Would you like to save this?

nvestors are reshaping Vermont’s housing market—and for many local families, that means getting priced out of the towns they’ve called home for generations. According to the Zillow Home Value Index, 15 Vermont towns are now seeing home prices spike at levels far beyond their historical norms. Some have jumped more than 1,000% above trend. These aren’t luxury markets—they’re everyday communities hit hard by speculative buying.

The data shows just how fast things have shifted. Between 2010 and 2019, price growth in these towns was steady. But since 2021, it’s exploded. And while statewide inventory is rising, prices in these towns keep climbing—pushed higher by out-of-town investors chasing profit, while locals struggle to keep up.

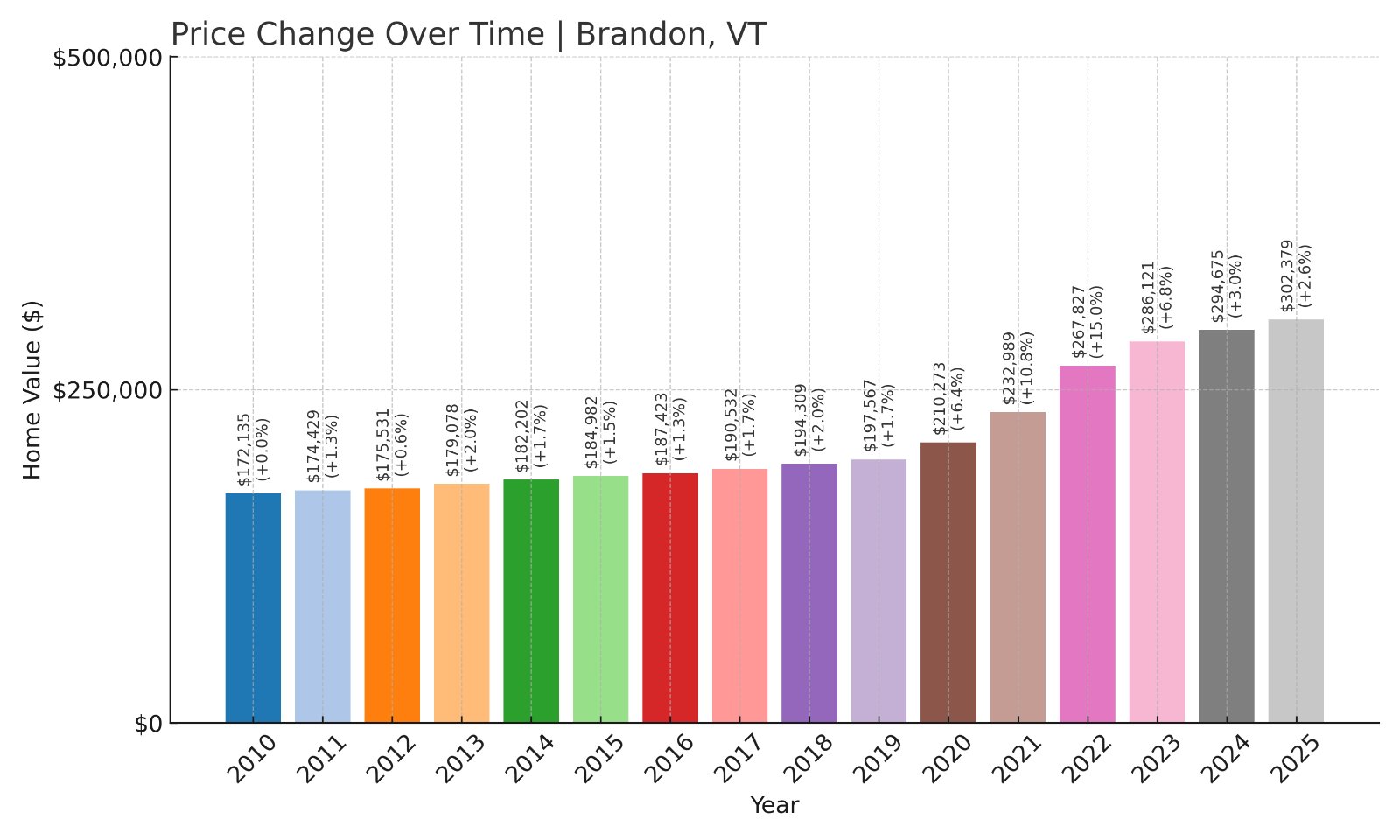

15. Brandon – Investor Feeding Frenzy Factor 336.5% (July 2025)

- Historical annual growth rate (2010–2019): 1.54%

- Recent annual growth rate (2021–2025): 6.73%

- Investor Feeding Frenzy Factor: 336.5%

- Current 2025 price: $302,379

Brandon rounds out our list with a 336% acceleration in housing price growth, transforming this historic Rutland County town into another casualty of Vermont’s speculation boom. The town has watched annual price increases surge from 1.54% historically to 6.73% recently, pushing the median home price to $302,379. This dramatic shift threatens the affordability that has long made Brandon attractive to young families and retirees seeking small-town Vermont charm.

Brandon – Historic Town Faces Modern Housing Crisis

Founded in 1761, Brandon sits in the Otter Valley along Route 7, one of Vermont’s main north-south corridors. The town of roughly 4,000 residents has maintained its 19th-century character with a walkable downtown, historic architecture, and strong community traditions. Brandon’s location between Rutland and Middlebury makes it a convenient base for commuters while offering access to nearby ski areas and Lake Champlain recreation.

The current median price of $302,379 represents a significant escalation from Brandon’s historically modest appreciation rates. During the 2010s, the town’s 1.54% annual growth allowed steady, sustainable homeownership for local families. The recent jump to nearly 7% annual increases has attracted outside investors and second-home buyers, fundamentally altering the town’s housing dynamics and pricing out many longtime residents.

Brandon’s appeal to investors stems from its proximity to outdoor recreation and its position as a gateway to central Vermont’s tourist destinations. The town’s Victorian-era homes and scenic mountain views make it particularly attractive for vacation rental conversions, while its relatively affordable prices compared to nearby resort towns have drawn speculative buying that continues to drive up costs for local families.

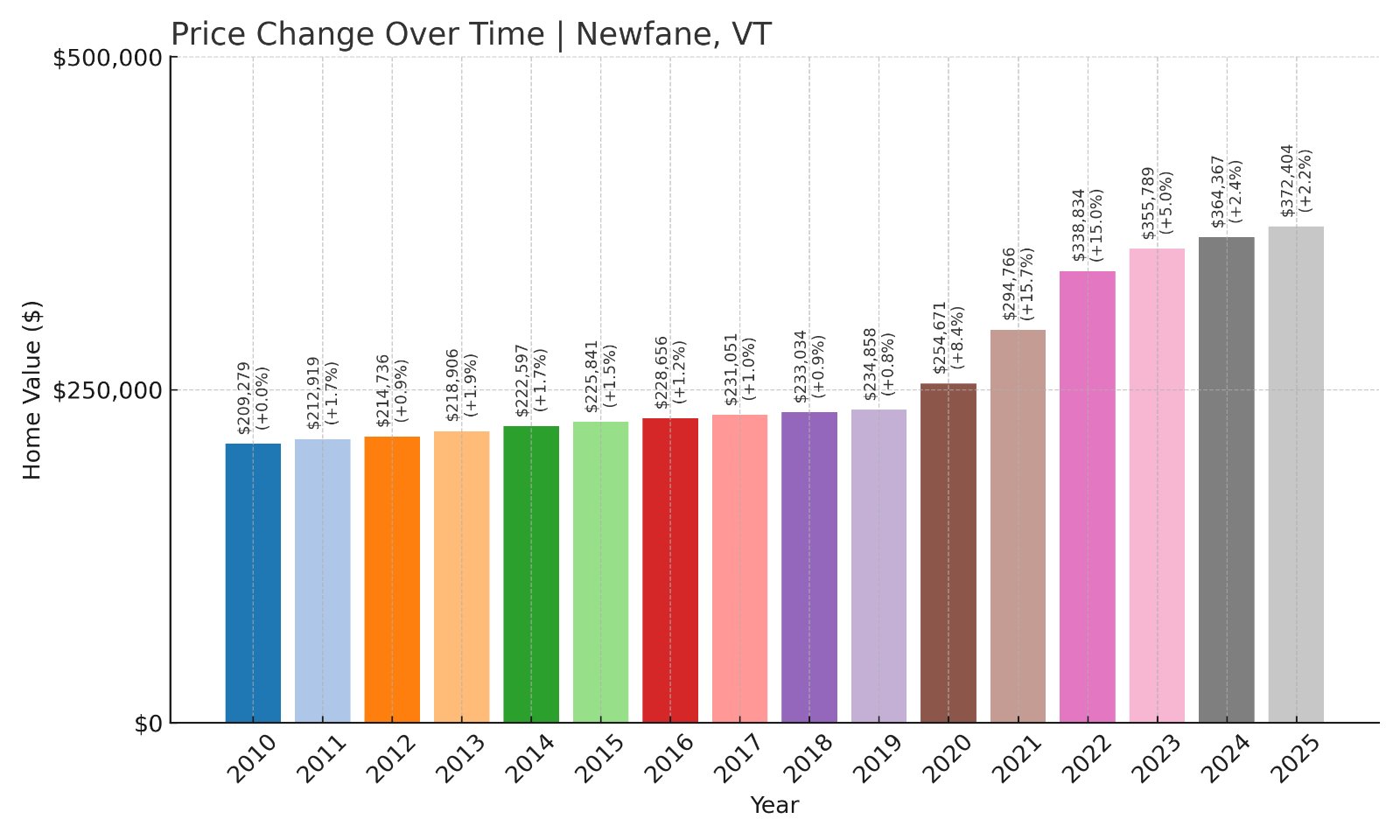

14. Newfane – Investor Feeding Frenzy Factor 366.8% (July 2025)

- Historical annual growth rate (2010–2019): 1.29%

- Recent annual growth rate (2021–2025): 6.02%

- Investor Feeding Frenzy Factor: 366.8%

- Current 2025 price: $372,404

Newfane’s housing market shows a 367% acceleration in price growth, with annual increases jumping from 1.29% historically to over 6% recently. The current median price of $372,404 reflects intense investor pressure in this picturesque Windham County town known for its covered bridges and fall foliage tourism. The speculation has made homeownership increasingly challenging for local families in this rural Vermont community.

