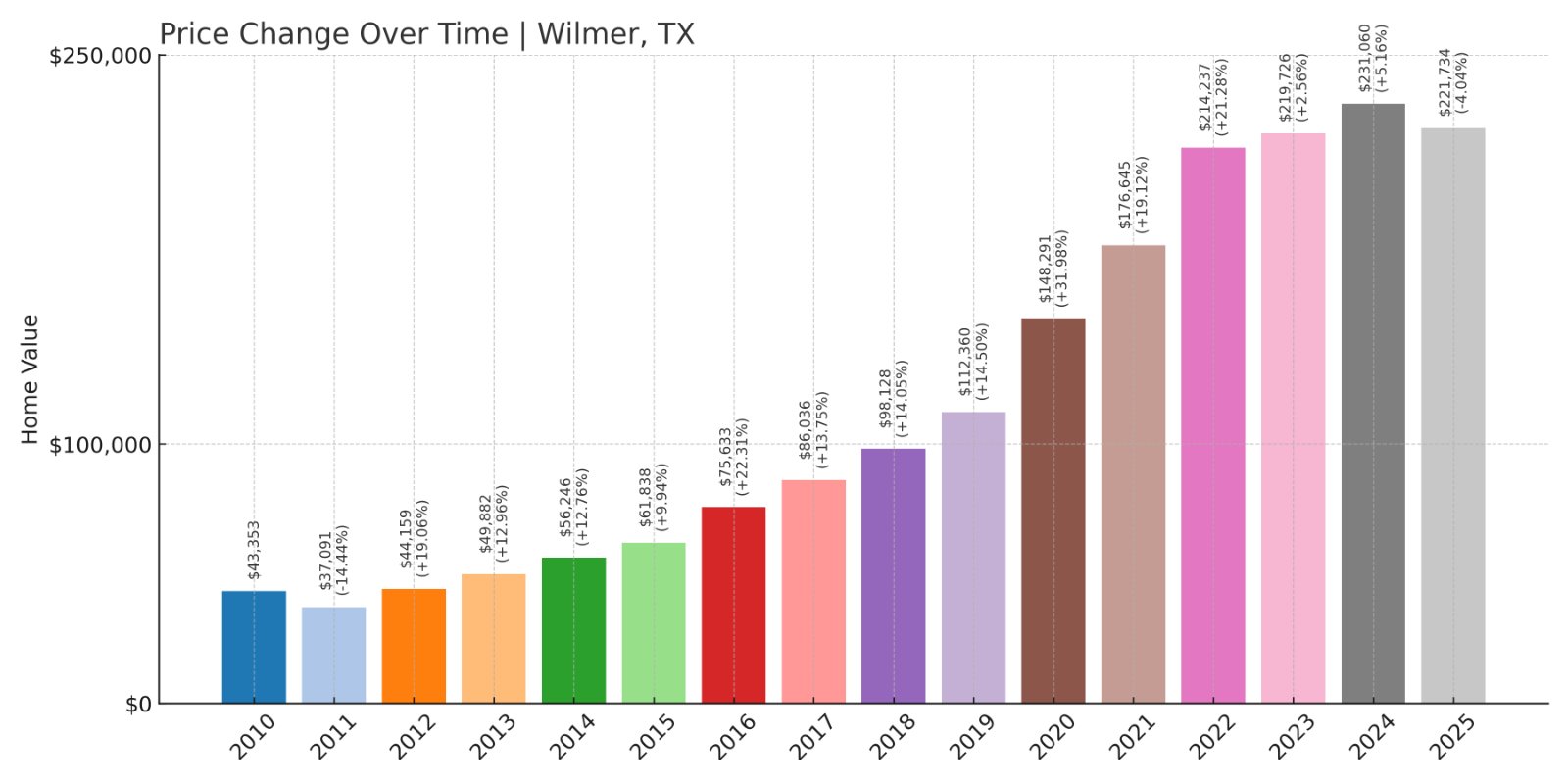

5. Wilmer – Crash Risk Percentage: 83.65%

- Crash Risk Percentage: 83.65%

- Historical crashes (8%+ drops): 1

- Worst historical crash: 14.4% (2011)

- Total price increase since 2010: 411.5%

- Overextended above long-term average: 89.1%

- Price volatility (annual swings): 11.4%

- Current 2025 price: $221,734

Wilmer’s home prices have skyrocketed over 400% since 2010, driven by Dallas-Fort Worth growth. However, it experienced a 14.4% crash in 2011, and prices are now nearly 90% above long-term averages, indicating potential correction risks.