Newfane – Tourism Magnet Becomes Investment Target

Newfane epitomizes Vermont’s postcard-perfect small towns, with its iconic village green, white-steepled church, and surrounding mountains drawing visitors year-round. Located in southern Vermont near the Connecticut River valley, the town of about 1,700 residents has long balanced agricultural heritage with growing tourism. Newfane’s proximity to Brattleboro and the Massachusetts border makes it accessible to urban buyers seeking rural retreats.

The median home price of $372,404 represents a dramatic shift from Newfane’s traditionally affordable housing market. The town’s modest 1.29% annual appreciation during the 2010s supported local families and retirees drawn to its peaceful rural character. However, the recent acceleration to over 6% annual growth has attracted significant outside investment, particularly in properties suitable for short-term vacation rentals.

Real estate activity in Newfane increasingly involves buyers from Boston, New York, and Connecticut seeking second homes or investment properties. The town’s reputation for spectacular fall foliage, combined with its historic architecture and rural charm, makes it particularly attractive to the vacation rental market. This investor demand has created pricing pressure that threatens to price out longtime residents and young families trying to establish roots in the community.

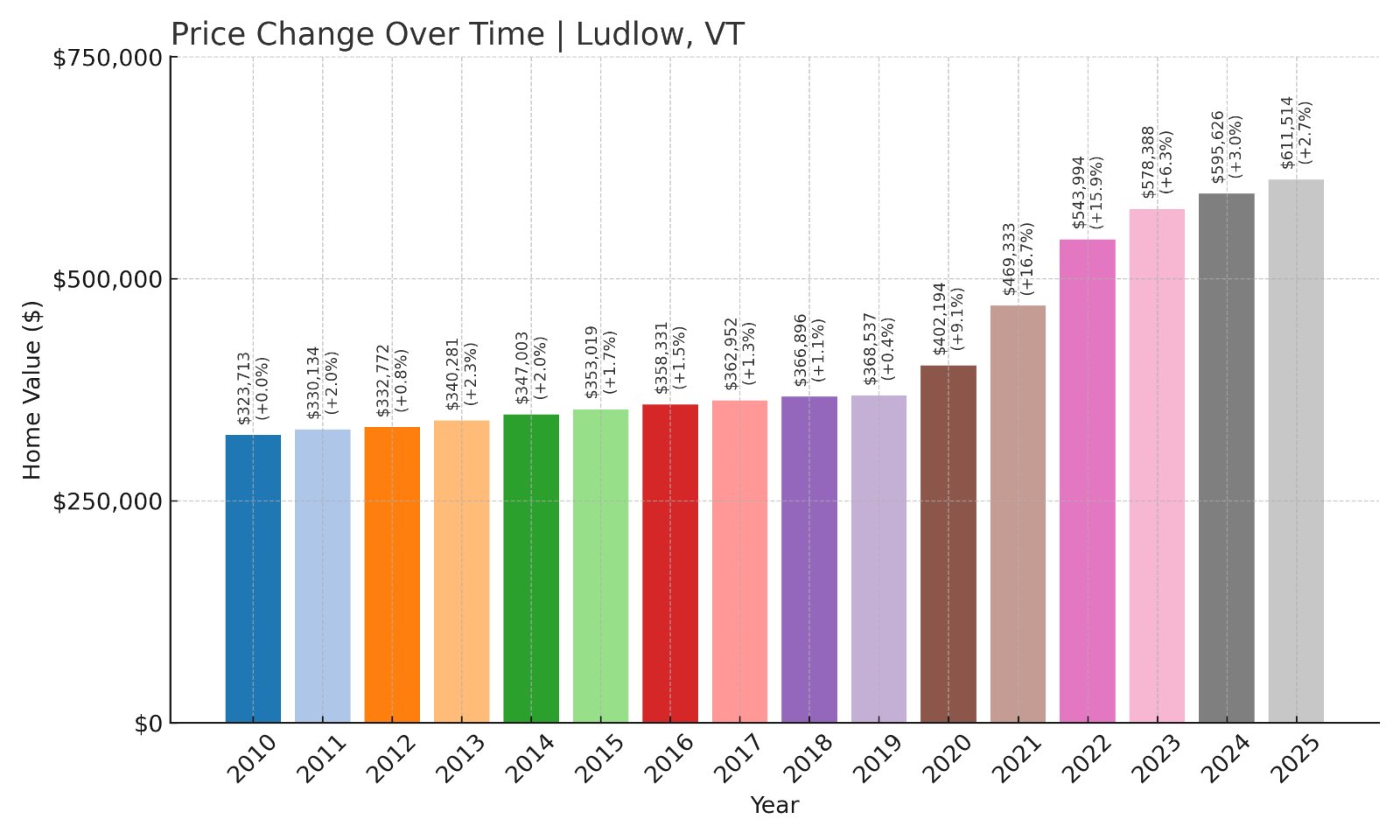

13. Ludlow – Investor Feeding Frenzy Factor 371.2% (July 2025)

- Historical annual growth rate (2010–2019): 1.45%

- Recent annual growth rate (2021–2025): 6.84%

- Investor Feeding Frenzy Factor: 371.2%

- Current 2025 price: $611,514

Ludlow shows a 371% acceleration in housing costs, with the median price reaching $611,514 – the highest on our list. This Windsor County ski town has seen annual price growth surge from 1.45% historically to nearly 7% recently. The dramatic price escalation reflects intense investor interest in Ludlow’s proximity to Okemo Mountain Resort, making it increasingly unaffordable for local workers and families who serve the tourism economy.

Ludlow – Ski Town Pricing Out Its Workforce

Would you like to save this?

Ludlow sits at the base of Okemo Mountain Resort, one of Vermont’s premier ski destinations, making it a natural magnet for real estate investors and second-home buyers. The town of roughly 2,000 year-round residents swells dramatically during ski season, creating significant demand for both vacation homes and short-term rentals. Ludlow’s location along Route 103 provides easy access from Boston and New York, further increasing its appeal to out-of-state buyers.

The current median price of $611,514 represents the most expensive housing market among our surveyed towns, reflecting Ludlow’s status as an established resort community. Despite this resort designation, the town historically maintained some affordable housing options for local workers, with modest 1.45% annual appreciation through the 2010s. The recent surge to nearly 7% annual growth has fundamentally altered this dynamic, creating a housing crisis for the service workers, ski instructors, and other locals who keep the town functioning.

The speculation in Ludlow centers heavily on properties suitable for vacation rentals and second homes near the ski area. Investors are increasingly purchasing traditional year-round housing and converting it to short-term rentals, reducing the available housing stock for permanent residents. This trend has forced many local workers to seek housing in distant towns, creating longer commutes and further straining the community’s character and sustainability.

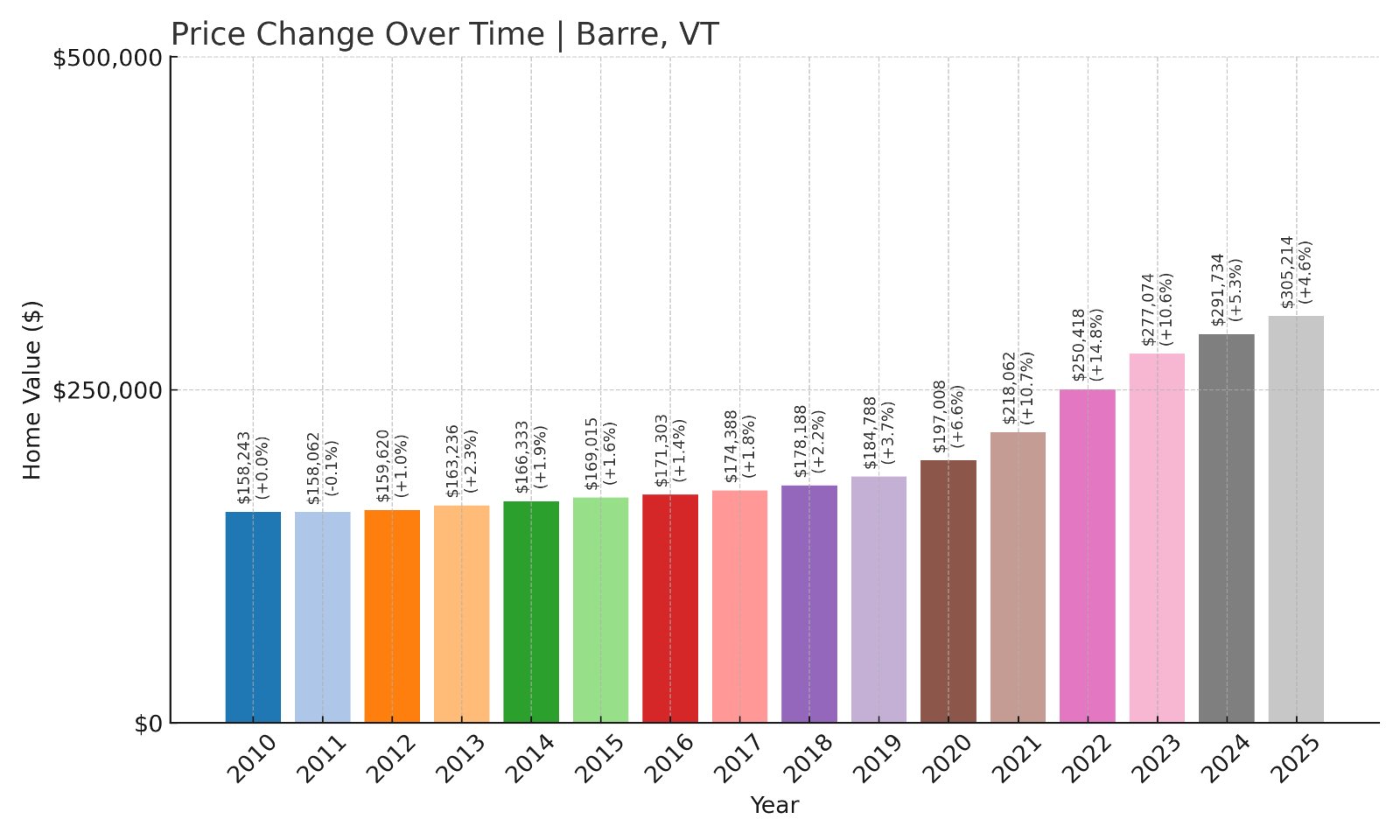

12. Barre – Investor Feeding Frenzy Factor 404.6% (July 2025)

- Historical annual growth rate (2010–2019): 1.74%

- Recent annual growth rate (2021–2025): 8.77%

- Investor Feeding Frenzy Factor: 404.6%

- Current 2025 price: $305,214

Barre demonstrates a 405% acceleration in housing price growth, with annual increases jumping from 1.74% during the 2010s to nearly 9% in recent years. The current median price of $305,214 reflects growing investor interest in this traditionally working-class granite city. The speculation threatens to displace longtime residents from this Washington County community known for its immigrant heritage and blue-collar character.

Barre – Granite City Faces Housing Speculation

Known as the “Granite Capital of the World,” Barre has been Vermont’s most ethnically diverse city, built by generations of European immigrants who came to work in the quarries. The city of about 9,000 residents sits in central Vermont, just southeast of the state capital Montpelier, making it an increasingly attractive option for commuters and investors seeking more affordable alternatives to pricier markets. Barre’s working-class character and affordable housing have long made it a landing place for new Vermonters.

The median price of $305,214 represents a significant escalation from Barre’s historically affordable housing market. The city’s 1.74% annual appreciation during the 2010s supported homeownership for immigrant families, young professionals, and blue-collar workers. However, the recent acceleration to nearly 9% annual growth – the highest rate among our surveyed towns – indicates intense speculative pressure that threatens to price out the very communities that give Barre its distinctive character.

Investment activity in Barre increasingly involves buyers seeking affordable entry points into Vermont’s real estate market, with many properties being purchased for renovation and resale or conversion to vacation rentals. The city’s proximity to Montpelier, combined with access to recreational activities like skiing and hiking, makes it attractive to investors despite its industrial heritage. This speculation threatens to displace longtime residents and erode the cultural diversity that has defined Barre for over a century.

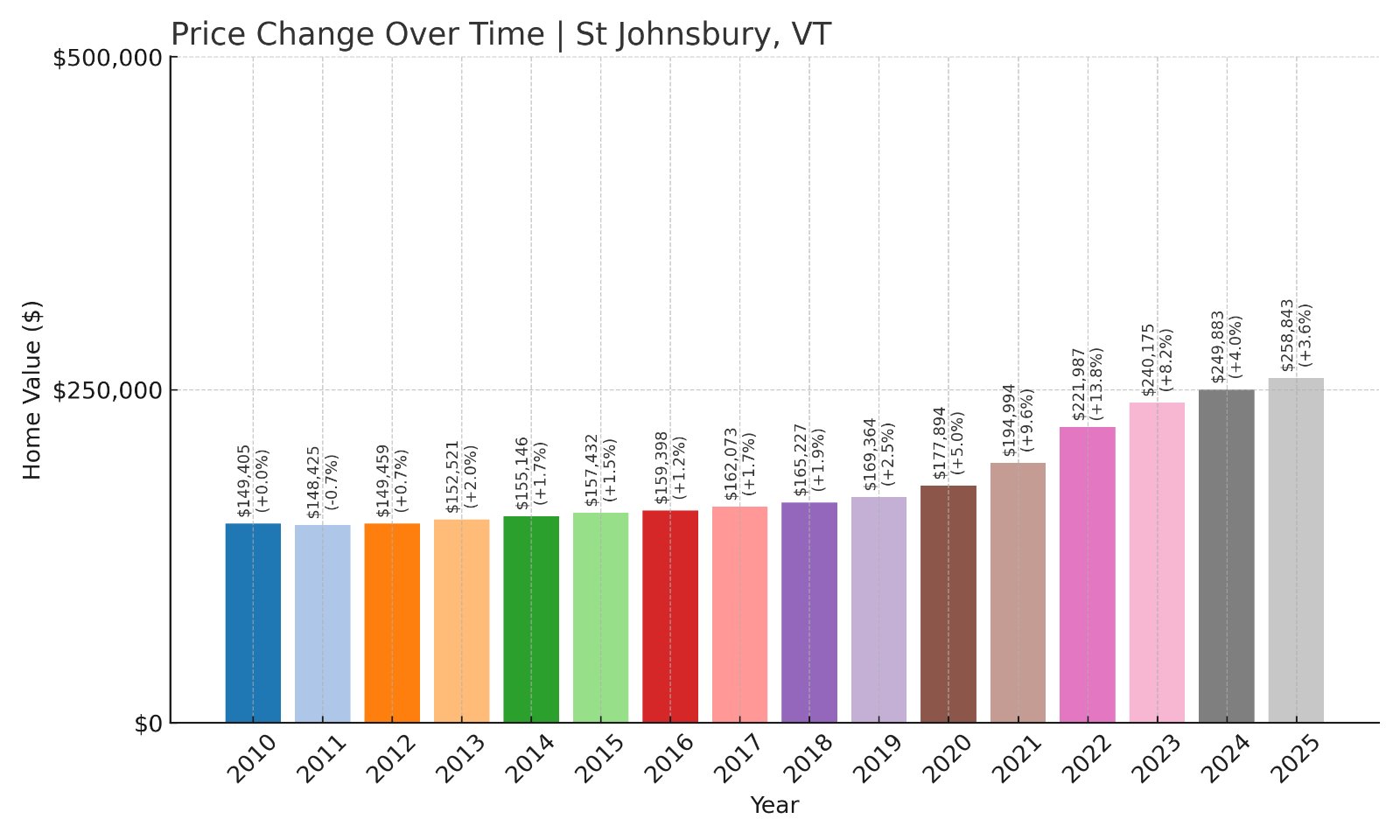

11. St Johnsbury – Investor Feeding Frenzy Factor 423.1% (July 2025)

- Historical annual growth rate (2010–2019): 1.40%

- Recent annual growth rate (2021–2025): 7.34%

- Investor Feeding Frenzy Factor: 423.1%

- Current 2025 price: $258,843

St Johnsbury shows a 423% acceleration in housing price growth, with annual increases surging from 1.40% historically to over 7% recently. The current median price of $258,843 reflects growing speculation in this Northeast Kingdom hub. The price acceleration threatens affordability in this Caledonia County town that has long served as an economic center for Vermont’s rural northeastern region.

St Johnsbury – Northeast Kingdom Hub Under Pressure

St Johnsbury serves as the commercial and cultural center of Vermont’s Northeast Kingdom, a region known for its rural character and relative affordability. The town of roughly 7,500 residents sits at the confluence of the Passumpsic and Moose rivers, with a historic downtown that includes the renowned Fairbanks Museum and St Johnsbury Athenaeum. Its location along Interstate 91 and Route 2 makes it accessible to both New Hampshire and Canada, contributing to its role as a regional hub.

The current median price of $258,843 represents a significant departure from St Johnsbury’s tradition as an affordable option for families and retirees. The town’s modest 1.40% annual appreciation during the 2010s supported local homeownership and attracted newcomers seeking rural Vermont living at reasonable prices. The recent surge to over 7% annual growth indicates growing investor interest in this previously overlooked market.

Real estate speculation in St Johnsbury appears driven by its relative affordability compared to other Vermont markets and its potential for growth as remote work enables more people to live in rural areas. The town’s Victorian architecture, mountain views, and small-town amenities make it increasingly attractive to out-of-state buyers seeking vacation homes or investment properties. This pressure threatens to price out local families and workers who depend on the region’s agricultural and tourism economy.