Wilmer – Explosive Growth Carries Correction Risk

Wilmer is a small city south of Dallas, increasingly favored for its affordable land and proximity to logistics hubs. Rapid industrial growth has boosted home prices to over $221,000 today, a dramatic rise from a decade ago.

Despite strong gains, its historical crash shows vulnerability, and current high overextension may limit future appreciation. Buyers should weigh the benefits of location against risks of market correction if industrial development slows or broader economic conditions shift.

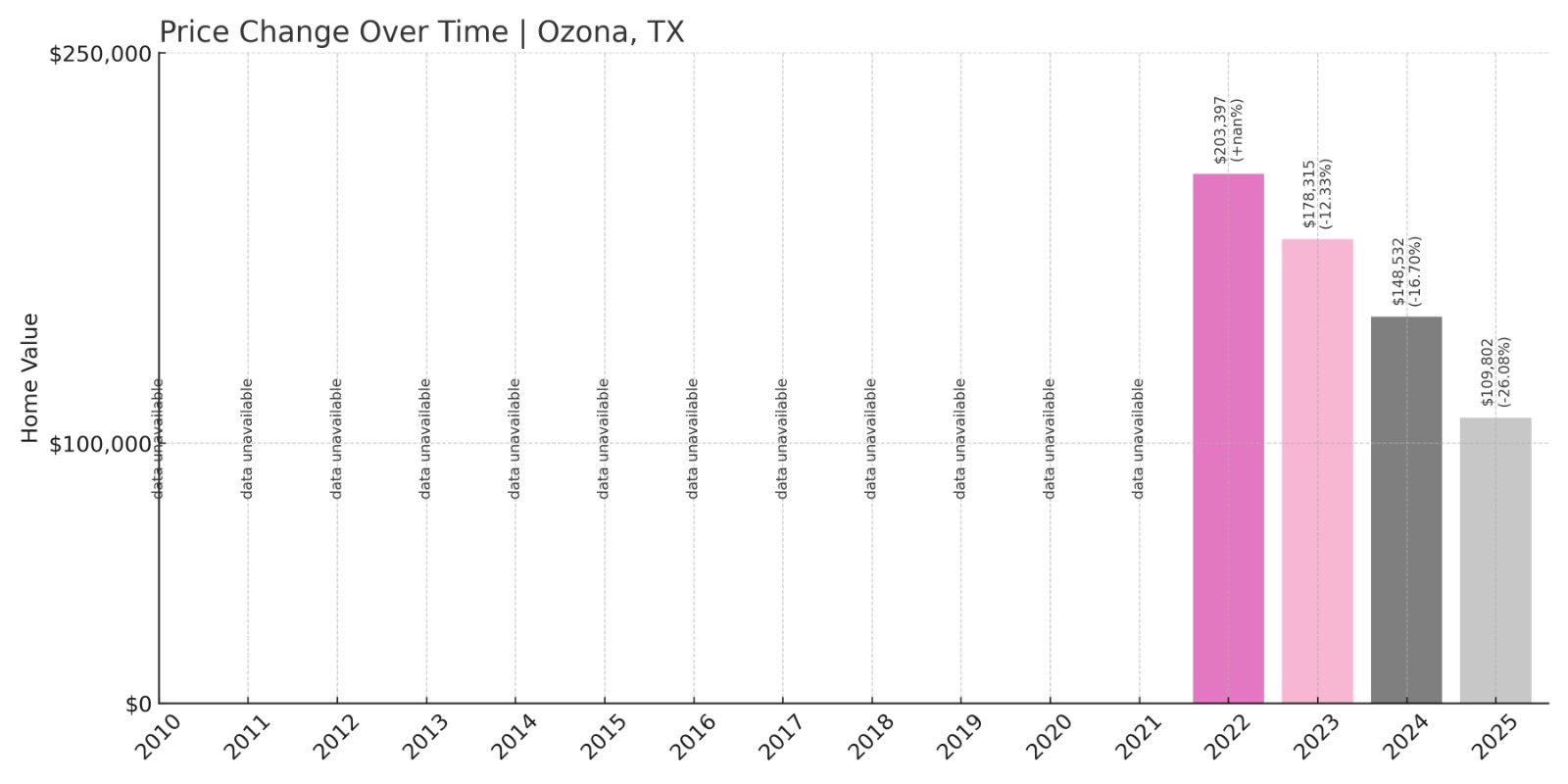

4. Ozona – Crash Risk Percentage: 85.05%

- Crash Risk Percentage: 85.05%

- Historical crashes (8%+ drops): 3

- Worst historical crash: 26.1% (2025)

- Total price increase since 2022: -46.0%

- Overextended above long-term average: -31.4%

- Price volatility (annual swings): 7.0%

- Current 2025 price: $109,802

Ozona has experienced a steep 26.1% crash this year, with prices down 46% since 2022. Its market remains below long-term averages, indicating prolonged weakness despite earlier gains.

Ozona – Market Collapse After Rapid Decline

Ozona is located in Crockett County along I-10 in West Texas. Known for its ranching history and small-town feel, it has struggled economically in recent years. The recent crash of over 26% this year alone highlights severe market instability.

With prices currently under $110,000, affordability is high, but investors seeking value appreciation may face challenges. Local economic stagnation and outmigration trends may continue to suppress housing demand.

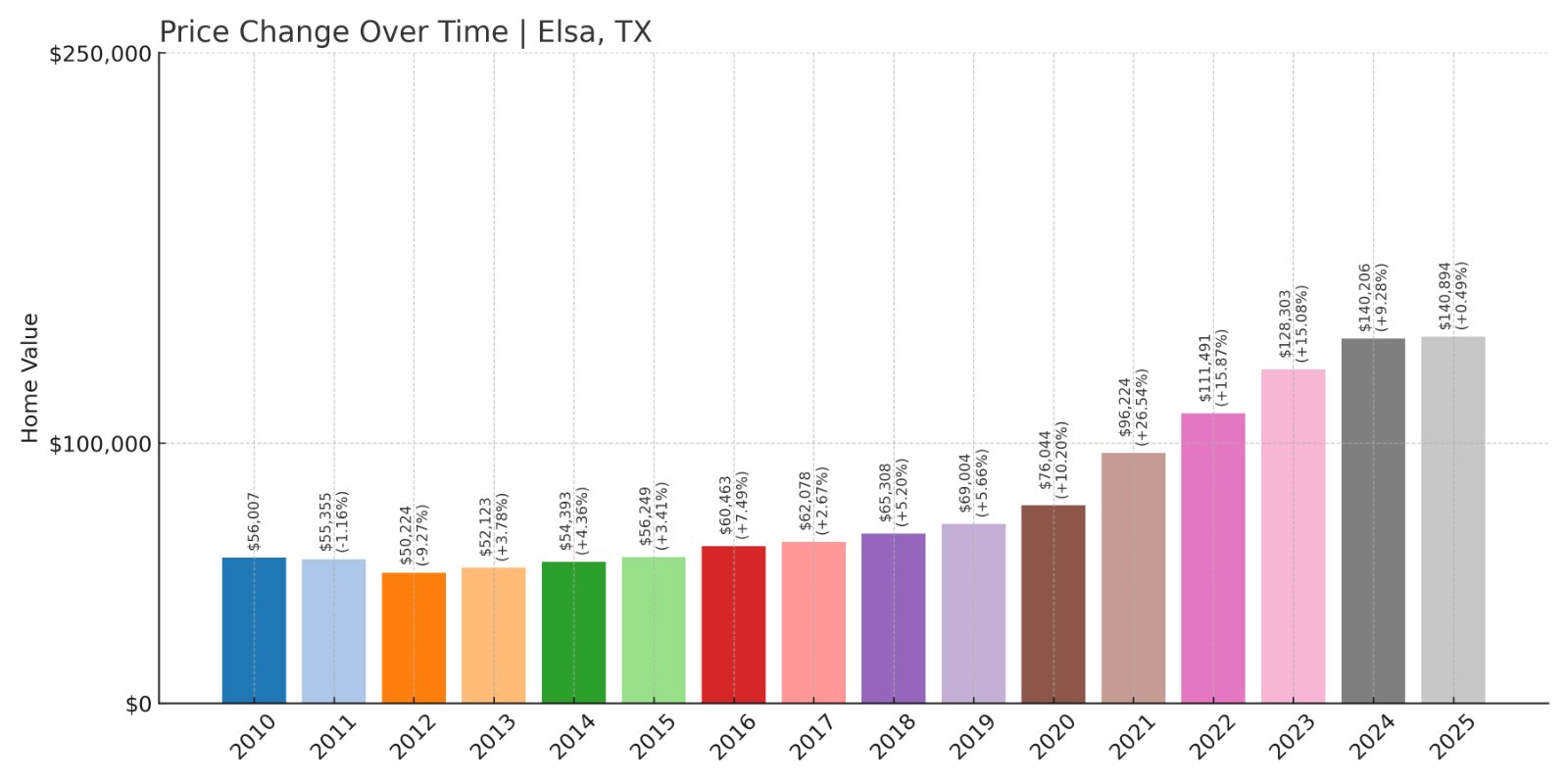

3. Elsa – Crash Risk Percentage: 86.65%

- Crash Risk Percentage: 86.65%

- Historical crashes (8%+ drops): 1

- Worst historical crash: 9.3% (2012)

- Total price increase since 2010: 151.6%

- Overextended above long-term average: 76.9%

- Price volatility (annual swings): 8.3%

- Current 2025 price: $140,894

Elsa’s home prices have risen by over 150% since 2010, but its single recorded crash of 9.3% in 2012 shows market vulnerability. Current prices remain nearly 77% above long-term averages, suggesting a risk of correction.

Elsa – Steady Growth With Underlying Fragility

Elsa is a small city in Hidalgo County, part of the Rio Grande Valley region. Its affordability attracts residents working in nearby McAllen and Edinburg. With median home prices under $141,000, it remains accessible, but rapid historical growth outpaces local income trends.

The town’s price volatility is moderate, but high overextension above trend increases correction risks, especially if economic slowdowns reduce demand. Buyers should evaluate long-term employment trends and regional growth plans before investing.