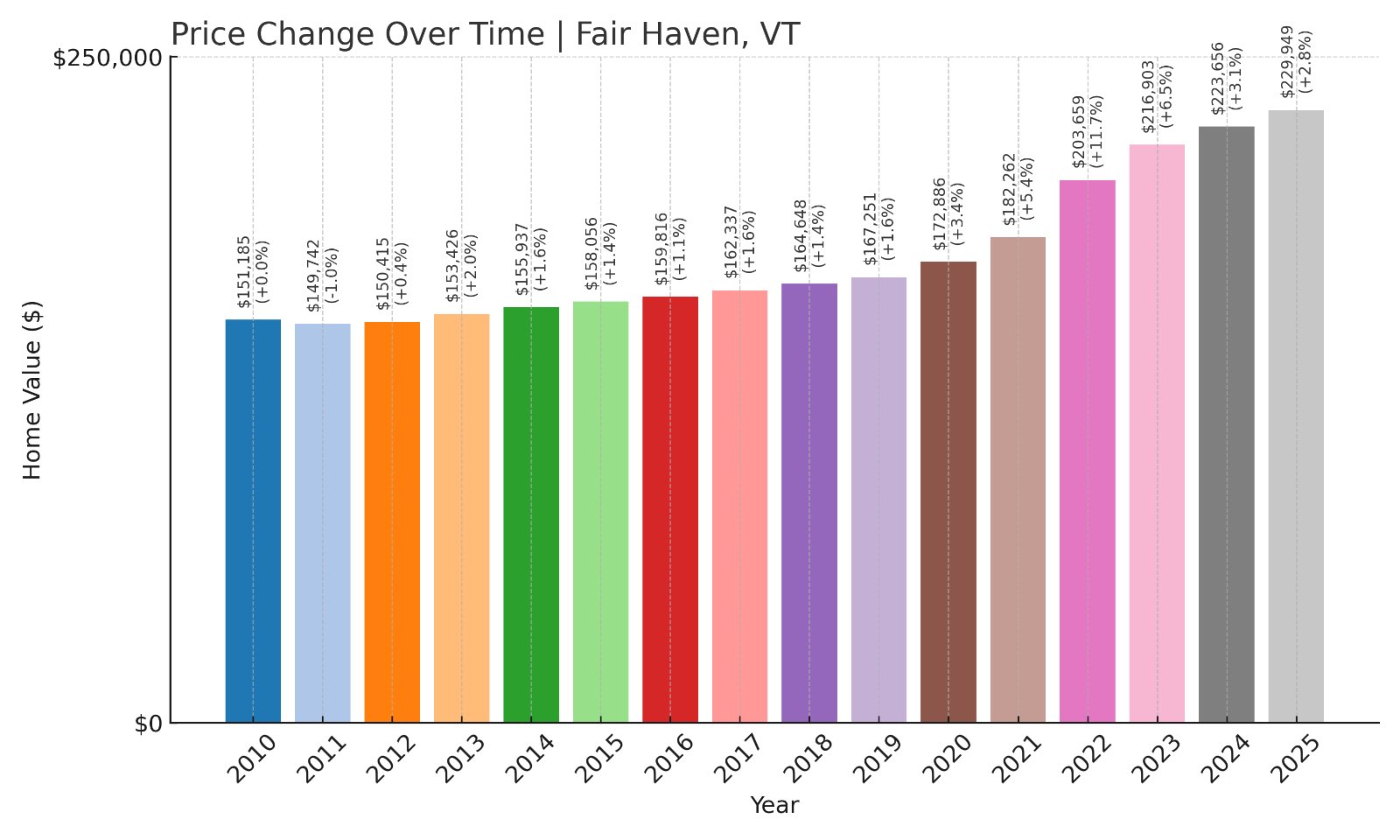

10. Fair Haven – Investor Feeding Frenzy Factor 430.2% (July 2025)

- Historical annual growth rate (2010–2019): 1.13%

- Recent annual growth rate (2021–2025): 5.98%

- Investor Feeding Frenzy Factor: 430.2%

- Current 2025 price: $229,949

Fair Haven demonstrates a 430% acceleration in housing price growth, with annual increases jumping from 1.13% during the 2010s to nearly 6% in recent years. The current median price of $229,949 reflects growing investor pressure in this Rutland County town near the New York border. The speculation threatens affordability in this working-class community that has traditionally offered some of Vermont’s most accessible homeownership opportunities.

Fair Haven – Border Town Faces Investment Pressure

Fair Haven sits in the Champlain Valley near the New York state line, making it an attractive option for buyers seeking Vermont residency with access to New York employment and urban amenities. The town of about 2,600 residents has maintained its small-town character while benefiting from its strategic location along Route 4, a major east-west corridor. Fair Haven’s proximity to both Rutland and the Adirondack region of New York adds to its appeal for both residents and investors.

The median price of $229,949 represents a dramatic shift from Fair Haven’s historically affordable housing market. The town’s 1.13% annual appreciation during the 2010s made it one of Vermont’s most accessible markets for first-time homebuyers and working families. However, the recent acceleration to nearly 6% annual growth indicates growing speculative interest that threatens to price out local residents who work in manufacturing, agriculture, and service industries.

Investment activity in Fair Haven appears driven by its border location and relative affordability compared to other Vermont markets. The town’s slate quarrying heritage and Victorian architecture attract buyers seeking authentic Vermont character at reasonable prices. Additionally, Fair Haven’s proximity to New York makes it appealing for second-home buyers and investors looking to capitalize on Vermont’s rural appeal while maintaining access to metropolitan areas.

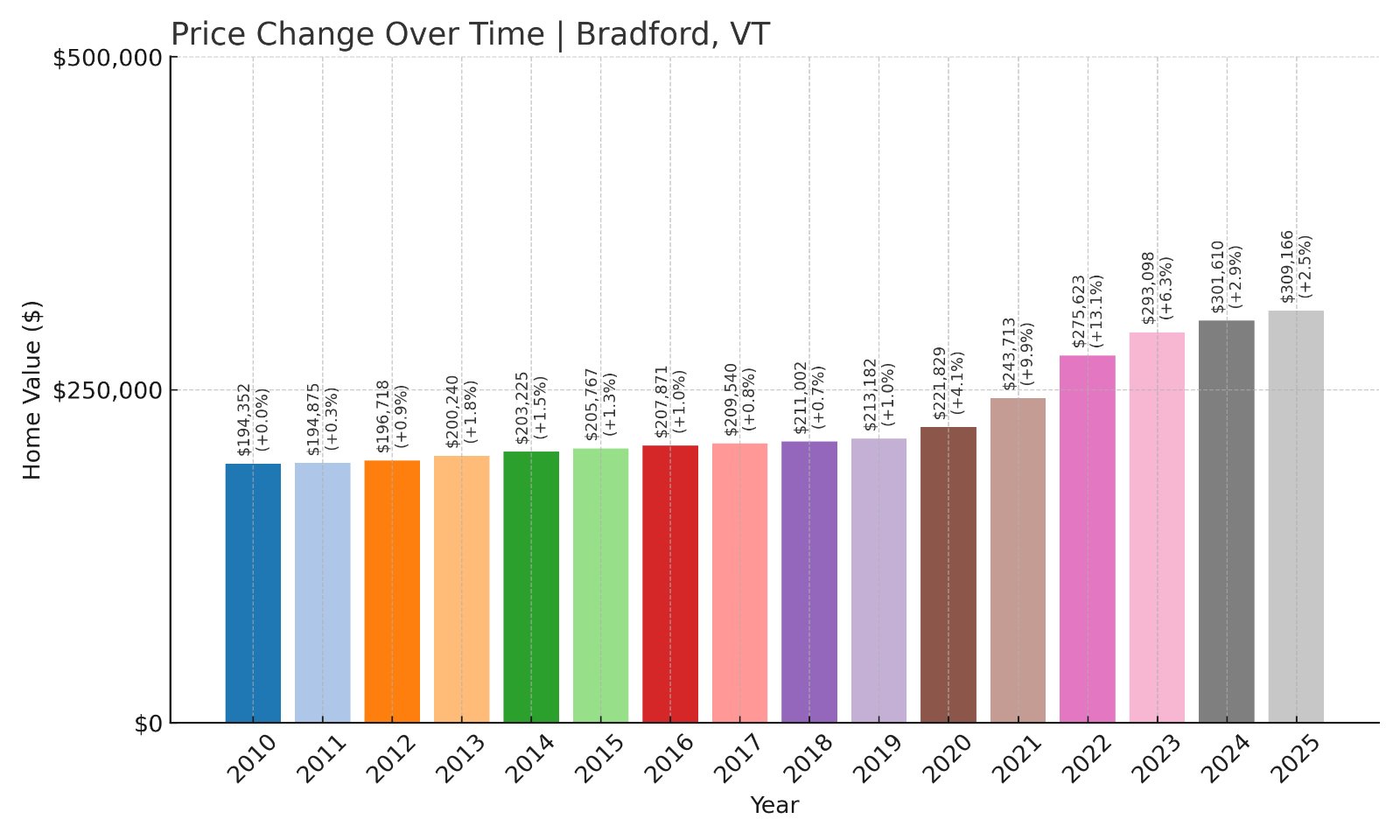

9. Bradford – Investor Feeding Frenzy Factor 493.3% (July 2025)

- Historical annual growth rate (2010–2019): 1.03%

- Recent annual growth rate (2021–2025): 6.13%

- Investor Feeding Frenzy Factor: 493.3%

- Current 2025 price: $309,166

Bradford shows a 493% acceleration in housing costs, with annual price growth surging from barely 1% historically to over 6% recently. The current median price of $309,166 reflects intense speculative pressure in this Orange County town along the Connecticut River. The dramatic price escalation threatens to displace longtime residents from this rural community that has long provided affordable housing for working families.

Bradford – Connecticut River Town Under Siege

Bradford sits along the Connecticut River in east-central Vermont, serving as a quiet agricultural community with scenic mountain views and river access. The town of roughly 2,800 residents has maintained its rural character while being accessible to both New Hampshire and the Upper Valley region, including Dartmouth College area. Bradford’s location along Interstate 91 makes it increasingly attractive to commuters and investors seeking rural Vermont properties with reasonable access to employment centers.

The median price of $309,166 represents a fundamental shift from Bradford’s tradition as an affordable rural community. During the 2010s, the town’s minimal 1.03% annual appreciation allowed local families, farmers, and retirees to build equity slowly and sustainably. The recent surge to over 6% annual growth indicates growing investor interest in this previously stable market, threatening to price out the agricultural workers and rural families who form the backbone of the community.

Speculation in Bradford appears driven by its river location, mountain views, and proximity to recreational activities like skiing and hiking. The town’s agricultural character and historic buildings attract buyers seeking authentic rural Vermont experiences, while its relatively affordable prices compared to resort areas make it appealing for investment purposes. This outside pressure threatens to fundamentally alter Bradford’s character and displace the farming families who have shaped its identity for generations.

8. Wallingford – Investor Feeding Frenzy Factor 497.4% (July 2025)

- Historical annual growth rate (2010–2019): 1.16%

- Recent annual growth rate (2021–2025): 6.94%

- Investor Feeding Frenzy Factor: 497.4%

- Current 2025 price: $300,185

Wallingford demonstrates a 497% acceleration in housing price growth, with annual increases jumping from 1.16% during the 2010s to nearly 7% in recent years. The current median price of $300,185 reflects growing speculative pressure in this Rutland County town. The price surge threatens affordability in this rural community that sits along the scenic Route 7 corridor between Manchester and Rutland.

Wallingford – Route 7 Corridor Feels Investment Heat

Wallingford sits astride Route 7, Vermont’s historic north-south corridor, placing it between the tourist destinations of Manchester to the south and Rutland to the north. The town of about 2,200 residents has maintained its agricultural character while benefiting from through-traffic and proximity to recreational activities. Wallingford’s location near the Green Mountain National Forest and various ski areas makes it increasingly attractive to both tourists and real estate investors seeking rural Vermont properties.

The median price of $300,185 represents a significant escalation from Wallingford’s historically modest housing costs. The town’s 1.16% annual appreciation during the 2010s supported local homeownership for farming families, rural workers, and retirees drawn to its peaceful character. However, the recent acceleration to nearly 7% annual growth indicates intense speculative pressure that threatens to price out longtime residents and alter the town’s rural identity.

Investment activity in Wallingford appears driven by its strategic location and scenic character. The town’s position along Route 7 makes it convenient for accessing southern Vermont’s ski areas and tourist attractions, while its agricultural landscape and mountain views attract buyers seeking authentic rural experiences. The speculation threatens to transform Wallingford from a working agricultural community into another casualty of Vermont’s real estate boom, displacing the families who have farmed and lived here for generations.

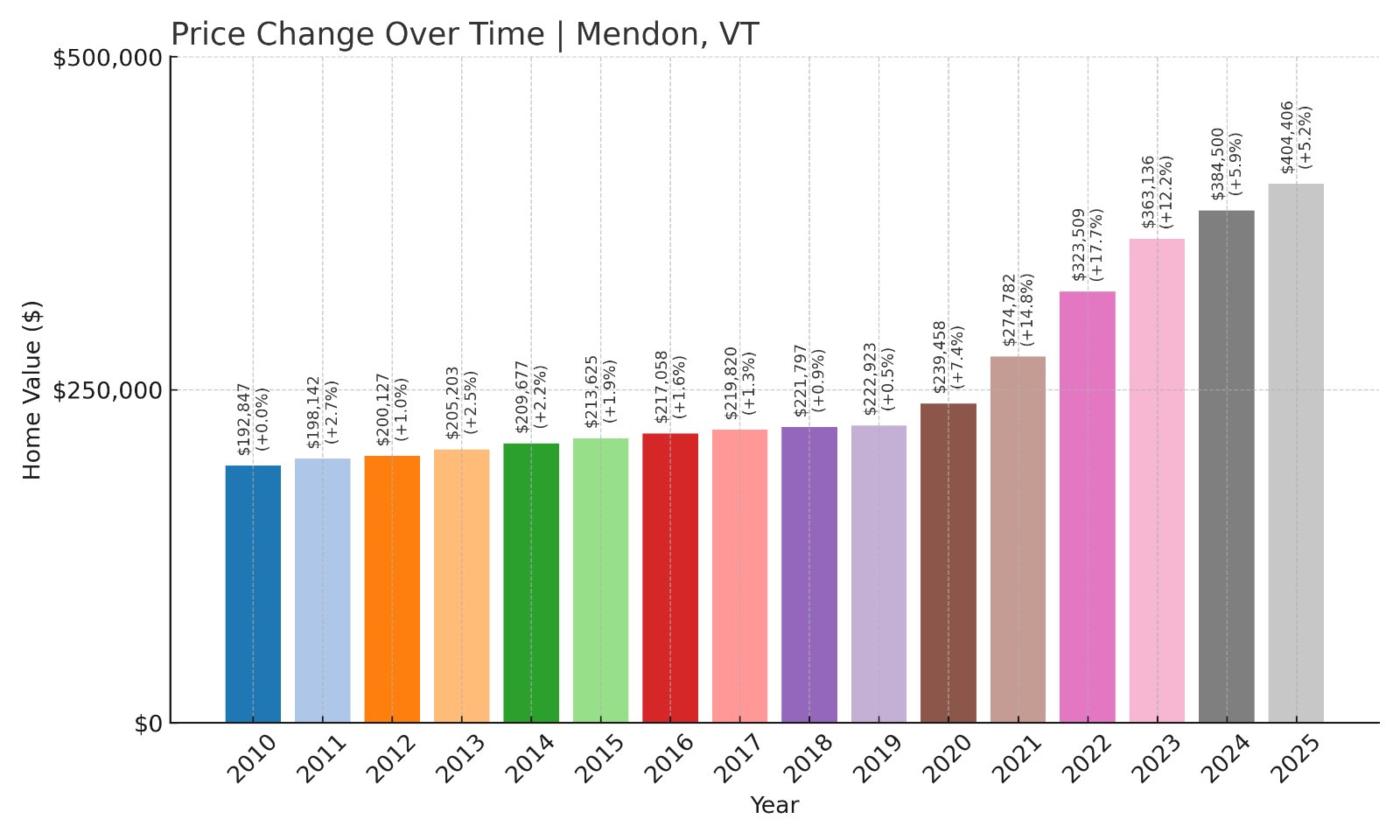

7. Mendon – Investor Feeding Frenzy Factor 524.8% (July 2025)

- Historical annual growth rate (2010–2019): 1.62%

- Recent annual growth rate (2021–2025): 10.14%

- Investor Feeding Frenzy Factor: 524.8%

- Current 2025 price: $404,406

Mendon shows a 525% acceleration in housing costs, with annual price growth exploding from 1.62% historically to over 10% recently – the second-highest rate among our surveyed towns. The current median price of $404,406 reflects intense investor interest in this Rutland County town near Killington Resort. The dramatic price escalation has made homeownership increasingly impossible for local workers who serve the resort economy.

Mendon – Killington’s Shadow Creates Housing Crisis

Mendon sits in the shadow of Killington Resort, Vermont’s largest ski area, making it a prime target for real estate investors and second-home buyers. The town of roughly 1,100 residents has long served as a more affordable alternative to properties directly on Killington’s slopes, attracting both permanent residents who work in the resort industry and investors seeking rental properties. Mendon’s rural character and mountain access have made it increasingly valuable as Vermont’s ski industry has grown.

The current median price of $404,406 represents a fundamental transformation of Mendon’s housing market. During the 2010s, the town’s modest 1.62% annual appreciation allowed local workers, young families, and retirees to find affordable housing within commuting distance of major employment centers. The recent explosion to over 10% annual growth – among the highest in our survey – indicates severe speculative pressure that has priced out most local buyers.

The speculation in Mendon centers heavily on properties suitable for vacation rentals and second homes serving Killington visitors. Investors are purchasing traditional year-round housing and converting it to short-term rentals, reducing the available stock for permanent residents while driving up prices for remaining properties. This trend has created a housing crisis for resort workers, who increasingly cannot afford to live in the communities where they work, forcing longer commutes and threatening the sustainability of the local workforce.

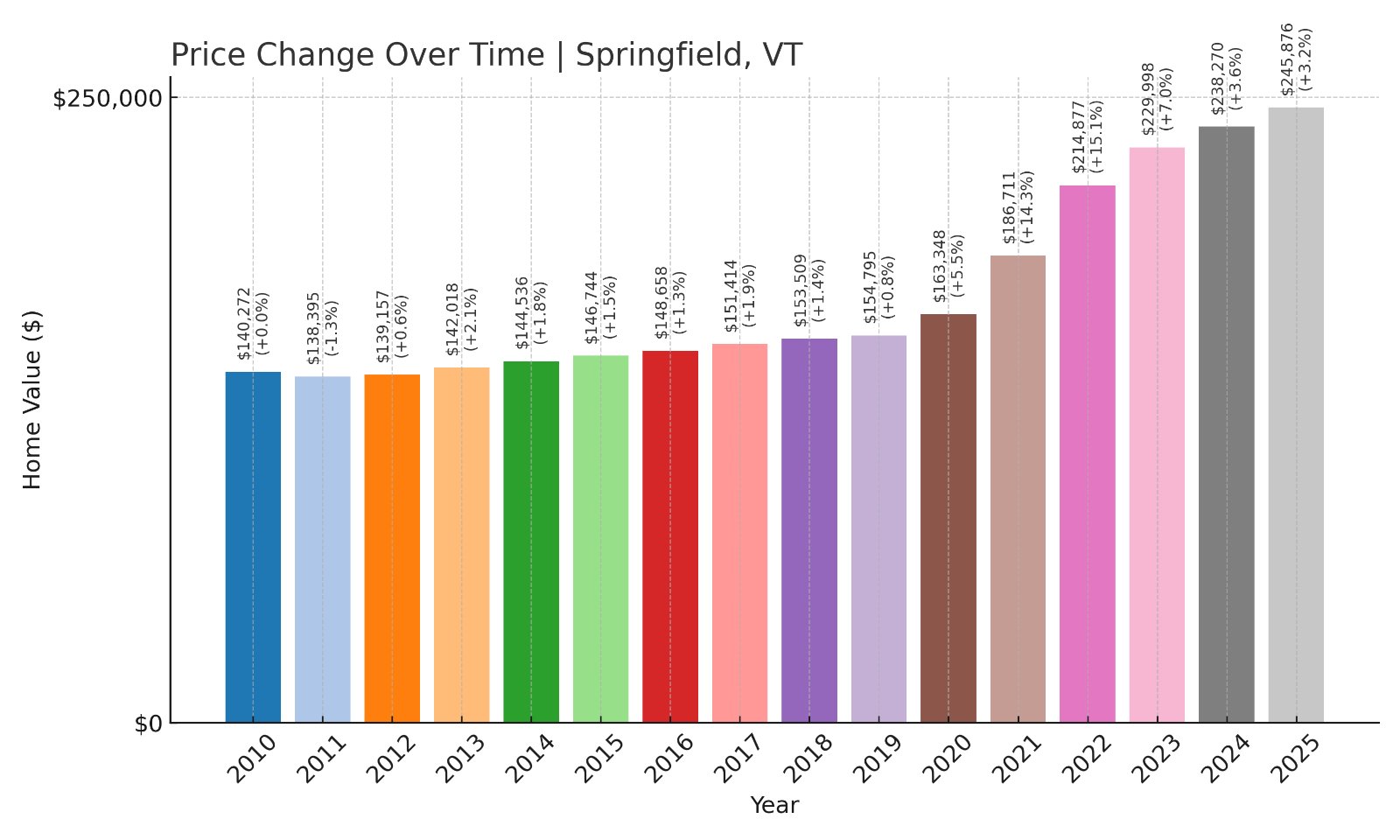

6. Springfield – Investor Feeding Frenzy Factor 547.2% (July 2025)

Would you like to save this?