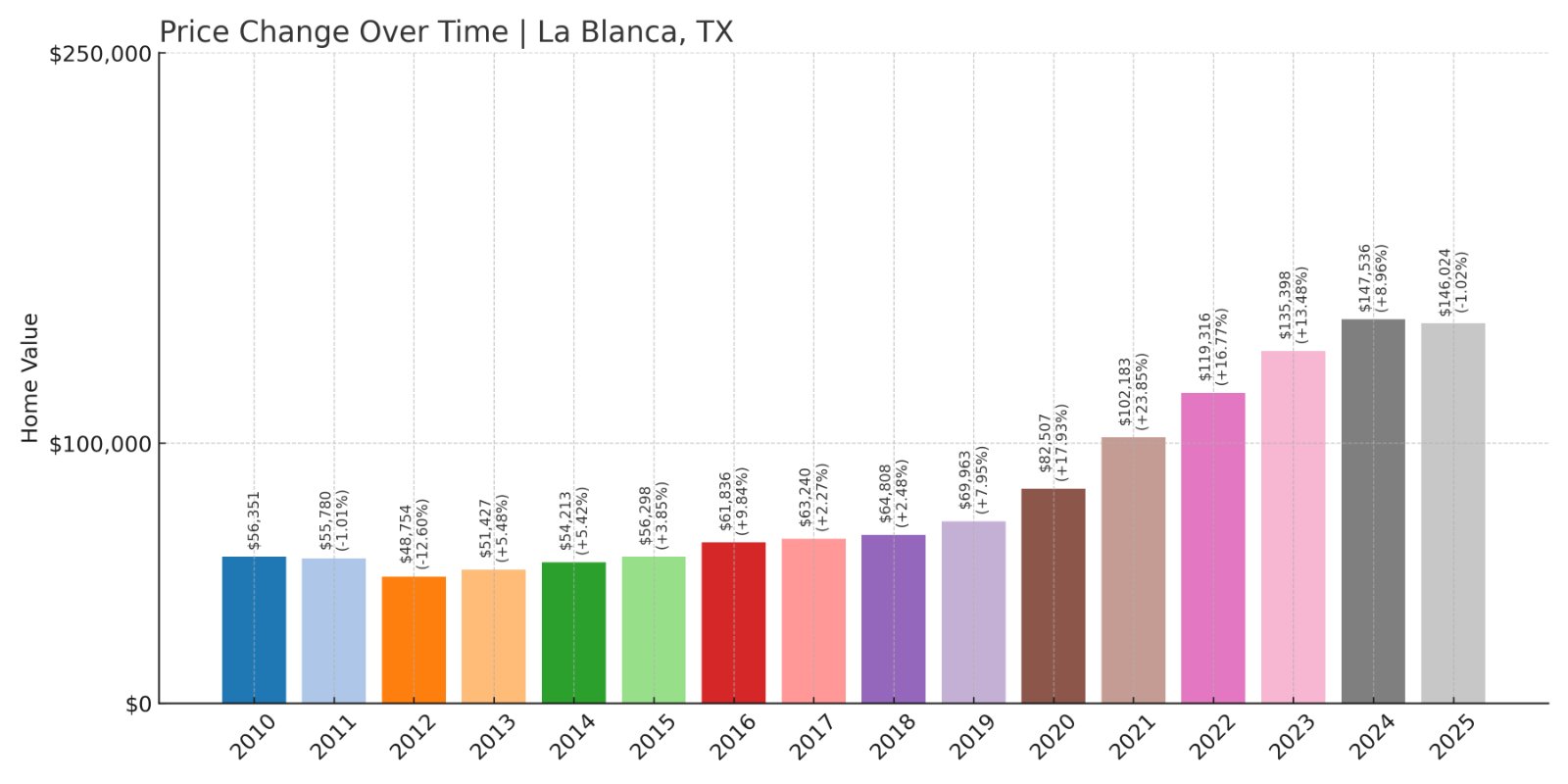

2. La Blanca – Crash Risk Percentage: 87.40%

- Crash Risk Percentage: 87.40%

- Historical crashes (8%+ drops): 1

- Worst historical crash: 12.6% (2012)

- Total price increase since 2010: 159.1%

- Overextended above long-term average: 77.6%

- Price volatility (annual swings): 9.0%

- Current 2025 price: $146,024

La Blanca’s prices have jumped over 159% since 2010, but a 12.6% crash in 2012 demonstrates vulnerability. High overextension and moderate volatility point to potential price corrections in the near future.

La Blanca – Rapid Appreciation With Correction Warnings

La Blanca is located north of Edinburg in Hidalgo County, primarily a residential community with agricultural surroundings. Current home prices average just above $146,000, attractive for buyers seeking affordability in South Texas.

However, the town’s previous crash and prices nearly 78% above long-term averages suggest caution. As with other Rio Grande Valley towns, future market performance will depend on regional economic development and housing demand stability.