- Historical annual growth rate (2010–2019): 1.10%

- Recent annual growth rate (2021–2025): 7.12%

- Investor Feeding Frenzy Factor: 547.2%

- Current 2025 price: $245,876

Springfield demonstrates a 547% acceleration in housing price growth, with annual increases surging from 1.10% during the 2010s to over 7% recently. The current median price of $245,876 reflects growing speculative pressure in this Windsor County town. The price acceleration threatens affordability in this Connecticut River community that has traditionally provided accessible homeownership for working families and retirees.

Springfield – Machine Tool Heritage Meets Modern Speculation

Springfield sits along the Connecticut River in southeastern Vermont, with a proud industrial heritage built around precision machine tool manufacturing. The town of roughly 9,000 residents has worked to reinvent itself as traditional manufacturing has declined, developing its downtown and leveraging its location along Interstate 91 for economic development. Springfield’s proximity to New Hampshire and accessibility to both Boston and Montreal make it increasingly attractive to investors seeking affordable Vermont real estate.

The median price of $245,876 represents a dramatic shift from Springfield’s tradition as an affordable working-class community. The town’s minimal 1.10% annual appreciation during the 2010s supported homeownership for manufacturing workers, young families, and retirees drawn to its small-town character and reasonable housing costs. The recent acceleration to over 7% annual growth indicates growing investor interest that threatens to price out the very residents who are trying to rebuild the community.

Investment activity in Springfield appears driven by its combination of affordability and potential for appreciation as Vermont’s real estate market continues to heat up. The town’s Victorian architecture, riverside location, and improving downtown make it attractive to buyers seeking authentic New England character at reasonable prices. However, this speculation threatens to displace longtime residents and undermine the community’s efforts to attract young families and workers needed for economic revitalization.

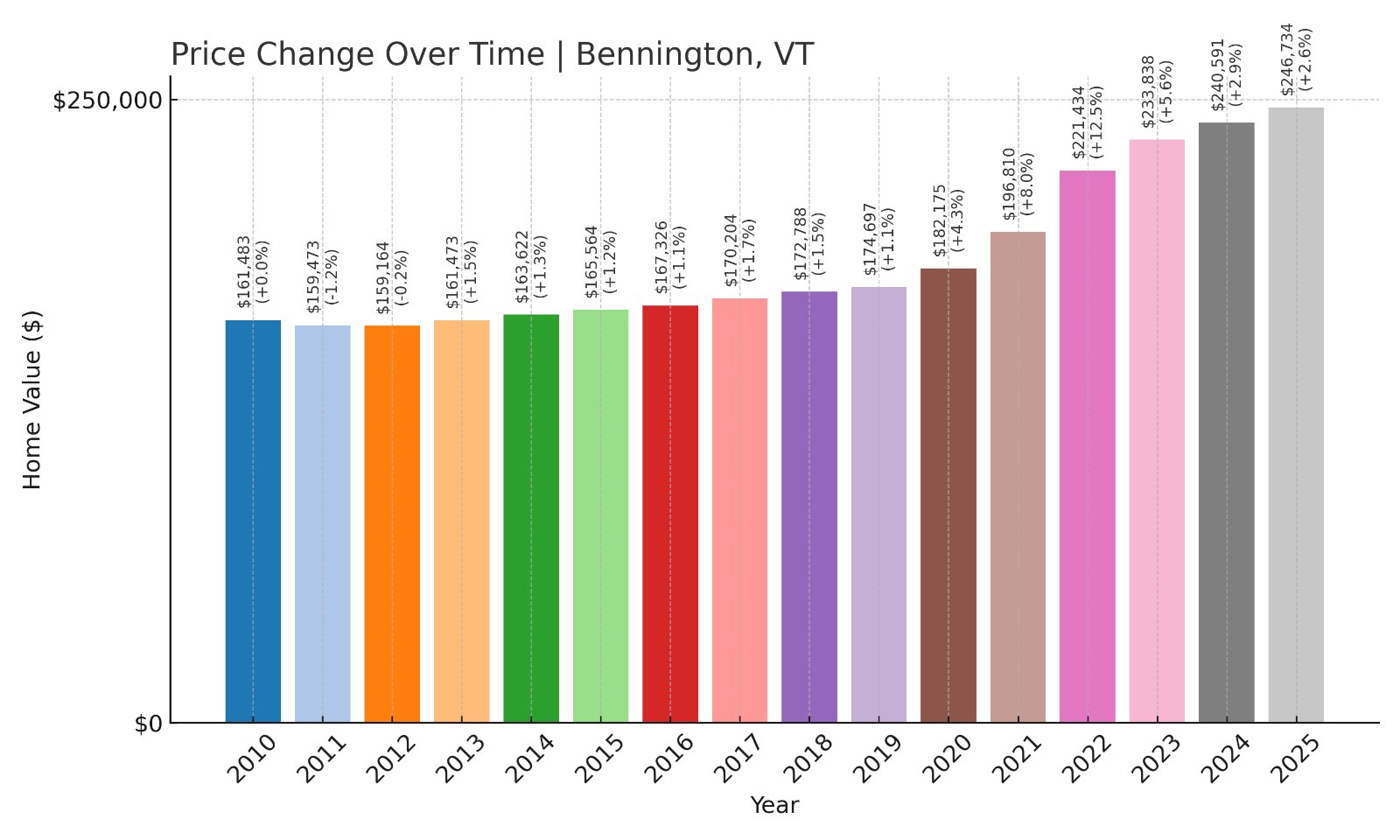

5. Bennington – Investor Feeding Frenzy Factor 562.4% (July 2025)

- Historical annual growth rate (2010–2019): 0.88%

- Recent annual growth rate (2021–2025): 5.81%

- Investor Feeding Frenzy Factor: 562.4%

- Current 2025 price: $246,734

Bennington shows a 562% acceleration in housing costs, with annual price growth jumping from less than 1% historically to nearly 6% recently. The current median price of $246,734 reflects intense speculative pressure in this southwestern Vermont college town. The dramatic price escalation threatens to displace longtime residents from this historic community known for its Revolutionary War heritage and liberal arts college.

Bennington – Historic College Town Under Investment Pressure

Bennington holds a special place in Vermont and American history as the site of a crucial Revolutionary War battle and home to Bennington College, known for its progressive liberal arts education. The town of roughly 15,000 residents sits in southwestern Vermont near the Massachusetts and New York borders, making it accessible to urban buyers from the Tri-State area. Bennington’s combination of historical significance, cultural institutions, and scenic mountain setting has made it increasingly attractive to real estate investors.

The median price of $246,734 represents a fundamental change from Bennington’s historically affordable housing market. During the 2010s, the town’s minimal 0.88% annual appreciation made it one of Vermont’s most accessible markets for first-time buyers, college employees, and working families. The recent surge to nearly 6% annual growth indicates growing speculative interest that threatens to price out local residents, including the service workers and young professionals who support the college and tourism economy.

Investment activity in Bennington centers on its historic architecture, cultural amenities, and proximity to outdoor recreation. The town’s location near ski areas and hiking trails, combined with its arts scene and college atmosphere, attracts buyers seeking both vacation homes and rental investment properties. This speculation threatens to alter Bennington’s character as an affordable college town and displace the diverse community that has made it a cultural center for southwestern Vermont.