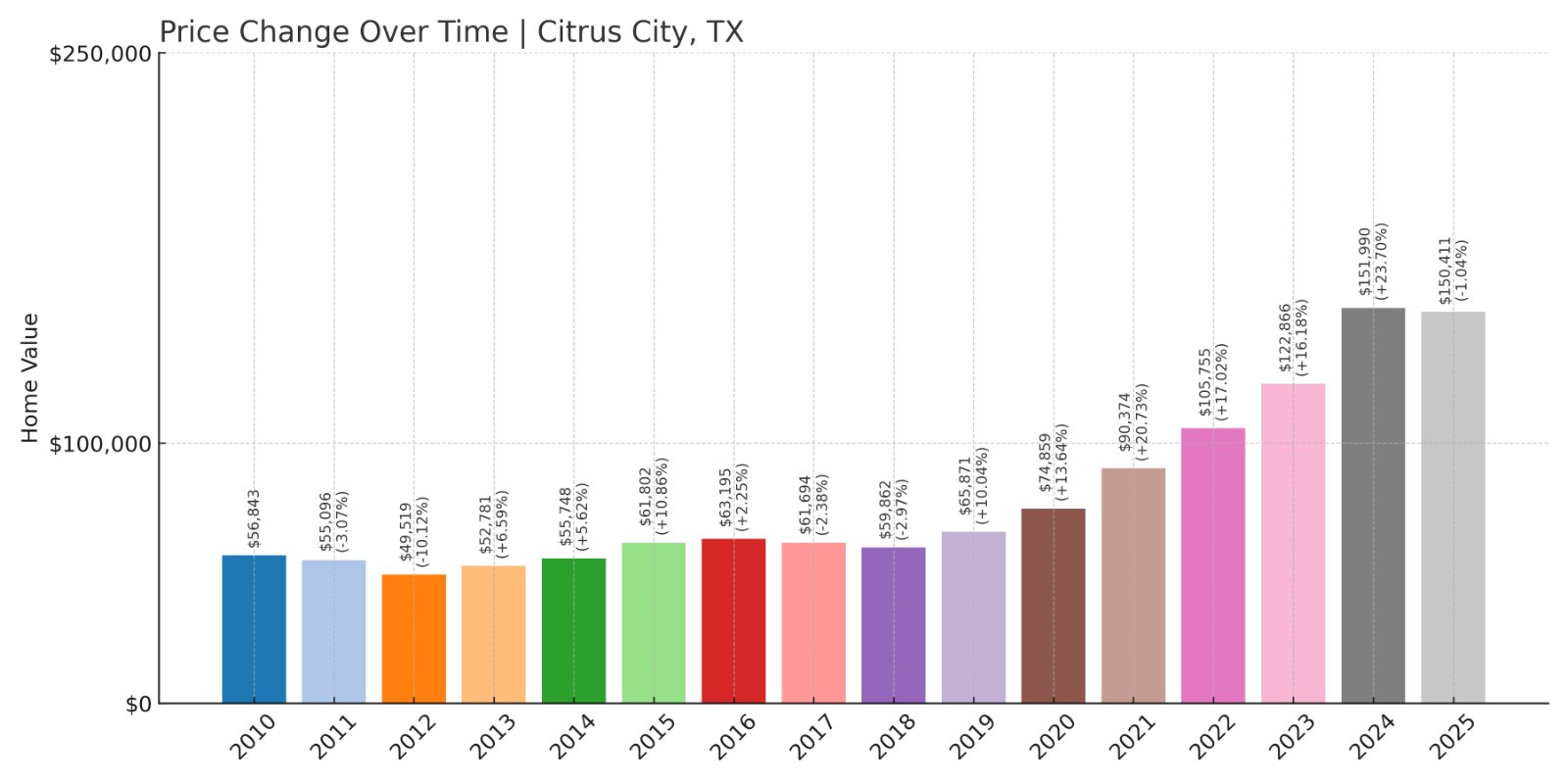

1. Citrus City – Crash Risk Percentage: 92.65%

- Crash Risk Percentage: 92.65%

- Historical crashes (8%+ drops): 1

- Worst historical crash: 10.1% (2012)

- Total price increase since 2010: 164.6%

- Overextended above long-term average: 88.2%

- Price volatility (annual swings): 10.0%

- Current 2025 price: $150,411

Citrus City tops this list with the highest crash risk percentage at over 92%. While prices have climbed by nearly 165% since 2010, the combination of a historical crash, high overextension, and notable volatility make this market especially risky.

Citrus City – Highest Risk Town in Texas Housing Market

Citrus City is a small unincorporated community in Hidalgo County, historically rooted in citrus farming. Home prices remain affordable at around $150,000, but the market’s fundamentals raise concern. A 10.1% crash in 2012 highlights its susceptibility to economic changes.

With prices nearly 90% above long-term averages, future corrections could significantly impact homeowners. Buyers considering Citrus City should carefully assess their risk tolerance and the stability of regional agricultural and service sector employment.