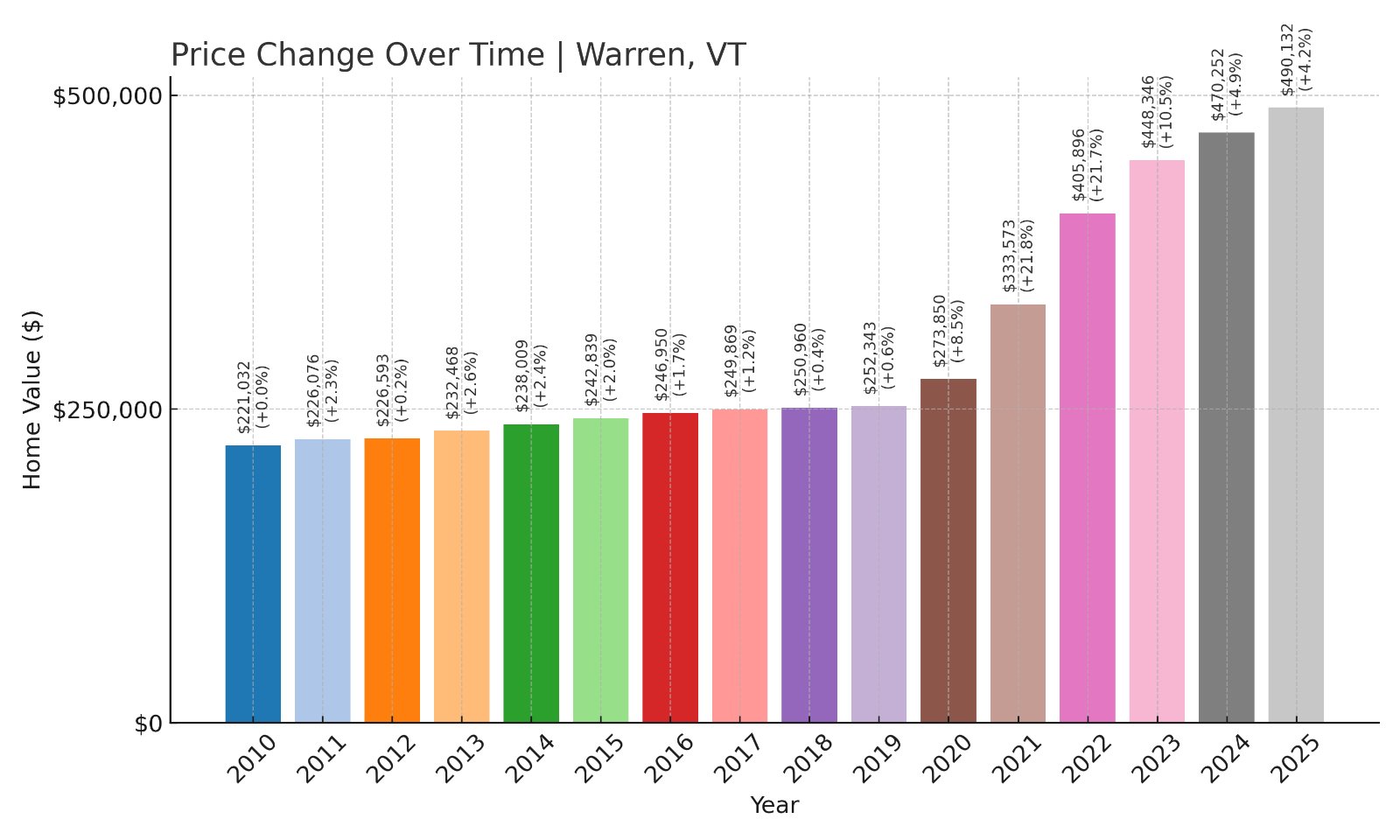

4. Warren – Investor Feeding Frenzy Factor 581.0% (July 2025)

- Historical annual growth rate (2010–2019): 1.48%

- Recent annual growth rate (2021–2025): 10.10%

- Investor Feeding Frenzy Factor: 581.0%

- Current 2025 price: $490,132

Warren demonstrates a 581% acceleration in housing price growth, with annual increases exploding from 1.48% historically to over 10% recently. The current median price of $490,132 reflects severe investor pressure in this Washington County ski town near Sugarbush Resort. The dramatic price escalation has created a housing crisis for local workers and families in this Mad River Valley community.

Warren – Mad River Valley Jewel Becomes Investment Target

Warren sits in the heart of the Mad River Valley, one of Vermont’s most scenic and recreational regions, adjacent to Sugarbush Resort and surrounded by the Green Mountain National Forest. The town of roughly 1,700 residents has long balanced its role as a ski destination with its agricultural heritage and year-round community. Warren’s combination of world-class skiing, mountain biking, and rural Vermont character has made it a magnet for both tourists and real estate speculators.

The current median price of $490,132 represents one of the most dramatic transformations in our survey, reflecting Warren’s evolution from an affordable rural community to a high-priced resort market. During the 2010s, the town’s modest 1.48% annual appreciation allowed local families, farmers, and resort workers to maintain homeownership. The recent explosion to over 10% annual growth has fundamentally altered this dynamic, pricing out most local buyers and creating a housing crisis for the workforce that supports the tourism economy.

The speculation in Warren centers heavily on properties suitable for vacation homes and short-term rentals serving Sugarbush visitors. Investors are purchasing traditional year-round housing and converting it to seasonal use, dramatically reducing the available housing stock for permanent residents. This trend has forced many local workers to seek housing in distant towns, creating longer commutes and threatening the sustainability of the rural community that gives Warren its authentic Vermont character.

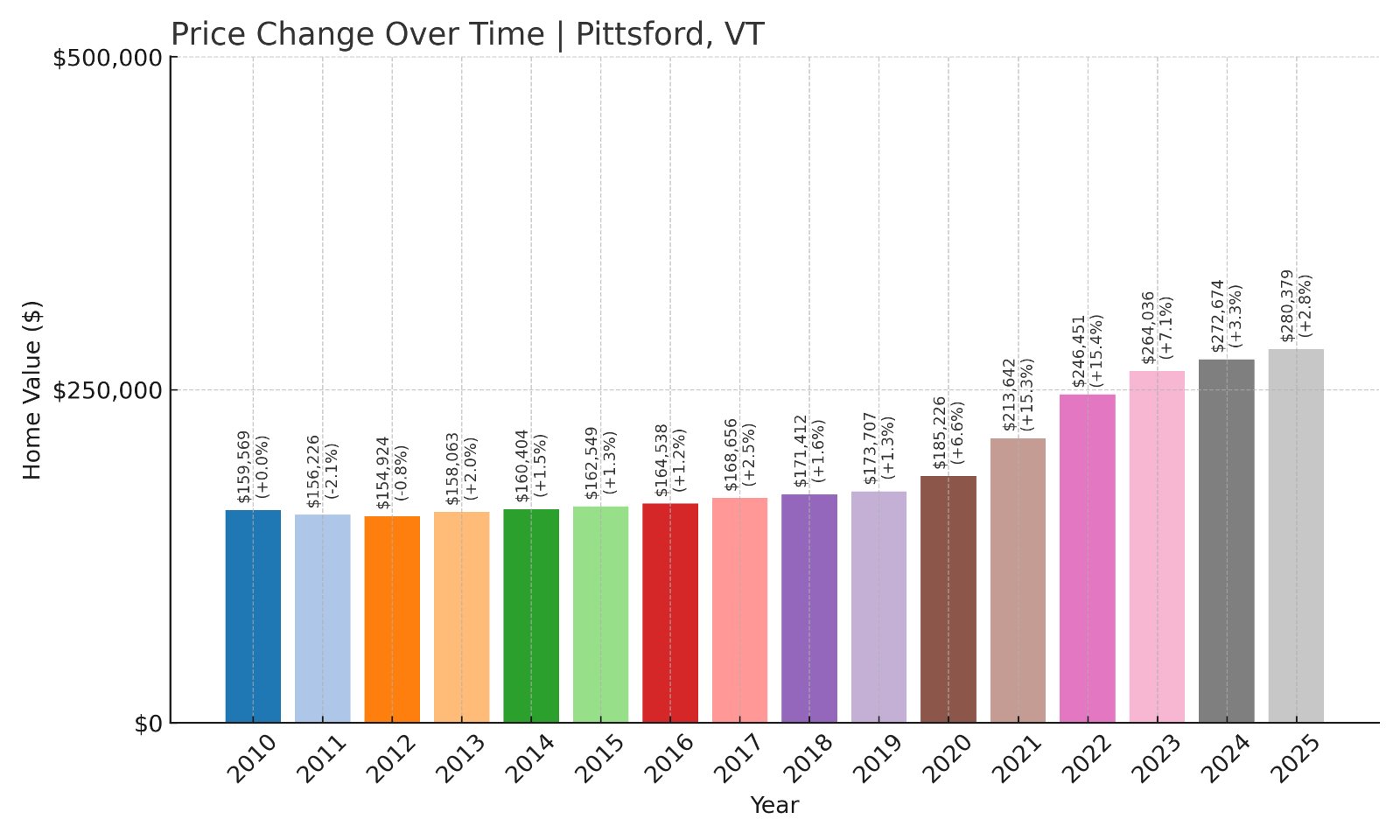

3. Pittsford – Investor Feeding Frenzy Factor 642.0% (July 2025)

- Historical annual growth rate (2010–2019): 0.95%

- Recent annual growth rate (2021–2025): 7.03%

- Investor Feeding Frenzy Factor: 642.0%

- Current 2025 price: $280,379

Pittsford shows a 642% acceleration in housing costs, with annual price growth surging from less than 1% historically to over 7% recently. The current median price of $280,379 reflects intense speculative pressure in this Rutland County town. The dramatic price escalation threatens to displace longtime residents from this rural community known for its agricultural heritage and small-town Vermont character.

Pittsford – Agricultural Town Faces Modern Land Rush

Pittsford embodies rural Vermont’s agricultural tradition, with rolling farmland, historic barns, and scenic mountain views that have attracted increasing attention from real estate investors. The town of roughly 3,000 residents sits in the Otter Creek valley between Rutland and Killington, making it accessible to both employment centers and recreational activities. Pittsford’s combination of working farms, rural character, and proximity to ski areas has made it a target for speculation as buyers seek authentic Vermont experiences.

The median price of $280,379 represents a fundamental departure from Pittsford’s tradition as an affordable agricultural community. During the 2010s, the town’s minimal 0.95% annual appreciation supported homeownership for farming families, rural workers, and retirees drawn to its peaceful character. The recent acceleration to over 7% annual growth indicates severe speculative pressure that threatens to price out the farming families and rural residents who have defined the community for generations.

Investment activity in Pittsford appears driven by its scenic agricultural landscape and proximity to recreational amenities. The town’s working farms, historic architecture, and mountain views attract buyers seeking rural Vermont properties for vacation homes or investment purposes. This speculation threatens to transform Pittsford from a working agricultural community into another casualty of Vermont’s real estate boom, potentially ending farming operations that have sustained the landscape for centuries.

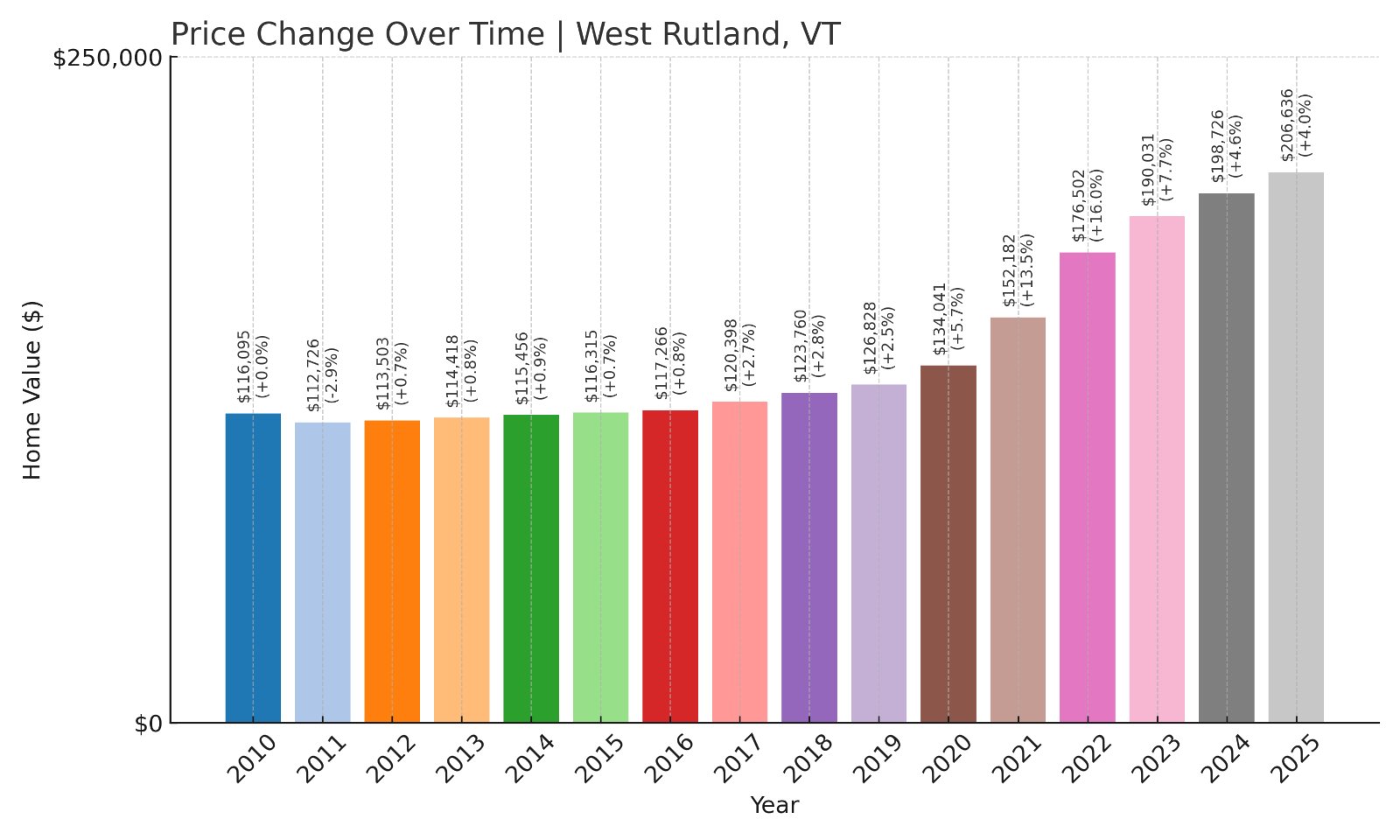

2. West Rutland – Investor Feeding Frenzy Factor 704.9% (July 2025)

- Historical annual growth rate (2010–2019): 0.99%

- Recent annual growth rate (2021–2025): 7.95%

- Investor Feeding Frenzy Factor: 704.9%

- Current 2025 price: $206,636

West Rutland shows a 705% acceleration in housing price growth, with annual increases jumping from less than 1% historically to nearly 8% recently. The current median price of $206,636 reflects intense speculative pressure in this Rutland County town. The dramatic price escalation threatens affordability in this working-class community that has traditionally provided some of Vermont’s most accessible homeownership opportunities.

West Rutland – Marble Heritage Meets Investment Frenzy

West Rutland shares the marble quarrying heritage of neighboring Proctor, with a working-class character built around Vermont’s historic stone industry. The town of roughly 2,300 residents sits along Route 4A in the Otter Creek valley, providing convenient access to Rutland’s employment opportunities while maintaining its small-town identity. West Rutland’s combination of affordability, accessibility, and Vermont character has made it increasingly attractive to real estate investors seeking entry points into the state’s heating market.

The median price of $206,636 represents a fundamental shift from West Rutland’s tradition as one of Vermont’s most affordable communities. During the 2010s, the town’s minimal 0.99% annual appreciation made homeownership accessible to manufacturing workers, young families, and retirees on fixed incomes. The recent acceleration to nearly 8% annual growth indicates severe speculative pressure that threatens to price out the very residents who have sustained the community through economic transitions.

Investment activity in West Rutland appears driven by its relative affordability compared to other Vermont markets and its potential for appreciation as the broader region experiences growth. The town’s historic architecture, mountain views, and proximity to recreational activities make it appealing to investors seeking authentic Vermont properties at reasonable entry costs. This speculation threatens to transform West Rutland from an affordable working-class community into another casualty of Vermont’s real estate boom, forcing out the families who have called this marble town home for generations.

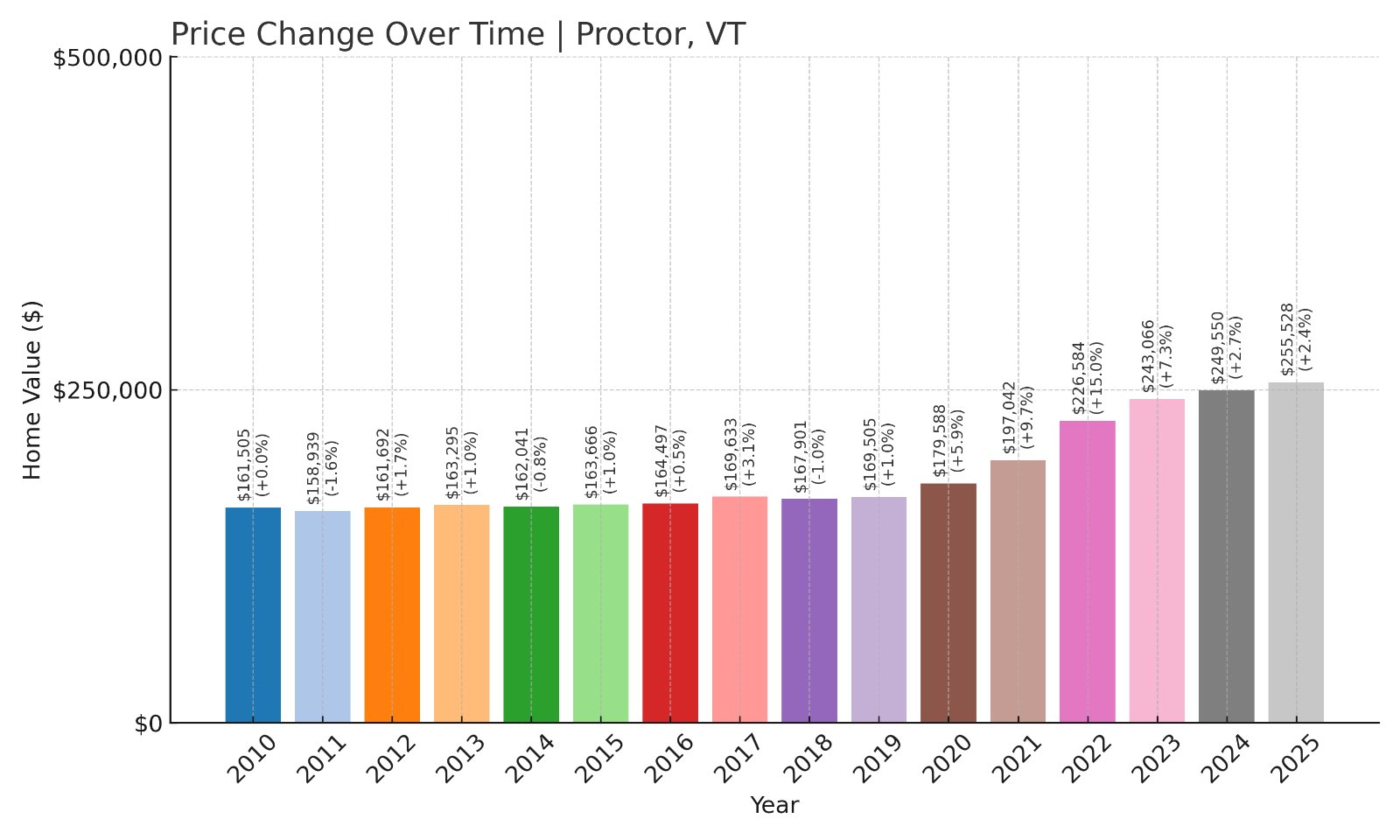

1. Proctor – Investor Feeding Frenzy Factor 1146.4% (July 2025)

- Historical annual growth rate (2010–2019): 0.54%

- Recent annual growth rate (2021–2025): 6.71%

- Investor Feeding Frenzy Factor: 1146.4%

- Current 2025 price: $255,528

Proctor leads Vermont’s speculative housing surge with a staggering 1,146% acceleration in price growth compared to its historical pattern. The tiny Rutland County town has seen annual price increases jump from just 0.54% during the 2010s to 6.71% in recent years. This dramatic shift has pushed the median home price to $255,528, making homeownership increasingly difficult for local families in this working-class community known for its marble quarrying heritage.

Proctor – Small Town Overwhelmed by Outside Investment

Nestled in the Taconic Mountains of central Vermont, Proctor was built around the Vermont Marble Company and has long been a blue-collar community where families could afford to buy homes. The town of just over 1,700 residents sits along the Otter Creek and Route 3, making it accessible to larger employment centers in Rutland while maintaining its small-town character. The historic marble quarries that once defined the local economy have given way to a tourism industry that increasingly attracts outside investors.

The current median price of $255,528 represents a dramatic departure from Proctor’s affordable housing tradition. During the decade from 2010 to 2019, homes appreciated at barely half a percent annually, allowing local families to build wealth slowly and sustainably. The recent acceleration to nearly 7% annual growth has priced out many longtime residents and attracted investors seeking quick returns in Vermont’s rural markets.

Local real estate professionals report that much of the recent buying activity comes from out-of-state investors and second-home buyers drawn to Proctor’s proximity to ski areas and outdoor recreation. The town’s location between Killington and Okemo ski resorts makes it particularly attractive for vacation rental investments, contributing to the speculative pressure that has driven prices beyond what most local workers can afford. This transformation threatens to end Proctor’s legacy as an affordable community where working families could achieve homeownership and build generational wealth in Vermont’s beautiful but increasingly exclusive landscape.